1 (23)

INTERIM REPORT JANUARY – JUNE 2024

Q2

Solid cash flow in a quarter affected by weak market

conditions

Second quarter 2024

• Net sales decreased by 9% to SEK 15,430m (16,976).

Changes in exchange rates impacted with -1%.

• Planned exits of low-margin petrol-powered business

impacted with -2%. Organic sales decreased by 6%.

• Operating income was SEK 1,899m (2,101) and the

operating margin was 12.3% (12.4).

• Excluding items affecting comparability, the operating

income amounted to SEK 1,906m (2,313) and the

operating margin was 12.4% (13.6).

• Earnings per share before dilution amounted to

SEK 2.22 (2.47) and earnings per share after dilution

amounted to SEK 2.22 (2.46).

• Cash flow from operations and investments amounted

to SEK 3,459m (4,432). Direct operating cash flow was

SEK 3,917m (4,443). Cash flow was impacted by the

planned reduction of trade receivables financing and

adjusted for this, direct operating cash flow decreased

by SEK 252m, compared to last year.

January – June 2024

• Net sales decreased by 12% to SEK 30,150m

(34,143). Changes in exchange rates had a neutral

effect.

• Planned exits of low-margin petrol-powered business

impacted with -3%. Organic sales decreased by 9%.

• Operating income was SEK 3,830m (4,465) and the

operating margin was 12.7% (13.1).

• Excluding items affecting comparability, the operating

income amounted to SEK 3,837m (4,723) and the

operating margin was 12,7% (13,8).

• Earnings per share before dilution amounted to

SEK 4.54 (5.37) and earnings per share after dilution

amounted to SEK 4.53 (5.35).

• Cash flow from operations and investments was

SEK 2,403m (5,020). Direct operating cash flow was

SEK 2,303m (4,204). Cash flow was impacted by the

planned reduction of trade receivables financing and

adjusted for this, direct operating cash flow improved

by SEK 354m, compared to last year.

