Investment Analysis: The Effectiveness of

Flipping Real Estate

Kaylee Zhou, 122230

Ms. Lori Hall

Alpha Valuations

Report Submitted: August 13, 2021

Executive Summary

As an appraisal firm, Alpha Valuations focuses on providing quality service and

expertise to customers. The company's objective is to provide service to those

interested in knowing the amount for which a property will transact on a particular date

(Pagourtzi, 2003). The aim of this business project was to focus on investment

properties. I focused on researching whether flipping real estate was effective. For this

project, I looked into three condos in Illinois. The first condo was in Bolingbrook, the

second was in Wheaton, and the third was in Lombard. Many have described the act of

property flipping as buying a smaller and cheaper property, restoring its interior and

exterior, and then quickly reselling it (LaCour-Little, 2021). During this project, I learned

that flipping homes involved more than considering product and labor costs. In fact,

insurance, taxes, and mortgage are all essential details to consider. I am very thankful

for this opportunity to explore a field that I wasn't as familiar with and am now more

informed about. I wish Alpha Valuations the best in the future in continuing condo

investment properties and exploring single-family homes as investment properties.

Business Context

Alpha Valuations is an appraisal firm in the real estate industry. The real estate

industry involves many facets of commercial and residential property management,

such as sales, developments, renovations, appraisals, etc. Real estate is controlled by

economic factors like interest rates, population growth, and economic strength

(Franchisee Resource Center, 2020). With this in mind, Alpha Valuations is a company

that focuses on specifically bringing service and expertise to customers who are looking

for an accurate assessment of the value of their property. Covering commercial and

residential real estate, they offer appraisals and consultations for commercial properties

throughout Illinois and services for residential properties in Cook, DuPage, Kane,

Kendall, Lake, Will, and McHenry counties. As an intern, I worked beside Alpha

Valuations on various projects such as completing a business plan, analyzing

investment properties, researching mortgages and taxes, and more.

Business Project Description

I was onboarded onto Alpha Valuations as an intern, and I worked weekly from

June to August alongside Mr. Will and Mrs. Lori Hall. Throughout this experience, some

key insights and tasks I focused on were organizing and completing a business plan,

creating home valuation tools, researching real estate trends for townhouses, condos,

and single family homes, analyzing investment properties, researching renovations for

flipping homes, and learning about mortgage and taxes.

One major project I worked on was organizing and completing the business plan.

The business plan is split into seven main sections, including the executive summary,

company description, market research, service line, marketing and sales, and

expectations. My advisor, Ms. Lori Hall, allowed me to work at my own pace and fill in all

the sections on a separate copy of the Alpha Valuations Business Plan. Throughout this

project, I learned an immense amount about how much background and small and large

details needed to be taken into account when launching and expanding a business.

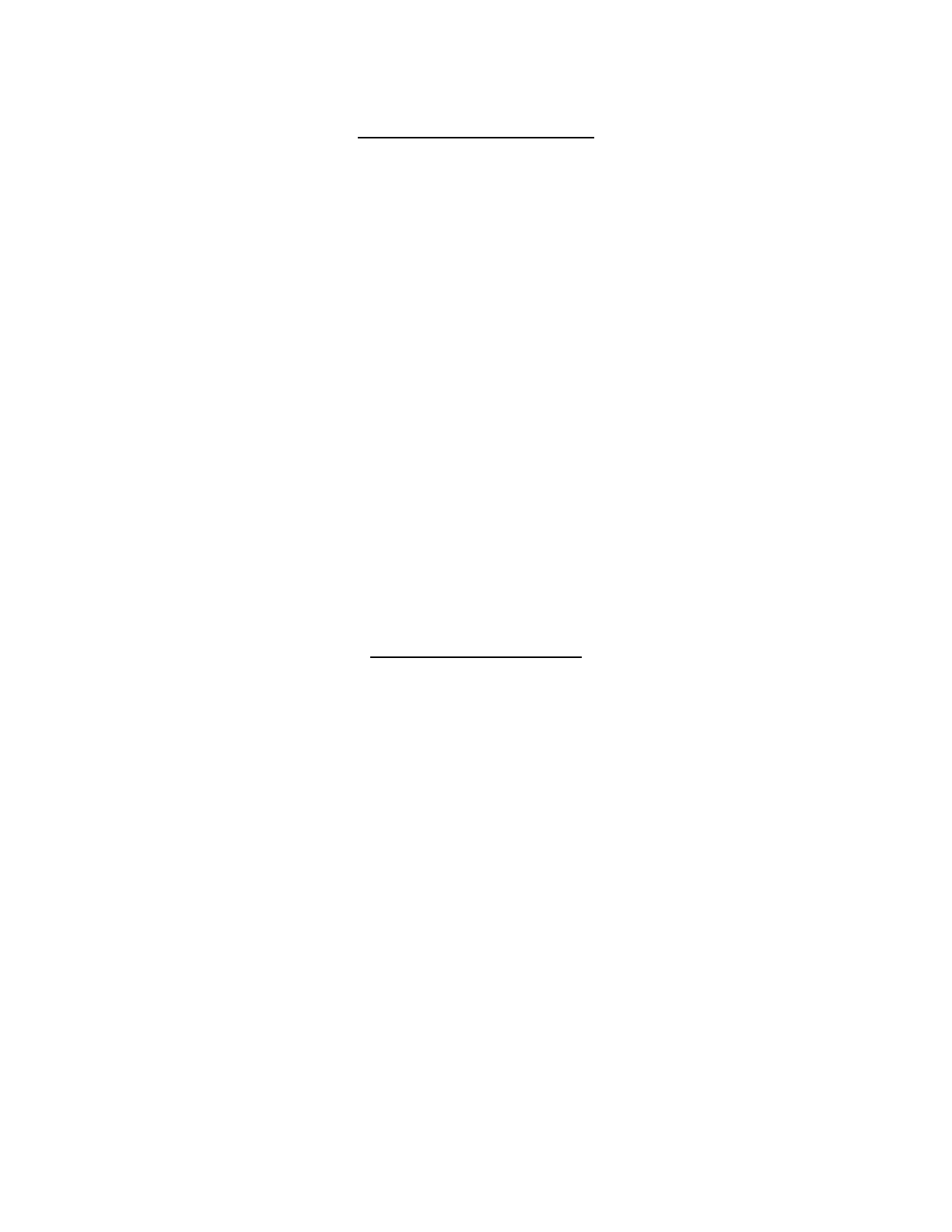

The executive summary, company description, and expectations were three

sections that stuck out to me the most. The executive summary focused on determining

