February 16, 2024

Provider Relief Programs:

Provider Relief Fund and ARP Rural Payments

Frequently Asked Questions

General Information

Overview

Attestation

Rejecting or Returning Payments

Provider Relief Fund Terms and Conditions

ARP Rural Payments Terms and Conditions

Ownership Structures and Financial Relationships

Auditing and Reporting Requirements

Use of Funds

Calculating Eligible Expenses and Lost Revenue

Supporting Data

Change of Ownership

Non-Financial Data

Extensions

Miscellaneous

COVID-19 Vaccine Distribution and Administration

Balance Billing

Publication of Payment Data

Provider Relief Fund General Distribution and ARP Rural Payments

Phase 4 and ARP Rural Payments

Phase 4 Overview and Eligibility

ARP Rural Payments Overview and Eligibility

Targeted Distributions

Nursing Home Infection Control Distribution

1

February 16, 2024

2

General Information

Overview

Who was eligible to receive payments from the Provider Relief Fund? (Modified

12/4/2020)

Provider Relief Fund payments were disbursed via both “General” and “Targeted” Distributions.

To have been eligible for the General Distribution, a provider must have billed Medicare fee-

for-service in 2019, been a known Medicaid and CHIP or dental provider and provided after

January 31, 2020 diagnoses, testing, or care for individuals with possible or actual cases of

COVID-19. HHS broadly views every patient as a possible case of COVID-19.

A description of the eligibility for the announced Targeted Distributions can be found here.

All providers retaining funds must have signed an attestation and accepted the Terms and

Conditions associated with payment.

Was this a loan or a grant that I will need to pay back?

(Added 4/25/2020)

Retention and use of these funds are subject to certain terms and conditions. If these terms and

conditions are met, payments do not need to be repaid at a later date. These Terms and

Conditions can be found here.

Were Provider Relief Fund recipients required to notify HRSA if they have filed a

bankruptcy petition? (Added 12/9/2021)

Yes. Provider Relief Fund recipients must immediately notify HRSA about their bankruptcy

petition or involvement in a bankruptcy proceeding so that the Agency may take the appropriate

steps. When notifying HRSA about a bankruptcy, please include the name that the bankruptcy is

filed under, the docket number, and the district where the bankruptcy is filed. You must submit

this information to PRFbankruptc[email protected]. If a Provider Relief Fund recipient has filed a

bankruptcy petition or is involved in a bankruptcy proceeding, federal financial obligations will

be resolved in accordance with the applicable bankruptcy process, the Bankruptcy Code, and

applicable non-bankruptcy federal law.

What was the Assistance Listing (AL) (formerly the Catalog of Federal Domestic Assistance

(CFDA)) number for the Provider Relief Fund program? (Added 9/29/2021)

The AL number is 93.498.

Why would a provider not have been eligible for a General or Targeted Distribution

Provider Relief Fund payment? (Modified 6/30/2022)

In order to be eligible for a payment under the Provider Relief Fund, a provider must have met

the eligibility criteria for the distribution and complied with the Terms and Conditions for any

previously received Provider Relief Fund payments. Additionally, a provider must not have

been terminated from participation in Medicare or precluded from receiving payment through

Medicare Advantage or Part D; must not have been excluded from participation in Medicare,

Medicaid, and other Federal health care programs; and must not have had Medicare billing

privileges revoked as determined by either the Centers for Medicare &

February 16, 2024

3

Medicaid Services or the HHS Office of Inspector General in order to have been eligible to

receive a payment under the Provider Relief Fund.

How should providers classify the Provider Relief Fund payments in terms of revenue type

for cost reports? (Modified 9/3/2020)

Please refer to CMS FAQs on how Provider Relief Fund payments should be reported on cost

reports.

Can providers who have ceased operation due to the COVID-19 pandemic still receive this

funding? (Modified 2/16/2024)

If a provider ceased operation as a result of the COVID-19 pandemic, they are still eligible to

receive Provider Relief Fund payments so long as they provided on or after January 31, 2020,

diagnoses, testing, or care for individuals with possible or actual cases of COVID-19. HHS

broadly views every patient as a possible case of COVID-19, therefore, care does not have to be

specific to treating COVID-19. Recipients of funding must have complied with the Terms and

Conditions related to permissible uses of Provider Relief Fund payments.

In addition, if the Reporting Entity has ceased operation, they will still be responsible for

reporting on funds received. Reporting entities must also indicate whether their business has

ceased operation. If they have ceased operation, they will be required to enter the business cease

date and indicate whether the business was operational on 01/01/2020.

Were Provider Relief funds accessible in whole or in part to bankruptcy creditors and other

creditors in active litigation? (Added 6/8/2020)

Payments from the Provider Relief Fund shall not have been subject to the claims of the

provider’s creditors and providers were limited in their ability to transfer Provider Relief Fund

payments to their creditors. A provider may have utilized Provider Relief Fund payments to

satisfy creditors’ claims, but only to the extent that such claims constitute eligible health care

related expenses and lost revenues attributable to coronavirus and were made to prevent,

prepare for, and respond to coronavirus, as set forth under the Terms and Conditions.

May a health care provider that received a payment from the Provider Relief Fund exclude

this payment from gross income as a qualified disaster relief payment under section 139 of

the Internal Revenue Code (Code)? (Added 7/10/2020)

No. A payment to a business, even if the business is a sole proprietorship, does not qualify as a

qualified disaster relief payment under section 139. The payment from the Provider Relief Fund

was includible in gross income under section 61 of the Code. For more information, visit the

Internal Revenue Services’ website at https://www.irs.gov/newsroom/frequently-asked-

questions-about-taxation-of-provider-relief-payments.

Was a tax-exempt health care provider subject to tax on a payment it received from the

Provider Relief Fund? (Added 7/10/2020)

Generally, no. A health care provider that was described in section 501(c) of the Code is exempt

from federal income taxation under section 501(a). Nonetheless, a payment received by a tax-

exempt health care provider from the Provider Relief Fund may be subject to tax under section

511 if the payment reimbursed the provider for expenses or lost revenue attributable to an

unrelated trade or business as defined in section 513. For more information, visit the Internal

Revenue Services’ website at https://www.irs.gov/newsroom/frequently-asked-questions-about-

taxation-of-provider-relief-payments.

February 16, 2024

4

Will I receive a Form 1099?

(Modified 2/16/2024)

Yes, you will receive a Form 1099 if you received and retained within the calendar year 2023 a

total net payment from either or both of the Provider Relief Fund and/or COVID-19 Claims

Reimbursement to Health Care Providers and Facilities for Testing, Treatment, and Vaccine

Administration for the Uninsured that is in excess of $600.

When will my Form 1099 be available?

(Modified 2/16/2024)

Form 1099s will be mailed by January 31, 2024. If you have previously established an account

with UnitedHealth Group and elected to receive electronic copies of documents and notices, you

will not receive a mailed copy.

Who do I contact if I have questions regarding my Form 1099? (Modified 1/30/2023)

Please call the Provider Support Line (866) 569-3522 (for TTY, dial 711) for any questions you

may have regarding your Form 1099. If you have questions about filing your taxes generally,

seek guidance from your accountant and/or tax professional.

Which sections of 45 CFR 75 – UNIFORM ADMINISTRATIVE REQUIREMENTS,

COST PRINCIPLES, AND AUDIT REQUIREMENTS FOR HHS AWARDS are

applicable to the General and Targeted Distributions of the Provider Relief Fund?

(Added 12/28/2020)

Recipients (both non-federal entities and commercial organizations) of the General and Targeted

Distributions of the Provider Relief Fund are subject to 45 CFR 75 Subpart A (Acronyms and

Definitions) and B (General Provisions), subsections §75.303 (Internal Controls), and §75.351-

.353 (Subrecipient Monitoring and Management), and Subpart F (Audit Requirements). In

addition, the terms and conditions of the PRF payments incorporate by reference the obligation

of recipients to comply with the requirements to maintain appropriate financial systems at

§75.302 (Financial management and standards for financial management systems) and the

requirements for record retention and access at §75.361 through §75.365 (Record Retention and

Access).

Attestation

What action did a provider need to take after receiving a Provider Relief Fund payment?

(Modified 10/28/2020)

The CARES Act required Provider Relief Fund payment recipients to meet certain terms and

conditions if a provider retained a payment. If a provider chose to retain the funds, they had to

attest to have met the terms and conditions of the payment. Not returning the payment within 90

days of receipt would have been viewed as acceptance of the Terms and Conditions. A provider

must have attested for each of the Provider Relief Fund distributions received.

Did the Provider Relief Fund attestation portals require payment recipients to attest that

the payment amount was received? (Modified 10/28/2020)

Yes. The attestation portals required payment recipients to (1) confirm they received a payment

and the specific payment amount that was received; and (2) agree to the Terms and Conditions of

the payment.

February 16, 2024

5

Rejecting or Returning Payments

If a provider rejected a payment and the associated Terms and Conditions in the

attestation portal but decided to keep the funds after rejecting it in the attestation portal,

what should the provider have done in order to report on the use of funds kept? (Modified

10/27/2022) Providers who rejected one or more Provider Relief Fund and/or ARP Rural

payments exceeding $10,000, in aggregate, and kept the funds were required to report on these

funds during the applicable reporting period per the Terms and Conditions associated with the

payment(s). In order to be able to report on the use of funds, a provider must have contacted the

Provider Support Line at (866) 569-3522 (for TTY, dial 711) to request a change to their

attestation from “rejected” to “accepted.” Once the attestation status has been updated in the

attestation portal, the Provider Relief Fund Reporting Portal will subsequently be updated to

accurately reflect the kept payment that the provider was required to report on during the

applicable reporting period.

How can I return a payment I received under the Provider Relief Fund? (Modified

2/16/2024)

If you received an invoice from the U.S. Department of Treasury Centralized Receivables Service or Cross-

Servicing, please refer to the payment options found in your invoice. For more information, see

https://www.hrsa.gov/provider-relief/compliance/returning-funds.

The following instructions are to return the full payment amount:

If the provider received payment via electronic transfer, the provider needs to contact their

financial institution and ask the institution to initiate a “R23 - Credit Entry Refused by Receiver"

code on the original Automated Clearing House (ACH) transaction.

If a provider was paid via paper check, the provider should have destroyed the check if it is not

deposited or mail a paper check to UnitedHealth Group with notification of their request to

return the funds. Mail a refund check for the full amount payable to “UnitedHealth Group” to

the address below.

UnitedHealth Group

Attention: Provider Relief Fund

PO Box 31376

Salt Lake City, UT 84131-0376

Returning the payment in full or not depositing the payment received by paper check within 90

days without taking further action in the attestation portal is considered a de facto rejection of the

terms and conditions associated with the payment.

The following instructions were to return a partial payment amount:

Entities can return partial payments via Pay.gov. For more information on this process, please

review the instructions available at

https://na3.docusign.net/Member/PowerFormSigning.aspx?PowerFormId=45c01db6-78db-403a-

baa3-480c1950f596&env=na3&acct=dd54316c-1c18-48c9-8864-0c38b91a6291&v=2.

February 16, 2024

6

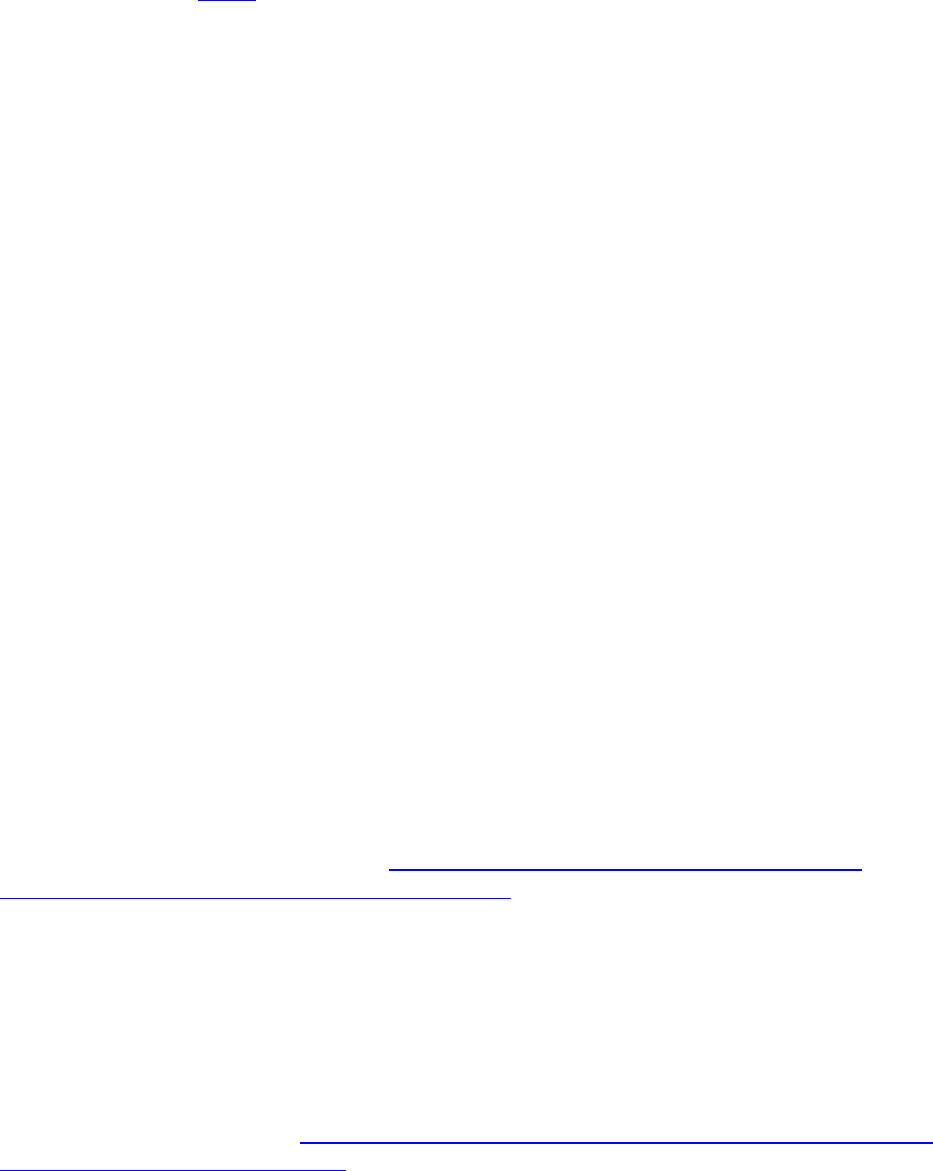

How can a provider return unused Provider Relief Fund payments that it has partially

spent? (Modified 2/16/2024)

Providers that have Provider Relief Fund payments that they cannot expend on allowable

expenses or lost revenues attributable to coronavirus by the Period of Availability that

corresponds to the Payment Received Period were required to return such funds to the

federal government.

Please note regarding the return of unused funds: The instructions on ‘PRF Return of Unused Funds

Portal’ explain the two-part process to return funds. There may be a delay in processing the return,

especially if repaying by paper check. If you have additional questions, please call the Provider

Support Line at (866) 569-3522 (for TTY, dial 711).

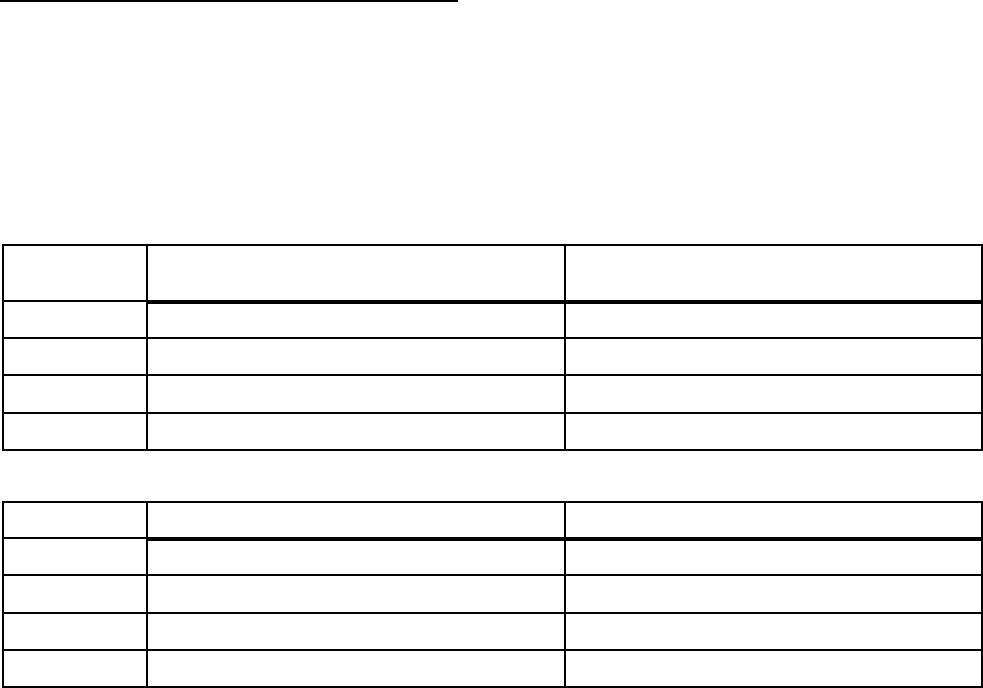

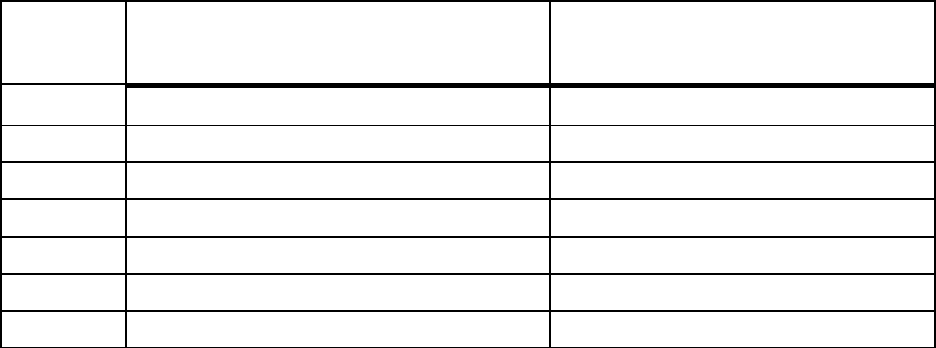

Period

Payment Received

Period

Period of

Availability for

Eligible Expenses

Period of

Availability for Lost

Revenues

Reporting Time

Period

1

April 10, 2020, to June

30, 2020

January 1, 2020, to

June 30, 2021

January 1, 2020, to

June 30, 2021

July 1, 2021, to

September 30, 2021

2

July 1, 2020, to

December 31, 2020

January 1, 2020, to

December 31, 2021

January 1, 2020, to

December 31, 2021

January 1, 2022, to

March 31, 2022

3

January 1, 2021, to

June 30, 2021

January 1, 2020, to

June 30, 2022

January 1, 2020, to

June 30, 2022

July 1, 2022, to

September 30, 2022

4

July 1, 2021, to

December 31, 2021

January 1, 2020, to

December 31, 2022

January 1, 2020, to

December 31, 2022

January 1, 2023, to

March 31, 2023

5

January 1, 2022, to

June 30, 2022

January 1, 2020, to

June 30, 2023

January 1, 2020, to

June 30, 2023

July 1, 2023, to

September 30, 2023

6

July 1, 2022, to

December 31, 2022

January 1, 2020, to

December 31, 2023

January 1, 2020, to

June 30, 2023

January 1, 2024, to

March 31, 2024

7

January 1, 2023, to

June 30, 2023

January 1, 2020, to

June 30, 2024

January 1, 2020, to

June 30, 2023

July 1, 2024, to

September 30, 2024

To return any unused funds, use the Return Unused PRF Funds Portal. Instructions for returning

any unused funds are available at:

https://na3.docusign.net/Member/PowerFormSigning.aspx?PowerFormId=45c01db6-78db-403a-

baa3-480c1950f596&env=na3&acct=dd54316c-1c18-48c9-8864-0c38b91a6291&v=2.

