Malta’s 2030

National Energy and Climate Plan

December 2019

CONTENTS

CONTENTS ................................................................................................................................... 1

LIST OF ABBREVIATIONS ............................................................................................................... 1

LIST OF TABLES ............................................................................................................................ 3

LIST OF FIGURES ........................................................................................................................... 5

1 OVERVIEW AND PROCESS FOR ESTABLISHING THE PLAN ........................................................ 1

1.1 EXECUTIVE SUMMARY ............................................................................................... 1

1.2 OVERVIEW OF CURRENT POLICY SITUATION ............................................................... 7

1.3 CONSULTATIONS AND INVOLVEMENT OF NATIONAL AND EU ENTITIES AND THEIR

OUTCOME .............................................................................................................................. 15

1.4 REGIONAL COOPERATION IN PREPARING THE PLAN ................................................. 25

2 NATIONAL OBJECTIVES AND TARGETS ................................................................................. 26

2.1 DIMENSION DECARBONISATION .............................................................................. 26

2.1.1 GHG EMISSIONS AND REMOVALS............................................................................. 26

2.1.2 RENEWABLE ENERGY ............................................................................................... 29

2.2 DIMENSION ENERGY EFFICIENCY .............................................................................. 45

2.3 DIMENSION ENERGY SECURITY ................................................................................ 50

2.4 DIMENSION INTERNAL ENERGY MARKET .................................................................. 52

2.5 DIMENSION RESEARCH, INNOVATION AND COMPETITIVENESS ................................. 59

3 POLICIES AND MEASURES ................................................................................................... 61

3.1 DIMENSION DECARBONISATION .............................................................................. 61

3.1.1 GHG EMISSIONS AND REMOVALS............................................................................. 61

3.1.2 RENEWABLE ENERGY ............................................................................................... 64

3.2 DIMENSION ENERGY EFFICIENCY .............................................................................. 78

3.3 DIMENSION ENERGY SECURITY ................................................................................ 89

3.5 DIMENSION RESEARCH, INNOVATION AND COMPETITIVENESS ............................... 107

4 CURRENT SITUATION AND PROJECTIONS WITH EXISTING POLICIES AND MEASURES ........... 110

4.1 PROJECTED EVOLUTION OF MAIN EXOGENOUS FACTORS INFLUENCING ENERGY

SYSTEM AND GHG EMISSION DEVELOPMENTS ...................................................................... 110

4.2 DIMENSION DECARBONISATION ............................................................................ 120

4.2.1 GHG EMISSIONS AND REMOVALS........................................................................... 120

4.2.2 RENEWABLE ENERGY ............................................................................................. 144

4.3 DIMENSION ENERGY EFFICIENCY ............................................................................ 150

4.4 DIMENSION ENERGY SECURITY .............................................................................. 153

4.5 DIMENSION INTERNAL ENERGY MARKET ................................................................ 158

4.6 DIMENSION RESEARCH, INNOVATION AND COMPETITIVENESS ............................... 160

5 IMPACT ASSESSMENT OF PLANNED POLICIES AND MEASURES ........................................... 168

5.1 IMPACTS OF PLANNED PAMS DESCRIBED IN SECTION 3 ON ENERGY SYSTEM AND GHG

EMISSIONS AND REMOVALS ................................................................................................. 168

5.2 MACROECONOMIC AND, TO THE EXTENT FEASIBLE, THE HEALTH, ENVIRONMENTAL,

EMPLOYMENT AND EDUCATION, SKILLS AND SOCIAL IMPACTS OF THE PLANNED POLICIES AND

MEASURES ........................................................................................................................... 206

5.3 OVERVIEW OF INVESTMENT NEEDS ........................................................................ 218

5.4 IMPACTS OF PLANNED PAMS ON OTHER MEMBER STATES AND REGIONAL

COOPERATION ..................................................................................................................... 228

ANNEX I – DETAILED SUMMARY OF PUBLIC’S VIEWS DURING PUBLIC CONSULTATION PROCESS 229

ANNEX II – NOTIFICATION OF DETAILED METHODOLOGY TO IMPLEMENT ARTICLE 7 OF DIRECTIVE

2012/27/EU ............................................................................................................................. 246

LIST OF ABBREVIATIONS

CCGT Combined Cycle Gas Turbine

CHP Combined Heat and Power

DSO Distribution System Operator

EED Energy Efficiency Directive

EIA Environmental Impact Assessment

EMD Electricity Market Directive

EPBD Energy Performance of Buildings Directive

ESD Effort Sharing Decision

ESR Effort Sharing Regulation

EU ETS EU Emissions Trading System

EU European Union

EWA The Energy & Water Agency

FAME Fatty Acid Methyl Esters

FEC Final energy consumption

FIT Feed-in-Tariff

GDP Gross domestic product

GHG Greenhouse Gas

GJ Giga Joule

GVA Gross value added

GWh Gigawatt hour

H&C Heating and cooling

HPWH Heat pump water heater

HVAC High Voltage Alternating Current

HVO Hydrotreated vegetable oil

ICE Internal Combustion Engines

IMSC Inter-Ministerial Steering Committee

IPPU Industrial processes and product use

ktoe kilotonnes of oil equivalent

kWh Kilowatt hour

kWp Kilowatt peak

LN Legal Notice

LNG Liquified Natural Gas

LULUCF Land Use, Land use change and Forestry

MCCAA Malta Competition and Consumer Affairs Authority

MCST Malta Council for Science and Technology

MESDC Ministry for Environment, Sustainable Development and Climate Change

MMR Monitoring Mechanism Regulation

MRA Malta Resources Authority

MS Member State

MTGP Melita TransGas Pipeline

MTIP Ministry for Transport, Infrastructure and Capital Projects

NECP National Energy and Climate Plan

NEEAP National Energy Efficiency Action Plan

NREAP National Renewable Energy Action Plan

NSO National Statistics Office

PA Planning Authority

PAMs Policies and measures

PEC Primary energy consumption

PV Photovoltaic

R&I Research and innovation

RED Renewable Energy Directive

RES Renewable Energy Sources

REWS Regulator for Energy and Water Services

SEA Strategic Environmental Assessment

SL Subsidiary Legislation

SME Small and Medium-Sized Enterprise

SWH Solar Water Heater

TSO Transmission System Operator

UNFCCC United Nations Framework Convention on Climate Change

WSC Water Services Corporation

WSM WasteServ Malta

WEM ‘With Existing Measures’ scenario

WPM ‘With Planned Measures’ scenario

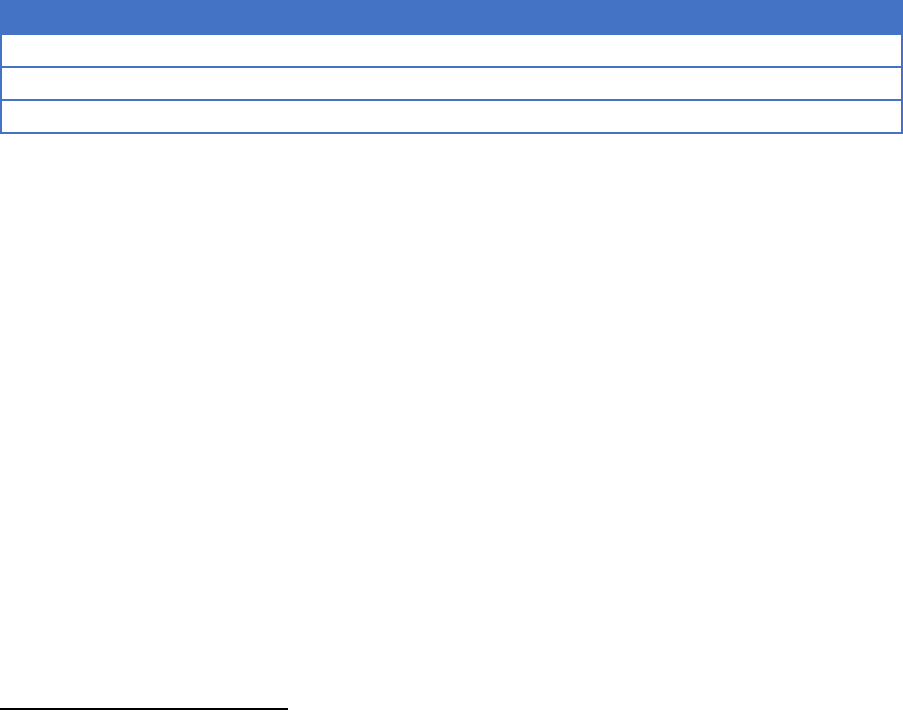

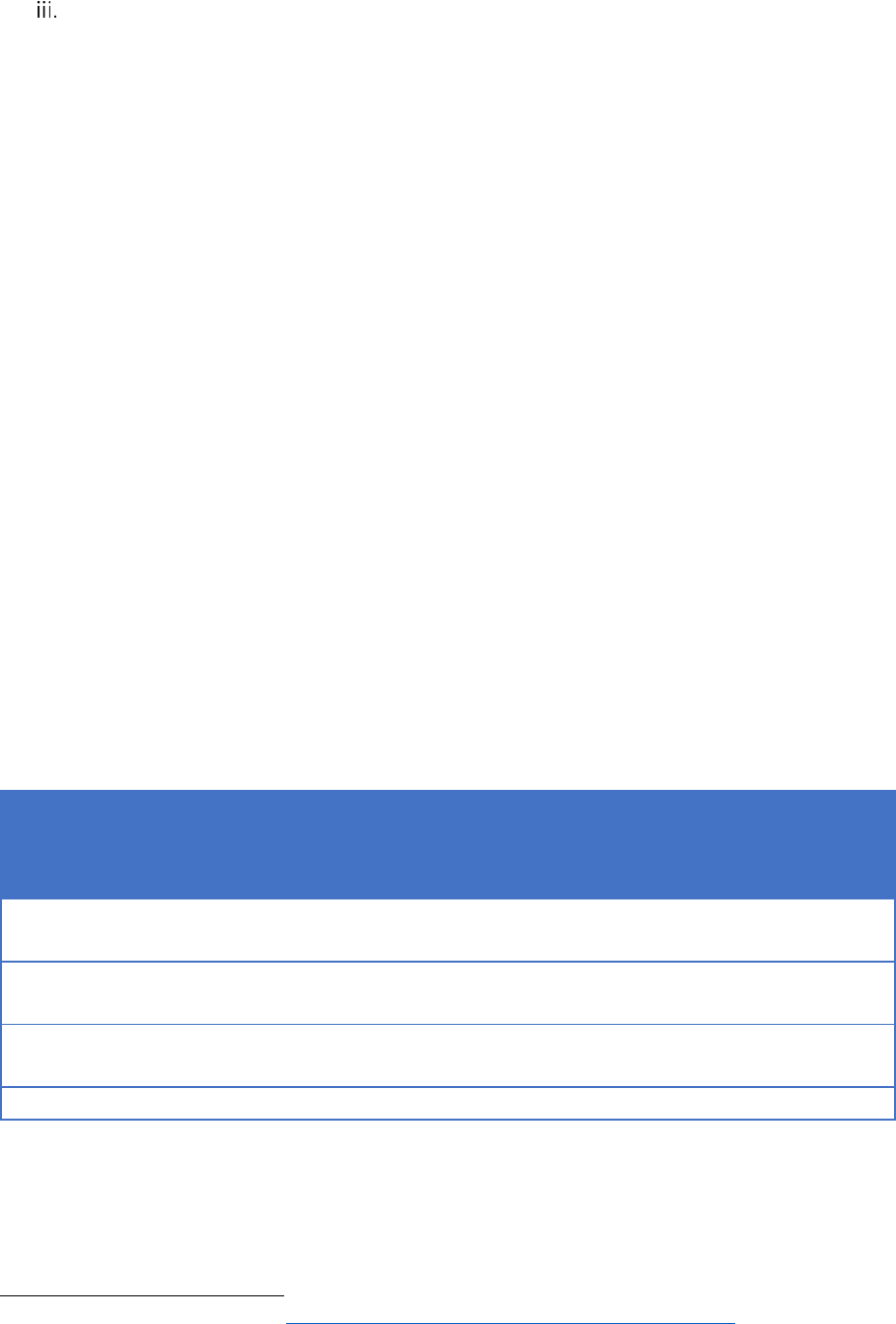

LIST OF TABLES

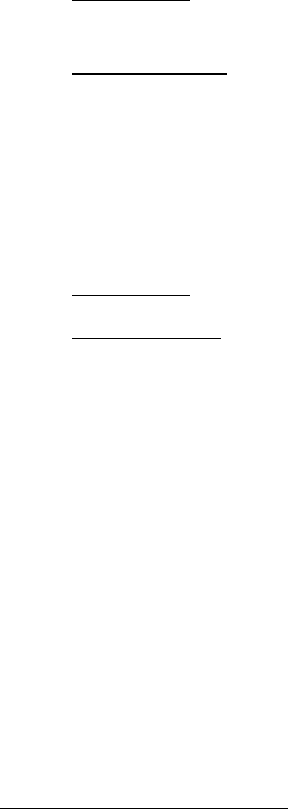

Table 1 - Recommendations on Draft NECP issued to Malta and corresponding justifications ........... 21

Table 2 - Malta's RES contribution between 2021-2030, % .................................................................. 38

Table 3 - Estimated trajectories for sectoral share of RES (WPM), 2021-2030 .................................... 39

Table 4 – National NECP Population projections, thousands ............................................................... 45

Table 5 - Final energy consumption, ktoe. ............................................................................................ 49

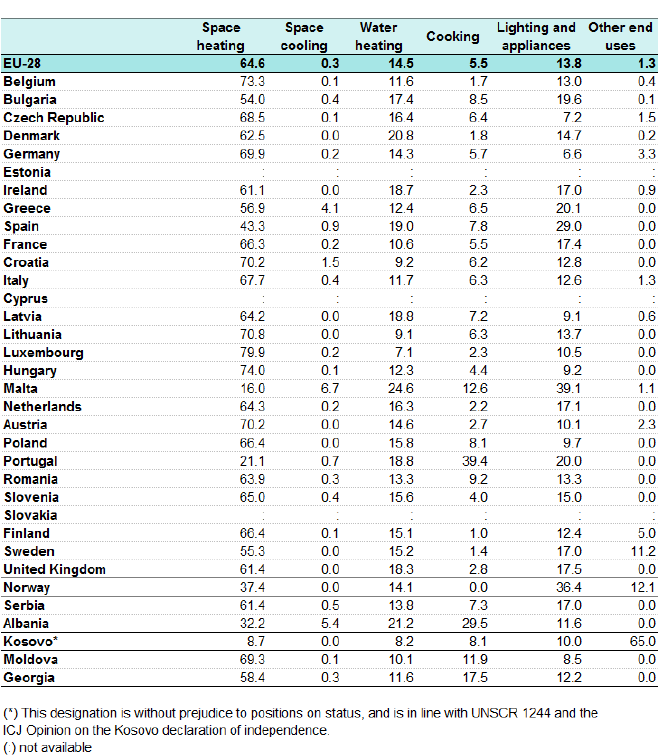

Table 6 - Share of final energy consumption in the residential sector by type of end-use in 2016, %

(Source: Eurostat) ................................................................................................................................. 81

Table 7 – Gas pipeline project implementation plan ............................................................................ 92

Table 8 - Projected total population and number of households as five-year averages. ................... 110

Table 9 - Projected average GDP growth in five-year periods, %. ...................................................... 111

Table 10 - Projections of GDP per capita, EUR 2016 prices. ............................................................... 111

Table 11 Natural gas and carbon price (EU ETS) projections, EUR (2016)/MWh

and EUR (2016)/t CO

2

.

............................................................................................................................................................ 115

Table 12 Solar PV technology cost assumptions, EUR 2013/kW excluding taxes (Source: Technology

pathways in decarbonisation scenarios, 2018). .................................................................................. 116

Table 13 Cost reduction scenario, EUR 2014/kW excluding taxes (Source: Fraunhofer ISE, 2015). . 116

Table 14 - Low and high capital cost estimation, EUR/kW (Source: Zountouridou et al., 2015). ....... 117

Table 15 Technology assumptions for technologies in the residential and commercial sectors. ...... 118

Table 16 Technology assumptions for categories of vehicles. ............................................................ 119

Table 17- Total GHG emissions, with and without LULUCF ................................................................ 121

Table 18 - Greenhouse gas emission trends by gas ............................................................................ 124

Table 19 - Total CO2 emissions vs total electricity generated in Malta by power plants, 2005-2017 137

Table 20 Share of renewable energy in gross final energy consumption, total and per sector 2010 -

2017 .................................................................................................................................................... 144

Table 21 - Overall RES share and sectoral shares under WEM scenario, 2021-2030, GWh ............... 149

Table 22 - Total primary energy consumption and final energy consumption by sector from 2013-2017,

ktoe (including heat pumps) ............................................................................................................... 150

Table 23 Overall energy performance requirement for new dwellings, kWh/m² per annum. ......... 152

Table 24 Overall energy performance requirement for new non-dwellings (offices), kWh/m² per

annum. ................................................................................................................................................ 153

Table 25 - Gas deliveries to Malta, 2017-2018 ................................................................................... 155

Table 26 Malta-Sicily Electricity interconnector details. .................................................................... 158

Table 27 - Overview of domestic R&I projects carried out between 2010-2018, grouped by Set Plan

Actions ................................................................................................................................................ 164

Table 28 - Public sector R&I expenditure by relevant fields of socio-economic objective, EUR (Source:

NSO). ................................................................................................................................................... 164

Table 29 - Private sector R&I expenditure by relevant fields of socio-economic objective, EUR (Source:

NSO). ................................................................................................................................................... 165

Table 30 - Total number of researchers between 2014-2017, (Source: Eurostat tsc00003 & NSO). . 165

Table 31 - Number of researchers by relevant fields of science between 2014-2017, (Source: NSO).

............................................................................................................................................................ 165

Table 32 - Main price components by tariff bands in non-household sector in 2017, EUR nominal

(Source: Eurostat). .............................................................................................................................. 166

Table 33 - All policies and measures under the WPM scenario.......................................................... 169

Table 34 - Electricity imports and exports under the WPM scenario, GWh ....................................... 193

Table 35 Projected EU ETS carbon prices according to EU Reference Scenario 2016 ........................ 197

Table 36 – Policy interactions under WPM scenario between Energy Union dimensions ................. 205

Table 37 - Impacts Assessed: Economic (ECO), Social (SOC), Environmental (ENV), Others (OTH). .. 208

Table 38 - Modelled WPM PAMs ........................................................................................................ 211

Table 39 - Direct and Voluntary Financial Burden of a sub-set of PAMs ............................................ 219

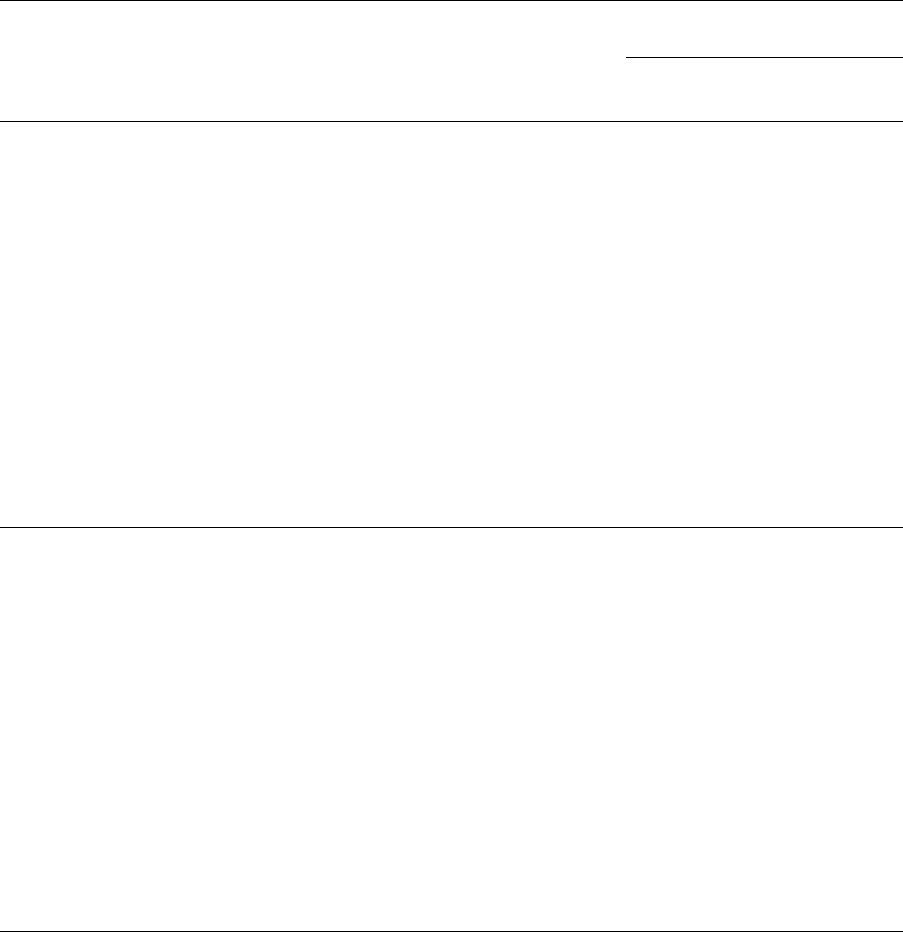

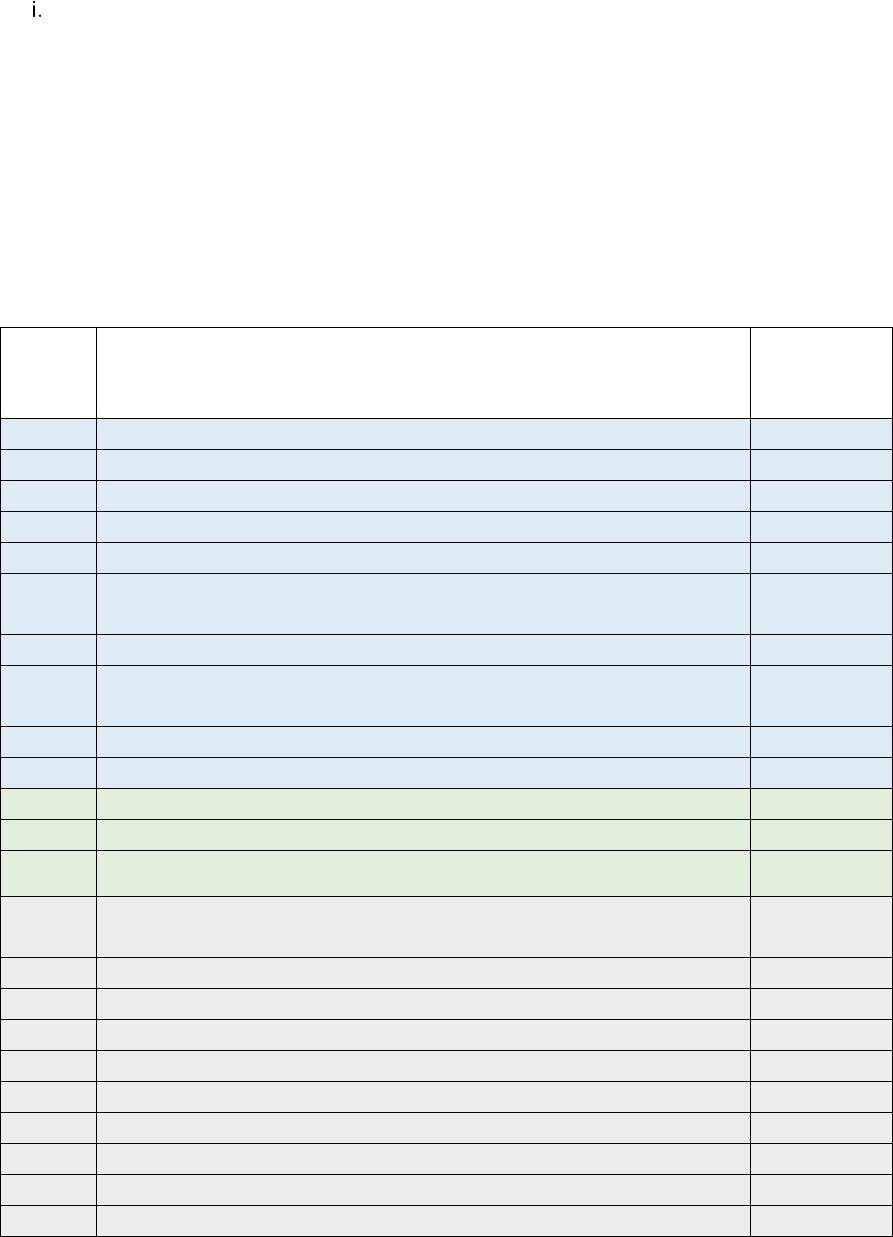

LIST OF FIGURES

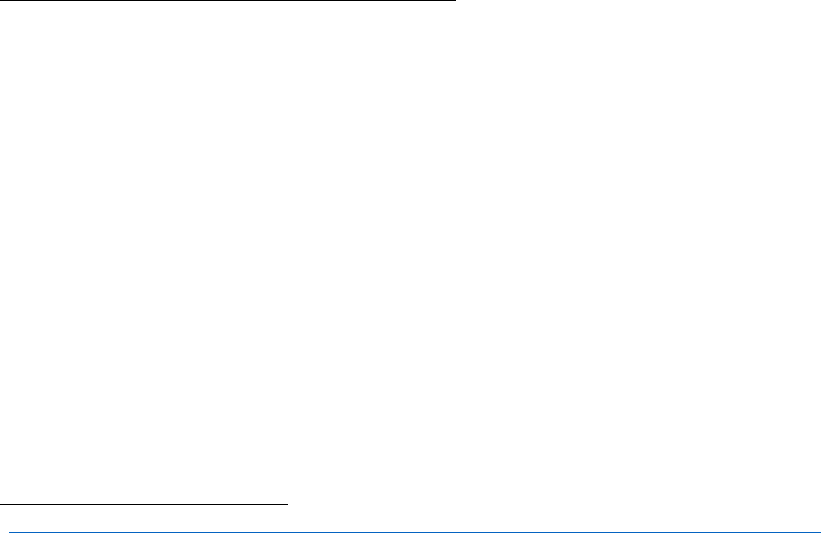

Figure 1 - Public consultation process on the NECP ............................................................................. 16

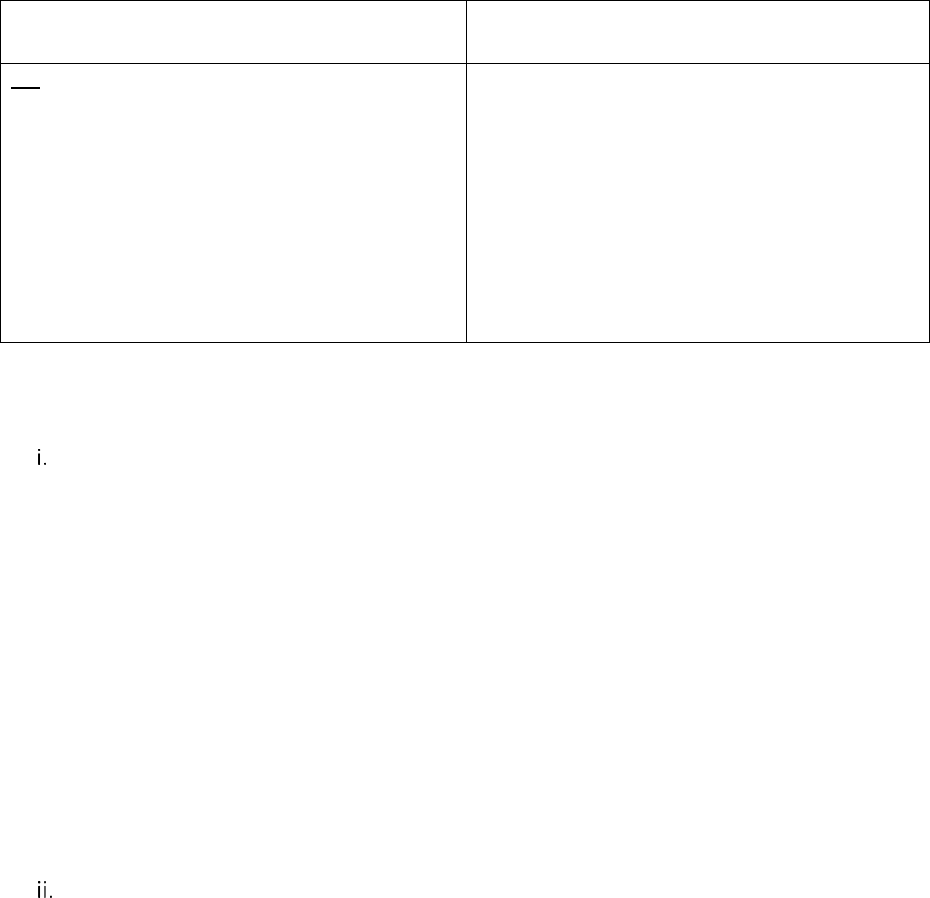

Figure 2 - Inshore marine areas used by Puffinus Yelkouan as recorded from 31 GPS data loggers,

extracted from Borg et all (2010) Source: MEPA .................................................................................. 31

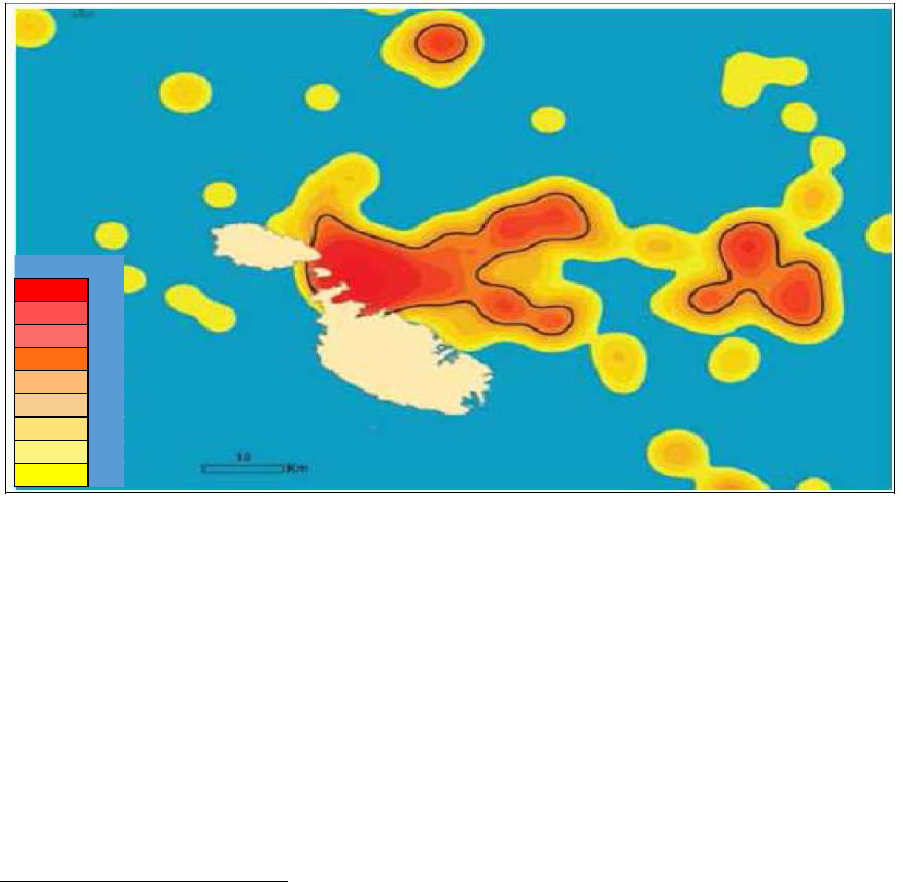

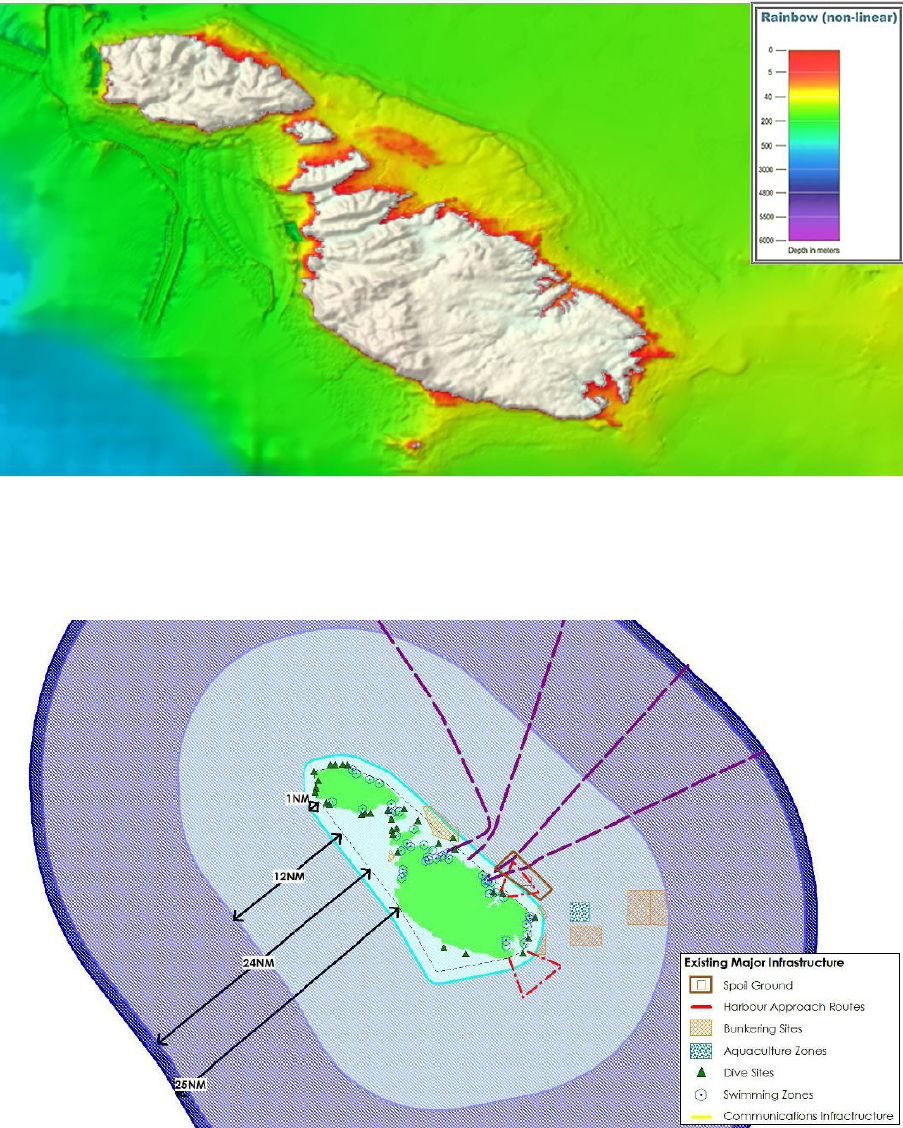

Figure 3 - Bathymetric map of the Maltese Islands .............................................................................. 33

Figure 4 - Overview of major maritime activities in Maltese waters (Source: Strategic Plan for

Environment and Development of Malta, 2015) .................................................................................. 33

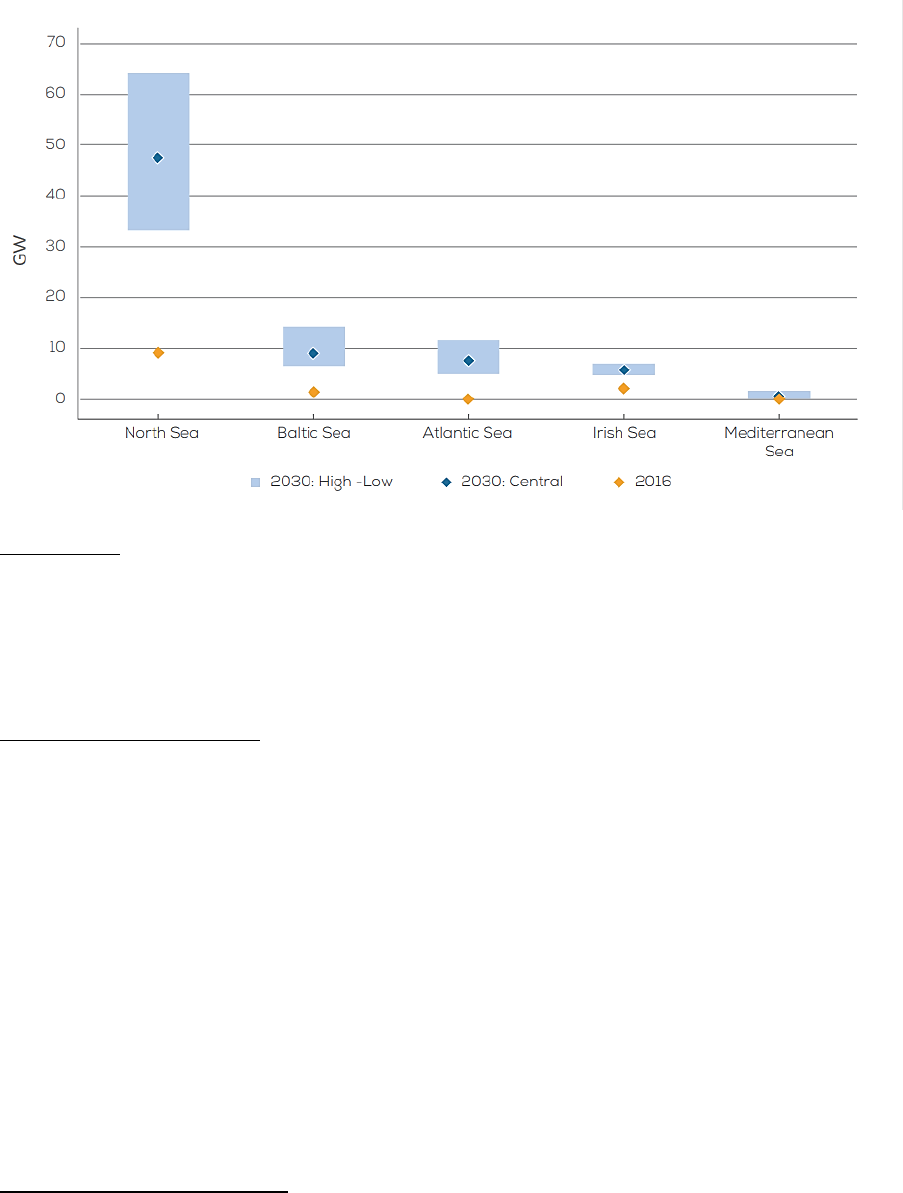

Figure 5 - WindEurope projections on 2016 and 2030 offshore wind installations per sea basin (Source:

WindEurope, 2017) ............................................................................................................................... 34

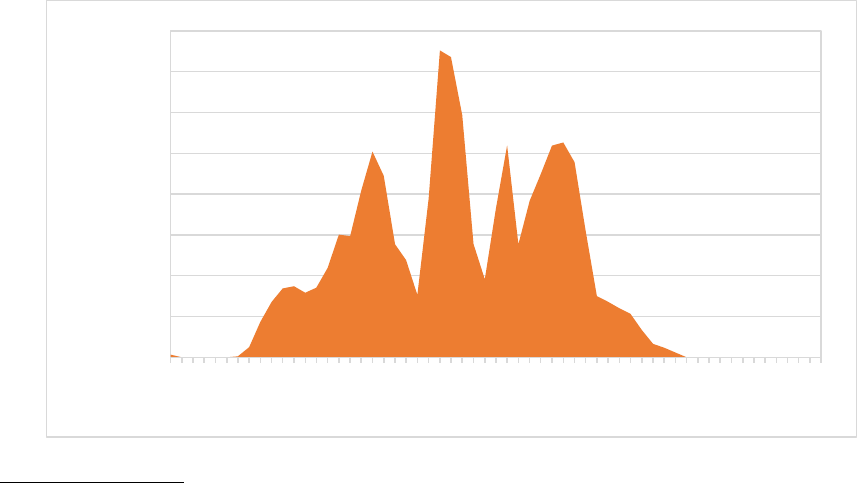

Figure 6 - The effect of cloud cover on electricity generation by 133 MWp of installed solar PV.

