Office of the Controller 1

Rev. October 2017

Questions? Contact: ctl-auxiliaryaccounting@fsu.edu

OMNI AR/Billing: Handling Advance

Prepayments

Detailed Business Process Guide – ABILL15

Unearned (deferred) revenue should be recorded when payments are requested and invoices made far

in advance of the event taking place. This will require 2 steps: a prepayment invoice and a subsequent

invoice that shows the payment as a credit and adjusts for the balance.

1. Prepayment Invoice (Half-Down Invoice)

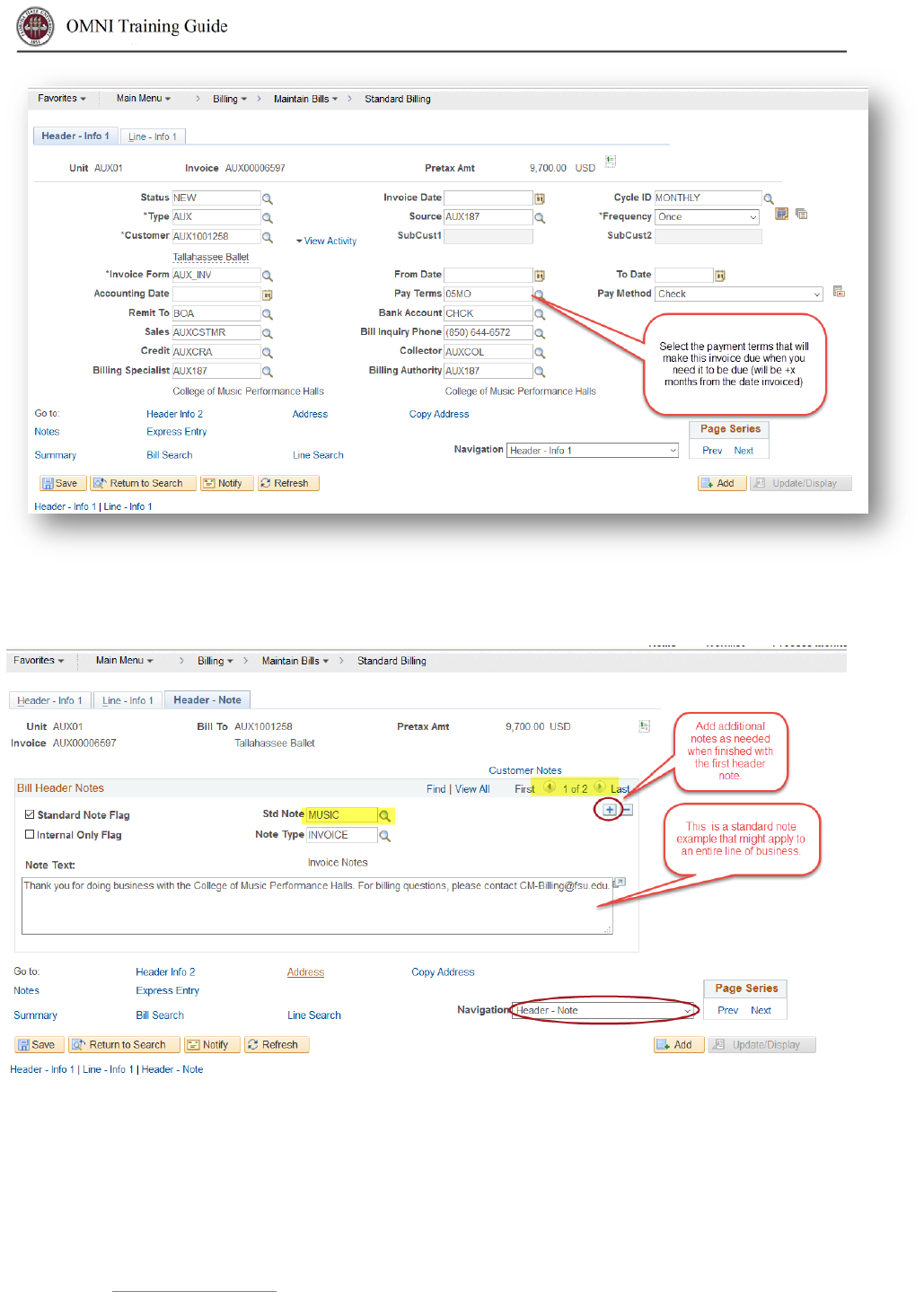

Here is an example of creating the original prepayment invoice. This invoice will create accounting

entries that will increase (debit) Accounts Receivable and increase (credit) Deferred Revenue.

Navigation: Main Menu > Billing > Maintain Bills > Standard Billing

1. Navigate to Main Menu > Billing > Maintain Bills > Standard Billing

2. Select “Add a New Value.”

a. Business Unit: AUX01

b. Invoice ID: NEXT

c. Bill Type ID: AUX

d. Enter your auxiliary’s Bill Source

e. Enter the Customer ID

f. Invoice Date & Accounting Date should be left blank

g. Select “Add.”

