CAPITAL Section 2.1

Risk Management Manual of Examination Policies 2.1-1 Capital (8/22)

Federal Deposit Insurance Corporation

INTRODUCTION.............................................................. 2

CAPITAL PLANNING ..................................................... 2

REGULATORY CAPITAL REQUIREMENTS ............... 2

COMPONENTS OF CAPITAL ......................................... 3

Common Equity Tier 1 Capital ...................................... 3

Additional Tier 1 Capital................................................ 4

Tier 2 Capital ................................................................. 4

Deductions and Limits ................................................... 4

CECL Transition Period ................................................. 5

CAPITAL RATIOS ........................................................... 5

RISK-WEIGHTED ASSETS ............................................. 5

Standardized Approach .................................................. 5

HVCRE Loans ............................................................... 5

Past-Due Asset Risk-Weights ........................................ 6

Structured Securities and Securitizations ....................... 6

Securitization Due Diligence ......................................... 6

Equity Risk-Weights ...................................................... 7

Collateralized Transactions ............................................ 7

Treatment of Guarantees ................................................ 8

Off-Balance Sheet Exposures ......................................... 8

REGULATORY CAPITAL REQUIREMENTS ............... 8

Capital Conservation Buffer ........................................... 9

COMMUNITY BANK LEVERAGE RATIO ................. 10

Statutory and Regulatory Background ......................... 10

The CBLR Calculation ................................................. 10

Maintaining CBLR Eligibility ...................................... 10

Additional Capital and Administrative Actions ........... 10

Compliance Grace Period............................................. 11

Discretionary Opt Out from the CBLR ........................ 11

PROMPT CORRECTIVE ACTION ................................ 11

Institutions that are Subject to the Generally Applicable

Capital Rule .................................................................. 11

CBLR Institutions ........................................................ 12

CAPITAL RULES APPLICABLE TO THE LARGEST

INSURED DEPOSITORY INSTITUTIONS ................... 12

Supplementary Leverage Ratio .................................... 12

Custody Banks ......................................................... 13

OTHER REGULATORY REQUIREMENTS ................. 13

EXAMINATION-IDENTIFIED DEDUCTIONS FROM

COMMON EQUITY CAPITAL ...................................... 13

Identified Losses and Insufficient Allowances ............. 13

Other Real Estate Valuation Allowances ..................... 14

Liabilities Not Shown on Books .................................. 14

CAPITAL ADEQUACY.................................................. 14

Fundamentally Sound and Well-Managed Institutions 14

Less Than Adequately Capitalized Institutions ............ 14

Problem Institutions ..................................................... 14

Capital Requirements of Primary Regulator ................ 15

Capital Plans Required by Corrective Programs .......... 15

Disallowing the Use of Bankruptcy ......................... 15

Increasing Capital in Operating Institutions ................. 15

Increased Earnings Retention ................................... 15

Sale of Additional Capital Stock .............................. 15

Reduce Asset Growth ............................................... 16

Contingent Liabilities ................................................... 16

Potential and Estimated Losses ................................ 16

Common Forms of Contingent Liabilities ............... 17

Litigation ................................................................. 17

Trust Activities ........................................................ 17

EVALUATING CAPITAL ADEQUACY ...................... 17

Financial Condition of the Institution .......................... 18

Quality of Capital ........................................................ 18

Emerging Needs for Additional Capital ...................... 18

Problem Assets ............................................................ 18

Balance Sheet Composition ......................................... 18

Off-Balance Sheet Risk Exposures .............................. 18

Earnings and Dividends ............................................... 18

Asset Growth ............................................................... 19

Access to Capital Sources ............................................ 19

RATING THE CAPITAL FACTOR ............................... 19

Uniform Financial Institution Rating System .............. 19

Ratings ......................................................................... 20

CAPITAL Section 2.1

Capital (8/22) 2.1-2 Risk Management Manual of Examination Policies

Federal Deposit Insurance Corporation

INTRODUCTION

Ca

pital serves four essential functions:

• Ab

sorbs Losses: Capital allows institutions to

continue operating as going concerns during periods

when operating losses or other adverse financial

results are experienced.

•

Pr

omotes Public Confidence: Capital provides a

measure of assurance to the public that an institution

will continue to provide financial services even when

losses have been incurred, thereby helping to maintain

confidence in the banking system and minimize

liquidity concerns.

•

Res

tricts Excessive Asset Growth: Capital, along

with minimum capital ratio standards, can act as a

constraint on expansion by requiring that asset growth

be funded by a commensurate amount of capital.

• Protects Depositors and the Deposit Insurance

Fund: Placing owners at significant risk of loss,

should the institution fail, helps to minimize the

potential for moral hazard, and promotes safe and

sound banking practices.

As f

ederal deposit insurer and supervisor of state

nonmember institutions, the FDIC places high importance

on capital adequacy. Capital supports prudent asset growth

and promotes public confidence, while helping banking

institutions absorb unexpected losses and remain viable in

times of stress. In addition, capital is the lifeblood of the

credit intermediation process as it provides institutions with

the capacity to gather deposits and make loans in their

markets. Since capital adequacy assessments are central to

the supervisory process, examiners evaluate all aspects of a

financial institution’s risk profile and activities to determine

whether its capital levels are appropriate and in compliance

with minimum regulatory requirements.

←

CAPITAL PLANNING

Ins

titution management performs capital planning to ensure

that capital protection is commensurate with the

institution’s financial condition, business and growth plans,

holding company support (if applicable), and projected

capital distributions. The sophistication of capital planning

can vary depending on an institution’s size and complexity,

as well as its products and business lines. In many cases,

institutions base their strategic planning and budget

processes on expectations for capital levels and earnings

retention. Therefore, capital planning is essential for setting

an institution’s capital cushion, establishing asset growth

and funding targets, pursuing new products or markets, and

determining whether dividends returning capital to

shareholders are appropriate and reasonable.

Ins

titution management typically supports capital plans

with realistic assumptions about prospective asset quality,

earnings performance, and other business considerations.

Management has a number of matters to consider when

devising a capital plan, including budgets and strategic

plans, expectations for loan quality through a full economic

cycle, merger and acquisition objectives, and competition

within the institution’s markets. Management of large and

complex institutions, in particular, use stress testing to help

inform their capital plans by assessing the impact of

plausible events or circumstances that could increase

exposure to losses. Community institutions are not subject

to capital stress testing, but some institutions have

developed their own analyses of asset concentrations or

commercial real estate loan exposures to better inform their

planning.

During supervisory reviews, examiners discuss the capital

planning process with management to understand how they

established current and prospective capital levels.

Examiners consider the board of directors’ involvement in

developing these plans, and whether capital levels can

support asset exposures, various business cycles, and

potential stress conditions.

←

REGULATORY CAPITAL

REQUIREMENTS

Regulatory capital requirements have evolved as

innovations in financial instruments and investment

activities introduced greater complexity to the banking

industry. Regulatory capital rules set forth minimum

capital ratio requirements and generally follow a framework

of standards adopted by the Basel Committee on Banking

Supervision (BCBS), an international standard-setting body

that deals with various aspects of bank supervision. The

FDIC is a member of the BCBS and works with the Board

of Governors of the Federal Reserve System (FRB) and the

Office of the Comptroller of the Currency (OCC) to

establish domestic capital regulations. Additionally,

statutory actions by Congress can set the direction and

content of regulatory capital regulations and policy for

banking organizations in the United States. Standards set

forth by the Financial Accounting Standards Board may

also influence domestic regulatory capital regulations.

In 2013, the FDIC, FRB, and OCC issued a comprehensive

set of post-crisis regulations for U.S. institutions that align

with Basel III capital standards (2013 capital rule). These

regulations are designed to strengthen the quality and

quantity of capital, and promote a stronger financial

industry that is more resilient to economic stress. The

purpose of these regulations is to promote the highest

CAPITAL Section 2.1

Risk Management Manual of Examination Policies 2.1-3 Capital (8/22)

Federal Deposit Insurance Corporation

quality forms of perpetual, loss absorbing capital (like

common equity, related surplus, and retained earnings),

while limiting the reliance on and permissibility of lower

quality forms of capital (such as hybrid or debt-like

issuances and trust preferred securities). The 2013 capital

rule promotes the use of capital instruments that have no

maturity, no obligation to make cash or cumulative cash

dividend payments, no liquidation preference, and expose

shareholders to loss.

Th

erefore, the 2013 capital rule emphasizes common equity

tier 1 capital as the predominant form of institution capital.

Common equity tier 1 capital is widely recognized as the

most loss-absorbing form of capital, as it is permanent and

places shareholders’ funds at risk of loss in the event of

insolvency. Moreover, the 2013 capital rule strengthens

minimum capital ratio requirements and risk-weighting

definitions, increases Prompt Corrective Action (PCA)

thresholds, establishes a capital conservation buffer, and

provides a mechanism to mandate counter-cyclical capital

buffers for the largest U.S. institutions. Some of the

requirements have since been revisited to make technical

amendments and incorporate statutory changes, but the

overarching provisions of the 2013 capital rule remain

intact.

