U.S. International

Development Finance

Corporation

Annual Management Report

Fiscal Year 2023

dfc.gov

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

TABLE OF CONTENTS

2

Agency Head Letter 3

Management's Discussion & Analysis (Unaudited)

Background, Mission, and Organization 4

Performance Goals, Objectives, and Results 4

Analysis of Financial Statements, Financial Condition, Position, and Results 6

Analysis of Systems, Controls, and Legal Compliance 17

Forward-Looking Information 18

Inspector General’s Transmittal Letter 20

Independent Auditor's Report

21

Financial Statements

Consolidated Balance Sheets 26

Consolidated Statements of Net Cost 27

Consolidated Statements of Changes in Net Position 28

Combined Statements of Budgetary Resources 29

Notes to the Financial Statements

Summary of Significant Accounting Policies 31

Note Disclosures Related to the Consolidated Balance Sheets 39

Note Disclosures Related to the Combined Statements of Budgetary Resources 54

Note Disclosure Related to the Reclassified Statement of Net Cost and Reclassified

Statement of Changes in Net Position 60

Required Supplementary Information (Unaudited)

Combining Statements of Budgetary Resources by Major Budget Account 62

Other Information (Unaudited)

Report on the Payment Integrity Information Act 64

Appendix (Unaudited)

Acronym Listing 65

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

AGENCY HEAD LETTER

3

November 15, 2023

On behalf of the United States International Development Finance Corporation

(DFC), it is my pleasure to provide you with the Corporation's Annual

Management Report and Financial Statements, which provide important

information about DFC’s year-end financial results. The report reflects DFC’s

successful financial management and stewardship of taxpayer funds, as well as

a steadfast commitment to accountability and transparency in all our programs

and operations. Our financial strength and positioning allow DFC to be a leader

and innovator in addressing international development challenges, while

furthering the foreign policy priorities of the United States.

DFC has again successfully received an unmodified audit opinion which

underscores our prudent management of exposure through sound underwriting and effective

governance. Additionally, as required by OMB Circular No. A-136, I am pleased to confirm with reasonable

assurance the completeness and reliability of the data presented in the FY 2023 Annual Management

Report. As of the end of FY 2023, DFC had combined total projected exposure of $41.4 billion, DFC

maintained corporate reserves of $6.2 billion in Treasury securities, and DFC recorded a negative net cost

of $341 million. DFC achieved these excellent financial results by adding new commitments of $9.3 billion

to support private sector projects and companies across its range of products - debt financing, equity

commitments, technical assistance, and political risk insurance.

Looking to FY 2024, DFC is undertaking efforts to evolve from the structure it inherited from its

predecessor organizations – Overseas Private Investment Corporation (OPIC) and USAID’s Development

Credit Authority (DCA) – to one that meets DFC’s structural and functional needs. Since its establishment

in 2019, DFC has experienced significant growth in the scope of its work and the size of its workforce. DFC

continues to grow to make full use of the authorities, resources, and tools provided by Congress. These

changes will position the agency to scale in line with anticipated growth, deepen sectoral expertise and

client relationships, pursue proactive planning and business development, and expand career

development opportunities for DFC staff. I look forward to sharing more with you in the coming year.

Sincerely,

Scott A. Nathan

Chief Executive Officer

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

4

BACKGROUND, MISSION, AND ORGANIZATION

The U.S. International Development Finance Corporation (DFC or Corporation) is America’s development finance

institution. DFC was launched in December 2019 with a mandate to partner with the private sector to finance

solutions to the most critical challenges facing the developing world while advancing America’s foreign policy goals

abroad. DFC’s transactions in developing markets directly further America’s interest in working towards a

prosperous, more equal world. Partnering with the private sector in these efforts is critical to marshaling the

resources needed to expand access to finance, reliable energy, lifesaving healthcare, food security, and critical

infrastructure and services. To learn more about our mission, organization, and background visit

https://www.dfc.gov/who-we-are/overview.

DFC is led by its Chief Executive Officer, with governance from its Board of Directors and independent oversight from

its Office of Accountability and Office of Inspector General. Generally, DFC’s departmental structure has reflected

the types of financial products it offers. In fiscal year (FY) 2024, DFC will be shifting to a departmental structure that

reflects key enduring sector priorities, which comprise the bulk of its investments. Further information regarding

DFC’s Executive Staff and leadership can be found online at https://www.dfc.gov/who-we-are/our-

people/executive-staff.

PERFORMANCE GOALS, OBJECTIVES, AND RESULTS

OVERVIEW

The Better Utilization of Investments Leading to Development (BUILD) Act (Public Law 115-254, Division F) provides

DFC the authority to issue insurance or reinsurance, make loans and guaranties, and invest equity in investment

funds and individual enterprises. In addition to these core programs, the BUILD Act provides the authority to offer a

variety of technical assistance to potential projects.

DFC’s program funding is deployed in coordination with the Executive Branch agencies charged with implementing

the private sector-focused foreign assistance programs of the United States and is targeted to support

developmental projects in less developed countries. During FY 2022, DFC published its first Strategic Plan for the FYs

2022-2026. Subsequently, DFC published its 2022 Annual Report, which details DFC’s impact through investments.

DFC is developing the infrastructure and key performance indicators to track progress against goals and objectives.

WHAT DFC OFFERS

The tools available to DFC to support its goals are detailed below and correspond with the breakout of gross cost

and revenue on DFC’s Statements of Net Cost.

• Insurance – DFC offers political risk insurance coverage against losses due to currency inconvertibility,

expropriation, and political violence including war and terrorism. DFC also offers reinsurance to increase

underwriting capacity.

• Financing – DFC meets the long-term capital investment financing needs of any size business through the

provision of loans and guaranties in a wide variety of industries such as critical infrastructure, energy,

telecommunications, housing, agribusiness, financial services, and in projects that can achieve a positive

developmental impact, including for underserved communities.

• Equity – DFC makes equity investments in funds and invests direct equity into projects in the developing

world which will have developmental impact or advance U.S. foreign policy. Equity investments can be

highly developmental because of their ability to support early and growth-stage companies that would

otherwise not be able to take on debt. For funds, it can be difficult to find investors willing to invest in

companies in low and lower-middle income countries where projected returns may not be viewed as

commensurate with the risks. As a financial tool, equity provides DFC with greater flexibility to invest in

strategically aligned companies and funds, partner with other financial institutions, and enable companies

to scale operations more efficiently to create greater development impact.

• Technical Assistance and Feasibility Studies – DFC’s feasibility studies and technical assistance program

accelerates project identification and preparation to better attract and support private investment in

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

5

development. In most cases, grants will be designed to increase the developmental impact or improve the

commercial sustainability of a project that has received, or may receive, DFC financing or insurance support.

DFC determines the technical assistance, feasibility study, or training work to be provided, and the grant

recipient selects an entity with relevant expertise and experience that will perform that work. In addition,

the program provides technical assistance for certain development credit activities requested by other

agencies by utilizing a competitively selected pool of contractors.

KEY PERFORMANCE RESULTS

FY 2023 COMMITMENTS

DFC’s commitments reflect the pressing need to address many of the world’s greatest challenges through the

mobilization of private sector capital. With more than $9.3 billion committed to new projects in FY 2023, DFC has

increased its commitments markedly year-over-year since its establishment in 2019. The 132 new transactions

across the globe in FY 2023 advance developmental impact and strategic priorities around the world. The

commitments align with DFC’s five priority sectors: energy, infrastructure, health, agribusiness, and small business

support. DFC’s investment portfolio demonstrates the agency’s commitment to the underserved regions where DFC

can maximize development impact and advance U.S. foreign policy objectives. A link to an interactive map of DFC’s

investments by country and type of investment can be found here.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

