Q4

2023

Shareholder Letter

2

Q4 2023Key Financial Measures FY 2023

Revenue

Q4 revenue of $2.2 billion increased 17% from Q4 2022

driven by continued strength in travel demand as well

as a foreign exchange rate (“FX”) tailwind.

$2.2B

17% Y/Y

14% Y/Y (ex-FX)

100% Y/4Y

$9.9B

18% Y/Y

17% Y/Y (ex-FX)

106% Y/4Y

Net Income (Loss)

Q4 net loss of $349 million included non-recurring

tax withholding expenses and lodging tax reserves

of approximately $1 billion. Excluding these and after

applying our anticipated long-term tax rate of 21%,

Adjusted Net Income was $489 million. Net loss margin

was (16)% and Adjusted Net Income Margin was 22%.

Adjusted EBITDA*

Our Q4 Adjusted EBITDA of $738 million represented

a 46% increase from Q4 2022, demonstrating the

continued strength of the business and discipline

Free Cash Flow (“FCF”)*

We generated $63 million of net cash provided

by operating activities and $46 million of FCF

a 39% FCF Margin.

$(349)M

$(316)M (ex-FX)

$319M Q4 2022

$(351)M Q4 2019

$4.8B

$4.8B (ex-FX)

$1.9B FY 2022

$(674)M FY 2019

$738M

$707M (ex-FX)

$506M Q4 2022

$(276)M Q4 2019

$46M

$455M Q4 2022

$(216)M Q4 2019

$3.7B

$3.6B (ex-FX)

$2.9B FY 2022

$(253)M FY 2019

$3.8B

$3.4B FY 2022

$108M FY 2019

Nights and Experiences Booked

Gross Booking Value (“GBV”)

Strong growth in Nights and Experiences Booked

and a modest increase in ADR drove $15.5 billion

98.8M

12% Y/ Y

30% Y/4Y

448.2M

14% Y/Y

37% Y/4Y

$15.5B

15% Y/Y

13% Y/Y (ex-FX)

81% Y/4Y

$73.3B

16% Y/Y

16% Y/Y (ex-FX)

93% Y/4Y

Key Business Metrics

3

Q4 2023 Shareholder Letter

Airbnb ended 2023 with another strong quarter. In Q4, Nights and Experiences Booked totaled 99 million,

growing 12% year-over-year, and marking our highest fourth quarter ever. Revenue of $2.2 billion grew 17%

year-over-year (14% ex-FX). Q4 net loss was $349 million and excluding non-recurring tax items, Adjusted

represented a 33% Adjusted EBITDA Margin, up 6 percentage points from the year prior.

• Making hosting mainstream

Airbnb, and we believe our approach is working. In Q4, our Host community surpassed 5 million

Hosts around the globe. Active listings exceeded 7.7 million by the end of 2023, increasing

18% in Q4 2023 relative to Q4 2022, with sustained double-digit supply growth across all regions.

And in 2023 alone, Hosts earned more than $57 billion. In 2024, we’ll continue raising awareness

around hosting and improving the overall host experience.

• Perfecting the core service

decreased by 36% in Q4 2023 compared to the same period in 2022. And two-thirds of our Hosts now

• Expanding beyond the core

perfecting our core service, and now we’re ready to embark on our next chapter. To unlock more

opportunities for growth, we're investing in under-penetrated international markets, and we’re

Netherlands. We also believe that now is the time for us to expand beyond our core business and

reinvent Airbnb. While this will be a gradual, multi-year journey, we’re excited to share more about

Q4 and Full-Year 2023 Financial Results

• Q4 revenue was $2.2 billion, up 17% year-over-year. Revenue increased to $2.2 billion in Q4

2023 from $1.9 billion in Q4 2022, driven by solid growth in Nights and Experiences Booked,

• Q4 net loss was $349 million, including non-recurring tax items. In Q4 2023, net loss included

non-recurring tax withholding expenses and lodging tax reserves of approximately $1 billion.

our Adjusted Net Income was $489 million compared to $319 million of net income in Q4 2022.

Our Adjusted Net Income increased primarily due to our revenue growth, expense discipline and

4

• Q4 Adjusted EBITDA was $738 million, up 46% year-over-year. Adjusted EBITDA increased

to $738 million in Q4 2023 from $506 million in Q4 2022, which demonstrates the continued

strength of our business and discipline in managing our cost structure. Adjusted EBITDA

1

• Q4 Free Cash Flow was $46 million, including non-recurring tax items. In Q4 2023, net cash

provided by operating activities was $63 million compared to $463 million in Q4 2022. This

decrease in year-over-year cash flow was due to non-recurring tax items associated with host

Our full-year FCF was $3.8 billion, including these tax items, representing a FCF Margin of 39%.

2

• Q4 share repurchases of $750 million. Our strong cash flow enabled us to repurchase $750 million

of our Class A common stock in Q4 2023. Share repurchases during the full year 2023 totaled

$2.25 billion, and we reduced our fully diluted share count from 694 million at the end of Q4 2022

31, 2023, we had $750 million remaining under our prior program and today, we're announcing

Business Highlights

• Guest demand remains strong—especially among rst-time bookers. Nights and Experiences

Booked grew 12% in Q4 2023 compared to a year ago. Following the volatility that impacted

our business in October, we saw an acceleration of nights booked growth throughout the rest

bookers during Q4 2023. In fact, we exited 2023 with the highest quarterly growth rate of the

with 55% of our gross nights booked in the Airbnb app during Q4 2023 compared to 50% in Q4

• Growth is accelerating in under-penetrated markets. As part of our international expansion

strategy, we’re investing in brand awareness and consideration in less mature markets. We’re also

doubled compared to the same period in 2019 and we anticipate rolling out our playbook to other

1, 2

5

• We’re driving aordability for guests. Throughout 2023, we introduced several features to help

transparency for guests. We’re encouraged by the results. Since launching these features, 1.4 million

remove or lower their cleaning fees. By the end of the year, nearly 40% of our active listings charged

2022. Also, while the average nightly price of a one-bedroom listing on Airbnb in December was

$114, down 2% from the prior-year period, hotel prices rose 7% to $149 over the same period.

3

• We’ve added nearly 1.2 million active listings over the last year. Airbnb has grown to more

than 5 million Hosts with over 7.7 million active listings around the world. In Q4 2023, our active

listings grew by 18% compared to Q4 2022. We continued to see double-digit supply growth

that also had the most year-over-year growth in Nights and Experiences Booked. Consistent

with the prior quarter, urban and non-urban supply grew at similar rates year-over-year.

We continued to see relatively similar growth among individual and professional Hosts and

believe the majority of new listings are exclusive to Airbnb.

