!"#$%&'()%

%

% %

*+,- .# /% 0#%+ 1 , 23% 45 .6 $ %

/.7.#/%8,23 %

95 $% 20:+%0;%:+" <$#+%60, #%: $17.2 .#/ % 81$,3 <04#:%;0 1 %=$0 =6$%:$17.#/%

+5$. 1%20> >" #.+. $: %

%

(% %

?$::,/$%;10>%+5$%@ABC%*+"<$#+%D0,#%E>8"<:>,#%

In September 2013, the Consumer Financial Protection Bureau (the Bureau) released “Public

Service and Student Debt,” a report that examined how a range of existing protections and

benefits offered the promise of debt relief to an important segment of student loan borrowers—

those who pursue careers serving in their communities.

1

At the time, the Bureau estimated that

1-in-4 U.S. workers were employed by a “public service organization,” as defined by the federal

Public Service Loan Forgiveness (PSLF) program.

2

Evidence suggests that many professions in

this segment of the workforce typically require advanced levels of education,

3

and that education

requirements in many of these fields have increased over time. These requirements are put in

place through federal or state law,

4

often as recommended by individual public service

organizations or by professional associations.

5

1

See Consumer Financial Protection Bureau (CFPB), Public Service & Student Debt (2013),

http://files.consumerfinance.gov/f/201308_cfpb_public-service-and-student-debt.pdf. Additionally, that same

year, the Bureau launched a workplace financial fitness initiative to empower public service employers to help their

employees reduce their student debt – the CFPB Public Service Pledge on Student Debt. See CFPB, Take the pledge

(accessed Feb. 3, 2017), http://www.consumerfinance.gov/pledge/. For more than three years, the Bureau has

provided organizations that take the Public Service Pledge with resources and toolkits to help employees stay on

track as they manage their student loan debt.

2

See 34 C.F.R. § 685.219 (defining public service as work in the following fields: federal, state, local, or tribal

government; public child or family service agency; non-profit organization under 501(c)(3) of the Internal Revenue

Code; tribal college or university; or a non-profit private organization that provides certain public services,

including emergency management, military service, public safety, law enforcement, public interest law services,

early childhood education, public service for individuals with disabilities, public health, public education, public

library services, school library or other school-based services.); see also CFPB, Public Service & Student Debt,

supra note 1.

3

See, e.g., Keith A. Bender & John S. Heywood, Out of Balance? Comparing Public and Private Sector

Compensation over 20 Years, National Institute on Retirement Security (Apr. 2010), slge.org/wp-

content/uploads/2011/12/Out-of-Balance_FINAL-REPORT_10-183.pdf (“Public and private workforces differ in

important ways. For instance, jobs in the public sector require much more education on average than those in the

private sector.”).

4

See, e.g., 10 U.S.C. § 12205(a) (requiring a bachelor’s degree for promotion beyond a first lieutenant for certain

branches of the military); 8 Va. Admin. Code § 20-22-40 (2017) (requiring prospective teachers to hold a bachelor’s

degree before applying for a teaching license in Virginia); see also U.S. Army Officer Program, Officer: Frequently

%

&% %

Communities across the country have continued to prioritize higher education for public service

professions by establishing new credential or degree requirements for a broad range of public

service workers, including classroom teachers,

6

first responders,

7

clinical social workers,

8

and

early childhood education providers.

9

In each instance, the public broadly shares the benefits of

a highly educated professional workforce serving in their communities. Yet, too often, the

financial costs of these new credentials fall on individuals in careers with limited opportunity for

wage growth to offset these costs. New credentialing initiatives continue to be enacted for those

entering public service professions amid growing concerns by researchers,

10

regulators,

11

and

Asked Questions (accessed May 30, 2017), www.goarmy.com/careers-and-jobs/become-an-officer/army-officer-

faqs.html#college (stating that individuals are required to have a bachelor’s degree before being commissioned as

an officer).

5

See, e.g., Assoc. of State and Provincial Psychology Boards, ASPPB Model Act for Licensure and Registration of

Psychologists (Oct. 2010), asppb.site-ym.com/resource/resmgr/guidelines/final_approved_mlra_november.pdf;

Nat. Assoc. of Social Workers, Social Work Credentials (accessed May 30, 2017),

naswdc.org/credentials/default.asp.

6

See, e.g., 16 Ky. Admin. Regs. 2:101 (2017) (Requiring individuals hold a bachelor’s degree with a minimum grade

point average to be eligible for a teaching certificate).

7

See, e.g., Cal. Code Regs. tit. 19, § 2530 (2017) (requiring state certified hazardous materials technicians to have at

least a bachelor of science). The Bureau of Labor Statistics (BLS) notes that first responders with college degrees,

including firefighters and police officers, have the best job prospects and opportunities for promotion. See, e.g.,

BLS, Firefighters: Job Outlook (Dec. 17, 2015), bls.gov/ooh/protective-service/firefighters.htm#tab-6; BLS, Police

and Detectives: Job Outlook (Dec. 17, 2015), bls.gov/ooh/protective-service/police-and-detectives.htm#tab-6.

8

See, e.g., 172 Neb. Admin. Code 94 § 005 (2017) (Requiring certified social workers to “have a master's or doctorate

degree in social work from an approved education program approved by the Council on Social Work Education

(CSWE) showing receipt of either the master's or doctorate degree in social work.”).

9

See, e.g., Minn. R. 8710.3000 (2017) (“A candidate for licensure in early childhood education for teaching young

children . . . shall . . . hold a baccalaureate degree from a college or university . . .).

10

See, e.g., Robert Hiltonsmith, At what cost? How student debt reduces lifetime wealth, Demos (Aug. 2013),

www.demos.org/what-cost-how-student-debt-reduces-lifetime-wealth; Mathieu R. Despard, et al., Student Debt

and Hardship: Evidence from a Large Sample of Low- and Moderate-Income Households, Children and Youth

Services Review, Vol. 70 Issue C; Fed. Res. Bank of Bos. Student Loan Debt and Economic Outcomes (2014),

bostonfed.org/publications/current-policy-perspectives/2014/student-loan-debt-and-economic-outcomes.aspx.

11

See Conn. Dept. of Banking, Public Comment on Request for Information on Student Loan Servicing (Jul. 13, 2015),

https://www.regulations.gov/document?D=CFPB-2015-0021-0381 (“Student loan servicing, a largely unregulated

financial market and opaque industry, cries out for transparency and consumer-focused regulation. . . estimates

show alarmingly high and consistently rising default rates. Delinquencies are a harrowing bellwether: as the Bureau

notes, the Department of Education estimates that 3 million borrowers are at least 30 days or more past due,

%

F% %

policymakers

12

about the potential spillover effects of mounting student indebtedness,

particularly where student loan borrowers do not realize robust economic benefits from a higher

education.

This raises serious questions about whether individual public service workers are caught

between two economic cross currents – a growing need for higher education to pursue careers in

this segment of the workforce, and the rising costs, and debt, associated with this education.

These concerns may be even greater in fields where wage growth has been more limited over

time, such as public education.

13

Furthermore, when these borrowers struggle to access critical

protections designed to mitigate the burden of student debt, it raises significant concerns about

the economic effects of this debt on a large segment of the workforce, including potential

declines in homeownership,

14

retirement security,

15

asset formation,

16

and access to a strong

comprising over $58 billion in balances. This is not deja vu. We have been here before.”); Washington State, Office

of the Attorney General, AG Ferguson files suit against Sallie Mae offshoot Navient Corp., announces student loan

bill of rights legislation (Jan 18, 2017), atg.wa.gov/news/news-releases/ag-ferguson-files-suit-against-sallie-mae-

offshoot-navient-corp-announces-student; see also CFPB, Student Loan Affordability: Analysis of Public Input on

Impact and Solutions (May 8, 2013), files.consumerfinance.gov/f/201305_cfpb_rfi-report_student-loans.pdf.

12

See, e.g., Financial Stability Oversight Council, 2013 Annual Report (2013), treasury.gov/initiatives/fsoc/studies-

reports/Pages/2013-Annual-Report.aspx; U.S. Dept. of the Treasury, Remarks by Deputy Secretary Sarah Bloom

Raskin at the Rappaport Center for Law and Public Policy Conference on the Student Debt Crisis (Mar. 18, 2016),

www.treasury.gov/press-center/press-releases/Pages/jl0389.aspx.

13

See, e.g., Ed Hurley, Teacher Pay 1940 – 2000: Losing Group, Losing Status (Dec. 12, 2013),

http://www.nea.org/home/14052.htm (“An analysis of decennial Census data clearly shows that over the past 60

years the annual pay teachers receive has fallen sharply in relation to the annual pay of other workers with college

degrees. . . Throughout the nation the average earnings of workers with at least four years of college are now over

50 percent higher than the average earnings of a teacher. At no other time since a college degree was required to

teach has this wage gap been so wide.”). Furthermore, research shows that real wage growth for individuals aged

25-34 with bachelor’s degrees has been stagnant over the last decade. Over the same period, the cost of healthcare,

housing, and childcare has outpaced inflation. See U.S. Census Bureau, Current Population Survey Annual Social

and Economic Supplement (2005 - 2015), https://www.census.gov/data/tables/time-series/demo/income-

poverty/cps-pinc/pinc-03.html#.html; Fed. Res. Bank of NY, The Labor Market for Recent College Graduates (Jan.

11, 2017), https://www.newyorkfed.org/research/college-labor-market/college-labor-market_wages.html; U.S.

BLS, Consumer Price Index (2005 – 2015), https://www.bls.gov/cpi/cpi_dr.htm.

14

See, e.g., Alvaro Mezza et al., On the Effect of Student Loans on Access to Home Ownership, Fed. Res. Board (Nov.

2015), www.federalreserve.gov/econresdata/feds/2016/files/2016010pap.pdf (finding that an increase in student

loan debt causes a drop in homeownership rates for student loan borrowers during the first five years out of school).

%

G% %

financial future.

17

The current federal programs described in our 2013 report were designed to protect borrowers

from the long-term economic consequences of the rising student indebtedness shouldered by

many who pursue careers in public service. In effect, these protections were intended to ensure

that nurses, teachers, first responders, and other public servants can serve their communities

without it being to their long-term financial detriment, particularly as college costs continue to

rise and advanced education requirements expand.

Unfortunately, too often this is not the case. As described in detail in the following report, many

borrowers attempting to invoke their rights under federal law to these protections point to a

range of student loan industry practices that delay, defer, or deny access to critical consumer

protections. The Bureau is committed to monitoring the industry for key issues and illegal

practices affecting borrowers who are trying to access key consumer protections so they can

continue to give back to their communities.

