International Journal for Multidisciplinary Research (IJFMR)

IJFMR240111965

Volume 6, Issue 1, January-February 2024

1

A Study on Private Bus Passengers Behaviour

With Special Reference to Bangalure City

Mr. D. Srinivasulu

1

, Mrs R. Nadiya

2

1,2

MBA Assistant Professor, Department of Management Studies, Kuppam Engineering College

Kuppam-517425

Abstract:

The transport system provides the basic infrastructure and it affects the economic activities of the

country. The transport sector in India is divided into passenger and freight. The passenger services are

available in both government private of bus category. At present private sector owns majority of the

buses compared to government. In Andhra Pradesh and Karnataka also the private transport players

dominating the passenger’s transportation market, especially if the travelling distance is more than 250

KM. Initially consumers (passengers) have been attracted with the facilities and service given by private

bus operators. With the increasing competition and other policy issues, the private bus operators are

implementing peak load pricing strategy.

This pricing strategy is unexpected and unjustifiable to any passenger and even unbearable to them. And

the facilities and service are same. Therefore a study has been made by the researcher to bring out the

passengers behavior with peak load pricing by private operators with reference to Bangalore city in the

state of Karnataka . By using judgment random sampling technique, 110 respondents were selected as

sample size and information gathered through interview method. The outcome of the research has

shown very interesting results such as customers’ dissatisfaction on Government failure to control the

Private Bus operators and the price exploitation, in connection with their no alternative to avoid the

services.

Introduction:

India is witnessed high growth and demand in travel industry due to urbanization, population growth and

rising incomes of individuals. The demand is very high in Bus passenger market and India ranks among

the top-10 in the whole world in bus segment; Buses take up over 90 percent of public transport in

Indian cities (Pucher, Korattyswaroopam and Ittyerah 2004). The operators include both public and

private, especially the private operators are playing pivotal role with 92.87 percent of total buses in 2015

of this segment.

Karnataka is one of the largest metropolitan in India and hub of information technology (IT),

information technology and enabled services (ITES) sectors and pharmaceutical industry and a centre

for Transport industry. The city of Bangalore has well developed bus routes which connect it with all the

major cities and towns of the country and it consist of three national and five state highways. Both

Andhra Pradesh State Road Transport Corporation (APSRTC) and Karnataka State Road Transport

Corporation (KSRTC) are running different varieties of buses to all parts of India and it is place as

initiative and developments like first double ducker bus.

International Journal for Multidisciplinary Research (IJFMR)

IJFMR240111965

Volume 6, Issue 1, January-February 2024

2

These two Road Transport Corporations are implementing IT initiatives. Those have helped for online

passenger reservation system, GPS based vehicle tracking system and some are under pipeline. The

APSRTC have 1840+ agents and KSRTC consist of 1692 agents and these are spread across different

locations in the country. But last few years they are facing a stiff competition from Private Bus

Operators’. From last two decades the Private Bus Operators are dominating the bus passenger market in

around Andhra Pradesh and Karnataka States. The Private Operators are targeting long journey trips; it

begins from 250km and is up to 650km. According to some unauthorized report approximately 1450

Private bus operators are available in Bangalore city alone.

