CITIZENS HOME MORTGAGE CAREERS APPLY NOW

2

INTRO

Anne S.

Apply Now

COVER ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

An environment invested

in your best interests.

WHAT DRIVES YOU?

At Citizens, we strive to help our customers, colleagues and

communities reach their potential. No matter what drives

you and your career, we support your goals with a culture

that encourages mentoring and empowers you to put your

ideas into action. In addition to your career, we continuously

look for ways to improve and grow our business, whether

they’re in customer experience or technology. And we always

remember that when our communities thrive, we succeed.

With people like you, we’re made ready to do great things —

now and in the future.

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

3

LEADERSHIPWHO WE ARE WHERE WE ARE

COVER ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITYINTRO

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

Citizens started out as a small community bank, founded

in 1828. By 2015, we successfully completed the largest

commercial bank IPO in U.S. history.

Our headquarters is in Providence, R.I., and we have a large

branch and ATM network across our footprint. We offer a

wide variety of banking products and services to a diverse

customer base.

No matter how large Citizens grows, we remember our roots —

to help customers by listening and understanding their needs

in order to offer tailored advice, ideas and solutions. That’s

because we raise families, pay mortgages, and have nancial

goals, too.

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

4

LEADERSHIPWHO WE ARE WHERE WE ARE

*

As of Nov 2022

COVER ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITYINTRO

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

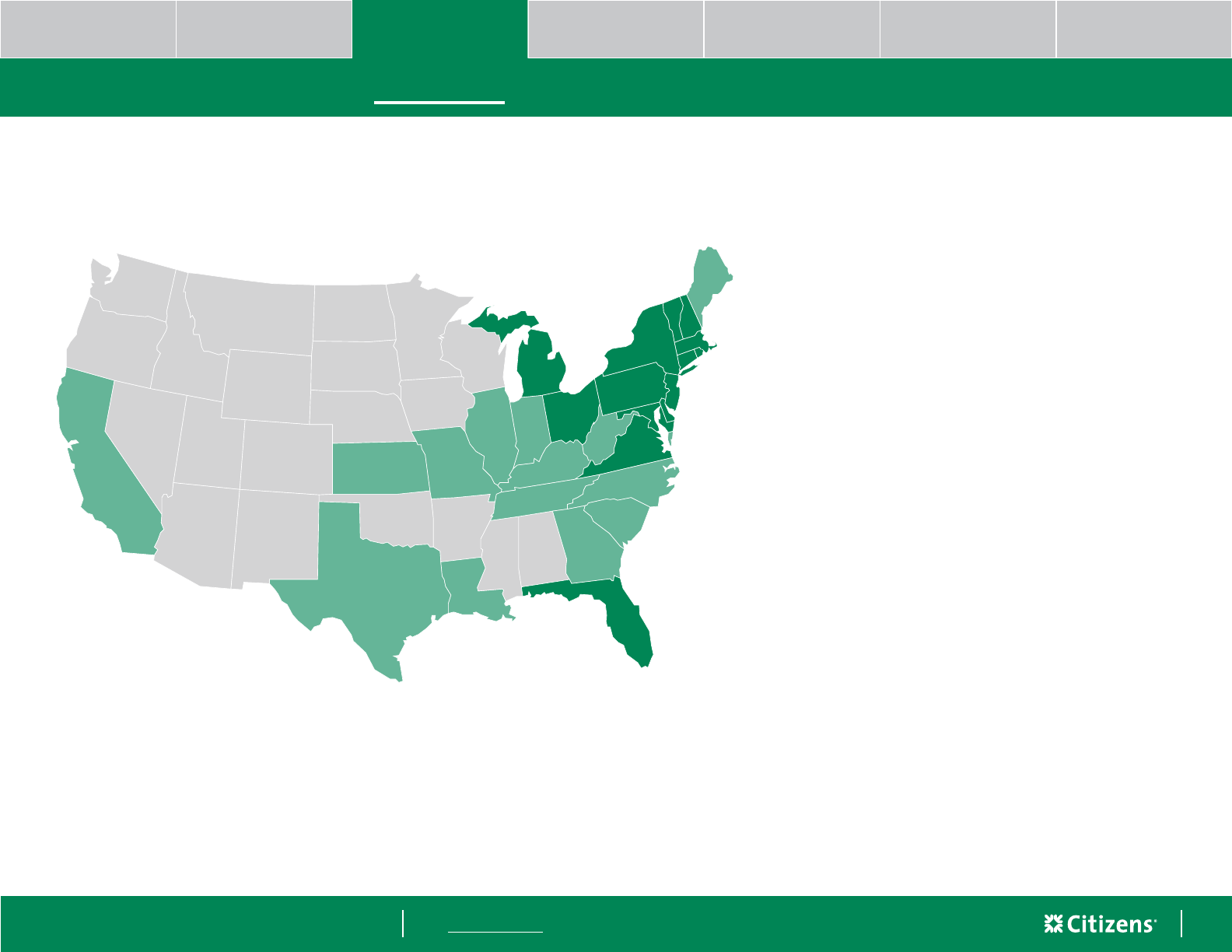

As a federally chartered bank, Citizens has

a nationwide reach for agency lending. Our

portfolio lending services are available in all

the highlighted states below.

*

BANK

FOOTPRINT

• Connecticut

• Delaware

• Florida

• Maryland

• Massachusetts

• Michigan

• New Hampshire

• New Jersey

• New York

• Ohio

• Pennsylvania

• Rhode Island

• Vermont

• Virginia

• Washington, D.C.

