PUBLIC

SAP Globalization Services, SAP SE

April 2021

SAP Document Compliance

Overview

Local solutions. Global success.

Globalization Services

2

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Disclaimer

The information in this presentation is confidential and proprietary to SAP and may not be disclosed without the

permission of SAP. This presentation is not subject to your license agreement or any other service or

subscription agreement with SAP. SAP has no obligation to pursue any course of business outlined in this

document or any related presentation, or to develop or release any functionality mentioned therein. This

document, or any related presentation and SAP's strategy and possible future developments, products and or

platforms directions and functionality are all subject to change and may be changed by SAP at any time for any

reason with-out notice. The information in this document is not a commitment, promise or legal obligation to

deliver any material, code or functionality. This document is provided without a warranty of any kind, either

express or implied, including but not limited to, the implied warranties of merchantability, fitness for a particular

purpose, or non-infringement. This document is for informational purposes and may not be incorporated into a

contract. SAP assumes no responsibility for errors or omissions in this document, except if such damages

were caused by SAP´s willful misconduct or gross negligence.

All forward-looking statements are subject to various risks and uncertainties that could cause actual results

to differ materially from expectations. Readers are cautioned not to place undue reliance on these forward-

looking statements, which speak only as of their dates, and they should not be relied upon in making

purchasing decisions.

Agenda

➢ Introduction

➢ Solution Overview

➢ Roadmap

➢ Useful Links

➢ Q&A

Document Compliance

Introduction

5

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

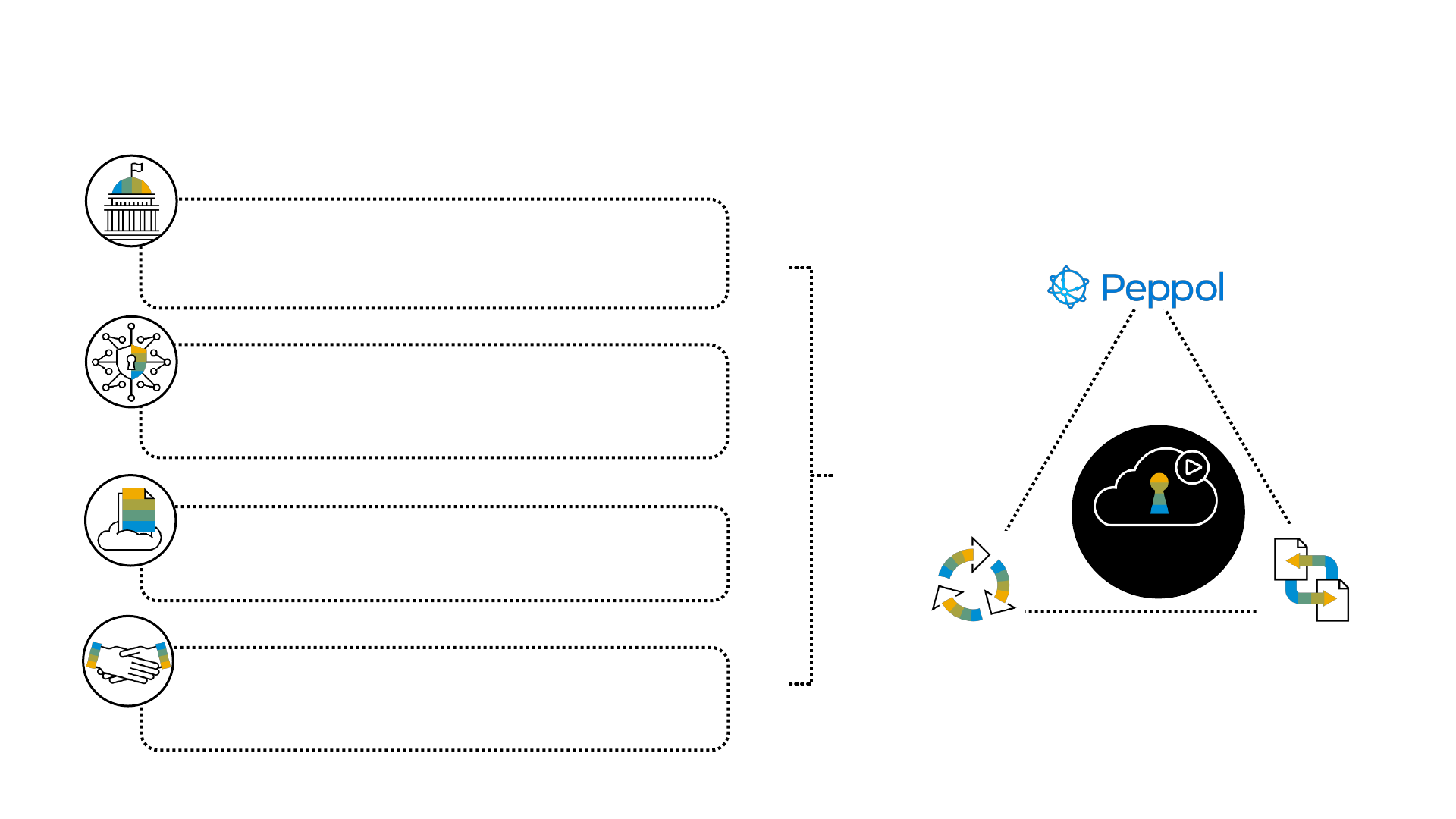

Customer Needs –

Compliance with on-line Exchange of Electronic Documents

compliance

Local Regulations

reimagine business process

fiscal control

minimize compliance risk

digitalization. tax administration.

savings in public procurement

Invoices & delivery notes & tax certificates &…

cost reduction

online

reporting

Business

Transactions

EU e-invoicing mandate

unified user

experience

Integration with the backend

(Business Suite or S/4HANA)

real-time

reporting

global coverage

6

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Explosion of Local Compliance Obligations

Governments worldwide are keeping pace with the evolving laws and governance frameworks

2014 20202011

2017

Denmark: B2G e-invoicing

Korea: E-tax

China: Golden tax interface

Brazil: E-invoicing (NFe)

Mexico: E-invoicing (CFDI)

Argentina: E-invoicing

Chile: E-invoicing

Chile: E-books

Chile: E-delivery

Peru: E-invoicing

Italy: B2G E-invoicing

Austria: B2G E-invoicing

Spain: B2G E-invoicing

Turkey: E-invoicing

Turkey: E-ledger

Slovenia: B2G E-invoicing

Hungary: Transport registration

Ecuador: E-invoicing

Uruguay: E-invoicing

Colombia: E-invoicing

Croatia: B2G E-invoicing

Czech Republic: Cash invoice registration

Slovenia: Cash invoice registration

Mexico: E-payroll

Spain: Real time reporting (SII)

Peru: E-tax certificates

India: GST reporting

Belgium: B2G E-invoicing

Netherlands: B2G E-invoicing

France: B2G E-invoicing

Turkey: E-delivery

Turkey: Export registration

Hungary: E- invoice registration

India: E-delivery (eWayBill)

Mexico: E-payment

Australia: E-payroll (Single Touch Payroll)

Australia: E-invoicing

New Zealand: E-invoicing

Singapore: E-invoicing

UK: Making Tax Digital

Italy: B2B E-invoicing

Sweden: B2G E-invoicing

Norway: B2G E-invoicing

Kazakhstan: E-delivery

Costa Rica: E-invoicing

Panama: E-invoicing

Paraguay: E-invoicing

Dominican Republic: E-invoicing

New Zealand: E-payroll (Payday reporting)

Greece: E-books

Greece: E-delivery

Greece: E-payroll

Greece: B2G E-invoicing

Italy: E-ordering

Chile: E-factoring

Argentina: E-factoring

Germany: B2G E-invoicing

Taiwan: E-invoicing

Poland: B2G E-invoicing

Portugal: B2G E-invoicing

Bulgaria: Cash invoice registration

India: Invoice registration

Vietnam: E-invoicing

7

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Motivation - Digital transformation driven by authorities

Detect VAT leakage

▪ B2B / B2C (cash)

transactions

▪ National / Foreign

transactions

Curb shadow economy

▪ Transaction controls beyond

e-invoices

Tax revenue

management

Analytics (forecasts,

predictions, statistics)

Public procurement

Process efficiency

▪ Automation

▪ Spend management

▪ Interoperability

▪ SME support

▪ Multiple document types

Financing

Digital

Government

Efficiency

Business

Benefits

Tax

Compliance

8

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

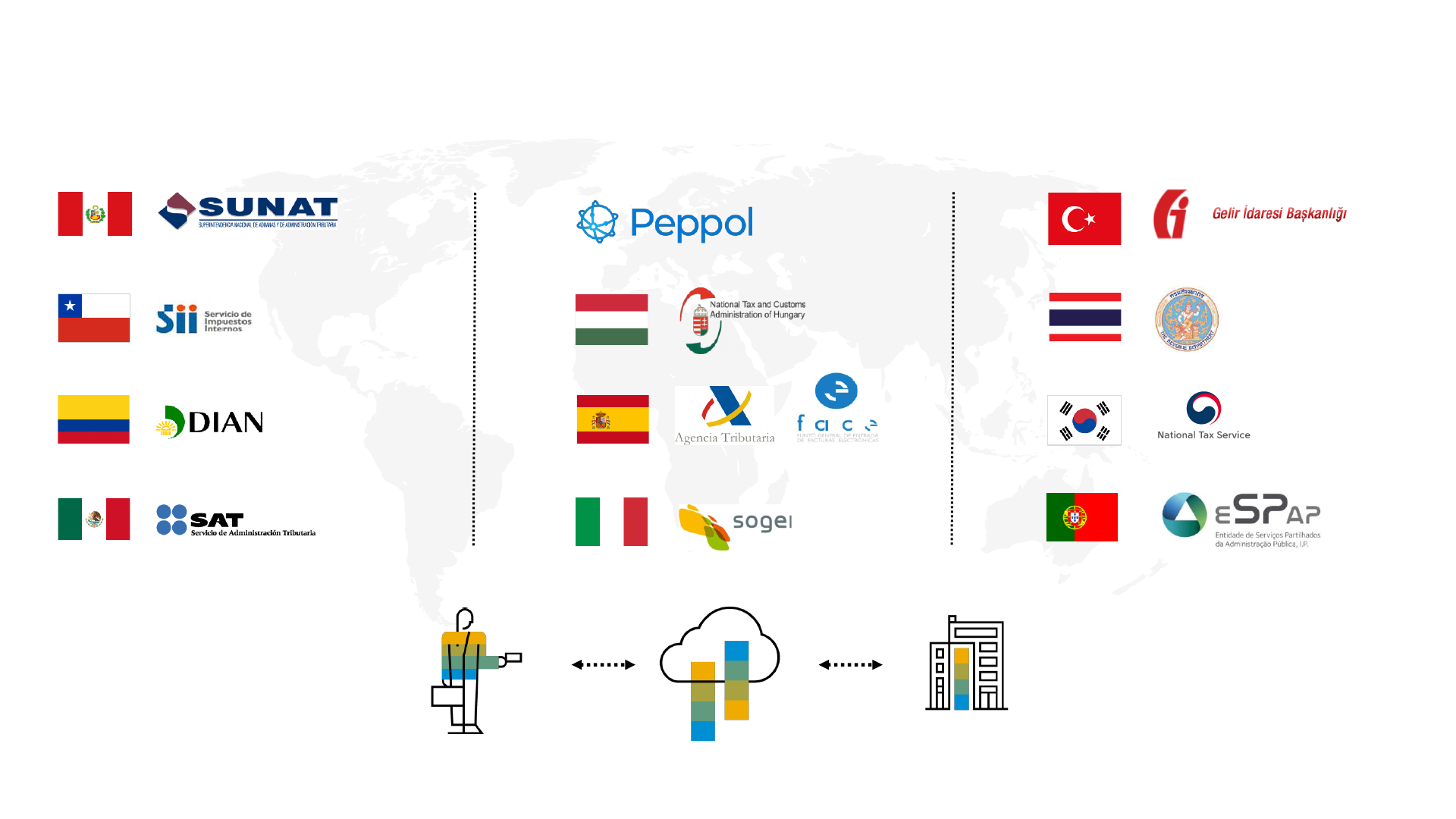

Mexico

▪ Customer invoice

▪ Payment receipt

▪ Delivery Note

Peru

▪ Customer invoice

▪ Consumer invoice

▪ Withholding tax certificate

▪ Collection tax certificate

Chile

▪ Customer invoice

▪ Supplier invoice

▪ Consumer invoice

▪ Delivery note

▪ Ledgers

▪ Credit Invoice (Factoring)

Colombia

▪ Customer invoice

▪ Supplier invoice

Brazil

▪ Customer invoice

▪ Supplier invoice

India

▪ Transport Registration

▪ Customer Invoice

Taiwan, China

▪ Customer invoice

▪ Consumer invoice

Thailand

▪ Customer Invoice

South Korea

▪ Customer invoice

▪ Supplier invoice

Singapore

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

Italy

▪ Customer invoice

▪ Supplier Invoice

Denmark

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

Portugal

▪ Customer invoice

Belgium

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

Hungary

▪ Transport registration

▪ Invoice Registration

Spain

▪ Customer invoice

▪ Tax Register Books

Turkey

▪ Customer invoice

▪ Consumer invoice

▪ Supplier invoice

▪ Export registration

▪ Transport registration

Netherlands

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

Sweden

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

Norway

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

Germany

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

▪ Customer invoice via e-mail (ZUGFeRD)

Greece

▪ Tax Register Books

Austria

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

Ireland

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

Poland

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

SAP Document Compliance – Local Versions

55 Scenarios in 26 Countries (SAP S/4HANA)

Australia

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

New Zealand

1

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

France

1

▪ Customer invoice via Peppol

▪ Supplier invoice via Peppol

1

This is the current stand of planning and can be changed by SAP without notice.