Government Vs Private Buses

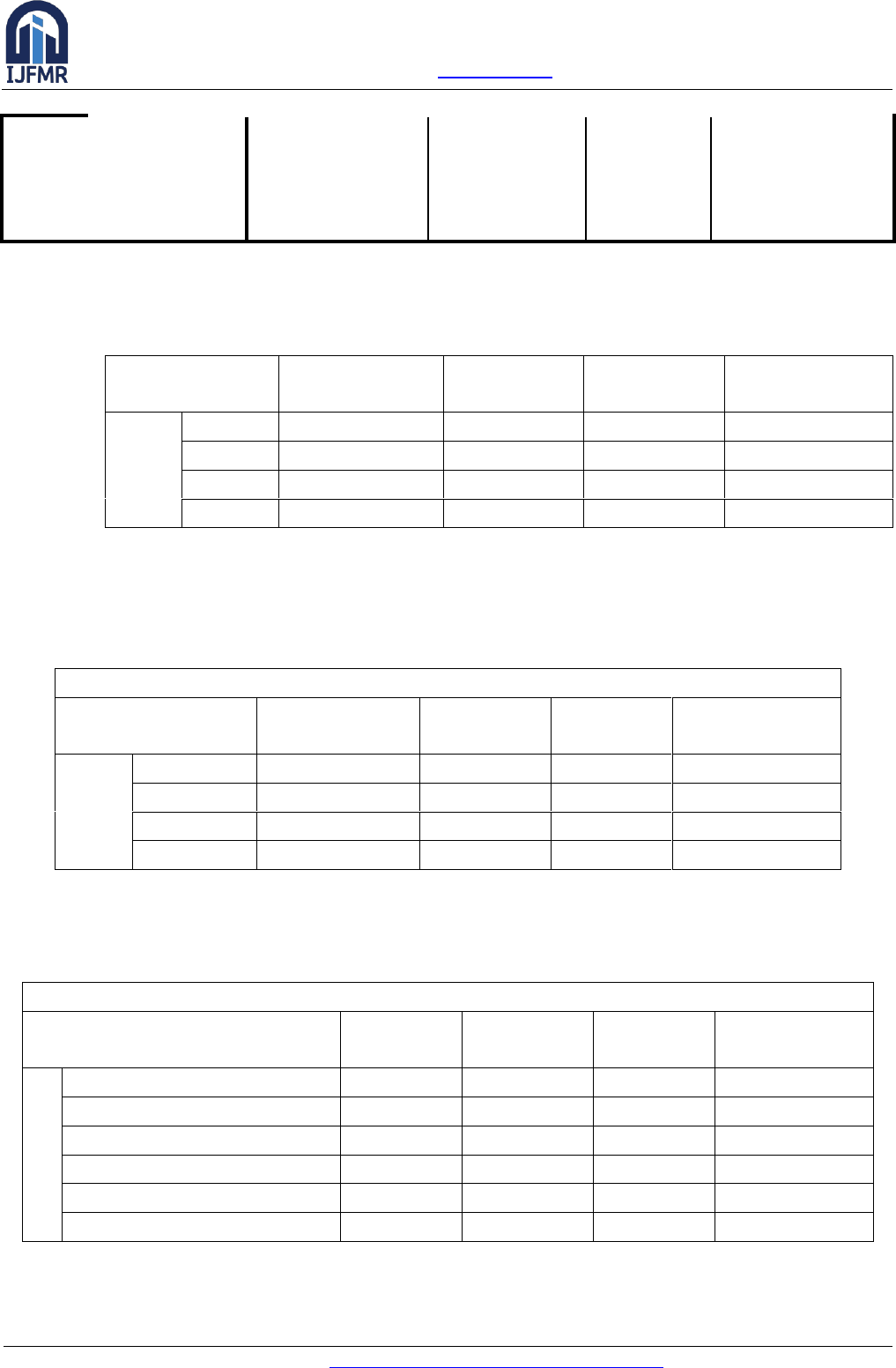

The table.1 represents the number of buses in ownership across the Private sector and Government

sector in India between the fiscal year of 2002 and the fiscal year of 2015.The total number of buses

owned by both government and private are increasing gradually during the period 2002 to 2015 .The

number of buses owned by the private sector was 520.3 thousand in 2002 and the share of private sector

in total buses owned in India was 81.94 percent in 2002.The number of buses owned by the private

sector was 1830 thousand in 2015.It is increased by 422 thousand as compared to 2010. The number of

buses owned by the public sector decreased during the period from 2003 to 2007.But it is increasing

during the period from 2008 to 2015.The share of private sector in total buses owned in India has

increased in successive periods during 2002 to 2015.The Compound annual growth rate (CAGR) of

number of private buses is very high ( 10.16%) compare to government buses which has only 1.57

percent .It says that there is significant growth of private buses in between 2002 to 2015 throughout the

country.

