DOING BUSINESS 2009

A copublication of the World Bank, the International Finance Corporation, and Palgrave Macmillan

© 2008 The International Bank for Reconstruction and Development / The World Bank

1818 H Street NW

Washington, DC 20433

Telephone 202-473-1000

Internet www.worldbank.org

E-mail [email protected]

All rights reserved.

1 2 3 4 08 07 06 05

A publication of the World Bank and the International Finance Corporation.

is volume is a product of the sta of the World Bank Group. e ndings, interpretations and conclusions expressed

in this volume do not necessarily reect the views of the Executive Directors of the World Bank or the governments

they represent. e World Bank does not guarantee the accuracy of the data included in this work.

Rights and Permissions

e material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without

permission may be a violation of applicable law. e World Bank encourages dissemination of its work and will

normally grant permission to reproduce portions of the work promptly.

For permission to photocopy or reprint any part of this work, please send a request with complete information to the

Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, USA; telephone 978-750-8400; fax 978-

750-4470; Internet: www.copyright.com.

All other queries on rights and licenses, including subsidiary rights, should be addressed to the Oce of the Publisher,

e World Bank, 1818 H Street NW, Washington, DC 20433, USA; fax: 202-522-2422; e-mail: pubrights@worldbank.org.

Additional copies of Doing Business 2009, Doing Business 2008, Doing Business 2007: How to Reform, Doing Business in

2006: Creating Jobs, Doing Business in 2005: Removing Obstacles to Growth and Doing Business in 2004: Understanding

Regulations may be purchased at www.doingbusiness.org.

ISBN: 978-0-8213-7609-6

E-ISBN: 978-0-8213-7610-2

DOI: 10.1596/978-0-8213-7609-6

ISSN: 1729-2638

Library of Congress Cataloging-in-Publication data has been applied for.

Doing Business 2009 is the sixth in a

series of annual reports investigating

the regulations that enhance business

activity and those that constrain it. Doing

Business presents quantitative indicators

on business regulations and the protec-

tion of property rights that can be com-

pared across 181 economies—from Af-

ghanistan to Zimbabwe—and over time.

Regulations aecting 10 stages of

the life of a business are measured: start-

ing a business, dealing with construction

permits, employing workers, registering

About Doing Business v

Overview 1

Starting a business 9

Dealing with construction permits 14

Employing workers 19

Registering property 24

Getting credit 29

Protecting investors 34

Paying taxes 39

Trading across borders 44

Enforcing contracts 49

Closing a business 54

References

58

Data notes

61

Ease of doing business

79

Country tables

85

ILO core labor standards

147

Acknowledgments

151

Contents

property, getting credit, protecting inves-

tors, paying taxes, trading across bor-

ders, enforcing contracts and closing a

business. Data in Doing Business 2009 are

current as of June 1, 2008. e indicators

are used to analyze economic outcomes

and identify what reforms have worked,

where and why.

e methodology for the legal rights

of lenders and borrowers, part of the get-

ting credit indicators, changed for Doing

Business 2009. See Data notes for details.

Current features

News on the Doing Business project

http://www.doingbusiness.org

Rankings

How economies rank—from 1 to 181

http://www.doingbusiness.org/

economyrankings

Reformers

Short summaries of DB2009 reforms, lists

of reformers since DB2004 and a ranking

simulation tool

http://www.doingbusiness.org/reformers

Data time series

Customized data sets since DB2004

http://www.doingbusiness.org/customquery

Methodology and research

The methodologies and research papers

underlying Doing Business

http://www.doingbusiness.org/

MethodologySurveys

Blog

Online journal focusing on business

regulation reform

http://blog.doingbusiness.org

Downloads

Doing Business reports as well as subnational,

country and regional reports and case studies

http://www.doingbusiness.org/downloads

Subnational projects

Dierences in business regulations at the

subnational level

http://www.doingbusiness.org/subnational

Law library

Online collection of business laws and

regulations

http://www.doingbusiness.org/lawlibrary

Local partners

More than 6,700 specialists in 181 economies

who participate in Doing Business

http://www.doingbusiness.org/LocalPartners

Reformers’ Club

Celebrating the top 10 Doing Business

reformers

http://www.reformersclub.org

Business Planet

Interactive map on the ease of doing business

http://www.doingbusiness.org/map

STARTING A BUSINESS

v

About Doing

Business

In 1664 William Petty, an adviser to

England’s Charles II, compiled the rst

known national accounts. He made 4

entries. On the expense side, “food, hous-

ing, clothes and all other necessaries”

were estimated at £40 million. National

income was split among 3 sources: £8

million from land, £7 million from other

personal estates and £25 million from

labor income.

In later centuries estimates of coun-

try income, expenditure and material

inputs and outputs became more abun-

dant. But it was not until the 1940s that

a systematic framework was developed

for measuring national income and ex-

penditure, under the direction of British

economist John Maynard Keynes. As the

methodology became an international

standard, comparisons of countries’ -

nancial positions became possible. Today

the macroeconomic indicators in na-

tional accounts are standard in every

country.

Governments committed to the eco-

nomic health of their country and op-

portunities for its citizens now focus on

more than macroeconomic conditions.

ey also pay attention to the laws, regu-

lations and institutional arrangements

that shape daily economic activity.

Until very recently, however, there

were no globally available indicator sets

for monitoring these microeconomic

factors and analyzing their relevance.

e rst eorts, in the 1980s, drew on

perceptions data from expert or business

surveys. Such surveys are useful gauges

of economic and policy conditions. But

their reliance on perceptions and their

incomplete coverage of poor countries

limit their usefulness for analysis.

e Doing Business project, launched

7 years ago, goes one step further. It looks

at domestic small and medium-size com-

panies and measures the regulations ap-

plying to them through their life cycle.

Doing Business and the standard cost

model initially developed and applied in

the Netherlands are, for the present, the

only standard tools used across a broad

range of jurisdictions to measure the

impact of government rule-making on

business activity.

1

e rst Doing Business report, pub-

lished in 2003, covered 5 indicator sets in

133 economies. is year’s report covers

10 indicator sets in 181 economies. e

project has beneted from feedback from

governments, academics, practitioners

and reviewers.

2

e initial goal remains:

to provide an objective basis for under-

standing and improving the regulatory

environment for business.

WHAT DOING BUSINESS COVERS

Doing Business provides a quantitative

measure of regulations for starting a

business, dealing with construction

permits, employing workers, register-

ing property, getting credit, protecting

investors, paying taxes, trading across

bor ders, enforcing contracts and closing

a business—as they apply to domestic

small and medium-size enterprises.

A fundamental premise of Doing

Business is that economic activity re-

quires good rules. ese include rules

that establish and clarify property rights

and reduce the costs of resolving disputes,

rules that increase the predictability of

economic interactions and rules that

provide contractual partners with core

protections against abuse. e objective:

regulations designed to be ecient, to be

accessible to all who need to use them

and to be simple in their implementa-

tion. Accordingly, some Doing Business

indicators give a higher score for more

regulation, such as stricter disclosure re-

quirements in related-party transactions.

Some give a higher score for a simplied

way of implementing existing regulation,

such as completing business start-up

formalities in a one-stop shop.

e Doing Business project encom-

passes 2 types of data. e rst come

from readings of laws and regulations.

e second are time and motion indi-

cators that measure the eciency in

achieving a regulatory goal (such as

granting the legal identity of a business).

Within the time and motion indicators,

cost estimates are recorded from ocial

fee schedules where applicable. Here,

Doing Business builds on Hernando de

Soto’s pioneering work in applying the

time and motion approach rst used

by Frederick Taylor to revolutionize the

production of the Model T Ford. De Soto

used the approach in the 1980s to show

the obstacles to setting up a garment fac-

tory on the outskirts of Lima.

3

WHAT DOING BUSINESS

DOES NOT COVER

Just as important as knowing what Doing

Business does is to know what it does

not do—to understand what limitations

must be kept in mind in interpreting

the data.

LIMITED IN SCOPE

Doing Business focuses on 10 topics, with

the specic aim of measuring the regula-

tion and red tape relevant to the life cycle

of a domestic small to medium-size rm.

Accordingly:

Doing Businessr does not measure all

aspects of the business environment

that matter to rms or investors—or

all factors that aect competitiveness.

It does not, for example, measure

security, macroeconomic stability,

corruption, the labor skills of the

population, the underlying strength

of institutions or the quality of

infrastructure.

4

Nor does it focus

on regulations specic to foreign

investment.

vi

DOING BUSINESS 2009

Doing Businessr does not cover all

regulations, or all regulatory goals,

in any economy. As economies and

technology advance, more areas

of economic activity are being

regulated. For example, the European

Union’s body of laws (acquis) has

now grown to no fewer than 14,500

rule sets. Doing Business measures

regulation aecting just 10 phases

of a company’s life cycle, through 10

specic sets of indicators.

BASED ON STANDARDIZED CASE

SCENARIOS

Doing Business indicators are built on the

basis of standardized case scenarios with

specic assumptions, such as the busi-

ness being located in the largest business

city of the economy. Economic indicators

commonly make limiting assumptions

of this kind. Ination statistics, for ex-

ample, are oen based on prices of con-

sumer goods in a few urban areas.

Such assumptions allow global cov-

erage and enhance comparability. But

they come at the expense of generality.

Business regulation and its enforcement

dier across an economy, particularly in

federal states and large economies. And

of course the challenges and opportuni-

ties of the largest business city—whether

Mumbai or São Paulo, Nuku’alofa or

Nassau—vary greatly across econo-

mies. Recognizing governments’ interest

in such variation, Doing Business has

complemented its global indicators with

subnational studies in such economies as

Brazil, China, Mexico, Nigeria, the Philip-

pines and the Russian Federation.

5

Doing

Business has also begun a work program

focusing on small island states.

6

In areas where regulation is complex

and highly dierentiated, the standard-

ized case used to construct the Doing

Business indicator needs to be carefully

dened. Where relevant, the standard-

ized case assumes a limited liability

company. is choice is in part empiri-

cal: private, limited liability companies

are the most prevalent business form in

most economies around the world. e

choice also reects one focus of Doing

Business: expanding opportunities for

entrepreneurship. Investors are encour-

aged to venture into business when po-

tential losses are limited to their capital

participation.

FOCUSED ON THE FORMAL SECTOR

In constructing the indicators, Doing

Business assumes that entrepreneurs are

knowledgeable about all regulations in

place and comply with them. In practice,

entrepreneurs may spend considerable

time nding out where to go and what

documents to submit. Or they may avoid

legally required procedures altogether—

by not registering for social security, for

example.

Where regulation is particularly

onerous, levels of informality are higher.

Informality comes at a cost: rms in

the informal sector typically grow more

slowly, have poorer access to credit and

employ fewer workers—and their work-

ers remain outside the protections of

labor law.

7

Doing Business measures one

set of factors that help explain the oc-

currence of informality and give policy

makers insights into potential areas of

reform. Gaining a fuller understanding

of the broader business environment,

and a broader perspective on policy chal-

lenges, requires combining insights from

Doing Business with data from other

sources, such as the World Bank Enter-

prise Surveys.

8

WHY THIS FOCUS

Doing Business functions as a kind of

cholesterol test for the regulatory envi-

ronment for domestic businesses. A cho-

lesterol test does not tell us everything

about the state of our health. But it does

measure something important for our

health. And it puts us on watch to change

behaviors in ways that will improve not

only our cholesterol rating but also our

overall health.

One way to test whether Doing Busi-

ness serves as a proxy for the broader

business environment and for competi-

tiveness is to look at correlations be-

tween the Doing Business rankings and

other major economic benchmarks. e

indicator set closest to Doing Business

in what it measures is the Organisation

for Economic Co-operation and Devel-

opment’s indicators of product market

regulation; the correlation here is 0.80.

e World Economic Forum’s Global

Competitiveness Index and IMD’s World

Competitiveness Yearbook are broader in

scope, but these too are strongly corre-

lated with Doing Business (0.80 and 0.76,

respectively). ese correlations suggest

that where peace and macroeconomic

stability are present, domestic business

regulation makes an important dier-

ence in economic competitiveness.

A bigger question is whether the

issues on which Doing Business focuses

matter for development and poverty re-

duction. e World Bank study Voices of

the Poor asked 60,000 poor people around

the world how they thought they might

escape poverty.

9

e answers were un-

equivocal: women and men alike pin their

hopes on income from their own business

or wages earned in employment. Enabling

growth—and ensuring that poor people

can participate in its benets—requires

an environment where new entrants with

drive and good ideas, regardless of their

gender or ethnic origin, can get started in

business and where rms can invest and

grow, generating more jobs.

Small and medium-size enterprises

are key drivers of competition, growth

and job creation, particularly in develop-

ing countries. But in these economies up

to 80% of economic activity takes place

in the informal sector. Firms may be pre-

vented from entering the formal sector

by excessive bureaucracy and regulation.

Where regulation is burdensome

and competition limited, success tends

to depend more on whom you know

than on what you can do. But where

regulation is transparent, ecient and

implemented in a simple way, it becomes

easier for any aspiring entrepreneurs,

regardless of their connections, to oper-

ate within the rule of law and to benet

from the opportunities and protections

that the law provides.

In this sense Doing Business values

ABOUT DOING BUSINESS

vii

good rules as a key to social inclusion. It

also provides a basis for studying eects

of regulations and their application. For

example, Doing Business 2004 found that

faster contract enforcement was associ-

ated with perceptions of greater judicial

fairness—suggesting that justice delayed

is justice denied.

10

Other examples are

provided in the chapters that follow.

DOING BUSINESS AS

A BENCHMARKING EXERCISE

Doing Business, in capturing some key

dimensions of regulatory regimes, has

been found useful for benchmarking.

Any benchmarking—for individuals,

rms or states—is necessarily partial:

it is valid and useful if it helps sharpen

judgment, less so if it substitutes for

judgment.

Doing Business provides 2 takes on

the data it collects: it presents “absolute”

indicators for each economy for each of

the 10 regulatory topics it addresses, and

it provides rankings of economies, both

by indicator and in aggregate. Judgment

is required in interpreting these mea-

sures for any economy and in determin-

ing a sensible and politically feasible path

for reform.

Reviewing the Doing Business rank-

ings in isolation may show unexpected

results. Some economies may rank un-

expectedly high on some indicators. And

some that have had rapid growth or

attracted a great deal of investment may

rank lower than others that appear to be

less dynamic.

Still, a higher ranking in Doing Busi-

ness tends to be associated with better

outcomes over time. Economies that rank

among the top 20 are those with high

per capita income and productivity and

highly developed regulatory systems.

But for reform-minded govern-

ments, how much their indicators im-

prove matters more than their absolute

ranking. As economies develop, they

strengthen and add to regulations to

protect investor and property rights.

Meanwhile, they nd more ecient ways

to implement existing regulations and

cut outdated ones. One nding of Doing

Business: dynamic and growing econo-

mies continually reform and update their

regulations and their way of implement-

ing them, while many poor economies

still work with regulatory systems dating

to the late 1800s.

DOING BUSINESS—

A USER’S GUIDE

Quantitative data and benchmark-

ing can be useful in stimulating debate

about policy, both by exposing poten-

tial challenges and by identifying where

policy makers might look for lessons

and good practices. ese data also pro-

vide a basis for analyzing how dierent

policy approaches—and dierent policy

reforms—contribute to desired out-

comes such as competitiveness, growth

and greater employment and incomes.

Six years of Doing Business data

have enabled a growing body of research

on how performance on Doing Busi-

ness indicators—and reforms relevant

to those indicators—relate to desired

social and economic outcomes. Some

325 articles have been published in peer-

reviewed academic journals, and about

742 working papers are available through

Google Scholar.

11

Among the ndings:

Lower barriers to start-up are r

associated with a smaller informal

sector.

12

Lower costs of entry can encourage r

entrepreneurship and reduce

corruption.

13

Simpler start-up can translate r

into greater employment

opportunities.

14

How do governments use Doing

Business? A common rst reaction is

to doubt the quality and relevance of

the Doing Business data. Yet the debate

typically proceeds to a deeper discussion

exploring the relevance of the data to the

economy and areas where reform might

make sense.

Most reformers start out by seeking

examples, and Doing Business helps in

this. For example, Saudi Arabia used the

company law of France as a model for re-

vising its own. Many economies in Africa

look to Mauritius—the region’s strongest

performer on Doing Business indicators—

as a source of good practices for reform.

In the words of Dr. Mahmoud Mohieldin,

Egypt’s minister of investment:

What I like about Doing Business…

is that it creates a forum for exchanging

knowledge. It’s no exaggeration when I

say I checked the top 10 in every indica-

tor and we just asked them, “What did

you do?” If there is any advantage to

starting late in anything, it’s that you can

learn from others.

Over the past 6 years there has been

much activity by governments in re-

forming the regulatory environment for

domestic businesses. Most reforms relat-

ing to Doing Business topics were nested

in broader programs of reform aimed at

enhancing economic competitiveness. In

structuring their reform programs, gov-

ernments use multiple data sources and

indicators. And reformers respond to

many stakeholders and interest groups,

all of whom bring important issues and

concerns into the reform debate.

World Bank Group support to these

reform processes is designed to encour-

age critical use of the data, sharpening

judgment and avoiding a narrow focus

on improving Doing Business rankings.

METHODOLOGY AND DATA

Doing Business covers 181 economies—

including small economies and some

of the poorest ones, for which little or

no data are available in other data sets.

e Doing Business data are based on

domestic laws and regulations as well as

administrative requirements. (For a de-

tailed explanation of the Doing Business

methodology, see Data notes.)

INFORMATION SOURCES FOR THE DATA

Most of the indicators are based on laws

and regulations. In addition, most of the

cost indicators are backed by ocial fee

schedules. Doing Business contributors

both ll out written surveys and provide

viii

DOING BUSINESS 2009

references to the relevant laws, regu-

lations and fee schedules, aiding data

checking and quality assurance.

For some indicators part of the

cost component (where fee schedules

are lacking) and the time component

are based on actual practice rather than

the law on the books. is introduces a

degree of subjectivity. e Doing Busi-

ness approach has therefore been to work

with legal practitioners or professionals

who regularly undertake the transac-

tions involved. Following the standard

methodological approach for time and

motion studies, Doing Business breaks

down each process or transaction, such

as starting and legally operating a busi-

ness, into separate steps to ensure a bet-

ter estimate of time. e time estimate

for each step is given by practitioners

with signicant and routine experience

in the transaction.

Over the past 6 years more than

10,000 professionals in 181 economies

have assisted in providing the data that

inform the Doing Business indicators.

is year’s report draws on the inputs of

more than 6,700 professionals. e Doing

Business website indicates the number

of respondents per economy and per

indicator (see table 12.1 in Data notes for

the number of respondents per indicator

set). Because of the focus on legal and

regulatory arrangements, most of the

respondents are lawyers. e credit in-

formation survey is answered by ocials

of the credit registry or bureau. Freight

forwarders, accountants, architects and

other professionals answer the surveys

related to trading across borders, taxes

and construction permits.

e Doing Business approach to

data collection contrasts with that of

perception surveys, which capture oen

one-time perceptions and experiences of

businesses. A corporate lawyer register-

ing 100–150 businesses a year will be

more familiar with the process than an

entrepreneur, who will register a business

only once or maybe twice. A bankruptcy

judge deciding dozens of cases a year will

have more insight into bankruptcy than a

company that may undergo the process.

DEVELOPMENT OF THE

METHODOLOGY

e methodology for calculating each

indicator is transparent, objective and

easily replicable. Leading academics col-

laborate in the development of the indi-

cators, ensuring academic rigor. Six of

the background papers underlying the

indicators have been published in lead-

ing economic journals. Another 2 are at

an advanced stage of publication in such

journals.

Doing Business uses a simple aver-

aging approach for weighting subindica-

tors and calculating rankings. Other ap-

proaches were explored, including using

principal components and unobserved

components.

15

e principal components

and unobserved components approaches

turn out to yield results nearly identical to

those of simple averaging. e tests show

that each set of indicators provides new

information. e simple averaging ap-

proach is therefore robust to such tests.

IMPROVEMENTS TO THE

METHODOLOGY AND DATA REVISIONS

e methodology has undergone contin-

ual improvement over the years. Changes

have been made mainly in response

to suggestions from economies in the

Doing Business sample. For enforcing

contracts, for example, the amount of

the disputed claim in the case scenario

was increased from 50% to 200% of

income per capita aer the rst year, as

it became clear that smaller claims were

unlikely to go to court.

Another change relates to starting a

business. e minimum capital require-

ment can be an obstacle for potential

entrepreneurs. Initially, Doing Business

measured the required minimum capital

regardless of whether it had to be paid

up front or not. In many economies only

part of the minimum capital has to be

paid up front. To reect the actual po-

tential barrier to entry, the paid-in mini-

mum capital has been used since 2004.

is year’s report includes one

change in the core methodology, to the

strength of legal rights index, which is

part of the getting credit indicator set.

All changes in methodology are

explained in the report as well as on

the Doing Business website. In addition,

data time series for each indicator and

economy are available on the website,

beginning with the rst year the indi-

cator or economy was included in the

report. To provide a comparable time

series for research, the data set is back-

calculated to adjust for changes in meth-

odology and any revisions in data due

to corrections. e website also makes

available all original data sets used for

background papers.

Information on data corrections is

provided on the website (also see Data

notes). A transparent complaint pro-

cedure allows anyone to challenge the

data. If errors are conrmed aer a data

verication process, they are expedi-

tiously corrected.

NOTES

1. e standard cost model is a quantita-

tive methodology for determining the

administrative burdens that regulation

imposes on businesses. e method can

be used to measure the eect of a single

law or of selected areas of legislation or

to perform a baseline measurement of

all legislation in a country.

2. In the past year this has included a re-

view by the World Bank Group Indepen-

dent Evaluation Group (2008).

3. De Soto (2000).

4. e indicators related to trading across

borders and dealing with construc-

tion permits take into account limited

aspects of an economy’s infrastructure,

including the inland transport of goods

and utility connections for businesses.

5. http://www.doingbusiness.org/

subnational.

6. http://www.doingbusiness.org.

7. Schneider (2005).

8. http://www.enterprisesurveys.org.

9. Narayan and others (2000).

10. World Bank (2003).

11. http://scholar.google.com.

12. For example, Masatlioglu and Rigolini

(2008), Kaplan, Piedra and Seira (2008)

and Djankov, Ganser, McLiesh, Ramalho

and Shleifer (2008).

ABOUT DOING BUSINESS

ix

13. For example, Alesina and others (2005),

Perotti and Volpin (2004), Klapper,

Laeven and Rajan (2006), Fisman and

Sarria-Allende (2004), Antunes and Cav-

alcanti (2007), Barseghyan (2008) and

Djankov, Ganser, McLiesh, Ramalho and

Shleifer (2008).

14. For example, Freund and Bolaky (forth-

coming), Chang, Kaltani and Loayza

(forthcoming) and Helpman, Melitz and

Rubinstein (2008).

