FEDERAL RESERVE SYSTEM

12 CFR Parts 217, 238, and 252

[Docket No. R-1673]

RIN 7100–AF56

Regulatory Capital Rules: Risk-Based Capital Requirements for Depository Institution

Holding Companies Significantly Engaged in Insurance Activities

AGENCY: Board of Governors of the Federal Reserve System.

ACTION: Final rule.

SUMMARY: The Board of Governors of the Federal Reserve System is adopting risk-based

capital requirements for depository institution holding companies that are significantly engaged

in insurance activities. This risk-based capital framework, termed the Building Block Approach,

adjusts and aggregates existing legal entity capital requirements to determine enterprise-wide

capital requirements. The final rule also contains a risk-based capital requirement excluding

insurance activities, in compliance with section 171 of The Dodd-Frank Wall Street Reform and

Consumer Protection Act. The Board also is adopting a reporting form FR Q-1 related to the

Building Block Approach. The capital requirements and associated reporting form meet

statutory mandates and will help to prevent the economic and consumer impacts resulting from

the failure of organizations engaged in banking and insurance.

DATES: This rule is effective on January 1, 2024.

2

FOR FURTHER INFORMATION CONTACT: Lara Lylozian, Deputy Associate Director

and Chief Accountant, (202) 475-6656; Matt Walker, Manager, Insurance Supervision &

Regulation, (202) 872–4971; or John Muska, Lead Insurance Policy Analyst, (202) 384–7278;

Division of Supervision and Regulation; or Dafina Stewart, Assistant General Counsel, (202)

452–2677; Andrew Hartlage, Special Counsel, (202) 452–6483; Jonah Kind, Senior Counsel,

(202) 452–2045; or Jasmin Keskinen, Attorney, (202) 475–6650, Legal Division, Board of

Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW,

Washington, DC 20551. For users of TTY–TRS, please call 711 from any telephone, anywhere

in the United States.

SUPPLEMENTARY INFORMATION:

3

Table of Contents

I. INTRODUCTION ..................................................................................................................................................... 5

A. B

ACKGROUND ............................................................................................................................................................................................ 7

B. D

ESCRIPTION OF THE BUILDING BLOCK APPROACH .................................................................................................................................. 9

C. S

UMMARY OF COMMENTS RECEIVED ON THE NPR AND FORM FR Q‐1 ............................................................................. 11

D. M

AIN CHANGES IN THE FINAL RULE AND FORM FR Q‐1 ................................................................................................. 13

II. EFFECTIVE DATE AND SCOPE ............................................................................................................................... 15

A. S

COPE ...................................................................................................................................................................................................... 15

B. E

FFECTIVE DATE ...................................................................................................................................................................................... 17

III. DODD‐FRANK ACT CAPITAL CALCULATION ......................................................................................................... 20

IV. MINIMUM CAPITAL REQUIREMENT AND CAPITAL CONSERVATION BUFFER .................................................... 23

V. DETERMINATION OF BUILDING BLOCKS AND RELATED ISSUES ......................................................................... 29

A. I

NVENTORY .............................................................................................................................................................................................. 29

B. I

DENTIFYING CAPITAL FRAMEWORKS FOR EACH INVENTORY COMPANY .............................................................................................. 30

C. I

DENTIFICATION OF BUILDING BLOCK PARENTS ..................................................................................................................................... 31

D. M

ATERIAL FINANCIAL ENTITY ................................................................................................................................................................. 34

E. T

REATMENT OF ASSET MANAGERS ........................................................................................................................................................ 37

VI. ADJUSTMENTS ..................................................................................................................................................... 39

A. C

APITAL INSTRUMENTS ........................................................................................................................................................................... 39

B. A

DJUSTMENTS FOR COMPARABILITY ....................................................................................................................................................... 41

C. T

ITLE INSURANCE ISSUES ........................................................................................................................................................................ 45

Title Insurance Reserves ....................................................................................................................................... 46

Title Plant Assets .................................................................................................................................................. 48

VII. SCALING ............................................................................................................................................................... 48

VIII. AGGREGATION ..................................................................................................................................................... 52

IX. REPORTING .......................................................................................................................................................... 53

A. S

UBMISSION DATE .................................................................................................................................................................................. 54

B. P

UBLIC DISCLOSURE ................................................................................................................................................................................ 55

C. A

UDIT REQUIREMENTS ........................................................................................................................................................................... 56

X. ECONOMIC IMPACT ANALYSIS OF THE BBA ........................................................................................................ 58

XI. ADMINISTRATIVE LAW MATTERS ....................................................................................................................... 64

4

A. PAPERWORK REDUCTION ACT ................................................................................................................................................................ 64

B. R

EGULATORY FLEXIBILITY ACT ................................................................................................................................................................ 66

C. P

LAIN LANGUAGE .................................................................................................................................................................................... 68

5

I. Introduction

The Board of Governors of the Federal Reserve System (Board) is adopting a rule that

establishes minimum risk-based capital requirements for certain depository institution holding

companies significantly engaged in insurance activities (insurance depository institution holding

companies). The rule establishes an enterprise-wide risk-based capital framework, termed the

“building block” approach (BBA), that incorporates legal entity capital requirements such as the

requirements prescribed by state insurance regulators, taking into account differences between

the business of insurance and banking.

This final rule follows the issuance of two documents for comment by the Board. The

first was the 2016 advance notice of proposed rulemaking (ANPR), in which the Board described

the concept of the BBA as a capital framework and sought input on all aspects of its

development at an early stage.

1

The Board considered this feedback and invited comment on a

detailed BBA proposal in the notice of proposed rulemaking (NPR or proposal)issued in

September 2019.

2

The NPR would have established risk-based capital requirements for

insurance depository institution holding companies. As discussed in that proposal, insurance

depository institution holding companies include depository institution holding companies that

are insurance underwriting companies and depository institution holding companies that hold a

significant percentage of total assets in insurance underwriting subsidiaries. In addition to the

enterprise-wide capital requirement for insurance depository institution holding companies based

on the BBA framework, the proposal would have applied a minimum risk-based capital

1

Capital Requirements for Supervised Institutions Significantly Engaged in Insurance Activities, 81 FR 38631

(June 14, 2016).

2

Regulatory Capital Rules: Risk-Based Capital Requirements for Depository Institution Holding Companies

Significantly Engaged in Insurance Activities, 84 FR 57240 (October 24, 2019).

6

requirement to the enterprise using the flexibility afforded under amendments enacted in 2014 to

section 171 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank

Act) to exclude certain state- and foreign-regulated insurance operations (section 171

calculation).

3

The proposal included a buffer requirement that would have limited an insurance

depository institution holding company’s capital distributions and discretionary bonus payments

if it did not hold sufficient capital relative to enterprise-wide risk, including risk from insurance

activities. The proposed rule would have relied on the Board’s authority under section 10 of the

Home Owners’ Loan Act (HOLA)

4

and section 171 of the Dodd-Frank Act.

5

The Board is responsible for protecting the safety and soundness of certain banking

organizations. This responsibility includes establishing minimum requirements for the capital of

holding companies of groups that conduct both depository and insurance operations.

6

In the

United States and other jurisdictions, the current risk-based capital assessment methodologies

have been designed specifically for either insurance or banking.