Transients of circa 60MW are experienced within 60 minutes with the current level of installed

capacity ................................................................................................................................................. 35

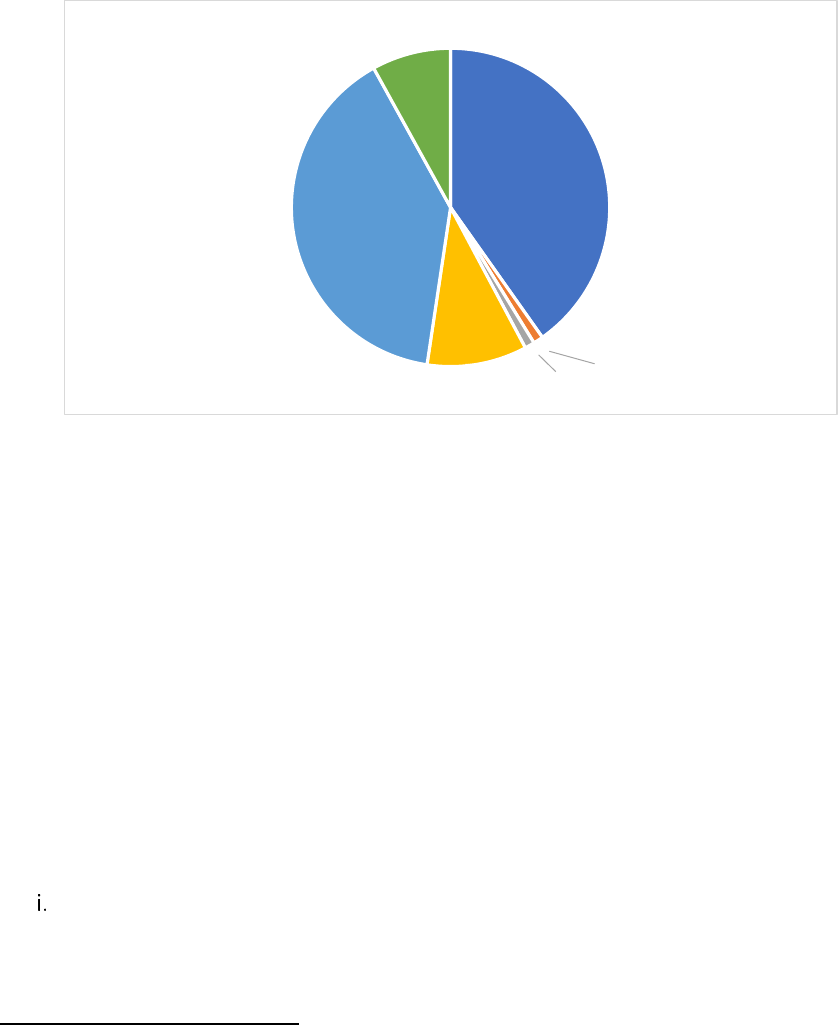

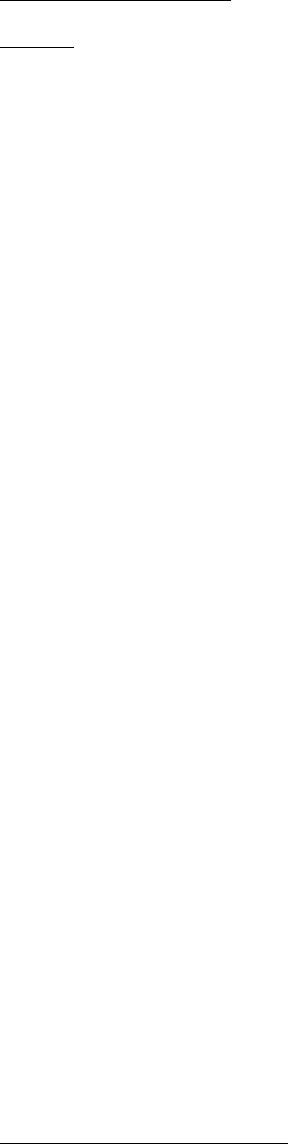

Figure 7 - Fuels consumed for Heating and Cooling in 2017 ................................................................ 36

Figure 8 - Annual energy consumption per square km and per capita, 2012. Source: Eurostat. ......... 37

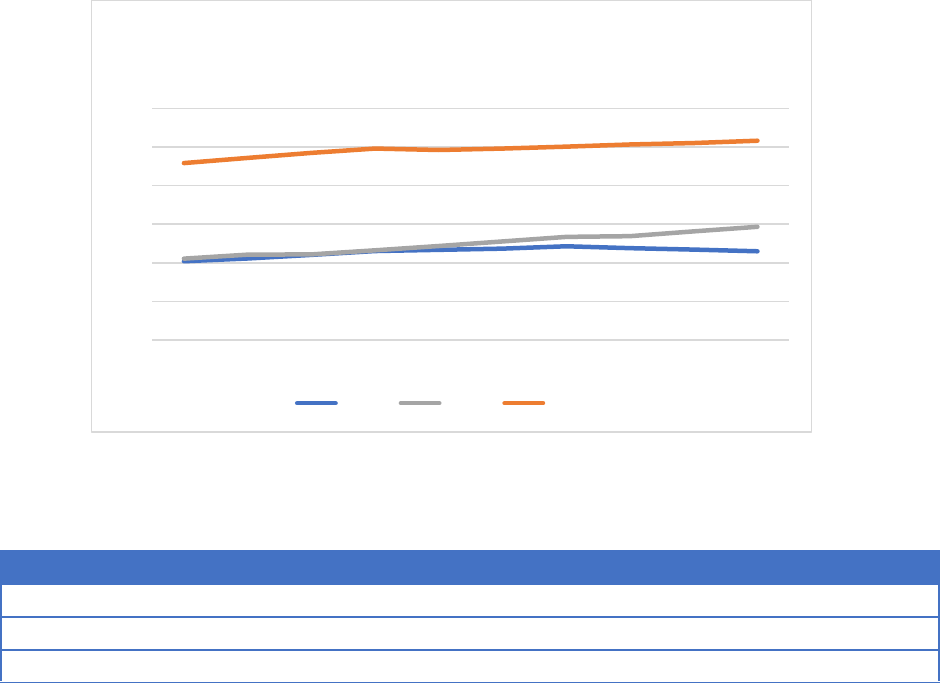

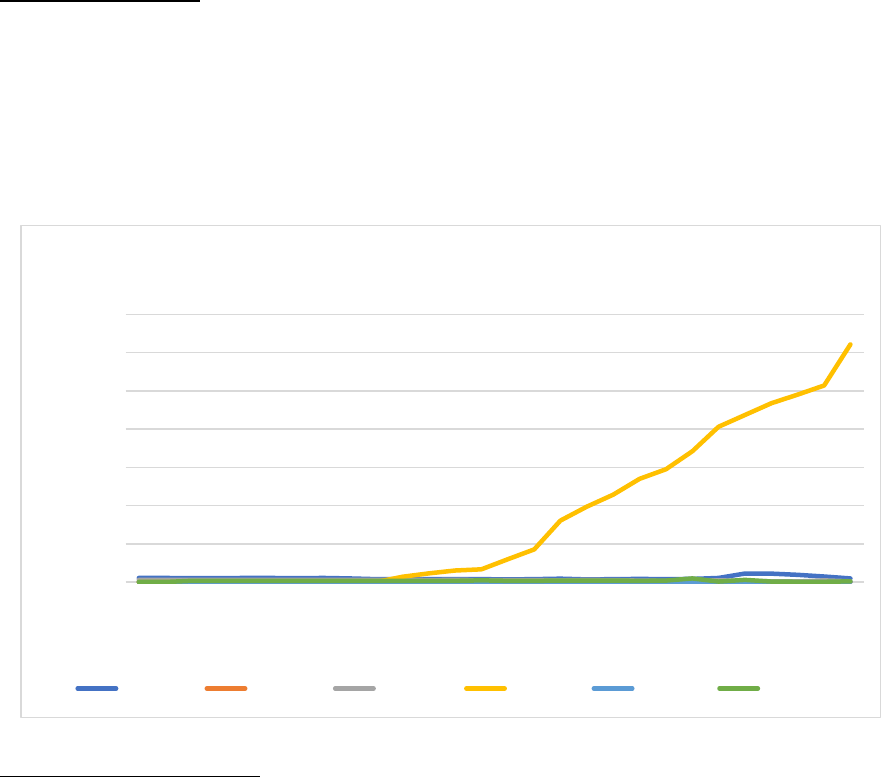

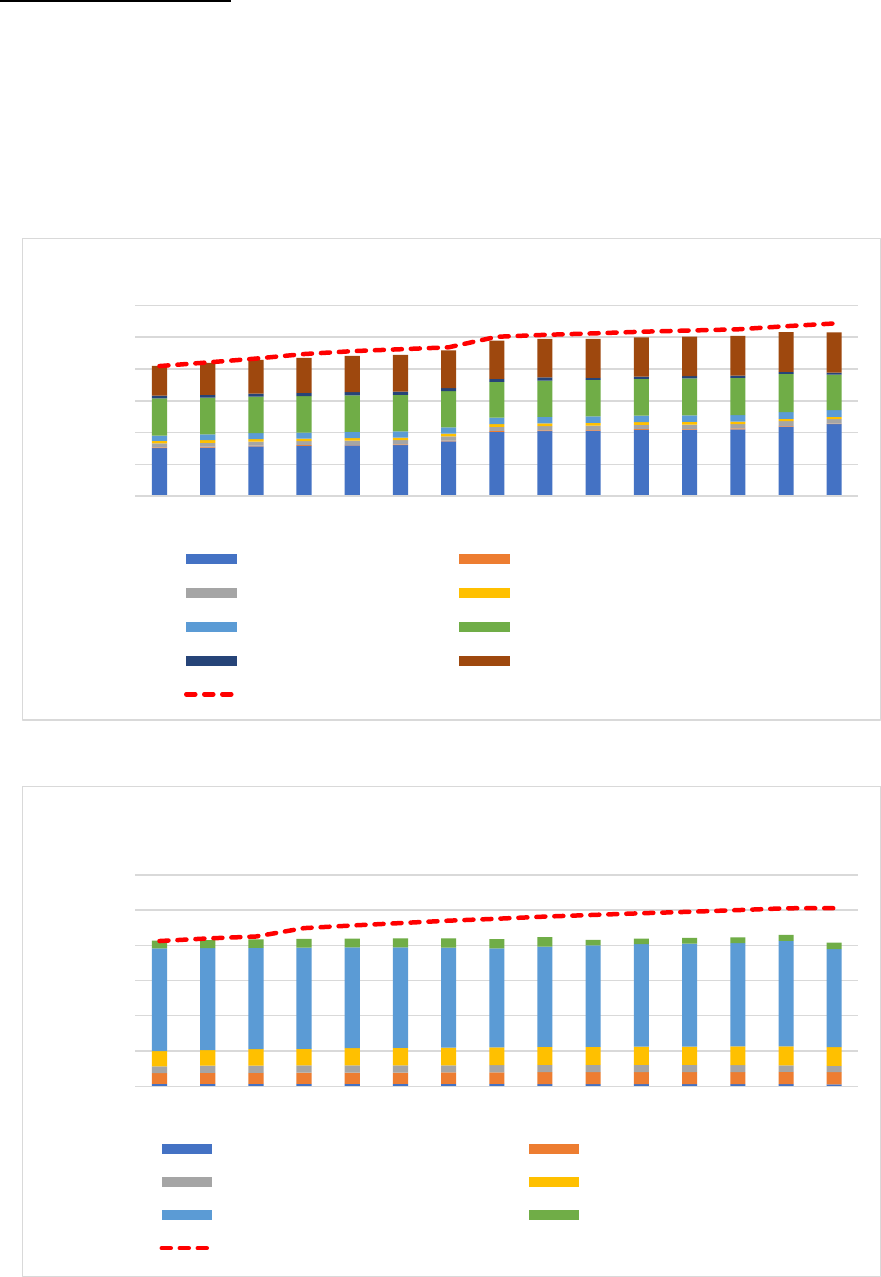

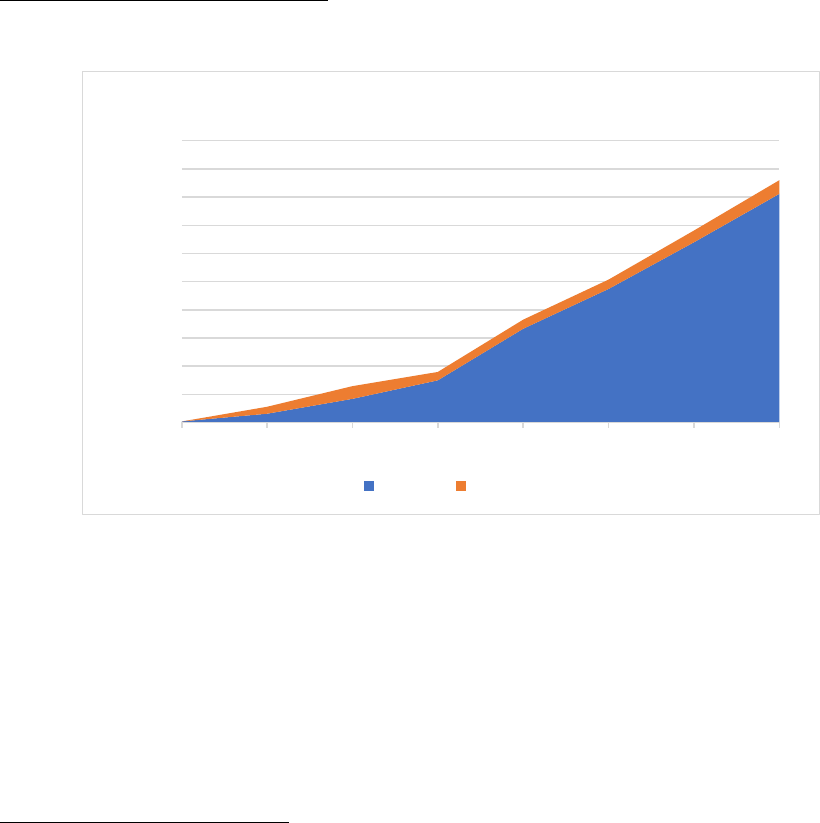

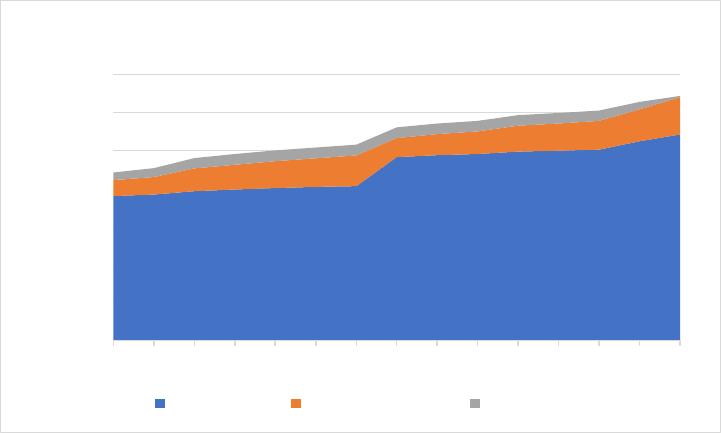

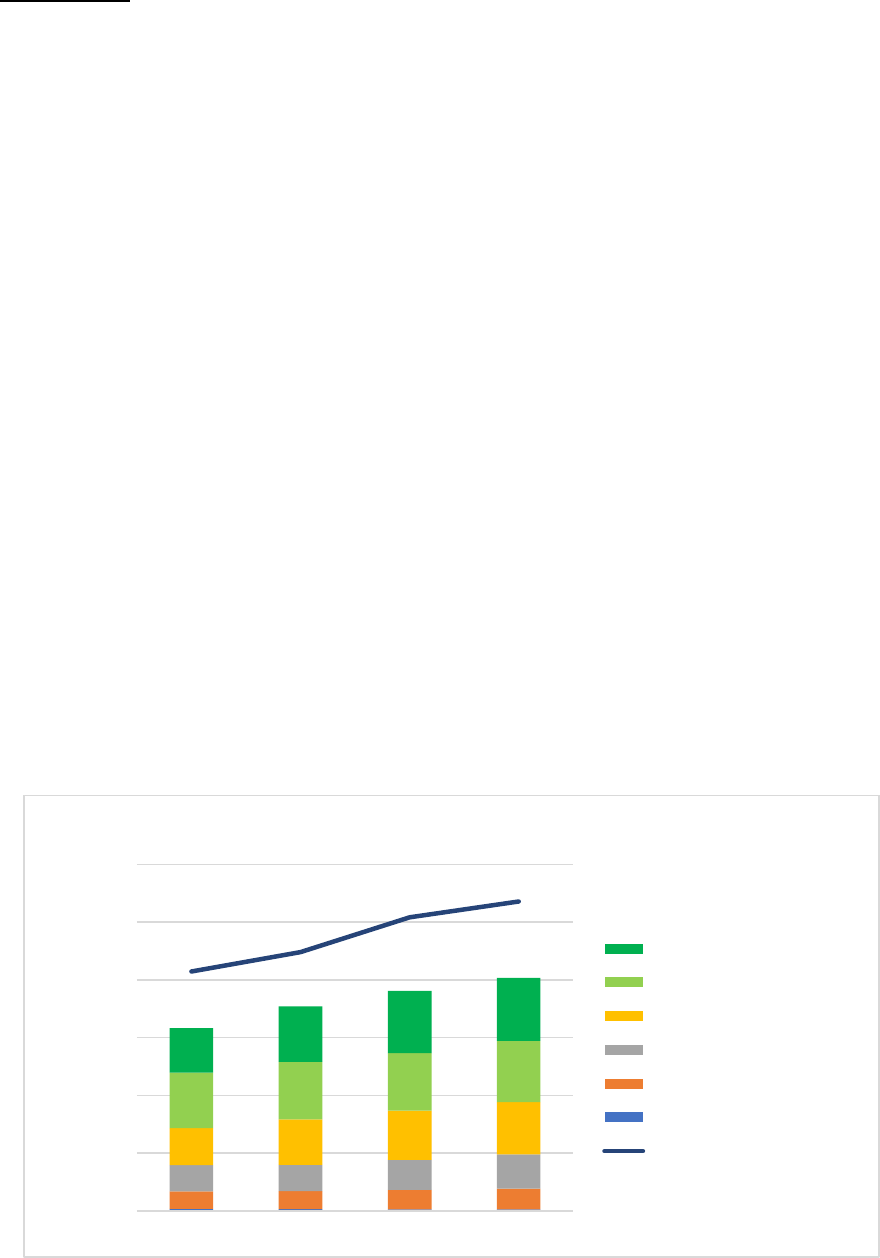

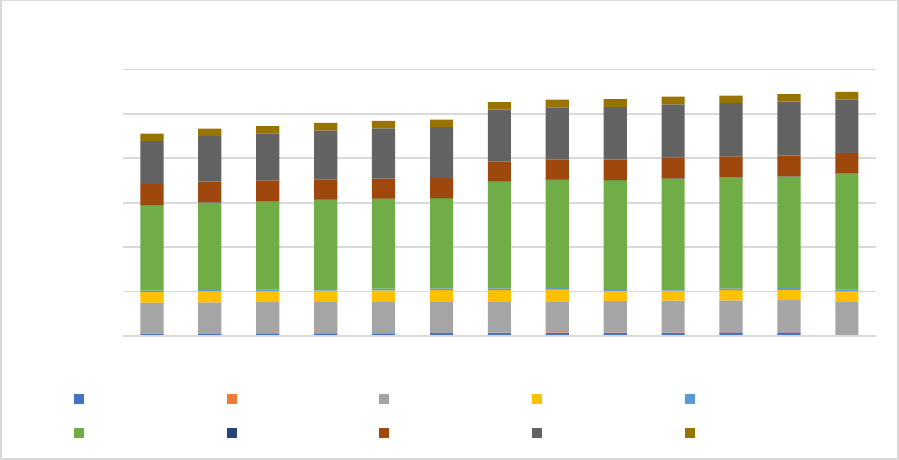

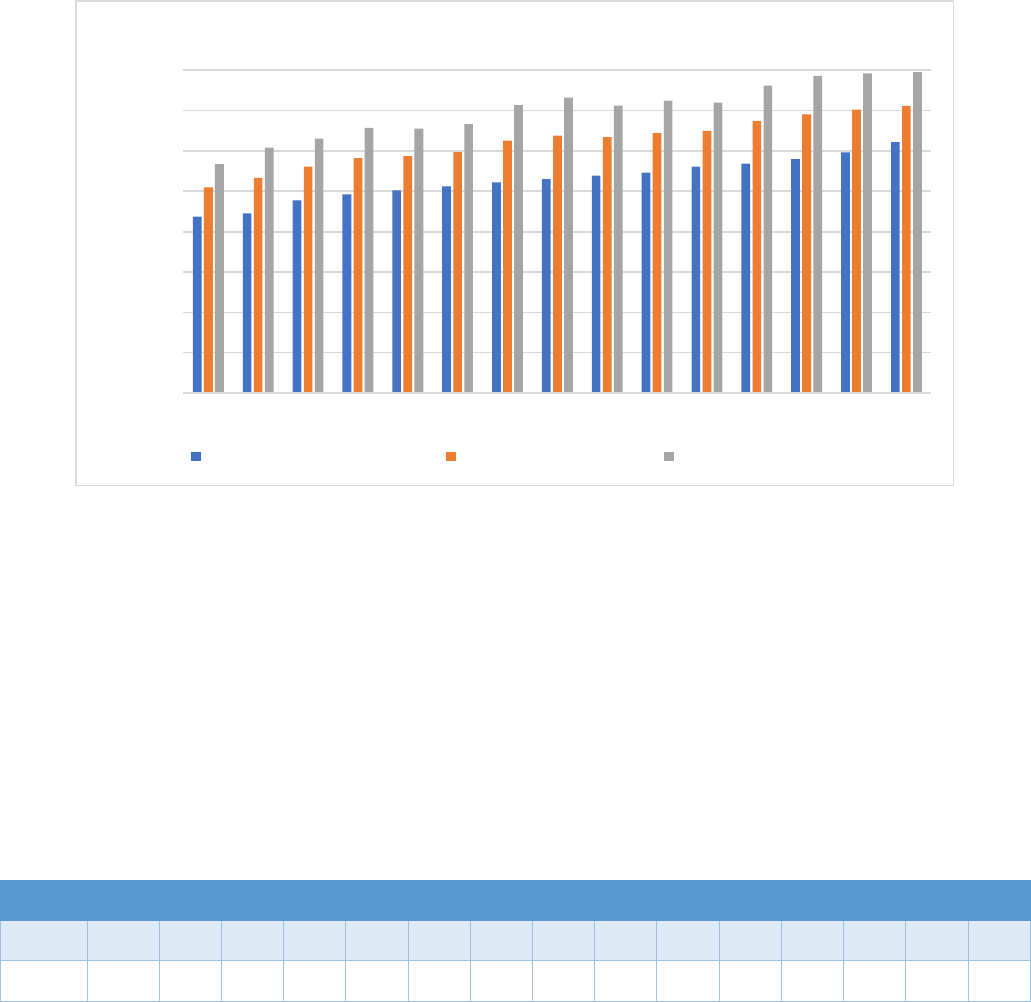

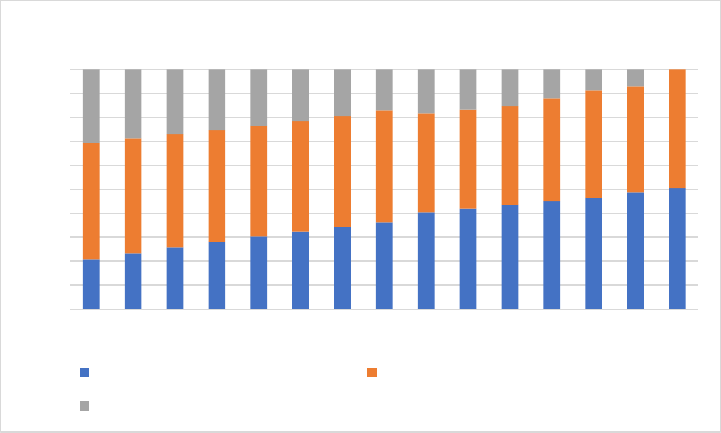

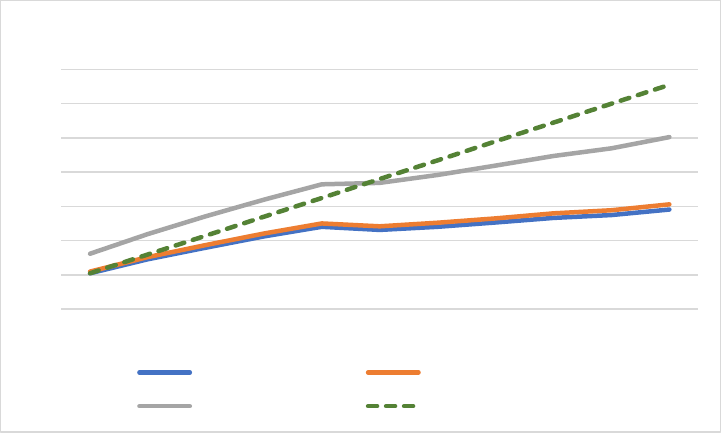

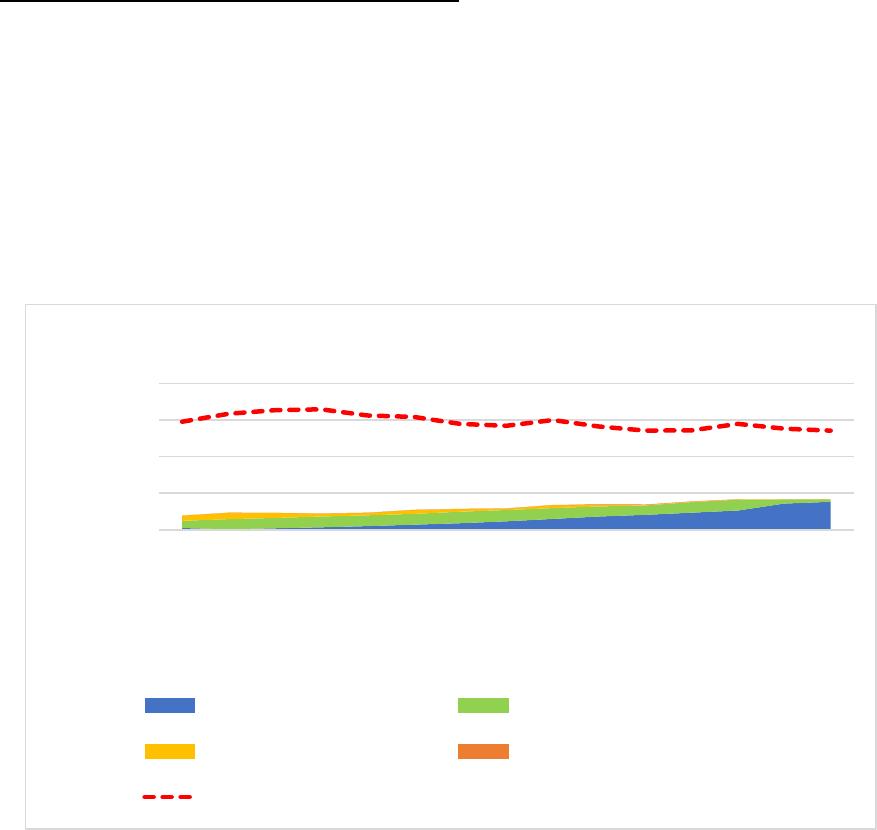

Figure 9 - Estimated trajectories for sectoral share of RES under WPM scenario, 2021-2030 ............ 39

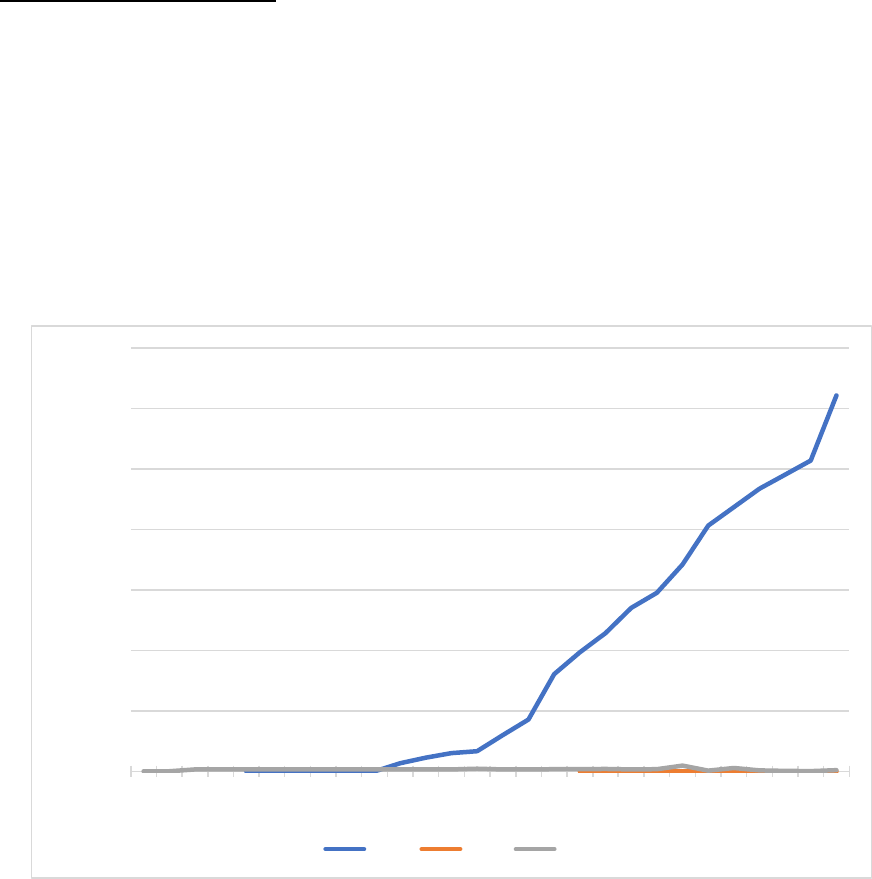

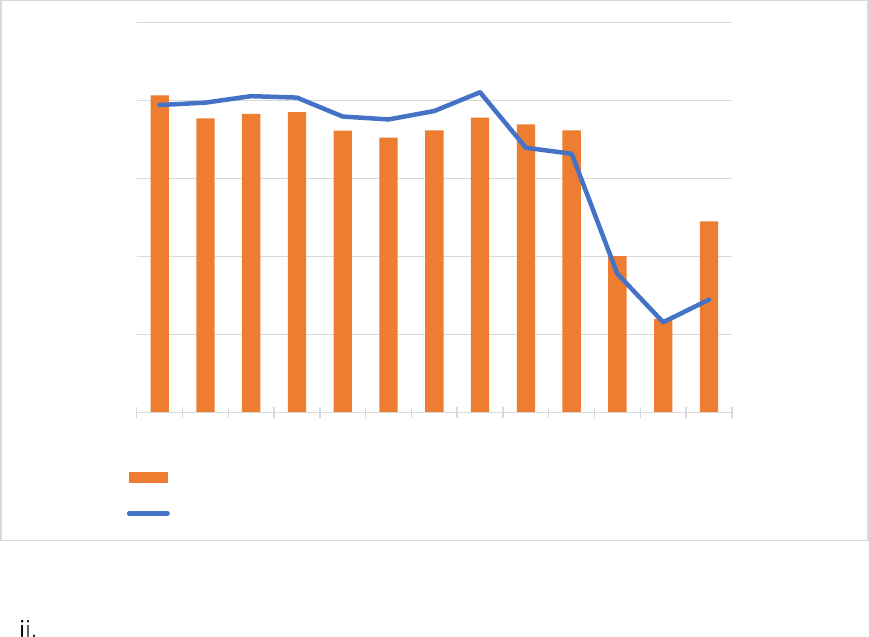

Figure 10 - Solar PV capacity and generation under the WPM scenario, 2021-2030 ........................... 40

Figure 11 - RES Electricity trajectory between 2021-2030, GWh ......................................................... 41

Figure 12 - RES Heating and cooling under WPM scenario 2021-2030, GWh ...................................... 41

Figure 13 - RES trajectory in transport under WPM scenario 2021-2030, GWh .................................. 42

Figure 14 - Estimated trajectory for bioenergy under the WPM scenario 2021-2030, GWh ............... 43

Figure 15 - Projections of biofuels under WPM scenario, 2021-2030, GWh ........................................ 44

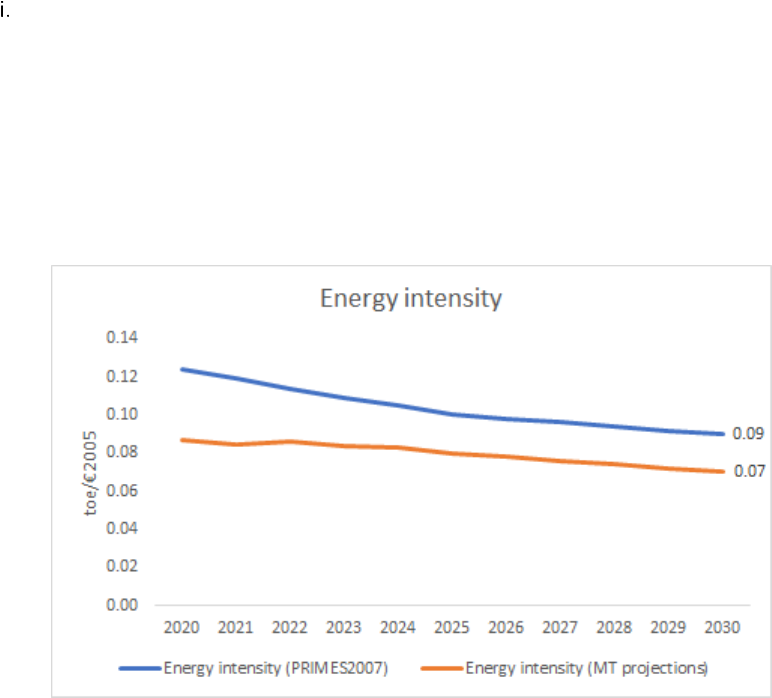

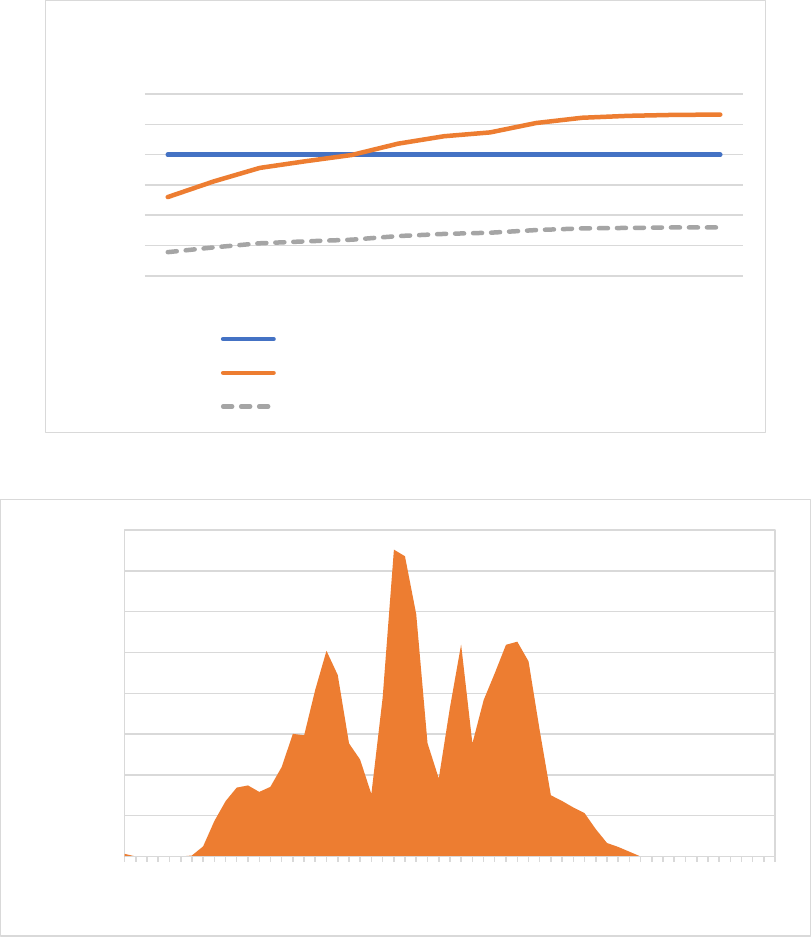

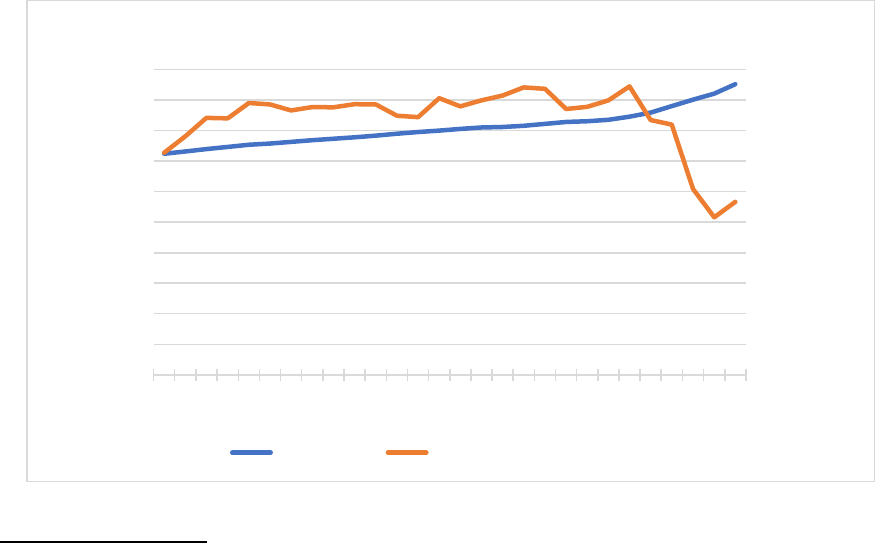

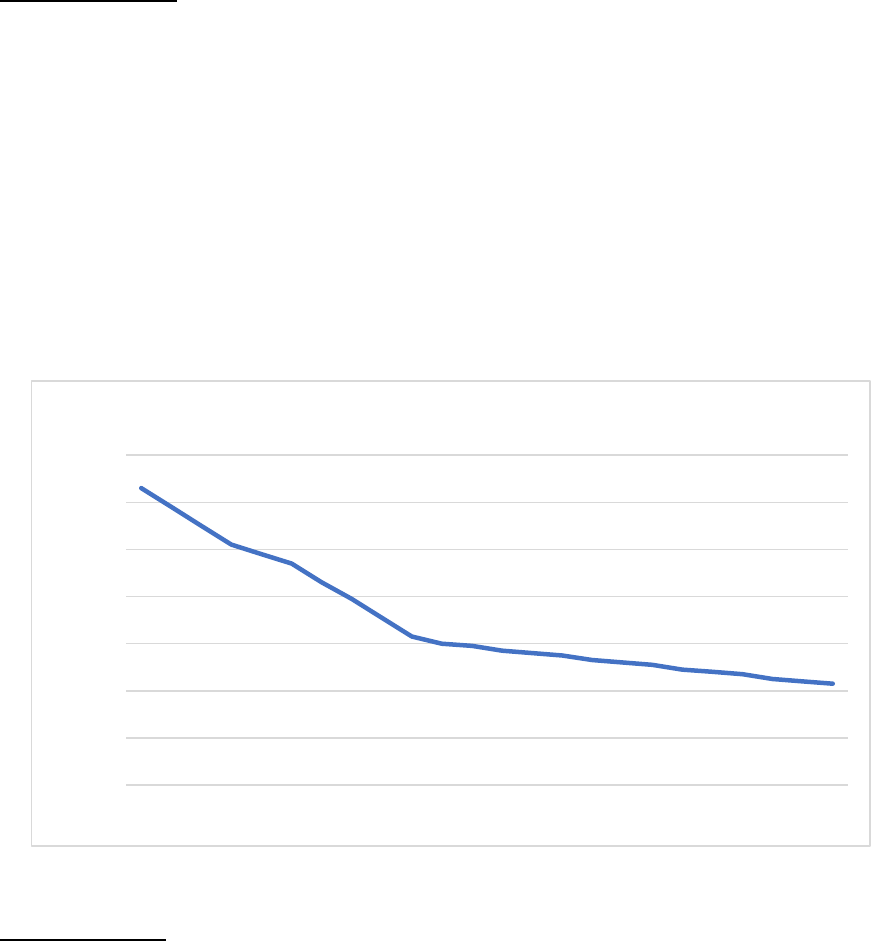

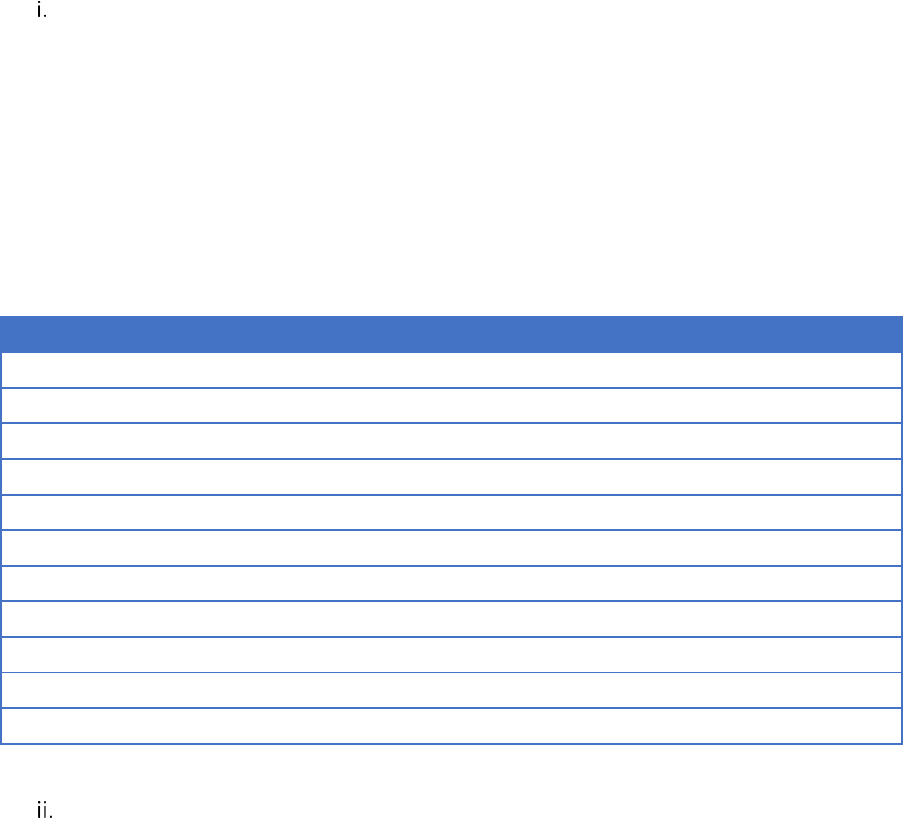

Figure 16 - Malta projections of energy intensity compared to those from PRIMES 2007 database .. 47