15. See Djankov and others (2005).

STARTING A BUSINESS

1

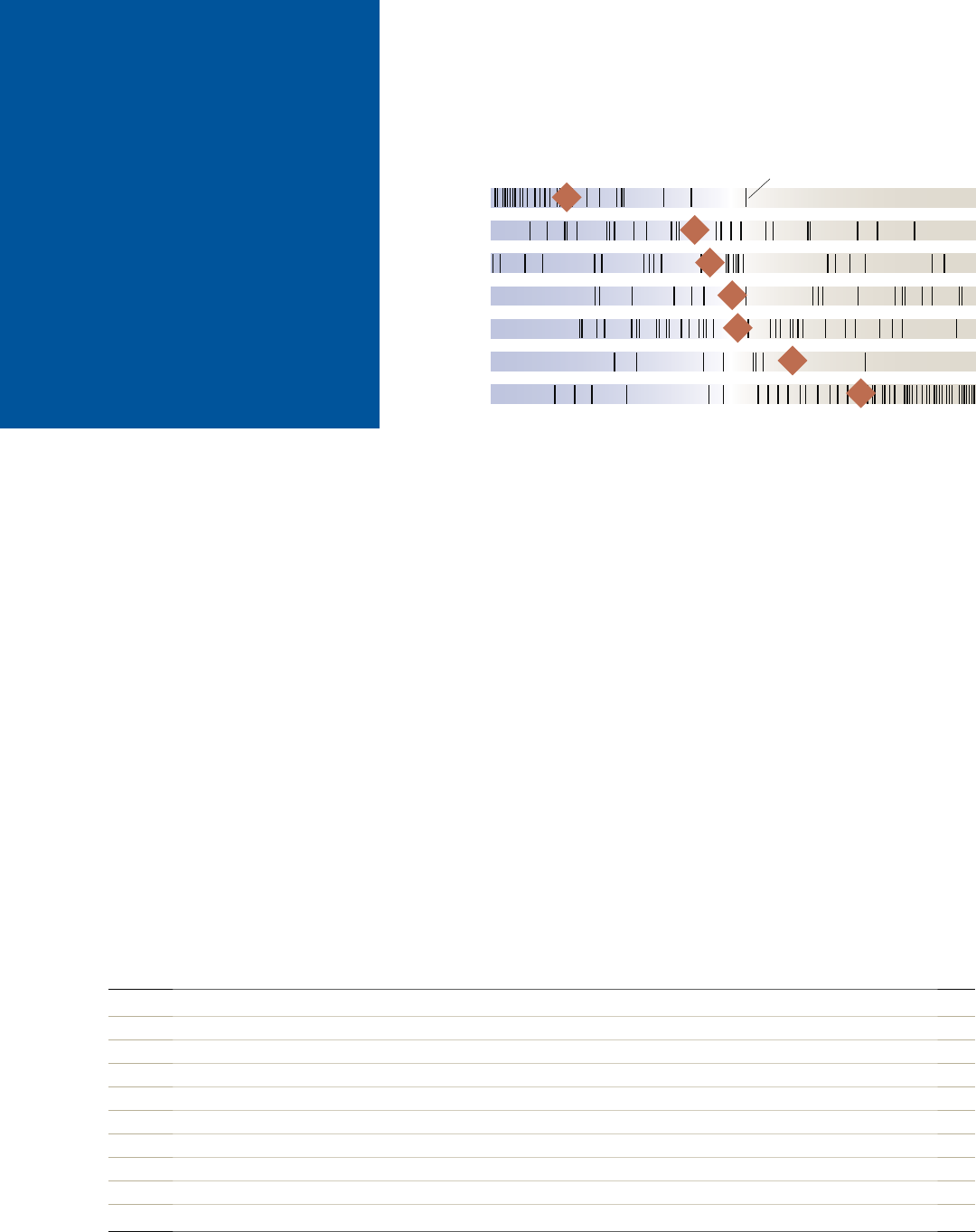

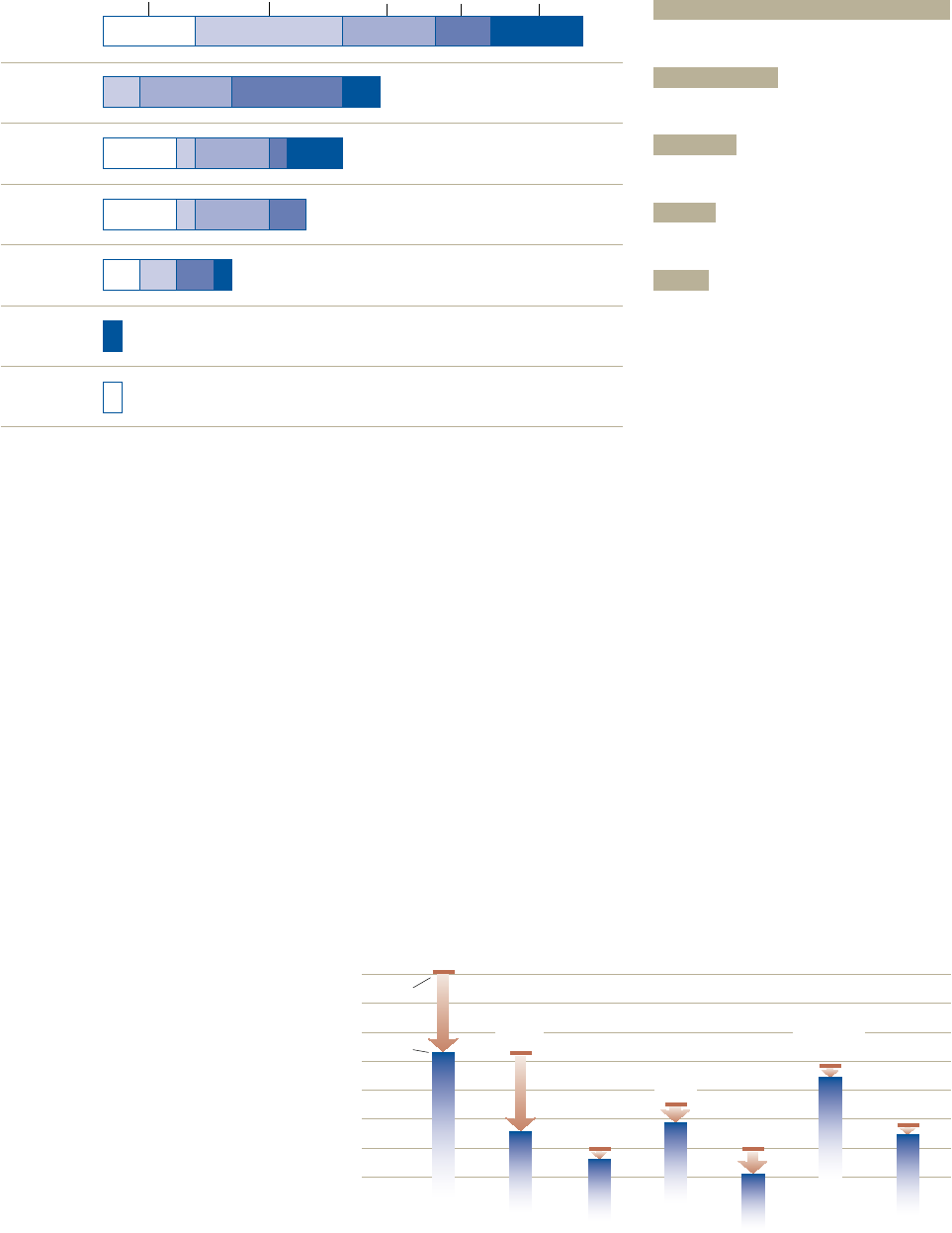

For the h year in a row Eastern Europe

and Central Asia led the world in Doing

Business reforms. Twenty-six of the re-

gion’s 28 economies implemented a total

of 69 reforms. Since 2004 Doing Business

has been tracking reforms aimed at sim-

plifying business regulations, strength-

ening property rights, opening up access

to credit and enforcing contracts by mea-

suring their impact on 10 indicator sets.

1

Nearly 1,000 reforms with an impact

on these indicators have been captured.

Eastern Europe and Central Asia has ac-

counted for a third of them.

e region surpassed East Asia

and Pacic in the average ease of doing

business in 2007—and maintained its

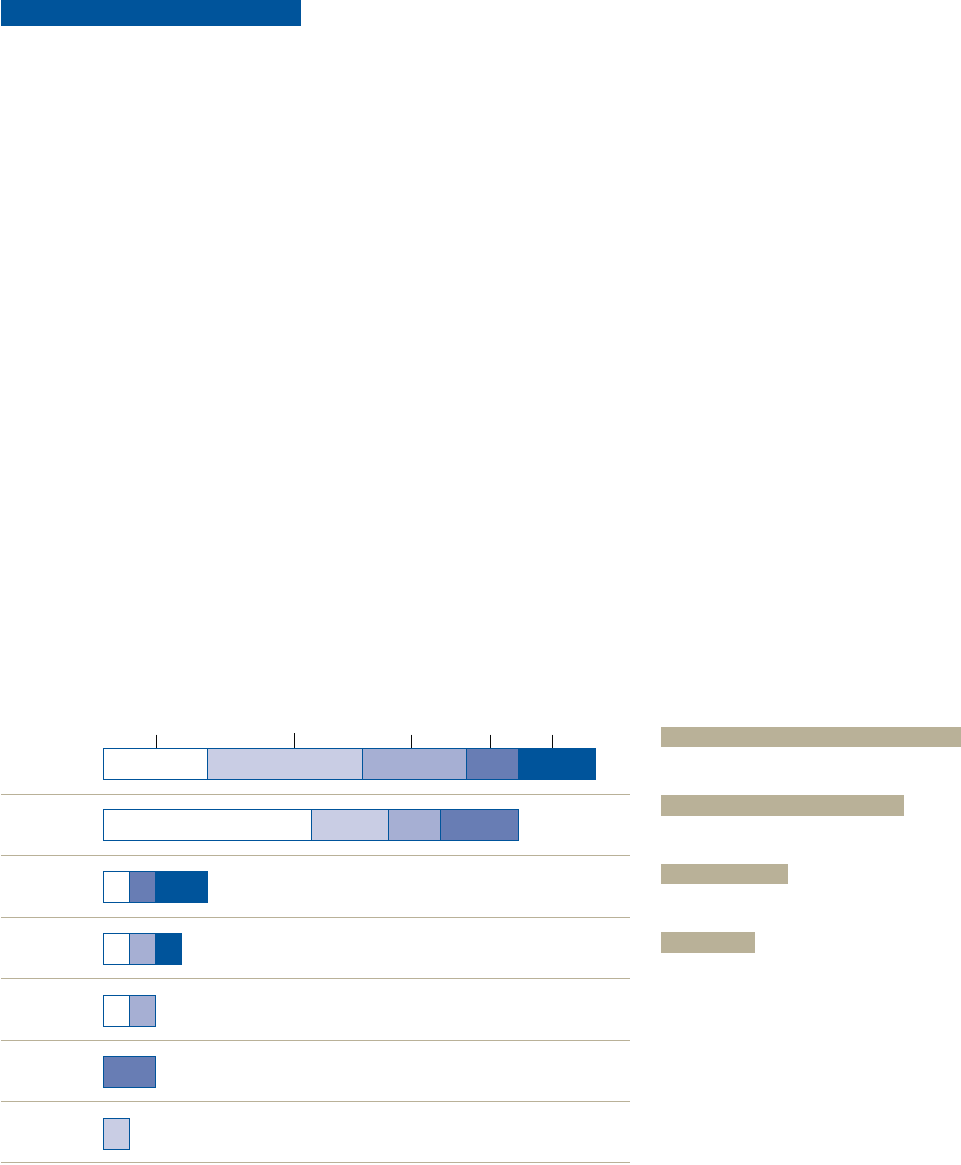

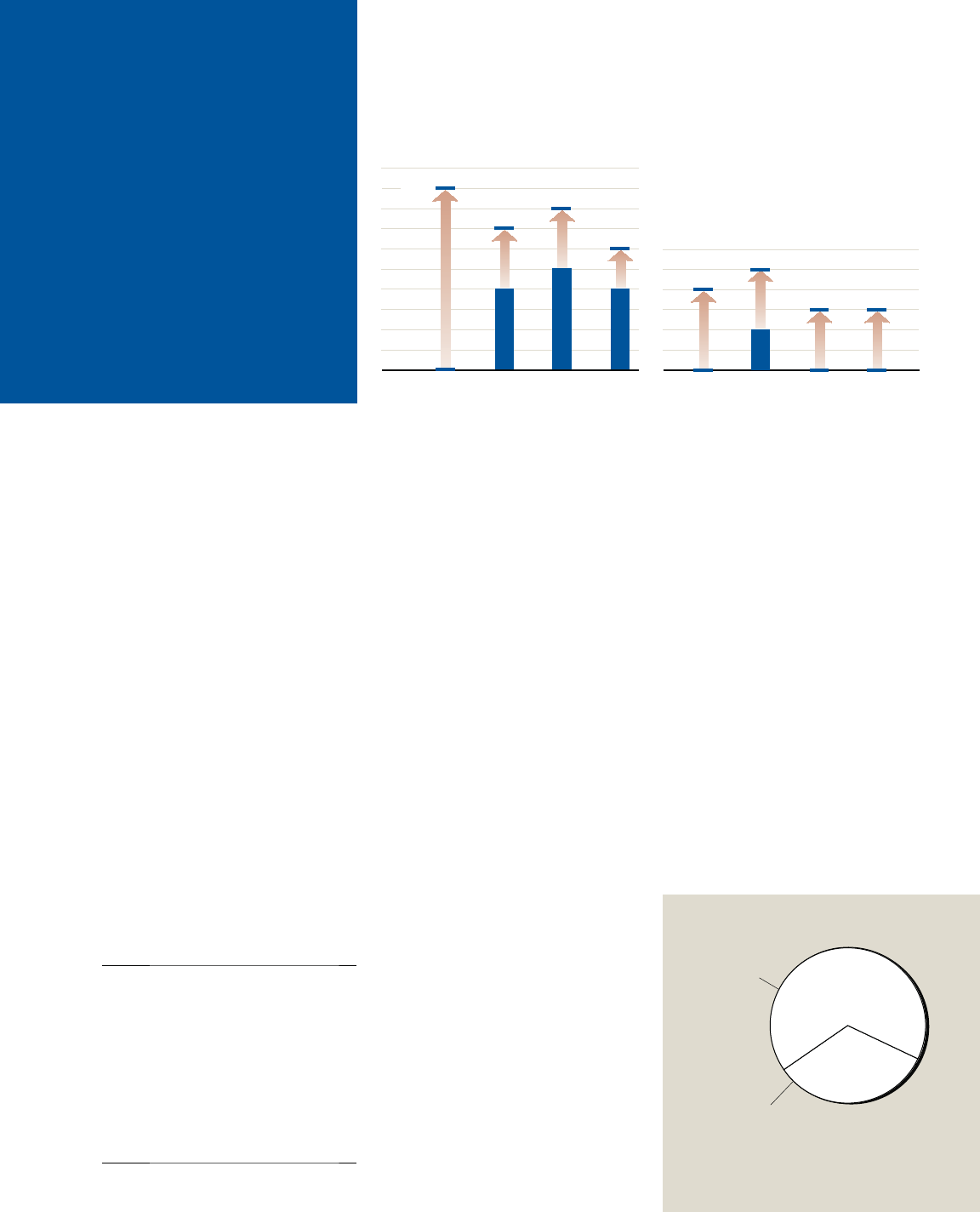

place this year (gure 1.1). Four of its

economies—Georgia, Estonia, Lithuania

and Latvia—are among the top 30 in the

overall Doing Business ranking.

Rankings on the ease of doing busi-

ness do not tell the whole story about an

economy’s business environment. e

indicator does not account for all fac-

tors important for doing business—for

example, macroeconomic conditions, in-

frastructure, workforce skills or security.

But improvement in an economy’s rank-

ing does indicate that its government is

creating a regulatory environment more

conducive to operating a business. In

Eastern Europe and Central Asia many

economies continue to do so—and econ-

omies in the region once again dominate

the list of top Doing Business reformers

in 2007/08. New this year: reforms in the

region are moving eastward as 4 new-

comers join the top 10 list of reformers:

Azerbaijan, Albania, the Kyrgyz Republic

and Belarus (table 1.1).

Many others reformed as well.

Worldwide, 113 economies implemented

239 reforms making it easier to do busi-

ness between June 2007 and June 2008.

at is the most reforms recorded in

a single year since the Doing Business

project started. In the past year reform-

ers focused on easing business start-up,

lightening the tax burden, simplifying

import and export regulation and im-

proving credit information systems.

Across regions, East Asia had the

biggest pickup in the pace of reform.

