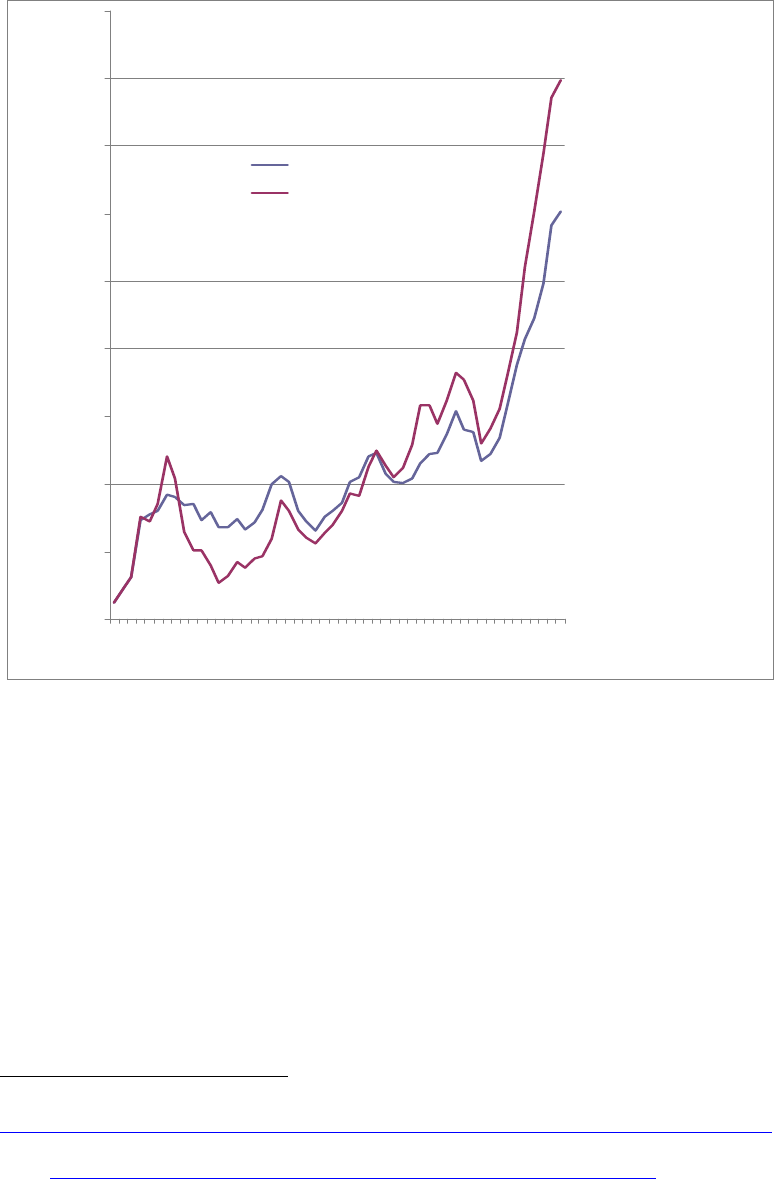

An Explanation of Medallion Prices Adjusted for Inflation

Annual Average Medallion Price, Adjusted for Inflation

$‐

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

1947

1960

1966

1971

1975

1979

1983

1987

1991

1995

1999

2003

2007

Independent

Minifleet

What Can Explain the Increase in Medallion Prices Over the Past Ten

Years?

Some factors include:

Access to financing – Lenders continue to offer prospective owners

access to funds to underwrite the price of medallions. Some organizations

(For example: Medallion Financial Corp

1

. and Melrose Credit Union)

believe medallions are a riskless investment, as they believe it is easy to

repossess a medallion

2

. My investigation revealed it is common practice

now for buyers to acquire their medallions with three year balloon

1

Cabby Capitalism, Wall Street Journal, Nov 6, 2010,

http://online.wsj.com/article/SB10001424052748704353504575596400925752906.html

2

The Secret To Melrose’s Great Rates: Taxis by PennySaved, November 11,

2010,ww.bankaholic.com/finance/the-secret-to-melroses-great-rates-taxis/

mortgages. This seems to imply they expect the price of the underlying

asset to increase.

Price of Medallion has Outstripped Underlying Value of Asset – From

an agent, fleet and individual owner perspective, the price of the medallion

appears to have outstripped its underlying value.

