Long-Term

Care Insurance

Multistate

Rate Review

Framework

April 2022

NAIC Long-Term Care Insurance (EX) Task Force of the

Executive (EX) Committee

Accounng & Reporng

Informaon about statutory accounng principles and the

procedures necessary for ling nancial annual statements

and conducng risk-based capital calculaons.

Consumer Informaon

Important answers to common quesons about auto, home,

health and life insurance — as well as buyer’s guides on annu-

ies, long-term care insurance and

Medicare supplement plans.

Financial Regulaon

Useful handbooks, compliance guides and reports on nancial

analysis, company licensing, state audit

requirements and receiverships.

Legal

Comprehensive collecon of NAIC model laws, regulaons

and guidelines; state laws on insurance topics; and other reg-

ulatory guidance on anfraud and consumer privacy.

Market Regulaon

Regulatory and industry guidance on market-related issues,

including anfraud, product ling requirements, producer

licensing and market analysis.

NAIC Acvies

NAIC member directories, in-depth reporng of state

regulatory acvies and ocial historical records of NAIC na-

onal meengs and other acvies.

Special Studies

Studies, reports, handbooks and regulatory research

conducted by NAIC members on a variety of insurance-

related topics.

Stascal Reports

Valuable and in-demand insurance industry-wide stascal

data for various lines of business, including auto, home,

health and life insurance.

Supplementary Products

Guidance manuals, handbooks, surveys and research

on a wide variety of issues.

Capital Markets & Investment Analysis

Informaon regarding porolio values and procedures for

complying with NAIC reporng requirements.

White Papers

Relevant studies, guidance and NAIC policy posions on

a variety of insurance topics.

© 1999-2022 National Association of Insurance Commissioners. All rights reserved.

ISBN: 978-1-64179-198-4

Printed in the United States of America

No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means,

electronic or mechanical, including photocopying, recording, or any storage or retrieval system, without written permission

from the NAIC.

NAIC Execuve Oce

444 North Capitol Street, NW

Suite 700

Washington, DC 20001

202.471.3990

NAIC Central Oce

1100 Walnut Street

Suite 1500

Kansas City, MO 64106

816.842.3600

NAIC Capital Markets

& Investment Analysis Oce

One New York Plaza, Suite 4210

New York, NY 10004

212.398.9000

The NAIC is the authoritave source for insurance industry informaon. Our expert soluons support the eorts of

regulators, insurers and researchers by providing detailed and comprehensive insurance informaon. The NAIC oers

a wide range of publicaons in the following categories:

For more informaon about NAIC

publicaons, visit us at:

hp://www.naic.org//prod_serv_home.htm

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

PREFACE

The Long-Term Care Insurance Multistate Rate Review Framework (LTCI MSA Framework) was drafted by the Ad Hoc

Drafting Group of the NAIC Long-Term Care Insurance (EX) Task Force. The Ad Hoc Drafting Group consists of

representatives from state insurance departments in Connecticut, Minnesota, Nebraska, Texas, Virginia, and

Washington.

The LTCI MSA Framework was adopted by the NAIC Long-Term Care Insurance Multistate Rate Review (EX) Subgroup

and the Long-Term Care Insurance (EX) Task Force on Dec. 12, 2021, and the NAIC Executive Committee and Plenary

on April 8, 2022.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS

Table of Contents

I. INTRODUCTION ............................................................................................................................................. 1

A. PURPOSE ............................................................................................................................................................. 1

B. STATE PARTICIPATION IN THE MSA REVIEW ............................................................................................................... 1

C. GENERAL DESCRIPTION OF THE MSA REVIEW ............................................................................................................. 2

D. BENEFITS OF PARTICIPATING IN THE MSA REVIEW ....................................................................................................... 3

E. DISCLAIMERS AND LIMITATIONS ............................................................................................................................... 3

F. GOVERNING BODY AND ROLE OF THE NAIC LONG-TERM CARE INSURANCE (EX) TASK FORCE .............................................. 4

II. MSA TEAM .................................................................................................................................................... 5

A. QUALIFICATIONS OF AN MSA TEAM MEMBER ............................................................................................................ 5

B. DUTIES OF AN MSA TEAM MEMBER ......................................................................................................................... 5

C. PARTICIPATION OF AN MSA TEAM MEMBER .............................................................................................................. 6

D. MSA ASSOCIATE PROGRAM .................................................................................................................................... 6

E. CONFLICTS, CONFIDENTIALITY, AND AUTHORITY OF THE MSA TEAM ............................................................................... 6

F. REQUIRED NAIC AND COMPACT RESOURCES .............................................................................................................. 7

III. REQUESTING AN MSA REVIEW ...................................................................................................................... 7

A. SCOPE AND ELIGIBILITY OF A RATE PROPOSALS FOR MSA REVIEW .................................................................................. 7

B. PROCESS FOR REQUESTING AN MSA REVIEW .............................................................................................................. 8

C. CERTIFICATION ...................................................................................................................................................... 8

IV. REVIEW OF THE RATE PROPOSAL .............................................................................................................. 9

A. RECEIPT OF A RATE PROPOSAL ................................................................................................................................. 9

B. COMPLETION OF THE MSA REVIEW .......................................................................................................................... 9

C. PREPARATION AND DISTRIBUTION OF THE MSA ADVISORY REPORT................................................................................. 9

D. TIMELINE FOR REVIEW AND DISTRIBUTION OF THE MSA ADVISORY REPORT ................................................................... 10

E. FEEDBACK TO THE MSA TEAM ............................................................................................................................... 10

V. ACTUARIAL REVIEW ..................................................................................................................................... 11

A. MSA TEAM’S ACTUARIAL REVIEW CONSIDERATIONS .................................................................................................. 11

B. LOSS RATIO APPROACH ........................................................................................................................................ 12

C. MINNESOTA APPROACH ....................................................................................................................................... 13

D. TEXAS APPROACH ................................................................................................................................................ 14

E. RBOS ............................................................................................................................................................... 15

F. NON-ACTUARIAL CONSIDERATIONS ......................................................................................................................... 16

VI. APPENDICES ............................................................................................................................................ 16

A. APPENDIX A – MSA ADVISORY REPORT FORMAT ...................................................................................................... 16

B. APPENDIX B – INFORMATION CHECKLIST .................................................................................................................. 17

C. APPENDIX C—ACTUARIAL APPROACH DETAIL ........................................................................................................... 21

D. APPENDIX D—PRINCIPLES OF RBOS ASSOCIATED WITH LTCI RATE INCREASES ............................................................... 25

E. APPENDIX E—GUIDING PRINCIPLES ON LTCI RBOS PRESENTED IN POLICYHOLDER NOTIFICATION MATERIALS ...................... 26

VII. EXHIBITS .................................................................................................................................................. 31

A. EXHIBIT A—SAMPLE MSA ADVISORY REPORT ................................................................................................ 31

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 1

I. INTRODUCTION

A. Purpose

The NAIC charged the Long-Term Care Insurance (EX) Task Force with developing a consistent national approach for

reviewing current long-term care insurance (LTCI) rates that results in actuarially appropriate increases being

granted by the states in a timely manner and eliminates cross-state rate subsidization. Considering that charge and

the threat posed by the current LTCI environment both to consumers and the state-based system (SBS) of insurance

regulation, the Task Force developed this framework for a multi-state actuarial (MSA) LTCI rate review process (MSA

Review).

This framework is based upon the extensive efforts of the Long-Term Care Insurance Multistate Rate Review (EX)

Subgroup, including its experience with a pilot program conducted by the pilot program’s rate review team (Pilot

Team). As part of that pilot program, the Pilot Team reviewed LTCI premium rate increase proposals and issued MSA

Advisory Reports recommending actuarially justified state-by-state rate increases. This framework aims to

institutionalize a refined version of the Pilot Team’s approach to create a voluntary and efficient MSA Review that

produces reliable and nationally consistent rate recommendations that state insurance regulators and insurers can

depend upon. The MSA Review has been designed to leverage the limited LTCI actuarial expertise among state

insurance departments by combining that expertise into a single review process analyzing in force LTCI premium

rate increase proposals or rate proposal

1

and producing an MSA Advisory Report for the benefit and use of all state

insurance departments. Note that rate decrease proposals can be contemplated within the MSA Review. The same

concepts of this MSA Framework would be applied, if such a rate decrease proposal is received for MSA Review. The

goal of this framework is to create a process that will not only encourage insurers to submit their LTCI products for

multi-state review, but also provide insurance departments the requisite confidence in the MSA Review so they will

voluntarily utilize the Multistate Actuarial LTCI Rate Review Team’s (MSA Team’s) recommendations when

conducting their own state level reviews of in force LTCI rate increase filings.