9

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Digital Compliance – Diversity of Local Requirements (examples)

Receiver

Sender

Solution Overview

11

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

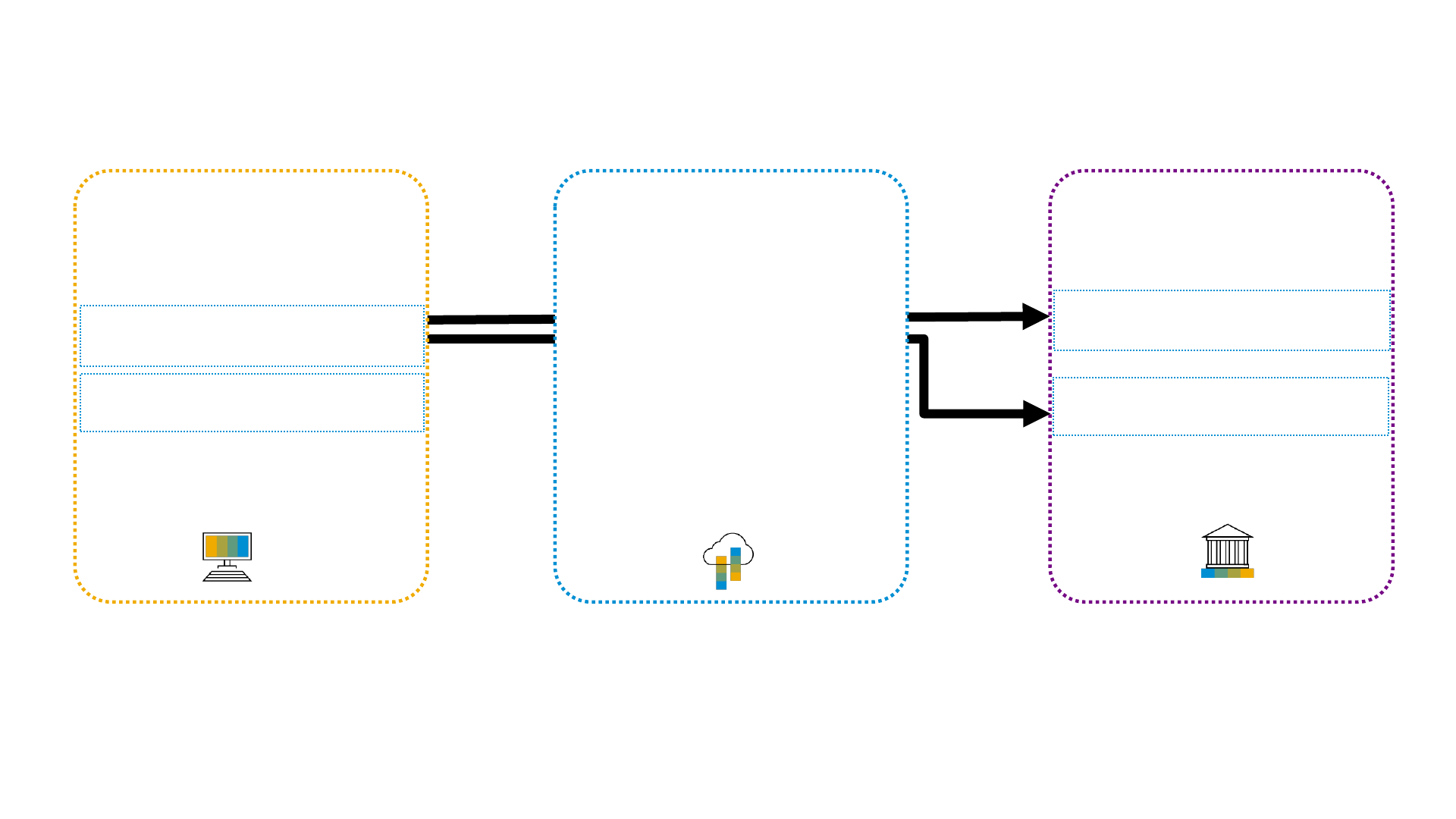

SAP Document Compliance is a global solution to address local

requirements mandating the submission of electronic documents to

authorities or business partners.

Local versions follow one of the following deployment models:

▪ PaaS Solutions

– Based on SAP Document Compliance, on-premise edition and SAP

Cloud Platform Integration to cover e-invoicing and real-time reporting

requirements in multiple countries

▪ SaaS Solutions

– SAP Document Compliance, cloud edition provides the ability to send

and receive fully compliant invoices based on the Peppol and ZUGFeRD

standards

– SAP Document Compliance, outbound invoicing option for Brazil &

inbound invoicing option for Brazil provide the ability to send / receive

and further process fully compliant Nota Fiscal documents in Brazil

What is the solution about?

12

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Direct link to Tax Office /

Business Partner

• No 3

rd

party required

• End-to-end security

• Semantic consistency among SAP DC,

LO, SD, FI and legal report

representations.

No Interfaces

• Integral part, automatic and silent

component of SAP S/4 HANA, SAP

ERP and industry solution.

• Full automation, real time

Far more than invoicing…

• Comprehensive, dynamic,

everchanging

• For any compliance process

• Extensible y configurable

Solution Approach

13

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

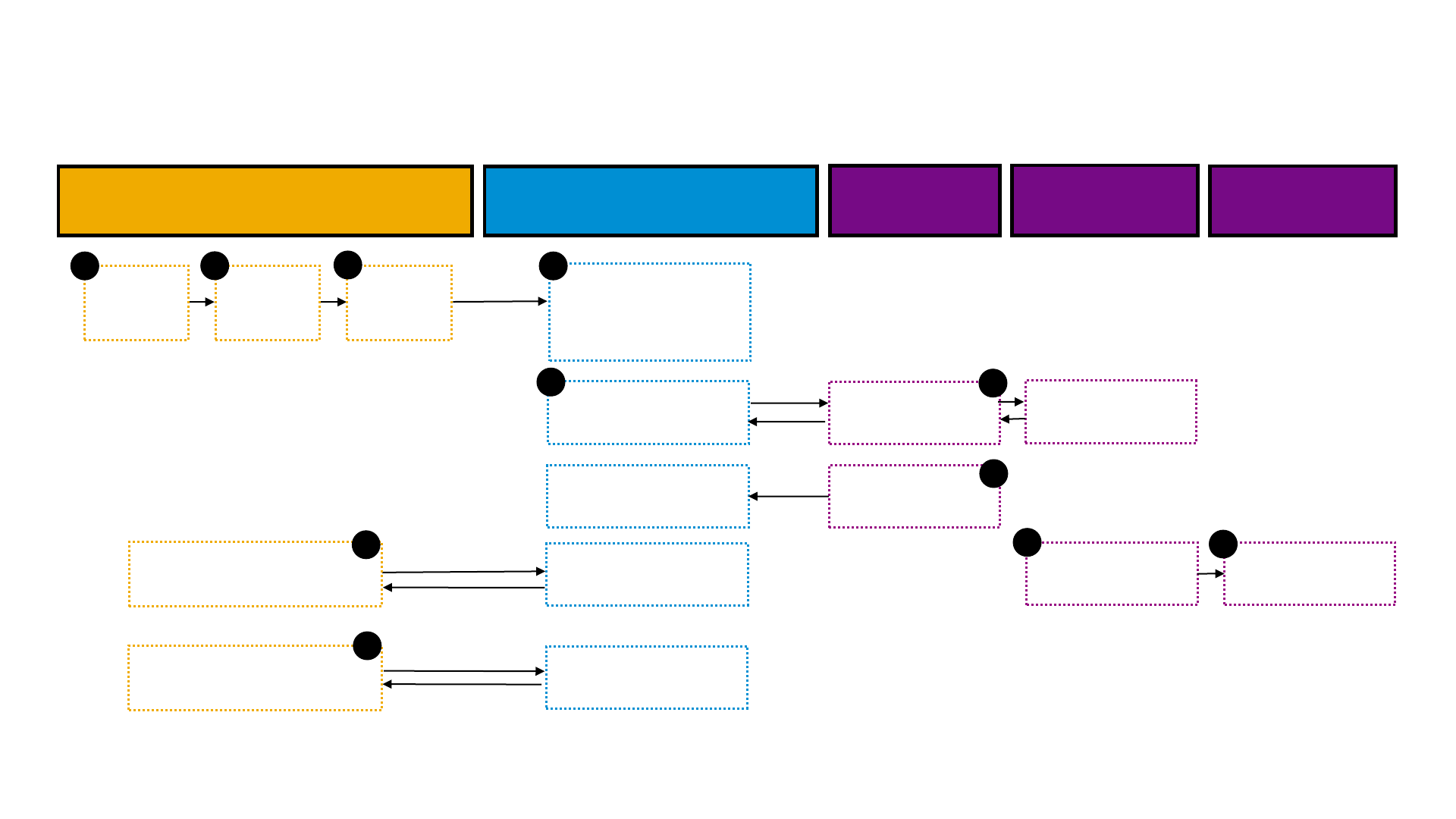

SAP Document Compliance

A Combination of an Open Compliance Framework + Library of

predefined country specific processes.

Open Framework

Library of predefined

processes

14

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Standardization

• Strong framework with

reusable components

• Multiple solutions can

be implemented in

parallel.

• No disruption among

solutions

Security from Design

• SAP Cloud Platform

Integration developed to

comply with highest

security requirements for

- Governments

- Financial Service

Providers

- Customers

Business Process

Integration

• “Source Document”

Concept

• Seamless integration

end-to-end.