the product, target market, objective, future, and personal goals. As I was completing

this portion, I realized the importance of considering how your personal goals can align

with your plans for your business, and why it is important to consider both. It also gave

me the opportunity to write and understand the objectives of the business and what the

company is trying to achieve.

Image 1: This image is a portion of the executive summary that shows the product and customers/target

market sections.

The company description consisted of producing tag lines, slogans, mission

statements, company members, and legal structure. While I have heard of tag lines,

slogans, and mission statements thrown around in my everyday life, this section allowed

me to dig deeper and research examples of each and how they differ from each other.

After developing a couple of ideas for tag lines, slogans, and mission statements, I

researched legal structure. The debate for the company was whether to be a sole

proprietorship or a limited liability company. Coming into this internship, I didn't know

either of these terms, but I now understand that a sole proprietorship is when a

business started doing business without declaring themselves as a separate legal entity,

while limited liability companies are those who went through the process of becoming a

separate legal entity.

The last section was the expectations portion, consisting of the forecast, yearly

financial highlights, financing needed, and time required per week. This section was

new to me and required me to research how to calculate monthly forecast, revenue and

expenses, and net profit/losses by year. I learned that this information is best displayed

in a chart labeled with projected profits/losses, revenue, direct costs, operating

expenses and income, and net profit percentage.