3. Set up the defaults for the invoice.

Office of the Controller 5

Rev. October 2017

Questions? Contact: ctl-auxiliaryaccounting@fsu.edu

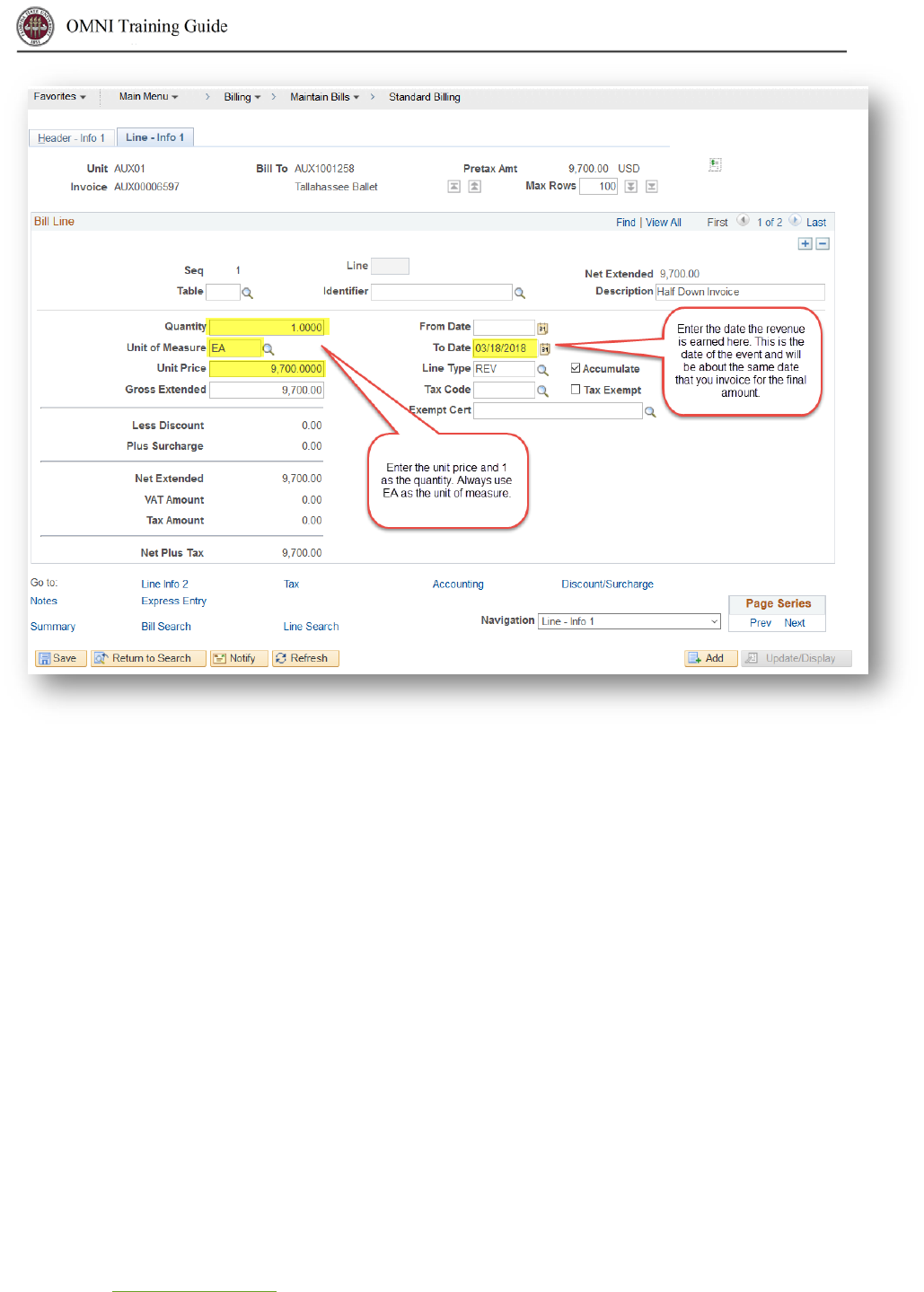

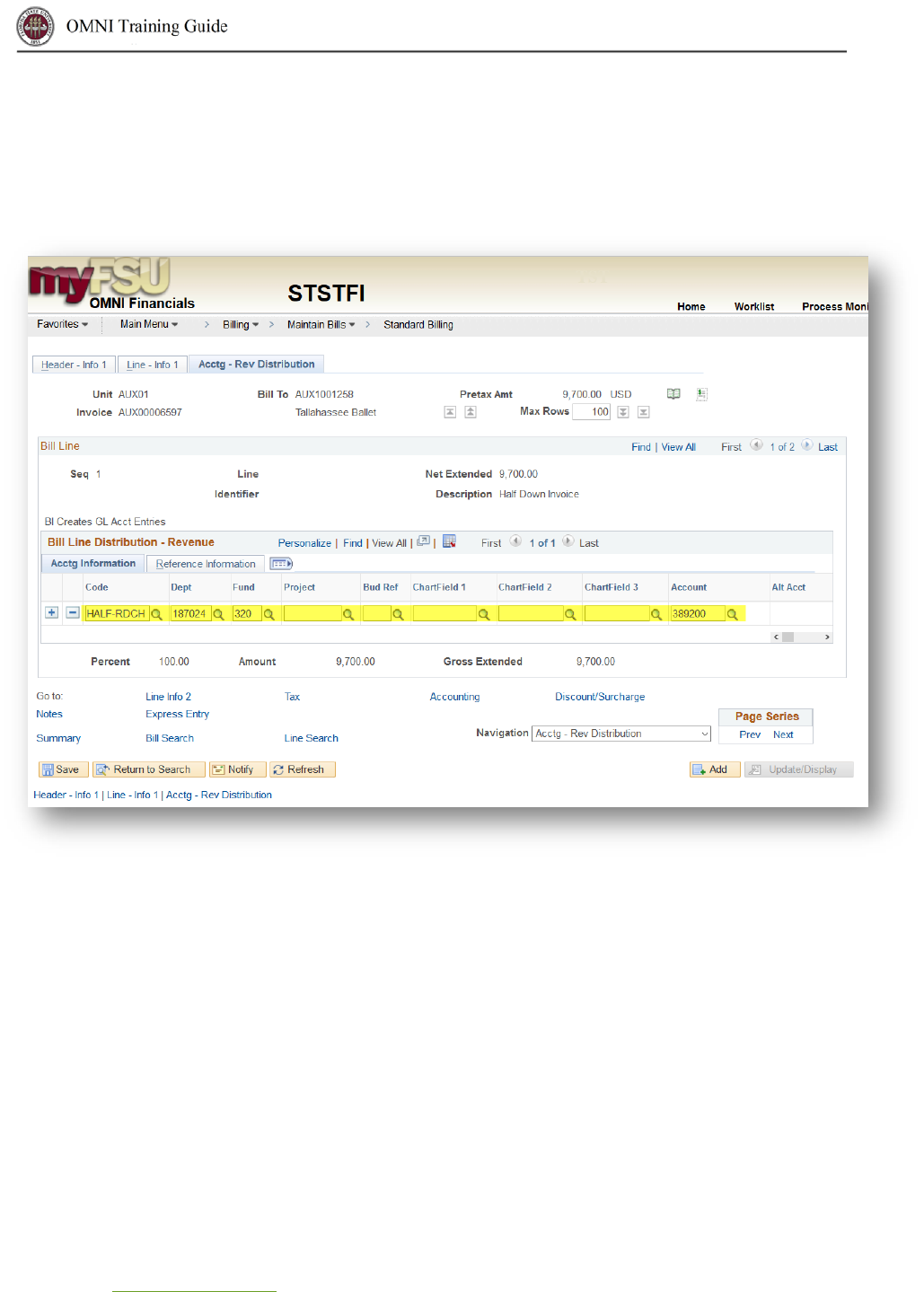

8. Enter the accounting information. (Navigation drop down – Acctg – Rev Distribution)

a. Because this is due so far in advance and you won’t have earned the revenue until the

event takes place, you need to enter a different account code.

b. Enter the Department, Fund, and Account 389200.

c. Note: Distribution Codes may be set up to automate this for you, or you may enter the

information manually.