OUT-OF-BANK

FOOTPRINT

• California

• Georgia

• Illinois

• Indiana

• Kansas

• Kentucky

• Louisiana

• Maine

• Missouri

• North Carolina

• South Carolina

• Tennessee

• Texas

• West Virginia

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

5

COVER INTRO ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

LEADERSHIPWHO WE ARE WHERE WE ARE

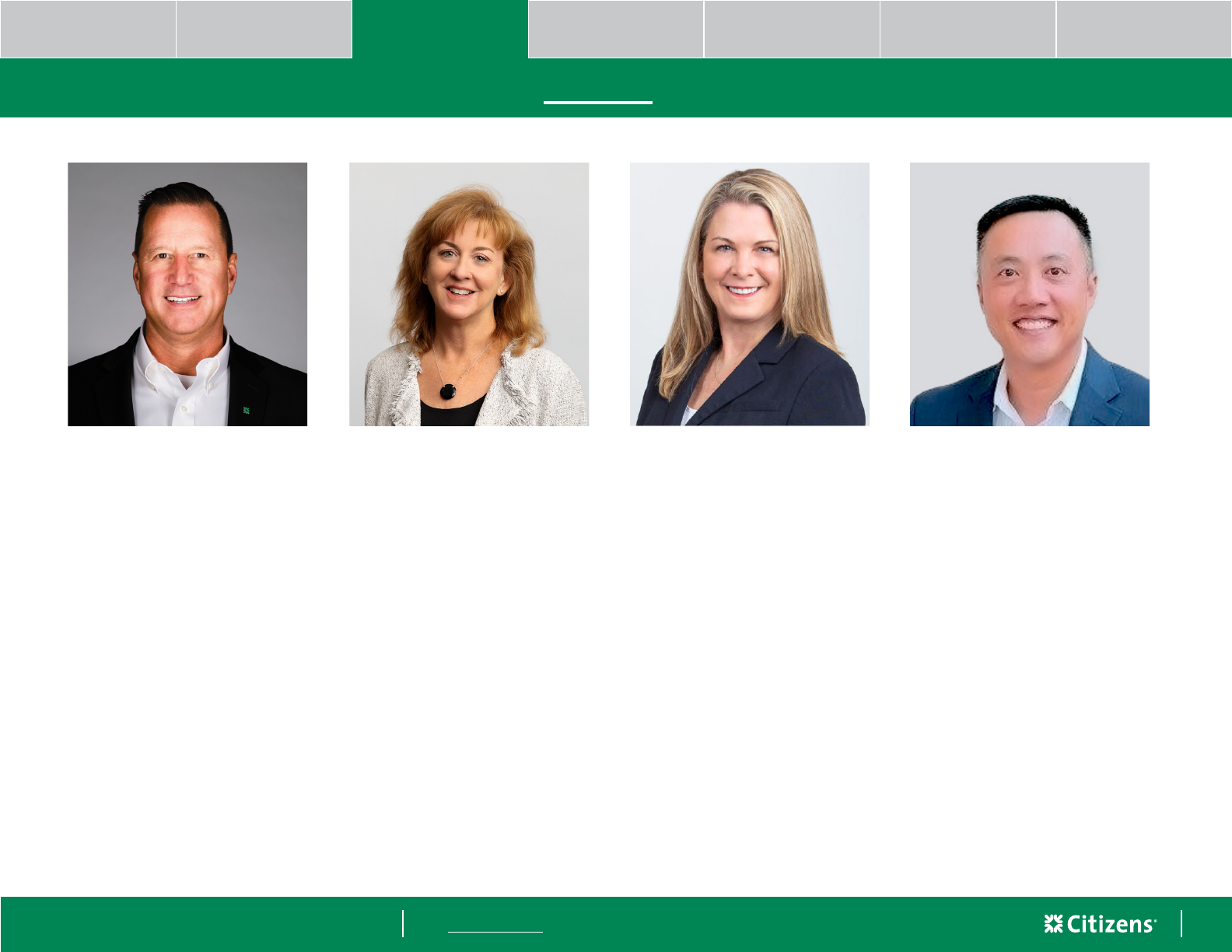

Lewis joined Citizens in March

2020 with over 20 years in the

mortgage industry. He currently

leads the Consumer Direct Loan

Ofcer Sales Division. Prior to

joining Citizens, Lewis worked as

a sales leader for Capital One,

Homebridge Financial, and Mr.

Cooper.

LEWIS TONG,

Head of Consumer Direct Sales

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

CHACE GUNDLACH,

Head of Mortgage Sales

Prior to joining Citizens in

December 2008, Chace was a

regional manager at JP Morgan

Chase for 18 years. He brings

more than 30 years of industry

experience and oversees Retail,

Virtual and Correspondent Sales,

and Mortgage Strategy and

Execution.

MARY ANN CALLAHAN,

Head of Mortgage Operations

Mary Ann joined Citizens in

September 2021, and has 35

years of consumer lending

experience including more

than 20 years in mortgage

operations, sales, servicing

and loss mitigation. Prior to

joining Citizens, Mary Ann

held leadership positions at

Bank of America, PNC, and

JP Morgan Chase. She is

responsible for Mortgage Retail

and Correspondent Operations.

DEBBIE STAFFORD,

Retail Sales Director

Debbie joined Citizens in 2020

as Midwest Regional Sales

Manager and in 2023, became

National Retail Sales Director.

Prior to joining Citizens, she

served in several leadership

roles including territory sales

executive at PNC Bank, as well

as Fifth Third Bank.

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

6

COVER INTRO ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

Scott B.

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

Our mission is to help our customers reach their potential

and to exceed their expectations by providing the best possible

customer experience.

From the rst conversation and even after closing, our

colleagues are focused on meeting our customers’ needs.

Likewise, we are focused on our colleagues’ needs, from support

during every step of closing, to support in your personal life

and goals.

It starts with customer relations training. This program will

