PUBLIC

March 16, 2020

SAP Document Compliance

for India / eInvoice (IRN) / eWay Bill

Local solutions. Global success.

Globalization Services

eInvoice(IRN) –

Regulatory Background

1

PUBLIC© 2019 SAP SE or an SAP affiliate company. All rights reserved. ǀ

The information in this presentation is confidential and proprietary to SAP and may not be disclosed without the permission of SAP.

Except for your obligation to protect confidential information, this presentation is not subject to your license agreement or any other service

or subscription agreement with SAP. SAP has no obligation to pursue any course of business outlined in this presentation or any related

document, or to develop or release any functionality mentioned therein.

This presentation, or any related document and SAP's strategy and possible future developments, products and or platforms directions and

functionality are all subject to change and may be changed by SAP at any time for any reason without notice. The information in this

presentation is not a commitment, promise or legal obligation to deliver any material, code or functionality. This presentation is provided

without a warranty of any kind, either express or implied, including but not limited to, the implied warranties of merchantability, fitness for a

particular purpose, or non-infringement. This presentation is for informational purposes and may not be incorporated into a contract. SAP

assumes no responsibility for errors or omissions in this presentation, except if such damages were caused by SAP’s intentional or gross

negligence.

All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from

expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates,

and they should not be relied upon in making purchasing decisions.

Disclaimer

3

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

The GST Council has decided to introduce with centralized issuance of an unique number (Invoice

Reference number) for each B2B invoice on reporting of invoice data to a central portal with

effective(Mandate) date from 1

st

October 2020 for all Tax payers

The new system will lead to one-time reporting on B2B invoice data in the form it is generated to reduce

reporting in multiple formats (one for GSTR 1 and the other for e-way bill) and to generate Sales and

Purchase Registers (ANX-1 and ANX-2) and from this data to keep the Return (RET-1 etc.) ready for

filing.

Status of legislation in India

GST council – Goods and Services Tax Council

GSTR 1 - monthly return that summarizes all sales (outward supplies) of a taxpayer

ANX 1 - FORM GST ANX-1 – Annexure Of Outward Supplies

ANX 2 - FORM GST ANX-2 – Annexure Of Inward Supplies

RET 1 – FORM GST RET-1 – Monthly Return for normal tax payer

Effective date – 1

st

October 2020

Businesses having a turnover of ₹500 crore (5 billion) or more would take up e-

invoicing from January 1, 2020 on voluntary

and trial basis while the businesses with turnover of ₹100crore (1 billion)or more

would start e-invoicing on voluntary and trial basis from February 1, 2020.

However, from October 1, 2020, the e-invoicing will be mandatory for both these

categories

4

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Legal changes, effective date and Impact

eInvoicing || effective from Jan 2020 on voluntary basis || mandatory on 1

st

October 2020

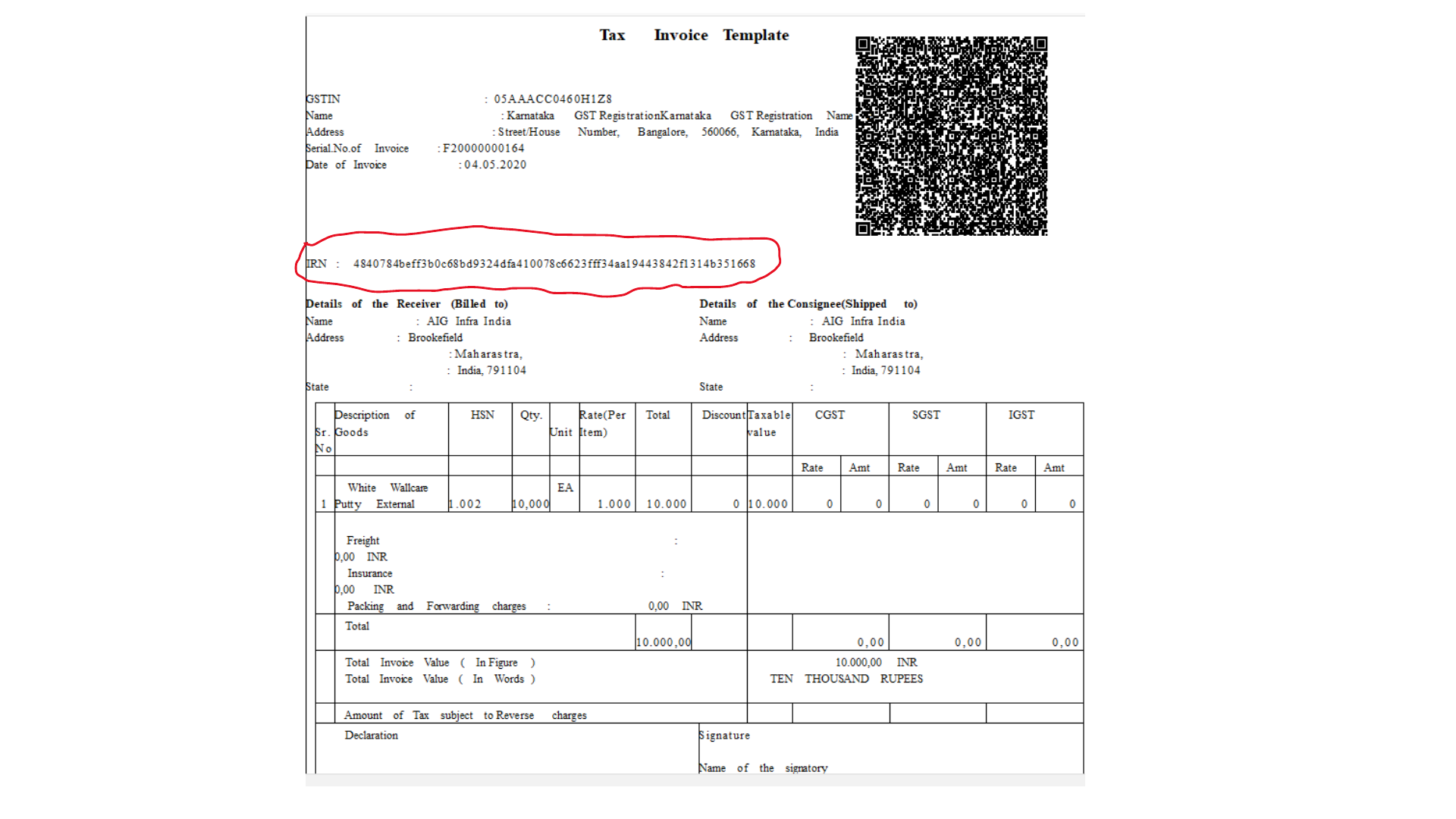

• Real Time – 64 digits (alpha numeric) || QR code || Digital Signature

• An invoice is valid only if invoice is registered in IRP(Invoice Reference Portal).

• Input tax credit can be availed only invoices with valid IRN(Invoice Reference Number)/eInvoice

• Manual update in ECC/S4 with 64 digits IRN is not practical

GST Simplification - Continuous upload|| effective from 1

st

October 2020 ||ANX-1, ANX-2 & RET-1

Invoice Reconciliation, Avail Input tax credit & Vendor payment after invoice is uploaded to GSTN

https://einv-apisandbox.nic.in/index.html

https://www.gstn.org/e-invoice/

5

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

eInvoice - IRP (Invoice Reference Portal)

o To standardize the format in which electronic data of an Invoice will be shared with others

to ensure there is interoperability of the data.

o The adaption of standards will in no way impact the way user would see the physical

(printed) invoice or electronic (ex pdf version) invoice.

