2023

UnitedHealthcare

Care Provider

Administrative Guide for

Commercial and Medicare

Advantage

i

2023 UnitedHealthcare Care Provider Administrative Guide

Welcome to UnitedHealthcare

Welcome to the UnitedHealthcare Care Provider Administrative Guide for Commercial and Medicare Advantage (MA) products.

This guide has important information on topics such as claims and prior authorizations. It also has protocol information for

health care professionals. This guide has useful contact information such as addresses, phone numbers and websites. More

policies and online solutions are available on uhcprovider.com.

• If you are looking for information about Surest, please see the Surest supplement to this guide.

• If you are looking for a Community and State manual, go to uhcprovider.com/guides > Community Plan Care Provider

Manuals By State and select the state.

• If you are a UnitedHealthcare or Optum® participating health care provider or facility with an active Department of Veterans

Affairs Community Care Network (VA CCN) agreement, you can find more information about VA CCN on the Optum VA

Community Care Network UnitedHealthcare Provider Portal at VACommunitycare.com/provider.

You may easily find information in this guide using these steps:

1. Hold keys CTRL+F.

2. Type in the key word.

3. Press Enter.

This 2023 UnitedHealthcare Care Provider Administrative Guide (this “guide”) applies to covered services you provide to our

members or the members of our affiliates

1

through our benefit plans insured by or receiving administrative services from us,

unless otherwise noted.

This guide is effective April 1, 2023, for physicians, health care professionals, facilities and ancillary health care providers

currently participating in our commercial and MA networks. It is effective now for health care providers who join our network

on or after Jan. 1, 2023. This guide is subject to change. We frequently update content in our effort to support our health care

provider networks.

Terms and definitions as used in this guide:

• “Member” or “customer” refers to a person eligible and enrolled to receive coverage from a payer for covered services as

defined or referenced in your Agreement.

• “Commercial” refers to all UnitedHealthcare medical products that are not MA, Medicare Supplement, Medicaid, CHIP,

workers’ compensation or other government programs. “Commercial” also applies to benefit plans for the Health Insurance

Marketplace, government employees or students at public universities.

• “You,” “your” or “provider” refers to any health care provider subject to this guide. This includes physicians, health care

professionals, facilities and ancillary providers, except when indicated. All items are applicable to all types of health care

providers subject to this guide.

• “Your Agreement,” “Provider Agreement,” “Agreement” or ”your contract” refers to your Participation Agreement with us.

• “Us,” “we” or “our” refers to UnitedHealthcare on behalf of itself and its other affiliates for those products and services

subject to this guide.

• Any reference to “ID card” includes both a physical or digital card.

MA policies, protocols and information in this guide apply to covered services you provide to UnitedHealthcare MA members,

including Erickson Advantage members and most UnitedHealthcare Dual Complete members, excluding UnitedHealthcare

Medicare Direct members. We indicate if a particular section does not apply to such MA members.

If there is a conflict or inconsistency between a Regulatory Requirements Appendix attached to your Agreement and this guide,

the provisions of the Regulatory Requirements Appendix controls for benefit plans within the scope of that appendix.

If there is inconsistency between the terms of your Agreement and this guide, your Agreement controls. The exception to this

rule is when your Agreement defines a protocol that is specific to one of our affiliates and is inconsistent with a protocol in the

corresponding affiliate supplement to this guide. In that situation, the protocol in the applicable affiliate supplement to this

guide controls.

Per your Agreement, you must comply with protocols. Payment will be denied, in whole or in part, for failure to comply with

a protocol.

1

UnitedHealthcare affiliates offering commercial and Medicare Advantage benefit plans and other services, are outlined in Chapter 1: Introduction.

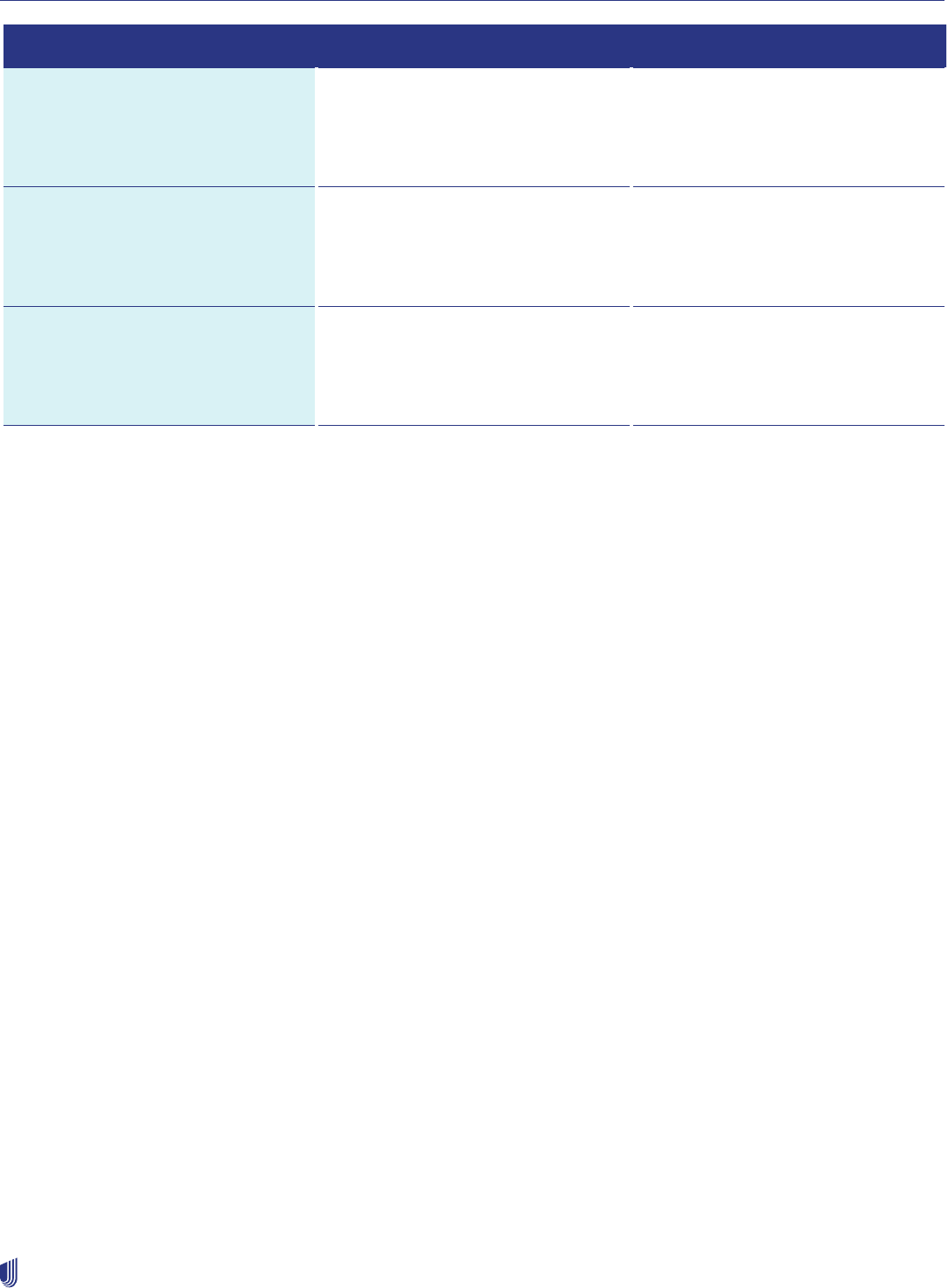

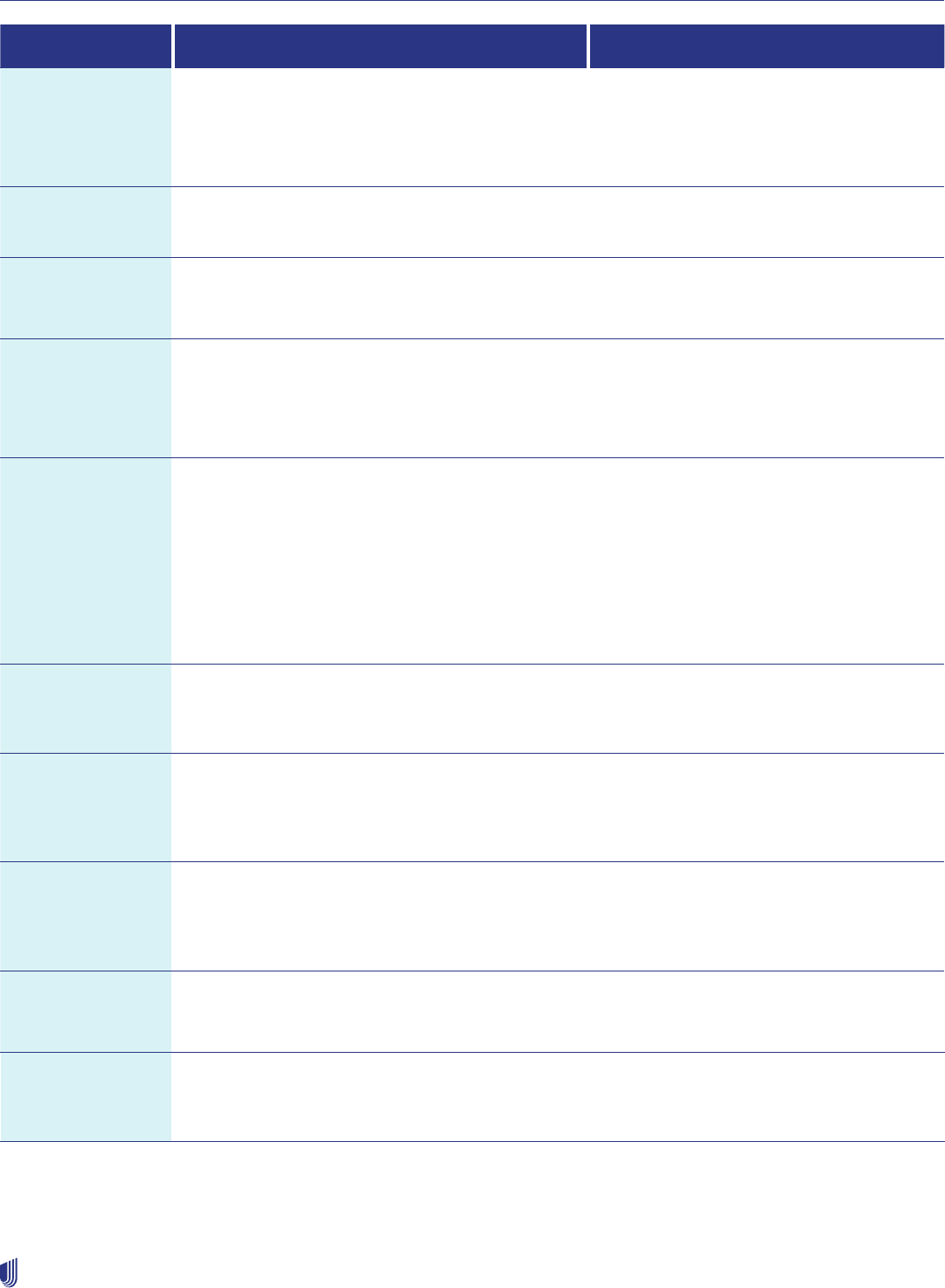

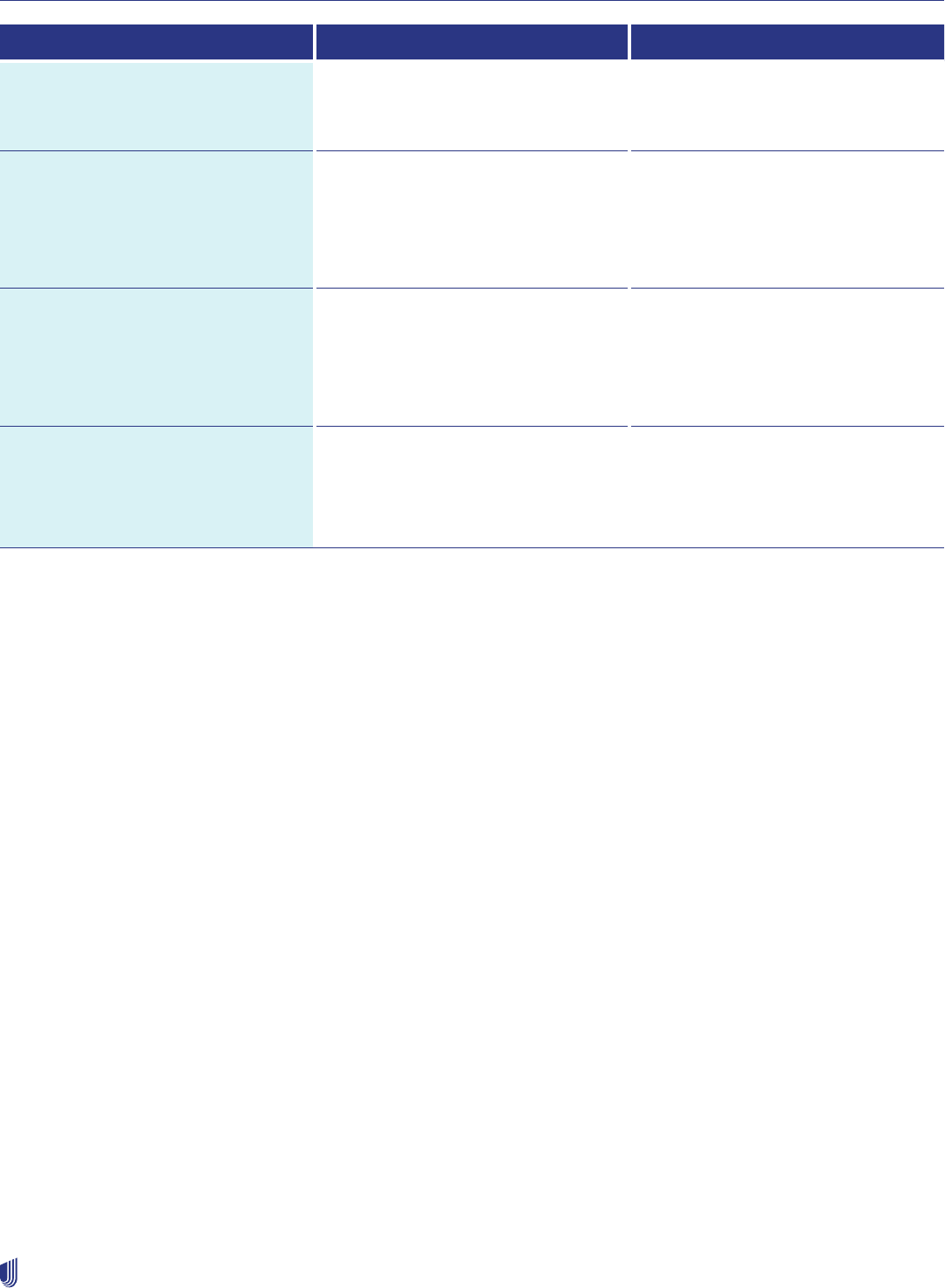

Quick reference guide

ii

2023 UnitedHealthcare Care Provider Administrative Guide

Quick reference guide

Join our Network

and Credentialing

If you are interested in joining our network, visit uhcprovider.com/join. To view our credentialing

policies and procedures.

Credentialing application: Check on your application status by emailing [email protected].

Digital Solutions uhcprovider.com: uhcprovider.com is your home for health care provider information with 24/7

access to the UnitedHealthcare Provider Portal, medical policies and news bulletins. The website

offers great resources to support administrative tasks including eligibility, claims, referrals, and prior

authorizations and notifications.

uhcprovider.com/digitalsolutions: Going digital means less paper and more automation, faster

workflow between applications and quicker claims submission process to get you paid faster. Our

three digital solutions, Electronic Data Interchange (EDI), Application Programming Interface (API)

and the UnitedHealthcare Provider Portal, help to make that a reality, and it’s not a one-size-fits-all

approach. There’s flexibility to choose the best approach for your practice, and there’s the ability to

integrate with the practice management systems you use today. This webpage will help you choose the

right solution to fit your practice’s needs.

uhcprovider.com/portal: Our portal allows you to quickly get the answers you need to claims

information like status updates, reconsiderations and appeals. You can also submit prior authorization

requests, check eligibility and benefits information, access items in Document Library (including

virtual card payment statements) and even track your work, all at no cost to you and without having to

make a phone call. To log in, click Sign In in the top right corner of uhcprovider.com.

uhcprovider.com/edi: Submit and receive data using HIPAA Electronic Data Interchange (EDI) X12

transactions for claim submissions, eligibility and benefits, claim status, authorizations, referrals,

hospital admission, discharge and observation stay notifications, and electronic remittance advice.

You can submit single or batch transactions for multiple members and payers without manual data

entry or logging into multiple payer websites.

uhcprovider.com/api: Our Application Programming Interface (API) solutions allow you to access

comprehensive real-time data on a timetable you set. Data can be distributed to your practice

management system, proprietary software or any application you prefer. We have APIs for claim status

and payment, eligibility and benefits, reconsiderations and appeals, documents, and referrals.

Healthcare

Professional

Education and

Training

We provide a full range of training resources including interactive self-paced courses and instructor-

led sessions at uhcprovider.com/training. The training content is organized by categories to make it

easier to find what you need.

Provider Portal

Access and New

User Registration

In order to access the UnitedHealthcare Provider Portal, you’ll need to create a One Healthcare ID.

Visit uhcprovider.com/access.

UnitedHealthcare

Communications

Network News: Find health care provider news and updates for national and state commercial,

Medicare and Medicaid plans at uhcprovider.com/news.

Policy and Protocol Updates: News and updates regarding policy, product or reimbursement

changes are posted online at uhcprovider.com/news. Updates are posted at the beginning of each

month. Sign up to receive notification of these updates by email at uhcprovider.com/subscribe.

Quick reference guide

iii

2023 UnitedHealthcare Care Provider Administrative Guide

Contact

UnitedHealthcare

Most questions can be answered using one of our online solutions at

uhcprovider.com/digitalsolutions. If you need to speak with someone, we’re here to help. For state-

specific contact information, visit uhcprovider.com > Contact us.

UnitedHealthcare Web Support 1-866-842-3278

providertechsuppor[email protected]

Provider Services 1-877-842-3210

Provider Services (Individual Exchange Plans) 1-888-478-4760

Prior Authorizations 1-877-842-3210

Prior Authorizations (Individual Exchange Plans) 1-888-478-4760

Optum Pay

TM

Helpdesk 1-877-620-6194

Participation Agreement questions: Contact your Network Management representative. To identify

your Network Management representative, go to uhcprovider.com > Contact us > State-specific

health plan and network support and select your state.

Provider Advocate: To find your health care provider advocate, go to uhcprovider.com > Contact us >

State-specific health plan and network support and select your state.

Find a health care

provider

uhcprovider.com > Our network > Find a provider.

• Search for doctors, clinics or facilities by plan type.

• Find dental providers by state, network or location.

• Locate mental health or substance abuse services.

Eligibility Access benefit, coverage and identification card information:

Online: uhcprovider.com/eligibility and click Sign In in the top right corner.

EDI: 270/271 transaction | uhcprovider.com/edi270

For Individual Exchange Plans, call 1-888-478-4760.

Advance

Notification/Prior

Authorization,

Admission

Notification,

Discharge

Notification,

Observation Stay

Notification and

Referrals

To notify us or request prior authorization:

EDI: Transactions 278 and 278N

• Submit prior authorization requests and referrals using EDI 278 transactions. Go to uhcprovider.

com/edi278 for more information.

• Submit hospital admission, discharge and observation stay notifications using EDI 278N

transactions. Go to uhcprovider.com/edi278n for more information.

• Check the status of prior authorization requests and notifications at uhcprovider.com/edi278i.

Online: uhcprovider.com/paan

Use the Prior Authorization and Notification tool in the UnitedHealthcare Provider Portal to:

• Determine if notification or prior authorization is required.

• Complete the notification or prior authorization process.

• Upload medical notes or attachments.

• Check request status.

Information: uhcprovider.com/priorauth (information and advance notification/prior

authorization lists)

Phone: Call Care Coordination at the number on the member’s ID card (self-service available after

hours) and select “Care Notifications.”

Quick reference guide

iv

2023 UnitedHealthcare Care Provider Administrative Guide

Claims EDI: uhcprovider.com/edi837 View our Claims Payer List to determine the correct payer ID.

Online: uhcprovider.com/claimstool > Click Sign In in the top right corner.

Information: uhcprovider.com/claims (policies, instructions and tips)

Phone: 1-877-842-3210 (follow the prompts for status information)

1-888-478-4760 (Individual Exchange Plans)

Reimbursement Policies:

uhcprovider.com > Resources > Plans, policies, protocols and guides > For Commercial Plans >

Reimbursement Policies for UnitedHealthcare Commercial Plans

uhcprovider.com > Resources >Plans, Policies, protocols and guides > For Exchange Plans >

Reimbursement Policies for UnitedHealthcare Individual Exchange Plans

uhcprovider.com > Resources > Plans, policies, protocols and guides > For Medicare Advantage

Plans> Reimbursement Policies for Medicare Advantage Plans

uhcprovider.com > Resources > Plans, policies, protocols and guides > For Community Plans >

Reimbursement Policies for Community Plan

Reimbursement policies may be referred to in your Agreement as “payment policies.” Refer to the

Medicare Advantage policies for DSNP members.

Claim

Reconsiderations

and Appeals

API: Submit reconsiderations and appeals with attachments using our API solution. Get more

information online at uhcprovider.com/api.

Online: uhcprovider.com. Click Sign In in the top right corner.