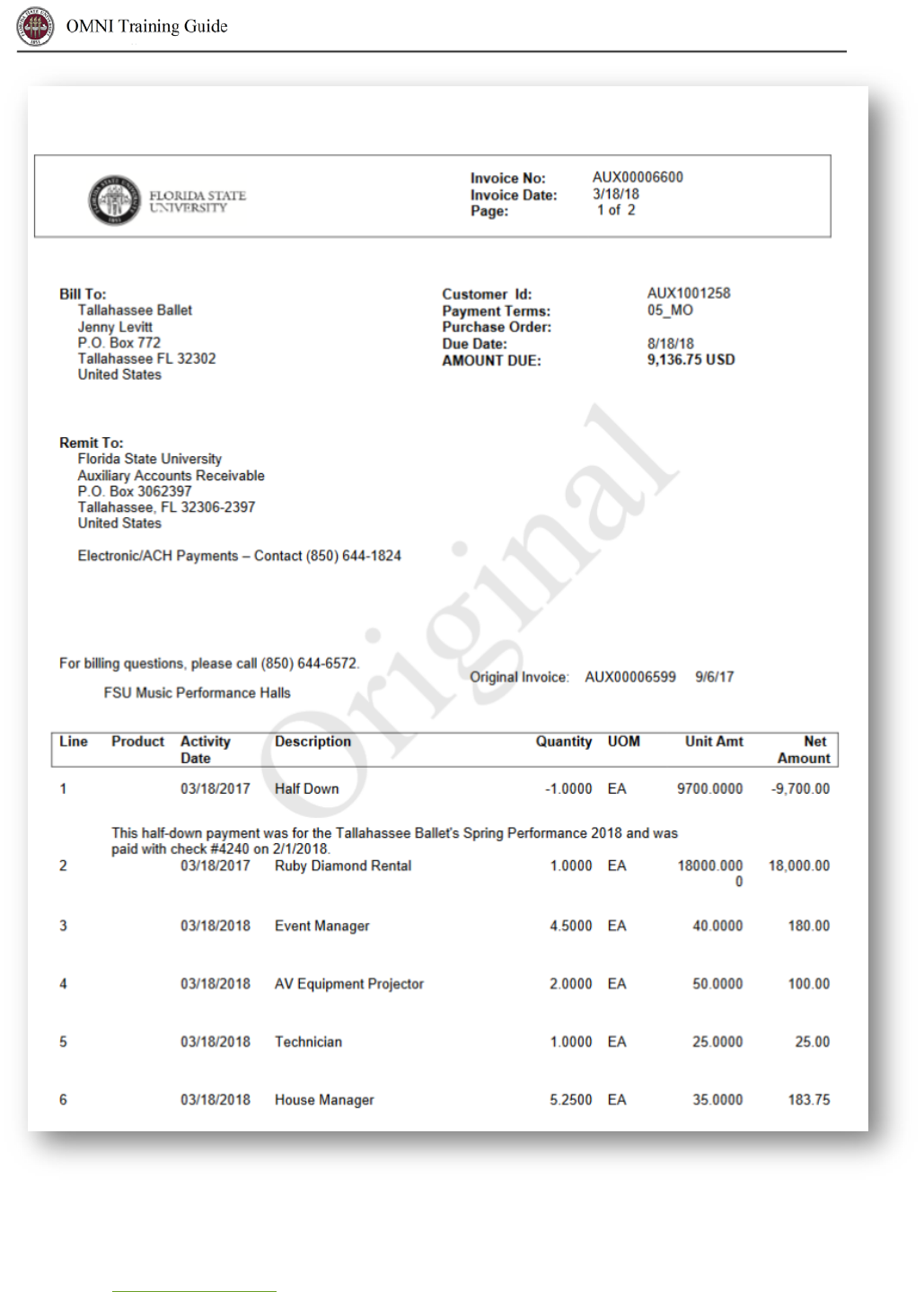

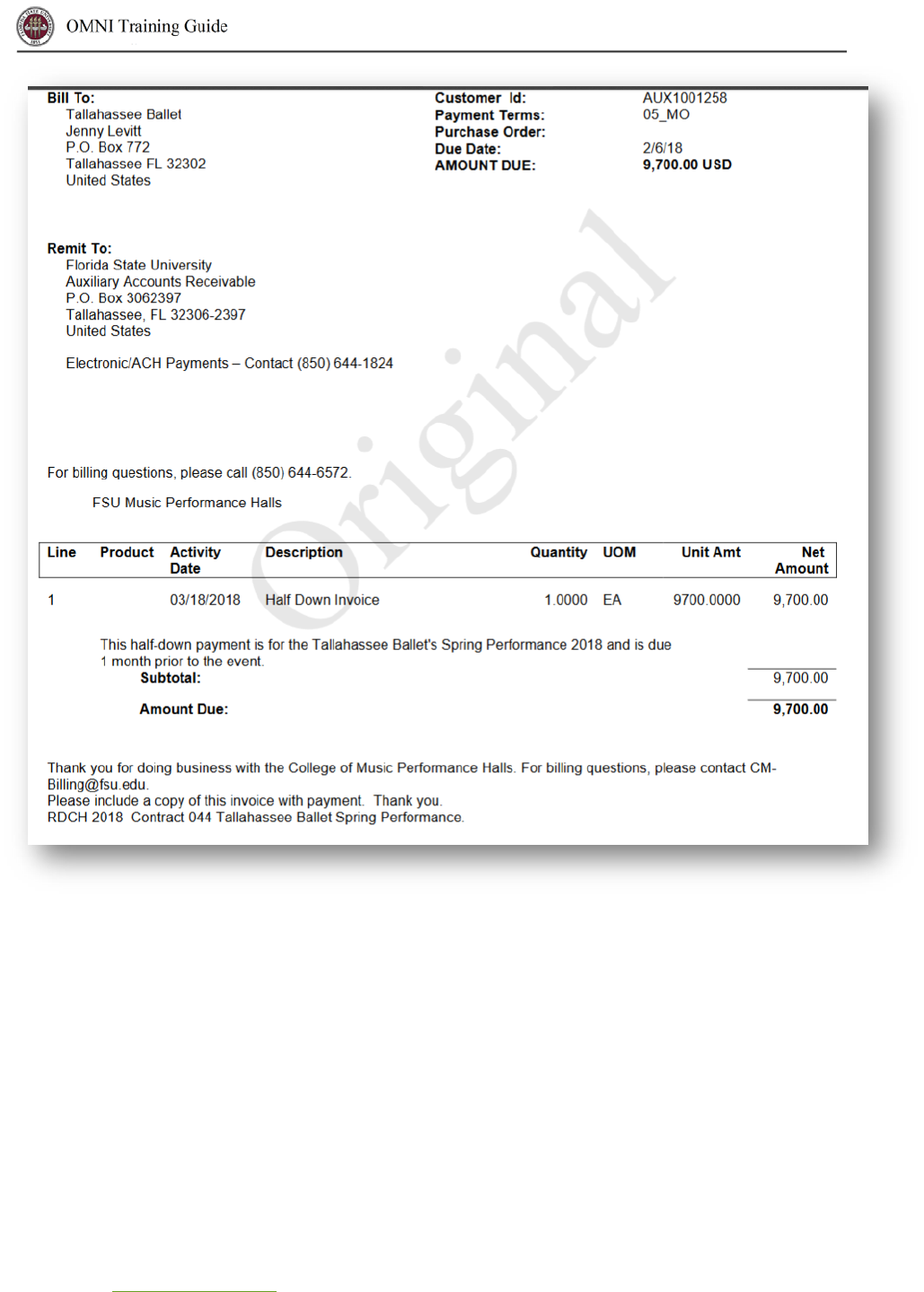

9. Set the bill to ready and invoice the bill as usual. The customer will pay the prepayment by the

due date and the event will take place (or the good/service will be provided). The invoice will

look like this:

Office of the Controller 6

Rev. October 2017

Questions? Contact: ctl-auxiliaryaccounting@fsu.edu

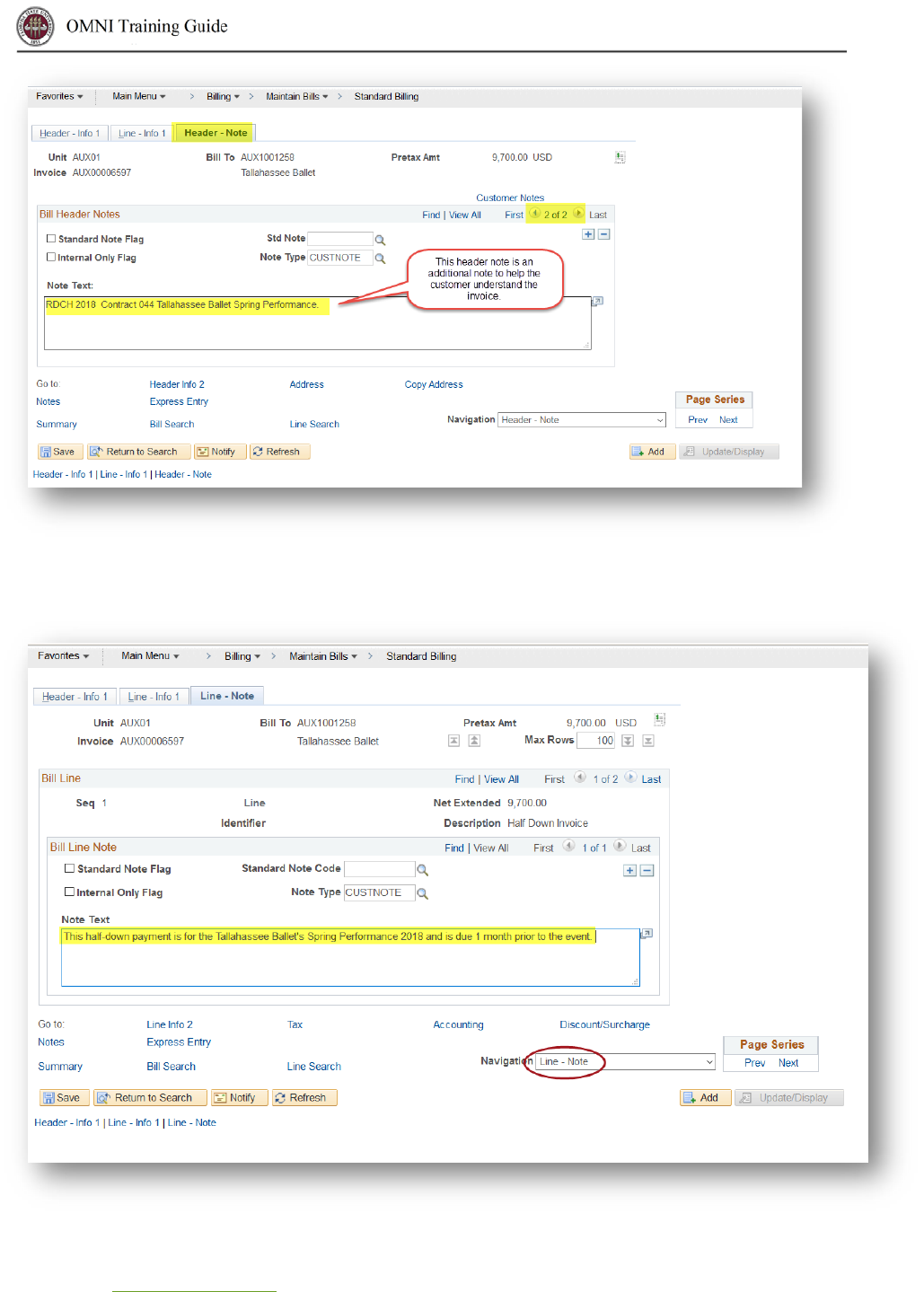

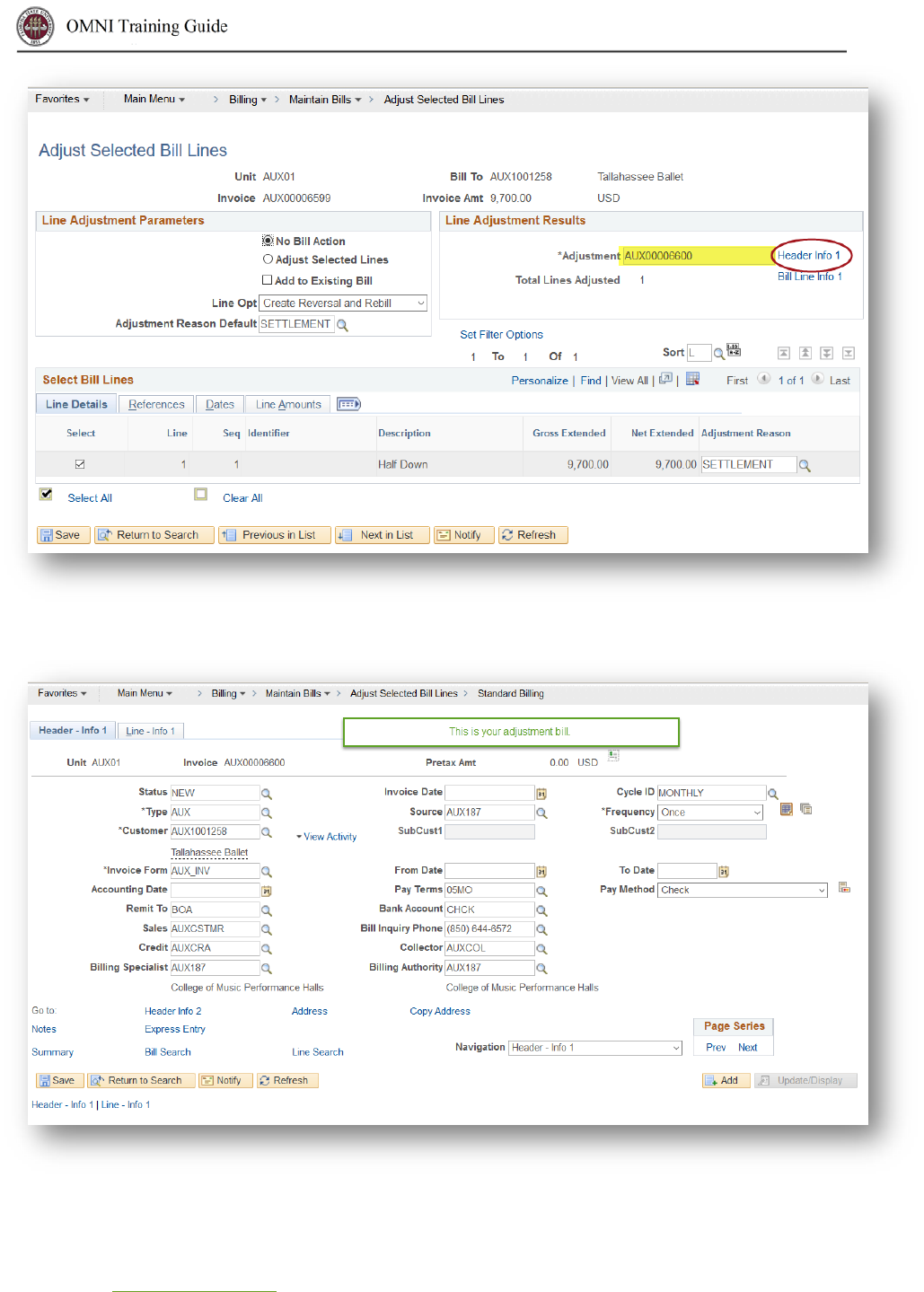

2. Settlement Invoice (Post-Event Invoice)

Here we will use the adjust bill feature to create the accounting entries needed to reverse the liability

(Deferred Revenue) and record the Revenue.

This usually takes place just after the event is completed / good/service is provided.

