TAX TYPE Income

YEAR ENACTED 1999

REPEAL/EXPIRATION DATE None

REVENUE IMPACT $2.6 million

(T

AX YEAR 2018)

NUMBER OF TAXPAYERS 12,500

WHAT DOES THE TAX EXPENDITURE

DO?

The Long-Term Care Insurance Credit [Section 39-

22-122 (1) and (3), C.R.S.] allows certain taxpayers

to claim a credit against their state income taxes for

25 percent of the premiums they paid during the

year for long-term care insurance, up to $150 per

policy. Statute allows the credit only for taxpayers

who:

Have federal taxable income below $50,000, are

filing a single or joint federal return, and are

claiming the credit for one policy; or

Have federal taxable income below $100,000,

are filing a joint return, and are claiming the

credit for separate policies that cover both

individuals on the return.

WHAT IS THE PURPOSE OF THE TAX

EXPENDITURE?

Statute and the enacting legislation for the credit do

not state its purpose; therefore, we could not

definitively determine the General Assembly’s

original intent. Based on our review of the credit’s

legislative history and operation; similar credits in

other states; and discussions with Division of

Insurance staff, we considered two potential

purposes:

1. To encourage taxpayers with lower and middle

incomes to purchase long-term care insurance

by making it more affordable, and

2. To reduce the State’s costs for long-term care

services and supports.

WHAT POLICY CONSIDERATIONS DID

THE EVALUATION IDENTIFY?

The General Assembly may want to:

Consider amending statute to establish a

statutory purpose and performance measures

for the credit.

Review the effectiveness of the credit and could

consider changes to the credit cap and income

limits.

LONG-TERM CARE

INSURANCE CREDIT

EVALUATION SUMMARY | APRIL 2022 | 2022-TE17

KEY CONCLUSION: The Long-Term Care Insurance Credit does not appear large enough to encourage

most individuals who qualify to purchase long-term care insurance and its relative benefit has declined since

it was established because premium costs have increased.

2

LONG-TERM CARE INSURANCE CREDIT

LONG-TERM CARE

INSURANCE CREDIT

EVALUATION RESULTS

WHAT IS THE TAX EXPENDITURE?

The Long-Term Care Insurance Credit (Long-Term Care Credit)

[Section 39-22-122(1) and (3), C.R.S.] allows certain taxpayers to claim

a credit against their state income taxes for 25 percent of the premiums

they paid during the year for long-term care insurance, up to $150 per

policy. If the credit exceeds the taxpayer’s income tax liability, the

remaining credit cannot be carried forward to be used in a future tax

year or refunded. Statute allows the credit only for taxpayers who:

Have federal taxable income below $50,000, are filing a single or

joint federal income tax return, and are claiming the credit for one

policy; or

Have federal taxable income below $100,000, are filing a joint

income tax return, and are claiming the credit for separate policies

that cover both individuals on the return.

Long-term care insurance is designed to help pay for care that is needed

due to chronic illness, disability, injury, or the general effects of aging.

To be eligible for the credit, policies must provide coverage for no less

than 12 consecutive months, and help cover the cost of assistance with

activities of daily living, such as bathing and dressing; nursing care; and

physical, occupational, or speech therapy for individuals who cannot

perform the tasks independently due to a chronic illness or disability.

Additionally, policies: (1) must provide coverage for care in a setting

other than an acute care unit of a hospital, and (2) shall not include any

insurance policy offered primarily to provide basic hospital expense or

Medicare supplemental coverage [Section 10-19-103(5), C.R.S.].

3

TAX EXPENDITURES REPORT

In 1999, House Bill 99-1246 created the Long-Term Care Credit and it

has remained substantively unchanged since that time. Taxpayers claim

the credit on Line 26 of the Individual Credit Schedule [Form 104 CR]

when filing their income tax return and must also submit supporting

documentation to show the premiums they paid.

WHO ARE THE INTENDED BENEFICIARIES OF THE TAX

EXPENDITURE?

