Economy Profile

India

India

Doing Business

2020

Page 1

Economy Profile of

India

Doing Business 2020 Indicators

(in order of appearance in the document)

Starting a business

Procedures, time, cost and paid-in minimum capital to start a limited liability company

Dealing with construction permits

Procedures, time and cost to complete all formalities to build a warehouse and the quality control and safety

mechanisms in the construction permitting system

Getting electricity

Procedures, time and cost to get connected to the electrical grid, and the reliability of the electricity supply and the

transparency of tariffs

Registering property

Procedures, time and cost to transfer a property and the quality of the land administration system

Getting credit

Movable collateral laws and credit information systems

Protecting minority investors

Minority shareholders’ rights in related-party transactions and in corporate governance

Paying taxes

Payments, time, total tax and contribution rate for a firm to comply with all tax regulations as well as postfiling

processes

Trading across borders

Time and cost to export the product of comparative advantage and import auto parts

Enforcing contracts

Time and cost to resolve a commercial dispute and the quality of judicial processes

Resolving insolvency

Time, cost, outcome and recovery rate for a commercial insolvency and the strength of the legal framework for

insolvency

Employing workers

Flexibility in employment regulation and redundancy cost

India

Doing Business

2020

Page 2

About Doing Business

The

project provides objective measures of business regulations and their enforcement across 190 economies and selected cities at the subnational and

regional level.

Doing Business

The

project, launched in 2002, looks at domestic small and medium-size companies and measures the regulations applying to them through their life

cycle.

Doing Business

captures several important dimensions of the regulatory environment as it applies to local firms. It provides quantitative indicators on regulation for

starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across

borders, enforcing contracts and resolving insolvency.

also measures features of employing workers. Although

does not present rankings

of economies on the employing workers indicators or include the topic in the aggregate ease of doing business score or ranking on the ease of doing business, it does

present the data for these indicators.

Doing Business

Doing Business Doing Business

By gathering and analyzing comprehensive quantitative data to compare business regulation environments across economies and over time,

encourages

economies to compete towards more efficient regulation; offers measurable benchmarks for reform; and serves as a resource for academics, journalists, private sector

researchers and others interested in the business climate of each economy.

Doing Business

In addition,

offers detailed

, which exhaustively cover business regulation and reform in different cities and regions within a nation.

These studies provide data on the ease of doing business, rank each location, and recommend reforms to improve performance in each of the indicator areas. Selected

cities can compare their business regulations with other cities in the economy or region and with the 190 economies that

has ranked.

Doing Business

subnational studies

Doing Business

The first

study, published in 2003, covered 5 indicator sets and 133 economies. This year’s study covers 11 indicator sets and 190 economies. Most

indicator sets refer to a case scenario in the largest business city of each economy, except for 11 economies that have a population of more than 100 million as of 2013

(Bangladesh, Brazil, China, India, Indonesia, Japan, Mexico, Nigeria, Pakistan, the Russian Federation and the United States) where

also collected data

for the second largest business city. The data for these 11 economies are a population-weighted average for the 2 largest business cities. The project has benefited from

feedback from governments, academics, practitioners and reviewers. The initial goal remains: to provide an objective basis for understanding and improving the

regulatory environment for business around the world.

