TREASURY SERVICES

2024 Global Wires Payments Formatting Requirements Guide

Your Guide to Making Cross-Currency Payments in over 160 Countries with Ease

2023 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

This guide is provided to JPMorgan Chase & Co clients for informational purposes only. JPMorgan Chase & Co makes no representations or warranties as to the accuracy,

completeness or timeliness of the information in this form. Information contained in the form is subject to change without notice.

The J.P. Morgan Global Wires Payments Formatting Requirements Guide is your desktop resource to help

you make timely and accurate payments to beneficiaries around the world.

Work with J.P. Morgan to get the global payment support that

your business demands

With employees, suppliers and operations located around the

globe, ensuring prompt payments in multiple currencies is a

challenge. Your business requires a partner who takes the

time to understand your needs and helps ensure your

payments are processed smoothly.

As one of the top-ranked cash management and payments

processors in the world, J.P. Morgan is able to offer the tools

that help you manage your day-to-day global operations,

along with your more sophisticated foreign exchange needs.

We make your priorities ours and recommend the high

quality solutions that meet your unique requirements.

As part of J.P. Morgan’s commitment to you, it is our

pleasure to provide you with this desktop companion, which

provides important, country-specific information to help

treasury and accounts payable professionals manage their

payments around the world. We look forward to providing

you with solutions that help take the complexity out of

managing your global cash and payments.

Note

If a capital payment of any description (loan services, capital

injection, investment, etc.) or any type of payment that may

result in a future repatriation is required, please contact your

JP Morgan Chase & Co representative before execution of the

transaction. Local regulations may require completion of

additional documentation and not all payment types can

necessarily be supported.

Setting up your payment

It is best practice to include the below standard information

in payment instructions to avoid potential delays or returns:

Ordering Customer

Account number

Full name (no initials)

Full address

Street address (avoid P.O. Box numbers)

City

State Code

Postal Code

Country code (2 characters)

Beneficiary Customer

Account number

Include the International Bank Account Number (IBAN) or Clave

Bancaria Estandarizada (CLABE), if applicable

Full name (no initials)

Full address

Street address (avoid P.O. Box numbers)

City

State Code

Postal Code

Country code (2 characters)

Beneficiary Bank

Full bank name

Address

SWIFT BIC

Some countries may also require additional information (i.e.,

telephone number, purpose of payment, routing codes, etc.).

Failing to provide all required information may result in

payment delays or returns.

Cross-Border Payment Requirement

Intermediary banks are often used when a payment is made

in a currency that is different from the local currency. When

making a payment through an intermediary bank, their

SWIFT BIC must be included.

Key Terms

International Bank Account Number (IBAN)

The International Bank Account Number, IBAN, is an

internationally agreed standard to identify an individual’s

account at a financial institution. IBANs should be included

for all SEPA payments. SWIFT maintains an IBAN registry

(https://www.swift.com/swift-resource/9606/download)that

provides details on the IBAN structure. The structure consists

of a two-letter ISO country code, followed by two check digits

and up to 30 alphanumeric characters for the Basic Bank

Account Number (BBAN).

Routing Codes

Some countries require the inclusion of national routing

codes to facilitate routing within the country’s payment

systems. Examples of countries with routing codes are

Australia and Canada.

SWIFT BIC

SWIFT BIC is a bank identifier code for members of the SWIFT

network. Please note: If a branch BIC is not known, the full

name and address should be used.

