is report was initially published on May 30, 2013, and contained a

mathematical error in adding the GSE and HUD inventories; the correct

total is 1,708,033. e underlying data are accurate and have not changed;

the error was an adding mistake only. e total inventory number was

corrected on pages 3 and 11.

In addition, a discrepancy with how “shadow inventory” is indicated

was adjusted on page 10. And, an example used to demonstrate a trend

between seriously delinquent mortgages and REO inventories was

removed from page 12 aer it was brought to our attention that the

example was incorrect. e adjusted report was reposted on June 3, 2013.

Joint Report on Federally Owned or Overseen

Real Estate Owned Properties

May 2013

• • •

U.S. Department of Housing and Urban Development Ofce of Inspector General

Federal Housing Finance Agency Ofce of Inspector General

2

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Table of Contents

Executive Summary .................................................................................................................. 3

Background on REO

.................................................................................................................. 4

Default and Foreclosure

............................................................................................... 4

Managing REO Inventory

.............................................................................................. 4

HUD’s REO Contractor Structure

.................................................................................. 7

The GSEs’ REO Contractor Structure

........................................................................... 9

The “Shadow Inventory”

.............................................................................................10

HUD & GSE Actions and Initiatives

........................................................................................12

FHA Note Sales Program and Distressed Asset Stabilization Program

...................12

FHFA and Fannie Mae REO Pilot Program

................................................................. 13

OIG Efforts on REO

..................................................................................................................14

HUD-OIG

.......................................................................................................................14

FHFA-OIG

...................................................................................................................... 17

Conclusion

............................................................................................................................... 21

Appendix A—Participating Ofces of Inspectors General

.....................................................22

U.S. Department of Housing and Urban Development

.............................................22

Federal Housing Finance Agency

............................................................................... 23

Appendix B—Acronyms and Abbreviations

.............................................................................25

Appendix C—Glossary

..............................................................................................................26

Appendix D—Contact Information

..........................................................................................29

3

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Executive Summary

The Oces of Inspector General for the U.S. Department of Housing and

Urban Development and the Federal Housing Finance Agency (HUD-OIG

and FHFA-OIG) have produced this report on “real estate owned” (REO)

properties. REO are residential properties that have been foreclosed upon and

transferred into an REO inventory for management and ultimately disposition.

This report addresses REO properties held by or on behalf of either HUD or

the Government-Sponsored Enterprises (GSEs or enterprises) for which FHFA

serves as conservator—the Federal National Mortgage Association (Fannie

Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac).

HUD and the GSEs have created infrastructures to manage and sell REO

properties. Though those infrastructures dier somewhat from one another,

they all rely heavily on contractors to perform tasks central to eective

REO management: (1) securing properties to avoid theft, vandalism, and

unauthorized use; (2) maintaining and repairing properties as needed;

(3) pricing properties appropriately through broker price opinions or

appraisals and satisfactory promotional eorts; and (4) selling properties

to homeowners or investors within a reasonable period.

As of September 30, 2012, HUD held 37,445 REO properties while the GSEs

held 158,138. In addition, the “shadow inventory”—residential loans at least

90 days delinquent—totaled 1,708,033 properties, roughly 8.7 times the size of

the HUD and GSE REO inventories combined. Even a fraction of the shadow

inventory falling into foreclosure could considerably swell HUD and GSE

inventories of REO properties.

This report reviews recent initiatives by HUD and the GSEs to shrink their

respective REO inventories, as well as steps taken by HUD-OIG and FHFA-

OIG to assess and address their respective agencies’ REO activities.

4

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Background on REO

Default and Foreclosure

Most residential real estate purchases in the United States are nanced through

loans provided by banks or other lenders, which typically require a secured

interest or mortgage on the property in exchange for nancing the purchase.

Among other promises, a borrower agrees to repay the mortgage over time in

accordance with its terms. A borrower’s failure to do so is called default.

Once a borrower defaults, the creditor holding the mortgage—the originating

lender, a subsequent institution that purchased the mortgage, or some other

entity such as a mortgage insurer—may foreclose on the property in an eort

to recoup the amount due under the mortgage. Foreclosure is a legal process

by which the creditor might mitigate its losses by acquiring and selling the

property. Once foreclosure is completed, the property enters into the creditor’s

REO inventory until it can be sold.

The current housing crisis has seen a signicant increase in the incidence of

mortgage defaults and foreclosures. Foreclosed and vacant properties can have

profoundly negative consequences in the neighborhoods and communities

in which they are located, including but not limited to reduced property

values. According to the U.S. Government Accountability Oce, vacant,

foreclosed properties can reduce prices of nearby homes by $8,600 to $17,000

per property.

1

In addition, vacant residential properties may aract crime,

cause blight, and threaten public safety. Public policy and nancial market

observers have aributed delinquency and foreclosure increases to a wide

range of causes and have oered varying policy prescriptions for what remains

a continuing problem.

Managing REO Inventory

A creditor typically takes possession of a foreclosed property to preserve its

value until it can be sold. Such eorts are referred to as “REO management.”

Creditors may take the following steps to manage REO inventories

successfully:

1. Hire qualied REO contractors—law rms, property

maintenance companies, real estate brokers, and others—to

secure, maintain, market, and sell REO properties.

1 Government Accountability Oce, Vacant Properties: Growing Number Increases Communities Costs and

Challenges, GAO-12-34 (November 4, 2011).

5

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

2. Provide contractor training.

3. Establish standard policies and procedures for key REO

maintenance activities, such as the number of times per month

lawns must be cut.

4. Establish budgets and reimbursement schedules for routine

property maintenance activities. In some cases, repairs may

enhance a property’s value and thereby maximize returns.

Without an eective way of making such determinations,

a creditor could reimburse contractors for repairs that are

unnecessary and increase property management costs.

However, a creditor must also be mindful that foreclosed

properties located in economically distressed areas may be

particularly dicult to sell. In some cases, demolishing rather

than rehabbing the property may be more cost eective.

5. Require multiple bids or reviews for proposed repairs that

exceed pre-established dollar thresholds.

6. Conduct onsite inspections of selected properties to ensure

that they are secured, maintained, and repaired according to

established standards.

7. Require multiple broker price opinions or appraisals to

establish each foreclosed property’s fair market value.

8. Audit bills submied by contractors to ensure their

appropriateness and screen for potential fraud.

9. Conduct account reviews and performance management audits

and monitor contractors using established metrics, including

contractual obligations.

10. Withhold payments to contractors for services rendered until

such services have been completed satisfactorily and suspend

or terminate unsatisfactory contractors.

Large national REO inventories present signicant challenges to

accomplishing these tasks. HUD, FHFA, and the GSEs are particularly

sensitive to such risks, given the size of their respective REO inventories.