2

Ultimately, the MSA Review is designed

to foster as much consistency as possible between states in their respective approaches to rate increases.

The purpose of this document is to function as a framework for the MSA Review that communicates to NAIC

members, state insurance department staff, and external stakeholders how the MSA Review works to the benefit of

state insurance departments and how insurers might engage in the MSA Review. This MSA framework is intended

to communicate the governance, policies, procedures, and actuarial methodologies supporting the MSA Review.

State insurance regulators can utilize the information and guidance contained herein to understand the basis of the

MSA Team’s MSA Advisory Reports. Insurance companies can access the information and guidance contained herein

to understand how to engage in the MSA Review, and how the MSA Advisory Report may affect the insurer’s in force

LTCI premium rate increase filing decisions and interactions with individual state insurance regulators.

This document will be maintained by NAIC staff under the oversight of the Task Force and be revised as directed by

the Task Force or an appointed subgroup. This document will be part of the NAIC library of official publications and

copyrighted.

B. State Participation in the MSA Review

The MSA Review of an insurer’s rate proposal will be available to state insurance departments who are both an

Impacted State and a Participating State. These are defined as follows.

• “Impacted State” is defined as the domestic state, or any state for which the product associated with the

insurer’s in force LTCI premium rate increase proposal is or has been issued.

1

“Premium rate increase proposal(s)” or “rate proposal(s)” in this document refers only to an insurer’s request for review of a proposed in force LTCI premium rate increase or

decrease under the MSA Review.

2

The term “rate increase filing” or “rate filing(s)” in this document refers only to the in force LTCI premium rate request(s) that is submitted to individual state departments of

insurance (DOI) for a regulatory decision. Filings refer to both rate increase filings and rate decrease filings.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 2

• “Participating State” is defined as any impacted state insurance department that agrees to participate in

the MSA Review. Participation is voluntary as described in Section IE(1) below. Participation may include

activities such as, but not limited to, receiving notifications of rate increase proposals in System for

Electronic Rate and Form Filing (SERFF), participation in communication/webinars with the MSA Team, and

access to the MSA Advisory Report.

Note that state participation is expected to increase in the future as the MSA Review process continues to be

developed and refined.

C. General Description of the MSA Review

The MSA Review provides for a consistent actuarial review process that will result in an MSA Advisory Report, which

state insurance departments may consider when deciding on an insurer’s rate increase filing or to supplement the

state’s own review process.

The MSA Review is conducted by a team of state’s regulatory actuaries with expertise in LTCI rate review. Each

review will be led by a designated member of the MSA Team. The review process is supported by NAIC staff and

Interstate Insurance Product Regulation Commission (Compact) staff, who will administratively assist insurers in

making requests to utilize the MSA process and facilitate communication between the insurer, the MSA Team and

[Participating/Impacted TBD

3

] States. The NAIC’s electronic infrastructure, SERFF, will be used to streamline the rate

proposal and review process. Although the administrative services of Compact staff and SERFF’s Compact filing

platform are utilized in the MSA Review, MSA rate proposals are reviewed, and MSA Advisory Reports are prepared

by the MSA Team. MSA rate proposals are not Compact filings, and Compact staff will not have any role in

determining the substantive content of the MSA Advisory Reports.

The MSA Review begins when an insurer expresses interest in an MSA Review being performed for an in force LTCI

rate proposal to the MSA Team through SERFF or supporting NAIC or Compact staff. The eligibility of the rate

proposal will be reviewed and determined by the MSA Team with assistance, as needed, from supporting staff.

The MSA Review of eligible rate proposals will resemble a state-specific rate review process utilizing consistent

actuarial standards and methodologies. The MSA Team will apply the Minnesota and Texas approaches to calculate

recommended, approvable rate increases. While aspects of the Minnesota and Texas approaches may result in lower

rate increases than those resulting from loss ratio-based approaches and are outside the pure loss ratio

requirements contained in many states’ laws and rules, the approaches fall in line with legal provisions that rates

shall be fair, reasonable, and not misleading. The MSA Team will review support for the assumptions, experience,

and projections provided by the insurer and perform validation steps to review the insurer-provided information for

reasonableness. The MSA Team will document how the proposal complies with the regulatory approach utilized by

the MSA Team for Participating States. See Section V for more details on the actuarial review.

Throughout the MSA Review, the MSA Team will provide updates to the insurer. The MSA Team will deliver the final

MSA advisory Report to the insurer and address any questions the insurer has about the results of the Review.

Additionally, the review will consider reduced benefit options (RBOs) that are offered in lieu of the requested rate

increases and factor in non-actuarial considerations.

At the completion of the review, the MSA Team will draft an MSA Advisory Report for Participating States and

insurers that provides both summary and detail information about the rate proposal, the review methodologies, the

analysis and other considerations of the team, and the recommendation for rate increases as outlined in Appendix

A. The MSA Advisory Report will also indicate whether the recommendation differs from the insurer’s proposal.

Participating States can utilize the MSA Advisory Report or supplement their own state’s rate review with it as

3

Certain processes for Impacted vs. Participating States are yet to be determined (TBD).

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 3

described in the following Section ID. Participating States may also utilize the information filed with the MSA Team

in addition to the Advisory Report as appropriate.

The rate proposal, review process, actuarial methodologies, and other review considerations are detailed within this

framework document and accompanying appendices.

D. Benefits of Participating in the MSA Review

Both state insurance regulators and insurers will benefit by participating in the MSA Review in multiple ways. For

state insurance regulators:

• First, they will be able to leverage the demonstrated expertise of the MSA Team in reviewing in force LTCI

rate increase filings in their state. It is recognized that multiple states may not have significant actuarial

expertise with LTCI, so participation in the MSA Review will allow those states to build on the specific,

dedicated LTCI actuarial expertise of the MSA Team.

• Second, state insurance regulators will be able to utilize the MSA Team to promote consistency of actuarial

reviews among filings submitted by all insurers to states and actuarial reviews across all states. Because the

MSA Team is using the same dedicated approach to in force LTCI rate increase reviews, states who utilize

the MSA Team will have the benefit of using the same consistent methodology that is relied upon by other

state insurance departments when reviewing in force LTCI rate increase filings in their state.

• Third, the MSA Review allows for more state regulatory actuaries to work with or under the supervision of

qualified actuaries, which affords them an opportunity to establish LTCI-specific qualifications in making

actuarial opinions. This is particularly important when we consider that requirements to be a qualified

actuary include years of experience under the supervision of another already qualified actuary in that

subject matter.

• Finally, participating in the MSA Review will allow all state insurance regulators to share questions and

information regarding a particular rate proposal or review methodologies; thus, increasing each state’s

knowledge base in this area and promoting a more consistent national approach to in force LTCI rate review.

Note that states’ use of and reliance on the MSA Advisory Report is expected to increase in the future as the MSA

Review continues to be developed and refined, and the benefits of the MSA Review described above become more

evident.

Long-Term Care (LTC) insurers will likewise see multiple benefits in participating in the MSA Review:

• First, by utilizing the MSA Review and through the receipt of MSA information and the MSA Advisory Report

from the MSA Team, insurers should see increased efficiency and reduced timelines for nationwide

premium rate increase filings. As the MSA Team delivers the MSA Advisory Report for a rate proposal to

Participating States, it has functionally reduced the review time for each state, meaning that LTC insurers

should see more efficient and timely reviews from these states.

