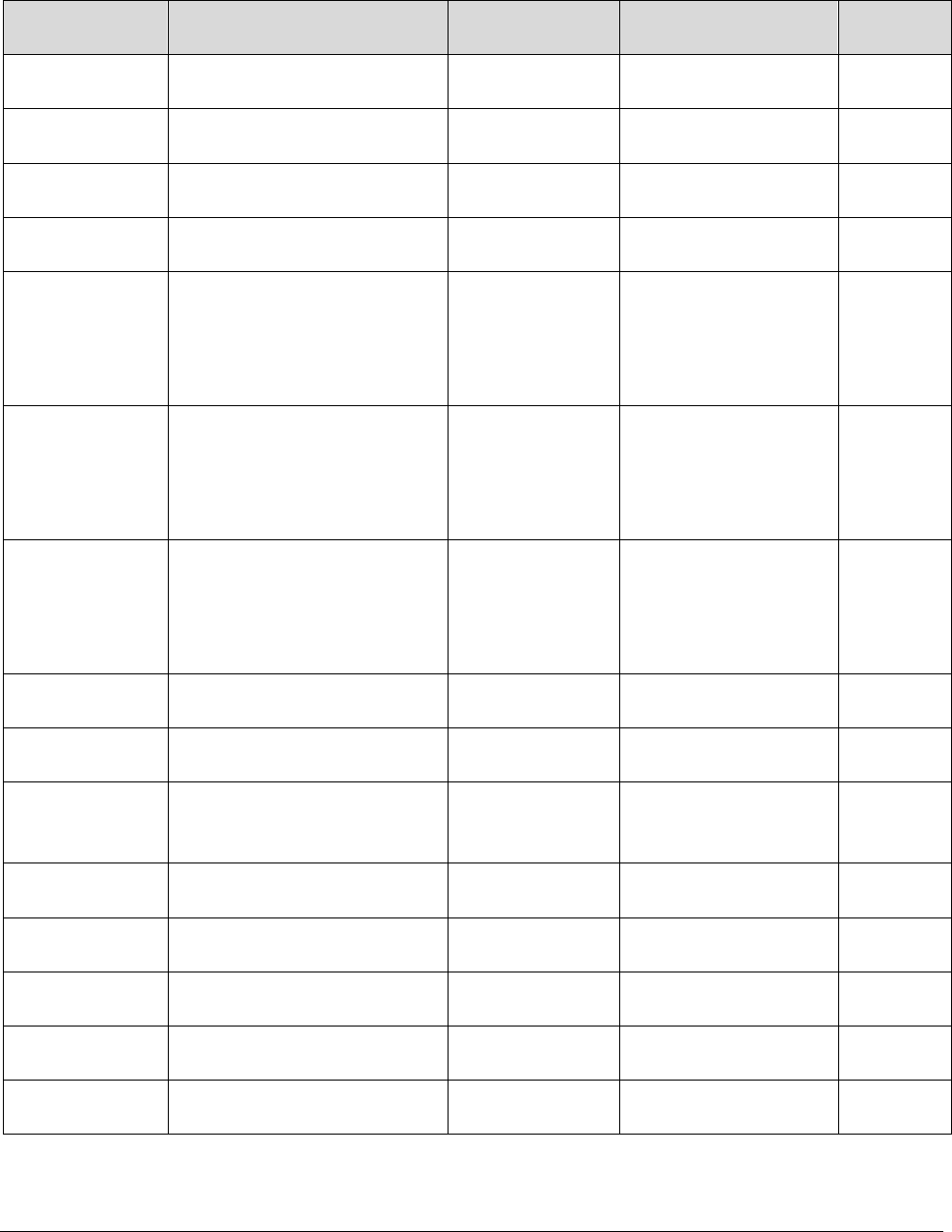

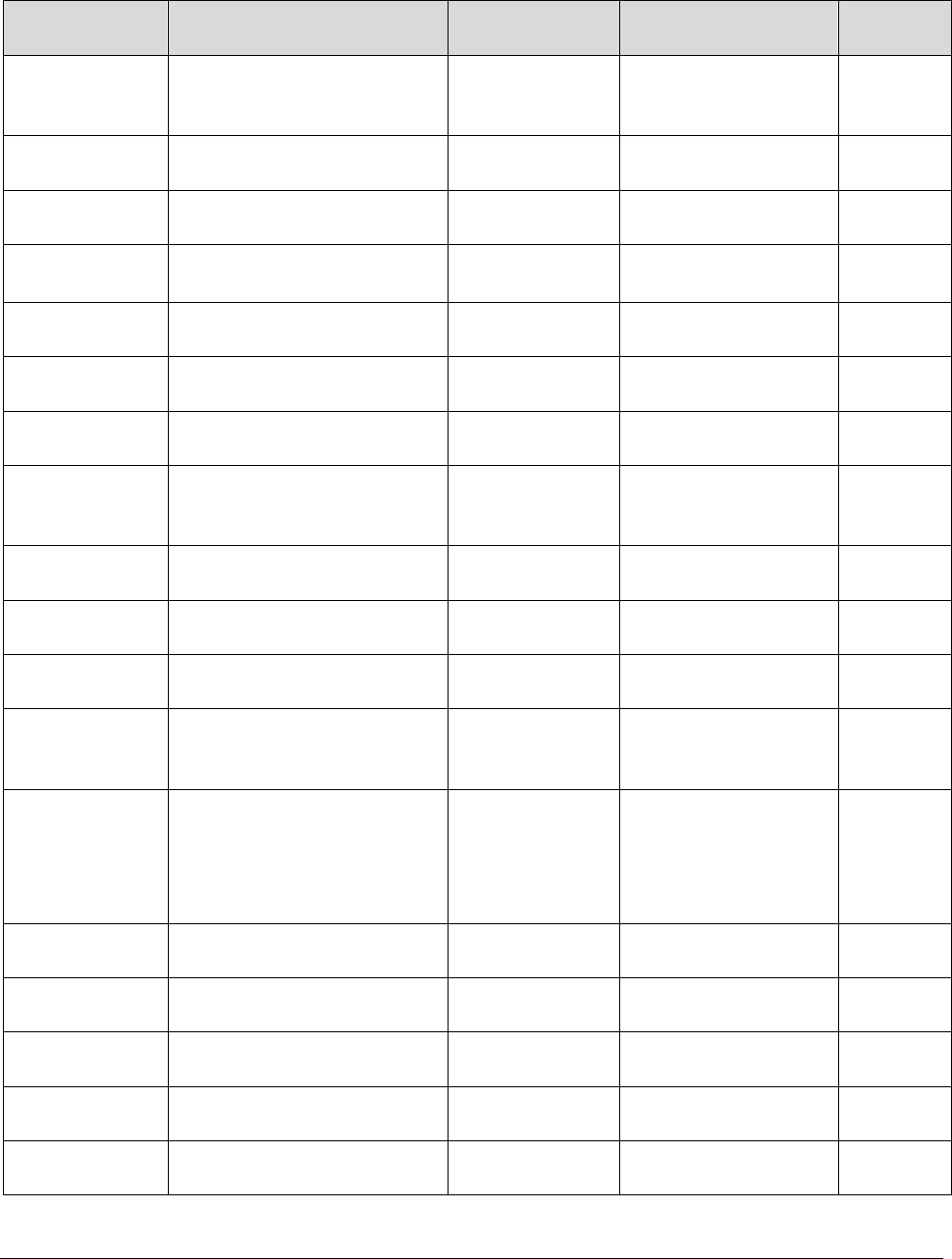

State of Nevada

Advantage – HR

Appendices – Deduction Code Crosswalk

Last Update 09/04/2019 Page 1 of 6

DEDUCTION

CODE

DESCRIPTION OF

DEDUCTION CODE

AMOUNT

PRE OR POST

TAX DEDUCTION

PAY

CYCLE

AFLAC

AMERICAN FAMILY

LIFE

AS

REQUESTED

POST TAX

2

ND

CH13

BANKRUPTCY

CHAPTER 13 TRUSTEE

AS

REQUESTED

POST TAX

EVERY

CH13F

BANKRUPTCY

CHAPTER 13 FEE

$3.00

POST TAX

EVERY

CHAPS

CHAPS

AS

REQUESTED

POST TAX

EVERY

CHSF1,

CHSF2,

CHSF3,

CHSF4,

CHSF5

CHILD SUPPORT FEE

$3.00

POST TAX

EVERY

CHSP1,

CHSP2,

CHSP3,

CHSP4,

CHSP5

CHILD SUPPORT

AS

REQUIRED

POST TAX

EVERY

CHST1

CHILD SUPPORT FEE-

TREASURER’S OFFICE

DOES NOT APPLY TO

OUT OF STATE CHILD

SUPPORT ORDERS

$2.00

POST TAX

EVERY

COL

COLONIAL

INSURANCE POST TAX

AS

REQUESTED

POST TAX

2

ND

COLP

**

COLONIAL

INSURANCE PRE TAX

AS

REQUESTED

PRE TAX

2

ND

CPOF

CORRECTIONAL

PEACE OFFICERS

FOUNDATION

AS

REQUESTED

POST TAX

2

ND

CSAVP

UPROMISE COLLEGE

SAVINGS PLAN

AS

REQUESTED

POST TAX

EVERY

CUSA

NEVADA

CORRECTIONS USA

AS

REQUESTED

POST TAX

1

ST

&

2

ND

DEAL

/CNTL1

DIR ENERGY

ASSISTANCE LOAN

AS

REQUESTED

POST TAX

1

ST

DEAL

/CNTRL

DIR ENERGY

ASSISTANCE LOAN

AS

REQUESTED

POST TAX

2

ND

DEPCR

**

DEPENDANT CARE

REIMBURSEMENT

AS

REQUESTED

PRE TAX

2

ND

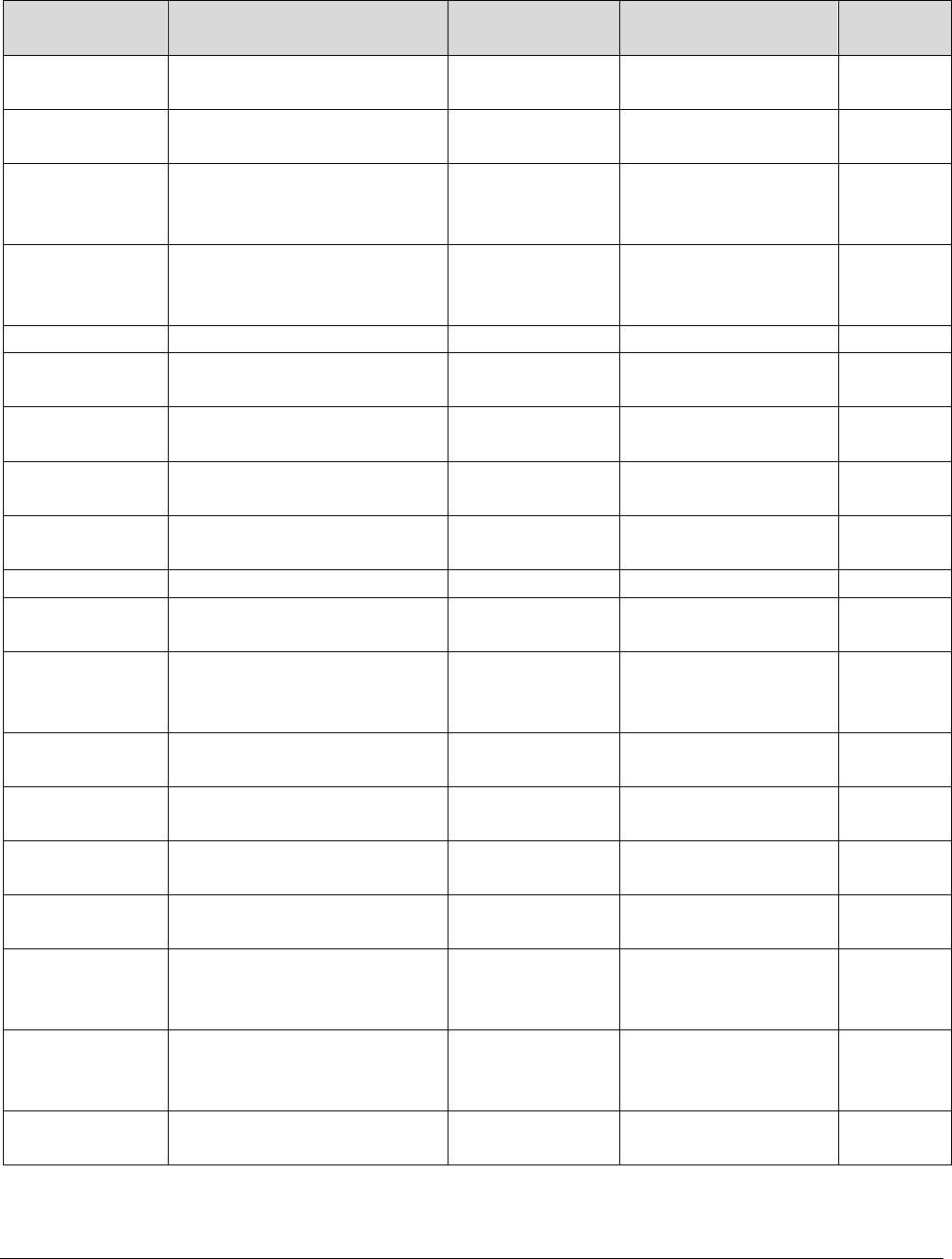

State of Nevada

Advantage – HR

Appendices – Deduction Code Crosswalk

Last Update 09/04/2019 Page 2 of 6

DEDUCTION

CODE

DESCRIPTION OF

DEDUCTION CODE

AMOUNT

PRE OR POST

TAX DEDUCTION

PAY

CYCLE

FLEXIBLE SPENDING

ACCOUNT

EFCU

ELKO FEDERAL

CREDIT UNION

AS

REQUESTED

POST TAX

EVERY

FGDEP

FISH & GAME

CLEANING DEPOSIT

AS

REQUESTED

POST TAX

UPON

REQUEST

FROM

NDOW

FGPWR

FISH & GAME

UTILITIES

AS

REQUESTED

POST TAX

UPON

REQUEST

FROM

NDOW

FGRNT

FISH & GAME RENTS

$50.00

POST TAX

EVERY

FIT

FEDERAL INCOME TAX

- MARGNL TABLE

AS

REQUESTED

N/A

EVERY

FITAD

FEDERAL INCOME TAX

- ADDED AMOUNT

AS

REQUESTED

N/A

EVERY

FSAF

FLEXIBLE SPENDING

ACCOUNT FEE

$3.25

POST TAX

2

ND

GARN

GARNISHMENT

AS

REQUIRED

POST TAX

EVERY

GARNF

GARNISHMENT FEE

$3.00

POST TAX

EVERY

GNCU

GREATER NV CREDIT

UNION

AS

REQUESTED

POST TAX

EVERY

HADJ

HEALTH INS ADJ

DEPENDANT POST

TAX

AS

REQUESTED

POST TAX

2

ND

HADJP

**

HEALTH INS ADJ

DEPENDANT PRE TAX

AS

REQUESTED

PRE TAX

2

ND

HREF

HEALTH INS REFUND

POST TAX

AS

REQUESTED

POST TAX

2

ND

HREFP

**

HEALTH INS REFUND

PRE TAX

AS

REQUESTED

PRE TAX

2

ND

HSAP

**

HEALTH SAVINGS

ACCOUNT PRE TAX

AS

REQUESTED

PRE TAX

2

ND

HTHD

HEALTH INS

DEPENDANT POST

TAX

AS

REQUESTED

POST TAX

1

ST

AND/OR

2

ND

HTHDP

**

HEALTH INS

DEPENDANT PRE TAX

AS

REQUESTED

PRE TAX

1

ST

AND/OR

2

ND

LEVY

IRS LEVY

AS

REQUIRED

POST TAX

EVERY

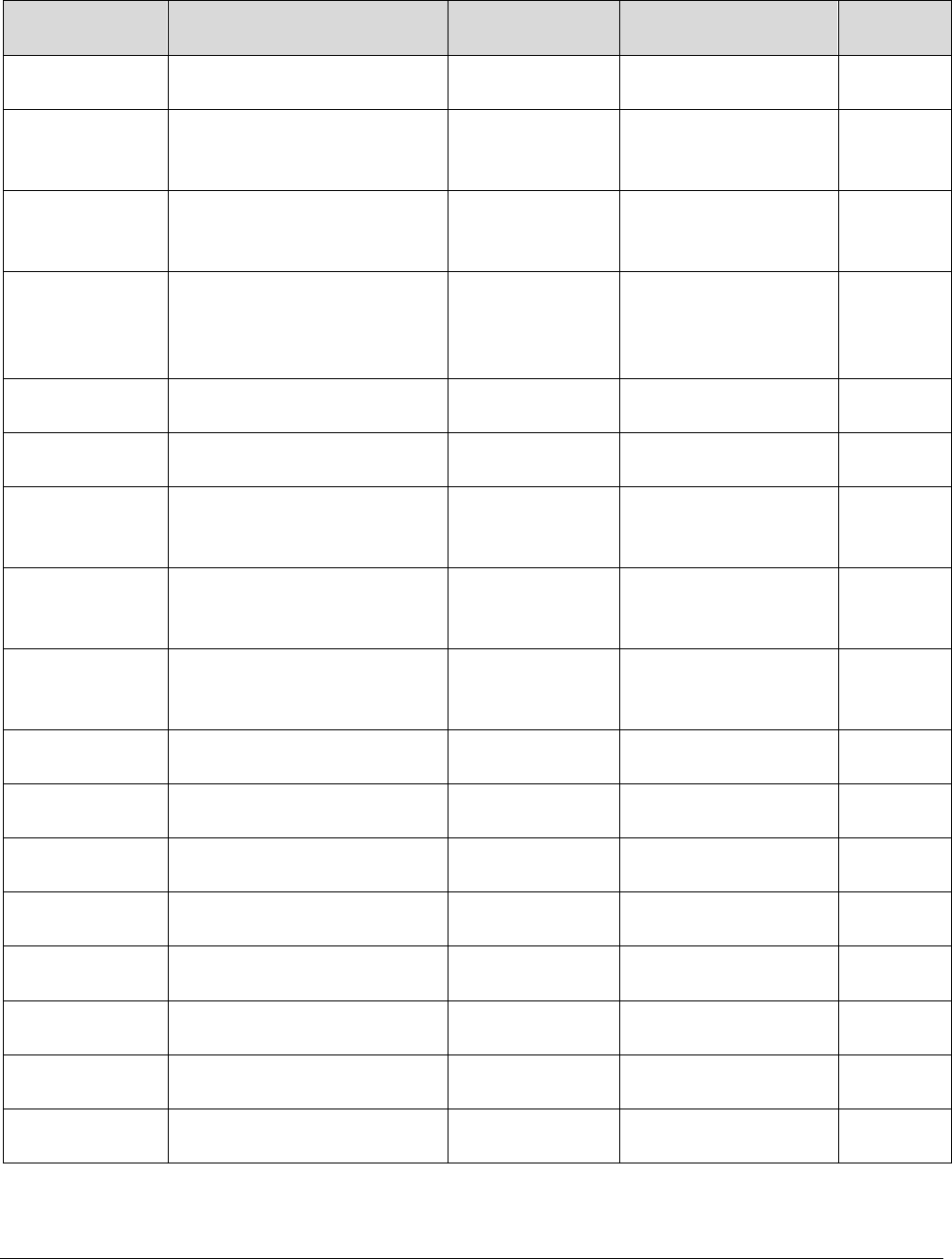

State of Nevada

Advantage – HR

Appendices – Deduction Code Crosswalk

Last Update 09/04/2019 Page 3 of 6

DEDUCTION

CODE

DESCRIPTION OF

DEDUCTION CODE

AMOUNT

PRE OR POST

TAX DEDUCTION

PAY

CYCLE

LMINS

LIBERTY MUTUAL

INSURANCE

AS

REQUESTED

POST TAX

2

ND

MEDEE

MEDICARE EMPLOYEE

1.45% OF

GROSS

WAGES

POST TAX

EVERY

MEDER

MEDICARE EMPLOYER

1.45% OF

GROSS

WAGES

POST TAX

EVERY

MEDRM

**

MEDICAL

REIMBURSEMENT

FLEXIBLE SPENDING

ACCOUNT

AS

REQUESTED

PRE TAX

2

ND

NETAD

NET ADJUSTMENT

AS

REQUESTED

POST TAX

AS

NEEDED

NTRPY

NET REPAYMENT

AS

REQUESTED

POST TAX

AS

NEEDED

NCA

NEVADA

CORRECTIONS

ASSOCIATION

$34.00

POST TAX

2

ND

NCAA

NEVADA

CORRECTIONS

ASSOC/AFLAC

AS

REQUESTED

POST TAX

2

ND

NHP

NEVADA HIGHWAY

PATROLL

ASSOCIATION

$25.00

POST TAX

EVERY

NRENT

NDOT RENTS

AS

REQUESTED

POST TAX

EVERY

PEREE

RETIREMENT ADJ

EE/ER EMPLOYEE

AS

REQUESTED

POST TAX

AS

NEEDED

PERER

RETIREMENT ADJ

EE/ER EMPLOYER

AS

REQUESTED

AGENCY FRINGE

AS

NEEDED

PEREP

RETIREMENT ADJ

ERPD EMPLOYER

AS

REQUESTED

AGENCY FRINGE

AS

NEEDED

PER1E

RETIREMENT EE/ER-

EMPLOYEE

SET

PERCENTAGE

POST TAX

EVERY

PER1R

RETIREMENT EE/ER

EMPLOYER

SET

PERCENTAGE

AGENCY FRINGE

EVERY

PER2E

RETIREMENT P/F

EE/ER - EMPLOYEE

SET

PERCENTAGE

POST TAX

EVERY

PER2R

RETIREMENT P/R

EE/ER-EMPLOYER

SET

PERCENTAGE

AGENCY FRINGE

EVERY

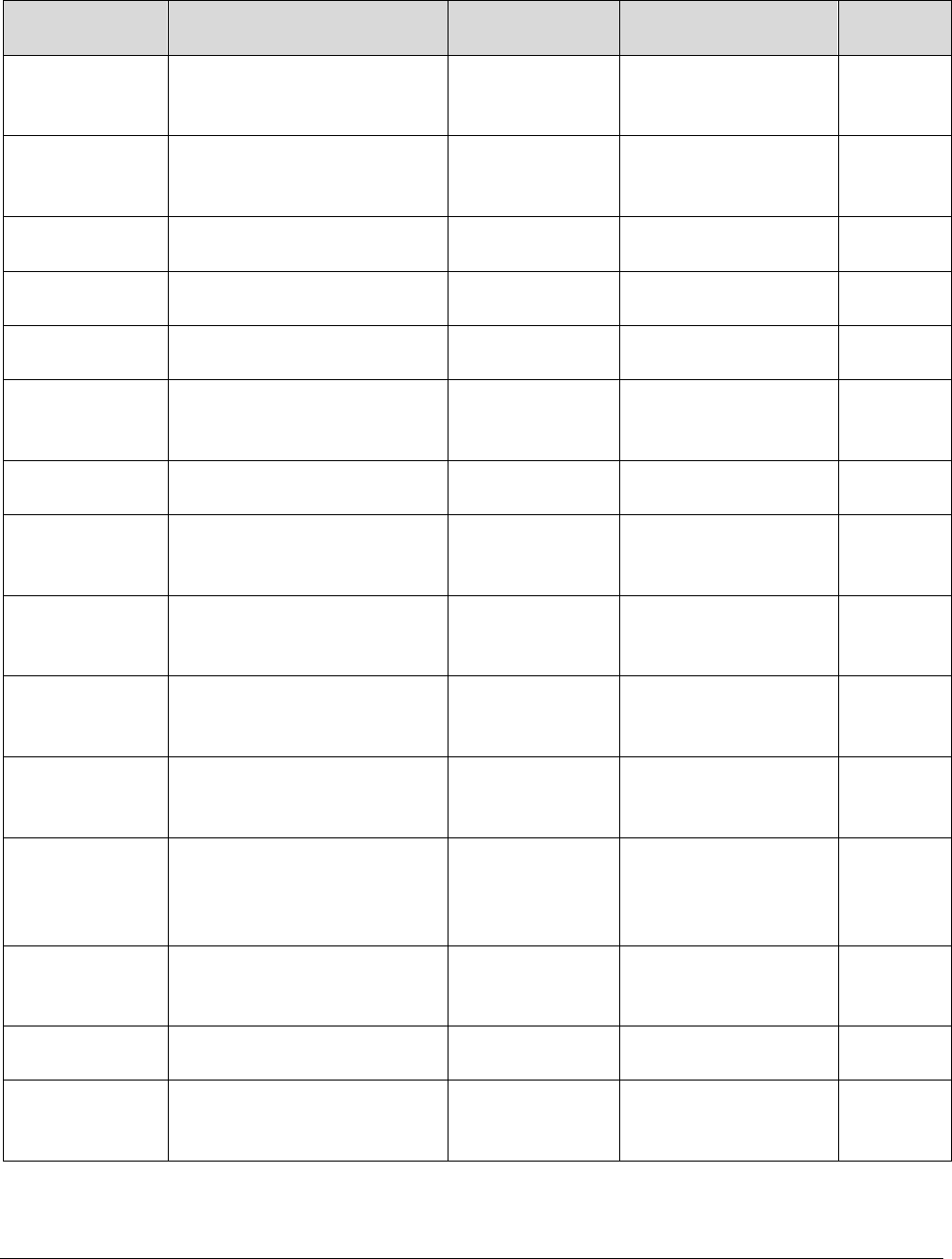

State of Nevada

Advantage – HR

Appendices – Deduction Code Crosswalk

Last Update 09/04/2019 Page 4 of 6

DEDUCTION

CODE

DESCRIPTION OF

DEDUCTION CODE

AMOUNT

PRE OR POST

TAX DEDUCTION

PAY

CYCLE

PER3E

RETIREMENT

JUDICIAL EE/ER

EMPLOYEE

SET

PERCENTAGE

POST TAX

EVERY

PER3R

RETIREMENT

JUDICIAL EE/ER

EMPLOYER

SET

PERCENTAGE

AGENCY FRINGE

EVERY

PER7R

RETIREMENT

JUDICIAL EMPLOYER

SET

PERCENTAGE

AGENCY FRINGE

EVERY

PER8R

RETIREMENT ER

EMPLOYER

SET

PERCENTAGE

AGENCY FRINGE

EVERY

PER9R

RETIREMENT P/F ER -

EMPLOYER

SET

PERCENTAGE

AGENCY FRINGE

EVERY

RETR1,

RETR2,

RETR3

RETIREMENT

BUYBACK/PURCHASE

OF SERVICE

AS

REQUESTED

POST TAX

EVERY

SLOAN

STUDENT LOAN

AS

REQUIRED

POST TAX

EVERY

SNEAA

STATE OF NV

EMPLOYEES

ASSOC/AFLAC

AS

REQUESTED

POST TAX

2

ND

SNEAC

STATE OF NV

EMPLOYEES

ASSOC/CASUALTY

AS

REQUESTED

POST TAX

2

ND

SNEAD

STATE OF NV

EMPLOYEES

ASSOC/DUES

AS

REQUESTED

POST TAX

EVERY

SNEAL

STATE OF NV

EMPLOYEES

ASSOC/LIFE

AS

REQUESTED

POST TAX

2

ND

SNEAP

STATE OF NV

EMPLOYEES

ASSOC/PEOPLE

COMM

AS

REQUESTED

POST TAX

EVERY

SNEAV

STATE OF NV

EMPLOYEES

ASSOC/VISION

AS

REQUESTED

POST TAX

2

ND

SPOC

STATE OF NV PEACE

OFFICERS ASSOC

$42.00

POST TAX

2

ND

SSEE

SOCIAL SECURITY

EMPLOYEE

6.2% OF

GROSS

WAGES

POST TAX

EVERY

State of Nevada

Advantage – HR

Appendices – Deduction Code Crosswalk

Last Update 09/04/2019 Page 5 of 6

DEDUCTION

CODE

DESCRIPTION OF

DEDUCTION CODE

AMOUNT

PRE OR POST

TAX DEDUCTION

PAY

CYCLE

SSER

SOCIAL SECURITY

EMPLOYER

6.2% OF

GROSS

WAGES

POST TAX

EVERY

STAND

STANDARD GROUP

TERM LIFE INS

AS

REQUESTED

POST TAX

2

ND

TUIT

NEVADA PREPAID

TUITION PROGRAM

AS

REQUESTED

POST TAX

2

ND

UNUM

UNUM VOLUNTARY

LIFE

AS

REQUESTED

POST TAX

2

ND

UNUMC

UNUM LONG TERM

CARE

AS

REQUESTED

POST TAX

2

ND

UWNO

UNITED WAY NORTH

AS

REQUESTED

POST TAX

EVERY

UWSO

UNITED WAY SOUTH

AS

REQUESTED

POST TAX

EVERY

VALIC

**

VARIABLE ANNUITY

LIFE INS 403B

DEFERRED COMP

AS

REQUESTED

PRE TAX

EVERY

VBEN

VOLUNTARY BENEFIT

– CORESTREAM

AS

REQUESTED

POST TAX

1

ST

&

2

ND

VBENP

VOLUNTARY BENEFIT

– CORESTREAM

AS

REQUESTED

PRE TAX

1

ST

&

2

ND

VOYA/C50

**

VOYA DEFERRED

COMP AGE 50+

AS

REQUESTED

PRE TAX

EVERY

VOYA

/CCHUP

**

VOYA DEFERRED

COMP CATCHUP

AS

REQUESTED

PRE TAX

EVERY

VOYAF

/CFALT

**

VOYA DEFERRED

COMP FICA

ALTERNATVE

AS

REQUIRED

7.5% OF

GROSS

WAGES

PRE TAX

EVERY

VOYA/CREG

**

VOYA REGULAR

DEFERRED COMP

AS

REQUESTED

PRE TAX

EVERY

VOYAR/C50

VOYA ROTH AGE 50+

AS

REQUESTED

POST TAX

EVERY

VOYAR

/CCHUP

VOYA ROTH CATCHUP

AS

REQUESTED

POST TAX

EVERY

VOYAR

/CREG

VOYA ROTH REGULAR

DEFERRED COMP

AS

REQUESTED

POST TAX

EVERY

WEST

WESTERN INSURANCE

SPECIALTIES/LIFE

AS

REQUESTED

POST TAX

2

ND

State of Nevada

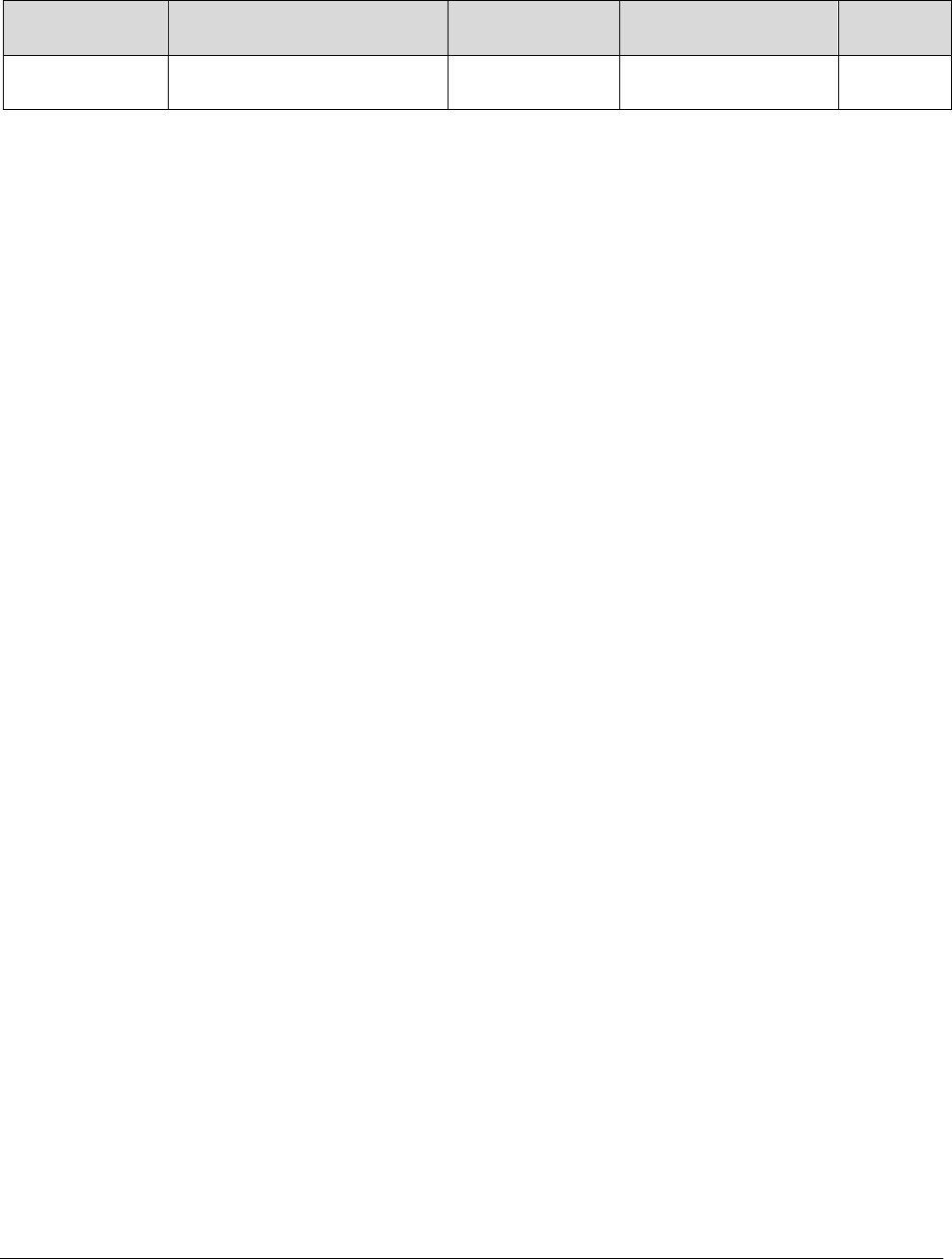

Advantage – HR

Appendices – Deduction Code Crosswalk

Last Update 09/04/2019 Page 6 of 6

DEDUCTION

CODE

DESCRIPTION OF

DEDUCTION CODE

AMOUNT

PRE OR POST

TAX DEDUCTION

PAY

CYCLE

WSCU

WESTSTAR CREDIT

UNION

AS

REQUESTED

POST TAX

EVERY

** Pre-tax can only be changed or cancelled during open enrollment or change in family

status. The exception being following codes: VALIC & VOYA: Deferred compensation can

be cancelled at any time.

Health Insurance premium deductions (HTHD & HTHDP) may be split between the 1

st

& 2

nd

checks of the month. Employees’ control the premium split through NEATS.

For the cancellation of SNEA membership, the cancellation must be submitted directly to

SNEA/AFSCME Local 4041 for approval to cancel.

Cancellation for any other unions are subject to approval by the union.

For the cancellation of voluntary deductions, the employee needs to complete a

Cancellation of Deduction form(s) and should notify the vendor entity of the deduction being

cancelled.