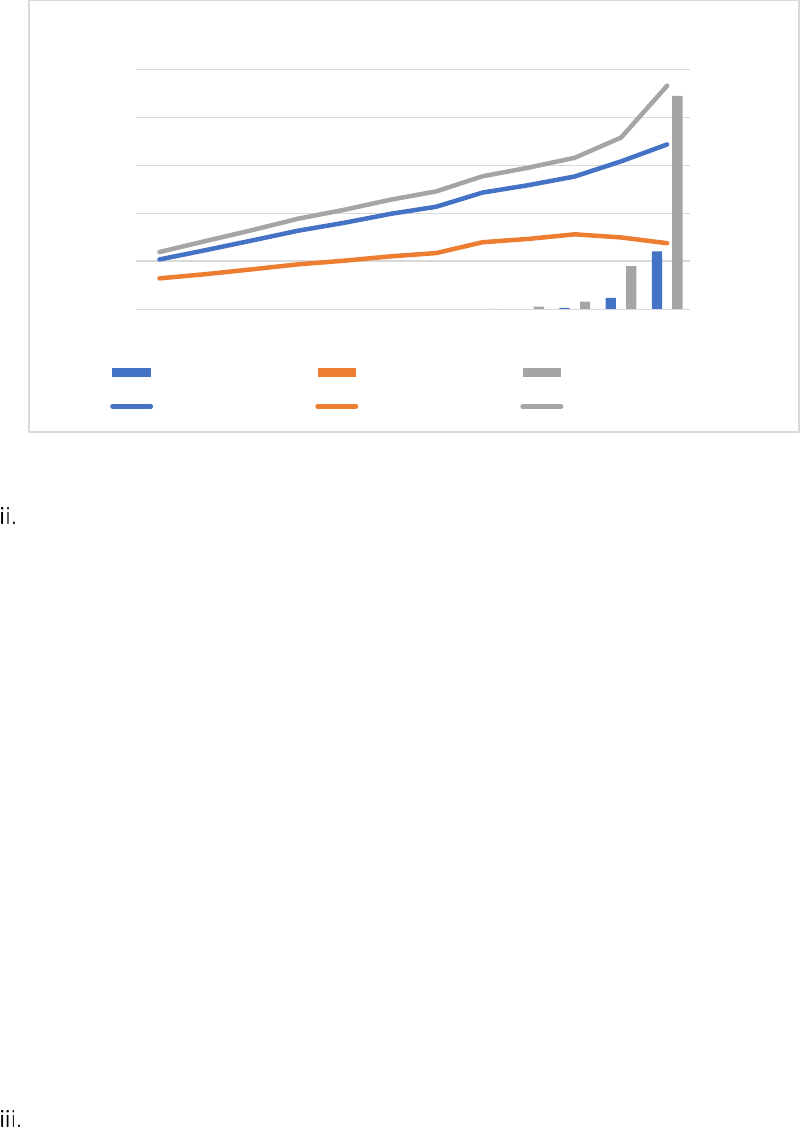

Figure 17 - Projected primary and final energy consumption levels in absolute terms, ktoe. ............. 48

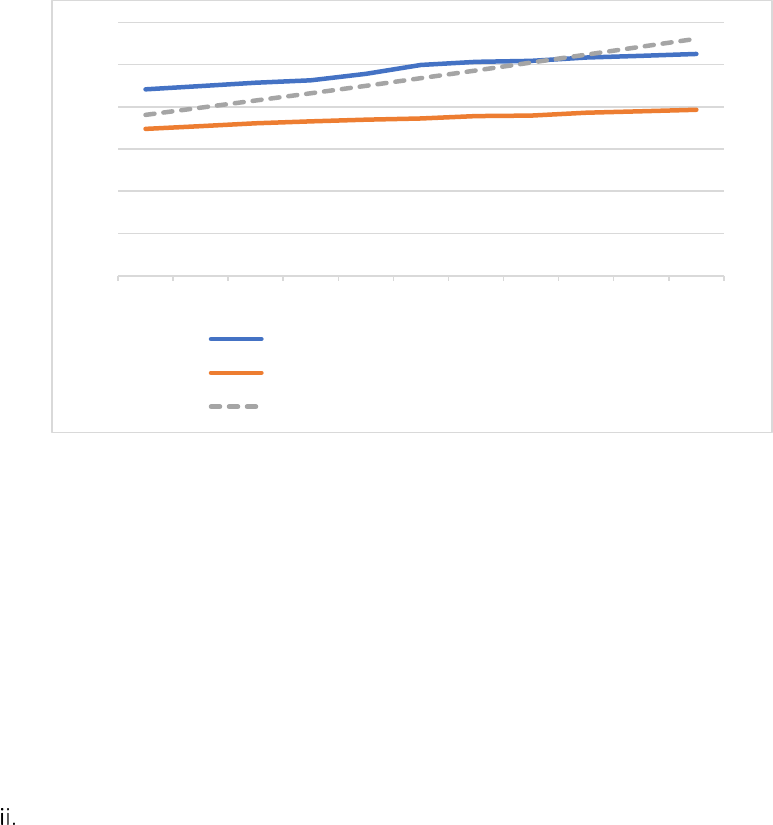

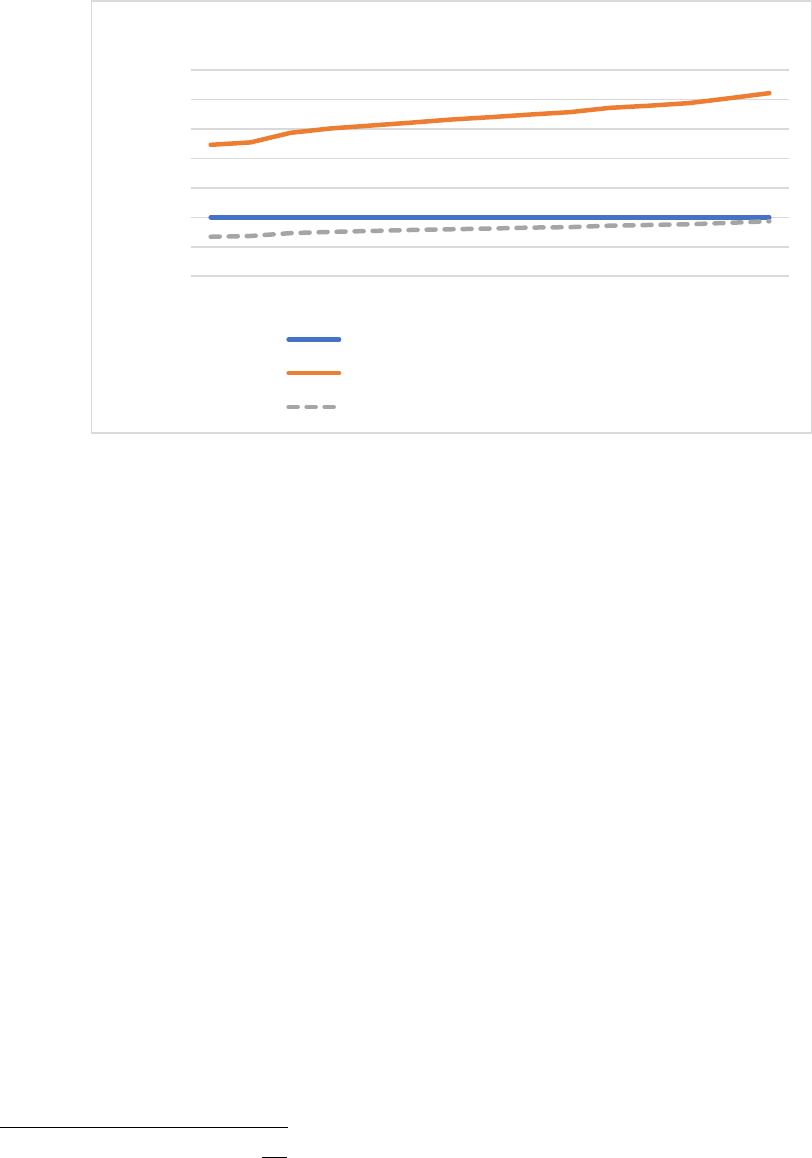

Figure 18 - Electricity interconnectivity level under WPM scenario ..................................................... 53

Figure 19 - Nominal transmission capacity of interconnector vs 30% of peak load (WPM), 2018-2040

.............................................................................................................................................................. 54

Figure 20 - Nominal transmission capacity of interconnector and installed RES generation capacity,

2018-2030 ............................................................................................................................................. 55

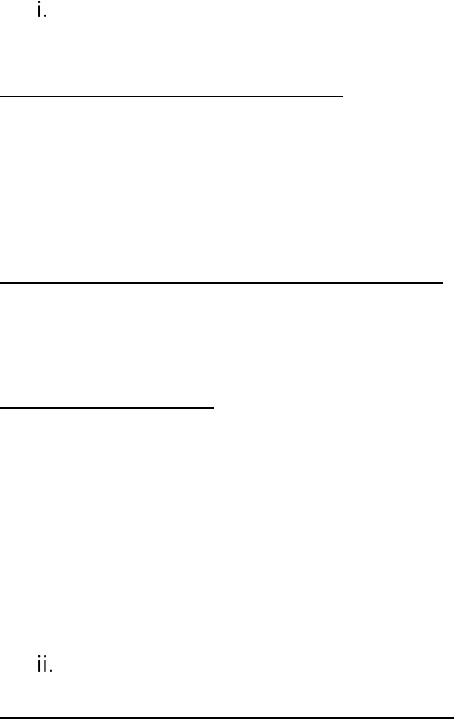

Figure 21 – Solar PV generation during a typical day in April with intermittent cloud cover (MW) .... 55

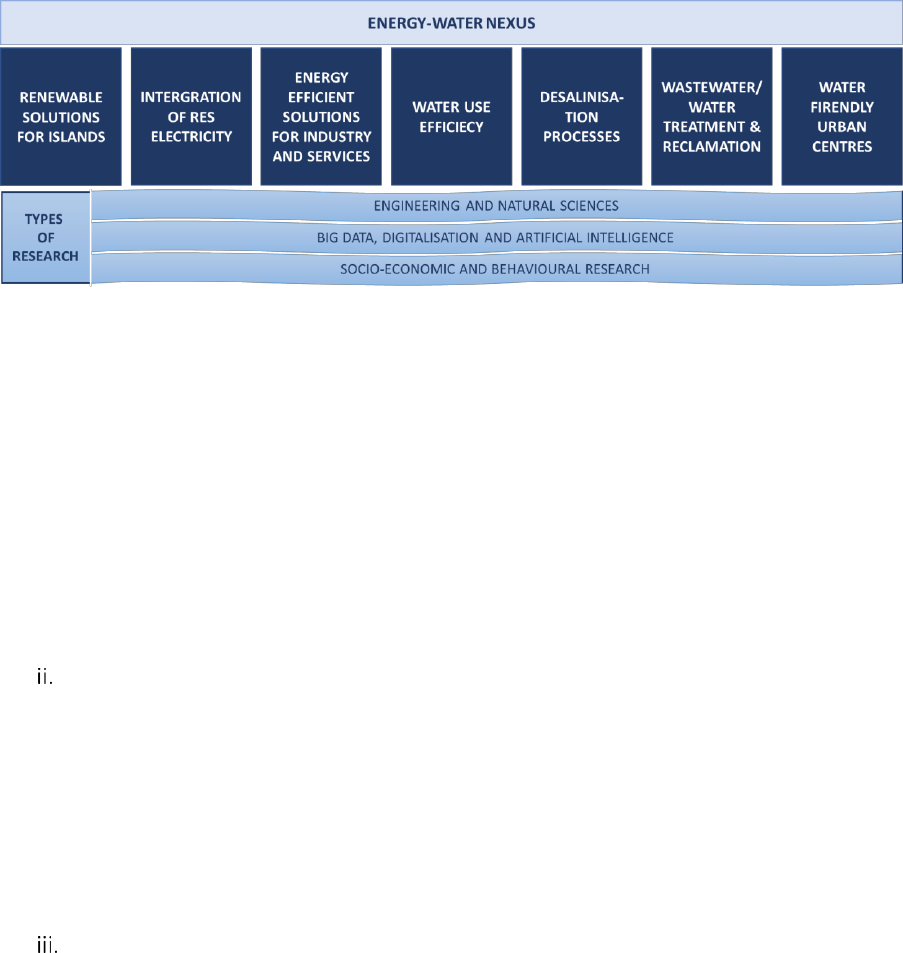

Figure 22 - Priority areas for R&I activities defined in the Draft National Strategy for Research and

Innovation in Energy and Water (2021-2030), subject to amendments following the upcoming public

consultation process. ............................................................................................................................ 60

Figure 23 - Electricity production in 2017 from PV systems on full vs partial export by sector (residential

(RSD) vs. non-residential (Non-RSD)), % ............................................................................................... 71

Figure 24 - Production from PV systems on full or partial export under WPM scenario, 2018-2030, %

.............................................................................................................................................................. 72

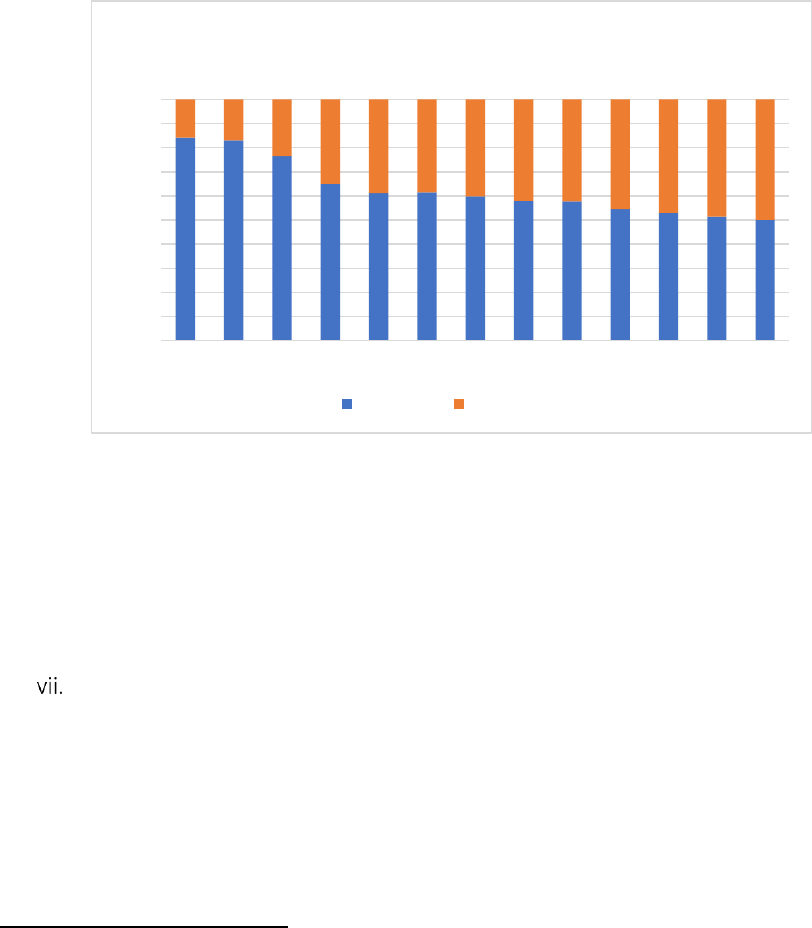

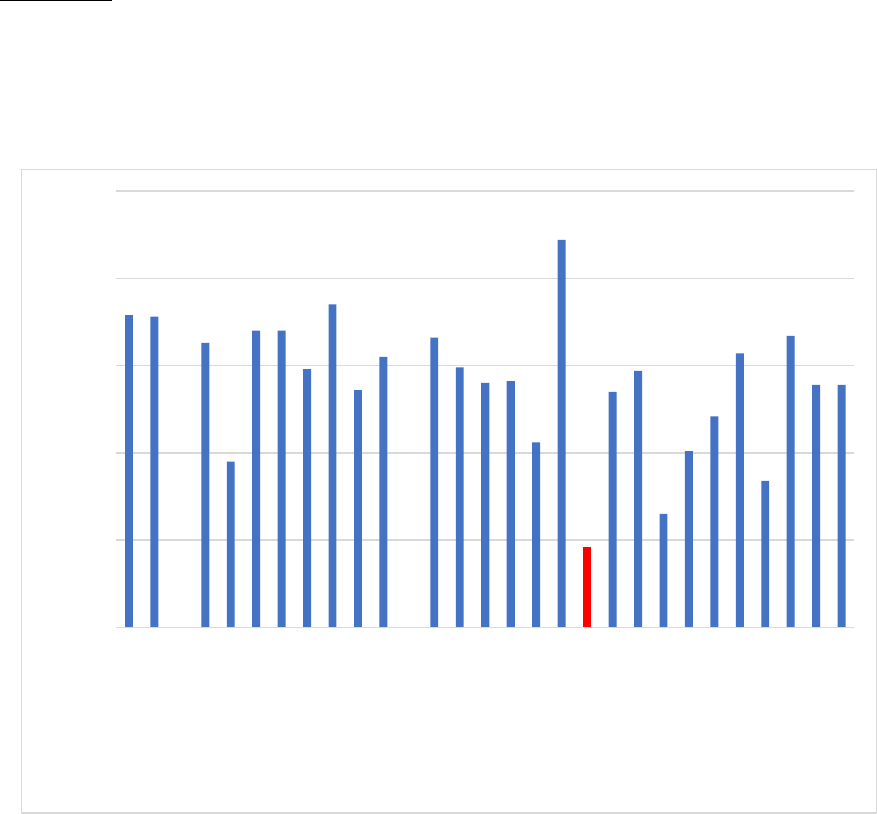

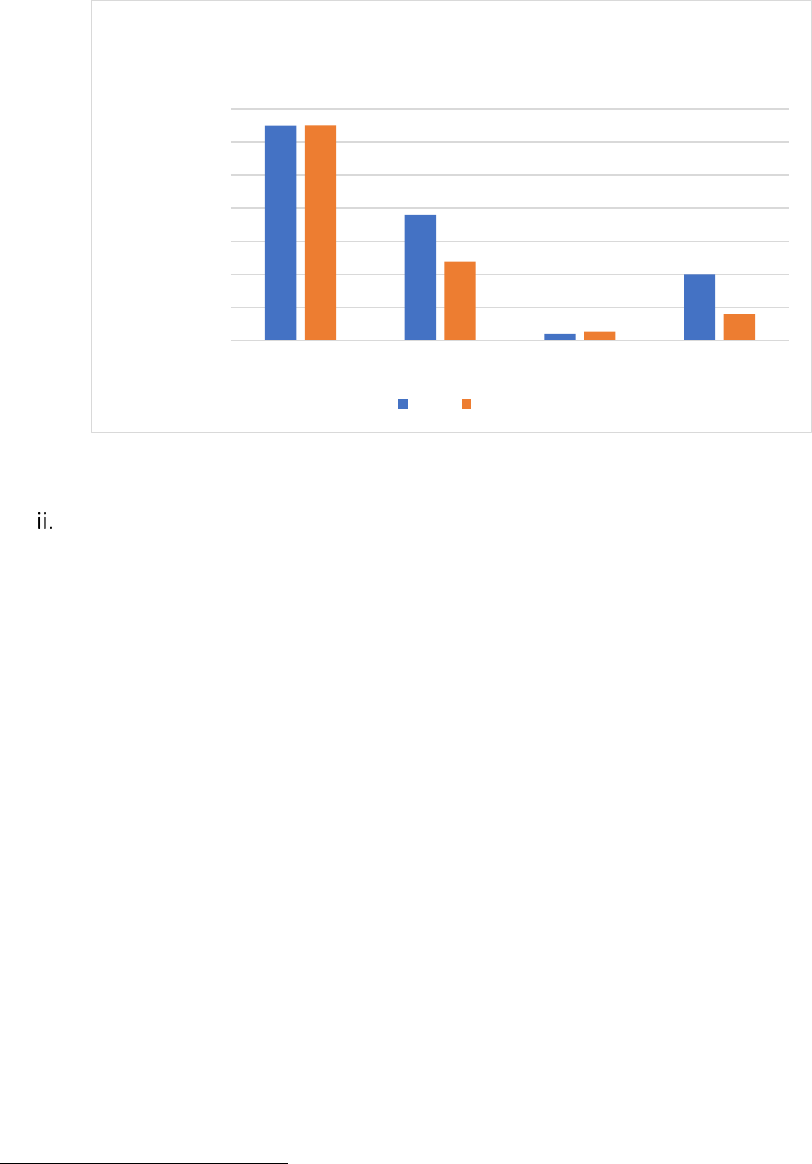

Figure 25 - Final energy consumption per capita in 2017, GJ/capita (Source: Eurostat) ..................... 78

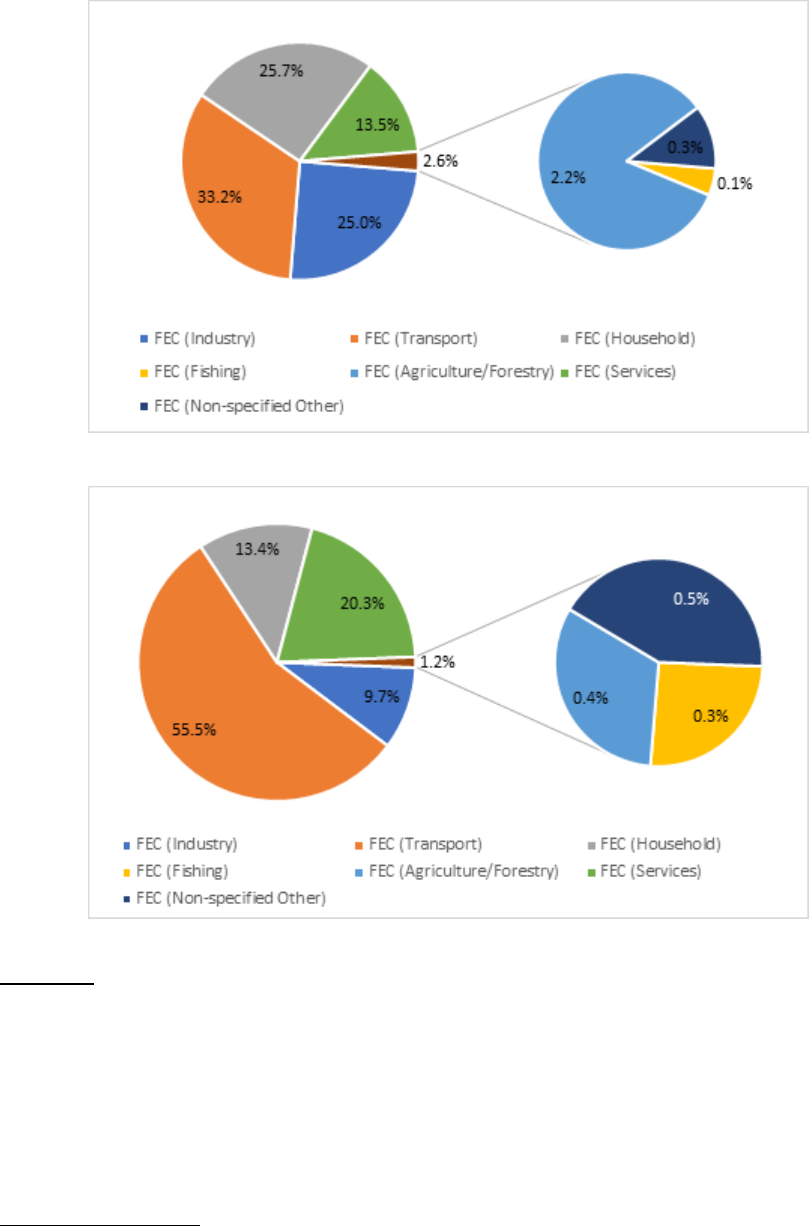

Figure 26 - Final energy consumption by sector in the EU in 2016, % (Source: Eurostat) ................... 79

Figure 27 - Final energy consumption in Malta by sector in 2016, % ................................................... 79

Figure 28 - Average consumption per dwelling (adjusted to EU climate) in 2016, toe/dw (Source:

Odyssee-Mure)...................................................................................................................................... 80

Figure 29 - Percentage of households unable to keep their home adequately warm in Malta compared

to EU average, % (Source: Eurostat) ................................................................................................... 106

Figure 30 - GVA distribution in 2017, %. ............................................................................................. 112

Figure 31 - Projected demographic trends. ........................................................................................ 113

Figure 32 The projected vehicle fleet profile by type of vehicle (fuel source not indicated), stock. . 114

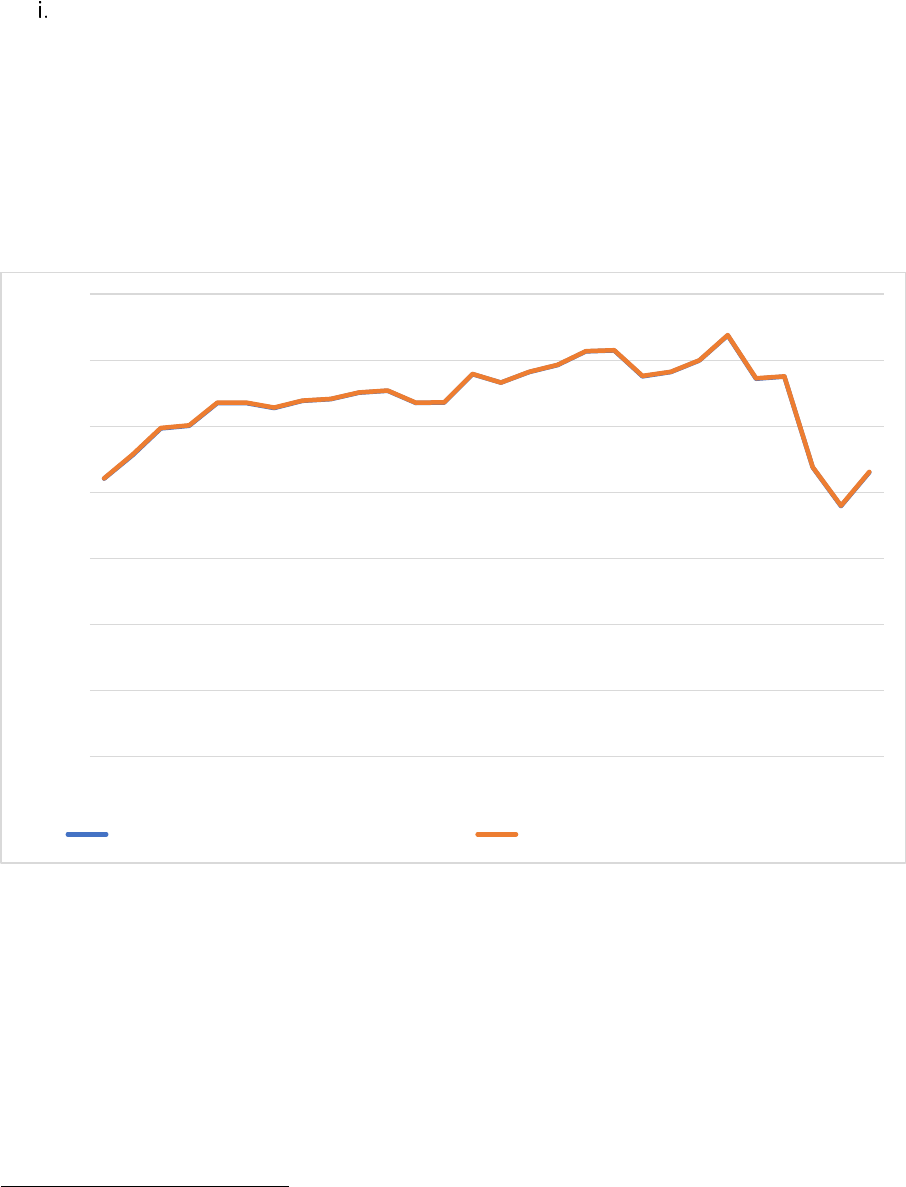

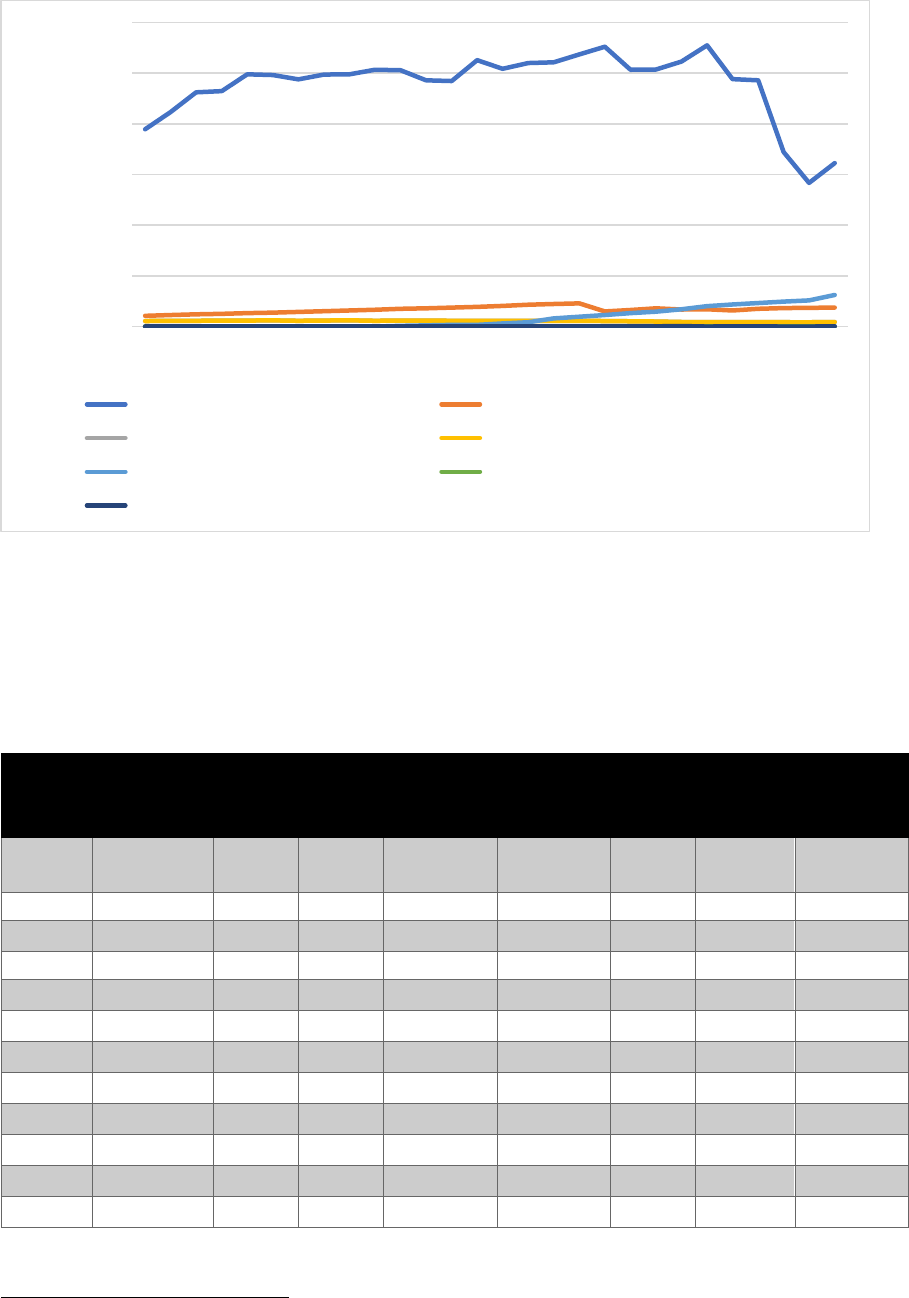

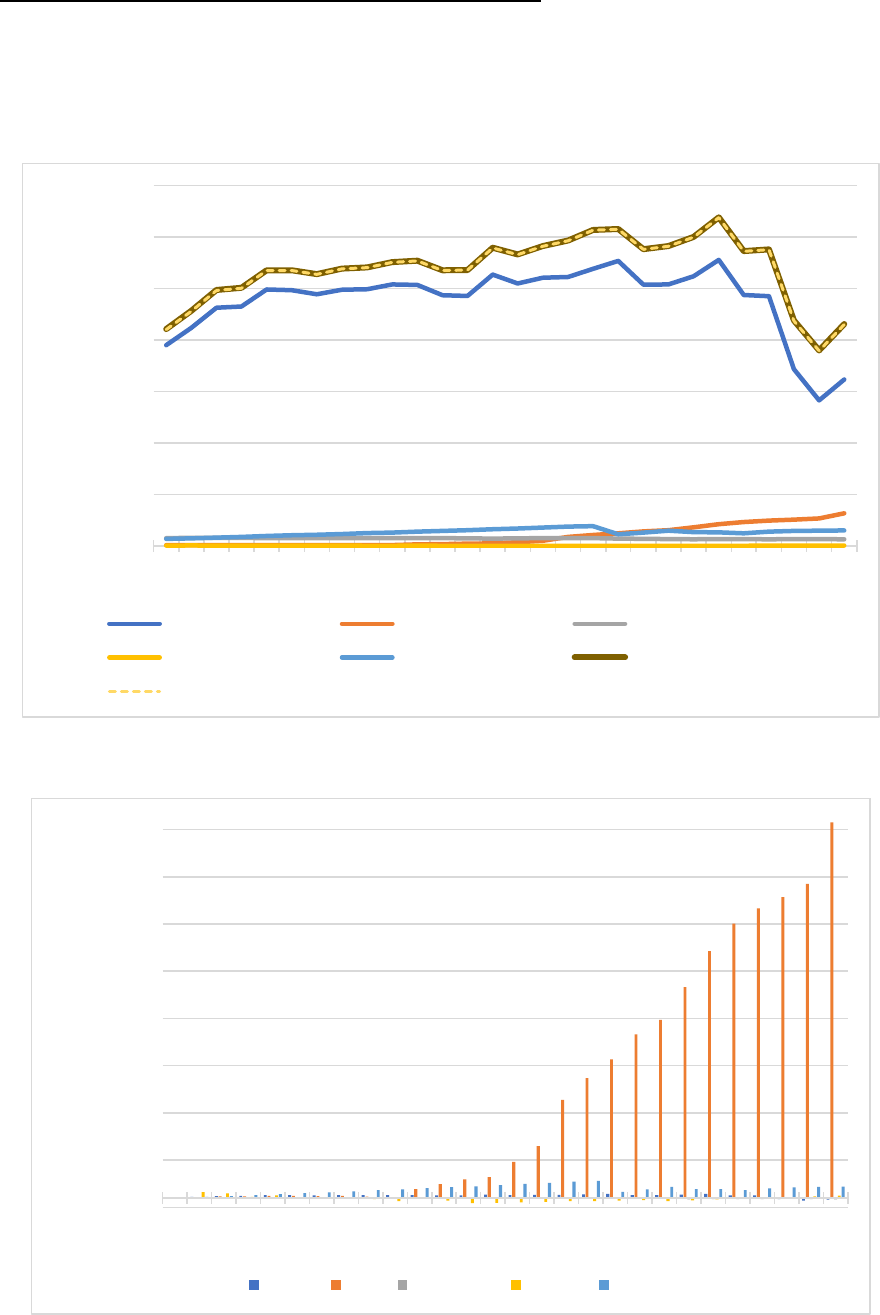

Figure 33 - Total GHG emission trends, 1990-2017 ............................................................................ 120