Th

e 2013 capital rule applies to all insured depository

institutions. For FDIC-supervised institutions, the capital

rules are contained in Part 324 of the FDIC Rules and

Regulations. Part 324 defines capital elements, establishes

risk-weighting approaches for determining capital

requirements under the standardized and advanced

approaches, and sets PCA standards that prescribe

supervisory action for institutions that are not adequately

capitalized. Part 324 also established requirements to

maintain a capital conservation buffer that affects capital

distributions and discretionary payments. The capital

requirements included in Part 324 that apply to all insured

depository institutions are collectively referred to as the

generally applicable requirements or the generally

applicable capital rule. Capital requirements such as the

supplementary leverage ratio (SLR) or the requirement to

use internal models to calculate risk-weighted assets

(advanced approaches) are additional requirements that

apply only to a subset of the largest U.S. institutions and are

not part of the generally applicable capital rule.

Th

is chapter is only meant to provide an overview of the

capital rules; examiners should refer to Part 324 for detailed

requirements.

1

Institutions that elect the Community Bank Leverage Ratio

(CBLR) framework do not calculate tier 2 capital (refer to the

←

COMPONENTS OF CAPITAL

Pa

rt 324 establishes two broad components of capital which

are known as tier 1 capital and tier 2 capital. Tier 1 capital

is the predominant form of capital in the U.S. and represents

the sum of common equity tier 1 capital and additional tier

1 capital. Tier 2 capital includes several less subordinated

capital instruments (i.e., less subordinated than tier 1 capital

instruments) and balance sheet items that are not allowable

in tier 1 capital.

1

Components of tier 1 and tier 2 capital are

used to calculate minimum regulatory capital ratios

described in Part 324 and are described in more detail

below.

Common Equity Tier 1 Capital

Common equity tier 1 capital is the most loss-absorbing

form of capital. It includes qualifying common stock and

related surplus net of treasury stock; retained earnings;

certain accumulated other comprehensive income (AOCI)

elements if institution management does not make an AOCI

opt-out election, plus or minus regulatory deductions or

adjustments as appropriate; and qualifying common equity

tier 1 minority interests. The federal banking agencies

expect the majority of common equity tier 1 capital to be in

the form of common voting shares and retained earnings.

Part 324 allowed all non-advanced approach institutions to

make a permanent, one-time opt-out election, enabling them

to calculate regulatory capital without AOCI. Such an

election neutralizes the impact of unrealized gains or losses

on balance sheet instruments, including available-for-sale

bond portfolios, in the context of regulatory capital levels.

To opt-out, institutions must have made a one-time

permanent election on the March 31, 2015 Call Report. For

institutions that did not or cannot opt-out, the AOCI

adjustment to common equity tier 1 capital could have an

impact on regulatory capital ratios if significant bond

portfolio appreciation or depreciation is encountered.

Part 324 requires that several items be fully deducted from

common equity tier 1 capital, such as goodwill, deferred tax

assets (DTAs) that arise from net operating loss and tax

credit carry-forwards, other intangible assets (except for

mortgage servicing assets (MSAs)), certain DTAs arising

from temporary differences (temporary difference DTAs),

gains on sale of securitization exposures, and certain

investments in another financial institution’s capital

instruments. Additionally, management must adjust for

unrealized gains or losses on certain cash flow hedges.

Community Bank Leverage Ratio section for details about the

CBLR).

CAPITAL Section 2.1

Capital (8/22) 2.1-4 Risk Management Manual of Examination Policies

Federal Deposit Insurance Corporation

Finally, non-advanced approaches institution management

must consider threshold deductions for three specific types

of assets: investments in the capital of unconsolidated

financial institutions, MSAs, and temporary difference

DTAs. Generally, management must deduct the amount of

exposure to these types of assets, by category that exceeds

25 percent of a base common equity tier 1 capital

calculation. The amounts of MSAs and temporary

difference DTA threshold items not deducted are assigned a

250 percent risk-weight, while investments in the capital of

unconsolidated financial institutions that are not deducted

get assigned a risk-weight determined by the type of asset

exposure (e.g., common stock, preferred stock, sub-debt).

Additional Tier 1 Capital

Additional tier 1 capital includes qualifying noncumulative

perpetual preferred stock, bank-issued Small Business

Lending Fund (SBLF) and Troubled Asset Relief Program

(TARP) instruments that previously qualified for tier 1

capital,

2

and qualifying tier 1 minority interests, less certain

investments in other unconsolidated financial institutions’

instruments that would otherwise qualify as additional tier

1 capital.

Tier 2 Capital

Under the generally applicable rule, tier 2 capital includes

the allowance for loan and lease losses (ALLL)

3

up to 1.25

percent of risk-weighted assets, qualifying preferred stock,

subordinated debt, and qualifying tier 2 minority interests,

less any deductions in the tier 2 instruments of an

unconsolidated financial institution. Effective April 1,

2019, the agencies revised the regulatory capital rules

to include a new term, adjusted allowances for credit

losses (AACL), which replaces the term ALLL in the

capital rules upon an institution’s adoption of

Accounting Standards Codification (ASC) Topic

326, Financial Instruments – Credit Losses, which

includes the Current Expected Credit Losses or

CECL allowance methodology. The term

allowance for credit losses (ACL) as used in ASC

Topic 326 applies to most financial assets, including

available-for-sale (AFS) debt securities. In contrast,

the term AACL, as used in the regulatory capital rules,

excludes credit loss allowances on purchased credit

deteriorated assets and AFS debt securities.

4

The

AACL also excludes an institution’s allocated transfer

risk reserves, if any.

2

SBLF and TARP were federal financial stability programs that

provided capital support to financial institutions in response to the

2008 financial crisis.

3

Adjusted allowances for credit losses replaces the term ALLL for

institutions that have adopted ASC Topic 326. Such institutions

may also elect to apply a Current Expected Credit Losses (CECL)

Part 324 eliminates previous limits on term subordinated

debt, limited-life preferred stock, and the amount of tier 2

capital includable in total capital.

Deductions and Limits

The 2013

capital rule introduced a number of limitations

and deductions that were generally in response to issues

recognized during the financial crisis of 2008 and were

adopted to enhance the quality of capital. Investments in

the capital instruments of another financial institution, such

as common stock, preferred stock, subordinated debt, and

trust preferred securities might need to be deducted from

each tier of capital.

For advanced

approaches institutions only, investments in

the capital of unconsolidated financial institutions must be

analyzed to determine whether they are significant or non-

significant, which depends on the percentage of common

stock that an institution owns in the other financial

institution. If the institution owns 10 percent or less of the

other institution’s common shares, then all of that

investment is non-significant. If an institution owns more

than 10 percent, then all of the investment in that company

is significant. Part 324 contains separate deduction

requirements for significant and non-significant

investments.

In most cases,

threshold-based deductions for all institutions

will be made from the tier of capital for which an investment

would otherwise be eligible. To illustrate, if an institution’s

investment is an instrument that qualifies as tier 2 capital, it

is deducted from tier 2 capital. If it qualifies as an additional

tier 1 capital instrument, it is deducted from additional tier

1 capital. If it qualifies as a common equity tier 1 capital

instrument, it is deducted from common equity tier 1 capital.

If the institution does not have sufficient tier 2 capital to

absorb a deduction, then the excess amount is deducted

from additional tier 1 capital or from common equity tier 1

capital if there is insufficient additional tier 1 capital.

Part 324 limits the amount of minority interest in a

subsidiary that may be included in each tier of capital. To

be included in capital, the instrument that gives rise to

minority interest must qualify for a particular tier of capital.

Non-advanced approaches institutions are allowed to

include common equity tier 1, tier 1, and total capital

minority interest up to 10 percent of the banking

organization’s total capital (before the inclusion of any

transition provision over three or five years, if applicable. See the

section below titled CECL Transition Period.

4

Purchased credit deteriorated assets and AFS debt securities are

risk-weighted net of credit loss allowances as measured under

ASC Topic 326.

CAPITAL Section 2.1

Risk Management Manual of Examination Policies 2.1-5 Capital (8/22)

Federal Deposit Insurance Corporation

minority interest). Minority interest is further limited for

non-advanced approaches institutions to 10 percent of each

tier of capital (before the inclusion of any minority interest).

For

advanced approaches banking organizations, limitations

for common equity tier 1 minority interest, tier 1 minority

interest, and total capital minority interest are based on the

capital requirements and capital ratios of each of the

banking organization’s consolidated subsidiaries that have

issued capital instruments held by third parties.