<https://launchpad.support.sap.com/#/legalchangenotification/NoteI

nforSet/jira=GSCBIN-643/TwoColumnsMidExpanded/0>

6

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

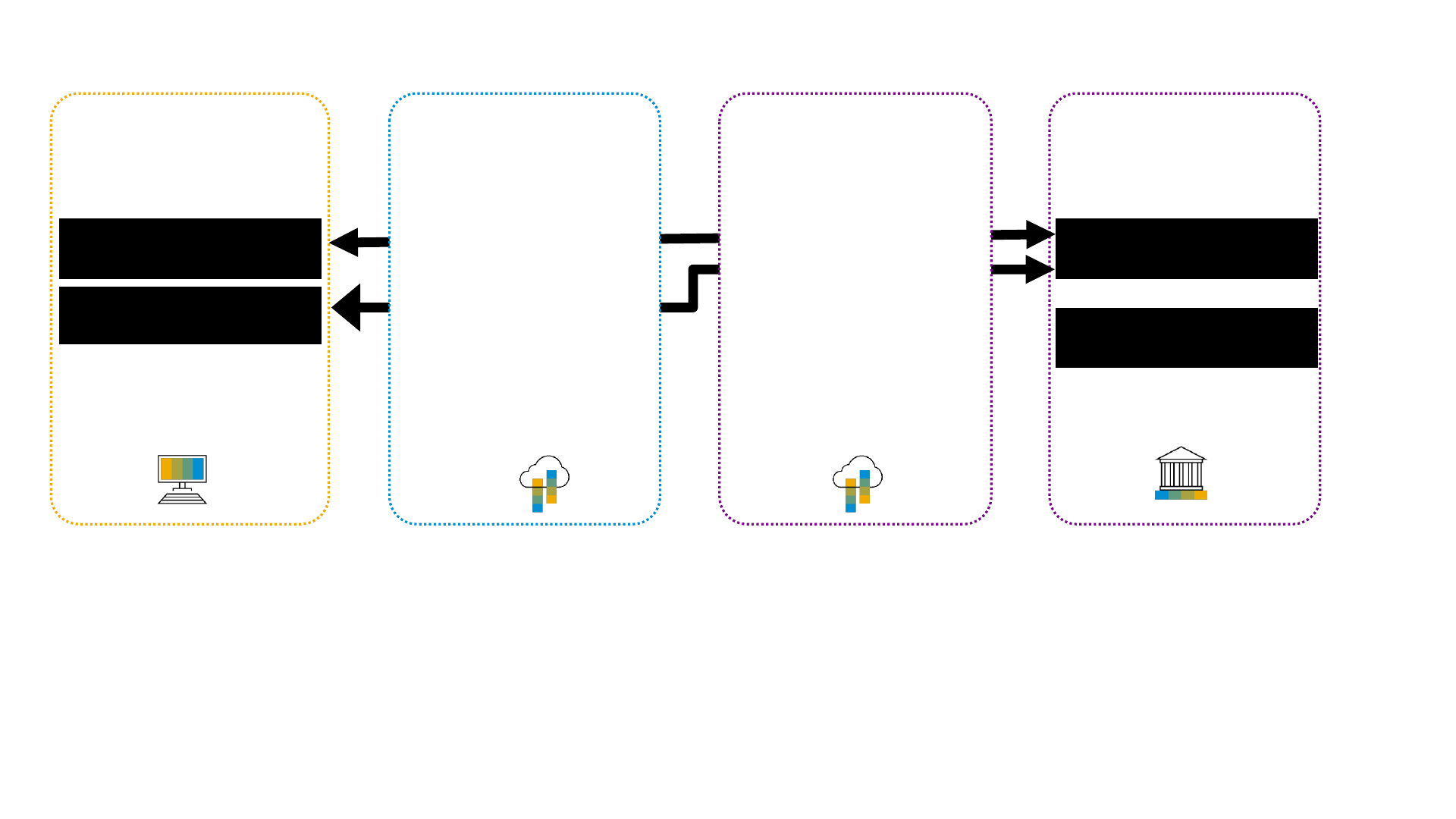

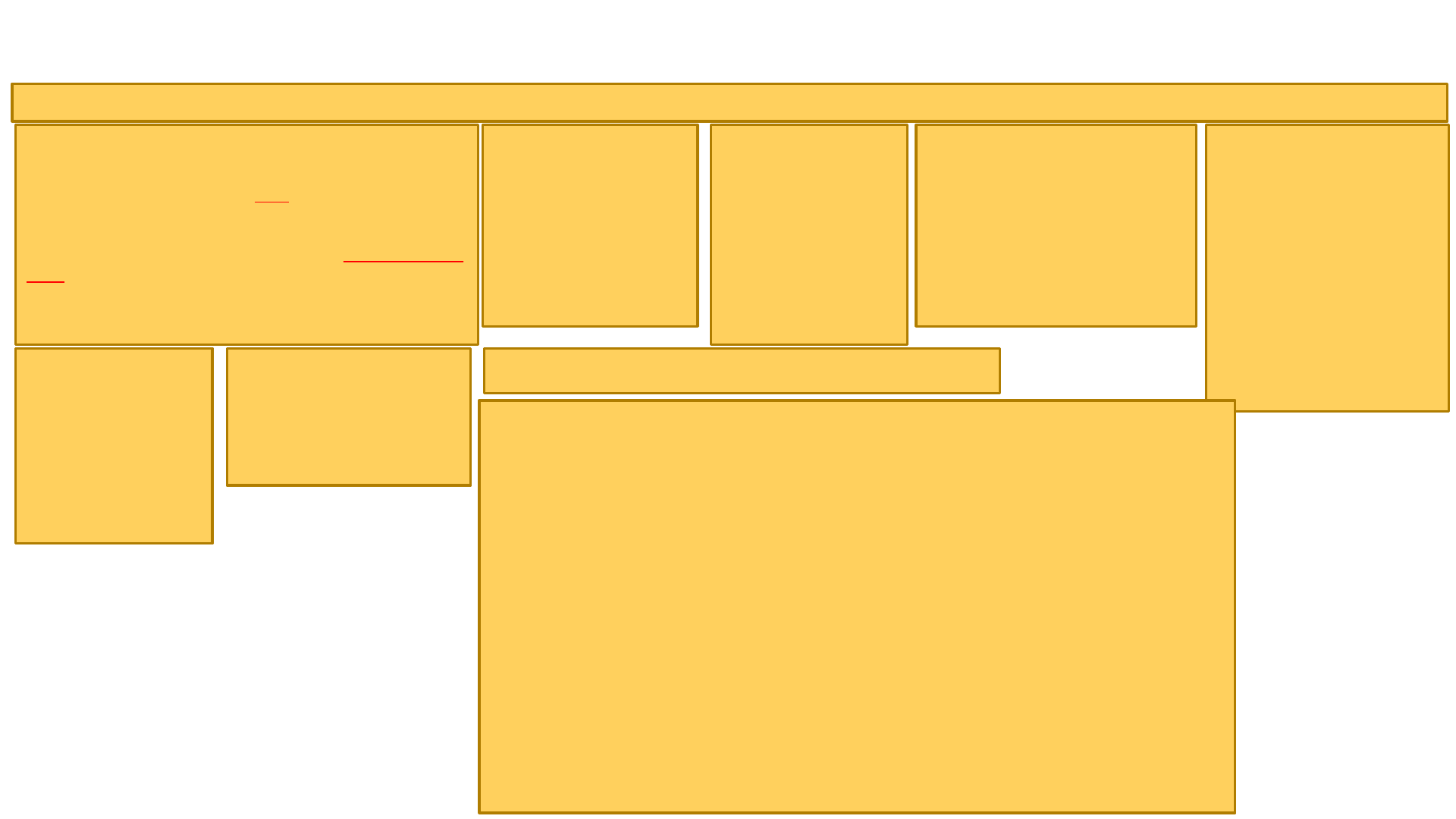

Recipient(Tax

Authority)

SAP ECC or S/4HANA

SAP Cloud Platform

Integration

• Country Format Mapping in

SAP Document Compliance

• Business Monitoring

• Generation of IRN in real time

• Communication

• Authentication

• Validation

• Unique number for each

B2B invoices

Integration flow

Solution Landscape – Document Compliance for India (eInvoice & eWay Bill)

SAP APPL 6.05

SAP Netweaver 7.02

eWayBill (NIC*))

Outward B2B

Invoice

Credit / Debit Note

SAP Certified

GSP

• Communication

eInvoice

(IRP*))

NIC*- National Informatics Centre

IRP* - Invoice Reference Portal

GSP- Goods and Service Suvidha Provider

CPI – Cloud Platform Integration

7

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Benefits

Global Platform: SAP Document Compliance platform is used for eInvoicing (IRN) and

real-time reporting globally around 18 countries. (eg: Spain, Italy, Colombia)