Statute does not explicitly identify the intended beneficiaries of the

credit. Based on statute, Department of Revenue (Department)

guidance, and discussions with the Division of Insurance within the

Department of Regulatory Affairs (Division), we inferred that the

beneficiaries of the Long-Term Care Credit are eligible Colorado

taxpayers who incur expenses in purchasing or paying premiums on

long-term care insurance. The U.S. Department of Health and Human

Services estimated that 70 percent of individuals 65 years or older will

require long-term care services or support at some point and that 48

percent will pay for at least some of their care. People buy long-term

care insurance to protect their income and savings, and to give

themselves options in their choice of care. In general, regular health

insurance does not cover long-term care; Medicare provides limited

coverage; and Medicaid offers some coverage, but with limited choices

in service providers and requires recipients to have income and assets

below certain thresholds.

Additionally, to the extent that the credit encourages individuals to

purchase long-term care insurance, the State may also benefit, since

individuals with insurance coverage may be less likely to need state-

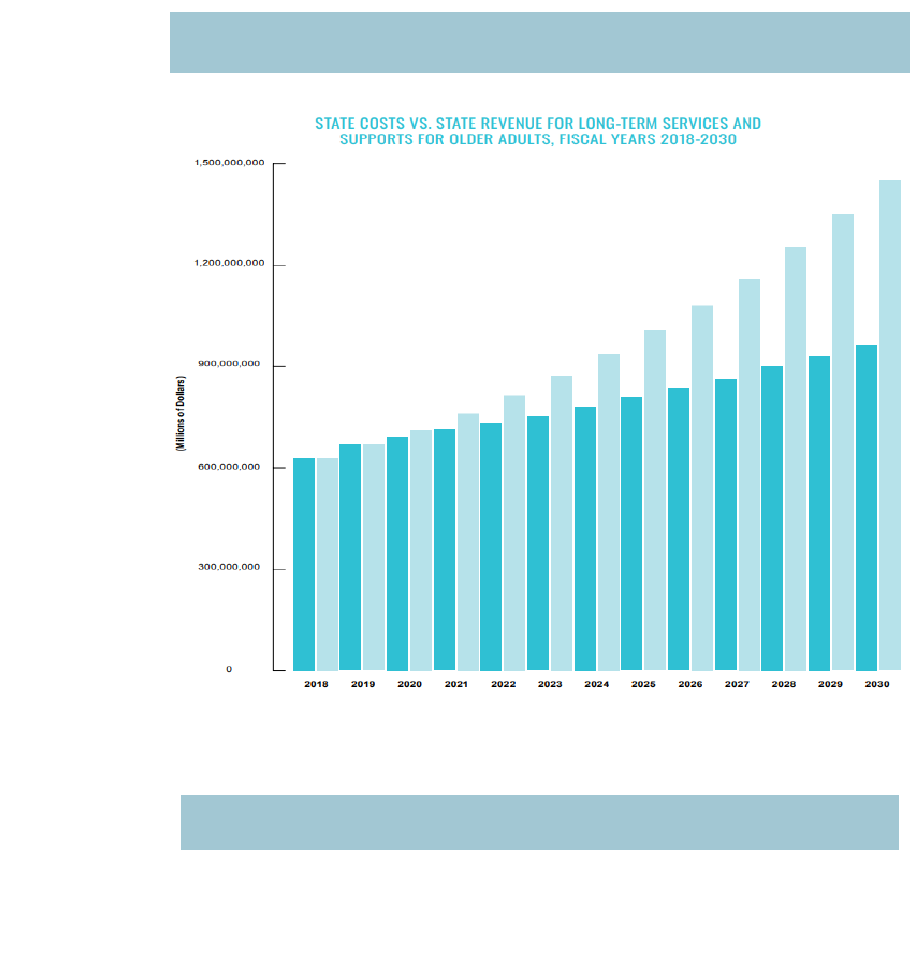

funded long-term care services. As shown in EXHIBIT 1, the cost for

state-funded long-term care programs, such as those provided through

Medicaid, are expected to increase significantly in the coming years,

with costs significantly exceeding projected available revenue by 2030.

