Page 1 of 29

PROJECT INFORMATION AND LOTTERY APPLICATION

Gemini Townhomes

Springfield, MA

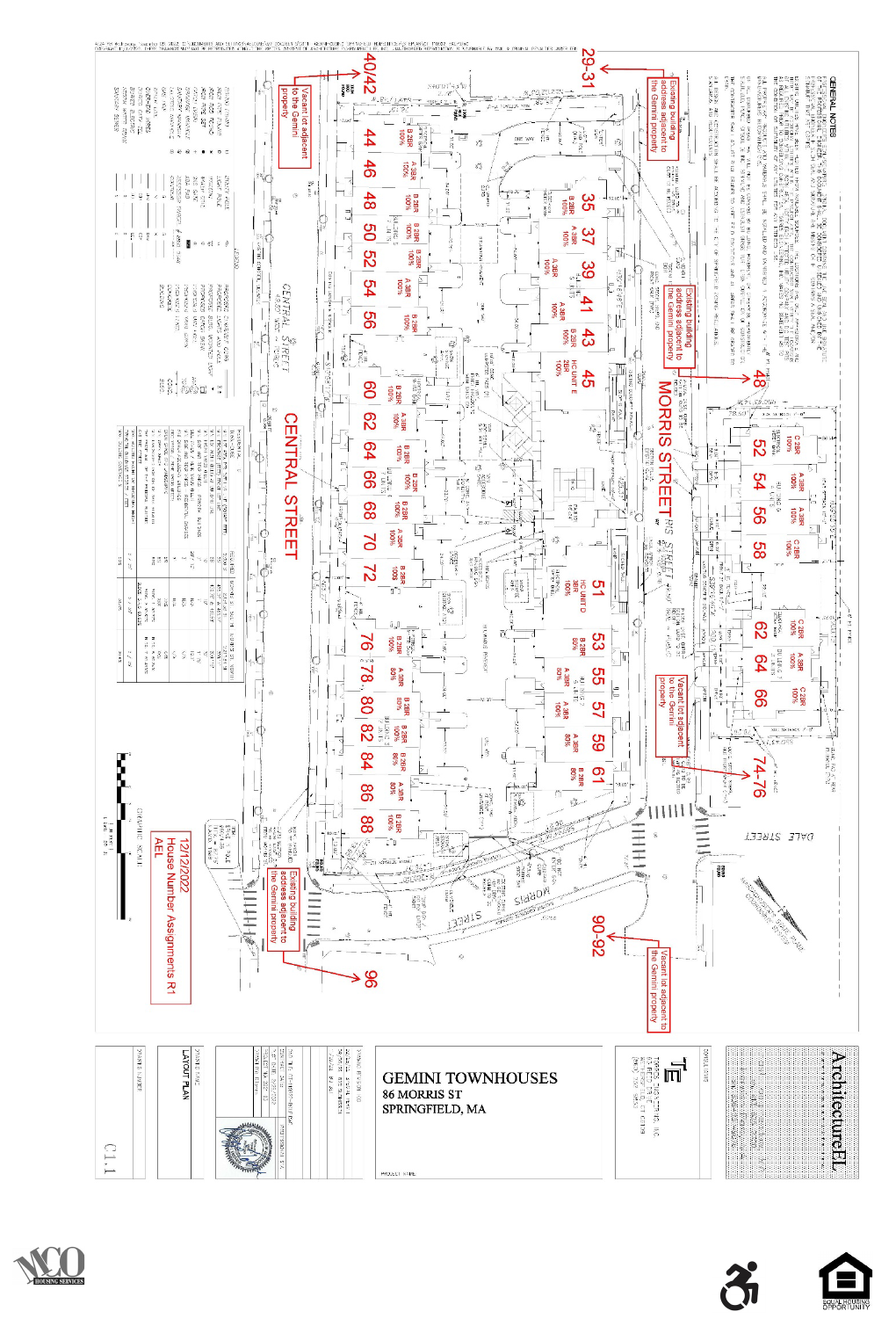

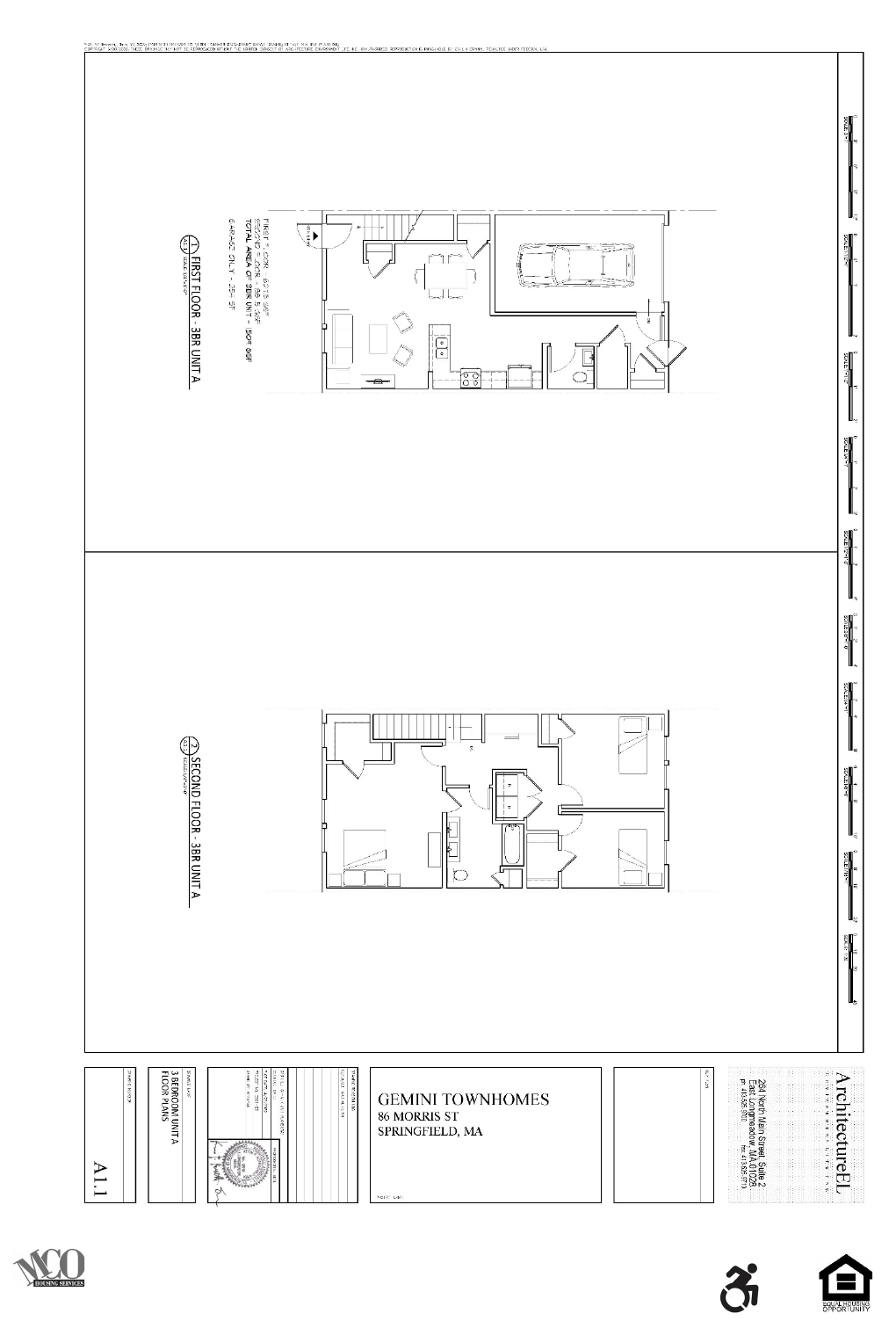

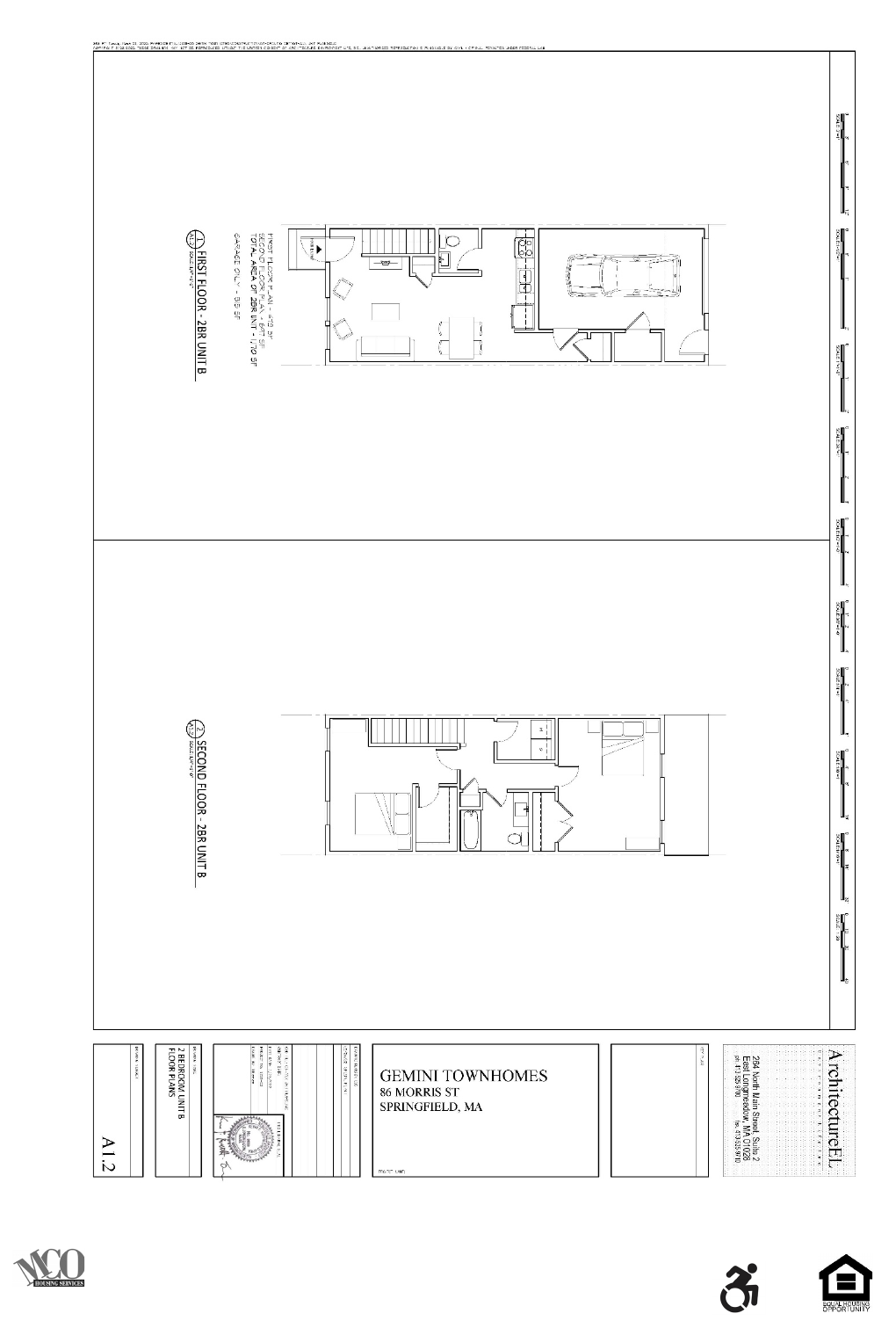

Gemini Townhomes, located at 89 Morris Street in Springfield, is a new 40-unit townhome condominium

development offering 40 two- and three-bedroom townhomes, by lottery, for eligible first-time homebuyers (certain

exceptions apply) earning up to 80% and 100% of the Area Median Income (AMI). The units include 1 or 1 1/2 baths and

a one-car garage in approximately 1,170-1,509 net sq. ft. depending on unit style and bedroom size. A refrigerator,

stove/oven, range hood, dishwasher, washer and dryer are included. Heat is a high efficiency electric heat pump with

air-conditioning. City water and sewer. There will be two lotteries to distribute the 40 units. This application is for the

first 20 units.

A condominium is an individually owned residential unit in a building or complex comprised of other residential

units. Unit owners share a common space and pay association fees to cover the cost of Shared Resources.

The maximum initial sales price for the first 20 affordable units are:

Units up to 80% AMI Price Monthly HOA Fee

Two Bedroom $170,000 $260

Three Bedroom $189,000 $287

Units up to 100% AMI

Two Bedroom $206,000 $260

Three Bedroom $227,000 $287

The units will be sold by lottery as outlined in the attached package. The lottery provides you with the

opportunity to purchase only. Please review the enclosed information packet in detail and complete the application and

all forms at the rear of the packet.

All applicants must submit a valid mortgage pre-approval with their application. In addition to the mortgage

pre-approval the following documentation must be provided if applicable to you: Proof of Local Preference, special

accommodation letter and signing off on the Disproportionately Impacted Households (DIH) definition on page 23. We

recommend you share the specific Mortgage Guidelines and Additional Mortgage Specifics on pages 4-5 with your

lender to make sure your pre-approval meets the guidelines.

Post lottery, if you have an opportunity to purchase a condominium, you will need to provide complete financial

documentation in order to determine program eligibility.

KEY MEETING DATES

Public Information Meeting via Zoom or in person in English

You must register for each event via Eventbrite

10:00 a.m. – 12:00 p.m., Saturday May 11, 2024

https://www.eventbrite.com/e/881410010067?aff=oddtdtcreator

Or

6:00 – 8:00 p.m. Friday, May 31, 2024

