20

20

ANNUAL FINANCIAL

REPORT SUMMARY

Board of Trustees .................................................................................................................................................. 1

Organizational Chart ............................................................................................................................................2

Executive Team ......................................................................................................................................................2

Awards & Recognition ..........................................................................................................................................2

Membership ...........................................................................................................................................................3

Defined Benefit Plan

– Breakdown of Membership

– Number of Benefit Recipients – Five-Year Summary

– Average Annuity Payments for Retirees

Defined Contribution Plan

– Breakdown of Membership

– Participating Employers

Customer Service ..................................................................................................................................................4

Mission

Initiatives

Customer Service Statistics

Number of SURS Employees

Financial ..................................................................................................................................................................5

Highlights

Analysis

Condensed Statement of Plan Net Position

Condensed Statement of Changes in Plan Net Position

Funding ...................................................................................................................................................................6

Schedule of Employer Contributions

Historic Funding Ratios

Investments ............................................................................................................................................................7

Investment Policy

Policy Portfolio

Investment Objectives

Fiscal Year Investment Results

Long-Term Investment Results

Self-Managed Plan Assets

Employers ...............................................................................................................................................................8

Breakdown of Participating Employers

Employer List

Profile

SURS is the administrator of a cost-sharing, multiple-employer public employee retirement system

established July 21, 1941, to provide retirement annuities and other benefits for employees, survivors and

other beneficiaries of those employees of the state universities, community colleges, and certain other state

educational and scientific agencies. SURS services 61 employers and approximately 241,000 members and

annuitants. The plans administered by SURS include a defined benefit plan established in 1941 and a defined

contribution plan established in 1998.

SURS is governed by an 11-member board of trustees. Four trustees are elected by active SURS members,

two trustees are elected by retired SURS members, and five trustees are appointed by the governor of Illinois

(one of whom is the chairperson of the Illinois Board of Higher Education). The governor designates the

board chairperson from among the 11 trustees. All appointed trustees must be approved by the Illinois Senate.

Trustees serve six-year terms.