Host-to-Host Formatting Assistance

For translation assistance between SWIFT and file based

formats, please reference the table on page 77

ISO 20022 (PACS) Formatting Assistance

For translation assistance between SWIFT MT and SWIFT MX

formats, please reference the table on page 77

| 2

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

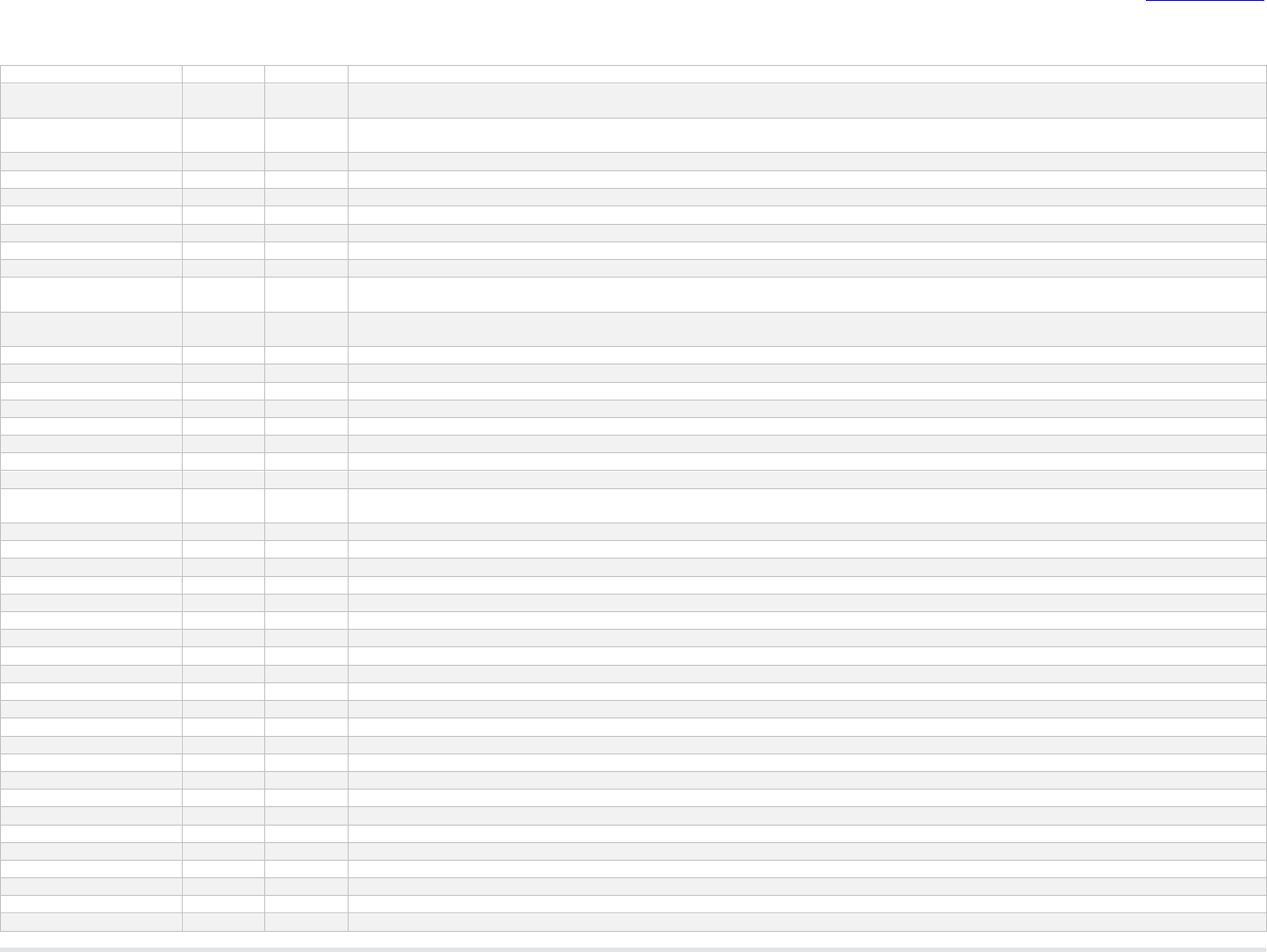

Table of Contents

Afghanistan.................................. 4

Albania

Algeria

Andorra........................................ 5

Angola

Anguilla

Antigua and Barbuda ................... 6

Argentina

Armenia

Australia....................................... 7

Austria

Azerbaijan

Bahamas ...................................... 8

Bahrain

Bangladesh

Barbados ...................................... 9

Belarus

Belize ......................................... 10

Belgium

Benin

Bermuda ....................................11

Bolivia

Bosnia and Herzegovina

Botswana.................................... 12

Brazil

Brunei-Darussalam..................... 13

Bulgaria

Burkina Faso .............................. 14

Burundi

Cambodia

Cameroon................................... 15

Canada

Cape Verde................................. 16

Cayman Island

Central African Republic............. 17

Chad

Chile

China.......................................... 18

Colombia .................................... 19

Costa Rica................................... 20

Croatia

Cyprus

Czech Republic (Czechia) ........... 21

Denmark

Djibouti ...................................... 22

Dominica

Dominican Republic

Egypt.......................................... 23

Equatorial Guinea

Eritrea

Estonia ....................................... 24

Ethiopia

Fiji

Finland ....................................... 25

France

Gabon

Gambia....................................... 26

Georgia

Germany

Ghana......................................... 27

Greece

Grenada

Guatemala.................................. 28

Guinea-Bissau

Guinea Republic

Guyana ....................................... 29

Haiti

Honduras

Hong Kong.................................. 30

Hungary

Iceland ....................................... 31

India

Indonesia ...................................

32

Iraq ............................................ 33

Ireland ....................................... 34

Israel

Italy

Ivory Coast ................................. 35

Jamaica

Japan

Jordan........................................ 37

Kazakhstan

Kenya......................................... 38

Kuwait

Kyrgyzstan

Laos ........................................... 39

Latvia

Lesotho

Liechtenstein ............................. 40

Lithuania

Luxembourg

Macau ........................................ 41

Madagascar

Malawi

Malaysia ..................................... 42

Maldives..................................... 44

Mali

Malta

Mauritania.................................. 45

Mauritius

Mexico

Mongolia

Monaco ...................................... 46

Montenegro

Montserrat

Morocco ..................................... 47

Mozambique

Myanmar

Namibia...................................... 48

Nepal

Netherlands

Netherlands Antilles - Curacao... 49

New Zealand

Nicaragua

Niger .......................................... 50

Nigeria

Norway

Oman ......................................... 52

Pakistan

Papua New Guinea ..................... 53

Paraguay

Peru ........................................... 53

Philippines

Poland........................................ 54

Portugal

Qatar.......................................... 55

Republic of the Congo

Romania

Russia ........................................ 56

Rwanda ...................................... 58

Saint Kitts and Nevis

Saint Lucia ................................. 59

Saint Vincent and the Grenadine

Samoa

San Marino................................. 60

São Tomé and Príncipe

Saudi Arabia

Senegal ...................................... 61

Serbia

Seychelles .................................. 62

Sierra Leone

Singapore

Slovakia ..................................... 63

Slovenia

Solomon Islands......................... 64

South Africa

South Korea

Spain.......................................... 65

Suriname

Sweden

Tahiti

Taiwan

Tonga

Turkey

Uganda

Vanuatu

Vietnam

Sri Lanka.................................... 66

Swaziland (Eswatini).................. 67

Switzerland................................ 68

Tanzania .................................... 69

Thailand..................................... 69

Togo........................................... 70

Trinidad and Tobago

Tunisia ....................................... 71

Ukraine ...................................... 72

United Arab Emirates

United Kingdom ......................... 74

United States ............................. 74

Zambia....................................... 76

Host-to-Host Format Assistance .76

Version Control...........................77

| 3

2024 Global Wires Payments Formatting Requirements Guide

Last Updated: February 16, 2024

Afghanistan

AFN – Afghan Afghani,

currently suspended

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Payment Formatting Rules for AFN

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxAFxx or

xxxxAFxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Currently Suspended for Payments

Additional Information

The local market is closed on Fridays.