https://www.eventbrite.com/e/886887332887?aff=oddtdtcreator

Page 2 of 29

Public Information Meeting via Zoom or in person in Spanish

You must register for each event via Eventbrite

2:00 – 4:00 p.m., Saturday May 11, 2024

https://www.eventbrite.com/e/886885146347?aff=oddtdtcreator

Or

6:00 – 8:00 p.m. Friday, June 7, 2024

https://www.eventbrite.com/e/886889489337?aff=oddtdtcreator

Application Deadline

June 28, 2024

Lottery via Zoom

July, 20, 2024

If you are unable to attend the Public Information Meetings they will be recorded and posted on the Gemini

Townhomes website, www.geminispringfield.com

within 48 hours for your listening pleasure.

Home Logic Real Estate has set up an ADA compliant satellite office where interested parties can pick up

applications and ask questions about the process. Computers are available with internet access. Translation services

will be available, as needed. The location information is:

Site Location: 1350 Main Street, Suite 1108

Springfield, MA 01103

Telephone: 413-707-2455

TTY: 711

Hours: Monday – Friday: 10:00 a.m. – 2:00 p.m.

Saturday: 9:00 a.m. – 1:00 p.m.

Potential applicants will not be discriminated against on the basis of age, physical or mental disability or

handicap, sex, sexual orientation, gender identity, genetic information, race, color, national origin, ancestry, alien or

citizenship status, religion, creed, pregnancy, children, marital status, familial status, veteran status or membership in

the armed services, the receipt of public assistance or any other characteristic protected by applicable federal, state or

local laws.

Thank you for your interest in affordable housing at Gemini Townhomes. We wish you the best of luck. If you

have questions and cannot attend the Public Information Meeting, please contact Home Logic Real Estate at 413-707-

2455 or email [email protected]

. We encourage you to advise other people or organizations that may be

interested in this program and make copies of the relevant information as needed.

Page 3 of 29

Page 4 of 29

Gemini Townhomes

AFFORDABLE HOMES through the MassHousing CommonWealth Builder Program

Question & Answer

What are the qualifications required for Prospective Buyers?

• Qualify based on the following maximum income table, which is adjusted for household size:

•

Household Size

1

2

3

4

5

6

Up to 80% AMI

$61,350

$70,100

$78,850

$87,600

$94,650

$101,650

Up to 100% AMI

$67,900

$77,600

$87,300

$97,000

$104,760

$112,520

(Income limits subject to confirmation based on HUD releasing new limits in June 2024.)