1. Locate the prepayment invoice number.

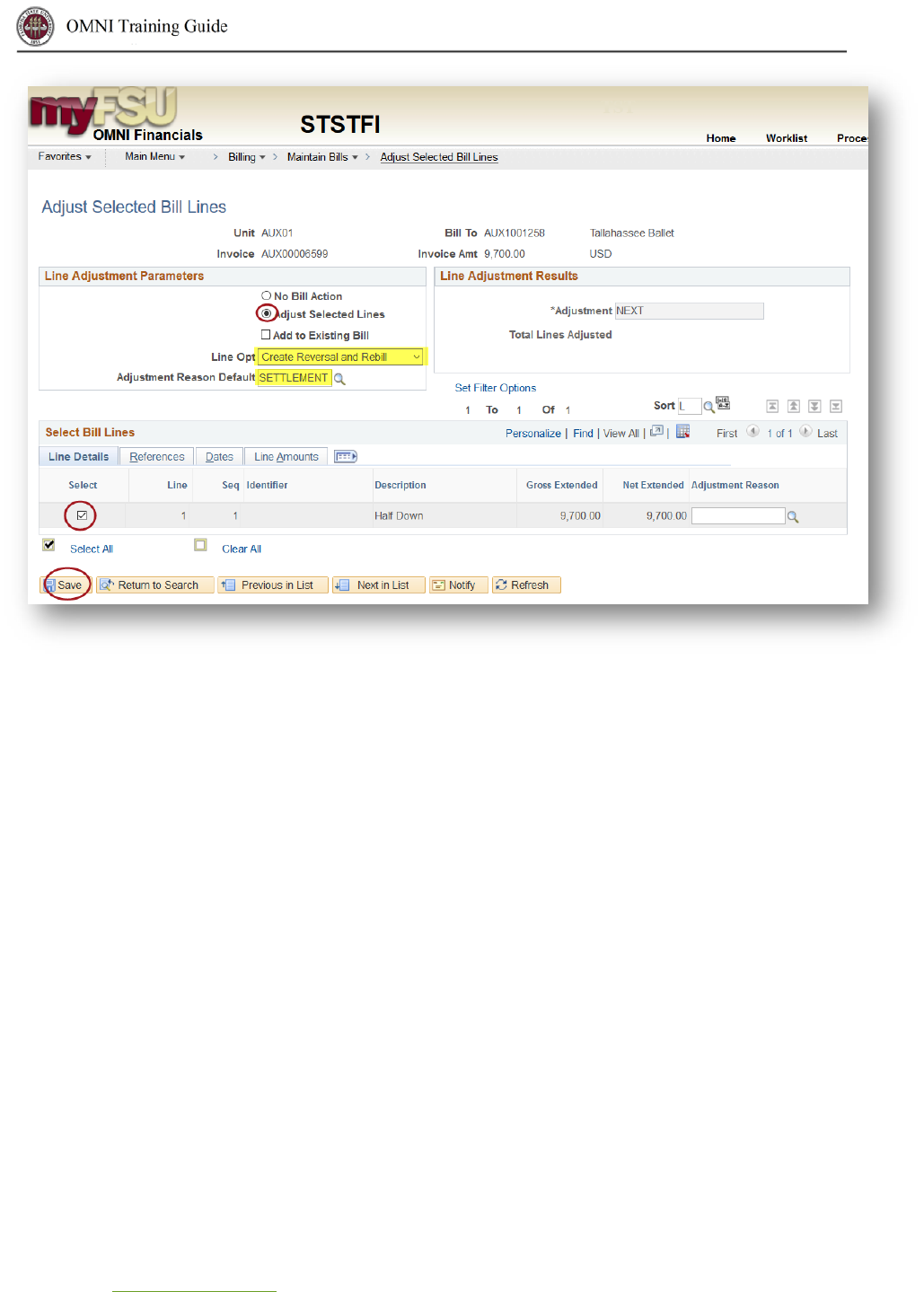

2. Select the “Adjust Selected Bill Lines” navigation and pull up the invoice.

3. Select “Adjust Selected Lines” and Line Option “Create Reversal & Rebill.” Choose Adjustment

Reason Default of “SETTLEMENT”. Select the half-down line.

Office of the Controller 9

Rev. October 2017

Questions? Contact: ctl-auxiliaryaccounting@fsu.edu

5. Review your lines. 1 line is reversing, and 1 line is rebilling. This allows us to account for any

differences in the expected amount of the charge and the actual amount of the charge after the

good/service is provided.

a. For example, the customer requests to prepay for 500 hours of equipment time, and

paid for 500 hours of equipment time. However, the experiment only took 459 hours of

equipment time. The adjustment would include an additional credit for 41 hours.

b. For example, the customer requests to prepay for 500 hours of equipment time, and

paid for 500 hours of equipment time. However, the experiment took an extra 50 hours

of equipment time. The adjustment would include an additional amount charged for the

extra 50 hours.

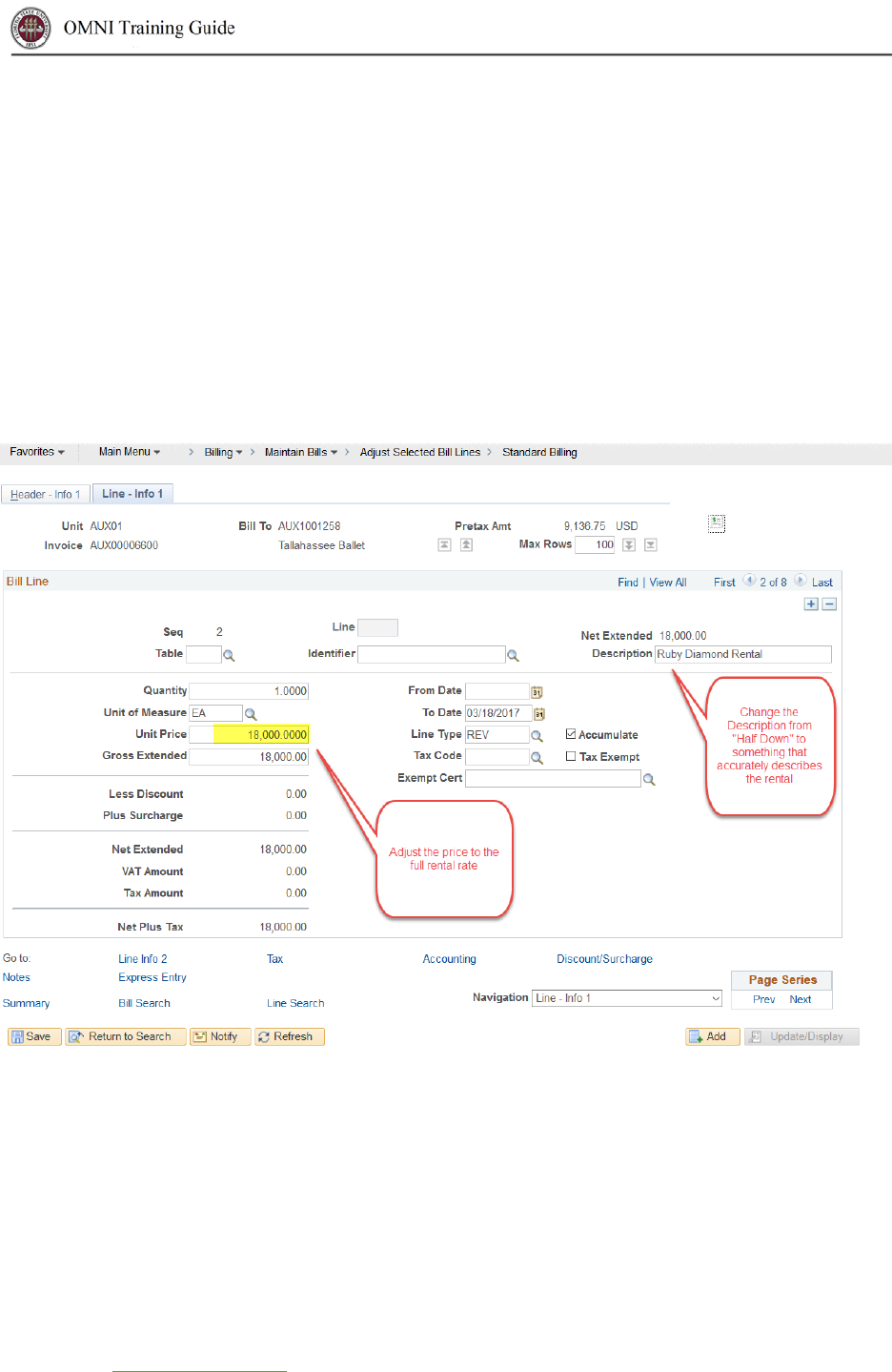

6. For the rebill line (The positive number), adjust to show the entire amount for the charge and

edit the description from “Half Down Payment” or “Prepayment” to something that actually