• Second, participating in the MSA Review will provide LTC insurers with one consistent recommendation to

be used when making rate increase filings to all states, thus reducing the carrier’s workload in developing

often widely differing filings for states’ review.

E. Disclaimers and Limitations

State Authority Over Rate Increase Approvals

The MSA Advisory Report is a recommendation to Participating States based upon the methodologies adopted by

the MSA Review. The recommendations are not specific to, and do not account for, the requirements of any specific

state’s laws or regulations. The MSA Review is not intended, nor should it be considered, to supplant or otherwise

replace any state’s regulatory authority, responsibility, and/or decision making. Each state remains ultimately

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 4

responsible for approving, partially approving, or disapproving any rate increase in accordance with applicable state

law.

A Participating State’s use of the MSA Advisory Report’s recommendations with respect to one filing does not require

that state to consider or use any MSA Advisory Report recommendations with respect to any other filing. The MSA

Review in no way: 1) eliminates the insurer’s obligation to file for a rate increase in each Participating State; or, 2)

modifies the substantive or procedural requirements for making such a filing. While encouraged to adopt the

recommendations of the MSA Review in each of their state filings, insurers are not obligated to align their individual

state rate filings with the recommendations contained within the MSA Advisory Report.

The MSA Advisory Reports, including the recommendations contained therein, are only for use by Participating

States in considering and evaluating rate filings. The MSA Advisory Reports or their conclusions shall not be utilized

by any insurer in a rate filing submitted to a non-Participating State, nor shall the MSA Advisory Reports be used

outside of each state insurance regulator’s own review process or challenge the results of any individual state’s

determination of whether to grant, partially grant, or deny a rate increase.

Information Sharing Between State Insurance Departments

The MSA Review, including, but not limited to, meetings, calls, and correspondence on insurer-specific matters are

held in regulator-to-regulator sessions and are confidential. In addition, if certain information and documents related

to specific companies that are confidential under the state law of an MSA Team member or a Participating State

need to be shared with other state insurance regulators, such sharing will occur as authorized by state law, and

pursuant to the Master Information Sharing and Confidentiality Agreement (Master Agreement) between states that

governs the sharing of information among state insurance regulators. Through the Master Agreement, state

insurance regulators affirm that any confidential information received from another state insurance regulator will

be maintained as confidential and represent that they have the authority to protect such information from

disclosure.

Confidentiality of the Rate Proposal

Members of the MSA Team and Participating States affirm and represent that they will provide any in force LTCI rate

proposal, as discussed herein with the same protection from disclosure, if any, as provided by the confidentiality

provisions contained within their state’s laws and regulations.

Confidentiality of the MSA Reports

Likewise, members of the MSA Team and Participating States affirm and represent that they will provide any MSA

Advisory Report(s), as discussed herein with the same protection from disclosure, if any, as provided by the

confidentiality provisions contained within their state’s laws and regulations for rate filings.

F. Governing Body and Role of the NAIC Long-Term Care Insurance (EX) Task Force

The Long-Term Care Insurance (EX) Task Force is expected to remain in place for the foreseeable future to oversee

the implementation of the MSA Review, and related MSA Advisory Reports, and to provide a discussion forum for

MSA-related activities. The Task Force or any successor will continuously evaluate the effectiveness and efficiency

of the MSA Review for the benefit of state insurance regulators and provide direction, as needed. The Task Force

may create one or more subgroups to carry out its oversight responsibilities.

Membership and leadership of the Task Force will be selected by the NAIC president and president-elect as part of

the annual committee assignment meeting held in January. Selection of the membership and leadership may

consider a variety of criteria, including commissioner participation, insurance department staff competencies,

market size, domestic LTC insurers, and other criteria considered appropriate for an effective governance system.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 5

II. MSA TEAM

The MSA Team comprises state insurance department actuarial staff. MSA Team members are chosen by their skill

set and LTCI actuarial experience. The Long-Term Care Insurance (EX) Task Force, or its appointed subgroup, will

determine the appropriate experience and skill set for qualifying members for the MSA Team. It is expected that

state participants will provide expertise and technical knowledge specifically regarding the array of LTCI products

and solvency considerations. The desired MSA Team membership composition should include a minimum of five and

up to seven members.

Membership must follow the requirements below and be approved by the chair of the Task Force or the chair of an

appointed subgroup. The following outlines the qualifications, duties, participation expectations and resources

required for MSA Team members.

A. Qualifications of an MSA Team Member

To be eligible to participate as a member of the MSA Team, a state insurance regulator is required to:

• Hold a senior actuarial position in a state insurance department in life insurance, health insurance, or LTCI.

• Be recommended by the insurance commissioner of the state in which the actuary serves.

• Have over five years of relevant LTCI insurance experience.

• Hold an Associate of the Society of Actuaries (ASA) designation.

• Currently participates as a member of the Long-Term Care Insurance Multistate Rate Review (EX) Subgroup

(or an equivalent Subgroup appointed by the Long-Term Care Insurance (EX) Task Force) and the LTC Pricing

(B) Subgroup.

• Be a member of the American Academy of Actuaries (Academy) (at least one member).

Additionally, the following qualifications are preferred:

• Hold a Fellow of the Society of Actuaries (FSA) designation

• Have spent at least one year engaged in discussions of either the Task Force or its appointed Subgroup

As both state insurance regulators and the MSA Review may benefit by developing and expanding specific LTCI

actuarial expertise through participation in this process, having one or more suitably experienced and qualified

actuaries participate in and supervise the work of the MSA Team is critical to the viability of the MSA process.

Participation also provides opportunities for additional actuaries to meet the requirements of the U.S. Qualification

Standards applicable to members of the Academy and other U.S. actuarial organizations as they relate to LTCI.

Consideration will be given to joint membership where two actuaries within a state combine to meet the criteria

stated above.

Consultants engaged by the state insurance department would not be considered for MSA Team membership.

B. Duties of an MSA Team Member

• Active involvement with the MSA Team, with an expected average commitment of 20 hours per month (see

Section IV for details of the MSA Review and activities of a team member).

• Participate in all MSA Team calls and meetings (unless an extraordinary situation occurs).

• Review and analyze materials related to MSA rate proposals.

• Provide input on the MSA Advisory Reports, including regarding the recommended rate increase approval

amounts.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 6

• Maintain confidentiality of MSA Team meetings, calls, correspondence, and the matters discussed therein

to the extent permitted by state law and protect from disclosure any confidential information received

pursuant to the Master Agreement. MSA Team members should communicate any request for public

disclosure of MSA information or any obligation to disclose.

• Active involvement within NAIC LTCI actuarial groups.

• Willingness to provide expertise to assist other states.

C. Participation of an MSA Team Member

Except for webinars and other general communications with state insurance departments, participation in the MSA

Review conference calls and meetings related to the review of a specific rate proposal will be limited to named MSA

Team members, supporting NAIC or Compact staff members who will be assisting the MSA Team, and the chair and

vice chair of the Long-Term Care Insurance (EX) Task Force, or its appointed subgroup. Other interested state

insurance regulators (e.g., domiciliary state insurance regulators) may be invited to participate on a call at the

discretion of the MSA Team or the chair or vice chair of the Task Force or its appointed subgroup.

D. MSA Associate Program

The MSA Associate Program within the MSA Framework is intended to encourage and engage state insurance

regulators to become actively involved in the MSA process. Additionally, a benefit of the program is to provide an

educational opportunity for state insurance department regulatory actuaries that wish to gain expertise in LTCI.

Regulatory actuaries can participate with varying levels of involvement or for different purposes as described.

Regulatory actuaries may participate:

• As a mentee. The mentee would participate in aspects of the MSA Review. An MSA Team member will serve

as a mentor to another state regulatory actuary and provide one-on-one guidance.

• To gain more knowledge and understanding of the Minnesota and Texas actuarial approaches.

• To share their own expertise through feedback to the MSA Team on MSA Advisory Reports to better

enhance the overall MSA process.

• To participate on an ad hoc limited basis, i.e., where a regulatory actuary would like to participate but is

unable to make the required time commitment.