LOTTERY APPLICANT QUALIFICATIONS:

1. Total gross household income cannot exceed the above maximum allowable income limits. Household income

is based on all household members 18 years of age or older (exception for full-time students)

2. Household must be a First Time Homebuyer, defined as an individual or household, of which no household

member has had an ownership interest in a principal residence at any time during the three (3)-year period prior

to the date of qualification as an eligible purchaser, unless such ownership was by:

a. displaced homemakers, where the displaced homemaker (an adult who has not worked full-time, full year in

the labor force for a number of years but has, during such years, worked primarily without remuneration to

care for the home and family), while a homemaker, owned a home with his or her partner or resided in a

home owned by the partner;

b. single parent, where the individual owned a home with his or her partner or resided in a home owned by

the partner and is a single parent (is unmarried or legally separated from a spouse and either has 1 or more

children of whom the individual has custody or joint custody, or is pregnant); or

c. any individual who has owned a dwelling unit who structure is not permanently affixed to a permanent

foundation in accordance with local or other applicable regulations or is not in compliance with applicable

building codes, or other applicable code, and cannot be brought into compliance with the codes for less than

the cost of constructing a permanent structure.

A home owned by one of the above exceptions must be sold prior to closing of the affordable unit.

3. Total household assets shall not exceed $100,000, excluding qualified retirement plans.

a. Assets divested at less than full market value within two years of application will be counted at full market

value when determining eligibility.

Other program highlights for Lottery applicants:

• Unit must be principal residence of the owners and cannot be rented or leased.

• Non-household members are not permitted to be co-signers on the mortgage.

• A mortgage pre-approval letter is required to participate in this lottery.

• Households earning up to 80% AMI are invited to apply for the City of Springfield’s $4,000 Down Payment Assistance

Program.

Are there mortgage guidelines that you need to follow?

Yes, they are:

(1) Must secure a 30-year fixed rate mortgage.

(2) The loan must have a current fair market interest rate. (No more than 2% (200 basis points) above the current

MassHousing Rate.)

(3) The buyer must provide a down payment of at least 3% of the purchase price and at least half (1 ½%) must come

from the buyer’s own funds.

Page 5 of 29

(4) The loan can have no more than 2 points.

(5) Non-household members are not permitted to be co-signers on the mortgage.

We recommend you investigate the One Mortgage Program through the Massachusetts Housing Partnership (MHP),

www.mhp.net, and MassHousing, www.masshousing.com, as both have programs geared to first-time homebuyers.

Speak with Home Logic Real Estate for affordable housing loan programs and lenders.

All homebuyers will need to complete an approved first-time homebuyer class before they can close on the home. The

list of approved classes will be provided if you have the opportunity to purchase, post lottery.

Additional Mortgage Specifics:

1. Your mortgage pre-approval must cover the purchase price. If you are applying for more than one unit size,

then the approval must cover the highest priced unit.

2. Your mortgage pre-approval must be a fixed rate mortgage. Adjustable-rate mortgages will not be accepted.

3. At minimum, your pre-approval must show purchase price, as stated on page 1, and financing amount.

4. If your mortgage pre-approval does not have an expiration date, then after 60 days from date of issue it will be

considered expired. If your pre-approval expires after your application submission, we will accept it, but should

you have a chance to purchase, it will need to be updated prior to final eligibility determination.

5. As a reminder, the minimum down-payment is 3% of your own funds. If you will be receiving a downpayment

gift or using a downpayment assistant program, then 1.5% of your own funds is required as long as the total

downpayment equals the minimum 3%. Your downpayment can be more than 3% but not less. Also remember

you are responsible for downpayment AND closing costs.

6. You must speak/meet with a mortgage lender who should be checking credit, assets and pay history to

determine your ability to secure a mortgage.

7. Non-household members cannot be co-signers on your mortgage.

Are there preferences for local residents and those with families?

Yes. Fourteen (14) of the townhomes are for households that meet at least one of the Local Preference criteria. Refer to

page 18 of the application for the Local Preference guidelines.

All 20 units have preference for Disproportionately Impacted Households which is define as a household that:

(i) has an annual income at or below 80% of area median income; or

(ii) currently resides in a “qualified census tract” (as designated by HUD); or

(iii) currently resides in one of the following towns or cities: Boston, Attleboro, Barnstable, Brockton, Chelsea,

Chicopee, Everett, Fall River, Fitchburg, Haverhill, Holyoke, Lawrence, Leominster, Lowell, Lynn, Malden,

Methuen, New Bedford, Peabody, Pittsfield, Quincy, Revere, Salem, Springfield, Taunton Westfield,

Worcester, Framingham, or Randolph.

Applicants are entered into all pools for which they are eligible.

Household size preferences are based on the following:

a. There is a least one occupant per bedroom.

b. A husband and wife, or those in a similar living arrangement, shall be required to share a bedroom. Other

household members may share but shall not be required to share a bedroom.

c. A person described in (b) shall not be required to share a bedroom if a consequence of sharing would be a severe

adverse impact on his or her mental or physical health. Reliable medical documentation substantiating the adverse

impact must be provided.

d. A household may count an unborn child as a household member. The household must submit proof of pregnancy

with the application.

e. If the applicant is in the process of a divorce or separation, the applicant must provide proof that the divorce or

separation has begun or has been finalized, as set forth in the application.

Page 6 of 29

Persons with disabilities are entitled to request a reasonable accommodation of rules, policies, practices, or services or

to request a reasonable modification of the housing, when such accommodations or modifications are necessary to

afford the person(s) with disabilities equal opportunity to use and enjoy the housing.