Doing Business

Doing Business

To learn more about

please visit

Doing Business

doingbusiness.org

India

Doing Business

2020

Page 3

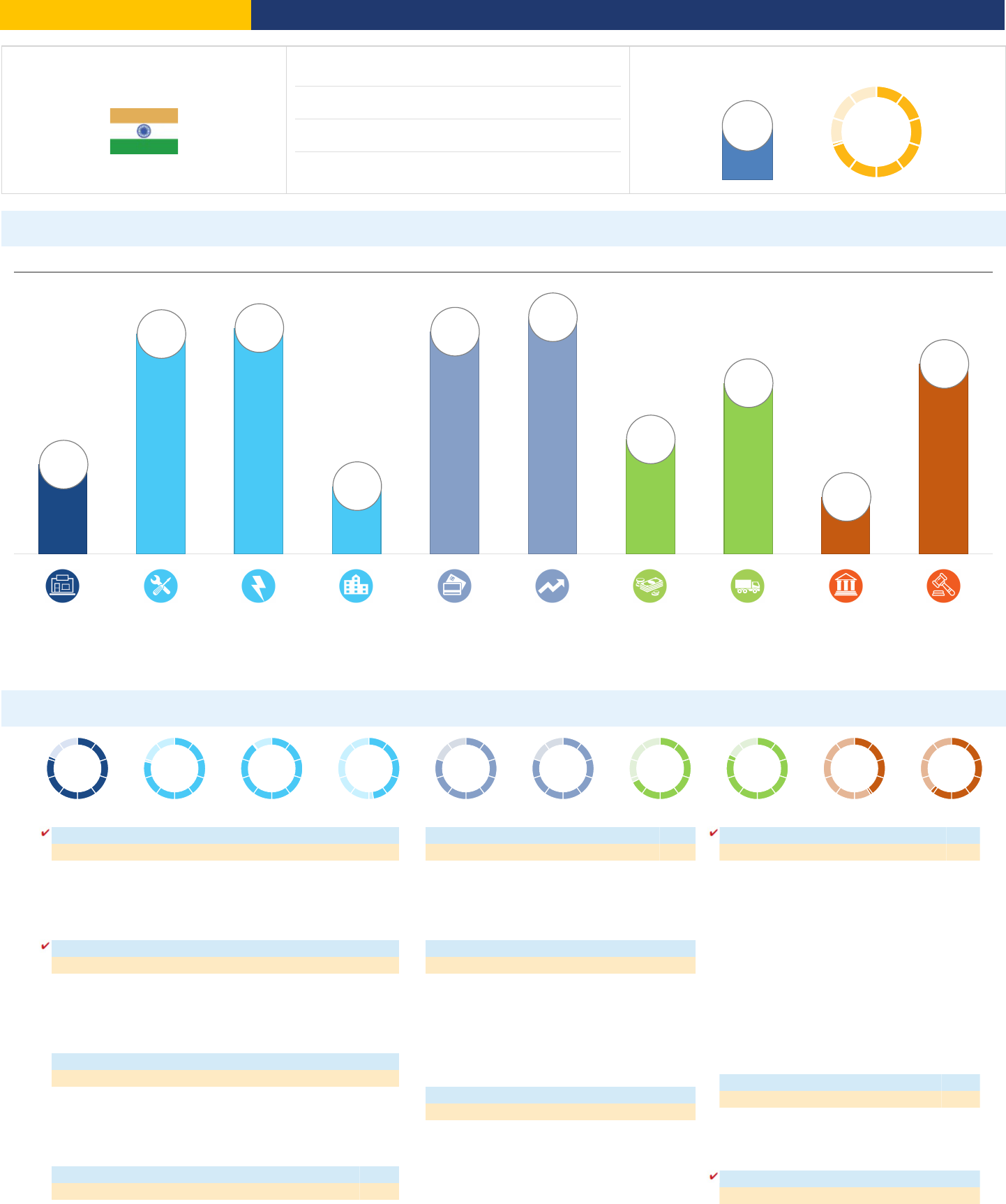

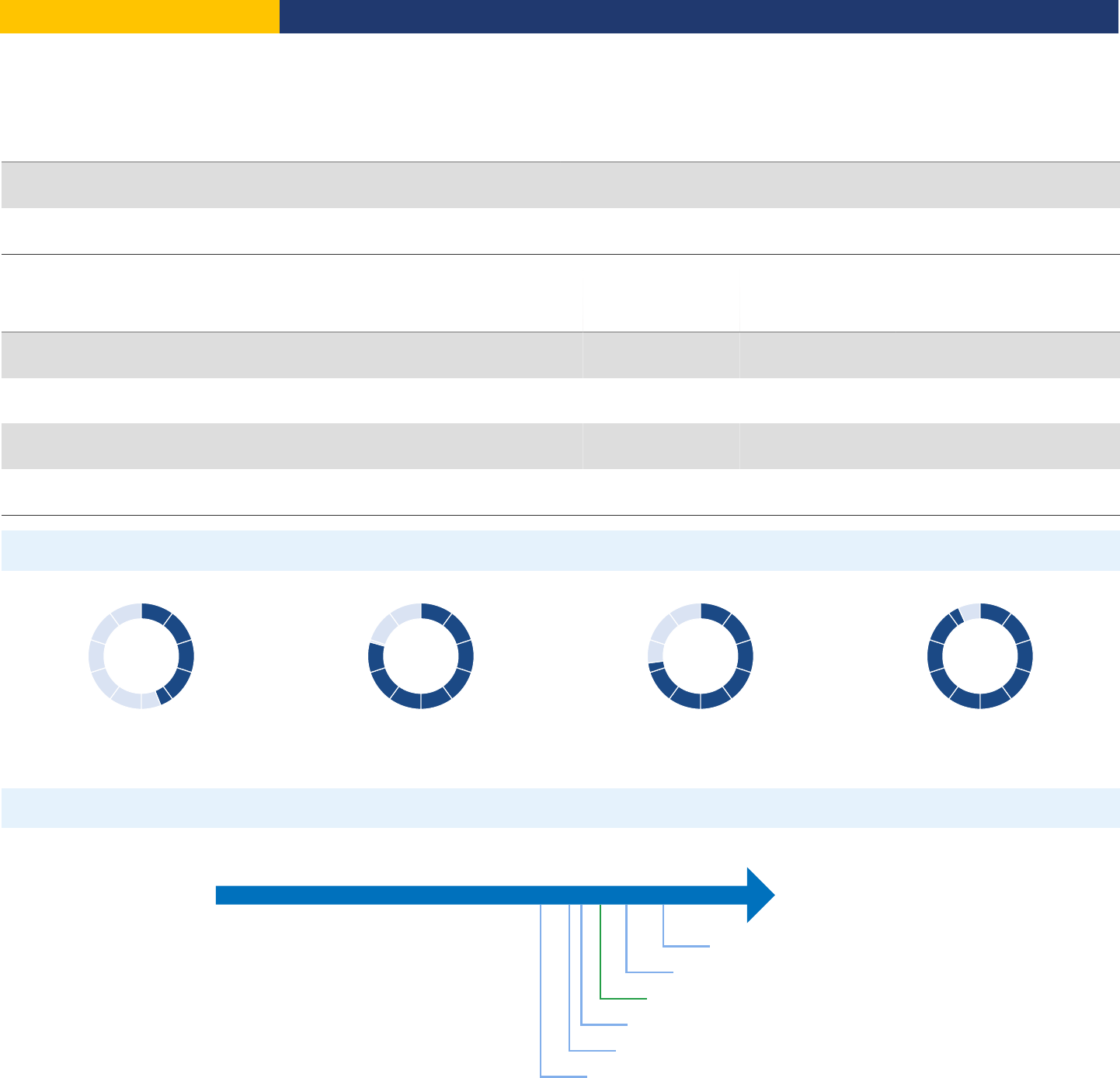

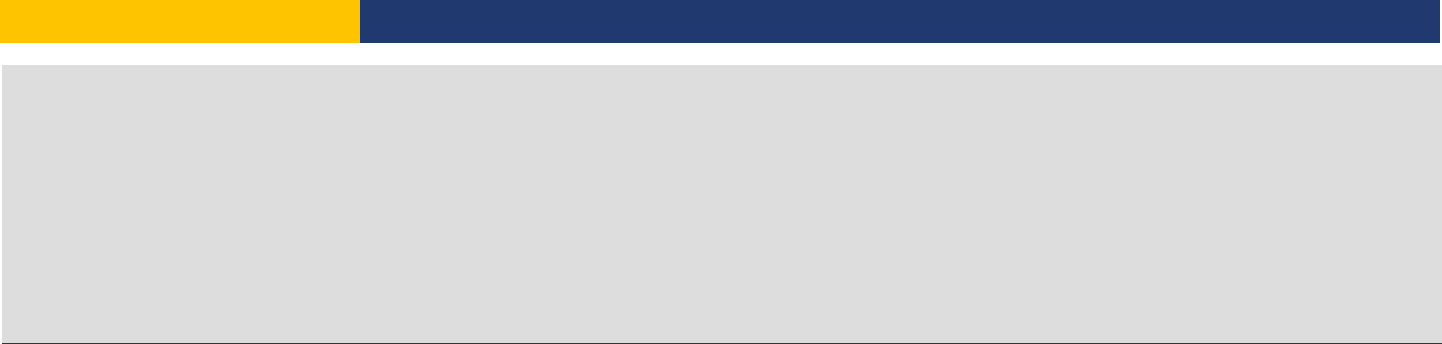

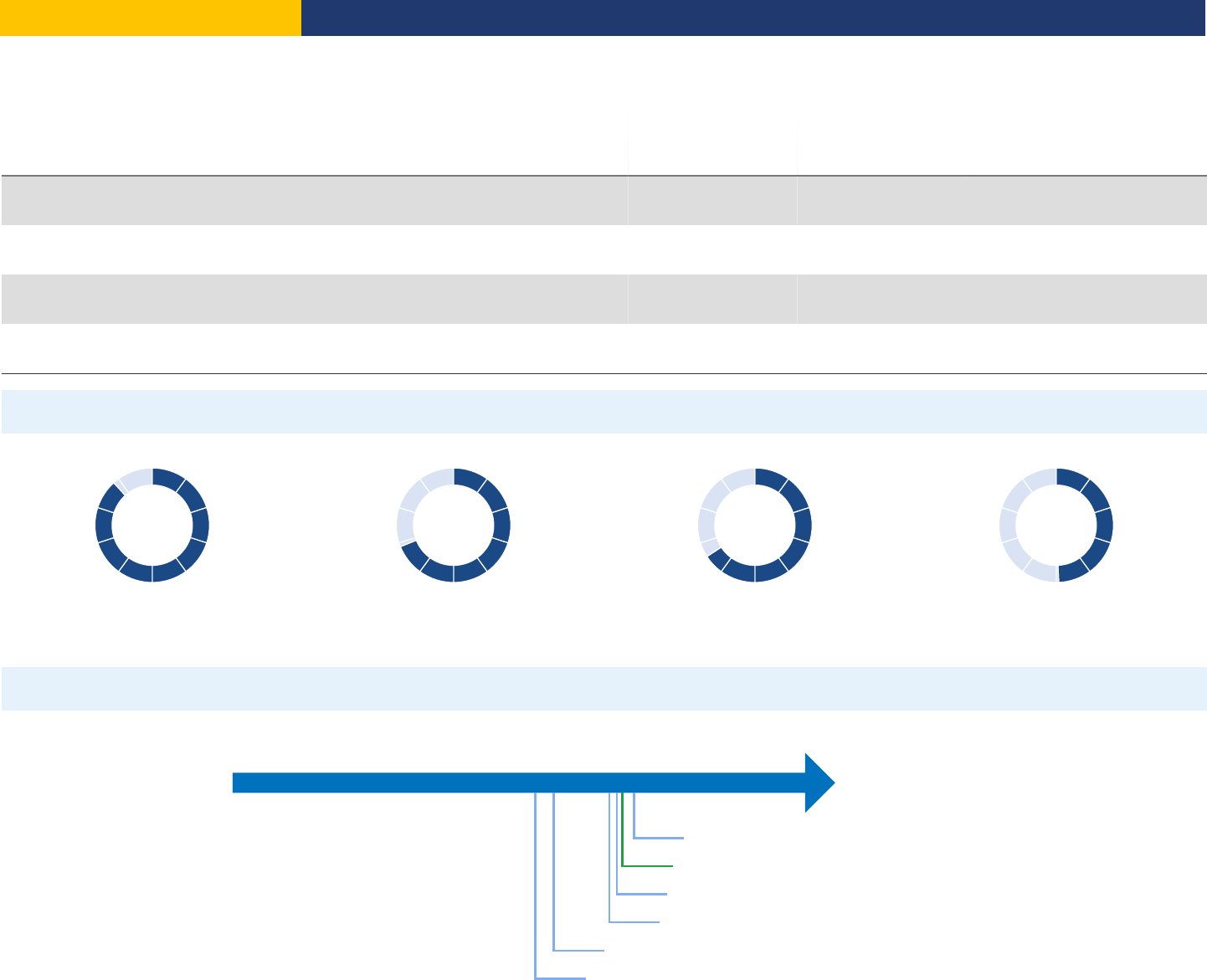

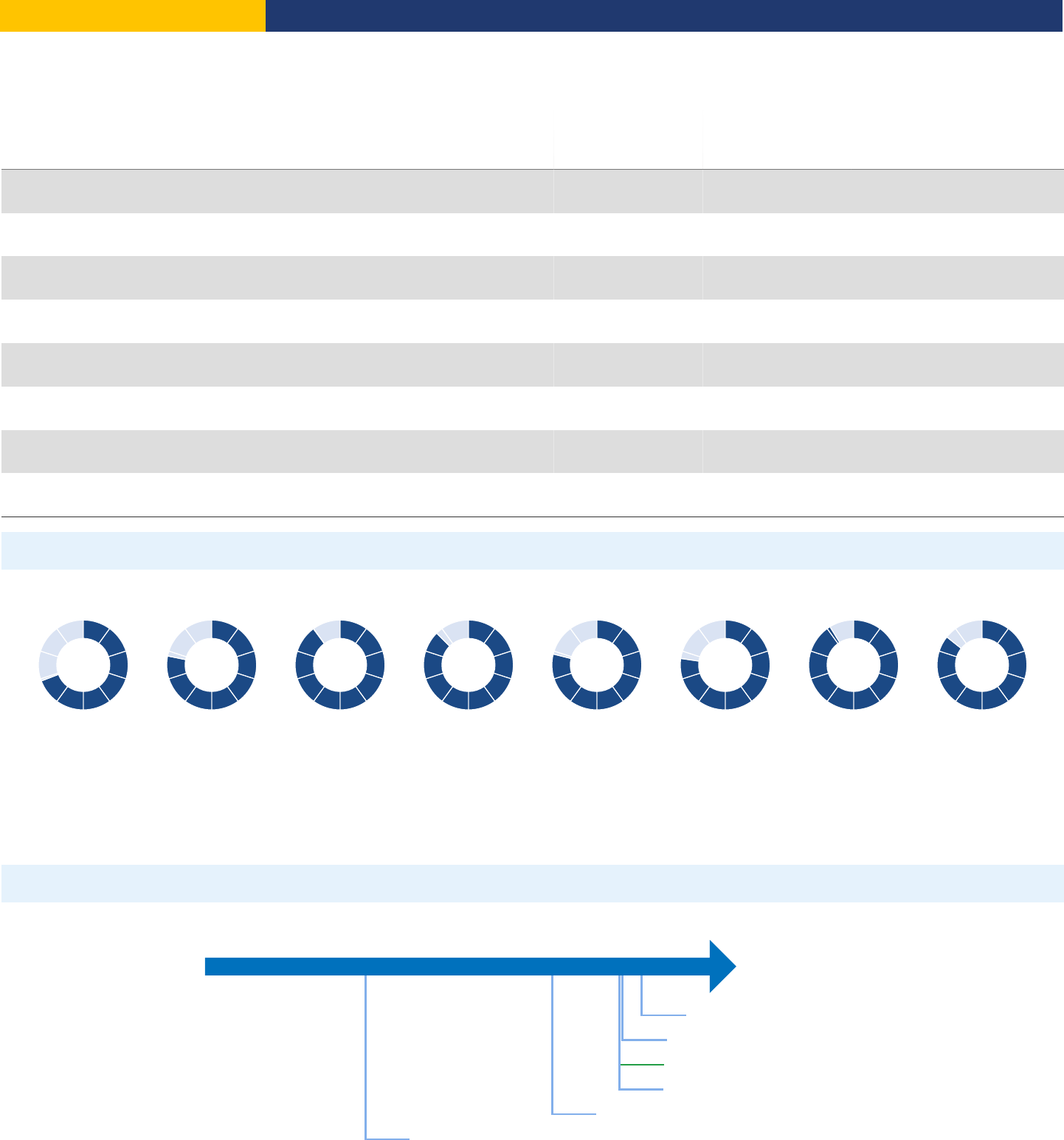

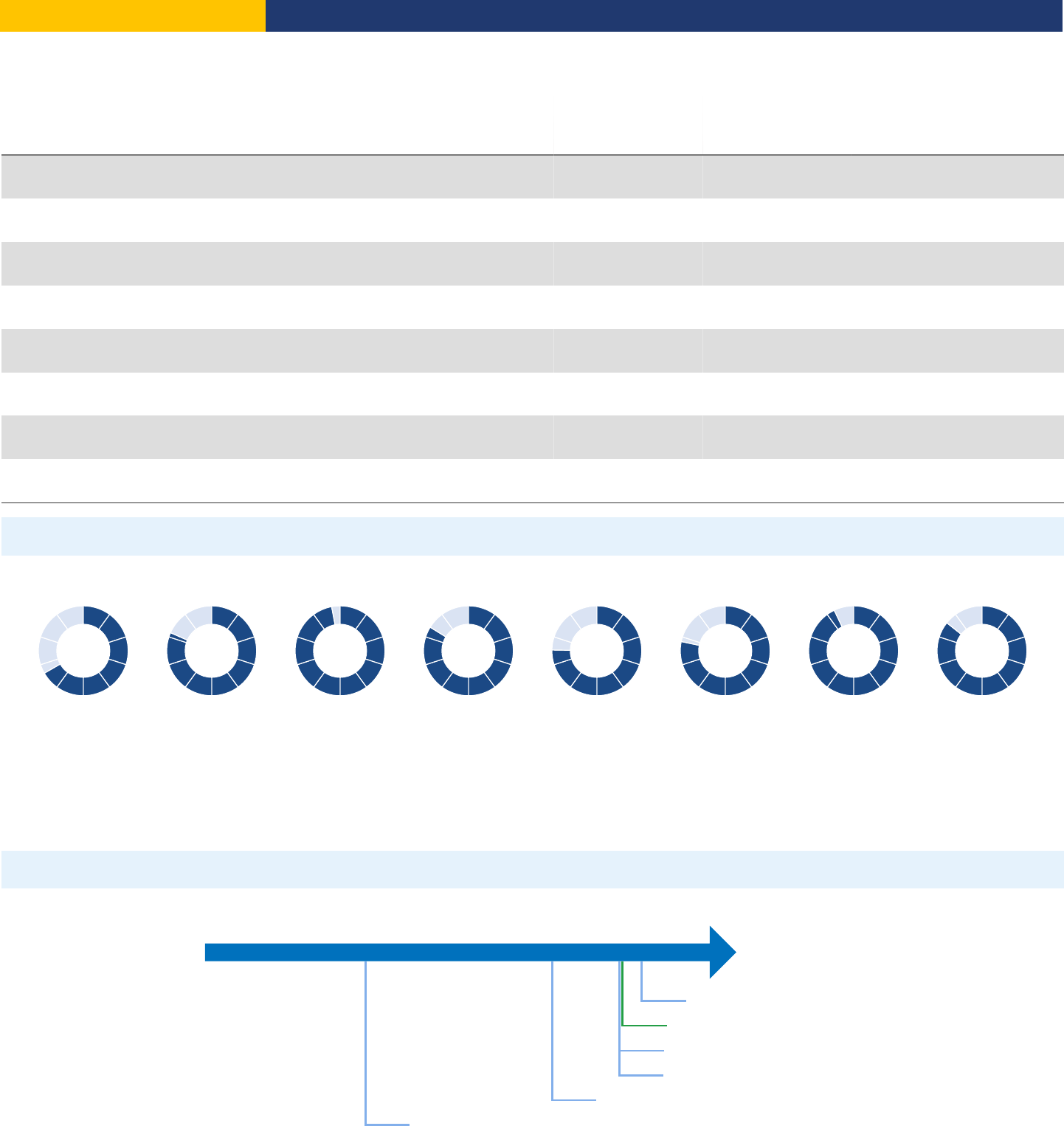

Ease of Doing Business in

India

Region

South Asia

Income Category

Lower middle income

Population

1,352,617,328

City Covered

Mumbai, Delhi

63

DB RANK DB SCORE

71.0

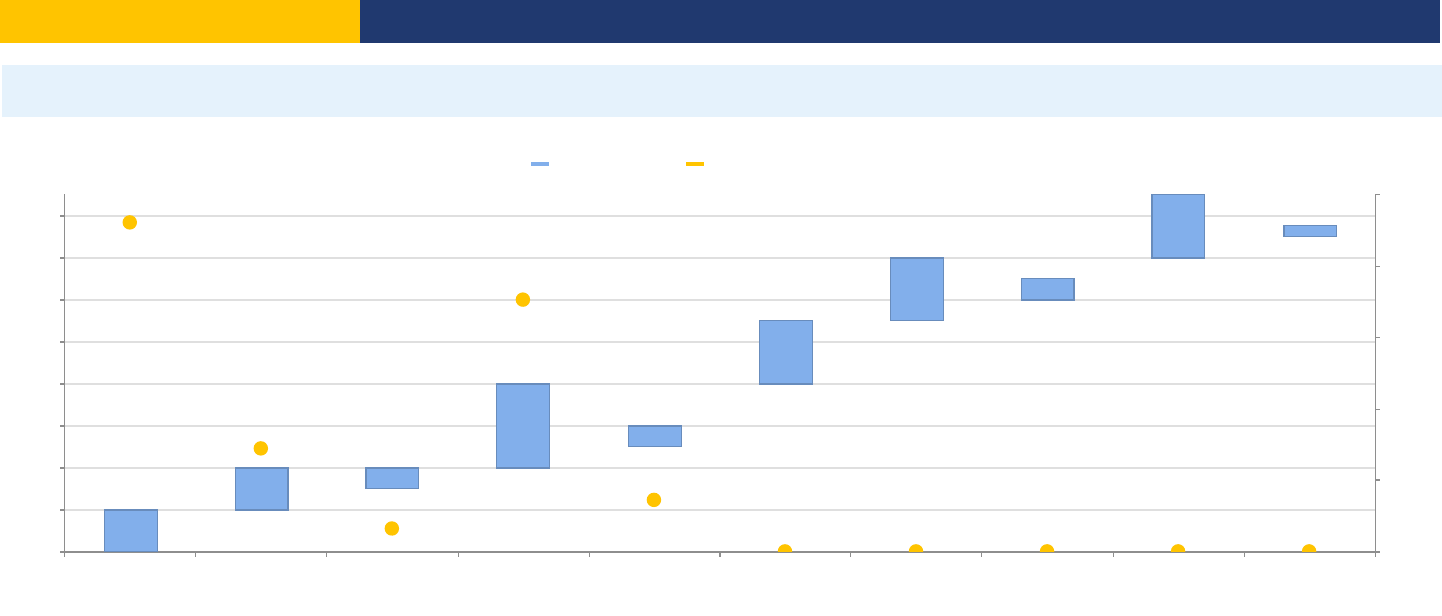

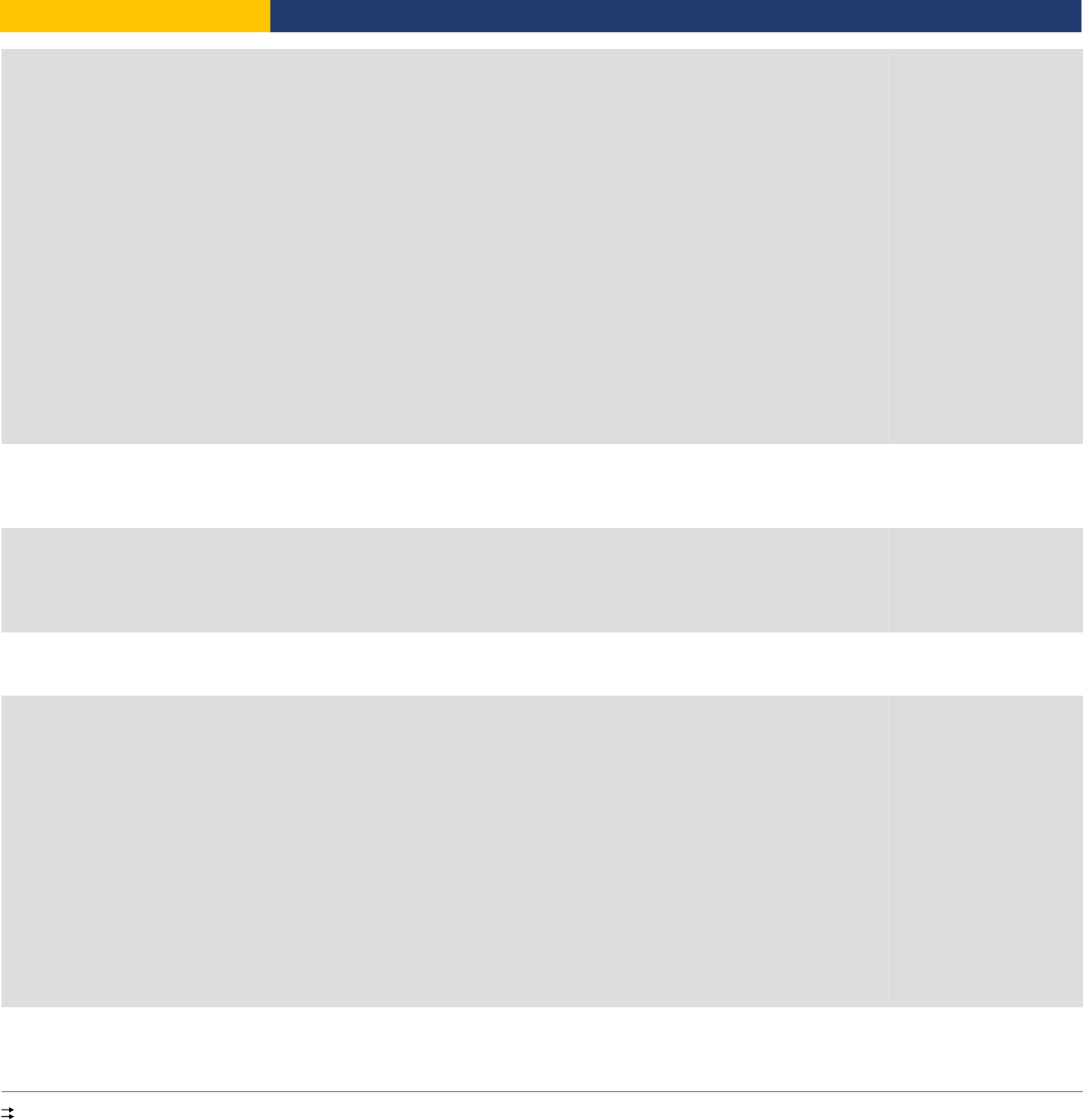

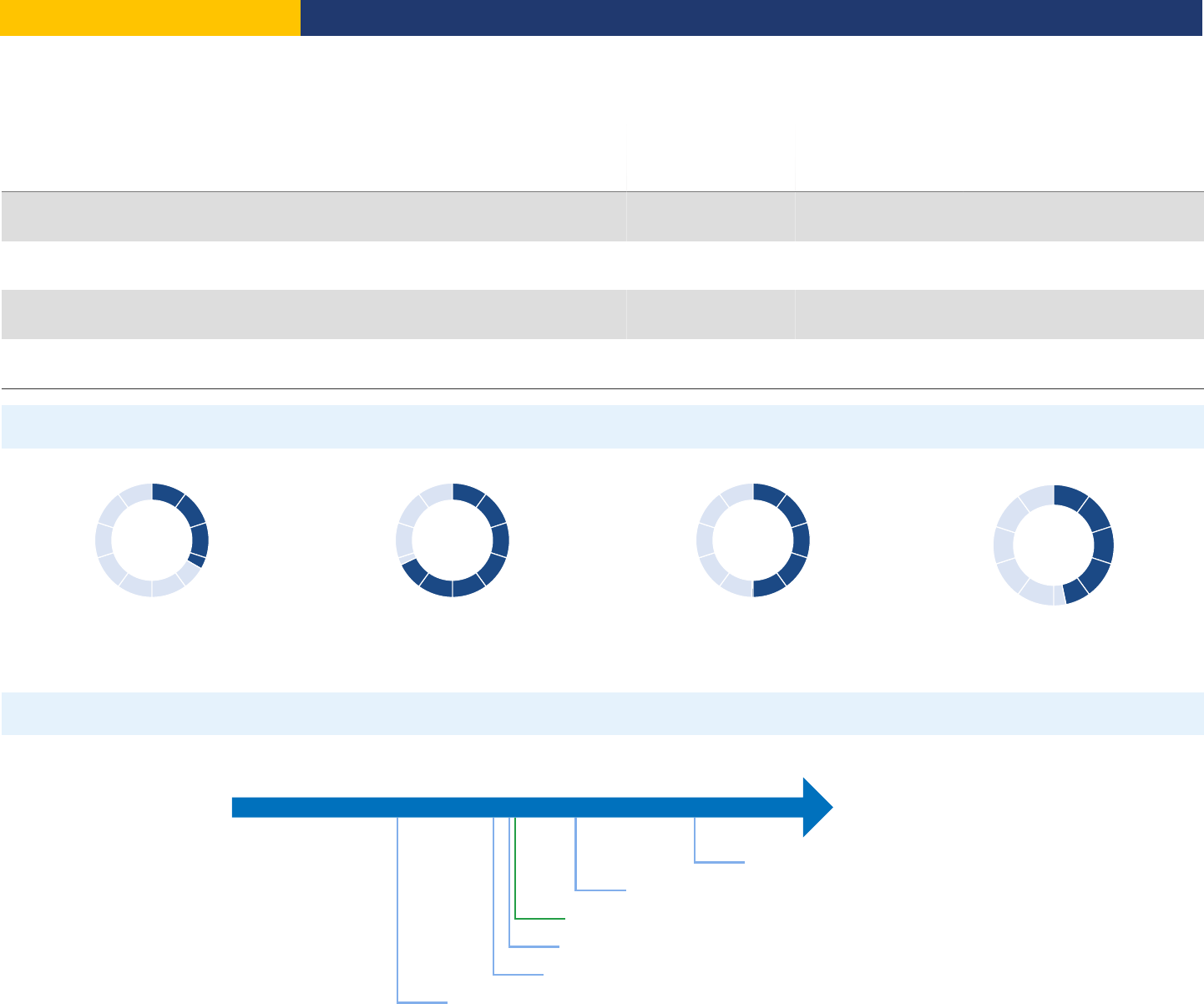

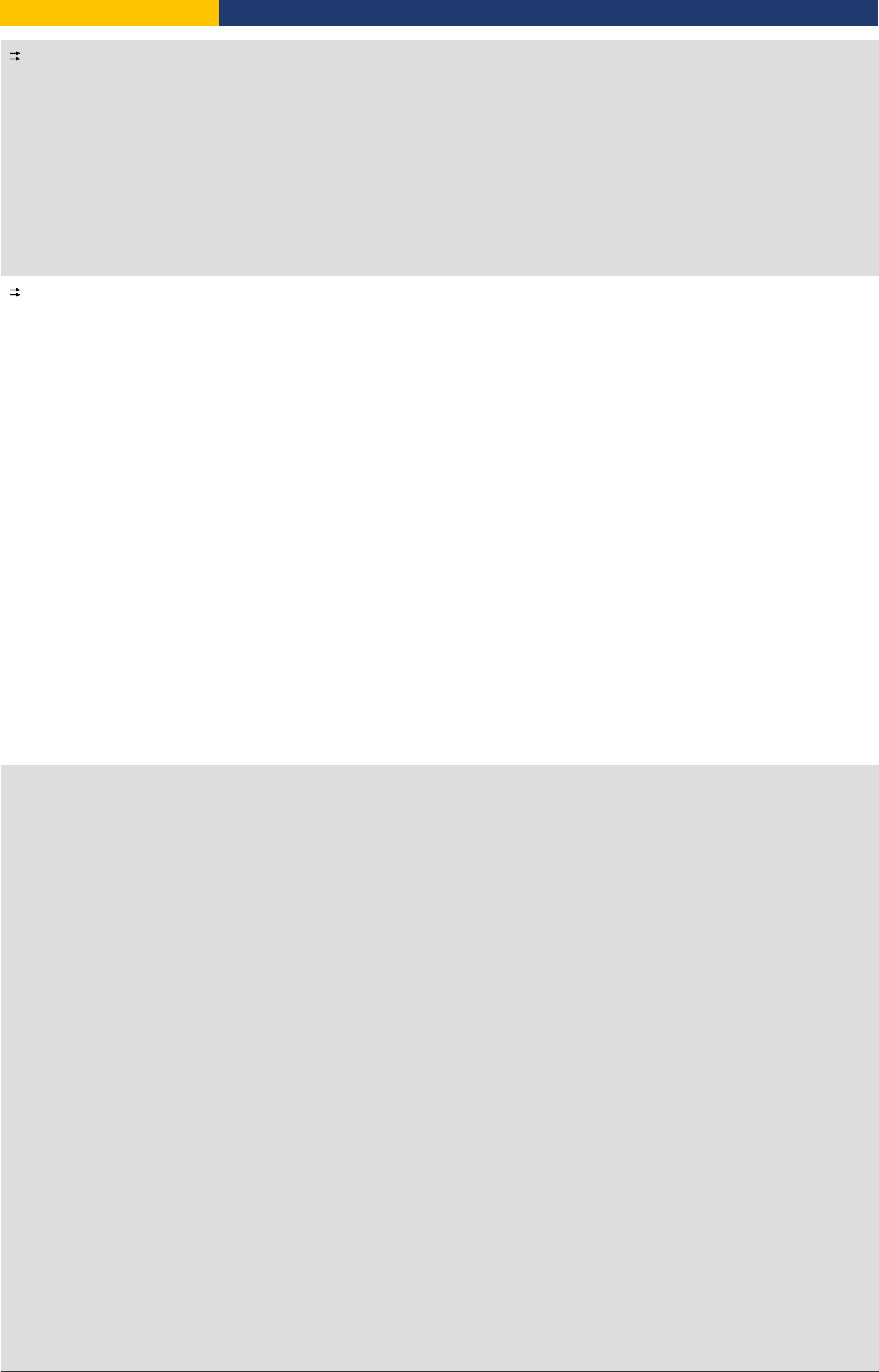

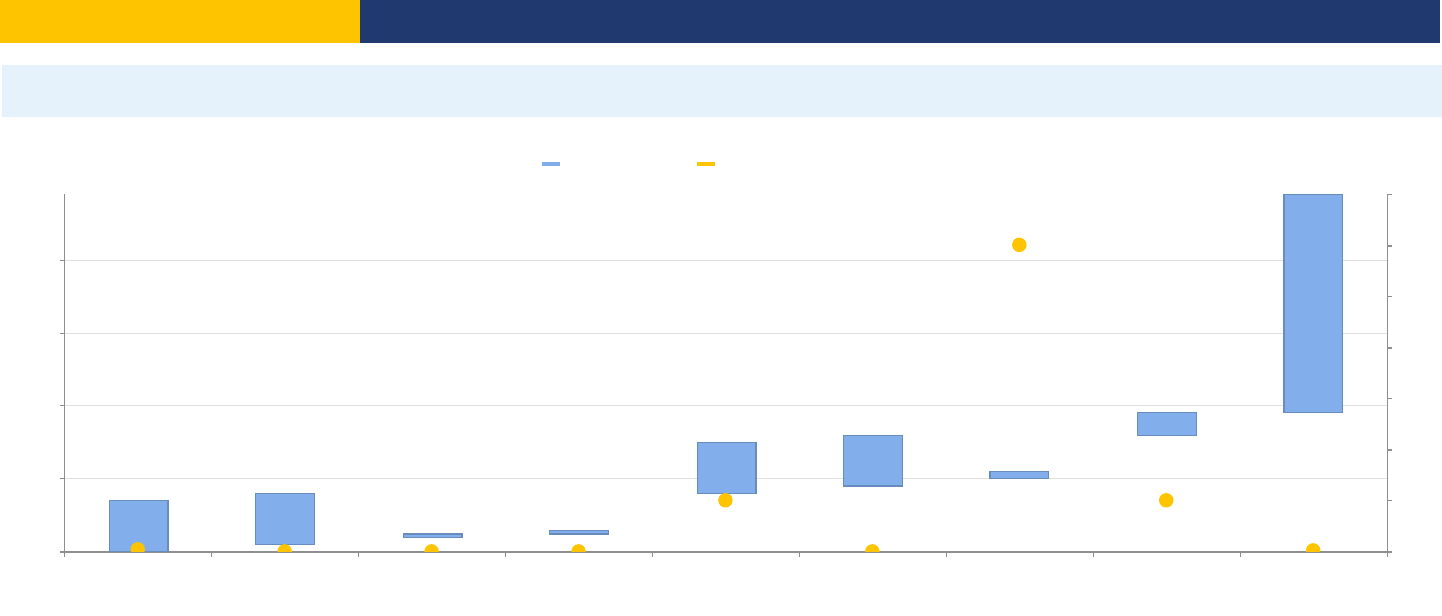

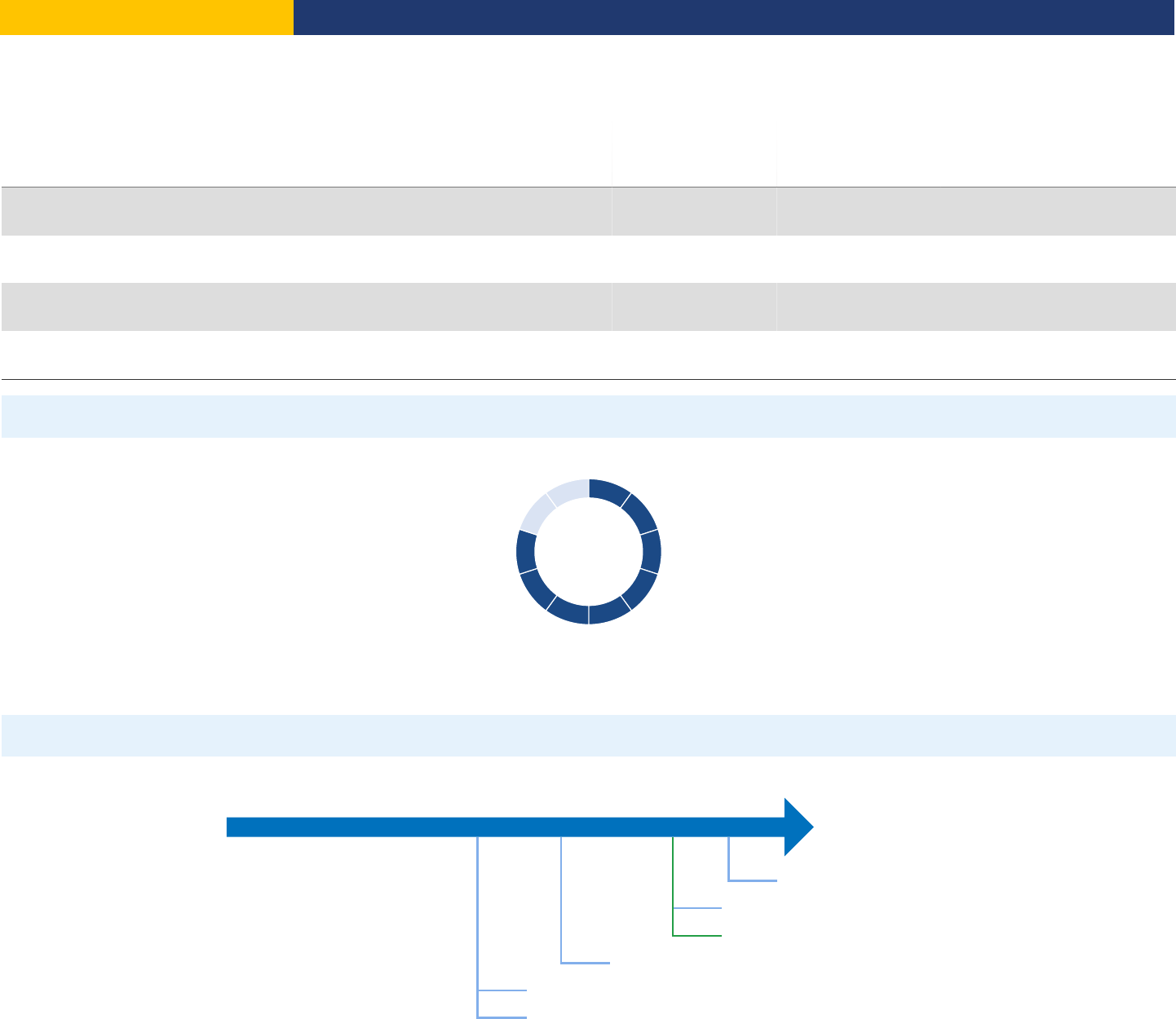

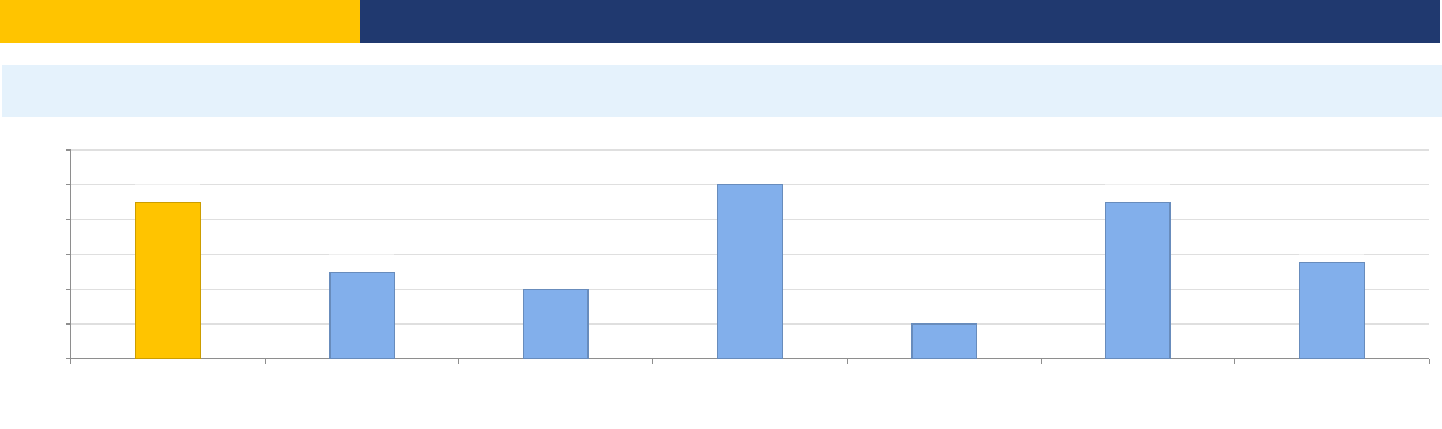

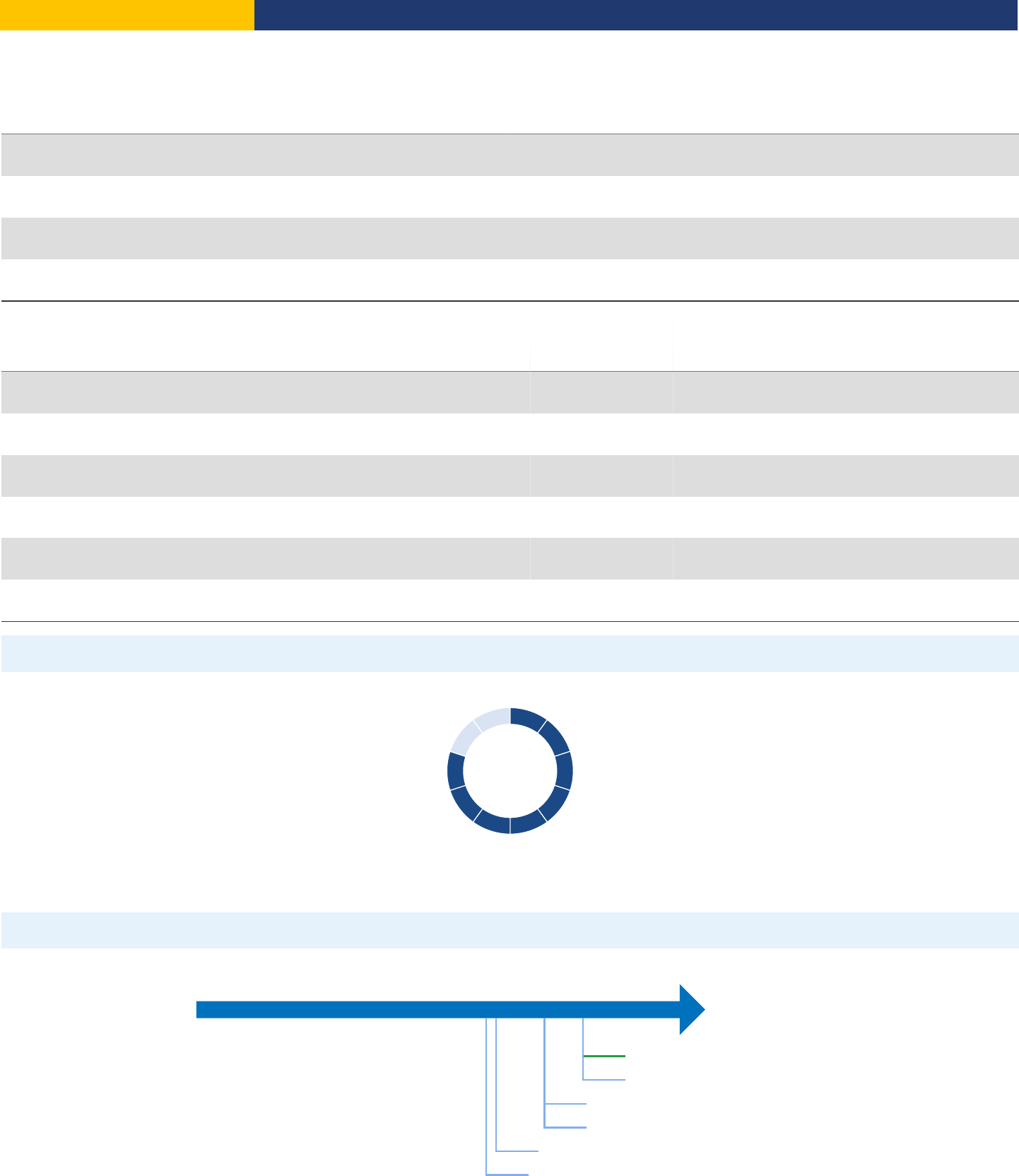

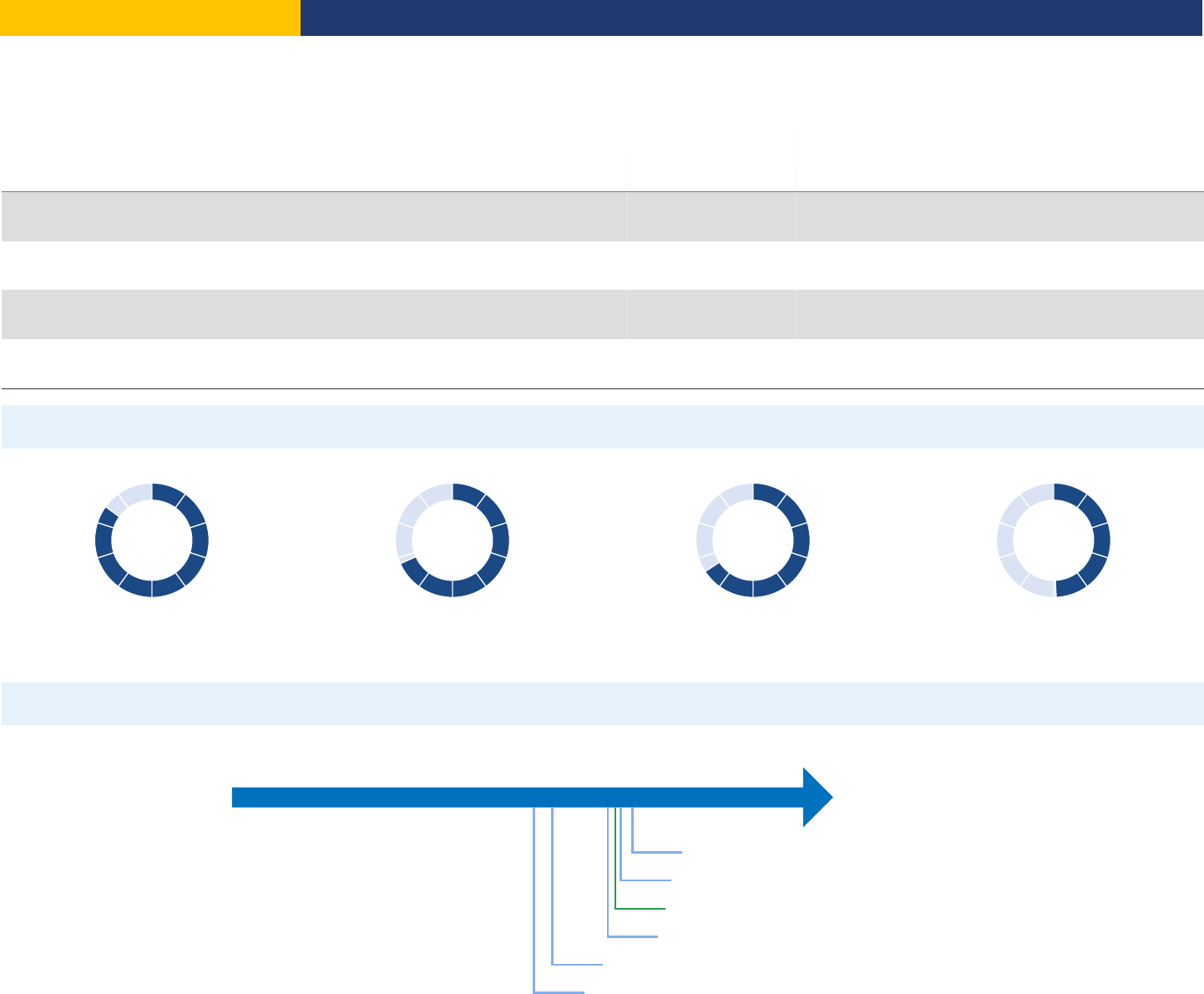

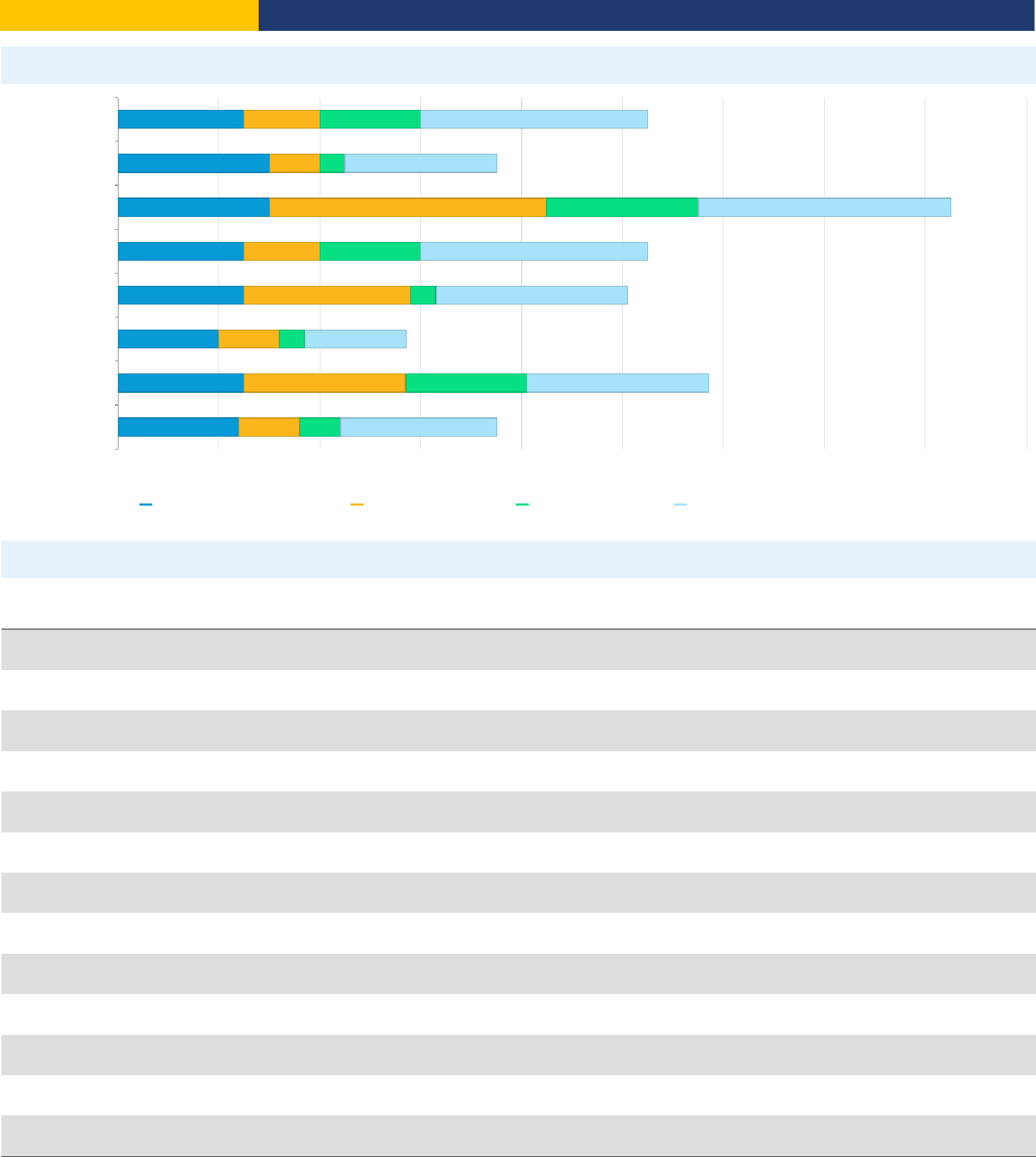

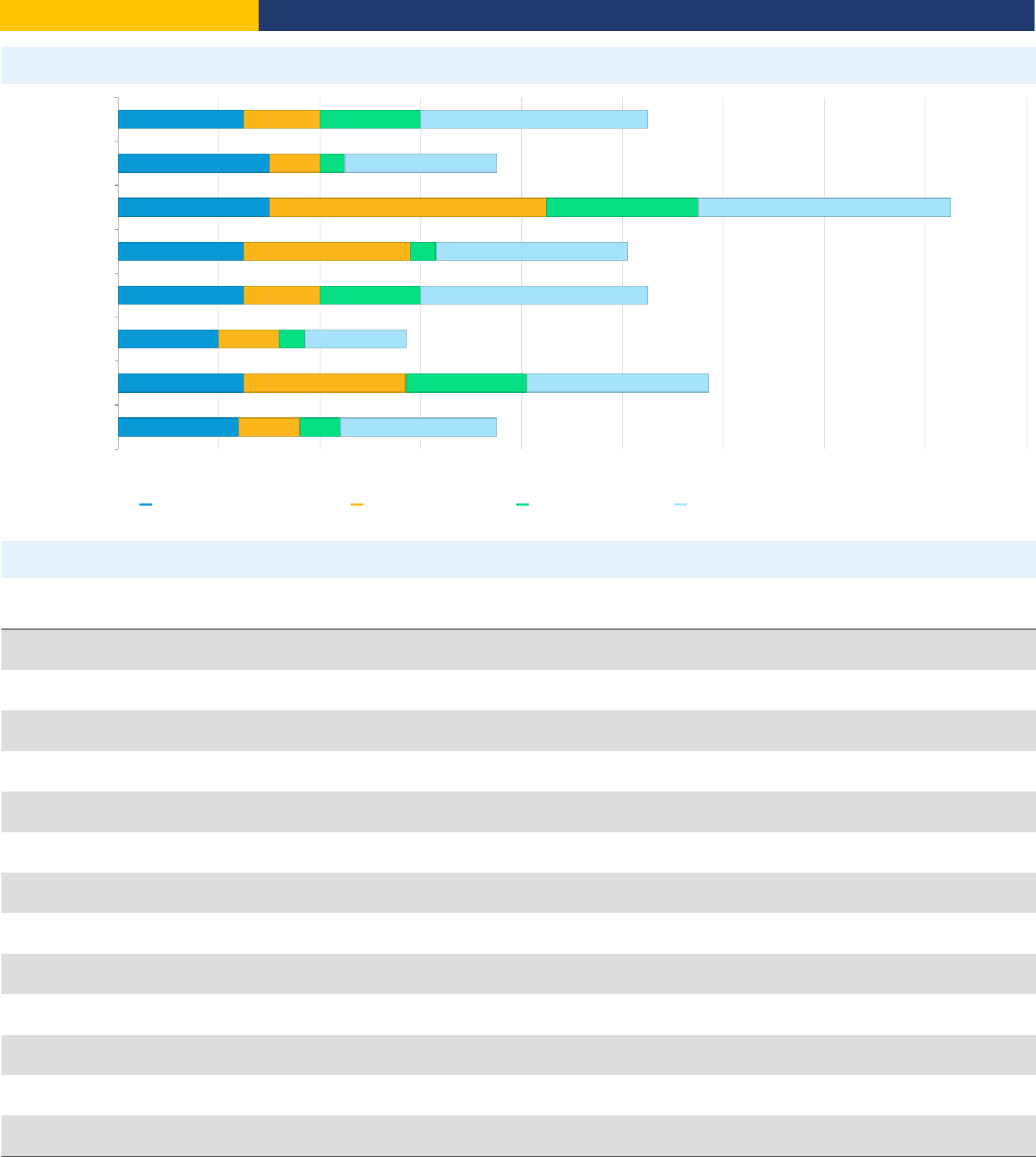

Rankings on Doing Business topics -

India

136

27

22

154

25

13

115

68

163

52

Starting

a

Business

Dealing

with

Construction

Permits

Getting

Electricity

Registering

Property

Getting

Credit

Protecting

Minority

Investors

Paying

Taxes

Trading

across

Borders

Enforcing

Contracts

Resolving

Insolvency

Topic Scores

81.6 78.7 89.4 47.6 80.0 80.0 67.6 82.5 41.2 62.0

(rank)

Starting a Business

136

Score of starting a business (0-100)

81.6

Procedures (number)

10

Time (days)

18

Cost (number)

7.2

Paid-in min. capital (% of income per capita)

0.0

(rank)

Dealing with Construction Permits

27

Score of dealing with construction permits (0-100)

78.7

Procedures (number)

15

Time (days)

106

Cost (% of warehouse value)

4.0

Building quality control index (0-15)

14.5

(rank)

Getting Electricity

22

Score of getting electricity (0-100)

89.4

Procedures (number)

4

Time (days)

53

Cost (% of income per capita)

28.6

Reliability of supply and transparency of tariff index (0-8)

6

(rank)

Registering Property

154

Score of registering property (0-100)

47.6

Procedures (number)

9

Time (days)

58

Cost (% of property value)

7.8

Quality of the land administration index (0-30)

10.8

(rank)

Getting Credit

25

Score of getting credit (0-100)

80.0

Strength of legal rights index (0-12)

9

Depth of credit information index (0-8)

7

Credit registry coverage (% of adults)

0.0

Credit bureau coverage (% of adults)

63.1

(rank)

Protecting Minority Investors

13

Score of protecting minority investors (0-100)

80.0

Extent of disclosure index (0-10)

8.0

Extent of director liability index (0-10)

7.0

Ease of shareholder suits index (0-10)

7.0

Extent of shareholder rights index (0-6)

6.0

Extent of ownership and control index (0-7)

6.0

Extent of corporate transparency index (0-7)

6.0

(rank)

Paying Taxes

115

Score of paying taxes (0-100)

67.6

Payments (number per year)

11

Time (hours per year)

252

Total tax and contribution rate (% of profit)

49.7

Postfiling index (0-100)

49.3

(rank)

Trading across Borders

68

Score of trading across borders (0-100)

82.5

Time to export

Documentary compliance (hours)

12

Border compliance (hours)

52

Cost to export

Documentary compliance (USD)

58

Border compliance (USD)

212

Time to export

Documentary compliance (hours)

20

Border compliance (hours)

65

Cost to export

Documentary compliance (USD)

100

Border compliance (USD)

266

(rank)

Enforcing Contracts

163

Score of enforcing contracts (0-100)

41.2

Time (days)

1,445

Cost (% of claim value)

31.0

Quality of judicial processes index (0-18)

10.5

(rank)

Resolving Insolvency

52

Score of resolving insolvency (0-100)

62.0

Recovery rate (cents on the dollar)

71.6

Time (years)

1.6

Cost (% of estate)

9.0

Outcome (0 as piecemeal sale and 1 as going

concern)

1

Strength of insolvency framework index (0-16)

7.5

India

Doing Business

2020

Page 4

Starting a Business

This topic measures the number of procedures, time, cost and paid-in minimum capital requirement for a small- to medium-sized limited liability company to start up and

formally operate in each economy’s largest business city.