Sincerely,

Seth Frotman

Assistant Director and Student Loan Ombudsman

Consumer Financial Protection Bureau

15

See, e.g., Alicia H. Munnell, et al., Will the Explosion of Student Debt Widen the Retirement Security Gap?, Ctr. for

Retirement Res., B. C. (Feb. 2016), crr.bc.edu/briefs/will-the-explosion-of-student-debt-widen-the-retirement-

security-gap/ (finding that an increase in student debt would raise the share of households at risk in retirement).

16

See, e.g., William Elliot & Melinda Lewis, Student Loans are Widening the Wealth Gap: Time to Focus on Equity,

Univ. of Kan. (Nov. 7, 2013), aedi.ku.edu/sites/aedi.ku.edu/files/docs/publication/CD/reports/R1.pdf (finding that

households with student loans have less assets and home equity than households without student loans).

17

See, e.g., Hiltonsmith, supra note 10; see also CFPB, Prepared Remarks of Seth Frotman, Hearing Before the CA

Senate Comm. on Banking and Financial Institutions (Mar. 22, 2017),

files.consumerfinance.gov/f/documents/201703_cfpb_Frotman-Testimony-CA-Senate-Banking-Committee.pdf.

%

H% %

9,86$%0;%20#+$#+:%

Executive)summary).....................................................................................................)6!

1.! About)this)report)...................................................................................................)9!

2.! Midyear)update)on)student)loan)complaints)....................................................)10!

2.1! Federal student loan complaint data ....................................................... 11!

2.2! Private student loan complaint data ....................................................... 14!

2.3! Debt collection complaint data ................................................................ 15!

3.! Issues)faced)by)borrowers)................................................................................)17!

3.1! Overview of student loan complaints ...................................................... 17!

3.2! Public service & student debt ................................................................. 19!

4.! Recommendations)..............................................................................................)44!

5.! Contact)information)............................................................................................)49!

Appendix)A:!Tagging)definitions)................................................................ ............. )50!

%

I% %

JK$2"+.7$%:">>,1-%%

!% This report analyzes complaints submitted by consumers from March 1, 2016 through

February 28, 2017. During this period, the Bureau handled approximately 7,500 private

student loan complaints, and also handled 2,200 debt collection complaints related to

private and federal student loans. Prior to this period, the Bureau also began handling

complaints about problems managing or repaying federal student loans, and handled

approximately 11,500 federal student loan servicing complaints during this reporting

period. All figures are current as of April 1, 2017.

!% Over the past 12 months, the Bureau saw a 325 percent increase in student loan

complaints, in which consumers identified a range of problems with payment processing,

billing, customer service, borrower communications, and income-driven repayment (IDR)

plan enrollment. These consumers submitted complaints about over 320 companies,

including student loan servicers, debt collectors, private student lenders, and companies

marketing student loan “debt relief.” The Bureau’s analysis of these complaints suggests

that borrowers assigned to the largest student loan servicers report encountering

widespread problems, whether these borrowers are trying to get ahead or struggling to

keep up with their student debt. Over this period, borrowers with federal student loans

continue to report substantial challenges with accessing basic information about

repayment options, including income-driven repayment plans, particularly when these

borrowers are experiencing financial distress.

!% This report highlights complaints from student loan borrowers seeking existing federal

protections for workers pursuing careers in public service, including those who pursue

debt relief under the Public Service Loan Forgiveness (PSLF) program. For nearly four

years, the Bureau has highlighted a range of student loan servicing practices that may

inhibit borrowers seeking to exercise their rights under federal law to a range of different

benefits and consumer protections, including programs designed to protect active duty

%

)% %

servicemembers, veterans, teachers, nurses, first responders, and other student loan

borrowers working in public service.

!% Beginning in October 2017, the Department of Education will begin accepting applications

from borrowers seeking loan forgiveness pursuant to PSLF. As this report details,

borrowers have identified a range of student loan industry practices that delay, defer, or

deny access to expected debt relief. Consequently, borrowers report that they are not on

track to qualify for PSLF.

!% The PSLF program was designed to encourage people to enter into public service careers,

despite increasing levels of student loan debt. These careers, including teaching, social

work, law enforcement, and public health, traditionally feature more modest wages,

relative to many private sector fields that require comparable levels of advanced education.

Nearly two-thirds of student loan borrowers engaged in public service who have certified

interest in PSLF make less than $50,000 per year.

!% To qualify for PSLF, borrowers must meet four requirements: the borrower (1) must have a

qualifying loan, (2) must be enrolled in a qualifying repayment plan, and (3) while the

borrower is working for a qualified public service employer, he or she must (4) make 120

on-time, qualified payments. Student loan servicers are responsible for administering each

of these requirements. This report highlights how a range of servicing problems that are

reported by student loan borrowers serving in their communities can impede borrowers’

ability to obtain these key protections.

!% This report also offers recommendations to policymakers and student loan industry

participants as they work to ensure borrowers have full access to the range of protections

guaranteed under federal law, including those offered through the PSLF program.

"% As policymakers reviewing this report note how servicing breakdowns can delay or

derail progress towards PSLF, those seeking to assist these borrowers should

consider whether additional flexibility is necessary to ensure that borrowers who

received inaccurate information about program requirements provided by their

student loan servicer will still be able to secure these benefits. This review process

can be modeled after a previous effort by the Department of Education in 2010 to

mitigate the harm caused to hundreds of borrowers who were advised by their

servicer to enroll in an ineligible repayment plan.

%

L% %

"% Servicers may wish to consider earlier engagement with borrowers about the

availability and benefits of IDR. Borrowers who reach out to their servicer to express

financial distress would benefit from having more information on IDR. Servicers can

also engage borrowers to determine potential eligibility for PSLF and explain how

enrollment in an income-driven plan is a first step towards loan forgiveness.

"% Student loan borrowers who submit timely recertification applications for IDR plans

should be granted the full extent of protections provided by federal law. Pursuant to

these laws, if a servicer cannot process a timely recertification application before the

expiration of the borrower’s current IDR, the borrower should be entitled to continue

making qualifying payments at their current payment level until the servicer can fully

process the recertification application. These interim payments, like other IDR

payments, should count towards loan forgiveness.

"% Borrowers would be well served by uniform, clear, periodic, plain language

reminders, including directly from servicing personnel, of the need to recertify

income and family size to remain enrolled in an IDR plan. Reminder notices could

clearly identify the date by which the borrower must submit the recertification

application, and the consequences of failing to recertify.

%

M% %

(N%%O80"+%+5.:%1$=01+%%

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Act) established a Student

Loan Ombudsman within the Bureau. Pursuant to the Act, the Ombudsman shall compile and

analyze data on private student loan complaints and make appropriate recommendations to the

Secretary of the Treasury, the Director of the Consumer Financial Protection Bureau, the

Secretary of Education, and Congress.

This report analyzes approximately 7,500 private student loan complaints, 11,500 federal

student loan servicing complaints, and approximately 2,200 debt collection complaints related

to private or federal student loan debt handled between March 1, 2016 and February 28, 2017.

Figures are current as of April 1, 2017.

%

('% %

&N%%?.<-$,1%"=<,+$%0#%:+"<$#+%

60,#%20>=6,.#+:%%

Information about consumer complaints, including information about federal student loan,

private student loan, and debt collection complaints, is available to the public through the

CFPB’s Consumer Complaint Database.

18

The database contains anonymized complaint data provided by consumers, including the type of

complaint, the date of submission, the consumer’s zip code, and the company that the complaint

concerns. The database also includes information about the actions taken by a company in

response to a complaint: whether the company’s response was timely, how the company

responded, and whether the consumer disputed the company’s response. The database does not

include consumers’ personal information. The database includes web-based features such as the

ability to filter data based on specific search criteria; and to aggregate data in various ways, such

as by complaint type, company, location, date, or any combination of available variables. The

database also provides the option to review consumer complaints narratives for consumers who

have submitted complaints and consented to share their narratives so others can learn from

their experience.

18

See CFPB, Consumer Complaint Database, http://www.consumerfinance.gov/complaintdatabase/. The database

lists complaints where the companies have had the opportunity to provide a response or after the companies have

had the complaint for 15 calendar days –whichever comes first. The publication criteria are available at CFPB,

Disclosure of Consumer Complaint Data (2012), http://files.consumerfinance.gov/f/201303_cfpb_Final-Policy-

Statement-Disclosure-of-Consumer-Complaint-Data.pdf. We do not verify the facts alleged in these complaints, but

we take steps to confirm a commercial relationship between the consumer and the company.

%

((% %

The following tables are based on complaints handled from March 1, 2016, through February 28,

2017, as exported from the public Consumer Complaint Database as of April 1, 2017.

19

These

tables are not indexed for market share.

20

&N(% A$<$1,6%:+"<$#+%60,#%20>=6,.#+%<,+,%

This section provides an analysis of a sample of 8,494 federal student loan complaints against

companies. For each complaint, the Bureau assigned an “Issue Tag” identifying the root of the

consumer’s complaint based on the consumer’s complaint narrative and the company’s

response.

21

This section reports the results of our review.

%

19

Not all complaints handled by the Bureau are published in the public Consumer Complaint Database. Therefore the

number of complaints published in the database may be fewer than the total number of complaints handled by the

Bureau. For example, complaints that do not meet the publication criteria, such as those where the entity

complained about indicates that there is no customer relationship, may be removed from the database.

20

Compared to other large markets of consumer financial products, such as residential mortgages and credit cards,

availability of market data is quite limited for private student loans, which grew rapidly in the years leading up to

the financial crisis. See CFPB and U.S. Dept. of Education, Private Student Loans (2012),

http://www.consumerfinance.gov/reports/private-student-loans-report/. In early 2017, the Bureau announced a

proposed information collection in accordance with the Paperwork Reduction Act, in which the Bureau seeks to

collect market monitoring data on the largest federal and private student loan servicers. See CFPB, Increasing

transparency in the student loan servicing market (Feb. 16, 2017), https://www.consumerfinance.gov/about-

us/blog/increasing-transparency-student-loan-servicing-market/.

21

The Bureau reviewed a sample of 8,494 federal student loan servicing complaints submitted between March 1, 2016

and February 28, 2017. Issue tags were assigned based on an independent review of each complaint by subject

matter experts. Consumer narratives and company responses were analyzed to determine the root cause of the

consumer’s complaint. For example, if the consumer complained about derogatory credit reporting by the servicer

because the servicer failed to accurately apply forbearance, the complaint would be tagged as “forbearance.” Note

that issue tags are distinct from consumer-selected issues provided in the public complaint database. See Appendix

A for more information on issue tag definitions.