CECL Transition Period

Th

e capital rule provides the option to phase in over a three-

year period the day-one adverse effects on regulatory capital

that may result when an institution adopts the new

accounting standard ASC Topic 326, which includes the

CECL methodology. Institutions can elect the CECL

transition provision to transition the day-one impact of

adopting ASC Topic 326 in regulatory capital through

transition adjustments to retained earnings, average total

consolidated assets, temporary difference DTAs, and the

AACL. The date of CECL adoption by institutions may

range between 2019 for early adopters, to as late as 2023 for

some institutions. An institution that does not elect to use

the CECL transition provision in the regulatory report for

the quarter in which it first reports its credit loss allowances

as measured under CECL will not be permitted to make an

election in subsequent reporting periods.

Institutions that adopted CECL in 2020 had the option to

mitigate the estimated regulatory capital effects of CECL

for two years, followed by a three-year transition period.

Taken together, these measures offered these institutions a

transition period of up to five years.

←

CAPITAL RATIOS

Min

imum regulatory capital requirements for insured

depository institutions are based on a combination of risk-

based and leverage ratio calculations. Part 324’s risk-based

requirements set minimum ratios for the Common Equity

Tier 1, Tier 1 Risk-Based, and Total Risk-Based Capital

Ratios as described in the following sections. A single

leverage ratio of Tier 1 Capital to Average Total Assets is

also required. If an institution qualifies for and elects the

CBLR framework, it only has one minimum regulatory

capital ratio—the CBLR.

A major difference between risk-based and leverage capital

ratios is the denominator. The three risk-based ratios use

risk-weightings to measure on- and off-balance sheet

exposures and are aggregated as “total risk-weighted

assets.” These risk-weightings can vary across asset classes

and exposures depending on their inherent risk. For

instance, U.S. Treasury securities have a 0 percent risk

weight, while a commercial loan to a private business would

generally receive a risk-weight of 100 percent under the

Standardized Approach. Separately, leverage ratios are

based on average total assets. The numerator for the

leverage capital ratio is tier 1 capital. The numerators for

the risk-based capital ratios are common equity tier 1

capital, additional tier 1 capital, and total capital. Total

capital includes the ALLL or AACL up to regulatory limits,

as applicable.

←

RISK-WEIGHTED ASSETS

Pa

rt 324 prescribes two approaches to risk weighting assets.

The standardized approach, which all institutions must use,

and the advanced approaches, which are used by larger,

more complex institutions. This section is not applicable to

institutions electing the CBLR framework, since those

institutions are not required to calculate or report risk-based

capital. As a result, examiners should not apply risk-based

calculations to CBLR-electing institutions or indicate to

management in any way that such computations are

required. The CBLR is described in more detail below.

Standardized Approach

An ins

titution’s balance sheet assets and credit equivalent

amounts of off-balance sheet items are generally assigned

to one of four risk categories (0, 20, 50, and 100 percent)

according to the obligor, or if relevant, the guarantor or the

nature of the collateral. Part 324, Subpart D (Risk-weighted

Assets-Standardized Approach) sets forth the criteria for

categorizing non-advanced approach institutions’ assets and

off-balance sheet exposures for risk-weighting purposes.

Si

nce the risk-weighting system was first introduced in the

United States in the early 1990s, the general process of risk

weighting assets has not changed. However, several

changes implemented by the standardized approach involve

risk-weights other than the 0, 20, 50, and 100 percent

categories. These changes are individually outlined below

and include high volatility commercial real estate (HVCRE)

loans; past due asset exposures; securitizations or structured

investments; equity exposures; and collateralized and

guaranteed exposures.

HVCRE Loans

An HV

CRE loan generally refers to a subset of acquisition,

development, and construction loans that is assigned a risk-

weight of 150 percent. HVCRE loans include:

CAPITAL Section 2.1

Capital (8/22) 2.1-6 Risk Management Manual of Examination Policies

Federal Deposit Insurance Corporation

• A credit facility that is secured by real property and

primarily finances, has financed, or refinances

acquisition, development, or construction of real

property;

•

An

extension of credit that provides financing to

acquire, develop, or improve such real property into

income-producing property; and

•

A c

redit facility that is dependent on future income or

sal

es proceeds from, or refinancing of, such real

property for repayment.

Th

e HVCRE definition provides several exclusions,

including:

• One-t

o four-family residential properties;

•

Co

mmunity development projects;

•

Ag

ricultural land;

• Existing income-producing property secured by

permanent financings;

•

Cer

tain commercial real property projects where the

borrower has contributed at least 15 percent of the as-

completed value of the project;

•

Real

property where the loan has been reclassified as a

non-HVCRE loan; and

•

Real

estate where the loan was made before January 1,

2015.

The

HVCRE definition does not apply in any manner to

institutions that elect the CBLR.

Past-Due Asset Risk-Weights

The

standardized approach requires financial institutions to

transition assets that are 90 days or more past due or on

nonaccrual from their original risk-weight to 150 percent.

For example, if the institution held a revenue bond that was

on nonaccrual, Part 324 requires the bond to be risk

weighted at 150 percent compared to its original 50 percent

risk-weight. This treatment could potentially apply to

commercial, agricultural, multi-family, and consumer loans

as well as fixed-income securities. However, this

requirement does not apply to past due 1-4 family

residential real estate loans (which would be risk weighted

at 100 percent), HVCRE (risk weighted at 150 percent),

exposures to sovereign entities, and the portion of loan

balances with eligible guarantees or collateral where the

risk-weight can vary.

Structured Securities and Securitizations

Pa

rt 324 establishes sophisticated risk-weight approaches

for securitization exposures and structured security

exposures that are retained on- or off-balance sheet. Typical

examples of securitization exposures include private label

collateralized mortgage obligations (CMOs), trust preferred

collateralized debt obligations, and asset-backed securities,

provided there is tranching of credit risk. Generally, pass-

through and government agency CMOs are excluded from

the securitization exposure risk-weight approaches. In

general, Part 324 requires FDIC-supervised institutions to

calculate the risk-weight of securitization exposures using

either the gross-up approach or the Simplified Supervisory

Formula Approach (SSFA) consistently across all

securitization exposures, except in certain cases. For

instance, the institution can, at any time, risk weight a

securitization exposure at 1,250 percent.

The gross-up approach is similar to earlier risk-based capital

rules, where capital is required on the credit exposure of the

institution’s investment in the subordinate tranche, as well

as its pro rata share of the more senior tranches it supports.

The gross-up approach calculates a capital requirement

based on the weighted-average risk-weights of the

underlying exposures in the securitization pool.

Th

e SSFA is designed to assign a lower risk-weight to more

senior-class securities and higher risk-weights to support

tranches. The SSFA is both risk sensitive and forward

looking. The formula adjusts the risk-weight for a

security’s underlying collateral based on key risk factors,

such as incurred losses, nonperforming loans, and the ability

of subordinate tranches to absorb losses. In any case, a

securitization is assigned at least a minimum risk-weight of

20 percent.

Securitization Due Diligence

Section 324.41(c) implements due diligence requirements

for securitization exposures. The analysis must be

commensurate with the complexity of the securitization

exposure and the materiality of the exposure in relation to

capital.

Under these requirements, management must demonstrate a

comprehensive understanding of the features of a

securitization exposure that would materially affect its

performance. The due diligence analysis must be conducted

prior to acquisition and at least quarterly as long as the

instrument is in the institution’s portfolio.

Whe

n conducting analysis of a securitization exposure,

management typically considers structural features, such as:

• Credit enhancements,

•

Per

formance of servicing organizations,

•

Deal-s

pecific definitions of default, and

• Any other features that could materially impact the

performance of the exposure.

CAPITAL Section 2.1

Risk Management Manual of Examination Policies 2.1-7 Capital (8/22)

Federal Deposit Insurance Corporation

Management also typically assesses relevant performance

information of the underlying credit exposures, such as:

• Pa

st due payments;

• Prepayment rates;

•

Pr

operty types;

•

Av

erage loan-to-value ratios;

•

Geo

graphic and industry diversification;

•

Rel

evant market data information, such as bid-ask

spreads;

• Recent sale prices;

•

Tr

ading volumes;

•

Histo

ric price volatility;

• Implied market volatility; and

•

The

size, depth, and concentration level of the market

for the securitization.

For re-securitization exposures, management will typically

assess the performance on underlying securitization

exposures.

If

management is not able to demonstrate sufficient

understanding of a securitization exposure, per Section

324.41(c)(1) the institution must assign the exposure a

1,250 percent risk-weight.

Equity Risk-Weights

Pa

rt 324 assigns various risk-weights for equity

investments. For institutions that are permitted to hold

publicly traded equities, the risk-weight for these assets

ranges from 100 to 300 percent. A risk-weight of 400

percent is assigned to non-publicly traded equity exposures.

