Introduction to Foreign Exchange

Education Module: 1

Dated July 2002

Part 1 – Spot Market

Definition of a Foreign Exchange Rate

A foreign exchange rate is the price at which one currency can be bought or sold, and which is

expressed in terms of another currency. All quotations are made up of two currencies: the base

currency and the terms currency. These form what is known as the currency pair.

One unit of the base currency is equal to x units of the terms currency.

Example:

USD/JPY 120.50 means 1 USD = 120.50 JPY

Direct and Indirect Quotations

Although all currencies are quoted against the USD, there are two different ways in which this is

done.

Direct Quotations

The most common method of quoting is where the USD is the base currency, as in the preceding

example.

Indirect Quotations

The USD is the terms currency and the other currency is the base.

Example:

1GBP = 1.5700 USD

As a general rule, all Commonwealth countries are indirect currencies (with some exceptions, notably

Canada). This convention originates prior to the decimal system, where these currencies were quoted

as pounds, shillings and pence.

Also note that the Euro (EUR) is an indirect currency.

Two-Way Quotes

The price maker quotes currencies in terms of the base currency. Both the bid, where the price

maker buys the base currency and the offer, where the price maker sells the base currency, are

quoted.

Example:

AUD/USD 0.5500/0.5505

At 0.5500 the bank, as price maker, will buy AUD and sell USD. Conversely, at 0.5505,

the bank will sell AUD and buy USD.

Spread

The difference between the bid and the offer of a quote is known as the ‘spread’. The spread will be

determined by the market, and will fluctuate according to the market conditions at the time. Wider

spreads usually apply to small transactions, less liquid currencies and during periods of volatility.

Narrower spreads will apply during ‘normal market conditions’ on liquid currencies and on deals for

market parcels.

Market Parcel

A market parcel represents the market-accepted amount for a regular trade used in the inter-bank

market. This amount will vary according to the currency pair being traded.

Points

A point is the final decimal place in a quotation. It can also be referred to as a ‘pip’. In the preceding

example, this is 0.0001.

The number of points quoted depends on the number of units involved in the quote. If there are less

than 10 units, market convention is to round the quote to four decimal places. For example,

NZD/USD is quoted as 0.5310.

If there are more than 10 units, the market convention is to round to two decimal places. For

example, USD/JPY is quoted as 120.30. However, there are some notable exceptions. For example,

THB, INR and PHP are quoted to three decimal places, whilst IDR is expressed as a whole number.

How Are Quotes Determined?

The quotes are determined by the supply and demand for the particular currency. However, bear in

mind that such things as rumour, intervention, expectation and the use of technical analysis can

artificially stimulate demand. Supply and demand is represented in the market by the buying and

selling actions of the following four main groups:

1) Market makers

2) Central banks

3) End-users

4) Brokers.

Market makers include domestic and international banks dealing with one another in the inter-bank

market, either on their own behalf or for their corporate clients. From time to time, central banks are

also involved, as they try to support or reduce their currency’s value or to manage their foreign

currency reserves. The third group – end users – can include banks or corporate clients. Brokers, the

fourth group, can act as intermediaries between market makers.

As the foreign exchange market is dynamic, a quote is only valid for a limited time. After a limited

period of a couple of seconds, or if your dealer advises you by calling ‘off’ the price, a quote will no

longer be valid. Therefore, you must ask for the quote again. Quotes need to be accepted in a timely

and concise manner to prevent confusion.

When quoting a rate, rather than quoting the whole price (e.g. ‘1.5720/25’ for GBP/USD), the dealer

may only quote the last two numbers, which are known as ‘significant figures’. The exchange rate will

be quoted to as ‘20/25’.

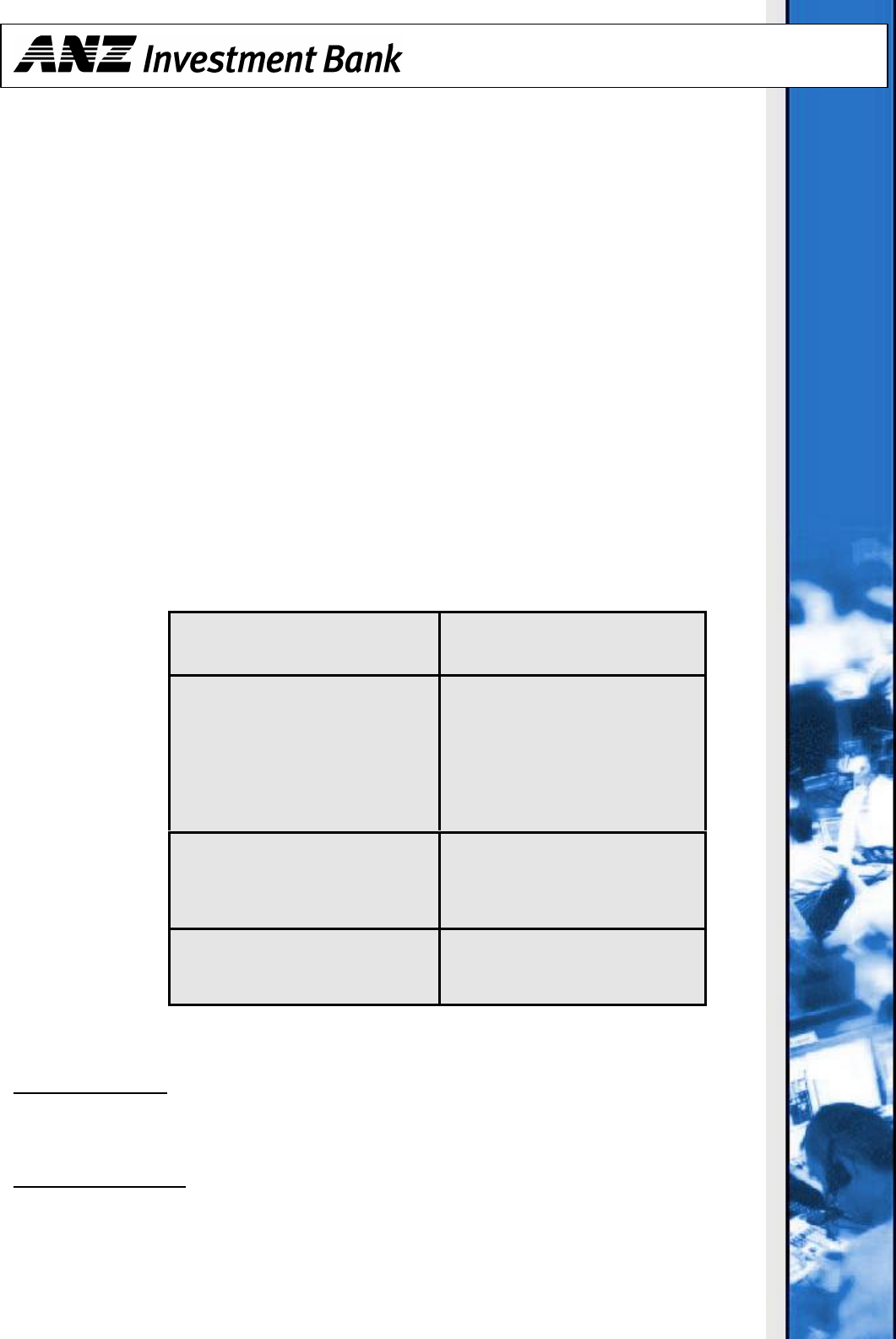

DIRECT

CURRENCY

INDIRECT

CURRENCY

eg. USD/JPY eg. EUR/USD

Bank buys USD/Bank sells USD Bank buys EUR/Bank sells EUR

Bank sells JPY/Bank buys JPY Bank sells USD/Bank buys USD

Payables (Importer): An importer of goods will normally be invoiced in a foreign currency. They

will need to buy the foreign currency to pay for the goods.