Legal Validation : Inbuilt validations on Master Data and transaction data to ensure

error free submission of your payload to IRN(Invoice Reference Number) and NIC

(National Informatics Centre) system

Real Time : Ability to push invoices to the IRN and NIC system in real time during the

relevant transaction in your ERP to generate an eWay bill and eInvoice (IRN)

Transparency : SAP Document Compliance cockpit provides live status update for

each invoice

8

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

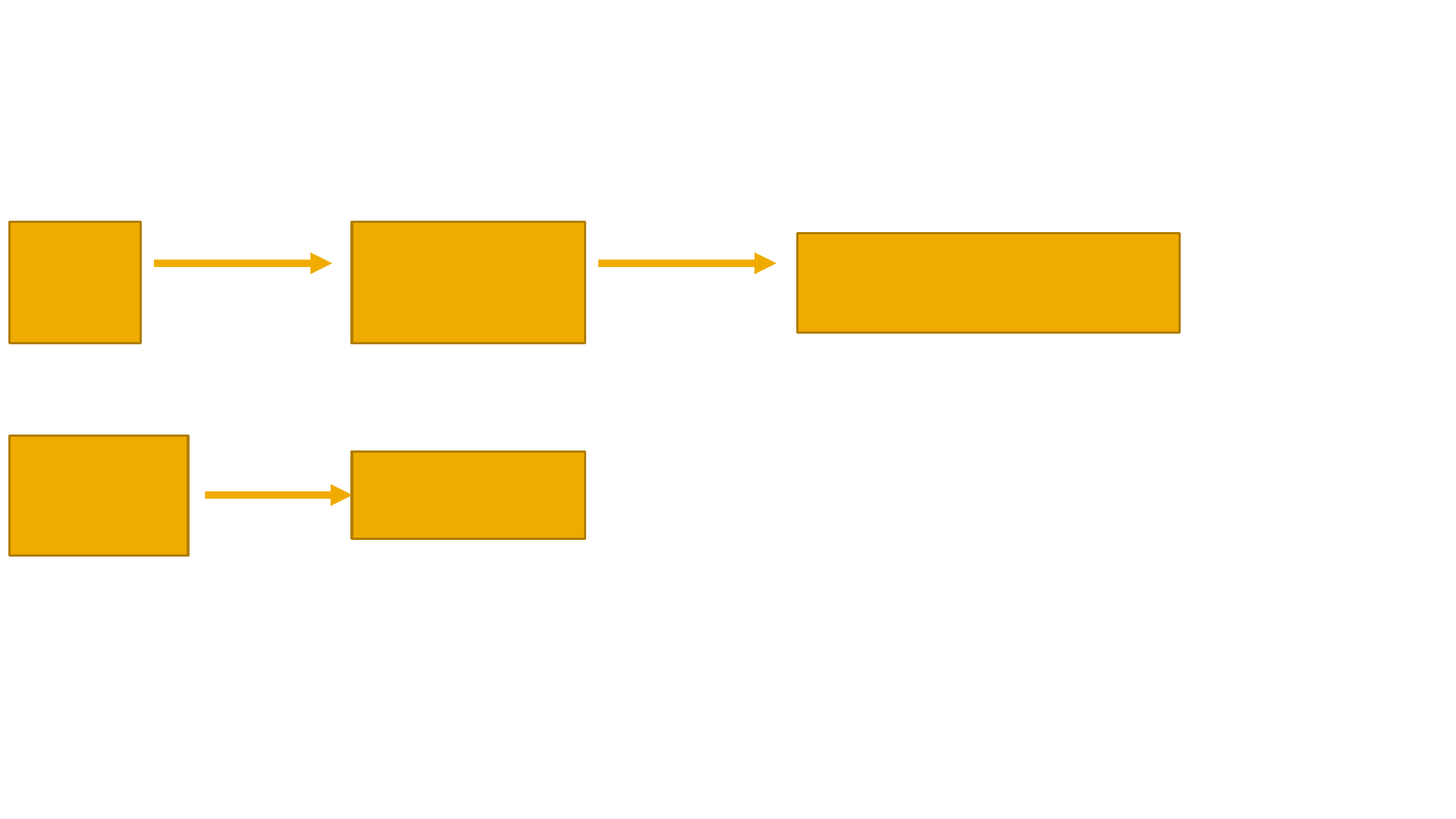

Process of generation of eInvoice

Creation of

Invoice

Preparation of

standardized

format (JSON)

API Upload

Generation of

IRN in IRP

Validation in

IRP & GSTN

Issue signed

QR code &

Invoice

4 Parameters to generate IRN

1. Supplier GSTIN

2. Supplier’s invoice number

3. Document Type (INV/CRN/DBN)

4. Financial year (YYYY-YY)

8 Parameters to generate a QR

Code

1. GSTIN of Supplier

2. GSTIN of Recipient

3. Invoice number as given by

Supplier

4. Date of generation of invoice

5. Invoice value (taxable value and

gross tax)

6. Number of line items

7. HSN Code of main item (the line

item having highest taxable

value)

8. Unique Invoice Reference

Number (hash)

Offline Upload

9

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

eInvoice Scheme (Mandatory Parameters)

Mandate \ Optional \eWaybill attributesrequired for eInvoice

Header (Auto Fill by System)

1. Invoice Reference Number (IRN)

2. Document Type : INV, CRN & DBN

3. Document Category : B2B/B2G/Exports

4. Invoice Type: Reg / REV (Reverse Charge)

5. Export Category : DIR / DEM/ SEZ/SED

6. Extra Information: Tax_Scheme (GST, Excise, Custom,

VAT etc)

7. Ship To (Relevant for Part A of eWay bill generation)

TransactionMode- Regular/BilTo/ShipTo/Both

Header (From Invoice)

1. Invoice Number (ODN) 2. Invoice Date

Header

(Delivery_Information)

DispatchFrom Details (Ship

From)

1. Company_Name

2. Address1

3. State

4. Pincode

Ship To

1. ShippingTo_Name

2. ShippingTo_GSTIN

3. ShippingTo_Address1

4. ShippintTo_State

5. ShippingTo_Pincode

Header (Supplier

Information)

1. Supplier_Legal_Name

2. Supplier_GSTIN

3. Supplier_Location

4. Supplier_Place

5. Supplier_Pincode

6. Supplier_Email

(Optional)

Header (Buyer

Information)

1. Buyer_Legal _Name

2. Buyer_GSTIN

3. Buyer_Place

4. Buyer_State

5. Buyer_Pincode

6. POS (Place of

Supply)

7. Buyer_Email

(Optional)

Header - Payee

Information (Seller

payment information)

1. Payee_Name

2.Branch (OR) IFSC

code

3. ModeofPayment

(Cash/Credit/Direct

Transfer)

Header (Document Totals)

1. Tax_Total

2. TotalDetails (Optional) - Total

Invoice Value

3. Paid_amount (amounts which

have been paid in advance)

4. Amount_due_for_payment

(outstanding amount that is

requested to be paid)

Header (Other References)

(Optional)

1. RefNum (Vendor PO

Reference number)

2. RefDate (Vendor PO

Reference date)

Item Details (From Invoice)

1. Item Description

2. Product Name

3. HSN /SAC Code

4. ISService (optional) - Y/N - Only for Service invoices

5. Quantity

6.Unit of measure

7.Total Amount (Tax Base )

8. Total Item Value (Tax Base + Tax Value)

9. FreeQty (optional) - Any free quantity in Invoice to be reported

10. Rate (This is per quantity Price)

11. AssesseebleValue (Net)

12. GST Rate

13. Iamt

14. Camt

15. Samt

16. Csamt

17. StateCessAmt (Optional - eg: Kerala cess)

18. OtherCharges (Optional - other allowance (OR) other than GST (eg: if Tax_Scheme is "excise /

VAT" )

10

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Highlights in the new API

o Document Number (ODN) - Document number should not be starting with '0', '/' and '-'. Also, alphabets in document

number should not have alphabets in lower cases.

o Document Date - Document date, for the purposes of IRN generation, can be present or yesterday's date only. This

implies that IRN can be generated for documents issued only up to one day before.

o Cancellation of IRN - e-invoice(IRN) cannot be re-generated for the cancelled e-invoice(IRN).

o IRN cannot be cancelled, if the valid/ active e-way bill exists for the same.

o Generation of e-invoice by SEZ units - e-invoice cannot be generated by the supplier SEZ units.

o Reverse Charge supplies - IRN generation to be done by the seller only, in case of Reverse charge supplies.

o It has been cleared that IRN should not be passed as part of the request.

o Legal Name is mandatory for Seller, Buyer and Ship To Party

o No B2G category supported

o Quantity and Unit Code are mandatory only for Goods.