A risk-weight of 600 percent is assigned to investments in a

hedge fund or investment fund that has greater than

immaterial leverage. In addition, under Part 324,

institutions may assign a 100 percent risk-weight to the

aggregate adjusted carrying value of certain equity

exposures that do not exceed 10 percent of the institution’s

total capital. To qualify for the 100percent risk-weight, an

institution must include the following equity exposures in

the following order up to 10 percent of total capital: first

include equity exposures to unconsolidated small business

investment companies or held through consolidated small

business investment companies described in section 302 of

the Small Business Investment Act, then include publicly

traded equity exposures (including those held indirectly

through investment funds), and then include non-publicly

traded equity exposures (including those held indirectly

through investment funds). For non-advanced approaches

institutions, the equity exposure risk-weights similarly

5

Investment grade means that the issuer has adequate capacity to

meet financial commitments for the projected life of the asset or

exposure.

apply to investments in the capital of unconsolidated

financial institutions that are not deducted from capital.

Pa

rt 324 also contains various look-through approaches for

equity exposures to investment funds. For example, if an

institution has an equity investment in a mutual fund that

invests in various types of bonds, the regulation directs how

to assign proportional risk-weights based on the underlying

investments. In addition, generally lower risk-weights

apply to a few specific classes of equity securities. The risk-

weight for Federal Reserve Bank stock is 0 percent, Federal

Home Loan Bank stock receives a 20 percent risk-weight,

and community development exposures, including

Community Development Financial Institutions, are

assigned 100 percent risk-weights. Examiners should refer

to Sections 324.51, 324.52, and 324.53 for additional

information regarding risk-weights for equity exposures.

Collateralized Transactions

In certain circumstances, management has the option to

recognize the risk-mitigating effects of financial collateral

to reduce the risk-based capital requirements associated

with a collateralized transaction. Financial collateral

includes cash on deposit (or held for the institution by a third

party trustee), gold bullion, certain investment grade

5

securities, publicly traded equity securities, publicly traded

convertible bonds, and certain money market fund shares.

Par

t 324 permits two general approaches to recognize

financial collateral for risk-weighting purposes. The simple

approach generally allows substituting the risk-weight of

the financial collateral for the risk-weight of any exposure.

In order to use the simple approach, the collateral must be

subject to a collateral agreement for at least the life of the

exposure, the collateral must be revalued at least every six

months, and the collateral (other than gold) and the

exposure must be denominated in the same currency. The

second approach, the collateral haircut (discount) approach,

allows management to calculate the exposure for repo-style

transactions, eligible margin loans, collateralized derivative

contracts, and single-product netting sets of such

transactions using a mathematical formula and supervisory

haircut factors. Refer to Section 324.37 for additional

details.

Mo

st institutions are likely to use the simple approach;

however, regardless of the approach chosen, it must be

applied consistently for similar exposures or transactions.

The following are examples under the simple approach.

Management may assign a 0 percent risk-weight to the

CAPITAL Section 2.1

Capital (8/22) 2.1-8 Risk Management Manual of Examination Policies

Federal Deposit Insurance Corporation

collateralized portion of an exposure where the financial

collateral is cash on deposit. Management may also assign

a 0 percent risk-weight if the financial collateral is an

exposure to a sovereign

6

that qualifies for a 0 percent risk-

weight and management has discounted the market value of

the collateral by 20 percent. Transactions collateralized by

debt securities of government-sponsored entities receive a

20 percent risk-weight, while risk-weights for transactions

collateralized by money market funds will vary according

to the funds’ investments. Finally, for transactions

collateralized by investment grade securities, such as

general obligation municipal, revenue, and corporate bonds,

management may use collateral risk-weights of 20, 50, and

100 percent, respectively.

Treatment of Guarantees

Und

er Part 324, management has the option to substitute the

risk-weight of an eligible guarantee or guarantor for the

risk-weight of the underlying exposure. For example, if the

institution has a loan guaranteed by an eligible guarantor,

management can use the risk-weight of the guarantor.

Eligible guarantors include entities such as depository

institutions and holding companies, the International

Monetary Fund, Federal Home Loan Banks, the Federal

Agricultural Mortgage Corporation, entities with

investment grade debt, sovereign entities, and foreign

institutions. An eligible guarantee must be written, be either

unconditional or a contingent obligation of the U.S.

government or its agencies, cover all or a pro rata share of

all contractual payments, give the beneficiary a direct claim

against the protection provider, and meet other requirements

outlined in the definition of eligible guarantees under

Section 324.2.

Off-Balance Sheet Exposures

The

risk-weighted amounts for all off-balance sheet items

are determined by a two-step process. First, the "credit

equivalent amount" is determined by multiplying the face

value or notional amount of the off-balance sheet item by a

credit conversion factor. A table contained in Part 324

shows the conversion factors. This process effectively turns

an off-balance sheet exposure into an on-balance sheet

amount for risk-based calculation purposes only. Next, the

appropriate risk-weight (based on the risk category of the

exposure) is applied to the credit equivalent amount, like

any other balance sheet asset. Refer to Part 324 for more

details.

6

Sovereign means a central government (including the U.S.

government) or an agency, department, ministry, or central bank.

7

Total assets means the quarterly average total assets as reported

in an FDIC-supervised institution’s Call Report, minus amounts

deducted from tier 1 capital under Sections 324.22(a), (c), and (d).

←

REGULATORY CAPITAL

REQUIREMENTS

As defined by Section 324.10(a), FDIC-supervised

institutions must maintain the following minimum capital

ratios under the generally applicable capital rule. These

requirements are identical to those for national and state

member institutions.

• Co

mmon equity tier 1 capital to total risk-weighted

assets ratio of 4.5 percent,

•

Tie

r 1 capital to total risk-weighted assets ratio of 6

percent,

•

To

tal capital to total risk-weighted assets ratio of 8

percent, and

•

Tie

r 1 capital to average total assets ratio (tier 1

leverage ratio) of 4 percent.

Qu

alifying institutions that elect the CBLR framework are

subject to a single leverage ratio of greater than 9 percent.

Institutions meeting or exceeding these minimum

requirements are considered to be compliant with the

generally applicable capital rule. Therefore, risk-based

capital requirements would not apply; refer to the section

below titled, Community Bank Leverage Ratio for more

information.

Se

ction 324.4(b) indicates that any insured institution that

has less than its minimum leverage capital requirement may

be deemed to be engaged in an unsafe and unsound practice

pursuant to Section 8 of the FDI Act, unless the institution

has entered into and is in compliance with a written

agreement or has submitted and is in compliance with a plan

approved by the FDIC to increase its leverage capital ratio

and take other action as may be necessary. Separately,

Section 324.4(c) mandates that any insured depository

institution with a tier 1 capital to total assets

7

ratio of less

than 2 percent may be deemed to be operating in an unsafe

and unsound condition.

No

twithstanding the minimum capital requirements under

the generally applicable capital rule and the CBLR, an

FDIC-supervised institution must maintain capital

commensurate with the level and nature of all risks to which

the institution is exposed. Furthermore, an FDIC-

supervised institution must have a process for assessing its

overall capital adequacy in relation to its risk profile and a

At its discretion, the FDIC may calculate total assets using an

FDIC-supervised institution’s period-end assets rather than

quarterly average assets.

CAPITAL Section 2.1

Risk Management Manual of Examination Policies 2.1-9 Capital (8/22)

Federal Deposit Insurance Corporation

comprehensive strategy for maintaining an appropriate level

of capital. The FDIC is not precluded from taking formal

enforcement actions against an insured depository

institution with capital above the minimum requirements if

the specific circumstances indicate such action is

appropriate.

Ad

ditionally, FDIC-supervised institutions that fail to

maintain capital at or above minimum leverage capital

requirements may be issued a capital directive by the FDIC.

Capital directives generally require institution management

to restore the institution’s capital to the minimum leverage

requirement within a specified time period. Refer to this

manual’s Section 15.1 – Formal Administrative Actions for

further discussion on capital directives.

Capital Conservation Buffer

The

capital conservation buffer is designed to strengthen an

institution’s financial resilience during economic cycles.

Financial institutions under the generally applicable capital

rule are required to maintain a capital conservation buffer of

greater than 2.5 percent in order to avoid restrictions on

capital distributions and other payments. Part 324 requires

institutions to meet their capital conservation buffer

requirement with common equity tier 1 capital. Again,

because qualifying institutions using the CBLR framework

are considered in compliance with the generally applicable

capital rule, they are not subject to the capital conservation

buffer.

Und

er Section 324.11, if an institution’s capital

conservation buffer falls below the amount listed in the table

below, its maximum payout amount for capital distributions

and discretionary payments declines to a set percentage of

eligible retained income based on the size of the institution’s

buffer.