help you learn or refresh best practices for building strong

relationships and delivering a great experience. During the

mortgage application process and beyond, you’ll have direct

access to our servicing partners and their escalation teams.

You’ll be ready for anything that comes your way.

We’re doing great things and getting recognized for it.

Recognized by Freddie Mac for the

fastest growth of a national lender

in 2023.

See all of our company honors

here.

Advancing your career

in strides.

WHAT DRIVES YOU?

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

7

DIGITAL CAPABILITIES OPERATIONS PRODUCTS

COVER INTRO ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

We invest in industry-leading technology, marketing, and lead

generation platforms to help you grow and serve your customer

base and connect with Realtor

®

partners. Here are just a few of

the ways we help you sharpen your competitive edge:

WHAT DRIVES YOU?

An online hub that

simplies construction loan

management and reporting

Salesforce CRM platform

that allows efcient lead

management

Individual,

personalized websites

for self marketing

Mortgage application

system and loan

origination systems

Modern products and the latest

tech to keep you productive.

Marketing automation

for loan ofcers

Industry expert insights,

real estate data, and

calculators

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

8

COVER INTRO ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

Name

Title

DIGITAL CAPABILITIES OPERATIONS PRODUCTS

Cathy R.

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

A collaborative team ensures that your transactions are a priority

and that your loan closings happen on time. That’s why we

work in pod structures — a loan ofcer, processor, underwriter

and closer work as a team from start to nish for every loan

application. This teamwork makes us ready to work faster,

smarter and smoother.

There’s even more that makes our operations team so great:

• Loan ofcers build a strong relationship with their dedicated

processor.

• Our paperless process helps the team be more efcient.

• With load balancing, there are no disruptions or delays in the

loan process.

• We have a pre-ight process with our Portfolio team — loan

ofcers can send scenarios before formally submitting a loan

to determine the likelihood of an exception.

• Each member of our leadership team averages 20-plus years

of industry experience.