Albania

ALL – Albanian Lek

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, IBAN, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.bankofalbania.org.

Country Requirements/Restrictions

Additional Documentation: For tax payments, the taxpayer must

provide a declaration form to the beneficiary bank.

Payment Formatting Rules for ALL

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

There are no specific bank clearing codes for Albania for cross-

border payments. SWIFT BIC is key to routing payments to the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxALxx or

xxxxALxxxxx.

Beneficiary Customer (SWIFT MT103 F59): Include account

number (IBAN), full name (no initials) and address of the

beneficiary customer. Use of initials may delay receipt of funds by

the beneficiary.

IBAN numbers for beneficiaries with accounts in Albania must be

included in the payment instructions.

Account # Ex. 1234567891234567

Country Code AL

Structure AL2!n8!n16!c

Length 28!c

Electronic Format Ex. AL98765432191234567891234567

Print Format Ex. AL98 7654 3219 1234 5678 9123 4567

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

For utility payments, the client’s name, month of the utility bill, and

contract number of the subscriber is required.

For tax payments, the FDP (payment order document generated by

Tax Office system) is required.

For custom fee payments, the NIPT (tax identification number) is

required.

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Algeria

DZD – Algerian Dinar

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

As of September 2019, Payments to individuals cannot be made in

DZD. Any DZD wire or FX ACH payment to individuals will result in a

rejection.

Country Requirements/Restrictions

Payment Restrictions: Any payment flows to individual

beneficiaries (B2P and P2P) must be pre-approved onshore before

the trade is booked.

Formatting Rules for DZD

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier, full name, and address of the beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxDZxx or

xxxxDZxxxxx.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

As best practice, format account numbers for beneficiaries with

accounts in Algeria according to the below specifications whenever

possible.

Country Code DZ

Length 22!c

Format DZ + 20 characters

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

For invoices, the reason for the invoice must be indicated (e.g.

invoice for health services).

Additional Information

The local market is closed on Fridays.

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 4

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Andorra

Angola

Anguilla

EUR – Euro

AOA – Angolan Kwanza

XCD – East Caribbean Dollar

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, IBAN, and beneficiary bank address).

Country Requirements/Restrictions

SEPA: Strict formatting standards and SEPA guidelines exist in

Europe regarding cross-border payments. IBAN and SWIFT BIC are

required for all euro payments. SEPA standards do not apply for

euro payments to beneficiaries with accounts in Andorra.

Payment Formatting Rules for EUR

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier, full name, and address of the beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxADxx or

xxxxADxxxxx.

Beneficiary Customer (SWIFT MT103 F59): Include account

number (IBAN), full name (no initials), and address of the

beneficiary customer. Use of initials may delay receipt of funds by

the beneficiary.

IBAN numbers for beneficiaries with accounts in Andorra must be

included in the payment instructions.

Account # Ex 1234567891234567

Country Code AD

Structure AD2!n4!n4!n12!c

Length 24!c

Electronic Format Ex. AD9876541234567891234567

Print Format Ex. AD98 7654 1234 5678 9123 4567

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Country Requirements/Restrictions

Additional Documentation: Additional supporting documentation

may be required from the beneficiary.

Payment Formatting Rules for AOA

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxAOxx or

xxxxAOxxxxx.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

Account numbers must be formatted according to the below

specifications.

Country Code AO

Length 25!c

Format AO + 2 characters + 21 digits

• Reason for Payment (SWIFT MT103 F70): Purpose of

payment is required. All AOA payments must include a 6

-

character purpose of payment code along with a Beneficiary

taxpayer number (NIF number, 10 characters for corporates

and 14 characters for individuals). This information can now be

formatted in either Field 70 or Field 72 and can follow one of

the below formats. Please ensure that your MT103 only

contains one of these formats:

– Format 1: /POP/XXX.XX/NIF/XXXXXXXXXX or

– Format 2: /BENEFRES/AO/XXX.XX/XXXXXXXXXX with XXX.XX

denoting the relevant purpose of payment code and

XXXXXXXXXX denoting the NIF (Taxpayer number)

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.eccb-centralbank.org.

Payment Formatting Rules for XCD

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxAIxx or

xxxxAIxxxxx.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

Payments where the underlying remitter is an MSB or PSP are not

supported.

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 5

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Antigua and Barbuda

Argentina

Armenia

XCD – East Caribbean Dollar

ARS – Argentine Peso

AMD – Armenian Dram

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.eccb-centralbank.org.

Payment Formatting Rules for XCD

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxAGxx or

xxxxAGxxxxx.

Payments to BIC NOSCAGAGXXX will not be processed as it’s no

longer available.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

Payments where the underlying remitter is an MSB or PSP are not

supported.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, CBU, 11-digit CUIT tax identification code, beneficiary

email address, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.bcra.gov.ar.

Country Requirements/Restrictions

Additional Documentation: Additional supporting documentation

may be required from the beneficiary stating the reason for

payment. The beneficiary must complete all required

documentation at their local bank to receive credit into the

account.

Payment Formatting Rules for ARS

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include the account

number (CBU), full name (no initials), address and tax ID of the

beneficiary customer. Use of initials may delay receipt of funds by

the beneficiary.

CBU (Clave Bancaria Uniforme) is a unique key comprised of 22

numbers representing the bank ID, branch account number and

other details. The CBU is required in all electronic payments in

Argentina, and should be entered in the account number field of

the payment instructions.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxARxx or

xxxxARxxxxx.

Reason for Payment (SWIFT MT103 F70):

– Purpose of Payment code and/or reason for payment freeform

text is mandatory to prevent delays or rejection.