Overview

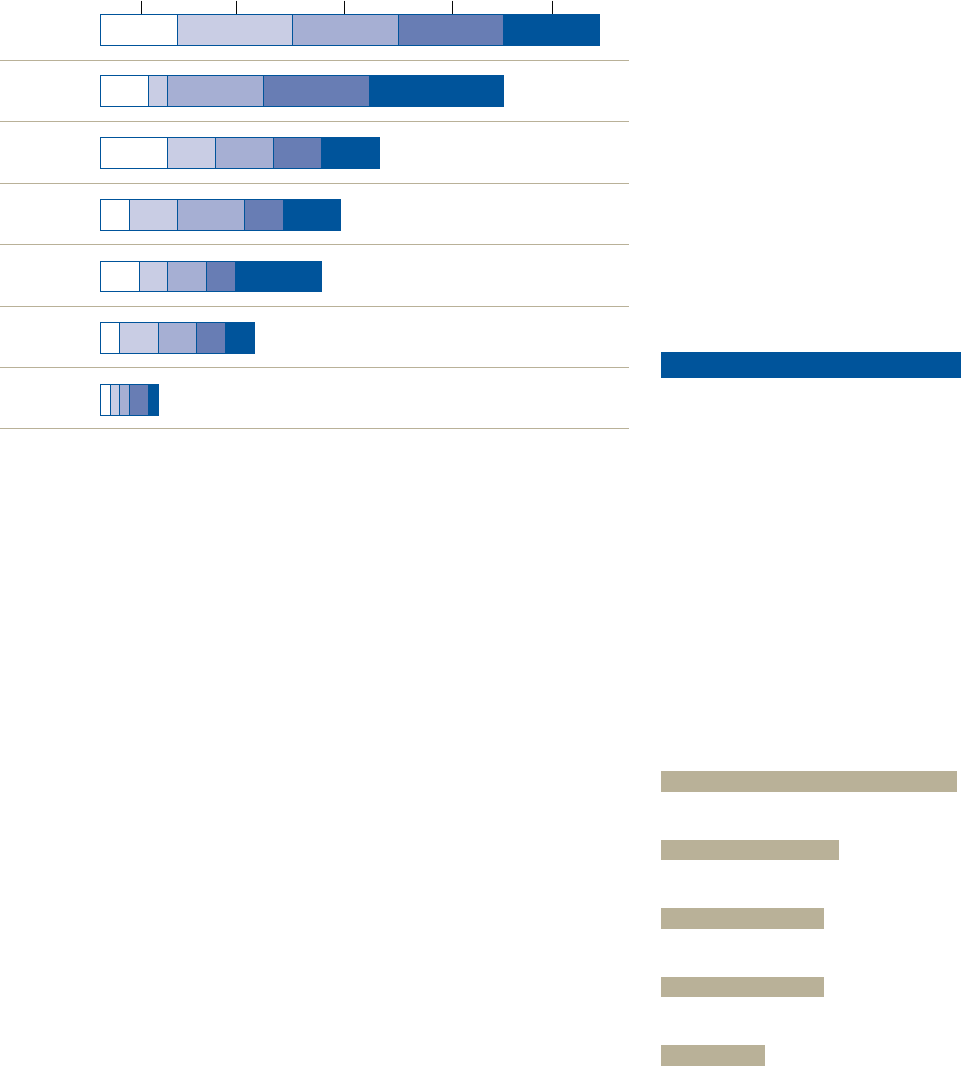

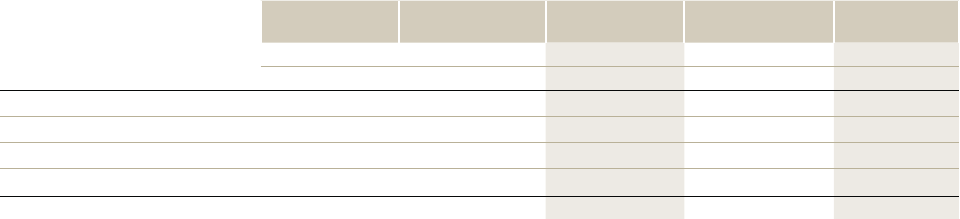

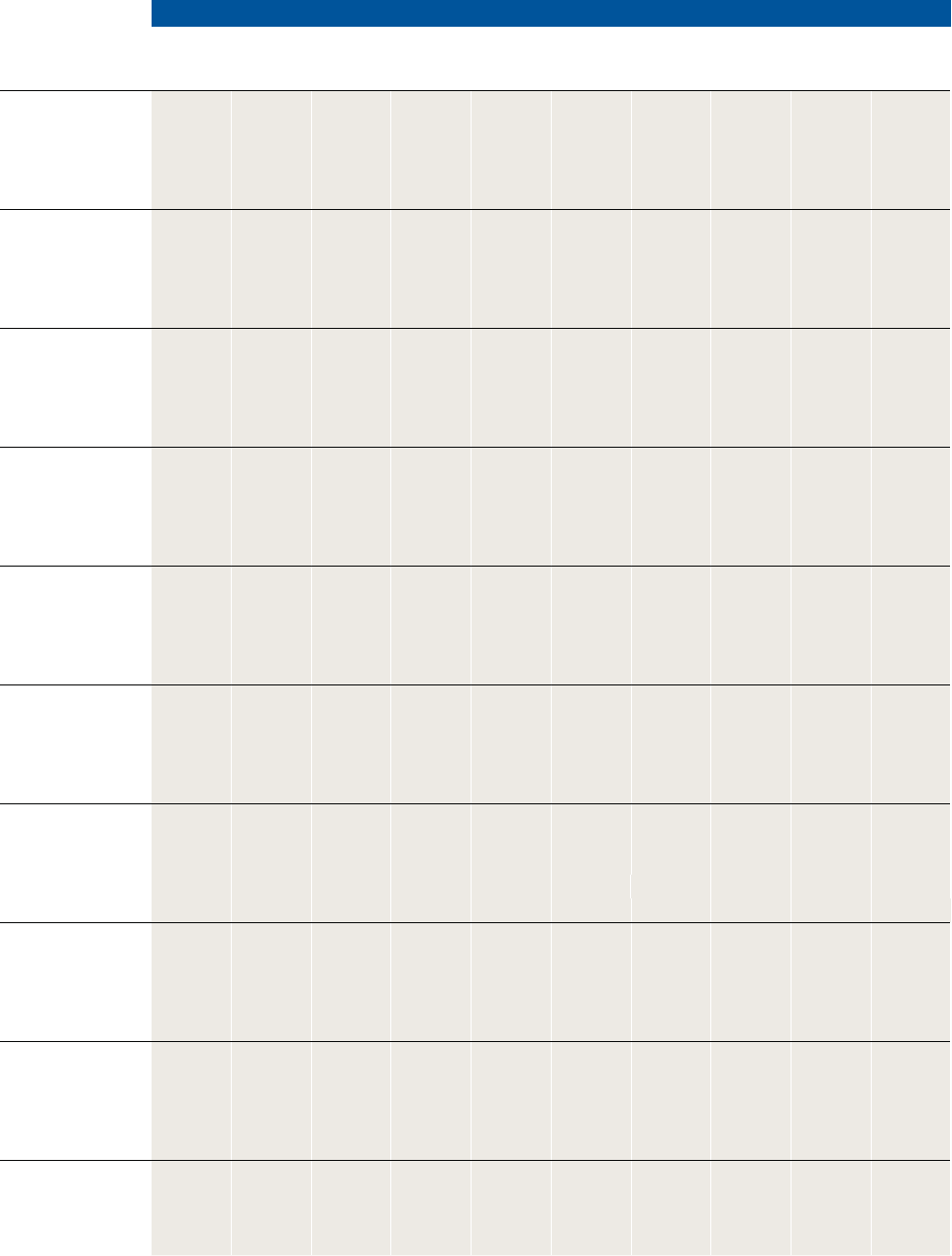

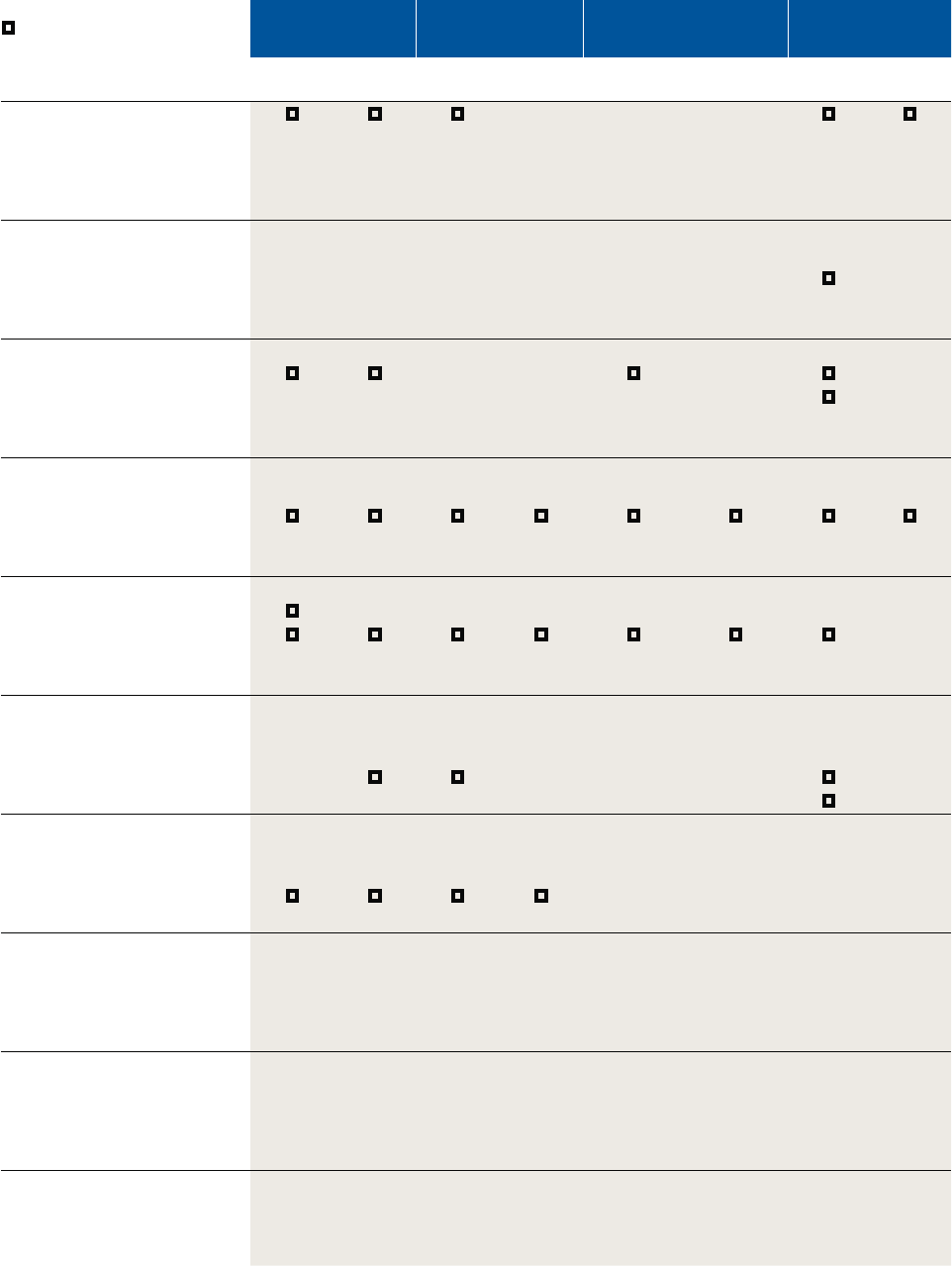

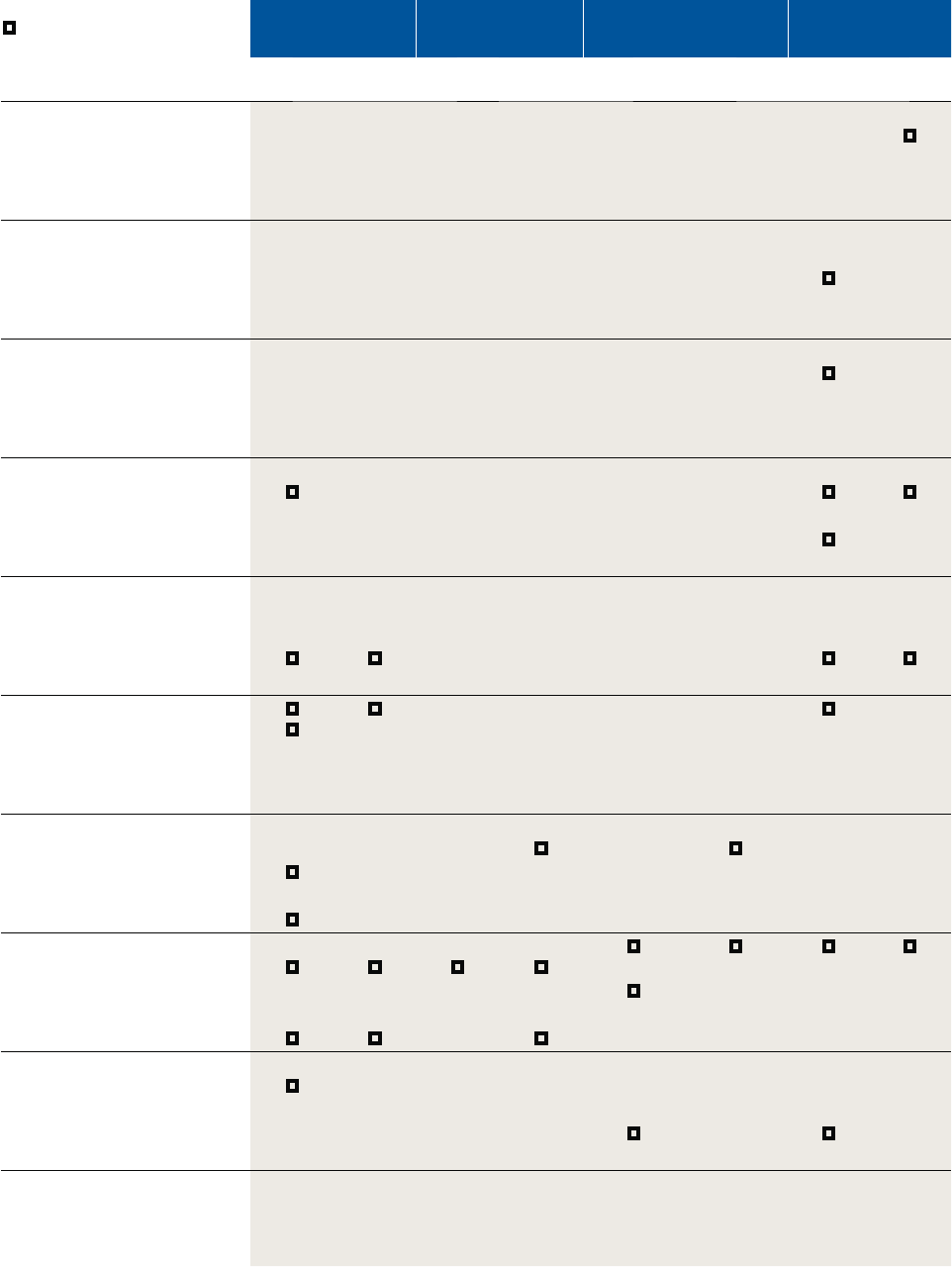

TABLE 1.1

The top 10 reformers in 2007/08

Economy

Starting a

business

Dealing with

construction

permits

Employing

workers

Registering

property

Getting

credit

Protecting

investors

Paying

taxes

Trading

across

borders

Enforcing

contracts

Closing a

business

Azerbaijan

Albania

Kyrgyz Republic

Belarus

Senegal

Burkina Faso

Botswana

Colombia

Dominican Republic

Egypt

Note: Economies are ranked on the number and impact of reforms. First,

Doing Business

selects the economies that implemented reforms making it easier to do business in 3 or more of the

Doing Business

topics.

Second, it ranks these economies on the increase in rank on the ease of doing business from the previous year. The larger the improvement, the higher the ranking as a reformer.

Source:

Doing Business

database.

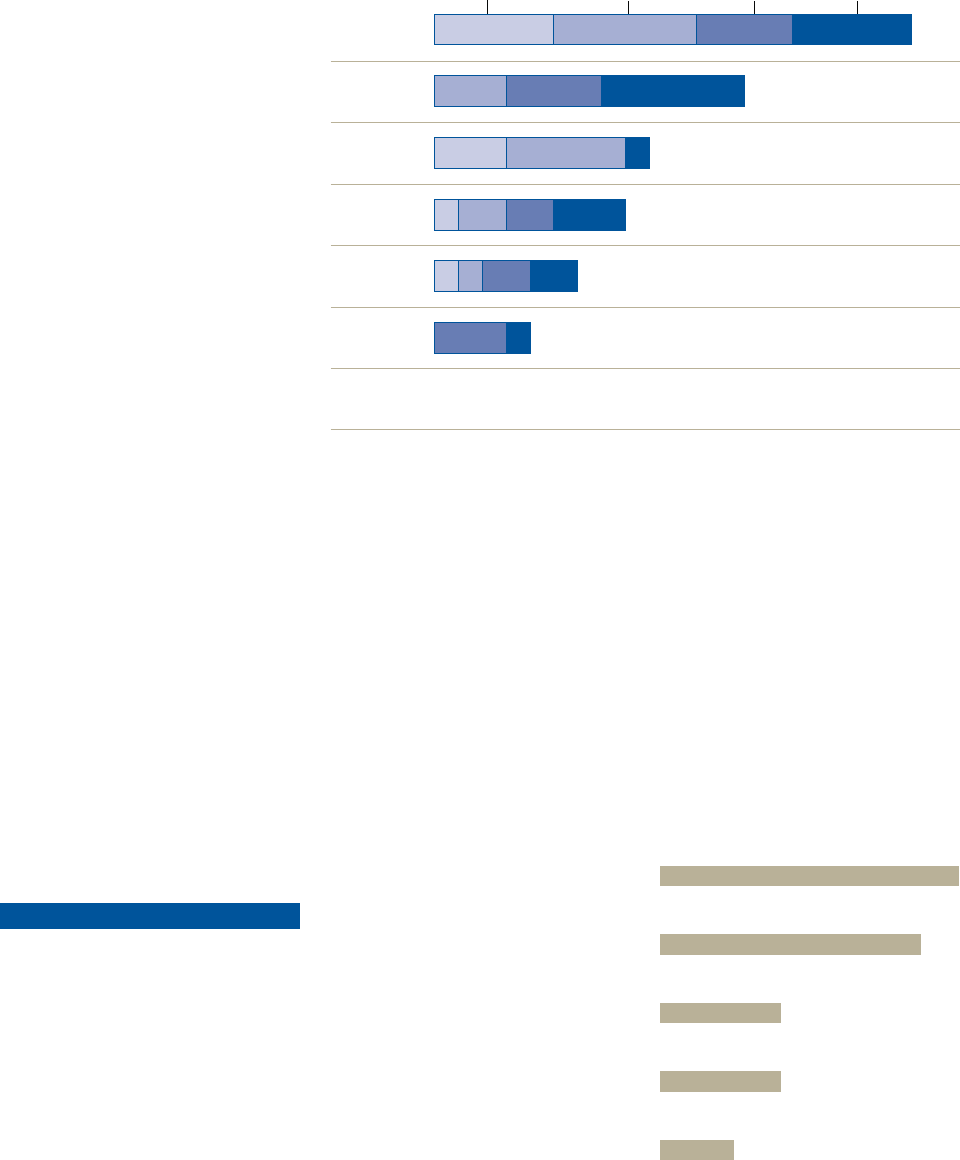

Source: Doing Business

database.

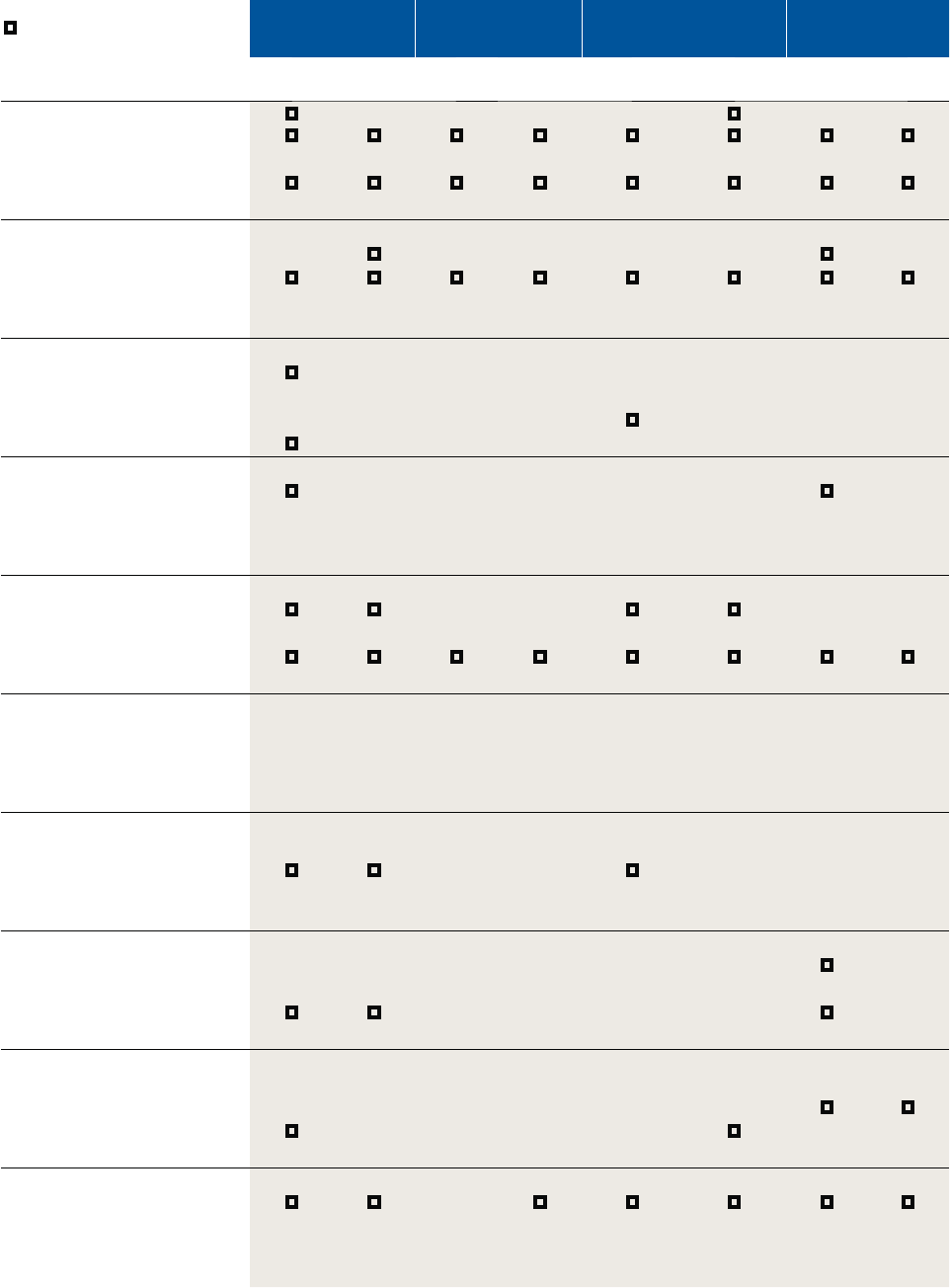

Latin America

& Caribbean

South Asia

Sub-Saharan

Africa

Middle East

& North Africa

East Asia

& Pacic

OECD

high income

Eastern Europe

& Central Asia

DB

2009

ranking on the ease of doing business (1–181)

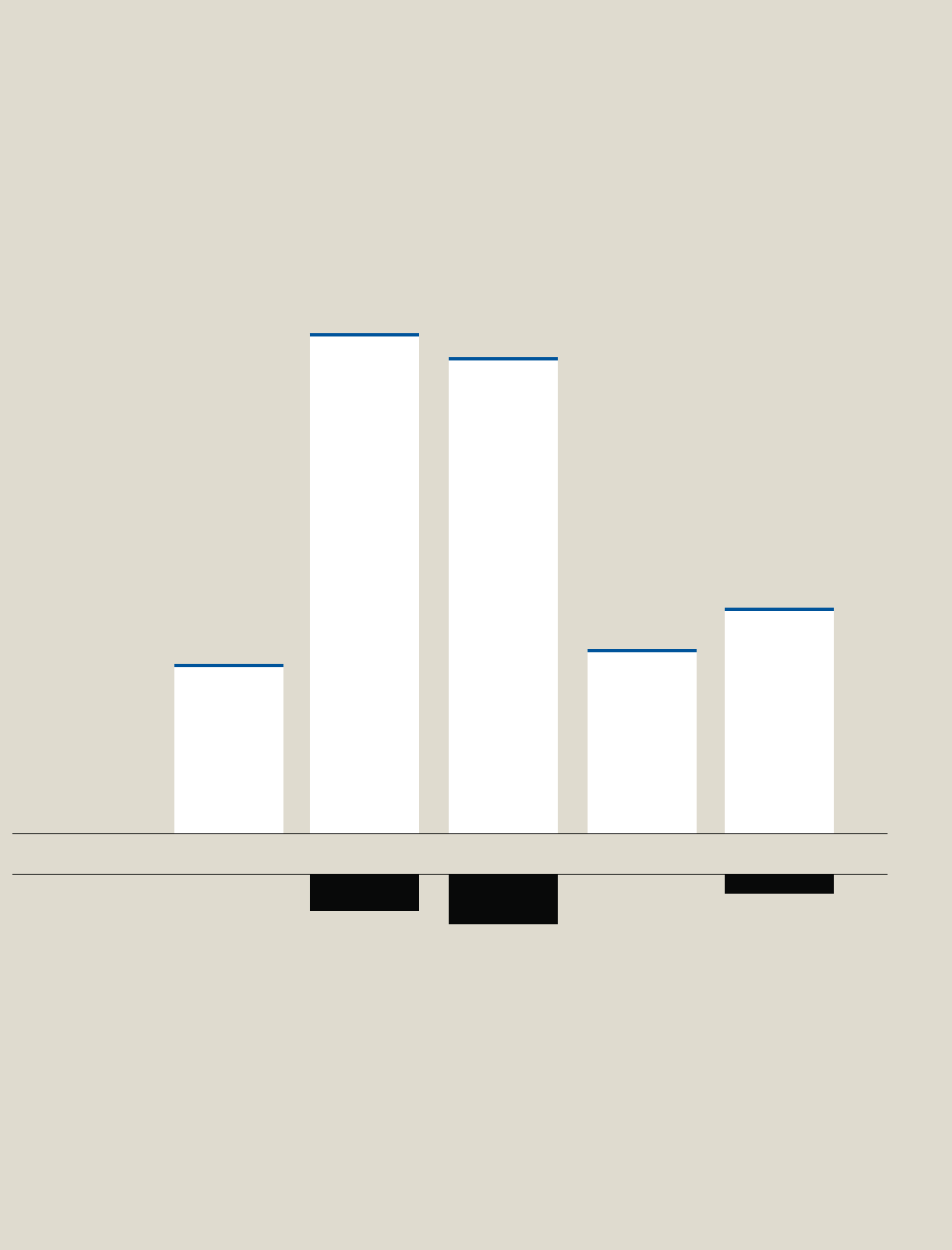

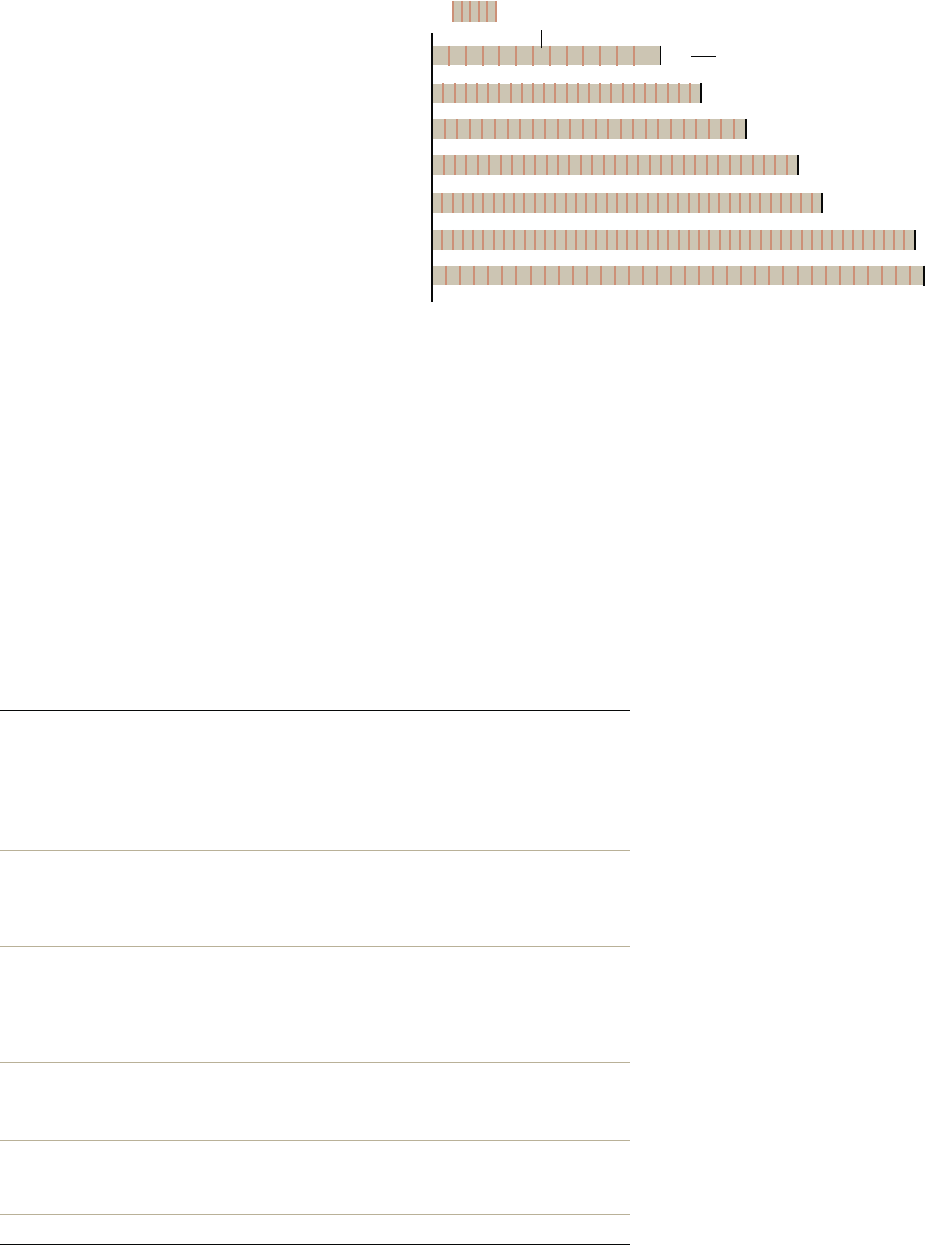

FIGURE 1.1

Which regions have some of the most business-friendly regulations?