The Provider Relief Fund Terms and Conditions and applicable laws authorized HHS to

audit Provider Relief Fund recipients now or in the future to ensure that program

requirements are/were met. HHS is authorized to recover any Provider Relief Fund payment

amounts that were made in error, exceed lost revenue or expenses due to coronavirus, or do

not otherwise meet applicable legal and program requirements.

February 16, 2024

7

If a provider rejected the payment in the attestation portal but did not return the payment

within 15 calendar days, was the provider still subject to the Terms and Conditions? (Added

8/30/2021)

Yes. If the provider did not return the payment within 15 calendar days of rejecting the

payment in the attestation portal, the provider would have been considered to have accepted the

payment and must abide by the Terms and Conditions associated with the distribution. The

government may pursue collection activity to collect the unreturned payment.

If a provider returned a Provider Relief Fund payment to HHS, must it also return any

accrued interest on the payment? (Modified 12/11/2020)

Yes, for Provider Relief Fund payments that were held in an interest-bearing account, the

provider must return the accrued interest associated with the amount being returned to HHS.

However, if the funds were not held in an interest-bearing account, there is no obligation for the

provider to return any additional amount other than the Provider Relief fund payment being

returned to HHS. HHS reserves the right to audit Provider Relief Fund recipients in the future to

ensure that payments that were held in an interest-bearing account were subsequently returned

with accrued interest.

To return accrued interest, visit pay.gov. On the webpage, locate “Find an agency,” and select

“Health and Human Services (HHS) Program Support Center HQ.” Verify that the description

is “PSC HQ Payment” and form number is “HHSHQ,” then click continue. You will then need

to complete the following steps:

Step 1: Preview the form, then click “Continue.”

Step 2: Indicate whether you are completing on behalf of an individual or business and enter

the following information.

Business Name Field: Legal name of organization that received the payment

Invoice or Ticket Number Field: “HHS-COVID-Interest”

Contract/Agreement Number Field: Tax Identification Number (TIN) of organization

or provider that received the payment

Point of contact: Business contact information

Payment Amount: (The payment amount must match the interest earned on the payment

received.)

Step 3: Verify the interest return payment amount and select to pay by ACH or debit/credit

card, then select “Continue.”

Step 4: Enter the required information to complete the payment, then select “Review and

Submit.”

Step 5: Ensure that all information is correct and select “Submit.”

How should a provider return a payment it received via check? (Modified 10/28/2020)

If the provider received a payment via check and had not yet deposited it, destroy, shred, or

securely dispose of it. If the provider had already deposited the check, mail a refund check for the

full amount, payable to “UnitedHealth Group” to the address below via United States Postal

Service (USPS); mailing services such as FedEx and UPS cannot be used with this PO box.

Please list the check number from the original Provider Relief Fund check in the memo. Mail a

refund check for the full amount payable to “UnitedHealth Group” to the address below.

UnitedHealth Group

Attention: Provider Relief Fund

PO Box 31376

Salt Lake City, UT 84131-0376

February 16, 2024

8

How did a provider who received an electronic payment return funding if their financial

institution did not allow them to return the payment electronically? (Added 5/12/2020)

Contact UnitedHealth Group’s Provider Support Line at (866) 569-3522 (for TTY, dial 711).

Provider Relief Fund Terms and Conditions

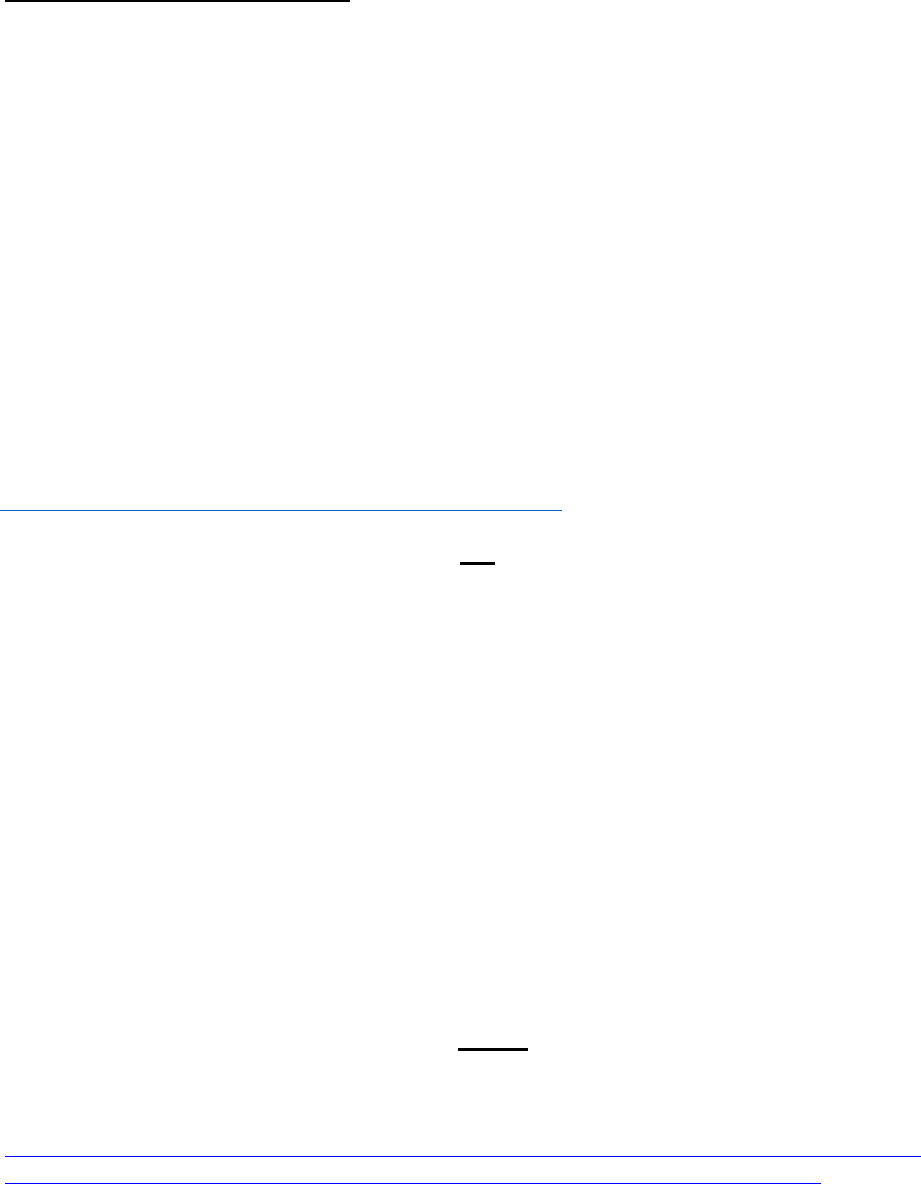

Was there a set period of time in which providers must use the payments to cover

allowable expenses or lost revenues attributable to COVID-19? (Modified 2/16/2024)

Yes. PRF and ARP Rural recipients must use payments for eligible expenses, including services rendered during

the period of availability, as outlined in Table 1 below. PRF and ARP Rural recipients may also use payments

for lost revenues attributable to COVID-19 incurred within the period of availability, but only up to June 30,

2023, the end of the quarter in which the COVID-19 Public Health Emergency ends.

The period of availability of funds was based on the date the payment was received. The payment was received

on the deposit date for automated clearing house (ACH) payments or the check cashed date. Providers must

follow their basis of accounting (e.g., cash, accrual, or modified accrual) to determine expenses.

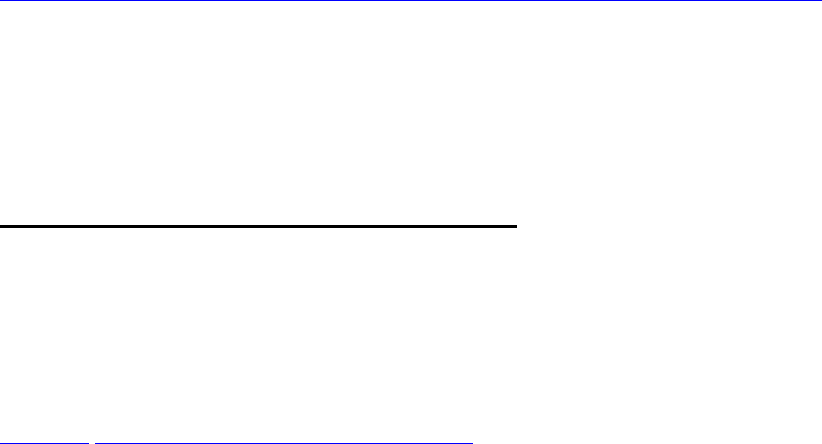

Period

Payment Received

Period

Period of

Availability for

Eligible Expenses

Period of

Availability for Lost

Revenues

Reporting Time

Period

1

April 10, 2020, to June

30, 2020

January 1, 2020, to

June 30, 2021

January 1, 2020, to

June 30, 2021

July 1, 2021, to

September 30, 2021

2

July 1, 2020, to

December 31, 2020

January 1, 2020, to

December 31, 2021

January 1, 2020, to

December 31, 2021

January 1, 2022, to

March 31, 2022

3

January 1, 2021, to

June 30, 2021

January 1, 2020, to

June 30, 2022

January 1, 2020, to

June 30, 2022

July 1, 2022, to

September 30, 2022

4

July 1, 2021, to

December 31, 2021

January 1, 2020, to

December 31, 2022

January 1, 2020, to

December 31, 2022

January 1, 2023, to

March 31, 2023

5

January 1, 2022, to

June 30, 2022

January 1, 2020, to

June 30, 2023

January 1, 2020, to

June 30, 2023

July 1, 2023, to

September 30, 2023

6

July 1, 2022, to

December 31, 2022

January 1, 2020, to

December 31, 2023

January 1, 2020, to

June 30, 2023

January 1, 2024, to

March 31, 2024

7

January 1, 2023, to

June 30, 2023

January 1, 2020, to

June 30, 2024

January 1, 2020, to

June 30, 2023

July 1, 2024, to

September 30, 2024

Provider Relief Fund recipients must use payments only for eligible expenses, including services

rendered, and lost revenues attributable to coronavirus, incurred by the end of the Period of

Availability that corresponded to the Payment Received Period. Providers were required to

maintain supporting documentation that demonstrated that costs were incurred during the Period

of Availability, as required under the Terms and Conditions. However, providers were not

required to submit that documentation when reporting. Providers must promptly submit copies of

such supporting documentation upon the request of the Secretary of HHS. Examples of costs

incurred for an entity using accrual accounting, during the Period of Availability include:

February 16, 2024

9

• Services that were received

• Renovation or construction that was completed

• Tangible property ordered, but need not have been delivered

For purchases of tangible items made using PRF payments, the purchase did not need to be in the

provider’s possession (i.e., back ordered PPE, ambulance, etc.) to be considered an eligible

expense but the costs must have been incurred by the end of the Period of Availability.

Providers must follow their basis of accounting (e.g., cash, accrual, or modified accrual) to

determine expenses. For projects that are a bundle of services and purchases of tangible items

that cannot be separated, such as capital projects, construction projects, or alteration and

renovation projects, the project costs cannot be reimbursed using Provider Relief Fund

payments unless the project was fully completed by the end of Period of Availability associated

with the Payment Received Period.

Recipients may use payments for eligible expenses or lost revenues incurred prior to receipt of

those payments (i.e., pre-award costs) so long as the were to prevent, prepare for, and respond to

coronavirus. However, HHS expects it would be highly unusual for providers to have incurred

eligible expenses or lost revenues before January 1, 2020. Additionally, the opportunity to apply

Provider Relief Fund payments (excluding the Nursing Home Infection Control Distribution) and

ARP Rural payments for lost revenues will be available up to June 30, 2023, the end of the quarter

in which the COVID-19 Public Health Emergency ends.

HHS reserves the right to audit Provider Relief Fund recipients now or in the future, and may

pursue collection activity to recover any Provider Relief Fund payment amounts that have not

been supported by documentation or payments not used in a manner consistent with program

requirements or applicable law. All payment recipients must have attested to the Terms and

Conditions, which required maintaining documentation to substantiate that these funds were

used for health care-related expenses or lost revenues attributable to coronavirus.

What financial transactions are Reporting Entities required to report in order to satisfy the

requirement in the Terms and Conditions for Phase 4 that recipients must notify HHS of a

merger with or acquisition of any other health care provider during the Payment Received

Period within the Reporting Time Period? (Added 12/9/2021)

The Terms and Conditions for Phase 4 required that recipients that received payments greater than

$10,000 notify HHS during the applicable Reporting Time Period of any mergers with or

acquisitions of any other health care provider that occurred within the relevant Payment

Received Period. HRSA considered changes in ownership, mergers/acquisitions, and

consolidations to be reportable events.

If a merger or acquisition was planned before receiving Phase 4 General Distribution

payments, will health care providers still need to report these activities? (Modified

12/9/2021)

If a Reporting Entity that received a Phase 4 General Distribution payment underwent a merger

or acquisition during the Payment Received Period, as described in the the Reporting Entity must

report the merger or acquisition during the applicable Reporting Time Period.

What type of review will HRSA do after a merger or acquisition has been reported by

recipients of a Phase 4 General Distribution payment? (Modified 12/9/2021)

If a Reporting Entity that received a Phase 4 General payment indicates when they report on the

use of funds that they have undergone a merger or acquisition during the applicable Payment

February 16, 2024

10

Received Period, this information will be a component that is factored into whether an entity is

audited.

Does HHS intend to recover any payments made to providers not associated with specific

claims for reimbursement, such as the General or Targeted Distribution payments?

(Modified 10/20/2021)

The Provider Relief Fund Terms and Conditions required that recipients be able to demonstrate

that lost revenues or expenses attributable to coronavirus, excluding expenses and losses that have

been reimbursed from other sources or that other sources are obligated to reimburse, meet or

exceed total payments from the Provider Relief Fund. Provider Relief Fund payment amounts that

have not been fully expended on health care expenses or lost revenues attributable to

coronavirus by the deadline to use funds that corresponds to the Payment Received Period must

be returned to HHS. The Provider Relief Fund Terms and Conditions and applicable legal

requirements authorized HHS to audit Provider Relief Fund recipients now or in the future to

ensure that program requirements are met. Provider Relief Fund payments that were made

incorrectly, or exceed lost revenues or expenses due to coronavirus, or do not otherwise meet

applicable legal and program requirements must be returned to HHS, and HHS is authorized to

recover these funds.

What should providers do if they had remaining Provider Relief Fund payments that they

cannot expend on allowable expenses or lost revenues by the relevant deadline? (Modified

10/20/2021)

Providers that had Provider Relief Fund payments that they cannot expend on allowable

expenses or lost revenues by the deadline to use funds that corresponds to the Payment Received

Period, as outlined in the Post-Payment Notice of Reporting Requirements, will return this

money to HHS. The Provider Relief Fund Terms and Conditions and legal requirements

authorize HHS to audit Provider Relief Fund recipients now or in the future to ensure that

program requirements are met. HHS is authorized to recover any Provider Relief Fund amounts

that were made incorrectly or exceed lost revenues or expenses due to coronavirus, or do not

otherwise meet applicable legal and program requirements.

What oversight and enforcement mechanisms did HHS use to ensure providers meet the

Terms and Conditions of the Provider Relief Fund? (Modified 10/20/2021)

Providers receiving payments from the Provider Relief Fund must comply with the Terms and

Conditions and applicable legal and program requirements. Failure by a provider that received a

payment to comply with any term or condition can result in action by HHS to recover some or all of the

payment. Per the Terms and Conditions, all recipients were required to submit documents to

substantiate that these funds were used for health care-related expenses or lost revenues attributable to

coronavirus, and that those expenses or lost revenues were not reimbursed from other sources and

other sources were not obligated to reimburse them. HHS monitored the funds distributed, and

oversaw payments to ensure that Federal dollars were used in accordance with applicable legal and

program requirements. In addition, the HHS Office of the Inspector General fights fraud, waste and

abuse in HHS programs, and may review these payments.

What if my payment was greater than expected or received in error? (Modified

10/14/2021) If HHS identified a payment made incorrectly, HHS recovered the amount paid

incorrectly or overpaid. If a provider received a payment that was greater than expected and

believed the payment was made incorrectly, the provider should contact the Provider Support

Line at (866) 569-3522 (for TYY, dial 711) and seek clarification.

February 16, 2024

11

Certain recipients are required to notify HHS of a merger with or acquisition of any other

health care provider during the Payment Received Period (as defined in the Provider Relief

Fund Post Payment Notice of Reporting Requirements). How will recipients report this

information to HHS/HRSA? (Added 9/29/2021)

To streamline the process and minimize provider burden, this information will be collected in the

Provider Relief Fund Reporting Portal as part of the regular reporting process. Additional

reporting information will be forthcoming for impacted providers.

If a provider cannot expend its Provider Relief Fund payment by the applicable deadline to

use funds, what was the deadline to return the unused funds to the government? (Modified

9/29/2021)

The provider must return any unused funds to the government within 30 calendar days after the

end of the applicable Reporting Time Period or any associated grace period.

Can providers use Provider Relief Fund distributions to repay payments made under the

CMS Accelerated and Advance Payment (AAP) Program? (Added 10/9/2020)

No, this was not a permissible use of Provider Relief Fund payments.

For how long are the Terms and Conditions of the Provider Relief Fund applicable? (Added

6/19/2020)

All recipients receiving payments under the Provider Relief Fund will be required to comply

with the Terms and Conditions. Some Terms and Conditions relate to the provider’s use of the

funds, and thus they apply until the provider has exhausted these funds. Other Terms and

Conditions apply to a longer time period, for example, regarding maintaining all records

pertaining to expenditures under the Provider Relief Fund payment for three years from the date

of the final expenditure.

What was the definition of individuals with possible or actual cases of COVID-19? (Added

5/6/2020)

Unless the payment was associated with specific claims for reimbursement for COVID-19

testing or treatment provided on or after February 4, 2020 to uninsured patients, under the

Terms and Conditions associated with payment, providers were eligible only if they provided or

provided after January 31, 2020, diagnoses, testing or care for individuals with possible or

actual cases of COVID-19. HHS broadly viewed every patient as a possible case of COVID-19.

Not every possible case of COVID-19 was a presumptive case of COVID 19.

What was the definition of Executive Level II pay level, as referenced in the Terms and

Conditions? (Added 5/29/2020)

The Terms and Conditions stated that none of the funds appropriated in this title shall be used to

pay the salary of an individual, through a grant or other mechanism, at a rate in excess of

Executive Level II. The salary limitation was based upon the Executive Level II of the Federal

Executive Pay Scale. Effective January 5, 2020, the Executive Level II salary is $197,300. For

the purposes of the salary limitation, the direct salary was exclusive of fringe benefits and

indirect costs. The limitation only applied to the rate of pay charged to Provider Relief Fund

payments and other HHS awards. An organization who received Provider Relief Fund payments

may pay an individual’s salary amount in excess of the salary cap with non-federal funds.

February 16, 2024

12

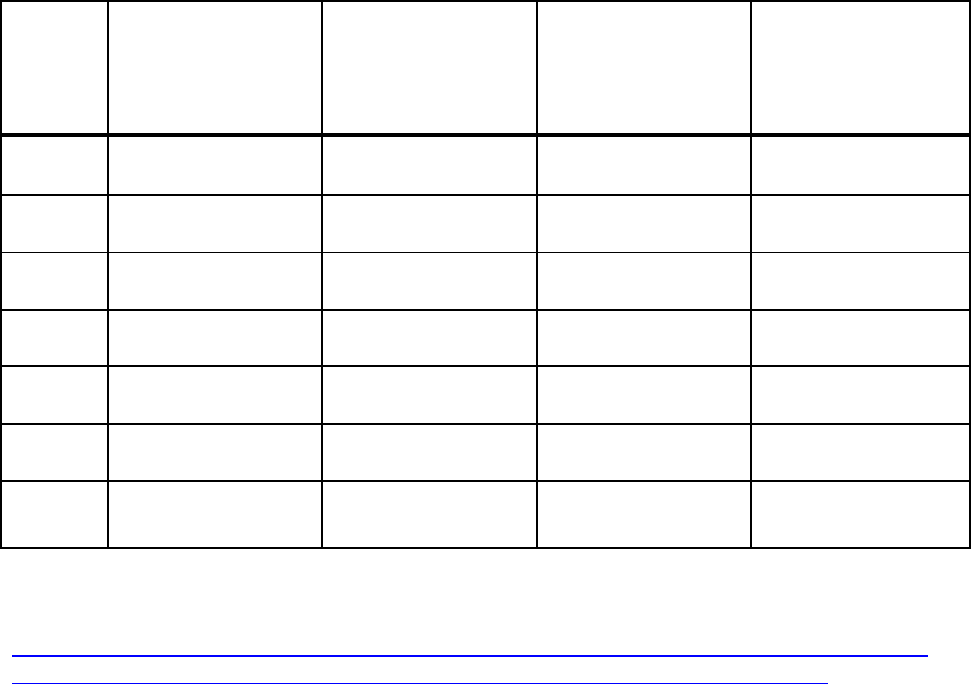

ARP Rural Payments Terms and Conditions

Was there a set period of time in which providers must use ARP Rural payments to

cover allowable expenses or lost revenues attributable to COVID-19? (Modified

2/16/2024i) Yes. Providers have at least 12 months, and as much as 18 months, based on the

payment received date, to control and use the payments for expenses and lost revenues

attributable to coronavirus incurred during the Period of Availability.

The payment was considered received on the deposit date for automated clearing house

(ACH) payments, or the check cashed date for all other payments.

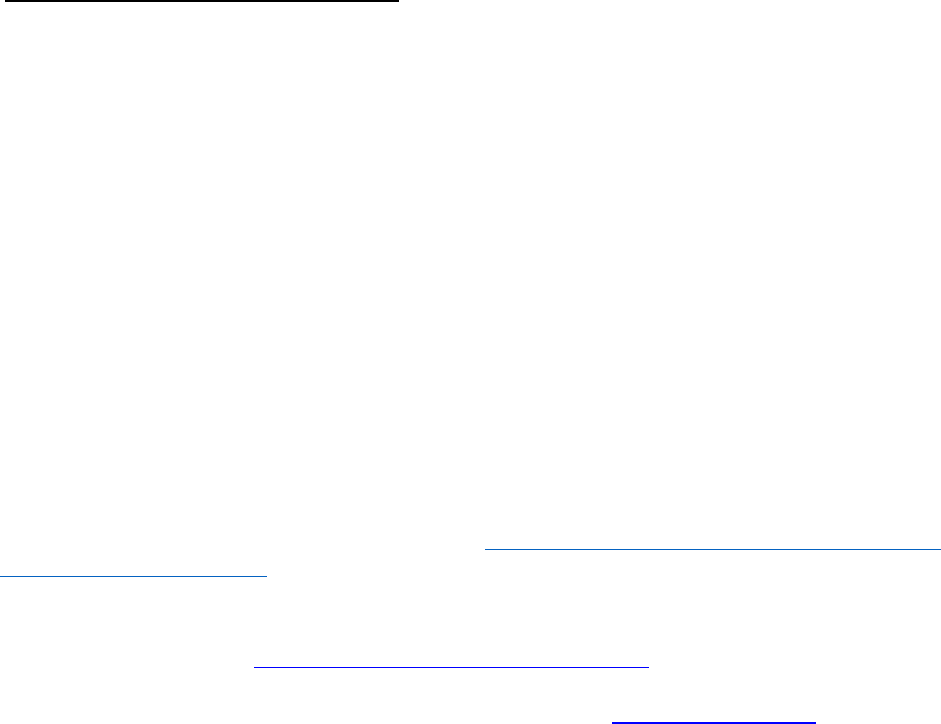

Period Payment Received Period

Period of Availability for Eligible

Expenses

Period 4

July 1, 2021 to December 31, 2021

January 1, 2020 to December 31, 2022

Period 5

January 1, 2022 to June 30, 2022

January 1, 2020 to June 30, 2023

Period 6 July 1, 2022 to December 31, 2022 January 1, 2020 to December 31, 2023

Period 7

January 1, 2023 to June 30, 2023

January 1, 2020 to June 30, 2024

Period

Payment Received Period

Period of Availability for Lost Revenues

Period 4

July 1, 2021 to December 31, 2021

January 1, 2020 to December 31, 2022

Period 5 January 1, 2022 to June 30, 2022 January 1, 2020 to June 30, 2023

Period 6

July 1, 2022 to December 31, 2022

January 1, 2020 to June 30, 2023

Period 7

January 1, 2023 to June 30, 2023

January 1, 2020 to June 30, 2023

ARP Rural recipients must use payments only for eligible expenses, including services rendered,

and lost revenues attributable to COVID-19, incurred by the end of the Period of Availability that

corresponds to the Payment Received Period. HRSA began distributing ARP Rural

payments on November 23, 2021. Providers were required to maintain supporting

documentation that demonstrated that costs were incurred during the Period of Availability, as

required under the Terms and Conditions. However, providers were not required to submit that

documentation when reporting. Providers must promptly submit copies of such supporting

documentation upon the request of the Secretary of HHS. Examples of costs incurred for an entity

using accrual accounting, during the Period of Availability include:

• Services that were received

• Renovation or construction that was completed

• Tangible property ordered, but need not have been delivered

For purchases of tangible items made using ARP Rural payments, the purchase did not need to be

in the provider’s possession (i.e., back ordered PPE, ambulance, etc.) to be considered an eligible

expense but the costs must be incurred by the end of the Period of Availability.

Providers must follow their basis of accounting (e.g., cash, accrual, or modified accrual) to

determine expenses. For projects that were a bundle of services and purchases of tangible items

that cannot be separated, such as capital projects, construction projects, or alteration and

renovation projects, the project costs cannot be reimbursed using Provider Relief Fund payments

unless the project was fully completed by the end of Period of Availability associated with the

Payment Received Period.

February 16, 2024

13

Recipients may use payments for eligible expenses or lost revenues incurred prior to receipt of

those payments (i.e., pre-award costs) so long as they were to prevent, prepare for, and respond

to coronavirus. Additionally, the opportunity to apply Provider Relief Fund payments

(excluding the Nursing Home Infection Control Distribution) and ARP Rural payments for lost

revenues were available up to June 30, 2023, the end of the quarter in which the COVID-19 Public

Health Emergency ended.

HHS reserved the right to audit Provider Relief Fund recipients now or in the future, and may

pursue collection activity to recover any ARP Rural payment amounts that have not been

supported by documentation or payments not used in a manner consistent with program

requirements or applicable law. All payment recipients must have attested to the Terms and

Conditions, which required maintaining documentation to substantiate that these funds were used

for health care-related expenses or lost revenues attributable to COVID-19.

What financial transactions were Reporting Entities required to report in order to satisfy

the requirement in the Terms and Conditions for ARP Rural payments that recipients

must notify HHS of a merger with or acquisition of any other health care provider during

the Payment Received Period within the Reporting Time Period? (Modified 12/9/2021)

The Terms and Conditions for ARP Rural payments required that recipients that received

payments greater than $10,000 notify HHS during the applicable Reporting Time Period of any

mergers with or acquisitions of any other health care provider that occurred within the Payment

Received Period. HRSA considered changes in ownership, mergers/acquisitions, and

consolidations to be reportable events.

If a merger or acquisition was planned before receiving ARP Rural payments, will health

care providers still need to report these activities? (Modified 12/9/2021)

If a Reporting Entity that received an ARP Rural payment undergoes a merger or acquisition

during the Payment Received Period, the Reporting Entity must report the merger or acquisition

during the applicable Reporting Time Period.

What type of review will HRSA do after a merger or acquisition has been reported by

recipients of an ARP Rural payment? (Modified 12/9/2021)

If a Reporting Entity that received an ARP Rural payment indicates when they report on the use

of funds that they have undergone a merger or acquisition during the applicable Payment

Received Period, this information will be a component that is factored into whether an entity is

audited.

Can an applicant allocate ARP Rural payments to its non-rural subsidiaries? (Added

9/29/2021)

No. As required by the Terms and Conditions, control and use of the ARP Rural payment must

be delegated to the provider associated with the billing TIN that was eligible for the ARP Rural

payment. The provider cannot not transfer or allocate the ARP Rural payment to another entity

not associated with the billing TIN.

What can ARP Rural payment recipients use funds for?

(Added 9/29/2021)

Payment recipients must have certified that the payment were only be used to prevent, prepare

for, and respond to COVID-19, and that the payment shall reimburse the Recipient only for

health care related expenses or lost revenues that were attributable to coronavirus not

reimbursed by other sources or that other sources are obligated to reimburse.

February 16, 2024

14

Lost revenues attributable to the coronavirus may include other income not derived from

delivery of health care services that was customarily used to support the delivery of health care

services by the recipient. Examples include, but were not limited to, decreases in tax revenue

and non-federal, government grant funding. In accounting for such lost revenues, the recipient

must document the historical sources and uses of these revenues. For more information about

lost revenues, please review HRSA’s Lost Revenues Guide available at

https://www.hrsa.gov/sites/default/files/hrsa/provider-relief/prf-lost-revenues-guide.pdf.

Additionally, expenditures to prevent, prepare for, and respond to coronavirus may include those

incurred expenses necessary to maintain health care delivery capacity by the recipient or to

increase health care delivery capacity in the future as informed by community health needs. This

may include outreach and education about the vaccine for the provider’s staff, as well as the

general public.

Ownership Structures and Financial Relationships

If, as a result of the sale of a healthcare facility, the TIN that received a Provider Relief Fund

payment is no longer providing health care services as of January 31, 2020, is it required to

return the payment? (Modified 7/1/2021)

Yes. If, as a result of the sale of a healthcare facility, the TIN that received a Provider Relief

Fund payment did not provide diagnoses, testing, or care for individuals with possible or actual

cases of COVID-19 on or after January 31, 2020, the provider must reject the payment. The

Provider Relief Fund Payment Attestation Portal guides providers through the attestation

process to reject the attestation and return the payment to HRSA.

Can a parent organization transfer General Distribution Provider Relief Fund payments to

its subsidiaries? (Modified 3/31/2021)

Yes, a parent organization can accept and allocate General Distribution funds at its discretion to

its subsidiaries, as long as the Terms and Conditions were met. Eligible health care entities,

including those that were parent organizations must substantiate that these funds were used for

health care-related expenses or lost revenue attributable to COVID-19, and that those expenses

or losses were not reimbursed from other sources and other sources were not obligated to

reimburse them.

Can a parent organization allocate Provider Relief Fund General Distribution to

subsidiaries that do not report income under their parent’s employee identification number

(EIN)? (Modified 3/31/2021)

Yes, as long as the Terms and Conditions were met. The parent organization (an eligible health

care entity) must substantiate that these funds were used for health care-related expenses or lost

revenue attributable to COVID-19, and that those expenses or losses were not reimbursed from

other sources and other sources were not obligated to reimburse them.

Must a parent organization that received a Provider Relief Fund Targeted Distribution on

behalf of a subsidiary in which it is has a direct ownership relationship remit the payment

to the subsidiary? (Modified 2/16/2024)

No. The parent organization may allocate the Targeted Distribution to any of its subsidiaries that

were eligible health care providers in accordance with the Consolidated Appropriations Act,

2021.

February 16, 2024

15

Can a parent organization with a direct ownership relationship with a subsidiary that

received a Provider Relief Fund Targeted Distribution payment control and allocate that

Targeted Distribution payment among other subsidiaries that were not themselves eligible

and did not receive a Targeted Distribution (i.e., Skilled Nursing Facility, Safety Net

Hospital, Rural, Tribal, High Impact Area) payment? (Modified 2/16/2024)

Yes, in accordance with the Consolidated Appropriations Act, 2021. The parent organization

may allocate the Targeted Distribution up to its pro rata ownership share of the subsidiary to any

of its other subsidiaries that were eligible health care providers. To determine whether an entity

is the parent organization, the entity must follow the methodology used to determine a subsidiary

in their financial statements. If none, the entity with a majority ownership (greater than 50

percent) will be considered the parent organization.

Auditing and Reporting Requirements

Were Provider Relief Fund payments to commercial (for-profit) organizations subject to

Single Audit in conformance with the requirements under 45 CFR 75 Subpart F? (Modified

2/16/2024)

Commercial (for-profit) organizations that expend $750,000 or more in annual awards have two

options under 45 CFR §75.216(d) and §75.501(i): 1) a financial related audit of the award or

awards conducted in accordance with Government Auditing Standards; or 2) an audit in

conformance with the requirements of 45 CFR 75 Subpart F (single or program-specific audit).

Non-Federal entities that expended $750,000 or more must have a single audit conducted in

accordance with §75.514 except when it elects to have a program-specific audit conducted in

accordance with §75.501(c).

To determine whether an audit in accordance with 45 CFR 75 Subpart F is required (i.e., annual total

awards expended are $750,000 or more), Provider Relief Fund and American Rescue Plan Rural

Distribution (93.498) and HRSA COVID-19 Claims Reimbursement for the Uninsured Program and

the COVID-19 Coverage Assistance Fund (93.461) must be included. Additionally, the Provider

Relief Fund payments included in the $750,000 was based on when the payment was received, the

specific period of availability, and aligned with the Provider Relief Fund Reporting Portal timelines.

Review the applicable Compliance Supplement at https://www.hrsa.gov/provider-relief/reporting-

auditing/audit-requirements for detailed information.

Commercial organizations subject to single audit requirements that received Provider Relief

Fund payments are highly encouraged to submit their audits electronically to the Commercial

Audit Reporting Portal at https://commercialaudit.hrsa.gov/s/login/. Commercial organizations

subject to single audit requirements not registered in the PRF Reporting Portal must submit their

Can my organization get an extension to the submission due date for Single Audits

conducted under 45 CFR Part 75? (Modified 2/16/2024)

HRSA followed federal guidelines set by the Office of Management and Budget (OMB) and did

not set requirements or provided extensions for the submission of the Single Audits. The due date

for an Audit was the earlier of 30 days after receipt of the auditor’s report(s), or 9 months after

the end of the audit period, which was likely your organization’s fiscal year end. (45 CFR 75.512).

February 16, 2024

16

OMB granted on October 20, 2022, under the Stafford Act, a six-month extension for all

single audits that covered recipients in the following areas declared as major disaster-

affected areas impacted by Hurricanes Fiona and Ian as well as the record storm occurring in

the following areas: Puerto Rico (September 18, 2022), Alaska (September 23, 2022),

Florida (September 29, 2022), South Carolina (September 29, 2022) and North Carolina

(October 1, 2022). Consistent with these declarations, OMB has granted a six-month

extension for all single audits that cover recipients in the affected areas and have due dates

between September 18, 2022 and December 31, 2022.

Additionally, OMB waived the 30-day deadline for any 2023 submissions with fiscal periods ending

between January 1, 2023 and September 30, 2023 and any 2022 submissions with fiscal periods ending

between January 1, 2022 and October 31, 2022. Requirement 2 CFR 200.512(1) stating that single

audits were due 30 days after receipt of the auditor’s report(s) was waived and considered on time if

they were submitted within nine months after their fiscal period end date.

If you have questions about this extension or want to inform HRSA you will be taking advantage

of this flexibility, please email HRSA's Division of Financial Integrity at [email protected]v.

If you have questions about the Single Audit for Provider Relief Fund, please email your

questions to Pr[email protected].

If a Reporting Entity had unallowable costs identified during an audit, can these

unallowable or offset costs be accounted for in a subsequent reporting period?

(Modified 10/18/2022)

Yes. Due to the cumulative nature of lost revenues, any lost revenues adjustments may be made

in subsequent reporting periods. If an unallowable expense was “replaced” by unreimbursed lost

revenues for use of funds purposes, the Reporting Entity should ensure that the lost revenues

reported in subsequent reports are deducted to avoid “double dipping.” Reporting Entities should

maintain appropriate documentation to support the deduction from the report.

If a Reporting Entity received a finding during an audit (including Single Audit), may it

amend its previously submitted report to resolve the finding? (Modified 2/16/2024)

No. The Reporting Entity may not amend its report after the reporting period has passed. However,

providers have the following options available:

• For providers required to report in subsequent reporting periods and that chooses to replace its

unallowable expense with its unreimbursed lost revenues in the reporting period in question.

o Providers would update their previously entered lost revenues information in the next

available reporting period.

o Providers are required to enter a justification for the change with a description

(including the notation that they were making this change to replace an unallowable

expense as part of their audit finding corrective action plan, adding the audit and/or

finding number).

• For providers that were not required to report in subsequent reporting period and chose to

replace its unallowable expenses with its unreimbursed lost revenues in the reporting period

in question.

In the corrective action plan, the provider would indicate that the unallowable expense was “replaced”

by unreimbursed lost revenues.

February 16, 2024

17

If a Reporting Entity had unallowable costs identified during an audit, can auditors

replace the unallowable costs (e.g. questioned costs) with unreimbursed lost revenues

noted in the submitted report being audited? (Added 2/16/2024)

No. Questioned cost per 45 CFR §75.2, means a cost that was questioned by the auditor because

of an audit finding:

1) Which resulted from a violation or possible violation of a statute, regulation, or the terms

and conditions of a Federal award, including for funds used to match Federal funds;

2) Where the costs, at the time of the audit, are not supported by adequate documentation; or

3) Where the costs incurred appear unreasonable and do not reflect the actions a prudent

person would take in the circumstances.

It was the responsibility of the Reporting Entity to address questioned costs through its corrective action

plan and HRSA to evaluate the Reporting Entity’s corrective action plan to determine its

appropriateness. Auditors must associate questioned costs with the specific award number(s) (AL) in the

audit finding detail and must not perform any offset, which results in the reduction of questioned costs.

I am having trouble submitting my commercial audit report in the Commercial Audit

Reporting Portal. (Added 2/16/2024)

The Provider Relief Bureau (PRB) Commercial Audit Reporting Portal had two user groups: 1) Provider

and 2) Audit Report Submitter.

1) The "Provider" user group contained all Provider Relief Fund (PRF) Reporting Portal users that

registered on behalf of their respective commercial entities. Providers used the same login

credentials (i.e., username, password, two-factor authentication) as the PRF Reporting Portal to

access the portal.

2) The "Audit Report Submitter" user group contained users created by the Provider user group to

allow audit report submissions on their commercial entity's behalf.

Commercial entities can only submit their audit reports using the Audit Report Submitters user group

login credentials. The Provider user group must create an Audit Report Submitter user account to

submit an audit report. Instructions to create an Audit Report Submitter are located in Section 3.6 STEP

2 – MANAGE AUDIT REPORT SUBMITTER ASSIGNMENT. Once the Audit Report Submitter user

account was created, the Audit Report Submitter user can follow the instructions in Section 4 USING

THE PORTAL – AUDIT REPORT SUBMITTER USER GROUP EXPERIENCE to submit an audit

report in the portal. Note, an Audit Report Submitter user profile must be associated with an email

address not used previously for PRF reporting purposes. A different email address must be used

to successfully add the Audit Report Submitter, which would then allow for audit report

submittal.

February 16, 2024

18

Do commercial organizations that did not submit their audit through the Federal Audit

Clearinghouse get an extension to the submission due date for their audit? (Modified

2/16/2024)

HRSA followed federal guidelines set by the Office of Management and Budget (OMB).

Both commercial organizations and non-federal entities are granted a six-month extension to the

submission of audits that have a fiscal-year end through June 30, 2021. As a reminder, audits are

due 30 calendar days after receipt of the audit report or nine months after the end of the audit period

– whichever is earlier. On March 19, 2021, the Office of Management and Budget (OMB) Memo

(M-21-20) extended the deadline for Single Audit submissions to six months beyond the normal

due date, and on October 28, 2021, HHS granted the same extension to commercial

organizations.

OMB granted on October 20, 2022, under the Stafford Act, a six-month extension for all

single audits that cover recipients in the following areas declared as major disaster-affected

areas impacted by Hurricanes Fiona and Ian as well as the record storm occurring in Alaska:

Puerto Rico (September 18, 2022), Alaska (September 23, 2022), Florida (September 29,

2022), South Carolina (September 29, 2022) and North Carolina (October 1, 2022).

Consistent with these declarations, OMB has granted a six-month extension for all single

audits that cover recipients in the affected areas and have due dates between September 18,

2022 and December 31, 2022. HHS granted the same extension to commercial organization.

Additionally, OMB waived the 30-day deadline for any 2023 submissions with fiscal periods

ending between January 1, 2023 and September 30, 2023 and any 2022 submissions with fiscal

periods ending between January 1, 2022 and October 31, 2022.

Requirement 2 CFR

§200.512(1) stating that single audits were due 30 days after receipt of the auditor’s report(s) was

waived and considered on time if they were submitted within nine months after their fiscal period

end date.

If you have questions about this extension or want to inform HRSA you will be taking advantage

of this flexibility, please email HRSA's Division of Financial Integrity at [email protected].

If you have questions about the audit in accordance with 45 CFR §75.501 for Provider Relief Fund

payments, please email your questions to ProviderReliefContact@hrsa.gov.

A non-profit corporation has multiple subsidiaries, including a for-profit subsidiary, that

were consolidated for financial reporting purposes. Can the Single Audit of the non-

profit corporation include the expenditures of federal awards of the for-profit subsidiary?

(Added 9/13/2021)

Yes, the non-profit corporation can include the expenditures of federal awards of its for-profit

subsidiary in its Single Audit. Federal regulations at 45 CFR §75.501 or “Uniform

Administrative Requirements, Cost Principles, and Audit Requirements for HHS Awards”

(Uniform Guidance) permitted a for-profit subsidiary to be included in the Single Audit, as long

as the for-profit subsidiary’s operations were included in the consolidated financial statements

and program expenditures were included in the Schedule of Expenditure of Federal Awards

(SEFA). The inclusion of the for-profit subsidiary in the consolidated entity’s Single Audit

would have met the for-profit entity’s responsibility for an audit under 45 CFR §75.501(i).

February 16, 2024

19

A for-profit corporation had multiple subsidiaries that were consolidated for financial

reporting purposes, and some of the subsidiaries also reported separately. Can the for-

profit entity fulfill the 45 CFR §75.501 audit requirements by having one financial-related

audit of all HHS awards in accordance with Government Auditing Standards that

incorporates all entities that are consolidated under Generally Accepted Accounting

Principles (GAAP)? (Added 9/13/2021)

Yes, the for-profit entity can have one financial-related audit of all HHS awards that incorporates

all entities. 45 CFR §75.501(i) audit requirements permit this approach.

Multiple for-profit entities under common control issue combined financial statements.

Can each of the for-profit entities fulfill the 45 CFR §75.501 audit requirements by having

one financial-related audit of all HHS awards in accordance with Government Auditing

Standards that incorporates each of the entities? (Added 9/13/2021)

Yes, multiple for-profit entities under common control that issue combined financial statements

can have one financial-related audit of all HHS awards that incorporated each of the entities. 45

CFR §75.501(i) audit requirements permit this approach.

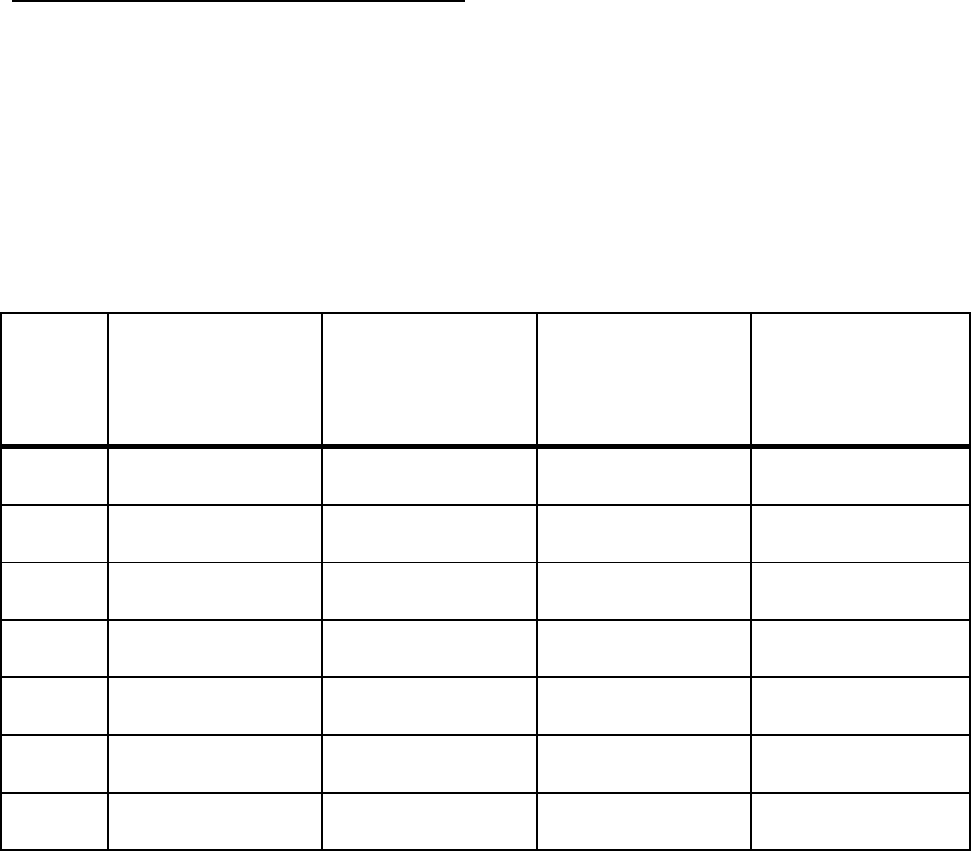

When should Provider Relief Fund expenditures and/or lost revenue be reported on a for-

profit entity’s Schedule of Expenditures of Federal Awards (SEFA) or other schedules

prepared for the financial-related audit option conducted in accordance with Government

Auditing Standards? (Added 8/30/2021)

Similar to non-federal entities, for-profit entities included Provider Relief Fund expenditures

and/or lost revenues on their SEFAs or other schedules for fiscal year ends (FYEs) ending on or

after June 30, 2021.

How did a for-profit entity determine the amount of expenditures and/or lost revenues to

report on its SEFA or other schedules prepared for the financial-related audit option

conducted in accordance with Government Auditing Standards (for FYEs ending on or

after June 30, 2021)? (Modified 2/16/2024)

Similar to non-federal entities, a for-profit entity’s SEFA (or other schedules) was linked to its

report submissions to the Provider Relief Fund Reporting Portal. Therefore, the timing of

reporting of Provider Relief Fund payments on the SEFA (or other schedules) were as follows:

•

For a FYE of June 30, 2021, and through FYEs of December 30, 2021, recipients were

to report on the SEFA, the total expenditures and/or lost revenues from the PRF

Reporting Portal Period 1 PRF report submission.

•

For a FYE of December 31, 2021, and through FYEs of June 29, 2022, recipients were

to report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 1 and Period 2 PRF report submissions.

•

For a FYE of June 30, 2022, and through FYEs of December 30, 2022, recipients were

to report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 2 and Period 3 PRF report submission.

•

For a FYE of December 31, 2022, and through FYEs of June 29, 2023, recipients were

to report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 3 and Period 4 PRF report submissions.

•

For a FYE of June 30, 2023, and through FYEs of December 30, 2023, recipients were

to report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 4 and Period 5 PRF report submission.

February 16, 2024

20

•

For a FYE of December 31, 2023, and through FYEs of June 29, 2024, recipients were

to report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 5 and Period 6 PRF report submissions.

For FYEs on or after June 30, 2024, reporting guidance for the SEFA or other schedules will be

provided at a later date.

When should Provider Relief Fund expenditures and/or lost revenue be reported on a non-

federal entity’s Schedule of Expenditures of Federal Awards (SEFA)? (Modified 2/16/2024)

Non-federal entities must begin including Provider Relief Fund expenditures and/or lost

revenues on their SEFAs for fiscal year ends (FYEs) on or after June 30, 2021. Please refer to

the Office of Management and Budget Compliance Supplement, available at

https://www.whitehouse.gov/wp- content/uploads/2021/08/OMB-2021-Compliance-

Supplement_Final_V2.pdf, for additional information.

How will a non-federal entity determine the amount of expenditures and/or lost revenues to

report on its SEFA for FYEs ending on or after June 30, 2021? (Modified 2/16/2024)

A non-federal entity’s SEFA reporting is linked to its report submissions to the Provider Relief

Fund (PRF) Reporting Portal. Therefore, the timing of SEFA reporting of PRF will be as

follows:

•

For a FYE of June 30, 2021, and through FYEs of December 30, 2021, recipients are to

report on the SEFA, the total expenditures and/or lost revenues from the PRF

Reporting Portal Period 1 PRF report submission.

•

For a FYE of December 31, 2021, and through FYEs of June 29, 2022, recipients are to

report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 1 and Period 2 PRF report submissions.

•

For a FYE of June 30, 2022, and through FYEs of December 30, 2022, recipients are

to report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 2 and Period 3 PRF report submission.

•

For a FYE of December 31, 2022, and through FYEs of June 29, 2023, recipients are to

report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 3 and Period 4 PRF report submissions.

•

For a FYE of June 30, 2023, and through FYEs of December 30, 2023, recipients are to

report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 4 and Period 5 PRF report submission.

•

For a FYE of December 31, 2023, and through FYEs of June 29, 2024, recipients are to

report on the SEFA, the total expenditures and/or lost revenues from both the PRF

Reporting Portal Period 5 and Period 6 PRF report submissions. For FYEs on or after

June 30, 2024, SEFA reporting guidance will be provided at a later date.

February 16, 2024

21

Will HHS provide guidance to certified public accountants and those organizations that

providers will rely on to perform audits? (Modified 2/16/2024)

The only guidance HHS provided to auditors was through the Office of Management and

Budget Compliance Supplement. Entities subject to Single Audit requirements can find

guidance in the applicable Compliance Supplement, which is available at

https://www.whitehouse.gov/omb/office-federal-financial-management/.

The applicable

AL numbers include 93.498 [Provider Relief Fund] and 93.461 [HRSA COVID- 19 Uninsured

Program].

Were Provider Relief Fund payments to non-Federal entities (states, localgovernments,

Indian tribes, institutions of higher education, and nonprofit organizations) subject to

Single Audit? (Modified 2/16/2024)

Provider Relief Fund General and Targeted Distribution payments (AL 93.498) and Uninsured

Testing and Treatment reimbursement payments (AL 93.461) to non-Federal entities are

Federal awards and must be included in determining whether an audit in accordance with 45

CFR Part 75, Subpart F is required (i.e., annual total federal awards expended are

$750,000 or more). Additionally, the Provider Relief Fund payments included in determining whether

an audit was required were based on when the payments were received, the specific period of

availability, and aligned with the Provider Relief Fund Reporting Portal timelines. Review the

applicable Compliance Supplement at https://www.hrsa.gov/provider-relief/reporting-auditing/audit-

requirements for detailed information.

Effective October 1, 2023, audit reports must be submitted through the new Federal Audit Clearinghouse

(FAC) hosted by the General Services Administration (GSA), including all single audits for entities with

2023 fiscal year end dates.

Audit data submitted by non-Federal entities in 2022 and prior will be available via the Census Bureau

through the end of 2023. Beginning January 2024, historic single audit data will be available on the new

FAC, and the Census Bureau will close down the distribution of historical data at that time. Visit

https://www.fac.gov/ for more information.

(Requirements for audit of payments to commercial organizations are discussed in a separate

question.)

Use of Funds

Can Reporting Entities continue to put Provider Relief Fund and/or ARP Rural payments

toward lost revenues attributable to coronavirus or COVID-19 once the Public Health

Emergency ends? (Modified 5/5/2023)

The opportunity to apply Provider Relief Fund payments (excluding the Nursing Home Infection

Control Distribution) and ARP Rural payments for lost revenues will be available up to June 30,

2023, the end of the quarter in which the COVID-19 Public Health Emergency ends.

How did a Reporting Entity determine whether an expense was eligible for reimbursement

through the Provider Relief Fund or ARP Rural Distribution? (Modified 5/5/2023)

To be considered an allowable expense under the Provider Relief Fund or ARP Rural

Distribution, the expense must be used to prevent, prepare for, and respond to coronavirus.

Provider Relief Fund and ARP Rural payments may also be used for lost revenues attributable to

the coronavirus up to June 30, 2023, the end of the quarter in which the COVID-19 Public

February 16, 2024

22

Health Emergency ends. Reporting Entities are required to maintain adequate documentation to

substantiate that these funds were used for health care-related expenses or lost revenues

attributable to coronavirus or COVID-19, and that those expenses or losses were not reimbursed

from other sources and other sources were not obligated to reimburse them.

Reporting Entities were not required to submit that documentation when reporting. Providers

were required to maintain supporting documentation which demonstrated that costs were

incurred during the Period of Availability. The Reporting Entity was responsible for ensuring

that adequate documentation was maintained.

How did cost-based reimbursement relate to my Provider Relief Fund and/or ARP Rural

payment? (Modified 10/27/2022)

Recipient must follow CMS instructions for completion of cost reports available at

https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/Paper-Based-Manuals-

Items/CMS021935.

Under cost-based reimbursement, the payer agreed to reimburse the provider for the costs

incurred in providing services to the insured population. If the full cost were reimbursed based

upon this method, there is nothing eligible to report as a Provider Relief Fund or ARP Rural

expense attributable to coronavirus because the expense was fully reimbursed by another source.

Provider Relief Fund and/or ARP Rural payments cannot be used to cover costs that were

reimbursed from other sources or that other sources are obligated to reimburse. Therefore, if

Medicare or Medicaid made a payment to a provider based on the provider’s Medicare or

Medicaid cost, such payment generally was considered to fully reimburse the provider for the

costs associated with providing care to Medicare or Medicaid patients and no payment from the

Provider Relief Fund or ARP Rural Distribution would be available for those identified Medicare

and Medicaid costs. Per its authorizing statutes, Provider Relief Fund resources may only be

used for allowable expenses and lost revenues attributable to coronavirus, and may only be

reimbursed once. Reporting Entities should work with their accountants and maintain

documentation demonstrating that any reported health care expenses that Provider Relief Fund

and/or ARP Rural payments were applied to were not reimbursed by any other source, or

obligated to be reimbursed by another source.

However, in cases where a ceiling is applied to the cost reimbursement, or the costs were not

reimbursed under cost-based reimbursement (such as costs for care to commercial payer

patients), and the reimbursed amount by Medicare or Medicaid does not fully cover the actual cost,

those non-reimbursed costs were eligible for reimbursement under the Provider Relief Fund or

ARP Rural Distribution.

Must HRSA Health Center Program-funded health centers and look-alikes fully draw down

Health Center Program COVID-19 Supplemental grant funding received from HRSA

before using Provider Relief Fund or ARP Rural payments for eligible expenses and lost

revenues attributable to coronavirus? (Modified 10/27/2022)

Yes, Health Center Program COVID-19 Grants awarded to FQHCs and FQHC Look-Alikes for

costs for expenses or losses that were potentially eligible for payments under the Provider Relief

Fund and/or ARP Rural Distribution would need to be fully drawn down before Provider Relief

Fund or ARP Rural payments could be used during the applicable period of availability. The

Provider Relief Fund and ARP Rural Distribution required that payments not be used to

reimburse expenses or lost revenues that have been reimbursed from other sources or that other

February 16, 2024

23

sources are obligated to reimburse. If FQHCs or FQHC Look-alikes have incurred expenses or

lost revenues attributable to coronavirus that these grant awards do not cover, they may use

Provider Relief Fund or ARP Rural payments towards those expenses or losses. Grant funding

may be awarded to support either broad or specific allowable uses, depending on the terms and

conditions of the award. Recipients must use grant funding awarded by HRSA for the purposes

(as budgeted) approved by HRSA. Should those costs also be eligible for payment under the

Provider Relief Fund or ARP Rural Distribution, a Health Center Program-funded health center

or look-alike must use their grant funds before utilizing Provider Relief Fund or ARP Rural

payments.

If rent or mortgages were paid during the applicable period of availability but staff worked

remotely, could those expenses be claimed as eligible expenses? (Modified 10/27/2022) Health

care-related operating expenses were limited to costs incurred to prevent, prepare for, and respond

to coronavirus. The amount of mortgage or rent eligible for Provider Relief Fund or ARP Rural

reimbursement was limited to that which was incurred to prevent, prepare for, and respond to

coronavirus or COVID-19. Providers are required to maintain documents to substantiate that these

funds were used for health care-related expenses attributable to coronavirus, and that those

expenses or losses were not reimbursed from other sources and other sources were not obligated

to reimburse them. The burden of proof is on the provider to ensure that documentation is

maintained to show that expenses are to prevent, prepare for, and respond to coronavirus.

If a Reporting Entity anticipated that it would receive coronavirus-related assistance, such

as from FEMA, but that assistance was not received, should that be accounted for in its

Provider Relief Fund and ARP Rural reporting? (Modified 10/27/2022)

Provider Relief Fund and ARP Rural payments may have been applied to expenses or lost

revenues attributable to coronavirus, after netting the other funds received or obligated to be

received which offset those expenses. If a provider submitted an application to FEMA, but had not

yet received the FEMA funds, the provider should not have reported the requested FEMA

amounts in the Provider Relief Fund and/or ARP Rural report. If FEMA funds were received

during the same Payment Received Period in which provider reported on use of Provider Relief

Fund and/or ARP Rural payments, the receipt and application of each payment type is required in

the Provider Relief Fund and/or ARP Rural reporting process. If an entity received a retroactive

payment from FEMA that overlapped with the period of availability, the entity must not use the

FEMA payment on expenses or lost revenues already reimbursed by Provider Relief Fund or ARP

Rural payments.

Must the Reporting Entity have been in receipt of purchases made using Provider Relief

Fund Payments and/or ARP Rural in order for the expense to be considered eligible for

reimbursement? (Modified 10/27/2022)

No. For purchases of tangible items made using Provider Relief Fund and/or ARP Rural

payments, the purchase does not need to be in the Reporting Entity’s possession (i.e.,

backordered personal protective equipment, capital equipment) to be considered an eligible

expense. However, the costs must have been incurred before the Deadline to Use Funds.

Providers must follow their basis of accounting (e.g., cash, accrual, or modified accrual) to

determine expenses.

Could providers have allocated parent overhead costs to the entities that received Provider

Relief Funds and/or ARP Rural? (Modified 10/27/2022)

Yes, providers that already had a cost allocation methodology in place at the time they received

February 16, 2024

24

funds, may allocate normal and reasonable overhead costs to their subsidiaries, which may be an

eligible expense if attributable to coronavirus or COVID-19 and not reimbursed from other

sources.

How would I have determined if expenses should be considered “expenses attributable to

coronavirus not reimbursed by other sources?” (Modified 10/27/2022)

Expenses attributable to coronavirus may include items such as supplies, equipment, information

technology, facilities, personnel, and other health care-related costs/expenses for the period of

availability. The classification of items into categories should align with how Provider Relief Fund

and/or ARP Rural payment recipients maintain their records. Providers can identify their expenses

attributable to coronavirus, and then offset any amounts received through other sources, such as

direct patient billing, commercial insurance, Medicare/Medicaid/Children’s Health Insurance

Program (CHIP); other funds received from the federal government, including the Federal