Commercial Card Expense Reporting:

Cardholders, Reconcilers, Approvers

Wholesale Customer Training

CCER for Cardholders, Reconcilers, Approvers

Agenda

Getting started (activate your card)

Commercial Electronic Office

®

(CEO

®

) access

CCER homepage (all roles)

– Review Open Statements vs. View Cycle-to-Date

Manage Statements

– Add Descriptions

– Reclassify, Split (itemize), Dispute transactions

– Add Out-of-pocket Expenses option (OOP)

– Receipt Imaging option

– Submit/Approve Open Statements

Post class resources

2

To get started

After receiving your card…

Activate your card by calling the toll free number

located on the activation sticker

Sign the back of your card

Record the Wells Fargo Customer Service number

(800-932-0036) located on the back of your card in

your mobile device, or address book

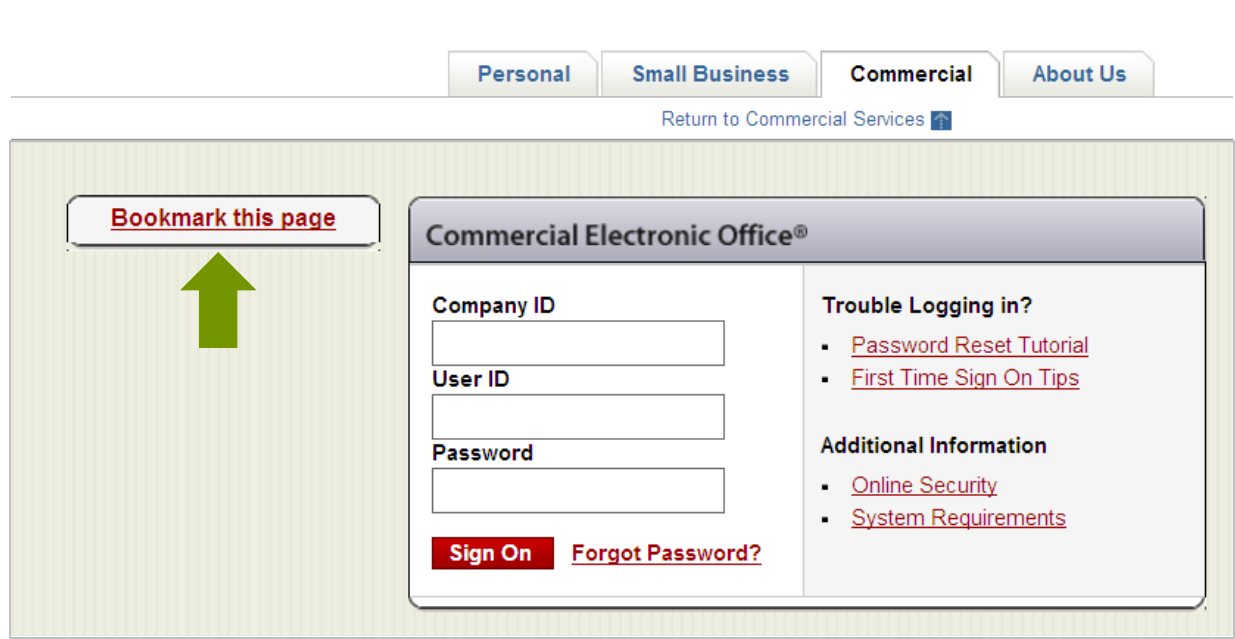

Sign on to the CEO and initialize your User ID

3

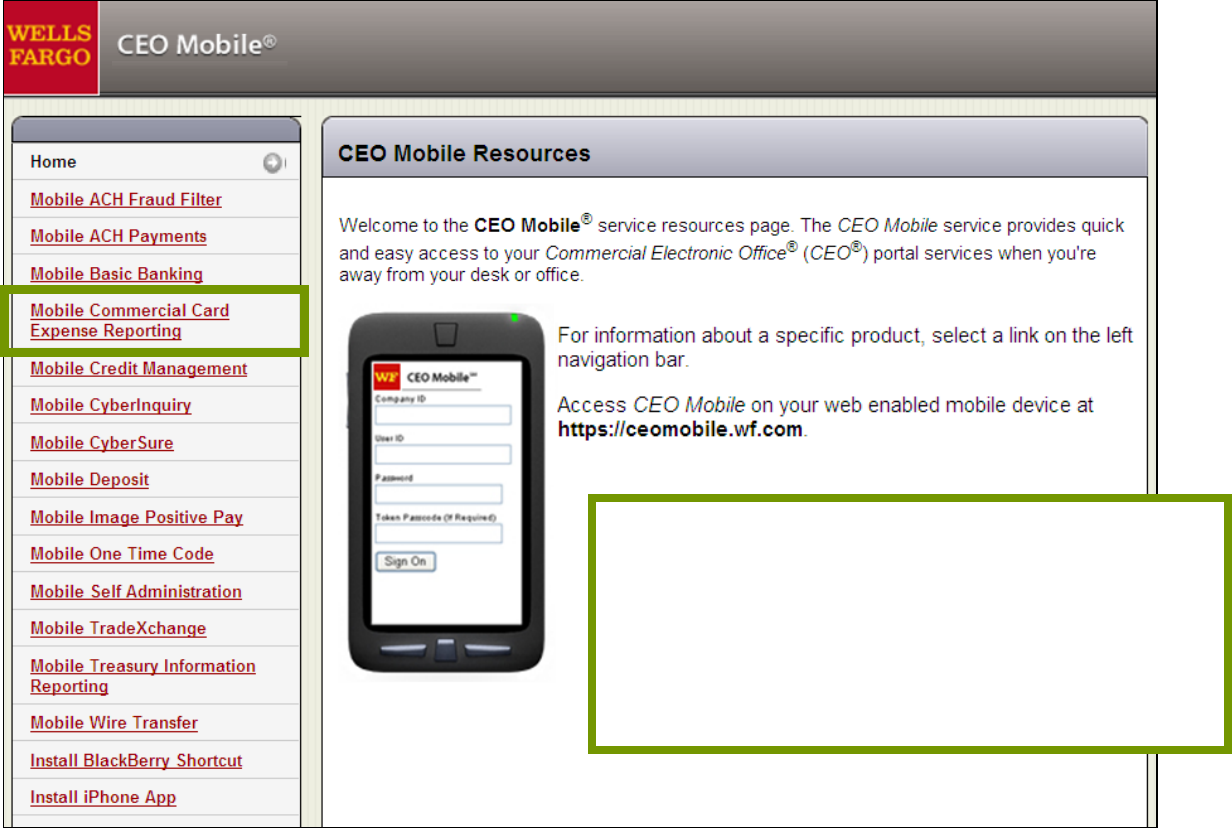

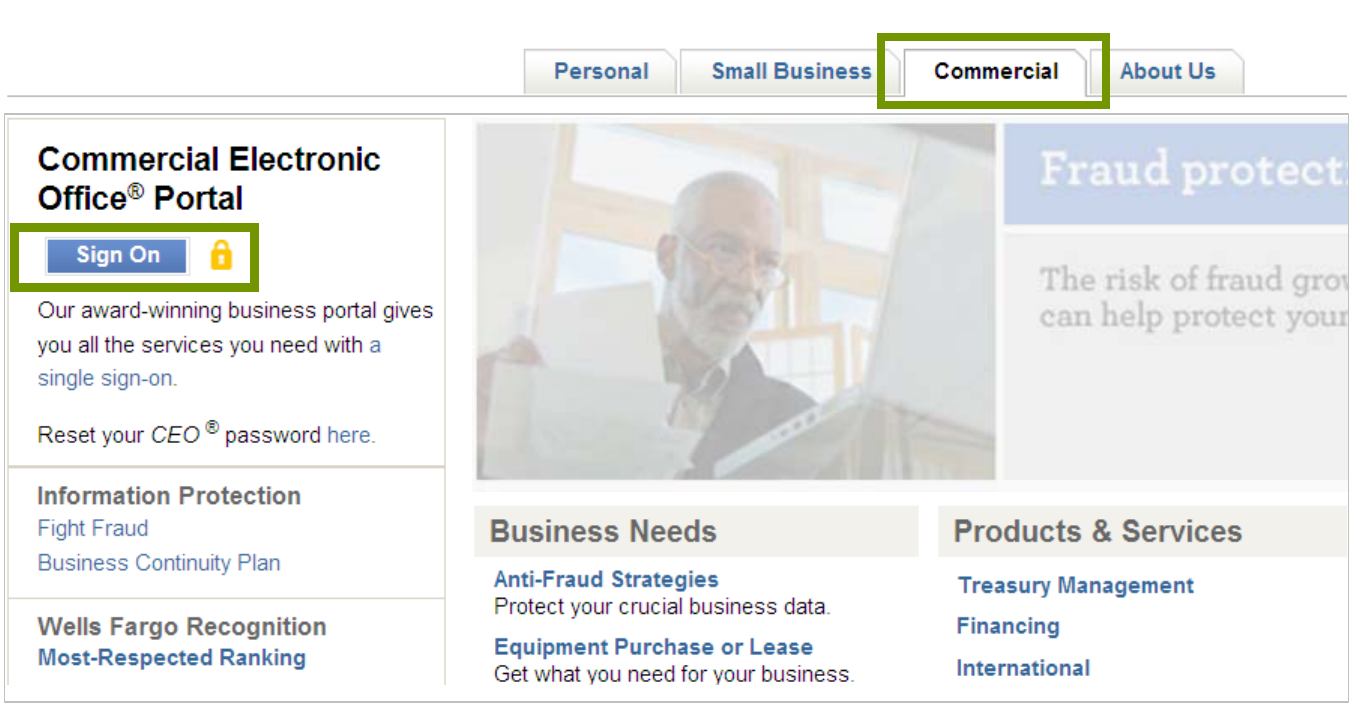

https://www.wellsfargo.com

4

https://wellsoffice.wellsfargo.com

5

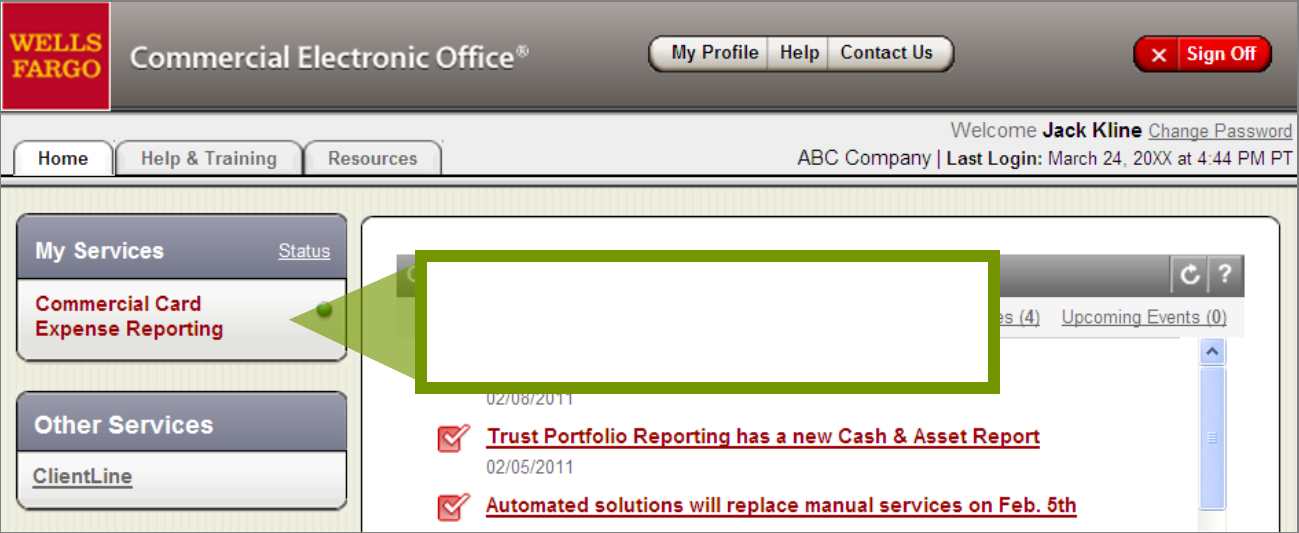

CEO homepage

Access Commercial Card Expense Reporting

6

Commercial Card

Expense Reporting

Cardholders, Reconcilers, and Approvers

7

CCER homepage

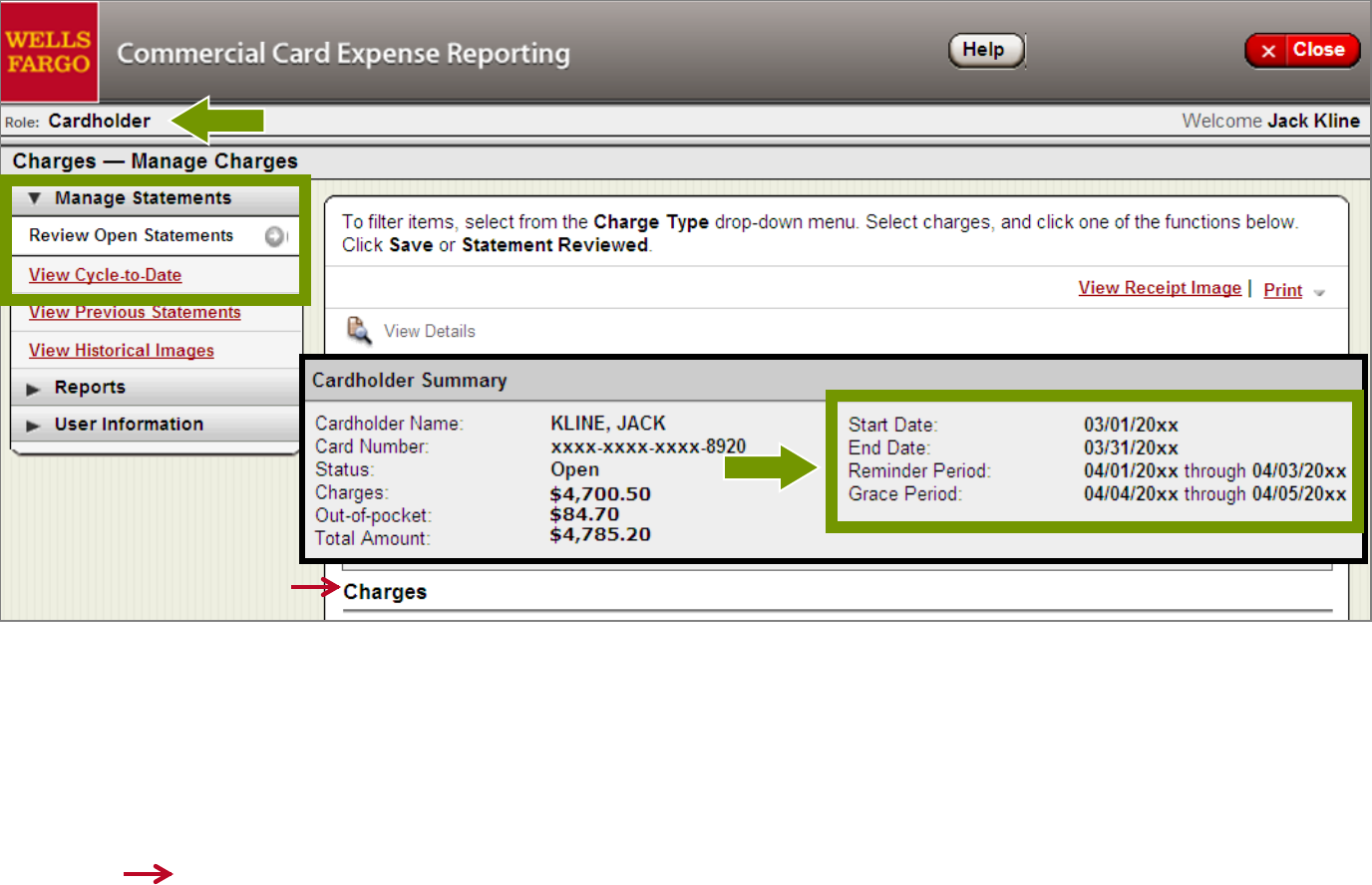

Cardholder (statement) homepage

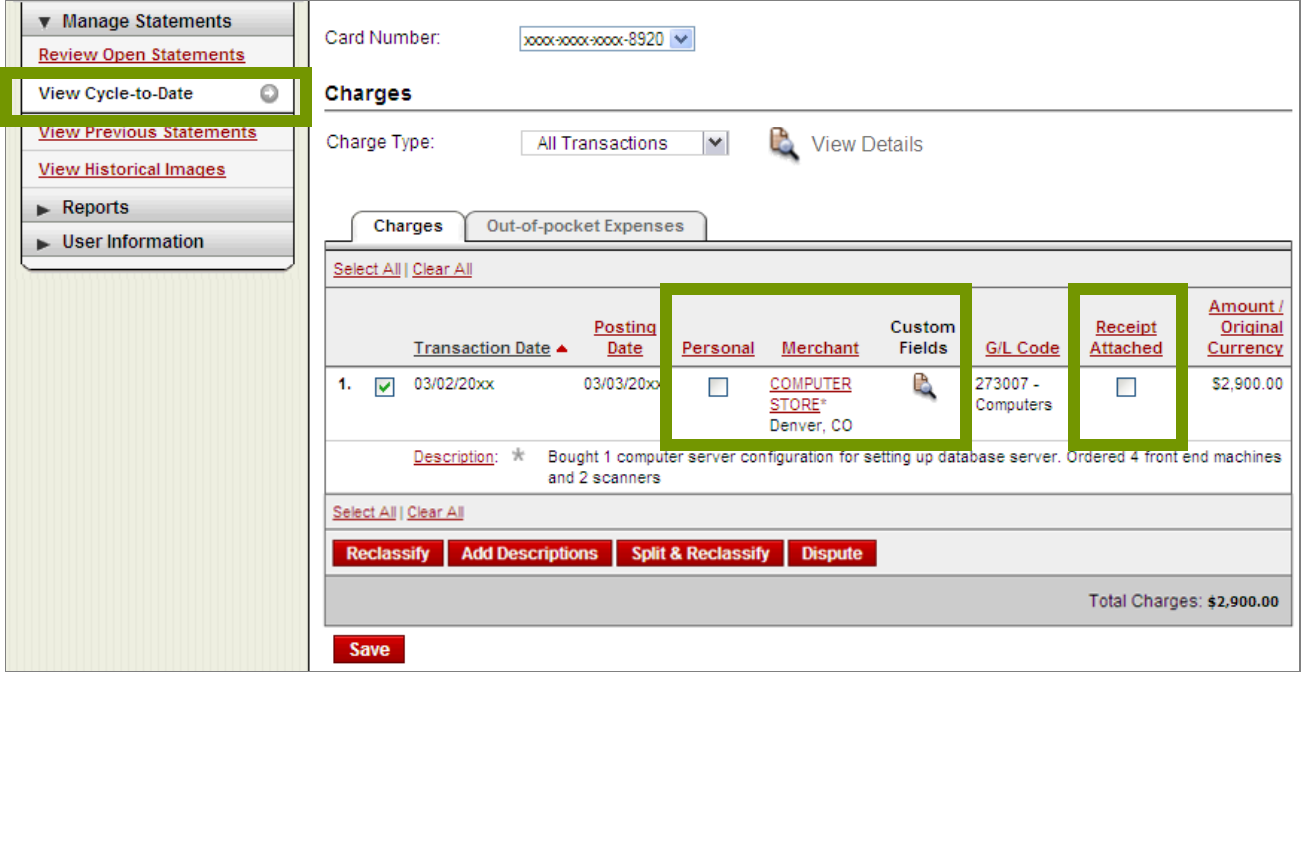

Review Open Statements vs. View Cycle to Date

8

Review Open Statements will become available when your company has reached the statement End Date

View Cycle-to Date (transactions) appear on your statement as they post and will be available

throughout the on-going statement cycle (from the statement Start Date up to the End Date)

You are encouraged to use Cycle-to-Date transactions throughout the expense reporting period to keep

your current statement up to date

Card charges and functions flow below – and will be covered in depth in a few slides…

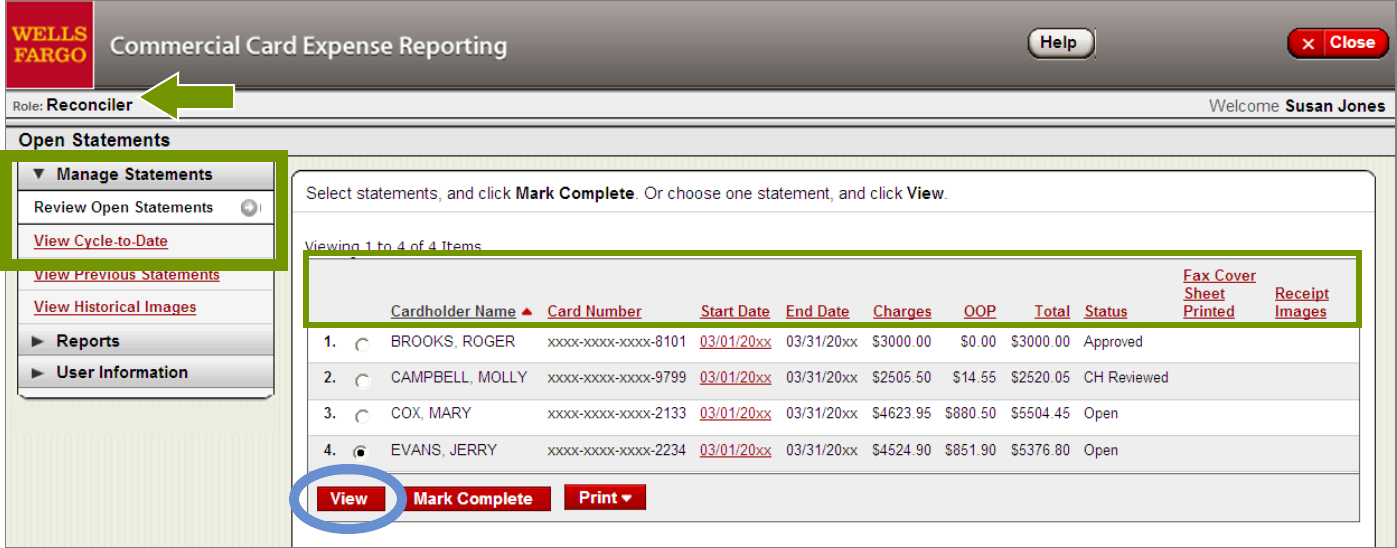

Reconciler homepage

Manage Statements – Review Open Statements

9

Cardholder statements that need to be reconciled will be in an Open status

Viewing the Cardholder statement when reconciling – looks and feels the same as what

the Cardholder would experience

Reconcilers can also access View Cycle-to-Date as charges are occurring, before the

statement closes

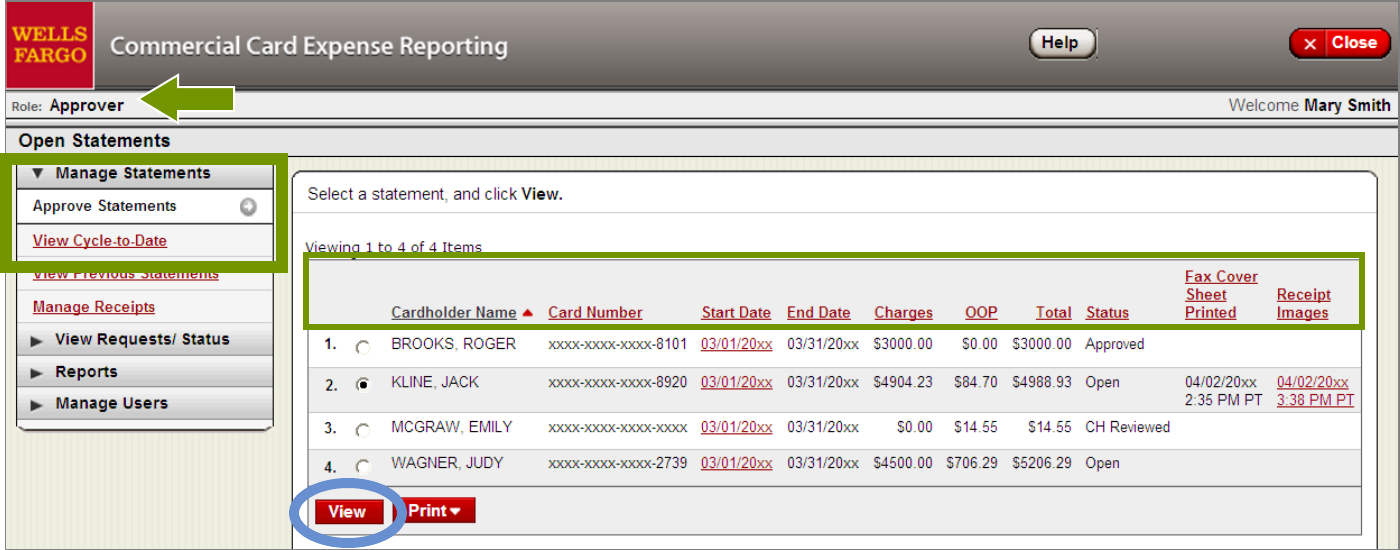

Approver homepage

Manage Statements – Approve Statements

10

Cardholder statements that are ready for approval will be in a CH Reviewed status

Viewing the Cardholder statement when approving – looks and feels similar to what the

Cardholder experiences

Approvers can also access View Cycle-to-Date as on-going and accruing charges for that

expense report period are occurring

The upcoming functions can be performed in either

Review Open Statements or View Cycle-to-Date transactions

(by Cardholders and Reconcilers)

Approvers can perform the upcoming functions in Approve

Statements or View Cycle-to-date transactions

Exception:

Receipt Images may only be uploaded in Review Open Statements/Approve Statements

11

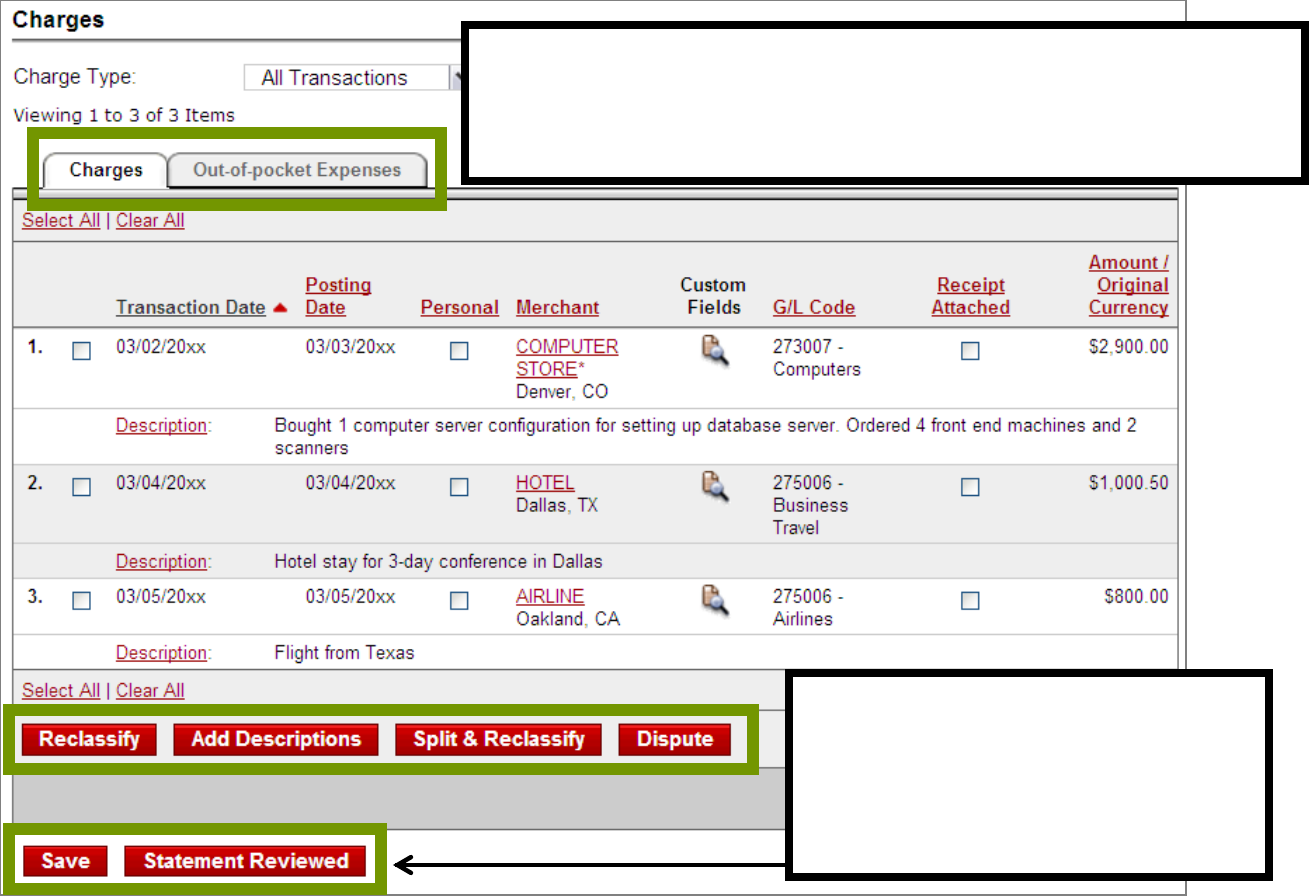

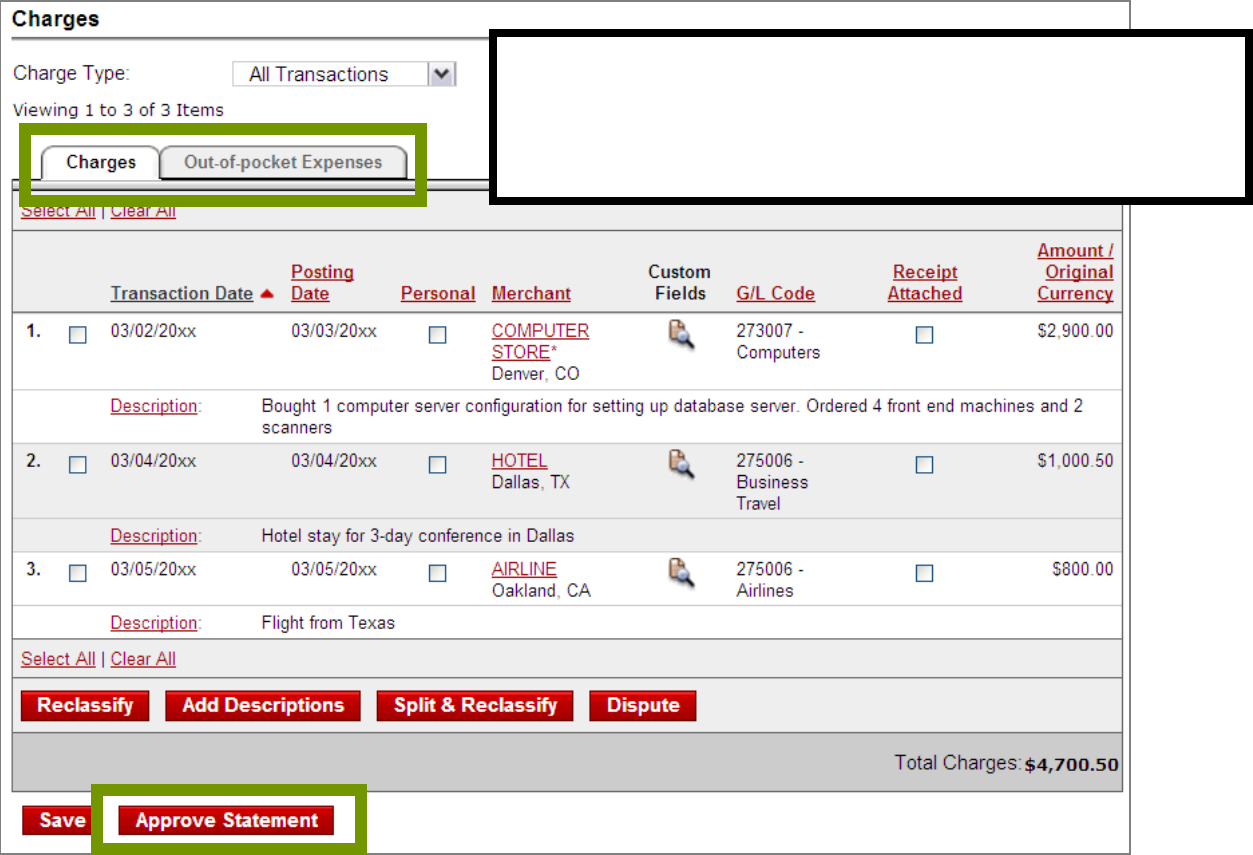

Manage Statements

Manage Statements

Charge functions

12

*

The charge functions at the bottom are available in

both the Open Statement – and ongoing throughout

the expense report period in Cycle-to-Date transactions

*

The Statement Reviewed

button (which submits the

expense report to the

Approver) will only be available

in Review Open Statements

Manage Statements

Review posted charge features

13

Indicate that a purchase was a Personal charge (if your company has this option)

View additional Merchant details by selecting the Merchant name (red hyperlink)

Select the View Details icon to view Custom Fields (if your company uses them)

Acknowledge that you have the purchase receipt ready to provide (Receipt Attached)

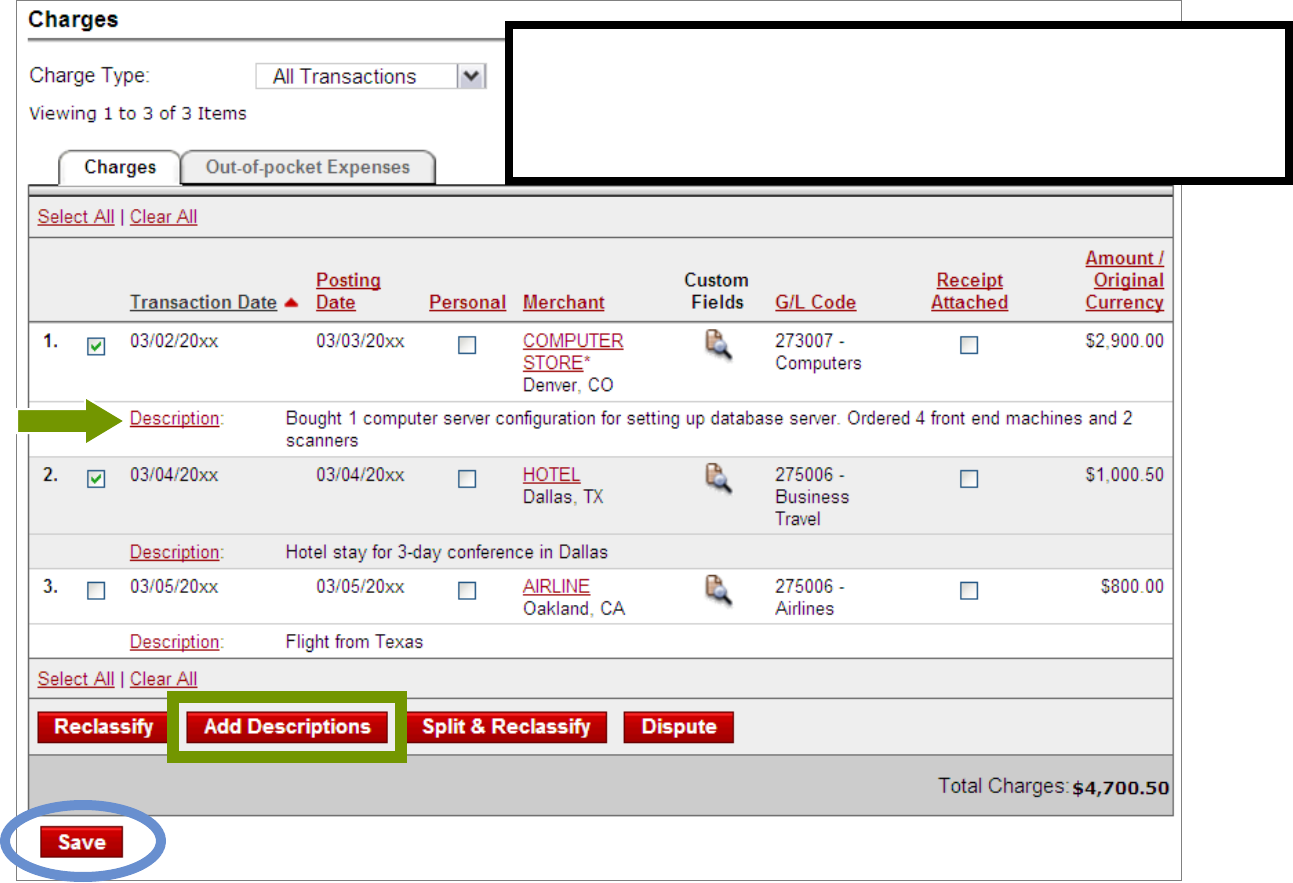

Add Descriptions

Most Program Administrators require business descriptions

14

Select the Description link to type a business

description for that charge, or select multiple

charges and click Add Descriptions

Remember to Save below if adding Descriptions from this page

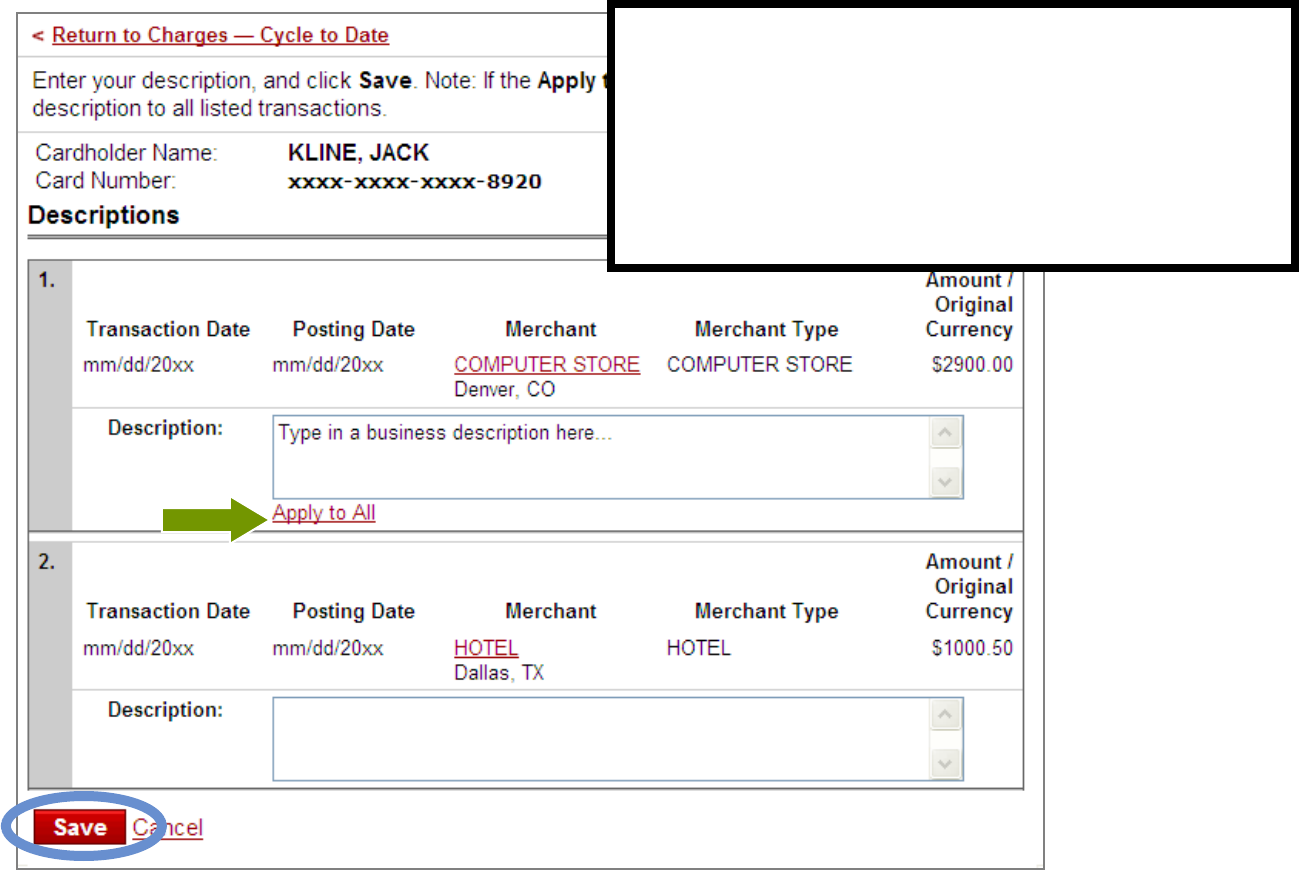

Add Descriptions

To multiple charges (selected on the previous screen)

15

Descriptions can be up to 200 characters

Accepted special characters are the period,

comma, and hyphen (dash)

Select the Apply to All link to apply a single

Description to all selected charges

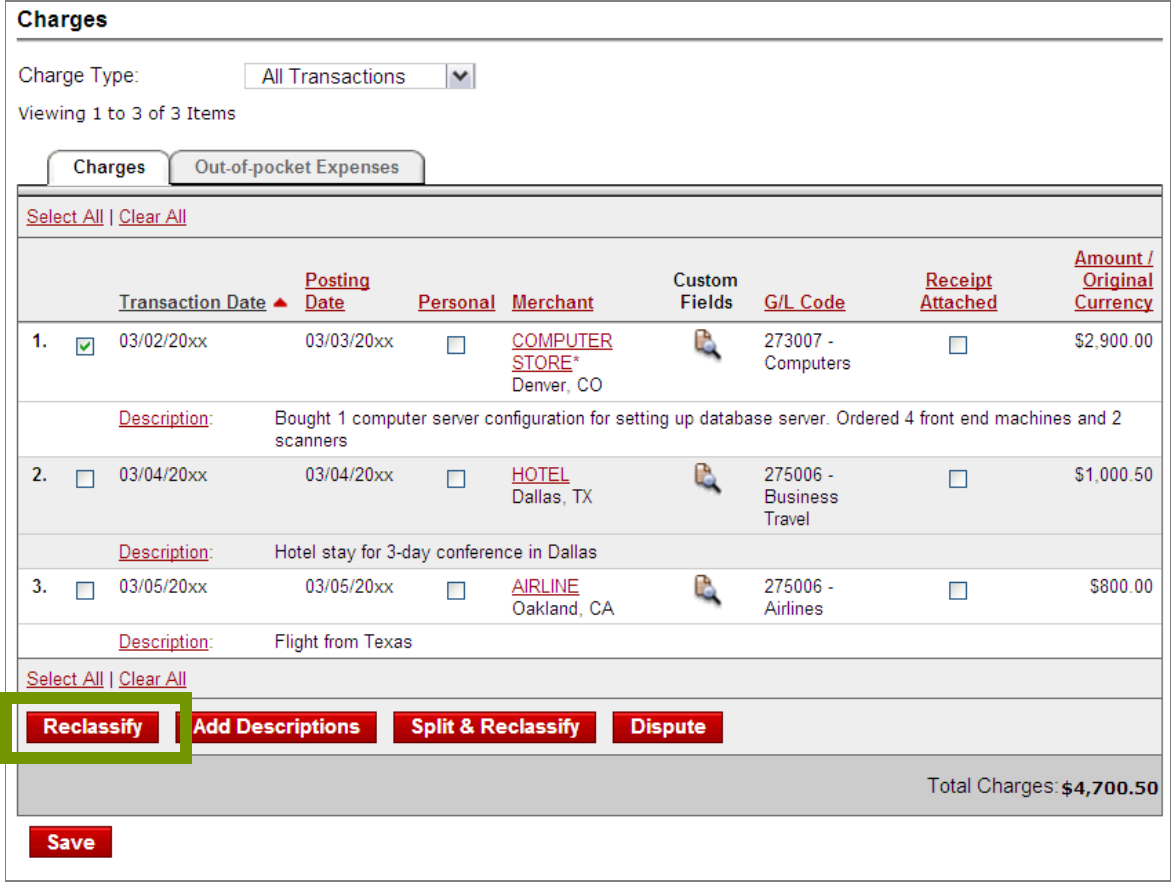

Reclassify

Allocate an entire charge to another General Ledger Code

16

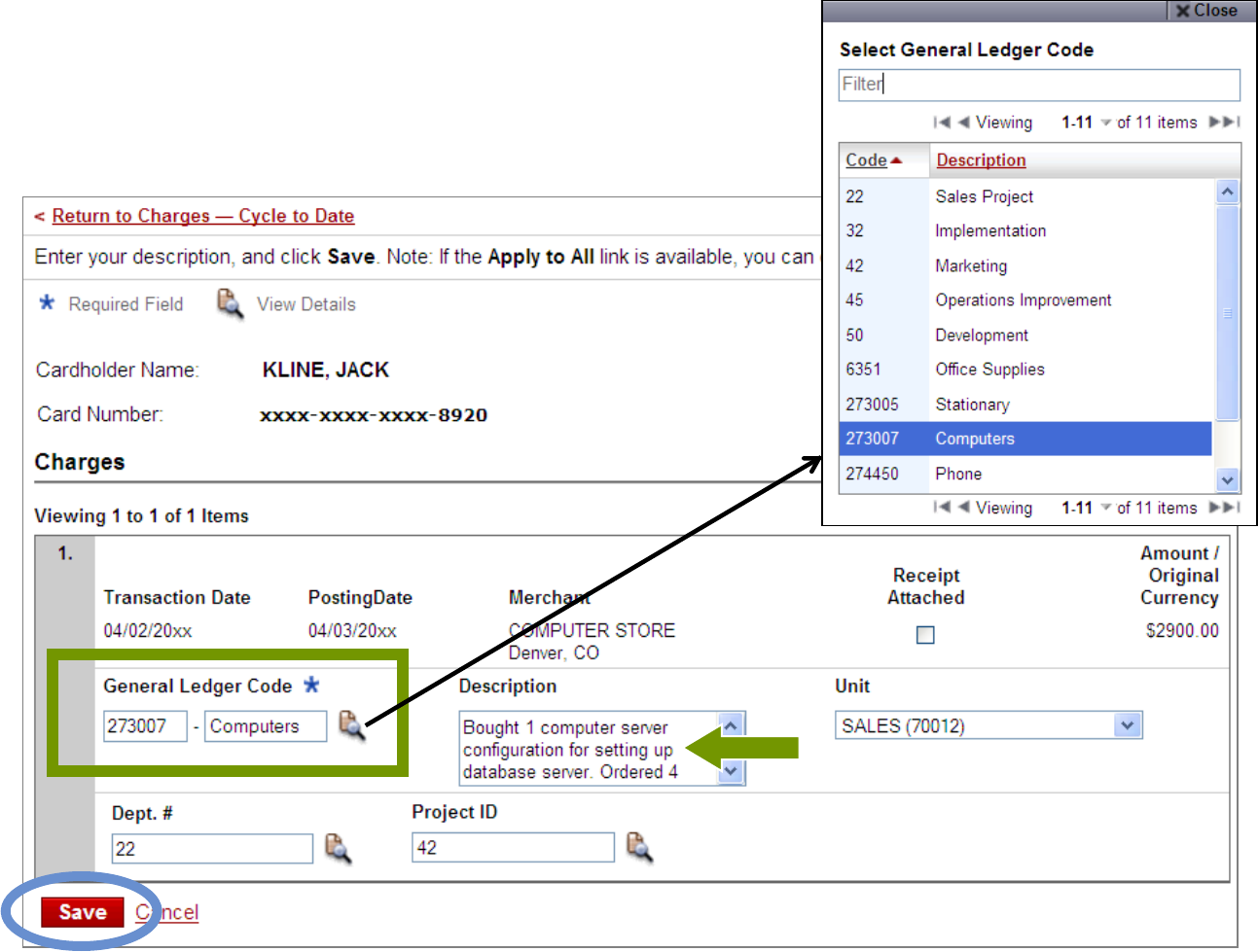

Reclassify

General Ledger Code (View Details icon)

