Tenants to Homeowners Inc.

2518 Ridge Court, Suite 103, Lawrence, Kansas 66046

PHONE: 785.842.5494 ♦ FAX 785.842.7570

lawrencelandtrust@yahoo.com ♦ www.tenants-to-homeowners.org

Home Buyer

Workshop

Handbook

Workshop Sponsored by US Bank

Homebuyer Workshop Handbook Index

2019-20 LCHT Income Guidelines 1

The Fair Housing Act 2

Getting Ready to Buy a House 3

What to Bring to a Loan Application 4

Types of Loans Available 5

Nine Strategies to Reduce Your Debt 6

Budgeting 7

House Need/Want List 8

Agent Description 9

Useful Online Home Buyer Resources 10

Homebuyer Checklist 11

Neighborhood Checklist 12

Negotiating Tips 13

Inspector's Top Ten/Fix-It Chick Home Checklist 14

Twelve Ways to Reduce Homeowner's Insurance Costs 16

Potential Tax Benefits for Homeowners 17

HUD's Mortgage Insurance Programs 18

Lawrence Habitat for Humanity 21

Home Security Inspection Checklist 22

Year Round Maintenance Schedule 23

Steps to Acquire an LCHT Home 25

Professional Land Surveying 26

How to Avoid Foreclosure 27

1

U.S. Department of Housing and Urban Development (HUD)

2019-20 Maximum Income Guidelines

Add the annual gross (before-taxes) income of all adults in your household. If that total is less than or equal to the

number below, then you are income-eligible for the Lawrence Community Housing Trust Program.

2019-20 Maximum Income Guideline for the Housing Trust Program

Household size

1

2

3

4

5

6

Annual Gross

Income

$44,500

$52,400

$58,950

$65,500

$70,750

$76,00

2

The Fair Housing Act (Title VIII of the Civil Rights Act of 1968) introduced meaningful federal

enforcement mechanisms.

It outlawed:

• Refusal to sell or rent a dwelling to any person because of race, color, religion, sex, or national origin.

• Discrimination based on race, color, religion or national origin in the terms, conditions or privilege of the sale or

rental of a dwelling.

• Advertising the sale or rental of a dwelling indicating preference of discrimination based on race, color, religion

or national origin.

• Coercing, threatening, intimidating, or interfering with a person's enjoyment or exercise of housing rights based

on discriminatory reasons or retaliating against a person or organization that aids or encourages the exercise or

enjoyment of fair housing rights.

When the Fair Housing Act was first enacted, it prohibited discrimination only on the basis of race, color, religion, sex, and

national original In 1988, disability and familial status (the presence or anticipated presence of children under 18 in a

household) were added (further codified in the Americans with Disabilities Act of 1990). In certain circumstances, the law

allows limited exceptions for discrimination based on sex, religion, or familial status.

The United States Department of Housing and Urban Development is the federal executive department with the statutory

authority to administer and enforce the Fair Housing Act. The Secretary of Housing and Urban Development has

delegated fair housing enforcement and compliance activities to HUD's Office of Fair Housing and Equal Opportunity

(FHEO) and HUD's Office of General Counsel. FHEO is one of the United States' largest federal civil rights agencies. It has a

staff of more than 600 people located in 54 offices around the United States. As of June 2014, the head of FHEO is

Assistant Secretary for Fair Housing and Equal Opportunity Gustavo Velasquez, whose appointment was confirmed on

June 19, 2014.

Individuals who believe they have experienced housing discrimination can file a complaint with FHEO at no charge. FHEO

funds and has working agreements with many state and local governmental agencies where "substantially equivalent" fair

housing laws are in place. Under these agreements, FHEO refers complaints to the state or locality where the alleged

incident occurred, and those agencies investigate and process the case instead of FHEO. This is known as FHEO's Fair

Housing Assistance Program (or "FHAP").

There is also a network of private, non-profit fair housing advocacy organizations throughout the country. Some are

funded by FHEO's Fair Housing Initiatives Program (or "FHIP"), and some operate with private donations or grants from

other sources.

Victims of housing discrimination need not go through HUD or any other governmental agency to pursue their rights,

however. The Fair Housing Act confers jurisdiction to hear cases on federal district courts. The United States Department

of Justice also has jurisdiction to file cases on behalf of the United States where there is a pattern and practice of

discrimination or where HUD has found discrimination in a case and either party elects to go to federal court instead of

continuing in the HUD administrative process. (https://en.wikipedia.or g/wiki/Fair Housing Act)

3

Getting Ready to Buy a House

Information courtesy of CNN Money.com

First: Should you Buy or Rent? Usually, but not always, the financial and psychological benefits of homeownership

far outweigh renting. However, renting may be a better option if:

1. You plan on moving in a few years. The transaction costs, not to mention the time and angst, may not be worth it

if you plan to move in three or four years.

2. Your rent is a great deal. Calculate your monthly house payment, including mortgage, taxes, insurance, and any

homeowner's fees. If your monthly rent is 35% less than your estimated house payment, consider carefully

whether you can afford to buy.

3. The house is more than you can afford. Rule of thumb; a house should cost no more than two-and-a-half times

your gross annual salary.

Second: Getting Pre-Approval. To get approved for a loan, you need to convince a lender that you can pay a

mortgage regularly and on time. To determine whether to give you a mortgage loan, a lender looks at the following

factors:

1. Employment History. Have you been steadily employed for two tax years? If self- employed, have you been

working for at least three years? Consistent employment looks good to lenders.

2. Sufficient Income. How much is your gross annual income? An honest lender wants to see that your monthly

mortgage payment eats up no more than 38 percent (in some cases, your lender may go as high as 42 percent) of

your monthly gross. Important: Make sure your lender includes taxes and insurance in your estimated monthly

payment. If you calculate that your monthly payment is more than 38 percent of your monthly income, be VERY

careful.

3. Good Credit. If your FICO credit score is 670 or more, this shows you pay your bills on time. You have to right to

one free credit report annually from each of the three credit reporting agencies (Experian, Equifax and Trans

Union). A credit report is a document that shows the details of your payments as reported by creditors. Your

FICO credit score is a three-digit number that is applied by each credit agency according that agency's

calculations based on information from your credit report.

4. Low Debt. That $600 monthly debt payment is $600 that you could be paying towards a mortgage. This reduces a

$2,000 monthly mortgage to $1,400. This makes a huge difference in the amount of house you can finance.

5. Down Payment and Closing Costs. The amount of down payment differs according to the lender, but you will

need sufficient funds for a down payment and closing costs. Also, make sure you have enough left over for

emergencies.

4

What to Bring to a Loan Application for Pre-Approval

□

Names, addresses, Social Security Numbers and dates of birth for all borrowers.

□

Names, addresses and phone numbers of employers and/or landlords for the past two years.

□

Name address, account, number, minimum monthly payment and balance owed on all outstanding debts (car

payments, credit cards, child support, etc.).

□

Copies of last month's pay stubs.

□

Copies of the last two months account statements on all deposit accounts, stock accounts, mutual funds , etc.

□

Complete personal income tax returns and W-2 forms for the past two years.

□

Complete business income tax returns for the past two years.

□

If self-employed or commissioned, year-to-date Profit and Loss statement and balance sheet.

□

Letter of explanation on any gaps in employment during the past two years.

□

Letter of explanation on past credit problems.

□

Copy of divorce decree and property settlement, if applicable.

□

Copy of bankruptcy documents (filings and discharges), if applicable.

□

Letter of explanation for bankruptcy, if applicable.

□

Credit report fee/appraisal fee.

□

Lease agreement

□

Helpful Web Sites: www.hsh.com www.hud.gov and www.lendingtree.com

5

Types of Loans Available

Information courtesy of Kansas Action for Children, HUD and bankrate.com

A typical mortgage payment includes "PIT! MI":

1. Principal and Interest - part of the monthly mortgage payment to the lender

2. Taxes and Insurance - held in Escrow and paid by the lender to the appropriate party when due.

3. Mortgage Insurance - protect lenders against loss if a borrower defaults.

Loans available:

□

Conventional Loan - A fixed rate, fixed term loan made without government insurance.

□

FHA Loan - A mortgage insured by the Federal Housing Administration. It provides a low down payment (3%-5%)

on the house of your choice.

□

VA Loan - A loan guaranteed by the Veterans Administration. Qualified veterans are allowed to buy a house at a

certain price with no down payment.

□

Mortgage Tax Credit - Authorized by the federal government, this program allows purchasers to reduce their

federal income tax liability. The purchaser must be a first time homebuyer.

□

Bond Money - Authorized by the federal government, this program helps a first time homebuyer with 4% of the

down payment and closing costs.

□

Contract for Deed - A written real estate agreement between a purchaser and seller in which the payments are

made to the seller at a specified interest rate for a number of years.

Watch out! Signs of Predatory Loan Packages:

□

Adjustable Rate Mortgage (ARM) - This is not necessarily predatory, but be cautious. Unlike the conventional

mortgage, the payments change as interest rates change. Many subprime loans are ARMs.

□

Subprime Loans - Available to buyers with low credit scores (generally 620 or less). These loans carry an

increased interest rate to compensate for the added financial risk. May include outrageous fees, extremely high

interest rates and pressure to refinance constantly, which incurs greater fees.

□

Balloon Payment - Included in a mortgage package and can be a component of a subprime loan. Requires the

loan to be paid in a lump sum after a certain time period.

□

Prepayment Penalty- Also may be included in a subprime loan. This is an extra fee for paying a loan early - e it her

after refinancing or selling the house.

6

Nine Strategies to Reduce Your Debt

You need a plan to get out of debt. Meeting with a credit counselor at Housing and Credit Counseling, Inc. is a very helpful

way to begin. To speak to a credit counselor and/or make an appointment with a counselor in your area, call HCCI at (800)

383-0217.

1. Figure out how much you owe. Gather your credit card statements and make a list that includes the interest

rates, total amounts you owe and monthly minimum payments.

2. Keep the two cards with the lowest interest rates. Cut up the rest and close the accounts.

3. If none of your cards have interest rates lower than 14%, get one.

4. Don't add to your balance. Pay off your debt without incurring more. To continue to build credit, charge a little

bit on your credit card each month and pay it off in full.

5. Pay more than the minimum. If you only pay the minimum, you will never get rid of your debt.

6. Pay off the card with the highest interest rate first. Prioritize. Pay the minimum on your lowest-rate cards until

you have paid the balances on your highest-rate cards.

7. Consolidate your debt. Many credit cards offer low introductory rates. Transfer your high interest balances and

pay them off as quickly as possible.

8. Consider using your savings to pay off your debts. At the bank, your savings earns a little more than 3.2%, while

the interest rate on your debt costs 18% or more.

9. Now, decide to stay out of debt. If necessary, use only a debit card or cash.

7

Budgeting

Rules of Budgeting

1. Spending limits must be realistic.

2. Be willing to sacrifice and compromise to live within a budget.

3. Know your priorities. Allow enough for the essentials: Housing, food, utilities and health care.

4. Be consistent in your spending. Set aside regular sums to cover upcoming large expenses, such as insurance and

car repairs.

5. To stick with your plan, accurately record your income and expenses.

6. Be creative. Look for ways to save money and eliminate non-essential expenses.

7. Involve everyone. Make your budget a family project.

8. Deposit part of your income into a savings account to prepare for emergencies.

9. Don't use credit as a source of income.

10. Try to keep your debt load lower than 20% of your net monthly income.

Budgeting Tips

1. Work overtime.

2. Have your spouse or children contribute to income.

3. Pack your lunch.

4. Carpool or take the bus to work.

5. Cancel your cable.

6. Do odd jobs.

7. Downgrade your phone service.

8. Quit smoking.

9. Bargain shop.

10. Shop for the best price on gas.

11. Only buy one brand of toothpaste, shampoo, deodorant, razors for the entire family.

12. Set your thermostat at 68 degrees and wear a sweater.

13. Learn to enjoy inexpensive pleasures.

14. Be tough. Give yourself the third degree: "Do I really need it?" "Do I really need it today?" "What would happen if

I don't buy it now?" Get comfortable with saying "No."

8

House Need/Want List

Basic Questions:

1. What part of town do I want to live in?

2. What is my price range?

3. Do I need a certain school district?

4. How many stories

5. Bedrooms

6. Bathrooms

7. How much renovation am I willing to do?

8. Do I need to be near public transportation?

9. What, if any, accessibility features do I need?

10. Do I want an older home or newer home?

11. Do I prefer a certain style?

Considering the lot:

Must Have Optional

Large yard ☐ ☐

Small yard ☐ ☐

Fenced yard ☐ ☐

Garage ☐ ☐

Carport ☐ ☐

Patio/deck ☐ ☐

Pool ☐ ☐

Outdoor spa ☐ ☐

Extra parking ☐ ☐

Other buildings (barn, shed, etc) ☐ ☐

Special view ☐ ☐

Considering the Interior

Wall-to- Wall carpet Must Have Optional

Ceramic tile ☐ ☐

Hardwood floors ☐ ☐

Eat -in kitchen ☐ ☐

Separate dining room ☐ ☐

Formal living room ☐ ☐

Family room ☐ ☐

Lots of windows/light ☐ ☐

Fireplace ☐ ☐

Basement ☐ ☐

No interior steps ☐ ☐

9

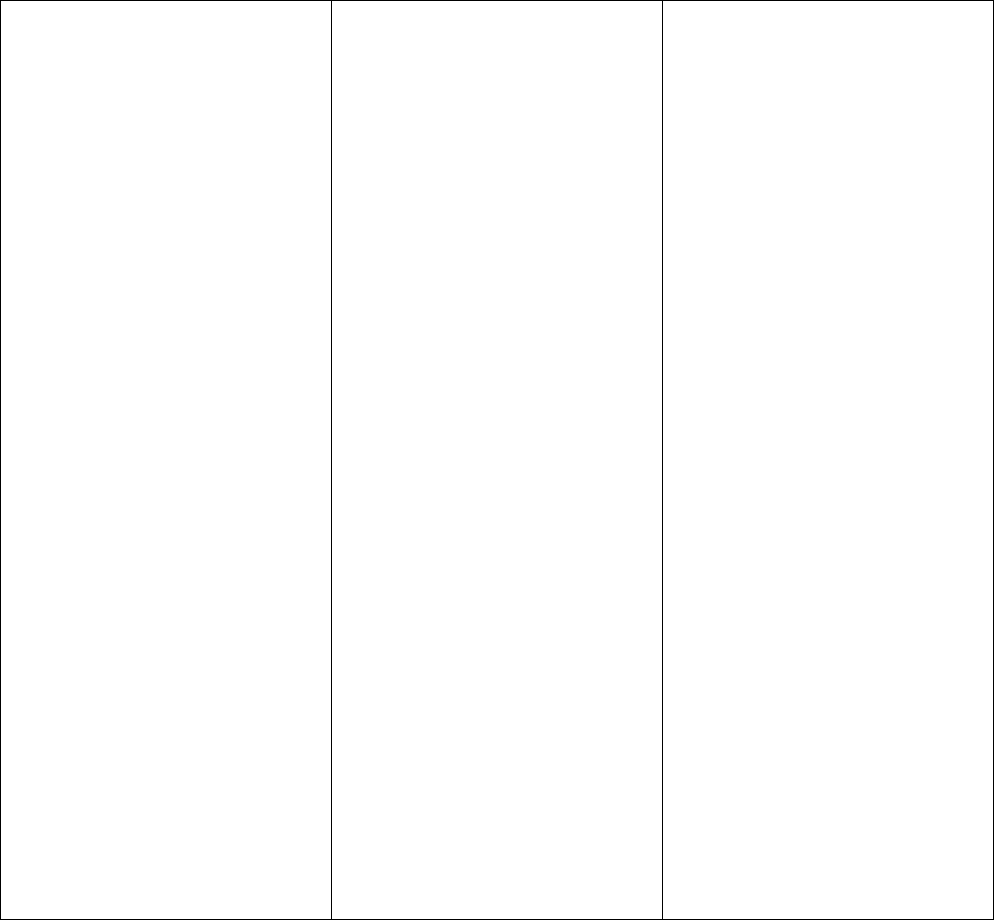

SELLER'S AGENT

or

DESIGNATED SELLER'S AGENT

BUYER'S AGENT

or

DESIGNATED BUYER'S AGENT

TRANSACTION BROKER

For

RESIDENTIAL TRANSACTIONS

The SELLER'S Agent represents the SELLER

only, so the BUYER may be either

unrepresented or represented by another

agent.

The SELLER'S Agent is responsible for

performing the following duties:

•promoting the interests or the SELLER

with the utmost good faith, loyalty, and

fidelity.

•protecting the SELLER'S confidences,

unless·disclosure is required.

•presenting all offers in a timely manner.

•advising the SELLER to obtain expert

advice.

•accounting for all money and property

received.

•disclosing to the SELLER all adverse

material facts about the BUYER that the

agent knows.

•disclosing to the BUYER all the adverse

material facts actually known by the

agent, including:

>environmental hazards affecting the

property that are required to be

disclosed.

>the physical condition of the property

>the material defects in the property or in

the Title to the property.

>any material limitation on the SELLER'S

ability to complete the contract.

The SELLER'S Agent has no duty to:

•conduct an independent inspection of

the property for the benefit of the buyer.

•independently verify the accuracy or

completeness of any statement by the

SELLER or any qualified third party

The BUYER'S Agent represents the BUYER only, so the

SELLER may be either unrepresented or represented

by another agent.

The BUYER'S Agent is responsible for performing the

following duties:

•promoting the interests of the BUYER with the

utmost good faith, loyalty, and fidelity.

•protecting the BUYER'S confidences, unless

disclosure is required.

•presenting all offers in a timely matter.

•advising the BUYER to obtain expert advice.

•accounting for all money and property received.

•disclosing to the BUYER all the adverse material facts

that the agent knows.

•disclosing to the SELLER all adverse material facts

actually known by the agent, Including all material

facts concerning the BUYER'S financial ability to

perform the terms of the transaction.

The BUYER'S agent has no duty to:

•conduct an independent investigation of the

BUYER'S financial condition for the benefit of the

SELLER.

•independently verify the accuracy or completeness

of any statement by the BUYER or any qualified third

party.

The Transaction Broker is not an agent for either

party, so the Transaction Broker does not advocate

the interest of either party.

The Transaction Broker is responsible for

performing the following duties:

protecting the confidences of both parties,

including the following information:

>the fact that the BUYER is willing to pay more.

>the fact that a SELLER is willing to accept less.

>factors that are motivating any party.

>the fact that a party will agree to different

financing terms.

>any-information or personal confidences about a

party that might place the other party at an

advantage.

•exercising reasonable skill and care.

• presenting all offers in a timely manner.

• advising the parties regarding the transaction.

• suggesting that the parties obtain expert advice.

• accounting for all money and property received.

• keeping the parties fully informed.

• disclosing to the BUYER all adverse material facts

actually known by the Transaction Broker,

including:

>environmental hazards affecting the property

that·are required to be disclosed.

>the physical condition of the property.

>any material defects in the property or in the title

to the property.

>any material limitation on the SELLER'S ability to

complete the contract.

• disclosing to the SELLER all adverse material facts

.actually known by the Transaction Broker,

including all material facts concerning the BUYER'S

financial ability to perform the terms of the

transaction.

The Transaction Broker has no duty to:

• conduct an independent inspection of the

property for the benefit of any party.

• conduct an independent investigation of the

BUYEIR'S financial condition.

• independently verify the accuracy of

completeness of statements made by the SELLER,

BUYER, or any qualified third party.

CLIENTS are represented by an agent: CUSTOMERS are

not. Do not assume an agent is acting on your behalf,

unless you have signed a contract with the agent’s firm

to represent you. As a customer, you represent

yourself. Any information that you, the customer,

disclose to the agent representing the other party will

be disclosed to that other party. Even though licencees

may be representing other parties, they are obligated

to treat you honestly, give you accurate information,

and disclose all know adverse material facts.

10

Useful Web Sites: Online Homebuyer Resources

Figuring out the cost of your principal and interest at bankrate.com

http://www.bankrate.com/calculators/mortgages/mortgage-calculator.aspx

Choosing insurance: Kansas Insurance Dept. guides: http://www.ksinsurance.org/autohome/home/hrins.php

Credit scoring: Credit Karma helps estimate your score based on info you enter https://www.creditkarma.com

Annual Credit Report: Free report once a year from each of 3 credit agencies: https://www.annualcreditreport.com/

Home Inspection: a 4 minute how to/what to look for on YouTube: https://www.youtube.com/watch?v=8LfFilOQOZs

Local Online Home Shopping: http:/ / www.hom etownlawrence.com

Researching Lead, Mold or Radon in Homes: www.epa.gov

List of Deductible Home Costs: www.irs.gov

HUD Fair Housing Brochure: http://portal.hud.gov

11

HOME BUYER'S CHECKLIST

Use this checklist to compare and contrast the cost, size and maintenance of listed homes.

Financial

Maximum down payment

Maximum monthly payments

Neighborhood

Values (rising/falling/stable) General

condition

School district and schools Public

transportation

Friends, relatives nearby

Major roads, high ways, traffic

Children

Safety, security

Zoning, restrictions

Convenience to stores and

recreational facilities

Full municipal services

Home Space

Total square footage (under roof,

heated area) Bedrooms (number,

size, closets)

Bathrooms (number, size, location)

Kitchen (size, built-ins, appliances,

counter space, cabinets, eating area,

pantry)

Living room (size, location)

Dining room or area (size)

Family room (size and location)

Utility/Laundry room (location)

Garage/carport (attached)

Storage space, utility areas

Basement (finished/unfinished, crawl

space, recreation room)

Attic

Traffic patterns

Conversion and/or expansion

capabilities

Space requirements for special

circumstances

Interior Features

Move-in condition or fixer upper

Fire place(s)

Type of floors

Carpeting (condition and color)

Drapes, curtains (location, condition)

General appearance (need to

redecorate) Walls (plaster, drywall,

papered, painted)

Type of interior wood finish (natural

wood, painted)

Bathrooms (new, older)

Kitchen

Exterior Features

Style (colonial, contemporary,

modern, split- level , ranch, two story,

Tudor, Spanish)

Balconies, decks, patios porches

(open, screened)

Roof (composition, age, condition)

Exterior finish (brick, stone,

aluminum siding, cedar, stucco,

Masonite, clap board, combination,

trim)

Maintenance requirements of

exterior materials

Size of lot and maintenance required

Access to lot

Landscaping

Energy Efficiency

Type of heating Central air

conditioning

Energy costs (high or low) Insulation

Storm windows

Weather-stripping

12

NEIGHBORHOOD CHECKLIST

The LOCATION of a home can be the most important factor to consider when buying a home. Make your own personal

observations, but also consult with your real estate agent, local governments, friends or homeowners already in the area

you're considering. Use this checklist of items of concern to most buyers to decide if the location in mind will suit your

wants and needs.

• Neighborhood Property Values -Are they stable or rising?

• Are values in line with the home you are considering?

Personal

Are there churches of your religious preference in the area?

Are there suitable recreational facilities in the area to provide for you and/or your children's need s and interests?

Community Services

Are there zoning or other restrictions?

ls there adequate police and fire protection?

Are there arrangements for trash collection, snow removal and insect spraying?

Is there a reliable and drinkable source of water and adequate water pressure?

ls there a hospital nearby?

Streets and Transportation

Are the streets well maintained? Are they well lit?

Does the speed limit suit you?

Are there major roads or high ways near?

Is public transportation adequate and handy?

Schools

Do the schools your children will attend provide the quality of education that suits you?

Are there a variety of schools (i.e., elementary, secondary, public/private)?

Are they located at a convenient distance?

Environment

Is the home near sources of smoke, soot, dust, odors or excessive noise?

ls the home at a safe distance from streams, and hazards such as gas or oil tanks which might overflow?

Is the home on a busy street or highway?

Shopping

Are there adequate facilities close by (i.e., supermarkets, drug stores, shopping plaza, department stores)?

13

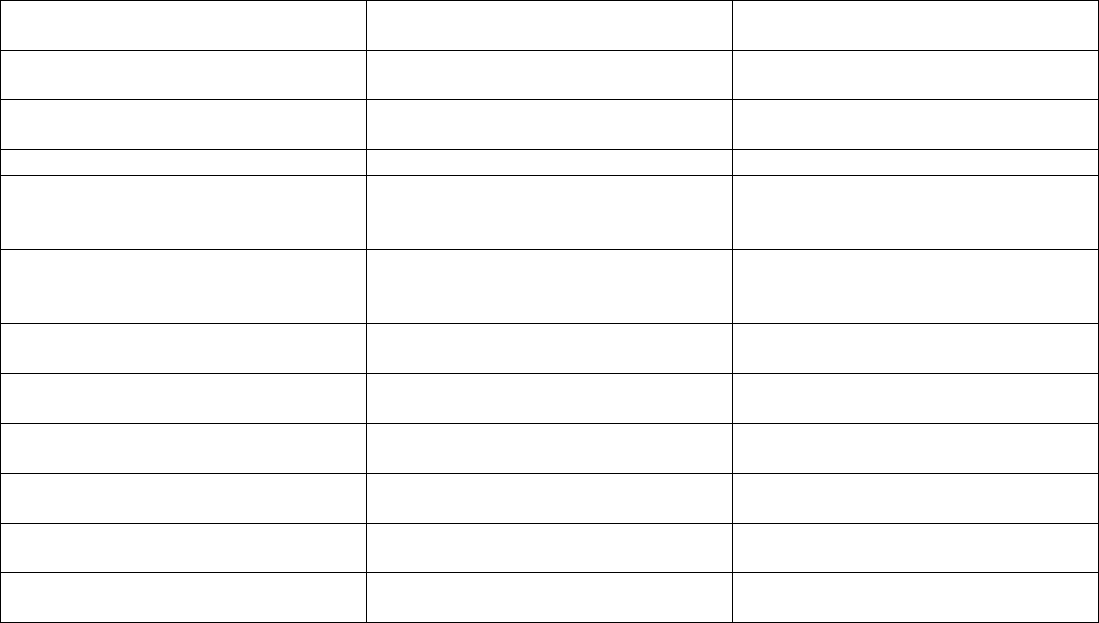

Negotiating Tips

Remember, all negotiations must be done in writing.

Technique

When most effective

Possible Outcomes

start low & move up

When a property is overpriced in a slow

market

Seller rejects outright or counteroffers

Offer close to asking price

When a property is priced well in an

active market

Seller accepts or counters for slightly

more money

Offer top price you can afford

When the market is Hot

Walk away if the seller rejects

Save terms to bargain

When the seller is highly motivated

Seller may lower price or agree to repairs

after the inspection, in exchange for a

quicker closing date

Compromise

Works in most cases

You gain a lower price or other

concession, but also give seller something

you don’t really want

Move in small increments

When a property is overpriced in a slow

market

Seller may accept a lower price after

considering it for a while

Focus on issues you can resolve to keep

momentum

After several rounds of negotiations

Seller and buyer agree after resolving

easiest issues first

Be unpredictable

After several rounds of negotiations

Seller may accept after you make a

dramatic change

Either/or offer

After several rounds of negotiations

Seller may accept one of two scenarios

you offer

Split the difference

After several rounds of negotiations

You settle on a price exactly between

asking price and offer

Set deadlines

Any situation

What a time limit, everyone acts more

decisively

14

Inspector's Top Ten

Know how extensive repairs will be before you take them on

1. Poor drainage. This is the most common problem. You may need to install a new system of roof gutters and

downspouts or have the lot re-graded to channel water away from the house.

2. Faulty wiring. An insufficient or out-of-date electrical system is common, especially in older homes. This is a

dangerous and serious problem, and you may need to replace all or part of the electrical system.

3. Leaky roof. Water damage on the roof may be due to old/damaged shingles or improper flashing. Depending on

the extent of the problem, the solution may be as simple and cheap as replacing a few sections, or as expensive

as installing a new roof.

4. Hazardous heating system. An old or poorly maintained heating system is dangerous and serious. Repairing or

replacing a furnace is expensive, but an energy- efficient furnace will lower your utility bills. If you do not have an

electric heating system, install carbon monoxide detectors throughout your house.

5. The whole house has been poorly maintained. Cracked, peeling paint, crumbling masonry, broken fixtures,

sloppy wiring, shoddy plumbing. Cosmetic problems are easily fixed, but electrical or plumbing problems are

much more serious and must be replaced immediately.

6. Minor structural damage. While the house won't fall down tomorrow, small problems may become serious later.

Structural damage is usually caused by water seeping into the foundation, floor joists, rafters or window and

door headers. First, fix the problem at its source, then repair the damage.

7. Plumbing problems. This usually involves old or incompatible piping materials and faulty fixtures or waste lines.

Solutions range from the simple to the expensive.

8. Water and air leaks in around windows and doors. This is usually not due to a structural problem. The culprit is

usually poor caulking and weather stripping, which can be re paired simply and inexpensively.

9. Poor ventilation. Excessive moisture due to poor ventilation damages interior walls, structural elements and can

cause allergic reactions. Install ventilation fans in bathrooms or open windows. An inexpensive solution is to

replace drywall. A more expensive solution involve s replacing a structural element.

10. Environmental hazard(s). This includes lead -based paint (common in homes built prior to 1978), asbestos,

formaldehyde, contaminated drinking water, radon and leading underground oil tanks. Such problems require

special inspections and are very costly to fix.

15

Bathroom remodels can be very expensive, so pay attention to the layout and functionality of the bathrooms when looking

to buy a home.

LJWorld.com, March 19, 2016 Fix-It Chick

Fix-It Chick: Make a checklist before buying a home

When it comes to purchasing a new home, "buyer beware" are words to live by. Follow these steps to help avoid

unexpected homeowner expenses:

Step 1: Examine the roof for worn or missing shingles. Check to see if there are multiple layers of shingles already on the

roof. Make sure the roof is not sagging and confirm that the fascia boards and soffits are free from rot. Typical roofs last

20 to 25 years. Removing multiple layers of roofing or replacing damaged wood is expensive.

Step 2: Look for peeling paint and dry rot around the home's exterior. Painting a home is not an easy task and replacing

rotting windows can be costly.

Step 3: Look for cracks and crevices on the inside and outside of the home's foundation. Examine the gutters to ensure

they are secure and properly angled. Check to see that the ground slopes away from the house. Improper drainage can do

irreparable damage to a home's foundation, and a home is only as strong as the foundation it is built on.

Step 4: Consider the age and condition of the furnace and the air conditioner. Mechanical updates are costly and usually

come at the most inopportune time.

16

Twelve ways to Lower Homeowner's Insurance Costs

Insurance Information Institute

You can usually get discounts for a smoke detector, dead-bolt, sophisticated sprinkler system and a fire and burglar alarm

that rings at a monitoring station. These systems aren’t cheap and not every system qualifies. Ask your insurer to

recommend a system.

1. Seek other discounts

For example, if you’re at least 55 years old and retired, you may qualify for a discount of up to 10 percent. Some employers

and professional associations offer group insurance.

2. Maintain a good credit record

Insurers often look at credit to price their policies. In most states, your insurer must inform you of adverse action due to poor

credit. Make sure the insurer has correct information. For good credit, pay bills on time, don’t get too much coverage and

keep a low balance. Check your credit report for errors.

3. Stay with the same insurer

After several years, you may get a discount for being a long-term policyholder. Some insurers will reduce will reduce their

premiums by 5 percent after three to five years, and by 10 percent after six years or more.

4. Review the limits in your policy and the value of your possessions at least once a year

Cover major purchases or additions. However, if your old fur coat is no longer worth the $5,000 you paid for it, reduce or

cancel the floater (extra insurance for valuables not covered by standard homeowner’s policies).

5. Look for private insurance if you are in a government plan

If you live in a high-risk area and received homeowners insurance through the government, look for a lower price in the

private market.

6. When you’re buying a home, consider the cost of homeowners insurance

Depending on your location you may reduce your insurance or if your home’s electrical, heating ad plumbing systems are less

than 10 years old. Check the CLUE (Comprehensive Loss Underwriting Exchange) report for the property’s insurance claim

history. Floods and earthquakes are not covered by a standard homeowner’s policy. Ask questions about insurance for

valuables. If you run a home business, ask about coverage for that business.

7. Take time to save money. Ask your friends, check the Yellow Pages or contact your state insurance department The National

Association of Insurance Commissioners (www.naic.org) has state-by -state information on insurers and complaints. States

often provide information on rates charged by major insurers and the frequency of consumer complaints.

8. Check consumer guides, insurance agents, companies and online insurance quote services. Choose an insurer that offers a

fair price and quality service. To assess service quality, use the complaint information above and talk to a number of insurers.

Ask them how they would lower your costs. Use rating companies such as A M. Best (www.ambest.com) and Standard &

Poor's (www.standardandpoors.com) and consult consumer magazines to check an insurance company's financial stability.

Narrow your choices to three insurers and get price quotes.

9. Raise Your Deductible

Deductibles are the amount of money you pay toward a loss before your insurance company pays a claim. The higher your

deductible, the lower your premium. Most insurance companies recommend at least a $500 deductible. If you can afford a

$1,000 deductible, you may save as much as 25 percent. If you live in a disaster-prone area, you may have a separate

deductible for certain kinds of da mage.

10. Don't confuse what you paid for your house with rebuilding costs

The land under your house isn't at risk from the perils covered in your homeowner’s policy. Don't consider it value in selecting

homeowners insurance.

11. Buy your home and auto policies from the same insurer

Some companies will reduce your premium if you buy two or more policies. But be sure this combined price is worth it.

12. Make your home more disaster resistant

Ask how to make your home more resistant to natural disasters. You may reduce your premiums by adding storm shutters,

reinforcing your roof or buying stronger roofing materials. Older homes can be retrofitted to better withstand earthquakes. Also,

consider updating your heating, plumbing and electrical systems to prevent fire and water damage. Improve your home security

17

Potential Tax Benefits for Homeowners

The following can be eligible for a homeowner tax deduction:

• Your property taxes. Don’t forget to include any taxes you may have reimbursed the seller for. These are taxes

the seller had already paid before you took ownership. You won't get a 1098 report listing these taxes. Instead,

that amount will be shown on the settlement sheet.

• The mortgage interest on your primary residence, as well as on a second residence. (There are limits, but

relatively few taxpayers are affected.)

• The interest on up to $100,000 borrowed on a home equity loan or home equity line of credit, regardless of the

reason for the loan.

• If you paid points to get a better mortgage loan when you purchased your home.

• The premiums paid for Mortgage Insurance Premiums, but only for policies issued after 2006. Unless Congress

renews this deduction, 2016 is the last year it can be claimed. (The right to this deduction disappears as your

Adjusted Gross Income rises from $100,000 to $109,000 (or $50,000 to $54,500 for those who use married filing

separately status.)

• Home improvements required for medical care.

18

HUD's Mortgage Insurance Programs

Courtesy of pueblo.gsa.gov

Many individuals and families who could not otherwise buy a home become homeowners with the help of the Federal Ho

using Administration (FHA) mortgage insurance programs. FHA is a part of the U.S. Department of Housing and Urban

Development (HUD). One of the chief purposes of FHA is to help people obtain financing. Persons who cannot make a

large down payment may need the help of an FHA-insured mortgage to get a loan.

How FHA Mortgage Insurance Works

FHA's mortgage insurance programs help low - and moderate-income individuals and families buy homes or refinance

their current mortgages. FHA mortgage insurance allows a homebuyer to make a low down payment and get a mortgage

loan.

The mortgage loan is made by a HUD approved lender. FHA insures the mortgage and pays the lender if the homebuyer

defaults on the loan. FHA/HUD does not make direct home loans.

Who Can Get FHA Mortgage Insurance

If you are buying a home, refinancing a mortgage for a home you already own, or making home improvements, you may

qualify for an FHA-insured mortgage.

In fact, almost anyone with good credit, enough cash to close the loan and sufficient steady income to make monthly

mortgage payments can be approved. There is no upper age limit and no certain income level required, although

mortgage amounts are limited by law.

Generally, the home must be owner-occupied. The program is not open to investors.

See a HUD -approved housing counselor or lender, who will look at your income and spending to determine if you qualify.

Federal law prohibits housing discrimination based on your race, color, national origin, religion, sex, family status, or

disability.

How FHA Mortgage Insurance Can Help You

Whether you are buying a home, making home improvements, or refinancing your mortgage, work with a HUD-approved

lender. Once your loan is approved, FHA will insure the loan. Because the lender is protected by this insurance, you can

get better terms on your loan.

A lower down payment - Some lenders require 10 percent or more of the price of a home as a down payment. With FHA-

insured mortgages, your down payment can be as low as 3.5 percent. The lender will likely require proof that you can

afford the down payment.

Use of cash gifts toward down payment - With an FHA-insured mortgage, under certain circumstances you can use a gift

from a relative, a local nonprofit organization, or a government agency for all or part of the down payment and closing

costs.

19

HUD's Mortgage Insurance Programs

Courtesy of pueblo.gsa.gov

FHA-insured mortgages are available in urban and rural areas for:

• Single family houses

• Houses with two, three, or four units

• Condominium units

• Houses needing rehabilitation

In addition, FHA-insured mortgages are available for reverse mortgages for seniors, called a Home Equity Conversion

Mortgage.

To make sure that its programs serve low- and moderate-income people, FHA sets upper limits on the value of the

mortgage loan. These limits change annually and vary by city and state. Check with a local lender or look online on HUD's

website, www.hud.gov.

Shopping for an FHA-Insured Loan

To become pre-qualified, you will complete a loan application. When a lender pre-qualifies you, the lender tells you the

maximum amount of money you can borrow to buy a home.

With that information, you can look for homes within your budget. Some lenders may charge a fee for pre-qualification.

Shop for an FHA-insured mortgage loan the way you shop for any high-cost item- compare prices and feature s. The cost

of getting a mortgage can vary from one lender to another. Negotiate with the lender on the interest rate, points, and

most processing fees.

Interest Rate

You can negotiate with your lender on the interest rate. Interest rates fluctuate daily, depending on the market. Check

with several mortgage lenders for the best interest rate.

Discount Points

Lenders can charge you discount points when the interest rate is lower than the yield required by investors who buy

mortgage securities. A discount point is $1 for every $100 of the mortgage loan amount. The number of points charged

varies. Discount points for an FHA-insured mortgage may be paid by you as the homebuyer, by the homebuilder, or by the

person selling the house.

Closing Costs and Prepaid Items

When your loan is finished, you will have to pay closing costs. Closing costs are costs in addition to the price of the

property paid when you close your loan to cover the transfer of ownership.

Closing costs generally include the following:

• Closing agent's or attorney fees

• Interest paid from date of closing through the end of the month of closing

• Loan origination fee to cover lender administrative costs

• Credit report fees

• Appraisal fees

• Recording fees

• Survey fee

• First mortgage insurance premium

• Title insurance (yours and your lender's)

20

Certain of these closing costs, as well as certain of the prepaid items listed below, may be paid by the seller, or shared

between the borrower and the seller, depending on the terms of the sales contract.

Prepaids are advance payments (property taxes, first annual premium for homeowners insurance, etc.) made at closing by

the borrower that may be placed in an escrow account and used by the lender to pay these bills as they become due.

While the property taxes due at closing are usually covered in your prepaids, your mortgage payment also includes an

amount to pay future taxes. These tax rates vary by area and typically increase with time.

Annual Percentage Rate

The Truth in Lending Act requires the lender to tell you the annual percentage rate (APR) charged on your home

mortgage. APR is calculated by adding the interest rate, the discount points, the initial service charge, the premium paid

to insure the mortgage, and certain other charges collected by the lender. The APR is not the same as the mortgage loan

interstate.

The Cost of FHA Mortgage Insurance

When you get a mortgage loan insured by FHA, you have to pay an up-front insurance premium, which can be included in

your loan. You will also have to pay a monthly insurance premium as well as the regular mortgage payment. FHA uses the

premiums to pay the lender if you default on your mortgage.

The Importance of Getting a Home Inspection

Buy a home in good condition. During a home inspection, a qualified inspector takes an in- depth, impartial look at the

property. The inspector will:

• Evaluate the physical condition: the structure, construction, and mechanical systems.

• Identify items that should be repaired or replaced.

• Estimate the remaining useful life of the major systems (such as electrical, plumbing, heating, air conditioning),

equipment, structure, and finishes.

After the inspection is complete, you will receive a written report of the findings from the home inspector, usually within

five to seven days.

FHA does not guarantee the value or condition of your future home, and FHA does not perform home inspections. If you

find problems with your new home after closing, FHA cannot give or lend you money for repairs, nor can it buy the home

back from you.

That's why it is so important for you, the buyer, to get an independent home inspection. You should remember that an

inspection is different from an appraisal, which also will be performed as part of the mortgage process.

Information Resources

You may want more information for yourself, your family, or others. The following services are available to help you.

Internet

www.hud.gov or espanol.hud.gov

HUD's website contains comprehensive information about homebuying, homeownership, selling a home, making home

improvements, and other housing-related topics-in English and Spanish.

HUD-Approved Housing Counseling Agency Locator

HUD supports a network of approved housing counseling agencies that provide counseling services across the nation. For

a complete list of HUD approved agencies in your area, call the HUD housing counseling referral line toll-free at 1-800-

569-4287 or visit the HUD website at www.hud.gov.

21

Lawrence

Habitat for Humanity· https://www.habitat.org/

Starting the Process

Lawrence Habitat for Humanity Family Selection Committee holds public meetings to explain our program and

requirements prior to accepting applications.

If you would like to receive an invitation, please e-mail buildinghope@lawrencehabitat.org with your name, mailing

address, phone number and family size with "homeownership interest" in the subject line OR call the Habitat office at

785-832-0777.

Attendance at this meeting is expected of all applicants. However, if attendance is not possible because of circumstances

beyond your control, please contact Family Selection or call the main office at 785 832-0777 for the necessary information

and application forms.

You will have approximately two weeks to gather the required information and complete the application form.

Application information is kept strictly confidential. Applicants who meet our income guidelines and pass reference

checks and a credit history review will be interviewed in their homes by members of the Family Selection Committee. The

selection process takes about three months.

Families who applied in the past but were not selected are invited to apply again.

For upcoming application dates or for any other questions, please contact Family Selection at

familyselection@lawrencehabitat.org or call 785-832-0777.

How We Select Family Partners: Habitat for Humanity is for people who need a better place to live and are willing and

able to take on the responsibility of homeownership. Habitat is a hand up, not a hand out.

Homeowner applications are reviewed by the Family Selection committee, and the select ion criteria does not

discriminate on the basis of race, sex, color, age, handicap , religion, national origin, family status or marital status, or

because all or part of income is derived from any public assistance program.

Three things are required to own a Habitat for Humanity home:

1. Need - We look for families who are living in inadequate housing and who don't have the financial resources to buy a

home without some help.

2. Ability to Pay - We look for families who have a stable income, either from employment or from other legitimate

sources, who have an acceptable credit history, and who don' t have excessive debt. Habitat families have income s that

are between 30% and 60% of the HUD median income guidelines for the Lawrence area, adjusted for family size.

3. Willingness to Partner - We look for families who are willing to work hard to build their own home and help build

homes for other Habitat families; who are responsible neighbors ; and who have shown that they are financially

responsible by making regular payments to landlords, utility companies, and other creditors. We select families who have

made this area their permanent home, and who have lived and/or worked in Douglas or Jefferson Counties for at least

one year.

22

HOME SECURITY INSPECTION CHECKLIST

An important step in preventing burglary and other crimes is to make sure that a residence is as secure as possible. A

careful inspection can indicate features which would make entry either easy or difficult for a prospective burglar.

Chances are good that home security can be improved. Take a hard look at entry points in your residence and determine

what steps can reduce vulnerability.

A security inspection begins at the front door and goes on to include side and rear doors, windows, locks, lights and

landscaping. Most security modifications that you might consider making are simple and quite cost effective.

Disclaimer: The following recommendations in no way ensure that this residence will be one hundred percent burglar

proof, but these are proven techniques to make your home more secure and a more difficult target for burglars.

EXTERIOR DOORS & ENVIRONMENT:

Apply these security recommendation s to all exterior doors including entrances from garage/ basement to house.

1. Is house address clearly posted and lit to aid emergency response? Yes□ No□

2. Is door itself of metal or solid wood construction? Yes□ No□ (including doors between garage/basement &

house)

3. Is doorframe strong enough and tight enough to prevent forcing or spreading? Yes□ No□

4. Are door hinges protected from removal from outside? Yes□ No□

5. Are there windows/glass panels in the door within 40 inches of the lock? Yes□ No□

6. If there are no windows in or near door, is there a wide-angle viewer or voice intercom device? Yes□ No□

7. Is door secured by a deadbolt lock with a minimum 1-inch throw? (including door from garage/basement to

home) Yes□ No□

8. Are strikes and strike plates adequate and properly installed with 2 ½ -3 inch screws? Yes□ No□

9. Can the lock mechanism be reached through a mail slot, delivery port or pet entrance at the doorway? Yes□ No□

10. Is there a screen or storm door with an adequate lock? Yes□ No□

Look at your Home from the Outside-In

1. Is the exterior of the front/rear entrance lighted with at least a 40-watt bulb? Yes□ No□

2. Can front/rear entrance be easily observed from street or other homes or a public area? Yes□ No□

3. Does porch or landscaping offer concealment from view of the street, other homes or public areas? Yes□ No□

SLIDING GLASS DOORS & WINDOWS:

1. Do all windows have adequate locks in operating condition? Do windows/sliding doors close snugly? Yes□ No□

2. Can the sliding panel be lifted out of the track? Yes□ No□

3. Is there a dowel or "Charlie bar" in the bottom of track to prevent horizontal movement? Yes□ No□

4. Are exterior areas of windows free from a concealing structure or landscaping? Yes□ No□

GARAGES

*Security tips: Double-check to ensure garage door is closed when not in use. If there are ground-level windows in your

garage they should be covered with curtain or blind to prevent someone from looking in. Unplug garage door opener

when away from home for vacation or extended period of time.

MISCELLANEOUS HOME SAFETY:

Smoke Detector: Check each one in the home. Test to ensure they are functioning.

Fire Extinguisher: Have one in the garage and a small one in or near the kitchen.

23

Home Maintenance Checklist

Prevent tomorrow's problems with our month-by-month chart of tasks for your home. MONTHLY

• Fire Extinguisher: Check that it's fully charged; recharge or replace if needed.

• Sink/Tub Stoppers and Drain Holes: Clean out debris.

• Garbage Disposal: Flush with hot water and baking soda.

• Water Softener: Check water softener salt drum and replenish salt if necessary.

• Forced-Air Heating System: Change filters once a month if user's manual recommends fiberglass filters.

EVERY 2 MONTHS

• Wall Furnace: Clean grills.

• Range Hood: Clean grease filter.

EVERY 3 MONTHS

• Faucet: Clean aerator.

• Tub Drain Assembly: Clean out debris; inspect rubber seal and replace if needed.

• Floor and Outdoor Drain Grates: Clean out debris.

EVERY 6 MONTHS

• Smoke Detector: Test batteries and replace if needed.

• Toilet: Check for leaks and water run-on.

• Interior Caulking: Inspect caulking around tubs, showers, and sinks; replace any if it is deteriorating.

• Forced-Air Heating System: Change semi-annually if user's manual recommends high efficiency pleated or HEPA-

style filters.

• Garbage Disposal: Tighten drain connections and fasteners.

• Clothes Washer: Clean water inlet filters; check hoses and replace them if they are leaking.

• Clothes Dryer: Vacuum lint from ducts and surrounding areas.

• Wiring: Check for frayed cords and wires; repair or replace them as needed.

• Range Hood: Wash fan blades and housing.

EVERY SPRING

• Roof: Inspect roof surface, flashing, eaves, and soffits; repair if needed.

• Gutters and Downspouts: Clean them out or install no-clean version. Inspect and repair weak areas; check for

proper drainage and make repairs if needed.

• Siding: Inspect and clean siding and repair if needed.

• Exterior Caulking: Inspect caulking and replace any that is deteriorating.

• Windowsills, Doorsills, Thresholds: Fill cracks, caulk edges, repaint; replace if needed.

• Window and Door Screens: Clean screening and repair or replace if needed; tighten or repair any loose or

damaged frames and repaint if needed; replace broken, worn, or missing hardware; tighten and lubricate door

hinges and closers.

EVERY FALL

• Roof: Inspect roof surface, flashing, eaves, and soffits; repair if needed.

• Gutters and Downspouts: Clean out. Inspect and repair weak points; check for proper slope.

• Chimney or Stovepipe: Clean flue (more frequently if needed); repair any cracks in flue or any loose or crumbling

mortar.

• Siding: Inspect and clean siding and repair if needed.

• Exterior Caulking: Inspect caulking and replace any that is deteriorating.

• Storm Windows and Doors: Replace any cracked or broken glass; tighten or repair any loose or damaged frames

and repaint if needed. Replace damaged hardware; tighten and lubricate door hinges and closers.

• Window and Door Weather Stripping: Inspect and repair or replace if it is deteriorating or if it does not seal.

• Thermostat: Clean heat sensor, contact points, and contacts; check accuracy and replace thermostat if it is not

functioning properly.

• Outdoor Faucets: If you live in an area with freezing winters, shut off valves to outdoor faucets. Open spigots and

drain, store hoses.

24

ANNUALLY

• Septic Tank: Have a professional check the tank (watch for backup throughout the year). In many areas, it is

recommended that the tank be pumped every year.

• Main Cleanout Drain: Have a "rooter" professional clean out the main line, particularly if there are mature trees

in your yard whose roots could have cracked the pipe in their search for moisture.

• Water Heater: Drain water until it is clear of sediment; test temperature pressure relief valve; clean burner and

ports (gas heater)

• HVAC System: Have a professional tune up your heat/air conditioning system.

25

Steps to Acquire a Lawrence Housing Trust Home

Housing Trust loans are available only on properties located in Lawrence city limits. Homebuyers need two years of

consistent income and bill paying history. Purchase price and income limitations change annually according to HUD

requirements. The Lawrence Community Housing Trust is a nonprofit housing developer that partners with the City of

Lawrence Community Development Division and local lenders to use federal HOME funds and create affordable homes

within the context of a community land trust.

Step 1: Workshop. Attend a First Time Homebuyers Workshop presented by Tenants to Homeowners, Inc. The Lawrence

Community Housing Trust Program. These workshops explain the housing trust, how to shop for a home, prepare for a

housing trust mortgage application and be a responsible homeowner. These workshops are free at the United Way Center

at 2518 Ridge Court from 9:30am to 1:30pm. Call TTH at 842-5494 for more details.

Step 2: Pre-Qualifying Session. Meet with TTH staff to determine if you are income- eligible for the Housing Trust

Program. You will need to provide income verification (pay stubs and/or tax statements and bank statements), and staff

will download a free credit report. However, even if you are income-eligible for the program, this does not mean you will

be approved for a mortgage loan by a LCHT-participating lender. You may need to improve your finances before you will

be pre-approved for a loan. TTH staff can only establish program eligibility and estimate the amount of mortgage that a

lender may pre- approve you for. However, TTH has no influence on any lender's decision to approve or deny a mortgage

loan application.

Step 3: Budget Counseling. Meet with a credit counselor at Consumer Credit Counseling for your pre-purchase budget

counseling session. This is an important step and should be done at the last minute. Step 2 determines the amount of

mortgage you might qualify for, but this step determines what fits with your personal budget. HCCI is located in the

United Way Center, Suite 207, but you must call 749-4224 to schedule an appointment.

Step 4: Apply for a Loan. Collect records for the loan application and schedule an appointment with an LCHT participating

lender. If the lender determines you are eligible for conventional financing and a prime rate, and you can afford the

payment, then you are not eligible for an LCHT mortgage. Also, please note that the income determination TTH uses to

determine eligibility may not be the same method as the lender. The lender will need your workshop certificate, budget

counseling session feedback and TTH income verification sheet to pre-approve you for an LCHT loan.

Step 5: Pre-approval. Once all information is gathered, the lender estimates the amount you can finance. An official pre-

approval letter includes an official estimate that locks your interest rate in a 30-year mortgage.

Step 6: Selecting an LCHT Home. You may purchase a TTH new construction or rehabilitated home, or a home resold on

the Housing Trust. If funds are available, you may also be able to select a home on the market that will be added to the

housing trust with a grant that reduces its price. These funds are not currently available. To use these funds, the house

must also meet strict criteria for city and federal health and safety codes with minimal rehabilitation needs.

Step 7: The Contract. All LCHT contracts include contingency clauses that require LCHT pre-approval, signed Letters of

Stipulation and Acknowledgment from prospective buyers and a Housing Trust Orientation Certificate from prospective

buyers before closing can occur.

While these steps are a guideline for the most appropriate way to participate with the Lawrence Community Housing

Trust Program, they are not necessarily all- inclusive. Consult TTH staff for further details at 842-5494.

26

About Surveyors

• Land Surveying as a Profession

• Land Surveying is a proud profession with strong presidential ties; George Washington, Thomas Jefferson and

Abraham Lincoln were all land surveyors. In fact, surveyors are proud to say that "there are three surveyors and

another guy on Mt. Rushmore." Roosevelt was, unfortunately, never a member of the surveying profession.

• What Are We?

• The Kansas Society of Land Surveyors is an association of professionals who render a highly technical service

while taking into account applicable laws, regulations, codes and court decision s established by city, county,

state and federal authorities.

What Do We Do?

Surveyors are the first professionals consulted when new sites are proposed, constructed and sold.

Surveyors:

• set and mark monuments at your property corners so they can be easily found*

• study your property description & applicable evidence, and indicate, in their professional opinion, what the

records and facts indicate the boundaries of your land to be

• advise you of defects which can have adverse effects on the ownership of your land Using specialized equipment

and some of the latest technology, surveyors perform:

• Mortgage Title Inspections

• Preliminary Surveys

• Boundary Surveys

• Lot Split Surveys

• ALTAlASCM Land Title Surveys

• Topographic Surveys

• Site Plan Surveys

• Subdivision Plat Surveys

• Construction Surveys

• Archeological Surveys

• Flood Zone Surveys

• Mineral and Mining Surveys

• Forensic or Crash Site Surveys

Why Surveyors are Important

• We protect the interests and rights of property owners.

• In cases of controversy, a surveyor can appear as an expert witness.

• By law, surveyors are the only professionals who are allowed to write original descriptions of real property for

conveyance of or recording thereof. (KSA 74-7003)

When to Call Us

• Before you buy or sell a house, construct a building or fence, or develop property.

• In short, before a boundary dispute arises!

Where to Reach Us

• Contact your attorney or local Register of Deeds. (Most Registers of Deeds offices have copies of our brochures

and know how to reach us.)

• Check to see if your county has a County Surveyor; call that office

• Call our office 316.680.5159

• Check our website to locate a surveyor in your area

27

Avoiding Foreclosure

Foreclosure is a situation in which a homeowner is unable to make mortgage payments as required, which allows the

lender to seize the property, evict the homeowner and sell the home, as stipulated in the mortgage contract.

Step one: communicate with your lender

As soon as you realize that you are going to have trouble making your mortgage payments, contact your "lender and tell

them about your financial difficulties. This gives them the opportunity to work with you to create a plan. Do not stop

paying your bills, and do not wait until you cannot make payments before you act. Though you may feel scared or

embarrassed, immediately begin working with your lender to avoid foreclosure on your home.

Step two: work with the MHA program

You can get help through the Making Home Affordable (MHA) program, which provides free counselors for advice and

assistance with keeping you in your home or getting out safely. Visit the MHA website to read about the options and what

you'11 need to prepare.

MHA has a hot line you can call anytime: 1-888-995-HOPE (1-888-995 -4673) and TTY users should call 1-877-304- 9709.

You can also find a counselor in your area. Your state's housing agency might have a foreclosure avoidance program as

well.

If you have an FHA loan, call the FHA National Servicing Center at 1-877-622-8525.

Beware of mortgage relief scams. One sign of a scam is when they ask for a fee in advance. Learn how to spot housing

scams and report housing scams.

Foreclosure Scams

Dishonest companies or individual s sometimes target homeowners who are struggling to meet their mortgage

commitment or are anxious to sell their homes. Scam operators like this promise to help you keep your home or sell your

home without having to go into foreclosure, for a fee. However, they rarely deliver on what they promised.

Common Foreclosure Scams

• Offers to negotiate with your lender

• Advises that they can stop foreclosure by "helping" you file for bankruptcy

• Ask s you to sign over the title to your house to them and make smaller rental payments to them until you can

afford to buy the house back later

• Promises to act as an intermediary between you and your mortgage lender to refinance your loan

• Instructs you to make payments directly to them instead of the lender

• Claims that they are affiliated with government mortgage modification program s (keep in mind that legitimate,

government approved programs do not charge fee s to participate in them)

• Encourages you to sign fake foreclosure rescue documents

• Claims that they can perform a forensic mortgage lo an audit to help you hold onto your home

File a Complaint

If you need to report a foreclosure scam, you may file a complaint by contacting the Federal Trade Commission (FTC). If

the scam involves bankruptcy, contact a local U.S Trustee office.