• To meet the U.S. Qualification Standards applicable to members of the Academy and other U.S. actuarial

organizations as they relate to LTCI by serving under the supervision of a qualified actuary on the MSA

Team.

• To serve as a peer reviewer of the MSA Advisory Reports.

E. Conflicts, Confidentiality, and Authority of the MSA Team

Authority of the MSA Team

Members of the MSA Team serve on a purely voluntary basis, and any member’s participation shall not be viewed

or construed to be any official act, determination, or finding on behalf of their respective jurisdictions.

Disclosures and Confidentiality Obligations, as Applicable

All members of the MSA Team acknowledge and understand that the MSA Review, including, but not limited to,

meetings, calls, and correspondence are confidential and may not be shared, transmitted, or otherwise reproduced

in any manner. Additionally, all members of the MSA Team affirm and represent that they will: a) provide any in

force LTCI rate proposal with the same protection from disclosure, if any, as provided by the confidentiality

provisions contained within their state’s laws and regulations; and, b) provide any MSA Advisory Report with the

same protection from disclosure, if any, as provided by the confidentiality provisions contained within their state’s

laws and regulations for rate filings.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 7

Conflict of Interest Avoidance Procedures and Certifications

No member of the MSA Team may own, maintain, or otherwise direct any financial interest in any company or its

affiliates subject to the regulation of any individual state, nor may any member serve or otherwise be affiliated with

the management or board of directors in any company or its affiliates subject to the regulation of any individual

state. All conflicts of interest, whether real or perceived are prohibited and no member of the MSA Team shall

engage in any behaviors that would result in or create the appearance of impropriety.

F. Required NAIC and Compact Resources

The MSA Team will require administrative and technical support from the NAIC. As the MSA Review develops, it is

expected that NAIC support resources will play an integral role in managing the overall program. Administrative staff

support will be needed to support MSA Team communications and manage record keeping for underlying

workpapers and final MSA Advisory Reports associated with each rate proposal, etc. Additionally, it is possible that

limited actuarial support will be needed for the analysis of rate proposals, including preparing data files, gathering

information, performing limited actuarial analysis procedures, drafting MSA Advisory Reports, and monitoring

interactions among the state insurance departments and the MSA Team. Dedicated staff support for the ongoing

work of the Long-Term Care Insurance (EX) Task Force will be needed as well. As more experience with rate proposal

volumes and average analysis time is gained, the full complement of human resources required will be better

understood.

The MSA Team and supporting NAIC and Compact staff will use the NAIC SERFF electronic infrastructure to receive

insurer rate increase proposals and correspond with insurers. As needed, the MSA Team or supporting NAIC and

Compact staff may communicate with the insurer outside of SERFF. The material substance of such communication

can be documented within SERFF. NAIC and Compact staff will communicate with insurers only at the direction of

the MSA Team. Compact staff will perform administrative work related to MSA rate increase proposals at the

direction of the MSA Team and as described in this framework.

III. REQUESTING AN MSA REVIEW

A. Scope and Eligibility of a Rate Proposals for MSA Review

The following are the preferred eligibility criteria for requesting an MSA Review of a rate proposal.

• Must be an in force LTCI product (individual or group).

• Must be seeking a rate increase in at least 20 states and must affect at least 5,000 policyholders nationwide.

• Includes any stand-alone LTCI product approved by states, not by the Compact.

• For Compact-approved products meeting certain criteria, the Compact office will provide the first-level

advisory review subject to the input and quality review of the MSA.

It is recognized that rate proposals vary from insurer to insurer. The above criteria and the timelines provided below

are general guidelines. The MSA Team has the authority to weigh the benefits of the MSA Review for state insurance

departments and the insurer against available MSA Team resources when considering the eligibility of rate proposals

and the timeline for completion. Based on these considerations, the MSA Team, at its discretion, may elect to

perform an MSA Review on a rate proposal that does not satisfy the above eligibility criteria.

The MSA Team reserves the right to deny a proposal that does not meet eligibility criteria. An insurer will be notified

if the proposal for an MSA Review is denied.

An insurer may ask questions for more information about a potential rate proposal through communication to

supporting NAIC and Compact staff and the MSA Team. This will be accomplished through a Communication Form

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 8

that will be available on the Compact web page. Supporting NAIC and Compact staff will work with the insurer to

complete the necessary steps to assess eligibility, discuss any technical or other issues, and answer questions.

The insurer will have access to primary and supplementary checklists in Appendix B that provide guidance to the

insurer for information that should be included in a complete MSA rate proposal requested through the NAIC’s SERFF

application.

B. Process for Requesting an MSA Review

As noted in Section IC above, the MSA Review will utilize the Compact’s multistate review platform within the NAIC’s

SERFF application and its format for in force LTCI rate increase proposals. Therefore, a state may participate in the

MSA Review without being a member of the Compact. The following describes a few key elements of the process

for insurers and state insurance regulators:

• The insurer will work with NAIC and Compact support staff and the MSA Team to make a seamless rate

increase proposal.

• Instructions containing a checklist for information required to be included in the rate increase proposal, as

reflected in Appendix B, will be available to insurers through the Compact’s web page or within SERFF.

• The insurer shall include in the rate proposal a list of all states for which the product associated with the

rate increase proposal is or has been issued. Participating States will have access to view the insurer’s rate

proposal and review correspondence in SERFF.

• Fee schedule for using the MSA Review [TBD].

• Rate increase proposals for MSA Review within SERFF will be clearly identified as separate from Compact

filings.

• The supporting NAIC and Compact staff through SERFF will notify the Impacted States upon receipt of the

rate increase proposal with the SERFF Tracking Number.

• The MSA Team may utilize a “queue” process for managing workload and resources for incoming rate

increase proposals through SERFF.

• The MSA Team may utilize Listserv or other communication means for inter-team communications.

• The MSA Team’s review of objections and insurer responses are completed through SERFF.

C. Certification

The insurer shall provide certifications signed by an officer of the insurer that it acknowledges and understands the

non-binding effect of the MSA Review and MSA Advisory Report. The certification shall also provide, and the insurer

shall agree, that it will not utilize or otherwise use the MSA Review and/or the resulting MSA Advisory Report to

challenge, either through litigation or any applicable administrative procedure(s), any state’s decision to approve,

partially approve, or disapprove a rate increase filing except when: 1) the individual state is a (Participating/Impacted

State [TBD]) that affirmatively relied on the MSA Review and/or the MSA Advisory Report in making its

determination; or 2) the individual state consents in writing to use of the MSA Review and/or the MSA Advisory

Report.

Failure to abide by the terms of the insurer’s certification will result in the insurer and its affiliates being excluded

from any future MSA Reviews, and it will permit the MSA Team to terminate, at its sole discretion, any other ongoing

review(s) related to the insurer and its affiliates.

Should the MSA Team exclude any insurer and its affiliates for failure to adhere to its certification, the MSA Team,

at its sole discretion, may permit the insurer and its affiliates to resume submitting rate proposals for review upon

written request of the insurer.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 9

IV. REVIEW OF THE RATE PROPOSAL

A. Receipt of a Rate Proposal

The MSA rate review process begins when an insurer expresses interest in an MSA Review being performed for a

rate proposal. This interest can be expressed through completion of a Communication Form, which will be available

through the Compact web page. The initial request will be reviewed by the MSA Team lead reviewer and/or

supporting NAIC and Compact staff. Once an insurer has completed this initial communication and meets the criteria

for requesting an MSA Review, the insurer will work with supporting NAIC and Compact staff and the MSA Team to

complete the rate increase proposal in SERFF. The MSA Team will be notified, via SERFF, when the rate increase

proposal is available for review.

The supporting NAIC and Compact staff will notify (Participating/Impacted States [TBD]) via SERFF or e-mail when

rate increase proposals are submitted, correspondence between the MSA Team and insurer is sent or received in

SERFF, the MSA Advisory Report is available, and other pertinent activities occur during the review.

B. Completion of the MSA Review

The MSA Team shall designate a lead reviewer to perform the initial review of each rate proposal. Once the rate

increase proposal is made through SERFF, the MSA Review will resemble a state-specific review process.