11

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

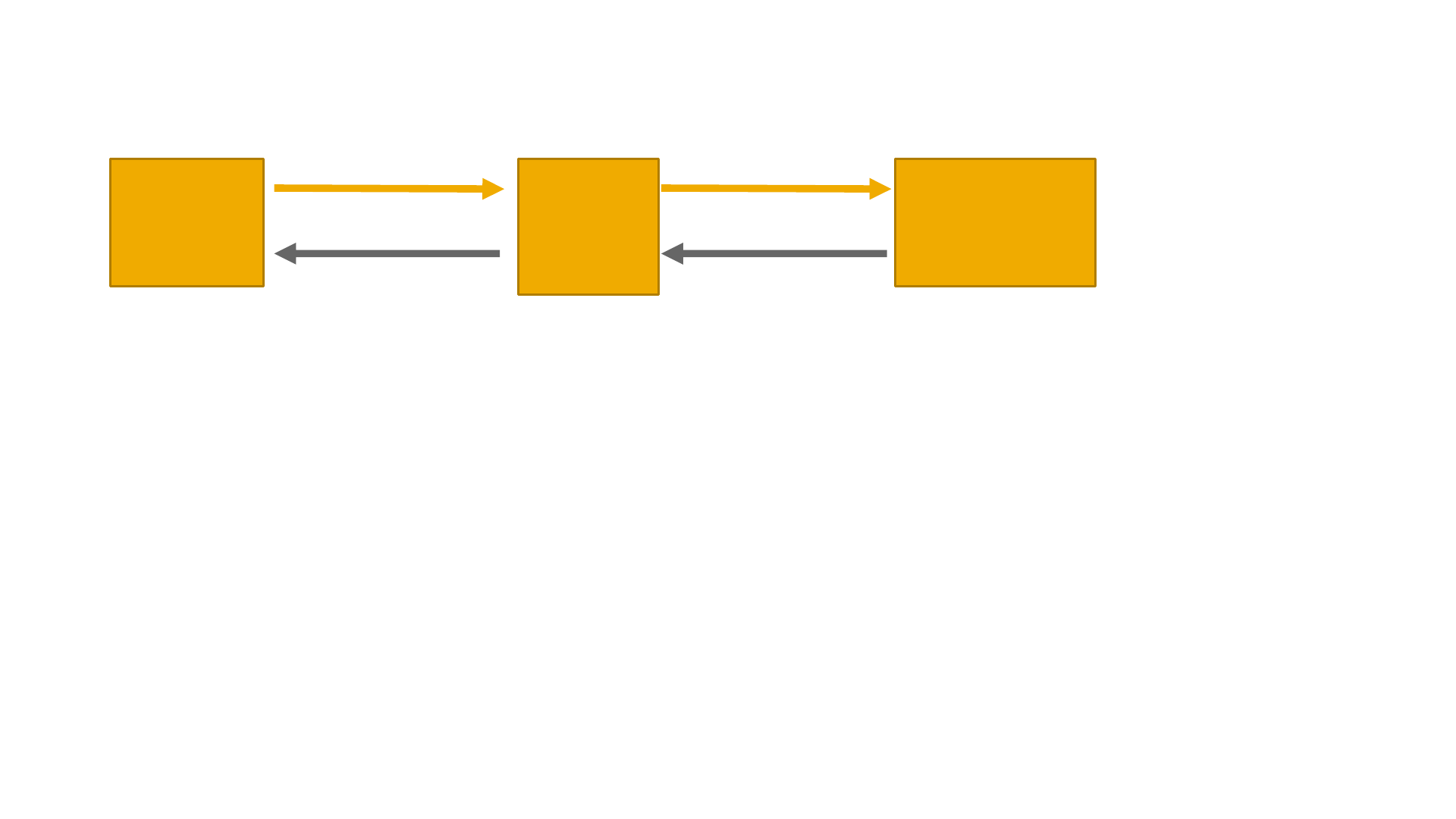

Business Process : Generate / Update an IRN (Invoice Reference Number)

SAP ERP

SAP CPI /

GSP

IRP (Invoice

Reference Portal)

Invoice Payload

1) Signed QR code

2) Signed Invoice

Invoice Payload

1) Signed QR code

2) Signed Invoice

Use Cases for the generation of IRN

o B2B – Regular Invoice – Inter & Intra – VF01 / FB70

o B2B – Invoice to SEZ With (OR) Without Payment – Inter & Intra – VF01/ FB70

o B2B – Export Invoice With (OR) Without Payment - Inter – VF01 / FB70

o Sub type of export, Payment type – With or Without, Port code, Country code, Currency and value

o B2B – Deemed export Invoice – Inter & Intra – VF01/ FB70

o B2B – Invoices for RCM

o Credit Note by supplier – for Regular / SEZ / Export /Deemed export – FB75 Original Invoice number

o Debit Note by customer - for Regular / SEZ / Export /Deemed export - FB75 – Original Invoice number

12

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

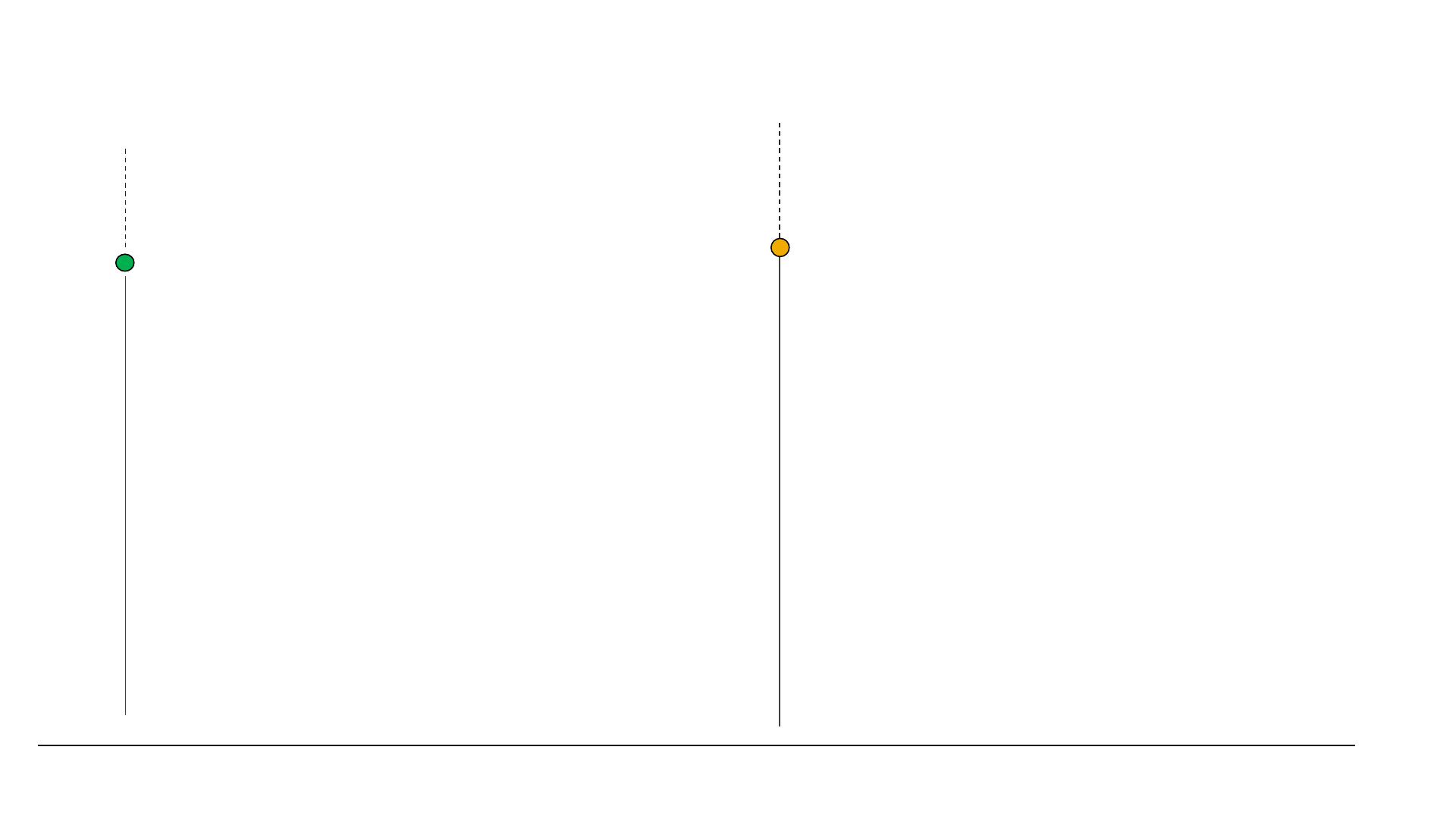

Business Process : Cancellation of an IRN (Invoice Reference Number)

Use Case 1: (Pre-Requirements : IRN is generated for Invoice)

o Cancellation of IRN should be within 24 hrs in IRP and it is considered to be a cancellation of billing

document

o Duplicate IRN requests are not considered.