describes the good/service

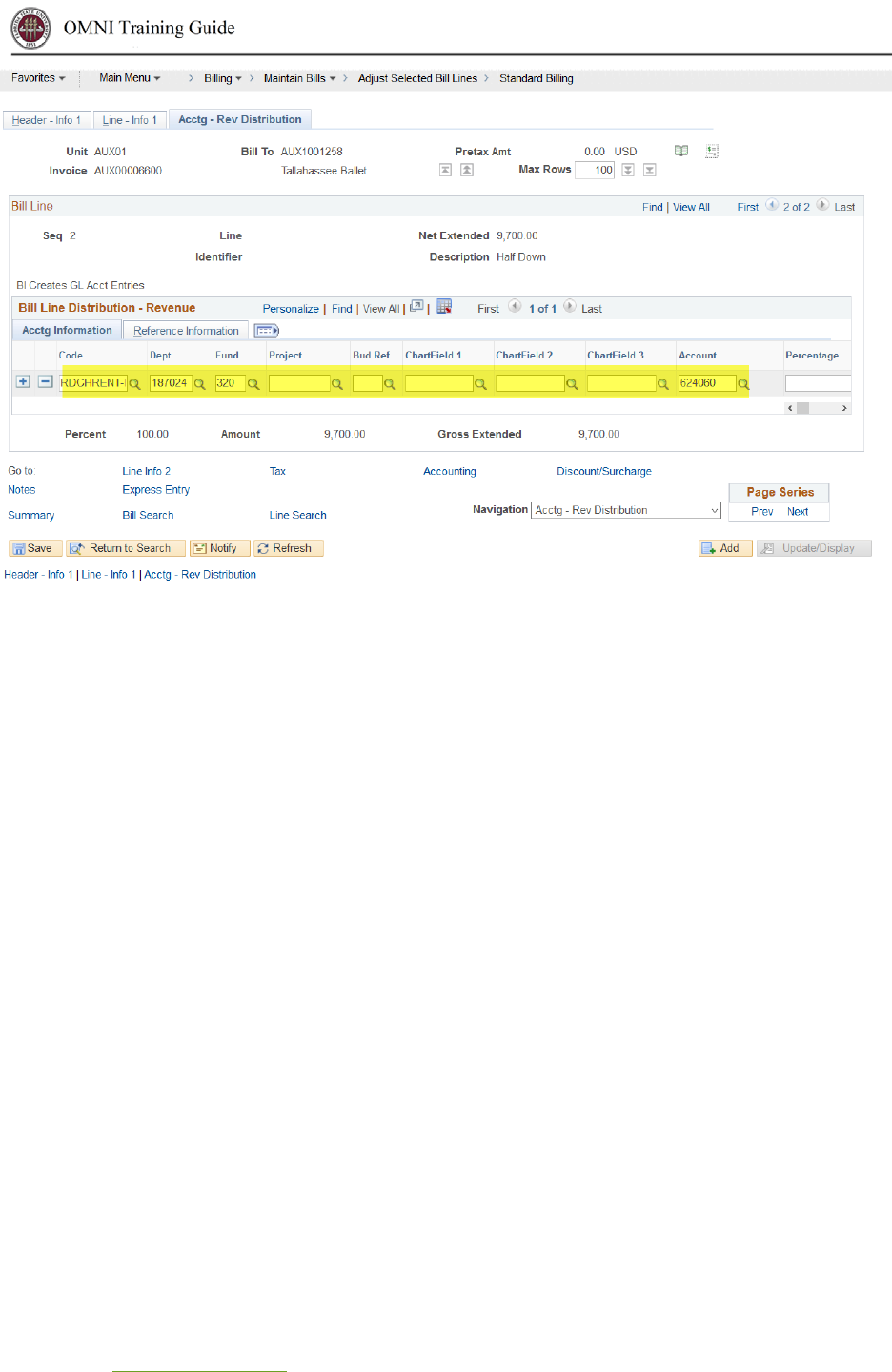

7. For the rebill line, you need to edit the accounting information before moving forward. This way,

you record the revenue selecting the normal revenue account code / distribution code.

a. Navigation Drop Down: “Acctg – Rev Distribution”

b. Enter the Department, Fund & Revenue Account Code (e.g. 623001)