%

(&% %

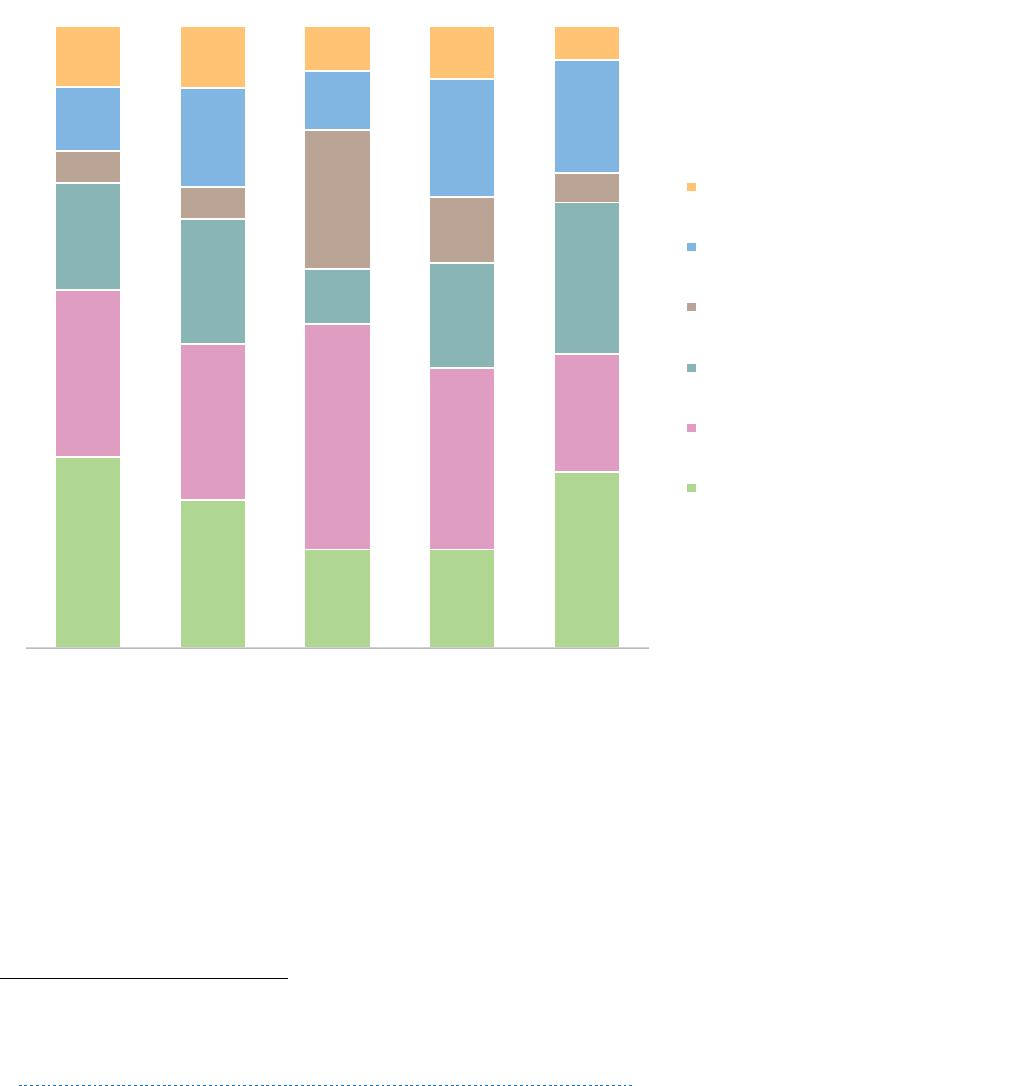

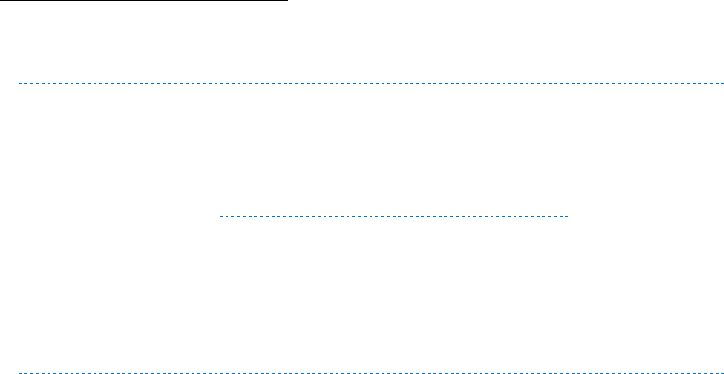

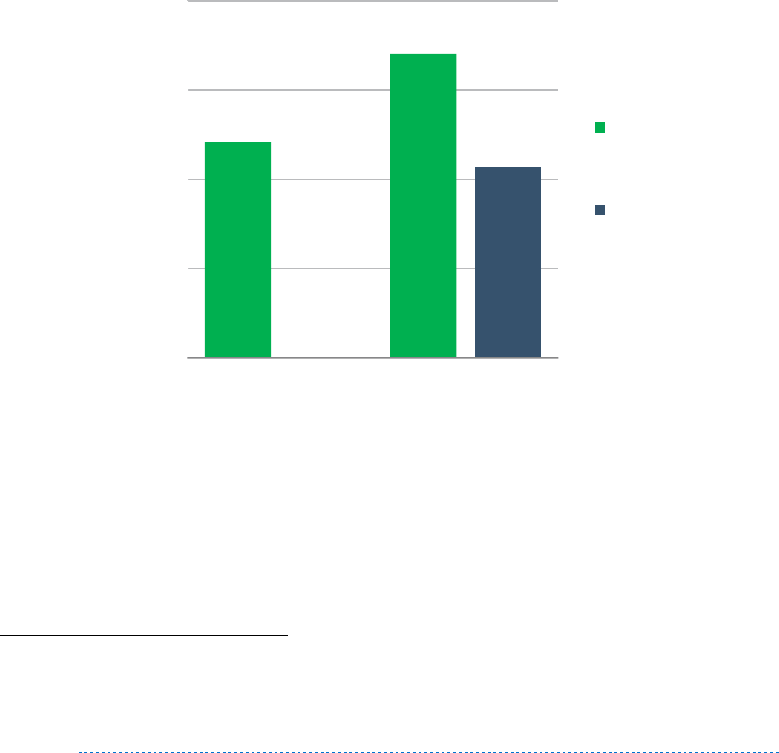

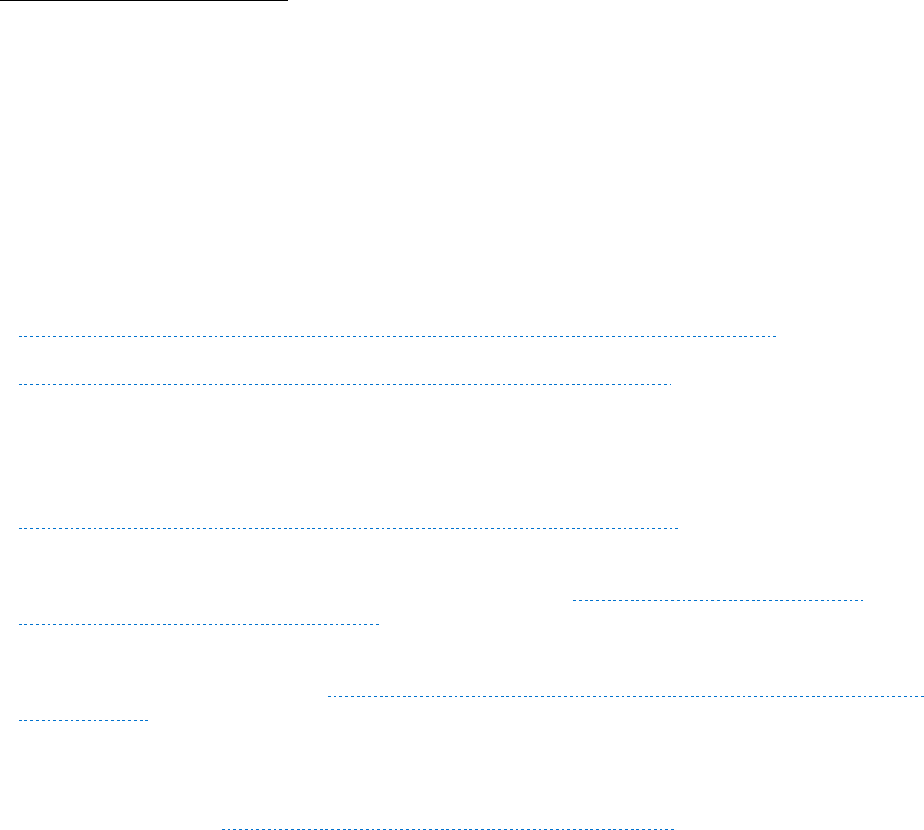

FIGURE)1:) 9EB%9JP%Q**R J * %QSJP9QAQJS%QP%AJSJTOD%*9RSJP9%DEOP%@E?BDOQP9*%

22

%

%%

TABLE)1:) @E?BOPQJ*%UQ9V%9VJ%?E*9%AJSJTOD%*9RSJP9%DEOP%@E?BDOQP9*%TOPWJS%CX%YEDR?J%

23

%

%

%

%

%

%

%

22

This chart reflects the top ten issues identified in federal student loan servicing complaint sample. Percentages are

rounded and therefore may add up to more than 100 percent.

23

This table reflects complaints where (1) the consumer identified the sub-product as “federal student loan servicing”

and (2) the identified company responded to the complaint, confirming a relationship with the consumer. The

Bureau also initiated an enforcement action against a large student loan servicer during the time period covered by

this report.