– The beneficiary’s 11-digit tax identification code (CUIT – tax ID

for corporates / CUIL – tax ID for individuals) is required to

avoid payment delays or returns

Additional Information

Payment will be rejected if it does not include complete and

correct delivery instructions.

Payments to Judicial accounts (Depositors Judiciales) are not

supported

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.cba.am/en.

Country Requirements/Restrictions

Additional Documentation: Beneficiary is required to provide

supporting documentation indicating the reason for payment for

transactions greater than 20 million AMD.

Payment Formatting Rules for AMD

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include bank code (3

digit numeric bank code in front of beneficiary account number),

account number, full name (no initials) and address, of the

beneficiary customer. Use of initials may delay receipt of funds by

the beneficiary. Bank codes are required to be added in front of all

beneficiary account numbers.

Include the full legal entity type of the beneficiary (e.g., corporate,

charity).

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxAMxx or

xxxxAMxxxxx.

For payments to Central Bank of Armenia (CBRAAM22XXX), the

following information is required:

Residency of the customer (1 for resident ; 2 for nonresident)

Legal status of the customer (11 for commercial organization; 12 for

non-profit organization; 21 for individual; 22 for individual

entrepreneur)

TIN 10 digits (for Legal entity or Individual Entrepreneur) or Social

card (for individual)

Name of the customer

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

mandatory.

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 6

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Australia

Austria

Azerbaijan

AUD – Australian Dollar

EUR – Euro

AZN - Azerbaijani Manat

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, BSB number, account number and beneficiary bank

address).

Central Bank: For additional information, please refer to

www.rba.gov.au.

Country Requirements/Restrictions

Payment Restrictions: AUD is a freely traded currency for both

onshore and offshore clearing.

Payment Formatting Rules for AUD

Ordering Customer(SWIFT MT103 F50): For all transactions in

and out of Australia, including those paid through an intermediary

bank, include account number, full name (no initials), and address

of the ordering customer. Failure to provide full ordering customer

details may result in payment delays.

Include city, state, country and postal code for the ordering

customer’s address. P.O. Box numbers are not permitted.

Beneficiary Customer (SWIFT MT103 F59): For all transactions in

and out of Australia, including those paid through an intermediary

bank, include account number, full name (no initials) and address

of the beneficiary customer. Failure to provide full beneficiary

customer details may result in payment delays.

Include city, state, country and postal code for the beneficiary

customer’s address. P.O. Box numbers are not permitted.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

Australian banks are identified by a 6-digit Bank State Branch

(BSB) number where the first two digits specify the bank, the third

digit specifies the state, and the last three digits specify the branch

(e.g. 112-908). BSB numbers must be included in the ordering

details (for payments out of Australia) and beneficiary details (for

payments into Australia). For detailed payment message field

where BSB numbers must be included, please refer to XLSX

version of the JPM Global Wires Payments Formatting Guide

. Refer

to the Australian Payments Clearing Association website

(www.apca.com.au) for list of current BSBs.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxAUxx or

xxxxAUxxxxx.

Additional Information

Banks are required to report to the local regulator, AUSTRAC, on

any international funds transfers to or from Australia in any

currency including those transactions paid through an

intermediary bank. For more information on bank reporting

regulations, refer to the AUSTRAC website www.austrac.gov.au

.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, IBAN, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.oenb.at/en.

Country Requirements/Restrictions

SEPA: Strict formatting standards and SEPA guidelines exist in

Europe regarding cross-border payments. IBAN and SWIFT BIC are

required for all euro payments. SEPA standards apply for euro

payments to beneficiaries with accounts in Austria.

Payment Formatting Rules for EUR

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds.

Beneficiary Customer (SWIFT MT103 F59): Include account

number (IBAN), full name (no initials), and address of the

beneficiary customer. Use of initials may delay receipt of funds.

IBAN numbers for beneficiaries with accounts in Austria must be

included in the payment instructions.

Account # Ex ABC 12345 Abc 678912345

Country Code AT

Structure AT2!n5!n11!n

Length 20!c

Electronic Format Ex. AT981234567891234567

Print Format Ex. AT98 1234 5678 9123 4567

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

There are no specific bank clearing codes in this country for cross-

border payments. SWIFT BIC is key to routing payments.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxATxx or

xxxxATxxxxx.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Payments to non-resident beneficiaries are classified in 2

categories: taxpayer and non-taxpayer

a) Taxpayer non-resident (having Azerbaijani tax ID) can receive

funds from a legal entity abroad showing clear purpose of

transfer

b) Non-taxpayer non-resident can only receive `financial aid`

from abroad with supporting documents.

c) Non-resident legal entity (taxpayers) can receive funds from

abroad only with supporting documents (invoice, contract,

other real business papers).

Payment Formatting Rules for AZN

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include beneficiary bank’s

correspondent AZN account number, beneficiary bank’s tax

identification number (TIN/VOEN), 6 digit BIK code, SWIFT BIC with

branch identifier (where required), full name,

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxAZxx or

xxxxAZxxxxx

Beneficiary Customer (SWIFT MT103 F59): Include account

number

(IBAN), 10 digit tax identification number (TIN/VOEN) , full name

(no initials) and full address of the beneficiary customer . Use of

initials may delay receipt of funds by the beneficiary. Tin/VOEN is

not required for individual.

IBAN numbers for beneficiaries with accounts Azerbaijan must be

included in the payment instructions.

Account # Ex 123456789123745678912345

Country Code AZ

Structure AZ2!n24

Length 28!c

Electronic Format Ex. AZ98123456789123745678912345

Print Format Ex. AZ98 1234 5678 9123 7456 7891 2345

Reason for Payment (SWIFT MT103 F70): In depth purpose of

payment must be provided. If the payment is for charitable

purposes, this must be clearly stated, or the beneficiary maybe

subject to a tax charge for income received.