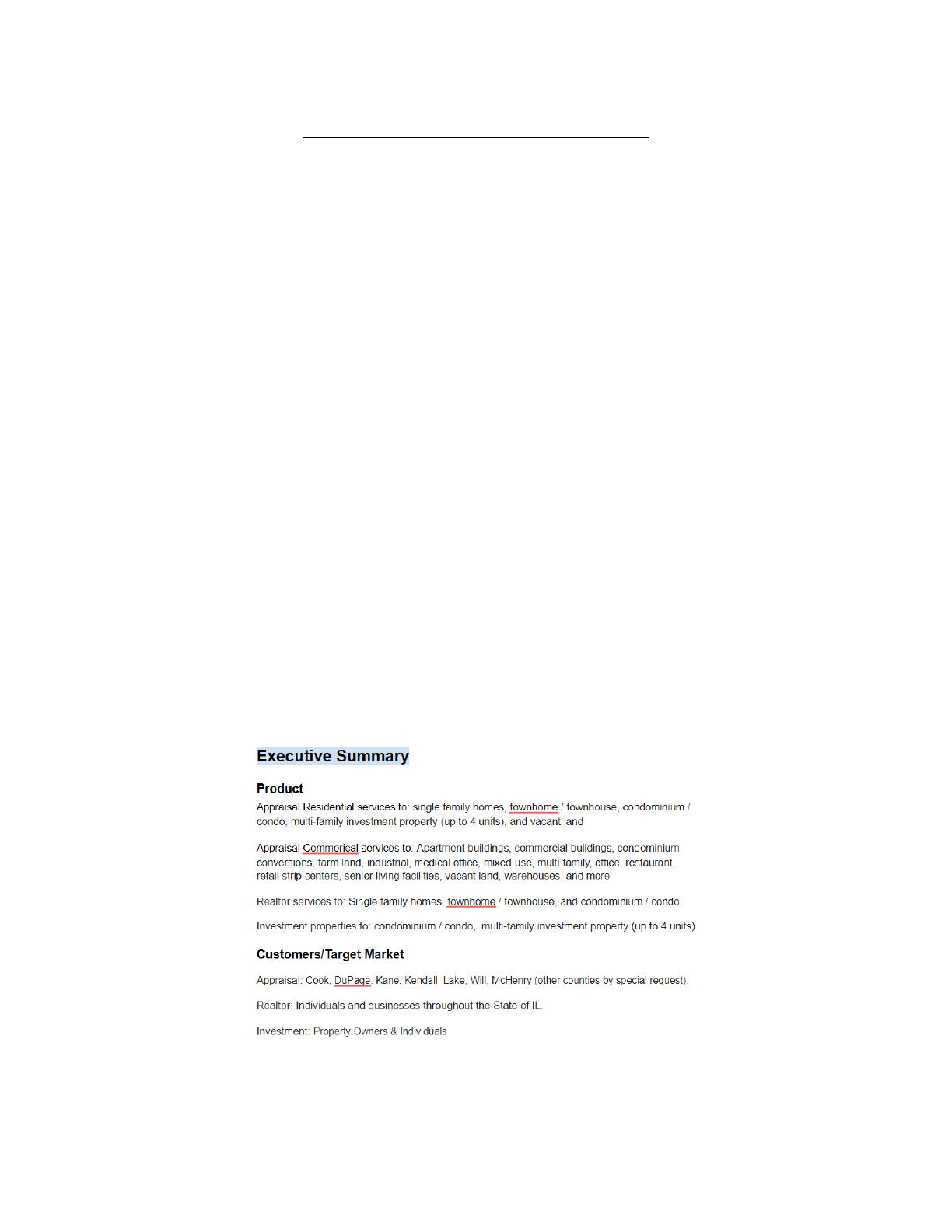

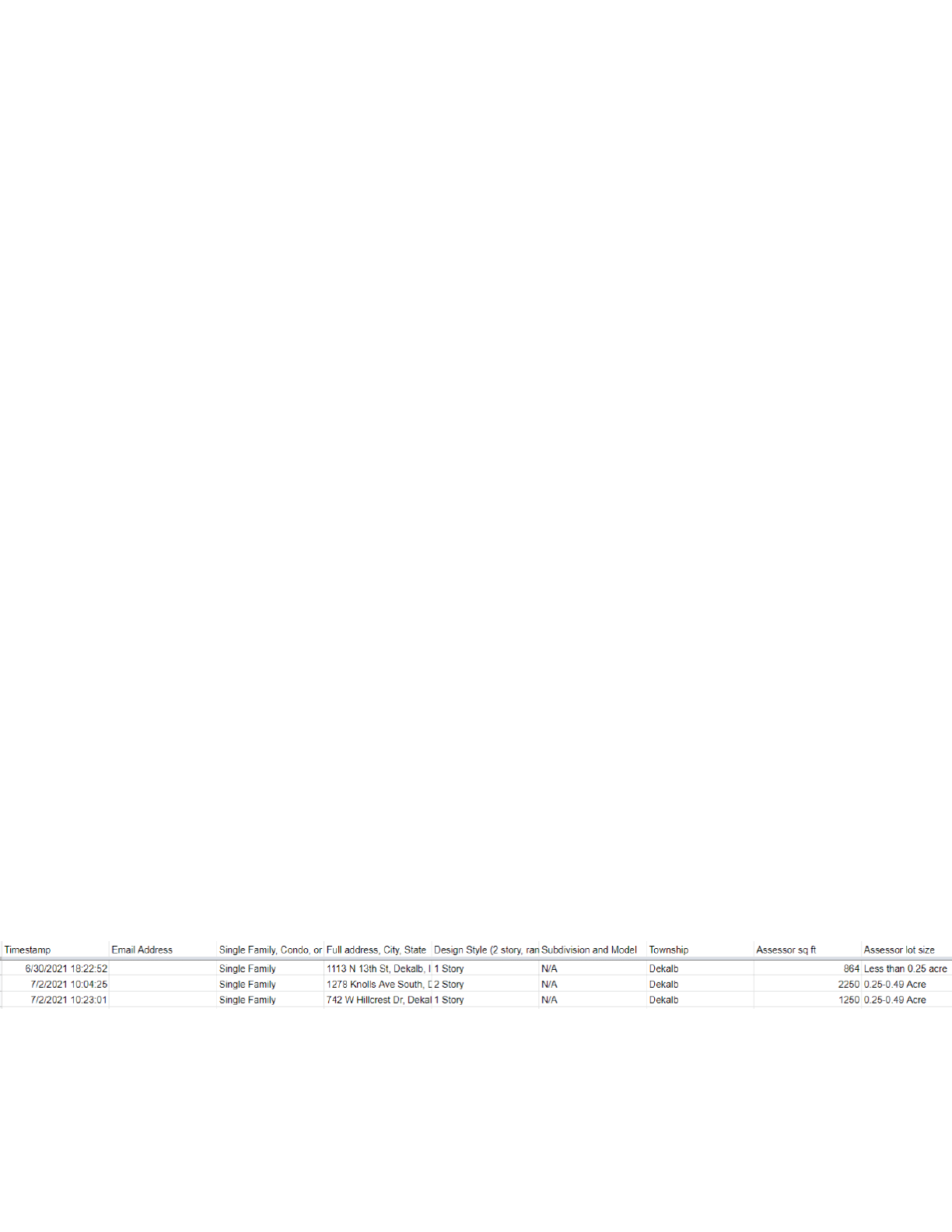

Another major project I focused on was creating home valuation tools. For

appraisal purposes, many components of a home need to be considered in order to

obtain an accurate estimate of the property's value. These components can include

asking how many rooms and the exact rooms the home has, the square footage of the

lot and property, the exterior and interior design, the model type, the exterior

commodities, etc. These home valuation tools came in a short, long, and future form.

The short form consisted of basic questions about the property. The long-form asked

more in-depth questions about the interior and exterior components of the property. The

future form is all the questions from the short and long forms combined. I created this

valuation tool by plugging the questions from the short, long, and future forms into the

Google Forms software. This allows Alpha Valuations to provide customers with Google

Forms if they want their property appraised.

Image 2: This image shows a portion of the long home valuation tool form. Specifically, It shows where the

data from completed forms end up.

Image 3: This image shows the first few questions and is a portion of the long home valuation tool form.

Along with these two major projects, I also completed several shorter tasks. One

task was researching real estate trends for townhouses, condos, and single-family

homes. With this research, I focused on recent styles in trends involved in flipping

properties. For condos, my results concluded that popular interior color schemes seem

to be white/beige/burgundy, while popular exterior color schemes involve creamy

whites/wood accents. As for interior flooring, homeowners seem interested in investing

in condos that provide multifunctional spaces with engineered hardwood floors and

laminate/granite/ceramic tile countertops. This research allowed me to delve into the

online real estate industry and learn more about the importance of the physical appeal

of a property. I also realized how quickly trends move around in real estate depending

on prospective buyers.

In addition to the previous tasks, I was also given the opportunity to explore

mortgages and taxes and learn about their history. I researched many terms such as

PMI Insurance, Interest Only Mortgages, No Document Loans, Balloon Payments, and

Early Prepayment Penalties for mortgages. From this, I learned that PMI Insurance is

an insurance policy for those who make less than a 20% down payment on a property,

while Interest Only Mortgages and No Document Loans are exactly what they sound

like. I also learned that Balloon Payments and Early Prepayment Penalties are

complicated and are usually advised to avoid. A history lesson was also included in this

research. I read about the aftermath of the 2005-2008 No Document Loans and Interest

Only Mortgages. Specifically, I was able to read about the history of the Lehman

Brothers and Merrill Lynch.