6

ANALYSIS OF FINANCIAL STATEMENTS, FINANCIAL CONDITION, POSITION, AND

RESULTS

FINANCIAL POSITION

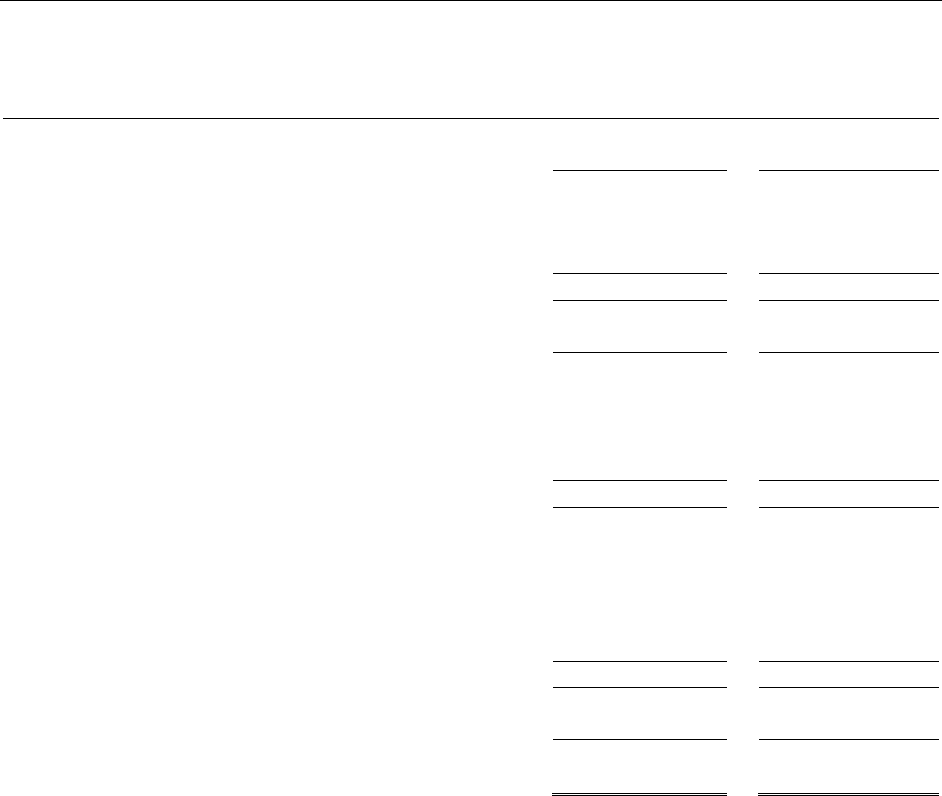

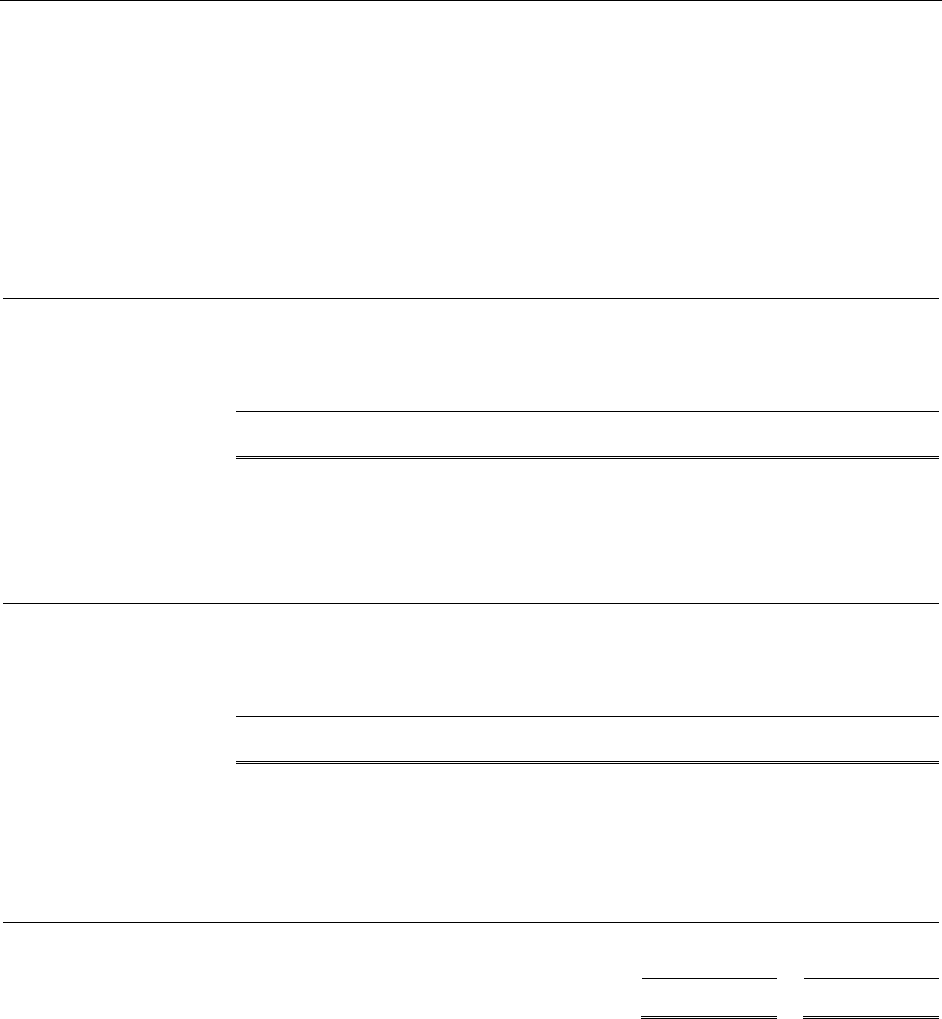

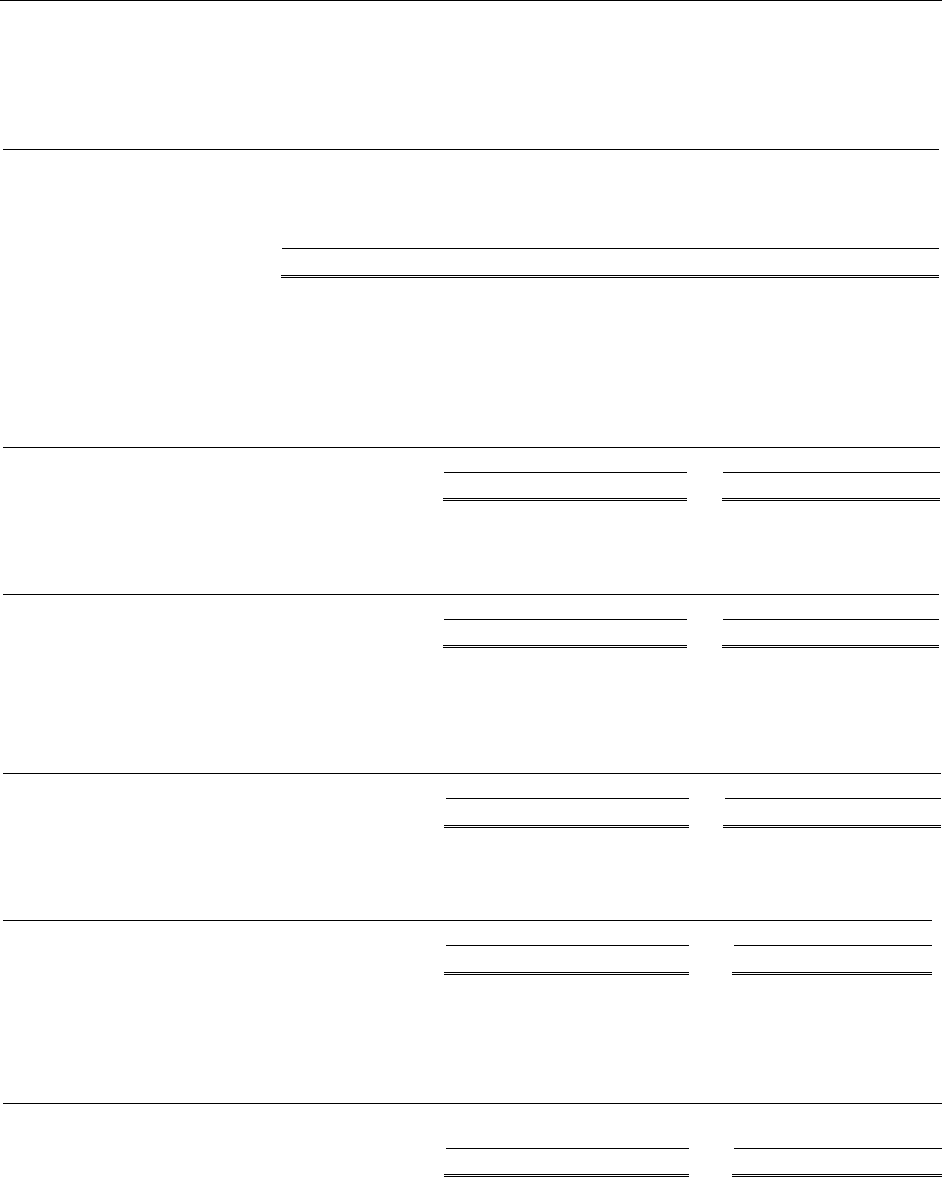

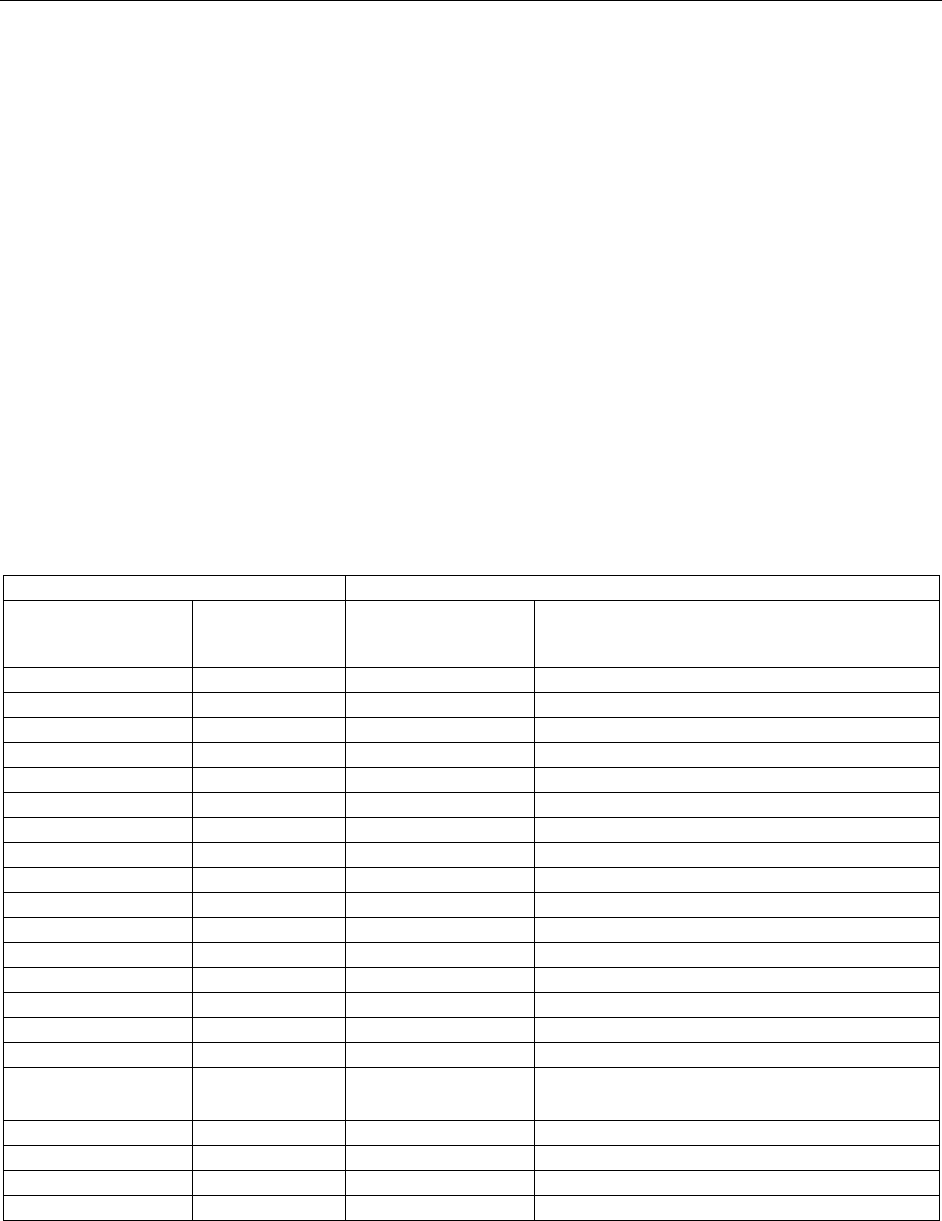

SUMMARY OF FINANCIAL POSITION AS OF, AND FOR THE YEARS ENDED SEPTEMBER 30,

(Dollars in Thousands)

Balance Sheet

2023

2022

$ Change

%

Change

Assets

Fund Balance with Treasury

$ 3,041,884

$ 2,631,003

$ 410,881

16%

Investments, Net

6,548,937

6,380,979

167,958

3%

Loans Receivable, Net

10,242,062

7,523,771

2,718,291

36%

Other

189,638

214,532

(24,894)

(12%)

Total Assets

$ 20,022,521

$ 16,750,285

$ 3,272,236

20%

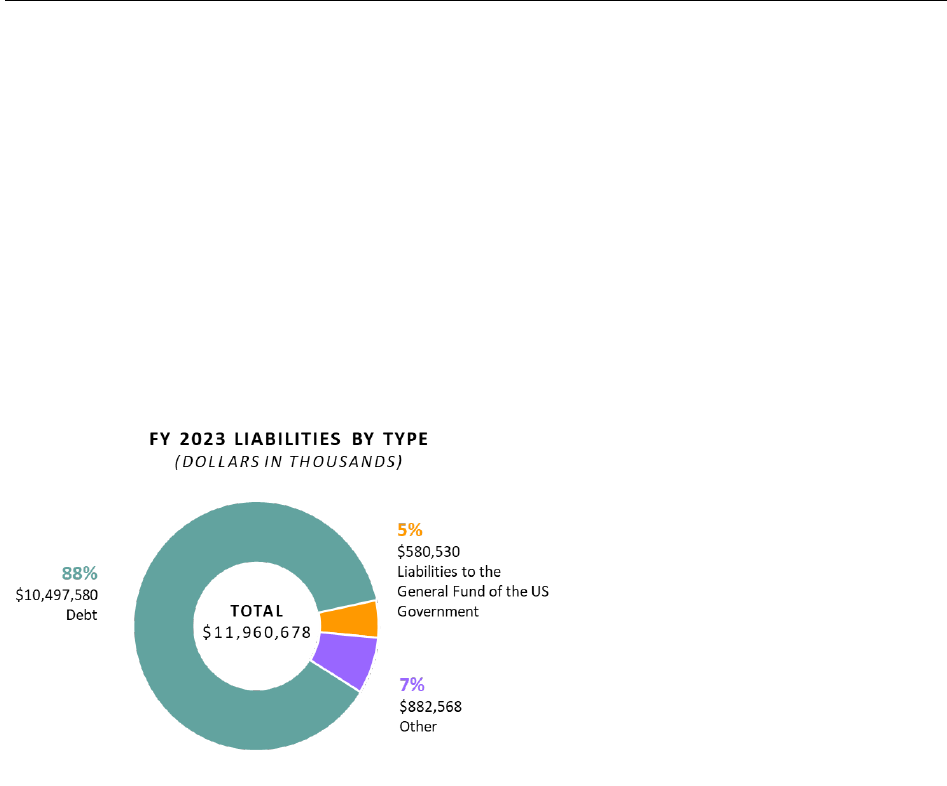

Liabilities

Debt

$ 10,497,580

$ 8,964,971

$ 1,532,609

17%

Liabilities to the General Fund of the US

Government

580,530

392,542

187,988

48%

Other

882,568

219,349

663,219

302%

Total Liabilities

11,960,678

9,576,862

2,383,816

25%

Total Net Position

8,061,843

7,173,423

888,420

12%

Total Liabilities and Net Position

$ 20,022,521

$ 16,750,285

$ 3,272,236

20%

Net Position

2023

2022

$ Change

%

Change

Total Unexpended Appropriations

$ 674,382

$ 400,785

$ 273,597

68%

Cumulative Results of Operations

7,387,461

6,772,638

614,823

9%

Net Position

$ 8,061,843

$ 7,173,423

$ 888,420

12%

Net Cost

2023

2022

$ Change

%

Change

Gross Costs

$ 240,778

$ 465,399

$ (224,621)

(48)%

Less: Earned Revenue

(581,672)

(448,924)

(132,748)

30%

Net Cost of Operations

$ (340,894)

$ 16,475

$ (357,369)

(2,169)%

Budgetary Resources

2023

2022

$ Change

%

Change

Unobligated Balance from Prior Year Budget

Authority

$ 7,135,854

$ 7,363,322

$ (227,468)

