Cherokee County Appraisal

District

2022 Mass Appraisal Report

Prepared Pursuant to Standard 6 of the Uniform Standards of Professional Appraisal Practice

Cherokee County Appraisal District

2022 Mass Appraisal Report

Introduction

The Cherokee County Appraisal District has prepared and published this report to provide our citizens and taxpayers with a better

understanding of the District’s responsibilities and activities. This mass appraisal report was written in compliance with Standard 6 of

the Uniform Standards of Professional Appraisal Practice (USPAP) as developed by the Appraisal Standards Board of the Appraisal

Foundation. This report has several parts: a general introduction and then several sections describing information specific to particular

appraisal divisions.

The 2022 mass appraisal was prepared under the provisions of the Texas Property Tax Code. Taxing jurisdictions that participate in the

District must use the appraisals as the basis for property taxation. The State of Texas allocates state funds to school districts based

upon the District’s appraisals, as tested and modified by the State Comptroller’s office in a biennial study of value.

The 2022 mass appraisal results in an estimate of the market value of each taxable property within the District’s boundaries. Where

required by law, the District also estimates value on several bases other than market value. These are described where applicable later in

this report.

General Assumptions and Limiting Conditions

The appraised value estimates provided by the District are subject to the following conditions:

The appraisals were prepared exclusively for ad valorem tax purposes.

The property characteristic data upon which the appraisals are based is assumed to be correct.

Physical inspections of the property appraised were performed as staff resources and time allowed and were scheduled based

upon the biennial Reappraisal Plan developed by the Chief Appraiser and approved pursuant to law by the Board of Directors

(as amended if applicable).

Validation of sales transactions occurred through questionnaires to buyers and sellers, review of information received from

Transunion, various fee appraisal reports, closing statements and the interview of real estate professionals. In the absence of

secondary confirmation, all sales data obtained was considered reliable.

No responsibility is assumed for the legal description or for matters including legal or title considerations. Title to any

property is assumed to be good and marketable, unless otherwise stated.

All property is appraised as if free and clear of any or all liens or encumbrances, unless otherwise stated. All taxes are assumed

to be current.

All property is appraised as though under responsible, adequately capitalized ownership and competent property management.

All parcel boundary data and structure sketches are assumed to be correct. Any plot plans and/or illustrative material

contained with the appraisal records are included only to assist in visualizing the property.

It assumes that there is full compliance with all applicable federal, state, and local environmental regulations and laws unless

noncompliance is stated, defined, and considered in the mass appraisal report.

It is assumed that all applicable zoning and use regulations and restrictions have been complied with unless a nonconformity

has been stated, defined, and considered in this mass appraisal report.

It is assumed that all required licenses, certificates of occupancy, consents or other legislative or administrative authority from

any local, state or nation government or private entity or organization have been or can be obtained or renewed for any use on

which the value estimate contained in this report is based.

It is assumed that the utilization of the land and improvements or the properties described are within the boundaries or

property lines, and that there are no encroachments or trespasses unless noted on the appraisal record.

General Assumptions and Limiting Conditions, Continued

Unless otherwise stated in this report, the appraiser is not aware of the existence of hazardous substances or other

environmental conditions. The value estimates are predicated on the assumption that there is no such condition on or in the

property or in such proximity thereto that it would cause a loss in value. No responsibility is assumed for any such conditions,

or for any expertise or engineering knowledge required to discover them.

The Date of all appraisals is as of January 1, 2022. The effective date of this report is August 23, 2022.

Disclosure of Interest

The Chief Appraiser signing this mass appraisal report discloses the following property as being property in which he has interest in:

Property ID 116396000, Tract 12, Block 723 of the W. Nutt Survey Abstract 644

Property ID 103564012, Tract 12, Block 1447 of the J. T. Jones Survey Abstract 26

Property ID 103564011, Tract 11, Block 1447 of the J. T. Jones Survey Abstract 26

Property ID 101287010, Tract 10, Block 1229 of the J. T. Jones Survey Abstract 11

Property ID 101287009, Tract 9, Block 1229 of the J. T. Jones Survey Abstract 11

The Chief Appraiser signing this mass appraisal report discloses the following party as being a party in which he has personal interest in:

None Disclosed

Properties in which the Chief Appraiser has an interest were appraised in accordance with state statutes and professional standards.

Additionally, a list of properties in which the licensed appraisal staff has an interest or an interest in parties is included as an addendum

to this report. No appraiser is allowed to appraise properties or influence the appraisal of properties within the jurisdiction of the

District in which they have an interest or an interest in a party within three degrees of consanguinity by agency rule.

Definition of Value

Except as otherwise provided by the Texas Tax Code, all taxable property is appraised at its “market value” as of January 1. Under the

Tax Code, “market value” means the price at which a property would transfer for cash or its equivalent under prevailing market

conditions if:

exposed for sale in the open market with a reasonable time for the seller to find a buyer;

both seller and buyer know of all the uses and purposes to which the property is adapted and for which it is capable of being

used and of the enforceable restrictions on its use, and;

both the seller and buyer seek to maximize their gains and neither is in a position to take advantage of the exigencies of the

other.

Departure

THE TAX CODE DEFINES SPECIAL APPRAISAL PROVISIONS FOR THE VALUATION OF SEVERAL DIFFERENT CATEGORIES OF PROPERTY

THAT DIFFER FROM 100% MARKET VALUE. SPECIALLY APPRAISED PROPERTY IS TAXED ON A BASIS OTHER THAN MARKET VALUE AS

DEFINED ABOVE. THESE CATEGORIES INCLUDE

LIMITATION ON RESIDENTIAL HOMESTEAD PROPERTY (§23.23, TAX CODE)

LIMITATION OF HIGHEST AND BEST USE ON HOMESTEAD PROPERTY (§23.01 (C), TAX CODE)

RESTRICTION ON APPRAISALS FOR PROPERTIES SUBJECT TO PRIOR YEAR ADMINISTRATIVE REVIEW (§23.01 (C), TAX CODE)

AGRICULTURAL, WILDLIFE AND TIMBER DESIGNATED PROPERTIES (CHAPTER 23, SUBCHAPTERS C, D, E AND H, TAX CODE)

RECREATIONAL, PARK, SCENIC OR PUBLIC ACCESS AIRPORT PROPERTIES (CHAPTER 23, SUBCHAPTERS F AND G, TAX CODE)

REAL AND PERSONAL PROPERTY INVENTORY (§23.12, TAX CODE)

CERTAIN TYPES OF DEALER INVENTORY (§23.121, 23.124, 23.1241 AND 23.127, TAX CODE)

NOMINAL (§23.18) OR RESTRICTED USE PROPERTIES (§23.83).

Properties Appraised

The mass appraisal model appraised all taxable real and business personal property known to the District as of the date of this report,

with the exception of certain properties on which valuation was not complete as of the date of this report. These, by law, will be

appraised and supplemented to the jurisdictions after equalization. The property rights appraised were fee simple interests, with the

exception of leasehold interests in property exempt to the holder of the property’s title. The description and identification of each

property appraised is included in the appraisal records submitted to the Cherokee County Appraisal Review Board as required by law.

Scope of Work Used to Develop the Appraisal

The mass appraisal model appraised all taxable real and tangible business personal property within the boundaries of the Cherokee

County Appraisal District, which encompasses all of Cherokee County, Texas. This involves approximately 64,658 accounts. The

District distributes the work of the appraisal among several appraisal personnel, as well as assignment of certain categories of property

to the firm of Capitol Appraisal Group, Inc. The following sections describe, by area of responsibility, the scope of work performed,

and those items addressed in USPAP Standard 6-8 (k) through (p).

The Chief Appraiser, who is the chief executive officer of the District, manages the District. All District employees report to the chief

appraiser through their immediate supervisor. The District is divided into four divisions: Executive, Collections, Appraisal and 911

Addressing. The Collections Division of the District is charged with the tasks of assessment and collections for all Cherokee County

taxing authorities except the County. The 911 Addressing Division is the primary addressing authority for all of Cherokee County

outside of the municipal boundaries of the City of Jacksonville. The Executive Division is made up of senior management, systems

administrator and one office manager and carries the responsibility of managing the fiscal and overall operations management of the

District. The Appraisal Division is divided into three different departments: Deeds and Mapping, Records, and finally, Appraisal Staff.

The Deeds and Mapping Department handles all ownership transactions via recorded deeds or filed real estate renditions. They initiate

each ownership modification and also create and maintain plat, county block and subdivision maps. The Records Department answers

most calls and over-the-counter requests. They also have the duty of computer data entry for all appraisal related items. Appraisal Staff

performs all appraisal related work for real and business personal property in the jurisdiction. Additionally, they handle all property

owner requests for value, special appraisal and equalization questions, as well as Appraisal Review Board cases. The District’s

appraisers are subject to the provisions of the Property Taxation Professional Certification Act and must be duly registered with The

Texas Department of Licensing and Regulation.

The Appraisal District staff consists of 17 (as of the date of this report) employees (depending on staffing arrangements) with the

following classifications:

4 – Executive Division

3.5 – Collections Division

1 – 911 Rural Addressing

3.5 – Support

5 – Field Appraisal

While the appraisal staff conducts most of the appraisal activities, the District also contracts with Capitol Appraisal Group, Inc. for

complex properties, mineral valuation, utility and industrial appraisals.

Determination of Highest and Best Use for Real Property

The District’s market value appraisals are performed pursuant to Article VIII, Section 1, Texas Constitution, which provides that

property must be taxed in proportion to its value as determined by law, §23.01, Tax Code implements this provision as follows:

Sec. 23.01. Appraisals Generally.

(a) Except as otherwise provided by this chapter, all taxable property is appraised at its market value as of January 1.

(b) The market value of property shall be determined by the application of generally accepted appraisal methods and

techniques. If the appraisal district determines the appraised value of a property using mass appraisal standards, the mass

appraisal standards must comply with the Uniform Standards of Professional Appraisal Practice. The same or similar appraisal

methods and techniques shall be used in appraising the same or similar kinds of property. However, each property shall be

appraised based upon the individual characteristics that affect the property's market value, and all available evidence that is

specific to the value of the property shall be taken into account in determining the property's market value.