In view of the above, the Board is adopting aggregation-based capital requirements for

insurance depository institution holding companies. These capital requirements aggregate the

required capital from insurance activities, as determined based on insurance capital rules set by

the states or foreign jurisdictions, and banking activities, as determined based on banking capital

rules. These requirements fulfill the Board’s goal of designing an appropriate capital standard

for insurance depository institution holding companies. Prior to this rule, savings and loan

3

Pub. L. 111-203, 124 Stat. 1376, 1435–38 (2010), as amended by Pub. L. 113-279, 128 Stat. 3017 (2014).

4

12 U.S.C. 1467a.

5

12 U.S.C. 5371.

6

12 U.S.C. 5371.

7

holding companies (SLHCs) with significant insurance operations have been excluded from the

Board’s banking capital rule pending this rulemaking, while bank holding companies (BHCs)

with significant insurance operations have been required to comply with the Board’s banking

capital rule.

In addition to the NPR, the Board invited comment on a draft reporting form “Capital

Requirements for Board-Regulated Institutions Significantly Engaged in Insurance Activities”

(form FR Q-1) and associated instructions, which would gather data related to the BBA, and

published a white paper describing how the BBA translated between the banking and insurance

capital frameworks. The Board also launched a quantitative impact study (QIS) alongside the

NPR using the draft reporting form. The comments received on the NPR and on the reporting

form and instructions, as well as the QIS results, have informed this final rule and are discussed

in the following sections. The reporting form and instructions are being finalized along with this

final rule with certain changes in response to the comments.

A. Background

In response to the 2007-09 financial crisis, Congress enacted the Dodd-Frank Act, which,

among other purposes, was enacted to ensure appropriate supervision of depository institution

holding companies without regard to charter type of their insured depository institution

subsidiaries and to streamline the supervision of such holding companies. In furtherance of these

purposes, Title III of the Dodd-Frank Act expanded the Board’s supervisory role by transferring

to the Board all supervisory functions related to SLHCs and their non-depository subsidiaries.

As a result, the Board became the federal supervisory authority for all depository institution

8

holding companies, including insurance depository institution holding companies.

7

Concurrent

with the expansion of the Board’s supervisory role, section 616 of the Dodd-Frank Act amended

HOLA to provide the Board express authority to adopt regulations or orders that set capital

requirements for SLHCs.

8

Any capital requirements the Board may establish for SLHCs are subject to minimum

standards under the Dodd-Frank Act. Specifically, section 171 of the Dodd-Frank Act requires

the Board to establish minimum risk-based and leverage capital requirements on a consolidated

basis for depository institution holding companies. These requirements must be not less than the

capital requirements established by the federal banking agencies to apply to insured depository

institutions under the prompt corrective action regulations implementing section 38 of the

Federal Deposit Insurance Act,

9

nor quantitatively lower than the capital requirements that

applied to these institutions when the Dodd-Frank Act was enacted.

Section 171 of the Dodd-Frank Act was amended in 2014 (2014 Amendment) to provide

the Board flexibility when developing consolidated capital requirements for insurance depository

institution holding companies.

10

The 2014 Amendment permits the Board, in establishing

minimum risk-based and leverage capital requirements on a consolidated basis, to exclude

7

Pub. L. 111–203, title III, section 301, 124 Stat. 1520 (2010).

8

Dodd-Frank Act 616(b); HOLA Sec. 10(g)(1). Under Title I of the Dodd-Frank Act, the Board also supervises

any nonbank financial companies designated by the Financial Stability Oversight Council (FSOC) for supervision

by the Board. Under section 113 of the Dodd-Frank Act, the FSOC may designate a nonbank financial company,

including an insurance company, to be supervised by the Board. Currently, no firms are subject to the Board’s

supervision pursuant to this provision.

9

12 U.S.C. 1831o. The floor for capital requirements established pursuant to section 171 of the Dodd-Frank Act,

referred to as the “generally applicable” requirements, is defined to include the regulatory capital components in the

numerator of those capital requirements, the risk-weighted assets in the denominator of those capital requirements,

and the required ratio of the numerator to the denominator.

10

Pub. L. 113-279, 128 Stat. 3017 (2014).

9

companies engaged in the business of insurance and regulated by a state insurance regulator, as

well as certain companies engaged in the business of insurance and regulated by a foreign

insurance regulator.

Section 171 of the Dodd-Frank Act also provides that the Board may not require, under

its authority pursuant to section 171 of the Dodd-Frank Act or HOLA, a supervised firm that is

also a state-regulated insurer and files financial statements with a state insurance regulator or the

National Association of Insurance Commissioners (NAIC) utilizing only Statutory Accounting

Principles (SAP) to prepare such financial statements in accordance with U.S. generally accepted

accounting principles (GAAP).

11

The Board notes that, unlike GAAP, SAP does not include an

accounting consolidation concept. As discussed in detail in subsequent sections of this

Supplementary Information, the BBA is thus an aggregation-based approach, designed to

comprehensively capture risk, including all material risks, at the level of the entire enterprise or

group.

The Board is adopting the BBA in this final rule in order to set risk-based capital

requirements for BHCs and SLHCs that are significantly engaged in insurance activities.

B. Description of the Building Block Approach

As adopted in this final rule, the BBA aggregates the available capital and required

capital positions of certain entities determined to be building block parents in order to determine

the capital position of top-tier supervised insurance depository institution holding companies

(supervised insurance organizations or SIOs). The BBA expresses such a capital position as a

BBA ratio, which is the ratio of the aggregated available capital to the aggregated required

11

12 U.S.C. 5371(c)(3)(A).

10

capital of the enterprise.

12

The SIO must maintain a BBA ratio of at least 250 percent and a

capital conservation buffer of 150 percent, resulting in a total requirement of 400 percent.

The BBA groups legal entities together into building blocks to calculate the BBA ratio.

These building blocks are developed by grouping entities in the supervised insurance

organization that are covered under the same regulatory capital framework. By grouping related

legal entities in this manner, the BBA maintains the regulatory framework developed for the

particular business activity and reduces regulatory burden. Without grouping in this type of

capital construct, a large SIO would need to perform a capital calculation for each of hundreds of

legal entities. Typically, the building blocks follow other existing legal-entity capital

regulations. For instance, a typical U.S. legal entity that offers life insurance is assessed together

with most of its subsidiaries using its existing regulatory capital framework, NAIC Risk-Based

Capital (RBC). Depository institutions and their subsidiaries are assessed using federal banking

capital rules. The BBA does, however, sometimes deviate from existing regulatory groupings to

ensure risks are appropriately captured. For example, certain financial companies owned by

insurance companies are not directly subject to capital regulation. For these companies, the

parent’s regime assesses a simplified capital charge that may not appropriately reflect the risk.

The BBA separately assesses, applies a capital regime to, and aggregates these companies if they

are material and engage in financial activities and their risks would not otherwise be

appropriately measured.

13

12

When aggregating required capital for the denominator, the BBA follows NAIC Risk-Based Capital in using the

Authorized Control Level (ACL) risk-based capital. This is the amount of capital below which a state insurance

regulator would be authorized to take control of the company.

13

For example, it would typically be inappropriate to assess the risk of a material financial subsidiary engaging

primarily in derivative transactions by application of a risk charge applied to its net equity.

11

The BBA makes certain adjustments to the required and available capital of entities when

preparing the building blocks for aggregation. Some of these adjustments avoid double counting

capital or risk, others increase comparability among SIOs, while others are intended to align with

certain aspects of the banking capital requirements to reduce the potential for arbitrage. One

such adjustment is requiring all capital instruments to meet certain criteria and subjecting certain

types of capital instruments to limits. These criteria and limits substantively match those applied

to other depository institution holding companies.