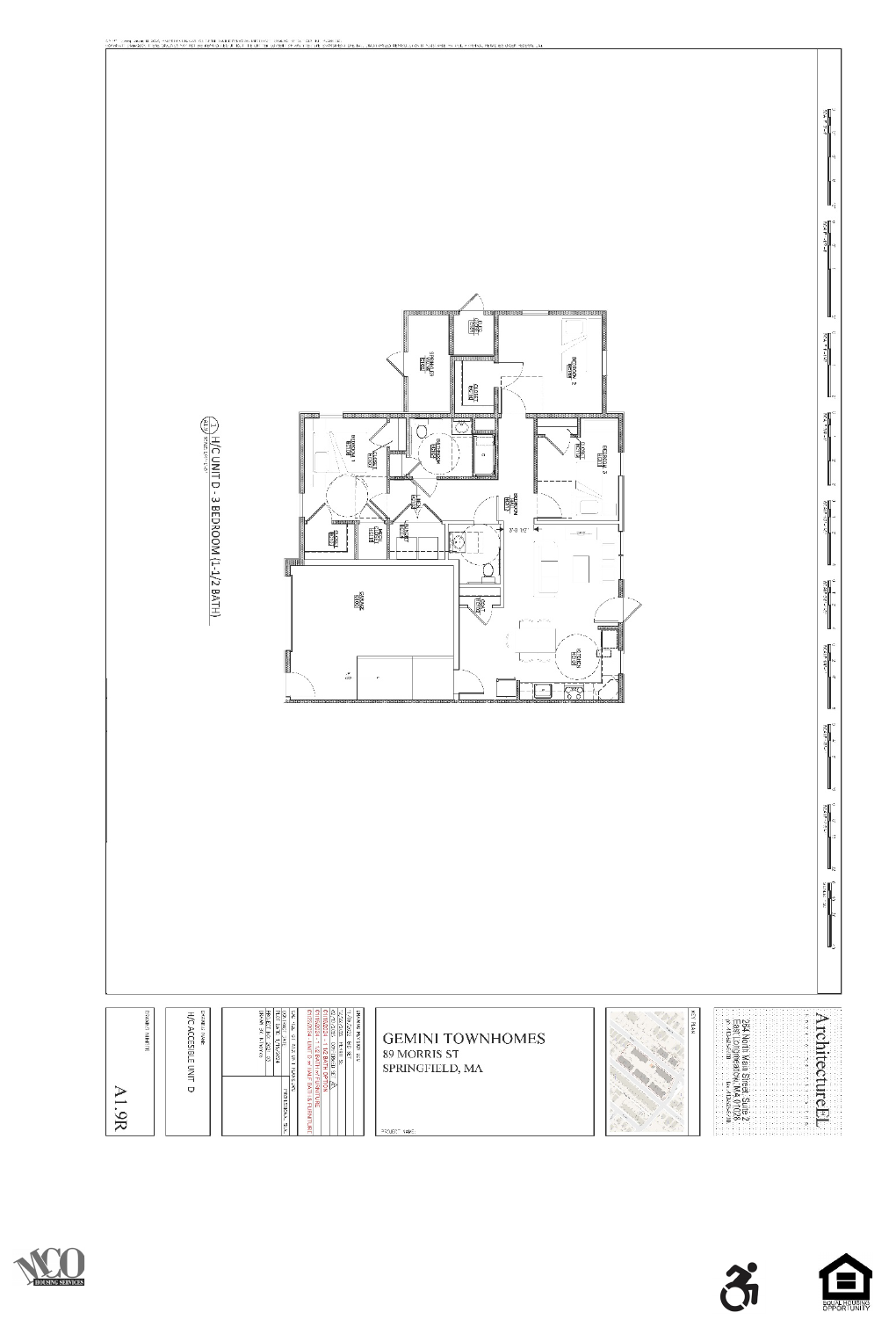

Are there Group 2B units available?

Group 2B units apply to dwelling units that contain features that provide, at the time of initial construction, full

accessibility without needs for further modification.

There is one 3-bedroom Group 2B unit at 100% AMI. The units can

be adapted to satisfy a reasonable accommodation request. Persons with disabilities are entitled to request a

reasonable accommodation in rules, policies, practices, or services, or to request a reasonable modification in the

housing, when such accommodations or modifications may be necessary to afford persons with disabilities an equal

opportunity to use and enjoy the housing. Such reasonable accommodation is not limited to Group 2 units. The request

for reasonable accommodation must be made at the time of initial lottery application with the required documentation,

i.e. letter from doctor.

Are there preferences for minorities?

Yes, if the percentage of minority applicants in the Local Preference Pool is less than the percentage of minorities in the

Springfield, MA HUD Metro FMR Area, currently 33.1%, a preliminary lottery will be held, comprised of all the minority

applicants who do not qualify for the Local Preference Pool. Minority applicants would be drawn until their percentage

in the Local Preference Pool at least meets the percentage in the Springfield, MA HUD Metro FMR Area. Applicants not

selected for the Local Preference Pool would be in the Open Pool only.

Are there any Deed Restrictions?

Yes. An Affordable Housing Restriction Deed Rider (AHR Deed Rider) is used to ensure the units are affordable for future

buyers. Following are highlights of the Deed Restrictions for both the 80% and 100% units:

Homebuyer Disclosure Statement

Gemini Townhomes, Springfield, MA – 80% of AMI Units

The home you are interested in buying was built in part with funding from the Massachusetts Housing Finance Agency

(known as “MassHousing”) under its CommonWealth Builder Program and from the City of Springfield under the

HOME Program. This funding allows the home to be sold for a discounted price, ensuring it is affordable to first-time

homebuyers with moderate incomes.

In exchange for the discounted purchase price, these programs require that the buyer of this home sign a binding legal

document that restricts the buyer’s right to sell, rent-out and refinance the home. This legal document will be attached

to the deed to the home and is sometimes called a “deed rider”.

If you buy this home, by signing the deed rider, you will be agreeing that:

For the first 15 years after you buy the home, for so long as you own it:

• This home will need to be your primary residence and you will not be allowed to rent it out.

• You will only be able to sell this home to another moderate-income first-time homebuyer and only for a limited

sale price.

• There will be restrictions on refinancing and second mortgages.

After 15 years, all of the restrictions in the deed rider will expire. If you still own this home, you will then be able to sell,

rent and refinance this home without any restrictions.

Page 7 of 29

Homebuyer Disclosure Statement

Gemini Townhomes, Springfield, MA – 100% of AMI Units

The home you are interested in buying was built in part with funding from the Massachusetts Housing Finance Agency

(known as “MassHousing”) under its CommonWealth Builder Program. This funding allows the home to be sold for a

discounted price, ensuring it is affordable to first-time homebuyers with moderate incomes.

In exchange for the discounted purchase price, the CommonWealth Builder Program requires that the buyer of this

home sign a binding legal document that restricts the buyer’s right to sell, rent-out and refinance the home. This legal

document will be attached to the deed to the home and is sometimes called a “deed rider”.

If you buy this home, by signing the deed rider, you will be agreeing that:

For the first 15 years after you buy the home, for so long as you own it:

• This home will need to be your primary residence and you may not be allowed to rent it out

• You will only be able to sell this home to another moderate-income first-time homebuyer and only for a

limited sale price, but you may transfer it to certain close family members

• There will be restrictions on refinancing and second mortgages

After 15 years, all of the restrictions in the deed rider will expire. If you or a close family member still own this home,

you will then be able to sell, rent and refinance this home without any restrictions.

All selected applicants are urged to review the AHR Deed Rider with their own attorney. All buyers will be provided with

a copy of the AHR Deed Rider at the time of the Purchase and Sale Agreement.

How much money do I need to make to afford the unit?

The minimum income required to purchase is based upon an applicant’s ability to secure a mortgage. Attached is a

“Sample Affordability Analysis” based upon current interest rates and anticipated real estate taxes and related housing

expenses.

Lottery Process

It is very important for everyone to understand the procedure. Please understand the allowable income guidelines

are adjusted based upon your household size. Also be advised that the program and its requirements are subject to

changes in state or federal regulations.

Lottery Pools

The lottery has two pools – Local Preference and Open. The pool and unit breakdown are as follows:

Total # of Units Local Pool Open Pool

Two Bedrooms

80% 4 2 2

100% 8 6 2

Three Bedrooms

80% 4 3 1

100% 4 3 1

All applicants who submitted a valid mortgage pre-approval letter will be included in the lottery and will receive a lottery

code prior to the lottery. The lottery code is what will be announced during the lottery. Local applicants would have two

Page 8 of 29

opportunities to purchase a unit by being included in both the Local Preference Pool and Open Pool. All units have the

Disproportionately Impacted Household preference.

All eligible applicants will be pulled, and their lottery code announced at the time of the lottery. This order of selection

will establish the rankings for the home’s distribution. Post lottery, if you have the opportunity to purchase you will

need to provide the required financial documentation in order for your program eligibility to be determined. Applicants

with the initial opportunity to purchase will have 7 days to provide their financial documentation once notified. The List

of Required Documentation is provided at the end of the packet if you want to begin compiling the documentation.

There will be two pools of applicants, one for the Local Preference Pool applicants and the second for Local Preference

and non-local applicants (Open Pool). The highest-ranking Local Preference Pool applicants at 80% and 100% AMI that

meet the household size and Disproportionately Impacted Households preference criteria (see page 5/6) for a two-

bedroom unit would have an opportunity to purchase the homes in the Local Preference Pool. The highest-ranking

applicants that meet the household size and Disproportionately Impacted Households preference criteria (see page 5/6)

for the Open Pool at 80% and 100% AMI would have the opportunity to purchase the available homes. The same

process would take place for the three-bedroom units. Local Pool applicants will select unit locations first.

The highest ranked applicant that requires the three-bedroom Group 2B unit will have priority for the unit no matter

where they stand in the lottery ranking.

NOTE: Homes will not be offered to one-bedroom households for a two- or three-bedroom unit or a two-bedroom

household for a three-bedroom unit until all two- or three-bedroom households have been offered a unit. (See page 6

for Household Size Preferences). This means if we exhaust the three-bedroom households in the Local Preference Pool

we will move to the Open Pool to fill the units before offering them first to 2-bedroom households and if they are

exhausted to one-bedroom households in the Local Preference Pool or Open Pool.

Time Frames

If you are selected and have the opportunity to purchase a unit and program eligibility has been determined your

application will be submitted to the Monitoring Agent for final eligibility determination. Once final approval has been

received by the Monitoring Agent, you will speak with a representative to view the units and select a unit location. An

Applicant selected for a home will start working with their lender immediately to finalize the necessary mortgage loan,

depending on the anticipated closing date. Please be advised that the final income verification will be done at the time

you have an opportunity to purchase a unit. If the closings are more than 3 months after the lottery the buyers will

need to update their information for submission to the Monitoring agent to determine final eligibility prior to closing.