TABLE OF CONTENTS

SURS ANNUAL REPORT 2020

1

Mitchell Vogel

Elected

Jamie-Clare Flaherty

Appointed

Scott Hendrie

Appointed

John Atkinson

Chairperson

Appointed

Steven Rock

Elected

Antonio Vasquez

Elected

Collin Van Meter

Vice Chairperson

Elected

John Lyons

Treasurer

Appointed

Aaron Ammons

Elected

Richard Figueroa

Appointed

J. Fred Giertz

Elected

BOARD OF TRUSTEES

SURS ANNUAL REPORT 2020

2

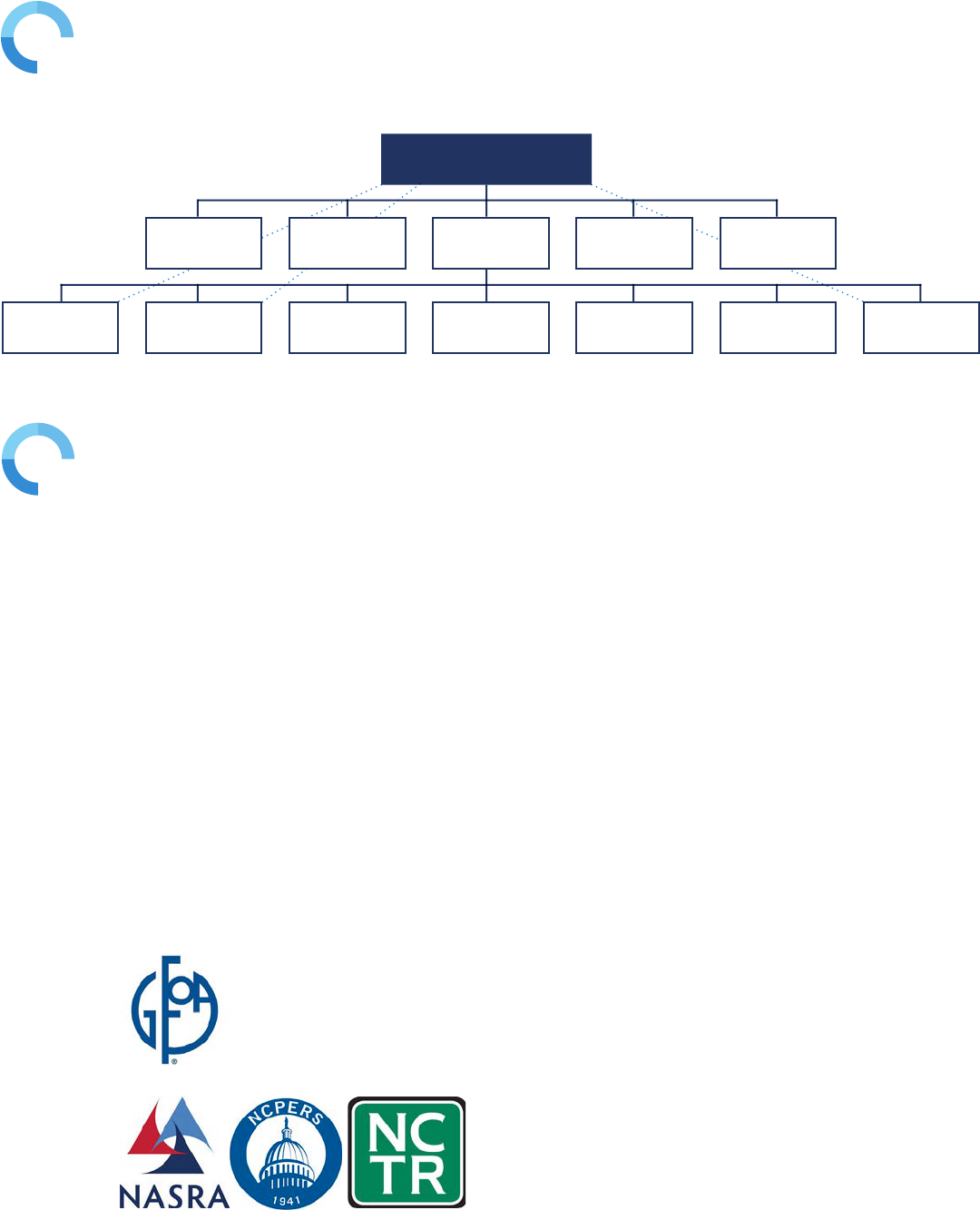

Excellence in Financial Reporting Award

The Government Finance Officers Association of the United States and Canada (GFOA) awarded

a Certificate of Achievement for Excellence in Financial Reporting to SURS for its FY 2019

financial report. It was the 36th consecutive year the System has earned the award. To be awarded

the certificate, a governmental unit must publish an easily readable and efficiently organized

comprehensive annual financial report whose contents conform to program standards. The report

must satisfy both generally accepted accounting principles and applicable legal requirements.

The Public Pension Coordinating Council (PPCC), a coalition

of three national associations that represents more than

500 of the largest pension plans in the U.S., awarded

SURS the Public Pension Standards Award for Funding and

Administration. Public Pension Standards are a benchmark

to measure public defined benefit plans in the areas of

retirement system management, administration and funding.

Awards & Recognition

Executive Director ...............................................................................Martin Noven

Chief Investment Ocer ..................................................................Doug Wesley

General Counsel ..................................................................................Bianca Green

Chief Technology Ocer ..................................................................Jeerey Saiger

Chief Financial Ocer ....................................................................... Tara Myers

Chief Benefits Ocer ........................................................................Suzanne Mayer

Chief Human Resources Ocer ..................................................... Brenda Dunn

Chief Internal Auditor ........................................................................Jacqueline Hohn

SURS Board of Trustees

Outside

Legal Counsel

Executive

Director

Actuarial

Consultant

External

Auditors

General

Counsel

Chief Technology

Ocer

Chief Financial

Ocer

Chief Benefits

Ocer

Chief Human

Resources Ocer

Chief Investment

Ocer

Chief Internal

Auditor

Investment

Consultant

ORGANIZATIONAL CHART

EXECUTIVE TEAM

SURS ANNUAL REPORT 2020

3

DEFINED BENEFIT TRADITIONAL & PORTABLE PLANS

MEMBERSHIP

At June 30, 2020, membership was:

Benefit Recipients* ,

Active Members ,

Inactive Members ,

,

*Does not include lump-sum refund recipients

At June 30, 2020, the number

of SMP participating employers was:

Universities

Community Colleges

Allied Agencies

State Agencies

Note: Excluded from the employer totals above is the

state of Illinois, a non-employer contributing entity.

