Citation: Pennisi, S. The Integrated

Circuit Industry at a Crossroads:

Threats and Opportunities. Chips

2022, 1, 150–171. https://doi.org/

10.3390/chips1030010

Academic Editor: Paris Kitsos

Received: 5 September 2022

Accepted: 30 September 2022

Published: 6 October 2022

Publisher’s Note: MDPI stays neutral

with regard to jurisdictional claims in

published maps and institutional affil-

iations.

Copyright: © 2022 by the author.

Licensee MDPI, Basel, Switzerland.

This article is an open access article

distributed under the terms and

conditions of the Creative Commons

Attribution (CC BY) license (https://

creativecommons.org/licenses/by/

4.0/).

Perspective

The Integrated Circuit Industry at a Crossroads: Threats and

Opportunities

Salvatore Pennisi

Dipartimento di Ingegneria Elettrica, Elettronica e Informatica (DIEEI)—University of Catania,

95125 Catania, Italy; [email protected]

Abstract:

With the outbreak of the COVID-19 pandemic, the persistent chip shortage, war in Ukraine,

and U.S.–China tensions, the semiconductor industry is at a critical stage. Only if it is capable of major

changes, will it be able to sustain itself and continue to provide solutions for ongoing exponential

technology growth. However, the war has undermined, perhaps definitively, a global order that

urged the integration of markets above geopolitical divergences. Now that the trend seems to be

reversed, the extent to which the costs of this commercial and technological decoupling can be

absorbed and legitimized will have to be understood.

Keywords: semiconductors; integrated circuits; fabs; shortage; talent

1. Introduction

The integrated circuit (IC) industry forms the basis of the overwhelming digitaliza-

tion process, i.e., the most important enabling technology for current and future applica-

tions. This has been made possible by the tremendous miniaturization and performance

improvement of IC processes—predicted by Moore’s Law—which, starting from about

10

3

transistors

on the first Intel 4004 microprocessor in 1970, reached

10

11

transistors

in

March 2022 (Apple M1 Ultra) [

1

]—an unprecedented and unsurpassed rate of improvement,

which has enabled, among other inventions, the Internet, mobile telecommunications, and

now smart cars. In brief, every industry into which ICs (microchips or simply chips) have

been introduced has benefited from greater efficiency, intelligence, and extended functions.

Due to this success, chips are today the fourth-most traded product globally (1.15 million

semiconductor units shipped last year, 2021)—after crude oil, motor vehicles and their

components, and refined oil—in a market that was valued at 0.6 trillion dollars in 2021,

with a 26% increase in year-on-year sales, and which is expected to reach 1 trillion dollars

in 2035 [2].

Some analysts have gone so far as to call chips the new oil, in that chips ‘power’ appli-

cations, by giving the country that is able to produce the highest-performing chips—thanks

to cutting-edge technology—greater power than other countries, in terms of computing

and communication capabilities, but also from a purely military point of view. One concept

that the Russia–Ukraine war has underscored so far is that Ukrainian forces have used

small and relatively inexpensive weapons, such as the Javelin and Stinger anti-aircraft

missiles, which adopt advanced semiconductors for guidance systems. A single Javelin

contains about 250 chips [

3

]. Western countries have banned the export of semiconductors

to Russia, and Russia does not have its own advanced chip production capacity; without

imports the Russian military cannot supply itself with precision-guided munitions.

Quite surprisingly, the key role of chips in global economies has only recently been rec-

ognized by governments and occupied public debate. In recent decades, global economies

have focused more on software and tertiary services, leaving chips as a pure commodity.

However, the COVID-19 pandemic and the war in Ukraine have highlighted the problem

of chip shortage (insufficient production of chips relative to demand), the fragility of the

Chips 2022, 1, 150–171. https://doi.org/10.3390/chips1030010 https://www.mdpi.com/journal/chips

Chips 2022, 1 151

semiconductor supply chain, and the fact that chips are strategic components. As a result,

the goal of many governments is currently to strengthen their resilience to external shocks,

and to safeguard their technological sovereignty by strongly supporting the integrated

circuit industry. Chipmakers, on the other hand, while improving the quality and number

of their fabrication plants (fabs) to satisfy the increased demand due to the exponential ex-

plosion of applications, have better understood their responsibilities as well as their newly

strengthened position of power, which in principle allows them to select their customers,

and to determine who can and who cannot get their chips. However, the war in Ukraine

and trade tensions between the U.S. and China have made the scenario more complex,

deteriorating a global order that preached the integration of markets above geopolitical

divergences, and resulting in the end of the age of globalization.

Finally, a difficult problem that can undermine any semiconductor strengthening

policy is the shortage of talent. While new fabs can be built in a couple of years with the

availability of adequate resources from private/public funding, qualified personnel cannot

be found simply by putting up money. It takes many years to train qualified professionals,

but first there must be people (young people) willing to invest their future employment in

this field. Semiconductor engineers (and, at the top of the list, analog design engineers),

are in high demand today, and their scarcity is likely to increase in percentage terms,

because the younger generation is less and less interested in hardware, while the number of

applications that use electronic components, and thus require hardware skills, is growing.

This paper follows another recent complementary publication by the same author [

4

],

and further analyzes the semiconductor ecosystem, in light of the rapidly changing sce-

narios. Section 2 describes the semiconductor supply chain and the types of companies

associated with making integrated circuits. Section 3 analyzes the key weaknesses and bot-

tlenecks in the chain. Section 4 elaborates on geopolitical and socioeconomic considerations.

Conclusions are drawn in Section 5.

2. IC Market, Supply Chain, and Types of Semiconductor Companies

ICs are the major enablers of current and future technologies and applications, such

as 5G/6G, smart factories and cars, blockchains, artificial intelligence (AI), and machine

learning. The semiconductor supply chain industry makes all this possible. This chain can

be broken down into six main stages, which take place in different parts of the world, and

involve thousands of companies and millions of people. For the purpose of the following

analysis, these stages, and the types of companies, will be summarized in the following

subsections. Before doing so, however, let us briefly mention the different segments that IC

production can be divided into: Logic; Memory; Analog; MPU (microprocessor unit); MCU

(microcontroller unit); Optoelectronics; Sensor/Actuators; Discretes; and DSP (digital signal

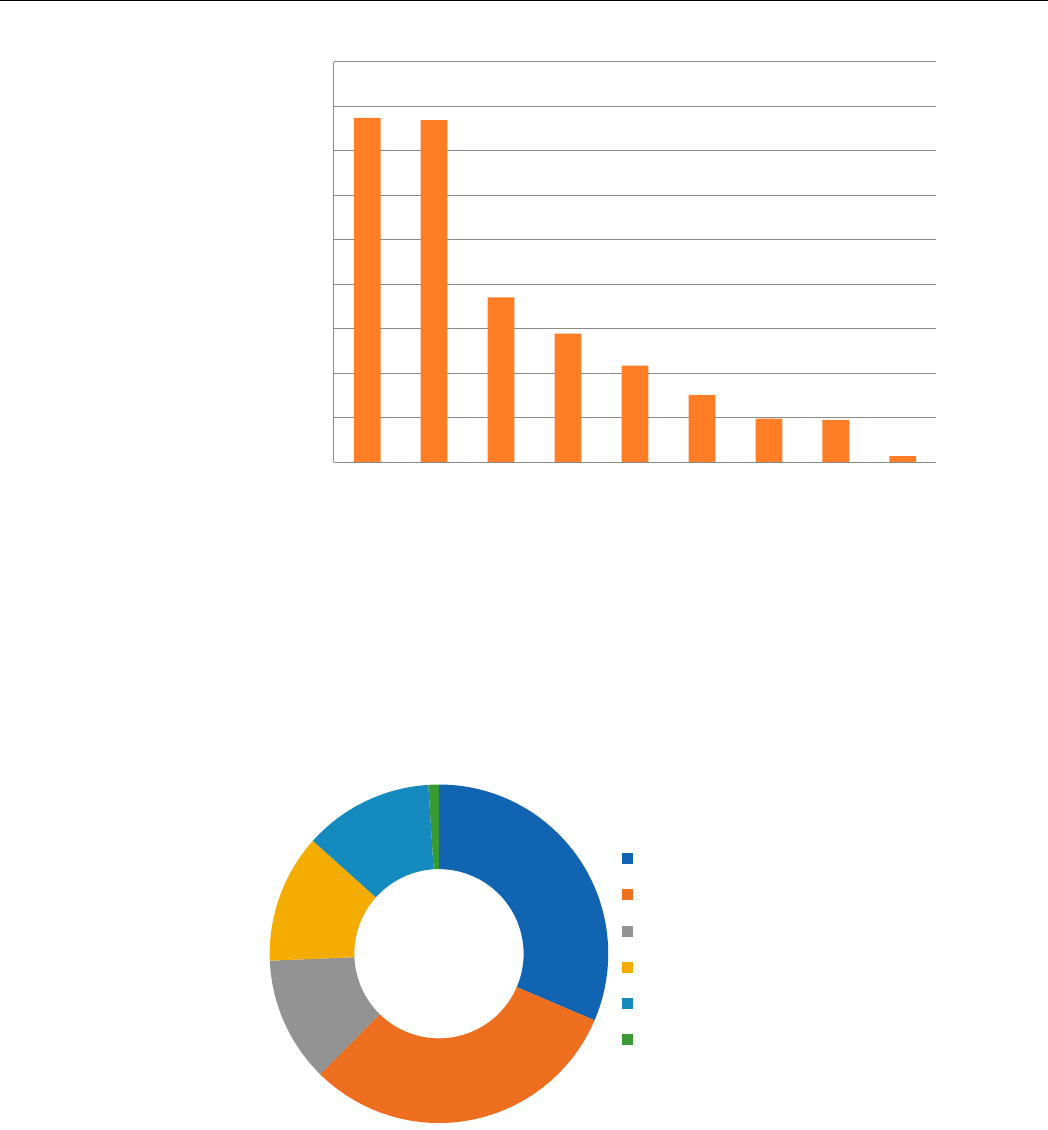

processor). See Figure 1 for global IC sales in 2021 (in billions of dollars), as reported by the

U.S. Semiconductor Industry Association, SIA [

2

]. In this framework—not specified in the

figure—Graphic Processing Units (GPUs) alone have a market of $23.90 billion. Driven by

power ICs, discrete semiconductors have had a big boost, as they were previously valued

at $23.8 billion in 2020. Memory and logic devices are expected to experience the highest

growth rate in the coming years, followed by the analog ICs needed for data conversion,

emerging automotive applications, and power management, and by microcontrollers and

sensors, due to high-performance IoT applications.

Chips 2022, 1 152

Chips 2022, 2, FOR PEER REVIEW 3

Figure 1. Global IC production segments and their market value in U.S. billions of dollars in 2021 [2].