SAP ERP

SAP CPI /

GSP

IRP (Invoice Reference

Portal) Cancel IRN and

Invoice within 24 hrs

Invoice Cancel Payload

Update Cancel status

Invoice Cancel Payload

Update Cancel status

13

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Business Process : Cancellation of an IRN (Invoice Reference Number)

Use Case 2: (Pre-Requirements : IRN is generated for Invoice)

Step 1:

IRN

generated

Step 2: Identified

the issue in tax

details - After 24

hrs

Step 3: Invoice which generated

with IRN is not present in IRP to

Cancel

Step 4 :

Create a

Credit Note

Step 5 : Credit

Note with IRN

from IRP

14

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

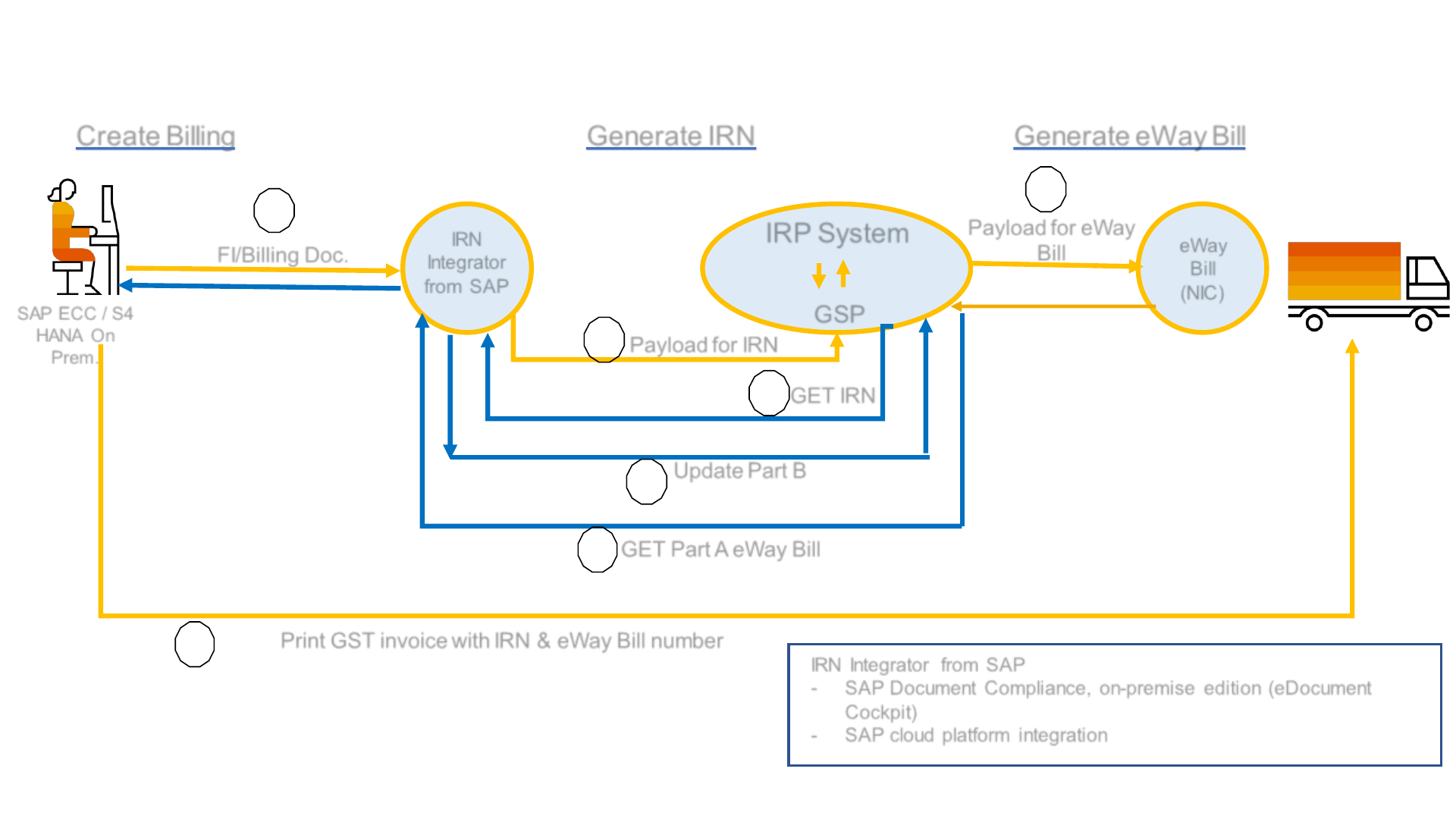

eInvoice (IRN) for India – Process flow

SAP ECC / S4

HANA On

Prem.

IRN Integrator from SAP

- SAP Document Compliance, on-premise edition (eDocument

Cockpit)

- SAP cloud platform integration

FI/Billing Doc.

IRN

Integrator

from SAP

Create Billing

IRP System

GSP

Payload for IRN

GET IRN

Generate IRN

Print GST invoice with IRN & eWay Bill number

1

2

3

7

eWay

Bill

(NIC)