Results from our 2023 Winter Release

As part of our November 2023 Winter Release, we introduced major upgrades to help guests understand

Guest Favorites

Airbnb has more than 7 million homes all over the world. Each home is one-of-a-kind, and this uniqueness

is what sets Airbnb apart. But guests have told us that with so much variety, it can be hard to know

ratings data, feedback left in guest reviews, Host cancellations, and the number of quality-related

The Listings tab

Managing a listing is one of the most essential parts of hosting because it’s how guests learn about

3

6

their listings. These tools include a redesigned interface making it easy for Hosts to add listing details,

7

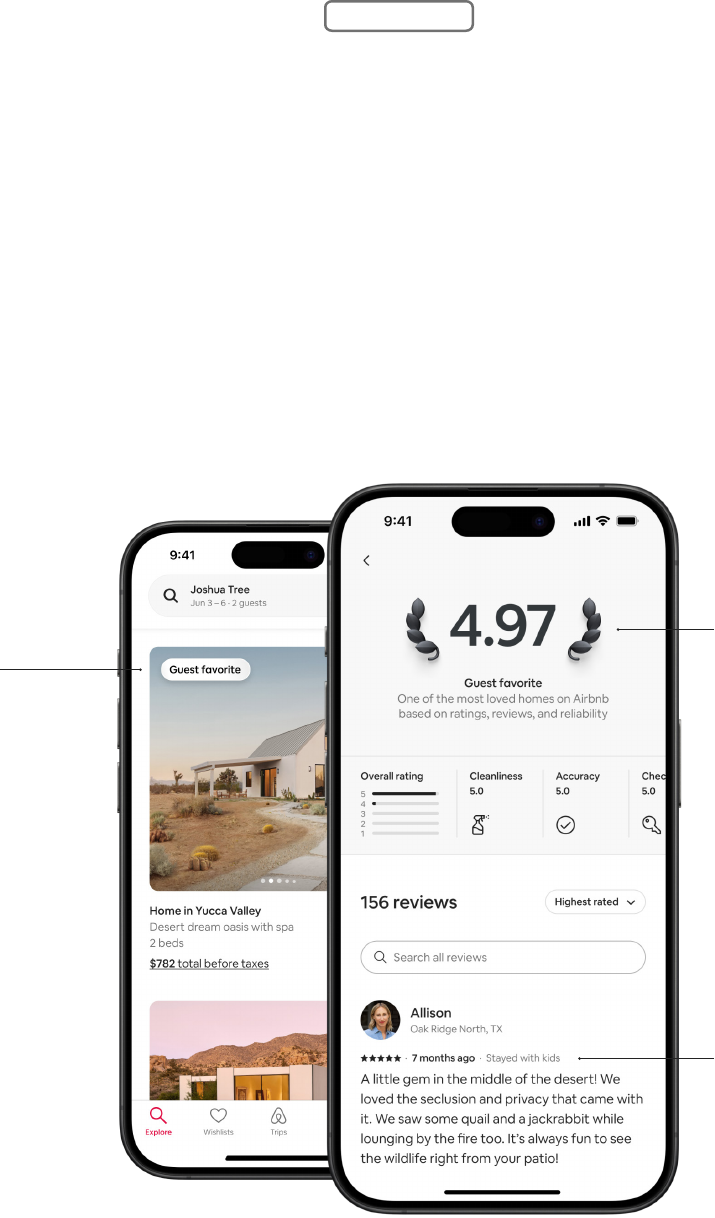

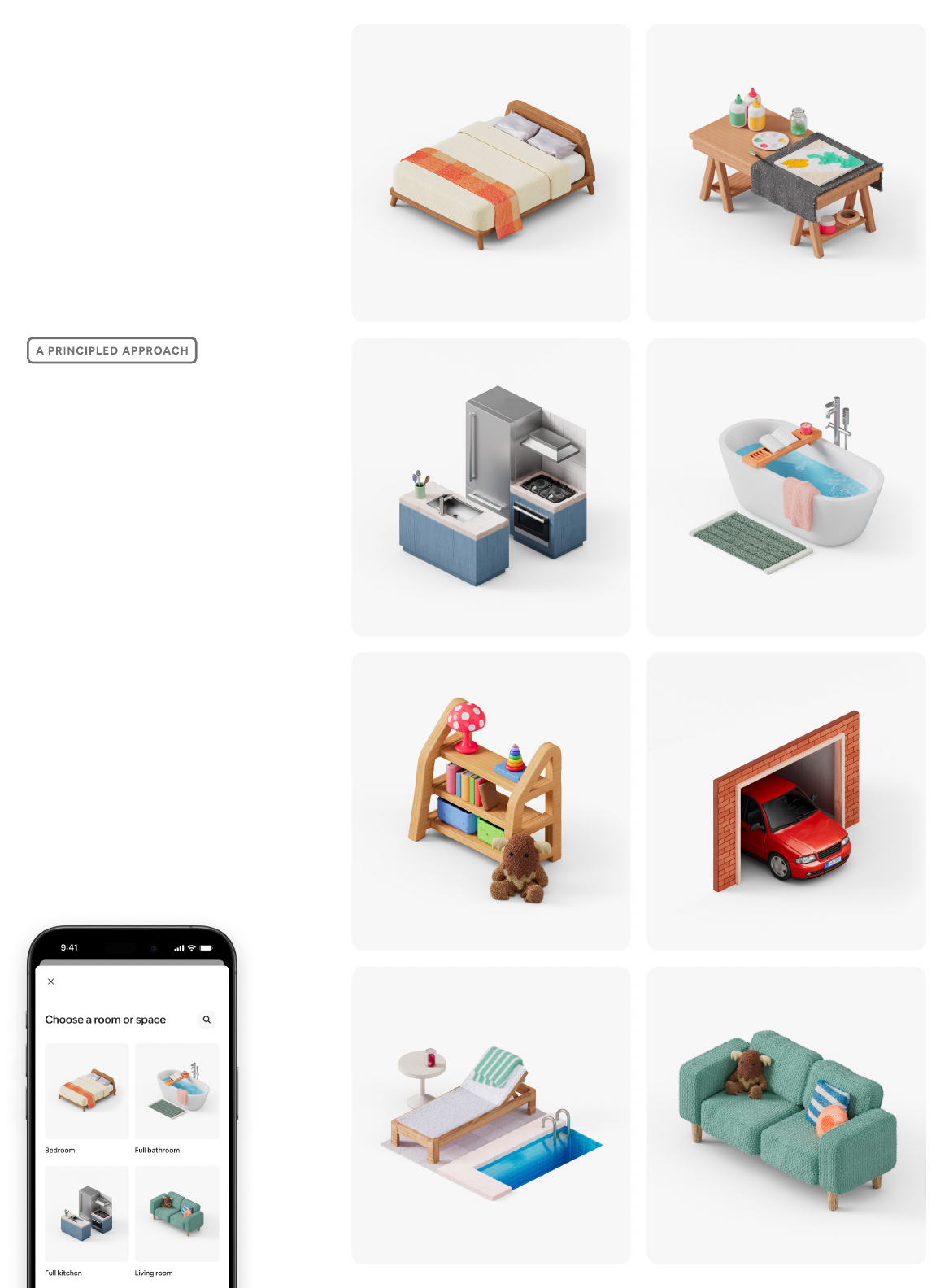

A CLOSER LOOK

of the 2 million most loved homes on Airbnb, based on ratings, reviews,

and reliability from over half a billion trips.

Guest Favorites

A new badge

It’s easy to spot the top

homes on Airbnb according

to guests. Just look for the

More detailed ratings

All listings feature new

breakdowns of their ratings,

above 4.9 stars on average—

get a special callout.