To make the data comparable across 190 economies,

uses a standardized business that is 100% domestically owned, has start-up capital equivalent to

10 times the income per capita, engages in general industrial or commercial activities and employs between 10 and 50 people one month after the commencement of

operations, all of whom are domestic nationals. Starting a Business considers two types of local limited liability companies that are identical in all aspects, except that one

company is owned by 5 married women and the other by 5 married men. The ranking of economies on the ease of starting a business is determined by sorting their

scores for starting a business. These scores are the simple average of the scores for each of the component indicators.

Doing Business

The most recent round of data collection for the project was completed in May 2019.

.

See the methodology for more information

What the indicators measure

Procedures to legally start and formally operate a company

(number)

Preregistration (for example, name verification or reservation,

notarization)

•

Registration in the economy’s largest business city

•

Postregistration (for example, social security registration,

company seal)

•

Obtaining approval from spouse to start a business or to leave

the home to register the company

•

Obtaining any gender specific document for company

registration and operation or national identification card

•

Time required to complete each procedure (calendar days)

Does not include time spent gathering information

•

Each procedure starts on a separate day (2 procedures cannot

start on the same day)

•

Procedures fully completed online are recorded as ½ day

•

Procedure is considered completed once final document is

received

•

No prior contact with officials

•

Cost required to complete each procedure (% of income per

capita)

Official costs only, no bribes

•

No professional fees unless services required by law or

commonly used in practice

•

Paid-in minimum capital (% of income per capita)

•

Funds deposited in a bank or with third party before registration

or up to 3 months after incorporation

Case study assumptions

To make the data comparable across economies, several assumptions about the business and the

procedures are used. It is assumed that any required information is readily available and that the

entrepreneur will pay no bribes.

The business:

-Is a limited liability company (or its legal equivalent). If there is more than one type of limited

liability company in the economy, the limited liability form most common among domestic firms is

chosen. Information on the most common form is obtained from incorporation lawyers or the

statistical office.

-Operates in the economy’s largest business city. For 11 economies the data are also collected for

the second largest business city.

-Performs general industrial or commercial activities such as the production or sale to the public of

goods or services. The business does not perform foreign trade activities and does not handle

products subject to a special tax regime, for example, liquor or tobacco. It is not using heavily

polluting production processes.

-Does not qualify for investment incentives or any special benefits.

-Is 100% domestically owned.

-Has five business owners, none of whom is a legal entity. One business owner holds 30% of the

company shares, two owners have 20% of shares each, and two owners have 15% of shares

each.

-Is managed by one local director.

-Has between 10 and 50 employees one month after the commencement of operations, all of them

domestic nationals.

-Has start-up capital of 10 times income per capita.

-Has an estimated turnover of at least 100 times income per capita.

-Leases the commercial plant or offices and is not a proprietor of real estate.

-Has an annual lease for the office space equivalent to one income per capita.

-Is in an office space of approximately 929 square meters (10,000 square feet).

-Has a company deed that is 10 pages long.

The owners:

-Have reached the legal age of majority and are capable of making decisions as an adult. If there

is no legal age of majority, they are assumed to be 30 years old.

-Are in good health and have no criminal record.

-Are married, the marriage is monogamous and registered with the authorities.

-Where the answer differs according to the legal system applicable to the woman or man in

question (as may be the case in economies where there is legal plurality), the answer used will be

the one that applies to the majority of the population.

