HUD PROGRAMS

Good Neighbor Next Door

Gives public servants a path to homeownership

BACKGROUND AND PURPOSE

The Good Neighbor Next Door (GNND) strengthens

communities by making homeownership possible for

public servants. The program enables affordable home-

ownership opportunities in neighborhoods designated

as “revitalization areas” to full-time law enforcement

ofcers, pre-kindergarten through 12th-grade teachers,

reghters, and emergency medical technicians (EMTs)

via a 50 percent discount off the purchase price of the

property. HUD designates revitalization areas based

on neighborhood household income, homeownership

rate, and FHA-insured mortgage foreclosure activ-

ity. The program provides discounts on the purchase

of HUD-owned homes and qualied GNND buyers

seeking an FHA-insured mortgage are eligible for a

minimum down payment of $100 instead of the stan-

dard 3.5 percent of the adjusted value of the property,

and can include closing costs and prepaid expenses in

the FHA-insured mortgage.

To participate, borrowers must verify their employ-

ment status, nd a HUD-owned single-family property

through the HUD Homes database (listed by state), and

purchase it through the program within seven days.

Eligible properties are HUD real estate owned (REO)

single-family, one- to four-unit residential properties

acquired as a result of a foreclosure on the under-

lying FHA-insured mortgage for properties within

designated revitalization areas. A limited number of

properties are available under this program.