At June 30, 2020, membership was:

Benefit Recipients ,

Active Members ,

Inactive Members ,

,

Number of Benefit Recipients 5-Year Summary

Disability

Fiscal Contribution Retirement

Year Survivors Disability Refunds Retirement Allowance

, , ,

, , ,

, , ,

, , ,

, , ,

Average Annuity Payments For Retirees as of June 30, 2020

Years of Credited Service

0–10 11–15 16–20 21–25 26–29 30+ Total

Number of Retirees , , , , , , ,

Avg Monthly Annuity $ , , , , , ,

Final Average Salary $, , , , , , ,

Avg Service Credit . . . . . . .

SURS is the plan sponsor and administrator of a defined contribution plan

established as of January 1, 1998, by the Illinois General Assembly as an amend-

ment to the Illinois Pension Code through Illinois Public Act 90-0448. This

plan is referred to as the Self-Managed Plan (SMP) and is offered to employees

of all SURS employers who elect to participate. This plan is a qualified money

purchase pension plan under Section 401(a) of the Internal Revenue Code. The

assets of the SMP are maintained under a trust administered by the SURS

Board of Trustees in accordance with the Illinois Pension Code, and are made up

of the account balances of individual members.

DEFINED CONTRIBUTION SELFMANAGED PLAN

Benefit

Recipients

.%

Inactive

.%

Active

.%

38.8%

32.0%

29.2%

BENEFIT

RECIPIENTS

INACTIVE

ACTIVE

Defined Benefit Plan

SURS ANNUAL REPORT 2020

4

Mission

To secure and deliver the retirement benefits promised to our members.

Major Initiatives and Changes

In March of 2020, SURS closed to the public and most of the staff began working from home to protect their health. Our staff has risen to the

work challenges caused by the coronavirus outbreak and will continue to change and adapt when necessary. As we have adopted new working

conditions, our members have seen the same excellent service, delivery of benefits and fiduciary responsibility they have come to expect. Benefit

checks are going out on time, our call center is fully operational and retirement counselors are conducting appointments remotely.

Although we are coping with the COVID-19 pandemic, we continue to move forward with major initiatives and changes at SURS.

The following changes occurred to SURS Board of Trustees in fiscal year 2020

• In August 2019, Mitchell Vogel, SURS annuitant and former board member, was selected to fill a vacancy on the SURS Board of Trustees by

the elected SURS trustees. The vacancy was created when elected annuitant board member John Engstrom resigned after the June 2019

board meeting.

• In March 2020, Gov. Pritzker appointed Scott Hendrie to the board. Trustee Hendrie’s term will expire in June 2021.

SURS staff worked diligently to complete IT, administration and member service projects.

• Several new software packages were implemented to assist the administrative support teams.

• Sage Intacct – a cloud-based financial management and services software

• ADP – cloud-based human capital management solution

• Agiloft - software for contract lifecyle management that will be used for legal and compliance

• A pension administration system assessment was done by the consulting firm Linea. This was the first step of many as SURS moves forward

with the replacement of the pension administration system.

• Renovations to the Champaign headquarters began. The call center and the counselor offices are being restructured to make more room for

the growing staff. Just under 6,000 sq. ft. are being renovated.

• New security and life safety tool updates, such as perimeter and interior monitoring of the main office, were completed.

• Work continued on the redesign of the Self-Managed Plan (SMP) and implementation of a new supplemental plan. On Sept. 1, 2020, we

launched the redesigned SMP, renamed the SURS Retirement Savings Plan (RSP). The new SURS Deferred Compensation Plan (DCP) will be

rolled out in 2021.

Number of SURS Employees (full-time equivalents) — 10-Year Summary

Fiscal Human Resources Investments Member Services Information Systems Self-Managed

Year & Administration & Accounting & Outreach & Support Services Plan Total

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

Counseling

Individual Retirement Counseling Appointments ............ ,

Written Retirement Estimates Mailed

.....................................

Campus Visits (July-March)

..........................................................

Retirement Education Seminars

....................................................

Benefit Fairs

......................................................................................

Webinars/Group Presentations

...................................................

Average Member Satisfaction Rating

.....................................%

Call Center

Incoming Calls ....................................................................... ,

Member Satisfaction Rating

.....................................................%

Lobby Visits

Walk-in Visits (July-March) ..................................................... ,

Member Satisfaction Rating (July-March)

............................%

Electronic Service

SURS Website Page Views ................................................ ,

SURS Member Website Visits

.......................................... ,

SURS Employer Website Visits

...........................................,

Incoming Webmails Processed

............................................. ,

Informational Emails Sent To Members

........................ ,

Claims Processed

Retirement ................................................................................... ,

Refund

........................................................................................... ,

Death

............................................................................................. ,

Disability

...........................................................................................

