The International Accounting Standards Board is an independent standard-setting body of the IFRS Foundation, a not-for-profit corporation promoting the

adoption of IFRS Standards. For more information visit www.ifrs.org.

Staff paper

Agenda reference: 9D

IASB

®

meeting

Date

December 2023

Project

Rate-regulated Activities

Topic

Items affecting regulated rates on a cash basis

Contacts

Nhlanhla Mungwe ([email protected])

Mariela Isern ([email protected])

This paper has been prepared for discussion at a public meeting of the International Accounting Standards Board

(IASB). This paper does not represent the views of the IASB or any individual IASB member. Any comments in

the paper do not purport to set out what would be an acceptable or unacceptable application of IFRS

®

Accounting

Standards. The IASB’s technical decisions are made in public and are reported in the IASB

®

Update.

Objective

1. This paper sets out staff analysis and recommendations on the proposals in the

Exposure Draft Regulatory Assets and Regulatory Liabilities (Exposure Draft) dealing

with the measurement and the presentation of items affecting regulated rates only

when the related cash is paid or received (that is, when items affect regulated rates on

a cash basis—paragraphs 59–66 and 69 of the Exposure Draft).

2. This paper does not discuss requests to extend the proposed measurement and

presentation of items affecting regulated rates on a cash basis to other items (for

example, when items affect regulated rates on an accrual basis). We will discuss these

requests at a future meeting.

Staff recommendations

3. The staff recommend that the final Accounting Standard:

(a) continue to state that differences in timing that arise from differences between

the regulatory and accounting criteria represent enforceable present rights or

enforceable present obligations that meet the proposed definitions of

regulatory assets and regulatory liabilities;

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 2 of 27

(b) retain the proposed measurement requirements in paragraph 61 of the

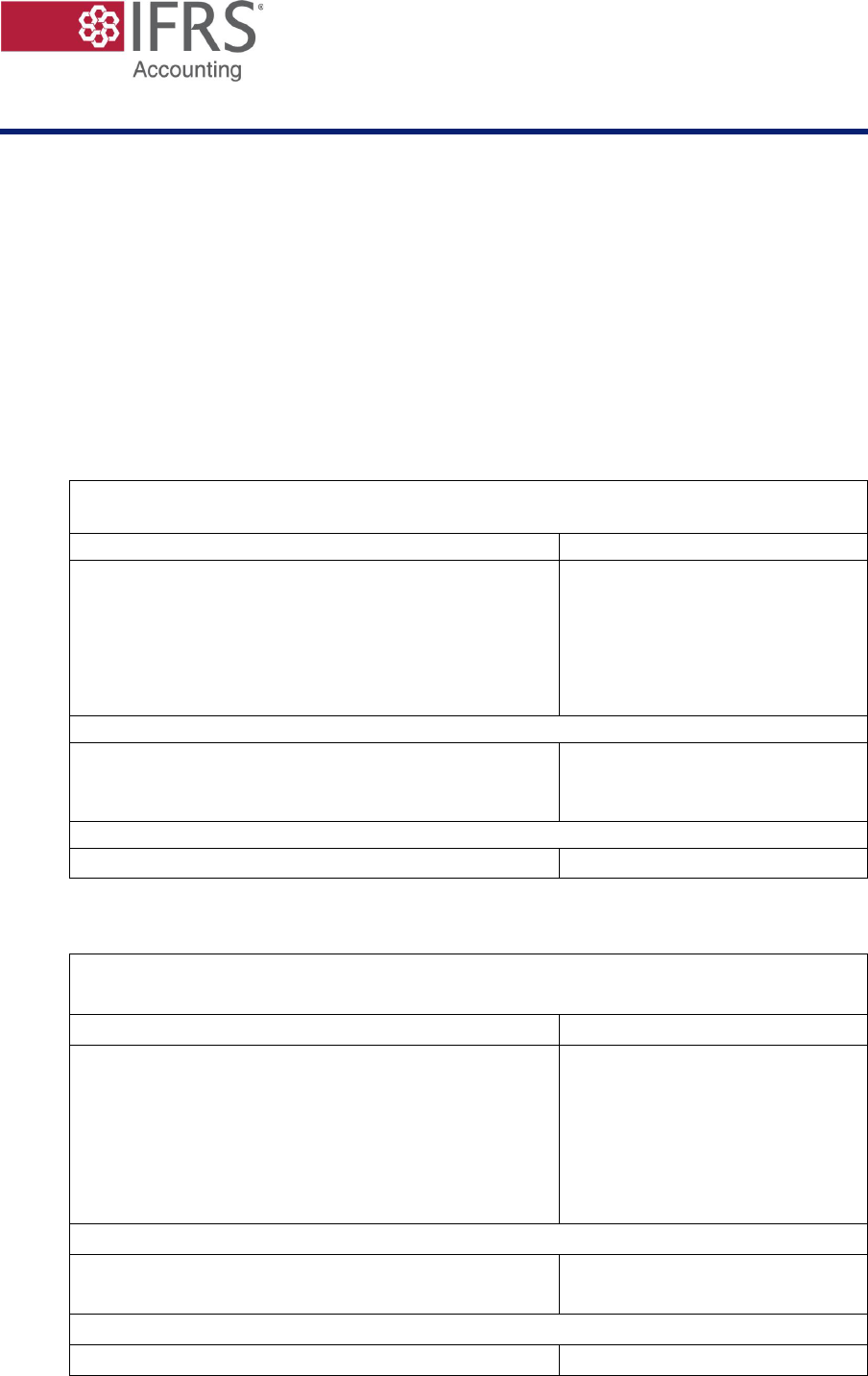

Exposure Draft for items that affect regulated rates only when the related cash

is paid or received;

(c) retain the proposed requirements in paragraph 69 of the Exposure Draft to

present specified regulatory income and regulatory expense in other

comprehensive income;

(d) clarify that an entity reclassifies regulatory income or regulatory expense

presented in other comprehensive income to profit or loss when, and to the

extent that, IFRS Accounting Standards require the reclassification of the

related expense or income to profit or loss; and

(e) not include additional presentation requirements for other comprehensive

income and instead relies on the requirements in IAS 1 Presentation of

Financial Statements or the prospective [draft] IFRS 18 Presentation and

Disclosure in Financial Statements.

Structure of the paper

4. This paper is structured as follows:

(a) proposals in the Exposure Draft (paragraphs 6–14);

(b) enforceable rights and enforceable obligations (paragraphs 15–27);

(c) measurement proposals (paragraphs 28–34); and

(d) presentation proposals (paragraphs 35–62).

5. Appendix A illustrates an example of defined benefit pension costs that an entity is

entitled to recover on a cash basis. Appendix B illustrates variations on that example

which could be considered when developing illustrative examples. The examples in

the appendices support the staff analysis.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 3 of 27

Proposals in the Exposure Draft

6. Paragraph 59 of the Exposure Draft states:

In some cases, a regulatory asset or regulatory liability arises because a

regulatory agreement treats an item of expense or income as allowable or

chargeable in determining the regulated rates only once an entity pays or

receives the related cash, or soon after that, instead of when the entity

recognises that item as expense or income in its financial statements by

applying, for example, IAS 12 Income Taxes, IAS 19 Employee Benefits or

IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

7. Paragraph 61 of the Exposure Draft states that an entity shall measure this regulatory

asset and regulatory liability by:

(a) using the measurement basis used in measuring the related liability or related

asset by applying IFRS Accounting Standards; and

(b) adjusting the measurement of the regulatory asset or regulatory liability to

reflect any uncertainty present in it but not present in the related liability or

related asset.

8. Paragraph BC175 of the Basis for Conclusions accompanying the Exposure Draft

summarises the IASB’s rationale for this proposal:

…In the Board’s view, this approach:

(a) would provide users of financial statements with the most relevant and

understandable information, because the cash flows arising from the

regulatory assets or regulatory liabilities are a replica of the cash flows

arising from the related liabilities or related assets, except for the effect

of any uncertainty present in the regulatory asset or regulatory liability

but not present in the related liability or related asset.

(b) would provide users with more useful and more understandable

information because it would avoid creating accounting mismatches in

the statement(s) of financial performance that would result from using

different measurement bases. […]

(c) is consistent with the requirements in IFRS Standards for indemnification

assets and for reimbursement assets. IFRS 3 Business Combinations

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 4 of 27

requires an acquirer to recognise an indemnification asset at the same

time that it recognises the related indemnified item and to measure that

asset on the same basis as the related indemnified item, subject to a

valuation allowance for uncollectible amounts. IAS 37 requires that the

amount recognised for a reimbursement asset not exceed the amount of

the related provision.

9. Paragraph 66 of the Exposure Draft proposes that an entity cease applying

paragraph 61 when the entity pays cash to settle the related liability or receives cash

that recovers the related asset. From that date, the entity measures any remaining part

of the regulatory asset or regulatory liability by applying the cash-flow-based

measurement technique proposed for all other regulatory assets and regulatory

liabilities.

10. The Exposure Draft includes examples that illustrate the proposed requirements in

paragraphs 59–66 (Illustrative Examples 4, 7A.9, 7A.10, 7A.11, 7A.12, 7A.13 and

7B.10).

11. Paragraph 69 of the Exposure Draft proposes that when an entity remeasures a

regulatory asset or regulatory liability applying the proposals in paragraph 61 of the

Exposure Draft, the entity presents the resulting regulatory income or regulatory

expense in other comprehensive income to the extent that the regulatory income or

regulatory expense results from remeasuring the related liability or related asset

through other comprehensive income.

12. The alternative view on the Exposure Draft disagreed with both the proposed

measurement and the proposed presentation of these items.

1

According to this view:

(a) the cash-flow-based measurement technique proposed for all other regulatory

assets and regulatory liabilities should also apply to this case; and

(b) the presentation proposed for all other regulatory assets and regulatory

liabilities—ie to present in the statement(s) of financial performance all

1

Paragraphs AV2–AV6 of the alternative view on the Exposure Draft.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 5 of 27

regulatory income minus all regulatory expense in a separate line item

immediately below revenue—should also apply to this case.

13. The alternative view disagreed with the measurement proposals, seeing them as an

exception to the general measurement proposals. The alternative view argued that the

measurement proposal in paragraph 61 of the Exposure Draft was unnecessary to

achieve the objective of the proposed Standard. The alternative view stated that the

IASB should ‘provide information about the relationship between an entity’s revenue

and expenses by focusing solely on how the regulatory agreement impacts the timing

of charging customers the total allowed compensation.’ The alternative view

considered that the measurement proposals would reduce the usefulness and

understandability of the statement of financial performance and risk implying that the

IASB is incorporating a matching concept into the proposed Standard.

14. The alternative view stated that it was unnecessary to address the accounting

mismatches that could occur if regulatory income or regulatory expense were

presented in the statement of financial performance and the related item of expense or

income were presented in other comprehensive income.

Enforceable rights and enforceable obligations

15. The Exposure Draft sought feedback on the proposed measurement and presentation

of items affecting regulated rates only when the related cash is paid or received.

However, some respondents disagreed that these items would give rise to enforceable

rights and enforceable obligations or queried whether they would give rise to

enforceable rights and enforceable obligations before cash is paid or received.

16. This section is structured as follows:

(a) feedback (paragraphs 17–18); and

(b) staff analysis (paragraphs 20–27).

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 6 of 27

Feedback

17. A few respondents—an accounting firm, a preparer and a regulator in Asia-Oceania—

noted that the model in the Exposure Draft would give rise to the recognition of

regulatory assets and regulatory liabilities that would represent differences in timing

between the criteria used in IFRS Accounting Standards (for example, accrual basis)

and those used in the regulatory agreements (for example, cash basis). These

respondents disagreed that these differences in timing represent an entity’s

enforceable rights or enforceable obligations to adjust future regulated rates in

accordance with the regulatory agreements. These respondents disagreed with the

recognition of—and therefore with the proposed measurement requirements for—such

regulatory assets and regulatory liabilities.

2

This feedback is analysed in paragraphs

20–23.

18. A few respondents that agreed with the proposals—mainly accounting firms, a few

preparers in Europe and a few national standard-setters in Asia-Oceania—questioned

whether an entity would have enforceable present rights or enforceable present

obligations before the cash for a related liability or related asset is paid or received.

This feedback is analysed in paragraphs 24–26.

Staff analysis

19. This section is structured as follows:

(a) differences in timing that do not represent explicit adjustments to future

regulated rates (paragraphs 20–23); and

(b) enforceable rights or enforceable obligations only when cash is paid or

received (paragraphs 24–26).

2

These respondents had similar views for regulatory assets and regulatory liabilities arising from differences

between the assets’ regulatory recovery pace and assets’ useful lives (Agenda Paper 9C discussed in October

2021).

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 7 of 27

Differences in timing that do not represent explicit adjustments to future

regulated rates

20. The Exposure Draft proposed that regulatory assets and regulatory liabilities could

arise from both explicit differences in timing and implicit differences in timing.

Explicit differences in timing are those that result in actual adjustments to the future

rates; implicit differences in timing are those that arise when the regulatory agreement

uses a basis for including an item of expense or income in the regulated rates charged

that differs from the basis used in accounting.

3

As noted in earlier agenda papers,

some respondents said the final Standard should focus only on explicit differences in

timing.

4

21. Implicit differences in timing reverse over time, but not through explicit adjustments

to future regulated rates. For example, an implicit difference in timing can arise when

a regulatory agreement allows an entity to include an item of expense in the regulated

rates charged using a criterion that is different from the criterion applied to the

recognition of the expense in the financial statements. In these cases, the differences

in timing reflect the differences in the pace of recovery in regulated rates and the pace

of recognition in the financial statements.

22. Appendix A illustrates an example of defined benefit pension costs in which the

regulator uses a criterion (cash basis) that is different from that used in accounting

(accrual basis).

23. We acknowledge regulatory agreements would neither track differences in timing

arising from differences between the regulatory and accounting criteria, nor consider

them when determining explicit adjustments to the future regulated rates. However,

we think differences between the regulatory and accounting criteria are differences in

timing that represent an enforceable present right (obligation) to recover a cost (to

charge a lower amount in the future than the entity would have, had the regulatory and

3

Illustrative Examples 1 and 2A accompanying the Exposure Draft illustrate explicit differences in timing and

Examples 2B and 2C illustrate implicit differences in timing. The Illustrative Examples can be accessed here.

4

Agenda Paper 9B discussed at the October 2021 IASB meeting and Agenda Paper 9A discussed at the

July 2022 IASB meeting.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 8 of 27

accounting criteria been aligned) if the regulatory agreement gives the entity an

enforceable right to recover the underlying costs through regulated rates.

Enforceable rights or enforceable obligations only when cash is paid or

received

24. In developing the Exposure Draft the IASB concluded that differences in timing

arising from items affecting regulated rates only when related cash is paid or received

represent an enforceable present right or enforceable present obligation.

5

25. This conclusion is consistent with the discussion of rights and obligations in the

Conceptual Framework for Financial Reporting (Conceptual Framework), which is

clear that rights and obligations can exist, even if they are conditional on future

events:

(a) the Conceptual Framework states that a right may take many forms including

rights to benefit from an obligation of another party to transfer an economic

resource if a specified uncertain future event occurs (paragraph 4.6(a)(iv) of

the Conceptual Framework).

(b) one of the criteria for a liability to exist is that the entity has an obligation to

transfer an economic resource. The Conceptual Framework explains that

although the obligation must have the potential to require the entity to transfer

an economic resource, certainty of the transfer is not required (paragraph 4.37

of the Conceptual Framework). An obligation to transfer an economic

resource could include obligations to transfer an economic resource if a

specified uncertain future event occurs (paragraphs 4.37 and 4.39(d) of the

Conceptual Framework).

26. The fact that a regulator determines the compensation for items of expense on the

basis of when related cash payments occur does not prevent an entity from having an

enforceable present right to recover the item of expense before the cash payment has

5

Paragraph 59 of the Exposure Draft.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 9 of 27

taken place. The key consideration is that the entity has an enforceable present right

to recover, through regulated rates, the costs it incurs for supplying goods or services

and the entity has incurred such costs in supplying such goods and services.

27. Considering the analysis in paragraphs 20–26, we recommend that the final

Accounting Standard continue to state that differences in timing that arise from

differences between the regulatory and accounting criteria represent enforceable

present rights or enforceable present obligations that meet the proposed definitions of

regulatory assets and regulatory liabilities.

Question for the IASB

1. Does the IASB agree with the staff recommendation in paragraph 27?

Measurement proposals

28. This section is structured as follows:

(a) feedback (paragraphs 29–31); and

(b) staff analysis (paragraphs 32–34).

Feedback

29. Most respondents agreed with the measurement proposals described in paragraph 7.

Many of these respondents said that the proposals would:

(a) avoid creating accounting mismatches that would arise when using bases to

measure a regulatory asset or regulatory liability that differ from the bases

used to measure its related liability or related asset;

(b) simplify the measurement of the regulatory assets or regulatory liabilities by

using the same judgements that were applied to the measurement of the related

liabilities or related assets;

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 10 of 27

(c) reflect that the cash flows arising from the regulatory asset or regulatory

liability are a replica of the cash flows arising from the related liability or

related asset; and

(d) be consistent with the requirements in IFRS Accounting Standards for

indemnification assets and reimbursement assets.

30. In addition to those who disagreed with the measurement proposals on the grounds of

enforceability (paragraphs 17–18), a few other respondents disagreed with the

measurement proposals:

(a) an individual expressed explicit support for the alternative view (paragraphs

12–13); and

(b) an accountancy body in Asia-Oceania was concerned that the proposals would

add complexity to the model in the Exposure Draft.

31. A preparer representative body in Europe asked whether and how the proposals in

paragraph 61 of the Exposure Draft would apply when a regulatory agreement

includes an estimate of the pension amounts that will be paid over a regulatory period

in the rates for that period.

Staff analysis

32. We do not agree that the measurement proposals add unnecessary complexity to the

model. The alternative—to apply the measurement requirements in paragraphs 30–58

of the Exposure Draft to all regulatory assets and regulatory liabilities—could lead to

less useful information and to additional operational complexities:

(a) when developing the Exposure Draft, the IASB thought that measuring these

regulatory assets or regulatory liabilities using the same measurement basis as

that used to measure the related liabilities or related assets would provide users

of financial statements with the most relevant and understandable information

(paragraph 8). Example 1 in Appendix A illustrates that the cash flows arising

from a regulatory asset mirror those of the underlying liability and shows that

the accounting proposed in the Exposure Draft avoids measurement

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 11 of 27

mismatches in the statement of financial position and statement of financial

performance (paragraph BC175(a) and (b) of the Basis for Conclusions,

reproduced in paragraph 8 of the paper).

(b) using the proposed measurement requirements in paragraphs 30–58 of the

Exposure Draft to measure items affecting regulated rates only when related

cash is paid or received would also be operationally more complex than the

proposals for these items. This is because regulatory agreements do not

provide or charge a regulatory interest rate for these items.

6

If entities used the

proposed measurement requirements in paragraphs 30–58 of the Exposure

Draft, they would need to determine a discount rate to be applied to these

regulatory assets and regulatory liabilities.

(c) the benefit of any incremental information provided by applying the

measurement requirements in paragraphs 30–58 of the Exposure Draft to all

regulatory assets and regulatory liabilities would be unlikely to outweigh the

costs for users in understanding the resulting accounting mismatches and for

preparers in determining an appropriate discount rate for these regulatory

assets and regulatory liabilities.

7

33. A few respondents suggested that examples dealing with pension costs could be

beneficial. When drafting the final Standard, we will consider whether to include

examples illustrating how the proposals would apply to particular pension scenarios.

Appendix A includes worked examples for some of the scenarios mentioned by

respondents (including that mentioned in paragraph 31).

34. We recommend that the final Accounting Standard retain the proposed measurement

requirements in paragraph 61 of the Exposure Draft for items that affect regulated

rates only when the related cash is paid or received.

6

This matter was discussed by the members of the Consultative Group on Rate Regulation at their meeting on

13 October 2023. The meeting summary notes can be found here.

7

Paragraph BC176 of the Basis for Conclusions accompanying the Exposure Draft.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 12 of 27

Question for the IASB

2. Does the IASB agree with the staff recommendation in paragraph 34?

Presentation proposals

35. This section is structured as follows:

(a) feedback (paragraphs 36–41); and

(b) staff analysis (paragraphs 42–62).

Feedback

36. Most respondents agreed with the proposal in paragraph 69 of the Exposure Draft,

with some explicitly supporting the IASB’s rationale for these proposals.

8

37. The IASB acknowledged that presenting all regulatory income and regulatory expense

in profit or loss (immediately below revenue) would ‘coherently and understandably

show the effects on revenue of regulatory assets and regulatory liabilities and changes

in them.’ Nevertheless, the IASB proceeded with the presentation proposals in

paragraph 69 of the Exposure Draft because presenting certain components of

regulatory income or regulatory expense in profit or loss would mean that the same

underlying remeasurement would lead to two opposite effects: one in profit or loss for

the regulatory asset or regulatory liability and the other in other comprehensive

income for the related liability or related asset.

38. A few respondents—mainly national standard-setters in Asia-Oceania and Latin

America—disagreed with the proposal. The same individual referred to in

paragraph 30, expressed explicit support for the alternative view. Many of the

respondents that disagreed with the proposal said that all regulatory income and

8

See paragraphs BC183–BC186 of the Basis for Conclusions accompanying the Exposure Draft.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 13 of 27

regulatory expense should be presented in profit or loss because such presentation

would:

(a) show the effects on revenue of regulatory assets and regulatory liabilities and

changes in them. In addition, this would better portray the total allowed

compensation for the goods or services supplied to customers during the

period;

(b) avoid implying that the proposal incorporates a matching concept;

(c) avoid additional complexity that may result from presenting regulatory income

and regulatory expense wholly or partly in other comprehensive income; and

(d) avoid extending the list of items presented in other comprehensive income

because no conceptual basis has been developed for what should be included

in other comprehensive income.

39. A few respondents—mainly accounting firms and standard-setters in Europe—asked

whether and how the cumulative amount of regulatory income or regulatory expense

presented in other comprehensive income should be reclassified to profit or loss. One

respondent said that reclassification could be complex when the underlying item is

remeasured partly through profit or loss and partly through other comprehensive

income (for example, in the case of a regulatory asset recognised in relation to a

defined benefit obligation).

40. A few respondents who agreed with the proposed presentation asked for the final

Standard to include examples on the presentation of regulatory income or regulatory

expense in other comprehensive income, in particular for pension costs and their

related income tax effects.

41. A national standard-setter in Asia-Oceania asked whether the principle underlying the

proposal should be extended to require an entity to present regulatory income or

regulatory expense relating to allowable or chargeable income taxes within the tax

expense line item in profit or loss.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 14 of 27

Staff analysis

42. This section is structured as follows:

(a) presentation proposals in the Exposure Draft (paragraphs 43–50);

(b) guidance on reclassification (paragraphs 51–58); and

(c) other matters (paragraphs 59–61).

Presentation proposals in the Exposure Draft

43. IFRS Accounting Standards limit the items that can be included in other

comprehensive income. The regulatory income and regulatory expense presented in

other comprehensive income in accordance with paragraph 69 of the Exposure Draft

would be limited to these types of remeasurements. However, as some respondents

commented, the amounts of such remeasurements could be material.

44. Items in other comprehensive income include:

(a) unrealised gains and losses from financial instruments (for example, bonds,

derivatives and hedges);

(b) foreign exchange currency adjustments; and

(c) unrealised gains and losses on pension plans.

45. Out of the items above, the ones that may be most relevant for rate-regulated entities

are gains and losses on pension plans and financial instruments. Regulatory schemes

generally provide compensation for pension costs, although regulators may not always

follow a cash basis methodology. Regulatory schemes may also entitle entities to add

to (deduct from) regulated rates charged to customers realised losses (realised gains)

arising from derivatives that aim to protect an entity against changes in, for example,

input prices or foreign exchange rates.

9

We have also learned that these examples

would be more common in North America.

9

Illustrative Example 7A.13 accompanying the Exposure Draft illustrates the case of a regulatory agreement that

allows an entity to recover losses arising from the settlement of a futures contract.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 15 of 27

46. Using the fact pattern from Example 1 (in Appendix A) we have illustrated both the

presentation approach in the Exposure Draft and the alternative approach (presenting

all regulatory income and regulatory expense in profit or loss).

(a) Table 2 in Appendix A (reproduced below) shows the presentation proposals

in paragraph 69 of the Exposure Draft.

(b) Table 2A in Appendix A (reproduced below) shows the presentation of all

regulatory income and regulatory expense in profit or loss.

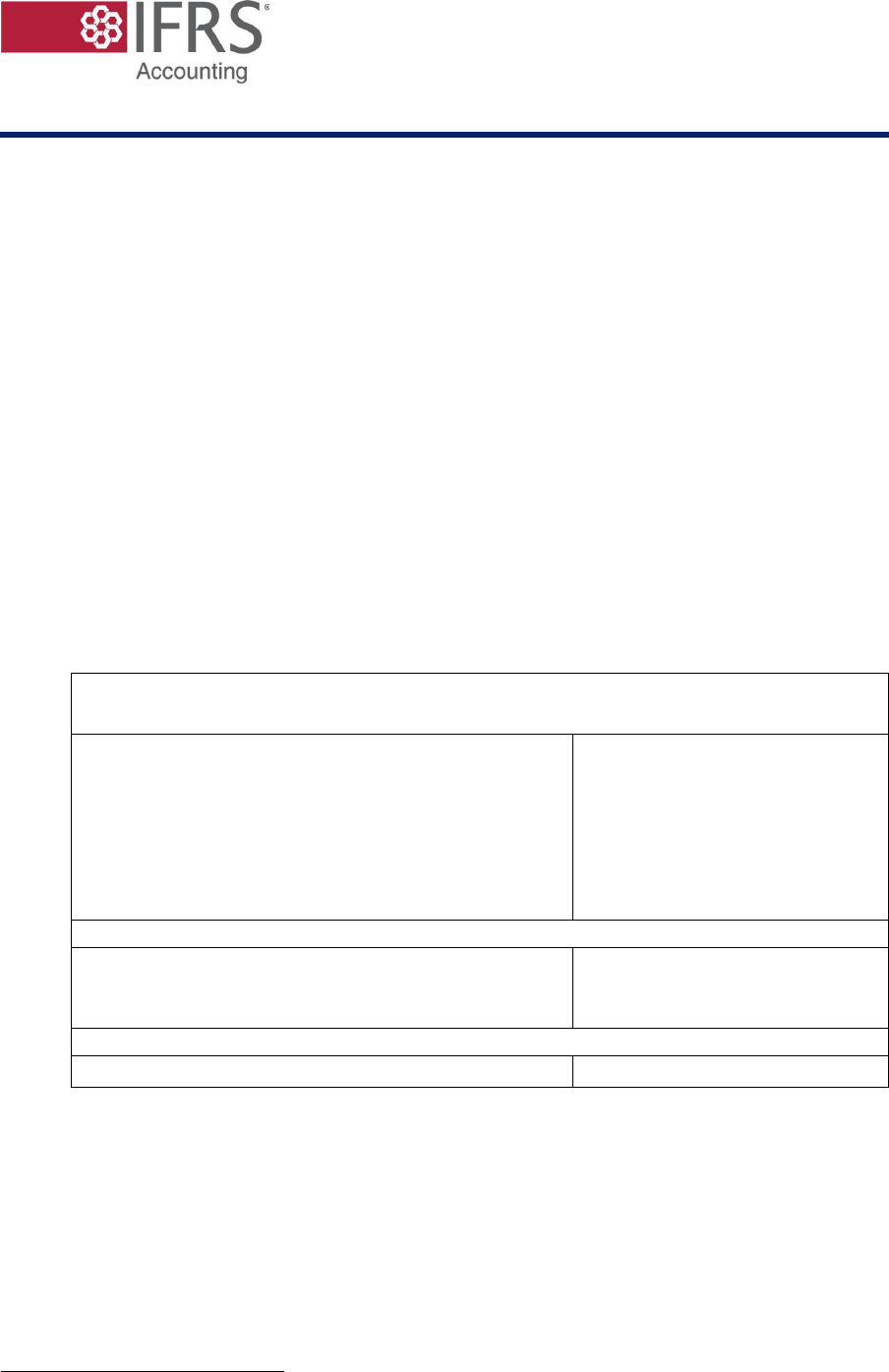

Table 2—Statement of comprehensive income

(illustrating the presentation proposals in paragraph 69 of the Exposure Draft)

In CU

Year 0

Year 1

Year 2

Revenue

10

15

20

Regulatory income / (Regulatory expense)

80

92

108

Defined benefit plan

Service costs

(90)

(98)

(108)

Net interest on the net defined benefit liability

(9)

(20)

Profit / (loss)

0

0

0

Remeasurement of the net defined benefit liability

0

(53)

38

Remeasurement of the related regulatory asset

0

53

(38)

Other comprehensive income

0

0

0

Total comprehensive income

0

0

0

Table 2A—Statement of comprehensive income

(illustrating the alternative presentation approach)

In CU

Year 0

Year 1

Year 2

Revenue

10

15

20

Regulatory income / (Regulatory expense)

80

145

70

Defined benefit plan

Service costs

(90)

(98)

(108)

Net interest on the net defined benefit liability

(9)

(20)

Profit / (loss)

0

53

(38)

Remeasurement of the net defined benefit liability

0

(53)

38

Other comprehensive income

0

(53)

38

Total comprehensive income

0

0

0

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 16 of 27

47. We have discussed the presentation approaches in Tables 2 and 2A with users of

financial statements—specifically a few equity analysts from Asia-Oceania and North

America and a credit analyst from Europe. These users expressed a preference for the

approach in Table 2 (as proposed in paragraph 69 of the Exposure Draft) on the

grounds that it is simple to understand. They said users typically do not rely on

information presented in other comprehensive income for their analysis.

48. These users also thought that the approach in Table 2A could lead to entities

presenting alternative performance measures to explain their operating performance or

to help users reconcile financial statements to regulatory reports. These alternative

performance measures would seek to eliminate the volatility in profit or loss arising

from the approach illustrated in Table 2A. These users expressed a preference for the

approach proposed in the Exposure Draft because it would be less likely to result in

the entity providing alternative performance measures.

49. However, one of these users also said that:

(a) the most useful information is a measure of profit or loss that is most closely

aligned with how the regulator evaluates an entity’s overall performance. If

the regulator evaluates an entity’s overall performance without considering

actuarial gains or losses, the approach in Table 2 would be preferable. If the

regulator evaluates the entity’s overall performance considering actuarial gains

or losses, the approach in Table 2A would then be preferable.

(b) if the pension cost is recovered in full, the approach in Table 2 would be

preferred because it avoids reflecting volatility in profit or loss over reporting

periods.

50. We think the final Standard should retain the proposed presentation requirements in

paragraph 69 of the Exposure Draft for the following reasons:

(a) most respondents agreed with the proposed presentation, for the reasons

outlined in the Basis for Conclusions accompanying the Exposure Draft; and

(b) users of financial statements support the proposals.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 17 of 27

Guidance on reclassification

51. As mentioned in paragraph 39, a few respondents asked for more guidance on the

reclassification of regulatory income or regulatory expense presented in other

comprehensive income to profit or loss. One respondent also asked how an entity

would allocate recovery of a regulatory asset when the underlying item has been

remeasured partly through profit or loss and partly through other comprehensive

income.

52. We think that the reclassification to profit or loss of amounts of regulatory income or

regulatory expense presented in other comprehensive income should follow the

presentation requirements of the underlying item (paragraph 56).

53. For example, in the case of a defined benefit pension, paragraph 122 of IAS 19

Employee Benefits says (emphasis added):

122 Remeasurements of the net defined benefit liability (asset) recognised in

other comprehensive income shall not be reclassified to profit or loss

in a subsequent period. However, the entity may transfer those amounts

recognised in other comprehensive income within equity.

54. Because IAS 19 would prohibit an entity from reclassifying remeasurements of the net

defined benefit liability (asset) to profit or loss in a subsequent period, we think that

an entity should also be prohibited from reclassifying regulatory income (regulatory

expense) relating to such remeasurements. This would also mean that an entity should

not allocate the recovery of the regulatory asset between profit or loss and other

comprehensive income. Example 1 in Appendix A illustrates a remeasurement that

would not be subsequently reclassified (paragraph A9).

55. There will also be cases when the amounts presented in other comprehensive income

in relation to the underlying assets or liabilities would be reclassified to profit or loss

in accordance with the relevant IFRS Accounting Standards. Cash flow hedges would

be such an example. In the case of a cash flow hedge, regulatory income or regulatory

expense relating to gains or losses arising from a hedging instrument presented in

other comprehensive income would be reclassified to profit or loss at the same time as

the gains or losses on the hedging instrument are reclassified to profit or loss.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 18 of 27

56. We think an entity presenting regulatory income or regulatory expense in other

comprehensive income in accordance with paragraph 69 of the Exposure Draft should

be required to reclassify amounts to profit and loss as and when application of IFRS

Accounting Standards to the related liability or asset would require such

reclassification. That is, we think the presentation of remeasurements of the related

regulatory asset or regulatory liability should mirror the presentation of

remeasurements of the underlying liability or asset. This would be aligned with the

current requirement in paragraph 22 of IFRS 14 Regulatory Deferral Accounts.

57. Paragraph 22 of IFRS 14 says (emphasis added):

An entity shall present, in the other comprehensive income section of the

statement or profit or loss and other comprehensive income, the net movement

in all regulatory deferral account balances for the reporting period that relate to

items recognised in other comprehensive income. Separate line items shall be

used for the net movement related to items that, in accordance with other

Standards:

(a) will not be reclassified subsequently to profit or loss; and

(b) will be reclassified subsequently to profit or loss when specific

conditions are met.

58. Apart from the clarification proposed in paragraph 56, we have not identified a need

to include additional guidance in the final Standard. However, we think it may be

helpful to include an example illustrating a case when the cumulative amount of

regulatory income or regulatory expense presented in other comprehensive income is

reclassified to profit or loss.

Other matters

59. When developing the proposed presentation requirement in paragraph 69 of the

Exposure Draft, the IASB did not propose any other presentation and disclosure

requirements for the regulatory income or regulatory expense presented in other

comprehensive income beyond the requirements in IAS 1.

10

10

Paragraph BC186 of the Basis for Conclusions accompanying the Exposure Draft.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 19 of 27

60. IAS 1 requires separate presentation of items of other comprehensive income

classified by nature and grouped according to whether they will be reclassified

subsequently to profit or loss. IAS 1 also requires that an entity disclose

reclassification adjustments relating to components of other comprehensive income.

11

Our understanding is that these requirements will be carried forward largely

unchanged in the prospective [draft] IFRS 18.

12

We think the decision of the IASB

when developing the Exposure Draft remains appropriate and therefore do not

recommend requirements beyond those in IAS 1 or in the prospective [draft] IFRS 18.

61. A national standard-setter in Asia-Oceania asked whether the principle underlying the

presentation proposal in paragraph 69 of the Exposure Draft should be extended to

require an entity to present regulatory income or regulatory expense relating to

allowable or chargeable income taxes within the tax expense line item in profit or loss

(paragraph 41). We do not think that further disaggregation of regulatory income and

regulatory expense in the financial statements is appropriate because:

(a) the presentation proposals in the Exposure Draft would allow users to clearly

identify the net movement in regulatory balances. Introducing further

disaggregation would make this more difficult;

(b) the presentation proposals in the Exposure Draft would result in the consistent

application of IFRS Accounting Standards for all other transactions or

activities, regardless of whether an entity has rate-regulated activities; and

(c) an entity can provide disaggregated information about regulatory income and

regulatory expense in the notes.

62. We recommend that the final Accounting Standard:

(a) retain the proposed requirements in paragraph 69 of the Exposure Draft to

present specified regulatory income and regulatory expense in other

comprehensive income (paragraph 50);

11

Paragraphs 82A and 92 of IAS 1.

12

The IASB expects to publish the new IFRS Accounting Standard in Q2 2024.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 20 of 27

(b) clarify that an entity reclassifies regulatory income or regulatory expense

presented in other comprehensive income to profit or loss when, and to the

extent that, IFRS Accounting Standards require the reclassification of the

related expense or income to profit or loss (paragraph 56); and

(c) not include presentation requirements for other comprehensive income and

instead relies on the requirements in IAS 1 or the prospective [draft] IFRS 18

(paragraph 60).

Question for the IASB

3. Does the IASB agree with the staff recommendations in paragraph 62?

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 21 of 27

Appendix A—Pension cost example

A1. Appendix A illustrates the application of the Exposure Draft proposals to defined

benefit pension costs.

Example 1

Assume a regulatory agreement allows the recovery of defined benefit pension

costs based on estimates of an entity’s cash contributions rather than when the costs

are incurred in accordance with IAS 19. The example assumes:

(a) estimated and actual cash contributions are the same.

(b) the regulatory asset is not subject to uncertainties that are not present in the

related pension liability (paragraph 61(b) of the Exposure Draft).

A2. Table 1 shows the movement of the pension liability for Years 0–2.

13

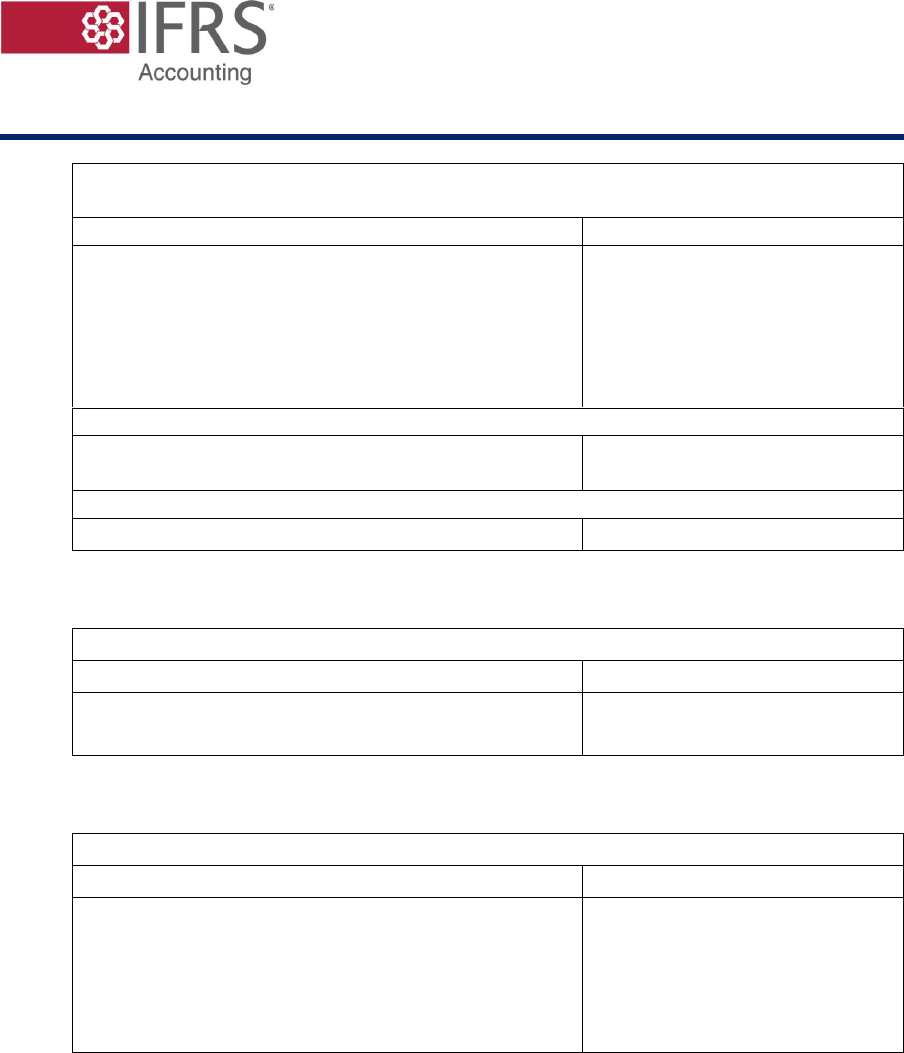

Table 1—Movement of the pension liability

In CU

Year 0

Year 1

Year 2

Opening balance

0

80

225

Service costs and net interest

90

107

128

Remeasurement

0

53

(38)

Cash payments

(10)

(15)

(20)

Closing balance

80

225

295

A3. In this example, the regulatory agreement provides the entity with a right to recover

the pension costs and that right is enforceable. However, when establishing the

regulatory compensation to which the entity is entitled for Years 0–2, the regulator

would consider the estimated cash payments for these years (which in this case equal

the actual cash payments), not the expense incurred by the entity in accordance with

IAS 19.

A4. For example, in Year 0 the regulator would have determined the rates to be charged

during that period considering the estimated cash payments of CU10, not the entity’s

expense for that period of CU90. In this case, a regulatory asset of CU80 arises in

13

Monetary amounts are denominated in ‘currency units’ (CU).

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 22 of 27

Year 0. That regulatory asset represents a difference in timing arising from

differences between the regulatory criterion for determining the compensation for

Year 0 and the accounting criterion for recognising the expense in that period. The

regulator will not track the difference of CU80 and will not explicitly adjust the future

rates for this amount. However, regardless of the criterion used by the regulator for

determining the compensation for the pension cost, over the long term, the entity’s

entire pension cost would be included in regulated rates charged and in revenue

recognised.

A5. Table 2 shows the statement of comprehensive income. Because the example

assumes that estimated and actual cash payments are the same, the revenue line of the

statement of comprehensive income is the same as the cash payments of the pension

liability in Table 1.

14

Table 2—Statement of comprehensive income

(illustrating the presentation proposals in paragraph 69 of the Exposure Draft)

In CU

Year 0

Year 1

Year 2

Revenue

10

15

20

Regulatory income / (Regulatory expense)

80

92

108

Defined benefit plan

Service costs

(90)

(98)

(108)

Net interest on the net defined benefit liability

(9)

(20)

Profit / (loss)

0

0

0

Remeasurement of the net defined benefit liability

0

(53)

38

Remeasurement of the related regulatory asset

0

53

(38)

Other comprehensive income

0

0

0

Total comprehensive income

0

0

0

A6. Using the fact pattern from Example 1, Table 2A illustrates the alternative

presentation approach discussed in paragraph 46 of the paper.

14

The term ‘revenue’ in the tables should be read as ‘revenue from contracts with customers’.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 23 of 27

Table 2A—Statement of comprehensive income

(illustrating the alternative presentation approach)

In CU

Year 0

Year 1

Year 2

Revenue

10

15

20

Regulatory income / (Regulatory expense)

80

145

70

Defined benefit plan

Service costs

(90)

(98)

(108)

Net interest on the net defined benefit liability

(9)

(20)

Profit / (loss)

0

53

(38)

Remeasurement of the net defined benefit liability

0

(53)

38

Other comprehensive income

0

(53)

38

Total comprehensive income

0

0

0

A7. Table 3 shows the statement of financial position.

Table 3—Statement of financial position

In CU

Year 0

Year 1

Year 2

Regulatory asset

80

225

295

Defined benefit obligation

(80)

(225)

(295)

A8. Table 4 shows the reconciliation of the regulatory asset related to the pension liability.

Table 4—Reconciliation of regulatory asset

In CU

Year 0

Year 1

Year 2

Opening balance

0

80

225

Amount recognised

90

107

128

Remeasurements in OCI

0

53

(38)

Recovery

(10)

(15)

(20)

Closing balance

80

225

295

A9. Table 4 also shows the recovery of the regulatory asset arising in Example 1. In

Year 1 the regulatory asset recovery is CU15, which is the estimated cash payments

for Year 1. The recovery of the regulatory asset by the estimated cash payment is

reflected in revenue recognised and in regulatory expense in Year 1 (see Table 2).

This means that the amounts relating to the remeasurement of the regulatory asset

presented in other comprehensive income are not reclassified to profit or loss as the

regulatory asset is recovered (paragraph 54 of this paper).

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 24 of 27

Appendix B—Additional pension cost examples

B1. This appendix illustrates the application of the Exposure Draft proposals to specific

fact patterns mentioned by respondents. In considering these fact patterns we have

not identified any changes that would be required to the Exposure Draft proposals.

These fact patterns could be considered when developing additional illustrative

examples. Examples 2 and 3 are variations of Example 1 in Appendix A.

Example 2

Example 2 is similar to Example 1 in that the regulator allows an entity to recover

pension costs on the basis of estimated cash payments. However, Example 2

assumes that there is a difference between estimated and actual cash payments.

B2. For Example 2:

(a) Table 5 shows actual and estimated cash payments;

(b) Table 6 shows the statement of comprehensive income. In this case, the

revenue line of the statement of comprehensive income is the same as the

estimated cash payments of the pension costs in Table 5;

(c) Table 7 shows the statement of financial position. For simplicity, the example

assumes the regulatory asset is not subject to uncertainties that are not present

in the related pension liability;

15

and

(d) Table 8 shows the reconciliation of the regulatory asset related to the pension

liability.

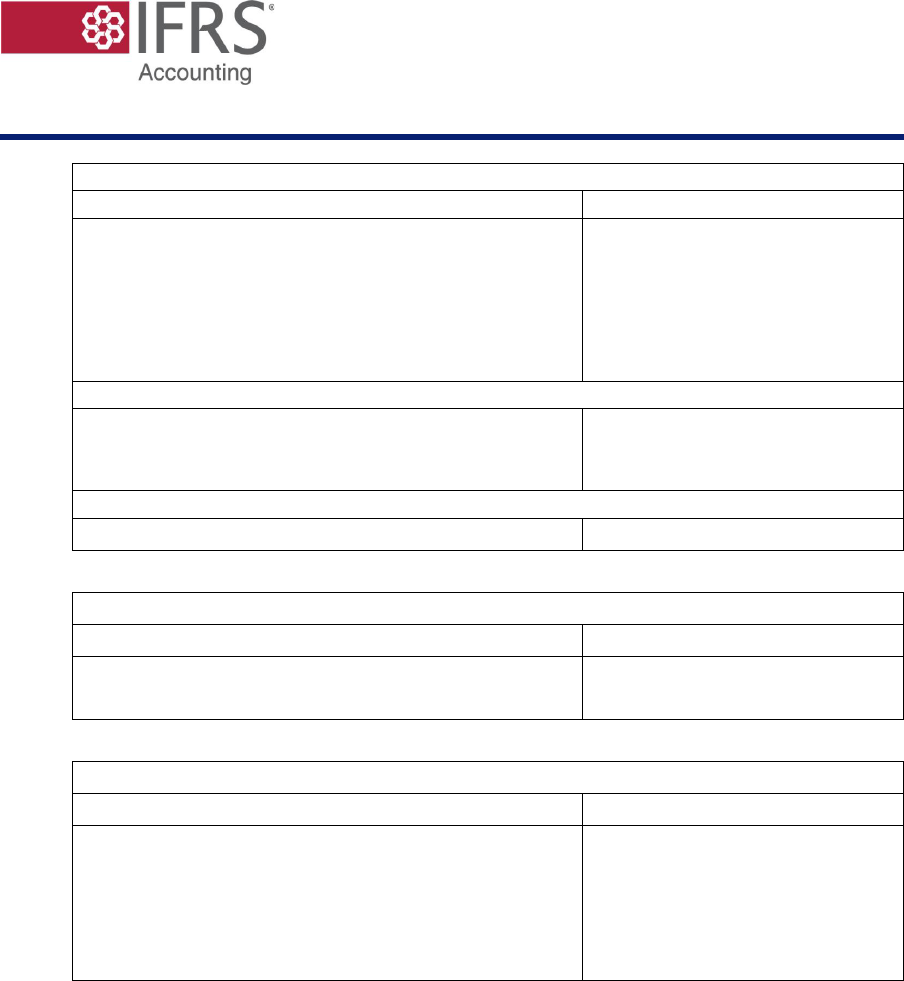

Table 5—Actual and estimated cash payments

In CU

Year 0

Year 1

Year 2

Actual cash payments

10

15

20

Estimated

5

10

30

15

Paragraph 61 (b) of the Exposure Draft.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 25 of 27

Table 6—Statement of comprehensive income

In CU

Year 0

Year 1

Year 2

Revenue

5

10

30

Regulatory income / (Regulatory expense)

80

92

108

Defined benefit plan

Service costs

(90)

(98)

(108)

Net interest on the defined benefit liability

(9)

(20)

Profit / (loss)

(5)

(5)

10

Remeasurement of the net defined benefit liability

(53)

38

Remeasurement of the related regulatory asset

0

53

(38)

Other comprehensive income

0

0

0

Total comprehensive income

(5)

(5)

10

Table 7—Statement of financial position

In CU

Year 0

Year 1

Year 2

Regulatory asset

80

225

295

Defined benefit obligation

(80)

(225)

(295)

Table 8—Reconciliation of regulatory asset

In CU

Year 0

Year 1

Year 2

Opening balance

0

80

225

Amount recognised

85

102

138

Remeasurements in OCI

0

53

(38)

Recovery

(5)

(10)

(30)

Closing balance

80

225

295

B3. As shown in Example 2, we think the measurement proposal in paragraph 61 of the

Exposure Draft can be applied to the case when a regulator allows an entity to recover

pension costs on the basis of estimated cash payments. In Example 2:

(a) the estimated cash payments for Years 0–2 are the amounts included in

regulated rates charged in these years and are also the amounts that recover the

related regulatory asset; and

(b) differences between estimated and actual cash payments are reflected in profit

or loss.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 26 of 27

B4. Example 3 illustrates another possible scenario.

Example 3

Example 3 is similar to Example 2 in that the regulator allows the entity to recover

pension costs on the basis of estimated cash payments. However, the regulator also

allows the entity to adjust differences between estimated and actual cash payments

in the regulated rates charged in the subsequent period.

B5. In Example 3, we think two differences in timing arise:

(a) a difference in timing arising from the regulator allowing recovery of the

pension costs on a cash basis, based on estimates of cash payments; and

(b) a difference in timing arising from differences between estimated and actual

cash payments.

B6. The difference in timing in paragraph B5(a) would give rise to the same regulatory

asset as that in Example 2 (see Table 8).

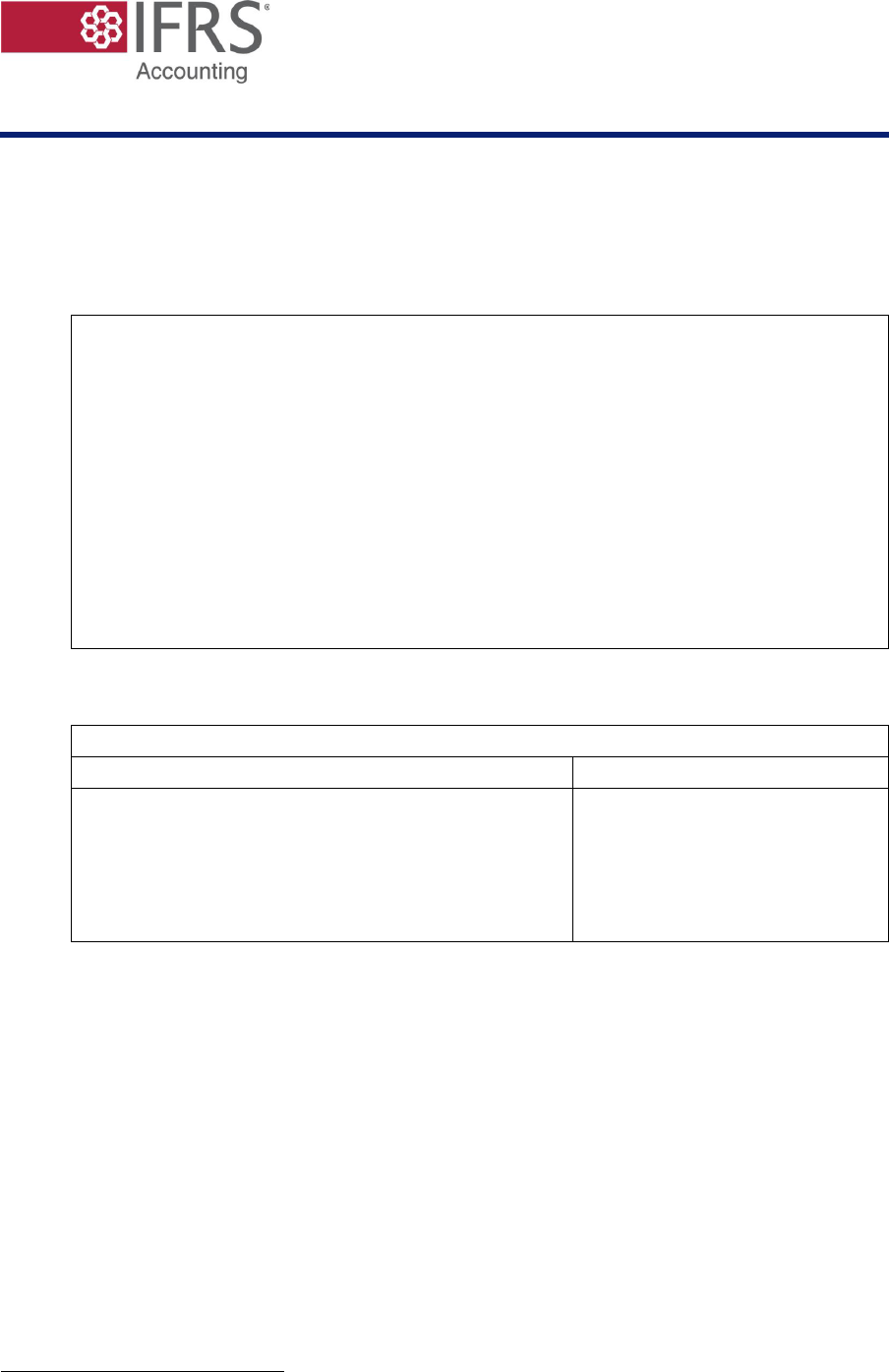

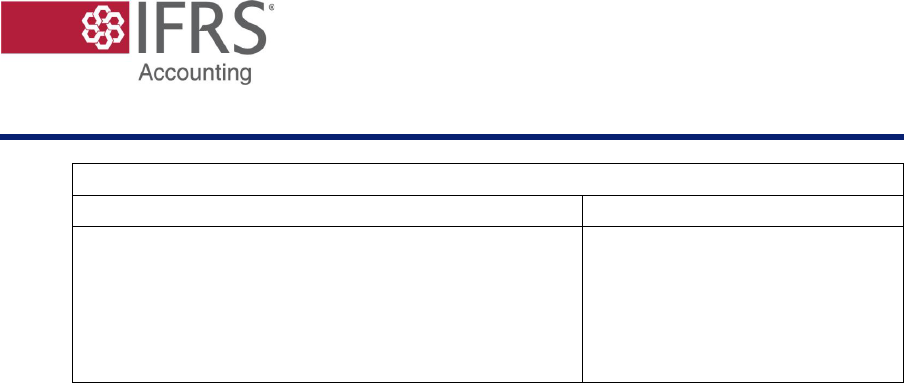

Table 8—Reconciliation of regulatory asset

In CU

Year 0

Year 1

Year 2

Opening balance

0

80

225

Amount recognised

85

102

138

Remeasurements in OCI

0

53

(38)

Recovery

(5)

(10)

(30)

Closing balance

80

225

295

B7. The difference in timing in paragraph B5(b)would give rise to an enforceable right

(regulatory asset) or enforceable obligation (regulatory liability) to adjust the

regulated rates in the subsequent period. We think that an entity should measure that

regulatory asset or regulatory liability by applying the cash-flow-based measurement

technique proposed for all other regulatory assets and regulatory liabilities. This

regulatory asset or regulatory liability is shown in Table 9.

Staff paper

Agenda reference: 9D

Rate-regulated Activities | Items affecting regulated rates on a

cash basis

Page 27 of 27

Table 9—Reconciliation of regulatory asset (regulatory liability)

In CU

Year 0

Year 1

Year 2

Opening balance

0

5

5

Amount recognised

5

5

(10)

Remeasurements in OCI

0

0

0)

Recovery

0

(5)

(5)

Closing balance

5

5

(10)