India

Doing Business

2020

Page 5

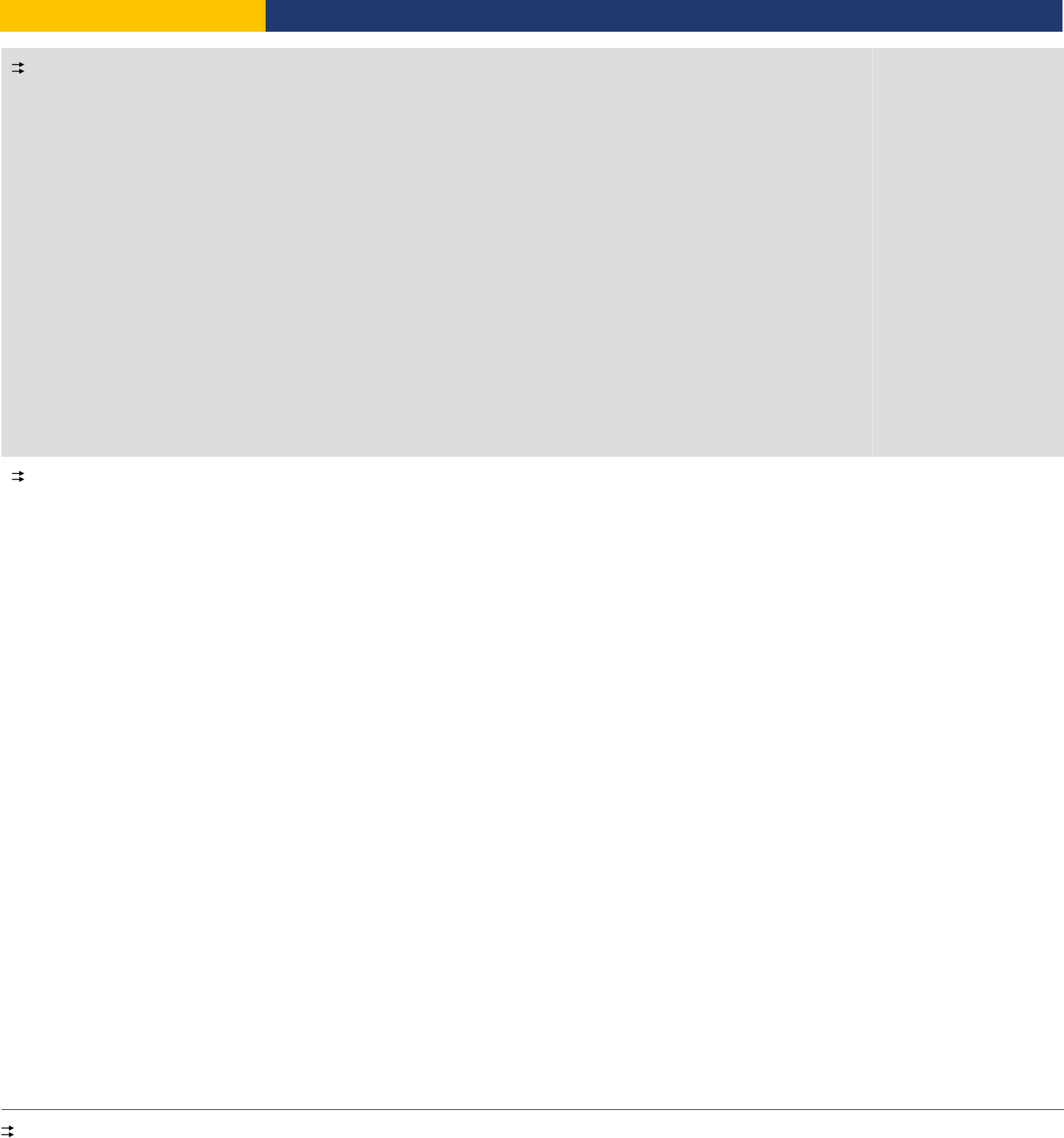

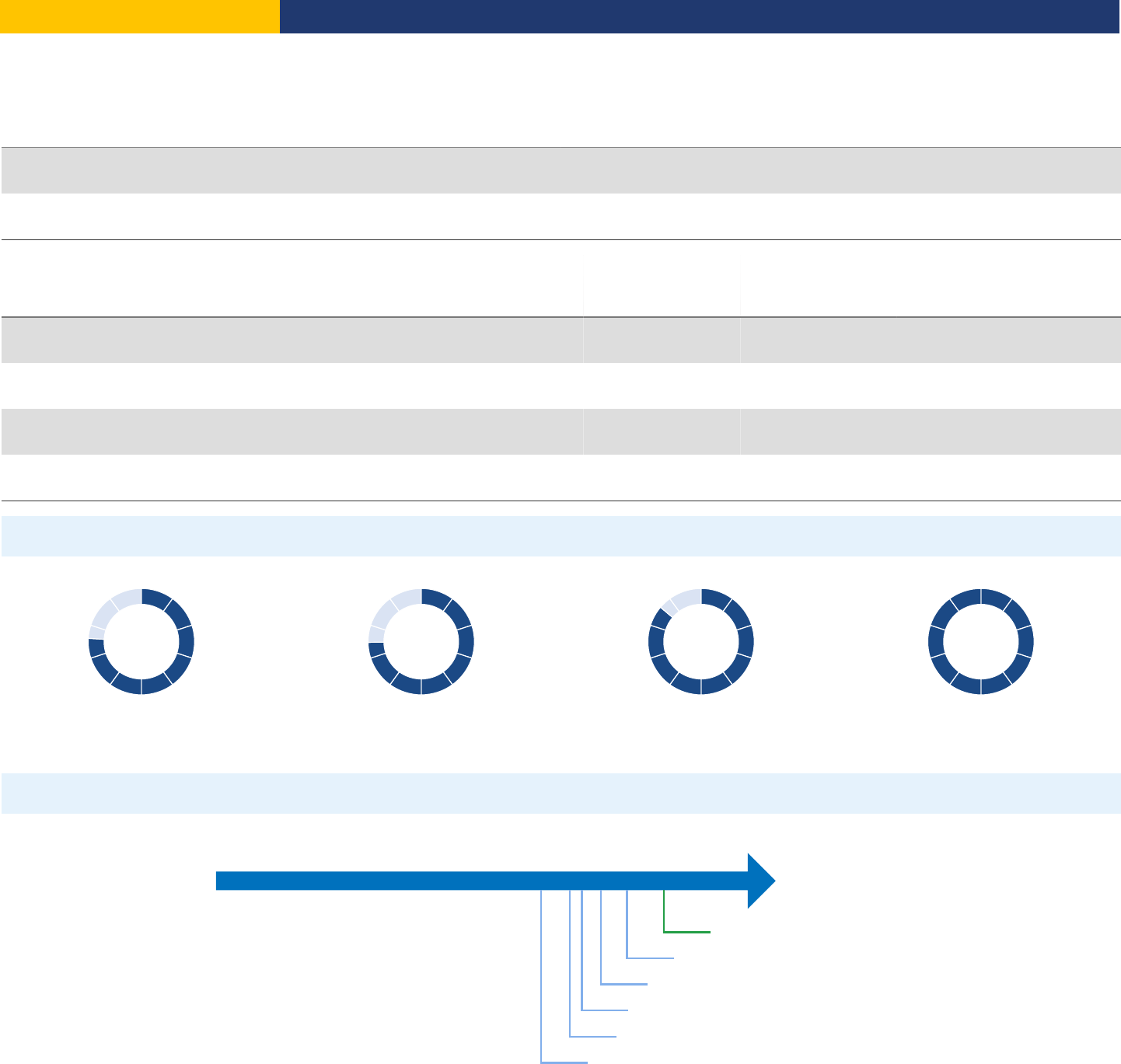

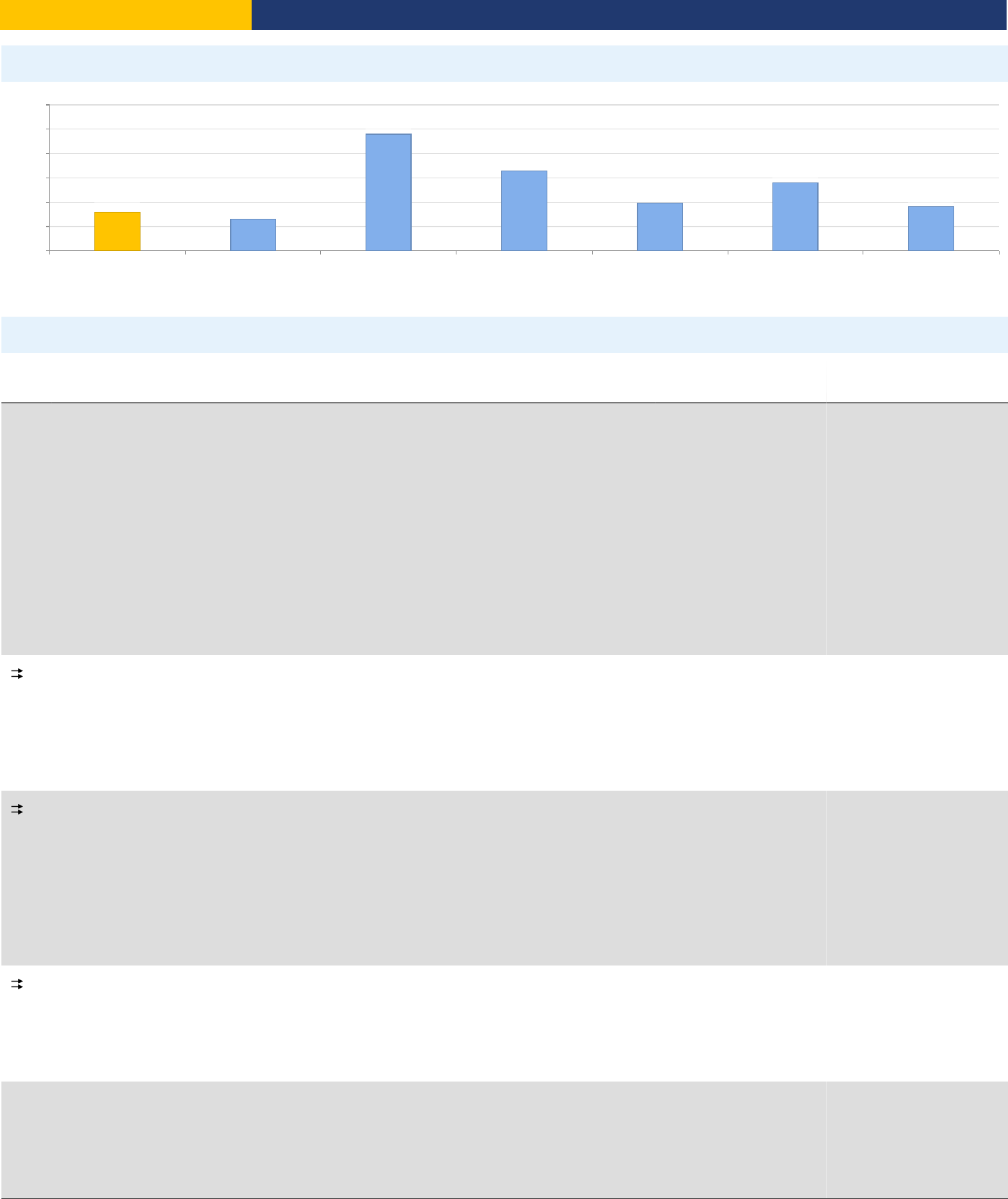

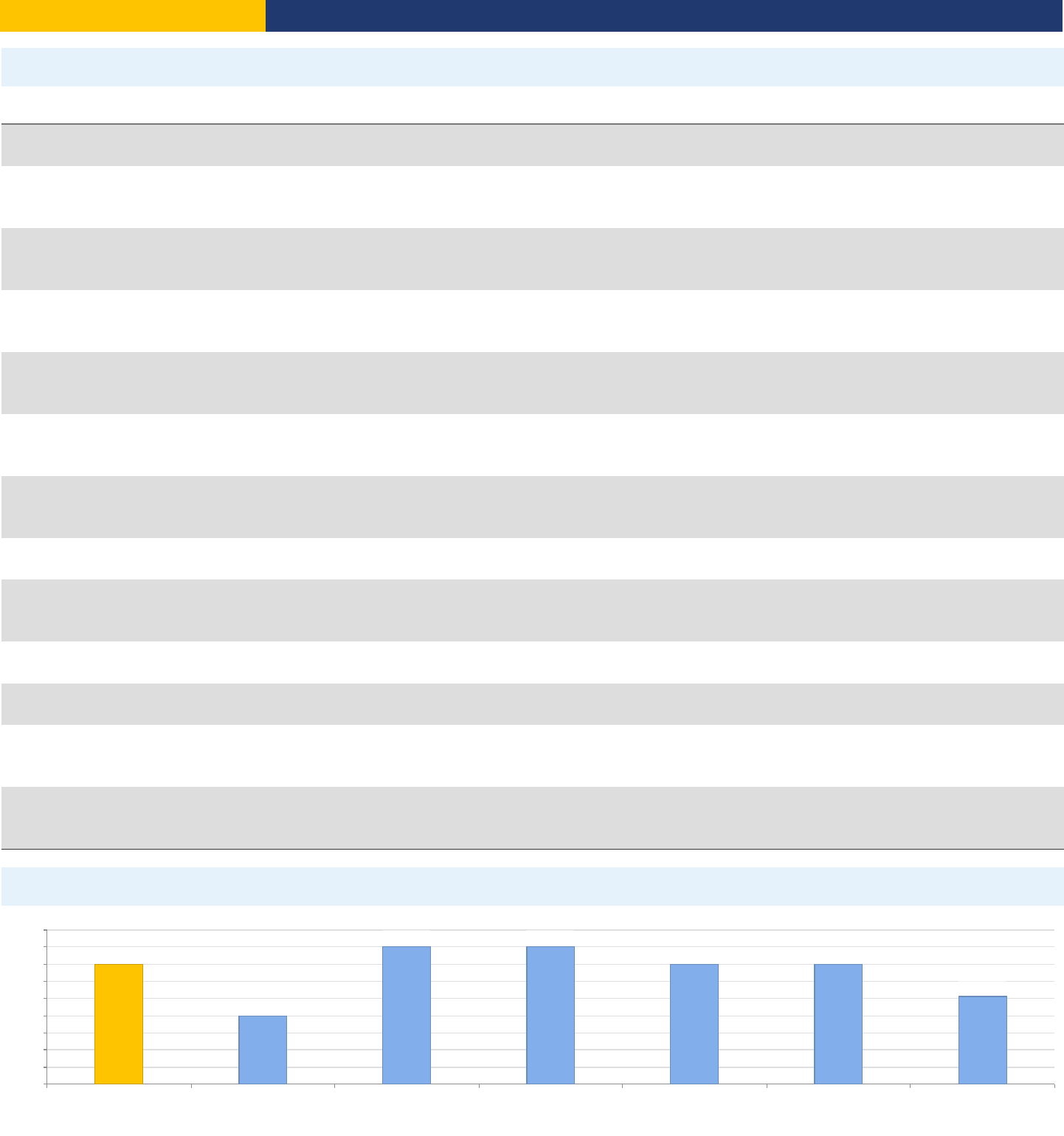

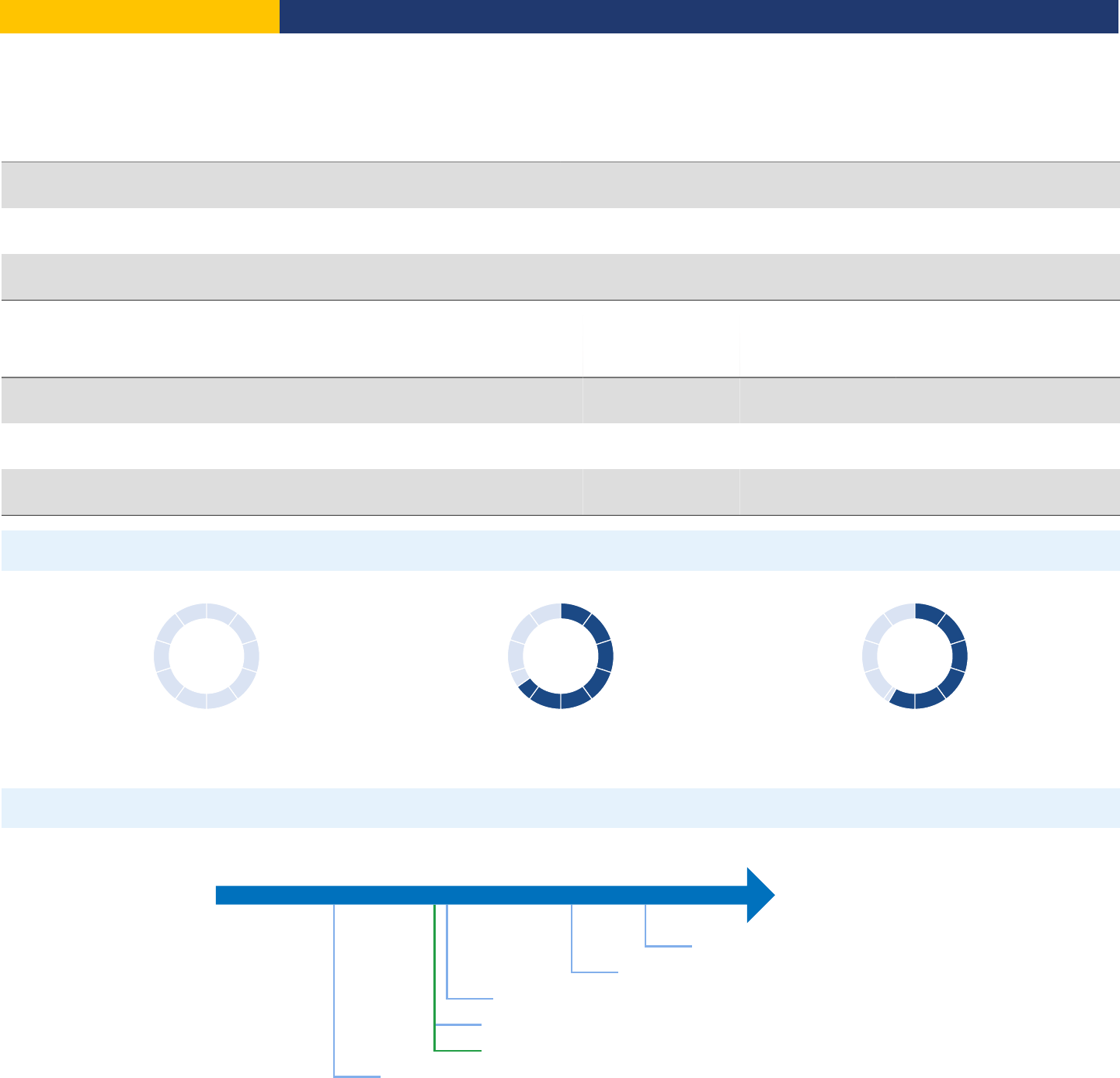

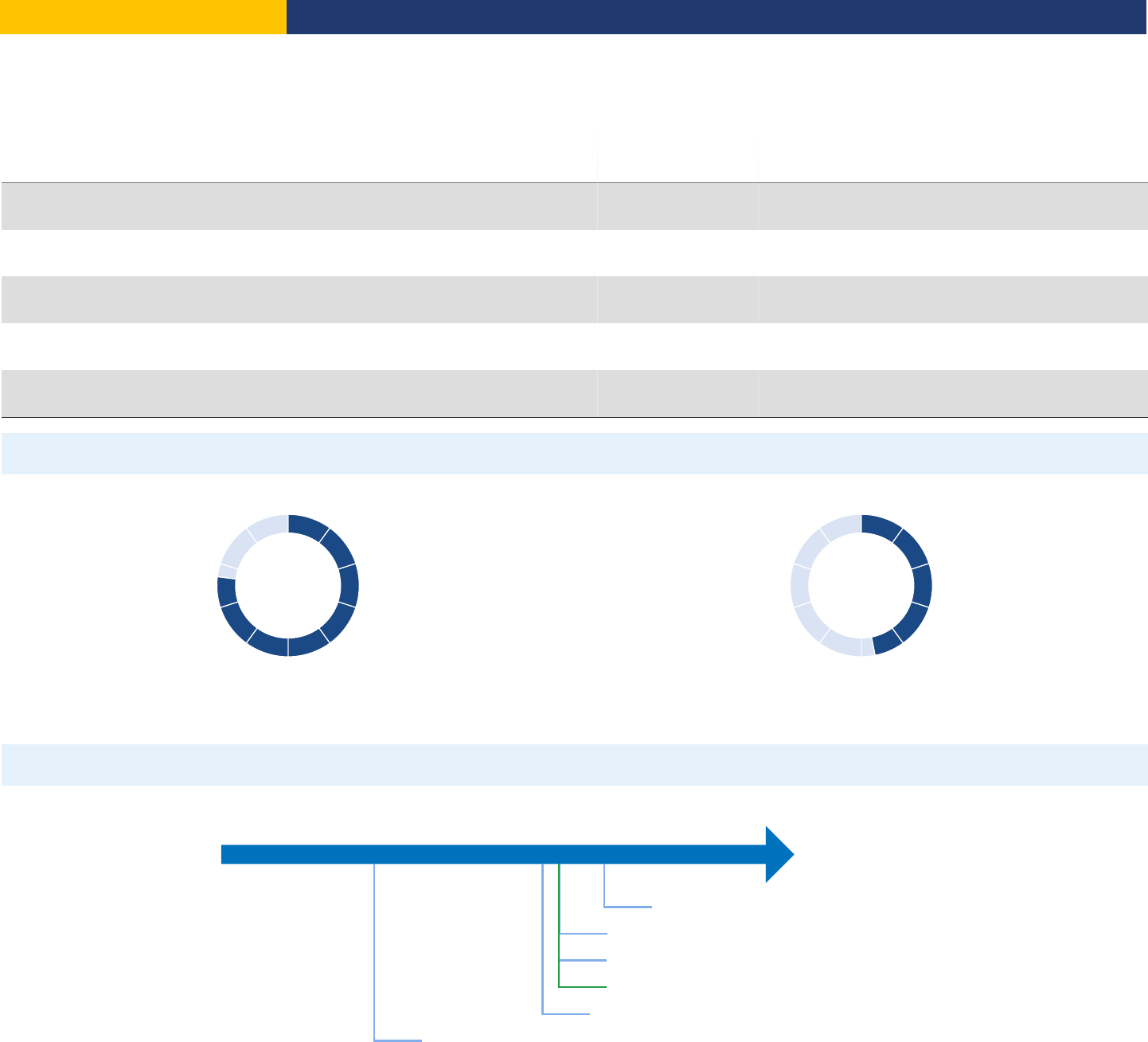

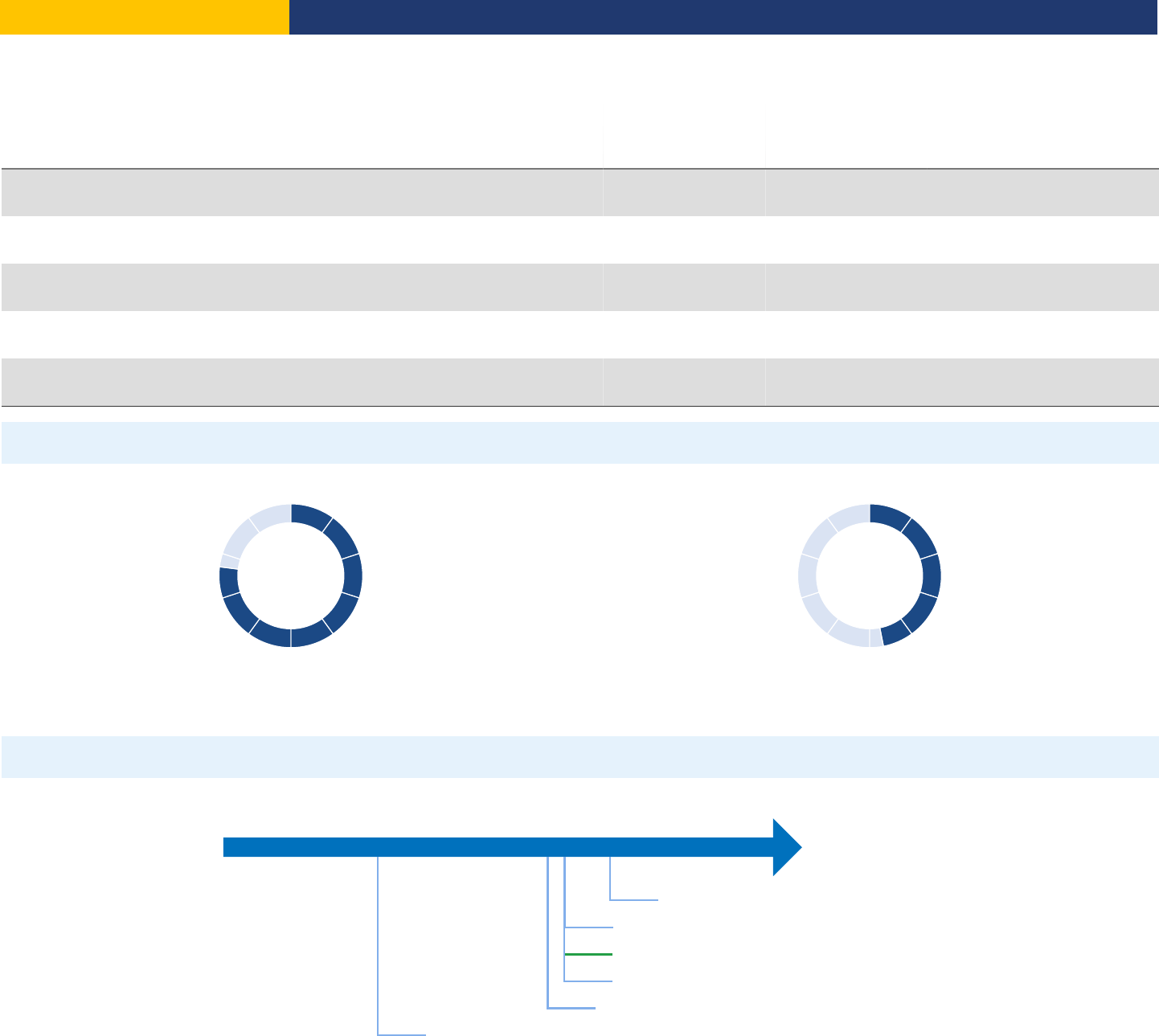

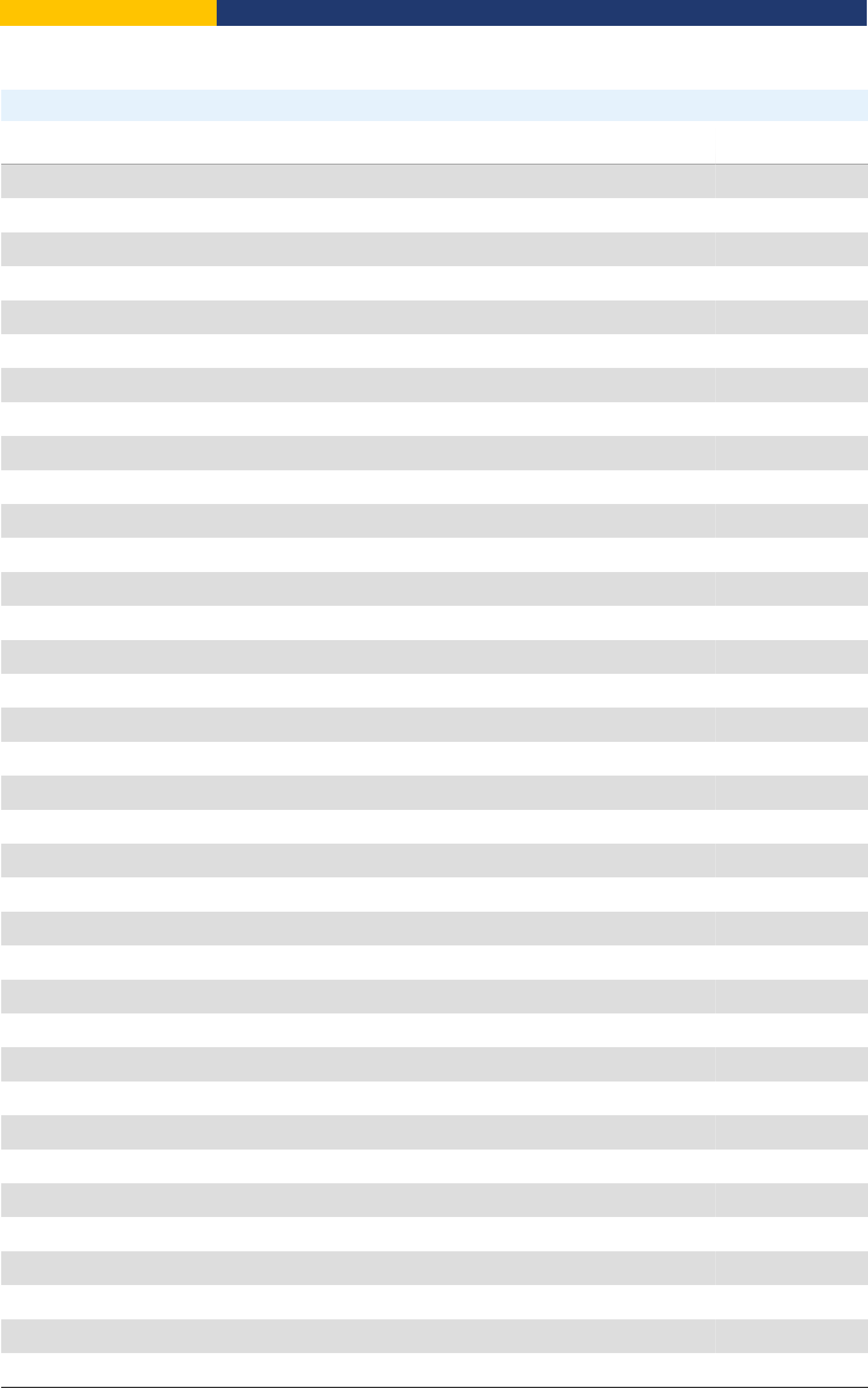

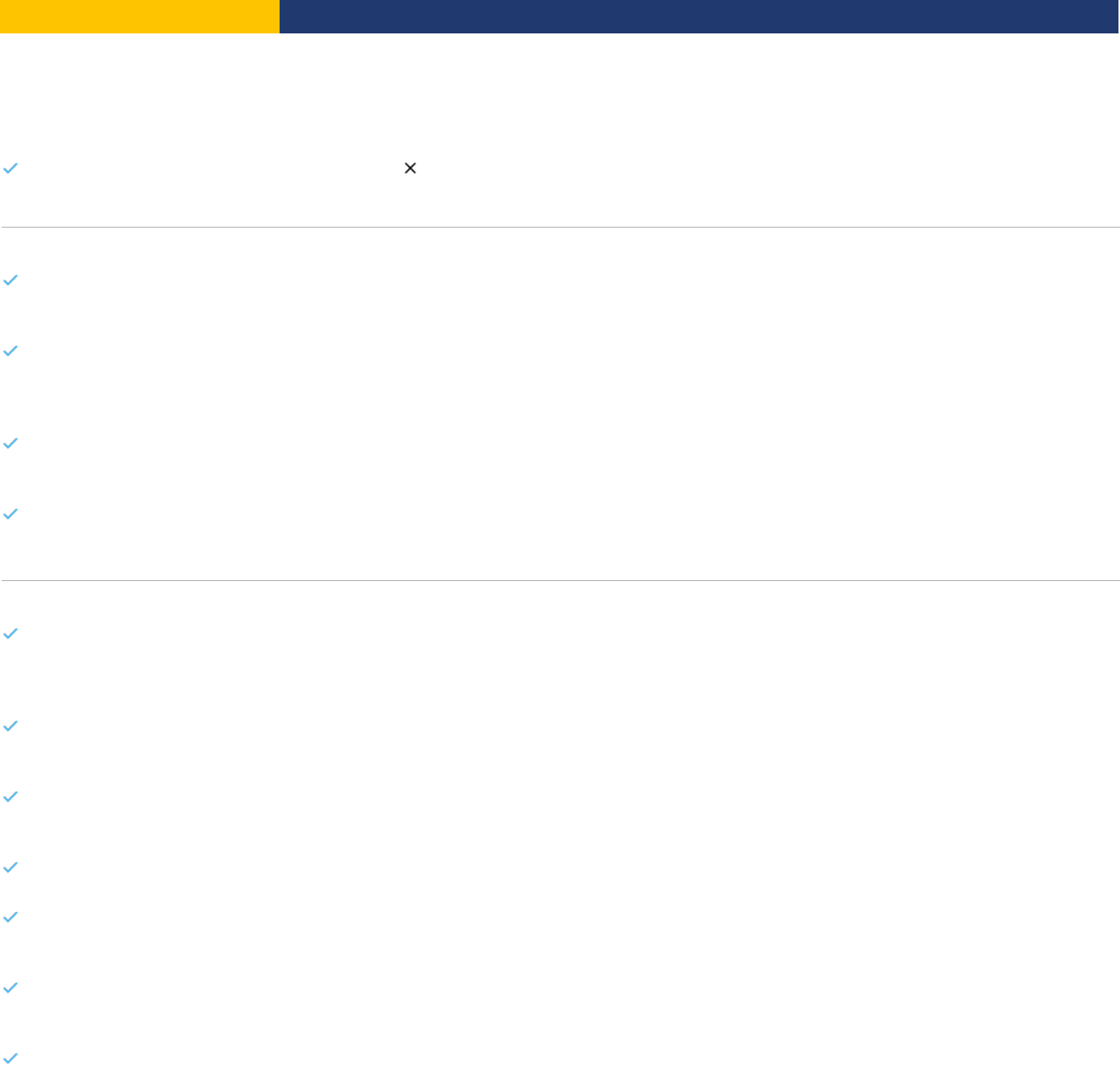

Starting a Business - Mumbai

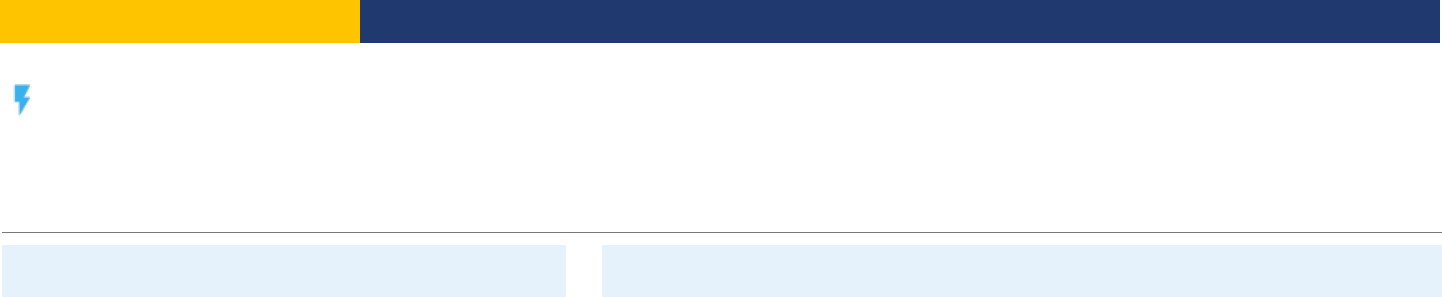

Figure – Starting a Business in Mumbai – Score

Procedures

47.1

Time

82.4

Cost

95.3

Paid-in min. capital

100.0

Figure – Starting a Business in Mumbai and comparator economies – Ranking and Score

DB 2020 Starting a Business Score

0 100

94.1: China (Rank: 27)

89.3: Pakistan (Rank: 72)

86.1: Mexico (Rank: 107)

82.4: Bangladesh (Rank: 131)

82.0: Delhi

81.2: Mumbai

Note: The ranking of economies on the ease of starting a business is determined by sorting their scores for starting a business. These scores are the simple average of

the scores for each of the component indicators.

Standardized Company

Legal form

Private Limited Company

Paid-in minimum capital requirement

No minimum

City Covered

Mumbai

Indicator

Mumbai

South Asia

OECD high

income

Best Regulatory

Performance

Procedure – Men (number)

10

7.1

4.9

1 (2 Economies)

Time – Men (days)

18

14.5

9.2

0.5 (New Zealand)

Cost – Men (% of income per capita)

9.3

8.3

3.0

0.0 (2 Economies)

Procedure – Women (number)

10

7.3

4.9

1 (2 Economies)

Time – Women (days)

18

14.6

9.2

0.5 (New Zealand)

Cost – Women (% of income per capita)

9.3

8.3

3.0

0.0 (2 Economies)

Paid-in min. capital (% of income per capita)

0.0

0.2

7.6

0.0 (120 Economies)

India

Doing Business

2020

Page 6

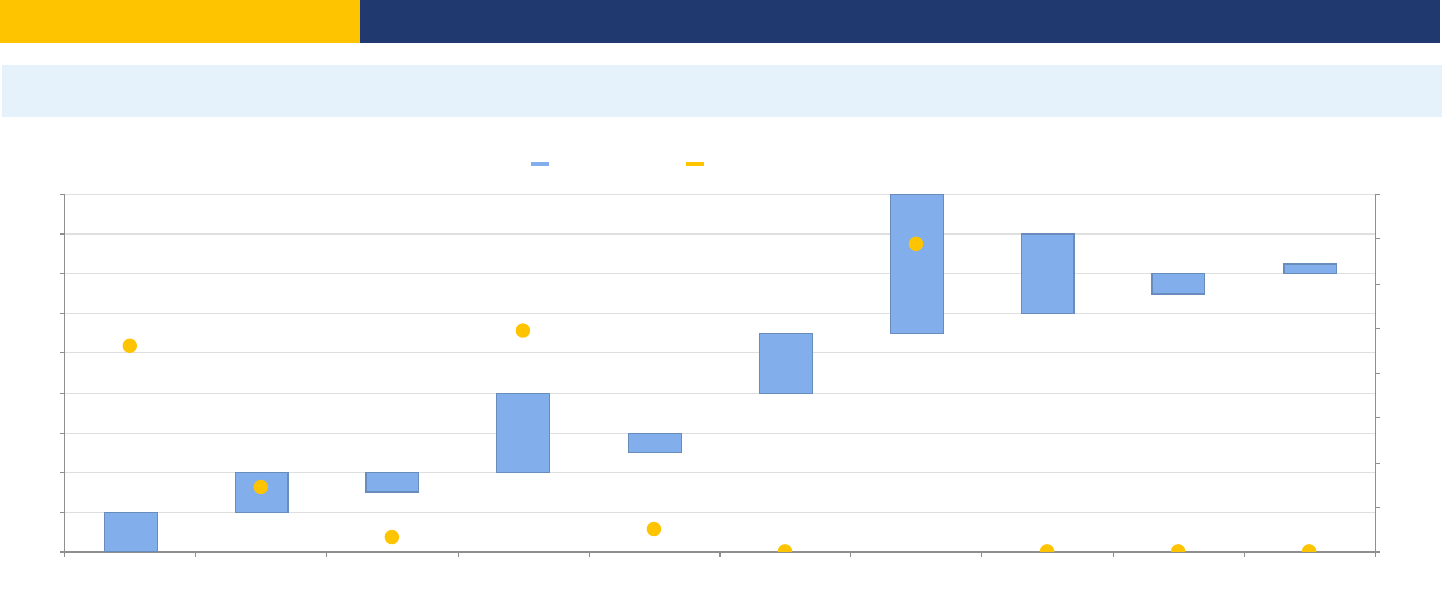

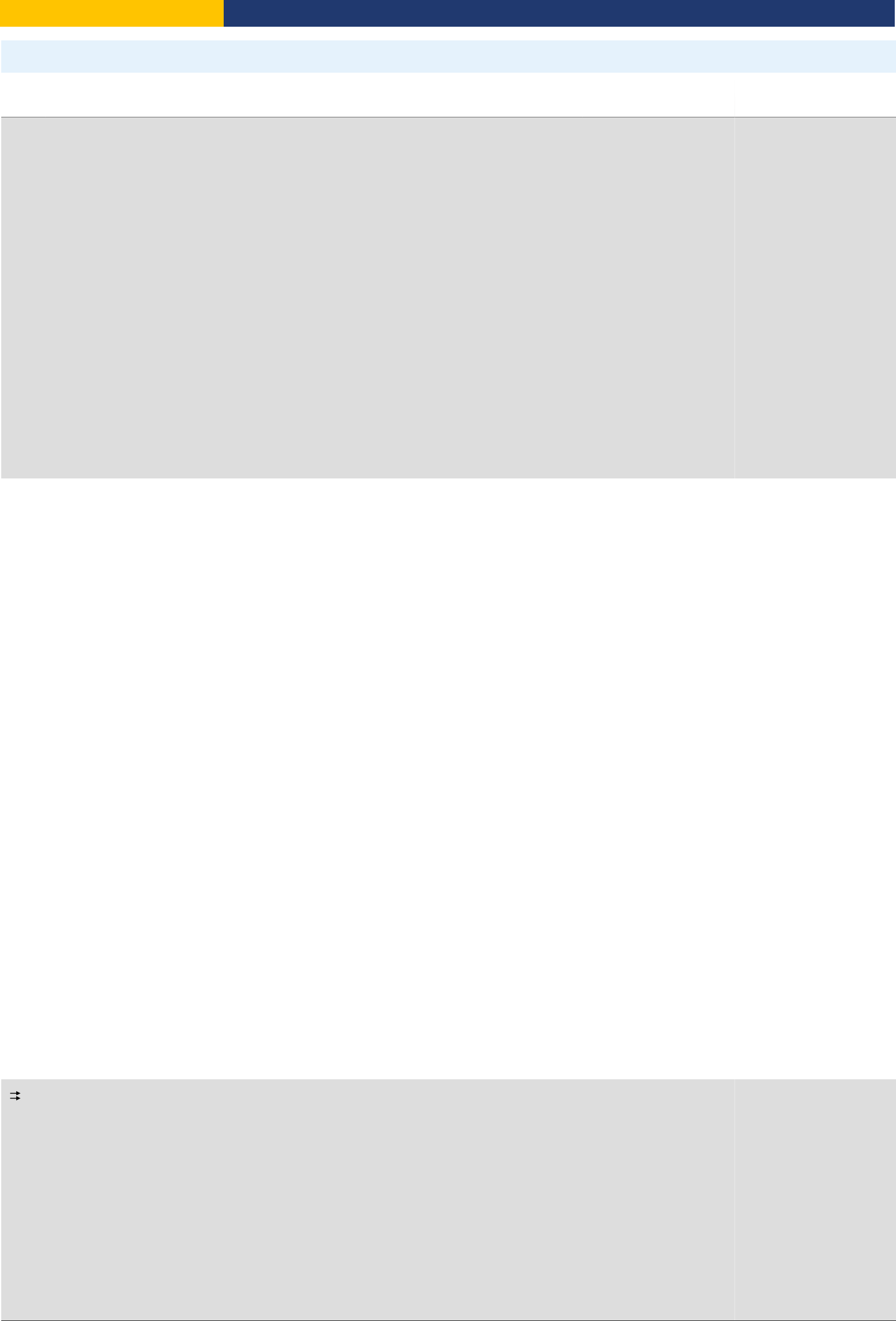

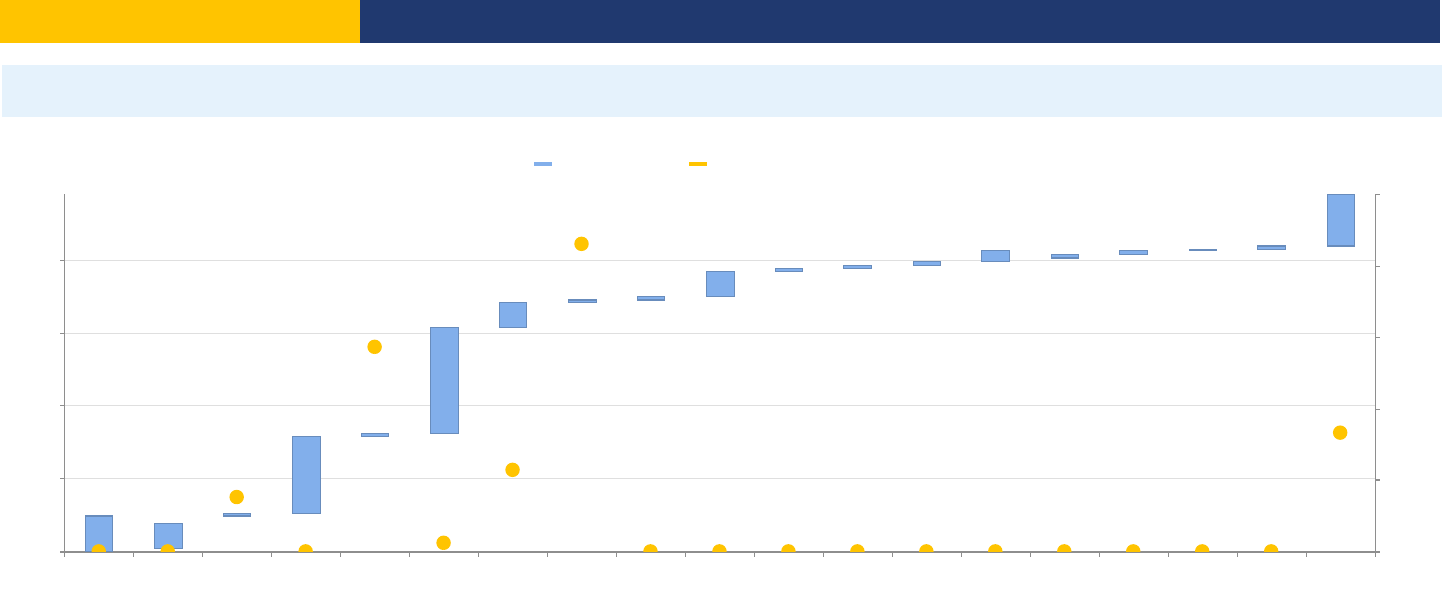

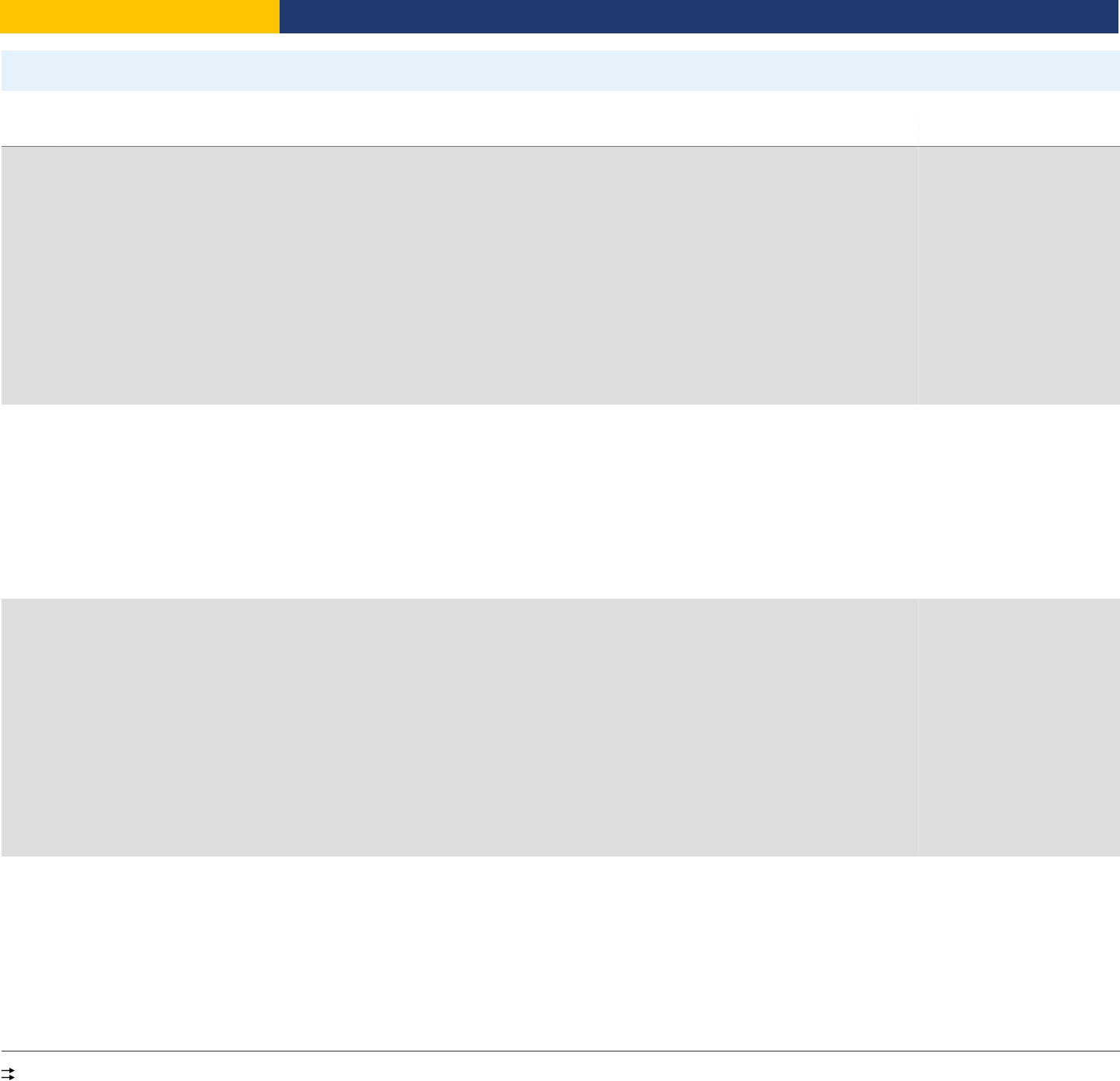

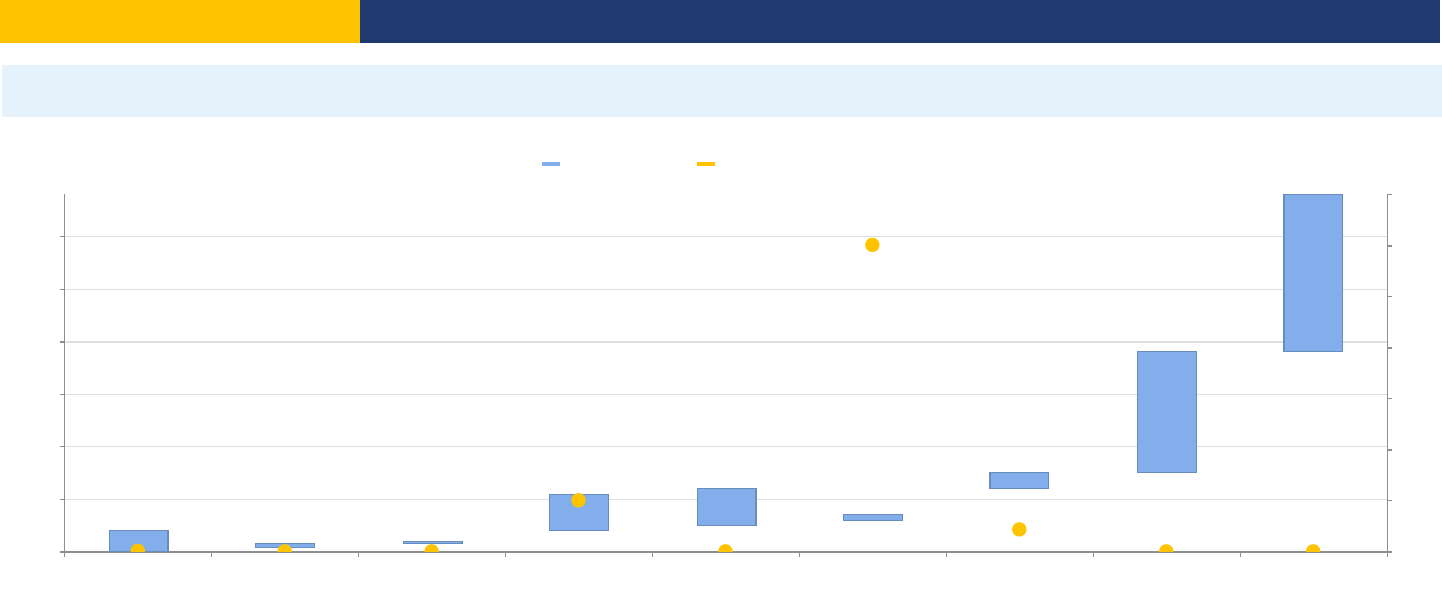

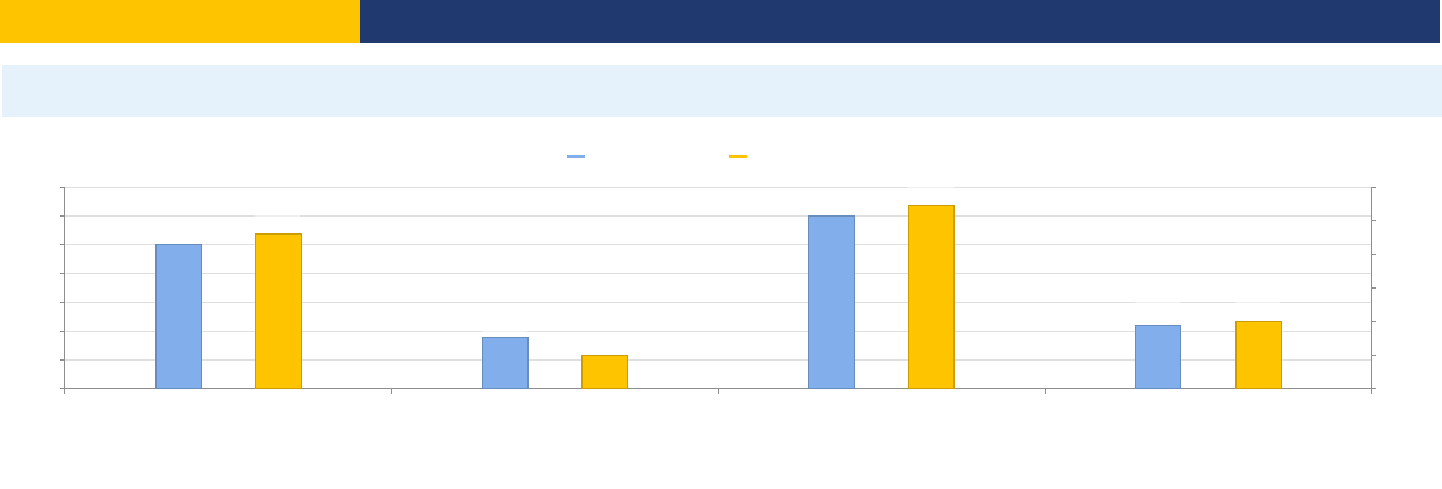

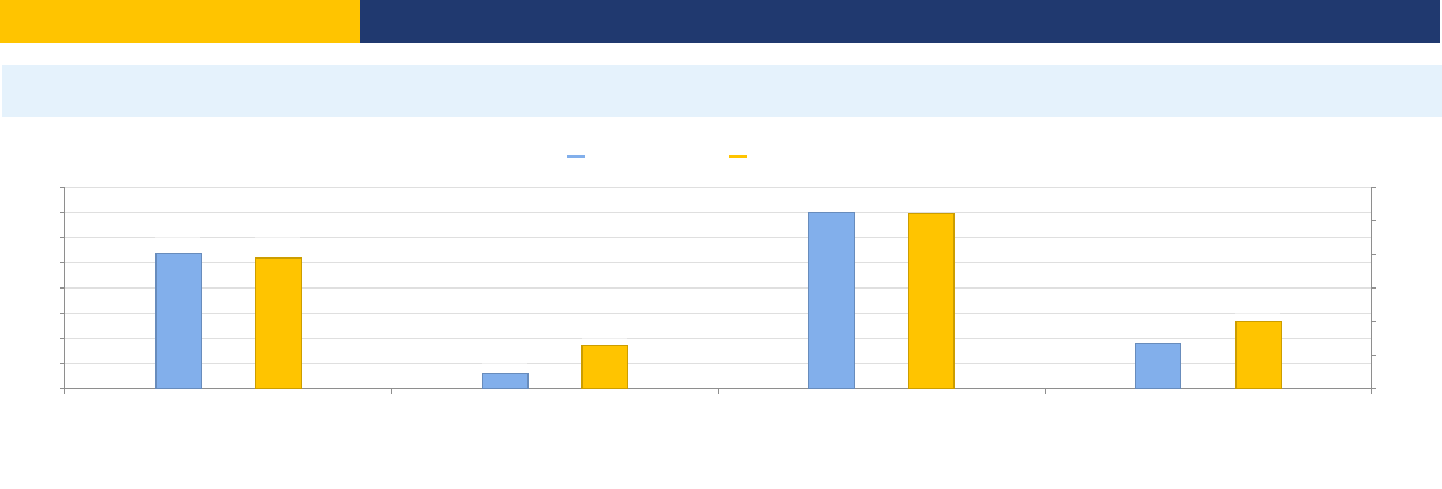

Figure – Starting a Business in Mumbai – Procedure, Time and Cost

This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.