The MSA Team will meet periodically to discuss the review and determine any needed correspondence with the

insurer. Objections and communications with filers will be conducted through SERFF, like any state-specific filing or

Compact filing, to maintain a record of the key review items. Other supplemental communication between the

insurer and the MSA Team or supporting NAIC and Compact staff, may occur, such as conference calls or emails, as

appropriate.

The timeframe for completing the MSA Team’s review and drafting the MSA Advisory Report will be dependent upon

the completeness of the rate proposal and the size and complexity of the block of policies for which the rate increase

applies. The MSA Team may utilize a “queue” process for managing workload and resources for incoming rate

increase proposals through SERFF. The timeliness of any necessary communication between the MSA Team and the

insurer to resolve questions or request/receive additional information about the rate proposal will affect the

completion of the review.

As the MSA Team completes its review: 1) the insurer will receive initial communication of a completed review, and

a final MSA Advisory Report with recommendations will be drafted and communicated to state insurance

departments within the next month, which may serve as a signal for a potential ideal time for the insurer to prepare

to submit the state-specific filings to each state; and 2) the insurer will receive sufficient information regarding the

MSA Team’s recommendation to allow the insurer an opportunity to review the recommendation and in the event

that the MSA Team recommendation differs from the proposal submitted by the insurer, the insurer will be given

the opportunity to interact with the MSA Team in order to ask questions, and understand the MSA Team’s reasoning.

C. Preparation and Distribution of the MSA Advisory Report

Upon completion of the actuarial review, the MSA Team will prepare a draft MSA Advisory Report for the rate

proposal. The reports will be made available within SERFF “reviewer notes” for Participating States. Supporting NAIC

and Compact staff will maintain a distribution list and send notifications of the availability of reports to Participating

States. Consultants engaged by state insurance department staff to perform rate reviews would be given access to

the MSA Advisory Report, subject to the terms of the agreement between the consultant and the Participating State

insurance department.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 10

Consultants who are bound by the actuarial Code of Professional Conduct, adopted by the Academy of Actuaries,

the Society of Actuaries (SOA) and the Conference of Consulting Actuaries (CCA), should consider whether receipt

of the MSA Advisory Report is acceptable under Precept 7 regarding Conflicts of Interest. For other professions,

similar consideration should be made if bound by similar professionalism standards.

Prior to finalizing the MSA Advisory Report, the MSA Team will present the draft MSA Advisory Report to

Participating States on a regulatory-only call, as deemed necessary, to provide an overview of the recommendations

and respond to questions from Participating States.

The MSA Team will issue the final MSA Advisory Report to the Participating States and the insurer after consideration

of any comments and questions from Participating States.

The MSA Advisory Report will include standardized content, as reflected in Appendix A, with modifications, as

necessary, for any unique factors specific to the rate proposal. The content and format are based on feedback

received from state insurance departments and the Long-Term Care Insurance (EX) Task Force during the pilot

project.

The content and format of the MSA Advisory Report may be modified in the future under the direction of the Task

Force, or an appointed subgroup, as the MSA Team gains more experience in generating the reports and receives

more feedback from Participating states and the insurer, through this process.

D. Timeline for Review and Distribution of the MSA Advisory Report

The draft MSA Advisory Report will be made available to Participating States for a two-week comment period prior

to being finalized. The following timeline for this comment period and distribution of the final MSA Advisory Report

will be adhered to as close as possible, barring timing delays due to holidays or other unexpected events. Note that

the MSA Review is intended to occur before filings are made to the state insurance departments, therefore not

affecting state insurance departments’ required timelines for review. However, use of the MSA Advisory Report by

the state is expected to reduce the amount of time required for the state to complete its review.

Pre-Distribution - Share the draft MSA Advisory Report with the insurer. The insurer will be given the opportunity to

interact with the MSA Team to ask questions and understand the MSA Team’s reasoning.

Day 1 – Distribution of a draft MSA Advisory Report to all Participating States.

Day 5-7 – Regulator-to-regulator conference call of all Participating States during which the MSA Team will

present the recommendations in the MSA Advisory Report and seek comments from states.

Day 21 – Deadline for comments on the draft MSA Advisory Report.

• Day 35 – Distribution of the final MSA Advisory Report, with consideration of comments, to Participating

States and the insurer.

• Date TBD by the Insurer – Individual rate increase filings submitted to each state insurance department.

• Date TBD by each state’s DOI – Approval or disapproval of the rate increase filing submitted in each state.

E. Feedback to the MSA Team

At the direction of the Long-Term Care Insurance (EX) Task Force, or an appointed subgroup, state insurance

departments will be requested to periodically provide data and feedback on their state rate increase approval

amounts and their state’s use of and reliance on the MSA Advisory Reports. The following items may be considered

in a feedback survey:

1. The number of rate proposals made with the MSA Review Team.

2. The number of rate proposals reviewed by the MSA Review Team.

3. Information regarding states approval of MSA recommendations.

4. Feedback on additional information states requested.

5. Feedback regarding how the review process and methodology could be improved.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 11

State responses will be confidential pursuant to the Master Agreement, and aggregated results of feedback surveys

will not specifically identify state responses. The MSA Team and state insurance regulators welcome feedback from

insurers on their experience using the MSA Review Process. This collective feedback will aid the Task Force in

understanding the practical effects of the MSA Review in achieving the goal of developing a more consistent state-

based approach for reviewing LTCI rate proposals that result in actuarially appropriate increases being granted by

the states in a timely manner and eliminates cross-state rate subsidization. The feedback will also help refine the

review process, improve future reports to better meet participants’ needs, and make updates to this MSA

Framework. Finally, the feedback will assist NAIC leadership in making decisions regarding the technology and staff

resources needed for the continued success of the project. Aggregated feedback results will be shared with

Participating States and insurers as determined appropriate.

V. ACTUARIAL REVIEW

A. MSA Team’s Actuarial Review Considerations

In conducting its actuarial review of a rate proposal, the MSA Team will consider assumptions, projections, and other

information provided by the insurer as outlined in Appendix B. The MSA actuarial review process will be evaluated

and evolve over time as more rate proposals are reviewed.

The Minnesota and Texas approaches ensure remaining policyholders do not make up for losses associated with

past policyholders. Professional judgment is used to address agreed upon policy issues, including the handling of

incomplete or non-fully credible data. The Minnesota approach also considers adverse investment expectations

related to the decline in market interest rates, and a cost-sharing formula is applied. The Texas approach ensures

rate changes reflect prospective changes in expectations. More detail of each approach is provided in the following

sections.

The MSA Team will consider the following in performing their review, applying their expertise and professional

judgement to the review, and reviewing the actuarial formulas and results:

• Review insurer experience, insurer narrative explanation, and relevant industry studies.

• Assess reasonability of assumptions for lapse, mortality, morbidity, and interest rates.

• Validate and adjust or request new projections of claim costs and premiums by year.

o Validate that the patterns of claims and premium projections over time reasonably align those

reflected in the assumptions.

o Adjust or request new projections of claims and premium to the extent that any underlying

assumptions are deemed unreasonable or unsupported by the MSA Team. Any differences will initially

result in correspondence between the MSA Team and the insurer via SERFF.

o After verifying loss ratio compliance, apply both the Minnesota and Texas approaches for each rate

proposal submitted.

In developing a recommendation, the MSA Team will apply a balanced approach and professional judgement for

each rate proposal based on the characteristics of the block reviewed to determine the most appropriate method.

The MSA Team’s recommendation will not be the lowest or the highest percentage method just because it is the

lowest or the highest. Rather, the recommendation may be the result of either the Texas or Minnesota approach, a

blend of the two approaches: or using professional judgement, the MSA Team may recommend a rate increase

outside of these two approaches. Other methods may evolve over time that may be incorporated into the future

process that generate similar or unique results. In applying professional judgement, (e.g., when considering the

extent to which less-than-fully credible older-age morbidity should be projected to cause adverse experience), a

balanced approach is applied as opposed to denying a rate increase, which could lead to a spike in the future, or

approving the rate increase as if there was full credibility, which could lead to rates that could be too high. As the

MSA Team reviews more rate proposals, it will consider and evaluate the characteristics of the rate proposals as it

refines the blending of the two methods.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 12

The MSA Team will consider how to reflect the differences in the histories of states’ rate approvals. Current approach

includes:

• The MSA Team’s recommendation results in the same rate per unit in each state following the current rate

increase round, leading to higher percentage rate increases in states that approved lower rate increases in

the past.

• Analysis of state cost differences affecting justifiable rate increases will continue. As of May 2021, there

does not appear to be substantial evidence that policyholders who purchased policies in lower-cost states

should receive lower percentage rate increases. Part of the reason is that there was a tendency for people

in lower-cost areas to purchase less coverage. Their premium rates will continue to be lower than rates for

policyholders with more coverage, even if percentage rate increases are the same.

• Any recommendation from the MSA Team for a catch-up increase aims to achieve only current rate equity

between states and not lifetime rate equity between states.

Consideration of Solvency Concerns

If concerns exist regarding an insurer’s financial solvency and the impact of rate increases on future solvency, each

state DOI, by their authority over rate approval, has the flexibility to consider solvency adjustments in these rare

instances. In rare, non-typical circumstances, adjustments could be considered within the MSA Review, including

consultation with states as part of the MSA Advisory Report comment period.

Follow-Up Proposals on the Same Block

Any subsequent rate increase proposal to the MSA Team on a block of business previously reviewed by the MSA

Team needs to involve the development of adverse experience and/or expectations. In the absence of adverse

experience or expectation development, the MSA Team will consider a reasonable explanation from an insurer for

an increase in credibility of morbidity data of being the reason for a rate increase. Prior rate increases would need

to be implemented before the implementation of a subsequent rate increase. The MSA Team will not consider a

new rate increase proposal on a block that did not receive the full percentage rate increase requested without the

experience, expectation, or credibility criteria noted above. If an insurer did not receive the full percentage rate

increase and has no adverse changes in experience or expectations, the insurer should work directly with the

applicable state DOI.

B. Loss Ratio Approach

Key aspects of the loss ratio approach to the actuarial review of rate changes include:

1. At policy issuance, pricing based on a lifetime loss ratio target is typically established. A common target is

60%, which means the present value of claims is targeted to equal 60% of the present value of premiums.

In some instances, products may be priced with a projected lifetime loss ratio in excess of 60%. The

remainder goes towards sales-related costs, administrative expenses, expenses related to claims, and

profit. Note that 60% is a required minimum loss ratio under the pre-rate stability rules; newer policies may

be priced with lower expected loss ratios. Refer to state law or regulation modeled from the Long-Term

Care Insurance Model Regulation (#641), Section 19 for more details on compliance with loss ratio

standards.

2. As lapses and mortality have generally been lower than expected, more people have reached ages where

claims tend to occur than originally expected. In some cases, this has resulted in a substantial increase in

the present value of claims; thus, resulting in substantially higher expected lifetime loss ratios than

originally targeted. For companies where morbidity expectations have increased over original assumptions,

lifetime loss ratios would be even higher.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 13

3. The loss ratio approach increases future premiums to a level, referred to as make-up premium, such that

the original loss ratio target is once again attained.

4. The loss ratio approach, one of the minimum standards in many states’ statutes, is evaluated by the MSA

Team. However, there is general recognition that this approach produces rate increases that are too high

and do not recognize other typical statutory standards, such as fair and reasonable rates.

a. The loss ratio approach also does not recognize actuarial considerations such as the shrinking block

issue, where past losses being absorbed by a shrinking number of remaining policyholders would lead

to unreasonably high-rate increases. This concern was the main driver of the Minnesota, Texas, and

other approaches.

b. The loss ratio approach shifts all the risk to the policyholders. If the insurer is allowed to always return

to the 60% loss ratio, there may be a lower incentive for more appropriate initial pricing.

5. For rate-stabilized business, lifetime loss ratios are broken out, such as in a 58%/85% pattern, where the

58% reflects the portion of initial premiums and the 85% reflects the portion of the increased premium

available to pay the claims. For relevant blocks, this standard is analyzed by the MSA Team. If this standard

produced lower increases than the Minnesota and Texas approaches, it would produce the recommended

rate increase.

C. Minnesota Approach

Key aspects of the Minnesota approach to the actuarial review of rate changes include:

1. Blended if-knew / makeup approach to address the shrinking block issue.

a. The if-knew concept is to estimate a premium that would have been charged at issuance of the policy

if information we know now on factors such as mortality, lapse, interest rates, and morbidity was

available then.

b. The makeup concept is for a premium to be charged going forward to return the block to its original

lifetime loss ratio.

c. The blending method helps ensure concepts discussed in public NAIC Long-Term Care Pricing (B)

Subgroup calls from 2015 to 2019

4

are incorporated, including the concept that rates will not

substantially rise as the block shrinks, as policyholder persistency falls over time.

2. Cost-sharing formula that increases the insurer’s burden as cumulative rate increases rise.

a. This addition to the insurer’s burden moves rates away from a direction that could potentially be seen

as misleading. The insurer likely had or should have had more information on the likelihood of large

rate increases than the consumer had at the time the policy was issued.

3. Assumption review.

a. Verification that the insurer’s original and current assumptions are indeed drivers of the magnitude

increase in lifetime loss ratio presented by the insurer.

b. Verification of appropriateness of current assumptions.

i. A combination of credible insurer experience, relevant industry experience, and professional

judgement is applied.

ii. For areas of uncertainty, such as older-age morbidity, conservatism may be added to the insurer-

provided assumptions. This conservatism can be released as credible experience develops.

4. Interest rate / investment return component

4

NAIC Proceedings including meeting minutes are available from the NAIC Library, https://naic.soutronglobal.net/portal/Public/en-US/Search/SimpleSearch.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 14

a. The Minnesota approach considers changes in expectations regarding interest rates and related

investment returns in a manner consistent with how other key assumptions are considered. Reasons

include:

i. Changes in market interest rates are among the key factors driving profits and losses associated

with blocks of LTC business.

ii. In the Minnesota approach, all factors impacting the business are considered.

1. If interest rates rise, this would tend to lead to lower rate increase approvals. Note, in this

scenario, if interest rate changes were not considered, it is possible an insurer would get

approval for rate increases even when profits on the block were higher than expected.

2. If interest rates fall, this would tend to lead to higher rate increase approvals.

iii. To prevent shifting of “good assets” and “bad assets” to supporting LTC rates and prevent an

insurer from increasing rates based on risky investments turned into losses, an index of average

corporate bond yields (e.g., Moody’s) is relied on to reflect experience and current expectations.

iv. Original pricing typically includes an assumption on investment returns, for which premiums and

other positive cash flows are assumed to accumulate. This forms the interest component of the

original assumption.

v. The original pricing investment return in Section VC(4)iv is compared to the average corporate

bond yields in Section VC(4)iii to determine the adversity associated with the interest rate factor.

5. Original Assumption Adjustment

a. If original mortality, lapse, or investment return assumptions were out of line with industry-average

assumptions at the time of original pricing, the original premium is replaced by a “benchmark

premium.”

i. This results in a lower rate increase.

ii. This adjustment wears off over 20 years from policy issue.

1. The rationale for the wearing off of this adjustment is the assumption that no insurer would

intentionally underprice a product, knowing it would suffer losses for 20 years and then hope

to offset a portion of that loss with a rate increase.

iii. This adjustment is intended to prevent for example, an insurer underpricing a product, gaining

market share, and then immediately requesting a rate increase).

D. Texas Approach

The Texas approach to the actuarial review of rate changes was developed in response to the NAIC Long-Term Care

Pricing (B) Subgroup’s discussions regarding the recoupment of past losses in LTCI rate increases. The Texas approach

relies upon a formula intended to prevent the recoupment of past losses by calculating the actuarially justified rate

increase for premium-paying policyholders based solely on projected future (prospective) claims and premiums.

Key aspects of the Texas approach to the actuarial review of rate changes include:

1. Past losses are assumed by the insurer and not by existing policyholders. An approach that considers past

claims in the calculation of the rate increase, such as a lifetime loss ratio approach, permits, the recoupment

of past losses to some extent.