EACH LINE SHOWS

THE RANK OF ONE

ECONOMY IN THE REGION

AVERAGE

RANK

138

111

92

90

81

76

27

1811

2

DOING BUSINESS 2009

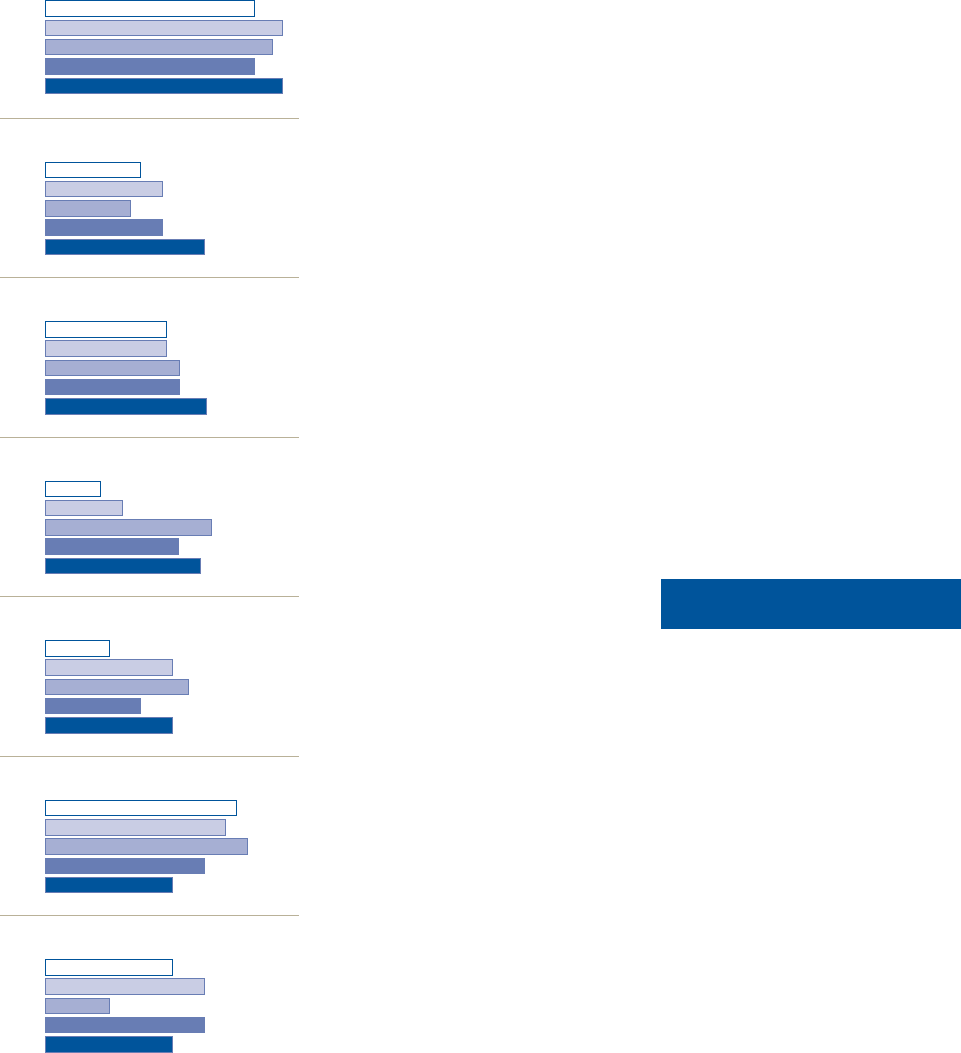

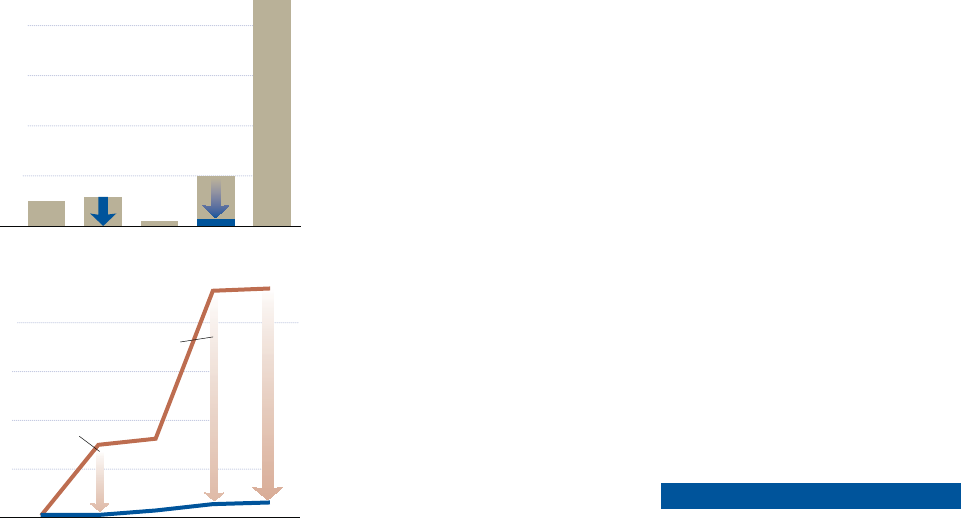

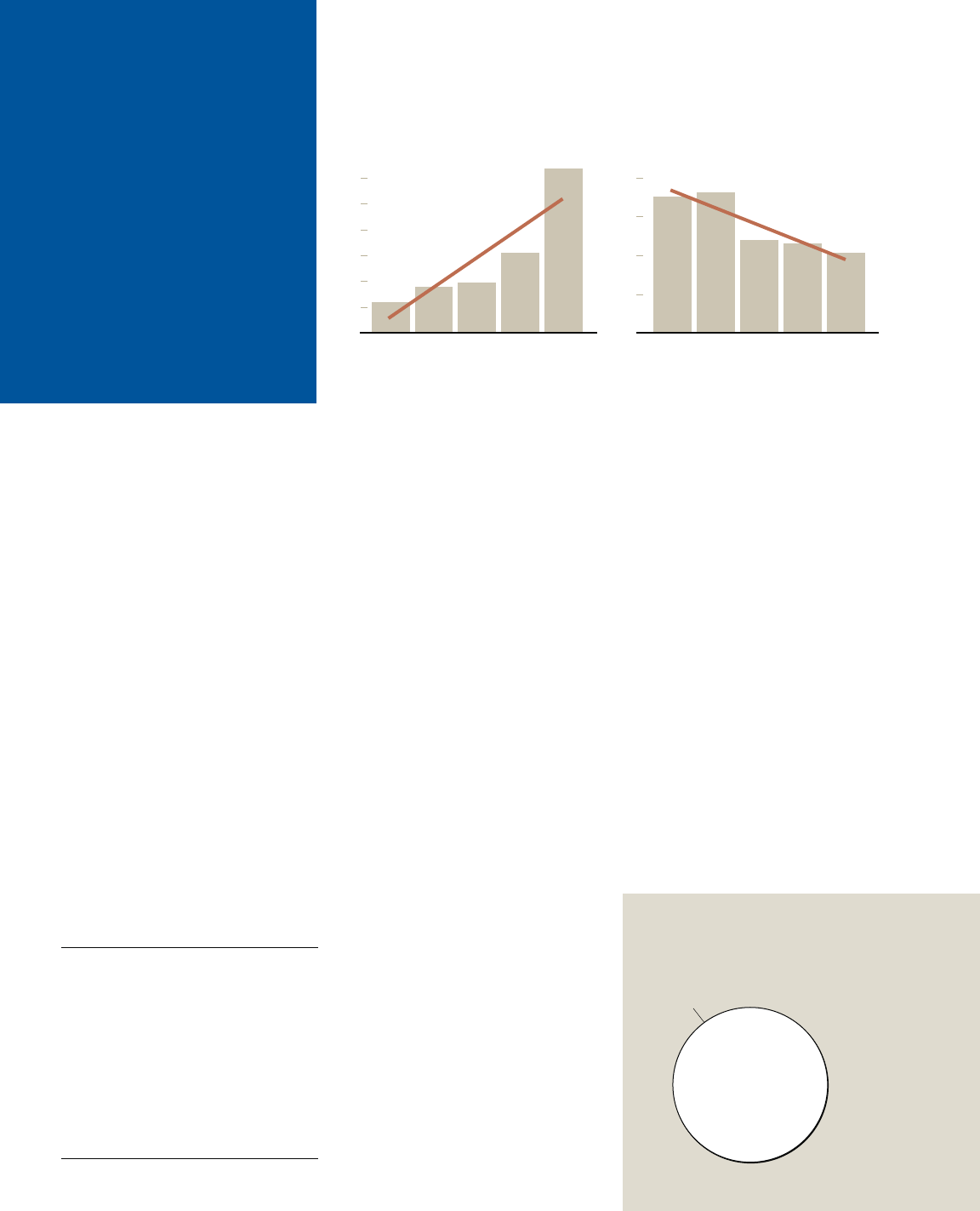

Two-thirds of its economies reformed,

up from less than half last year (gure

1.2). e Middle East and North Af-

rica continued its upward trend, with

two-thirds of its economies reforming.

In a region once known for prohibitive

entry barriers, 2 countries—Tunisia and

Yemen—eliminated the minimum capi-

tal requirement for starting a business,

while Jordan reduced it from 30,000

Jordanian dinars to 1,000.

Sub-Saharan Africa continued its

upward trend in reform too: 28 econ-

omies implemented 58 reforms, more

than in any year since Doing Business

began tracking reforms. Two West Afri-

can countries led the way, Senegal and

Burkina Faso. In Latin America, Colom-

bia and the Dominican Republic were the

most active. OECD high-income econo-

mies saw a slowdown in reform. So did

South Asia.

Azerbaijan is the top reformer for

2007/08. A one-stop shop for business

start-up began operating in January 2008,

halving the time, cost and number of

procedures to start a business. Business

registrations increased by 40% in the

rst 6 months. Amendments to the labor

code made employment regulation more

exible by allowing the use of xed-term

contracts for permanent tasks, easing

restrictions on working hours and elimi-

nating the need for reassignment in case

of redundancy dismissals. And property

transfers can now be completed in 11

days—down from 61 before—thanks to

a unied property registry for land and

real estate transactions.

at’s not all. Azerbaijan eliminated

the minimum loan cuto of $1,100 at the

credit registry, more than doubling the

number of borrowers covered. Minor-

ity shareholders enjoy greater protec-

tion, thanks to amendments to the civil

code and a new regulation on related-

party transactions. Such transactions

now are subject to stricter requirements

for disclosure to the supervisory board

and in annual reports. Moreover, inter-

ested parties involved in a related-party

transaction harmful to the company

must cover the damages and pay back

personal prots.

Taxpayers in Azerbaijan now take

advantage of online ling and payment

of taxes, saving more than 500 hours a

year on average in dealing with paper-

work. And a new economic court in Baku

helped speed contract enforcement. With

the number of judges looking at com-

mercial cases increasing from 5 to 9, the

average time to resolve a case declined

by 30 days.

Albania is the runner-up, with re-

forms in 4 of the areas measured by

Doing Business. A new company law

strengthened the protection of minority

shareholder rights. e law tightened

approval and disclosure requirements

for related-party transactions and, for

the rst time, dened directors’ duties.

It also introduced greater remedies to

pursue if a related-party transaction is

harmful to the company. Albania made

start-up easier by taking commercial reg-

istration out of the court and creating a

one-stop shop. Companies can now start

a business in 8 days—it used to take

more than a month. e country’s rst

credit registry opened for business. And

tax reforms halved the corporate income

tax rate to 10%.

AFRICA—MORE REFORM THAN

EVER BEFORE

Economies in Africa implemented more

Doing Business reforms in 2007/08 than

in any previous year covered. And 3

of the top 10 reformers are African:

Senegal, Burkina Faso and Botswana.

ree postconict countries—Liberia,

Rwanda and Sierra Leone—are reform-

ing fast too (gure 1.3). Mauritius, the

country with the region’s most favor-

able business regulations, continues to

reform, and this year joins the top 25 on

the ease of doing business.