• Regionalized in-house operation centers support the

team and are located in Providence, RI; Richmond, VA;

and Marlton, NJ.

WHAT DRIVES YOU?

Collaboration and

smooth operation.

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

9

COVER INTRO ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

DIGITAL CAPABILITIES OPERATIONS PRODUCTS

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

AGENCY

Conforming Products

Standard loan amounts up to 97% LTV including HomeReady (low- to

moderate-income)

• High balance loan amounts up to 95% LTV

• All occupancy/LTV parameters follow Fannie Mae without overlays

GOVERNMENT

FHA Products

Standard and jumbo loan amounts follow FHA parameters

• Up to 96.5% LTV

• Secondary nancing from HUD-approved entity permitted

• Fixed-rate products occupancy types follow FHA

VA Products

Loan amounts up to $2 million

• Fixed-rate products

• No/low down payment options for qualied veterans

• Gift funds from acceptable sources allowed toward closing costs, a

down payment, and/or cash reserves

• Fixed-rate mortgages for primary residences only

• Seller concessions permitted

• VA Interest Rate Reduction Loan on primary, second homes and

investment properties

PORTFOLIO*

Portfolio Jumbo Loans

Financing at competitive interest rates

• ACH discount of 0.125% to the rate (in and outside bank footprint)

1

• Jumbo and super jumbo loan amounts, up to $3.5 million (limited

states over $2 million)

For primary residences only:

• Up to 95% LTV with mortgage insurance on loan amounts up to

$850,000, 90% LTV with mortgage insurance on amounts up to

$1.5 million, and up to 85% LTV with mortgage insurance on

amounts up to $2 million

• Fixed- and adjustable-rate mortgages; interest-only option

available on select ARMs

• Second homes and investment properties eligible (on select plans)

WHAT DRIVES YOU?

Whether customers are looking for construction-to-permanent nancing, jumbo loans or affordable home loans, our diverse team

understands their needs and we have a full suite of products to support them.

* Portfolio loan programs are available only in select states. Mortgages are offered and originated by Citizens Bank, N.A. (NMLS ID# 433960). Offers may be withdrawn and subject to change without notice. All loans are subject to approval.

Products that are ahead of the curve.

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

10

DIGITAL CAPABILITIES OPERATIONS PRODUCTS

COVER INTRO ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

Construction-to-Permanent Financing

A single-close loan that combines construction and permanent

nancing. Also available for renovations and tear downs.

• Permanent interest rate locked before construction begins

• No reappraisal or re-qualifying at time of completion

• In-house draw team — builder will have same draw colleague from

beginning to end

• One loan qualication and one set of closing costs

• During construction, borrowers only required to make interest

payments calculated on disbursed funds up to 18 months

• Jumbo and super jumbo loan amounts, up to $3 million (limited

states permitted)

• Up to 90% LTV with lender-paid mortgage insurance for loan

amounts up to $1,000,000 (primary residence only)

• Fixed- and adjustable-rate mortgages

• Second homes eligible

Citizens Doctor Loan

A mortgage available to licensed doctors (MD), (MD PHD), (DO), (DDS),

and (DMD). Borrowers must have completed residency within the last

10 years, be a newly licensed medical resident currently in residency,

or begin residency within 60 days of mortgage closing. May also be

self-employed or a medical researcher employed by a major hospital.

• Up to 95% LTV with no mortgage insurance for loan amounts up to

$850,000 (for select states)

• Student loan debt deferred for greater than 12 months from

the date of closing can be excluded from the DTI (40% max. DTI)

• Construction-to-Permanent eligibility — maximum 85% LTV

• Fixed- and adjustable-rate mortgages; interest-only option

available on select ARMs

• Purchase transactions of primary residences only (Rate/Term Re

also eligible for fully amortization non-CTP plans)

Citizens Closing Cost Assistance

• Provides grant funds for down payment and/or closing costs

• Income restrictions

• Must be located in Citizens’ CRA Assessment Area

• Eligible with DHM Plus and HomeReady

Tandem Home Equity Loan or Line of Credit — 80-10-10

Subordinate nancing for purchase and renance transactions in

which Citizens is providing the rst mortgage.

• Closed simultaneously with the rst mortgage

• Helps borrowers avoid mortgage insurance on jumbo loan

amounts

• Second homes eligible

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

11

DIGITAL CAPABILITIES OPERATIONS PRODUCTS

COVER INTRO ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

OTHER PROGRAMS

Co-Op Financing

Loans for the purchase of individual co-operative share units in the

ve boroughs of New York City and the counties of Nassau, Rockland,

Suffolk, and Westchester.