The BBA aggregates the adjusted capital positions of the building blocks to calculate an

SIO’s capital position. To enable aggregation of the output of different capital frameworks, the

BBA includes a translation mechanism called scaling. Scaling converts a capital position from

one capital framework to its equivalent in another capital framework. The BBA then sums the

scaled, adjusted capital position of each building block to calculate an SIO’s capital position.

This aggregated capital position is compared to the minimum requirement and capital

conservation buffer discussed above.

C. Summary of comments received on the NPR and form FR Q-1

The Board received 18 substantive comment letters on the proposal and several

recommendations from the Board’s Insurance Policy Advisory Committee. Comments were

received from insurers supervised by the Board, insurers not supervised by the Board, insurance

trade groups, a U.S. Senator, and the NAIC.

Most commenters supported the BBA’s general framework, which aggregates existing

capital requirements to determine an enterprise-wide capital requirement. Commenters strongly

preferred applying this framework, rather than other frameworks like the banking capital rules or

the Insurance Capital Standard, to depository institution holding companies that are significantly

12

engaged in insurance activities. The Insurance Capital Standard is being developed by the

International Association of Insurance Supervisors. Indeed, certain commenters argued that the

BBA should further leverage existing insurance capital requirements. Although commenters

were supportive of the framework, some commenters expressed concerns with the level of detail

that would be required in form FR Q-1 due to the proposed requirement to report assets and

liabilities of inventory companies.

Specific comments are discussed below in the sections that follow. Some of the main

issues that were raised by commenters include:

Section 171 Calculation – Most commenters argued that the section 171 calculation was

flawed and should not be adopted. Commenters argued the BBA would still comply with section

171 of the Dodd-Frank Act without this calculation.

Calibration – Most commenters supported setting the BBA’s requirement equal to other

banking capital requirements based on the indicated results from the scaling white paper, rather

than including an upward adjustment designed to account for uncertainty. These commenters

contended that the upward adjustment would have resulted in excess conservatism.

Qualifying Capital Instruments and Limits – Most commenters argued that the Board’s

proposed capital instrument qualification criteria were too narrow and that senior debt should

qualify as capital, although several commenters and the Board’s Insurance Policy Advisory

Committee disagreed. Some commenters and the Board’s Insurance Policy Advisory Committee

also argued for increasing the proposed limits on less loss-absorbing tiers of capital instruments.

Some commenters also argued that surplus notes should qualify as tier 1 capital and if they are

tier 2, then no limits should apply.

Insurance Adjustments – Commenters expressed diverging opinions on the proposed

adjustments to reduce differences among states in insurance capital regulation.

13

Along with the NPR, the Board also invited comments about related work on the

International Association of Insurance Supervisors’ Insurance Capital Standard. In the NPR, the

Board asked for the comparative strengths and weaknesses of both approaches. The Board

appreciates the comments received on this work and will take these comments into consideration

in the ongoing International Association of Insurance Supervisors deliberations.

D. Main changes in the final rule and Form FR Q-1

The final rule differs from the proposal in several ways. One change relates to the capital

conservation buffer. The final rule includes a 150 percent capital conservation buffer, rather than

the 235 percent buffer proposed in the NPR. This smaller capital conservation buffer better

aligns the BBA’s stringency with the Board’s banking capital rule. With this change, the BBA’s

total capital requirement equals the total requirement applied to most other banking

organizations, as estimated based on the parameters derived in the Board’s scaling white paper.

The final rule includes an additional tier of capital instruments, additional tier 1 capital,

that is eligible as available capital. The proposal only included two tiers of capital because no

SIO had issued additional tier 1 capital. Commenters requested its addition in order to allow

SIOs flexibility in their capital structures. In order to provide such flexibility, and be consistent

with the Board’s banking capital rule, the final rule includes this additional capital tier. The

additional tier 1 capital limit has been set at 100 percent of the building block capital requirement

for the top-tier parent. Any amount of additional tier 1 capital above this amount would be

eligible for inclusion as tier 2 capital, subject to limitations on the inclusion of tier 2 capital

instruments.

The final rule also increases a proposed limit to 150 percent on the amount of tier 2

capital instruments that could have been counted toward the building block capital requirement

14

of a top-tier parent holding company in an SIO. Under the proposal, the BBA would have

limited tier 2 capital instruments to be no more than 62.5 percent of the building block capital

requirement for the top-tier parent. Commenters expressed concern that the conservative nature

of statutory accounting distorts the ratio of tier 2 capital instruments to common equity tier 1

capital which causes the 62.5 percent to be overly conservative.

The proposal included an adjustment that would have removed the effects of legacy

treatment or transitional measures under a capital framework in determining capital

requirements. Some commenters expressed concerns with the burden associated with adjusting

capital resources to eliminate the impact of transitional provisions or legacy treatment when

there are changes in an underlying capital regime. Some commenters were particularly

concerned with having to restate legacy business under the NAIC Principles Based Reserving

Standard (PBR) for life insurance reserves. PBR was adopted only prospectively by the NAIC

and states. The final rule maintains the legacy treatment and transitional requirements for

consistency in measurement, but provides a simple factor-based approximation rather than a full

PBR calculation to the legacy reserves. This approach will allow for consistency for the

measurement of life insurance reserves while minimizing burden.

In addition to the changes discussed above, the final rule simplifies the insurance

adjustments, increases the limits on certain capital instruments, and eliminates an exception of

certain asset managers from being material financial entities, and reduces the burden of the

proposed form FR Q-1.

The Board is also making changes to the reporting form FR Q-1 as part of this final rule.

The final form FR Q-1 is less burdensome than in the proposal. In particular, SIOs will not need

to report the assets and liabilities of all subsidiaries. Numerous companies said providing this

information would be difficult. Additionally, the annual due date for form FR Q-1’s has been

15

moved back from March 15 to March 31 to allow companies additional time to complete the

reporting template after their statutory filings are due.

II. Effective Date and Scope

A. Scope

The proposal would have applied to SLHCs significantly engaged in insurance activities.

Under the proposal, a firm would have been subject to the BBA if the top-tier SLHC were an

insurance underwriting company or the top-tier SLHC, together with its subsidiaries, if 25

percent of its total consolidated assets were in insurance underwriting subsidiaries (other than

assets associated with insurance underwriting for credit risk related to bank lending). For

purposes of this threshold, a supervised firm would have calculated its total consolidated assets

in accordance with U.S. GAAP, or, if the firm does not calculate its total consolidated assets

under U.S. GAAP for any regulatory purpose (including compliance with applicable securities

laws), the company would have been permitted to estimate its total consolidated assets, subject to

review and adjustment by the Board. The proposal also would have permitted the Board to

determine to apply the BBA to another Board-regulated institution.

14

As consolidated supervisor of the top-tier depository institution holding company of an

insurance depository institution holding company, the Board proposed to include, within the

scope of the BBA calculation, all owned or controlled subsidiaries of this top-tier parent.

14

The preamble to the proposal indicated that this type of determination may be appropriate with respect to, for

example, an intermediate holding company, if its top-tier parent company were primarily engaged in non-financial

commercial activity.

16

The NPR sought comments about whether the BBA should apply to BHCs. The proposal

would have excluded BHCs; however, the NPR noted the Board would consider subjecting

BHCs significantly engaged in insurance activities to the BBA in the final rule in light of the

enactment of the Economic Growth, Regulatory Relief, and Consumer Protection Act.

