Interim Report

Q2 2023|January–June 2023

39 909

Total sales, MSEK

6.6%

Operating margin

2.05

Earnings per share, SEK

April–June

2023

• Total sales MSEK 39 909 (30 535)

• Organic sales growth 11 percent (6)

• Operating income before amortization MSEK 2 620 (1 760)

• Operating margin 6.6 percent (5.8)

• Items affecting comparability (IAC) MSEK –311 (–226),

relating to the previously announced transformation

programs and the acquisition of STANLEY Security

• Earnings per share before and after dilution SEK 2.05

(2.32)*

• Earnings per share before and after dilution, before IAC,

SEK 2.46 (2.77)*

• Cash flow from operating activities 46 percent (53)

CONTENTS

Comments from the President and CEO

January–June summary

Group development

Development in the Group’s business segments

Cash flow

Capital employed and financing

Acquisitions and divestitures

Other significant events

Risks and uncertainties

Parent Company operations

Signatures of the Board of Directors

Review report

Consolidated financial statements

Segment overview

Notes

Parent Company

Financial information

* Number of shares outstanding has been adjusted for the rights issue completed on October 11, 2022.

For further information refer to Data per share on page 21.

** Includes STANLEY Security’s 12 months adjusted estimated EBITDA.

JANUARY–JUNE 2023

• Total sales MSEK 77 660 (59 133)

• Organic sales growth 11 percent (5)

• Operating income before

amortization MSEK 4 800 (3 212)

• Operating margin 6.2 percent (5.4)

• Items affecting comparability (IAC)

MSEK –592 (–360), relating to the

previously announced transform-

ation programs and the acquisition

ofSTANLEY Security

• Earnings per share before and after

dilution SEK 3.71 (4.24)*

• Earnings per share before and after

dilution, before IAC, SEK 4.49 (4.91)*

• Reported net debt/EBITDA 3.7 (2.2),

adjusted net debt/EBITDA 3.7**

• Cash flow from operating activities

29percent (25)

2Securitas ABInterim ReportQ2 2023|January–June 2023

“Strong margin development

inNorthAmerica and Europe”

Comments from

thePresident and CEO

In a period of global macroeconomic

uncertainty, we delivered yet another

strong quarter with 11 percent (6)

organic sales growth and an oper-

ating margin of 6.6 percent (5.8). We

recorded 12 percent real sales growth

in our technology and solutions busi-

ness, excluding STANLEY Security,

demonstrating that we are on the right

track. Overall, organic sales growth

in the Group continued to be driven

primarily by price increases, although

volume growth was good within tech-

nology and solutions and inthe airport

security business.

The operating margin improved to

6.6percent (5.8), driven by North

America and Europe with the contri-

bution from the STANLEY Security

acquisition and related cost benefits,

together with strong growth and margin

development in our technology and

solutions business.

Our integration and value creation

processes with STANLEY Security are

progressing according to plan. We

have realized substantial cost benefits

in our Technology business primarily

in North America, and expect further

benefits over the coming quarters.

Wesee significant client interest in our

strengthened offering and have mate-

rial commercial synergy opportunities

in our sales pipeline.

Within our security services business

we maintain sharp focus on quality

and actively managing contracts with

lower profitability. These efforts are

progressing well throughout the Group,

and especially in Europe the profit-

ability improved as a result. In Europe,

we saw strong margin development,

also compared to the first quarter of

2023, as start-up costs in the airport

security business were reduced and

cost control improved. Furthermore,

wewere on par with price increases

andwage costs in the Group in the first

halfyear.

During the summer we were glad to

announce that we have extended and

expanded our global secur ity services

contract and partnership with a leading

global technology company.

The Group’s operating cash flow was

46 percent (53) of the operating result

in the second quarter. Thefirst half

year is normally weaker from a season-

ality perspective, and we continue to

have a high cash flow focus across the

business to ensure a healthy full-year

outcome.

TRANSFORMING IN LINE WITH

OURSTRATEGY

Leadership in technology and solutions

as well as in digital capabilities are

core to the execution of our strategy.

With STANLEY Security we are number

two in the global security technology

market and the combined solutions

offering is truly unique. The transform-

ation programs we have implemented

in North America and are implementing

in Europe and Ibero-America funda-

mentally shift our digital capabilities

as a company, digitalizing our clients,

people, operational and financial

processes end-to-end.

A central part of the transformation

program in Europe is the creation of

aspecial ized solutions organization

that is now in place, delivering solutions

sales and profit growth. As communi-

cated earlier, we have decided to delay

parts of the program that relate to

systems integration with the STANLEY

integration to maximize cost efficiency

and benefits. We expect to conclude

these activities during 2024.

On July 25, we divested our entire

oper ation in Argentina due to the

weak macro economic prospects and

challenging business environment in

combination with a limited opportunity

to execute our long-term strategy with

healthy financial performance. As part

of our strategy we continue to assess

our business mix and presence to

further sharpen our performance and

position as the leading security solu-

tions and technology company.

We are executing according to plan

while at the same time going through

a period of extensive transformation –

with modernization and digitalization of

our business, integration of STANLEY

Security and further sharpening the

business. We still have a lot of work

ahead of us but with our new capabil-

ities, we are very well positioned to

deliver superior value as the new

Securitas.

Magnus Ahlqvist

President and CEO

3Securitas ABInterim ReportQ2 2023|January–June 2023

January–June summary

ACQUISITION OF STANLEY SECURITY

The acquisition of STANLEY Security

has a significant impact on Securitas’

reporting that should be considered

when reading this report.

STANLEY Security was consolidated as

of July 22, 2022, and is consequently in-

cluded in the first half year 2023 income

statement. There are no income items

relating to STANLEY Security in the

first half year com para tives except for

transaction costs incurred by the Group

prior to the date of acqui sition. In the

January–December 2022 income state-

ment STANLEY Security is included

from the date of consolidation.

STANLEY Security is according to

Securitas’ definition of organic sales

growth excluded from the calcu lation of

this key ratio during the first 12 months

from July 22, 2022. When organic

sales growth for STANLEY Security

is referred to, this is an estimate of

how the acquired business is growing

organically but this contri bution is

excluded from Securitas’ organic sales

growth. Real sales growth includes the

contribution from STANLEY Security

as acquired sales are included in the

determination of this key ratio.

In the balance sheet STANLEY Security

is included as of June 30, 2023, but not

in the first half year 2022 comparative.

STANLEY Security is included in the

balance sheet as of December 31, 2022.

STANLEY Security is included in the

operating and free cash flow in thefirst

half year 2023, but not in the first half

year 2022 comparative. In the full year

2022 operating and free cash flow

thecontribution from STANLEY Security

is attributable to the period July 22 to

December 31, 2022.

In our segment reporting STANLEY

Security is included in Securitas North

America and Securitas Europe.

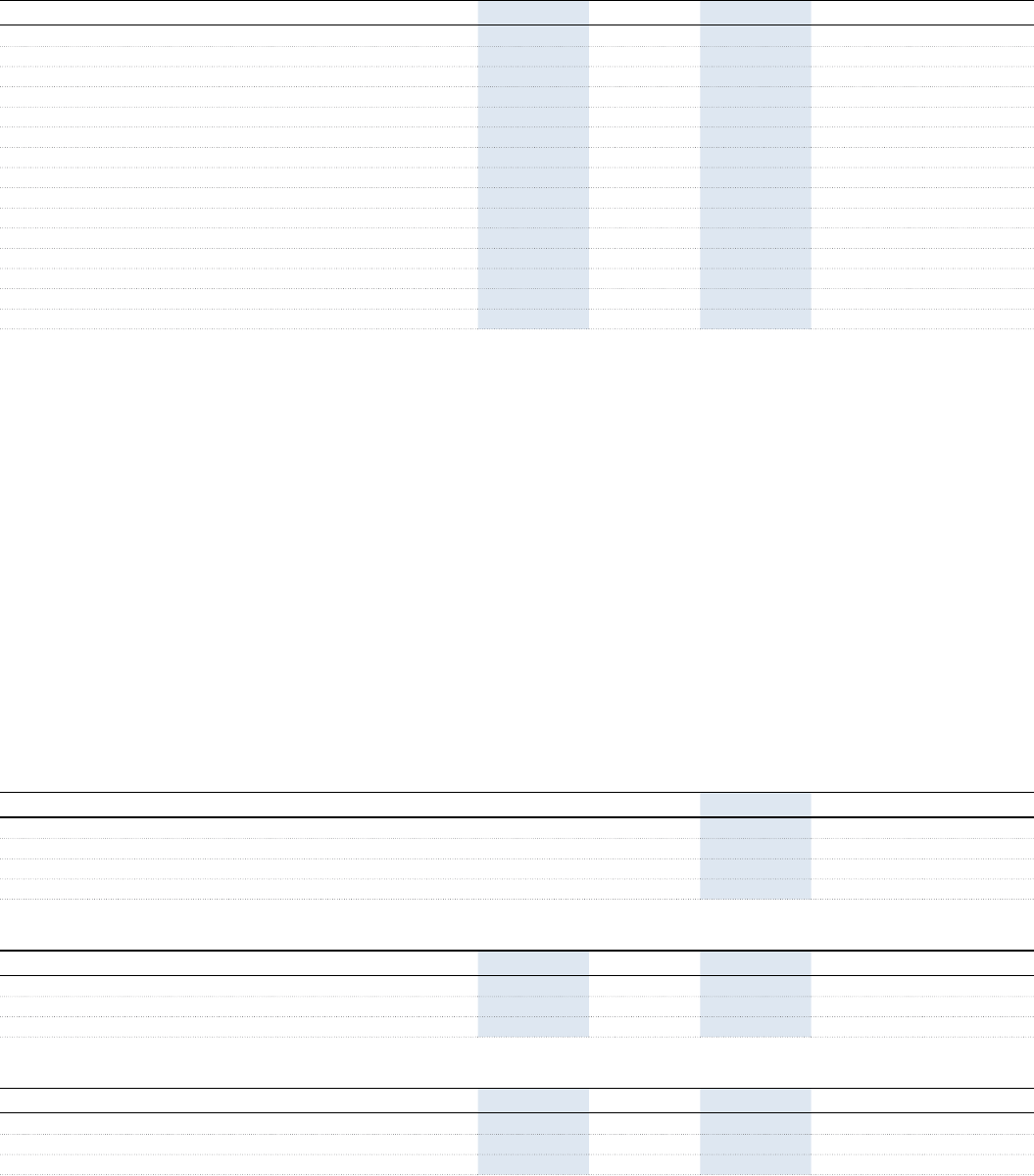

FINANCIAL SUMMARY

MSEK

Q2 Change, % H1 Change, % Full year Change, %

2023 2022 Total Real 2023 2022 Total Real 2022 Total

Sales

Organic sales growth, % 11 6 11 5 7

Operating income before

amortization

Operating margin, % 6.6 5.8 6.2 5.4 6.0

Amortization of acquisition-

related intangible assets – – – – –

Acquisition-related costs – – – – –

Items affecting comparability

1)

– – – – –

Operating income after

amortization

Financial income and expenses – – – – –

Income before taxes

Net income for the period

Earnings per share, SEK

2)

. . – – . . – – .

Earnings per share, before items

affecting comparability, SEK

2)

. . – – . . – – .

Cash flow from operating

activities, % 46 53 29 25 71

Free cash flow – –

Net debt to EBITDA ratio – – 3.7 2.2 4.0

1)

Refer to note 7 on page 28 for further information.

2)

Number of shares outstanding has been adjusted for the rights issue completed on October 11, 2022. For further information refer to Data per share on page 21.

4Securitas ABInterim ReportQ2 2023|January–June 2023

ORGANIC SALES GROWTH AND OPERATING MARGIN DEVELOPMENT PER BUSINESS SEGMENT*

%

Organic sales growth Operating margin

Q2 H1 Q2 H1

2023 2022 2023 2022 2023 2022 2023 2022

Securitas North America – – . . . .

Securitas Europe . . . .

Securitas Ibero-America . . . .

Group . . . .

* The business segments have been renamed as of May 3, 2023.

FINANCIAL SUMMARY PER BUSINESS LINE

Business line

Sales,

MSEK

Real sales growth,

%

Operating income

before amort iza tion,

MSEK

Operating margin,

% % of Group sales

% of Group

operating income

before amortization

Q2 2023 H1 2023 Q2 2023 H1 2023 Q2 2023 H1 2023 Q2 2023 H1 2023 Q2 2023 H1 2023 Q2 2023 H1 2023

Security services . .

Technology and

solutions * * . .

Risk management

services and costs

for Group functions – – – – – – – –

Group . .

*

Excluding STANLEY Security real sales growth was 12 percent in the second quarter and 12 percent for the first half year.

For further information regarding the revenue from the Group’s business lines, refer to note 3.

5Securitas ABInterim ReportQ2 2023|January–June 2023 January–June summary

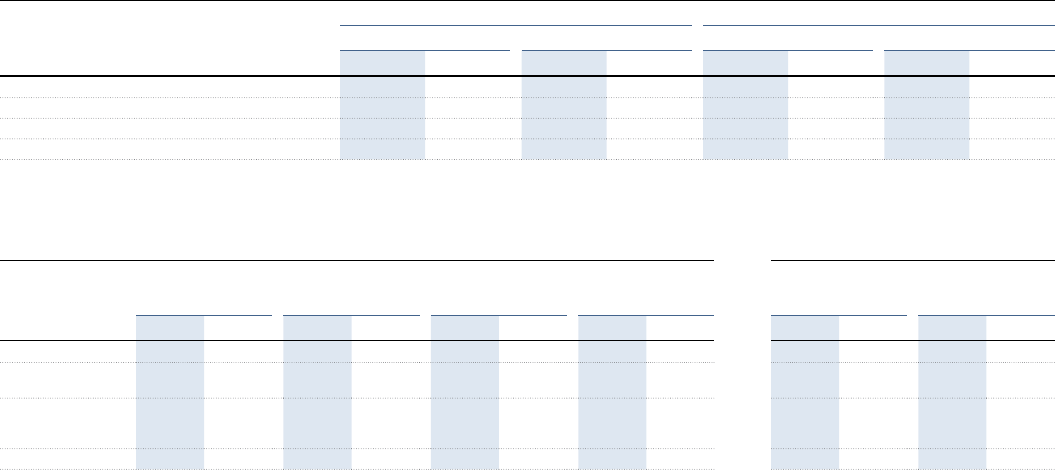

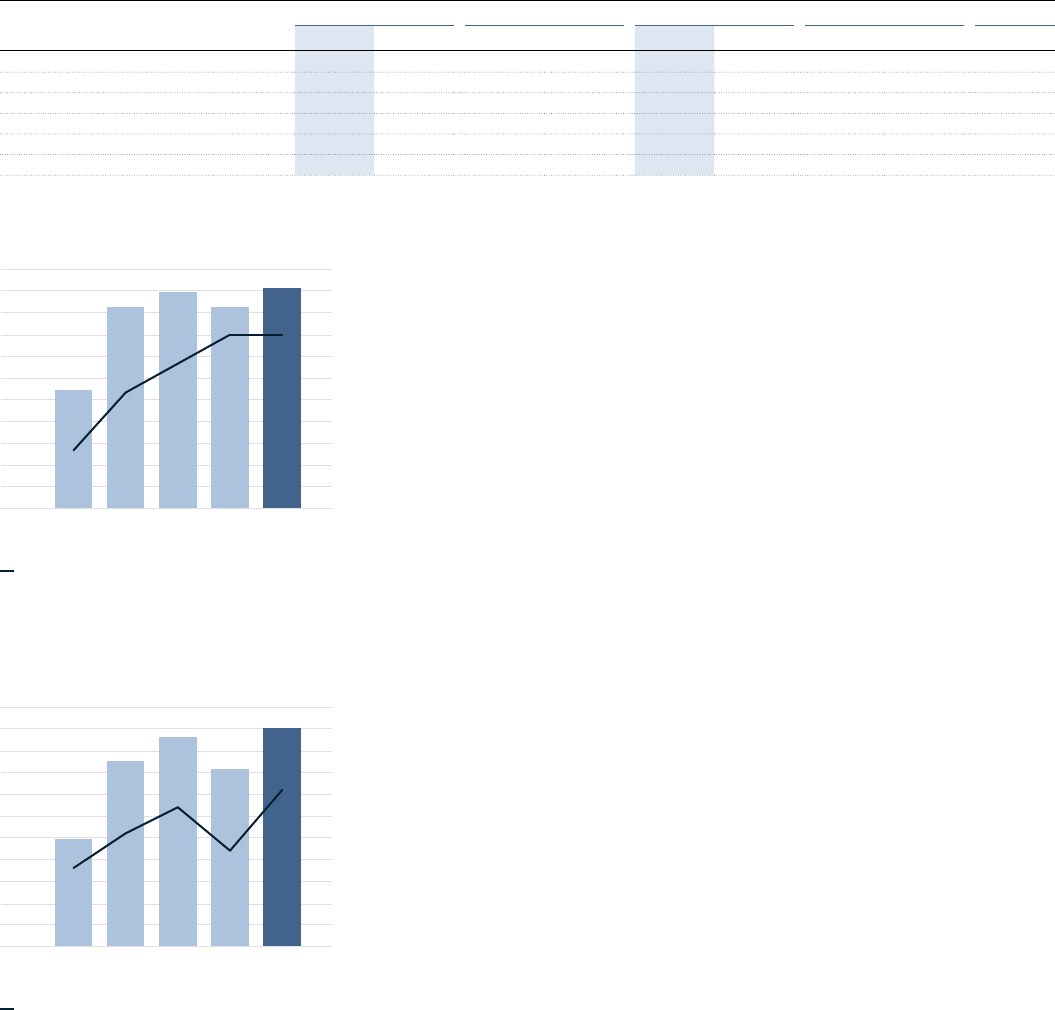

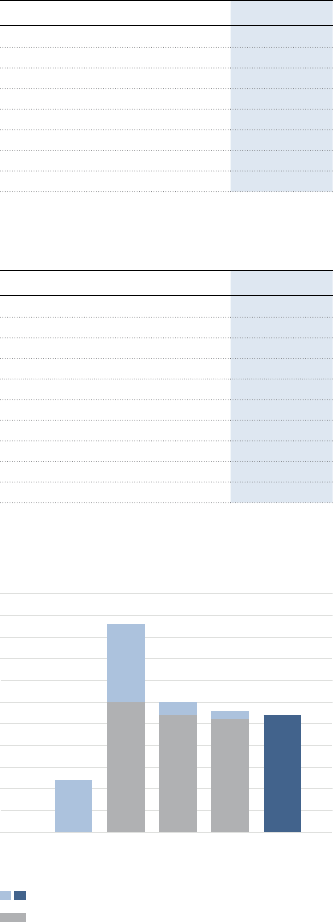

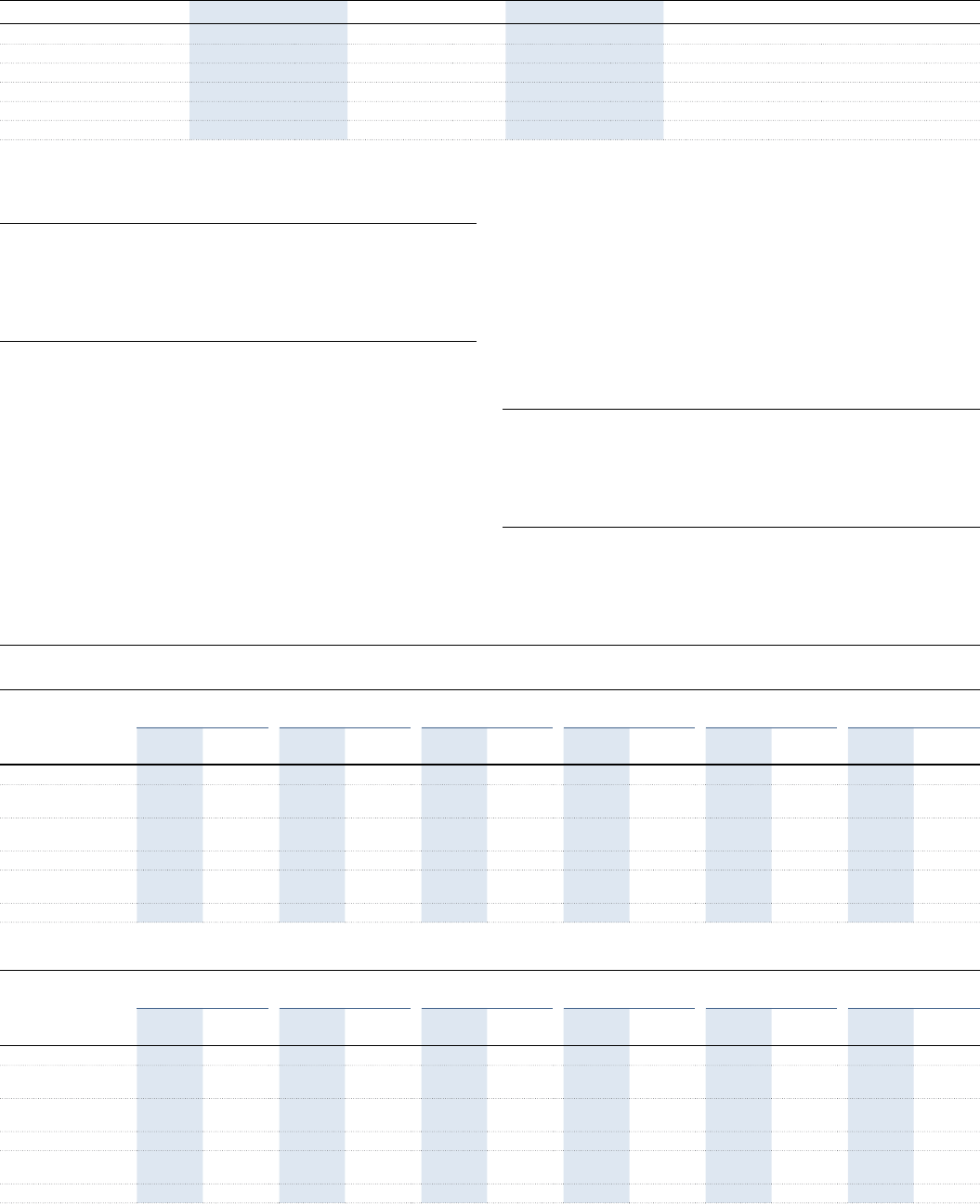

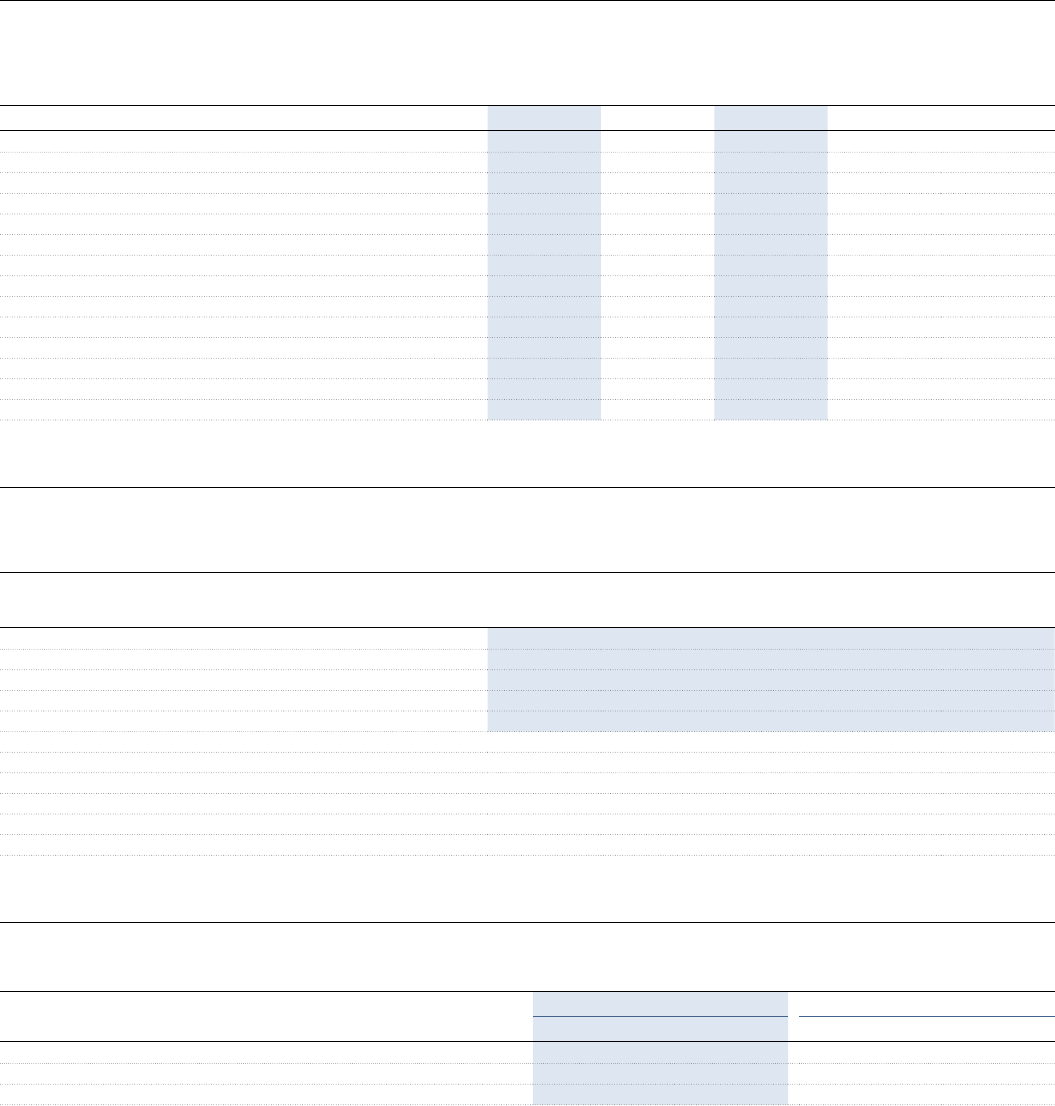

Organic sales growth, %

QUARTERLY SALES DEVELOPMENT

20 000

24 000

28 000

32 000

36 000

40 000

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

M

SEK

30 535

36 013

38 091

37 751

39 9 0 9

–2

2

6

10

14

18

%

Operating margin, %

QUARTERLY OPERATING INCOME

DEVELOPMENT

1 000

1 3 0 0

1 6 0 0

1 9 0 0

2 20 0

2 5 0 0

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

M

SEK

1760

2330

2491

2180

2 62 0

5.0

5.5

6.0

6.5

7.0

7.5

%

Group development

APRIL–JUNE 2023

SALES DEVELOPMENT

Sales amounted to MSEK 39 909

(30535) and organic sales growth to

11percent (6).

Securitas North America had 7 percent

(–1) organic sales growth driven by

the Guarding business unit. Securitas

Europe showed 13 percent (9), with

strong price increases across the busi-

ness and good growth within the air-

port security business and technology

and solutions. Securitas Ibero-America

reported 24 percent (17), driven by

price increases in the hyperinflationary

environment in Argentina. Extra sales in

the Group amounted to 13 percent (13)

of total sales.

Real sales growth, including acqui-

sitions and adjusted for changes in

exchange rates, was 25 percent (6).

Technology and solutions sales

amounted to MSEK 12 764 (7 095) or

32 percent (23) of total sales in the

quarter. Real sales growth, including

acquisitions and adjusted for changes

in exchange rates, was 73 percent (13)

with the acquired STANLEY Security

as the main contributor. Excluding

STANLEY Security, real sales growth

was 12 percent.

OPERATING INCOME

BEFORE AMORTIZATION

Operating income before amortization

was MSEK 2 620 (1 760) which, adjusted

for changes in exchange rates, repre-

sented a real change of 42 percent (8).

The Group’s operating margin was

6.6percent (5.8), an improvement

mainly driven by Securitas North

America where the business unit

Technology, including the acquired

STANLEY Security, was the main

contributor. The operating margin in

Securitas Europe improved primarily

through growth within technology and

solutions including STANLEY Security

and active portfolio management.

TheSecuritas Ibero-America operating

margin was on par with lastyear.

OPERATING INCOME

AFTER AMORTIZATION

Amortization of acquisition-related in-

tangible assets amounted to MSEK–157

(–61), whereof MSEK –92 (0) related to

the STANLEY Security acquisition.

Acquisition-related costs totaled

MSEK–2 (–15). For further information

refer to Acquisitions and divestitures

onpage 13 and note 6.

Items affecting comparability were

MSEK –311 (–226), whereof MSEK –170

(–57) related to the acquisition of

STANLEY Security and MSEK –141 (–169)

were related to the transformation

programs in Europe and Ibero-America.

For further information refer to note 7.

FINANCIAL INCOME AND EXPENSES

Financial income and expenses

amounted to MSEK –541 (–61), whereof

MSEK –402 (0) related to financing

of the STANLEY Security acquisition.

The impact from IAS 29 hyperinflation

was MSEK 26 (30) relating to the net

monetary gain. For further information

refer to note 8. Financial income and

expense also include foreign currency

gains, net, of MSEK 23 (16). Interest

income and expense excluding the

financing related to STANLEY Security

increased due to increased interest

rates.

INCOME BEFORE TAXES

Income before taxes amounted to

MSEK 1 609 (1 397).

TAXES, NET INCOME AND

EARNINGS PER SHARE

The Group’s tax rate was 26.8 percent

(27.0). The tax rate before tax on

items affecting comparability was

26.5 percent (25.0).

Net income was MSEK 1 178 (1 020).

Earnings per share before and after

dilution amounted to SEK 2.05 (2.32).

Earnings per share before and after

dilution and before items affecting

comparability amounted to SEK2.46

(2.77).

6Securitas ABInterim ReportQ2 2023|January–June 2023

JANUARY–JUNE 2023

SALES DEVELOPMENT

Sales amounted to MSEK 77 660

(59133) and organic sales growth to

11percent (5).

Securitas North America had 7 percent

(–1) organic sales growth driven by

the Guarding business unit. Securitas

Europe showed 13 percent (9), coming

from strong price increases across

the business, good portfolio growth

in the airport security business and

within solutions, and increased instal-

lation sales. Securitas Ibero-America

reported 24 percent (15), driven by

price increases in the hyperinflationary

environment in Argentina. Extra sales in

the Group amounted to 12 percent (13)

of total sales.

Real sales growth, including acqui-

sitions and adjusted for changes in

exchange rates, was 26 percent (5).

Technology and solutions sales

amounted to MSEK 24 785 (13 660) or

32 percent (23) of total sales in the first

half year. Real sales growth, including

acquisitions and adjusted for changes

in exchange rates, was 75 percent (11)

with the acquired STANLEY Security

as the main contributor. Excluding

STANLEY Security, real sales growth

was 12 percent.

OPERATING INCOME

BEFORE AMORTIZATION

Operating income before amortization

was MSEK 4 800 (3 212) which, adjusted

for changes in exchange rates, repre-

sented a real change of 42 percent (8).

The Group’s operating margin was

6.2percent (5.4), an improvement

mainly driven by Securitas North

America where the business unit

Technology, including the acquired

STANLEY Security, was the main

contributor. Theoperating margin in

Securitas Europe improved, supported

by growth within technology and

solutions including STANLEY Security

and active portfolio management.

InSecuritas Ibero-America the oper-

ating margin was on par with last year.

Price increases in the Group were on

par with wage cost increases in thefirst

six months.

OPERATING INCOME

AFTER AMORTIZATION

Amortization of acquisition-related in-

tangible assets amounted to MSEK–311

(–122), whereof MSEK –182 (0) related to

the STANLEY Security acquisition.

Acquisition-related costs totaled

MSEK–3 (–25). For further information

refer to Acquisitions and divestitures

onpage 13 and note 6.

Items affecting comparability were

MSEK –592 (–360), whereof MSEK–285

(–70) related to the acquisition of

STANLEY Security and MSEK –307

(–290) were related to the transform-

ation programs in Europe and Ibero-

America. For further information refer

to note 7.

FINANCIAL INCOME AND EXPENSES

Financial income and expenses

amounted to MSEK –969 (–156),

whereof MSEK –712 (0) related to

financing of the STANLEY Security

acqui sition. The impact from IAS 29

hyper inflation was MSEK 77 (42) relating

to the net monetary gain. For further

information refer to note 8. Financial

income and expense also include

foreign currency gains, net, of MSEK36

(20). Interest income and expense

excluding the financing related to

STANLEY Security increased due to

increased interest rates.

INCOME BEFORE TAXES

Income before taxes amounted to

MSEK 2 925 (2 549).

TAXES, NET INCOME AND

EARNINGS PER SHARE

The Group’s tax rate was 26.8 percent

(27.0). The tax rate before tax on

items affecting comparability was

26.6 percent (25.9).

Net income was MSEK 2 141 (1 861).

Earnings per share before and after

dilution amounted to SEK 3.71 (4.24).

Earnings per share before and after

dilution and before items affecting

comparability amounted to SEK 4.49

(4.91).

7Securitas ABInterim ReportQ2 2023|January–June 2023 Group development

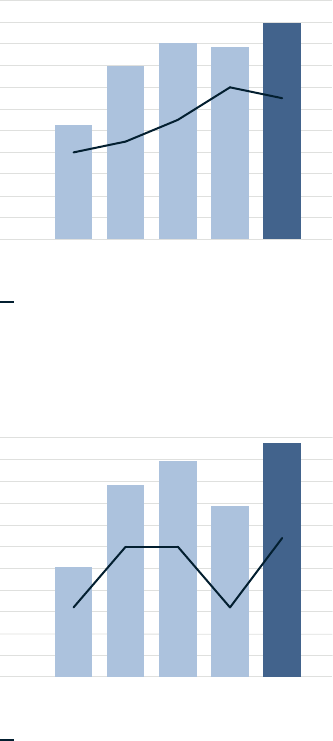

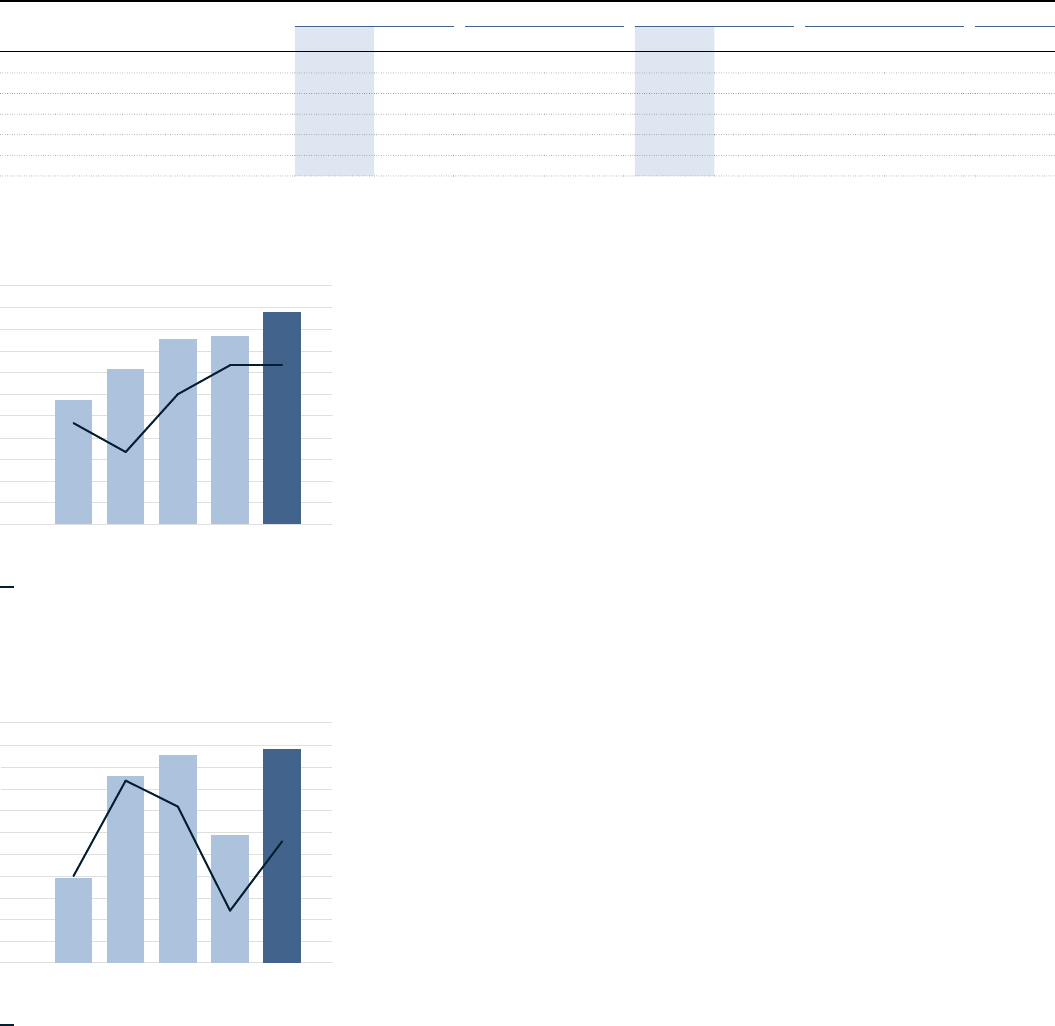

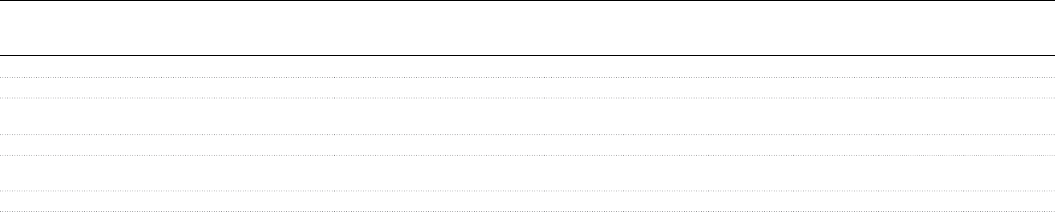

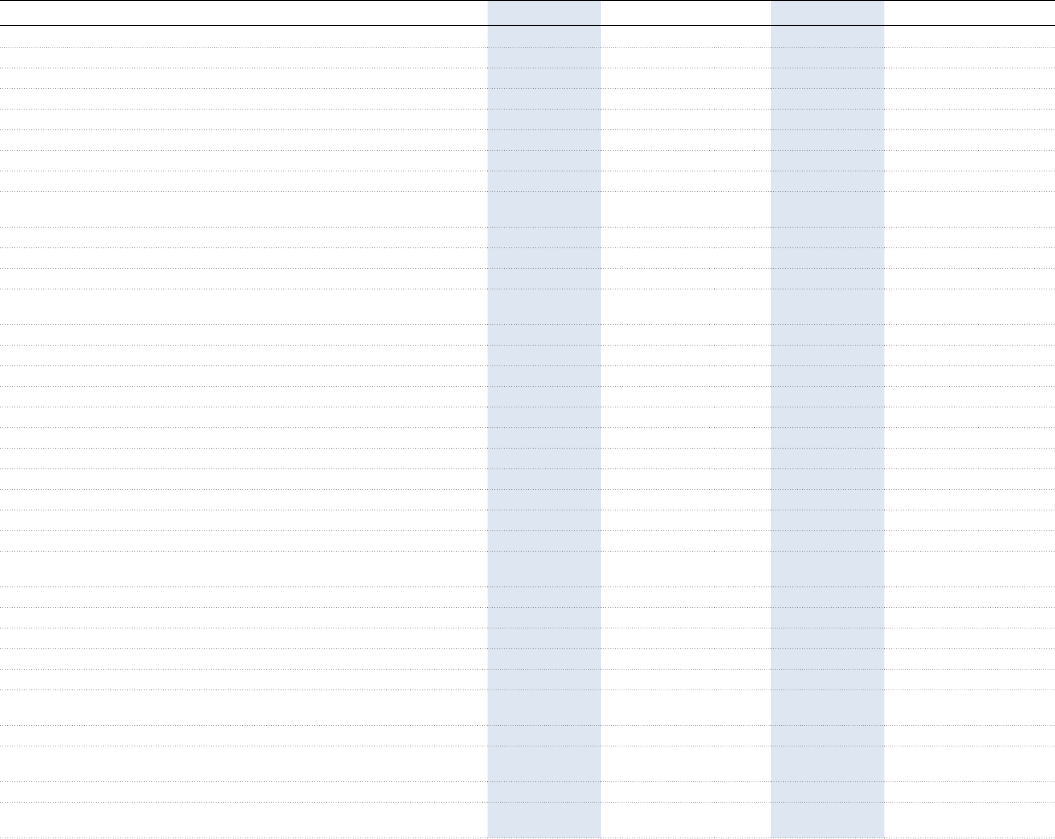

Organic sales growth, %

QUARTERLY SALES DEVELOPMENT

8 000

10 000

12 000

14 000

16 000

18 000

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

13 434

17 281

17 986

17 2 90

1 8 145

M

SEK

–5

–2

1

4

7

10

%

Operating margin, %

QUARTERLY OPERATING INCOME

DEVELOPMENT

500

700

900

1 1 0 0

1 3 0 0

1 5 0 0

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

M

SEK

994

1352

1463

1 3 1 8

1 5 0 4

6.5

7.0

7.5

8.0

8.5

9.0

%

Development in the Group’s

business segments

Securitas North America

Securitas North America provides protective services in the US, Canada and Mexico. The operations

in the US are organized in four specialized units – Guarding, Technology, Pinkerton Corporate Risk

Management and Critical Infrastructure Services. There is a unit for global and national clients as well as

specialized client segment units, such as aviation, healthcare, manufacturing, and oil and gas.

MSEK

Q2 Change, % H1 Change, % Full year

2023 2022 Total Real 2023 2022 Total Real 2022

Total sales

Organic sales growth, % 7 –1 7 –1 1

Share of Group sales, % 45 44 46 44 46

Operating income before amortization

Operating margin, % 8.3 7.4 8.0 6.9 7.5

Share of Group operating income, % 57 56 59 56 57

APRIL–JUNE 2023

Organic sales growth was 7 percent

(–1), primarily from strong growth in the

Guarding business unit driven by price

increases, good portfolio new sales and

a significant global guarding contract

renewed and expanded, as previously

com muni cated. By comparison, the

second quarter last year was hampered

by the termin ation of two significant

security contracts. The Technology

business unit also supported organic

sales growth with improved installation

sales and a continued healthy backlog.

Technology and solutions sales

accounted for MSEK 5 668 (2 586) or

31percent (19) of total sales in the busi-

ness segment, with real sales growth

of 111 percent (10) in the second quar-

ter. The acquired STANLEY Security

business in North America was the

main contributor to real sales growth,

although double-digit real sales growth

within solutions also supported.

The operating margin was 8.3 percent

(7.4), driven by the acquired STANLEY

Security business and strong cost syn-

ergies within the Technology business

unit. The operating margin in Guarding

was stable, supported by active port-

folio manage ment and leverage from

the strong topline growth but burdened

by cost of risk and medical expenses.

The Swedish krona exchange rate

weakened against the US dollar, which

had a positive impact on operating

income in Swedish kronor. Thereal

change was 44 percent (3) in the

second quarter.

JANUARY–JUNE 2023

Organic sales growth was 7 percent (–1),

driven by the business unit Guarding with

support from price increases, good port-

folio new sales and a signifi cant guarding

contract renewed and expanded, as

previously communicated. By com-

parison, the first six months last year

were hampered by the termination of two

significant security contracts. Organic

sales growth was also supported by the

Technology business unit from improved

installation sales and a con tinued healthy

backlog. The client retention rate was

88percent (85).

Technology and solutions sales

accounted for MSEK 11 083 (4 875) or

31 percent (19) of total sales in the busi-

ness segment, with real sales growth

of 118 percent (6) in the first half year.

Theacquired STANLEY Security business

in North America was the main con-

tri bu tor to real sales growth, although

double-digit real sales growth within

solutions also supported.

The operating margin was 8.0 percent

(6.9), driven by the acquired STANLEY

Security business within the business

unit Technology. The operating margin in

Guarding improved supported by active

portfolio management and leverage from

the strong topline growth, and Pinkerton

also improved in the first half year.

The Swedish krona exchange rate

weakened against the US dollar, which

had a positive impact on operating income

in Swedish kronor. The real change was

48 percent (5) in the first halfyear.

8Securitas ABInterim ReportQ2 2023|January–June 2023

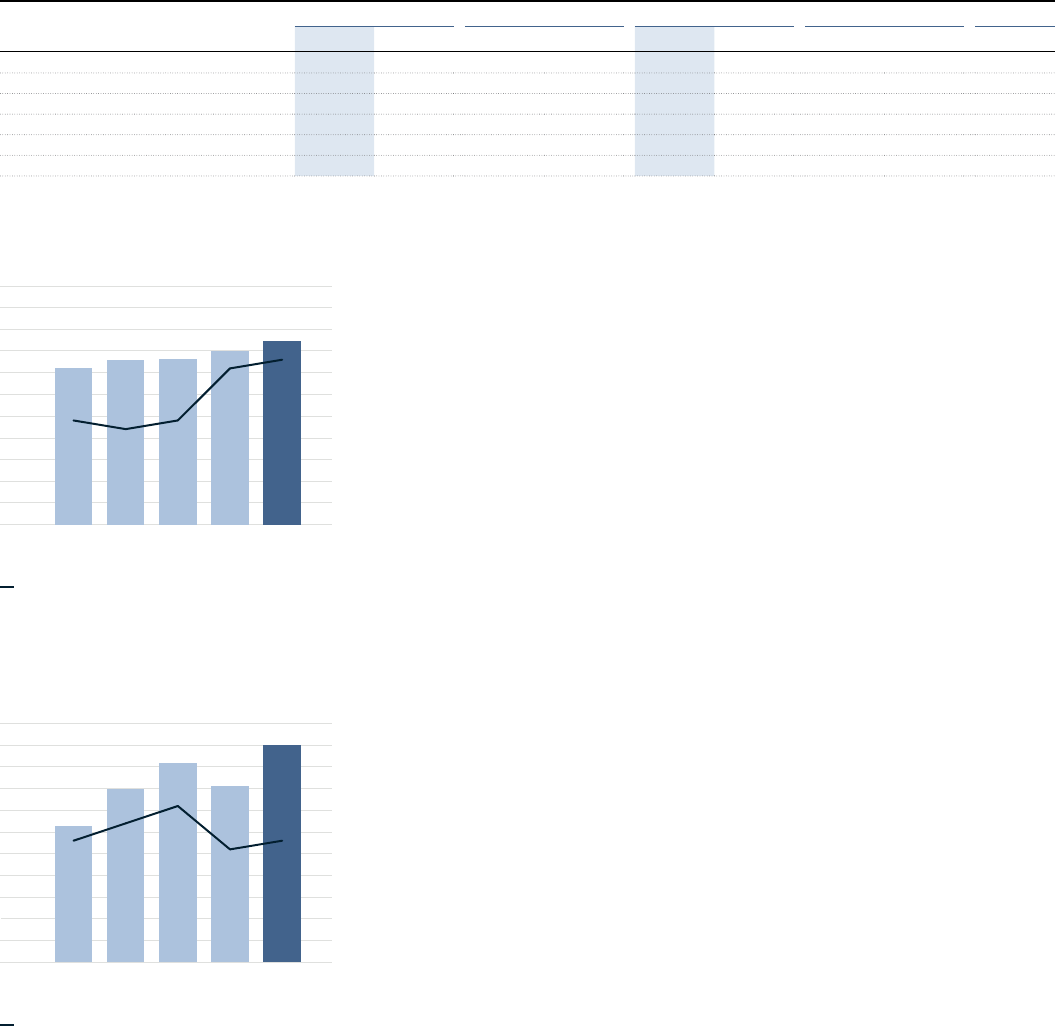

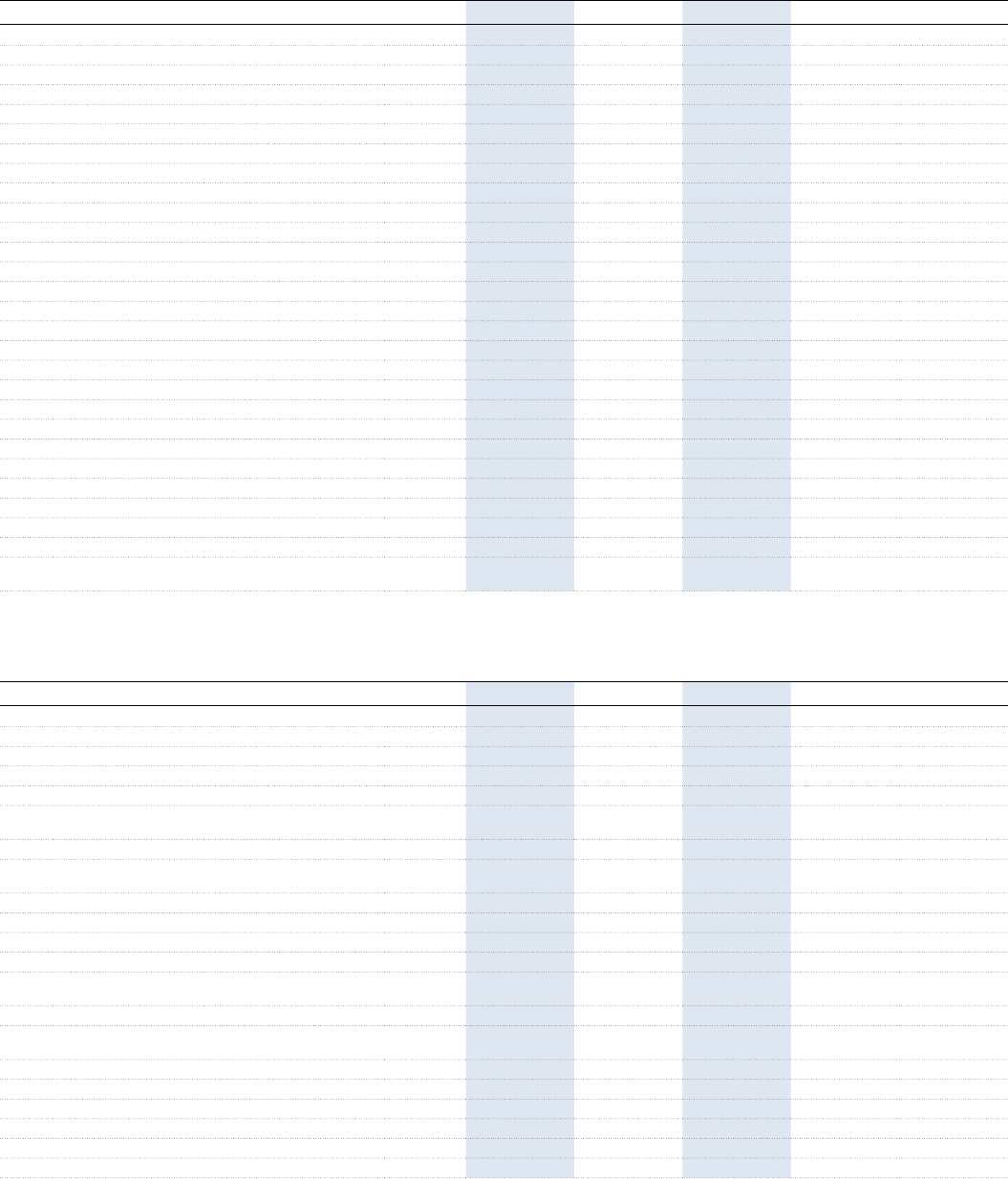

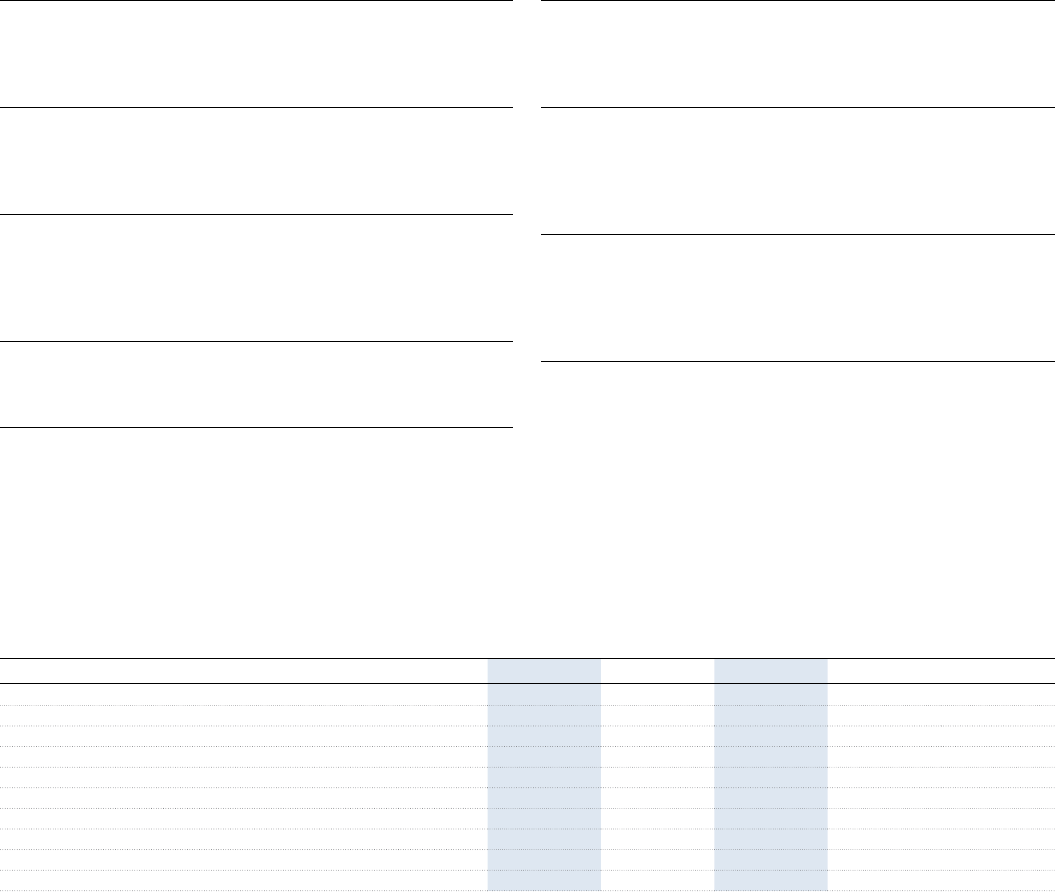

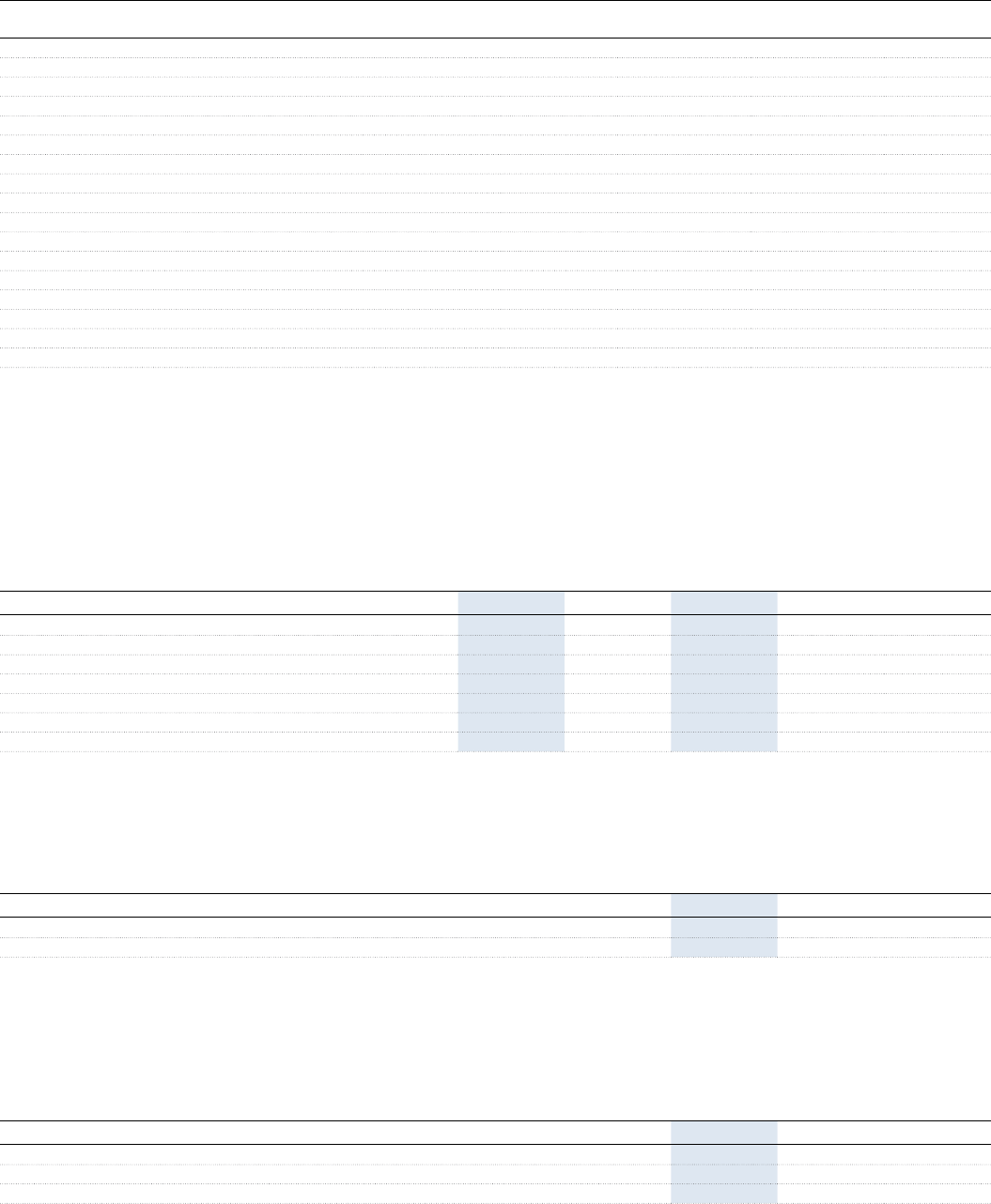

Organic sales growth, %

QUARTERLY SALES DEVELOPMENT

7 000

9 000

11 000

13 000

15 000

17 000

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

12 715

14 152

15 530

1 5 7 04

16 7 8 4

M

SEK

2

5

8

11

14

17

%

Operating margin, %

QUARTERLY OPERATING INCOME

DEVELOPMENT

500

600

700

800

900

1 000

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

M

SEK

695

930

978

794

992

4.5

5.0

5.5

6.0

6.5

7.0

%

Securitas Europe

Securitas Europe provides protective services in 21 countries. The full range of protective services

includes on-site, mobile and remote guarding, technology, fire and safety services and corporate

risk management. In addition, there are three specialized units for global clients, technology and

securitysolutions.

MSEK

Q2 Change, % H1 Change, % Full year

2023 2022 Total Real 2023 2022 Total Real 2022

Total sales

Organic sales growth, % 13 9 13 9 9

Share of Group sales, % 42 42 42 42 41

Operating income before amortization

Operating margin, % 5.9 5.5 5.5 5.2 5.9

Share of Group operating income, % 38 39 37 40 40

APRIL–JUNE 2023

Organic sales growth was 13 percent(9)

in the quarter, driven by strong price

increases, including the impact of

the hyperinflationary environment in

Türkiye. Organic sales growth was

also supported by a positive portfolio

development within the airport security

business and in solutions, as well as

increased installation sales.

Technology and solutions sales

accounted for MSEK 5 610 (3 210) or

33 percent (25) of total sales in the busi-

ness segment, with real sales growth of

68 percent (15) in the second quarter.

The acquired STANLEY Security

business in Europe was the main con -

tribu tor to real sales growth, although

double-digit real sales growth within

solutions also supported.

The operating margin was 5.9 percent

(5.5), an improvement primarily from

growth within technology and solu-

tions, including STANLEY Security

and active portfolio management.

However, increased costs related to

labor shortage, such as higher costs for

subcontracting, continued to hamper

the operating margin.

The Swedish krona exchange rate

weakened primarily against the euro

but was partly offset by the develop-

ment of the Turkish lira, which had

apositive impact on operating income

in Swedish kronor. The real change in

operating income was 37 percent (10)

inthe second quarter.

JANUARY–JUNE 2023

Organic sales growth was 13 percent (9)

in the first six months, driven by strong

price increases, including the impact

of the hyperinflationary environment in

Türkiye. Positive portfolio development

within the airport security business and

in solutions, as well as increased instal-

lation sales, also supported organic

sales growth. The client retention rate

was 90 percent (91).

Technology and solutions sales

accounted for MSEK 10 823 (6 269)

or 33 percent (25) of total sales in the

business segment, with real sales

growth of 68 percent (15) in the first half

year. Theacquired STANLEY Security

business in Europe was the main con-

tributor to real sales growth, although

double-digit real sales growth within

solutions also supported.

The operating margin was 5.5 percent

(5.2), an improvement mainly from

growth within technology and solu-

tions, including STANLEY Security and

active portfolio management. However,

the operating margin was hampered by

start-up costs within theairport secur-

ity business, increased costs related to

labor shortage, such as higher costs for

subcontracting, and negative leverage.

The Swedish krona exchange rate

weakened primarily against the euro

but was partly offset by the develop-

ment of the Turkish lira, which had

apositive impact on operating income

in Swedish kronor. The real change in

operating income was 33 percent (9)

inthe first half year.

9Securitas ABInterim ReportQ2 2023|January–June 2023 Development in the Group’s business segments

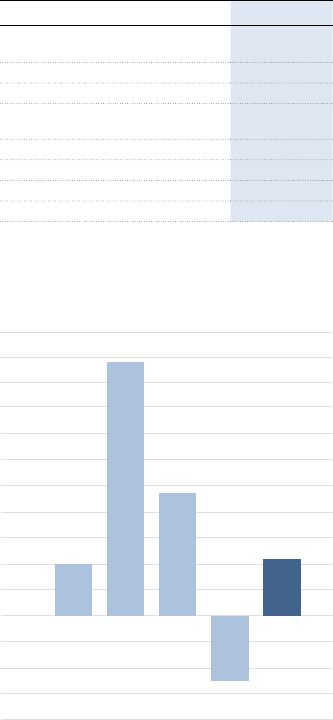

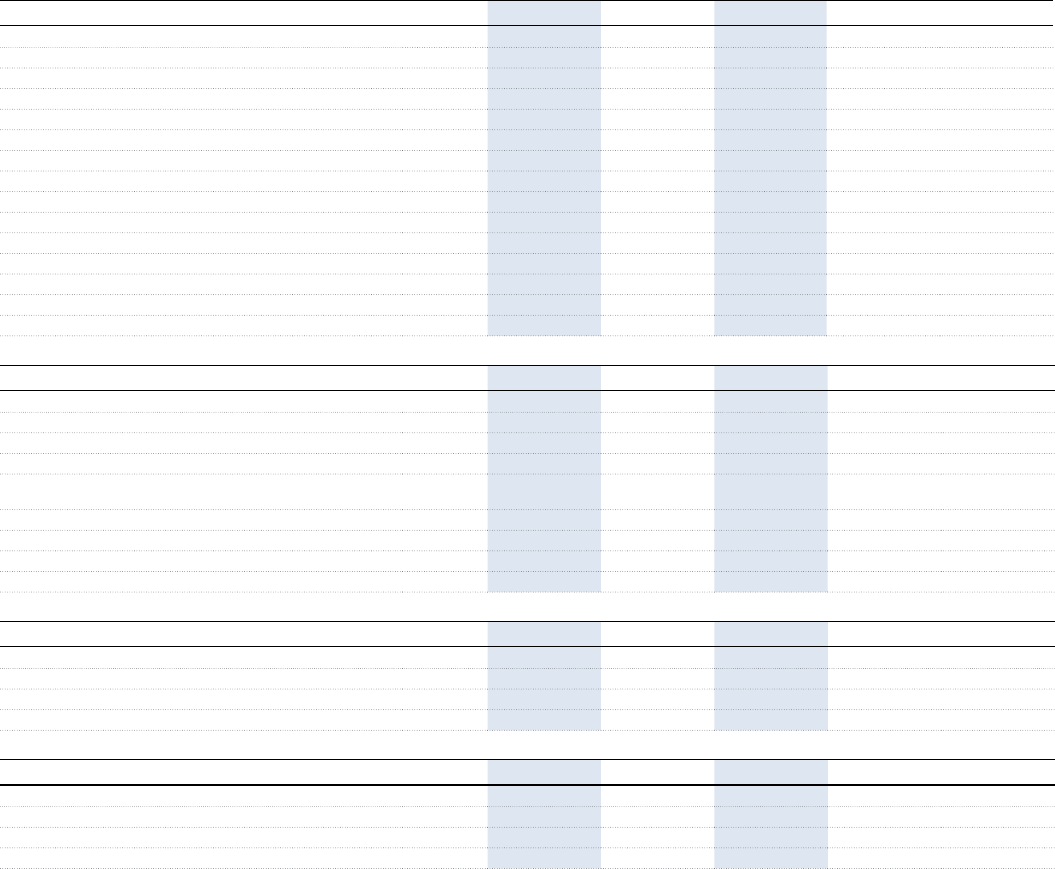

Organic sales growth, %

QUARTERLY SALES DEVELOPMENT

0

1 000

2 000

3 000

4 000

5 000

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

M

SEK

3 609

3 790

3819

4 0 02

4 2 3 3

5

10

15

20

25

30

%

Operating margin, %

QUARTERLY OPERATING INCOME

DEVELOPMENT

150

170

190

210

230

250

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

MSEK

213

230

242

231

250

4.5

5.0

5.5

6.0

6.5

7.0

%

Securitas Ibero-America

Securitas Ibero-America provides protective services in seven Latin American countries as well as

in Portugal and Spain in Europe. The offered services include on-site, mobile and remote guarding,

technology, fire and safety services, and corporate risk management.

MSEK

Q2 Change, % H1 Change, % Full year

2023 2022 Total Real 2023 2022 Total Real 2022

Total sales

Organic sales growth, % 24 17 24 15 16

Share of Group sales, % 11 12 11 12 11

Operating income before amortization

Operating margin, % 5.9 5.9 5.8 5.8 6.0

Share of Group operating income, % 10 12 10 13 11

APRIL–JUNE 2023

Organic sales growth was 24 percent

(17), driven by price increases primarily

in the hyperinflationary environment

in Argentina. Organic sales growth in

Spain was 3 percent (10), supported by

price increases and improved instal-

lation sales, but held back by active

portfolio management and a stronger

comparative figure. In Latin America,

organic sales growth continued on

ahigh level driven by price increases.

Technology and solutions sales

accounted for MSEK 1 305 (1 068) or

31percent (30) of total sales in the busi-

ness segment, with real sales growth of

17 percent (11) in the second quarter.

The operating margin was 5.9 percent

(5.9), supported by higher margin

technology and solutions sales and

portfolio management. Continued

wage pressure in Spain hampered, but

the situation improved compared to

the first quarter of 2023. The operating

margin in Latin America declined com-

pared to last year due to negative port-

folio development in a few countries.

The Swedish krona exchange rate

weakened primarily against the euro,

but was partly offset by the develop-

ment of the Argentinian peso, which

had a positive impact on oper ating

income in Swedish kronor. Thereal

change in the segment was 15percent

(25) in the second quarter.

JANUARY–JUNE 2023

Organic sales growth was 24 percent

(15), driven by price increases mainly

in the hyperinflationary environment

in Argentina. Organic sales growth in

Spain was 5 percent (10), supported by

price increases and improved instal-

lation sales, but held back by active

portfolio management and a stronger

comparative figure. Organic sales

growth continued on a high level in

Latin America driven by price increases.

The client retention rate was 92 percent

(92).

Technology and solutions sales

accounted for MSEK 2 529 (2 078) or

31percent (30) of total sales in the busi-

ness segment, with real sales growth of

17 percent (10) in the first half year.

The operating margin was 5.8 percent

(5.8), supported by higher margin tech-

nology and solutions sales and port-

folio management, but hampered by

wage pressure in Spain. The operating

margin in Latin America declined com-

pared to last year due to negative port-

folio development in a few countries.

The Swedish krona exchange rate

weakened primarily against the euro,

but was partly offset by the develop-

ment of the Argentinian peso, which

had a positive impact on oper ating

income in Swedish kronor. Thereal

change in the segment was 14percent

(24) in the first half year.

10Securitas ABInterim ReportQ2 2023|January–June 2023 Development in the Group’s business segments

QUARTERLY FREE CASH FLOW

–1 000

–500

0

500

1 000

1 5 0 0

2 000

2 5 0 0

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

MSEK

496

542

2438

1 175

–627

FREE CASH FLOW

MSEK Jan–Jun 2023

Operating income before

amortization

Net investments –

Change in accounts receivable –

Change in other operating capital

employed –

Cash flow from operating activities

Financial income and expenses paid –

Current taxes paid –

Free cash flow –

Cash flow

APRIL–JUNE 2023

Cash flow from operating activities

amounted to MSEK 1 199 (927), equiva-

lent to 46 percent (53) of operating

income before amortization.

The impact from changes in accounts

receivable was MSEK –1 283 (–873) and

was negatively impacted by organic

sales growth. Changes in other oper-

ating capital employed were MSEK 86

(191).

Free cash flow was MSEK 542 (496),

equivalent to 33 percent (39) of

adjusted income.

Cash flow from investing activities,

acquisitions and divestitures, was

MSEK–23 (–31). Refer to note 6 for

further information.

Cash flow from items affecting

compar ability amounted to MSEK–344

(–241). Refer to note 7 for further infor-

mation.

Cash flow from financing activities

was MSEK –92 (–646) due to dividend

paid of MSEK –1 003 (–1 604) and a net

increase in borrowings of MSEK 911

(958).

Cash flow for the period was MSEK 83

(–422).

JANUARY–JUNE 2023

Cash flow from operating activities

amounted to MSEK 1 386 (798), equiva-

lent to 29 percent (25) of operating

income before amortization.

The impact from changes in accounts

receivable was MSEK –1 892 (–1 321)

and was negatively impacted by

organic sales growth. Changes in

other oper ating capital employed were

MSEK–1229 (–899).

Financial income and expenses paid

was MSEK –872 (–273) reflecting the

increased interest cost relating mainly

to the acquisition of STANLEY Security.

Current taxes paid was MSEK –599

(–716).

Cash flow from operating activities

includes net investments in non-current

tangible and intangible assets, amount-

ing to MSEK –293 (–194), also including

capital expenditures in equipment for

solutions contracts. The net invest-

ments are the result of investments of

MSEK –2 066 (–1 588) and reversal of

depreciation of MSEK 1 773 (1 394).

Free cash flow was MSEK –85 (–191),

equivalent to –3 percent (–8) of

adjusted income.

Cash flow from investing activities,

acquisitions and divestitures, was

MSEK–28 (–38). Refer to note 6 for

further information.

Cash flow from items affecting compar-

ability amounted to MSEK –680 (–508).

Refer to note 7 for further information.

Cash flow from financing activities

was MSEK –70 (–843) due to dividend

paid of MSEK –1 003 (–1 604) and a net

increase in borrowings of MSEK 933

(761). A second dividend payment of

MSEK–974 will be made during the

fourth quarter compared to last year

when the total dividend amount was

paid in the second quarter. The total

dividend amounts to MSEK 1 977 (1 604).

Cash flow for the period was MSEK –863

(–1 580). The closing balance for liquid

funds after translation differences of

MSEK 31 was MSEK 5 491 (6 323 as of

December 31, 2022).

11Securitas ABInterim ReportQ2 2023|January–June 2023

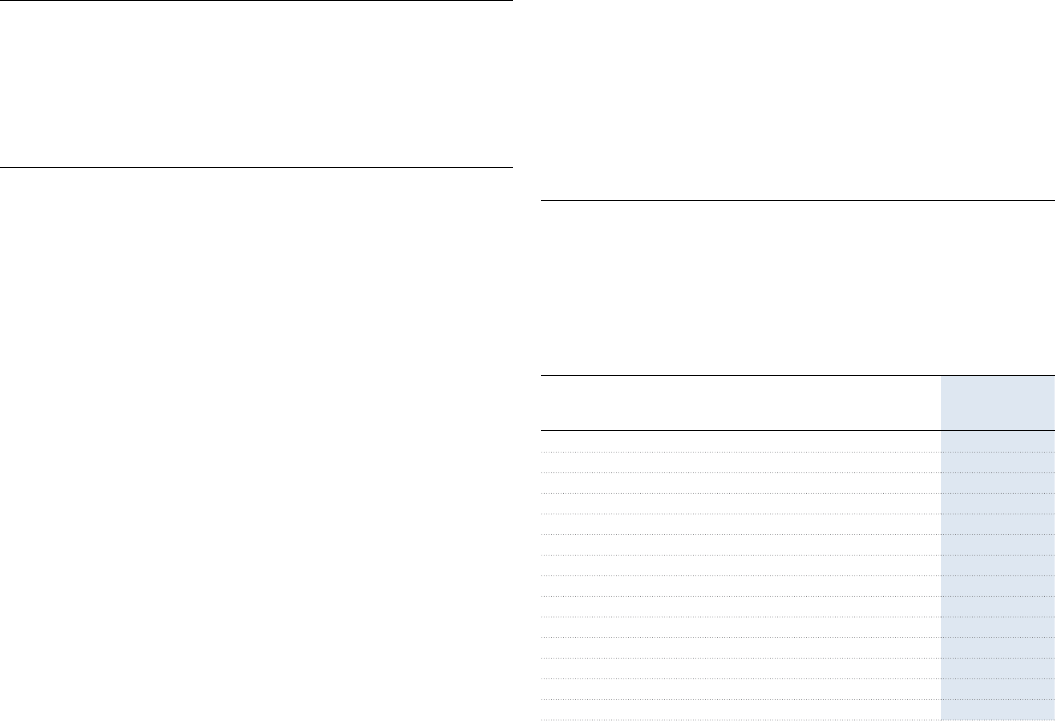

REPORTED NET DEBT/EBITDA

1.0

2.0

3.0

4.0

5.0

6.0

Q2

2023

Q1

2023

Q4

2022

Q3

2022

Q2

2022

2.2

4.0

4.0

3.7

3.8

3.7

3.6

5.8

Reported net debt/EBITDA

Adjusted net debt/EBITDA

Capital employed

andfinancing

CAPITAL EMPLOYED AS OF

JUNE 30, 2023

The Group’s operating capital

employed was MSEK 21 147 (18 377 as

of December 31, 2022), correspond-

ing to 13 percent of sales (13 as of

December 31, 2022), adjusted for the

full-year sales figures of acquired units.

Thetranslation of foreign operating

capital employed to Swedish kronor

increased the Group’s operating capital

employed by MSEK 652.

The Group’s total capital employed was

MSEK 81 683 (76 972 as of December

31, 2022). The translation of foreign

capital employed to Swedish kronor

increased the Group’s capital employed

by MSEK2 577. The return on capital

employed was 10 percent (9asof

December 31, 2022).

FINANCING AS OF JUNE 30, 2023

The Group’s net debt amounted to

MSEK 43 779 (40 534 as of Decem-

ber31, 2022). The net debt was

impacted mainly by a dividend of

MSEK–1 003, paid to the shareholders

in May 2023, translation differences

of MSEK –1 480, payments for items

affecting com par ability of MSEK –680,

free cash flow of MSEK –85 and lease

liabilities of MSEK27.

The net debt to EBITDA ratio was3.7

(2.2). The adjusted net debt to EBITDA

ratio was 3.7*. The free cash flow to

netdebt ratio amounted to 0.08 (0.14).

The interest coverage ratio amounted

to 5.3(14.7).

On June 30, 2023, Securitas had a

Revolving Credit Facility with its eleven

key relationship banks. The size of

thefacility amounted to MEUR 1 029,

ma tur ing 2027. The facility was un-

drawn on June 30, 2023.

A Swedish Commercial Paper Program

amounts to MSEK 5 000. MSEK 1 620

was outstanding as of June 30, 2023.

A debt bridge facility was used to

partly fund the acquisition of STANLEY

Security. The original debt bridge

facility amounted to MUSD 2 385and

has afinal maturity date of July 22,

2024. Inthe first quarter of 2023

amajority of the bridge was refinanced

through aMUSD 75 6-year Private

Placement, aMEUR 1 100 term loan

and a MEUR300 Schuldschein loan.

An additional MEUR 600 was repaid

on April4, 2023, from the proceeds of

a4-year Eurobond issue, reducing the

bridge facility balance to MUSD159

equivalent at end of June 2023. InJuly,

2023, the remaining balance of

MUSD159 of the debt bridge facility of

MUSD2385 raised for the acquisition

of STANLEY Security was repaid.

Standard & Poor’s rating of Securitas is

BBB- with stable outlook.

Further information regarding financial

instruments and credit facilities is

provided in note 9.

Shareholders’ equity amounted to

MSEK 37 904 (36 438 as of Decem-

ber31, 2022). The translation of foreign

assets and liabilities into Swedish

kronor increased shareholders’ equity

by MSEK 1 097. Refer to the statement

of comprehensive income on page 18

for further information.

The total adjusted number of shares

amounted to 572 917 552 (438 441 802)

as of June 30, 2023. Refer to page 21

forfurther information.

*

Includes STANLEY Security’s 12months adjusted estimated EBITDA.

CAPITAL EMPLOYED AND FINANCING

MSEK Jun 30, 2023

Operating capital employed

Goodwill

Acquisition-related intangible assets

Shares in associated companies

Capital employed

Net debt

Shareholders' equity

Financing

NET DEBT DEVELOPMENT

MSEK Jan–Jun 2023

Jan 1, 2023 –

Free cash flow –

Acquisitions/divestitures –

Items affecting comparability –

Dividend paid –

Lease liabilities

Change in net debt –

Revaluation

Translation –

Jun 30, 2023 –

12Securitas ABInterim ReportQ2 2023|January–June 2023

Acquisitions

and divestitures

DIVESTITURES AFTER

THE SECOND QUARTER

On July 25, 2023, the divestment of

Securitas Argentina to local manage-

ment was completed. Securitas is

exitingthe country due the weak macro -

economic prospects and challenging

business environment with limited

opportunity to execute our long-term

strategy and provide quality services

to our clients with healthy profit-

ability. Last12month’s sales based on

June 2023 of Securitas Argentina was

BSEK2.5,with an oper ating margin of

below average in Securitas Ibero-America.

Thedivestment will result in acapital

loss that is estimated to approximately

BSEK3.5, which will be recognized as an

item affecting compar ability inthethird

quarter of 2023. The estimated capital

loss mainly comprises accumulated

foreign currency losses. This impact is net

neutral in Group equity. The divestiture

has limited cash flow impact.

ACQUISITIONS AND DIVESTITURES JANUARY–JUNE 2023 (MSEK)

Company Business segment

1)

Included

from

Acquired

share

2)

Annual

sales

3)

Enterprise

value

4,7)

Goodwill

Acq. related

intangible

assets

Opening balance

Other acquisitions and divestitures

, )

– –

Total acquisitions and divestitures

January –June 2023

Amortization of acquisition-related intangible assets – –

Translation differences and remeasurement for

hyperinflation

Closing balance

1)

Refers to business segment with main responsibility for the acquisition.

2)

Refers to voting rights for acquisitions in the form of share purchase agreements. For asset deals no voting rights are stated.

3)

Estimated annual sales.

4)

Purchase price paid/received plus acquired/divested net debt but excluding any deferred considerations.

5)

Related to other acquisitions for the period and updated previous year acquisition calculations for the following entities: STANLEY Security, related to adjustments for several countries within

NorthAmerica and Europe, Draht+Schutz, Germany, Bewachungen ALWA (contract portfolio), Austria, DAK, Türkiye and Complete Security Integration, Australia. Related also to additional payment

received for the divestiture of Securitas Egypt as well as to deferred considerations paid in the US, Türkiye, Spain and Australia.

6)

Deferred considerations have been recognized mainly based on an assessment of the future profitability development in the acquired entities for an agreed period. The net of new deferred

considerations, payments made from previously recognized deferred considerations and revaluation of deferred considerations in the Group was MSEK –16. Total deferred considerations, short-term

and long-term, in the Group’s balance sheet amount to MSEK 110.

7)

Cash flow from acquisitions and divestitures amounts to MSEK –28, which is the sum of enterprise value MSEK –25 and acquisition-related costs paid MSEK –3.

All acquisition calculations are final-

ized no later than one year after the

acquisition is made. Transactions with

non-controlling interests are specified

in the statement of changes in share-

holders’ equity on page 21. Transaction

costs and revaluation of deferred con-

siderations can be found in note 6 on

page 27. Additional information regard-

ing the acquisition of STANLEY Security

can be found in note 13.

13Securitas ABInterim ReportQ2 2023|January–June 2023

Other significant

events

For critical estimates and judgments,

provisions and contingent liabilities

refer to the 2022 Annual Report and

to note 12 on page 30. If no significant

events have occurred relating to

theinformation in the Annual Report

no further comments are made in

theInterim Report for the respective

case.

OTHER SIGNIFICANT EVENTS

AFTERTHE BALANCE SHEET DATE

DIVESTMENT OF

SECURITASARGENTINA

On July 25, 2023, the divestment of

Securitas Argentina to local manage-

ment was completed. Last12month’s

sales based on June 2023 of Securitas

Argentina was BSEK2.5, with an

operating margin of below average

Risks and

uncertainties

Risk management is necessary for

Securitas to be able to fulfill its strat-

egies and achieve its corporate object-

ives. Securitas’ risks fall into three main

categories: operational risks, financial

risks and strategic risks and opportun-

ities. Securitas’ approach to enterprise

risk management is described in more

detail in the Annual Report for 2022.

In the preparation of financial reports,

the Board of Directors and Group

Management make estimates and

judgments. These impact the state-

ment of income and balance sheet as

well as disclosures such as contingent

liabilities. The actual outcome may

differ from these estimates and judg-

ments under different circumstances

and conditions.

Risks related to the general macro-

economic environment with the

increase in inflation, interest rates,

deterior ating insurance market, labor

shortages and supply chain issues

together with the changed geopolit-

ical situation in the world and lingering

effects from the corona pandemic

makes it difficult to predict the

economic development of the different

markets and geographies in which we

operate.

On July 22, 2022, Securitas completed

the acquisition of STANLEY Security.

The acquisition and integration of

new companies always carries certain

risks. The profitability of the acquired

company may be lower than expected

and/or certain costs in connection

with the acquisition may be higher than

expected.

Our transformation program in Europe

is being executed, although with

adelay into 2024, as we are currently

cali brating the program with the

STANLEY Security integration plan to

ensure we are maximising the cost and

benefit realization. The corresponding

program in Ibero-America is progress-

ing according to plan. The implemen-

tation and rollout of new systems and

platforms to support this transform-

ation naturally carries a risk in terms of

potential disruptions to our operations

that could result in a negative impact

on our result, cash flow and financial

position. This is mitigated by solid

change management and a phased

rollout on a country by country basis

over a longer period.

The geopolitical situation in the world

has changed radically with Russia’s

invasion of Ukraine at the end of

February 2022. We have no operations

either in Russia or in Ukraine but we

follow the development closely and con

-

tribute to a safer society where we can.

For the forthcoming six-month period,

the financial impact of the general

macro-economic environment

described above, the acquisition

and integration of STANLEY Security

including increased interest rates for

the acquisition-funding, the implemen

-

tation of new platforms as part of our

transformation programs, as well as

certain items affecting comparability,

provisions and contingent liabilities,

as described in the Annual Report for

2022 and, where applicable, under the

heading Other significant events above,

may vary from the current financial esti

-

mates and provisions made by manage-

ment. This could affect the Group’s

profitability and financial position.

inSecuritas Ibero-America. The divest-

ment will result in acapital loss that is

estimated to approxi mately BSEK3.5,

which will be recognized as an item

affecting compar ability inthethird

quarter of 2023. The estimated capital

loss mainly comprises accumulated

foreign currency losses. This impact

isnet neutral in Group equity. The

divesti ture has limited cash flow

impact.

14Securitas ABInterim ReportQ2 2023|January–June 2023

Parent Company

operations

JANUARY–JUNE 2023

The Parent Company’s income amounted to MSEK 982 (862) and mainly relates to

license fees and other income from subsidiaries.

Financial income and expenses amounted to MSEK 20 (5 299). The decrease

compared with last year is mainly explained by lower dividends received from

subsidiaries. Income before taxes amounted to MSEK 6 (5 601).

AS OF JUNE 30, 2023

The Parent Company’s non-current assets amounted to MSEK 66 680 (66 354 as

of December 31, 2022) and mainly comprise shares in subsidiaries of MSEK64076

(64040 as of December 31, 2022). Current assets amounted to MSEK 13 855

(11813as of December 31, 2022) of which liquid funds accounted for MSEK 2 725

(2376 as of December 31, 2022).

Shareholders’ equity amounted to MSEK 46 474 (48 282 as of December 31, 2022).

Total dividend amounts to MSEK 1 977 (1 604), whereof MSEK 1 003 (1 604) was paid

to the shareholders in May 2023. A second dividend payment will be made during

fourth quarter 2023 and has been reported as a non-interest-bearing current

liability.

The Parent Company’s liabilities and untaxed reserves amounted to MSEK 34 061

(29 885 as of December 31, 2022) and mainly consist of interest-bearing debt.

For further information, refer to the Parent Company’s condensed financial

statements on page 32.

The Group’s Parent Company,

Securitas AB, is not involved in any

operating activities. Securitas AB

consists of Group Management and

support functions for the Group.

15Securitas ABInterim ReportQ2 2023|January–June 2023

Signatures of the Board

of Directors

The Board of Directors and the President and CEO certify that the interim report gives a true and fair overview of

theParentCompany’s and Group’s operations, their financial position and results of operations, and describes significant

risks and uncertainties facing the Parent Company and other companies in the Group.

Stockholm, July 28, 2023

Jan Svensson

Chair

Åsa Bergman

Member

Ingrid Bonde

Member

John Brandon

Member

Fredrik Cappelen

Member

Gunilla Fransson

Member

Sofia Schörling Högberg

Member

Harry Klagsbrun

Member

Johan Menckel

Member

Åse Hjelm

Employee representative

Mikael Persson

Employee representative

Jan Prang

Employee representative

Magnus Ahlqvist

President and Chief Executive Officer

16Securitas ABInterim ReportQ2 2023|January–June 2023

Review report

This is a translation from the Swedish original

INTRODUCTION

We have reviewed the condensed interim report for Securitas AB as at June30,

2023, and for the six months period then ended. The Board of Directors and

thePresident and CEO are responsible for the preparation and presentation of this

interim report in accordance with IAS 34 and the Swedish Annual AccountsAct.

Ourresponsibility is to express a conclusion on this interim report based on

our review.

SCOPE OF REVIEW

We conducted our review in accordance with the International Standard on Review

Engagements, ISRE 2410 Review of Interim Financial Statements Performed

by theIndependent Auditor of the Entity. A review consists of making inquiries,

primarily of persons responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially less in scope than

an audit conducted in accordance with International Standards on Auditing and

other generally accepted auditing standards in Sweden.

The procedures performed in a review do not enable us to obtain assurance that

we would become aware of all significant matters that might be identified in an

audit. Accordingly, we do not express an audit opinion.

CONCLUSION

Based on our review, nothing has come to our attention that causes us to believe

that the interim report is not prepared, in all material respects, in accordance with

IAS 34 and the Swedish Annual Accounts Act regarding the Group, and in accord-

ance with the Swedish Annual Accounts Act regarding the Parent Company.

Stockholm, July 28, 2023

Ernst & Young AB

Rickard Andersson

Authorized Public Accountant

Securitas AB (publ), corporate identity

number 556302-7241

17Securitas ABInterim ReportQ2 2023|January–June 2023

Consolidated

financial statements

STATEMENT OF INCOME

MSEK Note Apr–Jun 2023 Apr–Jun 2022 Jan–Jun 2023 Jan–Jun 2022 Jan–Dec 2022

Sales

Sales, acquired business

Total sales

Organic sales growth, % 4 11 6 11 5 7

Production expenses – – – – –

Gross income

Selling and administrative expenses – – – – –

Other operating income

Share in income of associated companies

Operating income before amortization

Operating margin, % 6.6 5.8 6.2 5.4 6.0

Amortization of acquisition-related intangible assets – – – – –

Acquisition-related costs – – – – –

Items affecting comparability – – – – –

Operating income after amortization

Financial income and expenses , – – – – –

Income before taxes

Net margin, % 4.0 4.6 3.8 4.3 4.3

Current taxes – – – – –

Deferred taxes –

Net income for the period

Whereof attributable to:

Equity holders of the Parent Company

Non-controlling interests

Earnings per share before and after dilution (SEK)

1)

. . . . .

Earnings per share before and after dilution and

before items affecting comparability (SEK)

1)

. . . . .

1)

Number of shares outstanding has been adjusted for the rights issue completed on October 11, 2022. For further information refer to Data per share on page 21.

STATEMENT OF COMPREHENSIVE INCOME

MSEK Note Apr–Jun 2023 Apr–Jun 2022 Jan–Jun 2023 Jan–Jun 2022 Jan–Dec 2022

Net income for the period

Other comprehensive income for the period

Items that will not be reclassified to the statement of income

Remeasurements of defined benefit pension plans net of tax

Total items that will not be reclassified to

the statement of income

Items that subsequently may be reclassified to

the statement of income

Remeasurement for hyperinflation net of tax

Cash flow hedges net of tax – – –

Cost of hedging net of tax – – – – –

Net investment hedges net of tax – – – – –

Other comprehensive income from associated companies,

translation differences

Translation differences

Total items that subsequently may be reclassified to

the statement of income

Other comprehensive income for the period

Total comprehensive income for the period

Whereof attributable to:

Equity holders of the Parent Company

Non-controlling interests

18Securitas ABInterim ReportQ2 2023|January–June 2023

STATEMENT OF CASH FLOW

Operating cash flow MSEK Note Apr–Jun 2023 Apr–Jun 2022 Jan–Jun 2023 Jan–Jun 2022 Jan–Dec 2022

Operating income before amortization

Investments in non-current tangible and intangible assets – – – – –

Reversal of depreciation

Change in accounts receivable – – – – –

Change in other operating capital employed – –

Cash flow from operating activities

Cash flow from operating activities, % 46 53 29 25 71

Financial income and expenses paid – – – – –

Current taxes paid – – – – –

Free cash flow – –

Free cash flow, % 33 39 –3 –8 57

Cash flow from investing activities, acquisitions and divestitures – – – – –

Cash flow from items affecting comparability – – – – –

Cash flow from financing activities – – – –

Cash flow for the period – – –

Change in net debt MSEK Note Apr–Jun 2023 Apr–Jun 2022 Jan–Jun 2023 Jan–Jun 2022 Jan–Dec 2022

Opening balance – – – – –

Cash flow for the period – – –

Change in lease liabilities – – –

Change in loans – – – – –

Change in net debt before revaluation and translation

differences – – – – –

Revaluation of financial instruments 9 – – – –

Translation differences – – – – –

Change in net debt – – – – –

Closing balance – – – – –

Cash flow MSEK Note Apr–Jun 2023 Apr–Jun 2022 Jan–Jun 2023 Jan–Jun 2022 Jan–Dec 2022

Cash flow from operations

Cash flow from investing activities – – – – –

Cash flow from financing activities – – – –

Cash flow for the period – – –

Change in liquid funds MSEK Note Apr–Jun 2023 Apr–Jun 2022 Jan–Jun 2023 Jan–Jun 2022 Jan–Dec 2022

Opening balance

Cash flow for the period – – –

Translation differences

Closing balance

19Securitas ABInterim ReportQ2 2023|January–June 2023 Consolidated financial statements

CAPITAL EMPLOYED AND FINANCING

MSEK Note Jun 30, 2023 Jun 30, 2022 Dec 31, 2022

Operating capital employed

Operating capital employed as % of sales 13 12 13

Return on operating capital employed, % 42 47 49

Goodwill

Acquisition-related intangible assets

Shares in associated companies

Capital employed

Return on capital employed, % 10 13 9

Net debt – – –

Shareholders’ equity

Net debt equity ratio, multiple 1.15 0.78 1.11

BALANCE SHEET

MSEK Note Jun 30, 2023 Jun 30, 2022 Dec 31, 2022

ASSETS

Non-current assets

Goodwill

Acquisition-related intangible assets

Other intangible assets

Right-of-use assets

Other tangible non-current assets

Shares in associated companies

Non-interest-bearing financial non-current assets

Interest-bearing financial non-current assets

Total non-current assets

Current assets

Non-interest-bearing current assets

Other interest-bearing current assets

Liquid funds

Total current assets

TOTAL ASSETS

MSEK Note Jun 30, 2023 Jun 30, 2022 Dec 31, 2022

SHAREHOLDERS’ EQUITY AND LIABILITIES

Shareholders’ equity

Attributable to equity holders of the Parent Company

Non-controlling interests

Total shareholders’ equity

Equity ratio, % 31 34 32

Long-term liabilities

Non-interest-bearing long-term liabilities

Long-term lease liabilities

Other interest-bearing long-term liabilities

Non-interest-bearing provisions

Total long-term liabilities

Current liabilities

Non-interest-bearing current liabilities and provisions

Current lease liabilities

Other interest-bearing current liabilities

Total current liabilities

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES

20Securitas ABInterim ReportQ2 2023|January–June 2023 Consolidated financial statements

CHANGES IN SHAREHOLDERS’ EQUITY

MSEK

Jun 30, 2023 Jun 30, 2022 Dec 31, 2022

Attributable

to equity

holders of

the Parent

Company

Non-

controlling

interests Total

Attributable

to equity

holders of

the Parent

Company

Non-

controlling

interests Total

Attributable

to equity

holders of

the Parent

Company

Non-

controlling

interests Total

Opening balance January 1, 2023/2022

Total comprehensive income

for the period

Transactions with non-controlling interests – – – – – –

Share-based incentive schemes – – –

1)

– – – – – –

Rights issue – – – – – – –

Dividend to the shareholders

of the Parent Company

2)

– – – – – – – – –

Closing balance

June 30/December 31, 2023/2022

1)

Refers to an adjustment of non-vested shares of MSEK 2 related to Securitas’ short-term share-based incentive scheme 2021. Refers also to shares awarded under Securitas’ long-term share-based

incentive scheme 2020/2022 of MSEK

–33.

2)

Total dividend amounts to MSEK –1 977, whereof MSEK –1 003 was paid to the shareholders in May 2023. A second dividend payment of MSEK –974 will be made during the fourth quarter 2023.

DATA PER SHARE

SEK Apr–Jun 2023 Apr–Jun 2022 Jan–Jun 2023 Jan–Jun 2022 Jan–Dec 2022

Share price, end of period

1)

. . . . .

Earnings per share before and after dilution

1,2,3)

. . . . .

Earnings per share before and after dilution and

before items affecting comparability

1,2,3)

. . . . .

Dividend – – – – 3.45

5)

P/E-ratio after dilution and before items affecting comparability – – – –

Share capital (SEK)

Number of shares outstanding

1,2)

Average number of shares outstanding

1,2,4)

Treasury shares

1)

Share price, number of shares outstanding and the average number of shares outstanding have been adjusted for the rights issue completed on October 11, 2022. The bonus element of

therightsissue has in accordance with IAS 33 §64 been calculated and the number of shares are represented based on the fair value per share immediately before the exercise of the rights divided

by thetheorethical ex-rights fair value per share (SEK 85.72/SEK 71.28). The number of shares outstanding on October 11, 2022, increased by 208 333 655 shares in total and the total number of

outstanding shares on that date was 572 917 552 shares. Total number of shares, including treasury shares, as per the same date was 573 392 552 shares with a share capital of SEK 573 392 552.

2)

There are no convertible debenture loans. Consequently there is no difference before and after dilution regarding earnings per share and number of shares.

3)

Number of shares used for calculation of earnings per share includes shares related to the Group’s share based incentive schemes that have been hedged through swap agreements.

4)

Used for calculation of earnings per share.

5)

Dividend 2022 to be distributed to the shareholders in two payments of SEK 1.75 per share and SEK 1.70 per share, respectively. The first dividend of SEK 1.75 per share was distributed to

theshareholders inMay,2023. The second dividend payment will be made during the fourth quarter 2023.

21Securitas ABInterim ReportQ2 2023|January–June 2023 Consolidated financial statements

APRIL–JUNE 2023

MSEK

Securitas

North America

Securitas

Europe

Securitas

Ibero-America Other Eliminations Group

Sales, external –

Sales, intra-group – –

Total sales –

Organic sales growth, % 7 13 24 – – 11

Operating income before amortization – –

of which share in income of associated companies 3 0 – 14 – 17

Operating margin, % 8.3 5.9 5.9 – – 6.6

Amortization of acquisition-related intangible assets – – – – – –

Acquisition-related costs – – – – – –

Items affecting comparability – – – – – –

Operating income after amortization – –

Financial income and expenses – – – – – –

Income before taxes – – – – –

APRIL–JUNE 2022

MSEK

Securitas

North America

Securitas

Europe

Securitas

Ibero-America Other Eliminations Group

Sales, external –

Sales, intra-group – –

Total sales –

Organic sales growth, % –1 9 17 – – 6

Operating income before amortization – –

of which share in income of associated companies 2 – – 11 – 13

Operating margin, % 7.4 5.5 5.9 – – 5.8

Amortization of acquisition-related intangible assets – – – – – –

Acquisition-related costs – – – – –

Items affecting comparability – – – – – –

Operating income after amortization – –

Financial income and expenses – – – – – –

Income before taxes – – – – –

Segment overview

April–June 2023and2022

22Securitas ABInterim ReportQ2 2023|January–June 2023

JANUARY–JUNE 2023

MSEK

Securitas

North America

Securitas

Europe

Securitas

Ibero-America Other Eliminations Group

Sales, external –

Sales, intra-group – –

Total sales –

Organic sales growth, % 7 13 24 – – 11

Operating income before amortization – –

of which share in income of associated companies 4 0 – 24 – 28

Operating margin, % 8.0 5.5 5.8 – – 6.2

Amortization of acquisition-related intangible assets – – – – – –

Acquisition-related costs – – – – – –

Items affecting comparability – – – – – –

Operating income after amortization – –

Financial income and expenses – – – – – –

Income before taxes – – – – –

JANUARY–JUNE 2022

MSEK

Securitas

North America

Securitas

Europe

Securitas

Ibero-America Other Eliminations Group

Sales, external –

Sales, intra-group – –

Total sales –

Organic sales growth, % –1 9 15 – – 5

Operating income before amortization – –

of which share in income of associated companies 3 – – 19 – 22

Operating margin, % 6.9 5.2 5.8 – – 5.4

Amortization of acquisition-related intangible assets – – – – – –

Acquisition-related costs – – – – –

Items affecting comparability – – – – – –

Operating income after amortization – –

Financial income and expenses – – – – – –

Income before taxes – – – – –

Segment overview

January–June 2023and2022

23Securitas ABInterim ReportQ2 2023|January–June 2023

NOTE 1

Accounting principles

This interim report has been prepared in accordance with IAS 34 Interim

Financial Reporting and the Swedish Annual Accounts Act.

Securitas’ consolidated financial statements are prepared in

accordance with International Financial Reporting Standards (IFRS) as

endorsed by the European Union, the Swedish Annual Accounts Act and

the Swedish Financial Reporting Board’s standard RFR 1 Supplementary

Accounting Rules for Groups. The most important accounting principles

under IFRS, which is the basis for the preparation of this interim report,

can be found in note 2 on pages 67 to 73 in the Annual Report for 2022.

Theaccounting principles are also available on the Group’s website

www.securitas.com under the section Investors – Financial data –

Accounting Principles.

The Parent Company’s financial statements are prepared in accordance

with theSwedish Annual Accounts Act and the Swedish Financial Reporting

Board’s standard RFR 2 Accounting for Legal Entities. The most important

accounting principles used by the Parent Company can be found in note 41

on page 122 intheAnnual Report for 2022.

Introduction and effect of new and revised IFRS 2023

None of the published standards and interpretations that are mandatory for

the Group’s financial year 2023 are assessed to have any significant impact

on the Group’s financial statements.

Introduction and effect of new and revised IFRS 2024 or later

The effect on the Group’s financial statements from standards and

interpretations that are mandatory for the Group’s financial year 2024 or later

remain to be assessed.

Usage of key ratios not defined in IFRS

For definitions and calculations of key ratios not defined in IFRS, refer to

notes 4and5 in this interim report as well as to note 3 in the Annual Report

2022.

Notes

NOTE 2

Events after the balance sheet date

On July 25, 2023, the divestment of Securitas Argentina to local management

was completed. Securitas is exiting the country due the weak macro-

economic prospects and challenging business environment with limited

opportunity to execute our long-term strategy and provide quality services

to our clients with healthy profitability. Last12month’s sales based on June

2023 of Securitas Argentina was BSEK2.5, with an operating margin of below

average in Securitas Ibero-America. The divestment will result in acapital

loss that is estimated to approximately BSEK3.5, which will be recognized as

an item affecting comparability inthethird quarter of 2023. The estimated

capital loss comprises mainly accumulated foreign currency losses. This

impact is net neutral in Group equity. The divestiture has limited cash flow

impact.

There have been no other significant events with effect on the financial

reporting after the balance sheet date.

24Securitas ABInterim ReportQ2 2023|January–June 2023

NOTE 3

Revenue

MSEK Apr–Jun 2023 % Apr–Jun 2022 % Jan–Jun 2023 % Jan–Jun 2022 % Jan–Dec 2022 %

Security services

1)

Technology and solutions

Risk management services

1)

Total sales

Other operating income

Total revenue

1)

Comparatives have been restated for a move of certain ancillary business from Risk management services to Security services.

Security services

This comprises on-site and mobile guarding, which are services with

thesame revenue recognition pattern. Revenue is recognized over time,

astheservices are rendered by Securitas and simultaneously consumed

bythe client. Such services cannot be reperformed.

Technology and solutions

This comprises two broad categories regarding technology and solutions.

Technology consists of the sale of alarm, access control and video

installations comprising design, installation and integration (time, material

and related expenses). Revenue is recognized as per the contract, either

upon completion of the conditions inthe contract, or over time based

on thepercentage of completion. Remote guarding (in the form of alarm

monitoring services), that is sold separately and not as part of a solution,

is also included in this category. Revenue recognition is over time as this is

also a service that is rendered by Securitas and simultaneously consumed

by the clients. The category further includes maintenance services, that are

either performed upon request (time and material) with revenue recognition

at a point in time (when the work has been performed), or over time if part

of a service level contract with a subscription fee. Finally, there are also

product sales (alarms and components) without any design or installation.

Therevenue recognition is at a point in time (upon delivery).

Solutions are a combination of services such as on-site and / or mobile

guarding and/or remote guarding. These services are combined with

atechnology component in terms of equipment owned and managed by

Securitas and used in the provision of services. The equipment is installed

atthe client site. The revenue recognition pattern is over time, as theservices

are rendered by Securitas and simultaneously consumed by theclient.

Asolution normally constitutes one performance obligation.

Risk management services

This comprises various types of risk management services that are either

recognized over time or at a point in time depending on the type of service.

These services include risk advisory, security management, executive

protection, corporate investigations, due diligence and similar services.

Other operating income

Other operating income consists mainly of trade mark fees for the use of

theSecuritas brand name.

Revenue per segment

The disaggregation of revenue by segment is shown in the tables below. Totalsales agree to total sales in the segment overviews.

MSEK

Securitas

North America

Securitas

Europe

Securitas

Ibero-America Other Eliminations Group

Apr–Jun

2023

Apr–Jun

2022

Apr–Jun

2023

Apr–Jun

2022

Apr–Jun

2023

Apr–Jun

2022

Apr–Jun

2023

Apr–Jun

2022

Apr–Jun

2023

Apr–Jun

2022

Apr–Jun

2023

Apr–Jun

2022

Security services

1)

– –

Technology and

solutions – –

Risk management

services

1)

– – – – – – – –

Total sales – –

Other operating

income – – – – – – – –

Total revenue – –

1)

Comparatives have been restated for a move of certain ancillary business from Risk management services to Security services.

MSEK

Securitas

North America

Securitas

Europe

Securitas

Ibero-America Other Eliminations Group

Jan–Jun

2023

Jan–Jun

2022

Jan–Jun

2023

Jan–Jun

2022

Jan–Jun

2023

Jan–Jun

2022

Jan–Jun

2023

Jan–Jun

2022

Jan–Jun

2023

Jan–Jun

2022

Jan–Jun

2023

Jan–Jun

2022

Security services

1)

– –

Technology and

solutions – –

Risk management

services

1)

– – – – – – – –

Total sales – –

Other operating

income – – – – – – – –

Total revenue – –

1)

Comparatives have been restated for a move of certain ancillary business from Risk management services to Security services.

25Securitas ABInterim ReportQ2 2023|January–June 2023 Notes

NOTE 4

Organic sales growth and currency changes

The calculation of real and organic sales growth and the specification of currency changes on operating income before and after amortization,

incomebeforetaxes, netincomeand earnings per share are specified below. The impact from remeasurement for hyperinflation due to theapplication

ofIAS29 is included in currency change.

MSEK Apr–Jun 2023 Apr–Jun 2022 % Jan–Jun 2023 Jan–Jun 2022 %

Total sales

Currency change from 2022 – – – –

Real sales growth, adjusted for changes in exchange rates

Acquisitions/divestitures – – – –

Organic sales growth

Operating income before amortization

Currency change from 2022 – – – –

Real operating income before amortization, adjusted for

changes in exchange rates

Operating income after amortization

Currency change from 2022 – – – –

Real operating income after amortization, adjusted for

changes in exchange rates

Income before taxes

Currency change from 2022 – – – –

Real income before taxes, adjusted for changes in exchange rates

Net income for the period

Currency change from 2022 – – – –

Real net income for the period, adjusted for changes in exchange rates

Net income attributable to equity holders of the Parent Company

Currency change from 2022 – – – –

Real net income attributable to equity holders of the Parent Company,

adjusted for changes in exchange rates

Average number of shares outstanding

1)