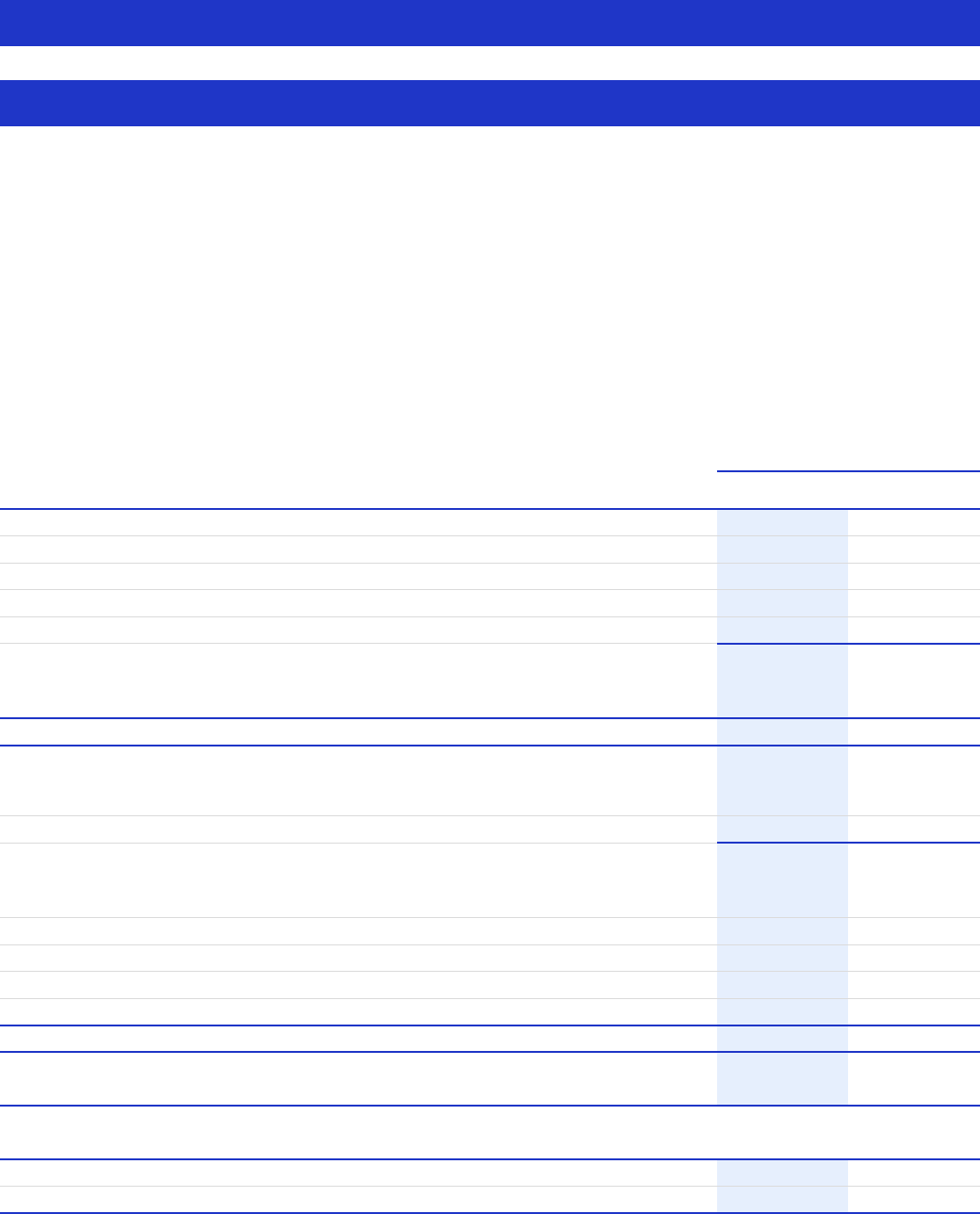

2022 Full Year Results

Strong sales growth and continued progress against strategy

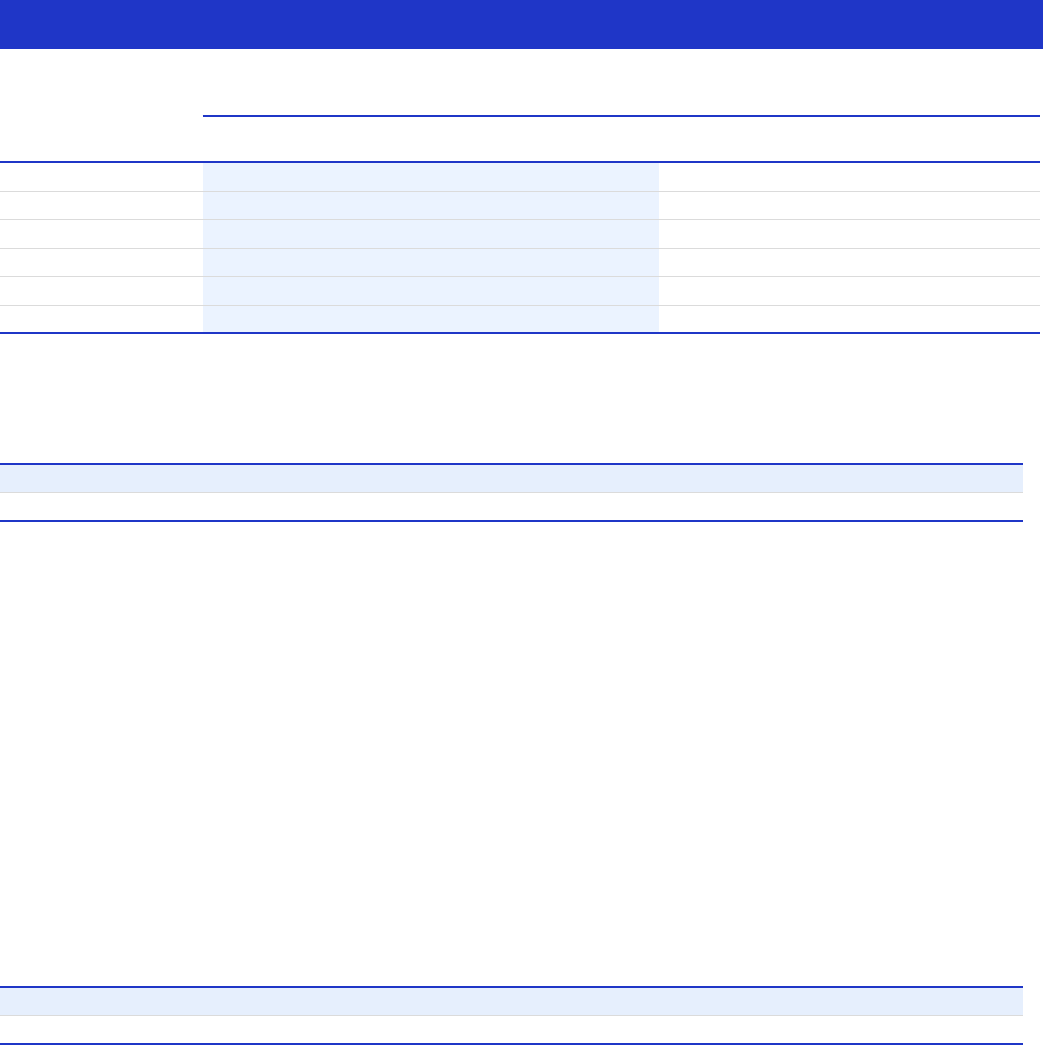

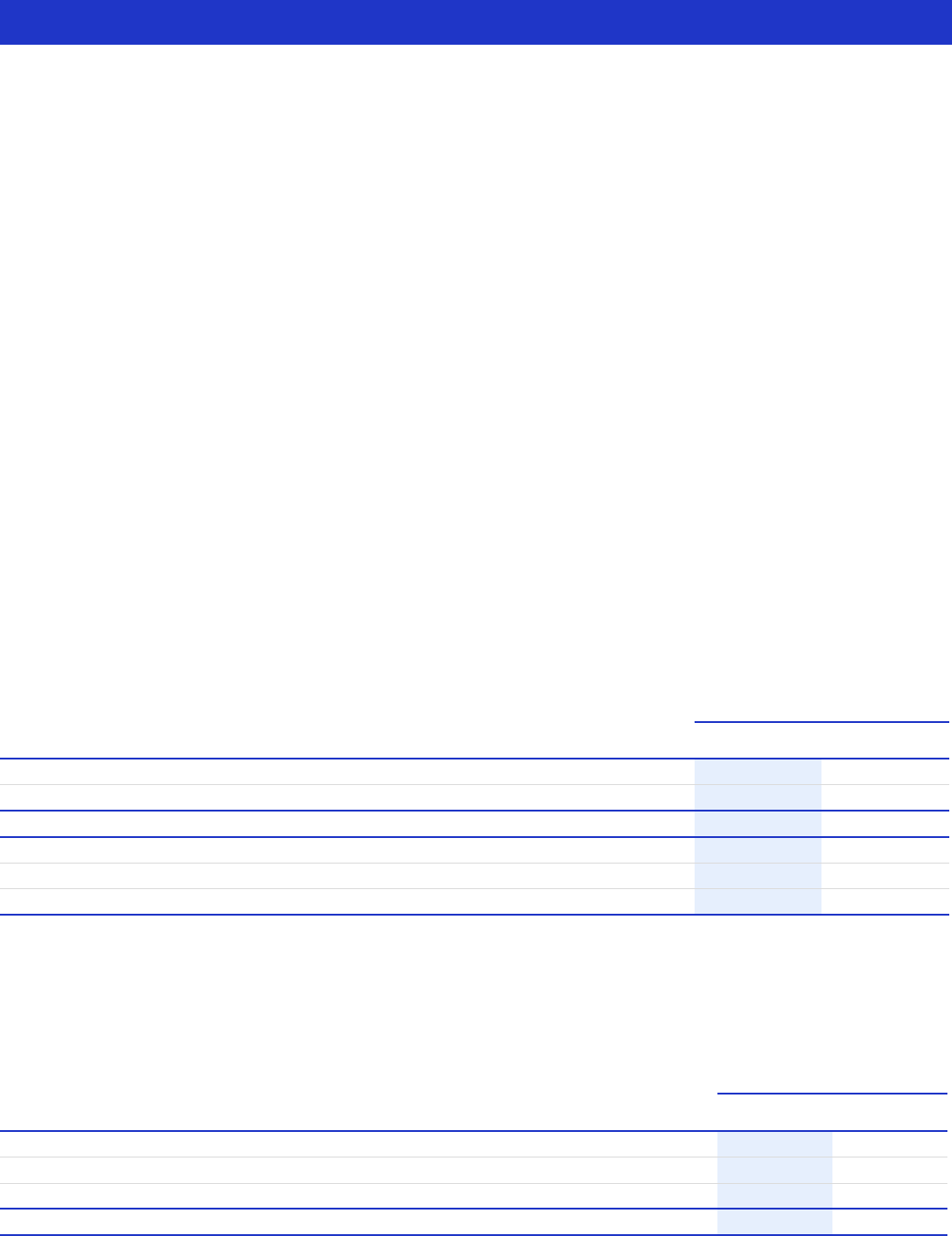

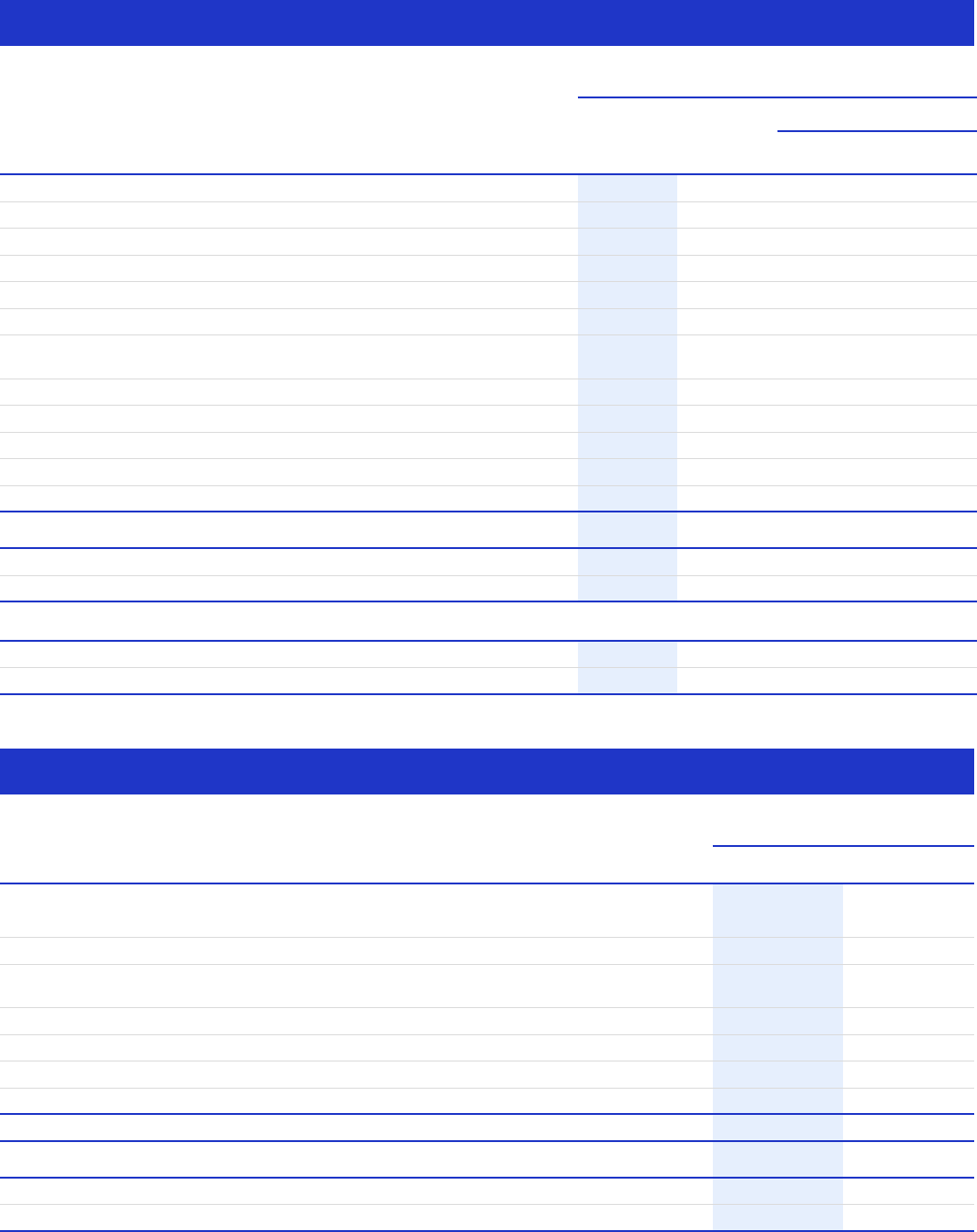

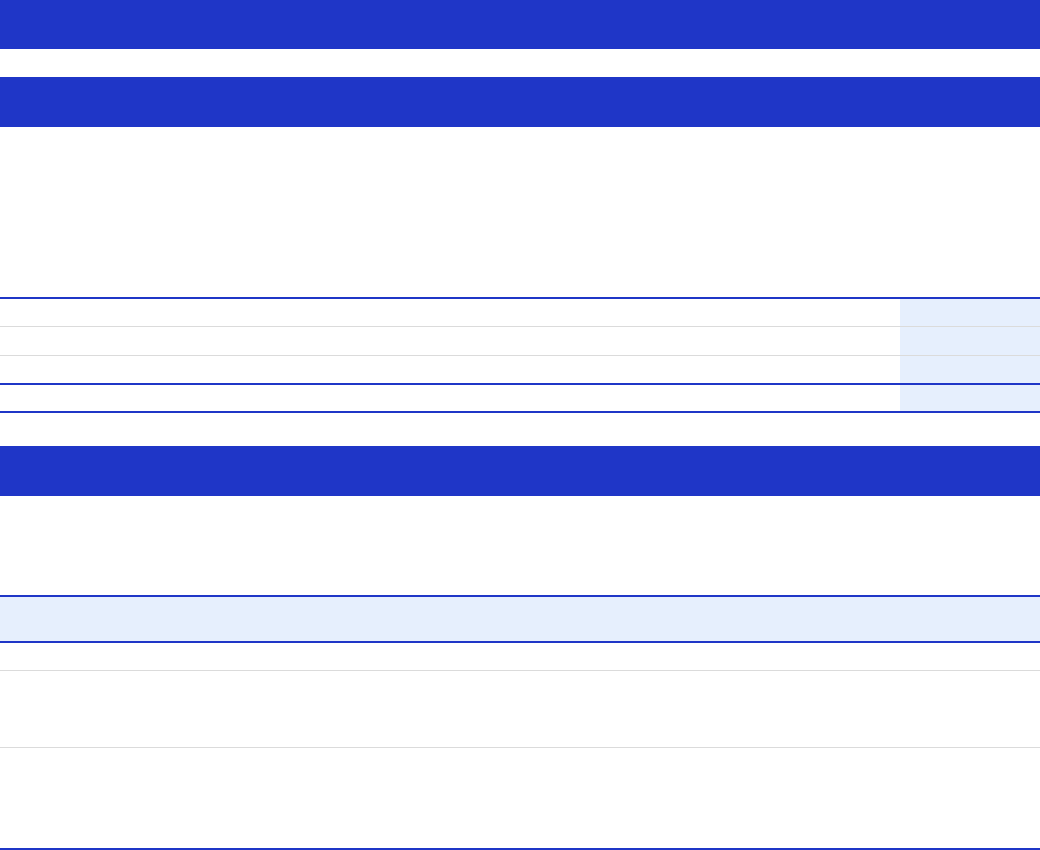

Underlying performance

GAAP measures

(unaudited) 2022 vs 2021 2022 vs 2021

Full Year

Underlying sales growth (USG) 9.0%

Turnover €60.1bn 14.5%

Beauty & Wellbeing 7.8%

Beauty & Wellbeing €12.3bn 20.8%

Personal Care 7.9%

Personal Care €13.6bn 15.9%

Home Care 11.8%

Home Care €12.4bn 17.3%

Nutrition 8.6%

Nutrition €13.9bn 6.1%

Ice Cream 9.0%

Ice Cream €7.9bn 14.8%

Underlying operating profit €9.7bn 0.5%

Operating profit €10.8bn 23.6%

Underlying operating margin 16.1% (230)bps

Operating margin 17.9% 130bps

Underlying earnings per share €2.57 (2.1) %

Diluted earnings per share €2.99 28.8%

Free cash flow €5.2bn €(1.2)bn

Net profit €8.3bn 24.9%

Fourth Quarter

USG 9.2%

Turnover €14.6bn 11.4%

Quarterly dividend payable in March 2023 €0.4268 per share

(a)

(a) See note 10 for more information on dividends

Full year highlights

• Underlying sales growth accelerated to 9.0%, driven by all Business Groups, with price growth of 11.3% and

volumes declining 2.1%

• Turnover increased 14.5% to €60.1 billion, including 6.2% from currency and (1.0)% from disposals net of

acquisitions

• Underlying operating profit improved slightly to €9.7 billion despite margin decline of 230bps driven by input

cost inflation

• Underlying earnings per share decreased 2.1%, diluted EPS up 28.8% helped by profit on disposals

• Free cash flow €5.2 billion, including €0.3 billion of tax paid on separation of ekaterra, the global Tea business,

reflects 97% cash conversion

• €1.5 billion share buyback and €4.3 billion dividends during 2022

• Brand and marketing investment increased €0.5 billion in constant exchange rates

• Our billion+ Euro brands, accounting for 53% of Group turnover, delivered underlying sales growth of 10.9%, led

by strong performances from OMO, Hellmann's, Rexona, Sunsilk and Magnum

• Simpler, more category-focused organisation, in place since 1 July, is driving greater operational focus and

faster decisions

Chief Executive Officer statement

"Unilever delivered a year of strong topline growth in challenging macroeconomic conditions. Underlying sales

growth was 9.0%, driven by disciplined pricing action in response to high input cost inflation. Growth was broad-

based across each of our five Business Groups, led by strong performances from our billion+ Euro brands. Despite

sharp rises in material costs, we have prioritised stepping up our brand and marketing investment. Underlying

operating margin was delivered in line with our guidance, with underlying operating profit up for the year.

USG, UVG, UPG, UOP, UOM, underlying EPS, constant underlying EPS, underlying effective tax rate, FCF, net debt, ROIC and UEBITDA are non-GAAP measures (see pages 9 to 13)

1

We have made further progress in the transformation of Unilever and continued to deliver against our strategic

priorities. Our new operating model is already unlocking a culture of bolder and more rapid decision-making with

improved accountability. We continue to improve our growth profile, with the sale of the global Tea business and the

acquisition of Nutrafol. We are increasingly realising the benefits from the reshaped portfolio, accelerated savings

delivery and improved execution. There is more to do, but the changes we have made mean that we start 2023 with

momentum, setting us up well for delivering another year of higher growth, which remains our first priority.”

Alan Jope

9 February 2023

Outlook for 2023

In 2022, we carefully balanced price growth, volume and competitiveness to navigate through the high cost inflation

environment. We will again deliver strong underlying sales growth in 2023, with improving volume performance and

competitiveness as the year progresses. We will continue to price and drive our cost savings programmes, in order to

allow us to invest behind our brands and deliver improved margin.

We expect cost inflation to continue in 2023. Our expectation for net material inflation (NMI) in the first half of 2023 is

around €1.5 billion. We anticipate significantly lower NMI in the second half, with a wide range of possible outcomes,

though we do not expect cost deflation.

In the first half, underlying price growth will remain high, and volume growth will be negative. Volume will improve

as price growth softens, but it is too early to say whether volume will turn positive in the second half. We expect 2023

underlying sales growth to be at least in the upper half of our multi-year range of 3 – 5%.

We will deliver only a modest improvement in underlying operating margin in the full year, as we plan for another

year of increased investment, and with cost inflation remaining high, underlying operating margin will be around

16% in the first half.