(c) Notwithstanding Section 1.04(7)(C), in determining the market value of a residence homestead, the chief appraiser may

not exclude from consideration the value of other residential property that is in the same neighborhood as the residence

homestead being appraised and would otherwise be considered in appraising the residence homestead because the other

residential property:

(1) was sold at a foreclosure sale conducted in any of the three years preceding the tax year in which the residence

homestead is being appraised and was comparable at the time of sale based on relevant characteristics with other

residence homesteads in the same neighborhood; or

(2) has a market value that has declined because of a declining economy.

(d) The market value of a residence homestead shall be determined solely on the basis of the property’s value as a residence

homestead, regardless of whether the residential use of the property by the owner is considered to be the highest and best use

of the property.

(e) Notwithstanding any provision of this subchapter to the contrary, if the appraised value of property in a tax year is lowered

under Subtitle F, the appraised value of the property as finally determined under that subtitle is considered to be the appraised

value of the property for that tax year. In the next tax year in which the property is appraised, the chief appraiser may not

increase the appraised value of the property unless the increase by the chief appraiser is reasonably supported by clear and

convincing evidence when all of the reliable and probative evidence in the record is considered as a whole. If the appraised

value is finally determined in a protest under Section 41.41(a)(2) or an appeal under Section 42.26, the chief appraiser may

satisfy the requirement to reasonably support by clear and convincing evidence an increase in the appraised value of the

property in the next tax year in which the property is appraised by presenting evidence showing that the inequality in the

appraisal of property has been corrected with regard to the properties that were considered in determining the value of the

subject property. The burden of proof is on the chief appraiser to support an increase in the appraised value of property under

the circumstances described by this subsection.

(f) The selection of comparable properties and the application of appropriate adjustments for the determination of an

appraised value of property by any person under Section 41.43(b)(3) or 42.26(a)(3) must be based on the application of

generally accepted appraisal methods and techniques. Adjustments must be based on recognized methods and techniques that

are necessary to produce a credible opinion.

(g) Notwithstanding any other provision of this section, property owners representing themselves are entitled to offer an

opinion of and present argument and evidence related to the market and appraised value or the inequality of appraisal of the

owner’s property.

Determination of Highest and Best Use for Real Property, Continued

(h) Appraisal methods and techniques included in the most recent versions of the following are considered generally accepted

appraisal methods and techniques for the purposes of this title:

(1) the Appraisal of Real Estate published by the Appraisal Institute;

(2) the Dictionary of Real Estate Appraisal published by the Appraisal Institute;

(3) the Uniform Standards of Professional Appraisal Practice published by The Appraisal Foundation; and

(4) a publication that includes information related to mass appraisal.

The following departure notwithstanding, there is no other specific statute defining highest and best use as it applies in appraisals

conducted under the Tax Code, Texas courts have acknowledged that highest and best use is a factor that must be considered in

determining market value.

Departure

AS IS EVIDENCED BY §23.01 (C), HIGHEST AND BEST USE IS LIMITED IN SPECIFIC CIRCUMSTANCES.

Appraisal Performance Tests and Performance Measures Attained

The Texas Comptroller of Public Accounts conducts a biennial study to determine the degree of uniformity of and the median level of

appraisals by the appraisal District within each major category of property constituting at least 5% of the total value in each school

district, as required by §5.10, Tax Code.

2021 was the last Study year for all schools in Cherokee CAD.

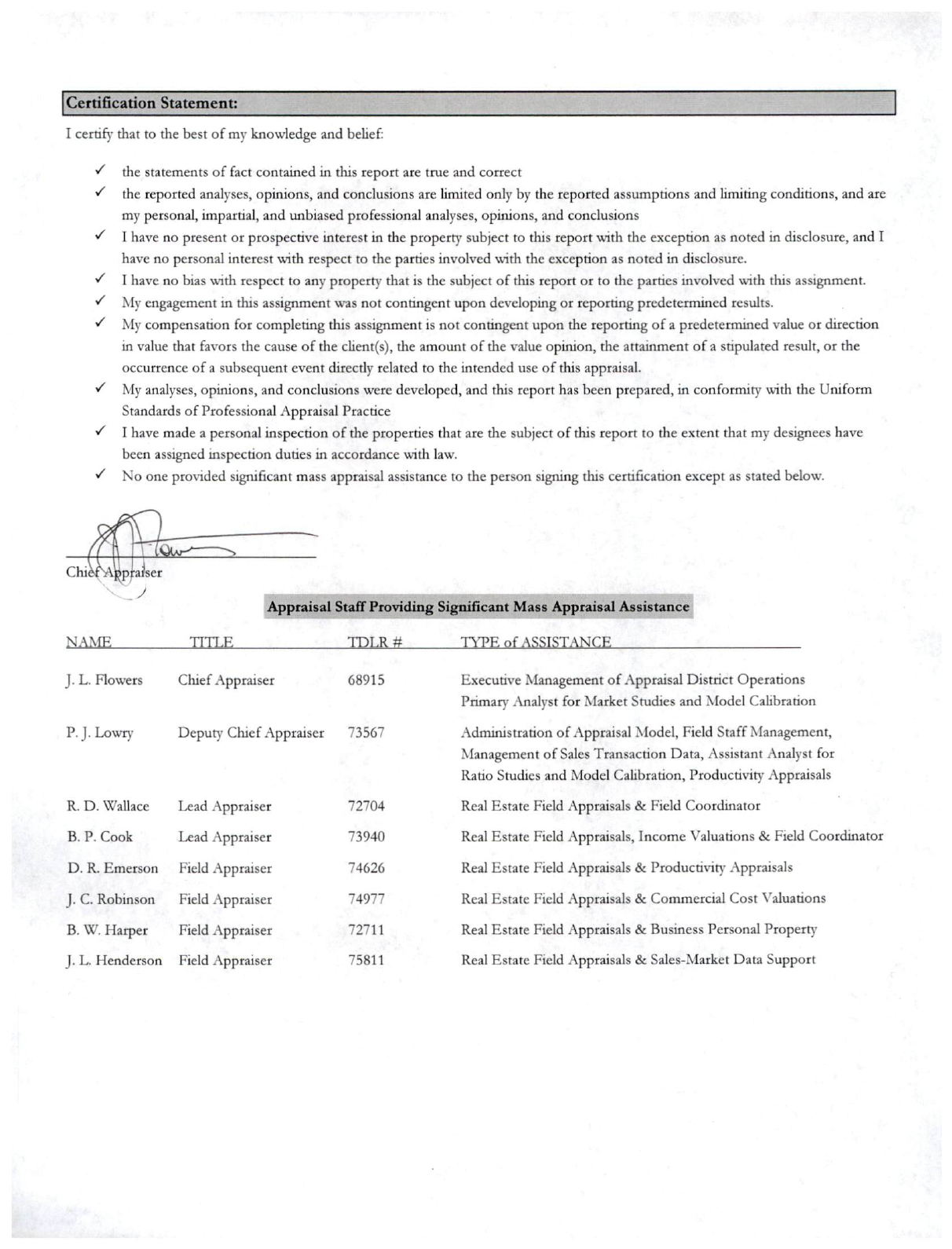

Certification

Statement:

I

certify

that

to

the

best

of

my

knowledge

and

belief:

✓

✓

✓

✓

✓

✓

✓

✓

✓

the

statements

of

fact

contained

in

this

report

are

true

and

correct

the

reported

analyses,

opinions,

and

conclusions

are

limited

only

by

the

reported

assumptions

and

limiting

conditions,

and

are

my

personal,

impartial,

and

unbiased

professional

analyses,

opinions,

and

conclusions

I

have

no

present

or

prospective

interest

in

the

property

subject

to

this

report

with

the

exception

as

noted

in

disclosure,

and

I

have

no

personal

interest

with

respect

to

the

parties

involved

with

the

exception

as

noted

in

disclosure.

I

have

no

bias

with

respect

to

any

property

that

is

the

subject

of

this

report

or

to

the

parties

involved

with

this

assignment.

My

engagement

in

this

assignment

was

not

contingent

upon

developing

or

reporting

predetermined

results.

My

compensation

for

completing

this

assignment

is

not

contingent

upon

the

reporting

of

a

predetermined

value

or

direction

in

value

that

favors

the

cause

of

the

client(s),

the

amount

of

the

value

opinion,

the

attainment

of

a

stipulated

result,

or

the

occurrence

of

a

subsequent

event

direcdy

related

to

the

intended

use

of

this

appraisal.

My

analyses,

opinions,

and

conclusions

were

developed,

and

this

report

has

been

prepared,

in

conformity

with

the

Uniform

Standards

of

Professional

Appraisal

Practice

I

have

made

a

personal

inspection

of

the

properties

that

are

the

subject

of

this

report

to

the

extent

that

my

designees

have

been

assigned

inspection

duties

in

accordance

with

law.

No

one

pro\'ided

significant

mass

appraisal

assistance

to

the

person

signing

this

certification

except

as

stated

below.

Chi

prarser

name

title

■pptaisal

Staff

Providing

Significant

Mass

Appraisal

Assistance!

Tni.R

#

TYPE

of

ASSISTANCE

J.

L.

Flowers

Chief

Appraiser

68915

Executive

Management

of

Appraisal

District

Operations

Primar}'

Analyst

for

Market

Studies

and

Model

Calibration

P.

J.

Lowry

Deput)'

Chief

Appraiser

73567

Administration

of

Appraisal

Model,

Field

Staff

Management,

Management

of

Sales

Transaction

Data,

Assistant

Analyst

for

Ratio

Studies

and

Model

Calibration,

Productivity

Appraisals

R.

D.

Wallace

Lead

Appraiser

72704

Real

Estate

Field

Appraisals

&

Field

Coordinator

B.

P.

Cook

Lead

Appraiser

73940

Real

Estate

Field

Appraisals,

Income

Valuations

&

Field

Coordinator

D.

R.

Emerson

Field

Appraiser

74626

Real

Estate

Field

Appraisals

&

Productivity

Appraisals

J.

C.

Robinson

Field

Appraiser

74977

Real

Estate

Field

Appraisals

&

Commercial

Cost

Valuations

B.

W.

Harper

Field

Appraiser

72711

Real

Estate

Field

Appraisals

&

Business

Personal

Property

J.

L.