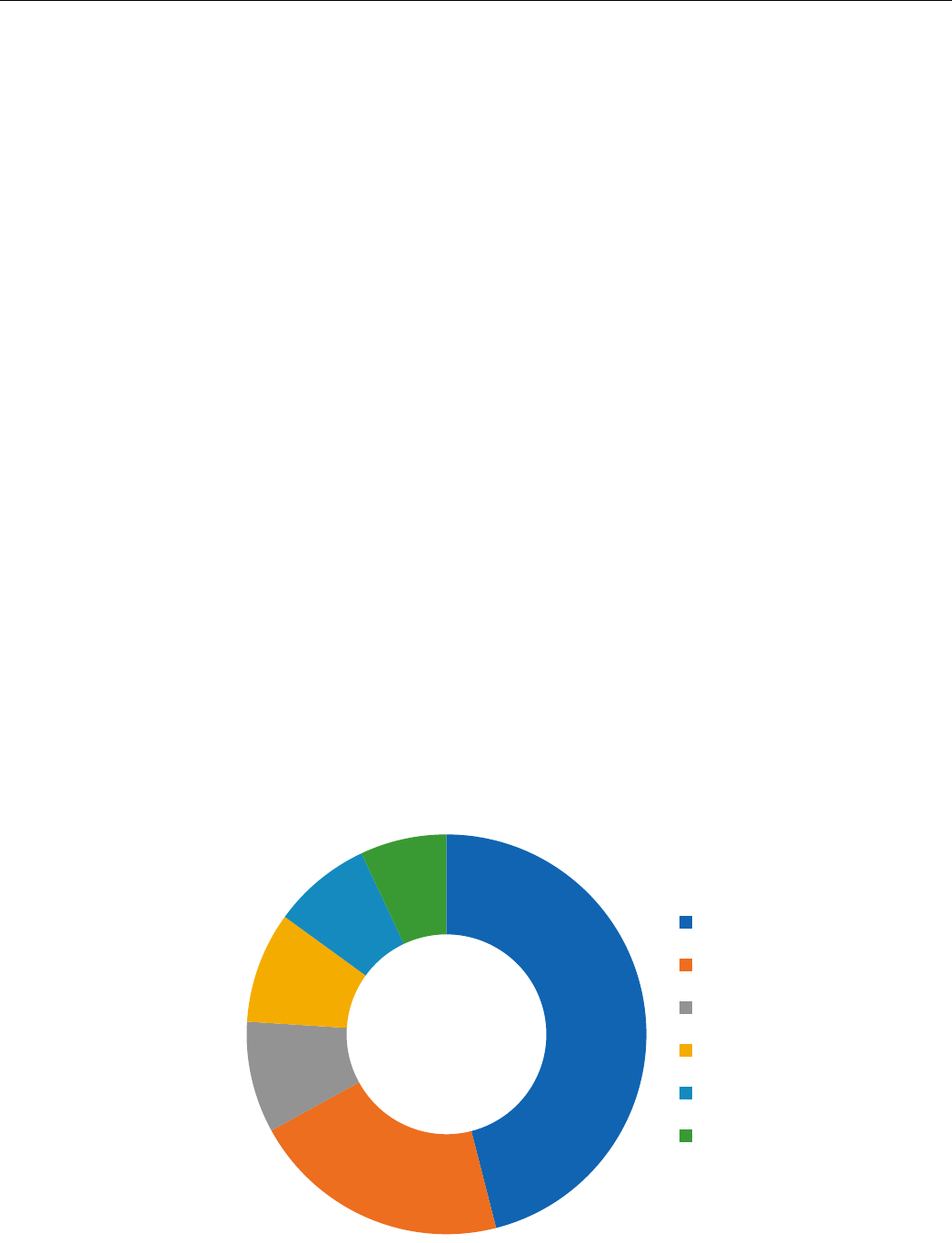

In order of market share, IC applications can be divided into: Communications; Com-

puter; Consumer; (these three C-segments will continue to grow, due to the demand for

smartphones and connected devices, as well as games, wearable devices, and the devel-

opment of the metaverse); Automotive (which will grow, due to the demand for electric

vehicles with assisted/autonomous driving); Industrial (expected to grow steadily, due to

the necessary adaptation of production machines required by the fourth industrial revo-

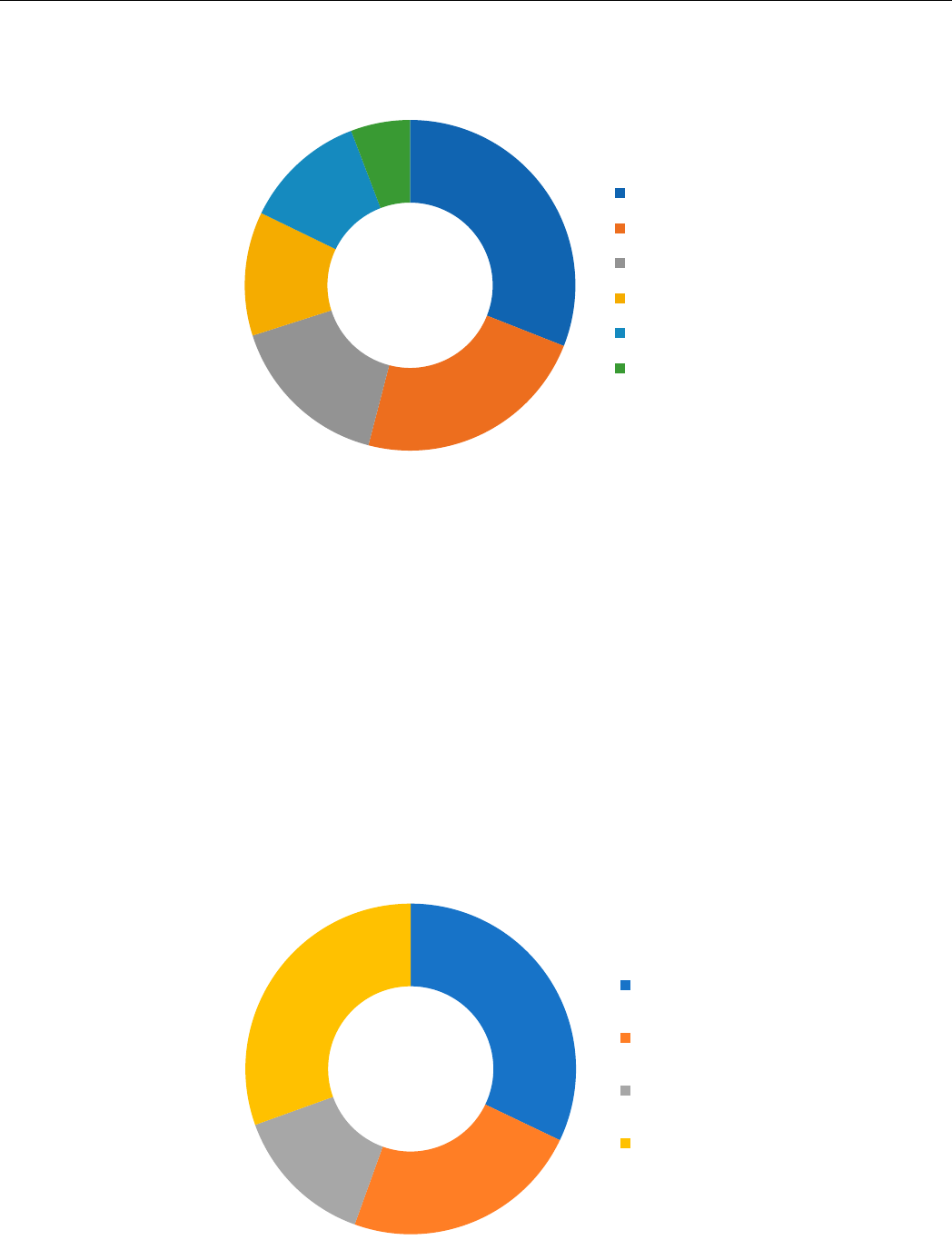

lution); and Government (which shows limited growth). Figure 2 shows the market share

of the above segments for 2021.

Figure 2. IC applications and their market share in 2021 [2].

2.1. The Six Phases of the Semiconductor Supply Chain

(a) Raw materials and wafer fabrication. A variety of raw materials are used to make

an integrated circuit, ranging in price and availability, from abundant silicon, through

more than 100 gases, fluids, photomasks, reagents, etc., to expensive gold and rare earth

elements (REEs). At this early stage of manufacturing, ingots are formed from pure silicon,

154.8

153.8

74.1

57.8

43.4

30.3

19.6

19.1

2.8

0

20

40

60

80

100

120

140

160

180

Logic Memory Analog MPU Opto Discretes MCU Sensor DSP

Billion $

32%

31%

12%

12%

12%

1%

Computer

Communications

Industrial

Consumer

Automotive

Government

Figure 1.

Global IC production segments and their market value in U.S. billions of dollars in 2021 [

2

].

In order of market share, IC applications can be divided into: Communications;

Computer; Consumer; (these three C-segments will continue to grow, due to the demand

for smartphones and connected devices, as well as games, wearable devices, and the

development of the metaverse); Automotive (which will grow, due to the demand for

electric vehicles with assisted/autonomous driving); Industrial (expected to grow steadily,

due to the necessary adaptation of production machines required by the fourth industrial

revolution); and Government (which shows limited growth). Figure 2 shows the market

share of the above segments for 2021.

Chips 2022, 2, FOR PEER REVIEW 3

Figure 1. Global IC production segments and their market value in U.S. billions of dollars in 2021 [2].

In order of market share, IC applications can be divided into: Communications; Com-

puter; Consumer; (these three C-segments will continue to grow, due to the demand for

smartphones and connected devices, as well as games, wearable devices, and the devel-

opment of the metaverse); Automotive (which will grow, due to the demand for electric

vehicles with assisted/autonomous driving); Industrial (expected to grow steadily, due to

the necessary adaptation of production machines required by the fourth industrial revo-

lution); and Government (which shows limited growth). Figure 2 shows the market share

of the above segments for 2021.

Figure 2. IC applications and their market share in 2021 [2].

2.1. The Six Phases of the Semiconductor Supply Chain

(a) Raw materials and wafer fabrication. A variety of raw materials are used to make

an integrated circuit, ranging in price and availability, from abundant silicon, through

more than 100 gases, fluids, photomasks, reagents, etc., to expensive gold and rare earth

elements (REEs). At this early stage of manufacturing, ingots are formed from pure silicon,

154.8

153.8

74.1

57.8

43.4

30.3

19.6

19.1

2.8

0

20

40

60

80

100

120

140

160

180

Logic Memory Analog MPU Opto Discretes MCU Sensor DSP

Billion $

32%

31%

12%

12%

12%

1%

Computer

Communications

Industrial

Consumer

Automotive

Government

Figure 2. IC applications and their market share in 2021 [2].