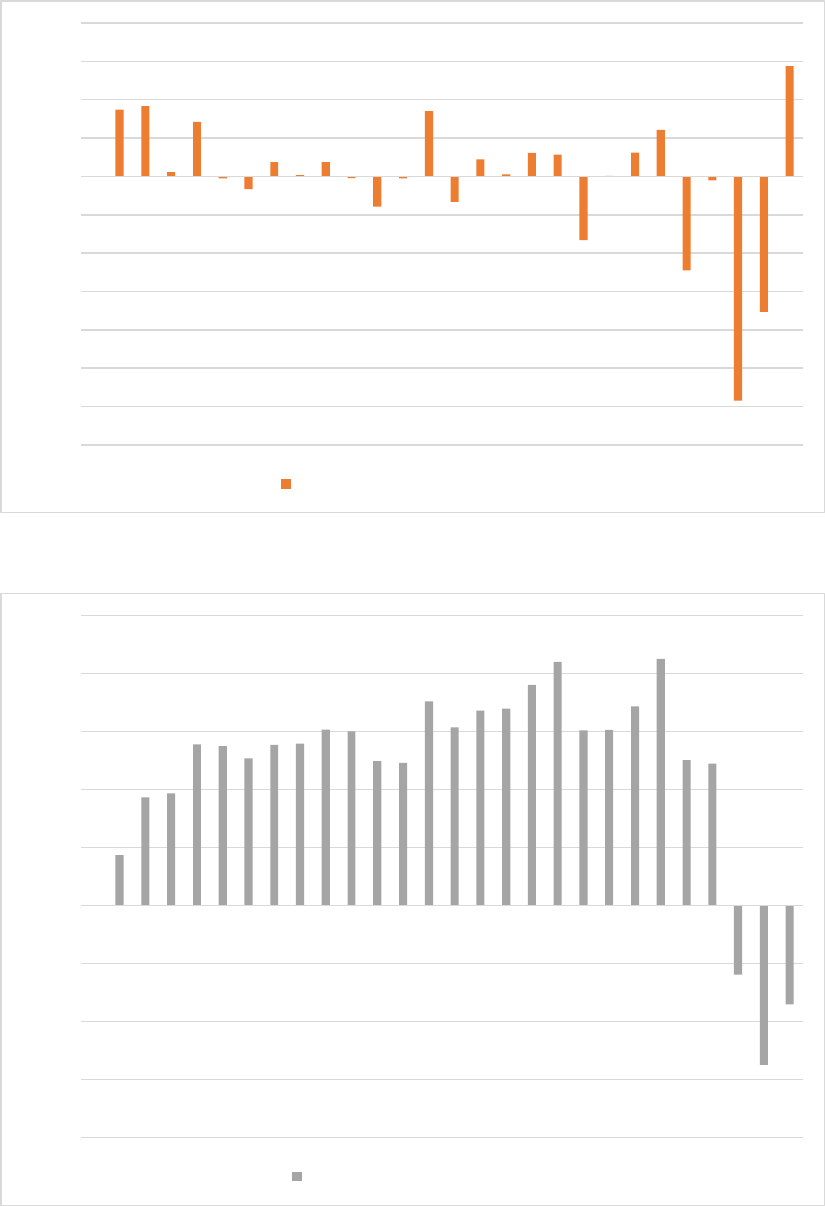

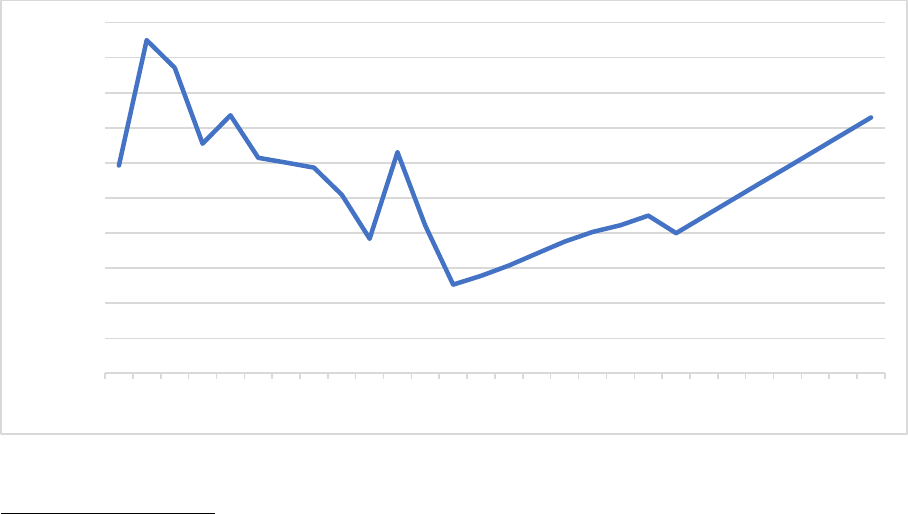

Figure 34 - Annual percentage change in total emissions year-to-year ............................................. 121

Figure 35 – Annual percentage change of total emissions compared to base year (1990) ............... 122

Figure 36 – Trend in emissions per capita compared to population growth trend ............................ 123

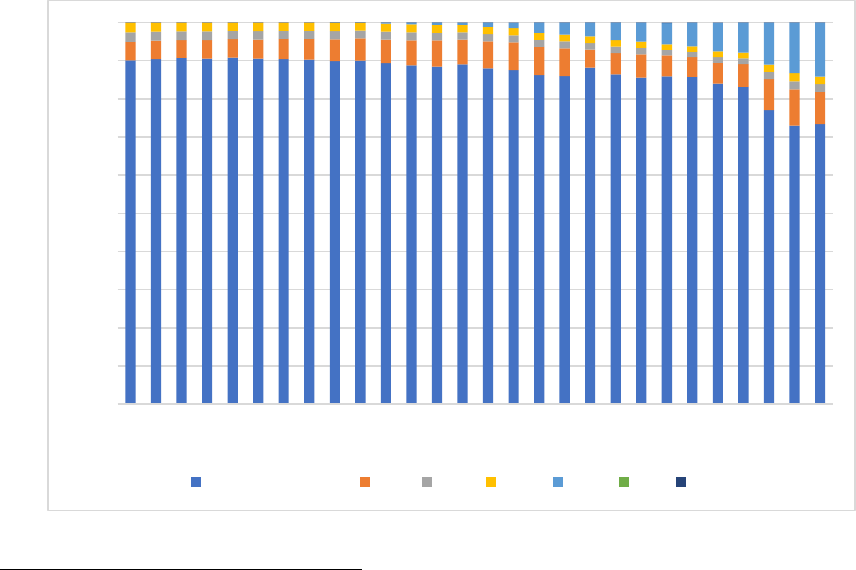

Figure 37 - Greenhouse gas emission trends by gas, 1990 – 2017 ..................................................... 124

Figure 38 - Percentage share by gas of total GHG emissions ............................................................. 125

Figure 39 - CO

2

emission trends by sector .......................................................................................... 126

Figure 40 - Share of sector/category in total CO

2

emissions for 2017 ................................................ 126

Figure 41 - CH

4

emission trend by sector ............................................................................................ 127

Figure 42 - Share of sector in total national CH

4

emissions, 2017 ...................................................... 127

Figure 43 - N

2

O Emission trends by gas, total and by sector .............................................................. 128

Figure 44 - Share of total national N

2

O emissions, 2017 .................................................................... 128

Figure 45 - F-Gases emission trends by gas: HFCs, PFCs, SF, totals by gas ......................................... 129

Figure 46 - Share by sector of total GHG emissions............................................................................ 130

Figure 47 - Annual percentage change compared to 1990, by sector ................................................ 130

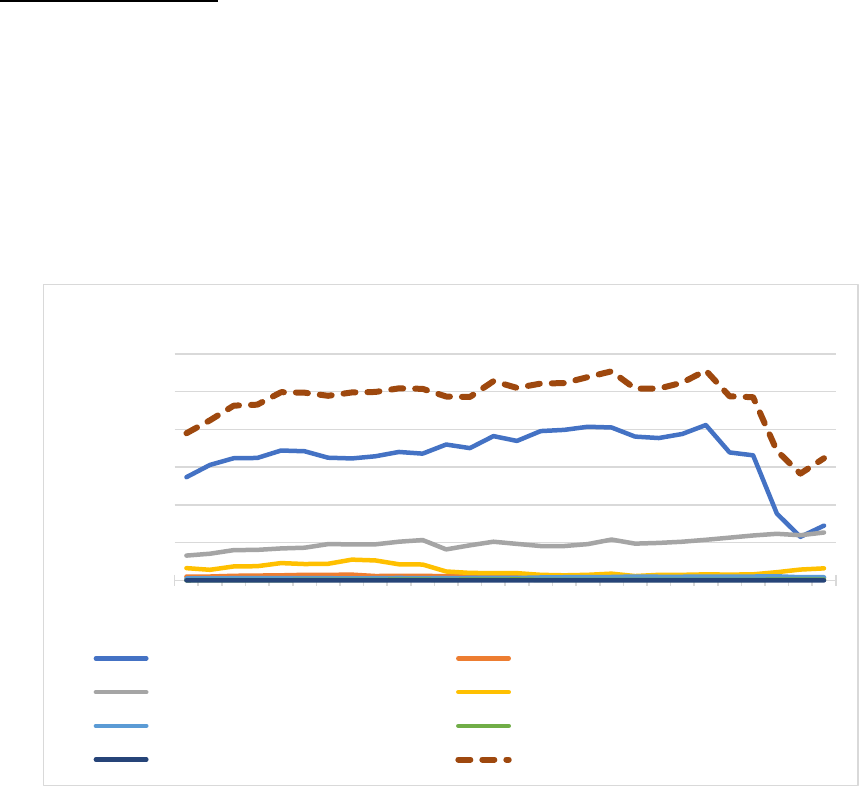

Figure 48 - Emission trends in the energy sector................................................................................ 131

Figure 49 - Annual percentage change in Energy sector emissions year to year ............................... 132

Figure 50 - Annual percentage change in Energy sector emissions compared to base year (1990) .. 132

Figure 51 - Emissions trends by gas within IPPU sector ..................................................................... 133

Figure 52 - Emission trends by gas within Agriculture sector ............................................................. 134

Figure 53 - Share by gas in total Agriculture emissions, 2017 ............................................................ 134

Figure 54 - Emission trends in LULUCF sector ..................................................................................... 135

Figure 55 - Emission trends in Waste sector ....................................................................................... 136

Figure 56 - Total GHG emissions from the energy sectors under WPM and total WEM, kt CO

2

eq. .. 138

Figure 57 - ESR energy ssector emissions under WPM scenario and total WEM, kt CO

2

eq. ............. 138

Figure 58 - Stock emissions in IPPU .................................................................................................... 139

Figure 59 - Agriculture GHG emission projections, WEM and WPM .................................................. 140

Figure 60 - Net LULUCF emission totals .............................................................................................. 141

Figure 61 - Landfilling profile projections, by scenario ....................................................................... 142

Figure 62 – Thermal treatment profile projections ............................................................................ 143

Figure 63 - Biological treatment, by scenario ..................................................................................... 143

Figure 64 - Emissions projections in Waste sector ............................................................................. 144

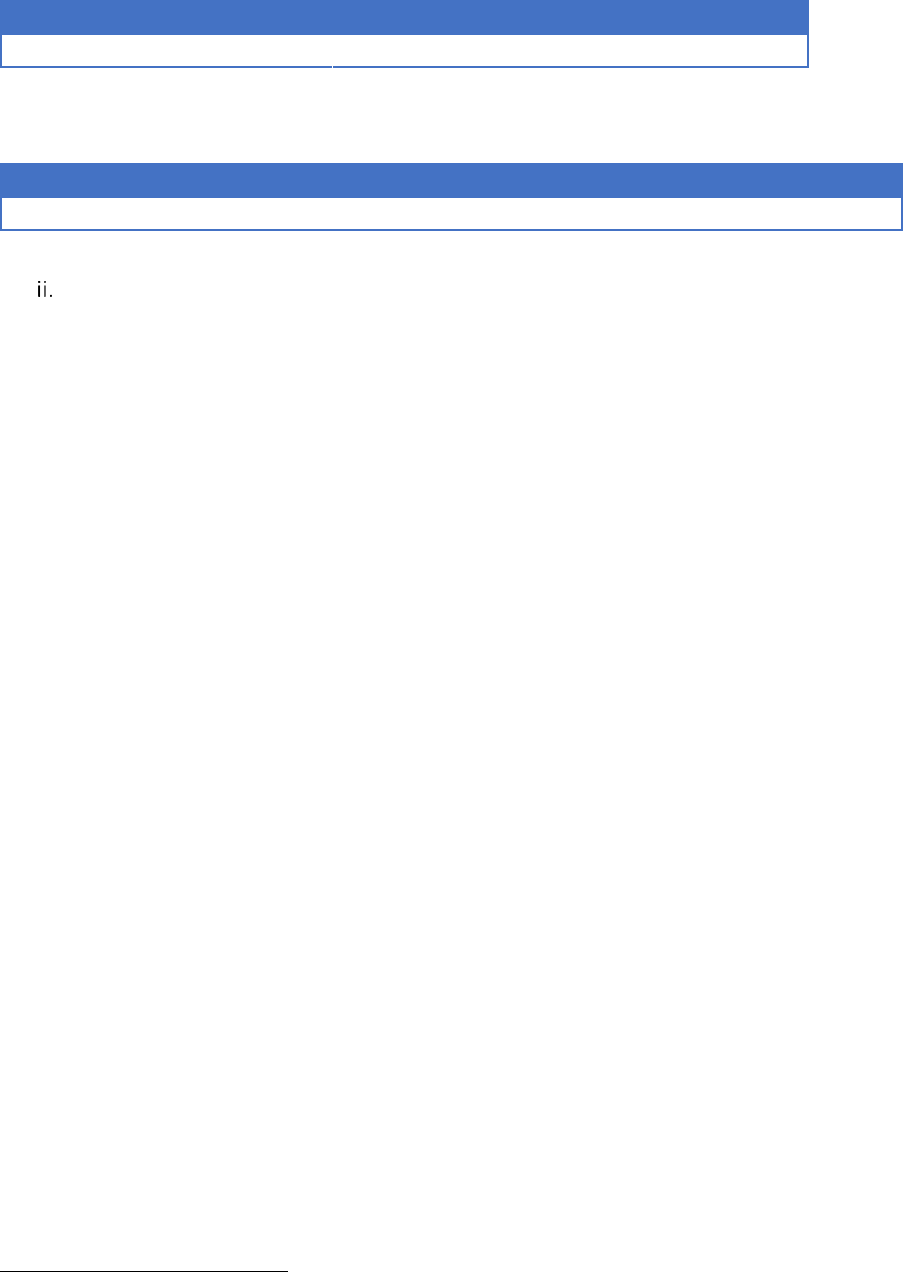

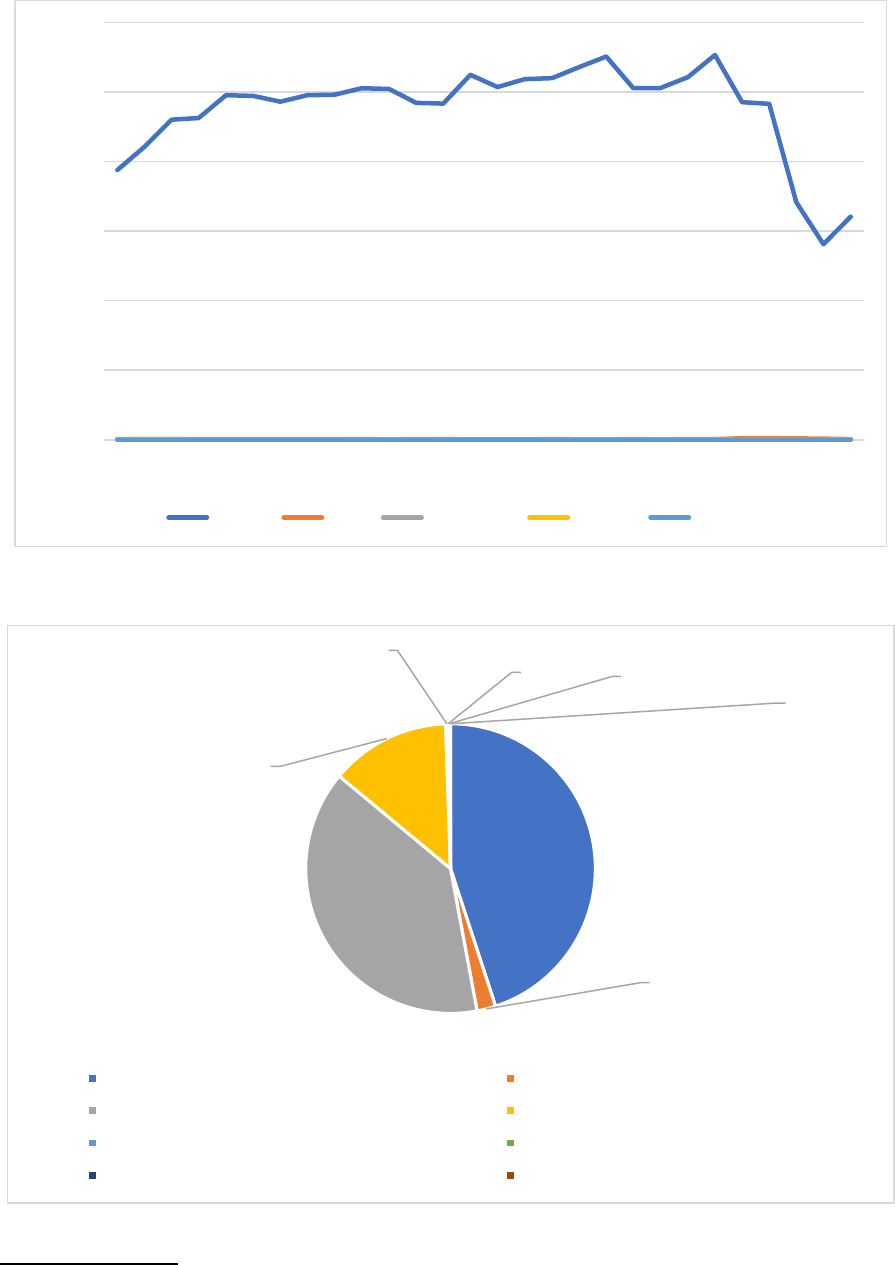

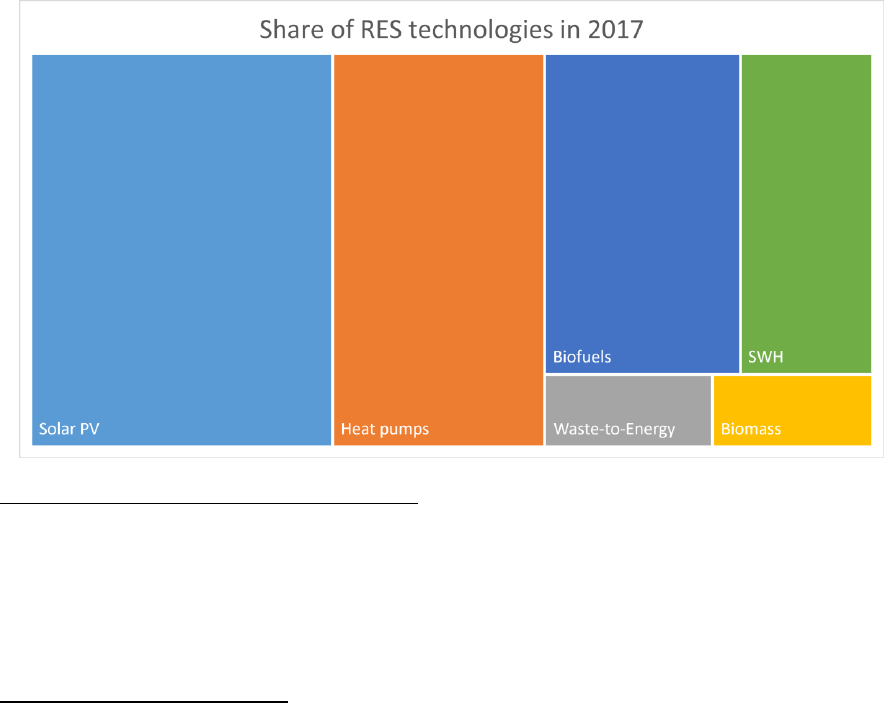

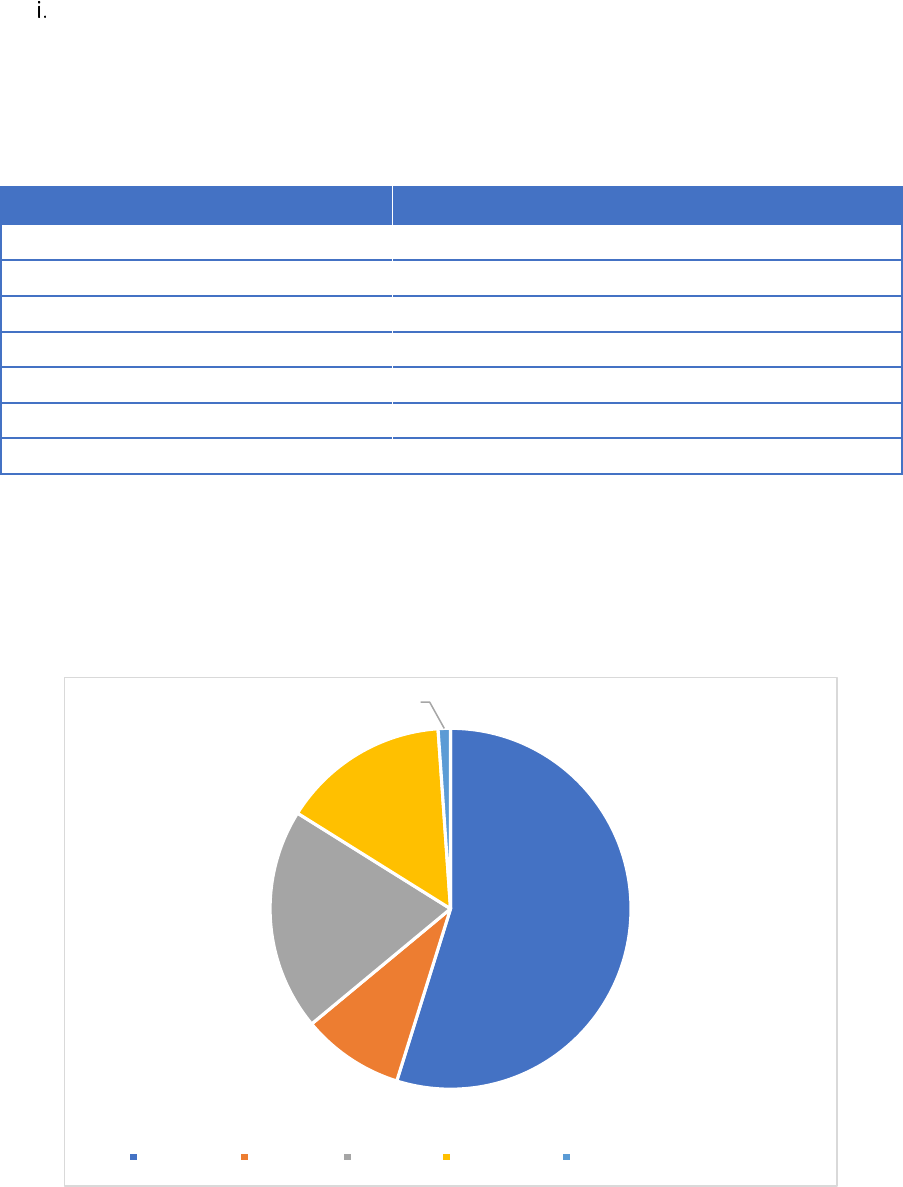

Figure 65 - Share of RES technologies in consumption in 2017 .......................................................... 145

Figure 66 - Renewable energy consumption in H&C, 2010-2017, GWh ............................................. 146

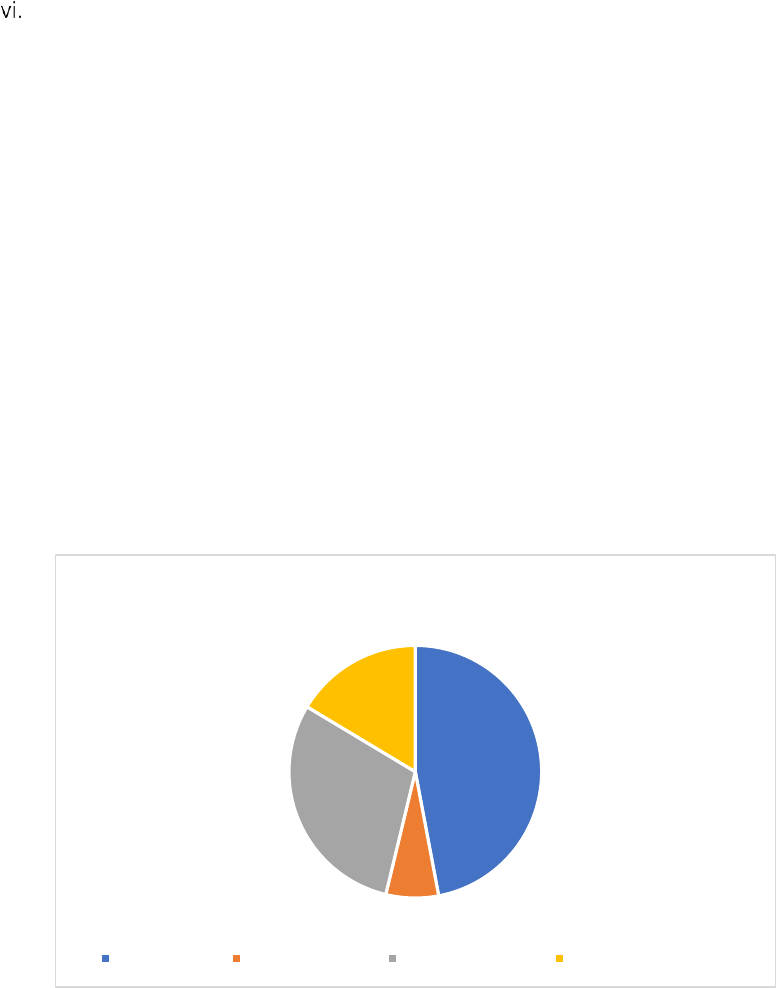

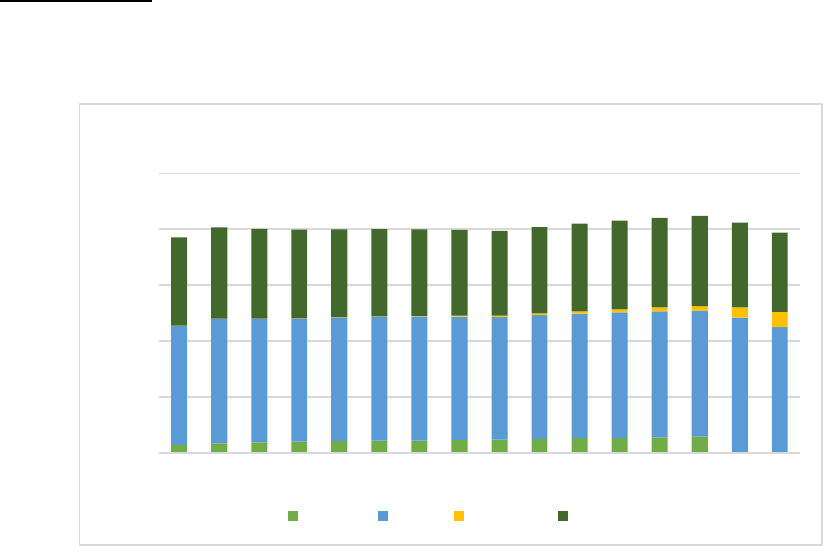

Figure 67 - Renewable energy consumption in the electricity sector between 2010-2017, GWh ..... 147

Figure 68 - Renewable energy consumption in the transport sector, GWh ....................................... 148

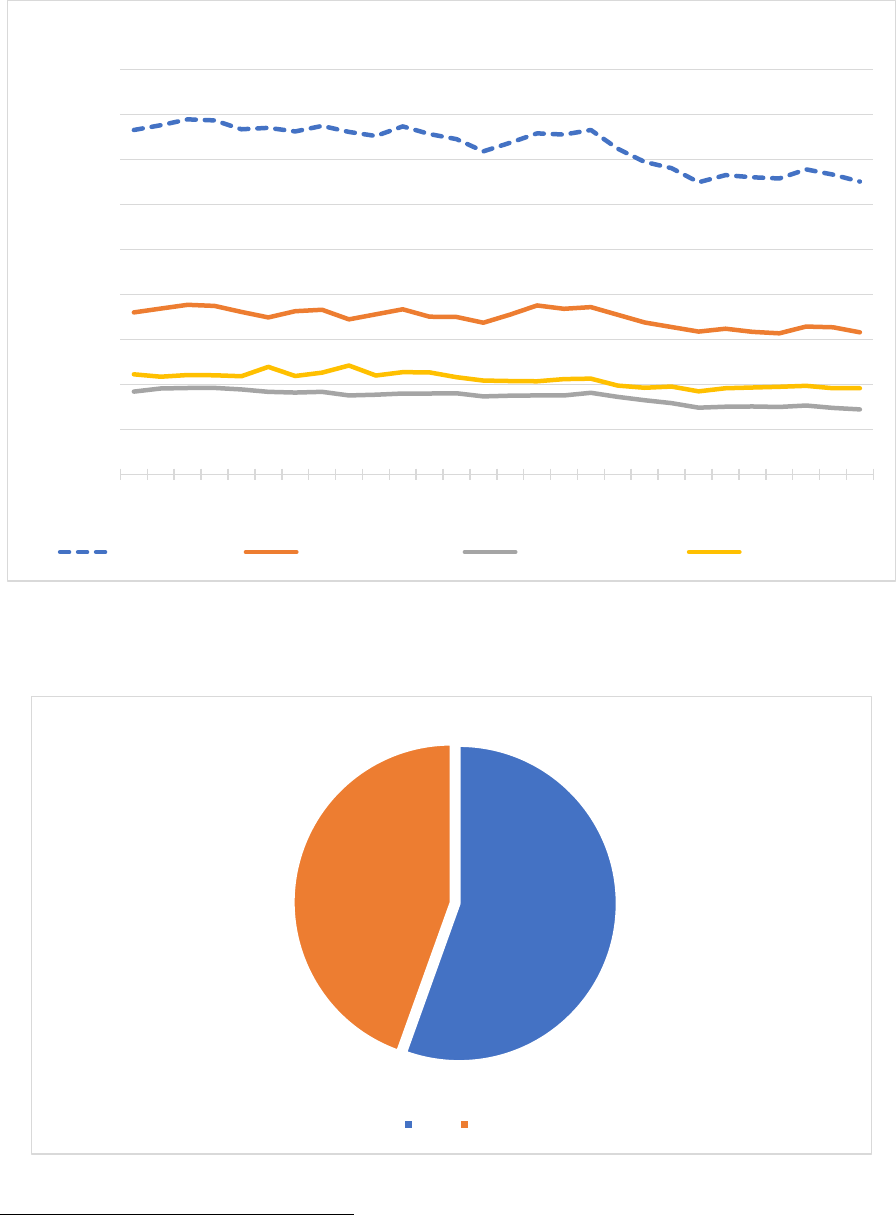

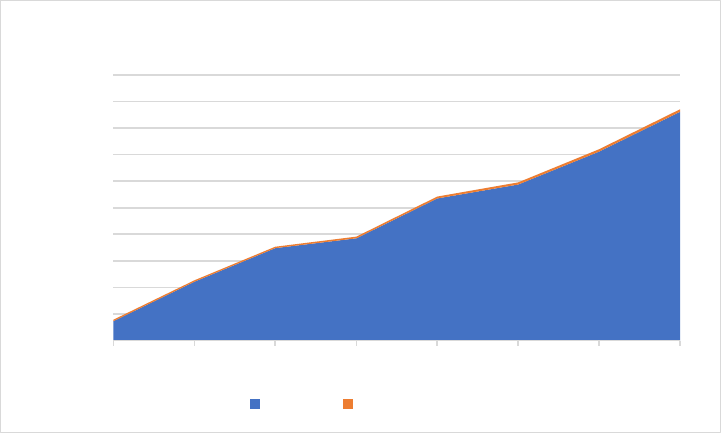

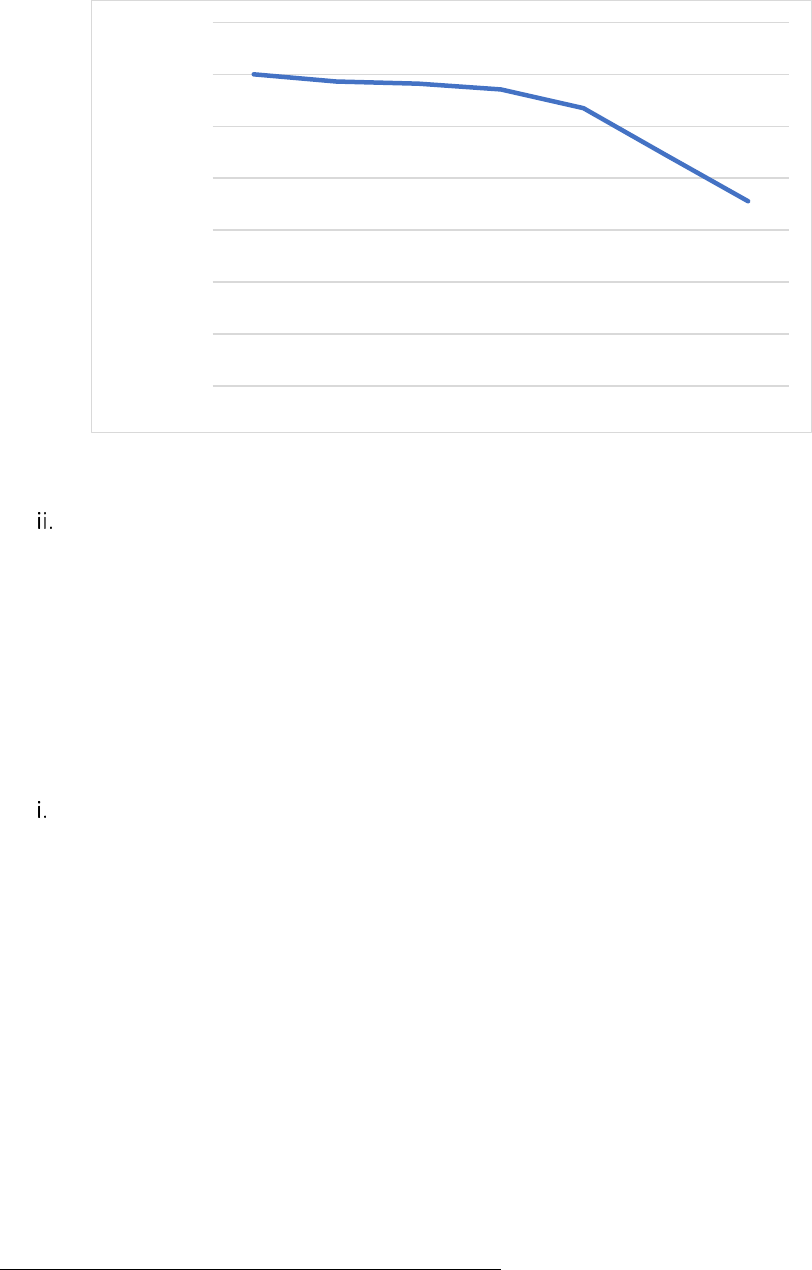

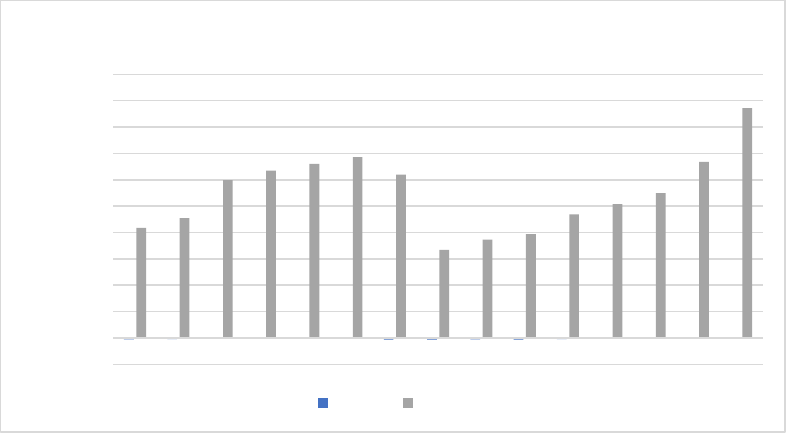

Figure 69 - RES overall share and by sector under the WEM scenario, 2021-2030, % ....................... 149

Figure 70 - Final energy consumption by sector in 2017, % ............................................................... 150

Figure 71 - Projections for energy consumption under the WEM scenario, ktoe (incl. heat pumps) 152

Figure 72 - Estimated energy mix as share in gross inland consumption, including electricity imported

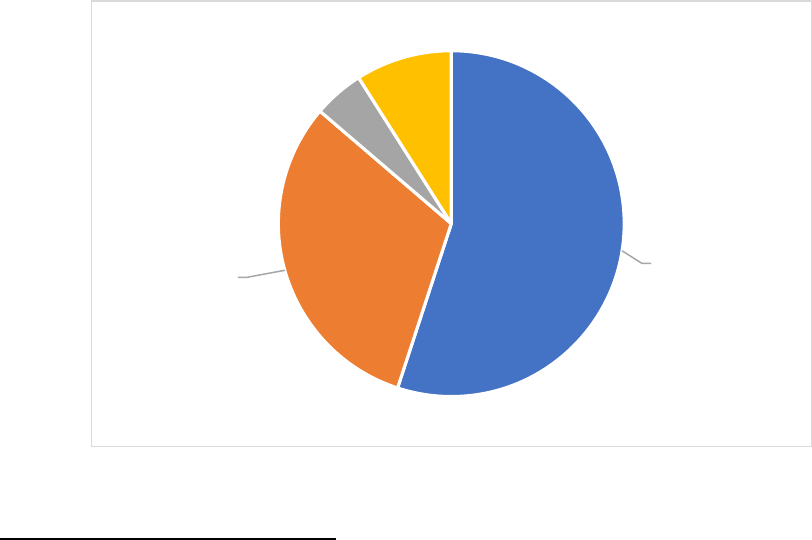

over the interconnector in 2017, %. ................................................................................................... 154

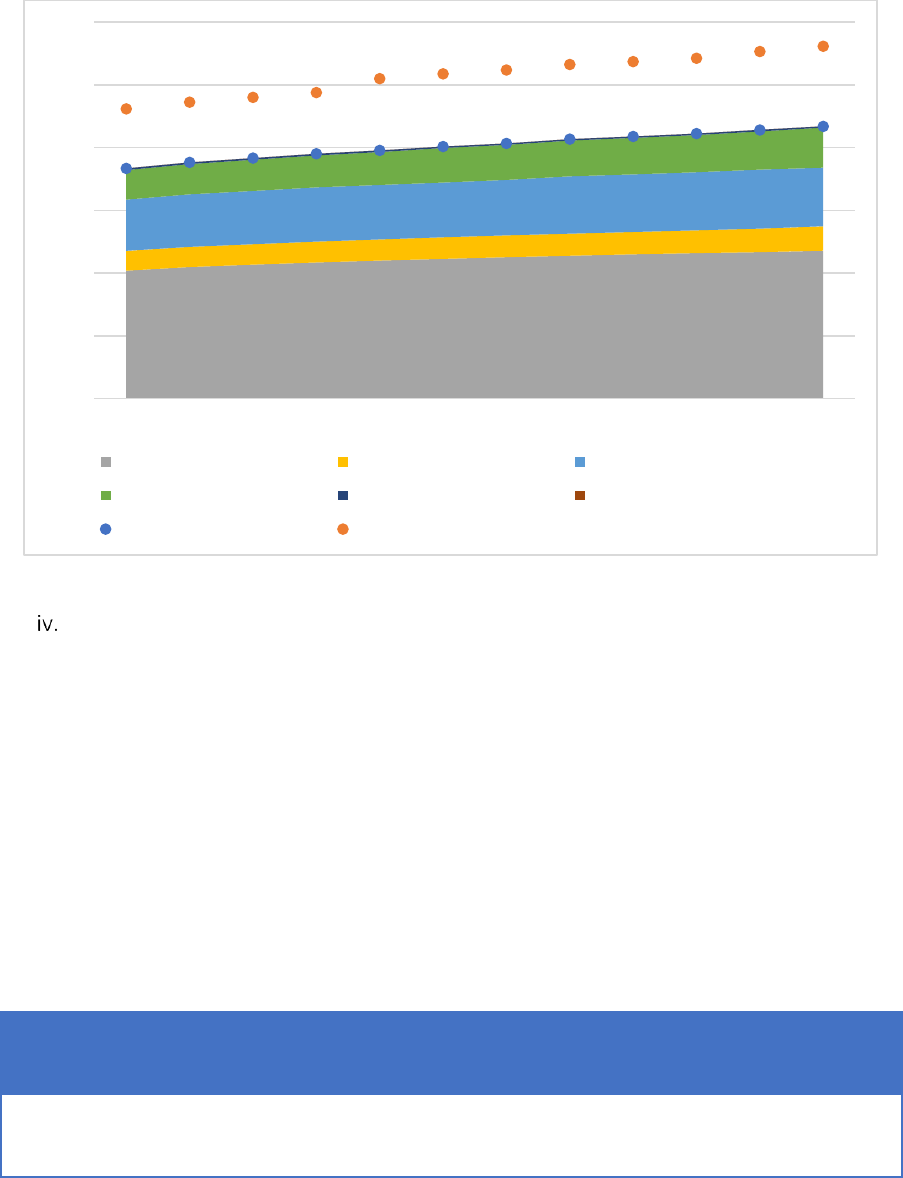

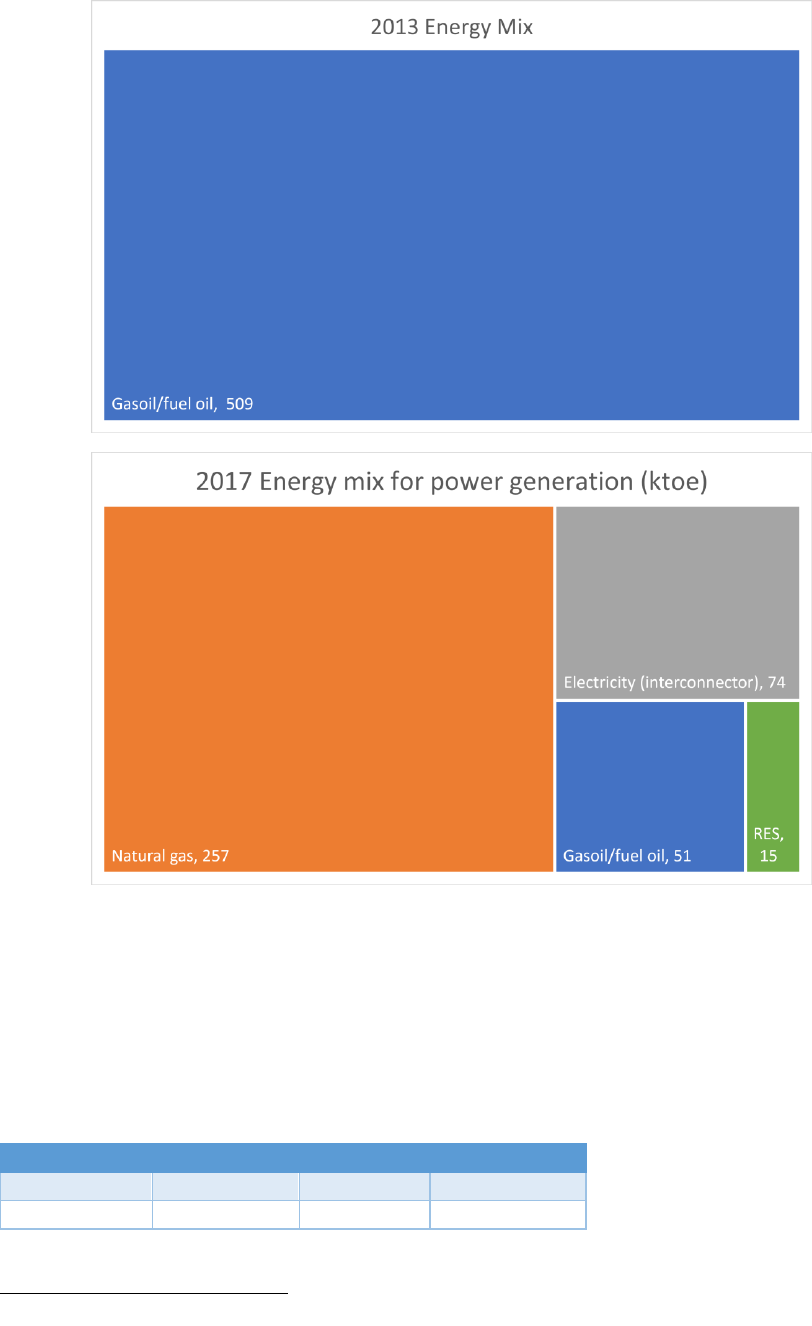

Figure 73 Energy mix for electricity generation between in 2013 and 2017, ktoe............................ 155