Henderson

Field

Appraiser

75811

Real

Estate

Field

Appraisals

&

Sales-Market

Data

Support

Report by Appraisal Division

As noted above, the District allocated the work of the mass appraisal among several areas within and without the District. The division

of tasks by property type typically involves all staff. All field appraisal staff conduct physical inspections of both real and business

personal property. These properties generally break down into four primary categories: Residential, Commercial, Business Personal and

Productivity Valuations. The firm of Capitol Appraisal Group, Inc. conducts all activities related to complex properties, mineral

valuation, utility and industrial accounts. That firm is also charged with the creation and maintenance of USPAP documentation for

those areas.

Field Operations

Scope of Work

The field operations activities involve appraisers responsible for collecting and maintaining property characteristic data for all

commercial, residential, agricultural and business personal property types, which are located within the jurisdictional boundaries of the

Cherokee County Appraisal District. These activities involve the field inspection of real and business personal property accounts.

Digital photographs are taken by field staff that in turn downloads those photographs into the District’s appraisal software system.

Data entry of field changes is primarily the responsibility of the staff field appraisers. However, the Support Department is available for

assisting in the data entry of field data.

Periodic physical review of property is recommended at least every four to six years, according to the International Association of

Assessing Officers (IAAO). The Cherokee County Appraisal District policy to inspect all real estate accounts once every three years

and business personal property every year. These inspections may be physical on-site inspections or analysis of available digital aerial

photography. Sale ratio studies and model calibrations are conducted on an annual basis for all property categories in the District.

Procedure for Collecting and Validating Data

Data collection requires organization, planning and supervision of the field staff. Data collection procedures have been established for

all properties. The appraisers are assigned throughout the jurisdiction of the District to conduct field inspections. Appraisers conduct

field inspections and record information on a property record card (PRC).

The quality of data used is extremely important in establishing accurate values of taxable property. While production standards are

established and upheld for the various field activities, quality of data is emphasized as the goal and responsibility of each appraiser.

New appraisers are trained in the specifics of data collection. Experienced appraisers are routinely employed in the effort to reinforce

data collection processes during mass reappraisals. Errors in data collection are the responsibility of the respective field appraiser for

correction and reproof.

Data collection of real property involves maintaining data characteristics of the property utilizing a CAMA (Computer Assisted Mass

Appraisal). The information contained in CAMA includes site characteristics, such as land size, frontage and location; improvement

data such as size, composition, quality of construction and physical, economic or function conditions; neighborhood or area types,

including micro neighborhood adjustments and digital photographs when available. Field appraisers use District protocols to establish

uniform classification coding and depreciation of real property. All real properties are coded with this protocol thus enabling the

administration of mass appraisal modeling.

Data collection for business personal property is not utilized to achieve an overall mass appraisal approach. The majority of business

personal property is appraised individually based upon property owner renditions. While it is true that some properties are appraised

based upon the valuations of other similar accounts, the multitude of personal property accounts are a one-on-one appraisal. All

business personal property accounts are categorized by Standard Industrial Codes (SIC) as set by the Comptroller of the State of Texas.

Sources of Data

The sources of data collection and verification are typically derived via field inspections, building permits, mechanics liens, new

electrical connections, Appraisal Review Board hearings, valuation publications, commercial vehicle registrations, property owner

correspondence, sales surveys, and real estate professional interviews.

Building permit data obtained from the various municipalities and mechanics lien data obtained from the Cherokee County Clerk’s

Office trigger annual upkeep inspections on properties with apparent significant changes in value or composition. New improvements

are found via several methods. First, the District conducts annual field inspections based primarily on the biennial Reappraisal Plan and

any amendments thereof. Second, a list of new utility connections is provided to the District by the county judge’s office and is used to

find new improvements. Finally, mechanic’s liens are filed by contractors and are relayed to the District via the County Clerk’s office

on a monthly basis. Data accuracy is also enhanced by the availability of the District’s records on the Internet. Property owners do

contact us to report data errors via this method and also during informal hearings.

Data review of entire neighborhoods, or of individual properties is conducted when ratio studies indicate wide dispersions in the ratio

study or out of the ordinary ratios for specific properties. Appraisers recheck these neighborhoods or re-inspect individual properties

to ascertain the validity of recorded field characteristics. This process also assists in the protocols to identify data outliers for statistical

analysis.

Data Maintenance

Data entry of all appraisal related information is performed by appraisal staff. They are tasked with the responsibility of creating and

maintaining files for each parcel, printing PRC’s, entry of appraisal field changes into the CAMA system and verifying the validity of

coding and sketch information. Field appraisers are responsible for downloading digital photographs into the CAMA system. Informal

and formal hearing information and changes are processed and administered by the appraisal review board staff coordinator.

Residential Valuation

Scope of Work

The Residential Valuation is responsible for developing equal and uniform market values for residential improved and vacant property

for ad valorem purposes. Residential improved property encompasses property in municipalities, subdivisions and rural areas. Vacant

property typically consists of property in residential or rural neighborhood settings.

Highest and Best Use Analysis

The highest and best use of property is the reasonable and probable use that supports the highest present value as of the date of the

appraisal. The highest and best use must be physically possible, legally and financially feasible, and productive to maximization of value.

The highest and best use of residential property is normally its current use. This is due in part to the fact that residential development,

in many areas, through use of deed restrictions and zoning, precludes other land uses. Residential Valuation undertakes reassessment of

highest and best use in transition areas and areas of mixed residential and commercial use. In transition areas, the appraiser must

determine the most typical use for property each year by examining the use of recently sold property in that area. Similarly, in mixed

areas, the appraiser looks for boundaries created by zoning or recent market sales to determine the highest and best use for that area.

However, pursuant to legislative changes in 2009, residential properties receiving a homestead are not subject to this appraisal standard.

Instead, according to §23.01 (c), these properties shall continue to be appraised based upon residential use regardless of external factors

to the contrary. This creates a departure as noted previously.

Model Specification

Neighborhood and Market Analysis

The identification of neighborhoods can be divided into four categories for Cherokee County: subdivisions, municipal neighborhoods,

major lake property and rural neighborhoods. In each case, the appraiser attempts to localize neighborhoods by geographic boundaries.

The determinations of subdivisions and municipal neighborhoods are similar in that the appraiser looks for areas of homogenous

property. During this examination, the type and quality of construction and physical factors such as maintenance and upkeep of homes

and vacant tracts are considered. Conversely, rural neighborhoods are determined in large part on the examination of sales prices as

compared with other areas within a geo-political boundary. For example, a particular area in a rural setting may exhibit higher sales

prices for improved and vacant property as compared to other areas within a school district that has a similar composition of property

types. Municipal neighborhoods are classified with Low, Fair, Average and Good codes while rural neighborhoods are classified with

alphanumeric identifiers. Lake properties are segmented based upon the particular lake. Additionally, there may be further

segmentation into various quality neighborhood areas for each lake area.

Micro-neighborhoods are also a part of municipal neighborhood profiling. Within any particular neighborhood there can exist areas

where the market is recognizing a discount or premium as compared with similar areas. In these instances, the appraiser still maintains

the Low, Fair, Average or Good neighborhood classification but also adds a second identifier for the micro-area. Micro-neighborhoods

are defined in large part by plotting sales activities geographically and using this geographical tool to identify these areas. In each

instance, the second identifier contains a percentage adjustment. This adjustment modifies the properties as a discount or premium off

of the baseline schedule.

Description of Residential Improvement Model

The modeling techniques used by the District allow for specific adjustment for each category of property in the county. To begin, each

site built improved residence is classified based upon type of exterior siding. Properties with brick-veneer are classified as a type “M”

property. Properties with frame, vinyl or aluminum, log or other non-brick sidings are classified as type “F” property. Currently, metal

sided structures are also classified as type “F”. There are also properties with mixed siding composition. For example, a home may

only have a brick veneer front with frame siding on the remainder of the house. In this case, the appraiser must make a determination

on the predominate siding when classifying the property.

Each type of property as described above is further assigned a numeric code that corresponds to the quality of construction of the

improvement. These breakdowns of quality loosely follow the suggestions outlined in the Marshal and Swift valuation guide for

residential property. Coding for quality is defined by the following table:

Quality Code Description of Quality

1 Substandard

2 Low

3 Fair

4 Average

5 Good

6 Very Good

7 Excellent

Further, the model provides for plus (+) classes for each breakdown. The plus classification is used when an appraiser determines that

a particular property is somewhat better quality than a category but not quite the quality of the next higher classification. For example,

an improvement may be better than fair but not quite average in quality. In this instance, the appraiser would assign a Fair + or “3+”

code. These numeric codes are appended to the “F” or “M” code above. For example, a brick veneer, good quality plus home would

have a code of “M5+”.

Following the description of siding type and quality, each code is further differentiated by a neighborhood location code. These codes

differ for municipal, rural subdivision, lake property and rural properties. For municipal property, the alpha initial of the city is first

used followed by the alpha code for the type of neighborhood. For example, an average neighborhood in the City of Jacksonville

would be “JA”. This also denotes a municipal improvement on a lot less than one acre. For municipal improvements on lots over one

acre, an additional “A” for acreage is added to the coding. For example, in the average neighborhood, City of Jacksonville instance, the

code would be “JAA”. This additional acreage delineation only applies to municipal schedules. Lake subdivisions are identified by an

“L” and a numeric code corresponding to the particular lake as set out below:

Code Lake Description

L1 Lake Jacksonville

L2 Lake Striker

L3 Lake Palestine

Rural subdivisions are identified by the alpha code for the school district followed by an “RS” for rural subdivision then an alpha

indicator for Low, Fair, Average or Good subdivision. In this scheme, a fair quality rural subdivision in Wells ISD would be “WRSF”

for Wells Rural Subdivision Fair. Rural properties are classified based upon the type of road access it has as set out in this table:

Access Code Access Description

H State Highway

P Paved County Road or F.M.

D Dirt Road

L Land Locked

Following the Access Code is the numeric indicator for the school district:

School Code School School Code School

08 Wells 42 New Summerfield

21 Alto 46 Jacksonville

23 Bullard 62 Carlisle

15 Rusk 81 Troup

Therefore, for a rural improvement in Alto ISD on a dirt road would have a code of “D08”. There is one exception to this rule in

Jacksonville ISD. There is a particular code for certain properties that are not in the city limits of Jacksonville but immediately adjacent

to the city. This is a type of buffer zone between municipal and rural. This area has a numerical code of “76”.