Governance per-se

• Openness

• Direct Integration with

ecosystem

• End-to-end Monitoring

• High level of security

granularity

Rationale behind SAP Document Compliance

15

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

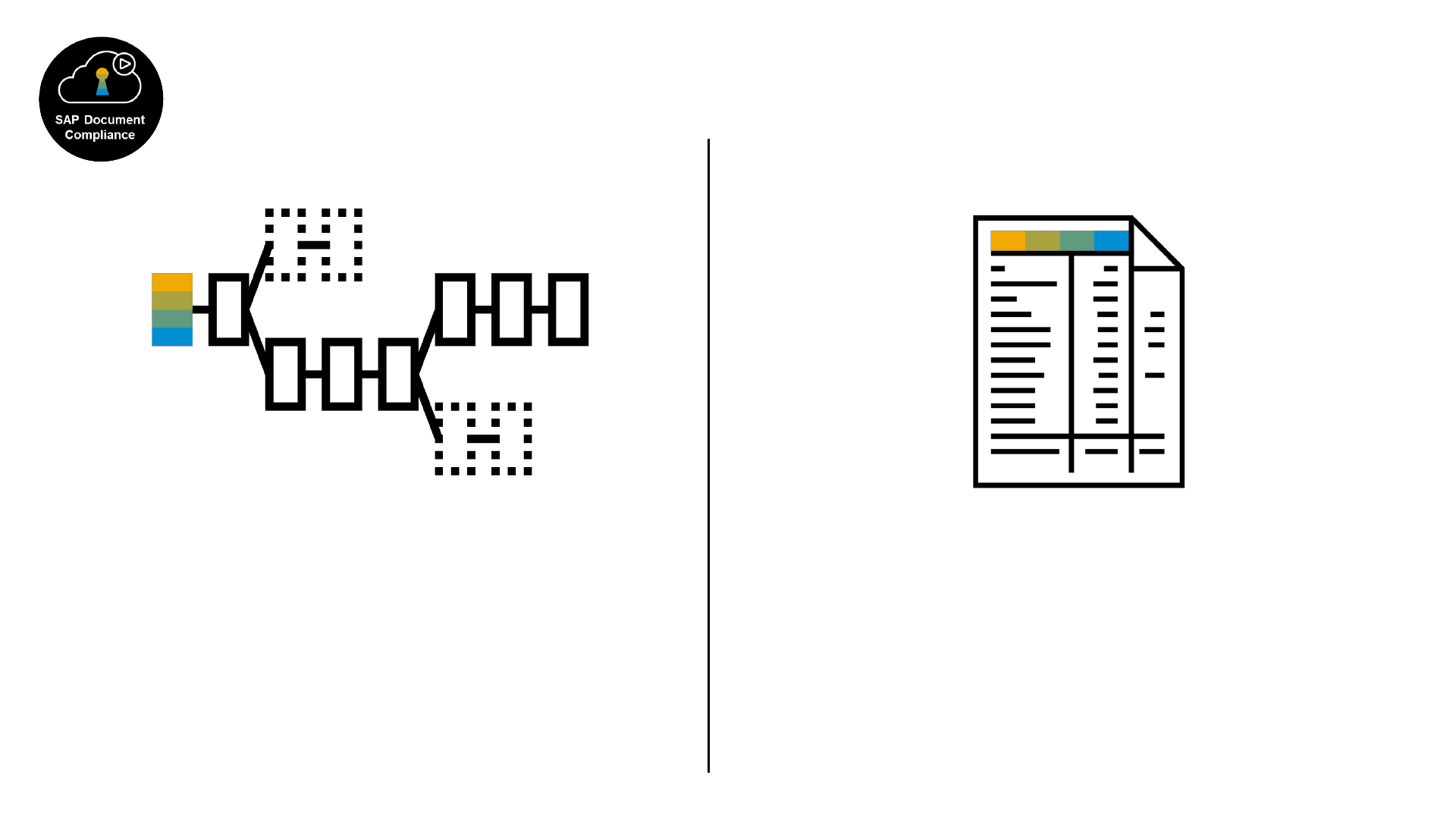

Document (e.g. “Peru Credit Note”)

• Mostly XML files exchanged in the context of a process.

• Are generated from a “Source Document” concept,

provided from framework level, e.g.: SD/FI Document,

FI Document, Shipment, Goods Issue, SII Document,

etc…

Processes (e.g. “Spain Bundle Processing”)

• How the execution will happen, including actions,

eventual errors and “variations” during the execution.

• Processes could be registrations, approval, updates,

etc..

Architectural components: flexibility + reusability

16

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

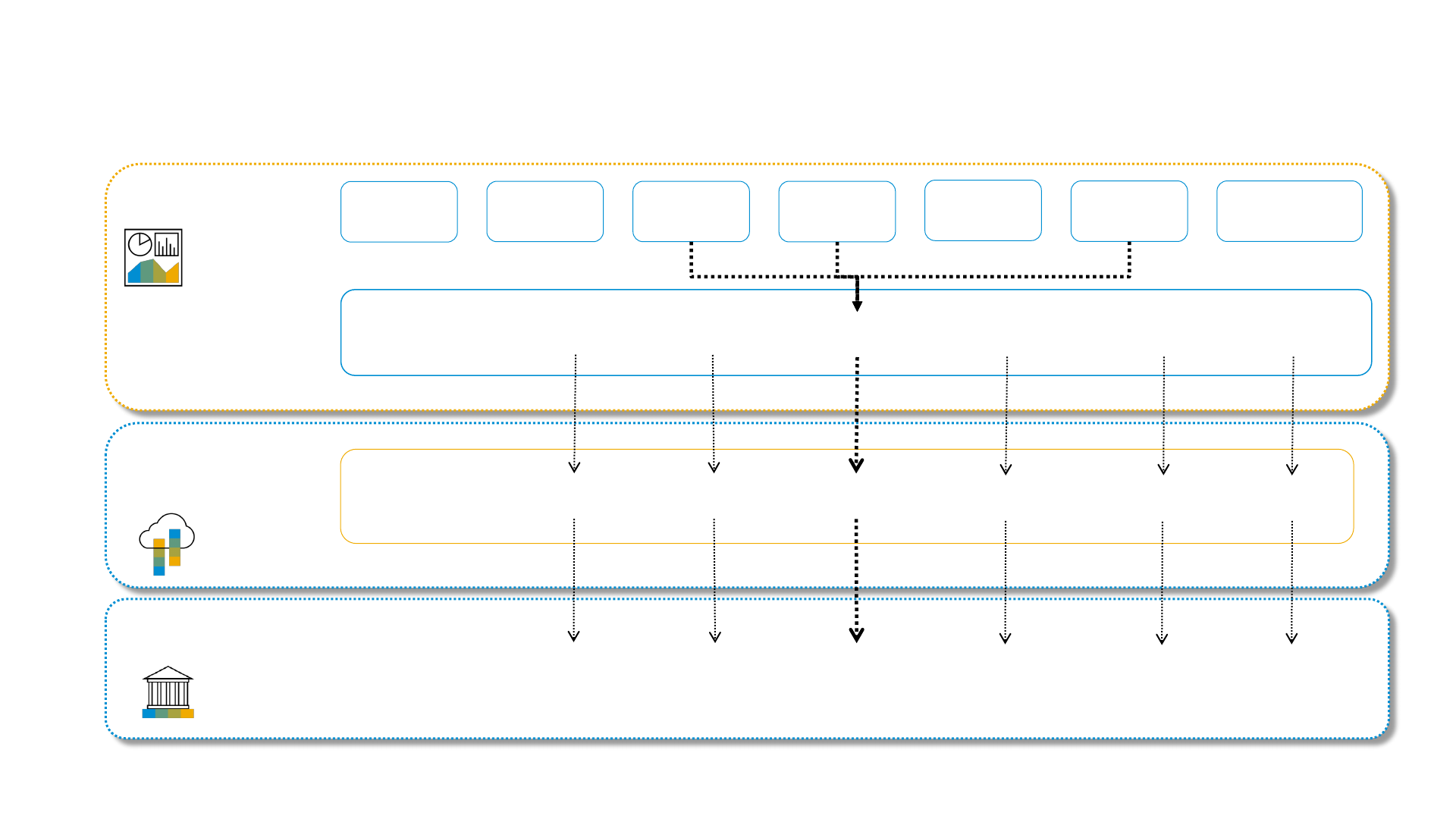

Comprehensive

Operations and

Monitoring

• Central “Cockpit”

• Single Access point

• UI-Navigation to

Business process

Process Auditing

• Full electronic

document history:

Users, date, time,

details, content if

available, approvals

and rejections.

Full Process

Automation

• Communications

• Error handling

Documentation Storage

and Archiving

• Save all send and

received documents

• Signatures

• Archiving

Framework Features Overview at a Glance – 1 / 2

17

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Multi-Compliance

• Run multiple

Compliance

processes for the

same transaction

• Generate several

different documents

for one transaction.

Multi-Level Grouping

• Allows transactional

integration as well

as packed-based

integration

• Navigation among

levels.

• Nesting of

processes

SAP Business Process

Integrations

• Compliance

processes run

silently among SAP

S/4HANA

transactions

Metadata Driven

Process configuration

• Process flow

managed by

configuration tables

Framework Features Overview at a Glance – 2 / 2

18

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

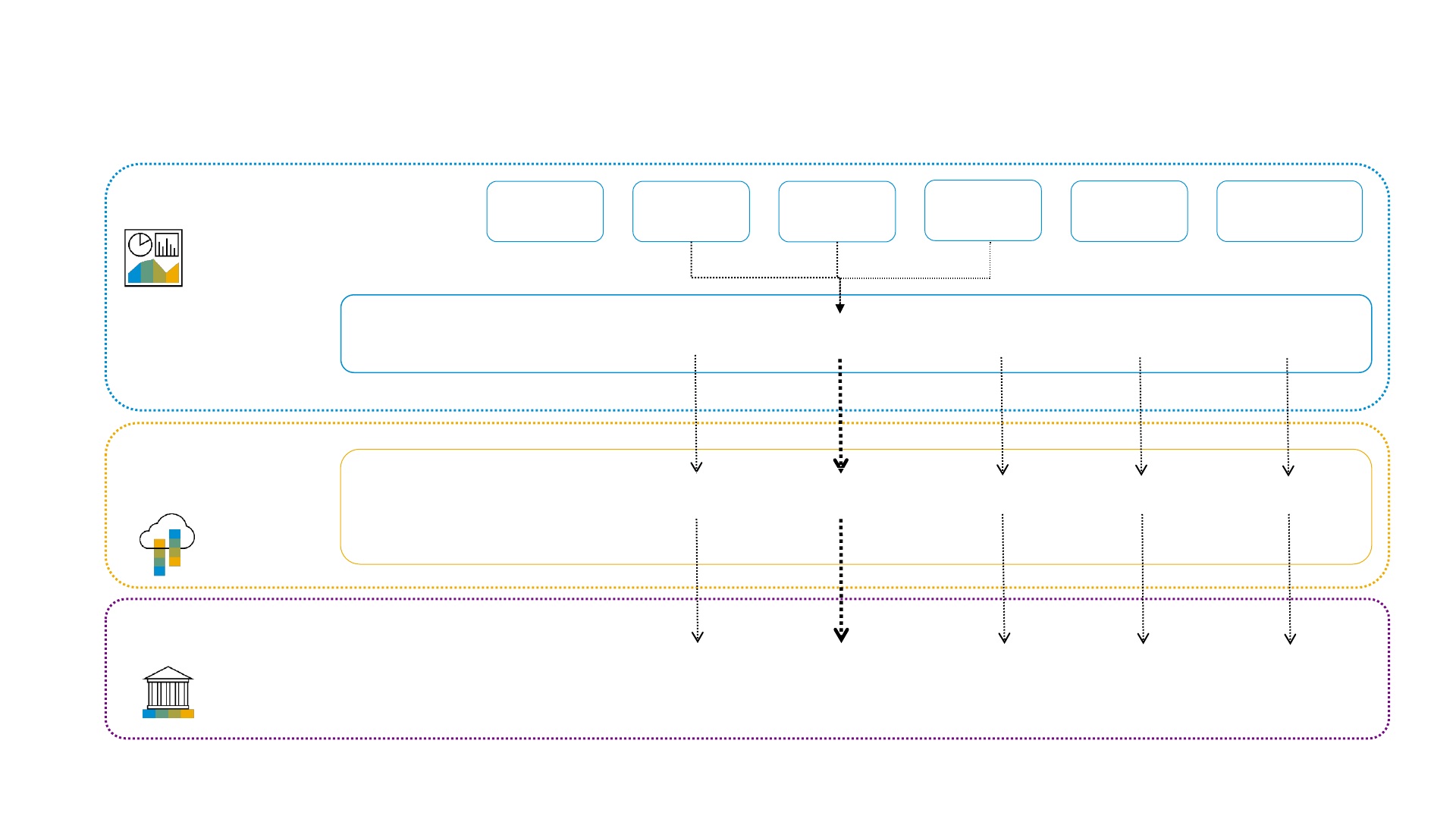

Compliance

Processes for a

Country

A Sample

Compliance Process

Actions dynamically determined for the Compliance process

• SAP Document Compliance works in a fully automated

way without human interaction (including retries and

notifications).