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 7

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Bahamas

Bahrain

Bangladesh

BSD – Bahamian Dollar

BHD – Bahraini Dinar

BDT – Bangladeshi Taka

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.centralbankbahamas.com.

Payment Formatting Rules for BSD

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBSxx or

xxxxBSxxxxx.

Where the beneficiary bank is “RBC Bahamas”, Transit Number is

required and should be updated in Field 70 (e.g. TRANSIT NUMBER:

XXXXX). Contact your J.P. Morgan Service Representative for a list

of transit numbers.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

Payments where the underlying remitter is an MSB or PSP are not

supported.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, IBAN, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.cbb.gov.bh.

Payment Formatting Rules for BHD

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number (IBAN), full name (no initials) and address of the

beneficiary customer. Use of initials may delay receipt of funds by

the beneficiary.

IBAN numbers for beneficiaries with accounts in Bahrain must be

included in the payment instructions.

Account # Ex 12345678912345

Country Code BH

Structure BH2!a4!n14

Length 22!c

Electronic Format Ex. BH98ABCD12345678912345

Print Format Ex. BH98 ABCD 1234 5678 9123 45

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBHxx or

xxxxBHxxxxx.

Reason for Payment (SWIFT MT103 F70): 3 letter Purpose of

payment code is mandatory. This can also be included in field 72 or

77B. Example: /ORDERRES/BH//POP/[Additional Narrative].

Please refer to the “Purpose of Payment Codes” section contained

within the below link.

https://cbben.thomsonreuters.com/rulebook/mandating-use-

purpose-codes-swift-cross-border-payments4-january-2021

Additional Information:

The local market is closed on Fridays.

POP = Provide supporting purpose of payment code

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.bangladesh-bank.org.

Country Requirements/Restrictions

Payment Restrictions: NGOs must register locally and obtain

approval before receiving payments for specific projects.

Account Restrictions: Account Restrictions vary.

Non-resident Foreign Currency Deposit (NFCD) accounts may now

be maintained at the account holder’s desire. Amounts brought in

by non-resident Bangladeshis can be deposited in a foreign

currency account any time after entering Bangladesh.

Foreign Currency (FC) accounts of non-resident Bangladeshis

(opened in the names of Bangladesh nationals or a person of

Bangladesh origin working or self-employed abroad) can now be

maintained as long as the account holder desires.

Residence Foreign Currency Deposit (RFCD) accounts may be

opened in US dollar, euro, pound sterling, or Japanese yen, and

may be maintained as long as the account holder desires.

Payments may be made into the account with declaration to

customs authorities on the FMJ form. A maximum of USD 5,000

may be credited into the account without declaration.

Additional Documentation: Additional supporting documentation

such as Form C may be required from the beneficiary stating the

reason for payment or providing evidence of the beneficiary’s

identity. The beneficiary must complete all required

documentation requested by their local bank or the correspondent

bank to receive credit into the account.

Declaration by their beneficiary on Form C shall not be required for

inward remittances up to USD 20,000 equivalent; BDT payments

that are larger than USD 20,000 equivalent will still require the

Form C to be submitted by the beneficiary at their bank.

Payment Formatting Rules for BDT

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials), address, and telephone number of

the beneficiary customer. Use of initials may delay receipt of funds

by the beneficiary.

(Continued on next page)

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 8

2024 Global Wires Payments Formatting Requirements Guide

Last Updated: February 16, 2024

Bangladesh

Continued

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC and 9

digit routing code if available or include full name and full address

of the beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBDxx or

xxxxBDxxxxx

Beneficiary bank branch address can also be mentioned in F72 if

only Swift BIC is included in field 57. Bene Bank Branch address is

optional if the 9 digit bank routing code is provided in field 57.

In case of space limitation in field 57 and 72, Beneficiary Bank

Branch address can be mentioned in field 70.

Below formats are acceptable for beneficiary bank details:

Format 1:

57D: Bank Name

Bank address

Bene bank address contd.

Swift code

Format 2:

57A: /XXXXXXXXX (9-digit beneficiary bank branch code)

Swift code

Format 3:

57A: Swift BIC code

72: bene bank branch complete address (Should be clearly

indicated)

Format 4:

57A: Swift BIC code

72:

routing code/ BBB, bene bank branch code XXXXXXXXX (9-digit

beneficiary bank branch code).

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

The local market is closed on Fridays.

Barbados

BBD – Barbadian Dollar

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.centralbank.org.bb.

Payment Formatting Rules for BBD

Ordering Customer(SWIFT MT103 F50): Include account number,

full name (no initials), and address of the ordering customer. Use

of initials can delay receipt of funds by the beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

The beneficiary’s full address is required to avoid payment delays.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBBxx or

xxxxBBxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

Payments where the underlying remitter is an MSB or PSP are not

supported.

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Belarus

BYN – Belarusian Ruble,

currently suspended

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.nbrb.by/engl/.

Country Requirements/Restrictions

Belarusian 'resident' beneficiary may be required to provide

supporting documentation to comply with the country’s Exchange

Control Regulations.

Taxpayer code required (UNN or UNP, INN)

Payment Formatting Rules for BYN

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBYxx or

xxxxBYxxxxx.

Beneficiary Customer (SWIFT MT103 F59): Include bank

SWIFT/BIC Code, 28- digit account number (IBAN), full name (no

initials) and address of the beneficiary customer. Use of initials

may delay receipt of funds by the beneficiary.

IBAN numbers for beneficiaries with accounts in Belarus must be

included in the payment instructions.

Account # Ex 1234 5678 9123 4567 8912

Country Code BY

Structure BY2!n4!c4!n16!c

Length 28!c

Electronic Format Ex. BY98ABCD12345678912345678912

Print Format Ex. BY98 ABCD 1234 5678 9123 4567 8912

Reason for Payment (SWIFT MT103 F70): Detailed Purpose of

payment is mandatory.

MFO Bank Code 3-9 digits.

Tax ID required (9 digit) with prefix of “TAX ID”.

Example: “TAX ID XXXXXXXXX”

Currently Suspended for Payments

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 9

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Belize

Belgium

Benin

BZD – Belize Dollar

EUR – Euro

XOF – West African CFA Franc

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.centralbank.org.bz.

Payment Formatting Rules for BZD

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

The beneficiary’s full address is required to avoid payment delays.

15 digit account number required for payments going to Belize

Bank Limited.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBZxx or

xxxxBZxxxxx.

Branch codes must be included in field 70 when making a payment

to a beneficiary at Scotiabank.

91595 Belize City

87965 Belama

61275 Corozal

13235 Orange Walk

44685 Dangriga

01875 San Ignacio

19075 Belmopan

18895 Placencia

39065 Punta Gorda

39685 Spanish Lookout

36715 San Pedro

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, IBAN, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.nbb.be/en.

Country Requirements/Restrictions

Payment Restrictions: There are no payment amount restrictions.

The high-valued payment system used in Belgium tends to be

limited to payments exceeding EUR 500,000. Banks may charge a

day’s float; however, companies can often obtain same-day value

settlement.

Account Restrictions: Residents and non-residents are permitted

to open and maintain domestic currency (EUR) and foreign

currency accounts both locally and abroad.

SEPA: Strict formatting standards and SEPA guidelines exist in

Europe regarding cross-border payments. IBAN and SWIFT BIC are

required for all euro payments. SEPA standards apply for euro

payments to beneficiaries with accounts in Belgium.

Payment Formatting Rules for EUR

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number (IBAN), full name (no initials), and address of the

beneficiary customer. Use of initials may delay receipt of funds by

the beneficiary.

IBAN numbers for beneficiaries with accounts in Belgium must be

included in the payment instructions.

Account # Ex 123-4567891-23

Country Code BE

Structure BE2!n3!n7!n2!n

Length 16!c

Electronic Format Ex. BE98123456789123

Print Format Ex. BE98 1234 5678 9123

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

There are no specific bank clearing codes in this country for cross-

border payments. SWIFT BIC is key to routing payments to the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBExx or

xxxxBExxxxx.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Country Requirements/Restrictions

Additional Documentation: Additional supporting documentation

may be required from the beneficiary.

Payment Formatting Rules for XOF

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials), address, and telephone number of

the beneficiary customer. Use of initials may delay receipt of funds

by the beneficiary.

It is mandatory to format account numbers for beneficiaries with

accounts in Benin according to the below specifications.

Account numbers should be 24 characters consisting of the 5

-

character bank code (including the 2 character country code) + 5

character branch code + 12 digit account number + 2 digit Clé RIB.

Country Code BJ

Length 24!c

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBJxx or

xxxxBJxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

This country is a member of the Central Bank of West African

States.

XOF is a zero-decimal currency.

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 10

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Bermuda

Bolivia

Bosnia and Herzegovina

BMD – Bermudian Dollar

BOB

– Bolivian Boliviano

BAM – Bosnia-Herzegovina Convertible Mark

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.bma.bm.

Payment Formatting Rules for BMD

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBMxx or

xxxxBMxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Payment Formatting Rules for BOB

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBOxx or

xxxxBOxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, IBAN, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.cbbh.ba.

Payment Formatting Rules for BAM

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number (IBAN), full name (no initials), address, and telephone

number of the beneficiary customer. Use of initials may delay

receipt of funds by the beneficiary.

IBAN numbers for beneficiaries with accounts in Bosnia and

Herzegovina must be included in the payment instructions. The

IBAN must start with BA39 followed by 16 digits.

Account # Ex 123-456-78912345-67

Country Code BA

Structure BA2!n3!n3!n8!n2!n

Length 20!c

Electronic Format Ex. BA391234567891234567

Print Format Ex. BA39 1234 5678 9123 4567

If the final beneficiary belongs to a government organization, the

following details must be included: budget organization code, 6-

digit profit type, and 3-digit citation number (municipality). This

information may also be provided in SWIFT MT103 F70.

The beneficiary’s telephone number is required to avoid payment

delays or return. This information may also be provided in SWIFT

MT103 F70.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBAxx or

xxxxBAxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

BAM is settled as a EUR transfer. Therefore, the beneficiary can

choose to withdraw this currency as BAM or EUR.

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 11

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Botswana

Brazil*

Brazil*

BWP – Botswana Pula

BRL – Brazilian Real–*Pre-trade Requirements

Continued

Overview Overview

Information provided by the Beneficiary: Remitter should Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g. obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address). SWIFT BIC, IBAN, beneficiary’s tax ID, email address, and

Central Bank: For additional information, please refer to

beneficiary bank address and agency code).

www.bankofbotswana.bw.

Central Bank: For additional information, please refer to

Payment Formatting Rules for BWP

www.bcb.gov.br.

Ordering Customer (SWIFT MT103 F50): Include account Country Requirements/Restrictions

number, full name (no initials), and address of the ordering

Payment Restrictions: Restrictions exist for BRL payments.

customer. Use of initials can delay receipt of funds by the Brazilian banks will convert USD and foreign receipts to local

beneficiary. currency for payment to beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account Resident and non-resident transactions involving foreign currency

number, full name (no initials) and address of the beneficiary can only be carried out through the intermediary of authorized

customer. Use of initials may delay receipt of funds by the financial institutions.

beneficiary. Brazilian Boletos Bancário is a form of payment employed within

For accounts held at First National Bank, 11-digit account numbers

Brazil. This type of payment can’t originate from or settle outside

are required.

of the country.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with 6-

USD and other foreign currencies are delivered to the Brazilian

digit branch code, full name, and address of the beneficiary bank.

bank’s correspondent in the United States.