*

Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows the

time for women. For more information on methodology, see the

website (

). For details on the procedures

reflected here, see the summary below.

Doing Business

http://doingbusiness.org/en/methodology

Procedures (number)

1 2 * 3 4 * 5 6 7 * 8 * 9 * 10

0

2

4

6

8

10

12

14

16

18

Time (days)

0

0.5

1

1.5

2

2.5

3

3.5

4

Cost (% of income per capita)

Time (days) Cost (% of income per capita)

India

Doing Business

2020

Page 7

Details – Starting a Business in Mumbai – Procedure, Time and Cost

No.

Procedures

Time to Complete

Associated Costs

1

Obtain a digital signature certificate

: Authorized private agency (Federal)

Agency

The applicant must obtain a Class-II Digital Signature Certificate from a certification agency

authorized by the Controller of Certification Agencies. These include private agencies like NIC, E-

Mudhra, MTNL Trust line, to which company directors submit the prescribed application form

along with notarized proof of identity and address.

For obtaining DSC, along with the documents (i.e., Proof of Identity and Proof of Address), a

verification video must be submitted by the applicant, stating the name, company name, mobile

number, email and intention for applying for DSC. Upon submitting the online application, a hard

copy of the form has to be submitted along with supporting documents to the authorized private

agency.

A Class-II Digital Signature Certificate can be obtained for either a period of 1 year or a period of 2

years, and then needs to be renewed for another 1 or 2 years upon payment of renewal fees.

Each agency has its own fee structure, starting from INR 700. The cost will vary in accordance

with the duration of the Digital Signature Certificate. Once the Digital Signature Certificate is

obtained, the authorized personnel (directors/manager/secretary) are required to register the

same with MCA for statutory e-filing.

2 days

INR 700 to INR 2,500 per

Digital Signature

Certificate

2

Reserve the company name online through "Reserve Unique Name" system (RUN)

: Registrar of Companies, Ministry of Corporate Affairs (Federal)

Agency

The company first looks up the availability of a name on the MCA website

(http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do), and then goes on to create a

new user account under the RUN link in the MCA website.

Online service for reservation of name (RUN or "Reserve Unique Name") was introduced through

the web service available on mca.gov.in. This service has replaced the Form INC-1 for name

approval. The following are the fields to be entered in Web-based Application :

- Entity Type: It is required to select the applicable option, i.e. New Company (Others) / Part I

Company, Producer Company, Unlimited Company, Private (OPC), IFSC Company, Section 8

Company, Nidhi Company.

- Corporate Identification Number (CIN): Only in case an Existing Company is applying for the

Change in Name, it is required to enter its CIN.

- Proposed Name: A Proposed Name option required to be entered here (the form allows to

provide 2 names in the form). After entering a Name, MCA has provided Auto Check Facility to

check the availability of the Name, accordingly the Applicant and enter the new Optional name, in

case the Entity already registered with such proposed name and again has to make Auto Check.

When the MCA System provides a Green Remark, Applicant can submit the Applicant with such

name option for further Approval.

- Comments: In this field, Applicant can provide the details related to the Proposed Company and

activities including the Prior Approvals and TradeMark Registration Details, Resolution (for

Existing Company / Foreign Subsidiary Registration).

All applicable documents must be scanned in a single file to be attached to the Web-based

Application. After providing the details in the fields and requisite attachments, Applicant can submit

the Form Online with the prescribed fees. Name will be reserved only for 20 Days within which the

Applicant and/or Promoters are required to file form with MCA-Concerned ROC with requisite

documents as per the Incorporation Rules 2014 as per the Companies Act 2013.

As of April 2016 companies can also complete the name reservation through the SPICe form.

However, in practice, companies reserve the company name before completing the application for

incorporation, as that way company name is confirmed and there is no ambiguity and no chance

of SPICe form being rejected due to name rejection.

1-3 days

INR 1,000

3

Prepare and notarize affidavit by each founder and proposed director

: Notary

Agency

Each founder and proposed director has to submit an affidavit confirming that he/she is not

convicted of any offence in connection with the promotion, formation or management of any

company, or has not been found guilty of any fraud or misfeasance or of any breach of duty to any

company during the preceding five years and that all the documents filed with the Registrar for

registration of the company contain information that is correct and complete and true to the best of

his knowledge and belief. A separate notarized affidavit is required for each person.

As per the Companies Act Amendment 2017 (July 27, 2017), Section 7, the requirement for

affidavit to be submitted as part of incorporation documents has been replaced with a requirement

of declaration by the directors. However, in practice, companies continue submitting notarized

affidavits.

1 day, simultaneous

INR 10 (stamp paper) +

INR 35 (notarizing) for

each affidavit

India

Doing Business

2020

Page 8

4

Pay stamp duties, file the SPICE form and obtain the certificate of incorporation, DIN, PAN

and TAN

: Registrar of Companies, Ministry of Corporate Affairs (Federal)

Agency

Pursuant to Section 7 (1) of the Companies Act, 2013 and pursuant to Rule 10, 12, 14 and 15 of

Companies (Incorporation) Rules, 2014, the following forms are required to be electronically filed

on the website of the Ministry of Corporate Affairs for incorporation purposes.

It is mandatory for private limited companies to complete the incorporation process using the

SPICe Form (Form INC -32). Applications for director identification number (DIN), Permanent

Account Number (PAN) and a Tax deduction and Collection Account Number (TAN) have been

integrated completely into the SPICe form. The particulars of maximum three directors can be

mentioned in SPICe form and DIN may be allotted to maximum three proposed directors through

this. If new directors are proposed for an existing company, then a separate DIN application can

be submitted.

SPICe eMoA (INC-33) and SPICe eAoA (INC-34) have to be uploaded as ‘Linked Forms’ to SPICe

(INC-32). The documents submitted for SPICe need to be digitally signed by all directors. A digital

signature of a witness is also required for eMoA and eAoA.

A consolidated challan gets generated at the time of filing SPICe(INC-32) which shall contain

applicable fee towards:

(i) Form Fee

(ii) MoA

(iii) AoA

(iv) PAN

(v) TAN

Two re-submissions are permitted for the SPICe form. On approval of SPICe forms, the Certificate

of Incorporation (CoI) is issued with PAN and TAN as allotted by the Income Tax Department. An

electronic mail with Certificate of Incorporation(CoI) as an attachment along with PAN and TAN is

also sent to the user. Finance Act, 2018 amended section 139A of the Income-tax Act, 1961 and

removed the requirement of issuing PAN in the form of a laminated card.

Companies with authorized share capital below INR 1,500,000 are not required to pay filing fees

for eMoA and eAoA.

4 days

Fee schedule for a

company with paid-up

share capital below INR

1,500,000:

- Electronic filing of the

Memorandum of

Association (eMOA): none

- Electronic filing fee for

filing the Articles of

association (eAOA): none

- Electronic filing fee for

Form INC-32 SPICe: none

- Stamp duty: INR 100

- Stamp duty for Articles of

Association: INR 3,000

(INR 500 for every

500,000 or part thereof)

- Stamp duty for

Memorandum of

Association: INR 200

- PAN application: INR 110

(including 18% GST)

- TAN application: INR 65

(including 18% GST)

5

Make a company stamp

: Authorized vendor (Private)

Agency

As per the amendment to the Companies Act 2013, making a company seal is no longer a legal

requirement. However, making a company rubber stamp is still commonly used in practice. The

stamp is normally required to be affixed by a director upon signing on behalf of the company in

order to file several applications relevant to business startup. This includes but is not limited to

opening a bank account, application for registration with the Employee State Insurance

Corporation (ESIC) and application for a company Permanent Account Numbers (PAN).

1 day, simultaneous

INR 350-500

6

Open a bank account

: Bank

Agency

The bank account details must be provided by the company in various post-registration

applications, such as registrations with GST.

After incorporation, company can immediately apply for bank account opening using electronically

provided CoI. Banks have introduced new KYC requirements, and request for multiple ID proofs

as well as address proofs, which results in a longer than usual processing time for providing with

bank account number.

The common documents required for account opening include:

• Certificate of Incorporation (CoI)

• MoA & AoA

• Communication address proof of company

• Registered address proof of company (if different from communication address)

• Board Resolution

• ID Proof of authorized signatory

• PAN card of company (now provided in CoI)

3 days

no charge

India

Doing Business

2020

Page 9

7

Register with Office of Inspector, Mumbai Shops and Establishment Act

: Municipal Corporation of Greater Mumbai

Agency

According to Section 7 of the Bombay Shops and Establishments Act, 1948, the establishment

must be registered as follows:

- Under Section 7(4), the employer must register the establishment in the prescribed manner

within 30 days of the date on which the establishment commences its work.

- Under Section 7(1), the establishment must submit to the local shop inspector Form A and the

prescribed fees for registering the establishment. Supporting documents must be attached,

including a certified true copy of the company's PAN Card, TAN Allotment Letter, Certificate of

Incorporation, Memorandum and Articles of Association, a list of company directors, their

particulars and copies of their PAN Cards.

- Under Section 7(2), after the statement in Form A and the prescribed fees are received and the

correctness of the statement is satisfactorily audited, the certificate for the registration of the

establishment is issued in Form D, according to the provisions of Rule 6 of the Maharashtra

Shops and Establishments Rules of 1961.

Since the amendments in the Maharashtra Shops & Establishment (Amendment) Rules, 2010, the

Schedule for fees for registration & renewal of registration (as per Rule 5) is as follows:

0 employees: INR 120

1 to 5 employees: INR 360

6 to 10 employees: INR 720

11 to 20 employees: INR 1,200

21 to 50 employees: INR 2,400

51 to 100 employees: INR 4,200

101 or more: INR 5,400.

In addition, an annual fee (three times the registration and renewal fees) is charged as trade

refuse charges (TRC), under the Mumbai Municipal Corporation Act, 1888.

7 days, simultaneous

INR 1,200 (registration

fee) + 3 times registration

fee for Trade Refuse

Charges (INR 3,600)

8

Obtain Goods and Service Tax (GST) Registration Number

: Department of Goods and Services Tax, Government of Maharashtra

Agency

GST Registration of a business with the tax authorities implies obtaining a unique, 15-digit Goods

and Service Tax Identification Number (GSTIN) from the GST authorities so that all the operations

of and the data relating to the business can be collected and correlated. Registration under the

GST Act is mandatory if your aggregate annual PAN-based turnover exceeds INR 20,00,000

(Rupees Twenty Lakhs). However, in practice, for any operating business, a GST registration is

done immediately after incorporation.

To apply for a new registration, the following documents are required

- PAN card/details of business

- Valid and accessible e-mail ID and Mobile Number

- Documentary proof of constitution of business

- Documentary proof of promoters/partners - Documentary proof of principal place of business

- Details of Authorised Signatories including photographs and proof of appointment - Details of

Primary Authorised Signatory

- Business bank account details

- Valid Class II or Class III DSC of authorised signatory in case of companies and LLPs; valid

Class II or Class III DSC or Aadhaar (for E-Sign option).

A maximum of 10 Promoters/Partners/Directors can be added in the form. Passport photographs

need to be uploaded of all the Promoters/Partners/Directors whose details you are adding in the

application form. Further, each passport photograph must be in JPEG format and not more than

100 KB.

The first step to the registration process is the application and verification of PAN number, and the

subsequent issue of a Temporary Registration Number (TRN).

The applicant then needs to submit an application in Part B of FORM GST REG-01, duly signed,

along with documents specified.

The application is forwarded to the proper officer who examines it and the accompanying

documents and if found to be in order, approve the grant of registration to the applicant within

three working days from the date of submission of application.

The certificate of registration in FORM GST REG-06 showing the principal place of business and

additional place(s) of business is then made available to the applicant on the Common Portal and

a GSTIN is assigned in the following format:

- two characters for the State code;

- ten characters for the PAN or the Tax Deduction and Collection Account Number;

- two characters for the entity code; and

- one checksum character.

4 days

no charge

India

Doing Business

2020

Page 10

Takes place simultaneously with previous procedure.

9

Register with the Employees' Provident Fund Organization (EPFO) and the Employees'

State Insurance Corporation (ESIC)

: Shram Suvidha Portal of Ministry of Labour and Employment

Agency

The Employees Provident Fund Organization (EPFO) is a statutory organization under the

Ministry of Labor and Employment. The Employees Provident Funds & Miscellaneous Provisions

Act, 1952 applies to an establishment, employing 20 or more persons and engaged in any of the

183 Industries and Classes of business establishments, throughout India excluding the State of

Jammu and Kashmir. Furthermore, new companies are required to register with the Employees'

State Insurance Corporation (ESIC).

On April 30, 2017, an online registration was introduced the Shram Suvidha Portal combining the

EPFO and ESIC registrations into one. However, it was not a preferred method for the majority

since paper copies had still to be filed after the online registration. In April 1, 2018, the electronic

registration process was further enhanced and it became the only option to register for ESIC and

EPFO. EPFO & ESIC registration is now done on the same Shram Suvidha portal

(https://registration.shramsuvidha.gov.in) and in one application. However, the website was

reported to be quite slow and with numerous glitches during the registration process – fields not

accepting information, the screen timing out, etc. As a result, although registration is done

electronically, it can take a long time in practice.

1 day, simultaneous

no charge

10

Register for Profession Tax

: Sales Tax Department, Government of Maharashtra

Agency

Professional Tax in Maharashtra is levied under Maharashtra State Tax on Professions, Trades,

Callings and Employments Act, 1975. It is levied on Company, Firm, Proprietary Concern, Hindu

Undivided Family (HUF), Society, Club, Association of Persons, Corporation or any other

corporate body in Maharashtra.

Professional Tax in Maharashtra for Organisations: An employer organization is required to get

registered under the Profession Tax Act and obtain a Registration Certificate under which the

payment in respect of taxes deducted from employees’ salaries can be made. Also as a firm, the

organization is required to obtain Enrollment Certificate and pay Profession tax on its behalf.

Delays in obtaining Enrollment or Registration Certificate are penalized at the rate of Rs. 2/-

(Rupees Two) per Day. In case a false information regarding enrollment is provided, then the

Penalty is 3 times of tax amount. The interest for non-payment / delayed payment of profession

tax is 1.25% per month and the Maharashtra state authority can also impose a penalty of 10% of

the amount of tax not paid/short paid/delayed.

There are 2 types of Profession Tax payers:

a) Profession Tax Enrollment Certificate (PTEC) : Any person engaged in Profession,

Trade and Callings and falling under one or the other of the classes mentioned in the

second column of Schedule I shall obtained PTEC

b) Profession Tax Registration Certificate (PTRC) : Every employer who has

employed even a single employee whose salary is above the prescribed limit for

deducting Profession Tax shall obtain PTRC.

All new companies must be first obtain a Profession Tax Registration Certificate. And then

proceed to enroll all employees for a Profession Tax Enrollment Certificate for any of the

employees who have never been employed (for employees who have been previously enrolled,

there is no need to re-enroll).

Less than one day

(online procedure)

no charge

India

Doing Business

2020

Page 11

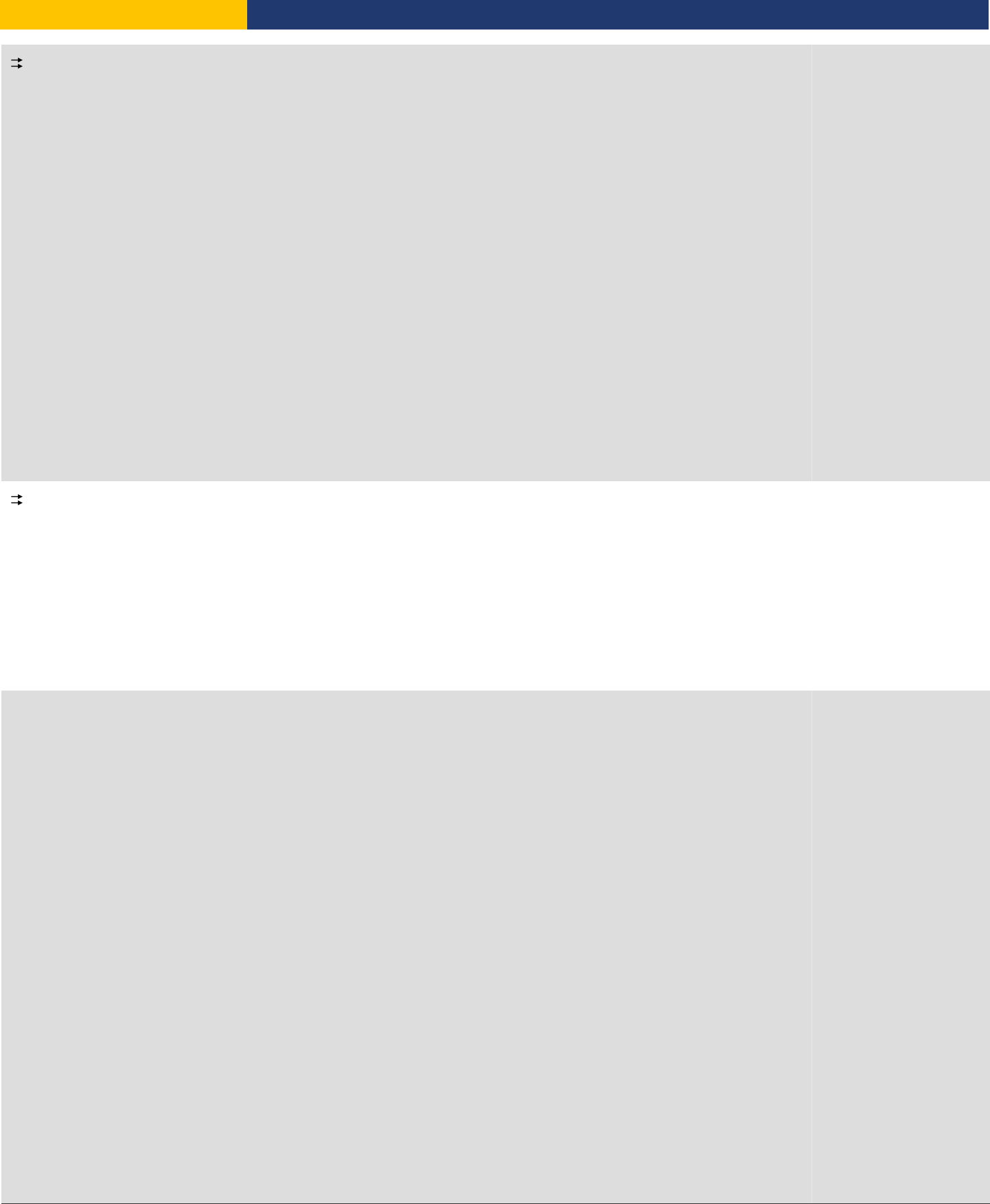

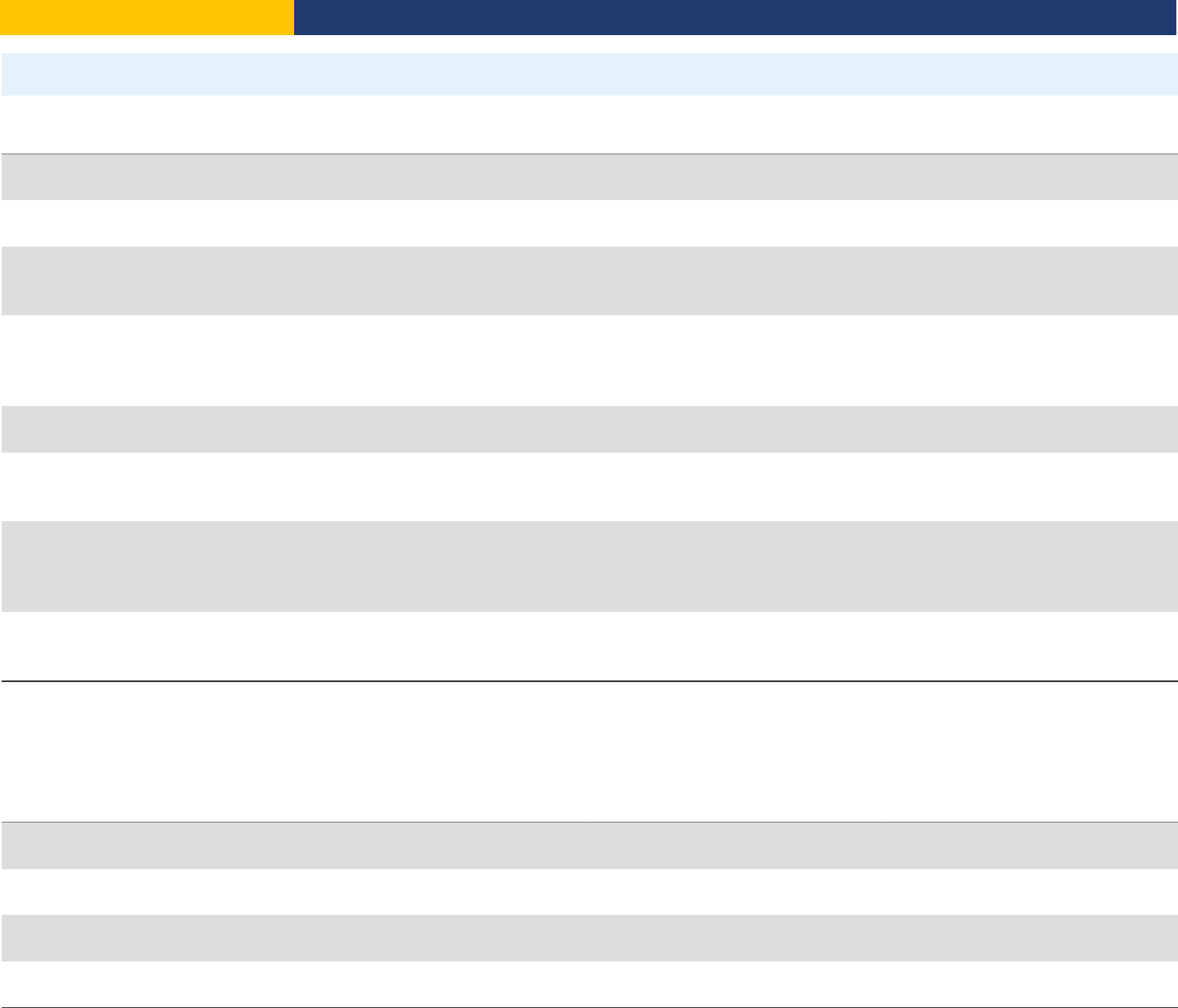

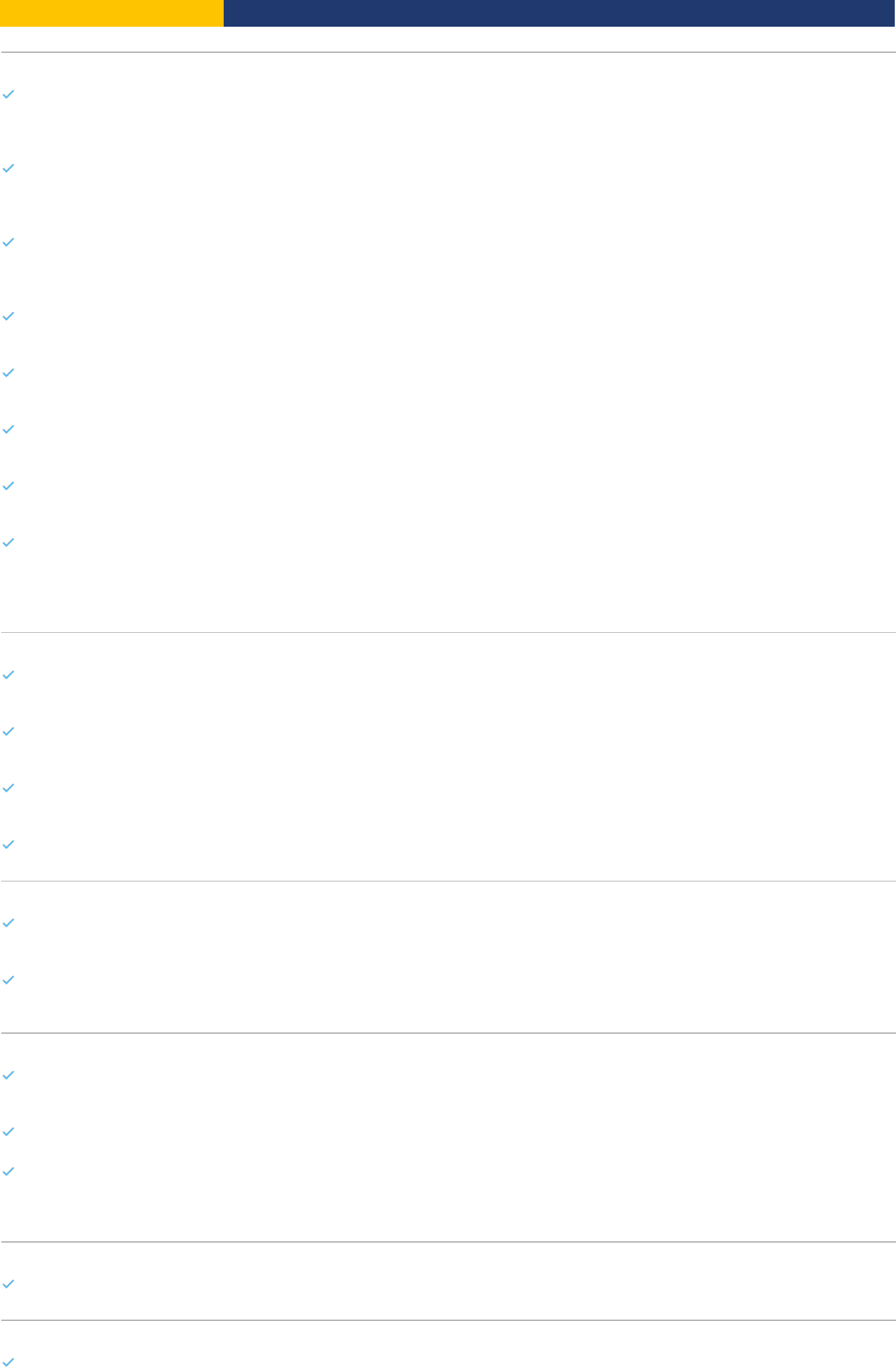

Starting a Business - Delhi

Figure – Starting a Business in Delhi – Score

Procedures

47.1

Time

83.4

Cost

97.4

Paid-in min. capital

100.0

Figure – Starting a Business in Delhi and comparator economies – Ranking and Score

DB 2020 Starting a Business Score

0 100

94.1: China (Rank: 27)

89.3: Pakistan (Rank: 72)

86.1: Mexico (Rank: 107)

82.4: Bangladesh (Rank: 131)

82.0: Delhi

81.2: Mumbai

Note: The ranking of economies on the ease of starting a business is determined by sorting their scores for starting a business. These scores are the simple average of

the scores for each of the component indicators.

Standardized Company

Legal form

Private Limited Company

Paid-in minimum capital requirement

No minimum

City Covered

Delhi

Indicator

Delhi

South Asia

OECD high

income

Best Regulatory

Performance

Procedure – Men (number)

10

7.1

4.9

1 (2 Economies)

Time – Men (days)

17

14.5

9.2

0.5 (New Zealand)

Cost – Men (% of income per capita)

5.3

8.3

3.0

0.0 (2 Economies)

Procedure – Women (number)

10

7.3

4.9

1 (2 Economies)

Time – Women (days)

17

14.6

9.2

0.5 (New Zealand)

Cost – Women (% of income per capita)

5.3

8.3

3.0

0.0 (2 Economies)

Paid-in min. capital (% of income per capita)

0.0

0.2

7.6

0.0 (120 Economies)

India

Doing Business

2020

Page 12

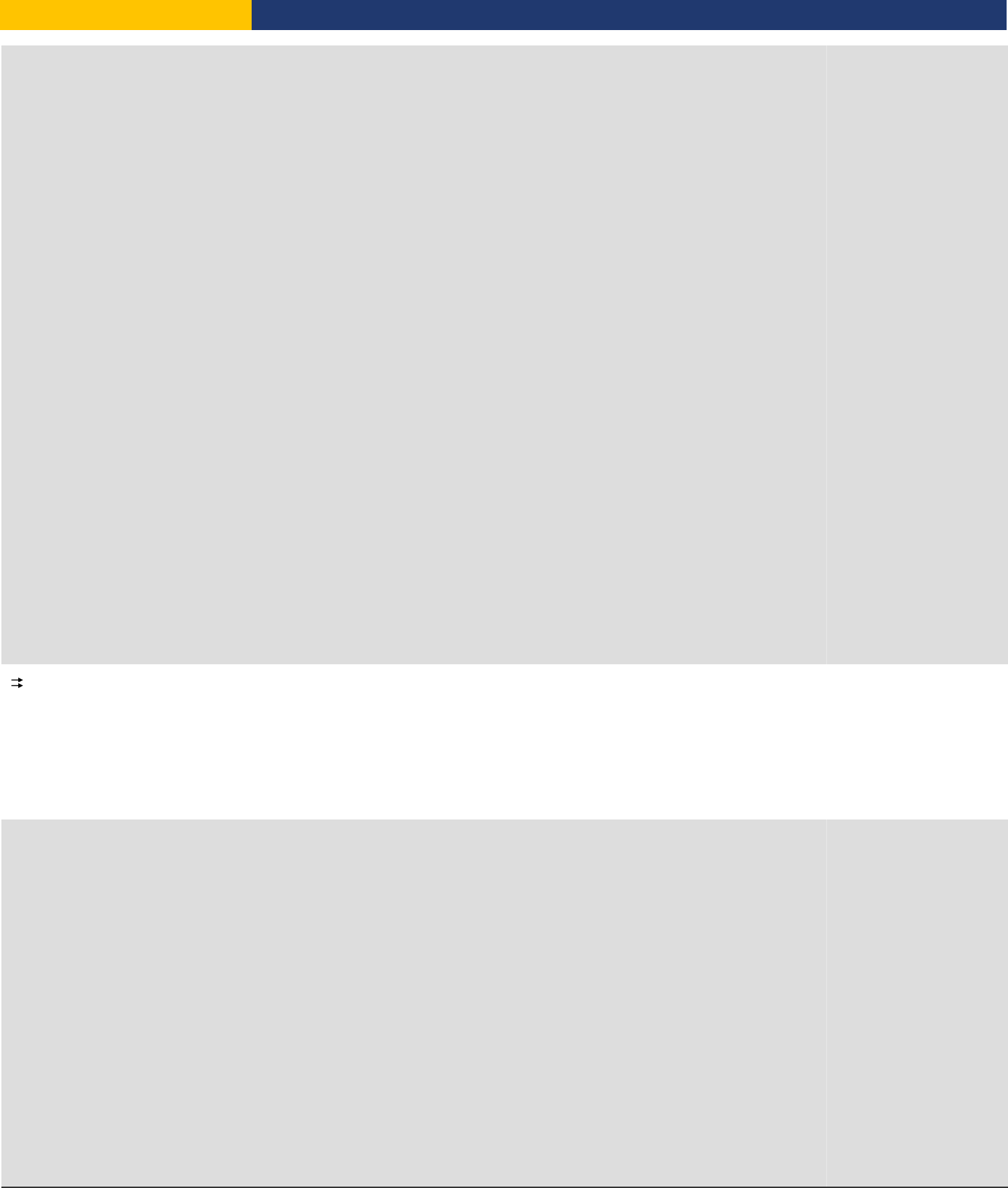

Figure – Starting a Business in Delhi – Procedure, Time and Cost

This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.