• The Cockpit is a tool that allows process analysis,

audit, navigation to Business doc, visualize the

technical representation, etc...

SAP Document Compliance

PaaS Solutions

20

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

• Local Format Mapping

• Business Monitoring

• Communication

• Authentication/Digital Signature

• Validation

• Approval/Registration

Solution Landscape – Document Compliance Scenarios

Recipient

SAP Integration SuiteSAP ECC or S/4HANA

SAP APPL 6.05

SAP Netweaver 7.02

Local Version A

Local Version B

Integration Flow

Document Type 1

Document Type 2

21

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Recipient

SAP Cloud

Platform

Suite

SAP Cloud

Platform

Integration

SAP Document

Compliance,

on-premise edition

Chile

Peru

SII

SUNAT FACe

Spain

DTE

Peruvian

UBL

Facturae

…

Italy

Hungary

Solution Architecture – SAP Document Compliance

on-premise edition + SAP Cloud Platform Integration

SD Del GI SD Bill

FI

IS-U

Real

Estate

MM returned

invoice

SII

Fattura

PA

…

…

EKAER

NAV

Legal

Reports

22

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

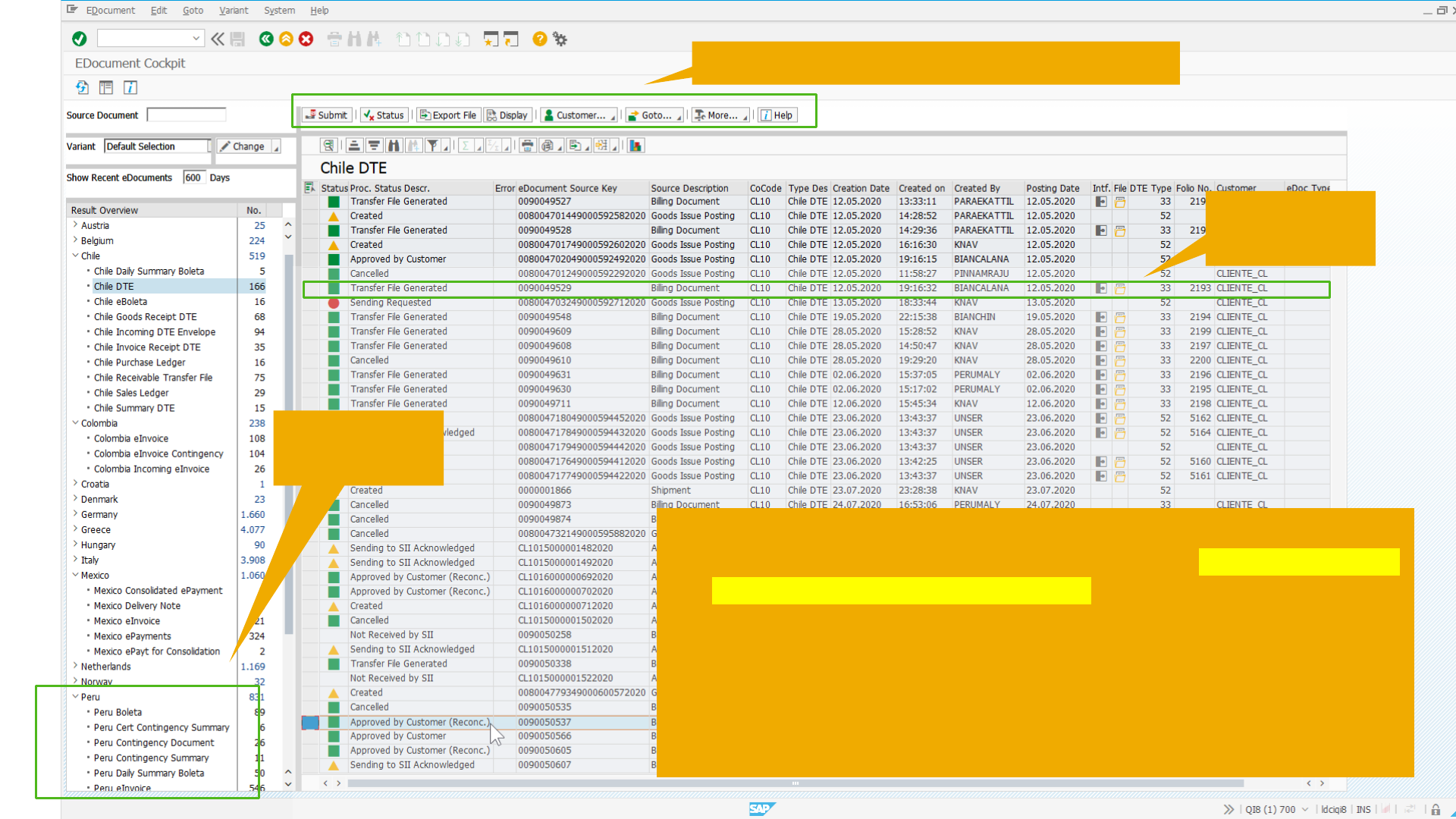

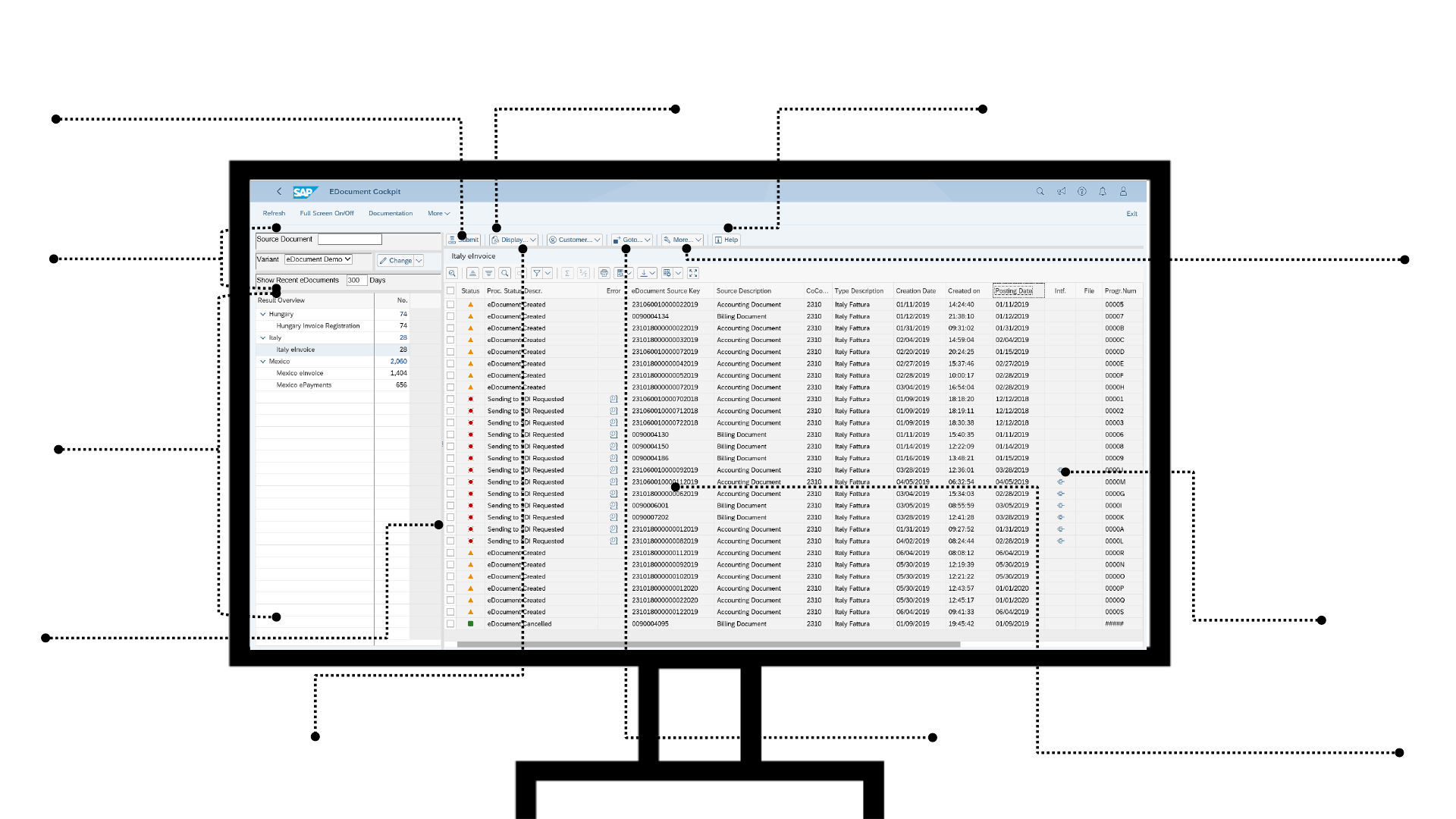

Key Product Features – eDocument Cockpit

Central monitor for

all scenarios

Only authorized

processes are

displayed

Selection variants

including filter by

source data

Navigate back to source document

Display eDocument history

Application Log

Submit / Resubmit

View / Export file

Information about the

selected process

PDF generation (XML-

based)

Batch & List

handling

- Switch to

contingency

- Import data from

non-SAP systems

- Send to customer

- Accept/Reject

- Cancel/Delete

Navigate to

interface monitor

Further local

capabilities:

23

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

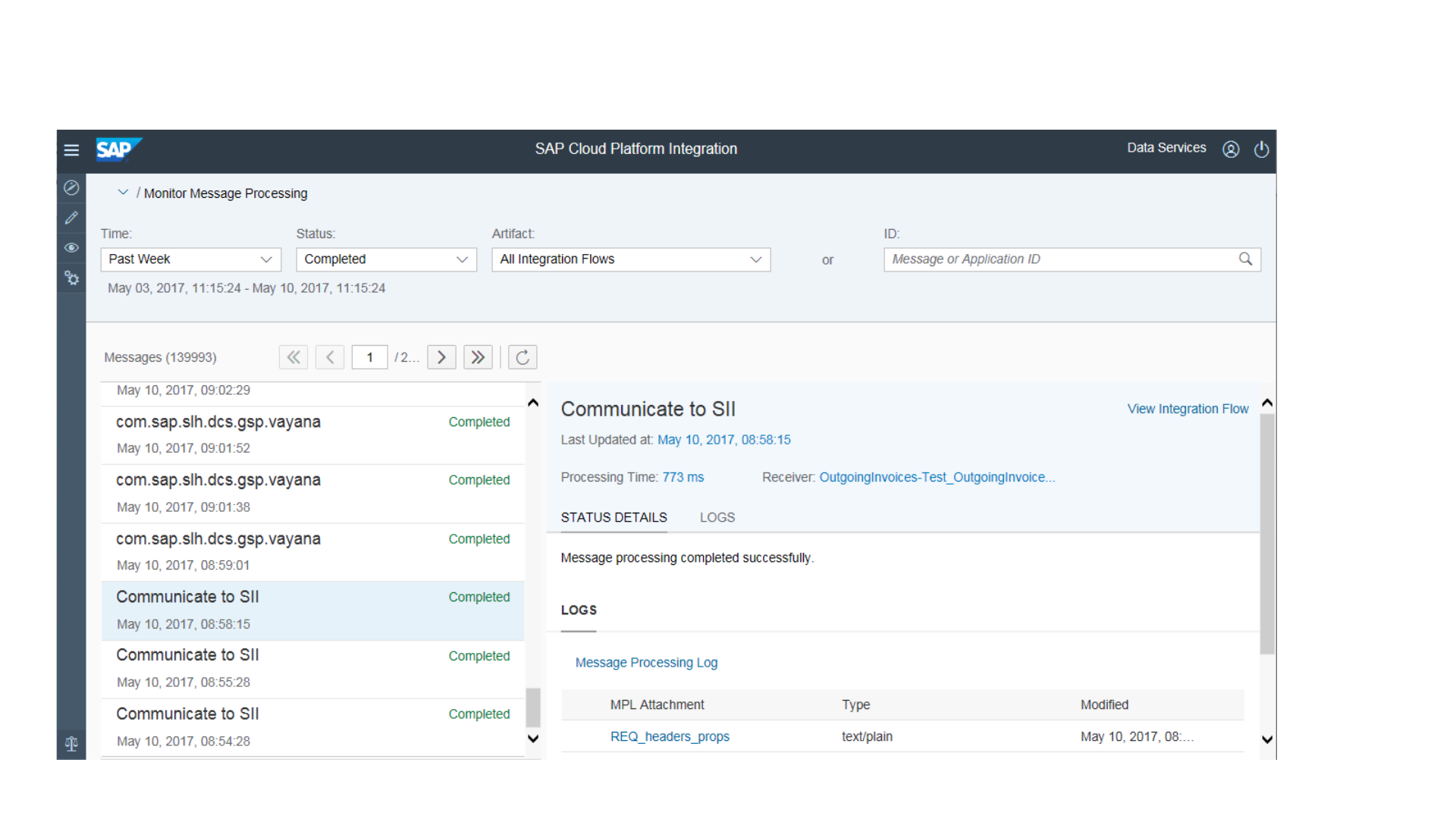

SAP Cloud Platform Integration

24

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

SAP Cloud Platform Integration

25

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Example Italy

Three Corner Model – Sender and Receiver Connect to a Central System

1

3

2

Receiver

SdI

(Sistema di

Interscambio)