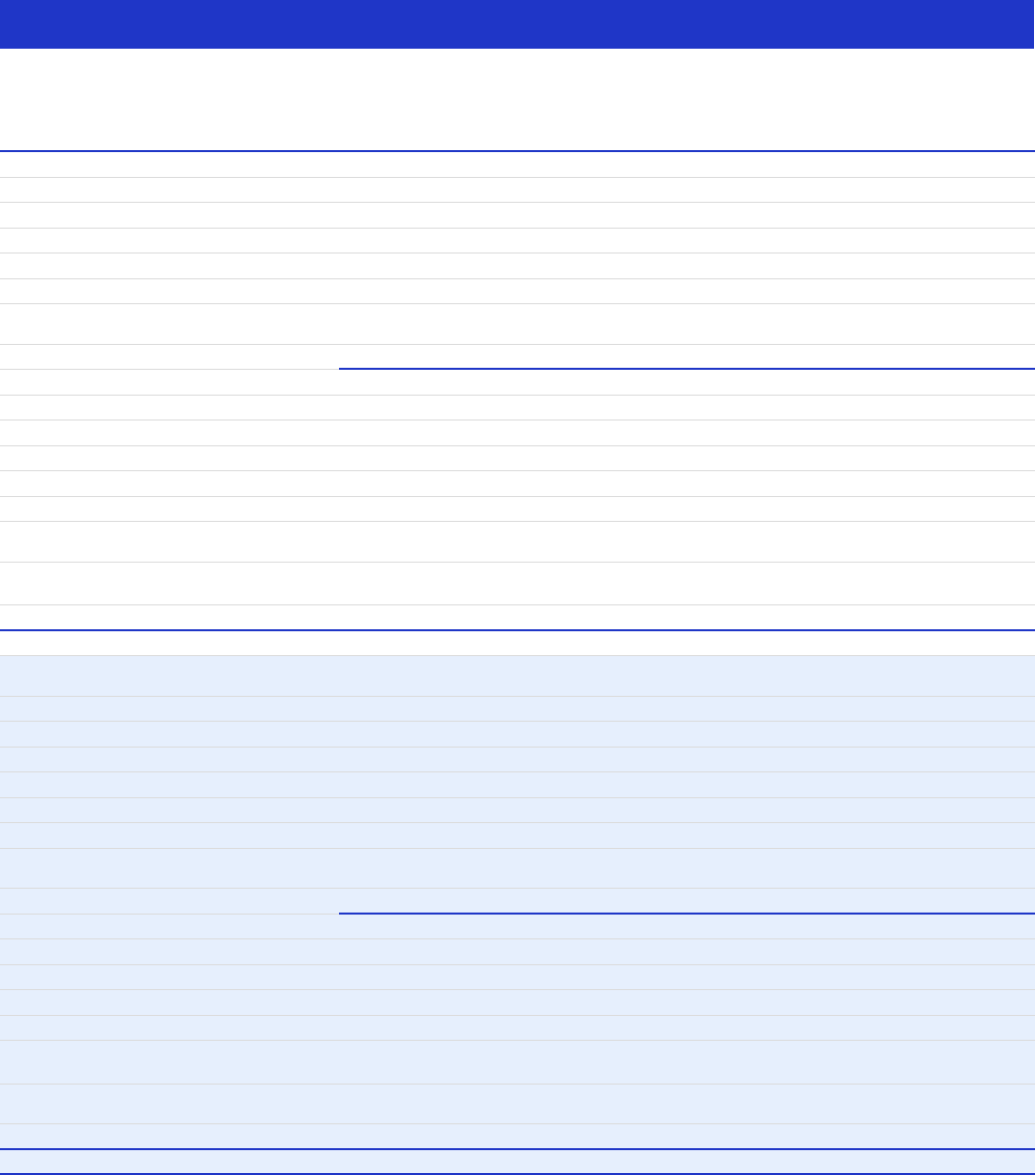

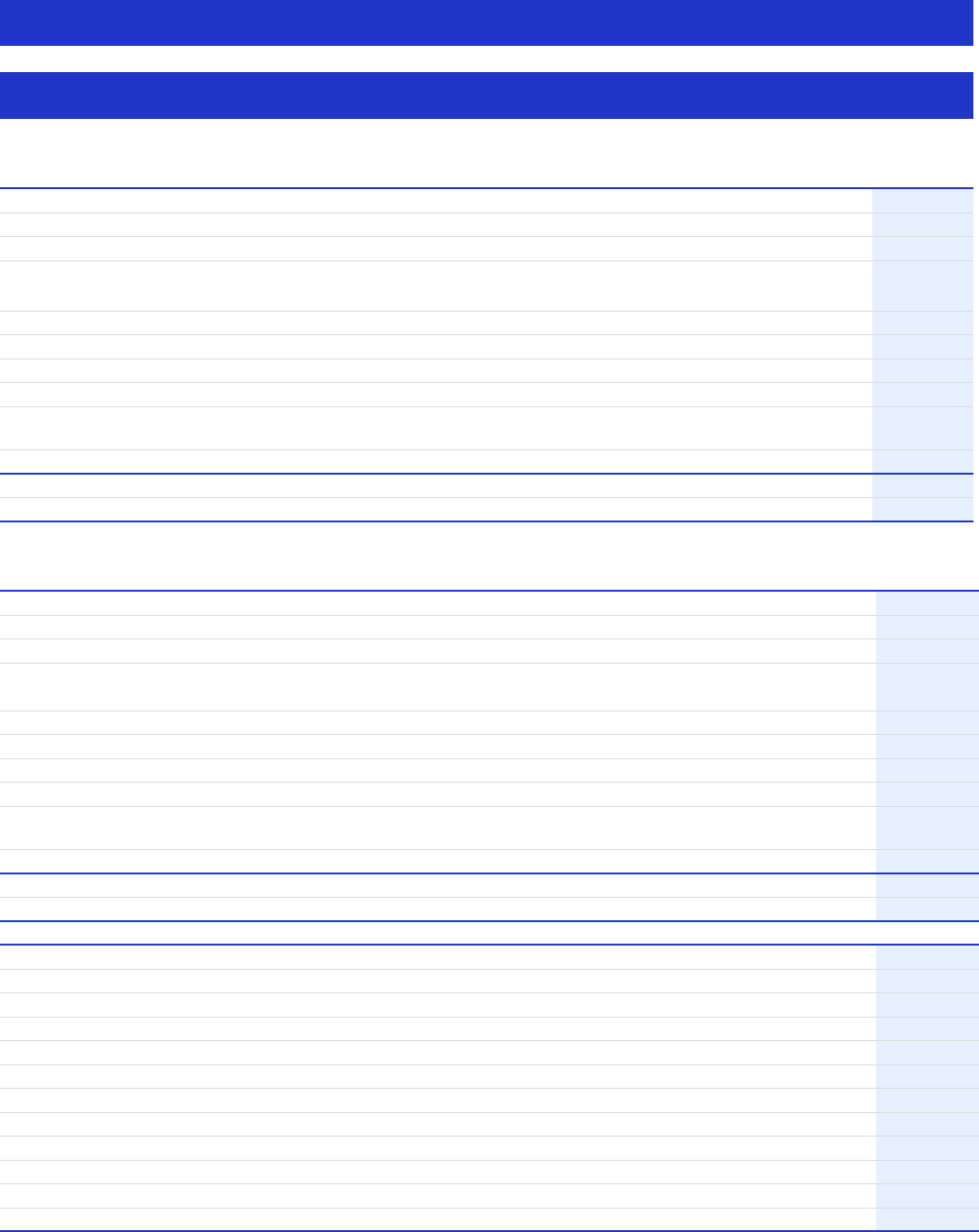

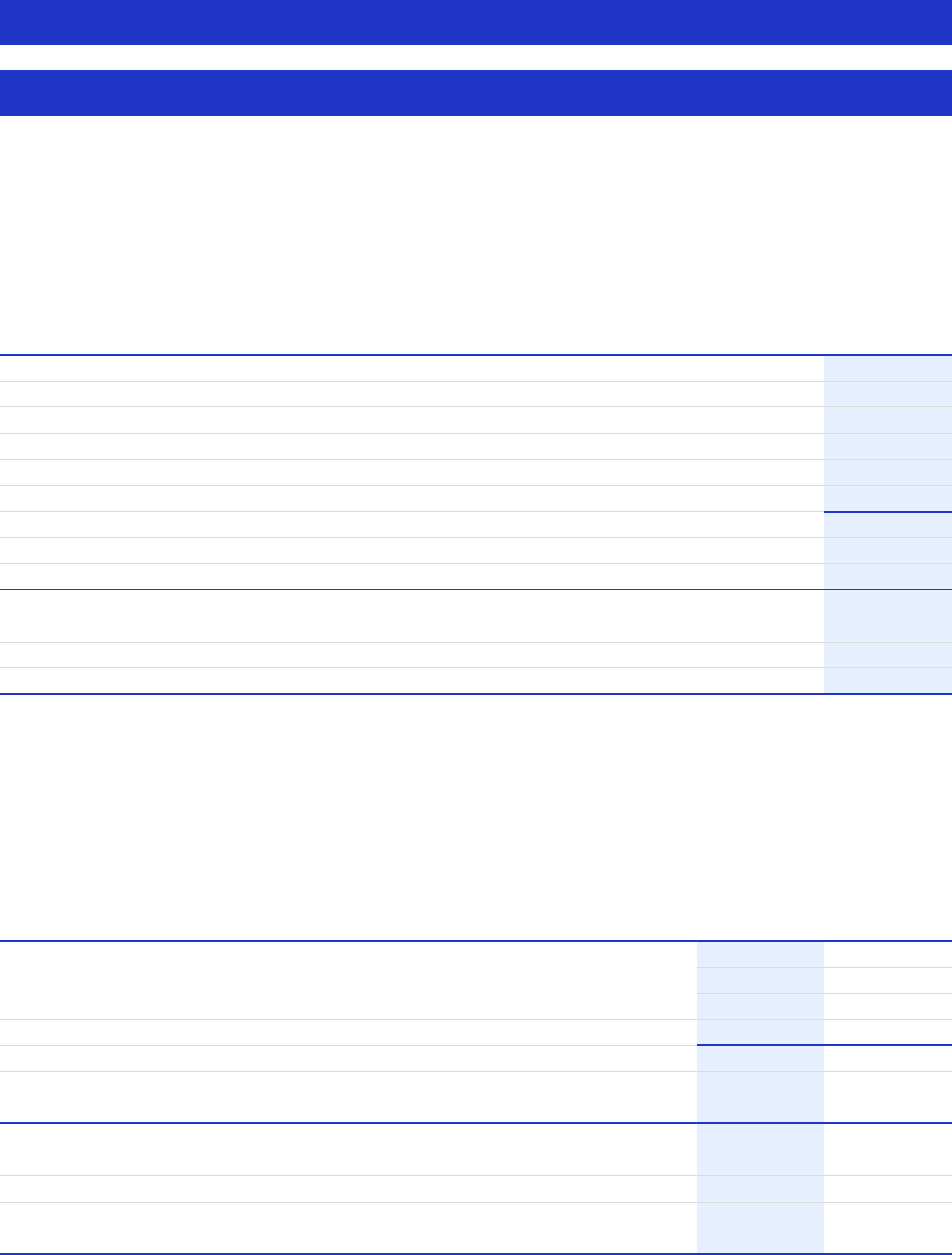

Full Year Review: Unilever Group

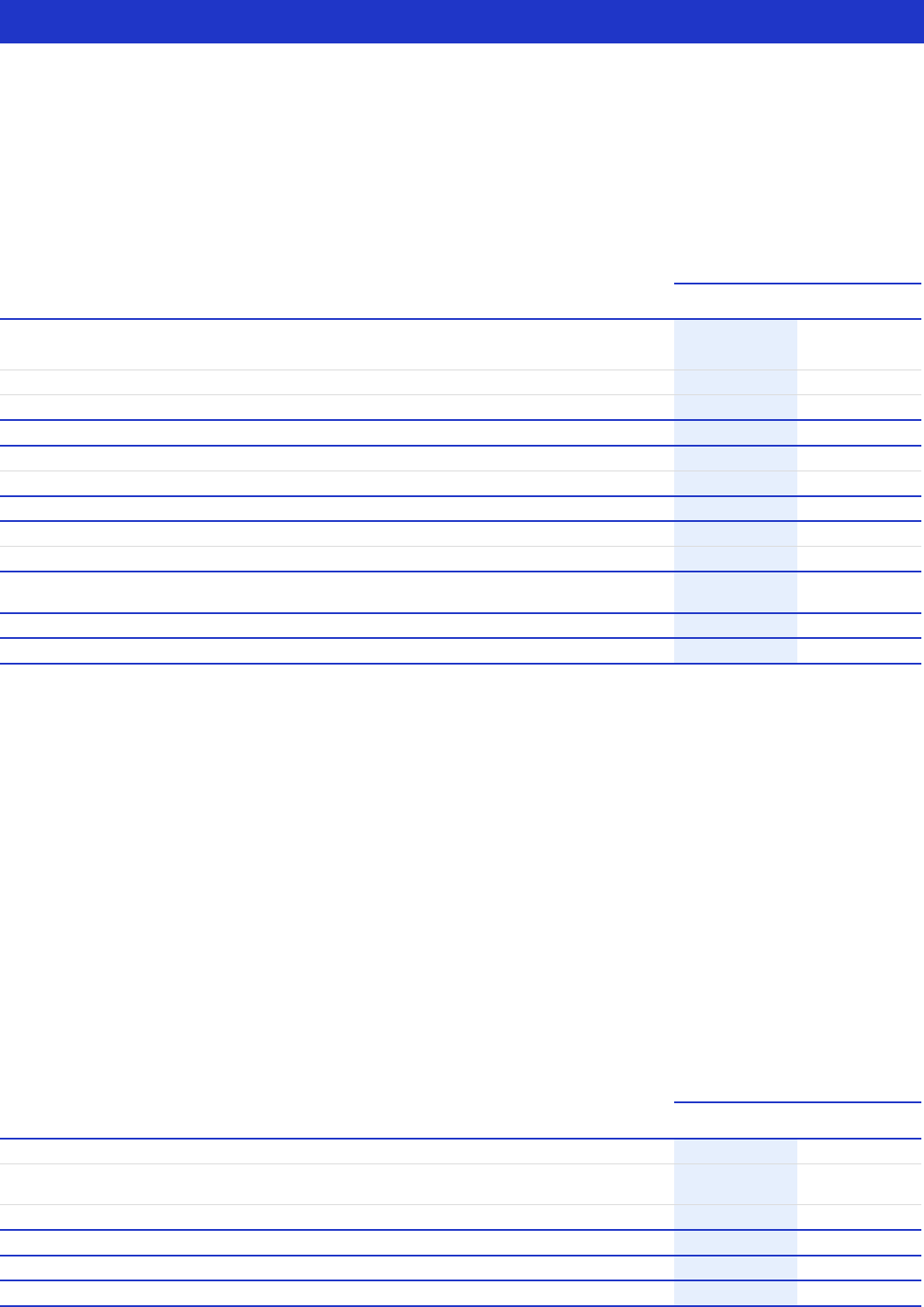

(unaudited) Turnover USG UVG UPG A&D Currency

Turnover

change

UOM%

Change

in UOM

Full Year €60.1bn 9.0% (2.1)% 11.3% (1.0)% 6.2% 14.5% 16.1% (230)bps

Fourth Quarter €14.6bn 9.2% (3.6)% 13.3% (3.1)% 5.3% 11.4%

Performance

Underlying sales growth stepped up to 9.0% in 2022, led by pricing, in the face of significant input cost inflation

across our markets. Price growth has sequentially improved in each of the past eight quarters, reaching 13.3% in the

fourth quarter and taking the full year underlying price growth to 11.3%. This had, as expected, some negative

impact on volumes, which declined 2.1%.

Beauty & Wellbeing grew underlying sales by 7.8% driven by price. Volumes were slightly positive, helped by another

year of strong growth in Prestige Beauty and Health & Wellbeing, which now account for more than €2.5 billion of

turnover. Personal Care underlying sales were up 7.9%, driven by strong pricing. Volumes grew in Deodorants, but

declined in other categories. Home Care, which was particularly exposed to rising input costs, delivered the highest

price growth and some volume decline, leading to underlying sales growth of 11.8%. Nutrition grew 8.6%, led by high

price growth of Dressings and a continued recovery of Unilever Food Solutions. Ice Cream improved underlying sales

by 9.0%, with strong volume growth in out-of-home channels, benefiting from a good summer season, but not quite

compensating for lower in-home volumes.

Emerging markets grew underlying sales by 11.2% with price of 13.5% and volume down 2.0%. South Asia grew

strongly through both price and volume. Price growth in Latin America increased to 20.4% with volumes contracting

by 4.6%. China declined slightly as it was affected by pandemic-related restrictions, particularly in the second and

fourth quarters. South East Asia achieved double-digit price growth with virtually flat volumes. Turkey delivered high

single-digit volume growth in a very inflationary environment. Developed markets increased by 5.9%, with 8.4% from

price and (2.3)% from volume. Volumes held up better in North America than in Europe.

USG, UVG, UPG, UOP, UOM, underlying EPS, constant underlying EPS, underlying effective tax rate, FCF, net debt, ROIC and UEBITDA are non-GAAP measures (see pages 9 to 13)

2

Full Year Review: Unilever Group (continued)

Turnover increased 14.5% to €60.1 billion, which included a currency impact of 6.2% and (1.0)% from disposals net of

acquisitions. Underlying operating profit was €9.7 billion, up 0.5% versus the prior year. Underlying operating margin

declined by 230bps to 16.1%. Gross margin decreased by 210bps which reflected €4.3 billion of net material inflation,

and increased production and logistics costs that were only partially mitigated by our pricing action and savings

delivery. Brand and marketing investment was stepped up by €0.5 billion in constant exchange rates. This equated to

a 10bps contribution to margin in current exchange rates. Overheads increased by 30bps largely due to investments