Purchasers are responsible for nding their own

nancing and paying closing costs and broker fees, if

applicable. Purchasers may be qualied for FHA or VA

insured loans or various federal programs based on

their special status and/or income level. The GNND

program can work in conjunction with other home

buying programs provided the purchaser meets all

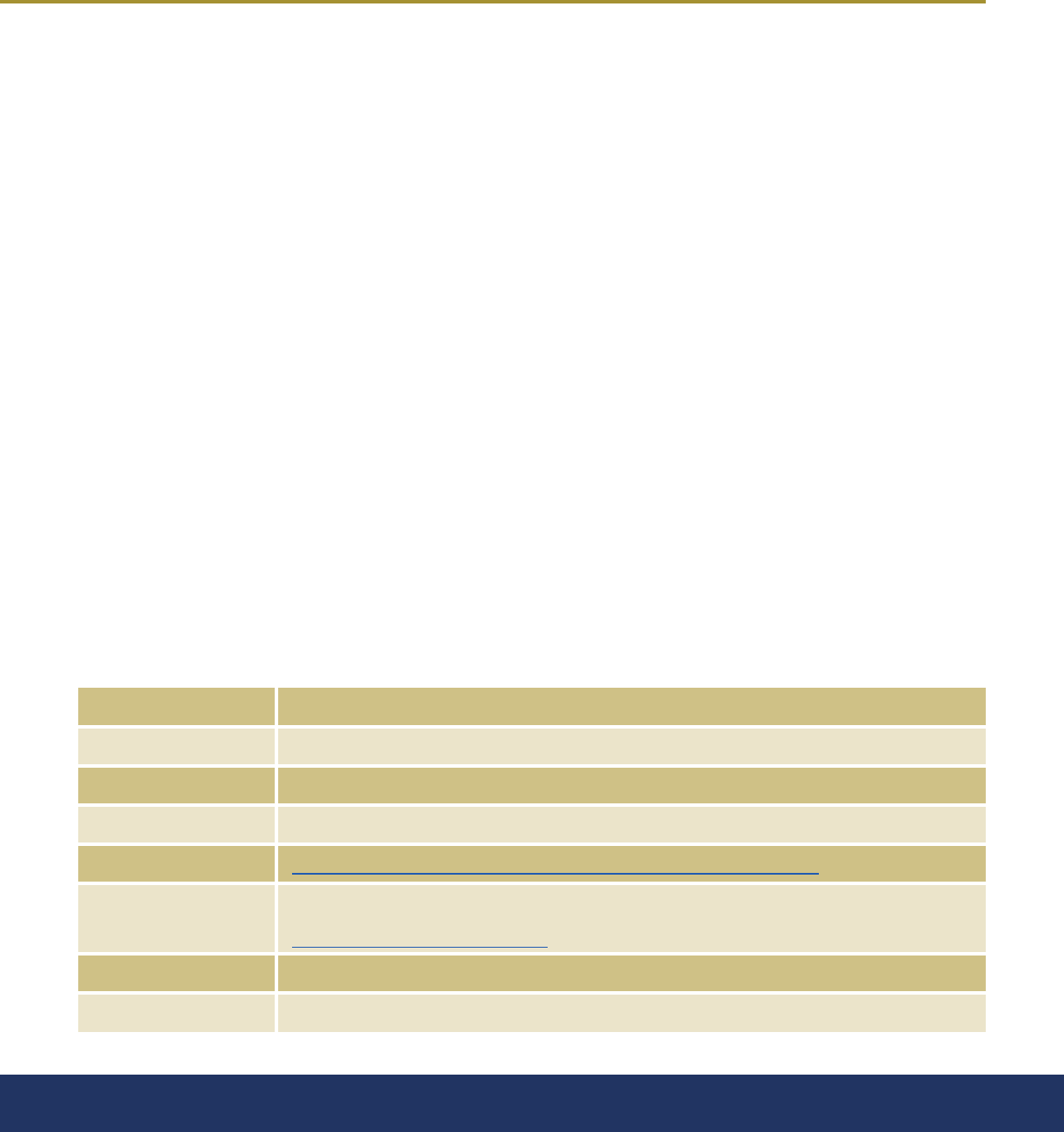

PROGRAM NAME

Good Neighbor Next Door Program (GNND)

AGENCY

U.S. Department of Housing and Urban Development

EXPIRATION DATE

Not Applicable

APPLICATIONS

Not Applicable

WEB LINK

https://www.hud.gov/program_ofces/housing/sfh/reo/goodn/gnndabot

CONTACT

INFORMATION

APPLICATION PERIOD

Continuous

GEOGRAPHIC SCOPE

HUD-owned properties in HUD designated “Revitalization Areas”

Lenders that have questions about the program can contact their local HUD Homeownership

Center (HOC) that has a GNND Coordinator. HOCs and their service areas are listed at

https://entp.hud.gov/clas/info2.cfm

41 | FDIC | Affordable Mortgage Lending Guide

-

-

-

GNND requirements. For example, the FHA Section 203(k) mortgage

program helps homebuyers buy a home and have enough money to

rehabilitate or repair it (repairs must cost more than $5,000). The cost

of the repairs and the mortgage are combined into a single monthly

payment. The FHA 203(b) mortgage program can be used to nance the

purchase and repairs under $5,000.

GNND borrowers are required to sign a second mortgage and note for

the discount (50 percent) on the purchase of the home. No interest or

payments are required as long as the borrower remains in the home

for a total of 36 months. After three years, HUD’s second mortgage is

released provided that the participant has completed and returned the

required annual certications, is not currently under investigation by the

Ofce of Inspector General, and complies with all GNND regulations.

The second mortgage will not show up on the title of the property after

it is released. Once this is released, the purchaser is free to sell the home

and keep the equity and/or appreciation generated by the sale.

BORROWER CRITERIA

Purchasers: The home must be located in a HUD-designated revital-

ization area and must be owned by HUD. Borrowers must t one of

three criteria:

1. Law enforcement ofcials can participate if they are employed

full-time by a law enforcement agency of the federal govern-

ment, a state, a unit of general local government, or an Indian

Tribal government.

2. Teachers may participate if they are employed as a full-time teacher

by a state-accredited public school or private school that provides

direct services to students in pre-kindergarten through grade 12

from the area where the teacher purchases the home.

3. Fireghters and emergency medical technicians may participate if

they are employed full-time as a reghter or EMT by a re depart-

ment or emergency medical services responder unit of the federal

government, a state, unit of general local government, or an Indian

tribal government serving the area where the home is located.

Income limits: This program has no income limits.

Credit: Borrowers applying for FHA-insured mortgages must meet FHA’s

minimum credit score requirements. If the borrower’s minimum decision

credit score is above 580, they are eligible for maximum nancing. If the

credit score is between 500 and 579, the borrower is limited to a maxi-

mum loan to value of 90 percent.

First-time homebuyers: The borrower does not have to be a rst-time

homebuyer to participate.