These location codes are appended to the type and quality code and separated by a dash “-“. The following table contains some

examples of residential coding:

Code Description

F5-RG

Good Quality Frame Exterior Residence in a Good Neighborhood in

the City of Rusk

M3+-JFA

Fair Plus Quality Brick Veneer Exterior Residence in a Fair

Neighborhood in the City of Jacksonville on more than one acre

F4-ARSA

Average Quality Frame Exterior Residence in an Average Rural

Subdivision in Alto ISD

M4-P46

Average Quality Brick Veneer Exterior Residence in on a Paved

Road in Jacksonville ISD

F3-L1

Fair Quality Frame Exterior Residence on Lake Jacksonville

Each one of these code combinations is tied to a specific table of value for that code. These tables are referred to by the District as

“improvement schedules”. Each schedule contains a value per square foot of living area for individual stratum of square footage. In

this manner, the District is able to modify only schedules for a select group of properties if desired. The downside to this approach is

that the District must track and maintain several hundred different schedules.

In addition to the base residential schedules, there are also separate schedules for features and amenities for residential property. These

would include items such as porches, decks, attached and detached garages or carports, fireplaces or central heat/air. In most of these

cases, the schedule calls for a percentage of base approach to value. For example, the square footage in a porch would be calculated as

20% of the base schedule square footage price. So if a 1,200 square foot F3-D15 called for $48.09, porches for that improvement

would be based on 20% of $48.09 or $9.62 per square foot. However, for fireplaces, central heat/air or swimming pools, the schedules

call for flat pricing. Fireplaces are set at a certain total dollar amount as is swimming pools, while central heat/air is set at a set price per

square foot of living area. Both fireplaces and central/heat air systems are categorized by the same quality grade as the base

improvement.

Description of Land Model

Land modeling for the District’s residential and rural areas can be divided into categories similar to the neighborhood profiling shown

above. Land is coded for municipal, rural subdivision, lake lots and for rural land in general. Land is valued primarily based upon

acreage or square footage of the lot or tract. However, there are cases in the model where front footage or flat value per lot is utilized.

For municipal residential property, land is coded to in the same manner as the neighborhood extension on the improvement code.

Neighborhoods are classified Low, Fair, Average and Good with the respective classification preceded by the alpha code for the

particular city. For example, “JF” would indicate a lot, under one acre, in a fair neighborhood in the City of Jacksonville. As was

discussed earlier, adding an “A” to the end of that code would denote a schedule for municipal lots over one acre. For the same

example, “JFA” would indicate a lot over one acre located in a fair neighborhood in the City of Jacksonville.

Rural subdivisions follow the same naming convention discussed in the improvement section. The land table for a rural subdivision

would begin with the alpha code for the school, followed by “RS” for rural subdivision followed by the alpha code for low, fair, average

or good. For example, “BRSG” would indicate a land schedule for a good quality rural subdivision in Bullard ISD.

Lake lots are somewhat different in style than their improvement counterparts. Most lake lots are valued based upon the amount of

usable water front. When we consider “usable” we are trying to exclude narrow insets and outcroppings that tend to come with water

front lots. This exclusion can also be used in the upper ends of inlets in the lake that never have usable water. We do not consider

“usable” in instances where water levels are seasonally low. In other words, a lot that has usable water front when lake levels are

normal will be considered water front regardless of low water level. For these schedules, the coding begins with “WF” for ‘water front’

followed by the lake code as shown previously. These two codes are separated by a dash (-). For example, “WF-L2” means a water

frontage schedule for a lot on Lake Striker. This method of coding in similar for Lake Jacksonville, but differs in that the lots are

divided into good, average and fair lots. The first letters of the grading is appended to the standard code structure to make: “WF-L1G”,

“WF-L1A” and “WF-L1F”. Furthermore, there are some lots on Lake Jacksonville that do not have good water unless the lake is full.

These lots are to the north and are classified as water view lots. In these cases, the “WF” is replaced with “WV” in the code structure.

Rural land follows the style of the rural improvement neighborhood extension. The type of access available to the property is coded

first (Land Locked, Dirt, Paved or Highway) followed by the numerical code for the school district. The same exception exists here as

in the improvement codes for property not in the City of Jacksonville but immediately adjacent to. This area is numerically coded “76”.

Some examples of these codes would be “P23” for land on a paved road in Bullard ISD or “H76” for land on a highway in the buffer

zone surrounding the City of Jacksonville.

Finally, all land is valued based upon the total size of all contiguously controlled tracts of a particular owner. In other words, a person

who owns three pieces of property that touch each other is valued on each individual tract as though it were one tract of the combined

size. Consider a person who owns a 5-acre, 15 acre and 10-acre tracts. That person would be valued as though all contiguous tracts

were combined into one for valuation purposes. In the example, each tract would be valued per unit as though it were one thirty-acre

tract. This is known as “pricing acres” or “pricing square footage.

Procedures for Model Calibration

Each year, the District analyzes sold property as compared to the appraised value of that sold property. The calibration of the model

begins here and progresses in two different stages. Land calibration first and followed by improvement calibration.

Land Model Calibration

The first stage in the residential calibration process is to analyze and calibrate all land schedules. Tract and lot sales are obtained

through the various means discussed in the section titled “Sources of Data”. This information is then analyzed by segregating the

various sales into their respective categories identified by the land schedule code for that sold property. For each category that has

sufficient sales activity, the sales are checked to confirm the total number of acres or square footage involved in the transaction. The

sales price is then divided by the total number of acres or square footage to arrive at a price per unit. These prices per unit are then

arrayed in ascending size of sale and plotted graphically. In this manner, the District has a picture of price per acre for example for all

tracts plotted against size. In addition to the graph line for sales, the District plots a logarithmic trend line for sales. Over this graph,

the District superimposes a graph of appraised value per unit for that particular category as determined by the current category

schedule. Using the sales and the sales trend line as compared to the line for the appraisal schedule allows the District to move the

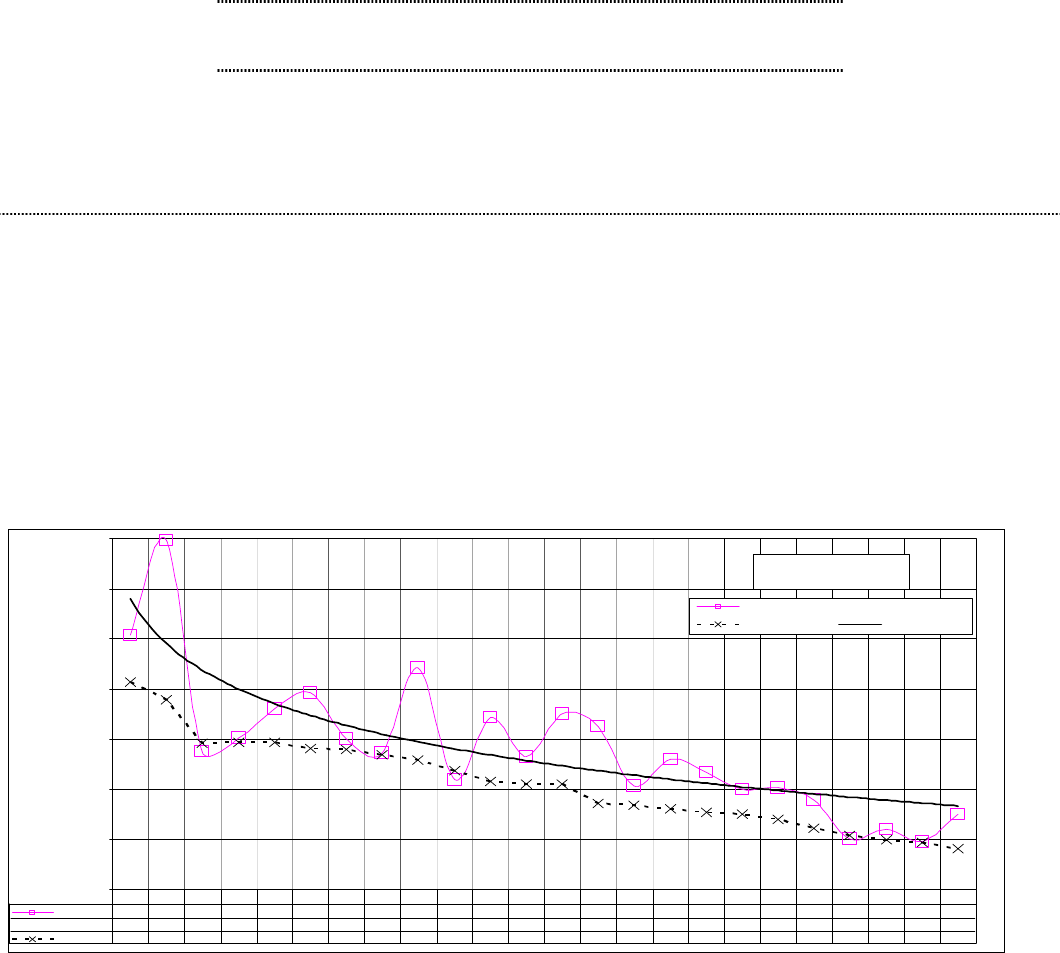

appraisal plot in a manner that best fits the sales data. The following is an example of a graphical plot:

Moving the appraisal plot to best fit the sales and sales trend lines will give the District the information needed to adjust the underlying

schedule. Calibrating the schedule will result in all properties being revalued for that particular classification of land. In this manner,

sold and unsold properties are all reappraised.

Typically, there are never enough sales in each different classification of property to perform the above-mentioned process. In these

instances, the District will adjust schedules lacking sufficient sales information based upon the adjustments of classifications with sales.