Report escalated or unresolved issues to your Provider Advocate by email. Submit an appeal as a

final resolution.

Medical Policies: Get copies of the medical policies and guidelines at uhcprovider.com/policies.

Timely Filing

Guidelines

Refer to your internal contracting contact or Participation Agreement for timely filing information.

Care Provider

or Group

Demographic

Information

Update Forms

Care Provider or Group Demographic Information Update forms:

• uhcprovider.com/mpp > My Practice Profile

• uhcprovider.com/getconnected > Step 3: Verify your demographic and tax ID information

Preferred Lab

Network

uhcprovider.com > Our network > Preferred Lab Network

Specialty

Pharmacy

Program

(Commercial and

Exchange)

Specialty Pharmacy Program provides focused support to help better manage rare and complex

chronic conditions. Find details about the Specialty Pharmacy Program online at uhcprovider.com >

Resources > Drug Lists and Pharmacy > Specialty Pharmacy - Medical Benefit Management

(Provider Administered Drugs).

Commercial medical benefit specialty prior authorizations are managed under the

Specialty Guidance Program (SGP).

Phone: 1-888-397-8129

Email: [email protected]

v

2023 UnitedHealthcare Care Provider Administrative Guide

Contents

Welcome to UnitedHealthcare ........................................................i

Quick reference guide ii

Chapter 1: Introduction 1

Manuals and benefit plans referenced in this guide ...................................... 1

Online/interoperability resources and how to contact us .................................5

Online resources and how to contact us ...............................................8

Chapter 2: Provider responsibilities and standards 11

Verifying eligibility, benefits and your network participation status .........................11

Health plan identification (ID) cards ..................................................11

Access standards ................................................................14

Network participating health care provider responsibilities ...............................16

Civil rights .......................................................................16

Confidentiality, Use of Licensed Marks, Publicity .......................................17

Consolidated Appropriations Act, 2021 (CAA) requirements .............................18

Cooperation with quality improvement and patient safety activities ........................19

Demographic changes ............................................................19

Notification of practice or demographic changes (applies to Commercial benefit plans in

California) .......................................................................21

Administrative terminations for inactivity ..............................................22

Member dismissals initiated by a PCP (Medicare Advantage) ............................23

Medicare opt-out .................................................................23

Additional MA requirements ........................................................23

Filing of a lawsuit by a member .....................................................25

Chapter 3: Commercial products 27

Commercial product overview table .................................................27

Benefit plan types ................................................................31

PCP selection ...................................................................31

Consumer-driven health benefit plans ................................................31

Chapter 4: Individual Exchange plans 33

UnitedHealthcare participation in Exchanges ..........................................33

Plan coverage and metal levels .....................................................36

UnitedHealthcare benefit plans for Individual Exchanges ................................38

Understanding your network participation ............................................40

Verifying eligibility and benefits .....................................................41

Plan requirements/features ........................................................41

Patient care coordination and case management ......................................43

Government Inspections and Audits .................................................44

Telemedicine and Virtual Care .....................................................44

Pharmacy .......................................................................45

Specialty services (hearing, vision, dental, transplant, behavioral health, chiropractor, skilled

nursing facility) ...................................................................45

Claims process ..................................................................45

Policies and protocols ............................................................46

Quick reference guide .............................................................46

Contents

vi

2023 UnitedHealthcare Care Provider Administrative Guide

Chapter 5: Medicare products 53

Medicare product overview tables ...................................................54

PCP selection ....................................................................60

Coverage summaries and policy guidelines for MA members ............................60

Special needs plans managed by Optum .............................................61

Medicare supplement benefit plans .................................................63

Free Medicare education for your staff and patients ....................................64

Chapter 6: Referrals 65

Commercial products referrals ......................................................65

Non-participating health care providers (all Commercial plans) ...........................68

Individual exchange referral required plan ............................................69

Medicare Advantage (MA) referral required plans ......................................69

Chapter 7: Medical management 71

Advance notification/prior authorization protocol ......................................71

Advance notification/prior authorization requirements ..................................72

Advance notification/prior authorization list ...........................................73

Facilities: Standard notification requirements* .........................................74

How to submit advance notification/prior authorization, admission notification, discharge

notification and observation stay notification ..........................................77

Updating advance notification or prior authorization requests ............................78

Coverage and utilization management decisions .......................................78

Clinical trials, experimental or investigational services ..................................80

Medical management denials/adverse determinations ..................................81

Pre-service appeals ...............................................................82

MA Part C reopenings .............................................................83

Outpatient cardiology notification/prior authorization protocol ............................84

Outpatient radiology notification/prior authorization protocol .............................91

Medication-assisted treatment ......................................................98

Trauma services .................................................................. 98

Air ambulance licensure ...........................................................99

Chapter 8: Specialty pharmacy and Medicare Advantage pharmacy 100

Commercial pharmacy ...........................................................100

Specialty pharmacy requirements for certain medical benefit specialty medications (commercial

plans – not applicable to UnitedHealthcare West) .....................................100

Medicare Advantage pharmacy ....................................................102

Drug utilization review program ....................................................106

Drug management program ......................................................106

Medication therapy management. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 107

Transition policy .................................................................108

Chapter 9: Specific protocols 109

Non-emergent ambulance ground transportation .....................................109

Interoperability protocol ..........................................................109

Laboratory services protocol ......................................................109

Nursing home and assisted living plans .............................................111

Social determinants of health protocol ..............................................112

Telehealth services protocol .......................................................113

Contents

vii

2023 UnitedHealthcare Care Provider Administrative Guide

Chapter 10: Our claims process 114

Optum Pay™ ...................................................................115

Virtual card payments ............................................................115

Enroll and learn more about Optum Pay .............................................116

Claims and encounter data submissions ............................................116

Risk adjustment data – MA, commercial and exchange ................................118

NPI ...........................................................................119

MA claim processing requirements .................................................119

Claim submission tips ............................................................120

Pass-through billing ..............................................................122

Special reporting requirements for certain claim types .................................122

Overpayments ..................................................................124

Subrogation and COB ............................................................125

Claim correction and resubmission .................................................126

Claim reconsideration and appeals process ..........................................127

Resolving concerns or complaints ..................................................129

Member appeals, grievances or complaints ..........................................130

Medical claim review .............................................................131

Chapter 11: Compensation 132

Reimbursement policies ..........................................................132

Charging members ..............................................................132

Member financial responsibility ....................................................135

Preventive care ..................................................................135

Extrapolation ...................................................................136

Audit services. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 136

Audit failure denials .............................................................137

Notice of Medicare Non-Coverage ..................................................137

Chapter 12: Medical records standards and requirements 138

Chapter 13: Health and disease management 141

Health management programs .....................................................141

Case management ..............................................................141

Commercial health services, wellness and behavioral health programs ...................142

Commercial consumer transparency tools ...........................................143

Medicare Advantage .............................................................143

Commercial and MA behavioral health information ....................................144

Chapter 14: Quality Management program 146

UnitedHealth Premium® program (commercial plans) ..................................147

Star ratings for MA and prescription drug plans .......................................148

Members’ experience of care ......................................................148

Imaging accreditation protocol .....................................................148

Chapter 15: Credentialing and recredentialing 149

Credentialing/profile reporting requirements .........................................149

Health care provider rights related to the credentialing process ..........................150

Credentialing committee decision-making process (non-delegated) ......................150

Monitoring of network providers and health care professionals ..........................151

Chapter 16: Member rights and responsibilities 152

Contents

viii

2023 UnitedHealthcare Care Provider Administrative Guide

Chapter 17: Fraud, Waste and Abuse 154

Medicare compliance expectations and training ......................................154

Exclusion checks ................................................................155

Preclusion list policy .............................................................155

Examples of potentially fraudulent, wasteful or abusive billing ...........................156

Prevention and detection .........................................................156

Corrective action plans ...........................................................157

Beneficiary inducement law .......................................................157

Reporting potential FWA to UnitedHealthcare ........................................157

Chapter 18: Provider communication 158

Email communication ............................................................158

Online resources ................................................................158

All Savers supplement 160

How to contact All Savers .........................................................160

Surest supplement 163

Surest plan resources ........................................................163

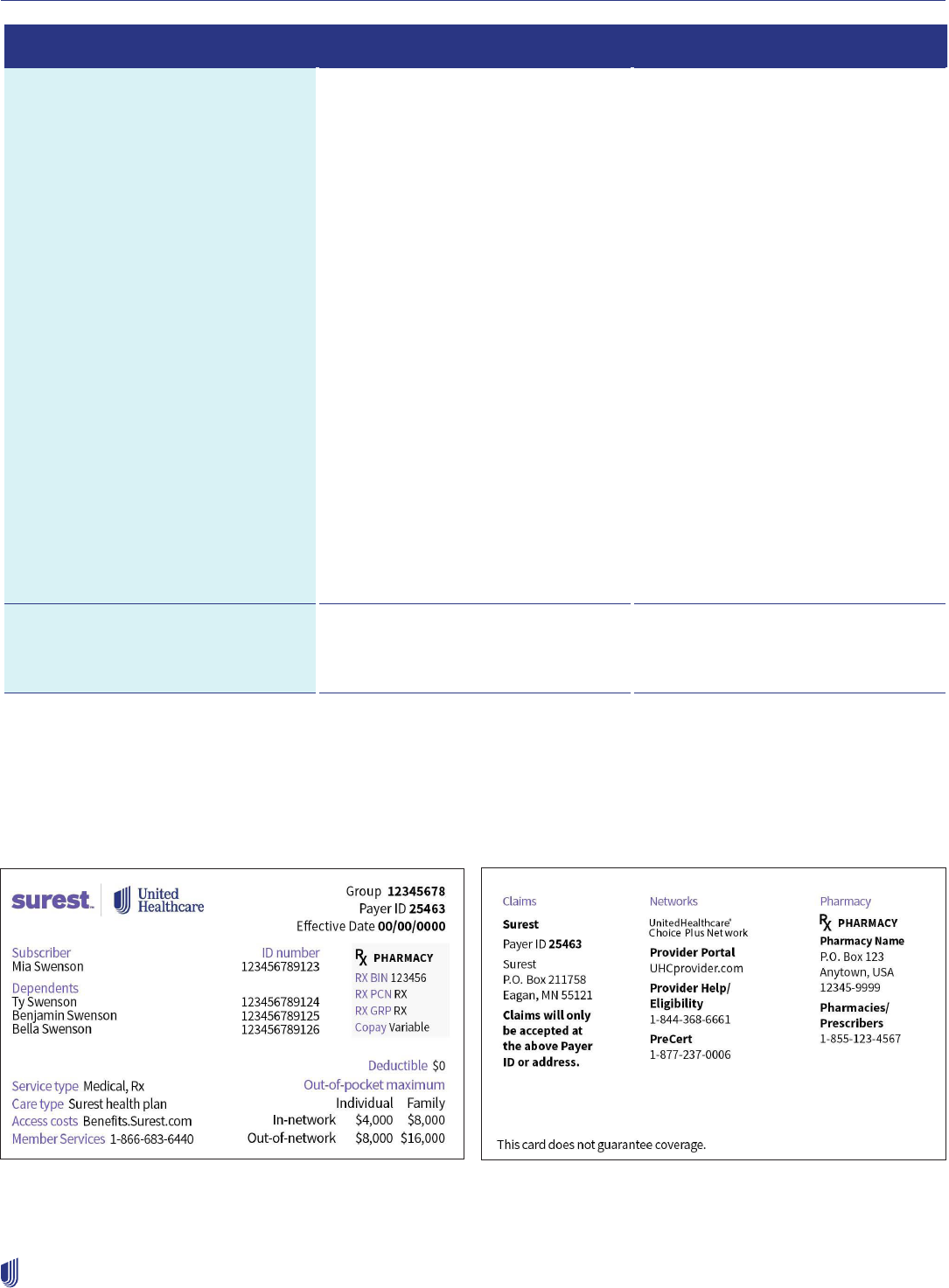

Surest health plan ID card. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 164

Our claims process ..............................................................165

Claim reimbursement (adjustments) ................................................165

How to submit your reconsideration or appeal ........................................165

Still have questions? .............................................................165

Capitation and/or Delegation Supplement 166

What is Capitation? ..............................................................166

What is Delegation? ..............................................................166

How to contact us ...............................................................167

Verifying eligibility and effective dates ...............................................167

Commercial eligibility, enrollment, transfers and disenrollment ..........................167

Medicare Advantage (MA) enrollment, eligibility and transfers, and disenrollment ..........172

Authorization guarantee (CA Commercial only) .......................................175

Health care provider responsibilities ................................................175

Delegated credentialing program ...................................................181

Virtual Care Services (Commercial HMO plans – CA only) ..............................183

Referrals and referral contracting ..................................................184

Medical management ............................................................188

Pharmacy ......................................................................197

Facilities .......................................................................198

Claim delegation oversight .......................................................203

Claims disputes and appeals ......................................................213

Contractual and financial responsibilities ............................................216

Customer service requirements between UnitedHealthcare and the delegated entity

(Medicare) .....................................................................221

Capitation reports and payments ...................................................222

CMS premiums and adjustments ...................................................226

Delegate performance management program ........................................229

Appeals and grievances ..........................................................230

Contents

ix

2023 UnitedHealthcare Care Provider Administrative Guide

Empire Plan supplement 231

Referrals .......................................................................231

ID cards .......................................................................231

Prior authorization and notification requirements ......................................232

Online resources and how to contact us .............................................234

Leased Networks 235

Level2 supplement 236

How to contact us ...............................................................236

Health plan ID cards .............................................................237

Claims process .................................................................237

Mid-Atlantic Regional supplement 239

Provider responsibilities ..........................................................240

Referrals .......................................................................242

Prior authorizations ..............................................................242

Claims process .................................................................244

Capitation ......................................................................245

Neighborhood Health Partnership supplement 247

How to contact NHP .............................................................247

Discharge of a member from participating provider’s care ..............................250

Laboratory services ..............................................................250

Referrals .......................................................................251

UM ............................................................................252

Claims reconsiderations and appeals ...............................................253

Capitated health care providers ...................................................253

New Mexico Supplement 254

OneNet PPO/Workers’ Compensation supplement 256

Who to contact ..................................................................257

Bill process .....................................................................258

Referrals .......................................................................263

Provider responsibilities and workflows .............................................264

Medical records standards and requirements ........................................264

Quality management and health management programs ...............................264

Participant rights and responsibilities ...............................................265

Oxford Commercial supplement 266

Oxford Commercial product overview ...............................................266

Oxford commercial products contact information .....................................266

Health care provider responsibilities and standards ...................................270

Referrals ......................................................................275

Utilization management ..........................................................277

Using non-participating health care providers or facilities ...............................279

Radiology and cardiology procedures ...............................................283

Emergencies and Urgent Care .....................................................288

Utilization reviews ...............................................................290

Claims process .................................................................298

Member billing ..................................................................301

Claims recovery, appeals, disputes and grievances ....................................302

Quality assurance ...............................................................307

Contents

x

2023 UnitedHealthcare Care Provider Administrative Guide

Case management and disease management programs ...............................308

Clinical process definitions ........................................................308

Member rights and responsibilities .................................................311

Medical/clinical and administrative policy updates ....................................311

Oxford Level Funded plans (CT, NJ and NY) 312

Oxford Level Funded product contacts ..............................................312

Our claims process ..............................................................312

How to submit your reconsideration or appeal ........................................313

Preferred Care Network supplement 314

How to contact us ...............................................................314

Confidentiality of Protected Health Information (PHI) ...................................318

Referrals .......................................................................318

Prior authorizations ..............................................................319

Appeal and reconsideration processes ..............................................323

Member rights and responsibilities .................................................324

Documentation and confidentiality of medical records .................................324

Provider reporting responsibilities ..................................................328

Preferred Care Partners supplement 329

About Preferred Care Partners .....................................................329

How to contact us ...............................................................329

Confidentiality of Protected Health Information (PHI) ...................................333

Prior authorizations ..............................................................333

Clinical coverage review ..........................................................335

Appeal and reconsideration processes ..............................................337

Member rights and responsibilities .................................................338

Documentation and confidentiality of medical records .................................339

Case management and disease management program information ......................340

Special needs plans .............................................................341

Health care provider reporting responsibilities ........................................342

River Valley Entities supplement 343

Eligibility .......................................................................343

How to contact River Valley .......................................................344

Reimbursement policies ..........................................................346

Referrals .......................................................................346

Utilization Management (UM) ......................................................347

Claims process .................................................................351

UMR supplement 355

How to contact UMR .............................................................355

Health plan identification cards ....................................................357

Prior authorization and notification requirements ......................................357

Clinical trials, experimental or investigational services .................................358

Pharmacy and specialty pharmacy benefits ..........................................358

Specific protocols ...............................................................358

Our claims process ..............................................................359

Health and disease management ...................................................360

Frequently asked questions .......................................................360

Contents

xi

2023 UnitedHealthcare Care Provider Administrative Guide

UnitedHealthcare FlexWork™ supplement 363

How to contact FlexWork™ ........................................................363

Health plan ID card ..............................................................364

Our claims process ..............................................................364

UnitedHealthcare Level Funded supplement 366

How to contact us ...............................................................366

Our claims process ..............................................................367

UnitedHealthcare West supplement 369

UnitedHealthcare West information regarding our health care provider website ............372

How to contact UnitedHealthcare West resources .....................................372

Health care provider responsibilities ................................................375

Utilization and medical management ................................................379

Hospital notifications .............................................................383

Home delivery pharmacy .........................................................387

Claims process .................................................................388

Health care provider claims appeals and disputes .....................................392

California language assistance program (California commercial plans). . . . . . . . . . . . . . . . . . . . 396

Member complaints and grievances ................................................397

California Quality Improvement Committee ..........................................397

UnitedHealthOne Individual Plans supplement 398

How to contact UnitedHealthOne resources ..........................................398

Claims process .................................................................399

Member complaints and grievances ................................................401

Glossary 404

1

2023 UnitedHealthcare Care Provider Administrative Guide

Chapter 1: Introduction

Manuals and benefit plans referenced in this guide

Some benefit plans included under your Agreement may be subject to requirements found in other health care provider guides

or manuals or to the supplements found in the second half of this guide.

This section provides information about some of the most common UnitedHealthcare products. Your Agreement may use

“benefit contract types,” “benefit plan types” or a similar term to refer to our products.

Visit uhcprovider.com/plans for more information

about our products and Individual Exchange

benefit plans offered by state.

If a member presents a health plan ID card with a product name you are not familiar with, use the UnitedHealthcare Provider

Portal > Eligibility to quickly find information on the plan. You may also call us at 1-877-842-3210 or Exchange Provider Services

at 1-888-478-4760.

You are subject to the provisions of additional guides when providing covered services to a member of those benefit plans, as

described in your Agreement and in the following table. We may make changes to health care provider guides, supplements

and manuals that relate to protocol and payment policy changes.

We may change the location of a website, a benefit plan name, branding or the health plan ID card. We inform you of those

changes through one of our health care provider communications resources.