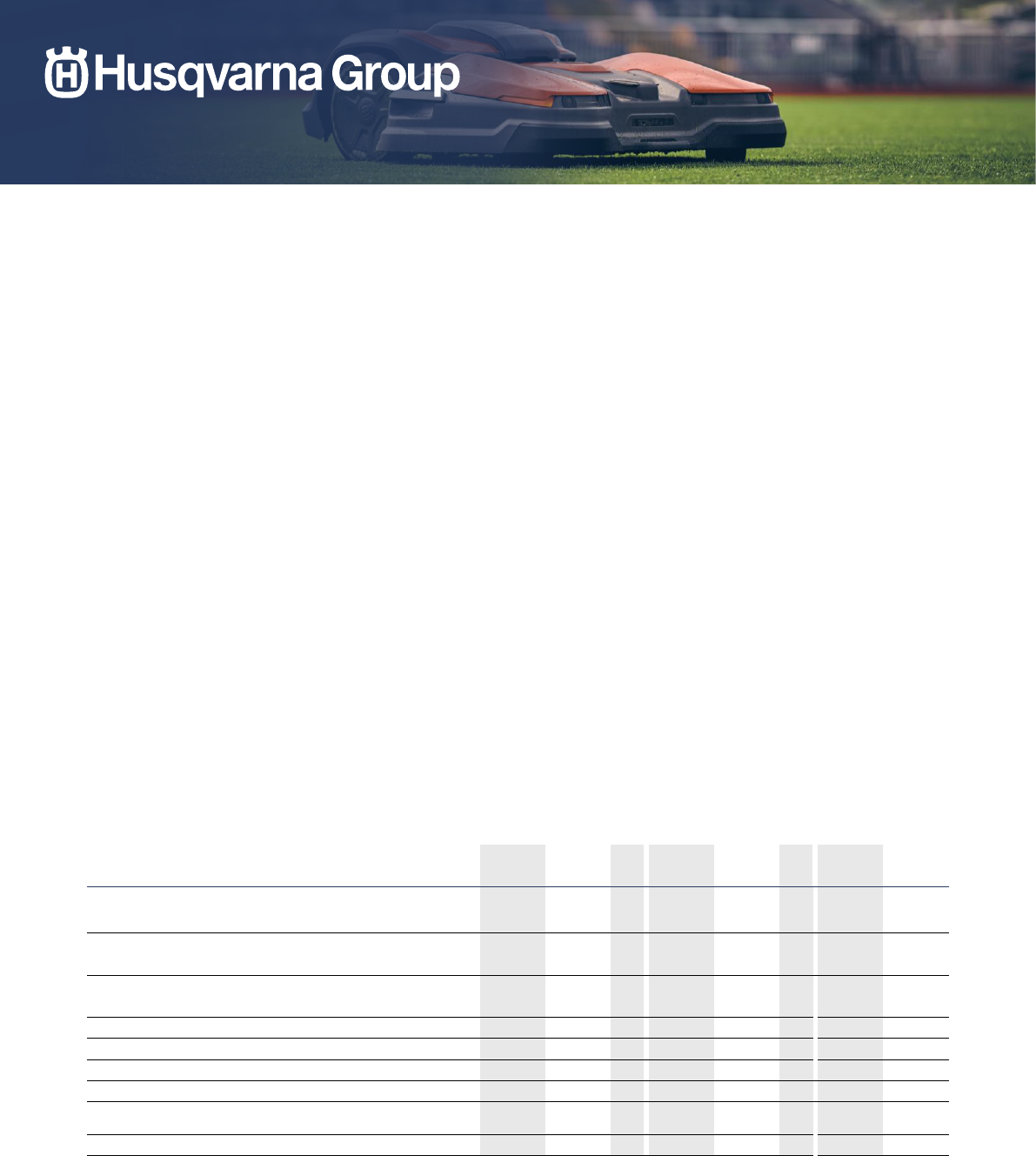

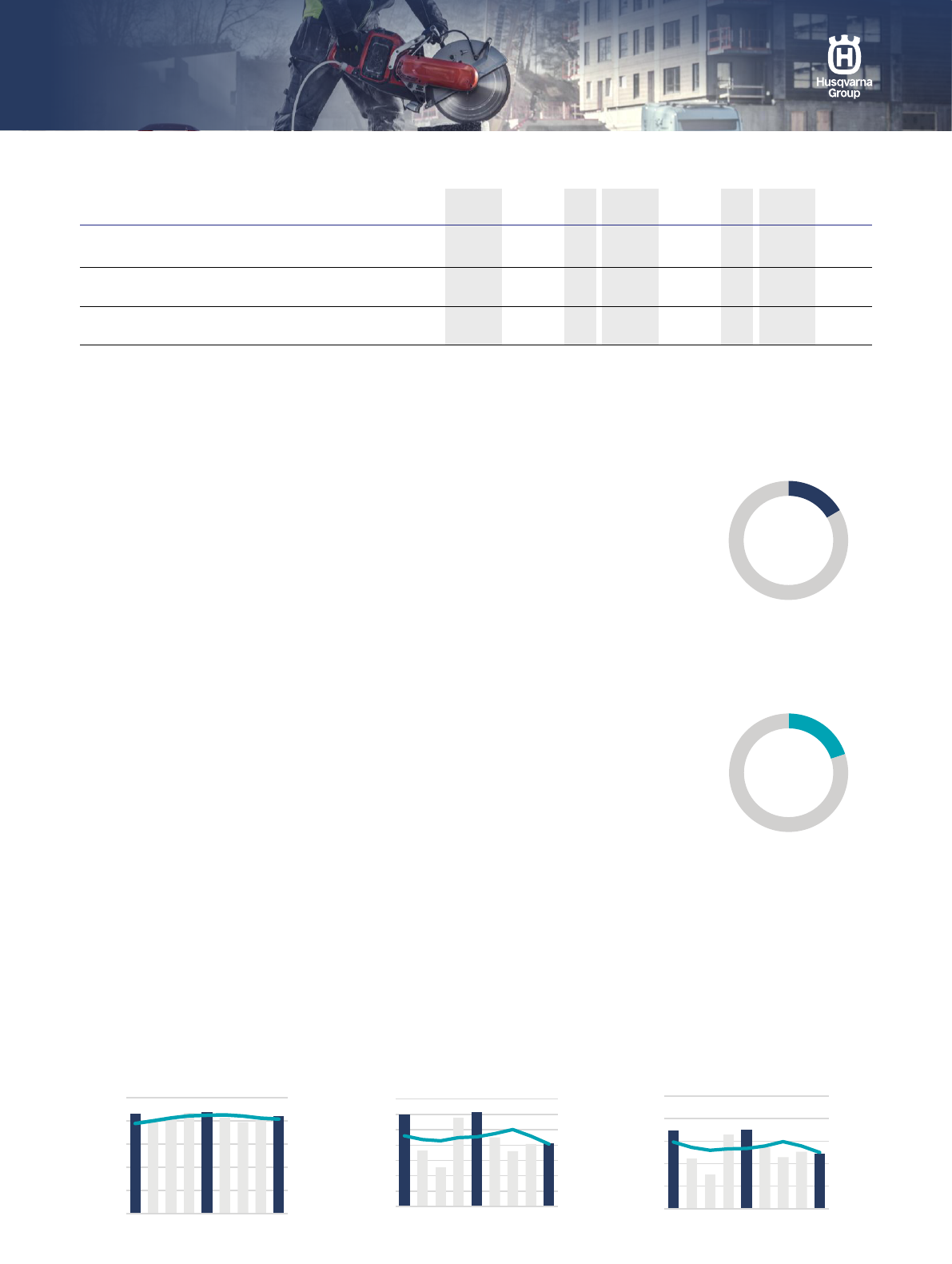

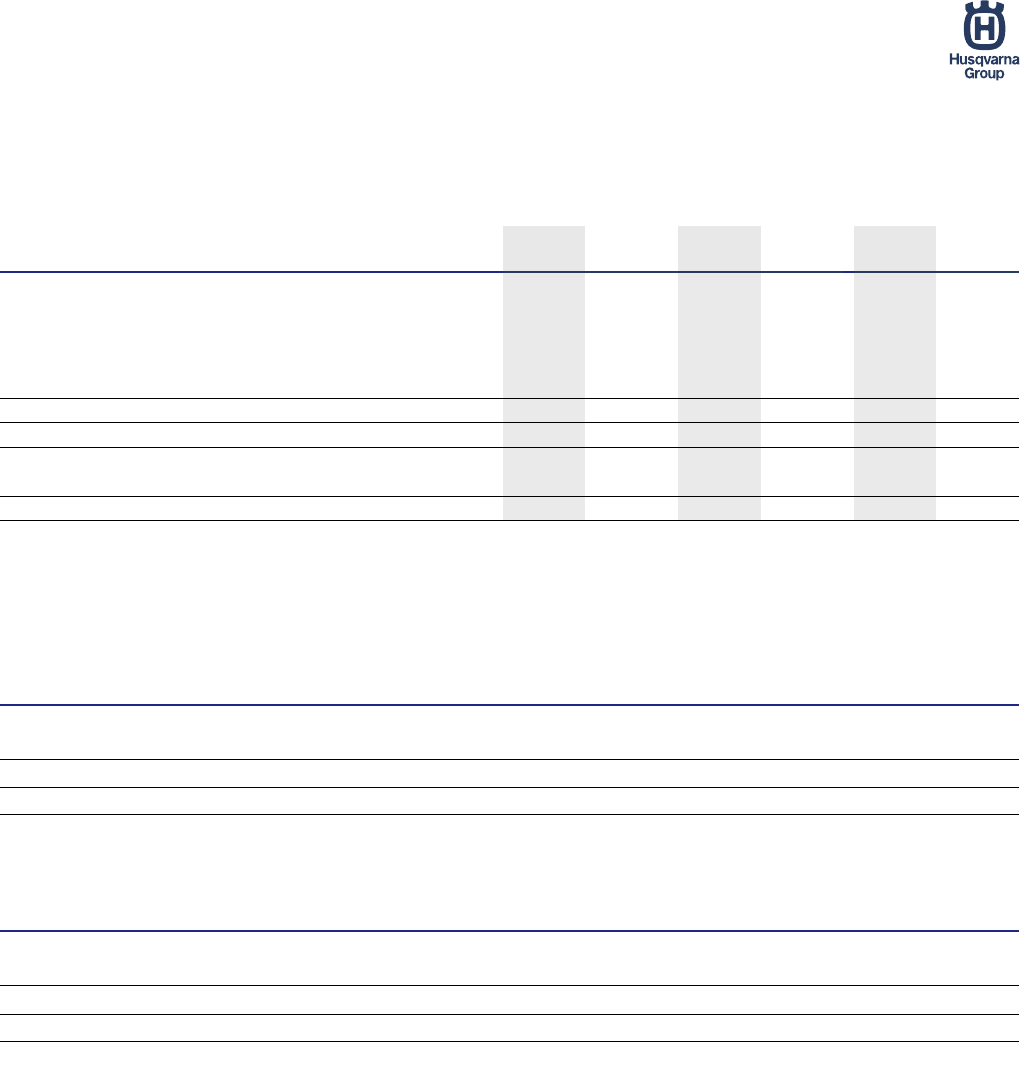

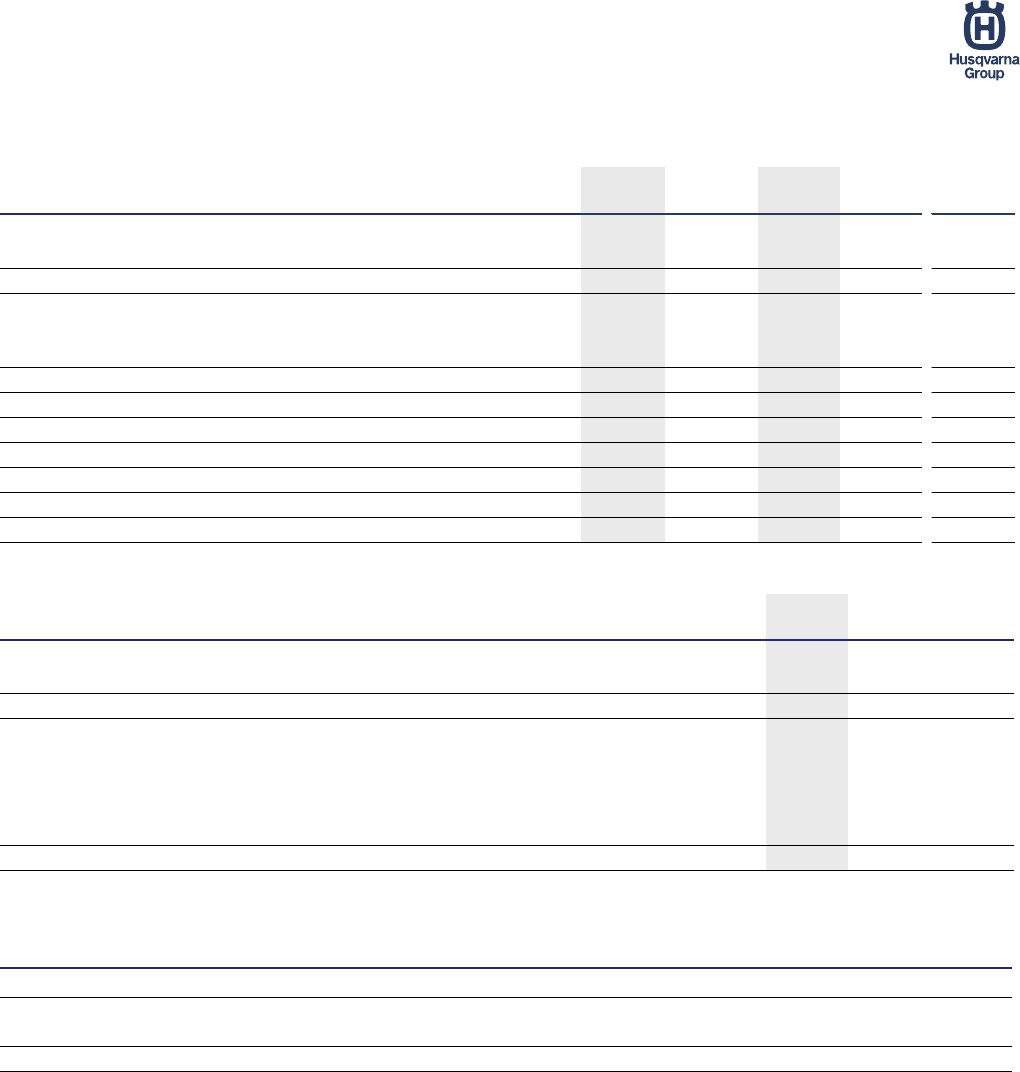

Financial summary

Q2 Q2 Jan-Jun Jan-Jun Full year

2024

2023 ∆%

2024

2023 ∆%

LTM*

2023

Net sales

15,430 16,976 -9 30,150 34,143 -12 49,267 53,261

Organic growth*, % -6 0 -9 1 -11 -5

Operating income (EBIT) 1,899 2,101 -10 3,830 4,465 -14 3,245 3,880

Operating margin, % 12.3 12.4 12.7 13.1 6.6 7.3

Operating income excl. items affecting comparability* 1,906 2,313 -18 3,837 4,723 -19 4,084 4,970

Operating margin excl. items affecting comparability*, % 12.4 13.6 12.7 13.8 8.3 9.3

Income after financial items 1,641 1,854 -11 3,343 3,973 -16 2,249 2,878

Net income for the period 1,273 1,411 -10 2,595 3,063 -15 1,709 2,177

Earnings per share before dilution, SEK 2.22 2.47 -10 4.54 5.37 -15 2.98 3.81

Earnings per share after dilution, SEK 2.22 2.46 -10 4.53 5.35 -15 2.99 3.81

Direct operating cash flow* 3,917 4,443 -12 2,303 4,204 -45 4,639 6,541

Operating working capital/net sales*, % 39.5 34.1 39.5 34.1 39.5 36.9

*Alternative Performance Measure, refer to "Definitions".

Group, SEKm

Husqvarna Group / Interim Report, Q2 2024

2 (23)

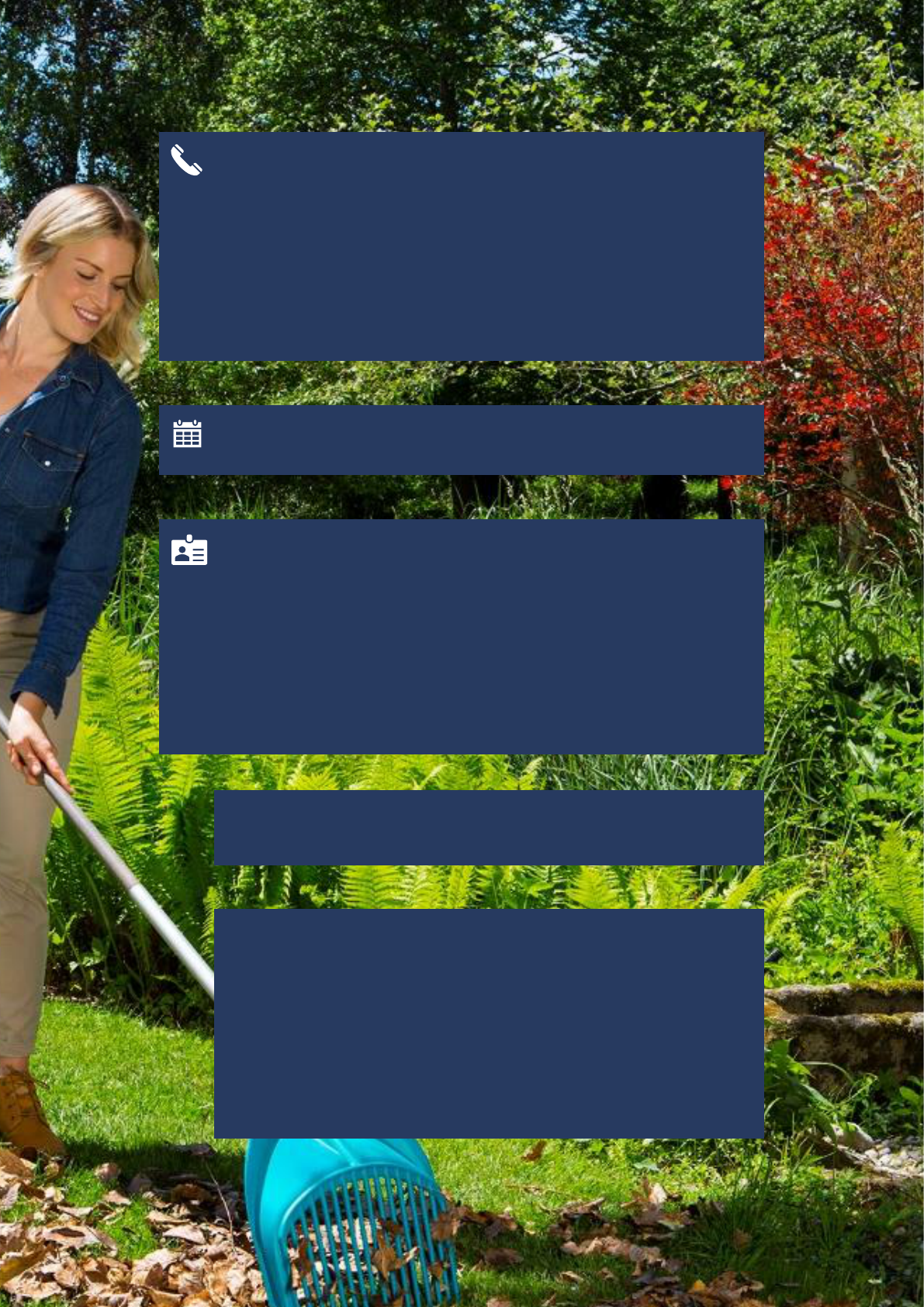

Solid cash flow in a quarter affected by weak market conditions

“During the second quarter, we continued executing

on our strategy and strengthened our positions in

segments such as robotic mowers for the

professional market, consumer battery-powered

products and parts and accessories. However, as

the quarter progressed, the continued challenging

macroeconomic environment and hence cautious

consumer spending gradually impacted the business

negatively. In combination with unfavorable weather

conditions in Central Europe and North America,

that significantly impacted Gardena’s watering

business, the Group’s organic sales decreased by

6%. The operating income decreased to SEK

1,906m (2,313).This was primarily a result of lower

sales volumes, product mix effects and low capacity

utilization in our production. Our cost-savings

programs are progressing as planned, with savings

of SEK 215m in the quarter.

Direct operating cash flow amounted to SEK 3.9bn

(4.4) for the quarter with a significant contribution

from our active efforts to reduce inventory levels,

which in turn has decreased by SEK 3.2bn. Since

second half of 2023 we have stopped using trade

receivables financing. The effect on cash flow this

quarter was approximately SEK -0.3bn and we

expect a positive effect from this going forward.

Organic sales in the Husqvarna Forest & Garden

Division decreased by 6% during the quarter.

Growth was strong in robotic mowers for the

professional market, driven by Husqvarna

CEORA

TM

. In addition, the segments consumer

battery-powered products and parts and accessories

performed well. In robotic mowers for the residential

market, growth was strong for the Husqvarna

Automower® NERA range, which was further

expanded with two boundary wire-free models this

season. The successful range now comprises five

models, which together accounted for approximately

one third of our residential robotic mower sales in

the quarter. Sales of petrol-powered wheeled

products remained at a low level, due to lower

demand and the fact that we are proactively exiting

parts of the segment in North America. Operating

margin improved in the quarter, driven by our cost

savings.

In the Gardena Division, organic sales decreased by

9%. Sales started well in the quarter but the

watering business was significantly impacted by

unfavorable weather conditions in Central Europe

and North America, resulting in lower end-user

demand.

Organic sales in the Husqvarna Construction

Division decreased by 3% in the quarter, where

sales were stable in Europe, decreased in North

America and grew in emerging markets.

Executing on strategy

We remain committed to our strategy and ongoing

transformation where we focus on the high-growth

areas of robotics, battery, smart watering and

professional solutions. An efficient and sustainable

cost base ensures delivery on our ambitions. To

mitigate the near-term macroeconomic dynamics,

we are now accelerating the existing cost-savings

programs.

In terms of sustainability and reduction of our overall

CO₂ footprint, our emissions (Scope 1, 2 and 3)

have decreased by -56% compared with the base

year of 2015. This means that we have exceeded

our target of a -35% reduction by 2025.

In summary, despite the challenging market

conditions in the quarter, our strategic focus and

execution of cost efficiencies continues. This will

enable us to continue to create sustainable value.”

Pavel Hajman, CEO

Husqvarna Group / Interim Report, Q2 2024

3 (23)

Financial Performance

Financial targets and performance

Husqvarna Group has three financial targets; organic

sales growth, operating margin and capital efficiency.

Second quarter 2024

Net sales

Net sales for the second quarter decreased by 9% to

SEK 15,430m (16,976). Changes in exchange rates

impacted with -1%. Planned exits impacted with

-2%. Organic sales declined by 6%. Net sales grew in

segments such as robotic mowers for the professional

market, consumer battery-powered products and parts

& accessories. Sales of watering products, petrol-

powered wheeled products and construction products

decreased during the quarter.

Operating income

Operating income for the second quarter amounted to

SEK 1,899m (2,101) and the operating margin was

12.3% (12.4). Excluding items affecting comparability,

operating income amounted to SEK 1,906m (2,313).

The decline was mainly a result of lower volumes with

lower capacity utilization in the production as well as

product mix effects. This was partly offset by cost

savings. Acquisition related amortizations amounted to

SEK -57m (-58). The operating margin was 12.4%

(13.6).

Changes in exchange rates had a positive contribution

of approximately SEK 80m compared with the

preceding year.

Financial items net

Financial items net amounted to SEK -258m (-247).

Income after financial items

Income after financial items amounted to

SEK 1,641m (1,854).

Taxes

Income tax amounted to SEK -369m (-443),

corresponding to an effective tax rate of 22.5% (23.9).

Earnings per share

Net income attributable to equity holders of the Parent

Company amounted to SEK 1,272m (1,411),

corresponding to SEK 2.22 (2.46) per share after

dilution.

Cash flow

Cash flow from operations and investments for April –

June amounted to SEK 3,459m (4,432). Direct operating

cash flow was SEK 3,917m (4,443). The decline was

related to lower operating income and lower cash flow

from change in trade receivables. This was due to the

planned reduction of trade receivables financing and

adjusted for this, direct operating cash flow declined by

SEK 252m, compared to last year.

January – June

Net sales

Net sales for the period decreased by 12% to

SEK 30,150m (34,143). Changes in exchange rates

had a neutral effect. Planned exits impacted with

-3%. Organic sales declined by 9%. Net sales grew in

segments such as robotic mowers for the professional

market, consumer battery-powered products and parts

& accessories. Sales of petrol-powered wheeled

products continued on a low level.