Payload for eWay

Bill

4

GET Part A eWay Bill

5

Generate eWayBill

Update Part B

6

15

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

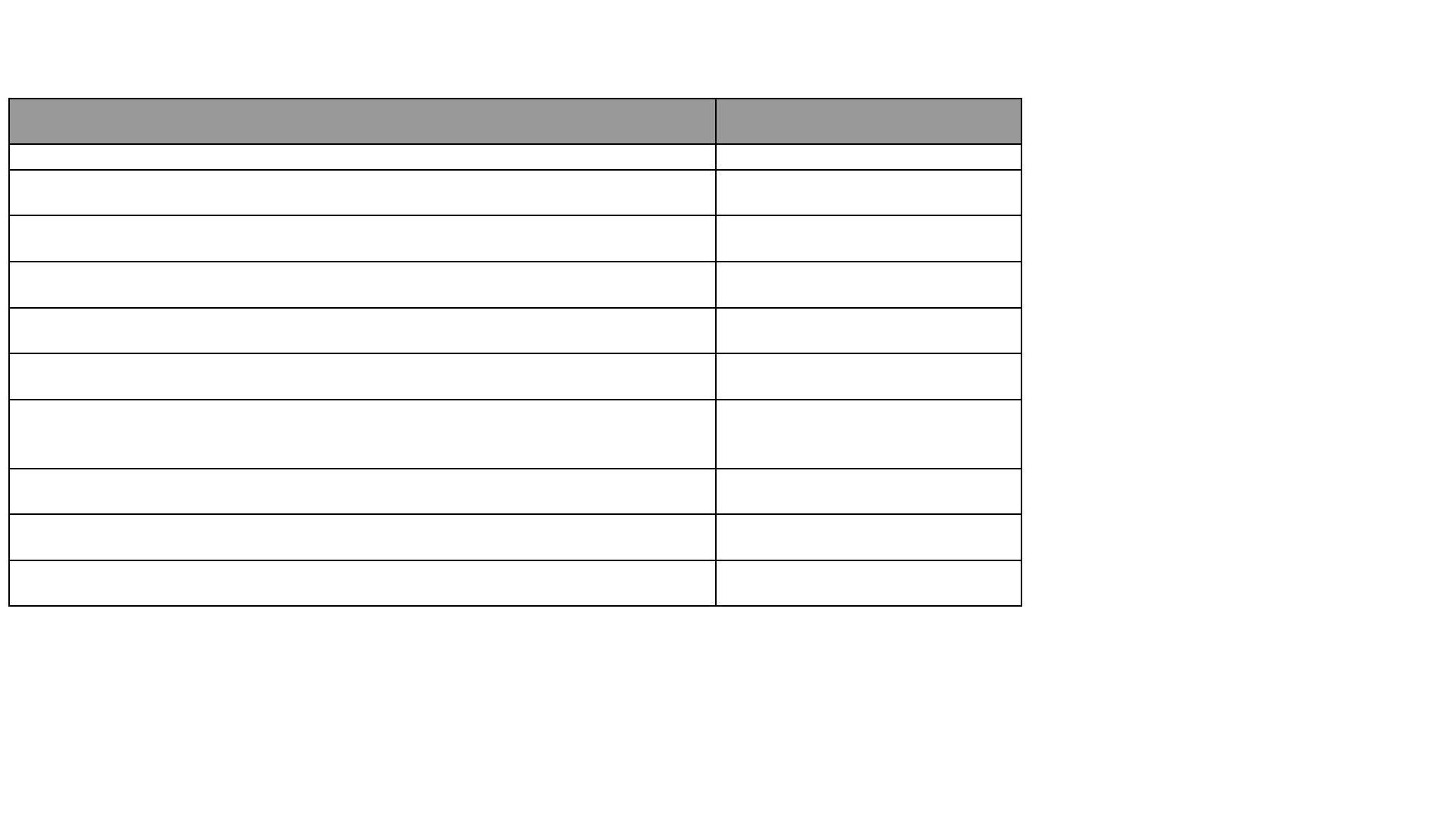

Minimum Supported Release (SAP ERP , S/4HANA)

SAP_APPL Release

Support Pack

SAP ERP 6.0 (600)

SP 26

EHP2 FOR SAP ERP 6.0 (602)

SP 16

EHP3 FOR SAP ERP 6.0 (603)

SP 15

EHP4 FOR SAP ERP 6.0 (604)

SP 16

EHP5 FOR SAP ERP 6.0 (605)

SP 13

EHP6 FOR SAP ERP 6.0 (606)

SP 14

EHP6 FOR SAP ERP 6.0 for HANA (616

- SAP HANA)

SP 08

EHP7 FOR SAP ERP 6.0(617)

SP 07

EHP8 FOR SAP ERP 6.0(618)