6

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

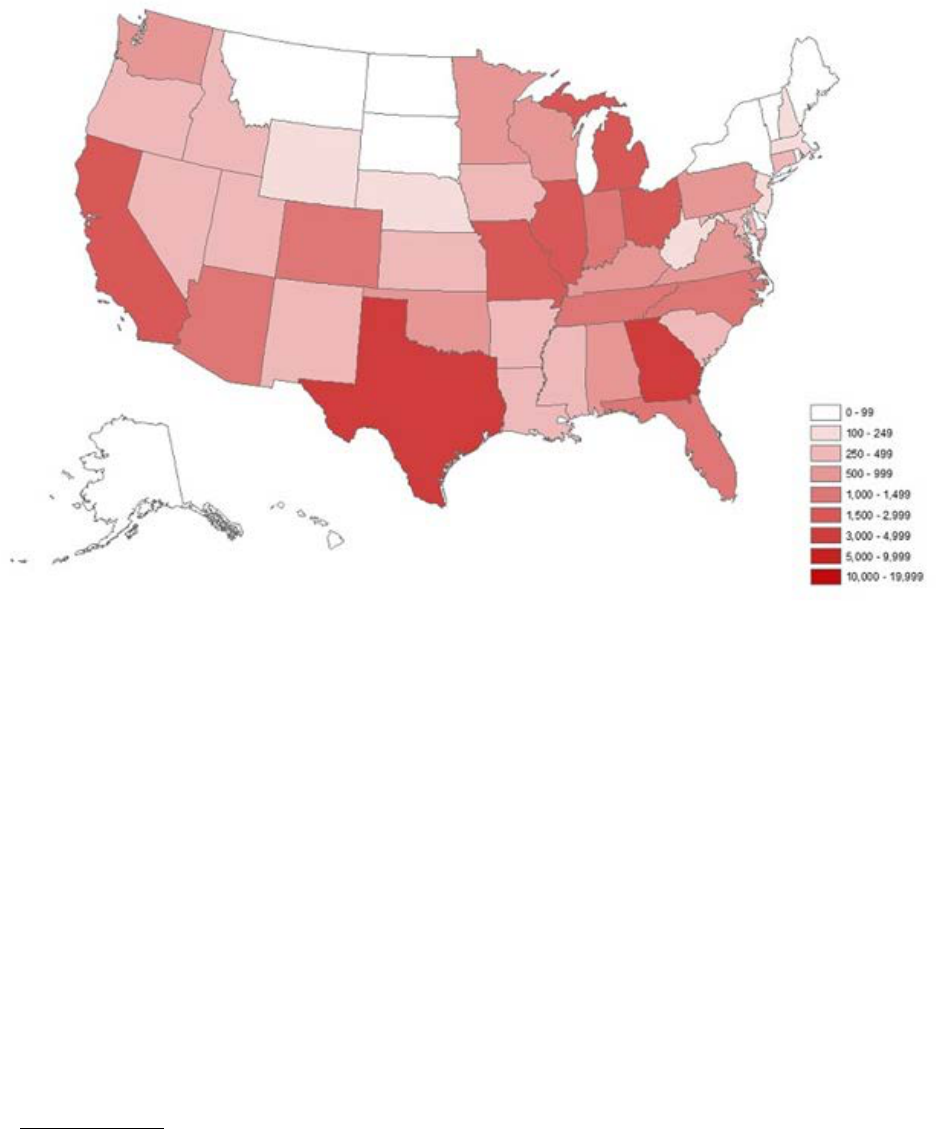

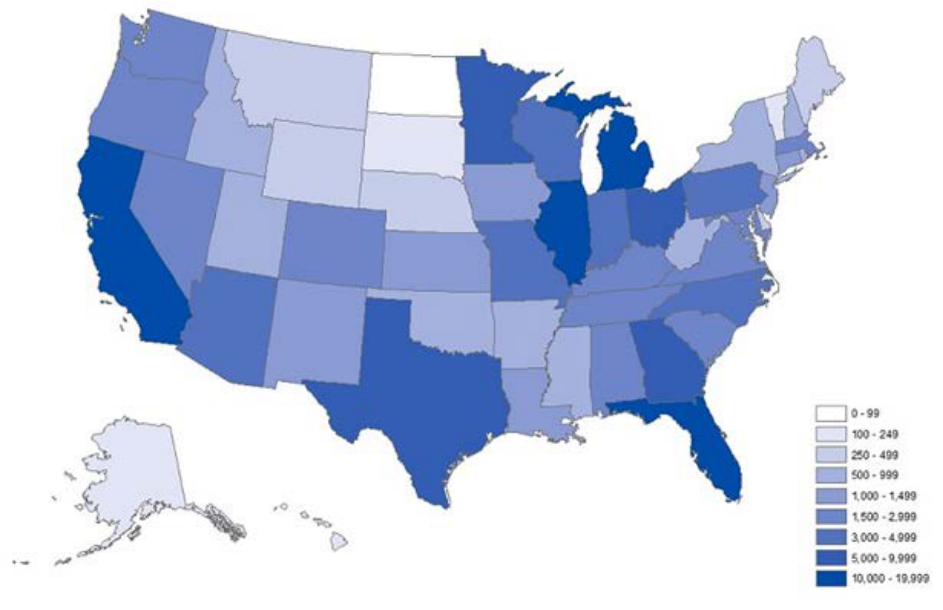

As of September 30, 2012, HUD’s nationwide REO inventory totaled 37,445

properties, while the GSEs’ totaled 158,138 (Figures 1 and 2).

2

Figure 1: HUD REO Properties by State, as of September 30, 2012

2 HUD, Month End Acquisition Property Report (September 30, 2012); FHFA, Foreclosure Prevention Report

for Third Quarter 2012. Accessed April 10, 2013, at hp://www.fa.gov/webles/24858/3q12FPR_nal.pdf.

7

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Figure 2: GSE REO Properties by State, as of September 30, 2012

HUD and the GSEs generally rely on extensive networks of contractors and

subcontractors to maintain and sell their properties. These networks require

signicant oversight to ensure that they perform eectively and that they

mitigate both REO-related expenses and foreclosure’s negative eects.

HUD’s REO Contractor Structure

The Federal Housing Administration (FHA), which is part of HUD, insures

both single-family and multifamily mortgage loans made by approved lenders.

If a buyer defaults on an FHA-insured loan, the lender acquires the title to

the property by foreclosure, a deed in lieu of foreclosure, or other acquisition

method. The lender then les a claim for insurance benets and conveys the

property to the Secretary of HUD.

Since 1999, HUD has outsourced the disposition of its REO inventory to

private contractors under its Management and Marketing (M&M) program.

In June 2010, HUD awarded contracts under the third generation of M&M.