Company)

Mar.)2016)–)Feb.)2017)

P,7.$#+%

GZIFL%

OJ*[BVJOO%

(Z&MI%

P$6#$+%

I('%

\1$,+%D,3$:%

FGH%

O@*%J<"2,+.0#%*$17.2$:%

&&I%

I]

)]

L]

M]

M]

(']

(']

((]

(F]

(L]

C.66.#/%*+,+$>$#+%

@1$<.+%T$=01+.#/

T$2$1+.;.2,+.0#

J<"2,+.0#,6%Q#:+.+"+.0#

@066$2+.0#%O2+.7.+-

B,->$#+%B102$::.#/

B"86.2%*$17.2$%D0,#%A01/.7$#$::

B,->$#+%O6602,+.0#

QST%B6,#%J#1066>$#+

C01104$1%@0>>"#.2,+.0#:

%

(F% %

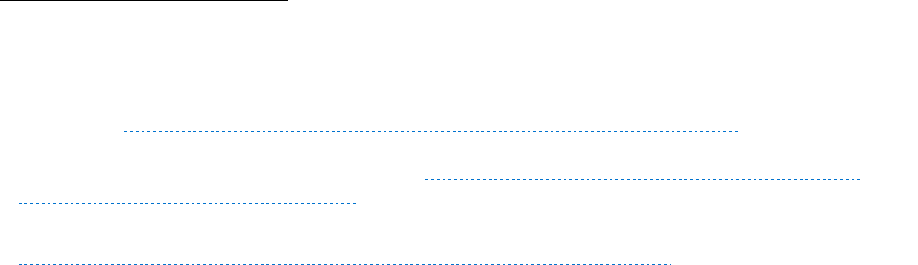

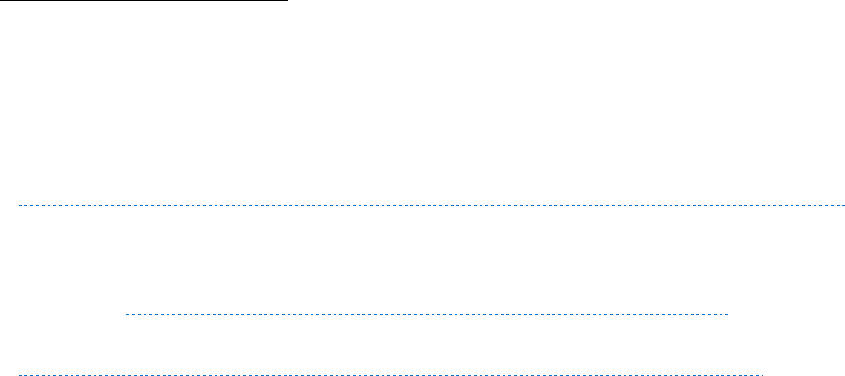

FIGURE)2:) BJT@JP9O\J%EA%@E?BDOQP9*%O\O QP * 9 %9 EB%AQYJ%@E?BOPQJ*%CX%*JDJ@9%Q**R J %9 O \%

24

%

%

24

This chart shows the relative percentage of complaints received about selected issues for the top five companies by

complaint volume. Issue tags featured in this chart were chosen based on consumer harms identified in the

Bureau’s 2015 Student Loan Servicing report. See CFPB, Student Loan Servicing (Sept. 2015),

files.consumerfinance.gov/f/201509_cfpb_student-loan-servicing-report.pdf.

F(]

&G]

(I]

(I]

&L]

&)]

&H]

FI]

&M]

(M]

()]

&']

M]

()]

&G]

H]

H]

&&]

((]

H]

(']

(I]

M]

(M]

(L]

(']

(']

)]

L]

I]

P,7.$#+ P$6#$+ OJ*[BVJOO O@* \1$,+%D,3$:

A018$,1,#2$

B,->$#+%B102$::.#/

B"86.2%*$17.2$%D0,#%A01/.7$#$::

B,->$#+%O6602,+.0#

QST%B6,#%J#1066>$#+%,#<%

T$2$1+.;.2,+.0#

C01104$1%@0>>"#.2,+.0#:

%

(G% %

&N&% B1.7,+$%:+"<$#+%60,#%20>=6,.#+%<,+,%

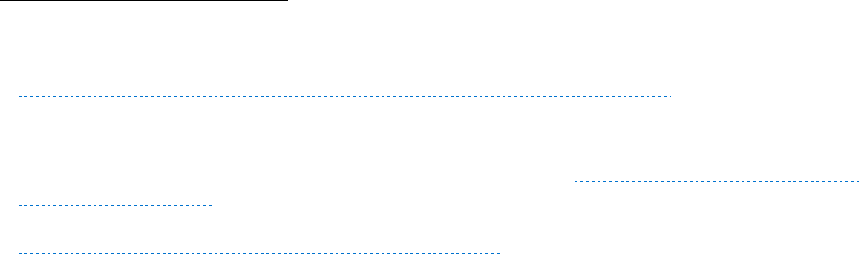

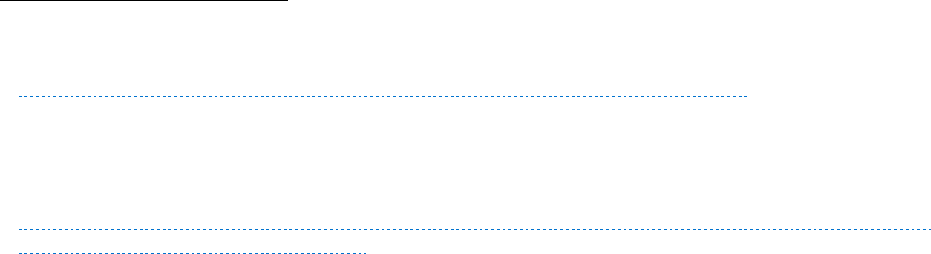

FIGURE)3:) BTQYO9J%*9RSJP9%DEOP%Q**RJ*%TJBET9JS%CX%@EP*R?JT*%ATE?%?OT@V%(Z%&'(I%

9VTER\V%AJCTROTX%&LZ%&'()

25

%

TABLE)2:) @E?BOPQJ*%UQ9V%9VJ%?E*9%BTQYO9J%*9RSJP9%DEOP%@E?BDOQP9*%TOPWJS%CX%YEDR?J

26

%

%

Company)

Mar.)2015)–)Feb.)2016)

Mar.)2016)–)Feb.)2017)

P,7.$#+%

(ZILI%

FZ()I%

OJ*[BVJOO%

GIH%

GIG%

*,66.$%?,$%

&I(%

FFM%

U$66:%A,1/0%

&)G%

&)M%

S.:207$1%

(HF%

(LG%

25

Consumers submitting student loan complaints can select from the following three types of complaint categories:

“Getting a loan,” “Can’t pay my loan,” and “Dealing with my lender or servicer.” This figure reflects the categories

consumers selected when submitting a complaint.

26

This table reflects complaints where (1) the consumer identified the sub-product as a non-federal student loan and

(2) the identified company responded to the complaint, confirming a relationship with the consumer.

F]

FG]

IF]

\$++.#/%,%60,#

@,#^+%1$=,-%>-%60,#

S$,6.#/%4.+5%>-%6$#<$1%01%:$17.2$1

%

(H% %

&NF% S$8+%2066$2+.0#%20>=6,.#+%<,+,%

From March 1, 2016 through February 28, 2017, the CFPB handled approximately 2,200 debt

collection complaints related to private or federal student loans.

TABLE)3:) 9EB%TJ@QBQJP9*%EA%*9RSJP9%DEOP%SJC9%@EDDJ@9QEP%@E?BDOQP9*%ATE?%?OT@V%(Z%&'(I%

9VTER\V%AJCTROTX%&LZ%&'()

27

%

Federal)Student)Loans)

Number)of)

Complaints)

Private)Student)Loans)

Number)of)

Complaints)

P,7.$#+%

(II%

P,7.$#+%

(HF%

OJ*[BVJOO%

HL%

OJ*[BVJOO%

HF%

J@?@%\10"=Z%Q#2N%

G'%

91,#:4016<%*-:+$>:%Q#2N%

FH%

\1$,+%D,3$:%

F&%

*,66.$%?,$%

&'%

O220"#+%@0#+106%9$25#060/-Z%Q#2N%

&&%

U$6+>,#Z%U$.#8$1/Z%_%T$.:%

&'%

91,#:4016<%*-:+$>:%Q#2N%

&&%

P,+.0#,6%J#+$1=1.:$%*-:+$>:Z%Q#2N%

(L%

%

27

This table reflects debt collection complaints where (1) the consumer identified the sub-product as a non-federal or

a federal student loan and (2) the identified company responded to the complaint, confirming a relationship with

the consumer. This table also reflects aggregated complaints of subsidiary debt collection companies that operate

under their respective parent companies.

%

(I% %

FIGURE)4:) SQ*9TQC R 9 QEP%EA%DEOP%9XBJ%AET%*9RSJP9%DEOP%SJC9%@EDDJ@9QEP%@E?BDOQP9*%CX%

@E?BOPX%ATE?%?OT@V%(Z%&'(I%9VTER\V%AJCTROTX%&LZ%&'()

28

%

%

28

This table reflects debt collection complaints where (1) the consumer identified the sub-product as a non-federal or

a federal student loan and (2) the identified company responded to the complaint, confirming a relationship with

the consumer. This table was not adjusted to reflect each company’s relative market share. This table reflects the

top companies by complaint volume. This table also reflects aggregated complaints of subsidiary debt collection

companies under the parent company.

%

()% %

FN%%Q::"$:%;,2$<%8-%801104$1:%

*0"12$:%0;%.#;01>,+.0#%%

To identify the range of issues faced by student loan borrowers, this report relies on complaints

handled by the Bureau. We also reviewed other information, such as comments submitted by

the public in response to requests for information, submissions to the “Tell Your Story” feature

on the Bureau’s website, and input from discussions with consumers, regulators, law

enforcement agencies, and market participants.

D.>.+,+.0#:%%

Readers should note that this report does not suggest the prevalence of the issues described as

they relate to the entire student loan market. The information provided by borrowers helps to

illustrate where there may be a mismatch between borrower expectations and actual service

delivered. Representatives from industry and borrower assistance organizations will likely find

the inventory of borrower issues helpful in further understanding the diversity of customer

experience in the market.

FN(% E7$17.$4%0;%:+"<$#+%60,#%20>=6,.#+:%%

Between March 1, 2016 and February 28, 2017, consumers with student loans identified a range

of payment processing, billing, customer service, borrower communications, and income-driven

repayment (IDR) plan enrollment problems. These consumers submitted complaints against

more than 320 companies, including student loan servicers, debt collectors, private student

lenders, and companies marketing student loan “debt relief.”

%

(L% %

As the figures in the preceding section illustrate, borrowers reported a broad range of servicing

problems from each of the largest student loan servicers. The Bureau’s analysis of these

complaints suggests that borrowers assigned to the largest student loan servicers may report

encountering widespread problems, whether they are trying to get ahead of or struggling to keep

up with their student debt.

The Bureau continues to receive complaints from borrowers related to a range of servicing

problems, including problems enrolling in and recertifying income under IDR plans, and

problems related to payment processing and allocation for borrowers with multiple loans.

Additionally, the Bureau continues to hear from struggling borrowers who are delinquent on

their student loans and report that they are unable to get access to accurate and actionable

information from their servicer to avoid default. As the remainder of this report highlights in

detail, consumers also report a range of problems related to certain borrower protections,

including the Public Service Loan Forgiveness program.

In addition to complaints about federal student loans, private student loan borrowers continued

to submit complaints about co-signer issues, including a lack of information surrounding co-

signer release requirements and co-signers’ ability to allocate payments to only co-signed loans

on borrowers’ accounts. Additionally, borrowers continued to submit complaints regarding their

inability to obtain flexible repayment options for their private student loans during times of

financial distress. Complaints indicate that borrowers may be told there are flexible repayment

options available, but when they seek to apply for such options, they are told that they are either

ineligible or the repayment plan is unavailable.