is focus on reform comes aer

several years of record economic growth

in Africa. Annual growth has averaged

nearly 6% in the past decade, thanks to

better macroeconomic conditions and

greater peace on the continent. With

more economic opportunities, regulatory

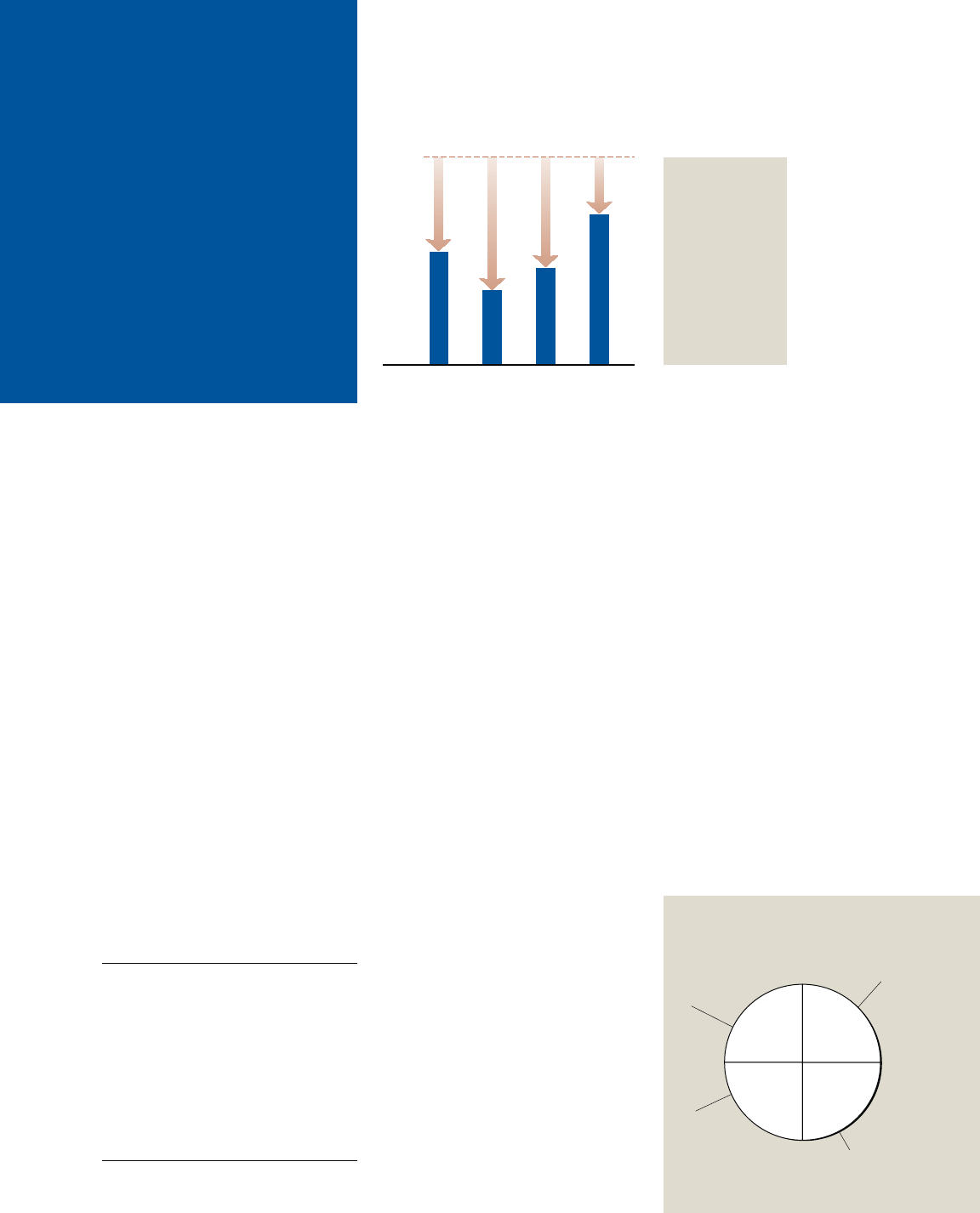

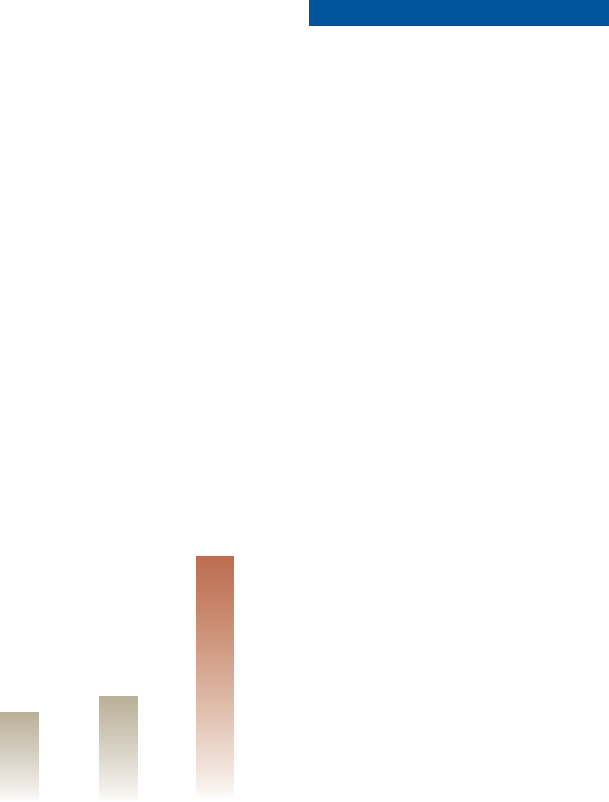

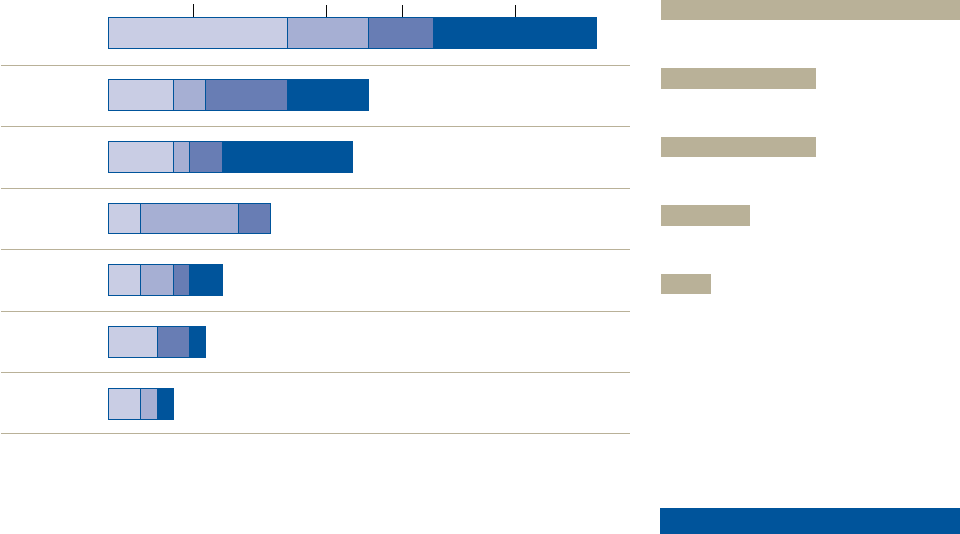

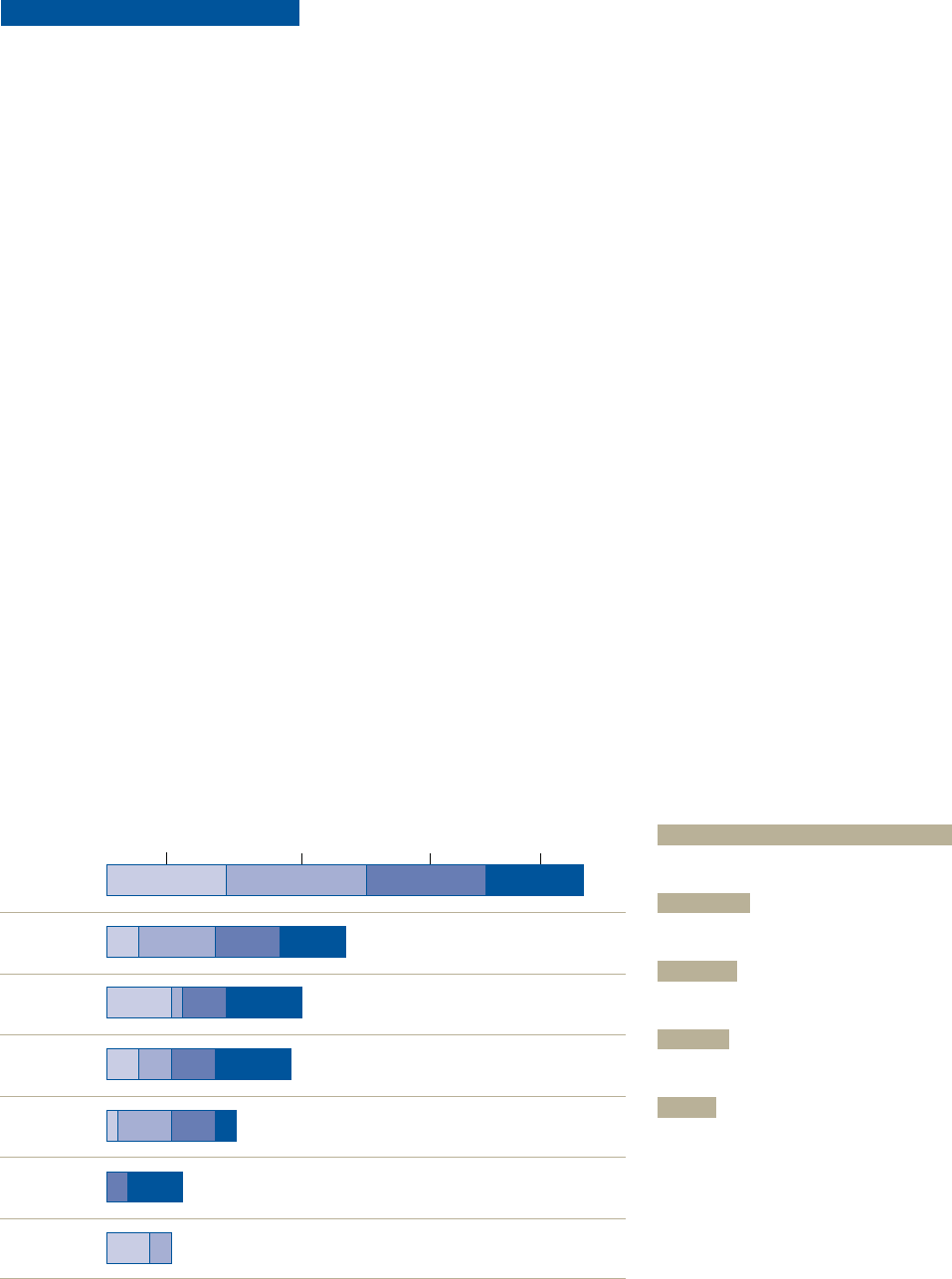

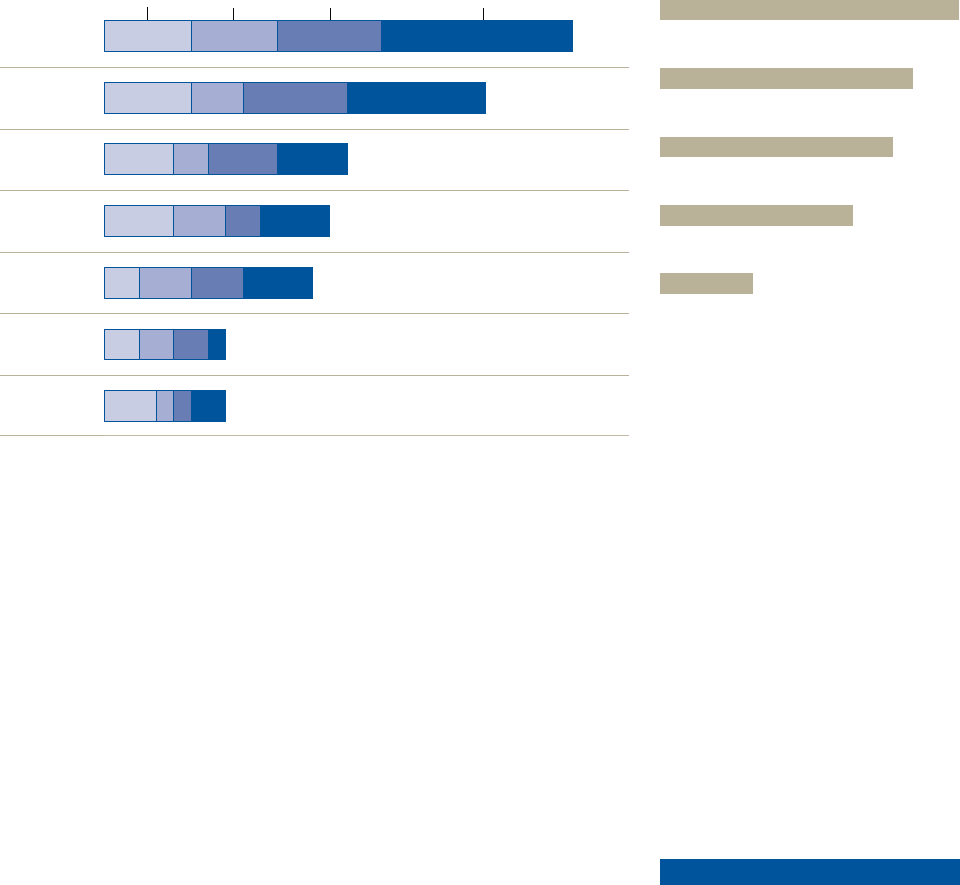

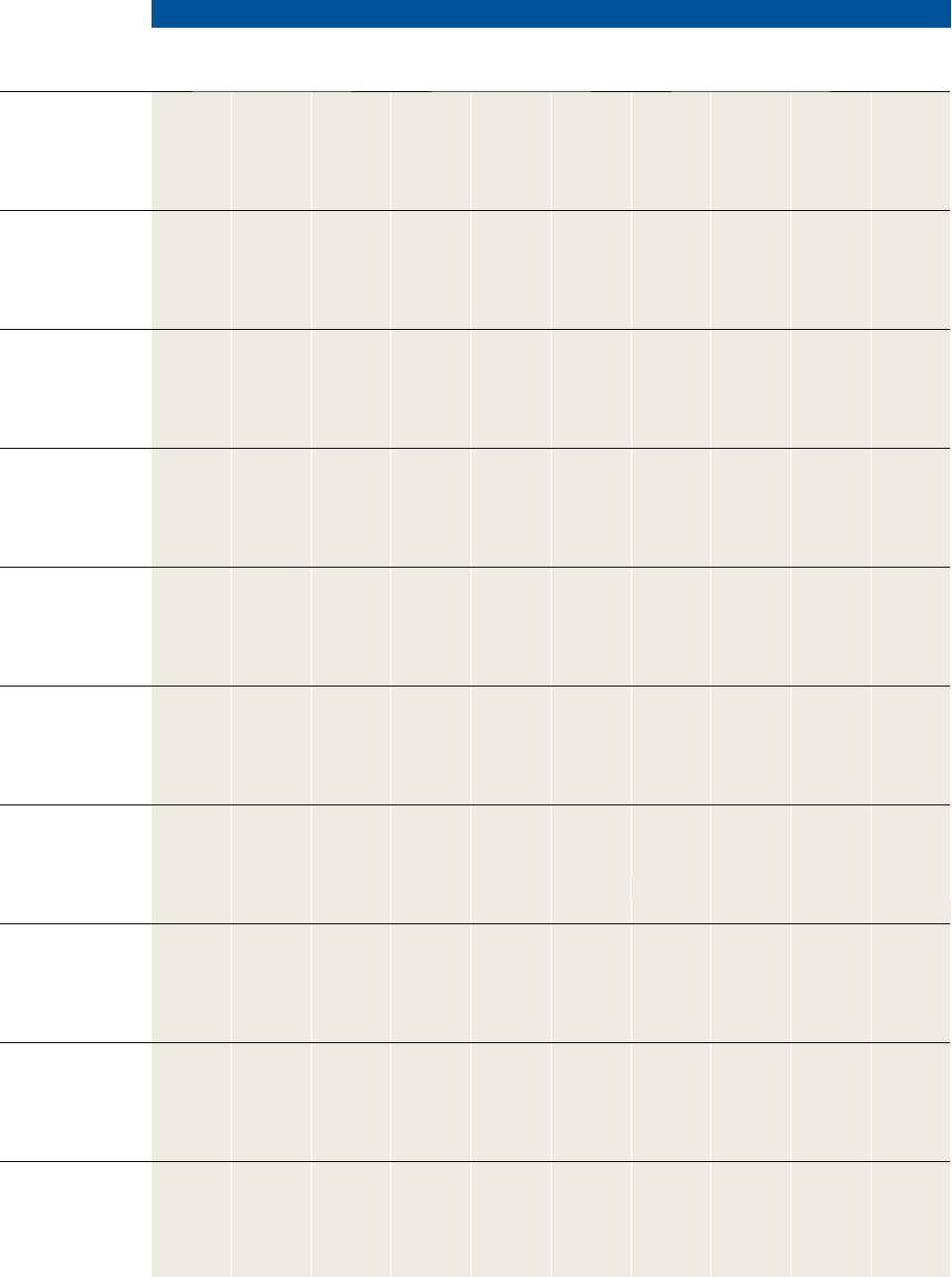

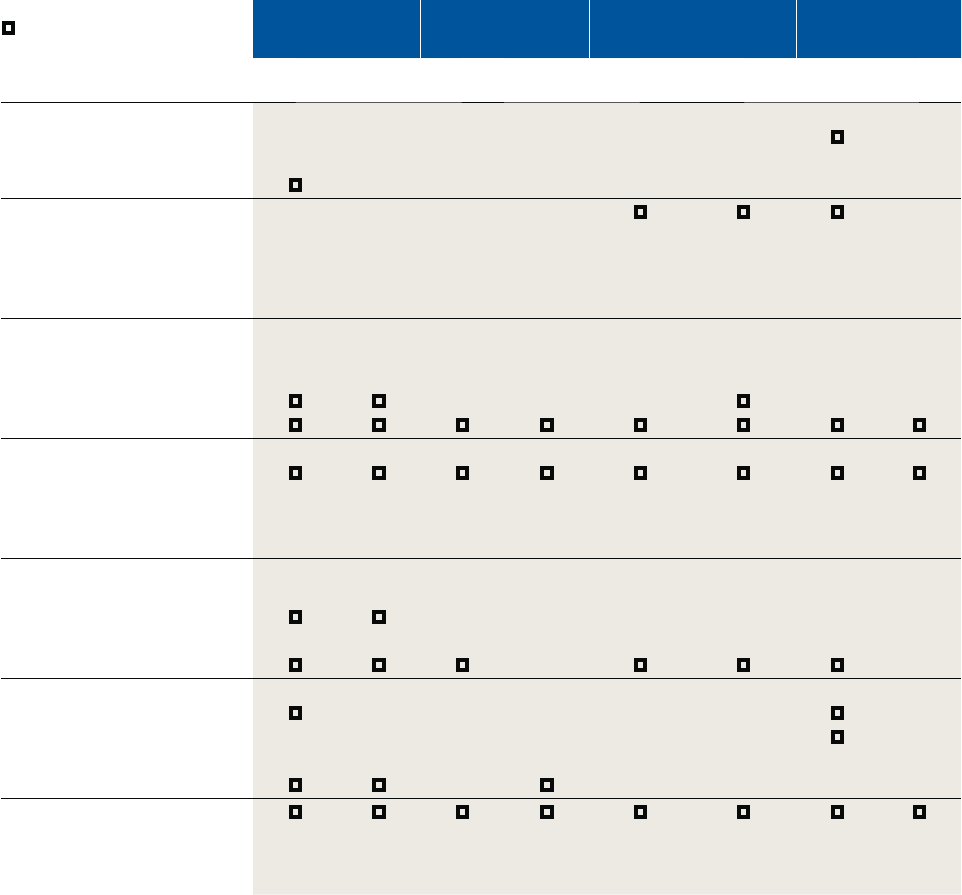

Eastern Europe & Central Asia

(28 economies)

DB

2005

DB

2006

DB

2007

DB

2008

DB

2009

82

93

89

82

93

OECD high income

(24 economies)

DB

2005

DB

2006

DB

2007

DB

2008

DB

2009

75

71

79

63

50

Middle East & North Africa

(19 economies)

DB

2005

DB

2006

DB

2007

DB

2008

DB

2009

47

47

53

53

63

South Asia

(8 economies)

DB

2005

DB

2006

DB

2007

DB

2008

DB

2009

50

63

25

63

50

Sub-Saharan Africa

(46 economies)

DB

2005

DB

2006

DB

2007

DB

2008

DB

2009

22

30

65

52

61

East Asia & Pacic

(24 economies)

DB

2005

DB

2006

DB

2007

DB

2008

DB

2009

38

46

33

46

63

Latin America & Caribbean

(32 economies)

DB

2005

DB

2006

DB

2007

DB

2008

DB

2009

25

50

56

38

50

Source: Doing Business

database.

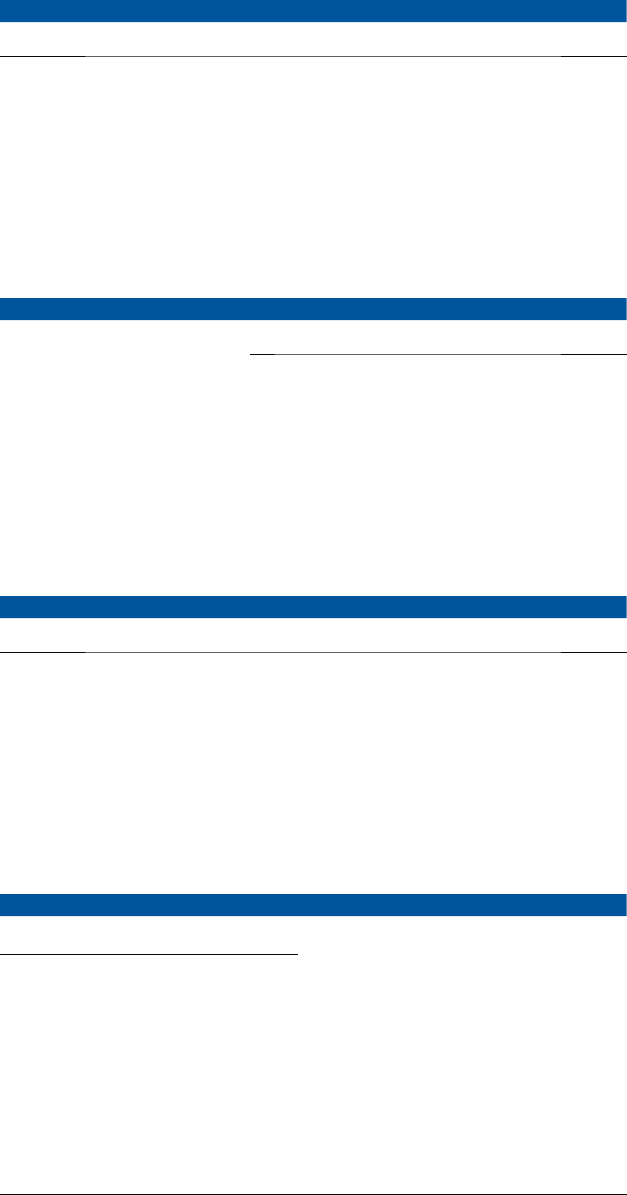

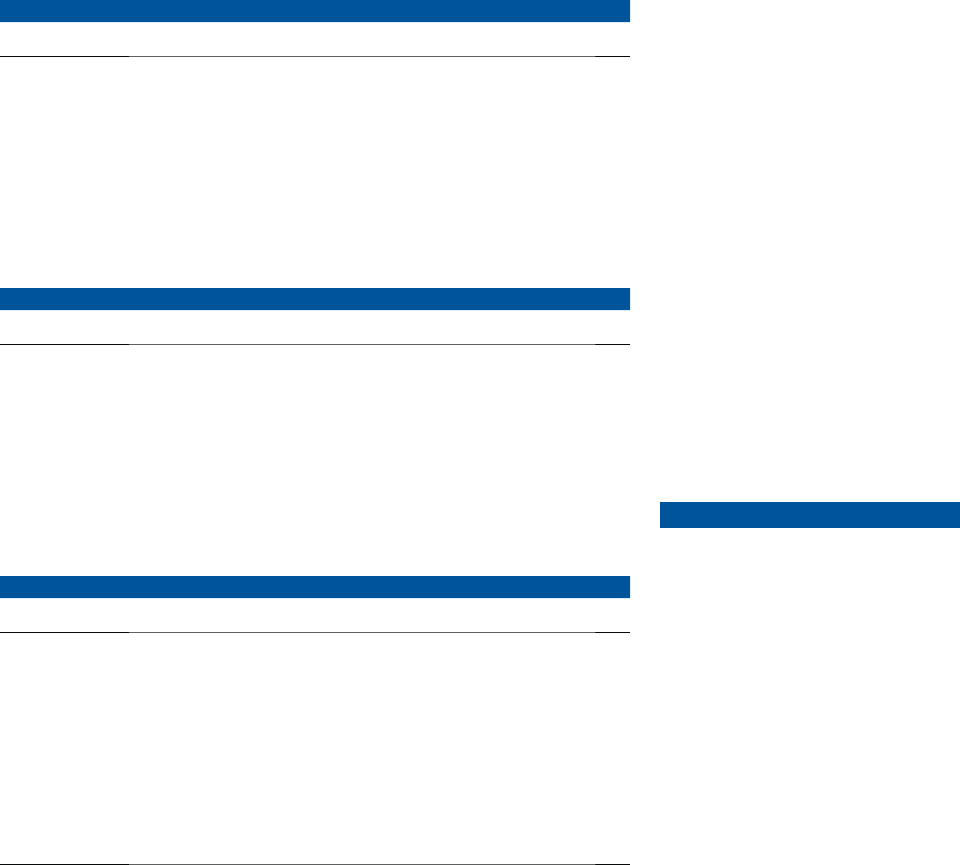

FIGURE 1.2

Eastern European and

Central Asian economies—

leaders in Doing Business reforms

Share of economies with at least 1 reform

making it easier to do business in past 5 years (%)

by Doing Business report year

OVERVIEW

3

constraints on businesses have become

more pressing. Governments increasingly

focus on reducing these constraints. And

reformers recognize that bringing more

economic activity to the formal sector

through business and job creation is the

most promising way to reduce poverty.

2

Rwanda is one example of the divi-

dends of peace and good macroeco-

nomic policies. e country has been

among the most active reformers of

business regulation worldwide this de-

cade. In 2001 it introduced a new labor

law as part of the national reconstruc-

tion program. In 2002 it started prop-

erty titling reform. In 2004 reformers

simplied customs, improved the credit

registry and undertook court reforms. In

2007 Rwanda continued with property

registration and customs. Some reforms

took longer to implement. For example,

judicial reforms were initiated in 2001,

but it was not until 2008 that the neces-

sary laws were passed and new commer-

cial courts started functioning.

3

Most African reformers focused on

easing start-up and reducing the cost of

importing and exporting. ere is room

to do more. Entrepreneurs in Africa still

face greater regulatory and administra-

tive burdens, and less protection of prop-

erty and investor rights, than entrepre-

neurs in any other region. e upside:

reform in such circumstances can send

a strong signal of governments’ commit-

ment to sound institutions and policies,

catalyzing investor interest.

EASING ENTRY—ONCE AGAIN

THE MOST POPULAR REFORM

Making it easier to start a business contin-

ued to be the most popular Doing Business

reform in 2007/08. Forty-nine economies

simplied start-up and reduced the cost

(gure 1.4). ese are among the 115

economies—more than half the world’s

total—that have reformed in this area over

the past 5 years. e second most popular

were reforms to simplify taxes and their

administration. ird were reforms to

ease trade. In all 3 areas much can be

achieved with administrative reforms.

Reforms in other areas can be harder,

particularly if they require legal changes

or involve dicult political tradeos.

Only 12 economies reformed their judi-

cial system. Seven amended collateral or

secured transactions laws. Six amended

labor regulations to make them more

exible; 9 opted for more rigidity.

e 3 boldest reforms driving the

biggest improvements in the Doing Busi-

ness indicators (table 1.2):

r "MCBOJBTJODSFBTFJOJOWFTUPS

protections

r :FNFOTFBTJOHPGCVTJOFTTTUBSUVQ

r ѮF%PNJOJDBO3FQVCMJDTUBYSFGPSN

REFORM CONTINUES AMONG

BEST PERFORMERS

Singapore continues to rank at the top on

the ease of doing business, followed by

New Zealand, the United States and Hong

Kong (China) (table 1.3). And reform

continues. Five of the top 10 economies

implemented reforms that had an im-

pact on the Doing Business indicators

in 2007/08. Singapore further simplied

its online business start-up service. New

Zealand introduced a single online pro-

cedure for business start-up, lowered the

corporate income tax and implemented a

new insolvency act. Hong Kong (China)

streamlined construction permitting as

part of a broader reform of its licens-

ing regime. Denmark implemented tax

reforms. And entrepreneurs in Toronto,

Canada, can now start a business with

just one procedure.

is continuing reform is not sur-

prising. Many high-income economies

have institutionalized regulatory reform,

setting up programs to systematically

target red tape. Examples include the

“Be the Smart Regulator” program in

Hong Kong (China), Simplex in Por-

tugal, the Better Regulation Executive

in the United Kingdom, Actal in the

Netherlands and Kaa in Belgium. To

identify priorities, these governments

routinely ask businesses what needs re-

form. Belgium reformed business regis-

tration aer 2,600 businesses identied

it as a major problem in 2003. Starting a

business there used to take 7 procedures

and nearly 2 months. Today it takes 3

Source: Doing Business

database.

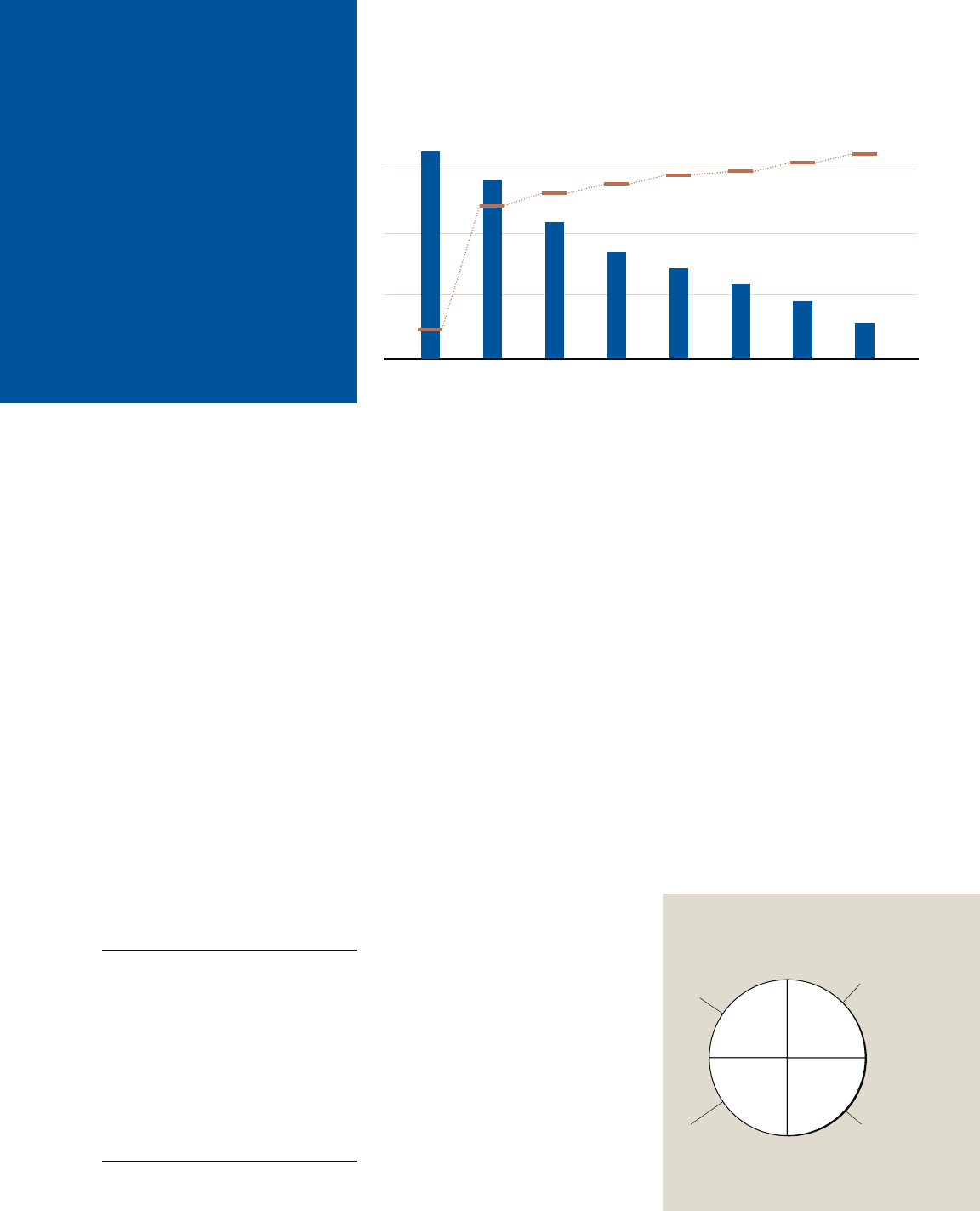

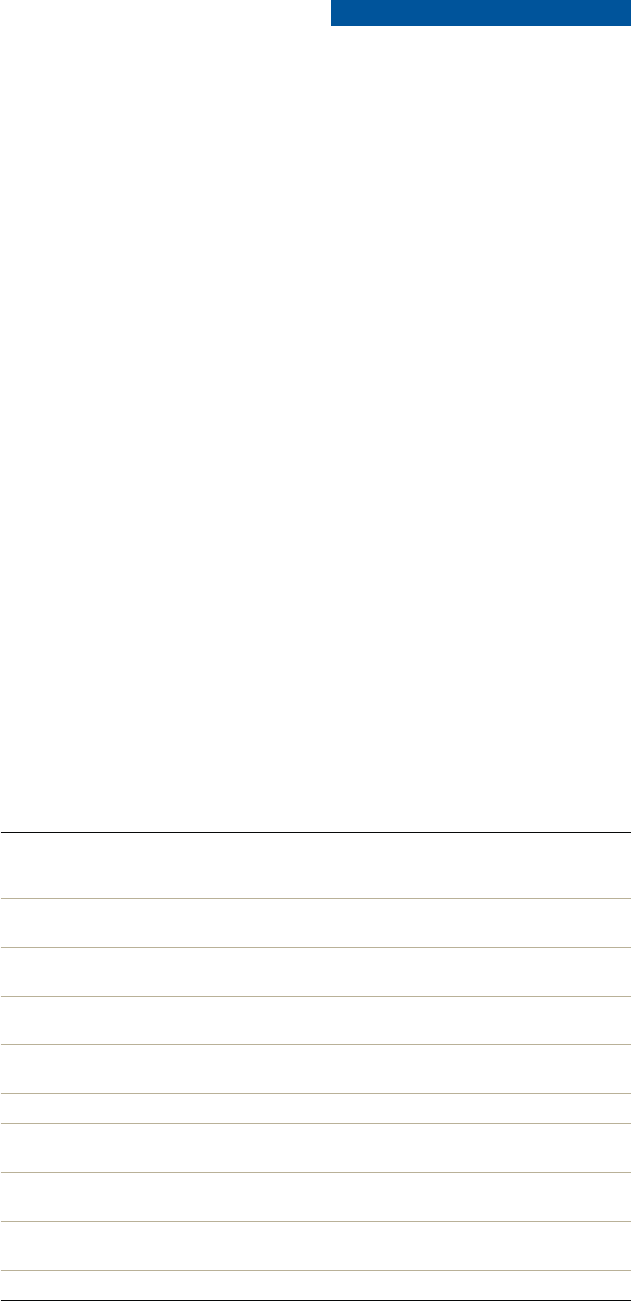

FIGURE 1.3

Who reformed the most in Africa in 2007/08?

