.

Public

Insurance Capital Standard as a

Prescribed Capital Requirement

Public Consultation Document

23 June 2023

Comments due by 21 September 2023

Public

About the IAIS

The International Association of Insurance Supervisors (IAIS) is a voluntary membership

organisation of insurance supervisors and regulators from more than 200 jurisdictions. The mission

of the IAIS is to promote effective and globally consistent supervision of the insurance industry in

order to develop and maintain fair, safe and stable insurance markets for the benefit and protection

of policyholders and to contribute to global financial stability.

Established in 1994, the IAIS is the international standard-setting body responsible for developing

principles, standards and other supporting material for the supervision of the insurance sector and

assisting in their implementation. The IAIS also provides a forum for Members to share their

experiences and understanding of insurance supervision and insurance markets.

The IAIS coordinates its work with other international financial policymakers and associations of

supervisors or regulators, and assists in shaping financial systems globally. In particular, the IAIS is

a member of the Financial Stability Board (FSB), member of the Standards Advisory Council of the

International Accounting Standards Board (IASB), and partner in the Access to Insurance Initiative

(A2ii). In recognition of its collective expertise, the IAIS also is routinely called upon by the G20

leaders and other international standard-setting bodies for input on insurance issues as well as on

issues related to the regulation and supervision of the global financial sector.

For more information, please visit www.iaisweb.org and follow us on LinkedIn: IAIS – International

Association of Insurance Supervisors.

International Association of Insurance Supervisors

c/o Bank for International Settlements

CH-4002 Basel

Switzerland

Tel: +41 61 280 8090

This document is available on the IAIS website (www.iaisweb.org).

© International Association of Insurance Supervisors (IAIS), 2023.

All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated.

Public

Table of Contents

Introduction.................................................................................................................. 6

1.1 Purpose of the consultation document (CD) .............................................................. 6

1.2 The consultation process ............................................................................................ 6

1.3 Next steps ..................................................................................................................... 6

The ICS – background information ............................................................................ 6

2.1 ICS and ComFrame ...................................................................................................... 7

2.2 Development of the ICS ............................................................................................... 7

2.2.1 Genesis of the ICS Project ............................................................................................................... 7

2.2.2 Principles for ICS Development ....................................................................................................... 7

2.2.3 Field Testing: 2014 to 2019.............................................................................................................. 8

2.2.4 Implementation of ICS Version 2.0 .................................................................................................. 9

2.3 Implementation of the ICS ........................................................................................... 9

General Guiding Principles ...................................................................................... 10

3.1 Substance over Form ................................................................................................. 10

3.2 Proportionality ............................................................................................................ 10

3.3 Look-Through ............................................................................................................. 10

3.4 ICS Rating Categories ................................................................................................ 11

Perimeter of the ICS Calculation .............................................................................. 13

4.1 Scope for Starting ICS Balance Sheet ...................................................................... 13

4.2 Development of Starting MAV Balance Sheet .......................................................... 15

Market-Adjusted Valuation ....................................................................................... 16

5.1 Valuation Principles ................................................................................................... 16

5.2 Current Estimate......................................................................................................... 17

5.2.1 Basis for calculation ....................................................................................................................... 17

5.2.2 Contract recognition, contract boundaries and time horizon ......................................................... 19

5.2.3 Data quality and setting of assumptions ........................................................................................ 20

5.2.4 Management actions ...................................................................................................................... 21

5.2.5 Discounting..................................................................................................................................... 21

5.3 Margin over Current Estimate (MOCE) ...................................................................... 32

5.3.1 Definition and underlying principles ............................................................................................... 32

5.3.2 Calculation of the MOCE ................................................................................................................ 32

5.3.3 Interaction of MOCE with other components ................................................................................. 32

5.4 Obligations replicable by a portfolio of assets ......................................................... 33

Capital Resources ..................................................................................................... 34

6.1 General considerations .............................................................................................. 34

6.2 Classification of financial instruments ..................................................................... 35

6.2.1 Tier 1 Unlimited financial instruments ............................................................................................ 37

6.2.2 Tier 1 limited financial instruments ................................................................................................. 38

Public

6.2.3 Tier 2 financial instruments (other than structurally subordinated) ................................................ 40

6.2.4 Structurally subordinated Tier 2 financial instruments ................................................................... 41

6.2.5 Tier 2 Non-paid-up capital .............................................................................................................. 42

6.3 Capital elements other than financial instruments .................................................. 43

6.3.1 Tier 1 capital elements ................................................................................................................... 43

6.3.2 Tier 2 capital elements ................................................................................................................... 43

6.4 Capital adjustments and deductions ........................................................................ 44

6.4.1 Deductions from Tier 1 capital resources ...................................................................................... 44

6.4.2 Deductions from Tier 2 capital resources ...................................................................................... 45

6.4.3 Treatment of encumbered assets .................................................................................................. 45

6.4.4 Limit on non-controlling interests ................................................................................................... 45

6.5 Capital composition limits ......................................................................................... 46

Capital Requirement – The Standard Method ......................................................... 47

7.1 ICS Risks and Calculation Methods .......................................................................... 47

7.1.1 Risk mitigation techniques ............................................................................................................. 49

7.1.2 Geographic segmentation .............................................................................................................. 51

7.1.3 Management actions ...................................................................................................................... 52

7.2 Insurance risks ........................................................................................................... 53

7.2.1 Grouping of policies for life insurance risks ................................................................................... 53

7.2.2 Calculation of Life risk charges ...................................................................................................... 53

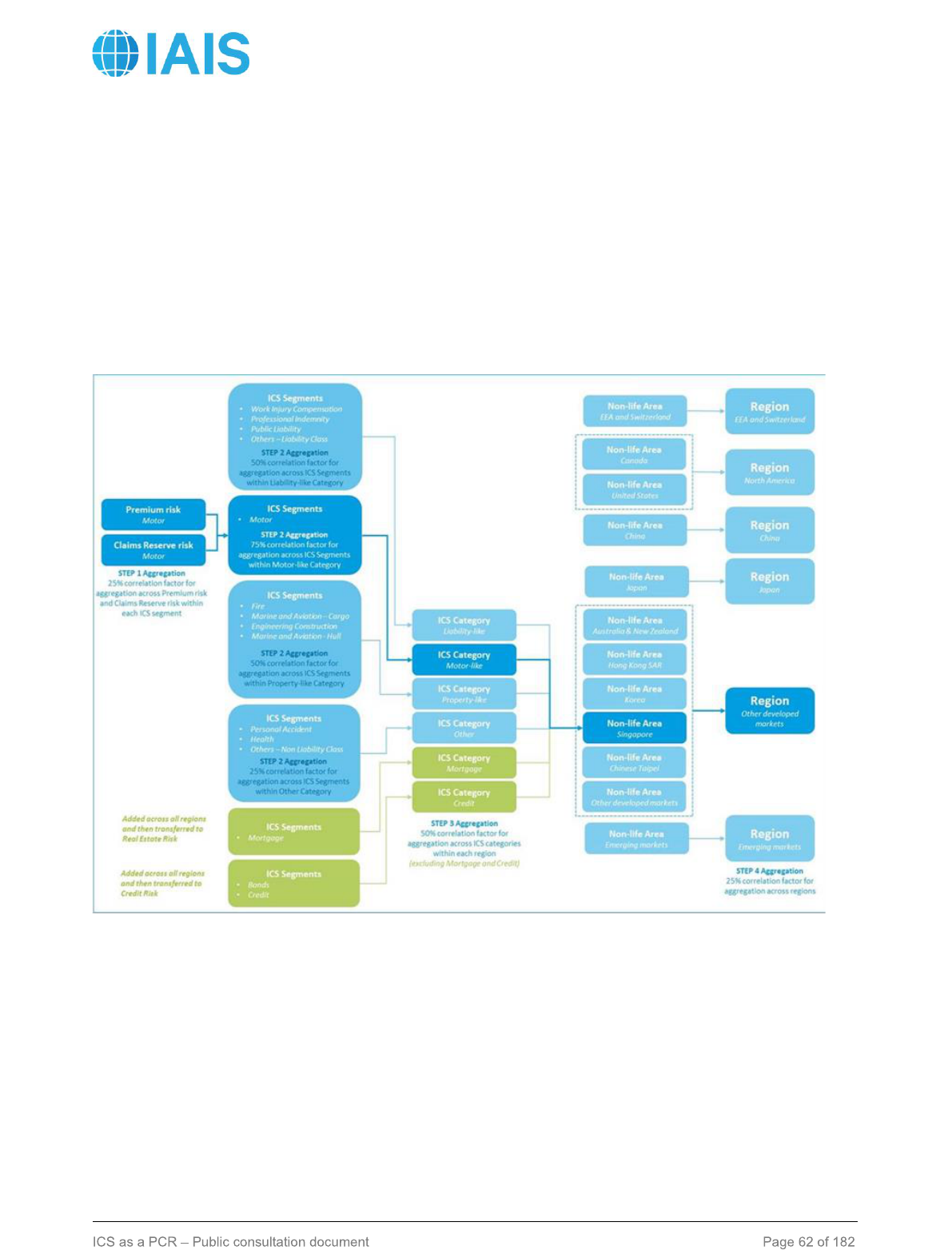

7.2.3 Calculation of Non-Life risk charges .............................................................................................. 60

7.2.4 Calculation of Catastrophe risk charges ........................................................................................ 72

7.3 Market Risks ............................................................................................................... 76

7.3.1 Calculation of the Market risk charge ............................................................................................. 76

7.3.2 Interest Rate risk ............................................................................................................................ 77

7.3.3 Non-Default Spread risk ................................................................................................................. 81

7.3.4 Equity risk ....................................................................................................................................... 82

7.3.5 Real Estate risk .............................................................................................................................. 85

7.3.6 Currency risk .................................................................................................................................. 86

7.3.7 Asset Concentration risk ................................................................................................................ 91

7.4 Credit risk.................................................................................................................... 93

7.4.1 Calculation of the Credit risk charge .............................................................................................. 93

7.4.2 Recognition of collateral, guarantees and credit derivatives ....................................................... 106

7.4.3 Use of external credit ratings ....................................................................................................... 112

7.5 Operational risk ........................................................................................................ 116

7.6 Aggregation / diversification of ICS risk charges .................................................. 117

7.7 Non-insurance risk charges .................................................................................... 118

Tax ............................................................................................................................ 121

8.1 General principles .................................................................................................... 121

8.2 Deferred tax resulting from the ICS Adjustment .................................................... 122

8.2.1 Utilisation assessment of DTAs recognised from the ICS Adjustment ........................................ 122

8.3 Tax effect on the ICS insurance capital requirement ............................................. 123

8.3.1 Component a: tax loss carry backs .............................................................................................. 124

8.3.2 Component b: post-stress future taxable income projections ...................................................... 124

8.3.3 Components c and d: Deferred taxes .......................................................................................... 124