4

LONG-TERM CARE INSURANCE CREDIT

EXHIBIT 1. PROJECTED STATE-FUNDED COST AND REVENUE

FOR LONG-TERM CARE SERVICES

SOURCE: The 2020 Strategic Action Plan on Aging by the State of Colorado’s Strategic

Action Planning Group on Aging.

State costs for long-term care services and supports.

State revenue for long-term care services and supports.

5

TAX EXPENDITURES REPORT

WHAT IS THE PURPOSE OF THE TAX EXPENDITURE?

Statute and the enacting legislation for the Long-Term Care Credit do

not state its purpose; therefore, we could not definitively determine the

General Assembly’s original intent. Based on our review of the credit’s

legislative history and operation; news articles from the time of its

passage; similar credits in other states; and discussions with Division

staff, we considered two potential purposes:

1. To encourage taxpayers with lower and middle incomes to purchase

long-term care insurance by making it more affordable, and

2. To reduce the State’s costs for long-term care services and supports.

At the time the credit was created, there was significant interest at the

federal and state levels in ensuring private long-term care insurance was

accessible. For example, the federal government enacted tax benefits for

qualifying long-term care insurance policies under the Health Insurance

Portability and Accountability Act (1996) and other states, including

Minnesota, New York, and Maryland, enacted long-term care

insurance tax credits between 1999 and 2000. According to Division

staff and reviews of similar policies in other states, these type of tax

credits were created to incentivize consumers to buy long-term care

policies. In addition, according to reviews of similar tax expenditures in

other states and other reports, states were interested in encouraging

individuals to purchase private insurance both to improve the

accessibility of care for individuals who require long-term care and also

to help reduce the costs that states ultimately bear, often through

increased Medicaid costs, when uninsured individuals require long-term

care.

IS THE TAX EXPENDITURE MEETING ITS PURPOSES AND

WHAT PERFORMANCE MEASURES WERE USED TO MAKE

THIS DETERMINATION?

We could not definitively determine whether the Long-Term Care

Credit is meeting its purpose because no purpose is provided in statute

or its enacting legislation. However, we found that the credit is only

6

LONG-TERM CARE INSURANCE CREDIT

meeting the potential purposes we considered to conduct this evaluation

to a limited extent because the benefit it provides appears insufficient to

make long-term care insurance significantly more affordable. Therefore,

it likely has only a small impact on individuals’ decisions on whether to

purchase qualifying policies.

Statute and the credit’s enacting legislation do not provide performance

measures to evaluate its effectiveness. We created and applied the

following performance measures to determine whether the Long-term

Care Credit is meeting its potential purposes:

PERFORMANCE MEASURE #1:

To what extent has the Long-term Care

Credit incentivized taxpayers to buy long-term care insurance policies,

and made those policies more affordable for low- and middle-income

taxpayers?

RESULT: Overall, we found that the credit is likely too small to

encourage most eligible taxpayers to purchase long-term care insurance,

although it provides some financial support for individuals who qualify.

As discussed, statute caps the credit at $150 per year, per policy. In

comparison, according to information reported by the National

Association of Insurance Commissioners (NAIC) and LifePlans, a long-

term care and health insurance provider, in 2015, the most recent year

with available data, the average cost of a policy ranged from $2,624

annually for individuals aged 55 to 64 years, up to $5,241 for

individuals 75 and over. Therefore, in 2015, the credit would have

offset the cost of these policies by between 3 and 6 percent. Although

this tax benefit could be enough to influence some taxpayers for whom

long-term care insurance is only marginally affordable, it appears

insufficient to drive most individuals’ decisions to purchase coverage or

cause a significant increase in the number of individuals with long-term

care insurance.

The cost of long-term care policies has continued to rise, while the credit

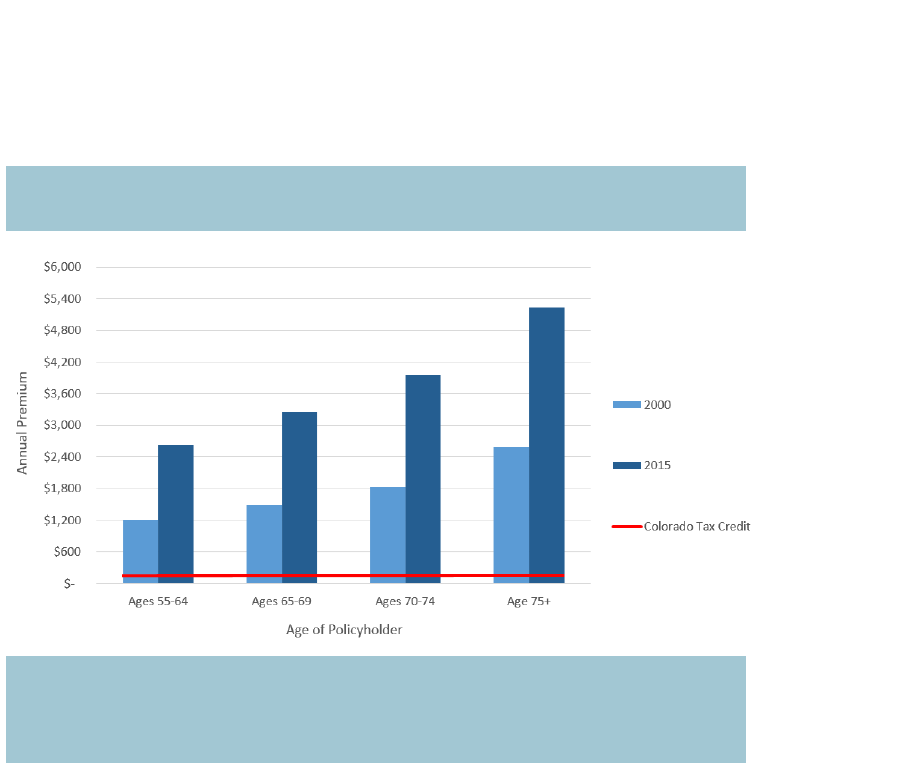

amount has remained unchanged. EXHIBIT 2 compares the premium

cost of long-term care insurance policies in 2000 and 2015 to the

7

TAX EXPENDITURES REPORT

maximum credit value. As shown, the premium cost for a policy more

than doubled during this period, while the maximum credit amount,

which has not been adjusted since it was created in 1999, has covered a

decreasing proportion of the cost.

EXHIBIT 2. PROPORTION OF ANNUAL PREMIUM COSTS

1

COVERED BY THE CREDIT BETWEEN 2000 AND 2015

SOURCE: Office of the State Auditor analysis of data from LifePlans and the National

Association of Insurance Commissioners.

1 The premium costs in this chart are an average of both single male and single female policies,

ages 55 to over 75.

According to Division staff, long-term care insurance is increasingly

difficult for most individuals to afford and is primarily purchased by

those with higher incomes. This is consistent with Department data,

which shows that between Tax Years 2011 and 2018, the number of

taxpayers who claimed the credit decreased from 18,975 to 12,532, a

34 percent decline. Furthermore, the taxpayers who claimed the credit

in 2018 represent only about 10 percent of the 127,216 long-term care

insurance policies that were active in Colorado as of 2018, according to

the NAIC. Therefore, although it is possible that some eligible taxpayers

did not claim the credit, it appears that most individuals with long-term

care insurance may not qualify for the credit, likely because those who

can afford long-term care insurance policies are primarily individuals

with higher incomes.

8

LONG-TERM CARE INSURANCE CREDIT

Increases in long-term care costs have caused insurance companies to

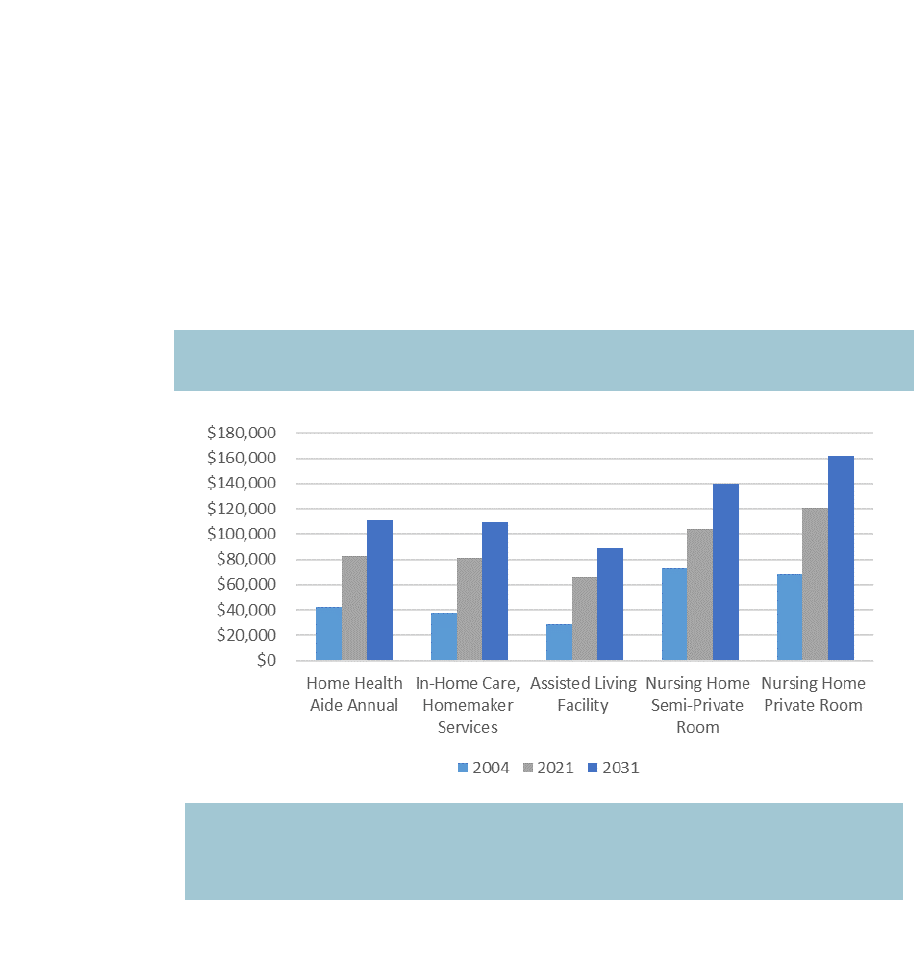

increase premiums to cover expected benefits payments. As shown in

EXHIBIT 3, the annual cost of long-term care services has increased over

time and is expected to grow between 2021 and 2031. Therefore, it

appears that the cost of long-term care insurance policies is likely to

increase, further reducing their overall affordability and decreasing the

relative impact of the credit because it will cover a decreasing percentage

of annual premiums.

EXHIBIT 3. ANNUAL COSTS OF LONG-TERM

CARE 2004 TO 2031 (ESTIMATED)

SOURCE: Office of the State Auditor review of Genworth Financial report anticipating long-

term care insurance services and supports costs. Genworth Financial is an insurance provider

that collaborates with the National Association of Insurance Commissions to produce

reports on long-term care insurance.

PERFORMANCE MEASURE #2:

To what extent has the Long-Term Care

Insurance Credit reduced the State’s long-term care program costs?

Due to the relatively low dollar amount of the credit, it appears that

the credit is too small to influence many taxpayers to purchase long-

term care insurance. As a result, the credit has also likely had a

relatively small impact on the State’s cost for providing long-term care

services. Further, although $2.6 million in credits were claimed in Tax

9

TAX EXPENDITURES REPORT

Year 2018, this represents less than 1 percent of the $630 million the

State spent on long-term care services during Calendar Year 2018.

Therefore, it appears that the support the credit provides to taxpayers

who purchase long-term care insurance has not likely had a

substantial impact on overall state costs.

WHAT ARE THE ECONOMIC COSTS AND BENEFITS OF THE

TAX EXPENDITURE?

Based on Department data, the Long-Term Care Insurance Credit had

a revenue impact of about $2.6 million in Tax Year 2018, and provided

a corresponding benefit to about 12,500 taxpayers, who claimed an

average credit amount of about $200. This amount exceeds the $150

per policy credit cap because joint filers may claim the credit for one

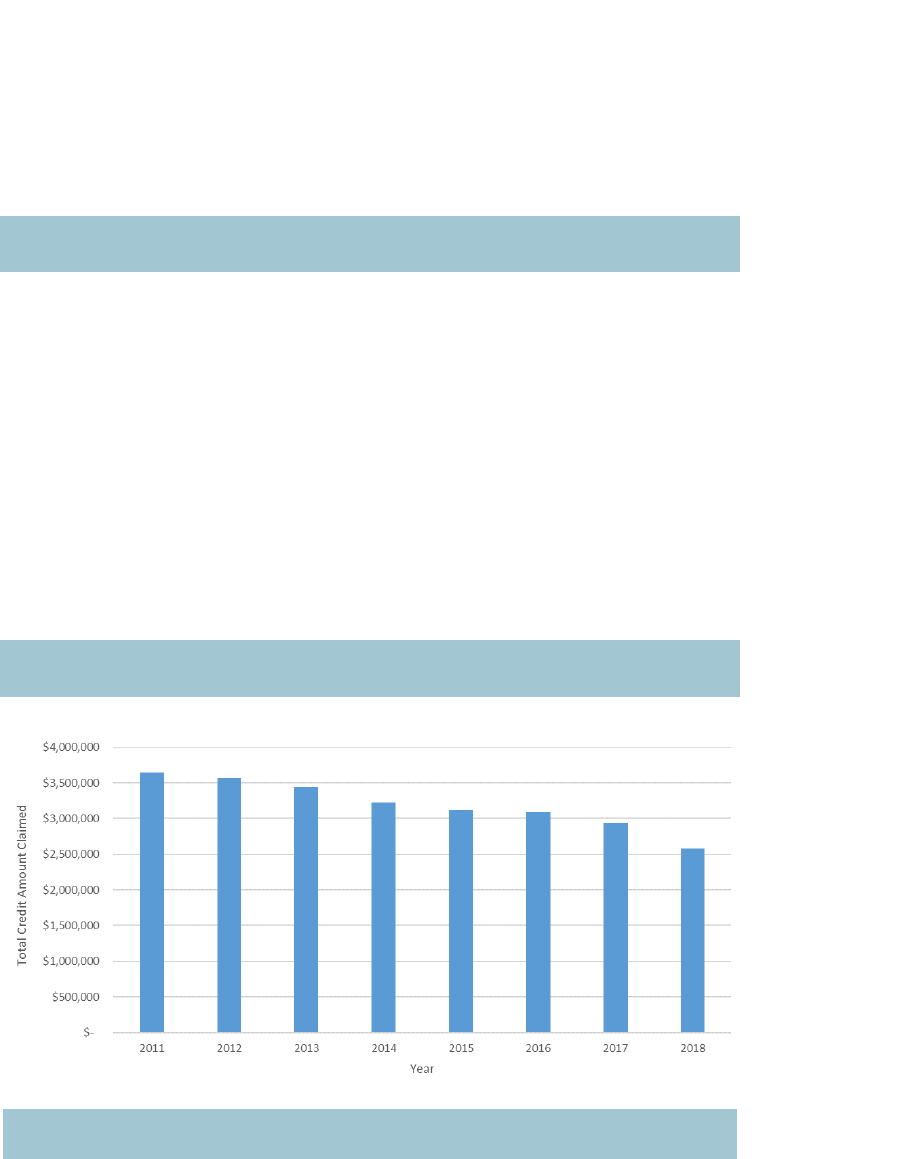

policy each, up to $300. As shown in EXHIBIT 4, the amount claimed

has steadily decreased from about $3.6 million in 2011, to about $2.6

million in 2018.

EXHIBIT 4. TOTAL CREDIT AMOUNT

CLAIMED TAX YEARS 2011-2018

SOURCE: Office of the State Auditor analysis of the Department of Revenue Annual Reports

data.

10

LONG-TERM CARE INSURANCE CREDIT

As discussed, long-term care insurance costs have increased

substantially in recent years, which has resulted in fewer lower and

middle-income taxpayers, who would qualify for the credit, purchasing

coverage. Because long-term care costs are expected to continue rising,

it is likely that the total credit amount claimed will continue to decline

as fewer lower and middle-income taxpayers are able to afford policies.

WHAT IMPACT WOULD ELIMINATING THE TAX

EXPENDITURE HAVE ON BENEFICIARIES?

If the credit was eliminated, the 12,500 taxpayers who claimed the

credit in Tax Year 2018 would not be able to claim 25 percent of their

long-term care insurance premiums, up to $150 per policy, as a credit

against their state income tax liability. To the extent that the credit

caused these taxpayers to purchase policies, this could result in fewer

Coloradans being covered by long-term care insurance. As discussed,

we estimated that the credit reduced the cost of eligible policies by about

3 to 6 percent, which appears unlikely to be a significant enough

difference to change most taxpayers’ decisions regarding whether to

purchase coverage. However, eliminating the credit would have the

largest impact on taxpayers for whom long-term care is marginally

affordable. Further, the credit provides some financial support for lower

and middle-income taxpayers who purchase long-term care insurance,

which would no longer be available. To the extent that eliminating the

Long-Term Care Insurance Credit would cause some current

beneficiaries to no longer be able to afford insurance, these individuals

would be at risk of having to pay for long-term care out of pocket, the

cost of which could be prohibitively expensive, or foregoing necessary

services. In addition, to the extent these individuals would qualify for

the State’s long-term care programs, eliminating the credit could

increase costs to the State, although as discussed, it appears this impact

would be small compared to the amount the State currently spends on

long-term care.

11

TAX EXPENDITURES REPORT

ARE THERE SIMILAR TAX EXPENDITURES IN OTHER STATES?

Forty-one other states (excluding Colorado) and the District of

Columbia impose an individual income tax. Of these, 14 states and the

District of Columbia allow taxpayers to take a deduction from state

taxable income for long-term care insurance expenses, and, like

Colorado, six states allow for a credit. For example, Maryland offers a

onetime credit of $500 and Louisiana offers a credit equal to 7 percent

of total premiums paid each year, which based on the cost of a policy,

can exceed $150. Additionally, 21 states follow federal guidelines,

which allow taxpayers to deduct the amount they spend for qualified

long-term care insurance policies from their taxable income so long as

1) the taxpayer itemizes their deductions, and 2) their unreimbursed

medical expenses exceed 7.5 percent of their adjusted gross income.

However, as discussed below, most taxpayers do not meet these

requirements.

ARE THERE OTHER TAX EXPENDITURES OR PROGRAMS

WITH A SIMILAR PURPOSE AVAILABLE IN THE STATE?

We did not identify any state tax expenditures with a similar purpose;

however, there are several federal tax expenditures that may help

individuals to purchase long-term care insurance. Additionally, because

Colorado uses federal taxable income as the starting place to determine

Colorado taxable income, taxpayers who claim a federal deduction

would also receive a state deduction. Two federal tax benefits are:

FEDERAL DEDUCTIONS—Federal tax laws allow taxpayers to deduct the

amount they spend for qualified long-term care insurance policies from

their federal taxable income so long as 1) the taxpayer itemizes their

deductions, and 2) their unreimbursed medical expenses exceed 7.5

percent of their adjusted gross income. If the insured qualifies for federal

deductions, the deduction limit is determined by age. However,

according to the American Association of Retired Persons Public Policy

Institute, few taxpayers meet this qualification.

12

LONG-TERM CARE INSURANCE CREDIT

SAVINGS ACCOUNTS—Taxpayers may also pay for long-term care

insurance expenses using other federal tax-advantaged medical

accounts such as a Health Savings Accounts, or Archer Medical Savings

Accounts. Furthermore, if a taxpayer’s policy is used to reimburse

qualified expenses, then the insured may not owe federal income tax on

their benefits.