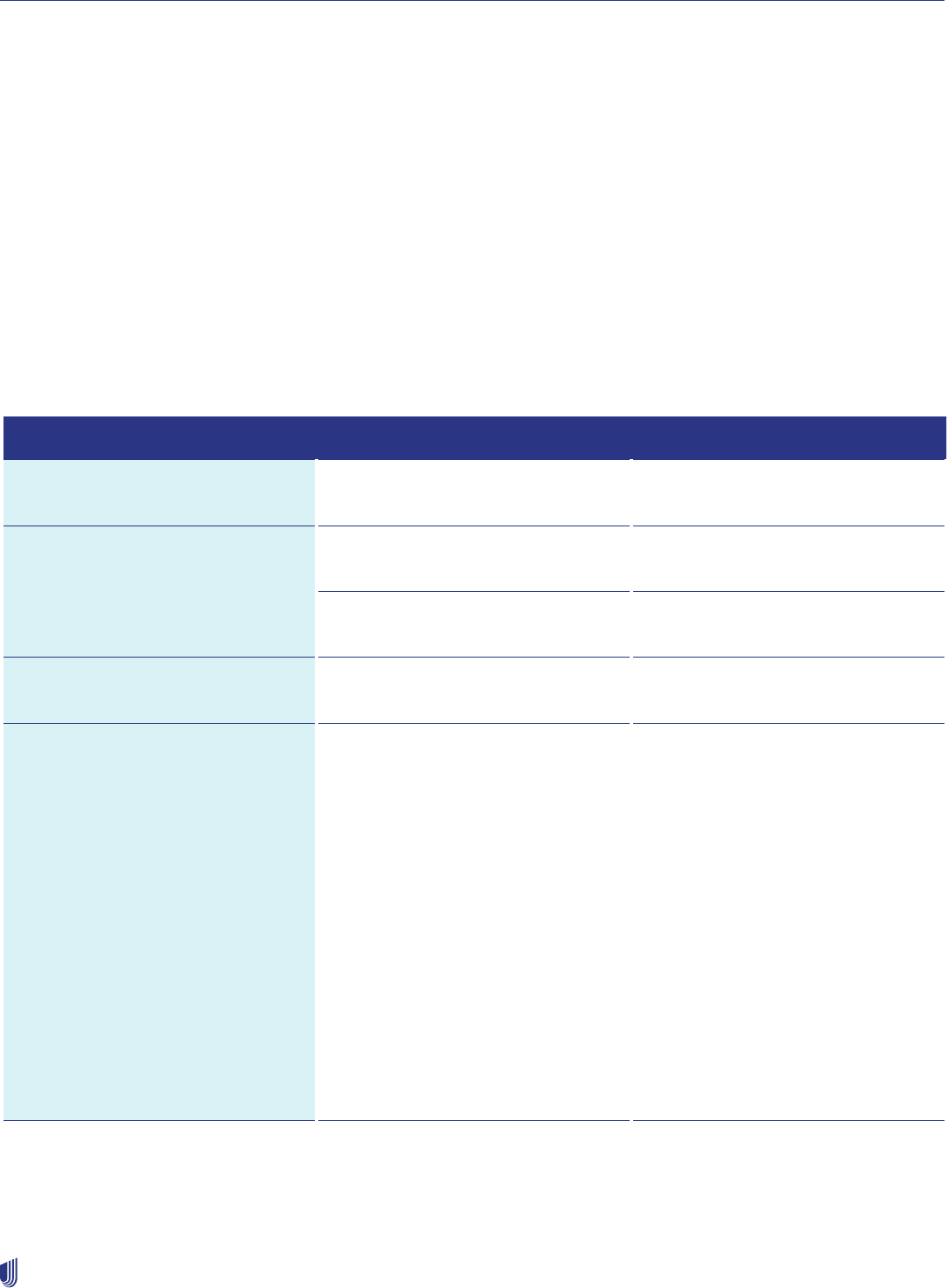

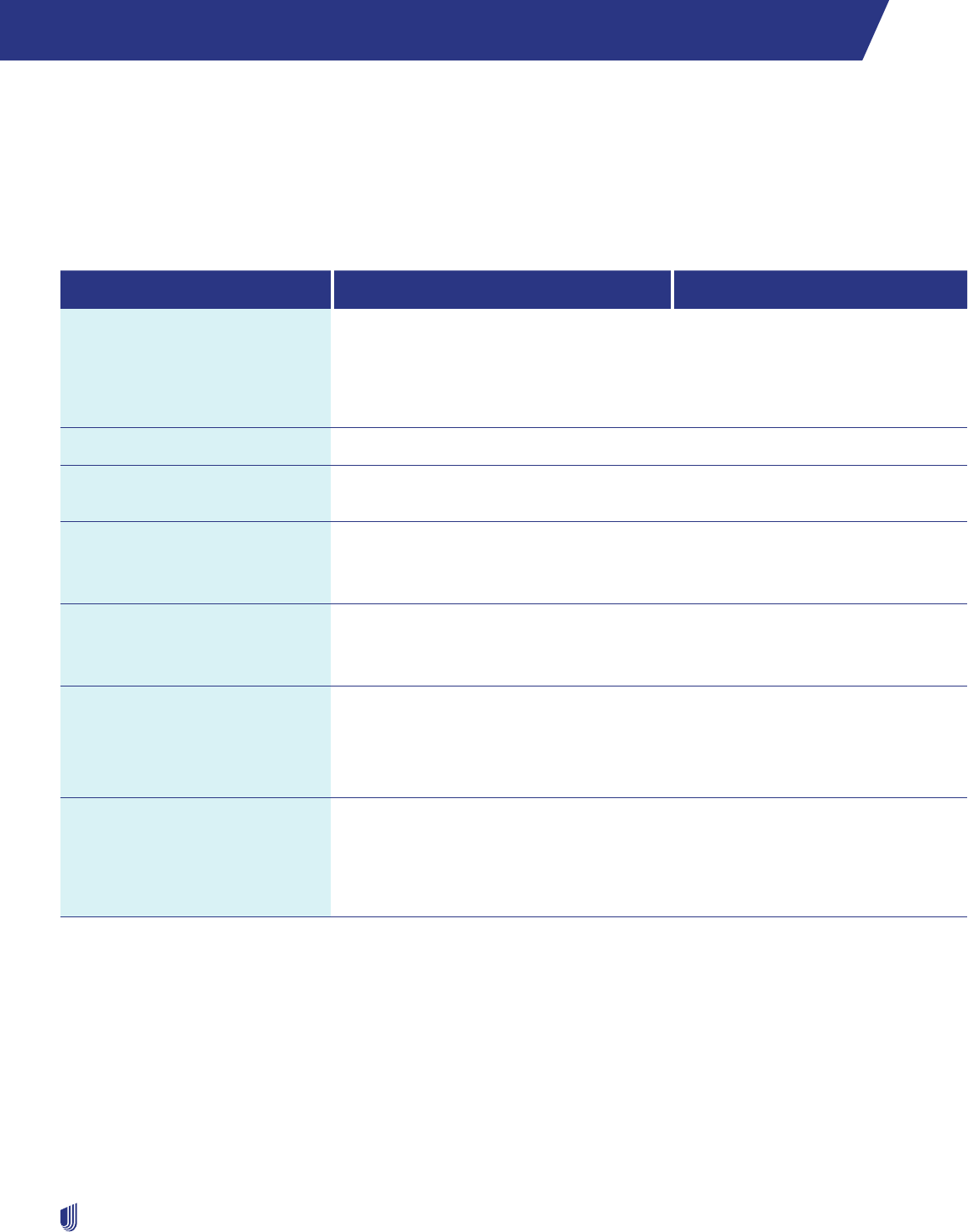

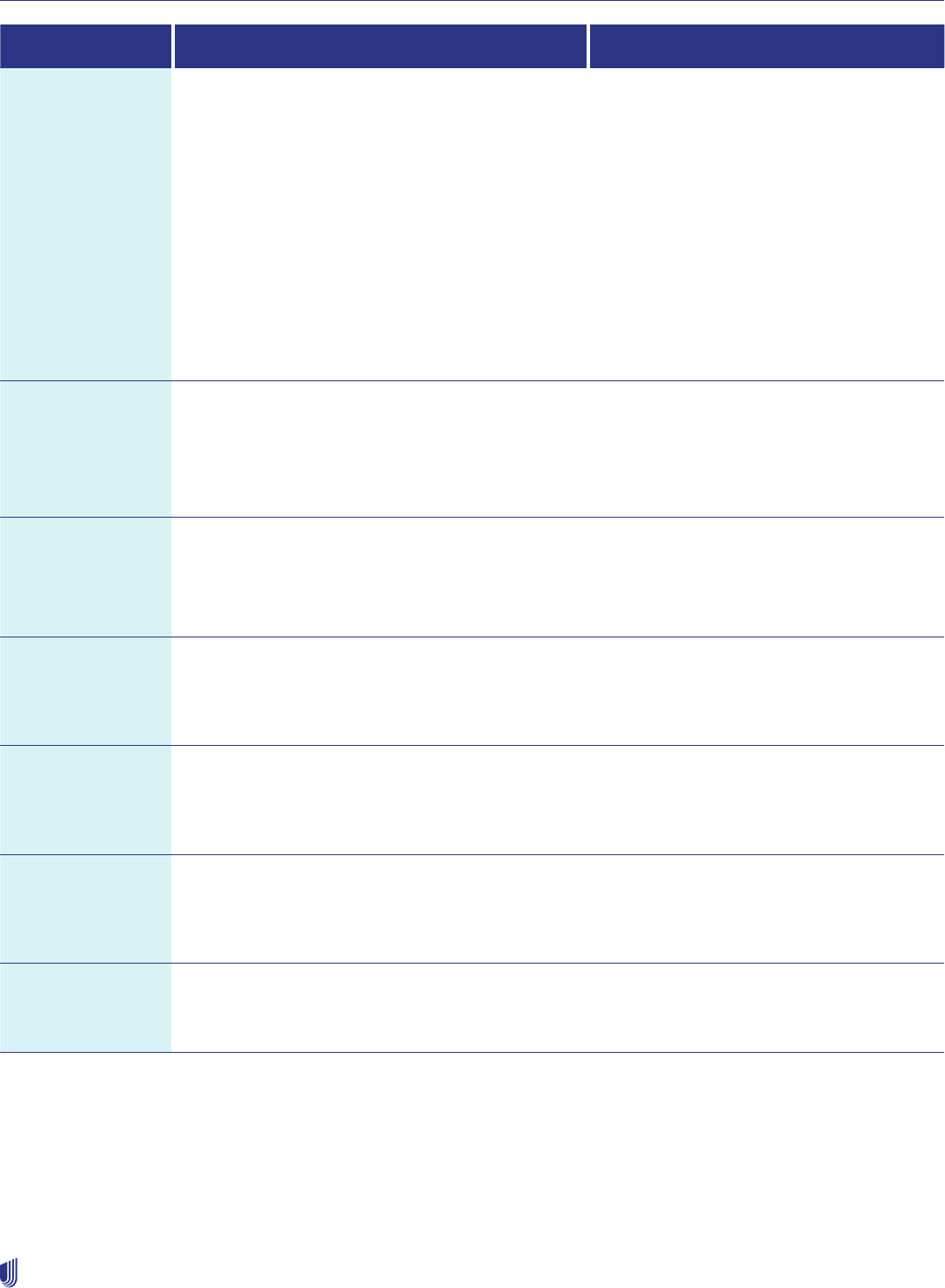

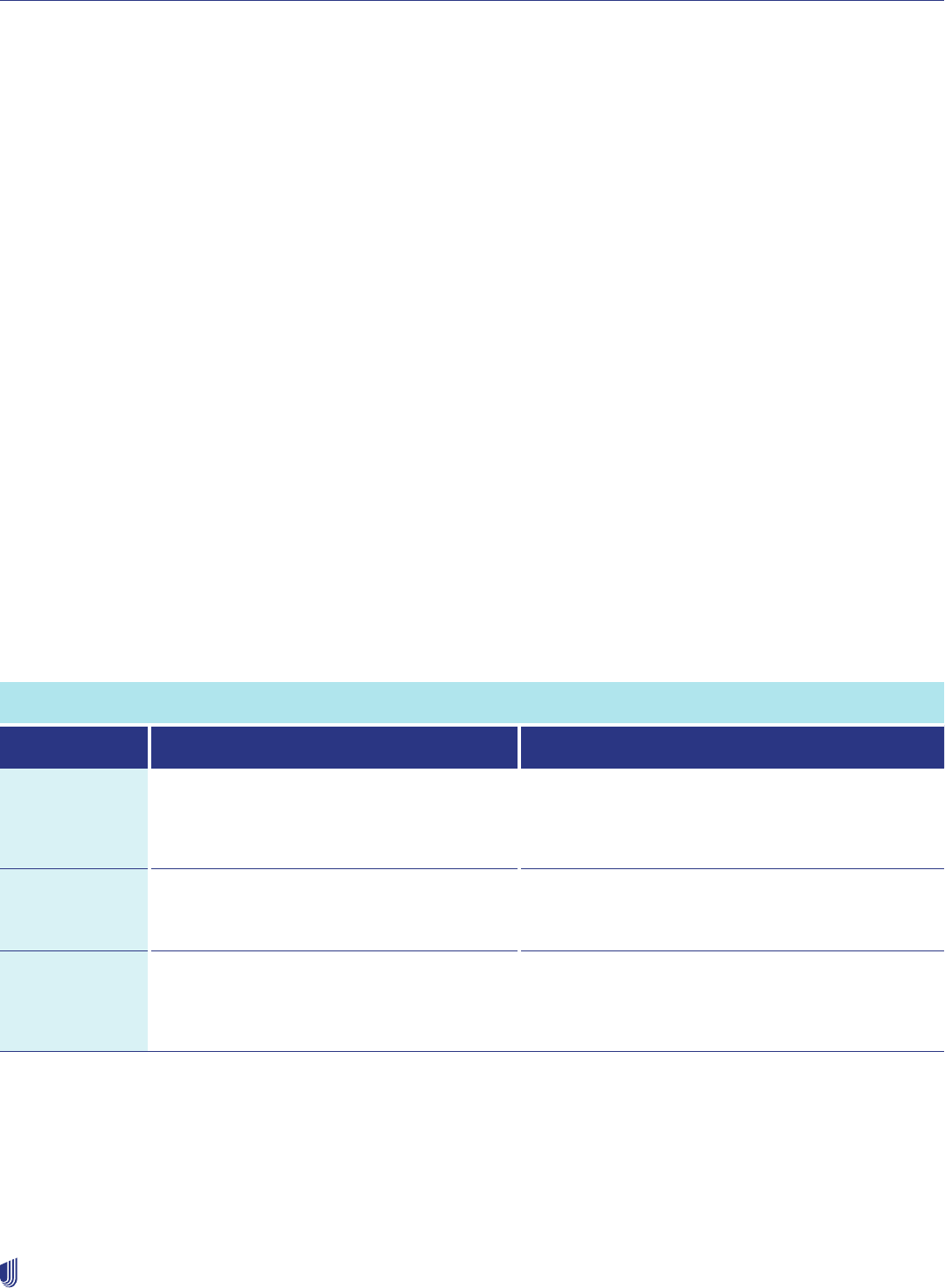

Benefit plans subject to this guide

Plan Name Location of most members

subject to additional guides

Location of plan information

All Savers:

All Savers Insurance Company

All markets All Savers supplement to this

guide

myallsaversconnect.com

Empire Plan All markets outside of NY* and national health

care providers; Primary concentrations in: AZ,

CA, CT, DE, FL, GA, MA, MD, NC, NJ, NV, PA,

SC, TN, TX, VA

Health plan ID card indicates NYSHIP, The

Empire Plan and references UnitedHealthcare

logo on the back

* In the NY markets, there are a limited number

of health care providers with the Empire Plan

specifically added to their UnitedHealthcare

Agreement. Otherwise, we have a separate

health care provider network for Empire Plan

members in NY.

Empire Plan supplement to this

guide

uhcprovider.com

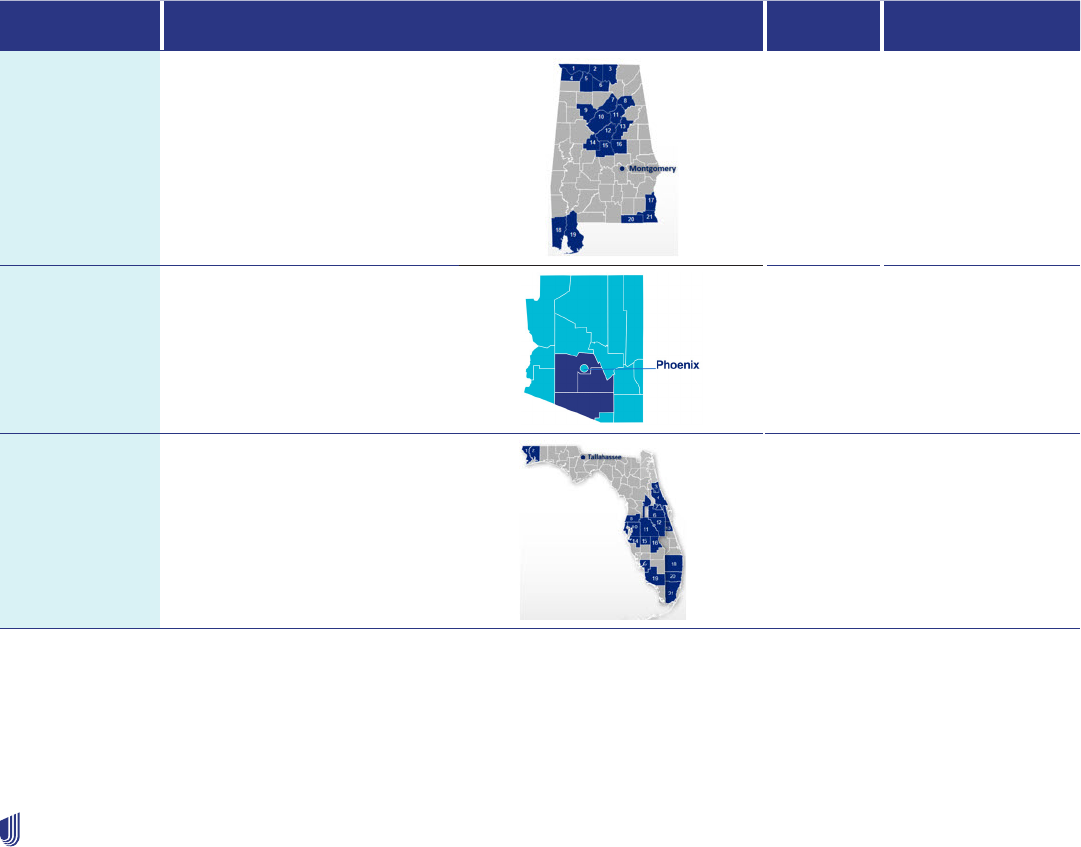

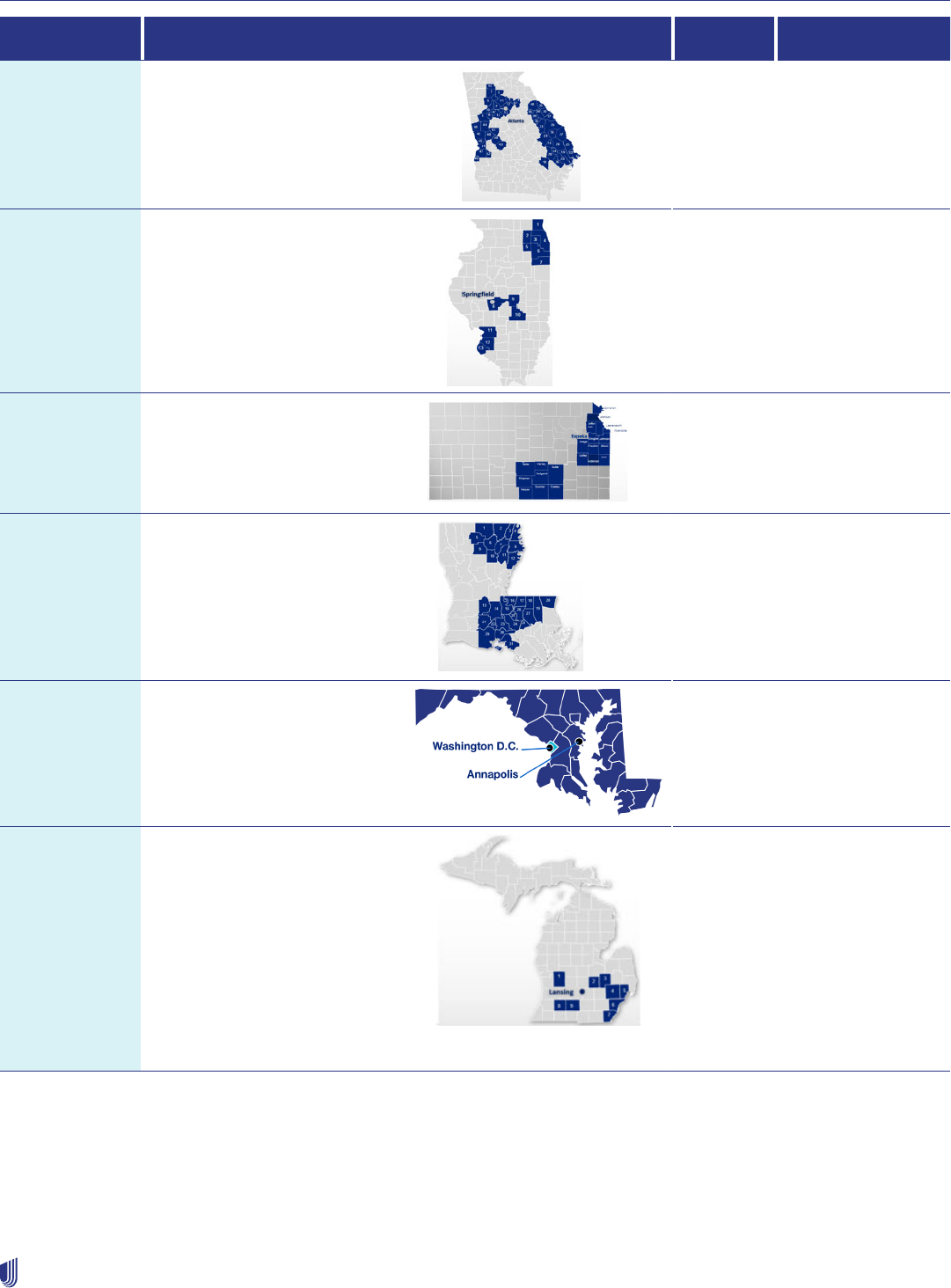

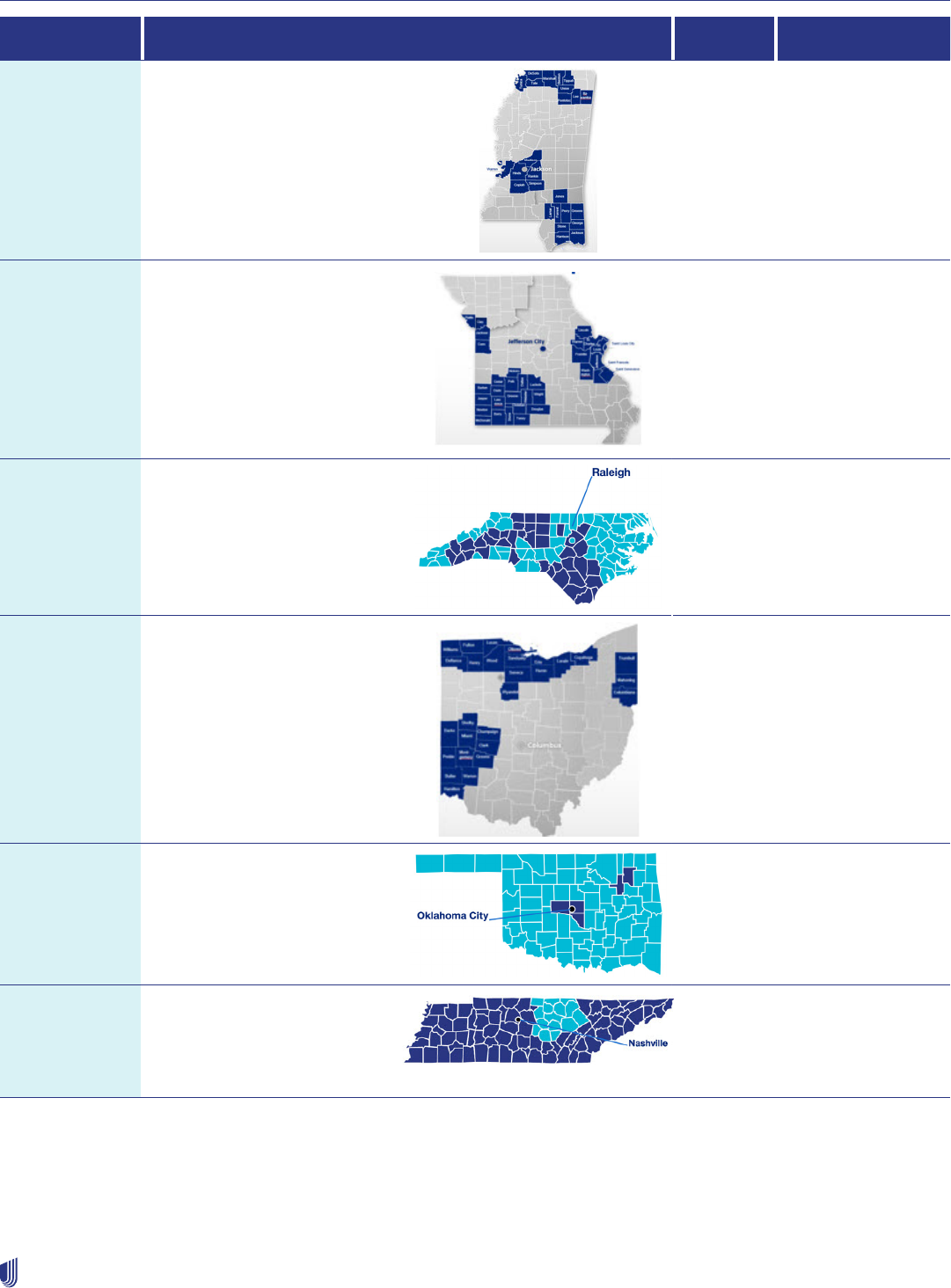

Exchanges AL, AZ, FL, GA, IL, KS, LA, MD, MI, MS, MO, NC,

OH, OK, TN, TX, VA, WA

Chapter 4: Individual Exchange

Plans to this guide.