Figure 74 - LNG Deliveries by origin, 2017 and 2018 .......................................................................... 156

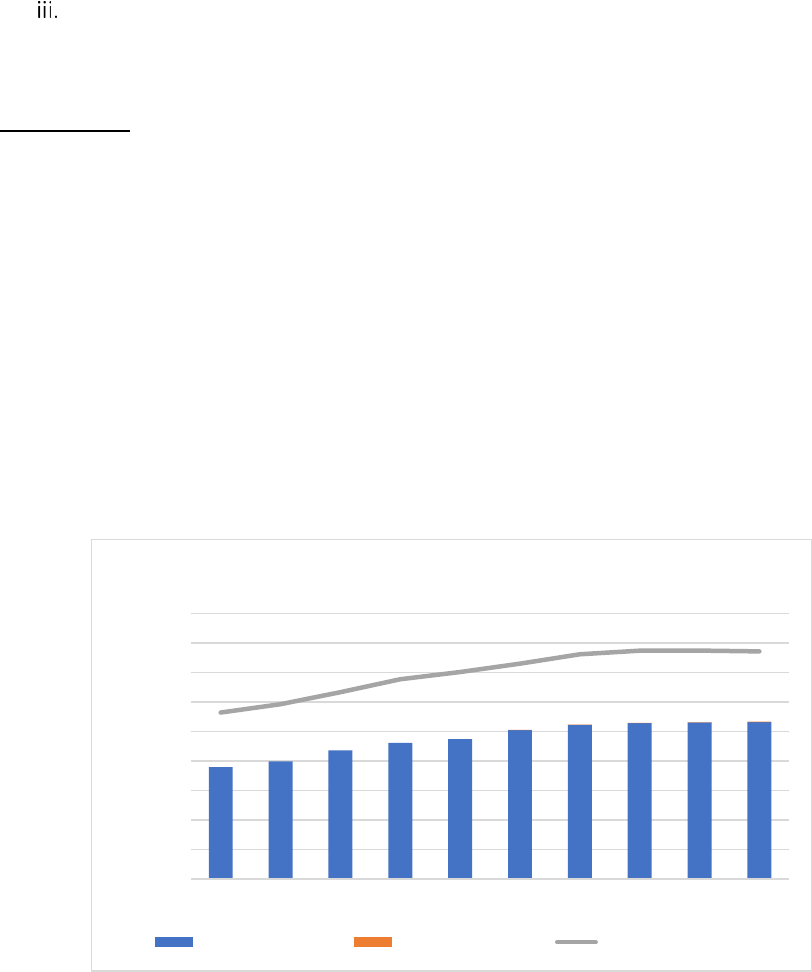

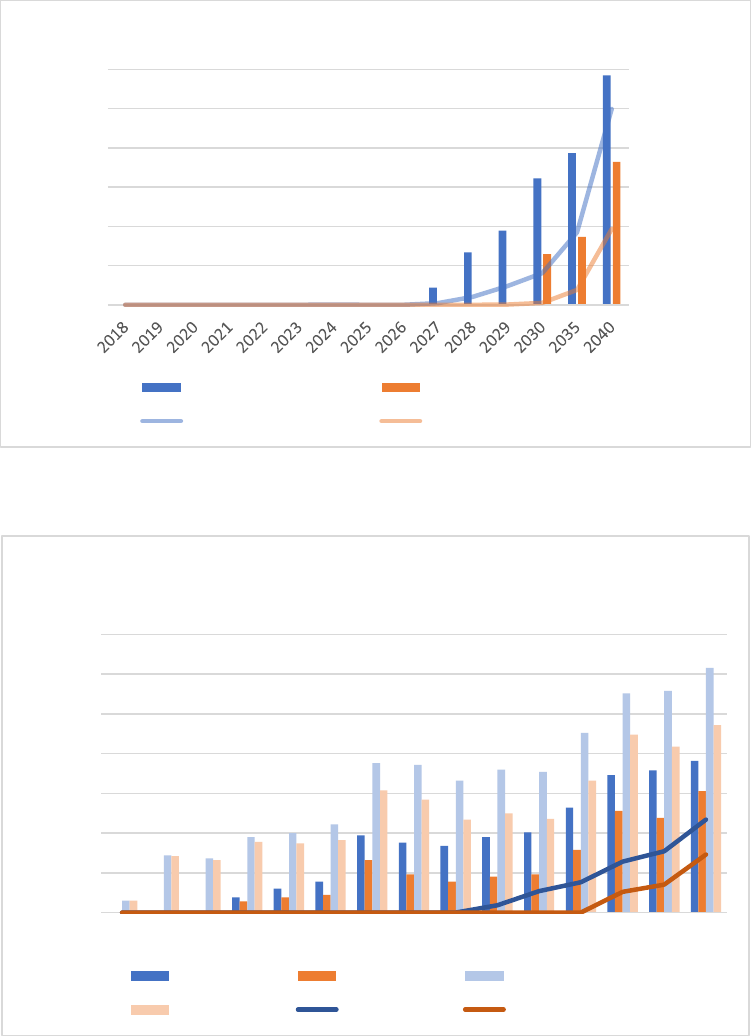

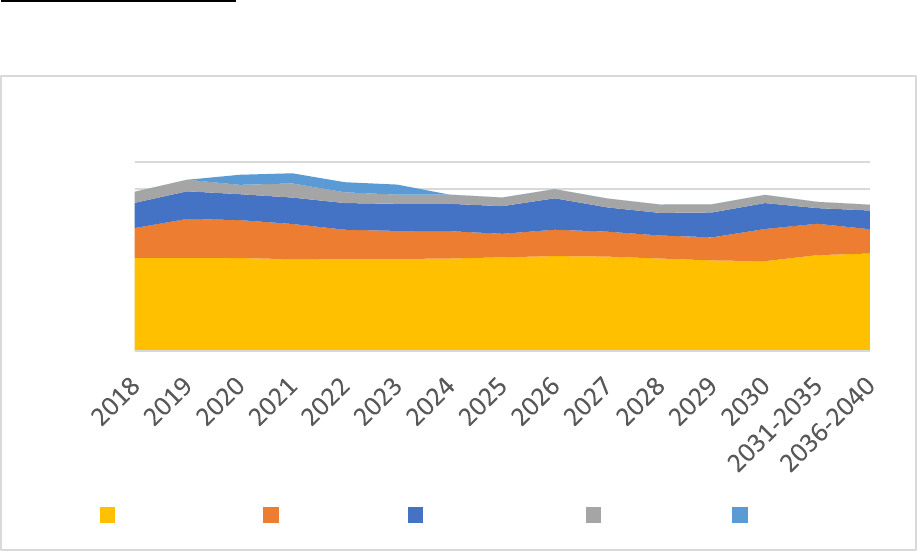

Figure 75 - Electricity generation by source under the WEM scenario, 2018-2040 ........................... 157

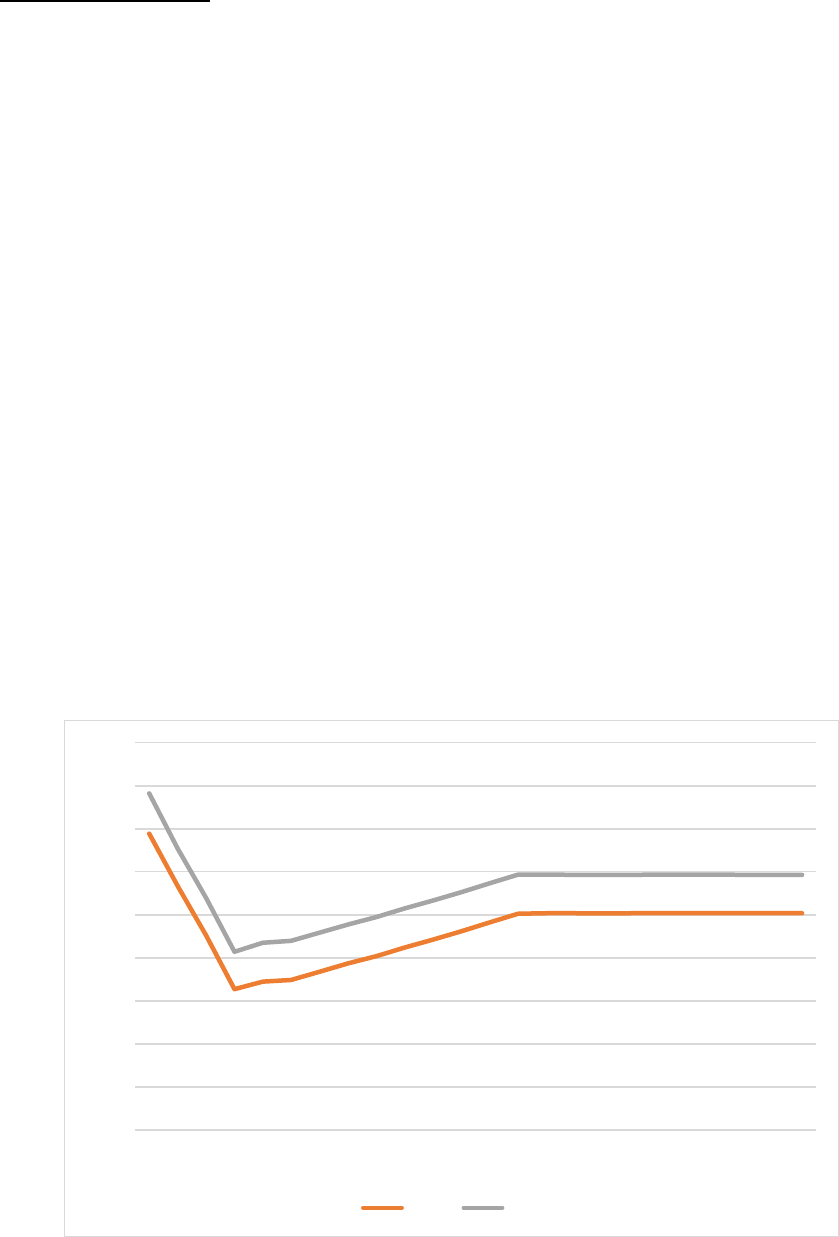

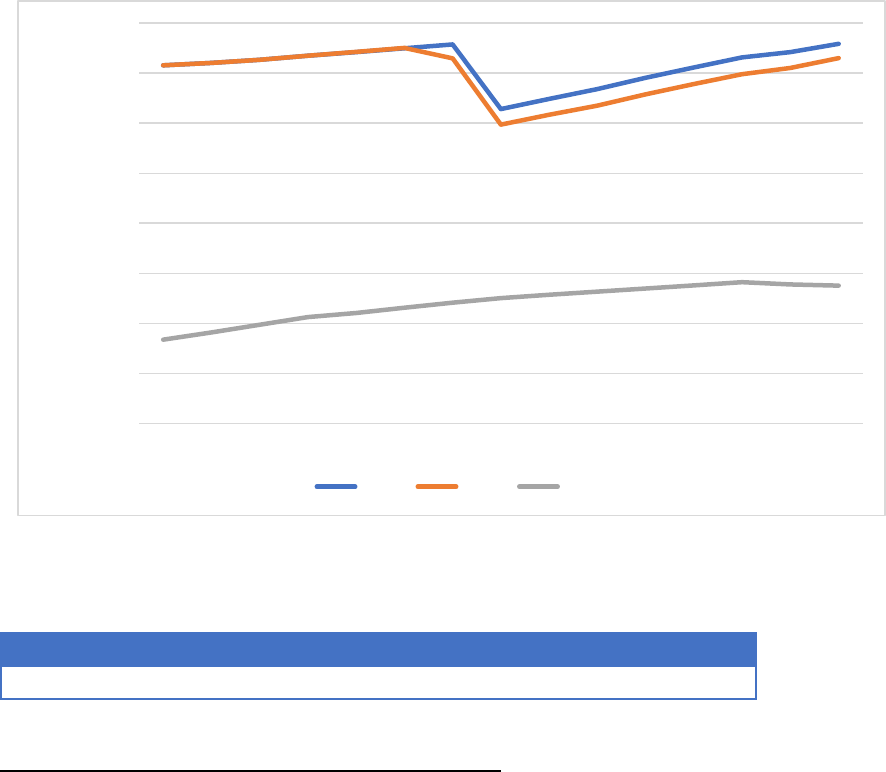

Figure 76 Trends in the proxy for the market price from 2011-2017, EUR (2016)/kWh. .................. 160

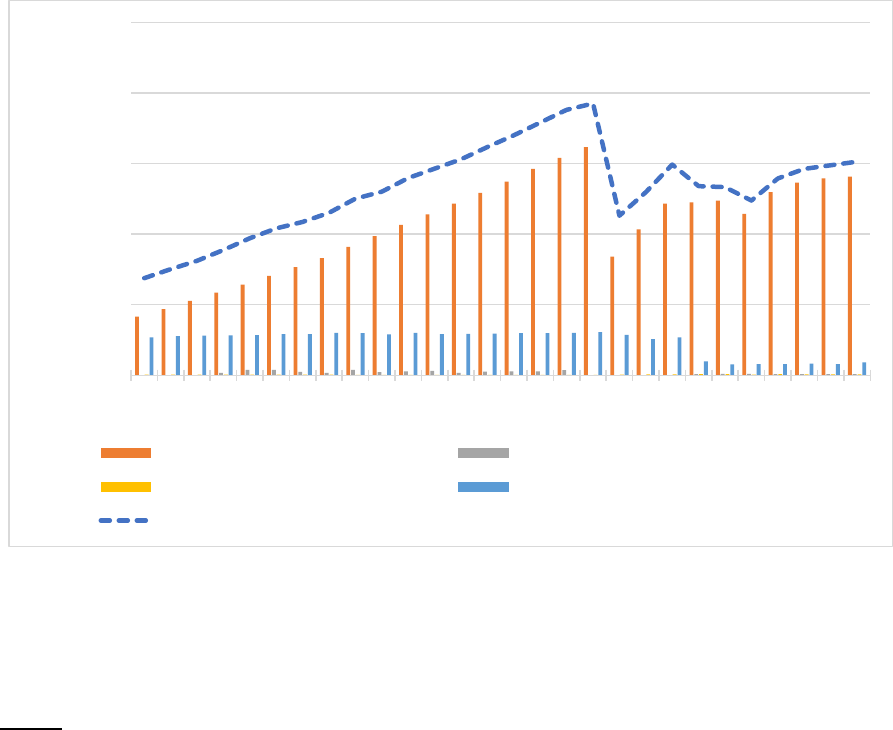

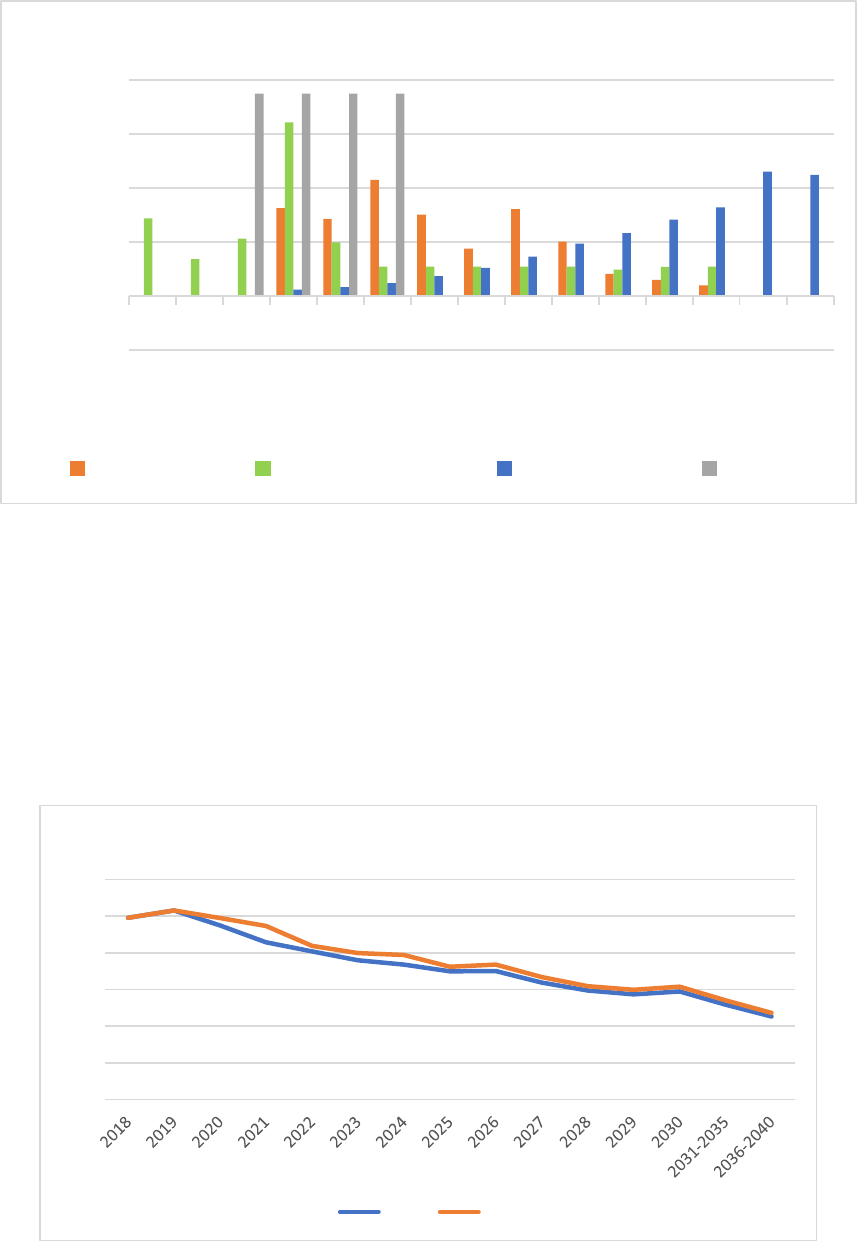

Figure 77 - ESD/ESR projections by sector .......................................................................................... 171

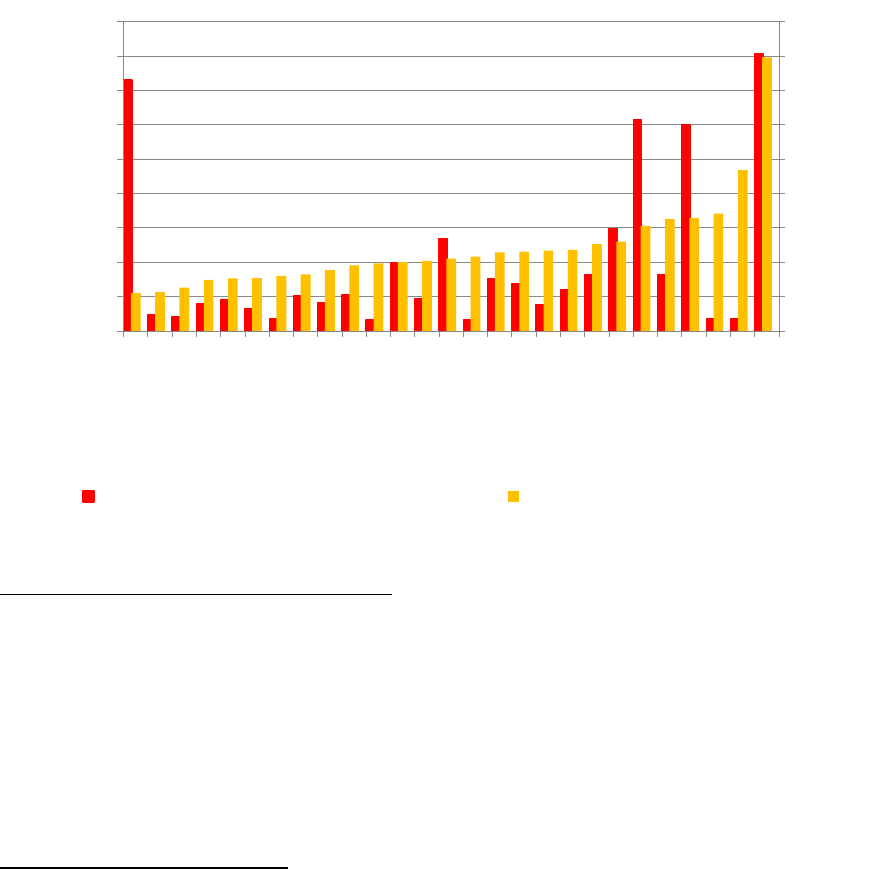

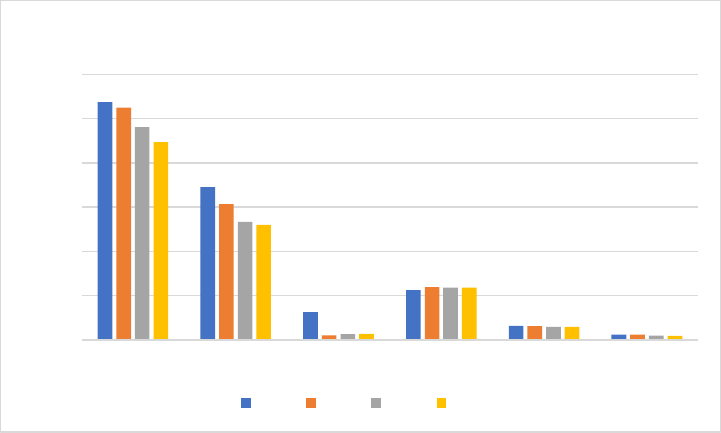

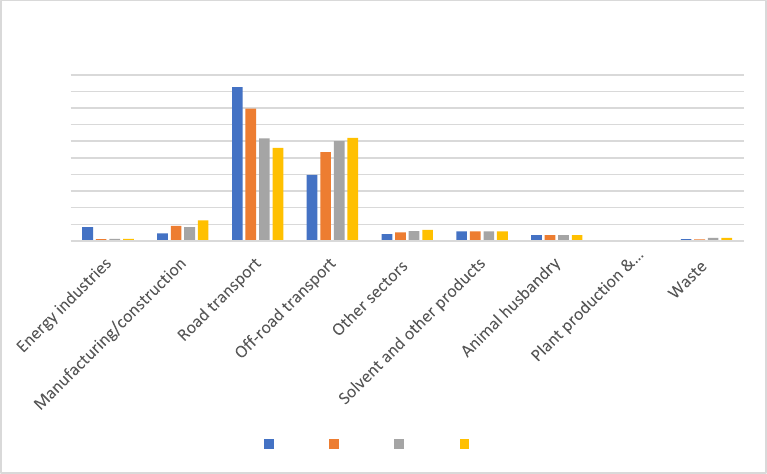

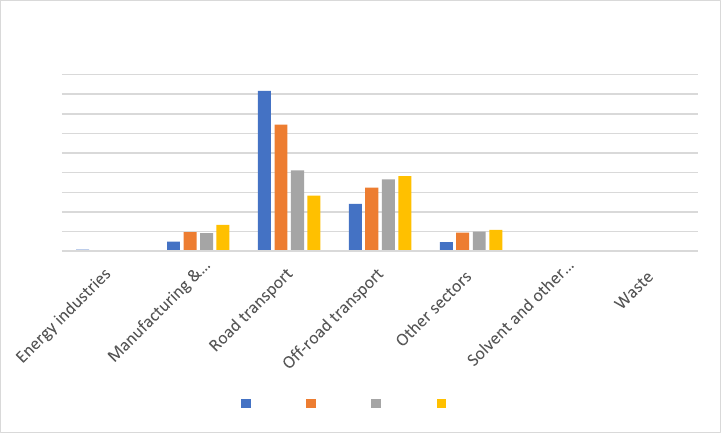

Figure 78 - National total air pollutant emission projections, kt ........................................................ 172

Figure 79 - NOx emission projections by sector, kt ............................................................................ 173

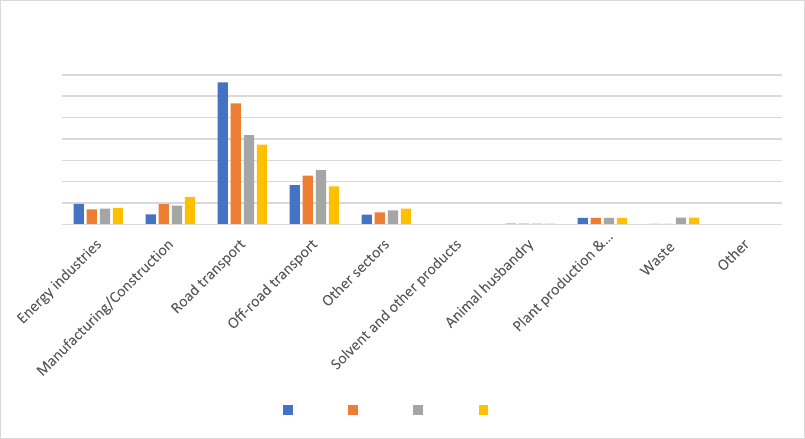

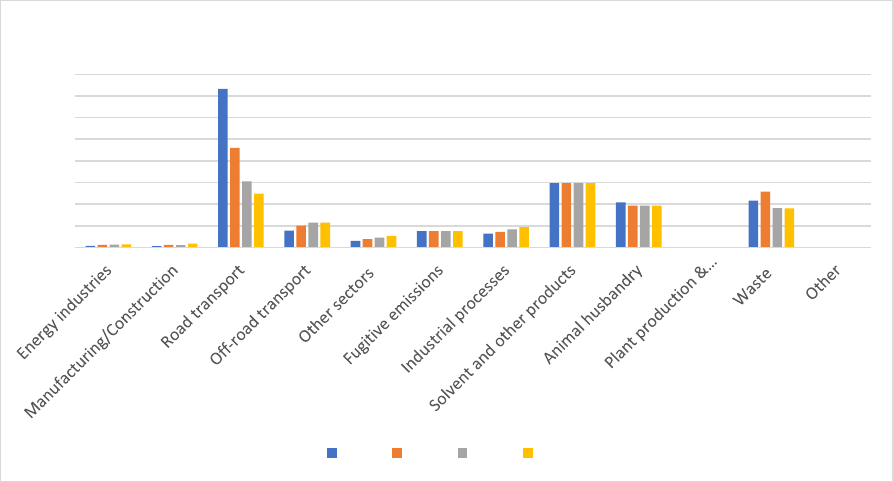

Figure 80 - NMVOC emission projections by sector, kt ...................................................................... 174

Figure 81 - SO

2

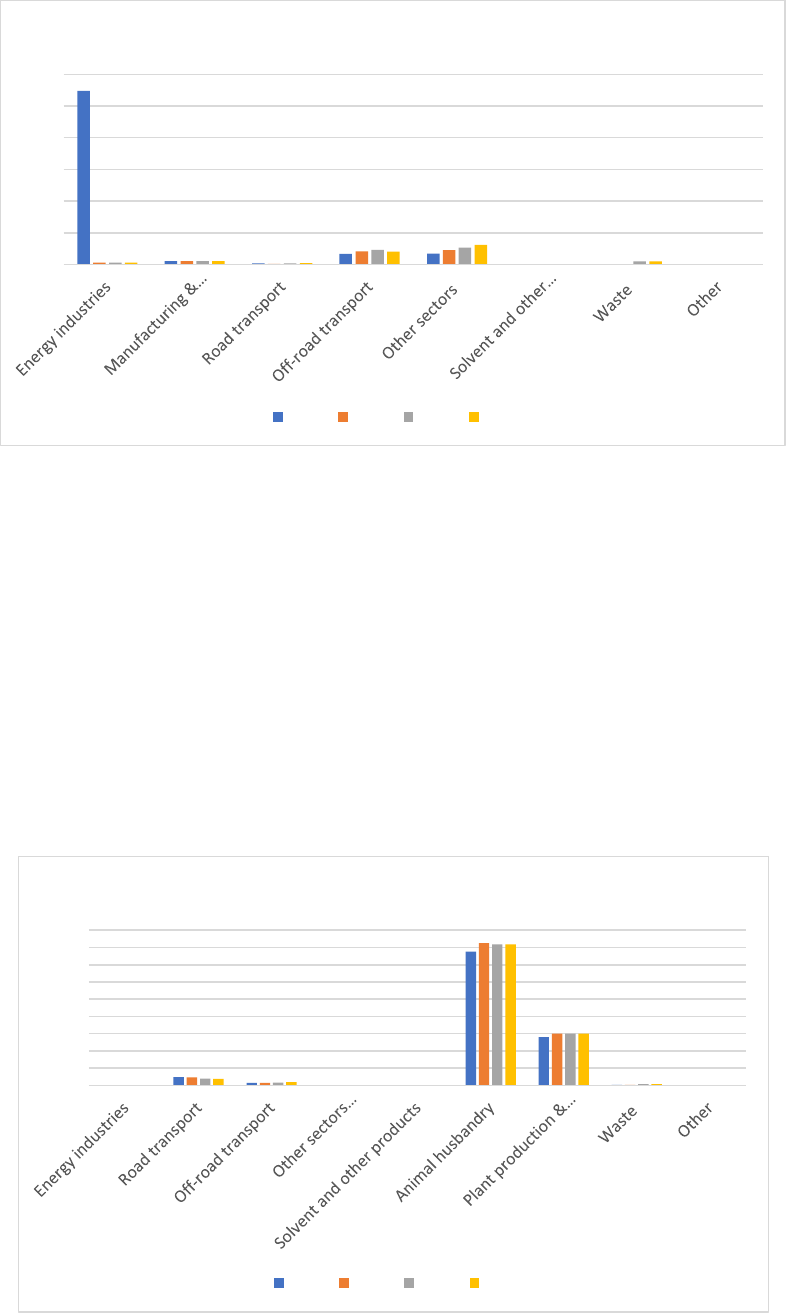

emission projections by sector, kt.............................................................................. 175

Figure 82 - NH

3

emission projections, kt ............................................................................................. 175

Figure 83 - PM

2.5

emission projections, kt .......................................................................................... 176

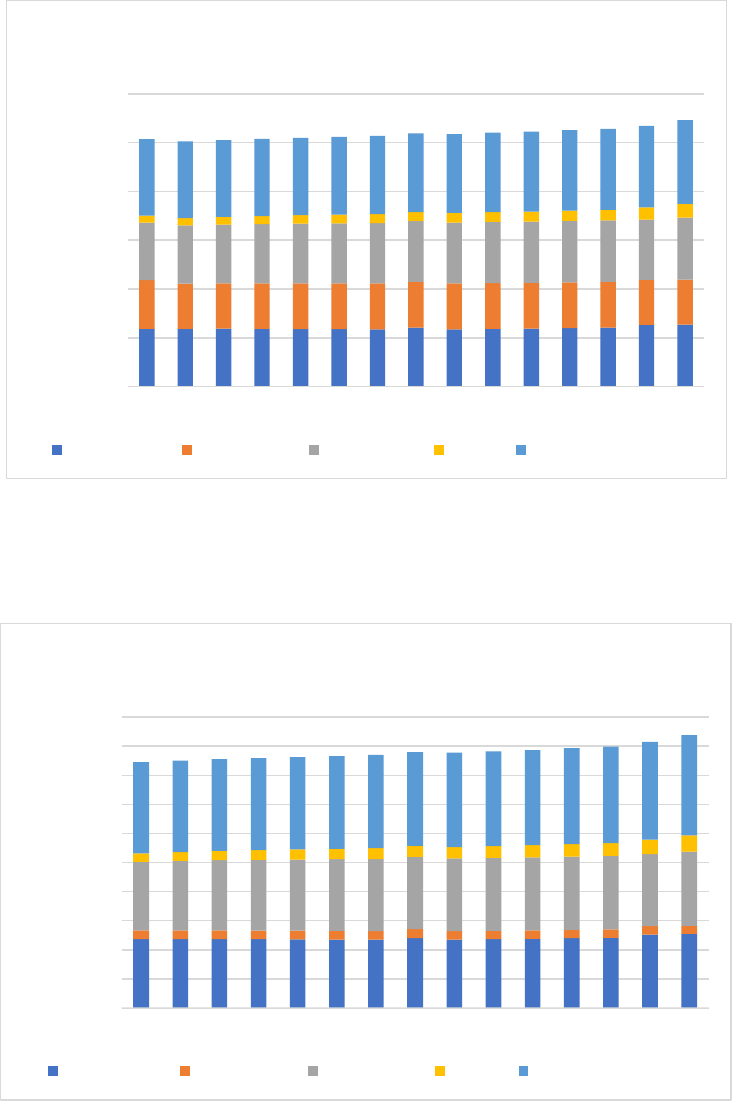

Figure 84 - Black carbon emission projections, kt .............................................................................. 177