Table 1: Comparisons of Government and private buses owned across India from FY 2002 to

FY 2015(in thousands)

Year

Government

Private Buses

Total

2002

114.7(18.06%)

520.3(81.94%)

635(100%)

2003

114.9(15.95%)

605.9(84.05%)

720.8

2004

111.4(14.51%)

656.2( 85.48%)

767.6

2005

113.3(12.69%)

779.4(83.30%)

892.7

2006

112.1(11.3%)

879.9(88.69%)

992

2007

107.8(7.99%)

1242.5(92.01%)

1350.3

2008

113.6(7.96%)

1313.6(92.04%)

1427.2

2009

117.6(7.92%)

1368(92.08%)

1485.6

2010

118.8(7.78%)

1408.3(92.22%)

1527.1

2011

130.6(8.14%)

1473.2(91.86%)

1603.8

2012

131.8(7.86%)

1544.7 (92.14%)

1676.5

2014

140.1(7.43%)

1746.7(92.57%)

1886.9

2015

140.5(7.13%)

1830.3(92.87%)

1970.8

CAGR

1.57%

10.16%

9.10%

Source: Ministry of Road Transport and Highways

Note: All figures are in thousands, CAGR-Compound annual growth rate.

International Journal for Multidisciplinary Research (IJFMR)

IJFMR240111965

Volume 6, Issue 1, January-February 2024

3

Peak Load Pricing:

The Peak Load Pricing is the pricing strategy wherein the high price is charged for the goods and

services during times when their demand is at peak. The peak load pricing is widely used in the case of

non-storable goods such as electricity, transport and telephone. It was originally conceived as applying

to monopolies and public sectors, it is now spread to private sectors also. Bus Transport operators are

using this pricing policy to gain more revenue in peak time and to cover for off peak period.

Need for the study:

Due to peak load pricing, bus ticket fares are increases twice or more than actual fare at peak time more

over in vacations and festival seasons. This pricing strategy is unexpected and unjustifiable to any

passenger and even unbearable to them. And the facilities and service are same. In this view, a study has

been made by the researcher to bring out the passengers behavior with peak load pricing by private

operators with reference to city in the state of Telangana

Objectives of the study:

The objectives of the study are

1. To study and analyze socio-economic profile of the respondents.

2. To know the passengers traveling experience in Private Buses.

3. To examine the passenger satisfaction towards Private Bus transport services in Bangalore City

4. To know the passenger behavior on peak load strategy adopted by Privatebus operators.

Research Methodology:

The data has been collected from important boarding points in Bangalore city. The judgment random

sampling technique was employed and 110 respondents were selected as sample size and information

gathered through interview method .The minimum travelling distance taken from boarding point is

251km. The survey provides detailed characteristics of bus passengers and Likert 5point scale is also

using to know the respondents satisfaction and opinion on peak load pricing strategy.spssv21 is used to

analyze the data and statistical tools used for analyses are Mean, Standard Deviation and Friedman Test.