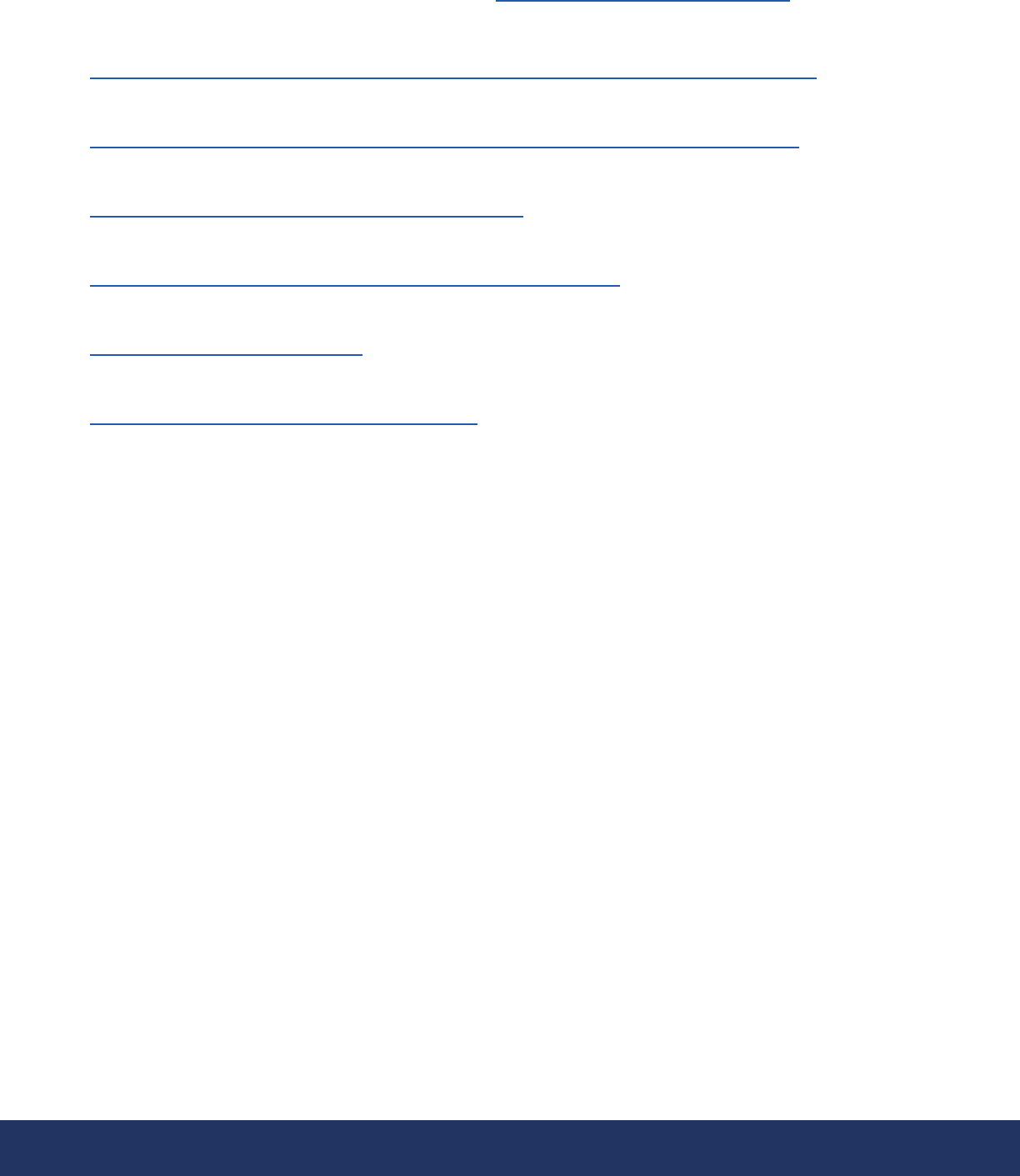

POTENTIAL BENEFITS

There are no income or credit

requirements as long as the pur

chaser meets the employment

qualifications, widening the pool

of potential applicants.

Since GNND is not a mortgage

program, non FHA-approved

lenders can finance the mort

gage for the GNND property if

the borrower meets conventional

loan requirements. Lenders are

making the equivalent of a 50

percent LTV loan.

GNND may allow community

banks to expand their customer

base in low- and moderate-

income communities.

GNND offers competitive pricing.

POTENTIAL CHALLENGES

The potential market for this

program is limited because of

the restrictions on both property

type and applicant employment.

Foreclosed homes may have

quality issues, in which case

lenders should be familiar with

renovation loan programs to cor

rect deficiencies.