%

(M% %

FN&% B"86.2%:$17.2$%_%:+"<$#+%<$8+%

A college degree has become a prerequisite to enter or advance in many public service careers.

29

However, research suggests that the prospect of several decades of student loan payments often

deters people from pursuing careers in public service.

30

For many student loan borrowers working in public service, the financial consequences of

student debt can be substantial. Consider, for example, a preschool teacher at a public or non-

profit preschool program during his first two years of employment. He earns $22,440 per

year—in line with the typical starting salaries for early childhood educators—while carrying an

average student debt balance for a borrower with a four-year degree.

31

Under a standard, 10-

29

See BLS, Should I get a master’s degree? (Sept. 2015), https://www.bls.gov/careeroutlook/2015/article/should-i-

get-a-masters-degree.htm (“In some occupations, you’re likely to need a master’s degree to qualify for entry-level

jobs. In others, a master’s degree may not be required, but having one might lead to advancement or higher pay.”);

Bender & Heywood, Out of Balance?, supra note 3; see also Ala. Code 1975 § 34-30-22 (requiring social workers in

Alabama to have at least a “baccalaureate degree from an accredited college or university including completion of a

social work program.”); 105 Ill. Comp. Stat. 5/21B-20 (2017) (requiring teachers in Illinois to hold at least a

bachelor’s degree); 21 N.C. Admin. Code 36.0803 (2017) (requiring nurse practitioners in North Carolina to hold at

least a Master’s degree).

30

See, e.g., Nat’l Ass’n of Social Workers, In the Red: Social Works and Educational Debt (2008),

workforce.socialworkers.org/whatsnew/swanddebt.pdf; Pew Charitable Trusts, Student Debt Means Many New

Graduates Can’t Afford to be Teachers or Social Workers (Apr. 5, 2006), Project on Student Debt,

http://www.pewtrusts.org/en/about/news-room/press-releases/2006/04/05/student-debt-means-many-new-

graduates-cant-afford-to-be-teachers-or-social-workers; The State PIRGs’ Higher Education Project, Paying Back,

Not Giving Back: Student debt’s negative impact on public service career opportunities (Apr. 5, 2006),

http://www.pirg.org/highered/payingback.pdf.

31

Many states require a postsecondary degree for those seeking to work in early childhood education. See BLS,

Occupational Outlook Handbook: How to Become a Preschool Teacher (accessed Feb. 21, 2017),

https://www.bls.gov/ooh/education-training-and-library/preschool-teachers.htm - tab-4. For this example, we

used the average student loan balance, $26,946, and interest rate, 3.9 percent, for graduates of four-year public

institutions. See U.S. Dept. of Education, Repayment Estimator (accessed Feb. 13, 2017),

https://studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action. We also assumed a

recent graduate with an entry-level salary of $22,440. See U.S. News & World Report, Preschool Teacher: Salary

Details (accessed Feb. 13, 2017), http://money.usnews.com/careers/best-jobs/preschool-teacher/salary. The

Department of Education’s Repayment Estimator assumes a five percent annual increase in salary when projecting

repayment estimates.

%

&'% %

year repayment plan, it would be nearly impossible for him to make his $272 payment each

month, which would consume over 75 percent of his discretionary income.

32

Fortunately, millions of teachers, nurses, first responders, servicemembers, and other public

servants have access to a range of protections under federal law designed to ensure that student

loan debt does not deter borrowers from entering or pursuing careers in public service

occupations.

33

For example, the preschool teacher noted above could make payments limited to

10 percent of his discretionary income (less than $40 per month, if he is single and has no

dependents), and after 10 years, earn loan forgiveness under the Public Service Loan

Forgiveness (PSLF) program.

34

This framework may be particularly important for workers in professions where credentials are

required under federal or state law, as part of professional licensure requirements, or by

employer prerequisites. These borrowers may have little control over education or credential

requirements required of them, yet the financial costs of these credentials fall on the individuals

– particularly those where limited opportunity for wage growth may limit borrowers’ ability to

offset these costs.

32

See U.S. Dept. of Education, Repayment Estimator, supra note 31.

33

In 2007, Congress passed into law the College Cost Reduction and Access Act, which authorized the Public Service

Loan Forgiveness program. The program is designed to encourage people to pursue careers in public service

professions in spite of increasing levels of student loan debt. See Pub. L. 110-84 (2007); see also 34 C.F.R. §

685.219 (defining public service as work in the following fields: federal, state, local, or tribal government; public

child or family service agency; non-profit organization under 501(c)(3) of the Internal Revenue Code; tribal college

or university; or a non-profit private organization that provides certain public services, including emergency

management, military service, public safety, law enforcement, public interest law services, early childhood

education, public service for individuals with disabilities, public health, public education, public library services,

school library or other school-based services).

34

By the end of 2016, more than 32 million borrowers were repaying loans that are potentially eligible for PSLF. Of

these borrowers, more than 500,000 people have certified their intent to pursue loan forgiveness under PSLF. See

U.S. Dept. of Education, Federal Student Aid Overview (accessed on May 28, 2017),

https://studentaid.ed.gov/sa/about/data-center/student/portfolio. Beginning in October 2017, the first student

loan borrowers are expected to complete the requirements of the program and be eligible to apply for PSLF.

%

&(% %

FN&N(% 95$%B"86.2%*$17.2$%D0,#%A01/.7$#$::%=10/1,>%

Student loan borrowers leaving school can choose between pursuing careers in the public or

private sectors. Many choose careers in public service – seeking to give back to their country or

community through teaching, nursing, military, or other service. Because many public service

fields traditionally offer lower wages, individuals with average student loan debt and entry-level

salaries in these fields are likely to face financial hardship when making their standard, 10-year

payment amount, as illustrated in the example above. PSLF was created to protect public

service workers against the prospect of this financial hardship and provide a pathway to satisfy

their student loan obligation over a “standard” period of time (10 years).

35

Recent data released by the Department of Education show that low-to-moderate income

student loan borrowers comprise the largest share of borrowers expected to benefit from this

program.

36

As of 2016, nearly two thirds (62 percent) of borrowers who have certified intent to

pursue PSLF reported earning less than $ 50,000 per year.

37

The vast majority of borrowers (86

percent) earned less than $75,000 per year.

38

35

Additionally, borrowers who obtain loan forgiveness under the PSLF program do not incur the tax consequences

they would otherwise face if they received loan forgiveness after 20-25 years under an IDR plan without PSLF. For

many borrowers, this could mean relief from thousands of dollars in tax liability. See I.R.C. § 108(f)(1); see also

Internal Revenue Service (IRS), Student Loan Cancellations and Repayment Assistance (accessed Mar. 1, 2017),

https://www.irs.gov/publications/p970/ch05.html. Borrowers who receive loan forgiveness after 20 to 25 years of

payments under an IDR plan may be taxed on the discharged loan balance. See 34 C.F.R. §§ 685.215(g)(1)(iii),

685.209 (a)(6) (v)(A)(3), (b)(3)(iii)(D)(3), (c)(5)(vii)(A)(3); I.R.C. § 108(f)(1); see also IRS, Student Loan

Cancellations and Repayment Assistance (accessed Mar. 1, 2017),

https://www.irs.gov/publications/p970/ch05.html.

36

See U.S. Dept. of Education, Direct Loan Public Service Loan Forgiveness (July 2016),

http://fsaconferences.ed.gov/conferences/library/2016/NASFAA/2016NASFAADirectLoanPSLF.pdf.

37

See U.S. Dept. of Education, 2016 FSA Training Conference for Financial Aid Professionals (Nov. 2016),

http://fsaconferences.ed.gov/conferences/library/2016/2016FSAConfSession18.ppt.

38

Id.

%

&&% %

J#:"1.#/%="86.2%:$17.2$%4013$1:%2,#%1$=,-%:+"<$#+%<$8+%07$1%+5$%`:+,#< ,1<a%

=$1.0<%0;%+.>$%b('%-$,1:cN%

The current federal framework for student loan repayment assumes that a typical student loan

borrower will be able to make a series of level monthly payments over 10 years in order to satisfy

his or her obligation in full.

39

All student loan borrowers who exit school and enter repayment

are assigned a monthly payment amount on this payment schedule.

40

In 2007, Congress

recognized that this standard payment schedule may present substantial financial hardship for

certain borrowers working in public service and designed the Public Service Loan Forgiveness

program to ensure public service workers could also satisfy their student debt over the

“standard” period of time.

41

The following examples illustrate this dynamic for two types of public service workers:

•% Public service careers with no private sector equivalent. For many public sector

careers, like teaching or military service, there are few, if any, private-sector equivalents.

For example, the average clinical social worker with a master’s degree owes $40,000 in

student loan debt, but is likely to earn approximately $28,800 in her first years of social

work.

42

Under a standard 10-year repayment plan, she will owe approximately $416 per

month, consuming nearly half of her discretionary income.

43

In contrast, under an IDR

39

See 20 U.S.C. §§ 1078(a)(9)(A), 1087e(d).

40

Borrowers also have the option of consolidating their federal student loans, which may extend the standard

repayment period depending on the balance of the loan. However, when borrowers exit school, the default

repayment plan is a standard, ten year term. See U.S. Dept. of Education, Loan Consolidation (accessed June 1,

2017), https://studentaid.ed.gov/sa/repay-loans/consolidation.

41

See Pub. L. 110-84 (2007); see also 34 C.F.R. §§ 685.208(b)(1), 685.219(c)(iv)(C).

42

All clinical social workers are required to have master’s degrees to become licensed in their state. See BLS, Social

Workers (Dec. 17, 2015), https://www.bls.gov/ooh/community-and-social-service/social-workers.htm. The Annual

Survey of the Council of Social Work Education (CSWE) reports that 80 percent of all people who earn a Masters of

Social Work (MSW) graduate with student loan debt. See CSWE, Annual Statistics on Social Education in the

United States (2015), https://www.cswe.org/getattachment/992f629c-57cf-4a74-8201-1db7a6fa4667/2015-

Statistics-on-Social-Work-Education.aspx.

43

A student loan borrower earning $28,800 per year with $40,000 in student loan debt at a weighted average

interest rate of 4.52 percent would pay $416 under a standard 10 year payment. Based on the same federal formula

to determine “discretionary income” under the most widely available income-driven repayment plans, this

%

&F% %

plan, the average social worker would pay $89 per month as she made payments that

count towards PSLF.

44

•% Public service careers that pay less than a comparable private sector

position. Alternatively, some individuals may pursue careers in which there are similar

positions in both the private and public sectors. Depending on the career, a public sector

position may offer lower wages than the private sector alternative.