Chapter 1: Introduction

2

2023 UnitedHealthcare Care Provider Administrative Guide

Plan Name Location of most members

subject to additional guides

Location of plan information

MDIPA:

MD Individual Practice

Association, Inc.

DC, DE, MD, VA, WV

Some counties in: Southeastern PA

Mid-Atlantic Regional Supplement

to this guide.

uhcprovider.com

Capitated and/or Delegated

Providers (Commercial and

MA) Supplement

All markets Capitation and/or Delegation

Supplement to this guide.

NHP:

Neighborhood Health

Partnership, Inc.

FL Neighborhood Health Partnership

Supplement to this guide.

uhcprovider.com

OCI:

Optimum Choice Inc.

DC, DE, MD, VA, WV

Some counties in: PA

Mid-Atlantic Regional Supplement

to this guide.

uhcprovider.com

OneNet PPO DC, DE, FL, GA, MD, NC, PA, SC, TN, VA, WV OneNet PPO Supplement to this

guide.

uhcprovider.com

Oxford:

• Oxford Health Plans, LLC

• Oxford Health Insurance, Inc.

• Investors Guaranty Life

Insurance Company, Inc.

• Oxford Health Plans (NY), Inc.

• Oxford Health Plans (NJ), Inc.

• Oxford Health Plans (CT), Inc.

• Oxford Level Funded Plans

(NJ, CT)

CT, NJ, NY (except upstate)

Some counties in: PA.

Oxford Commercial Supplement

to this guide.

For commercial benefits:

uhcprovider.com

For Medicare benefits:

uhcprovider.com

Preferred Care Network

Supplement

FL counties: Broward and Miami-Dade Preferred Care Network

Supplement to this guide.

uhcprovider.com

Preferred Care Partners FL counties: Broward, Miami-Dade and

Palm Beach

Preferred Care Partners

Supplement to this guide.

uhcprovider.com

Chapter 1: Introduction

3

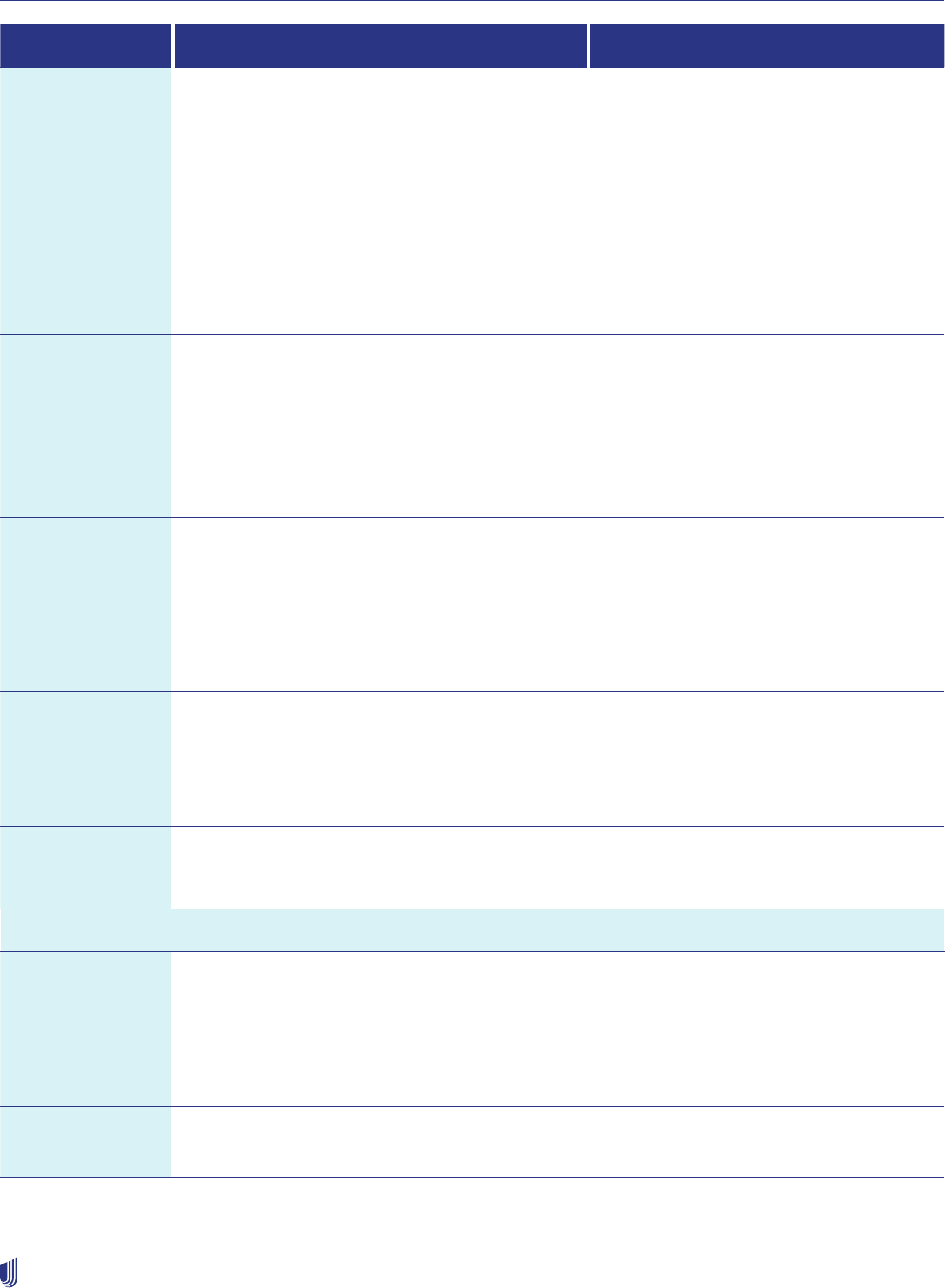

2023 UnitedHealthcare Care Provider Administrative Guide

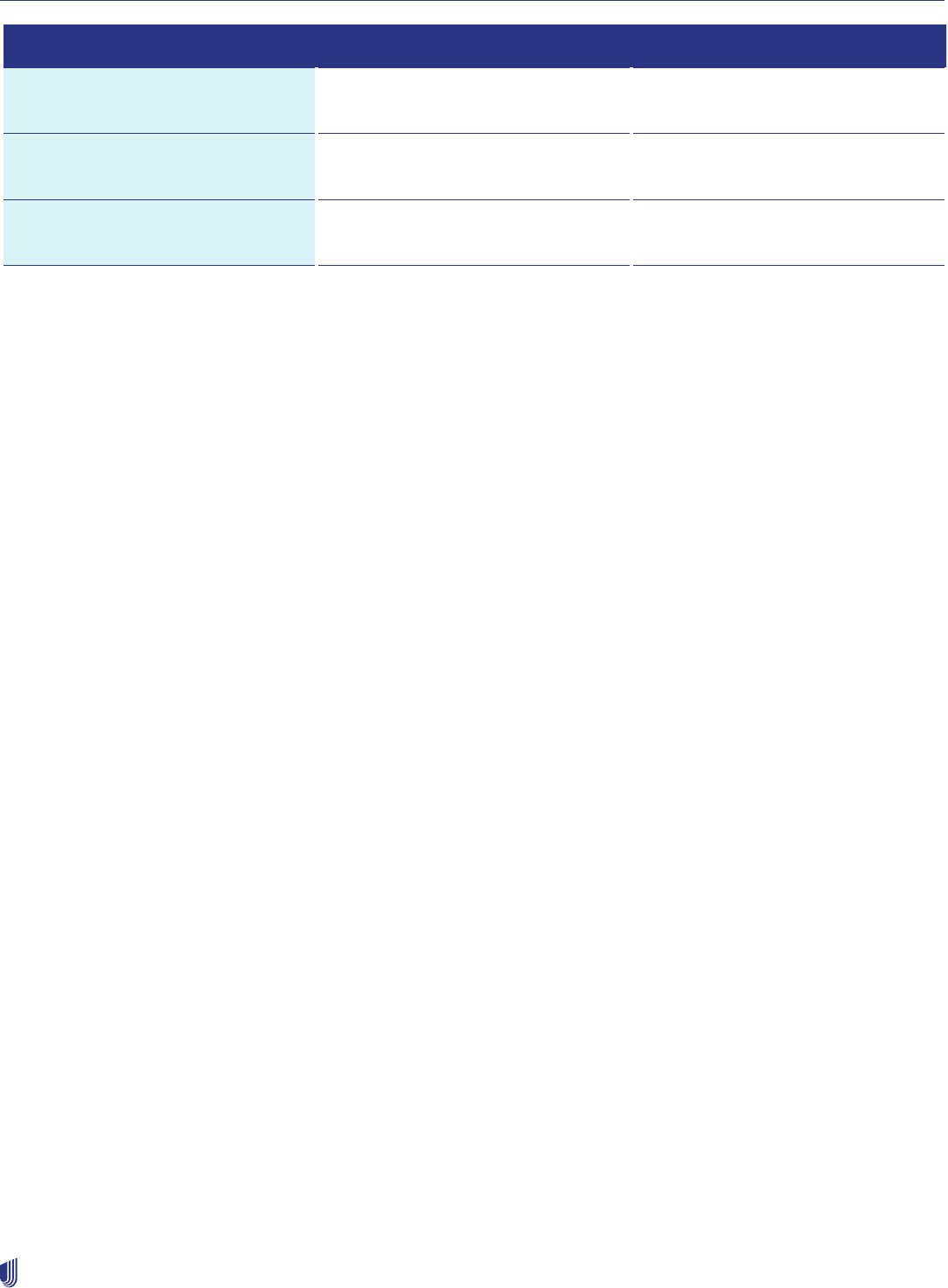

Plan Name Location of most members

subject to additional guides

Location of plan information

River Valley:

• UnitedHealthcare Services

Company of the River

Valley, Inc.

• UnitedHealthcare Plan

of the River Valley, Inc.

• UnitedHealthcare Insurance

Company of the River Valley

Parts of AR, GA, IA, IL, TN, VA, WI

Your UnitedHealthcare contract specifically

references River Valley or John Deere Health

protocols or guides; and

You are located in AR, GA, IA, TN, VA, WI

or these counties in Illinois: Jo Daviess,

Stephenson, Carroll, Ogle, Mercer, Whiteside,

Lee, Rock Island, Henry, Bureau, Putnam,

Henderson, Warren, Knox, Stark, Marshall,

Livingston, Hancock, McDonough, Fulton,

Peoria, Tazewell, Woodford, McLean; and

You are providing services to a River Valley

Commercial member and not a River Valley

Medicare Advantage, Medicaid or CHIP member.

Note: River Valley also offers benefit plans in LA,

NC, OH and SC, but the River Valley Additional

Guide does not apply to those benefit plans.

River Valley Entities Supplement

to this guide.

uhcprovider.com

Sierra or Health Plan of

Nevada:

• Sierra Health and Life

Insurance Co., Inc.

• Health Plan of Nevada, Inc.

• Sierra Healthcare Options,

Inc.

Outside NV only:

The health plan ID card identifies the Sierra or

Health Plan of Nevada members who access the

UnitedHealthcare network outside of Nevada,

and includes the following reference:

UnitedHealthcare Choice Plus Network

Outside Nevada.

Services rendered outside of

Nevada to Sierra or Health Plan of

Nevada members with the ID card

reference described in this row are

subject to your UnitedHealthcare

Agreement and to this guide unless

you are in Arizona or Utah and have

a contract directly with Sierra or

Health Plan of Nevada.

UMR:

• UMR

• UnitedHealthcare Shared

Services (UHSS)

All markets UMR supplement to this guide.

umr.com

UnitedHealthcare Level

Funded

(Previously sold under the

name All Savers® Alternate

Funding)

December 2020: AL, SD, ND, DE

September 2021: All markets

UnitedHealthcare Level Funded

supplement to this guide.

uhcprovider.com

Chapter 1: Introduction

4

2023 UnitedHealthcare Care Provider Administrative Guide

Plan Name Location of most members

subject to additional guides

Location of plan information

UnitedHealthcare West:

(Formerly referenced in this

guide as “PacifiCare”)

• UHC of California dba

UnitedHealthcare of California

(hereinafter referred to

as UnitedHealthcare of

California)

• UnitedHealthcare of

Oklahoma, Inc.

• UnitedHealthcare of

Oregon, Inc.

• UnitedHealthcare Benefits of

Texas, Inc.*

* PacifiCare of Arizona,

PacifiCare of Colorado

and PacifiCare of Nevada

are now referenced as

UnitedHealthcare Benefits of

Texas, Inc.

AZ, CA, CO, NV, OR, TX, WA UnitedHealthcare West

Supplement to this guide.

uhcprovider.com

UnitedHealthOne:

• Golden Rule

Insurance Company

Group #705214

• Oxford Health Insurance, Inc.

Group #908410

All markets

New Jersey

UnitedHealthOne Individual Plans

Supplement to this guide.

uhcprovider.com and

myuhone.com

UnitedHealthcare Freedom

Plans

NH, ME, VT uhcprovider.com

Chapter 1: Introduction

5

2023 UnitedHealthcare Care Provider Administrative Guide

Benefit plans not subject to this guide

Plan name Location of most

members subject to

additional guides

Additional guide/website

Rocky Mountain Health Plan (RMHP) CO rmhp.org

Sierra:

Sierra Health and Life Insurance Co., Inc.

Sierra Healthcare Options, Inc.

Health Plan of Nevada, Inc.

Health Plan of Nevada Medicaid/

Nevada Check Up

NV Benefit plans for Sierra Health and Life Insurance

Company, Inc.

sierrahealthandlife.com/provider

Benefit plans for Sierra Healthcare Options, Inc:

sierrahealthcareoptions.com

Benefit plans for Health Plan of Nevada, Inc:

healthplanofnevada.com/provider

myhpnmedicaid.com/provider

UnitedHealthcare Community Plan

Medicaid, CHIP and Uninsured

Multiple states UnitedHealthcare Community Plan Physician, Health

Care Professional, Facility and Ancillary Administrative

Guide for Medicaid, CHIP, or Uninsured.

uhcprovider.com/communityplan and

uhcprovider.com

Online/interoperability resources and how to contact us

Going digital means less paper and more automation, faster workflow between applications and a quicker claims submission

process to help you get paid faster. Learn the differences by viewing our Digital Solutions Comparison Guide. You will conduct

business with us electronically. This means using electronic means, where allowed by law, to submit claims and receive

payment, and to submit and accept other documents, including prior authorization requests and decisions, and reconsideration

and appeal requests and decisions. Using electronic transactions is fast, efficient, and supports a paperless work environment.

The UnitedHealthcare Provider Portal has tools such as EDI (uhcprovider.com/edi) and API (uhcprovider.com/api) that

provide maximum efficiency in conducting business electronically.

Application Programming Interface (API)

API is becoming the newest digital method in health care to distribute information to health care professionals and business

partners in a timely and effective manner. API is a common programming interface that interacts between multiple applications.

Our API solutions allow you to electronically receive detailed data on claims status and payment, eligibility and benefits, claim

reconsiderations and appeals (with attachments), referrals and documents. Information returned in batch emulates data in the

UnitedHealthcare Provider Portal and complements EDI transactions, providing a comprehensive suite of services. It requires

technical coordination with your IT department, vendor or clearinghouse. The data is in real time and can be programmed to be

pulled repetitively and transferred to your practice management system or any application you prefer. For more information, visit

uhcprovider.com/api.

Electronic Data Interchange (EDI)

EDI is a self-service resource using your internal practice management or hospital information system to exchange transactions

with us through a clearinghouse.

The benefit of using EDI is it permits health care providers to send batch transactions for multiple members and multiple payers

in lieu of logging into different payer websites to manually request information. This is why EDI is usually health care providers’

first choice for electronic transactions.

• Send and receive information faster.

• Identify submission errors immediately and avoid processing delays.

Chapter 1: Introduction

6

2023 UnitedHealthcare Care Provider Administrative Guide

• Exchange information with multiple payers.

• Reduce paper, postal costs and mail time.

• Cut administrative expenses.

The following are EDI transactions available to health care providers:

• Claims (837)

• Eligibility and benefits (270/271)

• Claims status (276/277)

• Referrals and authorizations (278)

• Hospital admission, discharge and observation stay notifications (278N)

• Electronic remittance advice (ERA/835)

Visit uhcprovider.com/edi for more information. Learn how to optimize your use of EDI at uhcprovider.com/optimizeEDI.

Getting started

• If you have a practice management or hospital information system, contact your software vendor for instructions on how to

use EDI in your system.

• Contact clearinghouses to review which electronic transactions can interact with your software system.

Read our Clearinghouse Options page for more information.

Point of Care Assist

TM

When made available by UnitedHealthcare, you will do business with us electronically. Point of Care Assist integrates members’

UnitedHealthcare health data within the Electronic Medical Record (EMR) to provide real-time insights of their care needs,

aligned to their specific member benefits and costs. This makes it easier for you to see potential gaps in care, select labs,

estimate care costs and check prior authorization requirements, including benefit eligibility and coverage details. This helps you

to better serve your patients and achieve better results for your practice. For more information, go to uhcprovider.com/poca.

uhcprovider.com

This public website is available 24/7 and does not require registration to access. You’ll find valuable resources including

administrative and plan-specific policies, protocols and guides, health plans by state, regulatory and practice updates, quality

programs, network news and more. You’ll also find information about our electronic workflow solutions, including Electronic

Data Exchange (EDI), Application Programming Interface (API), and the UnitedHealthcare Provider Portal.

UnitedHealthcare Provider Portal

This secure portal is available at uhcprovider.com. It allows you to access patient information such as eligibility and benefit

information and digital ID cards. You can also perform administrative tasks such as submitting prior authorization requests,

checking claim status, submitting appeal requests, and find copies of PRAs and letters in Document Library. All at no cost to

you and without needing to pick up the phone.

To access the portal, you will need to create or sign in using a One Healthcare ID. To use

the portal:

• If you already have a One Healthcare ID (formerly known as Optum ID), simply go to

uhcprovider.com > Sign In to access the portal.

• If you need to set up an account on the portal, follow these steps to register.

Use the UnitedHealthcare Provider Portal to access information for the following:

• UnitedHealthcare Commercial

• UnitedHealthcare Medicare Advantage

• UnitedHealthcare Community Plan (as contracted by state)

• UnitedHealthcare West

• UnitedHealthcare of the River Valley

Chapter 1: Introduction

7

2023 UnitedHealthcare Care Provider Administrative Guide

• UnitedHealthcare Oxford Commercial

• UnitedHealthcare Individual Exchange Plans

Available benefit plan information varies for each of our UnitedHealthcare Provider Portal tools.

Here are the most frequently used tools:

• Eligibility and Benefits — View patient eligibility and benefits information for most benefit plans. For more information, go to

uhcprovider.com/eligibility.

• Claims — Get claims information for many UnitedHealthcare plans, including access letters, remittance advice documents and

reimbursement policies. For more information, go to uhcprovider.com/claims.

• Prior Authorization and Notification — Submit notification and prior authorization requests. For more information, go to

uhcprovider.com/paan.