FDIC | Affordable Mortgage Lending Guide | 42

Special populations: Full-time law enforcement of-

cers, reghters, teachers, and EMTs purchasing a

HUD-owned home in a designated revitalization area

for use as their sole residence.

Occupancy and ownership of other properties:

Borrowers must commit to live in the property for 36

months as their sole residence and may not own any

other residential property at the time they submit the

offer to purchase a home and for one year previous

to the date. The program can be used to purchase a

single-unit home, townhouse, or condominium.

LOAN CRITERIA

Loan limits: FHA mortgage limits vary by the number of

units and by the county or Metropolitan Statistical Area

in which the property resides. HUD issues a Mortgagee

Letter announcing the new mortgage limits every year.

Loan-to-value limits: If nancing the purchase with an

FHA-insured mortgage, maximum LTV is based on the

borrower’s credit score. If the borrower’s minimum

decision credit score is above 580, they are eligible for

maximum nancing. If the credit score is between 500

and 579, the borrower is limited to a maximum LTV of

90 percent.

Down payment sources: Borrowers must arrange the

nancing, closing costs, and fees on their own. If nanc-

ing the purchase with an FHA-insured mortgage, FHA

allows for various acceptable sources of funds to cover

down payment costs. The acceptable sources fall into

six categories, including cash and savings/checking

account funds; investment funds; gifts; funds resulting

from the sale of personal or real property; loans and

grants; and employer assistance.

Homeownership counseling: Counseling is not a

requirement of the program, but HUD Homeownership

Centers have GNND program coordinators who can

help purchasers with the process.

Mortgage insurance: If nancing the purchase with

an FHA-insured mortgage, the mandatory note and

second mortgage are not included in the upfront and

annual mortgage insurance premium (MIP) associated

with the purchase of a GNND property. The upfront

and annual MIP should be based on the average out-

standing principal obligation of the rst mortgage.

Debt-to-income ratio: If nancing the purchase with

an FHA-insured mortgage, HUD requires lenders to

calculate two ratios to determine if a borrower can

reasonably meet the expected expenses. First, the

mortgage payment expense-to-effective income ratio

(or front-end DTI) should not exceed 31 percent.

Second, the total xed payment-to-effective income

ratio (or back-end DTI) should not exceed 43 percent.

Ratios that exceed 31 percent or 43 percent may be

acceptable if the lender documents qualied “signi-

cant compensating factors.”

Temporary interest rate buy downs: If nancing the

purchase with an FHA-insured mortgage, temporary

interest buy downs are permitted.

Potential Benets

• There are no income or credit requirements as long

as the purchaser meets the employment qualica-

tions, widening the pool of potential applicants.

• Since GNND is not a mortgage program, non FHA-

approved lenders can nance the mortgage for

the GNND property if the borrower meets conven-

tional loan requirements. Lenders are making the

equivalent of a 50 percent LTV loan.

• GNND may allow community banks to expand

their customer base in low- and moderate-

income communities.

• GNND offers competitive pricing.

• Lenders are not responsible for monitoring or

servicing HUD’s second mortgage. The National

Servicing Center in Tulsa monitors the servicing

of the GNND second mortgage after closing and

les the release with the county recorder after

successful completion of the three-year resi-

dence requirement.

Potential Challenges

• The potential market for this program is limited

because of the restrictions on both property type

and applicant employment.

• Foreclosed homes may have quality issues, in

which case lenders should be familiar with renova-

tion loan programs to correct deciencies.

43 | FDIC | Affordable Mortgage Lending Guide

RESOURCES

Direct access to the following web links can be found at https://www.fdic.gov/mortgagelending.

General information

http://portal.hud.gov/hudportal/HUD?src=/program_ofces/housing/sfh/reo/goodn/gnndabot

GNND-eligible participants

http://portal.hud.gov/hudportal/HUD?src=/program_ofces/housing/sfh/reo/goodn/particip

HUD Handbook 4000.1 See section II.A. for general FHA credit requirements.

https://www.hud.gov/sites/documents/40001HSGH.PDF

HUD Mortgagee Letter 2013-20 (includes sample note and second mortgage)

http://portal.hud.gov/hudportal/documents/huddoc?id=13-20ml.pdf

HUD Homeownership Center (HOC) contacts and service areas

https://entp.hud.gov/clas/info2.cfm

HUD homes database (updated daily)

https://www.hudhomestore.com/home/index.aspx

FDIC | Affordable Mortgage Lending Guide | 44