(3)%

Appropriations

1,236,707

928,884

307,823

33%

Borrowing Authority

6,424,983

5,521,406

903,577

16%

Spending Authority from Offsetting Collections

1,670,355

1,401,002

269,353

19%

Total Budgetary Resources

$ 16,467,899

$ 15,214,614

$ 1,253,285

8%

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

7

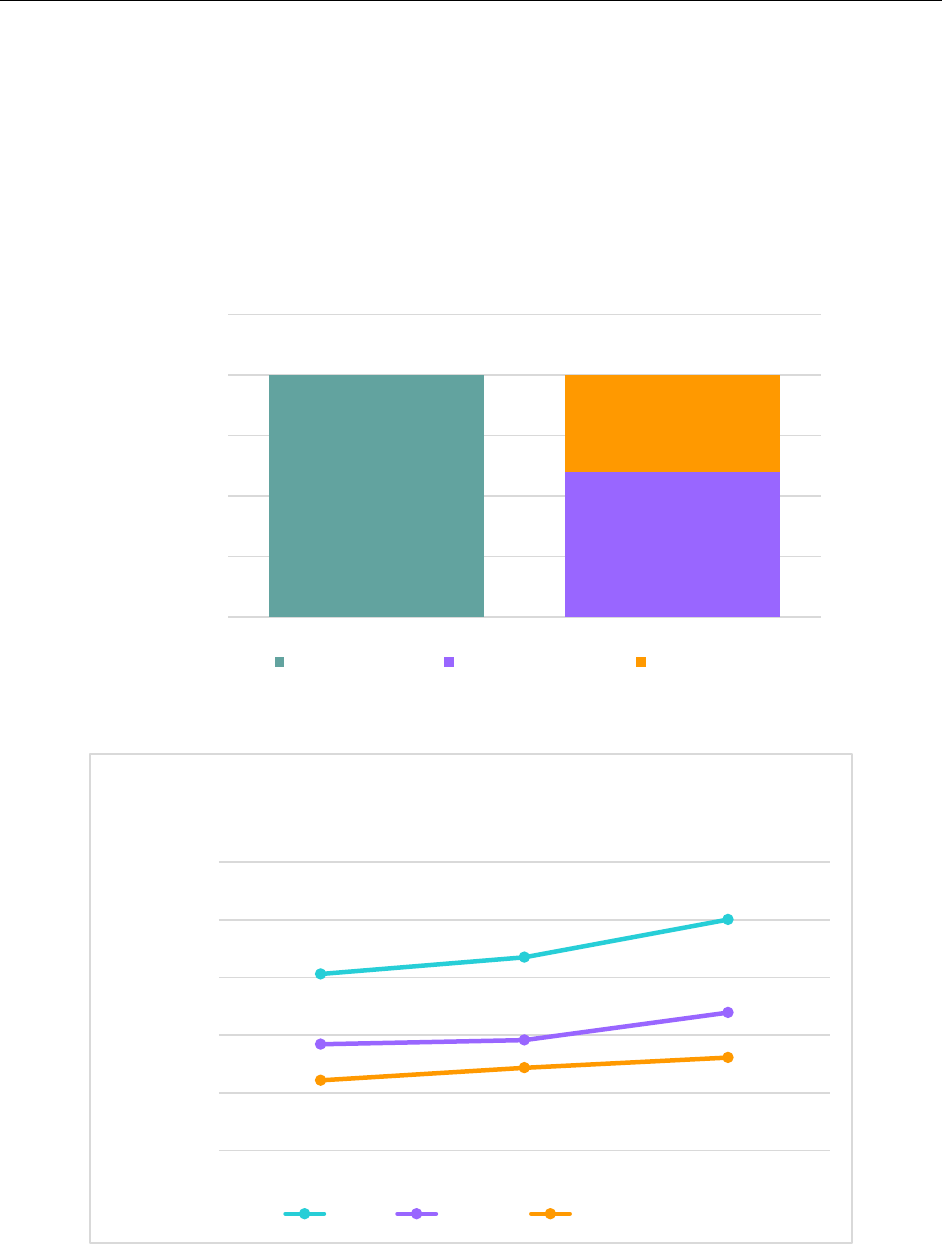

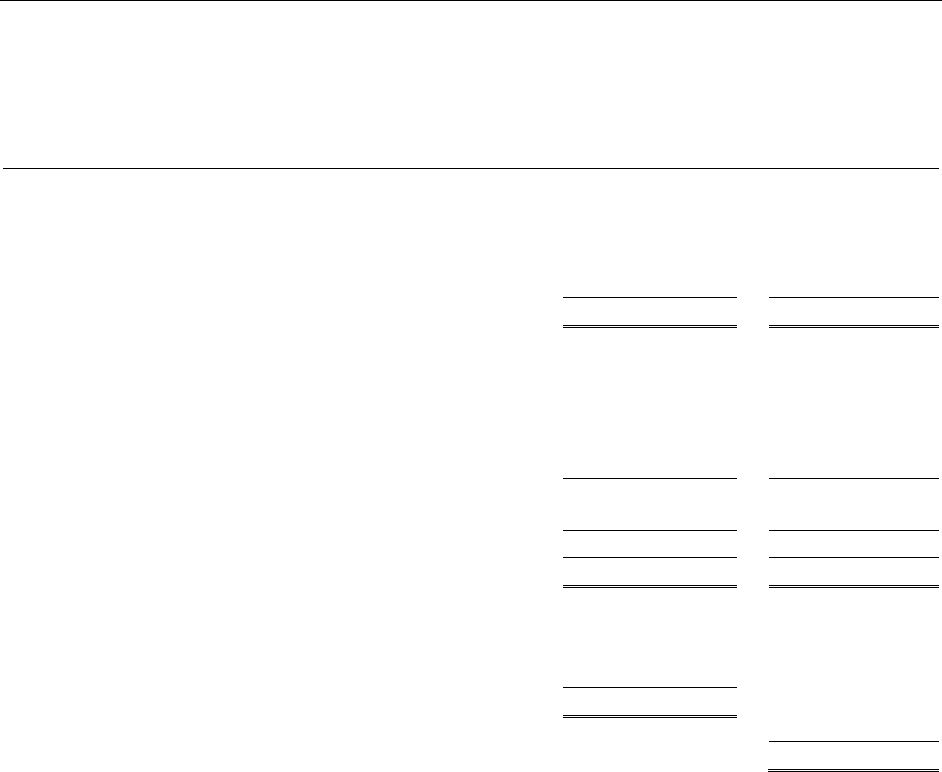

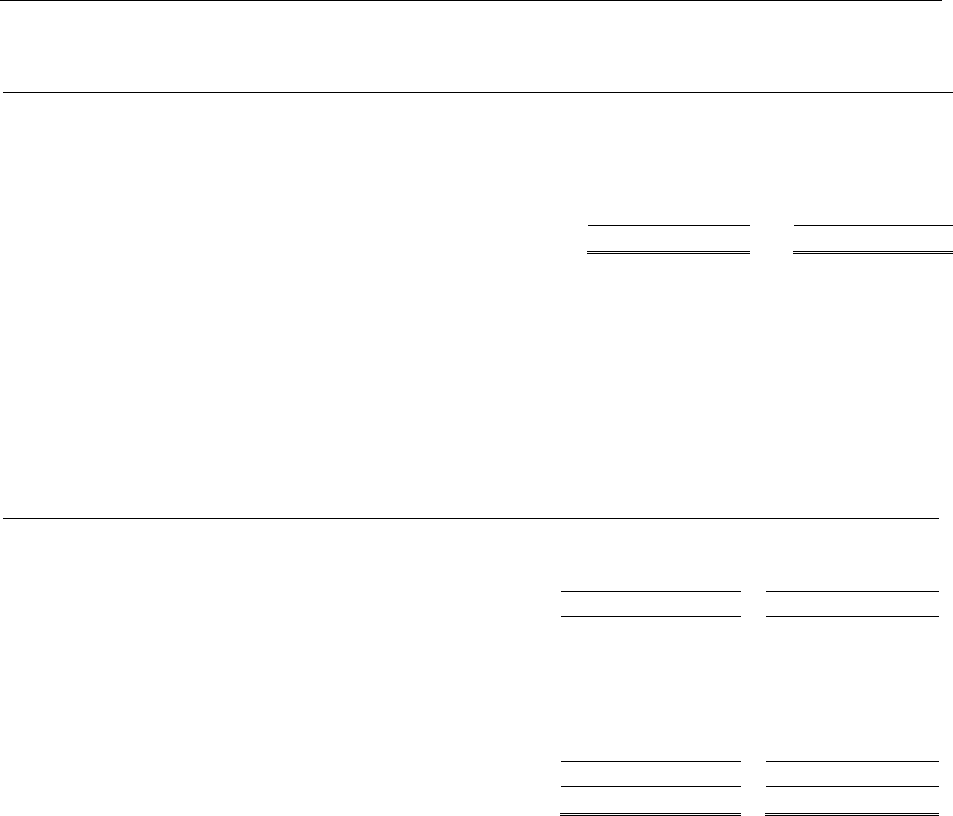

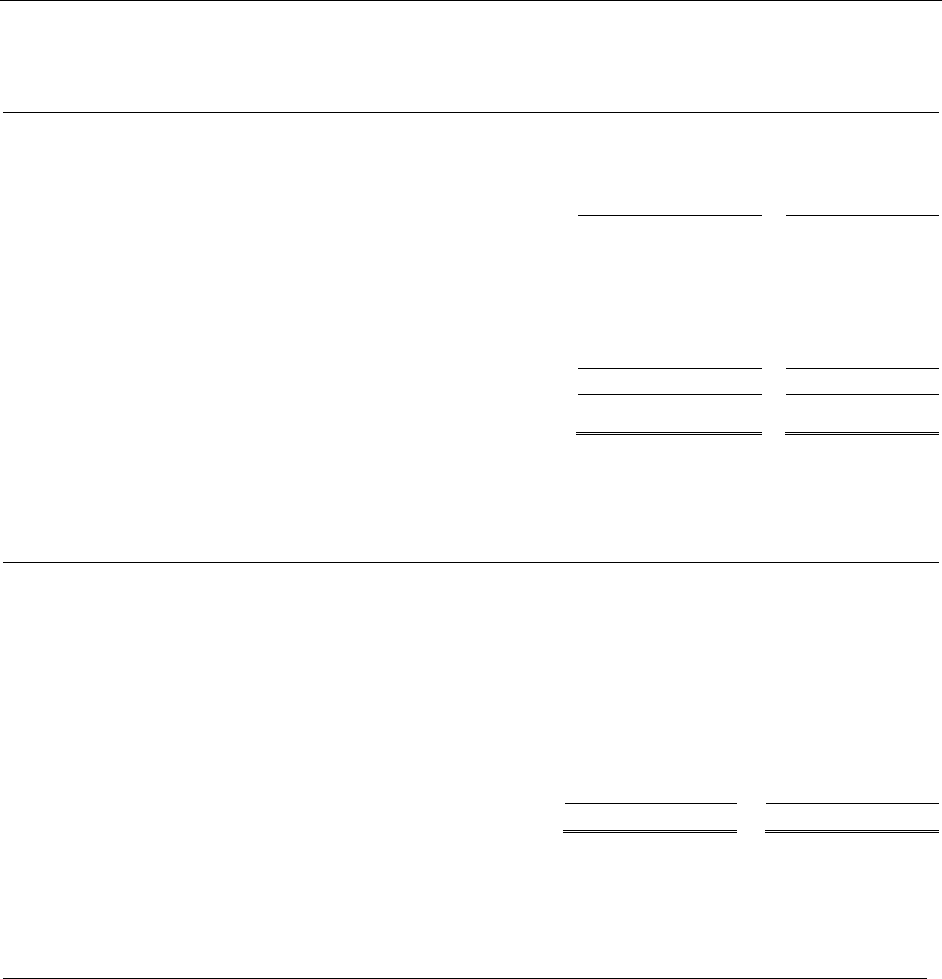

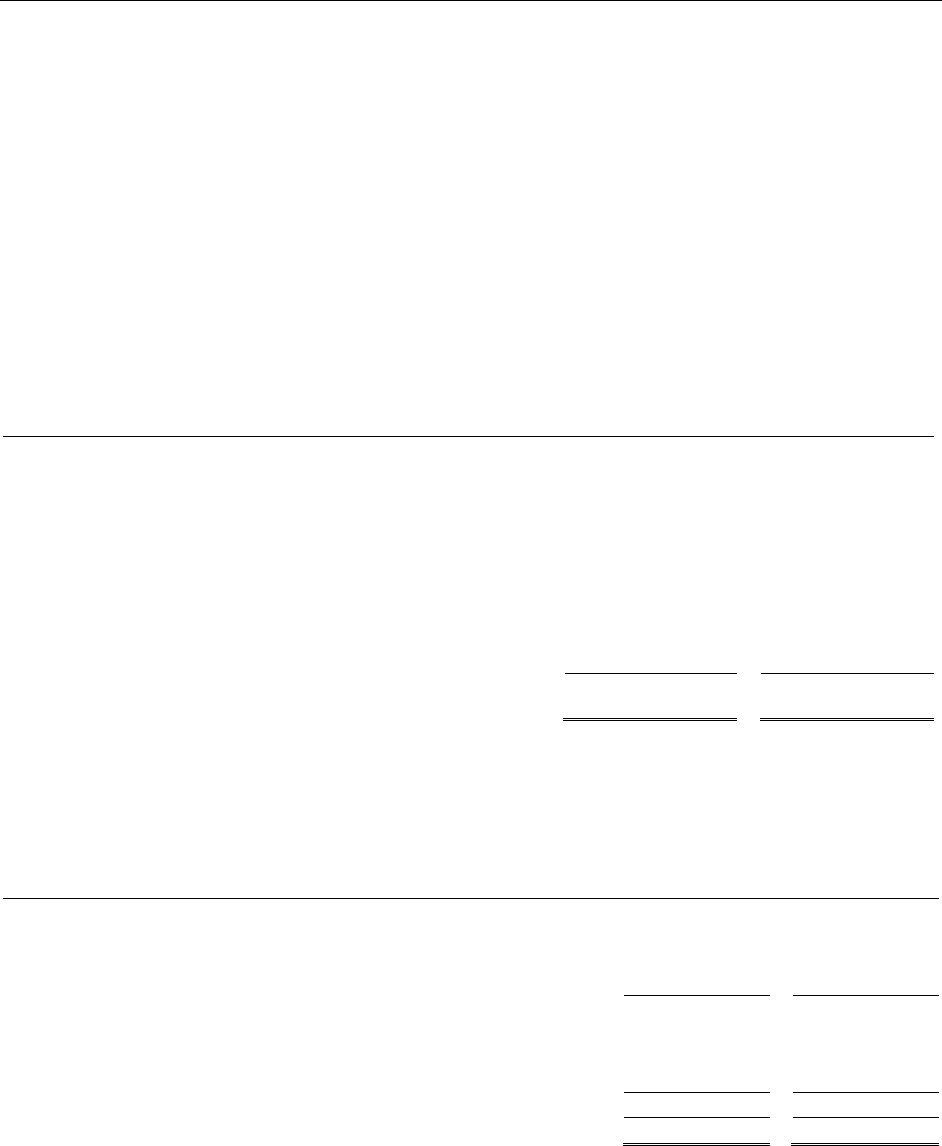

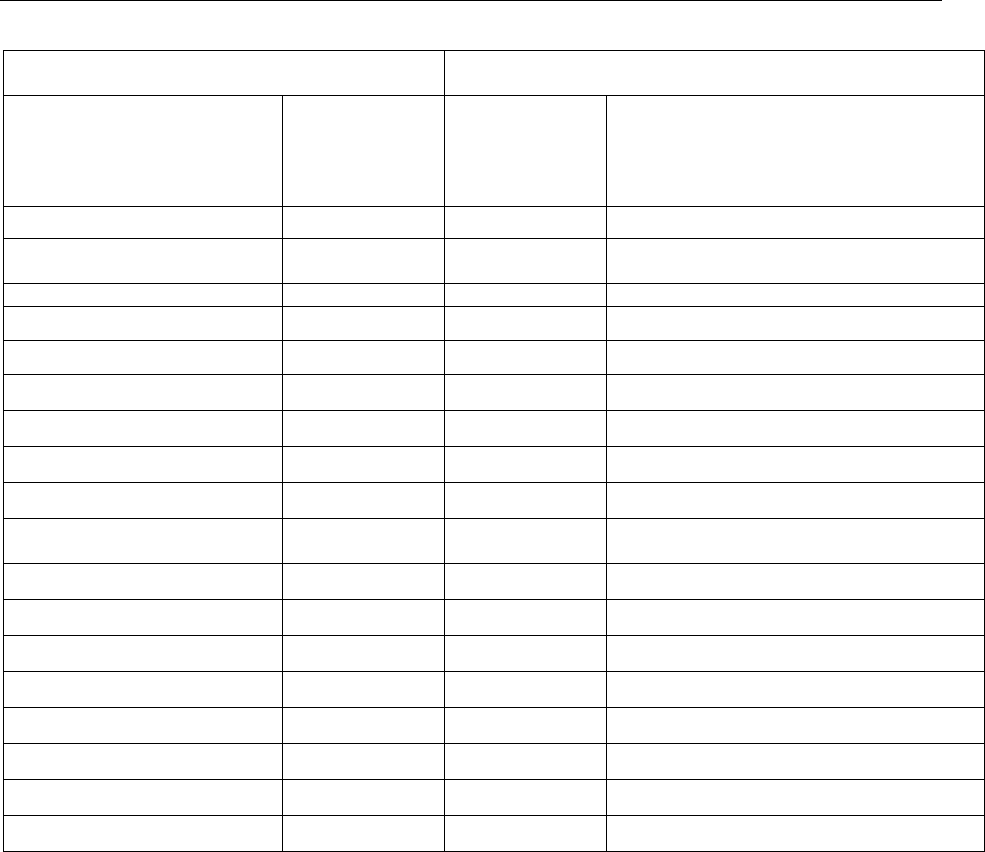

CONSOLIDATED BALANCE SHEETS

The Consolidated Balance Sheets represent DFC’s financial condition at the end of the fiscal year. The Consolidated

Balance Sheets show:

Assets: resources available to meet DFC’s statutory requirements;

Liabilities: monetary amounts DFC owes that will require payment from the available resources; and

Net Position: the difference between DFC’s assets and liabilities.

$20,022,521

$11,960,678

$8,061,843

$-

$5,000,000

$10,000,000

$15,000,000

$20,000,000

$25,000,000

FY 2023 BALANCE SHEET

(DOLLARS IN THOUSANDS)

Total Assets Total Liabilities Total Net Position

$-

$5,000,000

$10,000,000

$15,000,000

$20,000,000

$25,000,000

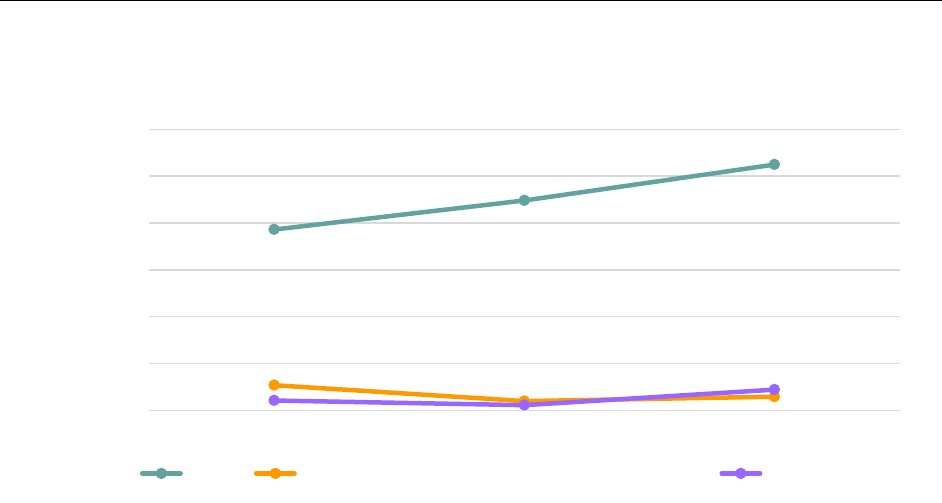

FY 2021 FY 2022 FY 2023

CONSOLIDATED BALANCE SHEET OVER TIME

(DOLLARS IN THOUSANDS)

Assets Liabilities Net Position

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

8

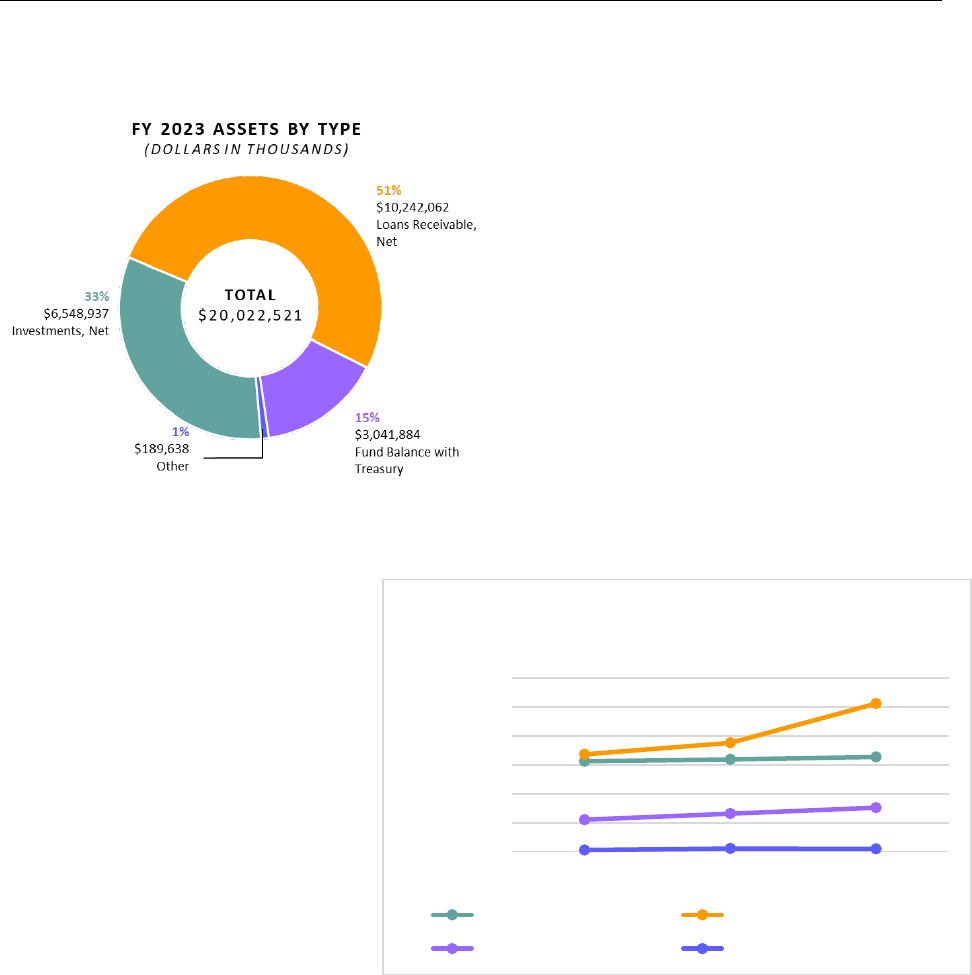

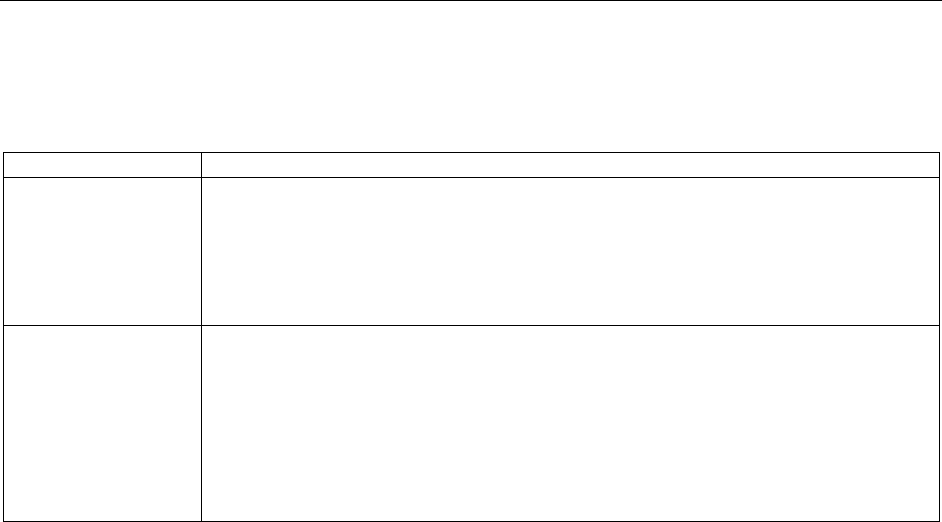

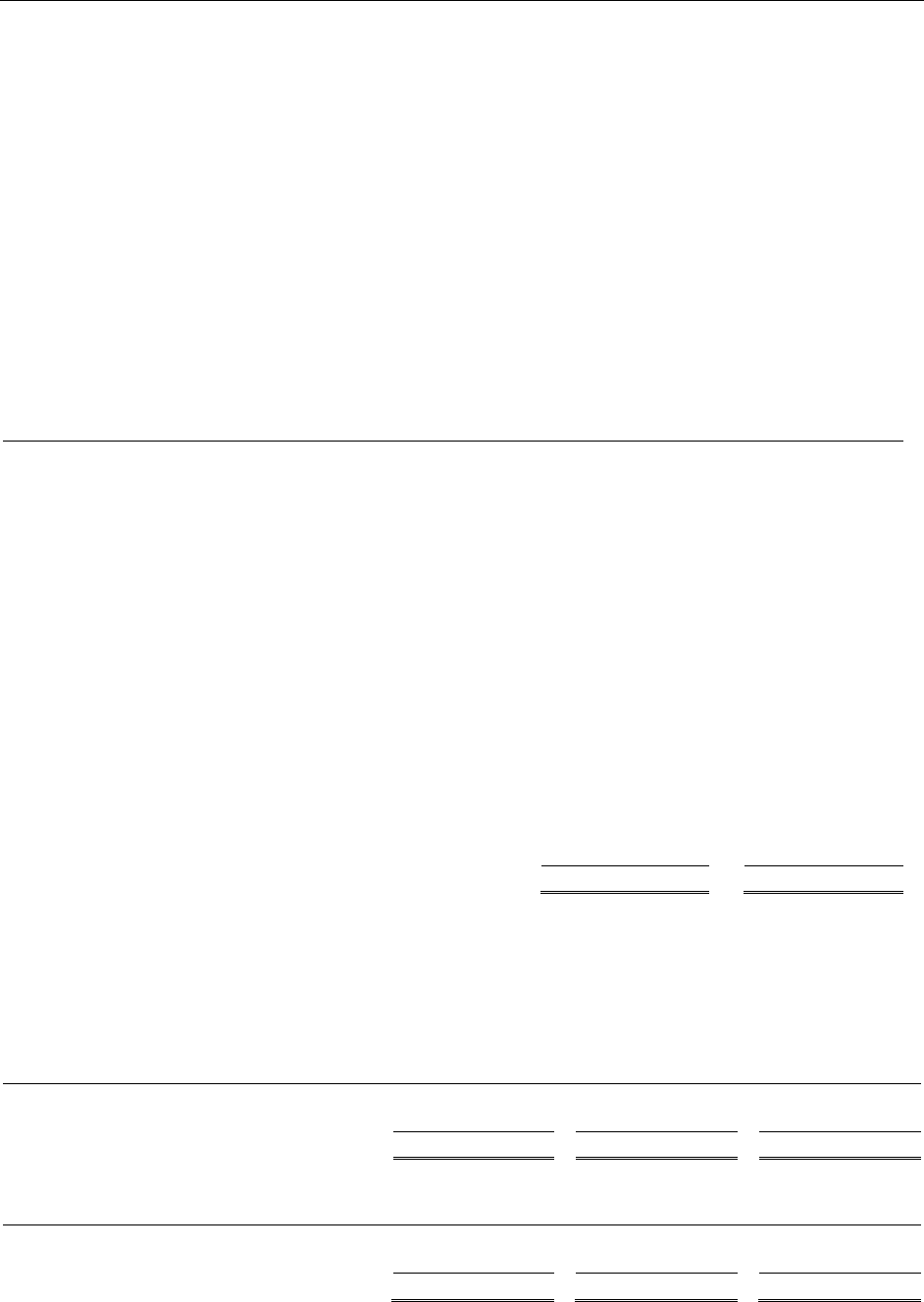

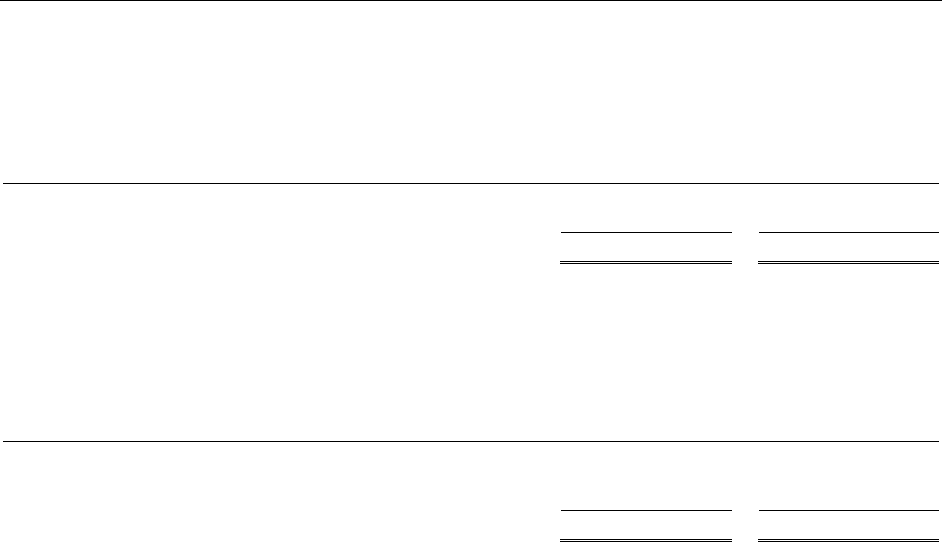

ASSETS

DFC’s assets are primarily composed of Loans Receivable, Net, Investments, Net, and Fund Balance with Treasury

(FBwT).

The largest category of assets in FY 2023 is Loans

Receivable, Net, which represents money owed to

DFC for loans it made to support its development

priorities. DFC’s loan portfolio generates loan

interest and fees for DFC. The value of the receivable

is based on the net present value of the expected

future cash flows for loans made after FY 1991. For

loans made prior to FY 1992, loans are valued based

on the expected future cash flow. DFC estimates

future cash flows for direct loans and loan guaranties

using economic and financial credit subsidy models

(for more information, refer to Significant Factors

Influencing Financial Results). In FY 2023, DFC’s

Loans Receivable, Net balance increased by $2.7

billion, due to the expansion of DFC’s investment

capacities provided under the BUILD Act.

Investments, Net are comprised of U.S.

Department of Treasury (Treasury) Market-

based Securities and equity investments.

DFC has the authority to invest funds

derived from revenue related to its

insurance programs, in order to support

possible future insurance payments. DFC

invests these funds in Treasury Securities,

which are stable investments that earn a

return of between 0.375% and 6%. DFC’s

investments in Treasury securities have

increased by approximately $31 million due

to the investment of fees from the

insurance program. DFC’s investments are

enough to cover insurance exposure. To

understand more about DFC’s insurance,

see Note 15.

The equity investments are another tool that DFC uses to invest in programs and projects to support its mission and

goals. In FY 2023, DFC disbursed an additional $147 million in new equity investments, and recorded approximately

$10 million in net unrealized gains and revenue on investments. Equity investments are critical to advancing

development, particularly to support young, innovative businesses that may not be able to take on debt, or

investment funds that have deep expertise in developing markets and where DFC can mobilize more private capital.

By investing in equity, DFC can bring its expertise and U.S. interests to a project early in a project or company's

lifecycle.

As investments are made in the future, they will increasingly drive financial performance due to market and other

factors affecting investment values. DFC leverages decades of institutional experience investing in Investment Funds

and comparable deals to ensure DFC is making sound investments while balancing its development objectives.

$-

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

FY 2021 FY 2022 FY 2023

ASSETS OVER TIME

(DOLLARS IN THOUSANDS)

Investments, Net Loans Receivable, Net

Fund Balance with Treasury Other

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

9

FBwT, the Federal government equivalent of cash, is made up of Congressional appropriations, loan disbursements

and collections, and interest and fee collections. The increase of approximately $411 million in FBwT is due to

increases in appropriated resources provided to fund DFC’s financing and equity programs, increases in collections

on existing loans, and increases in earnings from DFC’s direct loan and loan guaranty programs, offset by increases

in operating costs.

Other Assets decreased primarily due to a change in the Negative Loan Guaranty Liability. In FY 2022, DFC reported

a Negative Loan Guaranty Liability of $91 million as an asset on the Consolidated Balance Sheet. In FY 2023, DFC is

reporting a $710 million Loan Guaranty Liability as part of Other Liabilities on the Consolidated Balance Sheet. The

change from assets to liabilities was mainly due to an adjustment in the allowance on defaulted loan guaranties and

current year reestimates.

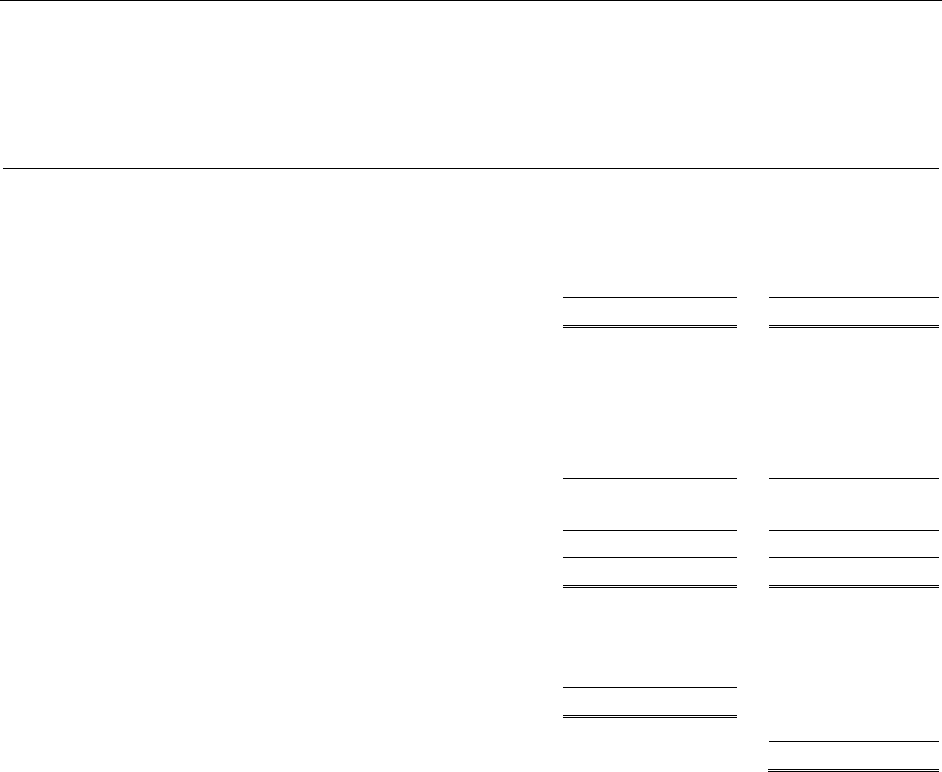

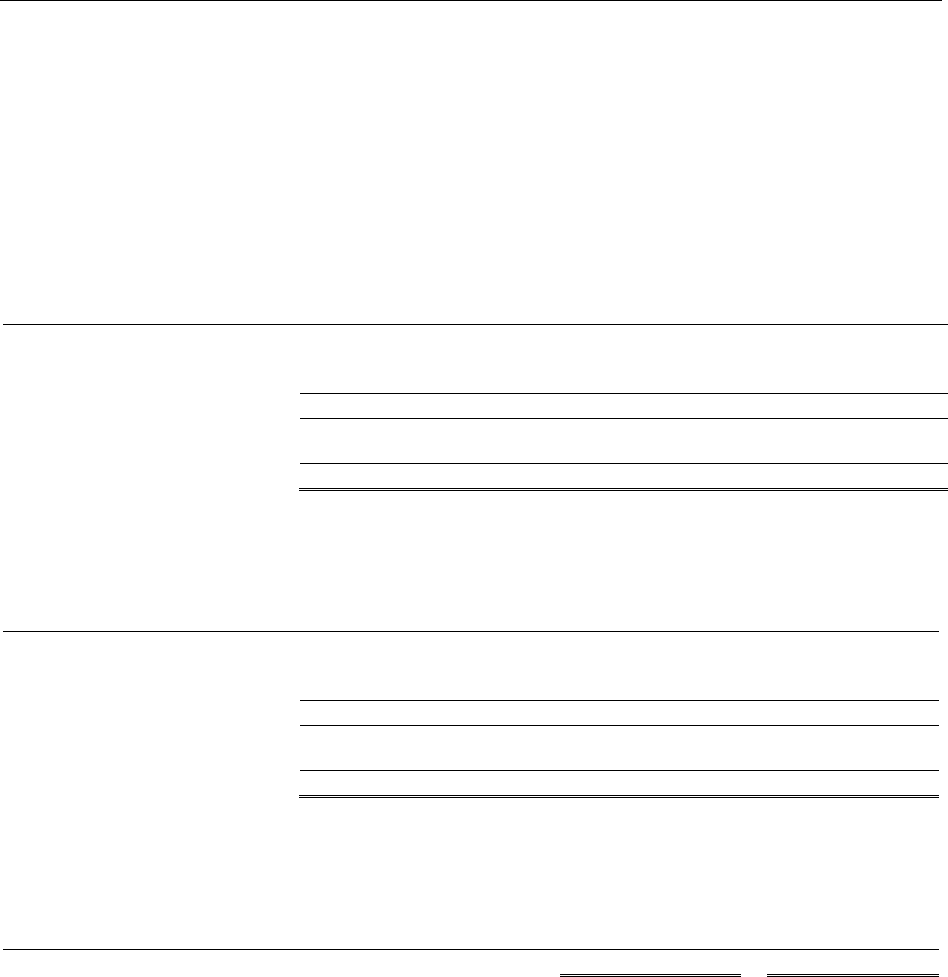

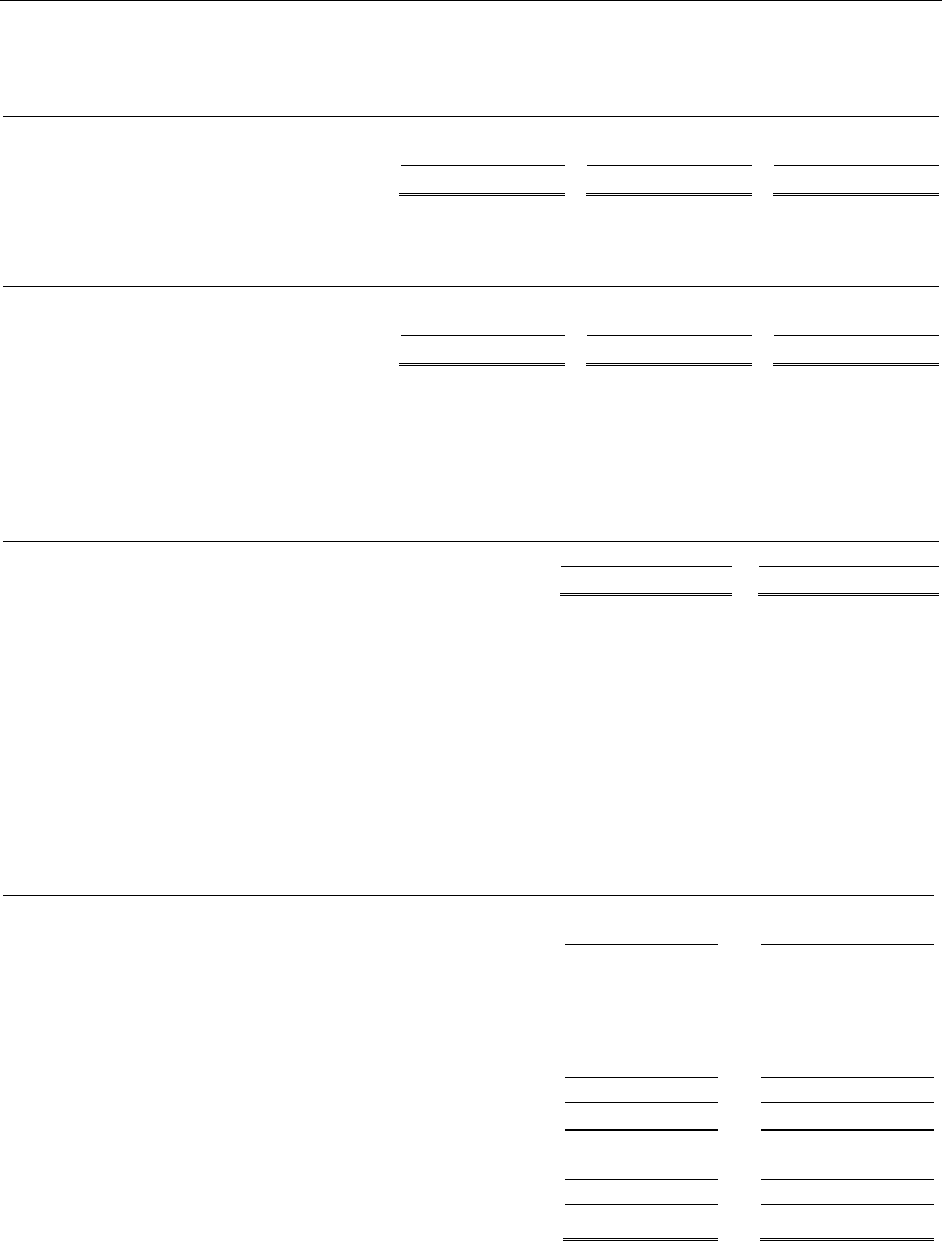

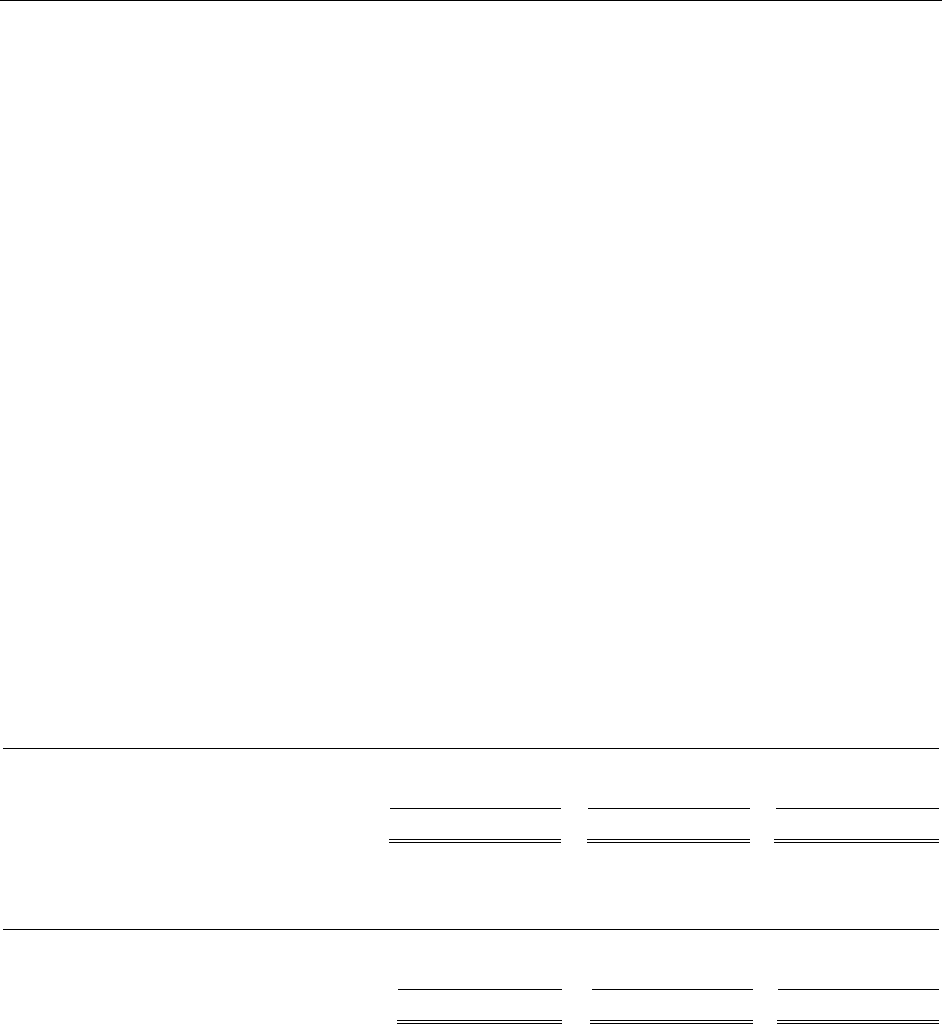

LIABILITIES

DFC’s liabilities are primarily composed of Debt in the form of Borrowings from Treasury, and the Liability to the

General Fund of the U.S Government.

Debt is DFC’s largest liability balance, and

represents amounts borrowed from the

Treasury to fund loans, as discussed above

for the Loans Receivable. DFC pays interest

to the Treasury on the borrowings until DFC

pays the funds back to the Treasury. DFC’s

debt balance has increased by

approximately $1.5 billion from FY 2022,

which is reflected in offsetting increase in

Loans Receivable and FBwT, as discussed

above.

DFC’s Liability to the General Fund of the

U.S. Government are amounts owed to the

Treasury for downward reestimates payable

to the Treasury in the next fiscal year. The

liability is reduced when the Office of Management and Budget (OMB) provides authority for DFC to transfer the

funds. For more information, refer to the discussion of Reestimated Subsidy Costs.

Other Liabilities primarily consists of DFC’s Loan Guaranty Liability in FY 2023 of $710 million. In FY 2022, DFC

reported a Negative Loan Guaranty Liability of $91 million, reported as an Other Asset on the FY 2022 Consolidated

Balance Sheet.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

10

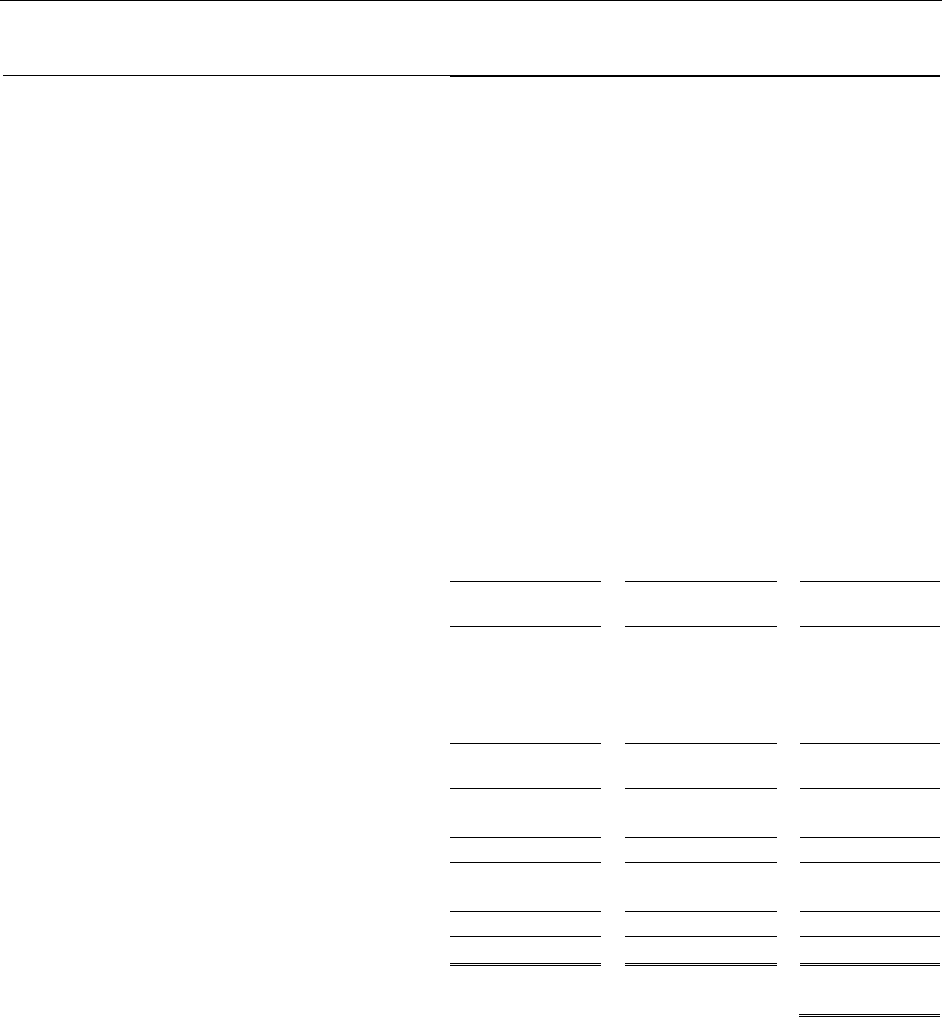

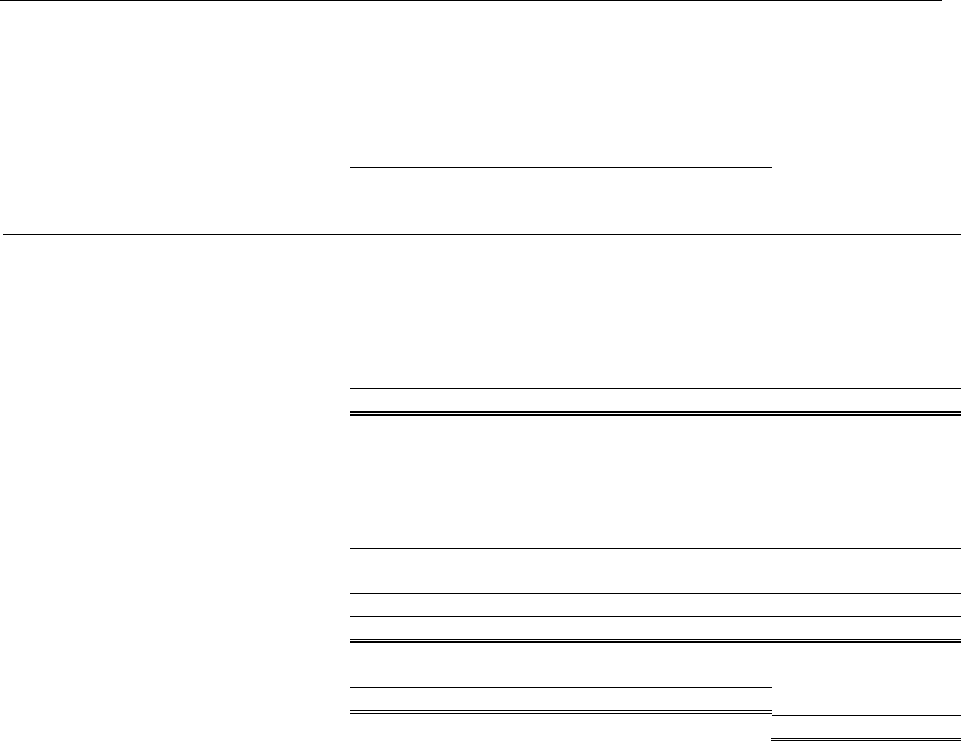

CONSOLIDATED STATEMENTS OF NET COST

The Consolidated Statements of Net Cost measure the program costs to the taxpayer. In FY 2023, DFC had net income

of $340 million. In FY 2022, DFC had net costs of $16 million. When DFC generates more revenue than its gross costs

it results in net income (or negative Net Cost), whereas when DFC incurs more gross costs than revenue it results in

net cost. The decrease in net cost was primarily driven by the following:

• In FY 2023, DFC recorded a net downward reestimate of $102 million compared to FY 2022 when DFC

recorded a net upward reestimate of $221 million. This is an estimate reflecting that DFC expects the Debt

Financing programs will cost less than previously estimated. The change in estimate is driven by the better

economic outlook in FY 2023 than in FY 2022 which included cumulative economic impacts of COVID and

the war in Ukraine.

• Negative subsidy earnings, net of positive subsidy costs, increased by approximately $36 million. This is

the expected earnings on loans disbursed, which is recognized at the time loans disburse.

• Insurance claims expenses decreased from FY 2022 to FY 2023. FY2022 insurance claims expenses were

higher due to a large claim recognized for a project in Ukraine.

• The increases in revenues were partially offset by increases in FY 2023 of administrative operating costs as

DFC continues to grow and receives larger administrative budgets.

DFC categorizes cost and revenue into four major programs: 1) Insurance, 2) Debt Financing, 3) Equity, and 4)

Technical Assistance.

$-

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

FY 2021 FY 2022 FY 2023

LIABILITIES OVER TIME

(DOLLARS IN THOUSANDS)

Debt Liabilities to the General Fund of the US Government Other

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

11

INSURANCE

DFC’s revenue over costs for its insurance program was $124 million in FY 2023 and $105 million in FY 2022. The

increase in net revenue was driven primarily by a reduction in operating costs. In FY 2023 DFC had less insurance

claims which were recorded as part of Gross Costs, than in FY 2022, when a large insurance claim was recorded

related to political violence in Ukraine. DFC provides Political Risk Insurance for overseas investments against several

risk types. For detailed information about the insurance program, refer to Note 15 in the Financial Section.

Administrative expenses include allocations of indirect operating costs that support the insurance program.

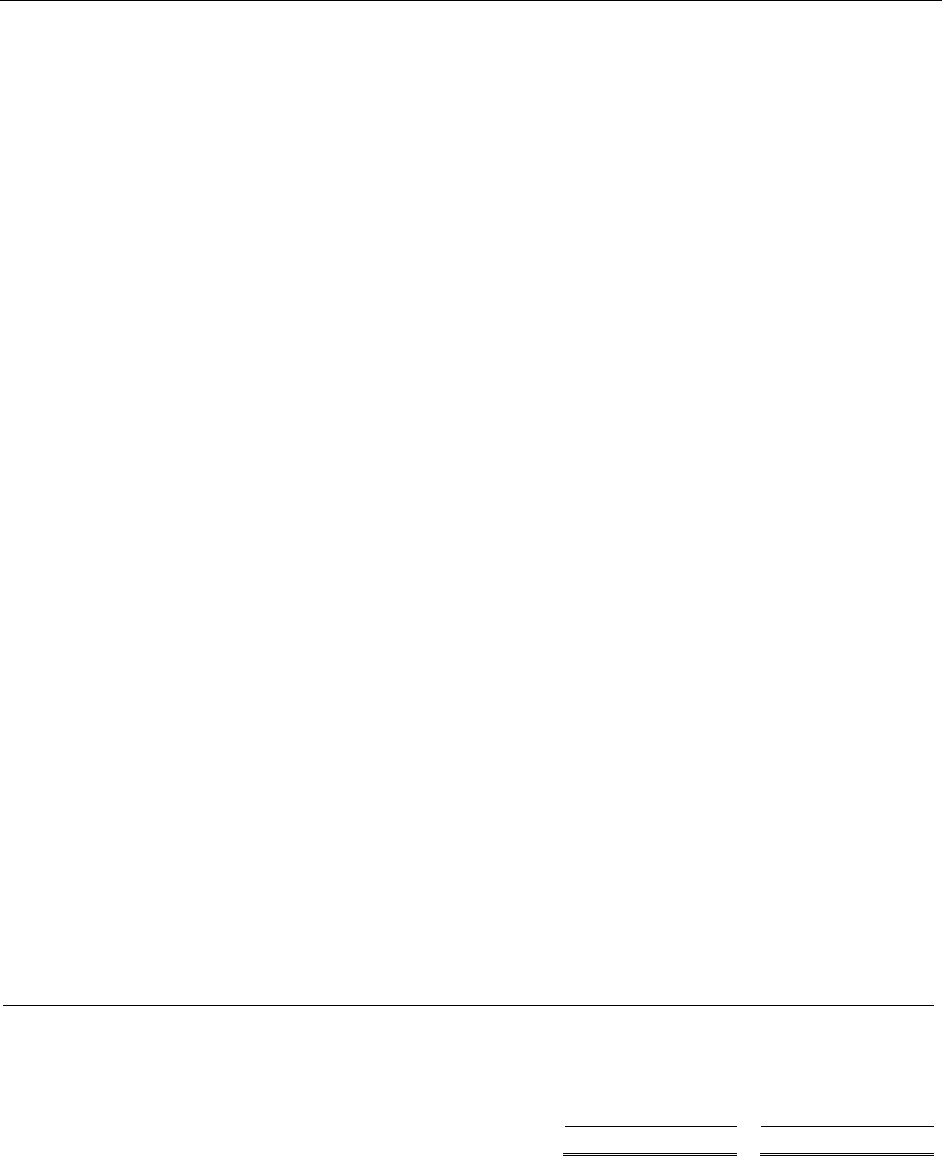

DEBT FINANCING

The debt financing program had a net income in FY 2023 of $261 million, compared to net cost in FY 2022 of $110

million. The increase was driven primarily by the reestimates of the direct loans and loan guaranties recorded. In FY

2023 DFC recorded a net downward reestimate of $102 million, in comparison to a net upward reestimate of $221

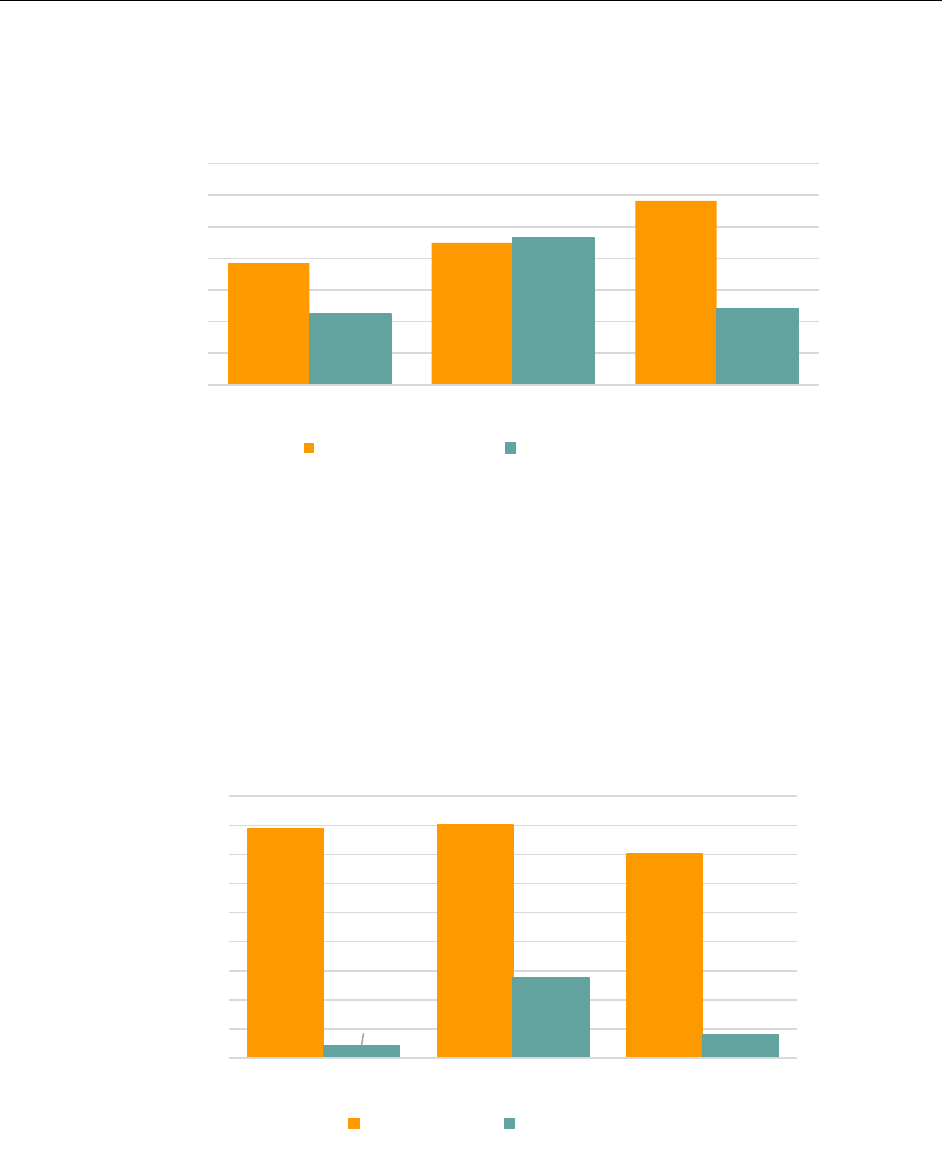

$384,832

$448,924

$581,672

$223,166

$465,399

$240,778

$-

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

FY 2021 FY 2022 FY 2023

CONSOLIDATED STATEMENTS

OF NET COST

(DOLLARS IN THOUSANDS)

Total Earned Revenue Total Gross Costs

$157,335

$160,236

$140,084

$8,862

$54,989

$16,086

$-

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

$160,000

$180,000

FY 2021 FY 2022 FY 2023

INSURANCE PROGRAM

(DOLLARS IN THOUSANDS)

Earned Revenue Gross Costs

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

12

million recorded in FY 2022. The debt financing program also had a $159 million increase in fees and interest revenue

on its loans and loan guaranties which were partially offset by increases in administrative execution costs.

For additional explanations of subsidy and how loans are valued, see Significant Factors Influencing Financial Results.

EQUITY

In FY 2023, DFC recognized approximately $1 million in net unrealized gains on investments as reflected on the

Consolidated Statements of Net Cost, compared to $7 million in unrealized gains in FY 2022. The Equity program

also generated $9 million of revenues from dividends on DFC’s equity investments in FY 2023 compared to $10

million in dividend revenues in FY 2022. In FY 2023 there were $41 million in administrative costs related to

identifying and evaluating potential investments, compared to $19 million in administrative costs in FY 2022. The

increase in expenses was driven by an expanding equity office that is building up the infrastructure for DFC’s future

equity investments.

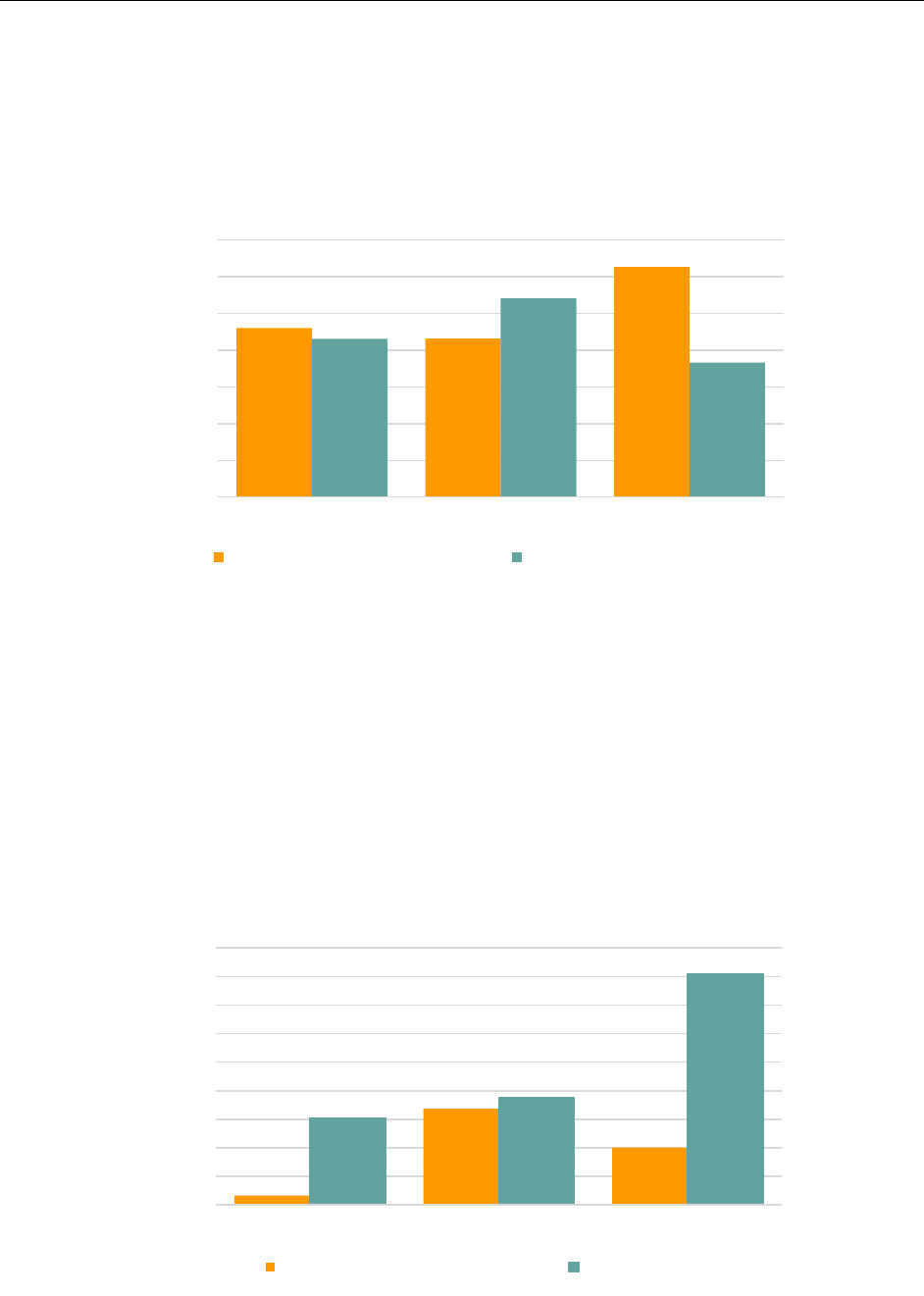

$460,566

$431,813

$626,530

$431,185

$541,444

$365,826

$-

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

FY 2021 FY 2022 FY 2023

DEBT FINANCING PROGRAM

(DOLLARS IN THOUSANDS)

Total Earned Revenue and Subsidy Gross Costs & Reestimates

$1,642

$16,835

$10,065

$15,236

$18,790

$40,501

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

$45,000

FY 2021 FY 2022 FY 2023

EQUITY PROGRAM

(DOLLARS IN THOUSANDS)

Total Revenue and Unrealized Gains Gross Costs

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

13

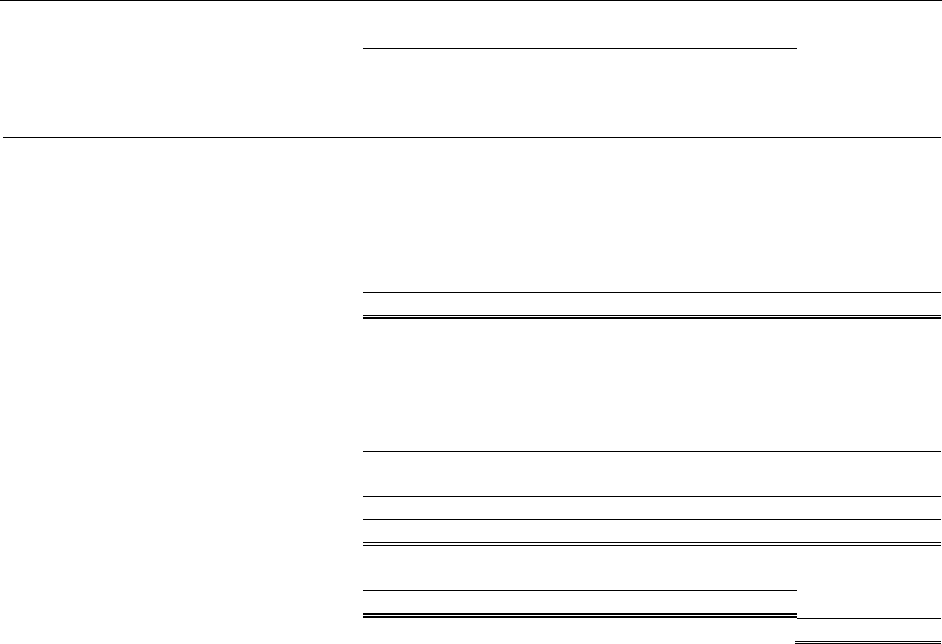

COMBINED STATEMENTS OF BUDGETARY RESOURCES

In accordance with Federal statutes and regulations, DFC may incur obligations and make payments to the extent it

has budgetary resources to cover such items. The Combined Statements of Budgetary Resources (SBR) are divided

into four sections: 1) Budgetary Resources; 2) Status of Budgetary Resources; 3) Net Outlays; and 4) Disbursements.

BUDGETARY RESOURCES STATUS OF BUDGETARY RESOURCES

Displays the sources of DFC’s funding, such as

appropriations from Congress, collections from the

public and other agencies, and authority to borrow

from the Treasury.

Displays the status of the funding, such as whether

the sources have been obligated for use, or if they

were not obligated. Unobligated sources are

displayed as funds that are apportioned for use,

unapportioned for use, or expired.

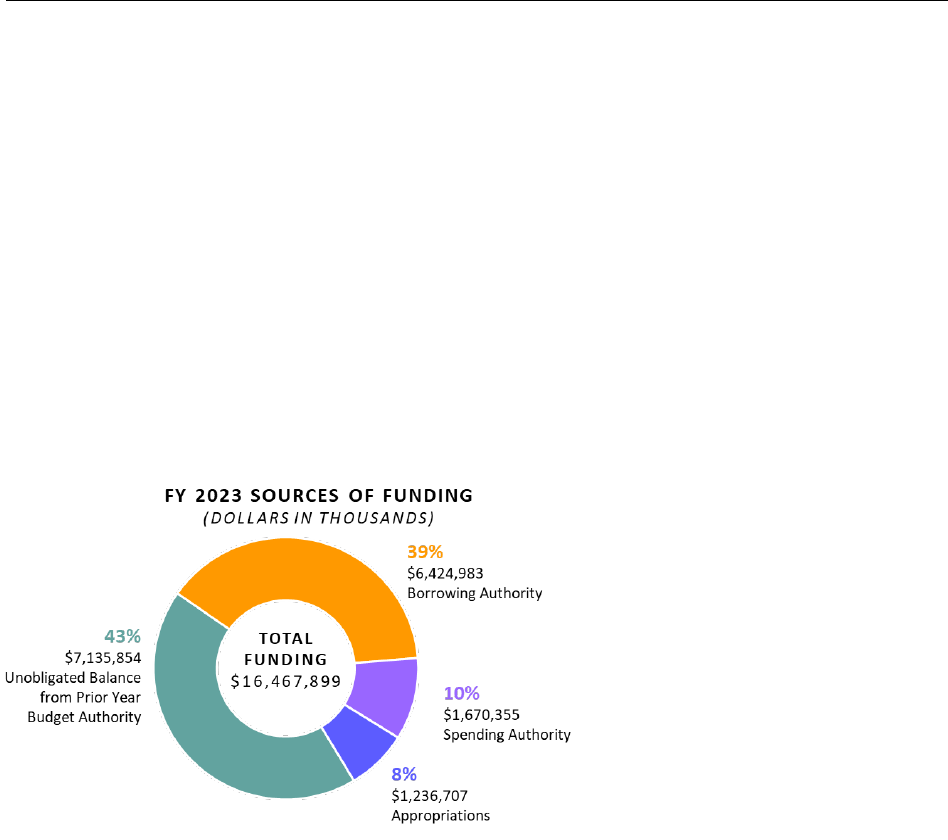

SOURCES OF FUNDING

In FY 2023 and FY 2022, DFC’s largest

source of funding was the Unobligated

Balance from Prior Year Budget Authority

which includes unused budget authority

since DFC’s inception, including

collections from DFC’s insurance

program, revenues from investments,

prior year recoveries of obligations, as

well as Budget Authority transferred in

from OPIC and USAID under the BUILD

Act to continue administering the

programs, loans, and loan guaranties

from the respective agencies.

Borrowing Authority allows DFC to borrow funds from the Treasury to make its loans. The borrowings are reflected

on the balance sheet as Debt, and the loans are reflected on the balance sheet as Loans Receivable, Net. DFC’s

increase in Borrowing Authority in FY 2023 is due to the expansion of DFC’s Debt Financing program.

DFC receives the following appropriations:

• Annual appropriations from the General Fund to fund subsidy on loans and loan guaranties, equity,

technical assistance, and for operations. Except for the appropriation for the Office of the Inspector

General, DFC reduces its annual appropriation from the General Fund, in an amount equal to offsetting

collections received during the fiscal year. In FY 2023, DFC reduced its annual appropriations of $1,010

million by $387 million, resulting in a net appropriation of $623 million. In FY 2022, DFC received $706

million in annual appropriations and returned $359 million, resulting in a net appropriation from the

General Fund of $347 million.

• Permanent and indefinite appropriations are made available to DFC to pay for upward reestimates of

subsidy on loans and loan guaranties. In FY 2023, DFC received $614 million in permanent and indefinite

appropriations to pay for upward reestimates compared to $582 million in FY 2022.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

14

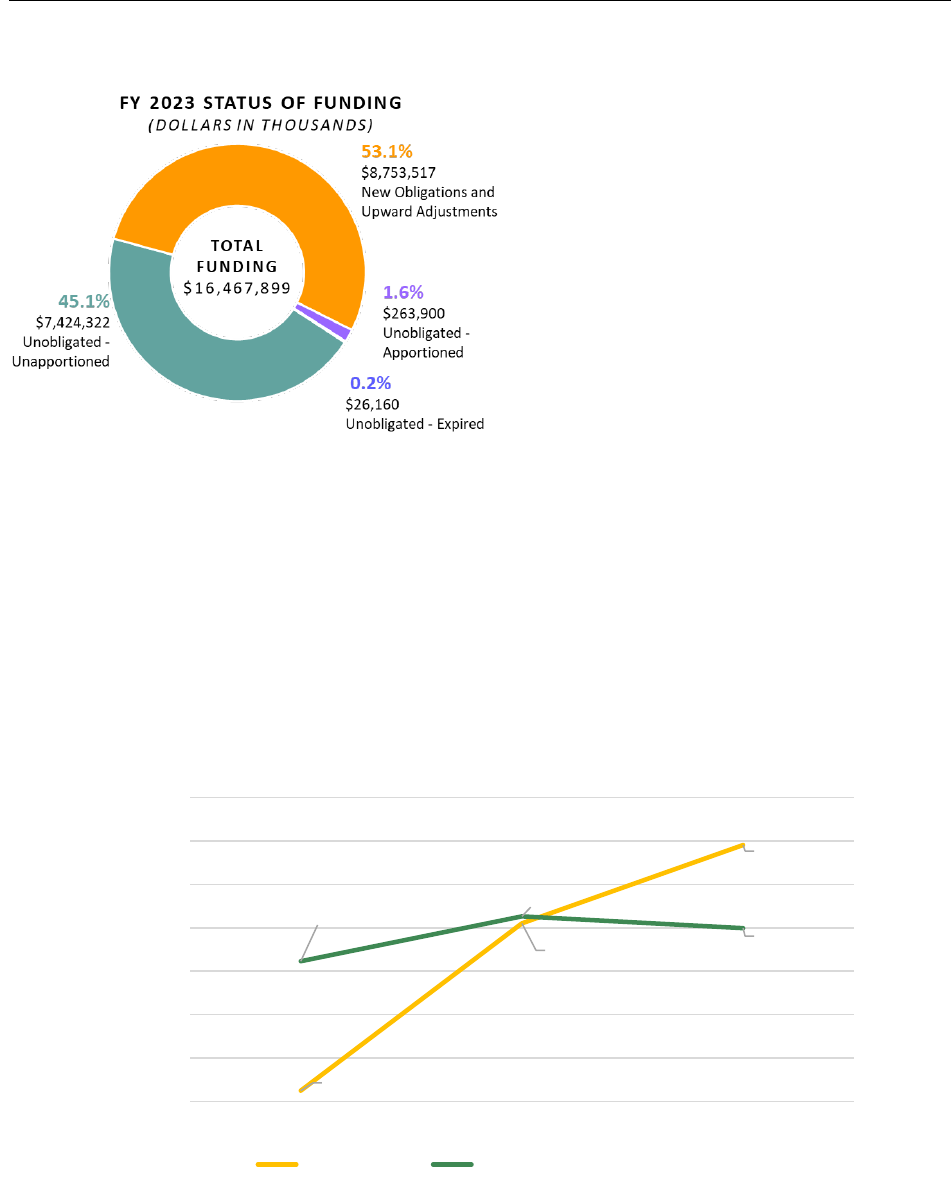

STATUS OF FUNDING

New obligations and Upward Adjustments represent

direct loan commitments, related positive and

negative subsidy commitments, contractual

commitments, and other reservations of funds to

operate the agency to meet its mission and goals.

New Obligations and Upward Adjustments increased

by approximately $1.3 billion in FY 2023 mainly due

to increases in direct loans obligated, as DFC

continues to expand the Debt Financing Program

through direct loans.

Unobligated unapportioned funds are mostly from

funds transferred in from OPIC’s Insurance program.

$6.2 billion of these funds are represented on the

Balance Sheet as investments in Treasury securities.

NET OUTLAYS

Net Outlays displays budgetary outlays for DFC, reduced by collections of interest, fees, and other revenue. In FY

2023, DFC had net outlays of $591 million, compared to $410 million in FY 2022. Net Outlays were further reduced

by Distributed Offsetting Receipts of $399 million and $426 million in fiscal years 2023 and 2022, respectively.

Distributed Offsetting Receipts are comprised of negative subsidy and downward reestimates on direct loan and

loan guaranty programs that DFC pays to the Treasury.

$24,442

$410,126

590,673

$322,808

$426,222

398,962

$-

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

FY 2021 FY 2022 FY 2023

OUTLAYS, NET AND DISTRIBUTED OFFSETTING

RECEIPTS

(DOLLARS IN THOUSANDS)

Outlays, Net Distributed Offsetting Receipts

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

15

DISBURSEMENTS

Non-budgetary disbursements are related to direct loans and loan guaranty programs covered under the Federal

Credit Reform Act of 1990 (FCRA). DFC had net disbursements of $1.6 billion in FY 2023 and $1.2 billion in FY 2022

for direct loan and loan guaranty programs. The disbursements for loans and claim payments are offset by

collections, including, but not limited to, collections of loan principal and loan interest, collections of fees and

subsidy. These are displayed separately from Net Outlays because the disbursements are excluded from U.S. budget

surplus or deficit totals. The increase in disbursements is directly traceable to the increase in loans receivable and

increase in debt owed to the Treasury reflected on the balance sheet.

SIGNIFICANT FACTORS INFLUENCING FINANCIAL RESULTS

The long-term cost to the government for direct loans and loan guaranties, other than for general administration of

the programs, is referred to as “subsidy cost.” Under FCRA, direct loan and loan guaranty subsidy costs are

determined as the estimated net present value of the future projected cash flows in the year the loan is obligated.