For example, if there were sufficient sales to perform an analysis of paved access land in rural Jacksonville ISD (P46) but not enough

sales for H46 or D46, the District would use the calibrated P46 schedule as a benchmark and adjust H46 and D46 up or down

accordingly as compared to P46. The same is also true of school districts that lack sales activity. Often times, an entire school district

market area has a low volume of sales thus prohibiting a sales analysis. These school districts will be adjusted based upon the activity of

neighboring schools. The calibration of schedules or schools with low sales volume based upon similar schedules or schools is referred

to by the District as “blending”. When blending schedules or schools, the District recognizes that there exists a certain difference

between schedules or areas. For example, the District recognizes that property in Wells ISD is not the same as property in Rusk or

Jacksonville ISDs. Additionally, land locked land is not worth the same as land with highway access. There is a premium or discount

employed when blending. Consideration is given to the schedules or schools with the most sales volume and further consideration is

P46 Initial Plot

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

Acres

$/Ac

Sale $/Ac Suppressed

SCH $/AC Log. (Sale $/Ac)

Sale $/Ac

$5,078 $6,958 $2,757 $3,019 $3,605 $3,922 $3,000 $2,718 $4,423 $ 2,188 $3,438 $2,650 $ 3,500 $3,250 $2,064 $2,600 $2,333 $2,001 $2,025 $1,790 $1,010 $1,200 $950 $1,500

Suppressed

0 0 0 0 0

SCH $/AC

$4,132 $3,783 $2,918 $ 2,938 $2,934 $2,815 $2,786 $2,681 $ 2,573 $2,363 $2,152 $2,100 $2,100 $1,710 $1,679 $1,603 $1,540 $1,499 $ 1,393 $1,226 $1,077 $ 990 $933 $ 810

1.3 1.5 3.6 3.9 3.9 4.6 4.6 5.5 6.3 8.0 9.6 10.0 10.0 19.3 20.4 25.7 30.0 33.0 40.5 55.3 79.2 92.9 108.0 186.1

given as to how other schedules or schools compare to them. The level of premium or discount is sought from what sales are available

in the low volume areas complemented with appraisal experience and judgment.

Once these processes are completed for a market area and all relevant schedules calibrated, the CAMA system is recalculated in order to

update all relevant parcels with the new appraisal data. Sales ratio reports are again pulled and the sold properties appraised value per

unit is double checked against the predicted outcome from the sales plotting discussed above. Attention is also given to the relative

change in appraised value for all properties as compared against the percentage change invoked in the calibration process. This allows

the District to identify properties or schedules of property that did not change in the manner anticipated by the calibration process.

When these tasks are complete, the CAMA system is ready with reappraised land values and therefore ready for the next step which is

the calibration of residential improvements.

Improvement Model Calibration

The second stage in the residential calibration process is to analyze and calibrate all improvement schedules. Following the same

procedures for data collection and segregation as outlined above, the improvement calibration process analyzes sales ratios by property

classification. The sales ratio is found by the following formula:

(Appraised Market Value ÷ Sales Price)*100 = Sales Ratio%

The sales ratio measures the level of appraised market value against a known sales price on a particular parcel of property. Ratios under

100% indicate sold property that is under appraised. Ratios over 100% indicate sold property that is over appraised. The sales ratio is

the first step in the analytical process.

Sales ratios are examined by improvement classification. For example, the District will look at all sales ratios for average quality brick

veneer homes in an average neighborhood in the City of Rusk (M4-RA). This task is performed for all classifications of sold property.

Greater weight is given to those classifications of property that possess adequate numbers of sales for analysis. As this process

proceeds, the District will examine those classifications for the influence of several factors such as physical condition, time of sale, size

of living area and neighborhood making adjustments as necessary to the analysis. After analyzing and adjusting the sales ratios for these

factors, the District calculates a weighted mean ratio for that classification found by the following formula:

∑ Appraised Market Values ÷ ∑ Sales Prices = Weighted Sales Ratio

The District also calculates a Coefficient of Dispersion for that sample by the following formula:

(Average Absolute Deviation ÷ Median Sales Ratio) 100 = COD

The average absolute deviation is the mathematical average of the absolute value of the differences between the sales ratio on each

parcel as compared to the median ratio for that sample. The COD is used to measure uniformity while the weighted mean ratio is used

to measure level of appraisal. The District employees these two factors and the sample size when giving weight to what classifications

to use as baseline schedules. The baseline schedules will determine how other schedules that lack adequate sales information are

modified. This is also a blending process as described in the section for land calibration. Blending in the improvement sense will

include differing classes of quality, exterior type and neighborhood. The appraiser uses market data and appraisal judgment to apply

premium or discount factors to the baseline schedule(s) when adjusted non-baseline schedules.

Once all schedules are calibrated and the data entered into the CAMA system, the system is recalculated and sales ratio reports are

pulled again for the purpose of seeing how the changes actually affected the system. Modifications to schedules or to other areas or

neighborhood factors are examined at this point. Following these adjustments, the District combines all sales ratios for improved

property in order to analyze the overall weighted mean ratio and COD. Overall statistics will also be calculated on neighborhood and

other market area levels.

Commercial Valuation

Scope of Work

The Commercial Valuation is responsible for developing equal and uniform market values for commercial improved and vacant

property for ad valorem purposes. Commercial improved property encompasses property in municipalities, as well as rural areas.

Vacant property typically consists of property in commercial market area settings.

Highest and Best Use Analysis

The highest and best use of property is the reasonable and probable use that supports the highest present value as of the date of the

appraisal. The highest and best use must be physically possible, legally and financially feasible, and productive to maximization of value.

The highest and best use of commercial property is normally its current use. This is due in part to the fact that commercial

development, in many areas, through use of deed restrictions and zoning, precludes other land uses. Commercial Valuation undertakes

reassessment of highest and best use in transition areas and areas of mixed commercial and residential use. In transition areas, the

appraiser must determine the most typical use for property each year by examining the use of recently sold property in that area.

Similarly, in mixed areas, the appraiser looks for boundaries created by zoning or recent market sales to determine the highest and best

use for that area. As previously noted, residential homestead property in areas of commercial highest and best use are appraised as

residences pursuant to §23.01(c).

Model Specification

Market Analysis

The identification of market areas typically consists of examining the primary commercial market areas as defined by municipal

boundaries. However, the use of other geographic boundaries in certain areas of the county is also utilized.

In determining market areas, the appraiser examines market sales activity. During this examination, physical factors such as

maintenance and upkeep of property and vacant tracts are considered. Municipal market areas are classified with Low, Fair, Average

and Good codes.

Micro-areas are also a part of municipal market areas. Within any particular area there can exist niches where the market is recognizing

a discount or premium as compared with similar areas. In these instances, the appraiser still maintains the Low, Fair, Average or Good

market area classification but also adds a second identifier for the micro-area. Micro-areas are defined in large part by plotting sales

activities geographically and using this geographical tool to identify these areas. In each instance, the second identifier contains a

percentage adjustment. This adjustment modifies the properties as a discount or premium off of the baseline schedule.

Description of Commercial Improvement Model

The modeling techniques used by the District allow for specific adjustment for each category of property in the county. Commercial

classifications roughly follow those set out in the Marshall and Swift Valuation Guide.

The numeric classification is the loose result of matching the class to the particular Marshall and Swift section number. While this is

predominately accurate to the section number, there are also exceptions to the rule. Following the numeric code, the classification was

divided into the type of construction: steel, concrete or wood as noted here:

Construction Code Description of Code

C Concrete

D Wood

S Steel

Further, the classification is divided into quality groups of good, average and low:

Quality Code Description of Code

G Good

A Average

L Low

Utilizing this system yields classifications such as:

Commercial Code Description of Code

10SA

Warehouse Steel Average Quality

21DG

Office Wood Good Quality

62CL

Concrete Low Quality

The following lists the commercial numeric codes and classification descriptions:

#Code Description #Code Description

10 Office Warehouse 43 43CG

11 Storage Warehouse 44 Fraternal Building

12 Distribution Warehouse 45 Recreational Building

13 Mini-Storage Warehouse 46 Funeral Home

14 14CA 47 Bowling Alley

15 Truck Terminal 48 Health Spa

16 Parking Garage 49 49CA

17 17CA 50 Hotel

18 Aircraft Hanger 52 Motel

20 Basement Area 54 Apartments

21

Office Bld - Stand Alone

Facility 55 School Building

21 Office Bld - Other 56 56CA

22 Bank 57 Daycare

23 Drive Through Bank 60 Light Industrial

24

Medical Office - Stand

Alone 61 Technical Building

24 Medical Office - Other 62 Heavy Industrial

25 Government Building 63 Auto Service Center

26 26CA 64 Auto Display Area

27 Nursing Home 65 Food Processing

28 Dispensary 66 Carwash

29 Veterinarian Clinic 67 Service Station

30 Beverage Store 68 Service Station Booth

30 Convenience Store 71 Drive in Restaurant

31 Department Store 72 Fast Food Restaurant

32 Discount Store 73 Restaurant

33 Supermarket 75 75CA

34 Retail Store - Stand Alone 81 Converted Service Station

35 Retail Strip Center 82 Converted Residence - Frame

36 Shopping Center 83 Converted Residence - Brick Ven.

37 Shopping Mall 84 Greenhouse

38 Mall Area 85 Canopy

39 Laundromat 86 Barn

40 Barber Shop 88 Gunite Pool

41 Church Building 89 Tennis Court

42 42CA 90 Utility Building

91 Automotive Repair

Finally, it is important to note that no market area extensions are present with commercial coding. Instead, all improved commercial

property is based upon the same schedule. To differentiate for market areas, the only factor used is a 95% good factor on all

commercial property outside of the City of Jacksonville.

Each one of these code combinations is tied to a specific table of value for that code. These tables are referred to by the District as

“improvement schedules”. Each schedule contains a value per square foot of the main improvement area. In this manner, the District

is able to modify only schedules for a select group of properties if desired. The downside to this approach is that the District must

track and maintain several different schedules.

Description of Land Model

Land modeling for the District’s commercial areas can be divided into categories similar to the residential neighborhood profiling

shown previously in the Residential section. Market areas are defined as good, average, fair and low for the Cities of Jacksonville and

Rusk. For other cities, the areas are not divided into market areas. In these areas, commercial property is fairly homogenous

throughout the municipality and does not warrant different market areas.

City of Jacksonville codes begin with “JC” followed by the market area code for good (G), average (A), fair (F) and low (L). If a

particular account is more than one acre, an additional “A” is attached to the end of the code. Therefore, “JCG” would be Jacksonville

Commercial Good while “JCFA” would be Jacksonville Commercial Fair Acreage for an account in excess of one acre. Likewise, the

City of Rusk schedules begin with “RC” followed by the same market area designators yielding examples such as “RCA” for Rusk

Commercial Average or “RCAA” for Rusk Commercial Average Acreage.

The cities of Troup, Alto and Wells have a different composition, beginning with the first letter of the city, followed by “CM1”. An

“A” is appended for parcels over one acre. In this manner, “WCM1” is commercial land in the City of Wells under one acre while

“TCM1A” would be commercial land over one acre in the City of Troup.

Finally, all land is valued based upon the total size of all contiguously controlled tracts of a particular owner. In other words, a person

who owns several contiguous lots in a city block is valued on each individual lot as though it were one lot of the combined size. This is

known as “pricing square footage.