Support Services

Items Mailed .......................................................................... ,

Documents Scanned/Imported

........................................ ,

SURS MEMBER SERVICESOUTREACH STATISTICS FISCAL YEAR 2020

CUSTOMER SERVICE

SURS ANNUAL REPORT 2020

5

Financial Analysis of the System

The State Universities Retirement System serves 216,122 members in its defined benefit plan and 24,416 members in its Self-Managed

Plan. The funds needed to finance the benefits provided by SURS are accumulated through the collection of member and employer con-

tributions and through income on investments. The total net position of the System increased from $22.4 billion as of June 30, 2019 to

$22.6 billion as of June 30, 2020. This $0.2 billion change was due to the following: an increase in cash and short-term investments, an

increase in pending investment sales, an increase in payables to brokers-unsettled trades, and an increase to securities lending collateral.

Condensed Statement of Changes in Plan Net Position

Reporting Entity ($ in millions) Change Change

2020 2019 Amount %

Employer contributions $ . $ . $ . .

Non-employer contributing entity contributions ,. ,. . .

Member contributions . . . .

Net investment income . ,. (.) (.)

Total additions ,. ,. (.) (.)

Benefits ,. ,. . .

Refunds . . (.) (.)

Administrative expense . . . .

Total deductions ,. ,. . .

Net increase (decrease) in plan net position $ . $ . $ (.) (.)

Additions

Additions to plan net position are in the form of employer and member contributions and returns on investment funds. For fiscal year

2020, non-employer contributing entity contributions increased by $199.5 million due to higher contributions from the State of Illinois.

Employer contributions increased by $4.2 million or 7.2%. Member contributions increased by $9.5 million or 2.6%. Net investment

income for fiscal year 2020 was $765.8 million for the System, representing a $526.6 million decrease from the prior year. For the defined

benefit plan, the overall rate of return was 2.6% (net of all investment management fees).

Condensed Statement of Plan Net Position

Reporting Entity ($ in millions) Change Change

2020 2019 Amount %

Cash and short-term investments $ ,. $ . $ . .

Receivables and prepaid expenses . . (.) (.)

Pending investment sales ,. . ,. .

Investments and securities lending collateral ,. ,. . .

Capital assets, net . . . .

Total assets ,. ,. ,. .

Payable to brokers-unsettled trades ,. . ,. .

Securities lending collateral ,. . . .

Other liabilities . . (.) (.)

Total liabilities ,. ,. ,. .

Total plan net position $,. $,. $ . .

FINANCIAL HIGHLIGHTS FOR FISCAL YEAR 2020

• Contributions from the State and employers were $1,917.0 million, an increase of $203.8 million, or 11.9% from fiscal year 2019.

• The System’s benefit payments were $2,744.1 million, an increase of $126.9 million or 4.8% for fiscal year 2020.

• The System’s return on investment, net of investment management fees, was 2.6% for fiscal year 2020.

• The System’s net position at the end of fiscal year 2020 was $22.6 billion, an increase of $193.2 million or 0.9%.