M&M III consists of the following major processes: (1) preconveyance

activity, (2) conveyance activity, (3) postconveyance activity, (4) property

management activity, (5) marketing activity, (6) accounting and reconciliation,

and (7) oversight monitoring. REO disposition eorts are administered

8

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

through HUD Homeownership Centers located in Atlanta, Georgia; Denver,

Colorado; Philadelphia, Pennsylvania; and Santa Ana, California. Each center

is responsible for a designated geographic area. The disposition structure’s key

elements include:

• Mortgage compliance manager (MCM): MCMs perform a variety

of pre- and postconveyance services to ensure that HUD’s interests

are protected. These services include reviewing property inspections

to ensure that the property is in conveyance condition, resolving

conveyance exceptions, providing guidance to lenders related to pre-

and postconveyance responsibilities, and leveraging HUD’s software

and information systems to execute and complete the tasks within this

contract.

• Field service manager (FSM): FSM companies provide property

maintenance and preservation services such as inspecting, securing,

maintaining, and repairing the property.

• Asset manager (AM): AMs handle REO property marketing and sales.

• Oversight monitor: Oversight monitors focus on overall portfolio

analysis and oversight of the disposition process.

The Single Family Insurance System (SFIS) is HUD’s primary system for

recording insurance and claim payments for all FHA-insured single-family

loans. SFIS utilizes P260, a web-based system of record for all REO case

management transactions. P260 assigns each HUD-owned property to FSMs

and AMs and tracks the disposition activity from conveyance to sale. AMs and

FSMs are required to scan and upload documents relating to properties, such

as inspection reports and photographs. The system also tracks preconvey

ance

activities. It integrates data from SFIS, FHA Connection, and the Single

Family Accounting Monitoring System (SAMS). FHA Connection is a web-

based system by which lenders report the status of insured loans. Also, FHA

Connection allows HUD to post information of interest to lenders. SAMS is

HUD’s automated system for managing, processing, and monitoring acquired

and custodial single-family properties. It is HUD’s primary system of record

for tracking nancial information and accounting data for properties acquired

by HUD.

P260 automatically assigns an FSM to the property. The assigned FSM

completes required inspections and cleanout services. An AM, also assigned

automatically, completes the required inspection and orders an appraisal.

9

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

The AM receives the appraisal and conducts an inspection before listing. If

the property needs to be reconveyed to the lender for whatever reason, the

property may be held o the market. The AM conducts a direct sale if the

property is eligible for special programs. If it is not, the AM establishes the

property’s value and validates that the property is ready to list. The general list

period is 180 days. If the property is not sold within this timeframe, the AM

oers the property to local governments. If there is an acceptable oer, the AM

accepts it and raties the contract. The closing agent orders a title search. If the

property is sold with FHA insurance and meets certain requirements, testing

of lead-based paint or wood-destroying organisms may be ordered. Finally,

the AM closes the property through a closing agent and reconciles the sales

transaction.

3

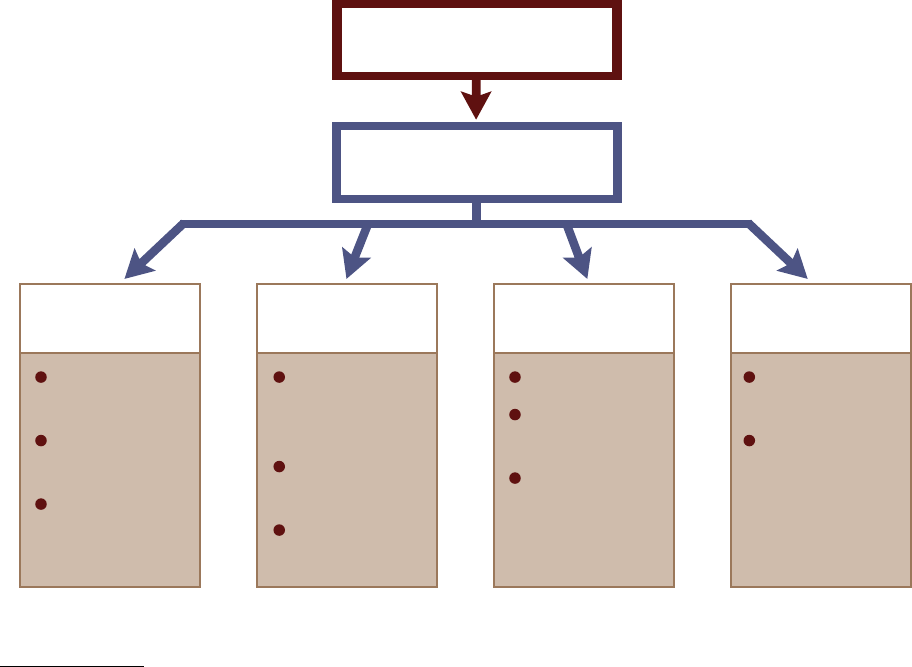

The GSEs’ REO Contractor Structure

The GSEs also manage their REO inventories using a series of contractors

(Figure 3).

Figure 3: GSEs’ REO Oversight Structure

3 HUD, Management & Marketing III Overview: Video Participant Guide (2010). Accessed April 5, 2013, at

hp://www.hud.gov/oces/hsg/s/reo/slides/Management_Marketing_III_Overview.pdf.

Enterprises

Asset Management Firm

Secure

Property

Real estate

brokers

Eviction

attorneys

Property

maintenance

companies

Maintenance

& Repair

Property

maintenance

companies

Repair

contractors

Real estate

brokers

Valuation

& Marketing

Appraisers

Broker price

opinion firms

Real estate

brokers

Sale

Real estate

brokers

Closing/title

companies

and attorneys

10

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

• Asset management rms: These rms direct certain REO

contractors in the performance of day-to-day property management

responsibilities.

• Real estate brokers: Instead of or in addition to hiring asset

management rms, the GSEs may contract brokers to manage portions

of their REO inventory. Their contractual duties could include

identifying and mitigating hazardous conditions at the properties,

developing and implementing marketing plans, listing properties, and

evaluating oers.

• Aorneys: The GSEs contract aorneys in the states in which their

properties are located to accomplish a variety of legal tasks, such

as managing evictions. Designated aorneys and national title

companies are employed to ensure that the GSEs obtain title to

foreclosed properties and manage the closing process upon resale.

• Property maintenance companies and repair contractors: These

contractors secure and maintain properties by removing interior

and exterior debris, cleaning houses, cuing lawns, inspecting and

repairing plumbing, and winterizing structures, among other things.

They also make repairs, such as xing leaking roofs, repairing or

replacing appliances, and installing major systems, such as heating

and air conditioning units.

• Appraisers and broker price opinion rms: These contractors

help the GSEs determine the value and listing prices of foreclosed

properties by reviewing comparable sales and conducting appraisal

reviews.