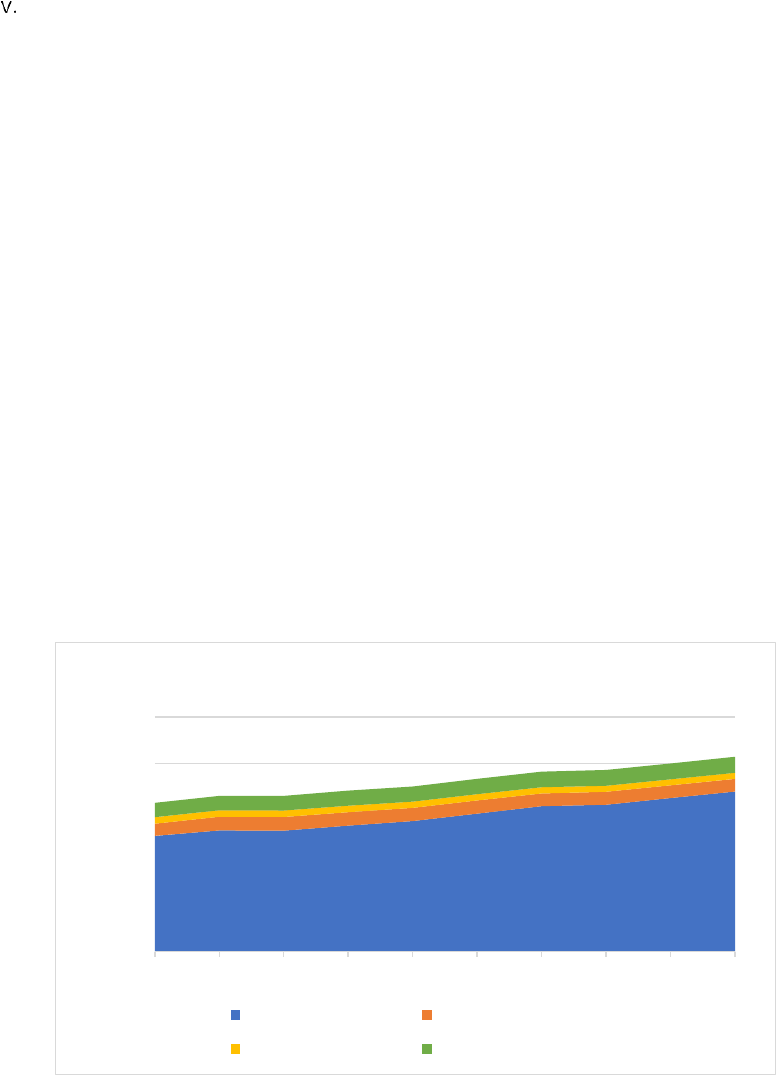

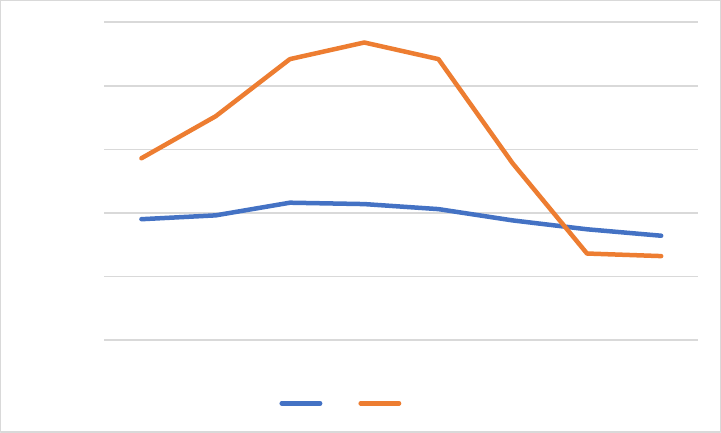

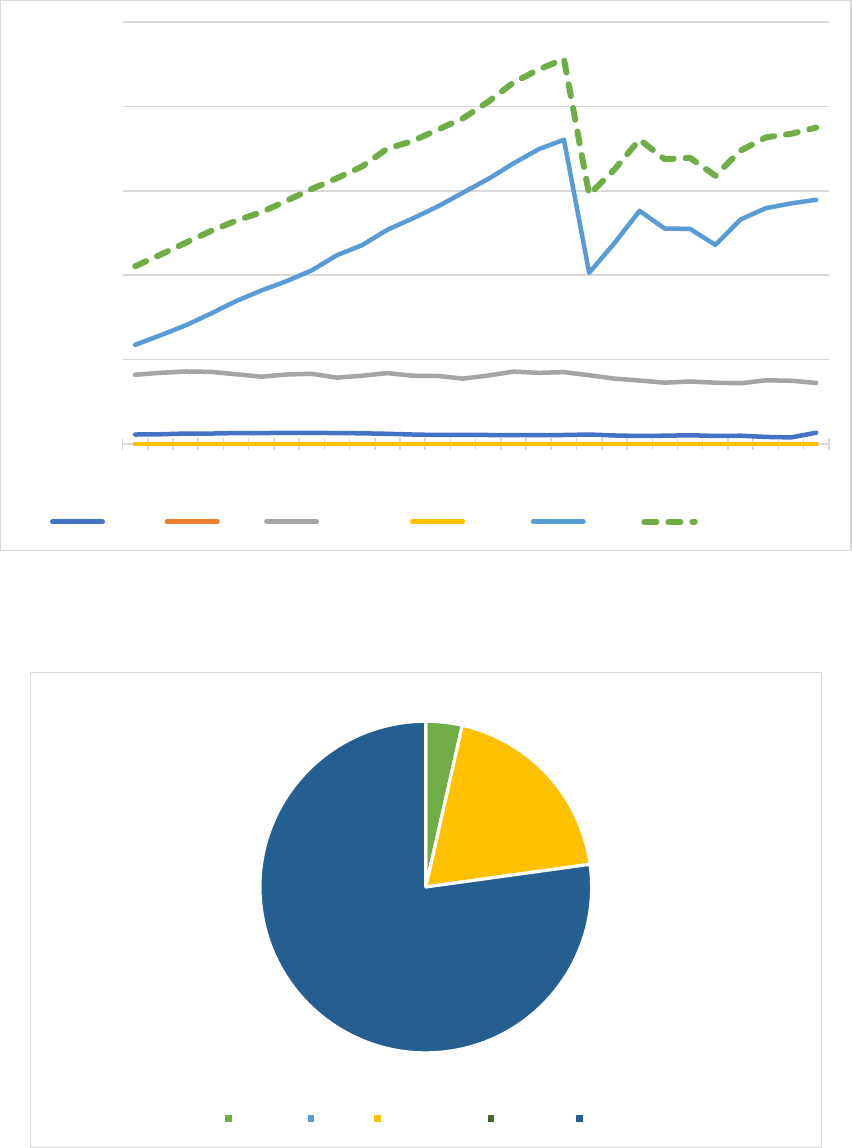

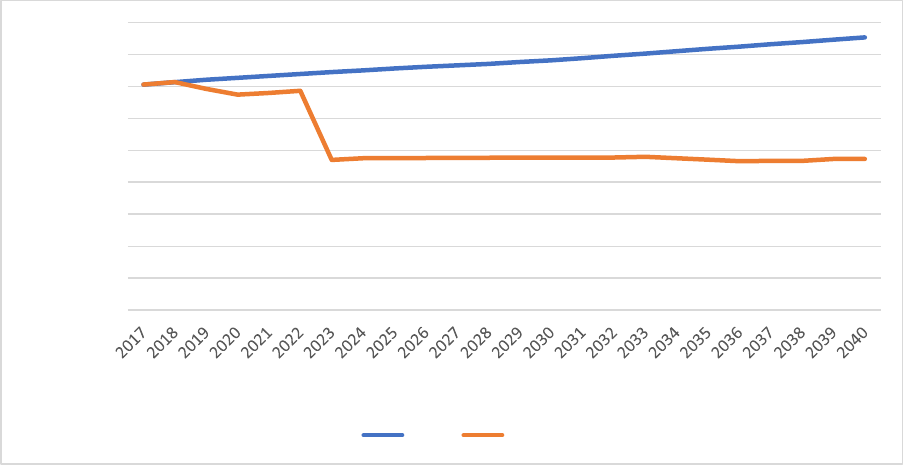

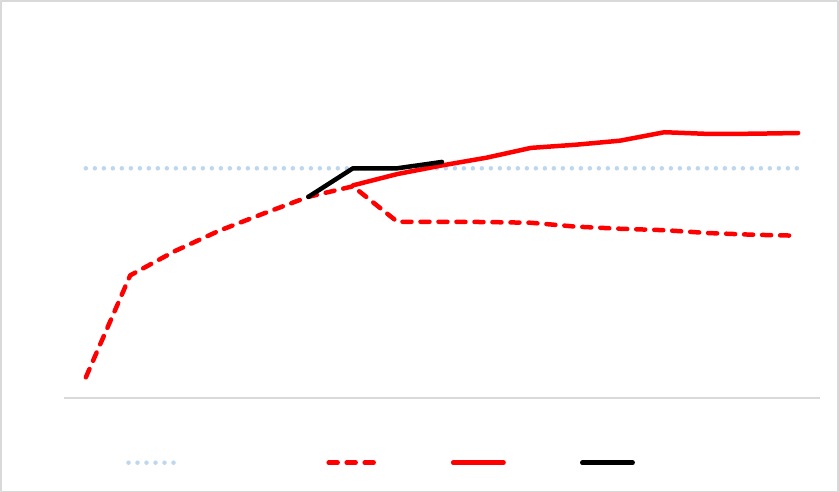

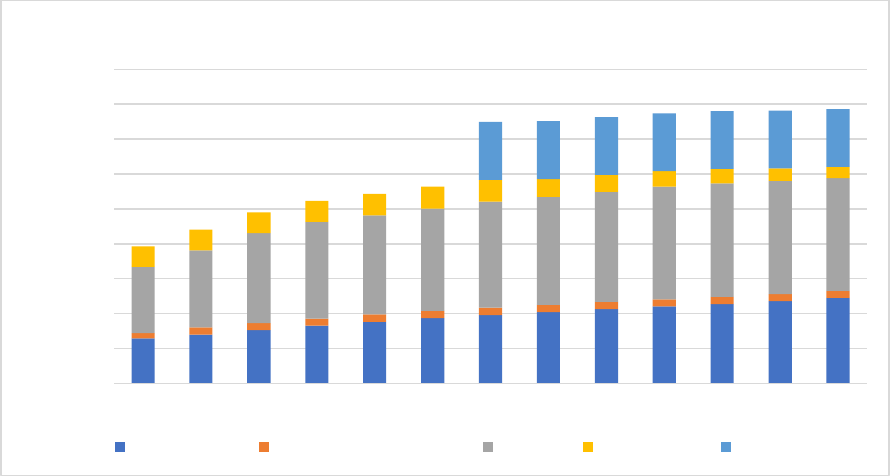

Figure 85 - RES share in gross final energy consumption for WEM and WPM scenario, incl. RES credits

............................................................................................................................................................ 178

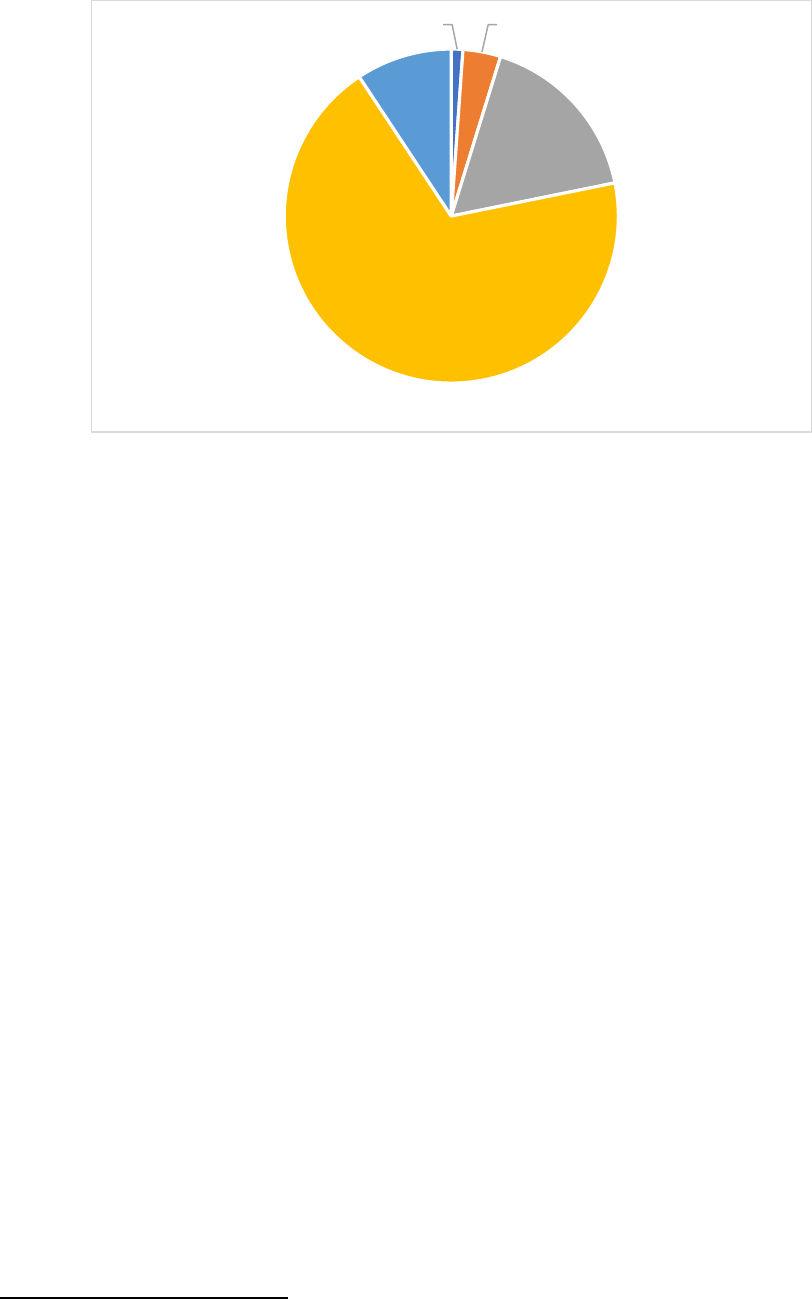

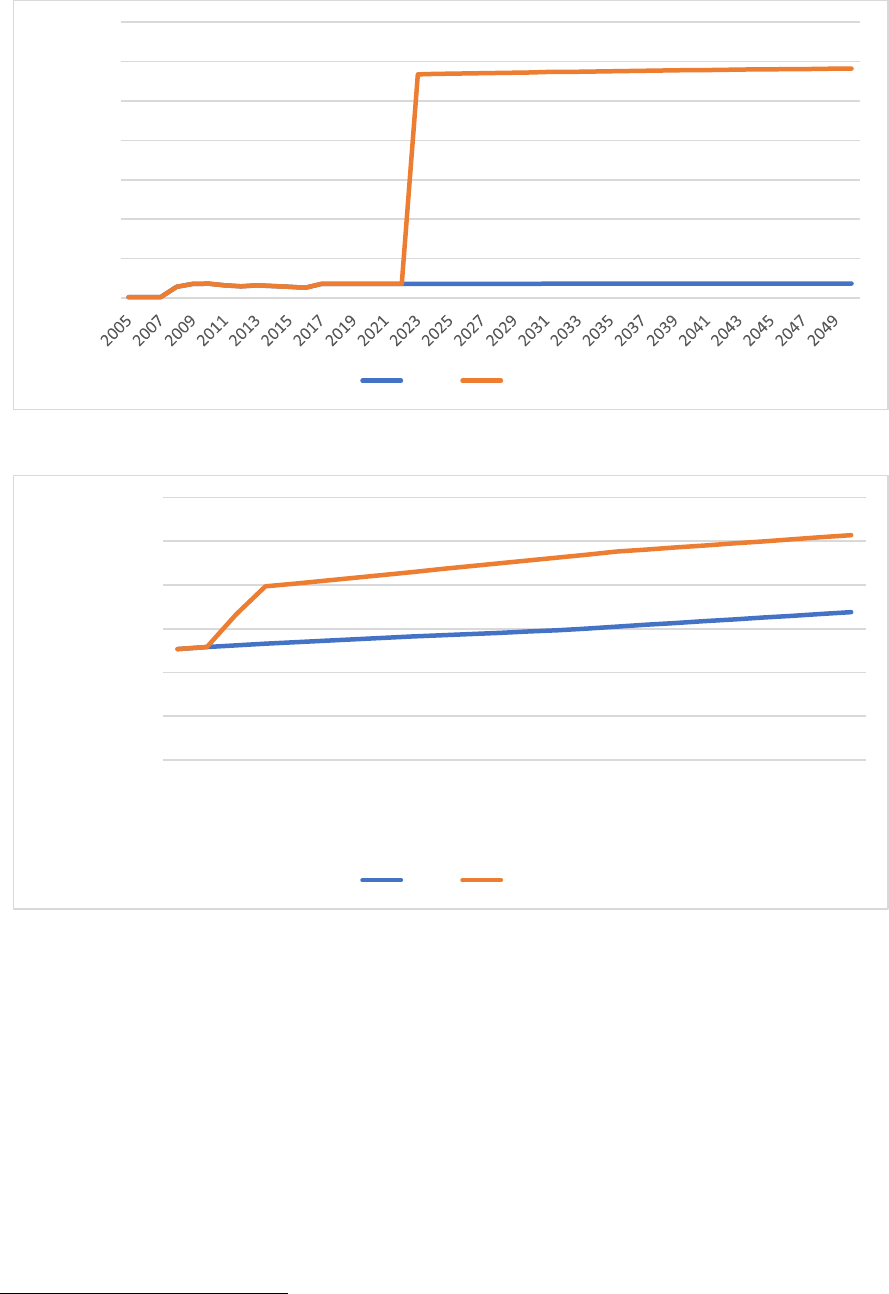

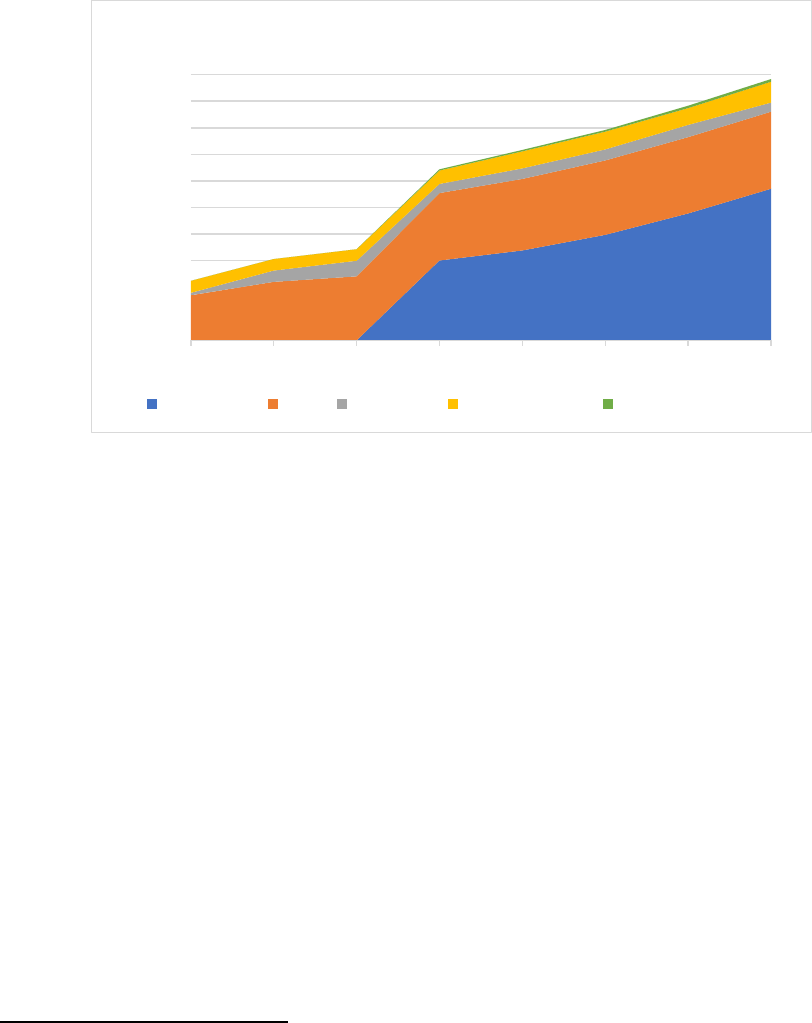

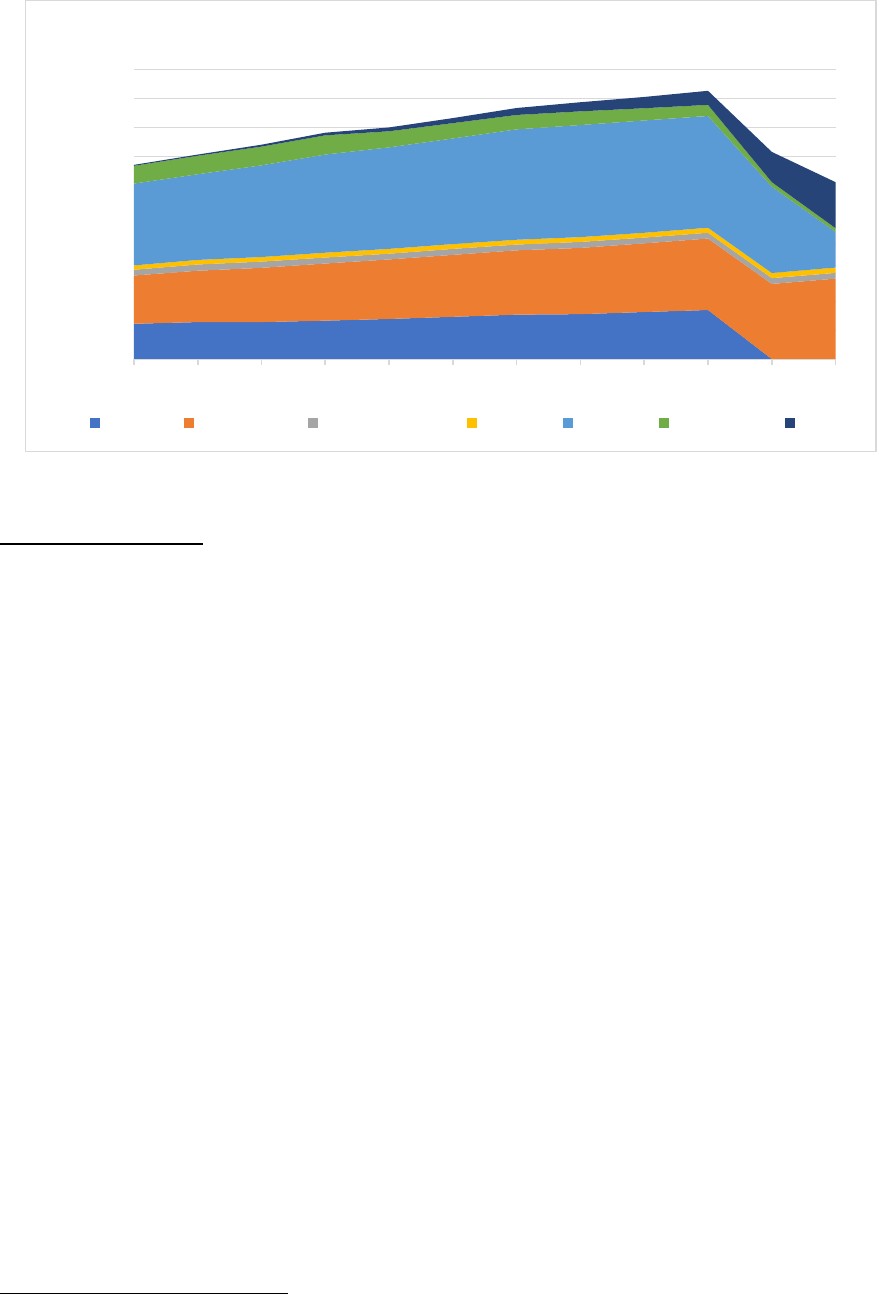

Figure 86 - RES technology consumption under WPM in 2021-2040, GWh ....................................... 179

Figure 87 - PV capacity for WEM vs WPM scenarios, 2010-2030, GWh ............................................. 180

Figure 88 - Projections for energy consumption under WPM, ktoe (incl. heat pumps) ..................... 181

Figure 89 - Projections for final energy consumption for road transport sector, split by fuel, under the

WPM scenario, ktoe ............................................................................................................................ 182

Figure 90 - Final energy consumption in aviation sector under WPM scenario, ktoe ........................ 183

Figure 91 - Final energy consumption in inland navigation sector, split by fuel under WPM scenario,

ktoe ..................................................................................................................................................... 183

Figure 92 - Final energy consumption in industry, split by fuel under the WPM scenario, ktoe ....... 184

Figure 93 - Final energy consumption split by fuel for services sector under WPM scenario, ktoe .. 184

Figure 94 - Final energy consumption split by fuel for agriculture sector under WPM scenario, ktoe

............................................................................................................................................................ 185

Figure 95 - Final energy consumption split by fuel in residential sector under WPM scenario, ktoe 185

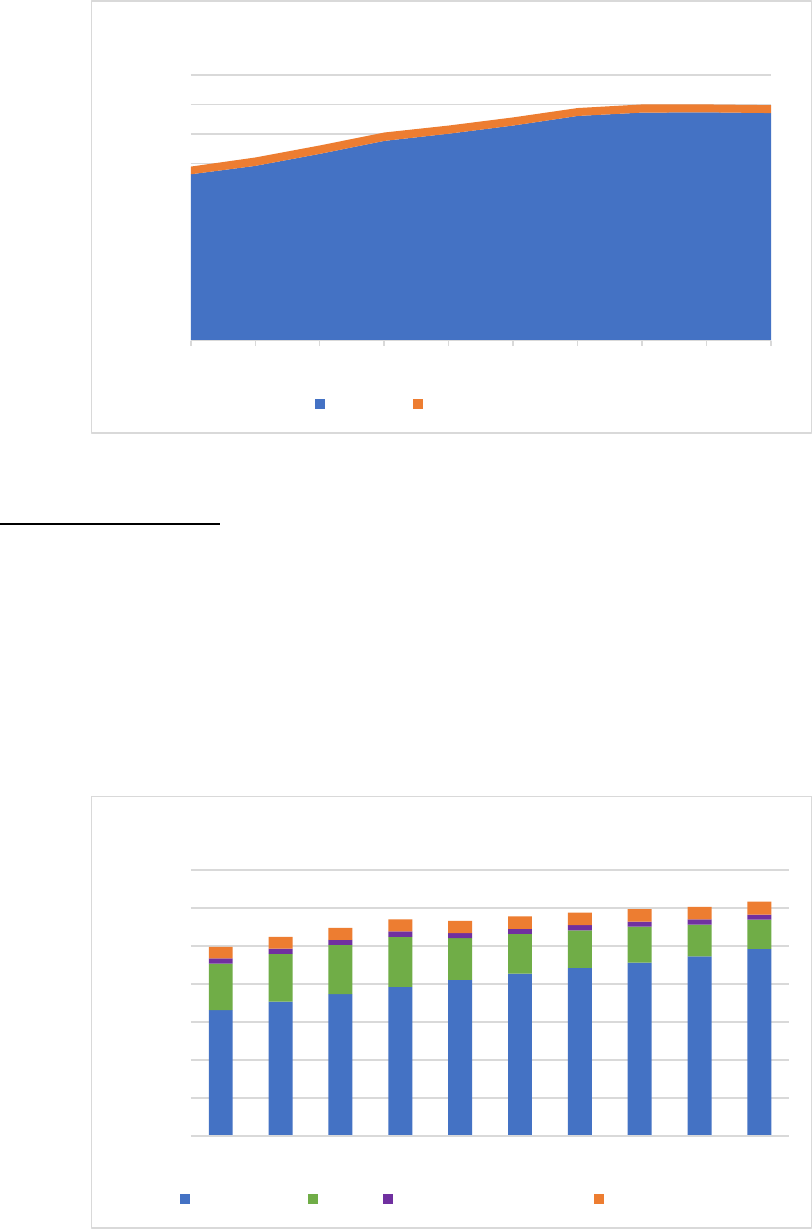

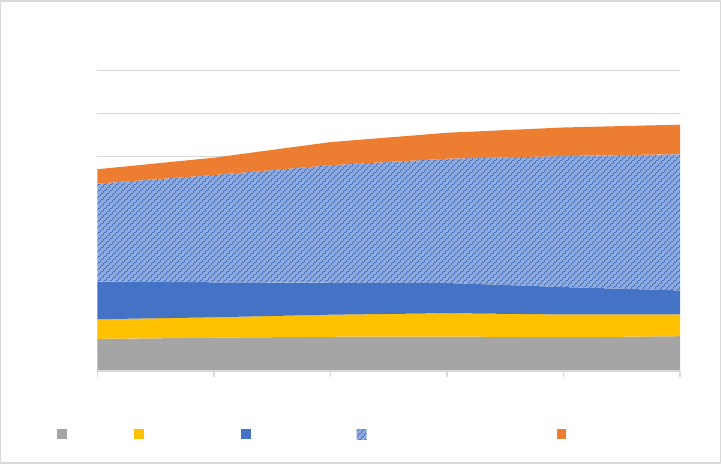

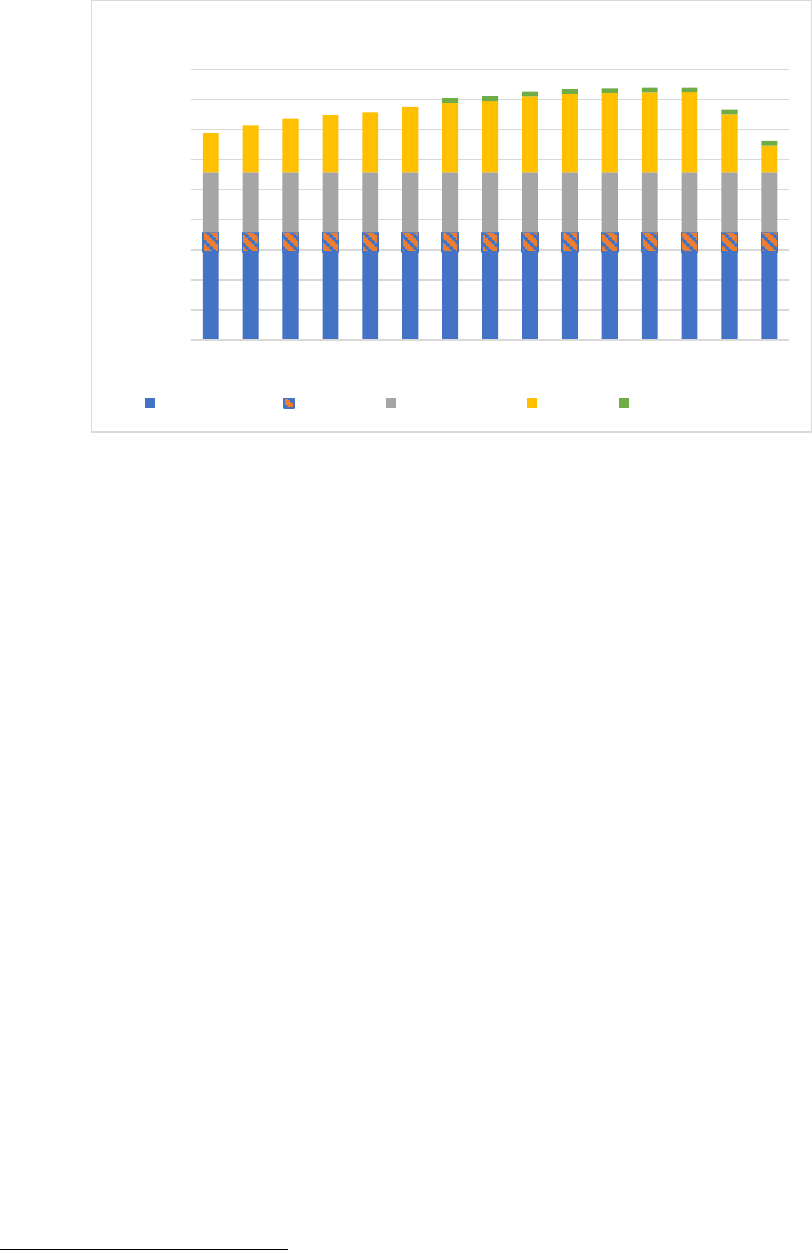

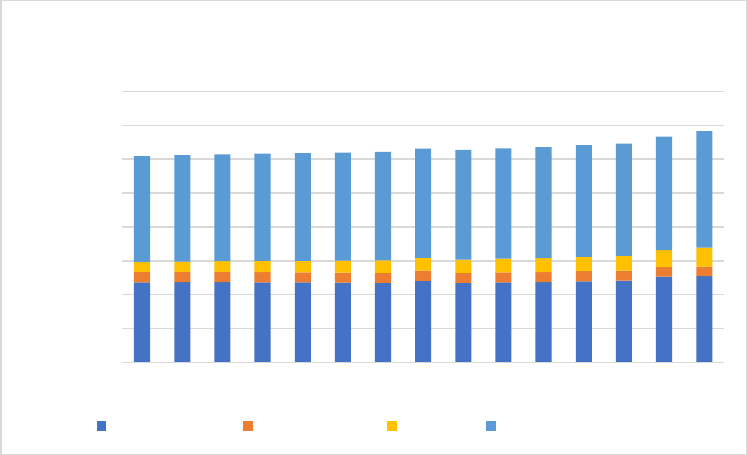

Figure 96 - Electricity generation by source under the WPM scenario, 2018-2040 ........................... 186

Figure 97 - Energy mix for electricity generation under WPM scenario (%) ...................................... 187

Figure 98 - Projected energy mix as a share in PEC under WPM scenario (%) ................................... 188

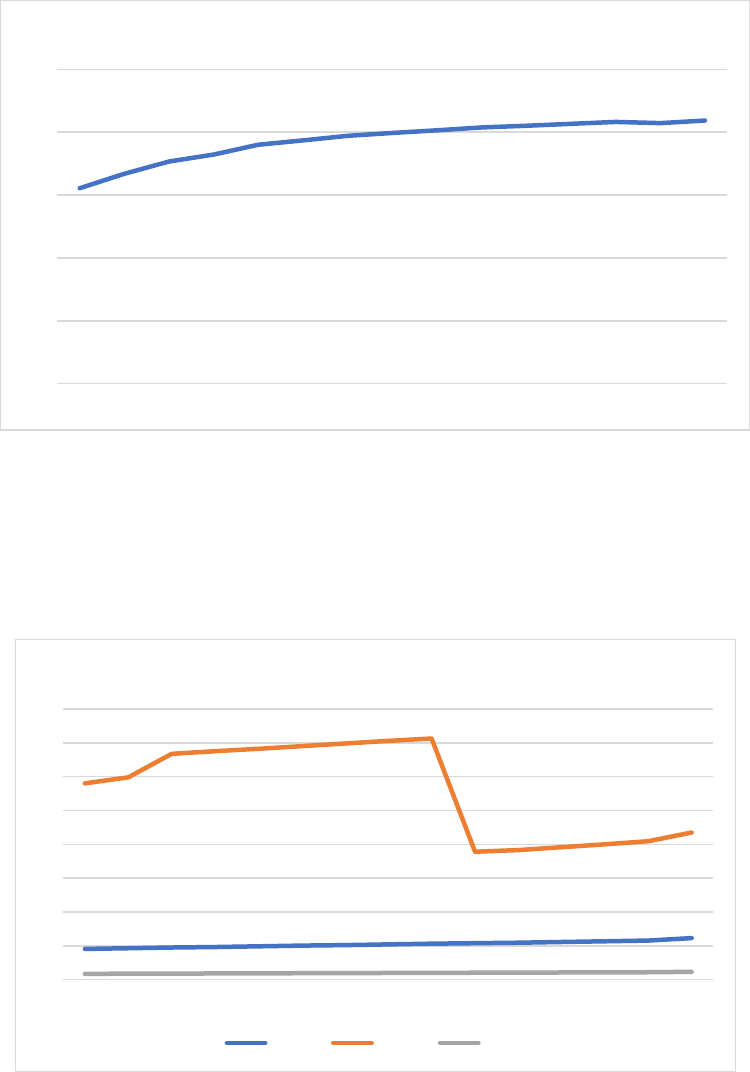

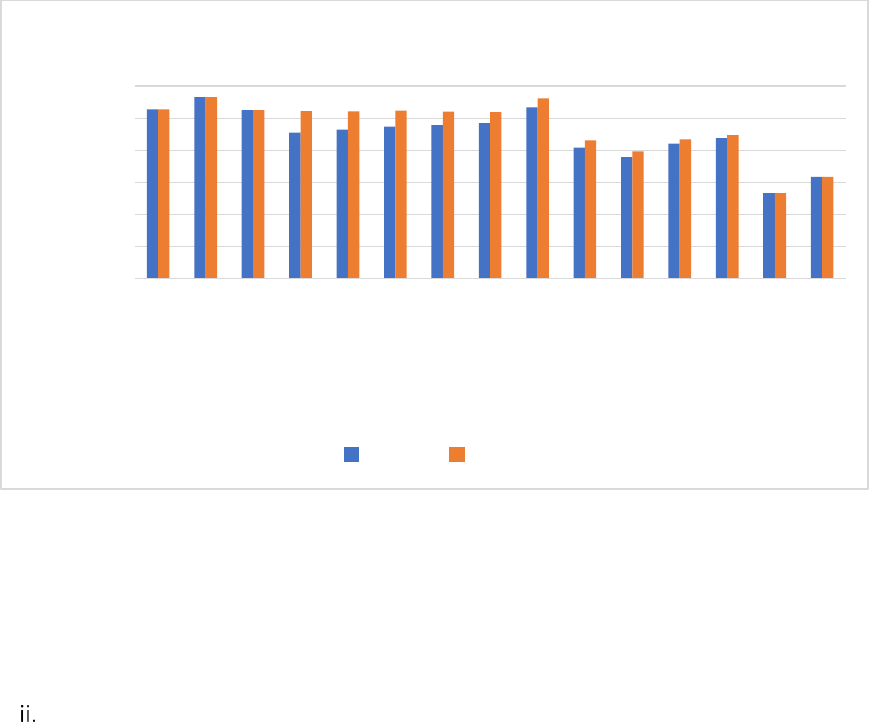

Figure 99 - Net import dependency of WEM and WPM scenarios (%) ............................................... 188

Figure 100 - Projected consumption of imported energy sources (WPM), GWh ............................... 189

Figure 101 - Projected consumption of domestic energy sources (WPM), GWh ............................... 190

Figure 102 - Installed capacity by source under WPM scenario (MW), 2018-2040 ........................... 191

Figure 103 - Peak load (MW) and gross electricity consumption (GWh) under WPM and WEM scenario,

2018-2040 ........................................................................................................................................... 192

Figure 104 WPM Annual Peak Demand (MW) under different temperature conditions: (i) normal

climate; (ii) extreme temperature with a 2.3% probability; and (iii) extreme temperature with a 0.1%

probability. .......................................................................................................................................... 193

Figure 105 - Electricity imports and exports over the interconnector (WPM), 2018-2040 ................ 194

Figure 106 - Peak electricity demand shortfall expressed in MW and total number of hours, WEM and

WPM ................................................................................................................................................... 195

Figure 107 - Shortfalls (MW) at peak hours under different temperature conditions: (i) normal climate;

(ii) extreme temperature with a 2.3% probability; and (iii) extreme temperature with a 0.1%

probability. .......................................................................................................................................... 195

Figure 107 - Projected minimum Sunday load and concurrent PV generation under WPM scenario

(MW) ................................................................................................................................................... 196

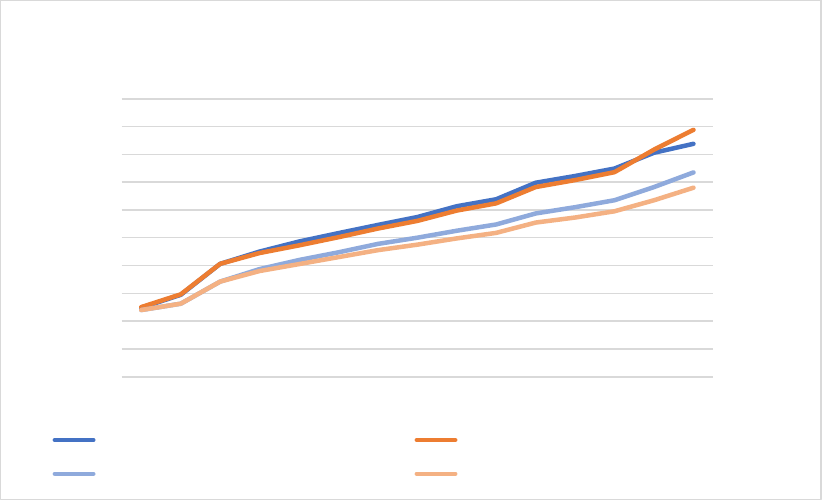

Figure 108 - Projected wholesale electricity and gas prices from 2018-2040, EUR (2016)/kWh. ..... 197

Figure 109 - Share of households with heat pumps by end-use and households with no heat pumps

under WPM scenario (%) .................................................................................................................... 198

Figure 110 - Typical annual electricity consumption of households with heat pumps for heating and

cooling under WPM (kWh/year) ......................................................................................................... 199

Figure 111 - Typical annual electricity consumption of households with heat pumps for cooling only

under WPM (kWh/yr) ......................................................................................................................... 199

Figure 112 - Typical annual electricity consumption of households with no heat pumps under WPM

(kWh/yr) .............................................................................................................................................. 200

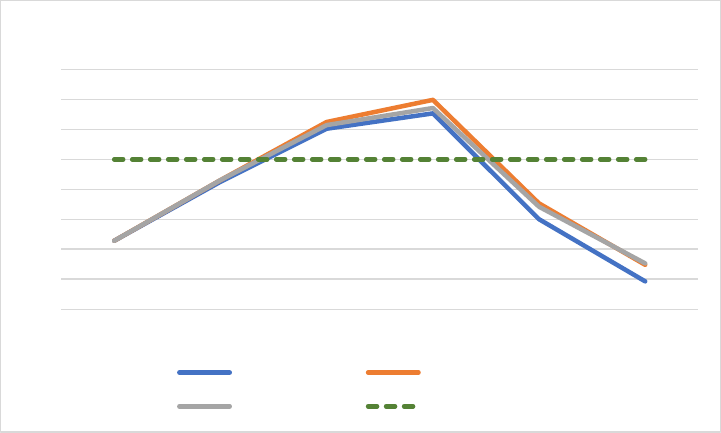

Figure 113 - Share of RES in gross final consumption of energy (GFCoE) under the different sensitivity

scenarios, % ........................................................................................................................................ 202

Figure 114 - The trajectory of increase in RES-H&C under the different sensitivity scenarios, % ...... 203

Figure 115 - Projected peak load and number of hours with electricity shortfall under the different

sensitivity scenarios ............................................................................................................................ 204

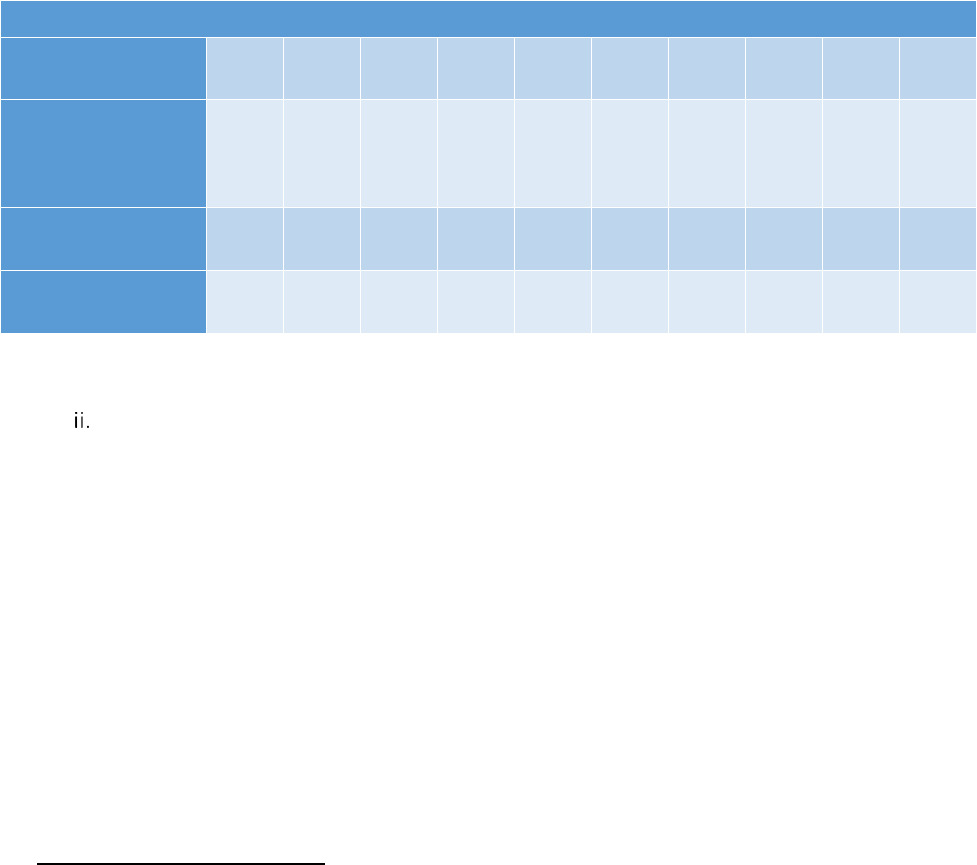

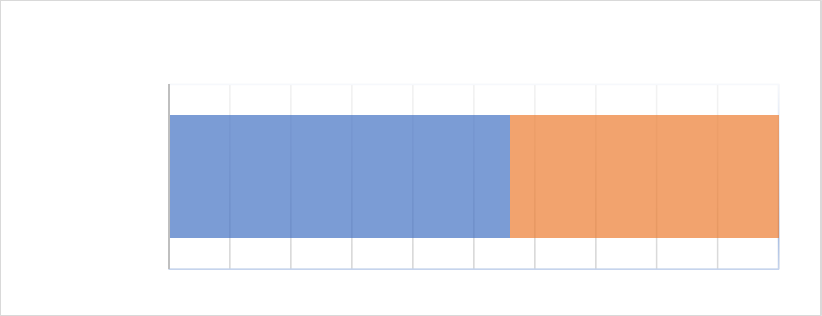

Figure 117 - NECP modelling rationale ............................................................................................... 207

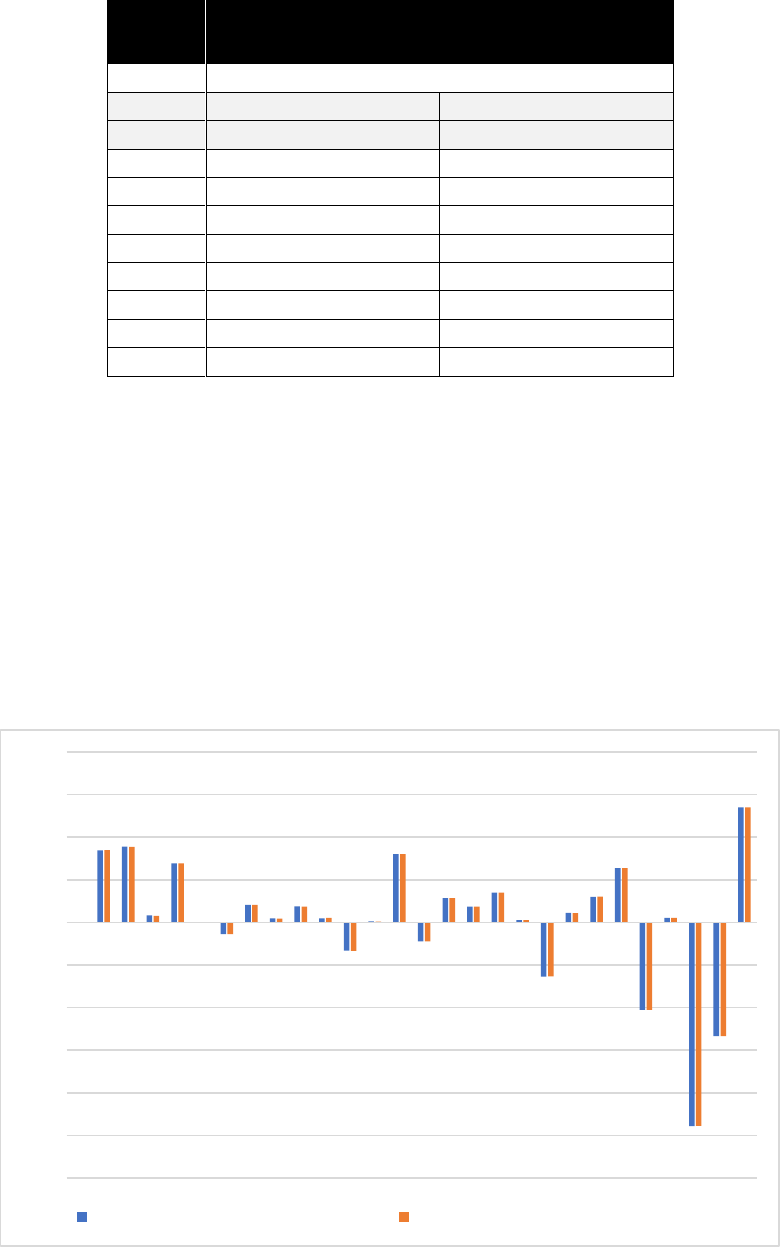

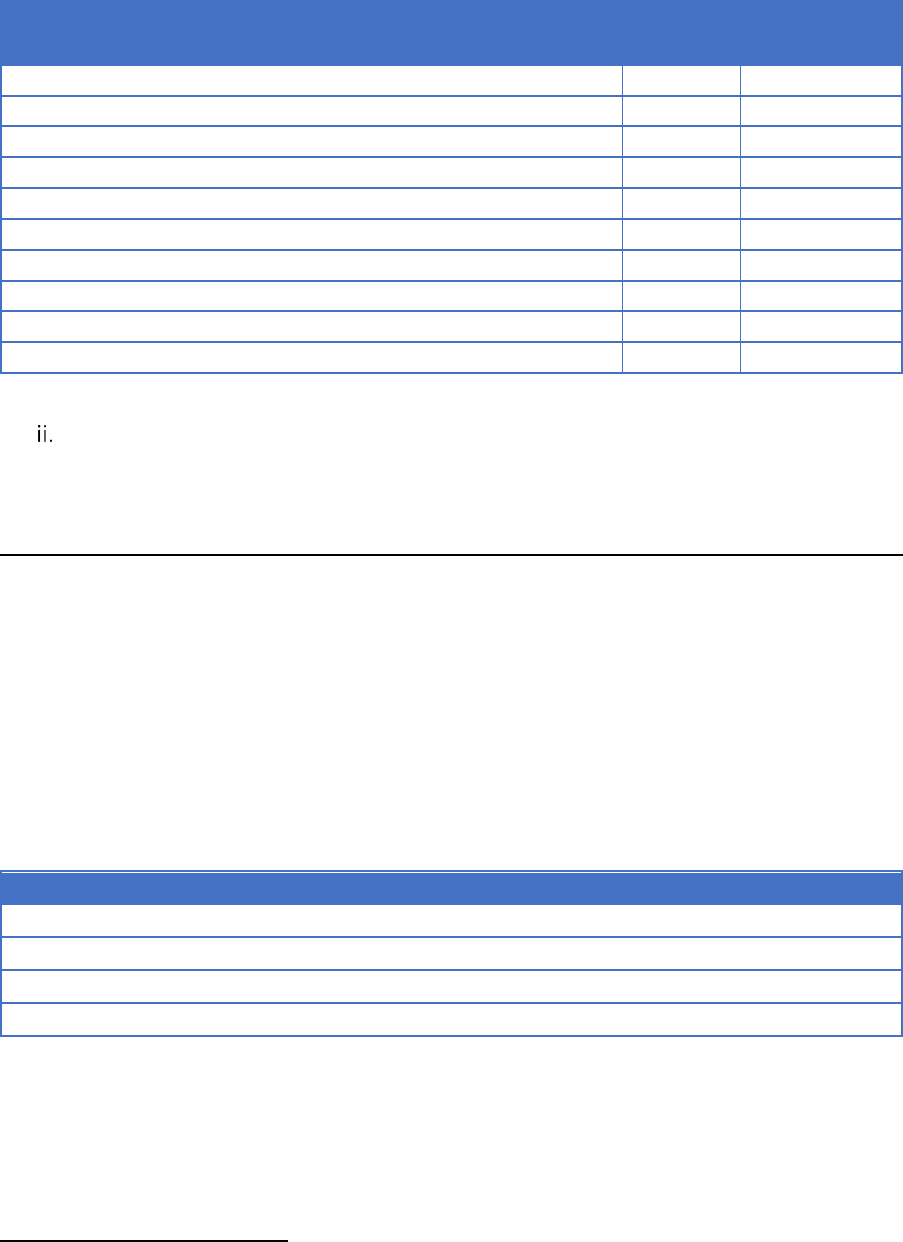

Figure 118 - Overall semi-qualitative score of modelled WPM PAMs ................................................ 213

Figure 119 - Individual PAM semi-quantitative score ......................................................................... 214

Figure 120 - Overall Semi-qualitative score of WPM PAMs excluding the Critical PAM .................... 214

Figure 121 - Semi-Qualitative Score of all Unmodelled WPM PAMs .................................................. 215

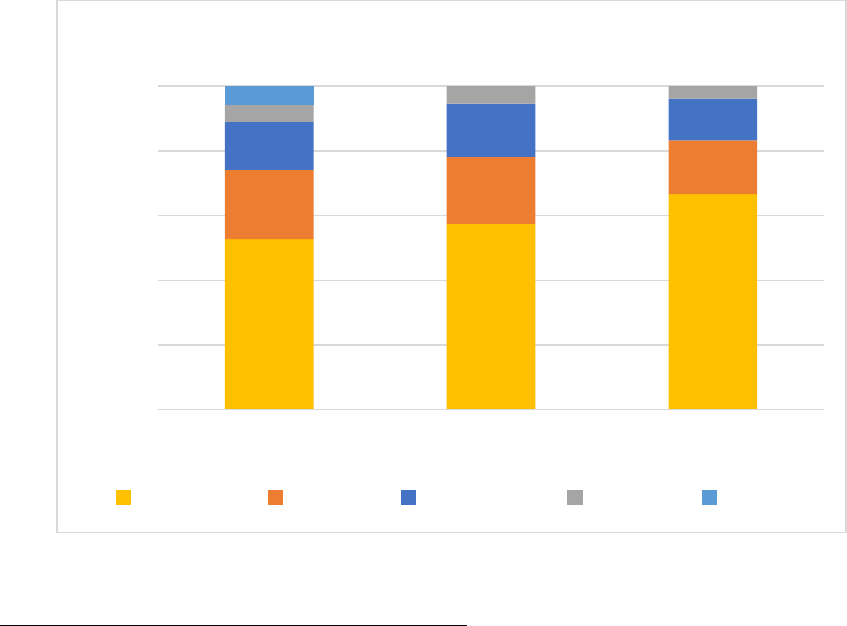

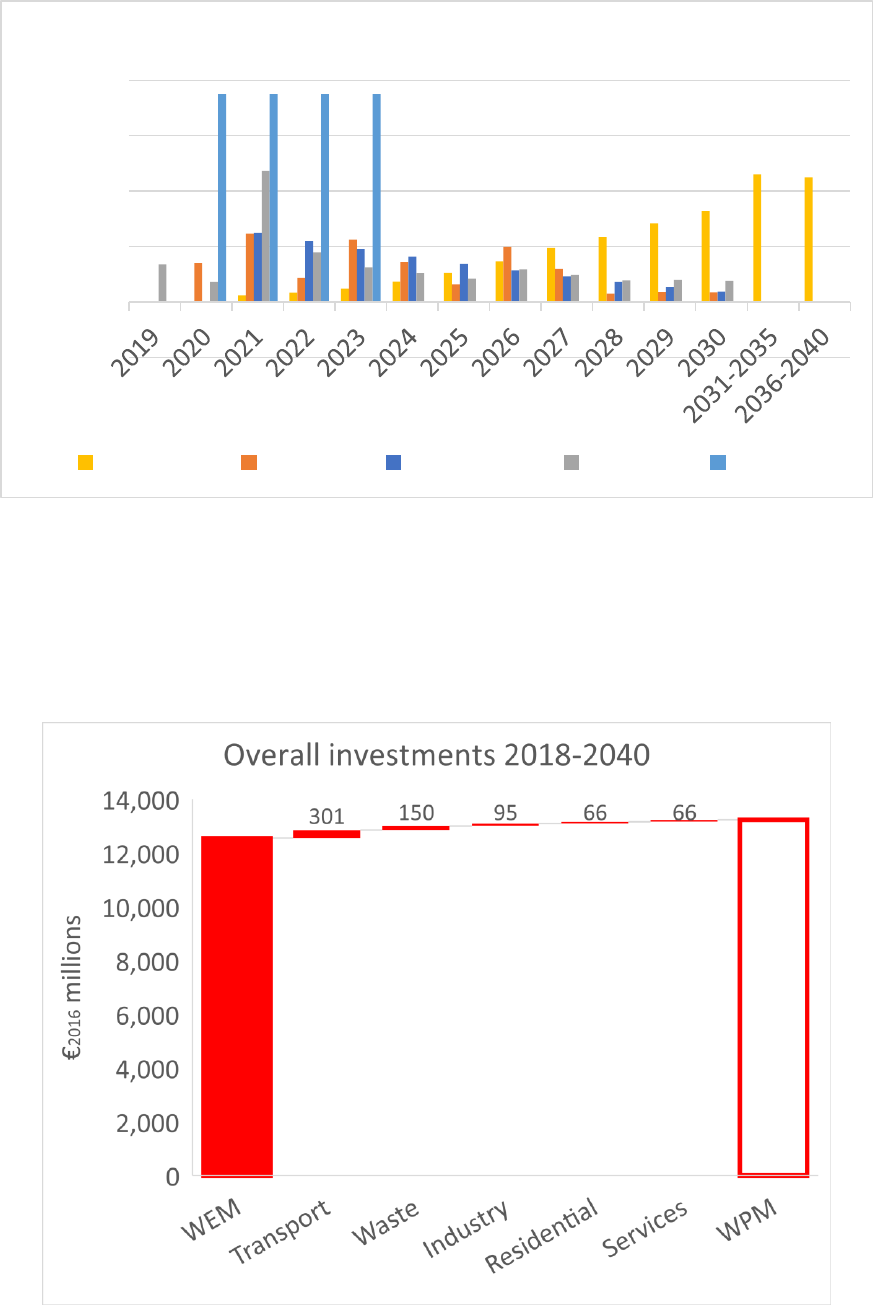

Figure 122 - WPM Impact on job creation .......................................................................................... 216

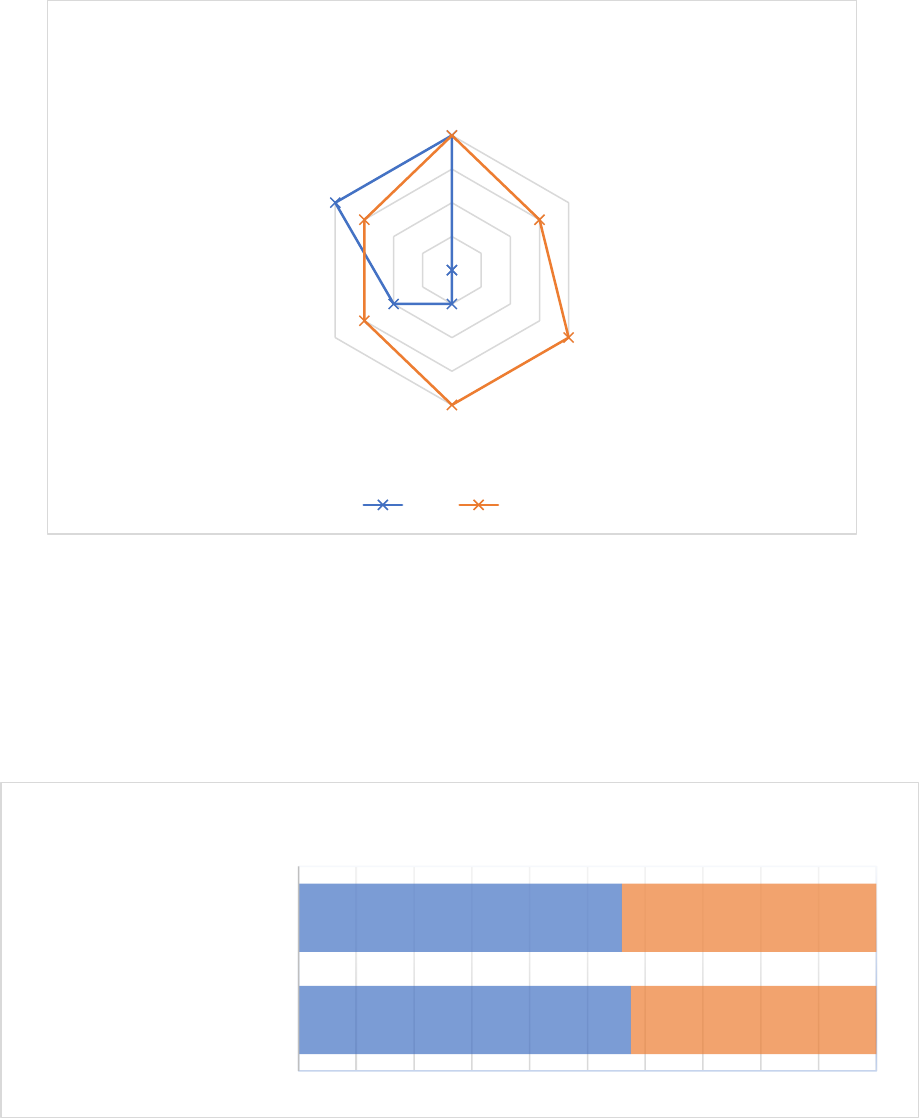

Figure 123 - Costs borne by Government under a WPM scenario ..................................................... 218

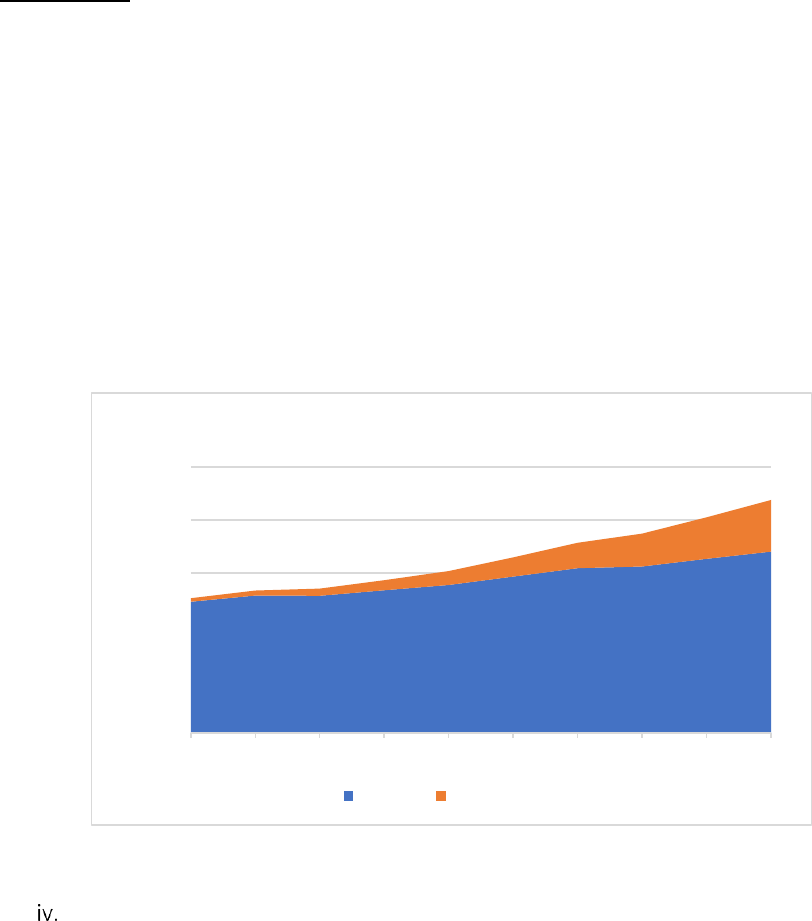

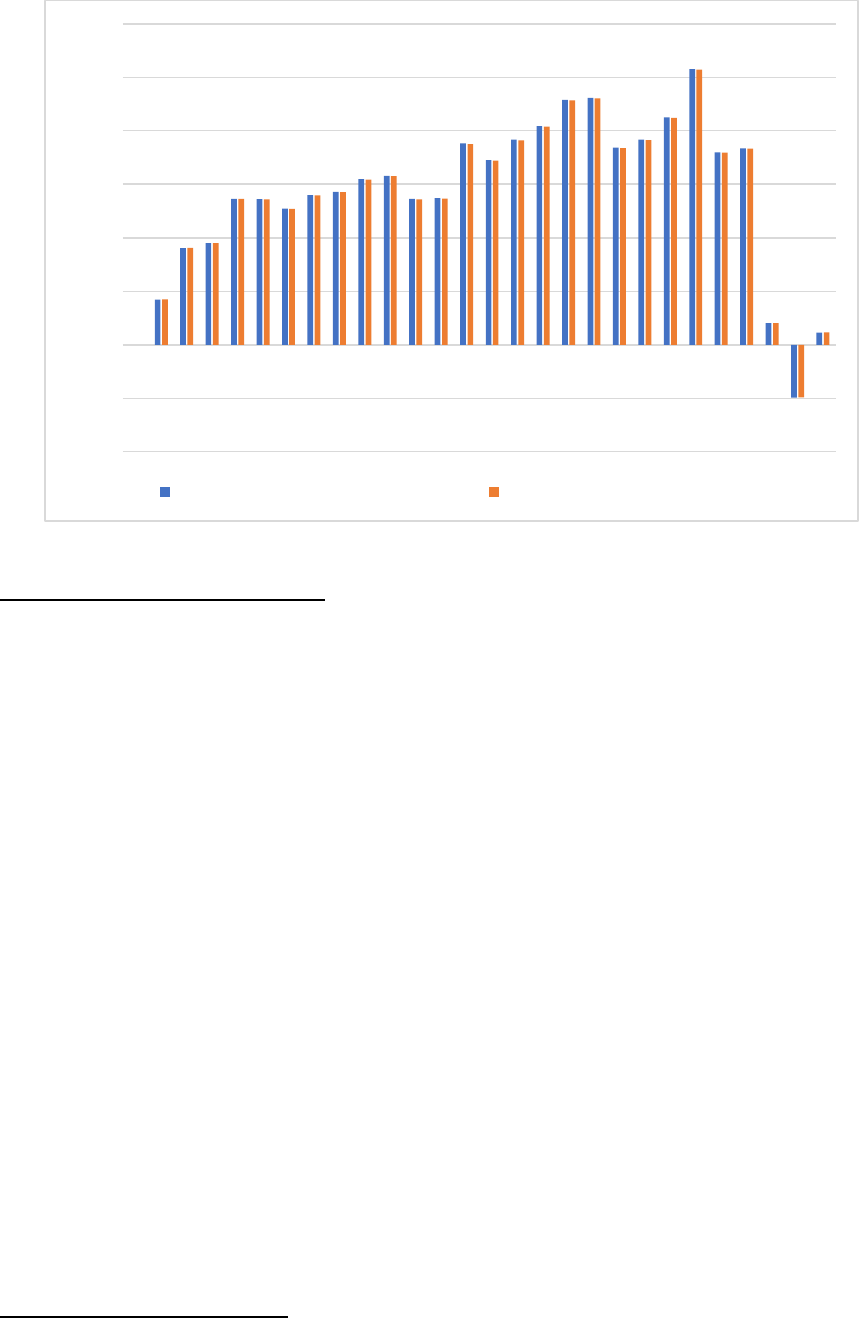

Figure 124 - Total investments by scenario, mil. €

2016

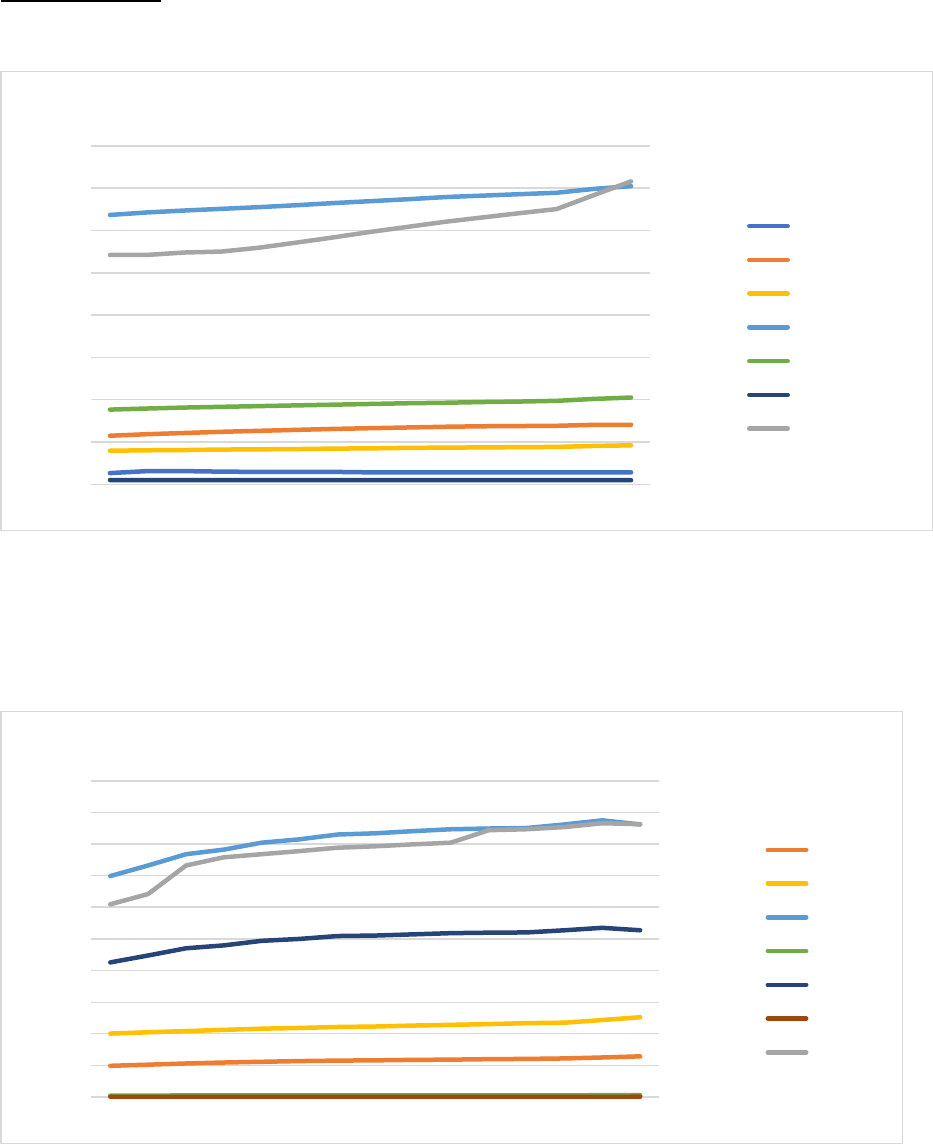

........................................................................ 221

Figure 125 - Investment costs by sector under the WPM scenario, mil. €

2016

.................................... 222

Figure 126 - Investment shares by sector under the WPM scenario (%) ........................................... 223

Figure 127 - Additional investments under the WPM scenario .......................................................... 224

Figure 128 - Overall discounted investments as a difference between WEM and WPM ................... 224

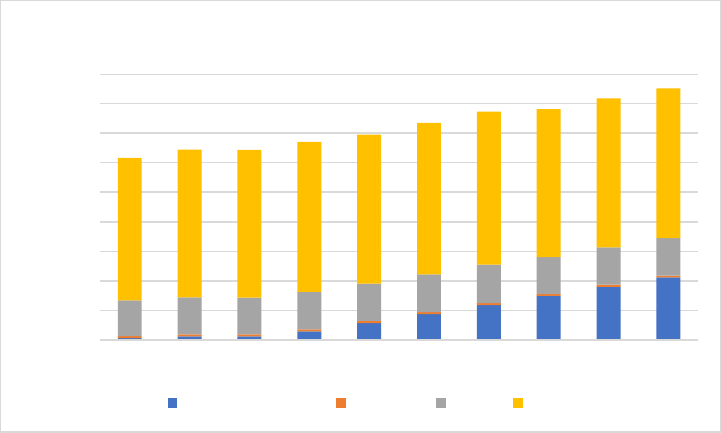

Figure 129 - WPM investments split by technology type, 2018-2040 ................................................ 225

Figure 130 - Net increased investment in the WPM scenario split by technology cluster ................. 226

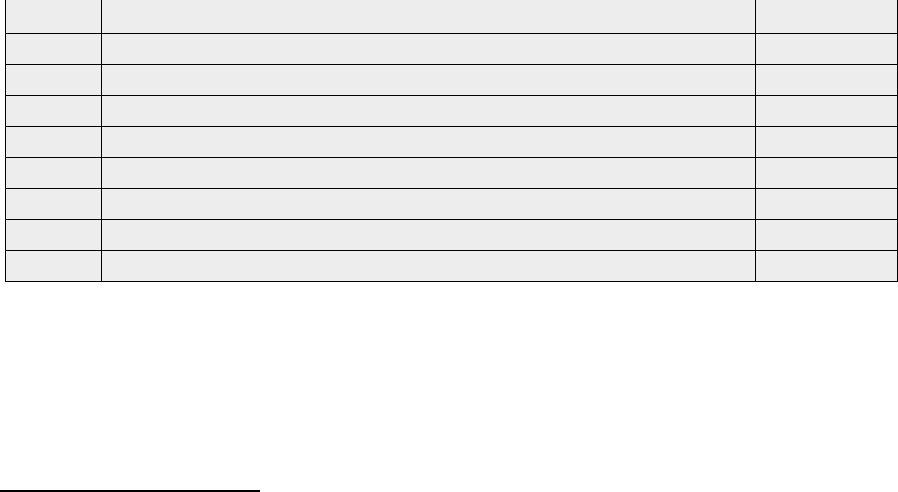

1

1 OVERVIEW AND PROCESS FOR ESTABLISHING THE PLAN

1.1 EXECUTIVE SUMMARY

Political, economic, environmental and social context of the plan

Malta’s National Energy and Climate Plan (NECP) is presented at a time when globally, energy and

climate issues are at the forefront of political and societal debate and the implications of climate

change are ever so perceptible. At European level there is a clear drive towards climate neutrality by

2050. The new European Commission acknowledges that although Europe is currently on track to

meet its 2030 emission reduction targets and goals enshrined in the Paris Agreement, reaching climate

neutrality by 2050 will require more ambitious contributions of all sectors. In view of this increased

ambition, the Commission is expected to present a proposal for the European Green deal which will

include even more ambitious proposals in the area of Energy and Climate Change.

The Governance Regulation

1

, which sets out the framework for the NECP, aims to ensure the

achievement of the Union’s 2030 long-term objectives and targets in line with the Union’s

international commitments under the Paris Agreement. A bottom-up approach is adopted, whereby

Member States present their fair and ambitious efforts and contributions towards a decarbonised

energy system and towards mitigating climate change. Whilst the Governance Regulation sets the

basis for the development of this plan, this is complimented by a package of new EU legislation

targeting energy efficiency, renewable energy, energy security and market design, appropriately

referred to as the “Clean Energy for all Europeans Package”.

Malta’s National Energy and Climate Plan follows the scope of the Energy Union and covers its five

dimensions: decarbonisation, energy efficiency, energy security, internal energy market, and research,

innovation and competitiveness. The five dimensions are considered as being closely related and

mutually reinforcing and are correspondingly treated as such within the plan. The underlying

requirement of the plan’s integrated and holistic nature was fully considered during the development

of the NECP. In line with the iterative process outlined in the Governance Regulation, Malta’s Draft

NECP was submitted to the European Commission in December 2018 and updated during the course

of 2019 whilst taking due account of the Recommendation

2

published by the European Commission

on Malta’s Draft NECP.

Malta’s NECP follows the structure required by Annex I of the Governance Regulation. The Plan sets

out Malta’s national objectives and contributions for 2030 in the respective dimensions in Section 2

of the Plan and contains a description of the policies and measures that need to be implemented in

order to reach these objectives in Section 3. This is supplemented by an analytical basis consisting of

a description of the current situation in the five dimensions as well as projections until 2040 which are

based on robust and consistent data, assumptions and modelling exercises. Projections under the

‘With Existing Measures (WEM)’ scenario are presented within Section 4, while the expected projected

1

Regulation (EU) 2018/1999 of the European Parlaiment and of the Council on the Governance of the Energy Union and

Climate Action.

2

Commission recommendation of 18.6.2019. SWD(2019)268. Available online:

https://ec.europa.eu/energy/sites/ener/files/documents/mt_rec_en.pdf

2

development of Malta’s energy system and emissions under a ‘With Planned Measures (WPM)’

scenario are presented under the Impact Assessment section in 5.1. The impact assessment, which

forms part of the analytical basis, further provides an overview of the impacts of the ‘WPM’ scenario

on macroeconomic, health, employment, social and skills, and including an overview of the expected

investment needs. Malta’s NECP presents two main scenarios: a ’With Existing Measures’ scenario

and a ‘With Planned Measures’ scenario. While the former provides a snapshot of the current situation

in Malta with implemented and adopted measures as of end of 2017 (with no impact post 2020), the

latter scenario also consists of planned policies and measures which were adopted and implemented

post-2017and portrays Malta’s projected achievement once these measures are implemented.

The NECP serves as a strategic planning framework and policy document that will guide Malta’s

contribution to achieving the Energy Union’s 2030 objectives and targets, whilst identifying those

measures necessary for their achievement during the period until 2030, with an outlook until 2040.

The Plan aims to support Malta’s economic, environmental and social development and sustainability,

while also focusing on providing clear benefits for citizens, businesses and investors in the Maltese

Islands. Whilst the Ministry responsible for finance and budget has been actively involved in the

development of this plan, all financial estimates included in Malta’s National Energy and Climate Plan

are subject to review and endorsement on annual basis by the Ministry responsible for finance and

budget.

It is crucial that the current social, economic and environmental context of the Maltese Islands and its

impact on the energy system and climate change mitigation is kept in mind when reading this plan.

Malta’s first NECP arrives at a time of high annual GDP and population growth driven by an expanding

service-based economy and a corresponding increased demand for labour force, leading to significant

net inwards migration.

The NECP provides a clear path for Malta to attain the overarching objectives of a sustainable,

affordable and secure energy system which needs to follow a decarbonisation trajectory, whilst

recognising the inherent challenges and opportunities brought about by national specificities such as

spatial constraints, high population density, and a mild Mediterranean climate. This calls for specific

solutions in each of the five dimensions, which may also depend on further technological and cost

developments.

Strategy relating to the five dimensions of the Energy Union

Malta’s strategy under the Decarbonisation dimension strives to promote the transition to a low-

carbon economy, primarily through the pursuit of upholding national GHG emissions reduction

commitments, and by continuing to deploy all viable indigenous renewable energy sources. Malta’s

efforts towards climate change mitigation and adaptation are enacted in the Climate Action Act,

established in 2015, and further strengthened through the ratification of the Paris Agreement,

whereby Malta reaffirmed its commitment to address climate issues to its fullest potential and

contribute towards achieving the EU’s collective target of 40% reduction of GHG emissions by 2030

compared to 1990 levels.

In the area of renewable energy, Malta will continue its efforts to increase its renewable energy share,

a task which is progressively becoming ever more daunting given the growth in final energy

consumption. Malta will extend its current support framework for RES to the period until 2030 and

3

launch new initiatives tailored to local specificities to ensure that technically and economically viable

indigenous sources of renewable energy may be exploited.

Temperate climatic conditions and lack of energy-intensive industries mean that Malta has the second

lowest final energy consumption per capita across all EU Member States. Nevertheless, the specific

characteristics of Malta’s energy system and market, such as its small nature, the existence of a single

electricity distributor/supplier, the absence of natural gas and district heating and cooling networks,

and the small size and number of suppliers and market players limit the range of measures available

to meet energy savings obligations. Steep population and GDP growth in recent years has made it

difficult to restrain energy consumption. Nevertheless, Malta’s efforts in the area of energy efficiency

post-2020 will seek to achieve cost efficient energy savings in the relative sectors whilst taking into

account the effective potential. Malta will strive to continue decreasing the overall energy intensity of

its economy and uphold its obligations under the Energy Efficiency Directive

3

.

Malta’s strategy under the Energy Security dimension will continue to emphasize the Government’s

commitment to achieving greater security of supply through the diversification of energy sources and

suppliers and reduce energy import dependency primarily through the deployment of indigenous RES.

Periodic contingency planning in the case of supply disruption for electricity, gas and oil sectors will

be ensured, while energy security is also tackled within the context of the long-term objective of

decarbonising the energy system, which will pose new challenges for Malta and thus will require new

solutions. Malta considers the Gas Pipeline project with Italy as an important element to secure its

energy supply and tap future opportunities such as the supply of biogas blended with natural gas and

possibly also Hydrogen.

Malta’s electricity grid is linked to the European grid via the 200MW Malta-Italy subsea

interconnector, which ensures that Malta’s interconnectivity shall remain well above the EU-wide

target of 15%

4

throughout the whole projected period. The interconnector contributes to the

robustness of the electricity system and strengthens Malta’s security of supply. Malta does not have

an electricity transmission system or a liquid wholesale market and is eligible to derogate from the

application of a number of provisions of the Electricity Market Directive

5

due to the small size and

peripheral position of Malta’s electricity system, which stands at the edge of the EU grid. Policies and

measures under the internal energy market and energy security dimensions are driven primarily by

the delivery of the gas pipeline project, but also focus on increasing the flexibility of the energy system

and ensuring that vulnerable and energy poor consumers are duly protected.

Malta will endeavour to boost research, innovation and competitiveness, and a national R&I strategy

driven by the smart specialization process is expected to be finalized by 2020. In order to foster

research & innovation specifically in the area of energy and low-carbon technologies, it was

determined that a sector-specific strategy for R&I in energy (and water) will be developed to fully take

advantage of the value-added of such targeted investment. The National Strategy for Research and

Innovation in Energy and Water (2021-2030) is expected to be finalized by Q1 2020. The Strategy’s

3

Directive (EU) 2018/2002 of the European Parliament and of the Council amending Directive 2012/27/EU on energy

efficiency.

4

Calculated as electricity interconnection capacity (i.e capacity of the electricity interconnector with Italy) over the net

installed capacity in Malta.

5

Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on common rules for the internal

market for electricity and amending Directive 2012/27/EU

4

main aim is to contribute to Malta’s transition to a low-impact and decarbonised economy in an

effective, just and timely manner; strengthen competitiveness, growth and commercial

attractiveness; and increase the level of domestic support for R&I in Malta.

5

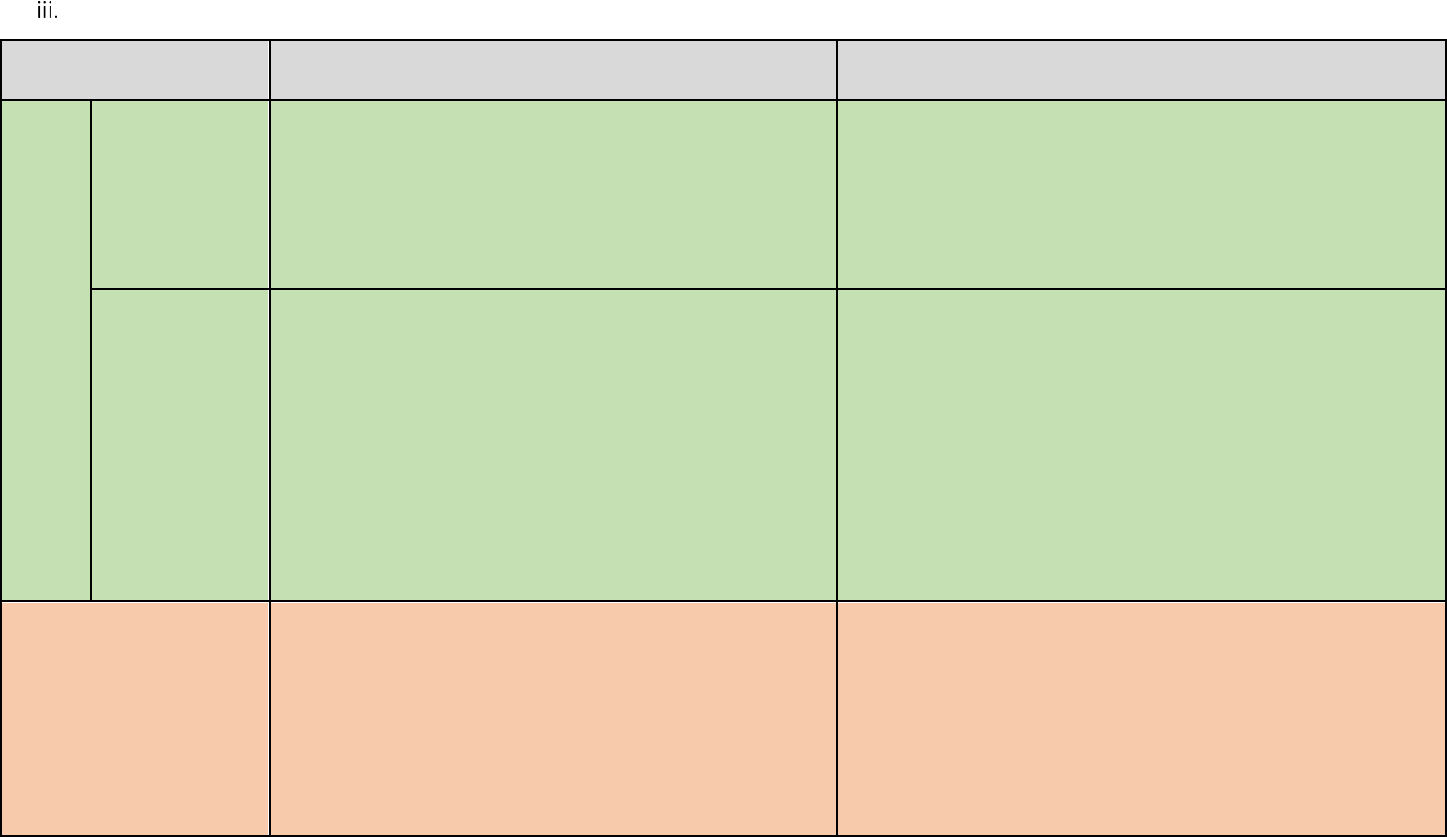

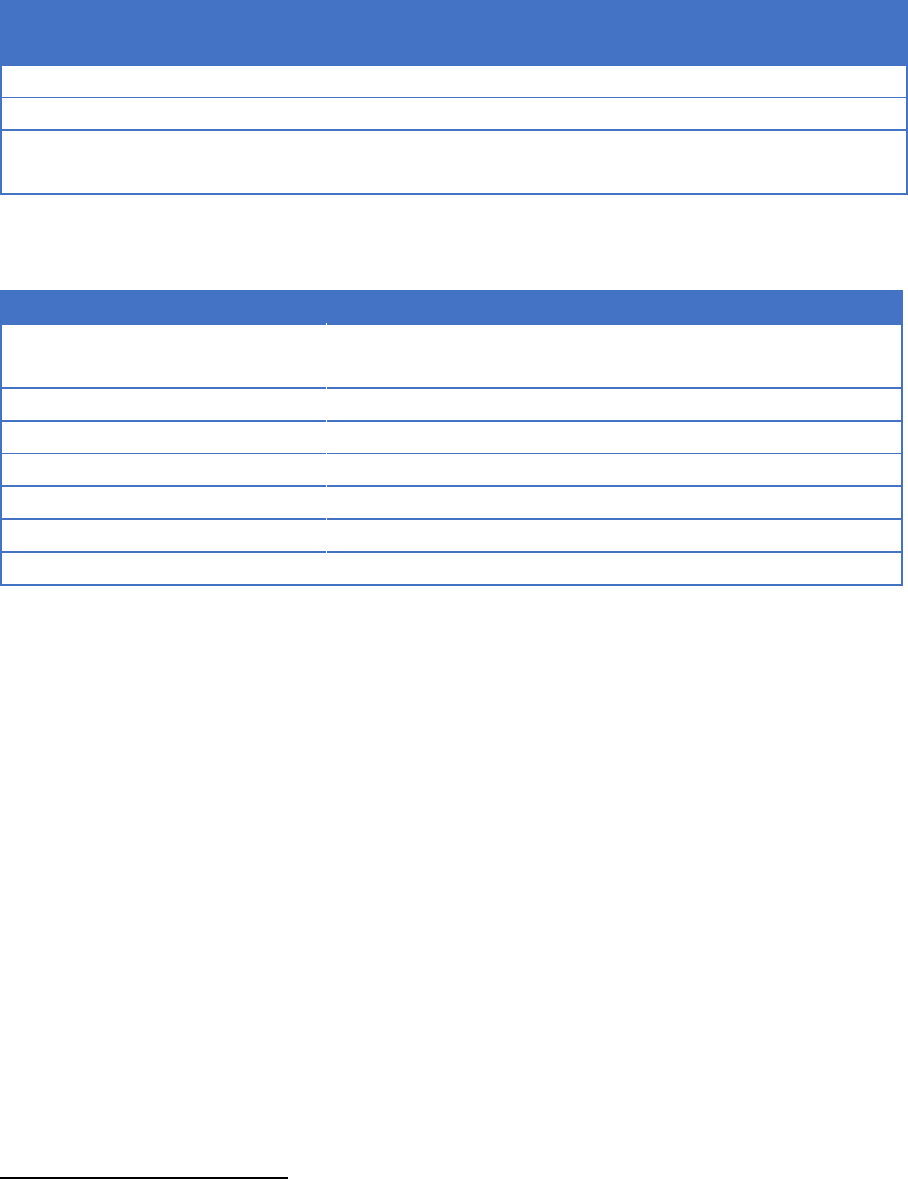

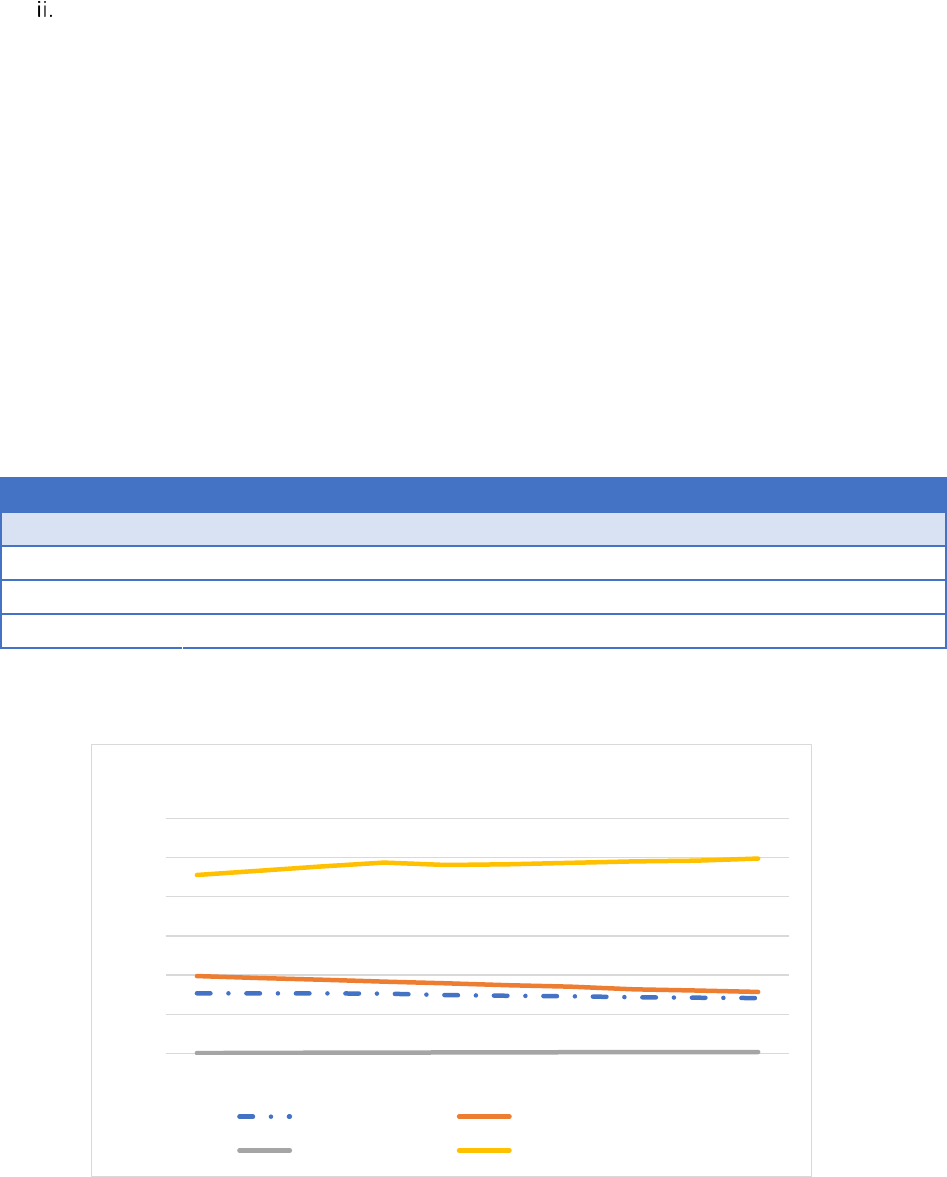

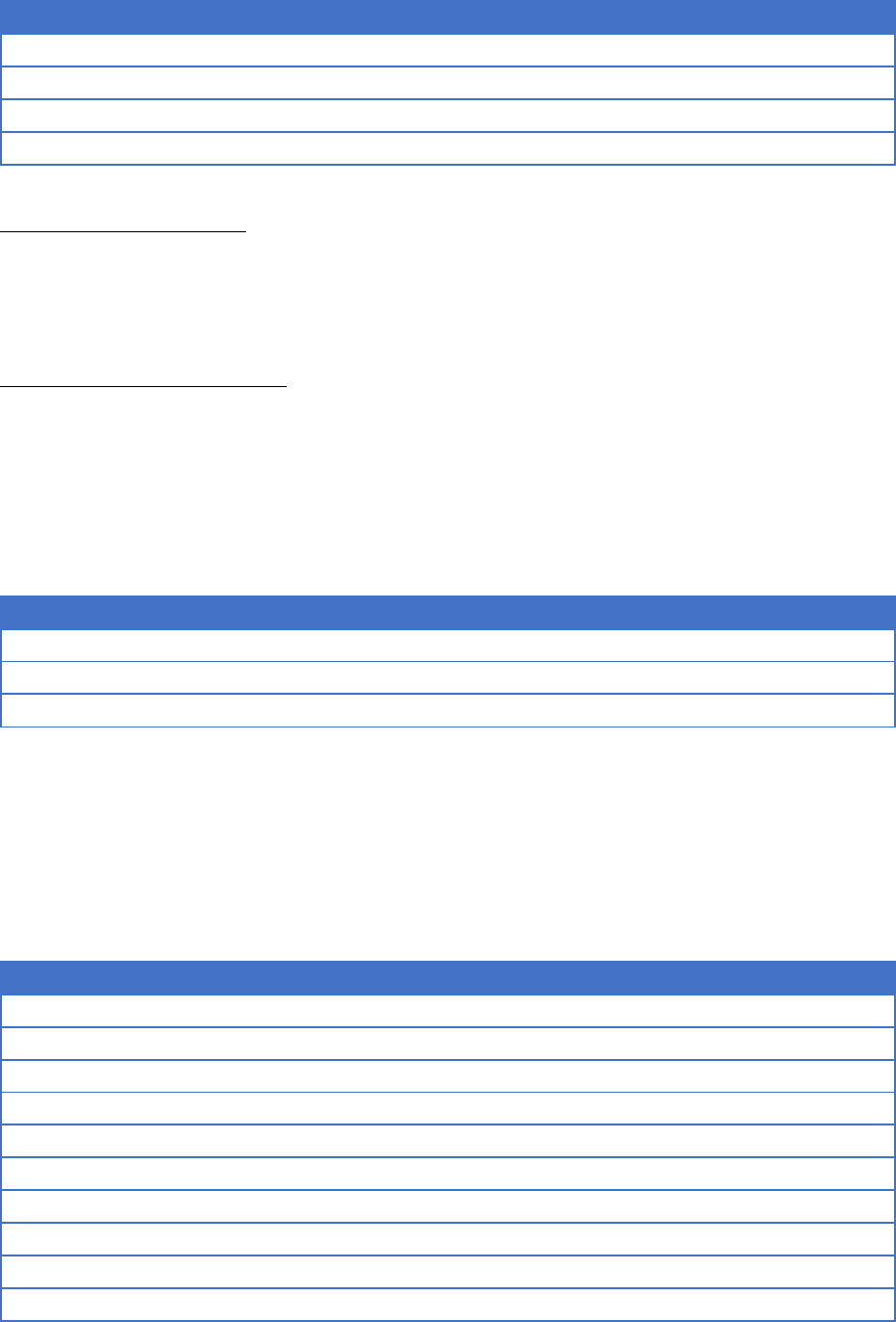

Overview table with key objectives, policies and measures of the plan

Dimension

Key objectives

Key policies and measures

Decarbonisatio

n

GHG emissions

and removals

-19% GHG emissions reduction target under the Effort

Sharing Regulation (ESR);

Contributing to the EU -40% GHG emission reduction target;

Fulfilling obligations of the Paris Agreement;

Management of Farm Slurries in the Maltese Islands;

Waste Management Plan 2020-2030;

Development of Waste-to-Energy Facility;

Sustainable mobility measures;

Renewable

Energy

11.5% share of Renewable energy in gross final energy

consumption in 2030;

14% RES share in the transport sector in line with Renewable

Energy Directive;

Measures exploiting all technically and economically viable

indigenous RES sources;

Extension of current policy framework in the area of RES for the

period until 2030 whilst providing new initiatives tailored to local

specificities.

- Financial support schemes for Solar PV;

- Schemes to support solar water heaters and heat pump

water heaters;

- Biofuels substitution obligation;

Energy

Efficiency

Energy intensity of 0.07 toe/€

2005

in 2030.

Reaching energy savings obligations under Article 7 of the

Energy Efficiency Directive.

Energy savings obligations and incentives for all energy end-use

sectors, through measures such as:

- Electricity tariffs supporting energy efficiency;

- Support schemes for services and industry;

- Government leading by example;

- Projects in primary water network and wastewater

treatment plants

6

Energy

Security

Continued diversification of energy sources and suppliers;

Reduction of import dependency through the deployment of

indigenous sources of RES, taking into account the

specificities of Malta’s energy system;

Periodic contingency planning in the case of supply

disruption for electricity, gas and oil sectors;

Energy Security in the context of the long-term objective of

decarbonization of the energy system and increased

deployment of RES;

Delivery of gas pipeline (“MTGP”) project;

Critical infrastructure protection and cyber-security in the energy

sector;

Contingency planning (Gas Security of Supply, Risk Preparedness

in the electricity sector, Oil Supply Disruption, Emergency stock

holding obligations);

Energy storage solutions and demand management

Internal

energy

market

Ensure competitive electricity prices for households,

commercial and industrial sectors;

Maintain the level of electricity interconnectivity well above

the EU 15% target during the projected period until 2030;

Measures targeting an increase in the flexibility of the energy

system and the protection of energy consumers.

Delivery of gas pipeline (“MTGP”) project;

Research &

Innovation and

competitiveness

Development of National Strategy for Research & Innovation

in Energy and Water (2021-2030), which would:

- Strengthen and support R&I that addresses national

policy priorities and challenges and/or bolsters

national competitiveness and growth in a variety of

sectors;

- Increase coordination and cooperation between the

wide array of stakeholders in fields of energy and

water;

Delivery of objectives of the National Strategy for R&I in Energy &

Water, which may include

6

:

- Establishment of Platform RINEW;

- Enhanced financing of R&I projects within the priority

areas identified;

- Increased public-private partnerships in energy R&I;

- Systematic collection of data for evidence-based

evaluation;

6

Subject to changes and updates following the public consultation on the Draft R&I Strategy expected to be finalized in January 2020.

7

1.2 OVERVIEW OF CURRENT POLICY SITUATION

National and EU energy system and policy context of the plan

Recent years proved to be a period of rapid enhancement of the energy sector in Malta. Government’s

energy policy focuses on providing Maltese citizens and businesses with affordable, sustainable and

secure forms of energy; this is a reflection of the overarching policy fundamentals expressed by the

EU Energy Union. The underlying objectives guiding Malta’s energy policy decisions in the last decade

include:

• Reducing Malta's dependence on the importation of oil through the achievement of a

diversified energy mix;

• Reducing the carbon footprint and greenhouse gas emissions of Malta through improved

efficiency in generation capacity, and through the replacement of heavy fuel oil with natural

gas and renewable sources;

• Enhancing and strengthening the security of supply of the country whilst ensuring the

availability of appropriate back up capacity;

• Stimulating investment in renewable energy sources through the provision of appropriate

incentives;

• Achieving a degree of interconnection for electricity supply; and

• Overhauling the generation capacity of the country with a view to achieving higher efficiency

gains whilst stimulating investment in natural gas infrastructures.

A number of these objectives have been successfully addressed. With Malta’s Energy Policy published

in 2012, a clear roadmap was delineated to ensure that Malta’s energy sector meets these objectives.

Priority was given to the swift upgrading of inefficient conventional electricity production

infrastructure and the introduction of LNG as fuel for power generation, which until then was reliant

on heavy fuel oil. Malta closed the inefficient Marsa Power Station; completed and placed in operation

the 200MW interconnector with the European grid; and has commissioned a new 205MW gas-fired,

high efficiency combined cycle gas turbine (CCGT) power plant as well as an LNG facility for the

provision of natural gas in the short term with a view to replace this option by a permanent multi-

purpose gas pipeline with Sicily. In addition, the recently built 149MW power plant which comprises

eight diesel engines has been converted to run on natural gas instead of heavy fuel oil. Four of these

engines can also run on diesel oil, a feature sought to contribute towards the desired level of security

of supply. The developments in the generation sector that have taken place have been given the

highest priority as these have resulted in significant primary energy savings and in substantial

reductions in GHG emissions from the energy sector. Investments in the power generation sector were

guided by the Energy Efficiency first principle and indeed managed to increase the overall conversion

efficiency from 25-30% to more than 50%.

The Distribution System Operator (DSO) executed a number of upgrades in its Distribution Centres to

consolidate the national electricity distribution grid. It also invested more than €100 million

7

over the

7

https://www.enemalta.com.mt/upgrading-your-network/2014-2017/

8

period 2014-2017 to upgrade and expand major nodes of the national electricity network and improve

the quality of service.

Malta’s energy policy also focuses on maximizing Malta’s effective renewable energy potential. The

Government increased its efforts to support the deployment of renewable energy, especially

photovoltaics, solar water heaters and heat pump water heaters (which are particularly well suited to

Malta’s geographic location), and whilst acknowledging the technical, geographical and spatial

barriers limiting renewable energy potential, Malta continues to support the exploitation of viable

indigenous sources of renewable energy.

Malta does not have a natural gas network (LNG is only made available to the power plant), although

uses of natural gas in niche applications may start to develop if the Malta-Italy gas pipeline is pursued.

Throughout the years, Malta continued in its effort to address climate action. These efforts culminated

in 2015 with the development and enactment of the Climate Action Act. This provides the legal

framework within which climate action is pursued and establishes a governance structure. Climate

mitigation and adaptation strategies were devised with programmes of measures to address the local

context. Through the ratification of the Paris Agreement, Malta reaffirmed its commitment to address

climate issues to their fullest potential and to contribute towards the European Union’s collective

target of 40% reduction of its GHG emissions by 2030 compared to 1990 levels.

Current energy and climate policies and measures relating to the five Energy Union

dimensions

The policy framework for energy and climate in the Maltese Islands is described in the following key

documents:

• The National Energy Policy, published in 2012;

• The National Renewable Energy Action Plan for 2020, published in 2017;

• The National Energy Efficiency Action Plan for 2020, published in 2017;

• National Strategy for Policy and Abatement Measures Relating to the Reduction of

Greenhouse Gas Emissions, published in 2009; and

• Malta’s Low Carbon Development Vision, 2017.

Other supporting documents amplify aspects of these policy frameworks and include measures

designed to implement the various policies. The policies and measures described in the above-

mentioned policy documents feature in the ‘With Existing Measures’ scenario.

National Energy Policy (2012)

The major policy areas and objectives set out in the 2012 National Energy Policy are listed below,

broadly annotated under the five dimensions of the Energy Union. These policy areas remain generally

valid within the current policy framework until 2030, even though priorities and emphases may have

changed, and various major projects have been implemented.

• Decarbonisation: The 2012 Energy Policy focused on Government support targeting the

sustainable development of renewable energy sources, including commitments to reduce

GHG emissions related to the production, distribution and consumption of energy. The

9

reduction of GHG and other emissions was to be reflected in policy, legislation and

implementation of projects.

• Energy efficiency: Government focused on encouraging and facilitating the achievement of

increased energy efficiency in electricity generation and distribution, and in energy end-use,

and through leading by example.

• Energy security: The Government’s focus was placed on diversification away from reliance on

oil products, replacement of ageing power plants, and ensuring that contingency plans are in

place to cater for short-term disruption of oil or LNG supply. The government continued to

support the sustainable deployment of viable indigenous renewable energy sources.

• Internal energy market: The objective was to establish an electricity and gas interconnection

with the European grids to provide the basis for integration with the EU internal energy

market. The Government also aimed to ensure that the legal and regulatory frameworks result

in affordable energy pricing, whilst encouraging competition within the limits imposed by the

market size and structure. Social measures are also in place to support and protect vulnerable

consumers.

• Research, innovation and competitiveness: The Government committed that its fiscal policy

and its education and research policies support the general objectives of ensuring security of

supply, environmental protection and competitiveness.

As a consequence of the changed priorities and of major projects undertaken in recent years, various

measures arising out of the Energy Policy (2012) have been implemented, others superseded or

rendered irrelevant. Several, certainly the more important, were achieved earlier than originally

planned.

The National Renewable Energy Action Plan (2017)

8

The need for an updated action plan covering the period 2015 to 2020 arose after reconsideration of

the RES options triggered by technological, social and economic developments. The plan includes a

revision of the national RES perspective while remaining faithful to the underlying Energy Policy of

2012 and Malta’s commitments to meet the 10% Renewable Energy Target in line with Directive

2009/28/EC.

The Policy measures set out in 2015 and updated in 2017 are listed below. These are classified under

the ‘Decarbonisation’ dimension in the NECP framework.

• Indigenous sources of RES to be prioritised: Malta will seek to reasonably exploit indigenous

sources of RES to reduce the country’s dependence on foreign energy sources and thus add

to security of energy supply, green job creation and foreign investment.

• ‘Cooperation Mechanisms with other Countries’ as a fallback solution: Malta will consider

Cooperation Mechanisms with other countries to meet its 2020 Renewable Energy target only

as fall-back in the case that there will be a minor shortfall in meeting its 2020 target.

8

https://ec.europa.eu/energy/en/topics/renewable-energy/national-action-plans

10

• Malta’s RES mix to be diverse and multi-faceted to counter natural constraints: Malta will

exploit all cost-effective sources of RES that can make a contribution, however small, to the

final target. This is to counter its specific geographic, environmental and spatial constraints

(limited land area and high population density and its rich but fragile natural environment).

• RES and conventional energy are to be considered holistically: Government and competent

authorities will ensure in their decisions that all the components of the local energy sector, of

which RES is part, must holistically contribute to reach the objectives of the energy policy.

• Well managed deployment of RES: Government will ensure that investment and incentives

in RES are staggered in such a way as to avoid creating shocks and economic bubbles, while

achieving targets in a timely manner.

• Investment in Renewable Energy will be incentivised: Government will put forward incentive

schemes, consistent with national and EU legislation, to make up for the cost premium over

conventional energy and that are optimised to achieve their objectives at the lowest cost.

• Energy efficiency to be prioritised: Government will robustly and effectively promote efficient

use of energy resources, in line with the framework in Directive 2012/27/EU of the European

Parliament and of the Council and the ‘Energy Efficiency First’ principle.

• Building a Knowledge base and support Research: Government supports indigenous

research, development and innovation (RDI), intended to address specific challenges faced by

Malta by virtue of its particular geographic specificities, while contributing towards building

the competence and prestige of local institutions. Government supports the development of

appropriate technology to harness renewable marine energy. This is of particular relevance

to Malta given the limited landmass.

The National Energy Efficiency Action Plan (2017)

9

The NEEAP of 2017, revising that of 2014, describes the policies and measures until 2020 targeting

end–use efficiency in Malta. The Plan was drawn up as required by, and in line with Directive

2012/27/EU.

The Policies guiding that NEEAP were the following:

• Energy Efficiency Obligation Scheme upon the national electricity supplier, to apply a

progressive (rising block) residential tariff system which is inductive of efficient use of

electricity.

• Financing schemes/instruments and fiscal incentives to incentivize target sectors to adopt

more energy efficient technologies. Measures aim to target the residential, industrial,

commercial and transport sectors.

• Regulations and voluntary agreements with relatively high consumers of energy, encouraging

them to adopt more energy efficient technologies.

9

https://ec.europa.eu/energy/en/topics/energy-efficiency/energy-efficiency-directive/national-energy-efficiency-action-plans

11

• Public Sector leading by example whereby Government and public entities are being seen to

actively pursue energy efficient measures and projects.

The National Strategy for Policy and Abatement Measures Relating to the Reduction of Greenhouse

Gas Emissions (2009)

10

This strategy, commonly referred to as Malta’s Mitigation Strategy, provides a policy framework to

address Greenhouse gases across all sectors. It includes a national governance structure for

management of greenhouse gases, as well as outlining actions to instil a cultural shift towards a better

appreciation of our individual responsibility towards climate protection. These principles were later

enshrined in the Climate Action Act 2015 (CAP543) which provided a solid basis in the form of a legal

structure for governance of Greenhouse Gas (GHG) emissions.

The Mitigation Strategy primarily addresses the decarbonisation pillar of the Energy Union Strategy

but, in doing so, has considered other aspects including energy efficiency and R&I, as described below.

• Decarbonisation: In general, the strategy addresses measures contributing towards a general

unquantified reduction for Greenhouse gas emissions. It also envisaged the basic governance

and administrative structure currently in place.

• Energy efficiency: The strategy included provisions regarding energy efficiency, especially in

the building and electricity sector.

• Research, innovation and competitiveness: The strategy embodied actions that addressed

Research and Development and Innovation (RDI), especially in the local scene and with specific

sectoral scopes.

Malta’s Low Carbon Development Vision (2017)

11

This document was prepared as a stepping-stone to Malta’s Low Carbon Development Strategy, which

in turn crystalizes Malta’s response to the requirements of the UNFCCC, the Paris Agreement, EU

legislation and the obligations under the Climate Change Act 2015 (CAP543). The Vision focuses on

ways and means to transform Malta into a low-carbon and climate resilient country through symbiotic

societal and economic collective actions by 2050.

The Vision has, at its core, a focus on integrating various mitigation and adaptation measures to reduce

local greenhouse gas emissions. It identifies a number of key areas with potential for carbon emissions

reduction and where diversification is possible. The areas identified for action include energy,

transport, waste, agriculture, water, enterprise, tourism, information and communication

technologies (ICT), infrastructure (planning and monitoring of existence infrastructure), finance and

expert knowledge.

Through the Vision, Malta commits to:

10

https://msdec.gov.mt/en/Document%20Repository/Malta%20Climate%20Change%20Adaptation%20Strategy/National%20Climate%20C

hange%20MITIGATION%20Strategy.pdf

11

https://meae.gov.mt/en/Public_Consultations/MSDEC/Documents/MSDEC%20LCDS%20Vision.PDF

12

• Uphold national GHG emissions reduction targets as required by EU legislation by 2020;

• To move towards a reduction of national GHG emissions as opposed to pursuing a continued

limited increase in emission levels post 2020;

• Reduce national GHG emissions post-2030 in accordance with Malta’s economic development

priorities of the time;

• Set sector specific GHG emission reduction targets post-2020 to contribute to meeting

national targets; and

• Identify and implement opportunities to enhance climate resilience in Malta.

Energy Performance of Buildings

The main piece of legislation related to the energy performance of buildings is Legal Notice 47 of 2018

transposing Directive 2010/31/EU on the energy performance of buildings (recast).

Following the transposition of the first Directive on the energy performance of buildings (Directive

2002/91/EC), the ‘Technical Guidance F – Minimum Energy Performance of Buildings in Malta 2006’

regulating the minimum energy performance of buildings was issued in 2006. This first technical

guidance on the energy performance of buildings only specified certain aspects of energy

performance, such as the maximum building element U-value and design parameters. For instance

whilst its specified the maximum allowable glazing to wall ratio or the building services efficiency, no

energy thresholds were included. In 2015, a new document ‘Technical Document F – Minimum Energy

Performance Requirements for Buildings in Malta 2015’ was issued, updating the existing minimum

energy performance requirements, and listing the overall energy thresholds for residential buildings

and offices.

In 2015, Malta published its first plan on how Nearly Zero Energy Buildings will be addressed in Malta.

This policy document establishes targets for new nearly zero energy buildings, both for residential and

other buildings, and examines possible barriers.

A number of policies and measures have been put in place to promote energy-efficiency in buildings.

Predominantly, these have taken the form of financial incentives or grants. For example, as of 2018,

REWS offers a grant on the purchase of roof insulation and double-glazing products for domestic use

that reduce the consumption of energy. As part of a process to preserve and restore the built heritage

of the Maltese Islands and promote sustainable regeneration, the restoration grant scheme Irrestawra

Darek

12

, aimed at privately owned residential buildings within urban conservation areas, was launched

to promote investment. Other policies and measures focused on financial incentives and grants for

the deployment of renewable energy, soft loans for green or energy efficiency investments, as well as

financial investments assisting businesses in becoming more energy-efficient and education

campaigns.

12

More information available at: https://www.pa.org.mt/en/irrestawra-darek

13

Key issues of cross-border relevance

Issues of cross-border relevance for Malta have to be viewed within the context of an island with no

land borders and with effectively one neighbouring Member State. This has direct implications on

Malta’s energy system which is reflected in this plan, in particular under the Energy Security and

Internal Energy Market dimensions.

Therefore, issues of cross-border relevance relate primarily to commercial contracts relevant to

importation of electricity via the electricity interconnector and LNG for fuelling of the power station.

As from April 2015, the Maltese electricity system has been synchronised with the Italian system, with

scheduled imports through the 200MW HVAC 220kV electricity interconnector. The interconnector is

operated by Enemalta plc in coordination with the transmission system operator in Italy, Terna.

According to this arrangement, the Maltese electricity system is being treated as a virtual consumption

and production point connected to the Italian transmission grid. The interconnector is prevalently

used for imports of electricity and balancing.

The planned gas pipeline interconnection between Malta and Gela (Sicily, Italy) has reached the

permitting stage and technical, financial and environmental studies are underway. The pipeline is

scheduled for completion in 2025 provided it secures the necessary financing.

Cross-border cooperation in areas falling under the other dimensions, such as joint projects in

renewables, cooperation and sharing of best-practices on measures targeting energy efficiency and

possible joint projects in the area of research & innovation in low-carbon technologies are also

considered.

Administrative structure of implementing national energy and climate policies

An Inter-Ministerial Steering Committee (IMSC) was established through Cabinet Decision

CAB/90/XIII/17 with the objective to deliver Malta’s first National Energy and Climate Plan. The IMSC

was established to ensure that all national stakeholders contribute effectively towards the National

Plan, as the development of the Plan required the coordination and contribution from several entities.

Each Ministry forming part of the IMSC designated a high-level political representative to sit on the

Committee. Under the IMSC, two Technical Working Groups were established, one on energy

modelling and another on non-energy, climate-related modelling, tasked with providing relevant

quantitative assessments and technical input to the IMSC. The main role of the IMSC is that of aligning

diverse Ministerial priorities so as to develop a holistic and integrated NECP. By the end of 2018, the

deadline for the submission of Malta’s Draft NECP, the IMSC had met eight times. The IMSC met

another five times during 2019 in order to ensure the timely development and completion of the

remaining sections required for the submission of Malta’s Final Plan and to address issues such as the

outcomes from the public consultation process and recommendations published by the European

Commission on Malta’s Draft Plan. There is a possibility that the IMSC structure or a similar one will

remain in place post-2019 to overlook the implementation of policies and measures which have been

established as part of the NECP.

Given that the legal basis of the Governance Regulation falls primarily within the remit of the

Directorate-General for Energy, the Ministry for Energy and Water Management is the lead Ministry

14

in the development of the NECP. The following Ministries, all of which are represented on the IMSC,

are considered as important contributors to the drafting of the Plan and have been tasked with

providing input to sections falling under their remit.

• The Office of the Prime Minister

• Ministry for the Environment, Sustainable Development and Climate Change

• Minister for Transport, Infrastructure and Capital Projects

• Ministry for the Economy, Investment and Small Business

• Ministry for Finance

• Ministry for European Affairs and Equality

• Ministry for Education and Employment

• Ministry for Justice, Culture and Local Government

• Parliamentary Secretary for Financial Services, Digital Economy and Innovation

Apart from the individual Ministries sitting on the IMSC which are listed above, other national

governmental entities are considered as key stakeholders responsible for the implementation of

specific sections of national energy and climate policies falling and are also represented on the IMSC.

Technical assistance on the NECP

During the development of the Malta’s Draft and Final Plans, Malta has benefitted from the use of

technical support programmes provided by European Commission services. Malta participated in a

European Commission’s project in which Member States were provided assistance in developing

national greenhouse gas projections

13

. The results and recommendations of this project fed into

another Commission project through which technical assistance was provided to six Member States

in their development of the Plan

14

. The scope of this project from DG CLIMA and DG ENERGY was to

provide support to Member States in preparing aspects covering climate-related data gaps. Technical

assistance was being provided in relation to expert peer-review of the models available at the Malta

Resources Authority for the elaboration of projections of GHG emissions by sources and removals by

sinks for the sectors Industrial Processes and Product Use (IPPU), Agriculture, Land Use, land-use

Change and Forestry (LULUCF), and Waste.

Malta also benefitted from technical assistance through the Commission’s Structural Reform Support

Service (SRSS) contract. As part of the SRSS, the Ministry for Energy and Water Management benefited

from the services of experts for a period of 12 months, who assisted with the development of energy

models. The Ministry for Environment

15

, Sustainable Development and Climate Change applied for

Advisory Service concerning the Agricultural Sector.

Technical assistance was provided by E4SMA who focused primarily on the review of the analytical

basis of Malta’s NECP, supporting updating of the NECP modelling framework, development of the

Impact Assessment section, as well as on the preparation of terms of reference for the Strategic

Environmental Assessment. Support was provided on running the updated and enhanced modelling

framework, in particular to conduct a scenario and sensitivity analysis. In relation to the Impact

13

Service request No. 2016/03 under framework contract CLIMA.001/FRA/2015/0014

14

CLIMA/C.2/SER/2017/0002

15

“Technical support for the development of the integrated NECP of Malta” (SRSS/C2018/035)

15

Assessment, support was provided primarily on section 5.2 (macroeconomic, social, health impacts)

and 5.3 (overview of investment needs).

The SRSS project “Technical support on the emission framework for the agriculture sector in Malta”,

the beneficiary of which was the Ministry for Environment, Sustainable Development, and Climate

Change reviewed the existing and potentially new data providers to establish the most appropriate

data streams on improving the agriculture inventory.

1.3 CONSULTATIONS AND INVOLVEMENT OF NATIONAL AND EU ENTITIES AND THEIR

OUTCOME

Involvement of Parliament

Malta’s national law does not require formal endorsement of Malta’s National Energy and Climate

Plan by the Parliament. As outlined in Section 1.2, through Cabinet Decision CAB/90/XIII/17, the IMSC

on the NECP was established to ensure a coordinated approach of all Ministries relevant to the

development of the Plan. The Cabinet of Ministers has been regularly updated on the status of the

Plan. The Draft Plan, as well as options for policy scenarios establishing the direction of Malta’s

national energy and climate policies post-2020, were presented to Cabinet on the 4th December 2018

and the Draft NECP subsequently endorsed, in time for the Draft Plan’s submission to the European

Commission by the end of 2018.

Malta’s Final NECP was approved by the Cabinet of Ministers on 3 December 2019, prior to its formal

submission to the Commission in December 2019 in line with the requirements of the Governance

Regulation.

Involvement of local and regional authorities

Given Malta’s size, regional authorities do not exist. Local Councils form the most basic form of local

government; however, their role is primarily administrative and their involvement in energy and

climate policy design is marginal. The Local Government Division at the Ministry for Justice, Culture

and Local Government is responsible for assisting the Ministry in the formulation of strategies, policies

and legislation as required. Nevertheless, Local Councils were invited to provide feedback on Malta’s

NECP as part of the formal online public consultation process which took place at the beginning of

2019. This is further detailed in the section below.

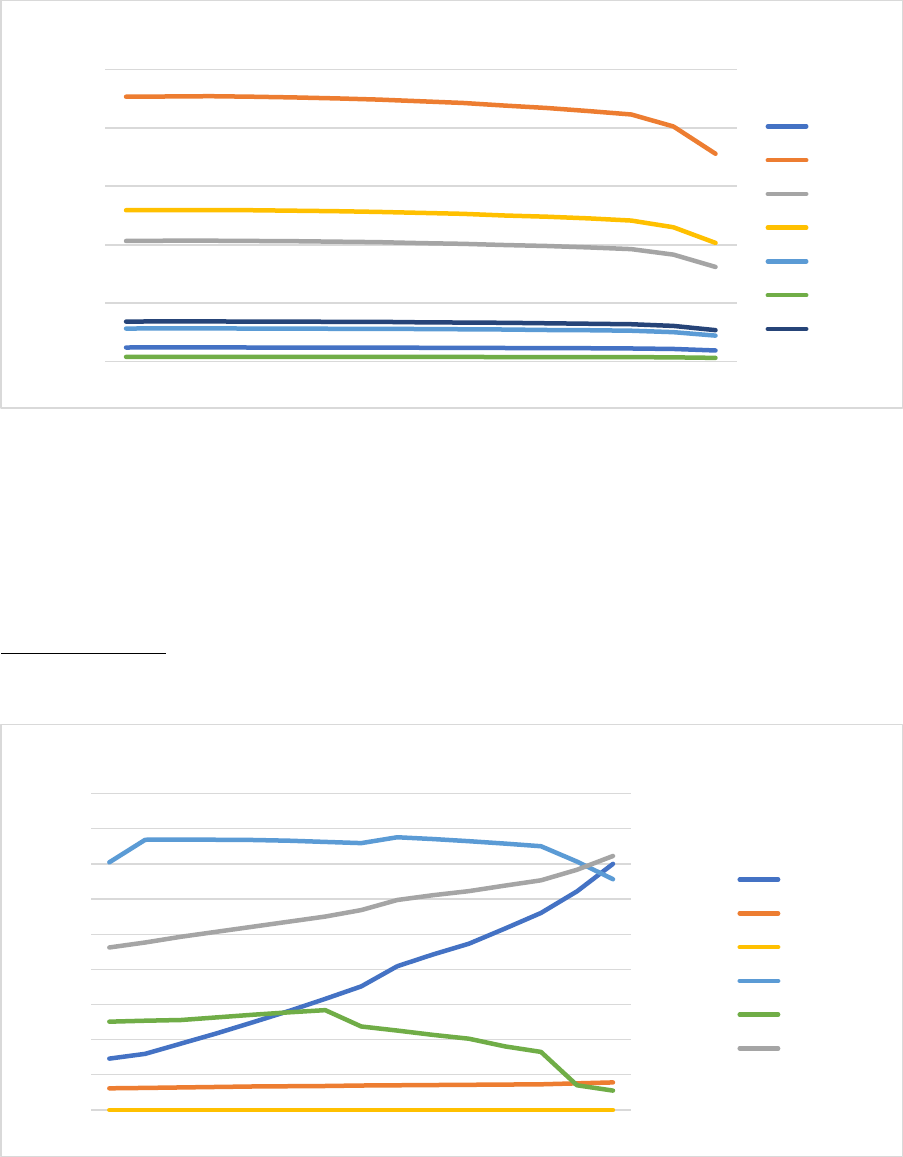

Consultations with stakeholders, social partners, and engagement of civil society