1

FOR IMMEDIATE RELEASE

November 7, 2019

THE WALT DISNEY COMPANY REPORTS

FOURTH QUARTER AND FULL YEAR EARNINGS FOR FISCAL 2019

BURBANK, Calif. – The Walt Disney Company today reported earnings for its fourth quarter and

fiscal year ended September 28, 2019. Diluted earnings per share (EPS) from continuing operations for

the fourth quarter decreased 72% to $0.43 from $1.55 in the prior-year quarter. Excluding certain items

affecting comparability

(1)

, diluted EPS for the quarter decreased 28% to $1.07 from $1.48 in the prior-year

quarter. Diluted EPS from continuing operations for the year decreased 25% to $6.27 from $8.36 in the

prior year. Excluding certain items affecting comparability

(1)

, diluted EPS from continuing operations for

the year decreased 19% to $5.77 from $7.08 in the prior year.

“Our solid results in the fourth quarter reflect the ongoing strength of our brands and businesses,”

said Robert A. Iger, Chairman and Chief Executive Officer, The Walt Disney Company. “We’ve spent the

last few years completely transforming The Walt Disney Company to focus the resources and immense

creativity across the entire company on delivering an extraordinary direct-to-consumer experience, and

we’re excited for the launch of Disney+ on November 12.”

On March 20, 2019, the Company acquired Twenty-First Century Fox, Inc., which was subsequently

renamed TFCF Corporation (TFCF), for cash and the issuance of 307 million shares. Additionally, as part

of the TFCF acquisition, we acquired a controlling interest in Hulu LLC (Hulu). Results for the current

quarter and fiscal year reflect the consolidation of TFCF and Hulu.

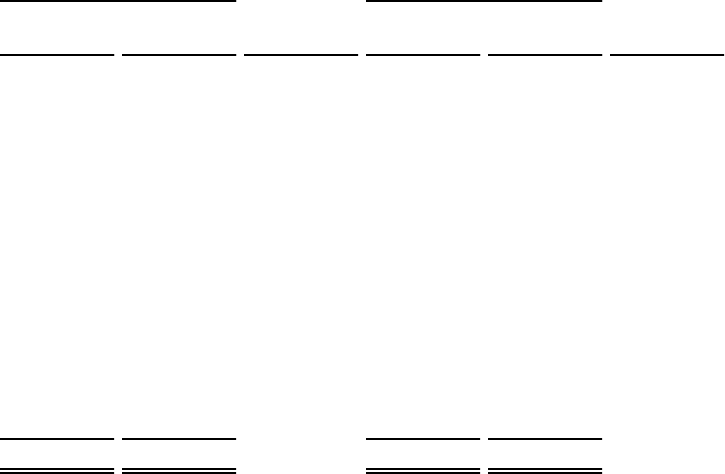

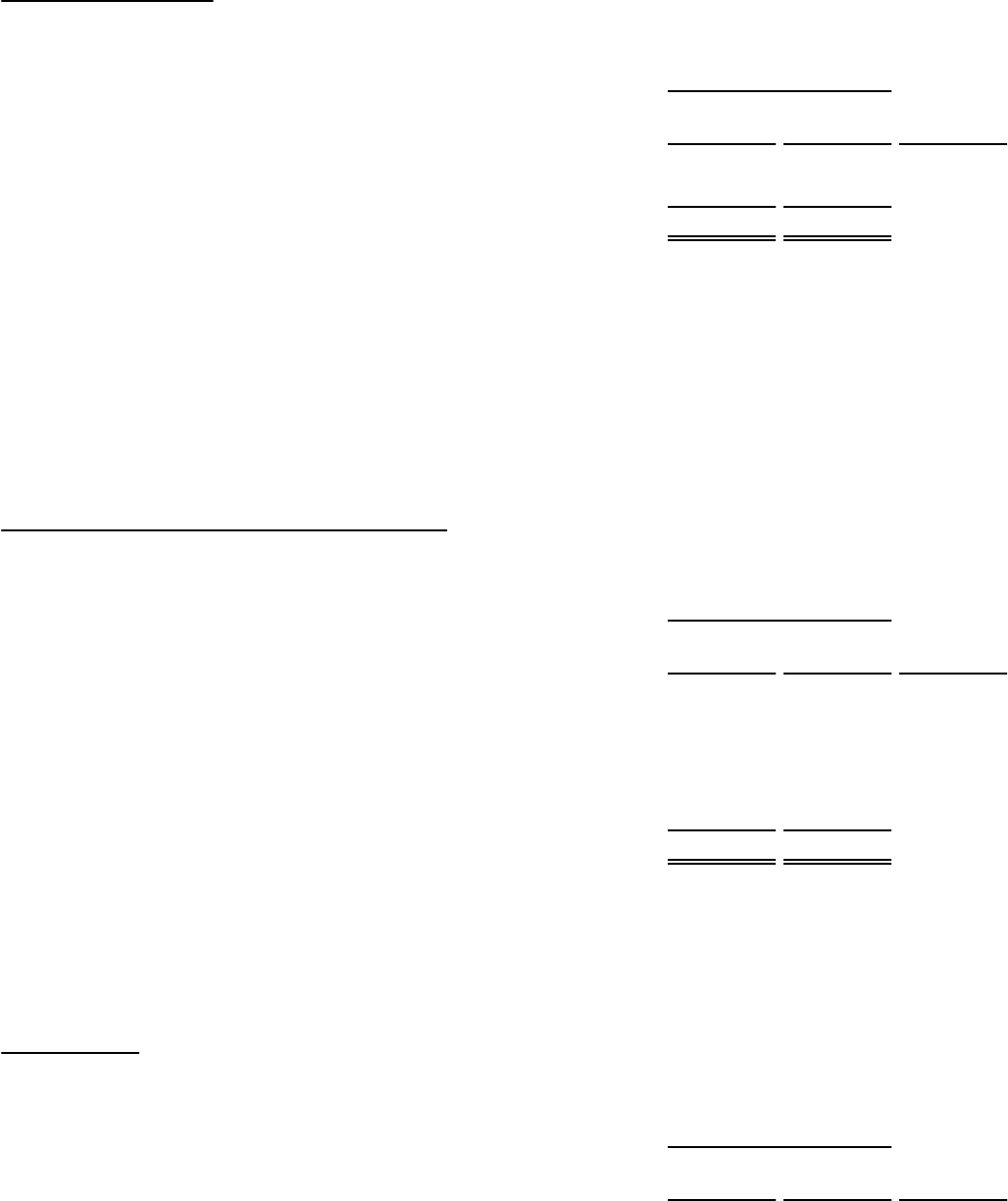

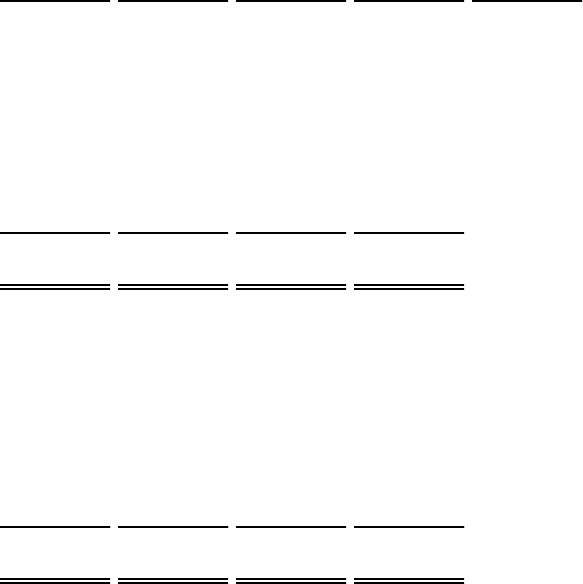

The following table summarizes the fourth quarter and full year results for fiscal 2019 and 2018 (in

millions, except per share amounts):

Quarter Ended Year Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Sept. 28,

2019

Sept. 29,

2018 Change

Revenues $ 19,100 $ 14,306 34 % $ 69,570 $ 59,434 17 %

Income from continuing operations

before income taxes

$ 1,258 $ 3,202 (61)% $ 13,944 $ 14,729 (5)%

Total segment operating income

(1)

$ 3,436 $ 3,277 5 % $ 14,868 $ 15,689 (5)%

Net income from continuing

operations

(2)

$ 785 $ 2,322 (66)% $ 10,441 $ 12,598 (17)%

Diluted EPS from continuing

operations

(2)

$ 0.43 $ 1.55 (72)% $ 6.27 $ 8.36 (25)%

Diluted EPS excluding certain items

affecting comparability

(1)

$ 1.07 $ 1.48 (28)% $ 5.77 $ 7.08 (19)%

Cash provided by continuing operations $ 1,718 $ 3,853 (55)% $ 5,984 $ 14,295 (58)%

Free cash flow

(1)

$ 409 $ 2,652 (85)% $ 1,108 $ 9,830 (89)%

(1)

EPS excluding certain items affecting comparability, total segment operating income and free cash flow are non-GAAP financial

measures. The comparable GAAP measures are diluted EPS from continuing operations, income from continuing operations before

income taxes, and cash provided by continuing operations, respectively. See the discussion on page 2 and on pages 9 through 12.

(2)

Reflects amounts attributable to shareholders of The Walt Disney Company, i.e. after deduction of noncontrolling interests.

2

SEGMENT RESULTS

The Company evaluates the performance of its operating segments based on segment operating

income, and management uses total segment operating income as a measure of the performance of

operating businesses separate from non-operating factors. The Company believes that information about

total segment operating income assists investors by allowing them to evaluate changes in the operating

results of the Company’s portfolio of businesses separate from non-operational factors that affect net

income, thus providing separate insight into both operations and the other factors that affect reported

results.

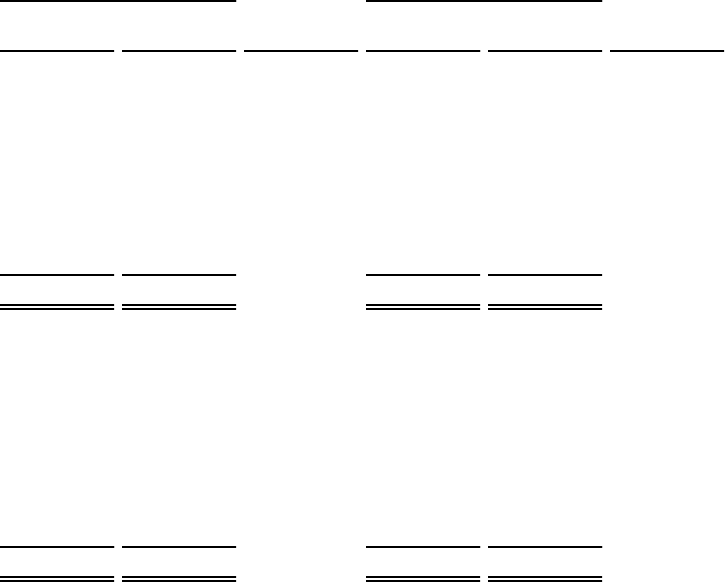

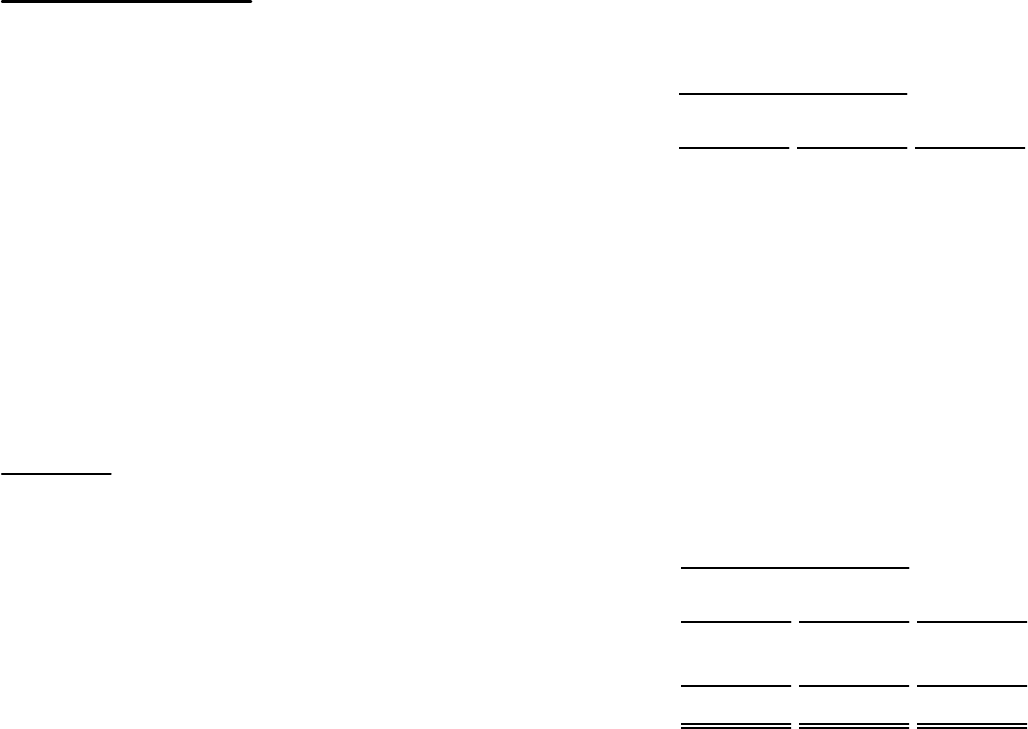

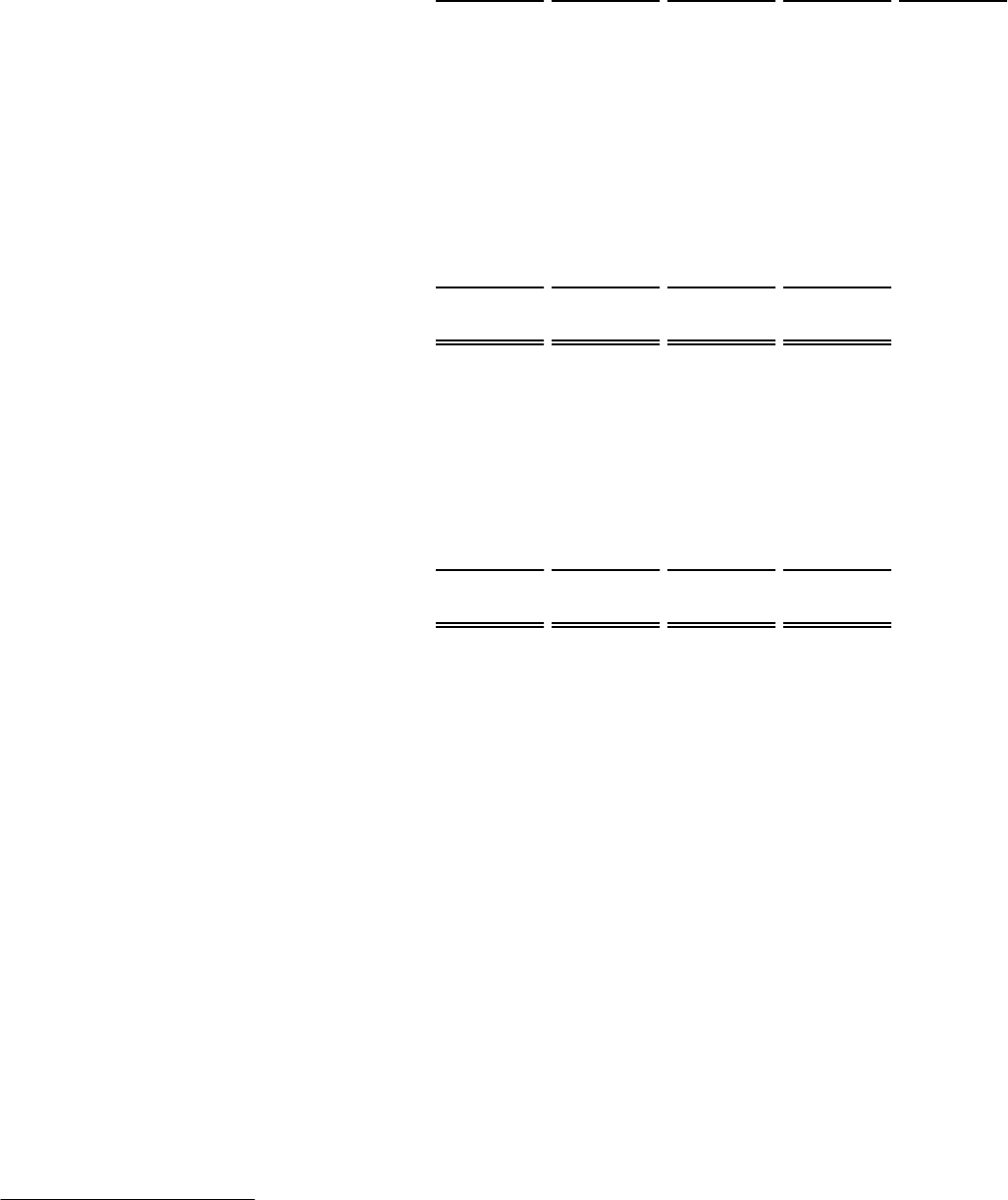

The following is a reconciliation of income from continuing operations before income taxes to total

segment operating income (in millions):

Quarter Ended Year Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Sept. 28,

2019

Sept. 29,

2018 Change

Income from continuing operations

before income taxes $ 1,258 $ 3,202 (61 )% $ 13,944 $ 14,729 (5 )%

Add/(subtract):

Corporate and unallocated shared

expenses

309 208 (49 )% 987 744 (33 )%

Restructuring and impairment

charges 314 5 >(100) % 1,183 33 >(100) %

Other (income) / expense, net

483

(507

) nm

(4,357

)

(601

) >100 %

Interest expense, net 361 159 >(100) % 978 574 (70 )%

Amortization of TFCF and Hulu

intangible assets and fair value

step-up on film and television

costs 711 — nm 1,595 — nm

Impairment of equity investments — 210 nm 538 210 >(100) %

Total Segment Operating Income $ 3,436 $ 3,277 5 % $ 14,868 $ 15,689 (5 )%

3

The following table summarizes the fourth quarter and full year segment revenue and segment

operating income for fiscal 2019 and 2018 (in millions):

Quarter Ended Year Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Sept. 28,

2019

Sept. 29,

2018 Change

Revenues:

Media Networks $ 6,510 $ 5,325 22 % $ 24,827 $ 21,922 13 %

Parks, Experiences and

Products

6,655 6,135 8 % 26,225 24,701 6 %

Studio Entertainment 3,310 2,177 52 % 11,127 10,065 11 %

Direct-to-Consumer &

International

3,428 825 >100 % 9,349 3,414 >100 %

Eliminations

(803)

(156

) >(100) %

(1,958

)

(668

) >(100) %

Total Revenues

$ 19,100 $ 14,306 34 % $ 69,570 $ 59,434 17 %

Segment operating income:

Media Networks $ 1,783 $ 1,842 (3 )% $ 7,479 $ 7,338 2 %

Parks, Experiences and

Products

1,381 1,177 17 % 6,758 6,095 11 %

Studio Entertainment 1,079 604 79 % 2,686 3,004 (11 )%

Direct-to-Consumer &

International

(740)

(340

) >(100) %

(1,814

)

(738

) >(100) %

Eliminations

(67)

(6

) >(100) %

(241

)

(10

) >(100) %

Total Segment Operating Income

$ 3,436 $ 3,277 5 % $ 14,868 $ 15,689 (5 )%

TFCF and Hulu operating results for the current period are consolidated and reported in our

segments. Prior to the acquisition of TFCF, Hulu was accounted for as an equity method investment and

was reported in our Direct-to-Consumer & International segment.

DISCUSSION OF FULL YEAR SEGMENT RESULTS

Segment operating income decreased at Direct-to-Consumer & International and Studio

Entertainment and increased at Parks, Experiences and Products and Media Networks. The decrease at

Direct-to-Consumer & International was due to the consolidation of Hulu, our ongoing investment in

ESPN+ and costs to support the launch of Disney+. Lower segment operating income at Studio

Entertainment was due to the consolidation of TFCF’s operations. TFCF results included a loss from

theatrical distribution and film cost impairments, partially offset by income from TV/SVOD distribution.

Higher operating results at Parks, Experiences and Products was due to growth at the domestic theme

parks and resorts and merchandise licensing. The increase at our domestic parks and resorts was due to

higher guest spending, partially offset by labor and other cost inflation. Growth at Media Networks was

due to the consolidation of TFCF’s operations, partially offset by a decrease at our legacy operations. The

decrease at our legacy operations was due to higher programming and production costs and a decrease in

ABC Studios program sales, partially offset by an increase in affiliate revenue. Eliminations of segment

operating income increased due to higher sales of ABC Studios programs to Hulu and the International

Channels. The elimination of sales of TFCF television programs to Hulu and our International Channels

also contributed to the increase.

4

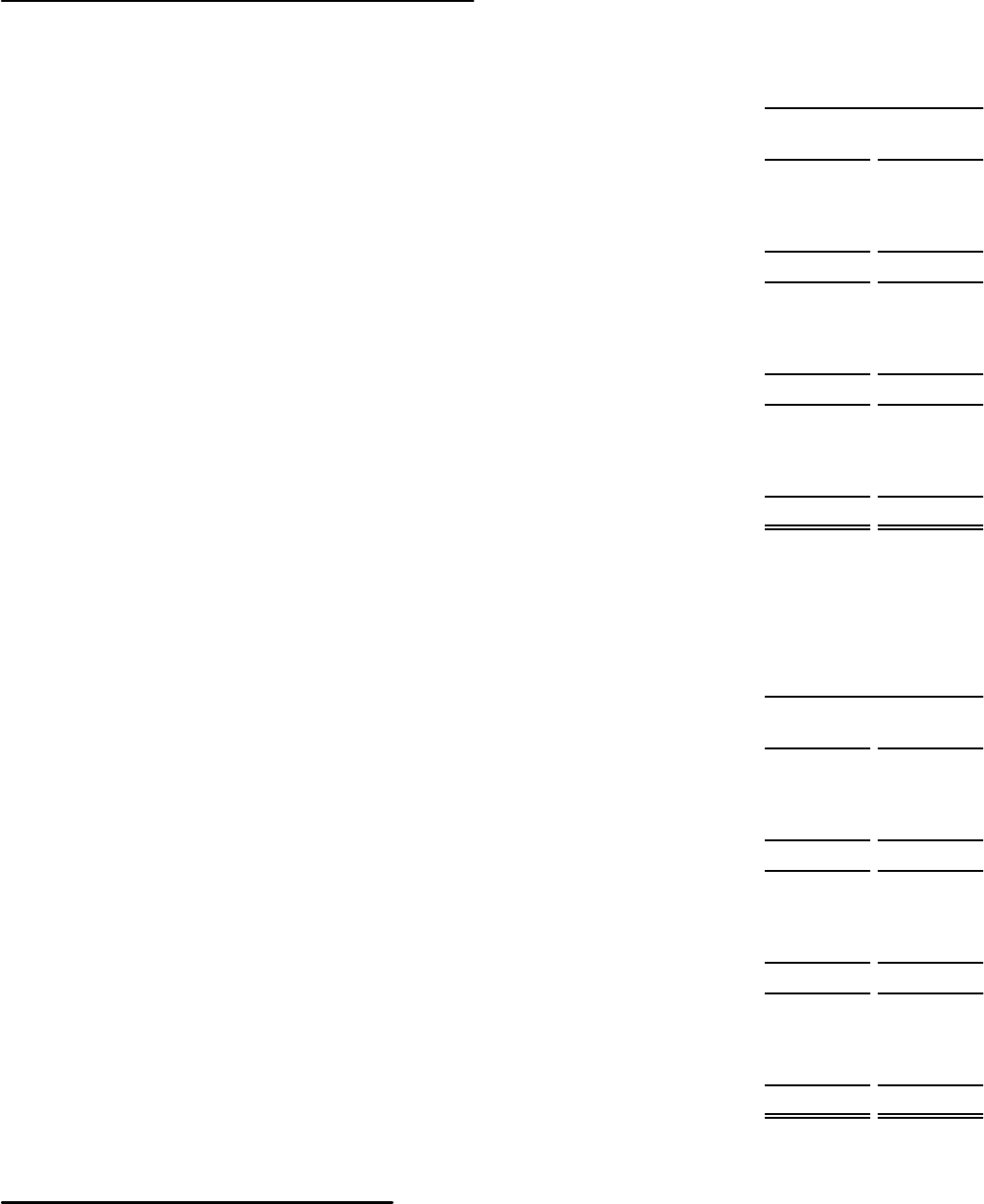

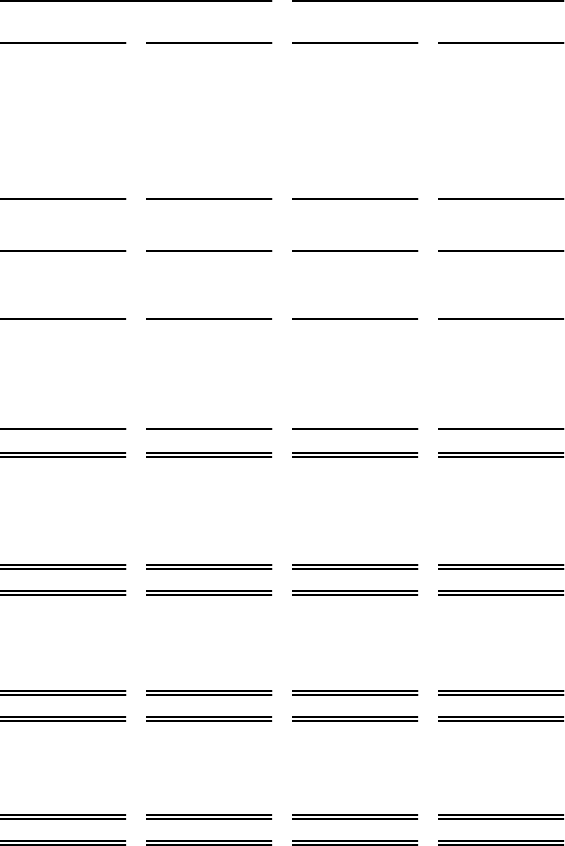

DISCUSSION OF FOURTH QUARTER SEGMENT RESULTS

Media Networks

Media Networks revenues for the quarter increased 22% to $6.5 billion, and segment operating

income decreased 3% to $1.8 billion. The following table provides further detail of the Media Networks

results (in millions):

Quarter Ended Year Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Sept. 28,

2019

Sept. 29,

2018 Change

Revenues:

Cable Networks $ 4,243 $ 3,527 20 % $ 16,486 $ 14,610 13 %

Broadcasting 2,267 1,798 26 % 8,341 7,312 14 %

$ 6,510 $ 5,325 22 % $ 24,827 $ 21,922 13 %

Segment operating income:

Cable Networks $ 1,256 $ 1,275 (1)% $ 5,425 $ 5,225 4 %

Broadcasting 377 394 (4)% 1,351 1,402 (4)%

Equity in the income of

investees

150 173 (13)% 703 711 (1)%

$ 1,783 $ 1,842 (3)% $ 7,479 $ 7,338 2 %

Cable Networks

Cable Networks revenues for the quarter increased 20% to $4.2 billion and operating income

decreased $19 million to $1.3 billion. Lower operating income was due to a decrease at ESPN, partially

offset by the consolidation of TFCF businesses (primarily the FX and National Geographic networks).

The decrease at ESPN was due to increases in programming, production and marketing costs,

partially offset by higher affiliate revenue. Higher programming costs were driven by rate increases for

NFL, college sports and MLB programming. Affiliate revenue growth was due to an increase in

contractual rates and the launch of the ACC Network, partially offset by a decrease in subscribers.

Broadcasting

Broadcasting revenues for the quarter increased 26% to $2.3 billion and operating income decreased

$17 million to $377 million. The decrease in operating income was due to lower results at our legacy

operations, partially offset by the consolidation of TFCF program sales.

The decrease at our legacy operations was due to lower ABC Studios program sales, an increase in

programming and production costs at the ABC Television Network, a decrease in advertising revenue and

higher marketing costs. These decreases were partially offset by an increase in affiliate revenue due to

higher rates. The decrease in ABC Studios program sales was driven by the comparison to prior-year sales

of Daredevil and Iron Fist and lower sales of Black-ish. The increase in programming and production

costs was driven by higher write-downs and an increase in the average cost of network programming in

the current quarter compared to the prior-year quarter. Lower advertising revenue reflected a decrease in

rates at the owned television stations.

Equity in the Income of Investees

Equity in the income of investees decreased from $173 million in the prior-year quarter to $150

million in the current quarter due to lower income from A+E Television Networks driven by a decrease in

affiliate and advertising revenues and higher marketing costs.

5

Parks, Experiences and Products

Parks, Experiences and Products revenues for the quarter increased 8% to $6.7 billion, and segment

operating income increased 17% to $1.4 billion. Operating income growth for the quarter was due to

increases from merchandise licensing, Disneyland Resort and Disney Vacation Club.

Higher operating income at our merchandise licensing business was due to an increase in revenue

from sales of merchandise based on Frozen and Toy Story, partially offset by lower sales of merchandise

based on Mickey and Minnie.

Growth at Disneyland Resort was primarily due to higher guest spending, partially offset by expenses

associated with Star Wars: Galaxy’s Edge, which opened on May 31, and, to a lesser extent, lower

attendance. Guest spending growth was primarily due to increases in average ticket prices and higher

food, beverage and merchandise spending.

The increase in operating income at Disney Vacation Club was due to higher sales at Disney’s Riviera

Resort in the current quarter, which included a timing benefit from the adoption of new revenue

recognition accounting guidance (see page 6), compared to sales of Copper Creek Villas & Cabins in the

prior-year quarter.

Results at Walt Disney World Resort were comparable to the prior-year quarter, despite the adverse

impact of Hurricane Dorian in the current quarter. Increases in guest spending and, to a lesser extent,

occupied room nights and attendance were offset by higher costs. Higher costs were driven by costs

associated with Star Wars: Galaxy’s Edge, which opened on August 29, and cost inflation. Guest spending

growth was primarily due to increased food, beverage and merchandise spending and higher average

ticket prices.

Operating income at our international parks and resorts was comparable to the prior-year quarter, as

growth at Disneyland Paris and Shanghai Disney Resort was largely offset by a decrease at Hong Kong

Disneyland Resort. The increase at Disneyland Paris was driven by higher average ticket prices and

attendance growth. At Shanghai Disney Resort, higher operating income was due to an increase in average

ticket prices, partially offset by lower attendance. Lower results at Hong Kong Disneyland Resort were

due to decreases in attendance and occupied room nights reflecting the impact of recent events.

Studio Entertainment

Studio Entertainment revenues for the quarter increased 52% to $3.3 billion and segment operating

income increased 79% to $1,079 million. Higher operating income was due to an increase in theatrical

distribution results, partially offset by a loss from the consolidation of the TFCF businesses.

The increase in theatrical distribution results was due to the performance of The Lion King, Toy Story

4 and Aladdin in the current quarter compared to Incredibles 2 and Ant-Man And The Wasp in the prior-

year quarter.

Operating results at the TFCF businesses reflected a loss from theatrical distribution driven by the

performance of Ad Astra, Art of Racing In The Rain and Dark Phoenix, partially offset by income from

TV/SVOD distribution.

Direct-to-Consumer & International

Direct-to-Consumer & International revenues for the quarter increased from $0.8 billion to $3.4

billion and segment operating loss increased from $340 million to $740 million. The increase in operating

loss was due to the consolidation of Hulu, costs associated with the upcoming launch of Disney+ and our

ongoing investment in ESPN+, which was launched in April 2018. These decreases were partially offset

by a benefit from the inclusion of the TFCF businesses driven by income at Star India.

6

Commencing March 20, 2019, as a result of our acquisition of a controlling interest in Hulu, 100% of

Hulu’s operating results are included in the Direct-to-Consumer & International segment. Prior to March

20, 2019, the Company’s ownership share of Hulu results was reported as equity in the loss of investees.

Eliminations

Revenue eliminations increased from $156 million to $803 million and segment operating income

eliminations increased from a loss of $6 million to a loss of $67 million driven by eliminations of sales of

ABC Studios and Twentieth Century Fox Television programs to the International Channels and Hulu.

ADOPTION OF NEW REVENUE RECOGNITION ACCOUNTING GUIDANCE

At the beginning of fiscal 2019, the Company adopted new revenue recognition accounting guidance

(ASC 606). Results for fiscal 2019 are presented under ASC 606, while prior period amounts continue to

be reported in accordance with our historical accounting.

The current quarter includes a $55 million favorable impact on segment operating income from the

ASC 606 adoption. The most significant impact was an $88 million increase at Parks, Experiences and

Products, which reflected licensing revenue from products related to films not yet released and benefits

from the timing of recognition of licensing minimum guarantees and sales of vacation club properties.

OTHER QUARTERLY FINANCIAL INFORMATION

Corporate and Unallocated Shared Expenses

Corporate and unallocated shared expenses increased $101 million from $208 million to $309

million for the quarter due primarily to the consolidation of TFCF operations, costs related to the

integration of TFCF and higher compensation costs.

Restructuring Charges

During the quarter, the Company recorded charges totaling $314 million, primarily for severance, in

connection with the integration of TFCF. These charges are recorded in “Restructuring and impairment

charges” in the Consolidated Statement of Income.

Other income (expense), net

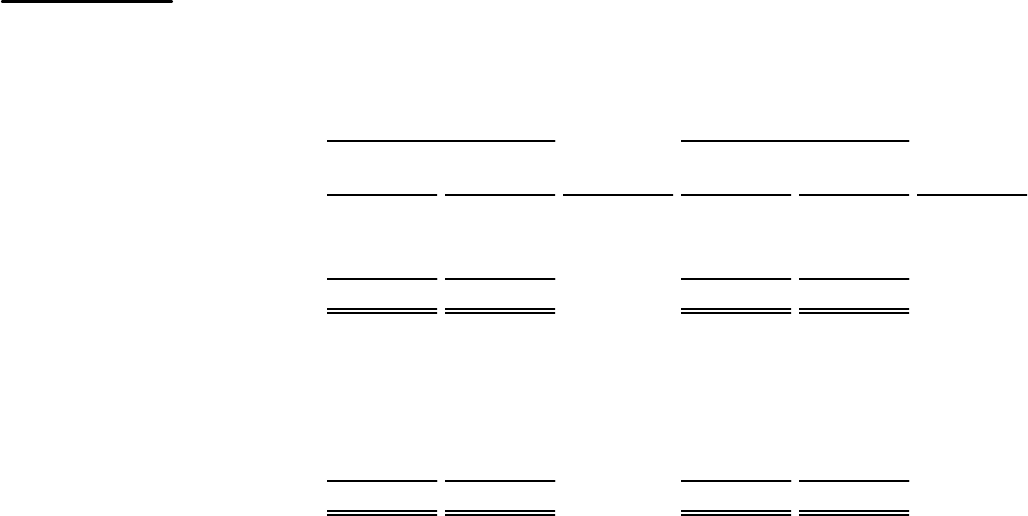

Other income (expense), net was as follows (in millions):

Quarter Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Loss on debt extinguishment

$ (511) $ — nm

Gain recognized in connection with the acquisition of TFCF

28 — nm

Gain on sale of real estate

— 507 nm

Other income (expense), net $ (483) $ 507 nm

In the current quarter, the Company recognized a loss on the extinguishment of a portion of the debt

originally assumed in the TFCF acquisition and a gain on the deemed settlement of preexisting

relationships with TFCF pursuant to acquisition accounting guidance.

7

Interest Expense, net

Interest expense, net was as follows (in millions):

Quarter Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Interest expense $ (413) $ (189) >(100)%

Interest, investment income and other 52 30 73%

Interest expense, net $ (361) $ (159) >(100)%

The increase in interest expense was due to higher debt balances as a result of the TFCF acquisition.

The increase in interest, investment income and other for the quarter was due to a $27 million benefit

related to pension and postretirement benefit costs, other than service cost. The Company adopted new

accounting guidance in fiscal 2019 and now presents the elements of pension and postretirement plan

costs, other than service cost, in “Interest expense, net.” The comparable benefit of $8 million in the prior-

year quarter was reported in “Costs and expenses.” The benefit in the current quarter was due to the

expected return on pension plan assets exceeding interest expense on plan liabilities and amortization of

net actuarial losses.

Equity in the Income (Loss) of Investees, net

Equity in the income (loss) of investees was as follows (in millions):

Quarter Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Amounts included in segment results:

Media Networks $ 150 $ 173 (13)%

Parks, Experiences and Products (1) (4) 75 %

Direct-to-Consumer & International (18) (183) 90 %

Impairment of equity investments — (210) nm

Equity in the income (loss) of investees, net $ 131 $ (224) nm

The decrease in equity income at Media Networks was due to lower income from A+E Television

Networks driven by a decrease in affiliate and advertising revenues and higher marketing costs.

The decrease in equity losses at Direct-to-Consumer & International was due to the consolidation of

Hulu.

Income Taxes

The effective income tax rate was as follows:

Quarter Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Effective income tax rate - continuing operations 27.3% 24.5% (2.8) ppt

The increase in the effective income tax rate from continuing operations for the quarter was driven

by an unfavorable impact from the update of our full year effective income tax rate for the current year

relative to the estimate at the end of the third quarter. The full year effective rate is used to determine the

quarterly income tax provision and is adjusted each quarter based on information available at the end of

8

that quarter. This increase was partially offset by a reduction of the Company’s U.S. statutory federal

income tax rate to 21.0% in fiscal 2019 from 24.5% in fiscal 2018 as the result of U.S. federal income tax

legislation (Tax Act), which was enacted in the prior year, and the comparison to a $0.1 billion

unfavorable impact from the Tax Act recognized in the prior-year quarter.

Noncontrolling Interests

Net (income) loss attributable to noncontrolling interests was as follows (in millions):

Quarter Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Net income attributable to noncontrolling interests $ (129) $ (97)

(33)%

The increase in net income attributable to noncontrolling interests was due to accretion of the fair

value of the redeemable noncontrolling interest in Hulu, partially offset by lower results at Hong Kong

Disneyland Resort.

Net income attributable to noncontrolling interests is determined on income after royalties and

management fees, financing costs and income taxes, as applicable.

FULL YEAR CASH FLOW STATEMENT INFORMATION

Cash Flow

Cash provided by operations and free cash flow were as follows (in millions):

Year Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Cash provided by operations $ 5,984 $ 14,295 $ (8,311)

Investments in parks, resorts and other property (4,876) (4,465) (411)

Free cash flow

(1)

$ 1,108 $ 9,830 $ (8,722)

(1)

Free cash flow is not a financial measure defined by GAAP. See the discussion on pages 9 through 12.

Cash provided by operations for fiscal 2019 decreased by $8.3 billion from $14.3 billion in the prior

year to $6.0 billion in the current year. The decrease was due to the payment of tax obligations that arose

from the spin-off of Fox Corporation in connection with the TFCF acquisition and the sale of the regional

sports networks acquired with TFCF, higher pension contributions, lower segment operating income, an

increase in film and television production spending and higher interest payments.

9

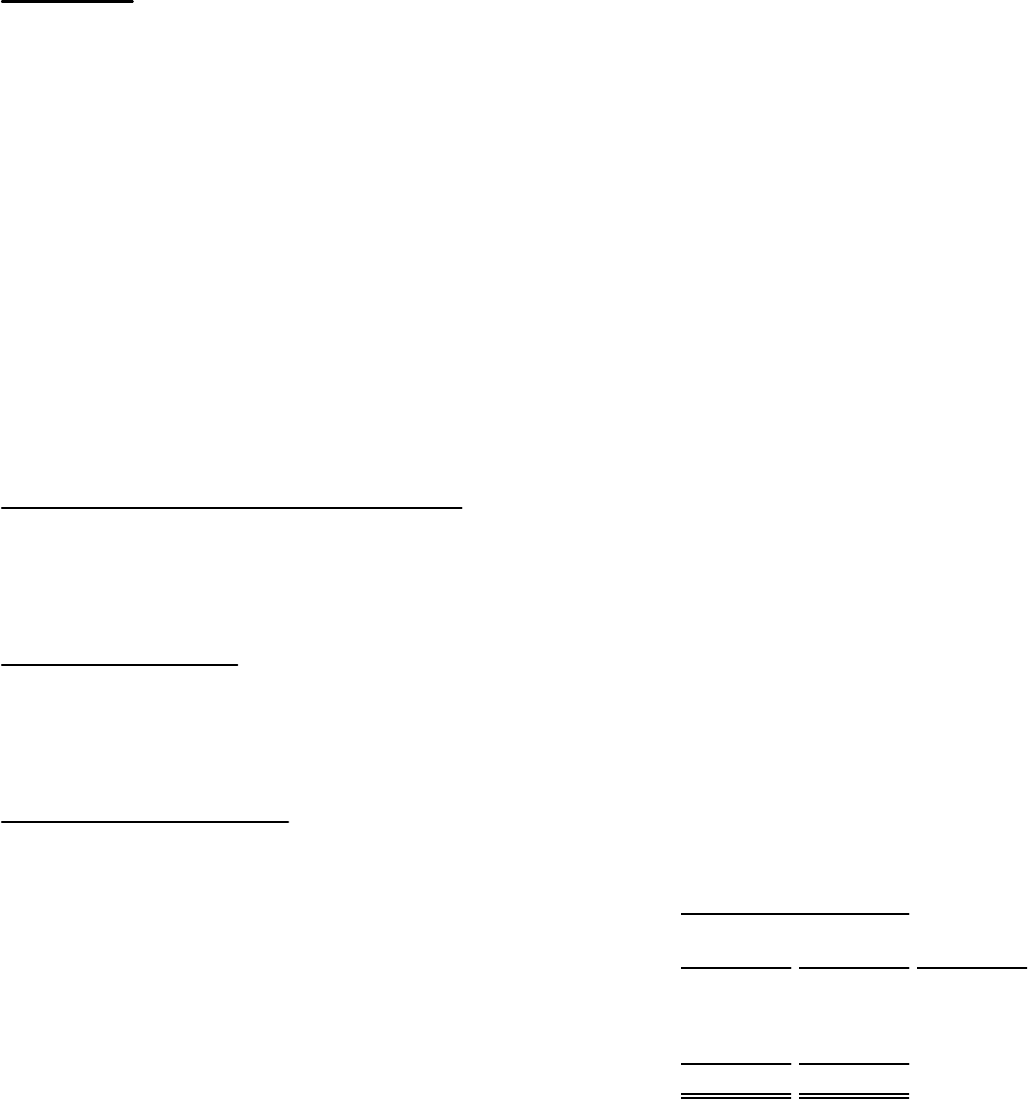

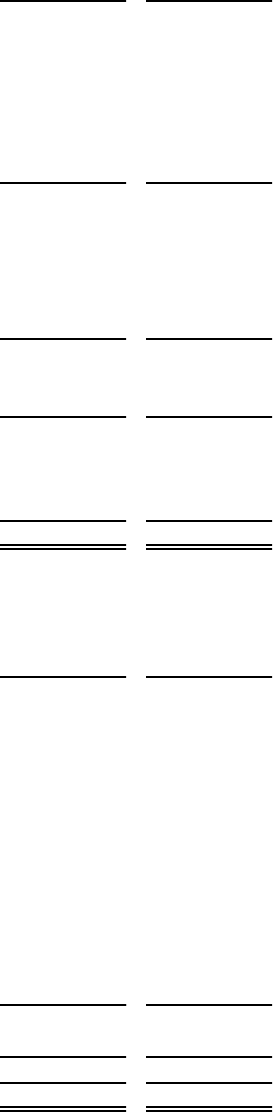

Capital Expenditures and Depreciation Expense

Investments in parks, resorts and other property were as follows (in millions):

Year Ended

Sept. 28,

2019

Sept. 29,

2018

Media Networks

Cable Networks

$ 93 $ 96

Broadcasting

81 107

Total Media Networks

174 203

Parks, Experiences and Products

Domestic

3,294 3,223

International

852 677

Total Parks, Experiences and Products

4,146 3,900

Studio Entertainment

88 96

Direct-to-Consumer & International

258 107

Corporate

210 159

Total investments in parks, resorts and other property

$ 4,876 $ 4,465

Capital expenditures increased from $4.5 billion to $4.9 billion driven by higher spending on new

attractions at our theme parks and resorts and spending on technology to support our direct-to-consumer

streaming services.

Depreciation expense was as follows (in millions):

Year Ended

Sept. 28,

2019

Sept. 29,

2018

Media Networks

Cable Networks

$ 107 $ 111

Broadcasting

84 88

Total Media Networks

191 199

Parks, Experiences and Products

Domestic

1,474 1,449

International

724 768

Total Parks, Experiences and Products

2,198 2,217

Studio Entertainment

74 55

Direct-to-Consumer & International

207 106

Corporate

167 181

Total depreciation expense

$ 2,837 $ 2,758

NON-GAAP FINANCIAL MEASURES

This earnings release presents free cash flow, diluted EPS excluding the impact of certain items

affecting comparability, and total segment operating income, all of which are important financial measures

for the Company, but are not financial measures defined by GAAP.

10

These measures should be reviewed in conjunction with the relevant GAAP financial measures and

are not presented as alternative measures of operating cash flow, diluted EPS or income from continuing

operations before income taxes as determined in accordance with GAAP. Free cash flow, diluted EPS

excluding certain items affecting comparability and total segment operating income as we have calculated

them may not be comparable to similarly titled measures reported by other companies. See further

discussion of total segment operating income on page 2.

Free cash flow – The Company uses free cash flow (cash provided by operations less investments in

parks, resorts and other property), among other measures, to evaluate the ability of its operations to

generate cash that is available for purposes other than capital expenditures. Management believes that

information about free cash flow provides investors with an important perspective on the cash available to

service debt obligations, make strategic acquisitions and investments and pay dividends or repurchase

shares.

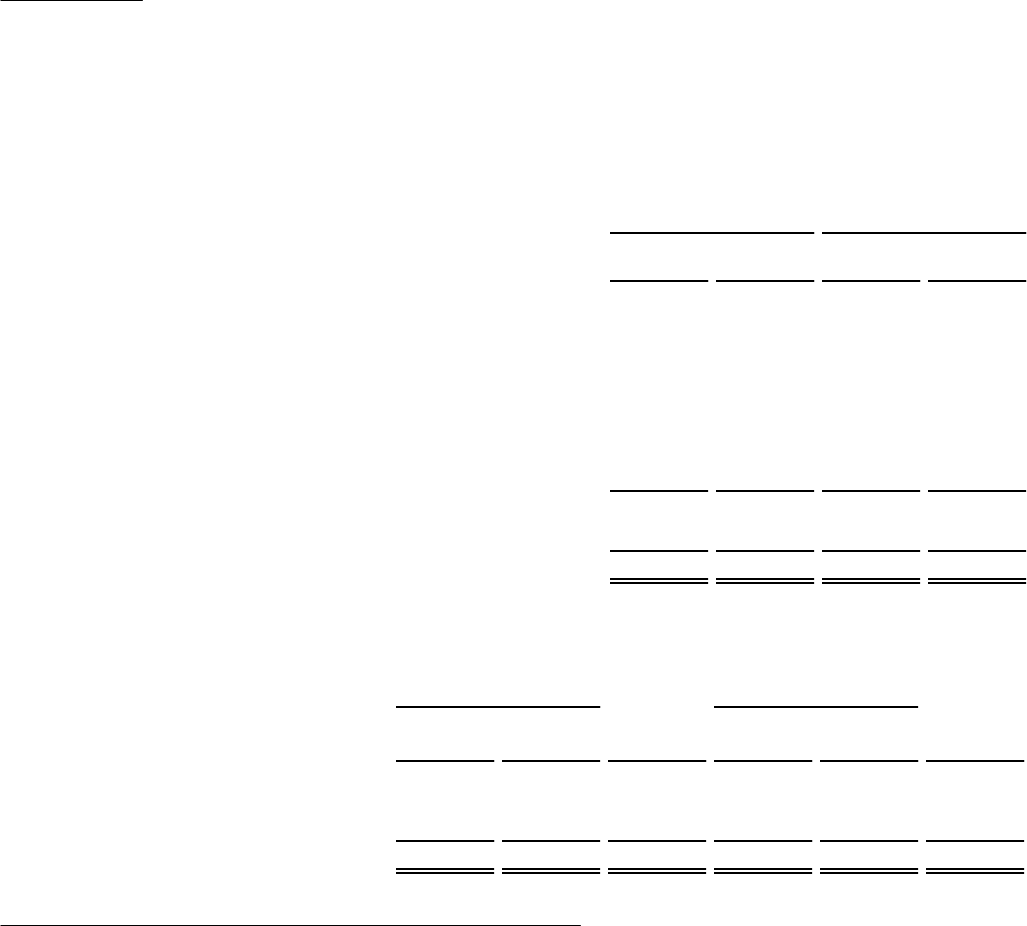

The following table presents a summary of the Company’s consolidated cash flows (in millions):

Quarter Ended Year Ended

Sept. 28,

2019

Sept. 29,

2018

Sept. 28,

2019

Sept. 29,

2018

Cash provided by operations - continuing operations $ 1,718 $ 3,853 $ 5,984 $ 14,295

Cash used in investing activities - continuing operations

(1,311

)

(193

)

(15,096

)

(5,336

)

Cash used in financing activities - continuing operations

(12,997

)

(3,862

)

(464

)

(8,843

)

Cash provided by operations - discontinued operations 302 — 622 —

Cash provided by investing activities - discontinued operations 10,978 — 10,978 —

Cash used in financing activities - discontinued operations

(447

) —

(626

) —

Impact of exchange rates on cash, cash equivalents and restricted cash

(145

) 26

(98

)

(25

)

Change in cash, cash equivalents and restricted cash

(1,902

)

(176

) 1,300 91

Cash, cash equivalents and restricted cash, beginning of period 7,357 4,331 4,155 4,064

Cash, cash equivalents and restricted cash, end of period $ 5,455 $ 4,155 $ 5,455 $ 4,155

The following table presents a reconciliation of the Company’s consolidated cash provided by

operations to free cash flow (in millions):

Quarter Ended Year Ended

Sept. 28,

2019

Sept. 29,

2018 Change

Sept. 28,

2019

Sept. 29,

2018 Change

Cash provided by operations - continuing

operations $ 1,718 $ 3,853 $ (2,135) $ 5,984 $ 14,295 $ (8,311)

Investments in parks, resorts and other property (1,309)

(1,201

) (108)

(4,876

)

(4,465

) (411)

Free cash flow $ 409 $ 2,652 $ (2,243) $ 1,108 $ 9,830 $ (8,722)

Diluted EPS excluding certain items affecting comparability – The Company uses diluted EPS excluding

certain items to evaluate the performance of the Company’s operations exclusive of certain items affecting

comparability of results from period to period. The Company believes that information about diluted EPS

exclusive of these items is useful to investors, particularly where the impact of the excluded items is

significant in relation to reported earnings, because the measure allows for comparability between periods

of the operating performance of the Company’s business and allows investors to evaluate the impact of

these items separately from the impact of the operations of the business.

11

The following table reconciles reported diluted EPS from continuing operations to diluted EPS

excluding certain items affecting comparability for the fourth quarter:

(in millions except EPS)

Pre-Tax

Income/

Loss

Tax

Benefit/

Expense

(1)

After-Tax

Income/

Loss

(2)

Diluted

EPS

(3)

Change vs.

prior year

period

Quarter Ended September 28, 2019:

As reported $ 1,258 $ (344) $ 914 $ 0.43 (72)%

Exclude:

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and

television costs

(4)

711 (164) 547 0.30

Other income, net

(5)

483 (112) 371 0.21

Restructuring and impairment charges

(6)

314 (73) 241 0.13

Excluding certain items affecting

comparability $ 2,766 $ (693) $ 2,073 $ 1.07 (28)%

Quarter Ended September 29, 2018:

As reported

$ 3,202 $ (783) $ 2,419 $ 1.55

Exclude:

Gain on sale of real estate (507) 134 (373) (0.25)

Impairment of equity investments

(7)

210 (49) 161 0.11

One-time impact from the Tax Act — 100 100 0.06

Restructuring and impairment charges 5 (1) 4 —

Excluding certain items affecting

comparability $ 2,910 $ (599) $ 2,311 $ 1.48

(1)

Tax benefit/expense is determined using the tax rate applicable to the individual item affecting comparability.

(2)

Before noncontrolling interest share.

(3)

Net of noncontrolling interest share, where applicable. Total may not equal the sum of the column due to rounding.

(4)

Intangible asset amortization was $481 million and step-up amortization was $230 million for assets recorded in

connection with the TFCF acquisition and consolidation of Hulu.

(5)

Reflects a charge for the extinguishment of a portion of the debt originally assumed in the TFCF acquisition ($511

million), partially offset by a gain on the deemed settlement of preexisting relationships with TFCF pursuant to our

acquisition accounting ($28 million).

(6)

Primarily severance related to the acquisition and integration of TFCF.

(7)

Reflects impairments of Vice Group Holding, Inc. and Villages Nature ($157 million and $53 million, respectively).

12

The following table reconciles reported diluted EPS from continuing operations to diluted EPS

excluding certain items affecting comparability for the year:

(in millions except EPS)

Pre-Tax

Income/

Loss

Tax

Benefit/

Expense

(1)

After-Tax

Income/

Loss

(2)

Diluted

EPS

(3)

Change vs.

prior year

period

Year Ended September 28, 2019:

As reported $ 13,944 $ (3,031) $ 10,913 $ 6.27 (25)%

Exclude:

Other income, net

(4)

(4,357) 1,002 (3,355) (2.01)

One-time impact from the Tax Act — (34) (34) (0.02)

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and

television costs

(5)

1,595 (355) 1,240 0.74

Restructuring and impairment charges

(6)

1,183 (273) 910 0.55

Impairment of equity investments

(7)

538 (123) 415 0.25

Excluding certain items affecting

comparability $ 12,903 $ (2,814) $ 10,089 $ 5.77 (19)%

Year Ended September 29, 2018:

As reported $ 14,729 $ (1,663) $ 13,066 $ 8.36

Exclude:

One-time impact from the Tax Act — (1,701) (1,701) (1.11)

Other income, net

(4)

(601) 158 (443) (0.30)

Impairment of equity investments

(7)

210 (49) 161 0.11

Restructuring and impairment charges 33 (7) 26 0.02

Excluding certain items affecting

comparability $ 14,371 $ (3,262) $ 11,109 $ 7.08

(1)

Tax benefit/expense is determined using the tax rate applicable to the individual item affecting comparability.

(2)

Before noncontrolling interest share.

(3)

Net of noncontrolling interest share, where applicable. Total may not equal the sum of the column due to rounding.

(4)

Other income, net for fiscal 2019 includes a non-cash gain recognized in connection with the acquisition of a controlling

interest in Hulu ($4.8 billion), insurance recoveries on a legal matter ($46 million) and a gain on the deemed settlement of

preexisting relationships with TFCF pursuant to acquisition accounting guidance ($28 million), partially offset by a charge

for the extinguishment of a portion of the debt originally assumed in the TFCF acquisition ($511 million). Other income

for fiscal 2018 included gains from the sale of real estate and property rights ($560 million), insurance proceeds related to

a legal matter ($38 million) and an adjustment to a fiscal 2017 non-cash gain ($3 million).

(5)

Intangible asset amortization was $1,043 million, step-up amortization was $537 million and amortization of intangible

assets related to TFCF equity investees was $15 million for assets recorded in connection with the TFCF acquisition and

consolidation of Hulu.

(6)

Reflects severance and accelerated equity-based compensation charges related to the acquisition and integration of TFCF.

(7)

Impairment of equity investments for fiscal 2019 primarily reflects impairments of Vice Group Holding, Inc. and of an

investment in a cable channel at A+E Television Networks ($353 million and $170 million, respectively). Impairment of

equity investments for fiscal 2018 reflects impairments of Vice Group Holding, Inc. and Villages Nature ($157 million and

$53 million, respectively).

CONFERENCE CALL INFORMATION

In conjunction with this release, The Walt Disney Company will host a conference call today,

November 7, 2019, at 4:30 PM EST/1:30 PM PST via a live Webcast. To access the Webcast go to

www.disney.com/investors. The discussion will be archived.

13

FORWARD-LOOKING STATEMENTS

Management believes certain statements in this earnings release may constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including

statements such as expectations regarding our products and services and other statements that are not

historical in nature. These statements are made on the basis of management’s views and assumptions

regarding future events and business performance as of the time the statements are made. Management

does not undertake any obligation to update these statements.

Actual results may differ materially from those expressed or implied. Such differences may result

from actions taken by the Company, including restructuring or strategic initiatives (including capital

investments, asset acquisitions or dispositions, integration initiatives and timing of synergy realization) or

other business decisions, as well as from developments beyond the Company’s control, including:

• changes in domestic and global economic conditions, competitive conditions and consumer

preferences;

• adverse weather conditions or natural disasters;

• health concerns;

• international, regulatory, political, or military developments;

• technological developments; and

• labor markets and activities.

Such developments may affect entertainment, travel and leisure businesses generally and may,

among other things, affect:

• the performance of the Company’s theatrical and home entertainment releases;

• the advertising market for broadcast and cable television programming;

• demand for our products and services;

• construction;

• expenses of providing medical and pension benefits;

• income tax expense;

• performance of some or all company businesses either directly or through their impact on those

who distribute our products; and

• achievement of anticipated benefits of the TFCF transaction.

Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended

September 29, 2018 under Item 1A, “Risk Factors,” Item 7, “Management’s Discussion and Analysis,”

Item 1, “Business,” and subsequent reports.

14

THE WALT DISNEY COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(unaudited; in millions, except per share data)

Quarter Ended Year Ended

September 28,

2019

September 29,

2018

September 28,

2019

September 29,

2018

Revenues $ 19,100 $ 14,306 $ 69,570 $ 59,434

Costs and expenses (16,815) (11,223) (57,719) (44,597)

Restructuring and impairment charges (314) (5) (1,183) (33)

Other income (expense), net (483) 507 4,357 601

Interest expense, net (361) (159) (978) (574)

Equity in the income (loss) of investees, net 131 (224) (103) (102)

Income from continuing operations before income taxes 1,258 3,202 13,944 14,729

Income taxes from continuing operations (344) (783) (3,031) (1,663)

Net income from continuing operations 914 2,419 10,913 13,066

Income from discontinued operations (includes income tax benefit of

$51, $0 and $0, respectively)

291 — 671 —

Net income 1,205 2,419 11,584 13,066

Less: Net income from continuing operations attributable to

noncontrolling and redeemable noncontrolling interests

(129) (97) (472) (468)

Less: Net income from discontinued operations attributable to

noncontrolling interests

(22) — (58) —

Net income attributable to The Walt Disney Company (Disney) $ 1,054 $ 2,322 $ 11,054 $ 12,598

Earnings per share attributable to Disney:

Continuing operations $ 0.43 $ 1.55 $ 6.27 $ 8.36

Discontinued operations 0.15 — 0.37 —

Diluted

(1)

$ 0.58 $ 1.55 $ 6.64 $ 8.36

Continuing operations $ 0.44 $ 1.56 $ 6.30 $ 8.40

Discontinued operations $ 0.15 $ — $ 0.37 $ —

Basic

(1)

$ 0.58 $ 1.56 $ 6.68 $ 8.40

Weighted average number of common and common equivalent shares

outstanding:

Diluted 1,816 1,497 1,666 1,507

Basic 1,804 1,489 1,656 1,499

(1)

Total may not equal the sum of the column due to rounding.

15

THE WALT DISNEY COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited; in millions, except per share data)

September 28,

2019

September 29,

2018

ASSETS

Current assets

Cash and cash equivalents

$ 5,418 $ 4,150

Receivables

15,481 9,334

Inventories

1,649 1,392

Television costs and advances

4,597 1,314

Other current assets

979 635

Total current assets

28,124 16,825

Film and television costs

22,810 7,888

Investments

3,224 2,899

Parks, resorts and other property

Attractions, buildings and equipment

58,589 55,238

Accumulated depreciation

(32,415) (30,764)

26,174 24,474

Projects in progress

4,264 3,942

Land

1,165 1,124

31,603 29,540

Intangible assets, net

23,215 6,812

Goodwill

80,293 31,269

Other assets

4,715 3,365

Total assets

$ 193,984 $ 98,598

LIABILITIES AND EQUITY

Current liabilities

Accounts payable and other accrued liabilities

$ 17,942 $ 9,479

Current portion of borrowings

8,857 3,790

Deferred revenue and other

4,722 4,591

Total current liabilities

31,521 17,860

Borrowings

38,129 17,084

Deferred income taxes

7,902 3,109

Other long-term liabilities

13,580 6,590

Commitments and contingencies

Redeemable noncontrolling interests

8,963 1,123

Equity

Preferred stock

— —

Common stock, $.01 par value, Authorized – 4.6 billion shares, Issued – 1.8 billion shares at

September 28, 2019 and 2.9 billion shares at September 29, 2018

53,907 36,779

Retained earnings

42,494 82,679

Accumulated other comprehensive loss

(6,617) (3,097)

Treasury stock, at cost, 19 million shares at September 28, 2019 and 1.4 billion shares at September 29, 2018

(907) (67,588)

Total Disney Shareholders’ equity

88,877 48,773

Noncontrolling interests

5,012 4,059

Total equity

93,889 52,832

Total liabilities and equity

$ 193,984 $ 98,598

16

THE WALT DISNEY COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited; in millions)

Year Ended

September 28,

2019

September 29,

2018

OPERATING ACTIVITIES

Net income from continuing operations

$ 10,913 $ 13,066

Depreciation and amortization

4,160 3,011

Gain on acquisitions and dispositions

(4,794) (560)

Deferred income taxes

117 (1,573)

Equity in the (income) / loss of investees

103 102

Cash distributions received from equity investees

754 775

Net change in film and television costs and advances

(542) (523)

Equity-based compensation

711 393

Other

206 441

Changes in operating assets and liabilities, net of business acquisitions:

Receivables

55 (720)

Inventories

(223) (17)

Other assets

932 (927)

Accounts payable and other accrued liabilities

191 235

Income taxes

(6,599) 592

Cash provided by operations - continuing operations

5,984 14,295

INVESTING ACTIVITIES

Investments in parks, resorts and other property

(4,876) (4,465)

Acquisitions

(9,901) (1,581)

Other

(319) 710

Cash used in investing activities - continuing operations

(15,096) (5,336)

FINANCING ACTIVITIES

Commercial paper borrowings/(payments), net

4,318 (1,768)

Borrowings

38,240 1,056

Reduction of borrowings

(38,881) (1,871)

Dividends

(2,895) (2,515)

Repurchases of common stock

— (3,577)

Proceeds from exercise of stock options

318 210

Contributions from / sales of noncontrolling interests

737 399

Acquisition of noncontrolling and redeemable noncontrolling interests

(1,430) —

Other

(871) (777)

Cash used in financing activities - continuing operations

(464) (8,843)

CASH FLOWS FROM DISCONTINUED OPERATIONS

Cash provided by operations - discontinued operations

622 —

Cash provided by investing activities - discontinued operations

10,978 —

Cash used in financing activities - discontinued operations

(626) —

Cash used in discontinued operations

10,974 —

Impact of exchange rates on cash, cash equivalents and restricted cash

(98) (25)

Change in cash, cash equivalents and restricted cash

1,300 91

Cash, cash equivalents and restricted cash, beginning of year

4,155 4,064

Cash, cash equivalents and restricted cash, end of year

$ 5,455 $ 4,155

17

Contacts:

Zenia Mucha

Corporate Communications

818-560-5300

Lowell Singer

Investor Relations

818-560-6601