Procedures for Model Calibration

Each year, the District analyzes sold property as compared to the appraised value of that sold property. The calibration of the model

begins here and progresses in two different stages. Land calibration first and followed by improvement calibration.

Land Model Calibration

The first stage in the commercial calibration process is to analyze and calibrate all commercial land schedules. Tract and lot sales are

obtained through the various means discussed in the section titled “Sources of Data”. This information is then analyzed by segregating

the various sales into their respective categories identified by the land schedule code for that sold property. For each category that has

sufficient sales activity, the sales are checked to confirm the total number of acres or square footage involved in the transaction. The

sales price is then divided by the total number of acres or square footage to arrive at a price per unit. These prices per unit are then

arrayed in ascending size of sale and plotted graphically. In this manner, the District has a picture of price per acre, for example for all

tracts plotted against size. In addition to the graph line for sales, the District plots a logarithmic trend line for sales. Over this graph,

the District superimposes a graph of appraised value per unit for that particular category as determined by the current category

schedule. Using the sales and the sales trend line as compared to the line for the appraisal schedule allows the district to move the

appraisal plot in a manner that best fits the sales data.

Moving the appraisal plot to best fit the sales and sales trend lines will give the District the information needed to adjust the underlying

schedule. Calibrating the schedule will result in all properties being revalued for that particular classification of land. In this manner,

sold and unsold properties are all reappraised.

Typically, there are never enough sales in each different classification of property to perform the above-mentioned process. In these

instances, the district will adjust schedules lacking sufficient sales information based upon the adjustments of classifications with sales.

For example, if there were sufficient sales to perform an analysis of average commercial land Jacksonville (JCA) but not enough sales

for JCF, the District would use the calibrated JCA schedule as a benchmark and adjust JCF up or down accordingly as compared to

JCA. The same is also true of cities that lack sales activity. Often times, an entire city market area has a low volume of sales thus

prohibiting a sales analysis. These cities will be adjusted based upon the activity of neighboring cities. The calibration of schedules or

schools with low sales volume based upon similar schedules or cities is referred to by the District as “blending”. When blending

schedules or cities, the District recognizes that there exists a certain difference between schedules or areas. For example, the District

recognizes that property in Wells is not the same as property in Rusk or Jacksonville. Additionally, land with limited access is not worth

the same as land with major roadway access. There is a premium or discount employed when blending. Consideration is given to the

schedules or cities with the most sales volume and further consideration is given as to how other schedules or cities compare to them.

The level of premium or discount is sought from what sales are available in the low volume areas complemented with appraisal

experience and judgment.

Once these processes are completed for a market area and all relevant schedules calibrated, the CAMA system is recalculated in order to

update all relevant parcels with the new appraisal data. Sales ratio reports are again pulled, and the sold properties appraised value per

unit is double checked against the predicted outcome from the sales plotting discussed above. Attention is also given to the relative

change in appraised value for all properties as compared against the percentage change invoked in the calibration process. This allows

the District to identify properties or schedules of property that did not change in the manner anticipated by the calibration process.

When these tasks are complete, the CAMA system is ready with reappraised land values and therefore ready for the next step, which is

the calibration of commercial improvements.

Improvement Model Calibration

The second stage in the commercial calibration process is to analyze and calibrate all improvement schedules. Following the same

procedures for data collection and segregation as outlined above, the improvement calibration process analyzes sales ratios by property

classification. The sales ratio is found by the following formula:

(Appraised Market Value ÷ Sales Price)*100 = Sales Ratio%

The sales ratio measures the level of appraised market value against a known sales price on a particular parcel of property. Ratios under

100% indicate sold property that is under appraised. Ratios over 100% indicate sold property that is over appraised. The sales ratio is

the first step in the analytical process.

Sales ratios are examined by improvement classification. For example, the District will look at all sales ratios for average quality frame

structure offices in the City of Rusk (21DA). This task is performed for all classifications of sold property. Greater weight is given to

those classifications of property that possess adequate numbers of sales for analysis. As this process proceeds, the District will examine

those classifications for the influence of several factors such as physical condition, time of sale, and market area making adjustments as

necessary to the analysis. After analyzing and adjusting the sales ratios for these factors, the District calculates a weighted mean ratio

for that classification found by the following formula:

∑ Appraised Market Values ÷ ∑ Sales Prices = Weighted Sales Ratio

The District also calculates a Coefficient of Dispersion for that sample by the following formula:

(Average Absolute Deviation ÷ Median Sales Ratio) 100 = COD

The average absolute deviation is the mathematical average of the absolute value of the differences between the sales ratio on each

parcel as compared to the median ratio for that sample. The COD is used to measure uniformity while the weighted mean ratio is used

to measure level of appraisal. The District employees these two factors and sample size when giving weight to what classifications to

use as baseline schedules. The baseline schedules will determine how other schedules that lack adequate sales information are modified.

This is also a blending process as described in the section for land calibration. Blending in the improvement sense will include differing

classes of quality, exterior type and neighborhood. The appraiser uses market data and appraisal judgment to apply premium or

discount factors to the baseline schedule(s) when adjusted non-baseline schedules.

When sales information is insufficient, commercial schedules are also analyzed and calibrated by comparing the cost of construction to

CAMA schedules. Cost data is used from the Marshall & Swift commercial cost source and augmented and adjusted by local cost

surveys. The Marshall & Swift estimator contains local area adjustments, and the District uses the adjustment for the Tyler market area.

This is typically further adjusted by applying an additional factor for the Cherokee County market area. The District applies the

additional local modifier because building codes and permitting costs are different than those associated costs in Tyler. Each property

appraised is given a percent good factor which is the mathematical result of subtracting depreciation from 100: (100 - 25% depreciation

= 75% good). In this manner, the cost of construction is adjusted for accumulated depreciation and physical condition.

Once all schedules are calibrated and the data entered into the CAMA system, the system is recalculated, and sales ratio reports are

pulled again for the purpose of seeing how the changes actually affected the system. Modifications to schedules or to other area or

neighborhood factors are examined at this point. Following these adjustments, the District combines all sales ratios for improved

property in order to analyze the overall weighted mean ratio and COD.

Industrial, Utility and Mineral Valuations

Scope of Work

Industrial, Utility and Mineral Valuations are the responsibility of the firm of Capitol Appraisal Group, Inc. They are responsible for

developing equal and uniform market values for these properties encompassing both real estate, royalty and relevant business personal

property for ad valorem purposes. For these categories of property, Capitol Appraisal Group has the contractual duty to develop and

maintain all relevant USPAP documentation.

Business Personal Property Valuation

Scope of Work

The District primarily employs one person for the actual valuation of Business Personal Property. That individual is charged with the

responsibility of developing fair and uniform values for this category of property. Property appraised by this section is all non-exempt

income producing personal property which includes leased assets, leased vehicles, commercial vehicles and dealer inventory appraisals

for heavy equipment, automobiles, marine vehicles and sports vehicles and manufactured housing. There are approximately 1,700 of

these accounts within the jurisdiction of the district. All business personal accounts are appraised annually.

Procedure for Collecting and Validating Data

Each December and January, the business personal property (BPP) appraiser in conjunction with the real estate appraisers conducts a

comprehensive field sweep of all BPP accounts to verify the existence of the account and ownership, as well as any new business

accounts that should be added to the roll. This data is collected, and any necessary changes written up on PRCs. The PRCs are

submitted to one data entry operator exclusively assigned to BPP data entry.

Once all changes have been made, the BPP appraiser, BPP data entry clerk and the Systems Administrator begin procedures to generate

and mail BPP Renditions to all BPP accounts. This is made possible via the CAMA system operated by the District and occurs by

February of each year. The owner has until April 15

th

to submit the completed rendition.

As renditions are submitted, a receipt of rendition is logged into an MS Access file built specifically for this purpose. The rendition is

then forwarded to the BPP appraiser. The appraiser reviews the rendition, making necessary adjustments and then totaling the

indicated values for inventory, vehicles, machinery & equipment, furniture & fixtures and computer equipment. Those totals are then

entered into the CAMA system by the BPP data entry clerk thus comprising the appraisal valuation record for the account. The original

rendition and any supporting documentation and appraisal notes are scanned into the CAMA system. Additionally, a paper record is

retained in the files of the District. ALL RENDITIONS ARE CONFIDENTIAL AND NOT OPEN TO PUBLIC

INFORMATION REQUESTS.

Rendition information is verified by in-field inspections of business assets by the BPP appraiser.

Sources of Data

As discussed previously, most information for business personal property is obtained via annual renditions required of owners with

income producing personal property. However, the District also subscribes to commercial vehicle registration and aircraft registration

firms to discover and list those types of assets. The District also subscribes to NADA to assist in valuing passenger vehicles and light

trucks. The BPP appraiser will also use data from other industry publications and personal field inspections during appraisal sweeps.

Data Maintenance

Data entry of all BPP related information is performed by the BPP appraiser with assistance from other appraisal staff as necessary.

The BPP appraiser is tasked with the responsibility of coordinating the flow of renditions and appraisal orders; the verification of

coding; and the data entry of orders. The creation and maintenance of files for each parcel, logging digital photographs, printing PRC’s

and generation of appraisal changes are the responsibility of the BPP appraiser. Informal and formal hearing information and changes

are maintained by the appraisal review board staff coordinator.

BPP Model Specification

Market Analysis

The District does not maintain a specified mass appraisal model for BPP property. Each of the many BPP accounts are manually

worked based upon data and information available. Therefore, this is no real market analysis performed. However, the District does

recognize that in comparing values and renditions among similar accounts and business types that market area factors do come into

play. For example, it is recognized that the inventory for two video stores will be different between Wells and Jacksonville due to

demand. In this respect, the District has established market areas that coincide with municipality boundaries and their extra territorial

influences.

Description of BPP Model

The District does not maintain a true statistical mass appraisal model for BPP accounts.

Procedures for BPP Calibration

Calibration efforts for BPP property involve a comparison of properties that are similar. The District utilizes the Comptroller’s list of

Standard Industrial Codes (SIC) to categorize and compare similar business accounts. In this manner, businesses that have not

rendered will be valued based upon the renditions of similar businesses that have. Businesses that have rendered can be compared

against other similar rendered businesses to determine the validity of the rendition and to determine if a spot field inspection is

warranted.