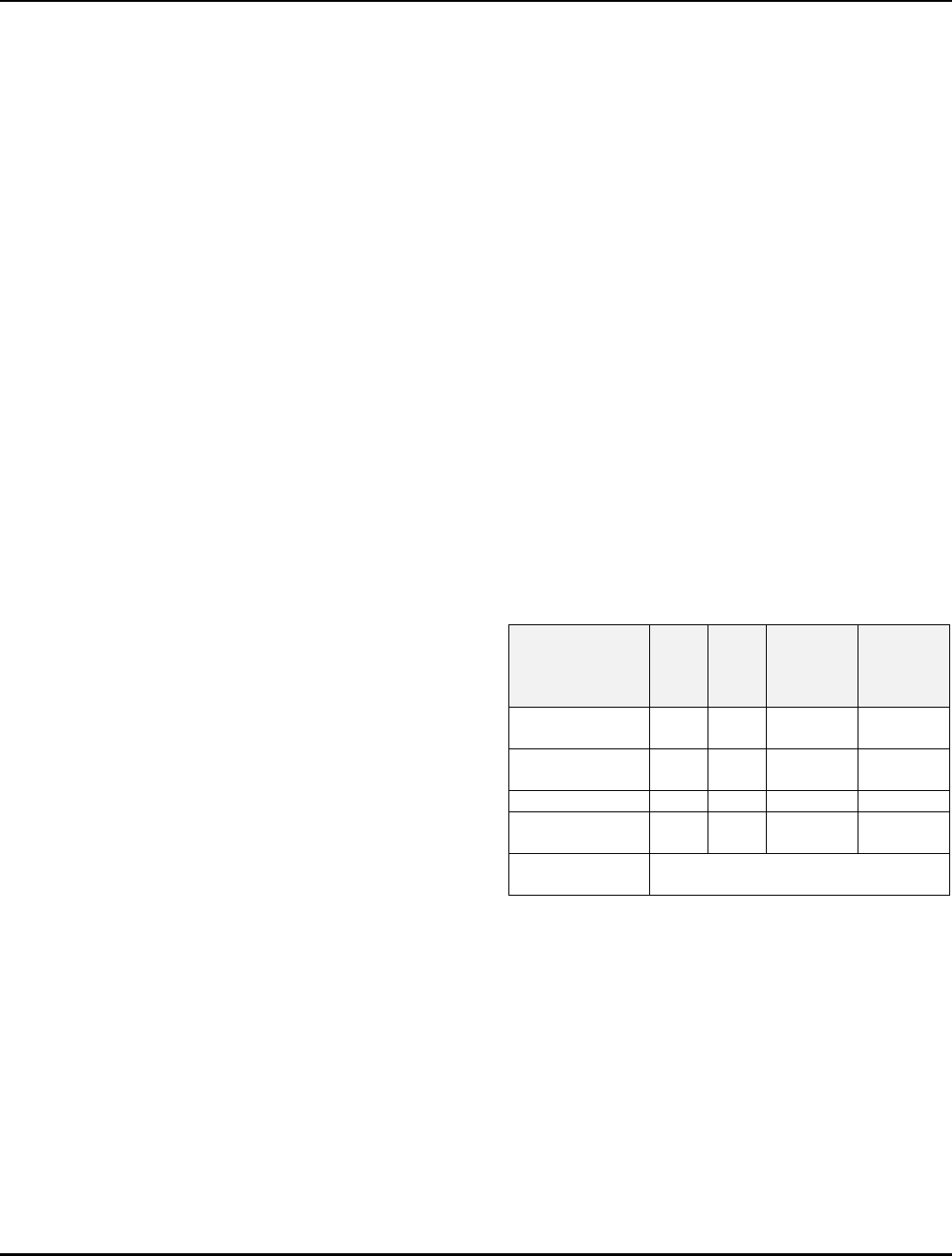

Capital Conservation Buffer

(% of RWA)

Maximum Payout Ratio (%

of Eligible Retained Income)

Greater than 2.5% No payout limitation

Less than or equal to 2.5%

and greater than 1.875%

60%

Less than or equal to 1.875%

and greater than 1.25%

40%

Less than or equal to 1.25%

and greater than 0.625%

20%

Less than or equal to 0.625% 0%

The types of payments subject to the restrictions include

dividends, share buybacks, discretionary payments on tier 1

instruments, and discretionary bonus payments. It is

important to note that the FDIC maintains the authority to

impose further restrictions to help ensure that capital is

commensurate with the institution’s risk profile.

An ins

titution cannot make capital distributions or certain

discretionary bonus payments during the current calendar

quarter if its eligible retained income is negative and its

capital conservation buffer was less than 2.5 percent as of

the end of the previous quarter. Eligible retained income is

the greater of (1) an institution’s net income, calculated in

accordance with the instructions to the Call Report, for the

four calendar quarters preceding the current calendar

quarter, net of any distributions and associated tax effects

not already reflected in net income; and (2) the average of

the institution’s net income, calculated in accordance with

the instructions to Call Report, for the four calendar quarters

preceding the current calendar quarter.

To

calculate the capital conservation buffer for a given

quarter, each minimum risk-based capital requirement in

Part 324 is subtracted from the institution’s corresponding

capital ratios. The following ratios would be subtracted

from the institution’s corresponding ratio to derive the

buffer amount:

• Co

mmon equity tier 1 risk-based capital ratio minus

4.5 percent;

• Tier 1 risk-based capital ratio minus 6 percent; and

•

To

tal risk-based capital ratio minus 8 percent.

Th

e lowest of the three measures would represent the

institution’s capital conservation buffer and is used to

determine its maximum payout for the current quarter. To

the extent an institution’s capital conservation buffer is 2.5

percent or less of risk-weighted assets, the institution’s

maximum payout amount for capital distributions and

discretionary payments would decline. Examiners should

be aware that an institution’s minimum capital ratios plus a

capital conservation buffer of 2.5 percent results in a capital

requirement that is 50 basis points greater than the PCA

well-capitalized ratio levels. For example, to avoid

restrictions under the capital conservation buffer, an

institution must have a total risk-based capital ratio of 10.5

percent, whereas to be well-capitalized under PCA an

institution must have a total risk-based capital ratio of 10

percent.

Th

e FDIC may permit an FDIC-supervised institution that

is otherwise limited from making distributions and

discretionary bonus payments to make a distribution or

discretionary bonus payment upon an institution’s request,

if the FDIC determines that the distribution or discretionary

bonus payment would not be contrary to the purposes of this

section, or to the safety and soundness of the FDIC-

supervised institution. The FDIC issued Financial

CAPITAL Section 2.1

Capital (8/22) 2.1-10 Risk Management Manual of Examination Policies

Federal Deposit Insurance Corporation

Institution Letter 40-2014 (Requests from S-Corporation

Banks for Dividend Exceptions to the Capital Conservation

Buffer) to describe how the FDIC will consider requests

from S-corporation banks or savings associations to pay

dividends to shareholders to cover taxes on their pass-

through share of the bank's earnings, when these dividends

would otherwise not be permitted under the capital

conservation buffer requirements.

←

COMMUNITY BANK LEVERAGE RATIO

Statutory and Regulatory Background

Th

e Economic Growth, Regulatory Relief, and Consumer

Protection Act of 2018 introduced the CBLR framework for

qualifying institutions as a simple, optional methodology

for calculating a single regulatory capital ratio. These

institutions would receive burden relief by not having to

calculate and report risk-weighted assets. Qualifying

institutions may elect the CBLR framework at any time

through their Call Report filings. To be a qualifying

community banking organization, an insured depository

institution must not be an advanced approaches banking

organization and must meet the following qualifying

criteria:

• A l

everage ratio of greater than 9 percent;

•

To

tal consolidated assets of less than $10 billion;

•

To

tal off-balance sheet exposures (excluding

derivatives other than sold credit derivatives and

unconditionally cancelable commitments) of 25

percent or less of total consolidated assets; and

•

The

sum of total trading assets and trading liabilities

of 5 percent or less of total consolidated assets.

If a

n institution has a ratio above the CBLR requirement,

the regulatory agencies would consider it to have met:

• Th

e generally applicable risk-based and leverage

capital requirements;

•

The

capital ratio requirements to be considered well

capitalized under the PCA framework, with some

exclusions (see the PCA and CBLR Institutions

section); and

•

An

y other applicable capital or leverage requirements,

such as the capital conservation buffer.

As

long as they meet the requirements, electing institutions

will not be required to report any risk-based or capital

conservation buffer calculations, including for example

risk-based capital requirements for HVCRE loan exposures.

The CBLR Calculation

Th

e CBLR is calculated as the ratio of tier 1 capital divided

by average total consolidated assets, consistent with the

generally applicable leverage ratio. The calculation takes

into account the modifications made in relation to the capital

simplifications rule and the CECL transitions final rule, and

it is anticipated that the numerator will reflect any future

modifications to the tier 1 capital definition applicable to

non-advanced approaches organizations.