Revamped reviews

Reviews now include more

relevant details—such as

trip type, length of stay, and

rating—making it easier for

8

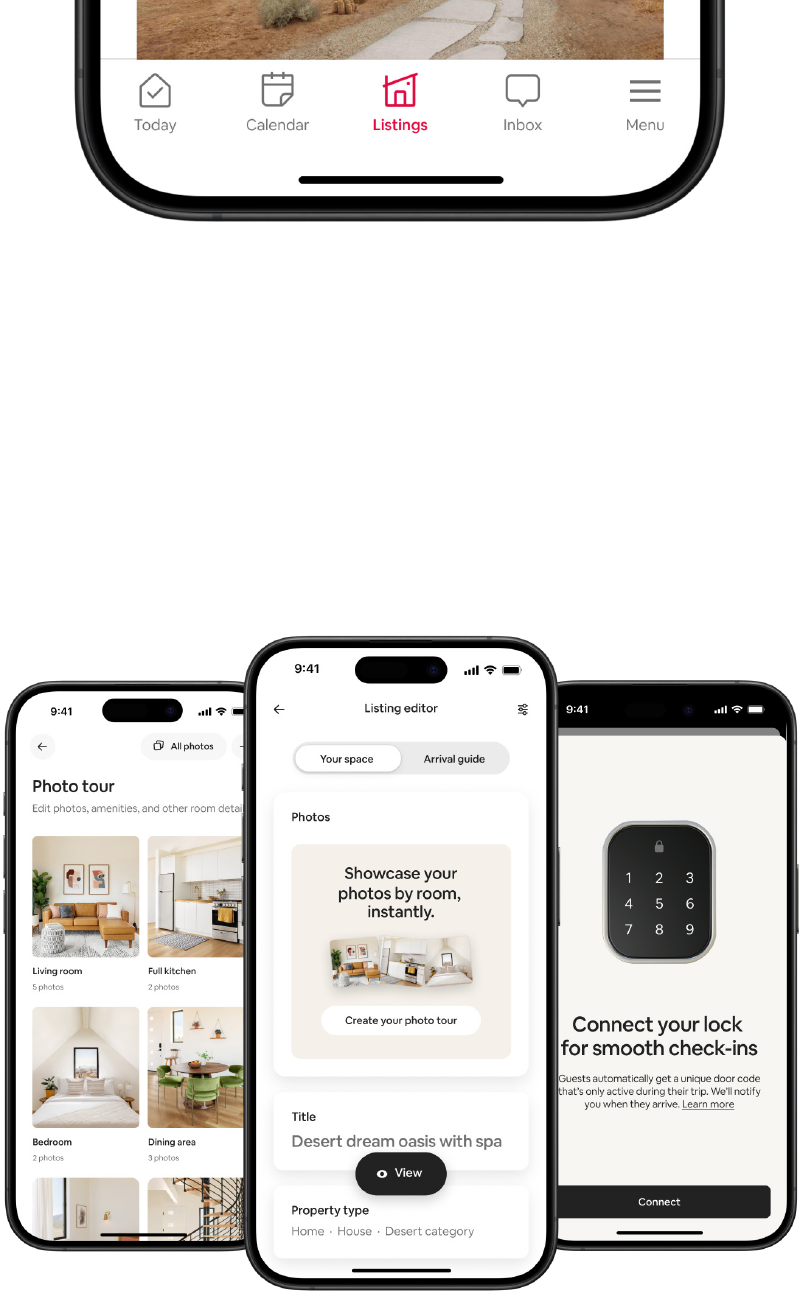

Managing a listing is one of the most essential parts of being a Host.

powerful new tools to easily manage their listings and showcase what

makes their homes special.

The Listings tab

AI-powered photo tour

their photos by room with the

help of AI, giving guests a more

complete picture of their space.

All-new listing editor

A redesigned editor streamlines

how Hosts add information to their

listings, while providing tips on the

best ways to display the details.

Smart lock integration

Soon Hosts will be able to

connect their Airbnb accounts

with compatible smart locks to

automatically generate unique

door codes for every reservation.

9

Q4 and FY 2023 Business and Financial Performance

Q4 2023

FY 2023

98.8M

Nights & Experiences Booked

12% Y/Y

30% Y/4Y

$15.5B

Gross Booking Value

15% Y/Y

13% Y/Y (ex-FX)

81% Y/4Y

448.2M

Nights & Experiences Booked

14% Y/Y

37% Y/4Y

$73.3B

Gross Booking Value

16% Y/Y

16% Y/Y (ex-FX)

93% Y/4Y

During Q4 2023, we had 98.8 million Nights and Experiences Booked—our highest fourth quarter ever.

We saw strong growth across all regions compared to Q4 2022, with the strongest growth seen in Asia

representing a year-over-year increase of 15% (13% ex-FX).

Geographic mix

In Q4 2023, we saw continued growth in all regions relative to the same period in 2022. Q4 2023 regional

• Continued solid growth of Nights and Experiences Booked in North America. ADR in North

America was flat in Q4 2023 compared to Q4 2022 and fell 2% for the same period when

excluding FX and mix shift. While the majority of travel in North America remains domestic,

quarter. In Q4 2023, gross nights booked to North America by guests outside the region

increased nearly 15% compared to Q4 2022.

• Stable growth of Nights and Experiences Booked compared to the prior quarter in EMEA.

Excluding the impact of FX, our ADR in EMEA increased 6% compared to Q4 2022, consistent

with the prior quarter. Relative to earlier in the year, we saw particular strength in domestic

travel in EMEA in Q4.

10

• Continued strength of Nights and Experiences Booked in Latin America

and Experiences Booked were 22% higher than Q4 2022, with continued strength in Mexico and

than double in Q4 2023 compared to Q4 2019. During each quarter in 2023, we saw the highest

compared to 2019.

• Strong growth of Nights and Experiences Booked in Asia Pacic as cross-border travel

continues to recover

over-year basis. This region has historically been reliant on cross-border travel and as this corridor

over-year. In addition, although the recovery has and continues to be gradual, we are encouraged

by the recovery of the outbound China business. In Q4 2023, nights booked in China on an origin

basis increased nearly 90% on a year-over-year basis.

Airbnb’s International Expansion

The overall lodging market is massive, and we’ve only scratched the surface. While we’re in over 220

markets are highly under-penetrated and we believe they represent huge growth opportunities. We

want our product to be local and relevant in each market. As such, we have implemented a playbook

Travel Corridors

In Q4 2023, domestic travel comprised the largest travel corridor in all regions. While domestic travel

remains strong, we continue to see cross-border travel increase relative to the peak of the pandemic.

nights booked, consistent with Q4 2022, but still slightly below 47% in Q4 2019.

Urban Destinations

Consistent with recent quarters, we continue to see strong demand for urban travel, historically one

of the strongest areas of our business. In Q4 2023, gross nights booked in high-density urban areas

grew by 11% year-over-year and represented 51% of our gross nights booked in Q4 2023, consistent

with Q4 2022, but still below 59% in Q4 2019.

than double a year ago. We believe Airbnb is crucial for accommodating the increased influx of visitors

11

Trip length

During Q4 2023, long-term stays of 28 days accounted for 19% of gross nights booked, up slightly from

the 18% level seen in Q3 2023. During our 2023 Summer Release, we announced that we would make

of our nights booked for long-term stays were for trip durations of three months or longer—with nights

booked for trips over three months increasing approximately 20% compared to Q4 2022.