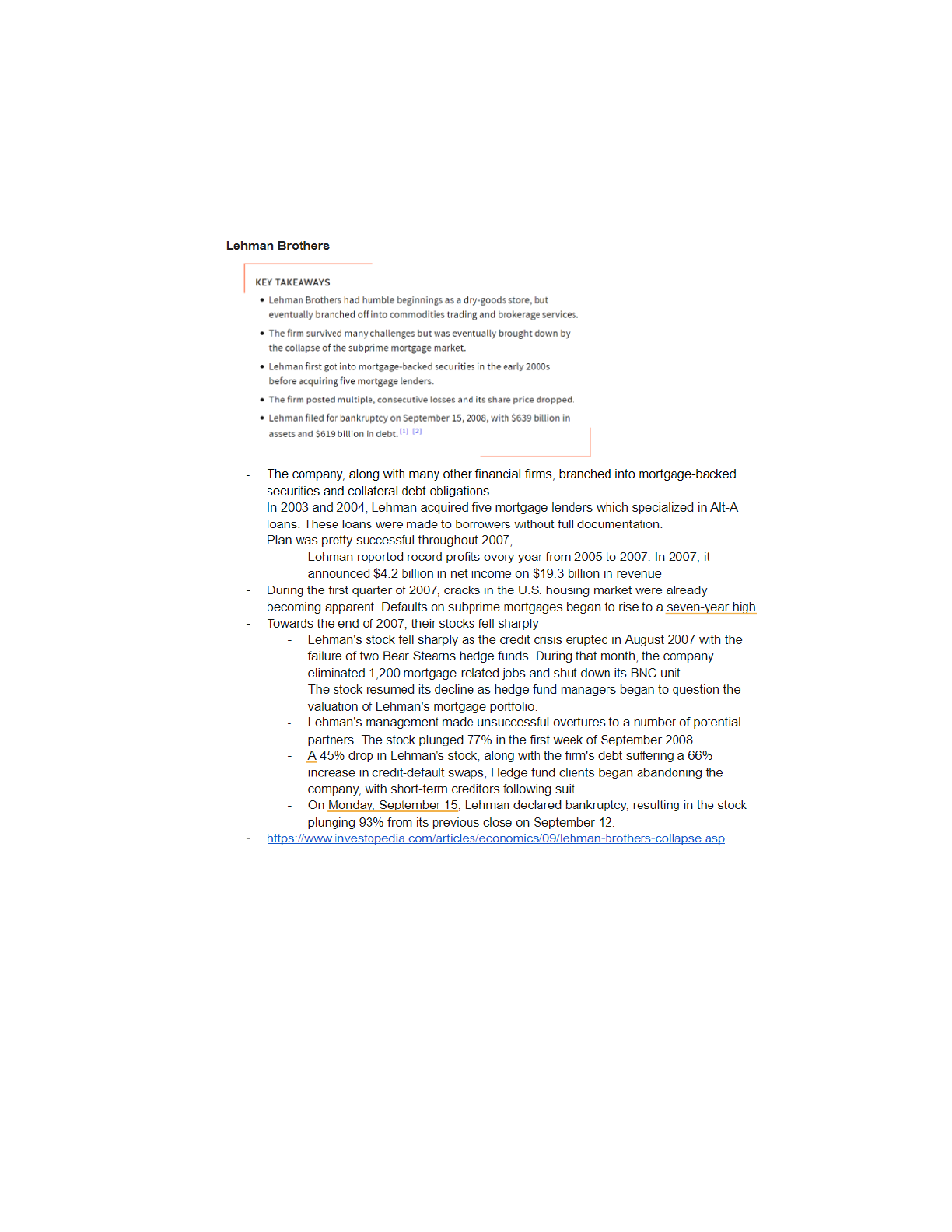

Image 4: This image shows the research and notes I took about how no document loans and interest only

mortgages affected the Lehman Brothers.

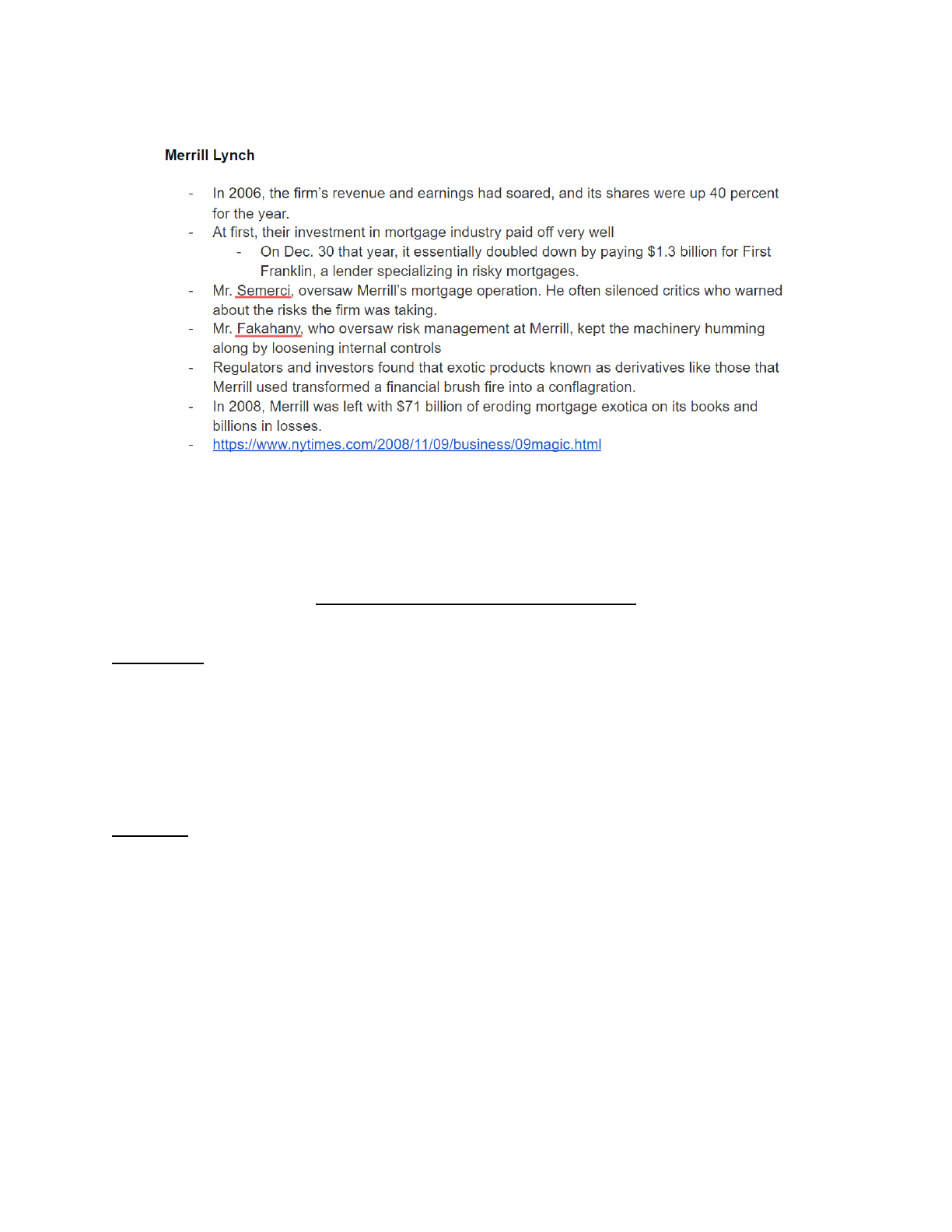

Image 5: This image shows the research and notes I took about the company, Merrill Lynch.

Business Project Research

Questions

Throughout this internship, business research was essential for success. My

main research question is as followed:

1. How does the return price compare to the labor/product costs for

investment flips and property renovations?

Methods

To further understand the economic values involved in investment properties, I

created theoretical renovations to condos in order to compare renovation/labor costs to

the value of the property in the end.

I renovated three condos during this process, one from Bolingbrook, IL, the

second from Wheaton, IL, and the third from Lombard, IL. However, for this business

project, the final return price of the Bolingbrook house was given to me, so I will

describe the labor/product cost for the Bolingbrook property instead of the Wheaton or

Lombard condos.

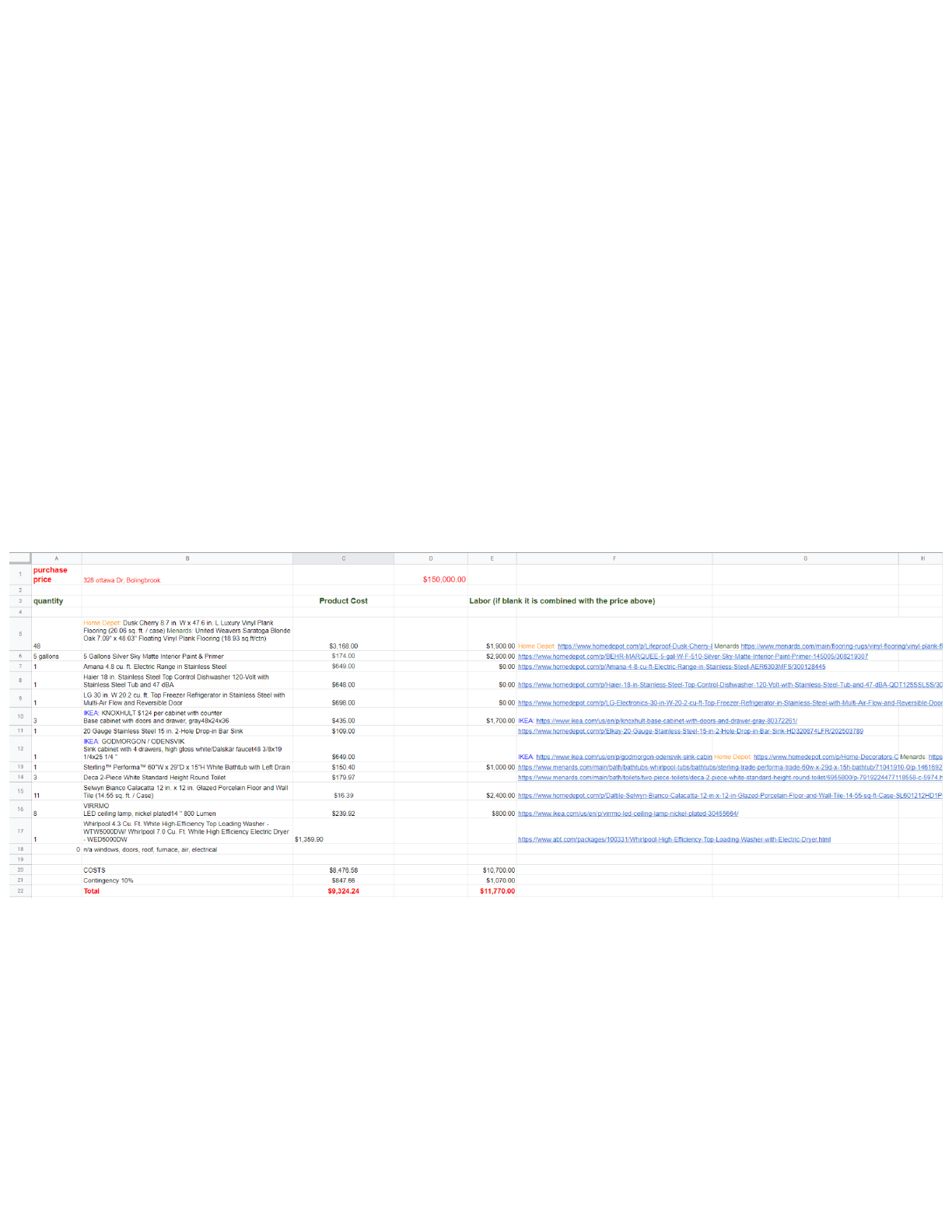

To start the theoretical renovations, I found products for the Bolingbrook condo

on sites such as Menards, Home Depot, ABT Electronics, and IKEA. The products I

collected for each property included new flooring, paint, ranges, dishwashers,

refrigerators, kitchen and bathroom cabinets, toilets, bathtubs, bathroom tiles, lights,