Receivables (Exporter): An exporter may receive payment for goods they have sold in a foreign

currency. They will need to sell the foreign currency and buy the domestic

currency.

Converting Currency Amounts

If the terms currency amount is known, the exchange rate is divided into this figure to provide the

base currency equivalent.

Example:

GBP/USD 1.6000/05

A customer wishing to buy USD1mio against GBP needs to pay GBP625,000.

Conversely, if the base currency amount is known, the exchange rate is multiplied by the figure.

Example:

USD/JPY 121.50/55

A customer wishing to buy JPY to the value of USD1 mio would receive

JPY121,500,000.

In determining the amount the customer is to pay or receive, the amount is always rounded to the

lowest currency unit. This is normally two decimal places, except for JPY; this does not have decimals

and is rounded to the nearest whole number.

Cross Rates

A cross rate is an exchange rate in which neither of the two currencies quoted is the USD. For

example, GBP/JPY.

Calculating a cross rate is simply a matter of multiplying or dividing two currency pairs, depending on

whether the other currency is Direct Quotations or Indirect Quotations.

Crossing an Indirect and a Direct Currency

Rule: Multiply the same sides.

Example:

USD/JPY 120.25/120.30

GBP/USD 1.5700/1.5705

Referring to the previous table, the preceding quotes read:

Bank sells JPY at 120.25 and buys JPY at 120.30, and

Bank buys GBP at 1.5700 and sells GBP at 1.5705.

To determine the GBP/JPY cross rate:

STEP 1: Bank buys GBP and sells JPY

1.5700 x 120.25 = 188.79

STEP 2: Bank sells GBP and buys JPY

1.5705 x 120.30 = 188.93

Therefore the GBP/JPY cross rate is 188.79/93, where GBP is the base currency, and

JPY is the terms currency.

Crossing Two Indirect Currencies

Rule: Divide opposite sides.

First decide how you want to express the cross rate (i.e. which currency is the base and which is the

terms).

1) To determine the bid, divide the terms currency offer into the base currency bid.

2) To determine the offer, divide the terms currency bid into the base currency offer.

Example:

AUD/USD 0.5450/55

EUR/USD 0.9810/15

Referring to the table, the preceding quotes read:

Bank buys AUD at 0.5450 and sells AUD at 0.5455, and

Bank buys EUR at 0.9810 and sells EUR at 0.9815.

To determine the AUD/EUR cross rate:

STEP 1: Bank buys AUD and sells EUR

0.5450 ÷ 0.9815 = 0.5553

STEP 2: Bank sells AUD and buys EUR

0.5455 ÷ 0.9810 = 0.5561

Therefore the AUD/EUR cross is 0.5553/61, where AUD is the base currency, and EUR is

the terms currency.

Crossing Two Direct Currencies

Rule: Divide opposite sides.

Again, decide how you want to express the cross rate.

1) To determine the bid, divide the base currency offer into the terms currency bid.

2) To determine the offer, divide the base currency bid into the terms currency offer.

Example:

USD/CAD 1.5745/55

USD/JPY 120.40/50

Referring to the previous table, the preceding quotes read:

Bank sells CAD at 1.5745 and buys CAD at 1.5755, and

Bank sells JPY at 120.40 and buys JPY at 120.50.

To determine the CAD/JPY cross rate:

STEP 1: Bank buys CAD and sells JPY

120.40 ÷ 1.5755 = 76.42

STEP 2: Bank sells CAD and buys JPY

120.50 ÷ 1.5745 = 76.53

Therefore the CAD/JPY cross is 76.42/53, where CAD is the base currency, and JPY is

the terms currency.

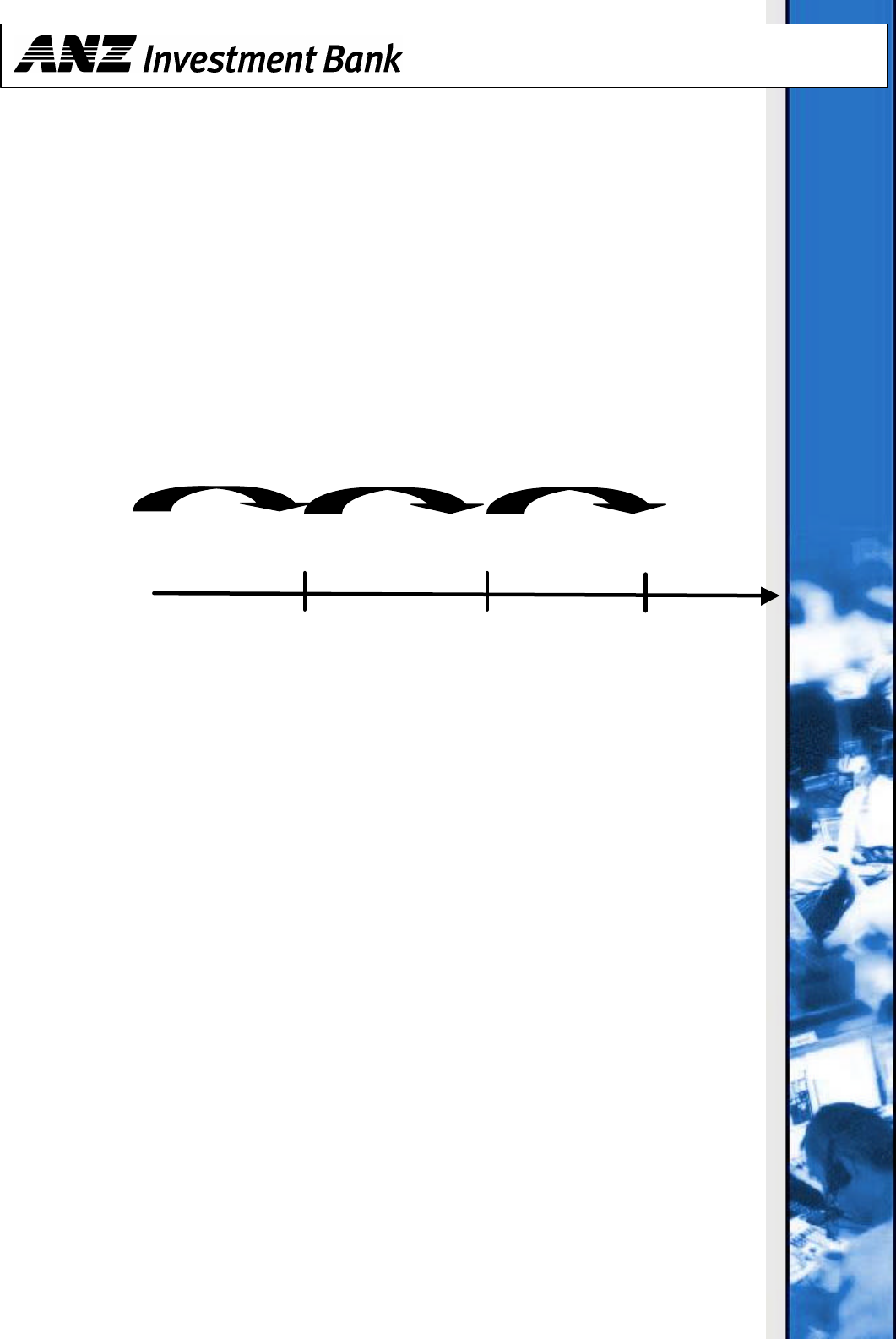

Value Dates

A value date refers to the day on which physical exchange of the currencies occurs.

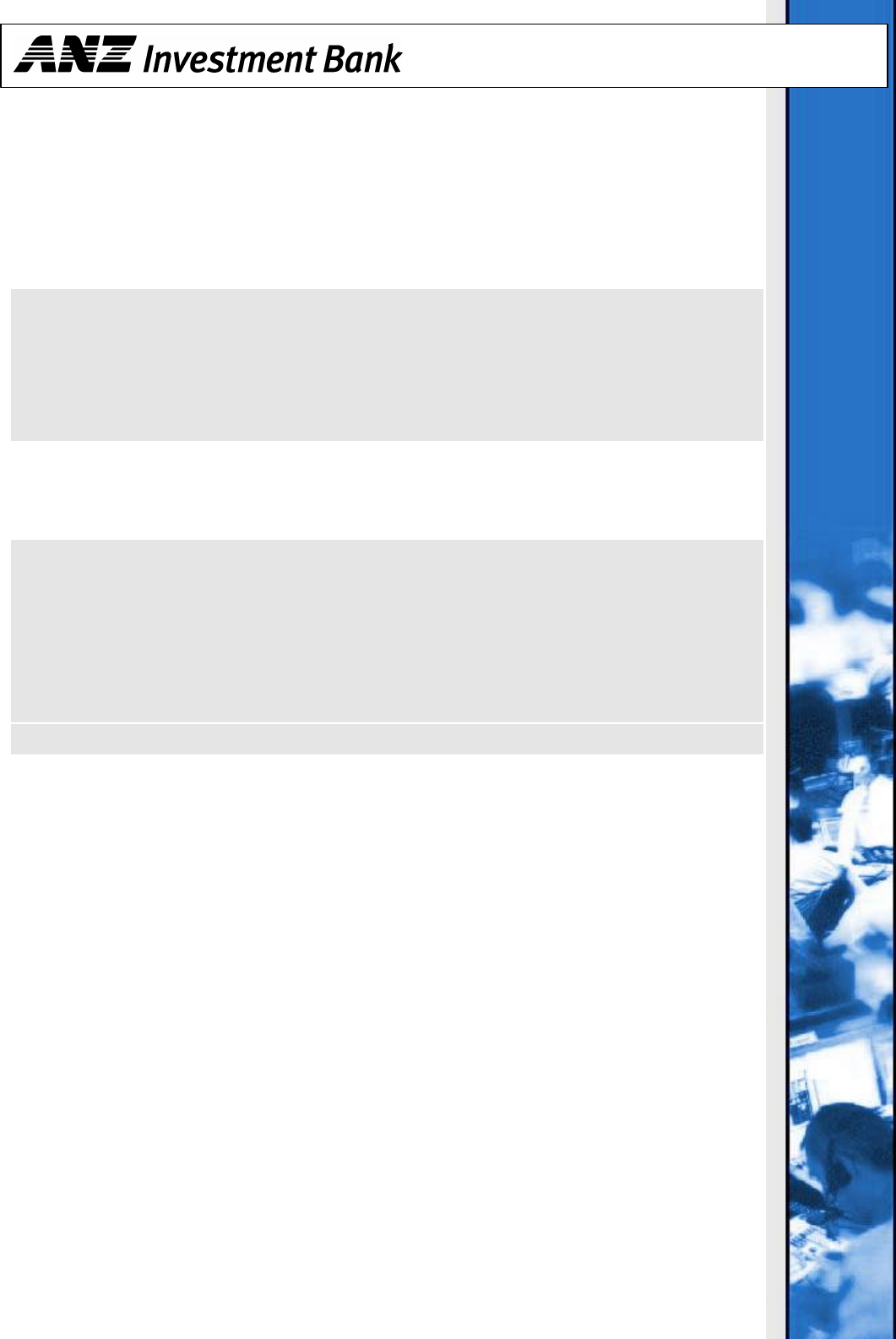

The most common terms are:

Value Today: Exchange of the currencies will occur today.

Value Tom: Exchange of the currencies will occur on the next business day.

Value Spot: Exchange of the currencies will occur two business days from today.

Value Forward: Exchange of the currencies will occur at a specified date beyond the spot date.

Today Tomorrow Spot Forward

Market convention is that all quotes are expressed as Value Spot. This is to ensure sufficient

settlement time. For example, a deal transacted on Tuesday has a value date of Thursday, provided

there is not a holiday in either of the main financial centres of the currencies being exchanged.

Weekends and holidays will result in more than two calendar days between the deal date and the

value date.

Canadian dollars are the exception, as they have only one day spot (i.e. value is the next clear

business day following the deal date).

Holidays

If there is a holiday in either currency’s main financial centre on the value date, spot automatically

moves out to the next clear business day. For example, a GBP/USD deal done on Monday with a UK

holiday on Wednesday will have a Value Spot value of Thursday.

Note that if the UK holiday falls within the spot period, say Tuesday, spot would move out a further

business day.

If the holiday is in the US, it will only move the Value Spot date if the holiday falls on the value date.

For example, a NZD/USD deal transacted on Tuesday, with a US holiday Wednesday, will have a spot

date of Thursday. If the US holiday fell on Thursday, the Value Spot date would become Friday.

For all cross rates, a holiday within the spot period for either or both currencies will move the value

date out for each non-business day. For example, an AUD/JPY deal transacted on Monday would

normally have a spot date of Wednesday. However, a Japanese or Australian holiday on Tuesday

would push the Value Spot date out until Thursday.

Part 2 – Forward Market

Forward Exchange Contract

A forward exchange contract is an agreement between two parties to exchange one

currency for another on a future date beyond the Value Spot date.

Purpose of Forward Exchange Contracts

A forward exchange rate is a tool used to assist market participants to fix current exchange

rates for a future date. The foreign currency payment or receipt is set, regardless of

subsequent movements in the exchange rate.

The contract rate does not represent a forecast of where the exchange rate will be on that

date. Rather, it is the spot price adjusted for interest differentials between the two

currencies involved for the period between the spot and value dates.

The contract can either be for a fixed term, or for an optional period.

Fixed term contracts are also known as outright forwards. A client entering into an

outright forward will specify the date on which delivery under the contract is to take place.

Optional term contracts are where the customer nominates a specific period, in which

delivery of the contract may take place without penalty/benefit. This type of contract is

often used where the customer is unsure when the funds are required. Alternatively, a fixed

term contract can be written to the earliest likely delivery date and extended if not required

on that date.

Forward Margins

To calculate the forward exchange rate, the current spot rate is adjusted by a ‘forward

margin’. The forward margin represents the interest rate differential of the two currencies

involved.

Forward Margin Quotes

Forward Margins are quoted as a bid and an offer, and in the same manner as spot quotes.

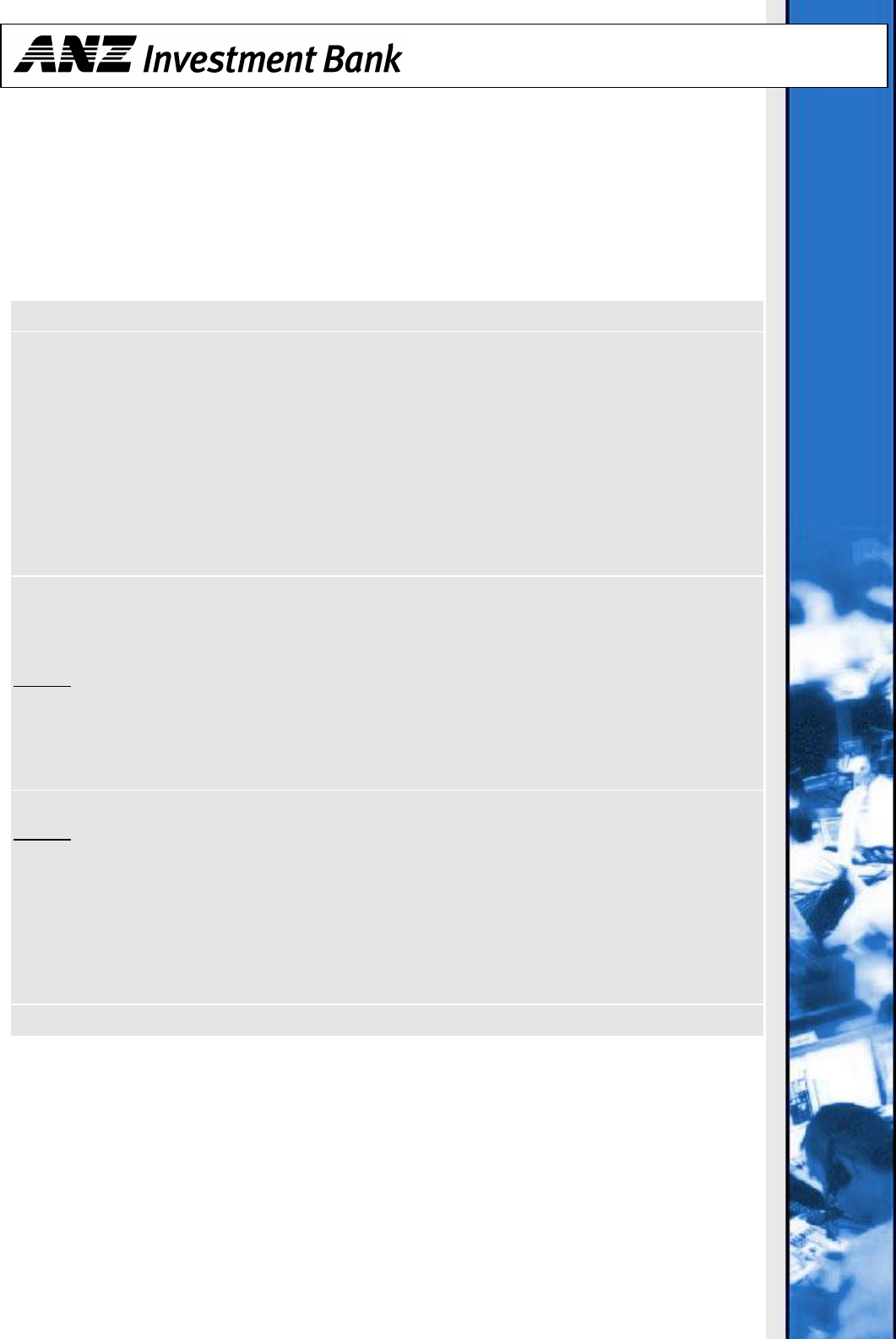

BID OFFER

Bank Sells the base

currency for settlement

Value Spot

Bank Buys the base

currency for settlement

Value Spot

Bank Buys the base

currency for settlement

Forward Dates

Bank Sells the base

currency for settlement

Forward Dates

Note that the bid/offer price relates to what the price maker does with the base currency on

the forward settlement date.

The terminology used to express this is:

Bid: Bank sell/buy the base currency and buy/sell the terms currency

Offer: Bank buy/sell the base currency and sell/buy the terms currency

Rule: To establish or extend a forward exchange contract, always

apply the bid margin to the bid spot and the offer margin to the offer

spot.

