2023

BBB Scam Tracker

SM

RISK

REPORT

All third-party trademarks referenced by BBB Institute for

Marketplace Trust

SM

remain the intellectual property of their

respective owners. Use of the third-party trademarks does

not indicate any relationship, sponsorship, or endorsement

between BBB Institute for Marketplace Trust and the owners

of these trademarks. Any references by BBB Institute for

Marketplace Trust to third-party trademarks is to identify the

corresponding third party.

2023

BBB Scam Tracker

SM

RISK

REPORT

4

Introduction

4

About BBB Scam Tracker

SM

6

8

Snapshot of 2023

– 2023 Risk Report highlights

9

BBB Risk Index: A three-dimensional approach

to measuring scam risk

12

13

Riskiest scams reported by consumers in 2023

– 10 riskiest consumer scams

14

More people reported losing money

to romance scams this year

16

Credit repair/debt relief scams

make the top 10 list for the first time

18

18

19

20

Demographics

– Age

– Scams targeting youth

– Gender

21

Contact and payment methods

29

29

30

Impact on specific audiences

– Canadian consumers

– Impersonated organizations

31

Carrot versus stick: Analyzing the impact of scam tactics

33

Self-reported cues and behaviors that

helped people avoid losing money

34

Other factors that may impact victimization

38

Scams targeting businesses

39

10 general tips for avoiding a scam

40

BBB Institute for Marketplace Trust

42

Appendix A: Glossary of scam types

45

Appendix B: Scam type data table, consumer scams

46

Appendix C: Top 10 consumer scam types by overall risk,

exposure, susceptibility, and median dollar loss

47

Acknowledgements

48

Project team

Table of

Contents

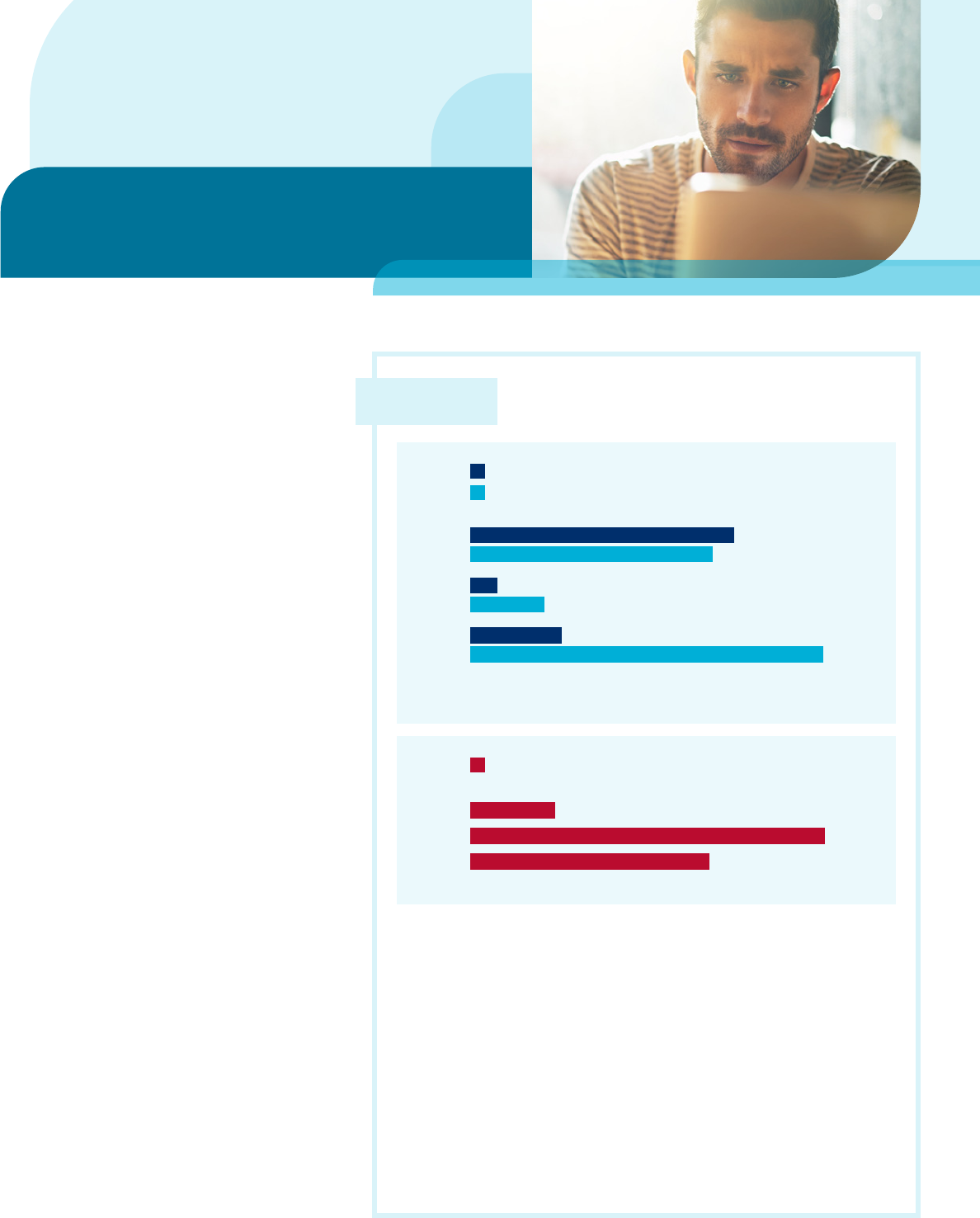

Introduction

The BBB Institute for Marketplace Trust (BBB Institute), the educational

foundation of the International Association of Better Business Bureaus, is

pleased to present the 2023 BBB Scam Tracker Risk Report. The annual report

analyzes data that individuals and businesses submitted to BBB Scam Tracker

SM

(BBB.org/ScamTracker) in 2023. The findings shed light on how scams are

perpetrated, who is being targeted, which scams have the greatest impact, and

which behaviors and factors may impact a person’s susceptibility. Highlights of

the 2023 report are provided in Figure 3.

Scams undermine trust in the marketplace, distort the level playing field, and

siphon money from legitimate transactions that could benefit both consumers

and businesses, thus impeding economic growth. A healthy marketplace requires

empowered and knowledgeable consumers and principled businesses that are

proactively working to stop scammers and to foster trustworthy relationships.

Combatting scammers requires a multisector effort. BBB shares its data with

partners that also work to combat fraud in the marketplace, such as government

agencies and law enforcement, not-for-profits, the media, and the business

community. We collaborate with partners to strategize about the best ways

to stop scammers, and we team with corporate partners and like-minded

organizations to expand our programming and consumer education activities,

evaluate which efforts are working, and continually update them based on

internal and external research and data.

BBB Institute uses the findings in this report to create consumer education

resources that empower people to protect themselves and others. Through the

expansive network of BBBs that serve communities throughout the United States

and Canada, BBB Institute then delivers consumer education programs digitally

and in person.

About BBB Scam Tracker

The BBB Scam Tracker Risk Report is made possible with data collected via BBB

Scam Tracker, an online platform that enables consumers and businesses to

report fraud and fraud attempts. The network of BBBs reviews and posts these

4 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

reported instances of fraud so

that the public can search through

published scams, determine whether

they’re being targeted, and avoid

losing money.

According to a survey of BBB Scam

Tracker reporters,

1

37.8% said they

visited the BBB Scam Tracker website

to determine whether a situation they

were experiencing could be a scam,

and 36.6% of those said the scam-

tracking tool helped them avoid losing

money when targeted by a scam.

With more than 1.7 million people

visiting the platform in 2023,

2

we

estimate BBB Scam Tracker saved

people $24.3 million in 2023 alone

(Figure 1).

Reporters to the BBB Scam Tracker

website sought to warn others about

a scam (44.3%), help law enforcement

stop the scammer (25.2%), and avoid

losing money to a scam attempt

(30.5%).

3

We extend our thanks to the

hundreds of thousands of people who

chose to speak out and help others

avoid losing money to scammers by

reporting to BBB Scam Tracker.

1

Web-intercept survey with 1,027 unique respondents who visited BBB Scam Tracker in January 2024. Respondents could choose

multiple reasons for visiting BBB Scam Tracker.

2

Adobe Analytics.

3

A survey was distributed to those who submitted a scam report to BBB Scam Tracker in 2023; 6,947 respondents completed the survey.

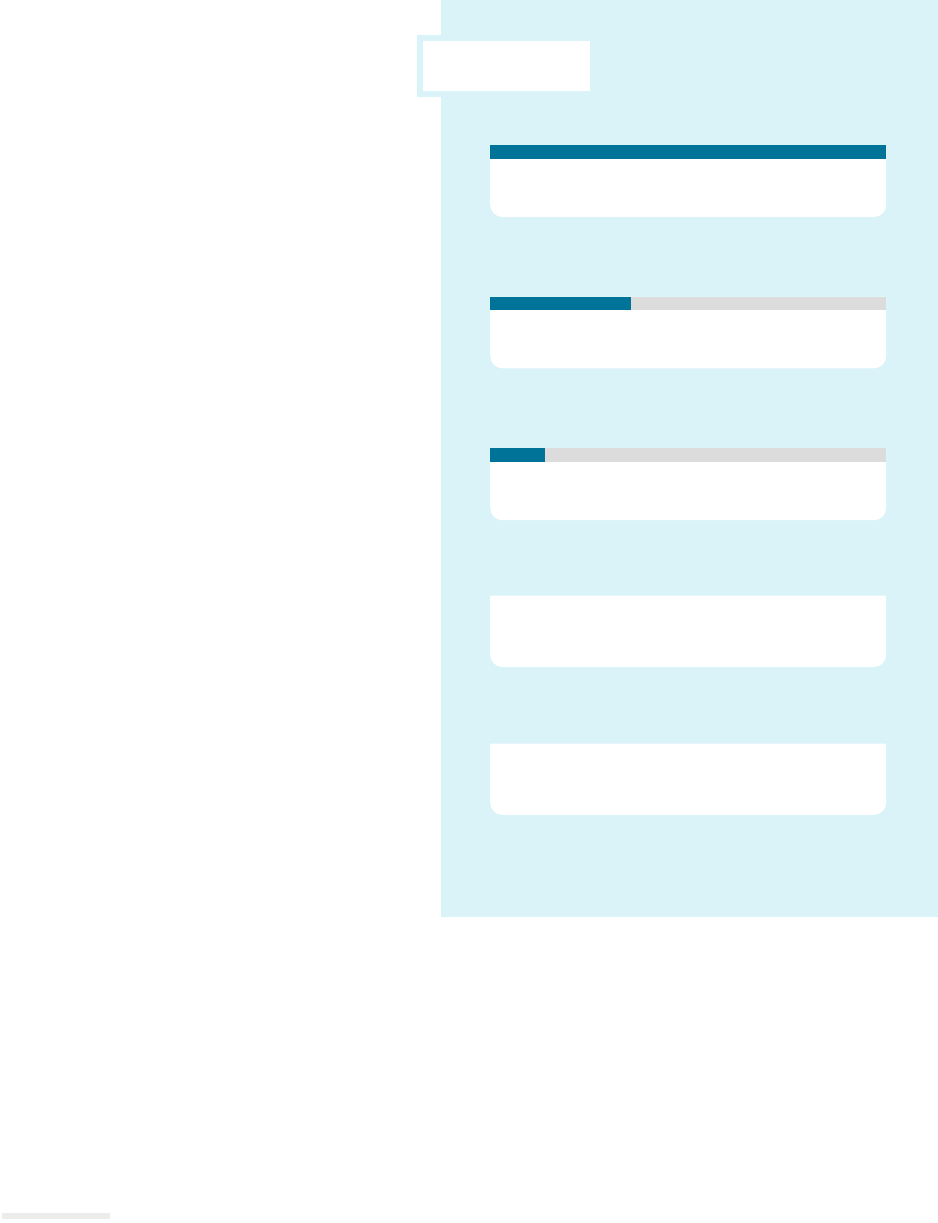

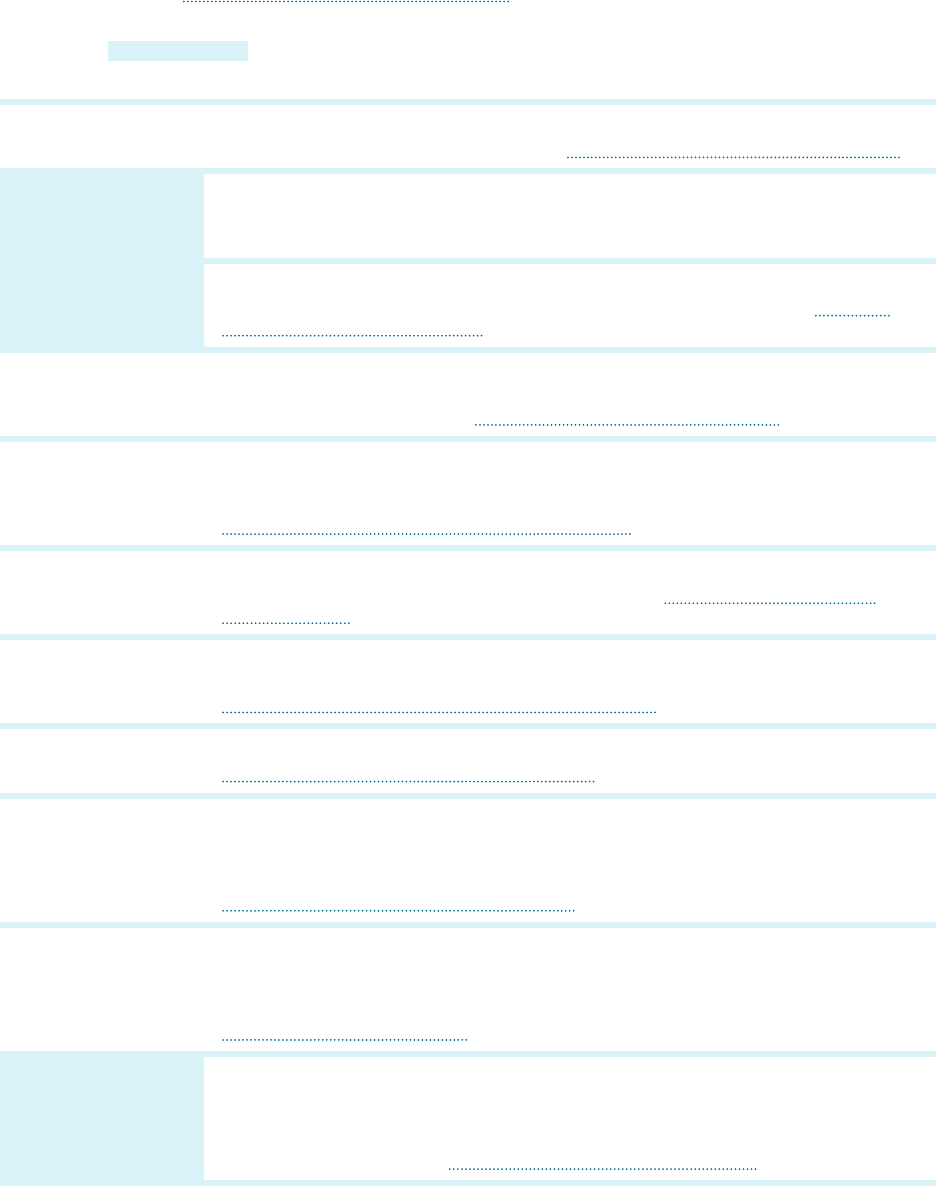

FIGURE 1

2023 BBB Scam Tracker

impact

Median U.S. dollar amount saved

Estimated dollar amount people avoided losing

thanks to BBB Scam Tracker

36.6%

$100

$24,259,931

Said BBB Scam Tracker helped them

avoid losing money

1,753,544

37.8%

Visited BBB Scam Tracker to determine

whether they were experiencing a scam

Unique visitors to BBB Scam Tracker

5 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Snapshot of 2023

The data and insights gleaned from BBB Scam Tracker reports enable BBB Institute

to better understand the impact of scams being perpetrated in the marketplace. In

2023, BBB Scam Tracker published more than 67,000 reported scams. Scam reports

submitted by businesses and individuals across the United States and Canada were

classified into 28 consumer scam types, five business scam types, and an “other”

category that represented 7.7% of all reports. See Appendix A for a full glossary of

scam types. Data collected in scam reports includes a description of the scam, the

dollar value of any loss, and information about the means of contact and method of

payment. Demographic data (age, gender, and postal code) about the person targeted

by the scam is optional for businesses and individuals to submit via the BBB Scam

Tracker platform. See Appendix B and Appendix C for detailed data by scam type.

Overall susceptibility rose while median dollar loss dropped.

In 2023, susceptibility (the percentage of people who reported losing money when

exposed to a scam) increased for the first time since 2020, up 27.8% from the year

before (Figure 2). Reported median dollar loss dropped 41.5%, from $171 in 2022 to

$100 in 2023.