2. Calculates the rate increase needed to fund the prospective premium deficiency for active, premium-paying

policyholders based on an actuarially supported change in assumption(s). This ensures that active

policyholders do noy pay for the past claims of policyholders who no longer pay premium.

3. Data Requirements for Calculation:

a. The following calendar year projections, including totals, for current premium-paying policyholders

only, prior to the rate increase, all discounted at the maximum valuation interest rate:

i. Present Value of Future Benefits (PVFB) under current assumptions.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 15

ii. PVFB under prior assumptions (from prior rate increase filing, or if no prior increase, from original

pricing).

iii. Present Value of Future Premiums (PVFP) under current assumptions.

iv. PVFP under prior assumptions (from prior rate increase filing, or if no prior increase, from original

pricing).

1. Note that for all four projections above, the projection period is typically 40–50 years:

although, some companies project for 60 or more years.

To emphasize, these projections should only include active policyholders currently paying premium and

should not include any policyholders not paying premium (e.g., policies on wavier, on claim, or paid up)

regardless of the reason. Projections under current actuarial assumptions must not include

policyholder behavior as a result of the proposed premium rate increase, such as a shock lapse

assumption.

Also, the insurer should identify and explain any estimates or adjustments to the data, as applicable.

4. Assumptions

a. Rate increases are commonly driven by a change to the persistency, morbidity, mortality assumption,

or a combination of the three.

b. Verification that assumption change(s) are supported by credible data.

c. The interest rate is the same for all four projections. This ensures that interest rate risk is assumed by

the insurer, not the policyholder.

The formula used in the Texas approach is provided in Appendix C.

E. RBOs

In 2020, the Long-Term Care Insurance Reduced Benefit Options (EX) Subgroup of the Long-Term Care Insurance (EX)

Task Force, developed a list of RBO principles to provide guidance for evaluating RBO offerings in Appendix D.

RBOs in the MSA Advisory Report

As part of the MSA Review, the MSA Team will perform a limited review of the reasonableness of RBOs included in

the rate proposal that are extracontractual. The MSA Advisory Report will highlight how the insurer demonstrates

the proposed RBOs’ reasonableness. Note that the MSA Team will not perform an assessment of RBOs in relation to

individual state specific requirements for RBOs. The purpose of the guidance in the MSA Advisory Report is to provide

initial information about the RBOs with which the state insurance regulators can then utilize to perform a more

detailed assessment specific to their state’s requirements. As the MSA Review develops and as the Subgroup

continues its work, this area of review may evolve.

Future RBOs

As the industry continues to innovate new RBOs for consumers, the MSA Review will likewise develop and evolve to

consider the reasonableness of RBOs. Additionally, as the MSA Review evolves, additional regulatory expertise with

RBOs may be added to the MSA Team in the future. To achieve more consistency across states in their understanding

and consideration of RBOs, the Task Force will encourage its appointed Subgroup and/or an appropriate NAIC

actuarial committee or group to collectively consider new RBOs as they arise. This process will provide for input and

technical advice from actuaries and non-actuarial experts to the state insurance departments as they exercise their

authority in considering RBOs as part of rate filings. States and insurers are therefore encouraged to discuss new

and developing RBOs through this process.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 16

F. Non-Actuarial Considerations

The Long-Term Care Insurance (EX) Task Force continues to review and consider non-actuarial considerations

affecting states’ approval or disapproval of LTCI rate changes to develop consensus among jurisdictions and develop

recommendations for application of these considerations. These considerations include such topics as:

1. Caps or limits on approved rate changes.

2. Phase-in of approved rate changes over a period of years.

3. Waiting periods between rate change requests.

4. Considerations of prior rate change approvals and disapprovals.

5. Limits or disapproval on rate changes based solely or predominately on the number of policyholders in a

particular state.

6. Limits or disapproval on rate changes based on attained age of the policyholder.

7. Fair and reasonableness considerations for policyholders.

8. The impact of the rate change on the financial solvency of the insurer.

Considerations in the MSA Advisory Report

As part of the MSA Review, the MSA Team will identify relevant aspects of the insurer’s rate proposal, based on the

information provided by the insurer, which may be affected by a state’s non-actuarial considerations. Note that the

MSA Team will not perform a state-by-state review of each state’s non-actuarial considerations, statutes, or

practices. Instead, the MSA Team will highlight in the MSA Advisory Report those aspects of the rate proposal that

relate to or that may be affected by non-actuarial considerations. The purpose of this guidance in the MSA Advisory

Report is to prompt state insurance regulators to contemplate those affected aspects of the rate proposal when

completing their individual state’s rate review. For example, the MSA Advisory Report may highlight:

• If cumulative rate increases are high, as this may affect the cost-sharing formula.

• If a rate proposal is for a block of business where the average policyholder age is predominately 85 or above,

as this may affect states that consider age caps.

• If it is determined that the block of business will likely continue to incur substantial financial losses and

impose a potential solvency concern, as this may affect the potential need for adjustments to the cost-

sharing formula.

• Aspects of the coordination of rate and reserving review, as this may signify adjustments to the

methodology assumptions used by the MSA Team in its review.

Future Non-Actuarial Considerations

The MSA Review will continue to develop and evolve as it is implemented. To achieve more consistency and minimize

the number of differences across states in their application of other non-actuarial considerations in rate review

criteria for LTCI rate filings, the Task Force will encourage its appointed Subgroup, or an appropriate NAIC actuarial

committee or group, to collectively consider new future non-actuarial considerations as they arise. This process will

provide for input and technical advice from actuaries to states as they exercise their authority in considering non-

actuarial factors. States are therefore encouraged to discuss new and developing practices and/or recommendations

in this area.

VI. APPENDICES

A. Appendix A – MSA Advisory Report Format

The MSA Advisory Report that is distributed to Participating State insurance departments and the insurer will

generally follow a template that includes the following information. Note that degree of rigor in the review and the

details and content of the MSA Advisory Report will depend on the magnitude of rate increase and the complexity

of the rate proposal and the insurer’s financial condition. See also the sample MSA Advisory Report in Exhibit A.

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 17

1. Executive Summary.

a. Overall recommended rate increase, before consideration of different states’ history of approvals.

2. Disclaimers.

a. Purpose and intent of how states should use the MSA Advisory Report.

b. Disclaimer that the MSA Review and findings shall not be considered an approval of the rate schedule

increase filing, nor shall it be binding on the states or the insurer.

c. Statement that the in force rate increase filing submitted to the respective states shall be subject to

the approval of each state, and each state's applicable state laws and regulations shall apply to the

entire rate schedule increase filing.

3. Background on the MSA Review.

4. Explanation of the insurer’s Proposal.

a. The explanation will be based on the aspects of the insurer’s rate proposal, which may include details

as to whether the rate increase submitted for review involved different types of coverages or

groupings.

5. Summary of the MSA Team’s rate review analysis, including these aspects:

a. Actuarial review.

i. The summary of the review and the MSA Team’s recommendation will be based on the aspects of

the insurer’s rate proposal, and may include specific details of the review, for example analysis of

projections, assumptions, margins, or other aspects.

b. Summary of consideration of differences in the history of state’s rate increase approvals.

c. Non-actuarial considerations and findings.

d. Financial solvency-related aspects and adjustments.

e. Review for reasonableness and clarity of RBOs.

f. Summary information about the mix of business.

6. Appendices.

a. Summary of the drivers of the rate proposal.

b. Details regarding the Minnesota and Texas approaches as applied to the rate proposal.

c. Summary of rate proposal correspondence.

d. Examples of rate increases if an RBO is not selected.

e. Potential cost–sharing formula for typical circumstances.

B. Appendix B – Information Checklist

At the request of the former Long-Term Care Insurance (B/E) Task Force, the Long-Term Care Pricing (B) Subgroup

developed a single checklist that reflects significant aspects of LTCI rate increase review inquiries from all states. In

this context, “checklist” means the list or template of inquiries that states typically send at the beginning of reviews

of state-specific rate increase filings.