Average daily rates

ADR was $157 in Q4 2023, representing a 3% increase from Q4 2022. Excluding the impact of FX, ADR

in Q4 2023 increased less than 1% from Q4 2022 partially due to mix shift. Excluding the impact of FX,

Supply

We ended Q4 2023 with our highest number of active listings yet. Active listings grew 18% in Q4 2023

compared to a year ago. We saw growth in supply across all market types in Q4 2023 compared to

Airbnb-Friendly Apartments

During Q4 2023, we celebrated the one year anniversary since announcing Airbnb-Friendly Apartments

time. When we launched AFA, we had approximately 175 buildings on the platform. We now have

more than 400 buildings and 125,000 units on the platform across over 40 markets including 127 cities

across 17 U.S. states—and these numbers continue to grow. Over the long term, we believe this will

Regulation

of each municipality while protecting our Hosts and still allowing our business to grow. That’s why we

options for guests, disperse travel to new destinations, and generate billions in economic activity and tax

revenue for local communities. As of December 31, 2023, we collected and remitted more than $10 billion

in tourism-related taxes to local governments on behalf of our global Host community. Overall, we believe

in transparent and equitable regulation and as of December 31, 2023, approximately 80% of our top 200

markets had some form of regulation in place.

12

York City has experienced higher hotel prices and a new analysis of publicly available data reveals

4

York City represented approximately 1% of Airbnb’s global revenue and, currently, no one city accounts

for more than 2% of Airbnb’s revenue on a global basis.

4

13

In Q4 2023, revenue was $2.2 billion, representing a year-over-year increase of 17% (14% ex-FX).

in non-USD currencies, while a minority of our recurring operating expenses were denominated

Q4 2023

$2.2B

Revenue

17% Y/Y

14% Y/Y (ex-FX)

100% Y/4Y

$(349)M

Net Income (Loss)

$489M Adjusted Net Income

$(316)M (ex-FX)

$319M Q4 2022

$(351)M Q4 2019

$738M

Adjusted EBITDA

$707M (ex-FX)

$506M Q4 2022

$(276)M Q4 2019

$9.9B

Revenue

18% Y/Y

17% Y/Y (ex-FX)

106% Y/4Y

$4.8B

Net Income (Loss)

$2.9B Adjusted Net Income

$4.8B (ex-FX)

$1.9B FY 2022

$(674)M FY 2019

$3.7B

Adjusted EBITDA

$3.6B (ex-FX)

$2.9B FY 2022

$(253)M FY 2019

$63M

Net Cash Provided by (Used In)

Operating Activities

$463M Q4 2022

$(190)M Q4 2019

$46M

Free Cash Flow

$455M Q4 2022

$(216)M Q4 2019

$3.9B

Net Cash Provided by

Operating Activities

$3.4B FY 2022

$233M FY 2019

$3.8B

Free Cash Flow

$3.4B FY 2022

$108M FY 2019

FY 2023

14

Operating expenses in Q4 2023 included the impact of $290 million of stock-based compensation

expense, which is excluded from Adjusted EBITDA. All operating expense line-items (excluding

increased more slowly year-over-year than revenue, allowing for considerable margin expansion.

withholding expenses and lodging tax reserves.

of $319 million in Q4 2022. Adjusted Net Income increased primarily due to higher revenue, expense

discipline and interest income. Adjusted Net Income Margin increased 5 percentage points to 22%

in Q4 2023 compared to net income margin of 17% in Q4 2022.

Adjusted EBITDA in Q4 2023 was a record $738 million, an improvement compared to Adjusted EBITDA

5

The growth in our Q4 2023 Adjusted EBITDA reflects the continued strength

from 27% in Q4 2022 to 33% in Q4 2023, consistent with our expectations for Q4 2023 Adjusted EBITDA

Margin to exceed the prior year.

of the year as compared to 2022. We continue to see great results from our brand marketing across all

penetrated. For instance, we saw faster growth in bookings on an origin basis in low penetration states

in performance marketing that are resulting in high return on investments. In 2024, marketing spend

Take Rate

stable with Q4 2022.

fee to give us the ability to charge an additional amount for cross-currency bookings. It is common

as cross-currency transactions only make up a portion of cross border bookings. We intend to test and

evaluate the application of this increase in guest service fee when it is enabled on April 1, 2024.

Stock-Based Compensation

As anticipated, full-year 2023 stock-based compensation (“SBC”) expense was 20% higher than in full-

year 2022. The increase in SBC expense exceeded the headcount growth over the same time period

5

15

due to the accounting for our restricted stock unit (“RSU”) awards, which has changed over time.

Taxes

16

Excludes approximately

$1 billion of non-recurring

tax items

*

$3,000M

$1,500M

$2,250M

$750M

$0M

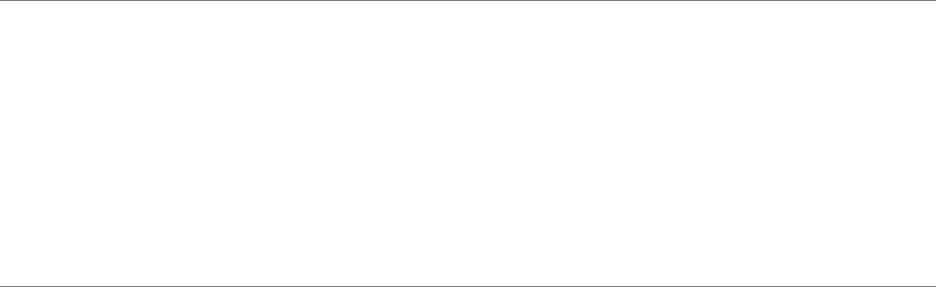

$1,107

$1,902

$2,218

Y/Y Change

Net income (loss)

% of revenue

Adjusted net income

(loss) % of revenue

Adjusted EBITDA

% of revenue

24%

32%

17%

$1,200M

$400M

$800M

$0M

$(400)M

$(276)

$506

$738

27%

(25)%

33%

$0M

$300M

$600M

$(300)M

$(600)M

$(351)

$319

$(349)

$489*

17%

(32)%

(16)%

22%

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

Excludes approximately

$1 billion of non-recurring

tax items

*

$3,000M

$1,500M

$2,250M

$750M

$0M

$1,107

$1,902

$2,218

Y/Y Change

Net income (loss)

% of revenue

Adjusted net income

(loss) % of revenue

Adjusted EBITDA

% of revenue

24%

32%

17%

$1,200M

$400M

$800M

$0M

$(400)M

$(276)

$506

$738

27%

(25)%

33%

$0M

$300M

$600M

$(300)M

$(600)M

$(351)

$319

$(349)

$489*

17%

(32)%

(16)%

22%

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

Quarterly Revenue ($M)

Revenue increased 17% from Q4 2022 to $2.2 billion, driven by continued strength in demand and an FX tailwind.

Quarterly Net Income (Loss) ($M)

Q4 net loss was $349 million, which included approximately $1 billion of non-recurring tax items.

Quarterly Adjusted EBITDA ($M)

Q4 Adjusted EBITDA was our highest fourth quarter ever, representing a 46% increase from Q4 2022.

Excludes approximately

$1 billion of non-recurring

tax items

*

$3,000M

$1,500M

$2,250M

$750M

$0M

$1,107

$1,902

$2,218

Y/Y Change

Net income (loss)

% of revenue

Adjusted net income

(loss) % of revenue

Adjusted EBITDA

% of revenue

24%

32%

17%

$1,200M

$400M

$800M

$0M

$(400)M

$(276)

$506

$738

27%

(25)%

33%

$0M

$300M

$600M

$(300)M

$(600)M

$(351)

$319

$(349)

$489*

17%

(32)%

(16)%

22%

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

17

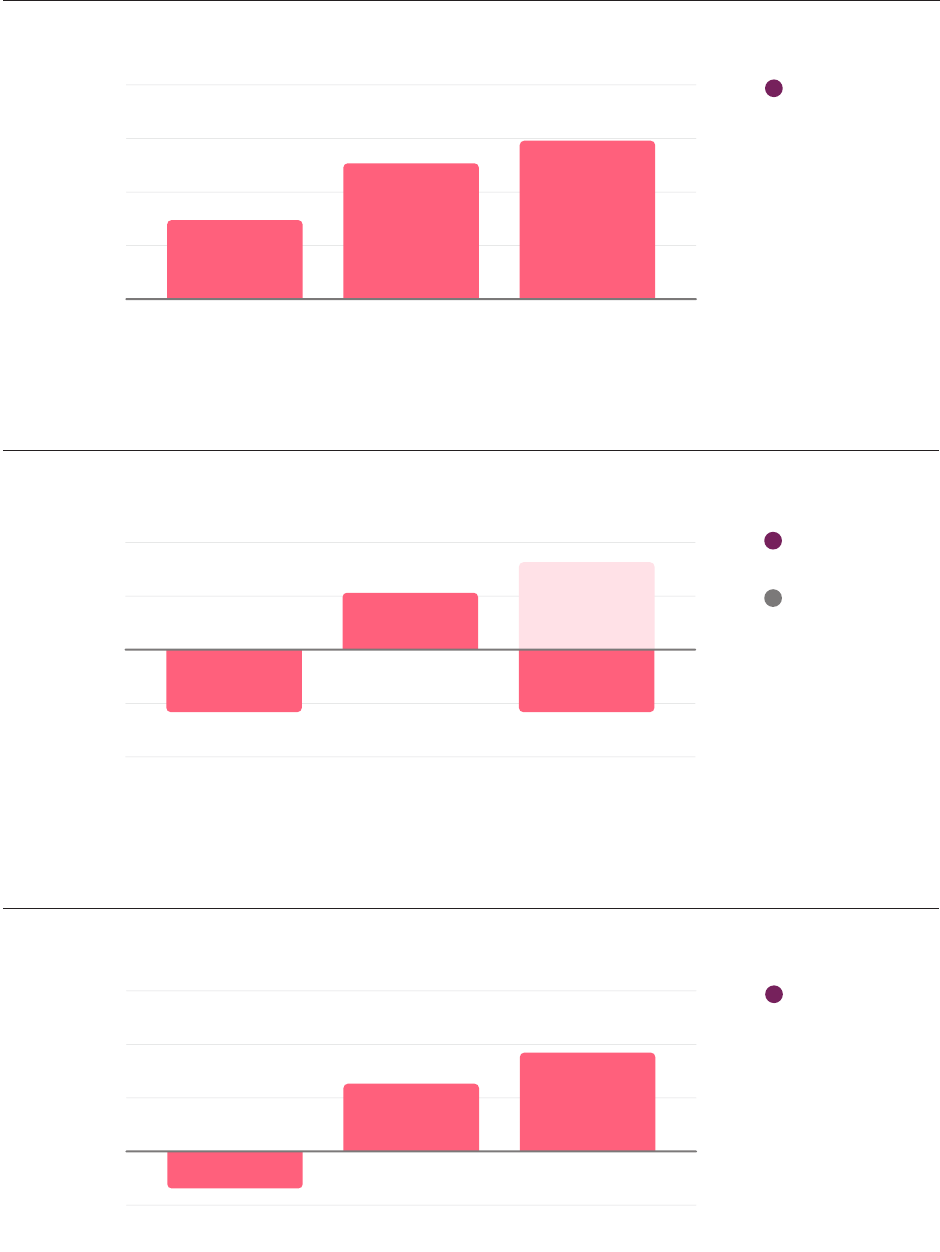

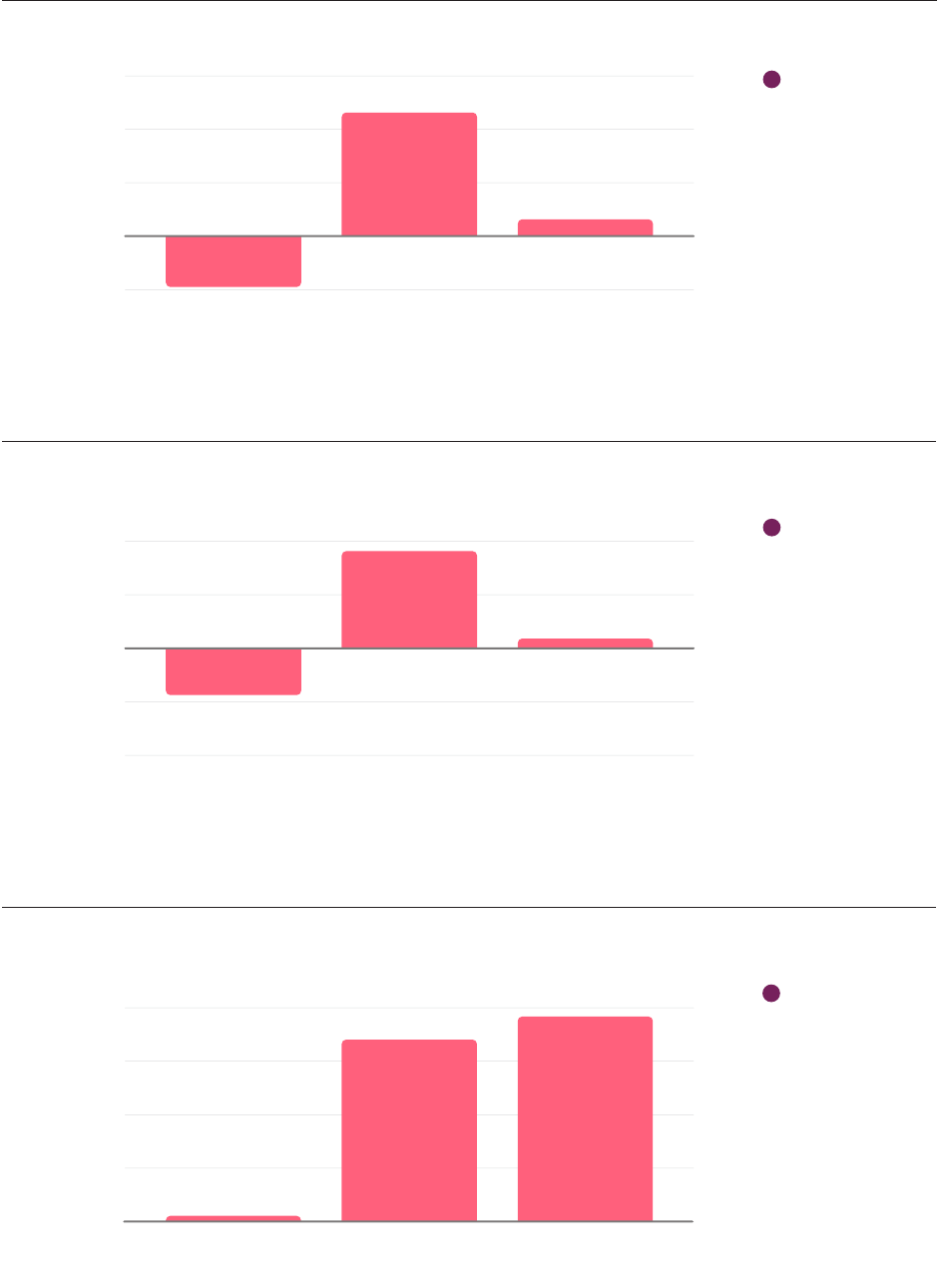

Quarterly Net Cash Provided by (Used in) Operating Activities ($M)

Q4 2023 net cash provided by operating activities was $63 million, primarily lower year-over-year due to non-recurring tax items.