Public

Capital Requirement – Other Methods .................................................................. 124

9.1 General principles .................................................................................................... 124

9.2 Dynamic Hedging ..................................................................................................... 125

9.3 Supervisory Owned and Controlled Credit Assessments (SOCCA) ..................... 125

9.4 Internal models ......................................................................................................... 126

9.4.1 Overall Requirements .................................................................................................................. 126

9.4.2 General Provisions on the use of an internal model to determine regulatory capital requirements

126

9.4.3 Criteria for internal model approval .............................................................................................. 131

9.4.4 Additional considerations ............................................................................................................. 136

9.4.5 General provisions on the use of partial internal models (PIM) ................................................... 138

General feedback .................................................................................................. 141

Economic Impact Assessment ............................................................................ 142

11.1 Impact on product availability ................................................................................. 142

11.2 Impact on IAIGs’ business models and capital position ....................................... 143

11.3 Impact on financial markets..................................................................................... 144

11.4 Implementing the ICS ............................................................................................... 145

Treatment of Non-Voting Interest Entities (Asset and Insurance

Securitisations).............................................................................................................. 146

Definition of ICS Non-Life Segments ......................................................... 148

Definitions and criteria applicable to infrastructure debt and equity ..... 173

Infrastructure investments ..................................................................................... 173

Criteria applicable to infrastructure equity ........................................................... 175

2.1 Subset of infrastructure corporate investments .................................................... 175

2.2 Subset of infrastructure project investments ......................................................... 176

Criteria applicable to infrastructure debt .............................................................. 177

3.1 Subset of infrastructure corporate investments .................................................... 178

3.2 Subset of infrastructure project investments ......................................................... 178

Risk-free yield curve parameters ............................................................... 181

Public

Introduction

1.1 Purpose of the consultation document (CD)

1. The purpose of this CD is to solicit feedback from stakeholders on the global insurance capital

standard (ICS) ahead of its adoption as a group prescribed capital requirement (PCR) for

Internationally Active Insurance Groups (IAIGs) at year-end 2024. This CD presents the ICS as

envisaged for implementation (“candidate ICS as a PCR”), subject to any further changes which may

be decided upon based on the resolution of comments from this public consultation and the outcome

of the ICS data collection, and provides in blue boxes background explanations relating to the main

changes compared to ICS Version 2.0 for the monitoring period.

1

Only the text identified as Level 1

or Level 2 text forms the ICS standard.

2. This CD also aims at collecting input from stakeholders to support the Economic Impact

Assessment (EIA) of the ICS that will be conducted by the IAIS.

1.2 The consultation process

3. Feedback on this CD is invited by 21 September 2023.

4. Stakeholders are invited to provide rationale and/or evidence supporting their responses.

Explanations are most helpful if they:

• Are clear as to the issue being addressed;

• Provide a clear rationale and basis for comments made; and

• Include evidence, examples or references (eg to publicly available documents or data

sources) to support the response.

5. Comments must be sent electronically via the IAIS Consultations webpage. All comments will

be published on the IAIS website unless a specific request is made for comments to remain

confidential.

1.3 Next steps

6. The feedback received on this CD as well as the outcome of the Economic Impact Assessment

will be considered for the finalisation of the ICS. A resolution of comments received through this

public consultation will be released along with the finalisation of the ICS. The adoption of the ICS is

planned for December 2024.

The ICS – background information

7. The ICS has been developed as a consolidated group-wide capital standard for IAIGs.

8. Once adopted, the ICS will apply to IAIGs as part of the Common Framework for the Supervision

of IAIGs (ComFrame).

1

The Level 1 and Level 2 documents for ICS Version 2.0 for the monitoring period are available here:

https://www.iaisweb.org/activities-topics/standard-setting/insurance-capital-standard/

Public

2.1 ICS and ComFrame

9. ComFrame consists of both quantitative and qualitative supervisory requirements tailored to the

complexity and international scope of IAIGs. The ICS is the quantitative component of ComFrame.

Following its adoption as a group-wide consolidated PCR, the ICS will be integrated into ComFrame.

10. The ICS is structured on two levels: Level 1 and Level 2.

11. The Level 1 text sets out the overarching principles and concepts of the ICS. It is adopted by

the General Meeting of IAIS Members after public consultation.

12. The Level 2 text contains more detail on the operationalisation of the relevant Level 1 text. It is

adopted by the Executive Committee of the IAIS after public consultation.

13. While the Level 1 text is intended to remain stable over time, the Level 2 text may be revised on

a more frequent basis. Changes to the Level 1 and Level 2 texts follow the same process as

described in paragraphs 11 and 12 respectively.

14. For the ease of reading, this CD brings together the Level 1 and Level 2 into one consolidated

document. The origin of each paragraph of the standard can be identified through the numbering:

L1-x for paragraphs from the Level 1 text, L2-x for paragraphs from the Level 2 text.

2.2 Development of the ICS

2.2.1 Genesis of the ICS Project

15. On 9 October 2013, the IAIS announced its plan to develop a risk-based global insurance capital

standard, in response to the request by the Financial Stability Board (FSB) that the IAIS produce a

work plan to create “a comprehensive group-wide supervisory and regulatory framework for

Internationally Active Insurance Groups.”

2

In its statement of 18 July 2013 the FSB stated that “a

sound capital and supervisory framework for the insurance sector more broadly is essential for

supporting financial stability.” The FSB further reinforced its support for the development of the ICS

in its statement of 6 November 2014.

3

2.2.2 Principles for ICS Development

16. The IAIS published a first version of the principles set forth in Table 1 in September 2014.

Principles 3 and 6 were subsequently amended following the 2014 ICS CD. These principles have

been followed in the ICS development.

17. The principles that reference Global Systemically Important Insurers (G-SIIs) have been

superseded by the development of the IAIS Holistic Framework for the assessment and mitigation

of systemic risk in the insurance sector.

4

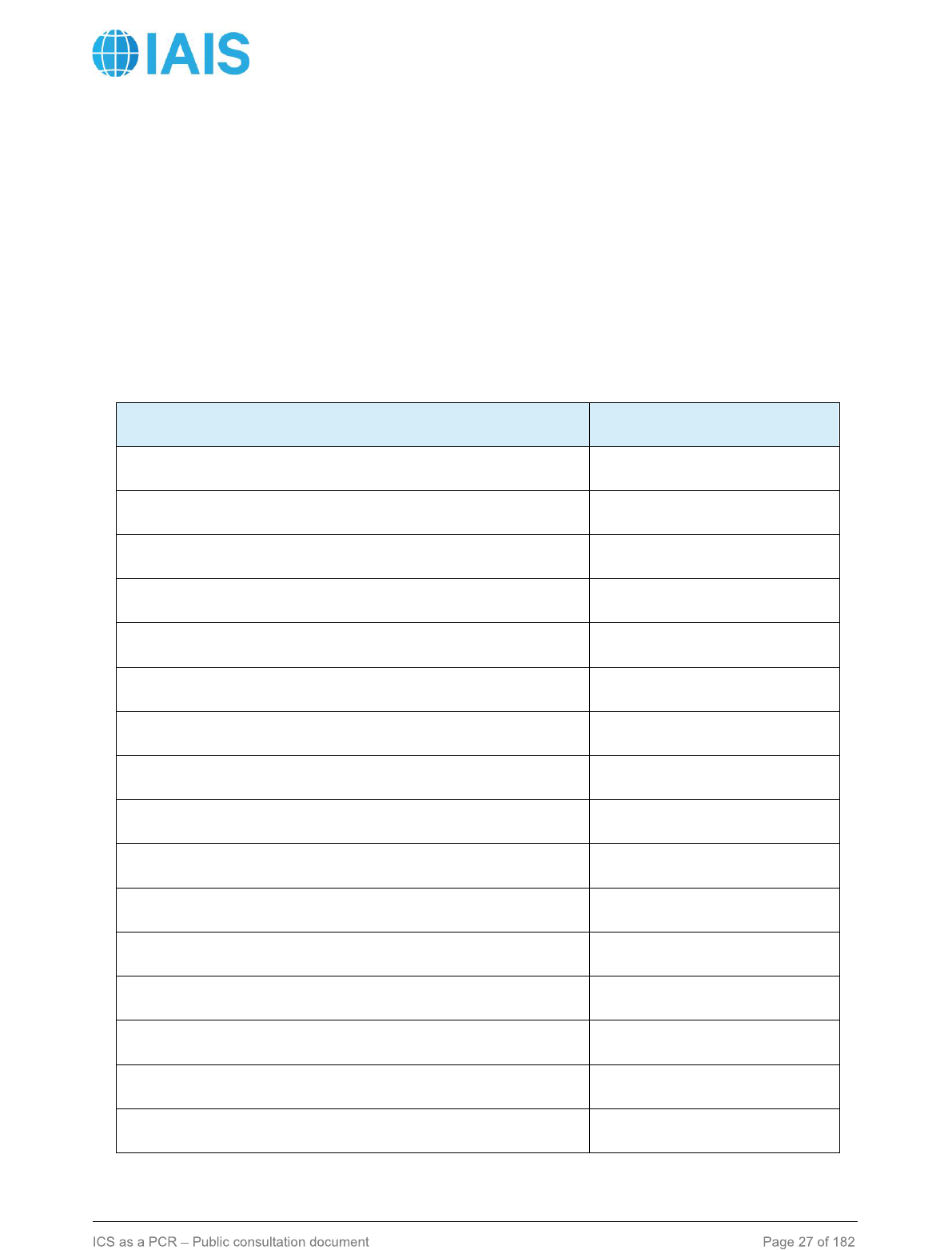

Table 1: The ICS Principles

ICS Principle 1: The ICS is a consolidated group-wide standard with a globally

comparable risk-based measure of capital adequacy for IAIGs and G-SIIs. The standard

incorporates consistent valuation principles for assets and liabilities, a definition of qualifying

2

http://www.financialstabilityboard.org/publications/r_130718.pdf

3

http://www.financialstabilityboard.org/wp-content/uploads/pr_141106a.pdf

4

See press release from the FSB, 9 December 2022, which noted that “The FSB decided to discontinue the annual identification

of G-SIIs. Going forward the FSB will utilise assessments available through the Holistic Framework to inform its considerations of

systemic risk in the insurance sector.”

Public

capital resources and a risk-based capital requirement. The amount of capital required to be

held and the definition of capital resources are based on the characteristics of risks held by the

IAIG irrespective of the location of its headquarters.

ICS Principle 2: The main objectives of the ICS are protection of policyholders and to

contribute to financial stability. The ICS is being developed in the context of the IAIS Mission,

which is to promote effective and globally consistent supervision of the insurance industry in

order to develop and maintain fair, safe and stable insurance markets for the benefit and

protection of policyholders and to contribute to global financial stability.