Maintaining CBLR Eligibility

Unde

r the CBLR framework, there are four ways that an

electing institution might be required to revert to the risk-

based capital requirements in the generally applicable

capital rule:

• Fa

iling to meet any of the CBLR eligibility

requirements and not returning to compliance by the

end of the two-quarter grace period which includes:

o Reporting a CBLR of 9 percent or lower but

greater than 8 percent,

o Holding trading assets and liabilities exceeding 5

percent of total consolidated assets,

o Reporting off-balance sheet exposures of more

than 25 percent of total consolidated assets, or

o Exceeding $10 billion in total consolidated assets;

• Becoming an advanced approaches banking

organization;

•

Re

porting a CBLR of 8 percent or less; or

• Ceasing to satisfy the qualifying criteria due to

consummation of a merger transaction.

Mana

gement weaknesses, non-capital financial problems,

or the existence of a corrective program, as well as other

supervisory issues that are significant for capital adequacy

assessment purposes, are not qualifying conditions for the

CBLR and have no bearing on whether an institution can

remain eligible for the CBLR framework. Supervisory

issues with no bearing on CBLR eligibility can include:

• Adverse CAMELS component and composite ratings

or downgrades,

•

Co

nsent orders,

•

Und

ue concentrations,

•

Ad

verse consumer protection and Community

Reinvestment Act ratings,

•

Ant

i-Money Laundering/Counter the Financing of

Terrorism deficiencies, or

•

Inf

ormation technology weaknesses.

Additional Capital and Administrative

Actions

In cer

tain circumstances, the FDIC can direct electing

institutions to hold additional capital above the 9 percent

CAPITAL Section 2.1

Risk Management Manual of Examination Policies 2.1-11 Capital (8/22)

Federal Deposit Insurance Corporation

CBLR to address high-risk exposures or significant

supervisory matters in accordance with Part 324. CBLR

implementation has no effect on the FDIC’s authority to

pursue administrative actions or require a higher CBLR

when appropriate to promote safety and soundness.

Compliance Grace Period

If

an electing institution does not satisfy one or more of the

qualifying criteria but continues to report a leverage ratio of

greater than 8 percent, it can continue to use the CBLR and

be deemed to meet the “well-capitalized” capital ratio

requirements for a grace period of up to two quarters. If the

institution is able to return to compliance with all the

qualifying criteria within two quarters, it will continue to

meet the “well-capitalized” ratio requirements and the

generally applicable capital rule.

An ele

cting institution will be required to comply with the

generally applicable capital rule, including risk-based and

capital conservation buffer requirements, and must file

relevant regulatory reports if it meets any of the following:

• Is

unable to restore compliance with all qualifying

criteria during the two-quarter grace period (including

compliance with the greater than 9 percent leverage

ratio requirement),

•

Rep

orts a leverage ratio of 8 percent or less, or

• Does not satisfy the qualifying criteria due to

consummation of a merger transaction.

The

re is no grace period for institutions with a CBLR of 8

percent or less as the CBLR framework automatically

makes such institutions ineligible. These institutions may

re-elect the CBLR framework once their CBLR is back

above 9 percent, assuming all other qualifying criteria are

met.

Discretionary Opt Out from the CBLR

An

electing institution can opt out of the CBLR framework

at any time, without restriction, and revert to the generally

applicable capital rule by providing the required leverage

and risk-based capital ratios to its primary federal regulator

at the time of opting out. This means that an FDIC-

supervised institution may opt out of the framework through

its Call Report filing, and also between quarters by

providing a letter notice to the regional director that details

the institution’s applicable leverage and risk-based capital

ratios at the time of opting out.

←

PROMPT CORRECTIVE ACTION

Institutions that are Subject to the Generally

Applicable Capital Rule

Pa

rt 324, Subpart H (Prompt Corrective Action) was issued

by the FDIC pursuant to Section 38 of the FDI Act. Its

purpose is to establish the capital measures and levels that

are used to determine supervisory actions authorized under

Section 38 of the FDI Act. Subpart H also outlines the

procedures for the submission and review of capital

restoration plans and other directives pursuant to Section 38.

Neither Subpart H nor Section 38 limits the FDIC’s

authority to take supervisory actions to address unsafe or

unsound practices or conditions, deficient capital levels, or

violations of law. Actions under this Subpart and Section

38 may be taken independently of, in conjunction with, or

in addition to any other enforcement action available to the

FDIC.

Th

e following table summarizes the PCA categories for

non-CBLR institutions.

PCA Category Total

RBC

Ratio

Tier 1

RBC

Ratio

Common

Equity

Tier 1 RBC

Ratio

Tier 1

Leverage

Ratio

Well Capitalized

≥

10%

≥ 8% ≥ 6.5% ≥ 5%

Adequately

Capitalized

≥ 8% ≥ 6% ≥ 4.5% ≥ 4%

Undercapitalized < 8% < 6% <4.5% < 4%

Significantly

Undercapitalized

< 6% < 4% < 3% < 3%

Critically

Undercapitalized

Tangible Equity/Total Assets ≤ 2%

An

y institution that does not meet the minimum PCA

requirements may be deemed to be in violation of Part 324,

and engaged in an unsafe or unsound practice, unless

institution management has entered into and is in

compliance with a written plan approved by the FDIC. In

addition, under Subpart H, the FDIC may reclassify a well-

capitalized FDIC-supervised institution as adequately

capitalized, or require an adequately capitalized or

undercapitalized FDIC-supervised institution to comply

with certain mandatory or discretionary supervisory actions

as if the institution were in the next lower PCA category.

Refer to Part 324, Subpart H for further details.

CAPITAL Section 2.1

Capital (8/22) 2.1-12 Risk Management Manual of Examination Policies

Federal Deposit Insurance Corporation

CBLR Institutions

Instit

utions electing the CBLR framework are considered to

have met the “well-capitalized” ratio requirements for PCA

purposes. However, an electing institution can meet the

PCA “well-capitalized” ratio requirements but be classified

as something other than well-capitalized. For example, if

an electing institution is subject to a consent order with a

capital maintenance provision, it would be reclassified as

“adequately capitalized” for PCA purposes pursuant to

Section 324.403(b)(1)(i)(E) of the capital rule. In such

situations, the electing institution can remain in the CBLR

framework as long as it continues to meet the qualification

standards.

Add

itionally, pursuant to Section 324.403(d) of the capital

rule, the FDIC can reclassify a qualified, electing institution

to “adequately capitalized” for PCA purposes based on

supervisory criteria other than capital. Again, such an

“adequately capitalized” institution can remain in the CBLR

framework.

←

CAPITAL RULES APPLICABLE TO THE

LARGEST INSURED DEPOSITORY

INSTITUTIONS

Whil

e all banking organizations are subject to the generally

applicable capital rule, beginning in 2020, the applicability

of certain capital requirements are tailored for the largest

banking organizations with total consolidated assets of $100

billion or more. These regulatory changes apply to capital

as well as liquidity requirements and are often referred to as

the “tailoring rule.” The tailoring rule sets forth four

categories for large banking organizations (depending on

size and other factors), and institution subsidiaries are

included in the same category as their parent. The rule

applies more complex aspects of the capital rule, such as the

advanced approaches according to risk profile. Category I

institutions are U.S. Global Systemically Important Banks

(GSIBs) and are considered the most complex and systemic

in the hierarchy of the tailoring rule. As such, Category I

organizations are subject to the most stringent requirements.