Sender

✘

26

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

SAP Document Compliance for Italy – Customer Invoice (Outgoing)

XML

Notification

Get Notification

Delete Confirmation

Delete Notification

Post SD/FI

Document

1

Create

eDocument

Submit

eDocument

2

3

Sdl

Receiver

Service Provider

Receiver

SAP Cloud Platform Integration

Data Reception

Validations

XML Completion

Digital Signature *

Store Notification**

Return Notifications

Delete Notifications

Confirm Deletion

Get Invoice Notification and

Update eDoc

*

Delete Notification

*

Invoice

4

5

SAP ERP

Process

Process

Send Notification

Send to Receiver

Process

7

8

9

6

• *Access to a cost-free signature service

provided. Special terms of use apply.

• **invoice and notification are held in a

data store until picked up, the recipient

delete the entries from the data store after

successful receipt

27

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

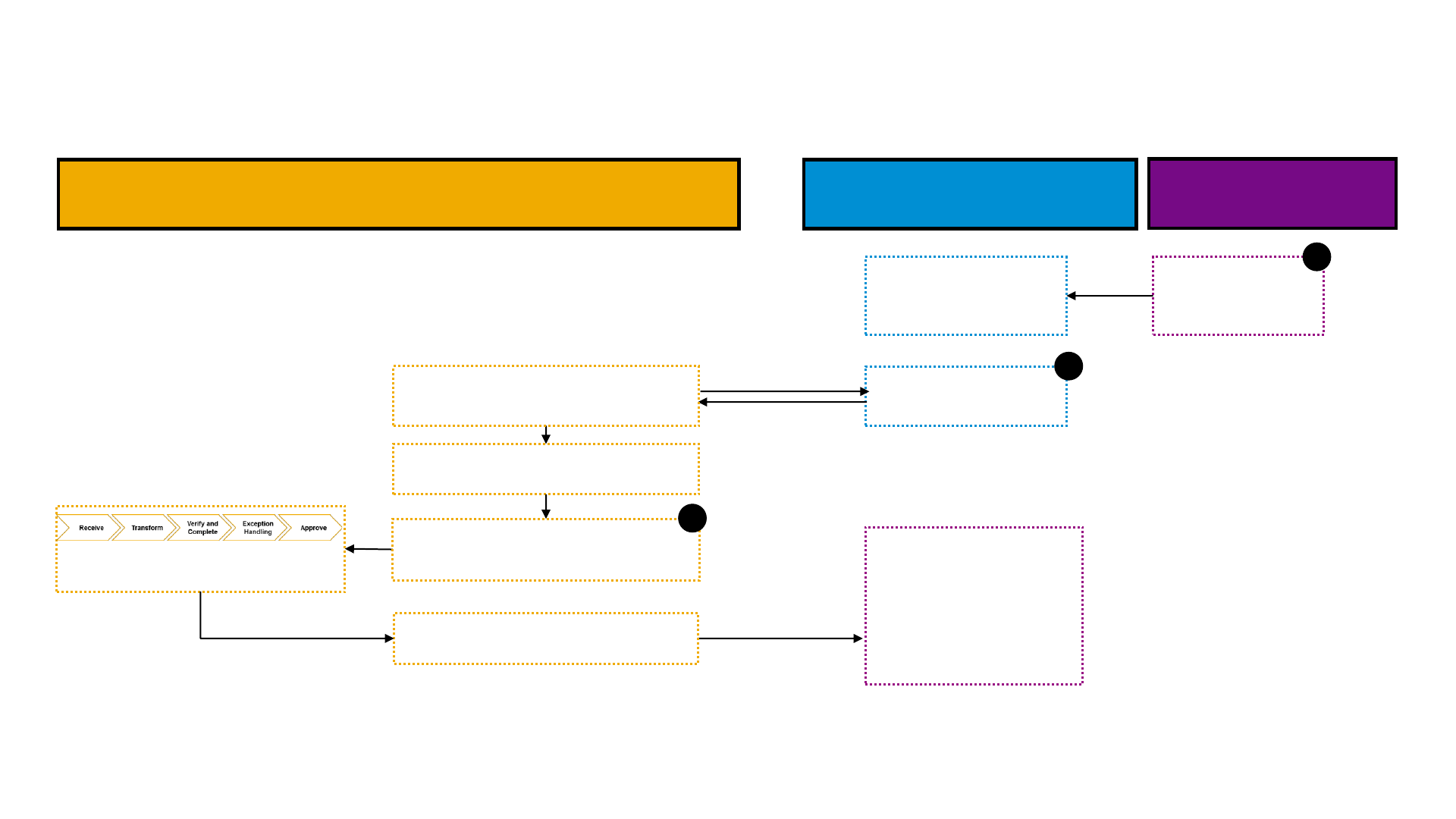

SAP Document Compliance for Italy – Inbound Invoice Processing via

SAP Invoice Management by OpenText

Sdl

SAP Cloud Platform Integration

Validations

Store Data

Process Invoice Request

Invoice matching, verification and

approval

2

SAP ERP

Send Invoice

1

Get Invoice

Get Invoice

FatturaPA

Create eDocument

Accept / Reject Notification

Trigger Invoice Management

3

FatturaPA

Process Notification:

For B2G: Accept / reject

generates a notification

For B2B: Only reject is

possible, this generates an

email.

Disclaimer

This presentation and SAP’s strategy and possible future developments are subject to change and may be changed by SAP at any time for any reason and without notice. This document is

provided without a warranty of any kind, either express or implied, including but not limited to the implied warranties of merchantability, fitness for a particular purpose, or noninfringement.

SAP Document Compliance

SaaS Solutions

29

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

SAP Document Compliance is a global solution to address local

requirements mandating the submission of electronic documents to

authorities or business partners.

Local versions follow one of the following deployment models:

▪ PaaS Solutions

– Based on SAP Document Compliance, on-premise edition and SAP

Cloud Platform Integration to cover e-invoicing and real-time reporting

requirements in multiple countries

▪ SaaS Solutions

– SAP Document Compliance, cloud edition provides the ability to send

and receive fully compliant invoices based on the Peppol and ZUGFeRD

standards

– SAP Document Compliance, outbound invoicing option for Brazil &

inbound invoicing option for Brazil provide the ability to send / receive

and further process fully compliant Nota Fiscal documents in Brazil

What is the solution about?

30

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Public Buyers must accept and process electronic invoices according to the European Standard

on electronic invoicing that includes:

Peppol Exchange service

Regulatory Background: Directive 2014/55/EU on B2G Invoicing

Obligation for Suppliers

• Several countries have chosen to define

tighter rules making e-invoicing

mandatory for Suppliers

• This is the case for example in Italy,

Netherlands, Germany and Spain

Obligation for contracting authorities

• Contracting authorities must be able to

receive and process e-invoices according

to the approved standards

• A semantic data

model (aligned

content of the

invoice)

• A list of agreed

syntaxes (defining

the technical

structure of the

invoice)

• A recommendation

for the

transmission of e-

invoices to Public

Buyers: Peppol

31

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Peppol – a global infrastructure for the exchange of electronic documents

The service determines

the receiver endpoint

dynamically

Exchange between a

sending and a

receiving Access Point

SAP Solutions

In numerous European and non-European countries,

Peppol is the selected infrastructure for the

electronic exchange of business documents.

The endpoint is determined within the infrastructure

defined by Peppol

The use of Peppol is often driven by but not

restricted to B2G exchanges. It can also be used for

B2B transactions between private companies.

Electronic documents are sent and received through

registered service providers.

32

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

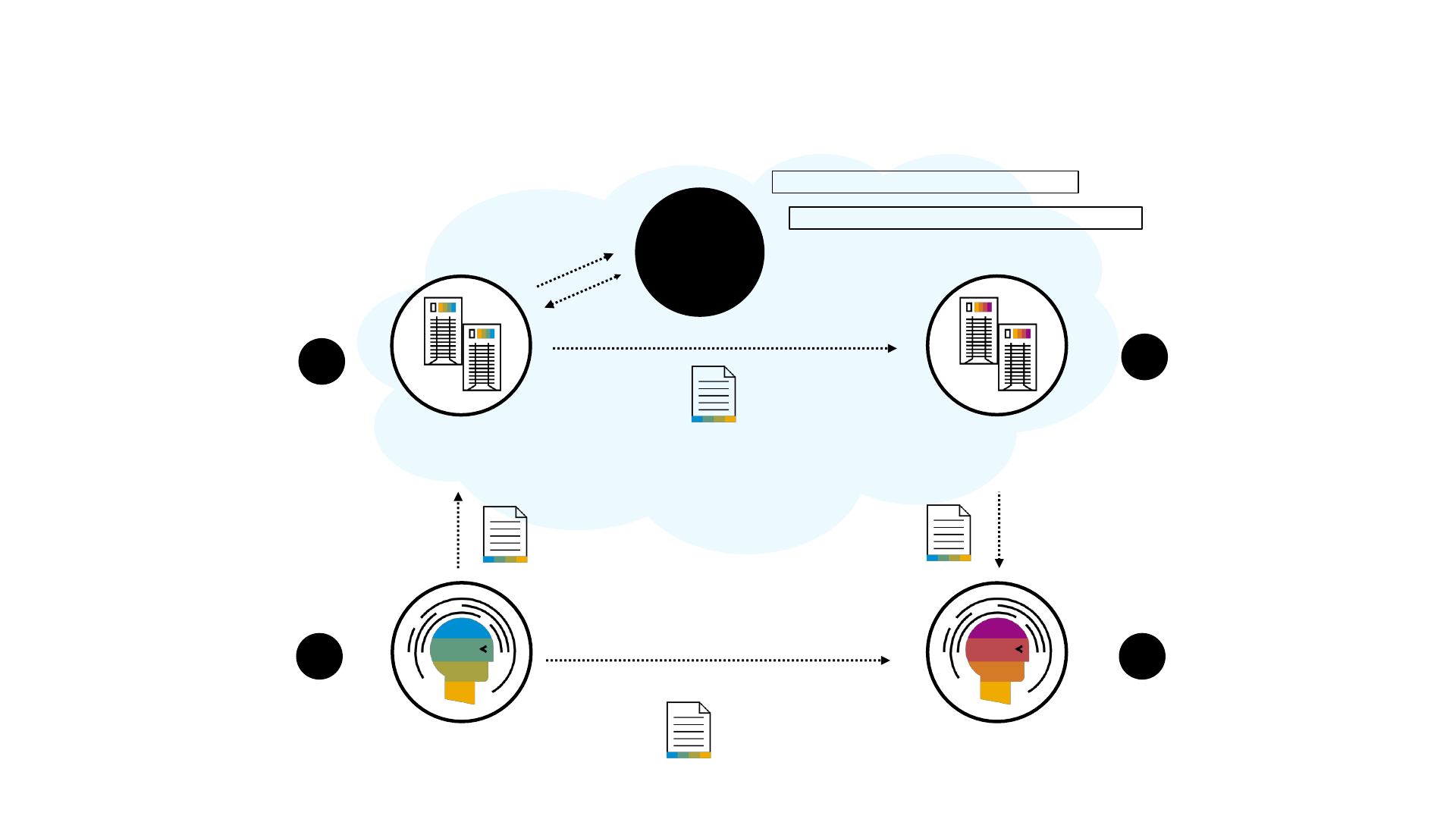

Four Corner Model – Sender and Receiver Connect to a Service Provider

1 4

2

Receiver

Sender

Peppol

Infrastructure

3

Sender

Access Point

Receiver

Access Point

SML – Service Metadata Locator

SMP – Service Metadata Publisher

✘

33

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Solution Architecture – SAP Document Compliance