45

Consider, for

example, the especially large wage disparity between two borrowers with degrees from

the same accounting program, owing the same amount of student loan debt. One may

choose to work for state government as an entry-level auditor and earn approximately

$33,000 per year, while the other may choose to work for a private accounting firm,

where the national average is more than double that amount.

46

After graduation, both

student loan borrowers would have the option of making the standard, 10-year payment

consumer would need to devote approximately 46.6 percent of her discretionary income to her student loan

payments. See U.S. Dept. of Education, Repayment Estimator (accessed June 1, 2017); CWSE, Annual Statistics on

Social Work Education in the United States (2015), Table 15, https://www.cswe.org/getattachment/992f629c-57cf-

4a74-8201-1db7a6fa4667/2015-Statistics-on-Social-Work-Education.aspx; U.S. Dept. of Education, Interest Rates

and Fees (accessed June 1, 2017), https://studentaid.ed.gov/sa/types/loans/interest-rates#rates.

44

See U.S. Dept. of Education, Repayment Estimator, supra note 31.

45

See, e.g., Bender & Heywood, Out of Balance? supra note 3 (finding that on average, public sector jobs require

much more education than those in the private sector, and wages and salaries of state and local employees are

lower than those for private sector workers with comparable earnings determinants); Federal Salary Council,

Memorandum on Level of Comparability Payments for January 2018 and Other Matters Pertaining to the

Locality Pay Program (Dec. 14, 2016), https://www.opm.gov/policy-data-oversight/pay-leave/pay-

systems/general-schedule/federal-salary-council/recommendation16.pdf; see also Congressional Budget Office,

Comparing the Compensation of Federal and Private Sector Employees (Jan. 2012). These public-sector positions

may also offer more generous non-wage compensation than their private sector alternatives, but this form of

compensation generally does not aid in the repayment of student loans.

46

See Tenn. Dept. of Human Resources, Alpha Compensation Plan (June 1, 2017),

http://www.tn.gov/dohr/class_comp/pdf/alpha_comp_plan.pdf; BLS, Accountants and Auditors (accessed Mar.

10, 2017), https://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm#tab-5.

%

&G% %

of $272; but, for the public sector accountant, that payment amount would consume

three times the share of his disposable income versus the private sector accountant.

47

As this example illustrates, while otherwise similarly situated borrowers may graduate

with the same level of student loan debt, those entering public service may be less able to

afford their standard 10-year payment amount.

48

In contrast, under certain IDR plans,

the accountant working for state government would have payments set at 10 percent of

his discretionary income – $124 per month – comparable to the share of discretionary

income a private sector accountant would devote to loan repayment under the standard

10 year repayment plan.

49

Through a combination of Public Service Loan Forgiveness and IDR plan, public service

borrowers can make the same number of payments as a typical borrower would under a

standard payment plan (120 months or 10 years of qualifying payments), but with a monthly

payment amount that is manageable relative to their salary.

47

Estimates are based on average loan balances for a four-year public institution, as provided by the Department of

Education. See U.S. Dept. of Education, Repayment Estimator (accessed Feb. 13, 2017),

https://studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action.

48

Research shows that public sector careers typically require more education than many private sector careers. See,

e.g., Bender & Heywood, Out of Balance? supra note 3.Without additional student loan protections for borrowers

working in public service, student loan borrowers may be prevented from pursuing public service careers. See Eric

Dunlop Velez & Jennie H. Woo, The Debt Burden of Bachelor’s Degree Recipients, National Center for Education

Statistics (Apr. 20 2017), https://nces.ed.gov/pubs2017/2017436.pdf (stating that, “As of 2012, about three-

quarters (72 percent) of 2007-2008 bachelor’s degree recipients had taken out federal or private student loans to

finance their undergraduate and subsequent education.”); see also CFPB, Public Service & Student Debt, supra

note 1.

49

Note that the private accountant would not benefit from an IDR plan as his monthly payment would exceed the

standard 10 year payment. See U.S. Dept. of Education, Repayment Estimator (accessed Feb. 13, 2017),

https://studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action.

%

&H% %

U.+50"+%B"86.2%*$17.2$%D0,#%A01/.7$#$::Z%=1060#/$<%=$1.0< : %0 ;%.# 20 >$d

<1.7$#%=,->$#+%40"6<%=1$:$#+%"#.e"$%25,66$#/$:%;01%4013$1:%.#%="86.2%

:$17.2$N%%

Income-driven plans were designed to allow borrowers to secure payment relief in the

immediate-term while still making progress toward satisfying their student loan debt.

50

Because

borrowers’ monthly payments increase as their income increases, the Department of Education

estimates that, over the lifetime of a loan, a typical borrower who makes payments based on his

or her income will repay more than her initial principal balance.

51

In contrast, public service

borrowers may not have this same opportunity because they earn lower starting wages but may

not realize equivalent future income gains. As a consequence, many public service borrowers

will continue to make lower income-driven payments over a comparatively longer period of

time, prolonging the length of their repayment obligation by a decade or more.

52

As a result, absent PSLF, these public service borrowers may pay comparatively more toward

their student debt in total than typical borrowers in IDR plans – a result of accruing interest

charges over a prolonged repayment term.

53

In this key respect, PSLF offers a path forward for

public service borrowers that IDR alone does not – PSLF ensures that both the total loan costs

and the repayment term for these borrowers remain manageable over the long term.

Consider, as an illustration, the social worker identified in the previous example, if she was

unable to access to PSLF. Under the newest IDR plan, Revised Pay As You Earn (REPAYE), and

50

All borrowers enrolled in IDR have access to a range of short-term and long term protections designed to ensure

that a typical borrower will be able to satisfy their obligation, either through payoff or loan forgiveness, in a

maximum of 20 or 25 years. For further discussion, see CFPB, Student Loan Servicing, supra note 24.

51

See U.S. Dept. of Education, Congressional Budget Justifications FY2018: Student Loans Overview, Q-6, Q-7

(2017), https://www2.ed.gov/about/overview/budget/budget18/justifications/q-sloverview.pdf (estimating that,

for the vast majority of borrowers under nearly all available repayment arrangements, total expected lifetime

student loan payments will range from 107 percent to 176 percent of initial principal balance. For borrowers

enrolled in Pay As You Earn who earn less than $70,000 and owe more than $25,000, the Department of

Education estimates that 90 percent of initial principal balance will be repaid).

52

As compared to an expected loan term of 120 months under the standard, 10 year repayment plan.

53

In contrast to a typical borrower using IDR, many public service borrowers may see more modest increases in their

income-driven payments year-after-year, over the course of their decade of service—a direct result of lower starting

salaries and more limited opportunities for wage growth in many public service fields.

%

&I% %

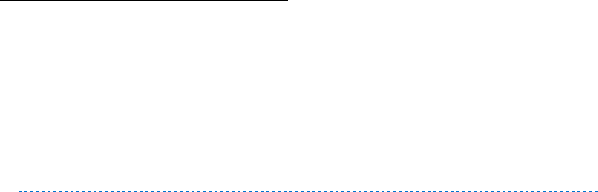

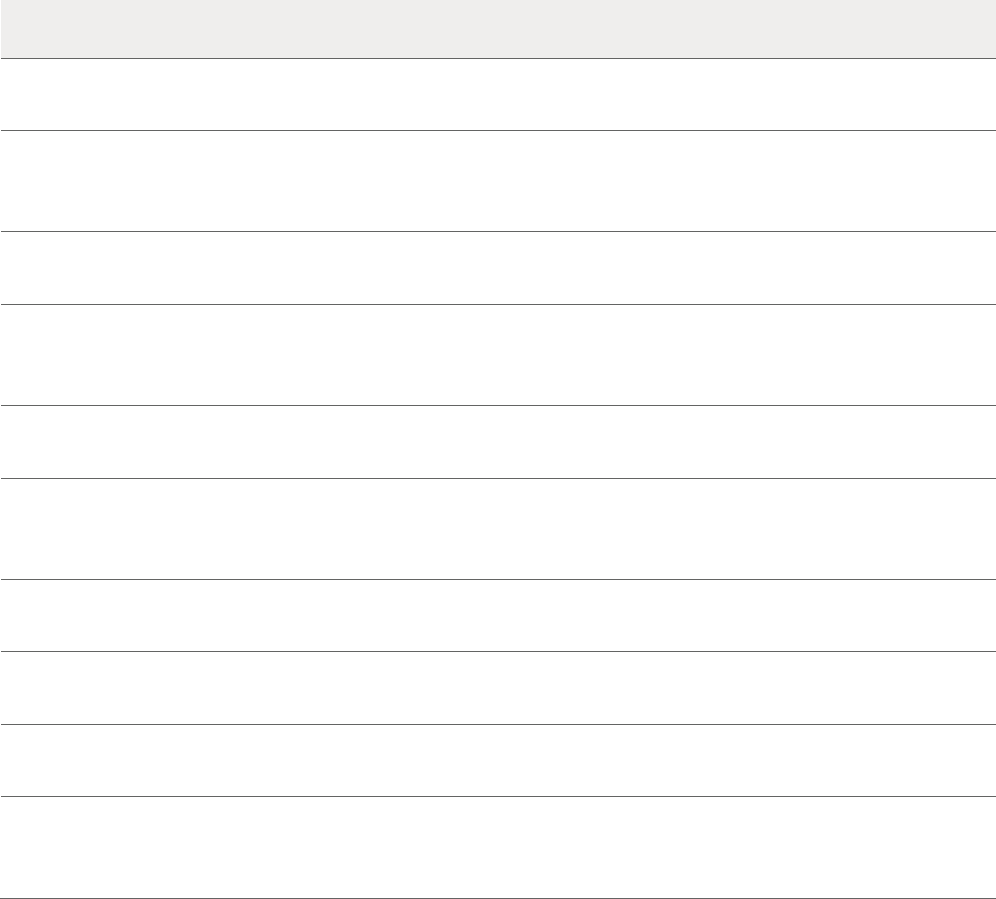

absent PSLF, this borrower can expect to pay nearly $20,000 more over the lifetime of her loan

than she would under the standard 10 year repayment plan (Figure 5).

54

Rather than reducing

the total cost of his student debt, REPAYE would, in effect, provide this borrower with a term

extension—permitting payment flexibility in the short term but ultimately requiring this

borrower to devote a greater share of lifetime earnings to repaying her student debt.