FINANCIAL

SURS ANNUAL REPORT 2020

6

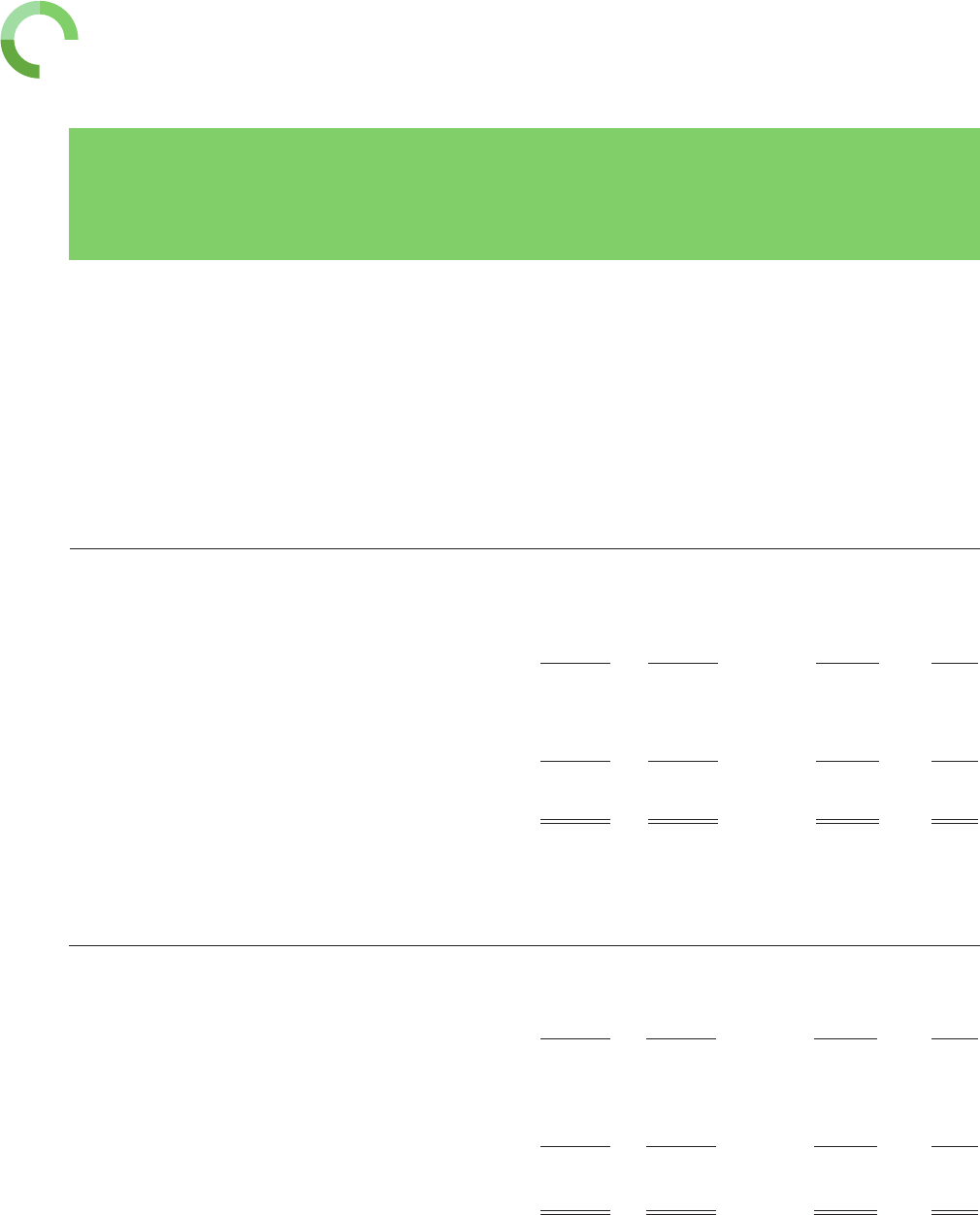

SURS is funded through contributions from non-employer, employer and employee contributions as well as investment earnings. The State of

Illinois, a non-employer contributing entity, provides funding from two sources: the General Revenue Fund and the State Pensions Fund, which is

funded with proceeds from unclaimed property.

Annually, the SURS actuary determines the annual “statutory contribution” needed to meet current and future benefit obligations in accordance with

the Illinois Pension Code, which sets forth the manner of calculating the statutory contribution under the Statutory Funding Plan. The Statutory

Funding Plan requires the state to contribute annually an amount equal to a constant percent of pensionable (capped) payroll necessary to allow

the System to achieve a 90% funded ratio by fiscal year 2045, subject to any revisions necessitated by actuarial gains or losses, or actuarial assump-

tions. All of the $1.85 billion statutory contribution for fiscal year 2020 was received by July 8, 2020. As of June 30, 2020, the plan net position as a

percentage of the total pension liability was 39.05%. The funding issue confronting SURS continues to represent a challenge to the System.

Although the statutory contribution requirement was met in fiscal year 2020, the Statutory Funding Policy creates a perpetual contribution vari-

ance of underfunding the System in earlier years. In later years, the statutory contribution would exceed a contribution equal to normal cost plus a

30-year closed period level percent of pay amortization of the unfunded liability. Further information is presented in the Required Supplementary

Information related to employer contributions and the funding of the plan.