There are no specific bank clearing codes in this country for cross-

NGOs must register locally to receive payments.

border payments. SWIFT BIC is key to routing payments to the

Additional Documentation: Additional documentation may be

beneficiary bank. required from the beneficiary stating reason for payment.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBWxx or

The beneficiary must complete a request/authorization to allow

xxxxBWxxxxx.

their bank to exchange the foreign currency to local currency,

Reason for Payment (SWIFT MT103 F70): Purpose of payment

indicating reason/destination of funds.

must be clearly identified (rent, salary, medical expenses, office Once the trade is closed, the beneficiary must complete and sign a

expenses, charity, etc.). “contracto de cambio” (a contract of trade) within 30 days to

identify that the funds are for the beneficiary and why they are

receiving the funds.

The beneficiary must present ID and proof of address at the local

bank. NGOs need to present current registration documents at

their local bank.

Beneficiary Setup: J.P. Morgan may use third party vendors for

processing payments in certain currencies. Third party vendor will

require on-boarding for beneficiaries only for the first payment.

The following information is required:

Remitter's name

Beneficiary name, account number (IBAN), telephone number, and

email address

CNPJ (taxpayer ID) for corporations or CPF for individuals

Purpose and amount of first payment

Payment Formatting Rules for BRL

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number (IBAN), full name (no initials), address, tax ID number (11

digit CPF for individuals and 14 digits CNPJ for

Corporations/NGO/Orgs), and telephone number of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

Beneficiary’s contact name is required.

IBAN numbers for beneficiaries with accounts in Brazil must be

included in the payment instructions.

Account # Ex 1234567891A2

Country Code BR

Structure BR2!n8!n5!n10!n1!a1!c

Length 29!c

Electronic Format Ex. BR9876543219876541234567891A2

Print Format Ex. BR98 7654 3219 8765 4123 4567 891A 2

Tax ID number (11 digit CPF for individuals and 14 digits CNPJ for

Corporations/NGO/Orgs), and telephone number of the beneficiary

customer is required to avoid payment delays or return. This

information may also be provided in SWIFT MT103 F70.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier, full name, address of the beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBRxx or

xxxxBRxxxxx.

(Continued on next page)

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 12

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Brazil

Brunei

-Darussalam

Bulgaria

Continued

BND – Brunei Dollar

BGN – Bulgarian Lev

Reason for Payment (SWIFT MT103 F70): A clear purpose of

payment is mandatory and consists of a full written description of

the nature of the payment to be provided in the remittance

information (rent, salary, office expenses, etc.). Insufficient

purpose of payment may result in errors or delays.

Sender to Receiver Information (SWIFT MT103 F72): To avoid

payment delays, the beneficiary’s email address should be

included. Please replace ‘@’ with ‘_AT_’ (blank space before and

after ‘_AT_’) for smooth processing. Sample Format: /INT/name AT

jpmchase.com.

Additional information:

Payments to beneficiaries who hold an account with Ourinvest

Bank,

Maxima Bank, Travelex, Topazio Bank, Confidence Bank and Bex

Bank is no supported.

Transaction size limit of payments less than or equal to USD

3,000.00 or a maximum of USD18,000.00 in total, per calendar

year, per tax ID without requiring the full Cadastro setup. This

used to be a lifetime limit in the past and has been changed to a

yearly limit. Exceptions to this rule now include NGOs, law offices,

exporters, tourism offices, loan and capital injections. These types

of beneficiaries will require complete Cadastro for all payments.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Payment Formatting Rules for BND

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address (street address, city,

and country) of the beneficiary customer. Use of initials may delay

receipt of funds by the beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBNxx or

xxxxBNxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional information:

Payments to Broker deals and football/ soccer teams are not

supported

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, IBAN, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.bnb.bg.

Country Requirements/Restrictions

SEPA: Strict formatting standards and SEPA guidelines exist in

Europe regarding cross-border payments. IBAN and SWIFT BIC are

required for all euro payments. SEPA standards apply for euro

payments to beneficiaries with accounts in Bulgaria.

Payment Formatting Rules for BGN

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number (IBAN), full name (no initials) and address, of the

beneficiary customer. Use of initials may delay receipt of funds by

the beneficiary.

IBAN numbers for beneficiaries with accounts in Bulgaria must be

included in the payment instructions.

Account # Ex BG98 ABCD 1234 5678 9123 45

Country Code BG

Structure BG2!n4!a4!n2!n8!c

Length 22!c

Electronic Format Ex. BG98ABCD12345678912345

Print Format Ex. BG98 ABCD 1234 5678 9123 45

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBGxx or

xxxxBGxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended. If the payment is for tax budgetary purposes,

always state one of the following as well as the 6-digit payment

type defined by the Ministry of Finance and local regulation.

BULSTAT (Bulgarian Identification Tax Number) is a 6-digit number

for the registration of a company.

EGN is the personal identification number of the Bulgarian citizen.

PNF is the personal number of the foreign citizen.

IZL is the name of the legal entity or private individual’s full name.

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 13

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Burkina Faso

Burundi

Cambodia

XOF

– West African CFA Franc

BIF – Burundian Franc

KHR – Cambodian Riel

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Country Requirements/Restrictions

Additional Documentation: Additional supporting documentation

may be required from the beneficiary.

Payment Formatting Rules for XOF

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials), address, and telephone number of

the beneficiary customer. Use of initials may delay receipt of funds

by the beneficiary.

