WHITE PAPER

FCPA 2023 Year In Review

Foreign Corrupt Practices Act (“FCPA”) enforcement continues to slowly rebound from

pre-pandemic levels. In 2023, the Department of Justice (“DOJ”) and the Securities and

Exchange Commission (“SEC”) resolved 13 corporate FCPA matters for $733million in

penalties, disgorgement, and interest. Meanwhile, the DOJ announced nine FCPA indict-

ments against individuals and, for the third year in a row, the SEC announced no individual

FCPA enforcement actions. DOJ and SEC leadership attributed their enforcement statis-

tics to the natural ebb and flow of FCPA cases and the lingering effects of the COVID-19

pandemic, and not due to any lack of focus on FCPA enforcement. Indeed, the Biden

administration continues to prioritize anticorruption enforcement, reiterating that fighting

corruption is a core national security interest.

This White Paper reviews 2023 FCPA enforcement, the DOJ’s enhanced incentives for

companies to voluntarily self-disclose FCPA issues, and other changes to corporate crim-

inal enforcement policies and guidance on corporate compliance programs.

January 2024

1

Jones Day White Paper

THERE WERE FIVE KEY HIGHLIGHTS FROM FCPA ENFORCEMENT IN 2023.

1

The number of corporate FCPA resolutions rebounded to pre-

pandemic levels, but the total amount of fines imposed has yet

to do the same. In 2023, the DOJ and the SEC resolved a total

of thirteen corporate FCPA cases, accounting for $733mil-

lion in penalties, disgorgement, and interest. Individual FCPA

enforcement activity continues to lag pre-pandemic levels. The

DOJ announced only nine indictments of individuals and no

plea agreements under the FCPA, and SEC resolved no FCPA

actions with individuals for the third year in a row.

2

The slow rebound in FCPA enforcement activity can be attrib-

uted to the lingering impact of the COVID-19 pandemic and

what may be a general reluctance on the part of companies

to voluntarily self-disclose to the DOJ and the SEC. Moving

forward, we anticipate that FCPA enforcement statistics will

continue to rebound, especially given the backlog of over 90

publicly announced DOJ and / or SEC FCPA investigations in

the pipeline.

3

The DOJ announced important revisions to its corporate

enforcement policies. Most significantly, in January, the

Criminal Division announced a new and narrow path for com-

panies with what the DOJ considers “aggravating circum-

stances” to receive a declination of prosecution and decrease

in fine amounts.

4

The DOJ announced additional guidance on corporate com-

pliance programs regarding the use of personal devices and

third-party messaging platforms to conduct company busi-

ness, how companies can use compensation incentives and

clawbacks to incentivize compliant behavior, and a focus on

the use of data analytics. These steps intend to further the

DOJ’s goal of elevating standards for corporate compliance

programs.

5

In other news, the DOJ announced an international anti-bribery

initiative and issued two new FCPA opinions, President Biden

signed a law addressing the demand side of bribery, and

the SEC issued a record-breaking $279million whistleblower

award in an FCPA case.

CONTINUED REBOUND IN POST-PANDEMIC FCPA

ENFORCEMENT

In 2023, President Biden reiterated that fighting corruption

is a core national security interest for his administration, and

DOJ and SEC enforcement leadership continued to stress the

importance of corporate and individual FCPA enforcement.

As outlined below, the number of resolved corporate FCPA

enforcement matters rebounded to pre-pandemic levels, while

the total fine amount still lags. As they have done in prior years,

DOJ and SEC officials stated that there is a healthy backlog of

FCPA investigations and predicted “a lot more” enforcement

activity in 2024 and beyond, especially given that FCPA cases

often take several years to investigate and resolve.

DOJ AND SEC RESOLVED 13 CORPORATE FCPA

CASES AND COLLECTED $733MILLION IN FINES

AND PENALTIES IN 2023

In 2023, the DOJ and the SEC resolved a total of 13 corpo-

rate FCPA cases, totaling $733million in penalties, disgorge-

ment, and interest, when considering credits and offsets in one

related foreign enforcement action and one company’s inabil-

ity to pay in another enforcement action. The DOJ and the SEC

coordinated only two corporate resolutions with each other.

The 13 corporate cases are on par with pre-pandemic levels.

The total monetary penalties of $733million assessed in 2023,

however, fall far short of the $2.65billion and $2.78billion col-

lected by the DOJ and the SEC in 2019 and 2020, respectively.

2

Jones Day White Paper

Meanwhile, coordinated FCPA resolutions with regulators out-

side the United States dropped from prior years. In 2023, the

DOJ and the SEC coordinated only two resolutions with author-

ities outside the United States. In August, the DOJ and the

SEC, in coordination with authorities in Colombia, resolved an

FCPA matter resulting in an additional $20.3million in fines and

penalties paid to Colombian authorities, and in mid-December,

the DOJ separately agreed to credit a criminal penalty up to

a maximum of $22.4million paid by the resolving company to

authorities in Brazil for violations of Brazilian law related to the

same conduct. The Brazil investigation is ongoing.