and washers and dryers. From here, I read through the MLS (Multiple Listing Service)

sheets to find out how many square feet of flooring, walls, and tiles must be replaced. I

then multiplied the number of square feet by the price of each product per square foot to

get the final product cost of each item. As for the ranges, dishwashers, refrigerators,

cabinets, toilets, bathtubs, lights, and washers and dryers, I multiplied the price by the

quantity needed for the condo, based on the number of rooms. After calculating the

product costs, I moved onto calculating the labor costs, which I did by using the home

intelligence tool. Once the total costs for product and labor were calculated, I added a

10% increase for contingency onto each cost. Then, I added the previous product cost

to the contingency amount to get the final product cost of $9,324.24 and added the

previous labor cost to the contingency amount to get the final labor cost of $11,770.00.

Image 6: This image shows the product and labor costs involved in the Bolingbrook Condo.

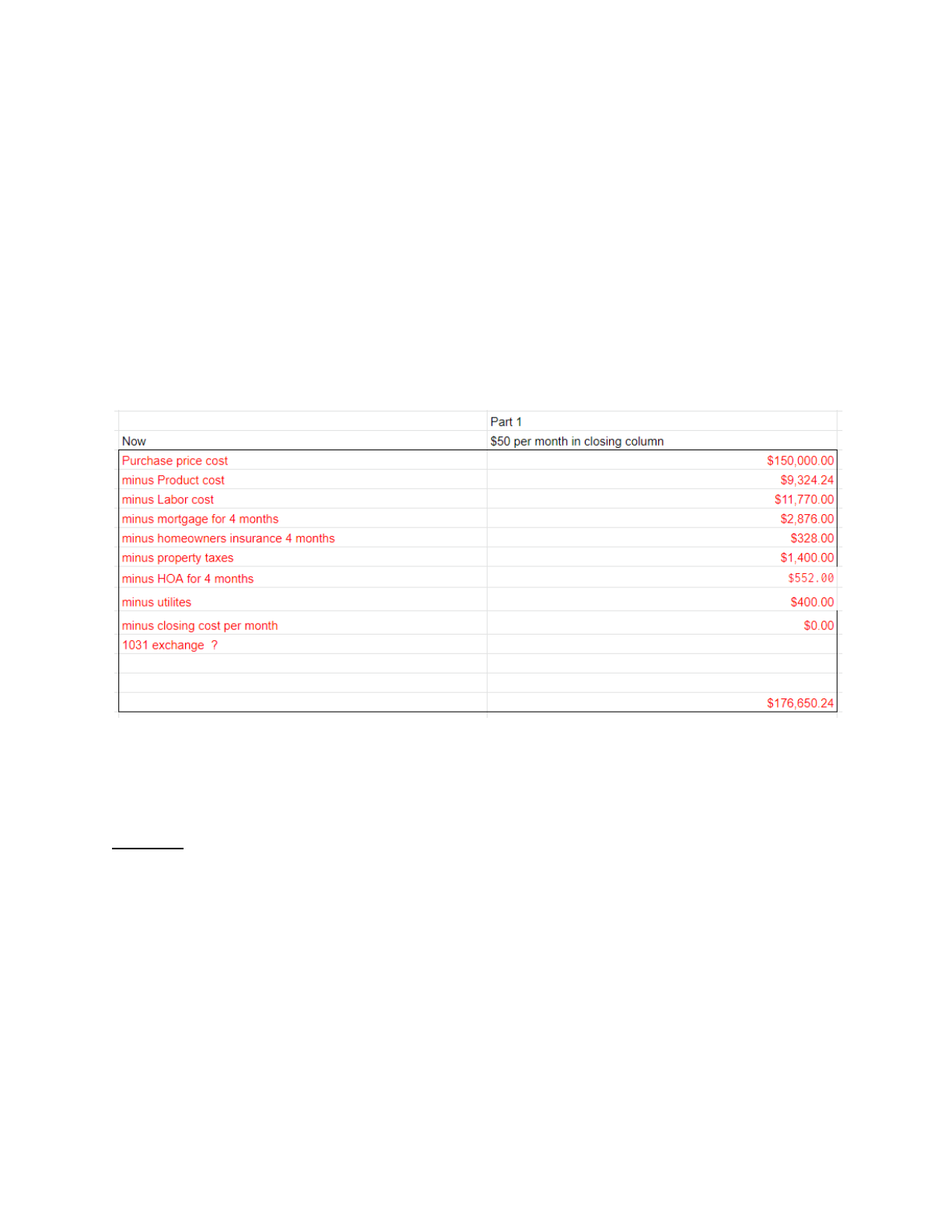

Once the product and labor costs were complete, I analyzed the MLS (Multiple

Listing Service). The next step was to collect information about the purchase price,

federal and state taxes, the mortgage, the homeowner's insurance, the property taxes,

and the HOA cost of the Bolingbrook Condo. The purchase price, which is $150,000,

can be found on the MLS, while additional work with a CPA is needed to determine

exact taxes. The mortgage was trickier to find because the current mortgage rate can't

be assumed with confidence since it is for an investment property rather than a primary

residence. For now, I calculated using mortgage calculators such as Bank Rate. On this

site, I inserted the value of $150,000, and it gave me a rate of $719. Since we would

only have the condo for four months because of renovations, the mortgage ended up

being $2,876. The homeowner's insurance, property taxes, and HOA rate were found

from online databases. As displayed in image 7, after adding all the columns together,

the final renovation cost was $176,650.24.

Image 7: This image displays the costs for section such as, mortgage, homeowners insurance, property

taxes, HOA, and more. Most importantly, this image shows the final renovation cost for the Bolingbrook

Condo.

Insights

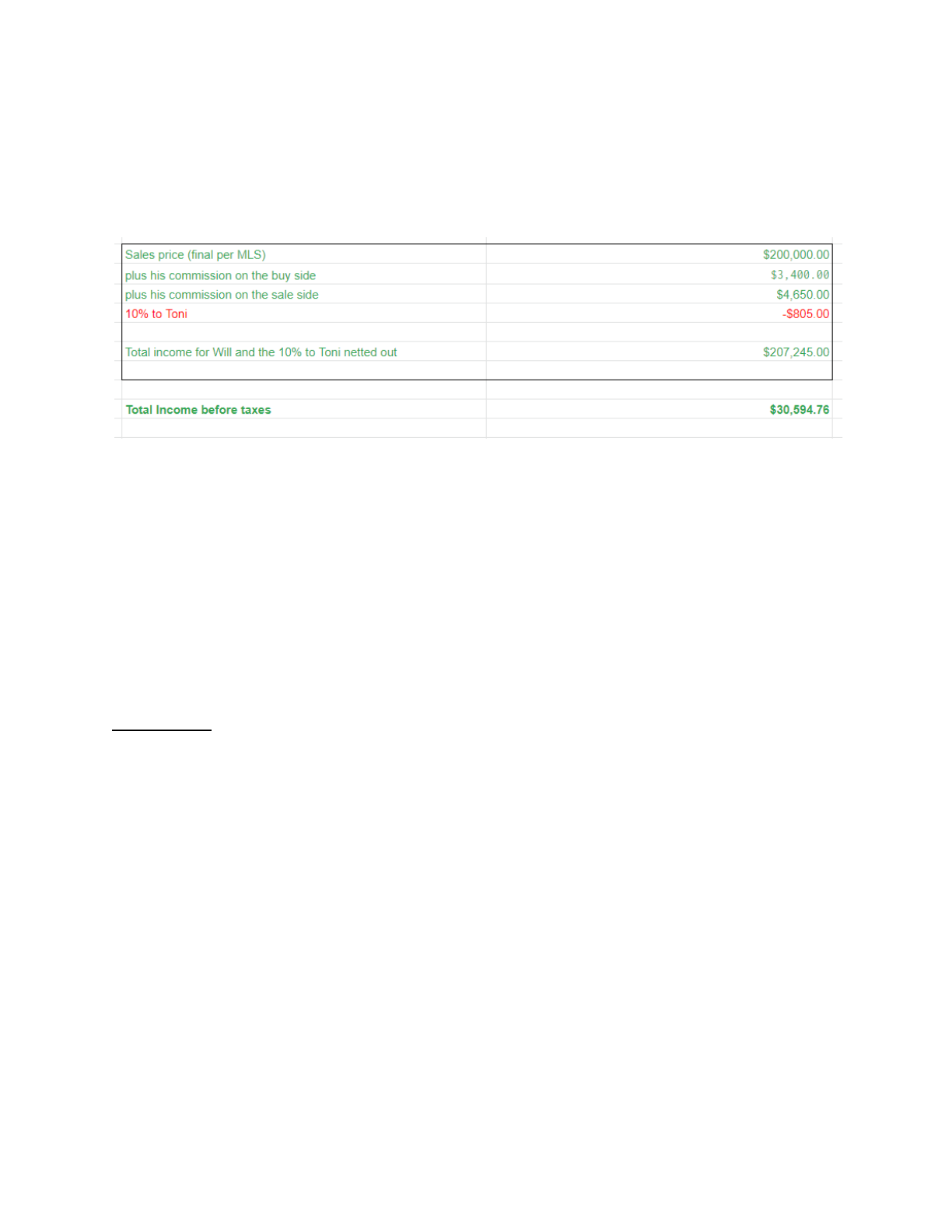

After I finished calculating the renovation costs, Mr. Will Hall, and Ms. Lori Hall,

worked together to determine the final sales price and commissions for the Bolingbrook

condo. Image 8 shows the final sales price of $200,000, and the commission on the buy

side was found by multiplying the purchase price of $150,000 by 2.5% and then

subtracting it by $350 to get $3,400. The commission on the sale side was found by

multiplying the sales price of $200,000 by 2.5% and then subtracting it by $350 to get

$4,650. After adding together the commissions, 10% is given to another party while the

rest is added onto the sales price to get a total of $207,245. However, the final return

price is determined by subtracting the final sales price from the renovation cost. This

happens to be $207,245 minus $176,650.24, which gives us $30,594.76.

Image 8: This image shows the final sales price, commission prices, and total income from the condo.

To conclude, $30,594.76 is the investment property's return before taxes, and the

after taxes return is still to be determined. There are still many factors to consult with a

CPA, such as renting out the property for a year to avoid short-term capital gains, selling

and itemizing costs, and 1031 exchange. For now, $30,594.76 as the amount before

taxes and additional factors shows that flipping real estate, especially condos in this

situation, seems to be effective.

Limitations

My major limitation while completing this project was the difficulty finding the

correct databases when searching through secondary sources. While I used primary

and secondary sources throughout this project, information such as homeowners

insurance, property taxes, and HOA rates was found through secondary sources. This

process took me a while, and I found that it took several tries before I could find the

correct databases with the information I was looking for.

Key Project Learnings and Recommendations

Learnings

This internship provided me with exposure and a more in-depth understanding of

the real estate industry and the business world. I gained experience calculating product,

labor, commission, and tax costs for a business. Along with this, I explored investment

properties and learned that flipping homes involve a lot more than the simple product

and labor costs needed to flip the home physically and that insurance, taxes, and

mortgage are essential details as well. I also had the opportunity to explore and

complete every component of a business plan, which will be helpful for me to look back

on in the future. The lessons and research I have done for this project will benefit me in

the future if I decide to continue exploring real estate, and when it comes time for me to

purchase property. I am very grateful for this opportunity to get hands-on experience

researching and working in a professional real estate setting.

Recommendations

My experience working with Alpha Valuations has been super rewarding, and I’m

glad to hear that they are moving forward with investing in condos. I hope they continue

looking into the profitability of condos and also continue researching investing in

single-family homes and apartments. For the business as a whole, I hope to see

continued efficiency and success.

Reference List

Franchisee Resource Center. “Real Estate Industry ANALYSIS 2020 - Cost & Trends.”

Franchisee Resource Center, 2020,

www.franchisehelp.com/industry-reports/real-estate-industry-analysis-2020-cost-trends/.

This website went more in-depth, describing the real estate market and industry and the

risks involved. While the article on this website was published in 2020, it commented on

real estate brokerage, leasing agents, management companies, industry risks, and

industry opportunities. In the end, it described hot real estate markets as cities such as

St. Louis, Boston, Atlanta, Providence, and San Diego.

LaCour-Little, M., Yang, J. Seeking Alpha in the Housing Market. J Real Estate Finan

Econ (2021). https://doi.org/10.1007/s11146-021-09853-1. This article focused on

examining and researching the effects of flipping houses on the housing market from

2000-2013. It mentions that house flipping was popular during that period and continues

to gain interest and popularity because of reality television shows. The article found

evidence of returns and index growth in the housing market because of house flipping.

Pagourtzi, E., Assimakopoulos, V., Hatzichristos, T. and French, N. (2003), "Real estate

appraisal: a review of valuation methods", Journal of Property Investment & Finance,

Vol. 21 No. 4, pp. 383-401. https://doi.org/10.1108/14635780310483656. This article

focused on explaining the different methods that are and can be used for valuation. It

goes on to explain how valuation methods can be tagged traditional or advanced. The

traditional methods listed include regression models, income, profit, contractor’s

method, and more. Advanced methods include ANNS, hedonic pricing methods, fuzzy

logic, and more.

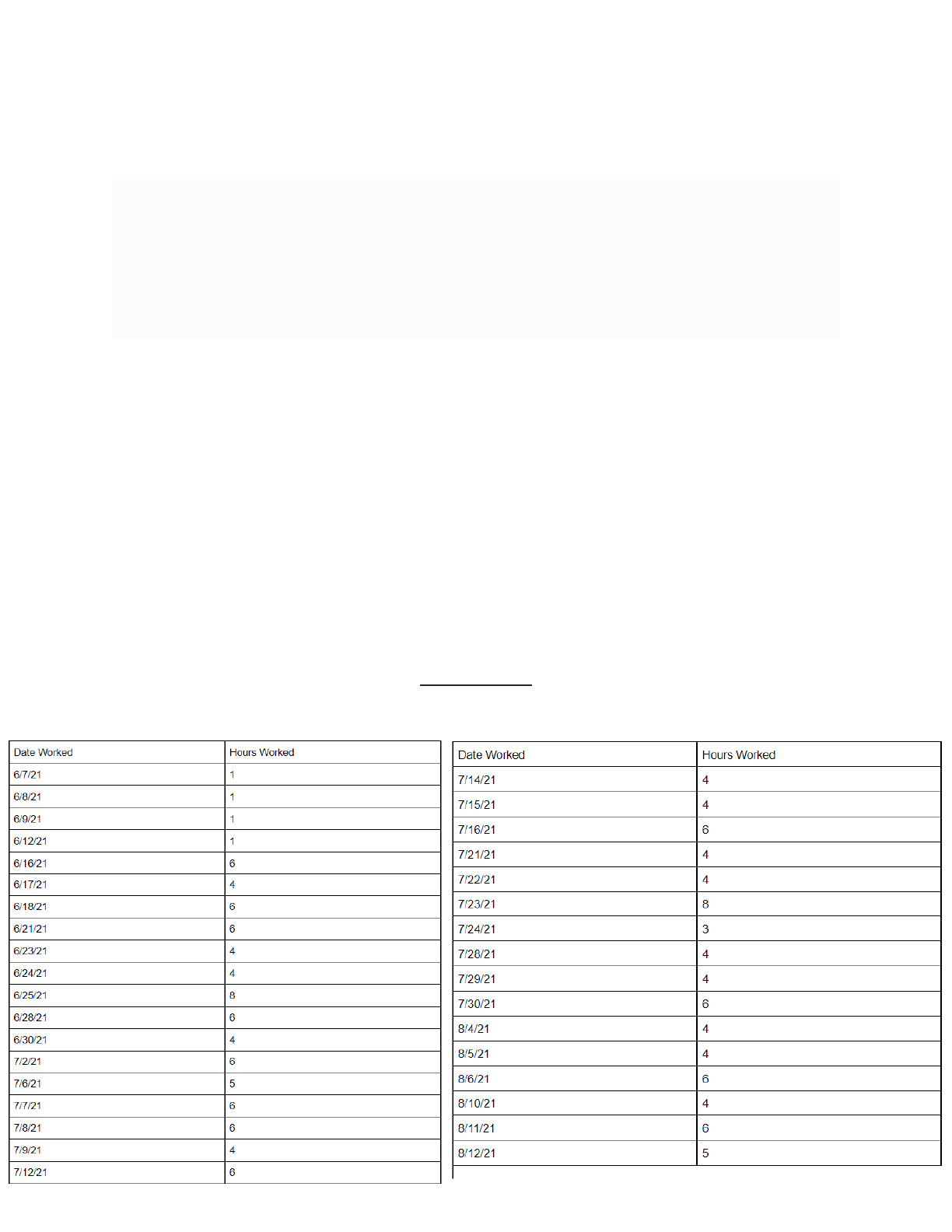

Appendix