The “Shadow Inventory”

While the burden of managing their respective REO inventories successfully

is signicant enough, Fannie Mae, Freddie Mac, and HUD must also pay

close aention to “shadow inventory.” This inventory consists of properties

with mortgages that are over 90-days delinquent, but which have not yet

completed the foreclosure process and therefore have not yet hit the active real

estate market. As of September 30, 2012, shadow inventory properties vastly

outnumbered properties already in the REO inventories (Figure 4).

11

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Figure 4: Single-Family REO Inventories and Mortgages over

90 Days Delinquent, as of September 30, 2012

Creditor Shadow Inventory REO Inventory

Ratio of Shadow to

REO Inventory

Fannie Mae 598,490 107,225 5.6 to 1

Freddie Mac 368,159 50,913 7.2 to 1

Enterprises Total

*

966,649 158,138 6.1 to 1

HUD 741,384

**

37,445

***

19.8 to 1

Overall Total 1,708,033 195,583 8.7 to 1

* GSE gures are derived from FHFA’s Foreclosure Prevention Report for Third Quarter 2012. Accessed

February 27, 2013, at hp://www.fa.gov/webles/24858/3q12FPR_nal.pdf.

** HUD’s Single Family Data Warehouse as of September 30, 2012. This is a collection of database tables

structured to provide HUD users easy and ecient access to single-family housing case-level data on

properties and associated loans, insurance, claims, defaults and demographics.

*** HUD’s Month End Acquisition Property Report from Single Family Asset Management System as of

September 30, 2012.

FHA-approved lenders must report the status of all delinquent loans to HUD

each month until nal resolution. In the event of foreclosure, which results in

FHA-insured properties entering HUD’s REO inventory, the nal resolution

is the insurance claim paid after the foreclosure auction is completed and the

marketable title is transferred to HUD. FHA’s Quarterly Report to Congress

on the Financial Status of the Mutual Mortgage Insurance Fund provides

information on serious delinquency trends and numbers of REO dispositions

and associated loss rates.

4

The average loss rate on REO properties for the

quarter ending September 30, 2012, was 62.1 percent.

5

Of the 741,384 active 90-

day delinquent loans as of September 30, 2012, 219,699 were in foreclosure.

6

The serious delinquency rate (more than 90 days delinquent) held steady at

9.4 percent in the third quarter. This level is about 1.4 percent higher than this

time a year ago. Three factors appear to be driving this result. The rst is the

persistence of loans in serious delinquency as lenders aempt to craft workout

4 HUD, Quarterly Report to Congress: FHA Single-Family Mutual Mortgage Insurance Fund Programs,

FY 2012 Q3. Accessed April 10, 2013, at hp://portal.hud.gov/hudportal/documents/huddoc?id=artc_

q3_2012.pdf.

5 The loss rate was used in a HUD-OIG report published on February 5, 2013, and can be accessed

at hp://www.hudoig.gov/Audit_Reports/Final%20Audit%20Memorandum_Standard%20Pacic%20

Mortgage_02-05-13_signed.pdf.

6 Calculation by HUD-OIG from data in HUD’s Single Family Data Warehouse.

12

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

plans. The second is the duration of loans in foreclosure processing.

7

The third

is that the historically large books of business for scal years 2009 and 2010 are

at the age at which their serious delinquency rates are increasing toward their

lifecycle peaks.

FHFA-OIG has not independently estimated the extent to which the level of

seriously delinquent mortgages could increase the GSEs’ REO inventories over

time. However, the GSEs’ data suggest that the numbers could be signicant

given the extent to which many borrowers are behind on their mortgage

payments. Fannie Mae has stated that due to elevated numbers of delinquent

borrowers, among other challenges in the housing sector, it does not expect its

REO inventory to return to pre-nancial crisis levels for years.

8

HUD & GSE Actions and Initiatives

HUD and the GSEs have taken steps to shrink their REO inventories.

FHA Note Sales Program and Distressed Asset Stabilization Program

The FHA Oce of Asset Sales was established December 1, 2001, by the

HUD Deputy Assistant Secretary for Finance and Budget to coordinate the

disposition of FHA-held single-family and multifamily mortgage notes. The

FHA note sales program began as a pilot in 2010 and has resulted in the

sale of nearly 2,400 single-family loans as of April 2013. Under the program,

FHA-insured notes are sold competitively at a market-determined price

generally below the outstanding principal balance. Once the note is purchased,

foreclosure is delayed for at least 6 months as the borrower gets direct help

from his or her servicer to nd an aordable foreclosure alternative. The

investor purchases the loan at a discount and then takes additional steps to

7 Such duration can be aected by multiple factors, including state laws governing homebuyers’ rights

of redemption. In general, redemption laws permit homeowners to “redeem” foreclosed properties by

paying o the outstanding debt within a specied time after foreclosure. These laws may have the eect

of tying up the property after foreclosure and rendering it more dicult to sell. This, in turn, results in

additional carrying costs for the GSEs as well as lost income on the mortgage.

8 Fannie Mae, 2011 10-K Report, at 16. Accessed February 27, 2013, at hp://phx.corporate-ir.net/

phoenix.zhtml?c=108360&p=irol-SECText&TEXT=aHR0cDovL2FwaS50ZW5rd2l6YXJkLmNvbS9ma

WxpbmcueG1sP2lwYWdlPTc0MzQ5MzkmRFNFUT0wJlNFUT0wJlNRREVTQz1TRUNUSU9OX0VO

VElSRSZzdWJzaWQ9NTc%3d.

13

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

help the borrower avoid default, whether by modifying the loan terms or

helping the borrower through a short sale, to maximize the return on the sale.

9

A servicer can place a loan into the loan pool if the following criteria are met:

• Borrower is at least 6 months delinquent on his or her mortgage,

• Servicer has exhausted all steps in the FHA loss mitigation process,

• Servicer has initiated foreclosure proceedings, and

• Borrower is not in bankruptcy.

In September 2012, FHA enhanced its single-family note program to include

pools of expanded size and use criteria with the goal of yielding beer

outcomes for troubled borrowers, neighborhoods, and taxpayers. This

revamped program is referred to as the Distressed Asset Stabilization Program.

HUD recognizes that thousands of FHA borrowers who are delinquent on

their loans and have exhausted the loss mitigation interventions available

through FHA. By strategically selling notes to new servicers rather than

carrying out foreclosure, FHA can reduce costs while helping to stabilize

communities. Beginning with the September 2012 sale, FHA will increase

the number of loans available for purchase from about 1,800 a year up to

5,000 a quarter and add a new neighborhood stabilization pool to encourage

investment in communities hardest hit by the foreclosure crisis.

10

The oerings

from the Distressed Asset Stabilization Program rst occurred in September

2012 with the latest oering conducted in March 2013. As of April 2013, the

program has resulted in the sale of nearly 26,000 mortgages. Another oering

is planned for June 2013 with an anticipated sale of 15,000 to 20,000 loans.