Acceptance of Home

If you choose not to purchase the property, you will go to the bottom of the list and will likely NOT have another

opportunity.

Summary

We hope this helps explain the process by which the units will be distributed. It can be a lengthy and sometimes

complicated process. We greatly appreciate your participation and wish you the best of luck in the lottery process.

Page 9 of 29

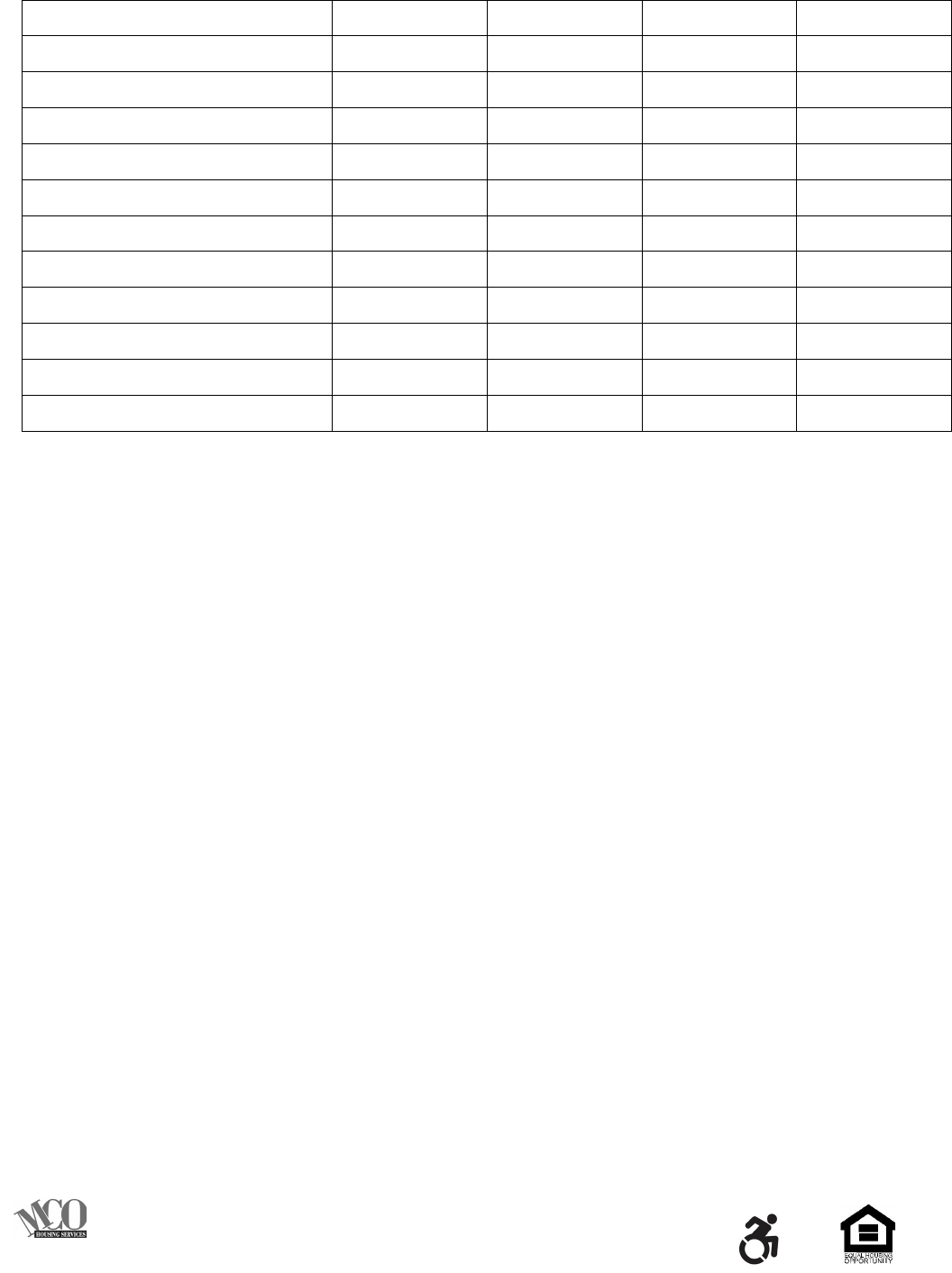

SAMPLE AFFORDABILITY ANALYSIS

80% Two BR 100% Two BR 80% Three BR 100% Three BR

Home Price

$ 170,000.00

$ 206,000.00

$ 189,000.00

$ 227,000.00

Interest Rate

6.99%

6.99%

6.99%

6.99%

Down Payment (%)

5%

5%

5%

5%

Down Payment ($)

$ 8,500.00

$ 10,300.00

$ 9,450.00

$ 11,350.00

Mortgage Amount

$ 161,500.00

$ 195,700.00

$ 179,550.00

$ 215,650.00

Monthly Expenses

Principal & Interest

$ 1,073.00

$ 1,300.00

$ 1,193.00

$ 1,433.00

Real Estate Taxes

228.00

276.00

253.00

304.00

Private Mortgage Insurance

105.00

127.00

117.00

140.00

Hazard Insurance

57.00

69.00

63.00

76.00

Monthly HOA Fee

260.00

260.00

287.00

287.00

TOTAL Monthly Expenses

$ 1,723.00

$ 2,032.00

$ 1,913.00

$ 2,240.00

NOTES:

ALL values are estimates and are subject to change.

Springfield 2024 Residential Tax Rate = $16.06 per thousand

Page 10 of 29

Unit Availability and Distribution

Unit Address

Bldg #

BR Size

# of

Baths

Unit Style

AMI

Estimated

Availability*

51 Morris St (H)

2

3 BR

1.5

H/C Unit D

100%

8/29/2024

53 Morris St

2

2 BR

1.5

B

80%

8/29/2024

55 Morris St

2

3 BR

1.5

A

80%

8/29/2024

57 Morris St

2

3 BR

1.5

A

100%

8/29/2024

59 Morris St

2

3 BR

1.5

A

80%

8/29/2024

60 Central St

4

2 BR

1.5

B

100%

11/6/2024

61 Morris St

2

2 BR

1.5

B

80%

8/29/2024

62 Central St

4

3 BR

1.5

A

100%

11/6/2024

64 Central St

4

2 BR

1.5

B

100%

11/6/2024

66 Central St

4

2 BR

1.5

B

100%

11/6/2024

68 Central St

4

2 BR

1.5

B

100%

11/6/2024

70 Central St

4

3 BR

1.5

A

100%

11/6/2024

72 Central St

4

2 BR

1.5

B

100%

11/6/2024

76 Central St

3

2 BR

1.5

B

100%

8/29/2024

78 Central St

3

3 BR

1.5

A

80%

8/29/2024

80 Central St

3

2 BR

1.5

B

80%

8/29/2024

82 Central St

3

2 BR

1.5

B

100%

8/29/2024

84 Central St

3

2 BR

1.5

B

80%

8/29/2024

86 Central St

3

3 BR

1.5

A

80%

8/29/2024

88 Central St

3

2 BR

1.5

B

100%

8/29/2024

H = Handicap Accessible Group 2B

*Estimated Availability subject to change.