• Specialty Pharmacy Transactions — Submit notification and prior authorization requests for certain medical injectable drugs

by selecting the Prior Authorization dropdown in the UnitedHealthcare Provider Portal landing page. You will be directed to

Prior Authorization and Notification capability to complete your requests.

• My Practice Profile — View and update

1

your health care provider demographic data that UnitedHealthcare members see for

your practice. For more information, go to uhcprovider.com/mpp.

• Document Library — Access reports and correspondence from many UnitedHealthcare plans for viewing, printing or

download. For more information on the available correspondence, go to uhcprovider.com/documentlibrary.

• Paperless Delivery Options — Eliminate paper mail correspondence. In Document Library, you can set up daily or weekly

email notifications to alert you when we add new letters to your Document Library. With our delivery options, you decide when

and where the emails are sent for each type of correspondence. This tool is available to One Healthcare ID Primary Access

Administrators only.

You can learn more about the portal and access self-paced user guides for many of the

tools and tasks available in the portal.

UnitedHealthcare Web Support:

providertechsuppor[email protected] or 1-866-842-3278, option 1. Monday-Friday, 7 a.m. – 9 p.m. CT.

1

For more instructions, visit uhcprovider.com/training.

Chapter 1: Introduction

8

2023 UnitedHealthcare Care Provider Administrative Guide

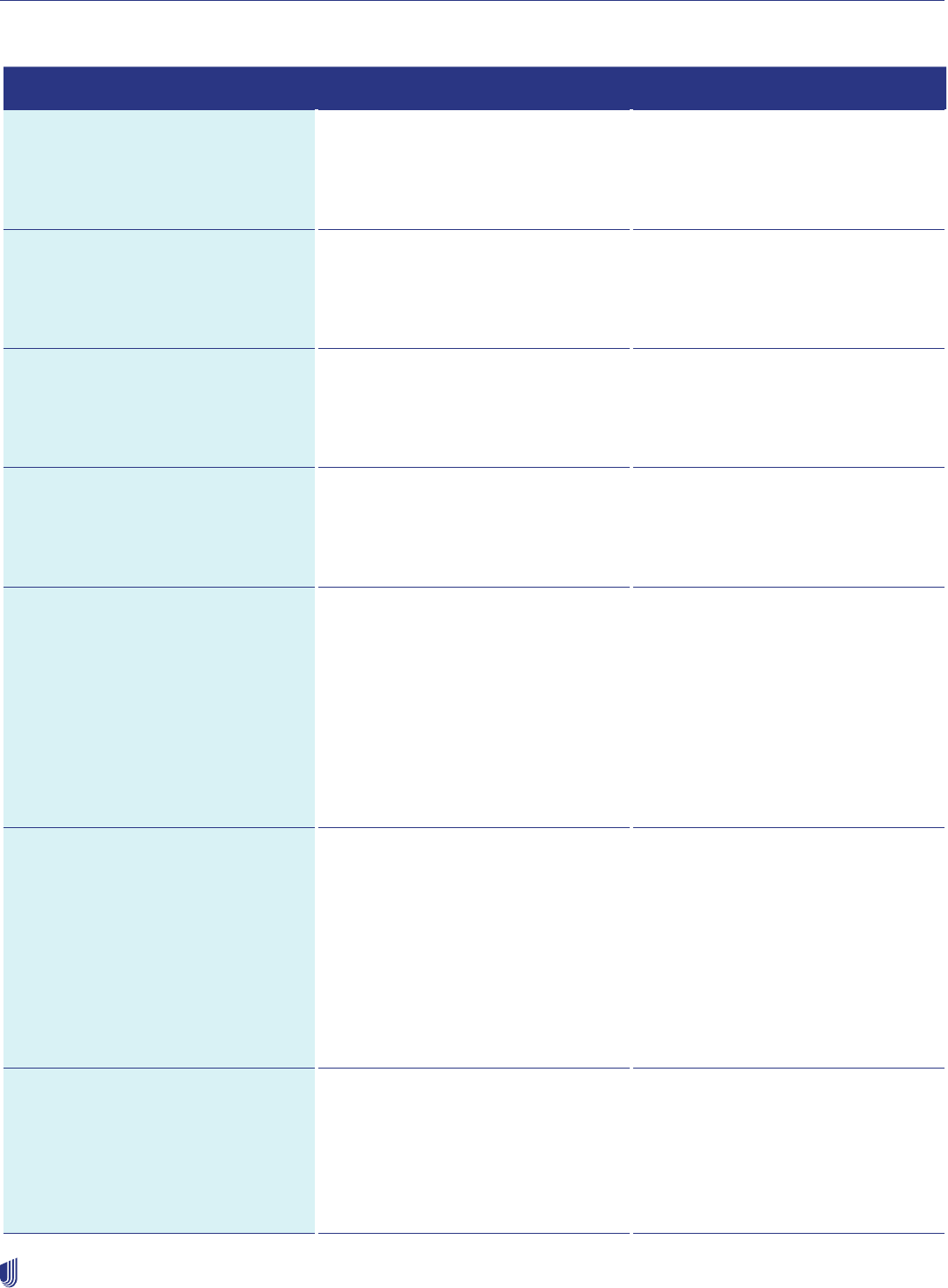

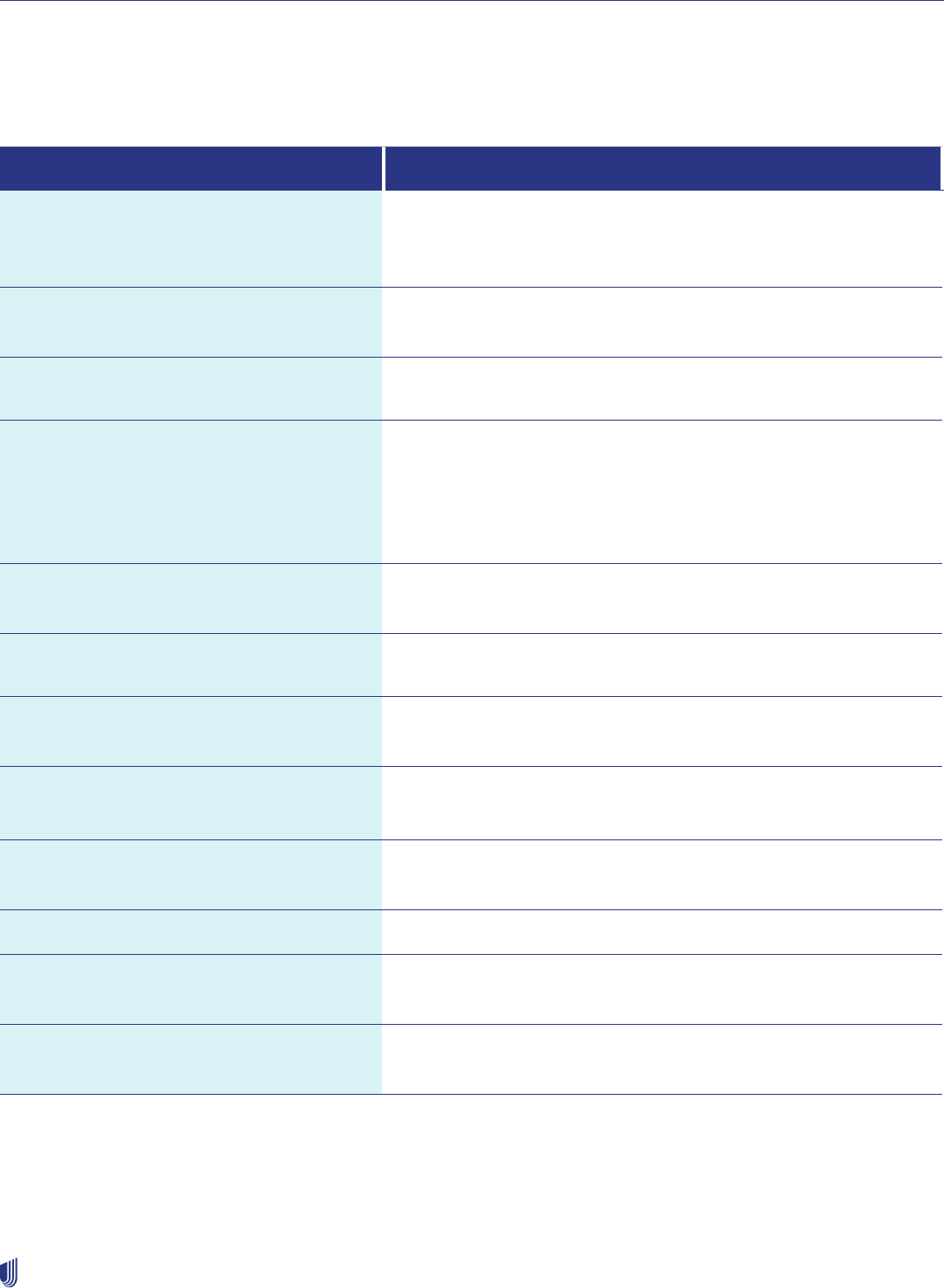

Online resources and how to contact us

Online resources and how to contact us Where to go

How to Join Our Network For instructions on joining the UnitedHealthcare provider network, go to

uhcprovider.com/join. There you will find guidance on our credentialing

process, how to sign up for online tools and other helpful information.

UnitedHealthcare Provider Website uhcprovider.com

Resources:

• Administrative guides for network health care providers

• Plan-specific policies, protocols and guidelines

• Health plans by state

• News, regulatory and practice updates

• Guidance on common member- and claim-related tasks, including

eligibility and benefit verification, prior authorization and referral

requirements, and claims submissions and payments

• Information on our electronic workflow solutions, including Electronic

Data Interchange (EDI), Application Programming Interface (API) and the

UnitedHealthcare Provider Portal.

Advance Notification, Prior Authorization and

Admission, Discharge and Observation Stay

Notification

(To submit and get status information)

EDI: See EDI transactions and code sets on uhcprovider.com/edi

Online: Go to the UnitedHealthcare Provider Portal: uhcprovider.com >

Sign In to get started.

Information: Go to uhcprovider.com/priorauth and select the specialty

you need.

Phone: 1-877-842-3210 (Provider Service Voice Portal)

1-888-478-4760 (Individual Exchange Plans)

See ID card for specific service contact information.

Air Ambulance Non-Emergency Transport Online: uhcprovider.com/findprovider

Appeal – (Clinical) Urgent Submission

(Commercial members)

(Medicare Advantage – follow the directions in

the customer decision letter)

All Savers, Golden Rule Insurance Company

and UnitedHealthcare Oxford Navigate

Individual

An expedited appeal may be available if the time needed to complete a

standard appeal could seriously jeopardize the member’s life, health or

ability to regain maximum function.

Urgent medical fax: 1-801-994-1083

Urgent pharmacy fax: 1-801-994-1058

Urgent appeal fax: 1-866-654-6323

For Individual Exchanges:

Urgent medical fax: 1-888-808-9123

Application Programming Interface (API) Online: uhcprovider.com/api

Cardiology and Radiology

Notification/Prior Authorization

–Submission and Status

Online: Go to the UnitedHealthcare Provider Portal: uhcprovider.com >

Sign In to get started.

Information: Go to uhcprovider.com/priorauth and select the specialty

you need.

Phone: 1-866-889-8054

Chapter 1: Introduction

9

2023 UnitedHealthcare Care Provider Administrative Guide

Online resources and how to contact us Where to go

Chiropractic, Physical Therapy, Occupational

Therapy and Speech Therapy Providers

(Contracted with Optum Physical Health, a

UnitedHealth Group company)

Online: myoptumhealthphysicalhealth.com

Phone: 1-800-873-4575

Claims

(Filing, payments, reconsiderations)

EDI: uhcprovider.com/edi837 Learn more about the types of claims you

can file using EDI and view our claims payer list to identify the correct

payer ID.

Online: Go to UnitedHealthcare Provider Portal: uhcprovider.com > Sign

In to get started.

Information: uhcprovider.com/claims for policies, instructions and tips.

Phone: 1-877-842-3210 (follow the prompts for status information)

1-888-478-4760 (Individual Exchange Plans)

Optum Pay Online: optum.com/optumpay

Help Desk: 1-877-620-6194

Electronic Data Interchange (EDI)

and EDI Support

Online: uhcprovider.com/edi

Help: uhcprovider.com/edicontacts

Phone: 1-800-842-1109 (Monday–Friday, 7 a.m.–9 p.m. CT)

UnitedHealthcare EDI Support

Online: EDI Transaction Support Form

Email: suppor[email protected]

Phone: 1-800-842-1109

UnitedHealthcare Community Plan EDI Support

Online: EDI Transaction Support Form

Email: [email protected]

Phone: 1-800-210-8315

Fraud, Waste and Abuse

(Report potential fraud, waste

or abuse concerns)

Online: uhc.com/fraud, select the “Report a concern” icon.

Phone: 1-844-359-7736

Phone: 1-877-842-3210 (United Voice Portal)

For more information on fraud, waste and abuse prevention efforts, refer

to Chapter 17: Fraud, Waste and Abuse.

Genetic and Molecular Testing Online: Go to the UnitedHealthcare Provider Portal: uhcprovider.com >

Sign In to get started.

Information: Go to uhcprovider.com/priorauth and select the specialty

you need.

Member/Customer Care Online: myuhc.com

Phone: 1-877-842-3210 or the number listed on the back of the ID card

Mental Health and Substance Use Services See ID card for carrier information and contact numbers.

Chapter 1: Introduction

10

2023 UnitedHealthcare Care Provider Administrative Guide

Online resources and how to contact us Where to go

Outpatient Injectable Chemotherapy and

Related Cancer Therapies

Online: Go to the UnitedHealthcare Provider Portal: uhcprovider.com >

Sign In to get started.

Information: Go to uhcprovider.com/priorauth and select the specialty

you need.

Phone: 1-888-397-8129

Pharmacy Services Online: professionals.optumrx.com

Phone: 1-800-711-4555

Provider Advocates

For participating hospitals, health care, and

ancillary providers; locate your physician or

hospital advocate

Online: uhcprovider.com > Contact us > State-specific health plan and

network support

Provider Directory uhcprovider.com/findprovider

Radiation Therapy Prior Authorization For members:

Online:

1. Go to the UnitedHealthcare Provider Portal: uhcprovider.com > Sign

In to access the Prior Authorization and Notification tool.

2. Select Radiology, Cardiology, Oncology and Radiation Oncology

Transactions.

3. Select the service type Radiation Oncology

4. Select one of the product types: Commercial, Exchanges, Medicaid,

Medicare, or Oxford.

Phone: 1-888-397-8129 (8 a.m. – 5 p.m. local time Monday-Friday)

Referral Submission and Status

You can determine if a member’s benefit

plan requires a referral when you view their

eligibility profile.

EDI: 278 transaction

API: Referral API details are online at uhcprovider.com/api

Online: Go to the UnitedHealthcare Provider Portal: uhcprovider.com >

Sign In to get started.

Information: uhcprovider.com/referrals

Note: Submitted referrals are effective immediately but may not be

viewable for 48 hours.

Skilled Nursing Facilities

(Free-standing)

Online: uhcprovider.com/skillednursing

Phone: 1-877-842-3210 (Provider Service)

1-888-478-4760 (Individual Exchange Plans)

Subrogation Online: subroreferrals.optum.com

Fax: 1-800-842-8810

Mail: Optum

11000 Optum Circle

MN102-0300

Eden Prairie, MN 55344

Transplant Services See ID card for carrier information and contact numbers.

Vision Services See ID card for carrier information and contact numbers.

11

2023 UnitedHealthcare Care Provider Administrative Guide

Chapter 2:

Provider responsibilities and standards

Verifying eligibility, benefits and your network

participation status

Check the member’s eligibility and benefits prior to providing care. Doing this:

• Helps ensure you submit the claim to the correct payer.

• Allows you to collect copayments.

• Determines if a referral, prior authorization or notification is required.

• Reduces denials for non-coverage.

One of the primary reasons for claims rejection is incomplete or inaccurate eligibility information.

There are 4 easy ways to verify eligibility and benefits as shown in the Online/interoperability resources and how to contact

us section in Chapter 1: Introduction.

Eligibility grace period for Individual Exchange Plan members

When individuals enroll in a health benefit plan through the Health Insurance Marketplace (also known as Individual Exchange),

the plans are required to provide a 3-month grace period before terminating coverage. The grace period applies to those who

receive federal subsidy assistance in the form of an advanced premium tax credit and who have paid at least 1 full month’s

premium within the benefit year. Additionally, for individuals who do not receive federal subsidy assistance, plans are required

to provide a grace period consistent with state law (typically 30 or 31 calendar days) before terminating coverage.

You can verify if the member is within the grace period when you verify eligibility.

Refer to the Chapter 4: Individual Exchange Plans for more information.

Understanding your network participation status

Your network status is not returned on 270/271 transactions. Know your status prior to submitting 270 transactions. As our

product portfolio evolves and new products are introduced, it is important for you to confirm your network status for the medical

or pharmacy benefit plan (and tier status for commercial tiered benefit plans) while checking eligibility and benefits in the

UnitedHealthcare Provider Portal or by calling us at 1-877-842-3210 or 1-888-478-4760 (Individual Exchange Plans). If you

are not participating in the member’s benefit plan or are outside the network service area for the benefit plan, the member may

have higher costs or no coverage.

Commercial only

For more information about tiered benefit plans, visit uhcprovider.com/plans > Select your state > Commercial >

UnitedHealthcare Tiered Benefit Plans.