This document contains aspects of the NAIC Guidance Manual for Rating Aspect of the Long-Term Care Insurance

Model Regulation

5

(Guidance Manual) and checklists developed by several other states. This consolidated checklist

is not intended to prevent a state from asking for additional information. The intent is to take a step toward moving

away from 50 states having 50 different checklists to a more efficient process nationally to provide the most

important information needed to determine an approvable rate increase. To keep the template at a manageable

length, it is anticipated that this template will result in states attaining 90–100% of the information necessary to

5

https://www.naic.org/documents/committees_b_senior_issues_160609_ltc_guidance_manual.pdf

LTCI MSA Framework

©

2022 NATIONAL ASSOCIATION OF INSURANCE COMMISSIONERS 18

decide on approvable rate increases. State and block specifics will generate the other 0-10% of requests. As states

apply this checklist, it or an improved version may be considered for a future addition to the Guidance Manual.

Information Required for an MSA Review of a Rate Proposal

The following provides a checklist of information necessary for a complete rate proposal to the MSA Review. This

checklist is consistent with the “Consolidated, Most Commonly Asked Questions – States’ LTC Rate Increase

Reviews”

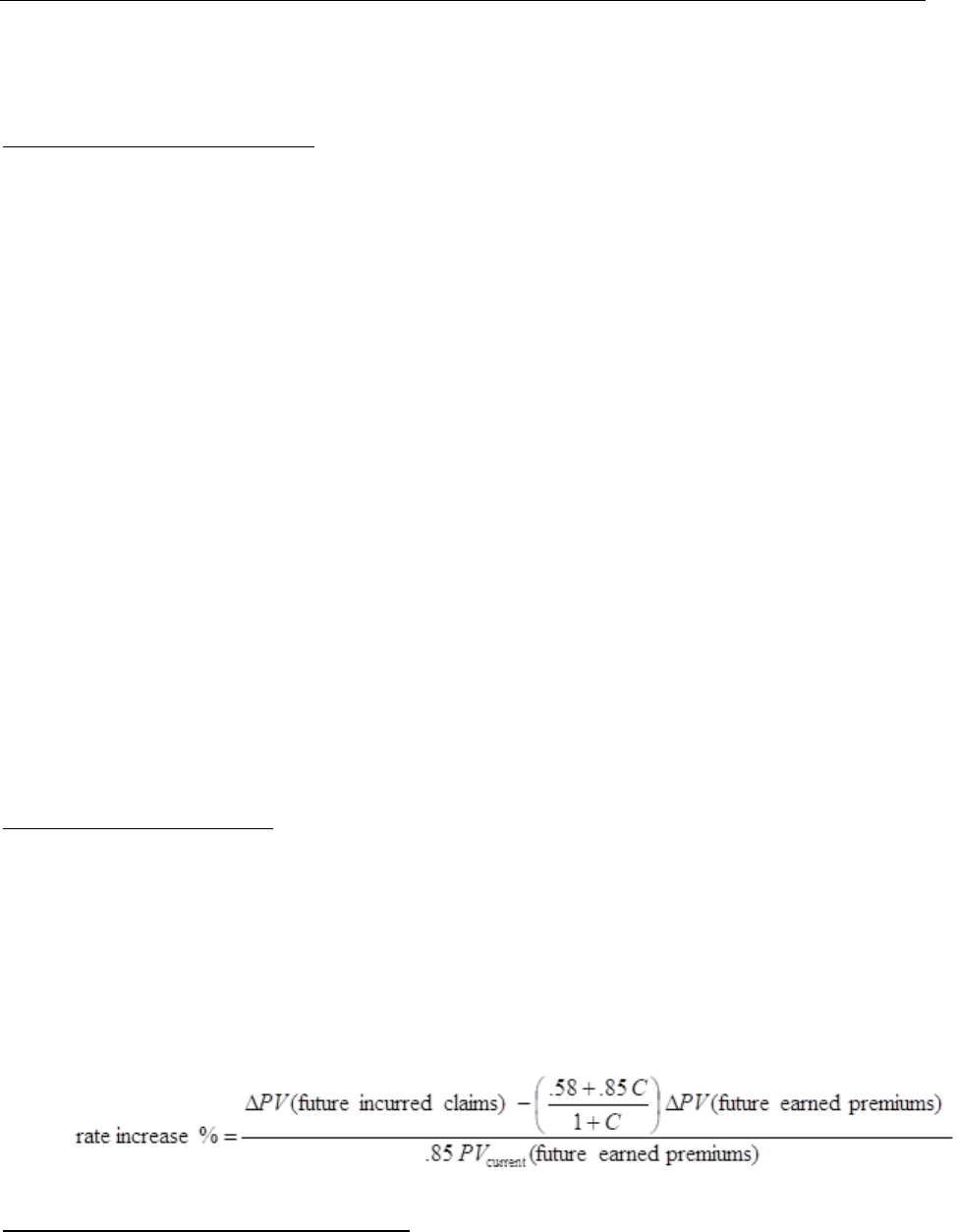

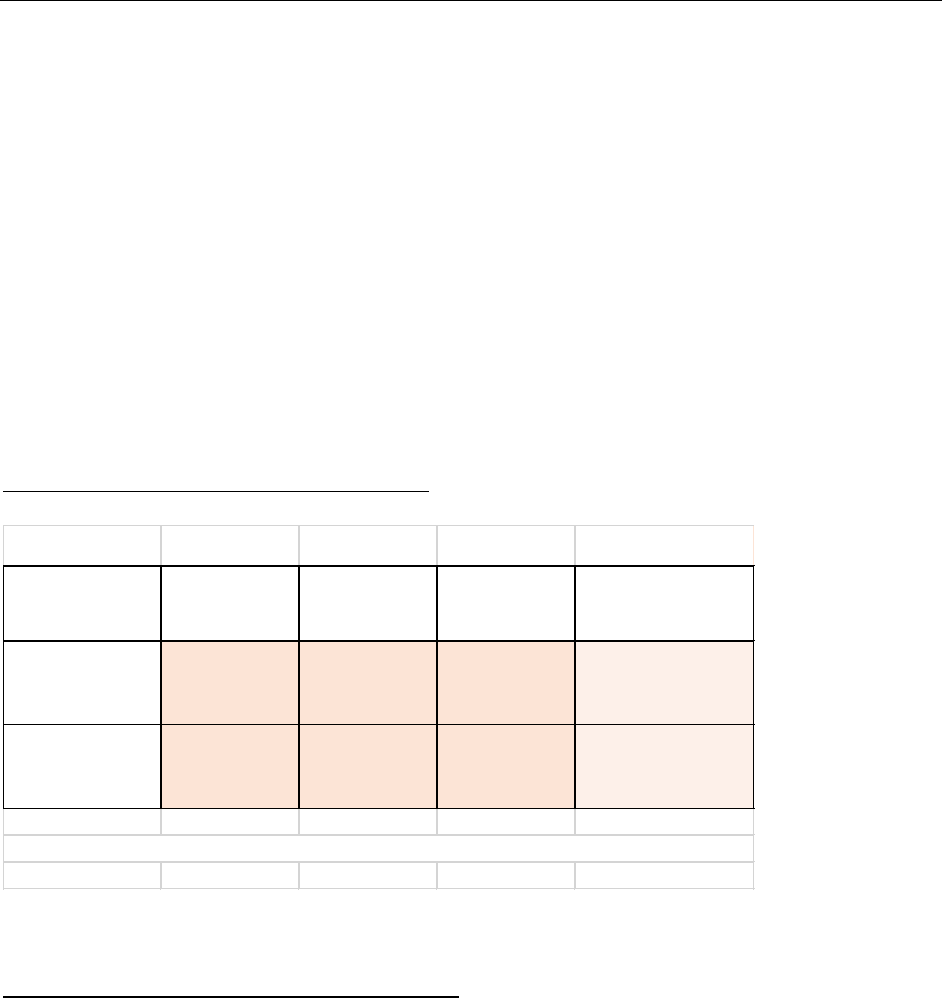

6