2.1. The Six Phases of the Semiconductor Supply Chain

(a)

Raw materials and wafer fabrication

. A variety of raw materials are used to make

an integrated circuit, ranging in price and availability, from abundant silicon, through more

than 100 gases, fluids, photomasks, reagents, etc., to expensive gold and rare earth elements

(REEs). At this early stage of manufacturing, ingots are formed from pure silicon, and

cut into wafers, the size of which has gradually increased over the decades, to improve

productivity and reduce costs. The current state of the art uses wafers 300 mm in diameter

and 775 mm thick. Over the past two decades, the silicon wafer industry has gone from

more than 20 suppliers in the 1990s, to a handful of companies today. As Figure 3 illustrates,

Chips 2022, 1 153

Japan’s Shin-Etsu and Sumco are the world’s largest producers of silicon wafers, followed

by Taiwan’s GlobalWafers, Germany’s Siltronic, Korea’s SK Siltron, and France’s Soitec [

5

].

Chips 2022, 2, FOR PEER REVIEW 4

and cut into wafers, the size of which has gradually increased over the decades, to im-

prove productivity and reduce costs. The current state of the art uses wafers 300 mm in

diameter and 775 mm thick. Over the past two decades, the silicon wafer industry has

gone from more than 20 suppliers in the 1990s, to a handful of companies today. As Figure

3 illustrates, Japan’s Shin-Etsu and Sumco are the world’s largest producers of silicon wa-

fers, followed by Taiwan’s GlobalWafers, Germany’s Siltronic, Korea’s SK Siltron, and

France’s Soitec [5].

Figure 3. Principal silicon wafer producers and market share in 2021.

(b) Design. The typical design phase of a digital IC includes architectural or system-

level design, logic design, circuit design, functional safety, physical design, post-design

verification and, finally, preparation of photolithographic masks for the next stage of man-

ufacturing. All these steps are supported by highly sophisticated computer-aided design

(CAD) or electronic design automation (EDA) tools, which provide integrated simulation

environments and automation, with optimization capabilities to meet IC design specifica-

tions in terms of performance, power consumption, area, etc. Digital designs take ad-

vantage of more scaled-up technology nodes, while analog and automotive applications

adopt more mature, reliable, and robust nodes.

The global EDA market is monopolized by three major companies, as shown in Figure

4: Synopsys and Cadence, from the U.S., and Siemens EDA, from Germany (which acquired

U.S. Mentor Graphics in 2017). Each company’s portfolio is very rich, but each has its own

peculiarities. Synopsys focuses on digital chip design, static timing verification and confir-

mation, and System in Package support, neglecting complete process tools. Cadence focuses

on analog and mixed-signal platforms and digital back-ends. Siemens EDA focuses on back-

end verification, testability design, and optical proximity correction.

29.4

21.9

15.2

11.5

11.4

5.5

Shin-Etsu

Sumco

GlobalWafers

Siltronic

SK Siltron

Soitec

Figure 3. Principal silicon wafer producers and market share in 2021.

(b)

Design

. The typical design phase of a digital IC includes architectural or system-

level design, logic design, circuit design, functional safety, physical design, post-design

verification and, finally, preparation of photolithographic masks for the next stage of

manufacturing. All these steps are supported by highly sophisticated computer-aided

design (CAD) or electronic design automation (EDA) tools, which provide integrated

simulation environments and automation, with optimization capabilities to meet IC design

specifications in terms of performance, power consumption, area, etc. Digital designs take

advantage of more scaled-up technology nodes, while analog and automotive applications

adopt more mature, reliable, and robust nodes.

The global EDA market is monopolized by three major companies, as shown in

Figure 4: Synopsys and Cadence, from the U.S., and Siemens EDA, from Germany (which

acquired U.S. Mentor Graphics in 2017). Each company’s portfolio is very rich, but each has

its own peculiarities. Synopsys focuses on digital chip design, static timing verification and

confirmation, and System in Package support, neglecting complete process tools. Cadence

focuses on analog and mixed-signal platforms and digital back-ends. Siemens EDA focuses

on back-end verification, testability design, and optical proximity correction.

Chips 2022, 2, FOR PEER REVIEW 5

Figure 4. EDA companies: market share in 2020.

Closing verified digital designs, using EDA tools, requires less and less engineering

effort. In contrast, the availability of well-trained and experienced circuit designers is a

more crucial issue for high-performance analog circuit design, where human knowledge

is still mandatory.

(c) Front-End Fabrication. Identical integrated circuits (each called a die), are fabri-

cated on each wafer in a multistep process, using various techniques and materials (e.g.,

etching, photolithography, material deposition). Some of the most complicated (and ex-

pensive) machines on the planet are used in this step. The global production capacity of

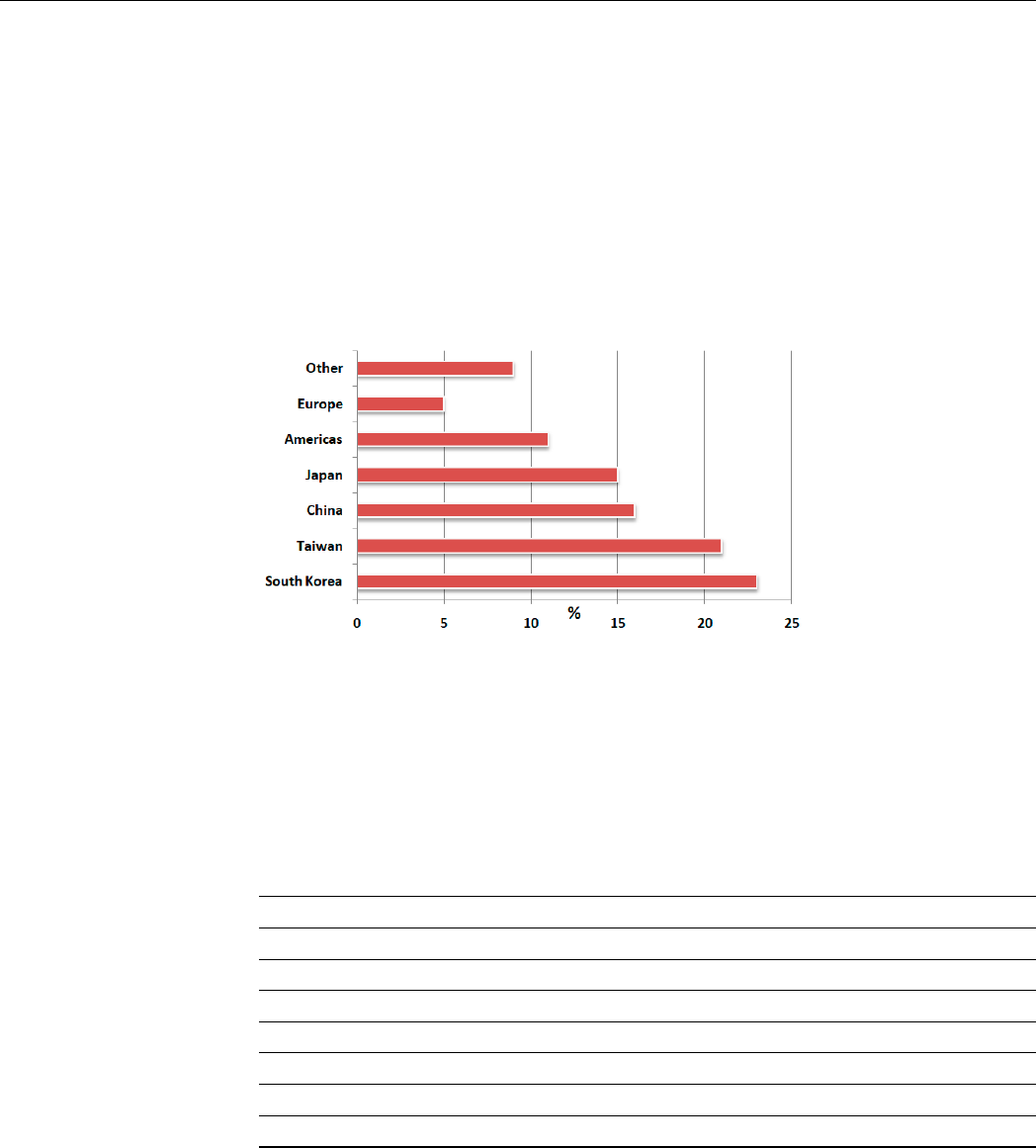

integrated circuits, by location of production facilities, is shown in Figure 5, while the

global percentage capacity of integrated circuits by technology node is summarized in

Table 1. All data refer to 2021.

Figure 5 shows that South Korea, Taiwan, and Japan account for about 60% of global

production capacity [6]. China is expanding rapidly, because the cost of building and op-

erating a plant is lower than in any other nation, but currently about half of its wafer

capacity is controlled by foreign companies (Korea’s SK Hynix and Samsung, and Tai-

wan’s TSMC and UMC) and it does not lead the volume fabrication of advanced nodes,

as Table 1 shows.

Figure 5. Global percentage IC capacity by fab location in 2021 [6].

32.1

23.4

14.0

30.5

Synopsys

Cadence

Siemens EDA

Other

Figure 4. EDA companies: market share in 2020.

Chips 2022, 1 154

Closing verified digital designs, using EDA tools, requires less and less engineering

effort. In contrast, the availability of well-trained and experienced circuit designers is a

more crucial issue for high-performance analog circuit design, where human knowledge is

still mandatory.

(c)

Front-End Fabrication

. Identical integrated circuits (each called a die), are fabri-

cated on each wafer in a multistep process, using various techniques and materials (e.g.,

etching, photolithography, material deposition). Some of the most complicated (and ex-

pensive) machines on the planet are used in this step. The global production capacity of

integrated circuits, by location of production facilities, is shown in Figure 5, while the global

percentage capacity of integrated circuits by technology node is summarized in Table 1. All

data refer to 2021.

Chips 2022, 2, FOR PEER REVIEW 5

Figure 4. EDA companies: market share in 2020.

Closing verified digital designs, using EDA tools, requires less and less engineering

effort. In contrast, the availability of well-trained and experienced circuit designers is a

more crucial issue for high-performance analog circuit design, where human knowledge

is still mandatory.

(c) Front-End Fabrication. Identical integrated circuits (each called a die), are fabri-

cated on each wafer in a multistep process, using various techniques and materials (e.g.,

etching, photolithography, material deposition). Some of the most complicated (and ex-

pensive) machines on the planet are used in this step. The global production capacity of

integrated circuits, by location of production facilities, is shown in Figure 5, while the

global percentage capacity of integrated circuits by technology node is summarized in

Table 1. All data refer to 2021.

Figure 5 shows that South Korea, Taiwan, and Japan account for about 60% of global

production capacity [6]. China is expanding rapidly, because the cost of building and op-

erating a plant is lower than in any other nation, but currently about half of its wafer

capacity is controlled by foreign companies (Korea’s SK Hynix and Samsung, and Tai-

wan’s TSMC and UMC) and it does not lead the volume fabrication of advanced nodes,

as Table 1 shows.

Figure 5. Global percentage IC capacity by fab location in 2021 [6].

32.1

23.4

14.0

30.5

Synopsys

Cadence

Siemens EDA

Other

Figure 5. Global percentage IC capacity by fab location in 2021 [6].

Figure 5 shows that South Korea, Taiwan, and Japan account for about 60% of global

production capacity [

6

]. China is expanding rapidly, because the cost of building and

operating a plant is lower than in any other nation, but currently about half of its wafer

capacity is controlled by foreign companies (Korea’s SK Hynix and Samsung, and Taiwan’s

TSMC and UMC) and it does not lead the volume fabrication of advanced nodes, as

Table 1 shows.

Table 1. Global percentage IC capacity by technology node in 2021 [7].

<10 nm 10–22 nm 28–45 nm >45 nm

Europe 12% 4% 6%

Americas 43% 6% 9%

Japan 5% 13%

China 3% 19% 23%

Taiwan 92% 28% 47% 31%

South Korea 8% 5% 6% 10%

Other 9% 13% 8%

The front-end manufacturing process is the most capital-intensive. Most of the fac-

tory’s construction costs are semiconductor manufacturing equipment, with some parts

costing more than $100 million each. ASML of The Netherlands is a world leader in the

production of advanced photolithography systems (Deep Ultraviolet Lithography, DUVL),

and is the only company to have developed the next-generation technique needed for

leading-edge nodes, namely Extreme Ultraviolet Lithography (EUVL). To understand the

effort required to make EUVL possible, one only has to consider that the major foundries

(TSMC, Intel, and Samsung, see Section 2.2) had to invest in ASML for the necessary

financial capacity. Each year, ASML is only able to build a few EUVL machines (31 in 2020),

Chips 2022, 1 155

because of their complexity. ASML is developing the next High NA (numerical aperture)

machine, to be available for early access from 2023.

As a result, building a new semiconductor factory at an advanced node (5 nm) can cost

up to $20 billion, and the cost of designing a new chip (tapeout) is more than

$500 million

.

Table 2 compares the price of a processed wafer, the average cost of designing a chip, and

the days of work required for different nodes. Exponential growth in cost and labor is

observed below 16 nm [8].

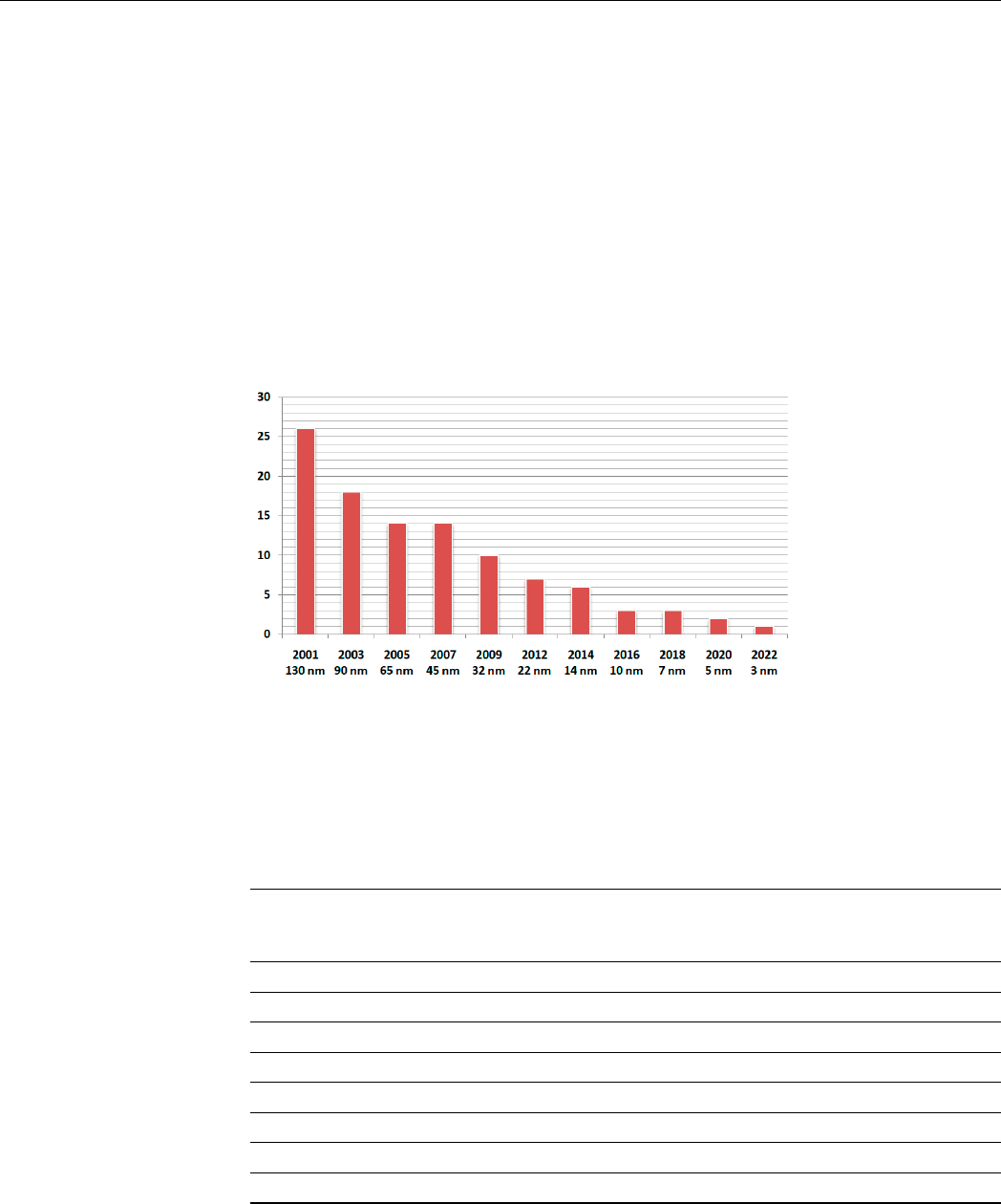

High capital costs create barriers to entry or even to staying. We saw that in 2001 the

state-of-the-art in processes was 130 nm, and that 26 companies were capable of producing

that technology (see Figure 6), but that only 2 companies (TSMC and Samsung) were

capable of producing 5-nm processes in 2020. In 2022, Samsung began production of

3-nm nanosheet GAA (Gate All Around) technology [

9

], and it will be soon followed by

TSMC [

10

], which confirmed that mass production of 2-nm process would start in 2025 [

11

].

Chips 2022, 2, FOR PEER REVIEW 7

Figure 6. Number of companies with leading-edge manufacturing capabilities versus year of intro-

duction of the technology node.

(d) Back-End Fabrication (Assembly, Test, and Packaging—ATP). Several steps are

required to obtain a finished chip. Firstly, an Optical/E-beam inspection of the wafer is

conducted, to identify defects—such as metal shorts (up to 10 nm and 3 nm, respec-

tively)—and eventually repair them. Secondly, a Wafer Probe/Test, which is the first time

that the chips are tested to see if they work as designed: highly accurate non-destructive

measurement of a test element group (TEG)—including transistors, interconnects and

other devices—is conducted through a probe board that interfaces the wafer and the test

equipment.

Thirdly, Wafer Dicing (individual cuts are made on the wafers). Fourthly, Die Bond

(the process of attaching the bare die to a substrate, which provides electrical connectivity

to the outside, and to the base of the package). Fifthly, Wire Bond/Solder Bump, in which

each die pad is connected to a corresponding pad on the substrate via a thin gold wire, or

through flip chip technology. Sixthly, encapsulation, when the die is packed. Finally, testing,

to detect defects that may have occurred during the assembly process; an integrated circuit

socket is used in the final testing, which plays the crucial role of connecting the device to the

tester, similar to a probe board in wafer testing. Each individual integrated circuit must be

tested with a custom test socket.

Automated Test Equipment (ATE) is a computerized machine that uses test tools to

perform and evaluate the results of functionality, performance, quality, and stress tests

performed on integrated circuits. The ATE requires minimal human interaction, and is

directly responsible for ensuring not only that the IC functions as intended, but also that

the IC does not cause hazards as a result of its use. The growth of the ATE market is driven

by the significant use of test equipment in the automotive industry, which utilizes, among

other things, microcontrollers, sensors, and radar chips, and which has ‘Zero Defects’

goals, to ensure very high levels of reliability and safety in automobiles. This means that

integrated circuit manufacturers are shifting their specifications from defects per million

to defects per billion (DPB) [13]. Teradyne (U.S.), LTX–Credence–Xcerra (U.S.), and Ad-

vantest (Japan) hold the majority of the ATE global market share. The probe cards market

is dominated by FormFactor (U.S.), Technoprobe (Italy), and Micronics (Japan).

Semiconductor packaging technology has evolved to minimize costs and improve

the overall performance of integrated circuits (counteracting heating, mechanical damage,

radio frequency noise emission, electrostatic discharge, etc.), while providing higher

speeds, smaller footprints, higher pin counts, and lower profiles. The semiconductor pack-

aging market is under constant pressure to provide innovative solutions, in terms of size,

performance, and ‘time-to-market’. The market is moderately fragmented, with no domi-

nant players, but is mainly concentrated in East Asia, due to lower labor costs. Taiwanese

companies hold about 50% of the global market for Outsourced Semiconductor Assembly

and Testing services (OSAT). Taiwan’s ASE is the world’s largest supplier, with more

Figure 6.

Number of companies with leading-edge manufacturing capabilities versus year of intro-

duction of the technology node.

Despite Intel’s aggressive roadmap to recover lost positions, leading technologies are

dominated by the two Asian companies. In 2021, TSMC produced 92% of global logic

ICs [12].

Table 2. Wafer cost, chip cost, and labor requirements for different technology nodes [8].

Technology

Node (nm)

Foundry Sale Price

per Wafer ($)

Average Chip

Design Cost

(Million $)

Person Days

(×1000)

65 1937 28 45

40 2274 36 58

28 2891 40 80

22 3677 69 110

16 3984 104 166

10 5992 174 278

7 9346 297 475

5 16,988 540 864

(d)

Back-End Fabrication

(Assembly, Test, and Packaging—

ATP

). Several steps are

required to obtain a finished chip. Firstly, an Optical/E-beam inspection of the wafer is

conducted, to identify defects—such as metal shorts (up to 10 nm and 3 nm, respectively)—and

eventually repair them. Secondly, a Wafer Probe/Test, which is the first time that the chips

are tested to see if they work as designed: highly accurate non-destructive measurement

Chips 2022, 1 156

of a test element group (TEG)—including transistors, interconnects and other devices—is

conducted through a probe board that interfaces the wafer and the test equipment.

Thirdly, Wafer Dicing (individual cuts are made on the wafers). Fourthly, Die Bond

(the process of attaching the bare die to a substrate, which provides electrical connectivity

to the outside, and to the base of the package). Fifthly, Wire Bond/Solder Bump, in which

each die pad is connected to a corresponding pad on the substrate via a thin gold wire,

or through flip chip technology. Sixthly, encapsulation, when the die is packed. Finally,

testing, to detect defects that may have occurred during the assembly process; an integrated

circuit socket is used in the final testing, which plays the crucial role of connecting the

device to the tester, similar to a probe board in wafer testing. Each individual integrated

circuit must be tested with a custom test socket.

Automated Test Equipment (

ATE

) is a computerized machine that uses test tools to

perform and evaluate the results of functionality, performance, quality, and stress tests

performed on integrated circuits. The ATE requires minimal human interaction, and is

directly responsible for ensuring not only that the IC functions as intended, but also that the

IC does not cause hazards as a result of its use. The growth of the ATE market is driven by

the significant use of test equipment in the automotive industry, which utilizes, among other

things, microcontrollers, sensors, and radar chips, and which has ‘Zero Defects’ goals, to

ensure very high levels of reliability and safety in automobiles. This means that integrated

circuit manufacturers are shifting their specifications from defects per million to defects per

billion (DPB) [

13

]. Teradyne (U.S.), LTX–Credence–Xcerra (U.S.), and Advantest (Japan)

hold the majority of the ATE global market share. The probe cards market is dominated by

FormFactor (U.S.), Technoprobe (Italy), and Micronics (Japan).

Semiconductor packaging technology has evolved to minimize costs and improve

the overall performance of integrated circuits (counteracting heating, mechanical damage,

radio frequency noise emission, electrostatic discharge, etc.), while providing higher speeds,

smaller footprints, higher pin counts, and lower profiles. The semiconductor packaging

market is under constant pressure to provide innovative solutions, in terms of size, per-

formance, and ‘time-to-market’. The market is moderately fragmented, with no dominant

players, but is mainly concentrated in East Asia, due to lower labor costs. Taiwanese

companies hold about 50% of the global market for Outsourced Semiconductor Assembly

and Testing services (

OSAT

). Taiwan’s ASE is the world’s largest supplier, with more than

24% of the market, followed by Amkor (U.S.), JCET (China), and SPIL (Taiwan). These

companies hold about 70% of the market share. In addition, Malaysia accounts for more

than 10% of the global packaging trade.

Initially, OSAT companies required significantly less investment in plant, equip-

ment, EDA tools, and R&D than foundries and IDMs, but their profit margins were also

lower. This picture changed substantially with the advent of the system-in-a-package

approach, particularly 3D Flip Chip. InFO (Integrated Fan-Out) packaging is a wafer-level

system-integration technology platform, featuring high-density RDL (Redistribution Lay-

ers) and TIV (Through InFO Via) for high-density interconnect, which requires complex

and expensive processes. In this framework, chip-on-wafer-on-substrate (CoWoS) technol-

ogy and chiplets will strongly influence the advanced development of high-performance

computing [14].

(e)

Product manufacturing.

Finished chips are sent or sold to electronics manufactur-

ers, or other types of manufacturers, and are incorporated into products. In the past, most

large-scale electronics manufacturing was handled by in-house assembly. The division

of labor in the electronics industry has led to the emergence of electronics manufactur-

ing services (

EMS

) or electronics contract manufacturing (

ECM

) companies. These new

companies offer flexibility and large economies of scale in manufacturing, raw material

sourcing and resource sharing, industrial design expertise, and the creation of value-added

services, such as warranty and repair. This market is dominated by Taiwanese companies

Foxconn (Hon Hai), Pegatron, and Wistron (all three being contract manufacturers for Ap-

ple). Foxconn—which also produces products for Amazon, Cisco, Dell, Nintendo, Nokia,

Chips 2022, 1 157

Acer, Xiaomi, etc.—has 12 plants in China, where it is the largest private employer, with

about 1.3 million employees [15].

At this final stage, printed circuit boards (PCBs) are also needed in almost all electronic

products, to secure integrated circuits in specific locations, and to provide reliable electrical

connections between component terminals. PCBs can be produced in-house by many large

companies, or they can be outsourced.

(f)

Sales.

IC components, as well as final products with IC content, are sold

to consumers.

2.2. Types of Semiconductor Companies

In the past, semiconductor companies’ production facilities were mostly in-house: that

is, almost the entire process, from research and design to assembly and testing. In the early

2000s, profit margins were low at semiconductor companies, with most generating returns

below the cost of capital; therefore, due to financial and time-to-market constraints, IC

manufacturing companies began to outsource segments of their manufacturing operations

to subcontractors. Today, we can find companies that design integrated circuits, and may

or may not produce their own chips, and companies that produce chips but may or may

not design them. All these companies can be identified primarily in

fabless

,

IDM

, and

foundry, as specified below.

An

Integrated Device Manufacturer

(

IDM

) carries out chip design, fabrication, and

ATP in-house. IDMs include Intel (whose CEO, Pat Gelsinger, recently shared his IDM2.0

vision for the company [

16

]), IBM, Samsung, NEC, SK Hynix, Micron, Texas Instruments,

Toshiba, Sony, STMicroelectronics, NXP, and Onsemi. IDMs can also provide contract

fabrication services for other firms, or can a outsource consistent part of their production

cycles to ‘pure-play foundries’, or simply foundries, like TSMC, Samsung Foundry, UMC,

GlobalFoundries, and SMIC.

A

fabless

semiconductor company, on the other hand, focuses exclusively on chip

design, and outsources the various manufacturing steps to foundries and IDMs (to pro-

duce the designed chips), to OSAT (to assemble, package, and test the chips), and to EMS

companies (to integrate the packaged chips into devices). Examples of fabless companies

include Broadcom, Qualcomm, AMD, Media Tek, Nvidia, and Xilinx. Fabless semiconduc-

tor companies need less capital, and have generally higher and less volatile profit margins

than IDMs, but quality control and ensuring on-time production can be an issue for them.

Between IDMs and fabless, a

fab-lite

semiconductor manufacturing model allows in-house

production targeted only at specific low-cost technology nodes that are still in high demand.

In this list, we can also include large technology companies that have the economic

ability and convenience to design their own chips in-house for their specific applications,

for competitive differentiation, preventing replication and ensuring consistency across

different devices [

17

]. For example, Apple develops custom chips for the iPhone and

iPad, Facebook (now Meta) designs chips optimized for the types of content it stores and

processes on its servers, Amazon’s Graviton and Inferentia and Google’s (now Alphabet)

Tensor Processing Unit (TPU) are AI-based IC accelerators for cloud computing, and Tesla

has developed the D1 Dojo Chip to train AI models. It may sound surprising, but Apple

can be considered the third largest fabless player in the world, behind Broadcom and

Qualcomm. Moreover, besides Tesla, many automakers are collocating semiconductor

engineers to develop new chips. They are understood to be part of the semiconductor

industry, as the average IC content per vehicle will exceed $1000 by 2026 [18].

IC designers often rely on other companies (sometimes referred to as design houses) for

IP cores, which are reusable units of logic design, cells, or IC layout (software) that are the

‘intellectual property’ of one party, and can be licensed to another party. This is especially

true for start-ups that, due to limited resources, focus their efforts on a specific design

with unique features, while referring to

IP cores

for standard functions. IP cores include

CPUs, GPUs, embedded memory compilers, interface, and interconnect technologies. The

semiconductor IP market is dominated by three companies that cover more than twothirds

Chips 2022, 1 158

of the market: ARM (UK-based), with a share of more than 40%, Synopsys (U.S.), and

Cadence (U.S.).

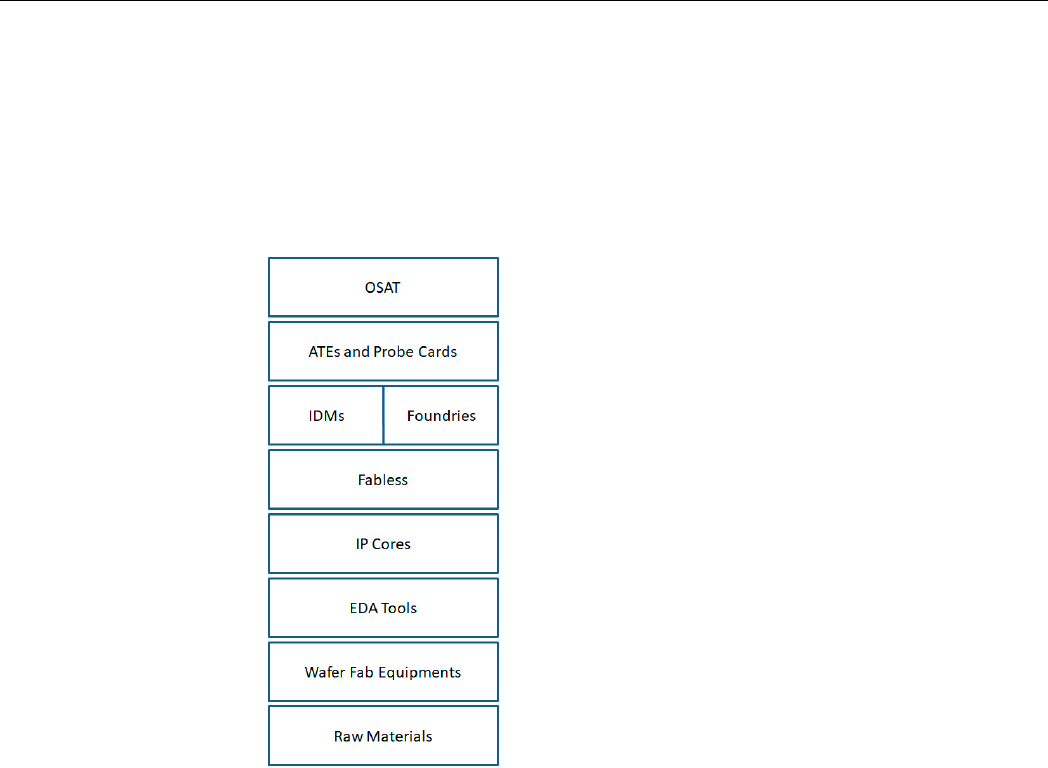

Figure 7 summarizes the types of companies that form the complete IC ecosystem.

Research is not explicitly included in this diagram, because in almost all cases it comes from

specific departments in the companies, and from government-funded institutions and aca-

demic laboratories. No other industry has the same intensity of R&D: about 22% of annual

sales ($90 billion), compared to the 21% of the pharmaceutical and biotechnology sector.

Chips 2022, 2, FOR PEER REVIEW 9

margins than IDMs, but quality control and ensuring on-time production can be an issue

for them. Between IDMs and fabless, a fab-lite semiconductor manufacturing model al-

lows in-house production targeted only at specific low-cost technology nodes that are still

in high demand.

In this list, we can also include large technology companies that have the economic

ability and convenience to design their own chips in-house for their specific applications,

for competitive differentiation, preventing replication and ensuring consistency across

different devices [17]. For example, Apple develops custom chips for the iPhone and iPad,

Facebook (now Meta) designs chips optimized for the types of content it stores and pro-

cesses on its servers, Amazon’s Graviton and Inferentia and Google’s (now Alphabet)

Tensor Processing Unit (TPU) are AI-based IC accelerators for cloud computing, and Tesla

has developed the D1 Dojo Chip to train AI models. It may sound surprising, but Apple

can be considered the third largest fabless player in the world, behind Broadcom and

Qualcomm. Moreover, besides Tesla, many automakers are collocating semiconductor en-

gineers to develop new chips. They are understood to be part of the semiconductor indus-

try, as the average IC content per vehicle will exceed $1000 by 2026 [18].

IC designers often rely on other companies (sometimes referred to as design houses)

for IP cores, which are reusable units of logic design, cells, or IC layout (software) that are

the ‘intellectual property’ of one party, and can be licensed to another party. This is espe-

cially true for start-ups that, due to limited resources, focus their efforts on a specific de-

sign with unique features, while referring to IP cores for standard functions. IP cores in-

clude CPUs, GPUs, embedded memory compilers, interface, and interconnect technolo-

gies. The semiconductor IP market is dominated by three companies that cover more than

twothirds of the market: ARM (UK-based), with a share of more than 40%, Synopsys

(U.S.), and Cadence (U.S.).

Figure 7 summarizes the types of companies that form the complete IC ecosystem.

Research is not explicitly included in this diagram, because in almost all cases it comes

from specific departments in the companies, and from government-funded institutions

and academic laboratories. No other industry has the same intensity of R&D: about 22%

of annual sales ($90 billion), compared to the 21% of the pharmaceutical and biotechnol-

ogy sector.

Figure 7. The ecosystem of semiconductor companies.

Figure 7. The ecosystem of semiconductor companies.

2.3. Remarks

In recent years, application domains have evolved from divergent, in which less so-

phisticated products with specific and minimal functions have been developed (e.g., cell

phones or cars used only for communication and transportation, respectively), to conver-

gent, in which the technological convergence of data processing, telecommunications, and

energy management is fully exploited (e.g., in smartphones or smart cars). In parallel,

the semiconductor industry’s value chain has shifted from a vertical integration model, in

which four of the six stages of the chain discussed earlier (with the exception of wafer and

product fabrication) were carried out in-house and integrated, to a vertical disintegration

model, in which specialized companies have emerged for each stage. This business model

was motivated by the rapid advancement of technology, with the continuous reduction in

chip size and the diversification of device features through special processes, which led to

an exponential increase in the design complexity and manufacturing costs of integrated cir-

cuits. This business model has also benefited from the global economy, which has required

the integration of markets above geopolitical divergences.

Both the converging application domains and the vertical disintegration model pro-

mote supply chain disruption. In fact, a system that incorporates an increasing number of

chips is increasingly exposed to a shortage, because it cannot be completed for the lack of

even one chip. In contrast, a long, often monopolistic, globally dispersed supply chain can

be easily disrupted by a single social or geopolitical event. All these aspects are explored in

the following.

Chips 2022, 1 159

3. Supply Chain Bottlenecks, Global Shortages, and Counteracting Measures

It can be understood from Section 2.3 that the semiconductor supply chain is extremely

fragile, and has several bottlenecks that can facilitate disruptions. In addition, the 2020

COVID-19 pandemic and the U.S.–China trade war highlighted and accelerated many of

these problems, quickly causing a chip shortage that persists to this day. The shortage,

along with economic and military conflicts, has convinced companies and governments

to take action. The bottlenecks, the causes of the silicon shortage, and some industry and

government responses are discussed below.

3.1. Bottlenecks

We have seen that there are only a few companies, or even one, that dominate the

entire global market. Samsung and Intel lead the overall semiconductor market, TSMC the

foundry sector for cutting-edge nodes (<10 nm), Qualcomm and Nvidia the fabless sector,

ASML the manufacturing of EUVL machinery, ARM the design of IP cores, FormFactor

and Technoprobe the probecard market, Foxconn the manufacturing of products, etc. In

addition, geographic regions, or even a single country, have specialized in the production

of certain raw materials (for example, in 2021, China supplied more than 85% of the world’s

refined Rare Earth Elements, followed by the rest of Asia at 13%, and Europe at 2%), or in

specific manufacturing processes and technologies. Due to the lockdown of factories, many

OSAT companies accumulated orders. The average lead time for packaging was 8 weeks,

pre-COVID; now it is 20 weeks (and can even be 50 weeks for prototypes).

In general, Figure 1 shows that East Asia supplies more than 75% of global IC produc-

tion capacity (led by Samsung, TSMC, and SK Hynix [

2

]), and is the hub of semiconductor

manufacturing, including ATEs, wafers, and IC substrates. This dominance is expected to

grow, especially with increased investment in China by foreign and domestic companies,

and government engagement. The U.S. has lost its primacy in IC manufacturing (from 37%

in 1990 to 12% today), and also, partially, in leading research (European R&D front-runners

in semiconductor technologies are IMEC, CEA-Leti, and the Fraunhofer Institute-FMD),

but the U.S. still leads global chip sales, as the last available data of 2021 from SIA show [

19

],

and as summarized in Figure 8. The success of the U.S. is due to its engineering workforce,

even if the U.S. position has declined slightly in recent years, with a parallel increase in

China (whose global chip sales figures are close to those of Taiwan, and also to Europe

and Japan).

Chips 2022, 2, FOR PEER REVIEW 11

its engineering workforce, even if the U.S. position has declined slightly in recent years,

with a parallel increase in China (whose global chip sales figures are close to those of

Taiwan, and also to Europe and Japan).

Figure 8. Global chip sales in 2021.

3.2. The Pandemic and Other Calamitous Events

The vulnerability of the supply chain became clear during the COVID-19 pandemic

of 2020 and the two years that followed, when cities or entire countries shut down or se-

verely slowed production. China’s ‘zero-COVID policy’ led to a total shutdown of activi-

ties for weeks (it seems, however, that SMIC was not stopped in Wuhan city during the

first block in 2020, nor in Shanghai city in 2022 [20,21]). However, the scenario was also

exacerbated by events such as:

(a) the worst drought in Taiwan in 56 years, in 2021 (chip makers use large amounts of

ultra-pure water to clean factories and wafers) [22].

(b) fires in plants (an Asahi Kasei semiconductor plant, in October 2020; a Renesas Elec-

tronics—which supplies 30%of the global market for microcontrollers used in auto-

mobiles—plant in March 2021 [23], and ASML’s Berlin plant, producing EUVL equip-

ment, in January 2022 [24]).

(c) winter storms (forcing the closure of two Samsung and NXP semiconductor plants

for several months in 2021, in Austin, Texas [25]).

All of these causes combined, along with the increased demand for integrated cir-

cuits, have repeatedly and at multiple points disrupted the chain, preventing global chip

production from meeting the demands of the different types of industries, of which there

are 169, according to a Goldman Sachs study which included industries that spend more

than 1% of their Gross Domestic Product on chips.

The pandemic played a primary role in initiating the 2020 chip shortage for the auto-

motive industry, as the global lockdown initially reduced personal mobility and demand

for cars and, consequently, the automotive industry’s demand for chips. At the same time,

the pandemic has accelerated digital transformation and the adoption of remote work,

remote study, movie streaming, and e-commerce technologies worldwide, greatly in-

creasing semiconductor demand in the consumer, telecommunications, and personal

computer sectors. For example, in the fourth quarter of 2020, sales of mainstream comput-

ers grew 26.1% year-on-year. As a result, chip makers shifted their production to where

demand was strongest, and failed to meet the needs of the automotive industry, which

recovered rapidly, and sooner than expected.

46%

21%

9%

9%

8%

7%

U.S.

S. Korea

Japan

EU

Taiwan

China

Figure 8. Global chip sales in 2021.

Chips 2022, 1 160

3.2. The Pandemic and Other Calamitous Events

The vulnerability of the supply chain became clear during the COVID-19 pandemic of

2020 and the two years that followed, when cities or entire countries shut down or severely

slowed production. China’s ‘zero-COVID policy’ led to a total shutdown of activities for

weeks (it seems, however, that SMIC was not stopped in Wuhan city during the first block

in 2020, nor in Shanghai city in 2022 [

20

,

21

]). However, the scenario was also exacerbated

by events such as:

(a)

the worst drought in Taiwan in 56 years, in 2021 (chip makers use large amounts of

ultra-pure water to clean factories and wafers) [22].

(b)

fires in plants (an Asahi Kasei semiconductor plant, in October 2020; a Renesas

Electronics—which supplies 30%of the global market for microcontrollers used in

automobiles—plant in March 2021 [

23

], and ASML’s Berlin plant, producing EUVL

equipment, in January 2022 [24]).

(c) winter storms (forcing the closure of two Samsung and NXP semiconductor plants for

several months in 2021, in Austin, Texas [25]).

All of these causes combined, along with the increased demand for integrated circuits,

have repeatedly and at multiple points disrupted the chain, preventing global chip produc-

tion from meeting the demands of the different types of industries, of which there are 169,

according to a Goldman Sachs study which included industries that spend more than 1%

of their Gross Domestic Product on chips.

The pandemic played a primary role in initiating the 2020 chip shortage for the

automotive industry, as the global lockdown initially reduced personal mobility and

demand for cars and, consequently, the automotive industry’s demand for chips. At the

same time, the pandemic has accelerated digital transformation and the adoption of remote

work, remote study, movie streaming, and e-commerce technologies worldwide, greatly

increasing semiconductor demand in the consumer, telecommunications, and personal

computer sectors. For example, in the fourth quarter of 2020, sales of mainstream computers

grew 26.1% year-on-year. As a result, chip makers shifted their production to where demand

was strongest, and failed to meet the needs of the automotive industry, which recovered

rapidly, and sooner than expected.

Automakers cannot return to pre-2020 supply levels, and the problem will continue

in the coming years, with components such as microcontrollers, image sensors, power-

management units, power MOSFETs, and display drivers. Many automakers are therefore

delaying vehicle deliveries, and suspending new orders for some models, to reduce pro-

duction due to the global chip shortage. General Motors said in November 2021 that it

would temporarily suspend the inclusion of heated and ventilated seats in several models,

although it was working on a plan to retrofit those vehicles when parts became available.

In the first seven months of 2022, automakers in North America skipped the assembly of

more than 1 million vehicles [26].

Eight major Japanese automakers said they had assembled about 3.4 million vehicles

in the first half of 2022—down more than 14% from the previous year. The world’s largest

automaker, Toyota (based in Japan), reported a 31% drop in profits in the January–March

quarter, compared with the same period a year earlier, and cut its production plans in

June 2022 by “tens of thousands of units globally”; it also announced the suspension of

production at various times in May and June, due to a shortage of spare parts caused by

the pandemic lockout in Shanghai [27].

According to the Society of Motor Manufacturers and Traders (SMMT), U.K. car

production shrank by onethird (32.4%) in the first three months of 2022, with nearly

100,000 fewer cars

than in the same period last year. Jaguar Land Rover’s latest financial

results for 2022 revealed a loss of more than £500 million for the British company, despite a

record order book [28,29].

The automotive sector exploits stable, mature semiconductor processes. But the

chip shortage also affected more advanced nodes for consumer, industrial, and medical

device manufacturing industries, with products such as video game consoles, graphic

Chips 2022, 1 161

cards (the rise of cryptocurrency mining in 2021 has further boosted demand), memories,

and processors.

3.3. U.S.–China Trade War

Other important reasons that have exacerbated the chip shortage are related to U.S.

sanctions against China, which have caused a reduction in global production capacity, and

an increase in inventories for Chinese companies. The case of Huawei is a clear example.

Huawei has been accused by the United States of putting backdoors in its equipment,

that could be exploited for espionage purposes. In 2019, Huawei was blacklisted by the

U.S., and placed on the so-called ‘Entity List’, which prohibits American companies (such

as Google with its Android operating system) from exporting specific technologies to

companies on the list. In 2020, Huawei was not able to source the cutting-edge chips it

needed for its smartphones, because the U.S. was preventing Chinese companies from

using advanced EDA tools and foundry services from companies (e.g., TSMC) that exploit

U.S. intellectual property. Huawei, and many other Chinese companies on the Entity List,

therefore had three to six months of chip inventories with which to try to secure their

business [

30

]; however, Huawei founder, Ren Zhengfei, recently warned of tough times

ahead for the firm, and committed to ensuring its survival [31].

Filling inventories reduced the number of chips available on the market in parallel

with the onset of the pandemic. In addition, Chinese foundries and IDMs were unable

to purchase new EUVL machines from ASML. In fact, in 2020, the U.S. forced the Dutch

government to ban the export of ASML’s EUVL machines to China, because ASML also uses

American intellectual property, according to Washington’s arguments (and the U.S. is now

pushing to also ban the export of mainstream machines [

32

]). In August 2022, the Bureau

of Industry and Security of the U.S. Department of Commerce issued a new provisional

rule on a wider range of technologies export restrictions, although not mentioning China

directly, and involving technologies for substrates of gallium oxide (Ga

2

O

3

) and diamonds,

as well as EDA software “specially designed for the development of integrated circuits with

Gate-All-Around Field-Effect Transistor (GAAFET) structure”, used to design 3-nm and

more advanced chips. While the U.S. wished to maintain an economic edge, its primary

motivation was military, as advanced chips are used in advanced weapons.

3.4. Response of Companies and Governments to the Chip Shortage

The semiconductor industry has responded to the shortage of and the rapid increase

in demand for chips, with a substantial increase in capital expenditures to support plans to

build new fabs and, thus, to increase global chip production capacity in the near future. The

most significant example is TSMC, which will increase capital spending from $30 billion in

2021 to $44 billion in 2022, and to a total of $100 billion in three years [33].

Intel has announced the construction of a 1000-acre mega chip production site in

Ohio, with an initial build-out of two fabs of more than $20 billion [

34

]. Intel has also

announced that it plans to spend more than $36.2 billion to build new semiconductor

manufacturing facilities and research centers in the EU. According to the company, total

investment could reach 80 billion euros over the next decade. Micron Technology has also

announced that it plans to invest $40 billion in its U.S. manufacturing operations through

to the end of the decade [

35

], while China’s largest semiconductor company, SMIC, has

invested an average of $9.5 billion over the 2021–2022 period [

36

]. These are just a few

examples that demonstrate the industry’s large investments in cutting-edge and in more

mature technologies around the world.

In this context, manufacturers have also received, or will receive, external funding

through government programs. Indeed, governments in several major economies are trying

to incentivize local chip design, research, and especially chip production. For example,

in 2014, China was the first to start providing government subsidies to its semiconductor

ecosystem; these subsidies, it is estimated, will be around $100 billion by 2030. This has

Chips 2022, 1 162

had, and will continue to have, an impact on chip supply, but most likely only for less

advanced nodes, even if SMIC recently announced that it is able to process 7-nm chips [

37

].

The European Chips Act is a legislative proposal that would allocate more than 43

billion euros to the integrated circuit industry [38].

The U.S. CHIPS and Science Act aims to restore U.S. leadership in chip production,

including for leading-edge technologies [

39

]. It has allocated about $52.7 billion in subsidies

for companies building additional semiconductor fabs in the U.S., with $2 billion of the

total to be used to build additional capacity for legacy chips, and about $13.2 billion also

available for R&D and workforce development programs.

The Indian government, in December 2021, launched an incentive program, worth

about $10 billion, to attract international semiconductor and display manufacturers, and to

make the country a global manufacturing hub [40].

TSMC has also announced its plans for further investment in the United States and

Japan, and potentially in the EU in the future [

41

]. Noteworthy is the construction of a 5-nm

factory (Fab 21), completed in Arizona in July 2022. Similarly, Foxconn recently announced

its plan to invest in India [

42

]. All such countermeasures, however, must take into account

the current socioeconomic and geopolitical situation, and the changing scenarios that are

unfolding. In addition, subsidizing the current industry could make it harder for potentially

more innovative start-ups to be successful. The biggest gains for the U.S. chip industry

come from disruptive new technologies replacing old ones, as the history of Intel has

demonstrated [43].

4. Analysis and Perspectives

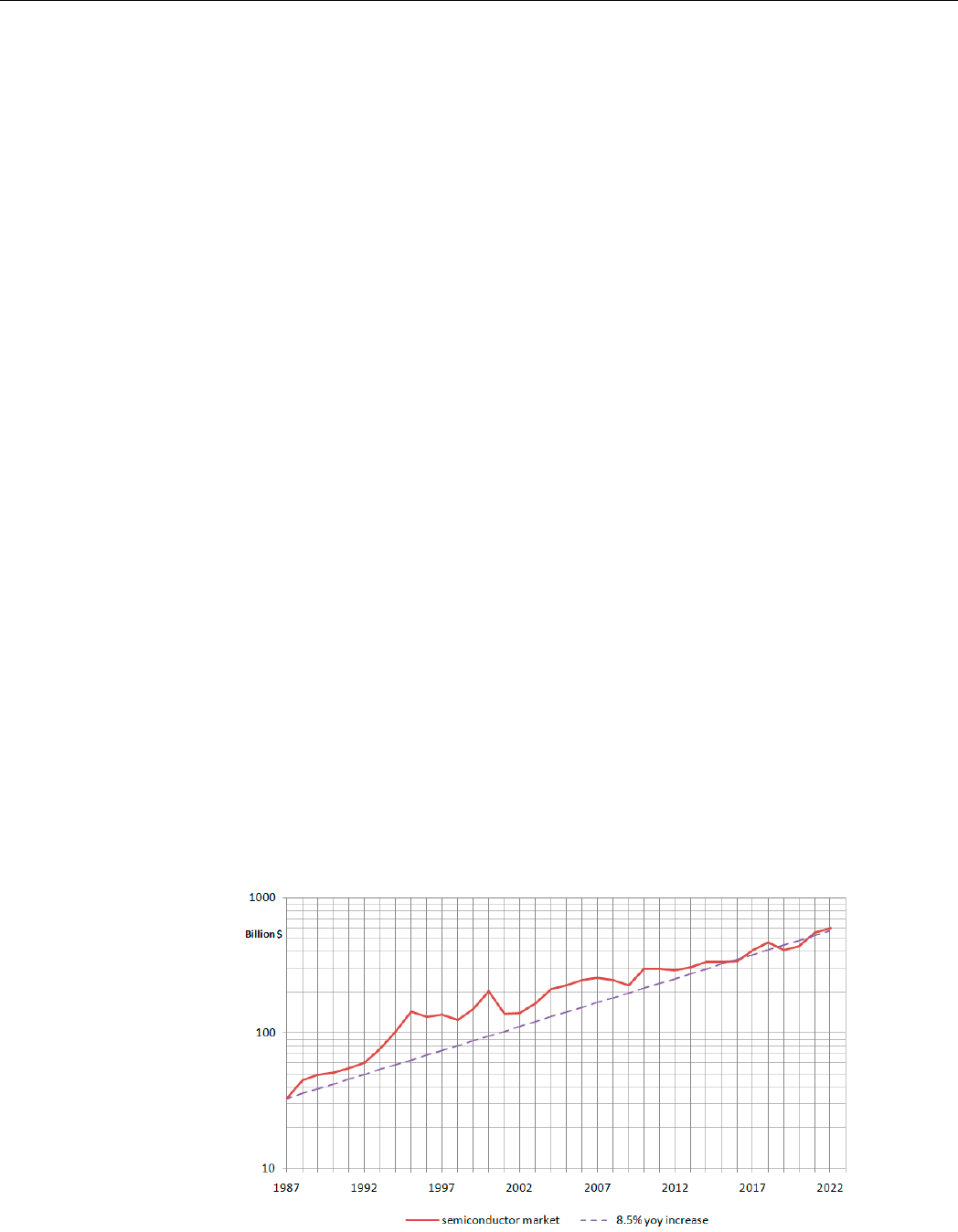

The semiconductor industry has grown over the past two decades, at an average of

8.5% per year (see Figure 9, which shows an exponential market growth, as the vertical axis

is logarithmic), fundamentally because

the industry’s extraordinary efforts have been

based on strong and open scientific, technological, and commercial cooperation

with

both the global market and the supply chain, albeit with all the critical issues highlighted

for the latter. In the semiconductor ecosystem, the capital-intensive segment of the fabs

(especially for the extreme technology nodes) was hence separated from that of the IC

design, so that fabless and fab-light houses could potentially generate a greater revenue.

The packaging step—once responsible for only a few percent of the final chip cost—became

more and more sophisticated, especially for systems in a package (SIP), and for advanced

RF chips, and was separated and specialized; furthermore, being the most labor-intensive,

and often based in low-cost countries such as China or Malaysia, it was also favored by

manufacturing incentives offered by the governments.

Chips 2022, 2, FOR PEER REVIEW 14

revenue. The packaging step—once responsible for only a few percent of the final chip

cost—became more and more sophisticated, especially for systems in a package (SIP), and

for advanced RF chips, and was separated and specialized; furthermore, being the most

labor-intensive, and often based in low-cost countries such as China or Malaysia, it was also

favored by manufacturing incentives offered by the governments.

Figure 9. Global semiconductor market from 1987 to 2022 (solid line), compared to a constant 8.5%

year-on-year growth (dashed line).

This ecosystem, highly dependent on business cooperation among nations, produced

a relatively stable market, where most of the demand came from consecutive killer appli-

cations such as computers, smartphones, and now automotive and industrial IoT. Because

of this stability, the oversight of supply chain inventory, production, sales, and even R&D

was quite predictable, and the scalability of technology nodes was ‘only’ a matter of re-

ducing optical size while keeping the transistor structure almost unchanged. Within this

framework, semiconductor shortages have occurred cyclically, sometimes due to the

emergence of a new killer application or exacerbated by external shocks, such as the tech-

nology bubble or the 2009 recession. In general, however, cycles from underproduction to

overproduction have been repeatedly observed in leading-edge ICs and memory ICs. In

the alternation of these semiconductor cycles, large fabless companies did not take on real

financial risks and stresses. Even the risks were outsourced to foundries and, ultimately,

to TSMC, which became the single supplier.

However, the semiconductor ecosystem is undergoing a dramatic change in its struc-

ture, for a number of important concomitant reasons that will be discussed in the remain-

der of this section; these reasons open up new scenarios in terms of market growth and

opportunities, but also present potential dangers, and require the development of new

policies and business models.

4.1. Unprecedented Market Growth and Profitability

We begin this analysis by observing an unprecedented level of demand for ICs, driven

by AI, 5G, IoT, health, and automotive applications. 2017 and 2021 were record years for

the semiconductor industry, with 22% and 25% year-on-year improvement [44,45].

2018 was identified as the year when the amount of data generated by humans was

equaled and surpassed by that generated by machines, which has since grown exponen-

tially [46].

Of course, data must be transmitted, processed, and stored electronically, with spe-

cific integrated circuits. The high demand for semiconductors has only been exacerbated

by the pandemic, but stems from the sudden increase of all these new applications that

require, and for many years will require, much greater capacity from the manufacturing

Figure 9.

Global semiconductor market from 1987 to 2022 (solid line), compared to a constant 8.5%

year-on-year growth (dashed line).

Chips 2022, 1 163

This ecosystem, highly dependent on business cooperation among nations, produced

a relatively stable market, where most of the demand came from consecutive killer applica-

tions such as computers, smartphones, and now automotive and industrial IoT. Because of

this stability, the oversight of supply chain inventory, production, sales, and even R&D was

quite predictable, and the scalability of technology nodes was ‘only’ a matter of reducing

optical size while keeping the transistor structure almost unchanged. Within this frame-

work, semiconductor shortages have occurred cyclically, sometimes due to the emergence

of a new killer application or exacerbated by external shocks, such as the technology bubble

or the 2009 recession. In general, however, cycles from underproduction to overproduction

have been repeatedly observed in leading-edge ICs and memory ICs. In the alternation

of these semiconductor cycles, large fabless companies did not take on real financial risks

and stresses. Even the risks were outsourced to foundries and, ultimately, to TSMC, which

became the single supplier.

However, the semiconductor ecosystem is undergoing a dramatic change in its struc-

ture, for a number of important concomitant reasons that will be discussed in the remainder

of this section; these reasons open up new scenarios in terms of market growth and oppor-

tunities, but also present potential dangers, and require the development of new policies

and business models.

4.1. Unprecedented Market Growth and Profitability

We begin this analysis by observing an unprecedented level of demand for ICs, driven

by AI, 5G, IoT, health, and automotive applications.

2017 and 2021 were record years for

the semiconductor industry, with 22% and 25% year-on-year improvement [44,45].

2018 was identified as the year when the amount of data generated by humans

was equaled and surpassed by that generated by machines, which has since grown

exponentially [46].

Of course, data must be transmitted, processed, and stored electronically, with specific

integrated circuits. The high demand for semiconductors has only been exacerbated by the

pandemic, but stems from the sudden increase of all these new applications that require,

and for many years will require, much greater capacity from the manufacturing industry.

The scenario is radically different from the usual alternating inventory cycles seen above.

In addition, the advent of AI, IoT, and autonomous vehicles requires the integrated circuit

industry to be more flexible, more focused on R&D, and with shorter production times.

Moreover, increased demand is leading to a resurgence of integrated circuit design start-

ups, and perhaps more importantly, many big technology and automotive companies have

begun to design chips in-house. The semiconductor industry has been faced with a

new

type of competitor.

4.2. Technological Breakpoints

Another major deal-breaker is the fact that, as we approach the atomic scale, optical

shrinking techniques no longer work. In other words,

the scaling road map is no longer

marked

. For each new nanoscale generation, new paths have to be worked out in terms

of materials, processes, and transistor architecture. Every technological advance requires

exponentially increasing expenditures in R&D, plant, machinery, and tools, which explains

why there are only a few state-of-the-art foundries in the world today. Another observation

needs to be made, about the

breaking of the link between mature and leading nodes

.

The state-of-the-art in lithography has moved to 7, 5, and 3 nm, while microcontrollers,

analog, IoT, and automotive, because of the functionality and reliability needed, are still

implemented at 40–180 nm. As a result, when the next node is released, the previous one

does not find suitable applications, contributing to increased foundry risks.

Chips 2022, 1 164

4.3. Foundry-Customer Agreements

The huge, high-risk expenditures discussed above can no longer be borne by foundries

alone. Because large fabless companies have a vital need for new technology nodes, fabless

must share these risks with foundries, by entering into

long-term agreements

(LTAs)

or

non-cancelable, non-refundable orders

(NCNRs). Just as ASML required strong co-

investment from its customers to realize EUVL machines, foundries require co-investment

and capacity risk-sharing with their customers, to manage the semiconductor cycles. This

is an indicator of the changing structure of the industry, which also explains TSMC’s

present investment of $100 billion over three years, based on consultation with customers

in anticipation of their needs [10].

At first glance, this radical change that occurs in agreeing on orders should not involve

chipmakers with older technologies. After all, TSMC has a monopoly, while there is much

competition among legacy-node companies. However, the recent chip shortage has shown

that even mature technologies can be in short supply, and has revealed the new power and

privileged position of the foundries, which can now take advantage of NCNR (no longer

accepting the usual just-in-time order policy) with customers who want to ensure constant

supply. Automakers are an example of such customers, who have had to partially abandon

the well-known lean manufacturing system (Toyota’s system) [

47

], aimed at minimizing

inventory, but exposing production to fluctuations in the IC market.

An agreement between chipmakers and automakers (and also with other industries)

is also necessary for another important reason. The majority of automotive and industrial

chips are realized in 40 nm or above, utilizing 200-mm wafers. Therefore, 200-mm wafer

manufacturing is still important for these sectors and, incidentally, also for RF, MEM’s

Analog, and Power Management ICs. Most of the 200-mm fabs are today fully depreciated,

which happens after at least four years of operation, and this means that the manufacturing

cost of a chip made in one of these fabs is very low, and that the final price is (or can be)

very low too. However, the addition of fabrication capacity means that companies have

to build

new 200-mm fabs

(from around 200 fabs worldwide in 2010, to 220 in 2025, as

estimated by SEMI [

48

]) and have to buy new machines and tools to produce chips whose

market price is a fraction of what they would really cost, because they are produced in a

new, non-depreciated fab. It clearly seems uneconomical, and consequently the investment

in foundry is justified if customers sign LTA and NCNR, or if the foundry is supported by

strong government subsidies (many of these new 200-mm fabs are in fact in China), or if

several companies join forces [49]).

4.4. Trade War

Another extremely important factor that is blocking previously observed cooperation

between nations is, of course, the already mentioned U.S.–China trade war. China is cur-

rently the main importer of semiconductors (35% of the global demand for semiconductors),

which cost the country more than foreign crude oil [

50

]. China plans to develop its chip

design and manufacturing industry (reaching 70% onshore chip manufacturing by 2025) by

supporting its industry with large sums of money. In reply, the U.S. government not only

is (perhaps belatedly) replicating this funding policy with the Chip and Science Act, but

is also attempting to set barriers in China’s way to developing advanced semiconductors.

Companies receiving subsidies from the U.S. cannot build advanced (<28 nm) chip fabs

in China.

The U.S. Chip Act tries also to push foreign companies to take sides in the war, in

order to obtain U.S. subsidies, surely affecting small and medium-sized businesses (TSMC

and Samsung are not dependent on U.S. subsides). U.S. House Speaker Nancy Pelosi’s

recent visit to East Asia—particularly South Korea, Taiwan and Japan—was an attempt

to influence adherence to the U.S. geopolitical policy; but the effect of the U.S. bans, as

SMIC and its 7-nm technology has shown, has been

to push Chinese companies to do

even more massive research

. China could also choose to block deals with large U.S. tech

companies such as Qualcomm, Broadcom, and Micron, cutting more than 50% of their

Chips 2022, 1 165

revenues, and further reducing the U.S. market share. As another countermeasure, China

could limit or ban Rare Earth Elements exports to the U.S. and its allies. In fact, U.S.–China

tensions are accelerating the decoupling of the two supply chains and markets, raising

concerns that

Western semiconductor capacity could be oversized

if the Chinese market

is cut off.

4.5. The Ukraine Conflict

The effects of the war on commodity prices, supply chain constraints, and overall

uncertainty will influence chip manufacturers and consumers. Ukraine is not only the

world’s largest supplier of neon gas (70% of global supply)—critical for lasers used in

lithography—but also the world’s largest supplier of xenon and krypton gas, also critical

for chip production [

51

]. Roughly 54% of Ukrainian neon comes from two companies,

Ingas (based in Mariupol) and Cryoin (based in Odessa), both cities highly affected by

Russian attacks. Moreover, Russia holds 40% of the market for palladium, 15% for titanium,

12% for platinum, and 10% for copper, all of which are important for printed circuit boards,

and for sensors and plating processes in chip production, as well as for high-tech products

such as catalytic converters and ion batteries [

52

]. Sanctions imposed on Russia make the

latter an uncertain source for such supplies in the near future [53].

In the short term, the impact of the conflict on semiconductor manufacturing should

be manageable, as the largest foundries have great purchasing power, and access to stocks

that can span two months or more. However, many other smaller companies do not have

this type of reserve. In the medium–long term, the industry may consider making larger

investments—for example, in neon recycling technologies.

Another effect of the conflict has been to create instability in world energy markets,

raising energy costs, and driving oil and gas prices to their highest levels in nearly a decade.

This could have a major impact on chipmakers, depending on local electricity prices. In

fact, large semiconductor factories consume up to 100-MWh of energy per hour [54].

In addition, rising energy and fuel costs, combined with rising inflation, taxes, and

interest rates, are putting pressure on consumers’ disposable income [

55

]. We are already

seeing weakness in semiconductor end markets, particularly those exposed to consumer

spending. After a period of record revenues for chipmakers, peaking in the first quarter of

2022 after five consecutive quarters of record revenues, a slowdown is expected (but not for

data centers and the automotive sectors). In this context, an increase in component prices

due to rising energy costs could amplify market uncertainty.

4.6. Technology Issues vs. Political Goals

One problem that is not being adequately addressed in this context is that many

political actions are taken by

technologically illiterate people

. Examples of policy mistakes

are numerous, and range from U.K. prime minister Theresa May’s satisfaction with the

acquisition of ARM by the Japanese SoftBank group, which was judged to be a good

reaction of the markets in the aftermath of Brexit [

56

,

57

]. According to a study by the U.S.–

China Business Council, the trade policies of former President Donald Trump have cost the

U.S. 245,000 jobs [

58

]. The U.S. Chip Act extends trade limits to 10 years—an enormous

time frame that doesn’t take into account the speed at which semiconductor technology is

advancing. Furthermore, manufacturing costs in the U.S. and the EU are much higher than

in China and Taiwan. Subsidizing the fabs is an attempt to offset these higher costs, but

it does not seem to be adequate. In any case, if technological issues become intertwined

and subordinated to unrelated political goals, then further pressure could be added to an