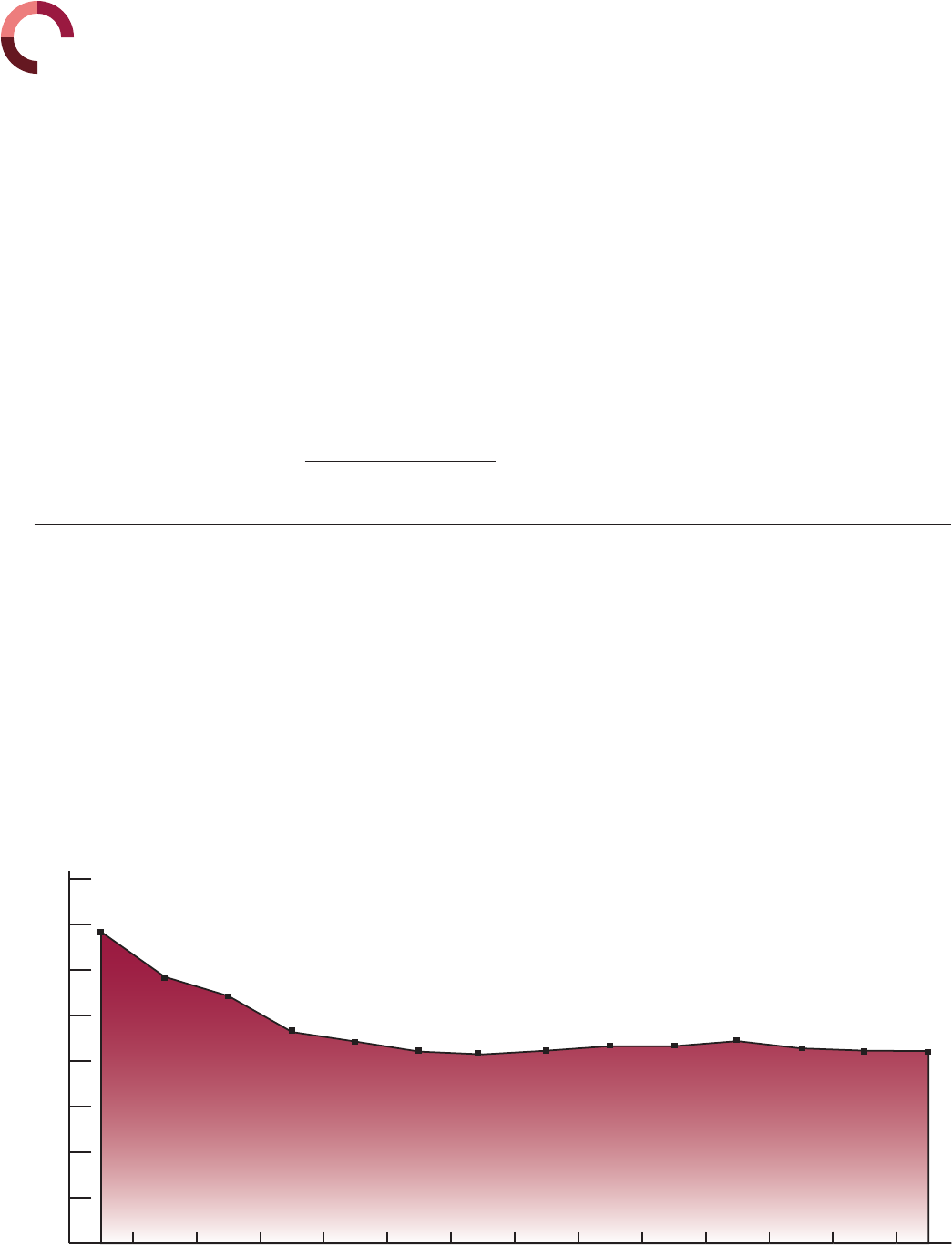

0

20

40

60

80

100

20202019201820172016201520142013201220112010200920082007

68.4%

58.5%

54.3%

46.4%

44.3%

42.1%

41.5%

42.3%

43.3%

43.3%

44.4%

42.8%

42.3%

42.2%

Historical Funding Ratios

Starting with fiscal year , the funding ratios were calculated using the actuarial value of assets. Prior to FY , the market

value of assets were used.

Fiscal Year

Schedule of Contributions from Employers and Other Contributing Entities ($ thousands)

Actual Contribution

Actuarially Other Contribution Actual Contribution

Determined Contributing Deficiency Covered as a % of

Fiscal Year Contribution Employers Entities (Excess) Payroll Covered Payroll

,, , , , ,, .

,, , , , ,, .

,, , ,, , ,, .

,, , ,, , ,, .

,, , ,, , ,, .

,, , ,, , ,, .

,, , ,, , ,, .