ICS Principle 3: One of the purposes of the ICS is the foundation for Higher Loss

Absorbency (HLA) for G-SIIs. Initially, the Basic Capital Requirements (BCR) is the foundation

for HLA for G-SIIs.

ICS Principle 4: The ICS reflects all material risks to which an IAIG is exposed. The ICS

reflects all material risks of IAIGs’ portfolios of activities taking into account assets, liabilities,

non-insurance risks and off-balance sheet activities. To the extent that risks are not quantified in

the ICS they are addressed in ComFrame.

ICS Principle 5: The ICS aims at comparability of outcomes across jurisdictions and

therefore provides increased mutual understanding and greater confidence in cross-

border analysis of IAIGs among group-wide and host supervisors. Applying a common

means to measure capital adequacy on a group-wide consolidated basis can contribute to a

level playing field and reduce the possibility of capital arbitrage.

ICS Principle 6: The ICS promotes sound risk management by IAIGs and G-SIIs. This

includes an explicit recognition of appropriate and effective risk mitigation techniques.

ICS Principle 7: The ICS promotes prudentially sound behaviour while minimising

inappropriate pro-cyclical behaviour by supervisors and IAIGs. The ICS does not

encourage IAIGs to take actions in a stress event that exacerbate the impact of that event.

Examples of pro-cyclical behaviour are building up high sales of products that expose the IAIG

to significant risks in a downturn or fire sales of assets during a crisis.

ICS Principle 8: The ICS strikes an appropriate balance between risk sensitivity and

simplicity. Underlying granularity and complexity are sufficient to reflect the wide variety of risks

held by IAIGs. However, additional complexity that results in limited incremental benefit in risk

sensitivity is avoided.

ICS Principle 9: The ICS is transparent, particularly with regard to the disclosure of final

results.

ICS Principle 10: The capital requirement in the ICS is based on appropriate target criteria

which underlie the calibration. The level at which regulatory capital requirements are set

reflects the level of solvency protection deemed appropriate by the IAIS.

2.2.3 Field Testing: 2014 to 2019

18. Following its announcement in October 2013, the IAIS undertook a multi-year quantitative Field

Testing process with Volunteer Insurance Groups (Volunteer Groups), including IAIGs. The IAIS

Public

conducted six quantitative Field Testing exercises in the development of the ICS between 2014 and

2019. Each quantitative ICS Field Testing exercise was informed by IAIS analysis of submitted data,

as well as additional feedback and comments provided by Volunteer Groups as part of their

submissions or through dedicated workshops. In addition to the Field Testing process, the IAIS

engaged with the broader group of stakeholders through dedicated stakeholder meetings and two

public consultations on the ICS.

2.2.4 Implementation of ICS Version 2.0

19. In November 2019, the IAIS adopted ICS Version 2.0. Starting from January 2020, the ICS

entered a five-year monitoring period, during which ICS Version 2.0 is used for confidential reporting

to the group-wide supervisor (GWS), discussion in supervisory colleges, and further analysis by the

IAIS.

20. The IAIS acknowledges the development by the United States of the Aggregation Method (AM)

as a group capital calculation. While the AM is not part of the ICS, the IAIS aims to be in a position

by the end of the monitoring period to assess whether the AM provides comparable (ie substantially

the same (in the sense of the ultimate goal)) outcomes to the ICS. If so, it will be considered an

outcome-equivalent approach for implementation of ICS as a PCR.

2.3 Implementation of the ICS

21. Once adopted as a PCR at the end of the monitoring period, the ICS will be a measure of capital

adequacy for IAIGs. It will constitute the minimum standard to be achieved and that supervisors

represented in the IAIS will implement or propose to implement taking into account specific market

circumstances in their respective jurisdictions.

5

5

While the IAIS as a standard setting body does not have any legal power to directly mandate the implementation of the ICS as

a PCR in jurisdictions, Article 6(6)(b) of the IAIS By-Laws notes that IAIS Members commit to “implementing IAIS supervisory

material taking into account specific market circumstances”.

Public

General Guiding Principles

Changes compared to ICS Version 2.0:

This section has not incurred any change compared to ICS Version 2.0 for the monitoring period.

3.1 Substance over Form

L1-1. The ICS balance sheet differs from publicly reported GAAP financial statements, as it

reflects a different objective (prudential supervision as opposed to investor information). For

example, certain assets in a GAAP balance sheet do not qualify as assets for the ICS.

L1-2. The economic substance of transactions and events are recorded in the ICS balance sheet

rather than just their legal form, in order to present a true and fair view of the risk profile of the entity.

This may require the use of judgment when preparing the ICS balance sheet.

L1-3. The allocation of insurance liabilities to the ICS line of business segments follows the

principle of substance over form. This means that insurance liabilities are allocated to the segment

that best reflects the nature of the underlying risks rather than the legal form of the contract. The

definitions for the insurance line of business segmentation are specified in the Level 2 text.

3.2 Proportionality

L1-4. Calculations and valuation are subject to the proportionality principle. When the IAIG can

demonstrate that taking into account a specific factor/rule in their calculation or valuation would lead

to a significant increase in complexity, without material improvement to the quality of the figure

produced or to the assessment of risk linked to this figure, then this factor or rule can be ignored or

simplified.

L1-5. The materiality of the impact of using a simplification is assessed with regard to:

• The volume of the item valued;

• The overall volume of the group’s business and capital resources; and

• The assessment of risk.

3.3 Look-Through

L1-6. In order to assess properly the risk inherent in collective investment funds and other indirect

exposures, their economic substance needs to be taken into account. This is achieved, to the extent

possible, by applying a look-through approach. Additional requirements on the use of look-through

are provided in the Level 2 text.

L2-1. The look-through approach applies to insurance arrangements and indirect investments

(including unleveraged mutual funds, other collective investment vehicles, etc.) in order to identify

all underlying exposures embedded in such arrangements and investments, including all indirect

Public

holdings that may artificially inflate the qualifying capital resources of an Internationally Active

Insurance Group (IAIG).

L2-2. When a full look-through is not possible, a partial look-through may be applied, along the

lines provided by the Basel III framework

6

.

L2-3. When no look-through is possible, the full investment is considered as unlisted equity for

the purpose of calculating the insurance capital standard (ICS) risk charges.

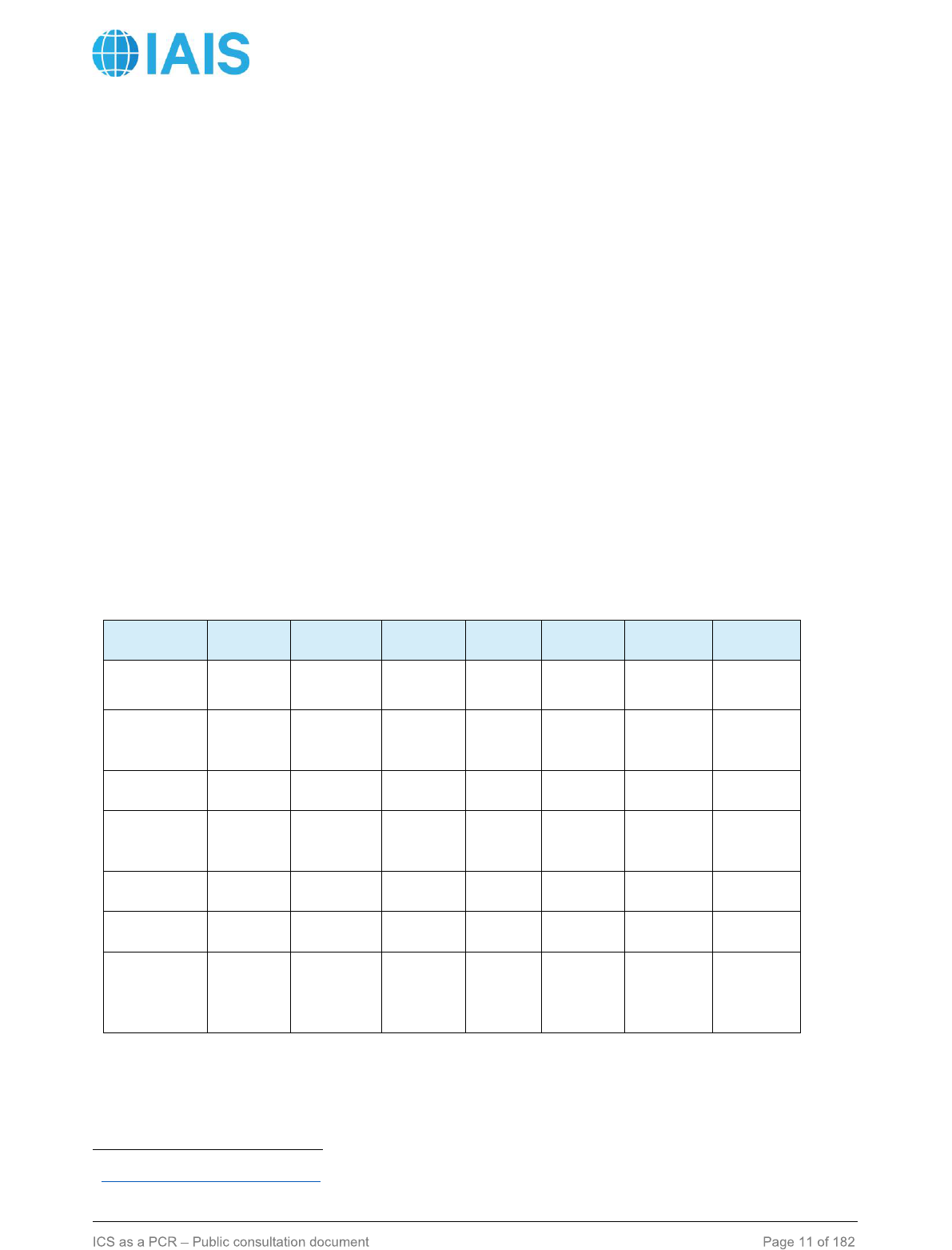

3.4 ICS Rating Categories

L1-7. The IAIS has developed a mapping between ICS Rating Categories (ICS RC) and credit

rating agency ratings. ICS Rating Categories range from 1 to 7. Additional specifications on ICS

Rating Categories, including the mapping to agency ratings, are included in the Level 2 text.

L2-4. Whenever the use of an ICS Rating Category (ICS RC) is needed, the IAIG uses the agency

ratings listed in the table below. Ratings from AM Best may be used only for calculating the risk

charge on reinsurance exposures. Modifiers such as + or – do not affect the ICS RC. Where two

ratings are listed in a cell, the first rating represents a long-term rating, and the second rating

represents the short-term rating mapped to the same ICS RC. The short-term rating is used only for

instruments with a remaining maturity of one year or less.

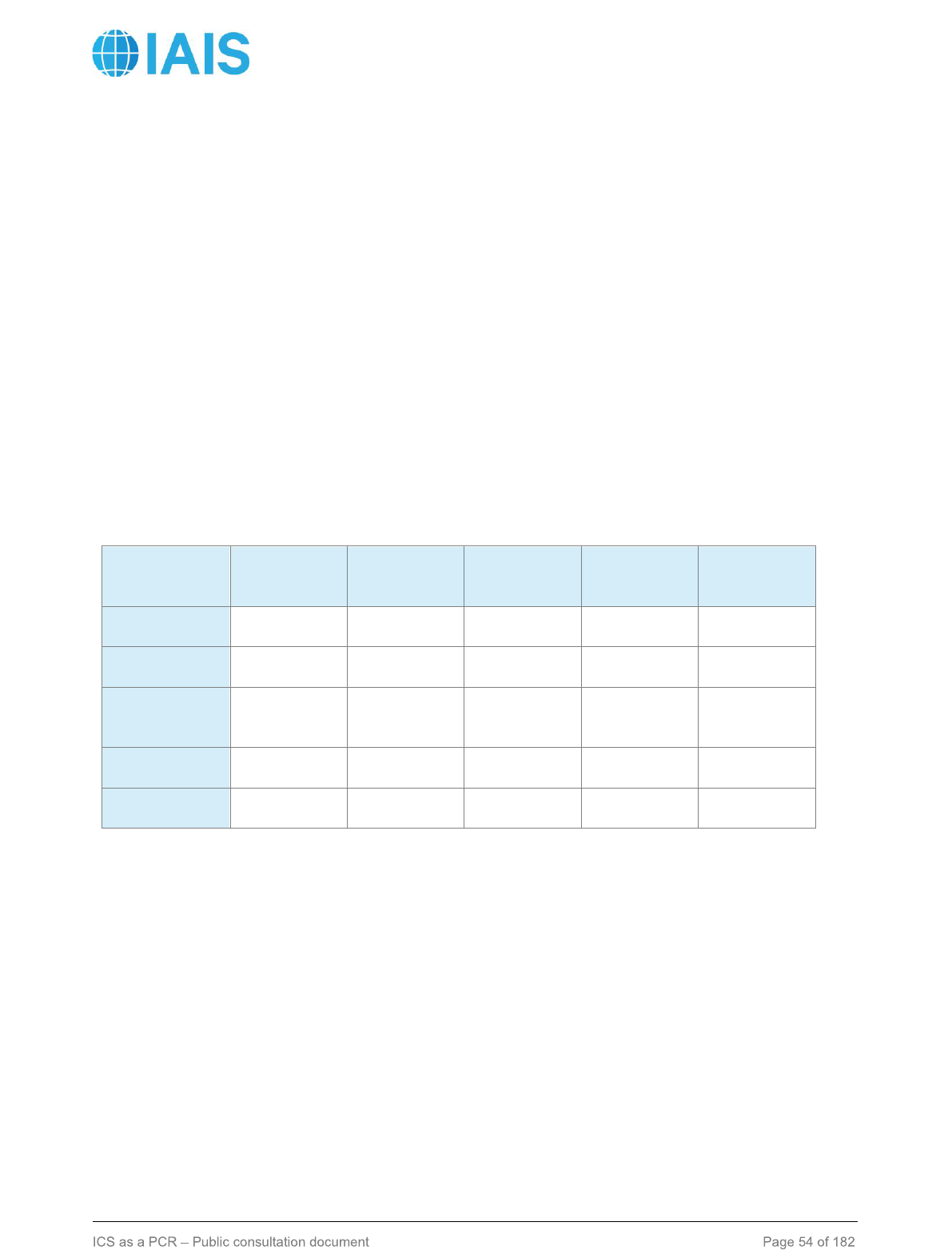

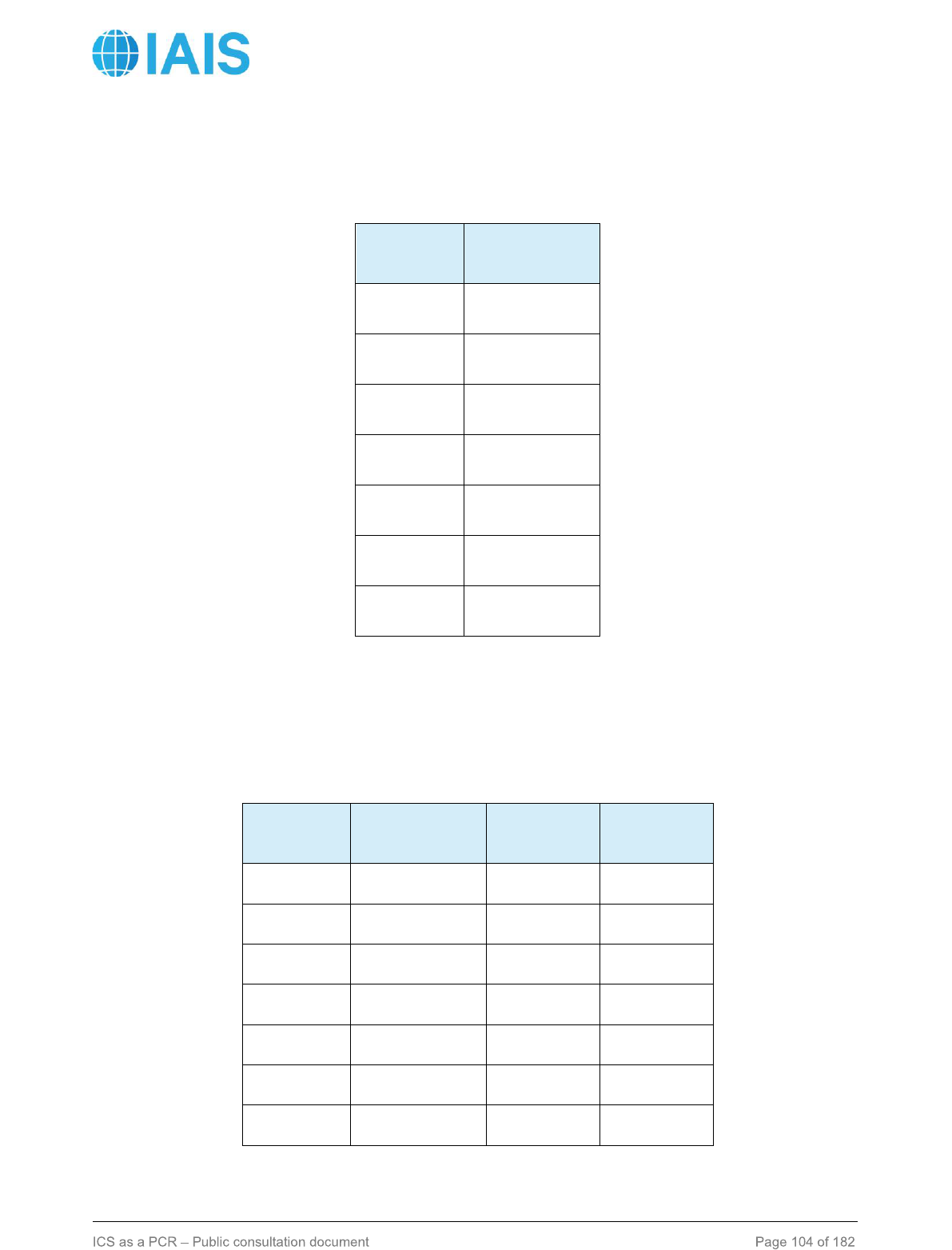

Table 2: Mapping to ICS RC (for instruments not in default)

ICS RC

S&P

Moody’s

Fitch

JCR

R&I

DBRS

AM Best

1

AAA

Aaa

AAA

AAA

AAA

AAA

2

AA / A-1

Aa / P-1

AA / F1

AA / J-

1

AA / a-1

AA / R-1

A+

3

A / A-2

A / P-2

A / F2

A / J-2

A / a-2

A / R-2

A

4

BBB /

A-3

Baa / P-3

BBB /

F3

BBB /

J-3

BBB / a-

3

BBB / R-

3

B+

5

BB

Ba

BB

BB

BB

BB

B

6

B / B

B / NP

B / B

B / NJ

B / b

B / R-4

C+

7

CCC / C

and

lower

Caa and

lower

CCC / C

and

lower

CCC

and

lower

CCC / c

and

lower

CCC /

R-5 and

lower

C and

lower

L2-5. Additionally, the IAIG may use ratings issued by a rating agency that the banking regulator

in its jurisdiction (or for a subsidiary, in the subsidiary’s jurisdiction) has recognised as an External

Credit Assessment Institution (ECAI) under the Basel II framework. The ICS RC corresponding to a

6

http://www.bis.org/publ/bcbs266.htm.

Public

rating produced by such an agency is the Basel II rating category to which the supervisor has

mapped the rating (the combined rating class AAA/AA corresponds to ICS RC 2).

L2-6. ICS RCs 1 to 4 in the table above are considered investment grade.

L2-7. The use of ICS RCs is further developed in section 7.4.3.

Public

Perimeter of the ICS Calculation

Changes compared to ICS Version 2.0:

This section has not incurred any change compared to ICS Version 2.0 for the monitoring period.

4.1 Scope for Starting ICS Balance Sheet

L1-8. The starting point of the ICS is the audited consolidated GAAP balance sheet of the

insurance holding company of an insurance group or financial holding company of a financial

conglomerate.

L1-9. Where an IAIG does not prepare audited consolidated GAAP financials, statutory financial

statements are aggregated to reflect the group level starting balance sheet.

L1-10. The audited GAAP balance sheet is split into two components: (1) entities that are insurers,

and entities whose purpose is insurance related; and (2) non-insurance entities. The Level 2 text

provides further description of which entities are considered insurance related and non-insurance.

L1-11. The non-insurance entities are reported separately from insurance entities, on a GAAP

basis, with the exceptions described in the Level 2 text.

L2-8. The perimeter of the ICS calculation is defined as including all consolidated legal entities

within the IAIG.

L2-9. The starting point to derive the balance sheet of the insurance group, prior to application of

any Market-Adjusted Valuation (MAV) adjustments, is the consolidated Generally Accepted

Accounting Principles (GAAP) balance sheet of the Head of the IAIG, as defined in the Common

Framework for the Supervision of IAIGs (ComFrame). For entities that do not have consolidated

GAAP financials, see paragraph L2-15.

L2-10. For purposes of the ICS calculation, balance sheets are segregated into insurance related

and non-insurance components. The insurance portion of the balance sheet is comprised of entities

that meet the following definitions:

a. Insurer: Insurance legal entity or insurance group.

b. Insurance legal entity: A legal entity, including its branches, that is licensed to conduct

insurance, regulated and subject to supervision.

c. Insurance related entities: Legal entities that mainly exist to support the operations of the

insurer.

L2-11. Legal entities that comprise the consolidated GAAP balance sheet are further categorised

according to the following definitions in order to apply certain accounting treatments that differ from

GAAP as well as to derive a capital requirement for non-insurance components:

a. Insurer and Insurance related entities;

b. Regulated non-insurance financial entity;

Public

c. Non-regulated non-insurance financial entity; and

d. Non-financial entity.

L2-12. The ICS follows GAAP accounting rules for consolidation accounting treatment except for

the following:

a. For insurer and insurance related entities that are determined under GAAP to be controlled

as joint ventures

7

, a proportional consolidation method is used unless it is determined through

consultation with the group-wide supervisor (GWS) that such treatment is not considered

feasible; in which case the entity remains unadjusted and reported as per GAAP as an equity

method investment.

b. For insurer and insurance related entities that are determined under GAAP to be controlled

as joint operations

8

and reported by recognising its own assets, liabilities and transactions,

including its share of those incurred jointly, the entity may remain unadjusted (ie proportional

consolidation on shared assets).

c. For non-insurance financial and non-financial entities that are determined under GAAP to be

joint operations and reported by recognising its own assets, liabilities and transactions,

including its share of those incurred jointly, the entity is reported as an equity method

investment.

d. For non-insurance financial and non-financial entities that are determined under GAAP to be

joint ventures, the entity is reported as an equity method investment.

L2-13. Adjustments related to non-voting interest entities

9

:

a. A non-voting interest entity that has been determined under GAAP to be unconsolidated is

consolidated if either the IAIG or its GWS assesses that it poses a material risk

10

to the group,

either individually or in the aggregate.

b. A securitisation originated within the group may not be consolidated provided that it meets

all of the conditions outlined in Annex 1.

c. Notwithstanding the materiality assessment or application of additional criteria, a non-voting

interest entity is consolidated when the GWS determines that the nature, scale and

complexity of the risks cannot be considered insignificant.

L2-14. Other non-GAAP adjustments: Structured settlement agreements with third parties are

recorded on a net basis (ie removed from reserves and reinsurance recoverables) when the

7

A joint venture is a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the

arrangement.

8

A joint operation is a joint arrangement whereby the parties that have joint control of the arrangement have rights to the assets, and

obligations for the liabilities, relating to the arrangement.

9

A non-voting interest entity is an entity where voting or similar rights are not the dominant factor in assessing control. Entities are often

thinly capitalised or contain no capital and are designed for a specific purpose (eg, special purpose entities, structured entities, GP/LP

structures, trusts and investment partnerships).

10

Material risk in this case relates to the risks posed to the group. In considering what might significantly contribute to group risks, a firm

may assess whether the related entity’s gross assets or gross revenue are more than 1% of the group’s gross assets or revenue. In

addition, an assessment of all immaterial entities exceeding 5% of the group’s asset’s or revenue, in the aggregate, may indicate that

other entities should be consolidated in order to avoid missing material risks.

Public

underlying claim is settled and the risk to the non-life company is contingent upon the life insurer

(and the guarantee fund, if applicable) having the ability to pay.

L2-15. Aggregated group balance sheet: an IAIG that does not prepare consolidated or group level

financial statements generates a balance sheet on an aggregated basis to reflect group level starting

balances.

L1-12. Non-insurance entities (financial and non-financial) are incorporated into the reference ICS,

based on the entity type and whether or not the entity is subject to a sectoral capital requirement.

The capital requirement for financial non-insurance entities is based on the entity’s sectoral capital

rules, when available. For financial non-insurance entities without sectoral capital rules and for non-

financial entities, the capital requirement included in the reference ICS is described in the Level 2

text. For all non-insurance entities, capital resources follow the capital resources framework set out

for the reference ICS.

4.2 Development of Starting MAV Balance Sheet

L1-13. The starting MAV balance sheet is comprised of the insurance and insurance-related

entities.

L1-14. The starting MAV balance sheet is subject to adjustments as described in the Level 2 text

and section 5.

Public

Market-Adjusted Valuation

Changes compared to ICS Version 2.0:

The MAV framework utilises the Three Bucket Approach to determine the level of spread adjustment

to the risk free curve for purposes of discounting liability cash-flows. Liabilities are classified into the

Top, Middle or General Buckets (unless they can be replicated by a portfolio of assets) depending

on the nature of the liabilities, their predictability, the assets backing those liabilities and the cash-

flow matching between assets and liabilities.

A spread term structure adjustment for the General and Middle Bucket has been introduced. This is

intended to be more consistent with market reality as spreads typically differ by maturity. In general,

the spread term structure leads to lower spread adjustments for shorter maturities and higher spread

adjustments for longer maturities compared to ICS 2.0.

There were specific instances in which an increase in credit spreads resulted in a greater reduction

in insurance liabilities than in asset values, producing an increase in capital resources. This increase

in capital resources may not be warranted if it is driven by asset-liability mismatches. A modulation

factor has been introduced for the General and Middle Buckets to mitigate non-economic increases

of solvency ratios in stress situations.

It was observed that the Middle Bucket criteria may be too restrictive and prevent products with a

high predictability of cash flows to qualify for the Middle Bucket. The Middle Bucket criteria have

been refined to include a broader range of products with predictable cash-flows (L2-69d and L2-

69e). In addition, the spread adjustment for the Middle Bucket can be computed portfolio-specific,

rather than currency-specific.

It was observed that the design of the spread adjustment for the Middle Bucket may disincentivise

holding of non-fixed income assets. Holding such assets results in a reduction of the overall Middle

Bucket spread adjustment, even if the assets are being held to match cash flows at late maturities

(beyond Last Observable Term). The computation of the spread adjustment has been revised to

address this.

5.1 Valuation Principles

L1-15. The MAV approach is based on the amounts as reported on audited, consolidated, general-

purpose GAAP or Statutory Accounting Principles (SAP) accounts, and includes adjustments to the

following items:

a) Insurance liabilities and reinsurance balances;

b) Financial investments (assets) and instruments (liabilities); and

c) Deferred taxes.

Public

L1-16. Unless they are replicable by a portfolio of assets (cf section 5.4), MAV insurance liabilities

are the sum of a current estimate and a margin over current estimate (MOCE). The details

underpinning the calculation of the current estimate and the MOCE are developed in the following

sub-sections as well as in the Level 2 text.

L1-17. The adjustments to items b) and c) are described in the Level 2 text.

L2-16. When deriving the adjustments to be made to insurance liabilities, reinsurance balances,

financial investments and instruments, and tax, the IAIG applies the following principles:

a. Property for own use is adjusted to fair value using the fair value guidance under the IAIG’s

GAAP or when the IAIG does not produce a GAAP consolidated balance sheet, the GAAP

fair value principles in the IAIG’s jurisdiction.

b. Mortgages and loans are adjusted to fair value using the fair value guidance under the

IAIG’s GAAP or when the IAIG does not produce a GAAP consolidated balance sheet, the

GAAP fair value principles in the IAIG’s jurisdiction.

c. Reinsurance recoverables are restated on a basis consistent with the determination of

insurance liabilities. Recoverables on paid and unpaid balances are reported net of

allowances for estimated uncollectable amounts.

d. Deferred tax assets (DTA) and liabilities (DTL) are treated according to section 8.

e. Deferred acquisition costs and other deferred expenses that are on the balance sheet at

the reporting date are adjusted to zero. Future acquisition costs related to future premiums

(within contract boundaries – see section 5.2.2) are reflected in the value of insurance

liabilities.

f. Premium receivables falling due after the reporting date and related to contracts that are

included in the current estimate calculation are reflected in the valuation of insurance

liabilities as negative cash flows. Premium receivables for which the due date is prior to the

reporting date are not part of the current estimate calculation and remain as assets on the

balance sheet.

g. Loans to policyholders are reported separately and are not netted against insurance

liabilities.

h. Other financial assets that are reported on the GAAP balance sheet at amortised cost (eg

Hold-To-Maturity investments) are restated to a fair value.

i. Financial liabilities: upon initial recognition, the valuation of these items is based on the

IAIG’s reported GAAP, and there is no subsequent adjustment to take account of changes to

the IAIG’s own credit standing.

5.2 Current Estimate

5.2.1 Basis for calculation

L1-18. The current estimate corresponds to the probability-weighted average of the present values

of the future cash-flows associated with insurance liabilities, discounted using the yield curve

relevant for the currency and bucket of each liability. The three buckets to which liabilities can be

allocated are described in section 5.2.5.3.

Public

L1-19. The current estimate does not include any implicit or explicit margins.

L1-20. Reinsurance recoverables are calculated in a way that is consistent with the current

estimates of insurance liabilities, based on the same assumptions and inputs.

L1-21. When valuing insurance liabilities, no adjustment is made to take into account the IAIG’s

own credit standing.

L1-22. More details on how to project cash-flows for the current estimate calculation are provided

in the Level 2 text.

5.2.1.1 General considerations

L2-17. The current estimate calculation is based on the probability weighted average of the future

cash flows, taking into account the uncertainty relating to:

a. The timing, frequency and severity of claim events;

b. Claim amounts and claim inflation, including where relevant any uncertainty on the value of

indices used to determine claim amounts;

c. The time needed to settle claims;

d. The amount of expenses; and

e. Policyholder behaviour.

L2-18. Cash flow projections reflect expected future demographic, legal, medical, technological,

social or economic developments, and are based on appropriate inflation assumptions, recognising

the different types of inflation to which the entity can be exposed. Premium adjustment clauses are

also considered, where relevant.

L2-19. The current estimate is calculated gross of reinsurance and special purpose vehicles (SPV).

Recoverables from reinsurance or SPVs are calculated separately and recognised as an asset.

L2-20. The projected cash flows include at a minimum the following items within the contract

boundaries:

a. Benefit and claim payments;

b. Direct and indirect expenses incurred;

c. Premiums received;

d. Subrogation payments and recoveries other than from reinsurance and special purpose

vehicles; and

e. Other payments made in order to settle the claims.

L2-21. All expenses related to existing contracts and contracts that are recognised at the reporting

date, but not yet in force, are included in the current estimate calculation. The expenses estimation

assumes that the IAIG will write business in the future. Future expenses relating exclusively to future

business are not considered for the current estimate calculation.

L2-22. Where a yield curve is needed as input to assess future returns on assets, the IAIG makes

use of the relevant IAIS yield curves with specified adjustments.

Public

5.2.1.2 Options and guarantees

L2-23. The expected cash flows relating to options and guarantees embedded in the insurance

contract are taken into account for the calculation of the current estimate. All payments connected

to the risks insured, and profit participation payments in particular, are taken into consideration for

the calculation of the value of options and guarantees.

L2-24. All options and guarantees are valued using arbitrage-free techniques

11

based on the

adjusted yield curve as a proxy for the risk-free curve.

5.2.1.3 Policyholder behaviour

L2-25. Where relevant, expected cash flows reflect the contractual right of policyholders to change

the amount, timing or nature of their benefits.

L2-26. The likelihood that policyholders will exercise contractual options, including lapses and

surrenders, is taken into account with a prospective view, considering in particular:

a. Past and expected behaviour of policyholders, considering also their reaction to management

actions;

b. How beneficial the exercise of options would be to policyholders under specific

circumstances; and

c. Economic conditions.

L2-27. To the extent that it is deemed representative of future expected behaviour, assumptions

on policyholder behaviour are based on appropriate statistical and empirical evidence.

L2-28. The assumptions concerning policyholder behaviour are consistent with the assumed

investment returns and the yield curves used for discounting insurance liabilities.

5.2.1.4 Future discretionary benefits

L2-29. Future discretionary benefits (FDB) are comprised of all non-guaranteed amounts, including

those bonuses linked to a legal or contractual obligation to distribute a portion of the IAIG’s

financial/underwriting profits to policyholders.

L2-30. The current estimate recognises FDB expected to be paid consistently with expected future

developments, the economic scenarios on which the liability valuation is based and policyholders’

reasonable expectations.

L2-31. The projection of FDB is also consistent with the yield curve applicable to the contract, as

well as with the modelling of policyholder behaviour as described in section 5.2.1.3.

5.2.2 Contract recognition, contract boundaries and time horizon

L1-23. A contract is recognised when the IAIG becomes a party to that contact, until all obligations

related to that contract are extinguished. All contracts that are recognised at the valuation date, and

only those, are taken into account for the current estimate calculation.

11

This implies in particular that where relevant, path dependency is taken into account in the valuation of options and guarantees.

Public

L1-24. The future premiums and associated claims and expenses linked to those recognised

contracts are taken into account up to each contract boundary.

L1-25. The projection horizon used in the calculation of the current estimate covers the full lifetime

of all the cash in- and out-flows required to settle the obligations (within contract boundaries) related

to recognised insurance and reinsurance contracts at the valuation date.

L1-26. The details for contract recognition and contract boundaries are specified in the Level 2 text.

L2-32. A contract is recognised and valued as soon as the IAIG becomes party to that contract,

without any possibility to amend or cancel it, even when the insurance coverage has not yet started.

L2-33. A contract is derecognised when all possible claims linked to this contract have been

completely settled, and all future cash-flows are nil.

L2-34. Only those contracts recognised at the reporting date are taken into account in the current

estimate calculation; in particular, no future business is included in the calculation.

L2-35. All obligations, including future premiums, relating to a recognised contract are taken into

account in the current estimate cash flow projection. However, future premiums (and associated

claims and expenses) beyond either of the following dates are not considered, unless the IAIG can

demonstrate that it is able and willing to compel the policyholder to pay the premiums:

a. The future date where the IAIG has a unilateral right to terminate the contract or reject the

premiums payable under the contract; or

b. The future date where the IAIG has a unilateral right to amend the premiums or the benefits

payable under the contract in such a way that the premiums fully reflect the risks.

L2-36. For group policies, similar rules apply. If premiums can be amended unilaterally for the

entire portfolio in a way that fully reflects the risks of the portfolio, the second condition above is

considered to be met.

5.2.3 Data quality and setting of assumptions

L1-27. The calculation of the current estimate is based on up-to-date and credible information and

realistic assumptions. The determination of the current estimate is objective, comprehensive, and

uses observable input data.

L1-28. The requirements relating to data quality and modelling assumptions are specified in the

Level 2 text.

L2-37. When selecting data for the calculation of the current estimate, the IAIG considers:

a. The quality of data based on the criteria of accuracy, completeness and appropriateness;

b. The use and setting of assumptions made in the collection and processing of data; and

c. The frequency of regular updates and the circumstances that trigger additional updates.

L2-38. When only limited or unreliable data are available from the IAIG’s own experience, the IAIG

supplements its own data with data from other sources. When the characteristics of the portfolio

differ from those of the population represented in the external data used, the external data are

adjusted in order to ensure consistency with the risk characteristics of the IAIG’s portfolio.

Public

L2-39. The assumptions used to calculate the current estimate reflect current expectations based

on all information available. This requires an assessment of expected future conditions, in particular

as soon as:

a. There is evidence that historical trends will not continue, that new trends will emerge or that

economic, demographic and other changes may affect the cash flows that arise from the

existing insurance contracts.

b. There have been changes in underwriting procedures and claims management procedures

that may affect the relevance of historical data to the portfolio of insurance contracts.

c. Historical data do not capture types of events that may have an impact on the current

estimate.

5.2.4 Management actions

L1-29. The current estimate calculation may recognise management actions when such actions

are objective, realistic and verifiable. Management actions recognised in the calculation are not

contrary to the IAIG’s obligations to policyholders or to legal provisions applicable to the IAIG.

L1-30. Further details regarding the recognition of management actions in the current estimate

calculation are provided in the Level 2 text.

L2-40. The management actions recognised for the calculation of the current estimate are confined

to decisions by the IAIG that have an impact on future bonuses or other discretionary benefits for

participating/profit sharing and adjustable products.

L2-41. Assumed future management actions are consistent with the IAIG’s current business

practice and business strategy unless the GWS is satisfied that there is sufficient evidence that the

IAIG will change its practices or strategy.

L2-42. When calculating the current estimate, future management actions are taken into account

only if they can reasonably be expected to be carried out under the specific circumstances to which

they apply.

L2-43. The assumptions about future management actions take into account the time needed to

implement them, as well as any resulting incremental expenses.

5.2.5 Discounting

5.2.5.1 Determination of yield curves for current estimate discounting

L1-31. In order to calculate a current estimate, insurance liabilities are discounted using an

adjusted yield curve. The adjusted yield curve is based on:

a) Risk adjusted liquid interest rate swaps or government bonds (risk-free yield curve); and

b) An adjustment.

L1-32. The adjusted yield curve is determined based on the methodology specified in the Level 2

text (sections 5.2.5.2 and 5.2.5.3).

5.2.5.2 Determination of the risk-free yield curve

L1-33. The risk-free yield curve is determined based on a three-segment approach:

Public

a) Segment 1: based on market information from government bonds or swaps, including a credit

risk correction, where necessary;

b) Segment 2: extrapolation between the first and third segments; and

c) Segment 3: based on a stable currency specific long-term forward rate (LTFR), to which a

spread is added in order to represent the expected spread that may be earned from

reinvestments in the long-term.

L1-34. For each currency, the transition from the first to the second segment occurs at the last

maturity for which market information can be observed in deep, liquid and transparent financial

markets (the last observed term or LOT).

L1-35. For each currency, the LTFR is the sum of an expected real interest rate and an inflation

target.

L1-36. For the purpose of determining the expected real interest rate, jurisdictions are allocated

according to areas that share common macroeconomic characteristics. The same expected real

interest rate is used for all currencies within a given area. For each area, the expected real interest

rate is based on a simple average of observed real interest rates over a certain period of time.

L1-37. The two components of the LTFR are reviewed annually, in order to reflect potential

changes in macroeconomic expectations. However, the magnitude of annual changes to the LTFR

is capped in order to mitigate its potential volatility.

L1-38. Further specifications on the methodology to determine the risk-free interest rate are

provided in the Level 2 text.

5.2.5.2.1 Choice of instrument for and length of Segment 1

L2-44. The base yield curves are derived from financial instruments that are traded in deep, liquid

and transparent (DLT) financial markets. A DLT assessment is carried out at regular intervals in

order to identify the financial instruments and maturities for which a DLT market exists.

L2-45. The DLT assessment determines, in particular, whether swaps or government bonds are

the relevant financial instruments for the risk-free interest rates and what the LOT is. The DLT

assessment is performed for each currency.

5.2.5.2.1.1 DLT assessment of the swap market

L2-46. The assessment of depth and liquidity of the swap market is carried out on the basis of

swap trade data, in particular the number and notional amount of trades and is made separately for

each currency and maturity. Only single-currency fixed-to-floating swaps are considered. Thresholds

may need to be adapted in light of the specific circumstances of individual markets (eg less liquid

currencies).

5.2.5.2.1.2 DLT assessment of the government bond market

L2-47. Given the specificity of government bond markets, a different approach to swap markets

may be followed to assess the DLT nature of government bond rates.

L2-48. The assessment starts from the analysis of trade volume and trade frequency of

government bonds, for all currencies.

Public

L2-49. Where trade volume and frequency data are not available or their analysis is not conclusive,

other criteria are assessed, including where possible, bid-ask spreads, the rate volatility, zero-trading

days, the number of pricing sources and the number of quotes.

5.2.5.2.1.3 Conclusions from the assessment

L2-50. The DLT assessment of the relevant instruments informs the choice of the instrument on

which the base yield curve is built upon, as well as the DLT maturities that are used in the derivation

of the base yield curve.

L2-51. To maximise the use of market information, the instrument with the longer DLT segment or

the instrument with a higher overall degree of liquidity should be chosen.

L2-52. Given the specificities of the financial markets of each currency, the group wide supervisor

should seek advice from the relevant jurisdiction which instrument to take as a basis, with due

consideration of the key objectives of the MAV approach. An appropriate justification for this choice

is presented, covering also the outcome of the DLT analysis.

5.2.5.2.1.4 Last Observed Term (Length of Segment 1)

L2-53. Following the DLT assessment and the choice of the instrument underlying segment one of

the yield curve, the LOT is set taking into consideration

• the longest maturity which is deemed to fulfil the DLT criteria, for the chosen instrument; and

• the specificities of the financial market.

5.2.5.2.2 Credit Risk Adjustment

L2-54. Inputs from chosen instruments are subject to the Credit Risk Adjustment (CRA).

L2-55. The CRA is 0 basis points when instruments for Segment 1 are considered risk free. The

CRA is 10 basis points otherwise.

5.2.5.2.3 Length of Segment 2

L2-56. For all currencies, the start of the third segment as referred to in paragraph L1-33 of the

Level 1 text is the later of the following:

• 30 years after the LOT; and

• 60 years.

5.2.5.2.4 Extrapolation, Interpolation and Convergence tolerance

L2-57. Both the interpolation between Segment 1 maturities and the extrapolation beyond the LOT

are based on the Smith-Wilson methodology.

L2-58. The control input parameters for the interpolation and extrapolation are the LOT, the LTFR,

the convergence point and the convergence tolerance.

L2-59. If the reference instruments are swap rates, the market interest rates to be used as inputs

are the swap par rates after deduction of the credit risk adjustments. If the reference instruments are

zero coupon government bonds, the market interest rates to be used as inputs are the zero-coupon

rates.

Public

L2-60. The parameter alpha that controls the convergence speed is set at the lowest value that

produces a yield curve reaching the convergence tolerance of the LTFR by the convergence point.

A lower bound for alpha is set at 0.05.

L2-61. The convergence tolerance is 0.1 basis point, and is achieved at the tenor which marks the

end of Segment 2.

5.2.5.2.5 LTFR Components

L2-62. The LTFR is the sum of the following two components:

a. The expected real interest rate, computed as the simple arithmetic mean of annual real

interest rates. Annual real rates are calculated as:

The expected real interest rate is rounded to the nearest five basis points.

b. The expected inflation target, computed as follows:

• For currencies for which the central bank has announced an inflation target, the expected

inflation is based on that inflation target. In this case the expected inflation rate is:

o 1%, where the inflation target is lower than or equal to 1%;

o 2%, where the inflation target is higher than 1% and lower than 3%;

o 3%, where the inflation target is higher or equal to 3% and lower than 4%; and

o 4%, otherwise.

• For currencies for which the central bank has not announced an inflation target, the expected

inflation rate is set to 2%. However, where past inflation experience and projection of inflation

both clearly indicate that the inflation in a currency area is materially higher or lower than 2%,

the expected inflation rate is chosen in accordance with those indicators.

L2-63. In order to determine the expected real interest rate, countries are grouped in the following

three geographical areas:

a. Geographical area 1, comprised of the following currency areas: AUD, CAD, CHF, CZK,

DKK, EUR, GBP, JPY, NOK, NZD, SEK, SGD, USD;

b. Geographical area 2, comprised of the following currency areas: HKD, ILS, KRW, TWD;

c. Geographical area 3, comprised of all other currency areas.

L2-64. The initial values of the expected real interest rate component are:

• 1.8% for geographical area 1;

• 2.4% for geographical area 2; and

• 3.0% for geographical area 3.

The values will be regularly reviewed.

L2-65. The maximum annual change to the LTFR is limited to 15 bps. The LTFR is changed

according to the following formula:

Public

where:

•

denotes the LTFR of year , after limitation of the annual change;

•

denotes the LTFR of year , after limitation of the annual change; and

•

denotes the LTFR of year , before limitation of the annual change.

Explanatory text

For most commonly used currencies, the initial value of the following parameters (observed

instrument, LOT and LTFR) needed for the determination of the risk-free yield curve will be published

by the IAIS by the date of adoption of the ICS.

These initial values can be found in Annex 4. The IAIS will publish updated values when necessary.

5.2.5.3 Determination of the adjustment to the risk-free yield curve

L1-39. The ICS yield curves include an adjustment to the risk-free curves. This adjustment is

determined using the Three-Bucket Approach.

L1-40. The Three-Bucket Approach classifies liabilities into General Bucket, Middle Bucket and

Top Bucket, depending on the nature of the liabilities and the assets backing these liabilities. A

different yield curve adjustment is determined for each bucket.

L1-41. The criteria used for the classification of liabilities and the adjustment relevant for each

bucket are specified in the Level 2 text.

L2-66. The following spread over the LTFR is added to all LTFR calculated according to

paragraphs L2-62 to L2-65 above:

• 20 basis points for geographical area 1;

• 25 basis points for geographical area 2; and

• 35 basis points for geographical area 3.

using the geographical areas laid down in L2-63.

5.2.5.3.1 Classification criteria

L2-67. Insurance liabilities are eligible for the Top Bucket if they meet all of the following criteria:

a. They belong to the category of life insurance and disability annuities in payment with no cash

benefits on withdrawal, taking into account e) below.

Public

b. The portfolio of assets to cover the insurance liabilities is identified and, together with the

corresponding liabilities, it is managed separately, without being used to make payments

relating to other business of the IAIG.

12

c. The expected cash flows of the identified portfolio of assets replicate the expected cash flows

of the portfolio of insurance liabilities in the same currency, up to the LOT of the risk-free

yield curve for the relevant currency. Any mismatch, addressed through the carry forward of

cash generated from excess of asset cash flows at previous maturities, does not give rise to

material risks. Carry forward of cash is limited to 10% of the total undiscounted liability cash

flows up to the LOT. Where insurance liabilities are backed with assets denominated in a

different currency, those asset cash flows are taken into account in the cash flow testing,

provided that the currency mismatch is fully hedged and the cost of hedging is deducted from

the asset cash flows.

d. The contracts underlying the insurance liabilities do not include future premiums.

e. The portfolio of insurance liabilities includes either no surrender option for the policyholder or

only a surrender option where the surrender value does not exceed the value of the assets

identified for this portfolio at the reporting date and at all future points in time.

L2-68. No unbundling is allowed when assessing eligibility for the Top Bucket.

L2-69. Insurance liabilities are eligible for the Middle Bucket if they meet all of the following criteria:

a. The portfolio of assets to cover the insurance liabilities is identified and, together with the

corresponding liabilities, is managed separately, without being used to cover losses arising

from other business of the IAIG.

12

b. The portfolio of insurance liabilities include either no surrender option for the policyholder or

only a surrender option where the surrender value does not exceed the value of the assets

identified for this portfolio at the reporting date.

c. The ICS Lapse risk charge does not represent more than 5% of the current estimate of the

liabilities discounted using the risk-free yield curve.

d. The total market value of assets identified for this portfolio is, at the reporting date, greater

than the current estimate of the liabilities calculated using the General Bucket yield curve.

For the calculation of the total market value of assets, all assets identified for this portfolio

are taken into account, irrespective of their classification in Table 3.

e. The contracts underlying the liabilities do not include future premiums or include only future

premiums that are contractually fixed or are at the discretion of the IAIG. Policyholder options

to pay additional future premiums do not disqualify these liabilities from the Middle Bucket,

but all corresponding cash flows that are not at the discretion of the IAIG have to be

unbundled and are subject to the General Bucket.

12

For both the Top and Middle Buckets, the separate management of assets does not refer to a legal ring fencing but to a portfolio

segmentation of clearly identified assets that would support an identified group of insurance liabilities over their lifetime. Should a

portfolio be restructured within the entity, this being exceptional, the assets contained therein can only be transferred to another

portfolio when done in conjunction with their corresponding liabilities. This does not preclude changes in investments within a

portfolio in the normal course of business.

Public

L2-70. No unbundling is allowed when assessing eligibility for the Middle Bucket with the exception

in the context of L2-69e.

L2-71. All liabilities that are not in the Top or Middle Bucket belong to the General Bucket.

5.2.5.3.2 Adjustments to the yield curve

5.2.5.3.2.1 Eligible investments

L2-72. For the purpose of calculating the Top Bucket and Middle Bucket adjustments, the eligibility

of types of investments is specified in the following table:

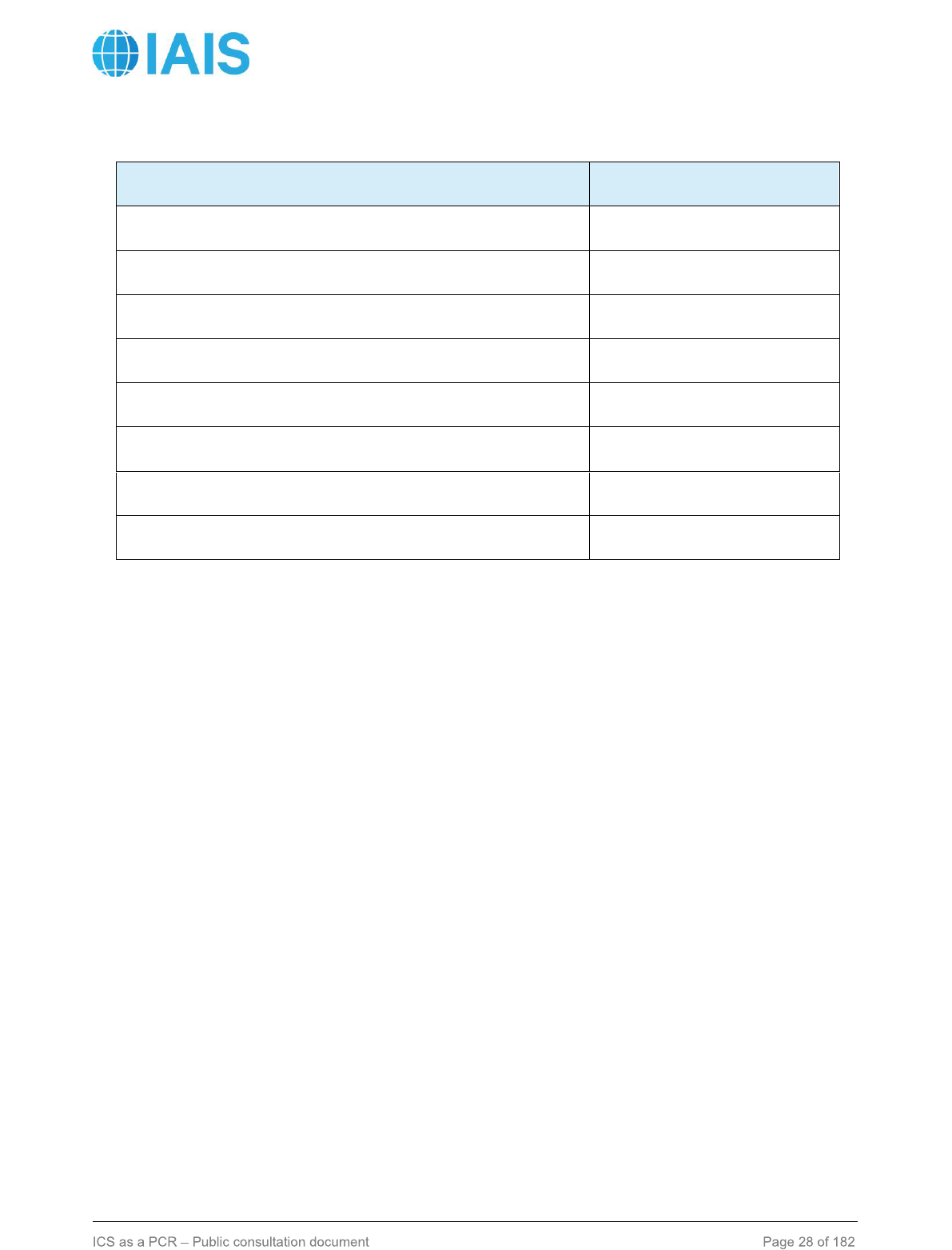

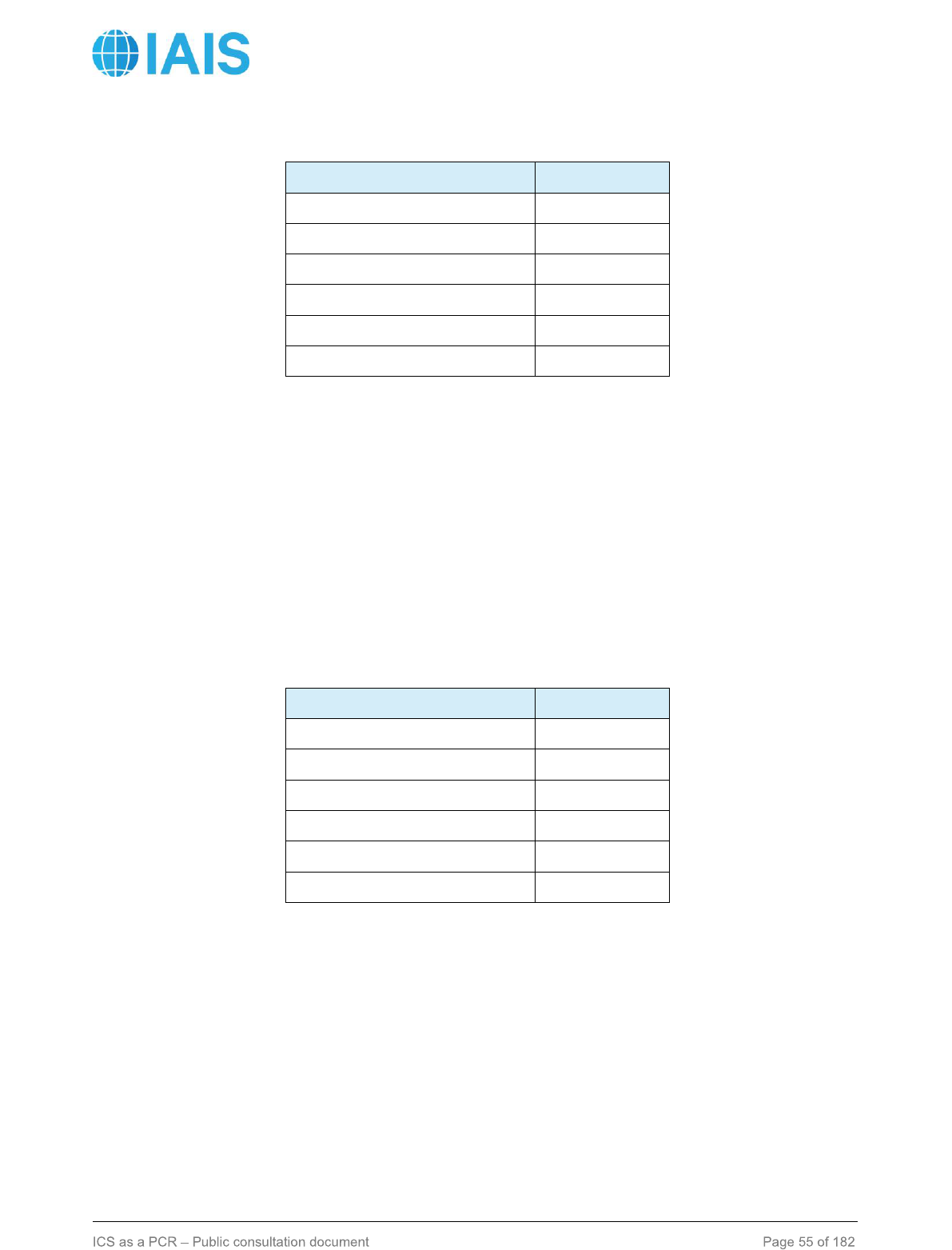

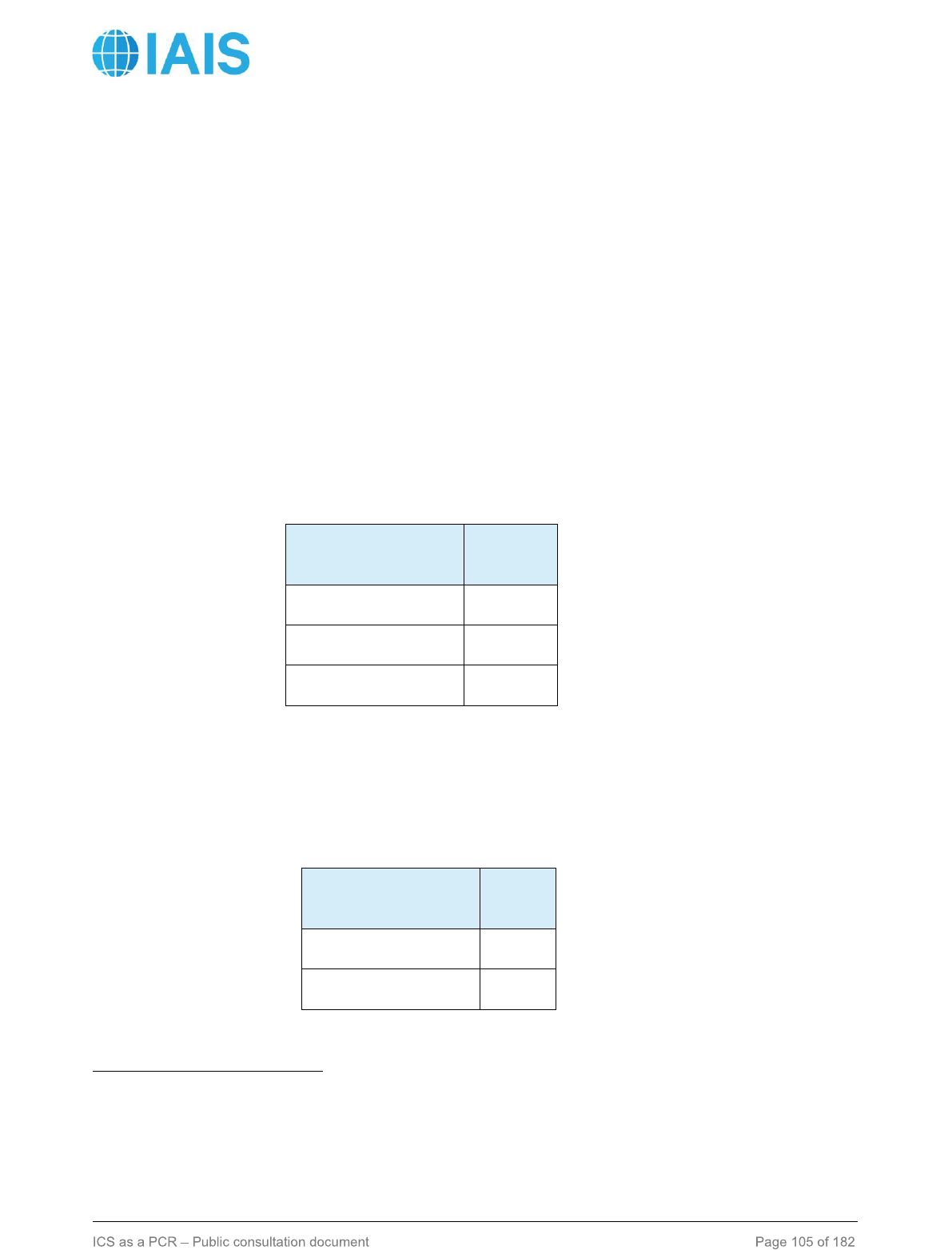

Table 3: Eligibility of types of investment

Type of investment

Eligible

Cash and other liquid assets not for investment purposes

(Excluded from portfolio)

Investment income receivable/accrued

N

Fixed Interest Government Bonds

Y

Fixed interest Corporate Bonds

Y

Fixed Interest Municipal Bonds

Y

Variable Interest Government Bonds

Y

Variable interest Corporate Bonds

Y

Variable Interest Municipal Bonds

Y

Convertible notes

N

Residential Mortgage Loans

Y

Non-residential Mortgage Loans

Y

Other (non-mortgage) Loans

Y

Loans to policyholders

Y

Residential Mortgage Backed Securities

Y

Commercial Mortgage Backed Securities

Y

Other structured securities

Y

Public

Type of investment

Eligible

Insurance Linked Securities

N

Equities

N

Hedge Funds

N

Private equity

N

Real estate (for investment purposes)

N

Infrastructure debt

Y

Infrastructure equity

N

Other investment assets

N

L2-73. Assets backing unit-linked or separate account insurance liabilities are not taken into

account when those insurance liabilities are valued using the asset replication approach presented

in section 5.4.

L2-74. Government bonds include only debt instruments issued or guaranteed by central

governments (excluding exposures to municipal and other public sector entities).

L2-75. Assets featuring call options (used at the discretion of the issuer) are ineligible to back

liabilities, unless it can be demonstrated that the exercise of the option does not imply a loss to the

IAIG and that the matching of the liability cash flows can be maintained.

5.2.5.3.2.2 Top Bucket

L2-76. The adjustment for the Top Bucket is based on the average spread above the risk-free yield

curve of the eligible assets, as listed in Table 3, identified by the IAIG to back the portfolio of liabilities

meeting the Top Bucket criteria.

L2-77. The IAIG may identify different portfolios, which will lead to the calculation of

portfolio-specific adjustments.

L2-78. A cap at the level of the ICS RC 4 spread applies for assets with a lower credit quality. The

ICS RC 4 cap is based on the spreads earned by the IAIG for ICS RC 4 rated assets denominated

in the same currency. Where no such assets exist, the spread used for the Middle Bucket adjustment

calculation is used.

L2-79. The spread is adjusted for credit risk and any other risk, using the same risk correction

parameters as specified in paragraph L2-85.

L2-80. For the Top Bucket, 100% of the spread adjustment is added to the risk-free rate to discount

insurance liabilities.

Public

L2-81. The IAIG uses the relevant adjusted yield curves according to the currency of the insurance

liability cash outflows.

L2-82. Where insurance liabilities are backed with assets denominated in a different currency, the

spread adjustment for the currency of the liability includes spreads which may be earned by the IAIG

in those assets, provided that the currency mismatch is hedged. The cost of hedging is deducted

from the Top Bucket adjustment.

L2-83. The spread adjustment determined according to this methodology is applied as a parallel

shift up to the run-off of the liabilities, which may be beyond the relevant LOT.

5.2.5.3.2.3 Middle Bucket

L2-84. The Middle Bucket spread adjustment is a group-wide adjustment based on the eligible

assets backing the Middle Bucket liabilities. The Middle Bucket spread adjustment is portfolio specific

within a single currency.

L2-85. The term structure of spreads by credit quality and currency serve as a basis for the

calculation of the Middle Bucket adjustment.

L2-86. Parametric spread term structures are determined by credit quality and currency. They are

obtained using the Nelson-Siegel approach on observed market spreads up to the LOT. Credit

spreads are segmented by credit quality and duration buckets and sourced from recognised market

data providers or if needed, derived from supervisory data.

L2-87. These corporate spreads are supplemented with a contribution from sovereign holdings

when the risk-free rate for the currency is determined from observing swap market instrument. A

proportional risk correction factor is applied on these spread components. The risk correction on

government bonds is defined as 30% of the difference between the government bonds indices at the

reporting date and their average over the last 10 years.

L2-88. For corporate bonds, the risk correction factor captures the expected loss and the credit risk

premium. The expected loss is determined assuming an annualised probability of default for a

theoretical 10-year bond and a loss given default of 70%. Credit risk premium is based on one

standard deviation of the loss distribution.

L2-89. Where insurance liabilities are backed with assets denominated in a different currency, the

weighted average calculation of the spread adjustment for the currency includes spreads earned by