Agents - Medallions face a lease cap of $800 per week or $41,600 per year.

Corporate medallions now sell for $850,000. A 15 year loan with a 4.5%

interest rate

3

on $765,000 (90% of the price of the medallion) costs

$70,226 per year to service

4

. The cost of financing is nearly 70% greater

than the weekly lease cap. Using a 3 year balloon mortgage with a 4.5%

interest rate costs $46,514

5

per year, which is still more than the revenue

from lease caps.

Fleets - A medallion can bring in $84,680

6

by double shifting, which only

leaves about $15,000 for running the taxicab over the year. TLC’s

analysis indicates it costs in the range of $50,000

7

per year to service a

taxi per year by a fleet.

Individual Owner Operators - A driver can generate $100,000 in fares and

tips per year. Independent medallions now sell for $624,000 and a

$561,600 mortgage (90% of the price of the medallion) with a 4.5%

interest rate over 15 years costs $51,554

8

annually. It is estimated to cost

about $40,000

9

annually to operate a taxi by an owner-operator. Even

with $100,000 in fares, this barely pays for the medallion mortgage and

operating costs. It is estimated that leasing out the taxi to a 2

nd

driver

would generate about $24,000/year

10

. With the extra income, the owner

operator would produce $33,000/year before taxes.

Alternatively, a three year balloon mortgage of $561,600 at 4.5% would

cost $34,146 /year. This reduction in mortgage costs would increase

income, but would require a balloon payment of $561,600 after three

years.

3

Lowest Rate on Bankrate (www.bankrate.com) mortgage rate search

4

Based on a 4.5% interest rate fixed over 15 years from the LOMTO Mortgage Calculator

http://lomto.org/index.php?option=com_calc_mortgage&Itemid=93

5

www.money-zine.com/Calculators/Mortgage-Calculators/Balloon-Mortgage-Calculator

6

Hybrid lease cap ($116) x days per year (365) x shifts per day (2) = $84,680

7

Income Statement: Fleet - IncomeStmts v10.xls prepared by the TLC

8

Based on 4.5% interest rate fixed over 15 years from the LOMTO Mortgage Calculator

http://lomto.org/index.php?option=com_calc_mortgage&Itemid=93

9

Income Statement: Individual Owner/Operator - IncomeStmts v10.xls prepared by the TLC

10

Income Statement: Individual Owner/Operator - IncomeStmts v10.xls prepared by the TLC

Low Volume of Transactions – The value of medallions is recognized as

the value of the last market based transaction. Based on 2010 values, the

total market value of medallions is about $9.5 billion

11

. The number of

transactions annually has averaged 362 over the past twelve years (1999 –

2010) or about 1.4 transactions per day

12

. For comparison, Southwest

Airlines has a market capitalization of $9.5 billion, but their trading volume

is 4.98 million per day

13

. As their stock price is $12.75

14

this means that

around $60 million worth of Southwest Airlines is traded per day, compared

with about $1.2 million worth of medallions. Southwest Airlines shares are

traded at a 5000% higher volume than TLC taxi medallions. The illiquid

nature of the medallions makes them susceptible to price manipulation.

When the volume of trades is high, no single entity can easily manipulate

the price.

The Friedman Factor – The fact that Gene Friedman entered the

marketplace and acquired many medallions may have an affect on the

asset price. In 2006 Gene Friedman’s bid won all 54 of the City's

wheelchair-accessible medallions up for auction for a price of $25.8 million

or $477,666.50 each

15

. The full extent of his medallion holdings is not

easily looked up at the TLC. To my understanding, the medallions are

listed under different spellings of his name, and with multiple principals.

According to the newspapers, he controls about 700 medallions

16

or over

5% of the medallion fleet. The TLC does not seem to keep good records of

how many medallions are controlled by individuals or groups. Records

contain multiple spellings of owner’s names and Social Security Numbers

are occasionally entered incorrectly.

Government Support – New York City government plays a factor in

keeping the price high as a 5% transfer fee is retained by the City on every

transfer. For this reason, if a seller wants to sell a medallion at below the

average of the last month’s price, permission first needs to be requested by

the Department of Finance. This gives the impression that medallion

prices only go in one direction, up. Last months average price becomes the

floor price the following month.