• Fixed- and adjustable-rate mortgages

• Second homes eligible

Non-Warrantable Condo Financing

(Only eligible on select portfolio plans)

Financing for condos that don’t meet minimum eligibility requirements

for a conforming Fannie Mae and Freddie Mac loan.

Citizens offers non-warrantable condo nancing in Connecticut,

Delaware, District of Columbia, Maryland, Massachusetts, Michigan,

New Jersey, New York, Pennsylvania, Virginia, Florida, Ohio and

New Hampshire.

Lock and Shop

Credit approved borrowers can obtain up to a 90-day rate lock, even

before they nd a home.

• A signed purchase-and-sale agreement must be signed within 30

days of rate lock, and loan must close within 90 days of rate lock.

Extended Rate Lock Without Float Down for Purchase Loans

Borrowers can lock in a rate for up to 12 months on Agency xed-

rate and adjustable-rate programs for an upfront fee and up to four

months on portfolio xed products.

Relationship Discounts Reward Your Clients

Citizens’ suite of banking solutions allows you to deepen client

relationships with exclusive rates and discounts.

• Clients get 0.125% off their interest rate simply by setting up

automatic monthly payments from any Citizens Checking account

and enrolling in e-statements.

1

• Robust corporate Afnity program features $1,000 credit at closing

on a purchase or renance mortgage loans.

• Best-in-class Private Wealth relationship discounts on most

mortgage product types (Saleable/Portfolio).

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

12

COVER INTRO ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

Yasmin G.

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

We value our colleagues as individuals with diverse interests

and unique experiences, providing them with the support,

care and resources to be their best selves — personally and

professionally. Our programs and benets support you in

whatever way you need it, when you need it.

• HEALTH, DENTAL AND VISION COVERAGE — choose from

plans that offer preventative care at no cost

• PARENTAL LEAVE — receive six weeks of 100% paid parental

leave; those who are giving birth and are full-time

colleagues are eligible for 16 weeks of leave

• EMERGENCY BACK-UP CARE — receive up to ve days of

emergency back-up care for children and elderly loved ones

• FLEXIBLE WORK ARRANGEMENTS — collaborate with your

manager to gure out a exible plan that makes sense

for you

• RETIREMENT BENEFITS — save for your future; we match

your contributions up to 4% (plus an annual company

contribution of 1.5% of your salary) after one year of service

WHAT DRIVES YOU?

A benets package that

gives you life.