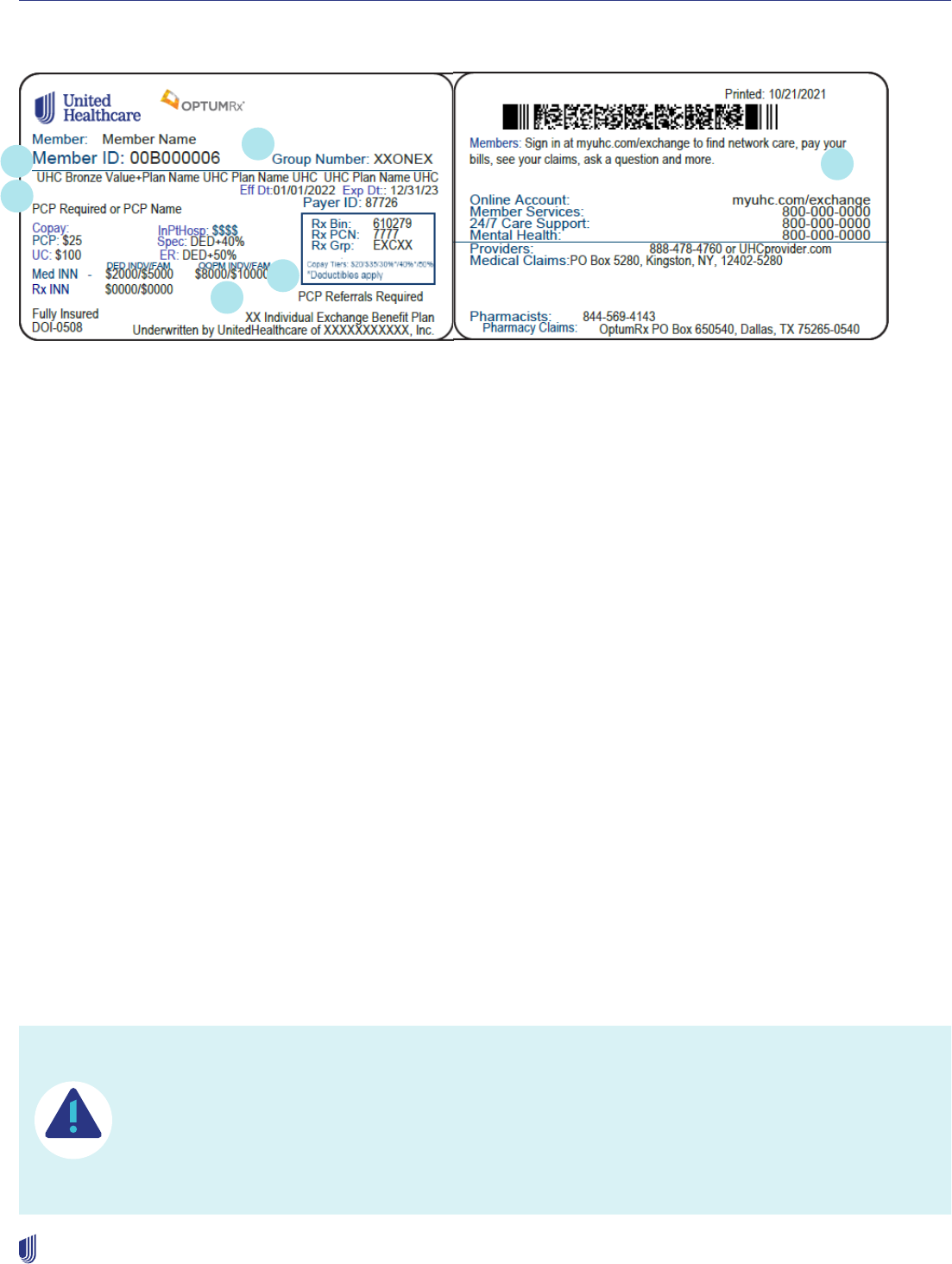

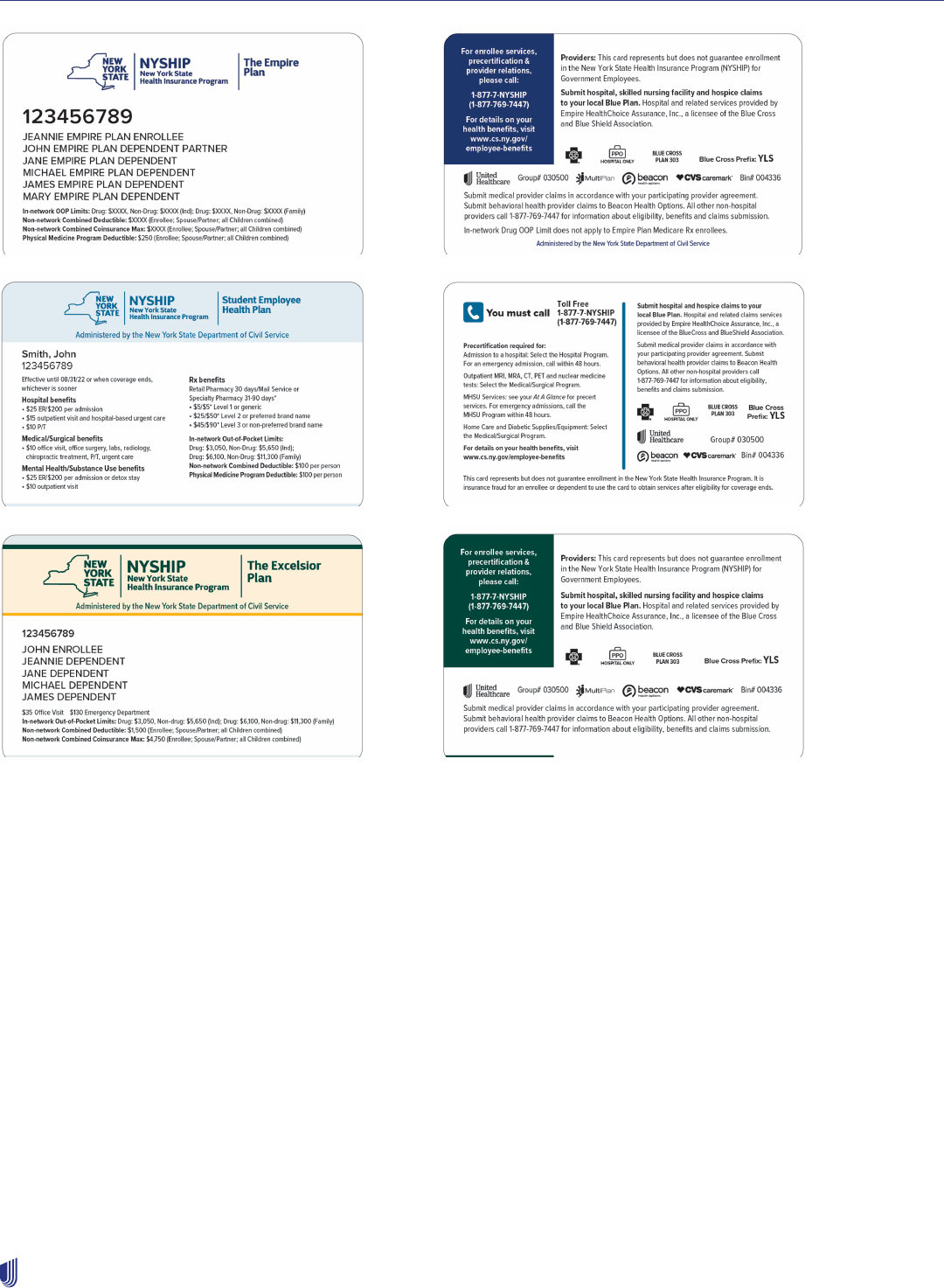

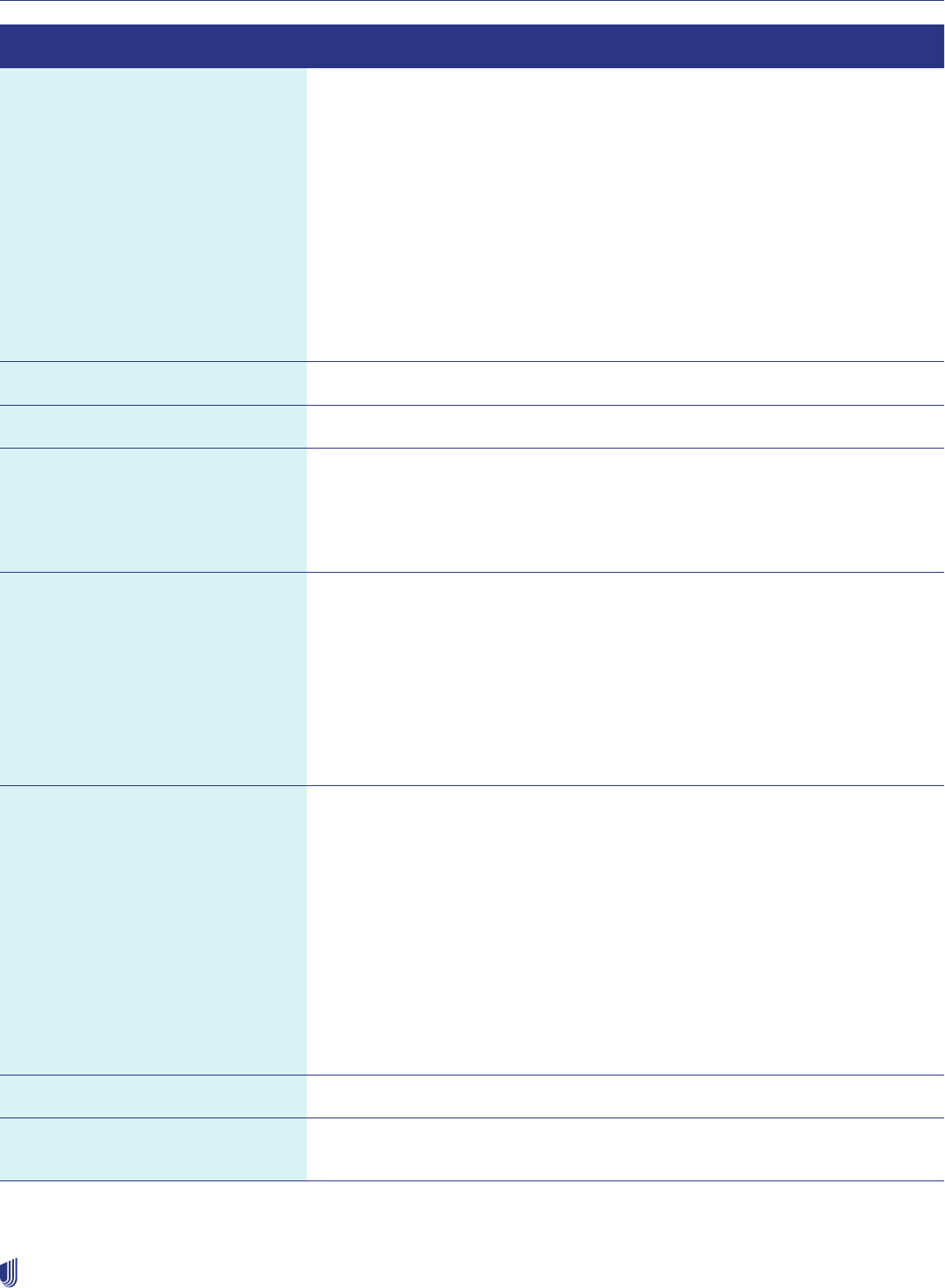

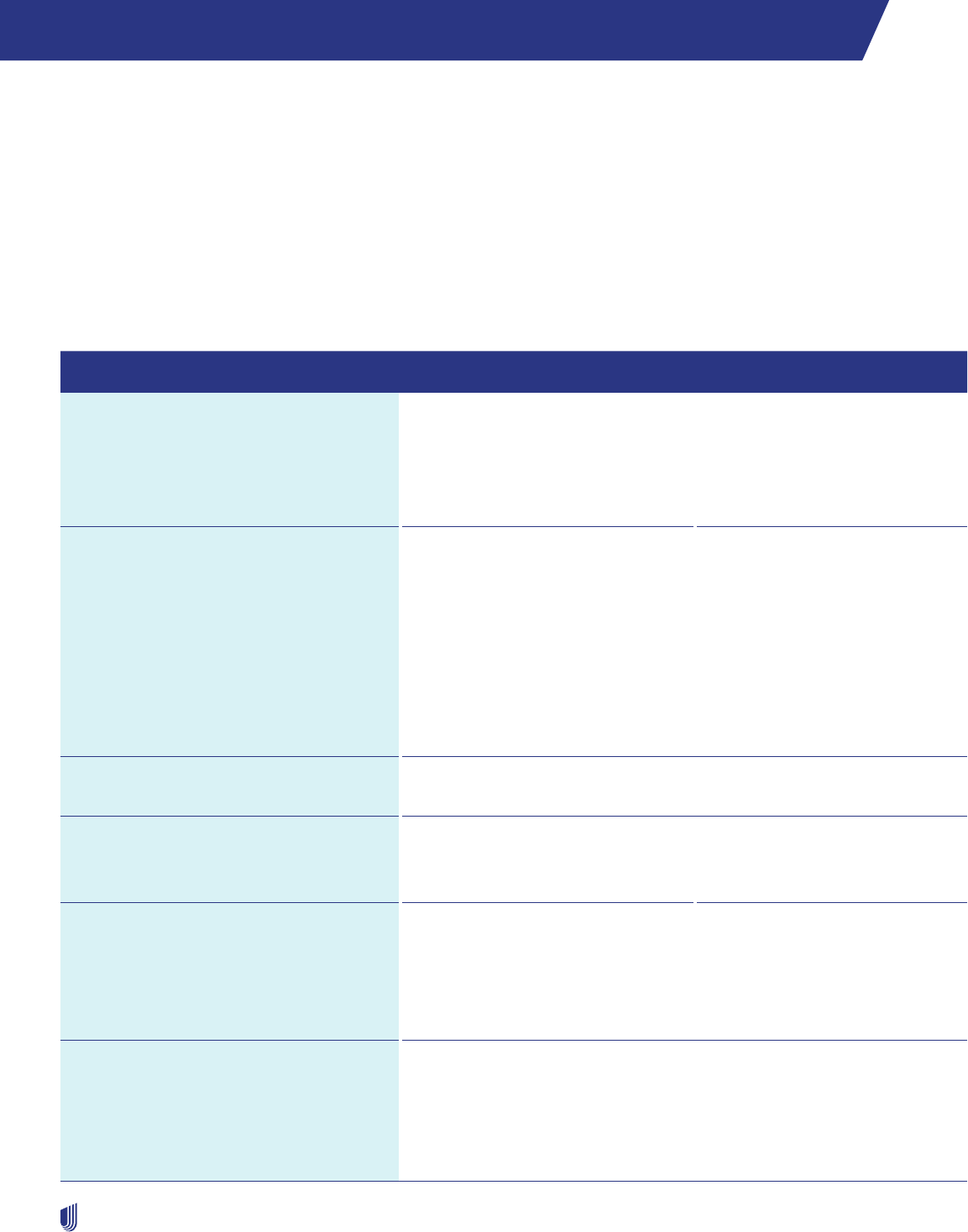

Health plan identification (ID) cards

We are moving towards eliminating physical ID cards, and members may not have one if not required by law. Use the Eligibility

and Benefits tool in the UnitedHealthcare Provider Portal to see a digital version of the ID card. You’ll also be able to access

member-specific information around plan benefits and requirements. Sample member ID cards are for illustration only; actual

information varies depending on payer, plan and other requirements.

Chapter 2: Provider responsibilities and standards

12

2023 UnitedHealthcare Care Provider Administrative Guide

View and download current ID cards for most

members using the Eligibility and Benefits tool in the

UnitedHealthcare Provider Portal. You can also view

member eligibility and benefits through an API solution.

You may download and keep a copy of both sides of the health plan ID card for your records. Possession of a physical ID card

is not proof of eligibility.