*

Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows the

time for women. For more information on methodology, see the

website (

). For details on the procedures

reflected here, see the summary below.

Doing Business

http://doingbusiness.org/en/methodology

Procedures (number)

1 2 * 3 4 * 5 6 7 * 8 9 * 10

0

2

4

6

8

10

12

14

16

Time (days)

0

0.5

1

1.5

2

2.5

Cost (% of income per capita)

Time (days) Cost (% of income per capita)

India

Doing Business

2020

Page 13

Details – Starting a Business in Delhi – Procedure, Time and Cost

No.

Procedures

Time to Complete

Associated Costs

1

Obtain digital signature certificate online from private agency authorized by the Ministry of

Corporate Affairs (National)

: Certified private agencies

Agency

The applicant must obtain a Class-II Digital Signature Certificate from a certification agency

authorized by the Controller of Certification Agencies. These include private agencies like NIC, E-

Mudhra, MTNL Trust line, to which company directors submit the prescribed application form

along with notarized proof of identity and address.

For obtaining DSC, along with the documents (i.e., Proof of Identity and Proof of Address), a

verification video must be submitted by the applicant, stating the name, company name, mobile

number, email and intention for applying for DSC. Upon submitting the online application, a hard

copy of the form has to be submitted along with supporting documents to the authorized private

agency.

A Class-II Digital Signature Certificate can be obtained for either a period of 1 year or a period of 2

years, and then needs to be renewed for another 1-2 years upon payment of renewal fees. Each

agency has its own fee structure, starting from INR 700. The cost will vary in accordance with the

duration of the Digital Signature Certificate. Once the Digital Signature Certificate is obtained, the

authorized personnel (directors/manager/secretary) are required to register the same with MCA for

statutory e-filing.

2 days

INR 700 to INR 2,500 per

Digital Signature

Certificate

2

Reserve the company name online through "Reserve Unique Name" system (RUN)

: Registrar of Companies (ROC)

Agency

The company first looks up the availability of a name on the MCA website

(http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do), and then goes on to create a

new user account under the RUN link in the MCA website.

Online service for reservation of name (RUN or "Reserve Unique Name") was introduced through

the web service available on mca.gov.in. This service has replaced the Form INC-1 for name

approval. The following are the fields to be entered in Web-based Application :

- Entity Type: It is required to select the applicable option, i.e. New Company (Others) / Part I

Company, Producer Company, Unlimited Company, Private (OPC), IFSC Company, Section 8

Company, Nidhi Company.

- Corporate Identification Number (CIN): Only in case an Existing Company is applying for the

Change in Name, it is required to enter its CIN.

- Proposed Name: A Proposed Name option required to be entered here (the form allows to

provide 2 names in the form). After entering a Name, MCA has provided Auto Check Facility to

check the availability of the Name, accordingly the Applicant and enter the new Optional name, in

case the Entity already registered with such proposed name and again has to make Auto Check.

When the MCA System provides a Green Remark, Applicant can submit the Applicant with such

name option for further Approval.

- Comments: In this field, Applicant can provide the details related to the Proposed Company and

activities including the Prior Approvals and TradeMark Registration Details, Resolution (for

Existing Company / Foreign Subsidiary Registration).

All applicable documents must be scanned in a single file to be attached to the Web-based

Application. After providing the details in the fields and requisite attachments, Applicant can submit

the Form Online with the prescribed fees. Name will be reserved only for 20 Days within which the

Applicant and/or Promoters are required to file form with MCA-Concerned ROC with requisite

documents as per the Incorporation Rules 2014 as per the Companies Act 2013.

As of April 2016 companies can also complete the name reservation through the SPICe form.

However, in practice, companies reserve the company name before completing the application for

incorporation, as that way company name is confirmed and there is no ambiguity and no chance

of SPICe form being rejected due to name rejection.

1-3 days

INR 1,000

3

Prepare and notarize affidavit by each founder and proposed director

: Notary

Agency

Each founder and proposed director has to submit an affidavit confirming that he/she is not

convicted of any offence in connection with the promotion, formation or management of any

company, or has not been found guilty of any fraud or misfeasance or of any breach of duty to any

company during the preceding five years and that all the documents filed with the Registrar for

registration of the company contain information that is correct and complete and true to the best of

his knowledge and belief. A separate notarized affidavit is required for each person.

As per the Companies Act Amendment 2017 (July 27, 2017), Section 7, the requirement for

affidavit to be submitted as part of incorporation documents has been replaced with a requirement

of declaration by the directors. However, in practice, companies continue submitting notarized

affidavits.

1 day, simultaneous

INR 10 (stamp paper) +

INR 35 (notarizing) for

each affidavit

India

Doing Business

2020

Page 14

4

Pay stamp duties, file the SPICE form and obtain the certificate of incorporation, DIN, PAN

and TAN

: Registrar of Companies (ROC)

Agency

Pursuant to Section 7 (1) of the Companies Act, 2013 and pursuant to Rule 10, 12, 14 and 15 of

Companies (Incorporation) Rules, 2014, the following forms are required to be electronically filed

on the website of the Ministry of Corporate Affairs for incorporation purposes.

It is mandatory for private limited companies to complete the incorporation process using the

SPICe Form (Form INC -32). Applications for director identification number (DIN), Permanent

Account Number (PAN) and a Tax deduction and Collection Account Number (TAN) have been

integrated completely into the SPICe form. The particulars of maximum three directors can be

mentioned in SPICe form and DIN may be allotted to maximum three proposed directors through

this. If new directors are proposed for an existing company, then a separate DIN application can

be submitted.

SPICe eMoA (INC-33) and SPICe eAoA (INC-34) have to be uploaded as ‘Linked Forms’ to SPICe

(INC-32). The documents submitted for SPICe need to be digitally signed by all directors

A consolidated challan gets generated at the time of filing SPICe(INC-32) which shall contain

applicable fee towards:

(i) Form Fee

(ii) MoA

(iii) AoA

(iv) PAN

(v) TAN

Two re-submissions are permitted for the SPICe form. On approval of SPICe forms, the Certificate

of Incorporation (CoI) is issued with PAN and TAN as allotted by the Income Tax Department. An

electronic mail with Certificate of Incorporation(CoI) as an attachment along with PAN and TAN is

also sent to the user. Finance Act, 2018 amended section 139A of the Income-tax Act, 1961 and

removed the requirement of issuing PAN in the form of a laminated card.

4 days

Fee schedule for a

company with paid-up

share capital below INR

1,500,000:

- Electronic filing of the

Memorandum of

Association (eMOA): none

- Electronic filing fee for

filing the Articles of

association (eAOA): none

- Electronic filing fee for

Form INC-32 SPICe: none

- Stamp duty: INR 10

- Stamp duty for Articles of

Association: INR 1,703

(0.15% of capital)

- Stamp duty for

Memorandum of

Association: INR 200

- PAN application: INR 110

(including 18% GST)

- TAN application: INR 65

(including 18% GST)

5

Make a company stamp

: Authorized vendor (Private)

Agency

As per the amendment to the Companies Act 2013, making a company seal is no longer a legal

requirement. However, making a company rubber stamp is still widely used in practice. The stamp

is normally required to be affixed by a director upon signing on behalf of the company in order to

file several applications relevant to business startup. A seal is also required in order to open a

bank account.

1 day, simultaneous

INR 500-1,000

6

Open a bank account

: Bank

Agency

The bank account details must be provided by the company in various post-registration

applications, such as registrations with GST.

After incorporation, company can immediately apply for bank account opening using electronically

provided CoI. Banks have introduced new KYC requirements, and request for multiple ID proofs

as well as address proofs, which results in a longer than usual processing time for providing with

bank account number.

The common documents required for account opening include:

• Certificate of Incorporation (CoI)

• MoA & AoA

• Communication address proof of company

• Registered address proof of company (if different from communication address)

• Board Resolution

• ID Proof of authorized signatory

• PAN card of company (now provided in CoI)

3 days

no charge

India

Doing Business

2020

Page 15

7

Obtain Goods and Service Tax (GST) Registration Number

: Department of Trade and Taxes, Government of NCT of Delhi

Agency

GST Registration of a business with the tax authorities implies obtaining a unique, 15-digit Goods

and Service Tax Identification Number (GSTIN) from the GST authorities so that all the operations

of and the data relating to the business can be collected and correlated. Registration under the

GST Act is mandatory if your aggregate annual PAN-based turnover exceeds INR 20,00,000

(Rupees Twenty Lakhs). However, in practice, for any operating business, a GST registration is

done immediately after incorporation.

To apply for a new registration, the following documents are required

- PAN card/details of business

- Valid and accessible e-mail ID and Mobile Number

- Documentary proof of constitution of business

- Documentary proof of promoters/partners - Documentary proof of principal place of business

- Details of Authorised Signatories including photographs and proof of appointment - Details of

Primary Authorised Signatory

- Business bank account details

- Valid Class II or Class III DSC of authorised signatory in case of companies and LLPs; valid

Class II or Class III DSC or Aadhaar (for E-Sign option).

A maximum of 10 Promoters/Partners/Directors can be added in the form. Passport photographs

need to be uploaded of all the Promoters/Partners/Directors whose details you are adding in the

application form. Further, each passport photograph must be in JPEG format and not more than

100 KB.

The first step to the registration process is the application and verification of PAN number, and the

subsequent issue of a Temporary Registration Number (TRN).

The applicant then needs to submit an application in Part B of FORM GST REG-01, duly signed,

along with documents specified.

The application is forwarded to the proper officer who examines it and the accompanying

documents and if found to be in order, approve the grant of registration to the applicant within

three working days from the date of submission of application.

The certificate of registration in FORM GST REG-06 showing the principal place of business and

additional place(s) of business is then made available to the applicant on the Common Portal and

a GSTIN is assigned in the following format:

- two characters for the State code;

- ten characters for the PAN or the Tax Deduction and Collection Account Number;

- two characters for the entity code; and

- one checksum character.

3 days

no charge

8

Register with the Employees' Provident Fund Organization (EPFO) and the Employees'

State Insurance Corporation (ESIC)

: Shram Suvidha Portal of Ministry of Labour and Employment

Agency

The Employees Provident Fund Organization (EPFO) is a statutory organization under the

Ministry of Labor and Employment. The Employees Provident Funds & Miscellaneous Provisions

Act, 1952 applies to an establishment, employing 20 or more persons and engaged in any of the

183 Industries and Classes of business establishments, throughout India excluding the State of

Jammu and Kashmir. Furthermore, new companies are required to register with the Employees'

State Insurance Corporation (ESIC).

On April 30, 2017, an online registration was introduced the Shram Suvidha Portal combining the

EPFO and ESIC registrations into one. However, it was not a preferred method for the majority

since paper copies had still to be filed after the online registration. In April 1, 2018, the electronic

registration process was further enhanced and it became the only option to register for ESIC and

EPFO. EPFO & ESIC registration is now done on the same Shram Suvidha portal

(https://registration.shramsuvidha.gov.in) and in one application. However, the website was

reported to be quite slow and with numerous glitches during the registration process – fields not

accepting information, the screen timing out, etc. As a result, although registration is done

electronically, it can take a long time in practice.

1 day, simultaneous

no charge

9

Visit EPFO to obtain approval of registration

: Employees' Provident Fund Organization

Agency

After online registration for EPFO, company visits the assistant labor commission in EPFO in

order to obtain approval for registration. This is a common practice in Delhi. In some cases,

several visits might be required prior the approval is provided.

3 days

no charge

10

Register online under the Delhi Shops and Establishments Act

: Department of Labor - Government of NCT of Delhi

Agency

Under the Delhi Shops and Establishments Act 1954, the company shall send to the Chief

Inspector a statement in prescribed form A containing:

(a) the name of the employer and the manager

(b) the postal address of the establishment

(c) the name of the establishment,

(d) the category of the establishment, i.e. whether it is a shop/commercial establishment

(e) the number of employees working in the establishment; and

(f) such other particulars as may be prescribed.

Upon receipt of the statement, a registration certificate will be generated online instantly.

Less than one day

(online procedure),

simultaneous

no charge

India

Doing Business

2020

Page 16

Takes place simultaneously with previous procedure.

India

Doing Business

2020

Page 17

Dealing with Construction Permits

This topic tracks the procedures, time and cost to build a warehouse—including obtaining necessary the licenses and permits, submitting all required notifications,

requesting and receiving all necessary inspections and obtaining utility connections. In addition, the Dealing with Construction Permits indicator measures the building

quality control index, evaluating the quality of building regulations, the strength of quality control and safety mechanisms, liability and insurance regimes, and professional

certification requirements. The most recent round of data collection was completed in May 2019.

See the methodology for more information

What the indicators measure

Procedures to legally build a warehouse (number)

Submitting all relevant documents and obtaining all necessary

clearances, licenses, permits and certificates

•

Submitting all required notifications and receiving all necessary

inspections

•

Obtaining utility connections for water and sewerage

•

Registering and selling the warehouse after its completion

•

Time required to complete each procedure (calendar days)

Does not include time spent gathering information

•

Each procedure starts on a separate day—though procedures

that can be fully completed online are an exception to this rule

•

Procedure is considered completed once final document is

received

•

No prior contact with officials

•

Cost required to complete each procedure (% of income per

capita)

Official costs only, no bribes

•

Building quality control index (0-15)

Quality of building regulations (0-2)

•

Quality control before construction (0-1)

•

Quality control during construction (0-3)

•

Quality control after construction (0-3)

•

Liability and insurance regimes (0-2)

•

Professional certifications (0-4)

•

Case study assumptions

To make the data comparable across economies, several assumptions about the construction

company, the warehouse project and the utility connections are used.

The construction company (BuildCo):

- Is a limited liability company (or its legal equivalent) and operates in the economy’s largest

business city. For 11 economies the data are also collected for the second largest business city.

- Is 100% domestically and privately owned; has five owners, none of whom is a legal entity. Has a

licensed architect and a licensed engineer, both registered with the local association of architects

or engineers. BuildCo is not assumed to have any other employees who are technical or licensed

experts, such as geological or topographical experts.

- Owns the land on which the warehouse will be built and will sell the warehouse upon its

completion.

The warehouse:

- Will be used for general storage activities, such as storage of books or stationery.

- Will have two stories, both above ground, with a total constructed area of approximately 1,300.6

square meters (14,000 square feet). Each floor will be 3 meters (9 feet, 10 inches) high and will be

located on a land plot of approximately 929 square meters (10,000 square feet) that is 100%

owned by BuildCo, and the warehouse is valued at 50 times income per capita.

- Will have complete architectural and technical plans prepared by a licensed architect. If

preparation of the plans requires such steps as obtaining further documentation or getting prior

approvals from external agencies, these are counted as procedures.

- Will take 30 weeks to construct (excluding all delays due to administrative and regulatory

requirements).

The water and sewerage connections:

- Will be 150 meters (492 feet) from the existing water source and sewer tap. If there is no water

delivery infrastructure in the economy, a borehole will be dug. If there is no sewerage

infrastructure, a septic tank in the smallest size available will be installed or built.

- Will have an average water use of 662 liters (175 gallons) a day and an average wastewater flow

of 568 liters (150 gallons) a day. Will have a peak water use of 1,325 liters (350 gallons) a day and

a peak wastewater flow of 1,136 liters (300 gallons) a day.

- Will have a constant level of water demand and wastewater flow throughout the year; will be 1

inch in diameter for the water connection and 4 inches in diameter for the sewerage connection.

India

Doing Business

2020

Page 18

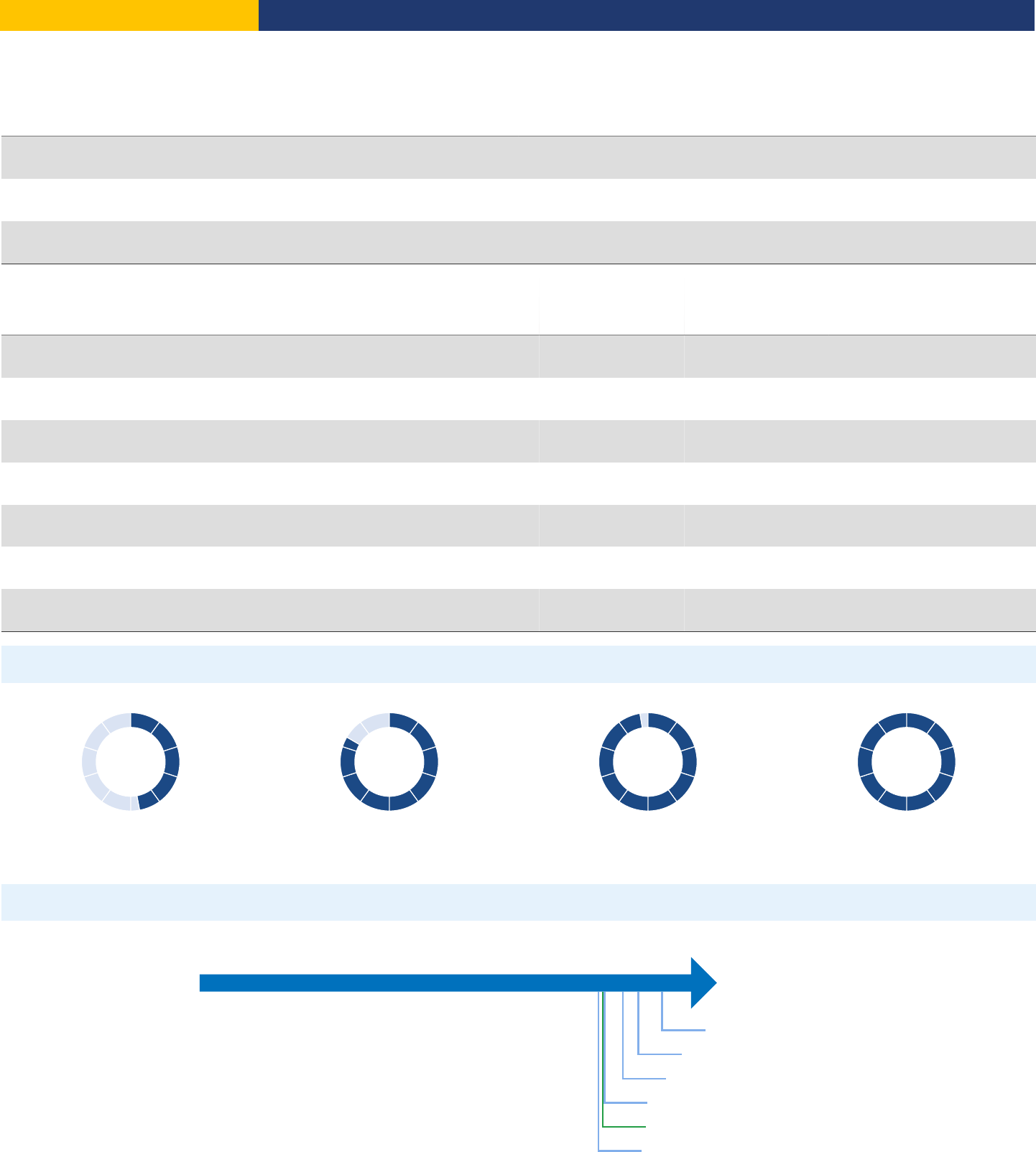

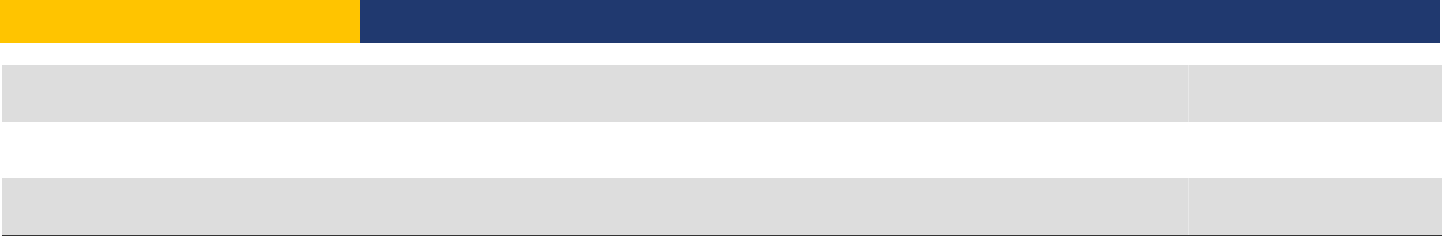

Dealing with Construction Permits - Mumbai

Figure – Dealing with Construction Permits in Mumbai – Score

Procedures

44.0

Time

79.3

Cost

72.9

Building quality control index

93.3

Figure – Dealing with Construction Permits in Mumbai and comparator economies – Ranking and Score

DB 2020 Dealing with Construction Permits Score

0 100

84.2: Delhi

77.3: China (Rank: 33)

72.4: Mumbai

68.8: Mexico (Rank: 93)

66.5: Pakistan (Rank: 112)

61.1: Bangladesh (Rank: 135)

Note: The ranking of economies on the ease of dealing with construction permits is determined by sorting their scores for dealing with construction permits. These scores

are the simple average of the scores for each of the component indicators.

Standardized Warehouse

Estimated value of warehouse

INR 6,968,643.60

City Covered

Mumbai

Indicator

Mumbai

South Asia

OECD high

income

Best Regulatory

Performance

Procedures (number)

19

14.6

12.7

None in 2018/19

Time (days)

98

149.7

152.3

None in 2018/19

Cost (% of warehouse value)

5.4

12.5

1.5

None in 2018/19

Building quality control index (0-15)

14.0

9.4

11.6

15.0 (6 Economies)

