Copyright Agreement

The purchase and use of all Software and Services is subject to the Agreement as defined in Kaseya’s “Click-Accept” EULATOS as

updated from time to time by Kaseya at http://www.kaseya.com/legal.aspx. If Customer does not agree with the Agreement, please

do not install, use or purchase any Software and Services from Kaseya as continued use of the Software or Services indicates

Customer’s acceptance of the Agreement.

2

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

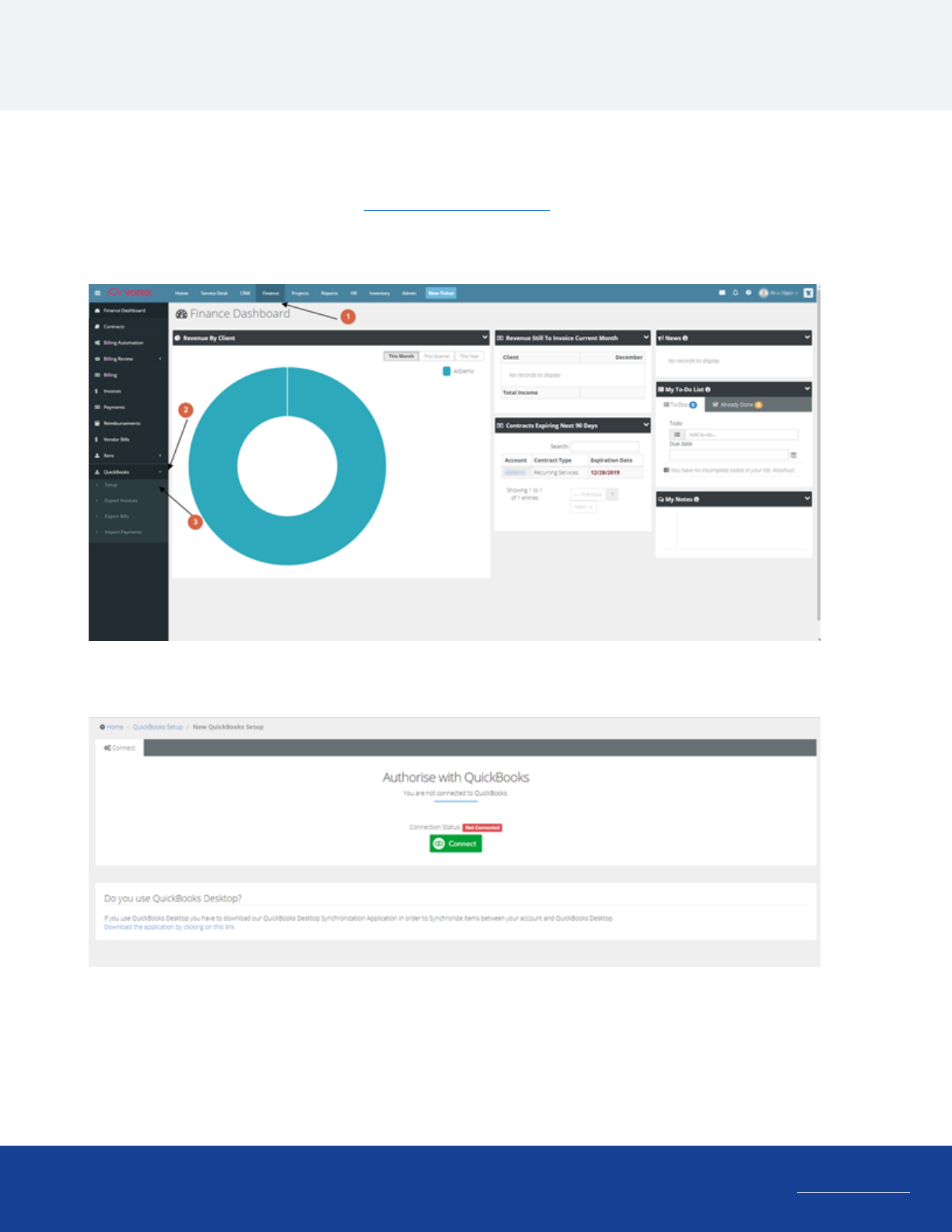

QuickBooks Connection

Assuming you have an active QuickBooks (http://quickbooks.intuit.com) account.

In order to setup BMS with QuickBooks you need first to connect to QuickBooks Online.

Connecting to QuickBooks online:

1 Navigate to Finance Module, then select QuickBooks > Setup.

2 Press the Connect button, you will be redirected to QuickBooks Online automatically.

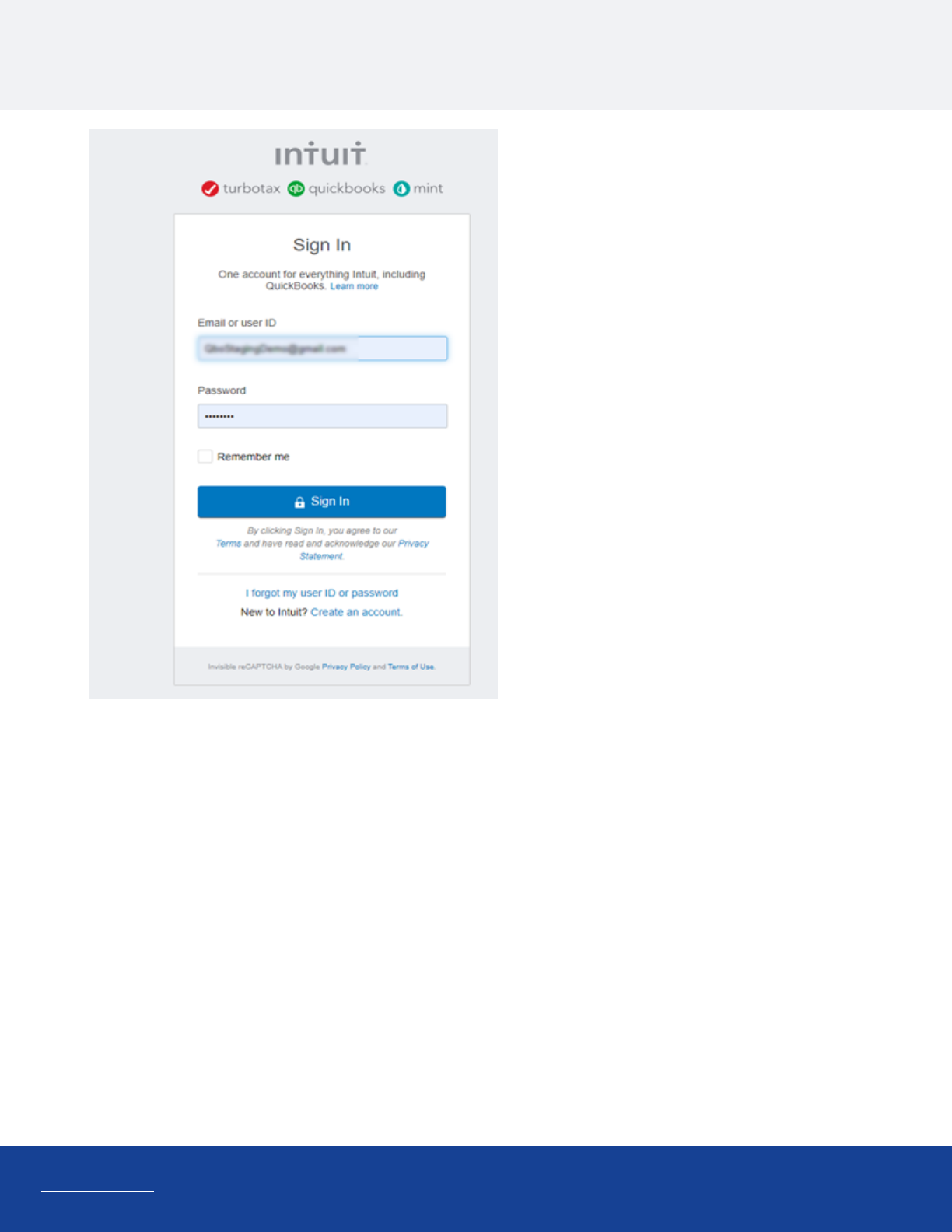

3 Enter your QuickBooks credentials.

4

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

QuickBooks Connection

5

QuickBooks Connection

www.kaseya.com

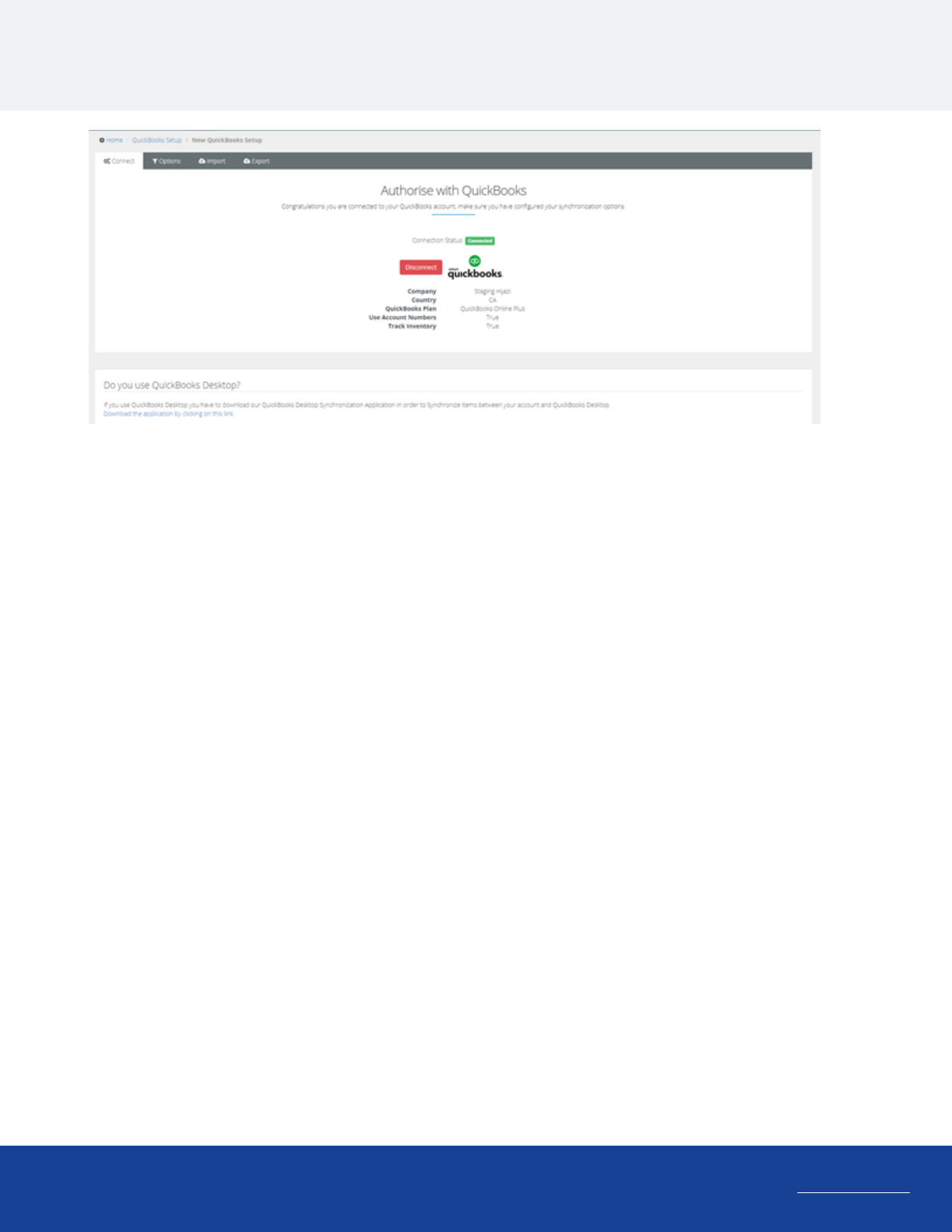

4 After validating the entered credentials, you will be automatically redirected to BMS again with some of your

QuickBooks Online information displayed:

– Company name

– Country

– QuickBooks online plan

– Use account numbers (settings for charts of accounts)

– Track inventory (settings for inventory products)

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

7

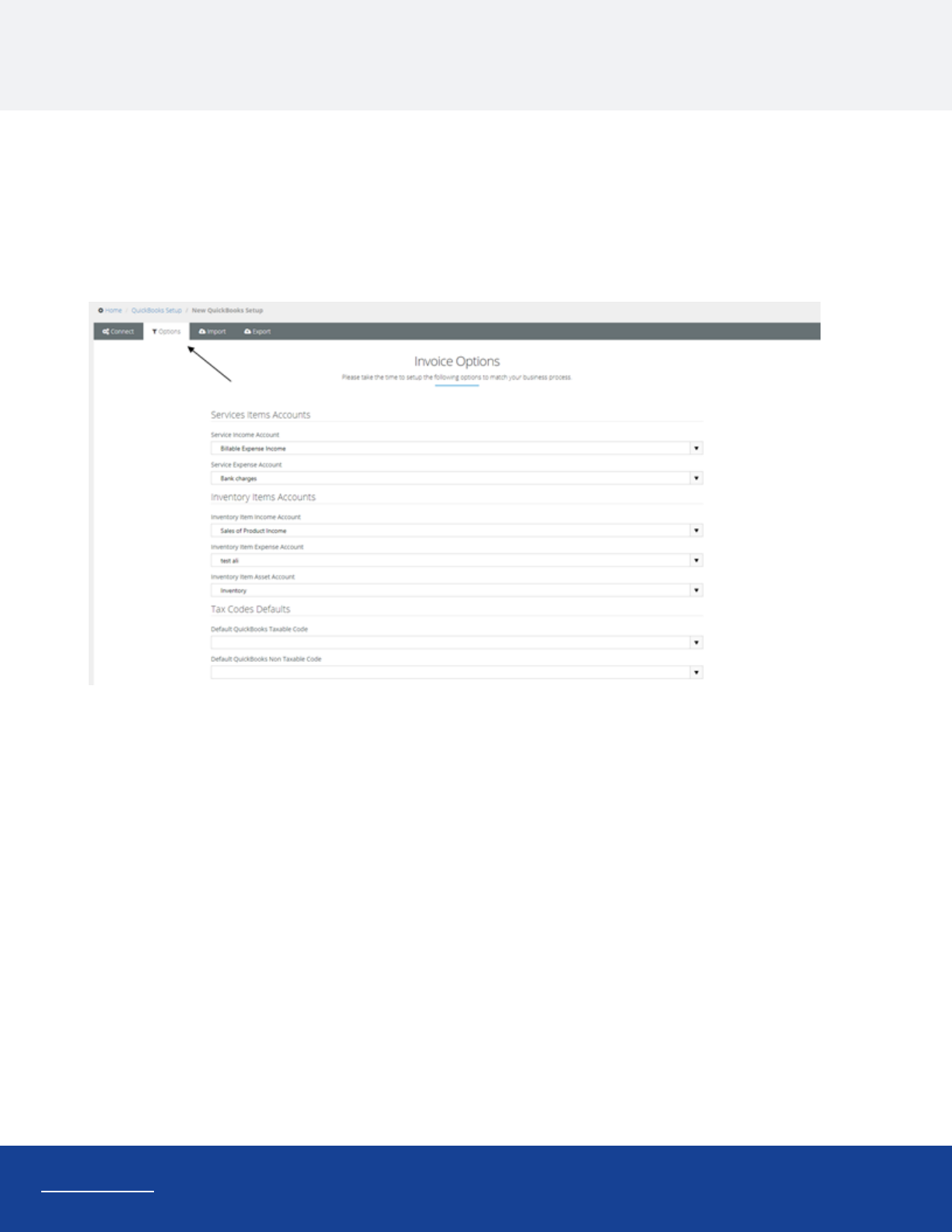

Setup and Default Settings

www.kaseya.com

Setup and Default Settings

In this latest version of the QuickBooks Online integration, a new Setup > Options page was introduced to address some

business differences between and QuickBooks Online.

1 Navigate to Finance Module, then select QuickBooks > Setup.

2 Select the Options tab and start filling your default settings.

The next drop downs are populated from QuickBooks Online data:

• The Service Items Accounts section - to handle missing Income/Expense chart of accounts for services and non

inventory products .

• The Inventory Items Accounts section- to handle missing in Income/Expense/Asset chart of accounts for inventory

products .

• The Tax Codes Defaults section- to handle missing taxable and non taxable taxes; this is specifically for US users.

Invoice Defaults section

This section is specific for invoicing settings.

• QB Invoice Numbers - this option specifies whether to use Invoice Numbers, Ids, or QuickBooks invoice numbers.

• Invoice Due Date - this option specifies the default due date for invoices.

• PO Number Custom Field Name and Order- this option matches with the custom field added in QuickBooks

company settings.

• PO Number QuickBooks Custom Field Name and Order- this option to decide adding the PO number or not.

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

• Allow Online ACH Payment - this option for allowing payments by bank transfers.

• Allow Online CreditCard Payment - this option allows credit card payment or not.

• CRM Account Name maps to - this option to decide whether to depend on Vendor/Customer Name or their

Corresponding Company name in mapping.

8

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

Setup and Default Settings

9

Import Section

www.kaseya.com

Import Section

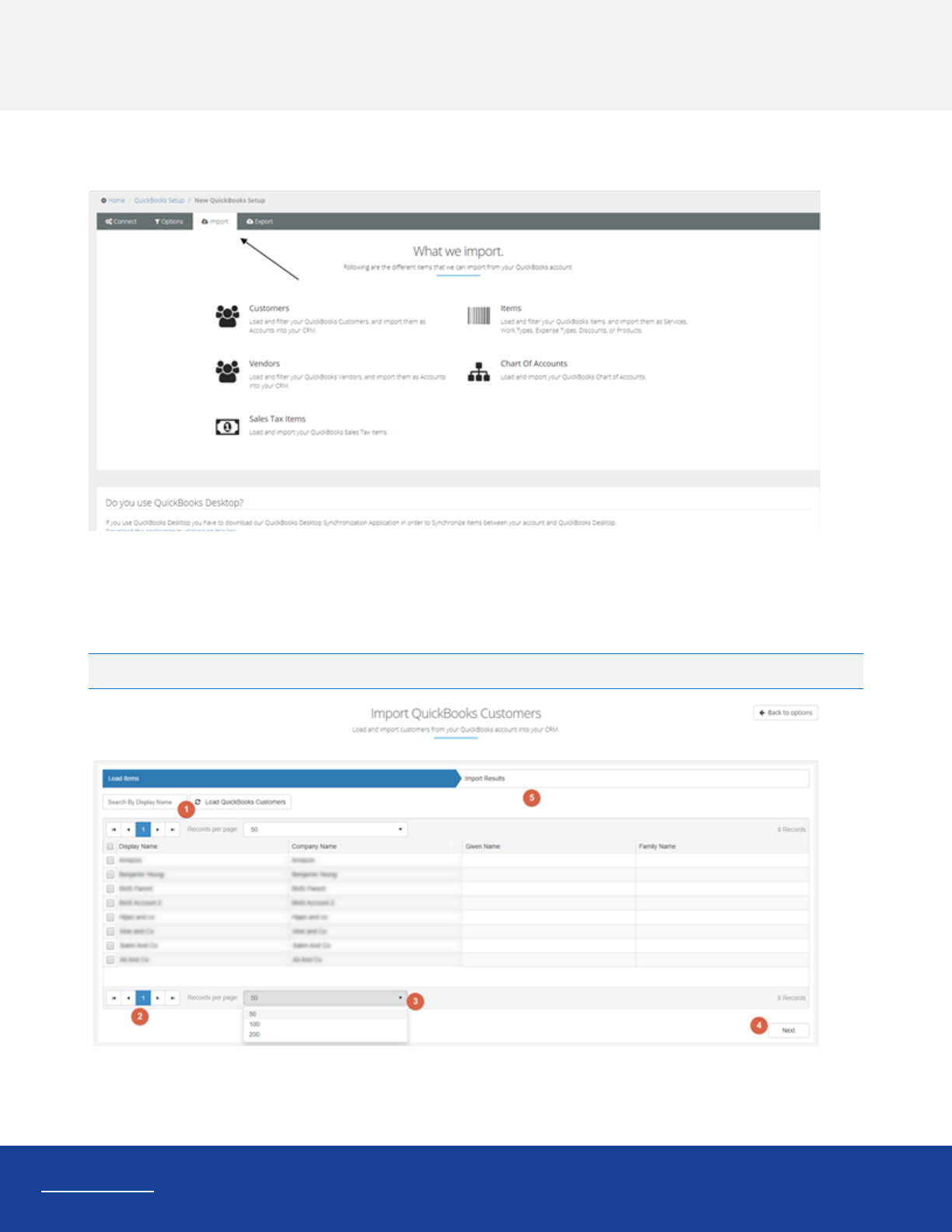

Once connection and options are established, you can now start importing data from QuickBooks to BMS.