FHFA and Fannie Mae REO Pilot Program

In August 2011, FHFA, HUD, and the Department of the Treasury issued a

Request for Information, soliciting public comment on new and advantageous

ways to sell single-family REO properties held in their inventories. In February

2012, FHFA directed Fannie Mae to launch an REO Pilot Program, as a result

of public feedback, in which bids were solicited from qualied investors to

purchase and then rent for a specied number of years about 2,500 of Fannie

Mae’s foreclosed single-family properties. These properties were located in

9 HUD, HUD to Expand Sale of Troubled Mortgages through Program Designed to Help Borrowers Avoid

Costly, Lengthy Foreclosures, HUD No. 12-096 (June 8, 2012). Accessed April 5, 2013, at hp://portal.hud.

gov/hudportal/HUD?src=/press/press_releases_media_advisories/2012/HUDNo.12-096.

10

Id.

14

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

geographically concentrated areas across the United States. Investors were

qualied to bid after an extensive review process that evaluated their nancial

strength, asset management experience, property management expertise, and

experience in the geographic area.

FHFA has targeted metropolitan areas hit hardest by foreclosures: Atlanta,

Chicago, Las Vegas, Los Angeles, Phoenix, and parts of Florida. In September

2012, FHFA announced that Pacica Companies, LLC was the rst winning

bidder in the REO Pilot Program, in which the investor purchased 699

properties in Florida. Subsequently, the Cogsville Group, LLC purchased 94

Fannie Mae REO properties in Chicago in October 2012. FHFA also announced

in November 2012 that Colony Capital, LLC purchased 970 properties in

California, Arizona, and Nevada.

11

OIG Efforts on REO

HUD-OIG

In its continuing eorts to improve the integrity of the single-family insurance

program, HUD-OIG has proactively sought to identify high-risk areas within

FHA’s REO program for audit opportunities. Specically, in 2011 HUD-OIG

conducted an auditability survey of HUD’s REO program and identied

audit opportunities in the areas of oversight, eld service management, and

asset management. HUD-OIG subsequently completed four audits: (1) HUD’s

oversight of its REO M&M III program;

12

(2) Innotion Enterprises (an FSM

contractor)’s performance;

13

(3) the reasonableness of certain Innotion pass-

through costs;

14

and (4) Ofori and Associates, PC (an Asset Manager)’s

compliance with case processing requirements and timeframes.

15

Below is a

summary of the audit objectives and results from those four issued reports.

1. Audit of HUD’s Oversight of Its REO Management and Marketing Program III

HUD-OIG audited HUD’s oversight of its REO M&M III program. This audit

work focused on HUD’s oversight of the Asset Managers (AMs) and Field

11 Properties in Atlanta were not awarded and will be evaluated for disposition through Fannie Mae’s

retail REO sales operation or through future transactions.

12 hp://www.hudoig.gov/Audit_Reports/2012-LA-0003.pdf, issued September 18, 2012.

13 hp://www.hudoig.gov/Audit_Reports/2012-LA-1010.pdf, issued September 12, 2012.

14 hp://www.hudoig.gov/Audit_Reports/2013-LA-0801.pdf, issued October 3, 2012.

15 hp://www.hudoig.gov/Audit_Reports/2013-BO-1001.pdf, issued February 19, 2013.

15

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Service Managers (FSMs), as well as enforcement of contract requirements,

including listing prices, bid thresholds, valuation, maintenance, inspections,

and payments. The objective was to determine whether HUD’s policies and

procedures provided for ecient and eective oversight of AMs and FSMs

under M&M III program.

The audit identied that HUD did not have adequate procedures in place

to ensure consistent and adequate enforcement of AM and FSM contracts.

Specically, (1) list prices were not always reduced according to the marketing

plans, (2) bids were approved that did not meet HUD’s exible threshold,

(3) bids were rejected that met the marketing plan thresholds, (4) bids that

met applicable thresholds were not always counteroered or forwarded to the

government technical representative for approval, and (5) properties were not

assigned to eld service managers based on performance even when HUD

identied performance issues.

In addition, HUD did not always pay FSMs in accordance with their

contracts, resulting in an estimated net underpayment of $553,784 to FSMs.

This condition occurred because HUD did not develop national standard

procedures and did not implement a performance scorecard to assign

properties to FSMs based on performance. As a result, HUD’s REO properties

may not have always been competitively valued, holding time may not have

always been minimized, sales may not have always achieved the highest net

return, and properties may have been assigned to contractors that did not

perform at a satisfactory performance level.

2. Audit of Innotion Enterprises, Inc.

HUD-OIG audited one of HUD’s REO M&M III FSMs. This audit work

focused on how well Innotion Enterprises, Inc. met the six primary objectives

of its FSM contract. Specically, HUD identied six primary objectives for

the FSM contract, which are to ensure that (1) FHA-insured properties are

maintained in a manner that preserves communities, (2) HUD has real-time

access to all property-related information, (3) properties are secured and safe

from hazardous conditions, (4) property values are preserved, (5) properties

are maintained in a manner that reects a high standard of care, and (6) there

is a high level of customer satisfaction with HUD’s property disposition

program. The overall audit objective was to determine whether Innotion

performed property preservation and protection services according to contract

requirements.

16

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

The audit identied that Innotion did not always perform property protection

and preservation services according to contract requirements. Specically,

38 of 96 (39.6 percent) properties selected materially failed to meet contract

requirements because homes were not secured or properly maintained. As

a result of Innotion not always following HUD’s and its own policies and

procedures, compounded by its inadequate quality control, HUD did not

have assurance that Innotion maintained REO homes at the high standard

of care required in the performance of work statement. HUD paid Innotion

$11,210 for monthly services for 38 homes that did not reect a high standard

of care. If Innotion does not implement adequate controls and procedures to

address property protection and preservation deciencies, HUD will spend

approximately $1 million for inadequate services over the next year.

3. Audit of Innotion Enterprises, Inc. Pass-through Costs

In conjunction with the external audit of Innotion, HUD-OIG reviewed the

termite inspection pass-through costs that it submied to HUD for payment

as part of its REO M&M III program FSM contract. The objective was to

determine whether Innotion’s Las Vegas, Nevada, branch met administrative

requirements concerning pass-through cost reasonableness.

HUD-OIG determined that HUD paid for unnecessary administrative costs of

Innotion’s subcontractor under HUD’s FSM contract. This condition occurred

because of the unclear denitions of actual and administrative costs in HUD’s

contract with Innotion. Although the contract stated that Innotion could

pay only the amount billed and not add its own administrative costs, it did

not specically disallow the payment of administrative costs incurred by a

subcontractor, such as One Stop, that subcontracted Innotion’s work to other

termite inspection contractors. As a result, 30 percent of the termite inspection

costs paid by HUD in the sample were for administrative costs of Innotion’s

subcontractor. If HUD does not revise its FSM eld contracts, it may continue

to pay for unnecessary administrative costs for termite inspections and other

pass-through costs submied by its FSM contractors.