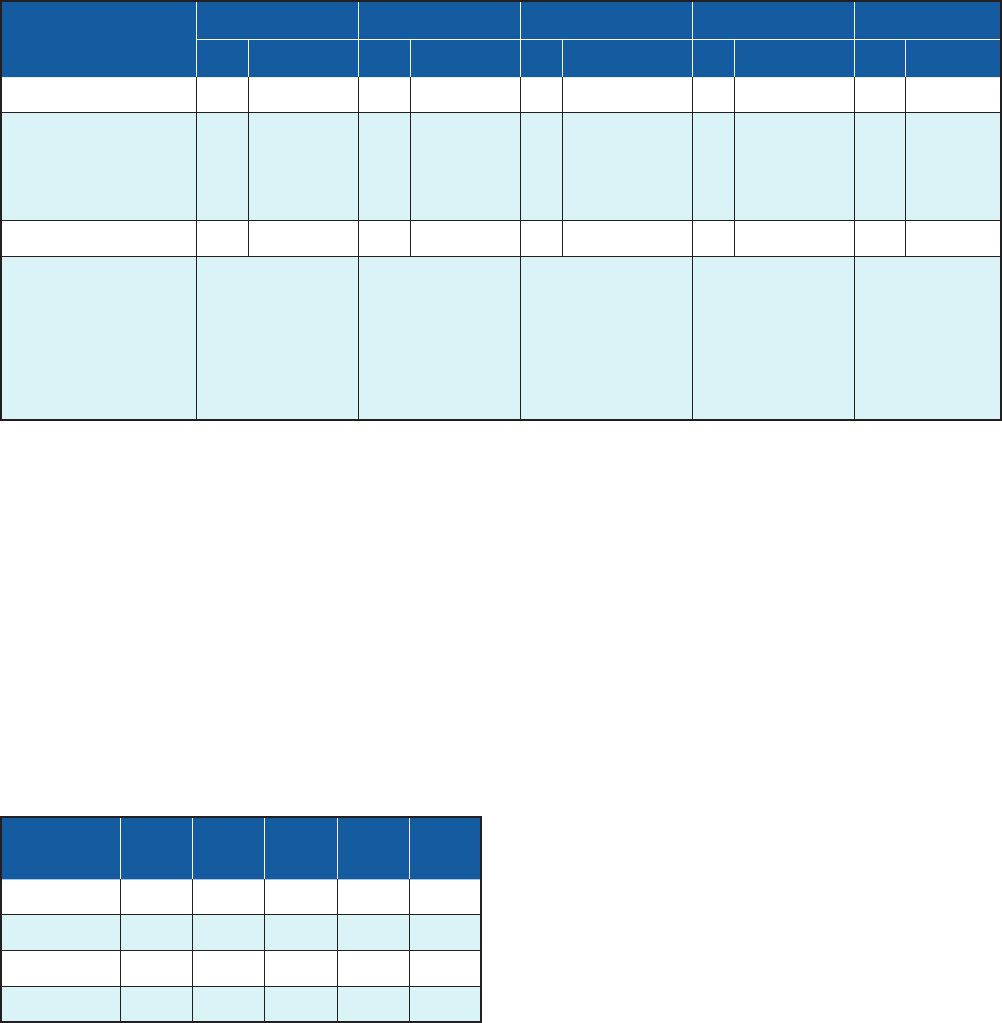

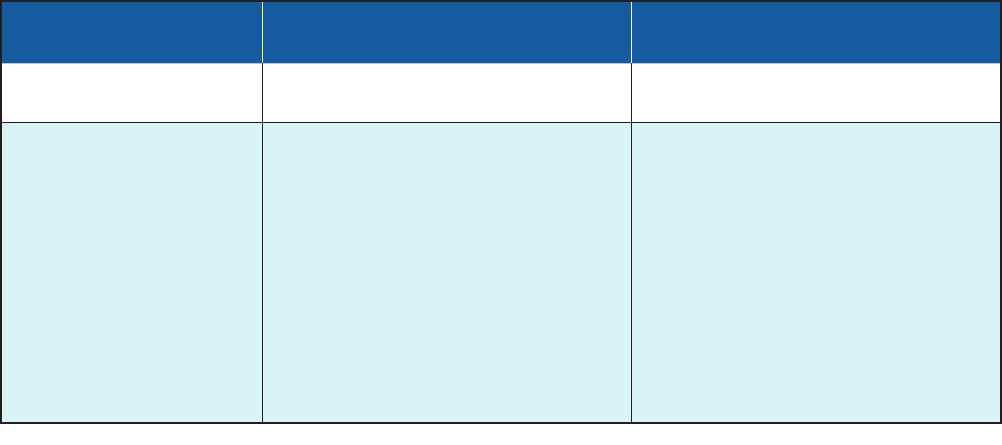

FIGURE 1: Total Fines and Penalties Collected in FCPA Corporate Actions and in Actions

Involving a Coordinated Global Anticorruption Resolution, 2019–2023

Corporate Actions

2019 2020 2021 2022 2023

# US$ # US$ # US$ # US$ # US$

DOJ / SEC Total 14 $2.65B 12 $2.78B 4 $259.0M 8 $877.9M 13 $733.3M

Non-U.S. Total

(Involving a

Coordinated

Non-U.S. Resolution)

2 $0.37B 4 $6.31B 2 $359.6M 4 $348.0M 2 $42.7M

Global Total $3.02B $9.09B $618.6M $1.23B $776.0M

Resolving Authorities Brazil

U.S.

Brazil

France

Hong Kong

Singapore

UK

U.S.

Brazil

Switz.

UK

U.S.

Brazil

Germany

South Africa

Switz.

UK

Brazil

Colombia

Individual FCPA Enforcement Statistics Continue to Lag

Pre-Pandemic Enforcement Levels

In 2023, DOJ and SEC officials emphasized individual account-

ability and encouraged companies to provide information

about the conduct of executives and employees to qualify for

full cooperation credit. However, individual FCPA enforcement

statistics continue to lag pre-pandemic enforcement levels.

In 2023, the DOJ announced nine FCPA indictments involv-

ing individuals, four of which related to a corporate FCPA

resolution. Meanwhile, the SEC announced zero FCPA individ-

ual actions. In fact, the SEC has not brought an FCPA matter

against an individual since April 2020. These statistics nearly

equal 2022’s enforcement activity against individuals and

reflect a trend of a drop in individual FCPA enforcement since

the onset of the pandemic. By comparison, in 2019, the DOJ

announced 25 indictments and pleas, and the SEC announced

six enforcement actions against individuals.

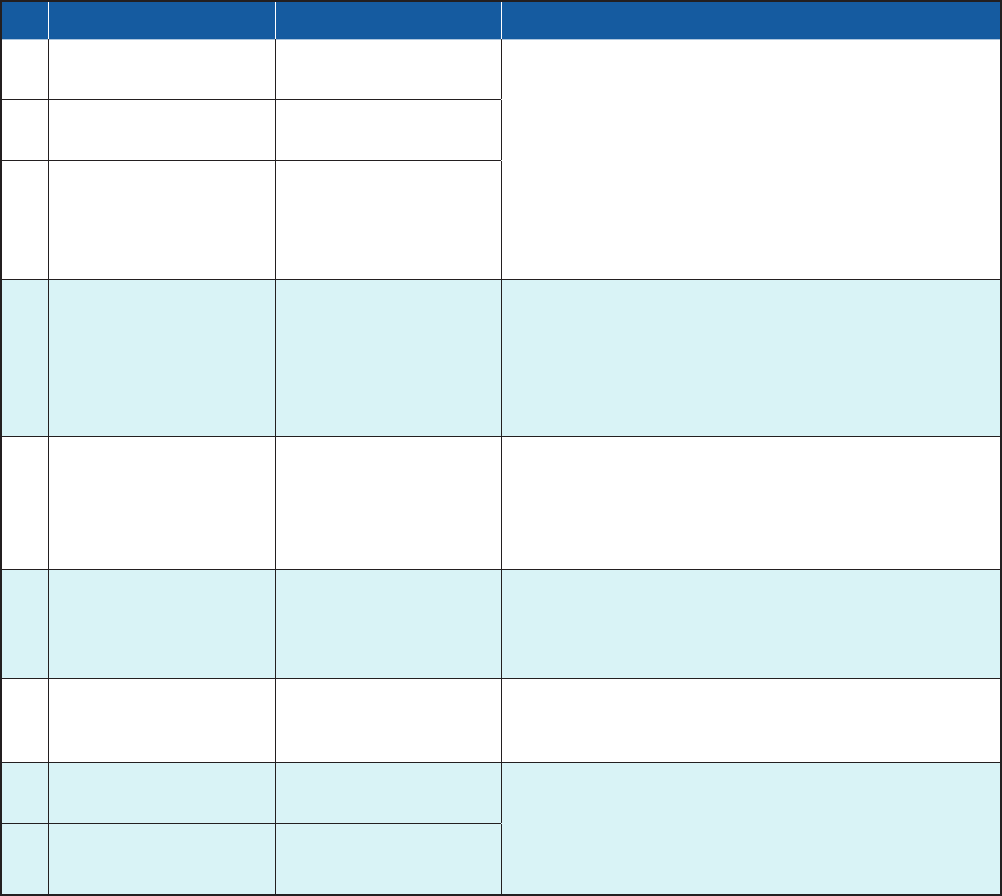

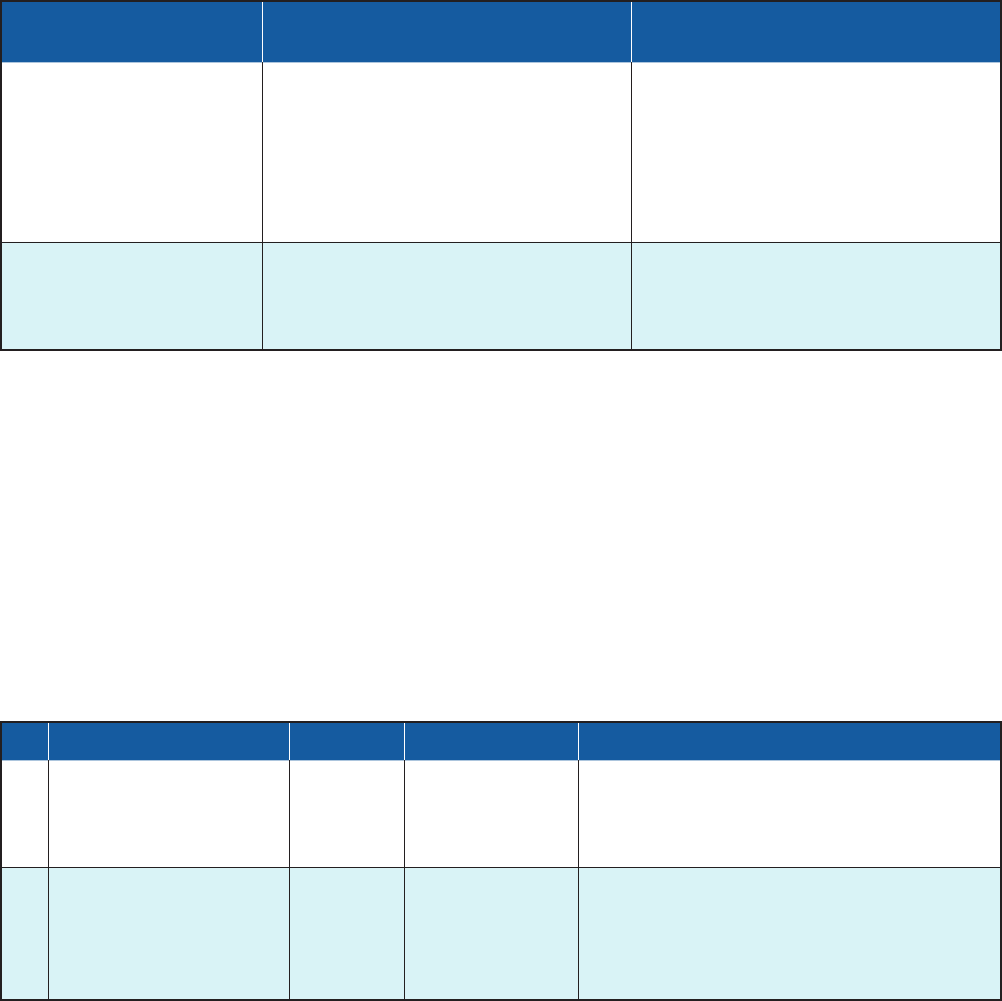

FIGURE 2: DOJ and SEC Individual FCPA Enforcement Actions, 2019–2023

Type of

Action 2019 2020 2021 2022 2023

Indictments 16 7 6 6 9

Pleas 9 8 3 1 0

DOJ – Total 25 15 9 7 9

SEC – Total 6 1 0 0 0

3

Jones Day White Paper

FIGURE 3: DOJ Individual FCPA Indictments, 2023

Individual Date Description

1 Glenn Oztemel Feb. 17

(indictment)

U.S.-based oil trader at Freepoint (Glenn Oztemel), his

brother who worked at another company (Gary Oztemel),

and a Brazil-based intermediary (Innecco) indicted for their

alleged roles in a scheme to pay bribes to Brazilian officials

to win contracts with Brazil’s state-owned and state-con-

trolled energy company, Petróleo Brasileiro S.A. (Petrobras).

Freepoint resolved an FCPA enforcement action with the

DOJ in December 2023 related to payments to Petrobras

officials in Brazil.

2 Eduardo Innecco Feb. 17

(indictment)

3 Gary Oztemel Aug. 29

(indictment)

4 Javier Alejandro Aguilar

Morales

Aug. 3

(indictment)

Former oil and commodities trader indicted for his alleged

role in a scheme to make improper payments to Mexican

government officials. Morales’s former employer resolved an

FCPA enforcement action with the DOJ in December 2020

related to improper payments to officials in Brazil, Ecuador,

and Mexico.

5 Samuel Bankman-Fried Mar. 28

(superseding indictment)

Former CEO of cryptocurrency exchange indicted for his

alleged improper transfer of millions in cryptocurrency to

Chinese officials to unfreeze certain cryptocurrency trading

accounts that collectively contained approximately $1 billion

in cryptocurrency.

6 Orlando Alfonso

Contreras Saab

Sept. 11

(criminal information)

Criminal information filed against a Venezuelan national for

allegedly conspiring with Colombian and Venezuelan indi-

viduals to make improper payments to Venezuelan officials

to obtain contracts to distribute food in Venezuela.

7 Amadou Kane Diallo Sept. 20

(superseding indictment)

Senegalese national indicted for allegedly making improper

payments to Senegalese government officials to secure a

landgrant from the Senegal government.

8 Carl Alan Zaglin Dec. 20

(unsealed indictment)

A Georgia businessman (Zaglin) and a former Florida resi-

dent (Marchena) indicted for their alleged participation in

a scheme to pay and conceal bribes to Honduran govern-

ment officials to secure contracts to provide goods to the

Honduran National Police.

9 Aldo Nestor Marchena Dec. 20

(unsealed indictment)

Several individuals were sentenced for FCPA-related offenses

in 2023. In May, a former banker was sentenced to 10 years in

prison after he was convicted by a jury in April 2022 for con-

spiring to launder billions of dollars from a Malaysian devel-

opment fund and conspiring to pay more than $1.6billion in

bribes to Malaysian government officials. Four individuals who

previously pled guilty to FCPA charges were also sentenced.

• • In January, a federal court sentenced a former chief execu-

tive officer and chief operating officer of a European oil

company to one year in prison and a fine of $1.5million,

following a guilty plea to one count of conspiracy to violate

the FCPA.

• •

In May, a federal court sentenced a former non-govern-

mental organization president to three and a half years in

prison, following a guilty plea to one count of conspiracy to

violate the FCPA.

• • In August, a federal court sentenced a former Petróleos de

Venezuela SA (“PDVSA”) director to one year and a day in

prison and a fine of $472,000, following a guilty plea to one

count of conspiracy to violate the FCPA.

• •

In September, a federal court sentenced a Canadian co-

founder of an energy startup to three years in prison, fol-

lowing a guilty plea to one count of conspiracy to violate

the FCPA related to a bribery scheme involving former

Chadian diplomats. Notably, the DOJ recommended a

4

Jones Day White Paper

shorter sentence because the Canadian proactively coop-

erated with the DOJ by sharing information regarding his

co-conspirators. The judge, however, stated that the DOJ’s

recommended sentence was too lenient given the scale

of the bribery and opted for a three-year sentence to help

deter future crimes.

Since the onset of the pandemic in the United States in early

2020 and through the end of 2023, the DOJ has tried only one

FCPA case. According to the chief of the FCPA unit, in 2024,

there will be an “active and full trial docket” of cases under

the FCPA, anti-money laundering laws, and other anticorrup-

tion laws.

Meanwhile, the DOJ filed indictments against two foreign gov-

ernment officials who were the alleged recipients of corrupt

payments under U.S. anti-money laundering laws, while the

alleged payers were charged under the FCPA.

As another tool to combat foreign corruption, the Office of

Foreign Assets Control (“OFAC”) continued to sanction indi-

viduals and entities under the Global Magnitsky Act to dis-

courage “the transfer or the facilitation of the transfer of the

proceeds of corruption.” Last year, OFAC issued sanctions

against dozens of individuals and entities tied to corruption or

human rights abuses.

POTENTIAL REASONS FOR LAG IN FCPA

ENFORCEMENT ACTIVITY

The lack of a full rebound in FCPA enforcement statistics as

compared to pre-pandemic levels is likely the result of a few

factors, most notably the medium-term impact of the COVID-19

pandemic.

• •

Continued Impact of the COVID-19 Pandemic on FCPA

Enforcement. DOJ and SEC officials acknowledged the

continued impact of the COVID-19 pandemic on FCPA

enforcement; in particular, the pandemic has impacted

the agencies’ ability to conduct in-person FCPA investiga-

tions, coordinate with foreign counterparts, and meet with

company and individual counsel. Since FCPA cases typically

take years to investigate, the impact of the pandemic on

enforcement may continue to linger for some time.

• • Fewer Self-Reports to DOJ and SEC. Notwithstanding DOJ

and SEC efforts to encourage companies to voluntarily self-

disclose potential misconduct, companies have questioned

the benefits of self-disclosure, which has potentially led to

fewer reports of potential FCPA violations to the DOJ and

the SEC. Still, the DOJ’s enhanced incentives programs for

companies to self-disclose FCPA violations, as summarized

in this White Paper, may lead to increased incidence of self-

disclosures moving forward.

• •

DOJ and SEC Focus on Other Issues. Another potential rea-

son for the recent decline in FCPA resolutions is the DOJ

and SEC focus on other enforcement priorities. In October,

the deputy attorney general (the “DAG”) stated that the

rapid expansion of national security-related corporate crime

has led to the biggest shift in corporate criminal enforce-

ment during her time in government. This expansion covers

a variety of criminal and regulatory violations in addition to

international bribery, including sanctions violations, export

controls violations, money laundering, terror financing, and

crypto-related crime. The DOJ plans to look for FCPA viola-

tions connected to these violations. Meanwhile, the SEC is

focusing on other emerging issues, such as cryptocurrency

and cases based on environmental, social, and governance

(“ESG”) matters. Indeed, in its enforcement statistics for its

fiscal year ending September 30, 2023, the SEC’s FCPA

enforcement amounted to only 2% of the SEC’s total new

enforcement actions for the year.

Nevertheless, the DOJ and the SEC have made clear that

they remain committed to enforcing the FCPA. The chief of

the SEC’s FCPA Unit acknowledged the SEC’s relatively low

enforcement numbers but attributed the trend to the “ebb and

flow” of new cases, rather than any drop in actual enforce-

ment activity. We anticipate that FCPA enforcement statistics

will continue to rebound in the coming years, especially given

the backlog of more than 90 publicly announced DOJ and / or

SEC FCPA investigations in the pipeline, and the DOJ’s and the

SEC’s shared objective of strengthening partnerships with their

anticorruption enforcement counterparts around the world.

5

Jones Day White Paper

DOJ ANNOUNCED MAJOR UPDATES TO

CORPORATE CRIMINAL ENFORCEMENT POLICIES

The DOJ continued to take steps to revise corporate enforce-

ment policies to incentivize companies to voluntarily self-

disclose, cooperate, remediate, and implement effective

compliance programs.

Criminal Division Announced Revised Corporate

Enforcement Policy

In January, the assistant attorney general for the Criminal

Division (the “AAG”) announced significant revisions to the

Criminal Division Corporate Enforcement and Voluntary Self-

Disclosure Policy, which is set forth in Section 9-47.120 of the

Justice Manual (the “Corporate Enforcement Policy”). The

revised Corporate Enforcement Policy is an outgrowth of the

Criminal Division’s prior FCPA Corporate Enforcement Policy,

which outlined the Division’s approach in FCPA cases involving

companies that self-disclose wrongdoing and cooperate with

investigations. The requirements for companies to receive full

cooperation credit under the revised Corporate Enforcement

Policy are stringent, and DOJ prosecutors retain significant

discretion to determine the form and size of any eventual reso-

lution with the agency.

The FCPA Corporate Enforcement Policy, adopted in 2017,

created a presumption that, absent any “aggravating fac-

tors,” the DOJ will decline to take any enforcement action

against a company that: (i) voluntarily self-discloses crimi-

nal conduct to the DOJ; (ii) fully cooperates with the DOJ’s

investigation; and (iii) takes timely and appropriate remedia-

tion steps. “Aggravating factors” include, but are not limited to,

“involvement by executive management of the company in the

misconduct, significant profit to the company from the miscon-

duct, or pervasive or egregious misconduct.”

Like the previous FCPA Corporate Enforcement Policy, if there

are no “aggravating factors” present, such as the involvement

of senior management in the misconduct at issue, a company

can qualify for a presumption of a declination if it voluntarily

self-disclosed the misconduct, fully cooperated, and timely

and appropriately remediated the misconduct. This option is

available not only for FCPA cases, but for all cases handled by

the Criminal Division.

Moving forward, under the revised policy, a company with

“aggravating factors” that voluntarily self-discloses corporate

criminal conduct, including potential FCPA violations, may nev-

ertheless qualify for a declination of prosecution if the com-

pany meets three more stringent requirements:

1.

The voluntary self-disclosure was made immediately

upon the company becoming aware of the allegation of

misconduct;

2.

At the time of the misconduct and the disclosure, the com-

pany had an effective compliance program and system of

internal accounting controls that enabled the identification

of the misconduct and led to the company’s voluntary self-

disclosure; and

3.

The company provided extraordinary cooperation with

the DOJ’s investigation and undertook extraordinary

remediation.

While these changes are intended to provide an enhanced

incentive for companies to self-disclose misconduct and

cooperate, it remains to be seen whether they will have this

effect in practice. What qualifies as truly extraordinary coop-

eration and remediation will vary depending on each case

and will be subject to prosecutorial discretion. In January,

the AAG “note[d] some concepts—immediacy, consistency,

degree, and impact—that apply to cooperation by both indi-

viduals and corporations... [and] will help to inform [the DOJ’s]

approach” in making these assessments under the Revised

Policy. Addressing this ambiguity in March, the AAG noted

that for “extraordinary” cooperation and remediation, compa-

nies must go “above and beyond.” With respect to coopera-

tion, this includes voluntarily making foreign-based employees

available for interviews in the United States, producing relevant

documents outside the country that do not implicate foreign

data privacy laws, and collecting, analyzing, translating, and

organizing information from abroad. And, with respect to reme-

diation, this includes conducting root-cause analyses and tak-

ing action to prevent the misconduct from occurring, even in

the face of substantial cost or pressure from the business,

and holding wrongdoers accountable, whether through termi-

nation, suspension, or recoupment of compensation.

6

Jones Day White Paper

As for what constitutes an “immediate” self-disclosure, the

DOJ attempted to provide additional clarity. In March, the

then-chief of the DOJ’s FCPA Unit explained that a company

should self-disclose suspected misconduct in a “reasonably

prompt” manner. The chief contrasted one company—which

did not qualify for a presumption of declination because it

took nine months to self-disclose to the DOJ after it had sub-

stantiated the allegation—with a separate company that did

qualify for a presumption of declination because it took only

three months to self-disclose to the DOJ after learning of the

potential misconduct and less than a day after substantiating

that misconduct.

Earlier, in March, the head of the DOJ Fraud Section’s

Corporate Enforcement, Compliance & Policy Unit stated his

“personal opinion” that in order to qualify for a presumption of

declination, a company with aggravating factors should take

only a “matter of weeks” as opposed to several months to self-

disclose. He acknowledged that the DOJ is aware that compa-

nies may need time to hire and consult with lawyers and their

boards before disclosure. It remains to be seen how the DOJ

will interpret these requirements under the Revised Corporate

Enforcement Policy given various fact scenarios.

Even if a company does not meet the requirements for a pre-

sumption of declination, the Revised Corporate Enforcement

Policy provides significant potential benefits in other contexts.

• • If a criminal resolution is warranted for a company that vol-

untarily self-discloses misconduct, fully cooperates, and

timely and appropriately remediates, the Criminal Division

generally will not require a guilty plea and will apply a fine

reduction of between 50% and 75% off the low end of the

applicable U.S. Sentencing Guidelines (“U.S.S.G.”) penalty

range—up from a previous maximum reduction of 50%. The

AAG emphasized that in all cases, prosecutors have discre-

tion to determine the starting point within the Guidelines

range—including in cases where the company has a history

of prior misconduct. In such cases, the reduction generally

will not be from the low end of the range.

• •

For companies that do not voluntarily self-disclose mis-

conduct but nevertheless fully cooperate and timely and

appropriately remediate, the Criminal Division will recom-

mend up to a 50% reduction off the low end of the U.S.S.G.

fine range—twice the maximum amount of 25% available

under the previous version of the Corporate Enforcement

Policy. As in self-disclosure cases, where a company has a

history of prior wrongdoing, the reduction will likely not be

off the low end of the range.

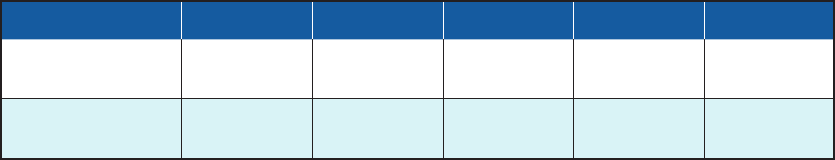

FIGURE 4: A Comparison of the FCPA Corporate Enforcement Policy and the Corporate Enforcement Policy

FCPA Corporate Enforcement Policy

(Nov. 2017–Jan. 2023)

Corporate Enforcement Policy (Jan.

2023–Present)

Scope • • Applied to all nationwide FCPA cases • • Applies to nationwide FCPA cases and all

matters handled by the Criminal Division

Voluntary Self-Report,

Full Cooperation, and

Remediation and One or

More “Aggravating Factors”

• • No presumption of declination • • The DOJ may determine that a declina-

tion is appropriate if the company dem-

onstrates it:

--

Made an "immediate" voluntary self-

disclosure to the DOJ;

--

Had an effective compliance program

and system of internal accounting

controls at the time of misconduct that

detected the suspected wrongdoing;

--

Provided "extraordinary" cooper-

ation; and

--

Undertook "extraordinary" remediation

continued on next page

7

Jones Day White Paper

FCPA Corporate Enforcement Policy

(Nov. 2017–Jan. 2023)

Corporate Enforcement Policy (Jan.

2023–Present)

Voluntary Self-Report,

Full Cooperation, and

Remediation and No

“Aggravating Factors”

• • Presumption of declination

• •

In the event presumption of declination

is overcome, 50% off the low end of the

U.S.S.G. fine range

• •

Generally will not require a corporate

monitor if the company had implemented

an effective compliance program

• • Presumption of declination

• •

In the event presumption of declination

is overcome, 50%–75% off the low end

of the U.S.S.G. fine range

• •

Generally will not require a corporate

monitor if the company had implemented

an effective compliance program

Full Cooperation and

Remediation but No Voluntary

Self-Report (With or Without

“Aggravating Factors”)

• •

Up to 25% off the low end of the U.S.S.G.

fine range (except in the case of a crimi-

nal recidivist)

• •

Up to 50% off the low end of the U.S.S.G.

fine range (except in the case of a criminal

recidivist)

The Corporate Enforcement Policy provides significant incen-

tives for companies to consider when deciding whether to

self-disclose conduct that may violate the FCPA. However, it

is still the case that companies will face uncertainty in various

respects in connection with their decision-making processes.

These include, but are not limited to, the broad range of inter-

pretation afforded to DOJ prosecutors under the Corporate

Enforcement Policy and potential collateral consequences,

such as the prospect of a parallel investigation by the SEC

or a foreign regulator, civil litigation, reputational harm, and

administrative sanctions (e.g., suspension or debarment).

Last year, the DOJ issued FCPA-related declinations to two

companies pursuant to the Corporate Enforcement Policy. To

date, 19 FCPA declinations have been issued under this policy

and the predecessor FCPA Corporate Enforcement Policy.

FIGURE 5: DOJ Declinations Pursuant to the Corporate Enforcement Policy, 2023

Company Date Disgorgement Description

1 Corsa Coal Corp.

(U.S.: Energy)

Mar. 8 $1.2M (based on

inability to pay a

total of $32.7M)

Improper payments to Egyptian government

officials to obtain and retain lucrative contracts

to supply coal to an Egyptian state-owned and

-controlled coke company.

2 Lifecore Biomedical, Inc.

(U.S.: Health Care)

Nov. 16 $406.5K Improper payments to one or more Mexican

government officials, by Lifecore’s former U.S.

subsidiary, paid both prior to and after Lifecore’s

acquisition, to secure a permit and prepare

fraudulent manifests.

DOJ Announced Safe Harbor Policy for Voluntary

Self-Disclosures in Mergers and Acquisitions

In October, the DAG deliveredremarks announcing a new

Mergers & Acquisitions (“M&A”) Safe Harbor Policy (the “Safe

Harbor Policy”), which applies across all DOJ divisions. The

Safe Harbor Policy builds upon a similar policy previously

applied by the DOJ’s Criminal Division in FCPA cases under

the former FCPA Corporate Enforcement Policy.

Under the Safe Harbor Policy, to receive a presumption of a

declination from the DOJ, an acquiring company in a “bona

fide, arm’s-length” M&A transaction must:

• •

Voluntarily self-disclose the suspected misconduct at the

acquired entity within six months of the date the deal closed,

whether the conduct is discovered pre- or post-acquisition;

• • Cooperate with any ensuing DOJ investigation;

8

Jones Day White Paper

• •

Fully remediate the misconduct within one year from the

closing date; and

• • Pay any applicable restitution or disgorgement.

The DAG noted that the post-closing timelines for self-disclo-

sure (six months) and remediation (one year) “are subject to

a reasonableness analysis,” reflecting the DOJ’s understand-

ing that “deals differ and not every transaction is the same.”

As a result, the deadlines could be extended by prosecutors

in certain cases. But, as the DAG noted, the converse is also

true where there is a threat to national security or ongoing or

imminent harm; in these circumstances, companies that have

discovered wrongdoing cannot wait for the deadline to self-

disclose. Nevertheless, as the acting assistant attorney gen-

eral for the Criminal Division (“Acting AAG”) stated infollow-up

remarksin October, “while early reporting is best, self-report-

ing late is always better than never,” and companies that miss

the deadline may still be eligible for “significant benefits,” such

as penalty reductions and the form of the resolution.

Under the Safe Harbor Policy, the presence of aggravat-

ing factors at the acquired entity, such as involvement by

senior management, does not impact the acquiring compa-

ny’s ability to receive a declination; those aggravating factors

may, however, preclude the acquired entity from receiving

otherwise applicable voluntary self-disclosure benefits. The

Safe Harbor Policy does not apply to misconduct that was

otherwise required to be disclosed (e.g., under a non-prose-

cution or deferred prosecution agreement) or to misconduct

already known by the DOJ. Additionally, the DAG noted that

the Safe Harbor Policy will not impact the DOJ’s civil merger

enforcement.

As with other DOJ policies incentivizing voluntary self-disclo-

sure and remediation, the path to receiving the Safe Harbor

Policy’s full benefits is a narrow one that leaves prosecu-

tors with significant discretion. Thus, companies considering

whether to self-disclose under the Safe Harbor Policy must

carefully weigh the pros and cons of self-disclosure.

DOJ ANNOUNCED CHANGES CONCERNING

ITS EVALUATION OF CORPORATE COMPLIANCE

PROGRAMS AND STANDARDS FOR IMPOSING

COMPLIANCE MONITORS

In March, the DOJ announced enhanced compliance programs

guidance (the “Compliance Guidance”). Under DOJ practice,

all DOJ prosecutors must evaluate the adequacy of a com-

pany’s compliance program—both at the time of the offense

and the charging decision—when determining the terms of a

resolution. The updates include additional guidance on use of

personal devices and third-party communication platforms, a

new pilot program to promote corporate compensation incen-

tives and clawbacks, and updated standards for appointing

corporate monitors.

DOJ Provided Additional Guidance Regarding Use

of Personal Devices and Third-Party Communication

Platforms

The new Compliance Guidance requires prosecutors to con-

sider personal device use and communication platforms when

evaluating the adequacy of a company’s compliance pro-

gram. The Compliance Guidance states that corporate poli-

cies should be tailored to the corporation’s risk profile, with

the goal of making business-related data accessible to the

company for preservation and review. To do this, DOJ prosecu-

tors will consider three topics related to company-related data

and communications: (i) the company’s communication chan-

nels; (ii) the company’s policy environment; and (iii) the com-

pany’s risk management. Relevant questions for each topic

are as follows:

• •

Communication Channels. What communication channels

do employees use, and what are the preservation settings

available to each employee in each channel? Has the com-

pany implemented procedures to manage and preserve

electronic communications?

• •

Policies. Does the company have policies in place to

make sure business-related data is preserved and acces-

sible, even on employees’ personal devices used for work-

related matters? Is there a policy governing transferring

data between work and personal devices? Are the com-

pany’s policies communicated to employees and regu-

larly enforced?

9

Jones Day White Paper

of disciplinary actions? Is the company monitoring the num-

ber of compliance-related allegations that are substantiated,

the average time to complete a compliance investigation,

and the effectiveness and consistency of disciplinary mea-

sures throughout the organization?

• •

Incentives to Promote Compliant Behavior. The Criminal

Division also updated its evaluation of whether a com-

pany has effective incentives to promote compliant behav-

ior. Considerations here are, among other things, whether

the company had made compliance a means of career

advancement, offered opportunities for management to

serve as a compliance “champion,” or made compliance a

significant metric for management bonuses.

• •

Compensation Incentives and Clawbacks Pilot Program.

The Criminal Division introduced a new Pilot Program

Regarding Compensation Incentives and Clawbacks (“Pilot

Program”). The Pilot Program is effective as of March 15, and

will be in effect for three years. The Program has two parts:

First, each corporate resolution with the Criminal Division will

include a requirement that the company involved implement

compliance-promoting criteria within its compensation and

bonus system. This criteria can include withholding bonuses,

disciplinary measures, and incentives for compliance. Under

the Pilot Program, every Criminal Division resolution now

requires companies to add compliance-promoting criteria to

their compensation systems. These incentive requirements

were included in the DOJ’s two most recent corporate FCPA

resolutions in 2023.

Second, companies that seek to claw back compensation

from corporate wrongdoers will be eligible for fine reductions

in connection with DOJ resolutions. If a company complies

with the Pilot Program procedures, the DOJ will accord a fine

reduction equal to the amount of any compensation that is

recouped within the term of the resolution. A company whose

clawback efforts are ultimately unsuccessful, but pursued in

good faith, can still be eligible for a fine reduction of up to

25% of the amount of sought compensation. In September, for

example, the DOJ credited one company close to $765,000

under the Pilot Program, based on the value of bonuses it with-

held from employees who engaged in suspected wrongdoing

in connection with the conduct under investigation.

• •

Risk Management. Has the company exercised policy rights

to access business-related data? How does the company

exercise control over its communication policies? What are

the consequences for employees who do not comply with

the policies? Does employees’ use of personal devices or

third-party messaging applications impair a company’s

compliance program?

The updated Compliance Guidance reflects the DOJ’s inter-

est in preserving and collecting relevant business information

from company-related data on personal devices, company

issued devices, and third-party messaging platforms. A com-

pany’s failure to provide relevant communications during an

investigation will prompt further questioning from the Criminal

Division and can impact the DOJ’s charging decision.

DOJ Provided Additional Compliance Programs

Guidance Regarding Compensation Incentives,

Clawbacks, and Related Pilot Program

The enhanced Compliance Guidance also provides informa-

tion on how prosecutors will assess whether a company’s

compensation system promotes compliant behavior. The

Compliance Guidance section previously titled “Incentives

and Disciplinary Measures” was changed to “Compensation

Structures and Consequence Management,” and added revi-

sions related to: (i) compensation structures; (ii) disciplinary

measures; and (iii) incentives. Further, a new DOJ pilot pro-

gram will be implemented to promote compensation systems

and compensation clawbacks to remedy violations of law.

• •

Compensation Structures. There is new guidance on how to

evaluate a company’s compensation structure and whether

it fosters a culture of compliance. In this regard, questions

the Criminal Division will consider are: Does the company

have policies to recoup or reduce compensation due to

compliance violations, policy violations, or misconduct?

Has the company enforced clawback provisions? Does the

compensation system tie certain compensation to conduct

consistent with the company’s values?

• •

Disciplinary Measures. The guidance includes additional

questions used to evaluate a company’s disciplinary pro-

gram, such as: Has the company publicized disciplinary

actions internally? Is the company tracking the effectiveness

10

Jones Day White Paper

DOJ Announced Revised Criteria for the Selection

ofCorporate Compliance Monitors

In March, the AAG separately issued a revised memorandum

on the selection of monitors in Criminal Division matters. The

revised memorandum clarifies four policy positions: (i) moni-

tor selections are and will be made in keeping with the DOJ’s

commitment to diversity, equity, and inclusion; (ii) DOJ pros-

ecutors should not apply presumptions for or against monitors;

(iii) the requirements for monitors apply to a monitor’s entire

team in addition to the lead monitor; and (iv) the cooling-off

period for monitors is now not less than three years, rather

than two years from the date of monitorship termination.

The Criminal Division is directed to impose a monitor where

there is a demonstrated need for, or benefit from, a monitor-

ship. This includes situations where the company’s compliance

program and controls are untested, ineffective, inadequately

resourced, or not fully implemented at the time of a resolution.

If the converse is true, a monitor may not be necessary.

Last year, no new FCPA corporate monitors were imposed. The

chief of the SEC’s FCPA unit stated that he views fewer moni-

torships as a “success story,” since companies today tend to

have more effective anticorruption compliance programs than

in the past.

DOJ Announced Ongoing Use of Data Analytics

toIdentify FCPA Cases

In November, the Acting AAG stated that the DOJ is increasing

the use of data analytics to proactively identify potential FCPA

cases. According to the Acting AAG, the DOJ has invested in

personnel and tools to “harness and analyze” public and non-

public data to “identify potential wrongdoing involving foreign

corruption.” She noted that the DOJ’s approach has gener-

ated successful FCPA investigations and prosecutions and

that the DOJ is “just getting started” in this area. Highlighting

this emphasis on data analytics, in September 2022, the Fraud

Section announced the hiring of a dedicated compliance and

data analytics counsel. Noting that companies have “better

and more immediate access to their own data,” the Acting

AAG stated that she expects companies, as part of an effec-

tive anticorruption compliance program, to adopt a similar

data-driven approach to compliance. As part of its assess-

ment of a company’s compliance program, the DOJ will also

ask what a company has done to analyze its data at the time

of misconduct and resolution.

DOJ ANNOUNCED AN INTERNATIONAL

ANTI-BRIBERY INITIATIVE AND ISSUED TWO

NEW FCPA OPINIONS, AND PRESIDENT BIDEN

SIGNED A LAW ADDRESSING THE DEMAND SIDE

OF BRIBERY

DOJ Announced International Corporate Anti-Bribery

Initiative

In November, the Acting AAG announced a new International

Corporate Anti-Bribery Initiative, which will build on existing

international partnerships and form new ones to facilitate

cross-border cooperation and information-sharing in foreign

bribery investigations. Led by three FCPA Unit prosecutors, the

Acting AAG announced that this Initiative will start by focus-

ing on key threats to financial markets and the rule of law in

regions where it can have the most impact in both coordina-

tion and case generation. The Initiative will look to facilitate

cooperation and enhance information-sharing with foreign

partners by leveraging prosecutors’ particular experience,

expertise, and language skills.

Members of the Initiative will work across the Criminal

Division—including with the DOJ’s Money Laundering and

Asset Recovery Section (“MLARS”), the Office of International

Affairs, the Office of Overseas Prosecutorial Development,

Assistance, and Training, and the International Criminal

Investigative Training Assistance Program—as well as with

other parts of the DOJ, law enforcement partners, and the

State Department. The Initiative’s members will also work with

data experts in Fraud and MLARS to develop proactive leads

in their respective regions and determine how the DOJ can

force multiply and assist foreign authorities in their parallel

investigations.

In October, the Acting AAG highlighted several “success-

ful partnerships” between the DOJ and foreign enforcement

counterparts through cooperating on cases and working

together in several international organizations, such as the

Organization for Economic Cooperation and Development’s

Working Group on Bribery.

11

Jones Day White Paper

DOJ Issued Two New Opinions

After issuing only two FCPA opinions over the preceding eight

years, the DOJ issued two FCPA opinions in 2023 under its

FCPA opinions procedure.

• •

In FCPA Opinion Release 23-01 (issued on August 14), the

DOJ stated that it would not take an enforcement action

against a U.S.-based child welfare agency that intended

to pay expenses for two government officials from a for-

eign country to visit the United States. The DOJ stated

the payments do not reflect any corrupt intent since the

expenses are reasonable and bona fide expenses directly

related to the promotion, demonstration, or explanation

of the agency’s products or services, which are permitted

under the FCPA.

• • In FCPA Opinion Release 23-02 (issued on October 25), the

DOJ stated that it would not take an enforcement action

against a U.S.-based provider of training events and logis-

tical support that intended to provide stipends to foreign

officials attending training events. The training company

is required to establish training events utilized by multiple

U.S. government entities. As part of these events, the com-

pany must provide stipend payments to foreign officials to

attend these training events. The DOJ stated that the pro-

posed foreign official stipends reflect no corrupt intent by

the company, since the contemplated payments to the for-

eign officials are both called-for and ultimately delivered by

agencies and / or personnel of the U.S. government.

President Biden Enacted Bill Addressing Demand Side

of Foreign Bribery

In December, President Biden signed the Foreign Extortion

Prevention Act (“FEPA”), which targets the “demand side” of

foreign bribery. The FCPA extends only to those who offer or

pay bribes, or the “supply side.” The FEPA received bipartisan

support in Congress.

Although the DOJ has charged government officials for receiv-

ing bribes under related statutes, such as anti-money launder-

ing laws, the FEPA amends the U.S. federal domestic bribery

statute to allow for the criminal prosecution of foreign officials

who seek or receive bribes from U.S. persons or businesses.

FEPA’s definition of “foreign official” is broader than that of the

FCPA. Not only does the statute extend to officials and employ-

ees of foreign governments, but also to any person acting in

an unofficial capacity on behalf of such a government. Such

improper activities must have a sufficient nexus to the United

States to trigger criminal liability. Thus, the FEPA uses the

same jurisdictional categories as the FCPA: the FEPA applies

to demands made to issuers of U.S.-listed securities, to U.S.

domestic concerns (i.e., U.S. citizens, residents, and compa

-

nies), or to any person while in the territory of the United States.

Penalties for violating the statute may include imprisonment of

up to 15 years and a fine of up to $250,000 or three times the

value of the bribe, whichever is greater.

SEC Announced Increase in FCPA Whistleblower Tips

and $279Million FCPA Reward

Under the SEC’s whistleblower program, whistleblowers who

provide the SEC with original, timely, and credible information

that leads to a successful enforcement action are eligible to

receive an award that can range from 10%-30% of the money

collected when monetary sanctions exceed $1million.

In November, the SEC announced that it had received

more than 18,000 whistleblower tips in its fiscal year end-

ing September 30, 2023—50% more than the record setting

year in fiscal year 2022. The SEC also announced that it had

awarded 68 whistleblower awards totaling nearly $600million

in fiscal year 2023, including a $279million award to a whistle-

blower in an FCPA-related case, even though the whistleblower

provided information to the SEC after it had already opened its

investigation. The SEC received 237 FCPA tips during the SEC’s

fiscal year 2023, up from 202 tips the prior fiscal year.

FIGURE 6: Number of Whistleblower Tips to the SEC’s Whistleblower Program, FY 2019–FY 2023

Type of Action FY2019 FY2020 FY2021 FY2022 FY2023

Number of

Whistleblower Tips

5,212 6,911 12,210 12,322 18,354

Number of FCPA

Tips

200 208 258 202 237

12

Jones Day White Paper

KEY TAKEAWAYS

For both the DOJ and the SEC, FCPA enforcement remains a

centerpiece of their enforcement agendas. As such, compa-

nies are advised to continue to assess their corruption risks

in light of their business operations and the locations in which

they do business and adopt and implement effective anticor-

ruption compliance programs that take into consideration their

risk profiles, as well as the current enforcement environment in

the United States and other relevant jurisdictions. In particular,

the updates covered in this White Paper underscore that com-

panies should take steps to ensure:

• •

Their compliance policies, procedures, and other internal

controls are appropriately designed and effectively operate

to prevent, detect, investigate, and remediate any potential

issues as they arise.

• •

Their policies and protocols for use of personal devices and

third-party communication platforms, data monitoring tools,

and employee-discipline procedures are up to date based

on recent DOJ guidance.

• •

Their internal reporting and investigation processes for

addressing potential FCPA issues help the company make

prompt and informed determinations as to whether self-

disclosure may be warranted in particular circumstances,

among other important considerations.

13

Jones Day White Paper

AUTHORS

Theodore T. Chung

Chicago

+1.312.269.4234

Henry Klehm III

New York

+1.212.326.3706

Sion Richards

London

+44.20.7039.5139

Justin E. Herdman

Cleveland

+1.216.586.7113

Karen P. Hewitt

San Diego

+1.858.314.1119

Samir Kaushik

Dallas

+1.214.969.5092

Leigh A. Krahenbuhl

Chicago

+1.312.269.1524

Andrew E. Lelling

Boston

+1.617.449.6856

James P. Loonam

New York

+1.212.326.3808

David E. Nahmias

Atlanta / Washington

+1.404.581.8241 / +1.202.879.3493

David Peavler

Dallas / Washington

+1.214.969.3685 / +1.202.879.3499

Cristina Pérez Soto

Miami

+1.305.714.9733

Brian C. Rabbitt

Washington

+1.202.879.3866

Sheila L. Shadmand

Dubai

+971.4.709.8408

Neal J. Stephens

Silicon Valley

+1.650.687.4135

Hank Bond Walther

Washington

+1.202.879.3432

14

Jones Day White Paper

ADDITIONAL CONTACTS

UNITED STATES

Bethany K. Biesenthal

Chicago

+1.312.269.4303

Toni-Ann Citera

New York

+1.212.326.3454

Kevin M. Comeau

Washington

+1.202.879.3909

Steven T. Cottreau

Washington

+1.202.879.5572

Stephen Cowen

Detroit

+1.313.230.7954

Roman E. Darmer

Irvine

+1.949.553.7581

Richard H. Deane Jr.

Atlanta

+1.404.581.8502

David J. DiMeglio

Los Angeles

+1.213.243.2551

W. Anders Folk

Minneapolis

+1.612.271.8923

Shirlethia V. Franklin

Washington

+1.202.879.3892

Louis P. Gabel

Detroit

+1.313.230.7955

Fahad A. Habib

San Francisco

+1.415.875.5761

Brian Hershman

Los Angeles

+1.213.243.2445

Adam Hollingsworth

Cleveland

+1.216.586.7235

Jill Keller Hengen

Atlanta

+1.404.581.8956

Kathy Keneally

New York

+1.212.326.3402

James T. Kitchen

Pittsburgh

+1.412.394.7272

Sarah L. Levine

Washington

+1.202.879.3883

Jerry C. Ling

San Francisco

+1.415.875.5890

Rebecca C. Martin

New York

+1.212.326.3410

Jordan M. Matthews

Chicago

+1.312.269.4169

Shireen Matthews

San Diego

+1.858.314.1184

Sidney Smith McClung

Dallas

+1.214.969.5219

Joan E. McKown

Washington

1.202.879.3647

15

Jones Day White Paper

Cheryl L. O’Connor

Irvine

+1.949.553.7505

Jeff Rabkin

San Francisco / Silicon Valley

+1.415.875.5850 / +1.650.739.3954

Lisa M. Ropple

Boston

+1.617.449.6955

Yaakov M. Roth

Washington

+1.202.879.7658

Jeffrey B. Schenk

Silicon Valley

+1.650.687.4130

Ronald W. Sharpe

Washington

+1.202.879.3618

Rasha Gerges Shields

Los Angeles

+1.213.243.2719

Erin Sindberg Porter

Minneapolis

+1.612.217.8926

Evan P. Singer

Dallas

+1.214.969.5021

Edward Patrick Swan Jr.

San Diego

+1.858.703.3132

Jason S. Varnado

Houston

+1.832.239.3694

Alexander J. Wilson

New York

+1.212.326.8390

Kristin K. Zinsmaster

Minneapolis

+1.612.217.8861

EUROPE

Mary Ellen Powers

Washington

+1.202.879.3870

Jérémy Attali

Paris

+33.1.56.59.39.54

Adam R. Brown

London

+44.20.7039.5292

Sébastien Champagne

Brussels

+32.2.645.15.20

Bénédicte Graulle

Paris

+33.1.56.59.46.75

Michael Mayer

Munich

+49.89.20.60.42.200

Glyn Powell

London

+44.20.7039.5212

Thomas Preute

Düsseldorf

+49.211.5406.5569

Paloma Valor

Madrid

+34.91.520.3903

Rick van ‘t Hullenaar

Amsterdam

+31.20.305.4223

© 2024 Jones Day. All rights reserved. Printed in the U.S.A.

Jones Day publications should not be construed as legal advice on any specific facts or circumstances. The contents are intended for general

information purposes only and may not be quoted or referred to in any other publication or proceeding without the prior written consent of the

Firm, to be given or withheld at our discretion. To request reprint permission for any of our publications, please use our “Contact Us” form, which

can be found on our website at www.jonesday.com. The mailing of this publication is not intended to create, and receipt of it does not constitute,

an attorney-client relationship. The views set forth herein are the personal views of the authors and do not necessarily reflect those of the Firm.

ASIA, AUSTRALIA, AND MIDDLE EAST

Javade Chaudhri

Washington / Dubai

+1.202.879.7651 / +971.4.709.8484

John Emmerig

Sydney

+61.2.8272.0506

Steven W. Fleming

Sydney

+61.2.8272.0538

Lillian He

Shanghai

+86.21.2201.8034

Sushma Jobanputra

Singapore

+65.6233.5989

Heather Martin

Dubai

+ 971.4.709.8484

Hiromitsu Miyakawa

Tok yo

+81.3.6800.1828

Daniel Moloney

Melbourne

+61.3.9101.6828

Zachary Sharpe

Singapore

+ 65.6233.5506

Peter J. Wang

Hong Kong

+852.3189.7211

Chen-Gang Yen

Taipei

+886.2.7712.3217

Simon M. Yu

Taipei

+886.2.7712.3230

LATIN AMERICA

Luis Riesgo

São Paulo

+55.11.3018.3939

Guillermo E. Larrea

Mexico City

+52.55.3000.4064

Fernando F. Pastore

São Paulo

+55.11.3018.3941