Import QuickBooks Customers

Once you click on Customers section, customers will be loaded from QuickBooks pages into a grid so that you are able to

select your page size and retrieve as much data as you have:

Note: Paging is applied on all the below grids for all items.

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

1 - you can search for specific customer by his name

2- you can navigate to any page you aim.

3- you can select your page size, once changed data will be loaded again based on your selection.

4,5- once you select your data you can either press next or the tab Import results and your process will begin.

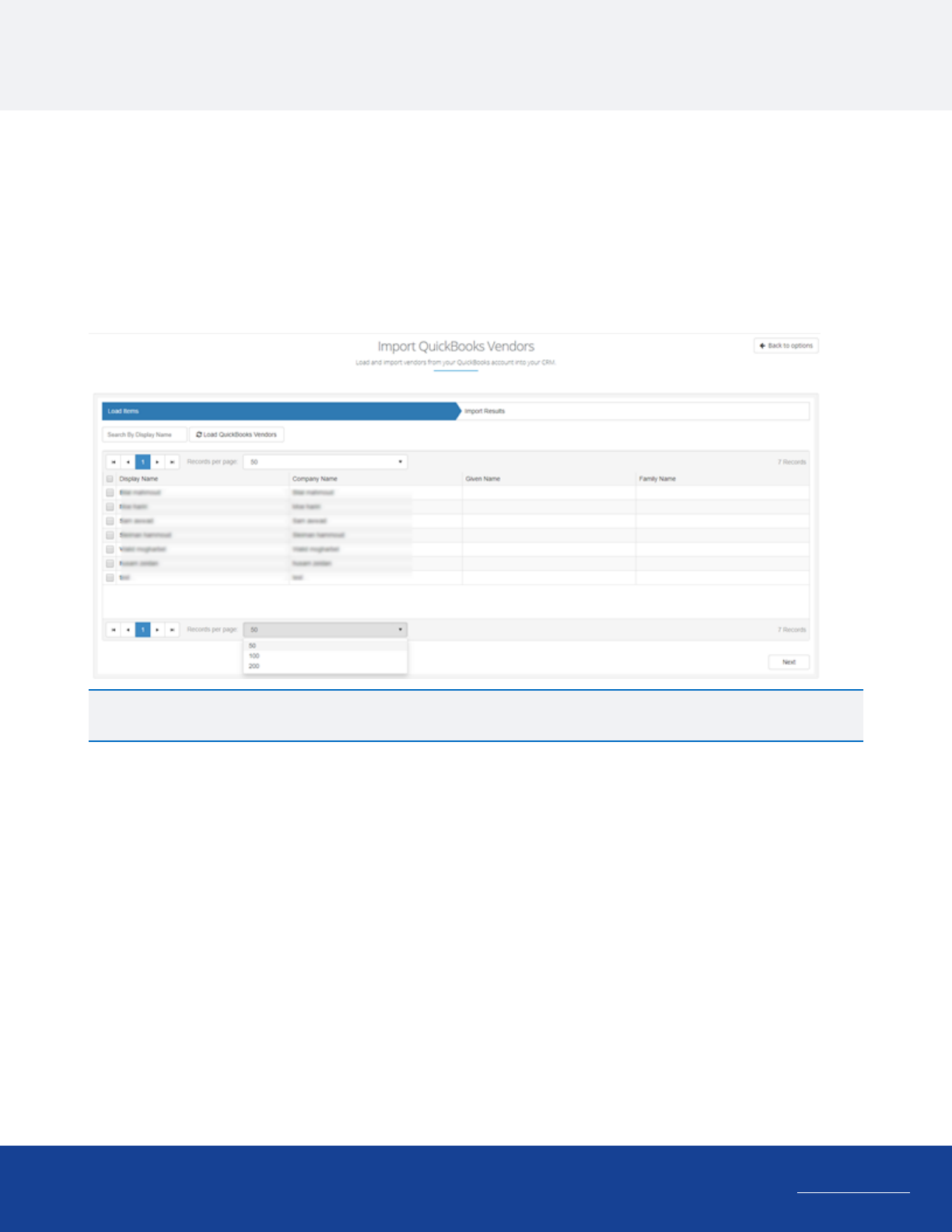

Import QuickBooks Vendors

Vendors follow the same procedure as customers, you are able to load, page, search , and import your QuickBooks

vendors to BMS.

IMPORTANT! For both Customers and Vendors, once a child account is selected and triggered for import procedure

the child is synced with his parent automatically in order to maintain the hierarchy.

Import QuickBooks Sales Tax Items

Once selected all tax items and groups will be loaded from QuickBooks into a paged, searchable grid allowing you to

select and import your taxes.

10

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

Import Section

11

Import Section

www.kaseya.com

Note: Once a group tax is selected it will be imported with all of it’s items.

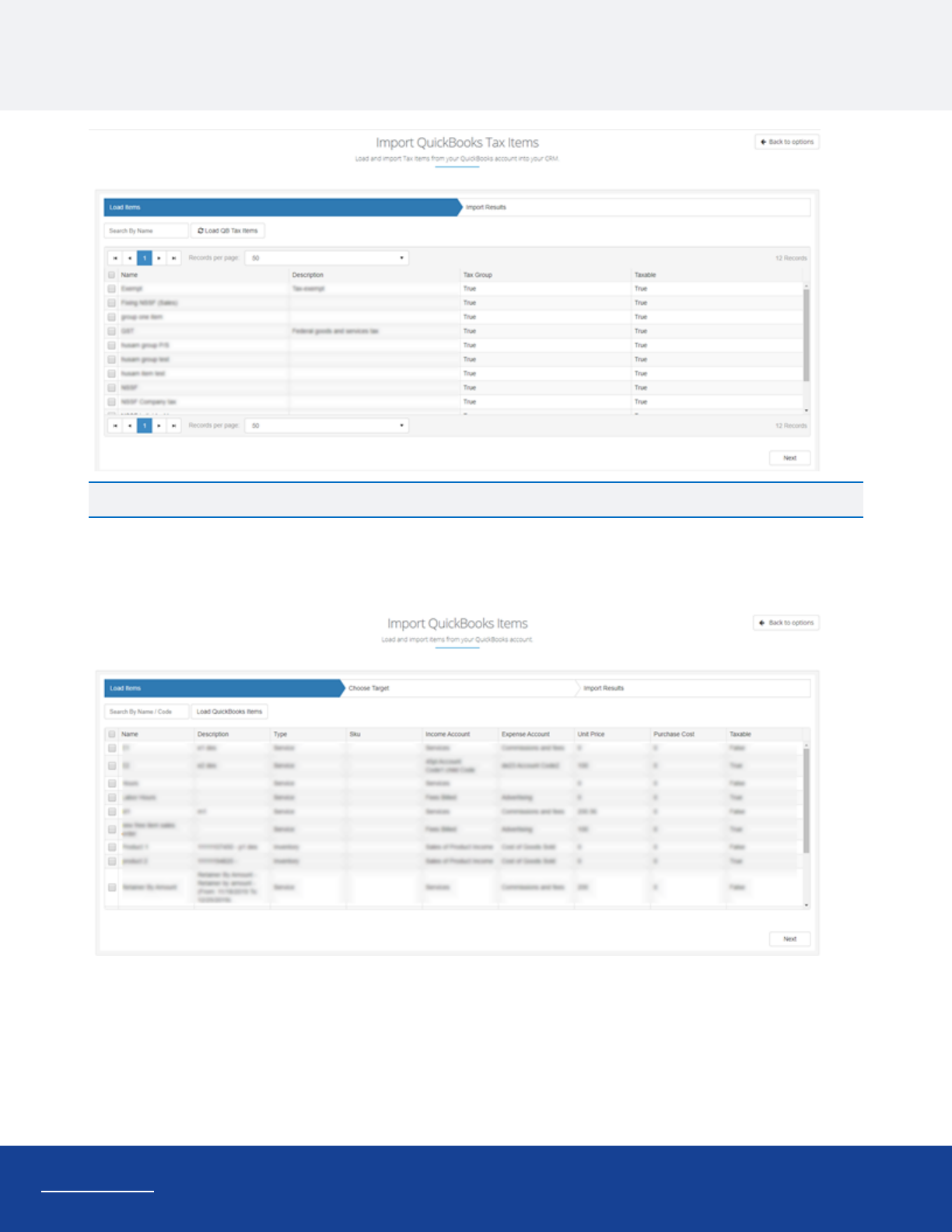

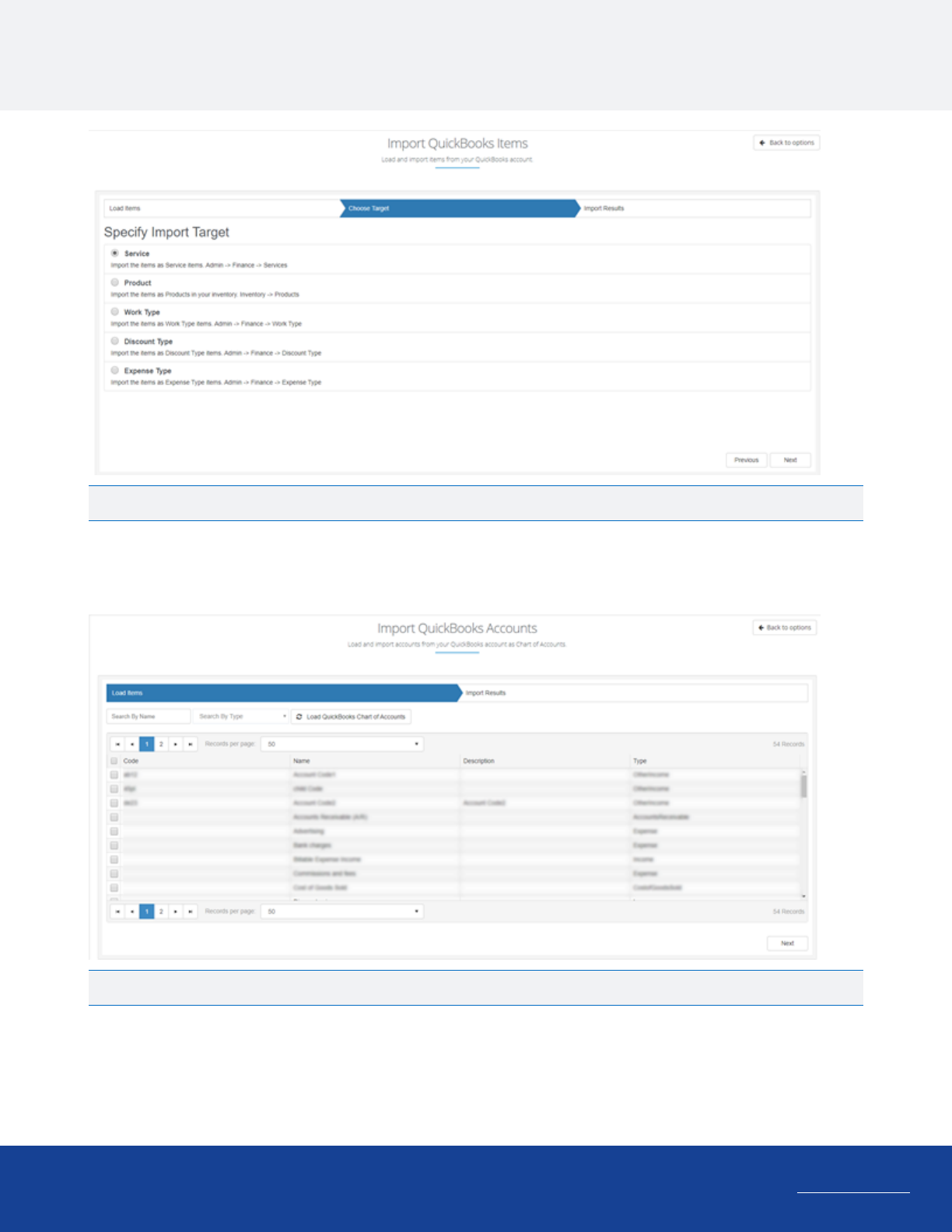

Import QuickBooks Items

In this section, services and products are loaded into the same paged searchable grid, but before starting the import

procedure you need to decide the target where you want to export your items.

Once Next or Choose Target tab is pressed, you will need to decide the target of your import (as on the image below).

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

Note: Same item may be imported into all available targets

Import QuickBooks Accounts

Chart Of Accounts are loaded from QuickBooks into a paged, searchable grid allowing you to select and import your

accounts.

Note: Once a child chart of account is selected for import it will be imported with its corresponding parent.

12

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

Import Section

13

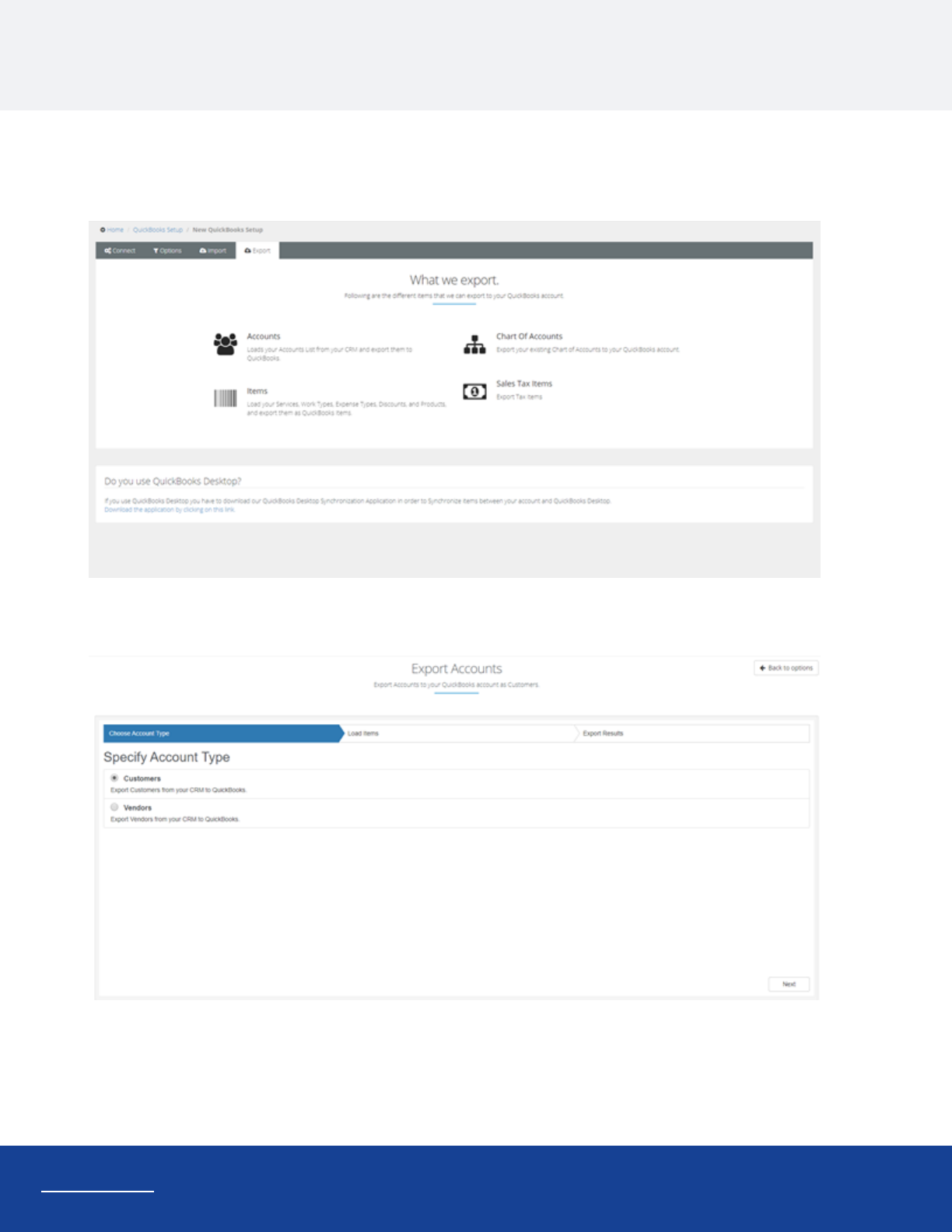

Export Section

www.kaseya.com

Export Section

This section is for exporting data from BMS to QuickBooks.

Export Accounts

In accounts section you must specify the account type before loading data from BMS.

After specifying the type of the accounts, data will be loaded correspondingly from BMS and then you can select and

Export data to QuickBooks.

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

Note: Once a child account is selected for export it will be exported with its corresponding parent.

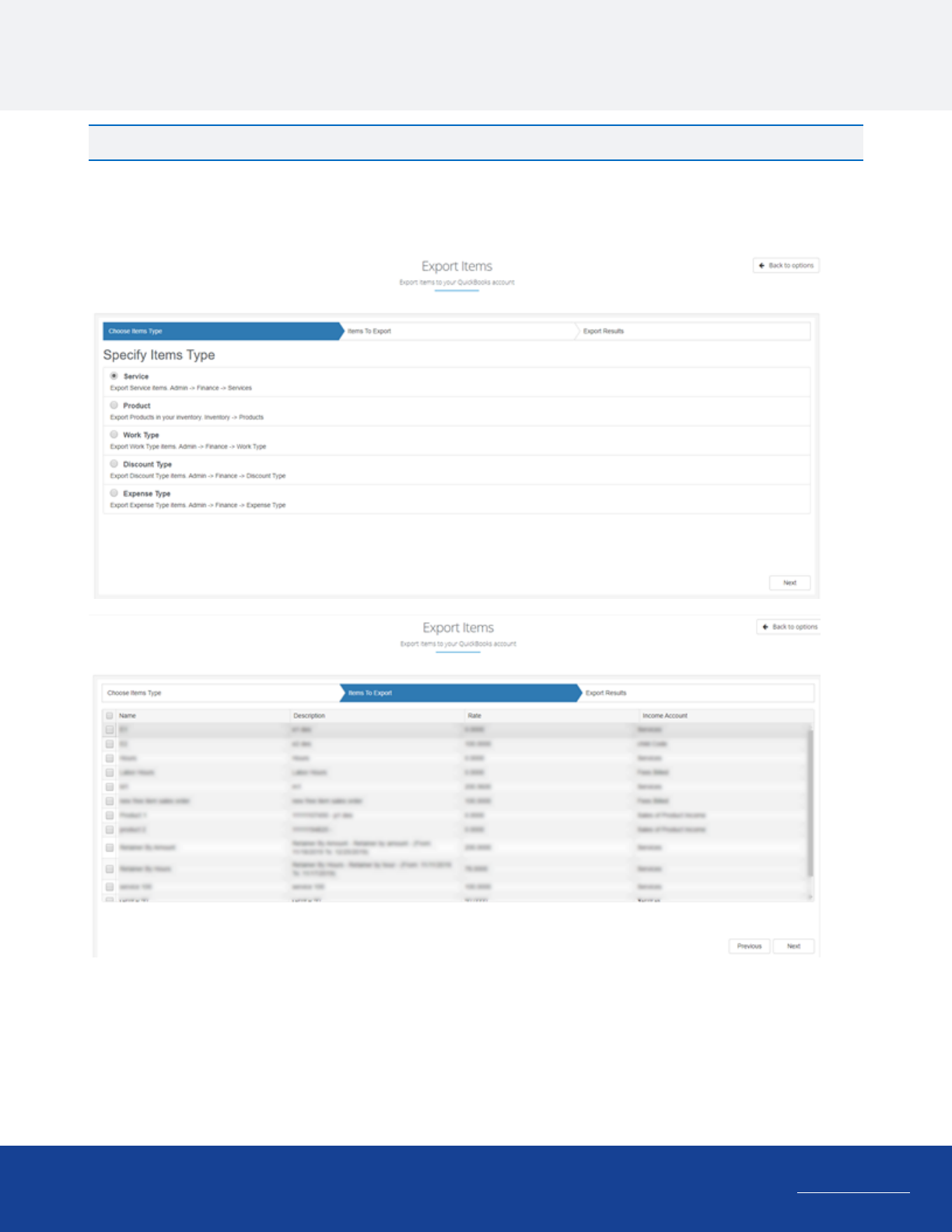

Export Items

In this section you should specify the item type first, which is the data source where grid will be populated from. Then you

can select items and proceed with your export.

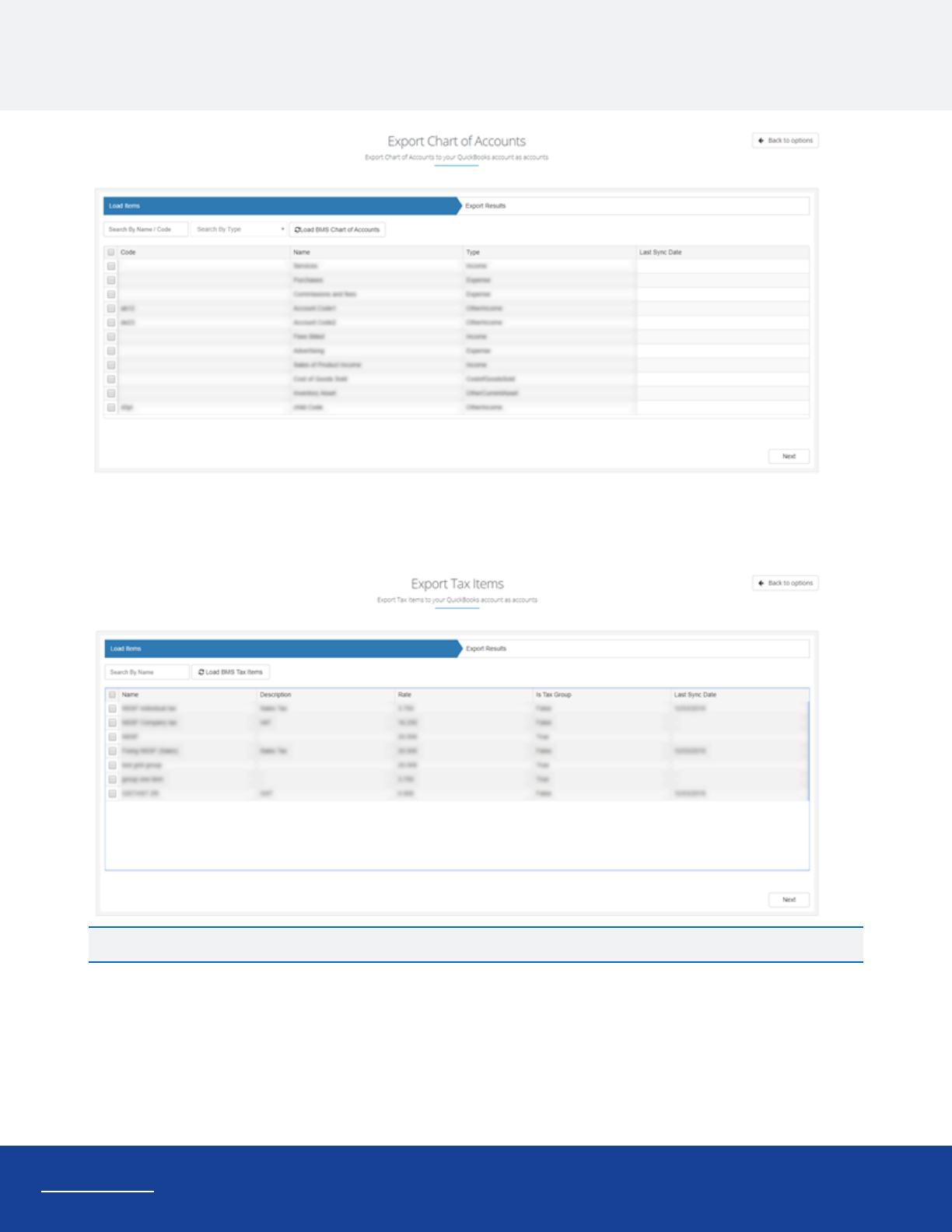

Export Chart Of Accounts

Chart Of Accounts are loaded from BMS, select target then proceed with your export.

14

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

Export Section

15

Export Section

www.kaseya.com

Export Sales Tax Items

Once selected all tax items and groups will be loaded from BMS into a paged, searchable grid allowing you to select and

Export your taxes.

Note: Once a group tax is selected it will be exported with all of it’s items .

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

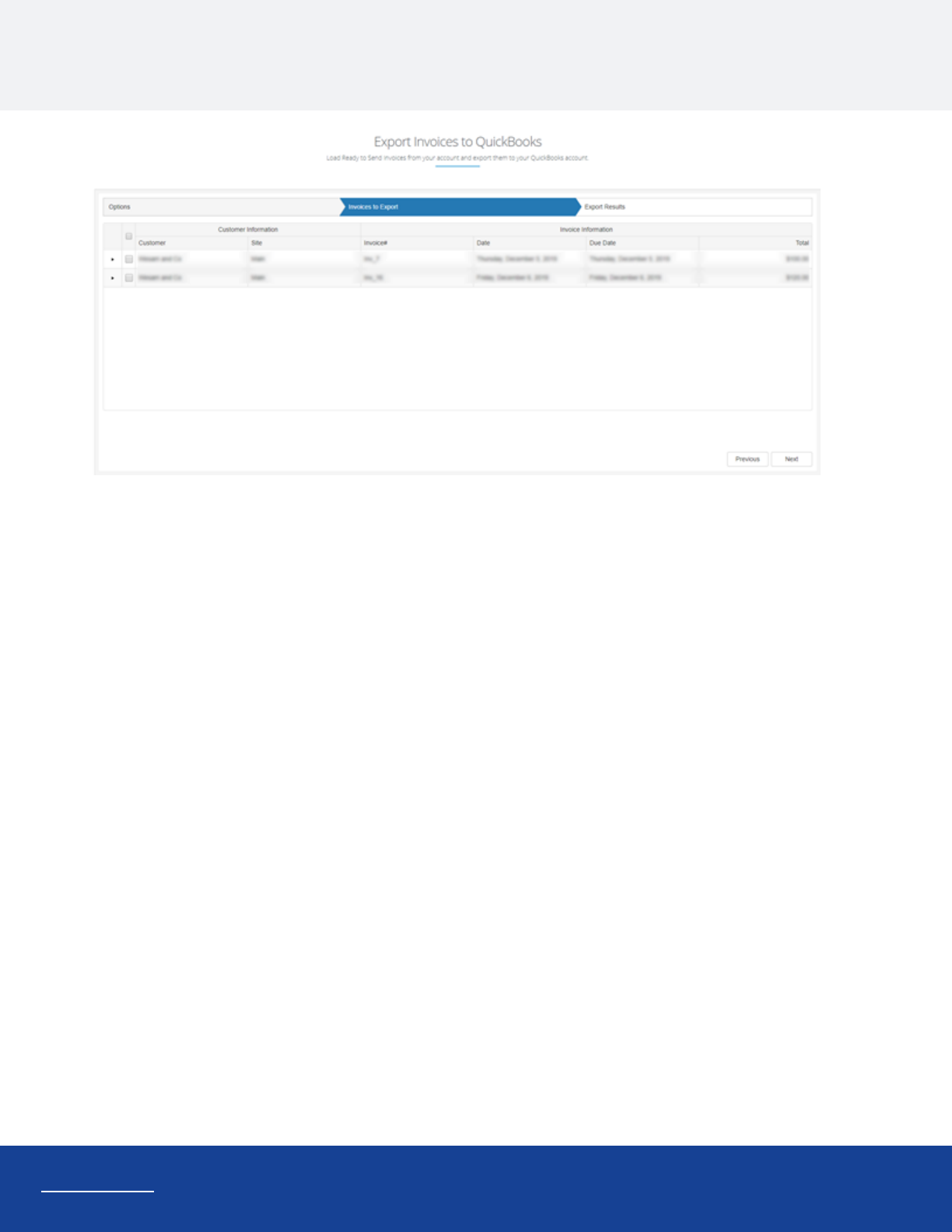

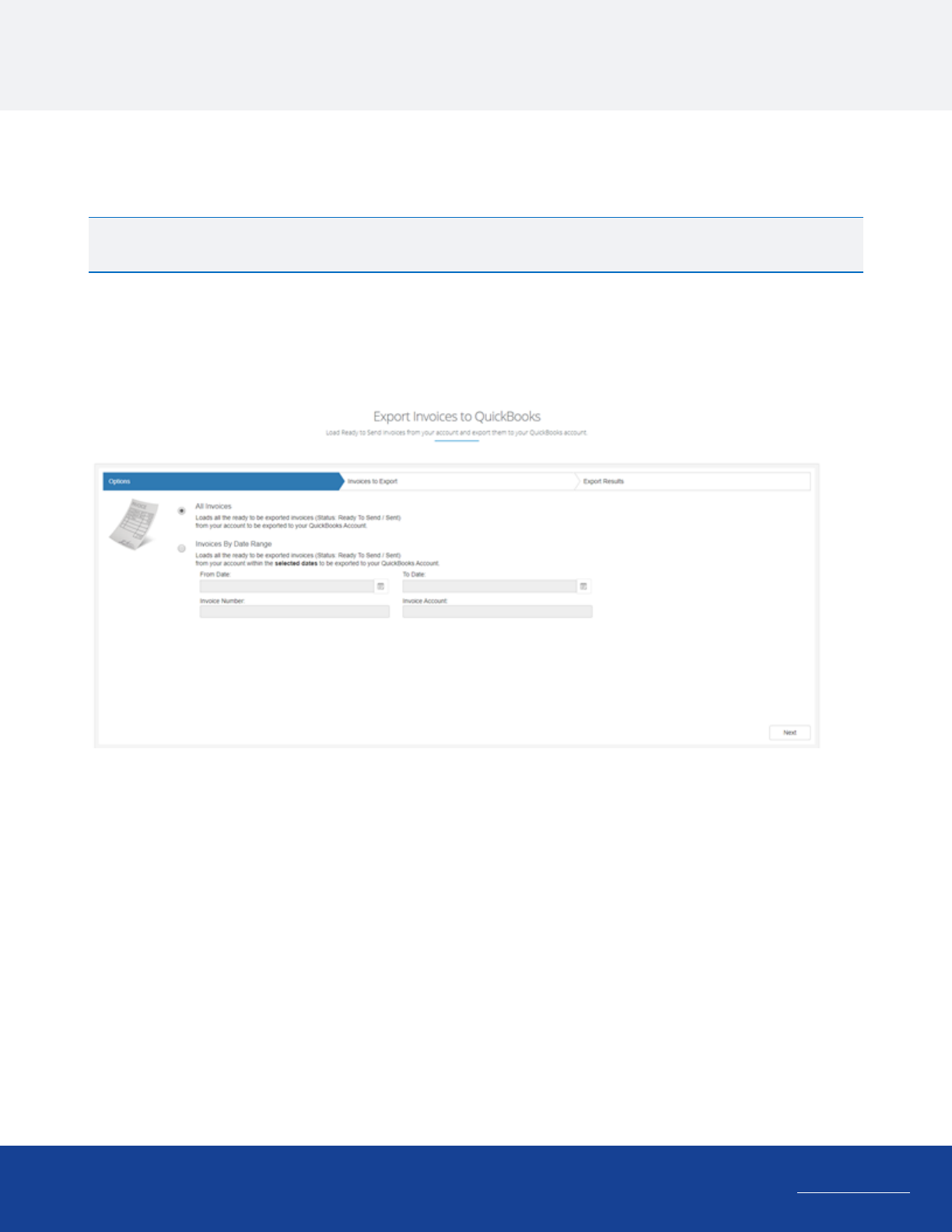

Export Invoices

This procedure configures the synchronization of invoice data between Quickbooks and BMS.

Note: Only after an invoice has been successfully generated and its status set to Ready to Send, Sent, Partially Paid,

or Fully Paid you can open the invoice in QuickBooks.

1 Click the Invoices Export page.

2 Search for your invoice by date range, invoice number , invoice account , or you can load all.

3 Select the invoices to send to Quickbooks.

4 Click Export selected Invoices to QuickBooks.

16

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

Export Invoices

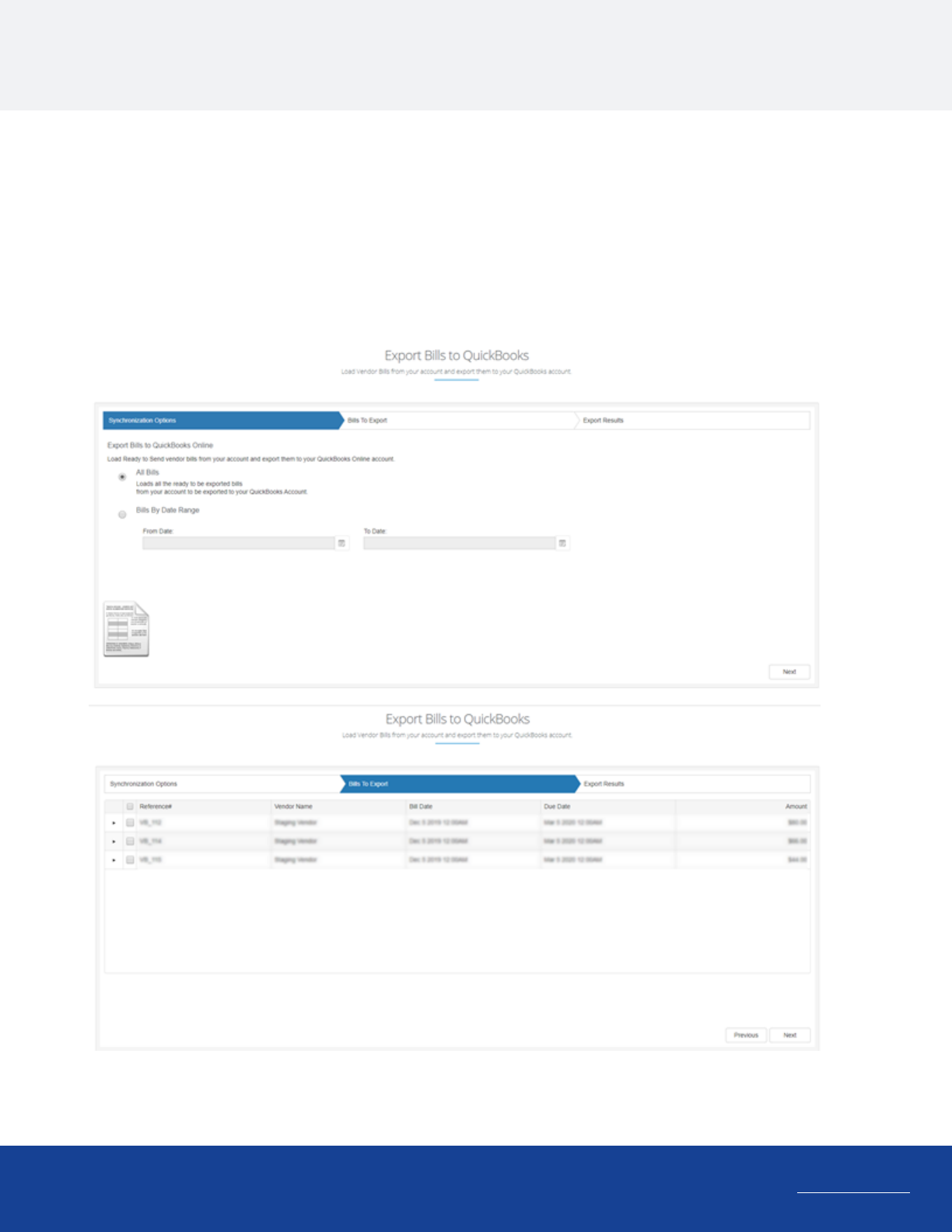

Export Bills

This procedure configures the synchronization of Bills data between Quickbooks and BMS.

1 Click the Bills Export page.

2 Search for your Bill by date range or you can load all.

3 Select the Bills to send to Quickbooks.

4 Click Export selected Bills to QuickBooks.

18

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

Export Bills

19

Import Payments

www.kaseya.com

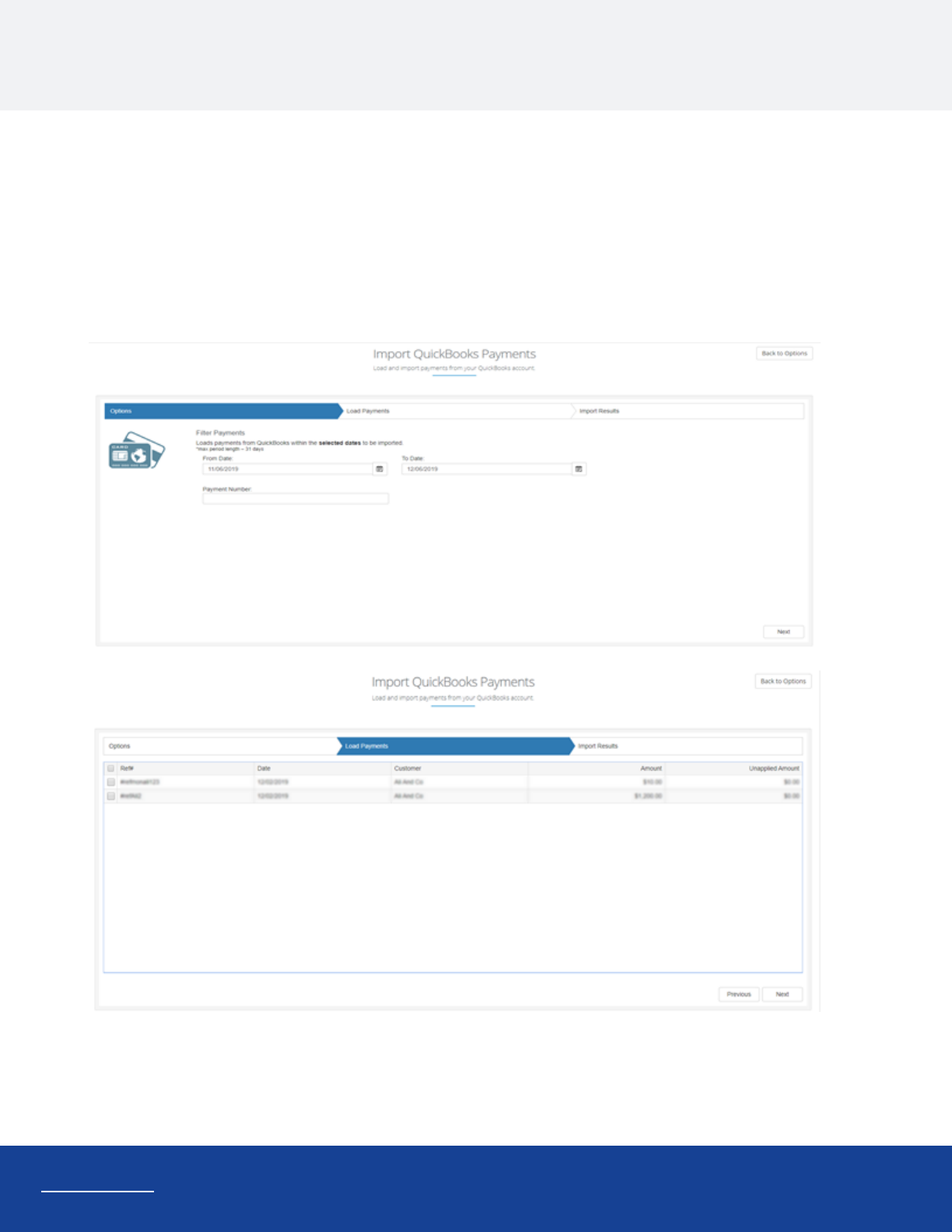

Import Payments

This procedure configures the synchronization of payment data between QuickBoks and BMS.

1 Click the Payments Page in the Menu tab.

2 Search for Payment By date range, payment number , or load them all.

3 Select the individual payments to import.

4 Review the list of imported payments on the Synchronization Results tab.

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

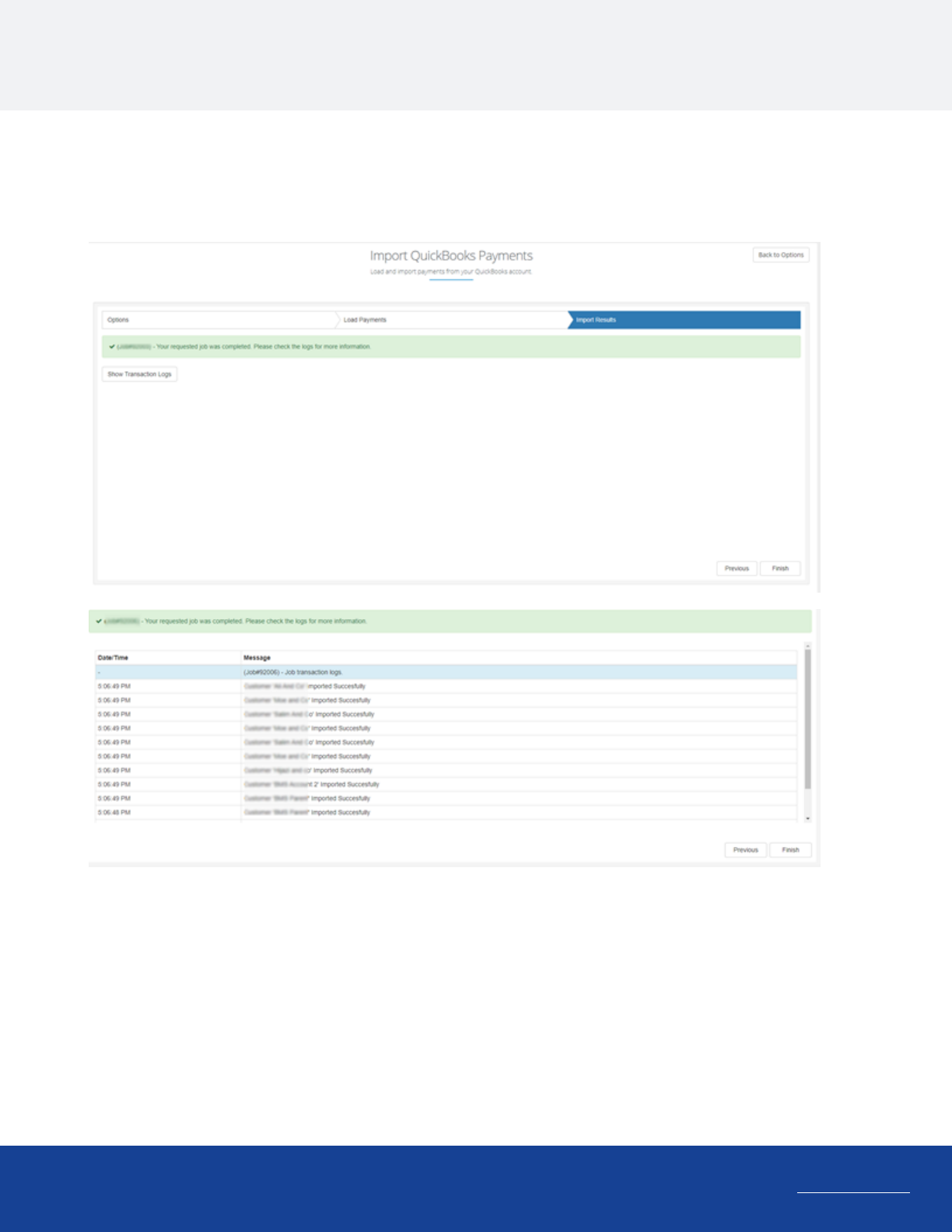

Logging

After any Import or Export procedure, you will get a final message describing the state of the status with all affected

items during this procedure. you can press show transaction Logs and check all affected items.

20

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

Logging

21

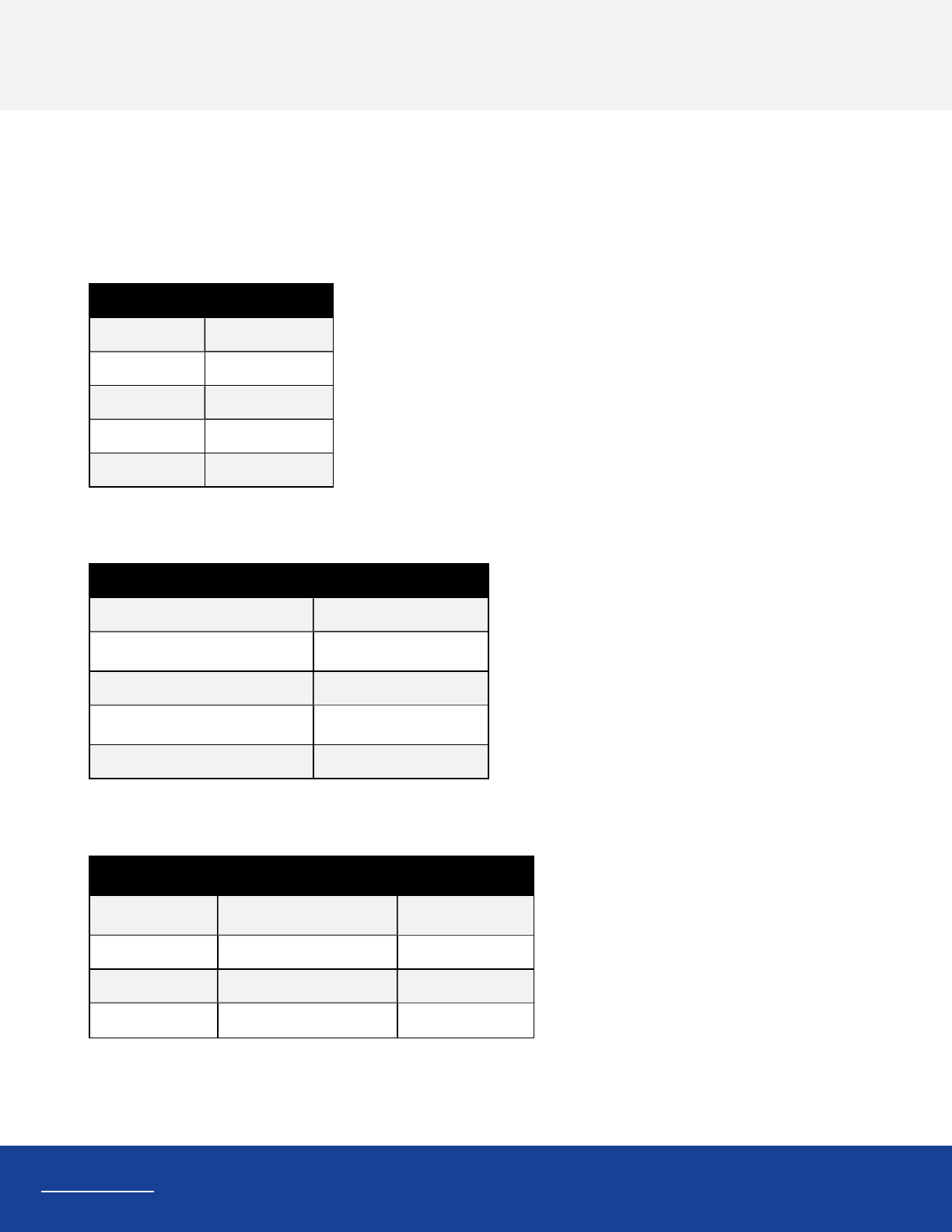

Data Mapping

www.kaseya.com

Data Mapping

The following tables describe the data mapping between BMS and QuickBooks Online.

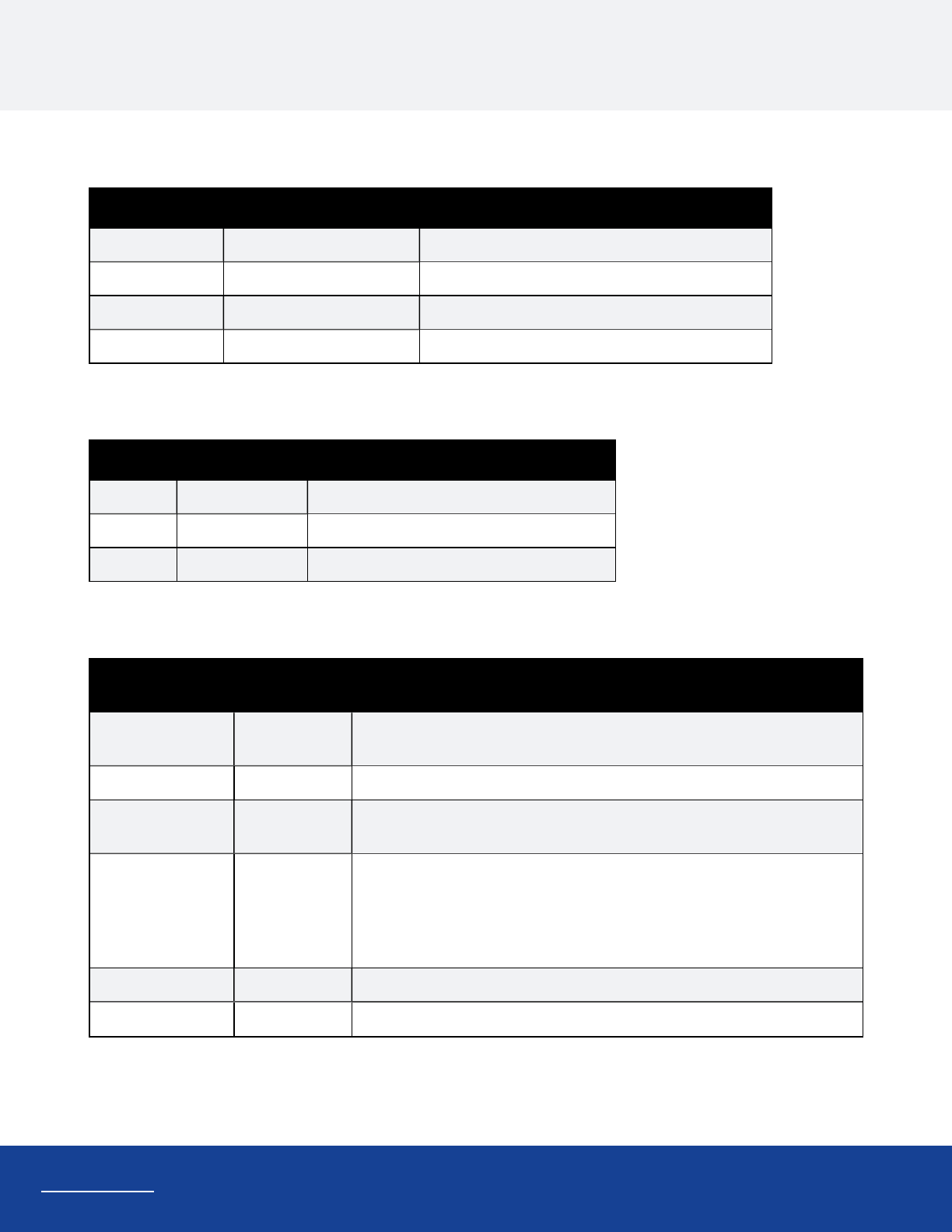

Account Code

QuickBooks entity: Account

BMS Fields QuickBooks Field

Account Code Field Number

Account Name Name

Description Description

Account Type Account Type

Parent Account Parent Account

Product

QuickBooks entity: Inventory/Non-Inventory Product

BMS Field QuickBooks Field

Product Name Name

Product Description

Description

Expense Account Expense Account

Income Account Income Account

Requires Procurement (Yes/No) Inventory/Non-Inventory

Work Type

QuickBooks entity: Service

BMS Field

QuickBooks Field Notes

Work Type Name

Name

Description Description on sales form

Income Account Income Account

Taxable Inclusive of tax non-US companies

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

Expense Account Expense account

Services

QuickBooks entity: Service

BMS Field

QuickBooks Field Notes

Service Name Name

Unit Price Sales price/rate

Description Description on sales form

Income Account Income Account

Taxable Inclusive of tax non-US companies

Expense Account Expense account

Expense Type

QuickBooks entity: Service

BMS Field

QuickBooks Field Notes

Name Name

Description Description on sales form

Income Account Income Account

Taxable Inclusive of tax non-US companies

Expense Account Expense account

Discount Type

QuickBooks entity: Service

BMS Field

QuickBooks Field Notes

Name Name

Description Description on sales form

Income Account Income Account

Taxable Inclusive of tax non-US companies

Expense Account Expense account

22

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

Data Mapping

23

Data Mapping

www.kaseya.com

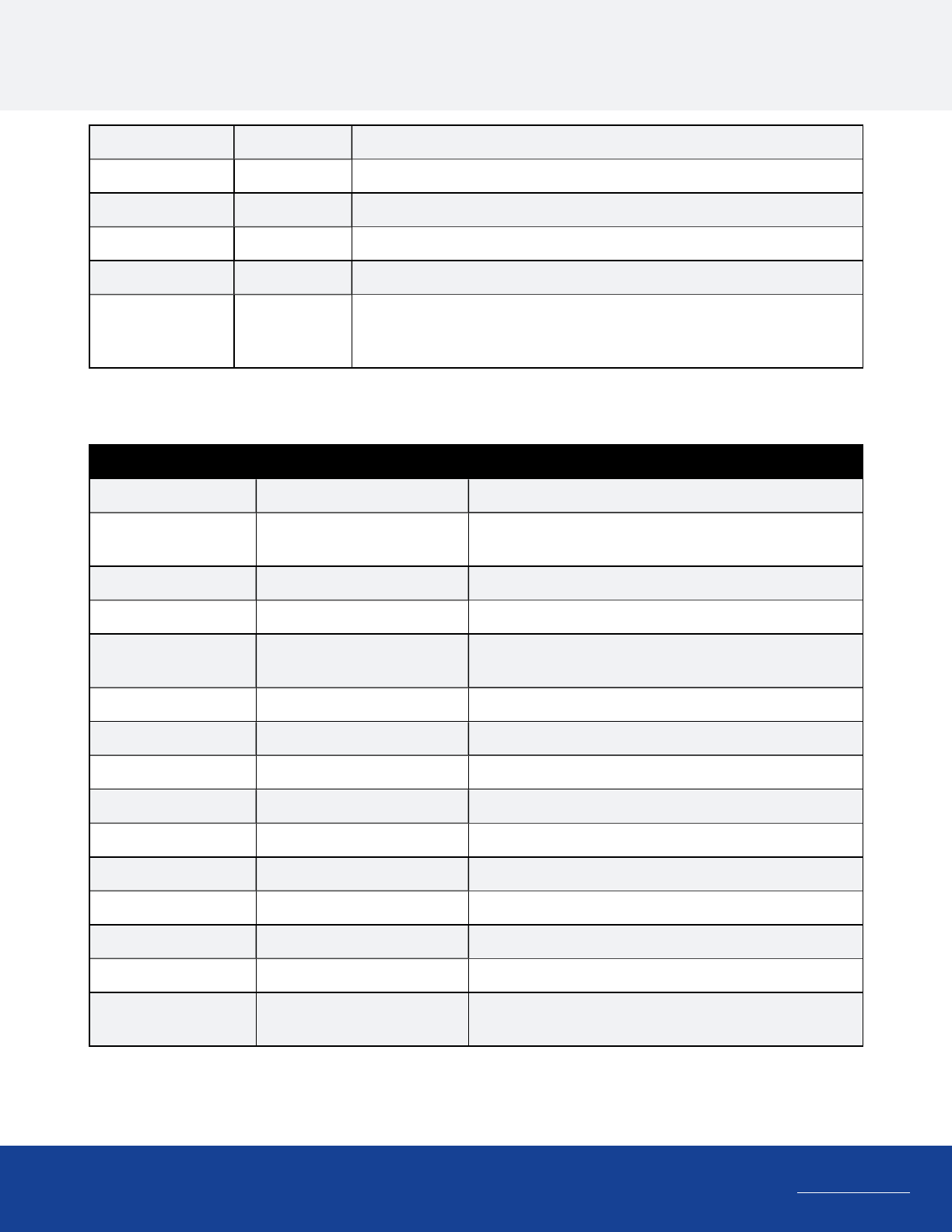

Tax Group

QuickBooks entity: Group rate

BMS Field

QuickBooks Field Notes

Name Group Rate

Tax Rate Sum of added sub tax items You can only ad 5 children using Tax rate dropdowns

Description Description

Related Tax Items Sub Tax Items Refer to the following Tax Item mapping

Tax Item

QuickBooks entity: Custom Tax

BMS Field

QuickBooks Field Notes

Name Group Rate

Tax Rate Rate You need to check "I collect this on sales"first

Tax Agency Tax Agency Name

Accounts

QuickBooks entity: Customer/Vendor

BMS Field QuickBooks

Field

Notes

Account Display name

as/Company

Website Website

Description Display name

as

Address Line 1 Street Line 1

• In case of customer : 1-QB billing address is mapped to BMS billing

address 2-QB Shipping address is mapped to S main address

• In case of vendor: 1-QB billing address is mapped to BMS billing

address 2- no shipping address , main site not filled

Address Line 2 Street Line 2

City City/Town

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

State State/Province

Post Code Postal code

Country Country

Phone Number Phone

Fax Number Fax

Email Address

(Billing Address

Info)

Email

Invoice

QuickBooks entity: Invoice

BMS Field QuickBooks Field Notes

Account Customer

P.O.Number Customer field, PO Number This field should be configured in company settings in

quick books as a custom field.

Invoice Date Invoice date

Due Date Due date

Notes Message on invoice/Message

on statement

Tax Item Sales Tax Where automatic sales tax calculation is disabled.

Total Price Total

Grand Total Balance due

Address Line 1 Billing Address

Address Line 2

City

State

Country

Post Code

Email Address(Billing

Address Info)

Customer email The first email address in BMS invoice

Invoice Item

24

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019

www.kaseya.com

Data Mapping

25

Data Mapping

www.kaseya.com

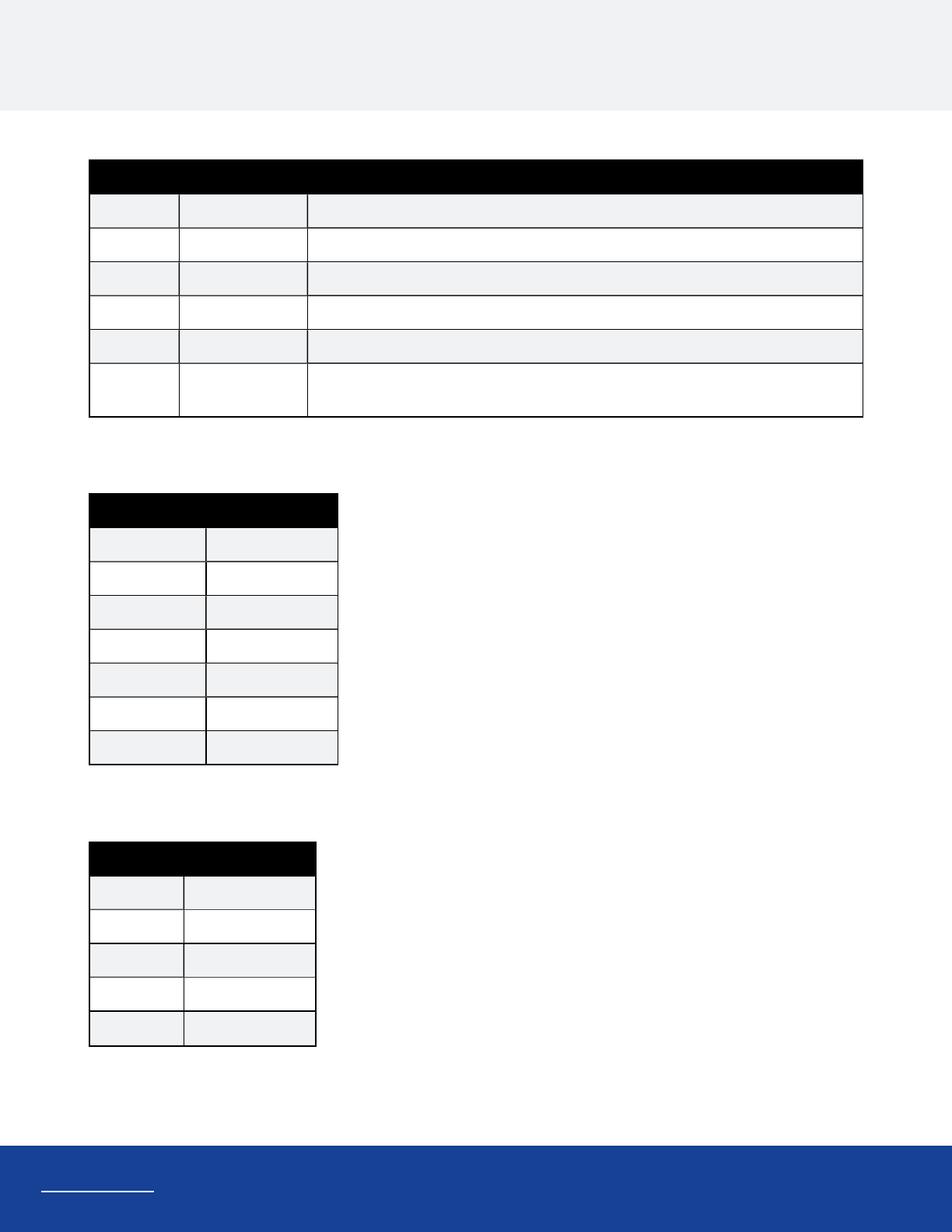

QuickBooks entity: Invoice Item

BMS Field QuickBooks Field Notes

Item Name Product/Service

Description Description

Quantity QTY

Unit Price Rate

Total Price Amount

Taxable Taxable (Yes/No) In non-US companies: the product/service tax will be the same as the invoice tax

item.

Payment

QuickBooks entity: Payment

BMS Field QuickBooks Field

Account Customer

Payment Date Payment Date

Reference # Reference no

Payment type Payment method

Memo Memo

Invoice Number Description

Amount Amount Received

Vendor Bill

QuickBooks entity: Expense

BMS Field QuickBooks Field

Vendor Vendor

Create On Bill Date

Due Date Due Date

Reference # Bill no.

Amount Balance Due

BMS-QuickBooks Online Integration

Release 4.0.28 | December 2019