SP 02

SAP S/4HANA ON

-PREMISE 1511

SP 02

SAP Note 1175384

16

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

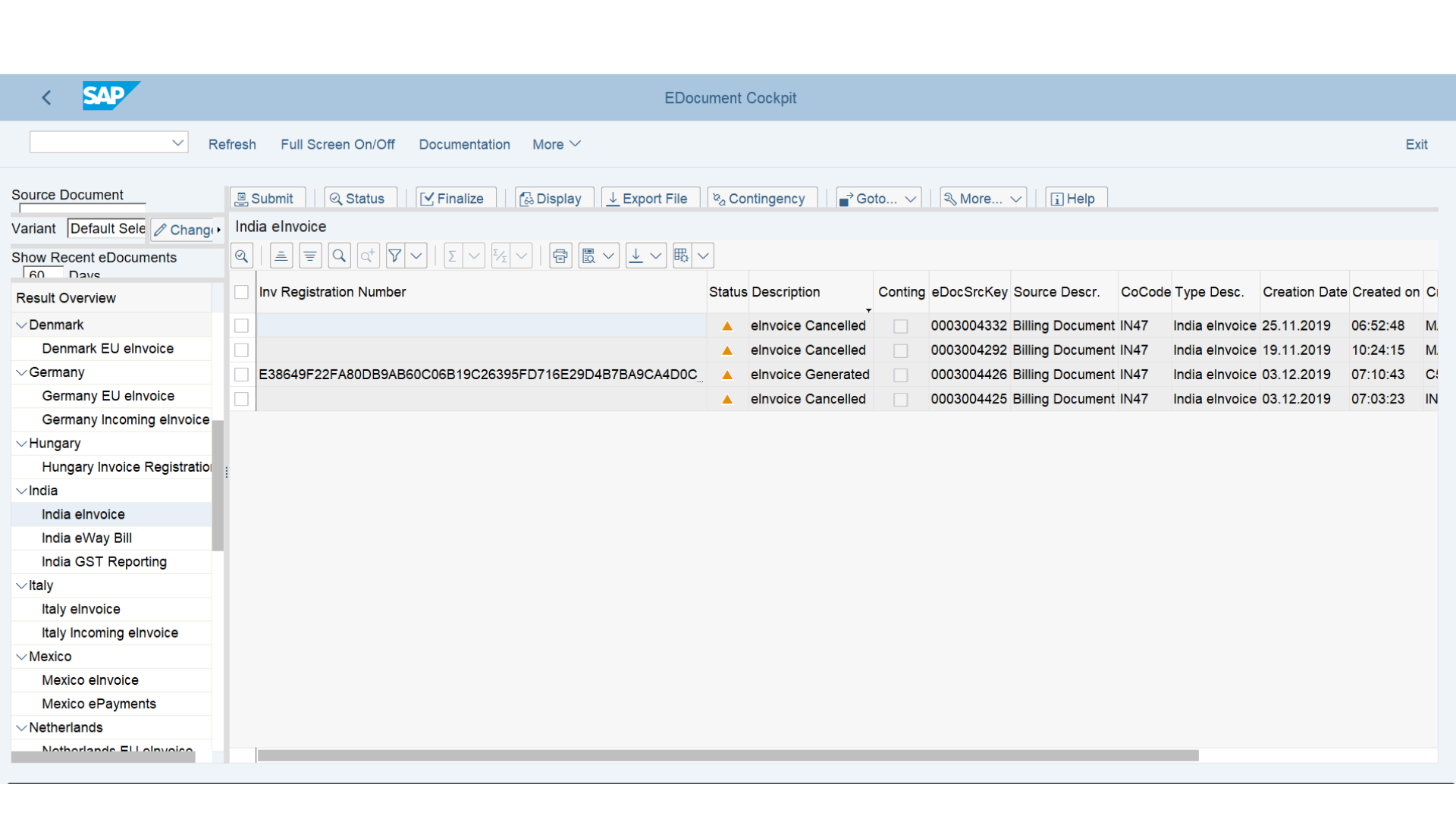

SAP eInvoice for India - SAP Document Compliance

17

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

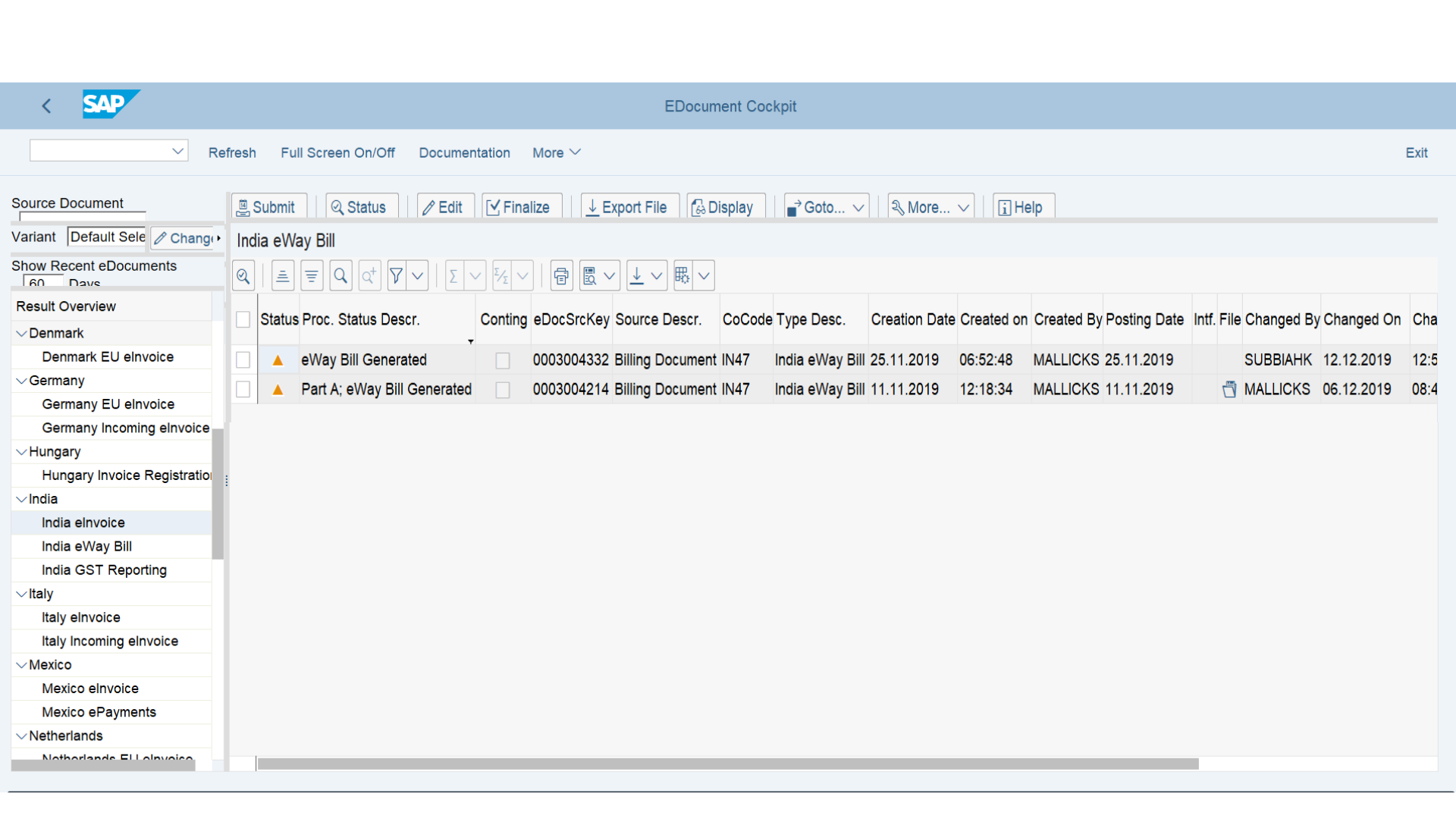

SAP eWay Bill Solution for India - SAP Document Compliance

18

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Roadmap

20

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

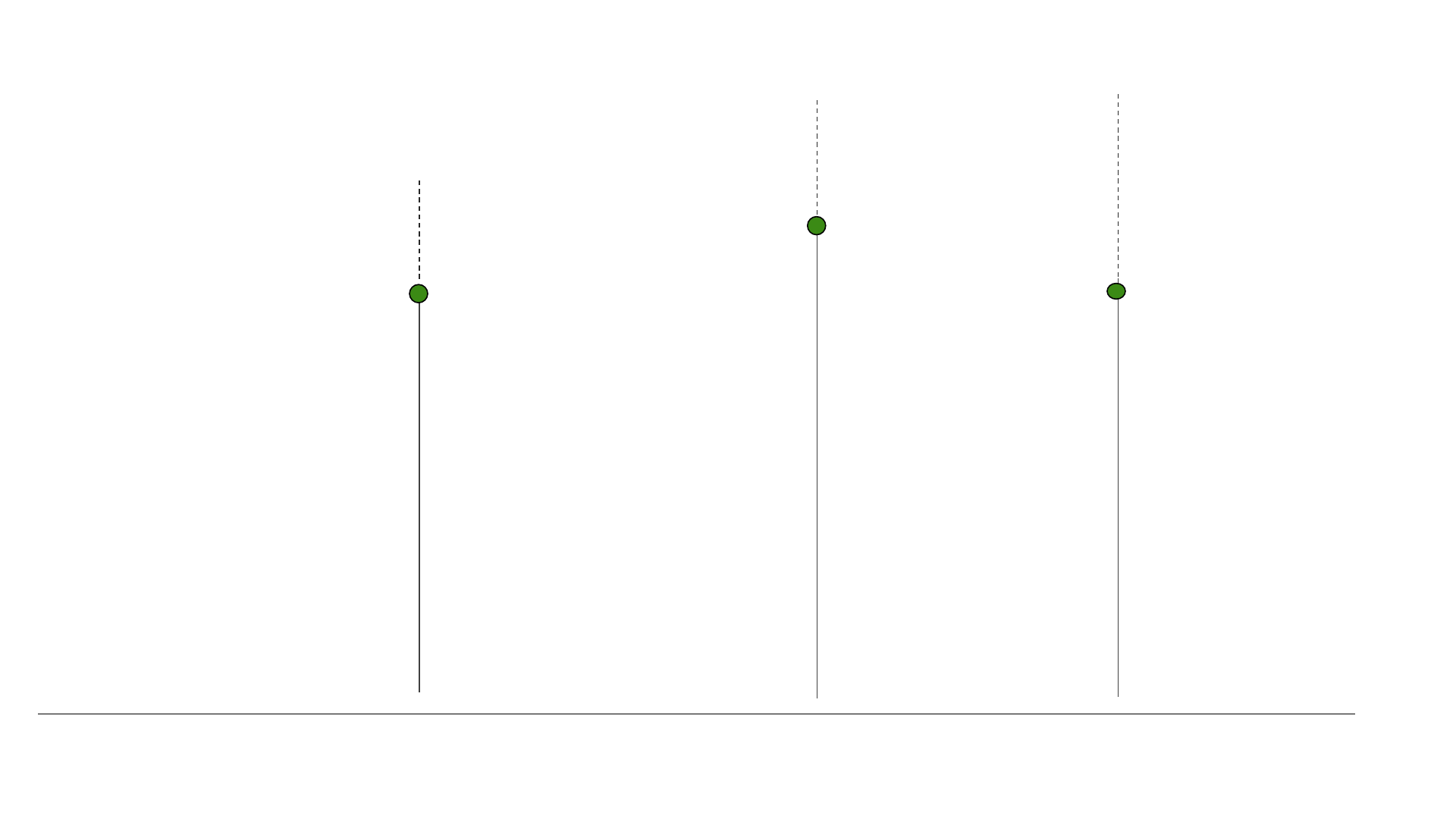

eInvoice (IRN) for India - Feature Roadmap

Q3/2019 Q1/2020Q4/2019

• eInvoice generation – Outward Supply

o Regular B2B Invoice, Exports with (or) without

payment

o Deemed export with (or) without payment

o Supplies to SEZ from DTA

o RCM B2B invoices created by the supplier

o Credit note by Supplier

• Real time update of response from IRP to SAP

o with IRN - Acknowledgement number & Date

o Digitally signed QR code

• Print of IRN and QR code in GST Invoice

• Audit Trial

• Outward reconciliation based on the status

• Cancellation of IRN

<https://launchpad.support.sap.com/#/legalchangenotification/NoteInforSet/jira

=GSCBIN-643/TwoColumnsMidExpanded/0>

Additional

Information

22

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

SAP eInvoice

Q4 – 2019 & Q1 – 2020 - Delivered (note #)

• eInvoice generation – Outward Supply

o Regular B2B Invoice, Exports with (or) without

payment

o Deemed export with (or) without payment

o Supplies to SEZ from DTA

o RCM B2B invoices created by the supplier

o Credit note by Supplier

• Real time update of response from IRP to SAP

o with IRN - Acknowledgement number & Date

o Digitally signed QR code

• Print of IRN and QR code in GST Invoice

• Audit Trial

• Outward reconciliation based on the status

• Cancellation of IRN

Q2 - 2020

• *Contingency mode – for uploading the response file for

eInvoice

• One step generation of eWay bill and eInvoice

• Capturing of IRN in Purchase invoices

• Vendor Return scenario.