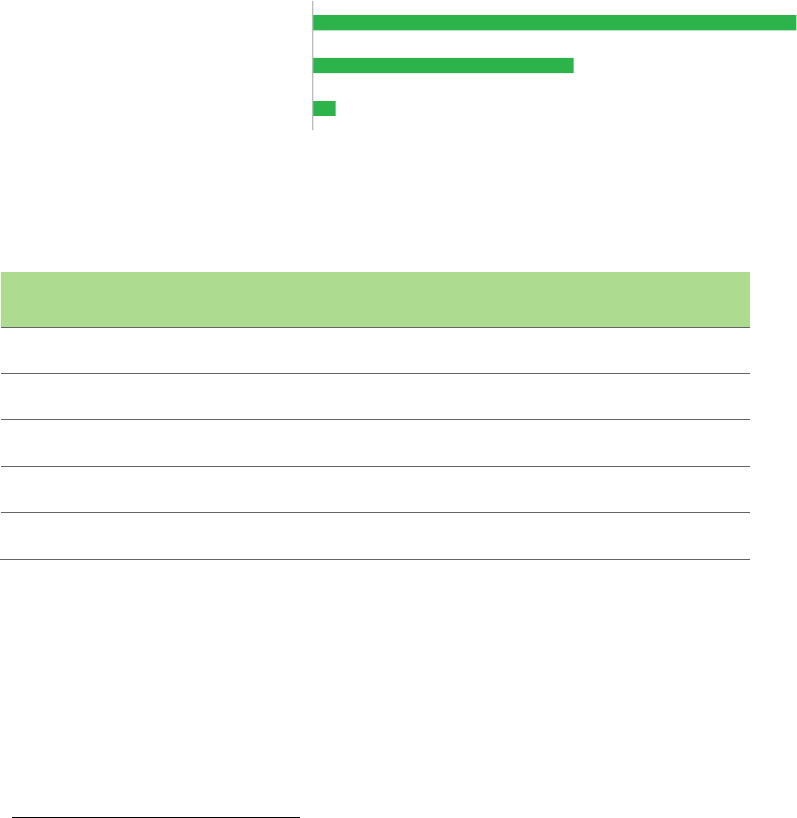

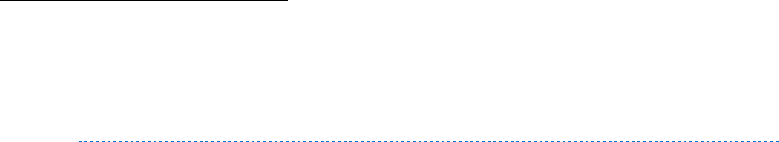

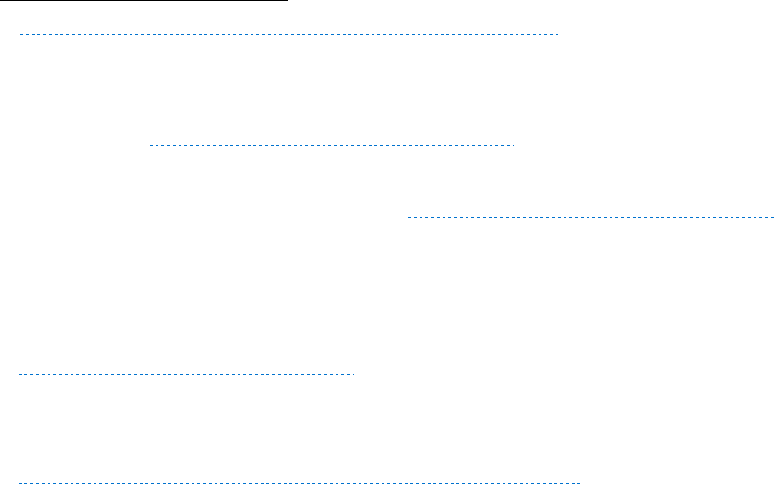

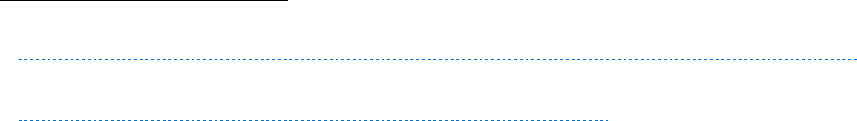

FIGURE)5:) 9E9OD%DQAJ9Q?J%BTQP@QBOD%OPS%QP9JTJ*9%bB_Qc%BOX?JP9*Z%OC*JP9%B*DA%

55

%

Recent projections made by the Department of Education indicate that this effect is even more

pronounced when comparing a public service borrower, absent PSLF, to a typical borrower

enrolled in REPAYE.

56

The Department of Education estimated that, in general, borrowers who

54

See U.S. Dept. of Education, Repayment Estimator, supra note 31. In this example, we assumed that this

hypothetical borrower had the same debt and income characteristics as described in the social worker example.

55

See U.S. Dept. of Education, Congressional Budget Justifications FY2018: Student Loans Overview, Q-6, Q-7

(2017), https://www2.ed.gov/about/overview/budget/budget18/justifications/q-sloverview.pdf

56

See id. Readers should also note that, as part of the most recent budget proposal, the U.S. Department of Education

recommended that Congress eliminate access to the Public Service Loan Forgiveness program for new borrowers,

beginning on July 1, 2018.

fGLZF)'

fILZ(HI

f'

fG&ZL''

fd

f&'Z'''%

fG'Z'''%

fI'Z'''%

fL'Z'''%

*+,#<,1<%B,->$#+ TJBOXJ

90+,6%D.;$+.>$%B_Q%

B,->$#+:Z%*02.,6%U013$1

90+,6%D.;$+.>$%B_Q%@0:+:Z%

O66%C01104$1:%.#%TJBOXJ%

bJS%AX(L%B10g$2+.0#c

%

&)% %

earn less than $70,000 per year and owe more than $25,000 in student debt would repay

approximately 107 percent of their initial principal balance over the lifetime of their loans.

57

In contrast, the social worker in this example, absent PSLF, could expect to repay more than 170

percent of her initial principal balance – nearly $70,000 in principal and interest charges – due

to his low starting salary.

58

In order to satisfy this debt, this borrower would make steadily

increasing payments for more than 23 years, paying more than $25,000 over-and-above the

total costs projected for a typical REPAYE borrower with similar characteristics.

59

The prospect of substantially higher lifetime costs under IDR present a large economic hurdle

for borrowers working in public service. As researchers continue to raise concerns that student

loan debt may inhibit progress toward important financial milestones, this illustration suggests

that PSLF can help protect public service borrowers from the considerable and detrimental

effects of high debts and low wages in a way that IDR alone cannot.

60

FN&N&% V04%:$17.2.#/%0;%801104$1:%="1:".#/%B*DA%4013:%b,#<%

<0$:#h+%-$+%4013c%;01%:+"<$#+%60,#%801104$1:%

As illustrated above, PSLF can offer powerful protection for borrowers committing to careers in

public service. However, complaints from student loan borrowers reveal that a series of

obstacles may cause delays or dead ends that can cost them thousands of dollars. The problems

highlighted below can trigger extra payments and interest charges, or render a borrower’s loans

entirely ineligible for PSLF, even after a decade of qualifying public service.

57

See id (estimating that a borrower who earns, on average, less than or equal to $70,000 throughout his or her full

repayment period, and owes more than $25,000 will repay, on average, 107 percent of initial principal balance

under REPAYE).

58

See U.S. Dept. of Education, Repayment Estimator, supra note 31. In this example, we assumed that this

hypothetical borrower had the same debt and income characteristics as described in the social worker example.

59

See id.

60

See, e.g., Hiltonsmith, supra note 10; see also CFPB, Prepared Remarks of Seth Frotman, Hearing Before the CA

Senate Comm. on Banking and Financial Institutions (Mar. 22, 2017),

http://files.consumerfinance.gov/f/documents/201703_cfpb_Frotman-Testimony-CA-Senate-Banking-

Committee.pdf.

%

&L% %

Student loan servicers are contracted and compensated for helping consumers

navigate the process of qualifying for PSLF. Lenders or loan holders, including the

Department of Education, generally contract with private companies to administer all aspects of

federal student loan repayment, including answering borrowers’ questions about the repayment

of federal student loans and about available loan forgiveness programs.

61

Additionally,

borrowers who express interest in PSLF rely on their servicers to have the necessary information

to help them stay on track with their repayment plans.

62

While the Department of Education

contracts with several private companies to service federal student loans, one servicer is

specifically designated to service loans for borrowers pursuing PSLF, the Pennsylvania Higher

Education Assistance Agency or PHEAA, operating under the FedLoan Servicing brand. In the

rest of this report, we refer to this entity as the PSLF servicer.

63

To be eligible for PSLF, borrowers must meet four basic requirements:

!% The borrower must have one or more Direct Loans;

!% The borrower must make 120 qualifying payments;

!% The borrower must be enrolled in a qualifying repayment plan; and

!% The borrower must work full-time for a qualified employer.

61

The student loan market is comprised primarily of three types of student loans: (1) federally guaranteed loans made

through the Federal Family Education Loan Program (FFELP) by private-sector lenders; (2) federal loans made

directly to borrowers by the Department of Education through the William D. Ford Direct Loan Program (Direct

Loans); and (3) private student loans. Only Direct Loans are eligible for PSLF. See CFPB, Student Loan Servicing

(Sept. 2015), files.consumerfinance.gov/f/201509_cfpb_student-loan-servicing-report.pdf. FFELP loans are only

eligible for PSLF after being consolidated into a Direct Consolidation Loan. See U.S. Dept. of Education, Public

Service Loan Forgiveness (accessed June 6, 2017), https://studentaid.ed.gov/sa/repay-loans/forgiveness-

cancellation/public-service - eligible-loans.

62

See U.S. Dept. of Education, Public Service Loan Forgiveness (accessed May 5, 2017),

https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/public-service (directing borrowers to contact

their federal student loan servicer with questions about PSLF).

63

Borrowers may earn credit toward PSLF while their Direct Loans are serviced by any federal student loan servicer.

A borrower’s loans are only transferred to the designated PSLF servicer once the borrower successfully certifies that

he or she works for a qualified employer by completing the Department of Education’s Employment Certification

Form. See ECF, infra note 87. While only one servicer is contracted to service accounts of borrowers who certify

interest in PSLF, borrowers can remain eligible for and make qualifying payments towards PSLF prior to

submitting an ECF. As such, all federal student loan servicers are integral in assisting borrowers seeking to navigate

the PSLF process.

%

&M% %

Servicers are the primary point of contact for all borrower questions related to repayment

matters, including PSLF requirements. However, borrowers report that servicing obstacles

affecting each requirement of the PSLF program have obstructed their ability to successfully

make progress towards the loan forgiveness that would support their sustained public service.

C01104$1%>":+%5,7$%0#$%01%>01$%S.1$2+%D0,#:%

Only loans made under the William D. Ford Direct Loan Program are eligible to be forgiven

under PSLF.