17

Update Custom Fields if needed

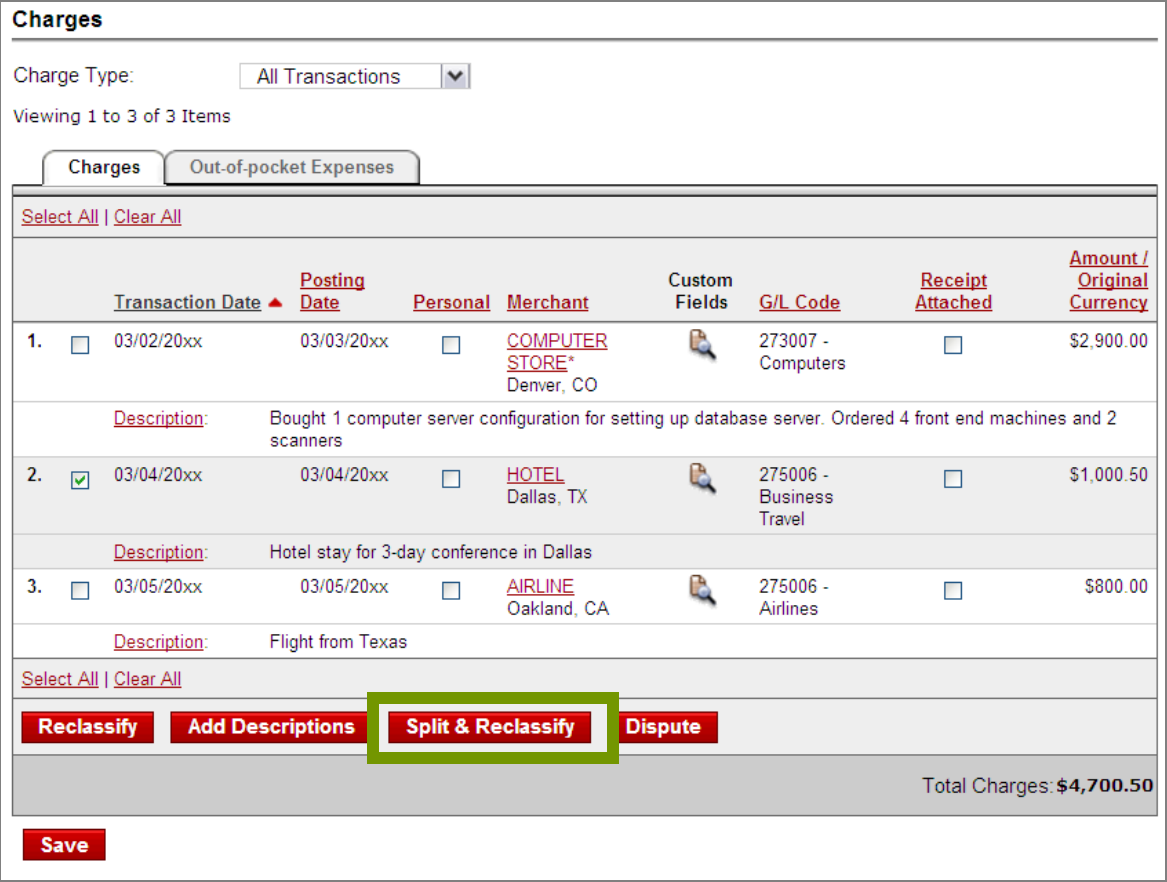

Split & Reclassify

Itemize and split a charge out to multiple GL Codes

18

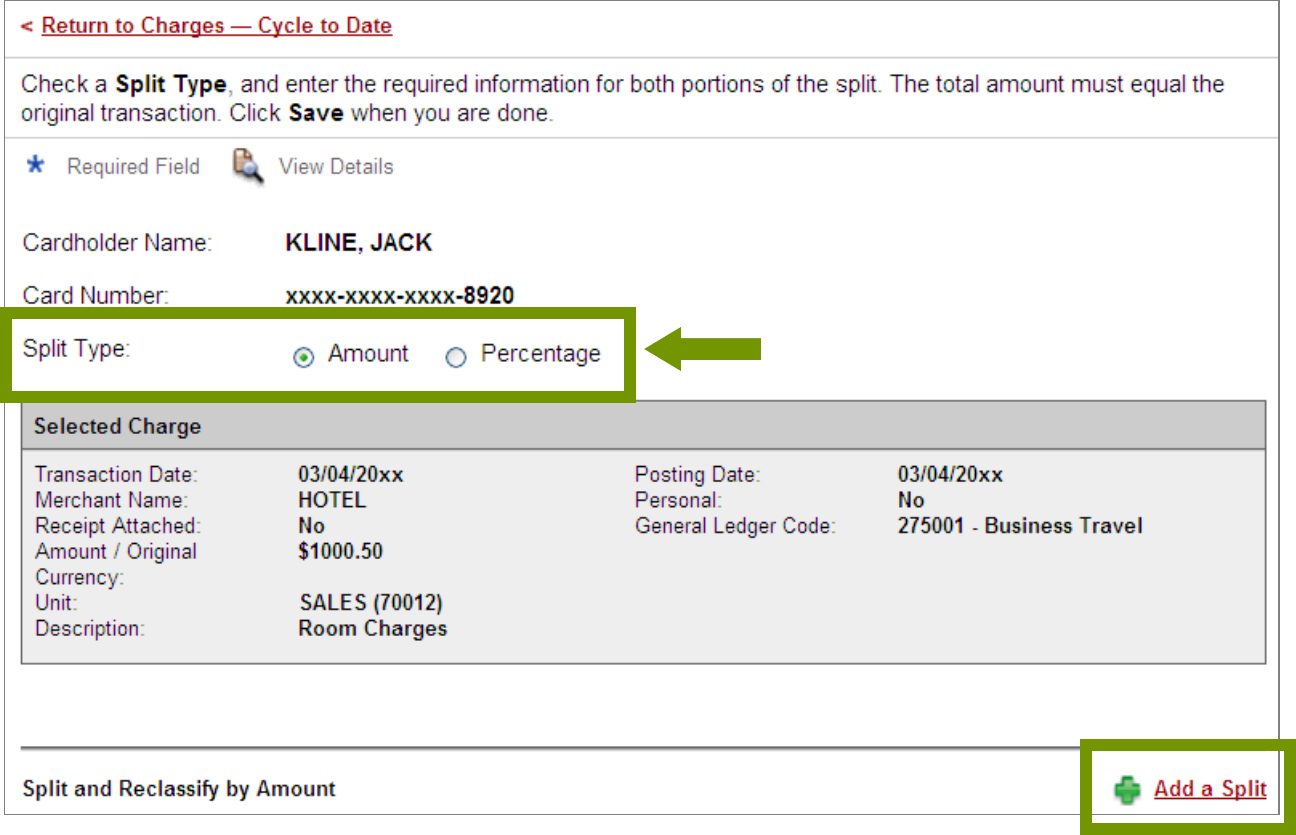

Split & Reclassify

Choose Split Type (Amount or Percentage) and Add a Split

19

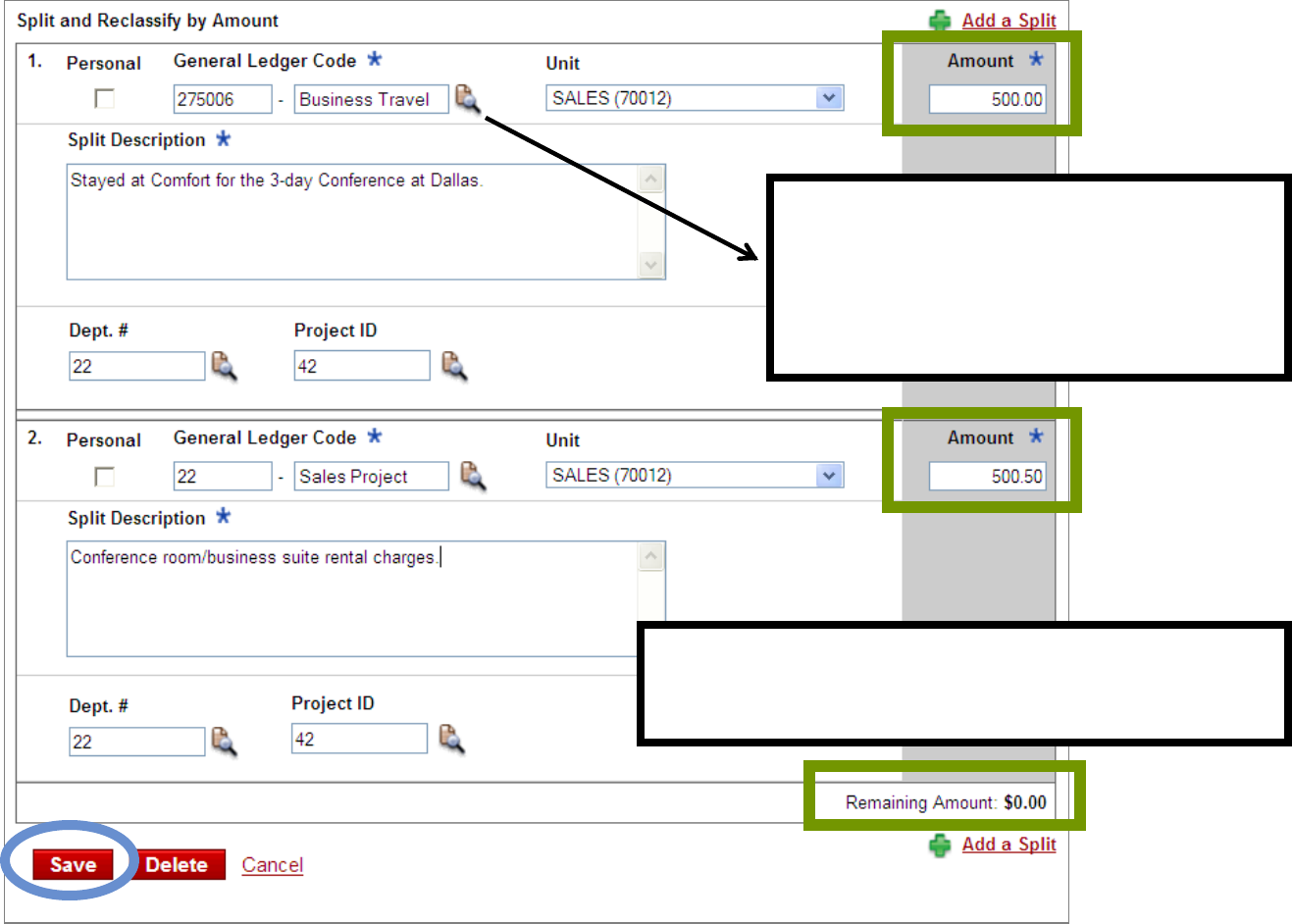

Split & Reclassify – finalize splits

20

Enter an Amount

Update the GL Code

Enter a Split Description

Update Custom Fields (if needed)

Continue to Add Splits until the

Remaining Amount equals “$0.00”

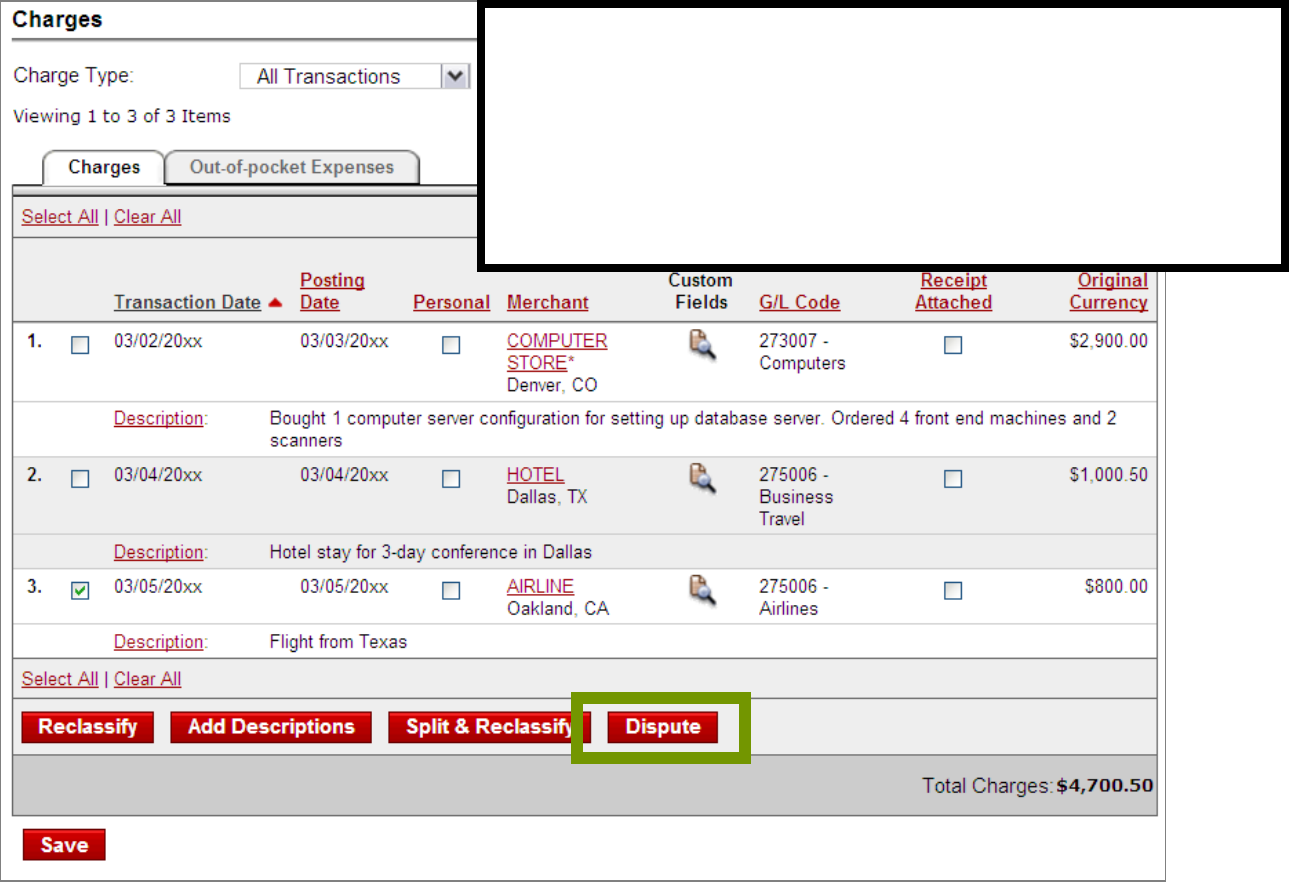

Dispute

Dispute posted transactions

21

If your card has been lost or stolen, contact

Wells Fargo immediately at 1-800-932-0036

(Do not use the online Dispute feature)

Contact the Merchant FIRST to get a refund

or correction (before filing an online dispute)

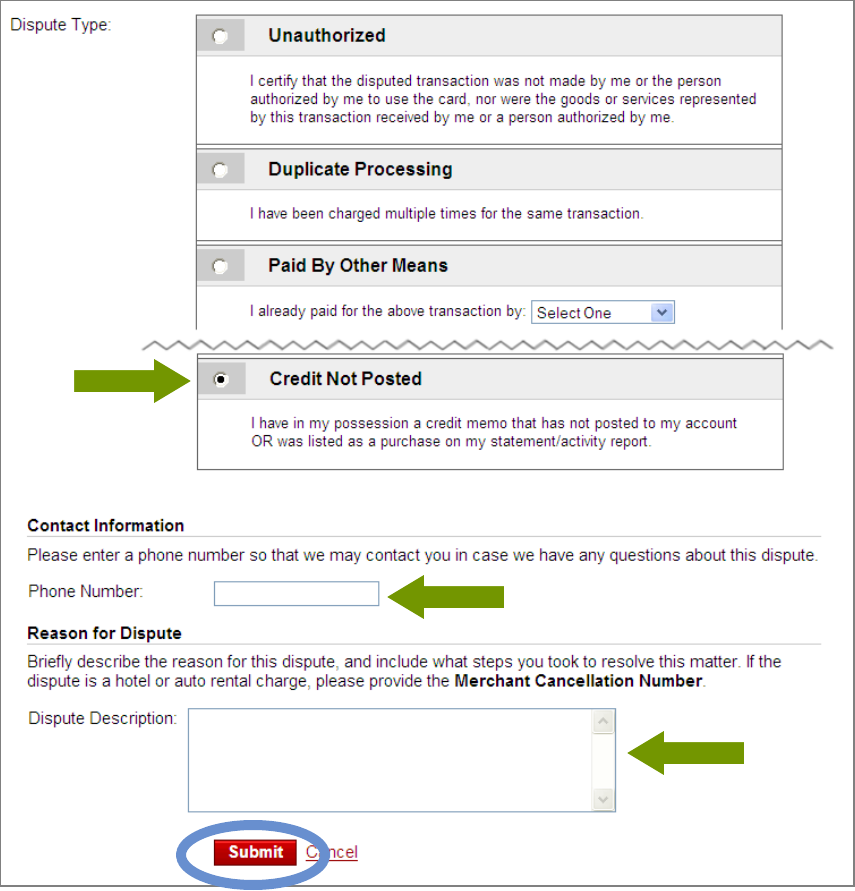

Dispute Details

You can dispute a charge up to 60 days after it has posted

22

Make sure to notify your

Program Administrator if

you file an online dispute

Charges will be taken off

your statement until the

dispute is resolved

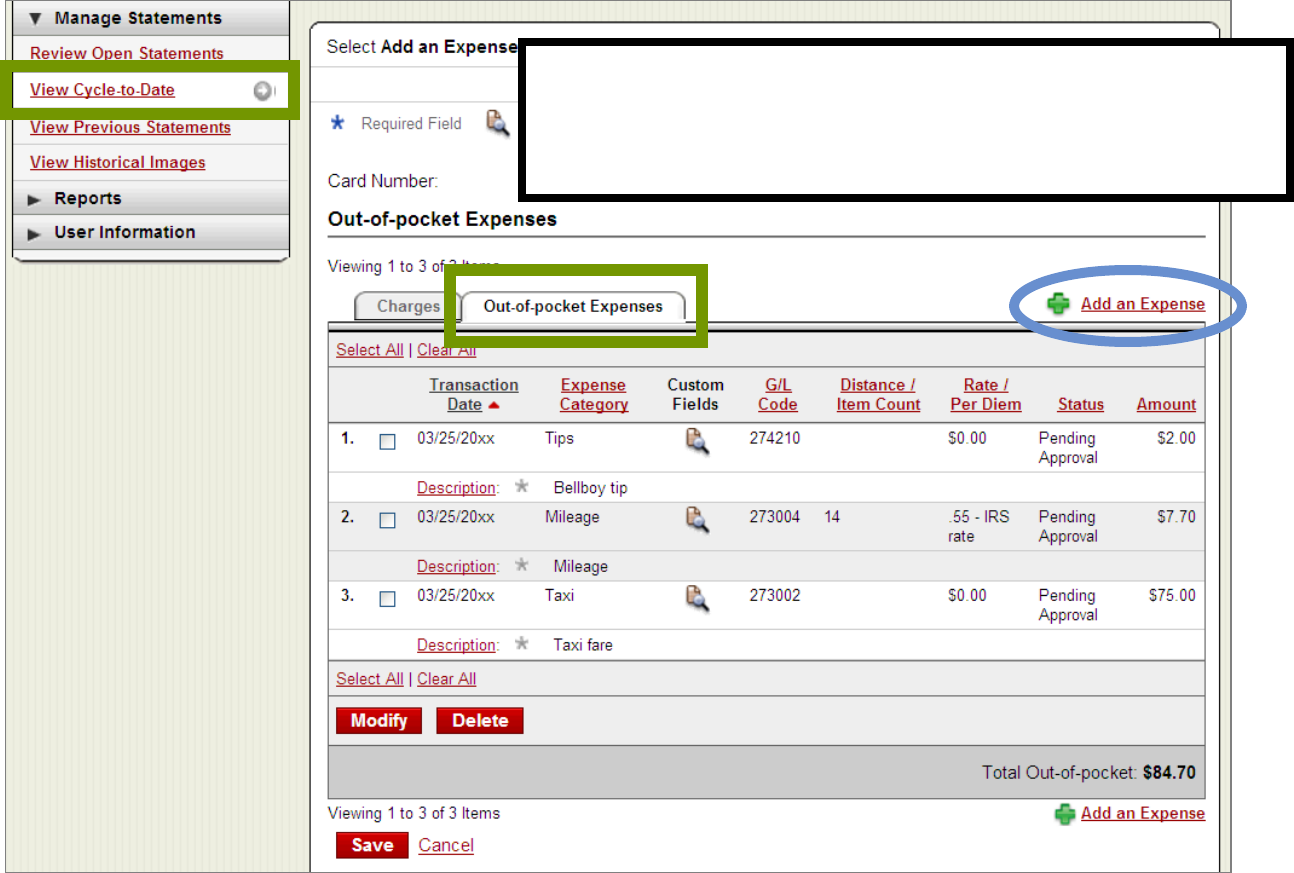

Out-of-pocket Expenses (tab)

Click Add an Expense to enter cash items

23

If the Out-of-pocket (OOP) option is used by

your company, Cardholders can enter their

cash items for reimbursement

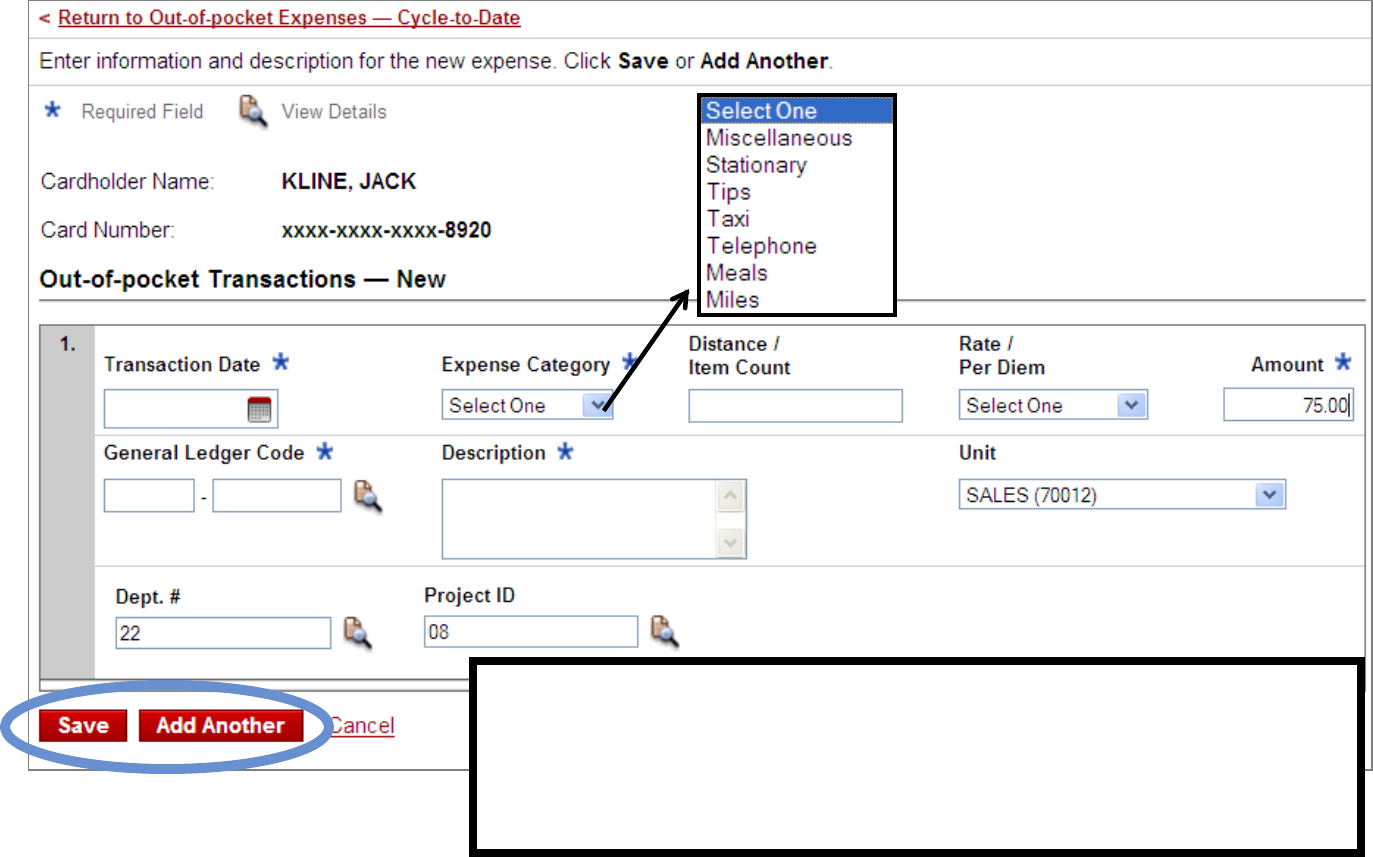

Out-of-pocket Transactions - New

Choose an Expense Category

24

The General Ledger Code will auto-populate according to

the selected Expense Category, but can be modified here

For the Mileage expense, enter the Distance traveled and

select a Rate to auto-calculate the reimbursement Amount

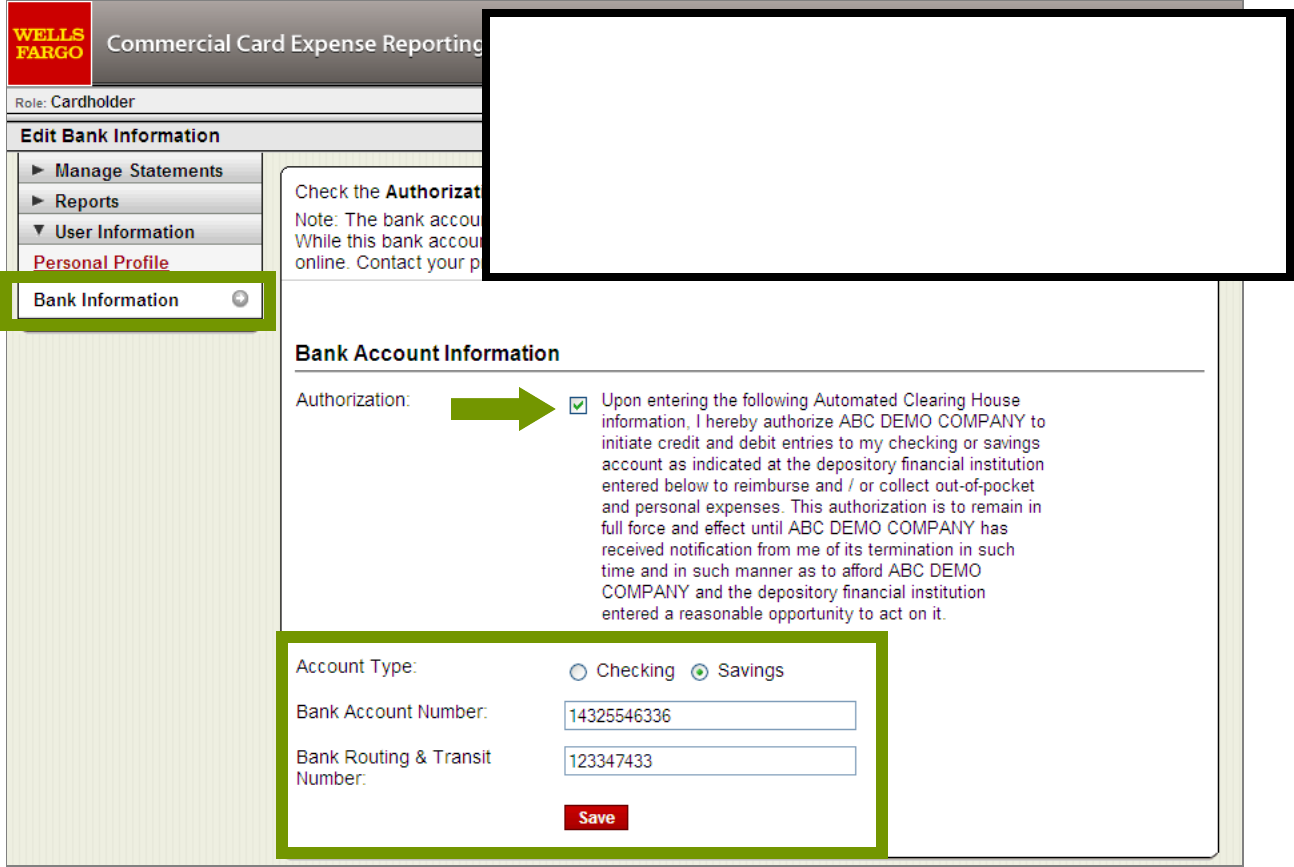

Direct deposit of OOP expenses (optional)