• Generation of eInvoice as soon as the invoice created

using foreground transaction

Q3 2020

• Sending signed eInvoice in JSON format to Customer from

edocument cockpit (via eMail)

• Automated eInvoice solution in S4C – CE 2008

23

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

SAP eWay bill for India - Delivered

Q2 2019

Released on 12

th

June

• Auto-calculation of distance

based on Pin

• Enhancement in the validity

extension

Vendor Return

• Inward eWay Bill – Purchaser

reject (Get Status)

• Maintenance of API Version

1.03

• eWay bill generation

o Intra state STO

o With one time

Vendor

o Consulting note for

SKD/CKD

Q4 - 2018

Q1’ 2019

Q2 - 2018

• eWay bill generation

o Outward supply – Billing,

Exports & Subcontracting

o Inward supply – Imports

• Provision to capture the Part B

o Outbound delivery

o eDocument

o BADI

▪ eWay Bill

o Validity date extension

o Update the Transporter ID

o Cancellation

• GST health check – Data

validation

• Scheduler – Automatic generation

of eWay bill

• Variants – to view required report

• Common enrollment ID

(Transporter)

• Maintenance of API Version 1.02

& 1.03

• eDcoument – authorization control

• Provision to capture the Part B

• Mass update

• Get Part B from NIC to SAP

• Contingency mode – Download

the data from NIC and upload into

SAP using same excel format

24

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

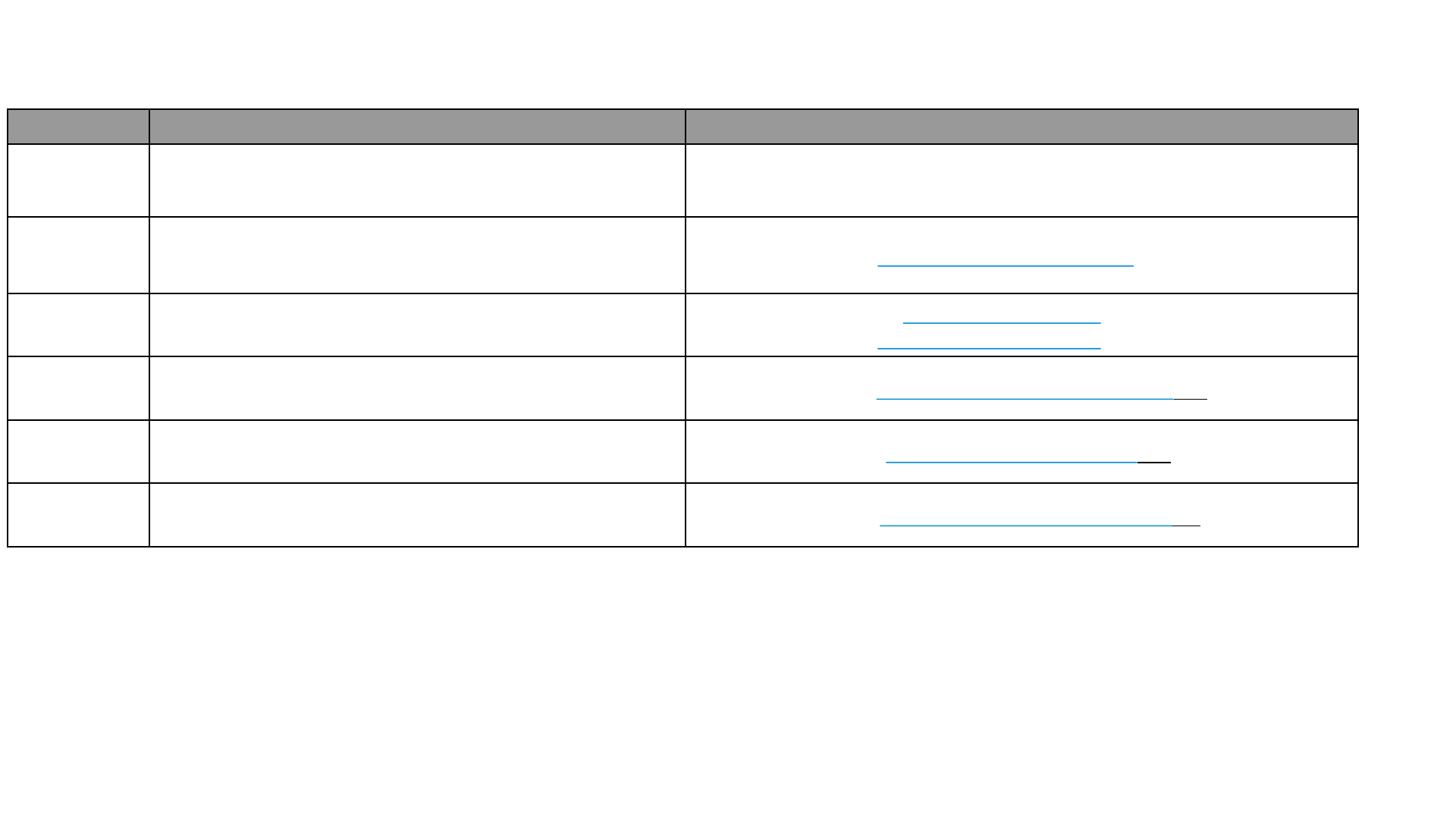

Certified GSP’s for eInvoice

Sr.no GSP Name Contact

1 Vayana Private Limited

Sanjay Phadke -> sanjay@vayana.in -> 9820339044

Manish Balani -> m[email protected] -> 8005644657

2 Excellon Software Private limited

Vinodkumar Tambi -> vinod@excellonsoft.com -> 94221 13491

Sachin Gandhi -> saching@excellonsoft.com-> 8411959030

3 Alankit limited

Sitesh Srivastava -> siteshs@alankit.com -> 9582200562

Deepak Sirohi -> deepaks1@alankit.com-> 95 82 200516

4 Masters India IT Solutions Private Limited Nishank Goyal -> nishankgoyal@mastersindia.co - > 9717700700

5 AdaequareInfo Pvt Ltd Naveen Mamidi -> nmamidi@adaequare.com- > 98660 12475

6 eMudhraTechnologies Ltd Venu Madhava -> venu.madhava@emudhra.com-> 9884302508

GSP – Goods and Services Suvidha Provider

GSTN - Goods and Service Tax Network

Plan to certify the same GSP’s for eInvoice only when the LIVE API available from GSTN

25

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Certified GSP’s for eInvoice & eWay bill

• Certified GSP’s Pre-delivered iflows between SAP cloud platform integration to GSTN via GSP’s

are developed, tested and certified by SAP

• Non certified GSP’s are supported and pre-delivered only the framework, so it required an

additional development for the iflows

The template iflow is already published in API Hub and can be accessed with SAP ERP

Integration with GST Suvidha Provider for India e-Invoice

GSP – Goods and Services Suvidha Provider

GSTN - Goods and Service Tax Network

Plan to certify the same GSP’s for eInvoice only when the LIVE API available from GSTN

SAP Note 2889709

© 2019 SAP SE or an SAP affiliate company. All rights reserved.

No part of this publication may be reproduced or transmitted in any form or for any purpose without the express permission of

SAP SE or an SAP affiliate company.

The information contained herein may be changed without prior notice. Some software products marketed by SAP SE and its

distributors contain proprietary software components of other software vendors. National product specifications may vary.

These materials are provided by SAP SE or an SAP affiliate company for informational purposes only, without representation or

warranty of any kind, and SAP or its affiliated companies shall not be liable for errors or omissions with respect to the materials.

The only warranties for SAP or SAP affiliate company products and services are those that are set forth in the express warranty

statements accompanying such products and services, if any. Nothing herein should be construed as constituting an additional

warranty.

In particular, SAP SE or its affiliated companies have no obligation to pursue any course of business outlined in this document or

any related presentation, or to develop or release any functionality mentioned therein. This document, or any related presentation,

and SAP SE’s or its affiliated companies’ strategy and possible future developments, products, and/or platforms, directions, and

functionality are all subject to change and may be changed by SAP SE or its affiliated companies at any time for any reason

without notice. The information in this document is not a commitment, promise, or legal obligation to deliver any material, code, or

functionality. All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ

materially from expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, and they

should not be relied upon in making purchasing decisions.

SAP and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered

trademarks of SAP SE (or an SAP affiliate company) in Germany and other countries. All other product and service names

mentioned are the trademarks of their respective companies.

See www.sap.com/copyright for additional trademark information and notices.

www.sap.com/contactsap

Follow us