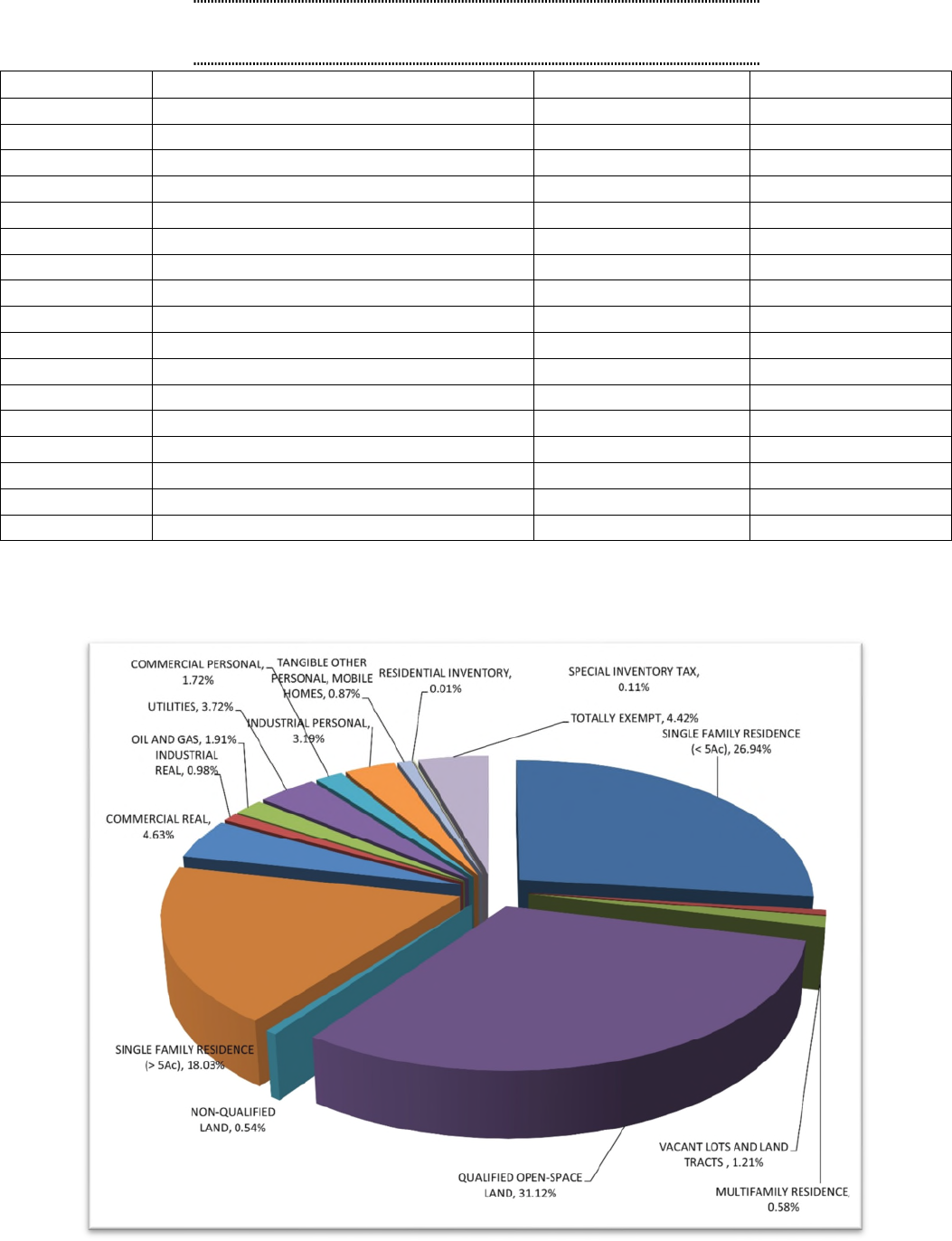

Cherokee County Appraisal District Combined Category Values

State Code Description Total Market Value Percent of Total

A SINGLE FAMILY RESIDENCE (< 5Ac) $1,859,046,615 26.94%

B MULTIFAMILY RESIDENCE $39,955,780 0.58%

C1 VACANT LOTS AND LAND TRACTS $83,348,236 1.21%

D1 QUALIFIED OPEN-SPACE LAND $2,147,228,799 31.12%

D2 NON-QUALIFIED LAND $37,133,370 0.54%

E SINGLE FAMILY RESIDENCE (> 5Ac) $1,244,303,632 18.03%

F1 COMMERCIAL REAL PROPERTY $319,779,132 4.63%

F2 INDUSTRIAL REAL PROPERTY $67,658,170 .98%

G1 OIL AND GAS $131,922,581 1.91%

J UTILITIES $256,864,880 3.72%

L1 COMMERCIAL PERSONAL PROPERTY $118,907,380 1.72%

L2 INDUSTRIAL PERSONAL PROPERTY $220,384.680 3.19%

M1 TANGIBLE OTHER PERSONAL, MOBILE HOMES $59,846,345 0.87%

O RESIDENTIAL INVENTORY $822,910 0.01%

S SPECIAL INVENTORY TAX $7,583,630 0.11%

X TOTALLY EXEMPT PROPERTY $305,064,344 4.42%

Total Market Value $6,899,850,484

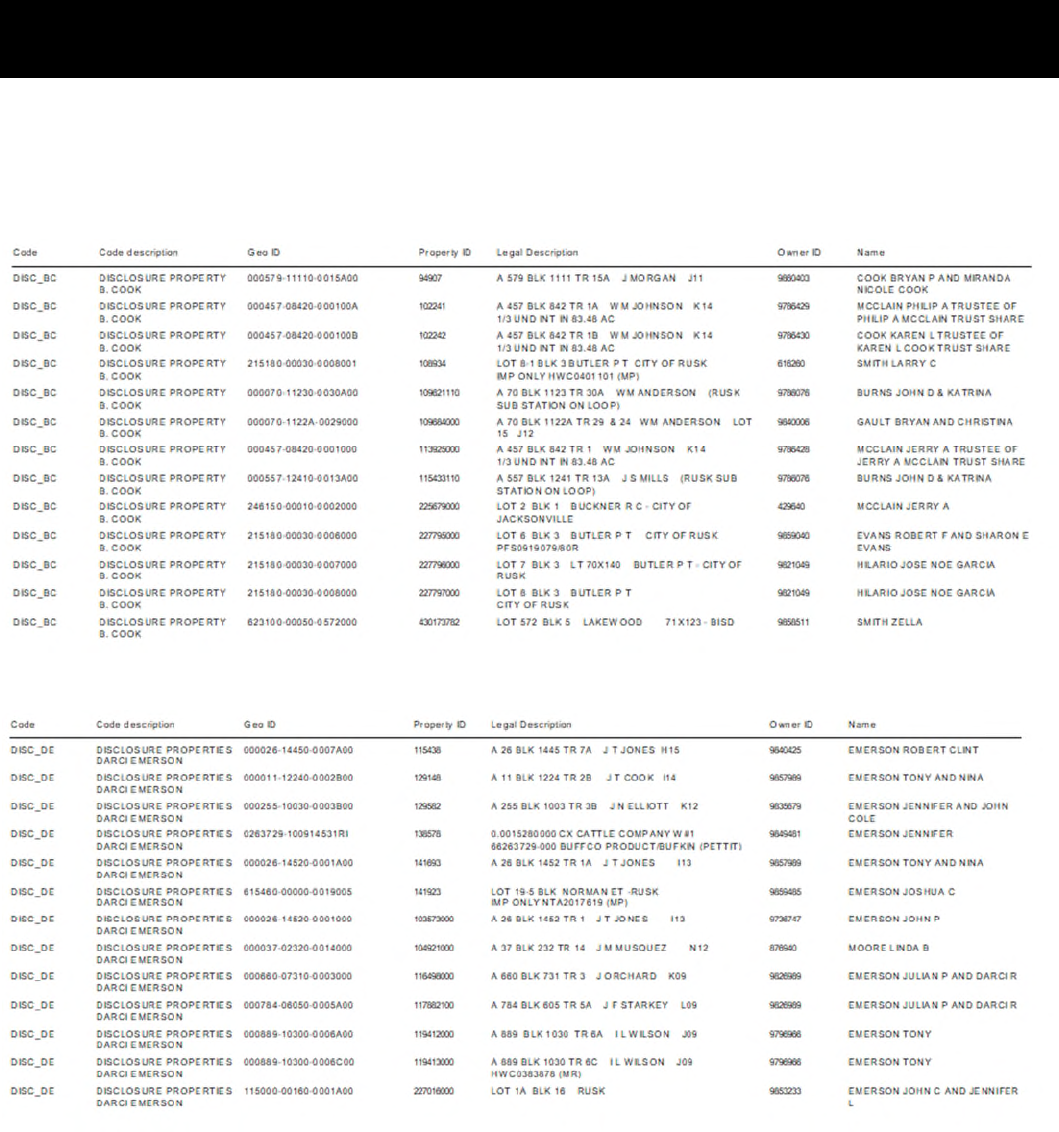

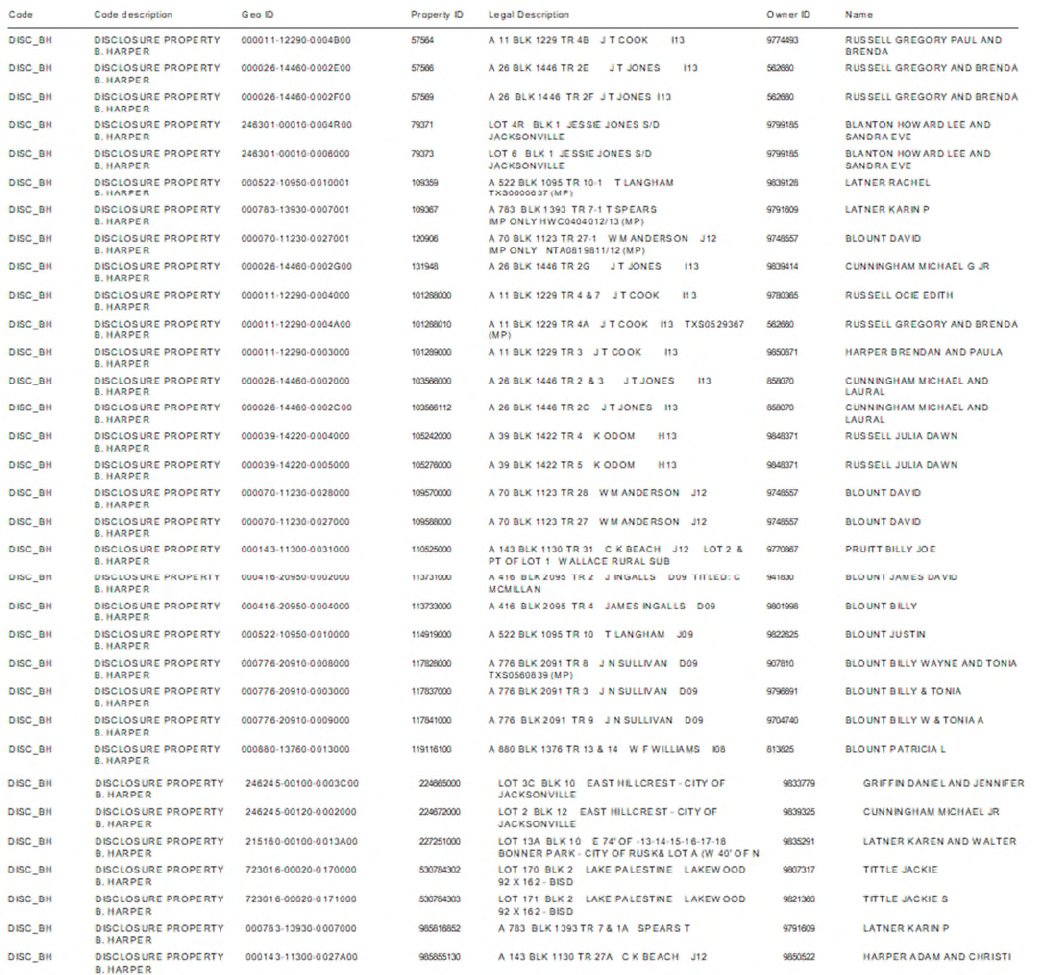

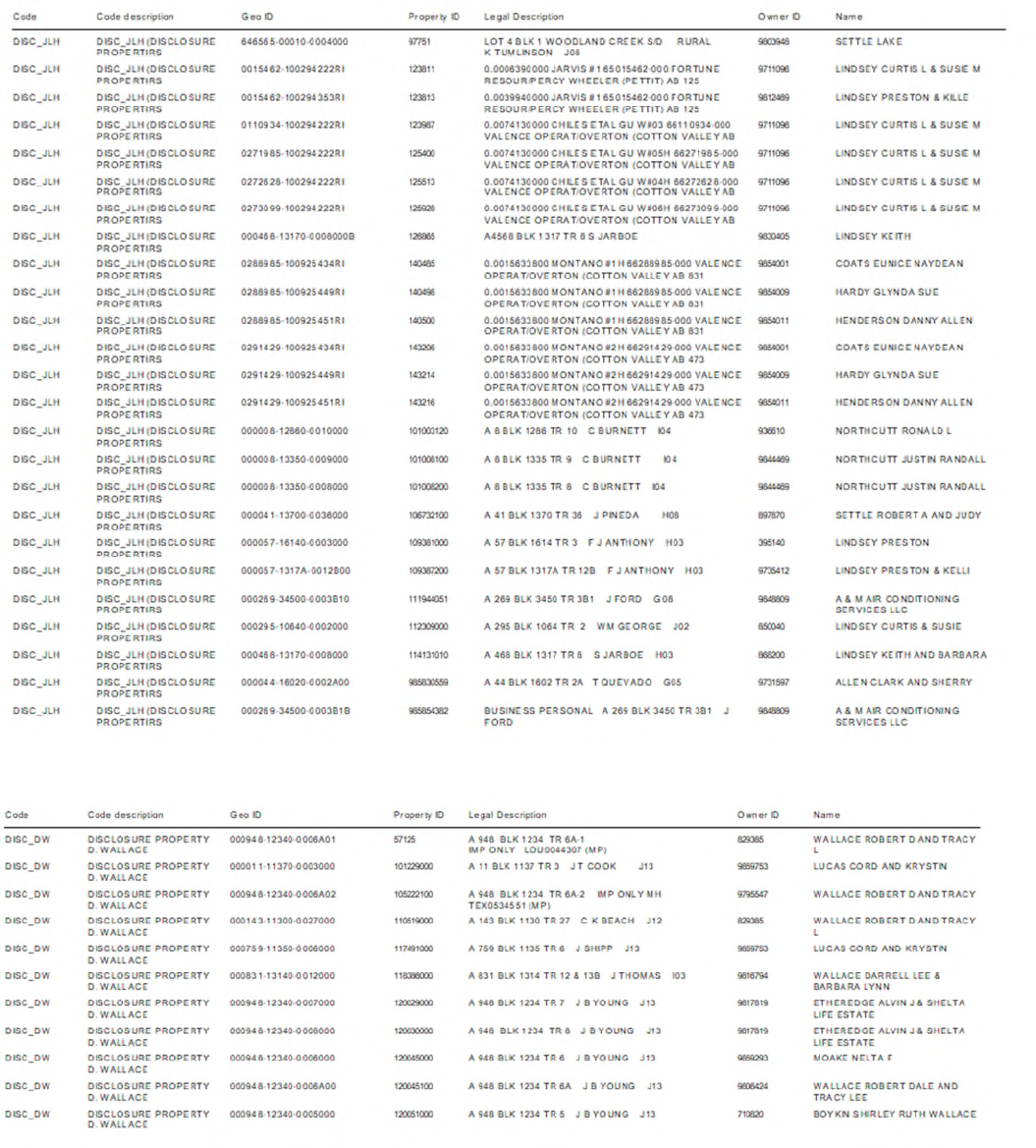