User Information – Bank Information

25

If your company has the ACH reimbursement option,

Cardholders (only) will see the Bank Information

link under the User Information section

Agree to the ACH terms and add your checking or

savings account that should receive Out-of-pocket

credits (and/or Personal debits)

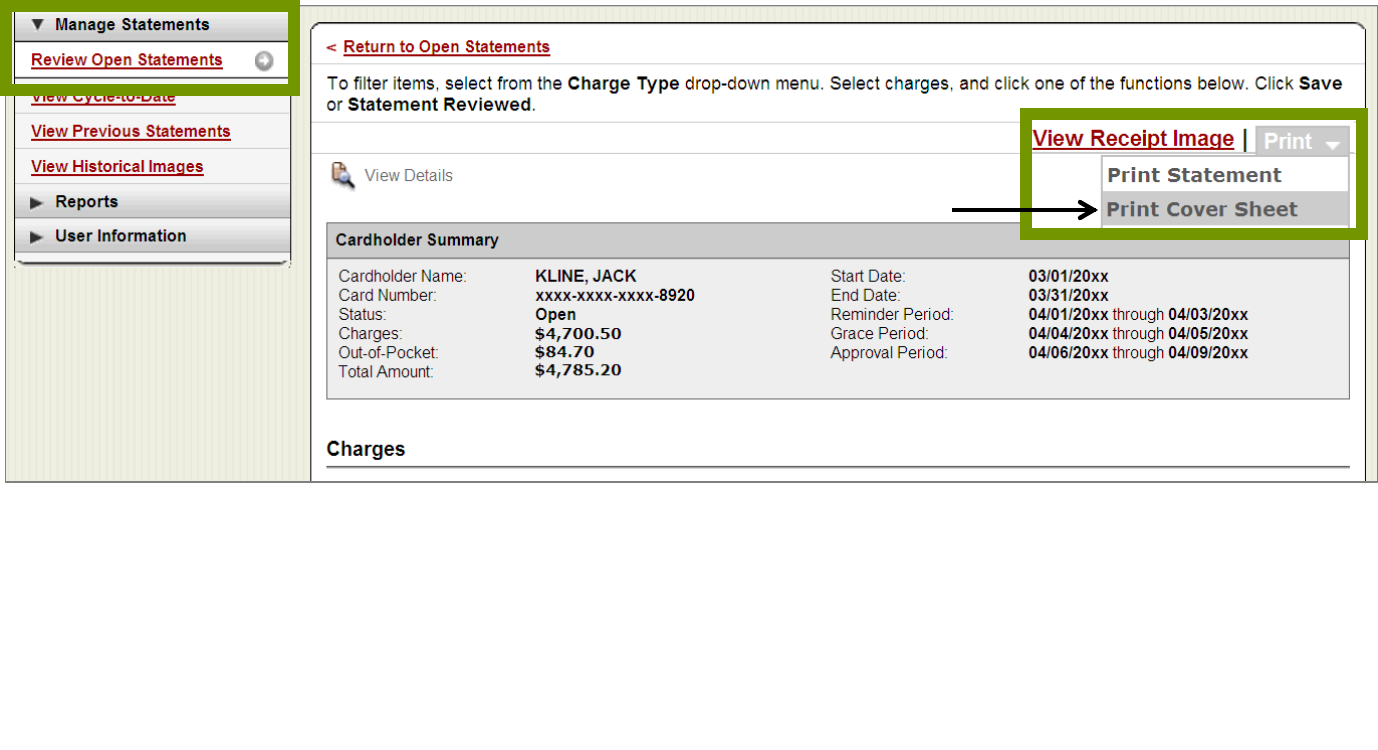

Review Open Statements – Receipt Imaging

Print Cover Sheet

26

If your company has the Receipt Imaging option , you will have to image your

receipts before you complete your statement review (fax or scan/email PDFs)

From the upper right hand corner of the Review Open Statements homepage,

select Print, then Print Cover Sheet

Please note, all CCER customers including those without Receipt Imaging will have

the option to Print Statement here

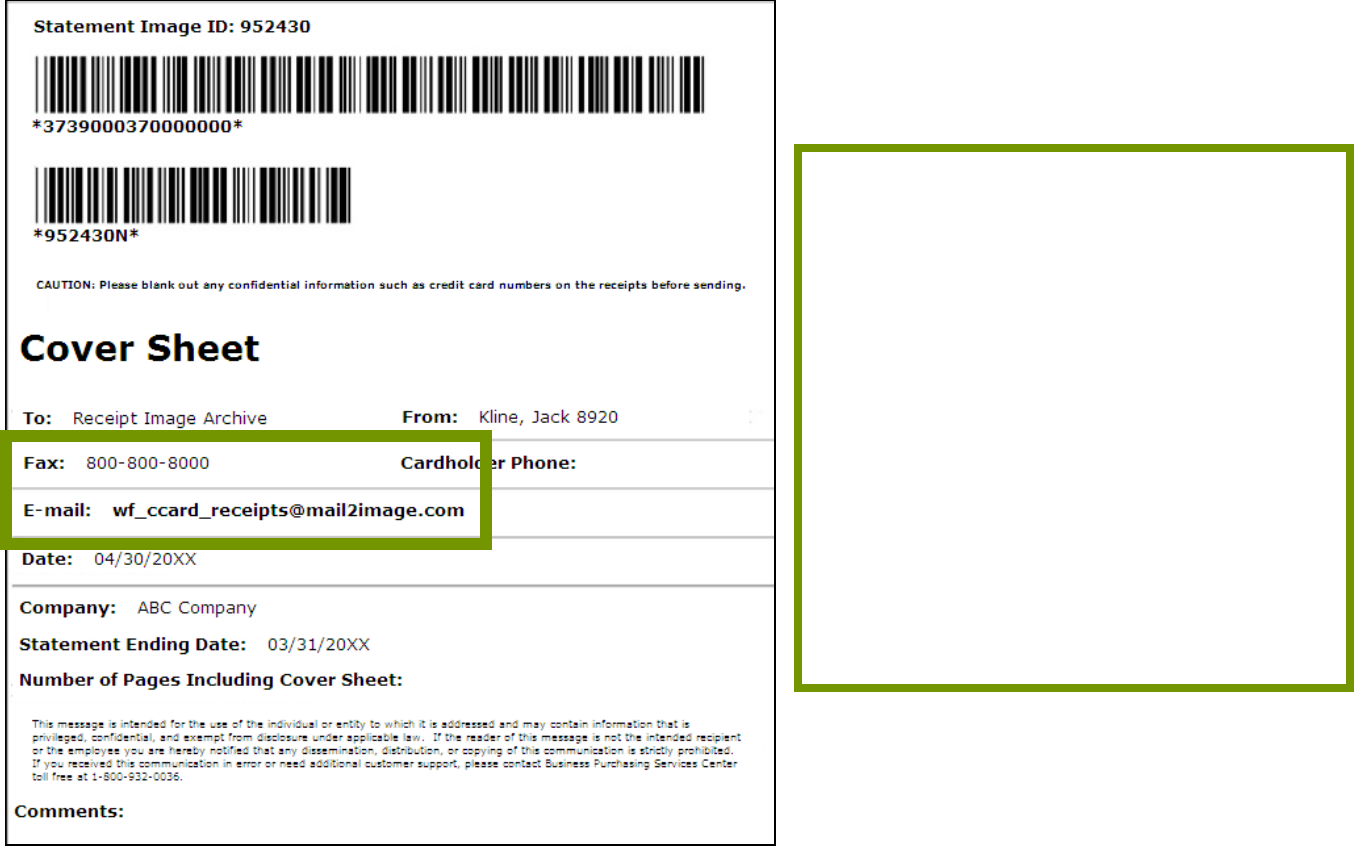

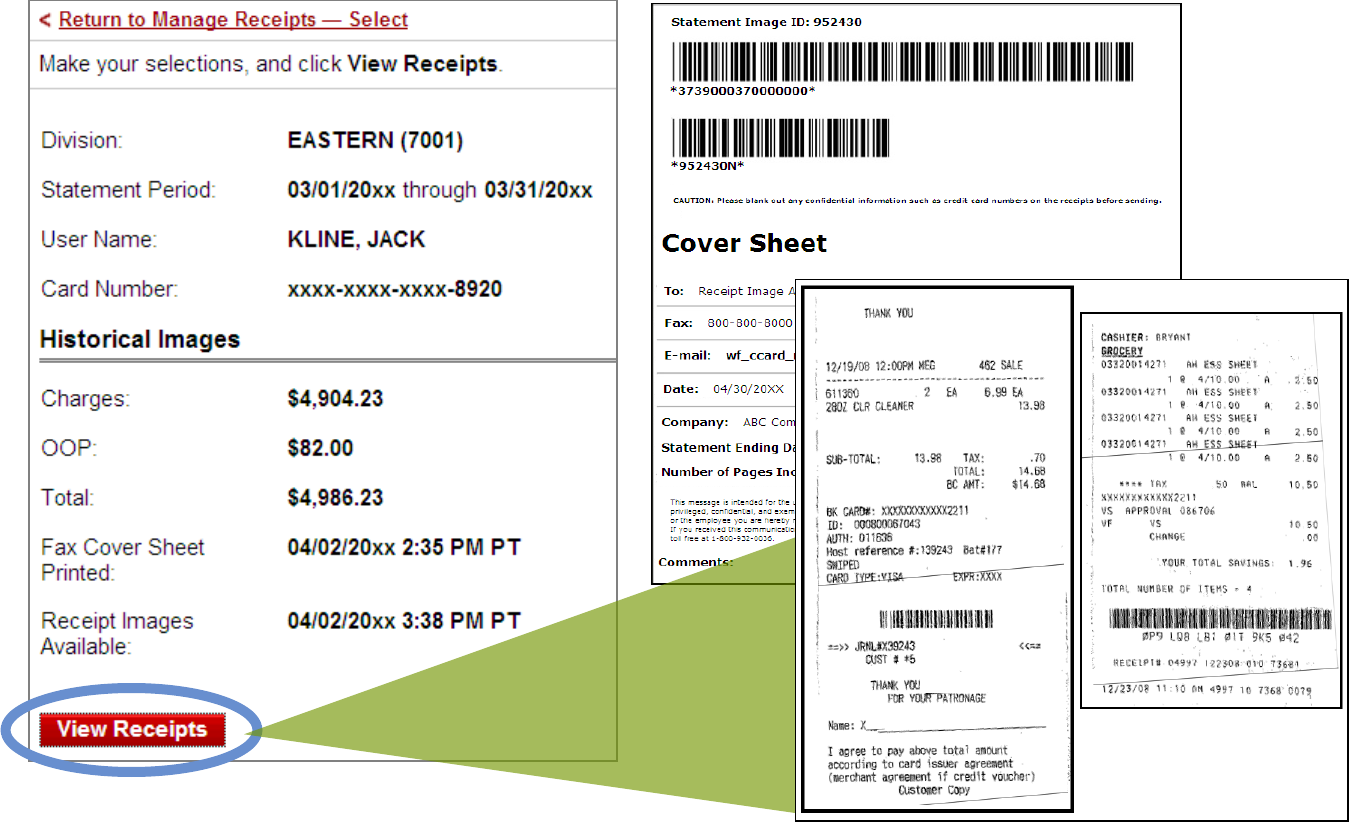

Receipt Imaging - Cover Sheet

Fax or scan/email (PDF files only)

27

2 options:

Fax the Cover Sheet and receipts for

the statement period to the Fax

number provided

OR

Scan the Cover Sheet followed by

the receipts for the statement period

and email them to the E-mail

address provided (PDF files only)

For a list of email best practices, see

the Additional Topics section of

today’s provided handout

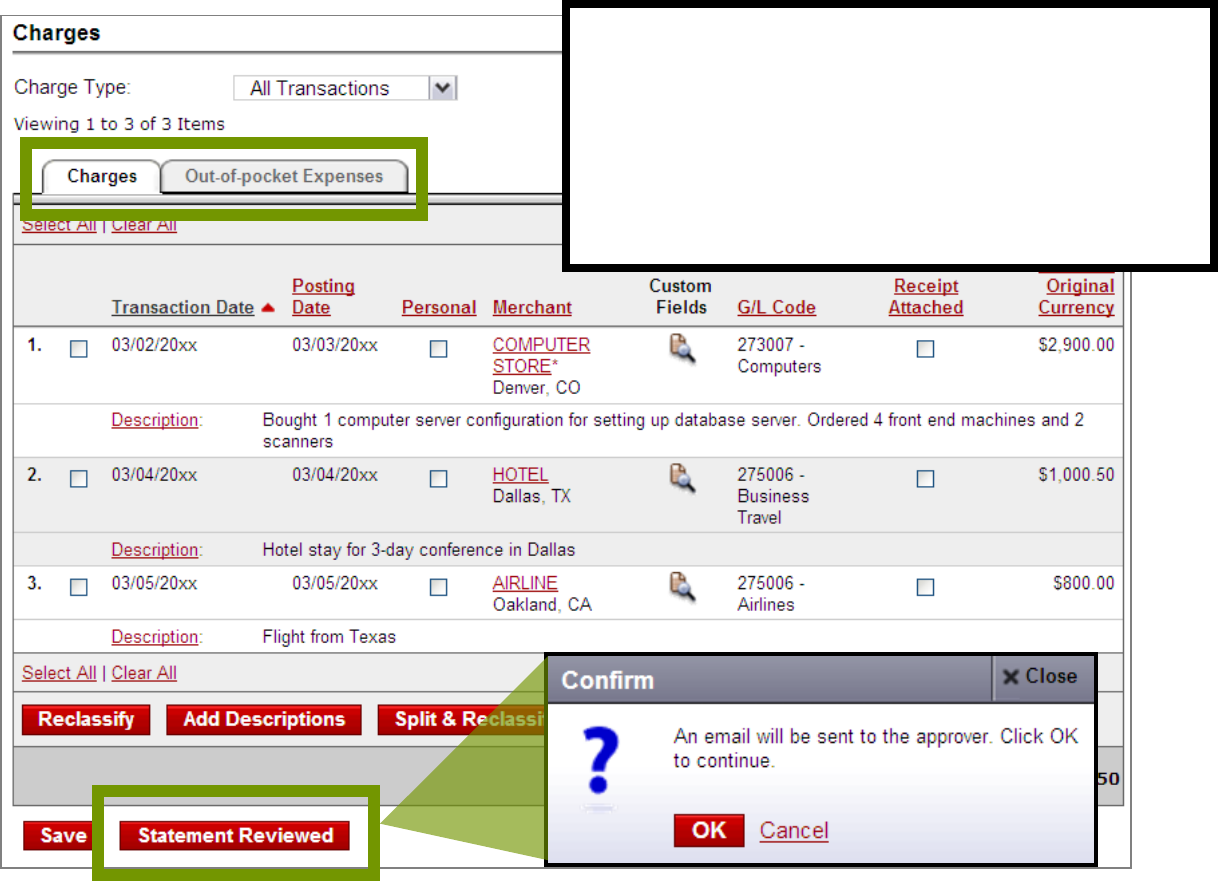

Cardholder/Reconciler view

Manage Statements – Review Open Statements homepage

28

Ensure all updates are made to both

Charges and Out-of-pocket Expenses

Cardholders (and Reconcilers) will

select Statement Reviewed to

submit the statement for approval

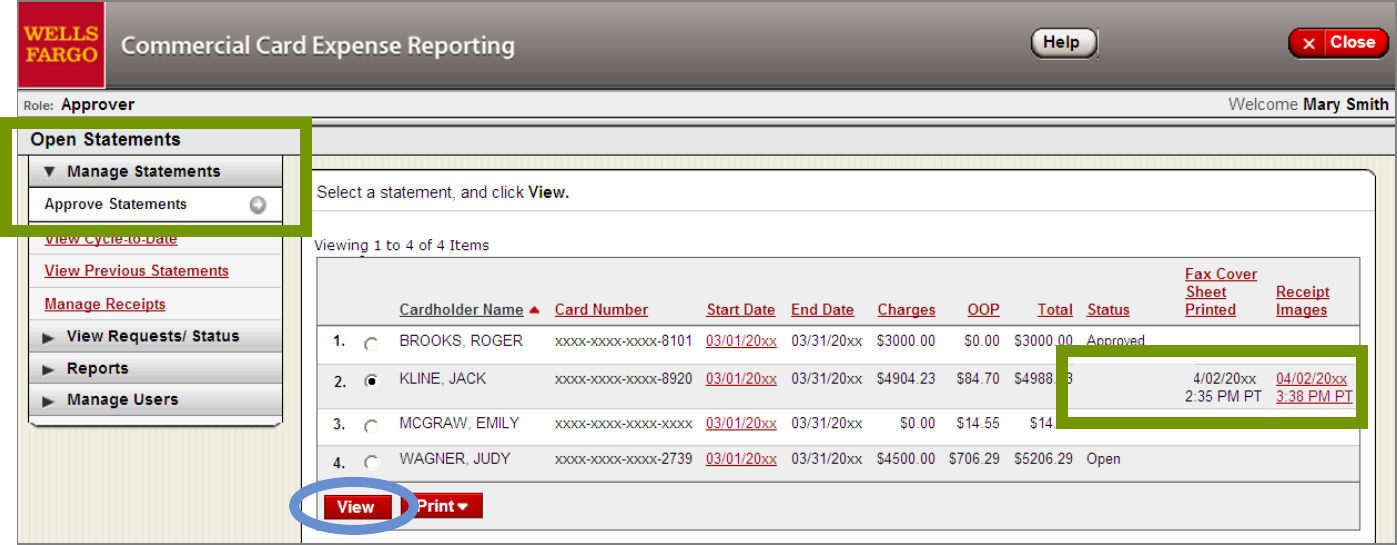

Approver view

Manage Statements – Approve Statements homepage

29

Approvers will select a Cardholder profile (in CH Reviewed Status) and click View

Approvers can also review faxed or emailed Receipt Images from this page

(Receipt Images link)

CH Reviewed

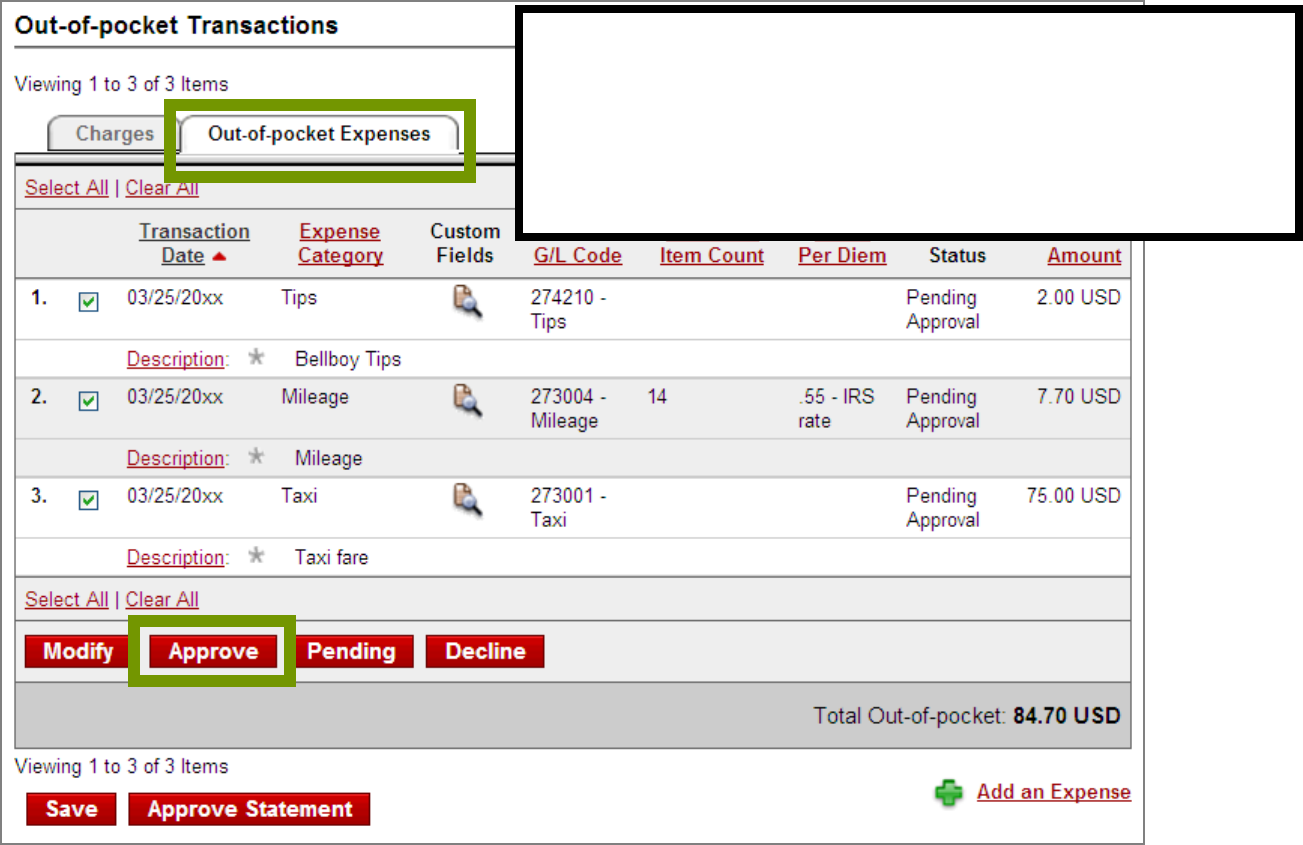

Approve OOP Expenses

(Separate from regular card transactions)

30

If an Approver fails to approve Out-of-pocket

Expenses before the Approver deadline, the

expenses will not be submitted for

reimbursement and will re-appear on the

Cardholder statement next month

Approve overall statement

Approvers will select (Approve Statement)

31

Approvers should make sure that submitted

statements are in compliance with company

policy for both Charges and OOP Expenses

Cardholder reminders

Collect receipts to verify purchases

Keep your card in a secure location and keep your

card number confidential

Use the Cycle-To-Date transactions statement to

keep your expense report current and to watch

for unauthorized transactions

Complete your statement review by the due date

32

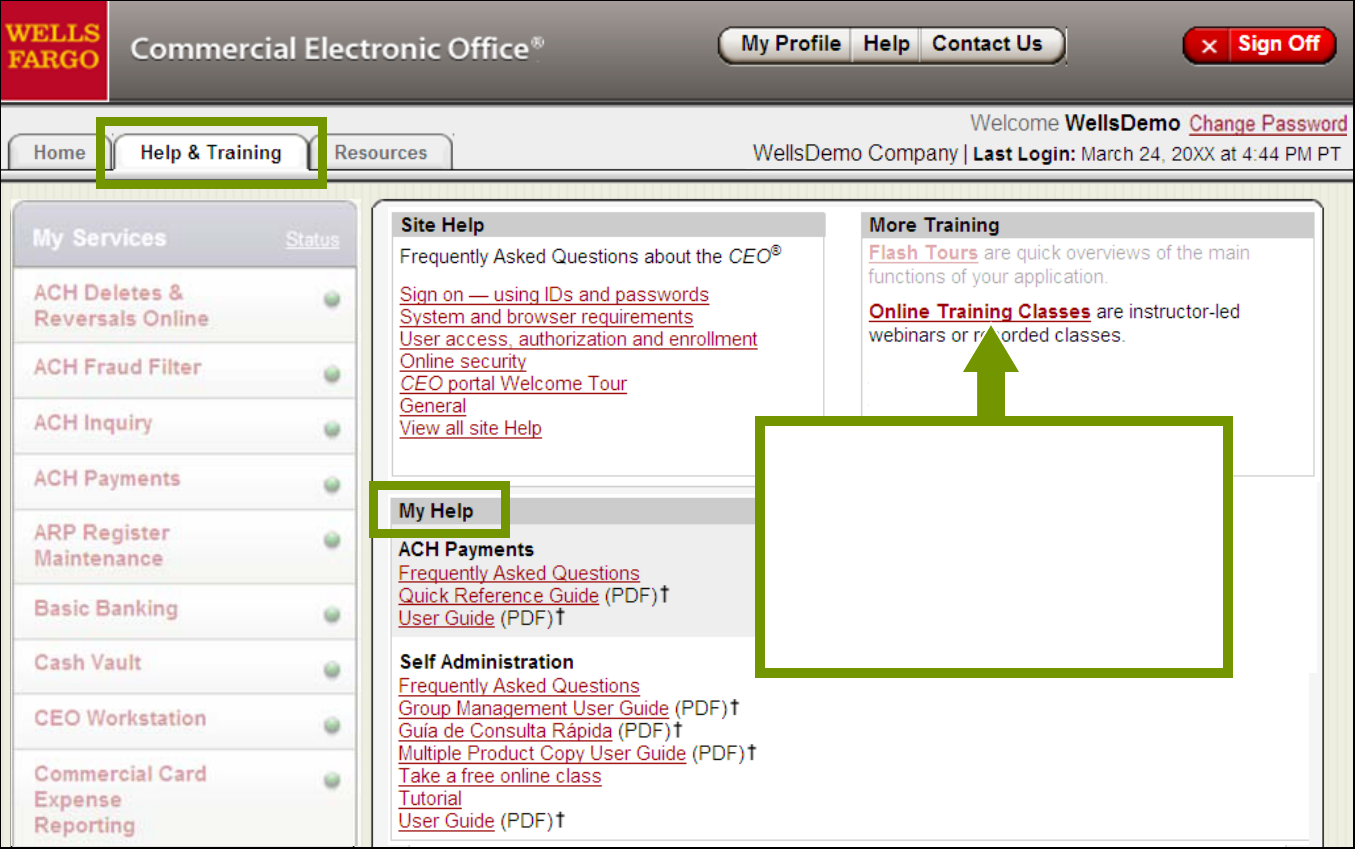

Help & Training tab

34

Register for free online

CEO product training

Access the full catalog of

available instructor-led

and recorded classes here

CCER for Cardholders, Reconcilers, Approvers

Post class resources

Product questions?

– CEO portal online help

– Wells Fargo Business Purchasing Service Center:

1-800-932-0036

Call immediately if your card is lost, stolen, or missing

To obtain immediate decline information

To access the automated voice response system for current

balance and available credit

– Credit limit increase, card ordering, or internal process

questions; contact your Program Administrator

Training feedback or questions?

– Send an email to: customer.training@wellsfargo.com

35

© 2012 Wells Fargo Bank, N.A. All rights reserved. For public use.

These additional topics are introduced here for future reference

– see the CCER Quick Reference Guides (available to

download from the "Help & Training" tab in your CEO portal)

for more comprehensive information on these topics

36

Additional topics

CCER issues automatic statement notifications via email

37

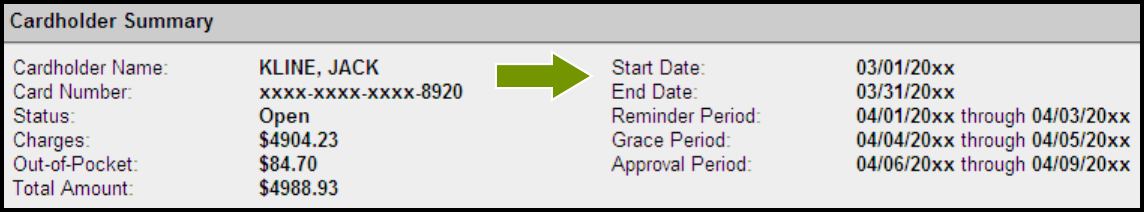

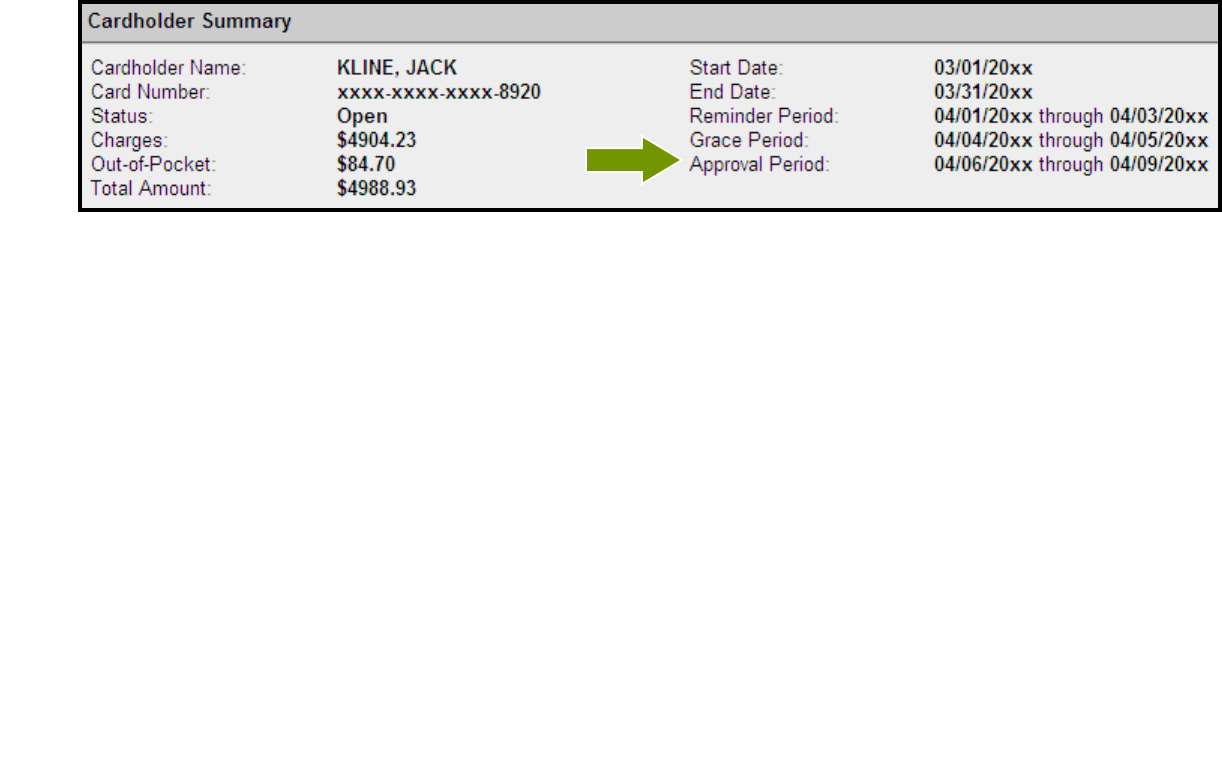

Review periods

Cardholder review period

Review your company’s unique CCER statement cycle, and Reminder

and Grace Periods within the Cardholder Summary located at the

top of the Review Open Statements and View Cycle-to-Date screens

38

An email will be sent out to Cardholders (and Reconcilers) when the current

statement cycle has ended, indicating that the statement can be submitted

for approval (Statement Reviewed). An email will be issued, even if the

Cardholder doesn’t have any transactions for that statement cycle.

If the Cardholder (or Reconciler) has not reviewed and submitted the

statement after X calendar days, a reminder email will be sent out.

Cardholders and Reconcilers will have an additional X days grace to complete

the review.

If you are on vacation or do not have online access, contact your PA.

Approver review period

Review your company’s unique CCER statement cycle, and Approval

Period within the Cardholder Summary located at the top of the

Review Open Statements and View Cycle-to-Date screens

39

An email will be sent to the Approver once Cardholders have submitted their

statements for approval (Statement Reviewed). An additional email will also

be sent listing any Cardholders that failed to submit their statements by the

grace period end date.

Approvers must approve all statements by X calendar days after the end of

the Cardholder period.

If an Approver fails to approve Out-of-pocket Expenses before the Approver

deadline, the expenses will not be submitted for reimbursement, and will

reappear on the Cardholder’s next statement cycle.

If you are on vacation, or do not have online access, contact your PA so a

secondary Approver can be assigned to your Cardholders.

40

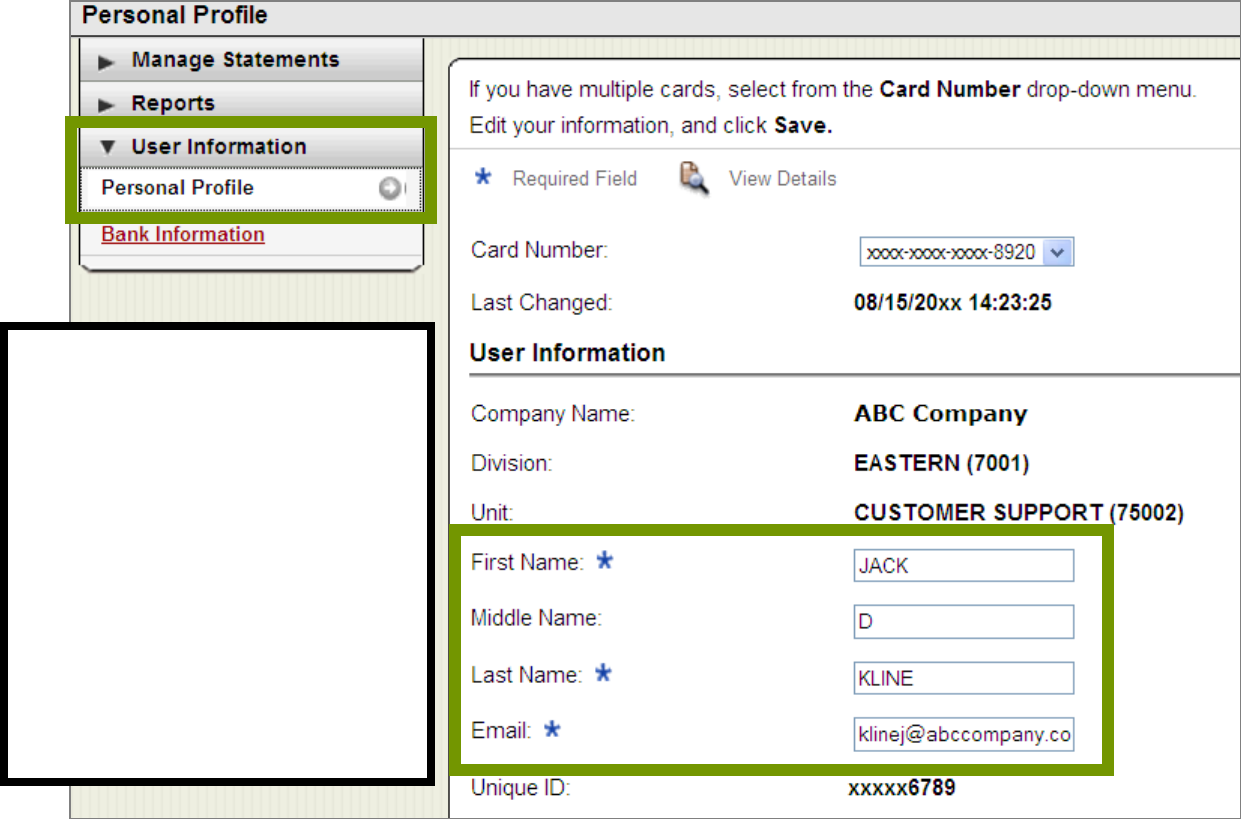

Personal Profile

User Information

Personal Profile – Update your name and email address

41

If you change your name here,

a new card with your new

name (same card number) will

be sent to your Program

Admin. for distribution to you

Your existing card is

deactivated immediately – it is

recommended that you check

with your Program Admin.

regarding name changes first

SAVE any changes at the

bottom of this screen

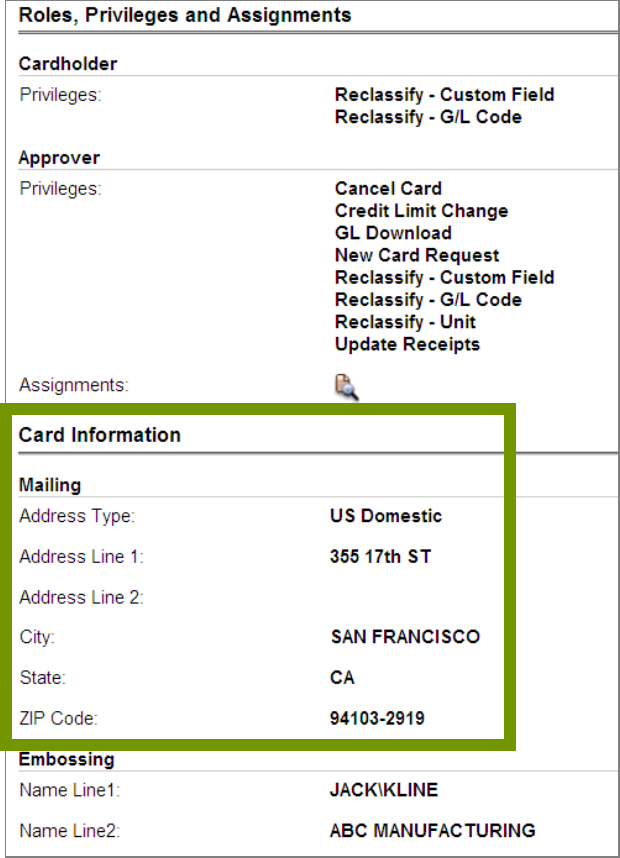

Personal Profile - continued

Card Information (billing address)

42

The Card Information section

provides the card billing address that

you will need to provide when making

online purchases

Some retailers may also ask for the

first five digits of the zip code

This is often the default address of

your company’s main office or

headquarters – although it can be

customized by your Program Admin.

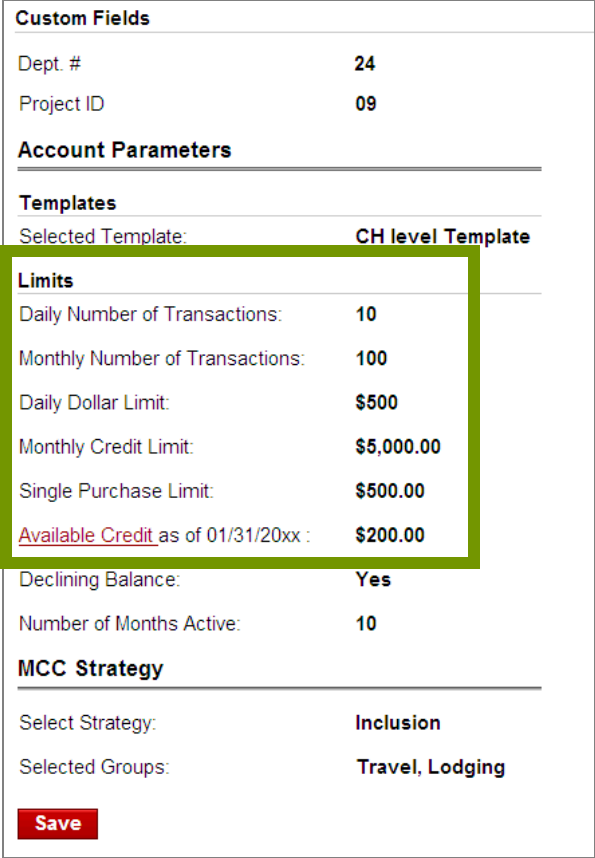

Personal Profile - continued

Account Parameters (Limits and Available Credit)

43

The Limits section provides transaction

limits currently in place on your card,

including your Monthly Credit Limit

Click the Available Credit link to

retrieve your current available credit (or

remaining credit balance for the month)

You can also contact the Business

Purchasing Service Center at any time

to obtain your available credit

(1-800-932-0036)

The Program Administrator must grant user rights to

access this function

44

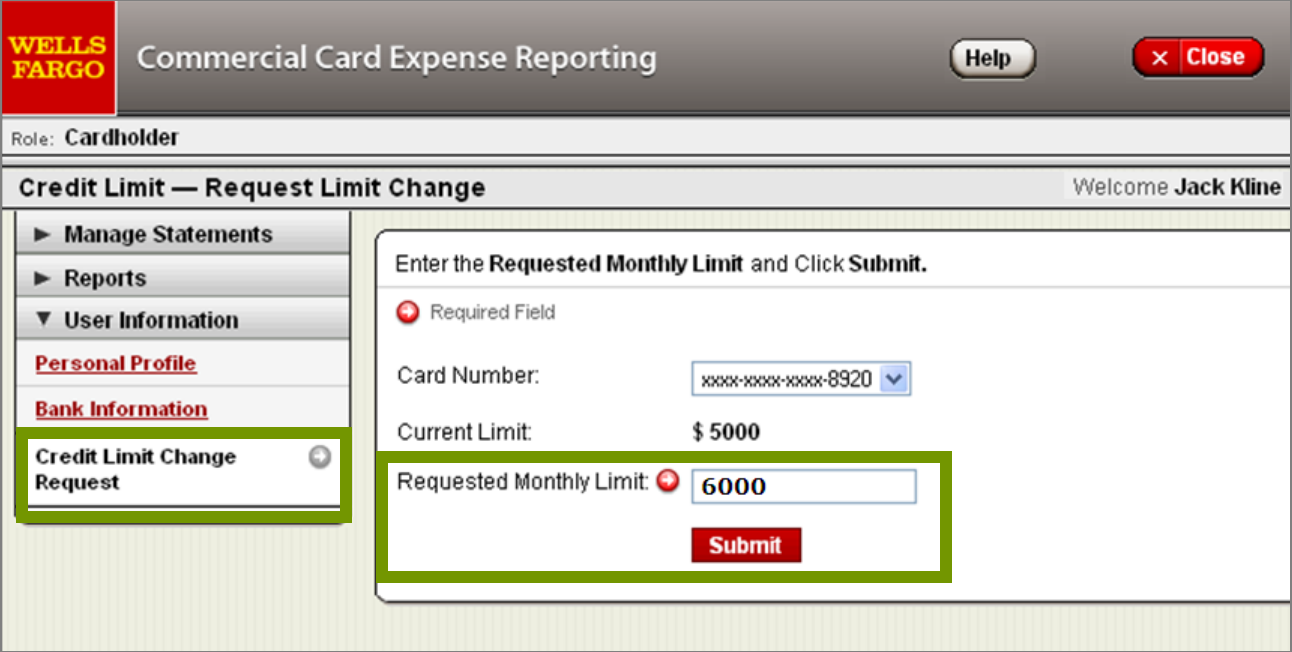

Credit Limit Change Request

User Information

Credit Limit Change Request

45

Enter your new desired limit into the Requested Monthly Limit field and Submit

If a credit limit change is needed immediately contact your Program Admin.

(limit changes can be made/approved in real time)

46

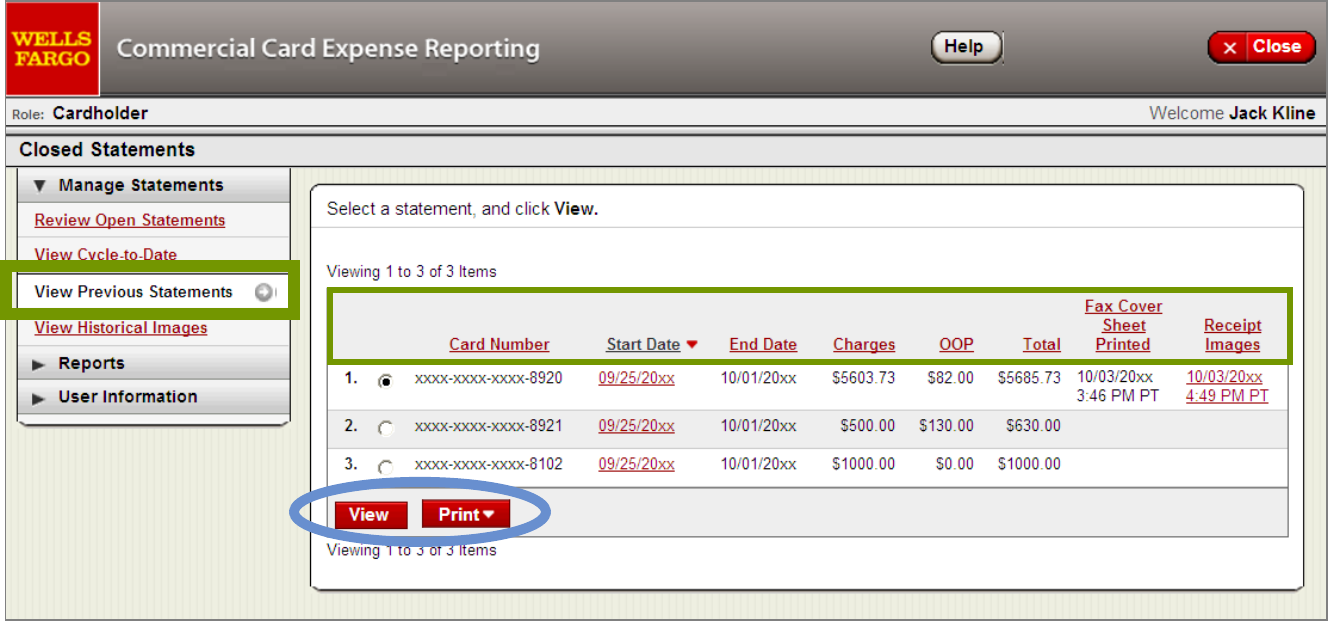

View Previous Statements

Manage Statements

View Previous Statements – 13 month history

47

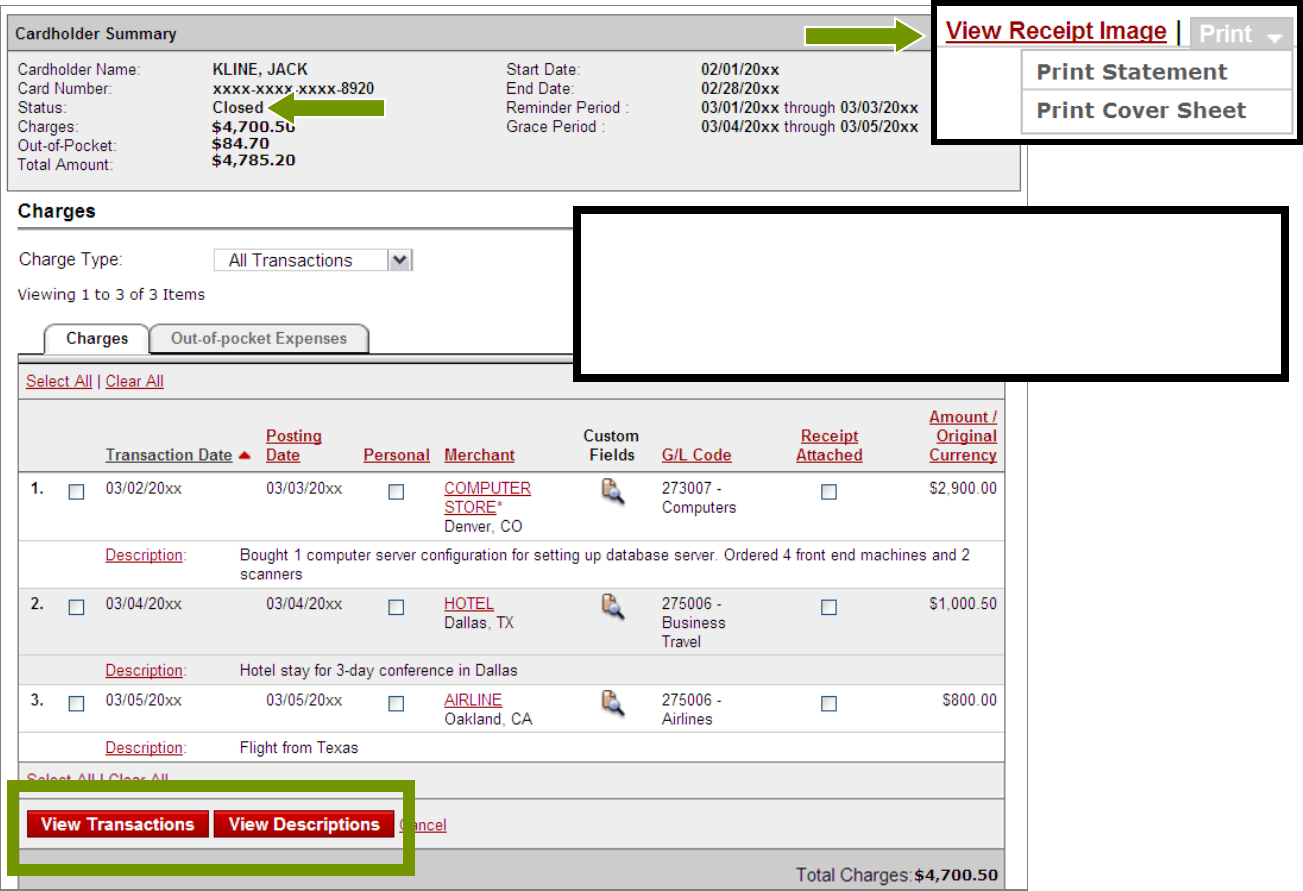

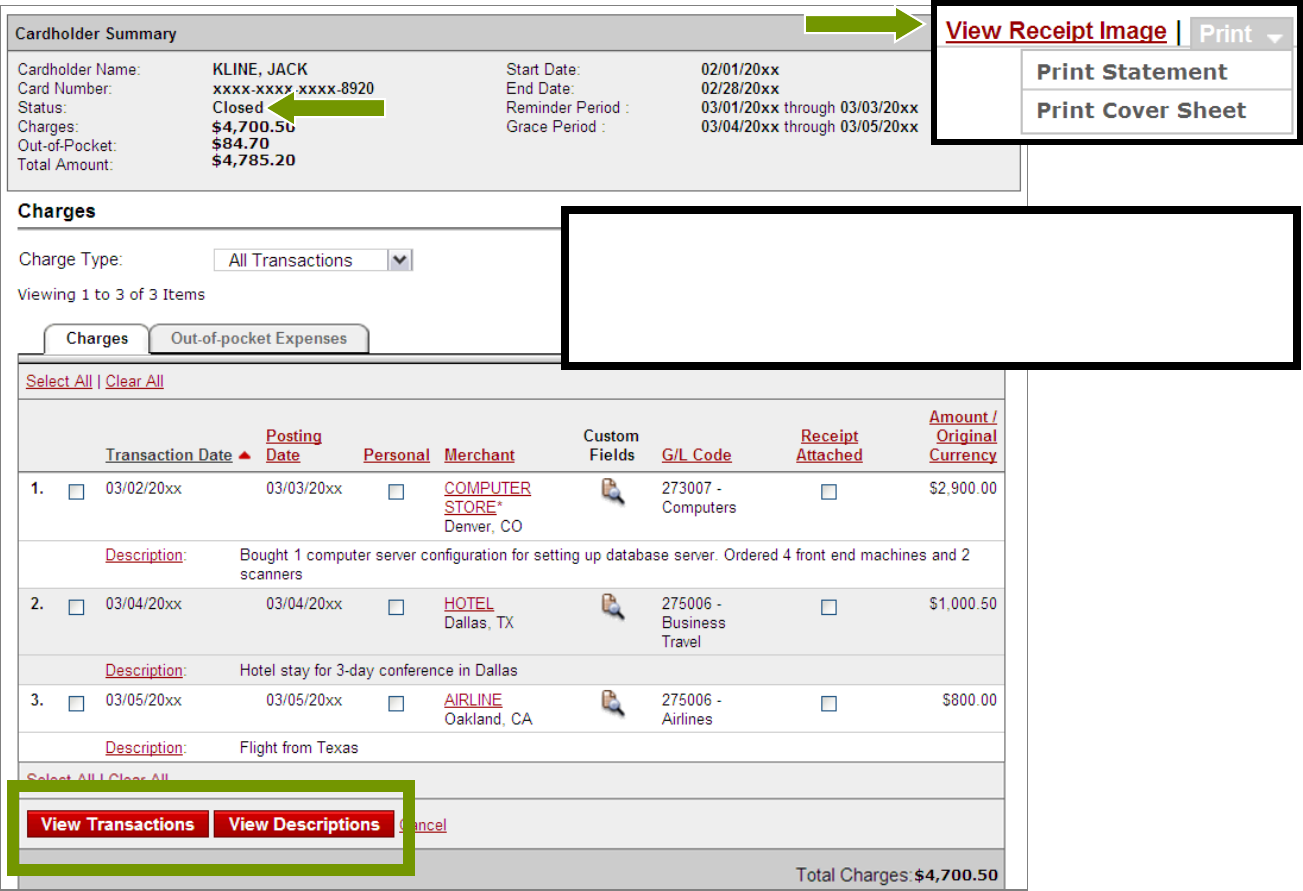

View Previous Statements

View Transactions, Descriptions, and Receipt Images

48

You can change/update transaction

Descriptions here up to 60 days after the

end of the statement period

Email Best Practices

49

Receipt Imaging option

Review Open Statements – Receipt Imaging

Print Cover Sheet

50

If your company has the Receipt Imaging option you will have to image your

receipts before you complete your statement review(fax or scan/email PDFs)

From the upper right hand corner of the Review Open Statements homepage,

select Print, then Print Cover Sheet

Receipt Imaging – Email Best Practices

Scan the Cover Sheet followed by the receipts for the statement

period and save as a PDF file. Then, email them to the E-mail address

provided on the Cover Sheet.

51

The cover sheet printed from the system should be the

first page of the PDF and the bar codes on the cover

sheet should be clear and easy to read.

All attachments must be in the required PDF file format.

Make sure that there are no other non PDF attachments

in the email, i.e. signatures, pictures, email footers, etc.

Attachments that are forwarded without opening the

original e-mail will not be processed; they must be re-

sent as a new email with the PDF attachment.

Multiple PDF file attachments in a single email are ok, but

each PDF must begin with a unique cover sheet followed

by the receipts for that statement.

For the best quality, scan receipts in black and white only.

Scanning receipts in color or using a scanner with

software set to grayscale may alter the quality of the

images during processing.

We recommend total attachment size under 5 megabytes

52

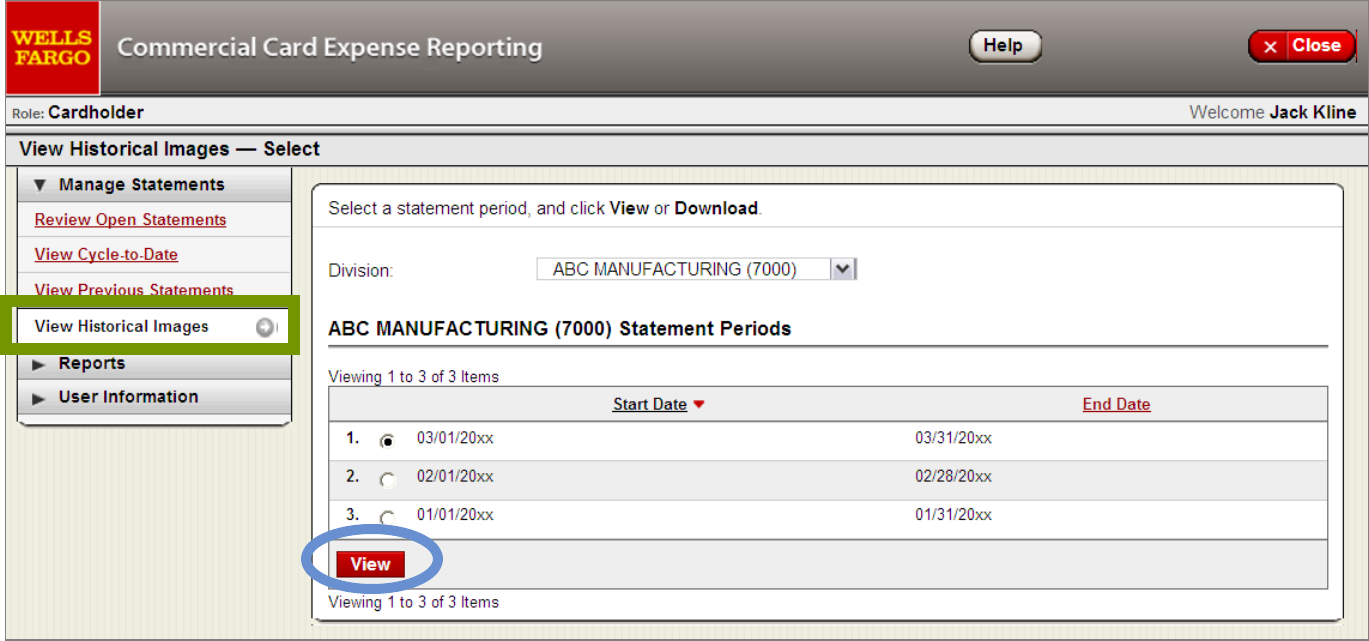

View Historical Images

Manage Statements

View Historical Images – 7 year history

53

Use View Historical Images to look up receipts that you faxed or emailed in for

particular statement cycle

View Historical Images

View the Cover Sheet and associated receipt images

54

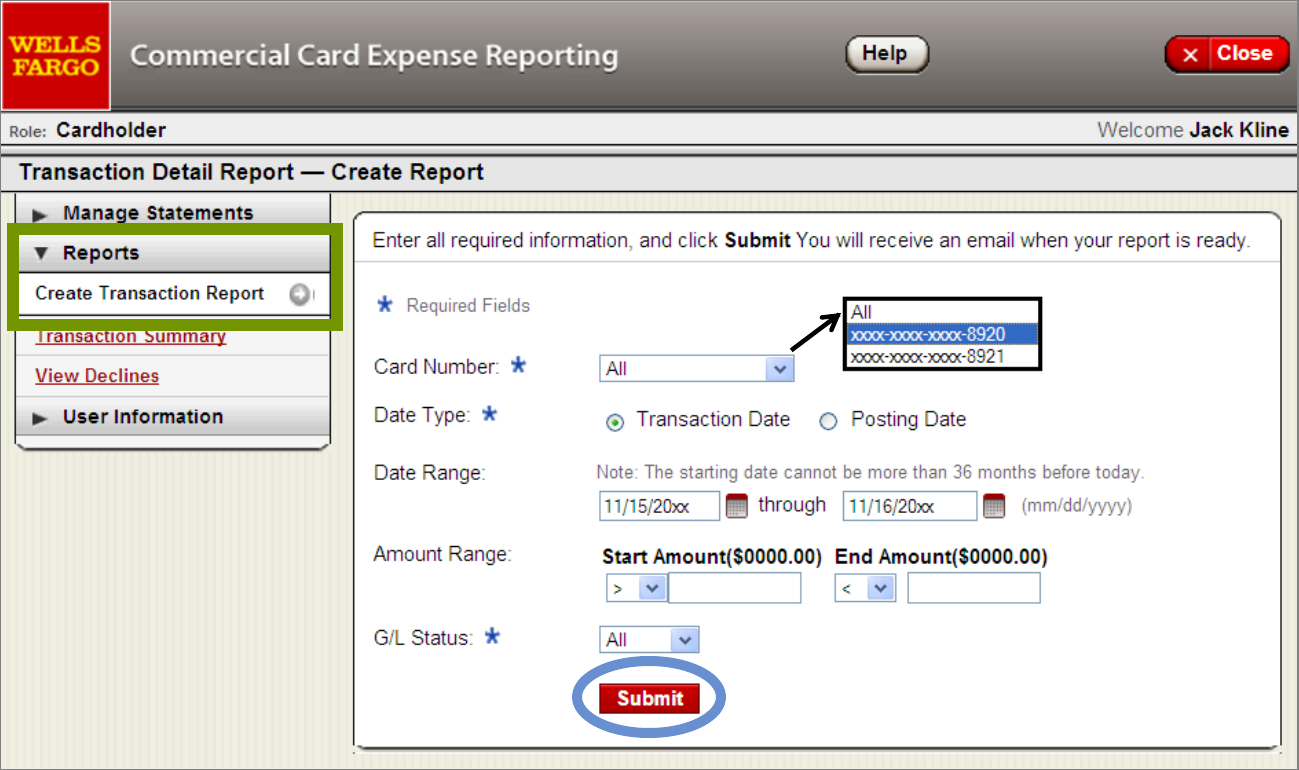

Create Transaction Report/Transaction Summary

View Declines

55

Reports

Create Transaction Report

Run transactions reports with various filters – 36 month history

56

If you have multiple cards, use the dropdown menu to select the appropriate card

You’ll receive an email when the report is ready to retrieve in Transaction Summary

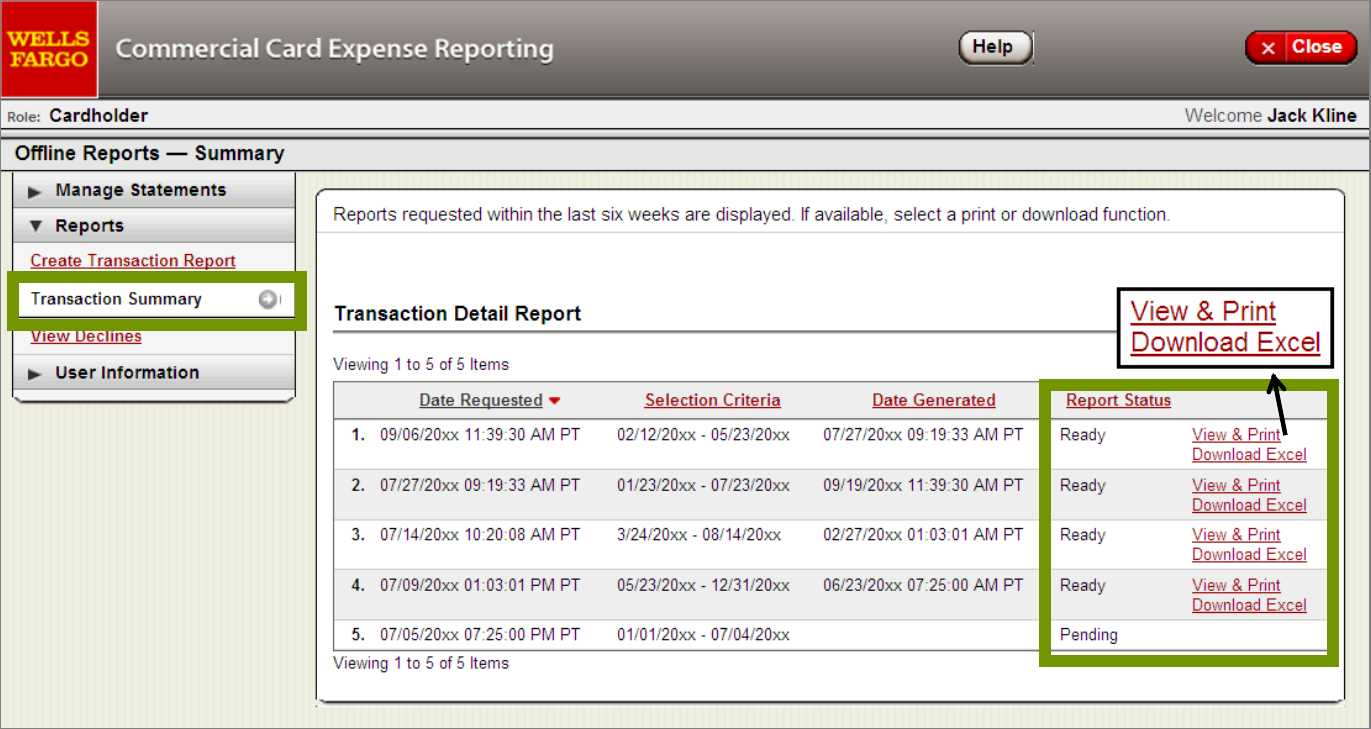

Transaction Summary

View & Print PDF or Download to Excel

57

Transaction Summary displays the last six weeks of requested Transaction Detail Reports

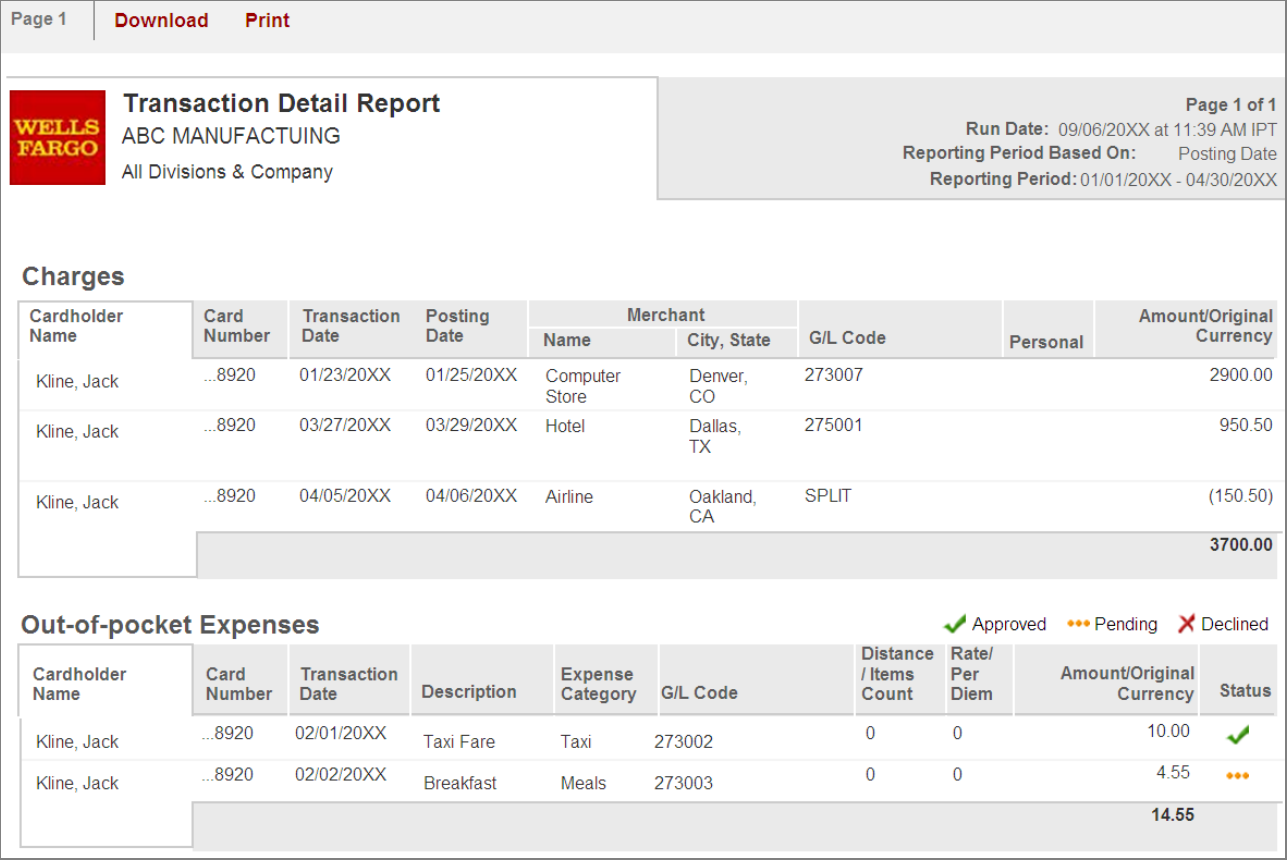

Transaction Detail Report – example

58

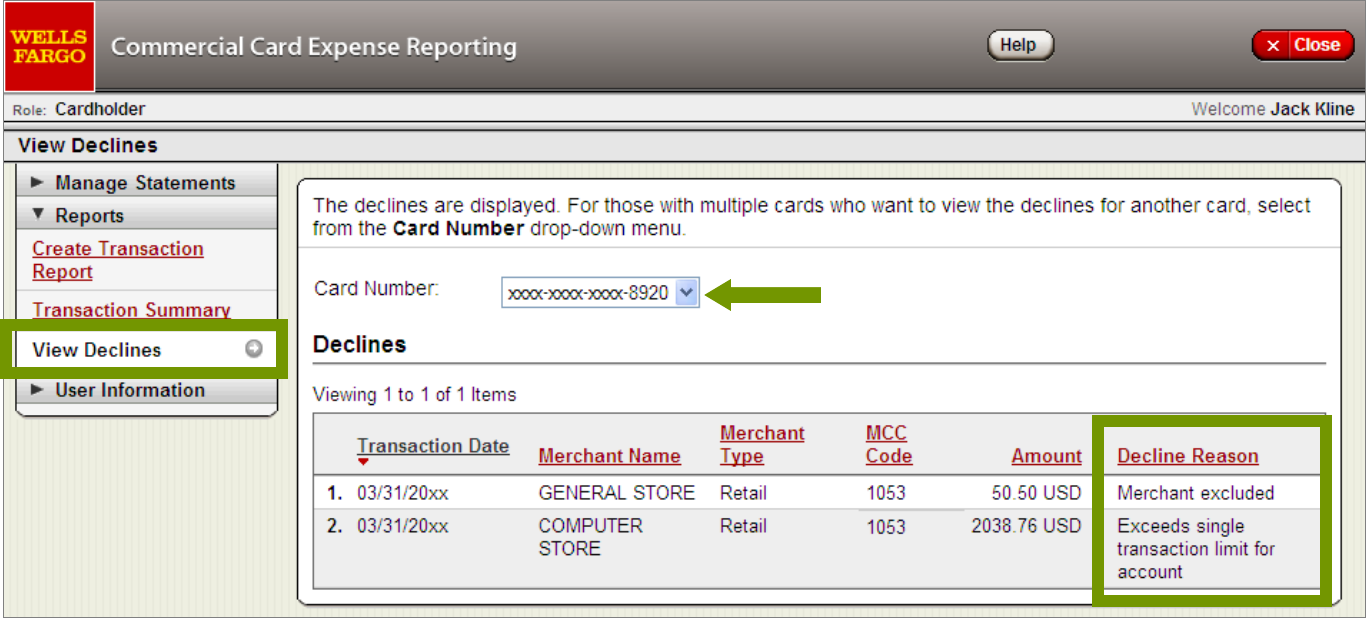

View Declines

See Decline Reason

59

View declined transactions (by card) to determine the reason for the decline

Declines do not appear online in real time, they will be displayed within 48 hours

Contact the Business Purchasing Service Center at any time to obtain

immediate decline information (1-800-932-0036)

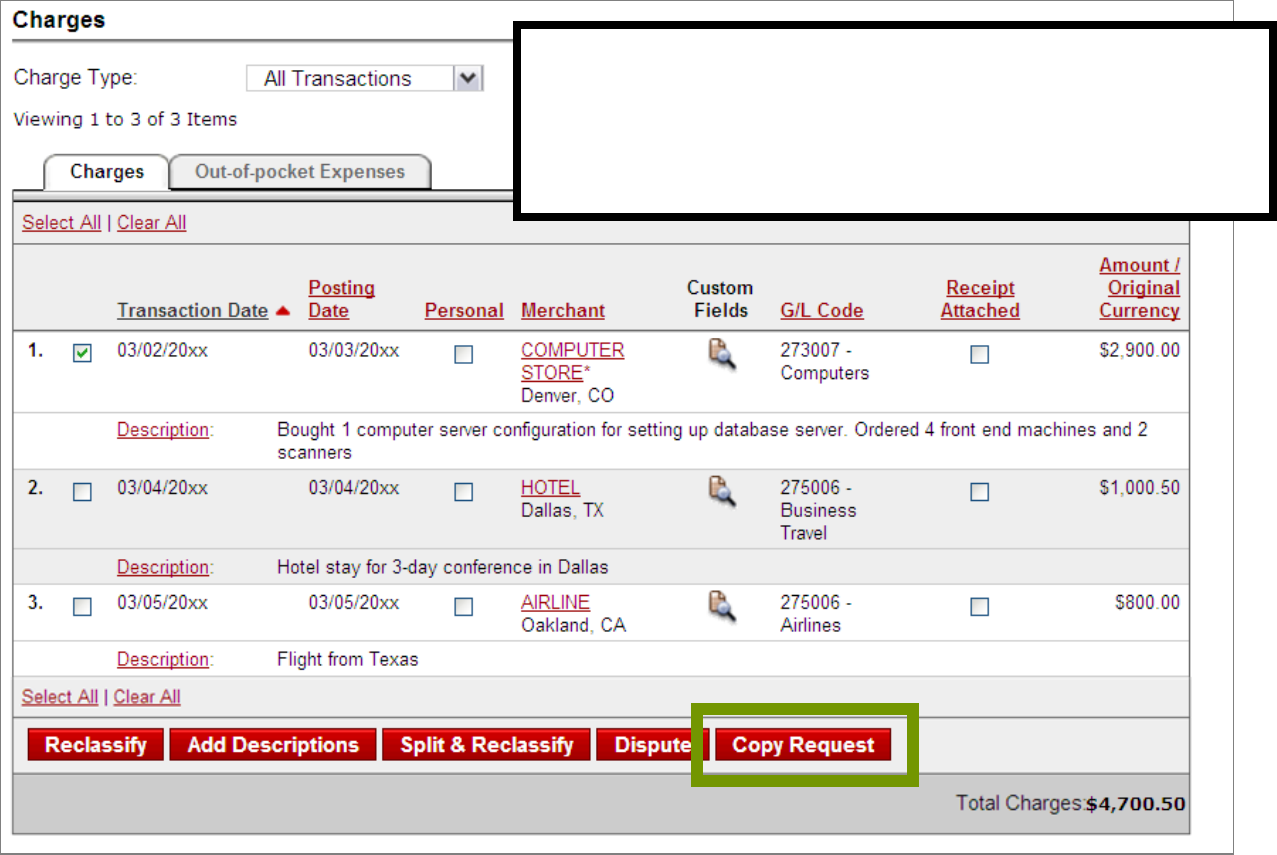

Request a copy of a purchase receipt

60

Copy Request function

From the Charges tab – Copy Request

Requests a copy of a transaction receipt

61

Only use Copy Request if you are unable to

obtain a copy of the purchase receipt from

the Merchant and you are not going to use

the online Dispute feature

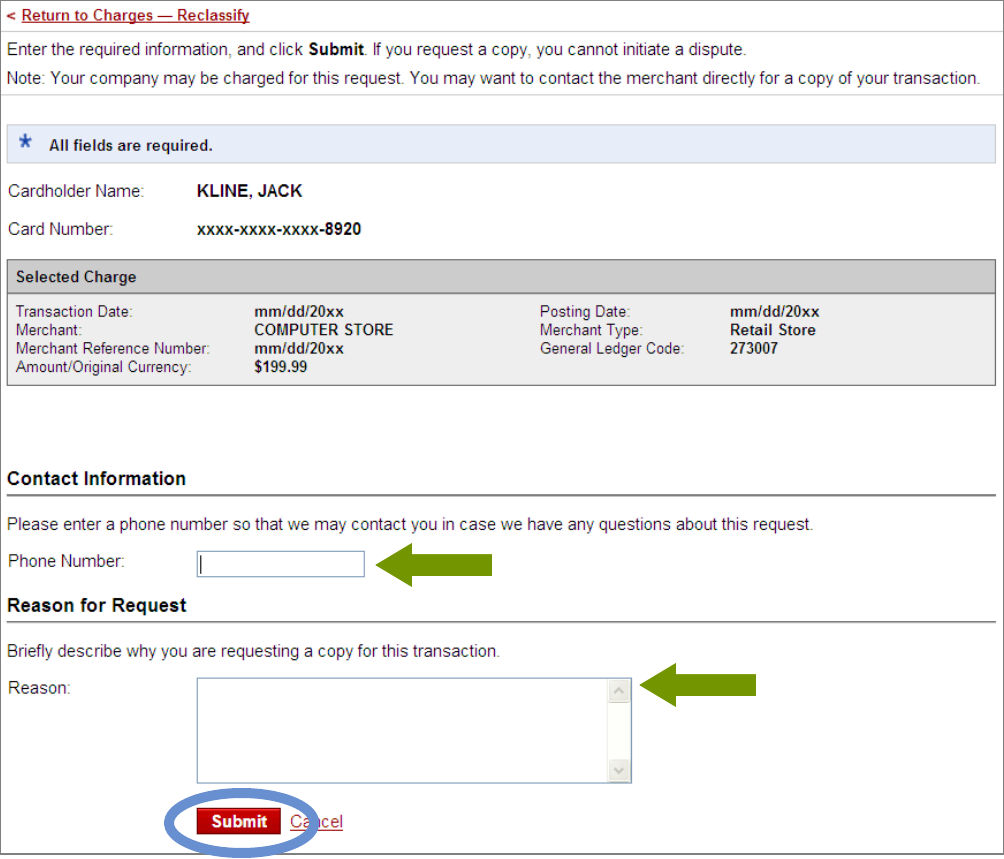

(Receipt) Copy Request

Enter Phone Number and Reason for Request

62

View Previous Statements

Reports overview

Manage Receipts (similar to View Historical Images)

View Requests/Status

Manage Users

See the Approver Quick Reference Guide (available to download from

the "Help & Training" tab in your CEO portal) for more comprehensive

information on these topics

63

Approver role options

(some options depend on access rights

granted by your Program Administrator)

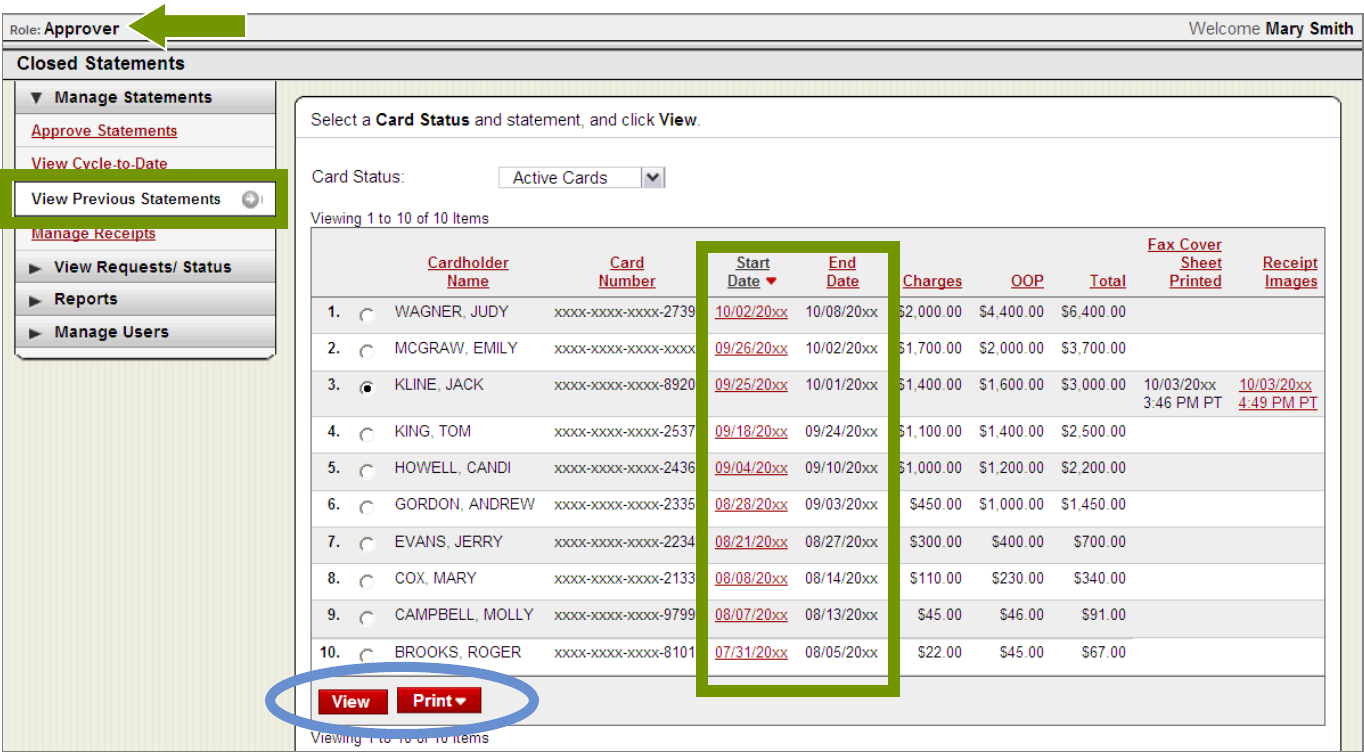

Manage Statements – View Previous Statements

Select the Cardholder profile first – 13 month history

64

View Previous Statements

Approver view (same view as Cardholder/Reconciler)

65

Approvers can change/update transaction

Descriptions here up to 60 days after the

end of the statement period

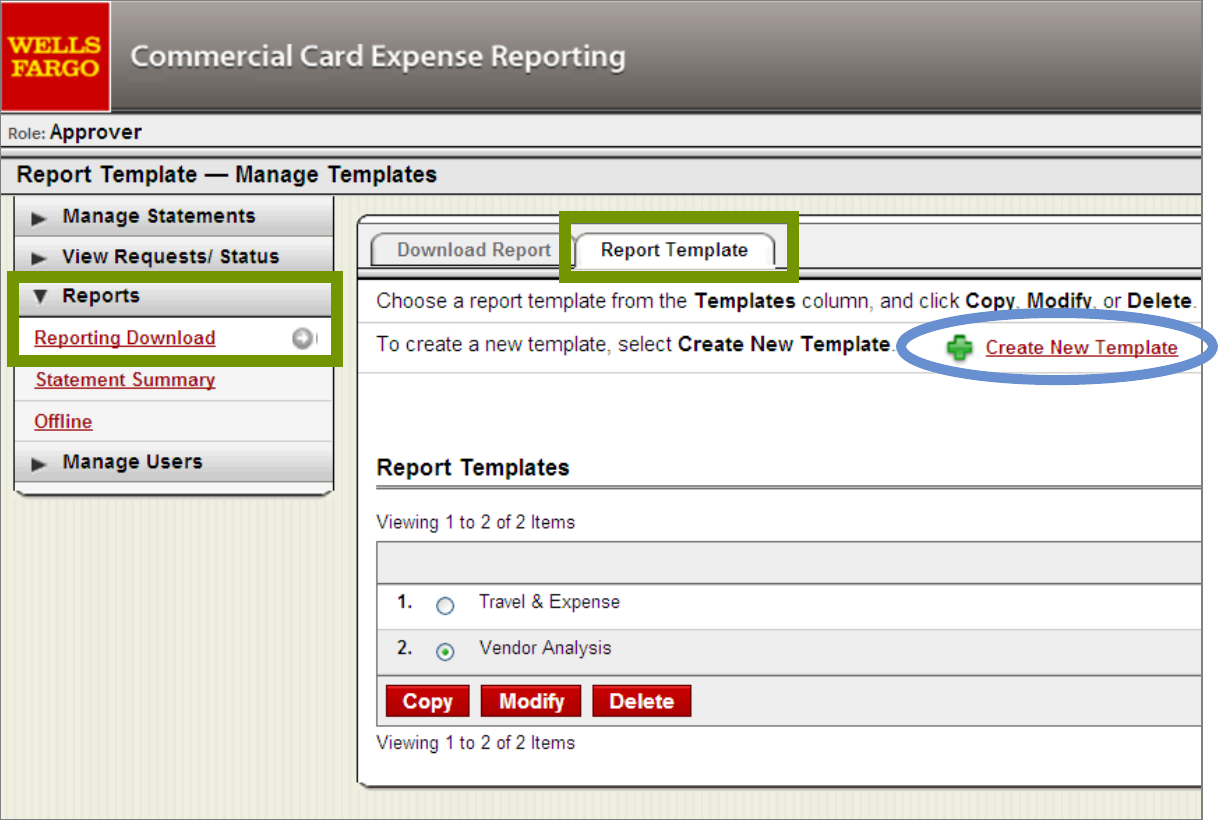

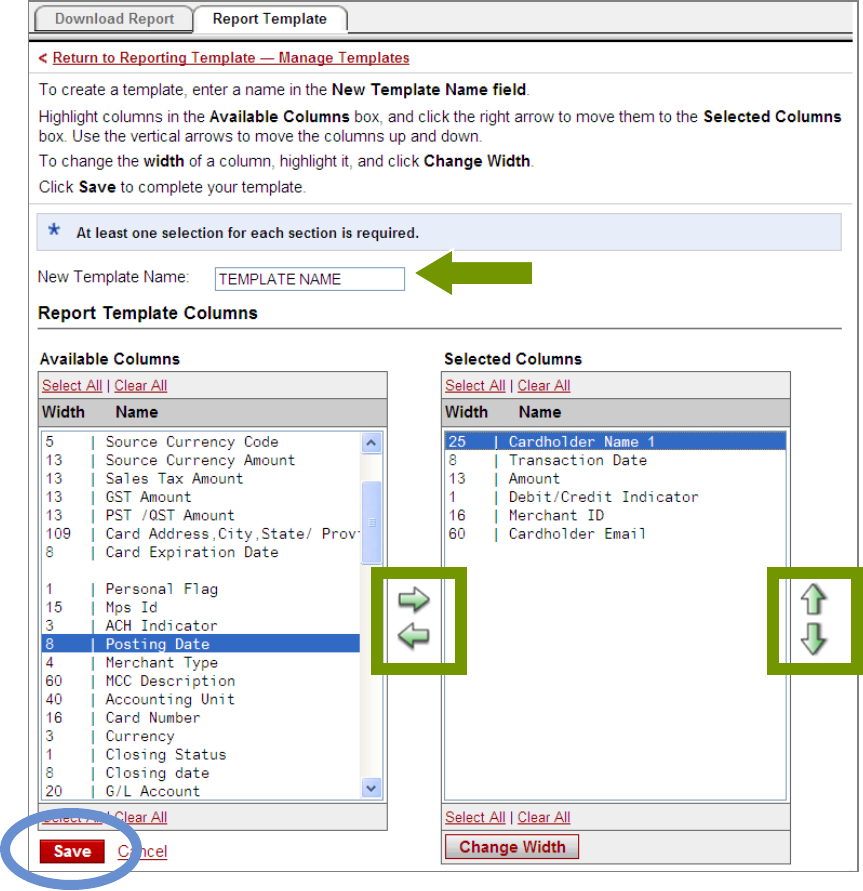

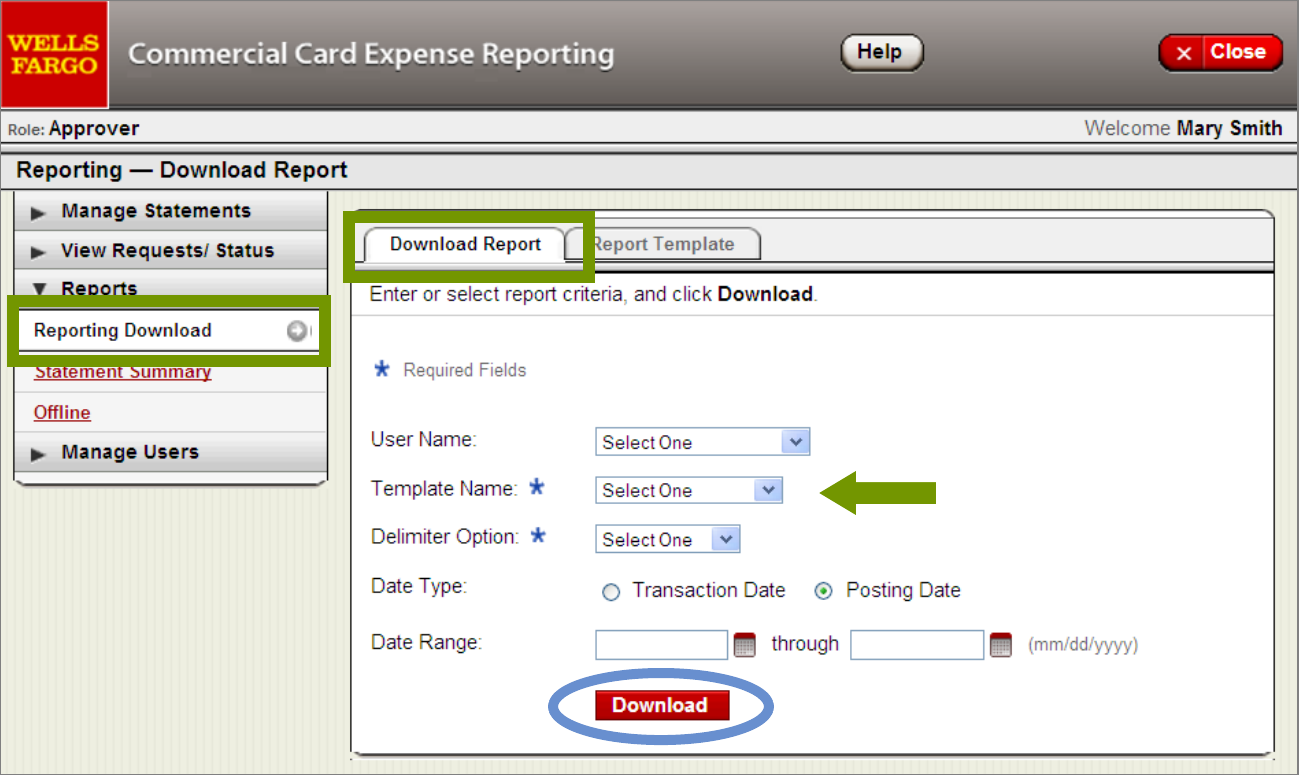

Reports – Reporting Download

Report Template (tab) – Create New Template

66

Report Template – Create Template

Approver option

67

Reporting Download - Download Report (tab)

Approver option

68

Download reports (by User – or ALL Users) and the saved Template Name

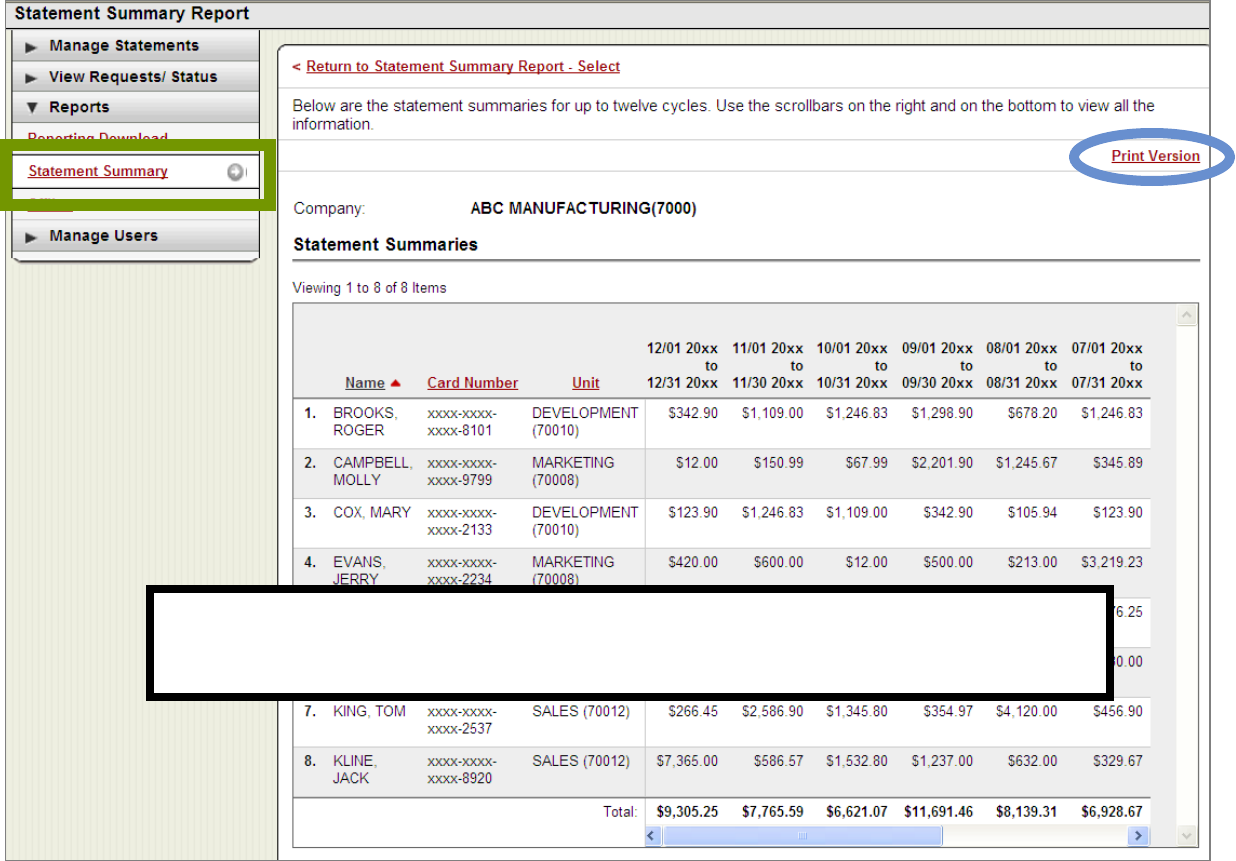

Reports - Statement Summary

Approver option – review up to 12 statement cycles

69

Use the Statement Summary report to show Cardholder

statement totals over a period of time (up to 12 months)

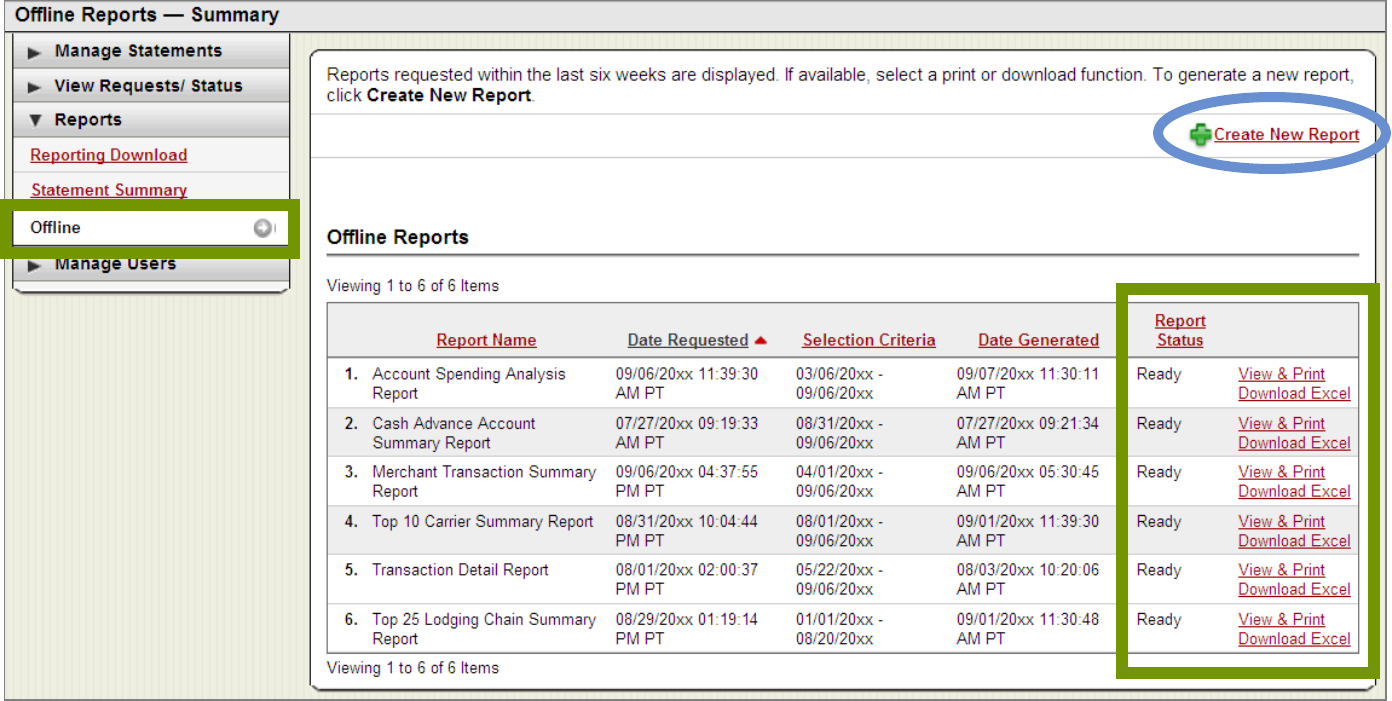

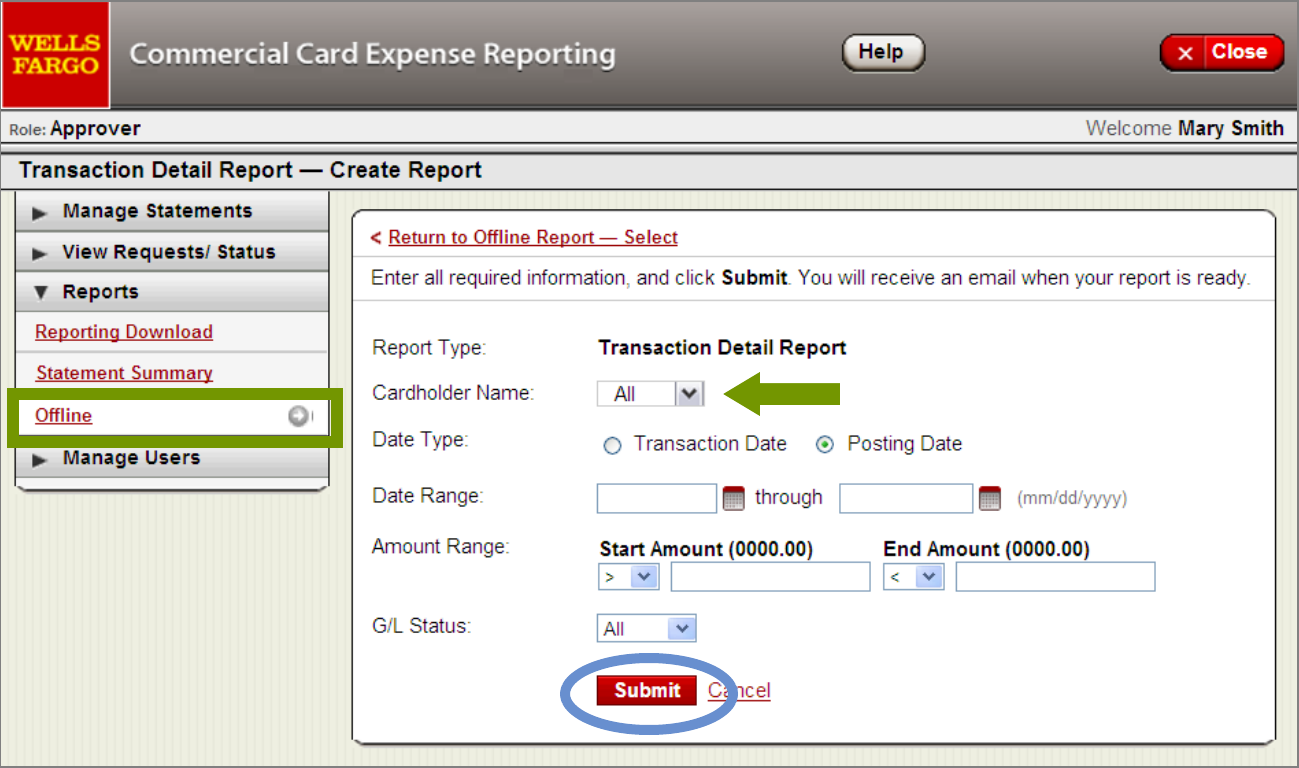

Reports - Offline

Approver option – Create New Report

70

The Offline link displays the last six weeks of requested reports

View & Print (PDF) or Download report data to Excel

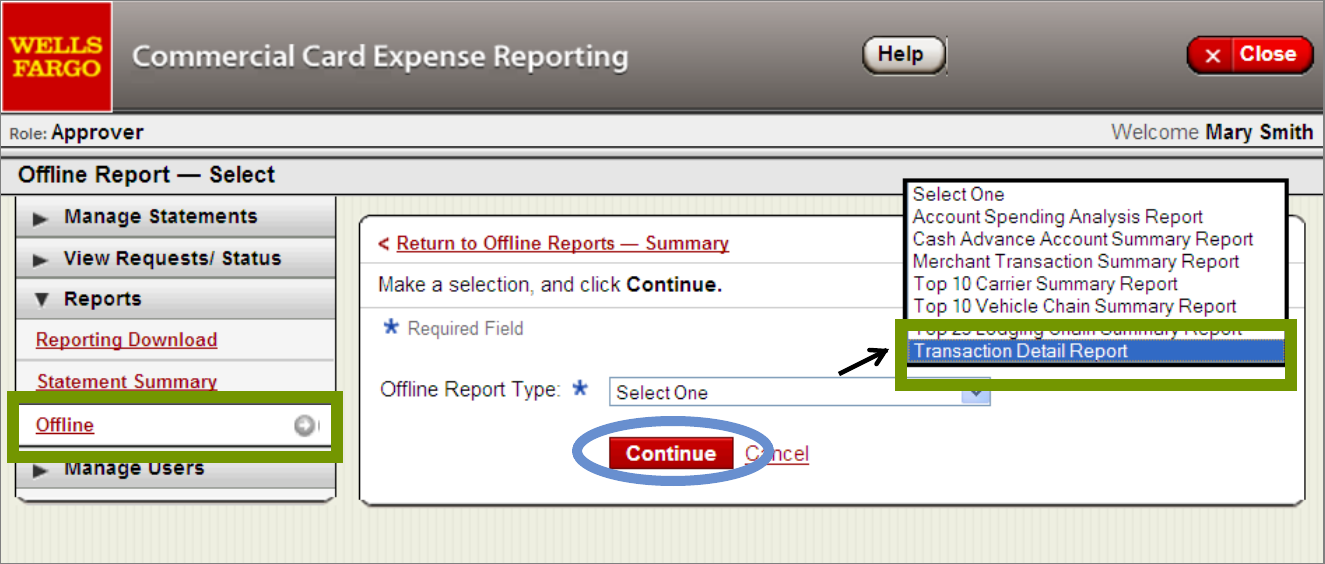

Offline – Create New Report

Select Report Type (Transaction Detail Report example)