181

1 10 20 30 40 50 130 140 150 160 170

Rwanda

148 TO 139

4 REFORMS

Madagascar

151 TO 144

4 REFORMS

Burkina Faso

164 TO 148

4 REFORMS

Sierra Leone

163 TO 156

4 REFORMS

Botswana

52 TO 38

3 REFORMS

Mauritius

29 TO 24

3 REFORMS

Liberia

167 TO 157

4 REFORMS

Senegal

168 TO 149

3 REFORMS

Improvement in the ranking on the ease of doing business, DB

2008

–DB

2009

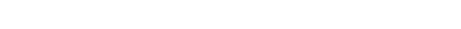

TABLE 1.2

Top reformers in 2007/08 by indicator set

Starting a business Yemen

Dealing with construction

permits

Kyrgyz Republic

Employing workers Burkina Faso

Registering property Belarus

Getting credit Cambodia

Protecting investors Albania

Paying taxes Dominican Republic

Trading across borders Senegal

Enforcing contracts Mozambique

Closing a business Poland

Source: Doing Business

database.

Source: Doing Business

database.

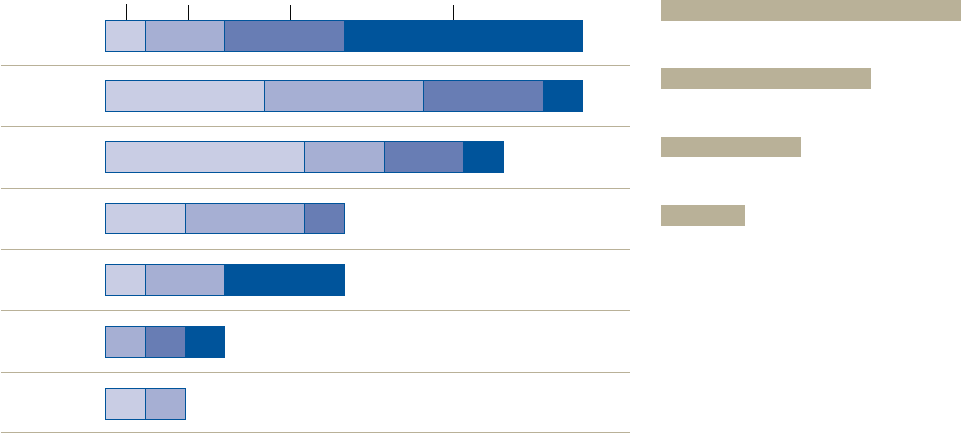

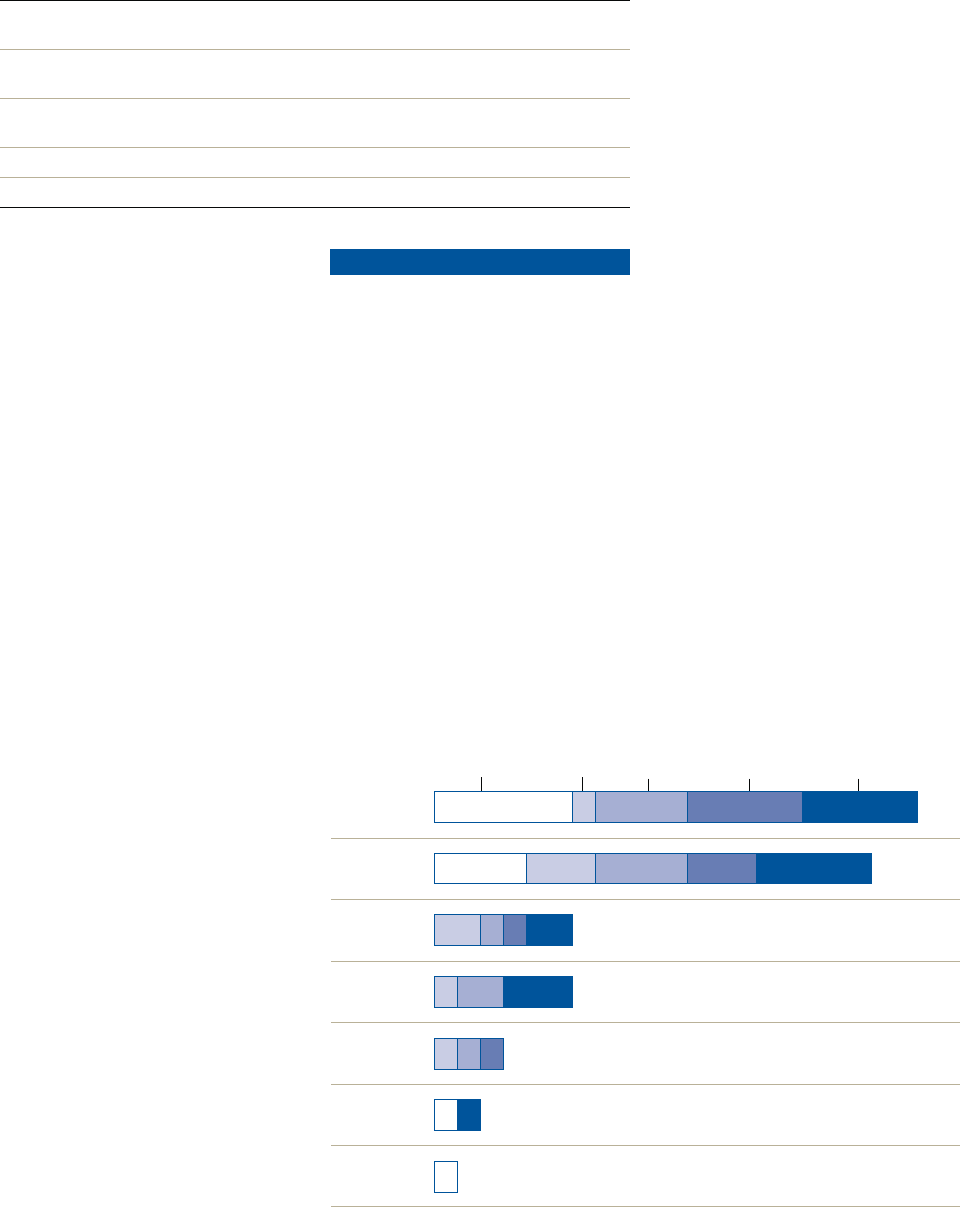

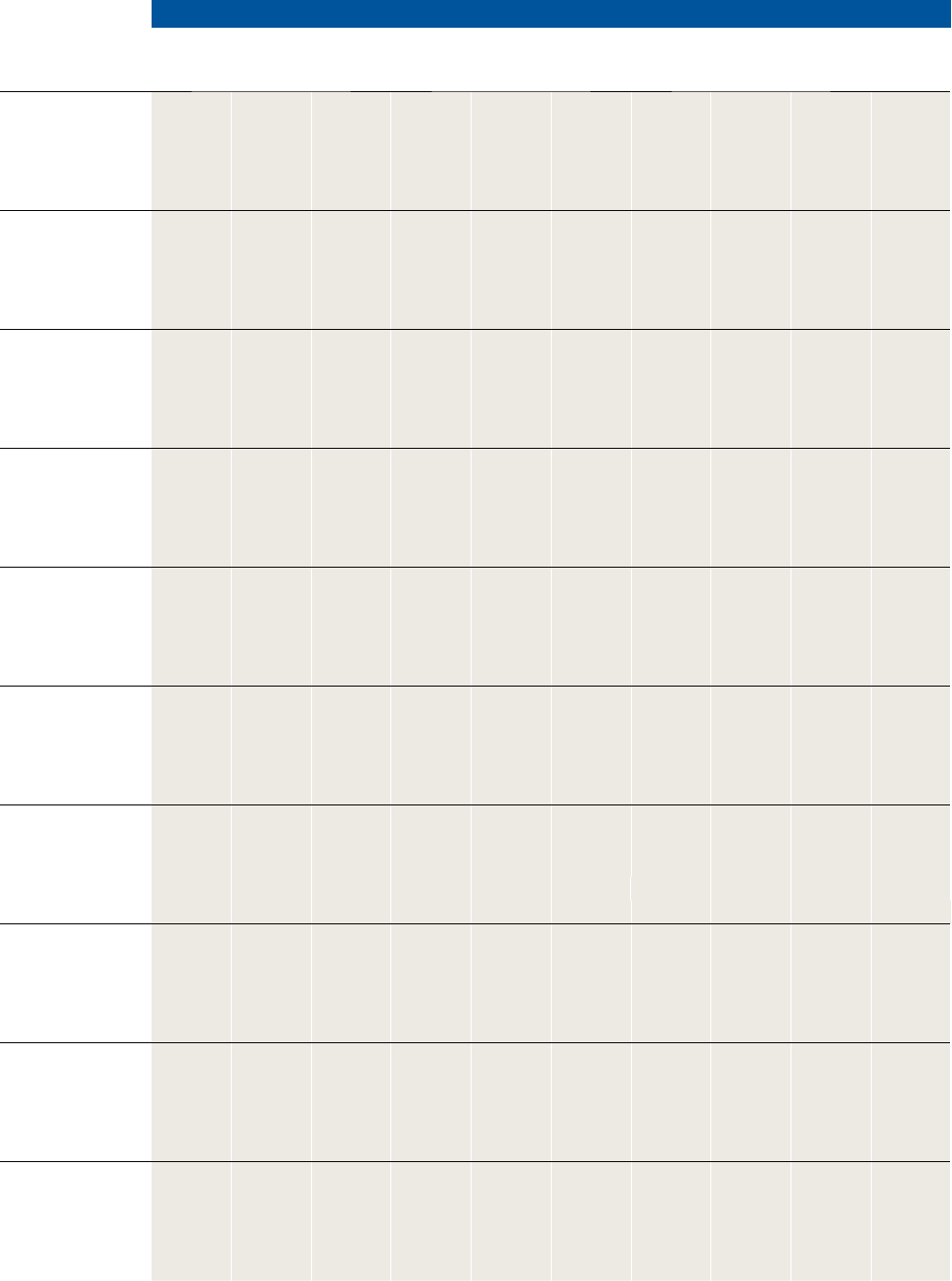

Reforms

making it

easier to

do business

Reforms

making it

more dicult

to do business

Albania

Azerbaijan

Belarus

Cambodia

Cameroon

Central African Republic

Chad

China

Congo, Rep.

Egypt

Equatorial Guinea

Finland

Gabon

Georgia

Guatemala

Indonesia

Kazakhstan

Liberia

Macedonia, former

Yugoslav Republic of

Mauritius

Moldova

Montenegro

Morocco

Sri Lanka

Taiwan, China

Tunisia

Ukraine

United Arab Emirates

Uzbekistan

Vanuatu

Vietnam

West Bank and Gaza

Getting

credit

Azerbaijan

Bangladesh

Belarus

Bosnia and Herzegovina

Burkina Faso

Congo, Rep.

Dominican Republic

Egypt

Georgia

Hungary

Jamaica

Kazakhstan

Latvia

Lithuania

Macedonia, former

Yugoslav Republic of

Madagascar

Mauritius

Rwanda

Saudi Arabia

Senegal

Serbia

Sierra Leone

Thailand

Zambia

Registering

property

Angola

Armenia

Belarus

Bosnia and Herzegovina

Burkina Faso

Colombia

Croatia

Egypt

Hong Kong, China

Jamaica

Kyrgyz Republic

Liberia

Mauritania

Portugal

Rwanda

Sierra Leone

Singapore

Tonga

Dealing with

construction permits

Benin

Bulgaria

Fiji

Montenegro

Serbia

Tajikistan

Ukraine

West Bank and Gaza

Zimbabwe

Argentina

Azerbaijan

Burkina Faso

Czech Republic

Mozambique

Slovenia

Employing

workers

Cape Verde

China

Fiji

The Gambia

Italy

Kazakhstan

Korea

Sweden

United Kingdom

Albania

Angola

Azerbaijan

Bangladesh

Belarus

Botswana

Bulgaria

Canada

Colombia

Costa Rica

Czech Republic

Dominican Republic

Egypt

El Salvador

Georgia

Ghana

Greece

Hungary

Italy

Jordan

Kenya

Kyrgyz Republic

Lebanon

Lesotho

Liberia

Macedonia, former

Yugoslav Republic of

Madagascar

Malaysia

Mauritania

Mauritius

Moldova

Namibia

New Zealand

Oman

Panama

Saudi Arabia

Senegal

Sierra Leone

Singapore

Slovakia

Slovenia

South Africa

Syria

Tonga

Tunisia

Uruguay

West Bank and Gaza

Yemen

Zambia

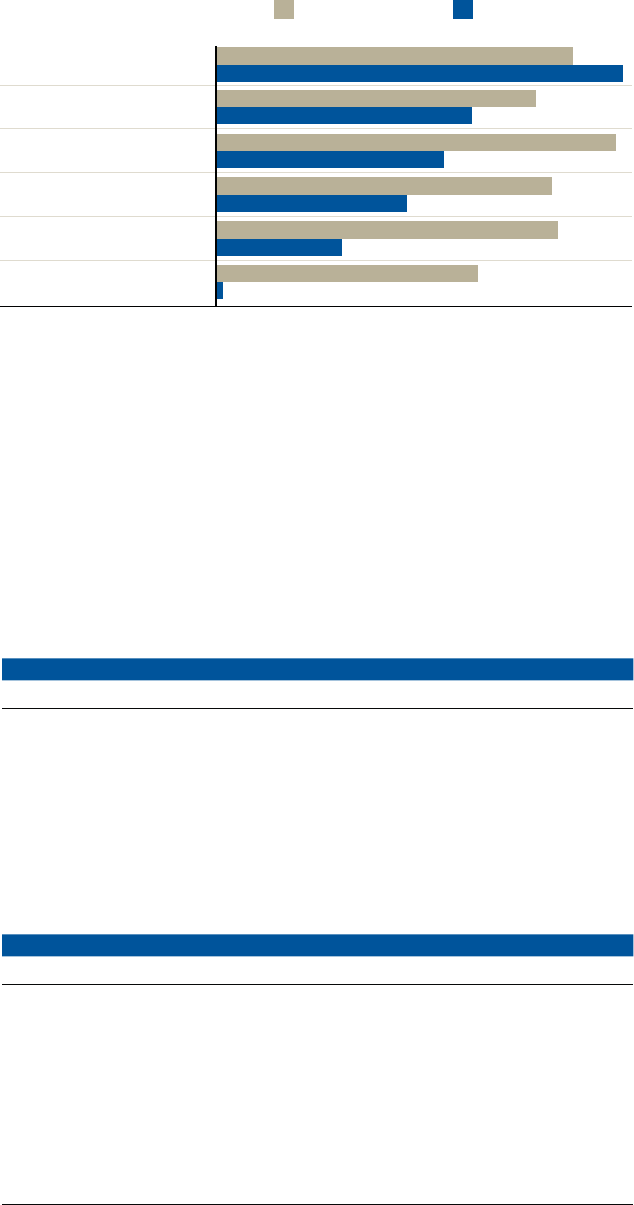

Starting

a business

Indonesia

Switzerland

49

18

6

24

32

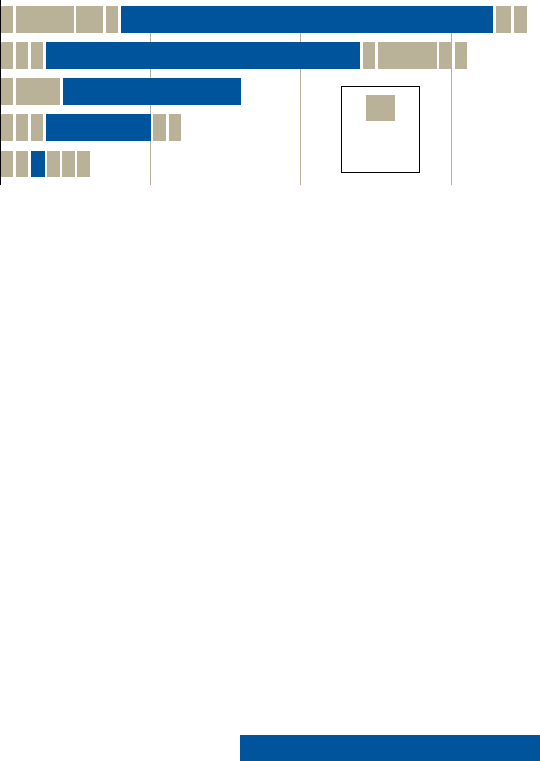

FIGURE 1.4

239 reforms in 2007/08 made it easier to do business—26 made it more dicult

4

DOING BUSINESS 2009

Albania

Azerbaijan

Botswana

Egypt

Greece

Kyrgyz Republic

Saudi Arabia

Slovenia

Tajikistan

Thailand

Tunisia

Turkey

Protecting

investors

Belarus

Benin

Botswana

Brazil

Colombia

Croatia

Djibouti

Dominican Republic

Ecuador

Egypt

El Salvador

Eritrea

France

Haiti

Honduras

India

Kenya

Korea

Liberia

Macedonia, former

Yugoslav Republic of

Madagascar

Mali

Mongolia

Morocco

Nigeria

Palau

Philippines

Rwanda

Senegal

Sierra Leone

Syria

Thailand

Ukraine

Uruguay

Trading

across borders

Equatorial Guinea

Gabon

Tunisia

Albania

Antigua and Barbuda

Azerbaijan

Belarus

Bosnia and Herzegovina

Bulgaria

Burkina Faso

Canada

China

Colombia

Côte d’Ivoire

Czech Republic

Denmark

Dominican Republic

France

Georgia

Germany

Greece

Honduras

Italy

Macedonia, former

Yugoslav Republic of

Madagascar

Malaysia

Mexico

Mongolia

Morocco

Mozambique

New Zealand

Samoa

South Africa

St. Vincent and the Grenadines

Thailand

Tunisia

Ukraine

Uruguay

Zambia

Paying

taxes

Botswana

Venezuela

Armenia

Austria

Azerbaijan

Belgium

Bhutan

Bulgaria

China

Macedonia, former

Yugoslav Republic of

Mozambique

Portugal

Romania

Rwanda

Enforcing

contracts

Bosnia and Herzegovina

Bulgaria

Cambodia

Colombia

Czech Republic

Finland

Germany

Greece

Hong Kong, China

Latvia

Mexico

New Zealand

Poland

Portugal

Saudi Arabia

St. Vincent and the Grenadines

Closing

a business

Bolivia

12

36

34

12

16

OVERVIEW

5

6

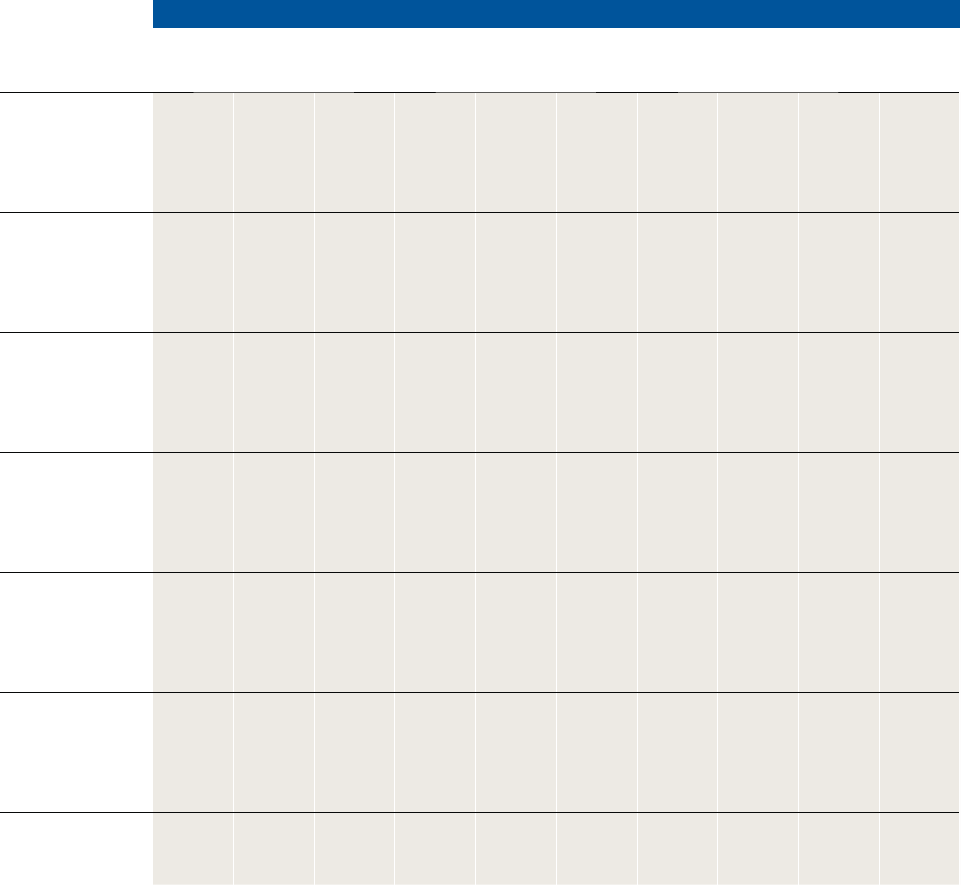

DOING BUSINESS 2009

2009

RANK

2008

RANK ECONOMY

1 1 Singapore

2 2 New Zealand

3 3 United States

4 4 Hong Kong, China

5 5 Denmark

6 6 United Kingdom

7 7 Ireland

8 8 Canada

9 10 Australia

10 9 Norway

11 11 Iceland

12 12 Japan

13 19 Thailand

14 13 Finland

15 21 Georgia

16 24 Saudi Arabia

17 14 Sweden

18 17 Bahrain

19 16 Belgium

20 25 Malaysia

21 15 Switzerland

22 18 Estonia

23 22 Korea

24 29 Mauritius

25 20 Germany

26 27 Netherlands

27 23 Austria

28 28 Lithuania

29 26 Latvia

30 30 Israel

31 32 France

32 35 South Africa

33 97 Azerbaijan

34 33

St. Lucia

35 31 Puerto Rico

36 37 Slovakia

37 38 Qatar

38 52 Botswana

39 34 Fiji

40 36 Chile

41 50 Hungary

42 40 Antigua and Barbuda

43 39 Tonga

44 41 Armenia

45 44 Bulgaria

46 54 United Arab Emirates

47 47 Romania

48 43 Portugal

49 46 Spain

50 45 Luxembourg

51 48 Namibia

52 49 Kuwait

53 66 Colombia

54 64 Slovenia

55 51 Bahamas, The

56 42 Mexico

57 57 Oman

58 55 Mongolia

59 60 Turkey

60 67 Vanuatu

61 58 Taiwan, China

2009

RANK

2008

RANK ECONOMY

62 53 Peru

63 62 Jamaica

64 56 Samoa

65 59 Italy

66 61 St. Vincent and the Grenadines

67 63 St. Kitts and Nevis

68 99 Kyrgyz Republic

69 68 Maldives

70 80 Kazakhstan

71 79 Macedonia, former Yugoslav

Republic of

72 77 El Salvador

73 81 Tunisia

74 70 Dominica

75 65 Czech Republic

76 72 Poland

77 74 Pakistan

78 69 Belize

79 75 Kiribati

80 71 Trinidad and Tobago

81 76 Panama

82 78 Kenya

83 90 China

84 73 Grenada

85 115 Belarus

86 135 Albania

87 82 Ghana

88 83 Brunei

89 85 Solomon Islands

90 84 Montenegro

91 88 Palau

92 87 Vietnam

93 86 Marshall Islands

94 91 Serbia

95

89 Papua New Guinea

96 106 Greece

97 110 Dominican Republic

98 123 Yemen

99 98 Lebanon

100 101 Zambia

101 94 Jordan

102 103 Sri Lanka

103 92 Moldova

104 93 Seychelles

105 95 Guyana

106 107 Croatia

107 96 Nicaragua

108 100 Swaziland

109 113 Uruguay

110 104 Bangladesh

111 105 Uganda

112 116 Guatemala

113 102 Argentina

114 125 Egypt

115 108 Paraguay

116 109 Ethiopia

117 118 Costa Rica

118 114 Nigeria

119 117 Bosnia and Herzegovina

120 112 Russian Federation

121 111 Nepal

2009

RANK

2008

RANK ECONOMY

122 120 India

123 119 Lesotho

124 122 Bhutan

125 126 Brazil

126 121 Micronesia

127 124 Tanzania

128 129 Morocco

129 127 Indonesia

130 128 Gambia, The

131 132 West Bank and Gaza

132 130 Algeria

133 134 Honduras

134 131 Malawi

135 150 Cambodia

136 133 Ecuador

137 140 Syria

138 145 Uzbekistan

139 148 Rwanda

140 136 Philippines

141 139 Mozambique

142 138 Iran

143 137 Cape Verde

144 151 Madagascar

145 144 Ukraine

146 141 Suriname

147 142 Sudan

148 164 Burkina Faso

149 168 Senegal

150 149 Bolivia

151 143 Gabon

152 146 Iraq

153 153 Djibouti

154 147 Haiti

155 152

Comoros

156 163 Sierra Leone

157 167 Liberia

158 154 Zimbabwe

159 156 Tajikistan

160 166 Mauritania

161 155 Côte d’Ivoire

162 161 Afghanistan

163 159 Togo

164 158 Cameroon

165 162 Lao PDR

166 160 Mali

167 165 Equatorial Guinea

168 169 Angola

169 157 Benin

170 170 Timor-Leste

171 172 Guinea

172 171 Niger

173 173 Eritrea

174 175 Venezuela

175 176 Chad

176 177 São Tomé and Principe

177 174 Burundi

178 178 Congo, Rep.