,, , ,, , ,, .

,, , ,, , ,, .

,, , ,, , ,, .

FUNDING

SURS ANNUAL REPORT 2020

7

Self-Managed Plan

Fiscal year 2020 marks the 22nd complete year of the Self-Managed Plan (SMP). As of June 30, 2020, the SMP had accumulated plan assets of

approximately $3.0 billion. This represents an increase of approximately $294 million since the end of fiscal year 2019. Contributing to the growth

in plan assets was a market-related increase of $224 million. During the past several years, SMP participants have continued to maintain a balanced

exposure to equities. In aggregate, the total funds invested by SMP participants have an allocation of 71% equity, 27% fixed income, and 2% real

estate. This was a 3% decrease in the equity allocation as compared to last year’s position.

Investment Objectives

The investment objective of the total portfolio is to achieve long-term, sustainable, investment performance necessary to meet or exceed the

System’s assumed rate of return, net of all management fees with appropriate consideration for portfolio volatility (risk) and liquidity.

Fiscal Year 2020 Results

During fiscal year 2020, the SURS portfolio returned 2.64%, net of fees, exceeding the policy portfolio return of 2.00%. The positive relative perfor-

mance was especially noteworthy, given the significant portfolio restructuring completed during the fiscal year. As discussed last year, SURS has

adopted a risk-based, functional framework for allocating capital. This framework makes use of strategic/functional classes that in-turn utilize under-

lying asset classes and strategies. As a result, each of SURS’s existing asset classes have been remapped to various risk-based, functional strategic

classes.

The Total Fund’s outperformance relative to the policy portfolio for Fiscal 2020 was primarily due to:

• Strong relative performance by the aggregate Traditional Growth portfolio and the option strategies sub-class of the Stabilized Growth portfolio;

• Strong absolute and relative performance by the Inflation Sensitive class due to a legacy commodities allocation; and

• Outperformance by the newly implemented Crisis Risk Offset class, which was funded during the fiscal year.

Long-Term Investment Results

From a long-term perspective, the SURS portfolio has performed well, earning a 7.9% annualized rate of return over the past 30 years, exceeding the

7.6% policy portfolio return. This return is also in line with the 8.0% average assumed rate of return in effect over the last 30 years and the current

6.75% assumed rate of return. For the 10-year period ended June 30, 2020, SURS total fund earned an annualized total return, net of all investment

management expenses, of 8.5%. This matched the policy portfolio benchmark.

INVESTMENTS

Strategic Asset Allocation

The purpose of the strategic allocation is to establish a framework that has a high likelihood, in the judgment of the Board, of realizing the System’s

long-term funding success. Strategic allocation involves establishing target allocation percentages for each approved strategic class and their sub-

class components. The asset-liability study completed in September 2018 resulted in significant structural changes to SURS asset allocation targets.

The foundation of these changes consisted of a transition from conventional asset classes to functional asset classes as the basis of portfolio weight-

ing. The transition to functional classes was completed during Fiscal Year 2020.