71

Offline – Create New Report

Transaction Detail Report setup

72

The Approver will receive an email when the report is ready to retrieve on the Offline homepage

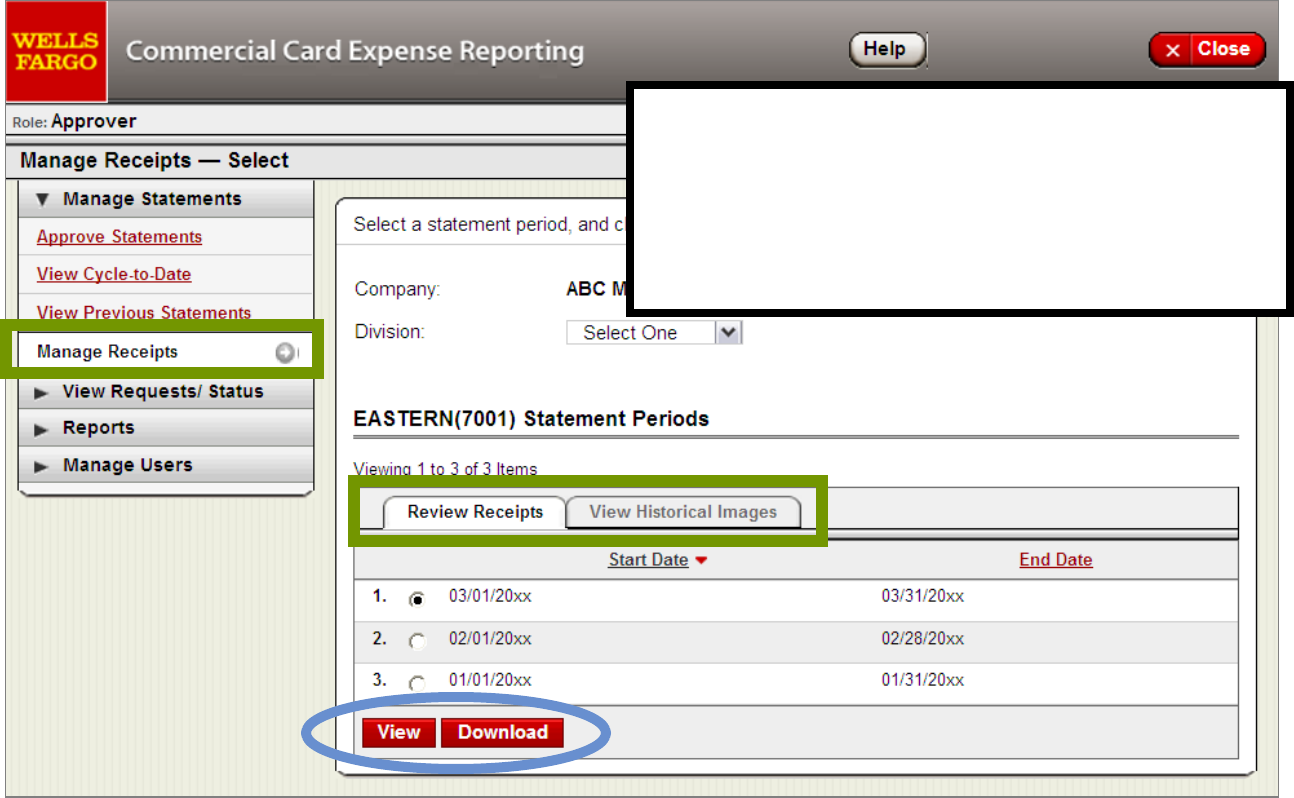

Manage Statements - Manage Receipts

Expanded Approver access to View Historical Images

73

The Review Receipts tab stores the

last 12 months of receipt images

The View Historical Images tab

stores the last 7 years

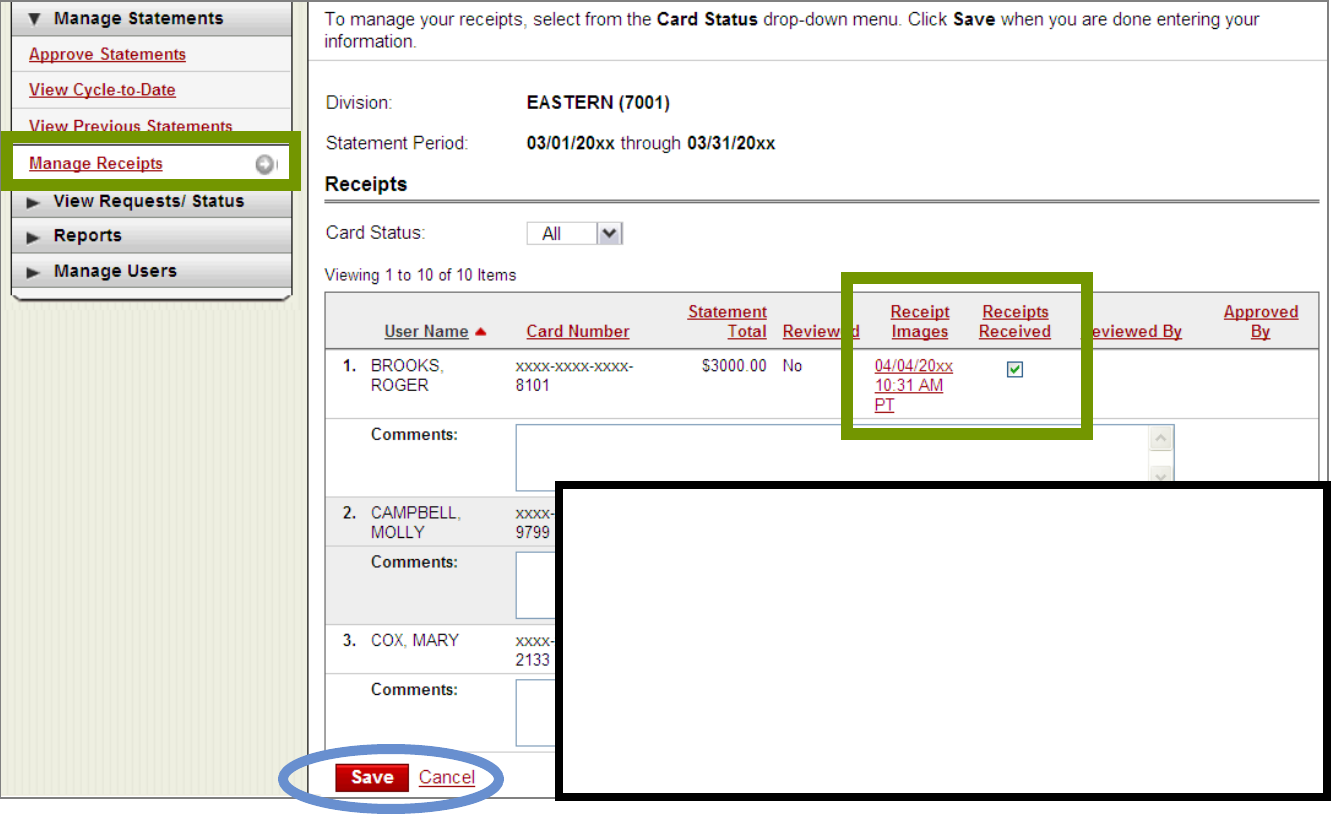

Manage Receipts

Approvers can view each Cardholder within the selected statement

74

Approvers can:

View the Cover Sheet and associated receipt

images by selecting the Receipt Images link

Check the Receipts Received box to indicate and

track that receipts have been received

Add Comments (if needed)

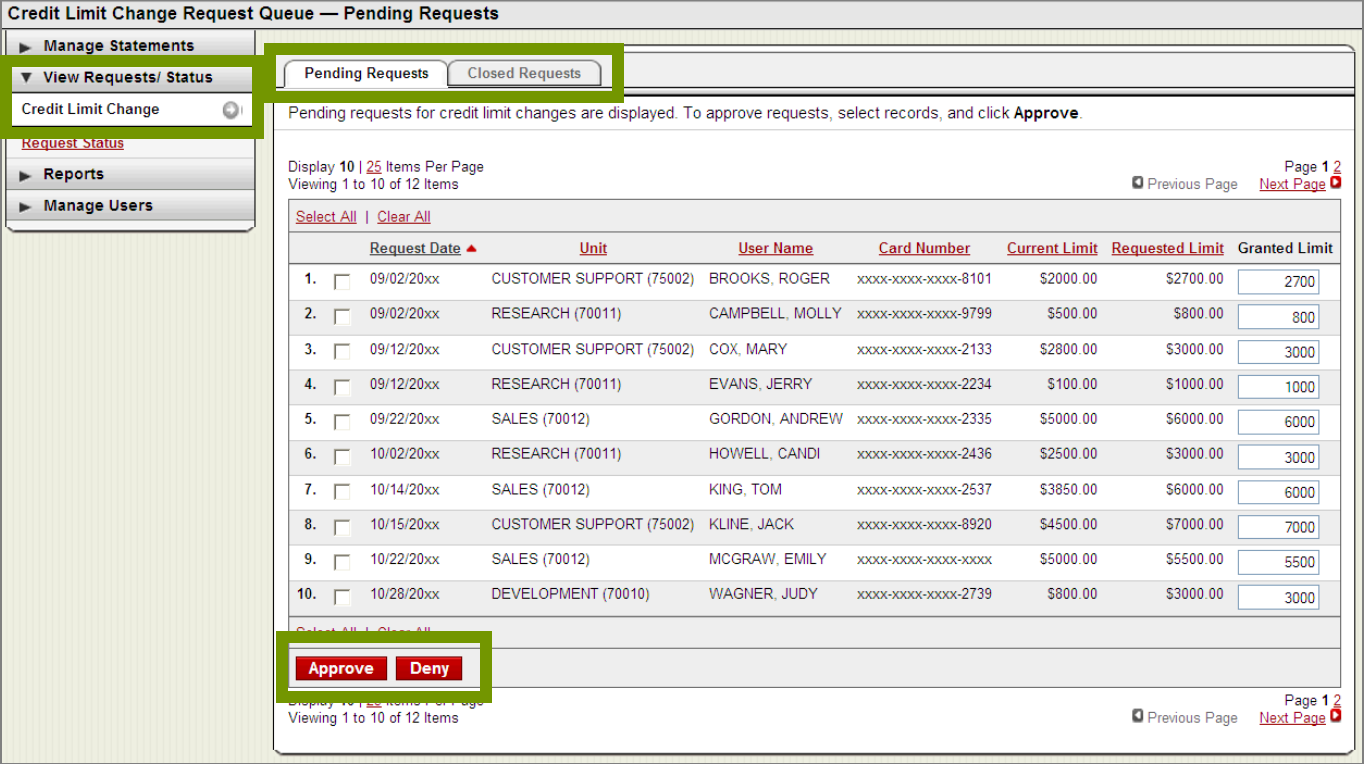

View Requests/Status – Credit Limit Change

Approvers can Approve or Deny Pending Requests

75

Decisioned requests move from Pending Requests to the Closed Requests tab

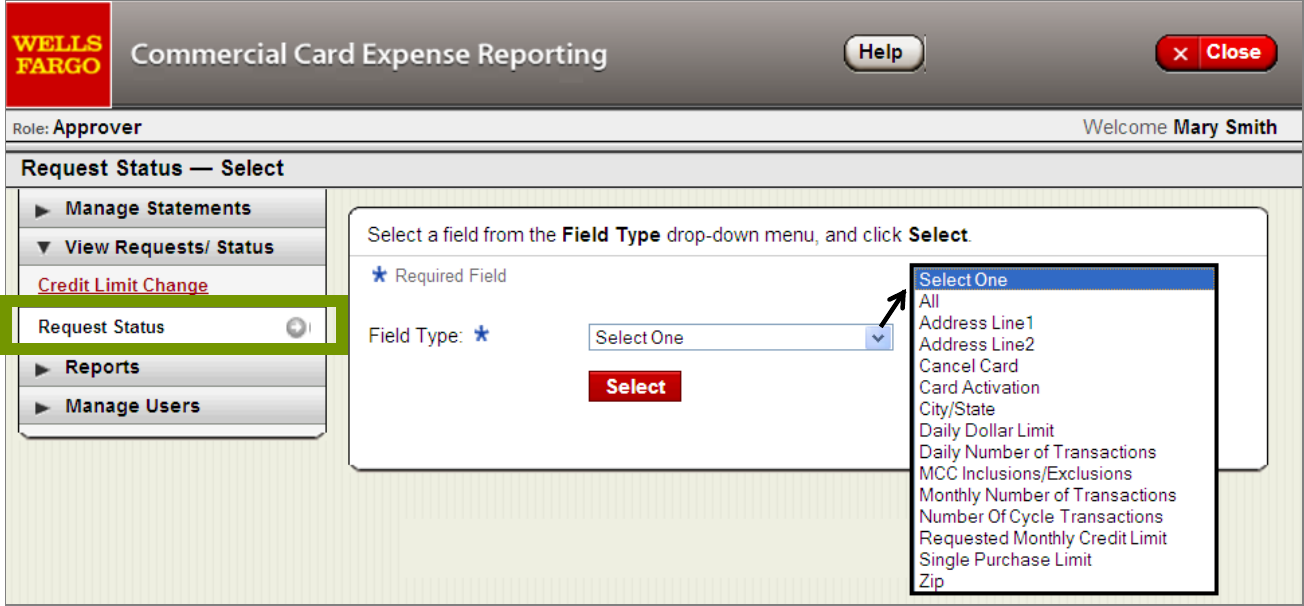

View Requests/Status – Request Status

Approver option

76

Approvers can use the Request Status option to determine if there have been recent

requests to change certain Cardholder profile information, such as addresses or credit limits

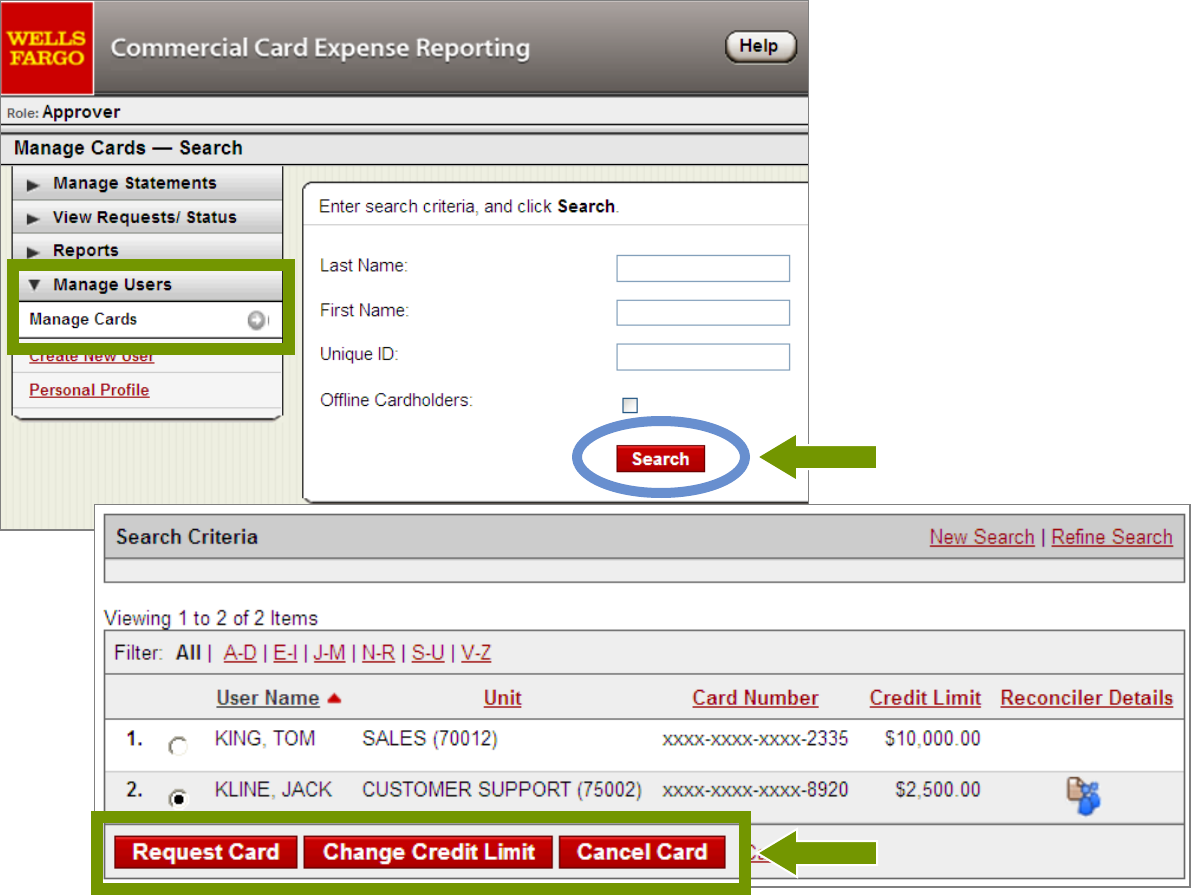

Manage Users – Manage Cards

Approver option

77

Authorized Approvers can search

for a specific Cardholder, or select

Search to pull up a full list of

their assigned Cardholders

By Cardholder, the Approver can:

Request a new Card,

Change a Credit Limit, or

Cancel a Card

(if it’s no longer needed)

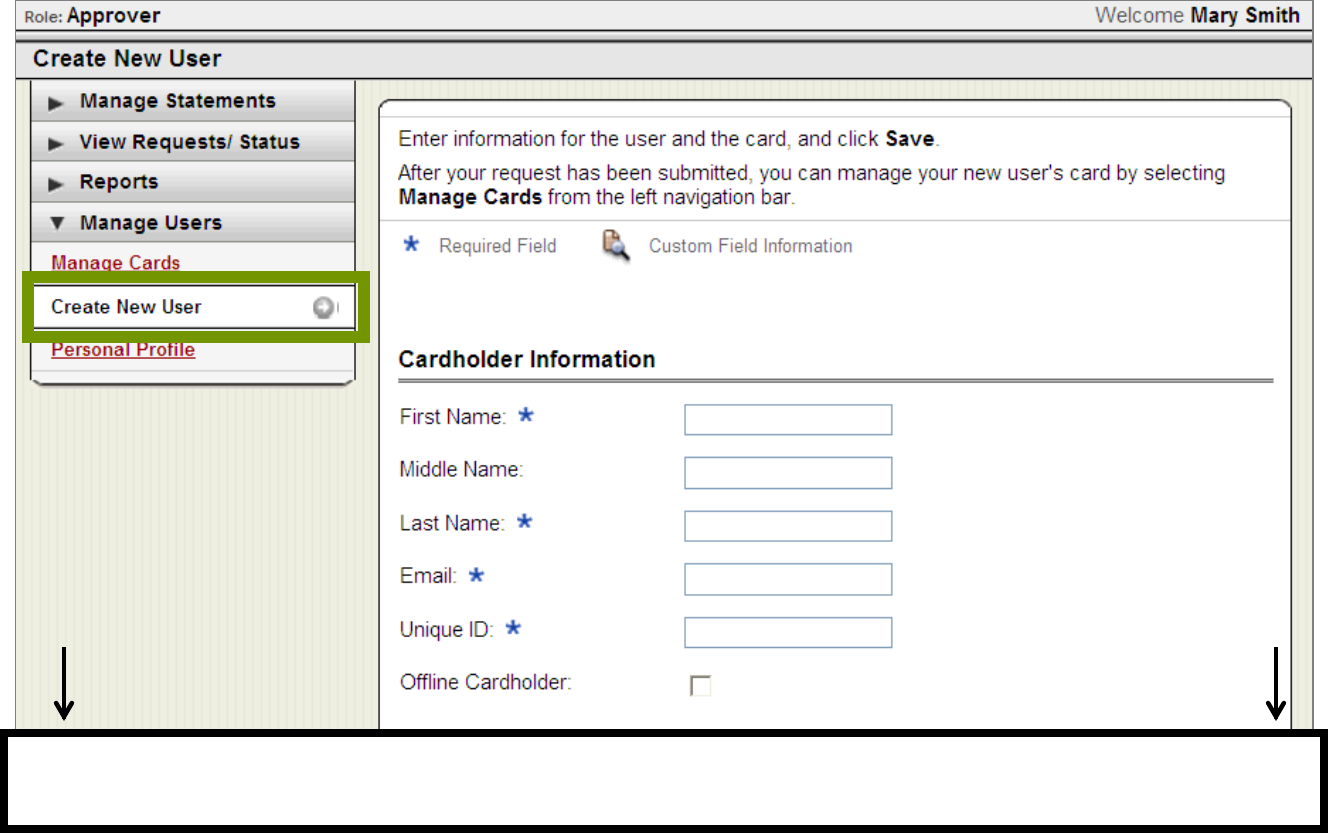

Manage Users – Create New User

Approver option – also places a card order

78

The Create New User process continues on this page prompting the card shipping address,

embossing instructions, and card limits/parameters…

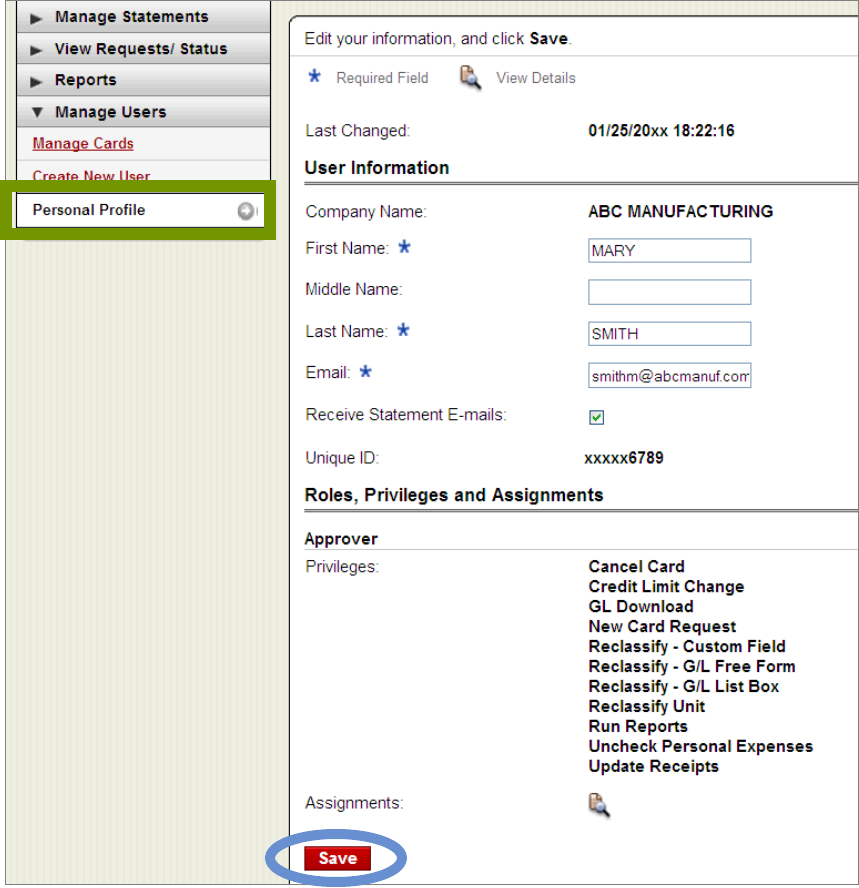

Manage Users – Personal Profile

Provides the Approvers own CCER profile information

79