Page 11 of 29

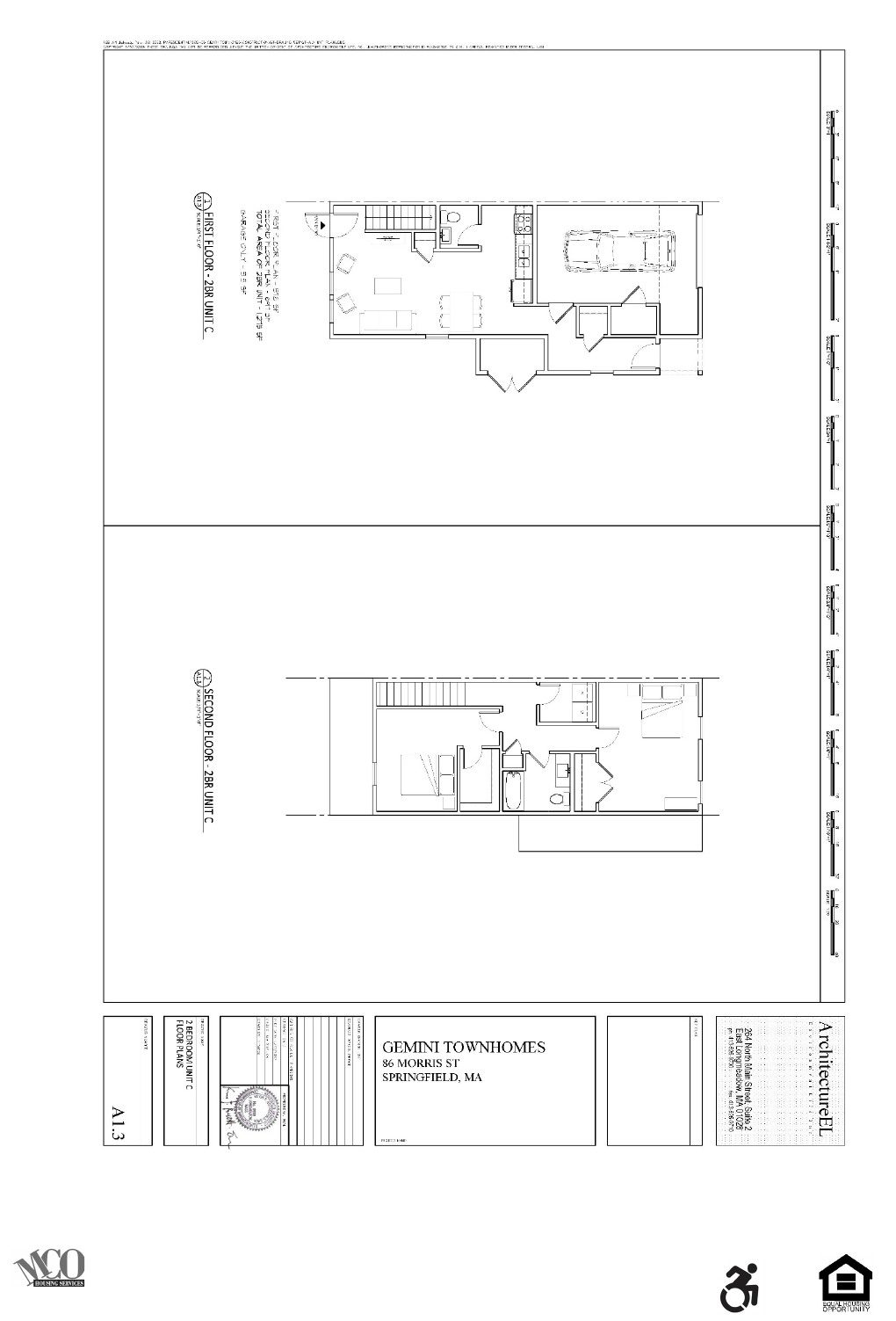

Page 12 of 29

Page 13 of 29

Page 14 of 29

Page 15 of 29

1,242.5 net sq. ft

Page 16 of 29

Page 17 of 29

Gemini Townhomes

LOTTERY APPLICATION

APPLICATION DEADLINE: June 28, 2024

PERSONAL INFORMATION: PRINT LEGIBILLY Date: ___________________

Name: ___________________________________________________________________________________________

Address: _________________________________________________Town/City: _______________ Zip: ____________

Cell/Home:________________________________________________ Work:_____________ _____________________

Email: ___________________________________________________________________________________________

Do you or any member of your household currently or have ever owned a home? ________ If so, when was the home

sold? ____________

You must meet one of the Local Preference Eligibility Criteria established by the City of Springfield to be in the Local

Preference Pool. Please check the appropriate category(s) that applies to your household:

Current Springfield Resident

Employed by the City of Springfield or the Springfield Public Schools

Employee working in the City of Springfield or with a bonafide offer from an employer located in the City of

Springfield.

Parents of children attending Springfield Public Schools, i.e. METCO.

Disproportionately Impacted Household (see page 5/6 for Disproportionately Impacted Household definition) is a

preference for all units. Please check below if your household meets this definition:

Disproportionately Impacted Household

Bedroom Size: ____ Two Bedroom _____Three Bedroom _____Both

Do you require a Group 2 handicap accessible unit? ____Yes ____ No

Do you require Special Accommodation? ____Yes ____ No, if yes provide explanation and documentation:

___________________________________________________________________________________________

Household Composition: The total household size is _________ (Number of people that will be living in the unit.)

Name ______________________________________________________ Relationship_____________ Age_____

Name ______________________________________________________ Relationship_____________ Age_____

Name ______________________________________________________ Relationship_____________ Age_____

Name ______________________________________________________ Relationship_____________ Age_____

Name ______________________________________________________ Relationship_____________ Age_____

Name ______________________________________________________ Relationship_____________ Age_____

For Office Use Only:

Date Appl. Rcvd: _____________

Local: Y / N

DIH: Y / N

Household Size: ________

Lottery Code: _______________

Page 18 of 29

EMPLOYMENT STATUS: (include for all working household members. Attach separate sheet, if necessary.)

Employer: ______________________________________________________________________________

Street Address: ______________________________________________________________________________

City/State/Zip: ___________________________________________________________________________

Date of Hire (Approximate): ______________________________________________________________________

Annual Wage - Base: __________________________

Additional: ______________________ (Bonus, Commission, Overtime, etc.)

FINANCIAL WORKSHEET: (Include all Household Income which includes gross wages, retirement income (if drawing on it

for income), business income, veterans’ benefits, alimony/child support, unemployment compensation, social security,

pension/disability income, supplemental second income and dividend income.)

Borrowers Monthly Base Income (Gross) _______________________

Other Income _______________________

Co-Borrowers Monthly Base Income (Gross) _______________________

Other Income _______________________

TOTAL MONTHLY INCOME: _______________________

Household Assets: (This is a partial list of required assets. Complete all that apply with current account balances.

Checking ________________________

Savings ________________________

Stocks, Bonds, Treasury Bills, CD or

Money Market Accounts and Mutual Funds ________________________

Individual Retirement, 401(k) and Keogh accounts ________________________

Retirement or Pension Funds ________________________

Revocable trusts ________________________

Equity in rental property or other capital investments ________________________

Cash value of whole life or universal life insurance policies ________________________

Downpayment Gift ________________________

TOTAL ASSETS _______________________

ABOUT YOUR FAMILY: OPTIONAL

You are requested to fill out the following section in order to assist us in fulfilling affirmative action requirements.

Please be advised that you should fill this out based upon family members that will be living in the home. Please check

the appropriate categories:

Applicant Co-Applicant (#) of Dependents

Black or African American _________ _________ _________

Asian _________ _________ _________

Hispanic/Latino _________ _________ _________

Native Hawaiian / Pacific Islander _________ _________ _________

Native American or Alaskan Native _________ _________ _________

Other, Not White _________ _________ _________

ADDITIONAL INFORMATION:

Please be advised that the income to be used should include income for all members of the household that are to be

residing in the home. Applicants will be responsible for all closing costs associated with the purchase of a home. The

down payment must be a minimum of 3%, 1.5% or half of which must come from the buyer’s own funds, based upon

standard underwriting procedures. Some of this may be in the form of a gift depending on the lending institution.

Page 19 of 29

SIGNATURES:

The undersigned warrants and represents that all statements herein are true. I/we understand, if selected, all

information provided shall be verified for accuracy at the time of bank application prior to closing.

Applicant Name _____________________________________

Applicant Signature ___________________________________ Date: _________________________

Co-Applicant Name ___________________________________

Co-Applicant Signature ________________________________ Date: _________________________

See page 23 for submission information

Page 20 of 29

Affidavit & Disclosure Form

I/We understand and agree to the following conditions and guidelines regarding the allocation of affordable homes at

Gemini Townhomes in Springfield, MA.

1. The annual total gross household income for my family does not exceed the allowable limits as follows:

Household Size

1

2

3

4

5

6

Up to 80% AMI

$61,350

$70,100

$78,850

$87,600

$94,650

$101,650

Up to 100% AMI

$67,900

$77,600

$87,300

$97,000

$104,760

$112,520

Income from all family members must be included.

(Income limits subject to confirmation based on HUD releasing new limits in June 2024.)

2. I/We have not individually or jointly owned a single-family home, townhome, condominium, or co-op within the

past three (3) years, including homes in a trust. We understand the exceptions that apply.

3. I/We certify that my/our total household assets do not exceed the $100,000 asset limit. I/We understand that

assets divested at less than full market value at least two years prior to application will be counted at full market

value in determining eligibility.

4. The household size listed on the application form includes all the people that will be living in the residence.

5. I/We certify all data supplied on the application is true and accurate to the best of my/our knowledge and belief.

I/We understand that providing false information will result in disqualification from further consideration.

6. I/We understand that being selected in the lottery does not guarantee that I/we will be able to purchase a home.

I/We understand that all financial documentation will be required, reviewed in detail, and verified prior to purchasing

a home.

7. I/We understand that it is my/our obligation to submit the a valid mortgage pre-approval for the home purchase

from a lender experienced with Deed Restricted housing. I/We understand all expenses, including closing costs and

down payments, are my responsibility.

8. I/We further authorize MCO Housing Services to verify any and all income, assets and other financial information, to

verify any and all household, resident location and workplace information and directs any employer, landlord or

financial institution to release any information to MCO Housing Services and consequently the project’s Monitoring

Agency, for the purpose of determining income eligibility.

9. I/We understand that if selected I/we may be offered a specific home. I/We will have the option to accept the

available home, or to reject the available home. If I/we reject the available home I/we will move to the bottom of the

waiting list and will likely not have another opportunity to purchase an affordable home at this development.

10. Program requirements are established by the Executive Office of Housing and Livable Communities (EOHLC),

MassHousing and the City of Springfield. I/We agree to be bound by whatever program changes that may be

imposed at any time throughout the process. If any program conflicts arise, I/we agree that any determination made

by the Monitoring Agent is final.

11. The affordable units may not be purchased by individuals who have a financial interest* in the development or to a

Related Party,** or to their families. I/we certify that no member of our household has a financial interest in this

Project, is a Related Party, or is a family member of someone who has a financial interest or is a Related Party.

*“Financial interest” means anything that has a monetary value, the amount of which is or will be determined by

the outcome of the Project, including but not limited to ownership and equity interests in the Developer or in the

Page 21 of 29

subject real estate, and contingent or percentage fee arrangements; but shall not include third party vendors and

contractors.

**Related Party means:

a. any person that, directly or indirectly, through one or more intermediaries, controls or is controlled by or is under

common control with the Developer, as well as any spouse of such person or “significant other” cohabiting with

such person, and any parent, grandparent, sibling, child or grandchild (natural, step, half or in-law) of such person;

b. any person that is an officer of, member in, or trustee of, or serves in a similar capacity with respect to the

Developer or of which the Developer is an officer, member, or trustee, or with respect to which the Developer

serves in a similar capacity, as well as any spouse of such person or “significant other” cohabiting with such person,

and any parent, grandparent, sibling, child or grandchild (natural, step, half or in-law) of such person;

c. any employee of the Developer; and

d. any spouse, parent, grandparent, sibling, child or grandchild (natural, step, half or in-law) of an employee of the

Developer or “significant other” cohabiting with an employee of the Developer.

12. I/We understand these are Deed Restricted units and acknowledge that it is recommended we consult an attorney.

13. I/We understand all financial documentation will be submitted after the lottery and program eligibility will be

determined at that time.

I/We have completed an application and have reviewed and understand the process that will be utilized to allocate the

available homes at Gemini Townhomes. I/We am qualified based upon the program guidelines and agree to comply

with applicable regulations.

_______________________ ____________________________ _____________________

Applicant Co-Applicant Date:

See page 23 for submission information

Page 22 of 29

REQUIRED DOCUMENTATION FORM

Provide one copy of all applicable information. A valid mortgage pre-approval is required and must be

sent with your application to participate in the lottery. Incomplete applications will not be included in the

lottery and the applicant will be notified after the application deadline. If you have any questions on what to

provide it is YOUR responsibility to ask prior to application submission.

Initial each that are applicable and provide the documents. Return this sheet with your application.

1. ______ Mortgage Pre-approval – See Mortgage Guidelines and Additional Mortgage Specifics on pages

4-5 to make sure your pre-approval is valid.

2. ______ If you require reasonable accommodation you must request at time of application and provide

any supporting documentation, if needed, i.e. letter from doctor, at the same time.

3. ____ Proof of Local Preference, i.e. copy of lease, utility bills, pay stubs, letter from school if child

attends a Springfield school, offer letter from company located in Springfield, etc.

4. ____ Disproportionately Impacted Household (DIH) please read the following:

Disproportionately Impacted Households which is define as a household that:

(i) has an annual income at or below 80% of area median income; or

(ii) currently resides in a “qualified census tract” (as designated by HUD); or

(iii) currently resides in one of the following towns or cities: Boston, Attleboro, Barnstable, Brockton,

Chelsea, Chicopee, Everett, Fall River, Fitchburg, Haverhill, Holyoke, Lawrence, Leominster, Lowell,

Lynn, Malden, Methuen, New Bedford, Peabody, Pittsfield, Quincy, Revere, Salem, Springfield,

Taunton Westfield, Worcester, Framingham, or Randolph.

I/We qualify as a Disproportionately Impacted Household: ______Yes; _____No (check one)

We understand if we do not provide a valid mortgage pre-approval we will not be included in the lottery. If we

do not provide the information for #2, #3 or complete #4, on or before the application deadline, you will not

be included in the Local Pool, Disproportionately Impacted Household Pool or have special accommodation.

Print Applicants Name(s): ______________________________________________________

______________________________________ ______________________________________

Applicants Signature DATE Co-Applicants Signature DATE

Page 23 of 29

Return the following to MCO Housing Services:

1. Completed, signed, and dated application – pages 17 - 19.

2. Signed and dated Affidavit and Disclosure Form – pages 20-21.

3. Completed, signed, and dated Required Documentation Form – page 22.

4. Proof of Local Preference, if applicable.

5. Special Accommodation Documentation, if needed.

6. Mortgage Pre-approval.

RETURN ALL by email, encrypted email, or fax by 11:59 p.m. or mailed

postmarked on or before the application deadline of June 28, 2024 to:

MCO Housing Services, LLC

P.O. Box 372

Harvard, MA 01451

Overnight mailing address: 206 Ayer Road, Harvard, MA 01451

FAX: 978-456-8986

Email: lotteryinfo@mcohousingservices.com

TTY: 711, when asked 978-456-8388

TO SECURELY SEND YOUR DOCUMENTS, GO TO WWW.GEMINISPRINGFIELD.COM

. CLICK ON APPLICATION

SUBMISSION LINK, CREATE AN ACCOUNT AND UPLOAD YOUR DOCUMENTS.

NOTE: If you are mailing your application close to the application deadline, make sure you go into the Post Office and

have them date stamp and mail. Mail that is sent to the central sorting facility may use bar codes so we would have no

idea when the application was mailed and it can take longer for MCO to receive. If we receive an application after the

deadline that has a barcode it will be counted as a late application and will not be included in the lottery.

Page 24 of 29

THE FOLLOWING DOCUMENTATATION IS FOR YOUR INFORMATION

ONLY.

YOU WILL NEED TO COMPLETE AND PROVIDE THE DOCUMENTATION

ONLY IF YOU HAVE THE OPPORTUNITY TO PURCHASE BASED ON YOUR

LOTTERY RANKING.

IF YOU HAVE THE OPPORTUNITY TO PURCHASE, WE WILL PROVIDE A

COPY OF THE FORM AND YOU WILL HAVE SEVEN (7) DAYS TO PROVIDE

THE DOCUMENTATION AFTER YOU HAVE BEEN NOTIFIED. YOU MAY

WANT TO BEGIN COLLECTING THE DOCUMENTATION NOW.