There are also state-level programs that may help individuals with long-

term care costs:

PARTNERSHIP POLICIES—The General Assembly passed legislation

allowing for long-term care insurance partnership policies in 2006. This

policy type allows consumers to protect their personal assets in the event

that they must apply for Medicaid to pay for long-term care services. It

was the General Assembly’s intent that the legislation would

“encourage individuals to purchase long-term care insurance” instead

of first expending all of their personal resources, then ultimately relying

on Medicaid, to cover the cost of long term care [Section 25.5-6-110(2),

C.R.S.]. According to information presented by the NAIC, partnership

policies represented slightly over two in five sales nationally in 2015.

LONG-TERM CARE PROGRAMS—Several state programs administered by

the Colorado Department of Health Care Policy and Financing and

Department of Human Services provide support for long-term care

services. These programs include home care, long-term home health,

home- and community-based services, assisted living, skilled nursing,

and others—all of which are primarily funded through Medicaid and

Medicare, and are provided to eligible taxpayers. According to

information from the Colorado Health Institute, the State spent about

$630 million on long-term care programs in Calendar Year 2018.

WHAT DATA CONSTRAINTS IMPACTED OUR ABILITY TO

EVALUATE THE TAX EXPENDITURE?

We did not encounter any data constraints that impacted our ability to

evaluate the tax expenditure.

13

TAX EXPENDITURES REPORT

WHAT POLICY CONSIDERATIONS DID THE EVALUATION

IDENTIFY?

THE GENERAL ASSEMBLY MAY WANT TO CONSIDER AMENDING STATUTE

TO ESTABLISH A STATUTORY PURPOSE AND PERFORMANCE MEASURES FOR

THE CREDIT

. As discussed, statute and the enacting legislation do not

state the credit’s purpose or provide performance measures for

evaluating its effectiveness. Therefore, for the purposes of our

evaluation, we considered two potential purposes for the credit:

1. To encourage taxpayers with lower and middle incomes to purchase

long-term care insurance by making it more affordable.

2. To reduce the State’s costs for long-term care services and supports.

We identified these purposes based on our review of other state credits,

consideration of the historical context for long-term care insurance, and

discussions with state departments. We also developed performance

measures to assess the extent to which the credit is meeting this potential

purpose. However, the General Assembly may want to clarify its intent

for the credit by providing a purpose statement and corresponding

performance measure(s) in statute. This would eliminate potential

uncertainty regarding the credit’s purpose and allow our office to more

definitively assess the extent to which the credit is accomplishing its

intended goal(s).

THE GENERAL ASSEMBLY MAY WANT TO REVIEW THE EFFECTIVENESS OF

THE CREDIT AND COULD CONSIDER CHANGES TO THE CREDIT CAP AND

INCOME LIMITS

. As discussed, we found that the Long-Term Care

Insurance Credit is only meeting its purpose to a limited extent because

it is likely too small to encourage most eligible individuals to purchase

long-term care insurance, covering approximately 3 to 6 percent of

typical annual premiums. Even with the credit, according to Division

staff, long-term care insurance is often difficult for many individuals to

afford and most coverage is purchased by individuals with high

incomes. Additionally, the impact of the credit has decreased over time

because, since 1999 when the credit was established, the cost of long-

14

LONG-TERM CARE INSURANCE CREDIT

term care policies has more than doubled, but the maximum credit

available has remained at $150 annually per policy.

We also found that there has been a steady decline in the number of

taxpayers who claim the credit, with claims falling from 18,975 to

12,532—a 34 percent decrease—between Tax Years 2011 and 2018.

This decline appears to have occurred, at least in part, because the

number of individuals who meet the income limits for the credit (i.e.,

under $50,000 for individual filers and $100,000 for joint filers) and

can afford long-term care insurance has declined as household incomes

in the state and costs for long-term care have grown. When the credit

was established in 1999, the household median income of Coloradans

was about $47,000. Since that time, the median household income in

Colorado has grown by about 60 percent, to $75,000 in Calendar Year

2020. However, the credit’s income limits have not been adjusted since

it was established.

Therefore, the General Assembly could consider evaluating the amount

of the credit and the income limits to determine whether changes are

needed to increase the effectiveness of the credit. Any changes to the

credit cap or income limits would likely increase the credit’s revenue

impact to the State.