Implied Scarcity – One of the often stated factors for medallions’ price is

their scarcity. It is true that the number of medallions on the road has been

basically constant, but this is not true for taxis when including FHVs &

11

Assuming 42% of medallions are selling as individual and 58% are selling as corporate

(13,237 x 0.42 x $602,145) + (13,237 x 0.58 x $797,495) = $9,470,388,040

12

http://nyc.gov/html/tlc/html/misc/avg_med_price.shtml

13

www.google.com/finance?&gl=us&hl=en&q=NYSE%3ALUV&client=fss

14

www.nyse.com/about/listed/lcddata.html?ticker=LUV

15

King of the road, January 24, 2010, New York Post,

www.nypost.com/p/news/business/king_of_the_road_6lFc74ViNtiEY7OZABB99L#ixzz180wFviJQ

16

King of the road, January 24, 2010, New York Post,

www.nypost.com/p/news/business/king_of_the_road_6lFc74ViNtiEY7OZABB99L#ixzz180wFviJQ

Black Cars. The FHV / Black Car market adds an additional 35,000 taxi

like vehicles into the marketplace. While these are not permitted to

perform street hails, they perform an analogous service. In addition, the

TLC has created and sold additional medallions on occasion.

Agent Price Inflation – It is possible that Agents themselves are pushing

up the price through two factors. The first is the illiquid nature of the

medallion allows the agents to talk the price up to prospective buyers. The

second is that by offering an ever greater lease fee for the medallions, the

agents themselves are increasing the underlying price of the asset.

Ironically, the agents are now requesting the TLC to increase the lease

caps, as the monthly fee they need to pay medallion holders is too high.

Amortization Under the Tax Code – The IRS tax code states:

A taxpayer shall be entitled to an amortization deduction with

respect to any amortizable section 197 intangible. The amount

of such deduction shall be determined by amortizing the adjusted

basis (for purposes of determining gain) of such intangible

ratably over the 15-year period beginning with the month in

which such intangible was acquired.

17

This seems to have been in the tax code since 1993 and allows

purchasers of medallions to write off the value of their medallion purchase

over 15 years.18 The presence of this section of the tax code encourages

people to purchase medallions for the ability to deduct other business

profits.

Why Does This Matter to the TLC?

If the price of medallions dropped significantly, it could force recent medallion

buyers “underwater”, meaning the value of their outstanding loan is greater than

the current selling price for a medallion. In this case, owners may default on their

loan, and have the medallion repossessed by the bank. If there were large

number of repossessions, it could cause the major financers to go into default,

and put a damper on sales. We do not know the capacity of the mortgage

financers to absorb losses and we do not track financers’ exposure to medallions.

The main impact on the TLC would be a potential reduction in service, as

medallions going through repossession may not be driven on the road.

Additionally, TLC does not currently have rules for the repossession of

medallions.

17

Sec. 197. Amortization of goodwill and certain other intangibles

www.taxalmanac.org/index.php/Internal_Revenue_Code:Sec._197._Amortization_of_goodwill_an

d_certain_other_intangibles

18

IRS Publications, Section 8

www.irs.gov/publications/p535/ch08.html#en_US_publink1000208962

A secondary factor may be calls from the industry to “prop up the price of the

medallion” through an increase in the lease caps and fares. While increased

lease caps may be needed to bail out agents who signed pricy contracts or

medallion owners who bought at the peak of the market, it would come at the

expense of passengers and drivers who would be asked to pay for the bail out.

In addition, it would simply increase the profit margin of medallion owners who do

not hold a mortgage.

Moving forward I foresee three scenarios:

Price of Medallions Continues to Increase – In this scenario the price

would become so high, that it may prevent new participants from entering

the marketplace. At the current pricing, it is very difficult for drivers to

acquire a medallion. Medallions will be owned by the very wealthy and

leased to the less wealthy.

Price of Medallions Levels Off – In this scenario the price would reach

equilibrium near the current prices. All participants will continue to state

their displeasure about the high or low values, but things would remain

status quo.

Price of Medallions Reduces Significantly – In this scenario many

recent entrants into the marketplace would be forced to default on their

loans when the three year balloon mortgages are due. It is possible that if

the price drops significantly, deep pocketed medallion holders will buy up

all of the medallions sold at the new lower pricing. There is the possibility

that the prices would fall considerably if a significant number of medallion

holders were forced to divest. This could result in service disruptions as

medallions are repossessed by banks or entangled in foreclosure lawsuits.