4. Audit of Ofori and Associates, PC

HUD-OIG audited one of HUD’s REO M&M III AMs. This audit work

focused on determining whether or not Ofori complied with case processing

requirements and timeframes to obtain the highest net return for HUD’s REO

inventory and minimize holding time.

17

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

The audit identied that Ofori did not always comply with case processing

requirements and timeframes for the disposition of REO properties assigned to

them. Specically, it did not always perform all case processing requirements

in a timely manner to minimize holding time and costs to HUD. They did not

adequately document information in case les and in the HUD P260 computer

system.

16

This condition occurred because Ofori ocials did not always

follow contract and marketing plan requirements; they did not have adequate

controls in place to ensure that case processing requirements were completed

and documented; and they did not always adequately address procedures,

processes, and timeframes they would follow. As a result, HUD did not have

assurance it always received the highest net return on its REO inventory and

that holding time was minimized.

Ofori ocials have begun addressing the deciencies identied during our

audit, including a checklist for Ofori’s marketing specialists to use to improve

the review of appraisals and for hard to sell properties; had updated their

inspection and closing procedures; and were revising their marketing plans.

Ofori ocials also began notifying HUD of amounts paid at closing that

were not previously reported to HUD, however, Ofori needs to ensure that

the added controls address the deciencies identied in the report, including

conicts of interest, and are followed.

FHFA-OIG

Given the risks associated with the GSEs’ REO management, FHFA-OIG is

implementing a proactive audit and evaluation strategy under which it will

assess FHFA’s related oversight and conservatorship eorts. It is intended to

determine whether FHFA and the GSEs manage REO to maximize nancial

recoveries and minimize the negative eects of foreclosures on aected

communities. In this regard, FHFA-OIG will analyze the potential eectiveness

of these REO management activities, and determine whether proper risk

management controls are in place to prevent fraud and abuse.

FHFA-OIG’s REO strategy consists of the following:

1. Audit of FHFA’s Oversight of the Enterprises’ REO Management Programs

Since 2008, FHFA has consistently listed the GSEs’ large REO inventories as

contributing to “critical concern” ratings in their quarterly risk assessments.

However, in spite of FHFA’s identication of REO as a prominent and

16 P260 is an internet based system that serves as a primary system of record for all REO case

management transactions.

18

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

ascending risk, FHFA did not conduct targeted examinations or similar

focused reviews of REO until 2011. FHFA-OIG subsequently audited FHFA’s

oversight of the GSEs’ REO management programs.

17

This audit focused

on FHFA’s supervision of the GSEs’ management and marketing of REO

properties.

FHFA-OIG found that FHFA’s targeted examinations, which were completed

in 2012, were positive supervisory steps that the agency can supplement in the

future by closely assessing other REO risk areas that need focused supervision

(i.e., areas in addition to contractor management and the management of

unmarketable homes and canceled foreclosures). For example, the GSEs’

sizable shadow inventory may stress their systems for cost-eectively

managing, marketing, and disposing of REO. FHFA-OIG also found that

FHFA will benet from using a more comprehensive REO risk assessment and

from using this assessment to enhance its planning of supervisory activities.

According to FHFA’s Supervision Handbook, risk assessment is the process of

developing a comprehensive, risk-focused view of a GSE in order to formulate

and articulate a current understanding of its emerging and existing risk

characteristics, to be used as a blueprint for planning supervisory activities.

18

However, until early in 2011, FHFA’s supervisory planning did not focus on

the signicant and increasing risks associated with the GSEs’ REO. FHFA-OIG

recommended that FHFA implement a more comprehensive performance risk

assessment of REO and link the results to supervisory plans that address those

risks through specic supervisory activities.

2. Assessments of FHFA’s Oversight of the Enterprises’ REO Management

Programs

In pending and planned FHFA-OIG activities, FHFA-OIG intends to cover the

key steps in the REO management process, including maers such as securing

the property, maintenance and repair, valuation and marketing, and sale.

FHFA-OIG is considering several evaluations of FHFA’s oversight of the GSEs’

planning, monitoring, and management of REO, with a focus on their ability

to handle future workloads and mitigate adverse eects on homeowners and

communities. The specic objectives of these REO activities are or will be to

assess FHFA’s oversight of the GSEs’:

17 FHFA-OIG, FHFA’s Supervisory Risk Assessment for Single-Family Real Estate Owned, AUD-2012-005

(July 19, 2012).

18

FHFA, FHFA Division of Enterprise Regulation Supervision Handbook 2.1 (June 16, 2009), at 40. Accessed

February 27, 2013, at hp://www.fa.gov/webles/2921/DERHandbook21.pdf.

19

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

• Management systems, risk controls, and capacity to deal with any

surge of foreclosures in their REO inventories due to seriously

delinquent mortgages; and

• Eorts to mitigate the eects of concentrations of REO inventories and

abandoned or vacant foreclosed properties in economically distressed

areas of the country.

3. Assessments of Any Expanded REO Program

FHFA-OIG also plans to assess FHFA’s and Fannie Mae’s REO Pilot Program

should FHFA decide to implement the sale-rental commitment model on a

wider scale. The areas that FHFA-OIG may cover include:

• Whether the program is achieving key expected outcomes and the

quality of the data and analytics FHFA and Fannie Mae use to make

such determinations. For example, the evaluation could cover FHFA’s

and Fannie Mae’s basis for determining whether, in certain cases,

it is more cost-eective to proceed with the bulk sale with rental

commitment model than it is to make sales through the traditional

retail channel.

• The quality of the controls that are established to ensure that investors

have sucient expertise and nancial resources to meet their rental

commitments, as well as Fannie Mae’s and FHFA’s eorts to ensure

compliance with these controls.

• The quality of the processes by which Fannie Mae monitors investor

compliance with their rental commitments and the restrictions on the

number of properties that may be sold annually, as well as FHFA’s

oversight of the GSEs’ processes; FHFA’s and Fannie Mae’s program

enforcement eorts to ensure compliance with program requirements;

and, where necessary, their eorts to penalize or sanction investors for

noncompliance.

• FHFA’s general oversight of Fannie Mae’s eorts to implement the

program, as well as its technical expertise and the suciency of the

resources allocated to these eorts.