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

13

COVER INTRO ABOUT US CULTURE RESOURCES COMPENSATION COMMUNITY

CITIZENS HOME MORTGAGE CAREERS APPLY NOW

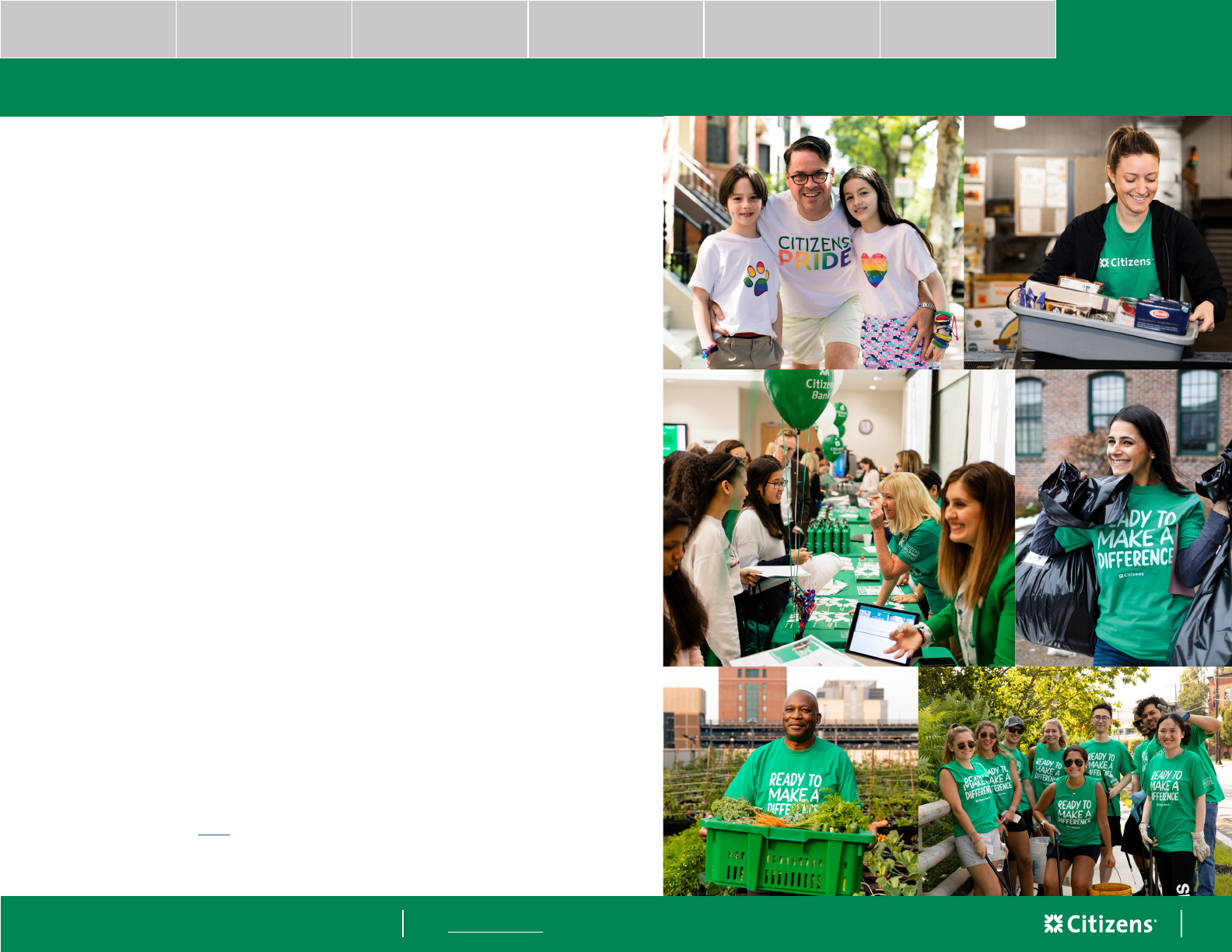

Belief in the greater good

Our commitment to creating a diverse, equitable and inclusive

organization extends beyond our walls to encompass the ways we serve

not only our colleagues, but also our customers and the communities

where we live and work.

We’re fostering a culture of inclusion and belonging in our workplace by:

• Increasing transparency and accountability through an internal

diversity scorecard

• Supporting Business Resource Groups that serve as catalysts for

change within Citizens

• Building a more diverse workforce through partnerships with

organizations such as the Association of Latino Professionals for

America, Disability:IN, Four Block, Year Up and Out in Finance

Citizenship is at the heart of who we are, rooted in the belief that when

people and communities reach their potential, we all thrive. We partner

with the National Association of Minority Mortgage Bankers of America,

which is dedicated to the inclusion of minorities and women in the

mortgage industry and who advocate for sustainable homeownership in

local communities.

Our colleagues invest their time, talent, and resources in our

communities and causes that are meaningful to them. In 2023,

colleagues volunteered more than 232,000 hours. We encourage

colleagues to take four hours of paid volunteer time, without utilizing

personal paid time off.

Learn about these efforts and more in our annual Environmental Social

Governance Report here.

1

In the following states: CT, DC, DE, FL, MA, MD, MI, NH, NJ, NY, OH, PA, RI, VA ,VT, a Citizens consumer checking account set up with automatic monthly payment deduction and e-statement enrollment is required at time of loan origination to be eligible for a

0.125% rate discount. All other states require a consumer checking account set up with automatic monthly mortgage payment deduction. One offer per property. No applicable to Bond or CRA programs. Other exclusions and restrictions may apply.

Mortgages are offered and originated by Citizens Bank, N.A. (NMLS ID# 433960). Offers may be withdrawn and subject to change without notice. All loans are subject to approval.

Equal Housing Lender. © 2024 Citizens Financial Group, Inc. All rights reserved.

Citizens, its parent, subsidiaries, and related companies provide equal employment and advancement opportunities to all colleagues and applicants for employment without regard to age, ancestry, color, citizenship, physical or mental disability or perceived disability,

ethnicity, gender, gender identity or expression, genetic information, genetic characteristic, marital or domestic partner status, victim of domestic violence, family status/parenthood, medical condition, military or veteran status, national origin, pregnancy/childbirth/

lactation, colleague’s or a dependent’s reproductive health decision making, race, religion, sex, sexual orientation, or any other category protected by federal, state and/or local laws.

Equal Employment and Opportunity Employer/Disabled/Veteran.

2334597_HR24_Mortgage_Brchr