India

Doing Business

2020

Page 19

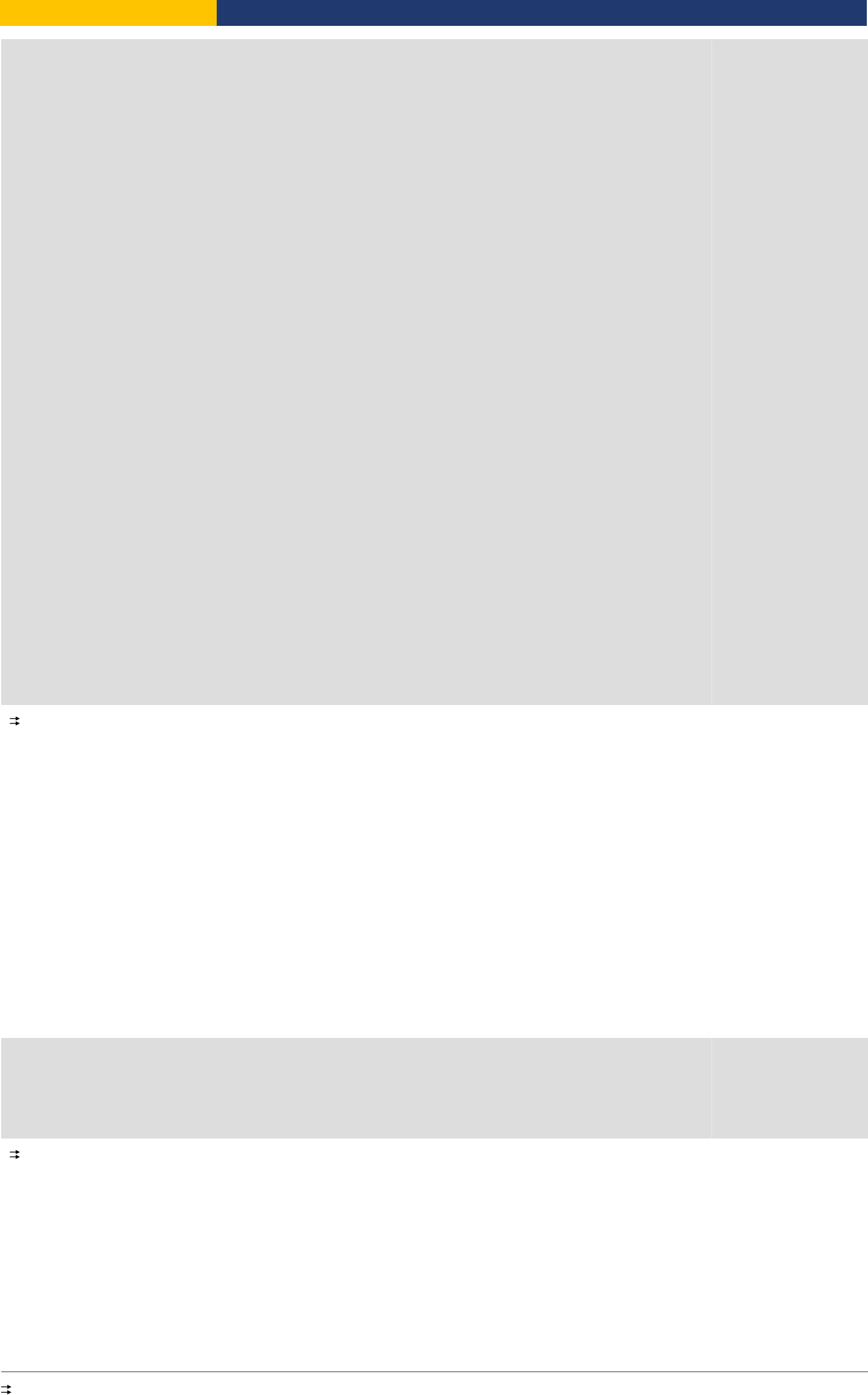

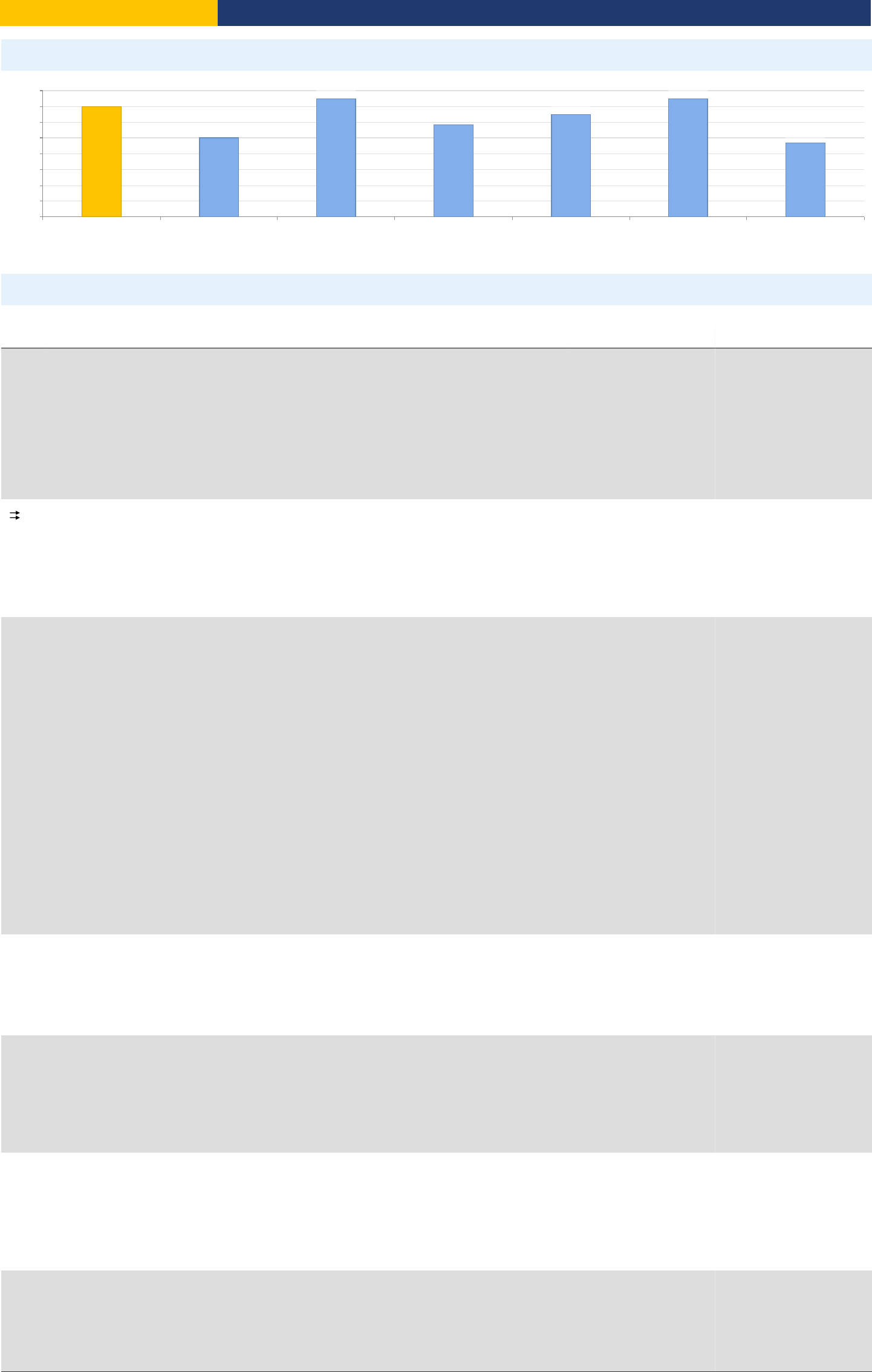

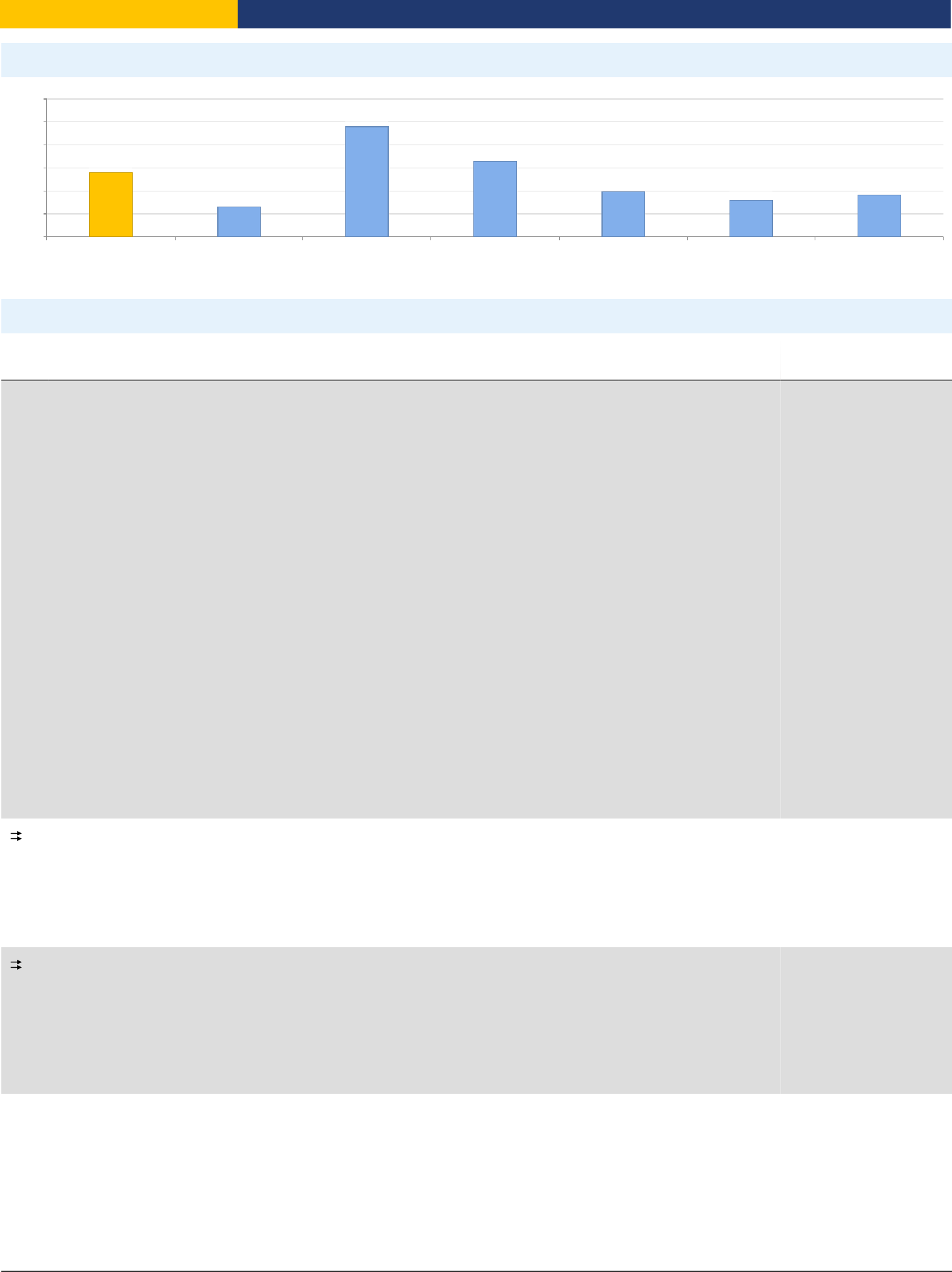

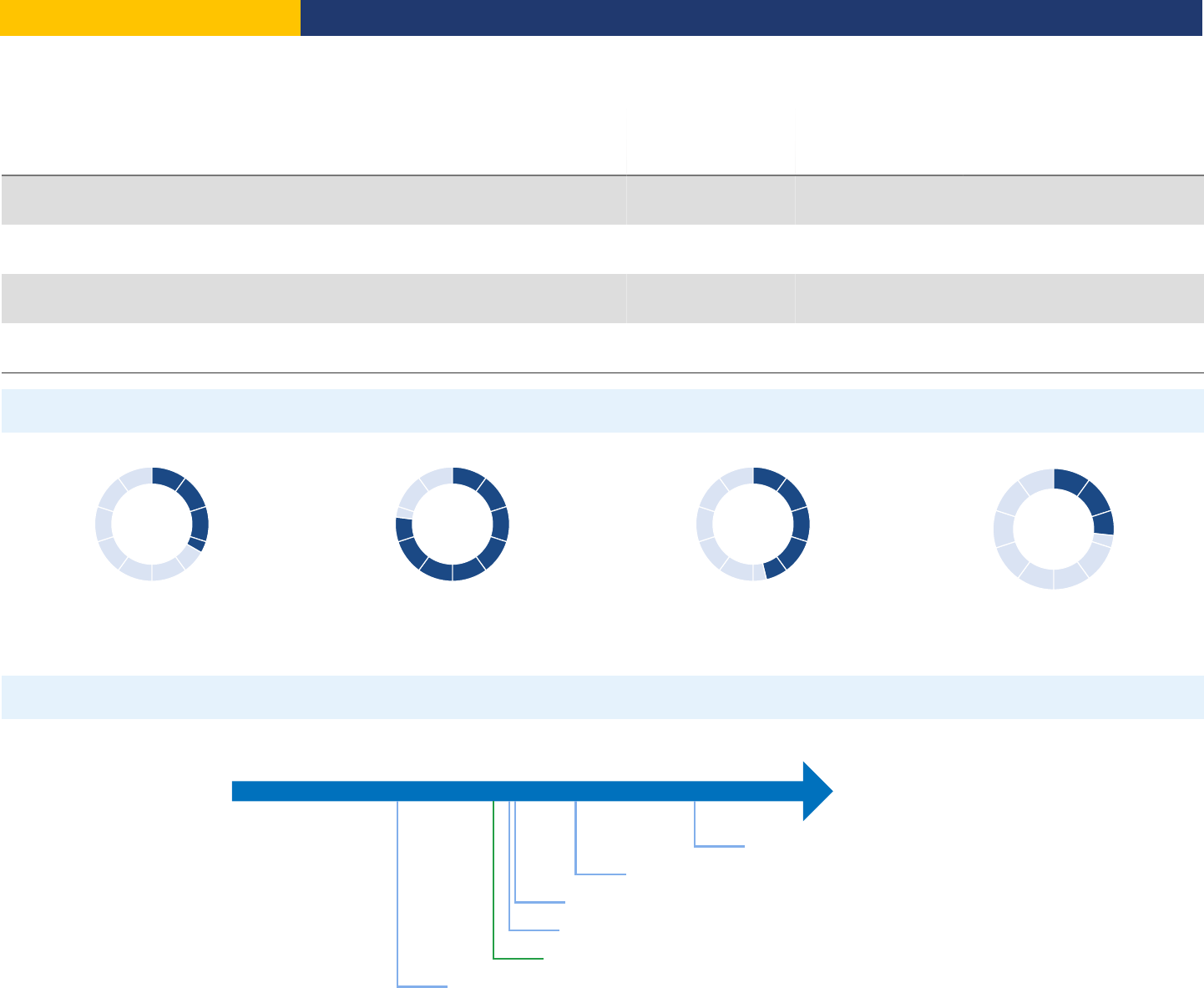

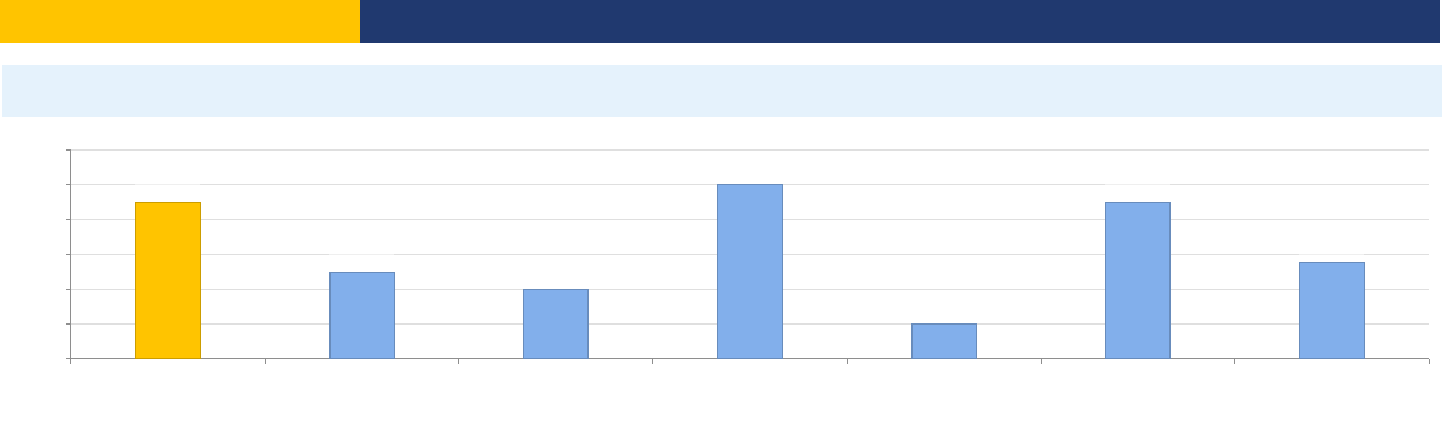

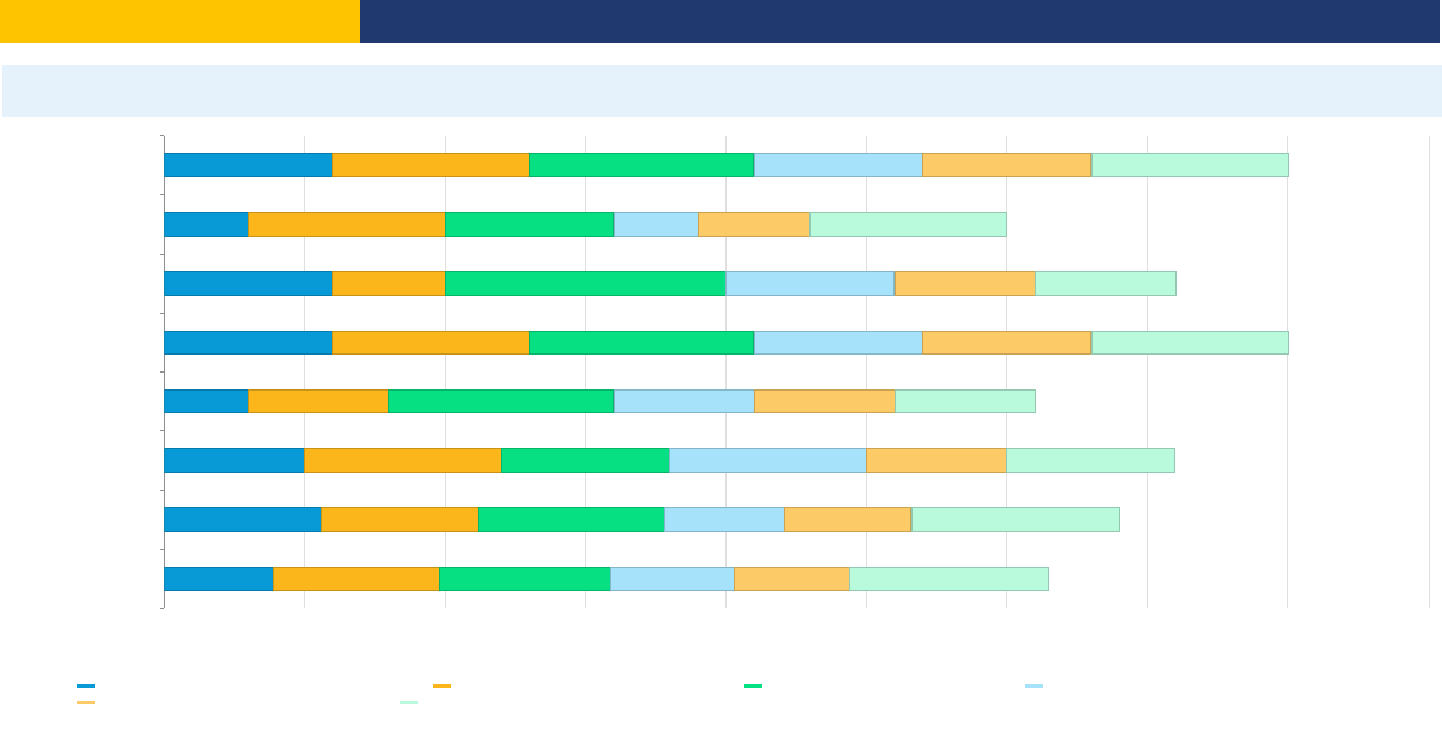

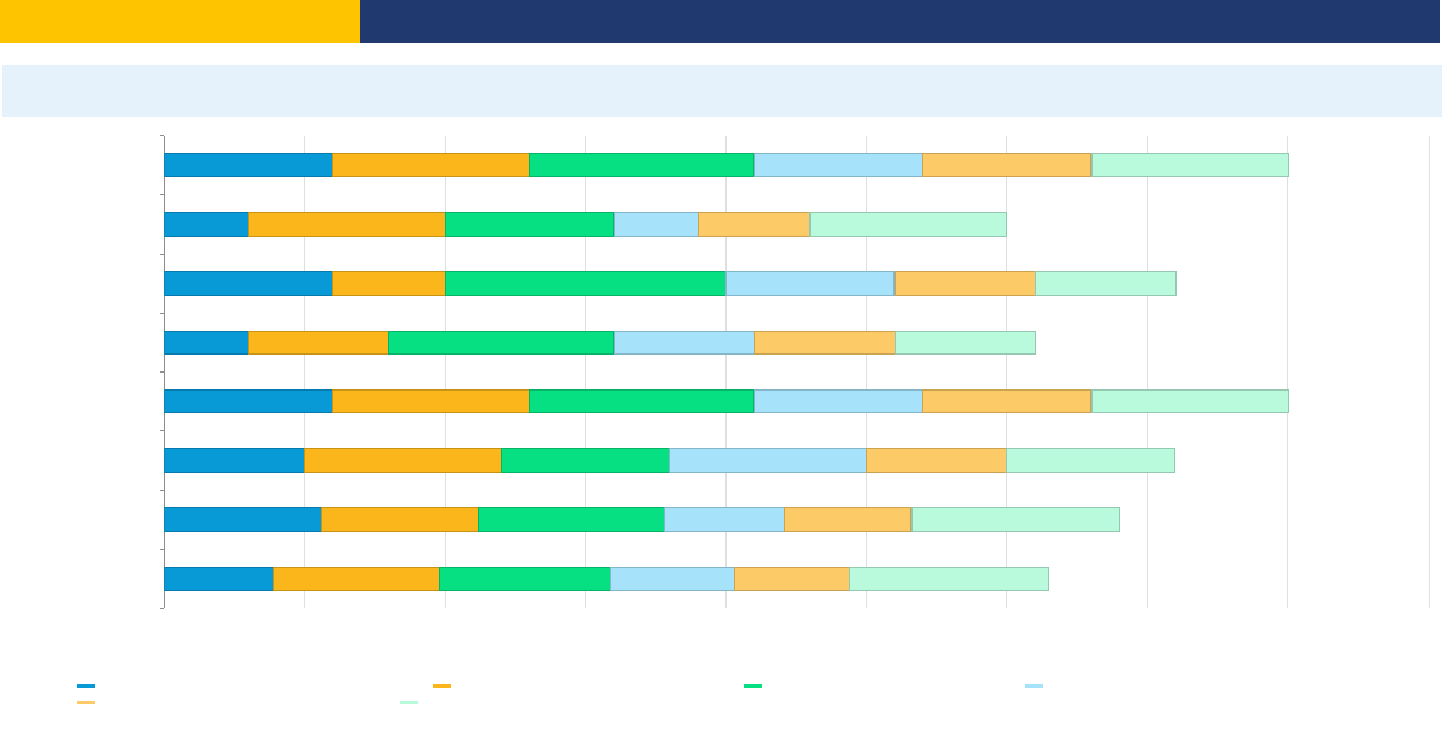

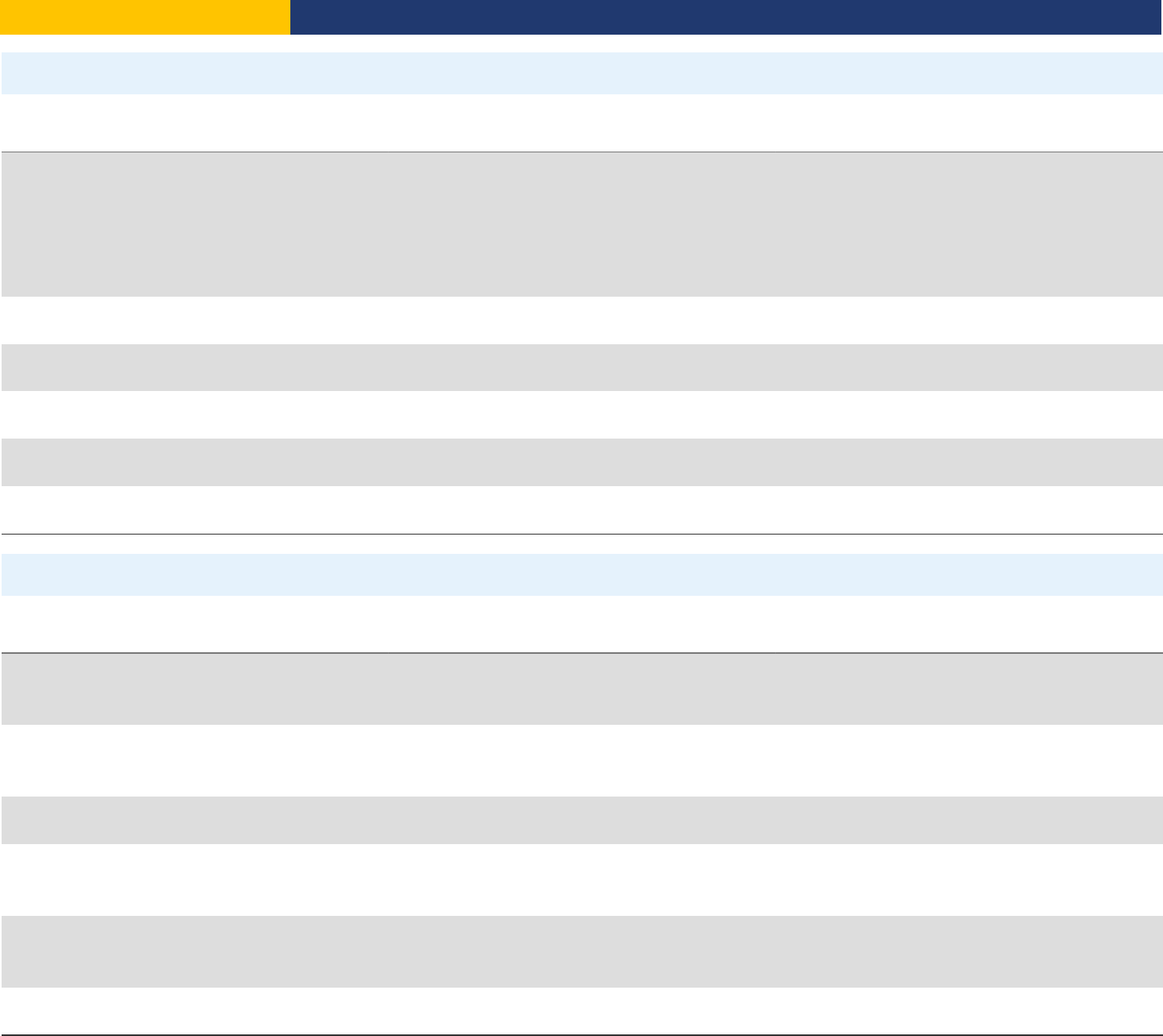

Figure – Dealing with Construction Permits in Mumbai – Procedure, Time and Cost

This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.

*

Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows the

time for women. For more information on methodology, see the

website (

). For details on the procedures

reflected here, see the summary below.

Doing Business

http://doingbusiness.org/en/methodology

Procedures (number)

1 * 2 3 4 5 6 7 8 9 10 11 12 * 13 14 * 15 * 16 17 18 19

0

20

40

60

80

Time (days)

0

0.5

1

1.5

2

2.5

Cost (% of warehouse value)

Time (days) Cost (% of warehouse value)

India

Doing Business

2020

Page 20

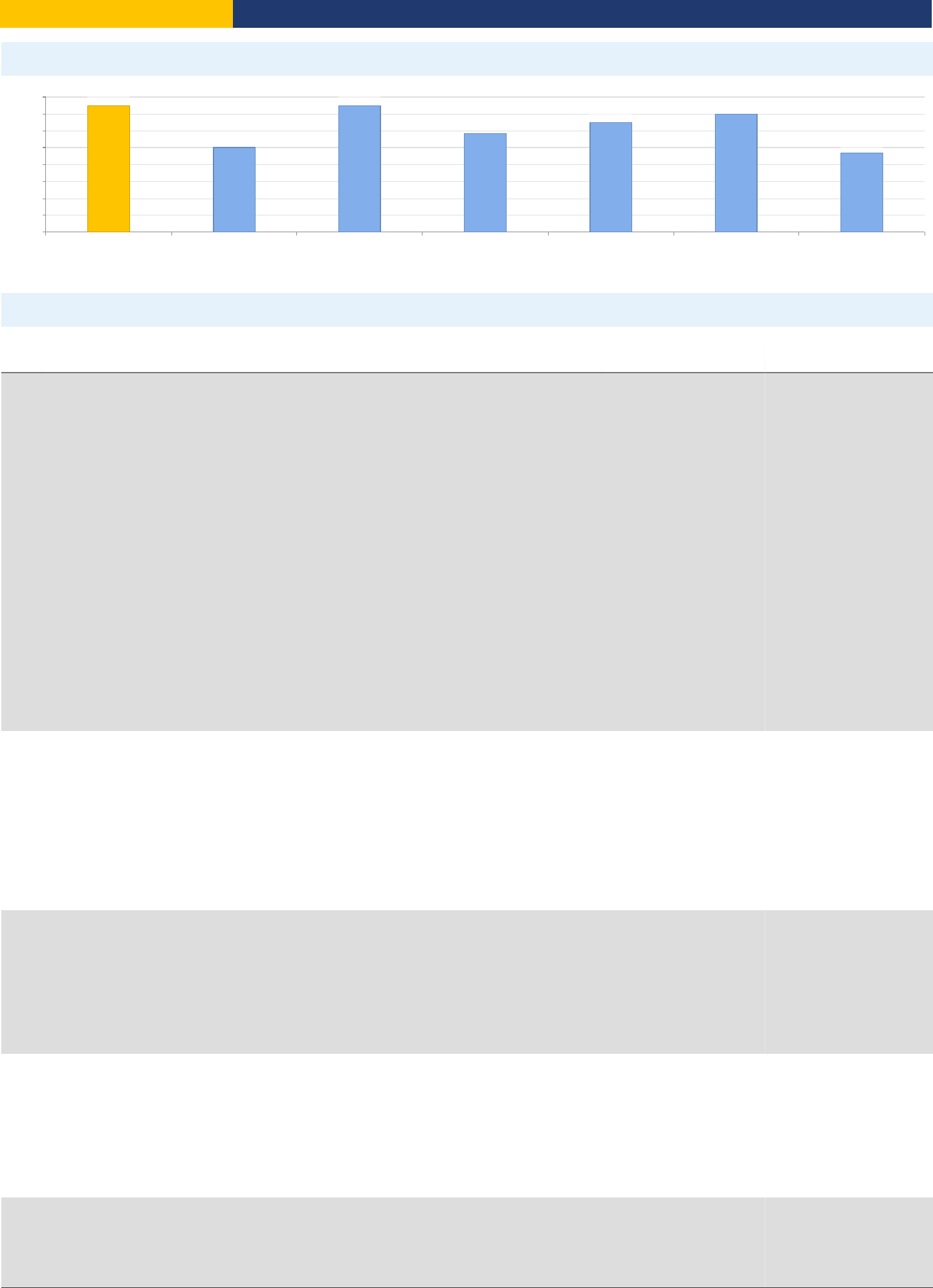

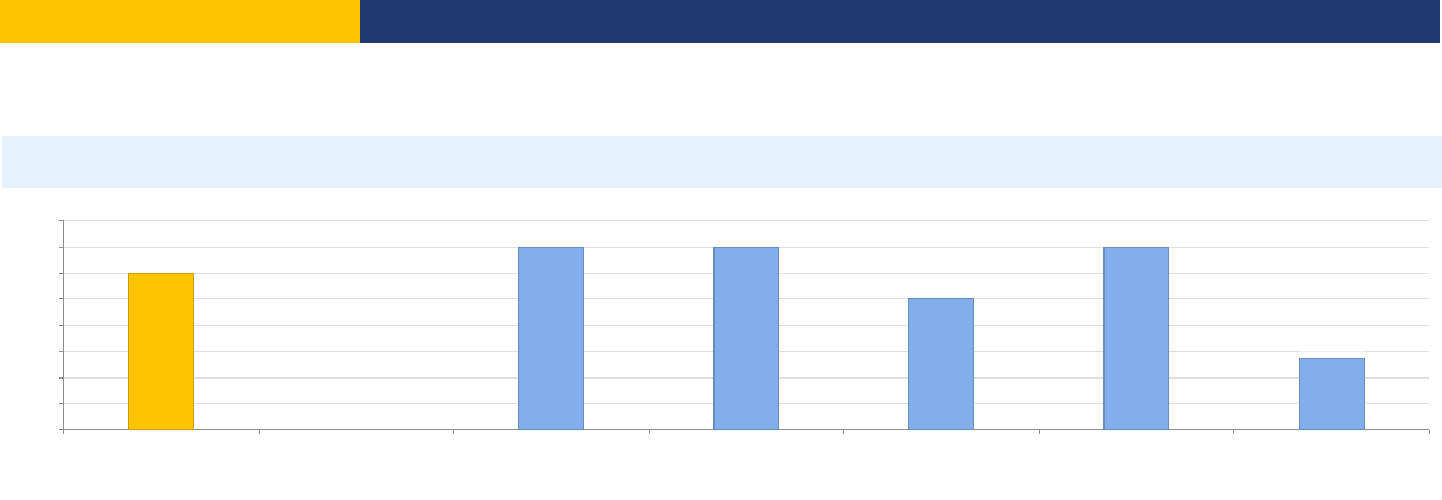

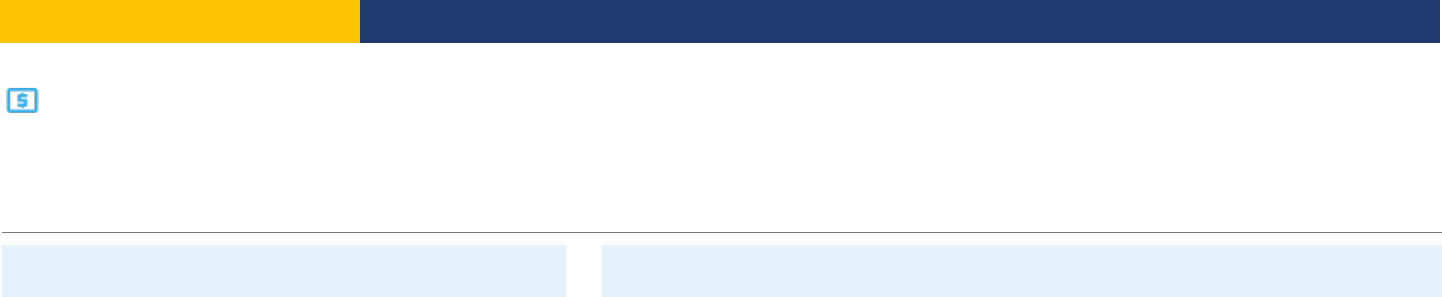

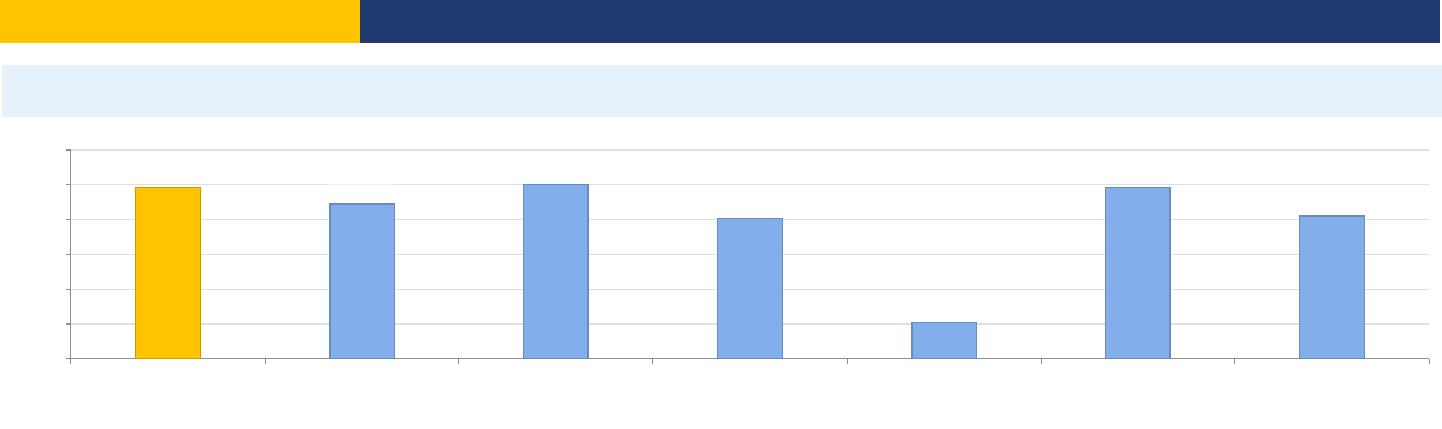

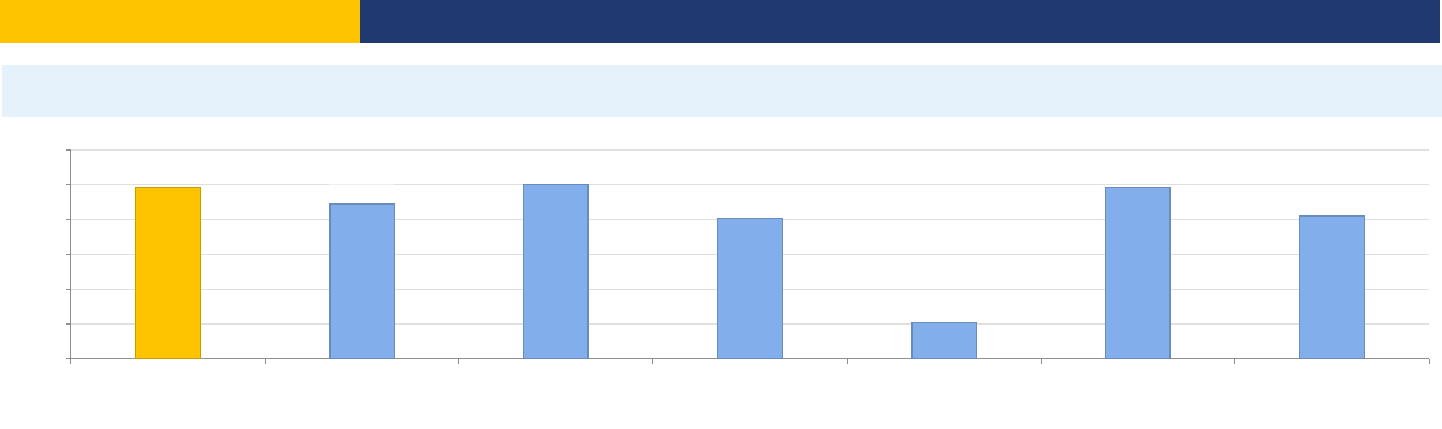

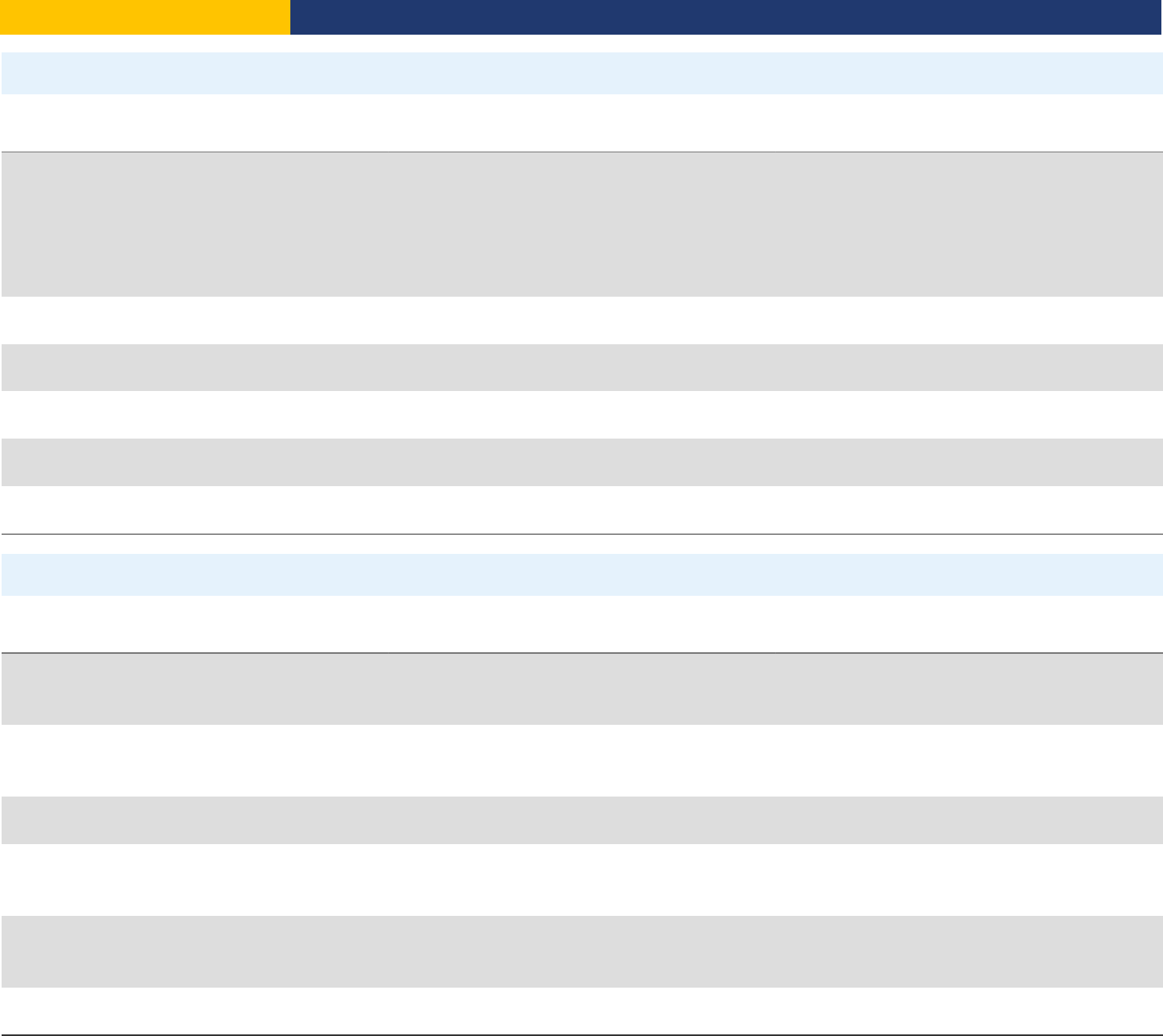

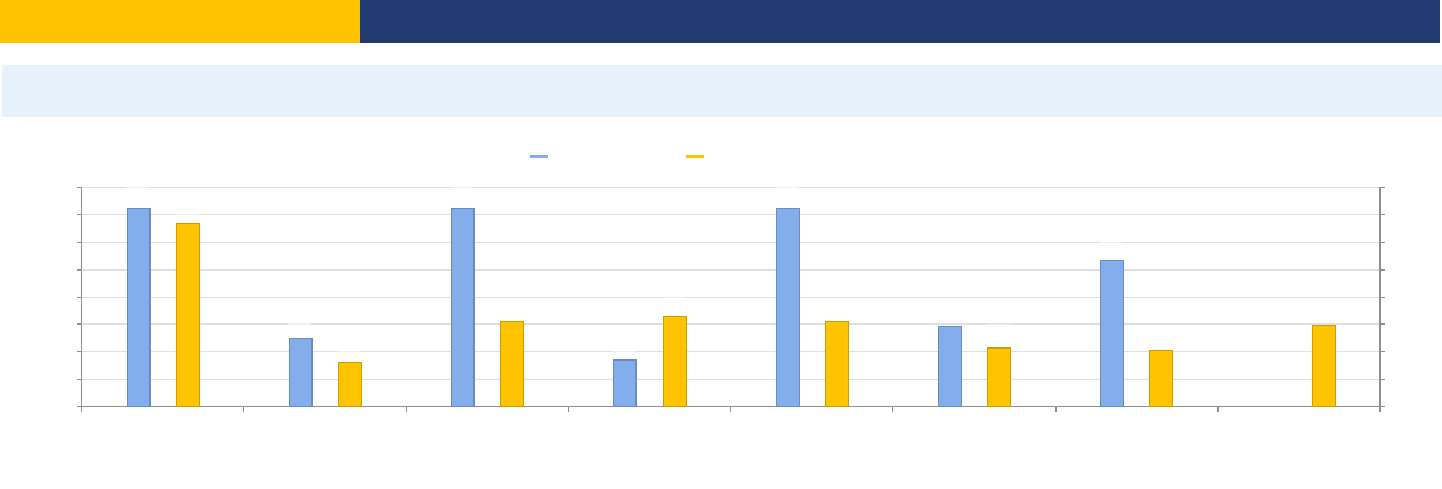

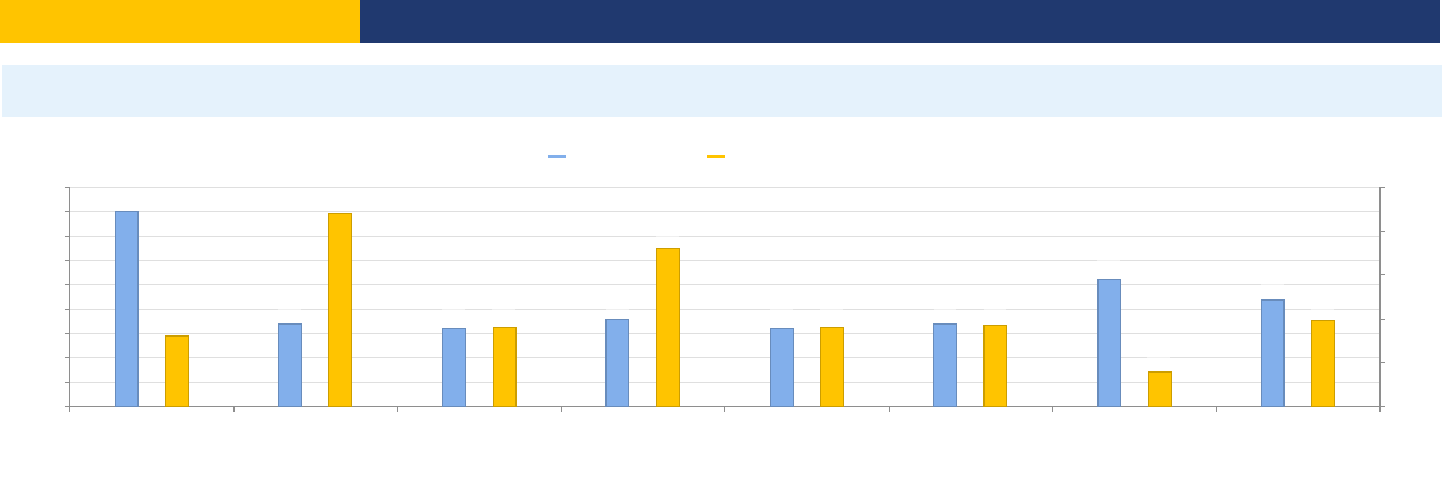

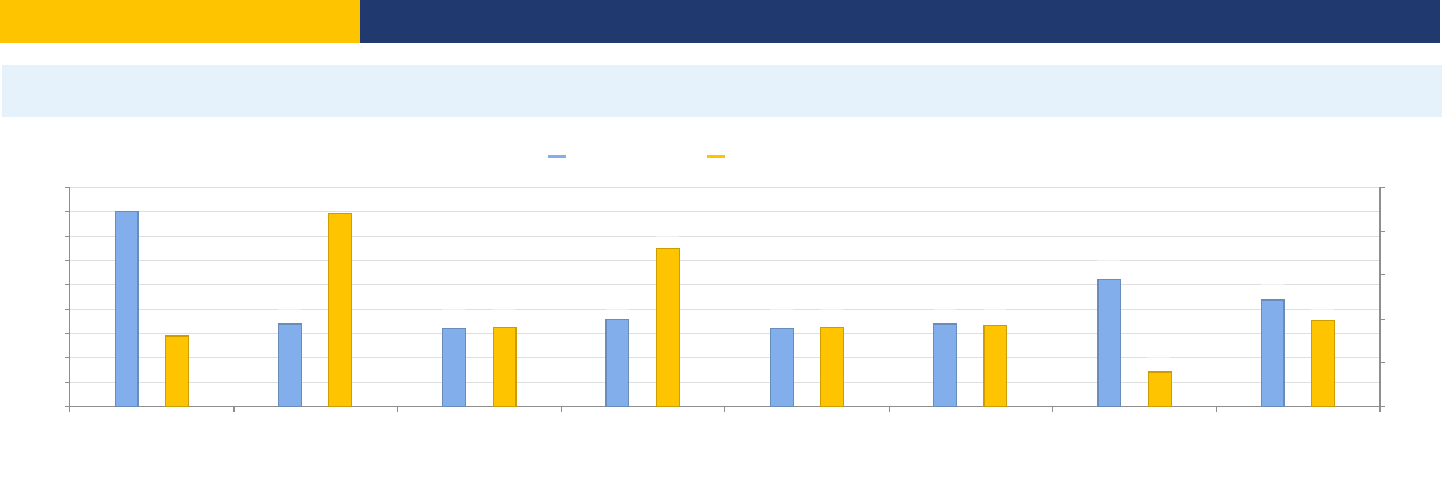

Figure – Dealing with Construction Permits in Mumbai and comparator economies – Measure of Quality

Mumbai Bangladesh China Mexico Pakistan Delhi South

Asia

0

2

4

6

8

10

12

14

16

Index score

14.0

10.0

15.0

11.7

13.0

15.0

9.4

Details – Dealing with Construction Permits in Mumbai – Procedure, Time and Cost

No.

Procedures

Time to Complete

Associated Costs

1

Obtain latest Property Register Card (P.R. Card) in words from the Revenue Department

: Revenue Department

Agency

The Property Register Card (P.R. Card) is a record showing the (i) Land ownership details; (ii)

historical ownership details; (iii) City Title Survey Number (CTS); (iv) Plot Number; (v) area of the

land; (vi) records of encumberances and mutations of the holdings held by the Revenue

Department about the Building Land/Plot. This P.R. Card is a mandatory document to be provided

to the MCGM when applying for a Building Permit. The Application for the P.R. Card is made to the

City Survey Officer (An Officer of the Revenue Department) by affixing a Rs.10 Court Fee Stamp.

10 days

INR 60

2

Obtain latest authenticated City Title Survey (CTS) Plan

: Collector's Office (Revenue Records Department)

Agency

The latest copy of the City Title Survey (CTS) Plan need to be obtained from Collector's office

(Revenue Records Department), and has to be certified by Land Records Officer as an authentic

document. This is required as MCGM needs to be certain that there have been no changes to

existing boundaries or structures since the original CTS plan was issued.

7 days

no charge

3

Submit application and design plans and pay scrutiny fee

: Building Proposal Office, Municipal Corporation of Greater Mumbai

Agency

BuildCo submits an online application Common Application Form of Online Building Plan Approval

System (OBPS) - alongwith all requisite documents and PreDCR drawings of proposed work at

http://autodcr.mcgm.gov.in. After uploading the drawings and essential documents, on payment of

scrutiny fees online the file/application will be accepted online by MCGM.

The concerned officer at the zonal building proposal office will scrutinize the proposal and

essential documents as per procedure. If all documents are in order and the file is complete,

BuildCo can proceed to pay the scrutiny fees online in the portal. No-Objection Certificates

(NOCs) for various agencies, including Stormwater and Drain Department, Sewerage Department,

Hydraulic Engineer Department, Roads and Traffic Department are obtained through the OBPS.

Uploaded PreDCR drawings will run through AutoDCR software for the verification of consumed

FSI in the proposal and to check if the various parameters of the proposed building are in

consonance with the provisions of DCR and policies in force. The building proposal office will

submit the file to the competent authority online for approval of required concessions, if any. On

receipt of approval to the concessions, the IOD will be given at Zonal EE(BP).

0.5 days

INR 26,385

4

Obtain no-objection certifcates (NOC) from various agencies

: Building Proposal Office, Municipal Corporation of Greater Mumbai

Agency

Once the application is submitted through the Online Building Plan Approval System (OBPS)

portal, the various agencies selected in the application who need to provide no objection

certificates review the proposal, and provide their NOCs in the portal.

21 days

no charge

5

Hire licensed fire safety consultant to obtain certification for Fire NOC

: Private consultant

Agency

BuildCo needs to hire a licensed fire safety consultant who prepares the Building Details Form 2

(for Active Fire Safety Measures) and at completion prepares the Form A along with its Annexure

about installation of all fire-fighting requirements / installations stipulated by the Mumbai Fire

Brigade.

1 day

INR 100,000

6

Obtain Intimation of Disapproval and pay fees

: Building Proposal Office, Municipal Corporation of Greater Mumbai

Agency

Intimation of Disapproval (IOD) is granted as per the provisions of Section 346 of MMC Act 1888.

The IOD includes various conditions to be complied before requesting for further approvals.

Upon submission of online application through CAF, the IOD is issued within 29 days.

29 days

INR 4,200

7

Obtain excavation permission

: Office of the Collector, Mumbai/Suburban District

Agency

Excavation permission needs to be obtained from Office of Collector. This permit is a requirement

for the Construction and Debris Management Plan to be submitted by BuildCo to municipality. The

cost of the permit depends on the amount of soil being excavated.

7 days

INR 40,000

India

Doing Business

2020

Page 21

Takes place simultaneously with previous procedure.

8

Obtain plinth commencement certificate and pay development charges

: Building Proposal Office, Municipal Corporation of Greater Mumbai

Agency

Once IOD has been issued, the applicant may submit a request for the commencement certificate

on the Online Building Building Approval System (OBPS) portal. The documents and NOC

submitted by the applicants are verified on the portal by the staff (Licesnsed Engineer, Sub-

Engineer, Assistant Engineer, Executive Engineer) and the necessary commencement certificate

is issued through the portal. After payment of development charges and other applicable premium

the commencement certificate is issued within 7 days.

0.5 days

INR 149,708

9

Request and receive inspection of plinth

: Building Proposal Office, Municipal Corporation of Greater Mumbai

Agency

1 day

no charge

10

Request and obtain further commencement certificate

: Building Proposal Office, Municipal Corporation of Greater Mumbai

Agency

The building permit is done in 2 steps. First, BuildCo must obtain the permit up to the plinth level.

Once the plinth level has been completed, there is an inspection to verify that is in compliance

with approved plans. It is only after this inspection has been done and approval obtained that the

BuildCo can move on with the construction and start the superstructure of the warehouse. But in

order to do so, it is necessary to obtain a permit to start building the superstructure.

7 days

no charge

11

Request completion NOCs from various agencies through the Common Completion

Request Form (CCRF)

: Chief Fire Office, Municipal Corporation of Greater Mumbai

Agency

0.5 days

no charge

12

Receive inspection from Storm Water and Drain Department

: Storm Water and Drain Department, Municipal Corporation of Greater Mumbai

Agency

The Assistant Engineer of the Municipal Corporation makes the inspection. There are two

inspections: one before the connections are completed and another after completion. The

inspection would not take more than a day. An officer of the Municipal Corporation inspects the

premises and prepares a report on the connection.

1 day

no charge

13

Receive inspection from Sewerage Department

: Sewerage Department, Municipal Corporation of Greater Mumbai

Agency

1 day

no charge

14

Obtain water connection from Hydraulic Engineer

: Hydraulic Engineer Department, Municipal Corporation of Greater Mumbai

Agency

3 days

no charge

15

Receive inspection from Roads & Traffic Department

: Roads &Traffic Department, Municipal Corporation of Greater Mumbai

Agency

1 day

no charge

16

Receive inspection from Chief Fire Office

: Chief Fire Office, Municipal Corporation of Greater Mumbai

Agency

1 day

no charge

17

Submit letter stating completion of building works to obtain an occupancy certificate and

certificate of completion

: Building Proposal Office, Municipal Corporation of Greater Mumbai

Agency

The owner, through a licensed plumber, shall furnish a drainage completion certificate to certify

that the works were completed according to approved drainage plans. The licensed surveyor,

engineer, or architect who has supervised the construction shall furnish a building completion

certificate to certify that the building has not deviated from the approval plans. These certifications

are submitted online through the portal. Following the reception of both certificates of completion

MCGM shall inspect the work, and after satisfying that there is no deviation from the approved

plans, issue a certificate of acceptance of the completion of the work.

0.5 days

no charge

18

Receive final inspection from Building Proposal Office

: Building Proposal Office, Municipal Corporation of Greater Mumbai

Agency

1 day

no charge

19

Obtain Completion and Occupancy Certificate from online portal

: Building Proposal Office, Municipal Corporation of Greater Mumbai

Agency

Once the final inspection has been concluded and the final plans are stamped by the Building

Proposal Office, the combined Completion certificate and Occupancy certificate are issued. The

final stamped plans by the Building Proposal Office and a copy of the Completion and Occupancy

certificate are forwarded to the Hydraulic Engineer (Water) Department.

Fees for water connection include:

• Water connection charges: INR 1,060.00

• Water meter: INR 150.00

• Refundable security deposit towards water charges bills at INR 25.00 per 1,000 liter + 60% of

sewerage charges for the requirement of the building

Sewer fees are INR 50,000

14 days

INR 57,713

India

Doing Business

2020

Page 22

Details – Dealing with Construction Permits in Mumbai – Measure of Quality

Answer

Score

Building quality control index (0-15)

14.0

Quality of building regulations index (0-2)

2.0

How accessible are building laws and regulations in your economy? (0-1)

Available online; Free

of charge.

1.0

Which requirements for obtaining a building permit are clearly specified in the building regulations or on any

accessible website, brochure or pamphlet? (0-1)

List of required

documents; Fees to

be paid; Required

preapprovals.

1.0

Quality control before construction index (0-1)

1.0

Which third-party entities are required by law to verify that the building plans are in compliance with existing

building regulations? (0-1)

Licensed architect;

Licensed engineer.

1.0

Quality control during construction index (0-3)

2.0

What types of inspections (if any) are required by law to be carried out during construction? (0-2)

Inspections by in-

house engineer;

Inspections at various

phases.

1.0

Do legally mandated inspections occur in practice during construction? (0-1)

Mandatory

inspections are

always done in

practice.

1.0

Quality control after construction index (0-3)

3.0

Is there a final inspection required by law to verify that the building was built in accordance with the approved

plans and regulations? (0-2)

Yes, final inspection

is done by

government agency;

Yes, in-house

engineer submits

report for final

inspection.

2.0

Do legally mandated final inspections occur in practice? (0-1)

Final inspection

always occurs in

practice.

1.0

Liability and insurance regimes index (0-2)

2.0

Which parties (if any) are held liable by law for structural flaws or problems in the building once it is in use

(Latent Defect Liability or Decennial Liability)? (0-1)

Architect or engineer;

Professional in

charge of the

supervision;

Construction

company; Owner or

investor.

1.0

Which parties (if any) are required by law to obtain an insurance policy to cover possible structural flaws or

problems in the building once it is in use (Latent Defect Liability Insurance or Decennial Insurance)? (0-1)

Architect or engineer;

Professional in

charge of the

supervision;

Construction

company.

1.0

Professional certifications index (0-4)

4.0

What are the qualification requirements for the professional responsible for verifying that the architectural plans

or drawings are in compliance with existing building regulations? (0-2)

Minimum number of

years of experience;

University degree in

architecture or

engineering; Being a

registered architect or

engineer.

2.0

India

Doing Business

2020

Page 23

What are the qualification requirements for the professional who supervises the construction on the ground? (0-

2)

Minimum number of

years of experience;

University degree in

engineering,

construction or

construction

management; Being

a registered architect

or engineer.

2.0

India

Doing Business

2020

Page 24

Dealing with Construction Permits - Delhi

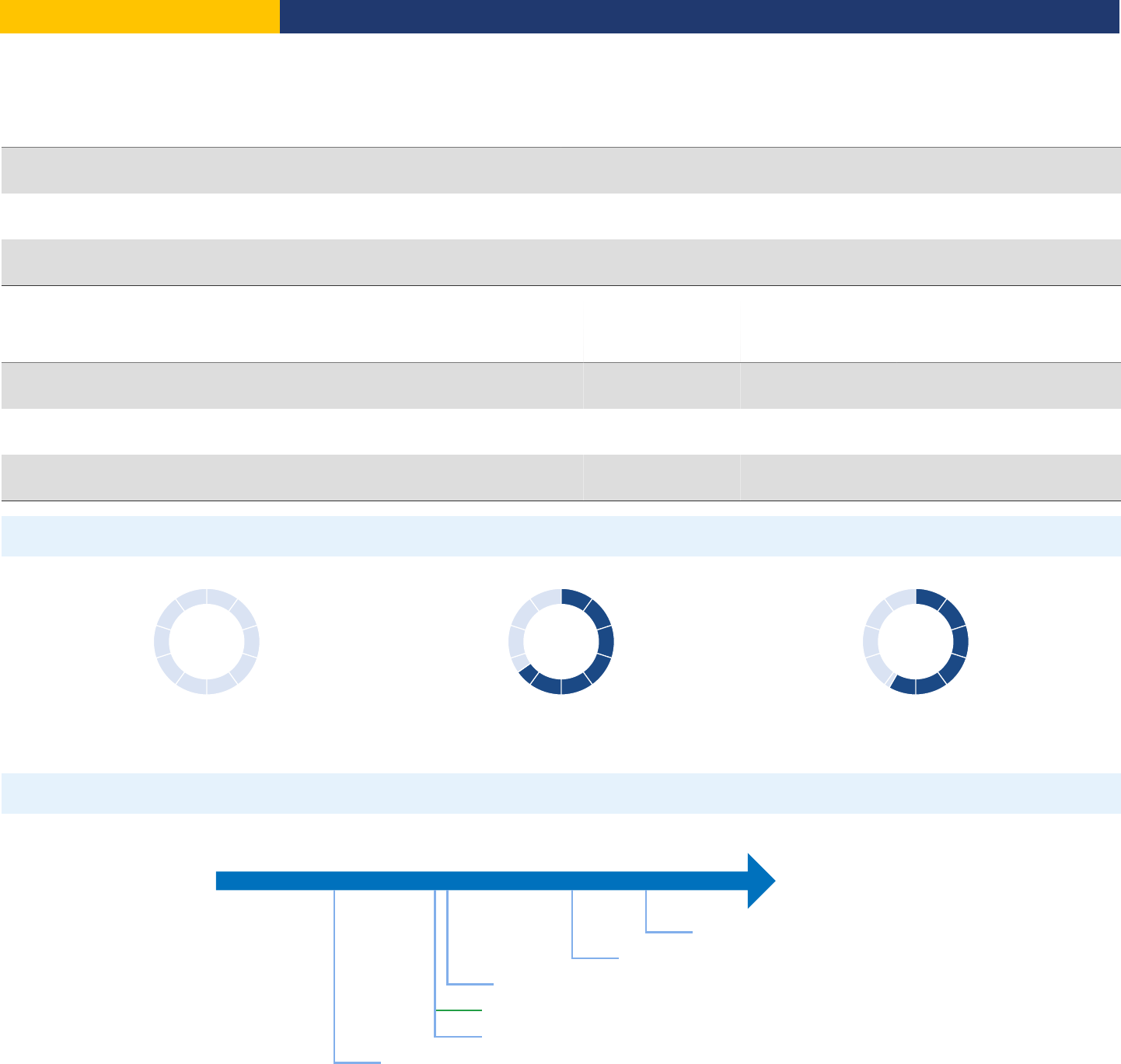

Figure – Dealing with Construction Permits in Delhi – Score

Procedures

76.0

Time

74.8

Cost

86.2

Building quality control index

100.0

Figure – Dealing with Construction Permits in Delhi and comparator economies – Ranking and Score

DB 2020 Dealing with Construction Permits Score

0 100

84.2: Delhi

77.3: China (Rank: 33)

72.4: Mumbai

68.8: Mexico (Rank: 93)

66.5: Pakistan (Rank: 112)

61.1: Bangladesh (Rank: 135)

Note: The ranking of economies on the ease of dealing with construction permits is determined by sorting their scores for dealing with construction permits. These scores

are the simple average of the scores for each of the component indicators.

Standardized Warehouse

Estimated value of warehouse

INR 6,968,643.60

City Covered

Delhi

Indicator

Delhi

South Asia

OECD high

income

Best Regulatory

Performance

Procedures (number)

11

14.6

12.7

None in 2018/19

Time (days)

113.5

149.7

152.3

None in 2018/19

Cost (% of warehouse value)

2.8

12.5

1.5

None in 2018/19

Building quality control index (0-15)

15.0

9.4

11.6

15.0 (6 Economies)

India

Doing Business

2020

Page 25

Figure – Dealing with Construction Permits in Delhi – Procedure, Time and Cost

This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.

*

Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows the

time for women. For more information on methodology, see the

website (

). For details on the procedures

reflected here, see the summary below.

Doing Business

http://doingbusiness.org/en/methodology

Procedures (number)

1 2 3 4 5 6 7 8 9 10 11

0

20

40

60

80

100

Time (days)

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

Cost (% of warehouse value)

Time (days) Cost (% of warehouse value)

India

Doing Business

2020

Page 26

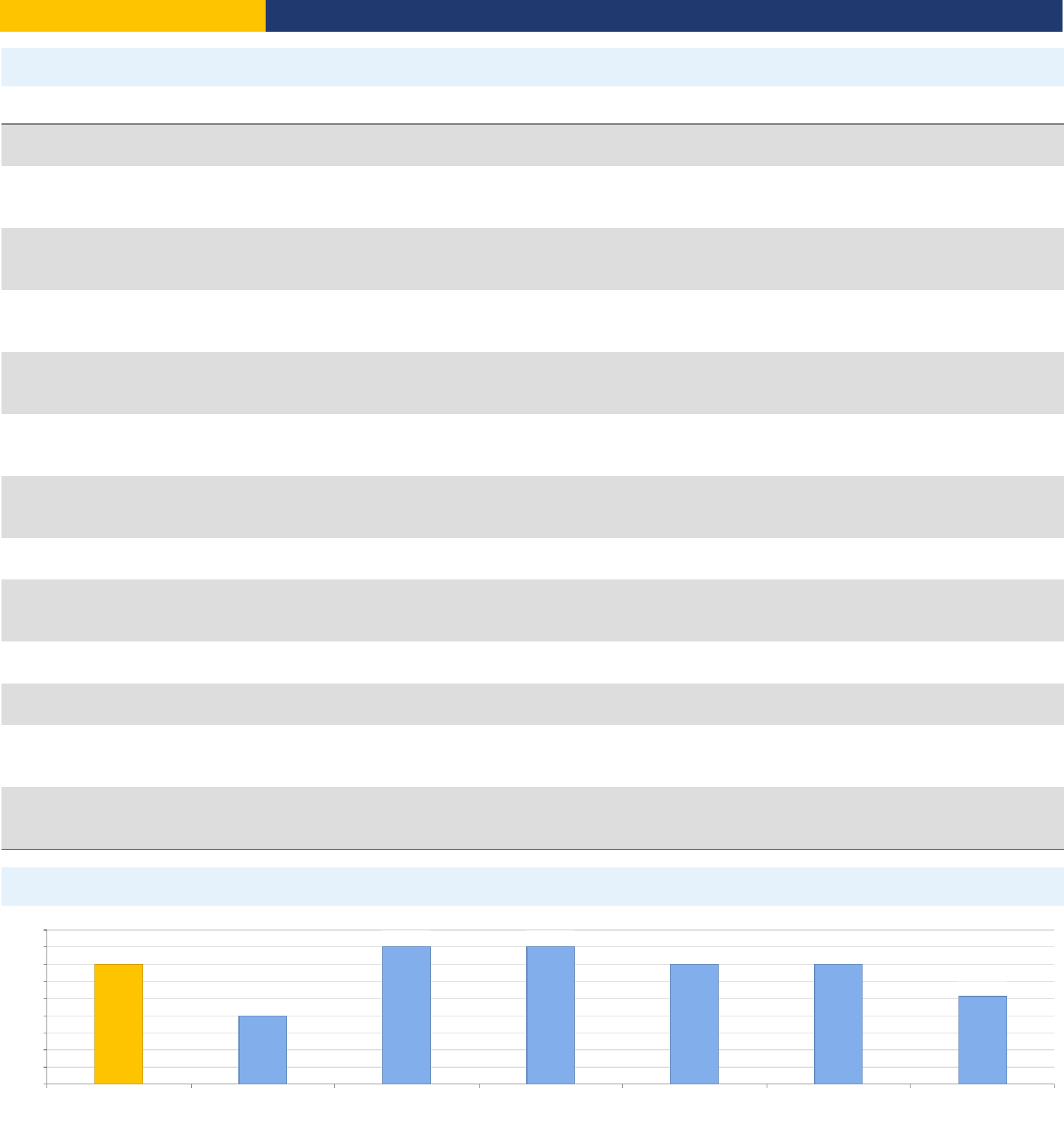

Figure – Dealing with Construction Permits in Delhi and comparator economies – Measure of Quality

Delhi Bangladesh China Mexico Pakistan Mumbai South

Asia

0

2

4

6

8

10

12

14

16

Index score

15.0

10.0

15.0

11.7

13.0

14.0

9.4

Details – Dealing with Construction Permits in Delhi – Procedure, Time and Cost

No.

Procedures

Time to Complete

Associated Costs

1

Submit online Common Application Form along with requisite building permit fees and

drawings

: Municipal Corporation of Delhi

Agency

BuildCo applies for the sanction of the building plans online through the Common Application

Form by submitting the following documents:

1. Building plan (Site plan, set back, architectural plans)

2. Proof of ownership

3. Specifications of the proposed construction

4. Supervision certificate signed by the licensed architect/engineer, supervisor and plumber;