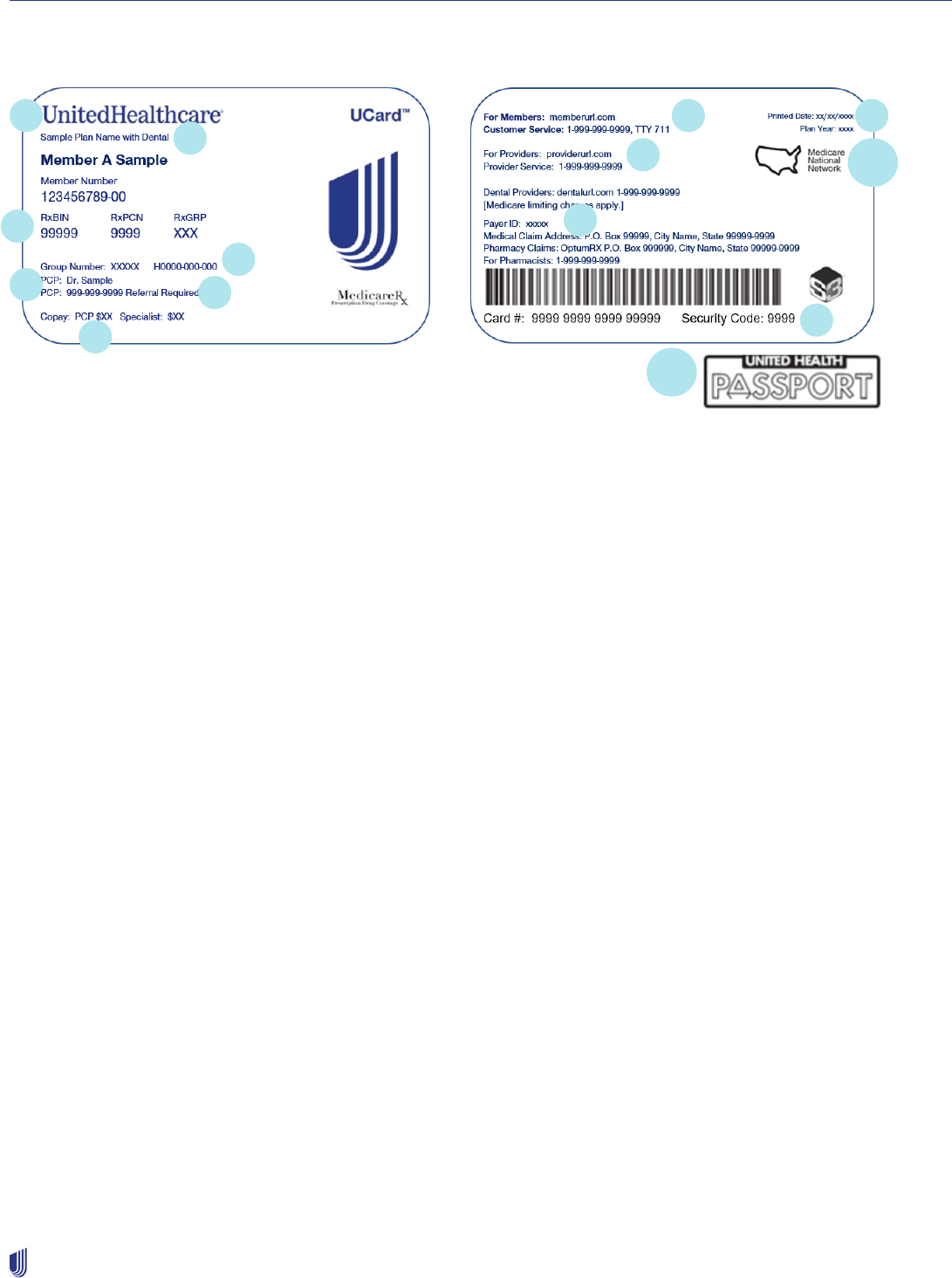

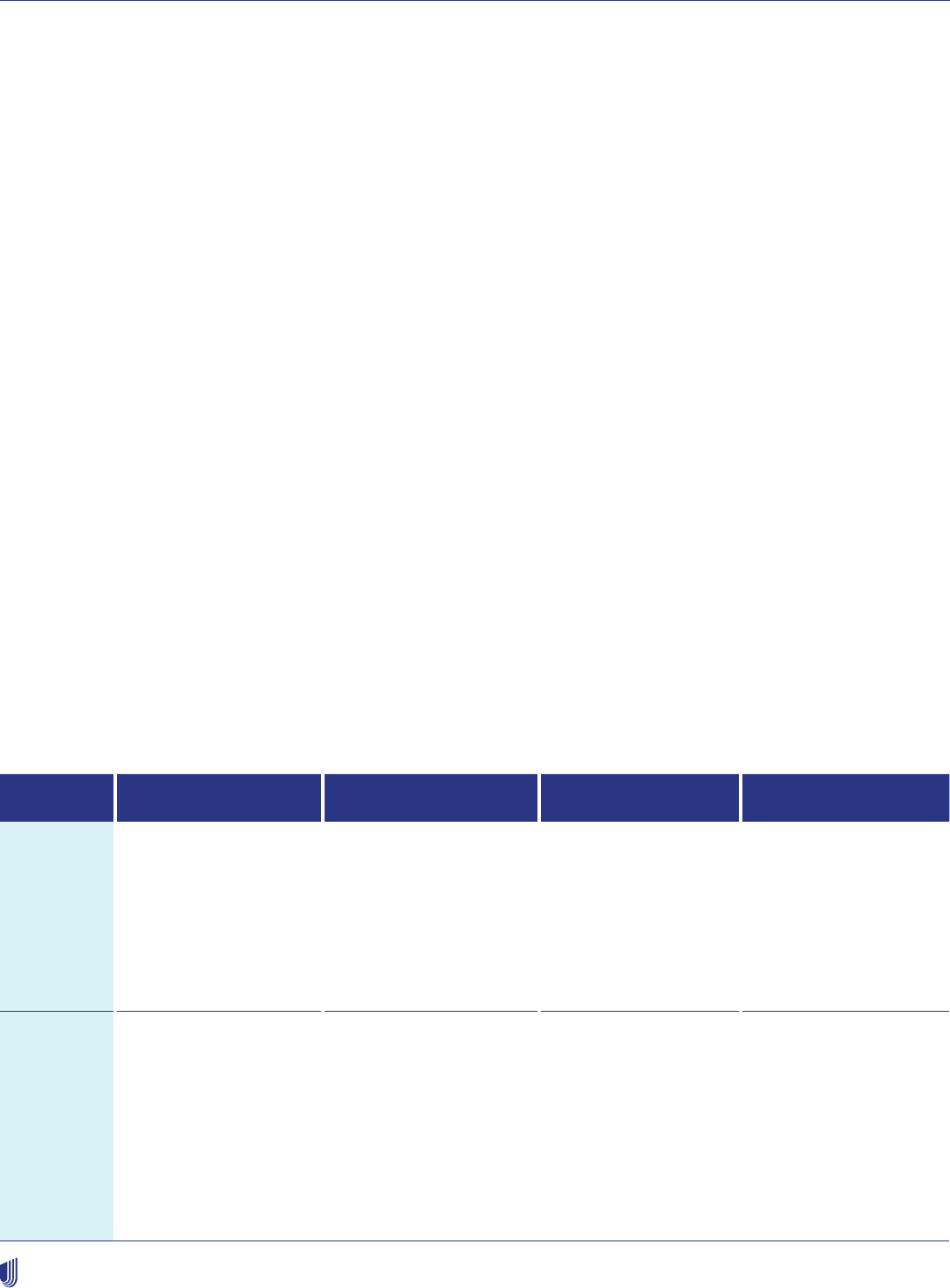

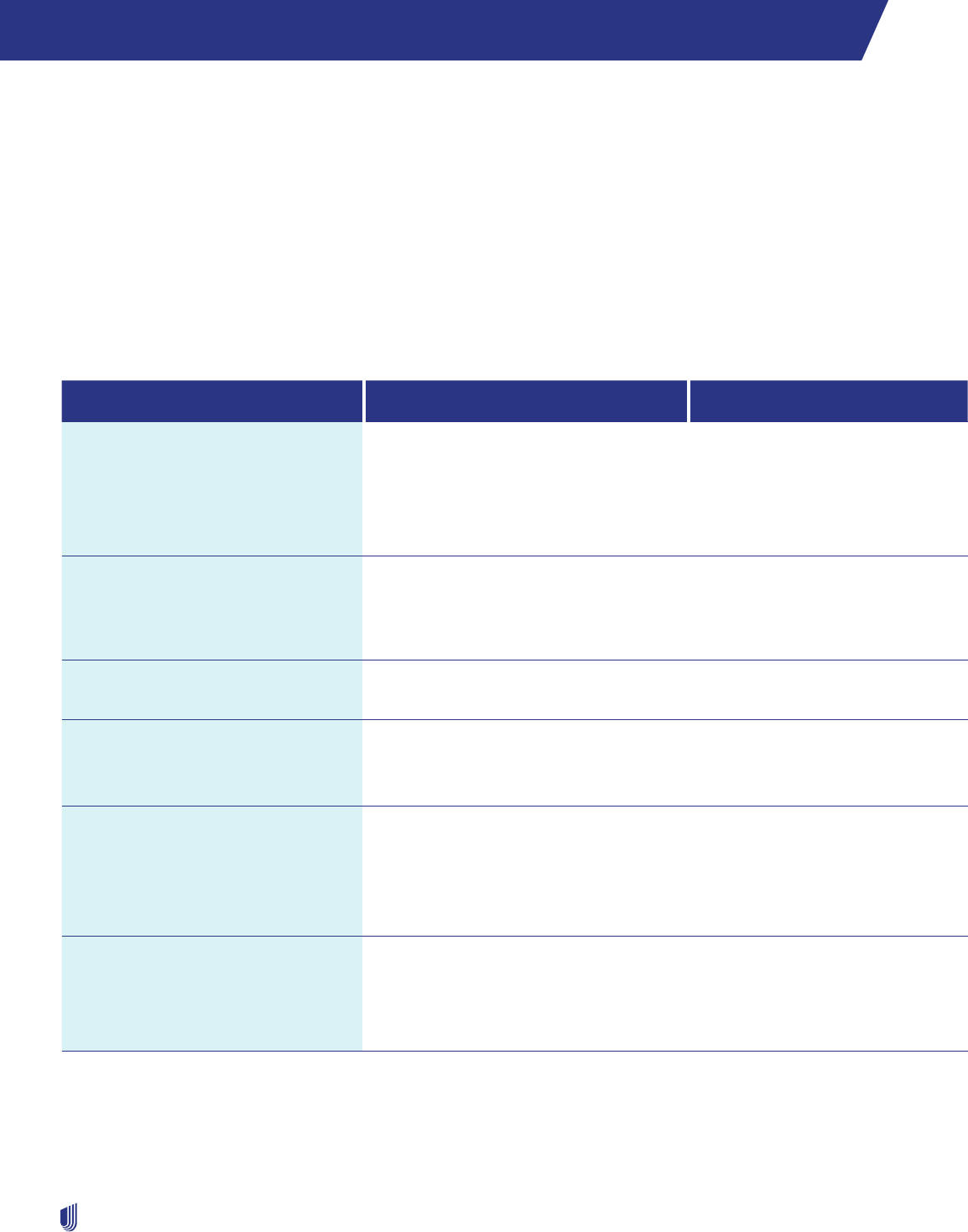

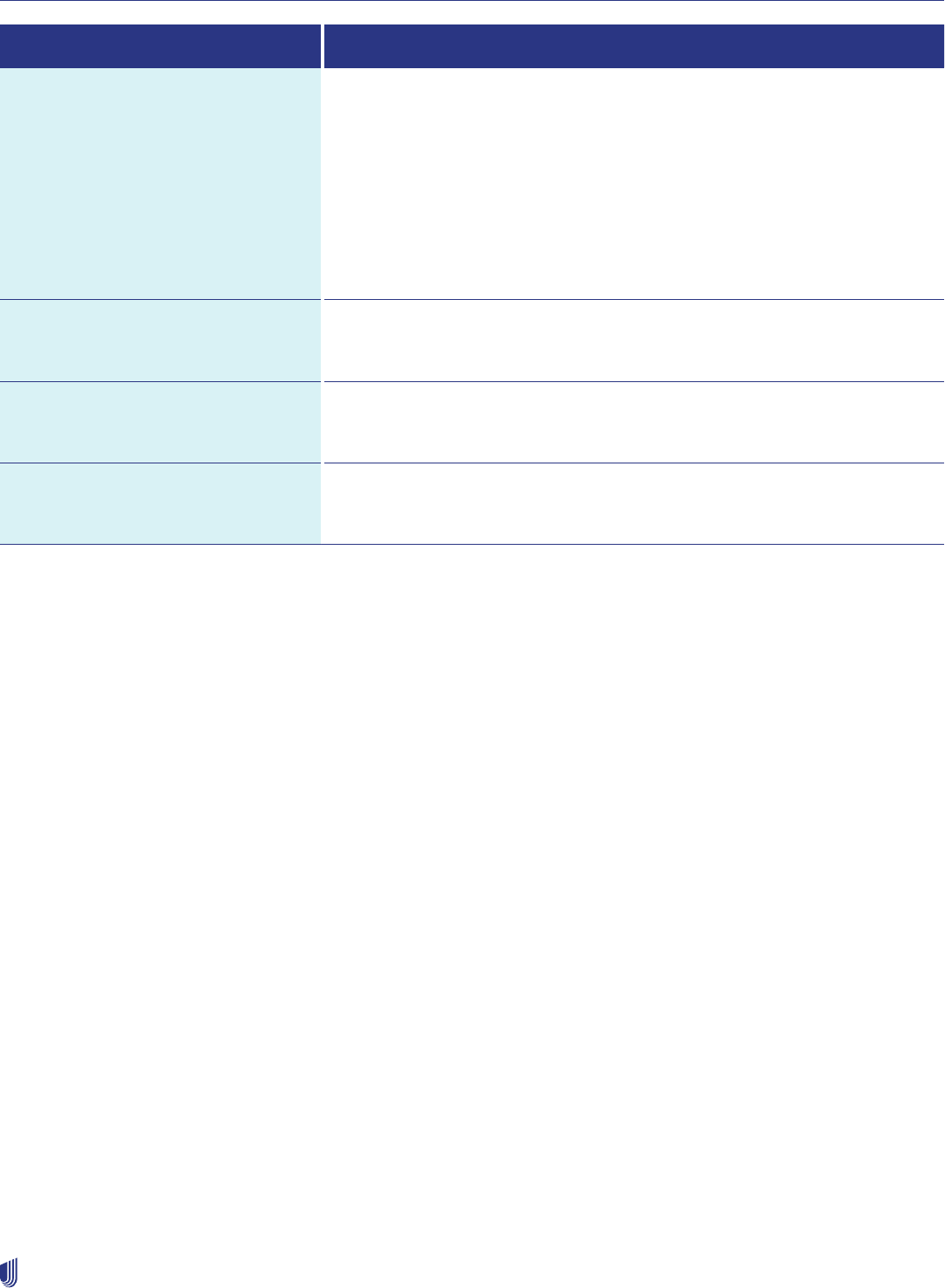

Commercial health plan ID card legend

Front Back

Member ID: Group Number:

Member:

Office: $99

Referrals Required

UrgCare: $99

Rx Bin:

610279

Rx PCN:

9999

Rx Grp:

UHEALTH

UnitedHealthcare Navigate

Underwritten by UnitedHealthcare Insurance Company

DOI-0508

ER: $99

Payer ID 87726

Copays:

999999999 999999

Customer Name Line 1

PCP:

FIRSTNAME LASTNAME

PCP Phone: (999) 999-9999

Spec: $99

MEMBER SMITH

Customer Name Line 2

INN: $99999/$99999 $99999/$99999

Tier 1: $99999/$99999 $99999/$99999

OON: $99999/$99999 $99999/$99999

Coins 99%

Ded IND/FAM OOPM IND/FAM

Ded IND/FAM

OOPM IND/FAM

$99999/$99999

$99999/$99999

$99999/$99999

$99999/$99999

INN:

OON:

Printed: 10/17/21

Members: We're here to help. Check benets, view claims, nd

a doctor, ask a question and more.

Web:

myuhc.com

Phone:

Providers:

UHCprovider.com 877-842-3210 or

Medical Claims:

555-555-5555

Pharmacy Claims: OptumRx PO Box 650540 Dallas, TX 75265-0540

Pharmacists:

888-290-5416

PO Box 740825, Atlanta GA 30374-0825

1. UnitedHealthcare brand: This includes UnitedHealthcare, All Savers, UnitedHealthcare Level Funded, UnitedHealthcare

Oxford Level Funded, Golden Rule, UnitedHealthcare Oxford, UnitedHealthOne, UMR and UnitedHealthcare Shared

Services (UHSS), UnitedHealthcare Freedom Plans.

2. Member Plan Identifier: This is a customized field to describe the member’s benefit plan (i.e., Individual Exchange, Tiered

Benefits, ACO).

3. Payer ID: Indicates claim can be submitted electronically using the number shown on card. Contact your vendor or

clearinghouse to set up payer in your system, if necessary.

4. PCP name and phone number: Included for benefit plans that have PCP selection requirements. For Individual Exchange

Members “PCP required” is listed in place of the PCP name and number. This section may also include Laboratory (LAB),

Preferred Lab Network (PLN) and Radiology (RAD) participant codes.

5. Copay information: If this area is blank, the member is not required to make a copay at the time of service.

6. Benefit plan name: identifies the applicable benefit plan name.

7. Referral requirements identifier: Identifies plans with referral requirements. Requires PCP to send electronic referrals.

8. For members section: Lists benefit plan contact information and, if applicable, referrals and notifications information.

9. For providers section: Includes the prescription plan name.

1

5

3

4

2

9

6

8

7

Chapter 2: Provider responsibilities and standards

13

2023 UnitedHealthcare Care Provider Administrative Guide

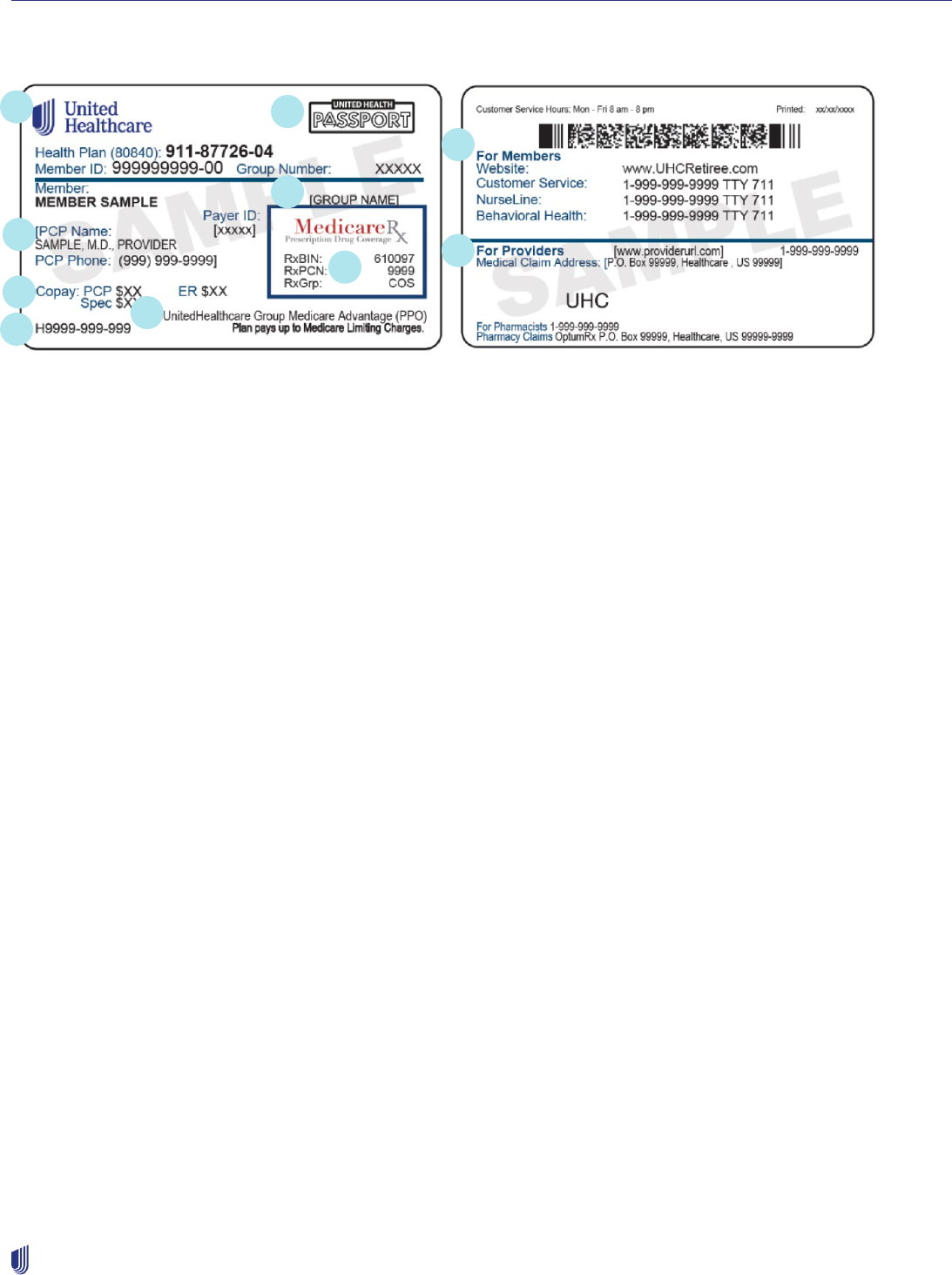

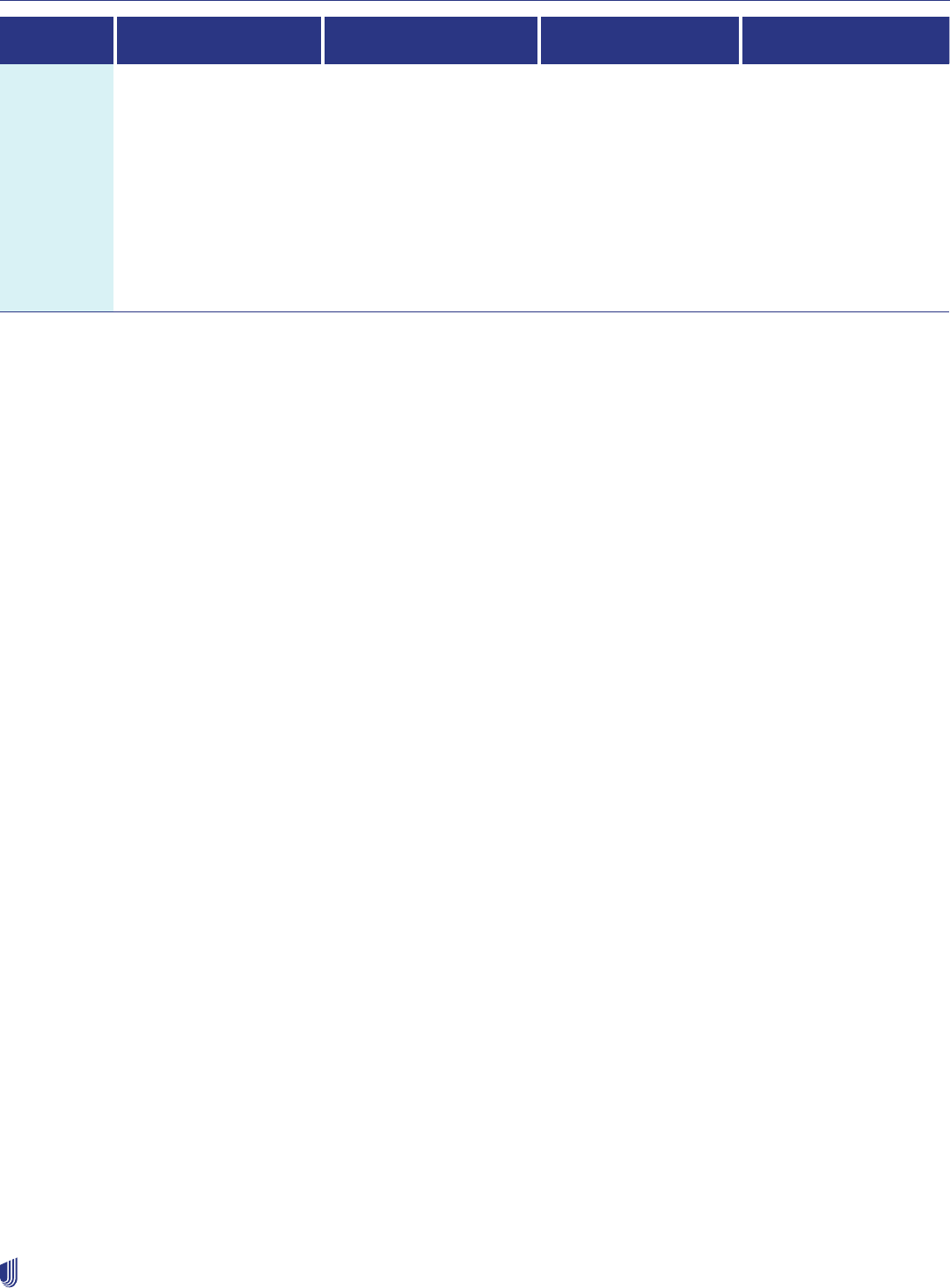

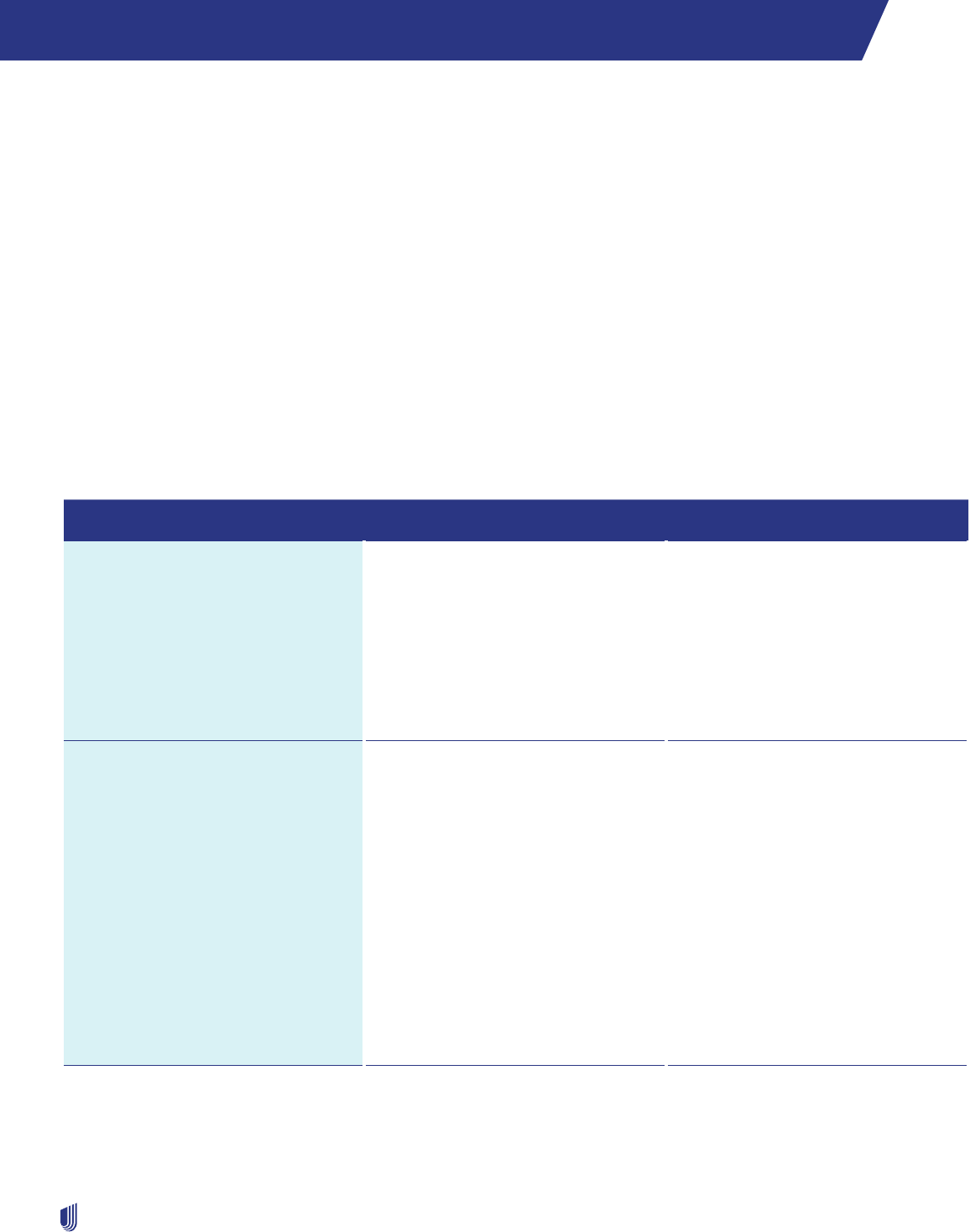

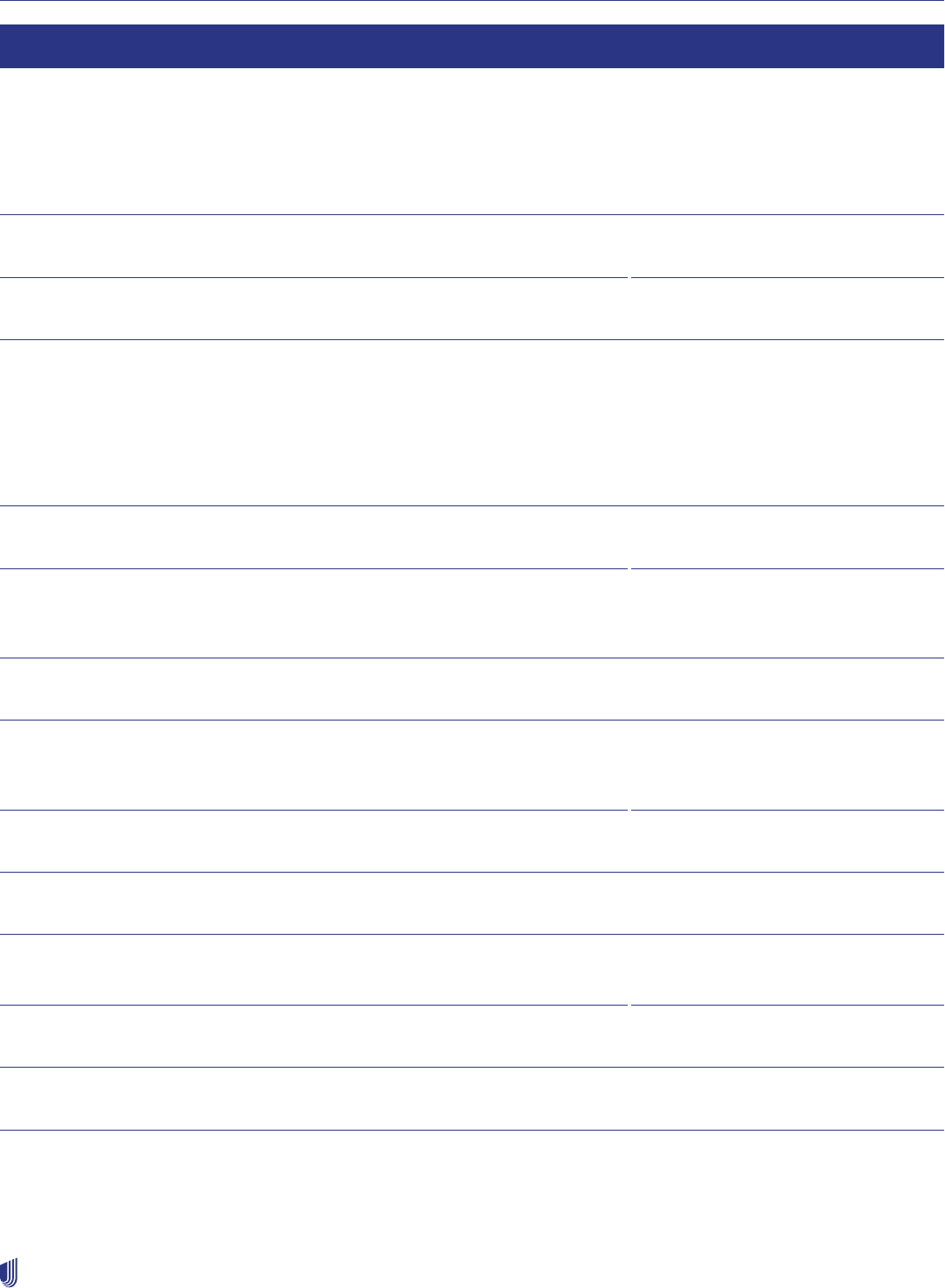

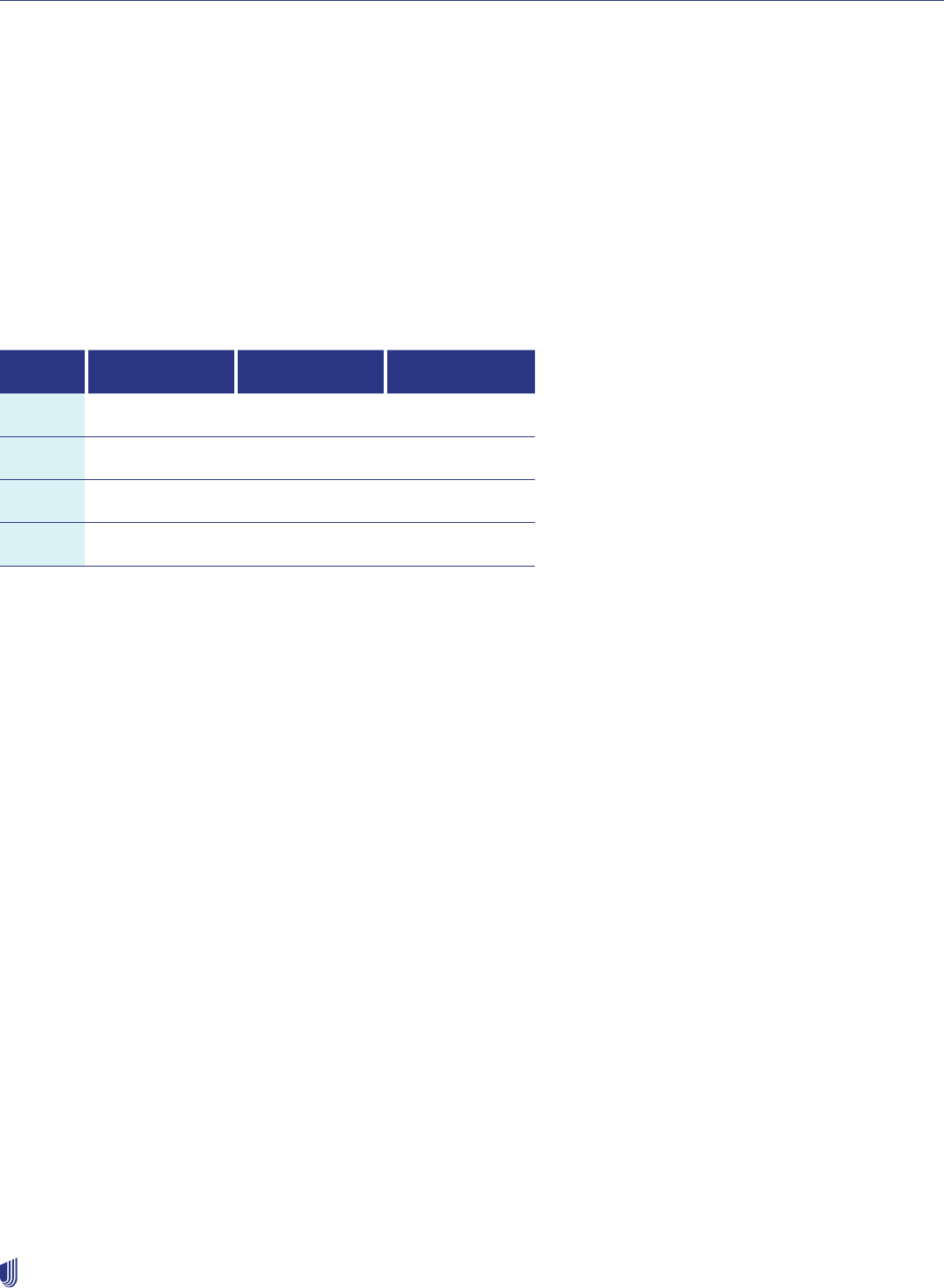

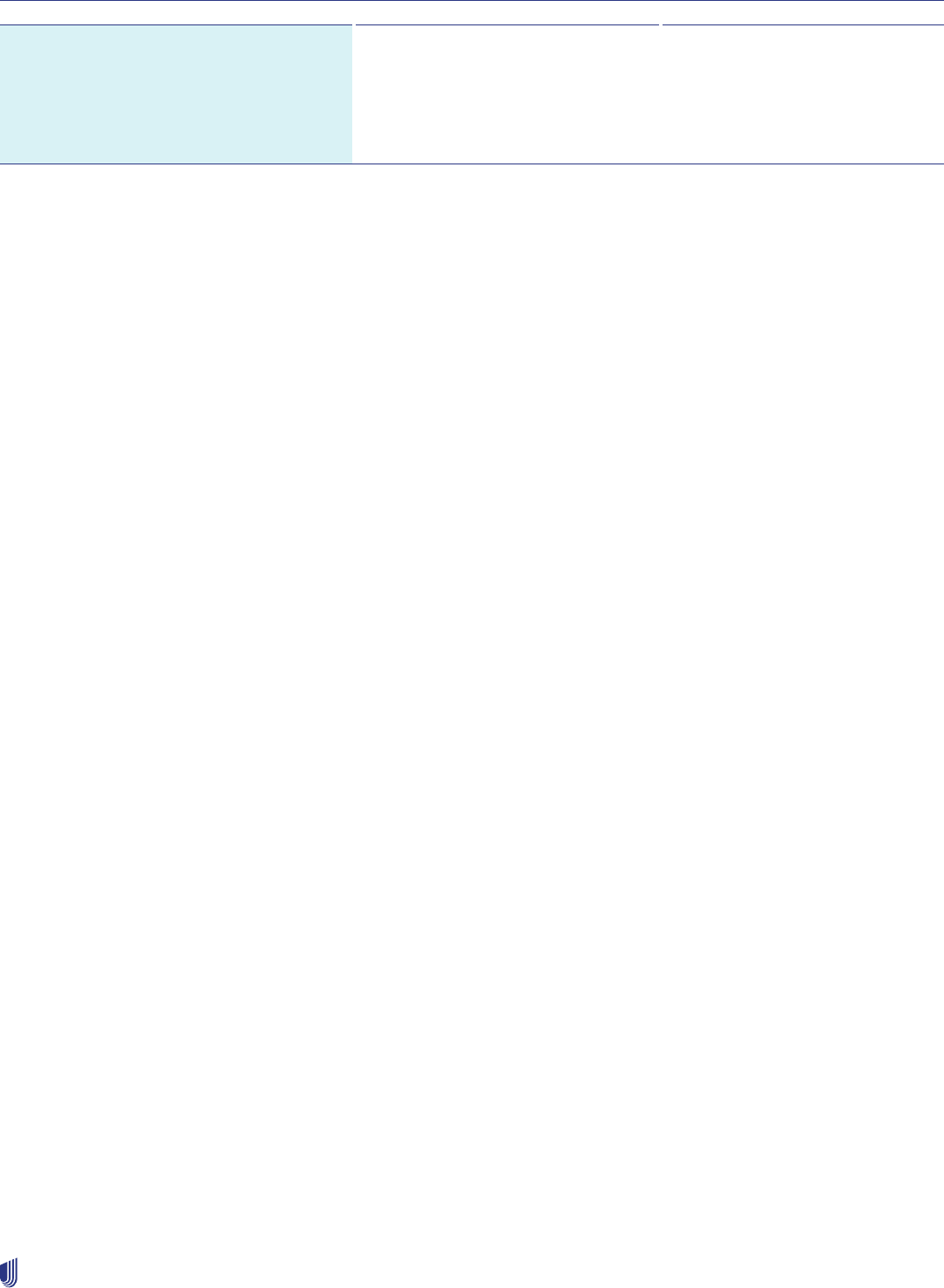

Medicare Advantage (MA) member ID card legend

Front Back

1. Benefit plan name: Identifies the applicable benefit plan name.

2. Dental benefits: Included if routine dental benefits are part of the benefit plan and/or if the member purchased an

optional supplemental dental benefit rider.

3. Prescription information: If the benefit plan includes Part D prescription drug coverage, the Rx BIN, PCN and Group

code are visible. If Part D coverage is not included, this area lists information for Medicare Part B Drugs.

4. Plan ID number: Identifies the plan ID number that corresponds to Centers for Medicare & Medicaid Services (CMS)

filings.

5. PCP: Included for benefit plans that require a PCP selection.

6. Referrals required: Identifies benefit plans with referral requirements. Refer to the Medicare Advantage (MA) Referral

Required Plans section in Chapter 6: Referrals for more detailed information.

7. Copay information: Select plans do not list copay information or may have a variance.

8. For members: Lists benefit plan contact information for the member.

9. For providers: Lists benefit plan contact information for the health care provider.

10. Plan Year: The year (1/1-12/31) during which plan benefits apply.

11a. Network Logo: If the Medicare National Network logo is present, the member has access to the national network.

11b. UnitedHealth Passport Logo: If the UnitedHealth Passport logo is present, the member’s plan has the Passport travel

benefit.

12. Payer ID: Indicates claim can be submitted electronically using the number shown on card. Contact your vendor or

clearinghouse to set up payer in your system, if necessary.

13. S3 Bar code, logo, card number and security code: S3 technology allows UnitedHealthcare to direct members to

approved products for in-store purchase.

1

2

3

4

5

6

7

8

12

10

11a

9

13

11b

Chapter 2: Provider responsibilities and standards

14

2023 UnitedHealthcare Care Provider Administrative Guide

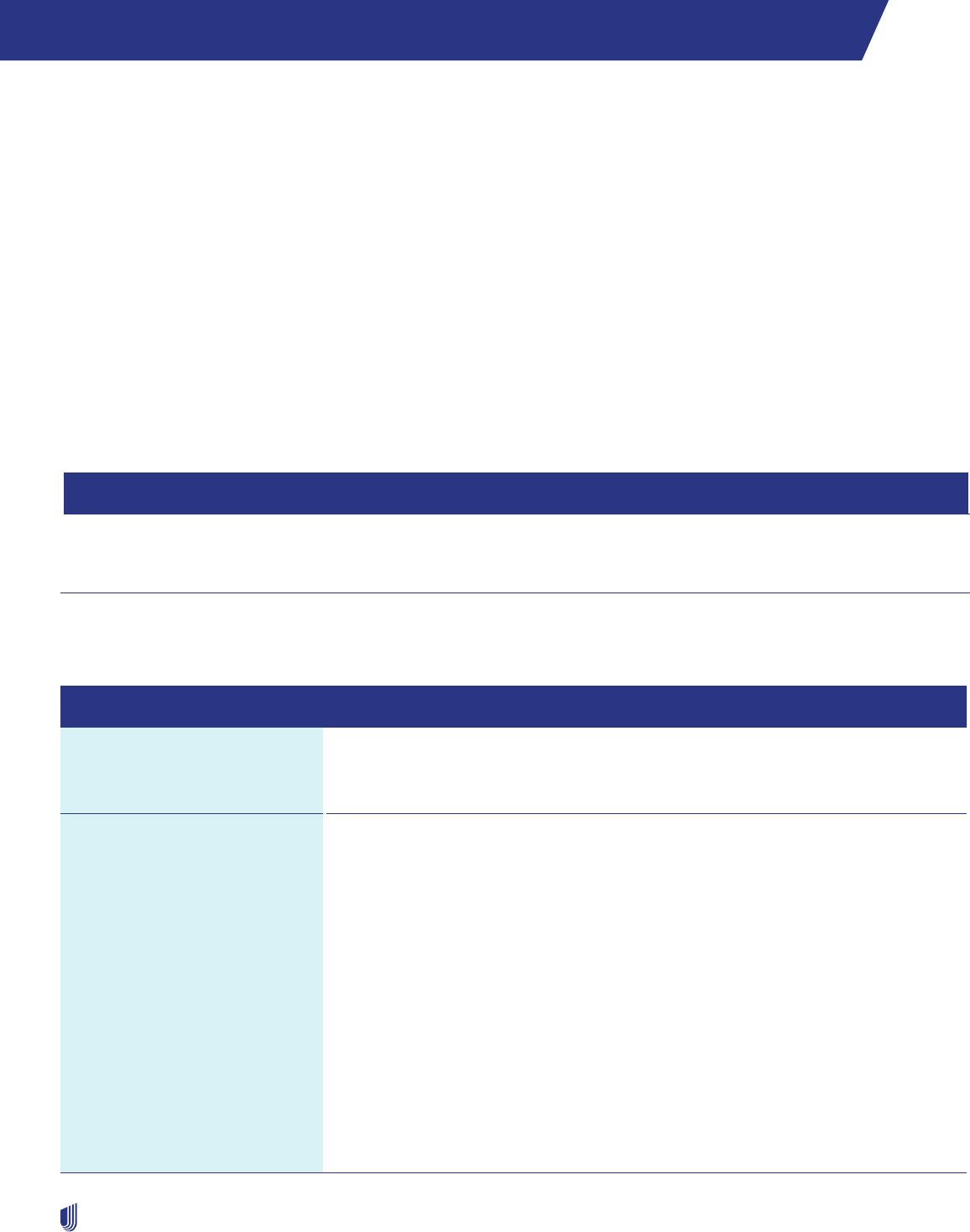

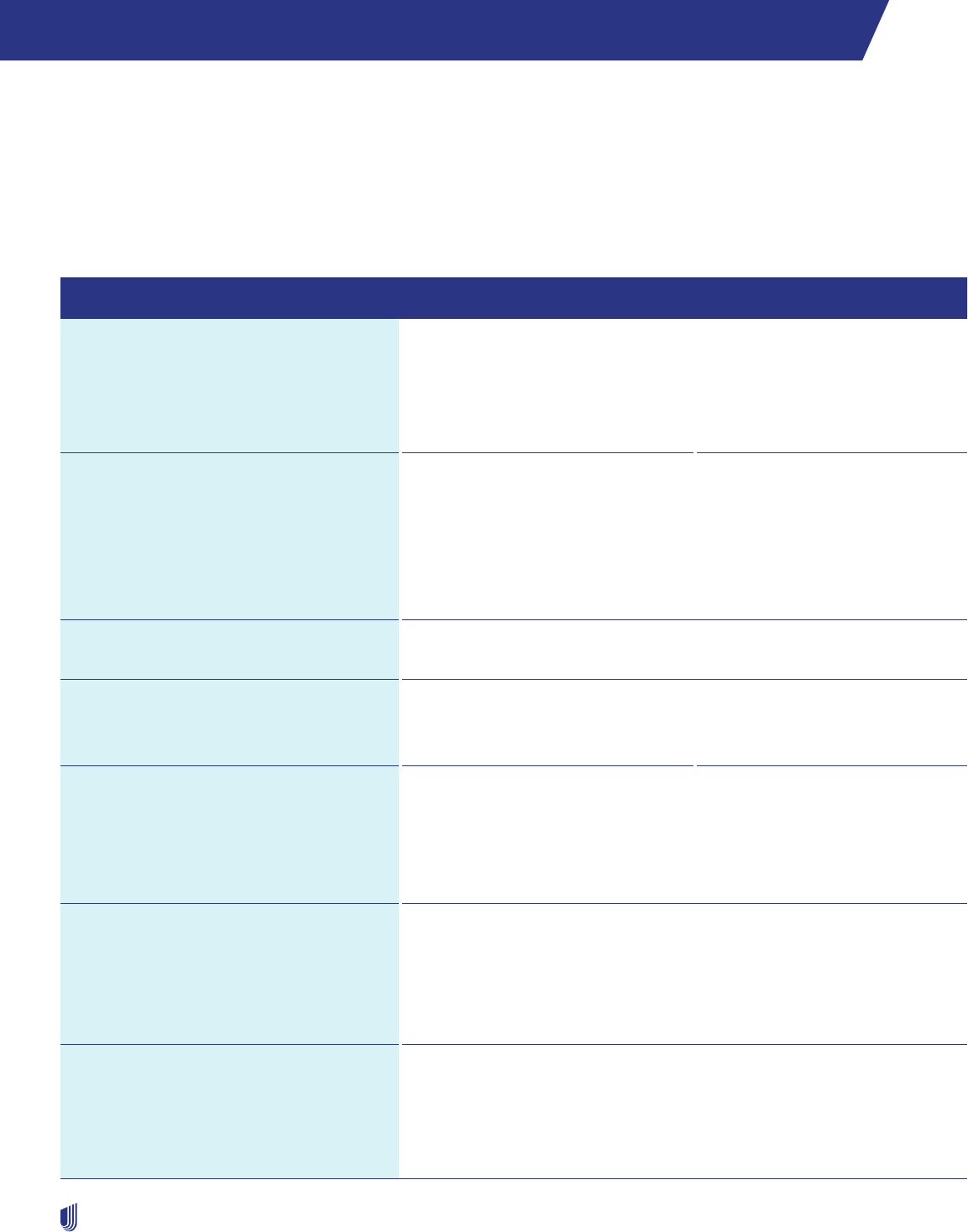

Medicare Advantage (MA) Group Retiree member ID card legend

Front Back

1. UnitedHealthcare brand: Present on a UnitedHealthcare ID card.

2. Network Logo: If the UnitedHealth Passport logo is present, the member’s plan has the Passport travel benefit.

3. Group name: Identifies the name of the employer group.

4. PCP: Included for benefit plans that require a PCP selection.

5. Prescription information: If the benefit plan includes Part D prescription drug coverage, the Rx Bin, PCN and Group code

are visible. If Part D coverage is not included, this area lists information for Medicare Part B Drugs.

6. Copay information: Includes PCP, specialist and ER copays.

7. Plan ID number: Identifies the plan ID number that corresponds to Centers for Medicare & Medicaid Services (CMS)

filings.

8. Benefit plan name: Identifies the applicable benefit plan name.

9. For members: Lists benefit plan contact information for the member.

10. For providers: Lists benefit plan contact information for the health care provider.

Access standards

Covering physician

As a PCP, you must arrange for 24 hours a day, 7 days per week coverage of our members. If you are arranging a substitute

health care provider, use those who are in-network with the member’s benefit plan.

You must alert us if the covering health care provider is not in your medical group practice to prevent claim payment issues.

Use modifiers for substitute physician (Q5), covering physician (CP) and locum tenens (Q6) when billing services as a covering

physician. Collect the copay at the time of service.

To find the most current directory of our network physicians and health care professionals, go to

uhcprovider.com/findprovider.

2

3

4

5

6

7

8

9

10

1

Chapter 2: Provider responsibilities and standards

15

2023 UnitedHealthcare Care Provider Administrative Guide

Appointment standards

We have appointment standards for access and after-hours care to help ensure timely access to care for members. We use

these to measure performance annually. Our standards are shown in the following table.

Type of service Standard

Preventive care Within 30 calendar days

Regular/routine care appointment Within 30 calendar days

Urgent care appointment Same day

Emergency care Immediate

After-hours care 24 hours/7 days a week for PCPs

These are general UnitedHealthcare guidelines. State or federal regulations may require standards that are more stringent.

Contact your Network Management representative for help determining your state or federal regulations.

After-hours phone message instructions

If a member calls your office after hours, we ask that you provide emergency instructions, whether a person or a recording

answers. Tell callers with an emergency to do one of the following:

• Hang up and dial 911 or local equivalent.

• Go to the nearest emergency room.

When it is not an emergency, but the caller cannot wait until the next business day, advise them to do one of the following:

• Go to a network urgent care center.

• Stay on the line to connect to the physician on call.

• Leave a name and number with your answering service (if applicable) for a physician or qualified health care professional to

call back within specified time frames.

• Call an alternative phone or pager number to contact you or the physician on call.

Timely access to non-emergency health care services (applies to Commercial in California)

• The timeliness standards require licensed health care providers to offer members appointments that meet the California time

frames. The applicable waiting time for a particular appointment may be extended if the referring or treating licensed health

care provider, or the health professional providing triage or screening services, as applicable, is: