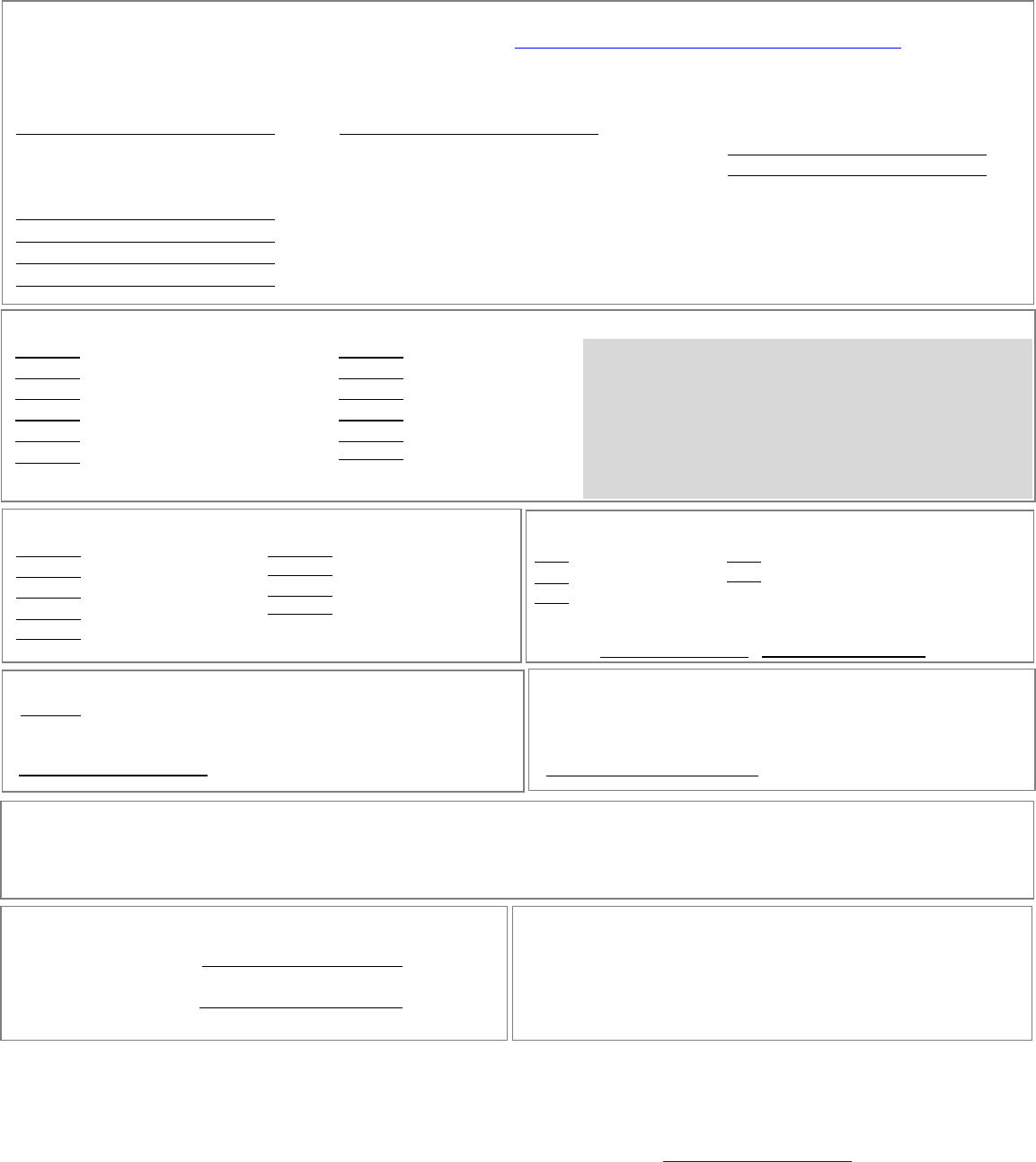

TRULASKE COLLEGE OF BUSINESS - BS IN ACCOUNTANCY & MASTER OF ACCOUNTANCY

BS in Accountancy & Master of Accountancy - Beginning Summer 2018

SEE YOUR ACADEMIC ADVISOR FOR PROPER SEQUENCING

GENERAL EDUCATION REQUIREMENTS

A full list of available courses can be found at http://generaleducation.missouri.edu/courses/

STATE REQUIREMENT (3)

IN GOV’T OR HISTORY

BIO or PHYS LAB SCIENCE (1+)

Depth of K nowledge Fulfilled

HL:____

HL:____

REQUIRED ACCOUNTANCY COURSES (21 HOURS)

PROFESSIONAL ELECTIVES (6 HOURS) 2000+ Non-Business Courses or 3000+ Level Business Elective Courses

______________________ ______________________

HL:____

REQUIRED CORE COURSES (27 HOURS)

HL:____

PRE-ACCOUNTANCY COURSES (34 HOURS) - These courses are required prior to application for admission to upper level.

*Accy 2036/2026/2136H

*Accy 2037/2027/2137H

#Accy 2258***

Econ 1014 or 1024

Econ 1015

English 1000**

HL:____

SENIOR CAPSTONE

____ Mgmt 4970 (3)(p – Mgmt 3000, Mktg 3000, Fin 3000,

Senior standing, admission to TCoB Upper Level and 93

credit hours earned). Must earn C- or higher.

HL:____

INTERNATIONAL STUDIES COMPONENT (3 HOURS)

Can be taken at undergraduate or graduate level.

Selected with academic advisor.

HL:____

*Must have a B- or higher

for upper level admission to Accy.

#Must have an overall cumulative 3.0 GPA (all graded hours) in per-

accountancy courses, excluding Math 1100, BA 1500, BA 2500, and

Accy 2258 for upper level admission to accountancy.

Econ 1000 (5) satisfies Econ 1014 or 1024 & 1015 requirement.

**Must receive C- or better to fulfill requirement.

*** No substitution allowed for Accy 2258.

-Must earn C- or better in Math 1300 or 1400.

Complete Professional EDGE requirements for admission - see advisor

*ACCOUNTANCY FOUNDATION COURSES (9 HOURS)

*Phil 1000, 1100 OR 1200 (3) _____ Comm 1200 (3)

HL:____

TWO WRITING INTENSIVE (WI) COURSES C- or

higher

College of Business WI

#BA 1500 (2)

#BA 2500 (2)

#Math 1100**

Math 1300-

Math 1400-

Stat 2500**

(3)

Economics 3251/4351

Management 3300

Management 3540

Statistics 3500

(3)

HL:____

Accy or Business Electives (6) - 4000+ Level

Outside the College WI

BEHAVIORAL and SOCIAL SCIENCE (9)

Fulfilled by BSAcc Econ/Mktg courses

MATH SCIENCES (9)

Fulfilled by BSAcc Math/Stat courses

HUMANITIES (6 Hours)

(9hrs required, Addt'l 3hrs fulfilled

with PHIL* Below)

Accy 3326 (3) (Fall)

Accy 3328 (3) (Fall)

Accy 3347 (3) (Fall)

Accy 3346 (3) (Spring)

Accy 4353 (3) (Spring)

121%86,1(66(/(&7,9(6

Varies based on &oursework

Psychology 1000, Sociology 1000, or Rural Sociology 1000 (3)

Economics 3229

Finance 3000

Marketing 3000

Management 3000

Management 4140W/3200HW

BSAcc Total: 120 Credit Hours

Must have 2.5 Trulaske College of Business GPA and completed Professional Edge Program requirements to graduate

Must have 3.0 UM Cumulative GPA subsequent to admission to Upper Level to graduate

Can only transfer in 6 hours of Upper Level Business Courses

For a full list of course options to fulfill specific degree requirements, see http://catalog.missouri.edu

IN ADDITION, YOU MUST COMPLETE 30 HOURS OF GRADUATE-LEVEL WORK

CHOSEN WITH YOUR ACADEMIC ADVISOR (outlined on back)

Combined Total BSAcc/MAcc: 150 Credit Hours

07/01/2018

ACCOUNTANCY – GRADUATE REQUIREMENTS

ACCOUNTANCY ELECTIVES (15-24 HOURS)*

BUSINESS ELECTIVES (3-9 HOURS)*

HL:____

ACCY 7384 (3)*

ACCY 8450 (3)

MGMT 7010 (3)**

ACCCOUNTANCY CORE

MAcc Total: 30 Credit Hours

At least 15 of 30 credits must be competed in 8000-9000 level courses

Min 24 credits must be completed under MU Faculty

Max 6 graduate credits may be transferred from another college or university

Combined BSAcc/MAcc Total: 150 Credit Hours

ACCOUNTANCY – GRADUATE CERTIFICATES

ASSURANCE CERTIFICATE

TAXATION CERTIFICATE

Total Hours: 15 Credit Hours

12 of 15 Hours must be Graduate Credit

* If not taken as an undergraduate

** Or Substitute one of the following: Acct 7365, Acct 8436, Mgmt 7540, Fin 7010, Fin 7020

MU School of Accountancy

303 Cornell Hall

Columbia, MO 65211

Required: 3 HOURS

• Auditing Theory and Practice I (Acct 4384/7384) (3)

Electives: 12 HOURS

• Taxation of Corporations & Shareholders (Acct 8373) (3)

• Internal Auditing (Acct 8404) (3)

• Audit of Internal Controls (Acct 8414) (3)

• Fraud Examination (Acct 8424) (3)

o OR Forensic Accounting (Acct 8438) (3)

• Data Visualization & Data Mining (Acct 8428) (3)

• Advanced Accounting (Acct 8436) (3)

• Advanced Audit (Acct 8444) (3)

• Emerging Issues in AIS (Acct

8448) (3)

• Corporate Governance (Acct 8456) (3)

Required: 9 HOURS

• Introduction to Taxation (Acct 4353/7353) (3)

• Taxation of Corporations & Shareholders (Acct 8373) (3)

• Tax Research & Planning (Acct 8423) (3)

Electives: 6 HOURS

• Multi-Jurisdictional Tax (Acct 8363) (3)

• Mergers & Acquisitions Taxation (Acct 8433) (3)

• Taxes & Business Strategies (Acct 8453) (3)

• Partnership Taxation (Acct 8463) (3)

Note: Acct 8401(Topics in Accounting), may count for

Assurance Cert. Please see academic advisor

Note: Acct 8401(Topics in Accounting), may count for

Taxation Cert. Please see academic advisor

Total Hours: 15 Credit Hours

12 of 15 Hours must be Graduate Credit