15

This

Act allowed federal savings associations with total consolidated assets of up to $20 billion, as

reported to the Office of the Comptroller of the Currency (OCC) as of year-end 2017, to elect to

operate as covered savings associations.

16

Four commenters addressed the scope of the BBA in their comments. One commenter

supported applying the BBA to BHCs significantly engaged in insurance activities. Two

commenters asked for clarifications related to 25 percent asset test. These commenters noted

that some SIOs do not calculate consolidated assets and contended that the Board legally cannot

require GAAP financial statements from certain insurers. They asked that the asset test be

aligned the Board’s Regulation TT, which concerns the assessment of fees from certain Board-

regulated companies based on their total assets and contains a provision for estimating total

assets in the absence of GAAP statements.

17

One commenter recommended that the BBA

include additional flexibility to exclude certain companies within an SIO from the BBA and

instead treating a subsidiary company as if it were the top tier. This commenter was concerned

that the Board may lack the legal authority to select a mid-tier holding company as the top-tier

holding company for purposes of the BBA when the insurance company is controlled by a

15

Pub. L. 115-174, 132 Stat. 1296 (2018).

16

EGRRCPA section 206. With limited exceptions, a covered savings association has the same rights and

privileges, and is subject to the same duties, restrictions, penalties, liabilities, conditions, and limitations, as a

national bank that has its main office in the same location as the home office of the covered savings association.

The Board generally treats a company that controls a covered savings association as a bank holding company.

17

12 CFR part 246.

17

company significantly engaged in non-insurance commercial activities. Another commenter

suggested explicitly excluding certain non-operating holding companies from the BBA.

Based on the comments received, as well the Board’s policy to achieve regulatory

consistency across both types of depository institution holding companies, the final rule adopts

the proposed scope of the BBA framework with a change to include BHCs significantly engaged

in insurance activities. The final rule does not alter the proposed 25 percent asset test but does

address the comments received. The final rule will instead allow SIOs that do not calculate

consolidated GAAP assets to provide an estimate of consolidated total assets. The calculation

would be subject to review and adjustment by the Board.

The final rule does not amend the Board’s authority to modify the scope of the BBA, as

the reservations of authority in the final rule and elsewhere in the banking capital rule are

sufficient to allow the Board to exclude from the BBA a top-tier holding company that is a

controlling depository institution holding company under this rule. While possible, this likely

will not occur frequently due to statutory mandates to ensure that depository institution holding

companies can serve as a source of strength to their depository institutions, as well as other

policy considerations. The final rule does streamline the reservation of authority to clarify the

Board’s authority to require an SIO to make certain decisions involved in the BBA calculation,

such as the identification of the top-tier building block parents, building block parents, and

Material Financial Entities (MFEs).

B. Effective Date

The NPR did not propose an effective date for the BBA framework. Several commenters

requested delaying the BBA’s effective date significantly beyond its finalization. One suggested

having at least a two-year transition period from the effective date, or a longer transition period if

18

the finalized total capital requirement were above 400 percent. This commenter also suggested

providing a further opportunity for public comment regarding any changes related to the

proposed form FR Q-1, which could impact the effective date because form FR Q-1 is needed to

effectuate the BBA’s requirements. Another commenter suggested that the first filing date of the

associated form FR Q-1 should be two years after the publication date of the final rulemaking.

One commenter suggested using a five-year monitoring period, like that used by the International

Association of Insurance Supervisors for its Insurance Capital Standard, before making the BBA

effective. Other commenters argued that there is a need to delay certain of the proposed

requirements of form FR Q-1. The proposed form FR Q-1 attestation section of the cover page

would have required reporting firms to attest that effective controls were in place throughout the

reporting period. Because form FR Q-1 was proposed as an annual report, commenters asserted

that at least a one-year delay would be needed between the final rule becoming effective and the

first form FR Q-1 attestation requirement to avoid it applying retroactively.

Under the final rule, companies must comply with most of the BBA beginning on

January 1, 2024. Beginning at that time, companies are expected to hold capital sufficient to

comply with the BBA’s minimum requirement.

Companies must first report on their capital adequacy under the BBA capital requirement

as of December 31, 2024. As described above, the comments received on form FR Q-1

primarily related to reporting of legal entities, filing date, and reporting of results. The Board

received only non-substantive clarification requests through the QIS process on form FR Q-1.

Given that only small technical changes were made to the proposed reporting form based on

these comments and requests for clarification, the Board elected not to seek further comments on

form FR Q-1. Additionally, the January 1, 2024, effective date of this rules allows firms time to

ensure that effective internal controls are in place for the first reporting date. As such, the first

19

form FR Q-1 submissions, which will be due in March 2025, must include the attestation section

of the cover page.

Firms that are not initially subject to the BBA, but subsequently become subject to the

BBA during January through June in a year, will be required to begin submitting the form FR Q-

1 in March of the calendar year following the year they become subject to the BBA, except for

the attestation section of the cover page, which must be submitted beginning with the firm’s

second form FR Q-1. Firms that are not initially subject to the BBA, but subsequently become

subject to the BBA during July through December in a year, will be required to begin submitting

the form FR Q-1 in March of the second calendar year following the year they become subject to

the BBA, except for the attestation section of the cover page, which must be submitted beginning

with the firm’s second form FR Q-1.

The final rule also clarifies the timing of the application of the buffer. In the absence of

any enterprise-wide group income calculation, the BBA links the amount of eligible distributions

under the capital conservation buffer with changes to building block available capital.

Calculating the change in building block available capital requires two years of BBA data,

meaning that firms would not be able calculate their permissible distributions before completing

their second form FR Q-1. Consequently, the BBA’s buffer requirements are effective starting

with the submission of a firm’s second form FR Q-1.

18

In the year proceeding the second form

FR Q-1 submission, the Board expects firms to consider the pending requirements and to set

their distribution policies to avoid needing a large and sudden change in payouts at the effective

date.

18

See 12 CFR 217.306.

20

III. Dodd-Frank Act Capital Calculation

The proposal would have applied a separate minimum risk-based capital requirement

calculation to insurance depository institution holding companies, which would have used the

flexibility afforded by the 2014 Amendment to exclude certain state- and foreign-regulated

insurance operations and to exempt top-tier insurance underwriting companies from the risk-

based capital requirement. The proposed section 171 calculation would have applied the Board’s

existing minimum risk-based capital requirements to a top-tier insurance SLHC on a

consolidated basis when this company is not an insurance underwriting company. In the case of

an insurance SLHC that is an insurance underwriting company, the proposal would have applied

the requirements to any subsidiary SLHC of an insurance SLHC, where the subsidiary SLHC is

not itself an insurance underwriting company, provided that the subsidiary SLHC is the farthest

upstream non-insurer SLHC (i.e., the subsidiary SLHC’s assets and liabilities are not

consolidated with those of a holding company that controls the subsidiary for purposes of

determining the parent holding company’s capital requirements and capital ratios under the

Board’s banking capital rule) (an insurance SLHC mid-tier holding company).

The proposed section 171 calculation would have been implemented by amending the

definition of “covered savings and loan holding company” for the purposes of the Board’s

banking capital rule.

19

The proposal would have resulted in an insurance SLHC becoming a

covered SLHC subject to the requirements of the Board’s banking capital rule unless it was a

legacy unitary SLHC

20

that derived 50 percent or more of its total consolidated assets or 50

19

12 CFR 217.2.

20

This term refers to a SLHC that meets the requirements of section 10(c)(9)(C) of HOLA (12 U.S.C.

1467a(c)(9)(C).

21

percent or more of its total revenues on an enterprise-wide basis (as calculated under GAAP)

from activities that are not financial in nature. However, the proposal would not have required

top-tier SLHCs that are engaged in insurance underwriting and regulated by a state insurance

regulator, or certain foreign insurance regulators, to comply with the generally applicable risk-

based capital requirements.

21

Instead, those requirements would have applied to any insurance

SLHC mid-tier holding companies.

As noted above, commenters opposed this calculation and argued that the BBA would

comply with section 171 of the Dodd-Frank Act without this additional calculation. Commenters

contended that the proposal without the section 171 calculation meets the Board’s statutory

requirements under section 171 of the Dodd-Frank Act, as amended by the 2014 Amendment, to

establish minimum risk-based capital requirements for these companies. Commenters argued

that the section 171 calculation would introduce burdens and costs that do not meaningfully

advance the Board’s supervisory objectives. Some commenters also contended that the 2014

Amendment indicates that Congress did not intend for the Board to implement the section 171

calculation. Commenters argued that the section 171 calculation duplicates certain requirements

of the BBA and inappropriately treats firms differently according to legal form.

The Board considered the comments and has decided to include the section 171

calculation in the final rule. Section 171 of the Dodd-Frank Act generally requires that the

minimum risk-based capital requirements established by the Board for depository institution

holding companies apply on a consolidated basis. The Board believes that including the section

21

In accordance with section 171 of the Dodd-Frank Act, a foreign insurance regulator that falls under this

provision is one that “is a member of the [IAIS] or other comparable foreign insurance regulatory authority as

determined by the Board of Governors following consultation with the State insurance regulators, including the lead

State insurance commissioner (or similar State official) of the insurance holding company system as determined by

the procedures within the Financial Analysis Handbook adopted by the [NAIC].”

22

171 calculation accords with the plain language meaning of section 171 of the Dodd-Frank Act,

considering also the use of terms in section 171 elsewhere in the federal banking laws, and the

legislative history of section 171 and the 2014 Amendment. Moreover, the Board believes that

the treatments for insurance activities under the section 171 calculation is an appropriate exercise

of the discretion given to the Board by Congress in the 2014 Amendment.

The proposed section 171 calculation would have allowed an insurance SLHC subject to

the generally applicable risk-based capital requirements (i.e., that is not a top-tier insurance

underwriting company) to elect not to consolidate the assets and liabilities of all of its subsidiary

state-regulated insurers and certain foreign-regulated insurers. The proposal would have

provided two alternative approaches if this election is made. Under the first alternative, the

holding company could have elected to deduct the aggregate amount of its outstanding equity

investment in its subsidiary state-regulated and certain foreign-regulated insurers, including

retained earnings, from its common equity tier 1 capital elements. Under the second alternative,

the holding company could have included the amount of its investment in its risk-weighted assets

and assigned to the investment a 400 percent risk weight, consistent with the risk weight

applicable under the simple risk-weight approach in section 217.52 of the Board’s banking

capital rule to an equity exposure that is not publicly traded.

22

A commenter expressed concerns regarding the proposed equity-deduction treatment,

contending that it would be unduly punitive. The commenter also urged the Board to permit

firms to risk-weight a company’s net equity investment in insurance operations consistently with

NAIC RBC’s treatment of equity investments in affiliates. The commenter also suggested that

the Board permit firms to satisfy the section 171 calculation through use of the Small Bank

22

12 CFR 217.52(b)(6).

23

Holding Company and Savings and Loan Holding Company Policy Statement and measuring

compliance with the applicability thresholds of that statement after applying the election not to

consolidate the assets and liabilities of subsidiary state-regulated insurers and certain foreign-

regulated insurers.

In the final rule, firms that elect not to consolidate the assets and liabilities of all of its

subsidiary state-regulated insurers and certain foreign-regulated insurers have the option to

choose between the proposed treatments. This optional provision should provide firms with

greater flexibility to apply an appropriate treatment in view of a firm’s individual structural and

other business circumstances. In the final rule, a firm that makes such an election and chooses to

risk-weight its net equity investment in the deconsolidated subsidiaries must apply a risk weight

of 400 percent, consistent with the proposal. The Board believes that this treatment is

appropriate considering the risk weights applied to non-publicly traded equity exposures.

Finally, a firm may not comply with the section 171 calculation through use of the Small Bank

Holding Company and Savings and Loan Holding Company Policy Statement.

23

This policy

statement states expressly that the statement applies only to holding companies that are “not

engaged in significant nonbanking activities either directly or through a nonbank subsidiary”;

24

the section 171 calculation applies only to companies that are members of a holding company

organization that is significantly engaged in insurance activities, a nonbank activity.

IV. Minimum Capital Requirement and Capital Conservation Buffer

The proposal was designed to produce an enterprise-wide risk-based capital requirement

that is not less stringent than the results derived from the Board’s banking capital rule. To enable

23

12 CFR part 225 app. C.

24

Id. section 1.

24

aggregation of available capital and capital requirements across different building blocks, the

proposal included a mechanism (scaling) that would have translated a capital position under one

capital framework to its equivalent in another capital framework.

25

At the enterprise level, the

proposal would have applied a minimum risk-based capital requirement that leverages the

minimum requirement from the Board’s banking capital rule, expressed as its equivalent value in

terms of the BBA ratio based on the Board’s published scaling white paper. In addition to this

equivalent value, the proposal would have also included a margin of conservatism to provide a

heightened degree of confidence that the BBA’s requirement would be compliant with

section 171 of the Dodd-Frank Act, which requires the BBA to be “not less than” the Board’s

banking capital requirements. In addition to complying with section 171 of the Dodd-Frank Act,

calibrating the BBA to the same stringency level as the banking capital requirements minimizes

the incentive for depository institution holding companies to acquire or sell insurance operations

due to disparate capital requirements.

The proposal would have established a minimum BBA ratio of 250 percent and a capital

conservation buffer of 235 percent. Together, these would have created a 485 percent total

requirement. Insurers that breach this total requirement would have faced limits on capital

distributions such as dividend payments and on discretionary bonus payments. The proposed

minimum ratio, 250 percent, would have aligned with the midpoint between two prominent,

existing state insurance supervisory intervention points, the “company action level” and “trend

test level” under state insurance RBC requirements. To determine the appropriate threshold for a

25

Two building blocks under two different capital frameworks cannot typically be added together if, as is

frequently the case, each framework has a different scale for its ratios and thresholds. As discussed below in section

VII, the BBA proposes to scale and equate capital positions in different frameworks through analyzing historical

defaults under those frameworks.

25

capital conservation buffer under the BBA, the Board took a similar approach to how it

determined the minimum requirement. The full amount of the buffer under the Board’s banking

capital rule, 2.5 percent, translates to approximately 235 percent under the NAIC RBC

framework. This translated buffer threshold would have been applied in the BBA.

Commenters criticized the proposed margin for conservatism and indicated that proposed

minimum capital requirements and total capital requirements are significantly higher than the

banking capital requirements. Some of these comments distinguished between including

margins for conservatism in the minimum and total capital requirements. Consequently, while

most commenters opposed including the margins in the total requirement, only some opposed

uplifting the minimum requirement. Commenters justified this nuance because section 171 of

the Dodd-Frank Act applies to only the minimum requirement. Legally, any margin included in

the minimum requirement could be offset by a smaller capital conservation buffer. This would

reduce the BBA’s total requirement from 485 percent to 400 percent.

26

Commenters argued that

the margin could competitively disadvantage SIOs as compared to other insurers or alternatively

create externalities for companies not subject to the rule by changing industry-wide perceptions

of capital adequacy.

Several commenters also argued that other aspects of the BBA are excessively

conservative. These commenters criticized the BBA for the lack of diversification credit

between entities in the group, treatment of captive reinsurance transactions, and criteria for

26

The proposal’s capital requirement included an approximately 85 percent increase over the best-estimate

translation to account for the uncertainty. That is, the best-estimate translation of an 8 percent total capital ratio is a

BBA ratio of near 165 percent. This was uplifted to a 250 percent proposed requirement in the proposal. Removing

this 85 percent uplift from the buffer reduces the proposed 485 percent total BBA ratio requirement to 400 percent.

A 400 percent BBA ratio requirement aligns with the best-estimate translation of a 10.5 percent total capital ratio.

26

including capital instruments in available capital. Several commenters argued the BBA’s capital

requirements should be reduced in order to offset these conservative aspects of the framework.

Some commenters suggested fundamental changes to the calibration of the BBA. A few

commenters argued that the BBA’s requirements should not equal those applied to other banking

organizations. Two commenters suggested instead tailoring the BBA’s requirements to the loss

experience of insurers. Two other commenters argued for eliminating the capital conservation

buffer, either because insurance does not create systemic risk or because subsidiary depository

institutions already are subject to a buffer requirement. Finally, one commenter argued that any

capital requirements in excess of state insurance capital requirements would be unlawful and

inappropriate. In the alternative, this commenter argued that an SIO buffer should depend on the

size of its depository institution.

Commenters also raised concerns about the impact of breaching the BBA requirements

and how they would interact with the NAIC RBC requirements. First, two commenters

disagreed with limiting policyholder dividends when the BBA’s total requirement is breached.

Second, some commenters questioned how the BBA’s requirements would interact with NAIC

RBC, which is calibrated differently. An additional commenter requested clarification of the

impact of not meeting the total capital requirement.

Based on the comments received, the Board has decided to modify the proposed

calibration of the BBA. Most significantly, the Board has removed the margin from the

proposed capital conservation buffer, dropping the BBA’s total requirement from 485 percent to

400 percent.

Like the proposal, the final rule attempts to calibrate the BBA to the same level of

stringency as the Board’s banking capital rules. The BBA takes into account the different risks

involved in insurance activities, on the one hand, and banking activities, on the other, through its

27

aggregation process, rather than through an altered calibration or by eliminating the capital

conservation buffer. While some commenters suggested that the BBA’s calibration should be

tailored to insurance, no commenter explained either how or why engaging in insurance activities

should change the stringency of capital requirements that apply to a bank holding company or

SLHC.

27

To ensure safety and soundness of the SIOs, the BBA’s minimum capital requirement

includes a margin. This margin ensures, to a high degree of confidence, that the BBA’s

minimum requirement is not less than the banking capital requirements. The margin’s size

corresponds to the upper bound of a 95 percent confidence interval on the BBA’s calibration

from the scaling regressions.

28

Sensitivity tests of the calibration using different assumptions

also informed the analysis.

29

Consequently, the final rule does not include a margin for the

capital conservation buffer. As a result, the BBA’s total requirement equals the total requirement

applicable to most other banking organizations.

The minimum capital ratio of 250 percent has not been reduced in the final rule in

response to the comments about the proposal’s alleged conservatism in its treatment of certain

capital instruments, application of the banking rules to unregulated entities, lack of

27

A commenter contended that the proposal was inconsistent with the McCarran-Ferguson Act, 15 U.S.C. 1011 et

seq. The Board believes that section 5 of the Bank Holding Company Act, section 10(g) of the Home Owners’ Loan

Act, and section 171 of the Dodd-Frank Act provide authority for the Board to establish capital requirements for

companies significantly engaged in insurance activities that have elected also to engage in the business of banking

by operating a subsidiary bank or savings association. In particular, the 2014 Amendment expressly contemplates

that the Board would establish minimum capital requirements for such companies.

28

The Board used Monte Carlo simulation to translate the standard errors displayed in Table 2 of the white paper to

a confidence interval for the calibration. In 95 percent of simulations, 8 percent total capitalization Risk Weighted

Assets ratio translated to between 80 percent ACL RBC and 251 percent ACL RBC.

29

Table 3 of the white paper parameterizes the scalars using alternative assumptions. These parameters can be used

to translate 8 percent and 10.5 percent risk-weighted assets to NAIC RBC using the scaling formulas derived in

Appendix 1.

28

diversification credit, or treatment of prescribed and permitted practices. While some of these

differences may make the BBA more conservative than NAIC RBC, the differences provide for a

consistent level of conservatism between the BBA and the banking capital rule and consistency

between SIOs. For example, the Board’s capital rule applies to holding companies on a

consolidated basis, including any unregulated entities. The BBA treatment of some non-

depository institution, non-insurer subsidiaries of insurance BHCs and insurance SLHCs as

MFEs and application of the banking capital rule to them does not justify reducing the BBA’s

calibration to below the banking capital rule.

Additionally, even if the BBA were intended to match the stringency of NAIC RBC

rather than the banking capital rule, many of the referenced details still would not justify

reducing the BBA’s requirements. Senior debt does not qualify as capital for the issuer in either

the BBA or NAIC RBC. If senior debt is downstreamed to a subsidiary as equity, it qualifies as

capital for the subsidiary in both.

30

By design, NAIC RBC excludes the parent and other

affiliated companies. The impact of these exclusions varies. If an unregulated entity is relatively

well capitalized, including it would be less conservative than NAIC RBC. Similarly, prescribed

and permitted practices could either increase or decrease surplus.

No changes were made regarding the interaction of the BBA and NAIC RBC or the

operation of the capital conservation buffer. The BBA and NAIC RBC create separate

requirements. SIOs must comply with all applicable legal requirements. The final rule, like the

proposal, treats policyholder dividends as capital distributions. Policyholder dividends are how

30

Senior debt may qualify as capital for the issuer in the NAIC’s Group Capital Calculation (GCC). The BBA is,

however, designed to match the stringency of requirements for other depository institution holding companies, not

the GCC. The BBA and GCC also have different purposes. The GCC will be used as a tool by state insurance

regulators, rather than a requirement. No GCC ratio would necessarily produce a similar intervention to a breach of

the BBA’s minimum requirement.

29

mutual insurers distribute earnings to their owners. These capital distributions are analogous to

shareholder dividends for stock companies. Prudent management requires limiting these

payments when capital is low.

V. Determination of Building Blocks and Related Issues

A. Inventory

The proposed BBA calculation started by creating an inventory of the legal entities in a

SIO, which generally would have been all legal entities under the depository institution holding

company. This inventory would have served as the foundation for the BBA’s aggregation.

As the proposal did elsewhere, it leveraged existing regulations to define the inventory.

Under the proposal, a SIO’s inventory would have included all entities that appear on

organizational structure data reported to the Board or state insurance regulators.

31

In rare cases, the inventory would have included a special purpose entity not included in

the organizational structure data provided to the Board or filed with the state insurance

regulators. The organizational data provided are generally based on control of a subsidiary, and

therefore may not include all entities that the Board intends to include in the scope of the BBA in

order to avoid missing risks. The burden of including such entities in the inventory would have

been limited, as only special purpose entities with which an SIO enters into a derivative or

reinsurance contract would have been included.

Under the proposed form FR Q-1, SIOs would have needed to report certain basic

information (e.g., total assets) for all inventory companies. Two commenters suggested

31

The inventory would have contained any entity required to be reported under the Board’s FR Y-6 or Y-10 reports

or considered an affiliate under Statutory Statement of Accounting Principle (SSAP) 25 and reported on Schedule Y

of the insurer’s statutory annual report.

30

significantly reducing the reporting burden. The commenters asserted that SIOs could not easily

calculate the total assets of subsidiaries multiple levels down their organization chart. To avoid

this burden, these commenters argued for excluding immaterial, non-operating entities from the

inventory.

One other commenter opposed including in the inventory any company that is not

included in existing regulatory reporting. The commenter noted that determining whether a

company needed to be included in the inventory would require estimating the company’s

expected losses, which would be difficult.

In response to the comments, the final form FR Q-1 requires less information than the

proposal. Specifically, the final form FR Q-1 does not require reporting the assets and liabilities

of inventory companies whose parents represent less than one percent of the group’s assets.

Based on QIS data, this form FR Q-1 change reduces the BBA’s burden similarly to the

inventory change suggested by two commenters.

In light of this change to the reporting form FR Q-1, the final rule does not alter the scope

of the inventory in determining the scope in the BBA. For each inventory company, the final

rule still requires checking whether the company should become a building block parent, but it

would not require the asset and liability information from all inventory companies. The tests for

becoming a building block parent, which are examined in the next section, focus on whether the

BBA appropriately captures the company’s risks. The final rule applies these tests broadly to

avoid excluding material risks.

B. Identifying Capital Frameworks for Each Inventory Company

After the creation of the inventory, the proposal would have identified each inventory

company’s applicable capital framework, which would have been used to partition the inventory

31

companies into building blocks. For insurance companies, the applicable capital framework

would have been their current regulatory framework, except in rare cases.

32

For all other

companies, the applicable capital framework would have been the Board’s capital rule or, the

capital rule applied by the Federal Deposit Insurance Corporation (FDIC), or the capital rule

applied by the Office of the Comptroller of the Currency (OCC).

Commenters generally did not oppose the rules for assigning companies to capital

frameworks, but several QIS participants expressed confusion that the proposal would not

actually have applied the “applicable capital framework” in all instances.

33

For instance, the

applicable capital framework for non-insurance subsidiaries of insurers would have been the

Board’s capital rule. However, most such companies would have remained in their insurance

parent’s building block. This insurance parent would continue to assess the inventory

companies’ risks using its insurance capital framework, unless they are an MFE.

To address this comment, the final rule replaces the term “applicable capital framework”

with “indicated capital framework.” This revised terminology better describes the BBA’s usage.

The indicated capital framework is the capital framework that would apply to a company if it

were determined to be a building block parent.

C. Identification of Building Block Parents

After identifying an applicable capital framework for each inventory company, the

proposal would have identified building block parents (BBPs). Under the proposal, a building

32

Examples of rare cases would have included title insurers and non-scalar compatible insurers.

33

Some commenters criticized the proposed application of the banking capital rule to companies other than banks.

The root disagreement from these commenters appeared to be with the scoping and grouping rules rather than the

identification of the banking capital rule as the indicated capital framework for companies not engaged in insurance.

The commenters preferred to either exclude the companies from the BBA or analyze these companies together with

their parents rather than specifying an alternative capital framework for analysis.

32

block parent could have been one of several different types of companies. The first would have

been the top-tier depository institution holding company. In the absence of any other identified

building block parents, the top-tier depository institution holding company’s building block

would have contained all of the top-tier depository institution holding company’s subsidiaries. A

second type of building block parent would have been a mid-tier holding company that is a

“depository institution holding company” under U.S. law. The proposed treatment of these

companies as building block parents would have allowed for the calculation of a separate BBA

ratio at the level of these companies in the enterprise and helped to ensure that these companies

remain appropriately capitalized.

The proposal would have identified additional building block parents based on grouping

rules that would have generally relied on existing capital regulations. Relying on these

frameworks materially reduces burden and the potential for unintended consequences.

Additionally, the proposal would have identified certain other financial entities that are material

to the group as building block parents. The proposal deemed these entities as MFEs, which are

described below.

The proposal would have determined which entities are building block parents by

considering whether the capital framework applicable to each inventory company or MFE is the

same as that of the next-upstream company that is directly subject to a capital framework.

Generally, the proposal would have had companies subject to the same capital framework remain

in the same building block, except for one case. This exceptional case would have been where a

company’s applicable capital framework treats the company’s subsidiaries in a way that does not

substantially reflect the subsidiary’s risk. For instance, there could be situations in which NAIC

RBC may not fully reflect the risks in certain subsidiaries (typically, certain foreign subsidiaries)

33

that assume risk from affiliates.

34

In such cases, the subsidiary (which could be a capital-

regulated company or MFEs) would have been identified as a building block parent so that its

risks could more appropriately be reflected in the BBA.

The proposal would have taken into account the risks of companies that are not building

block parents indirectly through a building block parent’s capital calculation using its regulatory

requirements. This could have been through consolidation by a building block parent or

accounting for the inventory company as an investment by the building block parent.

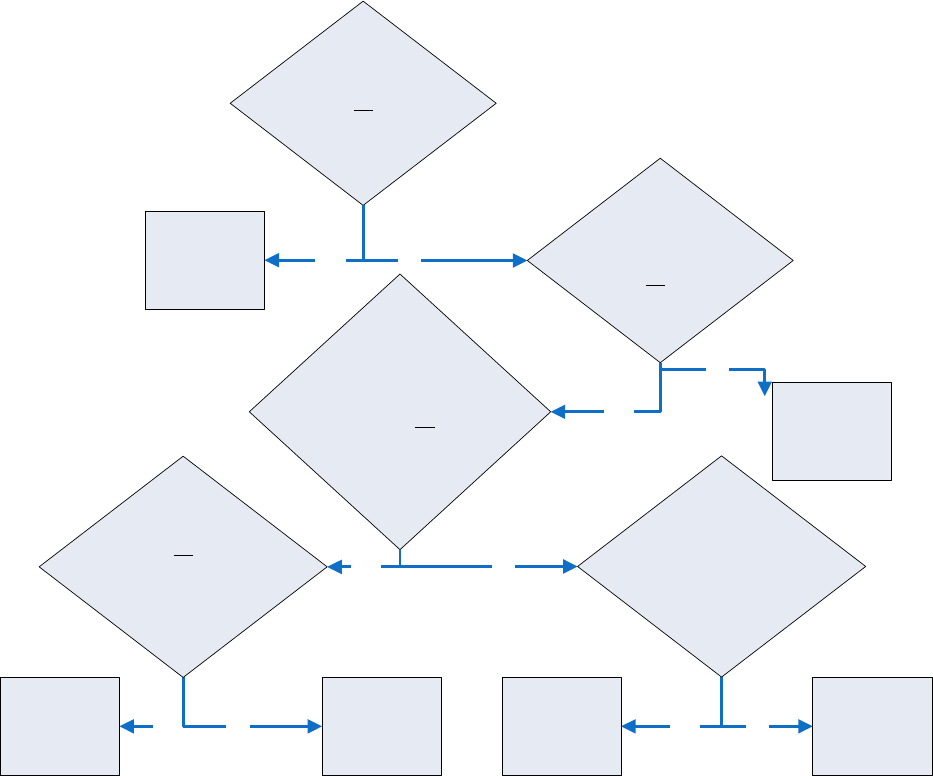

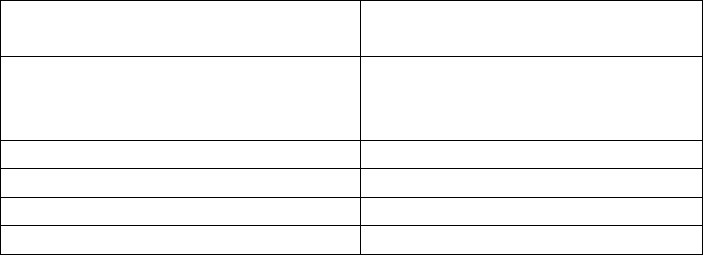

Figure 1 illustrates the how the rules for identifying building block parents would have

worked under the proposal.

34

The BBA proposes to apply NAIC RBC to such subsidiaries. However, under state laws, the application of

NAIC RBC on the parent would not normally operate to include the available and required capital from applying

NAIC RBC to the subsidiary. However, when the subsidiary is identified as a building block parent in the BBA, the

subsidiary’s available and required capital under NAIC RBC would be reflected by the parent after aggregation.

34

Figure 1. Building Block Parent Identification

D. Material Financial Entity

A key step in the proposal’s identification of building block parents would have been

assessing whether a financial entity is an MFE. If an entity was determined to be a MFE in the

proposal, it would have become a building block parent and assessed under either the banking

capital rule or NAIC RBC. The proposal would have defined a financial entity as material if the

top-tier depository institution holding company’s total exposure to it exceeds 1 percent of the

top-tier depository institution holding company’s consolidated assets. While a parent company’s

exposure to a subsidiary most commonly arises from potential losses on the parent company’s

Is the entity

a top-tier parent

OR

depository institution holding

company?*

The entity is a

building block

parent.

Yes

No

Is the entity a

capital-regulated

company

OR

material financial

entity?

Does the

entity’s indicated capital

framework differ from the current

building block parent’s indicated

capital framework, OR is the same

framework, but the entity receives an

equity charge or is deducted in

the parents framework?

No

Yes

The entity

is not a

building block

parent.

Is a scalar

specified for the

Indicated capital framework

OR

Is the entity material individually or

with other capital regulated company

subject to the same

regulatory capital

framework?

Yes

No

Does the indicated

capital framework fully reflect the

risk of the subsidiary?

Yes

No

Yes

No

The entity is a

building block

parent.

The entity

is not a

building block

parent.

The entity

is not a

building block

parent.

The entity is a

building block

parent.

35

investment, the exposure could also result from guarantees and other sources. In addition to this

quantitative materiality definition, the proposed rule would have included a qualitative definition

to capture entities that are otherwise significant when assessing capital. The proposal would

have excluded certain entities, including some asset managers, from the MFE definition. The

proposal would have also contained an option of electing to treat certain pass-through entities as

MFEs or including their risks in the capital calculation of other building block parents.

Typically, such a company would be one that serves as a pass-through or risk management

intermediary for other companies under the insurance depository institution holding company.

35

If an insurance depository institution holding company were to make this election, the risks

posed by this company would nonetheless have been reflected in the BBA. As proposed, the

BBA would have required the insurance depository institution holding company to allocate the

risks that the company faces to the other companies in the enterprise with which the company

engages in transactions.

Commenters expressed diverging views on the concept of MFEs. Several commenters

criticized some results of identifying MFEs as building block parents. These commenters noted

the burden and complexity of applying the banking capital rule to non-banking companies. One

commenter noted that this would be particularly problematic in the case of investment

subsidiaries, as it would create burden and result in a misalignment with how an entity is treated

in its parent’s capital regime. This commenter believed these entities should be assessed along

with the insurance company.

35

Frequently a pass-through company enters into transactions with affiliates (e.g., operating insurers) and enters

into back-to-back transactions with third parties to manage risks on a portfolio basis.

36

Other commenters either explicitly agreed with the proposal or suggested only minor

revisions. Commenters suggested that the threshold of 1 percent of total assets should be higher.

One commenter argued that using total assets as the base measure for materiality is inconsistent

with state-based insurance regulations, where surplus is most often used. Additionally, a

commenter asserted that using total assets could penalize property and casualty (P&C) insurers

relative to life insurers because P&C insurers are generally less leveraged. Another commenter

suggested clarifying aspects of the definition of materiality, particularly with regards to captive

insurers who may not use NAIC Statutory Accounting Practices. One commenter suggested

considering size, off-balance sheet exposures, and activities involving derivatives or

securitizations within the materiality definition.

Consistent with the proposal, the final rule continues to designate MFEs as building block

parents when certain conditions are met. The Board intends the BBA to capture all material risks

within the group. Designating MFEs as building block parents is essential to ensuring that these

risks are appropriately reflected. Without this designation, SIOs could easily evade and

manipulate BBA results by transferring risks from regulated entities to unregulated entities that

would only be captured in the BBA through inclusion in their parent’s capital requirement based

on an equity risk factor applied to their net equity, which could result in a very small capital

requirement if the entity is thinly capitalized. Based on the QIS results, identifying MFEs as

building block parents will result in only minimal burden, but could have a significant impact in

reducing the potential for regulatory arbitrage. All SIOs collectively identified only a very small

number of MFEs in the QIS.

The final rule does, however, modify the definition of materiality in response to the

comments. The final rule uses a threshold of 5 percent of equity of the top-tier depository

institution’s holding company rather than 1 percent of its assets. Because the BBA assesses

37

capitalization, capital represents a better benchmark for materiality than assets, and 5 percent

better aligns with the thresholds used in other contexts (e.g., accounting). By assessing the

materiality of exposure from all sources (e.g., investments and guarantees), the BBA’s

assessment of materiality incorporates the factors suggested by one commenter (e.g., off-balance

sheet exposures).

The Board does not agree that designating an investment subsidiary as an MFE is

problematic, as the proposal contained an exclusion that would have allowed pass-through

treatment of the risk of the entity rather than treating it as an MFE. In addition, QIS results

indicated this exclusion will operate as intended. The final rule does not change this treatment.

Based on the QIS, the final rule also makes a small change to address inventory

companies that have no upstream entity and that are not a top-tier SLHC (e.g., a mutual

insurance company controlled through common management). The NPR did not contemplate

these types of companies. The final rule clarifies that if a company is an MFE or a company

subject to capital regulation, then it must be considered a building block parent. These

companies are exempted from the typical tests comparing their indicated capital framework to

their upstream building block parent’s indicated capital framework.

E. Treatment of Asset Managers

The proposal would have excluded certain asset managers from the MFE definition.

Asset managers owned by insurers would have been assessed as they currently are in their

insurance parent’s risk-based capital calculation based on NAIC RBC. Asset managers owned

by companies assessed using the Board’s banking capital rule would have been consolidated by

their parent company.

38

Commenters were divided on this exclusion from the MFE definition. Several

commenters supported the exclusion and noted that the Board’s banking capital rule would not