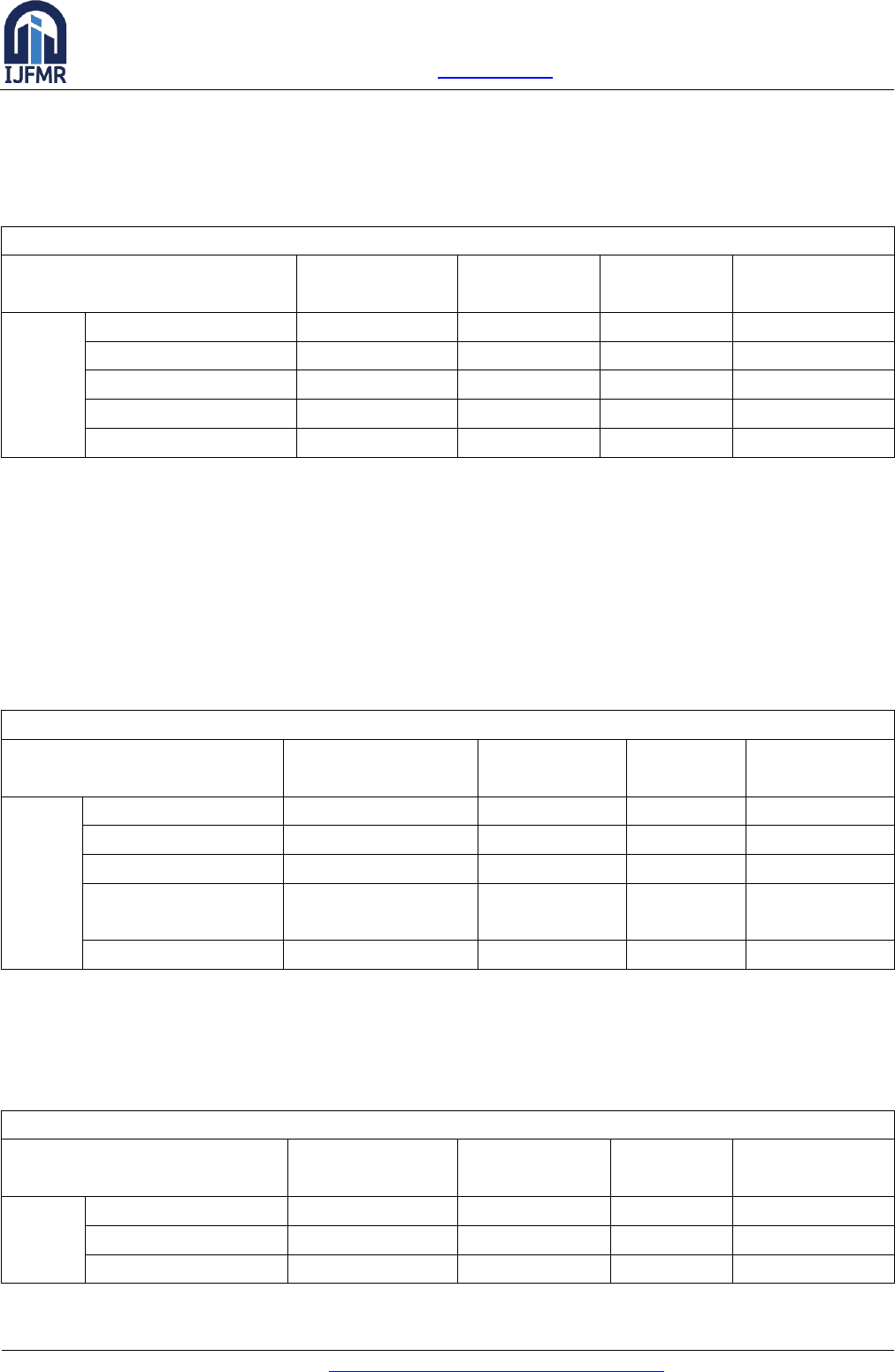

SOCIO-ECONOMIC PROFILE OF THE RESPONDENTS:

The study results of the socio economic profile of the respondents have been shown from table 2 to 6.

The socio-economic profile of the respondents has been examined based on some factors such as age,

gender, material status, educational qualification and income.

Age is an important factor which decides customer preferences, awareness and the level of satisfaction.

It also decides the passenger’s expectation on convenience, comfort and safety and security. From the

above table.2 it is found that 59.2 percent of the passengers belong to the age group between 21-40 ,

followed by 20.0 percent in the age between 41-60,, 12.5 percent represent the age below 20 and 8.3

percent is represented by the aged passengers above 60.

Table 2: Age Group of the Passengers

Age Group

Frequency

Percent

Valid

Percent

Cumulative Percent

Valid

Below 20 yrs

13

11.81

11.81

11.81

International Journal for Multidisciplinary Research (IJFMR)

IJFMR240111965

Volume 6, Issue 1, January-February 2024

4

21-40

66

60

60

71.81

41-60

21

19

19

90.9

Above 60

10

9

9

100.0

Total

110

100.0

100.0

The table 3 has shown the gender of the respondents. It is observed that majority of the respondents

belong to ‘male’ category i.e. 58.3 percent and remain 39.2 percent belong to ‘female’ category

Table.3: Gender of the Respondents

Gender

Frequency

Percent

Valid

Percent

Cumulative

Percent

Valid

Male

70

63.63

63.63

63.63

Female

40

36.36

36.36

100.0

Total

110

100.0

100.0

The present study divides the marital status of the respondents in three distinct groups namely married,

unmarried and others .Others includes divorcees and lives in relationship. From the table.4, it is found

that 70.8 percent are married, 26.7 percent are unmarried and with the impact of modern culture, the

reaming respondents i.e. 2.5% belong to other category.

Table 4: Marital Status of the Respondents

Marital status

Frequency

Percent

Valid

Percent

Cumulative

Percent

Valid

Married

75

68.18

68.18

68.18

Unmarried

32

29.09

29.09

97.27

Others

3

2.72

2.72

100.0

Total

110

100.0

100.0

The educational qualification of the respondents consists of illiterate, SSC, graduation.PG and other

qualifications such as ITI, diploma. From the table.5, it is observed that majority (57.5%) are graduates,

followed by PG(19.2% ) and interestingly few are from illiterate(4.2%) and SSC (4.2%).

Table 5: Educational qualification

Educational qualification

Frequency

Percent

Valid

Percent

Cumulative

Percent

Illiterate

5

4.54

4.54

4.54

SSC

5

4.54

4.54

9.09

Graduation

64

58.18

58.18

67.27

PG

20

18.18

18.18

85.45

Others

16

14.54

14.54

100.0

Total

110

100.0

100.0

Household Income is also an important part of socio-economic factor. This factor is also divided in

to 4 groups that are, the respondents whose level of income is upto2 lakh, more than 2 lakhs, to 4 lakhs

and 4 lakhs to 6 lakhs and above 6 lakhs (see table 6). The frequency distribution is also given in the

International Journal for Multidisciplinary Research (IJFMR)

IJFMR240111965

Volume 6, Issue 1, January-February 2024

5

table in a proper order. Out of the total respondents, 10.8 percent of passengers belong to the first

category of income group i.e. less than 2 lakh and 40.8 percent are at the second level of income

category i.e. more than 2 lakhs to 4 lakhs and 29.2 percent and 18%of passengers or the passenger are

belongs to the 3rd and 4th level of income group i.e. 4 lakhs to 6 lakhs and above 6 lakhs respectively

Table 6: Total annual household Income (in Rs.)

Total annual household

Income (in Rs.)

Frequency

Percent

Valid

Percent

Cumulative

Percent

Valid

up to 2,00,000

13

11.81

11.81

11.81

2,00,001- 4,00,000

41

37.27

37.27

49.09

4,00,001- 6,00,000

33

30

30

79.09

Above 6,00,000

23

20.90

20.90

100.0

Total

110

100.0

100.0

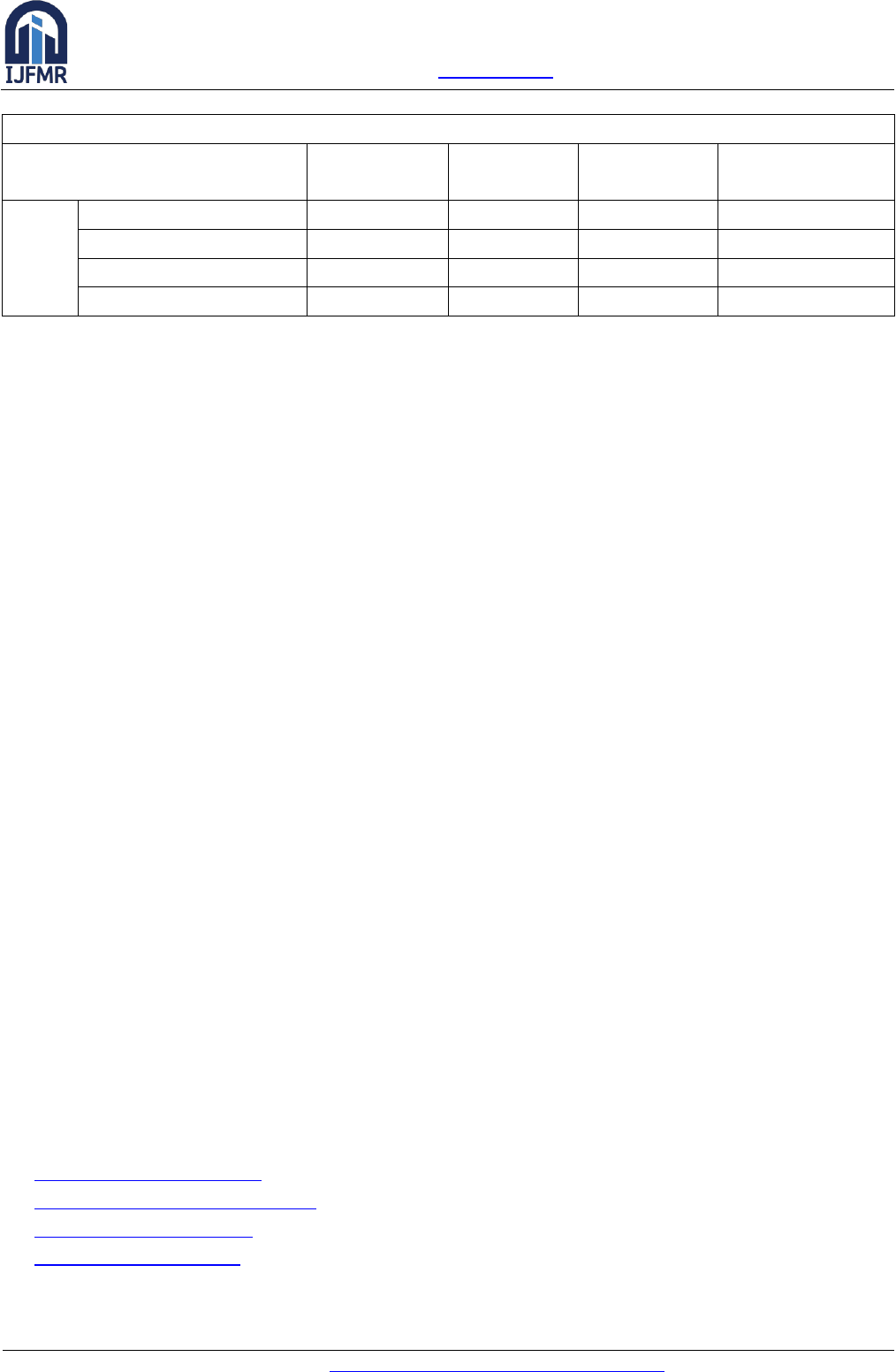

BASIC INFORMATION SEARCH ABOUT TRAVELLING IN PRIVATE BUSES

The basic information search about travelling in private buses has been studied on various factors and

the results of the study have been shown from table 7 to 12.

Out of the total respondents 120 in numbers, 17.5 percent of respondents are using the service providers

for a period less than 2 years. 10.8 percent and 15.2 percent passengers are at the second level and they

belong to the passengers who are using private bus transport services for 2-4 years.. The rest of the

passengers i.e. 50.0 percent belong to the category of the passengers who are using bus transport

services for more than 6years (see table 7).

Table 7: Since how long you have been using private bus transport services.

Frequency

Percent

Valid

Percent

Cumulative

Percent

Valid

less than 2 years

21

19.09

19.09

19.09

2- 4 years

13

11.81

11.81

30.9

4-6 years

21

19.09

19.09

50

more than 6 years

55

50

50

100

Total

110

100.0

100.0

Traveling distance is very important factor for the study and minimum distance taken is 251km .It is

divided into four distinct groups that are, 251-350km, from 351 to 450 is second distinct groups, third

group is from 451 to 550km and fourth group is more than 550km.Out of the respondents majority of

them travelled in between 351to 400km i.e. 42.5 percent. It is followed by the first distinct group (251 to

350 km) with 30.8 percent (see table 8)

Table 8: Travelling distance from Bangalore

Travelling distance from

Bangalore

Frequency

Percent

Valid

Percent

Cumulative

Percent

Valid

251-350km

32

29.09

29.09

29.09

351 to 450 km

46

41.81

41.81

70.9

451 to 550 km

19

17.27

17.27

88.18

International Journal for Multidisciplinary Research (IJFMR)

IJFMR240111965

Volume 6, Issue 1, January-February 2024

6

More than 550 km

13

11.81

11.81

100.0

Total

110

100.0

100.0

From the table.9 it is found that 44.2 percent of the respondents have 6-10 times of traveling experience

and it is interesting 23.3 percent of the respondents have more than 15times travel experience by private

Buses. It concludes that passengers are giving more preference to private Buses.

Table 9: Frequency of travel by Pvt. Buses (per year)

Frequency of travel by Pvt. Buses

(per year)

Frequency

Percent

Valid Percent

Cumulative

Percent

Valid

upto 5 times

23

20.9

20.9

20.9

6-10 times

50

45.45

45.45

66.36

11-15 times

10

9.09

9.09

75.45

More than 15 times

27

24.54

24.54

100

Total

110

100.0

100.0

From the table10 has been study the purpose of the journey, it is observed that most of the respondents

(63.3%) who are travelling in private Buses for personal use only and followed by holiday trip (25.8%)

and as business purpose (10.9).