64

Borrowers with other types of federal loans, such as Federal Family Education

Loan Program (FFELP) Loans or Perkins Loans, are not eligible for PSLF, but student loan

borrowers may consolidate these loans into a Direct Consolidation Loan in order to become

eligible.

65

When federal student loan borrowers express interest in loan forgiveness while

working in public service, they expect their servicer to inform them of how to get on track,

including whether they need to consolidate their otherwise ineligible loans.

66

However,

borrowers complain that servicers withhold essential information about eligibility for PSLF.

Borrowers report spending years making payments, believing they were making

progress towards PSLF, before servicers explain that their loans do not qualify for

PSLF. Borrowers with FFELP or Perkins Loans complain to the Bureau that despite informing

their servicer that they work in public service, or specifically mentioning that they are pursuing

64

See 34 C.F.R. § 685.219(c)(1)(iii).

65

See U.S. Dept. of Education, Public Service Loan Forgiveness (accessed Feb. 1, 2017),

https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/public-service.

66

Some individual public service organizations, school districts and government agencies now provide information

about PSLF to their employees as part of existing workplace financial education. See, e.g., American Federation of

Teachers, Sharing simple solutions with student loan debtors (2015), https://www.aft.org/periodical/aft-

campus/fall-2015/pay-it; U.S. Dept. of Education, Remarks of U.S. Secretary of Education Arne Duncan to the

2014 National HBCU Conference, HBCUs: Innovators for Future Success (Sept. 2014),

https://www.ed.gov/news/speeches/hbcu-value-proposition (“We've all agreed to . . . talk to our employees about

their options for student loan forgiveness, to help them document that they work for a public service organization,

and to check in annually with employees to make sure they stay on track.”). Additionally, acknowledging the crucial

protections offered by the PSLF program, several states require or are considering legislation to require that state

government employees receive periodic information about PSLF. See, e.g., Mo. Rev. Stat. § 105.1445 (requiring

that the Missouri Department of Higher Education create guidance regarding public employees’ eligibility for

PSLF).

%

F'% %

PSLF, their servicer never advised them that their student loans were not eligible loans. As a

result, these borrowers make years of payments that do not count towards PSLF.

67

For example,

one consumer states:

I started working for a public school and learned about the loan forgiveness

program. I called [my servicer] to consolidate my loans to qualify for loan

forgiveness. They said that their income based loan would qualify me for the

loan forgiveness program. I consolidated my loans, and AGAIN asked "does this

qualify me for loan forgiveness program?" They told me, "I was all set!" They

also stated that there was no form to submit for loan forgiveness until I

completed 120 payments over 10 years so I did not follow up sooner. Recently, I

called to check in around this, and was informed that I WAS NOT in the loan

forgiveness program, and that I needed to consolidate my loans [into a Direct

Loan]. . . I have been paying for 4 years and was misled by this company

completely . . . Now I have consolidated my loans [into a] a direct loan, and

have ONE payment toward my 10 years.

For certain populations of borrowers, servicers are aware that they work in public service, yet

borrowers complain that servicers do not proactively inform them of their eligibility for PSLF.

In particular, complaints from military borrowers indicate they may not be receiving

information about PSLF at a time when they can be making substantial progress towards the

qualified payment requirement. For example, one borrower reported that his servicer did not

explain that his loans were not eligible for PSLF until after years of military service. The

borrower was only informed that he needed to consolidate his loans to become eligible for PSLF

after he left the military due to a service-related injury.

I was told that none of my active military service, including deployments to

Afghanistan, would count for PSLF purposes. This is a slap in the face to all

Veterans. PSLF is supposed to provide reward those who serve the public. . . .

[M]y military service, in which my leg function was sacrificed, did not count for

67

Additionally, if these borrowers choose to consolidate, they will lose any prior progress made towards loan

forgiveness through 20 or 25 years of payments under an IDR plan. See 34 C.F.R. § 682.215(f).

%

F(% %

anything [toward PSLF]. This is contrary to the alleged policy for which the

PSLF program was created and it is insulting.

68

Recent changes to industry practices for handling military borrowers should ensure that

servicers have a clear understanding of which customers are pursuing active duty

military service, which would be employment potentially eligible for PSLF.

69

Each

month, the largest student loan servicers use the Department of Defense’s Manpower

Database (DMDC) to proactively identify their military customers, in order to

automatically administer other military specific protections relating to student loans.

70

Borrowers identify delays and defects in the loan consolidation process that can

increase costs and disrupt progress toward loan forgiveness. In order to consolidate

FFELP loans into a Direct Consolidation Loan, a borrower must complete a new federal Direct

Consolidation Loan application. Borrowers consolidating for purposes of PSLF must choose the

designated PSLF servicer.

71

After an application is submitted, the PSLF servicer works with the

68

https://www.regulations.gov/document?D=CFPB-2015-0021-0499.

69

In 2014, the Department of Education announced that it had directed its servicers to “check the names of

borrowers against the DMDC.” U.S. Dept. of Education, Improved Administration of the Servicemembers Civil

Relief Act for Borrowers under the William D. Ford Direct Loan and Federal Family Education Loan Programs

(Aug. 25, 2014), https://ifap.ed.gov/dpcletters/GEN1416.html. As of July 1, 2016, all FFEL program loan holders

were required to “apply the SCRA interest limitation without a request and based on a data match with the DMDC.”

U.S. Dept. of Education, Approval of Servicemember Civil Relief Act (SCRA) Interest Rate Limitation Request for

Direct Loan and FFEL Programs (May 5, 2016), https://ifap.ed.gov/dpcletters/GEN1608.html. This data match

would alert the servicer to the borrower’s active duty status, also indicating that the borrower would be eligible for

PSLF if he or she consolidated his or her FFELP loans into a Direct Consolidation Loan.

70

See U.S. Dept. of Education, Approval of Servicemember Civil Relief Act (SCRA) Interest Rate Limitation Request

for Direct Loan and FFEL Programs, supra note 69; see also Govt. Accountability Office (GAO), Student Loans:

Oversight of Servicemembers’ Interest Rate Cap Could Be Strengthened, GAO-17-4 (Nov. 18, 2016),

https://www.gao.gov/products/GAO-17-4. For a further discussion of the unique challenges servicemembers face

when seeking to navigate the range of available protections and benefits, see CFPB, Public Service & Student Debt,

supra note 1.

71

See U.S. Dept. of Education, Federal Student Aid, Loan Consolidation (accessed Feb. 2, 2017),

https://studentaid.ed.gov/sa/repay-loans/consolidation - how-apply.

%

F&% %

borrower’s current servicer to obtain loan information, including the remaining loan balance, in

order to pay off the original, non-eligible loans and disburse the consolidation loan.

72

Generally, this process should take no more than 30 days,

73

but borrowers report that the

consolidation process can take more than six months to complete because their original servicer

does not provide the necessary account information required to complete the consolidation.

74

Additionally, some borrowers complain that the consolidation process is stymied when their

servicer incorrectly reports their outstanding balance to the PSLF servicer. Without an accurate

balance reported, the PSLF servicer cannot originate the consolidation loan. Other borrowers

complain that servicing errors result in some individual loans being left out of the consolidation,

preventing borrowers from making qualified payments on all of their loans. Each of these

servicing errors can prevent borrowers from making qualifying payments, and ultimately add

years and potentially thousands of dollars to repayment.

C01104$1%>":+%8$%$#1066$<%.#%,%e",6.;-.#/%1$=,->$#+%=6,#%

To be eligible for PSLF, borrowers must be enrolled in a qualifying repayment plan.

75

Qualifying

repayment plans primarily consist of income-driven repayment plans.

76

Graduated and

72

See, e.g., U.S. Dept. of Education, Federal Consolidation Loan Verification Certificate, OMB No. 1845-0036 (2010),

https://ifap.ed.gov/dpcletters/attachments/FP0705AttECORRECTEDLVC.pdf.

73

See U.S. Dept. of Education, Transcript for New Direct Consolidation Loan Process Conference Call (Mar. 25,

2014), ifap.ed.gov.edgekey.net/media/podcasts/NewDirectConsolidationLoanProcessWebinarTranscript.doc.

74

The GAO, in response to a request from Congress, reported, “Because servicers are not compensated for their loss

when a loan is transferred, in effect, they are paid less than if they were able to keep all of their assigned loans.

Education officials acknowledged that the lack of compensation for transferred loans could be a disincentive for

servicers to counsel borrowers about loan consolidation and PSLF. [The Department of Education] said that [it]

believes [its] oversight efforts discourage servicers from acting on this potential disincentive.” GAO, Federal

Student Loans: Education Could Improve Direct Loan Program Customer Service and Oversight (May 2016),

GAO-16-523, http://www.gao.gov/products/GAO-16-523.

75

See 34 C.F.R. § 685.219(c)(1)(iv); see also U.S. Dept. of Education, Federal Student Aid, Public Service Loan

Forgiveness: What is a qualifying repayment plan? (accessed Feb. 2, 2017), https://studentaid.ed.gov/sa/repay-

loans/forgiveness-cancellation/public-service - qualifying-repayment-plan.

76

See 34 C.F.R. § 685.219(c)(1)(iv). While standard repayment is a qualifying repayment plan, a borrower would pay

off his or her loan after ten years, the same time he or she became eligible for loan forgiveness under PSLF.

%

FF% %

extended repayment plans generally do not qualify.

77

Any payments made while in a non-

qualifying repayment plan will not count towards PSLF. Federal student loan borrowers rely on

their servicer to ensure their repayment plan keeps them on track for PSLF.

78

Borrowers complain that servicers may enroll them into non-qualifying

repayment plans, despite borrowers expressing interest in PSLF. Some borrowers

complain to the Bureau that despite telling their servicer that they work in public service, their

servicer never informs them about PSLF, or the necessary requirements to become eligible for

PSLF. Other borrowers complain that their servicer did not enroll them into a qualifying

repayment plan, despite expressly telling their servicer that they are pursuing PSLF.

79

Instead,

their servicer enrolled them into a non-qualifying plan, like a graduated or extended repayment

plan with payments that are too low to be considered qualifying payments. Other borrowers

complain that after submitting all required materials to be enrolled into a qualifying IDR plan,

their servicer did not accept the applications. In these cases, borrowers reported that servicers

either incorrectly denied their applications, or failed to give borrowers a chance to correct any

77

Payments made under extended or graduated repayment plans may qualify if “the monthly payment amount is not

less than what would have been paid under the Direct Loan standard, 10-year repayment plan described in [the

fixed, standard 10 year plan provision].” 34 C.F.R. § 685.219(c)(1)(iv)(D).

78

See CFPB, Student Loan Servicing, supra note 24. The Bureau has previously reported on how servicers may not be