Subsidy costs are reestimated on an annual basis. DFC’s financial results are dominated by these estimates of subsidy

costs and year-to-year adjustments to the valuation of its finance portfolio.

SUBSIDY COSTS OF NEW DISBURSEMENTS

To calculate subsidy costs for new loans or guaranties, estimates are developed of the expected future cash outflows

and inflows of the direct loan or loan guaranty agreement. Historical information and various assumptions are used,

including the probabilities of default, borrower prepayments, DFC recoveries of funds from past defaults, as well as

the projected timing of these events, to make informed predictions about expected future cash flows. These

expected cash flows are then discounted to determine the net present value of the cash flows. If the present value

of estimated cash outflows exceeds estimated cash inflows, there is a positive subsidy cost, which is a cost to the

Federal government. If the present value of estimated cash inflows exceeds estimated cash outflows, that is

recorded as a negative subsidy, which is a benefit to the Federal government. When loans are disbursed, DFC

recognizes this subsidy cost (or negative subsidy) in the Statements of Net Cost.

REESTIMATED SUBSIDY COSTS

The data used for subsidy cost estimates are updated—or reestimated—annually at the end of each fiscal year to

reflect actual loan performance and to incorporate any changes in expectations about future loan performance. The

following are the primary drivers of DFC’s annual reestimated subsidy costs.

Reevaluation of Risk Ratings

Repayment risk is the risk that a borrower will not pay according to the original agreement and DFC may eventually

have to write-off some, or all, of the obligation. Repayment risk is primarily composed of credit and political/country

risk, which may be defined as follows:

• Credit Risk: The risk that a borrower may not have sufficient funds to make loan and fee payments or may

not be willing to make payments, even if sufficient funds are available.

• Political Risk/Country Risk: The risk that payment may not be made to DFC, its guarantied lender, or its

insured due to factors such as war, if a country nationalizes, or takes over the borrower’s property, or if a

country disallows the borrower’s payments to be converted into U.S. dollars.

Updates to Loan Level Discount Rates

Discount rates are used to calculate the net present value of the estimated cash flows to determine the subsidy cost.

In accordance with OMB Circular No. A-11, DFC uses the OMB’s Credit Subsidy Calculator (CSC) to calculate the

discount rates. When loan and loan guaranty agreements are initiated and obligated, an initial discount rate is used

to calculate estimated cash flows. At the end of each fiscal year, revised rates are calculated for loans that became

at least 90 percent disbursed in the current fiscal year. The new discount rates are calculated by the CSC using actual

loan activity, updated forecasts, and all available actual interest rates. The updated discount rates are used to

calculate the reestimated cash flows.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

16

Updates to Interest Rates

For loans with variable interest rates charged to the borrower, the original cash flow projections are adjusted to

incorporate the actual interest rate(s) prevailing during the year(s) of disbursement and are subsequently adjusted

after the end of each year for loans that are outstanding.

Updates to Projected Cash Flows with Actual Data

Projected cash flows need to be updated due to differences between the original projections, and the amount and

timing of cash flows that are expected based on actual experience. DFC uses loan-level accounting transactions that

are captured in the general ledger for the current year of the cash flows. This actual data replaces the projections

developed from the prior year reestimates to develop more accurate assumptions of future cash flows from

disbursements, collections of principal, interest, fees, and recoveries.

INSURANCE PROGRAM CLAIMS

Insurance claims are assessed for probability of becoming an actual payment, and when payment is probable, claims

are recorded, net of estimated recoveries, as expenses on the Consolidated Statement of Net Cost, and as Insurance

and Guaranty Program Liabilities on the Consolidated Balance Sheet. In FY 2023, DFC recorded new insurance claims

of approximately $6 million, compared to approximately $44 million in FY 2022. In FY 2023, $49 million of insurance

claims were paid, reducing the insurance liabilities. The payments are reflected on the Statement of Budgetary

Resources as part of Disbursements in FY 2023.

EQUITY VALUATIONS

DFC’s equity investments are valued in accordance with accounting standards that require recording unrealized gains

and losses during the year. Unrealized gains and losses result from recording adjustments to the valuation of the

investments and are not the result of selling or disposing of the investments. The unrealized gains and losses are

recorded on the Consolidated Statements of Net Cost and can change year to year depending on the performance

of the individual investments. In FY 2023 and FY 2022, several of the investments have been adjusted to net asset

value as determined by the fund manager and provided to DFC. Net asset value is the amount of net assets

attributable to each share of capital stock outstanding at the close of a period. In FY 2023 and FY 2022, DFC recorded

approximately $1 million and $7 million, respectively, in net unrealized gains on investments. DFC expects these

investments to continue to grow in value and ultimately produce realized gains when DFC eventually sells

investments.

LIMITATIONS OF THE FINANCIAL STATEMENTS

The financial statements have been prepared to report the financial position, financial condition, and results of

operations of DFC, consistent with the requirements of 31 U.S.C. § 3515(b). The statements are prepared from

records of Federal entities in accordance with Federal generally accepted accounting principles (GAAP) and the

formats prescribed by OMB. Reports used to monitor and control budgetary resources are prepared from the same

records. Users of the statements are advised that the statements are for a component of the U.S. Government.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

17

ANALYSIS OF SYSTEMS, CONTROLS, AND LEGAL COMPLIANCE

FISCAL YEAR 2023 CHIEF EXECUTIVE OFFICER STATEMENT OF ASSURANCE

The management of the U.S. International Development Finance Corporation (DFC) is responsible for

establishing, maintaining, evaluating, and reporting on the agency’s internal controls consistent with the

objectives of the Federal Managers’ Financial Integrity Act of 1982 (FMFIA).

In accordance with FMFIA and the guidance contained within Office of Management and Budget (OMB)

Circular No. A-123, Management’s Responsibility for Enterprise Risk Management and Internal Control,

DFC management monitored and evaluated risks and the effectiveness of its internal control over the

efficiency and effectiveness of operations, reliability of reporting, and compliance with applicable laws

and regulations, including considerations of fraud risk.

DFC provides reasonable assurance that its internal controls over operations, reporting, and compliance

met the objectives of agency management, complied with applicable requirements, and were operating

effectively as of September 30, 2023. DFC did not identify any material weaknesses in the design or

operating effectiveness of the controls.

Scott A. Nathan

Chief Executive Officer

U.S. International Development Finance Corporation

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

18

SUMMARY OF INTERNAL CONTROL ASSESSMENT

In FY 2023, DFC continued to exhibit strength and increasing maturity in its risk and control environments. DFC

evaluated its entity and transaction level internal controls using a risk-based assessment approach that was adopted

by the agency’s Senior Management Council and developed pursuant to OMB Circular No. A-123, Management’s

Responsibility for Enterprise Risk Management and Internal Controls and its associated guidance. Risk was assessed

both at the enterprise and business process levels based on both quantitative as well as qualitative factors, including

but not limited to financial materiality, mission orientation, the complexity and frequency of transactions, and

exposure to fraud. DFC continues to test the design and operating effectiveness of its controls pursuant to a

rotational testing plan that is influenced by recurring updates to agency risk assessments. No material weaknesses

in internal control were identified in FY 2023, and the results of this year’s activities, combined with management’s

role in the daily execution and monitoring of internal controls, allows the agency to assert there is reasonable

assurance that internal controls were properly designed and operating effectively during the year to support efficient

and effective operations, reliability of reporting, and compliance with laws and regulations. In FY 2024, DFC will

continue to mature its Enterprise Risk Management program and further strengthen its internal controls over

operations, reporting, and compliance through continued risk-based assessments and monitoring activities.

SYSTEMS COMPLIANCE

DFC’s Financial Management unit establishes funds controls in the Oracle financial system. All obligations are

centralized in the Oracle system, and through those processes, DFC maintains control of its funding. Lending records

and operations are maintained in an Oracle extension with direct integration to Oracle Government Financials.

LEGAL COMPLIANCE

Anti-Deficiency Act

DFC maintains compliance with the Anti-Deficiency Act (codified as amended in 31 U.S.C. §§ 1341, 1342, 1351, 1517)

through several tiers of process and system controls to maintain funds control. Apportionments are developed in

consultation with OMB and designed to provide DFC with funds consistent with DFC’s authorities in appropriations

and authorizing legislation. DFC’s financial management system records apportionments and establishes automated

funds controls. All obligations are centralized in the financial management system, and through those processes,

DFC maintains control of its funding.

Federal Credit Reform Act of 1990

The Federal Credit Reform Act (FCRA) of 1990 (Public Law 101-508) establishes the accounting, budgeting, analysis,

and display of loans and guaranties (i.e. Credit Reform). Credit Reform is therefore central to the budgetary and

financial operation of the Corporation and its operations with the Treasury. The Corporation maintains several key

processes and platforms in support of its Credit Reform implementation, and maintains data and modeling

capabilities for each stage of its life cycle from budgetary formulation, to obligation, and throughout actual execution

to ensure DFC maintains compliance with the Federal Credit Reform Act of 1990.

FORWARD-LOOKING INFORMATION

CLIMATE-RELATED RISKS

Climate action is one of the key objectives of the DFC, as stated in the DFC Strategic Plan for 2022-2026. Pursuant to

Executive Order 14008, Tackling the Climate Crisis at Home and Abroad, DFC established a Climate Action Plan in

2021. Building an impactful portfolio of climate-smart investments is key to furthering DFC’s commitment to

development, and to providing a values-driven, sustainable investment alongside like-minded partners and allies.

Over the past year, DFC has announced hundreds of millions in climate investments focused on supporting economic

mobility, jobs, and tools to build prosperous clean energy economies in developing countries. At a project level, DFC

has been incorporating climate change resiliency assessments since 2015 in response to Executive Order 13677.

DFC’s climate reports include:

• Climate Action Plan - DFC has published its Climate Action Plan in accordance with Executive Order 14008.

• Climate Adaptation Reports – DFC has published Climate Adaptation Reports, reporting on its progress

against its Climate Action Plan, in accordance with Executive Order 14057.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS (UNAUDITED)

19

• Green House Gas (GHG) Emissions Inventory Report - P.L. 111-117 Sec 7079(a) required that OPIC (now

DFC) reduce the GHG emissions associated with its projects by at least 30% over 10 years and 50% over 15

years. This report tracks progress on achievement of those emission reduction goals. The most recent report

issued in FY 2022 addresses portfolio emission in FY 2021.

DIVIDEND

Under the BUILD Act the DFC Board of Directors could under certain circumstances declare a dividend. Such a

dividend would be paid from Cumulative Results of Operations, thereby reducing DFC’s overall financial position.

Any material dividends would affect the future financial position of the agency.

EVOLUTION OF PROGRAMS

To meet its development and foreign mandates, DFC is developing new and innovative products using its expanded

program flexibilities. This has led to a shifting of products being used for development, with more reliance on direct

loans and equity investments. These flexibilities also allow DFC to lend in local currencies, and DFC is working to

offer more loans in the currencies of the countries where the loans and investments are located. DFC’s involvement

in the President’s Partnership for Global Infrastructure and Investment (PGI) is also driving DFC’s investments in the

infrastructure areas of climate and energy security, digital connectivity, health and health security, and gender

equity. As part of the PGI, DFC is particularly focused on sourcing strategic projects that help close the estimated

$40 trillion infrastructure financing gap in developing countries and thereby provide an alternative to financial

support from authoritarian governments. Additionally, DFC is responding through its investments to uncertainties

throughout the world, such as food insecurity and climate change adversely impacting critical ecosystems necessary

for food, shelter, and income.

20

MEMORANDUM:

DATE: November 15, 2023

TO:

MR. SCOTT NATHAN

CHIEF EXECUTIVE OFFICER

MS. MILDRED CALLEAR

VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

FROM: Mr. Anthony “Tony” Zakel

Inspector General

SUBJECT: DFC’s Consolidated Financial Statements for Fiscal Years 2023 and 2022

(Report Number DFC-24-003-C)

Enclosed is the Fiscal Year 2023 Consolidated Financial Statement opinion audit report.

We contracted with the independent public accounting firm RMA Associates, LLC (RMA) to

audit the consolidated financial statements of the United States International Development

Finance Corporation (DFC) for the fiscal years ended September 30, 2023 and 2022, report on

internal control over financial reporting, and report on compliance with laws and other matters.

The contract required the audit to be performed in accordance with U.S. generally accepted

auditing standards, Office of Management and Budget audit guidance, and the Government

Accountability Office’s and Council of the Inspectors General on Integrity and Efficiency’s

Financial Audit Manual.

In its audit of DFC, RMA reported

• the consolidated financial statements were fairly presented, in all material respects, in

accordance with U.S. generally accepted accounting principles;

• no material weaknesses

1

and no significant deficiencies

2

in internal control over financial

reporting; and

• no reportable noncompliance with provisions of laws tested and other matters.

RMA is responsible for the attached auditor’s report dated November 15, 2023 and the

conclusions expressed therein. We do not express opinions on DFC’s consolidated financial

statements, or report on internal control over financial reporting, or report on compliance and

other matters.

Anthony “Tony” Zakel

Inspector General

U.S. International Development Finance Corporation

1

A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a

reasonable possibility that a material misstatement of the entity's financial statements will not be prevented, or

detected and corrected on a timely basis.

2

A significant deficiency is a deficiency, or a combination of deficiencies, in internal control that is less severe than

a material weakness, yet important enough to merit attention by those charged with governance.

1005 N. Glebe Road, Suite 610

Arlington, VA 22201

Phone: (571) 429-6600

www.rmafed.com

Member of the American Institute of Certified Public Accountants’ Government Audit Quality Center

21

Independent Auditor’s Report

Chief Executive Officer, Chief Financial Officer, and Inspector General

United States International Development Finance Corporation

Report on the Audit of the Consolidated Financial Statements

Opinion

We have audited the accompanying financial statements of the United States International

Development Finance Corporation (DFC), which comprise the consolidated balance sheets as of

September 30, 2023 and 2022, and the related consolidated statements of net cost, statement of

changes in net position, and the combined statements of budgetary resources, for the years then

ended, and the related notes to the financial statements (collectively referred to as ‘consolidated

financial statements’).

In our opinion, the consolidated financial statements referred to above present fairly, in all material

respects, the financial position of the DFC as of September 30, 2023 and 2022 and its net cost,

changes in net position, and combined budgetary resources for the years then ended, in accordance

with U.S. generally accepted accounting principles.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America (GAAS) and the standards applicable to financial audits contained in

Government Auditing Standards issued by the Comptroller General of the United States, and the

Office of Management and Budget (OMB) Bulletin No. 24-01, Audit Requirements for Federal

Financial Statements. Our responsibilities under those standards are further described in the

Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our

report. We are required to be independent of the DFC and to meet our other ethical responsibilities,

in accordance with the relevant ethical requirements relating to our audit. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Other Matter – Interactive Data

Management has elected to reference to information on websites or other forms of interactive data

outside the fiscal year 2023 Annual Management Report to provide additional information for the

users of its consolidated financial statements. Such information is not a required part of the

consolidated financial statements or supplementary information required by the Federal

Accounting Standards Advisory Board. The information on these websites or the other interactive

data has not been subjected to any of our auditing procedures, and accordingly we do not express

an opinion or provide any assurance on it.

1005 N. Glebe Road, Suite 610

Arlington, VA 22201

Phone: (571) 429-6600

www.rmafed.com

Member of the American Institute of Certified Public Accountants’ Government Audit Quality Center

22

Responsibilities of Management for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial

statements in accordance with U.S. generally accepted accounting principles, and for the design,

implementation, and maintenance of internal control relevant to the preparation and fair

presentation of consolidated financial statements that are free from material misstatement, whether

due to fraud or error.

Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial

statements as a whole are free from material misstatement, whether due to fraud or error, and to

issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of

assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in

accordance with GAAS, Government Auditing Standards, and OMB Bulletin No. 24-01, will

always detect a material misstatement when it exists. The risk of not detecting a material

misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve

collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Misstatements are considered material if there is a substantial likelihood that, individually or in

the aggregate, they would influence the judgment made by a reasonable user based on the

consolidated financial statements.

In performing an audit in accordance with GAAS, Government Auditing Standards, and OMB

Bulletin No. 24-01 we:

• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the consolidated financial statements,

whether due to fraud or error, and design and perform audit procedures responsive to those

risks. Such procedures include examining, on a test basis, evidence regarding the amounts and

disclosures in the financial statements.

• Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the DFC’s internal control. Accordingly, no such opinion is

expressed.

• Evaluate the appropriateness of accounting policies used and the reasonableness of significant

accounting estimates made by management, as well as evaluate the overall presentation of the

financial statements.

We are required to communicate with those charged with governance regarding, among other

matters, the planned scope and timing of the audit, significant audit findings, and certain internal

control-related matters that we identified during the audit.

1005 N. Glebe Road, Suite 610

Arlington, VA 22201

Phone: (571) 429-6600

www.rmafed.com

Member of the American Institute of Certified Public Accountants’ Government Audit Quality Center

23

Required Supplementary Information

U.S. generally accepted accounting principles require management’s discussion and analysis be

presented to supplement the basic consolidated financial statements. Such information is the

responsibility of management and, although not a part of the basic consolidated financial

statements, is required by the Federal Accounting Standards Advisory Board who considers it to

be an essential part of financial reporting for placing the basic financial statements in an

appropriate operational, economic, or historical context.

We have applied certain limited procedures to the required supplementary information in

accordance with GAAS, which consisted of inquiries of management about the methods of

preparing the information and comparing the information for consistency with management’s

responses to our inquiries, the consolidated financial statements, and other knowledge we

obtained during our audit of the consolidated financial statements. We do not express an opinion

or provide any assurance on the information because the limited procedures do not provide us with

sufficient evidence to express an opinion or provide any assurance.

Other Information

Management is responsible for the other information included in the Annual Management Report.

The other information comprises the Table of Contents, Agency Head Letter, Inspector General’s

Transmittal Letter, Other Information Section, and Appendix but does not include the consolidated

financial statements and our auditor’s report thereon. Our opinion on the consolidated financial

statements does not cover the other information, and we do not express an opinion or any form of

assurance thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read

the other information and consider whether a material inconsistency exists between the other

information and the consolidated financial statements, or the other information otherwise appears

to be materially misstated. If, based on the work performed, we conclude that an uncorrected

material misstatement of the other information exists, we are required to describe it in our report.

Report on Internal Control Over Financial Reporting

In planning and performing our audit of the financial statements as of and for the year ended

September 30, 2023, we considered the DFC’s internal control over financial reporting (internal

control) as a basis for designing audit procedures that are appropriate in the circumstances for the

purpose of expressing our opinion on the consolidated financial statements, but not for the purpose

of expressing an opinion on the effectiveness of the DFC’s internal control. Accordingly, we do

not express an opinion on the effectiveness of the DFC’s internal control. We did not test all

internal controls relevant to operating objectives as broadly defined by the Federal Managers’

Financial Integrity Act of 1982.

A deficiency in internal control exists when the design or operation of a control does not allow

management or employees, in the normal course of performing their assigned functions, to prevent,

or detect and correct, misstatements on a timely basis. A material weakness is a deficiency, or a

combination of deficiencies, in internal control, such that there is a reasonable possibility that a

1005 N. Glebe Road, Suite 610

Arlington, VA 22201

Phone: (571) 429-6600

www.rmafed.com

Member of the American Institute of Certified Public Accountants’ Government Audit Quality Center

24

material misstatement of the entity’s consolidated financial statements will not be prevented, or

detected and corrected, on a timely basis. A significant deficiency is a deficiency, or a combination

of deficiencies, in internal control that is less severe than a material weakness, yet important

enough to merit attention by those charged with governance.

Our consideration of internal control was for the limited purpose described in the first paragraph

of this section and was not designed to identify all deficiencies in internal control that might be

material weaknesses or significant deficiencies and therefore, material weakness or significant

deficiencies may exist that were not identified. Given these limitations, during our audit, we did

not identify any deficiencies in internal control that we consider to be material weaknesses.

However, material weaknesses or significant deficiencies may exist that were not identified.

Report on Compliance and Other Matters

As part of obtaining reasonable assurance about whether the DFC’s consolidated financial

statements are free from material misstatement, we performed tests of its compliance with certain

provisions of laws, regulations, and contracts, noncompliance with which could have a direct and

material effect on the consolidated financial statements. However, providing an opinion on

compliance with those provisions was not an objective of our audit, and accordingly, we do not

express such an opinion. The results of our tests disclosed no instances of non-compliance or other

matters that are required to be reported under Government Auditing Standards or OMB Bulletin

No. 24-01.

DFC’s Response to Audit

DFC’s response to our audit can be found in Exhibit I. DFC’s response was not subject to the

auditing procedures applied in the audit of the financial statements and, accordingly, we express

no opinion on it.

Purpose of the Other Reporting Required by Government Auditing Standards

The purpose of the communication described in the Report on Internal Control over Financial

Reporting and Report on Compliance and Other Matters sections of this report is solely to describe

the scope of our testing of internal control and compliance and the results of that testing, and not

to provide an opinion on the effectiveness of the DFC’s internal control or compliance. This section

is an integral part of an audit performed in accordance with Government Auditing Standards in

considering the DFC’s internal control and compliance. Accordingly, this communication is not

suitable for any other purpose.

Arlington, VA

November 15, 2023

1005 N. Glebe Road, Suite 610

Arlington, VA 22201

Phone: (571) 429-6600

www.rmafed.com

Member of the American Institute of Certified Public Accountants’ Government Audit Quality Center

25

Exhibit 1: DFC Response

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

FINANCIAL STATEMENTS

26

CONSOLIDATED BALANCE SHEETS

(dollars in thousands)

2023

2022

As of September 30,

Assets

Intragovernmental:

Fund Balance with Treasury (Note 2)

$ 3,041,884

$ 2,631,003

Investments, Net (Note 3)

6,237,010

6,206,042

Accounts Receivable, Net (Note 4)

21,627

609

Total Intragovernmental

9,300,521

8,837,654

With the Public:

Accounts Receivable, Net (Note 4)

167,807

121,155

Loans Receivable, Net (Note 5)

10,242,062

7,523,771

General Property, Plant and Equipment, Net (Note 6)

21

155

Advances and Prepayments (Note 7)

183

1,247

Investments, Net (Note 3)

311,927

174,937

Other Assets:

Negative Loan Guaranty Liabilities (Note 5)

-

91,366

Total With the Public

10,722,000

7,912,631

Total Assets

$ 20,022,521

$ 16,750,285

Liabilities (Note 8)

Intragovernmental:

Debt (Note 9)

$ 10,497,580

$ 8,964,971

Advances from Others and Deferred Revenue (Note 10)

1,267

3,561

Other Liabilities:

Liability to the General Fund of the U.S. Government for Other

Non-Entity Assets (Note 11)

580,530

392,542

Other Liabilities (Note 12)

390

431

Total Intragovernmental

11,079,767

9,361,505

With the Public:

Accounts Payable (Note 13)

2,389

7,045

Federal Employee Benefits Payable (Note 14)

7,344

6,247

Loan Guaranty Liabilities (Note 5)

710,092

-

Insurance and Guaranty Program Liabilities (Note 15)

11,183

56,192

Advances from Others and Deferred Revenue (Note 10)

144,524

141,514

Other Liabilities (Note 12)

5,379

4,359

Total With the Public

880,911

215,357

Total Liabilities

11,960,678

9,576,862

Commitments and Contingencies (Note 1)

Net Position

Unexpended Appropriations – Funds Other Than Dedicated

Collections

674,382

400,785

Cumulative Results of Operations – Funds Other than Dedicated

Collections

7,387,461

6,772,638

Total Net Position

8,061,843

7,173,423

Total Liabilities and Net Position

$ 20,022,521

$ 16,750,285

The accompanying notes are an integral part of these principal financial statements.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

FINANCIAL STATEMENTS

27

CONSOLIDATED STATEMENTS OF NET COST

(dollars in thousands)

2023

2022

For the Years Ended September 30,

Insurance Program

Gross Costs

Operating Costs

$ 16,086

$ 54,989

Total Gross Costs

16,086

54,989

Less: Earned Revenue

(140,084)

(160,236)

Net Insurance Program Costs

(123,998)

(105,247)

Debt Financing Program

Gross Costs

Operating Costs

468,415

320,233

Subsidy Costs/(Reduction) (Note 5)

(195,307)

(159,960)

Net Reestimates (Note 5)

(102,589)

221,211

Total Gross Costs

170,519

381,484

Less: Earned Revenue

(431,223)

(271,853)

Net Debt Financing Program Costs

(260,704)

109,631

Equity Program

Gross Costs

Operating Costs

40,501

18,790

Total Gross Costs

40,501

18,790

Less: Net Unrealized (Gains)

(931)

(6,723)

Less: Earned Revenue

(9,134)

(10,112)

Net Equity Program Costs

30,436

1,955

Technical Assistance Program

Gross Costs

Operating Costs

13,672

10,136

Total Gross Costs

13,672

10,136

Less: Earned Revenue

(300)

-

Net Technical Assistance Program Costs

13,372

10,136

Net Cost of Operations

$ (340,894)

$ 16,475

The accompanying notes are an integral part of these principal financial statements.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

FINANCIAL STATEMENTS

28

CONSOLIDATED STATEMENTS OF CHANGES IN NET POSITION

(dollars in thousands)

2023

2022

For the Years Ended September 30,

Unexpended Appropriations

Beginning Balance

$ 400,785

$ 171,177

Appropriations Received

1,236,707

928,884

Appropriations Transferred-In

12,388

9,322

Other Adjustments

(1,361)

-

Appropriations Used

(974,137)

(708,598)

Net Change in Unexpended Appropriations

273,597

229,608

Total Unexpended Appropriations

$ 674,382

$ 400,785

Cumulative Results of Operations

Beginning Balance

6,772,638

5,916,392

Adjustments:

Changes in Accounting Principles (Note 1)

-

656,763

Beginning Balance as Adjusted

6,772,638

6,573,155

Appropriations Used

974,137

708,598

Imputed Financing

6,189

3,520

Offset to Non-entity Collections

(728,286)

(496,160)

Other Adjustments

21,889

-

Net Cost of Operations

340,894

(16,475)

Net Change in Cumulative Results of Operations

614,823

199,483

Total Cumulative Results of Operations

$ 7,387,461

$ 6,772,638

Net Position

$ 8,061,843

$ 7,173,423

The accompanying notes are an integral part of these principal financial statements.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

FINANCIAL STATEMENTS

29

COMBINED STATEMENT OF BUDGETARY RESOURCES

(dollars in thousands)

For the Year Ended September 30, 2023

Budgetary

Non-Budgetary

Credit Reform

Financing

Accounts

Budgetary Resources

Unobligated Balance from Prior Year Budget Authority, Net

$ 6,486,341

$ 649,513

Appropriations

1,236,707

-

Borrowing Authority

-

6,424,983

Spending Authority from Offsetting Collections

685,457

984,898

Total Budgetary Resources

$ 8,408,505

$ 8,059,394

Status of Budgetary Resources

New Obligations and Upward Adjustments

$ 1,732,011

$ 7,021,506

Unobligated Balance, End of Year

Apportioned, Unexpired Accounts

263,900

-

Unapportioned, Unexpired Accounts

6,386,434

1,037,888

Unexpired Unobligated Balance, End of Year

6,650,334

1,037,888

Expired Unobligated Balance, End of Year

26,160

-

Unobligated Balance, End of Year (Total)

6,676,494

1,037,888

Total Budgetary Resources

$ 8,408,505

$ 8,059,394

Outlays, Net and Disbursements, Net

Outlays, Net

$ 590,673

Distributed Offsetting Receipts

(398,962)

Agency Outlays, Net

$ 191,711

Disbursements, Net

$ 1,609,419

The accompanying notes are an integral part of these principal financial statements.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

FINANCIAL STATEMENTS

30

COMBINED STATEMENT OF BUDGETARY RESOURCES

(dollars in thousands)

For the Year Ended September 30, 2022

Budgetary

Non-Budgetary

Credit Reform

Financing

Accounts

Budgetary Resources

Unobligated Balance from Prior Year Budget Authority, Net

$ 6,547,244

$ 816,078

Appropriations

928,884

-

Borrowing Authority

-

5,521,406

Spending Authority from Offsetting Collections

465,749

935,253

Total Budgetary Resources

$ 7,941,877

$ 7,272,737

Status of Budgetary Resources

New Obligations and Upward Adjustments

$ 1,472,116

$ 5,975,518

Unobligated Balance, End of Year

Apportioned, Unexpired Accounts

230,510

6,608

Unapportioned, Unexpired Accounts

6,207,094

1,290,611

Unexpired Unobligated Balance, End of Year

6,437,604

1,297,219

Expired Unobligated Balance, End of Year

32,157

-

Unobligated Balance, End of Year (Total)

6,469,761

1,297,219

Total Budgetary Resources

$ 7,941,877

$ 7,272,737

Outlays, Net and Disbursements, Net

Outlays, Net

$ 410,126

Distributed Offsetting Receipts

(426,222)

Agency Outlays, Net

$ (16,096)

Disbursements, Net

$ 1,195,213

The accompanying notes are an integral part of these principal financial statements.

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

NOTES TO THE FINANCIAL STATEMENTS

31

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A. REPORTING ENTITY

The U.S. International Development Finance Corporation (DFC) is a United States (U.S.) Government corporation

created under the Better Utilization of Investments Leading to Development (BUILD) Act (Public Law 115-254,

Division F) which combined the assets, liabilities, and functions of the Overseas Private Investment Corporation

(OPIC) and certain functions of the United States Agency for International Development (USAID). DFC facilitates U.S.

private investment in developing countries and emerging market economies primarily by providing direct loans, loan

guaranties, equity investments, technical assistance, and political risk insurance.

B. BASIS OF PRESENTATION AND ACCOUNTING

BASIS OF PRESENTATION

The accompanying principal financial statements account for all resources for which DFC is responsible and present

the financial position, results of operations, changes in net position, and the combined budgetary resources of DFC,

as required by the Government Corporation Control Act title 31 United States Code §9106. The principal financial

statements are prepared from the books and records of DFC activities in accordance with U.S. Generally Accepted

Accounting Principles (U.S. GAAP) promulgated by the Financial Accounting Standards Advisory Board (FASAB).

FASAB is the official body for setting accounting standards of the U.S. Government. The format of the financial

statements and notes are presented in accordance with the form and content guidance provided in Office of

Management and Budget (OMB) Circular No. A-136, Financial Reporting Requirements, as amended (A-136).

Significant intra-agency transactions and balances have been eliminated from the principal statements for

presentation on a consolidated basis, except for the Combined Statements of Budgetary Resources, which are

presented on a combined basis in accordance with A-136. As such, intra-agency transactions have not been

eliminated from the Combined Statements of Budgetary Resources.

BASIS OF ACCOUNTING

DFC’s transactions are recorded on an accrual and a budgetary basis of accounting. Under the accrual basis, revenue

is recognized when earned, and expenses are recognized when incurred, regardless of when cash is exchanged. The

accompanying Consolidated Balance Sheets, Consolidated Statements of Net Cost, and Consolidated Statements of

Changes in Net Position are prepared on an accrual basis.

Budgetary accounting is based on concepts set forth by OMB Circular No. A-11, Preparation, Submission, and

Execution of the Budget, as amended, which provides instructions on budget execution. Budgetary accounting is

designed to recognize the budgetary resources and the related status of those budgetary resources, including the

obligation and outlay of funds according to legal requirements, which in many cases is made prior to the occurrence

of an accrual-based transaction. Budgetary accounting is essential for compliance with legal constraints and controls

over the use of Federal funds.

COMBINED STATEMENTS OF BUDGETARY RESOURCES

The Combined Statements of Budgetary Resources have been prepared in accordance with budgetary accounting

concepts and definitions. The Combined Statements of Budgetary Resources present:

Budgetary Resources: Budgetary resources are amounts available to incur obligations in a fiscal year (FY). DFC’s

budgetary resources include unobligated balances of resources from prior years and new resources, consisting of

appropriations, borrowing authority, and spending authority from offsetting collections. DFC’s budgetary resources

are from both mandatory and discretionary spending authority. Mandatory spending authority is controlled by laws

other than appropriations acts, such as authority provided under the BUILD Act. Discretionary spending authority is

budgetary resources (except those provided to fund mandatory spending programs) provided in appropriations acts.

Status of Budgetary Resources: Displays the status of the funding for the fiscal year, including whether the sources

have been obligated for use, or if they were not obligated. Unobligated sources are displayed as funds that are

apportioned for use, unapportioned for use, or expired. Obligations are legally binding agreements that will result

U.S. INTERNATIONAL DEVELOPMENT FINANCE CORPORATION

NOTES TO THE FINANCIAL STATEMENTS

32

in outlays in the future. Unobligated amounts mean the cumulative amount of budget authority that remains

available for obligation under law in unexpired accounts.

Outlays, Net: Outlays are payments to liquidate an obligation (other than the repayment to the U.S. Department of

Treasury (Treasury) of debt principal). Outlays are a measure of Government spending. Net outlays display budgetary

outlays for DFC, reduced by actual offsetting collections, and distributed offsetting receipts. Offsetting collections

are payments to the government that, by law, are credited directly to expenditure accounts and deducted from

gross budget authority and outlays of the expenditure account, rather than added to receipts, and are authorized to

be spent for the purposes of the account without further action by Congress. DFC’s offsetting collections include the

receipt of interest, fees, and other revenue. Distributed offsetting receipts are collections credited to general fund

receipt accounts that offset gross outlays. DFC’s distributed offsetting receipts include negative subsidy and

downward reestimates that are transferred from DFC to general fund receipt accounts of the Treasury.

Disbursements, Net: Non-budgetary disbursements are limited to the DFC’s non-budgetary credit reform financing

accounts that account for DFC’s direct loans and loan guaranty programs under the Federal Credit Reform Act of

1990 (FCRA). Disbursements include payments for loans, and loan guaranty claim payments, reduced offsetting

collections of loan principal, loan interest, fees and subsidy amounts received.

INTRAGOVERNMENTAL AND WITH THE PUBLIC TRANSACTIONS

Statement of Federal Financial Accounting Standards (SFFAS) 1, Accounting for Selected Assets and Liabilities,

distinguishes between intragovernmental and with the public assets and liabilities. Intragovernmental assets and

liabilities arise from transactions among Federal entities. Intragovernmental assets are claims other Federal entities

owe to DFC. Intragovernmental liabilities are claims DFC owes to other Federal entities, whereas with the public

assets and liabilities arise from transactions with public entities. The term public entities encompasses domestic and

foreign persons and organizations outside the U.S. Government. With the public assets are claims of DFC against

public entities. With the public liabilities are amounts that DFC owes to public entities.

USE OF ESTIMATES