179 179 Guinea-Bissau

180 180 Central African Republic

181 181 Congo, Dem. Rep.

Note:

The rankings for all economies are benchmarked to June 2008 and reported in the country tables. Rankings on the ease of doing business are the average of the economy’s rankings on the 10 topics covered

in

Doing Business 2009.

Last year’s rankings are presented in italics. These are adjusted for changes in the methodology, data corrections and the addition of 3 new economies.

Source: Doing Business

database.

TABLE 1.3

Rankings on the ease of doing business

OVERVIEW

7

procedures and 4 days. New business

registrations increased by 30% in 2 years.

In Portugal 86 of the 257 initiatives of the

Simplex program came from discussions

with businesses.

Simplifying regulation helps busi-

nesses and governments alike. In Portu-

gal the “on the spot” registration reform

saved entrepreneurs 230,000 days a year

in waiting time.

4

And the government

saves money. e United Kingdom es-

timated an annual administrative bur-

den for businesses of £13.7 billion in

2005. Easing such burdens would allow

businesses to expand faster and generate

savings that governments could use to

enhance public services.

FIVE YEARS OF DOING BUSINESS

REFORM

e key to regulatory reform? Commit-

ment. For many economies the reforms

captured in Doing Business reect a

broader, sustained commitment to im-

proving their competitiveness. Among

these systematic reformers: Azerbaijan,

Georgia and the former Yugoslav Repub-

lic of Macedonia in Eastern Europe and

Central Asia. France and Portugal among

the OECD high-income economies. Egypt

and Saudi Arabia in the Middle East and

North Africa. India in South Asia. China

and Vietnam in East Asia. Colombia,

Guatemala and Mexico in Latin America.

And Burkina Faso, Ghana, Mauritius,

Mozambique and Rwanda in Africa.

Each of these countries has reformed in

at least 5 of the areas covered by Doing

Business, implementing up to 22 reforms

in one country over the past 5 years.

Several reformers were motivated by

growing competitive pressure related to

joining common markets or trade agree-

ments, such as the European Union (the

former Yugoslav Republic of Macedonia)

or the U.S.–Central America Free Trade

Agreement (Guatemala). Others saw a

need to facilitate local entrepreneurship

(Azerbaijan, Colombia, Egypt) or diver-

sify their economy (Mauritius, Saudi

Arabia). And others faced the daunting

task of reconstructing their economy

aer years of conict (Rwanda).

Many of the reformers started by

learning from others. Egypt looked to

India for information technology solu-

tions. Colombia took Ireland as an ex-

ample. As the country’s trade minister,

Luis Guillermo Plata, put it, “It’s not like

baking a cake where you follow the rec-

ipe. No. We are all dierent. But we can

take certain things, certain key lessons,

and apply those lessons and see how they

work in our environment.”

Several now serve as examples to

others. e Azerbaijan reformers vis-

ited Georgia and Latvia. Angola has re-

quested legal and technical assistance

based on the Portuguese model of busi-

ness start-up.

e most active reformers did not

shy away from broad reform programs.

Since 2005 Georgia has introduced a new

company law and customs code, a new

property registry that replaced a confus-

ing system requiring duplicate approvals

by multiple agencies, the country’s rst

credit information bureau and large-scale

judicial reforms. Egypt has implemented

one-stop shops for import and export and

business start-up, undertaken sweeping

tax reforms, continually improved its

credit information systems and modi-

ed the listing rules of the Cairo Stock

Exchange. Colombia has strengthened

investor protections through stricter dis-

closure rules, amended insolvency laws

and reformed customs. And its one-stop

shop for business start-up has served as

an inspiration to others in the region.

Among emerging market reform-

ers, India has focused on technology,

implementing electronic registration of

new businesses, an electronic collateral

registry and online submission of cus-

toms forms and payments. China has

focused on easing access to credit. In

2006 a new credit registry allowed more

than 340 million citizens to have credit

histories for the rst time. A new com-

pany law lowered the minimum capital

requirement and strengthened investor

protections. And in 2007 a new prop-

erty law expanded the range of assets

that can be used as collateral. Mexico

has focused on strengthening investor

protections through a new securities law

while continually reducing bureaucracy

at the state level.

REGULATORY REFORM—

WHAT ARE THE BENEFITS?

Of Egypt’s estimated 25 million urban

properties, only 7% were formally regis-

tered in 2005. Six months aer reforms

of its property registry, title registration

increased and revenue rose by 39%.

5

Aer reforms of the property registry

in Tegucigalpa, Honduras, the registry

received 65% more registration applica-

tions between July and December of

2007 than in the same period of 2006.

Similarly, a reduction in the mini-

mum capital requirement was followed

by an increase in new company registra-

tions of 55% in Georgia and 81% in Saudi

Arabia. Georgia now has 15 registered

businesses per 100 people—comparable

to numbers in such economies as Malay-

sia and Singapore.

Initial results like these show that

reforms are leading to change on the

ground. Conrming this are the nd-

ings of an increasing number of studies

using the Doing Business data to analyze

the eect of regulatory burdens on such

outcomes as informality, job creation,

productivity, economic growth and pov-

erty reduction.

6

Research generally nds that coun-

tries with burdensome regulation have

larger informal sectors, higher unem-

ployment rates and slower economic

growth. More recent research gives rst

insights into the impact of reforms. One

study reports some of the payos of

reforms in Mexico: the number of regis-

tered businesses rose by nearly 6%, em-

ployment increased by 2.6%, and prices

fell by 1% thanks to competition from

new entrants.

7

Another study nds that

increasing the exibility of labor regula-

tions in India would reduce job informal-

ity in the retail sector by a third.

8

But nothing says more than the

experience of the people aected. Janet,

who runs a business producing baskets

8

DOING BUSINESS 2009

in Kigali, Rwanda, says, “I have sur-

vivors, I have widows, I have women

whose husbands are in prison. To see

them sitting under one roof weaving

and doing business together is a huge

achievement . . . these women are now

together earning an income.”

9

NOTES

1. Doing Business records only reforms

relevant to the 10 indicator sets. Legal

changes are counted once the respective

legislation and implementing decrees, if

applicable, are eective. Administrative

reforms such as the introduction of time

limits must be fully implemented.

2. Narayan and others (2000).

3. Hertveldt (2008).

4. Ramos (2008).

5. Haidar (2008).

6. e data on the regulation of entry, for

example, have been used in 168 articles

published in refereed journals and more

than 200 research working papers. e

data on the eciency of court proceed-

ings have been used in 54 articles and

86 working papers. Altogether, the data

generated by the Doing Business project

have been used in 325 published articles

and 742 working papers.

7. Bruhn (2008).

8. Amin (forthcoming).

9. is example is from the World Bank’s

Doing Business: Women in Africa (2008a),

a collection of case studies of African

entrepreneurs.

STARTING A BUSINESS

9

Julian started out working for her broth-

ers. But she was saving to start her own

business. She began trading, traveling

from Uganda to neighboring Kenya to

buy goods for resale. “I would take the

overnight bus and stand up the whole

way to get the 50% discount,” she recalls.

“My aim was to start a juice processing

business, a real factory.”

Once she had saved enough money,

Julian began production. Unable to af-

ford transport, she had to take her prod-

ucts by foot to the government chemist

for testing. “My only means of transport

was my wheelbarrow, and I was the

whole company.”

Julian also remembers how arduous

it was to register her business. “ere

was so much to do and so many dif-

ferent places I had to go—for business

registration and taxpayer identication

numbers, dierent licenses from dier-

ent authorities, a declaration that had to

be made before a commissioner of oaths,

a company seal to get, inspections of

my premises from municipal and health

authorities. I remember paying a lawyer

what seemed to me a gigantic fee of

USh 500,000 [$279].”

1

Entrepreneurs like Julian now have

it easier. Reforms in Uganda and in many

other economies have streamlined busi-

ness start-up in the past 5 years. Look at

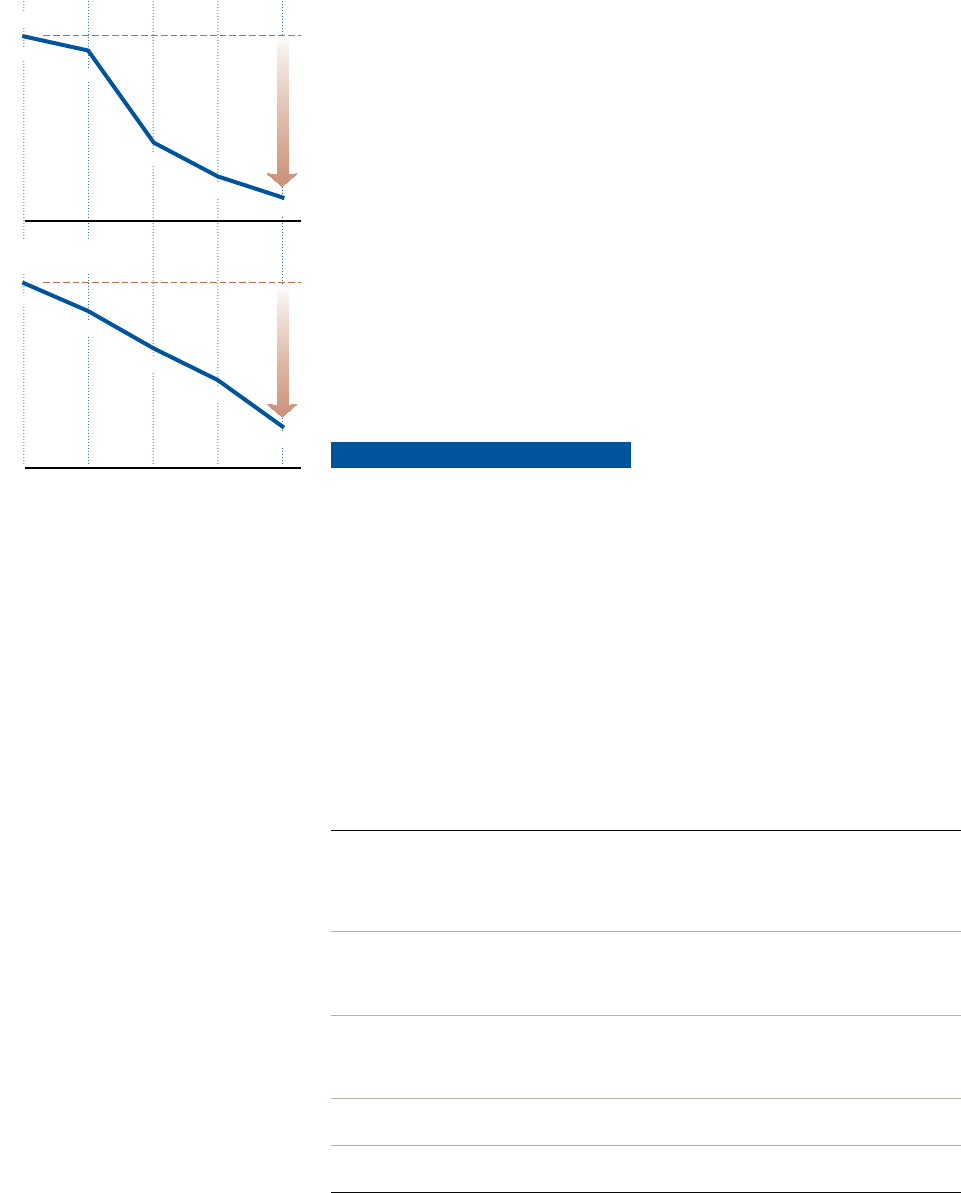

Azerbaijan. In 2004 its government set a

preliminary time limit for the registra-

tion process. In 2005 it introduced a

silence-is-consent rule for tax registra-

tion. A year later it further tightened the

time limit for business registration. In

2007 it abolished the need for a company

seal. And in 2007/08 it set up a one-stop

shop. Starting a business used to take 122

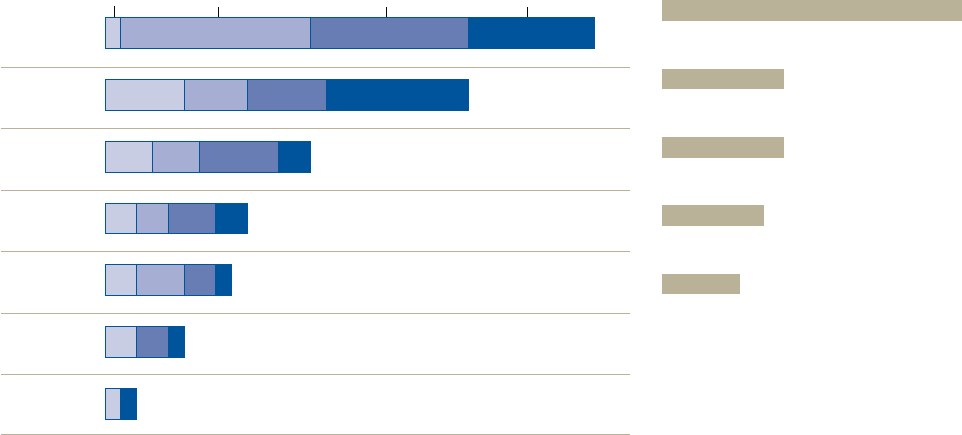

days. Now it takes only 16 (gure 2.3).

Formal incorporation of companies

has several benets. Legal entities out-

live their founders. Resources are oen

pooled as shareholders join forces to

start a company. And companies have ac-

cess to services and institutions ranging

from courts to commercial banks.

But many economies make starting

and legally running a business as mea-

sured by Doing Business so cumbersome

that entrepreneurs opt out and operate in

the informal sector.

Simpler entry encourages the cre-

ation of new companies. Take Senegal,

which reformed business registration in

July 2007. By May 2008 entrepreneurs had

registered 3,060 new rms, 80% more than

in the previous year. Studies in Mexico,

India, Brazil and the Russian Federation

all conclude that simpler entry regimes

are associated with more new rms being

registered. e study in Mexico analyzes

the eect of making it simpler to get a

municipal license, 1 of several procedures

required to start a business. e nding:

easing business entry increased new start-

ups by about 4%.

2

Easier start-up is also correlated

with higher productivity among existing

rms. A recent study, in an analysis of 97

countries, nds that reducing entry costs

by 80% of income per capita increases

total factor productivity by an estimated

22%. Analyzing 157 countries, it nds

that the same reduction in entry costs

raises output per worker by an estimated

Overview

Starting a

business

Dealing with construction permits

Employing workers

Registering property

Getting credit

Protecting investors

Paying taxes

Trading across borders

Enforcing contracts

Closing a business

As % of income per

capita, no bribes included

Procedure is

completed when

nal document

is received

Funds deposited in a bank

or with a notary before

registration

Time

Cost

Procedures

Paid-in

minimum

capital

25% 25%

25%25%

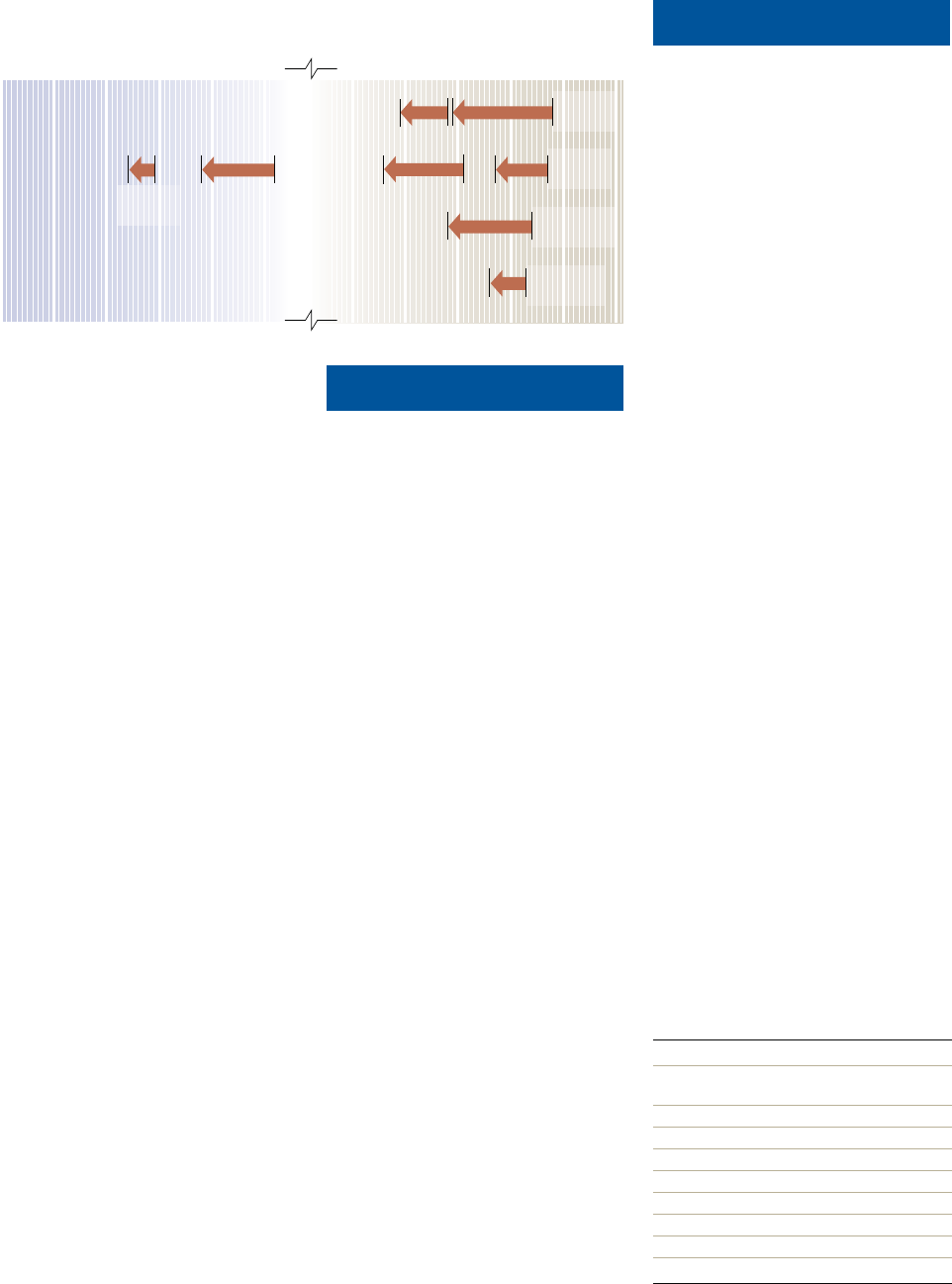

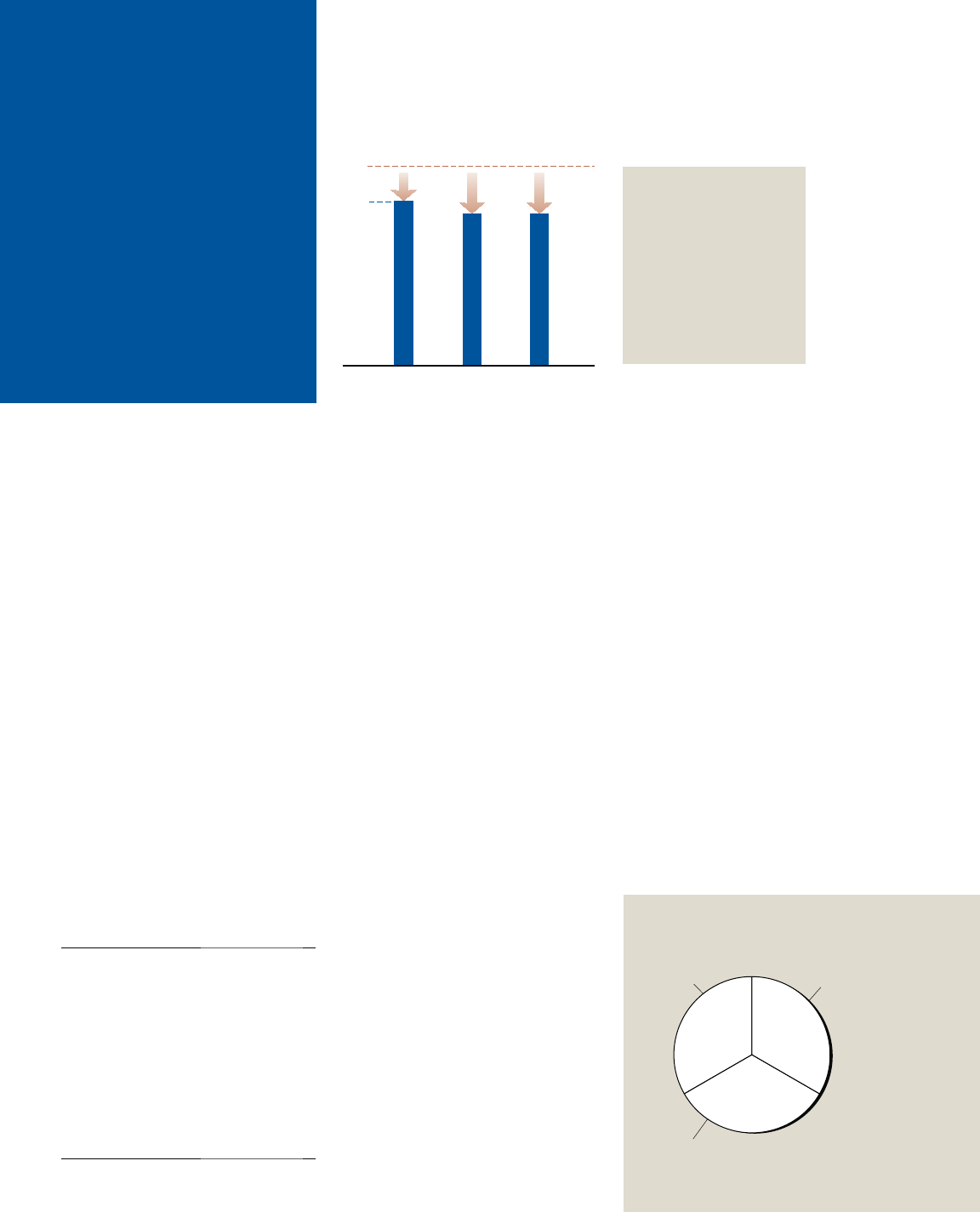

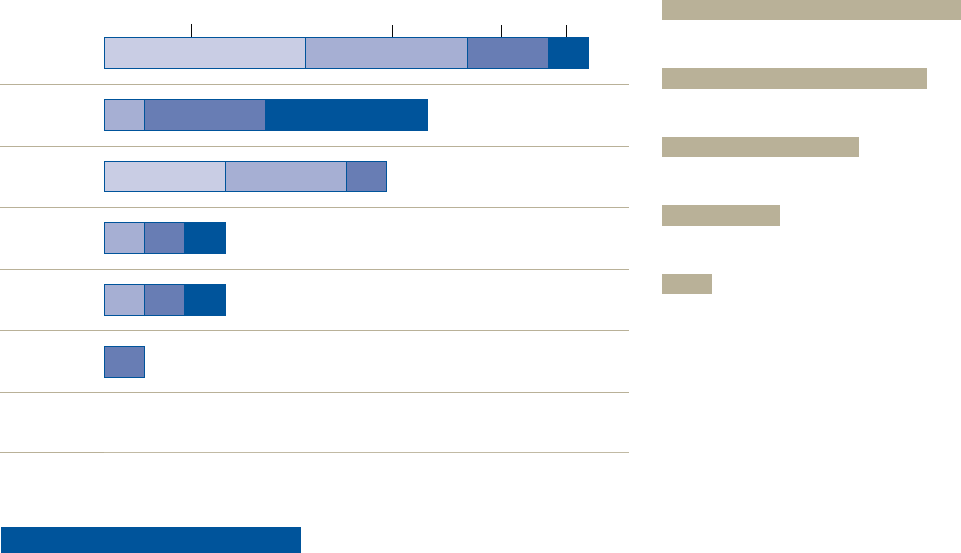

FIGURE 2.2

Rankings on starting a business

are based on 4 subindicators

Note: See Data notes for details.

Preregistration,

registration and

postregistration

Source: Doing Business

database.

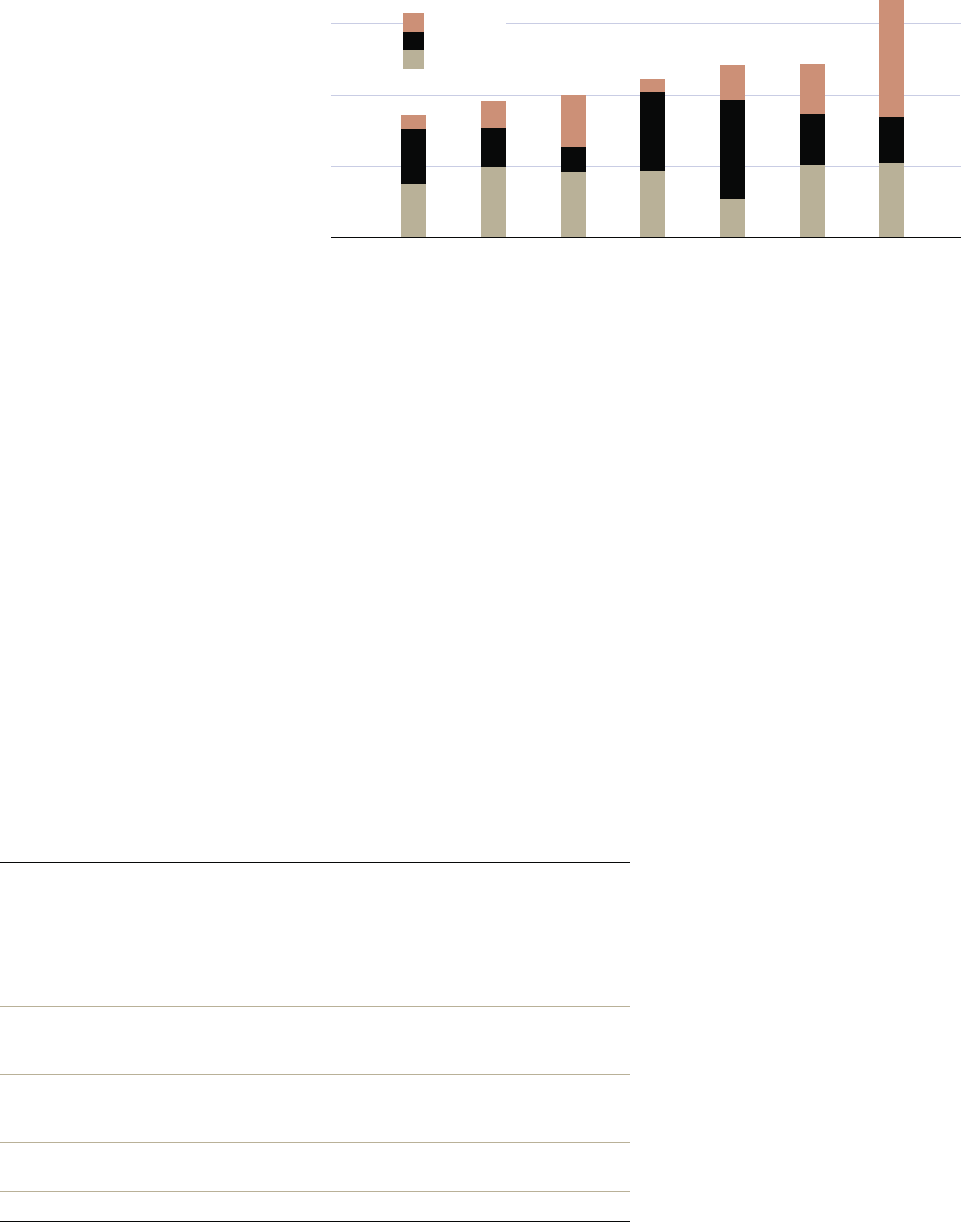

Average improvement

FIGURE 2.1

Top 10 reformers in starting a business

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Procedures Time Paid-in

minimum

capital

Cost

2007

2008

46% 65% 54% 28%

Yemen

Slovenia

Senegal

Albania

Liberia

Azerbaijan

Syria

Hungary

Oman

Sierra Leone

TABLE 2.1

Where is it easy to start a business—and

where not?

Easiest RANK Most dicult RANK

New Zealand 1 Cameroon 172

Canada 2 Djibouti 173

Australia 3 Equatorial Guinea 174

Georgia 4 Iraq 175

Ireland 5 Haiti 176

United States 6 Guinea 177

Mauritius 7 Eritrea 178

United Kingdom 8 Togo 179

Puerto Rico 9 Chad 180

Singapore 10 Guinea-Bissau 181

Note:

Rankings are the average of the economy rankings on the

procedures, time, cost and paid-in minimum capital for starting a

business. See Data notes for details.

Source: Doing Business

database.

10

DOING BUSINESS 2009

29%.

3

One reason for these large ef-

fects may be that reducing entry costs

increases entry pressure, pushing rms

with lower productivity out of the mar-

ket. Indeed, a study on business entry

in Mexico nds that competition from

new entrants lowered prices by 1% and

reduced the income of incumbent busi-

nesses by 3.5%.

4

Simpler and faster business entry

makes it easier for workers and capital

to move across sectors when economies

experience economic shocks. A recent

study of 28 sectors in 55 countries com-

pares sectoral employment reallocation

in the 1980s and 1990s. e nding: real-

location is smoother in countries where it

takes fewer days to start a business.

5

is

nding is conrmed by many studies on

the eect of entry regulation in economies

opening their product markets to trade.

6

e explanation is simple: with high xed

costs of entry, rms cannot easily move

into the industries beneting the most

from trade openness. is friction re-

duces the value of greater openness.

Recognizing such benets, econo-

mies around the world have been devel-

oping innovative solutions to ease the

entry of new rms into the market. As

one company registrar put it, “At the end

of the day, we all have the same goal.”

Yet as Doing Business shows, com-

pany registration is oen only one piece

of the puzzle. In many economies en-

trepreneurs have to visit at least 7 agen-

cies before they can get down to busi-

ness. e most ecient economies focus

on creating a single interface between

government and entrepreneur to take

care of all necessary registrations and

notications, mainly commercial and

tax registration. Entrepreneurs in New

Zealand, for example, have to le all nec-

essary information only once—because

agencies are linked through a unied

database. ere is no minimum capital

requirement. And no judge has to ap-

prove the creation of a company.

WHO REFORMED IN 2007/08?

In 2007/08, 49 economies made it easier

to start a business—more reforms than

in any previous year (table 2.2). One

highlight of the reforms: entrepreneurs

in Canada and New Zealand can now

start a business with a single online

procedure.

Yemen reformed business start-up

the most. In 2007 it had the second larg-

est minimum capital requirement in the

world at $15,225 (2,003% of income per

capita). is is now gone, reduced to

zero. at’s not all. Yemen also activated

its one-stop shop, making it possible to

complete all steps—from reserving the

company name to obtaining a license for

incorporation to announcing the com-

pany’s formation—in a single location.

It made it easier to obtain a license from

the municipality and to register with the

chamber of commerce and the tax oce.

And it publicized the fact that a company

seal is not mandatory. e reforms re-

duced the number of procedures to start

a business by 5, and the time by 50 days.

Slovenia was the runner-up in busi-

ness start-up reforms. It simplied busi-

ness registration by introducing a single

access point, making company infor-

mation available online and eliminating

court fees and the requirement to reg-

ister at the statistical oce. e changes

reduced the procedures by 4, the time by

41 days and the cost by 8.4% of income

per capita.

Senegal is among the 14 econo-

mies that made Africa the leading region

in start-up reforms. Senegal’s one-stop

shop became fully operational, merging

7 start-up procedures into 1. Start-up

time fell from 58 days to 8.

Liberia too

streamlined business registration, cut-

ting 3 months from the time. Businesses

can now start in less than 1 month. Libe-

ria also made the process more aord-

able, making the use of lawyers optional.

Source: Doing Business

database.

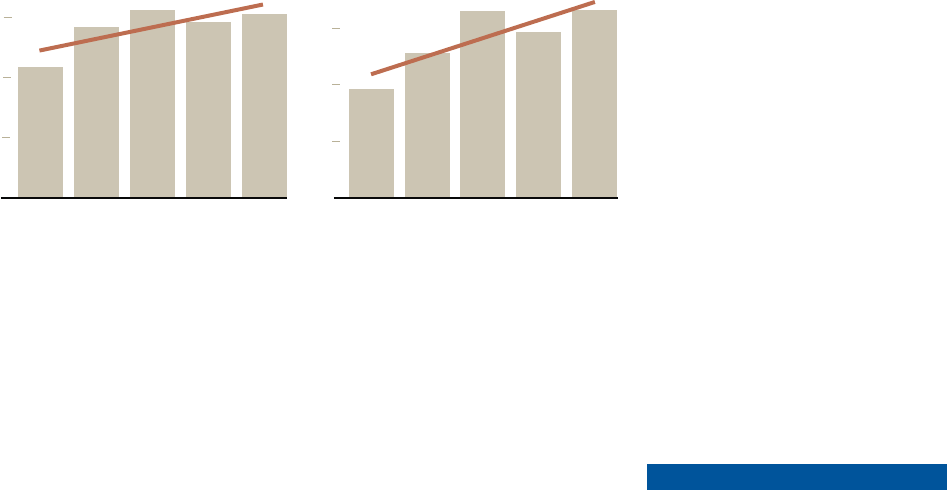

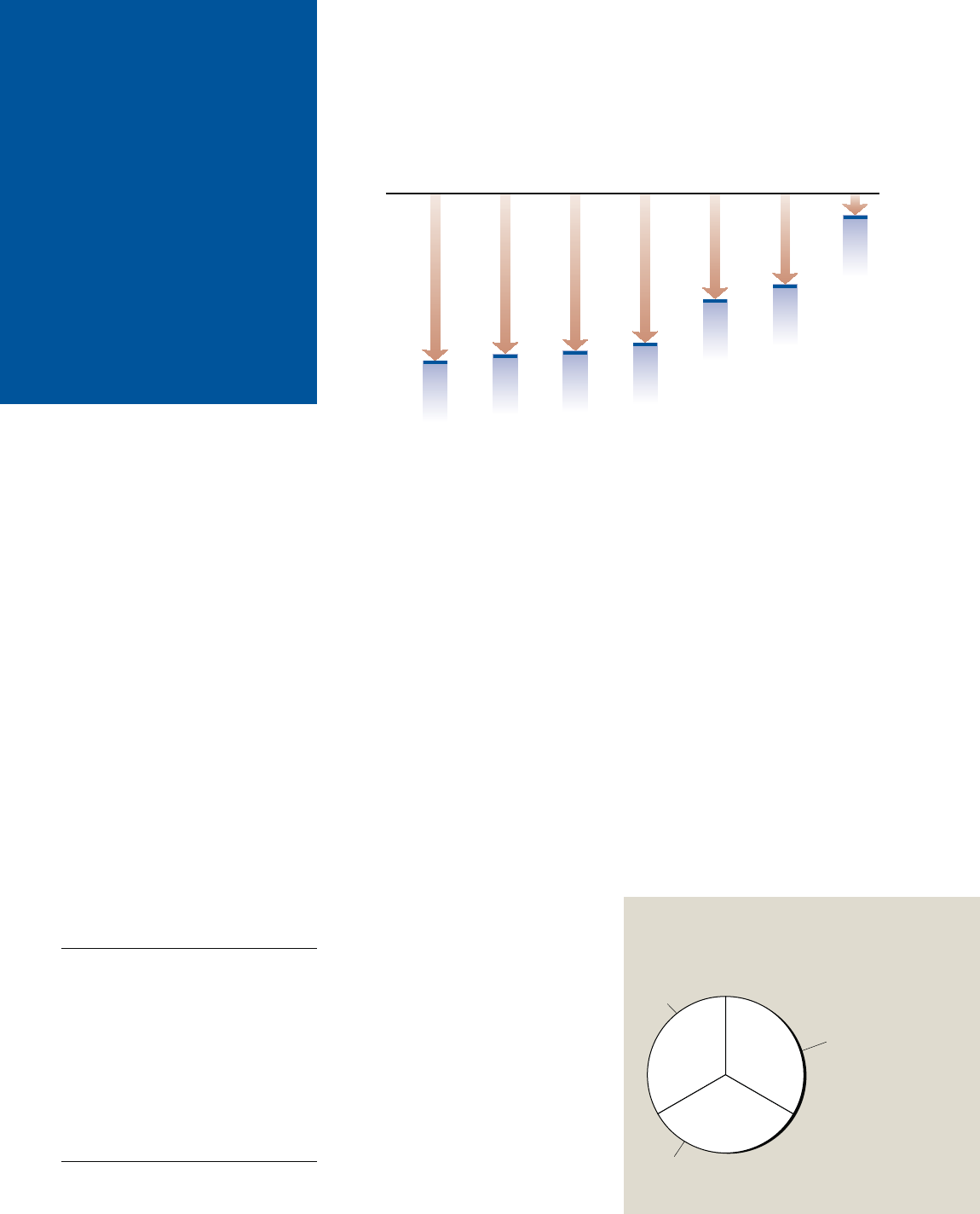

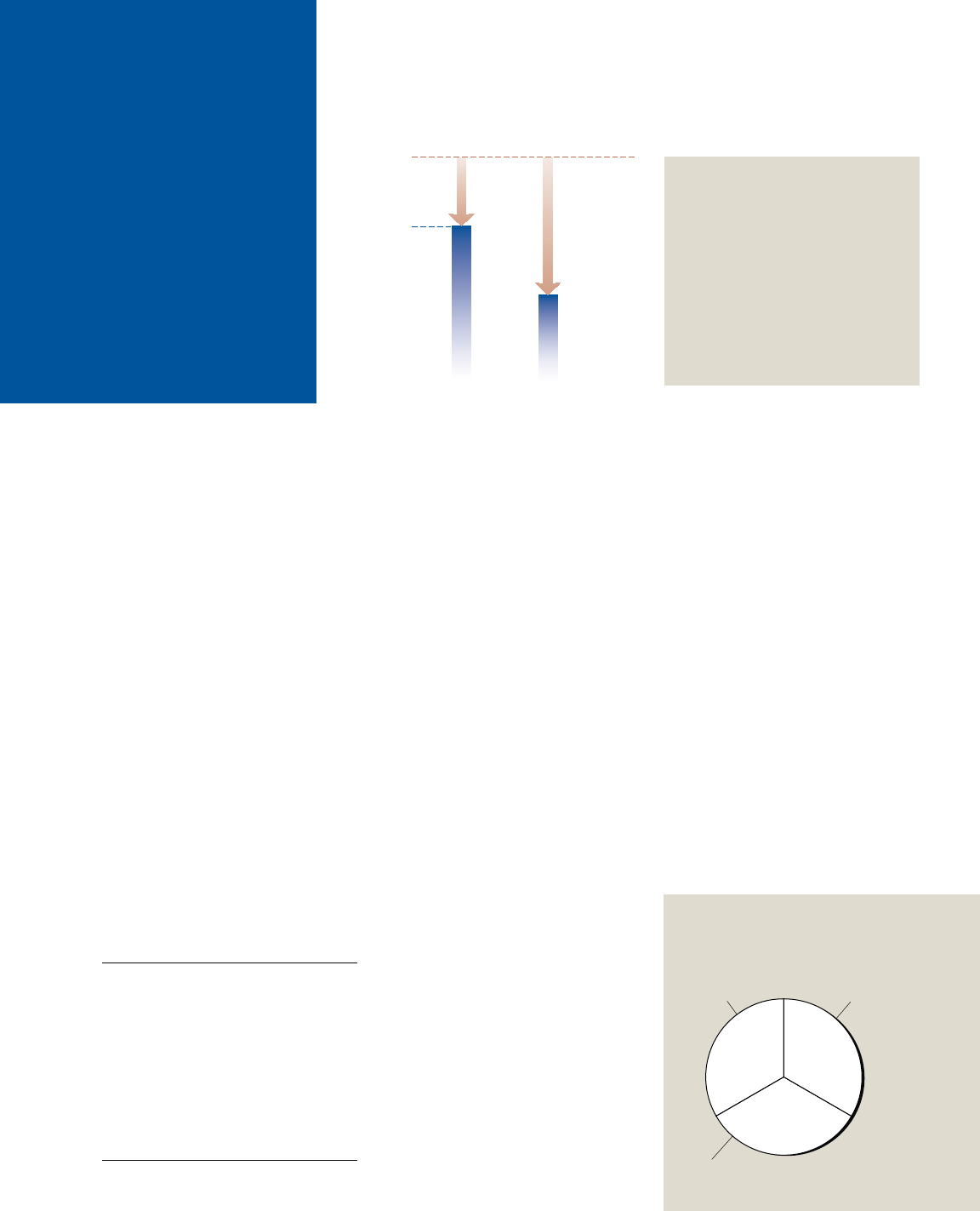

FIGURE 2.3

Starting a business in Azerbaijan

gets faster and cheaper

Time and cost to start a business

2005 2006 2007 20082004

Time (days)

Cost

(% of income per capita)

Time cut

by 87%

Cost cut

by 77%

122

114

52

30

16

14.4

12.3

9.3

6.9

3.2

0

0

TABLE 2.2

Simplifying registration formalities—the most popular reform feature in 2007/08

Simplied other registration formalities

(seal, publication, notary, inspection,

other requirements)

Bangladesh, Botswana, Bulgaria, Costa Rica,

El Salvador, Georgia, Ghana, Hungary, Kenya, Kyrgyz

Republic, Liberia, former Yugoslav Republic of

Macedonia, Moldova, Namibia, Saudi Arabia, Syria,

Yemen

Created or improved one-stop shop Albania, Angola, Azerbaijan, Belarus, Bulgaria, Czech

Republic, Italy, Lebanon, Lesotho, former Yugoslav

Republic of Macedonia, Oman, Senegal, Slovakia,

Slovenia, Yemen, Zambia

Introduced or improved online

registration procedures

Bulgaria, Canada, Colombia, Dominican Republic,

Hungary, Italy, former Yugoslav Republic of

Macedonia, Malaysia, Mauritius, New Zealand,

Panama, Senegal, Singapore

Abolished or reduced minimum capital

requirement

Belarus, Egypt, El Salvador, Georgia, Greece,

Hungary, Jordan, Tunisia, Uruguay, Yemen

Cut or simplied postregistration procedures Colombia, Madagascar, Mauritania, Sierra Leone,

South Africa, Tonga, West Bank and Gaza

Source: Doing Business

database.

STARTING A BUSINESS

11

e cost is a fourth of what it used to be.

Madagascar also focused on cost, abol-

ishing the professional tax.

Sierra Leone and South Africa

made the use of lawyers optional. South

Africa also introduced electronic means

of certifying and publishing company

documents. In Botswana and Namibia

entrepreneurs now benet from com-

puterized registration systems. Zambia

revamped the company registry and

created a one-stop shop. So did Leso-

tho, reducing start-up time by 33 days.

Burkina Faso continued reforms at its

one-stop shop, CEFORE. Ghana ocially

eliminated the requirement for a com-

pany seal. Angola, Kenya, Mauritania

and Mauritius also reformed.

Eastern Europe and Central Asia

saw reform in 10 economies. Six reduced

the running-around time for entrepre-

neurs by creating one-stop shops. Alba-

nia took registration out of the courts

and merged company, social security,

labor and tax registrations. Before, en-

trepreneurs had to wait more than a

month to start doing business; now it’s

just 8 days. Azerbaijan’s one-stop shop

reduced delays by 2 weeks, Slovenia’s by