Page 25 of 29

APPLICATION TIPS

PLEASE READ THE FOLLOWING CAREFULLY

1. More than 60% of applications submitted to MCO Housing Services are incomplete. Please take the

time to read the application and submit all required documentation. It is your responsibility to provide

the correct documentation.

2. Read the NOTES on the Required Personal Identification and Income Verification Documents. Failure

to do so could mean the difference between a complete and incomplete application as well as

eligibility for a unit.

3. All financial documentation, income and assets, are required from all household adults aged 18 or

older. No exceptions.

4. All Asset statements must include your name, account number and Institution name. Do not take

photos or copy a statement from your phone. If you provide any asset statements without the above

information your application is an automatic incomplete.

5. DO NOT ASSUME you do not need to provide a certain document. When in question call or email

BEFORE you submit your application.

6. We will not use the amount listed on your paystubs or W2’s regarding your retirement account i.e.

401K, 403B, IRA, Roth IRA etc. Your paycheck and W2’s tells us you have a retirement account only.

You must provide the last statement from whoever is managing the account. Although retirement

accounts are not counted as part of your assets you still need to provide the statements.

7. Do NOT forget to include statements from Robinhood or any other online investment accounts. They

are considered part of your assets. If you have an open account, you must provide a statement

whether there are any funds in the account or not.

8. If you are unable to provide specific information, then submit a note with your application explaining

the circumstances. This will not guarantee your application will be accepted, but depending on the

circumstances, we may be able to work with you.

9. Do not take photos with your cellphone of any documentation and email it to us. The photos are not

legible, and we will not accept them.

10. You can fax your information, but it is not recommended. If all pages are not received your application

would be considered incomplete.

I/We have read the above Application Tips.

_______________________________________ _____________________________________

Applicant Signature Date Co-Applicant Signature Date

Page 26 of 29

SAMPLE LIST OF DOCUMENTS TO BE PROVIDED IF YOU HAVE THE OPPORTUNITY TO PURCHASE

Initial each that are applicable and provide the documents.

1. _____ The last twelve (12) consecutive pay stubs for all jobs (check/direct deposit stubs) if applying for

an 80% unit. The last five (5) pay stubs for all jobs (check/direct deposit stubs) if applying for a 100%

AMI unit. For unemployment, DOR verification stating benefits and pay history. Same for disability

compensation, worker’s compensation and/or severance pay.

• NOTE: If you have obtained a new job within the last 12 months you must provide a copy of the

Employment Offer Letter.

• NOTE: If you are no longer working for an employer you worked for in the last 12 months, you must

provide a letter from the employer with your separation date.

• NOTE: You need to provide 5 pay stubs whether you are paid weekly, bi-weekly, semi-monthly or

monthly.

2. _____ Benefit letter providing full amount of periodic amounts received from Social Security, annuities,

insurance policies, retirement funds, pensions, disability or death benefits and other similar types of

periodic receipts.

3. _____ Child support and alimony: court document indicating the payment amount or DOR statement.

If you do not receive child support provide a letter stating that you are not receiving child support or

complete Custody and Child Support Affidavit on page 27.

4. _____ If you are self-employed you MUST provide a detailed expense and income statement for the

last 12 months and three months of business checking and savings accounts along with last three

Federal Income Tax Returns.

5. _____ Federal Tax Returns –2021, 2022 and 2023 (NO STATE TAX RETURNS)

• NOTE: Provide all pages that are submitted to the IRS. For example, if a Schedule C is submitted to

the IRS and not part of your application, your application will be considered incomplete.

• NOTE: If you filed but do not have copies of your Federal Income Tax returns, you can obtain a copy

of your Tax Transcript using form 4506-T that you can obtain at irs.gov or create an account at

irs.gov and print out the Tax Transcript.

• NOTE: If you have not filed tax returns you must provide a letter from the IRS Verifying Non-filing of

your tax return(s). Request Verification of Non-filing letter by using form 4506-T that you can obtain

at irs.gov or create an account at irs.gov and print out the Verification of Non-filing letter(s).

6. _____ W2 and/or 1099-R Forms: 2021, 2022, 2023

• NOTE: If you do not have copies of W2’s and/or 1099’s, you can obtain a copy of your Wage

Transcript using form 4506-T that you can obtain at irs.gov or create an account at irs.gov and print

out the Wage Transcript.

7. _____ Interest, dividends and other net income of any kind from real or personal property.

Page 27 of 29

8. Asset Statement(s): provide current statements of all that apply, unless otherwise noted:

GENERAL NOTE: ALL STATEMENTS MUST INCLUDED YOUR NAME, ACCOUNT NUMBER AND

INSTITUTION NAME FOR ALL CHECKING, SAVINGS, INVESTMENT ACCOUNTS AND RETIREMENT

ACCOUNTS. ANY ACCOUNTS PROVIDED WITHOUT THIS INFORMATION IS AN AUTOMATIC INCOMPLETE

APPLICATION.

• _____Checking accounts – Last three (3) months of statements – EVERY PAGE – FRONT AND BACK.

NOTE: Direct deposits from Payroll, SS, tax refund, transfers between your accounts, DOR, DTA

etc. we can identify. If you have cash deposits, or non-payroll or other income deposits you MUST

identify where the funds have come from. For example only, VENMO, EBAY, POSHMARK,

PAYPAL, CASH APP, ATM and MOBILE deposits, ZELLE and other transfers between any accounts

but your accounts, etc. There is no way we can list all sources. If you fail to explain they will be

counted as income, which may put you over the income limit.

NOTE: Do NOT provide a running transaction list of activity. You must provide individual

statements.

• _____Pre-paid debit card statements – current month.

NOTE: This is NOT your ATM/Debit card. This is usually a separate debit card statement showing

income deposited directly onto the debit card, i.e. Social Security or other regular income.

NOTE: If Social Security payments are deposited on a Direct Express card, it is your responsibility

to provide proof. You can print a statement from the Direct Express website at

https://www.usdirectexpress.com/.

• _____Saving accounts – last three months of full statements.

NOTES: Direct deposits from Payroll, SS, tax refund, transfers between your accounts, DOR, DTA

etc. we can identify. If you have cash deposits, non-payroll or other income deposits you MUST

identify where the funds have come from. For example only, VENMO, EBAY, POSHMARK,

PAYPAL, CASH APP, ATM and MOBILE deposits, ZELLE and other transfers between any accounts

but your accounts, etc. There is no way we can list all sources. If you fail to explain they will be

counted as income, which may put you over the income limit.

• _____Revocable trusts

• _____Equity in rental property or other capital investments

• _____Investment accounts, including stocks, bonds, Treasury Bills, Certificates of Deposit, Mutual

Funds, Money Market, Robinhood and all online accounts, etc. Current statement(s) only.

• _____ Retirement accounts, IRA, Roth IRA, 401K, 403B, etc for all current and past jobs. Current

statement(s) only.

• _____Cash value of Whole Life or Universal Life Insurance Policy.

• _____Personal Property held as an investment.

• _____Lump-sum receipts or one-time receipts.

9. _____Proof of student status for household members 18 or older. Letter from High School or College

providing student status, full time or part time for current or next semester.

Page 28 of 29

10. _____A household may count an unborn child as a household member. The household must submit

proof of pregnancy with the application, i.e. letter from doctor.

11. _____If the applicant is in the process of a divorce, the applicant must provide legal documentation the

divorce has been finalized. Information must be provided regarding the distribution of family assets. If you

are unable to provide then both parties income/assets and first-time homebuyer status will be used in

determining eligibility even if the individual will not be living in the home.

15. _____If you will be receiving a gift for down payment and/or closing costs the giftee needs to provide a

letter stating the gift amount. All gifts count towards the asset limit.

NOTE: If your deposit is cash and you have it in your home you must deposit in your bank account to show

evidence of available funds.

Print Applicants Name(s): ______________________________________________________

______________________________________ ______________________________________

Applicants Signature DATE Co-Applicants Signature DATE

Page 29 of 29

Complete one form for each child