4

Investment/cryptocurrency scams were the riskiest.

In 2023, a shift occurred in our list of top 10 riskiest scams. Investment scams

have frequently ranked in the top 10 riskiest scams since we began publishing the

Risk Report. In 2019, we added a category for cryptocurrency scams, which have

appeared consistently in the top three riskiest scams ever since. This year, we

combined investment and cryptocurrency scams into one category because most

cryptocurrency scams involved investment opportunities. The result was investment/

cryptocurrency scams rising to the top of our list of riskiest scams, with a high

percentage of people reporting a monetary loss (80.4%) and a high median dollar

loss ($3,800).

Employment scams remained the No. 2 riskiest scam type, with a high median dollar

loss of $1,995. Reports of employment scams rose 54.2% from 2022 to 2023.

4

Median dollar loss was calculated only for scams with a reported loss.

6 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Although online purchase scams had the highest number of reports to BBB Scam Tracker

again this year and the second-highest susceptibility, this scam type dropped to No. 3

on our list after three years as the No. 1 riskiest scam type. You can find more information

about our top 10 list on page 13.

How scammers engaged their targets

In 2023, the top three contact methods resulting in a reported monetary loss remained

the same as in 2022, with a shift in order. For the first time, social media overcame website

as the top means of contact with a monetary loss. Credit cards remained the top payment

method for scams with a monetary loss, followed by bank account debit and online

payment system. Susceptibility for scams perpetrated by social media rose 23.8% from

the previous year. You can find more information on pages 21-28.

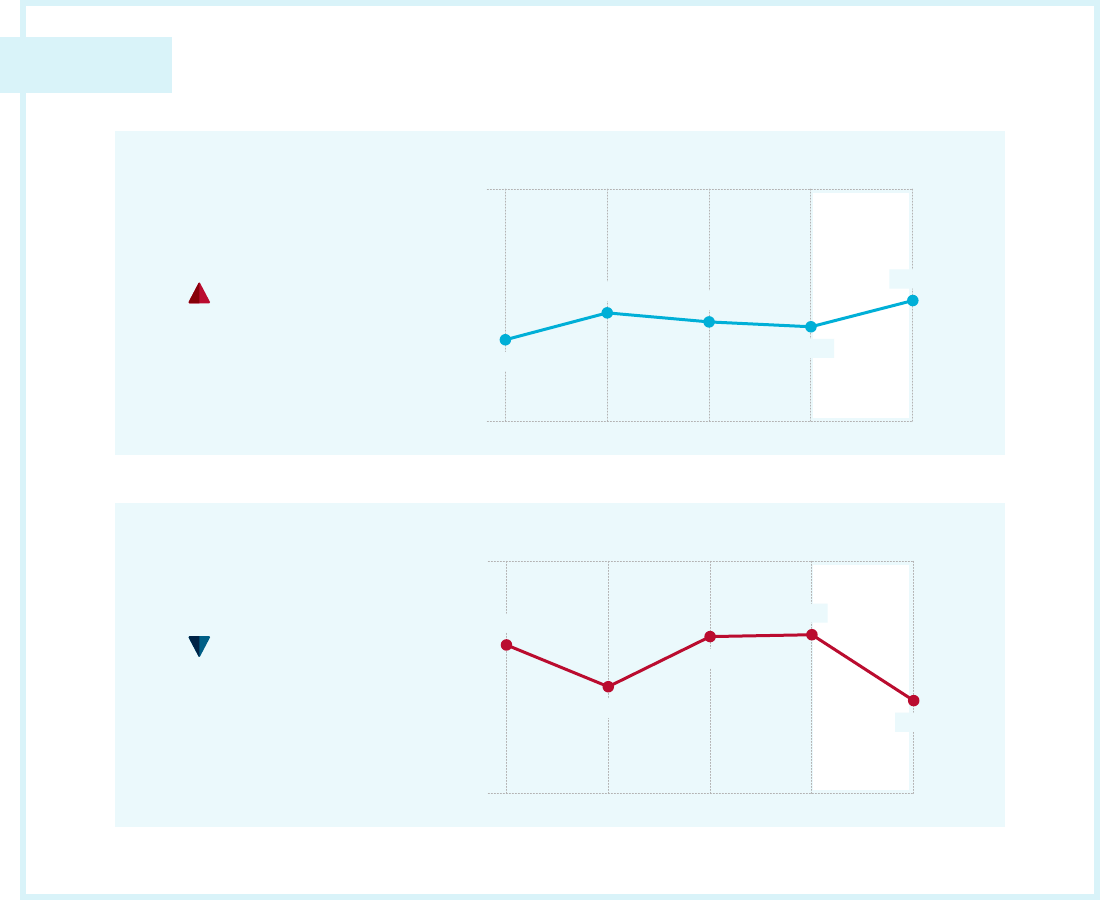

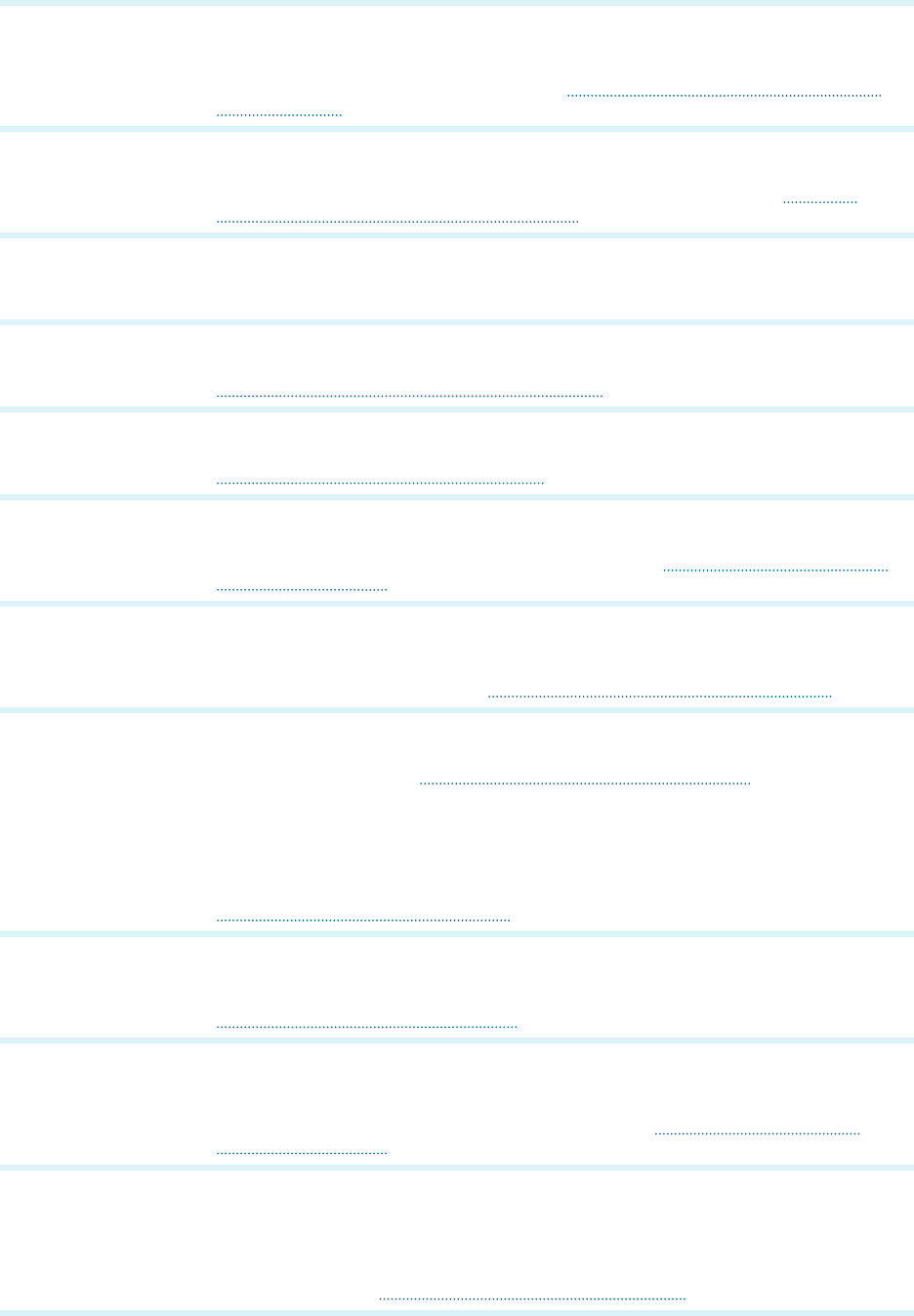

FIGURE 2

Snapshot of risk (2019–2023)

SUSCEPTIBILITY

Percentage of reports that

include a dollar loss

MONETARY LOSS*

Median reported dollar loss

41.5%

DECREASE

from 2022

27.8%

INCREASE

from 2022

* Median dollar loss was calculated only for scams with a reported loss.

2019 2020 2021 2022 2023

2019 2020 2021 2022 2023

0.0

%

100.0

%

35.1

%

46.7

%

42.8

%

40.7

%

52.0

%

0

60k

37,283

46,575

46,143

40,503

0

$

0

$

250

$

160

$

115

$

169

$

171

$

100

7 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

2023 BBB Scam Tracker Risk Report

HIGHLIGHTS

SURVEY RESEARCH HIGHLIGHTS

of survey

respondents

said they will

be able to spot

the red flags

of a similar

scam in the

future.

92.5%

People ages

18–54 prefer

getting

information

about scams

from social

media stories,

whereas people

ages 55+ prefer

receiving scam

alerts.

Scams perpetrated online continued to grow,

making up 68.4% of all reports. More concerning,

online scams were more likely to result in a

reported monetary loss than scams perpetrated

in person or via phone.

For the second year in a row, people ages 18 to 24

reported the highest median dollar loss of all

age groups.

The percentage of people who reported engaging

with a scammer via social media rose 63.8% from

2022 to 2023.

The U.S. Postal Service was the organization

reported to be the most often impersonated

by scammers in 2023.

Romance scams rose from No. 7 to No. 5 on the list

due to a significant increase in susceptibility and

a high median dollar loss.

of survey

respondents

reported losing

money to a

scam at least

three times,

up from 8.4%

in 2022.

10.3%

Anxiety/stress

was the top

emotion reported

by people ages

18–44 after being

targeted by a

scam.

Anger was the top

emotion reported

by people ages

45+.

52.0%

27.8%

INCREASE from 2022

LIKELIHOOD

OF LOSS

OVERALL SUSCEPTIBILITY

$100

41.5%

DECREASE from 2022

MEDIAN $

LOSS

OVERALL MONETARY LOSS

FIGURE 3

TOP 3 RISKIEST SCAMS

REPORTED BY CONSUMERS

Investment/cryptocurrency scams

rose to become the No. 1 riskiest

scam type, with the third-highest

susceptibility and the second highest

median dollar loss.

1

Investment/

cryptocurrency

scams

Employment scams remained the

No. 2 riskiest scam type, with a high

median dollar loss of $1,995. Reports

of employment scams rose 54.2%

from 2022 to 2023.

2

Employment

scams

More than 40% of scams reported

to BBB Scam Tracker were online

purchase scams, which for the first

time since 2019 fell to No. 3 on the list

of riskiest scams.

3

Online

purchase

scams

8 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

BBB Risk Index: A three-dimensional

approach to measuring scam risk

To better understand which scam types pose the highest

risk, we assessed scams on the basis of three factors:

exposure, susceptibility, and monetary loss. This unique

formula makes up the BBB Risk Index (Figure 4). By

combining these three factors, we gain a meaningful

understanding of scam risk that goes beyond the volume

of reports received and enables BBB and its partners to

better target scam-prevention efforts.

Risk cannot be determined by viewing just one of these

factors in isolation. For example, scams that occur

in high volumes typically target as many people as

possible but yield a lower likelihood of monetary loss. In

comparison, scams with a “high-touch” approach often

reach fewer individuals, but those exposed individuals

are often more likely to lose money and to lose higher

amounts of money.

The BBB Risk Index does not factor in the non-financial

impacts of scams. According to our survey research,

people also reported losing time (55.8%) and personal

information (37.7%) (Figure 5).

5

We also asked people about the emotional impact of

being targeted by a scam (Figure 6). The No. 1 emotion

they reported was anger (69.0%), followed by anxiety

and stress (66.7%). Loss of trust was the third most

common response (58.0%).

FIGURE 4

BBB Risk Index

The formula for calculating the BBB Risk Index

for a given scam type in a given population is:

Exposure Susceptibility

(Median Loss / Overall Median Loss) 1,000.

EXPOSURE*

is a measure of the prevalence

of a scam type, calculated as

the percentage of a particular

scam type as part of the total

scams reported.

SUSCEPTIBILITY

is a measure of the likelihood of

losing money when exposed to

a scam type, calculated as the

percentage of all reports that

included a monetary loss.

MONETARY LOSS

is calculated as the median

dollar amount of losses

reported for a particular scam

type, excluding reports where

no loss occurred.

* Exposure is limited by the nature of self-reporting;

the percentage of those who reported to BBB

Scam Tracker does not necessarily match the

percentage of people in the full population who

were targeted by scams.

5

A survey was distributed to those who submitted a scam to BBB Scam

Tracker in 2023; 6,947 respondents completed the survey.

9 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

FIGURE 5

Other impacts of being targeted by a scam

Lost time

of responses

Lost personal

information

of responses

Lost credit

health

(credit score)