Peppol Exchange service

Recipient

SAP Cloud

Platform

Suite

SAP Document Compliance,

cloud edition

Connector for

SAP Document Compliance

Germany

Netherlands

Peppol-UBL

Business

Partner

Belgium

SD Del GI SD Bill

FI

IS-U

Real

Estate

MM returned

invoice

Business

Partner

Business

Partner

xRechnung-UBL

SI-UBL

EFH3

Business

Partner

Norway

Svefaktura

Business

Partner

Sweden

34

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

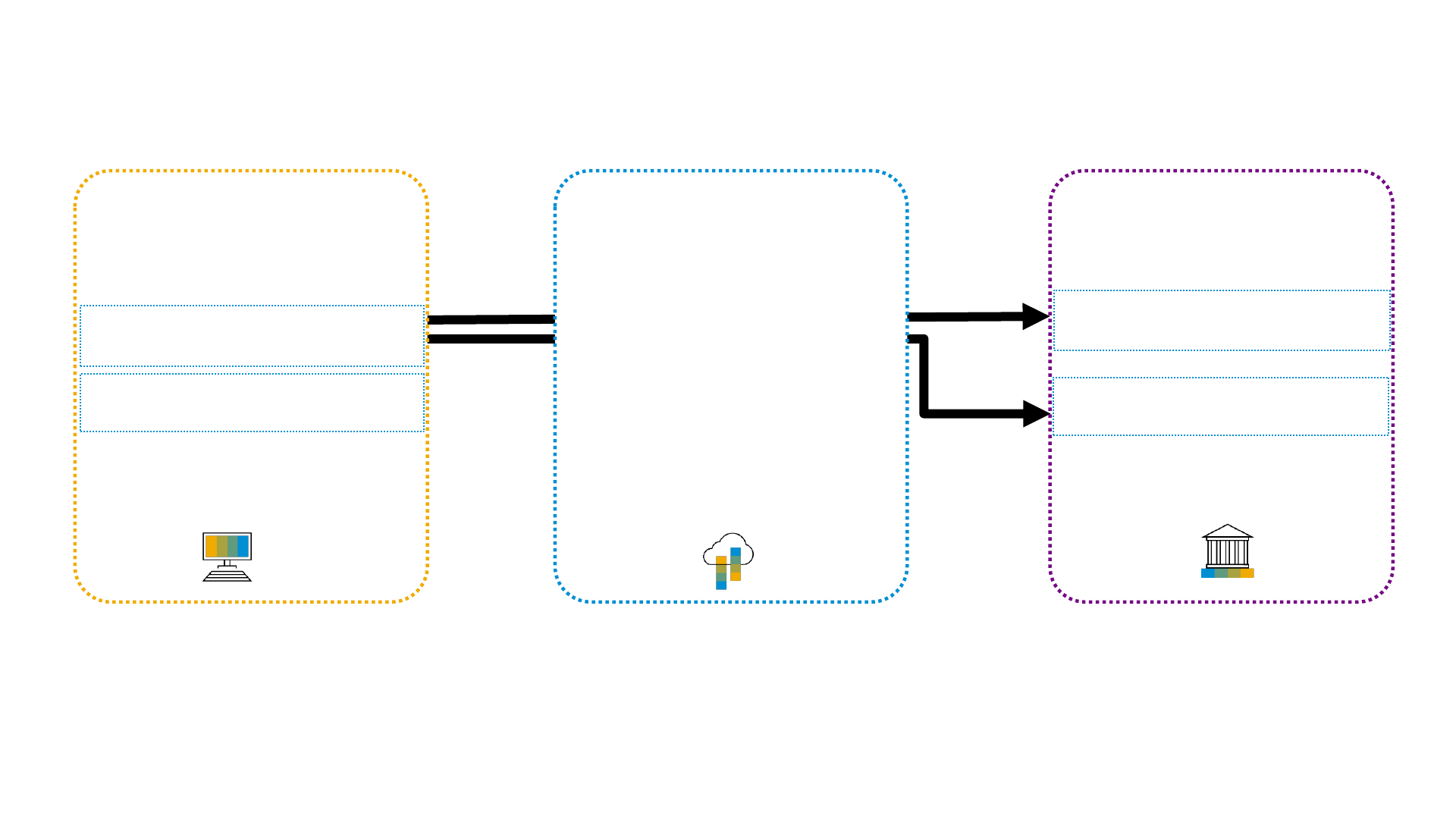

Recipient

SAP Document Compliance,

cloud edition

SAP ECC or S/4HANA

▪ Local Format Mapping

▪ Business Monitoring

▪ Communication

▪ Authentication

▪ Provider Managed

▪ Validation

▪ Approval/Registration

Solution Landscape – SAP Document Compliance for Peppol

SAP APPL 6.05

SAP Netweaver 7.02

Local version A

Local version B

Peppol Exchange

service

Document Type 1

Document Type 2

35

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

SAP Document Compliance is a global solution to address local

requirements mandating the submission of electronic documents to

authorities or business partners.

Local versions follow one of the following deployment models:

▪ PaaS Solutions

– Based on SAP Document Compliance, on-premise edition and SAP

Cloud Platform Integration to cover e-invoicing and real-time reporting

requirements in multiple countries

▪ SaaS Solutions

– SAP Document Compliance, cloud edition provides the ability to send

and receive fully compliant invoices based on the Peppol and ZUGFeRD

standards

– SAP Document Compliance, outbound invoicing option for Brazil &

inbound invoicing option for Brazil provide the ability to send / receive

and further process fully compliant Nota Fiscal documents in Brazil

What is the solution about?

36

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

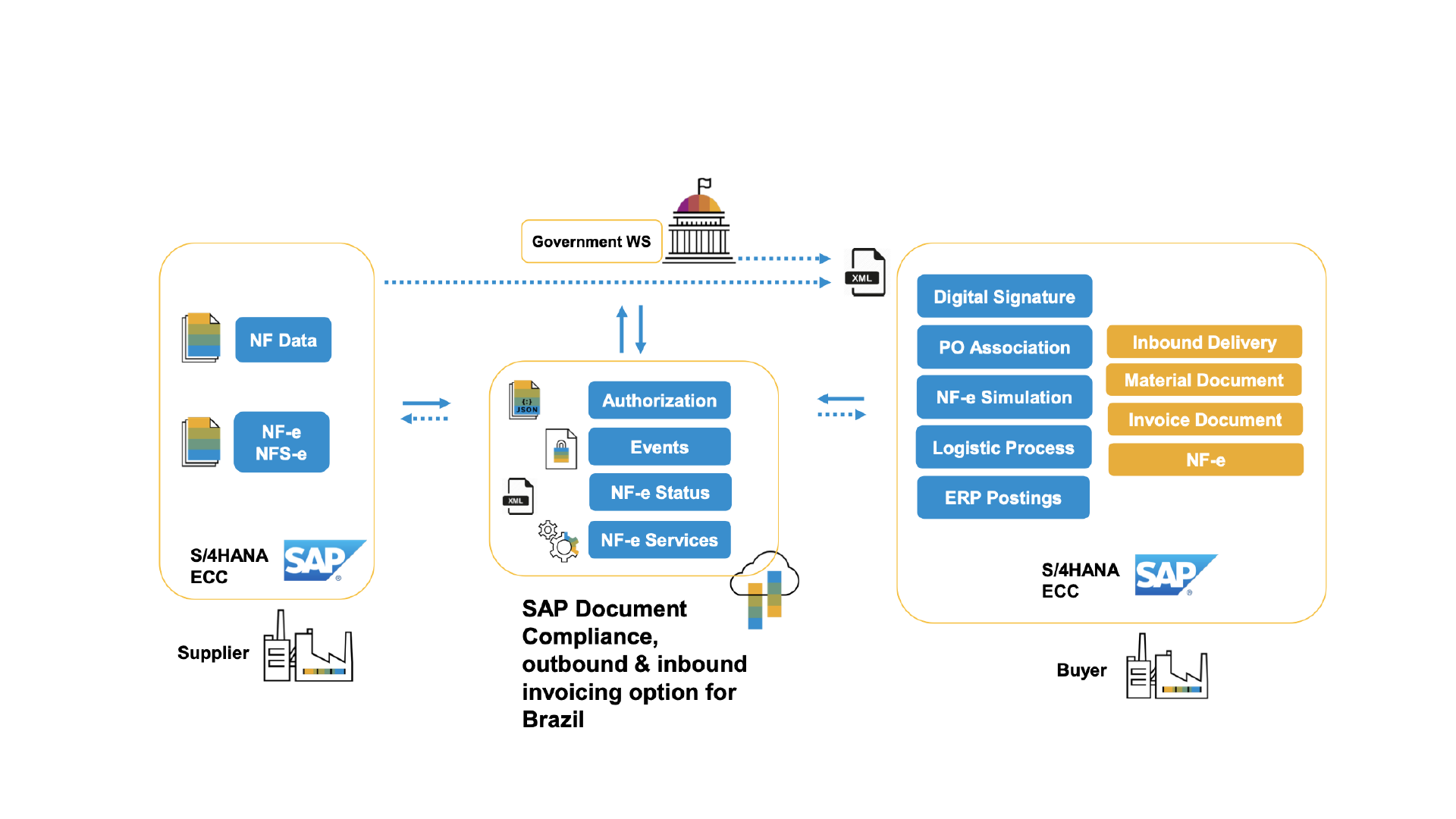

SAP Document Compliance for Brazil

Overview Business Process Flow

37

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

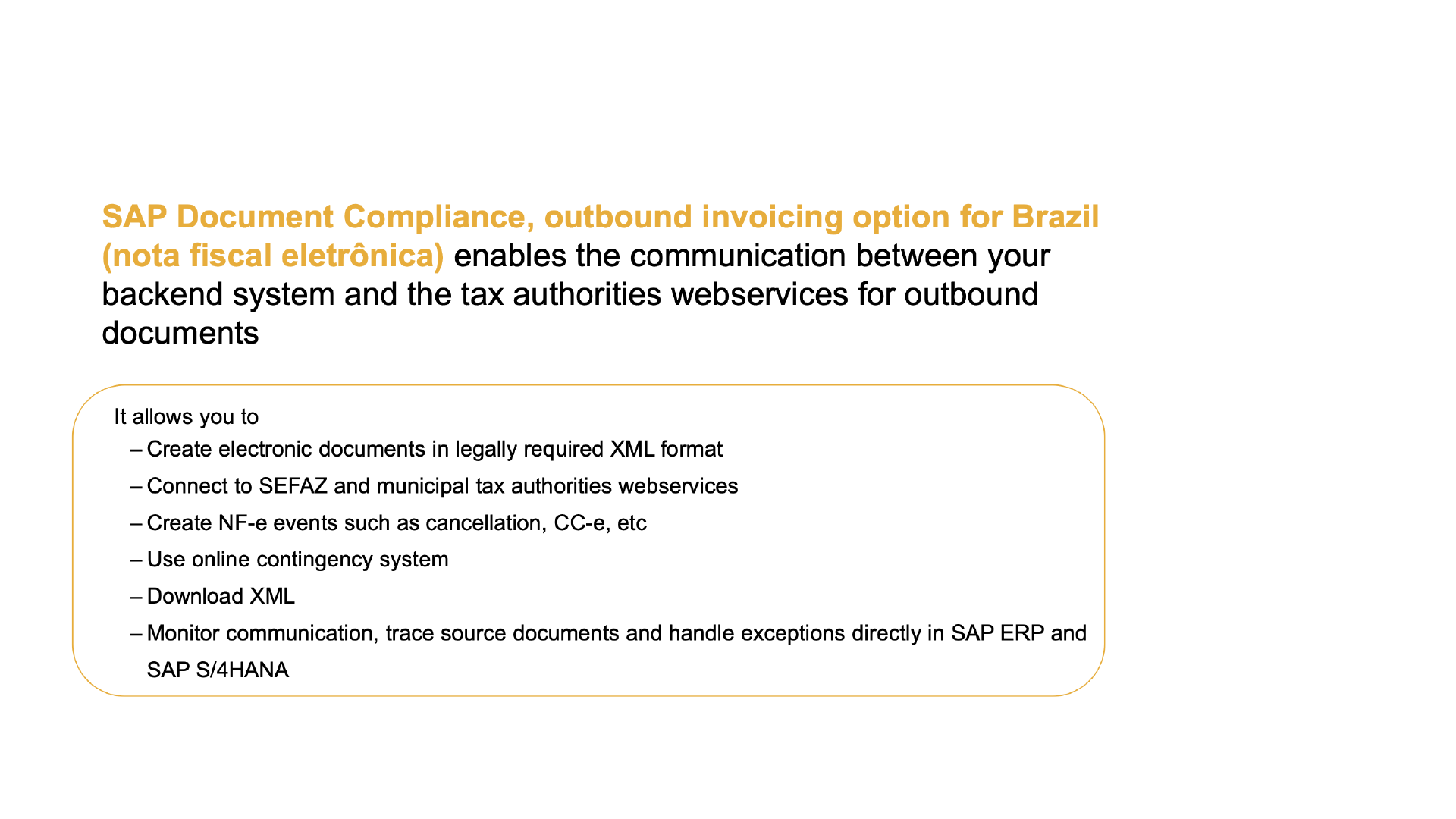

SAP Document Compliance for Brazil – Outbound

38

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

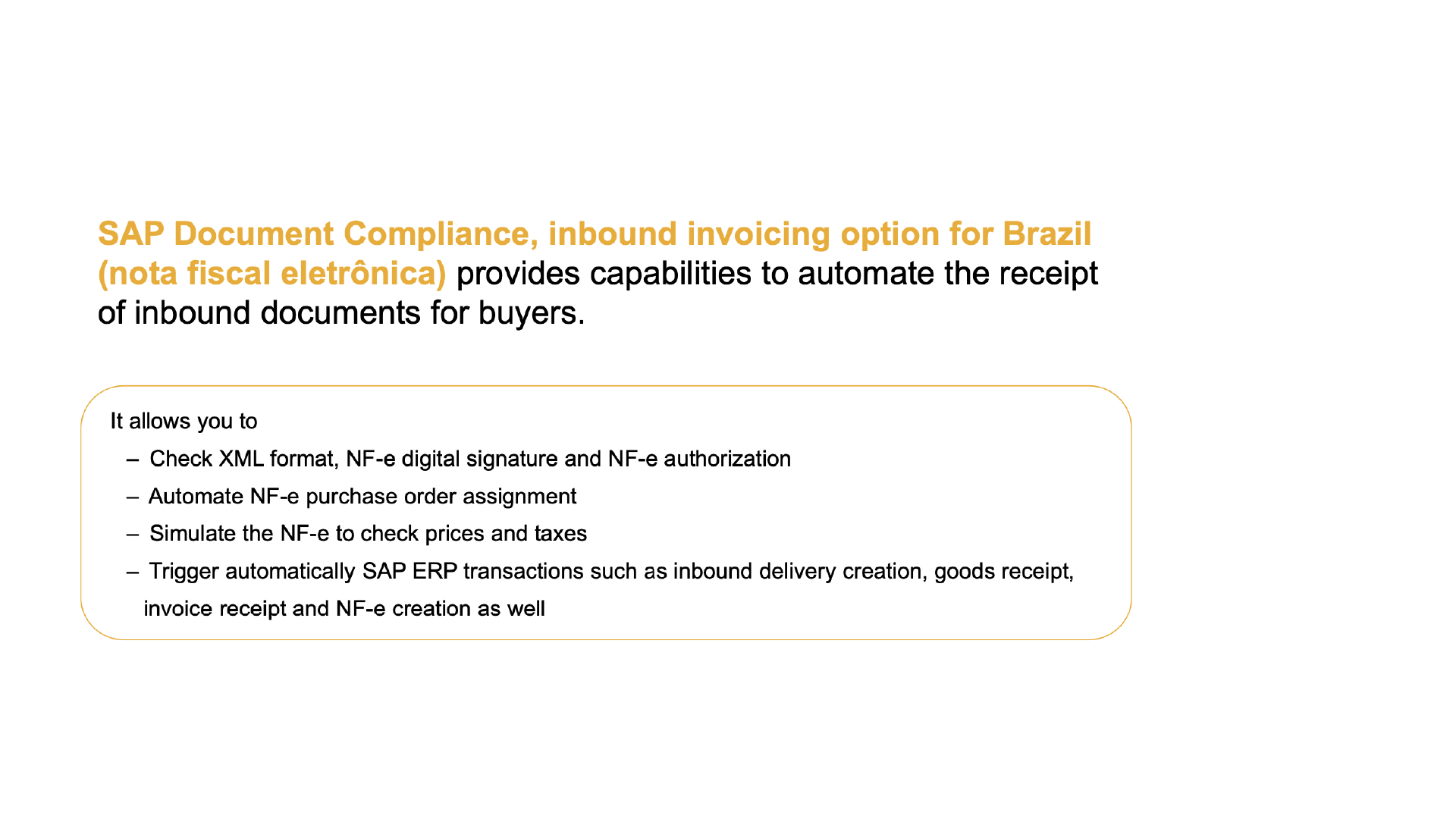

SAP Document Compliance for Brazil – Inbound

Roadmap

Local Versions

40

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Scenarios for Latin America (Available / Planned*)

Customer Invoice

Supplier Invoice

Delivery Note

Consumer Invoice

Ledgers

Credit Invoice

ChileBrazil

Customer Invoice

Supplier Invoice

Customer Invoice

Consumer invoice

Withholding Tax

Certificate

Tax Collection

Certificate

PeruMexicoColombia

Payment Receipt

Customer Invoice

Delivery Note

Customer Invoice

Supplier Invoice

* Planned: This is the current state of planning and may be changed by SAP at any time without notice.

41

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Greece

Tax Register Books

(e-Books)

Scenarios for Europe (Available / Planned*)

Customer Invoice

Tax Register Books

(SII Reporting)

Spain

* Planned: This is the current state of planning and may be changed by SAP at any time without notice.

ItalyHungary

Transport Registration

Invoice Registration

Portugal

Customer InvoiceCustomer Invoice

Supplier Invoice

Purchase Order

42

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Scenarios for Europe (Available / Planned*)

* Planned: This is the current state of planning and may be changed by SAP at any time without notice.

1

Supported through the Peppol Exchange service of SAP Document Compliance, cloud edition

Belgium

1

Germany

1

Netherlands

1

Norway

1

Sweden

1

Customer Invoice

Supplier Invoice

Customer Invoice

Supplier Invoice

Customer Invoice

Supplier Invoice

Customer Invoice

Supplier Invoice

Purchase Order

Customer Invoice

Supplier Invoice

Purchase Order

43

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Scenarios for Europe (Available / Planned*)

Austria

1

Customer Invoice

Supplier Invoice

Denmark

1

Customer Invoice

Supplier Invoice

Purchase Order

Ireland

1

Customer Invoice

Supplier Invoice

Poland

1

Customer Invoice

Supplier Invoice

* Planned: This is the current state of planning and may be changed by SAP at any time without notice.

1

Supported through the Peppol Exchange service of SAP Document Compliance, cloud edition

44

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Scenarios for Europe (Available / Planned*)

* Planned: This is the current state of planning and may be changed by SAP at any time without notice.

1

Supported through the Peppol Exchange service of SAP Document Compliance, cloud edition

Switzerland

1

France

1

Customer Invoice

Supplier Invoice

Customer Invoice

Supplier Invoice

45

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Scenarios for APJ (Available / Planned*)

Customer Invoice

Invoice Registration

(IRN)

Transport Registration

(eWayBill)

India Thailand

Customer Invoice

Consumer Invoice

Taiwan, China

* Planned: This is the current state of planning and may be changed by SAP at any time without notice.

Customer Invoice

Supplier Invoice

South Korea

Customer Invoice

Consumer Invoice

Supplier Invoice

Export Registration

Delivery Note

Turkey

46

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Scenarios for APJ (Available / Planned*)

Singapore

1

New Zealand

1

Australia

1

Customer Invoice

Supplier Invoice

Customer Invoice

Supplier Invoice

Customer Invoice

Supplier Invoice

* Planned: This is the current state of planning and may be changed by SAP at any time without notice.

1

Supported through the Peppol Exchange service of SAP Document Compliance, cloud edition

Appendix

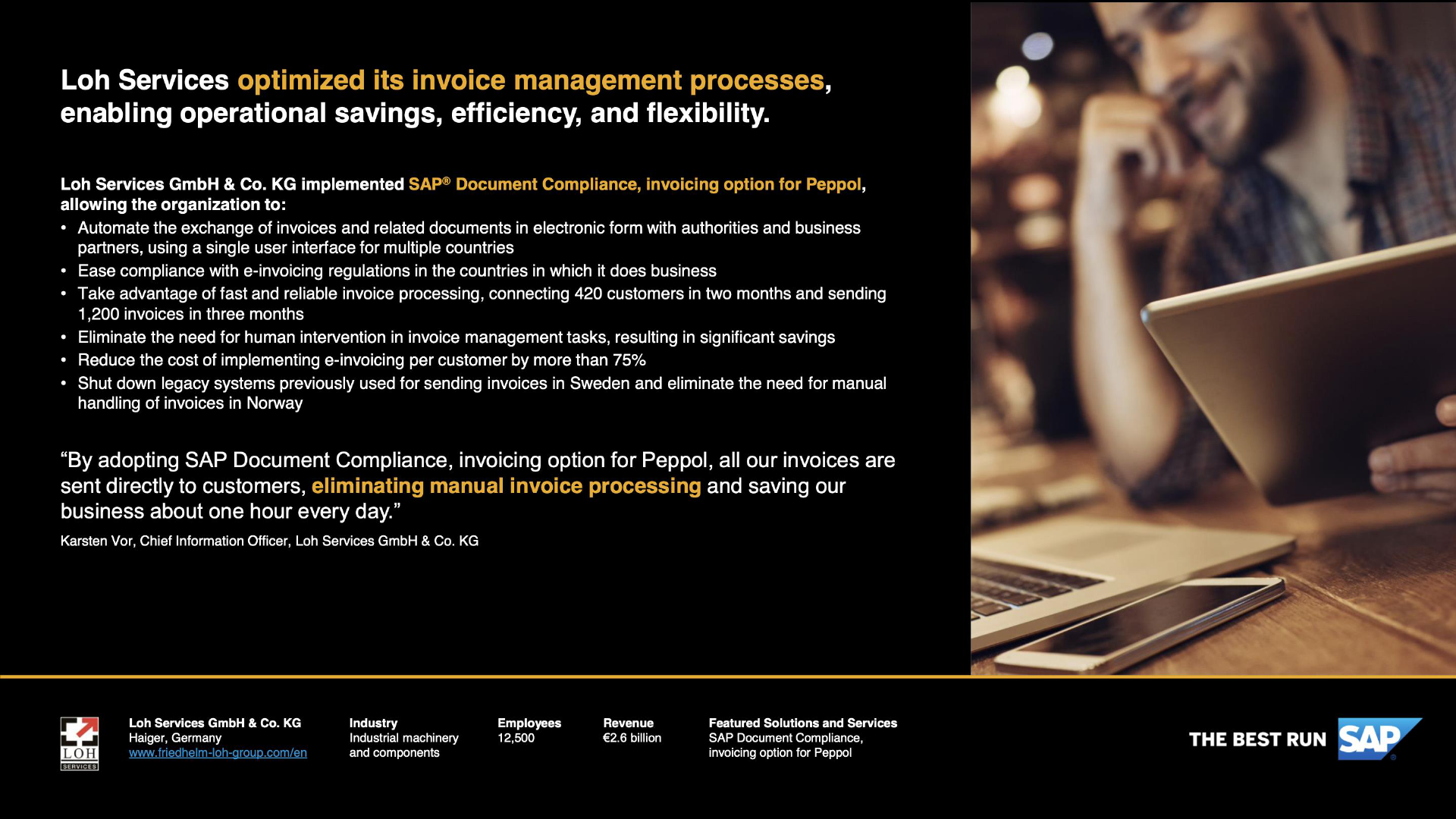

Customer

Testimonials

49

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

50

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Studio SAP | 54028enUS (17/10) | This content is approved by the customer and may not be altered under any circumstances.

100%

Transparency of tax submissions

Complying Punctually with Spanish Tax

Authorities with SAP

®

ERP

Newell Brands

Hoboken, New Jersey

www.newellbrands.com

Industry

Consumer products

Products and Services

Well-known brands for homes,

workplaces, classrooms,

playing fields, and parks

Employees

57,000 worldwide

Revenue

US$16 billion

SAP

®

Solutions

SAP

®

ERP application;

SAP ERP, option for

e-document processing;

SAP Cloud Platform

Integration service; and

SAP MaxAttention

™

services

“I’ve been impressed with the support we received from SAP MaxAttention

and how robust SAP Cloud Platform Integration is. Going live in July made

us one of the first customers to use this sophisticated solution.”

Neil Trigg, IT Director, Newell Brands

As a global supplier of popular consumer and commercial products, Newell Brands is subject to local

regulations worldwide. By implementing SAP ERP, option for e-document processing, at its site in

Madrid, Spain, it now has software support to comply with local regulations mandating the exchange of

electronic documents with tax authorities. SAP MaxAttention services helped it complete the work right

on time for the enforcement that began July 1, 2017.

Before: Challenges and Opportunities

• Comply with new tax regulations for business transactions with Spain and within Spain

• Meet the tight deadline to have the new solution in place by July 1, 2017, to avoid penalties

Why SAP

• User-friendly and intuitive solutions

• Experienced, highly cooperative consultants from SAP MaxAttention services

• Prepackaged content from SAP that expedited integration of SAP ERP with the authorities’ system

• High integration of SAP software with current ERP software

• An e-document solution that combines the interface management capabilities of the SAP Application Interface

Framework tool with SAP Cloud Platform Integration to implement business-to-government communication

After: Value-Driven Results

• Higher security as a result of simplified integration

• Centralized e-document processing

• Full compliance with the Spanish tax authority for electronically transmitting billing records from VAT books

• Ability to react faster in response to changes mandated by the tax authorities

100%

Compliance with tax regulations

Flexible

Electronic transmission of invoices

51

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Studio SAP | 54028enUS (17/10) | This content is approved by the customer and may not be altered under any circumstances.

Easing International Tax Compliance with

Help from SAP

®

Document Compliance

Alfred Kärcher SE & Co. KG

Winnenden, Germany

www.kaercher.com

Industry

Industrial machinery and

components

Products and Services

Manufacturing of cleaning

systems, products, and related

services for home, garden,

commerce, and industry

Employees

>13,000

Revenue

€2.5 billion (2018)

SAP

®

Services

SAP

®

Document Compliance

service, on-premise edition, and

SAP Cloud Platform Integration

service

“SAP Document Compliance makes managing international tax requirements

much easier. SAP Digital Business Services was key in helping to get it set up.

We are now planning to expand the solution to other countries.”

Dr. Daniel Heubach, Vice President Information Technology and Digital Transformation, Alfred Kärcher SE & Co. KG

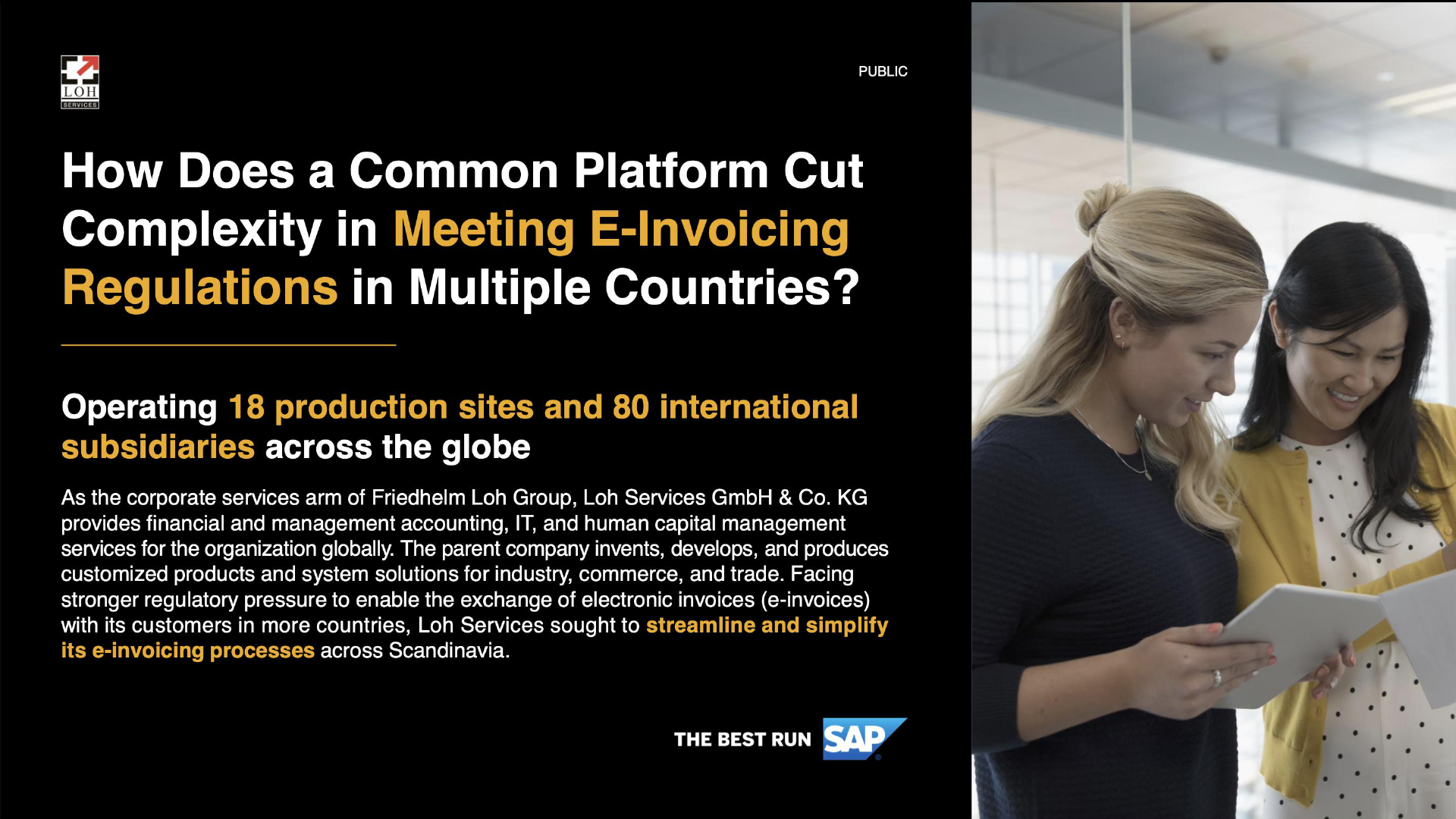

As the leading provider of cleaning technology worldwide, Kärcher has subsidiaries in more than

70 countries – each with its own invoicing and tax requirements. To bring e-document, tax, and invoice

management onto a single IT framework, Kärcher is using the SAP Document Compliance service.

Before: Challenges and Opportunities

• Fulfill local tax requirements and process customer invoices for international branch offices

• Simplify international and regional regulatory compliance to help ease future expansion

• Implement a standardized e-document and tax management solution with a single architecture framework

Why SAP

• Strong cooperation between SAP and local tax authorities around the world to provide solutions that can be

used across a global enterprise

• E-document solutions from SAP that support a wide range of countries and languages and come with a clear

road map for future functionality

• Solution expertise, advisory, and implementation support from the SAP Digital Business Services organization

• Integration of SAP Document Compliance, on premise edition, with the SAP HANA

®

business data platform

and SAP Cloud Platform using the SAP Cloud Platform Integration service

After: Value-Driven Results

• E-document framework that covers operations in Spain, Mexico, Hungary, Colombia, and Italy

• Deployment in each country on time and within budget

• Tax filing that complies with the regulations and meets the deadlines for each country

• Standard e-document framework and tax management solution for all countries, streamlining processes and

lowering total cost of ownership (TCO)

Lower

TCO through centralized e-document

management

One

E-document framework to manage

compliance in multiple countries

On-time

Deployments in five countries, with more

rollouts planned

52

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

53

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

54

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

PUBLIC

Making healthcare more accessible in more than

100,000 hospitals worldwide

Helping customers to deliver quality care in a safe, secure, and affordable environment,

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. is a leading developer, manufacturer,

and supplier of medical devices. The global company is on a mission to make healthcare

more accessible and delivers advanced technology to hospitals in almost 200 countries

worldwide. Needing to comply with mandatory electronic invoicing requirements in Italy,

Mindray decided to replace its existing solution that was potentially putting the business at

risk of noncompliance. The company opted to use the latest cloud technologies supported

by expert knowledge.

How Does a Medical Devices Firm

Ensure Its Electronic Invoicing

Processes Exceed Expectations?

55

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Mindray called on SAP

®

MaxAttention™ services to implement the SAP Document Compliance service,

invoicing option for Italy, ensuring:

• Successful replacement of the existing third-party silo-based solution with an advanced hybrid solution based on

SAP Cloud Platform

• Compliance with local regulations, enabling the business to send electronic documents to trading partners and

regulatory authorities

• Smooth integration with the SAP ERP application, enabling the IT team in the company’s head office to centrally

monitor the new electronic document framework

• Simplified and standardized compliance processes in multiple countries, with a unified user experience and a

reduced set of tools

• Readiness to roll out the SAP Document Compliance service in other countries with one united expert team from

SAP on hand using country-specific scenarios

Mindray uses a unified platform to receive and monitor

electronic invoices while improving operational efficiency.

“With SAP MaxAttention services, we successfully implemented the hybrid-based

SAP Document Compliance service, invoicing option for Italy, in just eight weeks –

becoming the first business in the world to do so.”

Wang Lue, Application Development and Support Manager, Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Shenzhen Mindray Bio-

Medical Electronics Co., Ltd.

Shenzhen, China

Industry

Life sciences

Employees

10,000

Revenue

US$1.8 billion

Featured Solutions and Services

SAP MaxAttention services, SAP Cloud

Platform, and SAP Document Compliance

service, invoicing option for Italy

Picture Credit | Customer Name, City, State/Country. Used with permission.

Where to find more

Information

57

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Solutions already released

(in General Availability):

SAP Document Compliance in

the SAP Community

▪ Links to all relevant information

in one page

▪ Blogs, articles, presentations and

expert discussions around SAP

Document Compliance

Local variants under

development:

Early Customer Engagement

JAM

▪ Preliminary information about

solution scope and design

▪ Webinars

▪ Engagement platform for Q&A

before solution release

New legal requirements and

legal changes:

Legal change notification

service

▪ First point of information about

upcoming regulations affecting

SAP Products, impact, timelines

and expected solution

▪ Updated with link to overview

note once released

Where to find which information

58

PUBLIC© 2020 SAP SE or an SAP affiliate company. All rights reserved. ǀ

Troubleshooting Guide

Classroom Training

Development Guide

Recorded Webinar Series

Youtube Playlist

External Customer and Partner Engagement JAM (access request via Mail to [email protected])

Product Page

Useful links