20

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

4. Assessment of FHFA’s Oversight of Enterprise Controls over Single-Family

Property Inspections for REO

FHFA-OIG also plans to assess FHFA’s oversight of single-family property

inspections at the GSEs, which view property inspections as essential to the

successful management of their REO inventories. Property inspections are

required at various points in the mortgage servicing process, including upon

delinquency, in foreclosure, and while managing and disposing of REO. These

inspections should determine the overall condition of the property, security

of the house, occupancy status, maintenance and capital repair requirements,

neighborhood conformity, and other related information. Inspectors must be

qualied to perform the inspections.

With this audit and evaluation strategy, FHFA-OIG believes that it will be well

positioned to:

• Determine whether FHFA is ensuring that the GSEs are eectively

mitigating REO risks and costs and the negative impacts of

foreclosures on communities and

• Evaluate the eectiveness of the controls associated with selling in

bulk foreclosed properties with rental commitments.

Further, FHFA-OIG will be in a position to make recommendations, as

necessary, to strengthen FHFA’s REO-related oversight and conservatorship

eorts.

21

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Conclusion

This report is the latest eort from the Federal Housing Inspectors General,

a joint initiative consisting of Oces of Inspector General (OIGs) for Federal

agencies that play central roles in supporting housing in the United States: the

U.S. Departments of Agriculture, Housing and Urban Development (HUD),

Veterans Aairs, and the Federal Housing Finance Agency (FHFA). These

OIGs are working to protect the U.S. taxpayer by eliminating fraud, waste, and

abuse in federal housing programs.

REO management and disposition are challenging tasks, likely to become

more so as shadow inventory is foreclosed upon and becomes REO properties.

HUD-OIG and FHFA-OIG have undertaken signicant work to ensure that

their respective agencies address REO-related issues eectively and eciently.

Substantial aention must continue to be paid to the manner in which HUD,

FHFA, and the GSEs handle such issues.

22

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Appendix A

Participating Ofces of Inspectors General

U.S. Department of Housing and Urban Development

HUD has its origins in the National Housing Act of 1934, which created the

Federal Housing Administration (FHA). Since 1934, the FHA has helped more

than 41 million families to become and remain homeowners.

19

The Oce of

Housing within HUD oversees the FHA, the largest mortgage insurer in the

world, as well as regulates housing industry business. HUD’s Single Family

programs include mortgage insurance on loans to purchase new or existing

homes, condominiums, manufactured housing, houses needing rehabilitation,

and for reverse equity mortgages to elderly homeowners.

20

HUD was

established in 1965 through the Housing and Urban Development Act and

continues to administer federal programs that provide assistance for housing

and community development. HUD-OIG was established by the Inspector

General Act of 1978. Over the years, HUD-OIG has forged an alliance with

HUD personnel in recommending ways to improve departmental operations

and in prosecuting program abuses. HUD-OIG strives to make a dierence in

HUD’s performance and accountability.

HUD-OIG is commied to the statutory mission of detecting and preventing

fraud, waste, and abuse and promoting the eectiveness and eciency of

government operations. While organizationally located within the Department,

HUD-OIG operates independently with separate budgetary authority. It seeks

to:

• Promote eciency and eectiveness in programs and operations,

• Detect and deter fraud and abuse,

• Investigate allegations of misconduct by HUD employees, and

• Review and make recommendations regarding existing and proposed

legislation and regulations aecting HUD.

HUD-OIG’s audits, inspections and evaluations, and investigations continue to

complement the Department’s strategic initiatives, and its employees continue

19 hp://www.huduser.org/portal/publications/hsgn/a_singlefamily2012.html, accessed April 8,

2013.

20

hp://portal.hud.gov/hudportal/HUD?src=/program_oces/housing/hsgabout, accessed April 8,

2013.

23

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

to work with the Department to improve HUD’s eectiveness. As a result,

HUD-OIG has developed and implemented beer and more eective audit

recommendations.

During the public reporting period from April 1 through September 30,

2012, HUD-OIG’s audit work identied more than $827 million in funds that

could be put to beer use and more than $1.2 billion in questioned costs, and

accumulated nearly $34 million in collections. HUD-OIG reported more than

$538 million in recoveries and receivables, 354 indictments and informations,

285 convictions, pleas, and pretrial diversions, and 280 arrests.

21

Federal Housing Finance Agency

FHFA was established by the Housing and Economic Recovery Act of

2008 (HERA) in the midst of the worst economic crisis in decades. HERA

created FHFA by consolidating into one agency HUD’s Oce of Federal

Housing Enterprise Oversight, the Federal Housing Finance Board, and

the GSE mission oce within HUD. FHFA’s mission is to provide eective

supervision, regulation, and oversight of Fannie Mae, Freddie Mac, and the 12

Federal Home Loan Banks. FHFA is charged with promoting their safety and

soundness, supporting housing nance and aordable housing, and fostering

a stable and liquid mortgage market. In September 2008, FHFA became the

conservator of Fannie Mae and Freddie Mac. At that time, both GSEs began to

receive federal support and, to date, have received a combined total of $187.5

billion from the Treasury. As conservator, FHFA has the authority to ensure

that they are preserving and conserving their assets.

HERA also established FHFA-OIG. FHFA-OIG began operating in October

2010, following Senate conrmation of its rst Inspector General. FHFA-

OIG works to promote the economy, eciency, and eectiveness of FHFA’s

programs; prevent and detect fraud, waste, and abuse; and seek sanctions

and prosecutions against those who are responsible for such fraud, waste,

and abuse. FHFA-OIG also provides independent and objective reporting

to the FHFA Director, Congress, and the American people through audits,

evaluations, and investigations. Among the eects of FHFA-OIG’s reporting

eorts is Freddie Mac’s likely recovery of approximately $1 billion in added

income in 2012 and up to $3.4 billion in later years, due to Freddie Mac

broadening the scope of loans reviewed for potential repurchase claims after

FHFA-OIG determined that its prior loan review scope was too narrow.

21 An information is a charging document in which the defendant foregoes his or her constitutional

right to have the facts of the case presented to a grand jury. Usually, an information is accompanied by

a plea agreement.

24

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

FHFA-OIG has had several key accomplishments since it began. From its start,

with limited sta and resources, FHFA-OIG commenced operations and has

issued 32 reports through September 30, 2012. For additional information on

any of FHFA-OIG’s published reports, visit www.faoig.gov/Reports. FHFA-

OIG has also initiated and participated in criminal, civil, and administrative

investigations. Notably, FHFA-OIG made signicant contributions to the

investigation, prosecution, and conviction of seven individuals connected

to Taylor, Bean & Whitaker Mortgage Corporation and Colonial Bank, who

defrauded Freddie Mac and other victims out of $2.9 billion, making it among

the largest mortgage frauds in U.S. history. Further, FHFA-OIG has made over

80 recommendations to date in order to improve the transparency, eciency,

and eectiveness of FHFA’s operations and aid in the prevention and detection

of fraud, waste, and abuse.

25

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Appendix B

Acronyms and Abbreviations

Enterprises Fannie Mae and Freddie Mac

Fannie Mae Federal National Mortgage Association

FHA Federal Housing Administration

FHFA Federal Housing Finance Agency

FHFA-OIG Federal Housing Finance Agency Oce of Inspector General

Freddie Mac Federal Home Loan Mortgage Corporation

GAAP Generally Accepted Accounting Principles

GSE Government-Sponsored Enterprise

HERA Housing and Economic Recovery Act of 2008

HUD U.S. Department of Housing and Urban Development

HUD-OIG U.S. Department of Housing and Urban Development Oce

of Inspector General

M&M Management and Marketing

MCM Mortgage Compliance Manager

REO Real Estate Owned

SAMS Single Family Accounting Monitoring System

SFIS Single Family Insurance System

26

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Appendix C

Glossary

Claims

A request or demand for payment on a guaranteed loan by the loan holder due

to default by the borrower. The guarantor will generally issue the payment to

the loan servicer, who will be responsible for forwarding the funds to the loan

holder in accordance with its servicing agreement.

Debt

A specic sum of money due by agreement or otherwise.

22

Obligations can

be incurred by households (consumer debt) or corporations (corporate debt).

Corporate debt may also refer to securities issued by a corporation, each an

individual obligation owed by the corporation to the investor.

Deed in lieu

A voluntary transfer of property from the borrower to the loan holder for a

release of all obligations under the mortgage.

Default

Failure to comply with an obligation’s terms.

Equity

In the context of residential mortgage nance, the dierence between the fair

market value of the borrower’s home and the outstanding balance on the

mortgage (and any other debt secured by it, such as home equity loans).

Federal Home Loan Mortgage Corporation (Freddie Mac)

A federally chartered corporation that purchases residential mortgages,

securitizes them, and sells them to investors; this provides lenders with funds

that can be used to make loans to homebuyers.

Federal Housing Administration (FHA)

Part of HUD, provides mortgage insurance on loans made by approved

lenders throughout the United States and insures residential mortgages against

payment losses. It is the largest insurer of mortgages in the world, having

insured more than 34 million properties since its inception in 1934.

Federal National Mortgage Association (Fannie Mae)

A federally chartered corporation that purchases residential mortgages and

22 Garner, Bryan A., ed., Black’s Law Dictionary, 7th ed., p. 300 (2000).

27

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

converts them into securities for sale to investors. By purchasing mortgages,

Fannie Mae supplies funds to lenders so they may make loans to homebuyers.

Foreclosure

A legal procedure in which a mortgaged property is sold in a legal process to

pay the outstanding debt in case of default.

23

Foreclosure laws vary according

to each state’s statutes on the topic. Generally, foreclosures are either judicial

(i.e., conducted primarily through court proceedings) or nonjudicial (i.e.,

conducted largely outside of the state’s judicial system).

Government-Sponsored Enterprises (GSEs)

Business organizations chartered and sponsored by the federal government,

such as Fannie Mae and Freddie Mac.

Guarantee

An agreement to repay a loan or ensure performance. It may be limited in time

and amount.

24

With respect to mortgage-backed securities, a guarantee takes

the form of assurance of timely principal and interest payments to security

holders.

25

Insurance

Indemnication one obtains against loss from a specic hazard or peril.

26

Mortgage insurance is one such example. A federal agency may insure private

lenders against the risk that a particular borrower will default on his or her

mortgage. By oering to insure the borrower’s mortgage, the federal agency

reduces the risks those private lenders might incur and thereby encourages

those lenders to extend credit to borrowers who might not otherwise qualify

for mortgages in the private market.

Loan Modication

A loan modication alters the original loan’s terms to make it comparatively

easier for the borrower to pay back what is owed. A loan modication may

extend the period in which the borrower must repay the amounts due,

reduce those amounts, or take some other step to make the obligation less

burdensome on the borrower.

23 Mortgage Bankers Association, Mortgage Banking Terms, 10th ed., p. 67 (2004).

24 Esty, Benjamin C., Glossary of Project Finance Terms and Acronyms (2004). Accessed August 30, 2011, at

www.people.hbs.edu/besty/projnportal/glossary.htm#Top.

25

HUD, Glossary. Accessed August 30, 2011, at hp://portal.hud.gov/hudportal/HUD?src=/program_

oces/housing/s/buying/glossary.

26

Institute of Financial Education, Glossary of Financial Services Terminology, p. 40 (1990).

28

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Loss Mitigation

Steps taken by the mortgage lenders to avoid the need to foreclose on

properties subject to a mortgage upon which the borrower is at risk of going

into default. Such steps may benet both the lender and the borrower.

Examples of loss mitigation activities include but are not limited to loan

modications and short sales.

Real Estate Owned (REO)

A class of real property owned by the lender. The term REO is derived from

the Generally Accepted Accounting Principles (GAAP) category, “Other Real

Estate Owned.” Under GAAP, REO properties are booked as nonperforming

assets due to the lender’s lack of recourse against the borrower. The lender

may acquire the property through a forcible repossession or foreclosure or by

the borrower’s voluntary award, such as a deed in lieu of foreclosure.

27

Servicing

Certain activities undertaken in connection with loans. Servicing a mortgage

loan means taking those steps that are necessary to maintain the loan from

when it is made until when the last payment is received, at which point the

mortgage instrument is canceled. Servicing steps are varied and may include

billing the borrower, collecting mortgage payments, and escrowing real estate

tax and re and casualty insurance payments.

28

Short Sale

The sale of a mortgaged property in which the lender permits the property to

be sold for less than the full amount owed on the loan. However, a lender’s

permiing a short sale does not necessarily entail acceptance of this lesser

amount as full payment on the loan or otherwise waiving the remaining

deciency.

Underwater

Term used to describe situations in which the homeowner’s equity is below

zero (i.e., the home is worth less than the balance of the loan(s) it secures).

27 Washington State Department of Financial Institutions, Managing Your Credit Union’s OREO Property:

Guidance and Best Practices (2010). Accessed August 31, 2011, at www.d.wa.gov/cu/pdf/oreo-best-

practices.pdf.

28

Institute of Financial Education, Glossary of Financial Services Terminology, p. 46 (1990).

29

Joint Report on Federally Owned or Overseen Real Estate Owned Properties • May 2013

Appendix D

Contact Information

U.S. Department of Housing and Urban Development

Oce of Inspector General

451 7th Street, SW

Washington, DC 20410

Main Phone: 1-202-708-0430

Hotline Phone: 1-800-347-3735

www.hudoig.gov

Federal Housing Finance Agency

Oce of Inspector General

400 7th Street, SW

Washington, DC 20024

Main Phone: 1-202-730-0880

Hotline Phone: 1-800-793-7724

www.faoig.gov