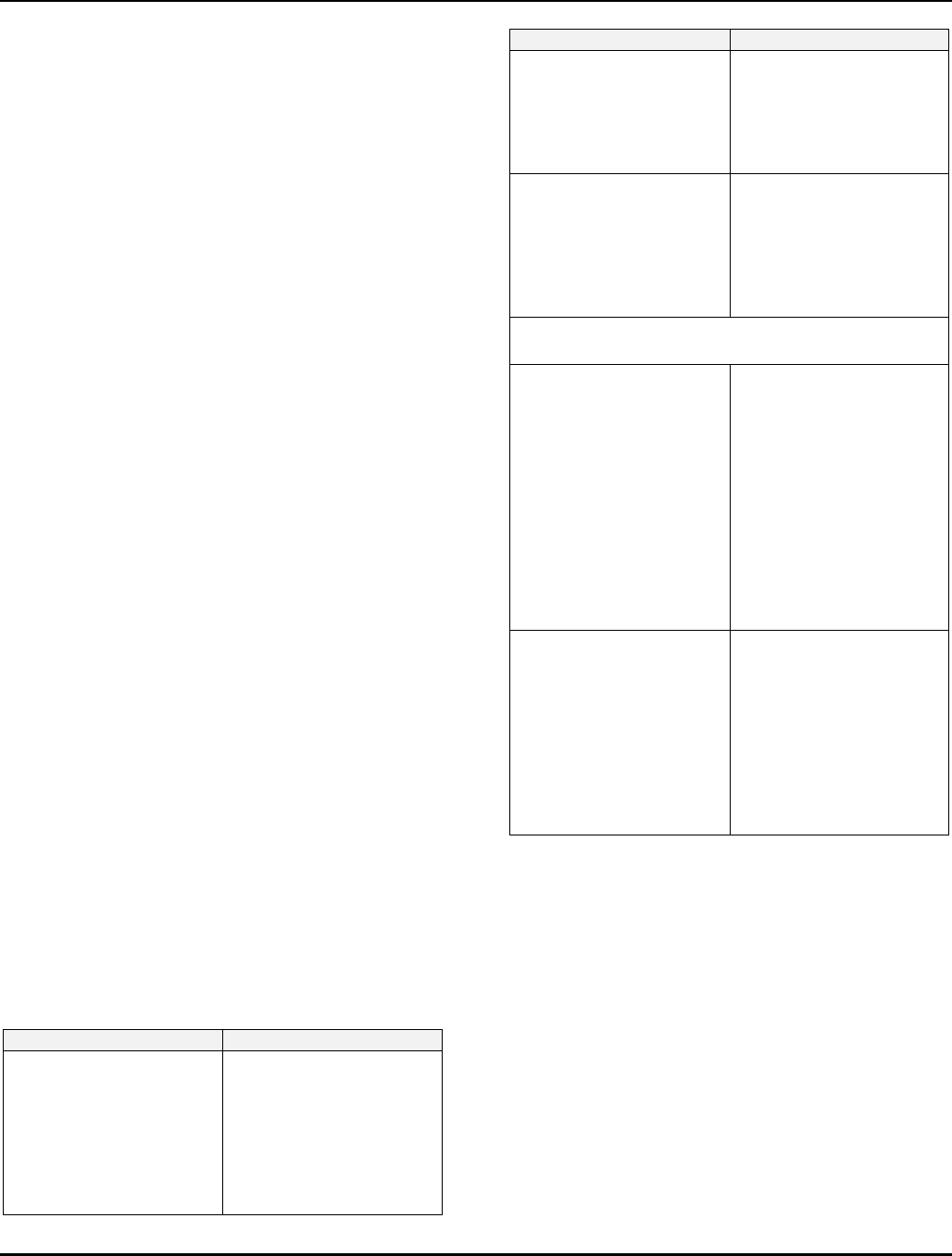

The table below summarizes the additional capital

requirements for Category I – IV institutions.

Category Requirements

Category I: U.S. Global

Systemically Important Banks

(GSIBs)

Advanced approaches;

countercyclical capital

buffer; no opt out of

accumulated other

comprehensive income

(AOCI) capital impact; GSIB

surcharge for BHCs;

enhanced SLR; Total Loss

Category Requirements

Absorbing Capacity and Long

Term Debt requirements for

BHCs; Federal Reserve’s

Comprehensive Capital

Analysis and Review process

for BHCs.

Category II: Banking

organizations with $700

billion or more in total assets

or $75 billion or more in

cross-jurisdictional activity

that are not GSIBs.

Advanced approaches;

countercyclical capital

buffer; no opt out of AOCI

capital impact; SLR; Federal

Reserve’s Comprehensive

Capital Analysis and Review

process for BHCs.

Banks in Categories I and II are known as “advanced

approaches banks”

Category III: Banking

organizations that are not

subject to Category I or

Category II thresholds and

that have either: $250 billion

or more in total assets; or

$100 billion but less than

$250 billion in total assets

and $75 billion or more of

any of the following nonbank

assets, weighted short-term

wholesale funding (STWF), or

off-balance-sheet exposures

Countercyclical capital

buffer; allow opt out of AOCI

capital impact; SLR; Federal

Reserve’s Comprehensive

Capital Analysis and Review

process for BHCs.

Category IV: Banking

organizations that are U.S.

depository institution

holding companies or U.S.

intermediate holding

companies with at least $100

billion in total assets that do

not meet any of the

thresholds specified for

Categories I-III.

Allow opt out of AOCI capital

impact; Federal Reserve’s

Comprehensive Capital

Analysis and Review process

for BHCs.

Supplementary Leverage Ratio

For

advanced approaches institutions, as well as institutions

that are part of a Category III banking organization, an SLR

ratio of 3 percent is required. The SLR is calculated

differently than the tier 1 leverage ratio. The SLR is a stand-

alone ratio that must be calculated by dividing tier 1 capital

by total leverage exposure. Total leverage exposure

consists of on-balance sheet items, less amounts deducted

from tier 1 capital, plus certain off-balance sheet exposures

including:

• Potential future credit exposure related to derivatives

contracts;

•

Cash

collateral for derivative transactions not meeting

certain criteria;

•

Eff

ective notional amounts of sold credit derivatives;

CAPITAL Section 2.1

Risk Management Manual of Examination Policies 2.1-13 Capital (8/22)

Federal Deposit Insurance Corporation

• Gross value of receivables of repo-style transactions

not meeting certain criteria;

•

Ten pe

rcent of the notional amount of unconditionally

cancellable commitments; and

• The notional amount of all other off-balance sheet

exposures multiplied by standardized credit

conversion factors, excluding securities lending and

borrowing transactions, reverse repurchase

agreements, and derivatives.

The supplementary leverage ratio is derived by calculating

the arithmetic mean of this measure for the last day of each

month in the reporting period.

Custody Banks

Certain deposits of custody banks with qualifying central

banks are excluded from the supplementary leverage ratio.

For purposes of the supplementary leverage ratio, a custody

bank is defined as any U.S. top-tier depository institution

holding company with a ratio of assets-under-custody-to-

total-assets of at least 30:1. Any depository institution

subsidiary of such a holding company would be considered

a custody bank. The amount of central bank deposits that

can be excluded from total leverage exposure cannot exceed

the amount of deposit liabilities that are linked to fiduciary

or custody and safekeeping accounts.

←

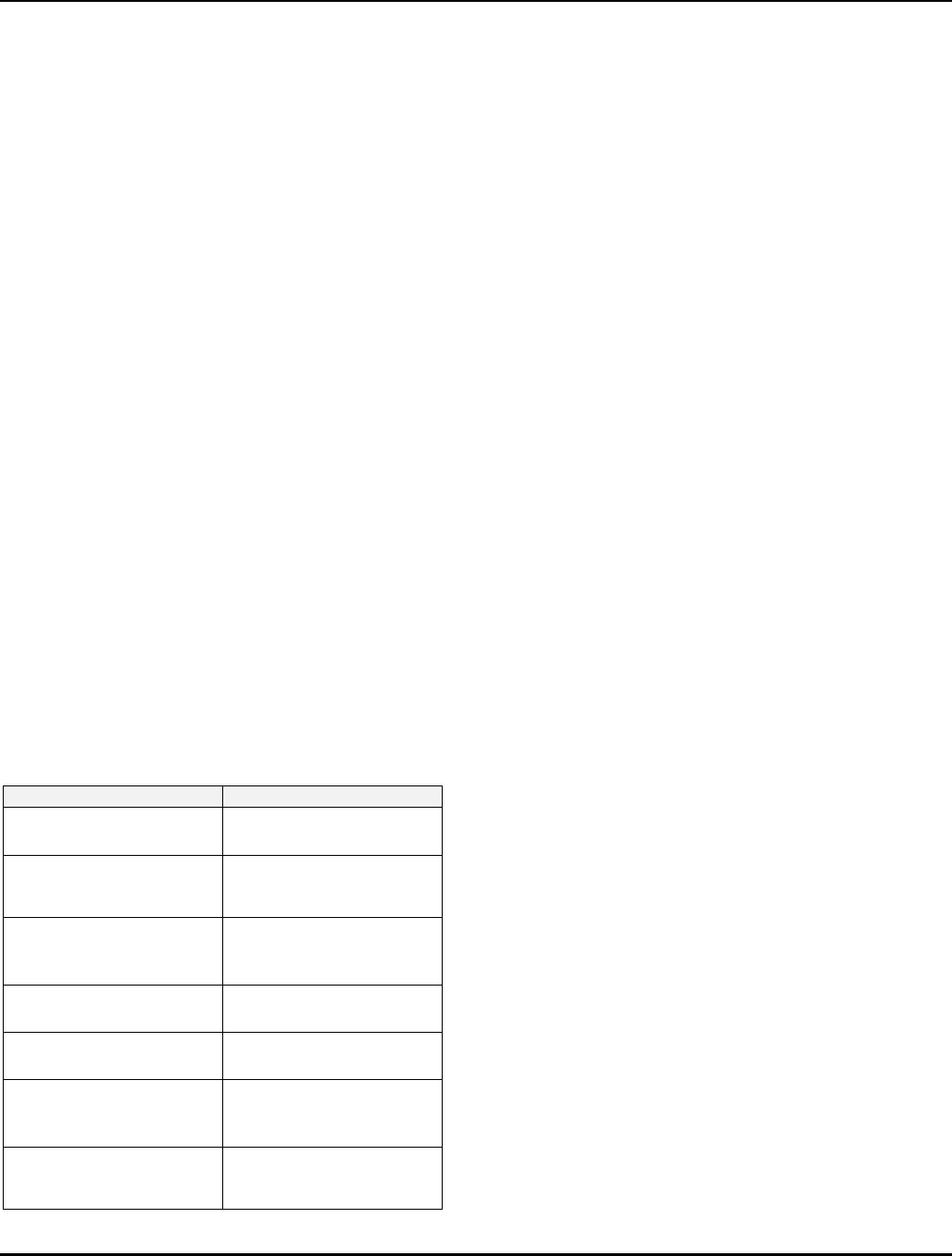

OTHER REGULATORY REQUIREMENTS

Examin

ers should be aware of other regulatory

requirements that may address capital, which include but are

not limited to:

Topic Rule

Risk-Based Insurance

Premiums

Part 327 of the FDIC Rules

and Regulations

Brokered Deposits and

Interest Rate Restrictions

Sections 337.6 and 337.7 of

the FDIC Rules and

Regulations

Limits on Extensions of

Credit to Insiders

Section 337.3 of the FDIC

Rules and Regulations and

FRB Regulation O

Activities and Investments

Insured State Nonmember

Part 362 of the FDIC Rules

and Regulations

Limitations on Interbank

Liabilities

Part 206 of FRB Regulations

Limitations on Federal

Reserve Discount Window

Advances

Section 10B of the Federal

Reserve Act

Grounds for Appointing of

Conservator or Receiver

Section 11(c)(5) of the

Federal Deposit Insurance

Act (FDI Act)

←

EXAMINATION-IDENTIFIED

DEDUCTIONS FROM COMMON EQUITY

CAPITAL

Identified Losses and Insufficient Allowances

Part

324 provides that, on a case-by-case basis and in

conjunction with supervisory examinations of an FDIC-

supervised institution, deductions from capital may be

required. The definition of common equity tier 1 capital

specifically provides for the deduction of identified losses,

such as items classified Loss, any provision expenses that

are necessary to replenish the ALLL or ACL, as applicable,

to an appropriate level, estimated losses in contingent

liabilities, differences in accounts which represent

shortages, and liabilities not shown on books. Losses

attributed to a criminal violation may also need to be

deducted from capital. Additionally, for the calculation of

capital ratios, assets may need to be adjusted for certain

identified losses. Refer to this manual’s Section 16.1 –

Report of Examination Instructions for the Capital

Calculations page for details.

When it is deemed appropriate during an examination to

adjust capital for items classified Loss or for an insufficient

ALLL or ACL, as applicable, the following method should

be used.

• Deduct the amount of Loss for items other than held-

for-investment loans and leases in the calculation of

common equity tier 1 capital. If other real estate

(ORE) valuation allowances exist, refer to the

discussion of Other Real Estate Valuation Allowances

below.

•

Deduc

t the amount of Loss for held-for-investment

loans and leases from the ALLL or ACL, as

applicable, in the calculation of tier 2 capital.

•

If the

ALLL or ACL, as applicable, is considered

insufficient, an estimate of the provision expense

needed for an appropriate ALLL or ACL, as

applicable, should be made. The estimate is made

after identified losses have been deducted from the

ALLL or ACL, as applicable. Loans and leases

classified Doubtful should not be directly deducted

from capital. Rather, any deficiency in the ALLL or

ACL, as applicable, related to assets classified

Doubtful should be included in the evaluation and

accounted for as part of the insufficient ALLL or ACL

adjustment. An adjustment from common equity tier

CAPITAL Section 2.1

Capital (8/22) 2.1-14 Risk Management Manual of Examination Policies

Federal Deposit Insurance Corporation

1 capital to tier 2 capital for the provision expenses

necessary to adjust the ALLL or ACL, as applicable,

to an appropriate level should be made when the

amount is significant.

Thi

s method avoids adjustments that may otherwise result

in a double deduction (e.g., for loans classified Loss),

particularly when common equity tier 1 capital already has

been effectively reduced through provision expenses

recorded in the ALLL or ACL, as applicable. Additionally,

this method addresses situations where institution

management overstated the amount of common equity tier

1 capital by failing to take necessary provision expenses to

establish and maintain an appropriate ALLL or ACL, as

applicable.

Other Real Estate Valuation Allowances

ORE v

aluation allowances are not recognized as a

component of regulatory capital. However, these valuation

allowances should be considered when accounting for ORE

that is classified Loss. To the extent ORE valuation

allowances appropriately cover the risks inherent in any

individual ORE properties classified Loss, there would not

be a deduction from common equity tier 1 capital. The ORE

Loss in excess of ORE valuation allowances should be

deducted from common equity tier 1 capital under Assets

Other Than Held-for-Investment Loans and Leases

Classified Loss.

Liabilities Not Shown on Books

Non-b

ook liabilities have a direct bearing on capital

adjustments. These definite and direct, but unbooked

liabilities (contingent liabilities are treated differently)

should be carefully verified and supported by factual

comments. Examiners should recommend that institution

records be adjusted so that all liabilities are properly

reflected. Deficiencies in an institution’s accrual

accounting system, which are of such magnitude that the

institution’s capital accounts are significantly overstated,

constitutes an example of non-book liabilities for which an

adjustment should be made in the examination capital

analysis. Similarly, an adjustment to capital should be made

for material, deferred tax liabilities or for a significant

amount of unpaid items that are not reflected on the

institution’s books.

←

CAPITAL ADEQUACY

The

FDIC’s authority to enforce capital standards at

financial institutions includes the use of written agreements,

capital directives, and discretionary actions. A discussion

on the use of these powers is included in this manual’s

Section 15.1 - Formal Administrative Actions. Specific

recommendations regarding capital adequacy should not be

made solely on the examiner’s initiative. Coordination

between the examiner and the regional office is essential in

this area. If the level or trend of the institution’s capital

position is adverse, the matter should be discussed with

management with a comment included in the examination

report. It is particularly important that management’s plans

to correct the capital deficiency be accurately assessed and

noted in the report, along with the examiner’s assessment of

the feasibility and sufficiency of those plans.

Fundamentally Sound and Well-Managed

Institutions

Mi

nimum capital ratios are generally viewed as the

minimum acceptable standards for institutions where the

overall financial condition is fundamentally sound, which

are well-managed, and which have no material or significant

financial weaknesses. While the FDIC will make this

determination based on each institution’s own condition and

specific circumstances, the definition generally applies to

those institutions evidencing a level of risk which is no

greater than that normally associated with a CAMELS

Composite rating of 1 or 2. Institutions meeting this

definition, which are in compliance with the minimum

capital requirements, will not generally be required by the

FDIC to raise new capital from external sources.

Less Than Adequately Capitalized

Institutions

In

stitutions that fail to meet the applicable minimum capital

requirements are often subject to CAMELS component and

composite downgrades, corrective programs with a

provision to increase capital, and other supervisory

measures. Less than well capitalized institutions can

increase risk to the FDIC’s Deposit Insurance Fund and are

usually subject to heightened examination coverage. The

key supervisory objective is to help management return the

institution to a well-capitalized, safe and sound financial

position.

Problem Institutions

In

stitutions evidencing a level of risk at least as great as that

normally associated with a Composite rating of 3, 4, or 5

will be required to maintain capital higher than the

minimum regulatory requirement and at a level deemed

appropriate in relation to the degree of risk within the

institution. These higher capital levels should normally be

addressed through informal actions, such as Memoranda of

Understanding, between the FDIC and the institution or, in

cases of more pronounced risk, through the use of formal

enforcement actions under Section 8 of the FDI Act.

CAPITAL Section 2.1

Risk Management Manual of Examination Policies 2.1-15 Capital (8/22)

Federal Deposit Insurance Corporation

Capital Requirements of Primary Regulator

All insured depository institutions are expected to meet any

capital requirements established by their primary federal or

state regulator that exceed the minimum capital

requirements set forth by regulation. The FDIC will consult

with the institution’s primary state or federal regulator when

establishing capital requirements higher than the minimum

set forth by regulation.

Capital Plans Required by Corrective

Programs

In

stitutions with insufficient capital in relation to their risk

profile are often required to submit a capital plan to the

FDIC in conjunction with a formal enforcement action or

other directive. The development of a capital plan is

frequently recommended by the FDIC to help boards of