Office of the Controller 10

Rev. October 2017

Questions? Contact: ctl-auxiliaryaccounting@fsu.edu

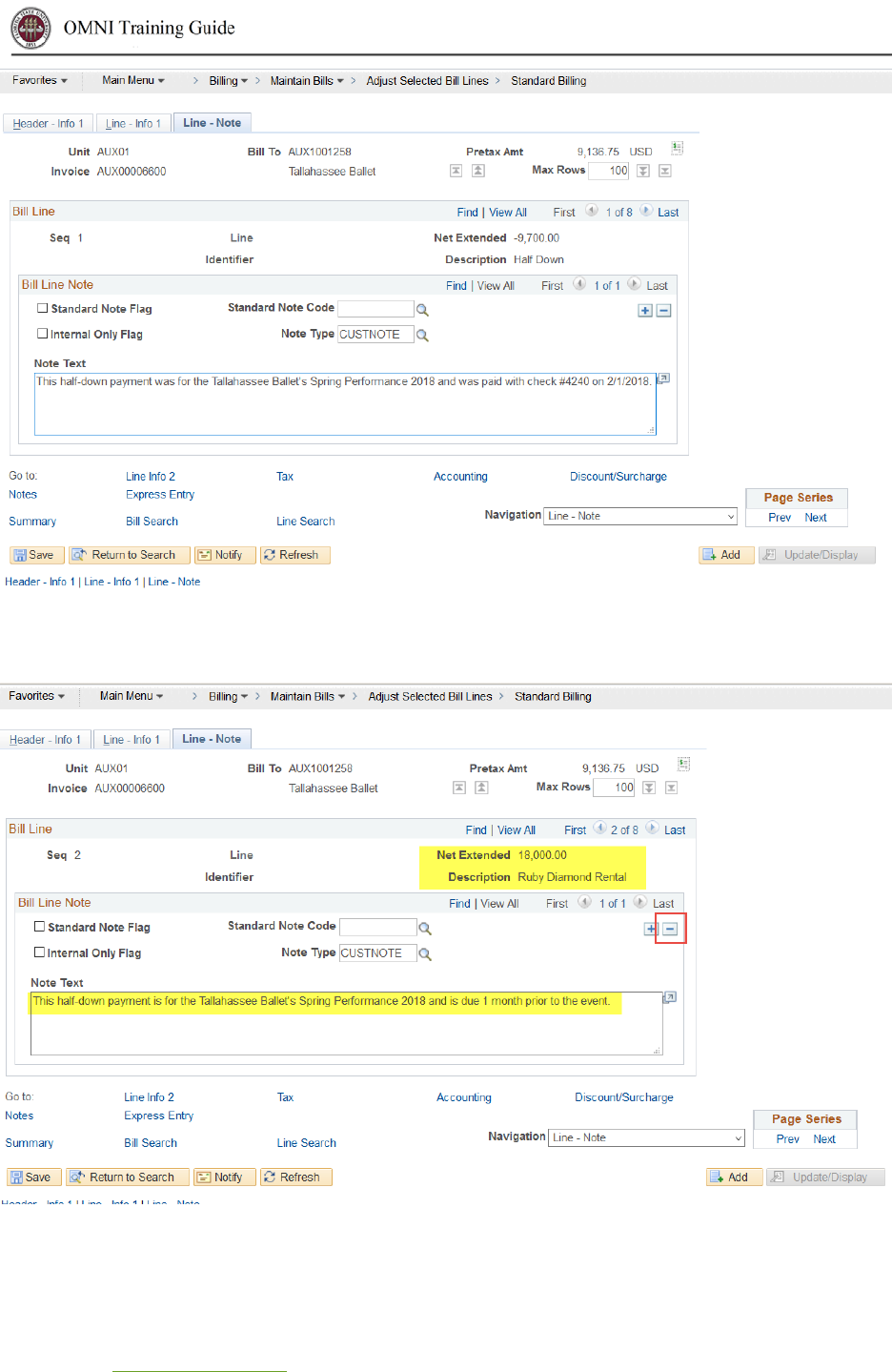

8. You might also want to delete or edit any line notes so they don’t keep showing up on the

invoice after they’ve lost relevance.

a. Here, we are editing the line note for the prepayment to show that the payment was

made and make it clear to the customer.

b. Navigation – Line – Note

c. Use the + or – signs to delete or add notes

Office of the Controller 11

Rev. October 2017

Questions? Contact: ctl-auxiliaryaccounting@fsu.edu

d. Here, I’m deleting the note because it doesn’t apply any more.