of responses

Lost potential

earnings

of responses

Financial

stability

impacted

of responses

55.8

%

37.7

%

6.9

%

5.7

%

8.1

%

FIGURE 6

Top emotions/impact of being

targeted by a scam

Anger

Anxiety/stress

Loss of trust

Shame/embarrassment

Loss of confidence

Guilt

Strained relationships

Loss of reputation

69.0

%

66.7

%

58.0

%

39.4

%

28.7

%

19.6

%

7.5

%

4.6

%

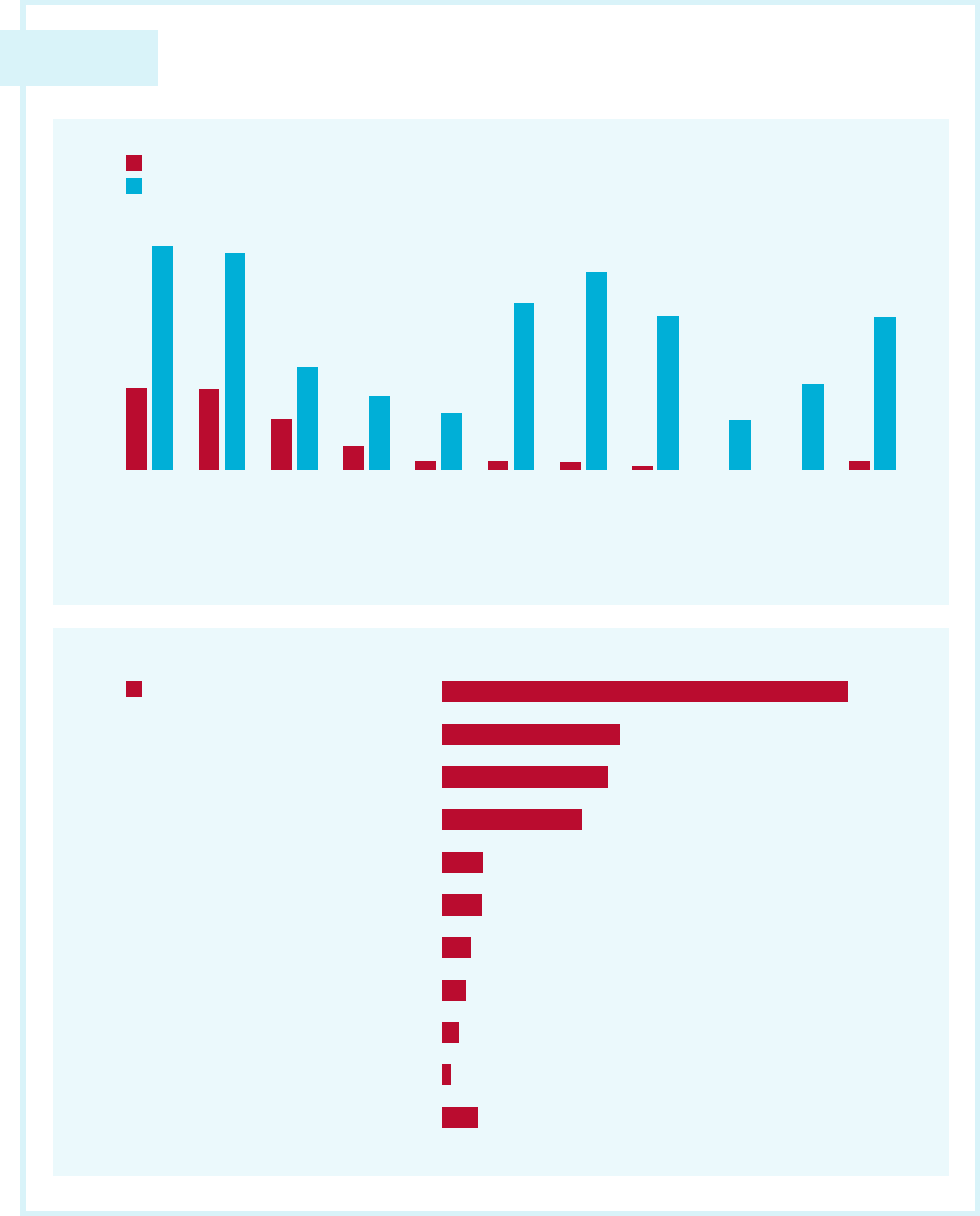

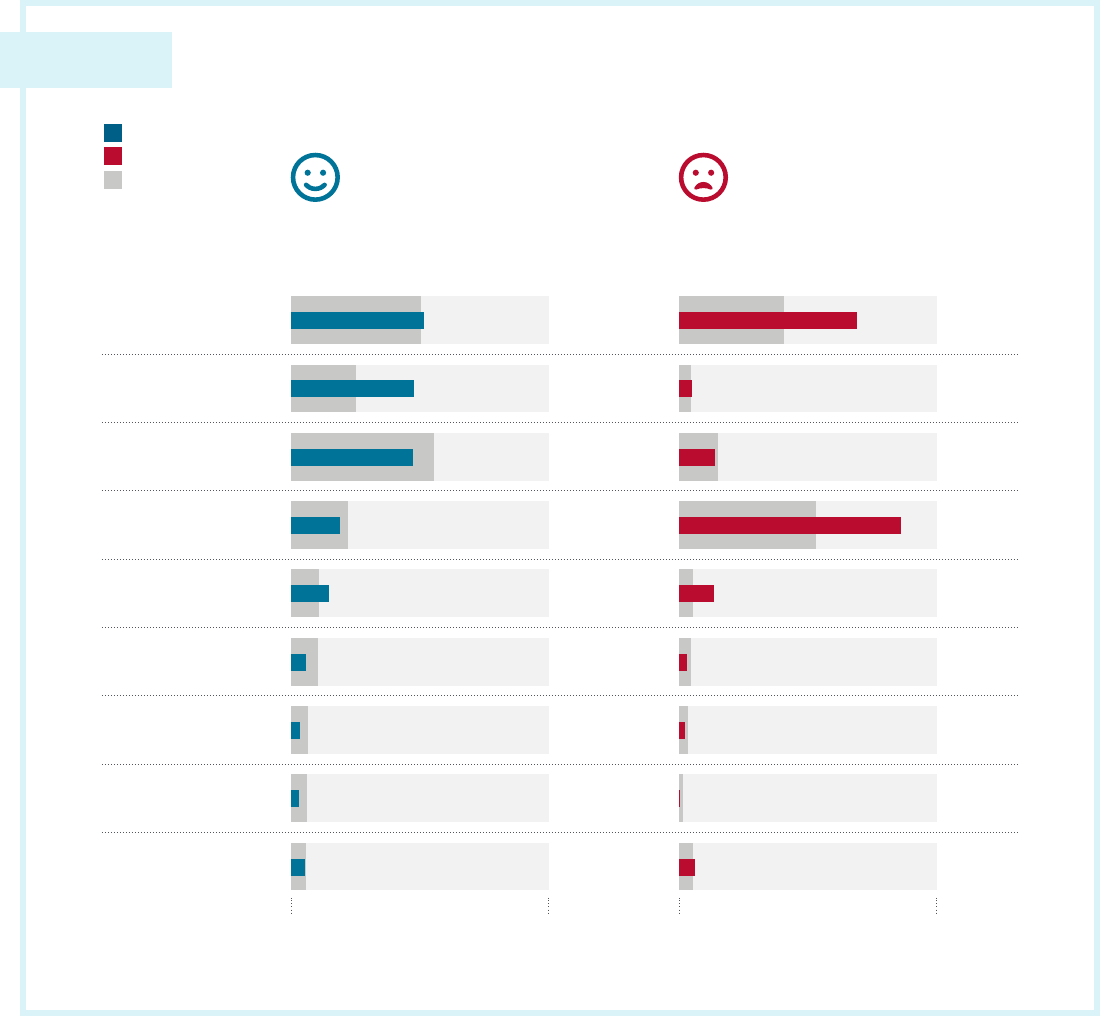

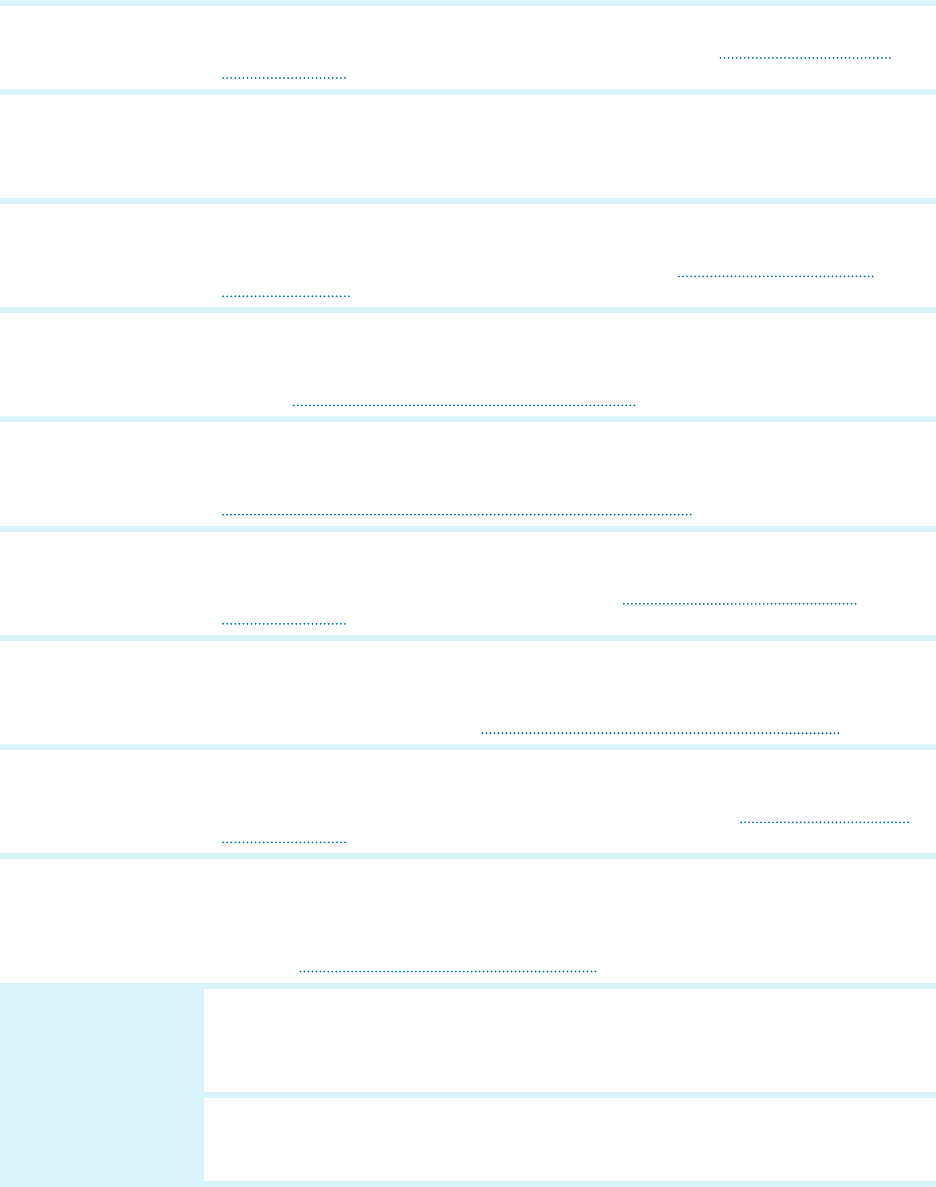

A breakdown by age group highlights some interesting differences (Figure 7). People

between the ages of 18 and 44 named anxiety/stress as the No. 1 emotional impact,

whereas those aged 45+ cited anger as the No. 1 emotional impact. Younger people

reported higher percentages of feeling shame/embarrassment, loss of confidence,

and guilt.

When asked

about the

emotional

impact of being

targeted by a

scam, people

reported anger

as the number

one emotion,

followed by

anxiety and

stress.

10 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

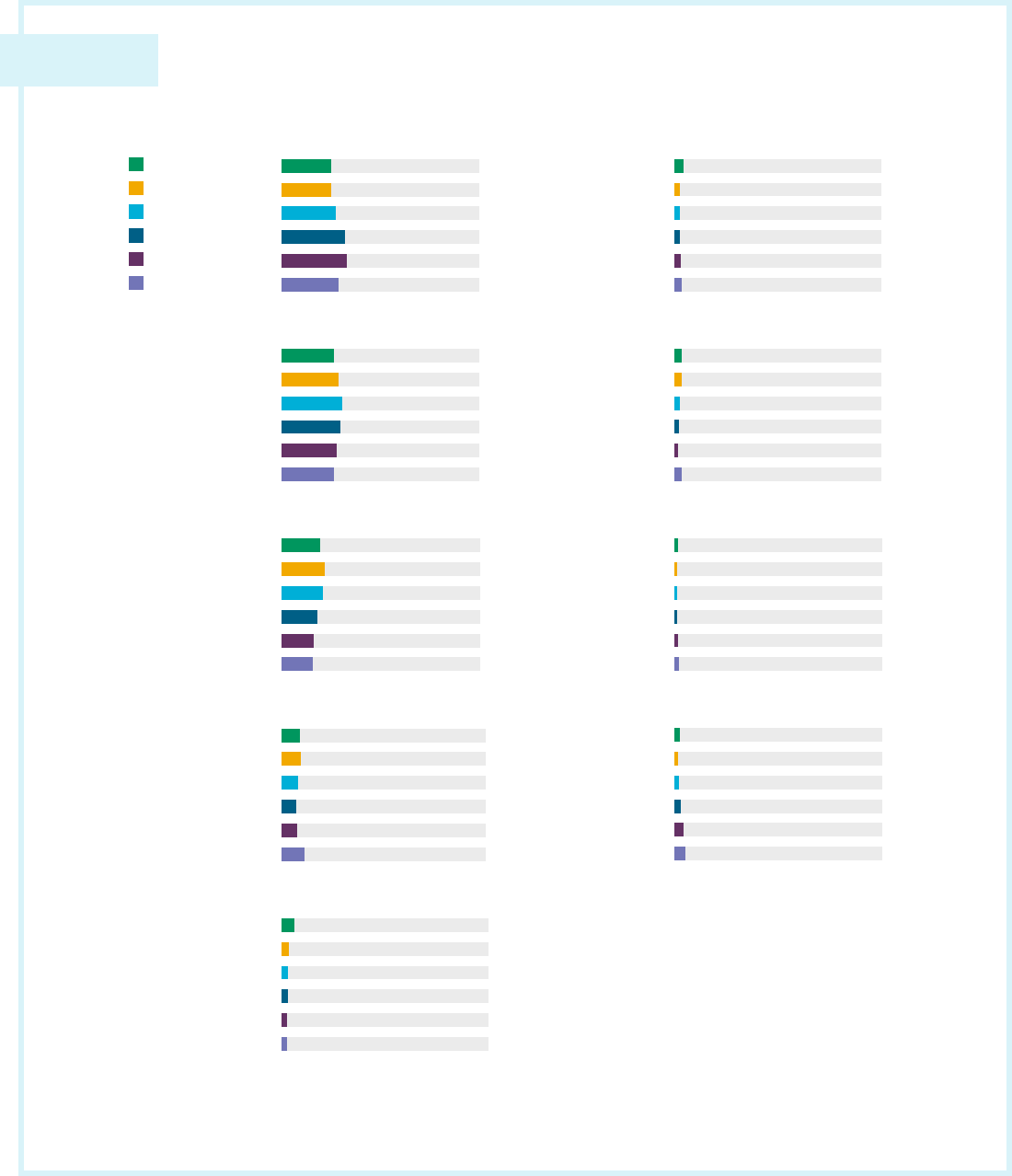

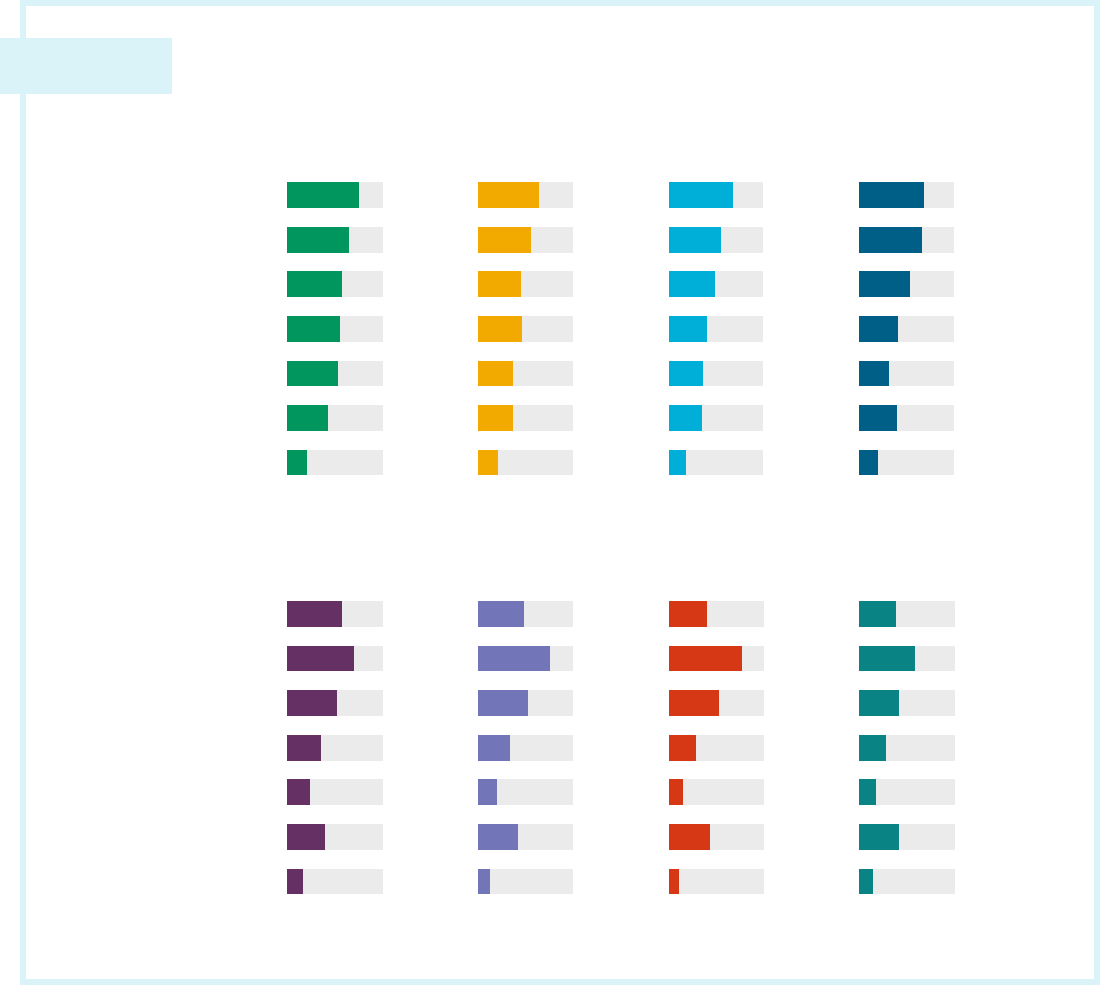

FIGURE 7

Emotional impact of being targeted by a scam (by age)

83.5

%

76.6

%

73.5

%

68.0

%

67.2

%

62.8

%

61.4

%

55.2

%

55.3

%

67.8

%

65.5

%

61.0

%

61.2

%

51.3

%

48.4

%

44.8

%

34.0

%

32.4

%

32.4

%

30.4

%

31.6

%

27.2

%

27.3

%

27.6

%

14.6

%

12.7

%

10.3

%

7.2

%

7.7

%

5.0

%

7.5

%

13.8

%

30.1

%

28.6

%

28.0

%

20.7

%

19.1

%

16.3

%

17.2

%

17.2

%

58.3

%

53.3

%

51 .1

%

42.3

%

40.2

%

32.3

%

33.1

%

27.6

%

65.1

%

68.7

%

72.4

%

72.0

%

73.7

%

68.6

%

73.1

%

72.4

%

4.9

%

7.9

%

6.8

%

5.1

%

3.9

%

2.5

%

3.3

%

6.9

%

Anger Loss of confidence

Anxiety/stress Guilt

Loss of trust Strained relationships

Shame/embarrassment Loss of reputation

85+

75–84

65 –74

55–64

45–54

35–44

25–34

18–24

11 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

10 riskiest scams reported

by consumers in 2023

Credit repair/

debt relief

scams appeared

on the list of 10

riskiest scams

for the first time

since we began

publishing the

BBB Scam

Tracker Risk

Report in 2016.

Each year, BBB publishes its list of 10 riskiest scam types (Table 1), which is

calculated using the BBB Risk Index and reports submitted to BBB Scam

Tracker. In 2023, there were some significant shifts in position on the list.

Investment/cryptocurrency scams became the No. 1 riskiest scam

type this year, with 80.4% of those targeted reporting a monetary loss.

The reported median dollar loss ($3,800) was the second highest of all

scam types.

6

In 2023, employment scams remained the second riskiest scam. The

percentage of reports for this scam type rose 54.2%, from 9.6% in 2022 to

14.8% in 2023. The reported median dollar loss for employment scams rose

33%, from $1,500 in 2022 to $1,995 in 2023.

Although online purchase scams dropped to third riskiest on our list, these

scams continued to have a huge impact, with the highest percentage of

reports to BBB Scam Tracker (41.9%) and the second-highest percentage

of reports with a monetary loss (susceptibility). More than 82% of those who

reported being targeted by online purchase scams lost money. The median

dollar loss for this scam type dropped from $100 in 2022 to $71 in 2023.

Romance scams rose on the list from seventh to fifth riskiest. The reported

median dollar loss rose from $1,411 in 2022 to $3,600 in 2023. In 2023,

65.7% of romance scam reports included a monetary loss compared to only

16.1% in 2022.

Credit repair/debt relief scams appeared on the list of 10 riskiest

scams for the first time since we began publishing the BBB Scam Tracker

Risk Report in 2016. The percentage of reports with a monetary loss

(susceptibility) for this scam type rose 64.3% from 2022 to 2023. The

median dollar loss rose from $870 to $1,000.

6

This year, we combined cryptocurrency and investment scams into one category because

the majority of cryptocurrency scams involve investment scenarios.

12 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Susceptibility up overall

Overall susceptibility rose significantly in 2023, with more people reporting a monetary

loss. Beyond the top five scams mentioned above, the following scam types also saw a

significant increase in susceptibility from the previous year: counterfeit product (83.3%),

rental (64.1%), travel/vacation/timeshare (59.6%), and credit repair/debt relief (55.7%).

A full breakout of the scam types with the highest susceptibility can be found on page 46.

Overall median dollar loss down

Although overall median dollar loss dropped in 2023, several scam types outside of the

top five riskiest saw a high reported median dollar loss, including foreign money exchange

($7,400), tax collection ($2,306), fake check/money order ($1,165), credit repair/debt relief

($1,000), family/friend emergency ($900), and government grant ($948). A full breakout of

scam types with the highest median dollar loss can be found on page 46.

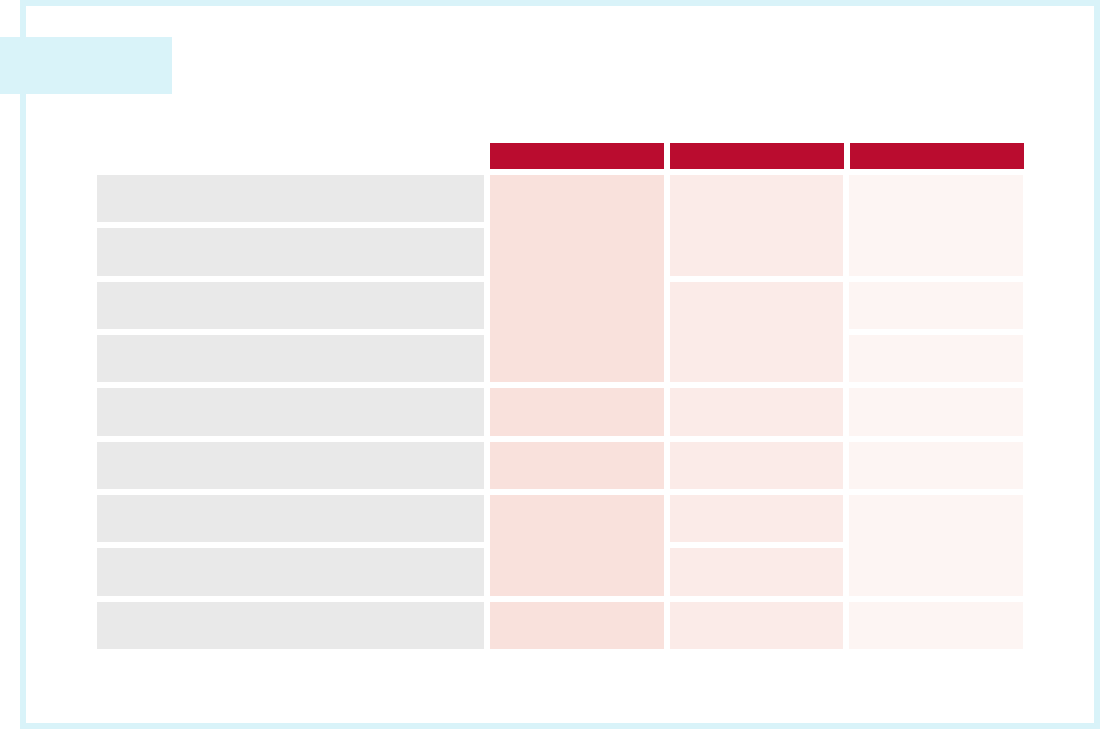

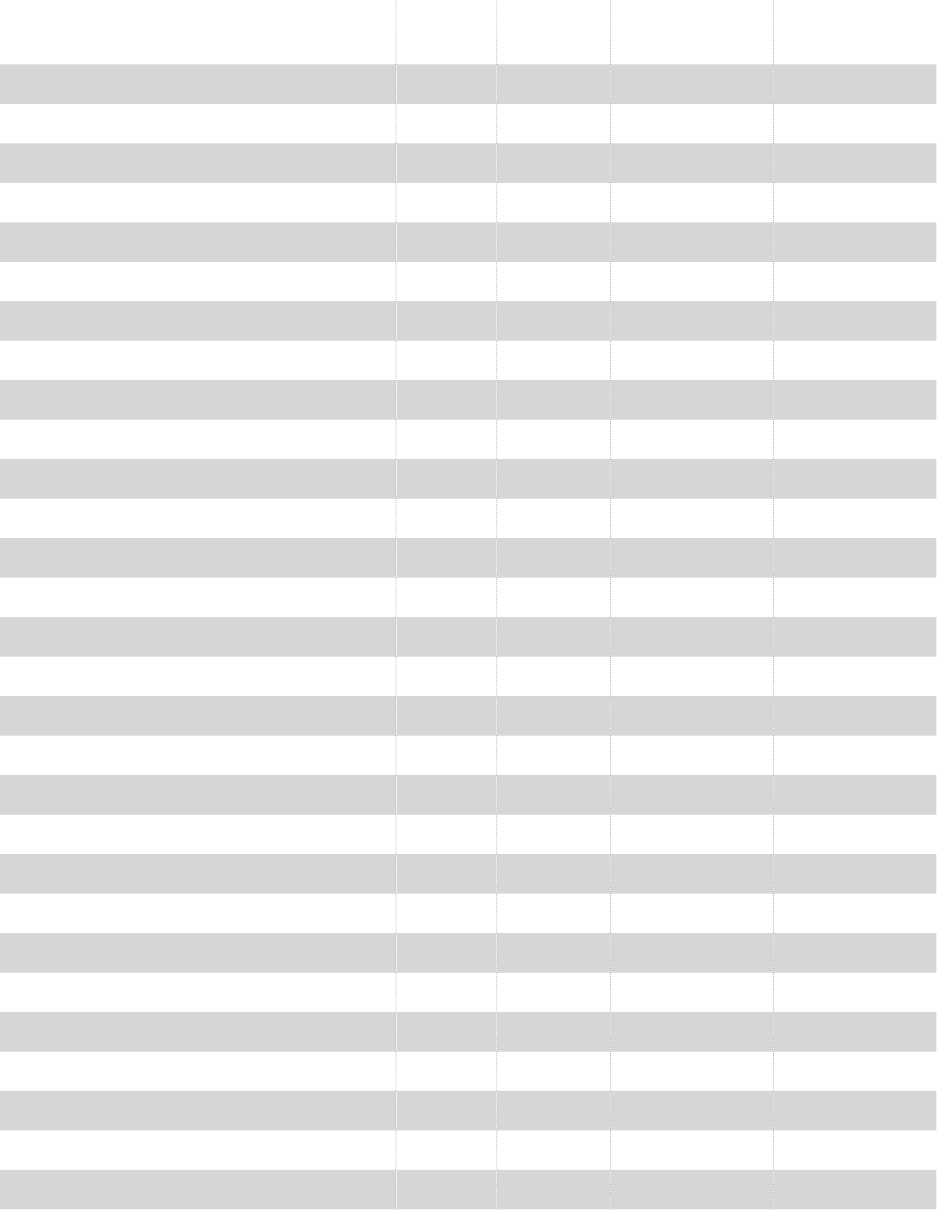

TABLE 1

10 riskiest consumer scams in 2023

RANK SCAM TYPE

BBB RISK

INDEX

EXPOSURE* SUSCEPTIBILITY MEDIAN $ LOSS

2023 2022 2023 2022 2023 2022 2023 2022

1 6/3

Investment/

cryptocurrency**

520.9 1.7%

0.7%/

1.7%

80.4%

49.0%/

60.5%

$3,800

$1,369/

$1,100

2 2

Employment 445.9 14.8% 9.6% 15.1% 15.1% $1,995 $1,500

3 1

Online purchase 244.9 41.9% 31.9% 82.6% 74.0% $71 $100

4 4

Home

improvement

201.2 1.3% 1.4% 74.7% 55.3% $2,073 $1,500

5 7

Romance 151.4 0.6% 1.6% 65.7% 16.1% $3,600 $1,411

6 5

Advance fee loan 57.2 1.4% 1.9% 45.3% 36.7% $900 $800

7 9

Phishing/social

engineering

56.5 12.6% 11.7% 15.0% 10.6% $300 $267

8 11

Credit repair/

debt relief

29.4 0.5% 1.1% 55.7% 33.9% $1,000 $870

9 10

Tech support 25.5 1.9% 2.6% 26.6% 25.2% $500 $490

10 13

Travel/vacation/

timeshare

23.6 0.7% 1.0% 59.6% 49.3% $543 $602

* Exposure is limited by the nature of self-reporting; the percentage of those who reported to BBB Scam Tracker does not necessarily

match the percentage of people in the full population who were targeted by scams.

** For this year’s report, we combined cryptocurrency scams with investments scams. We did this because the majority of

cryptocurrency scams involve investment scenarios.

13 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

More people reported losing money

to romance scams this year

The percentage of

those who reported

losing money to

romance scams

increased more

than 300%

from 2022.

This year, romance scams rose on the list of riskiest scams

from No. 7 to No. 5 for a couple reasons. First, the reported

median dollar loss rose 155.1% from 2022 to 2023. Second,

the percentage of those who reported losing money to

romance scams increased 308.1%. In 2023, 65.7% of romance

scam reports included a monetary loss compared to only

16.1% in 2022.

How the scam works

Most romance scams start with fake profiles on online dating

sites that scammers create by stealing photos and text from

real accounts or elsewhere. Scammers often claim to be in the

military or working overseas to explain why they can’t meet in

person. Over a short period of time, the scammer builds a fake

relationship with the person they are targeting, exchanging

photos and romantic messages, even talking on the phone

or through a webcam. Just when the relationship seems to

be getting serious, the person’s new sweetheart has a health

issue or family emergency or wants to plan a visit. No matter

the story, the request is the same: they need money. But after

the person sends money, there’s another request, and then

another. Or the scammer stops communicating altogether.

Romance scams and cryptocurrency

Scammers have begun to build relationships with the purpose

of introducing their targets to cryptocurrency. The topic of

cryptocurrency comes up casually at first, with the scammer

dropping hints about their own financial success. Eventually,

the scammer encourages the person to try investing in

cryptocurrency. It always starts small, with the scammer

building trust over time. The target begins to see their initial

investment grow, with the scammer encouraging them to invest

more money. But then the target realizes too late, once they’ve

invested a significant amount, that the platform is fake, and they

can’t get their money back.

14 BBB. org/Scam Tracker | 2023 BBB SCAM TRACKER RISK REPORT

The following scam report was submitted

by a person in North Dakota.

7

I met a woman when she texted me by accident. I started talking

with her and thought she wanted to have a relationship with me.

She and I talked on Telegram. She introduced me to her aunt who

is supposedly the head lady of the stock market. After talking

with her for weeks, she said she was going to come and be with

me in a relationship and I started believing her. She then asked

me to invest with Tiger Trades, so I did. Then she changed her

mind about coming to be with me and I went online and tried to

withdraw my money, but I can’t get it. I went online to find out about

Tiger Trades and talked to someone who said that it was a fake

app and had no ties with the real Tiger Trades! So, I’m out $587!

7

This scam report was edited for brevity and clarity.

ROMANCE SCAM

red flags to watch for:

Too good-looking to be true.Scammers

offer up attractive photos and tales of

financial success. If they seem “too perfect,”

your alarm bells should ring.

In a hurry to get off the site.Scammers

will try very quickly to get you to move to

communicate through email, messenger, or

phone.

Moving fast.Scammers begin speaking of

a future together and tell you they love you

quickly. They often say they’ve never felt this

way before.

Talking about trust. Scammers will start

manipulating you with talk about trust and

its importance. This often is the first step to

asking you for money.

Don’t want to meet.Be wary of someone

who always has an excuse to postpone a

meeting such as saying they are traveling, live

overseas, or are in the military.

Using suspect language.If the person you

are communicating with claims to be from

your hometown but has poor spelling or

grammar, uses overly flowery language, or

uses phrases that don’t make sense, that’s

a red flag.

Hard luck stories. Before moving on to

asking you for money, the scammer may hint

at financial troubles such as heat being cut

off, a stolen car, or a sick relative, or they may

share a sad story from their past (death of

parents or spouse, etc.).

Financial opportunity. If the person

encourages you to take advantage of an

investment opportunity such as buying

cryptocurrency, this is a huge red flag.

15 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Credit repair/debt relief scams make

the top 10 list for the first time

The median dollar

loss from credit

repair/debt relief

scams rose from

$870 in 2022 to

$1,000 in 2023.

Credit repair/debt relief scams appeared on the list

of 10 riskiest scams for the first time since we began

publishing the BBB Scam Tracker Risk Report in 2016.

The percentage of reports with a monetary loss

(susceptibility) for this scam type rose 64.3% from

2022 to 2023. The median dollar loss rose from $870

in 2022 to $1,000 in 2023.

How the scam works

Online ads, social media popups, or unsolicited phone

calls offer services to people who are dealing with high

debt or bad credit. These offers may “guarantee” a

better credit score, pledge to alleviate debt, or promise

a better financial situation. Those who are targeted may

be tempted to pay the up-front fee to help relieve their

stress. The companies that are calling or advertising

online frequently promise—and charge for—impossible

services. This includes removing past credit mistakes,

such as late payments or a bankruptcy, from your credit

report. They offer to provide a new “credit identity”

or negotiate with lenders or credit card companies to

completely eliminate the debt. When the services aren't

provided, the person is out the fees they paid.

16 BBB. org/Scam Tracker | 2023 BBB SCAM TRACKER RISK REPORT

The following scam report was submitted

by a person in Kentucky.

8

I was contacted by phone a little over a year ago about debt

resolution. So I went with it, paying $369 a month for their service.

They resolved none of my debts. I have been trying to reach them

for over a month with no luck. I need to find out what is happening.

The email address gets sent back to me saying no such address.

Their phones go to a waitlist and then hang up. I’ve tried five

different numbers. I did receive a call from Mallory, and she told

me payments would stop coming out. Today, my bank account is

overdrawn because of them. She also said I could call her with any

questions. But she will not answer. Her mailbox is full. I need some

answers.

8

This scam report was edited for brevity and clarity.

CREDIT REPAIR/DEBT RELIEF SCAM

red flags to watch for:

Advance fees. Not all businesses promising

to help you repair bad credit are scams, but

if you are asked to pay in advance, that’s a

big red flag. In both the U.S. and Canada,

credit repair and debt relief companies can

only collect their fee after they perform the

services promised.

Guarantees. Nobody can guarantee making

debt go away or improving your credit score.

In fact, they can’t promise you anything

before they have even reviewed your personal

financial situation.

Too many promises. Other red flags are

big promises such as removing negative

information from your credit report or

urging you to get a new identity or apply for

an Employer Identification Number to use

instead of your SSN/SIN (that’s a crime, by

the way). Receiving no contract or one that is

vague is another warning sign.

17 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Demographics

Self-reported demographic data

provided through BBB Scam

Tracker combined with survey

research enables us to better

understand how risk varies

across different subgroups of

the population. BBB uses this

information to enhance how we

target outreach and educational

strategies aimed at empowering

consumers and businesses to

identify and avoid scams.

Age

For the second year in a row,

people ages 18–24 reported

a higher median dollar loss

($155) than all other age

groups (Figure 8). People ages

35–54 again submitted a higher

percentage of reports with a

monetary loss (susceptibility)

than other age groups; people

aged 65+ reported the lowest

susceptibility (44.9%).

Table 2 highlights the three

riskiest scam types by age.

Employment scams were the

riskiest scam type for ages 18–

44. Investment/cryptocurrency

scams were riskiest for those

aged 45+.

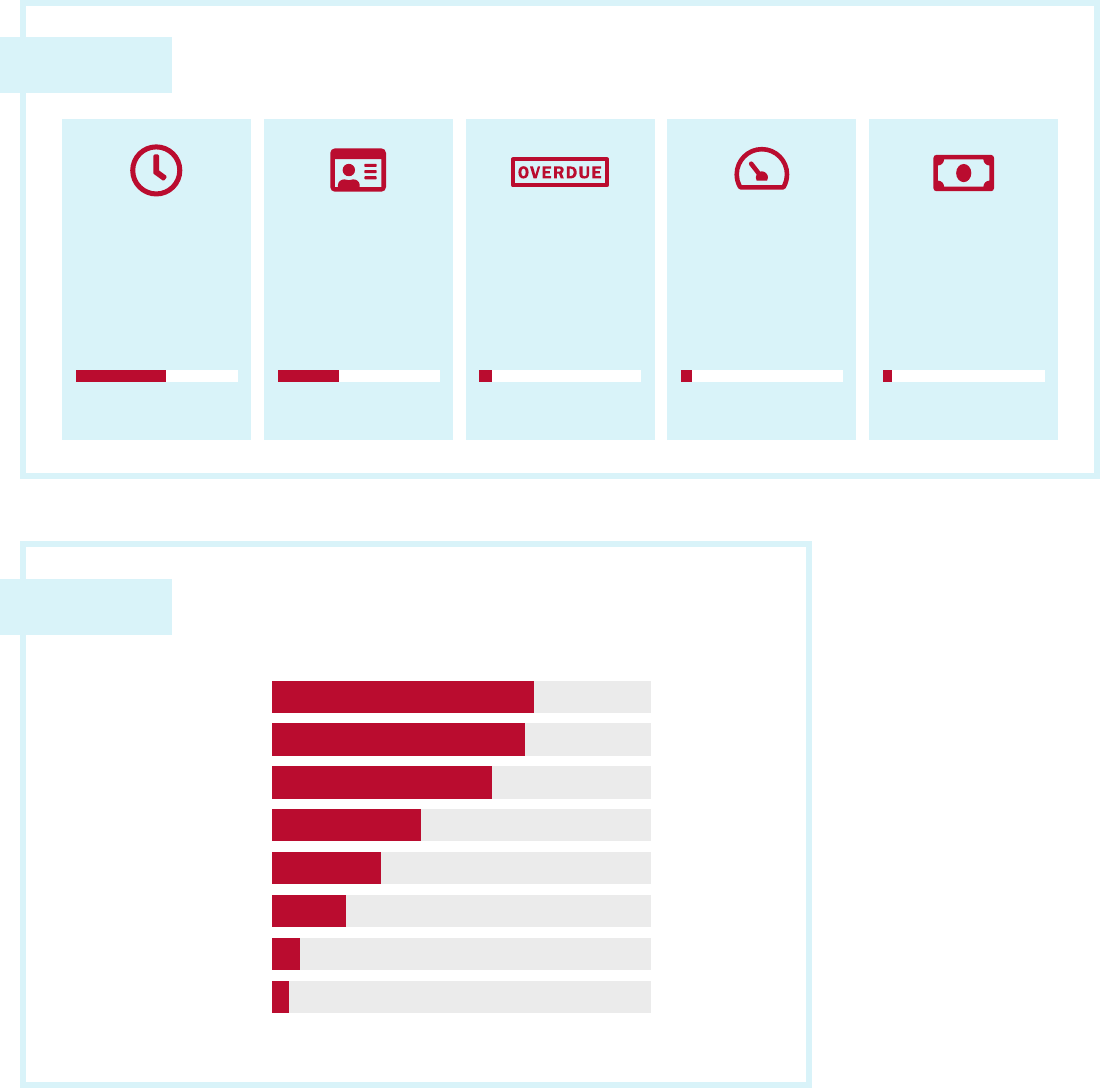

FIGURE 8

Exposure, susceptibility, and median dollar loss

by age (all scam types)

EXPOSURE

SUSCEPTIBILITY

MEDIAN $ LOSS

For the second year in a row, people ages

18–24 reported a higher median dollar

loss ($155) than all other age groups.

18–24

25–34

35–44

45–54

55–64

65+

6.1

%

16.0

%

20.1

%

19.8

%

18.8

%

19.2

%

45.6

%

50.1

%

58.2

%

57.0

%

54.6

%

44.9

%

18–24

25–34

35–44

45–54

55–64

65+

$

155

$

130

$

100

$

100

$

91

$

109

18 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

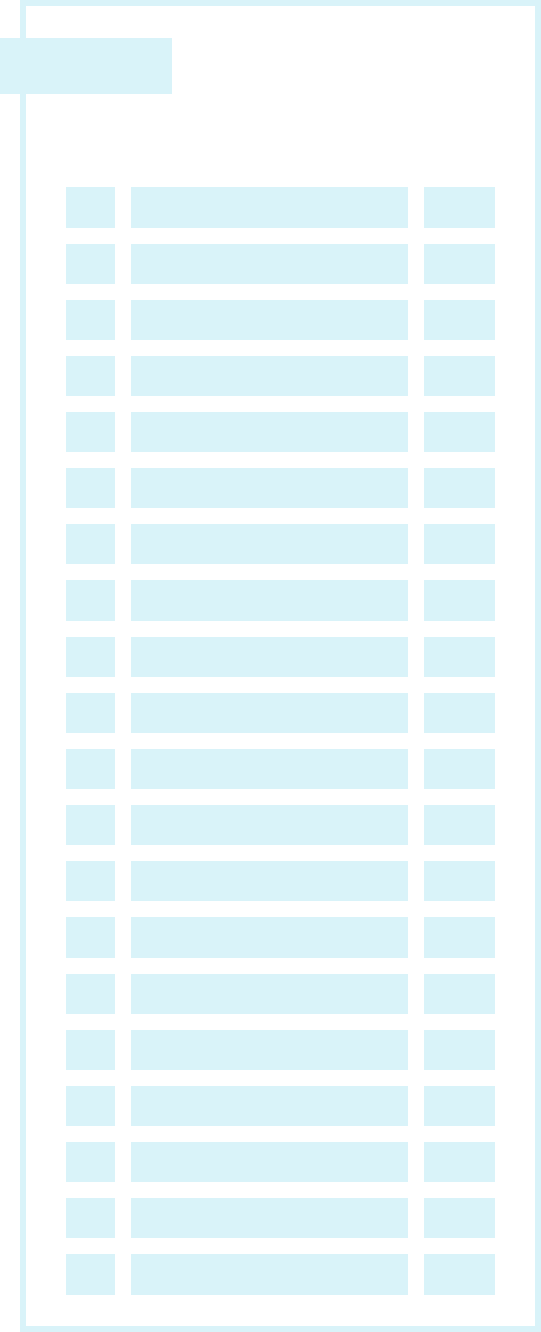

Scams targeting youth

BBB Scam Tracker does not collect information from people under the age of 18. However,

we know young people are being targeted. Of the 20.1% of survey respondents who

reported having children between the ages of seven and 18 years, 16.4% said their children

were targeted by scams. This was an increase from the 11.1% who said their children were

targeted in 2022. Respondents reported that their children were targeted via social media,

phone call, text message, gaming platform, email, and phone application (Figure 9).

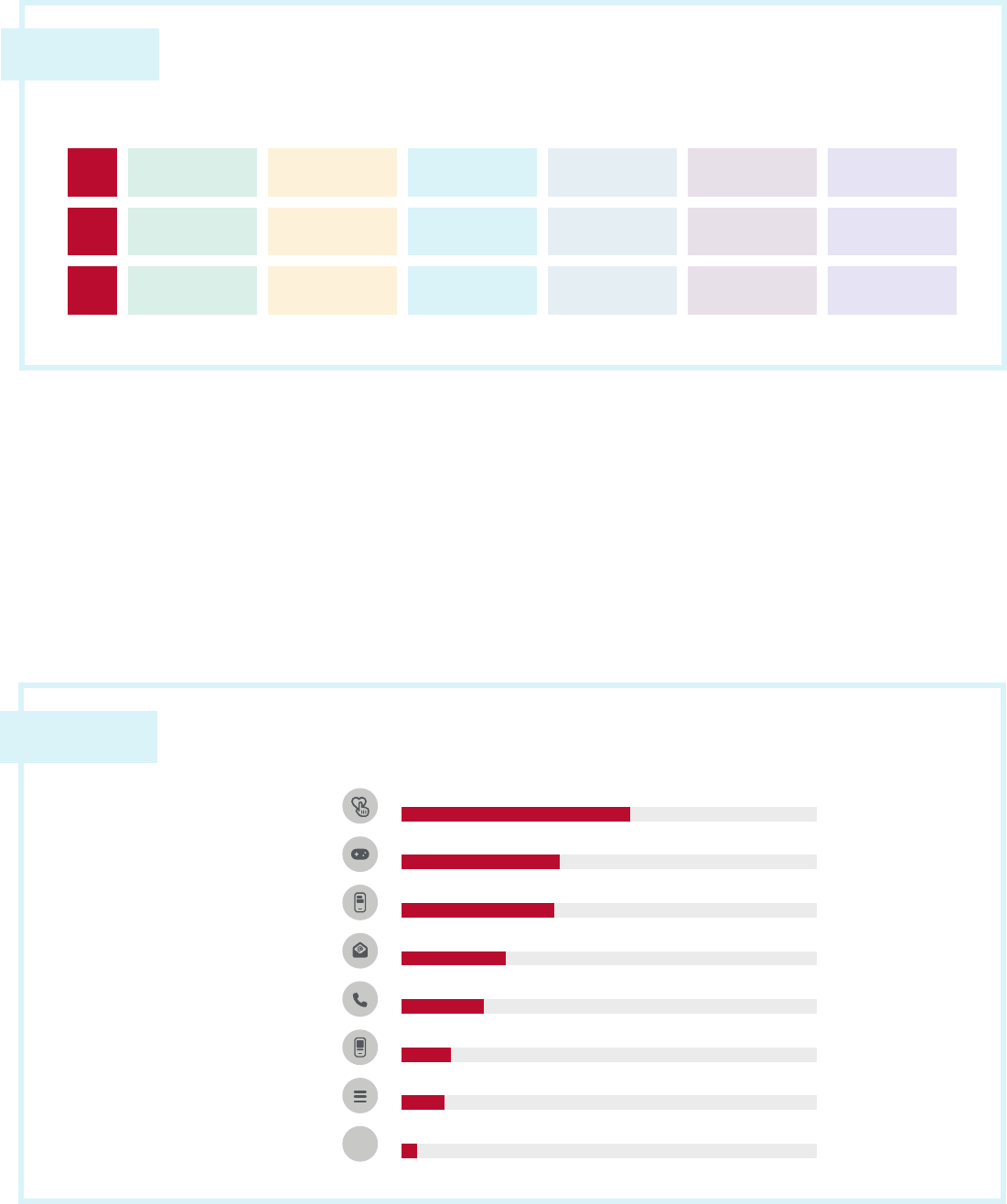

FIGURE 9

Reported method of contact for youth

The totals do not add up to

100% because respondents

were encouraged to choose

all that applied.

When asked where they

were targeted by a scam,

respondents answered:

Social media

Gaming platform

Text message

Email

Phone call

Phone application

Other

None of the above

55.0

%

38.2

%

36.7

%

25.1

%

19.9

%

12.0

%

10.5

%

3.7

%

TABLE 2

Three riskiest scam types by age

18–24 25–34 35–44 45–54 55–64 65+

1

Employment Employment Employment

Investment/

cryptocurrency

Investment/

cryptocurrency

Investment/

cryptocurrency

2

Online

purchase

Investment/

cryptocurrency

Investment/

cryptocurrency

Employment

Online

purchase

Romance

3

Investment/

cryptocurrency

Online

purchase

Online

purchase

Online

purchase

Home

improvement

Home

improvement

19 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Gender

Similar to previous years, more

than two-thirds of reports to BBB

Scam Tracker were submitted by

women in 2023 (Figure 10). Females

reported being more susceptible

to losing money when exposed to a

scam (53.2%) compared to males

(49.8%) and non-binary people

(36.3%). The reported median dollar

loss was significantly lower for

females ($95) than for males ($178)

and non-binary people ($187).

The riskiest scam types by

gender shifted this year. In

2023, employment scams were

riskiest for females, investment/

cryptocurrency scams were riskiest

for males, and online purchase

scams were riskiest for non-binary

people (Table 3).

FIGURE 10

Exposure, susceptibility,

and median dollar loss by gender

EXPOSURE

SUSCEPTIBILITY

TABLE 3

Three riskiest scam types by gender

Female

Male

Non-binary

67.0

%

32.1

%

0.9

%

53.2

%

49.8

%

36.3

%

Female

Male

Non-binary

$

95

$

178

$

187

MEDIAN

$ LOSS

FEMALE MALE NON-BINARY

1

Employment

Investment/

cryptocurrency

Online purchase

2

Investment/

cryptocurrency

Employment Employment

3

Online purchase Home improvement

Phishing/

social engineering

20 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Contact and payment methods

The percentage

of people

who reported

engaging with

a scammer via

social media

rose 63.8% from

2022 to 2023.

Contact methods

The top three contact methods that resulted in a reported monetary loss in

2023 were social media (29.3%), website (28.9%), and email (18.5%)

(Figure 11). The percentage of people who said they were contacted via email

rose 31.8% from 2022 to 2023.

Impact of social media increases

The percentage of people who reported being contacted via social media

rose 63.8% from 2022 to 2023. The median dollar loss for social media

scams dropped from the year before, but susceptibility rose from 64.8% in

2022 to 80.2% in 2023.

Online scams continue to rise

Scams perpetrated online increased from 56.5% in 2022 to 68.4% in 2023.

As in previous years, scams perpetrated online were more likely to result in a

monetary loss than were those perpetrated in person or via phone (Figure 12).

Figure 13 breaks out age range and contact method. Older people were more

likely to report losing money when they were targeted by phone or online

classifieds. Younger people were more likely to report losing money when

they were targeted by text message or internet messaging.

Online purchase scams were the most reported scam type in which the

person reported engaging with a scammer via website, social media, email,

internet messaging, and online classifieds (Table 4).

21 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

FIGURE 11

Method of contact with a monetary loss

29.3

%

28.9

%

18.5

%

8.7

%

3.3

%

3.0

%

2.7

%

1.5

%

0.0

%

0.0

%

3.2

%

80.2

%

77.8

%

36.8

%

26.4

%

20.3

%

59.9

%

71.2

%

55.5

%

18.1

%

30.8

%

54.8

%

$

1,480

$

650

$

604

$

509

$

150

$

148

$

107

$

90

$

65

$

34

$

133

PERCENTAGE OF TOTAL SCAMS WITH A LOSS BY CONTACT METHOD

SUSCEPTIBILITY

OtherPostal

mail

FaxOnline

classifieds

(e.g.,

Craigslist)

In

person

Internet

messaging

(e.g.,

WhatsApp)

Text

message

Phone

call

EmailWebsiteSocial

media

(e.g.,

Facebook)

MEDIAN $ LOSS

In person

Other

Postal mail

Social media

(e.g., Facebook)

Website

Email

Fax

Online classifieds

(e.g., Craigslist)

Text message

Phone call

Internet messaging

(e.g., WhatsApp)

These figures do not add up to 100% because data that was 'not applicable' was not included.

22 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

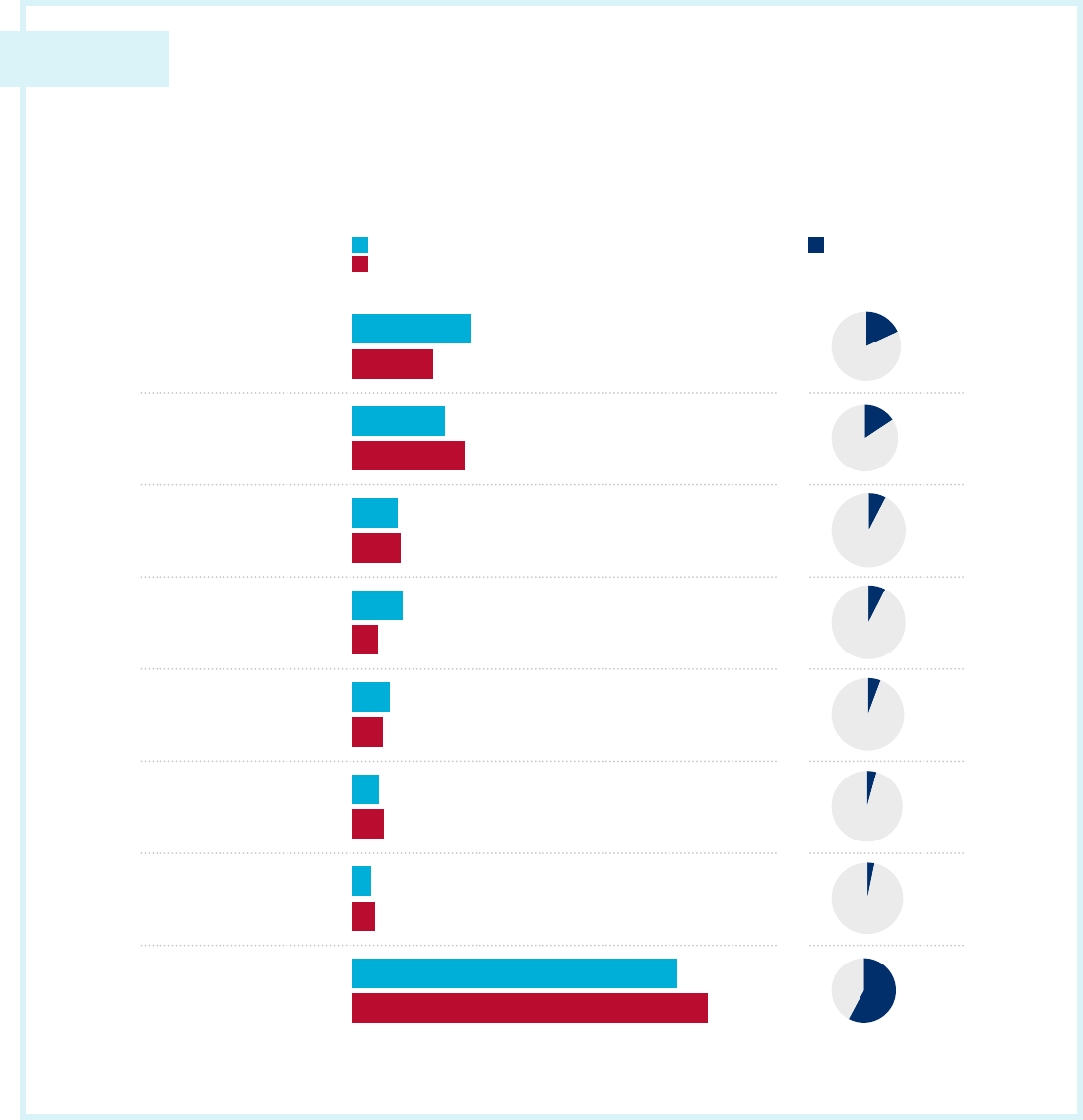

FIGURE 12

All scams compared to scams with a reported monetary loss

by means of contact

Phone

(includes phone

and text messaging)

Online

(includes website, social media,

email, internet messaging,

and online classifieds)

In person

(includes in person

and postal mail)

Percentage of all scams and scams with a $ loss do not add up to 100% because the "other" category was not included.

of all scams reported

81.2

%

68.4

%

12.0

%

25.6

%

2.7

%

1.9

%

of all scams reported with a $ loss

of all scams reported

of all scams reported with a $ lossof all scams reported with a $ loss

of all scams reported

23 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

FIGURE 13

Contact method by age (reports with a monetary loss)

25.0

%

25.4

%

27.6

%

32.2

%

33.1

%

29.0

%

Social media

26.5

%

28.7

%

30.9

%

29.6

%

28.2

%

26.4

%

Website

6.2

%

3.8

%

3.1

%

3.2

%

3.0

%

2.7

%

Text message

9.2

%

9.8

%

8.1

%

7.3

%

7.7

%

11.4

%

Phone call

19.6

%

21.8

%

20.9

%

18.1

%

16.3

%

15.7

%

Email

4.5

%

2.8

%

2.7

%

2.6

%

3.2

%

3.3

%

Internet messaging

1.7

%

1.2

%

1.1

%

1.3

%

1.6

%

2.2

%

Online classifieds

3.6

%

3.7

%

2.6

%

2.0

%

1.9

%

3.3

%

In person

2.5

%

1.9

%

2.2

%

2.9

%

4.2

%

5.1

%

Other

18–24

25–34

35–44

45–54

55–64

65+

Contact methods with insignificant responses are not shown.

24 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

TABLE 4

Most reported scam types by contact method

Website

Online purchase Employment

Counterfeit

product

Internet messaging (e.g., WhatsApp)

Investment/

cryptocurrency

Social media

Phishing/social

engineering

Online classified (e.g., Craigslist)

Email

Fax

Text message Employment

Phishing/social

engineering

Online purchase

In person

Home

improvement

Online purchase

Counterfeit

product

Phone call

Phishing/social

engineering

Debt collection

Postal mail

Sweepstakes/

lottery/prizes

Fake check/

money order

CONTACT METHOD

#

1

#

2

#

3

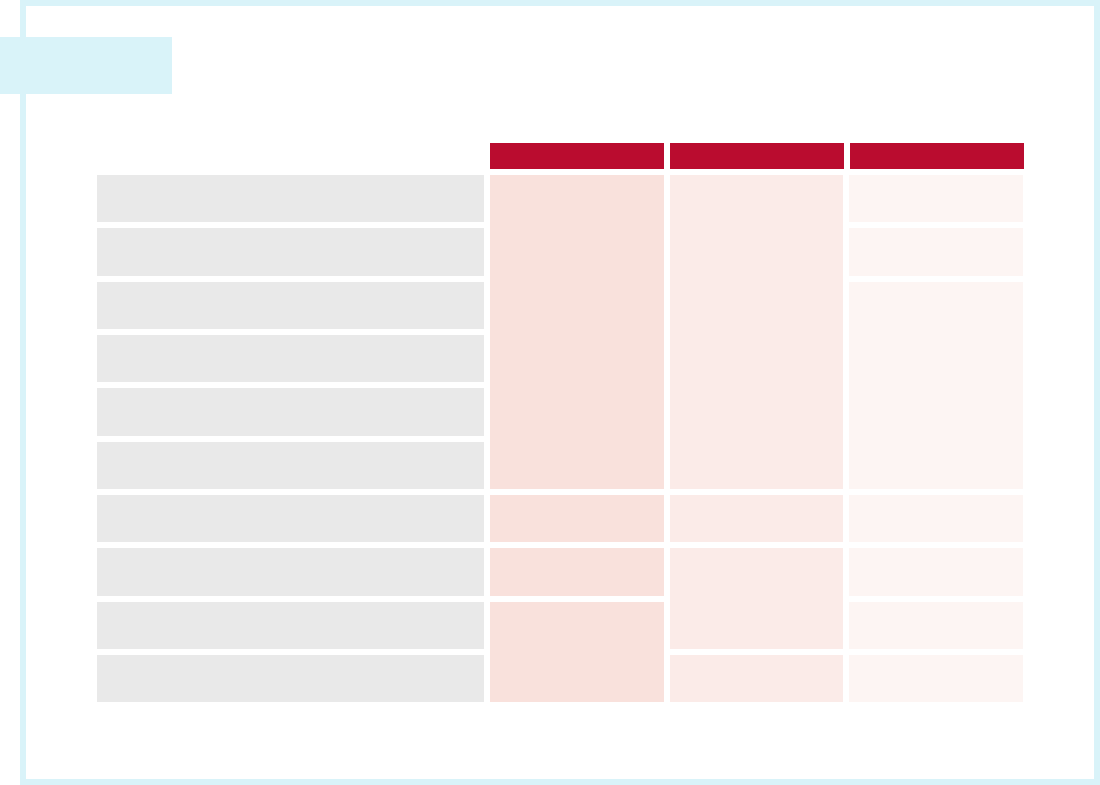

Payment method

In 2023, credit cards (41.9%) remained the top reported payment method with a

monetary loss (Figure 14), followed by bank account debit (21.8%) and online payment

system (17.5%). Interestingly, reports of bank account debit with a loss increased 66.4%,

while reports of online payment system with a loss decreased 30.8% from 2022 to 2023.

Prepaid (gift) card scams with a loss decreased from 5.0% in 2022 to 3.2% in 2023.

Payment methods with the highest median dollar loss were wire transfer ($8,000),

cryptocurrency ($3,300), and check ($2,625). The reported median dollar loss for these

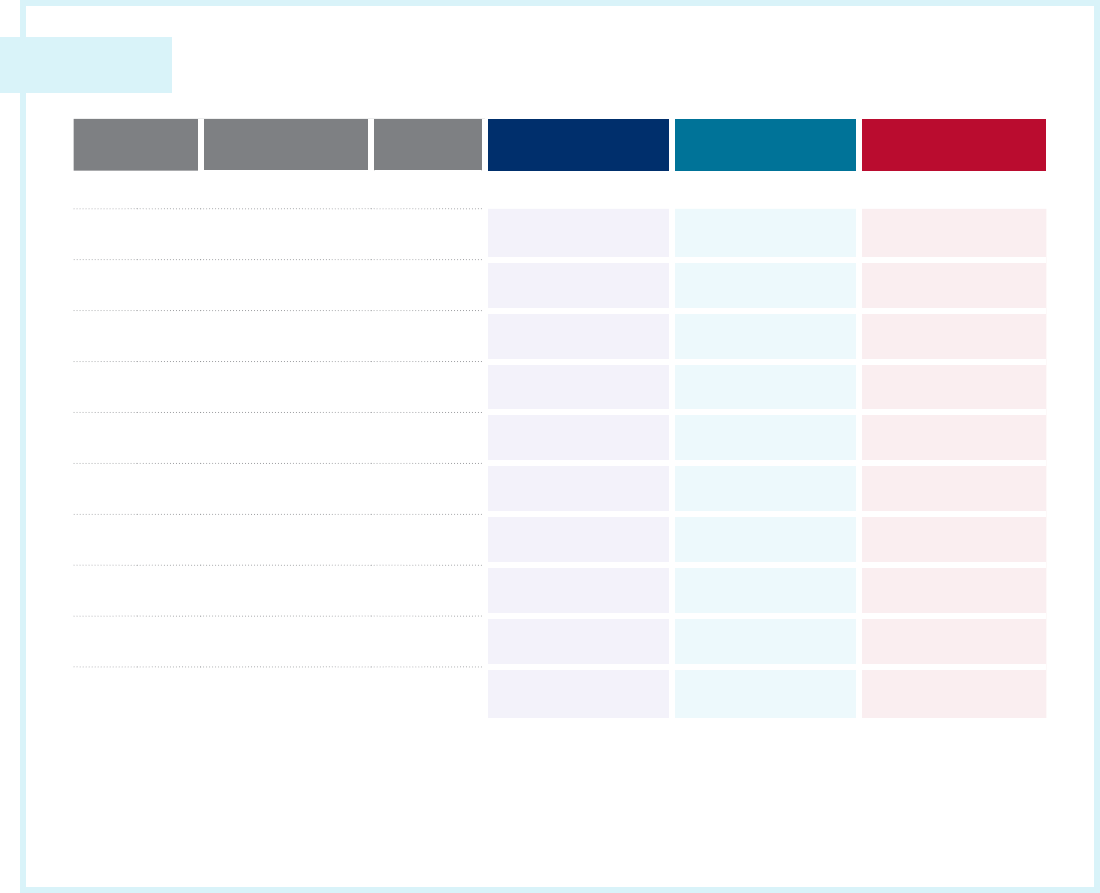

payment methods rose significantly from the year before.

When monetary loss is broken out by age and payment method (Figure 15), older people

were more likely to report a monetary loss via credit card, prepaid/gift card, and check.

Younger people were more likely to report a monetary loss via online payment system

and bank account debit.

25 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

FIGURE 14

Payment method with a reported monetary loss

0

%

50

%

41.9

%

21.8

%

17.5

%

3.2

%

3.0

%

2.3

%

2.2

%

1.8

%

0.3

%

6.0

%

$

0

$

8,500

$

65

$

75

$

200

$

512

$

3,300

$

2,625

$

1,000

$

8,000

$

1,875

$

500

Wire transfer

(e.g., Western Union)

Money order

Other

Cash

Check

Cryptocurrency

Prepaid card

(e.g., gift card)

Online

payment system

Bank account debit

Credit card

Online purchase scams were the most reported scam type for several payment methods

(credit card, online payment system, bank account debit, prepaid card, wire transfer,

money order) (Table 5).

PERCENTAGE OF ALL SCAMS WITH

$ LOSS BY PAYMENT METHOD

MEDIAN $ LOSS

BY PAYMENT METHOD

26 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

FIGURE 15

Payment method by age (reports with a monetary loss)

23.0

%

36.0

%

41.1

%

42.8

%

44.6

%

47.8

%

Credit card

27.5

%

23.3

%

18.9

%

18.1

%

14.9

%

10.5

%

Online payment system

2.6

%

3.9

%

3.8

%

3.4

%

2.3

%

1.7

%

Cryptocurrency

2.9

%

1.9

%

2.5

%

2.7

%

3.7

%

5.5

%

Prepaid card

2.9

%

2.1

%

2.1

%

1.7

%

1.9

%

4.0

%

Check

30.3

%

22.0

%

21.7

%

21.3

%

22.6

%

20.0

%

Bank account debit

3.0

%

2.8

%

2.0

%

1.9

%

1.9

%

2.4

%

Cash

0.2

%

0.3

%

0.2

%

0.2

%

0.3

%

0.4

%

Money order

1.8

%

1.6

%

1.8

%

1.6

%

2.0

%

2.2

%

Wire transfer

5.9

%

6.2

%

6.1

%

6.3

%

5.8

%

5.6

%

Other

18–24

25–34

35–44

45–54

55–64

65+

27 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

TABLE 5

Most reported scam type by payment method

Credit card

Online purchase

Counterfeit

product

Phishing/social

engineering

Online payment system

Bank account debit

Phishing/social

engineering

Employment

Prepaid card Advance fee loan

Cryptocurrency

Investment/

cryptocurrency

Online purchase Employment

Check Employment

Home

improvement

Online purchase

Wire transfer

Online purchase

Investment/

cryptocurrency

Advance fee loan

Money order Employment

Cash

Home

improvement

Online purchase Employment

CONTACT METHOD

#

1

#

2

#

3

28 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Impact on specific audiences

Canadian consumers

In 2023, Canadian consumers reported 2,104 scams to BBB Scam Tracker (3.2% of total

reports submitted in both the United States and Canada). The overall median dollar loss

reported in 2023 was $300 CAD, the same overall median dollar loss reported in 2022.

The percentage of those who reported losing money after being targeted by a scam

(susceptibility) increased from 46.9% in 2022 to 61.1% in 2023.

The top three riskiest scams reported in Canada shifted in 2023. This year, we combined

two scam types (cryptocurrency and investment) into one category because the majority

of cryptocurrency scams involve investment scenarios. Investment/cryptocurrency

scams rose to be the No. 1 riskiest scam, with a high median dollar loss ($9,365 CAD).

More than 82% of those who reported being targeted by investment/cryptocurrency

scams lost money (Table 6).

Employment scams rose from fifth riskiest to second riskiest, with a median dollar loss

of $3,600 CAD. Home improvement scams, the third riskiest, had a median dollar loss of

$2,000 CAD and a high percentage of reports with a dollar loss (84.1%). You can view the

full Canada Risk Report at BBBMarketplaceTrust.org/CanadaRiskReport.

TABLE 6

Top three riskiest scams in Canada

RANK SCAM TYPE

BBB RISK

INDEX

EXPOSURE* SUSCEPTIBILITY MEDIAN $ LOSS

1

Investment/

cryptocurrency

1127.6 4.4% 82.6% $9,365 CAD

2

Employment 484.8 15.6% 25.8% $3,600 CAD

3

Home

improvement

469.0 8.4% 84.1% $2,000 CAD

* Exposure is limited by the nature of self-reporting; the percentage of those who reported to BBB Scam Tracker does not necessarily

match the percentage of people in the full population who were targeted by scams.

29 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Impersonated organizations

By pretending to be well-known companies,

government agencies, or organizations,

scammers seek to co-opt the trust and

authority of these brands. In some cases,

scammers impersonate real-life individuals.

In 2023, the U.S. Postal Service rose to the top

of our list of most-impersonated organizations

reported to BBB Scam Tracker (Table 7).

The agency switched places with Amazon,

which fell to No. 2 on the list. About 58% of

U.S. Postal Service impersonation reports

were phishing scams. For Amazon, 43% of

impersonation reports were phishing scams,

17% were online purchase scams, and 10%

were employment scams.

Many of the same organizations from 2022

remain on this year’s list. Better Business

Bureau moved into the top 15 impersonated

organizations this year. Mentions of “warranty

department” and the “U.S. Business

Regulations Department” were also reported,

but not included on the list because the

references could not be connected to one

specific organization.

TABLE 7

Top 20 organizations/individuals

used for impersonation

Rank Organization/individual name

No. of

reports

1

U.S. Postal Service 804

2

Amazon 606

3

Publishers Clearing House 536

4

Geek Squad 430

5

Norton 387

6

PayPal 384

7

Microsoft 206

8

Walmart 198

9

Facebook 189

10

McAfee 188

11

Better Business Bureau 184

12

Bed Bath & Beyond 178

13

IRS 162

14

Medicare 154

15

Advance America 136

16

Macy’s 134

17

Spectrum 114

18

Best Buy 104

19

Capital One 98

20

Lending Club 95

30 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

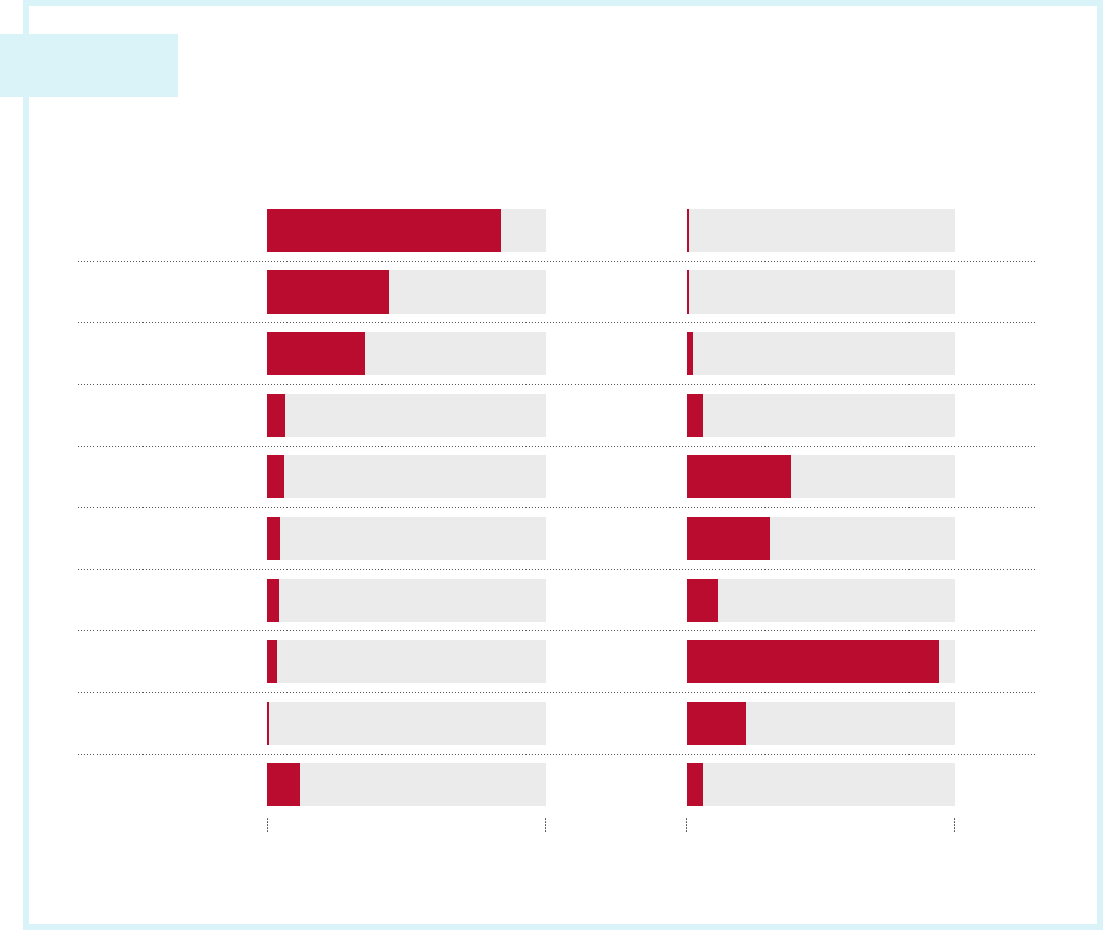

FIGURE 16

"Carrot" versus "Stick" tactics by exposure,

susceptibility, and median dollar loss

Carrot versus stick: Analyzing

the impact of scam tactics

Scammers use a wide variety

of tactics to perpetrate their

scams, some of which are

more effective than others.

Some tactics use the promise

of an opportunity (“carrot”)

to encourage the target to

continue the engagement.

Examples of the carrot

approach include the chance to

make quick money through low-

risk investments or too-good-

to-be-true job offers. Other

tactics utilize a threat (“stick”) or

negative situation to manipulate

the targets, such as jail time for

back taxes or news that a loved

one is in trouble and needs help.

This year’s report breaks out the

various scam types into three

categories: carrot method, stick

method, and other (scam types

that do not easily fit into

a category).

Carrot scams: Advance fee loan,

investment/cryptocurrency, fake

check/money order, credit repair/

debt relief, employment, counterfeit

product, government grant, home

improvement, sweepstakes/lottery/

prizes, charity, foreign money

exchange, rental, romance, vanity

award, travel/vacation/timeshare,

online purchase, COVID-19, Yellow

Pages/directories, and worthless

problem-solving service.

Stick scams: Debt collection,

tax collection, business email

compromise, family/friend

emergency, government agency

imposter, fake invoice/supplier bill,

tech support, and utility.

“Other” scams that don’t easily

qualify as carrot or stick: Phishing,

bank/credit card company imposter,

identify theft, credit card, moving,

and healthcare/Medicaid/Medicare.

Scams targeting both consumers and businesses were included in

this analysis. The breakdown of scam types includes the following:

EXPOSURE

SUSCEPTIBILITY

Carrot

Stick

Other

68.7

%

7.2

%

23.8

%

63.2

%

19.5

%

91.8

%

Carrot

Stick

Other

$

96

$

400

$

270

These figures do not add up to 100% because data

that was 'not applicable' was not included.

MEDIAN $ LOSS

31 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

FIGURE 17

Contact method by carrot or stick method

These figures do not add up to 100% because data that was "not applicable" was not included.

Carrot-type scam tactics

by contact method

Stick-type scam tactics

by contact method

0% 50%

0% 50%

25.2

%

12.6

%

27.6

%

11.0

%

5.4

%

5.2

%

3.3

%

3.2

%

2.9

%

20.3

%

2.4

%

7.5

%

26.6

%

2.7

%

2.4

%

1.8

%

0.8

%

2.7

%

25.7

%

23.9

%

23.7

%

9.4

%

7.4

%

3.0

%

1.8

%

1.6

%

2.8

%

34.4

%

2.5

%

7.0

%

43.0

%

6.8

%

1.6

%

1.1

%

0.2

%

3.1

%

Email

Other

Online classifieds

In person

Internet messaging

Text message

Phone call

Website

Social media

2023 carrot

2023 stick

2022

Using the BBB Risk Index, we found that people were much more likely to report losing

money to scams perpetrated via a carrot method (63.2%) compared to a stick method

(19.5%) (Figure 16). However, when people reported losing money to scams that were

perpetrated with a stick method, they reported losing significantly more money ($400)

than those who reported losing money to carrot-type scams ($96).

Carrot-type tactics were more likely to use social media or websites to target people.

Stick-type tactics were more likely to target people via phone (Figure 17). Interestingly,

carrot-type tactics via social media rose from 12.6% in 2022 to 23.9% in 2023.

32 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Self-reported cues and behaviors that

helped people avoid losing money

Factors people say helped them avoid losing money

Our team asked survey respondents again this year what they believe helped them avoid

losing money when targeted by a scam (Figure 18). Of those surveyed who submitted a scam

report in 2023, 52.1% said they avoided losing money to a scam because they “felt something

wasn’t right about the situation.”

Other top cues/behaviors included researching the type of scam/offer (21.4%), researching

the background of the scammer (17.9%), and knowing about the methods and behaviors of

scammers in general (17.7%).

FIGURE 18

Cues/behaviors respondents say helped them avoid losing money

The percentages do not add up to 100% because respondents were encouraged to choose more than one answer.

52.1

%

21.4

%

17.9

%

17.7

%

14.4

%

10.4

%

8.8

%

7.5

%

7.5

%

6.7

%

35.1

%

Felt something wasn’t right about

the situation

Researched the type of scam/offer

that targeted me

Researched the background

of the scammer

Knew about the methods and behaviors

of scammers in general

Reached out to BBB or another

fraud-fighting organization for advice

Read about a similar scam on

BBB Scam Tracker

Warned about the possible scam

by an app, service, or security features

Reached out to family/friend for advice

Somebody intervened to stop the transaction

(financial organization or a retail employee)

Knew about the particular type of scam

Other

33 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Other factors that may

impact victimization

Repeat victimization

When we asked survey respondents to self-report on how many times they had lost

money to a scam, 10.3% reported losing money at least three times, up from 8.4% in

2022 (Figure 19). Twenty-nine percent reported losing money two or more times (up

from 23.5% in 2022).

FIGURE 19

Number of times a person reported losing money to a scam

41.8

%

18.7

%

6.7

%

1.5

%

2.1

%

29.2

%

1 time

2 times

3 times

4 times

5+ times

I have not lost

money to a scam

34 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Survey respondents who reported losing money to a scam three or more times were

more likely to report that they experienced significant financial distress during the past

year. Those who reported losing money three or more times were also more likely to say

they are isolated (live alone or have few friends) (Figure 20).

FIGURE 20

Factors that may impact repeat victimization

I was under financial stress.

I am isolated (I live alone or

I have few close friends).

60.9

%

38.9

%

18.7

%

42.2

%

RESPONDENTS WHO LOST MONEY

3 OR MORE TIMES SAID:

AGREE DISAGREE

AGREE DISAGREE

I was under financial stress.

I am isolated (I live alone or

I have few close friends).

RESPONDENTS WHO DID NOT

LOSE MONEY SAID:

34.6

%

17.5

%

38.7

%

62.3

%

When asked whether they agreed or disagreed with factors

describing their experience while being targeted by a scam:

35 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

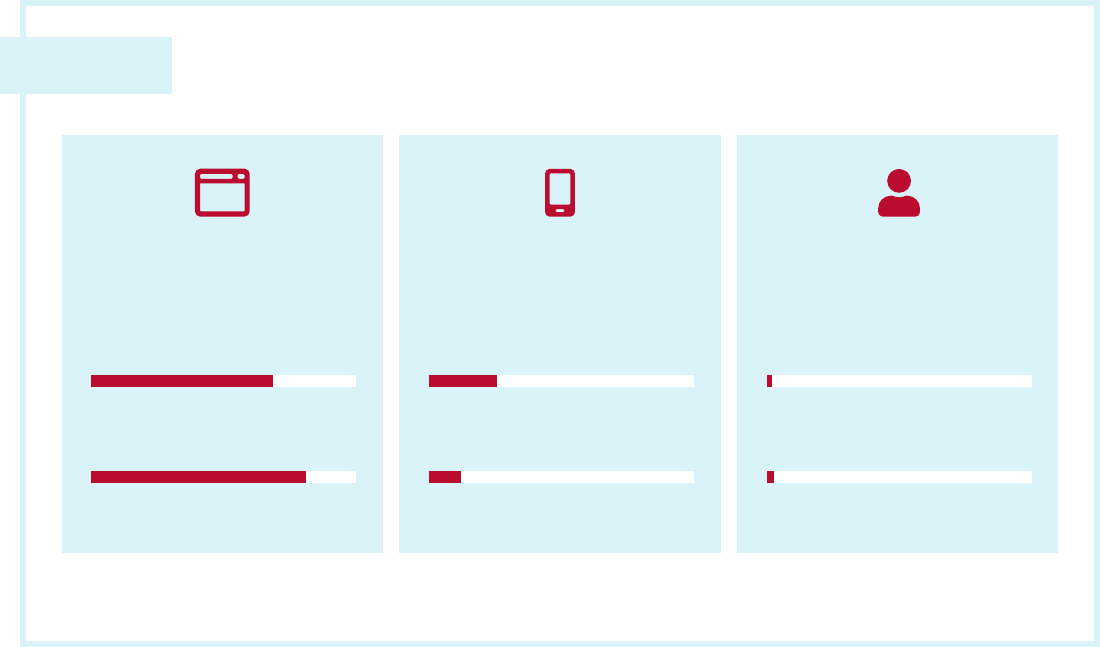

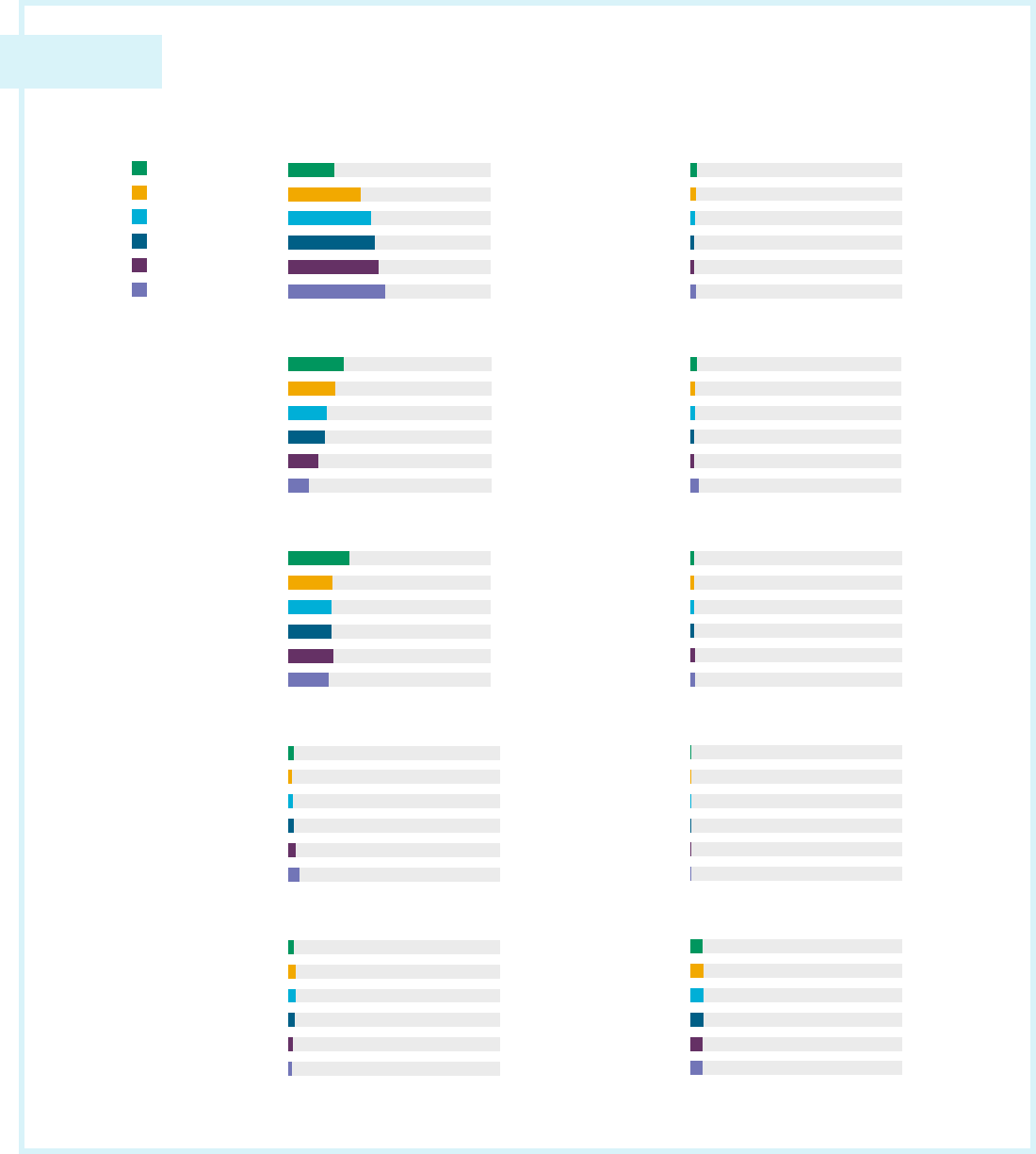

Preferred consumer education resources

We asked survey respondents to tell us how they prefer to receive information about

scam prevention (Figure 21). People between the ages of 18 and 54 chose social media

as their top source of scam education information. People over the age of 55 said they

preferred scam alerts.

FIGURE 21

Preferred scam education resources by age

Social media stories

Scam alert articles

TV news

Scam detection

training

Online videos

Consumer

education email

Radio programs

Social media stories

Scam alert articles

TV news

Scam detection

training

Online videos

Consumer

education email

Radio programs

74.8

%

65.1

%

57.3

%

55.3

%

53.4

%

42.7

%

20.4

%

18–24

64.4

%

56.5

%

45.6

%

46.0

%

37.4

%

36.7

%

20.9

%

25–34

67.7

%

55.4

%

48.9

%

39.9

%

36.0

%

34.7

%

18.2

%

35–44

67.9

%

66.4

%

53.1

%

41.1

%

31.2

%

39.6

%

19.4

%

45–54

57.8

%

69.5

%

51.7

%

35.8

%

24.2

%

39.7

%

16.3

%

55–64

49.0

%

75.6

%

52.4

%

33.9

%

19.9

%

41.9

%

12.9

%

65–74

40.6

%

77.3

%

53.3

%

28.9

%

15.3

%

43.8

%

10.4

%

75–84

37.9

%

58.6

%

41.4

%

27.6

%

17.2

%

41.4

%

13.8

%

85+

36 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

Other scam tactics

We asked people who reported to BBB Scam Tracker to tell us about other tactics

scammers used to engage with them (Figure 22). Clicking on a link in an email or text

message was the top reported tactic, followed by sending money via an online payment

system (digital payment app).

FIGURE 22

Scammer tactics

20.3

%

15.9

%

8.0

%

8.8

%

6.7

%

4.8

%

3.5

%

55.1

%

14.0

%

19.3

%

8.4

%

4.6

%

5.5

%

5.7

%

4.2

%

60.2

%

Click on a link

(via email, text, etc.)

Send money via

a digital payment app

Go to a store to

purchase gift cards

Deposit a check

into your bank account

Share a one-time code

you received

Purchase

cryptocurrency

Submit cash to

a Bitcoin ATM

None of the above

18.1

%

15.7

%

7.6

%

7.5

%

5.7

%

4.3

%

3.2

%

57.8

%

TACTIC RESPONDENTS WHO DID NOT LOSE $

RESPONDENTS WHO LOST $

PERCENT OF ALL

SCAM REPORTS

When asked, “At any point during your interaction with the scammer(s),

were you asked to do any of the following?” survey respondents

selected all scammer tactics that applied.

The totals do not add up to 100% because respondents could choose more than one option.

37 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

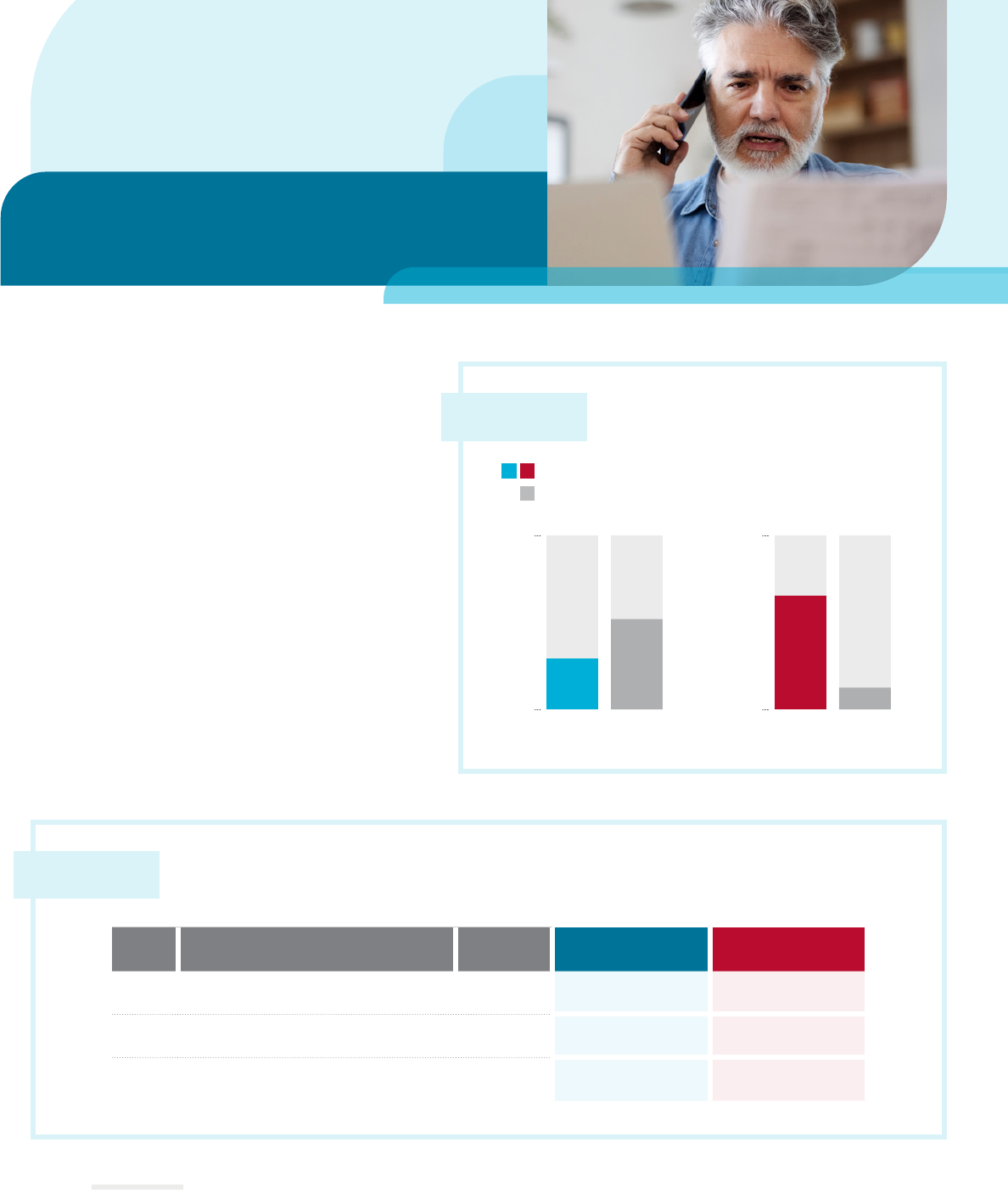

Scams targeting businesses

9

Sometimes scammers claim to be able to provide low-cost solutions to problems they know many businesses have. For example,

they might claim they can repair the business’s online reputation or provide quick relief if it’s struggling with debt or back taxes—for

an up-front fee, of course.

BBB Scam Tracker also collects

information about scams that target

businesses. Businesses reported losing

money 29.5% of the time, a significantly

lower susceptibility than that reported by

consumers (52.0%). However, the overall

median dollar loss reported by businesses

($523) was significantly higher than that

reported by consumers ($100) (Figure 23).

The three riskiest business scams based

on the BBB Risk Index were worthless

problem-solving service scams,

9

bank/

credit card company imposter scams, and

fake invoice/supplier bill scams (Table 8).

TABLE 8

Riskiest scam types reported by businesses

RANK SCAM TYPE

BBB RISK

INDEX

SUSCEPTIBILITY MEDIAN $ LOSS

1

Worthless problem-solving service 175.1 59.8% $500

2

Bank/credit card company imposter 111.6 28.0% $983

3

Fake invoice/supplier bill 36.7 11.9% $413

FIGURE 23

Overall susceptibility and

monetary loss (business versus

consumer scams)

0

%

100

%

29.5

%

52.0

%

$

0

$

800

$

523

$

100

SUSCEPTIBILITY MEDIAN $ LOSS

Business

Consumer

38 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

BBB.org/AvoidScams

BBB.org/ScamTips

For more about scams targeting businesses:

BBB.org/all/business-scams

1

Avoid making quick

purchases while

browsing social media.

Reports of scams being

perpetrated via social

media increased 63.8%

from 2022 to 2023.

Take time to research

the website that is

offering that amazing

deal to make sure it

isn't fake.

2

Be very cautious

engaging with

someone you’ve

met online.

Make sure you don’t

share personal details

with somebody you

haven’t met in person.

If they begin to ask for

money or offer a no-risk

investment opportunity,

it’s a red flag.

3

Don’t click on links

or open attachments

in unsolicited email

or text messages.

If the person claims

to be somebody you

know or a well-known

organization, contact

the person directly or go

directly to your account

to confirm the details.

Impersonation was

reported as the most

common tactic used to

perpetrate scams.

4

Don’t believe

everything you see

or read. Scammers

are great at mimicking

official seals, fonts,

and other details. Just

because a website or

email looks official does

not mean it is. Even

Caller ID can be faked.

5

Take precautions

when making online

purchases.

Don’t shop based on

price alone. Scammers

offer hard-to-find

products at great

prices.

Don’t buy online unless

the transaction is

secure. Make sure the

website has “https”

in the URL (the “s” is

for “secure”) and a

small lock icon on the

address bar. However,

even secure websites

can be fraudulent.

Do more research on

the products and the

business before you

make the purchase.

6

Know general red

flags of scams:

The offer sounds too

good to be true.

The person insists you

must act immediately,

or the deal ends soon.

Somebody asks you to

deposit money into a

Bitcoin ATM or sends

a check and asks you

to deposit it and then

transfer the funds.

They require an up-

front payment before a

service is provided.

7

Never disclose

personally

identifiable

information to an

unsolicited contact.

If somebody asks you

to share your SSN/SIN

or your driver’s license

number, consider it a

red flag and proceed

with caution.

8

Take your time. Don’t

be pressured to act

immediately. Instead,

do your research or

discuss the situation

with a third party.

9

Use secure, traceable

transactions when

making payments for

goods, services, taxes,

and debts. Prepaid/

gift cards, for example,

cannot be traced.

They are intended to

be used as gifts, not as

payment.

10

Whenever possible,

work with businesses

that have proper

identification,

licensing, and

insurance. Research

the company first at

BBB.org.

10 GENERAL TIPS

FOR AVOIDING A SCAM

These tips can help you avoid most scams

and protect yourself and your family.

Learn more about

avoiding scams at:

39 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

BBB Institute

for Marketplace Trust

The BBB Scam Tracker Risk Report is published each year by the BBB Institute

for Marketplace Trust (BBB Institute), the charitable arm of the Better Business

Bureau. Our mission is to educate and protect consumers, establish best

practices for businesses, and solve complex marketplace problems. Our

consumer educational programs, which include a wide array of resources

on fraud prevention and education, are delivered digitally and in person

through the network of BBBs serving communities across the United States

and Canada. Research is an integral component of our work, enabling us to

incorporate the latest scammer trends in our consumer education resources

and initiatives. You can find more information about BBB Institute and its

programs at BBBMarketplaceTrust.org.

Scam Prevention Guide

In 2023, BBB Institute introduced a new microsite aimed at helping people gain

the knowledge they need to spot and avoid scams. The guide includes quizzes,

videos, a library of materials, and a Risk Calculator that helps users understand

the types of scams that pose the biggest risk to their demographic profile

(age, gender, country, military status). You can find the guide at

BBB.org/scamprevention.

Scam Survival Toolkit

We also introduced a test version of a new online resource for scam victims. Built

with support provided by Amazon and Capital One, the Scam Survival Toolkit connects

scam victims with the resources they need to restore their financial, mental, and emotional

well-being. The final version will be launched this year at BBB.org/ScamSurvivalKit.

BBB Institute research

Targeting Our Youth: How Scams Are Impacting Ages 18–24

We know from previous research that scams target people of all ages. However, the

ways in which people engage with scammers and how they are impacted can vary

across different demographic groups. Published in October 2023, the Targeting Our

Youth report takes a closer look at how this age group is being targeted and how they

are impacted by scams.

Thank you to

our sponsors.

BBB Institute would

like to recognize our

funding partners for

making BBB Institute’s

research and

programs possible.

All BBB Institute research can be found on our website at BBBMarketplaceTrust.org/research.

40 BBB. org/Scam Tracker | 2023 BBB SCAM TRACKER RISK REPORT

ADVANCE FEE LOAN

A loan is guaranteed, but once the victim pays up-front charges such as taxes or a

“processing fee,” the loan never materializes. Read our advance fee loan prevention tips.

BANK/CREDIT

CARD COMPANY

IMPOSTER

This scam typically involves impersonation of a bank or other credit card issuer. Under the

guise of verifying account information, they persuade their targets to share credit card or

banking information.

BUSINESS EMAIL

COMPROMISE

A scammer impersonates a senior executive via email or another communication vehicle

to persuade an employee to wire payment for goods to another bank account. Read our

business email compromise tips.

CHARITY

Fake or imposter charities are used to get money from individuals who believe they are

making donations to legitimate charities. This is particularly common in the wake of a

natural disaster or other tragedy. Read our charity scam prevention tips.

COUNTERFEIT

PRODUCT

Counterfeit goods mimic original merchandise, right down to the trademarked logo;

however, they are typically of inferior quality. This can result in a life-threatening health or

safety hazard when the counterfeit item is medication, a supplement, or an auto part.

Read our counterfeit product scam prevention tips.

CREDIT CARD

Scammers impersonate a bank or other credit card issuer, pretending to verify account

details to get a target’s credit card or banking information. Read our credit card scam

prevention tips.

CREDIT REPAIR/

DEBT RELIEF

Scammers posing as legitimate service providers collect payment in advance, with

promises of debt relief and repaired credit, but provide little or nothing in return.

Read our credit repair/debt relief scam prevention tips.

DEBT COLLECTION

Phony debt collectors harass their targets to get them to pay debts they don’t owe.

Read our debt collection scam prevention tips.

EMPLOYMENT

Job applicants are led to believe they are applying for or have just been hired for

a promising new job when instead they have given personal information via a fake

application or money to scammers for “training” or “equipment.” In another variation, the

victim may be “overpaid” with a fake check and asked to wire back the difference.

Read our employment scam prevention tips.

FAKE CHECK/MONEY

ORDER

The victim deposits a phony check and then returns a portion by wire transfer or digital

payment app to the scammer. The stories vary, but the victim is often told they are

refunding an “accidental” overpayment. Scammers count on the fact that banks make

funds available within days of a deposit but can take weeks to detect a fake check.

Read BBB’s Fake Check study.

FAKE INVOICE/

SUPPLIER BILL

Scammers target business owners and hope they won’t notice a bill, often for office

supplies that the company never ordered. They may even deliver unordered merchandise

and then try to make the business pay. In other cases, scammers send urgent notices for

renewal of website domain hosting or other critical services, hoping businesses will pay

without proper due diligence. Read our fake invoice/supplier bill tips.

Scams reported to BBB Scam Tracker this year are classified into 28 consumer scams and

five business scams. These classifications represent common scams reported to BBB and are

informed by type classifications used by the Federal Trade Commission and the Internet Crime

Complaint Center of the Federal Bureau of Investigation. You can find prevention tips for all of

these scam types at https://www.bbb.org/all/scamtips.

APPENDIX A: Glossary of scam types

The scam types highlighted in blue are scams that are reported by businesses.

42 BBB.org/ScamTracker | 2023 BBB SCAM TRACKER RISK REPORT

FAMILY/FRIEND

EMERGENCY

This scheme involves the impersonation of a friend or family member experiencing a

fabricated urgent or dire situation. The “loved one” invariably pleads for money to be sent

immediately. Aided by personal details typically found on social media, imposters can offer

very plausible stories to convince their targets. Read our family/friend emergency scam

prevention tips.

FOREIGN MONEY

EXCHANGE

The target receives an email from a foreign government’s official, member of royalty, or

a business owner offering a huge sum of money to help get money out of the scammer’s

country. The victim fronts costs for the transfer, believing they will be repaid. Read our

foreign money exchange scam prevention tips.

GOVERNMENT

AGENCY

IMPOSTER

Scammers pretend to be representatives of a U.S. or Canadian government agency such

as the IRS, the Canada Revenue Agency, the Social Security Administration, or a wide

range of others. In 2023, scammers pretended to be from the U.S. Postal Service.

GOVERNMENT

GRANT

Individuals are enticed by promises of free, guaranteed government grants requiring an

up-front “processing fee.” Other fees follow, but the promised grant never materializes.

Read our government grant scam prevention tips.

HEALTHCARE,

MEDICAID, AND

MEDICARE

The scammer seeks to obtain the insured’s health insurance, Medicaid, or Medicare

information to submit fraudulent medical charges or for purposes of identity theft.

Read our healthcare scam prevention tips.

HOME

IMPROVEMENT

Door-to-door solicitors offer quick, low-cost repairs and then either take payment without

returning, do shoddy work, or “find” issues that dramatically raise the price. These types of

schemes often occur after a major storm or natural disaster. Read our home improvement

scam prevention tips.

IDENTITY THEFT

Identity thieves use a victim’s personal information (e.g., SSN/SIN, bank account