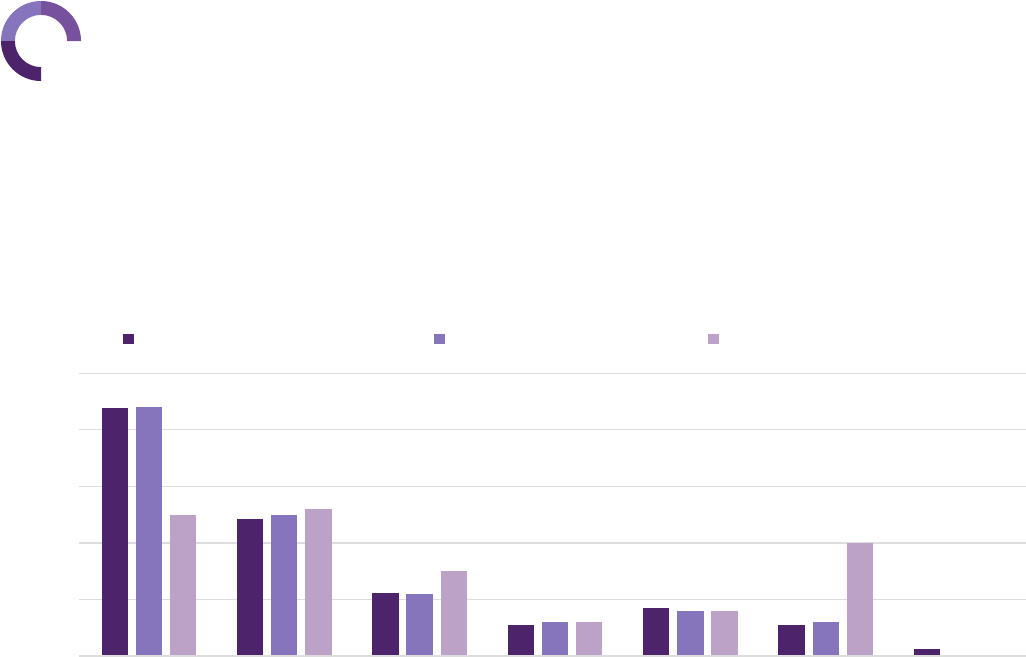

Policy vs. Actual

Percentage

0%

10%

20%

30%

40%

50%

Traditional

Growth

Stabilized

Growth

Non-Traditional

Growth

Inflation

Sensitive

Principal

Protection

Crisis Risk

Offset

Cash

44.0

25.0

24.3

25.0

26.0

11.2

11.0

15.0

5.4

6.0 6.0

8.5

8.0 8.0

5.5

6.0

20.0

1.2

0.0 0.0

43.9

Asset Allocation (Including Overlay) Interim Strategic Policy Target Long-Term Strategic Policy Target

0%

10%

20%

30%

40%

50%

Traditional

Growth

Stabilized

Growth

Non-Traditional

Growth

Inflation

Sensitive

Principal

Protection

Crisis Risk

Offset

Cash

44.0

25.0

24.3

25.0

26.0

11.2

11.0

15.0

5.4

6.0 6.0

8.5

8.0 8.0

5.5

6.0

20.0

1.2

0.0 0.0

43.9

Asset Allocation (Including Overlay) Interim Strategic Policy Target Long-Term Strategic Policy Target

Committment to Diversity

SURS continues to display a strong commitment to diversity as investments with firms owned by minorities, women, and persons with a disabili-

ty (MWDB), continue to grow. The search activity and portfolio restructuring completed during the fiscal year presented an opportunity to further

demonstrate this important initiative. Assets managed by diverse firms now represent approximately $7.2 billion or 37% of the Total Fund.

SURS ANNUAL REPORT 2020

8

Universities

Community Colleges

Allied Agencies

State Agencies

Note: Excluded from the employer totals above is the state of Illinois,

a non-employer contributing entity.

Black Hawk College

Carl Sandburg College

Chicago State University

City Colleges of Chicago

College of DuPage

College of Lake County

Danville Area Community College

Eastern Illinois University

Elgin Community College

Governors State University

Heartland Community College

Highland Community College

ILCS Section 15-107(I) Members

ILCS Section 15-107(c) Members

Illinois Board of Examiners

Illinois Board of Higher Education

Illinois Central College

Illinois Community College Board

Illinois Community College Trustees Association

Illinois Department of Innovation and Technology

Illinois Eastern Community Colleges

Illinois Mathematics and Science Academy

Illinois State University

Illinois Valley Community College

John A. Logan College

John Wood Community College

Joliet Junior College

Kankakee Community College

Kaskaskia College

Kishwaukee College

Lake Land College

Lewis & Clark Community College

Lincoln Land Community College

McHenry County College

Moraine Valley Community College

Morton College

Northeastern Illinois University

Northern Illinois University

Northern Illinois University Foundation

Oakton Community College

Parkland College

Prairie State College

Rend Lake College

Richland Community College

Rock Valley College

Sauk Valley College

Shawnee College

South Suburban College

Southeastern Illinois College

Southern Illinois University – Carbondale

Southern Illinois University – Edwardsville

Southwestern Illinois College

Spoon River College

State Universities Civil Service System

State Universities Retirement System

Triton College

University of Illinois — Alumni Association

University of Illinois — Chicago

University of Illinois — Foundation

University of Illinois — Springfield

University of Illinois — Urbana

Waubonsee Community College

Western Illinois University

William Rainey Harper College

Number of defined benefit plan participating employers

SURS Participating Employers

EMPLOYERS

State Universities Retirement System of Illinois

A Component Unit of the State of Illinois

1901 Fox Drive • Champaign, Illinois 61820

Toll Free 800-275-7877 • Direct 217-378-8800

www.surs.org

S U R S

STATE UNIVERSITIES RETIREMENT SYSTEM