in capabilities to drive growth and increased scale of our Prestige Beauty and Health & Wellbeing businesses.

Capital allocation and operating model

On 22 July and 19 December 2022, we completed the first and second €750 million tranches of our ongoing share

buyback programme of up to €3 billion. The quarterly interim dividend for the fourth quarter is maintained at

€0.4268. Since 1 July 2022, our simpler, more category-focused operating model for Unilever has been in place,

organised around five Business Groups and a technology-driven backbone, Unilever Business Operations. We are on

track to deliver the new structure within existing restructuring plans, and to generate around €600 million of cost

savings over the first two years after 1 July 2022, with the majority in 2023.

Conference Call

Following the release of this trading statement on 9 February 2023 at 7:00 AM (UK time), there will be a live webcast

at 8:00 AM available on the website www.unilever.com/investor-relations/results-and-presentations/latest-results. A

replay of the webcast and the slides of the presentation will be made available after the live meeting.

USG, UVG, UPG, UOP, UOM, underlying EPS, constant underlying EPS, underlying effective tax rate, FCF, net debt, ROIC and UEBITDA are non-GAAP measures (see pages 9 to 13)

3

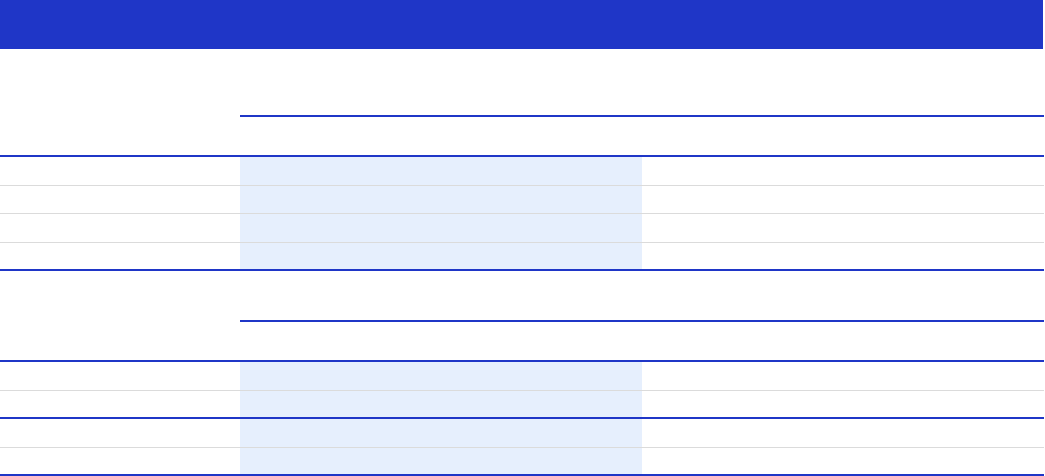

Full Year Review: Business Groups

Full Year 2022 Fourth Quarter 2022

(unaudited)

Turnover USG UVG UPG

Change

in UOM

Turnover USG UVG UPG

Unilever €60.1bn 9.0% (2.1)% 11.3% (230)bps €14.6bn 9.2% (3.6) % 13.3%

Beauty & Wellbeing

€12.3bn 7.8% 0.3% 7.5% (340)bps €3.2bn 7.7% (0.6) % 8.4%

Personal Care €13.6bn 7.9% (3.7)% 12.1% (170)bps €3.5bn 9.1% (3.5) % 13.0%

Home Care €12.4bn 11.8% (3.5)% 15.9% (260)bps €3.2bn 12.3% (3.8) % 16.7%

Nutrition €13.9bn 8.6% (2.1)% 10.9% (170)bps €3.5bn 10.1% (4.1) % 14.7%

Ice Cream €7.9bn 9.0% (0.7)% 9.7% (220)bps €1.2bn 2.9% (9.9) % 14.2%

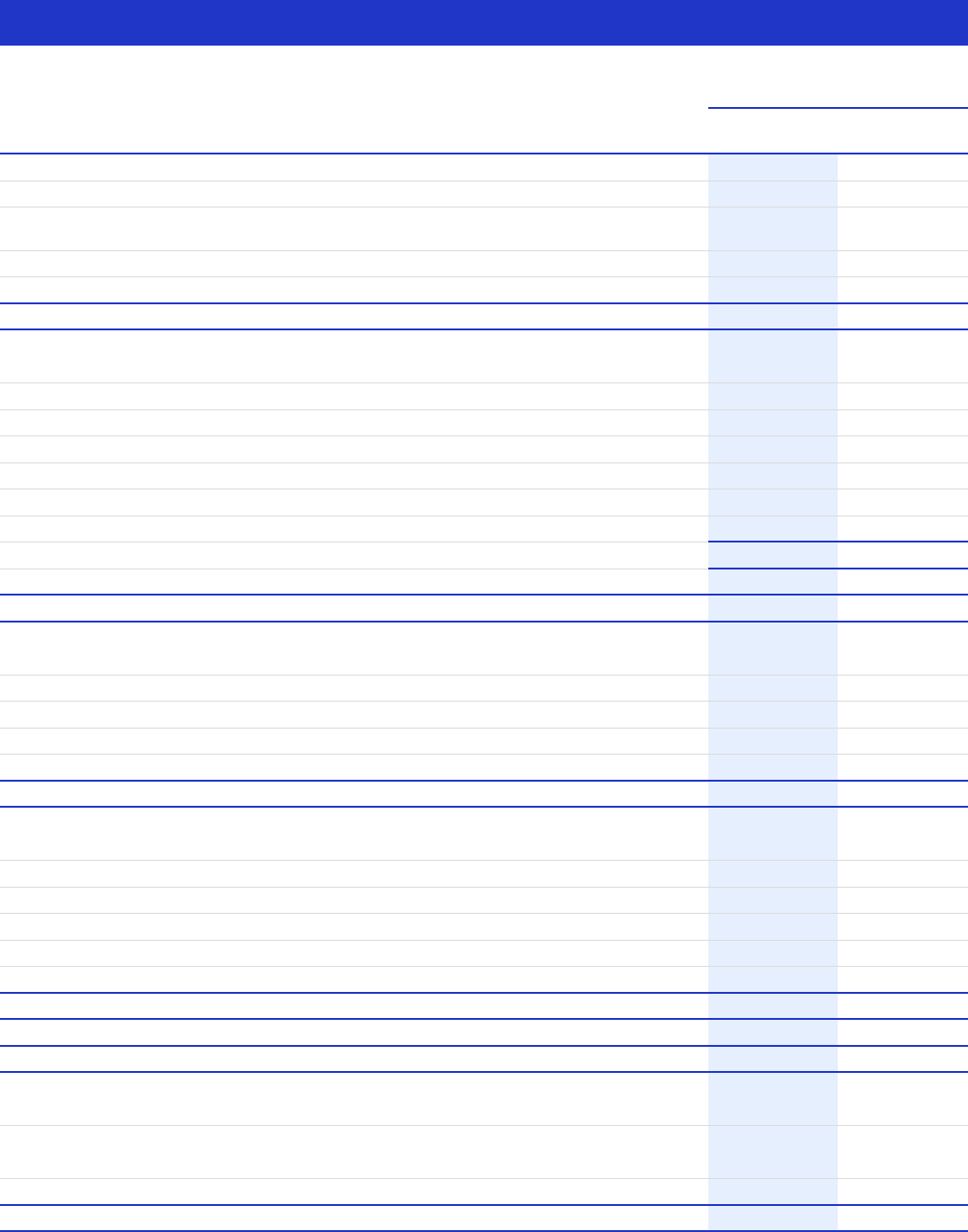

Beauty & Wellbeing

20% of Group turnover

(unaudited) Turnover USG UVG UPG A&D Currency

Turnover

change

UOM%

Change

in UOM

Full Year €12.3bn 7.8% 0.3% 7.5% 3.7% 8.1% 20.8% 18.7% (340)bps

Fourth Quarter €3.2bn 7.7% (0.6)% 8.4% 3.4% 6.9% 19.0%

Beauty & Wellbeing underlying sales grew 7.8% with 7.5% from price and 0.3% from volume. Growth was price-led in

core Skin Care and Hair Care, while it was volume-led in Prestige Beauty and Health & Wellbeing.

Hair Care grew mid-single digit, helped by strong performances of Sunsilk and Nexxus. Growth was driven by Latin

America, India and Turkey, partially offset by Europe and China where sales were affected by pandemic-related

restrictions. Skin Care grew low-single digit. South Asia and South East Asia delivered strong growth, helped by

Lifebuoy and rollout of the Vaseline premium Gluta-Hya innovation, while sales of AHC declined in North Asia.

Prestige Beauty delivered another year of double-digit growth, with strong contributions from Paula’s Choice and

Hourglass which continued its expansion into China, as well as Living Proof, which entered into the bond-building

premium hair care category. Liquid IV and Olly drove strong double-digit growth in Health & Wellbeing. The

acquisition of Nutrafol, a leading provider of hair wellness products, was completed in July.

Underlying operating margin declined 340bps due to input cost increases and the biggest step-up in brand and

marketing investment across the five Business Groups.

Personal Care

23% of Group turnover

(unaudited) Turnover USG UVG UPG A&D Currency

Turnover

change

UOM%

Change

in UOM

Full Year €13.6bn 7.9% (3.7)% 12.1% –% 7.4% 15.9% 19.6% (170)bps

Fourth Quarter €3.5bn 9.1% (3.5)% 13.0% –% 6.4% 16.1%

Personal Care underlying sales grew 7.9% with 12.1% from price and (3.7)% from volume. The volume decline was

higher in Skin Cleansing which was particularly affected by the commodity cost inflation.

Deodorants performed strongly, delivering double-digit price and positive volume growth. This was supported by

continued premiumisation and strong innovations, such as the 72-hour protection technology from Rexona. Skin

Cleansing grew high single-digit with strong price increases in response to the input cost inflation. While this led to a

volume decline, volumes held up better in North America, supported by premium innovations such as the Dove deep

moisture body wash with microbiome nutrient serum that delivers a further improved skin care experience. Oral Care

achieved price-led growth, helped by the relaunch of Pepsodent with increased naturals and efficacy credentials in

South East Asia, Africa and the Middle East, partially offset by a sales decline in Europe. Sales of Dollar Shave Club

declined during the year, and an impairment charge was recognised related to the business.

Underlying operating margin declined 170bps as a result of an input cost driven gross margin decline.

USG, UVG, UPG, UOP, UOM, underlying EPS, constant underlying EPS, underlying effective tax rate, FCF, net debt, ROIC and UEBITDA are non-GAAP measures (see pages 9 to 13)

4

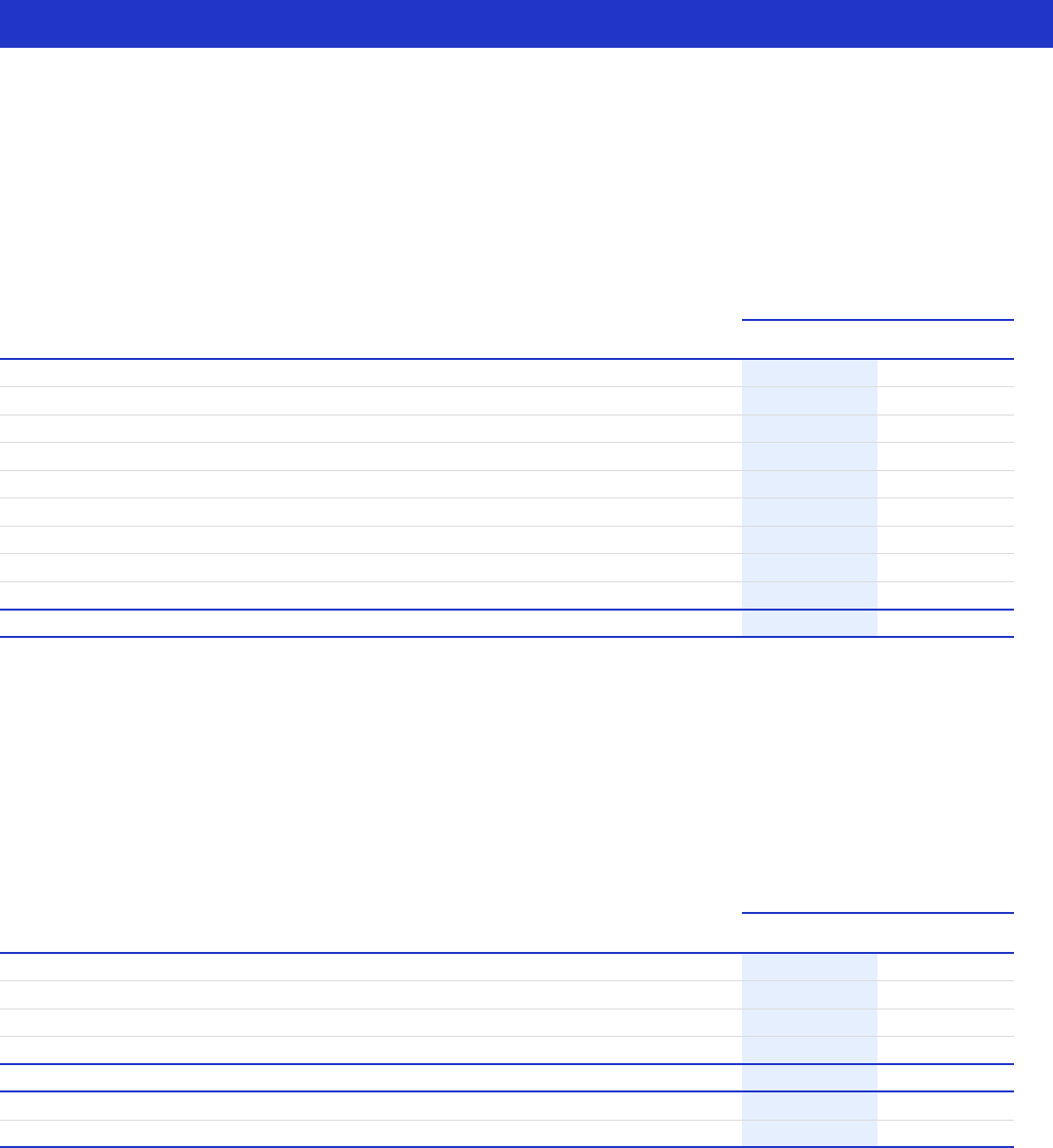

Full Year Review: Business Groups (continued)

Home Care

21% of Group turnover

(unaudited) Turnover USG UVG UPG A&D Currency

Turnover

change

UOM%

Change

in UOM

Full Year €12.4bn 11.8% (3.5)% 15.9% –% 4.9% 17.3% 10.8% (260)bps

Fourth Quarter €3.2bn 12.3% (3.8)% 16.7% –% 3.3% 15.9%

Home Care underlying sales grew 11.8%, with 15.9% from price and (3.5)% from volume. Price growth was led by

Fabric Cleaning which faced the highest commodity cost impact.

Fabric Cleaning grew high double-digit while holding volumes almost flat. This was driven by very strong

performances in South Asia, Brazil, Turkey and Vietnam with modest sales growth in Europe and China. The growth,

which was broad-based across formats, benefitted from our continuous market development of the liquids market,

with particularly strong contributions from OMO and Radiant. Fabric Enhancers grew high single-digit with modest

volume decline. Comfort delivered high growth in Latin America, South Asia and Turkey, but declined in Europe

where consumers reduced their spending in the category. Home & Hygiene grew slightly, with high single-digit

volume losses across most markets, while Air Wellness declined in 2022.

Underlying operating margin declined 260bps driven by gross margin contraction as a result of significant input cost

inflation despite having the highest price growth across all Business Groups.

Nutrition

23% of Group turnover

(unaudited) Turnover USG UVG UPG A&D Currency

Turnover

change

UOM%

Change

in UOM

Full Year €13.9bn 8.6% (2.1)% 10.9% (6.9)% 4.9% 6.1% 17.6% (170)bps

Fourth Quarter €3.5bn 10.1% (4.1)% 14.7% (14.2)% 3.9% (1.9)%

Nutrition underlying sales grew 8.6%, with 10.9% from price and (2.1)% from volume.

Scratch Cooking Aids, the biggest category, delivered mid single-digit growth. South East Asia, Africa and Latin

America performed strongly, led by Knorr, while China declined high single-digit as a result of pandemic-related

restrictions particularly in the second and fourth quarters. Dressings had a strong year with broad-based, double-

digit price growth and a modest volume decline, supported by continued high growth of Hellmann’s, particularly in

the United States. Despite a decline in China, Unilever Food Solutions delivered double-digit growth and almost

recovered to pre-pandemic volume levels, helped by extended distribution and consumers eating out-of-home more

frequently.

Underlying operating margin declined 170bps due to an input cost driven reduction in gross margin.

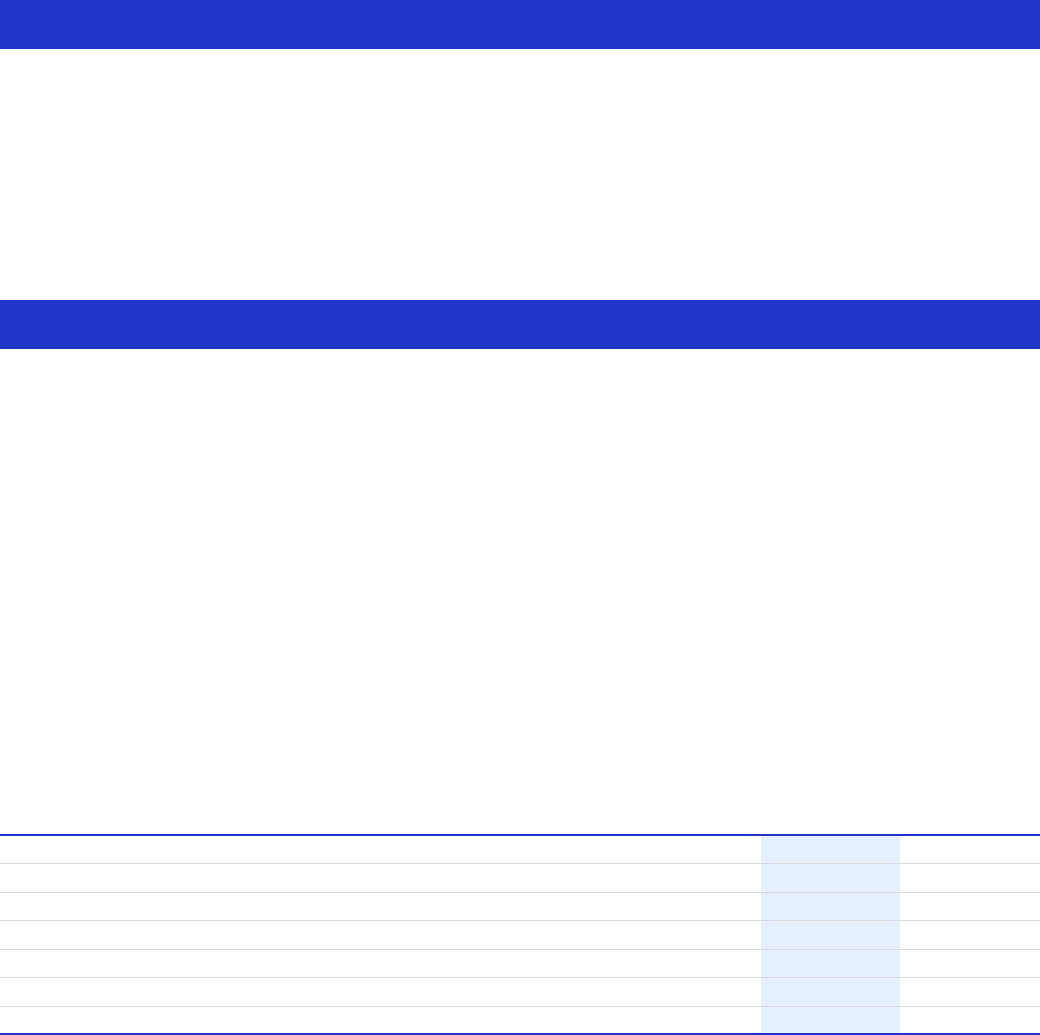

Ice Cream

13% of Group turnover

(unaudited) Turnover USG UVG UPG A&D Currency

Turnover

change

UOM%

Change

in UOM

Full Year €7.9bn 9.0% (0.7)% 9.7% –% 5.4% 14.8% 11.7% (220)bps

Fourth Quarter €1.2bn 2.9% (9.9)% 14.2% –% 7.5% 10.6%

Ice Cream underlying sales grew 9.0%, with 9.7% from price and (0.7)% from volume. Strong volume growth in out-of-

home was offset by volume declines in in-home, reversing some of the pandemic-related trends.

Out-of-home Ice Cream achieved double-digit price and high single-digit volume growth. The business continued to

recover sales lost during the pandemic but is yet to return to 2019 volumes. The in-home business grew mid single-

digit despite mid single-digit volume declines. Volumes were particularly weak in the fourth quarter as a result of

lapping strong in-home sales that were boosted by lockdowns in the prior two years. Magnum, Cornetto and Carte

d’Or delivered positive volume growth, supported by new variant innovations such as Magnum Remix, which has

launched across 65 countries, and new Cornetto variants in Turkey, South East Asia and China.

Underlying operating margin declined 220bps primarily due to high input cost inflation which affected gross margin.

USG, UVG, UPG, UOP, UOM, underlying EPS, constant underlying EPS, underlying effective tax rate, FCF, net debt, ROIC and UEBITDA are non-GAAP measures (see pages 9 to 13)

5

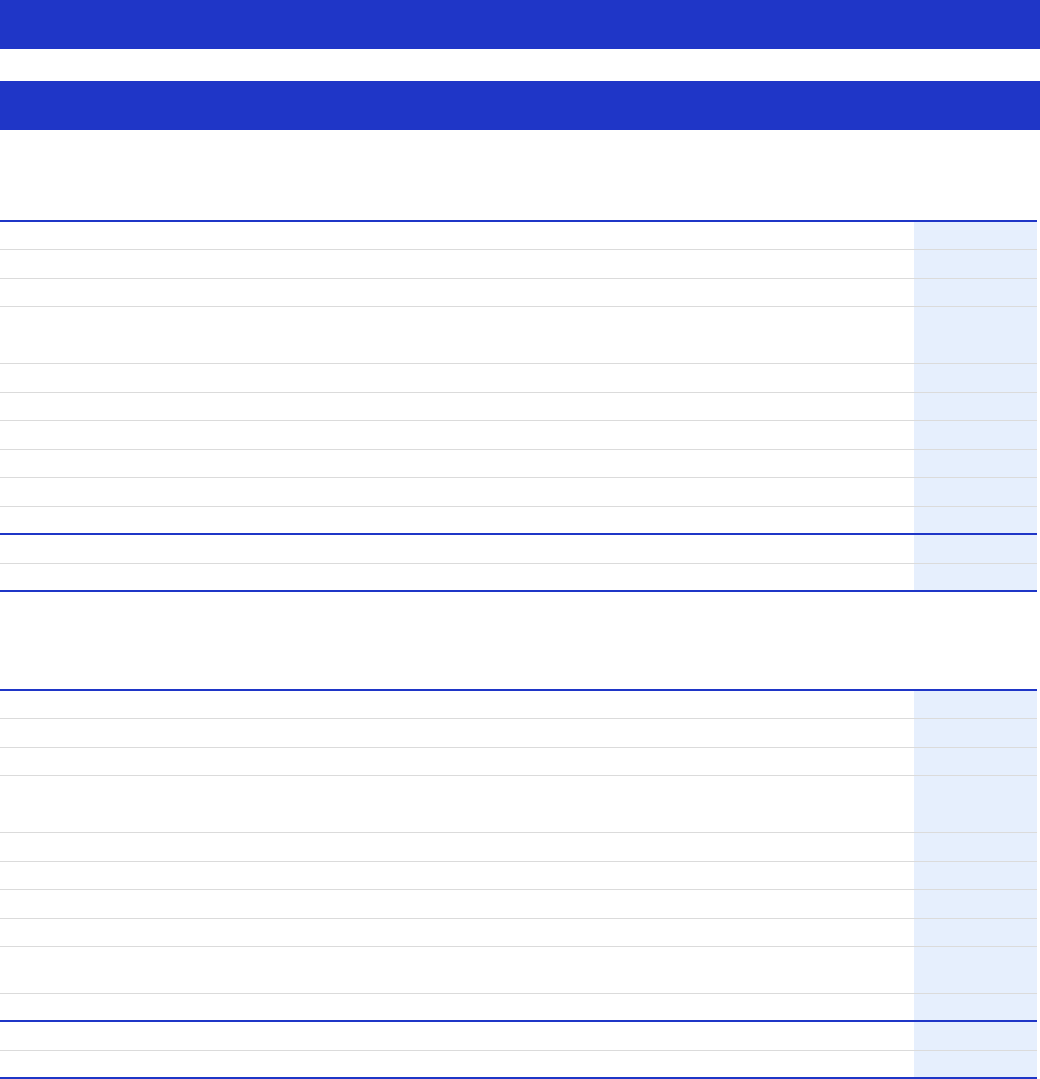

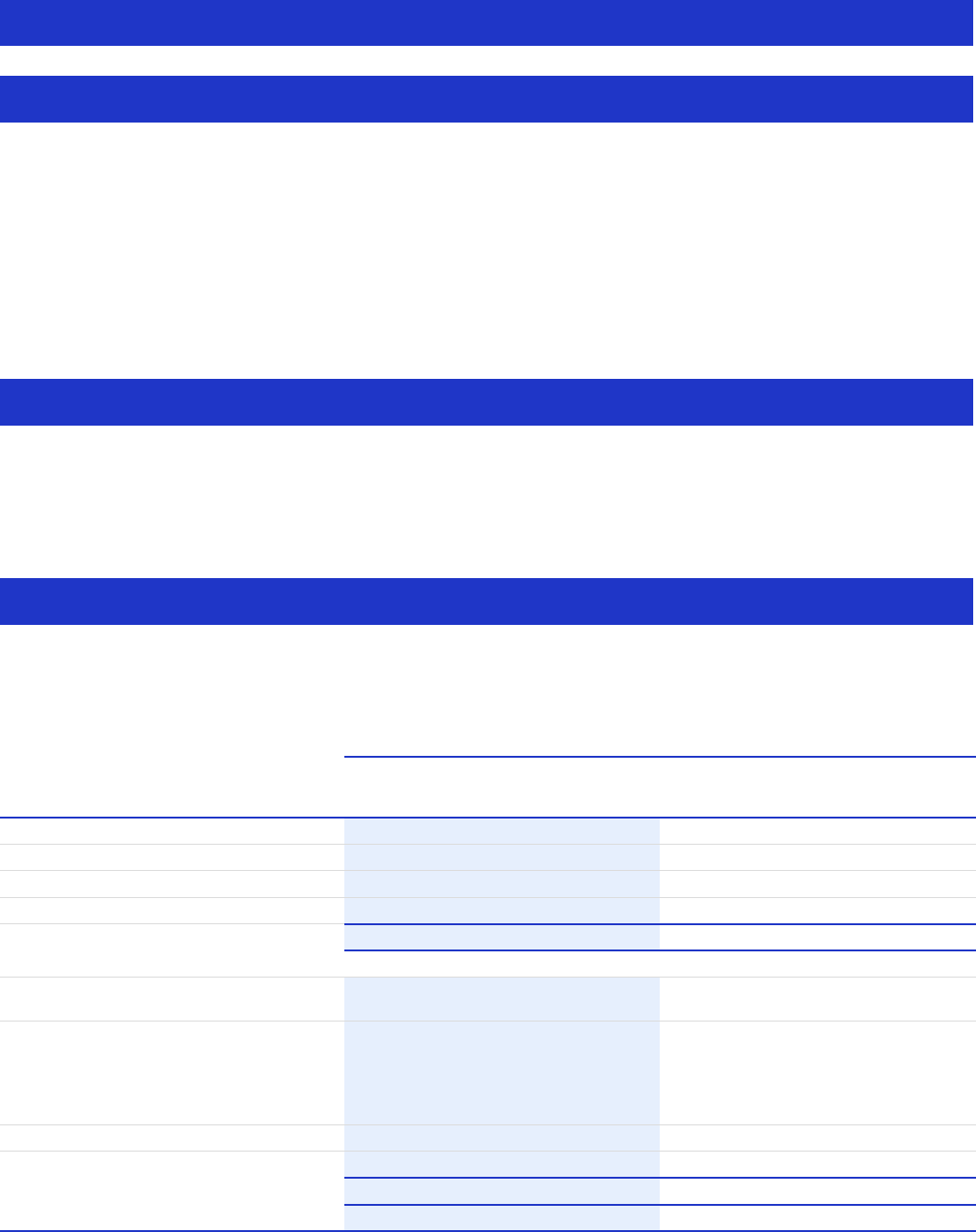

Full Year Review: Geographical Areas

Full Year 2022 Fourth Quarter 2022

(unaudited) Turnover USG UVG UPG Turnover USG UVG UPG

Unilever

€60.1bn 9.0 % (2.1) % 11.3 %

€14.6bn 9.2 % (3.6) % 13.3 %

Asia Pacific Africa €27.5bn 10.3 % (0.9) % 11.3 % €6.6bn 10.7 % (2.0) % 12.9 %

The Americas €20.9bn 10.4 % (2.6) % 13.3 % €5.4bn 9.3 % (4.0) % 13.9 %

Europe €11.7bn 4.1 % (3.9) % 8.3 % €2.6bn 5.5 % (6.8) % 13.2 %

Full Year 2022 Fourth Quarter 2022

(unaudited) Turnover USG UVG UPG Turnover USG UVG UPG

Emerging markets €35.3bn 11.2 % (2.0) % 13.5 % €8.7bn 11.6 % (2.8) % 14.8 %

Developed markets €24.8bn 5.9 % (2.3) % 8.4 % €5.9bn 5.7 % (4.8) % 11.0 %

North America €13.0bn 7.9 % (1.4) % 9.4 % €3.3bn 5.7 % (4.0) % 10.1 %

Latin America €7.9bn 14.9 % (4.6) % 20.4 % €2.1bn 15.0 % (4.1) % 19.9 %

Asia Pacific Africa

46% of Group turnover

Underlying sales grew 10.3% with 11.3% from price and (0.9)% from volume, driven by strong performances from

Home Care and Ice Cream. India delivered strong double-digit growth through pricing and positive volume growth,

supported by market development and continued strength of its premium portfolio. China declined slightly for the

year as lower market growth reflected Covid lockdown effects, particularly affecting Unilever Food Solutions and

Home Care in the second and fourth quarters. Indonesia delivered mid single-digit, price-driven growth, while

volumes were affected by a planned reduction in stock-in-trade levels. Philippines and Vietnam delivered broad-

based double-digit growth with positive volumes. Turkey saw consistent, strong volume growth, led by Home Care

and Ice Cream, in a hyperinflationary environment. In line with our treatment of other hyperinflationary countries,

the UPG in Turkey was capped from the second quarter. Africa grew double-digit, with increasing price growth and

volume reductions through the year.

The Americas

35% of Group turnover

Underlying sales growth in North America was 7.9% with 9.4% from price and (1.4)% from volume, helped by double-

digit growth in Beauty & Wellbeing and Nutrition, notably Dressings. Ice Cream grew high single-digit despite

volumes being negatively affected by some service issues earlier in the year. Deodorants performed strongly, and

the Air Wellness business declined sharply in a competitive market. Health & Wellbeing and Prestige Beauty grew

double-digit, while growth in core Skin Care and Hair Care was modest.

Latin America delivered underlying sales growth of 14.9%, with 20.4% from price and (4.6)% from volume. Growth was

broad-based, with all Business Groups landing strong double-digit pricing coupled with mid single-digit volume

declines. Volumes were helped by consumer-relevant innovations and a portfolio that spans across price points and

channels.

Europe

19% of Group turnover

Underlying sales grew 4.1% with 8.3% from price and (3.9)% from volume. Although price growth stepped up through

the year, the negative gross margin impact from high input cost inflation was materially higher than in the other

geographies. Ice Cream contributed strongly to growth for the year, driven by out-of-home sales and a strong

summer season, which was partially offset by a weak fourth quarter. Nutrition was boosted by double-digit growth

of Dressings and Unilever Food Solutions. Home Care sales declined low single-digit, driven by Home & Hygiene.

Deodorants were the main driver of underlying sales growth in Personal Care, while Beauty & Wellbeing grew

slightly.

USG, UVG, UPG, UOP, UOM, underlying EPS, constant underlying EPS, underlying effective tax rate, FCF, net debt, ROIC and UEBITDA are non-GAAP measures (see pages 9 to 13)

6

Additional commentary on the financial statements - Full Year

Finance costs and tax

Net finance costs increased €139 million to €493 million in 2022. The increase was driven by a higher cost of debt on

bonds and commercial papers. This was partially offset by higher interest income due to higher rates and cash

balances than in the prior year. Going forward, we expect net finance costs to be in the range of 2.5% to 3.0% on

average net debt. The negative impact from rising interest rates is partially offset by a bigger interest credit in 2023

from our pension plans which have a surplus position.

The underlying effective tax rate was 24.1% compared with 22.6% in 2021, primarily due to changes in the

geographical profit footprint as well as reduced benefits in tax settlements and other one-off items. Our guidance

for the underlying effective tax rate remains around 25%. In 2022, the effective tax rate was 20.4% compared with

23.1% in 2021, primarily due to the significant favourable impact of the ekaterra Tea disposal which benefited from

the participation exemption in the Netherlands.

Joint ventures, associates and other income from non-current investments

Net profit from joint ventures and associates was €208 million, an increase of €17 million compared to 2021. Other

income from non-current investments was €24 million, versus €91 million in the prior year that included higher gains

related to investments made by Unilever Ventures.

Earnings per share

Underlying earnings per share decreased by 2.1% to €2.57, including a positive impact of 6.1% from currency.

Constant underlying earnings per share decreased by 8.2%. The decrease was mainly driven by the margin decline, a

higher tax rate, lower income from non-current investments and an increase in finance costs. This was partially offset

by a reduction in the average number of shares as a result of our share buybacks, contributing 1.9%. Diluted earnings

per share were up 28.8% at €2.99, including a gain of €2.3 billion related to the disposal of ekaterra and an

impairment charge of €192 million related to Dollar Shave Club.

Free cash flow

Free cash flow was €5.2 billion in 2022, including €0.3 billion tax paid on the ekaterra separation. It was down from

the €6.4 billion delivered in 2021 due to increases in capital expenditure and working capital, notably inventory.

Net debt

Closing net debt was €23.7 billion compared to €25.5 billion as at 31 December 2021 driven largely by net disposal

proceeds that were partially offset by €1.5 billion share buyback executed during the year and a negative currency

impact. Net debt to underlying EBITDA was 2.1x as at 31 December 2022, in line with our guidance of around 2x and

slightly down versus 2.2x in the prior year.

Pensions

Pension assets net of liabilities were in surplus of €2.6 billion at 31 December 2022 versus a surplus of €3.0 billion at

the end of 2021. Both pension assets and pension liabilities reduced materially in 2022, primarily due to the impact

of higher interest rates on these values.

Underlying return on invested capital

Underlying return on invested capital was 16.0%, compared to 17.2% in the prior year. This was mainly due to

increased goodwill and intangibles, driven by Paula’s Choice and Nutrafol acquisitions and a currency impact.

Financial implications and impairment risk in Russia

We employ over 3,000 people in Russia and in 2022 the business contributed 1.4% of the Group’s turnover and 2% of

the Group’s net profit. As at 31 December 2022, we had an asset position of around €900 million in Russia, including

four factories. In March 2022, we announced our decision to suspend all imports and exports of Unilever products

into and out of Russia and cease any capital flows in and out of the country.

We will continue to review and disclose the financial implications from the conflict. While the potential impacts

remain uncertain, there is a risk that the operations in Russia are unable to continue, leading to loss of turnover,

profit and a write-down of assets.

Share buyback programme

On 22 July and 19 December 2022, we completed the first and second €750 million tranches of our share buyback

programme of up to €3 billion, initiated on 10 February 2022. The total consideration paid for the repurchase of

34,217,605 shares is recorded within other reserves. All shares purchased are held by Unilever as treasury shares.

USG, UVG, UPG, UOP, UOM, underlying EPS, constant underlying EPS, underlying effective tax rate, FCF, net debt, ROIC and UEBITDA are non-GAAP measures (see pages 9 to 13)

7

Additional commentary on the financial statements - Full Year (continued)

Finance and liquidity

In 2022, the following notes matured and were repaid:

• February: €750 million 0.50% fixed rate notes, £350 million 1.125% fixed rate notes

• March: $500 million 3.00% fixed rate notes

• May: $850 million 2.20% fixed rate notes

The following notes were issued:

• February: €500 million 0.75% fixed rate notes due February 2026, €650 million 1.25% fixed rate notes due February

2031, £300 million 2.125% fixed rate notes due February 2028

• May: €650 million 1.75% fixed rate notes due November 2028; €850 million 2.25% fixed rate notes due May 2034

On 31 December 2022, Unilever had undrawn revolving 364-day bilateral credit facilities in aggregate of $5,200

million and €2,550 million with a 364-day term out.

USG, UVG, UPG, UOP, UOM, underlying EPS, constant underlying EPS, underlying effective tax rate, FCF, net debt, ROIC and UEBITDA are non-GAAP measures (see pages 9 to 13)

8

Competition Investigations

As previously disclosed, Unilever is involved in a number of ongoing investigations by national competition

authorities, including those within France and South Africa. These proceedings and investigations are at various

stages and concern a variety of product markets. Where appropriate, provisions are made and contingent liabilities

disclosed in relation to such matters.

Ongoing compliance with competition laws is of key importance to Unilever. It is Unilever’s policy to co-operate fully

with competition authorities whenever questions or issues arise. In addition, the Group continues to reinforce and

enhance its internal competition law training and compliance programme on an ongoing basis.

Non-GAAP measures

Certain discussions and analyses set out in this announcement include measures which are not defined by generally

accepted accounting principles (GAAP) such as IFRS. We believe this information, along with comparable GAAP

measurements, is useful to investors because it provides a basis for measuring our operating performance, ability to

retire debt and invest in new business opportunities. Our management uses these financial measures, along with the

most directly comparable GAAP financial measures, in evaluating our operating performance and value creation.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information

presented in compliance with GAAP. Wherever appropriate and practical, we provide reconciliations to relevant

GAAP measures.

Unilever uses ‘constant rate’, and ‘underlying’ measures primarily for internal performance analysis and targeting

purposes. We present certain items, percentages and movements, using constant exchange rates, which exclude the

impact of fluctuations in foreign currency exchange rates. We calculate constant currency values by translating both

the current and the prior period local currency amounts using the prior year average exchange rates into euro,

except for the local currency of entities that operate in hyperinflationary economies. These currencies are translated

into euros using the prior year closing exchange rate before the application of IAS 29. The table below shows

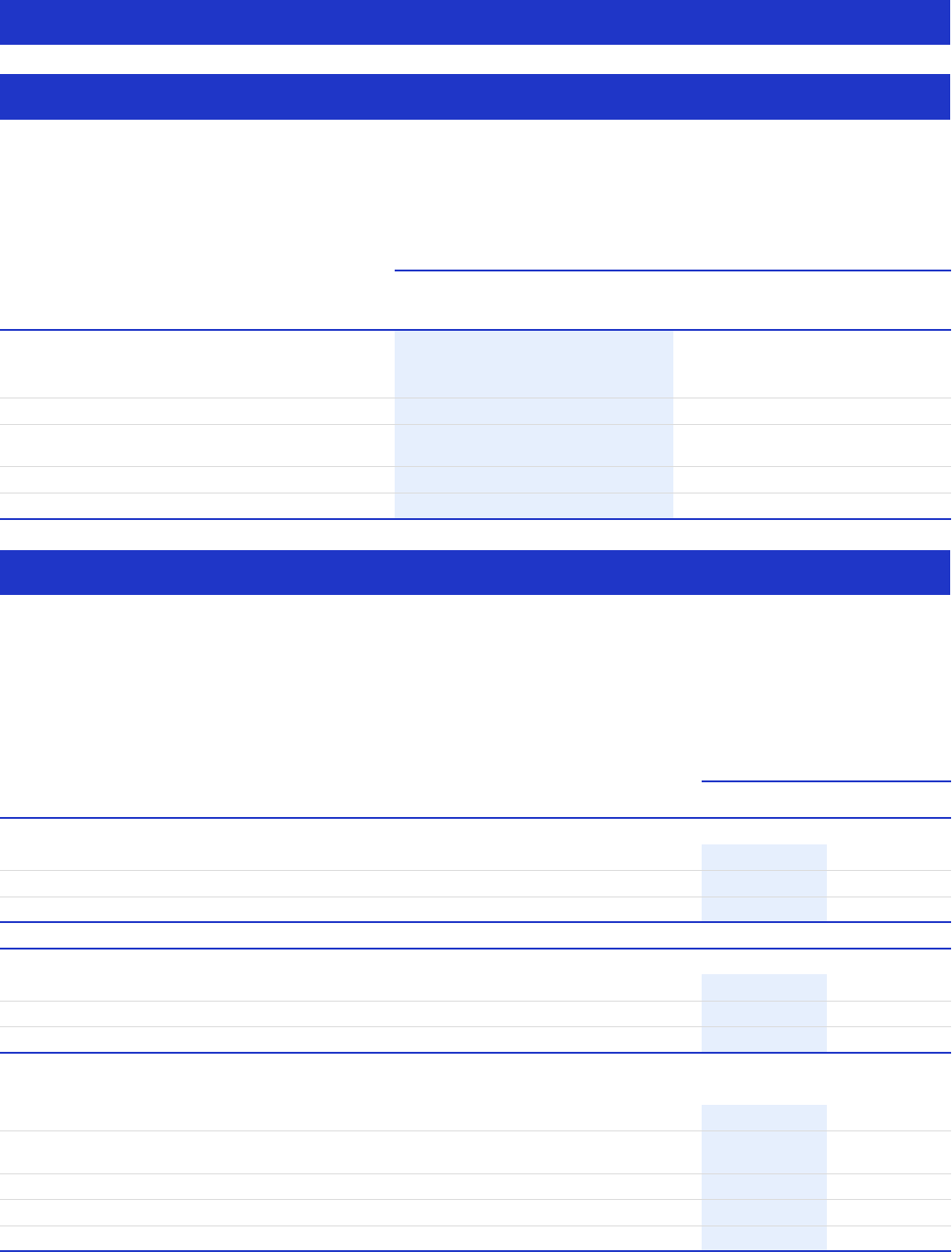

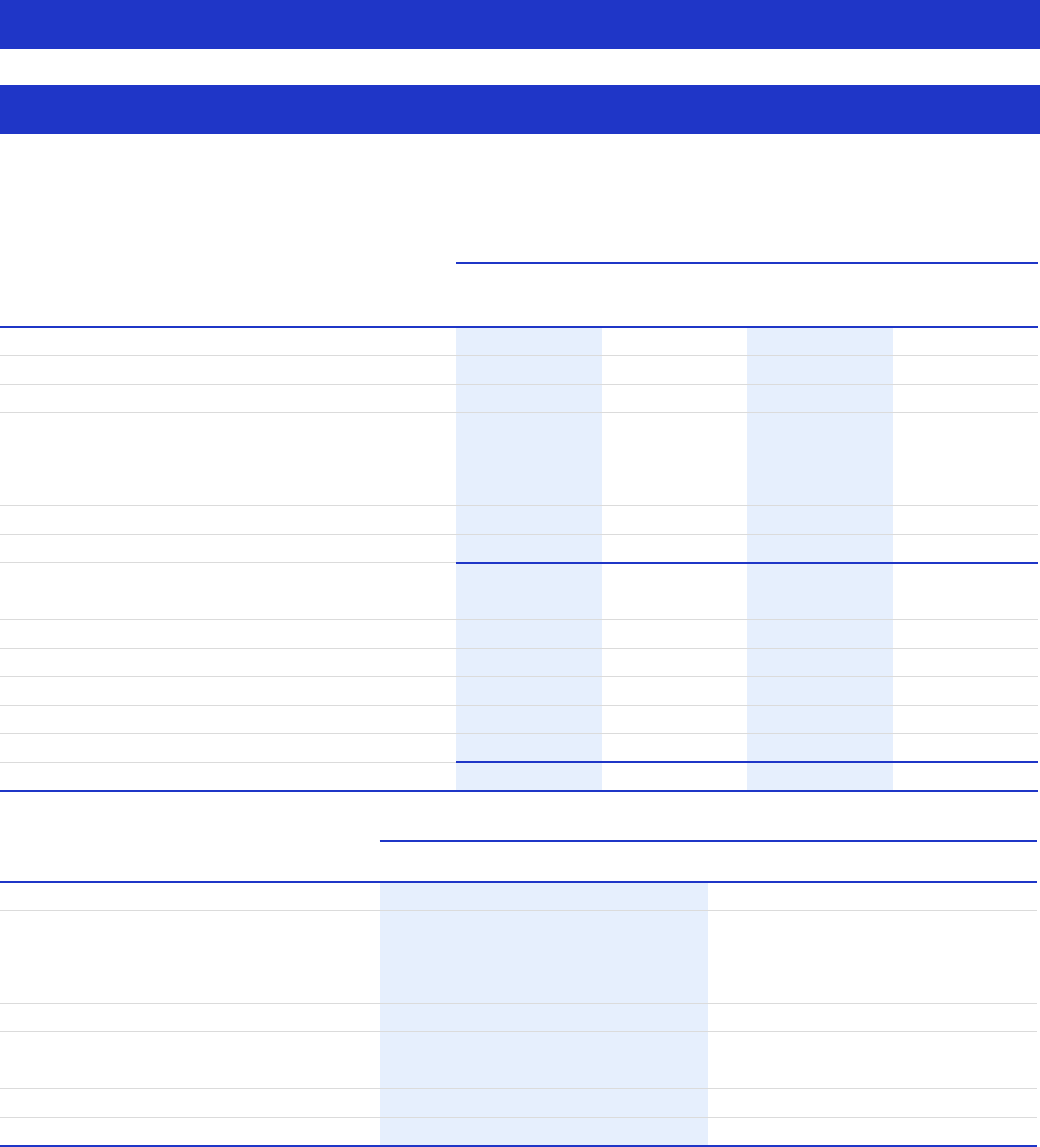

exchange rate movements in our key markets.

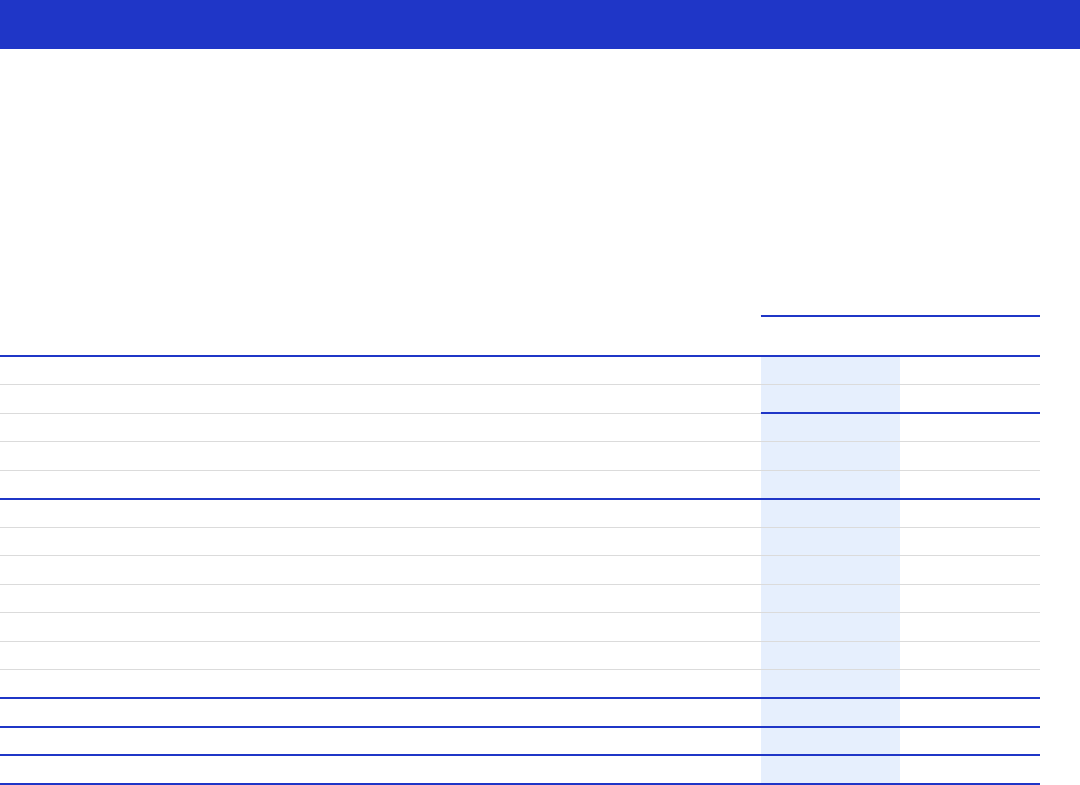

Annual

average rate

in 2022

Annual

average rate

in 2021

Brazilian Real (€1 = BRL) 5.414 6.366

Chinese Yuan (€1 = CNY) 7.047 7.663

Indian Rupee (€1 = INR) 82.303 87.599

Indonesia Rupiah (€1 = IDR) 15,535 16,983

Philippine Peso (€1 = PHP) 57.194 58.401

UK Pound Sterling (€1 = GBP) 0.851 0.861

US Dollar (€1 = US $) 1.050 1.187

Underlying sales growth (USG)

Underlying sales growth (USG) refers to the increase in turnover for the period, excluding any change in turnover

resulting from acquisitions, disposals, changes in currency and price growth in excess of 26% in hyperinflationary

economies. Inflation of 26% per year compounded over three years is one of the key indicators within IAS 29 to assess

whether an economy is deemed to be hyperinflationary. We believe this measure provides valuable additional

information on the underlying sales performance of the business and is a key measure used internally. The impact of

acquisitions and disposals is excluded from USG for a period of 12 calendar months from the applicable closing

date. Turnover from acquired brands that are launched in countries where they were not previously sold is included

in USG as such turnover is more attributable to our existing sales and distribution network than the acquisition itself.

The reconciliation of changes in the GAAP measure turnover to USG is provided in notes 3 and 4.

Underlying price growth (UPG)

Underlying price growth (UPG) is part of USG and means, for the applicable period, the increase in turnover

attributable to changes in prices during the period. UPG therefore excludes the impact to USG due to (i) the volume

of products sold; and (ii) the composition of products sold during the period. In determining changes in price, we

exclude the impact of price growth in excess of 26% per year in hyperinflationary economies as explained in USG

above. The measures and the related turnover GAAP measure are set out in notes 3 and 4.

9

Non-GAAP measures (continued)

Underlying volume growth (UVG)

Underlying volume growth (UVG) is part of USG and means, for the applicable period, the increase in turnover in such

period calculated as the sum of (i) the increase in turnover attributable to the volume of products sold; and (ii) the

increase in turnover attributable to the composition of products sold during such period. UVG therefore excludes any

impact on USG due to changes in prices. The measures and the related turnover GAAP measure are set out in notes 3

and 4.

Non-underlying items

Several non-GAAP measures are adjusted to exclude items defined as non-underlying due to their nature and/or

frequency of occurrence.

• Non-underlying items within operating profit are: gains or losses on business disposals, acquisition and

disposal related costs, restructuring costs, impairments and other items within operating profit classified here

due to their nature and frequency.

• Non-underlying items not in operating profit but within net profit are: net monetary gain/(loss) arising from

hyperinflationary economies and significant and unusual items in net finance cost, share of profit/(loss) of joint

ventures and associates and taxation.

• Non-underlying items are: both non-underlying items within operating profit and those non-underlying items

not in operating profit but within net profit.

Underlying operating profit (UOP) and underlying operating margin (UOM)

Underlying operating profit and underlying operating margin mean operating profit and operating margin before

the impact of non-underlying items within operating profit. Underlying operating profit represents our measure of

segment profit or loss as it is the primary measure used for making decisions about allocating resources and

assessing performance of the segments. The reconciliation of operating profit to underlying operating profit is as

follows:

€ million Full Year

(unaudited) 2022 2021

Operating profit 10,755 8,702

Non-underlying items within operating profit (see note 2) (1,072) 934

Underlying operating profit 9,683 9,636

Turnover 60,073 52,444

Operating margin (%) 17.9 16.6

Underlying operating margin (%) 16.1 18.4

Underlying earnings before interest, taxation, depreciation and amortisation (UEBITDA)

Underlying earnings before interest, taxation, depreciation and amortisation means operating profit before the

impact of depreciation, amortisation and non-underlying items within operating profit. We use UEBITDA in assessing

our leverage level, which is expressed as net debt / UEBITDA. The reconciliation of operating profit to UEBITDA is as

follows:

€ million Full Year

(unaudited) 2022 2021

Operating profit 10,755 8,702

Depreciation and amortisation 1,725 1,746

Non-underlying items within operating profit (1,072) 934

Underlying earnings before interest, taxes, depreciation and amortisation (UEBITDA) 11,408 11,382

10

Non-GAAP measures (continued)

Underlying effective tax rate

The underlying effective tax rate is calculated by dividing taxation excluding the tax impact of non-underlying items

by profit before tax excluding the impact of non-underlying items and share of net (profit)/loss of joint ventures and

associates. This measure reflects the underlying tax rate in relation to profit before tax excluding non-underlying

items before tax and share of net profit/(loss) of joint ventures and associates. Tax impact on non-underlying items

within operating profit is the sum of the tax on each non-underlying item, based on the applicable country tax rates

and tax treatment. This is shown in the following table:

€ million Full Year

(unaudited) 2022 2021

Taxation 2,068 1,935

Tax impact of:

Non-underlying items within operating profit

(a)

273 219

Non-underlying items not in operating profit but within net profit

(a)

(121) (41)

Taxation before tax impact of non-underlying items 2,220 2,113

Profit before taxation 10,337 8,556

Share of net (profit)/loss of joint ventures and associates (208) (191)

Profit before tax excluding share of net profit/(loss) of joint ventures and associates

10,129 8,365

Non-underlying items within operating profit before tax

(a)

(1,072) 934

Non-underlying items not in operating profit but within net profit before tax 164 64

Profit before tax excluding non-underlying items before tax and share of net profit/

(loss) of joint ventures and associates

9,221 9,363

Effective tax rate (%) 20.4 23.1

Underlying effective tax rate (%) 24.1 22.6

(a) See note 2.

Underlying earnings per share

Underlying earnings per share (underlying EPS) is calculated as underlying profit attributable to shareholders’ equity

divided by the diluted average number of ordinary shares. In calculating underlying profit attributable to

shareholders’ equity, net profit attributable to shareholders’ equity is adjusted to eliminate the post-tax impact of

non-underlying items. This measure reflects the underlying earnings for each share unit of the Group. Refer to note 6

for reconciliation of net profit attributable to shareholders’ equity to underlying profit attributable to shareholders'

equity.

Constant underlying EPS

Constant underlying earnings per share (constant underlying EPS) is calculated as underlying profit attributable to

shareholders’ equity at constant exchange rates and excluding the impact of both translational hedges and price

growth in excess of 26% per year in hyperinflationary economies divided by the diluted average number of ordinary

shares. This measure reflects the underlying earnings for each share unit of the Group in constant exchange rates.

The reconciliation of underlying profit attributable to shareholders’ equity to constant underlying earnings

attributable to shareholders’ equity and the calculation of constant underlying EPS is as follows:

€ million Full Year

(unaudited) 2022 2021

Underlying profit attributable to shareholders’ equity (see note 6) 6,568 6,839

Impact of translation from current to constant exchange rates and translational

hedges

(307) (106)

Impact of price growth in excess of 26% per year in hyperinflationary economies (200) –

Constant underlying earnings attributable to shareholders’ equity 6,061 6,733

Diluted average number of share units (millions of units) 2,559.8 2,609.6

Constant underlying EPS (€) 2.37 2.58

11

Non-GAAP measures (continued)

Net debt

Net debt is a measure that provides valuable additional information on the summary presentation of the Group’s

net financial liabilities and is a measure in common use elsewhere. Net debt is defined as the excess of total

financial liabilities, excluding trade payables and other current liabilities, over cash, cash equivalents and other

current financial assets, excluding trade and other current receivables, and non-current financial asset derivatives

that relate to financial liabilities.

The reconciliation of total financial liabilities to net debt is as follows:

€ million Full Year

(unaudited) 2022 2021

Total financial liabilities (29,488) (30,133)

Current financial liabilities (5,775) (7,252)

Non-current financial liabilities (23,713) (22,881)

Cash and cash equivalents as per balance sheet 4,326 3,415

Cash and cash equivalents as per cash flow statement 4,225 3,387

Add: bank overdrafts deducted therein 101 106

Less: cash and cash equivalents held for sale – (78)

Other current financial assets 1,435 1,156

Non-current financial asset derivatives that relate to financial liabilities 51 52

Net debt (23,676) (25,510)

Free cash flow (FCF)

Within the Unilever Group, free cash flow (FCF) is defined as cash flow from operating activities, less income taxes

paid, net capital expenditure and net interest payments. It does not represent residual cash flows entirely available

for discretionary purposes; for example, the repayment of principal amounts borrowed is not deducted from FCF. FCF

reflects an additional way of viewing our liquidity that we believe is useful to investors because it represents cash

flows that could be used for distribution of dividends, repayment of debt or to fund our strategic initiatives, including

acquisitions, if any.

The reconciliation of cash flow from operating activities to FCF is as follows:

€ million Full Year

(unaudited) 2022 2021

Cash flow from operating activities 10,089 10,305

Income tax paid (2,807) (2,333)

Net capital expenditure (1,627) (1,239)

Net interest paid (457) (340)

Free cash flow 5,198 6,393

Net cash flow (used in)/from investing activities 2,453 (3,246)

Net cash flow (used in)/from financing activities (8,890) (7,099)

12

Non-GAAP measures (continued)

Underlying return on invested capital (ROIC)

Underlying return on invested capital (ROIC) is a measure of the return generated on capital invested by the Group.

The measure provides a guard rail for long-term value creation and encourages compounding reinvestment within

the business and discipline around acquisitions with low returns and long payback. Underlying ROIC is calculated as

underlying operating profit after tax divided by the annual average of: goodwill, intangible assets, property, plant

and equipment, net assets held for sale, inventories, trade and other current receivables, and trade payables and

other current liabilities.

€ million Full Year

(unaudited)

2022 2021

Operating profit 10,755 8,702

Non-underlying items within operating profit (see note 2) (1,072) 934

Underlying operating profit before tax 9,683 9,636

Tax on underlying operating profit

(a)

(2,331) (2,175)

Underlying operating profit after tax 7,352 7,461

Goodwill 21,609 20,330

Intangible assets 18,880 18,261

Property, plant and equipment 10,770 10,347

Net assets held for sale 24 1,581

Inventories 5,931 4,683

Trade and other current receivables 7,056 5,422

Trade payables and other current liabilities (18,023) (14,861)

Period-end invested capital 46,247 45,763

Average invested capital for the period 46,005 43,279

Underlying return on invested capital (%) 16.0 17.2

(a) Tax on underlying operating profit is calculated as underlying operating profit before tax multiplied by the underlying effective tax rate of 24.1%

(2021: 22.6%) which is shown on page 23.

13

Cautionary statement

This announcement may contain forward-looking statements, including ‘forward-looking statements’ within the

meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as ‘will’, ‘aim’, ‘expects’,

‘anticipates’, ‘intends’, ‘looks’, ‘believes’, ‘vision’, or the negative of these terms and other similar expressions of

future performance or results, and their negatives, are intended to identify such forward-looking statements. These

forward-looking statements are based upon current expectations and assumptions regarding anticipated

developments and other factors affecting the Unilever Group (the ‘Group’). They are not historical facts, nor are they

guarantees of future performance.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could

cause actual results to differ materially from those expressed or implied by these forward-looking statements.

Among other risks and uncertainties, the material or principal factors which could cause actual results to differ

materially are: Unilever’s global brands not meeting consumer preferences; Unilever’s ability to innovate and remain

competitive; Unilever’s investment choices in its portfolio management; the effect of climate change on Unilever’s

business; Unilever's ability to find sustainable solutions to its plastic packaging; significant changes or deterioration

in customer relationships; the recruitment and retention of talented employees; disruptions in our supply chain and

distribution; increases or volatility in the cost of raw materials and commodities; the production of safe and high

quality products; secure and reliable IT infrastructure; execution of acquisitions, divestitures and business

transformation projects; economic, social and political risks and natural disasters; financial risks; failure to meet high

and ethical standards; and managing regulatory, tax and legal matters. A number of these risks have increased as a

result of the current Covid-19 pandemic. These forward-looking statements speak only as of the date of this

document. Except as required by any applicable law or regulation, the Group expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to

reflect any change in the Group’s expectations with regard thereto or any change in events, conditions or

circumstances on which any such statement is based. Further details of potential risks and uncertainties affecting

the Group are described in the Group’s filings with the London Stock Exchange, Euronext Amsterdam and the US

Securities and Exchange Commission, including in the Annual Report on Form 20-F 2021 and the Unilever Annual

Report and Accounts 2021.

Enquiries

Media: Media Relations Team Investors: Investor Relations Team

After the conference call on 9 February 2023 at 8AM (UK time), the webcast of the presentation will be available at:

www.unilever.com/investor-relations/results-and-presentations/latest-results

14

Income statement

€ million Full Year

2022 2021

Increase/ (Decrease)

(unaudited)

Current

rates

Constant

rates

Turnover 60,073 52,444 14.5% 9.5%

Operating profit 10,755 8,702 23.6% 19.2%

Net finance costs (493) (354)

Pensions and similar obligations 44 (10)

Finance income 281 147

Finance costs (818) (491)

Net monetary gain/(loss) arising from hyperinflationary

economies

(157) (74)

Share of net profit/(loss) of joint ventures and associates 208 191

Other income/(loss) from non-current investments and associates 24 91

Profit before taxation 10,337 8,556 20.8% 17.9%

Taxation (2,068) (1,935)

Net profit 8,269 6,621 24.9% 23.2%

Attributable to:

Non-controlling interests 627 572

Shareholders’ equity 7,642 6,049 26.3% 25.1%

Earnings per share

Basic earnings per share (euros) 3.00

2.33 28.9% 27.7%

Diluted earnings per share (euros)

2.99 2.32 28.8% 27.5%

Statement of comprehensive income

€ million Full Year

(unaudited) 2022 2021

Net profit 8,269 6,621

Other comprehensive income

Items that will not be reclassified to profit or loss, net of tax:

Gains/(losses) on equity instruments measured at fair value through other

comprehensive income

36 166

Remeasurement of defined benefit pension plans (473) 1,734

Items that may be reclassified subsequently to profit or loss, net of tax:

Gains/(losses) on cash flow hedges (91) 279

Currency retranslation gains/(losses) 614 1,177

Total comprehensive income 8,355 9,977

Attributable to:

Non-controlling interests 507 749

Shareholders’ equity 7,848 9,228

15

Statement of changes in equity

(unaudited)

€ million

Called

up share

capital

Share

premium

account

Unification

reserve

Other

reserves

Retained

profit

Total

Non-

controlling

interest

Total

equity

31 December 2020

92 73,472 (73,364) (7,482) 22,548 15,266 2,389 17,655

Profit or loss for the period

– – – – 6,049 6,049 572 6,621

Other comprehensive income, net of tax:

Gains/(losses) on:

Equity instruments

– – – 147 – 147 19 166

Cash flow hedges

– – – 276 – 276 3 279

Remeasurements of defined benefit

pension plans

– – – – 1,728 1,728 6 1,734

Currency retranslation gains/(losses)

– – – 1,025 3 1,028 149 1,177

Total comprehensive income

– – – 1,448 7,780 9,228 749 9,977

Dividends on ordinary capital

– – – – (4,458) (4,458) – (4,458)

Share capital reduction

(a)

– (20,626) – – 20,626 – – –

Repurchase of shares

(b)

– – – (3,018) – (3,018) – (3,018)

Movements in treasury shares

(c)

– – – 95 (143) (48) – (48)

Share-based payment credit

(d)

– – – – 161 161 – 161

Dividends paid to non-controlling

interests

– – – – – – (503) (503)

Hedging gain/(loss) transferred to non-

financial assets

– – – (171) – (171) (3) (174)

Other movements in equity

(e)

– (2) – (82) 231 147 7 154

31 December 2021

92 52,844 (73,364) (9,210) 46,745 17,107 2,639 19,746

Hyperinflation restatement to 1 January

2022 (Turkey)

– – – – 154 154 – 154

Adjusted opening balance

92 52,844 (73,364) (9,210) 46,899 17,261 2,639 19,900

Profit or loss for the period

– – – – 7,642 7,642 627 8,269

Other comprehensive income, net of tax:

Gains/(losses) on:

Equity instruments

– – – 45 – 45 (9) 36

Cash flow hedges

– – – (92) – (92) 1 (91)

Remeasurements of defined benefit

pension plans

– – – – (474) (474) 1 (473)

Currency retranslation gains/(losses)

(f)

– – – 240 487 727 (113) 614

Total comprehensive income

– – – 193 7,655 7,848 507 8,355

Dividends on ordinary capital

– – – – (4,356) (4,356) – (4,356)

Repurchase of shares

(b)

– – – (1,509) – (1,509) – (1,509)

Movements in treasury shares

(c)

– – – 106 (137) (31) – (31)

Share-based payment credit

(d)

– – – – 177 177 – 177

Dividends paid to non-controlling

interests

– – – – – – (572) (572)

Hedging gain/(loss) transferred to non-

financial assets

– – – (126) – (126) (1) (127)

Other movements in equity

(g)

– – – (258) 15 (243) 107 (136)

31 December 2022

92 52,844 (73,364) (10,804) 50,253 19,021 2,680 21,701

(a) Share premium has been adjusted to reflect the legal share capital of the PLC company, which reduced by £18,400 million following court approval

on 15 June 2021.

(b) Repurchase of shares reflects the cost of acquiring ordinary shares as part of the share buyback program announced on 29 April 2021 and 10

February 2022.

(c) Includes purchases and sales of treasury shares, other than the share buyback programme and the transfer from treasury shares to retained profit

of share-settled schemes arising from prior years and differences between purchase and grant price of share awards.

(d) The share-based payment credit relates to the non-cash charge recorded against operating profit in respect of the fair value of share options and

awards granted to employees.

(e) Includes €280 million related to hyperinflation adjustment and €82 million related to the Welly acquisition.

(f) Includes a hyperinflation adjustment of €514 million in relation to Argentina and Turkey.

(g) Includes the following items related to the acquisition of Nutrafol: €(269) million non-controlling interest purchase option in other reserves and €99

million non-controlling interest recognised on acquisition.

16

Balance sheet

(unaudited)

€ million

As at 31

December

2022

As at 31

December

2021

Non-current assets

Goodwill 21,609 20,330

Intangible assets 18,880 18,261

Property, plant and equipment 10,770 10,347

Pension asset for funded schemes in surplus 4,260 5,119

Deferred tax assets 1,049 1,465

Financial assets 1,154 1,198

Other non-current assets 942 974

58,664 57,694

Current assets

Inventories 5,931 4,683

Trade and other current receivables 7,056 5,422

Current tax assets 381 324

Cash and cash equivalents 4,326 3,415

Other financial assets 1,435 1,156

Assets held for sale 28 2,401

19,157 17,401

Total assets 77,821 75,095

Current liabilities

Financial liabilities 5,775 7,252

Trade payables and other current liabilities 18,023 14,861

Current tax liabilities 877 1,365

Provisions 748 480

Liabilities held for sale 4 820

25,427 24,778

Non-current liabilities

Financial liabilities 23,713 22,881

Non-current tax liabilities 94 148

Pensions and post-retirement healthcare liabilities:

Funded schemes in deficit 613 831

Unfunded schemes 1,078 1,295

Provisions 550 611

Deferred tax liabilities 4,375 4,530

Other non-current liabilities 270 275

30,693 30,571

Total liabilities 56,120 55,349

Equity

Shareholders’ equity 19,021 17,107

Non-controlling interests 2,680 2,639

Total equity 21,701 19,746

Total liabilities and equity 77,821 75,095

17

Cash flow statement

(unaudited) Full Year

€ million 2022 2021

Net profit 8,269 6,621

Taxation 2,068 1,935

Share of net (profit)/loss of joint ventures/associates and other (income)/loss from

non-current investments and associates

(232) (282)

Net monetary (gain)/loss arising from hyperinflationary economies 157 74

Net finance costs 493 354

Operating profit 10,755 8,702

Depreciation, amortisation and impairment 1,946 1,763

Changes in working capital (422) (47)

Pensions and similar obligations less payments (119) (183)

Provisions less payments 203 (61)

Elimination of (profits)/losses on disposals (2,335) 23

Non-cash charge for share-based compensation 177 161

Other adjustments (116) (53)

Cash flow from operating activities 10,089 10,305

Income tax paid (2,807) (2,333)

Net cash flow from operating activities 7,282 7,972

Interest received 287 148

Net capital expenditure (1,627) (1,239)

Acquisitions and disposals 3,643 (2,088)

Other investing activities 150 (67)

Net cash flow (used in)/from investing activities 2,453 (3,246)

Dividends paid on ordinary share capital (4,329) (4,483)

Interest paid (744) (488)

Change in financial liabilities (1,727) 1,390

Repurchase of shares (1,509) (3,018)

Other financing activities (581) (500)

Net cash flow (used in)/from financing activities (8,890) (7,099)

Net increase/(decrease) in cash and cash equivalents 845 (2,373)

Cash and cash equivalents at the beginning of the period 3,387 5,475

Effect of foreign exchange rate changes (7) 285

Cash and cash equivalents at the end of the period 4,225 3,387

18

Notes to the condensed financial statements

(unaudited)

1. Accounting information and policies

Except as set out below the accounting policies and methods of computation are consistent with the year ended 31

December 2021. In conformity with the requirements of the Companies Act 2006, the condensed preliminary financial

statements have been prepared in accordance with the International Financial Reporting Standards (IFRS) as issued

by the International Accounting Standard Board (IASB) and as adopted for use in the UK.

The condensed financial statements are shown at current exchange rates, while percentage year-on-year changes

are shown at both current and constant exchange rates to facilitate comparison. The income statement on page 15,

the statement of comprehensive income on page 15, the statement of changes in equity on page 16 and the cash

flow statement on page 18 are translated at exchange rates current in each period. The balance sheet on page 17 is

translated at period-end rates of exchange.

The condensed financial statements attached do not constitute the full financial statements within the meaning of

Section 434 of the UK Companies Act 2006, which will be finalised and delivered to the Registrar of Companies in due

course. Full accounts for Unilever for the year ended 31 December 2021 have been delivered to the Registrar of

Companies; the auditors’ reports on these accounts were unqualified, did not include a reference to any matters by

way of emphasis and did not contain a statement under Section 498 (2) or Section 498 (3) of the UK Companies Act

2006.

Change in reporting segments

On 1 July 2022, Unilever implemented a new, more category-focused operating model organised around five

Business Groups. The company replaced its previous matrix structure with distinct Business Groups: Beauty &

Wellbeing, Personal Care, Home Care, Nutrition, Ice Cream. Each Business Group is fully responsible and

accountable for its strategy, growth, and profit delivery globally.

From 1 July 2022 our segmental information is based on the five Business Groups as this reflects how the Group’s

performance will be monitored and managed going forward. We have presented the full year and 2021 segmental

information on this basis.

Change in cash generating units (CGU's)

The Group has revised its cash generating units (CGU’s) to align with the new Compass Organisation. In 2021, the

Group had eleven cash generating units based on the three Divisions by geography, Health & Wellbeing and

ekaterra. From 1 July 2022, the Group's CGUs are based on the Compass organisation structure of Business Units and

Global Business Units. For the purpose of impairment testing, goodwill is allocated to groups of CGUs (GCGU's) which

are based on the Business Groups. Goodwill and indefinite-life intangible assets which were previously allocated to

the eleven CGUs for the purpose of impairment testing have been reallocated respectively to the GCGUs and CGUs.

New accounting standards

All standards or amendments to standards that have been issued by the IASB and were effective by 1 January 2022

were not applicable or material to Unilever. IFRS 17 ‘Insurance Contracts’ has been released but is not yet adopted

by the Group. The standard is effective from the year ended 31 December 2023 and introduces a new model for

accounting for insurance contracts. We have reviewed existing arrangements and concluded that IFRS 17 is not

expected to be material for Unilever. All other new standards or amendments that are not yet effective that have

been issued by the IASB are not applicable or material to Unilever.

19

Notes to the condensed financial statements

(unaudited)

2. Significant items within the income statement

Non-underlying items

These include non-underlying items within operating profit and non-underlying items not in operating profit but

within net profit:

• Non-underlying items within operating profit are gains or losses on business disposals, acquisition and

disposal related costs, restructuring costs, impairments and other items within operating profit classified here

due to their nature and frequency.

• Non-underlying items not in operating profit but within net profit are net monetary gain/(loss) arising from

hyperinflationary economies and significant and unusual items in net finance cost, share of profit/(loss) of joint

ventures and associates and taxation.

Restructuring costs are charges associated with activities planned by management that significantly change either

the scope of the business or the manner in which it is conducted.

€ million Full Year

2022 2021

Acquisition and disposal-related credits/(costs)

(a)

(50) (332)

Gain/(loss) on disposal of group companies

(b)

2,335 36

Restructuring costs

(c)

(777) (632)

Impairments

(d)

(221) (17)

Other

(e)

(215) 11

Non-underlying items within operating profit before tax 1,072 (934)

Tax on non-underlying items within operating profit 273 219

Non-underlying items within operating profit after tax 1,345 (715)

Interest related to the UK tax audit of intangible income and centralised

services

(7) 10

Net monetary gain/(loss) arising from hyperinflationary economies (157) (74)

Non-underlying items not in operating profit but within net profit before tax (164) (64)

Tax impact of non-underlying items not in operating profit but within net profit:

Taxes related to separation of Ekaterra (35) –

Taxes related to the UK tax audit of intangible income and centralised services (5) (29)

Taxes related to the reorganisation of our European business – 31

Hyperinflation adjustment for Argentina and Turkey deferred tax (81) (43)

Non-underlying items not in operating profit but within net profit after tax (285) (105)

Non-underlying items after tax

(f)

1,060 (820)

Attributable to:

Non-controlling interests (14) (30)

Shareholders’ equity 1,074 (790)

(a) 2022 includes a charge of €42 million (2021: €196 million) relating to the disposal of ekaterra and other acquisition and disposal activities.

(b) 2022 includes a gain of €2,303 million related to the disposal of ekaterra.

(c) Restructuring costs are comprised of organisational change programmes including Compass and various technology and supply chain

optimisation projects.

(d) 2022 includes an impairment charge of €192 million relating to Dollar Shave Club and write downs of leased land and building assets.

(e) 2022 includes €89 million relating to a product recall and market withdrawal by The Laundress, €82 million relating to legal provisions for ongoing

competition investigations and €42 million of asset write-downs relating to our businesses in Russia and Ukraine.

(f) Non-underlying items after tax is calculated as non-underlying items within operating profit after tax plus non-underlying items not in operating

profit but within net profit after tax.

20

Notes to the condensed financial statements

(unaudited)

3. Segment information - Business Groups

Fourth Quarter

Beauty &

Wellbeing

Personal

care

Home

Care

Nutrition Ice cream Total

Turnover (€ million)

2021 2,734 3,035 2,729 3,534 1,089 13,121

2022 3,255 3,522 3,162 3,468 1,204 14,611

Change (%) 19.0 16.1 15.9 (1.9) 10.6 11.4

Impact of:

Acquisitions (%) 3.5 – – – – 0.8

Disposals (%) (0.2) – – (14.2) – (3.9)

Currency-related items (%), of which: 6.9 6.4 3.3 3.9 7.5 5.3

Exchange rates changes (%) 5.2 4.3 – 2.0 7.5 3.3

Extreme price growth in

hyperinflationary markets* (%)

1.6 2.0 3.3 1.9 – 2.0

Underlying sales growth (%) 7.7 9.1 12.3 10.1 2.9 9.2

Price* (%) 8.4 13.0 16.7 14.7 14.2 13.3

Volume (%) (0.6) (3.5) (3.8) (4.1) (9.9) (3.6)

Full Year

Beauty &

Wellbeing

Personal

care

Home

Care

Nutrition Ice cream Total

Turnover (€ million)

2021 10,138 11,763 10,572 13,104 6,867 52,444

2022 12,250 13,636 12,401 13,898 7,888 60,073

Change (%) 20.8 15.9 17.3 6.1 14.8 14.5

Impact of:

Acquisitions (%) 3.8 – – 0.3 – 0.8

Disposals (%) (0.1) – – (7.1) – (1.8)

Currency-related items (%), of which: 8.1 7.4 4.9 4.9 5.4 6.2

Exchange rates changes (%) 6.9 6.2 2.6 3.6 3.9 4.7

Extreme price growth in

hyperinflationary markets* (%)

1.0 1.1 2.2 1.2 1.5 1.4

Underlying sales growth (%) 7.8 7.9 11.8 8.6 9.0 9.0

Price* (%) 7.5 12.1 15.9 10.9 9.7 11.3

Volume (%) 0.3 (3.7) (3.5) (2.1) (0.7) (2.1)

Operating profit (€ million)

2021 2,135 2,336 1,294 2,104 833 8,702

2022 2,154 2,264 1,064 4,497 776 10,755

Underlying operating profit (€ million)

2021 2,237 2,505 1,417 2,525 952 9,636

2022 2,292 2,679 1,344 2,449 919 9,683

Operating margin (%)

2021 21.1 19.9 12.2 16.1 12.1 16.6

2022 17.6 16.6 8.6 32.4 9.8 17.9

Underlying operating margin (%)

2021 22.1 21.3 13.4 19.3 13.9 18.4

2022 18.7 19.6 10.8 17.6 11.7 16.1

*Underlying price growth in excess of 26% per year in hyperinflationary economies has been excluded when calculating the price growth in the tables

above, and an equal and opposite amount is shown as extreme price growth in hyperinflationary markets.

Turnover growth is made up of distinct individual growth components namely underlying sales, currency impact,

acquisitions and disposals. Turnover growth is arrived at by multiplying these individual components on a

compounded basis as there is a currency impact on each of the other components. Accordingly, turnover growth is

more than just the sum of the individual components.

Underlying operating profit represents our measure of segment profit or loss as it is the primary measure used for

the purpose of making decisions about allocating resources and assessing performance of segments. Underlying

operating margin is calculated as underlying operating profit divided by turnover.

21

Notes to the condensed financial statements

(unaudited)

4. Segment information - Geographical area

Fourth Quarter

Asia Pacific

Africa

The

Americas

Europe Total

Turnover (€ million)

2021 6,131 4,382 2,608 13,121

2022 6,640 5,374 2,597 14,611

Change (%) 8.3 22.6 (0.4) 11.4

Impact of:

Acquisitions (%) – 1.9 0.5 0.8

Disposals (%) (4.4) (2.4) (5.0) (3.9)

Currency-related items (%), of which: 2.3 12.8 (1.0) 5.3

Exchange rates changes (%) 0.7 9.0 (1.0) 3.3

Extreme price growth in hyperinflationary markets* (%) 1.7 3.6 – 2.0

Underlying sales growth (%) 10.7 9.3 5.5 9.2

Price* (%) 12.9 13.9 13.2 13.3

Volume (%) (2.0) (4.0) (6.8) (3.6)

Full Year

Asia Pacific

Africa

The

Americas

Europe Total

Turnover (€ million)

2021 24,264 16,844 11,336 52,444

2022 27,504 20,905 11,664 60,073

Change (%) 13.4 24.1 2.9 14.5

Impact of:

Acquisitions (%) 0.2 1.7 0.8 0.8

Disposals (%) (2.1) (1.2) (2.1) (1.8)

Currency-related items (%), of which: 4.7 11.9 0.2 6.2

Exchange rates changes (%) 3.2 9.5 0.2 4.7

Extreme price growth in hyperinflationary markets*

(%)

1.5 2.2 – 1.4

Underlying sales growth (%) 10.3 10.4 4.1 9.0

Price* (%) 11.3 13.3 8.3 11.3

Volume (%) (0.9) (2.6) (3.9) (2.1)

*Underlying price growth in excess of 26% per year in hyperinflationary economies has been excluded when calculating the price growth in the tables

above, and an equal and opposite amount is shown as extreme price growth in hyperinflationary markets.

22

Notes to the condensed financial statements

(unaudited)

5. Taxation

The effective tax rate for 2022 is 20.4% compared with 23.1% in 2021. The decrease is primarily driven by the impact of

the ekaterra disposal which benefited from the participation exemption in the Netherlands.

Tax effects of components of other comprehensive income were as follows:

2022 2021

€ million

Before

tax

Tax

(charge)/

credit

After tax

Before

tax

Tax

(charge)/

credit

After tax

Gains/(losses) on:

Equity instruments at fair value through

other comprehensive income 31 5 36 178 (12) 166

Cash flow hedges (121) 30 (91) 291 (12) 279

Remeasurements of defined benefit pension

plans

(537) 64 (473) 2,405 (671) 1,734

Currency retranslation gains/(losses) 547 67 614 1,237 (60) 1,177

Other comprehensive income (80) 166 86 4,111 (755) 3,356

6. Earnings per share

The earnings per share calculations are based on the average number of share units representing the ordinary

shares of PLC in issue during the period, less the average number of shares held as treasury shares.

In calculating diluted earnings per share and underlying earnings per share, a number of adjustments are made to

the number of shares, principally the exercise of share plans by employees.

Earnings per share for total operations for the twelve months were calculated as follows:

Full Year

2022 2021

EPS - Basic

Net profit attributable to shareholders’ equity (€ million) 7,642 6,049

Average number of shares (millions of share units) 2,548.2 2,599.9

EPS – basic (€) 3.00 2.33

EPS – Diluted

Net profit attributable to shareholders’ equity (€ million) 7,642 6,049

Adjusted average number of shares (millions of share units) 2,559.8 2,609.6

EPS – diluted (€) 2.99 2.32

Underlying EPS

Net profit attributable to shareholders’ equity (€ million) 7,642 6,049

Post tax impact of non-underlying items attributable to shareholders’ equity (see

note 2)

(1,074) 790

Underlying profit attributable to shareholders’ equity 6,568 6,839

Adjusted average number of shares (millions of share units) 2,559.8 2,609.6

Underlying EPS – diluted (€) 2.57 2.62

23

Notes to the condensed financial statements

(unaudited)

6. Earnings per share (continued)

In calculating underlying earnings per share, net profit attributable to shareholders’ equity is adjusted to eliminate

the post-tax impact of non-underlying items.

During the period the following movements in shares have taken place:

Millions

Number of shares at 31 December 2021 (net of treasury shares) 2,561.0

Net movements in shares under incentive schemes 2.2

Shares repurchased under the share buyback programme (34.2)

Number of shares at 31 December 2022 2,529.0

7. Acquisitions and disposals

In 2022, the Group completed the business acquisitions and disposals as listed below. The net consideration for

acquisitions in 2022 is €811 million (2021: €2,117 million for acquisitions completed during that year).

Deal completion

date

Acquired/disposed business

29 April 2022

Sold Unilever Life, the direct selling business in Thailand, to RS Group.

1 July 2022

Sold ekaterra (Global Tea business excluding India, Indonesia, Nepal and Ready to Drink) to

CVC Capital Partners. ekaterra includes brands such as Lipton, Brooke Bond and PG Tips.

Further details are provided below.

7 July 2022

Acquired a further 67% of Nutraceutical Wellness, Inc. (Nutrafol) bringing total investment

to 80%, a producer based in the US of hair growth solutions for men and women. The

acquisition complements Unilever’s existing Health and Wellbeing portfolio, bringing to

market a science-led approach to hair wellness. Further details are provided below.

Goodwill represents the future value that the Group believes it will obtain through operational synergies and the

application of acquired company ideas to existing Unilever channels and businesses.

Nutrafol Acquisition

On 7 July 2022, Unilever acquired a further 67% of the shares of Nutrafol, a U.S. based hair wellness company in which

Unilever Ventures previously held a minority stake (13%) to bring Unilever’s total equity interest to 80%. Strategically,

Nutrafol expands our Health & Wellbeing portfolio, bringing to market a science led approach to hair wellness

supported by digital-first capabilities. We believe Unilever’s capabilities and sustainability principles will allow us to

protect the legacy of the brand while strengthening it.

The total consideration paid for the 67% share of Nutrafol was €811 million, all of which was settled in cash on

completion.

The provisional fair value of net assets recognised on the balance sheet is €487 million. The main asset acquired was

the brand intangible valued using an income approach model by estimating future cash flows generated by the

brand and discounting them to present value using rates in line with a market participant expectation. The key

assumptions in the brand valuation are the revenue growth and discount rates. As part of the acquisition, goodwill

of €580 million has been recognised and is not deductible for tax purposes. Since the acquisition date, the goodwill

balance has decreased by €25 million as a result of foreign exchange.

Acquisitions

Effect on consolidated income statement

The acquisition deals completed in 2022 have contributed €174 million to the Group turnover and €31 million to the

Group operating profit since the date of acquisition. If the acquisition deals completed in 2022 had all taken place at

the beginning of the year, Group turnover would have been €60,206 million, and Group operating profit would have

been €10,772 million.

24

Notes to the condensed financial statements

(unaudited)

7. Acquisitions and disposals (continued)

Effect on consolidated balance sheet

The following table summarises the consideration and net assets acquired for the Nutrafol acquisition. The fair

values currently used for opening balances of the Nutrafol acquisition are provisional. These balances remain

provisional due to there being outstanding relevant information in regard to facts and circumstances that existed as

of the acquisition date and/or where valuation work is still ongoing.

In 2022, the net assets acquired and total payment for the Nutrafol acquisition consists of:

Total 2022

(€ million)

Intangible assets 603

Other non-current assets –

Trade and other receivables 11

Other current assets

(a)

70

Non-current liabilities

(b)

(160)

Current liabilities (37)

Net assets acquired 487

Non-controlling interest (99)

Goodwill 580

Total Consideration 968

Of which:

Cash consideration paid for 67% stake 811

Fair value of 13% stake previously held by Unilever Ventures 157

(a) Other current assets include inventories of €41 million and cash and cash equivalents of €29 million.

(b) Non-current liabilities include deferred tax of €153 million.

Disposals

Total consideration for 2022 disposals is €4,606 million (2021: €49 million for disposals completed during that year).

The following table sets out the effect of the disposals in 2022 and comparative years on the consolidated balance

sheet. The results of disposed businesses are included in the consolidated financial statements up until their date of

disposal.

2022

(€ million)

2021

(€ million)

Goodwill and intangible assets

(a)

948 3

Other non-current assets

(b)

1,075 4

Current assets

(c)

833 10

Liabilities

(d)

(649) (3)

Net assets sold

2,207 14

(Gain)/loss on recycling of currency retranslation on disposal

65 –

Profit/(loss) on sale attributable to Unilever

2,334 35

Consideration

4,606 49

Of which:

Cash

4,606 40

Cash balances of businesses sold

20 3

Non-cash items and deferred consideration (20) 6

(a) Includes €548 million of allocated goodwill and €395 million related to intangibles to Tazo, T2, Pukka & Glen related to the disposal of ekaterra.

(b) Non-current assets include PPE of €453 million and deferred tax assets of €595 million related to the disposal of ekaterra.

(c) Current assets include inventories of €301 million and trade and other receivables of €487 million related to the disposal of ekaterra.

(d) Liabilities include €518 million of trade payables, €59 million of financial liabilities and €31 million deferred tax liabilities related to the disposal of

ekaterra.

25

Notes to the condensed financial statements

(unaudited)

7. Acquisitions and disposals (continued)

ekaterra Disposal

On 1 October 2021, Unilever completed the internal reorganisation whereby it separated elements of its Tea

business into ekaterra, a separate legal structure, which at the time was still 100% owned by Unilever. In November

2021, Unilever Group signed an agreement to sell ekaterra to CVC Capital Partners.

On 1 July 2022, Unilever sold ekaterra, to CVC Capital Partners for €4,594 million cash consideration. The transaction

involved the sale of 100% shares of ekaterra Holdings B.V. and tea business assets in a small number of jurisdictions

that were delayed for local tax and/or legal reasons.

Profit on this disposal was €2,303 million, recognised as a non-underlying item.

8. Share-buy back

On 10 February 2022, we announced a share buyback programme of up to €3 billion to be completed over 2022 and

2023. During 2022, the Group repurchased 34,217,605 ordinary shares which are held by Unilever as treasury shares.

Consideration paid for the repurchase of shares including transaction costs was €1,509 million which is recorded

within other reserves.

9. Financial instruments

The Group’s Treasury function aims to protect the Group’s financial investments, while maximising returns. The fair

value of financial assets is the same as the carrying amount for 2022 and 2021. The Group’s cash resources and other

financial assets are shown below.

31 December 2022 31 December 2021

Current

Non-

current

Total Current

Non-

current

Total

Cash and cash equivalents