It is mandatory to format account numbers for beneficiaries with

accounts in Burkina Faso according to the below specifications.

Account numbers should be 24 characters consisting of the 5

-

character bank code (including the 2 character country code) + 5

character branch code + 12 digit account number + 2 digit Clé RIB.

Country Code BF

Length 24!c

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBFxx or

xxxxBFxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

This country is a member of the Central Bank of West African

States.

XOF is a zero-decimal currency.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Payment Formatting Rules for BIF

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include 11-digit format

account number, full name (no initials), and address of the

beneficiary customer. Use of initials may delay receipt of funds by

the beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxBIxx or

xxxxBIxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

BIF is a zero decimal currency.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Central Bank: For additional information, please refer to

www.nbc.org.kh.

Payment Formatting Rules for KHR

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials) and address of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier (where required), full name, and address of the

beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxKHxx or

xxxxKHxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information:

Tax payments in KHR can be processed to the General Department of

Taxation (GDT). Before sending the tax payment, please reach out to

your JPM representative for more information and include the

relevant P101 Document for the payment. Please note that the

deadline for tax payment is on the 25th of each month. Therefore, the

payment should be sent before the 25th of the month.

The following character representations and length indications are used: N Digits numeric characters c Upper and lowercase alphanumeric a Uppercase letter alphabetic e Blank space

characters (A-Z, a-z, and 0-9) characters (A-Z only) n Maximum length nn! Fixed length

| 14

2024 Global Wires Payments Formatting Requirements Guide

For the most up-to-date version, please visit jpmorgan.com/visit/guide

Last Updated: February 16, 2024

Cameroon

Canada

Canada

XAF

– Central African CFA Franc

CAD – Canadian Dollar

Continued

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

SWIFT BIC, account number, and beneficiary bank address).

Country Requirements/Restrictions

Additional Documentation: Additional supporting documentation

may be required from the beneficiary.

Payment Formatting Rules for XAF

Ordering Customer (SWIFT MT103 F50): Include account

number, full name (no initials), and address of the ordering

customer. Use of initials can delay receipt of funds by the

beneficiary.

Beneficiary Customer (SWIFT MT103 F59): Include account

number, full name (no initials), address (street name, city, country,

and postal code), and telephone number of the beneficiary

customer. Use of initials may delay receipt of funds by the

beneficiary.

Account numbers should be 23 digits. The RIB code consists of the

5 digit bank code + 5 digit branch code + 11 digit account number +

2 digit key. IBAN format is accepted but not mandatory.

Beneficiary Bank (SWIFT MT103 F57): Include SWIFT BIC with

branch identifier, full name, and address of the beneficiary bank.

SWIFT BIC is 8 or 11 alphanumeric characters: xxxxCMxx or

xxxxCMxxxxx.

Reason for Payment (SWIFT MT103 F70): Purpose of payment is

recommended.

Additional Information

This country is a member of the Bank of Central African States.

XAF is a zero decimal currency.

Overview

Information provided by the Beneficiary: Remitter should

obtain all required bank information from the Beneficiary (e.g.

Canadian bank branch routing number, SWIFT BIC code and

beneficiary bank address). Absence of this information may result

in delays or returns.

Central Bank: For additional information, please refer to

www.bankofcanada.ca.

Country Requirements/Restrictions

Currency and Clearing Information: Canada has well-developed

high-value and low-value electronic payment systems.

Account Restrictions: Residents and non-residents can hold both

domestic and foreign currency accounts. Most Canadian banks

offer accounts in USD.

Canada’s “Proceeds of Crime (Money Laundering) and Terrorist

Financing Act” and related regulations impose an obligation on all

Canadian financial institutions, including J.P. Morgan, to obtain

certain information for wire payments transmitted in a SWIFT

103/103+ format and SWIFT MT101s that result in the SWIFT MT103

format. In order to comply with these regulatory requirements,

J.P. Morgan will require complete order party/beneficiary

information to be included in any wire payments that are sent or

received through your accounts with us in Canada.

Complete order party/beneficiary information includes: full

account name, full account number, full beneficiary bank name,

the SWIFT BIC code, and full physical address information. A full

physical address must include: street number, street name, city or

town, state or province where applicable, and country, preferably

in the 2-character ISO format.

In circumstances where a street number is not assigned to a physical

location, a description of the location, such as a building and street

name, may be acceptable. A P.O. Box is not acceptable without a full

physical address. State or province is also required for all U.S. and

Canada addresses and for other countries, where applicable. Some

Canadian banks also require the Canadian Clearing Code to avoid

delays in processing.

The ideal size of the mandatory fields for ordering

party/beneficiary full account name is 35 characters. For the

mandatory ordering party/beneficiary address, full physical

address components should fit into the rest of the 3 lines with 35

characters in each line. Where the beneficiary name exceeds one

line, the full beneficiary name and full address should fit in 4 lines.

The address information should not overflow into other fields to

avoid delays or rejection.

Financial institutions may reject or delay your wires if the required

information is not provided or address information does not

include a full physical address in the mandatory fields.

Payment Formatting Rules for CAD

Ordering Customer (SWIFT MT103/MT101 F50): For MT103 wire

payments debiting a non-FCB

1

client account, the JPMorgan wire

engine will enhance the account name and address from account

records. For all other MT103MT101 formatted wire transactions in

and out of Canada, including those paid through an intermediary

bank, include account number, full name (no initials), and full

physical address of the ordering customer. Use of initials can delay

receipt of funds by the beneficiary.

Beneficiary Customer (SWIFT MT103 or MT101 resulting in a

SWIFT MT103 F59): For all transactions in and out of Canada,

including those paid through an intermediary bank, include

account number, full name (no initials), full physical address, and

telephone number of the beneficiary customer. Use of initials may