Operating income

Operating income for the period amounted to

SEK 3,830m (4,465) and the operating margin was

12.7% (13.1). Excluding items affecting comparability,

operating income amounted to SEK 3,837m (4,723).

The decline was mainly a result of lower volumes with

lower capacity utilization in the production. This was

partly offset by cost savings. Acquisition related

amortizations amounted to SEK -113m (-114). The

operating margin was 12.7% (13.8).

Changes in exchange rates had a positive contribution

of approximately SEK 280m compared with the

preceding year.

Metric

Financial

targets

Achievement

2023

Achievement

LTM

Organic sales growth 5% -5% -11%

Operating margin* 13% 9.3% 8.3%

Capital efficiency** 20% 36.9% 39.5%

*Excluding items affecting comparability

**Operating working capital / net sales, rolling 12-months

Net sales, SEKm

Operating income excl. IAC, SEKm

Operating margin excl. IAC

15,792

16,976

15,430

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

0

3,000

6,000

9,000

12,000

15,000

18,000

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

2,075

2,313

1,906

-2,000

0

2,000

4,000

6,000

8,000

10,000

12,000

-500

0

500

1,000

1,500

2,000

2,500

3,000

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

13.1%

13.6%

12.4%

-5%

0%

5%

10%

15%

20%

-5%

0%

5%

10%

15%

20%

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

Husqvarna Group / Interim Report, Q2 2024

4 (23)

Financial items net

Financial items net amounted to SEK -486m (-492).

Income after financial items

Income after financial items amounted to SEK 3,343m

(3,973).

Taxes

Income tax amounted to SEK -748m (-909),

corresponding to an effective tax rate of 22.4% (22.9).

Earnings per share

Net income for the period attributable to equity holders

of the Parent Company amounted to SEK 2,593m

(3,064), corresponding to SEK 4.53 (5.35) per share

after dilution.

Cash flow

Cash flow from operations and investments for January

– June amounted to SEK 2,403m (5,020). Direct

operating cash flow was SEK 2,303m (4,204). The

decline was related to lower operating income and

negative cash flow from change in trade receivables.

This was due to planned reduction of trade receivables

financing and adjusted for this, cash flow improved by

SEK 354m, compared to last year.

Due to the seasonal build-up of working capital, cash

flow is normally weaker in the first quarter, followed

by stronger cash flow in the second and third quarters.

Cash flow in the fourth quarter is usually negatively

impacted by the pre-season production for the next

year.

Financial position

Net debt as of June 30, 2024 was SEK 15,615m

(15,748). The net pension liability increased to

SEK 1,720m (1,451). Other interest-bearing liabilities

decreased to SEK 15,714m (18,141) and liquid funds

and other interest-bearing assets decreased to

SEK 2,962m (4,985).

The net debt/EBITDA ratio, excluding items affecting

comparability, increased to 2.3 (2.0), mainly due to lower

EBITDA. The equity/assets ratio was 42% (40).

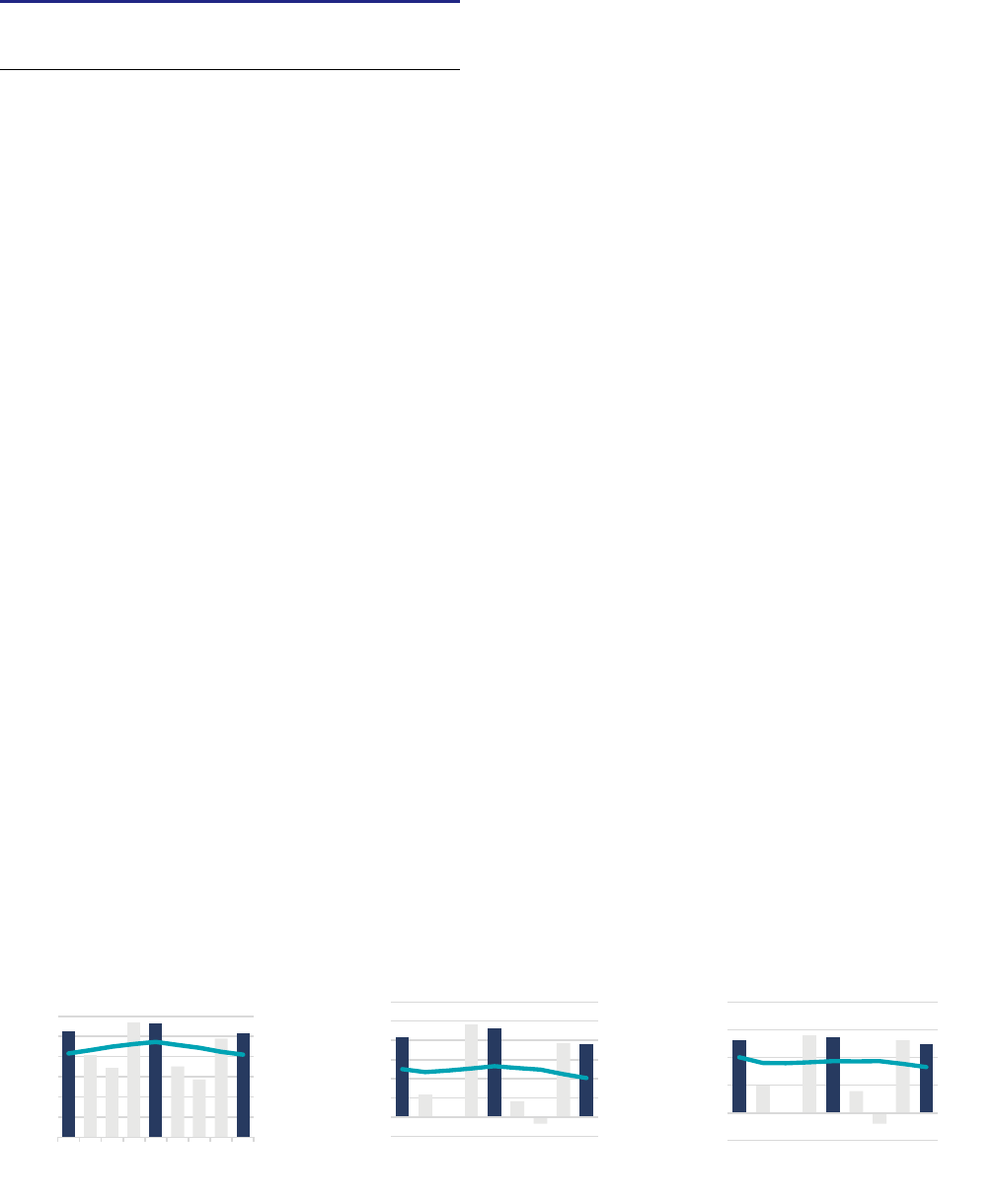

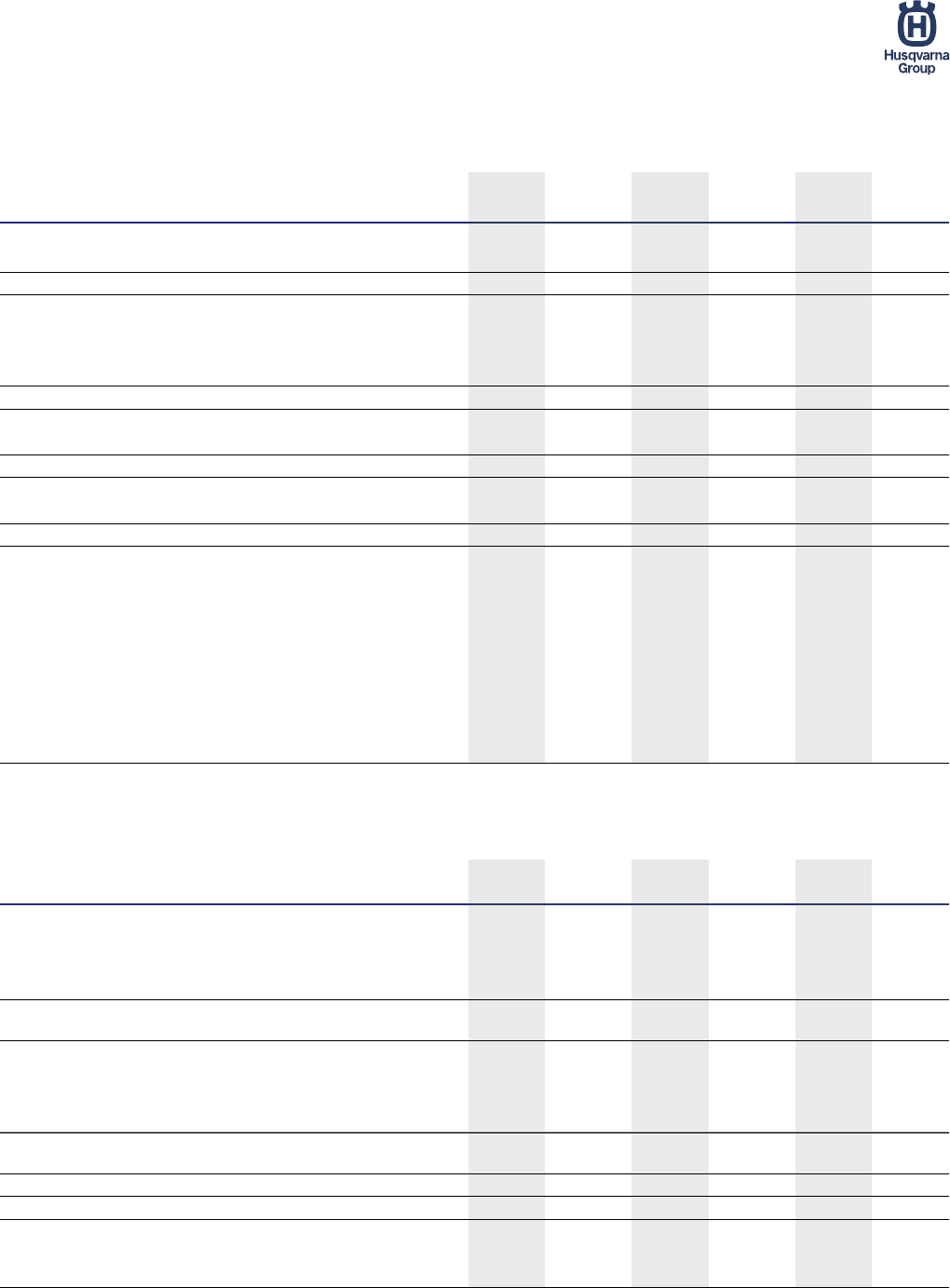

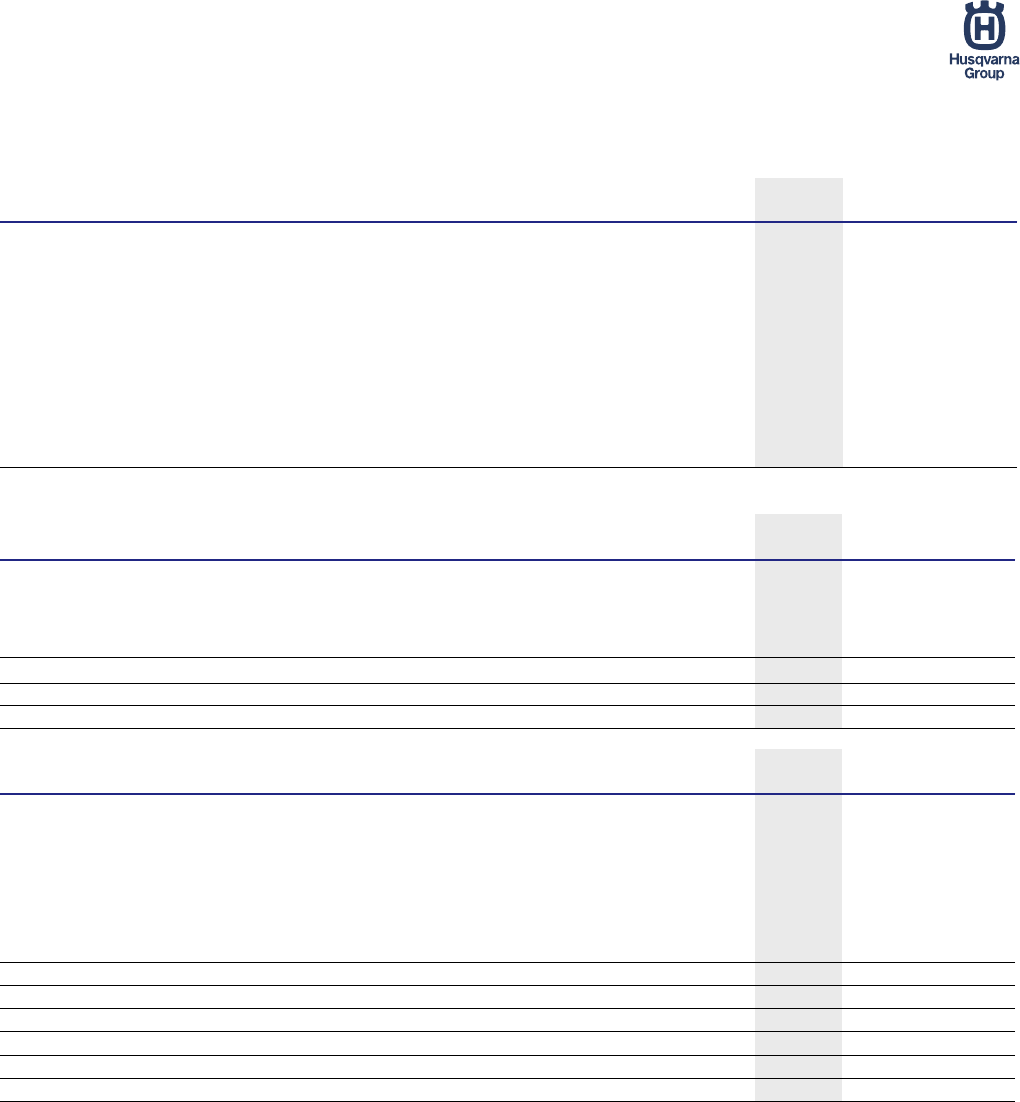

Husqvarna Forest & Garden Division

5 (23)

Financial summary

Second quarter 2024

Net sales decreased by 10% to SEK 8,722m (9,722) during the quarter. Currency had a

neutral effect. Planned exits had an impact of -4%. Organic sales declined by 6%. Sales of

robotic mowers for the professional market, including Husqvarna CEORA

TM

, consumer

battery-powered products and parts & accessories achieved good growth.

The product range of Husqvarna Automower

®

NERA has been expanded with robotic

mowers for medium-sized lawns and a new edge cut system. Automower

®

NERA is a good

example of the Group’s technology leadership and innovative capacity when it comes to

robotic mower technology. The NERA range, with its five models, accounted for

approximately one third of robotic mower sales to the residential market in the second

quarter. Sales of petrol-powered, wheeled products remained at low levels as a result of

lower demand and that the Group is proactively exiting parts of the segment in North

America.

Operating income amounted to SEK 1,145m (1,123) and the operating margin was 13.1%

(11.6). Excluding items affecting comparability, operating income was SEK 1,149m (1,260)

and the operating margin increased to 13.2% (13.0). The improved operating margin was

mainly related to cost savings and planned exits. Changes in exchange rates had a positive

contribution of approximately SEK 60m compared with the preceding year.

January – June 2024

Net sales decreased by 17% to SEK 16,994m (20,379). Currency had a neutral effect.

Planned exits had an impact of -5%. Organic sales declined by 12%. Sales of robotic

mowers for the professional market and consumer battery-powered products achieved a

good growth. Sales of petrol-powered, wheeled products remained at low levels as a result of lower demand and that

the Group is proactively exiting parts of the segment in North America.

Operating income amounted to SEK 2,336m (2,794) and the operating margin was 13.7% (13.7). Excluding items

affecting comparability, operating income was SEK 2,340m (2,950) and the operating margin was 13.8% (14.5).

Operating income was impacted by lower volumes and lower capacity utilization in production. Changes in

exchange rates had a positive contribution of approximately SEK 250m compared with the preceding year.

Q2 Q2 Jan-Jun Jan-Jun Full year

SEKm

2024

2023 ∆%

2024

2023 ∆%

LTM*

2023

Net sales 8,722 9,722 -10 16,994 20,379 -17 28,374 31,759

Organic growth*, % -6 3 -12 9 -15 -4

Operating income 1,145 1,123 2 2,336 2,794 -16 2,248 2,706

Operating margin, % 13.1 11.6 13.7 13.7 7.9 8.5

Operating income excl. items affecting comparability* 1,149 1,260 -9 2,340 2,950 -21 2,626 3,236

Operating margin excl. items affecting comparability*, % 13.2 13.0 13.8 14.5 9.3 10.2

* Alternative Performance Measure, refer to "Definitions".

Net sales, SEKm

Operating income excl. IAC, SEKm

Operating margin excl. IAC

Share of Group

net sales, LTM

Share of Group operating

income excl. IAC, LTM

8,826

9,722

8,722

0

8,000

16,000

24,000

32,000

40,000

48,000

0

2,000

4,000

6,000

8,000

10,000

12,000

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

1,113

1,260

1,149

0

1,600

3,200

4,800

6,400

8,000

0

400

800

1,200

1,600

2,000

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

12.6%

13.0%

13.2%

0%

5%

10%

15%

20%

0%

5%

10%

15%

20%

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

58%

64%

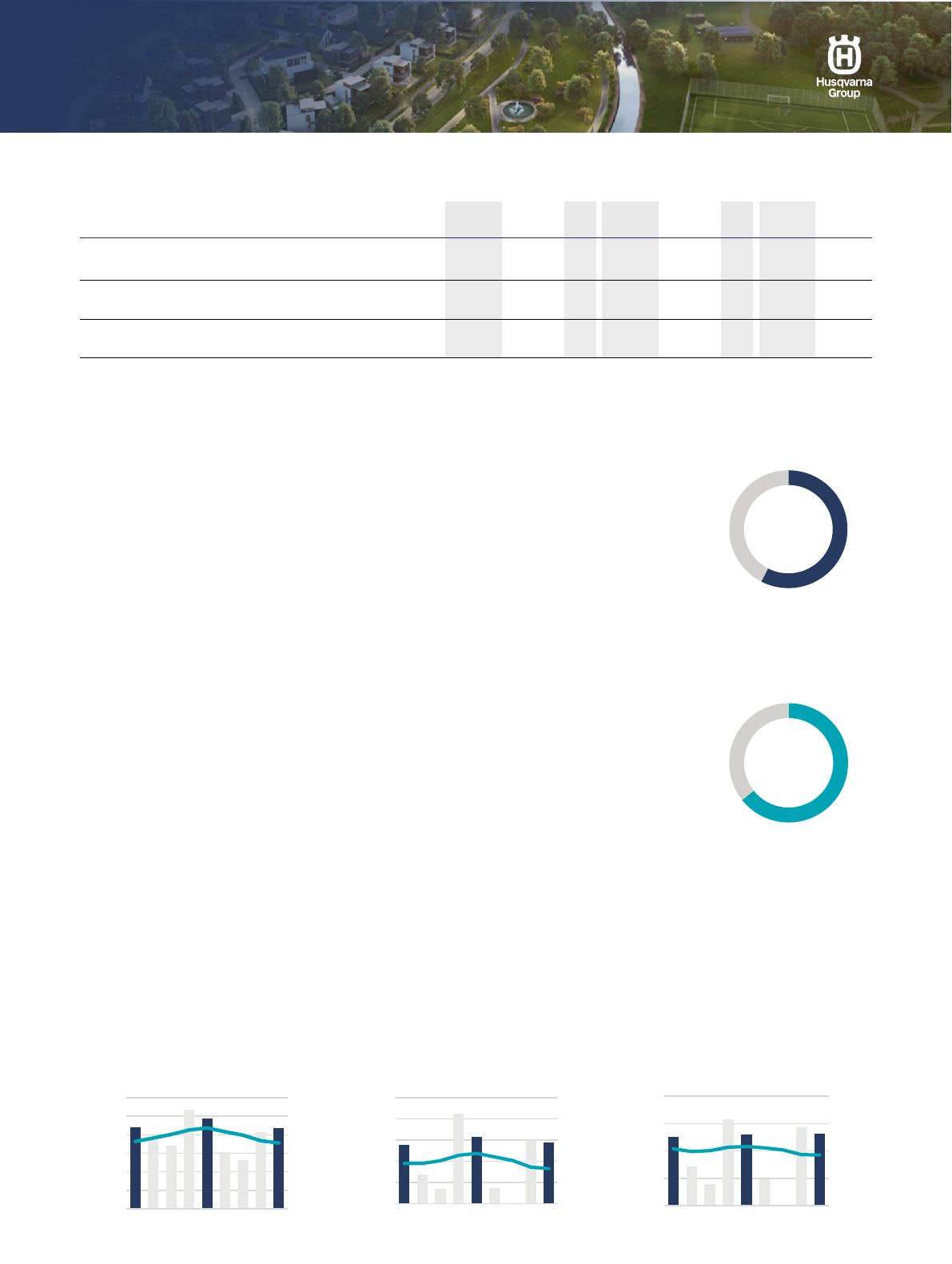

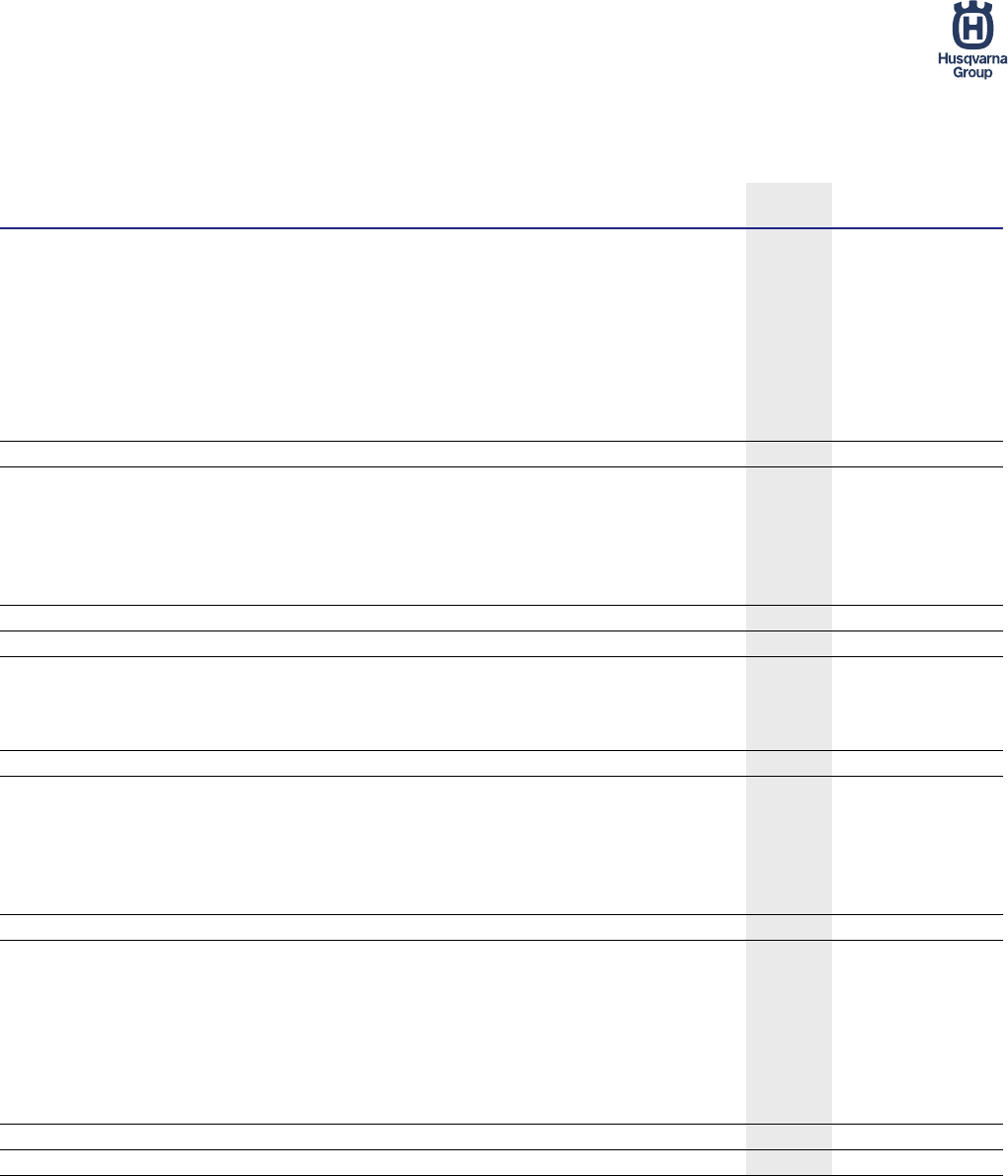

Gardena Division

6 (23)

Financial summary

Second quarter 2024

Net sales decreased by 9% to SEK 4,566m (5,031). Changes in exchange rates had a

neutral impact, and organic sales decreased by 9%. Sales were strong for handheld battery

products. Sales of watering products started well in the quarter, but was significantly

impacted by cold and rainy weather in Central Europe and North America.

Operating income decreased by 15% to SEK 691m (818) and the operating margin

decreased to 15.1% (16.3). Excluding items affecting comparability, operating income was

SEK 693m (857) and the operating margin was 15.2% (17.0). The decline in operating

income was related to lower volumes and lower capacity utilization in production, partly

offset by cost savings. Acquisition-related amortization amounted to SEK -30m (-30).

Changes in exchange rates had a positive contribution of approximately SEK 20m

compared with the preceding year.

January – June 2024

Net sales decreased by 4% to SEK 8,980m (9,351). Organic sales declined by 4% and

currency had a neutral effect.

Operating income amounted to SEK 1,365m (1,403) and the operating margin was 15.2%

(15.0). Excluding items affecting comparability, operating income was SEK 1,366m (1,441)

and the operating margin was 15.2% (15.4). Cost savings and efficiencies had a positive

effect, while lower volumes had a negative impact. Acquisition-related amortization

amounted to SEK -60m (-60). Changes in exchange rates had a positive contribution of

approximately SEK 15m compared with the preceding year.

Q2 Q2 Jan-Jun Jan-Jun Full year

SEKm

2024

2023 ∆%

2024

2023 ∆%

LTM*

2023

Net sales 4,566 5,031 -9 8,980 9,351 -4 12,593 12,964

Organic growth*, % -9 -2 -4 -11 -5 -10

Operating income 691 818 -15 1,365 1,403 -3 912 950

Operating margin, % 15.1 16.3 15.2 15.0 7.2 7.3

Operating income excl. items affecting comparability* 693 857 -19 1,366 1,441 -5 1,061 1,136

Operating margin excl. items affecting comparability*, % 15.2 17.0 15.2 15.4 8.4 8.8

* Alternative Performance Measure, refer to "Definitions".

Net sales, SEKm

Operating income excl. IAC, SEKm

Operating margin excl. IAC

Share of Group

net sales, LTM

Share of Group operating

income excl. IAC, LTM

4,775

5,031

4,566

0

4,000

8,000

12,000

16,000

20,000

24,000

0

1,000

2,000

3,000

4,000

5,000

6,000

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

776

857

693

-1,600

0

1,600

3,200

4,800

-400

0

400

800

1,200

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

16.3%

17.0%

15.2%

-30%

-20%

-10%

0%

10%

20%

30%

40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

26%

26%

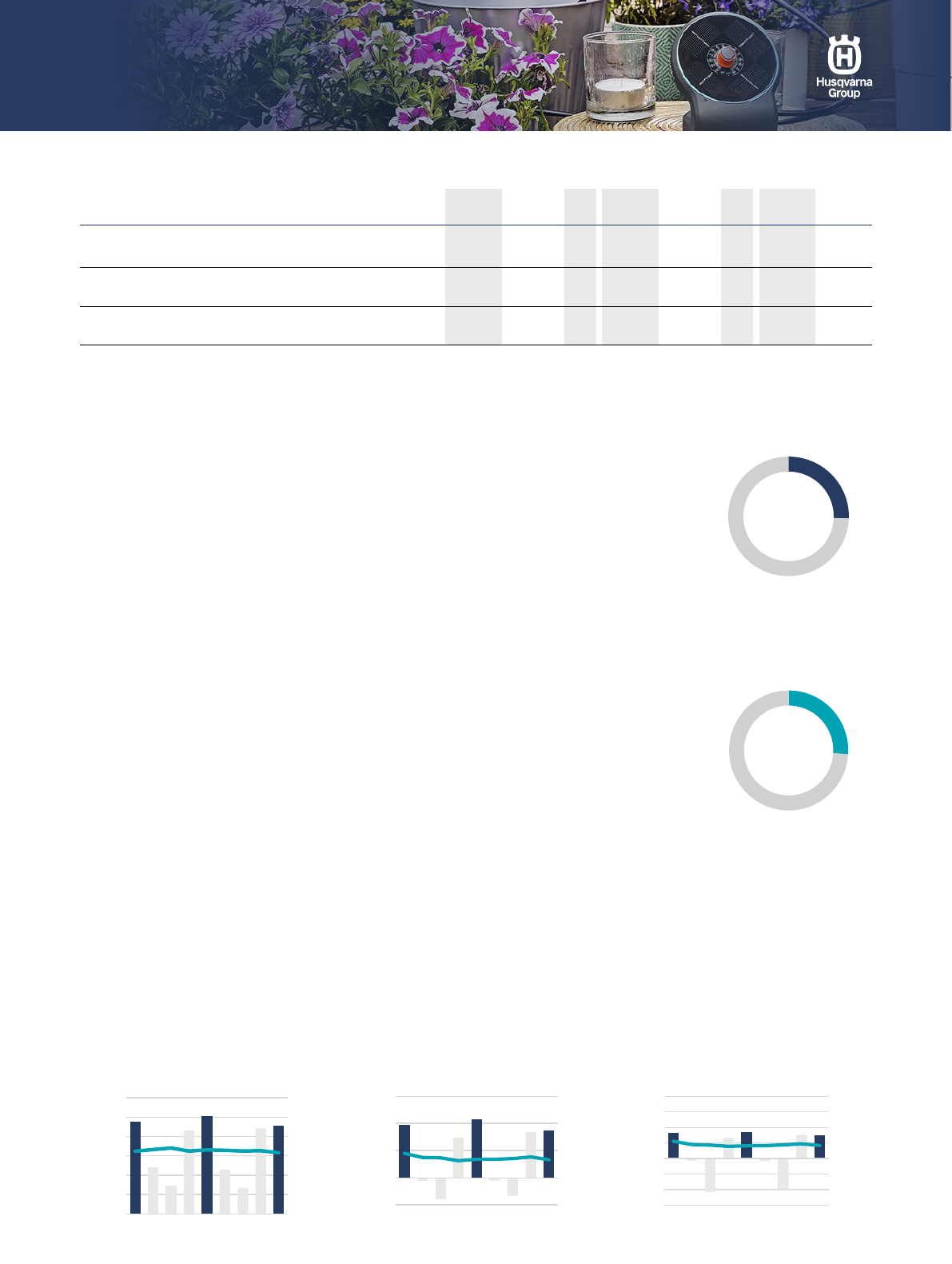

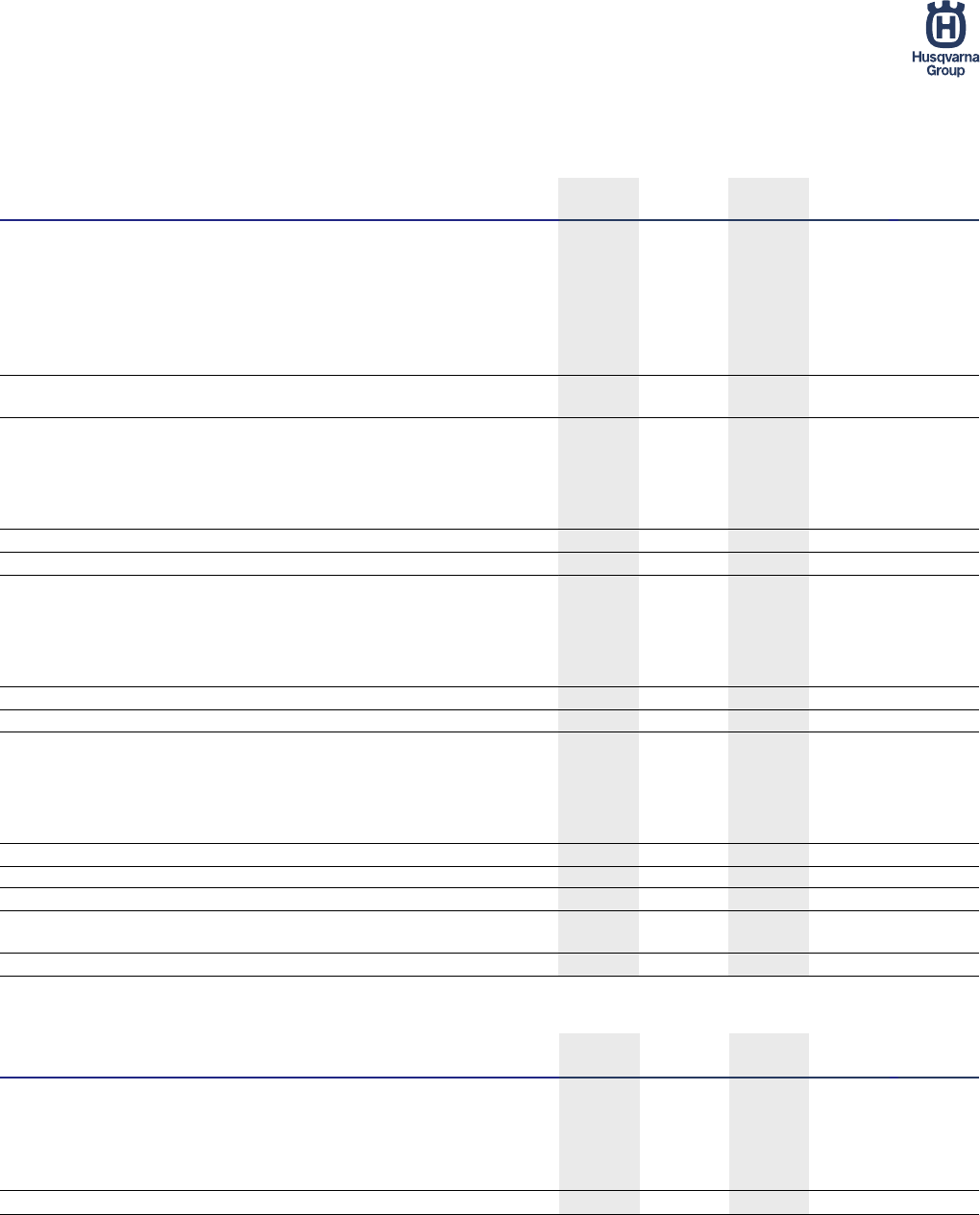

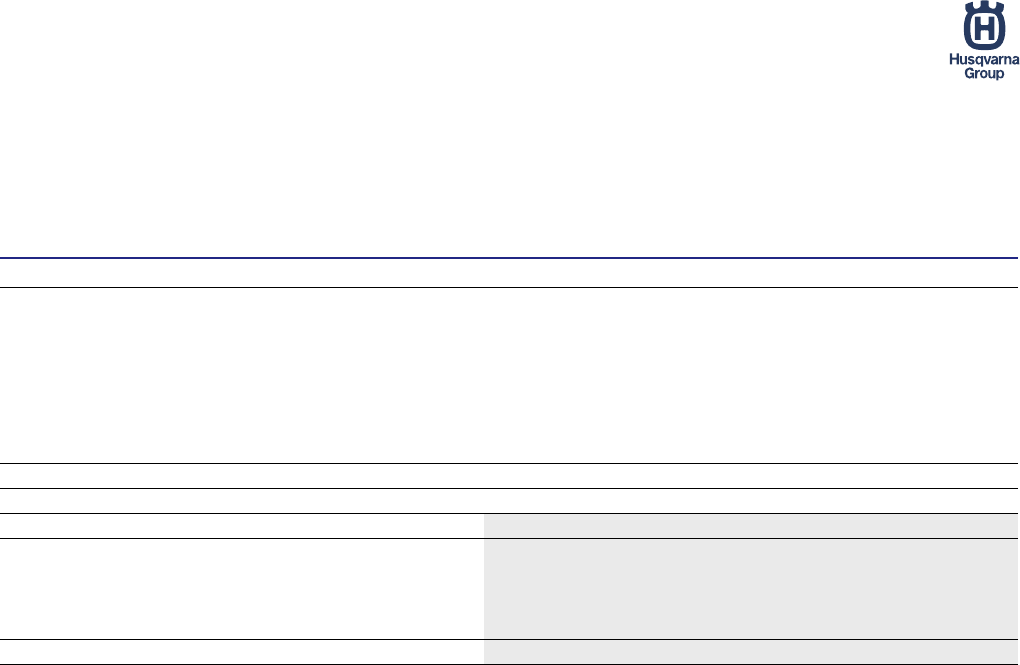

Husqvarna Construction Division

7 (23)

Financial summary

Second quarter 2024

Net sales decreased by 4% to SEK 2,105m (2,192). Changes in exchange rates had an

impact of -1%. Organic sales declined by 3%. Sales in emerging markets increased, were

stable in Europe, but decreased in North America. The offering of demolition robots has

been expanded and achieved good growth during the quarter.

Operating income was SEK 204m (272), and the operating margin was 9.7% (12.4).

Excluding items affecting comparability, operating income was SEK 205m (308) and the

operating margin was 9.7% (14.1). The decline in operating income was mainly related to

lower volumes and lower capacity utilization in production and partly offset by cost savings.

Acquisition-related amortization amounted to SEK -27m (-26). Changes in exchange rates

had a neutral effect compared with the preceding year.

January – June 2024

Net sales decreased by 6% to SEK 4,114m (4,369). Organic sales declined by 5% and

changes in exchange rates had an impact of -1%. Operating income amounted to

SEK 407m (534) and the operating margin was 9.9% (12.2). Excluding items affecting

comparability, operating income was SEK 408m (597) and the operating margin was 9.9%

(13.7). Acquisition-related amortization amounted to SEK -54m (-51). Changes in exchange

rates had a positive contribution of approximately SEK 15m compared with the preceding

year.

Q2 Q2 Jan-Jun Jan-Jun Full year

SEKm

2024

2023 ∆%

2024

2023 ∆%

LTM*

2023

Net sales 2,105 2,192 -4 4,114 4,369 -6 8,143 8,398

Organic growth*, % -3 -5 -5 -3

-5

-3

Operating income 204 272 -25 407 534 -24 628 755

Operating margin, % 9.7 12.4 9.9 12.2 7.7 9.0

Operating income excl. items affecting comparability* 205 308 -33 408 597 -32 813 1,002

Operating margin excl. items affecting comparability*, % 9.7 14.1 9.9 13.7 10.0 11.9

* Alternative Performance Measure, refer to "Definitions".

Net sales, SEKm

Operating income excl. IAC, SEKm

Operating margin excl. IAC

Share of Group

net sales, LTM

Share of Group operating

income excl. IAC, LTM

2,157

2,192

2,105

0

2,000

4,000

6,000

8,000

10,000

0

500

1,000

1,500

2,000

2,500

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

300

308

205

0

200

400

600

800

1,000

1,200

1,400

0

50

100

150

200

250

300

350

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

13.9%

14.1%

9.7%

0%

4%

8%

12%

16%

20%

0%

4%

8%

12%

16%

20%

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

Q1-24

Q2-24

LTM

17%

20%

Husqvarna Group / Interim Report, Q2 2024

8 (23)

Additional information

Sustainovate 2025

Sustainovate 2025 is designed to maximize the

Group’s contribution to tackle climate change and

resource scarcity. The five-year framework covers

three opportunities and associated targets to 2025.

2025 targets and status

• Reduce absolute CO

2

emissions across the value

chain by -35%, current result is -56%.

• Launch 50 circular innovations, the number of

approved innovations is currently 31.

• Empower 5 million People to make sustainable

choices, achieved so far is 3.3 million.

Carbon – drive the transition to low-carbon solutions

As of the second quarter 2024, the Group has further

reduced its CO

2

emissions by -5 percentage points

compared to Q1 2024 and exceeded the 2025 target.

The reduction is primarily linked to the product mix

driven by the electrification of the industry and lower

sales of petrol-powered products, primarily wheeled.

The CO

2

KPI is absolute and in direct relation to

volume performance which implies a rather volatile

behavior. Despite the clear long-term reduction trend,

fluctuations between quarters are expected to

continue.

Circular – rethink and redesign for a resource-smart

customer experience

The circular innovations will make smarter use of

materials and will extend product lifecycles. The target

addresses resource impacts across the value chain,

from suppliers and operations to product use and end-

of-life.

One circular innovation was approved in the second

quarter:

• A new design of the robotic lawn mower garage

for our Flymo and Gardena brands. The

lightweight garage with a toolless assembly

reduces the material consumption significantly.

People – inspire actions that make a lasting

difference

During the second quarter, the Group has continued

its communication campaigns and reached a total

accumulated sales number of 3.3 million products

qualified as Sustainable Choices.

Parent Company

Net sales for January – June 2024 for the Parent

Company, Husqvarna AB (publ) amounted to

SEK 13,281m (15,242), of which SEK 10,117m

(12,064) referred to sales to Group companies and

SEK 3,164m (3,179) to external customers. Income

after financial items decreased to SEK 804m (2,102).

The financial items are affected negatively by an

equity hedge. Income for the period decreased to

SEK 741m (1,745). Investments in property, plant and

equipment and intangible assets amounted to

SEK 747m (769). Cash and cash equivalents

amounted to SEK 199m (1,707) at the end of the

period. Undistributed earnings in the Parent Company

amounted to SEK 27,817m (29,118).

Significant events

Annual General Meeting 2024

The Annual General Meeting of Husqvarna AB (publ)

was held on April 18, 2024. The dividend was set at

SEK 3.00 per share to be paid in two installments,

firstly SEK 1.00 per share with Monday, April 22 as the

first record day, and secondly SEK 2.00 per share with

Tuesday, October 22, as the second record day. The

estimated dates for payment are Thursday, April 25,

and Friday, October 25, 2024.

Changes to Group Management

Husqvarna Group has appointed Claus Andersen as

the interim President of the Gardena Division until a

permanent successor to Pär Åström has been

appointed. Claus has held the position of Senior Vice

President Finance for the Gardena Division since

2017. During his interim role Claus will be a member

of the Group Management team.

Significant events after the quarter

No significant events after the quarter.

Husqvarna Group / Interim Report, Q2 2024

9 (23)

Risks and uncertainty factors

A number of factors may affect Husqvarna Group’s

operations in terms of operational and financial risks.

Geopolitical uncertainties and war can have a

significant impact on Husqvarna Group’s operations,

both in terms of difficulties of supply of raw materials

and components as well as difficulties to purchase

transportation and logistics services and related cost

increases. It can also affect demand of Husqvarna

Group’s products and solutions.

Operational risks include general economic conditions,

as well as trends in consumer and professional

spending, particularly in North America and Europe,

where the majority of the Group’s products are sold.

An economic downturn in these markets may have

an adverse effect on Group sales and earnings. Shifts

in product technology as well as shifts in distribution

structure and sales channels could also have

a negative impact, as will fluctuations in prices of

sourced raw materials and components. Short term,

demand for the Group’s products is impacted by weather

conditions. The Group’s production processes and

supply chain are therefore adapted to respond to

changes in weather conditions.

In the ordinary course of business, the Group is exposed

to legal risks such as commercial, product liability and

other disputes and provides for them as appropriate.

Financial risks refer primarily to currency exchange

rates, interest rates, financing, tax and credit risks.

Risk management within Husqvarna Group is

regulated by a financial policy established by

the Board of Directors. For further information on risks

and uncertainty factors, see the Annual and

Sustainability Report 2023 which is available at

www.husqvarnagroup.com.

Accounting Principles

This interim report has been prepared in accordance

with IAS 34, Interim financial reporting and

the Swedish Annual Accounts Act. The financial

statement of the Parent Company has been prepared

in accordance with the Swedish Annual Accounts Act,

chapter 9 and the Swedish Financial Reporting

Board’s standard RFR 2 Accounting for Legal Entities.

The accounting principles adopted are consistent with

those presented in the Annual and Sustainability

Report 2023, which is available at

www.husqvarnagroup.com.

10 (23)

Husqvarna Group / Interim Report, Q2 2024

The Board of Directors and the CEO certify that the interim report gives a fair view of the performance of the business,

position and income statements of the Parent Company and Husqvarna Group, and describes the principal risks and

uncertainties to which the Parent Company and the Group is exposed.

Stockholm, July 17, 2024

Tom Johnstone

Chair of the Board

Torbjörn Lööf

Deputy Chair of the Board

Ingrid Bonde

Board member

Katarina Martinson

Board member

Bertrand Neuschwander

Board member

Daniel Nodhäll

Board member

Lars Pettersson

Board member

Christine Robins

Board member

Pavel Hajman

Board member and CEO

Anders Krantz

Board member and

employee representative

Dan Byström

Board member and

employee representative

11 (23)

Husqvarna Group / Interim Report, Q2 2024

Auditors’ review report

To the Board of Directors of Husqvarna AB (publ)

Corp. id. 556000-5331

Introduction

We have reviewed the condensed interim financial information (interim report) of Husqvarna AB (publ) as of 30 June

2024 and the six-month period then ended. The Board of Directors and the President & CEO are responsible for the

preparation and presentation of this interim report in accordance with IAS 34 and the Annual Accounts Act. Our

responsibility is to express a conclusion on this interim report based on our review.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements ISRE 2410 Review of

Interim Financial Information Performed by the Independent Auditor of the Entity. A review of interim financial information

consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical

and other review procedures. A review is substantially less in scope than an audit conducted in accordance with

International Standards on Auditing and other generally accepted auditing practices and consequently does not enable us

to obtain assurance that we would become aware of all significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the interim report is not prepared,

in all material respects, for the Group in accordance with IAS 34 and the Annual Accounts Act, and for the Parent

Company in accordance with the Annual Accounts Act.

Stockholm July 17, 2024

KPMG AB

Joakim Thilstedt

Authorized Public Accountant

12 (23)

Husqvarna Group / Interim Report, Q2 2024

Condensed consolidated income statement

Condensed consolidated comprehensive income statement

Q2 Q2 Jan-Jun Jan-Jun Full year

SEKm 2024 2023 2024 2023 LTM* 2023

Net sales

15,430 16,976 30,150 34,143 49,267 53,261

Cost of goods sold

-10,236 -11,430 -19,989 -22,906 -34,218 -37,136

Gross income

5,195 5,547 10,161 11,237 15,049 16,125

Gross margin, %

33.7 32.7 33.7 32.9 30.5 30.3

Selling expenses

-2,423 -2,598 -4,580 -4,972 -8,642 -9,034

Administrative expenses

-874 -854 -1,752 -1,789 -3,175 -3,211

Other operating income/expense

1 7 2 -12 14 0

Operating income

1,899 2,101 3,830 4,465 3,245 3,880

Operating margin, %

12.3 12.4 12.7 13.1 6.6 7.3

Financial items, net

-258 -247 -486 -492 -996 -1,002

Income after financial items

1,641 1,854 3,343 3,973 2,249 2,878

Margin, %

10.6 10.9 11.1 11.6 4.6 5.4

Income tax

-369 -443 -748 -909 -540 -702

Net income for the period

1,273 1,411 2,595 3,063 1,709 2,177

Net income for the period attributable to:

Equity holders of the Parent Company

1,272 1,411 2,593 3,064 1,707 2,177

Non-controlling interest

1 0 2 0 1 -1

Earnings per share:

Before dilution, SEK

2.22 2.47 4.54 5.37 2.98 3.81

After dilution, SEK

2.22 2.46 4.53 5.35 2.99 3.81

Weighted average number of shares outstanding:

Before dilution, millions

571.6 570.6 571.6 570.6 572.5 570.9

After dilution, millions

572.5 573.1 572.4 573.1 570.2 571.6

Q2 Q2 Jan-Jun Jan-Jun Full year

SEKm 2024 2023 2024 2023 LTM* 2023

Net income for the period

1,273 1,411 2,595 3,063 1,709 2,177

Other comprehensive income

Items that will not be reclassified to the income statement:

Remeasurements on defined benefit pension plans, net of tax

223 -66 234 11 -202 -426

Total items that will not be reclassified to the income statement,

net of tax

223 -66 234 11 -202 -426

Items that may be reclassified to the income statement:

Translation differences

-260 1,497 1,395 1,436 -880 -839

Net investment hedge, net of tax

57 -566 -665 -487 226 403

Cash flow hedges, net of tax

-32 -103 -128 -57 167 238

Total items that may be reclassified to the income statement, net

of tax

-234 828 602 892 -487 -197

Other comprehensive income, net of tax

-11 762 836 903 -689 -622

Total comprehensive income for the period

1,262 2,173 3,431 3,966 1,019 1,554

Total comprehensive income attributable to:

Equity holders of the Parent Company

1,261 2,173 3,429 3,966 1,018 1,555

Non-controlling interest

1 0 2 0 1 -1

13 (23)

Husqvarna Group / Interim Report, Q2 2024

Condensed consolidated balance sheet

Assets

Property, plant and equipment

7,381 7,372 7,205

Right of use assets

2,058 2,207 2,068

Goodwill

10,292 10,581 9,920

Other intangible assets

8,624 8,785 8,400

Investments in associated companies

13 16 14

Derivatives

- 29 0

Other non-current assets

909 896 843

Deferred tax assets

1,984 2,452 2,143

Total non-current assets

31,262 32,338 30,592

Inventories

14,720 17,949 17,184

Trade receivables

10,519 9,373 5,289

Derivatives

406 500 1,604

Current tax receivables

295 544 242

Other current assets

1,221 1,576 1,171

Cash and cash equivalents

2,059 3,990 1,527

Total current assets

29,220 33,932 27,018

Total assets

60,482 66,270 57,610

Equity and liabilities

Equity attributable to equity holders of the Parent Company

25,512 26,276 23,770

Non-controlling interests

3 3 2

Total equity

25,516 26,279 23,772

Borrowings

11,629 12,074 8,556

Lease liabilities

1,390 1,613 1,436

Derivatives

2 - -

Deferred tax liabilities

2,351 2,607 2,334

Provisions for pensions and other post-employment benefits

1,935 1,713 2,209

Other provisions

682 713 620

Total non-current liabilities

17,988 18,720 15,155

Trade payables

5,934 7,017 5,487

Current tax liabilities

829 749 662

Other liabilities

4,916 6,202 3,866

Dividend payable

1,143 1,141 -

Borrowings

1,647 2,358 6,031

Lease liabilities

691 636 648

Derivatives

355 1,460 575

Other provisions

1,462 1,708 1,415

Total current liabilities

16,978 21,271 18,683

Total equity and liabilities

60,482 66,270 57,610

Jun 30

2024

Jun 30

2023

Dec 31

2023

SEKm

14 (23)

Husqvarna Group / Interim Report, Q2 2024

Condensed consolidated cash flow statement

Q2 Q2 Jan-Jun Jan-Jun Full year

2024

2023

2024

2023 2023

Cash flow from operations

Operating income 1,899 2,101 3,830 4,465 3,880

Non cash items

762 994 1,660 1,910 3,586

Cash items

Paid restructuring expenses

-116 -60 -190 -149 -565

Net financial items, received/paid

-234 -195 -400 -369 -862

Taxes paid/received

-100 -205 -353 -825 -493

Cash flow from operations, excluding change in

operating assets and liabilities

2,212 2,635 4,548 5,032 5,546

Operating assets and liabilities

Change in inventories

2,196 1,509 2,975 2,238 1,918

Change in trade receivables

590 1,336 -5,127 -2,726 917

Change in trade payables

-836 -825 328 -346 -1,579

Change in other operating assets/liabilities

1 340 899 1,923 264

Cash flow from operating assets and liabilities

1,951 2,360 -925 1,089 1,521

Cash flow from operations

4,163 4,995 3,623 6,122 7,067

Investments

Acquisitions of subsidiaries/operations

- - -5 - -9

Proceeds from sale of property, plant and equipment

8 5 11 16 5

Investments in property, plant and equipment and intangible assets

-703 -608 -1,209 -1,130 -2,627

Investments and divestments of financial assets

-10 41 -17 13 -22

Cash flow from investments

-704 -562 -1,221 -1,101 -2,652

Cash flow from operations and investments

3,459 4,432 2,403 5,020 4,414

Financing

Dividend paid to shareholders

-570 -571 -570 -571 -1,714

Dividend paid to non-controlling interests

0 -2 0 -2 -2

Proceeds/repayment of borrowings

-2,371 -2,229 -1,400 -2,434 -2,066

Other financing activities

-337 -279 56 -411 -1,380

Cash flow from financing

-3,279 -3,081 -1,915 -3,417 -5,161

Total cash flow

180 1,352 487 1,603 -746

Cash and cash equivalents at the beginning of the period

1,898 2,571 1,527 2,328 2,328

Exchange rate differences referring to cash and cash equivalents

-19 67 45 59 -55

Cash and cash equivalents at the end of the period

2,059 3,990 2,059 3,990 1,527

SEKm

Q2 Q2 Jan-Jun Jan-Jun Full year

2024

2023

2024

2023 2023

EBITDA excl. items affecting comparability

2,669 3,031 5,336 6,168 7,911

Change in inventories

2,196 1,509 2,975 2,238 1,918

Change in trade receivables

590 1,336 -5,127 -2,726 917

Change in trade payables

-836 -825 328 -346 -1,579

Investments in property, plant and equipment and intangible assets

-703 -608 -1,209 -1,130 -2,627

Direct operating cash flow

3,917 4,443 2,303 4,204 6,541

Direct operating cash flow, SEKm

15 (23)

Husqvarna Group / Interim Report, Q2 2024

Key performance indicators

Income statement

Organic growth*

Net sales, second quarter

Net sales, January - June

Q2 Q2 Jan-Jun Jan-Jun Full year

EBITDA*, SEKm

2024

2023

2024

2023

LTM*

2023

Operating income

1,899 2,101 3,830 4,465 3,245 3,880

Reversals

Depreciation

500 488 985 984 1,993 1,992

Amortization

260 229 509 445 995 931

Impairment

3 -2 5 27 160 182

Depreciation, amortization and impairment

763 715 1,500 1,456 3,148 3,105

EBITDA*

2,663 2,816 5,329 5,921 6,393 6,985

Excl. items affecting comparability* 2,669 3,031 5,336 6,168 7,080 7,911

EBITDA margin, % 17.3 16.6 17.7 17.3 13.0 13.1

Excl. items affecting comparability*, % 17.3 17.9 17.7 18.1 14.4 14.9

SEKm

Reported Net

sales

Acquisitions/

divestments

Planned exits

Organic net sales before

currency translation

Currency

translation

Organic net sales

2024 15,430 15,430 15,430

2023 16,976 -426 16,550 -89 16,462

Growth -1,546 -1,120 -1,031

Growth, % -9 -7 -6

SEKm

Reported Net

sales

Acquisitions/

divestments

Planned exits

Organic net sales before

currency translation

Currency

translation

Organic net sales

2024 30,150 0 30,150 30,150

2023 34,143 -1,099 33,044 -80 32,964

Growth -3,994 -2,894 -2,814

Growth, % -12 -9 -9

*Alternative Performance Measure, refer to "Definitions".

16 (23)

Husqvarna Group / Interim Report, Q2 2024

Other Key performance indicators

Operating working capital, SEKm

19,304 20,305 16,986

Average operating working capital LTM, SEKm 19,447 19,334 19,631

Operating working capital/net sales*, %

39.5 34.1 36.9

Return on capital employed, %

7.2 7.2 8.4

Excl. items affecting comparability*, %

9.0 11.7 10.8

Return on equity, %

6.7 7.6 8.5

Excl. items affecting comparability*, %

9.3 13.8 11.8

Capital turn-over rate, times

1.2 1.4 1.3

Equity/assets ratio, %

42 40 41

Equity per share after dilution, SEK

44.6 45.9 41.6

Average number of employees

13,789 14,371 13,755

Jun 30

2024

Dec 31

2023

Jun 30

2023

Key data

Net pension liability

1,720 1,451 1,994

Other interest-bearing liabilities

15,714 18,141 17,245

Dividend payable

1,143 1,141 -

Less: Liquid funds and other interest-bearing assets

-2,962 -4,985 -3,600

Net debt*

15,615 15,748 15,640

Net debt/equity ratio

0.61 0.60 0.66

Net debt/EBITDA excl. items affecting comparability*

2.3 2.0 2.1

Dec 31

2023

Jun 30

2023

Jun 30

2024

Net debt*, SEKm

Total equity and liabilities 60,482 66,270 57,610

Deduction; Non interest bearing liabilities: -16,174 -18,996 -14,383

Deferred tax liabilities -2,351 -2,607 -2,334

Other provisions -2,143 -2,420 -2,035

Trade payables -5,934 -7,017 -5,487

Current tax liabilities -829 -749 -662

Other liabilities -4,916 -6,202 -3,866

Capital employed* 44,308 47,274 43,227

Capital employed*, LTM Average 45,350 45,533 45,956

Operating income, LTM 3,245 3,283 3,880

Return on capital employed*, % 7.2 7.2 8.4

Operating income excl. items affecting comparability*, LTM 4,084 5,311 4,970

Return on capital employed excl. items affecting comparability*, % 9.0 11.7 10.8

* Alternative Performance Measure, refer to "Definitions".

Jun 30

2024

Jun 30

2023

Dec 31

2023

Return on capital employed*, SEKm

17 (23)

Husqvarna Group / Interim Report, Q2 2024

Change in Group equity, condensed

Fair value of financial instruments

The Group’s financial instruments carried at fair value are derivatives. Derivatives belong to Level 2 in the fair value

hierarchy. Future cash flows have been discounted using current quoted market interest rates and exchange rates for

similar instruments. Further information about the accounting principles for financial instruments and methods used for

estimating the fair value of the financial instruments are described in note 1 and note 20, respectively, in the Annual and

Sustainability Report 2023. The carrying value approximates fair value for all financial instruments.

SEKm

Attributable to equity

holders of the

Parent Company

Non-controlling

interests

Total equity

Opening balance January 1, 2023 24,002 10

24,011

Share-based payment 106 -

106

Hedge for LTI-programs -92

-92

Shareholder contribution from non-controlling interest 1

1

Dividend -1,712

-1,712

Total comprehensive income 3,967 0

3,966

Acquistion of non-controlling interest 5 -5

-

Dividend to non-controlling interest -2

-2

Closing balance June 30, 2023 26,276 3

26,279

Opening balance January 1, 2024 23,770 2

23,772

Share-based payment 338 - 338

Hedge for LTI-programs -311 -311

Dividend -1,714 -1,714

Total comprehensive income 3,429 2 3,431

Closing balance June 30, 2024 25,512 3

25,516

18 (23)

Husqvarna Group / Interim Report, Q2 2024

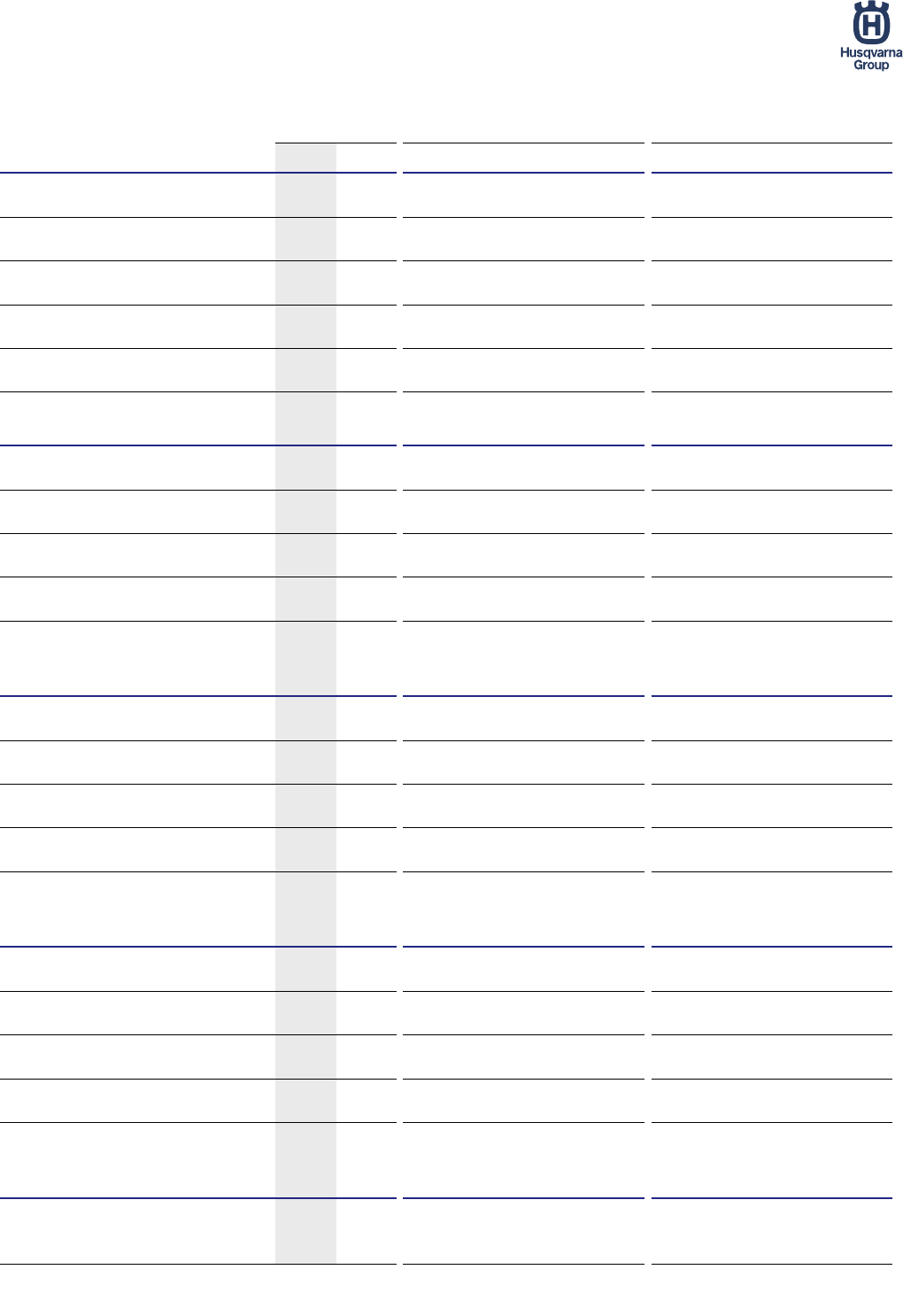

Net sales and income by division and quarter

SEKm

Group

Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1

Net sales

15,430 14,719 8,605 10,512 16,976 17,167 10,353 12,206 15,792 15,685

Net sales, LTM*

49,267 50,813 53,261 55,009 56,703 55,519 54,037 51,918 49,892 48,714

Operating income

1,899 1,930 -983 398 2,101 2,364 -1,737 555 2,065 2,159

Operating margin, % 12.3 13.1 -11.4 3.8 12.4 13.8 -16.8 4.5 13.1 13.8

Operating income excl. IAC* 1,906 1,930 -168 415 2,313 2,410 -13 601 2,075 2,190

Operating margin excl. IAC*, % 12.4 13.1 -1.9 3.9 13.6 14.0 -0.1 4.9 13.1 14.0

Operating income, LTM*

3,245 3,447 3,880 3,126 3,283 3,247 3,043 4,647 5,018 5,612

Operating margin, LTM*, % 6.6 6.8 7.3 5.7 5.8 5.8 5.6 9.0 10.1 11.5

Operating income excl. IAC*, LTM* 4,084 4,491 4,970 5,125 5,311 5,073 4,853 4,686 5,011 5,580

Operating margin excl. IAC*, LTM*, % 8.3 8.8 9.3 9.3 9.4 9.1 9.0 9.0 10.0 11.5

Net income for the period

1,273 1,322 -1,011 125 1,411 1,653 -1,392 269 1,417 1,638

Husqvarna Forest & Garden

Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1

Net sales

8,722 8,272 5,257 6,123 9,722 10,656 6,793 7,761 8,826 8,701

Net sales, LTM*

28,374 29,375 31,759 33,295 34,933 34,037 32,082 30,519 29,089 29,099

Operating income

1,145 1,191 -379 291 1,123 1,670 -1,252 560 1,107 1,392

Operating margin, % 13.1 14.4 -7.2 4.8 11.6 15.7 -18.4 7.2 12.5 16.0

Operating income excl. IAC* 1,149 1,191 -7 293 1,260 1,690 273 555 1,113 1,283

Operating margin excl. IAC*, % 13.2 14.4 -0.1 4.8 13.0 15.9 4.0 7.2 12.6 14.7

Operating income, LTM*

2,248 2,226 2,706 1,833 2,101 2,085 1,807 3,129 3,127 3,554

Operating margin, LTM*, % 7.9 7.6 8.5 5.5 6.0 6.1 5.6 10.3 10.8 12.2

Operating income excl. IAC*, LTM* 2,626 2,737 3,236 3,516 3,779 3,631 3,224 3,021 3,024 3,447

Operating margin excl. IAC*, LTM*, % 9.3 9.3 10.2 10.6 10.8 10.7 10.0 9.9 10.4 11.8

Gardena

Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1

Net sales

4,566 4,414 1,326 2,287 5,031 4,321 1,470 2,400 4,775 4,960

Net sales, LTM*

12,593 13,057 12,964 13,108 13,222 12,966 13,606 13,284 12,915 11,991

Operating income

691 673 -407 -46 818 585 -468 -93 773 706

Operating margin, % 15.1 15.3 -30.7 -2.0 16.3 13.5 -31.8 -3.9 16.2 14.2

Operating income excl. IAC* 693 673 -264 -41 857 584 -314 -42 776 752

Operating margin excl. IAC*, % 15.2 15.3 -19.9 -1.8 17.0 13.5 -21.4 -1.7 16.3 15.2

Operating income, LTM*

912 1,039 950 889 842 797 918 1,109 1,398 1,603

Operating margin, LTM*, % 7.2 8.0 7.3 6.8 6.4 6.2 6.8 8.3 10.8 13.4

Operating income excl. IAC*, LTM* 1,061 1,225 1,136 1,086 1,085 1,005 1,173 1,197 1,434 1,627

Operating margin excl. IAC*, LTM*, % 8.4 9.4 8.8 8.3 8.2 7.7 8.6 9.0 11.1 13.6

Husqvarna Construction

Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1

Net sales

2,105 2,008 1,968 2,061 2,192 2,177 2,071 2,024 2,157 1,981

Net sales, LTM*

8,143 8,230 8,398 8,500 8,463 8,428 8,232 7,992 7,763 7,511

Operating income

204 203 -4 225 272 262 80 183 299 152

Operating margin, % 9.7 10.1 -0.2 10.9 12.4 12.0 3.9 9.0 13.9 7.7

Operating income excl. IAC* 205 203 180 225 308 289 127 182 300 245

Operating margin excl. IAC*, % 9.7 10.1 9.1 10.9 14.1 13.3 6.1 9.0 13.9 12.4

Operating income, LTM*

628 696 755 839 796 823 713 778 826 787

Operating margin, LTM*, % 7.7 8.5 9.0 9.9 9.4 9.8 8.7 9.7 10.6 10.5

Operating income excl. IAC*, LTM* 813 916 1,002 948 905 897 854 871 920 880

Operating margin excl. IAC*, LTM*, % 10.0 11.1 11.9 11.2 10.7 10.6 10.4 10.9 11.9 11.7

Group Common

Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1

Net sales

38 24 54 41 31 13 20 22 34 43

Operating income

-141 -137 -193 -72 -112 -154 -97 -95 -114 -90

Operating income excl. IAC* -141 -137 -76 -62 -112 -154 -98 -95 -114 -90

The majority of net sales are recognized at a certain point in time.

*Alternative Performance Measure, refer to "Definitions".

2022

2023

2024

19 (23)

Husqvarna Group / Interim Report, Q2 2024

Items affecting comparability

In Q2 2024 items affecting comparability was SEK -7m, related to the Group’s cost saving initiatives. In 2023 items

affecting comparability was SEK -1,090m. This was mainly related to the expansion of the Group’s cost saving initiatives

(announced in October 2023), including the consolidation of operations and brands from previous acquisitions, a write-

down of inventory related to exits of petrol-powered, low-margin consumer wheeled products (announced in October

2022), as well as non-recurring costs related to Russia.

Classification in the income statement

Net assets by division¹

SEKm

Restructuring costs

Impairment of non-current assets - 3 - -11 -163

Write-down of inventory - -64 - -64 -272

Other restructuring costs -7 -151 -7 -183 -567

Non-recurring costs relating to Russia

Write-down/reversal of current assets - - - - 15

Write-down/reversal of inventory - - - - 0

Other restructuring costs - - - - -102

Total items affecting comparability -7 -212 -7 -258 -1,090

Full year

2023

Jan-Jun

2023

Jan-Jun

2024

Q2

2023

Q2

2024

SEKm

Cost of goods sold - -212 - -237 -725

Selling expenses - - - -5 -172

Administrative expenses -7 - -7 -15 -193

Total items affecting comparability -7 -212 -7 -258 -1,090

Full year

2023

Jan-Jun

2023

Jan-Jun

2024

Q2

2023

Q2

2024

SEKm

Jun 30

2024

Jun 30

2023

Jun 30

2024

Jun 30

2023

Jun 30

2024

Jun 30

2023

Husqvarna Forest & Garden

26,421 28,053 7,324 9,361 19,096 18,692

Gardena 19,074 20,144 4,045 4,478 15,028 15,666

Husqvarna Construction 8,998 9,476 1,365 1,736 7,633 7,740

Other² 2,813 3,350 3,440 3,421 -627 -70

Total 57,305 61,023 16,174 18,995 41,131 42,028

¹ Liquid assets, other interest-bearing assets, interest-bearing liabilities and equity are not included in the table above.

² Other includes tax items, associates and common Group functions such as Treasury and Risk Management.

Assets

Liabilities

Net Assets

20 (23)

Husqvarna Group / Interim Report, Q2 2024

Parent Company

Condensed income statement

Q2 Q2 Jan-Jun Jan-Jun Full year

2024

2023

2024

2023 2023

Net sales 6,761 7,574 13,281 15,242 23,454

Cost of goods sold -4,757 -5,386 -9,518 -10,444 -18,366

Gross income 2,004 2,188 3,762 4,798 5,089

Selling expense -530 -566 -1,011 -1,081 -2,129

Administrative expense -550 -539 -1,101 -1,123 -2,721

Other operating income/expense 0 0 0 -0 -1

Operating income 924 1,082 1,651 2,594 238

Financial items, net 329 -382 -847 -492 1,474

Income after financial items 1,254 700 804 2,102 1,711

Appropriations -10 -13 -29 -51 -266

Income before taxes 1,243 687 775 2,050 1,445

Tax on profit for the year -129 -21 -34 -305 80

Income for the period 1,114 666 741 1,745 1,525

SEKm

Condensed balance sheet

Non-current assets 52,408 49,811 50,263

Current assets 13,428 19,967 15,616

Total assets 65,836 69,777 65,880

Equity 30,931 32,124 32,030

Untaxed reserves 1,424 1,400 1,424

Provisions 608 515 542

Non-current liabilities 11,521 11,903 8,406

Current liabilities 21,352 23,836 23,478

Total equity and liabilities 65,836 69,777 65,880

Dec 31

2023

Jun 30

2023

Jun 30

2024

SEKm

Number of shares

Number of shares as of December 31, 2023

109,451,449 462,067,132 4,825,197 576,343,778

Conversion of shares -1,626,146 1,626,146 0

Hedge for LTI-programs 178,336 -178,336 0

Number of shares as of June 30, 2024 107,825,303 463,871,614 4,646,861 576,343,778

¹ All repurchased B-shares are included in a third party share swap agreement.

Outstanding

A-shares

Outstanding

B-shares

Repurchased

B-shares ¹

Total

Husqvarna Group / Interim Report, Q2 2024

21 (23)

Definitions

This report includes financial measures as required

by the financial reporting framework applicable to

Husqvarna Group, which is based on IFRS. In addition,

there are other measures (Alternative Performance

Measures) used by management and other

stakeholders to analyze trends and performance of

the Group’s operations that cannot be directly read

or derived from the financial statements. Husqvarna

stakeholders should not consider these as substitutes,

but rather as additions, to the financial reporting

measures prepared in accordance with IFRS. Please

note that the Alternative Performance Measures as

defined, may not be comparable to similarly titled

measures used by other companies. Refer below for

a list of definitions of all measures and indicators used,

referred to and presented in this report.

Computation of average amounts

The computation of key ratios is based on averages

of affected balance sheet items the last 12 months.

Roundings

All items are stated in SEKm and, accordingly,

rounding differences can occur.

Last twelve months (LTM)

Last twelve months rolling has been included to assist

stakeholders in their analysis of the seasonality that

Husqvarna Group's business is exposed to.

Earnings per share, after dilution

Earnings per share is expressed as net income

attributable to equity holders of the Parent Company

divided by the weighted average number of shares

outstanding (net of treasury shares), after dilution.

Earnings per share is a good measure of the

company’s profitability and is used to determine the

value of the company’s outstanding shares.

Growth measures

Net sales growth

Change in net sales compared to previous period

in percent.

Organic growth

Change in net sales, adjusted for acquisitions,

divestments, planned exits and currency translation

effects. The measure is important in order to

understand the underlying performance of the

operations and increases the comparability between

periods.

Profitability measures

EBITDA

EBITDA is a measure of earnings before interest,

taxes, depreciation, amortization and impairment

charges. EBITDA measures Husqvarna Group's

operating performance and the ability to generate cash

from operations, without considering the capital

structure of the Group or its fiscal environment. For a

reconciliation of EBITDA refer to section Key

Performance Indicators.

EBITDA margin

EBITDA as a percentage of net sales.

Gross margin

Gross income as a percentage of net sales.

Operating margin

Operating income as a percentage of net sales.

Return on capital employed

Operating income during the last twelve months as a

percentage of average capital employed. A central ratio

for measuring return on capital tied up in operations.

Return on equity

Net income attributable to equity holders of the Parent

Company last twelve months as a percentage of

average equity attributable to equity holders of the

Parent Company. The indicator shows how share

holders’ capital yields interest during the period.

Share-based measures

Equity per share, after dilution

Equity attributable to equity holders of the Parent

Company divided by the weighted average number of

shares outstanding (net of treasury shares), after dilution.

A measure of the amount of equity that exists per

outstanding share and is used for measuring the share

against the share price.

Capital indicators

Capital employed

Total equity and liabilities less non-interest-bearing

debt including deferred tax liabilities. This measure

shows the amount of capital that is used in the

operations and is an important component for

measuring the return from operations.

Capital expenditure

Investments in property, plant and equipment, right of

use assets and intangible assets.

Interest bearing liabilities

Long-term and short-term borrowings, net pension

liability and fair value derivative liabilities.

Husqvarna Group / Interim Report, Q2 2024

22 (23)

Liquid funds

Cash and cash equivalents, short-term investments

and fair value derivative assets.

Net assets

Total assets excluding liquid funds and interest-bearing

assets less operating liabilities, non-interest-bearing

provisions and deferred tax liabilities.

Net debt

Net debt describes the Group’s gearing and its ability

to repay its debts from cash generated from the

Group´s ordinary business, if they were all due today. It

is also used to analyze how future net interest costs

will impact earnings. Net debt is defined as total

interest-bearing liabilities plus dividend payable, less

liquid funds and interest-bearing assets.

Operating working capital

Inventories and trade receivables less trade payables.

This measure shows how much working capital is tied

up in the operations and can be put in relation to sales

to understand how efficient working capital is

managed.

Capital measures

Equity/assets ratio

Equity attributable to equity holders of the Parent

Company as a percentage of total assets. A measure

for showing financial risk, expressing the percentage of

total assets that is financed by the owners.

Capital turnover rate

Net sales last twelve months divided with average

net assets. Shows how effectively capital is managed

and is a key measure for monitoring value creation.

Net debt/EBITDA excl. items affecting comparability

Average net debt in relation to EBITDA last twelve

months, excluding items affecting comparability. Shows

the company’s capacity to repay its debt, adjusted for

the impact of items affecting comparability.

Net debt/equity ratio

Net debt in relation to total equity. Shows financial risk

and is a useful measure to monitor the level of the

company’s indebtedness.

Operating working capital/net sales

Average operating working capital as a percentage of

net sales last twelve months. This measure is an

important indicator for how efficient working capital is

managed.

Other measures

Direct operating cash flow

EBITDA, excluding items affecting comparability,

adjusted for change in trade payables, inventory and

trade receivables and investments in property, plant

and equipment and intangible assets. For a

reconciliation of direct operating cash flow refer to the

table below the cash flow statement. Direct operating

cash flow provides a measure of the cash generated by

the Groups operating business.

Items affecting comparability (IAC)

Under Items affecting comparability, Husqvarna

includes items that have the character of being non-

recurring, such as restructuring costs, and are relevant

when comparing earnings for one period with those of

another. Separate reporting of items affecting

comparability between periods provides a better

understanding of the company’s underlying operating

activities.

23 (23)

Webcast presentation and telephone conference

A webcast presentation of the Q2 report hosted by Pavel Hajman, CEO

and Terry Burke, CFO will be held at 10:00 CET on July 18, 2024.

To view the presentation, please use the link:

husqvarnagroup.creo.se/8080f1ee-635c-4505-8f81-a5c393bb2868

The dial-in to the telephone conference (in order to ask questions):

+46 (0) 8 505 100 31 (Sweden) or +44 207 107 06 13 (UK)

Dates for Financial Reports 2024

October 23 Interim report for January-September 2024

Contacts

Terry Burke, CFO and Executive Vice President, Finance, IR & Communication

+46 8 738 90 00

Johan Andersson, Vice President, Investor Relations

+46 702 100 451

Husqvarna AB (publ), P.O. Box 7454, SE-103 92 Stockholm

Regeringsgatan 28, +46 8 738 90 00, www.husqvarnagroup.com

Reg. Nr: 556000-5331

NASDAQ OMX Stockholm: HUSQ A, HUSQ B

This report contains insider information that Husqvarna AB is required to disclose under the EU

Market Abuse Regulation and the Securities Markets Act. The information was submitted for

publication, through the contact person set out above, at 07.00 CET on July 18, 2024.

Factors affecting forward-looking statements

This report contains forward-looking statements in the sense referred to in the American Private

Securities Litigation Reform Act of 1995. Such statements comprise, among other things, financial

goals, goals of future business and financial plans. These statements are based on present

expectations and are subject to risks and uncertainties that may give rise to major deviations in the

result due to several aspects. These aspects include, among other things: consumer demand and

market conditions in the geographical areas and lines of business in which Husqvarna operates, the

effects of currency fluctuations, downward pressure on prices due to competition, a material reduction

in sales by important distributors, success in developing new products and in marketing, outcome of

product responsibility litigation, progress in terms of reaching the goals set for productivity and efficient

use of capital, successful identification of growth opportunities and acquisition objects, integration of

these into the existing business and successful achievement of goals for making the supply chain more

efficient.