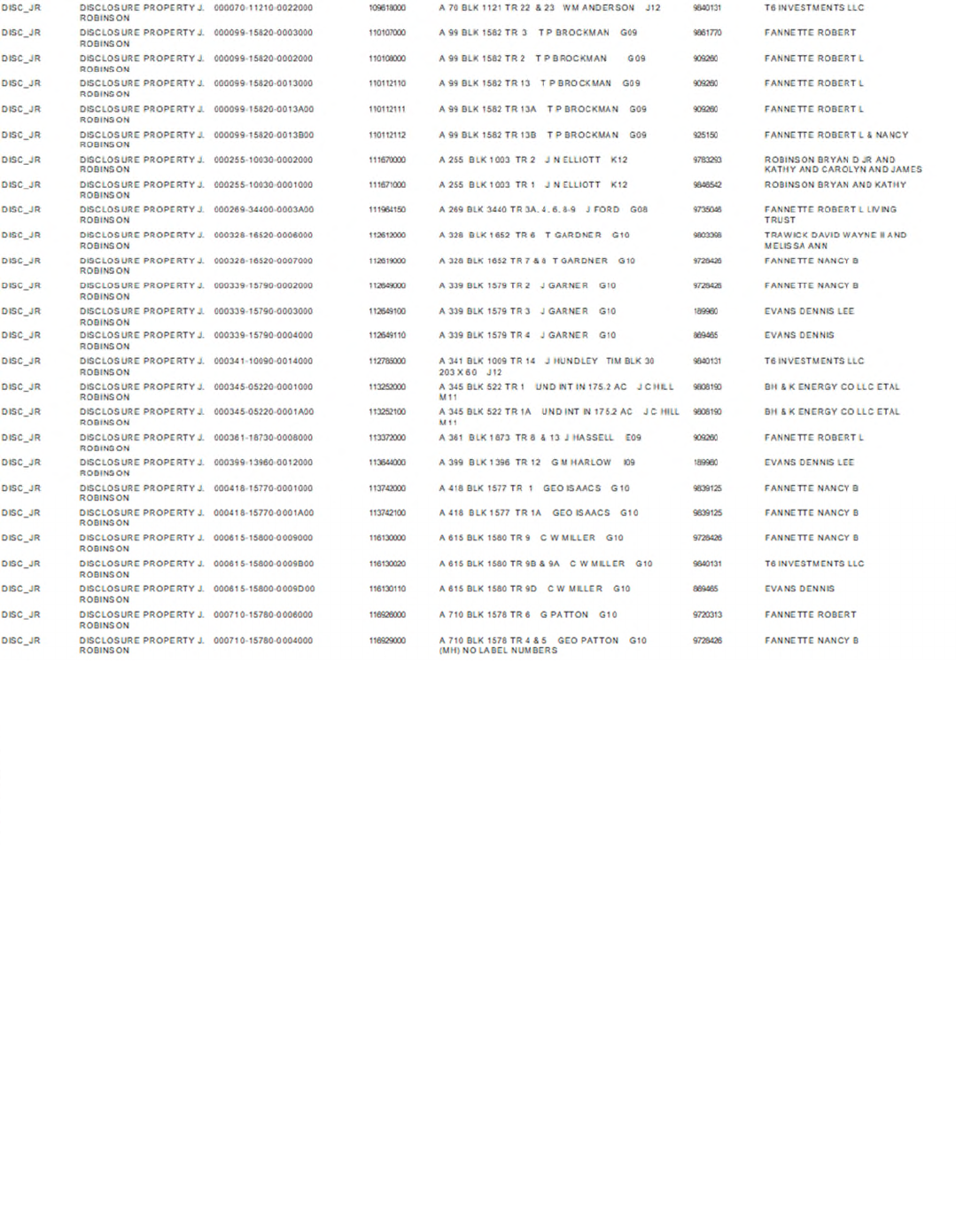

Appraisal Staff Disclosed Properties and Interests

This list is provided pursuant to agency disclosure requirements and comprises a list of properties in which members of the appraisal

staff have interest in either property or parties. Appraisers are not allowed to appraise or influence the appraisal of properties in which

they have an interest or properties owned by persons to whom they are related within three degrees of consanguinity or affinity.

B. P. Cook

D. R. Emerson

B. W. Harper

J. L. Henderson

R. D. Wallace

J. C. Robinson

Resources and Supporting Documentation

Ratio Studies for the various areas may obtained by request from the District’s server

Digital Property Records may be accessed on-line at www.cherokeecad.com or in the office via request

Digital Schedules of value may be obtained by request in the office

Mapping information may be obtained by request in the office

The CCAD Appraisal Manual

Biennial Reappraisal Plans

Various Records of the Property Tax Assistance Division of the State Comptroller’s Office