9. Then, add any new lines you need to completely settle the account. You will get a warning

message. This is ok. Proceed as usual to complete accounting, PO information, notes, etc.

Office of the Controller 12

Rev. October 2017

Questions? Contact: ctl-auxiliaryaccounting@fsu.edu

10. Review all information and ensure you’ve completed all tasks as required in the job aid for

Credit/Rebill (Bill Adjustment) before proceeding.

a. Note – bill header notes aren’t retained, so ensure you add any bill header notes that you

want to retain on the adjusting/settlement bill

11. Set the bill to ready and invoice.

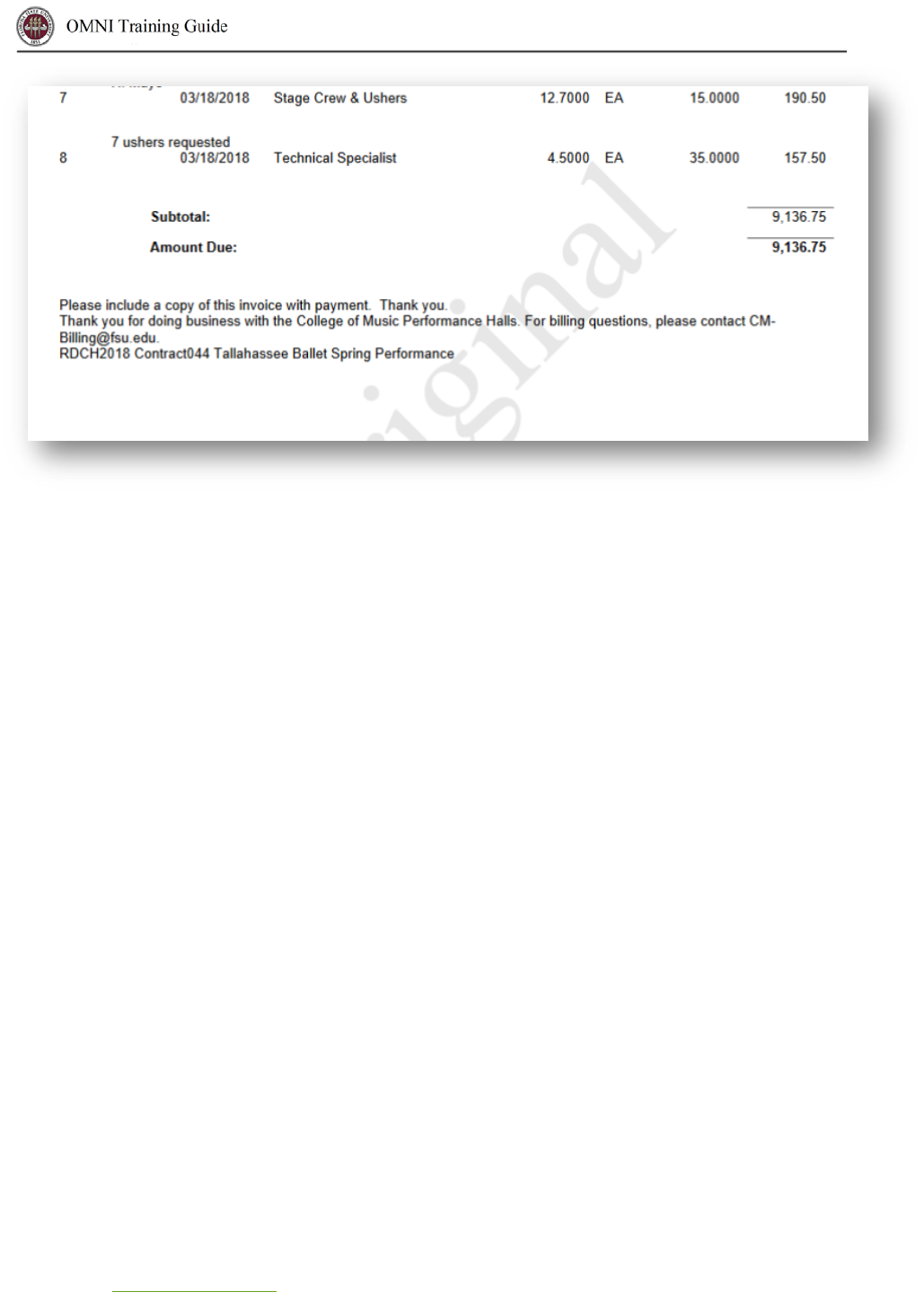

12. This is what your settlement bill will look like: