1 (21)

YEAR-END REPORT 2023

Q4

Improved operating margin and strong cash flow for the year

Fourth quarter 2023

• Net sales decreased by 17% to SEK 8,605m (10,353).

Changes in exchange rates impacted with -1%. Planned

exits of low-margin petrol-powered business impacted

with -2%.

• Organic sales declined by 15%.

• Operating income was SEK -983m (-1,737) and the

operating margin was -11.4% (-16.8).

• Excluding items affecting comparability, the operating

income amounted to SEK -168m (-13) and the operating

margin was -1.9% (-0.1).

• Items affecting comparability amounted to

SEK -815m (-1,724), and was mainly related to the

expansion of the Group’s cost savings initiatives,

announced in October 2023 and a write-down related to

the acceleration of the strategic transformation,

announced in October 2022, see page 17.

• Earnings per share before dilution amounted to

SEK -1.77 (-2.44) and earnings per share after dilution

amounted to SEK -1.77 (-2.43).

• Cash flow from operations and investments amounted to

SEK -743m (-2,845). Direct operating cash flow was

SEK 523m (-1,261).

• Husqvarna Construction Division acquired Total Diamond

Products, based in the UK, see page 8.

January – December 2023

• Net sales decreased by 1% to SEK 53,261m (54,037).

Changes in exchange rates contributed with 5%.

Planned exits impacted with -1%.

• Organic sales declined by 5%.

• Operating income was SEK 3,880m (3,043) and the

operating margin was 7.3% (5.6).

• Excluding items affecting comparability, the operating

income amounted to SEK 4,970m (4,853) and the

operating margin was 9.3% (9.0).

• Items affecting comparability amounted to

SEK -1,090m (-1,810), and was mainly related to the

expansion of the Group’s cost savings initiatives,

announced in October 2023 and a write-down related to

the acceleration of the strategic transformation,

announced in October 2022, see page 17.

• Earnings per share before dilution amounted to

SEK 3.81 (3.39) and earnings per share after dilution

amounted to SEK 3.81 (3.38).

• Cash flow from operations and investments was

SEK 4,414m (-4,009). Direct operating cash flow was

SEK 6,541m (-572).

• The CO

2

emissions across the value chain have been

reduced by -44% (-32) compared to the 2015 base line.

• The Board of Directors will propose a dividend for 2023

of SEK 3.00 per share (3.00) to the Annual General

Meeting.

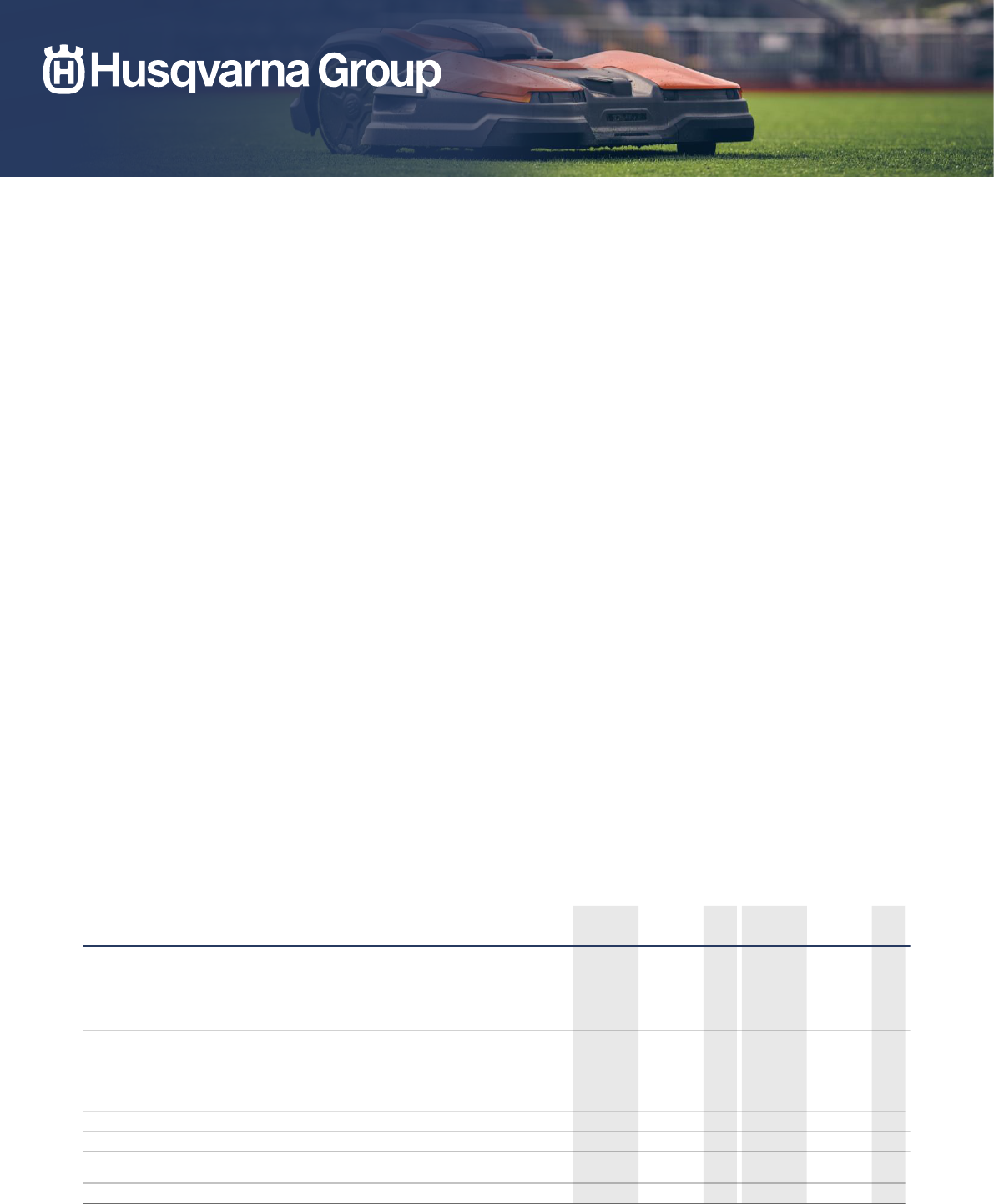

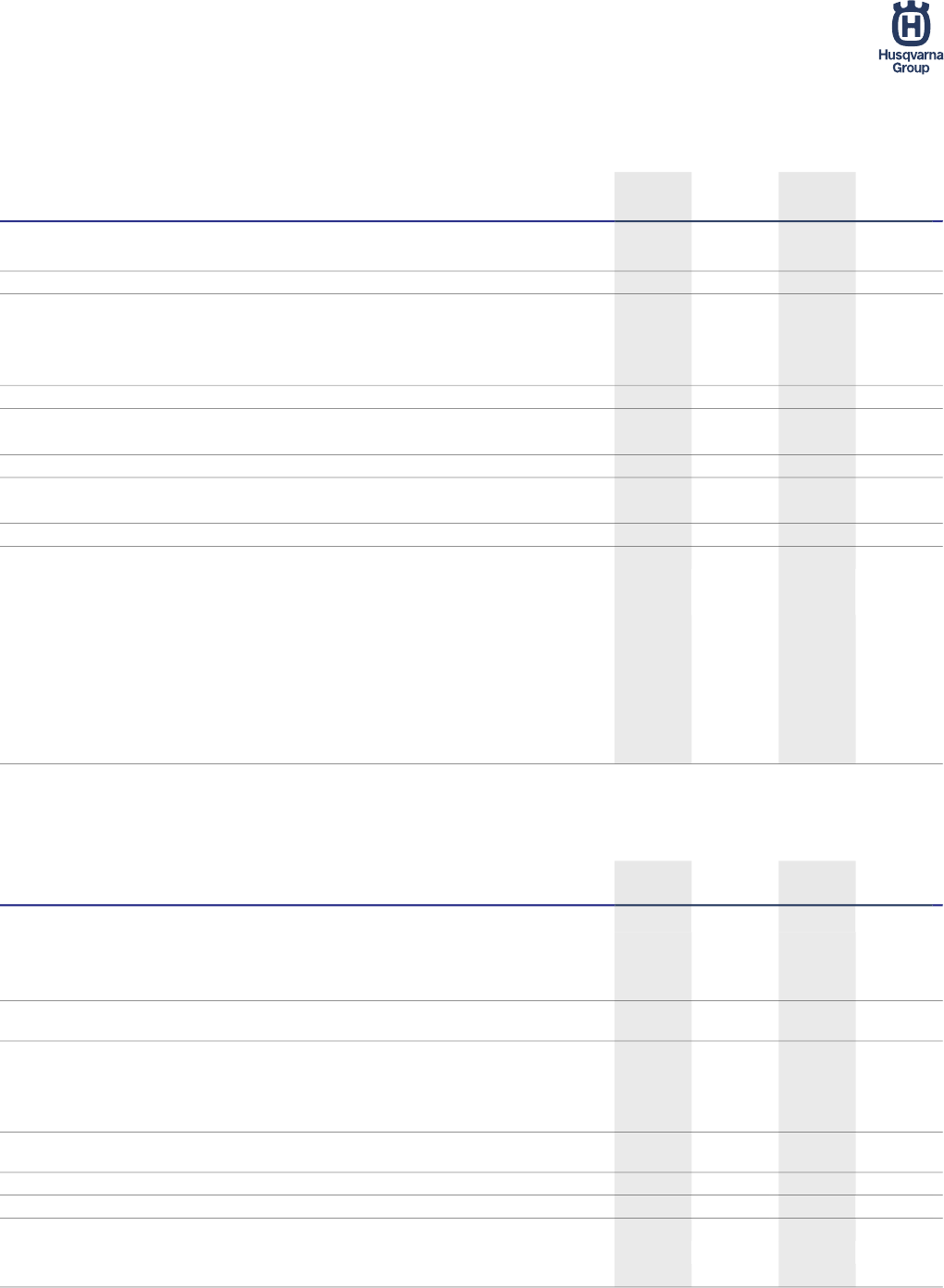

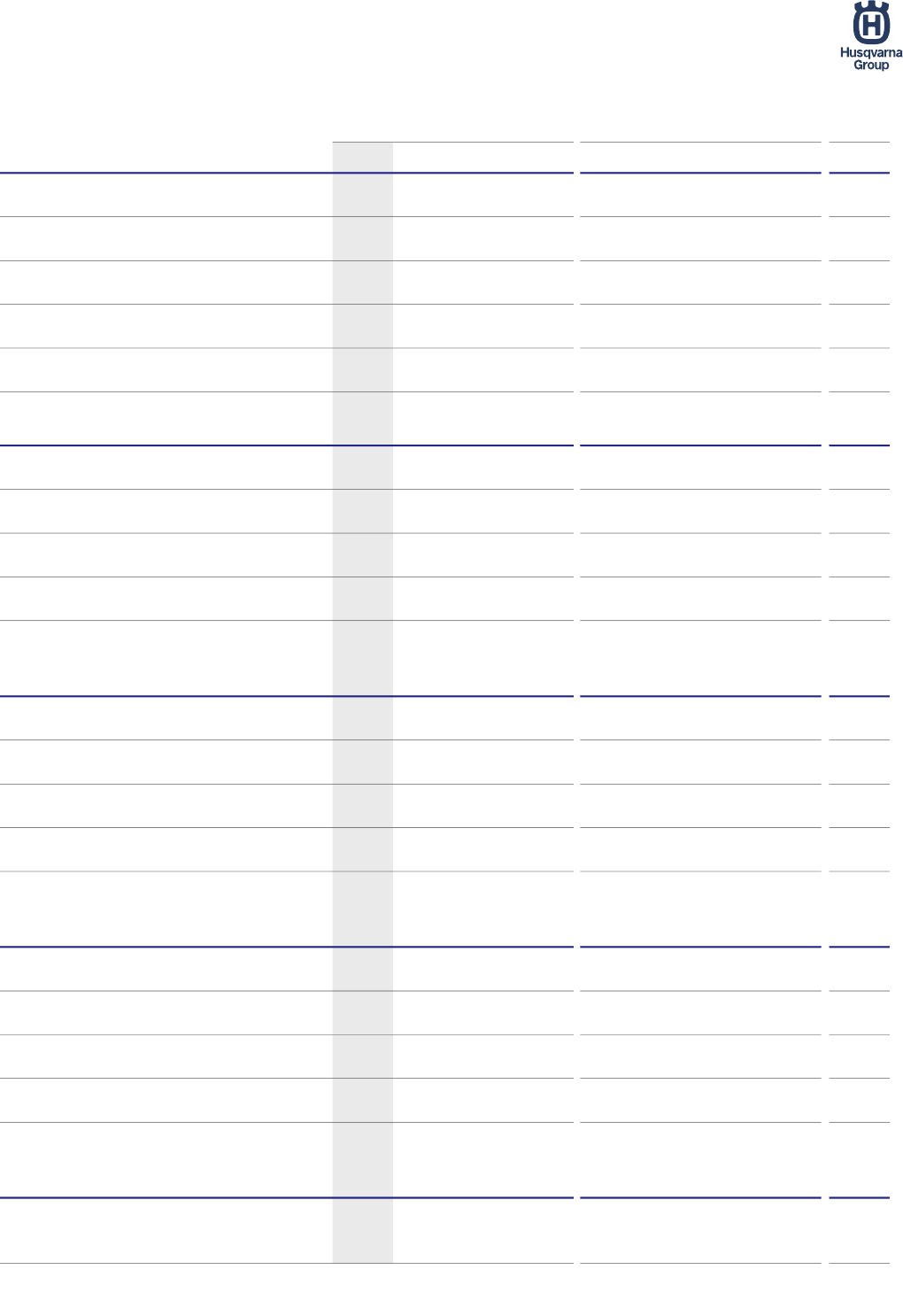

Financial summary

Q4 Q4 Jan-Dec Jan-Dec

2023

2022 ∆%

2023

2022 ∆%

Net sales

8,605 10,353 -17 53,261 54,037 -1

Organic growth*, % -15 8 -5 -1

Operating income (EBIT) -983 -1,737 43 3,880 3,043 28

Operating margin, % -11.4 -16.8 7.3 5.6

Operating income excl. items affecting comparability* -168 -13 4,970 4,853 2

Operating margin excl. items affecting comparability*, % -1.9 -0.1 9.3 9.0

Income after financial items -1,272 -1,963 35 2,878 2,581 12

Net income for the period -1,011 -1,392 27 2,177 1,932 13

Earnings per share before dilution, SEK -1.77 -2.44 27 3.81 3.39 12

Earnings per share after dilution, SEK -1.77 -2.43 27 3.81 3.38 13

Direct operating cash flow* 523 -1,261 141 6,541 -572

Operating working capital / net sales*, % 36.9 30.6 36.9 30.6

*Alternative Performance Measure, refer to "Definitions".

Group, SEKm

Husqvarna Group / Year-end report 2023

2 (21)

Improved operating margin and strong cash flow for the year

“During the year we continued to deliver on our

strategy, reinforced our positions in key segments as

well as achieved an improved operating margin and a

strong cash flow.

Challenging market conditions in the fourth quarter

The fourth quarter was characterized by a continuous

challenging market situation with lower demand. Group

net sales declined by 15% organically and operating

income, excluding items affecting comparability,

amounted to SEK -168m (-13).

In the Husqvarna Forest & Garden Division, sales of

professional robotic mowers and battery-powered

products were strong. However, sales of petrol-

powered wheeled products decreased significantly due

to lower demand and that we proactively are exiting

parts of this segment.

The Gardena Division delivered good growth in

Europe, driven by the watering category, but sales in

Orbit in North America declined. In the Husqvarna

Construction Division, the performance was solid in

emerging markets, however we experienced weaker

development in Europe and in North America in the

fourth quarter. We achieved an improved operating

income and operating margin, excluding items affecting

comparability, for both the Gardena and Construction

divisions driven by solid execution of cost savings as

well as operational efficiency measures.

Improved operating margin in all divisions for the year

For the full-year, Group net sales declined by 1%. The

operating margin, excluding items affecting

comparability, increased to 9.3% (9.0). This was driven

by our cost savings program, which delivered

SEK 380m as well as contribution from price increases

and lower costs for logistics. We improved the

operating margin for all three divisions. Direct operating

cash flow increased to SEK 6.5bn (-0.6), driven by

inventory reductions. The Board will propose to the

Annual General Meeting an unchanged dividend of

SEK 3.00 (3.00) for the year.

We are delivering on our strategic transformation

As part of our transformational journey, we are

focusing on growing in the areas of robotic mowers,

battery-powered products, watering and solutions for

the professional market. During the year, we

progressed on our operational ambitions, increasing

sales of robotic mowers to SEK 8.1bn (6.3), our share

of electrified solutions expanded to some 42% (34) of

our motorized products sales, and the number of

connected devices rose to 4.5m (3.6). With an

increased focus and new innovations, we have

strengthened our market positions in these segments

compared to the previous year. These product

segments have a high future growth potential and now

account for a larger share of our net sales.

The electrification ambition is the major driver to

consistently reduce our carbon footprint. To date, we

have reduced CO₂ emissions (Scope 1, 2 and 3) by

-44% compared with the base year of 2015. At present,

we have thus exceeded our target of a -35% reduction

by 2025. Our commitment to reducing CO₂ emission is

continuing, including our exploration of products using

alternative fuels.

I would like to express my gratitude to all colleagues

and partners for their hard work, exceptional

engagement and contribution this year. We are

dedicated to building a stronger Group while navigating

through ongoing market uncertainties. We have cost

savings and inventory management programs in place,

and we are prepared for 2024, backed by a strong

product lineup featuring many exciting innovative

product launches.”

Pavel Hajman, CEO

Husqvarna Group / Year-end report 2023

3 (21)

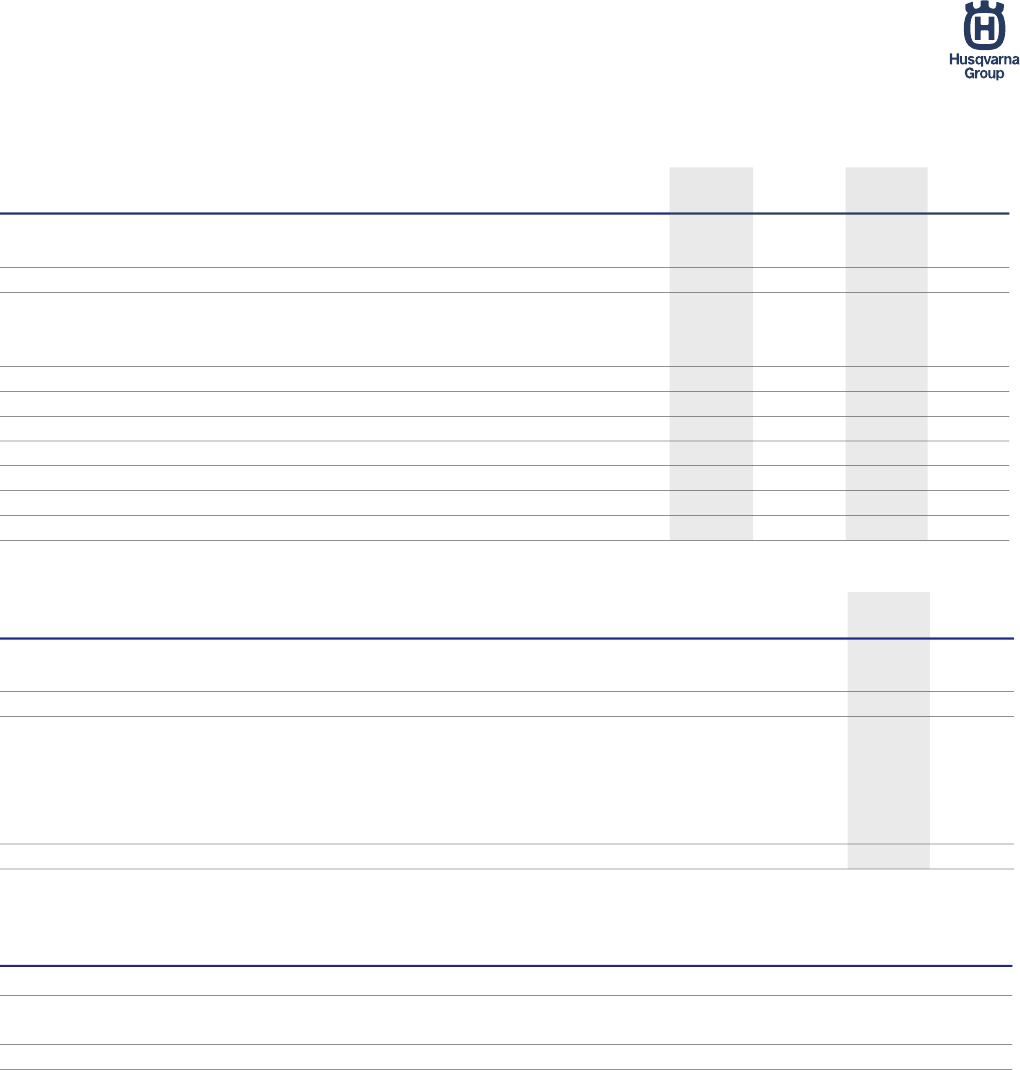

Financial Performance

Financial targets and performance

Husqvarna Group has three financial targets; organic

sales growth, operating margin and capital efficiency.

Fourth quarter

Net sales

Net sales for the fourth quarter decreased by 17% to

SEK 8,605m (10,353). Planned exits impacted with

-2% and changes in exchange rates impacted with

-1%. Organic sales declined 15%. Sales growth was

good for professional robotic mowers and battery-

powered products as well as aftermarket parts and

accessories. Sales for petrol-powered wheeled

products declined significantly during the quarter.

Operating income

Operating income for the fourth quarter amounted to

SEK -983m (-1,737) and the operating margin was

-11.4% (-16.8). Excluding items affecting comparability,

operating income decreased to SEK -168m (-13) and

the operating margin was -1.9% (-0.1). The decline

was mainly a result of lower volumes. This was partly

offset by cost savings, price increases and lower costs

for logistics. Acquisition related amortizations

amounted to SEK -58m (-58).

Changes in exchange rates had a negative impact of

approximately SEK 105m compared to last year,

mainly related to a stronger SEK.

Financial items net

Financial items net amounted to SEK -289m (-226).

The increase was related to higher interest rates.

Income after financial items

Income after financial items amounted to SEK -1,272m

(-1,963).

Taxes

Income tax amounted to SEK 261m (571).

Earnings per share

Net income for the period attributable to equity holders

of the Parent Company amounted to SEK -1,011m

(-1,390), corresponding to SEK -1.77 (-2.43) per share

after dilution.

January – December

Net sales

Net sales for the period decreased by 1% to

SEK 53,261m (54,037). Planned exits impacted with

-1% and changes in exchange rates contributed with

5%. Organic sales declined 5%. Sales growth was

strong for robotic mowers both for the residential and

professional segments as well as for battery-powered

products.

Operating income

Operating income for the period amounted to

SEK 3,880m (3,043) and the operating margin was

7.3% (5.6). Excluding items affecting comparability,

operating income increased to SEK 4,970m (4,853)

and was driven by price increases, lower costs for

logistics and cost savings. The operating margin

excluding items affecting comparability was 9.3% (9.0),

with improved operating margin in all divisions.

Acquisition related amortizations amounted to

SEK -230m (-225).

Changes in exchange rates had a negative effect of

approximately SEK 35m compared to last year.

Financial items net

Financial items net amounted to SEK -1,002m (-461).

The change was related to higher interest rates.

Income after financial items

Income after financial items amounted to SEK 2,878m

(2,581).

Taxes

Income tax amounted to SEK -702m (-649),

corresponding to an effective tax rate of 24.4% (25.1).

Metric

Financial

targets

Achievement

2022

Achievement

2023

Organic growth 5% -1% -5%

Operating margin* 13% 9.0% 9.3%

Capital efficiency** 20% 30.6% 36.9%

*Excluding items affecting comparability

**Operating working capital / net sales, rolling 12-months

Net sales, SEKm

Operating income excl. IAC, SEKm

Operating margin excl. IAC

8,234

10,353

8,605

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

0

3,000

6,000

9,000

12,000

15,000

18,000

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

-180

-13

-168

-4,000

-2,000

0

2,000

4,000

6,000

8,000

10,000

12,000

-1,000

-500

0

500

1,000

1,500

2,000

2,500

3,000

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

-2.2%

-0.1%

-1.9%

-10%

-5%

0%

5%

10%

15%

20%

-10%

-5%

0%

5%

10%

15%

20%

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

Husqvarna Group / Year-end report 2023

4 (21)

Earnings per share

Net income for the period attributable to equity holders

of the Parent Company amounted to SEK 2,177m

(1,935), corresponding to SEK 3.81 (3.38) per share

after dilution.

Cash flow

Cash flow from operations and investments for the year

amounted to SEK 4,414m (-4,009). Direct operating

cash flow was SEK 6,541m (-572). The improvement

was related to a higher operating income and improved

cash flow from working capital changes. Cash flow from

change in inventories amounted to SEK 1,918m

(-3,832), cash flow from change in trade receivables

amounted to SEK 917m (-1,511) and cash flow from

change in trade payables amounted to

SEK -1,579m (-336).

Due to the seasonal build-up of working capital, cash

flow is normally weaker in the first quarter, followed

by stronger cash flow in the second and third quarters.

Cash flow in the fourth quarter is usually negatively

impacted by the pre-season production for the next

year.

Financial position

Group equity as of December 31, 2023, excluding non-

controlling interests, decreased to SEK 23,770m

(24,002), corresponding to SEK 41.6 (41.9) per share

after dilution. Net debt decreased to SEK 15,640m

(17,709). The decrease was mainly related to the strong

cash flow. The net pension liability increased to

SEK 1,994m (1,431). Other interest-bearing liabilities

decreased to SEK 17,245m (19,897) and liquid funds

and other interest-bearing assets decreased to

SEK 3,600m (3,618).

The net debt/EBITDA ratio, excluding items affecting

comparability, increased to 2.1 (1.8), mainly due to

higher borrowings on average. The equity/assets ratio

was 41% (39).

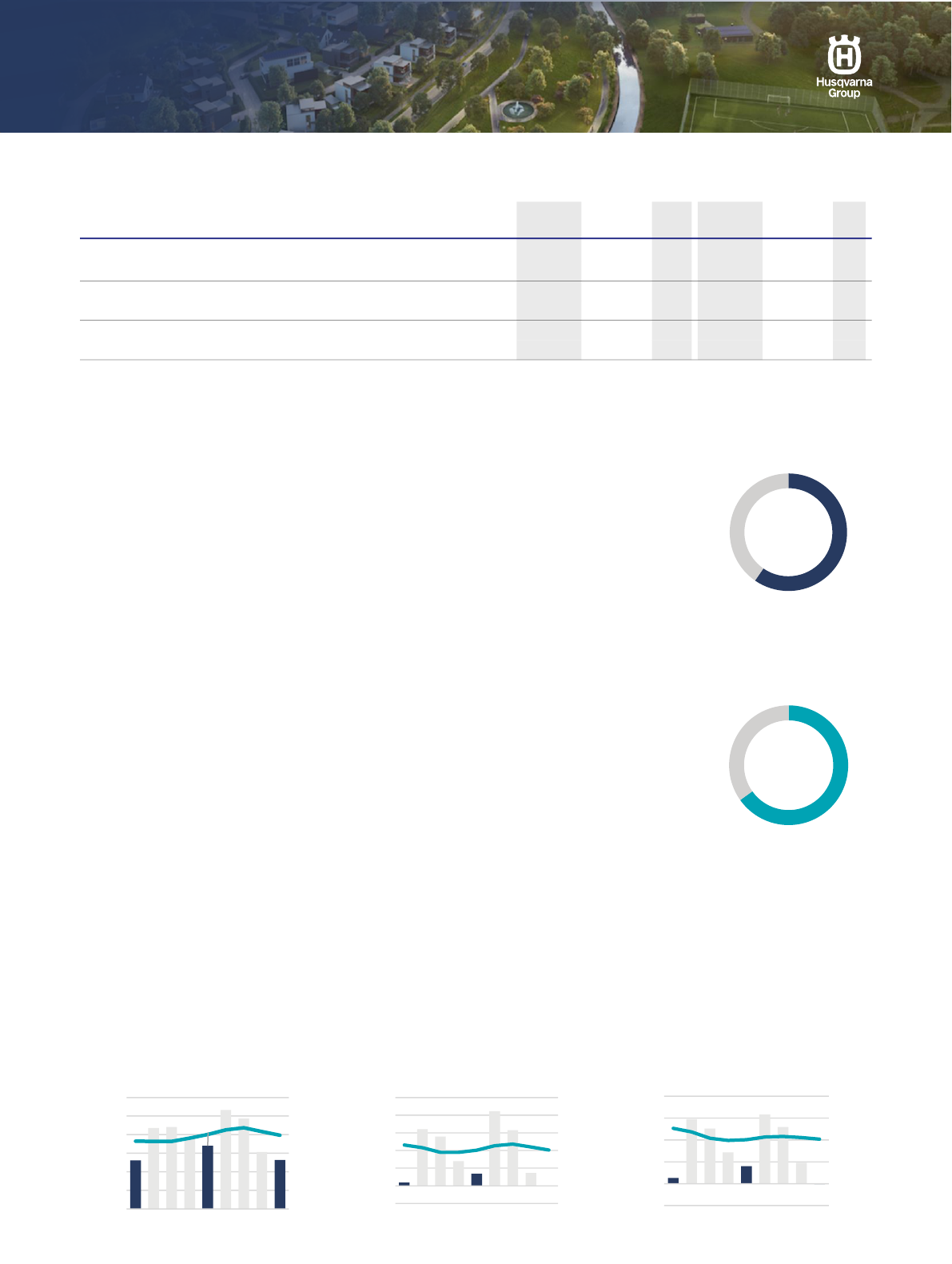

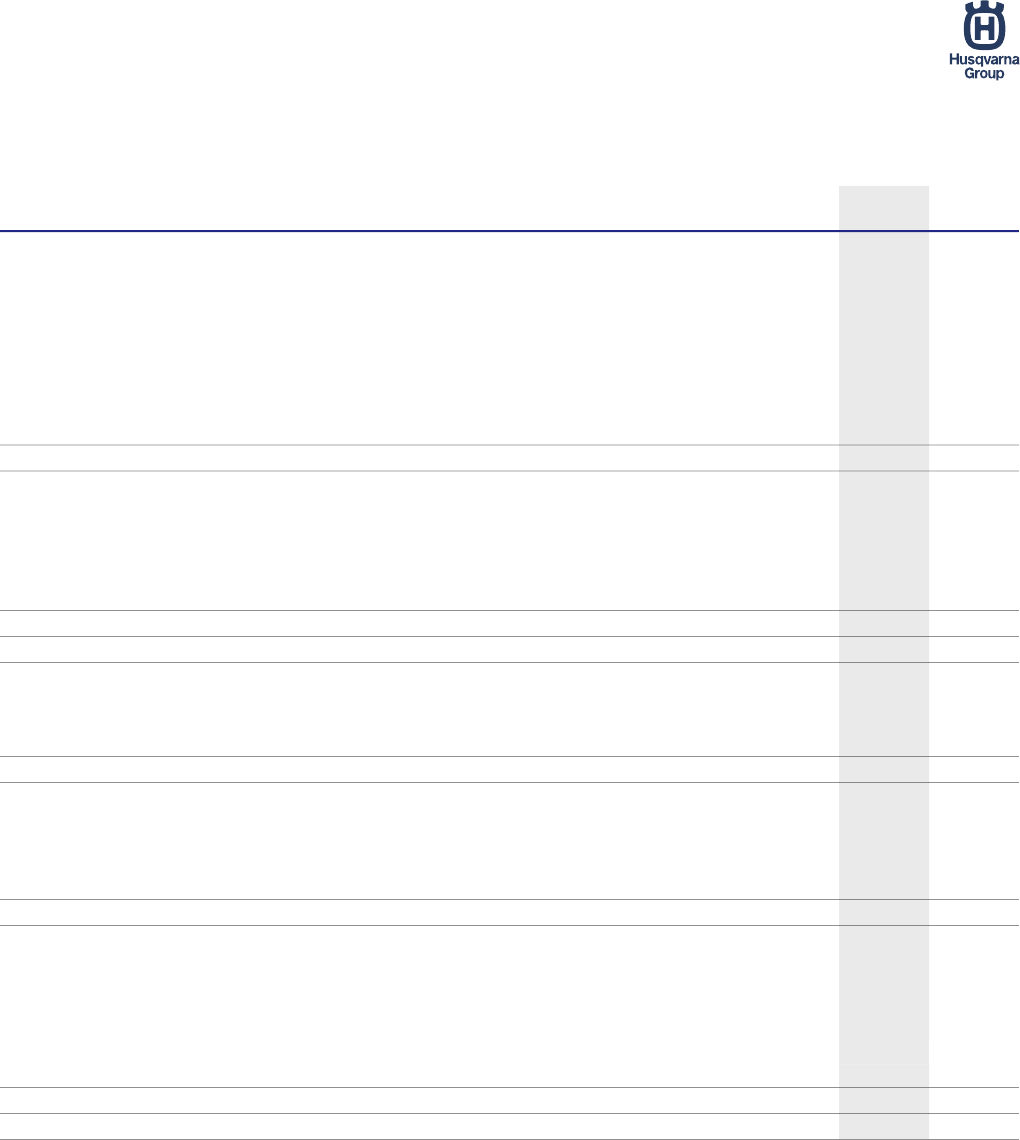

Husqvarna Forest & Garden Division

5 (21)

Financial summary

Fourth quarter 2023

Net sales decreased by 23% to SEK 5,257m (6,793) during the quarter. Planned exits

impacted with -3% and changes in exchange rates contributed with 1%. Organic sales

declined by 21%. The segment for professional robotic mowers achieved a strong growth,

supported by an expanded product range. Sales of residential robotic mowers were lower

during the quarter compared to last year, which was positively impacted by an improved

supply situation and backlog deliveries in the second half of 2022. However, robotic mower

sales in the fourth quarter this year was above the same quarter in previous years. Sales of

petrol-powered wheeled products decreased significantly as a result of lower demand and

that the Group is proactively exiting parts of the segment in North America.

Operating income amounted to SEK -379m (-1,252) and the operating margin was

-7.2% (-18.4). Excluding items affecting comparability, operating income was SEK -7m

(273) and the operating margin was -0.1% (4.0). The decrease was mainly related to lower

volumes and partly offset by cost savings and lower costs for logistics. Changes in

exchange rates had a positive contribution of approximately SEK 10m compared with the

preceding year.

January - December 2023

Net sales decreased by 1% to SEK 31,759m (32,082). Planned exits impacted with -1%

and changes in exchange rates contributed with 4%. Organic sales declined by 4%. Sales

of robotic mowers and battery-powered products were strong during the year, supported by

the fact that a growing number of customers are choosing robotic mowers rather than

traditional wheeled lawn mowers. Growth was solid in the professional segment of robotic

mowers, including Husqvarna CEORA™. Husqvarna Automower® NERA was launched as

the Group’s first robotic mower to offer virtual boundary technology for the residential market.

Operating income amounted to SEK 2,706m (1,807) and the operating margin was 8.5% (5.6). Excluding items

affecting comparability, operating income amounted to SEK 3,236m (3,224) and the operating margin to 10.2%

(10.0). The improvement was mainly related to price increases, cost savings and lower logistics costs. Changes in

exchange rates had a positive contribution of approximately SEK 80m compared with the preceding year.

Q4 Q4 Jan-Dec Jan-Dec

SEKm

2023

2022 ∆%

2023

2022 ∆%

Net sales 5,257 6,793 -23 31,759 32,082 -1

Organic growth*, % -21 15 -4 0

Operating income -379 -1,252 70 2,706 1,807 50

Operating margin, % -7.2 -18.4 8.5 5.6

Operating income excl. items affecting comparability* -7 273 102 3,236 3,224 0

Operating margin excl. items affecting comparability*, % -0.1 4.0 10.2 10.0

* Alternative Performance Measure, refer to "Definitions".

Net sales, SEKm

Operating income excl. IAC, SEKm

Operating margin excl. IAC

Share of Group

net sales, LTM

Share of Group operating

income excl. IAC, LTM

5,231

6,793

5,257

0

8,000

16,000

24,000

32,000

40,000

48,000

0

2,000

4,000

6,000

8,000

10,000

12,000

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

70

273

-7

-1,600

0

1,600

3,200

4,800

6,400

8,000

-400

0

400

800

1,200

1,600

2,000

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

1.3%

4.0%

-0.1%

-5%

0%

5%

10%

15%

20%

-5%

0%

5%

10%

15%

20%

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

60%

65%

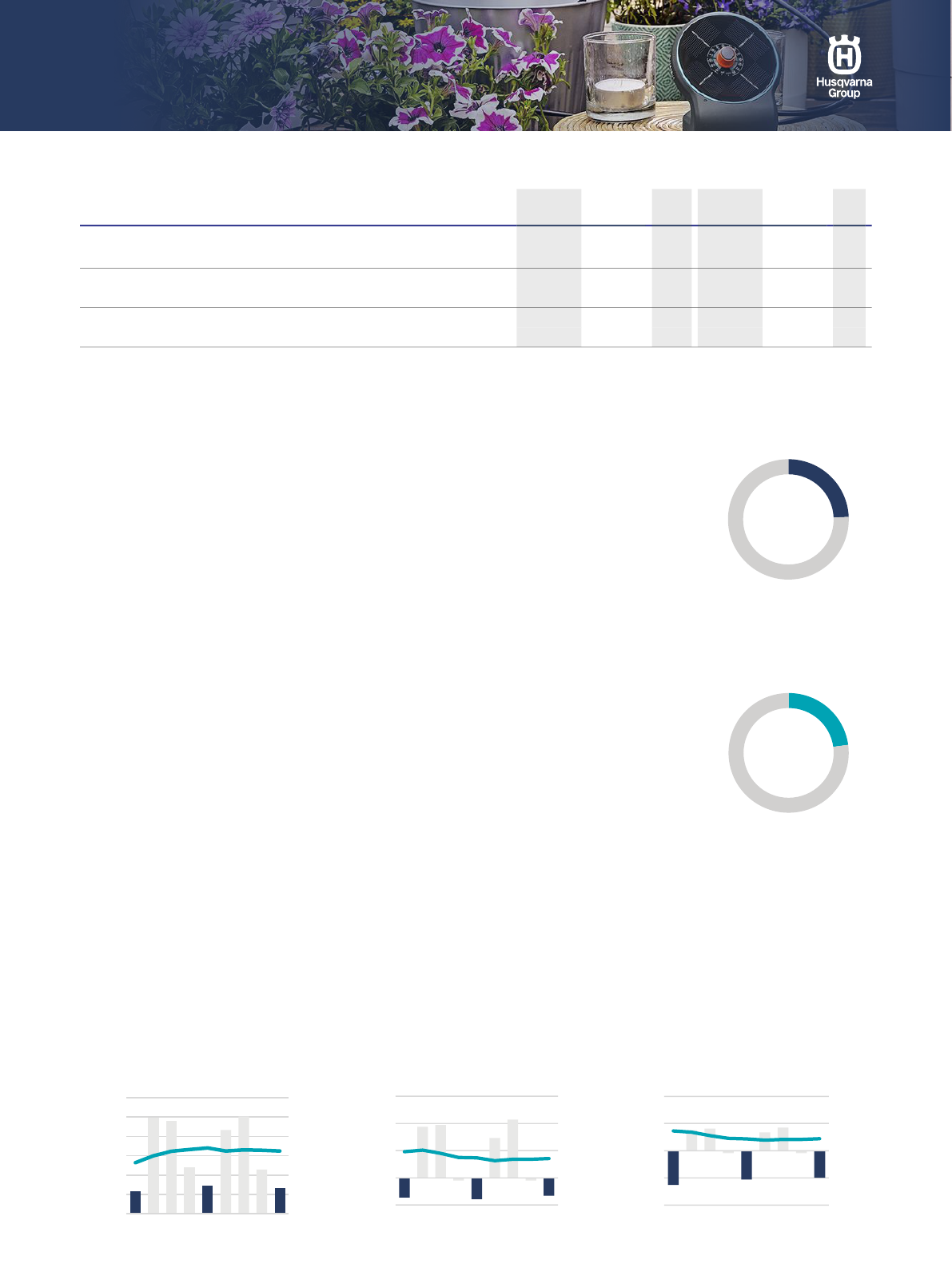

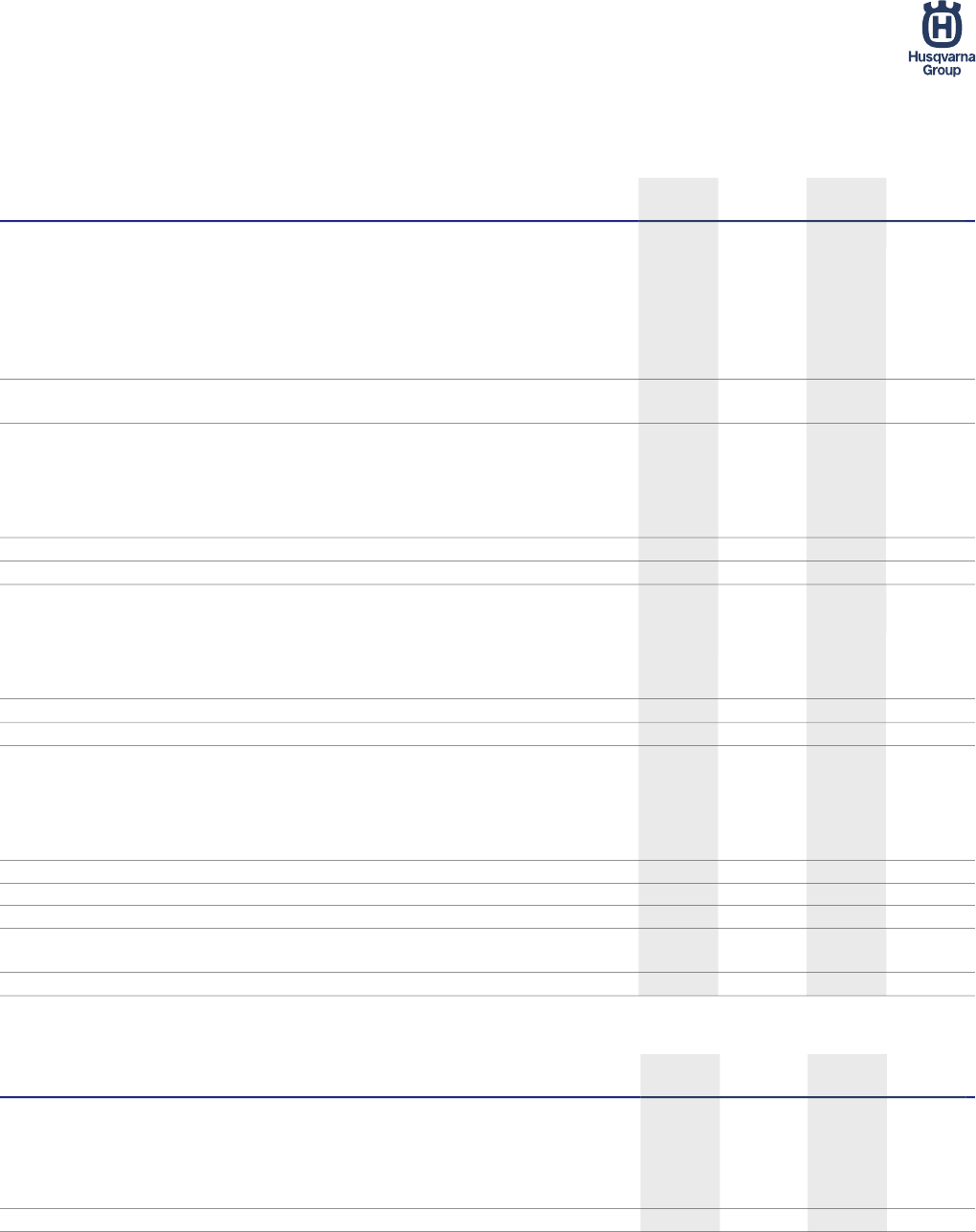

Gardena Division

6 (21)

Financial summary

Fourth quarter 2023

Net sales decreased by 10% to SEK 1,326m (1,470). Changes in exchange rates impacted

by -6%. Organic sales declined by 4%, with growth in the watering category in Europe, but

sales in Orbit in North America declined.

Operating income was SEK -407m (-468) and the operating margin was -30.7% (-31.8).

Excluding items affecting comparability, operating income improved to SEK -264m (-314)

and the operating margin was -19.9% (-21.4). Good cost control and cost savings as well

as lower logistics costs had a positive contribution. An improved operating income was

achieved despite that changes in exchange rates had an impact of approximately

SEK -145m compared with the preceding year.

Net sales growth for the acquired Orbit Irrigation was lower than the development for the

division overall but an improved operating margin was achieved. Orbit had an accretive

effect on the division of +5.1 ppts on the operating margin, excluding acquisition-related

amortization, which amounted to SEK -30m (-30).

January - December 2023

Net sales decreased by 5% to SEK 12,964m (13,606). Currency effects contributed with

5%. Organic sales declined by 10%.

Operating income was SEK 950m (918) and the operating margin amounted to 7.3% (6.8).

Excluding items affecting comparability, operating income amounted to SEK 1,136m

(1,173) and the operating margin improved to 8.8% (8.6). Price increases, good cost

control and lower logistics costs had a positive impact, while lower volumes had a negative

impact. The dilution effect from Orbit Irrigation was 0.3 ppts on the operating margin,

excluding acquisition-related amortization, which amounted to SEK -121m (-115). Changes in exchange rates had an

impact of approximately SEK -265m compared with the preceding year.

Q4 Q4 Jan-Dec Jan-Dec

SEKm

2023

2022 ∆%

2023

2022 ∆%

Net sales 1,326 1,470 -10 12,964 13,606 -5

Organic growth*, % -4 -11 -10 -7

Operating income -407 -468 13 950 918 3

Operating margin, % -30.7 -31.8 7.3 6.8

Operating income excl. items affecting comparability* -264 -314 16 1,136 1,173 -3

Operating margin excl. items affecting comparability*, % -19.9 -21.4 8.8 8.6

* Alternative Performance Measure, refer to "Definitions".

Net sales, SEKm

Operating income excl. IAC, SEKm

Operating margin excl. IAC

Share of Group

net sales, LTM

Share of Group operating

income excl. IAC, LTM

1,148

1,470

1,326

0

4,000

8,000

12,000

16,000

20,000

24,000

0

1,000

2,000

3,000

4,000

5,000

6,000

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

-290

-314

-264

-1,600

0

1,600

3,200

4,800

-400

0

400

800

1,200

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

-25.3%

-21.4%

-19.9%

-40%

-20%

0%

20%

40%

-40%

-20%

0%

20%

40%

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

24%

23%

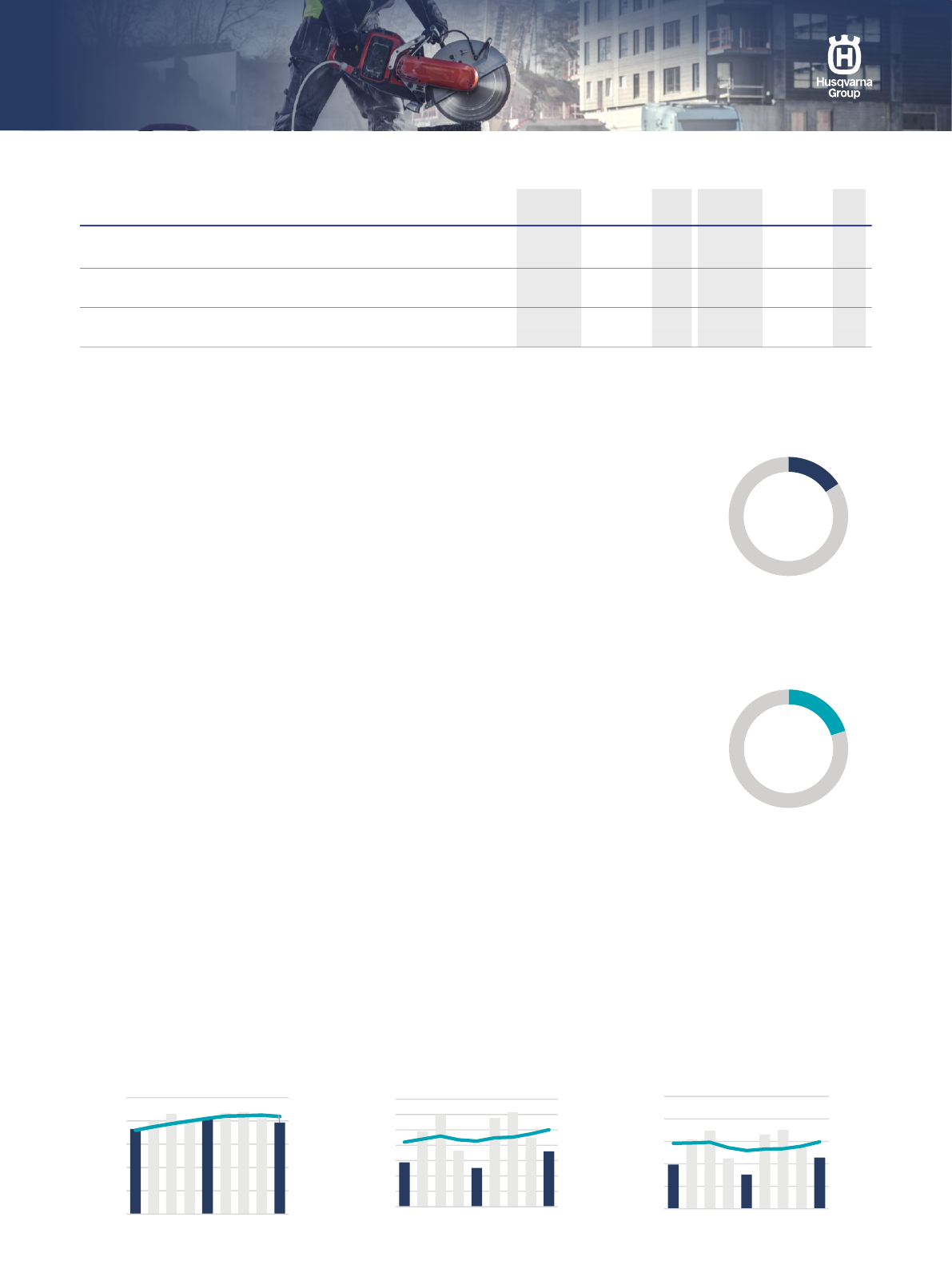

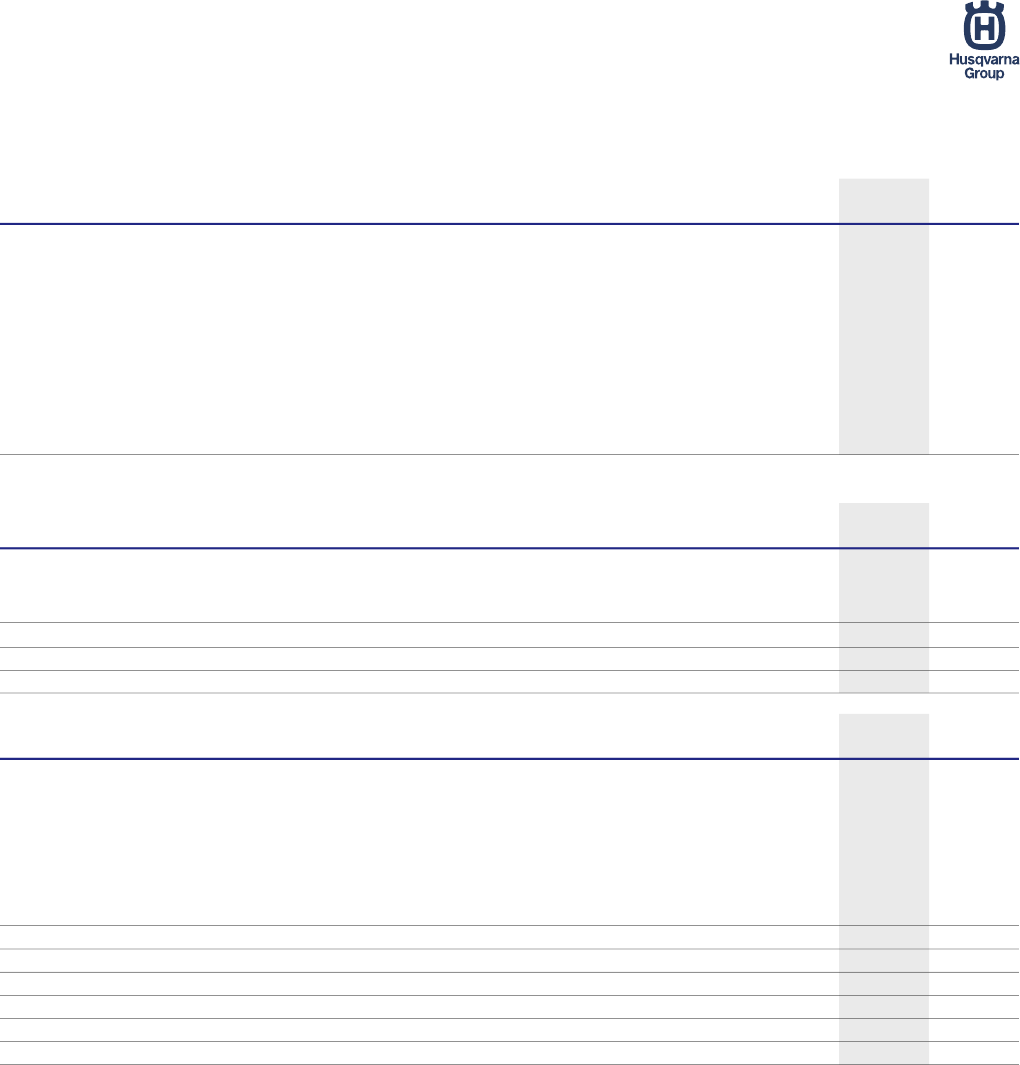

Husqvarna Construction Division

7 (21)

Financial summary

Fourth quarter 2023

Net sales decreased by 5% to SEK 1,968m (2,071). Changes in exchange rates

contributed with 1%. Organic sales decreased by 6%, with growth in emerging markets but

a decline in Europe and North America.

Operating income amounted to SEK -4m (80) and the operating margin was -0.2% (3.9).

Excluding items affecting comparability, operating income increased to SEK 180m (127)

and the operating margin improved to 9.1% (6.1). The margin improvement was driven by

price increases, cost control and lower logistics costs. Acquisition-related amortization

amounted to SEK -26m (-26). Changes in exchange rates had a positive contribution of

approximately SEK 30m compared to preceding year. During the quarter, Total Diamond

Products, in the UK was acquired to strengthen our distribution capacity in the UK market.

The company has a yearly net sales of around GBP 1m.

January – December 2023

Net sales increased by 2% to SEK 8,398m (8,232). Changes in exchange rates and

acquisitions contributed with 5%. Organic sales declined by 3%. The division has expanded

its range of battery-powered products.

Operating income was SEK 755m (713) and the operating margin was 9.0% (8.7).

Excluding items affecting comparability, operating income increased to SEK 1,002m (854)

and the operating margin was 11.9% (10.4). The margin improvement was supported by

price increases, good cost control and lower logistics costs. Acquisition-related

amortization amounted to SEK -103m (-104). Changes in exchange rates had a positive

contribution of approximately SEK 150m compared to preceding year.

Q4 Q4 Jan-Dec Jan-Dec

SEKm

2023

2022 ∆%

2023

2022 ∆%

Net sales 1,968 2,071 -5 8,398 8,232 2

Organic growth*, % -6 -1 -3 2

Operating income -4 80 105 755 713 6

Operating margin, % -0.2 3.9 9.0 8.7

Operating income excl. items affecting comparability* 180 127 42 1,002 854 17

Operating margin excl. items affecting comparability*, % 9.1 6.1 11.9 10.4

* Alternative Performance Measure, refer to "Definitions".

Net sales, SEKm

Operating income excl. IAC, SEKm

Operating margin excl. IAC

Share of Group

net sales, LTM

Share of Group operating

income excl. IAC, LTM

1,830

2,071

1,968

0

2,000

4,000

6,000

8,000

10,000

0

500

1,000

1,500

2,000

2,500

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

144

127

180

0

200

400

600

800

1,000

1,200

1,400

0

50

100

150

200

250

300

350

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

7.9%

6.1%

9.1%

0%

4%

8%

12%

16%

20%

0%

4%

8%

12%

16%

20%

Q4-21

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

Q3-23

Q4-23

LTM

16%

20%

Husqvarna Group / Year-end report 2023

8 (21)

Additional information

Sustainovate 2025

Sustainovate 2025 is designed to maximize the

Group’s contribution to tackle climate change and

resource scarcity. The five-year framework covers

three opportunities and associated targets to 2025.

2025 targets & status

• Reduce absolute CO

2

emissions across the value

chain by -35% – current result is -44%.

• Launch 50 circular innovations – the number of

approved innovations are now 27.

• Empower 5 million People to make sustainable

choices – achieved so far is 1.9 million.

Carbon – drive the transition to low-carbon solutions

As of the fourth quarter 2023, the Group has further

reduced its CO

2

emissions of -4 percentage points

compared to Q3 2023 and exceeded the 2025 target.

The reduction is primarily linked to the product mix

driven by the electrification of the industry.

The CO

2

KPI is absolute and in direct relation to

volume performance which implies a rather volatile

behavior. Despite the clear long-term reduction trend,

fluctuations between quarters are expected to

continue.

Circular – rethink and redesign for a resource-smart

customer experience

The circular innovations will make smarter use of

materials and will extend product lifecycles. The target

addresses resource impacts across the value chain,

from suppliers and operations to product use and end-

of-life.

Five circular innovations were approved in the fourth

quarter:

• Husqvarna’s All Season Chain Oil is now made of

30% high quality re-refined oils, reducing the

consumption of virgin oil.

• New low-noise Gardena garden pumps, with

integrated scheduling function, reduces raw

material, water and energy consumption

compared to preceding solutions.

• Recycling of magnesium-rich industrial waste from

our production that now is used as an input

material in alloy production at Stena Aluminium,

reducing the need for virgin magnesium.

• A new robotic diagnostic tool enables advanced

diagnostics that facilitates repair and the

avoidance of replacement of functioning

components.

• In core drilling equipment, the diamond tools

naturally experience wear and occasional

breakage over extended usage. Retipping is the

remanufacturing of core drills where new

segments are brazed onto the old drill tube,

extending product lifetime and enabling cost

efficiency while reducing waste.

People – inspire actions that make a lasting

difference

During the fourth quarter, the Group has continued its

communication campaigns promoting sales of another

140 000 products qualified as Sustainable Choices.

Parent Company

Net sales for January – December 2023 for the Parent

Company, Husqvarna AB (publ), amounted to

SEK 23,454m (23,308), of which SEK 18,358m

(18,195) referred to sales to Group companies and

SEK 5,096m (5,113) to external customers. Income

after financial items increased to SEK 1,711m (1,378).

The administrative costs have increased mainly due to

a Group internal transaction. Income for the period

increased to SEK 1,525m (507). Investments in

property, plant and equipment and intangible assets

amounted to SEK 1,915m (3,423). Cash and cash

equivalents amounted to SEK 136m (410) at the end

of the quarter. Undistributed earnings in the Parent

Company amounted to SEK 29,042m (29,250).

Significant events

Changes to Group Management

As announced in October 2023, efforts were initiated

to increase organizational and operational efficiency.

As a result of this, the Group Strategy & Innovation

function was distributed into the existing Group

function management structures and Erik Winberg,

Executive Vice President Strategy & Innovation, left

Husqvarna Group on December 31, 2023.

Husqvarna Construction acquired Total

Diamond Products

Husqvarna Construction Division acquired Total

Diamond Products, in the UK. The company has a

yearly net sales of around GBP 1m.

Significant events after the quarter

Changes to Group Management

Pär Åström, President of the Gardena Division, has

decided to take a position outside of Husqvarna

Group. His last day at Husqvarna Group is planned to

be June 30, 2024.

Husqvarna Group / Year-end report 2023

9 (21)

Dividend

The Board of Directors will propose a dividend for

2023 of SEK 3.00 (3.00) per share to the 2024 Annual

General Meeting, corresponding to a total dividend

payment of SEK 1,715m (1,714). It is proposed that

the dividend is to be paid in two installments, the first

of SEK 1.00 per share with record date on April 22 and

the second of SEK 2.00 per share with record date on

October 22, 2024.

Risks and uncertainty factors

A number of factors may affect Husqvarna Group’s

operations in terms of operational and financial risks.

Geopolitical uncertainties and war, can have a

significant impact on Husqvarna Group’s operations,

both in terms of difficulties of supply of raw materials

and components as well as difficulties to purchase

transportation and logistics services and related cost

increases. It can also affect demand of Husqvarna

Group’s products and solutions. Operational risks

include general economic conditions, as well as trends

in consumer and professional spending, particularly in

North America and Europe, where the majority of the

Group’s products are sold. An economic downturn in

these markets may have an adverse effect on Group

sales and earnings. Shifts in product technology as

well as shifts in distribution structure and sales

channels could also have a negative impact, as will

fluctuations in prices of sourced raw materials and

components. Short term, demand for the Group’s

products is impacted by weather conditions. The Group’s

production processes and supply chain are therefore

adapted to respond to changes in weather conditions. In

the ordinary course of business, the Group is exposed to

legal risks such as commercial, product liability and other

disputes and provides for them as appropriate. Financial

risks refer primarily to currency exchange rates,

interest rates, financing, tax and credit risks. Risk

management within Husqvarna Group is regulated by

a financial policy established by the Board of

Directors. For further information on risks and

uncertainty factors, see the Annual Report 2022 which

is available at www.husqvarnagroup.com.

Accounting Principles

This year-end report has been prepared in accordance

with IAS 34, Interim financial reporting and

the Swedish Annual Accounts Act. The financial

statement of the Parent Company has been prepared

in accordance with the Swedish Annual Accounts Act,

chapter 9 and the Swedish Financial Reporting

Board’s standard RFR 2 Accounting for Legal Entities.

The accounting policies adopted are consistent with

those presented in the Annual Report of 2022, which

is available at www.husqvarnagroup.com.

Auditors’ review report

This year-end report has not been subject to review by

the auditors.

Stockholm, February 2, 2024

Pavel Hajman

CEO

10 (21)

Husqvarna Group / Year-end report 2023

Condensed consolidated income statement

Condensed consolidated comprehensive income statement

Q4 Q4 Jan-Dec Jan-Dec

SEKm 2023 2022 2023 2022

Net sales

8,605 10,353 53,261 54,037

Cost of goods sold

-6,836 -9,085 -37,136 -39,424

Gross income

1,769 1,268 16,125 14,613

Gross margin, %

20.6 12.3 30.3 27.0

Selling expenses

-2,020 -2,197 -9,034 -8,770

Administrative expenses

-736 -810 -3,211 -3,001

Other operating income/expense

4 2 0 202

Operating income

-983 -1,737 3,880 3,043

Operating margin, %

-11.4 -16.8 7.3 5.6

Financial items, net

-289 -226 -1,002 -461

Income after financial items

-1,272 -1,963 2,878 2,581

Margin, %

-14.8 -19.0 5.4 4.8

Income tax

261 571 -702 -649

Net income for the period

-1,011 -1,392 2,177 1,932

Net income for the period attributable to:

Equity holders of the Parent Company

-1,011 -1,390 2,177 1,935

Non-controlling interest

0 -2 -1 -2

Earnings per share:

Before dilution, SEK

-1.77 -2.44 3.81 3.39

After dilution, SEK

-1.77 -2.43 3.81 3.38

Weighted average number of shares outstanding:

Before dilution, millions

571.5 570.5 570.9 570.4

After dilution, millions

572.2 573.0 571.6 573.0

Q4 Q4 Jan-Dec Jan-Dec

SEKm 2023 2022 2023 2022

Net income for the period

-1,011 -1,392 2,177 1,932

Other comprehensive income

Items that will not be reclassified to the income statement:

Remeasurements on defined benefit pension plans, net of tax

-473 -210 -426 436

Total items that will not be reclassified to the income statement, net of tax

-473 -210 -426 436

Items that may be reclassified to the income statement:

Translation differences

-1,758 -1,421 -839 2,728

Net investment hedge, net of tax

824 754 403 -916

Cash flow hedges, net of tax

118 -215 238 -89

Total items that may be reclassified to the income statement, net of tax

-816 -882 -197 1,723

Other comprehensive income, net of tax

-1,289 -1,092 -622 2,159

Total comprehensive income for the period

-2,300 -2,484 1,554 4,091

Total comprehensive income attributable to:

Equity holders of the Parent Company

-2,301 -2,483 1,555 4,094

Non-controlling interest

0 -1 -1 -2

11 (21)

Husqvarna Group / Year-end report 2023

Condensed consolidated balance sheet

Assets

Property, plant and equipment

7,205 7,151

Right of use assets

2,068 2,288

Goodwill

9,920 10,187

Other intangible assets

8,400 8,408

Investments in associated companies

14 16

Derivatives

0 53

Other non-current assets

843 913

Deferred tax assets

2,143 1,834

Total non-current assets

30,592 30,849

Inventories

17,184 19,334

Trade receivables

5,289 6,267

Derivatives

1,604 795

Current tax receivables

242 524

Other current assets

1,171 1,538

Cash and cash equivalents

1,527 2,328

Total current assets

27,018 30,787

Total assets

57,610 61,636

Equity and liabilities

Equity attributable to equity holders of the Parent Company

23,770 24,002

Non-controlling interests

2 10

Total equity

23,772 24,011

Borrowings

8,556 8,927

Lease liabilities

1,436 1,708

Deferred tax liabilities

2,334 2,056

Provisions for pensions and other post-employment benefits

2,209 1,681

Other provisions

620 700

Total non-current liabilities

15,155 15,072

Trade payables

5,487 7,111

Current tax liabilities

662 667

Other liabilities

3,866 4,097

Borrowings

6,031 7,700

Lease liabilities

648 649

Derivatives

575 912

Other provisions

1,415 1,416

Total current liabilities

18,683 22,553

Total equity and liabilities

57,610 61,636

Dec 31

2023

Dec 31

2022

SEKm

12 (21)

Husqvarna Group / Year-end report 2023

Condensed consolidated cash flow statement

Q4 Q4 Jan-Dec Jan-Dec

2023

2022

2023

2022

Cash flow from operations

Operating income -983 -1,737 3,880 3,043

Non cash items

1,276 2,239 3,586 3,979

Cash items

Paid restructuring expenses

-274 -111 -565 -222

Net financial items, received/paid

-315 -108 -862 -247

Taxes paid/received

431 -305 -493 -2,318

Cash flow from operations, excluding change in

operating assets and liabilities

135 -22 5,546 4,234

Operating assets and liabilities

Change in inventories

-852 -2,014 1,918 -3,832

Change in trade receivables

1,057 508 917 -1,511

Change in trade payables

645 338 -1,579 -336

Change in other operating assets/liabilities

-747 -876 264 -264

Cash flow from operating assets and liabilities

103 -2,043 1,521 -5,943

Cash flow from operations

238 -2,066 7,067 -1,709

Investments

Acquisitions of subsidiaries/operations

-9 - -9 -85

Proceeds from sale of property, plant and equipment

-21 26 5 240

Investments in property, plant and equipment and intangible assets

-959 -801 -2,627 -2,344

Investments and divestments of financial assets

7 -4 -22 -112

Cash flow from investments

-981 -779 -2,652 -2,301

Cash flow from operations and investments

-743 -2,845 4,414 -4,009

Financing

Dividend paid to shareholders

-1,143 -1,141 -1,714 -1,711

Dividend paid to non-controlling interests

0 - -2 -2

Proceeds/repayment of borrowings

1,392 4,677 -2,066 8,253

Other financing activities

-119 -701 -1,380 -2,566

Cash flow from financing

130 2,834 -5,161 3,975

Total cash flow

-612 -11 -746 -35

Cash and cash equivalents at the beginning of the period

2,196 2,423 2,328 2,208

Exchange rate differences referring to cash and cash equivalents

-57 -84 -55 154

Cash and cash equivalents at the end of the period

1,527 2,328 1,527 2,328

SEKm

Q4 Q4 Jan-Dec Jan-Dec

2023

2022

2023

2022

EBITDA excl. items affecting comparability

631 707 7,911 7,450

Change in inventories

-852 -2,014 1,918 -3,832

Change in trade receivables

1,057 508 917 -1,511

Change in trade payables

645 338 -1,579 -336

Investments in property, plant and equipment and intangible assets

-959 -801 -2,627 -2,344

Direct operating cash flow

523 -1,261 6,541 -572

Direct operating cash flow, SEKm

13 (21)

Husqvarna Group / Year-end report 2023

Key performance indicators

Income statement

Organic growth*

Net sales, fourth quarter

Net sales, January - December

Q4 Q4 Jan-Dec Jan-Dec

EBITDA*, SEKm

2023

2022

2023

2022

Operating income

-983 -1,737 3,880 3,043

Reversals

Depreciation

543 500 1,992 1,769

Amortization

248 214 931 821

Impairment

160 735 182 753

Depreciation, amortization and impairment

951 1,449 3,105 3,342

EBITDA*

-32 -287 6,985 6,385

Excl. items affecting comparability* 631 707 7,911 7,450

EBITDA margin, % -0.4 -2.8 13.1 11.8

Excl. items affecting comparability*, % 7.3 6.8 14.9 13.8

SEKm

Reported Net

sales

Acquisitions /

divestments

Planned exits

Organic net sales before

currency translation

Currency

translation

Organic net sales

2023 8,605 8,605 8,605

2022 10,353 -184 10,170 -74 10,096

Growth -1,748 -1,564 -1,490

Growth, % -17 -15 -15

SEKm

Reported Net

sales

Acquisitions /

divestments

Planned exits

Organic net sales before

currency translation

Currency

translation

Organic net sales

2023 53,261 -39 53,221 53,221

2022 54,037 -462 53,575 2,597 56,173

Growth -776 -354 -2,951

Growth, % -1 -1 -5

*Alternative Performance Measure, refer to "Definitions".

14 (21)

Husqvarna Group / Year-end report 2023

Other Key performance indicators

Operating working capital, SEKm

16,986 18,490

Operating working capital / net sales*, %

36.9 30.6

Return on capital employed, %

8.4 7.3

Excl. items affecting comparability*, %

10.8 11.6

Return on equity, %

8.5 7.9

Excl. items affecting comparability*, %

11.8 13.6

Capital turn-over rate, times

1.3 1.4

Equity/assets ratio, %

41 39

Equity per share after dilution, SEK

41.6 41.9

Average number of employees

13,755 14,416

Dec 31

2023

Dec 31

2022

Key data

Net pension liability

1,994 1,431

Other interest-bearing liabilities

17,245 19,897

Less: Liquid funds and other interest-bearing assets

-3,600 -3,618

Net debt*

15,640 17,709

Net debt/equity ratio

0.66 0.74

Net debt/EBITDA excl. items affecting comparability*

2.1 1.8

Dec 31

2022

Dec 31

2023

Net debt*, SEKm

Total equity and liabilities 57,610 61,636

Deduction; Non interest bearing liabilities: -14,383 -16,047

Deferred tax liabilities -2,334 -2,056

Other provisions -2,035 -2,116

Trade payables -5,487 -7,111

Current tax liabilities -662 -667

Other liabilities -3,866 -4,097

Capital employed* 43,227 45,589

Capital employed* (LTM Average) 45,956 41,710

Operating income, LTM 3,880 3,043

Return on capital employed*, % 8.4 7.3

Operating income excl. items affecting comparability*, LTM 4,970 4,853

Return on capital employed excl. items affecting comparability*, % 10.8 11.6

* Alternative Performance Measure, refer to "Definitions".

Dec 31

2023

Dec 31

2022

Return on capital employed*, SEKm

15 (21)

Husqvarna Group / Year-end report 2023

Change in Group equity, condensed

Fair value of financial instruments

The Group’s financial instruments carried at fair value are derivatives. Derivatives belong to Level 2 in the fair value

hierarchy. Future cash flows have been discounted using current quoted market interest rates and exchange rates for

similar instruments. Further information about the accounting principles for financial instruments and methods used for

estimating the fair value of the financial instruments are described in note 1 and note 20, respectively, in the Annual

Report 2022. The carrying value approximates fair value for all financial instruments.

SEKm

Attributable to equity

holders of the

Parent Company

Non-controlling

interests

Total equity

Opening balance January 1, 2022 21,633 14

21,646

Share-based payment 78 -

78

Hedge for LTI-programs -92 -

-92

Dividend -1,711 -

-1,711

Total comprehensive income 4,094 -2

4,091

Dividend to non-controlling interest - -2

-2

Closing balance December 31, 2022 24,002 10

24,011

Opening balance January 1, 2023 24,002 10

24,011

Share-based payment -79 - -79

Shareholder contribution from non-controlling interest - 1 1

Dividend -1,714 - -1,714

Total comprehensive income 1,555 -1 1,554

Acquistion of non-controlling interest 5 -5 0

Dividend to non-controlling interest - -2

-2

Closing balance December 31, 2023 23,770 2

23,772

16 (21)

Husqvarna Group / Year-end report 2023

Net sales and income by division and quarter

SEKm 2021

Group

Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4

Net sales

8,605 10,512 16,976 17,167 10,353 12,206 15,792 15,685 8,234

Net sales, LTM*

53,261 55,009 56,703 55,519 54,037 51,918 49,892 48,714 47,059

Operating income

-983 398 2,101 2,364 -1,737 555 2,065 2,159 -132

Operating margin, % -11.4 3.8 12.4 13.8 -16.8 4.5 13.1 13.8 -1.6

Operating income excl. IAC* -168 415 2,313 2,410 -13 601 2,075 2,190 -180

Operating margin excl. IAC*, % -1.9 3.9 13.6 14.0 -0.1 4.9 13.1 14.0 -2.2

Operating income, LTM*

3,880 3,126 3,283 3,247 3,043 4,647 5,018 5,612 5,746

Operating margin, LTM*, % 7.3 5.7 5.8 5.8 5.6 9.0 10.1 11.5 12.2

Operating income, LTM excl. IAC* 4,970 5,125 5,311 5,073 4,853 4,686 5,011 5,580 5,684

Operating margin, LTM excl. IAC*, % 9.3 9.3 9.4 9.1 9.0 9.0 10.0 11.5 12.1

Net income for the period

-1,011 125 1,411 1,653 -1,392 269 1,417 1,638 146

Husqvarna Forest & Garden

Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4

Net sales

5,257 6,123 9,722 10,656 6,793 7,761 8,826 8,701 5,231

Net sales, LTM*

31,759 33,295 34,933 34,037 32,082 30,519 29,089 29,099 29,217

Operating income

-379 291 1,123 1,670 -1,252 560 1,107 1,392 70

Operating margin, % -7.2 4.8 11.6 15.7 -18.4 7.2 12.5 16.0 1.3

Operating income excl. IAC* -7 293 1,260 1,690 273 555 1,113 1,283 70

Operating margin excl. IAC*, % -0.1 4.8 13.0 15.9 4.0 7.2 12.6 14.7 1.3

Operating income, LTM*

2,706 1,833 2,101 2,085 1,807 3,129 3,127 3,554 3,699

Operating margin, LTM*, % 8.5 5.5 6.0 6.1 5.6 10.3 10.8 12.2 12.7

Operating income, LTM excl. IAC* 3,236 3,516 3,779 3,631 3,224 3,021 3,024 3,447 3,701

Operating margin, LTM excl. IAC*, % 10.2 10.6 10.8 10.7 10.0 9.9 10.4 11.8 12.7

Gardena

Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4

Net sales

1,326 2,287 5,031 4,321 1,470 2,400 4,775 4,960 1,148

Net sales, LTM*

12,964 13,108 13,222 12,966 13,606 13,284 12,915 11,991 10,537

Operating income

-407 -46 818 585 -468 -93 773 706 -277

Operating margin, % -30.7 -2.0 16.3 13.5 -31.8 -3.9 16.2 14.2 -24.1

Operating income excl. IAC* -264 -41 857 584 -314 -42 776 752 -290

Operating margin excl. IAC*, % -19.9 -1.8 17.0 13.5 -21.4 -1.7 16.3 15.2 -25.3

Operating income, LTM*

950 889 842 797 918 1,109 1,398 1,603 1,552

Operating margin, LTM*, % 7.3 6.8 6.4 6.2 6.8 8.3 10.8 13.4 14.7

Operating income, LTM excl. IAC* 1,136 1,086 1,085 1,005 1,173 1,197 1,434 1,627 1,529

Operating margin, LTM excl. IAC*, % 8.8 8.3 8.2 7.7 8.6 9.0 11.1 13.6 14.5

Husqvarna Construction

Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4

Net sales

1,968 2,061 2,192 2,177 2,071 2,024 2,157 1,981 1,830

Net sales, LTM*

8,398 8,500 8,463 8,428 8,232 7,992 7,763 7,511 7,210

Operating income

-4 225 272 262 80 183 299 152 144

Operating margin, % -0.2 10.9 12.4 12.0 3.9 9.0 13.9 7.7 7.9

Operating income excl. IAC* 180 225 308 289 127 182 300 245 144

Operating margin excl. IAC*, % 9.1 10.9 14.1 13.3 6.1 9.0 13.9 12.4 7.9

Operating income, LTM*

755 839 796 823 713 778 826 787 840

Operating margin, LTM*, % 9.0 9.9 9.4 9.8 8.7 9.7 10.6 10.5 11.7

Operating income, LTM excl. IAC* 1,002 948 905 897 854 871 920 880 840

Operating margin, LTM excl. IAC*, % 11.9 11.2 10.7 10.6 10.4 10.9 11.9 11.7 11.7

Group Common

Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4

Net sales

54 41 31 13 20 22 34 43 26

Operating income

-193 -72 -112 -154 -97 -95 -114 -90 -69

Operating income excl. IAC* -76 -62 -112 -154 -98 -95 -114 -90 -104

The majority of net sales are recognized at a certain point in time.

*Alternative Performance Measure, refer to "Definitions".

2022

2023

17 (21)

Husqvarna Group / Year-end report 2023

Items affecting comparability

The fourth quarter 2023 included items affecting comparability of SEK -815m. This was mainly related to the expansion of

the Group’s cost saving initiatives (announced in October 2023), including the consolidation of operations and brands

from previous acquisitions, a write-down of inventory related to exits of petrol-powered, low-margin consumer wheeled

products (announced in October 2022), as well as non-recurring costs related to Russia.

Classification in the income statement

Net assets by division ¹

SEKm

Restructuring costs

Impairment of non-current assets -153 -730 -163 -745

Write-down of inventory -205 -221 -272 -249

Other restructuring costs -371 -811 -567 -858

Non-recurring costs relating to Russia

Write-down / reversal of current assets 15 3 15 -59

Write-down / reversal of inventory 0 101 0 -11

Other restructuring costs -102 -67 -102 -67

Other

Sale of property - - - 178

Total items affecting comparability

-815 -1,724 -1,090 -1,810

Jan-Dec

2022

Jan-Dec

2023

Q4

2022

Q4

2023

SEKm

Cost of goods sold -482 -1,433 -725 -1,610

Selling expenses -167 -189 -172 -277

Administrative expenses -166 -103 -193 -103

Other operating income/expense - - - 178

Total items affecting comparability -815 -1,724 -1,090 -1,810

Jan-Dec

2022

Jan-Dec

2023

Q4

2022

Q4

2023

SEKm

Dec 31

2023

Dec 31

2022

Dec 31

2023

Dec 31

2022

Dec 31

2023

Dec 31

2022

Husqvarna Forest & Garden

24,433 26,228 6,354 8,041 18,078 18,187

Gardena 17,763 20,010 2,940 3,213 14,823 16,798

Husqvarna Construction 8,722 9,058 1,614 1,724 7,107 7,334

Other ² 2,878 2,471 3,475 3,070 -597 -599

Total 53,795 57,767 14,383 16,047 39,412 41,720

¹ Liquid assets, other interest-bearing assets, interest-bearing liabilities and equity are not included in the table above.

² Other includes tax items, associates and common Group functions such as Treasury and Risk Management.

Assets

Liabilities

Net Assets

18 (21)

Husqvarna Group / Year-end report 2023

Parent Company

Condensed income statement

Q4 Q4 Jan-Dec Jan-Dec

2023

2022

2023

2022

Net sales 3,785 5,302 23,454 23,308

Cost of goods sold -4,617 -4,991 -18,366 -17,250

Gross income -832 312 5,089 6,057

Selling expense -456 -586 -2,129 -1,911

Administrative expense -1,156 -565 -2,721 -1,849

Other operating income/expense -1 0 -1 0

Operating income -2,445 -839 238 2,298

Financial items, net 2,089 813 1,474 -920

Income after financial items -356 -27 1,711 1,378

Appropriations -197 -728 -266 -858

Income before taxes -553 -755 1,445 521

Tax on profit for the year 360 149 80 -14

Income for the period -193 -606 1,525 507

SEKm

Condensed balance sheet

Non-current assets 50,263 41,563

Current assets 15,616 19,759

Total assets 65,880 61,322

Equity 32,030 32,054

Untaxed reserves 1,424 1,400

Provisions 542 408

Non-current liabilities 8,406 8,749

Current liabilities 23,478 18,710

Total equity and liabilities 65,880 61,322

Dec 31

2022

Dec 31

2023

SEKm

Number of shares

Number of shares as of December 31, 2022

110,106,194 460,347,003 5,890,581 576,343,778

Conversion of A-shares into B-shares -654,745 654,745 -

Shares allocated to 2020 LTI-program 1,065,384 -1,065,384 -

Number of shares as of December 31, 2023 109,451,449 462,067,132 4,825,197 576,343,778

¹ All repurchased B-shares are included in a third party share swap agreement.

Outstanding

A-shares

Outstanding

B-shares

Repurchased

B-shares ¹

Total

Husqvarna Group / Year-end report 2023

19 (21)

Definitions

This report includes financial measures as required

by the financial reporting framework applicable to

Husqvarna Group, which is based on IFRS. In addition,

there are other measures (Alternative Performance

Measures) used by management and other

stakeholders to analyze trends and performance of

the Group’s operations that cannot be directly read

or derived from the financial statements. Husqvarna

stakeholders should not consider these as substitutes,

but rather as additions, to the financial reporting

measures prepared in accordance with IFRS. Please

note that the Alternative Performance Measures as

defined, may not be comparable to similarly titled

measures used by other companies. Refer below for

a list of definitions of all measures and indicators used,

referred to and presented in this report.

Computation of average amounts

The computation of key ratios is based on averages

of affected balance sheet items the last 12 months.

Roundings

All items are stated in SEKm and, accordingly,

rounding differences can occur.

Last twelve months (LTM)

Last twelve months rolling has been included to assist

stakeholders in their analysis of the seasonality that

Husqvarna Group's business is exposed to.

Earnings per share, after dilution

Earnings per share is expressed as net income

attributable to equity holders of the Parent Company

divided by the weighted average number of shares

outstanding (net of treasury shares), after dilution.

Earnings per share is a good measure of the

company’s profitability and is used to determine the

value of the company’s outstanding shares.

Growth measures

Net sales growth

Change in net sales compared to previous period

in percent.

Organic growth

Change in net sales, adjusted for acquisitions,

divestments, planned exits and currency translation

effects. The measure is important in order to

understand the underlying performance of the

operations and increases the comparability between

periods.

Profitability measures

EBITDA

EBITDA is a measure of earnings before interest,

taxes, depreciation, amortization and impairment

charges. EBITDA measures Husqvarna Group's

operating performance and the ability to generate cash

from operations, without considering the capital

structure of the Group or its fiscal environment. For a

reconciliation of EBITDA refer to section Key

Performance Indicators.

EBITDA margin

EBITDA as a percentage of net sales.

Gross margin

Gross income as a percentage of net sales.

Operating margin

Operating income as a percentage of net sales.

Return on capital employed

Operating income during the last twelve months as a

percentage of average capital employed. A central ratio

for measuring return on capital tied up in operations.

Return on equity

Net income attributable to equity holders of the Parent

Company last twelve months as a percentage of

average equity attributable to equity holders of the

Parent Company. The indicator shows how share

holders’ capital yields interest during the period.

Share-based measures

Equity per share, after dilution

Equity attributable to equity holders of the Parent

Company divided by the weighted average number of

shares outstanding (net of treasury shares), after dilution.

A measure of the amount of equity that exists per

outstanding share and is used for measuring the share

against the share price.

Capital indicators

Capital employed

Total equity and liabilities less non-interest-bearing

debt including deferred tax liabilities. This measure

shows the amount of capital that is used in the

operations and is an important component for

measuring the return from operations.

Capital expenditure

Investments in property, plant and equipment, right of

use assets and intangible assets.

Interest bearing liabilities

Long-term and short-term borrowings, net pension

liability and fair value derivative liabilities.

Husqvarna Group / Year-end report 2023

20 (21)

Liquid funds

Cash and cash equivalents, short-term investments

and fair value derivative assets.

Net assets

Total assets excluding liquid funds and interest-bearing

assets less operating liabilities, non-interest-bearing

provisions and deferred tax liabilities.

Net debt

Net debt describes the Group’s gearing and its ability

to repay its debts from cash generated from the

Group´s ordinary business, if they were all due today. It

is also used to analyze how future net interest costs

will impact earnings. Net debt is defined as total

interest-bearing liabilities plus dividend payable, less

liquid funds and interest-bearing assets.

Operating working capital

Inventories and trade receivables less trade payables.

This measure shows how much working capital is tied

up in the operations and can be put in relation to sales

to understand how efficient working capital is

managed.

Capital measures

Equity/assets ratio

Equity attributable to equity holders of the Parent

Company as a percentage of total assets. A measure

for showing financial risk, expressing the percentage of

total assets that is financed by the owners.

Capital turnover rate

Net sales last twelve months divided with average

net assets. Shows how effectively capital is managed

and is a key measure for monitoring value creation.

Net debt/EBITDA excl. items affecting comparability

Average net debt in relation to EBITDA last twelve

months, excluding items affecting comparability. Shows

the company’s capacity to repay its debt, adjusted for

the impact of items affecting comparability.

Net debt/equity ratio

Net debt in relation to total equity. Shows financial risk

and is a useful measure to monitor the level of the

company’s indebtedness.

Operating working capital/net sales

Average operating working capital as a percentage of

net sales last twelve months. This measure is an

important indicator for how efficient working capital is

managed.

Other measures

Direct operating cash flow

EBITDA, excluding items affecting comparability,

adjusted for change in trade payables, inventory and

trade receivables and investments in property, plant

and equipment and intangible assets. For a

reconciliation of direct operating cash flow refer to the

table below the cash flow statement. Direct operating

cash flow provides a measure of the cash generated by

the Groups operating business.

Items affecting comparability (IAC)

Under Items affecting comparability, Husqvarna

includes items that have the character of being non-

recurring, such as restructuring costs, and are relevant

when comparing earnings for one period with those of

another. Separate reporting of items affecting

comparability between periods provides a better

understanding of the company’s underlying operating

activities.

21 (21)

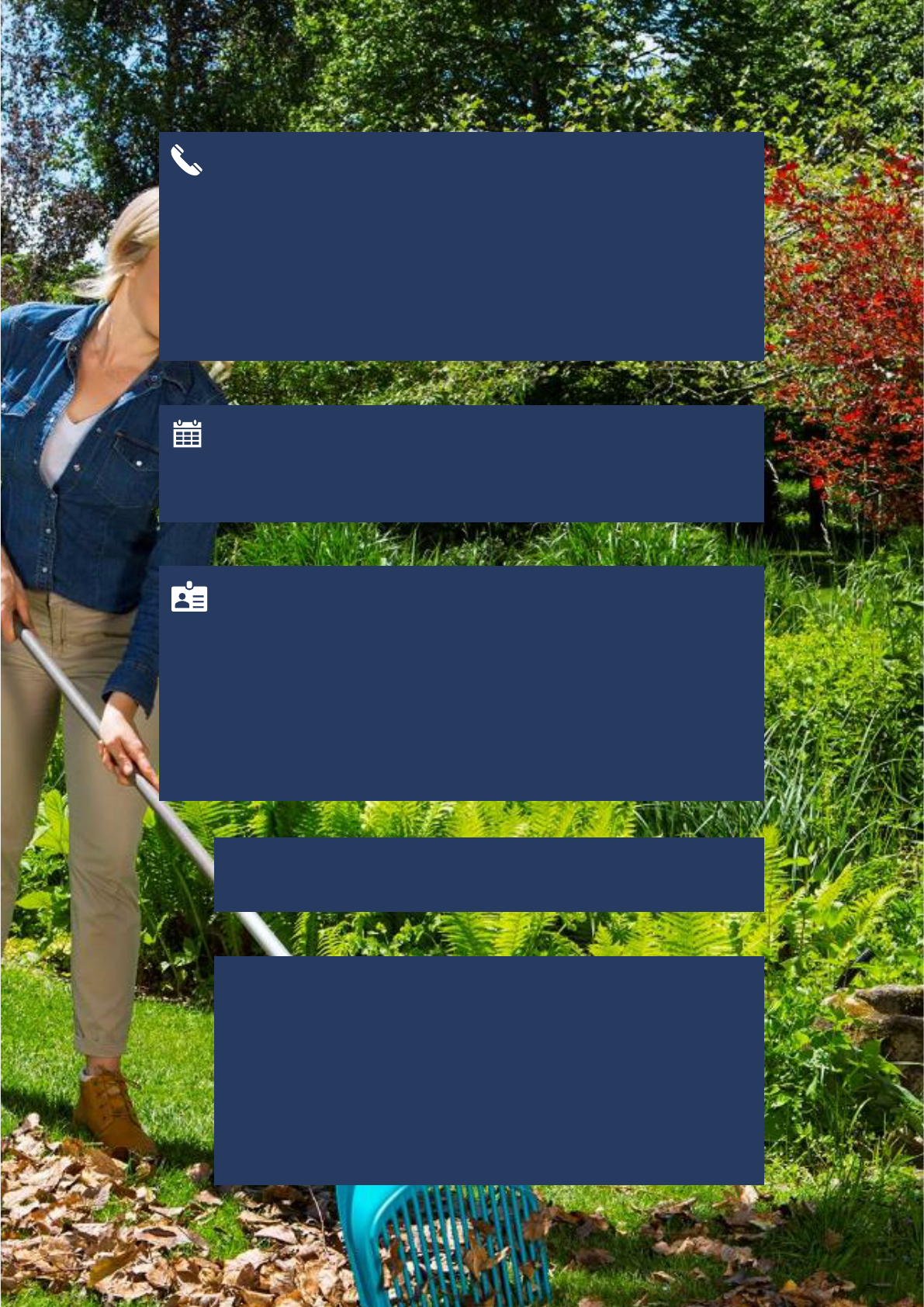

Webcast presentation and telephone conference

A webcast presentation of the Q4 report hosted by Pavel Hajman, CEO

and Terry Burke, CFO will be held at 10:00 CET on February 2, 2024.

To view the presentation, please use the link:

husqvarnagroup.creo.se/fa23e10e-c3d3-440d-8d99-8c463cbab7de

The dial-in to the telephone conference (in order to ask questions):

+46 (0) 8 505 100 31 (Sweden) or +44 207 107 06 13 (UK).

Dates for Financial Reports 2024

April 18 Annual General Meeting 2024

April 24 Interim report for January-March 2024

July 18 Interim report for January-June 2024

October 23 Interim report for January-September 2024

Contacts

Terry Burke, CFO and Executive Vice President, Finance, IR & Communication

+46 8 738 90 00

Johan Andersson, Vice President, Investor Relations

+46 702 100 451

Husqvarna AB (publ), P.O. Box 7454, SE-103 92 Stockholm

Regeringsgatan 28, +46 8 738 90 00, www.husqvarnagroup.com

Reg. Nr: 556000-5331

NASDAQ OMX Stockholm: HUSQ A, HUSQ B

This report contains insider information that Husqvarna AB is required to disclose under the EU

Market Abuse Regulation and the Securities Markets Act. The information was submitted for

publication, through the contact person set out above, at 07.00 CET on February 2, 2024.

Factors affecting forward-looking statements

This report contains forward-looking statements in the sense referred to in the American Private

Securities Litigation Reform Act of 1995. Such statements comprise, among other things, financial

goals, goals of future business and financial plans. These statements are based on present

expectations and are subject to risks and uncertainties that may give rise to major deviations in the

result due to several aspects. These aspects include, among other things: consumer demand and

market conditions in the geographical areas and lines of business in which Husqvarna operates, the

effects of currency fluctuations, downward pressure on prices due to competition, a material reduction

in sales by important distributors, success in developing new products and in marketing, outcome of

product responsibility litigation, progress in terms of reaching the goals set for productivity and efficient

use of capital, successful identification of growth opportunities and acquisition objects, integration of

these into the existing business and successful achievement of goals for making the supply chain more

efficient.