UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the quarterly period ended June 15, 2024 (24 weeks)

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the transition period from to

Commission file number 1-1183

PepsiCo, Inc.

(Exact Name of Registrant as Specified in its Charter)

North Carolina 13-1584302

(State or Other Jurisdiction of

Incorporation or Organization)

(I.R.S. Employer

Identification No.)

700 Anderson Hill Road, Purchase, New York 10577

(Address of principal executive offices and Zip Code)

(914) 253-2000

Registrant's telephone number, including area code

N/A

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

Title of each class Trading Symbols Name of each exchange on which registered

Common Stock, par value 1-2/3 cents per share

PEP

The Nasdaq Stock Market LLC

2.625% Senior Notes Due 2026

PEP26

The Nasdaq Stock Market LLC

0.750% Senior Notes Due 2027

PEP27

The Nasdaq Stock Market LLC

0.875% Senior Notes Due 2028

PEP28

The Nasdaq Stock Market LLC

0.500% Senior Notes Due 2028

PEP28A

The Nasdaq Stock Market LLC

3.200% Senior Notes Due 2029

PEP29

The Nasdaq Stock Market LLC

1.125% Senior Notes Due 2031

PEP31

The Nasdaq Stock Market LLC

0.400% Senior Notes Due 2032

PEP32

The Nasdaq Stock Market LLC

0.750% Senior Notes Due 2033

PEP33

The Nasdaq Stock Market LLC

3.550% Senior Notes Due 2034

PEP34

The Nasdaq Stock Market LLC

0.875% Senior Notes Due 2039

PEP39

The Nasdaq Stock Market LLC

1.050% Senior Notes Due 2050

PEP50

The Nasdaq Stock Market LLC

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted

pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period

that the registrant was required to submit such files). Yes ☒ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller

reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

☒

Accelerated filer

☐

Non-accelerated filer

☐

Smaller reporting company

☐

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐ No ☒

Number of shares of Common Stock outstanding as of July 5, 2024 was 1,373,572,400.

PepsiCo, Inc. and Subsidiaries

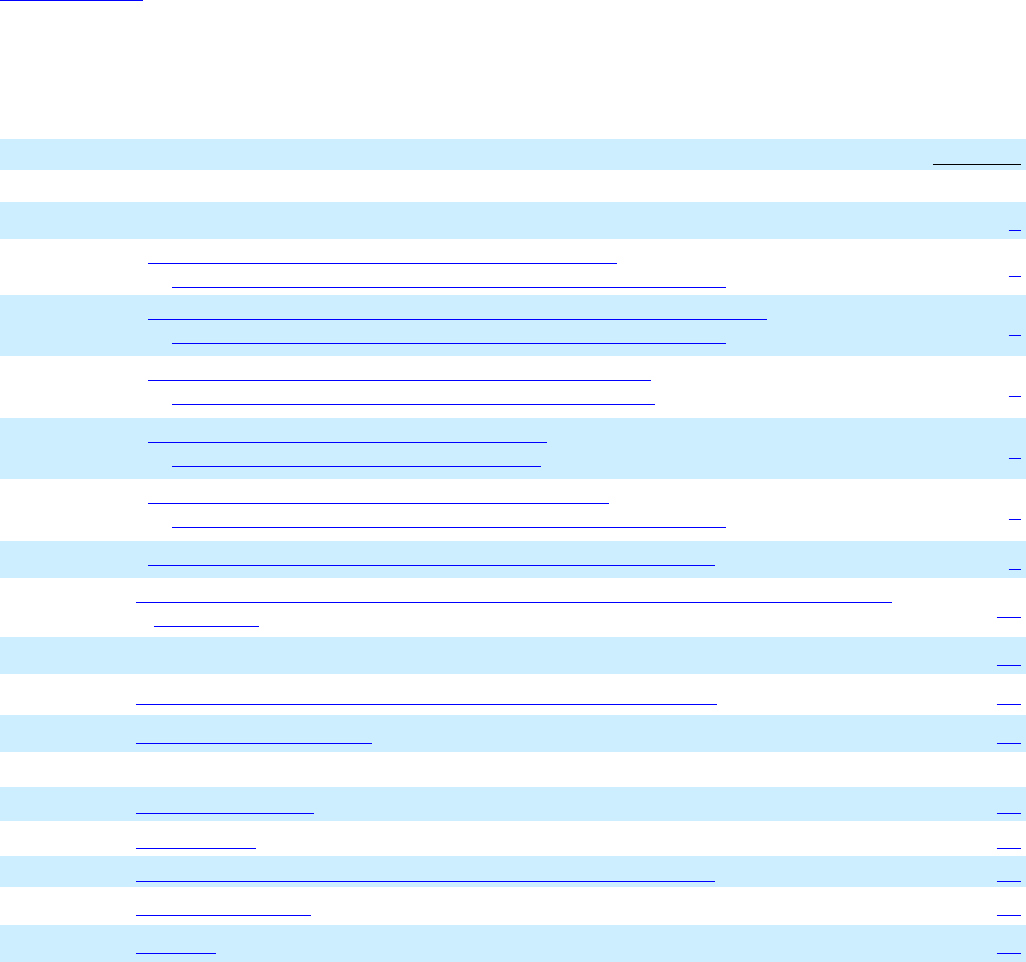

Table of Contents

Page No.

Part I Financial Information

Item 1. Condensed Consolidated Financial Statements 2

Condensed Consolidated Statement of Income –

12 and 24 Weeks Ended June 15, 2024 and June 17, 2023

2

Condensed Consolidated Statement of Comprehensive Income –

12 and 24 Weeks Ended June 15, 2024 and June 17, 2023

3

Condensed Consolidated Statement of Cash Flows –

24 Weeks Ended June 15, 2024 and June 17, 2023

4

Condensed Consolidated Balance Sheet –

June 15, 2024 and December 30, 2023

6

Condensed Consolidated Statement of Equity –

12 and 24 Weeks Ended June 15, 2024 and June 17, 2023

7

Notes to the Condensed Consolidated Financial Statements

8

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of

Operations

24

Report of Independent Registered Public Accounting Firm 44

Item 3. Quantitative and Qualitative Disclosures About Market Risk 45

Item 4. Controls and Procedures 45

Part II Other Information

Item 1. Legal Proceedings 46

Item 1A. Risk Factors 46

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds 46

Item 5. Other Information 47

Item 6. Exhibits 47

Table of Contents

1

PART I FINANCIAL INFORMATION

ITEM 1. Condensed Consolidated Financial Statements.

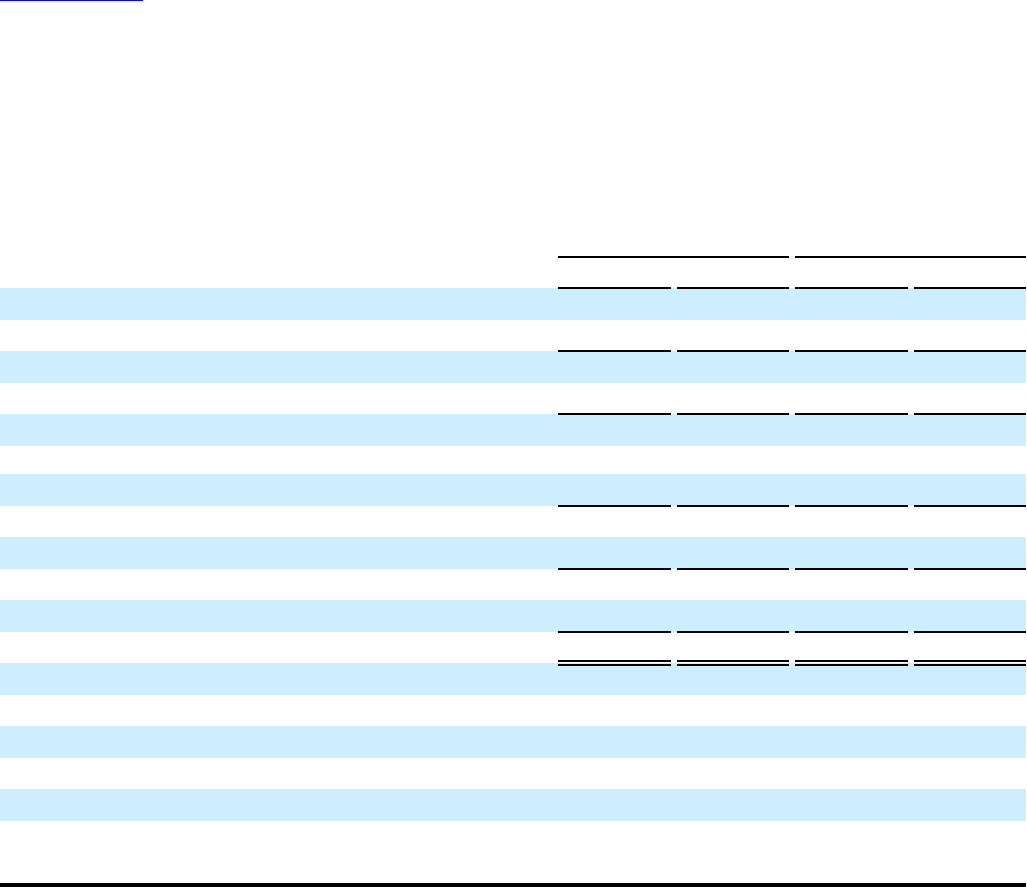

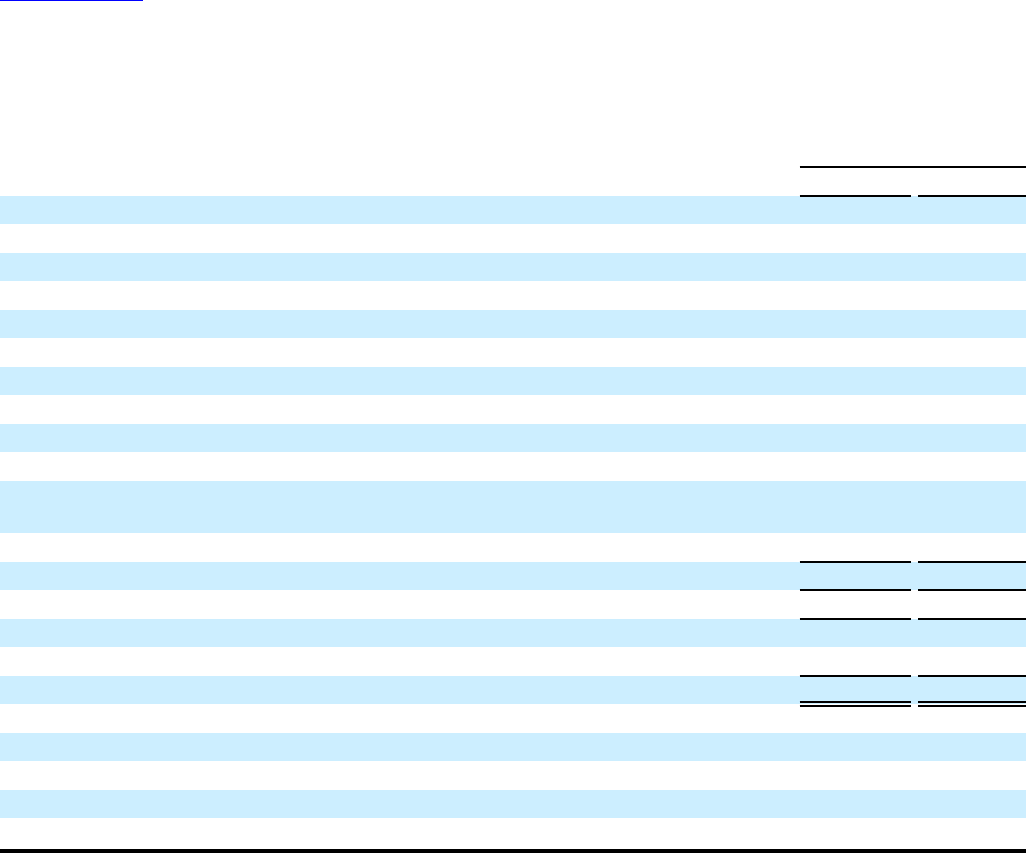

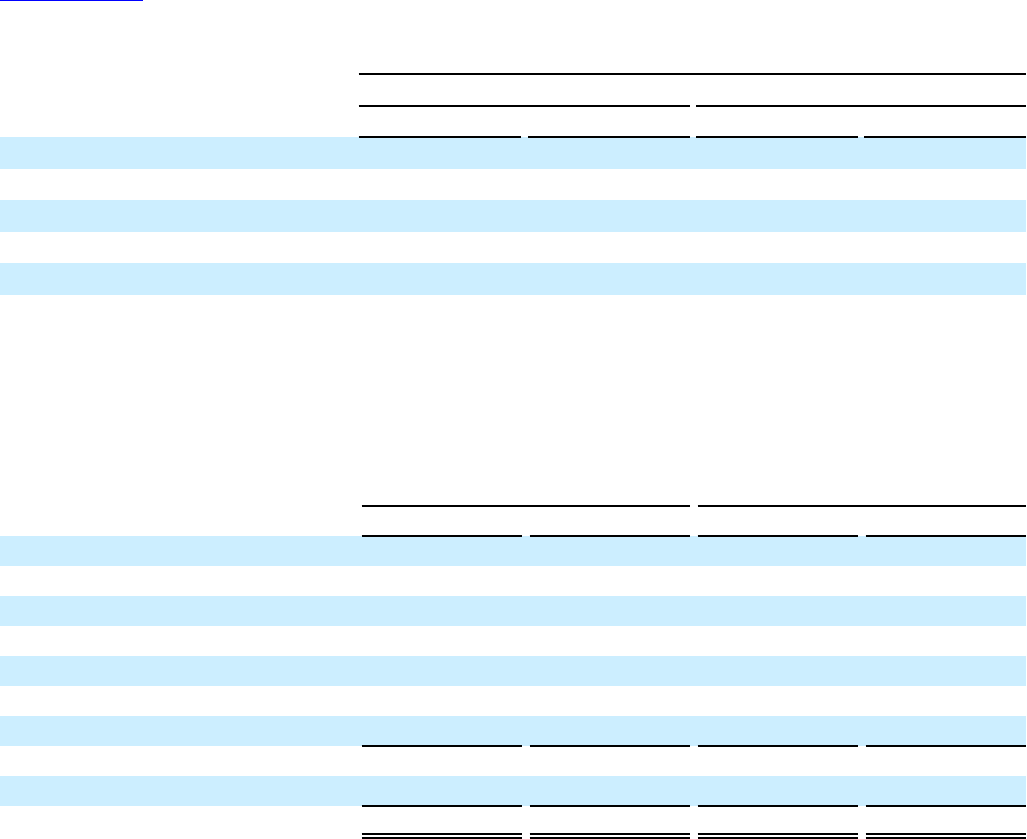

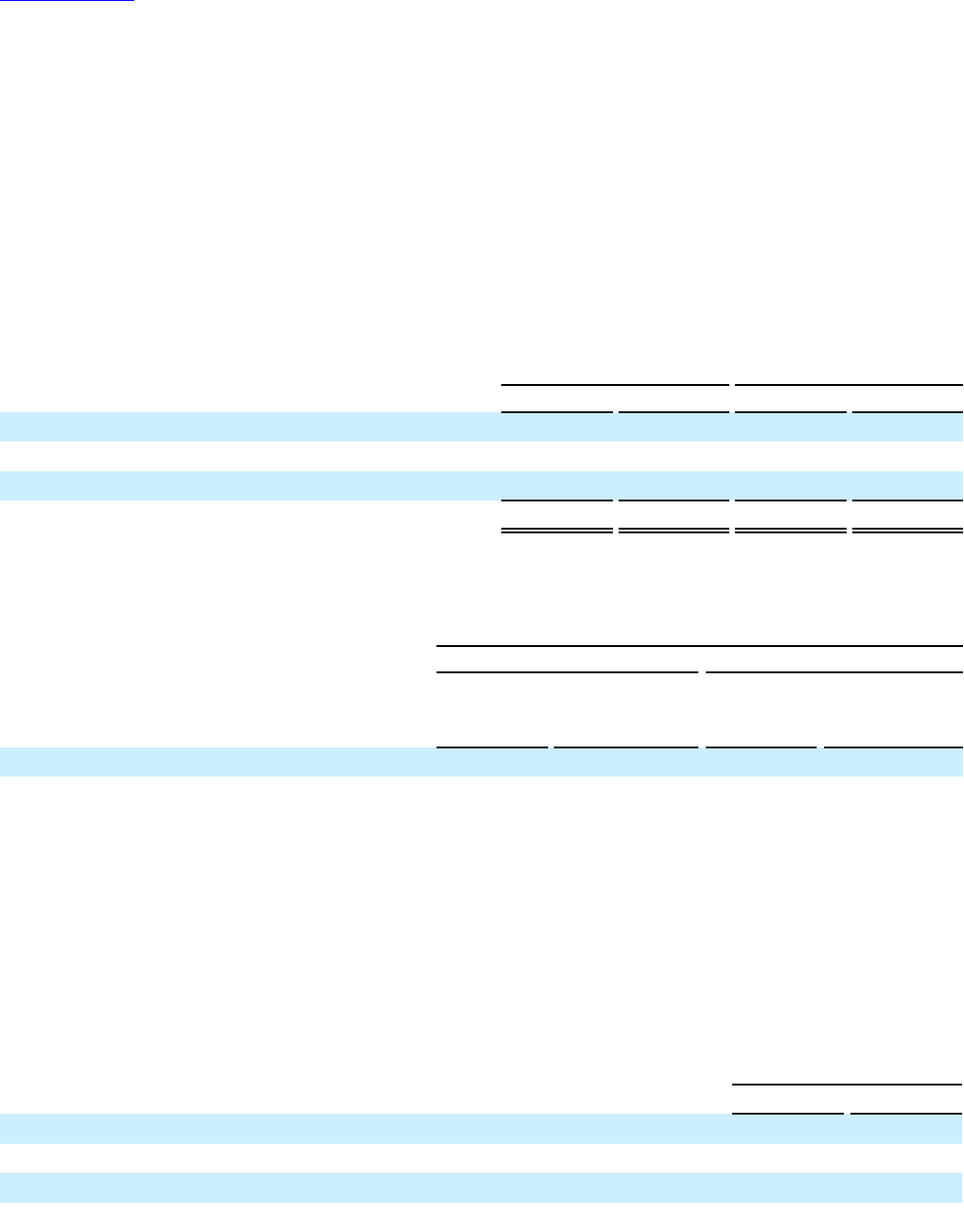

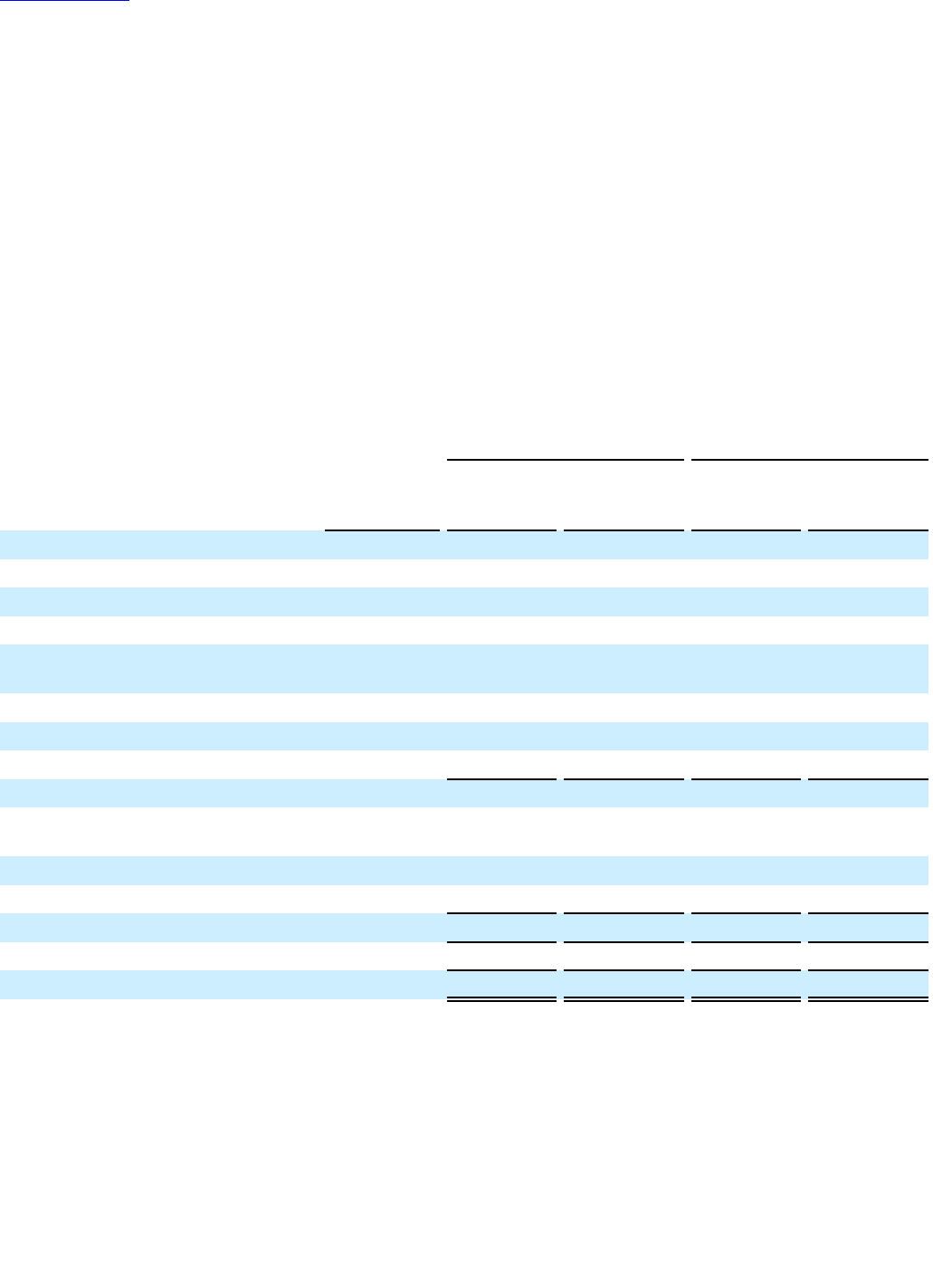

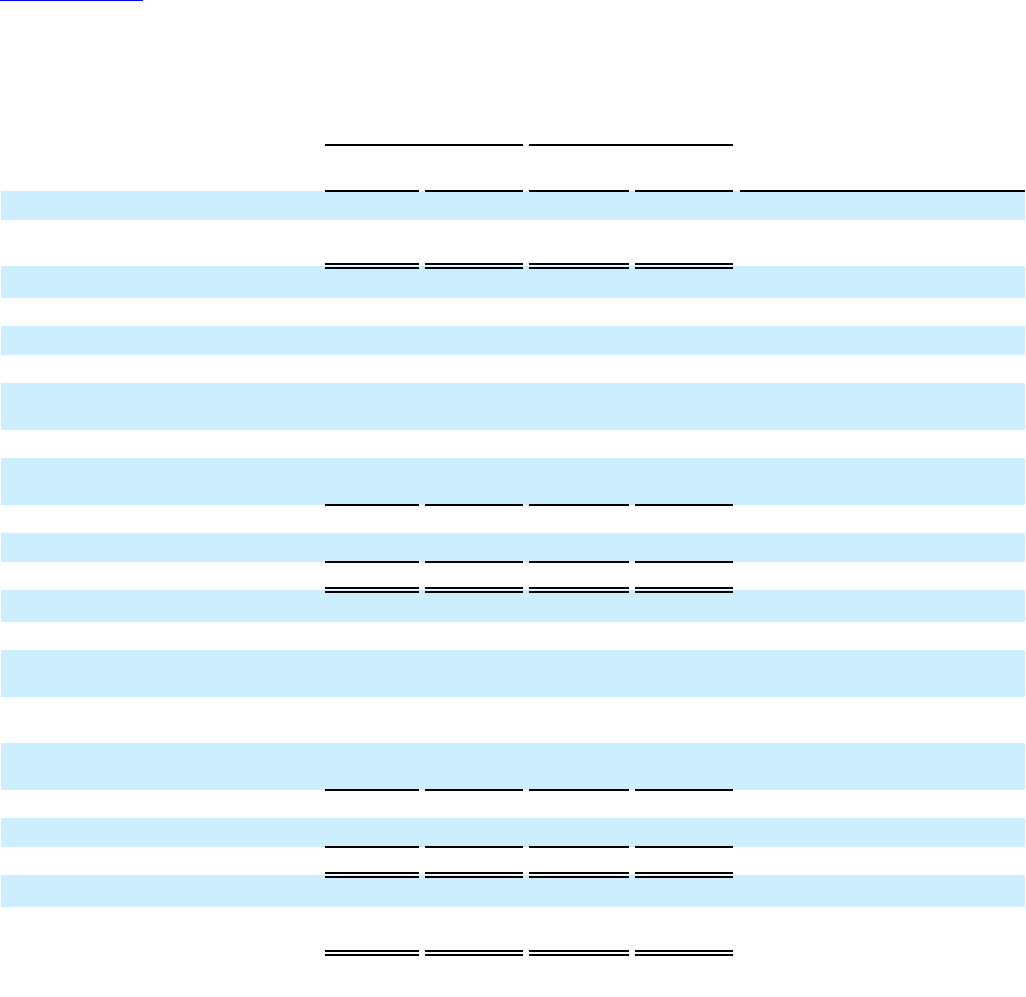

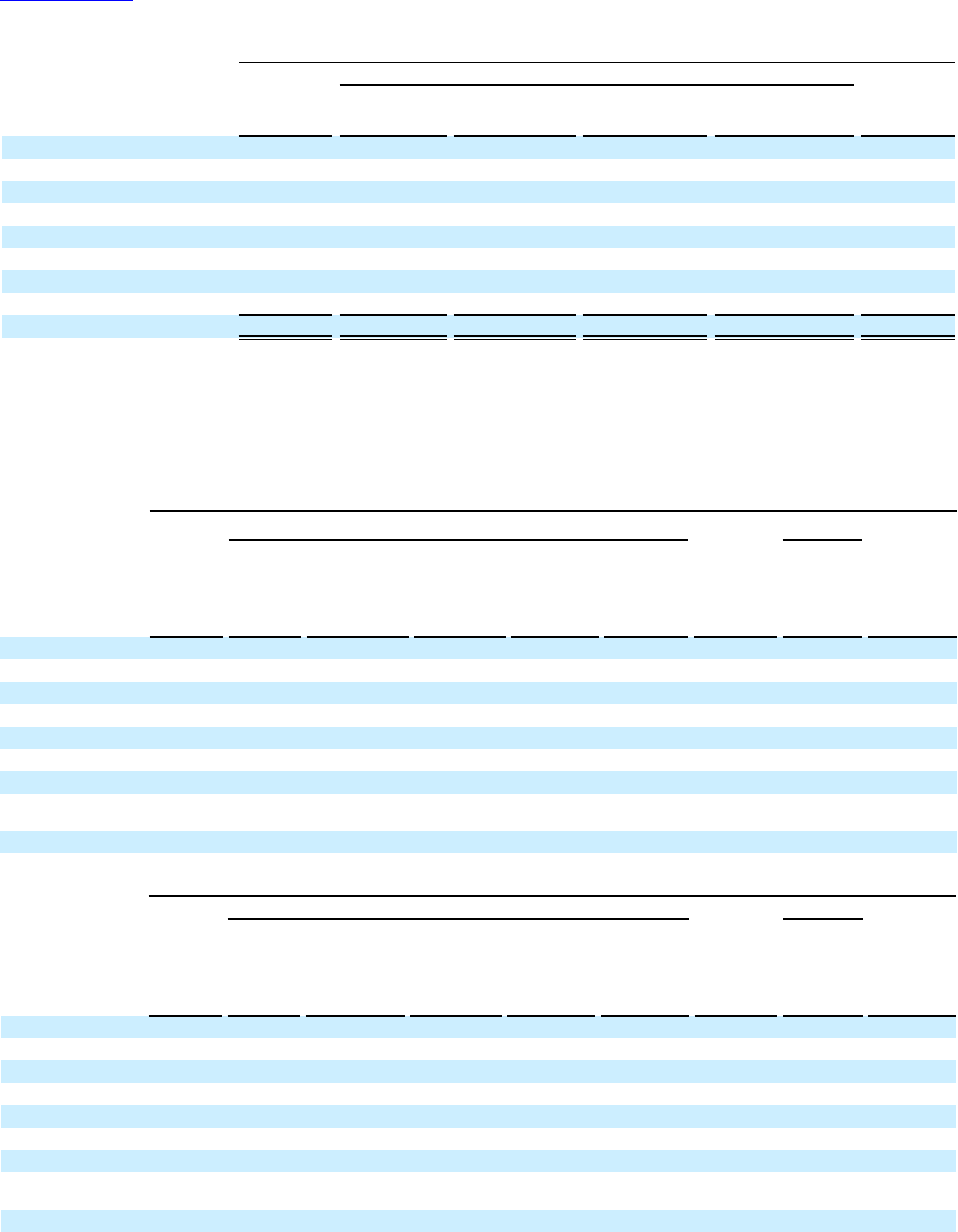

Condensed Consolidated Statement of Income

PepsiCo, Inc. and Subsidiaries

(in millions except per share amounts, unaudited)

12 Weeks Ended 24 Weeks Ended

6/15/2024 6/17/2023 6/15/2024 6/17/2023

Net Revenue

$ 22,501 $ 22,322 $ 40,751 $ 40,168

Cost of sales

9,919 10,121 18,167 18,109

Gross profit

12,582 12,201 22,584 22,059

Selling, general and administrative expenses

8,534 8,542 15,819 15,771

Operating Profit

4,048 3,659 6,765 6,288

Other pension and retiree medical benefits income

56 60 114 121

Net interest expense and other

(234) (201) (436) (401)

Income before income taxes

3,870 3,518 6,443 6,008

Provision for income taxes

776 747 1,296 1,293

Net income

3,094 2,771 5,147 4,715

Less: Net income attributable to noncontrolling interests

11 23 22 35

Net Income Attributable to PepsiCo

$ 3,083 $ 2,748 $ 5,125 $ 4,680

Net Income Attributable to PepsiCo per Common Share

Basic

$ 2.24 $ 1.99 $ 3.73 $ 3.40

Diluted

$ 2.23 $ 1.99 $ 3.71 $ 3.38

Weighted-average common shares outstanding

Basic

1,375 1,378 1,375 1,378

Diluted

1,379 1,384 1,380 1,384

See accompanying notes to the condensed consolidated financial statements.

Table of Contents

2

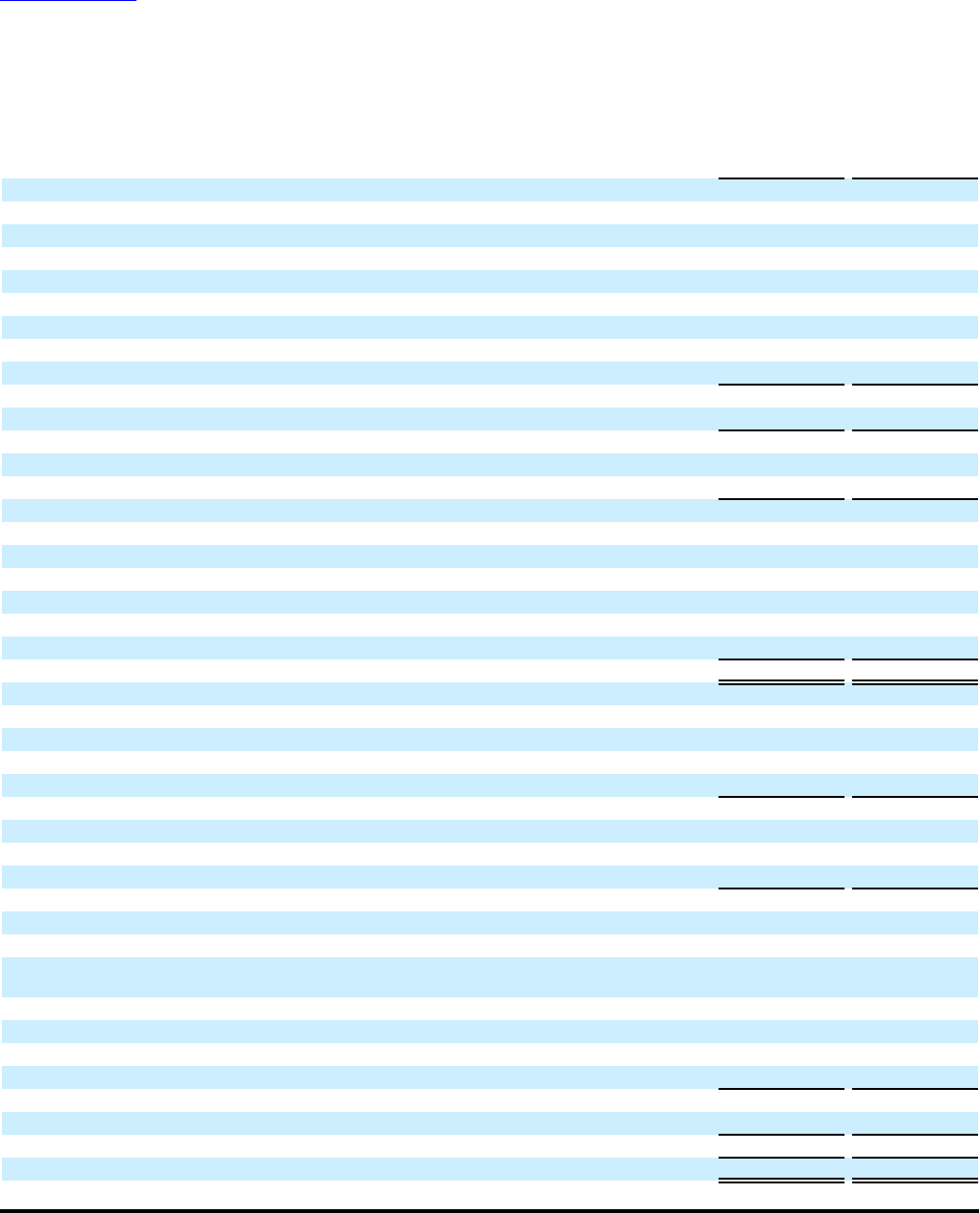

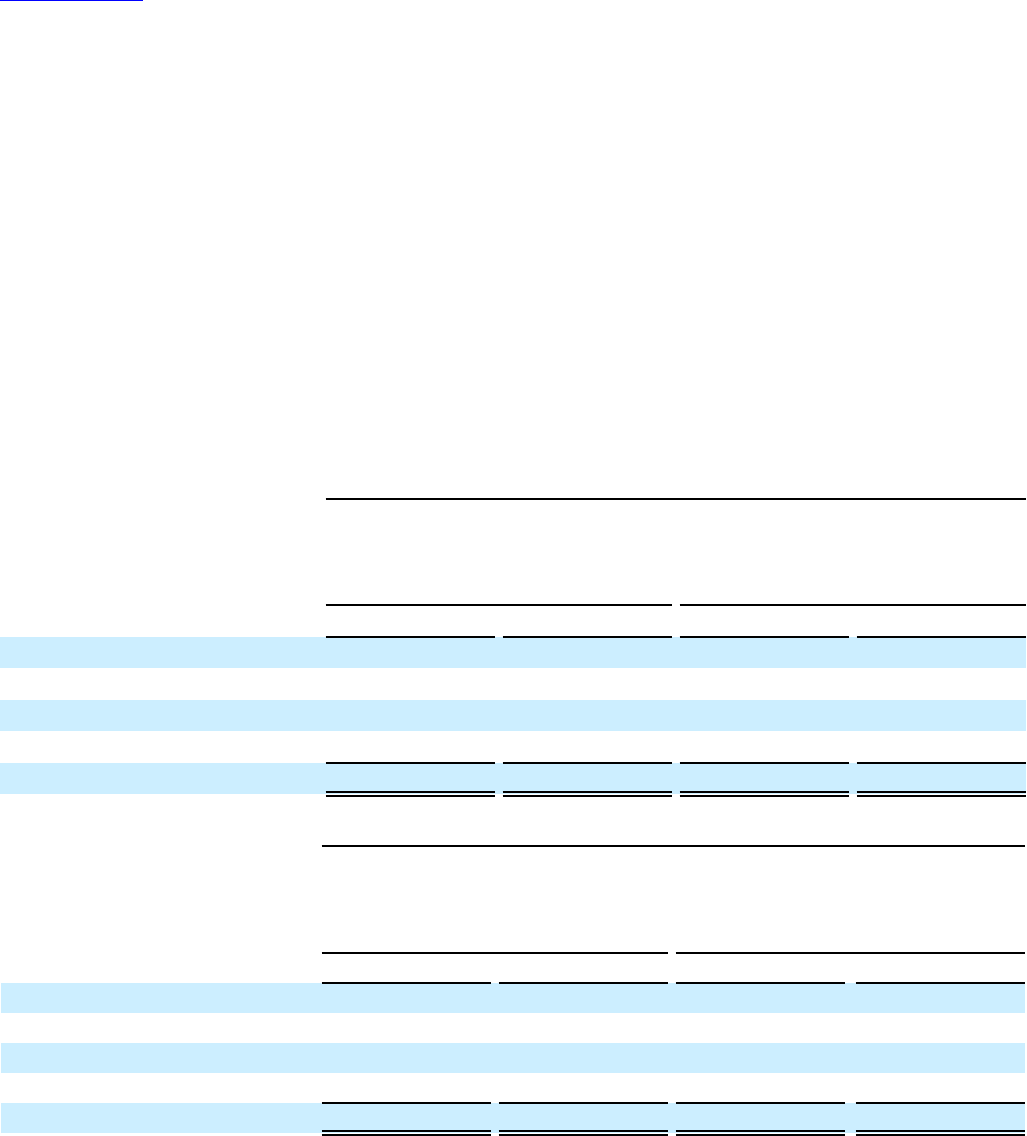

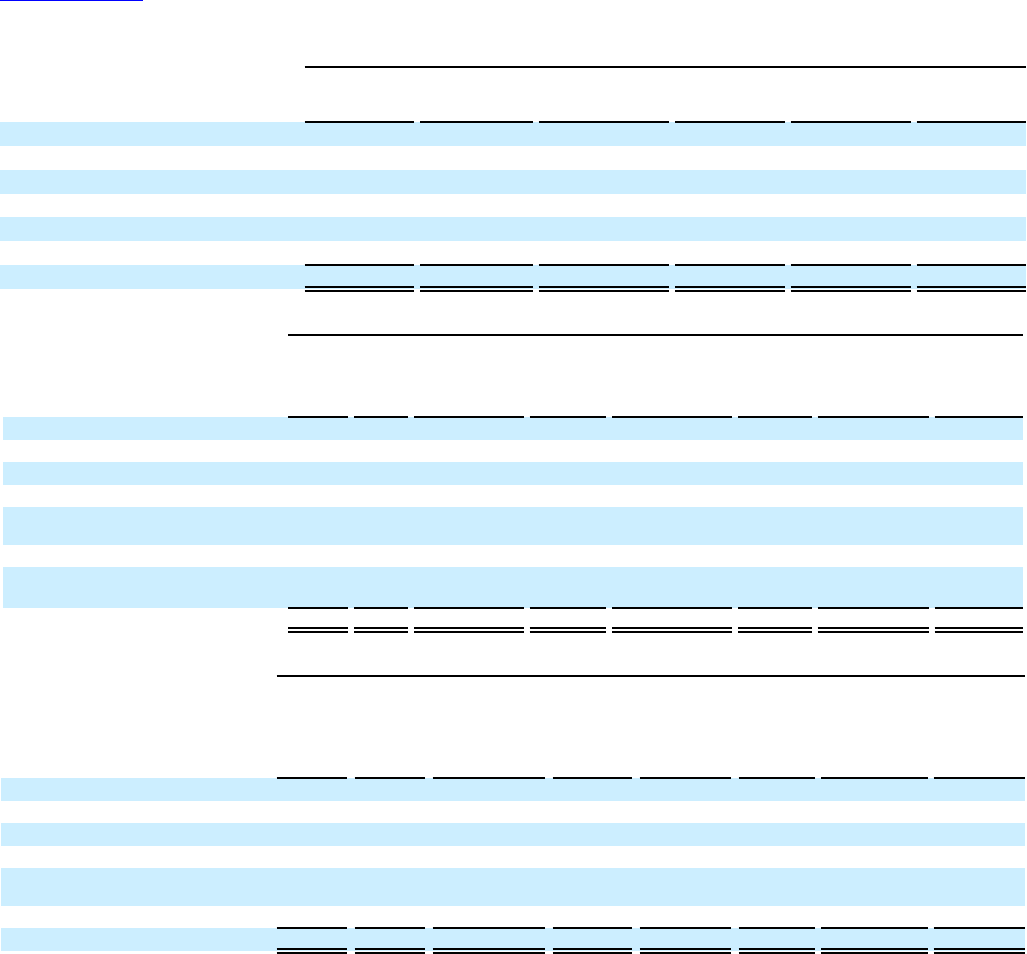

Condensed Consolidated Statement of Comprehensive Income

PepsiCo, Inc. and Subsidiaries

(in millions, unaudited)

12 Weeks Ended 24 Weeks Ended

6/15/2024 6/17/2023 6/15/2024 6/17/2023

Net income

$ 3,094 $ 2,771 $ 5,147 $ 4,715

Other comprehensive loss, net of taxes:

Net currency translation adjustment (267) (198) (449) (433)

Net change on cash flow hedges 42 24 45 (35)

Net pension and retiree medical adjustments 9 (6) 20 (10)

Net change on available-for-sale debt securities and other

(391) 1 132 —

(607) (179) (252) (478)

Comprehensive income

2,487 2,592 4,895 4,237

Less: Comprehensive income attributable to

noncontrolling interests

11 23 22 35

Comprehensive Income Attributable to PepsiCo

$ 2,476 $ 2,569 $ 4,873 $ 4,202

See accompanying notes to the condensed consolidated financial statements.

Table of Contents

3

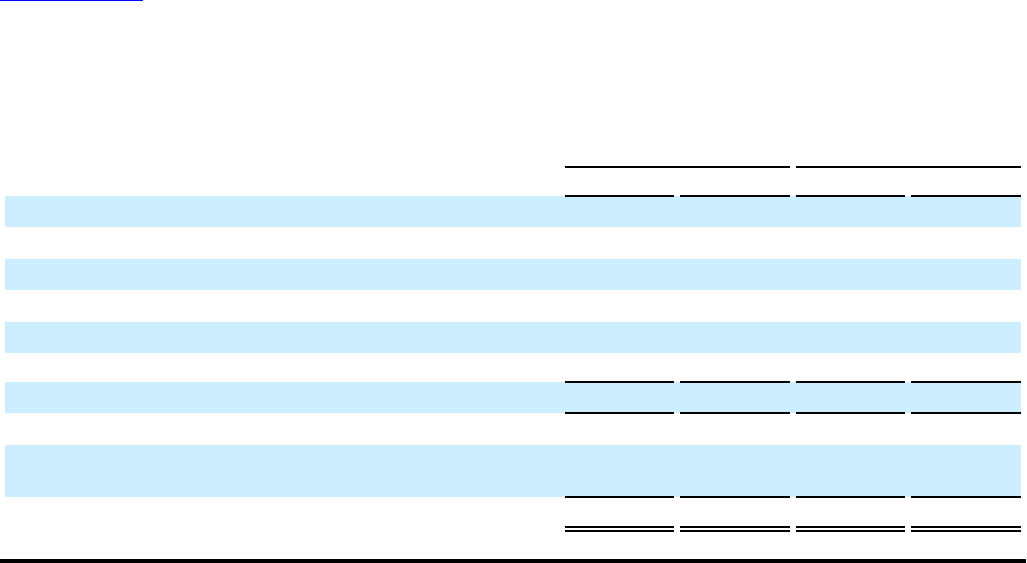

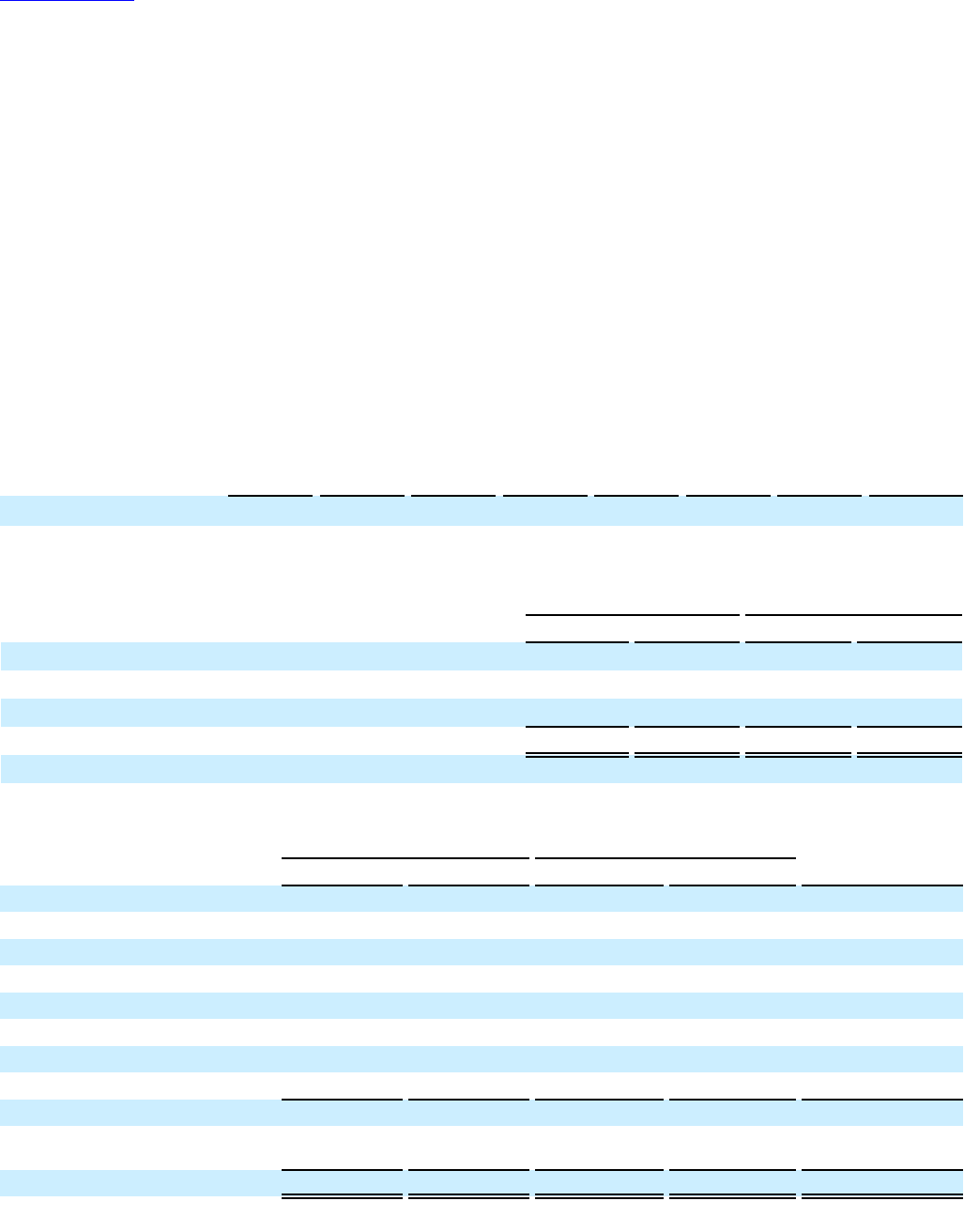

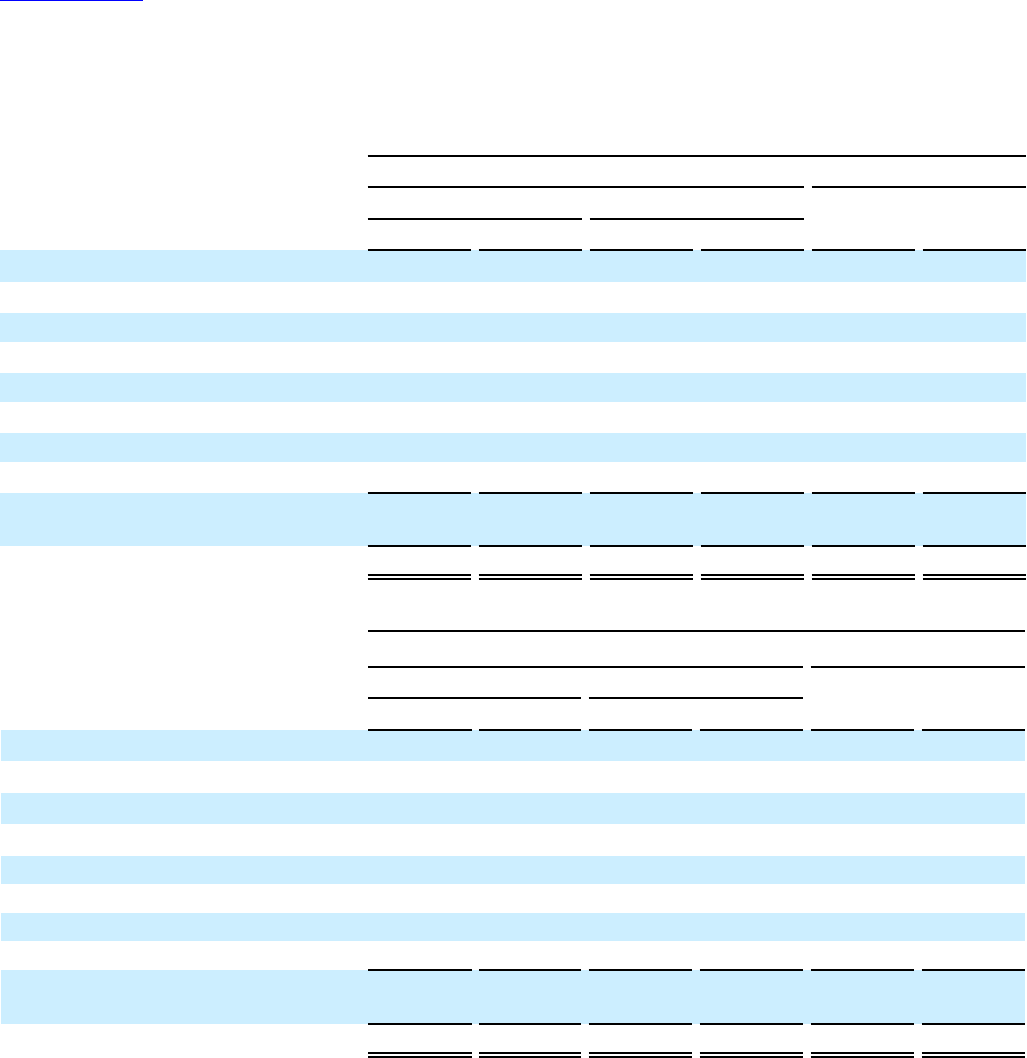

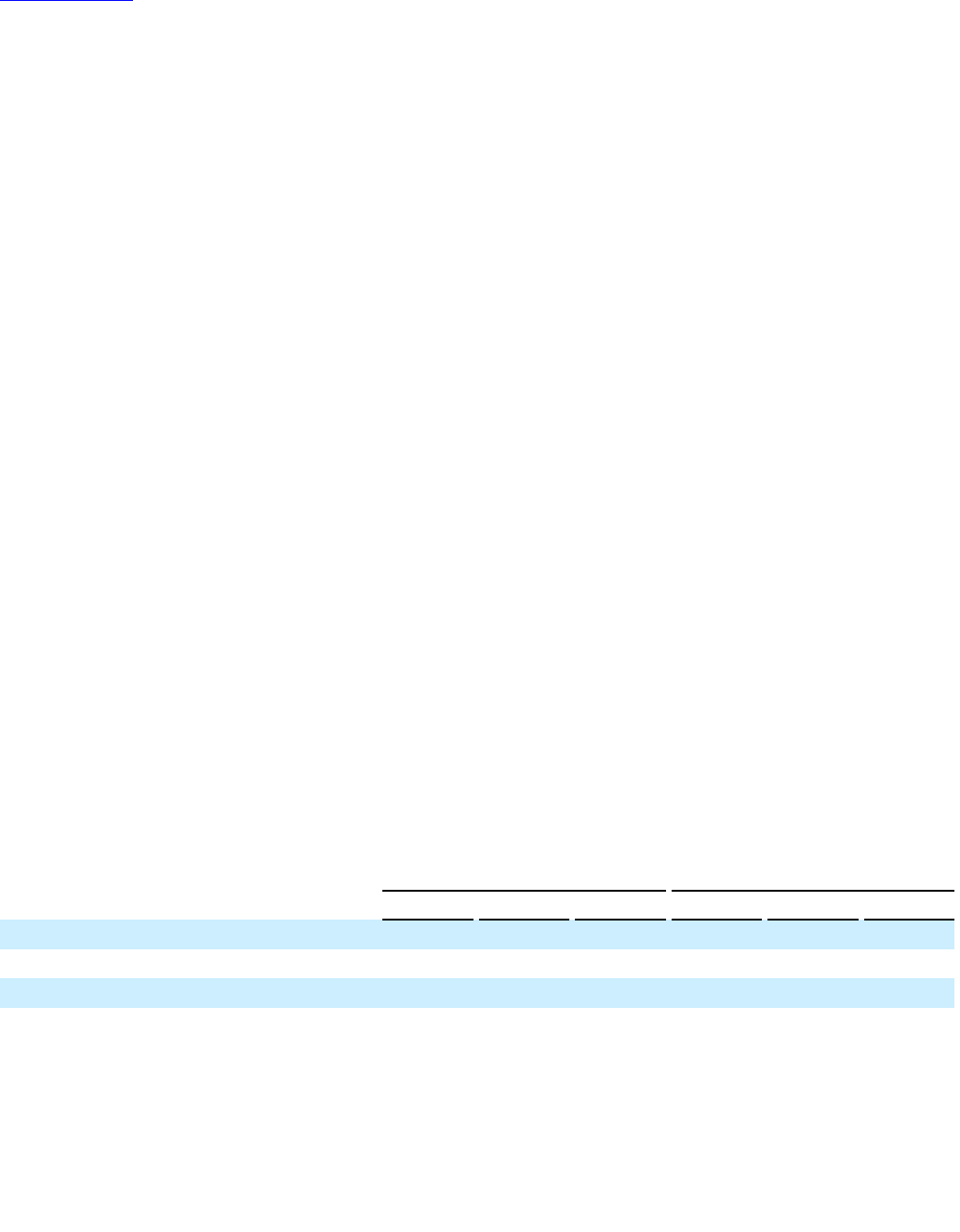

Condensed Consolidated Statement of Cash Flows

PepsiCo, Inc. and Subsidiaries

(in millions, unaudited)

24 Weeks Ended

6/15/2024 6/17/2023

Operating Activities

Net income

$ 5,147 $ 4,715

Depreciation and amortization

1,379 1,268

Impairment and other charges

— 97

Product recall-related impact

182 —

Cash payments for product recall-related impact

(135) —

Operating lease right-of-use asset amortization

278 248

Share-based compensation expense

183 179

Restructuring and impairment charges

170 204

Cash payments for restructuring charges

(173) (187)

Pension and retiree medical plan expenses

67 62

Pension and retiree medical plan contributions

(263) (209)

Deferred income taxes and other tax charges and credits

142 270

Tax payments related to the Tax Cuts and Jobs Act (TCJ Act)

(579) (309)

Change in assets and liabilities:

Accounts and notes receivable

(1,138) (1,330)

Inventories

(696) (851)

Prepaid expenses and other current assets

(365) (271)

Accounts payable and other current liabilities

(2,968) (1,960)

Income taxes payable

287 100

Other, net

(203) (7)

Net Cash Provided by Operating Activities

1,315 2,019

Investing Activities

Capital spending

(1,701) (1,513)

Sales of property, plant and equipment

127 122

Acquisitions, net of cash acquired, investments in noncontrolled affiliates and purchases

of intangible and other assets

(30) (83)

Other divestitures, sales of investments in noncontrolled affiliates and other assets

135 75

Short-term investments, by original maturity:

More than three months - purchases

— (435)

More than three months - maturities

— 363

Three months or less, net

1 16

Other investing, net

14 32

Net Cash Used for Investing Activities

(1,454) (1,423)

(Continued on following page)

Table of Contents

4

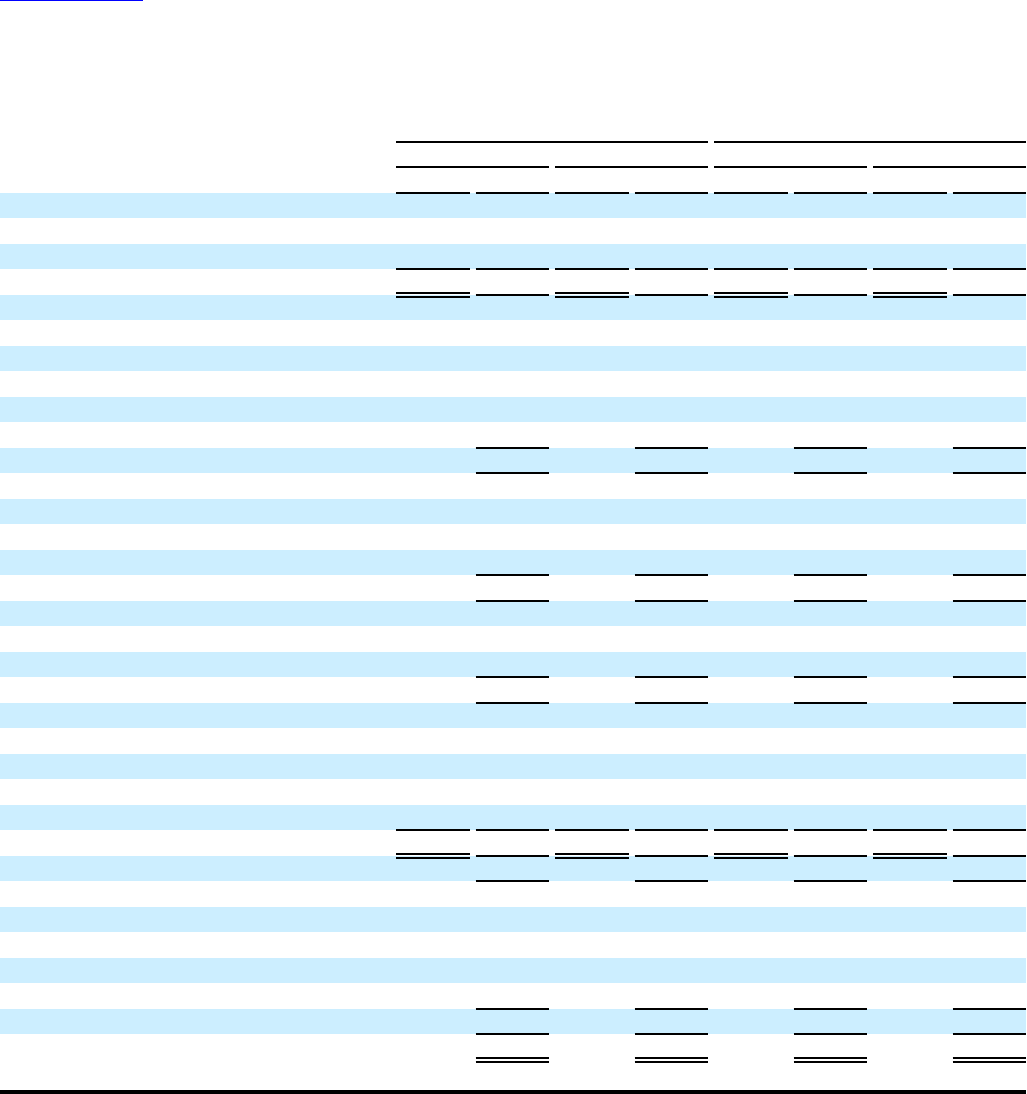

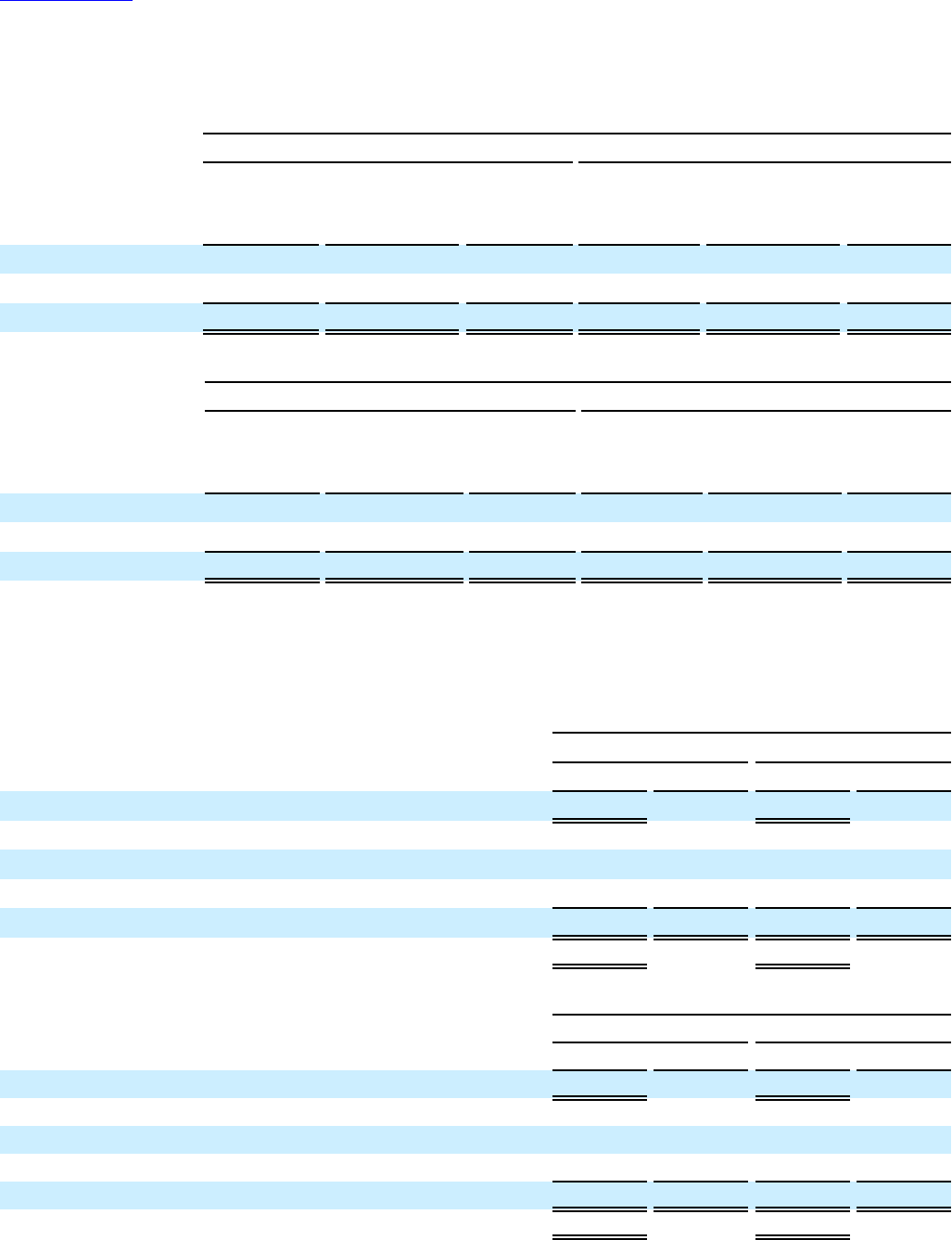

Condensed Consolidated Statement of Cash Flows (continued)

PepsiCo, Inc. and Subsidiaries

(in millions, unaudited)

24 Weeks Ended

6/15/2024 6/17/2023

Financing Activities

Proceeds from issuances of long-term debt

$ 1,765 $ 2,986

Payments of long-term debt

(2,882) (2,252)

Short-term borrowings, by original maturity:

More than three months - proceeds

3,080 1,660

More than three months - payments

(2,138) (26)

Three months or less, net

1,286 2,023

Cash dividends paid

(3,506) (3,199)

Share repurchases

(461) (453)

Proceeds from exercises of stock options

107 86

Withholding tax payments on restricted stock units (RSUs) and performance stock units

(PSUs) converted

(131) (119)

Other financing

(20) (16)

Net Cash (Used for)/Provided by Financing Activities

(2,900) 690

Effect of exchange rate changes on cash and cash equivalents and restricted cash

(304) (144)

Net (Decrease)/Increase in Cash and Cash Equivalents and Restricted Cash

(3,343) 1,142

Cash and Cash Equivalents and Restricted Cash, Beginning of Year

9,761 5,100

Cash and Cash Equivalents and Restricted Cash, End of Period

$ 6,418 $ 6,242

Supplemental Non-Cash Activity

Right-of-use assets obtained in exchange for lease obligations $ 541 $ 439

Debt discharged via legal defeasance $ — $ 94

See accompanying notes to the condensed consolidated financial statements.

Table of Contents

5

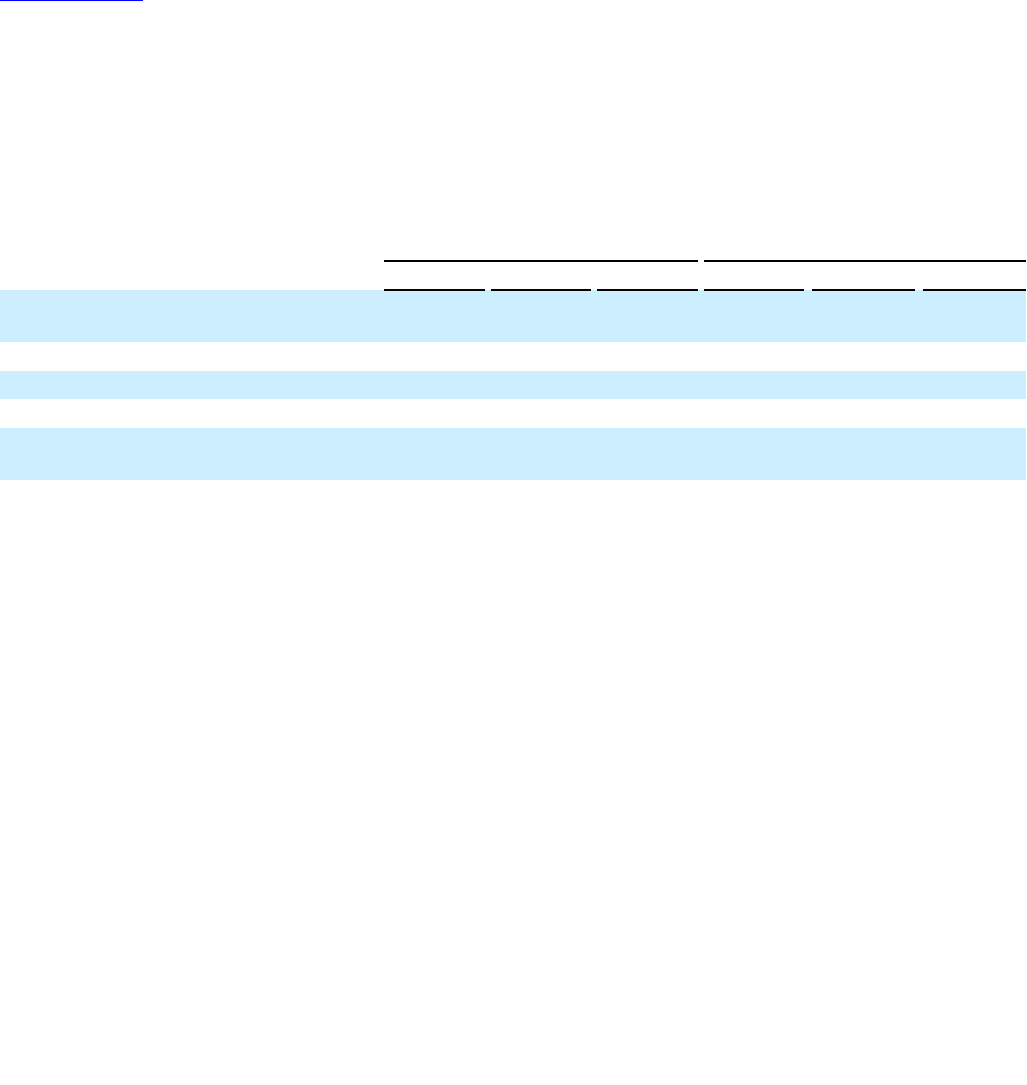

Condensed Consolidated Balance Sheet

PepsiCo, Inc. and Subsidiaries

(in millions except per share amounts)

(Unaudited)

6/15/2024 12/30/2023

ASSETS

Current Assets

Cash and cash equivalents

$ 6,353 $ 9,711

Short-term investments

315 292

Accounts and notes receivable, less allowance ($180 and $175, respectively)

11,942 10,815

Inventories:

Raw materials and packaging

2,635 2,388

Work-in-process

121 104

Finished goods

3,131 2,842

5,887 5,334

Prepaid expenses and other current assets

1,206 798

Total Current Assets

25,703 26,950

Property, plant and equipment

55,040 54,439

Accumulated depreciation

(27,998) (27,400)

Property, Plant and Equipment, net

27,042 27,039

Amortizable Intangible Assets, net

1,151 1,199

Goodwill

17,648 17,728

Other Indefinite-Lived Intangible Assets

13,675 13,730

Investments in Noncontrolled Affiliates

2,674 2,714

Deferred Income Taxes

4,465 4,474

Other Assets

7,175 6,661

Total Assets $ 99,533 $ 100,495

LIABILITIES AND EQUITY

Current Liabilities

Short-term debt obligations

$ 8,289 $ 6,510

Accounts payable and other current liabilities

22,859 25,137

Total Current Liabilities

31,148 31,647

Long-Term Debt Obligations

36,638 37,595

Deferred Income Taxes

3,908 3,895

Other Liabilities

8,259 8,721

Total Liabilities

79,953 81,858

Commitments and contingencies

PepsiCo Common Shareholders’ Equity

Common stock, par value 1

2

/

3

¢ per share (authorized 3,600 shares; issued, net of repurchased

common stock at par value: 1,374 shares)

23 23

Capital in excess of par value

4,203 4,261

Retained earnings

71,545 70,035

Accumulated other comprehensive loss

(15,786) (15,534)

Repurchased common stock, in excess of par value (493 shares)

(40,539) (40,282)

Total PepsiCo Common Shareholders’ Equity

19,446 18,503

Noncontrolling interests

134 134

Total Equity

19,580 18,637

Total Liabilities and Equity

$ 99,533 $ 100,495

See accompanying notes to the condensed consolidated financial statements.

Table of Contents

6

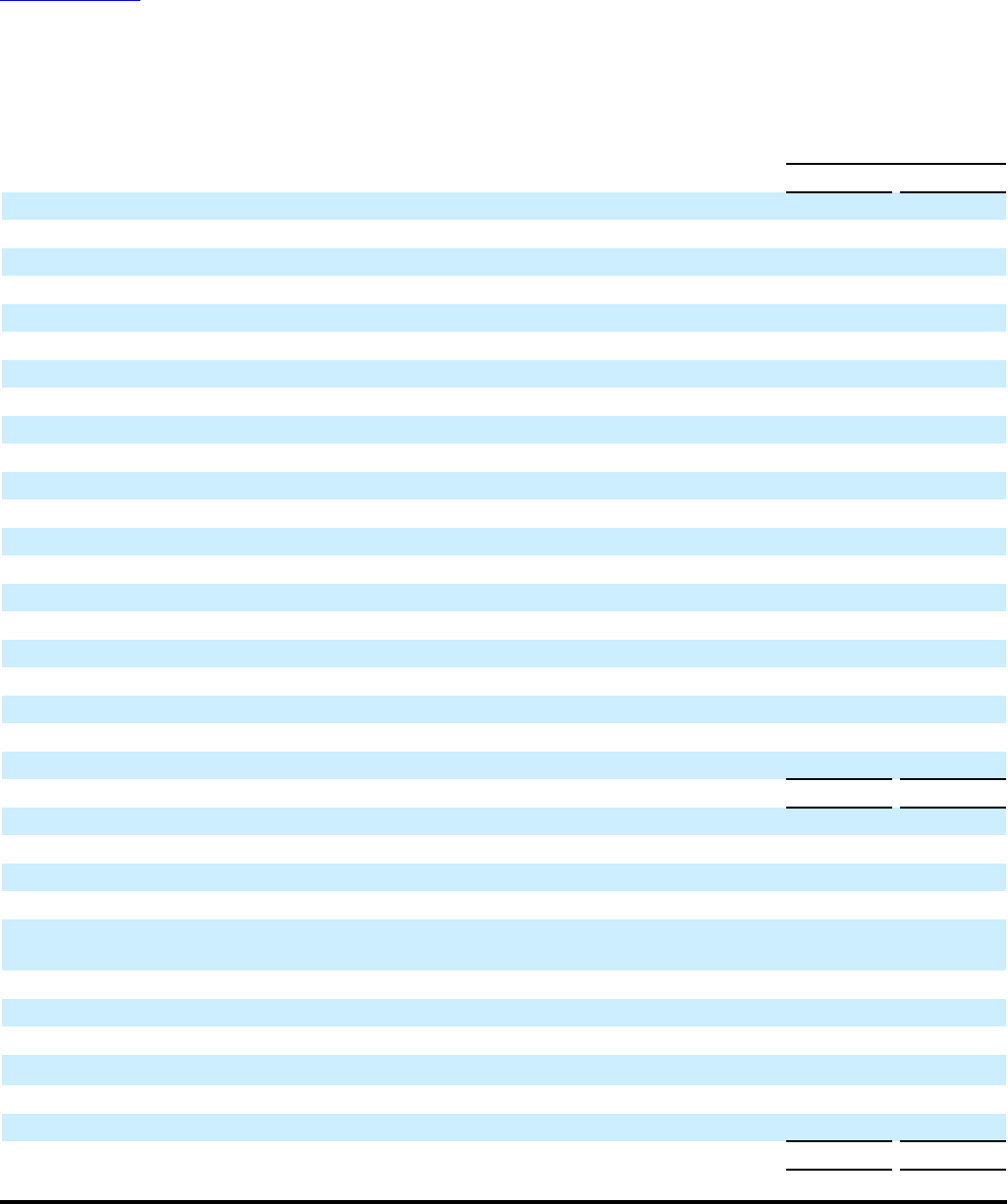

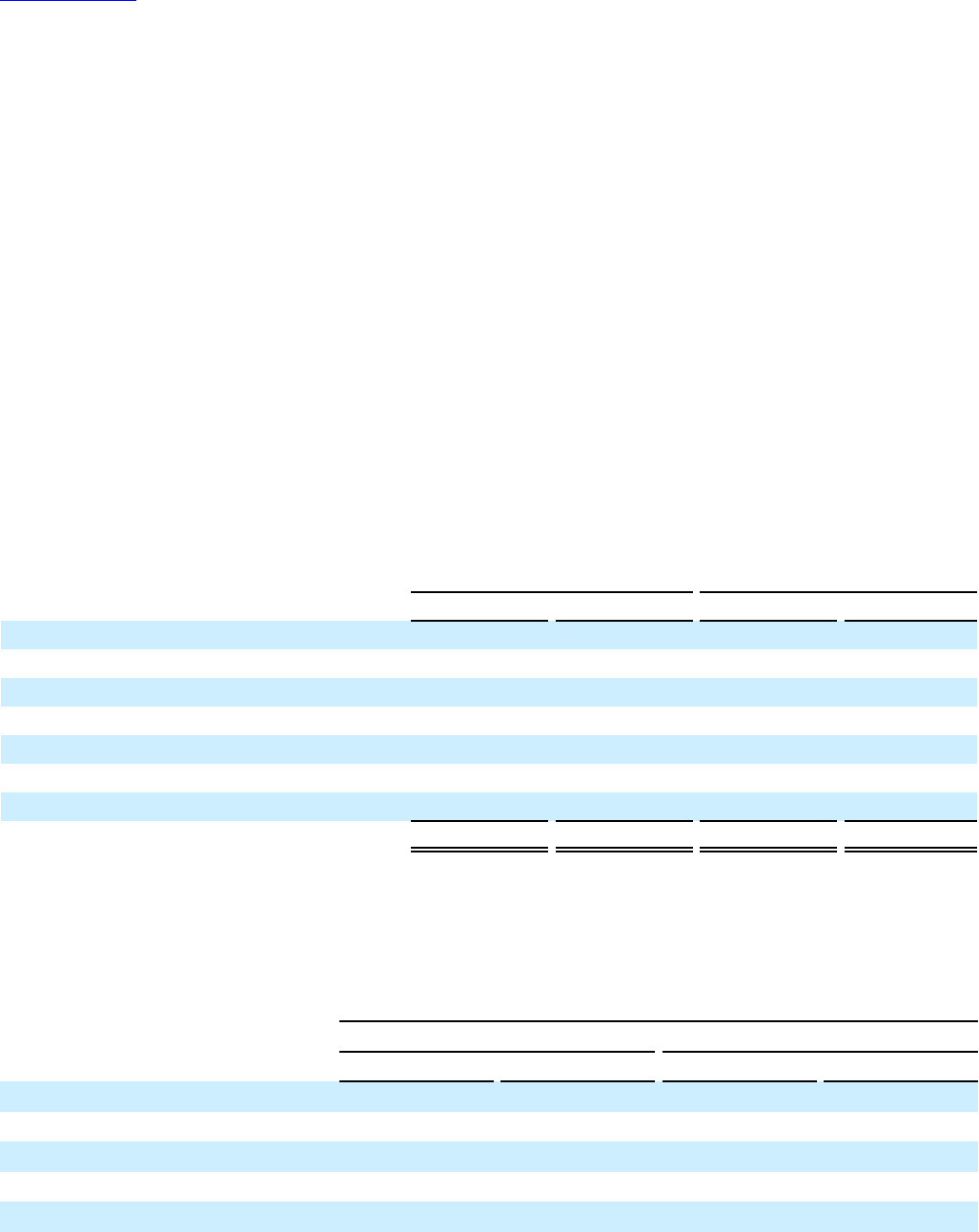

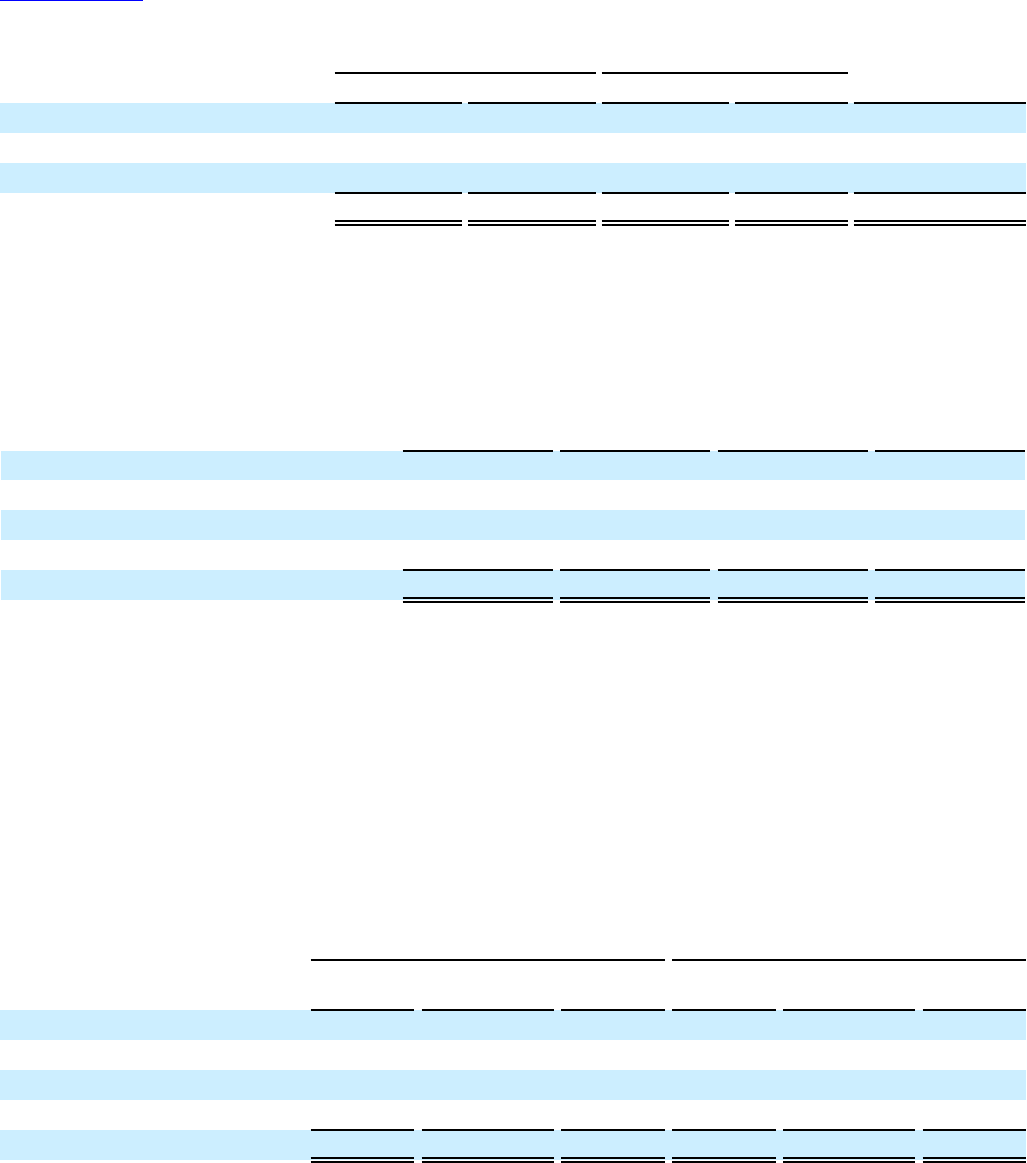

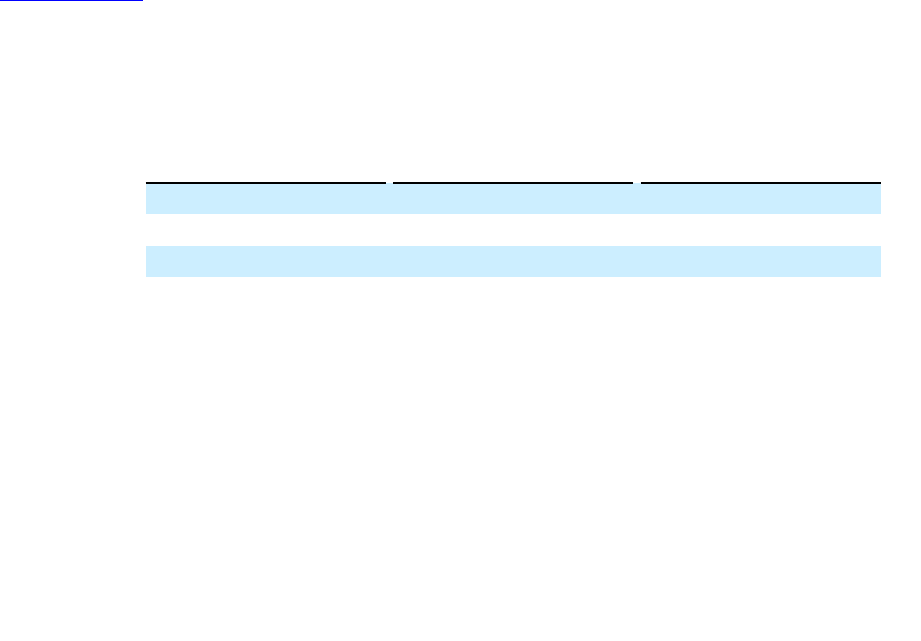

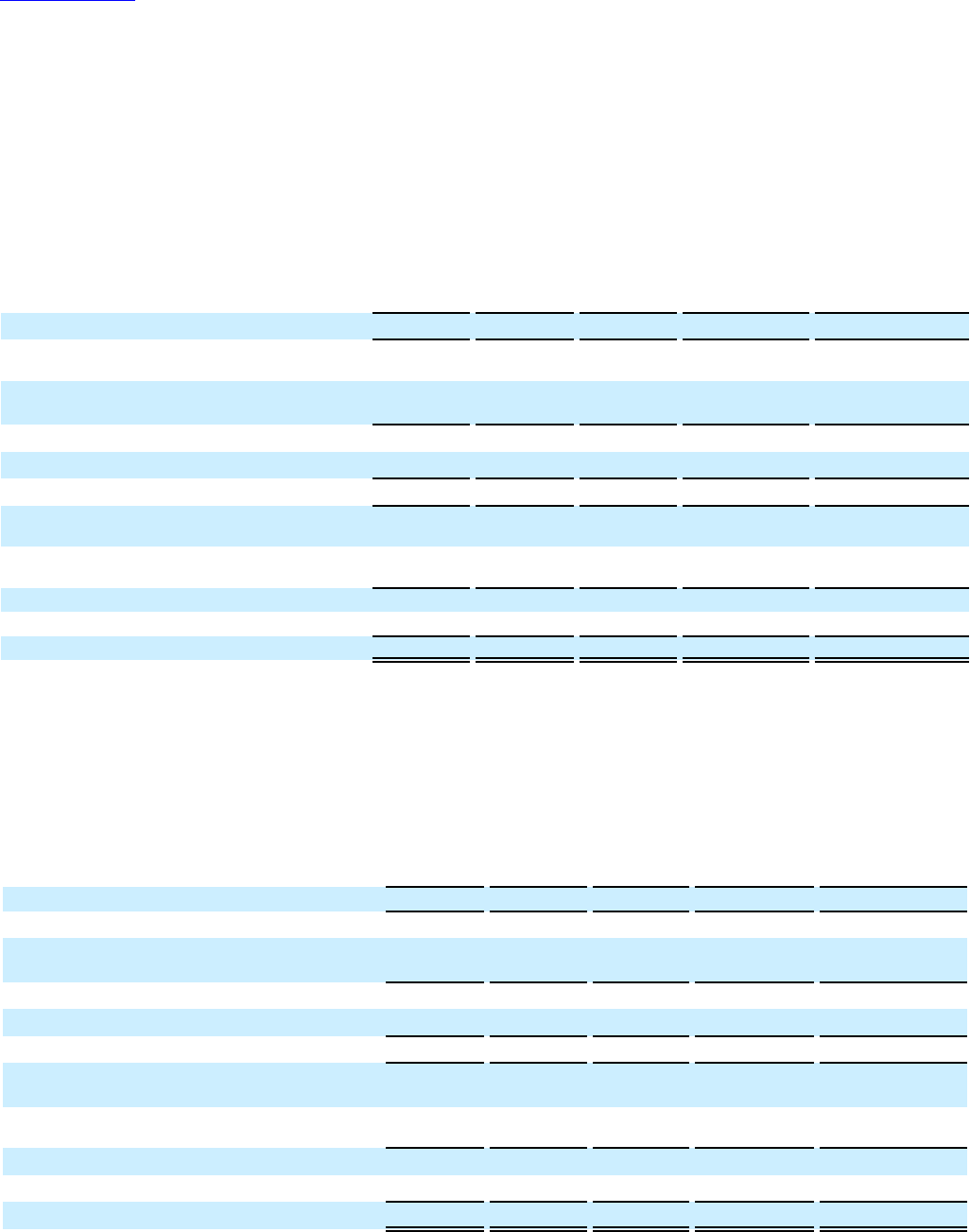

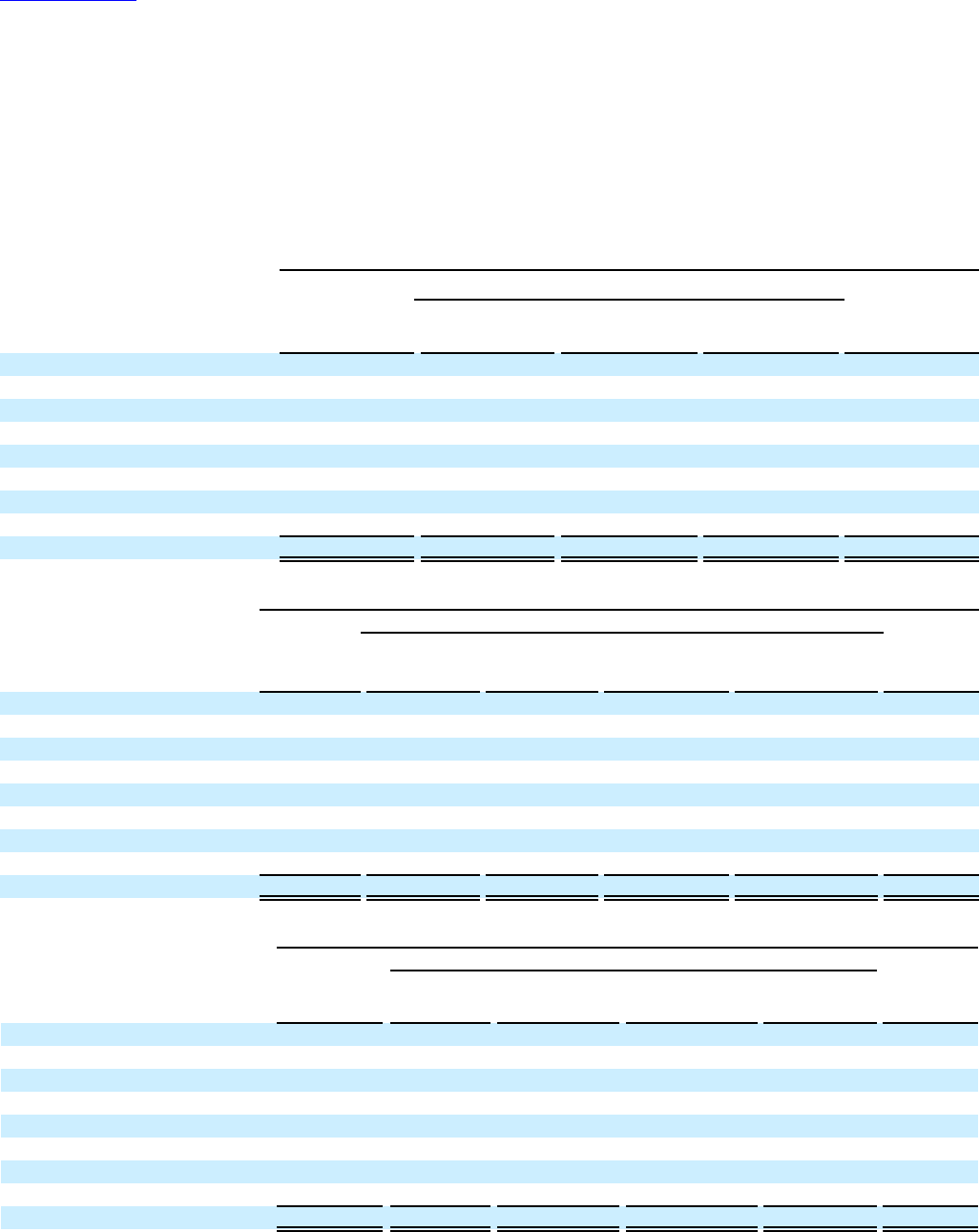

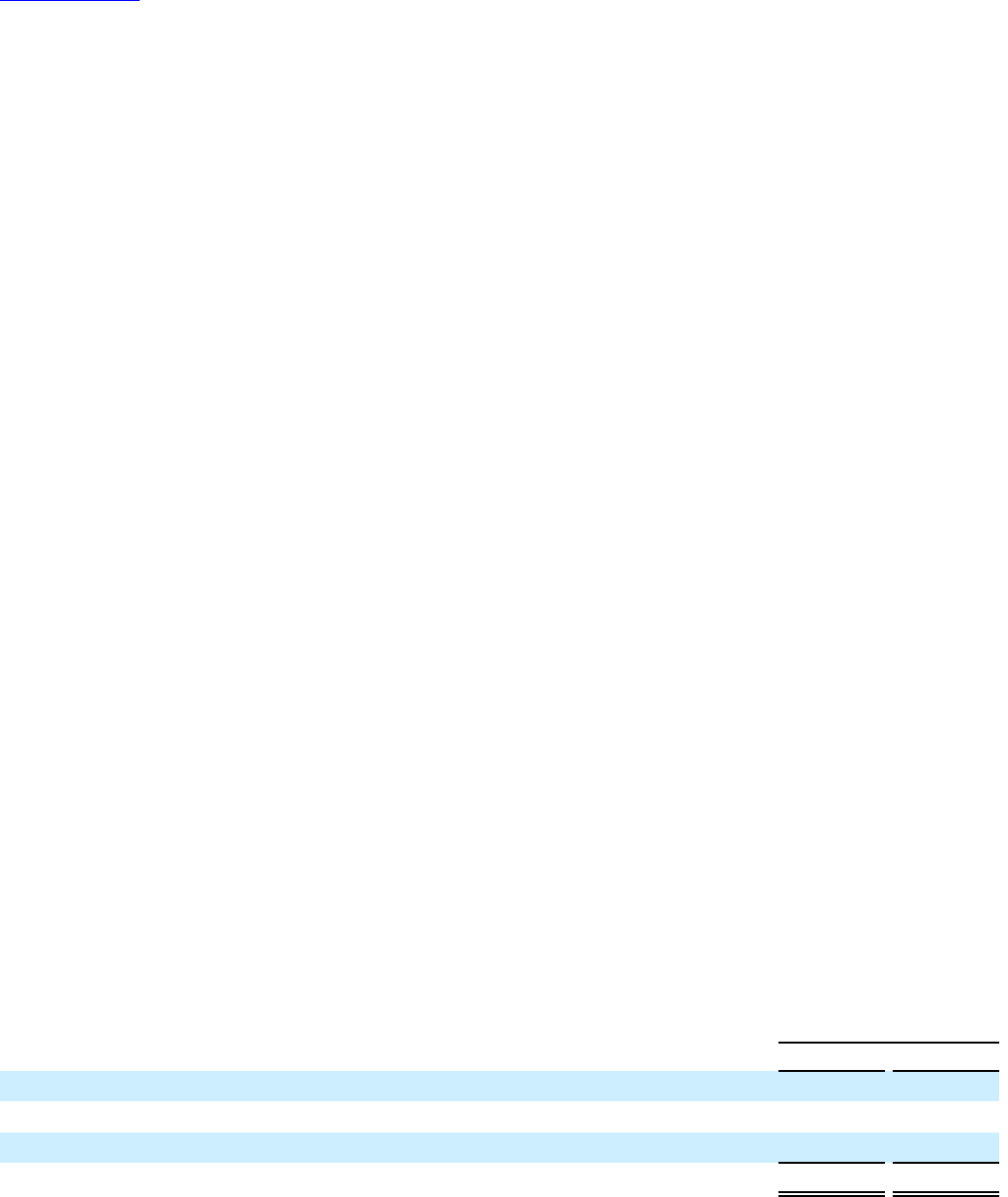

Condensed Consolidated Statement of Equity

PepsiCo, Inc. and Subsidiaries

(in millions, except per share amounts, unaudited)

12 Weeks Ended 24 Weeks Ended

6/15/2024 6/17/2023 6/15/2024 6/17/2023

Shares Amount Shares Amount Shares Amount Shares Amount

Common Stock

Balance, beginning of period

1,375 $ 23 1,378 $ 23 1,374 $ 23 1,377 $ 23

Change in repurchased common stock

(1) — (1) — — — — —

Balance, end of period

1,374 23 1,377 23 1,374 23 1,377 23

Capital in Excess of Par Value

Balance, beginning of period

4,132 3,996 4,261 4,134

Share-based compensation expense

87 85 179 179

Stock option exercises, RSUs and PSUs converted

9 5 (104) (111)

Withholding tax on RSUs and PSUs converted

(23) (3) (131) (119)

Other

(2) (1) (2) (1)

Balance, end of period

4,203 4,082 4,203 4,082

Retained Earnings

Balance, beginning of period

70,331 68,142 70,035 67,800

Net income attributable to PepsiCo

3,083 2,748 5,125 4,680

Cash dividends declared

(a)

(1,869) (1,755) (3,615) (3,345)

Balance, end of period

71,545 69,135 71,545 69,135

Accumulated Other Comprehensive Loss

Balance, beginning of period

(15,179) (15,601) (15,534) (15,302)

Other comprehensive loss attributable to PepsiCo

(607) (179) (252) (478)

Balance, end of period

(15,786) (15,780) (15,786) (15,780)

Repurchased Common Stock

Balance, beginning of period

(492) (40,260) (489) (39,518) (493) (40,282) (490) (39,506)

Share repurchases

(2) (310) (2) (292) (3) (468) (3) (466)

Stock option exercises, RSUs and PSUs converted

1 31 1 35 3 210 3 197

Other

— — — — — 1 — —

Balance, end of period

(493) (40,539) (490) (39,775) (493) (40,539) (490) (39,775)

Total PepsiCo Common Shareholders’ Equity

19,446 17,685 19,446 17,685

Noncontrolling Interests

Balance, beginning of period

143 133 134 124

Net income attributable to noncontrolling interest

11 23 22 35

Distributions to noncontrolling interests

(16) (14) (17) (15)

Other, net

(4) (2) (5) (4)

Balance, end of period

134 140 134 140

Total Equity

$ 19,580 $ 17,825 $ 19,580 $ 17,825

(a) Cash dividends declared per common share were $1.355 and $1.265 for the 12 weeks ended June 15, 2024 and June 17, 2023,

respectively, and $2.62 and $2.415 for the 24 weeks ended June 15, 2024 and June 17, 2023, respectively.

See accompanying notes to the condensed consolidated financial statements.

Table of Contents

7

Notes to the Condensed Consolidated Financial Statements

Note 1 - Basis of Presentation and Our Divisions

Basis of Presentation

When used in this report, the terms “we,” “us,” “our,” “PepsiCo” and the “Company” mean PepsiCo, Inc.

and its consolidated subsidiaries, collectively.

The accompanying unaudited condensed consolidated financial statements have been prepared in

accordance with U.S. Generally Accepted Accounting Principles (GAAP) for interim financial

information and with the rules and regulations for reporting the Quarterly Report on Form 10-Q (Form 10-

Q). Accordingly, they do not include all of the information and footnotes required by GAAP for complete

financial statements. The condensed consolidated balance sheet at December 30, 2023 has been derived

from the audited consolidated financial statements at that date, but does not include all of the information

and footnotes required by GAAP for complete financial statements. These financial statements have been

prepared on a basis that is substantially consistent with the accounting principles applied in our Annual

Report on Form 10-K for the fiscal year ended December 30, 2023 (2023 Form 10-K). This report should

be read in conjunction with our 2023 Form 10-K. In our opinion, these financial statements include all

normal and recurring adjustments necessary for a fair presentation. The results for the 12 and 24 weeks

ended June 15, 2024 are not necessarily indicative of the results expected for any future period or the full

year.

Raw materials, direct labor and plant overhead, as well as purchasing and receiving costs, costs directly

related to production planning, inspection costs and raw materials handling facilities, are included in cost

of sales. The costs of moving, storing and delivering finished product, including merchandising activities,

are included in selling, general and administrative expenses.

While our financial results in the United States and Canada (North America) are reported on a 12-week

basis, all of our international operations are reported on a monthly calendar basis for which the months of

March, April and May are reflected in our results for the 12 weeks ended June 15, 2024 and June 17,

2023, and the months of January through May are reflected in our results for the 24 weeks ended June 15,

2024 and June 17, 2023.

The preparation of our condensed consolidated financial statements requires management to make

estimates and assumptions that affect the amounts reported in our condensed consolidated financial

statements and related disclosures. Additionally, the business and economic uncertainty resulting from

volatile geopolitical conditions and the high interest rate and inflationary cost environment has made such

estimates and assumptions more difficult to calculate. Accordingly, actual results and outcomes could

differ from those estimates.

Our significant interim accounting policies include the recognition of a pro rata share of certain estimated

annual sales incentives and certain advertising and marketing costs in proportion to revenue or volume, as

applicable, and the recognition of income taxes using an estimated annual effective tax rate.

Unless otherwise noted, tabular dollars are in millions, except per share amounts. All per share amounts

reflect common per share amounts, assume dilution unless otherwise noted, and are based on unrounded

amounts. Certain reclassifications were made to the prior year’s financial statements to conform to the

current year presentation.

Table of Contents

8

Our Divisions

We are organized into seven reportable segments (also referred to as divisions), as follows:

1) Frito-Lay North America (FLNA), which includes our branded convenient food businesses in the

United States and Canada;

2) Quaker Foods North America (QFNA), which includes our branded convenient food businesses,

such as cereal, rice, pasta and other branded food, in the United States and Canada;

3) PepsiCo Beverages North America (PBNA), which includes our beverage businesses in the United

States and Canada;

4) Latin America (LatAm), which includes all of our beverage and convenient food businesses in

Latin America;

5) Europe, which includes all of our beverage and convenient food businesses in Europe;

6) Africa, Middle East and South Asia (AMESA), which includes all of our beverage and convenient

food businesses in Africa, the Middle East and South Asia; and

7) Asia Pacific, Australia and New Zealand and China region (APAC), which includes all of our

beverage and convenient food businesses in Asia Pacific, Australia and New Zealand, and China

region.

Net revenue of each division is as follows:

12 Weeks Ended 24 Weeks Ended

6/15/2024 6/17/2023 6/15/2024 6/17/2023

FLNA

$ 5,874 $ 5,904 $ 11,550 $ 11,487

QFNA

561 684 1,154 1,461

PBNA

6,811 6,755 12,685 12,553

LatAm

3,045 2,856 5,112 4,633

Europe

3,515 3,428 5,451 5,314

AMESA

1,592 1,568 2,632 2,587

APAC

1,103 1,127 2,167 2,133

Total $ 22,501 $ 22,322 $ 40,751 $ 40,168

Our primary performance obligation is the distribution and sales of beverage and convenient food products

to our customers. The following tables reflect the percentage of net revenue generated between our

beverage business and our convenient food business for each of our international divisions, as well as our

consolidated net revenue:

12 Weeks Ended

6/15/2024 6/17/2023

Beverages

(a)

Convenient Foods Beverages

(a)

Convenient Foods

LatAm

10 % 90 % 9 % 91 %

Europe

48 % 52 % 49 % 51 %

AMESA

33 % 67 % 31 % 69 %

APAC

28 % 72 % 26 % 74 %

PepsiCo 43 % 57 % 42 % 58 %

Table of Contents

9

24 Weeks Ended

6/15/2024 6/17/2023

Beverages

(a)

Convenient Foods Beverages

(a)

Convenient Foods

LatAm

9 % 91 % 9 % 91 %

Europe

47 % 53 % 48 % 52 %

AMESA

33 % 67 % 31 % 69 %

APAC

21 % 79 % 21 % 79 %

PepsiCo 42 % 58 % 42 % 58 %

(a) Beverage revenue from company-owned bottlers, which primarily includes our consolidated bottling operations in our PBNA and

Europe divisions, was 36% and 35% of our consolidated net revenue in the 12 and 24 weeks ended June 15, 2024, respectively, and 37%

and 36% of our consolidated net revenue in the 12 and 24 weeks ended June 17, 2023, respectively. Generally, our finished goods

beverage operations produce higher net revenue but lower operating margin as compared to concentrate sold to authorized bottling

partners for the manufacture of finished goods beverages.

Operating profit of each division is as follows:

12 Weeks Ended 24 Weeks Ended

6/15/2024 6/17/2023 6/15/2024 6/17/2023

FLNA

$ 1,592 $ 1,647 $ 3,146 $ 3,246

QFNA

(a)

85 129 36 317

PBNA

(b)

987 723 1,497 1,206

LatAm

637 592 1,122 956

Europe

620 476 822 547

AMESA

241 250 393 418

APAC

223 223 456 450

Total divisions

4,385 4,040 7,472 7,140

Corporate unallocated expenses

(c)

(337) (381) (707) (852)

Total $ 4,048 $ 3,659 $ 6,765 $ 6,288

(a) In the 12 weeks ended June 15, 2024, we recorded a pre-tax charge of $15 million ($11 million after-tax or $0.01 per share) associated

with a previously announced voluntary recall of certain bars and cereals in our QFNA division (Quaker Recall) with $8 million recorded

in cost of sales and $7 million recorded in selling, general and administrative expenses. In the 24 weeks ended June 15, 2024, we

recorded a pre-tax charge of $182 million ($139 million after-tax or $0.10 per share) associated with the Quaker Recall, with

$175 million recorded in cost of sales related to property, plant and equipment write-offs, employee severance costs and other costs and

$7 million recorded in selling, general and administrative expenses.

(b) In the 12 and 24 weeks ended June 17, 2023, we recorded our proportionate 39% share of Tropicana Brands Group’s (TBG) impairment

of indefinite-lived intangible assets, and recorded an other-than-temporary impairment of our equity method investment, both of which

resulted in pre-tax impairment charges of $113 million ($86 million after-tax or $0.06 per share), recorded in selling, general and

administrative expenses. See Note 9 for further information.

(c) In both the 12 and 24 weeks ended June 15, 2024 and June 17, 2023, we recorded a pre-tax gain of $76 million ($57 million after-tax or

$0.04 per share) and $85 million ($65 million after-tax or $0.05 per share), respectively, in selling, general and administrative expenses

as a result of the sale of corporate assets.

Table of Contents

10

Note 2 - Recently Issued Accounting Pronouncements

Adopted

In September 2022, the Financial Accounting Standards Board (FASB) issued guidance to enhance the

transparency of supplier finance programs to allow financial statement users to understand the effect on

working capital, liquidity and cash flows. The new guidance requires disclosure of key terms of the

program, including a description of the payment terms, payment timing and assets pledged as security or

other forms of guarantees provided to the finance provider or intermediary. Other requirements include the

disclosure of the amount that remains unpaid as of the end of the reporting period, a description of where

these obligations are presented in the balance sheet and a rollforward of the obligation during the annual

period. We adopted the guidance in the first quarter of 2023, except for the rollforward, which is effective

for the current fiscal year 2024. We will adopt the rollforward guidance when it becomes effective in our

2024 annual reporting, on a prospective basis. See Note 12 for disclosures currently required under this

guidance.

Not Yet Adopted

In December 2023, the FASB issued guidance to enhance transparency of income tax disclosures. On an

annual basis, the new guidance requires a public entity to disclose: (1) specific categories in the rate

reconciliation, (2) additional information for reconciling items that are equal to or greater than 5% of the

amount computed by multiplying income (or loss) from continuing operations before income tax expense

(or benefit) by the applicable statutory income tax rate, (3) income taxes paid (net of refunds received)

disaggregated by federal (national), state, and foreign taxes, with foreign taxes disaggregated by individual

jurisdictions in which income taxes paid is equal to or greater than 5% of total income taxes paid, (4)

income (or loss) from continuing operations before income tax expense (or benefit) disaggregated between

domestic and foreign, and (5) income tax expense (or benefit) from continuing operations disaggregated

between federal (national), state and foreign. The guidance is effective for fiscal year 2025 annual

reporting, with early adoption permitted, to be applied on a prospective basis, with retrospective

application permitted. We will adopt the guidance when it becomes effective, in our 2025 annual

reporting, on a prospective basis.

In November 2023, the FASB issued guidance to enhance disclosure of expenses of a public entity’s

reportable segments. The new guidance requires a public entity to disclose: (1) on an annual and interim

basis, significant segment expenses that are regularly provided to the chief operating decision maker

(CODM) and included within each reported measure of segment profit or loss, (2) on an annual and

interim basis, an amount for other segment items (the difference between segment revenue less the

significant expenses disclosed under the significant expense principle and each reported measure of

segment profit or loss), including a description of its composition, (3) on an annual and interim basis,

information about a reportable segment’s profit or loss and assets previously required to be disclosed only

on an annual basis, and (4) the title and position of the CODM and an explanation of how the CODM uses

the reported measure(s) of segment profit or loss in assessing segment performance and how to allocate

resources. The new guidance also clarifies that if the CODM uses more than one measure of a segment’s

profit or loss, one or more of those measures may be reported and requires that a public entity that has a

single reportable segment provide all the disclosures required by the amendments in this update and all

existing segment disclosures. The guidance is effective for the current fiscal year 2024 annual reporting,

and in the first quarter of 2025 for interim period reporting, with early adoption permitted. Upon adoption,

this guidance should be applied retrospectively to all prior periods presented. We will adopt the guidance

when it becomes effective in our 2024 annual reporting.

Table of Contents

11

Note 3 - Restructuring and Impairment Charges

2019 Multi-Year Productivity Plan

We publicly announced a multi-year productivity plan on February 15, 2019 (2019 Productivity Plan) that

leverages new technology and business models to further simplify, harmonize and automate processes; re-

engineers our go-to-market and information systems, including deploying the right automation for each

market; and simplifies our organization and optimize our manufacturing and supply chain footprint. To

build on the successful implementation of the 2019 Productivity Plan, in 2022, we expanded and extended

the plan through the end of 2028 to take advantage of additional opportunities within the initiatives

described above. As a result, we expect to incur pre-tax charges of approximately $3.65 billion, including

cash expenditures of approximately $2.9 billion. These pre-tax charges are expected to consist of

approximately 55% of severance and other employee-related costs, 10% for asset impairments (all non-

cash) resulting from plant closures and related actions, and 35% for other costs associated with the

implementation of our initiatives.

The total plan pre-tax charges are expected to be incurred by division approximately as follows:

FLNA QFNA PBNA LatAm Europe AMESA APAC Corporate

Expected pre-tax charges

10 % 1 % 30 % 10 % 25 % 5 % 4 % 15 %

A summary of our 2019 Productivity Plan charges is as follows:

12 Weeks Ended 24 Weeks Ended

6/15/2024 6/17/2023 6/15/2024 6/17/2023

Cost of sales

$ — $ 3 $ 6 $ 6

Selling, general and administrative expenses

66 89 149 199

Other pension and retiree medical benefits expense/(income)

(a)

8 — 15 (1)

Total restructuring and impairment charges

$ 74 $ 92 $ 170 $ 204

After-tax amount

$ 54 $ 63 $ 130 $ 161

Impact on net income attributable to PepsiCo per common share

$ (0.04) $ (0.05) $ (0.09) $ (0.12)

12 Weeks Ended 24 Weeks Ended Plan-to-Date

6/15/2024 6/17/2023 6/15/2024 6/17/2023 through 6/15/2024

FLNA

$ 13 $ 6 $ 35 $ 13 $ 287

QFNA

— — 4 — 23

PBNA

5 5 15 10 282

LatAm

16 6 21 11 221

Europe

19 52 37 141 603

AMESA

3 — 3 5 100

APAC

4 4 4 5 89

Corporate

6 19 36 20 353

66 92 155 205 1,958

Other pension and retiree medical

benefits expense/(income)

(a)

8 — 15 (1) 112

Total

$ 74 $ 92 $ 170 $ 204 $ 2,070

(a) Income amount represents adjustments for changes in estimates of previously recorded amounts.

Table of Contents

12

12 Weeks Ended 24 Weeks Ended Plan-to-Date

6/15/2024 6/17/2023 6/15/2024 6/17/2023 through 6/15/2024

Severance and other employee costs $ 10 $ 50 $ 82 $ 142 $ 1,132

Asset impairments 3 — 4 — 196

Other costs 61 42 84 62 742

Total $ 74 $ 92 $ 170 $ 204 $ 2,070

Severance and other employee costs primarily include severance and other termination benefits, as well as

voluntary separation arrangements. Other costs primarily include costs associated with the implementation

of our initiatives, including consulting and other professional fees, as well as contract termination costs.

A summary of our 2019 Productivity Plan activity for the 24 weeks ended June 15, 2024 is as follows:

Severance

and Other

Employee Costs

Asset

Impairments Other Costs Total

Liability as of December 30, 2023

$ 188 $ — $ 9 $ 197

2024 restructuring charges 82 4 84 170

Cash payments

(84) — (89) (173)

Non-cash charges and translation

(11) (4) 14 (1)

Liability as of June 15, 2024

$ 175 $ — $ 18 $ 193

The majority of the restructuring accrual at June 15, 2024 is expected to be paid by the end of 2024.

Other Productivity Initiatives

There were no material charges related to other productivity and efficiency initiatives outside the scope of

the 2019 Productivity Plan.

We regularly evaluate different productivity initiatives beyond the productivity plan and other initiatives

described above.

Note 4 - Intangible Assets

A summary of our amortizable intangible assets is as follows:

6/15/2024 12/30/2023

Gross

Accumulated

Amortization Net Gross

Accumulated

Amortization Net

Acquired franchise rights

$ 832 $ (219) $ 613 $ 840 $ (214) $ 626

Customer relationships 553 (274) 279 560 (265) 295

Brands

1,081 (986) 95 1,093 (989) 104

Other identifiable intangibles 440 (276) 164 449 (275) 174

Total $ 2,906 $ (1,755) $ 1,151 $ 2,942 $ (1,743) $ 1,199

Table of Contents

13

The change in the book value of indefinite-lived intangible assets is as follows:

Balance

12/30/2023

Translation

and Other

Balance

6/15/2024

FLNA

Goodwill

$ 453 $ (5) $ 448

Brands

251 — 251

Total

704 (5) 699

QFNA

Goodwill

189 — 189

Total

189 — 189

PBNA

Goodwill

11,961 (16) 11,945

Reacquired franchise rights

7,114 (29) 7,085

Acquired franchise rights

1,737 (5) 1,732

Brands

2,508 — 2,508

Total

23,320 (50) 23,270

LatAm

Goodwill

460 (11) 449

Brands

82 (2) 80

Total

542 (13) 529

Europe

Goodwill

3,166 (21) 3,145

Reacquired franchise rights

419 (4) 415

Acquired franchise rights

154 (4) 150

Brands

1,124 (5) 1,119

Total

4,863 (34) 4,829

AMESA

Goodwill

991 (16) 975

Brands

137 (2) 135

Total

1,128 (18) 1,110

APAC

Goodwill

508 (11) 497

Brands

204 (4) 200

Total

712 (15) 697

Total goodwill

17,728 (80) 17,648

Total reacquired franchise rights

7,533 (33) 7,500

Total acquired franchise rights

1,891 (9) 1,882

Total brands

4,306 (13) 4,293

Total

$ 31,458 $ (135) $ 31,323

Table of Contents

14

Note 5 - Income Taxes

Numerous countries have agreed to a statement in support of the Organization for Economic Co-operation

and Development (OECD) model rules that propose a global minimum tax rate of 15%. Certain countries

have enacted legislation incorporating the agreed global minimum tax effective in 2024. Legislation

enacted as of June 15, 2024 did not have a material impact on our financial statements for the 12 and 24

weeks ended June 15, 2024 and is not expected to have a material impact on our 2024 financial

statements.

Note 6 - Share-Based Compensation

The following table summarizes our total share-based compensation expense, which is primarily recorded

in selling, general and administrative expenses:

12 Weeks Ended 24 Weeks Ended

6/15/2024 6/17/2023 6/15/2024 6/17/2023

Share-based compensation expense – equity awards

$ 86 $ 86 $ 183 $ 179

Share-based compensation expense – liability awards

5 6 10 12

Restructuring charges

1 (1) (4) —

Total $ 92 $ 91 $ 189 $ 191

The following table summarizes share-based awards granted under the terms of the PepsiCo, Inc. Long-

Term Incentive Plan:

24 Weeks Ended

6/15/2024 6/17/2023

Granted

(a)

Weighted-

Average

Grant Price Granted

(a)

Weighted-

Average

Grant Price

Stock options

1.8 $ 164.25 2.0 $ 171.00

RSUs and PSUs

2.3 $ 164.25 2.1 $ 171.11

(a) In millions. All grant activity is disclosed at target.

We granted long-term cash awards to certain executive officers and other senior executives with an

aggregate target value of $19 million and $20 million during the 24 weeks ended June 15, 2024 and

June 17, 2023, respectively.

For the 12 weeks ended June 15, 2024 and June 17, 2023, our grants of stock options, RSUs, PSUs and

long-term cash awards were nominal.

Our weighted-average Black-Scholes fair value assumptions are as follows:

24 Weeks Ended

6/15/2024 6/17/2023

Expected life

7 years 7 years

Risk-free interest rate

4.2 % 4.2 %

Expected volatility 16 % 16 %

Expected dividend yield

2.9 %

2.7 %

Table of Contents

15

Note 7 - Pension and Retiree Medical Benefits

The components of net periodic benefit cost/(income) for pension and retiree medical plans are as follows:

12 Weeks Ended

Pension Retiree Medical

U.S. International

6/15/2024 6/17/2023 6/15/2024 6/17/2023 6/15/2024 6/17/2023

Service cost

$ 80 $ 75 $ 12 $ 10 $ 8 $ 7

Other pension and retiree medical benefits income:

Interest cost

135 137 36 34 8 9

Expected return on plan assets

(202) (196) (50) (46) (3) (3)

Amortization of prior service credits

(5) (6) (1) — (1) (2)

Amortization of net losses/(gains)

18 16 5 3 (6) (6)

Settlement losses

— — 2 — — —

Special termination benefits

8 — — — — —

Total other pension and retiree medical

benefits income

(46) (49) (8) (9) (2) (2)

Total

$ 34 $ 26 $ 4 $ 1 $ 6 $ 5

24 Weeks Ended

Pension Retiree Medical

U.S. International

6/15/2024 6/17/2023 6/15/2024 6/17/2023 6/15/2024 6/17/2023

Service cost

$ 160 $ 151 $ 21 $ 18 $ 15 $ 13

Other pension and retiree medical benefits income:

Interest cost

270 274 63 59 15 17

Expected return on plan assets

(403) (393) (89) (81) (6) (6)

Amortization of prior service credits

(11) (12) (1) — (2) (3)

Amortization of net losses/(gains)

36 32 9 5 (12) (12)

Settlement losses

— — 2 — — —

Special termination benefits

15 (1) — — — —

Total other pension and retiree medical

benefits income

(93) (100) (16) (17) (5) (4)

Total

$ 67 $ 51 $ 5 $ 1 $ 10 $ 9

We regularly evaluate opportunities to reduce risk and volatility associated with our pension and retiree

medical plans.

In the 24 weeks ended June 15, 2024 and June 17, 2023, we made discretionary contributions of $150

million and $125 million, respectively, to our U.S. qualified defined benefit plans, and $27 million and

$17 million, respectively, to our international defined benefit plans.

Table of Contents

16

Note 8 - Debt Obligations

In the 24 weeks ended June 15, 2024, we issued, through our wholly-owned consolidated finance

subsidiary, PepsiCo Singapore Financing I Pte. Ltd., the following notes:

(a)

Interest Rate Maturity Date Principal Amount

(b)

Floating rate February 2027 $ 300

4.650 % February 2027 $ 550

4.550 % February 2029 $ 450

4.700 % February 2034 $ 450

(a) PepsiCo Singapore Financing I Pte. Ltd. is a finance subsidiary and has no assets, operations, revenues or cash flows other than those

related to the issuance, administration and repayment of the notes and any other notes that may be issued in the future. The notes are

fully and unconditionally guaranteed by PepsiCo, Inc. on a senior unsecured basis and may be assumed at any time by PepsiCo, Inc. as

the primary and sole obligor.

(b) Excludes debt issuance costs, discounts and premiums.

The net proceeds from the issuances of the above notes were used for general corporate purposes,

including the repayment of commercial paper.

In the 24 weeks ended June 15, 2024, $1.3 billion of U.S. dollar-denominated senior notes, €1.0 billion of

euro-denominated senior notes and C$0.8 billion of Canadian dollar-denominated senior notes matured

and were paid.

As of June 15, 2024, we had $4.4 billion of commercial paper outstanding, excluding discounts.

In the 12 and 24 weeks ended June 15, 2024, we entered into a new five-year unsecured revolving credit

agreement (Five-Year Credit Agreement), which expires on May 24, 2029. The Five-Year Credit

Agreement enables us and our borrowing subsidiaries to borrow up to $5.0 billion in U.S. dollars and/or

euros, including a $0.75 billion swing line subfacility for euro-denominated borrowings permitted to be

borrowed on a same-day basis, subject to customary terms and conditions. We may request that

commitments under this agreement be increased up to $5.75 billion (or the equivalent amount in euros).

Additionally, we may, up to two times during the term of the 2024 Five-Year Credit Agreement, request

renewal of the agreement for an additional one-year period. The Five-Year Credit Agreement replaced our

$4.2 billion five-year credit agreement, dated as of May 26, 2023.

Also in the 12 and 24 weeks ended June 15, 2024, we entered into a new 364-day unsecured revolving

credit agreement (364-Day Credit Agreement), which expires on May 23, 2025. The 364-Day Credit

Agreement enables us and our borrowing subsidiaries to borrow up to $5.0 billion in U.S. dollars and/or

euros, subject to customary terms and conditions. We may request that commitments under this agreement

be increased up to $5.75 billion (or the equivalent amount in euros). We may request renewal of this

facility for an additional 364-day period or convert any amounts outstanding into a term loan for a period

of up to one year, which term loan would mature no later than the anniversary of the then effective

termination date. The 364-Day Credit Agreement replaced our $4.2 billion 364-day credit agreement,

dated as of May 26, 2023.

Funds borrowed under the Five-Year Credit Agreement and the 364-Day Credit Agreement may be used

for general corporate purposes. Subject to certain conditions, we may borrow, prepay and reborrow

amounts under these agreements. As of June 15, 2024, there were no outstanding borrowings under the

Five-Year Credit Agreement or the 364-Day Credit Agreement.

Table of Contents

17

Note 9 - Financial Instruments

We are exposed to market risks arising from adverse changes in:

• commodity prices, affecting the cost of our raw materials and energy;

• foreign exchange rates and currency restrictions; and

• interest rates.

There have been no material changes during the 24 weeks ended June 15, 2024 with respect to our risk

management policies or strategies and valuation techniques used in measuring the fair value of the

financial assets or liabilities disclosed in Note 9 to our consolidated financial statements in our 2023 Form

10-K.

Certain of our agreements with our counterparties require us to post full collateral on derivative

instruments in a net liability position if our credit rating is at A2 (Moody’s Investors Service, Inc.) or A

(S&P Global Ratings) and we have been placed on credit watch for possible downgrade or if our credit

rating falls below either of these levels. The fair value of all derivative instruments with credit-risk-related

contingent features that were in a net liability position as of June 15, 2024 was $141 million. We have

posted no collateral under these contracts and no credit-risk-related contingent features were triggered as

of June 15, 2024.

The notional amounts of our financial instruments used to hedge the above risks as of June 15, 2024 and

December 30, 2023 are as follows:

Notional Amounts

(a)

6/15/2024 12/30/2023

Commodity

$ 1.4 $ 1.7

Foreign exchange

$ 3.0 $ 3.8

Interest rate

$ 0.7 $ 1.3

Net investment

(b)

$ 2.9 $ 3.0

(a) In billions.

(b) The total notional amount of our net investment hedges consists of non-derivative debt instruments.

As of June 15, 2024, approximately 14% of total debt was subject to variable rates, compared to 9% as of

December 30, 2023.

Debt Securities

Held-to-Maturity

As of June 15, 2024, we had no investments in held-to-maturity debt securities. As of December 30, 2023,

we had $309 million of investments in commercial paper held-to-maturity debt securities recorded in cash

and cash equivalents. Held-to-maturity debt securities are recorded at amortized cost, which approximates

fair value, and realized gains or losses are reported in earnings. As of December 30, 2023, gross

unrecognized gains and losses and the allowance for expected credit losses were not material.

Available-for-Sale

There were no material impairment charges related to investments in available-for-sale debt securities in

both the 24 weeks ended June 15, 2024 and June 17, 2023. There were unrealized gains of $800 million as

of June 15, 2024 and no unrealized gains or losses as of June 17, 2023 related to investments in available-

for-sale debt securities. Related to our Level 3 (significant unobservable inputs) investment in Celsius

Holdings, Inc. (Celsius), we recorded an unrealized loss of $503 million and an unrealized gain of

$188 million in other comprehensive income during the 12 and 24 weeks ended June 15, 2024,

respectively. Additionally, we recorded a decrease in the investment of $7 million due to cash dividends

Table of Contents

18

received during the 12 and 24 weeks ended June 15, 2024. There were no Level 3 investments in

available-for-sale debt securities during the 24 weeks ended June 17, 2023.

TBG Investment

In the 12 and 24 weeks ended June 17, 2023, we recorded our proportionate 39% share of TBG’s

impairment of indefinite-lived intangible assets, and recorded an other-than-temporary impairment of our

equity method investment, both of which resulted in pre-tax impairment charges of $113 million

($86 million after-tax or $0.06 per share), recorded in selling, general and administrative expenses in our

PBNA division. We estimated the fair value of our ownership in TBG using discounted cash flows and an

option pricing model related to our liquidation preference in TBG, which we categorized as Level 3 in the

fair value hierarchy. There were no impairment charges recorded in the 24 weeks ended June 15, 2024.

Recurring Fair Value Measurements

The fair values of our financial assets and liabilities as of June 15, 2024 and December 30, 2023 are

categorized as follows:

6/15/2024 12/30/2023

Fair Value

Hierarchy

Levels

(a)

Assets

(a)

Liabilities

(a)

Assets

(a)

Liabilities

(a)

Available-for-sale debt securities

(b)

2,3

$ 1,519 $ — $ 1,334 $ —

Index funds

(c)

1

$ 315 $ — $ 292 $ —

Prepaid forward contracts

(d)

2

$ 13 $ — $ 13 $ —

Deferred compensation

(e)

2

$ — $ 493 $ — $ 477

Derivatives designated as cash

flow hedging instruments:

Foreign exchange

(f)

2

$ 14 $ 13 $ 3 $ 31

Interest rate

(f)

2

— 152 5 135

Commodity

(g)

2

23 8 10 24

$ 37 $ 173 $ 18 $ 190

Derivatives not designated as

hedging instruments:

Foreign exchange

(f)

2

$ 14 $ 14 $ 33 $ 38

Commodity

(g)

2

7 3 5 13

$ 21 $ 17 $ 38 $ 51

Total derivatives at fair value

(h)

$ 58 $ 190 $ 56 $ 241

Total

$ 1,905 $ 683 $ 1,695 $ 718

(a) Fair value hierarchy levels are categorized consistently by Level 1 (quoted prices in active markets for identical assets), Level 2

(significant other observable inputs) and Level 3 in both years. Unless otherwise noted, financial assets are classified on our balance

sheet within prepaid expenses and other current assets and other assets. Financial liabilities are classified on our balance sheet within

accounts payable and other current liabilities and other liabilities.

(b) Includes Level 2 assets of $182 million and Level 3 assets of $1,337 million as of June 15, 2024, and Level 2 assets of $178 million and

Level 3 assets of $1,156 million as of December 30, 2023. As of June 15, 2024 and December 30, 2023, $1,519 million and

$1,334 million were classified as other assets, respectively. The fair values of our Level 2 investments approximate the transaction price

and any accrued returns, as well as the amortized cost. The fair value of our Level 3 investment in Celsius is estimated using probability-

weighted discounted future cash flows based on a Monte Carlo simulation using significant unobservable inputs such as an 80%

probability that a certain market-based condition will be met and an average estimated discount rate of 5.8% and 8.1% as of June 15,

2024 and December 30, 2023, respectively, based on Celsius’ estimated synthetic credit rating. An increase in the probability that certain

market-based conditions will be met or a decrease in the discount rate would result in a higher fair value measurement, while a decrease

in the probability that certain market-based conditions will be met or an increase in the discount rate would result in a lower fair value

measurement.

Table of Contents

19

(c) Based on the price of index funds. These investments are classified as short-term investments and are used to manage a portion of market

risk arising from our deferred compensation liability.

(d) Based primarily on the price of our common stock.

(e) Based on the fair value of investments corresponding to employees’ investment elections.

(f) Based on recently reported market transactions of spot and forward rates.

(g) Primarily based on recently reported market transactions of swap arrangements.

(h) Derivative assets and liabilities are presented on a gross basis on our balance sheet. Amounts subject to enforceable master netting

arrangements or similar agreements which are not offset on our balance sheet as of June 15, 2024 and December 30, 2023 were not

material. Collateral received or posted against our asset or liability positions was not material. Exchange-traded commodity futures are

cash-settled on a daily basis and, therefore, not included in the table.

The carrying amounts of our cash and cash equivalents and short-term investments recorded at amortized

cost approximate fair value (classified as Level 2 in the fair value hierarchy) due to their short-term

maturity. The fair value of our debt obligations as of June 15, 2024 and December 30, 2023 was $41

billion, based upon prices of identical or similar instruments in the marketplace, which are considered

Level 2 inputs.

Losses/(gains) on our cash flow and net investment hedges are categorized as follows:

12 Weeks Ended

Losses/(Gains)

Recognized in

Accumulated Other

Comprehensive Loss

Losses/(Gains)

Reclassified from

Accumulated Other

Comprehensive Loss

into Income Statement

(a)

6/15/2024 6/17/2023 6/15/2024 6/17/2023

Foreign exchange

$ (1) $ 43 $ 9 $ 14

Interest rate

9 (37) 11 (30)

Commodity

(11) (15) 30 28

Net investment

(17) 71 — —

Total

$ (20) $ 62 $ 50 $ 12

24 Weeks Ended

Losses/(Gains)

Recognized in

Accumulated Other

Comprehensive Loss

Losses/(Gains)

Reclassified from

Accumulated Other

Comprehensive Loss

into Income Statement

(a)

6/15/2024 6/17/2023 6/15/2024 6/17/2023

Foreign exchange

$ (15) $ 59 $ 18 $ 15

Interest rate

34 (26) 35 (27)

Commodity

28 50 51 37

Net investment

(69) 108 — —

Total

$ (22) $ 191 $ 104 $ 25

(a) Foreign exchange derivative losses/(gains) are included in net revenue and cost of sales. Interest rate derivative losses/(gains) are

included in selling, general and administrative expenses. Commodity derivative losses/(gains) are included in either cost of sales or

selling, general and administrative expenses, depending on the underlying commodity. See Note 11 for further information.

Based on current market conditions, we expect to reclassify net losses of $55 million related to our cash

flow hedges from accumulated other comprehensive loss within common shareholders’ equity into net

income during the next 12 months.

Table of Contents

20

Losses/(gains) recognized in the income statement related to our non-designated hedges are categorized as

follows:

12 Weeks Ended

6/15/2024 6/17/2023

Cost of sales

Selling, general

and

administrative

expenses Total Cost of sales

Selling, general

and

administrative

expenses Total

Foreign exchange $ — $ 24 $ 24 $ — $ 44 $ 44

Commodity (14) 5 (9) 5 3 8

Total $ (14) $ 29 $ 15 $ 5 $ 47 $ 52

24 Weeks Ended

6/15/2024 6/17/2023

Cost of sales

Selling, general

and

administrative

expenses Total Cost of sales

Selling, general

and

administrative

expenses Total

Foreign exchange $ — $ 42 $ 42 $ (1) $ 39 $ 38

Commodity (15) (20) (35) 36 53 89

Total $ (15) $ 22 $ 7 $ 35 $ 92 $ 127

Note 10 - Net Income Attributable to PepsiCo per Common Share

The computations of basic and diluted net income attributable to PepsiCo per common share are as

follows:

12 Weeks Ended

6/15/2024 6/17/2023

Income Shares

(a)

Income Shares

(a)

Basic net income attributable to PepsiCo per common share

$ 2.24 $ 1.99

Net income available for PepsiCo common shareholders

$ 3,083 1,375 $ 2,748 1,378

Dilutive securities:

Stock options, RSUs, PSUs and other

(b)

— 4 — 6

Diluted

$ 3,083 1,379 $ 2,748 1,384

Diluted net income attributable to PepsiCo per common share

$ 2.23 $ 1.99

24 Weeks Ended

6/15/2024 6/17/2023

Income Shares

(a)

Income Shares

(a)

Basic net income attributable to PepsiCo per common share

$ 3.73 $ 3.40

Net income available for PepsiCo common shareholders

$ 5,125 1,375 $ 4,680 1,378

Dilutive securities:

Stock options, RSUs, PSUs and other

(b)

— 5 — 6

Diluted

$ 5,125 1,380 $ 4,680 1,384

Diluted net income attributable to PepsiCo per common share

$ 3.71 $ 3.38

(a) Weighted-average common shares outstanding (in millions).

(b) The dilutive effect of these securities is calculated using the treasury stock method.

Table of Contents

21

The weighted-average amount of antidilutive securities excluded from the calculation of diluted earnings

per common share was 4 million for the 12 and 24 weeks ended June 15, 2024, and was immaterial for the

12 and 24 weeks ended June 17, 2023.

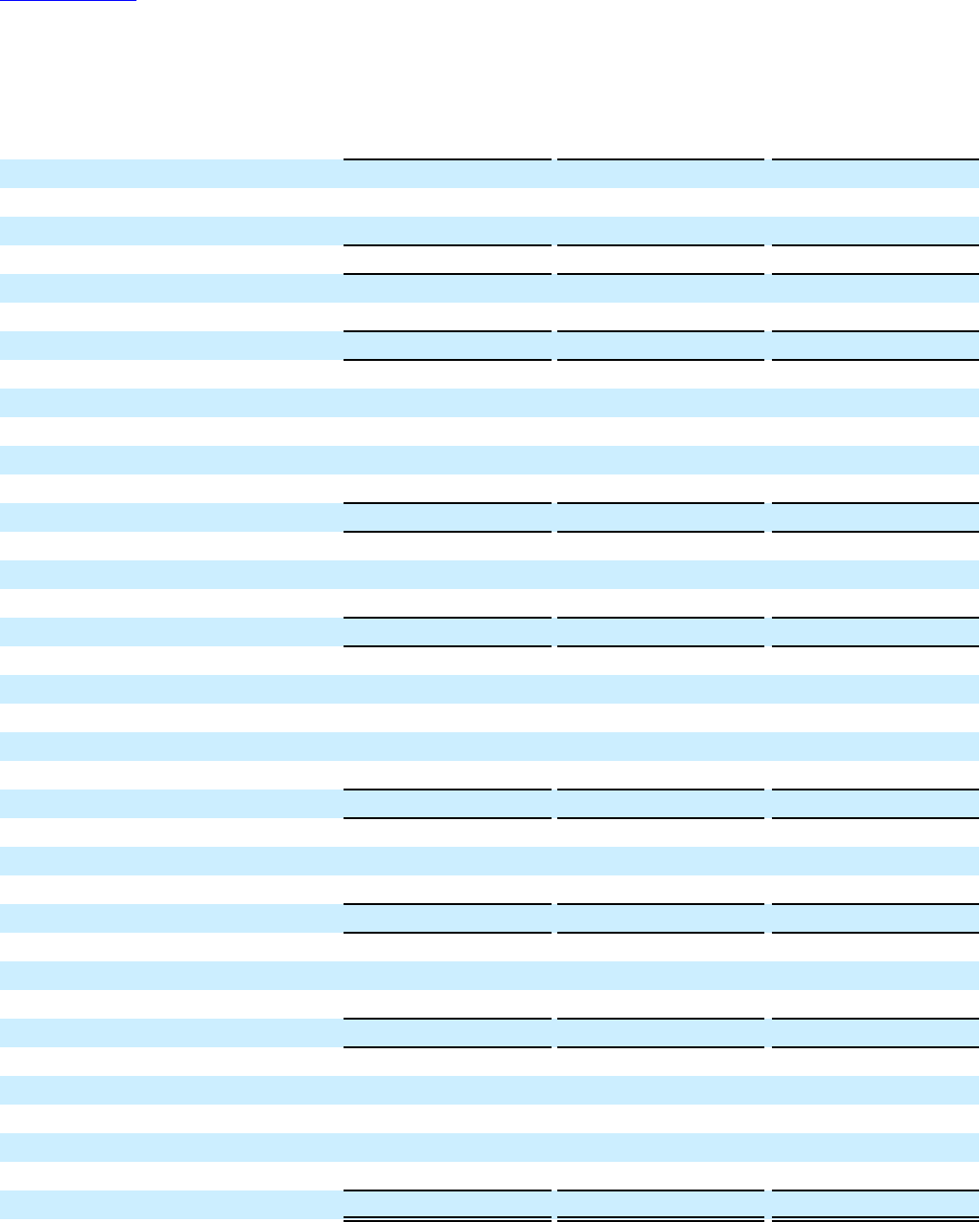

Note 11 - Accumulated Other Comprehensive Loss Attributable to PepsiCo

The changes in the balances of each component of accumulated other comprehensive loss attributable to

PepsiCo are as follows:

Currency

Translation

Adjustment

Cash Flow

Hedges

Pension

and Retiree

Medical

Available-for-

Sale Debt

Securities and

Other

(a)

Accumulated Other

Comprehensive

Loss Attributable

to PepsiCo

Balance as of December 30, 2023

(b)

$ (13,255) $ (31) $ (2,719) $ 471 $ (15,534)

Other comprehensive (loss)/income before

reclassifications

(c)

(168) (47) 4 685 474

Amounts reclassified from accumulated other

comprehensive loss — 51 9 — 60

Net other comprehensive (loss)/income (168) 4 13 685 534

Tax amounts (14) (1) (2) (162) (179)

Balance as of March 23, 2024

(b)

(13,437) (28) (2,708) 994 (15,179)

Other comprehensive (loss)/income before

reclassifications

(d)

(295) 3 (1) (511) (804)

Amounts reclassified from accumulated other

comprehensive loss

— 53 12 — 65

Net other comprehensive (loss)/income (295) 56 11 (511) (739)

Tax amounts 28 (14) (2) 120 132

Balance as of June 15, 2024

(b)

$ (13,704) $ 14 $ (2,699) $ 603 $ (15,786)

(a) The movements during the quarters primarily represent fair value changes in available-for-sale debt securities, including our investment

in Celsius convertible preferred stock. See Note 9 for further information.

(b) Pension and retiree medical amounts are net of taxes of $1,282 million as of December 30, 2023, $1,280 million as of March 23, 2024

and $1,278 million as of June 15, 2024.

(c) Currency translation adjustment primarily reflects depreciation of the South African rand, Canadian dollar and Russian ruble.

(d) Currency translation adjustment primarily reflects depreciation of the Egyptian pound.

Currency

Translation

Adjustment

Cash Flow

Hedges

Pension and

Retiree

Medical

Available-for-

Sale Debt

Securities and

Other

Accumulated Other

Comprehensive

Loss Attributable

to PepsiCo

Balance as of December 31, 2022

(a)

$ (12,948) $ 1 $ (2,361) $ 6 $ (15,302)

Other comprehensive (loss) before reclassifications

(b)

(350) (92) (9) (1) (452)

Amounts reclassified from accumulated other

comprehensive loss

(c)

108 13 5 — 126

Net other comprehensive (loss) (242) (79) (4) (1) (326)

Tax amounts 7 20 — — 27

Balance as of March 25, 2023

(a)

(13,183) (58) (2,365) 5 (15,601)

Other comprehensive (loss)/income before

reclassifications

(d)

(215) 19 (14) 1 (209)

Amounts reclassified from accumulated other

comprehensive loss — 12 5 — 17

Net other comprehensive (loss)/income (215) 31 (9) 1 (192)

Tax amounts 17 (7) 3 — 13

Balance as of June 17, 2023

(a)

$ (13,381) $ (34) $ (2,371) $ 6 $ (15,780)

(a) Pension and retiree medical amounts are net of taxes of $1,184 million as of both December 31, 2022 and March 25, 2023 and

$1,187 million as of June 17, 2023.

(b) Currency translation adjustment primarily reflects depreciation of the Egyptian pound and Russian ruble.

(c) Release of currency translation adjustment is in relation to the sale of a non-strategic brand and an investment within our AMESA

division.

(d) Currency translation adjustment primarily reflects depreciation of the Russian ruble.

Table of Contents

22

The reclassifications from accumulated other comprehensive loss to the income statement are summarized

as follows:

12 Weeks Ended 24 Weeks Ended

6/15/2024 6/17/2023 6/15/2024 6/17/2023

Affected Line Item in the

Income Statement

Currency translation:

Divestitures $ — $ — $ — $ 108

Selling, general and

administrative expenses

Cash flow hedges:

Foreign exchange contracts $ — $ (1) $ — $ (3) Net revenue

Foreign exchange contracts 9 15 18 18 Cost of sales

Interest rate derivatives 14 (30) 35 (27)

Selling, general and

administrative expenses

Commodity contracts 30 28 51 38 Cost of sales

Commodity contracts — — — (1)

Selling, general and

administrative expenses

Net losses before tax 53 12 104 25

Tax amounts (14) (3) (27) (7)

Net losses after tax $ 39 $ 9 $ 77 $ 18

Pension and retiree medical items:

Amortization of prior service

credits $ (7) $ (8) $ (14) $ (15)

Other pension and retiree medical

benefits income

Amortization of net losses 17 13 33 25

Other pension and retiree medical

benefits income

Settlement losses 2 — 2 —

Other pension and retiree medical

benefits income

Net losses before tax 12 5 21 10

Tax amounts (2) (1) (4) (2)

Net losses after tax $ 10 $ 4 $ 17 $ 8

Total net losses reclassified, net of tax $ 49 $ 13 $ 94 $ 134

Note 12 - Supply Chain Financing Arrangements

We maintain voluntary supply chain finance agreements with several participating global financial

institutions. Under these agreements, our suppliers, at their sole discretion, may elect to sell their accounts

receivable with PepsiCo to these participating global financial institutions. As of June 15, 2024 and

December 30, 2023, $1.6 billion and $1.7 billion, respectively, of our accounts payable are to suppliers

participating in these financing arrangements. For further information on the key terms of these supply

chain financing programs, see Note 14 to our consolidated financial statements in our 2023 Form 10-K.

Table of Contents

23

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

FINANCIAL REVIEW

Our discussion and analysis is intended to help the reader understand our results of operations and

financial condition and is provided as an addition to, and should be read in connection with, our

condensed consolidated financial statements and the accompanying notes. Unless otherwise noted,

tabular dollars are presented in millions, except per share amounts. All per share amounts reflect

common stock per share amounts, assume dilution unless otherwise noted, and are based on unrounded

amounts. Percentage changes are based on unrounded amounts.

Our Critical Accounting Policies and Estimates

The critical accounting policies and estimates below should be read in conjunction with those outlined in

our 2023 Form 10-K.

Total Marketplace Spending

We offer sales incentives and discounts through various programs to customers and consumers. Total

marketplace spending includes sales incentives, discounts, advertising and other marketing activities.

Sales incentives and discounts are primarily accounted for as a reduction of revenue. A number of our

sales incentives, such as bottler funding to independent bottlers and customer volume rebates, are based on

annual targets, and accruals are established during the year, as products are delivered, for the expected

payout, which may occur after year end once reconciled and settled.

These accruals are based on contract terms and our historical experience with similar programs and

require management judgment with respect to estimating customer and consumer participation and

performance levels. Differences between estimated expense and actual incentive costs are normally

insignificant and are recognized in earnings in the period such differences are determined. In addition,

certain advertising and marketing costs are also based on annual targets and recognized during the year as

incurred.

For interim reporting, our policy is to allocate our forecasted full-year sales incentives for most of our

programs to each of our interim reporting periods in the same year that benefits from the programs. The

allocation methodology is based on our forecasted sales incentives for the full year and the proportion of

each interim period’s actual gross revenue or volume, as applicable, to our forecasted annual gross

revenue or volume, as applicable. Based on our review of the forecasts at each interim period, any changes

in estimates and the related allocation of sales incentives are recognized beginning in the interim period

that they are identified. In addition, we apply a similar allocation methodology for interim reporting

purposes for certain advertising and other marketing activities.

Income Taxes

In determining our quarterly provision for income taxes, we use an estimated annual effective tax rate

which is based on our expected annual income, statutory tax rates and tax structure and transactions,

including transfer pricing arrangements, available to us in the various jurisdictions in which we operate.

Significant judgment is required in determining our annual tax rate and in evaluating our tax positions.

Subsequent recognition, derecognition and measurement of a tax position taken in a previous period are

separately recognized in the quarter in which they occur.

Our Business Risks

This Form 10-Q contains statements reflecting our views about our future performance that constitute

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995

(Reform Act). Statements that constitute forward-looking statements within the meaning of the Reform Act

Table of Contents

24

are generally identified through the inclusion of words such as “aim,” “anticipate,” “believe,” “drive,”

“estimate,” “expect,” “expressed confidence,” “forecast,” “future,” “goal,” “guidance,” “intend,”

“may,” “objective,” “outlook,” “plan,” “position,” “potential,” “project,” “seek,” “should,”

“strategy,” “target,” “will” or similar statements or variations of such words and other similar

expressions. All statements addressing our future operating performance, and statements addressing

events and developments that we expect or anticipate will occur in the future, are forward-looking

statements within the meaning of the Reform Act. These forward-looking statements are based on

currently available information, operating plans and projections about future events and trends. They

inherently involve risks and uncertainties that could cause actual results to differ materially from those

predicted in any such forward-looking statement. Such risks and uncertainties include, but are not limited

to: the risks associated with the deadly conflict in Ukraine; future demand for PepsiCo’s products;

damage to PepsiCo’s reputation or brand image; product recalls or other issues or concerns with respect

to product quality and safety; PepsiCo’s ability to compete effectively; PepsiCo’s ability to attract,

develop and maintain a highly skilled and diverse workforce or effectively manage changes in our

workforce; water scarcity; changes in the retail landscape or in sales to any key customer; disruption of

PepsiCo’s manufacturing operations or supply chain, including continued increased commodity,

packaging, transportation, labor and other input costs; political, social or geopolitical conditions in the

markets where PepsiCo’s products are made, manufactured, distributed or sold; PepsiCo’s ability to grow

its business in developing and emerging markets; changes in economic conditions in the countries in

which PepsiCo operates; future cyber incidents and other disruptions to our information systems; failure

to successfully complete or manage strategic transactions; PepsiCo’s reliance on third-party service

providers and enterprise-wide systems; climate change or measures to address climate change and other

sustainability matters; strikes or work stoppages; failure to realize benefits from PepsiCo’s productivity

initiatives; deterioration in estimates and underlying assumptions regarding future performance of our

business or investments that can result in impairment charges; fluctuations or other changes in exchange

rates; any downgrade or potential downgrade of PepsiCo’s credit ratings; imposition or proposed

imposition of new or increased taxes aimed at PepsiCo’s products; imposition of limitations on the

marketing or sale of PepsiCo’s products; changes in laws and regulations related to the use or disposal of

plastics or other packaging materials; failure to comply with personal data protection and privacy laws;

increase in income tax rates, changes in income tax laws or disagreements with tax authorities; failure to

adequately protect PepsiCo’s intellectual property rights or infringement on intellectual property rights of

others; failure to comply with applicable laws and regulations; potential liabilities and costs from

litigation, claims, legal or regulatory proceedings, inquiries or investigations; and other risks and

uncertainties including those described in “Item 1A. Risk Factors” and “Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations – Our Business Risks,”

included in our 2023 Form 10-K and in “Item 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations – Our Business Risks” of this Form 10-Q. Investors are cautioned

not to place undue reliance on any such forward-looking statements, which speak only as of the date they

are made. We undertake no obligation to update any forward-looking statement, whether as a result of

new information, future events or otherwise.

Risks Associated with Commodities and Our Supply Chain

During the 12 and 24 weeks ended June 15, 2024, we continued to experience higher operating costs,

including on transportation and labor costs, which may continue for the remainder of 2024. Many of the

commodities used in the production and transportation of our products are purchased in the open market.

The prices we pay for such items are subject to fluctuation, and we manage this risk through the use of

fixed-price contracts and purchase orders, pricing agreements and derivative instruments, including swaps

and futures. A number of external factors, including the ongoing conflict in Ukraine, the inflationary cost

environment, adverse weather conditions, supply chain disruptions and labor shortages, have impacted and

Table of Contents

25

may continue to impact transportation and labor costs. When prices increase, we may or may not pass on

such increases to our customers, which may result in reduced volume, revenue, margins and operating

results.

See Note 9 to our condensed consolidated financial statements in this Form 10-Q and Note 9 to our

consolidated financial statements in our 2023 Form 10-K for further information on how we manage our

exposure to commodity prices.

Risks Associated with Climate Change

Certain jurisdictions in which our products are made, manufactured, distributed or sold have either

imposed, or are considering imposing, new or increased legal and regulatory requirements to reduce or

mitigate the potential effects of climate change, including regulation of greenhouse gas emissions and

potential carbon pricing programs. These new or increased legal or regulatory requirements, along with

initiatives to meet our sustainability goals, could result in significant increased costs and additional

investments in facilities and equipment. However, we are unable to predict the scope, nature and timing of

any new or increased environmental laws and regulations and therefore cannot predict the ultimate impact

of such laws and regulations on our business or financial results. We continue to monitor existing and

proposed laws and regulations in the jurisdictions in which our products are made, manufactured,

distributed and sold and to consider actions we may take to potentially mitigate the unfavorable impact, if

any, of such laws or regulations.

Risks Associated with International Operations

In the 12 weeks ended June 15, 2024, our financial results outside of North America reflect the months of

March, April and May. In the 24 weeks ended June 15, 2024, our financial results outside of North

America reflect the months of January through May. In the 24 weeks ended June 15, 2024, our operations

outside of the United States generated 42% of our consolidated net revenue, with Mexico, Canada, Russia,

China, the United Kingdom, Brazil and South Africa comprising approximately 24% of our consolidated

net revenue. As a result, we are exposed to foreign exchange risk in the international markets in which our

products are made, manufactured, distributed or sold. In the 12 and 24 weeks ended June 15, 2024,

unfavorable foreign exchange reduced net revenue growth by 1 percentage point primarily due to declines

in the Russian ruble and Egyptian pound, partially offset by an appreciation of the Mexican peso.

Currency declines against the U.S. dollar which are not offset could adversely impact our future financial

results.

In addition, volatile economic, political, social and geopolitical conditions, civil unrest and wars and other

military conflicts, acts of terrorism and natural disasters and other catastrophic events in certain markets in

which our products are made, manufactured, distributed or sold, including in Argentina, Brazil, China,

Mexico, the Middle East, Pakistan, Russia, Turkey and Ukraine, continue to result in challenging

operating environments and have resulted in and could continue to result in changes in how we operate in

certain of these markets. Debt and credit issues, currency controls or fluctuations in certain of these

international markets (including restrictions on the transfer of funds to and from certain markets), as well

as the threat or imposition of new or expanded tariffs, sanctions or export controls have also continued to

impact our operations in certain of these international markets. We continue to closely monitor the

economic, operating and political environment in the markets in which we operate, including risks of

additional impairments or write-offs and currency devaluation, and to identify actions to potentially

mitigate any unfavorable impacts on our future results. Our operations in Russia accounted for 4% of our

consolidated net revenue for both the 12 and 24 weeks ended June 15, 2024. Russia accounted for 4% of

our consolidated assets, including 11% of our consolidated cash and cash equivalents, and 34% of our

accumulated currency translation adjustment loss as of June 15, 2024.

Table of Contents

26

See Note 9 to our condensed consolidated financial statements in this Form 10-Q for the fair values of our

financial instruments as of June 15, 2024 and December 30, 2023 and Note 9 to our consolidated financial

statements in our 2023 Form 10-K for a discussion of these items.

Imposition of Taxes and Regulations on our Products

Certain jurisdictions in which our products are made, manufactured, distributed or sold have either

imposed, or are considering imposing, new or increased taxes or regulations on the manufacture,

distribution or sale of our products or their packaging, ingredients or substances contained in, or attributes

of, our products or their packaging, commodities used in the production of our products or their packaging

or the recyclability or recoverability of our packaging. These taxes and regulations vary in scope and form.

For example, some taxes apply to all beverages, including non-caloric beverages, while others apply only

to beverages with a caloric sweetener (e.g., sugar). Further, some regulations apply to all products using

certain types of packaging (e.g., plastic), while others are designed to increase the sustainability of

packaging, encourage waste reduction and increased recycling rates or facilitate the waste management

process or restrict the sale of products in certain packaging.

We sell a wide variety of beverages and convenient foods in more than 200 countries and territories and

the profile of the products we sell, the amount of revenue attributable to such products and the type of

packaging used vary by jurisdiction. Because of this, we cannot predict the scope or form potential taxes,

regulations or other limitations on our products or their packaging may take, and therefore cannot predict