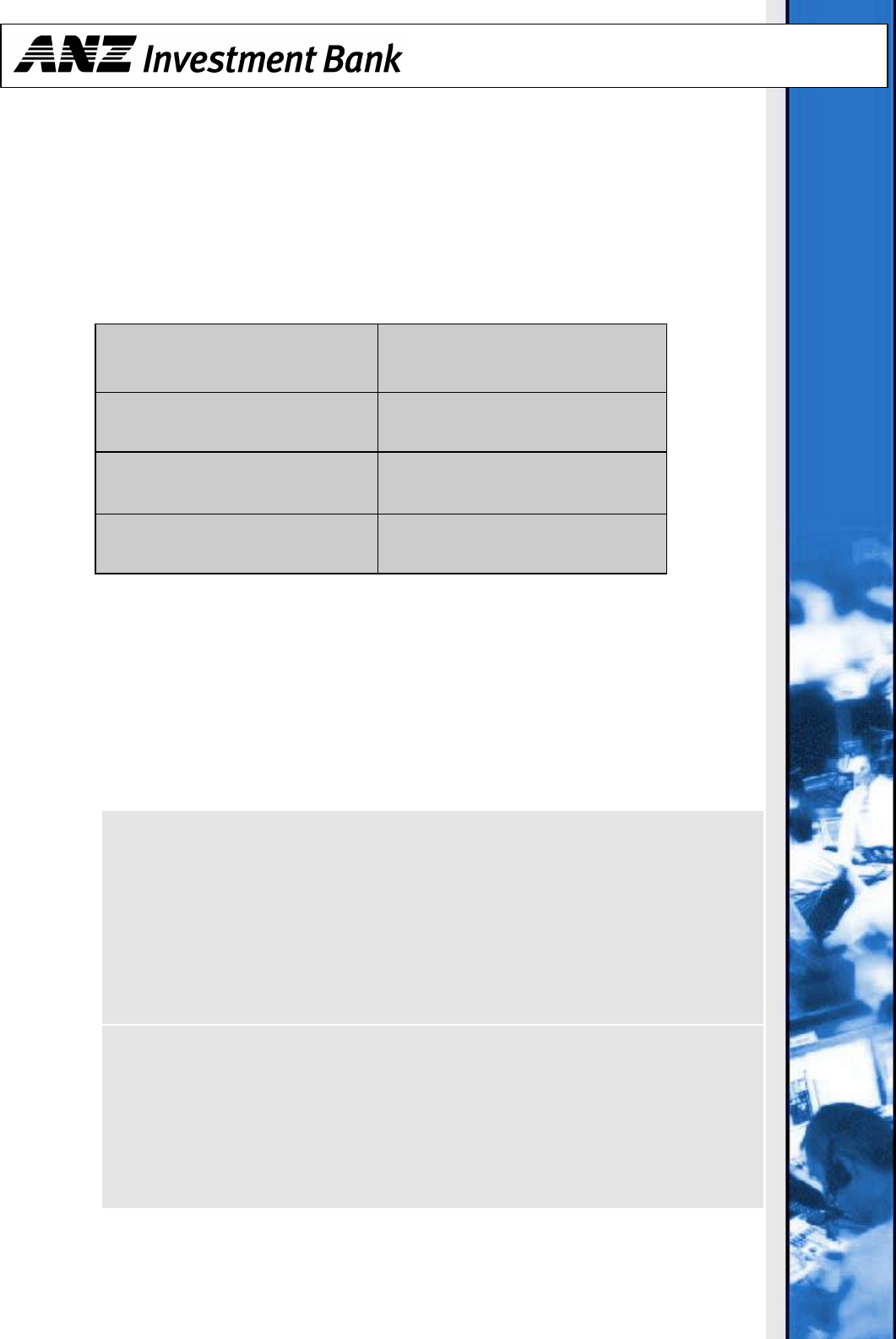

Discount or Premium

The forward margins are expressed as a number of foreign exchange points, also called

swap points. Whether the points are added to or subtracted from the spot rate depends

upon whether they are at a discount or a premium.

BID > OFFER

(High/Low)

BID < OFFER

(Low/High)

Base currency at a discount Base currency at a premium

Terms currency at a premium Terms currency at a discount

Subtract margin Add margin

In terms of interest rates, the higher interest rate currency will be at a Error! Reference

source not found. against the lower interest rate currency. Conversely, the lower interest

rate currency will be at a Error! Reference source not found. against the higher interest rate

currency.

Example:

GBP/USD 1.5700/05

Six month 170/168

As the points are running from high to low, they are subtracted from spot

rate. This reflects that interest rates in the UK are higher than interest rates

in the US.

The six month forward for GBP/USD is 1.5530/37 (i.e. the bank sells/buys

GBP at 1.5530 and buys/sells GBP at 1.5537).

Outright Forwards Versus Optional Term

Outright forwards involve applying the full amount of the forward margin to the spot rate,

as in the preceding example. However, if a client is uncertain about when they will need to

utilise the contract they may decide to have a forward exchange contract that is optional for

either the whole or part of the contract term. This allows them to pre-deliver the contract

with no adjustment made to the contract rate for delivery prior to the end of the contract

term.

Example:

Using the GBP/USD example shown in the preceding, assume a six month

forward exchange contract optional is required for the last month. This will

be fixed for five months and allow optional delivery without cost or benefit

for the last month. Additional to the preceding information, five month

forward margins are quoted at 140/139.

In deciding how to apply the forward margin, work on the basis that the

holder will receive the least favourable forward rate of the optional and full

term dates.

If applying the full six month margin to the spot of 1.5700/05, the forward

quote would become 1.5530/37. However, applying the five month forward

to the offer (i.e. 1.5705 – 0.0139), the quote becomes 1.5530/66.

Under this scenario, a client with a bank buys USD contract could request

pre-delivery on the first day of the option period at 1.5537 instead of 1.5566.

Rule:

1) If the base currency is at a discount (high/low), apply the

margin for the full term of the contract to the bid and the

margin applicable until the commencement of the option

period to the offer.

2) If the base currency is at a premium (low/high), apply the

margin applicable until the commencement of the option

period to the bid and the margin for the full term of the

contract to the offer.

Constructing a Forward Exchange Rate

Forward exchange rates are formulated by adjusting the spot rate by a forward margin. The

forward exchange rate is a combination of a spot deal and a swap (discussed in more detail

later).

Example:

Using the preceding GBP/USD example, the deal is done in two stages:

Client wants to buy USD:

STEP 1: Spot Deal – bank buys GBP and sells USD value spot at

1.5700

STEP 2: Swap – the bank sells GBP and buys USD value spot at

1.5700, and

− the bank buys GBP and sells USD in six months at

1.5530.

Remember that in technical terms this is where the bank sells/buys GBP.

Note that the two Value Spot deals cancel one another out, leaving the six

month forward deal to be settled.

Calculation of a Forward Margin

To calculate a forward margin, the following information is required:

§ The interest rate of both currencies.

§ Number of days in the period.

§ Spot rate.

§ 360 or 365 days per year.

Days Basis

Note that some countries base their calculations on a 360 day year, whilst others are based

on 365 days. In general, Commonwealth countries such as Australia, the UK and New

Zealand use a 365 day year, whereas the US, Japan and Europe calculate interest on a 360

day year.

The Forward Margin can be manually calculated if you have the Value Spot rate and interest

rates applicable for each currency.

Example:

USD/JPY Spot: 120.25

USD interest rates: 2.0%

JPY interest rates: 0.5%

Number of days: 30

Number of days in year for base currency: 360

Number of days in year for terms currency: 360

JPY 100 mil at 120.25 = USD 831,600.83

30 days at 0.5% 30 days at 2.0%

Interest = 41667.00 Interest = 1386.00

Principal + Interest = 100,041,667 Principal + Interest = 832,986.83

JPY÷ USD = 100,041,667 ÷ 832,986.83 = 120.10

(This represents the forward exchange rate)

Therefore, the forward points are: 120.10 – 120.25 = -0.15

Arbitrage Formula

The Arbitrage Formula has been devised to calculate the forward margin. The formula varies

depending upon the day basis and quotation terms of the two currencies.

360 Day Basis

Arbitrage = (It– Ib) x D x R

36,000 + (D x Ib)

where It = Interest rate of terms currency.

Ib = Interest rate of base currency.

D = Number of days in period.

R = Spot rate.

The forward margin in the preceding example can now be calculated thus:

Example:

One month USD/JPY = (0.5 – 2.0) x 30 x 120.25

36,000 + (30 x 2.0)

= -0.15

This represents –0.15 points.

365 Day Basis with Indirect Quotations Currency:

Arbitrage = [It (365/360) – Ib] x D x R

36,500 + (D x Ib)

Example:

One month AUD/USD = [2.0(365/360) – 3.0] x 30 x 0.5400

36,500 + (30 x 3.0)

= -0.00043 points

365 Day Basis with Direct Quotations Currency:

Arbitrage = [It (360/365) – Ib] x D x R

36,000 + (D x Ib)

Example:

One month USD/HKD = [7.5(360/365) – 5.5] x 30 x 7.7450

36,000 + (30 x 5.5)

= 0.012189 points

Other Uses of the Arbitrage Formula

The Arbitrage Formula can also be used to calculate the second interest rate if the forward

margin (swap points) and one currency’s interest rate are known.

Utility:

§ Used to transfer deposit/loan rates into swap prices.

§ Can overcome liquidity issues of some currencies in the deposit/loan market.

§ Can give the forwards traders an accurate measure of where deposit/loan

rate should be as the swap is a more accurate measure than the

deposit/loan pages on Reuters.

§ Enables the forwards traders to monitor the risk assumed when taking on a

deposit/loan via the swap book.

Transposing the Arbitrage Formula means:

To solve for the base currency interest rate (360 days):

Ib = It x D x R – (S x 36,000)

D(S + R)

Where It = Interest rate of terms currency

D = Number of days in period.

R = Spot rate.

S = Swap points.

Example:

Using the data from the preceding USD/JPY example,

USD one month interest rate = 0.5 x 30 x 120.25 – (-0.15 x 36,000)

30 x (-0.15 + 120.25)

= 1.994

To solve for the terms currency interest rate (360 days):

It = Ib x D x (S + R) + (36,000 x S)

D x R

Generally, the market maker will utilise a spreadsheet program to calculate the formula

rather than relying on manual calculation.

Forward Dates

The forward date can either be for a certain number of months out of spot, known

collectively as even month forwards, or some other specific date, which does not coincide

with a full month run. The latter is known as ‘broken date forwards’.

Even Months

Forwards are based on calendar days rather than a fixed number of days.

Example:

Deal date 14/08/2002

Spot date 16/08/2002

One month forward 16/09/2002 (31 days)

Deal date 09/09/2002

Spot date 11/09/2002

One month forward 11/10/2002 (30 days)

If there is a holiday in either of the two currency’s main financial centre, or the US on the

value date, the value date becomes the next clear business day.

Example:

Deal date 26/08/2002

Spot date 28/08/2002

US holiday 28/11/2002

3 months forward 29/11/2002

If spot is the last business day of the month, the forward date will be the last business day

of the forward month.

Example:

Deal date 28/08/2002

Spot date 30/08/2002

2 months forward 31/10/2002

All forward margins quoted on Reuters are for even month forwards. In addition to a

general page for each currency, each bank maintains its own page quoting forward margins

set by their traders. Similarly to spot quotes, the forward margins on these screens are

‘indication only’ depending upon the size of the transaction.

Broken Dates

In a number of circumstances, clients want delivery of a currency to occur on a specific

date, which does not coincide with an even month. When this is the case, pro-rata the

margin between the nearest even months.

The formula for the pro-rata is:

(A÷B) x C = margin

Where A = Number of days past the nearest even month forward prior to

maturity.

B = Number of days between nearest two even month forwards.

C = Margin for full run between the two even month forwards.

Example:

Deal date 04/09/2002

Spot date 06/09/2002

Forward date 27/11/2002 (82 days)

The forward margins for the nearest even months are:

Two month forward -28 (value date 06/11/2002 – 61 days)

Three month forward-43 (value date 06/12/2002 – 91 days)

STEP 1: Calculate the pro-rata:

(21÷30) x –15 = -10.5

STEP 2: Apply the pro-rata to the forward margin for the nearest

month prior to maturity.

(-28) + (- 10.5) = -38.5

The forward margin for value 27/11/2002 is –38.5.

All other rules referred to in the preceding for even month forwards still

apply.

Short Dates

Short dated forwards relate to deals whose value date occurs prior to spot (i.e. Value Today

and Value Tom deals).

The forward margins for dates prior to spot are known as ‘overnight’ and ‘tom/next’. The

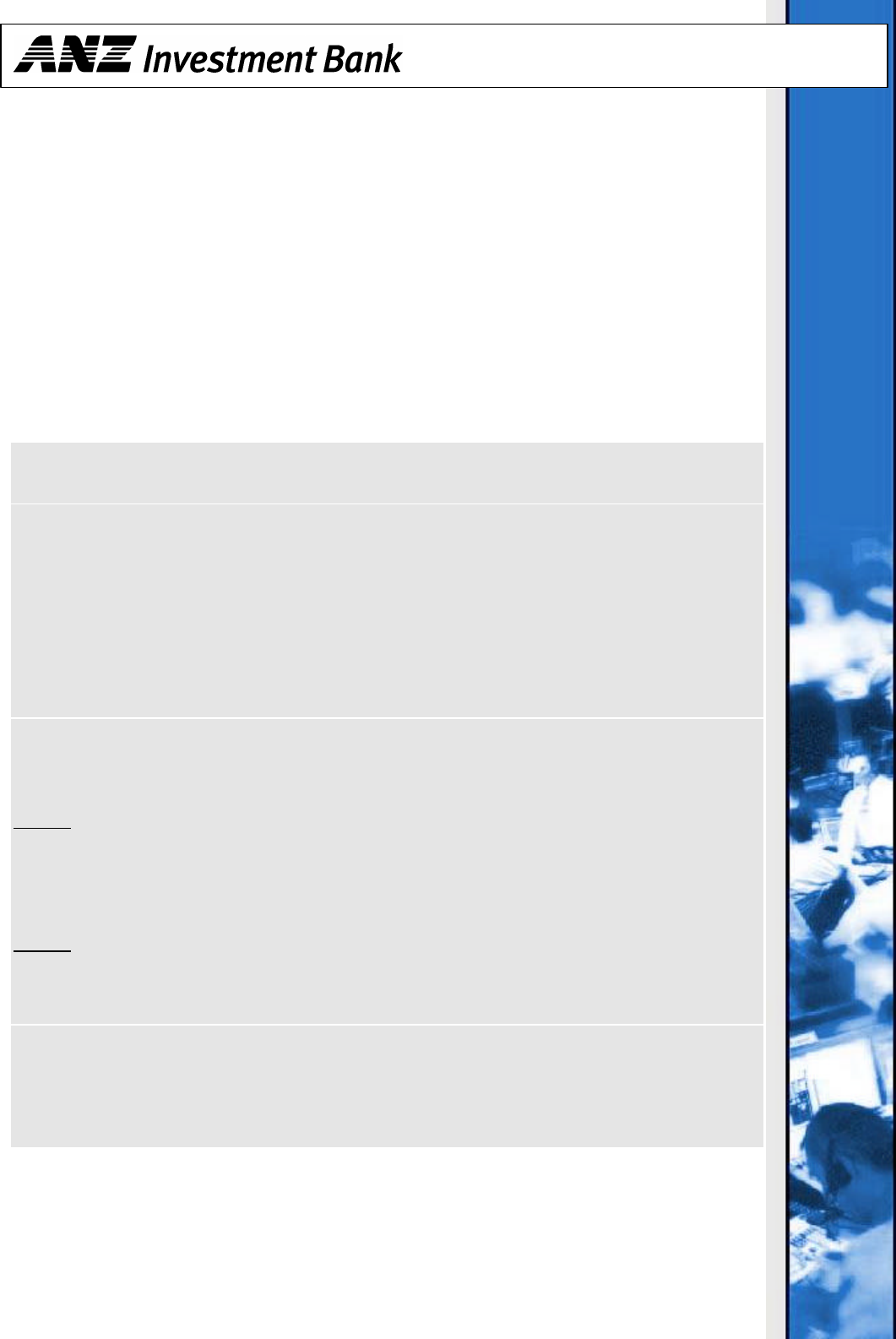

following graph assists in the explanation.

Today Tomorrow Spot

Overnight Tom/Next

The margins for short dates are calculated in a similar way to forward margins. However,

the key difference is that rather than the adjustment being made to take the deal beyond

the spot date, as in the top section of the graph, it is now being made to bring the deal to

an earlier date. Now move from right to left, as shown on the bottom section of the graph.

For this reason the margins are applied in reverse.

Rule: Take the margin from the opposite side of the market and

apply the opposite sign.

A deal for Value Today requires spot to be adjusted by the tom/next and overnight

margins.

Example:

NZD/USD Spot 0.4700/05

O/N forward 0.35/0.45

T/N forward 0.05/0.10

Assume we are on the bid of the spot quote (i.e. the bank will sell USD to the

customer and buy NZD from the customer for Value Today). The short dated

forward becomes:

0.4700

-0.000045 (O/N)

-0.000010 (T/N)

0.469945

A deal for Value Tom requires spot to be adjusted by the tom/next margin.

Example:

Using the preceding NZD/USD example, the exchange rate for a deal for

Value Tom is:

0.4700

-0.000010 (T/N)

0.46999

Note that due to the different timezones within which the markets operate, cut-off times

exist for short dated forwards. Some currencies must be dealt before a particular time to

qualify as Value Today, whilst some currencies cannot be dealt Value Today at all. The cut-

off times will vary, dependant on which market centre you are in. Check with your FX

Relationship Manager for a list of applicable cut-off times.

Extension of Forward Exchange Contracts

After taking out a Forward Exchange Contract, a delay in the foreign currency requirement

may occur. In such situations, the bank may agree to allow an extension to the term of their

contract. Approval by the bank can be sought, provided there is a valid reason for doing so,

and the extension is not done to postpone the realisation of losses.

Extensions of forward exchange contracts are known as historical rate rollovers. This

involves adjusting the historic contract rate by the applicable forward margin for the new

date. Effectively, a swap is created (explained in more detail later), as a cashflow mismatch

occurs.

Calculation of Historical Rate Rollover

Assume the client currently has a Forward Exchange Contract for the bank to sell them

USD1 million against AUD at 0.5300. The contract is due today. The client wishes to extend

the contract forward one month.

Longhand Example:

Rates today: Spot 0.5450/55

One month forward 2/3 (30 days)

Calculation: Contract USD1 million @ 0.5300 = AUD 1,886,792.45

STEP 1: Bank cancels the contract by buying USD value spot.

Bank buys USD1million @ 0.5455 = AUD 1,833,180.57

Loss to client AUD 53,611.88

Note that in this example for a bank to sell contract, there is a

loss to the client (i.e. their contract rate is below the current

spot rate). This is known as an ‘out of the money’ contract. In

effect, the client is asking the bank to lend them the difference

until the forward contract is settled.

For this reason, the client is charged interest on the loss at the

prevailing lending rate, including the bank’s lending margin. If

the contract rate was higher than the current spot, an ‘in the

money’ contract, the bank would pay the client interest at

the prevailing deposit rate.

Note that the reverse applies for a bank to buy contract. A

contract rate below the current spot rate is ‘in the

money’,

whilst a contract rate higher than the current spot rate is

‘out of the money’.

Interest payable by client on loss (at 4.75% per annum)

AUD209.31.

STEP 2: New selling contract written for one month

Bank sells USD1million @ 0.5457

(i.e. 0.5455 + 0.0002) = AUD1,832,508.70

Plus loss to client AUD 53,611.88

Plus interest payable on loss AUD 209.31

Amount bank is to receive in one month AUD1,886,329.89

STEP 3: Extension rate = USD1,000,000 ÷ AUD1,886,329.89

= 0.5301 or plus 1 point.

Note that the same spot rate, 0.5455 was used for both the buying and

selling of USD as a swap is undertaken and, as discussed earlier, the two

spot transactions cancel one another out.

Shorthand Example:

The shorthand method involves adjusting the contract rate by the forward

margin from the Reuters screen, remembering that the bid margin for a bank

to sell contract and the offer margin for a bank to buy contract is applied.

In the example, the new contract rate to extend the contract forward one

month would be:

0.5300 + 0.0002 = 0.5302 or 2 points.

A difference in the resulting extension rate occurs, depending on the method used. This is

because the longhand method takes into account the funding of any loss/gain on the face

value of the contract. Extreme care must be taken when extending forward exchange

contracts and is not an accepted market practice in all market centres.

Pre-Delivery of a Forward Exchange Contract

Should the need arise, a client can utilise an outright Forward Exchange Contract prior to its

maturity date. This involves adjusting the contract rate by the applicable forward margin to

pre-deliver the contract from the maturity date back to an earlier date.

Note that if the pre-delivery date falls within an option period, as specified by the client at

the time the contract was established, the pre-delivery is undertaken at the contract rate

with no penalty or benefit to the client.

Calculation of a Pre-Delivery

Assume the client currently has a forward exchange contract for the bank to sell them USD1

million against AUD at 0.5300. The contract is due in one month. The client wants to take

delivery of the entire contract today.

Longhand Example:

Rates today: Spot 0.5450/55

One month forward 2/3 (30 days)

Calculation: Contract USD1 million @ 0.5300 = AUD1,886,792.45

STEP 1: Bank cancels the contract by buying USD value one month.

Bank buys USD1million @ 0.5458 = AUD1,832,172.96

(0.5455 + 0.0003)

Loss to client (in one month) AUD54,619.49

Note that in this example, the contract is out of the money.

Rather than settling the loss in one month, the client is asking

the bank to build the loss into the contract rate for delivery

today. Effectively they are placing a deposit with the bank so

that the principal and interest equates to the loss to be paid

on that date. As a result, the present value of

the loss at the prevailing deposit rate for the term must be

determined, and interest paid for that term at the appropriate

deposit rate.

STEP 2:Present value of loss to client at a deposit rate of 4%:

54,619.49 ÷ [1+(4% x 30/365)] = AUD54,440.54

STEP 3:Bank sells USD1million @ 0.5455 = AUD1,833,180.57

Plus present value of loss to client AUD54,440.54

Amount bank receives today AUD1,887,621.11

STEP 4: Pre-delivery rate = USD1,000,000 ÷ AUD1,887,621.11

= 0.529767

Note that the same spot rate, 0.5455, was used for both the buying and

selling of USD as a swap is undertaken and the two spot deals cancel one

another out.

Shorthand Example:

The shorthand method involves adjusting the contract rate by the forward

margin from the Reuters screen. However, as is the case with short dated

forwards, where the adjustment is from a future date back to today, the

margins are applied in reverse.

In the example, the new contract rate to pre-deliver the contract due in one

month back to today would be:

0.5300 – 0.0003 = 0.5297

The difference between the two calculations represents the gain/loss resulting from the pre-

delivery of an in or out of the money contract.

Cancellation of Forward Exchange Contract

After taking out a forward exchange contract, a client may no longer require the funds.

Under such circumstances, the contract would need to be cancelled. The cancellation can

take place either on maturity date or some time prior to its maturity date.

On Maturity

To cancel the contract on the maturity date, the client would enter into an opposite deal for

Value Today. If they currently have a bank to sell contract, they need to undertake a bank

to buy deal.

Example:

Client holds a bank to sell USD500,000 against NZD contract due today at a

rate of 0.4900. To close out the contract, the client needs to enter into a

bank to buy Value Today deal. The current rate for the bank to buy USD for

Value Today is 0.4700.

Consequently, the customer has two deals:

1. Bought USD500,000 @ 0.4900 and sold NZD1,020,408.16

2. Sold USD500,000 @ 0.4700 and bought NZD1,063,829.79

NZD43,421.63

The close out represents a profit to the client on the deal of NZD43,421.63.

They have received (bought) NZD at a lower price (0.4700) than where they

have paid away (sold) NZD (0.4900).

Cancellation Prior to Maturity

To cancel a contract prior to the maturity date, the client still needs to enter into an

opposite Value Today deal. However, first the contract needs to be Pre-Delivery back to

Value Today and the consequent adjustment made to the contract rate.

Example:

Client holds a bank to sell USD500,000 against NZD contract due in one

month at a rate of 0.4900. The forward margins for one month are quoted as

2/3. The current rate for the bank to buy USD for Value Today is 0.4700.

STEP 1: Pre-Delivery 0.4900 – 0.0003 = 0.4897

(Remember: opposite side/opposite sign)

STEP 2: Cancellation

1. Bought USD500,000 @ 0.4897 = sold NZD1,021,033.29

2. Sold USD500,000 @ 0.4700 = bought NZD1,063,829.79

NZD42,796.50

This represents a profit to the client on the deal of NZD42,796.50.

Swaps

A foreign exchange swap is a transaction involving the simultaneous sale/purchase of one

currency on one settlement date, and the purchase/sale of the same currency on another

settlement date.

Swaps do not create a net foreign exchange position and the swap price is the forward

margin itself. Standard market practice is to use the spot mid-rate for the first leg of the

swap, and adjust this rate by the applicable forward margin for the second leg of the swap.

The main uses of swaps are:

§ To adjust for cashflow mismatches.

§ To raise funds.

Adjusting Cashflow Mismatches

A client may have both receivables and payables denominated in the same currency due on

different dates.

Example:

Assume the client is required to make a payment of USD10mio on the 15th of

the month whilst expecting to receive USD10mio on the 30th.

For the 15

th

, the spot quote is 0.5500/05 and the forward margins for 15

days are 6/5.

The client can do either of the following:

a) Buy USD10mio at the spot rate of .5500 and then sell USD10mio at

the outright forward rate of 0.5500 (0.5505-0.0005)

OR

b) Enter into a swap to buy and sell USD spot against 15 days forward at

-5 points. This involves two legs:

1st leg – buy USD10mio at 0.5502 (mid-rate)

2nd leg – sell USD10mio at 0.5497 (0.5502-0.0005).

Both a) and b) reflect hedging strategies for the client. However b) gives the

client a saving of five points, which reflects the benefit of not crossing the

spread as was done in a).

Fund Raising

Swaps can be utilised to identify opportunities to borrow at attractive interest rates.

If it is favourable, an Australian corporate may borrow in an offshore market in USD and use

a swap to convert the USD borrowing into AUD without any exchange rate risk. This is done

by issuing commercial paper (CP).

CP will be issued under the following conditions:

§ An arbitrage opportunity exists AND

§ The corporate can access the offshore market AND

§ There is no foreign exchange risk (i.e. a foreign exchange swap is used).

Example:

An Australian corporate can raise USD by issuing commercial paper into

another market centre at lower interest rates and fees. The company wants

to access the liquidity of the other market centre but does not want to take

on an exchange rate risk. To do so it can enter a swap, whereby it agrees to

sell USD spot and buy USD back in two months at the two-month margin.

To fully hedge the position, the corporate would also want to hedge the

interest cost. This would be done by undertaking a mismatched swap,

whereby the first leg would be for principal and the second leg would be for

the amount of principal plus interest. The interest component is essentially

an outright forward. Note that for this reason, both legs are based on the

appropriate side of the market rather than using the mid-rate. In this

example, the bid.

Current Market Conditions

AUD/USD spot rate 0.6300

Two month USD borrowing rate 3.0%

Two month AUD/USD forward -0.0019 (hence 2 month forward rate

0.6281)

Two month days’ run 62 days

The corporate borrows USD10mio at 3% for 62 days commencing at the spot

date at a cost of USD51,666.67.

At spot,

a) The corporate receives USD10mio (loan proceeds).

b) 1

st

leg of the swap – corporate sells USD10mio at 0.6300 and receives

AUD15,873,015.87.

Two months forward,

c) 2

nd

leg of swap – corporate buys USD10mio at 0.6281and pays

AUD16,003,290.35.

d) The corporate repays the USD10mio loan.

The corporate has borrowed in the other market centre to obtain AUD

requirements. This was done without incurring exchange rate risk on the

principal at a cost of 3% plus 19 forward points.

The corporate then has effectively borrowed AUD15,873,015.87 for two

months at a cost of AUD130,274.48 (AUD16,003,290.35 –

AUD15,873,015.87).

Using the Abitrage Formula to solve for the unknown AUD interest rate, it

can be converted into an AUD borrowing cost of 4.83% per annum.

DISCLAIMER

ANZ Investment Bank makes no representation and gives no warranty as to the accuracy of the information contained in this document and

does not accept any responsibility for any errors or inaccuracies in or omissions from this document (whether negligent or otherwise) and

ANZ Investment Bank is not liable for any loss or damage however it arises as a result of any person acting or refraining from acting in

reliance on any information contained in this document. No reader should rely on this document as it does not purport to be comprehensive

or to render advice. This disclaimer does not purport to exclude any warranties implied by law which may not be lawfully excluded.

ANZ Investment Bank is a business name of Australia and New Zealand Banking Group Limited ACN 005 357 522, which is a licensed

securities dealer.