Table 10: Purpose of the journey

Purpose of the journey

Frequency

Percent

Valid Percent

Cumulative Percent

Valid

personal

66

60

60

60

Business

13

11.81

11.81

71.81

Holiday trip

31

28.18

28.18

100.0

Total

110

100.0

100.0

The table 11 has shown the type of buses preferred by the respondents has been studied. In the study

the type of buses is divided into four distinct groups namely Non-A/C seater, A/C seater, Non A/C

sleeper and A/C sleeper. According to the above table majority of the commuters(45.8%) are giving

preference to A/C seater, in view of a pleasant bus ride to their preferred destination and unaffected by

weather conditions outside the AC bus. It followed by non-A/C seater (38.4%)

Table 11: Which type of buses do passengers prefer mostly

Frequency

Percent

Valid Percent

Cumulative

Percent

Valid

Non-A/C seater

41

37.27

37.27

37.27

A/C seater

50

45.45

45.45

82.72

Non A/C sleeper

6

4.45

4.45

88.18

A/C sleeper

13

11.81

11.81

100

Total

110

100.0

100.0

The table 12 has been reveals the study on the regular mode of bus tickets booking of the respondents.

Passenger’s mode to book bus tickets is divided in to three categories; these are online, travel agent and

travels office. The researcher observed that passengers of Bangalore is giving at most priority for

online booking, So, Most of the respondents (55.0%)are choosing online booking and they using ticket

windows like Abhibus.com,redbus.com etc.

International Journal for Multidisciplinary Research (IJFMR)

IJFMR240111965

Volume 6, Issue 1, January-February 2024

7

Table 12: Regular Mode to Book Tickets

regular mode to book tickets

Frequency

Percent

Valid Percent

Cumulative

Percent

Valid

online

56

50.9

50.9

50.9

Travel agent(by phone)

29

26.36

26.36

77.27

Travels office

25

22.72

22.72

100

Total

110

100.0

100.0

CONCLUSION:

Based on the study it has been noted that the respondents (bus passengers) have expressed their

happiness to use the private bus services , however they are stating that, lack of parking facilities,

waiting rooms, security at boarding points and some time indecent behavior (due to consumed alcohol

while in duty time) of staff (including driver) forced them to rethink about the usage of private bus

services.

In addition to this most of the respondents have been expressing their dissatisfaction with the peak load

pricing strategy adopted by Private Bus Operators in the Bangalore region, especially the factors like

affordable ticket fare, customized ticket cancelation policy; though the ticket prices are increasing two or

three times to actual fare there is no change in service quality as they expected. The final outcome of the

research has shown very interesting results such as customers’ dissatisfaction with the Government

(APSRTC and KSRTC) bus operator’s failure to control the Private Bus operators and the price

exploitation, in connection with their no alternative to avoid the service on peak load days (such as

festivals and holidays) .

REFERENCES

1. AHP, European Journal of Scientific Research, vol.66 no. 4.

2. Baskaran, R. and Krishnaiah, K. (2011): Performance Evaluation of Bus Routes Using Bus

Transport Services in Aruppukottai, Asian Journal of Managerial Science, Economics; 8: 215-248

(1995) ,@01995 Kluwer Academic Publishers,pg-216 electricity and transportation, Trasporti

Europei,14,24-32. Government of India ,New delhi ISSN: 2249-6300 Vol. 4 No.

3. Marcucci,E. and Polidori,P.(2000),Congestion and Peak load pricing: a comparison in

Michal.A.Crew, The Theory of Peak-Load Pricing: A Survey, Journal of Regulatory Ministry of

Road Transport and Highways(2017),buses in public and private sector in india, of Bangalore,

India”, IIM working paper – 2006.

4. Pangotra, PremSharma Somesh “Modeling Travel Demand in a Metropolitan City: Case Study

Patnaik, J., Chien, S., and. Bladikas, A. (2004). Estimation of Bus Arrival Times Selvakumar,M.

and Jegatheesan,K. (2015) A Study of Consumer Attitude towards Private Using APC Data. Journal

of Public Transportation, 7 (1), 2004, 1–20.

5. http://businessjargons.com

6. http://www.deccanchronicle.com

7. http://www.thehindu.com

8. http://www.autobei.com

9. https://community.data.gov.in