Quarterly Free Cash Flow ($M)

TTM Free Cash Flow ($M)

We generated $46 million of Free Cash Flow in Q4 2023, primarily lower year-over-year due to non-recurring tax items.

We generated $3.8 billion of TTM FCF in 2023, enabling us to repurchase $2.25 billion of our common stock in 2023.

*

Includes non-recurring tax

withholding expenses and

lodging tax reserves

*

Includes non-recurring tax

withholding expenses and

lodging tax reserves

*

$600M

$200M

$400M

$0M

$(200M)

$(190)

$463

$63*

$(216)

$455

$46*

Net cash provided by

(used in) operating

activities % of revenue

Free Cash Flow

% of revenue

24%

(17)%

3%

24%

(20)%

2%

$500M

$0M

$250M

$(250)M

$(500)M

TTM Free Cash Flow

% of TTM revenue

41%

2%

39%

$4,000M

$3,837*

$108

$3,405

$3,000M

$

1,000M

$0M

$2,000M

Includes non-recurring tax

withholding expenses and

lodging tax reserves

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

*

Includes non-recurring tax

withholding expenses and

lodging tax reserves

*

Includes non-recurring tax

withholding expenses and

lodging tax reserves

*

$600M

$200M

$400M

$0M

$(200M)

$(190)

$463

$63*

$(216)

$455

$46*

Net cash provided by

(used in) operating

activities % of revenue

Free Cash Flow

% of revenue

24%

(17)%

3%

24%

(20)%

2%

$500M

$0M

$250M

$(250)M

$(500)M

TTM Free Cash Flow

% of TTM revenue

41%

2%

39%

$4,000M

$3,837*

$108

$3,405

$3,000M

$

1,000M

$0M

$2,000M

Includes non-recurring tax

withholding expenses and

lodging tax reserves

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

*

Includes non-recurring tax

withholding expenses and

lodging tax reserves

*

Includes non-recurring tax

withholding expenses and

lodging tax reserves

*

$600M

$200M

$400M

$0M

$(200M)

$(190)

$463

$63*

$(216)

$455

$46*

Net cash provided by

(used in) operating

activities % of revenue

Free Cash Flow

% of revenue

24%

(17)%

3%

24%

(20)%

2%

$500M

$0M

$250M

$(250)M

$(500)M

TTM Free Cash Flow

% of TTM revenue

41%

2%

39%

$4,000M

$3,837*

$108

$3,405

$3,000M

$

1,000M

$0M

$2,000M

Includes non-recurring tax

withholding expenses and

lodging tax reserves

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

Q4 2022Q4 2019 Q4 2023

18

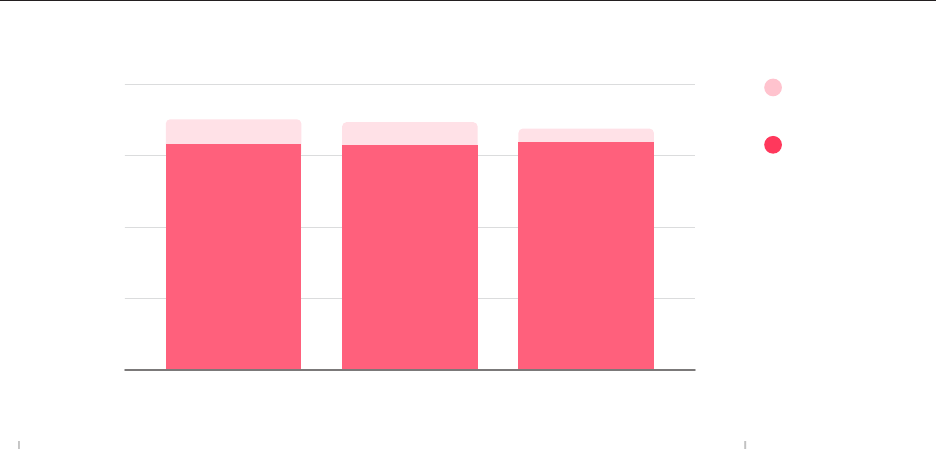

Shares (M)

We repurchased $2.25 billion of our shares during 2023, reducing our fully diluted share count to 676 million as of year-end.

600M

800M

400M

200M

0

M

Stock Based Awards &

Warrants Outstanding

Common Shares

Outstanding

638

631

634

68

63

38

694

702

676

Dec 2021 Dec 2022

Dec 2023

19

Balance Sheet and Cash Flows

For the three months ended December 31, 2023, we reported $63 million of net cash provided by

operating activities and $46 million of FCF, compared to $463 million and $455 million, respectively,

for the three months ended December 31, 2022.

6

The year-over-year decrease in net cash provided

As of December 31, 2023, we had $10.1 billion of cash and cash equivalents, short-term investments,

Capital Allocation

We’re announcing today that our Board of Directors has approved a share repurchase program with

The repurchase program continues to be executed as part of our broader capital allocation strategy

provides us the capital to do all three.

already using AI across our service, including large language models, computer vision models and machine

into Airbnb’s platform.

During Q4 2023, we repurchased $750 million of Class A common stock under our $2.5 billion

and withhold a corresponding number of shares from employees, rather than sell employee shares

dilution from our employee stock programs. In 2023, cash used for share repurchases and employee tax

obligations totaled $3.5 billion with an average share price of $121, ultimately reducing approximately

4.5% of our year-end 2023 outstanding shares of common stock.

Outlook

2024 started strong, with more than six million guests welcoming the New Year in an Airbnb. For Q1

2024, we expect to deliver revenue of $2.03 billion to $2.07 billion, which represents year-over-year

6

20

Due to particularly strong growth in Q1 2023 (19%), impacting year-over-year comparisons, we expect

the growth rate of nights booked in Q1 2024 to moderate relative to Q4 2023. We expect ADR for the

quarter to be flat to slightly up compared to Q1 2023.

four years to deliver a full-year Adjusted EBITDA Margin of 37% in 2023, up from negative 5% in 2019.

In 2024, we expect to continue to deliver Adjusted EBITDA growth on a nominal basis, for both Q1 and

the full-year. We expect Adjusted EBITDA Margin in Q1 2024 to expand relative to Q1 2023, primarily due

to the timing of expenses.

believe we have meaningful growth opportunities ahead. For the full-year 2024, we expect to maintain

an Adjusted EBITDA Margin of at least 35%, providing us flexibility to invest in incremental growth

opportunities over the course of the year.

Earnings Webcast

on February, 13, 2024. The link to the webcast will be made available on the Investor Relations website

lEAWnjeF. After registering, instructions will be shared on how to join the call.

ir@airbnb.com

cont[email protected]om

About Airbnb

Airbnb was born in 2007 when two Hosts welcomed three guests to their San Francisco home, and has

since grown to over 5 million Hosts who have welcomed over 1.5 billion guest arrivals in almost every

Forward-Looking Statements

Reform Act of 1995. All statements other than statements of historical fact could be deemed forward-

looking, including, but not limited to, statements regarding the future performance of Airbnb, Inc. and

21

the Company’s expectations with respect to the demand for bookings, and expectations with respect

by terms such as “may,” “will,” “appears,” “should,” “expects,” “plans,” “anticipates,” “could,” “outlook,”

“intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,”

strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks,

uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance,

not to place undue reliance on these statements, and reported results should not be considered as an

indication of future performance.

Risks that contribute to the uncertain nature of the forward-looking statements include, among others,

to the laws and regulations that may limit the Company’s Hosts’ ability and willingness to provide their

Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023

page of the Company’s website. All forward looking statements are based on information and estimates

available to the Company at the time of this letter and are not guarantees of future performance. Except

as required by law, the Company assumes no obligation to update any of the statements in this letter.

22

The information that can be accessed through hyperlinks or website addresses included herein is deemed

not to be incorporated in or part of this letter.

Non-GAAP Financial Measures

In addition to our results determined in accordance with generally accepted accounting principles in the

to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that

EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Free Cash Flow Margin, trailing twelve months (“TTM”)

exchange rates (“ex-FX”), net income ex-FX, and Adjusted EBITDA ex-FX.

the reserves for lodging taxes for which management believes it is probable that we may be held jointly

liable with Hosts for collecting and remitting such taxes, and the applicability of withholding taxes on

The above items are excluded from our Adjusted EBITDA measure because these items are non-cash

Reconciliations of expected Adjusted EBITDA and Adjusted EBITDA Margins to corresponding net

income (loss) and net income (loss) margins have not been provided because of the unpredictability

EBITDA in this letter because it is a key measurement used by our management internally to make

23

operating decisions, including those related to operating expenses, evaluating performance,

• Adjusted EBITDA does not reflect interest income (expense) and other income (expense),

• Adjusted EBITDA excludes certain recurring, non-cash charges, such as depreciation of property

EBITDA does not reflect all cash requirements for such replacements or for new capital

• Adjusted EBITDA excludes stock-based compensation expense, which has been, and will continue

•

changes in the fair value of contingent consideration arrangements. The contingent consideration,

which was in the form of equity, was valued as of the acquisition date and is marked-to-market

• Adjusted EBITDA does not reflect net changes to reserves for lodging taxes for which management

believes it is probable that we may be held jointly liable with Hosts for collecting and remitting such

•

lease right-of-use assets and leasehold improvements.

Free Cash Flow represents net cash provided by (used in) operating activities less purchases of property

and equipment. We believe that Free Cash Flow is a meaningful indicator of liquidity that provides

information to management and investors about the amount of cash generated from operations that,

after purchases of property and equipment, can be used for strategic initiatives, including continuous

investment in our business, growth through acquisitions, and strengthening our balance sheet. Our Free

which is generally before a stay or experience occurs. Funds held on behalf of our Hosts and guests and

amounts payable to our Hosts and guests do not impact Free Cash Flow, except interest earned on these

24

the time of booking. Free Cash Flow has limitations as an analytical tool and should not be considered

by (used in) operating activities. Free Cash Flow does not reflect our ability to meet future contractual

In addition to the actual amount or percentage change, we disclose the amount or percentage change

corresponding prior period results by comparing results using constant currencies. We present constant

currency amounts and change rate information to provide a framework for assessing how our revenue,

to evaluate period-to-period comparisons. We believe the presentation of results on a constant currency

results. We calculate the percentage change in constant currency by determining the change in the

current period over the prior comparable period where current period foreign currency amounts are

translated using the exchange rates of the comparative period.

Share Repurchases

Share repurchases under our share repurchase programs may be made through a variety of methods,

which may include open market purchases, privately negotiated transactions, block trades or accelerated

share repurchase transactions, or by any combination of such methods. Any such repurchases will be

made from time to time subject to market and economic conditions, applicable legal requirements and

25

Quarterly Summary

2019 2022 2023

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Nights and

Experiences Booked

81.3M 83.9M 85.9M 75.8M 102.1M 103.7M 99.7M 88.2M 121.1M 115.1M 113.2M 98.8M

Y/Y

59% 25% 25% 20% 19% 11% 14% 12%

Y/2019

26% 24% 16% 16% 49% 37% 32% 30%

$9.9B $9.9B $9.6B $8.6B $17.2B $16.9B $15.6B $13.5B $20.4B $19.1B $18.3B $15.5B

Y/Y

67% 27% 31% 20% 19% 13% 17% 15%

Y/2019

73% 73% 62% 58% 105% 94% 89% 81%

(or ADR)

$122.36 $117.14 $112.39 $112.63 $168.07 $163.74 $156.44 $152.81 $168.43 $166.01 $161.38 $156.73

Y/Y

5% 1% 5% (1)% —% 1% 3% 3%

Y/2019

37% 40% 39% 36% 38% 42% 44% 39%

2019 2022 2023

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Revenue

$839M $1,214M $1,645M $1,107M $1,509M $2,104M $2,884M $1,902M $1,818M $2,484M $3,397M $2,218M

Y/Y

31% 34% 30% 32% 70% 58% 29% 24% 20% 18% 18% 17%

FX Neutral Y/Y

74% 64% 36% 31% 24% 19% 14% 14%

Y/2019

80% 73% 75% 72% 117% 105 % 107 % 100 %

Net income (loss)

$(292)M $(297)M $266M $(351)M $(19)M $379M $1,214M $319M $117M $650M $4,374M $(349)M

Adjusted EBITDA

$(248)M $(42)M $313M $(276)M $229M $711M $1,457M $506M $262M $819M $1,834M $738M

Net cash provided

activities

$314M $152M $(43)M $(190)M $1,202M $801M $964M $463M $1,587M $909M $1,325M $63M

Free Cash Flow

$277M $122M $(75)M $(216)M $1,196M $796M $958M $455M $1,581M $900M $1,310M $46M

TTM Net cash provided

$591M $461M $321M $233M $2,909M $2,920M $3,349M $3,430M $3,815M $3,923M $4,284M $3,884M

TTM Free Cash Flow

$495M $349M $198M $108M $2,886M $2,899M $3,328M $3,405M $3,790M $3,894M $4,246M $3,837M

2019 2022 2023

Mar 31 Jun 30 Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 Dec 31

Cash and other

liquid assets (1)

$3,480M $3,407M $3,350M $3,084M $9,337M $9,910M $9,629M $9,639M $10,624M $10,369M $10,986M $10,095M

Funds receivable

and amounts held on

$3,800M $4,432M $2,919M $3,145M $6,105M $7,466M $4,805M $4,783M $7,760M $9,144M $5,986M $5,869M

Unearned fees

$966M $1,050M $665M $675M $1,748M $1,981M $1,220M $1,182M $2,172M $2,347M $1,467M $1,427M

1

Includes cash and cash equivalents, restricted cash, and short-term investments.

26

Condensed Consolidated Statements of Operations

Unaudited (in millions, except per share amounts)

Three Months Ended

December 31

Year Ended

December 31

2022 2023 2022 2023

Revenue

Cost of revenue

Operations and support (1)

Sales and marketing (1)

Restructuring charges — — —

Total costs and expenses

Income (loss) from operations

Interest income

Interest expense

Other income (expense), net

Income (loss) before income taxes

Net income (loss)

Net income (loss) per share attributable to

Basic

Diluted

Weighted-average shares used in computing

net income (loss) per share attributable to

Basic

Diluted

Three Months Ended

December 31

Year Ended

December 31

2022 2023 2022 2023

Operations and support

Sales and marketing

Stock-based compensation expense

27

Condensed Consolidated Balance Sheets

Unaudited (in millions)

December 31

2022 2023

Assets

Cash and cash equivalents

Short-term investments

Funds receivable and amounts held on behalf of customers

Total current assets

Deferred tax assets

Other assets, noncurrent

Total assets

Liabilities and Stockholders’ Equity

Accrued expenses, accounts payables, and other current liabilities

Funds payable and amounts payable to customers

Unearned fees

Total current liabilities

Operating lease liabilities, noncurrent

Other liabilities, noncurrent

Total liabilities

Common stock — —

Additional paid-in capital

Accumulated other comprehensive loss

Total stockholders’ equity

Total liabilities and stockholders’ equity

28

Condensed Consolidated Statements of Cash Flows

Unaudited (in millions)

Year Ended December 31

2022 2023

Cash flows from operating activities:

Net income

Adjustments to reconcile net income

Stock-based compensation expense

Deferred income taxes

Impairment of long-lived assets -

Other, net

Accrued expenses and other liabilities

Unearned fees

Net cash provided by operating activities

Cash flows from investing activities:

Sales and maturities of short-term investments

Other investing activities, net

Net cash used in investing activities

Cash flows from nancing activities:

Taxes paid related to net share settlement of equity awards

purchase plan

Repurchase of common stock

Change in funds payable and amounts payable to customers

Net increase in cash, cash equivalents, and restricted cash

Cash, cash equivalents, and restricted cash, beginning of year

Cash, cash equivalents, and restricted cash, end of year

29

Key Business Metrics

inclusive of Host earnings, service fees, cleaning fees, and taxes, net of cancellations and alterations that

occurred during that period. Nights and Experiences Booked on our platform in a period represents the

sum of the total number of nights booked for stays and the total number of seats booked for experiences,

net of cancellations and alterations that occurred in that period. We are not aware of any uniform

standards for calculating these key metrics, which may hinder comparability with other companies that

Three Months Ended

December 31

Year Ended

December 31

2022 2023 2022 2023

Nights and Experiences Booked

30

Reconciliations of Non-GAAP Financial Measures

Adjusted EBITDA Reconciliation

(in millions, except percentages)

Three Months Ended

Mar 31

2019

Jun 30

2019

Sept 30

2019

Dec 31

2019

Mar 31

2022

Jun 30

2022

Sept 30

2022

Dec 31

2022

Mar 31

2023

Jun 30

2023

Sept 30

2023

Dec 31

2023

Revenue $839 $1,214 $1,645 $1,107 $1,509 $2,104 $2,884 $1,902 $1,818 $2,484 $3,397 $2,218

Net income (loss) $(292) $(297) $266 $(351) $(19) $379 $1,214 $319 $117 $650 $4,374 $(349)

Adjusted to exclude

from) income taxes

13 226 14 10 11 4 56 25 13 26 (2,695) (34)

Other (income)

(7) (6) (29) 28 2 (2) (13) (12) 7 36 3 8

Interest expense 2 2 3 3 6 8 5 5 4 2 6 71

Interest income (22) (25) (22) (18) (5) (20) (59) (102) (146) (191) (192) (192)

Depreciation and

21 24 31 38 29 26 13 13 11 9 8 16

Stock-based

compensation expense

14 18 40 26 195 247 234 254 240 304 286 290

Acquisition-related

impacts

— — — — 11 (22) 1 (2) 12 (15) 3 (3)

and reserves for Host

withholding taxes

23 16 10 (12) (1) 2 6 6 4 (2) 41 931

Restructuring charges — — — — — 89 — — — — — —

Adjusted EBITDA $(248) $(42) $313 $(276) $229 $711 $1,457 $506 $262 $819 $1,834 $738

Net income

(35)% (24)% 16% (32)% (1)% 18% 42% 17% 6% 26% 129% (16)%

Adjusted EBITDA

Margin

(30)% (3)% 19% (25)% 15% 34% 51% 27% 14% 33% 54% 33%

31

provided by (used in) operating activities.

Free Cash Flow Reconciliation

(in millions, except percentages)

Three Months Ended

Mar 31

2019

Jun 30

2019

Sept 30

2019

Dec 31

2019

Mar 31

2022

Jun 30

2022

Sept 30

2022

Dec 31

2022

Mar 31

2023

Jun 30

2023

Sept 30

2023

Dec 31

2023

Revenue $839 $1,214 $1,645 $1,107 $1,509 $2,104 $2,884 $1,902 $1,818 $2,484 $3,397 $2,218

TTM Revenue $3,848 $4,159 $4,539 $4,805 $6,614 $7,383 $8,029 $8,399 $8,708 $9,088 $9,601 $9,917

Net cash provided by (used

in) operating activities

$314 $152 $(43) $(190) $1,202 $801 $964 $463 $1,587 $909 $1,325 $63

(37) (30) (32) (26) (6) (5) (6) (8) (6) (9) (15) (17)

Free Cash Flow $277 $122 $(75) $(216) $1,196 $796 $958 $455 $1,581 $900 $1,310 $46

Net cash provided by

(used in) operating

activities margin

37% 13% (3)% (17)% 80% 38% 33% 24% 87% 37% 39% 3%

Free Cash

33% 10% (5)% (20)% 79% 38% 33% 24% 87% 36% 39% 2%

TTM Net cash

provided by

operating activities

$591 $461 $321 $233 $2,909 $2,920 $3,349 $3,430 $3,815 $3,923 $4,284 $3,884

TTM Free Cash Flow $495 $349 $198 $108 $2,886 $2,899 $3,328 $3,405 $3,790 $3,894 $4,246 $3,837

TTM Net cash

provided by operating

15% 11% 7% 5% 44% 40% 42% 41% 44% 43% 45% 39%

TTM Free Cash

13% 8% 4% 2% 44% 39% 41% 41% 44% 43% 44% 39%

Other cash flow

Net cash provided by (used

in) investing activities

$42 $(110) $18 $(297) $(197) $368 $(56) $(143) $(183) $(20) $(364) $(475)

Net cash provided by (used

$1,480 $625 $(1,425) $165 $2,204 $1,445 $(3,574) $(764) $2,286 $167 $(3,712) $(1,171)

32

Reconciliation of Non-GAAP Operating Expenses

(in millions)

The following is a reconciliation of operating expense line items less stock-based compensation and

contingent consideration arrangements.

Three Months Ended

December 31

Year Ended

December 31

2022 2023 2022 2023

Operations and support

Operations and support excluding

Sales and marketing

Sales and marketing excluding stock-based

compensation and acquisition-related impacts

A list of rooms and spaces could have easily

been… a list. But to us, it was an opportunity—

to illustrate that whether it’s in your home

or in our app, when you care about every part

of the experience, it shows.

Here’s to big (and small) things in 2024.

Tiny details.

Big dierence.