1

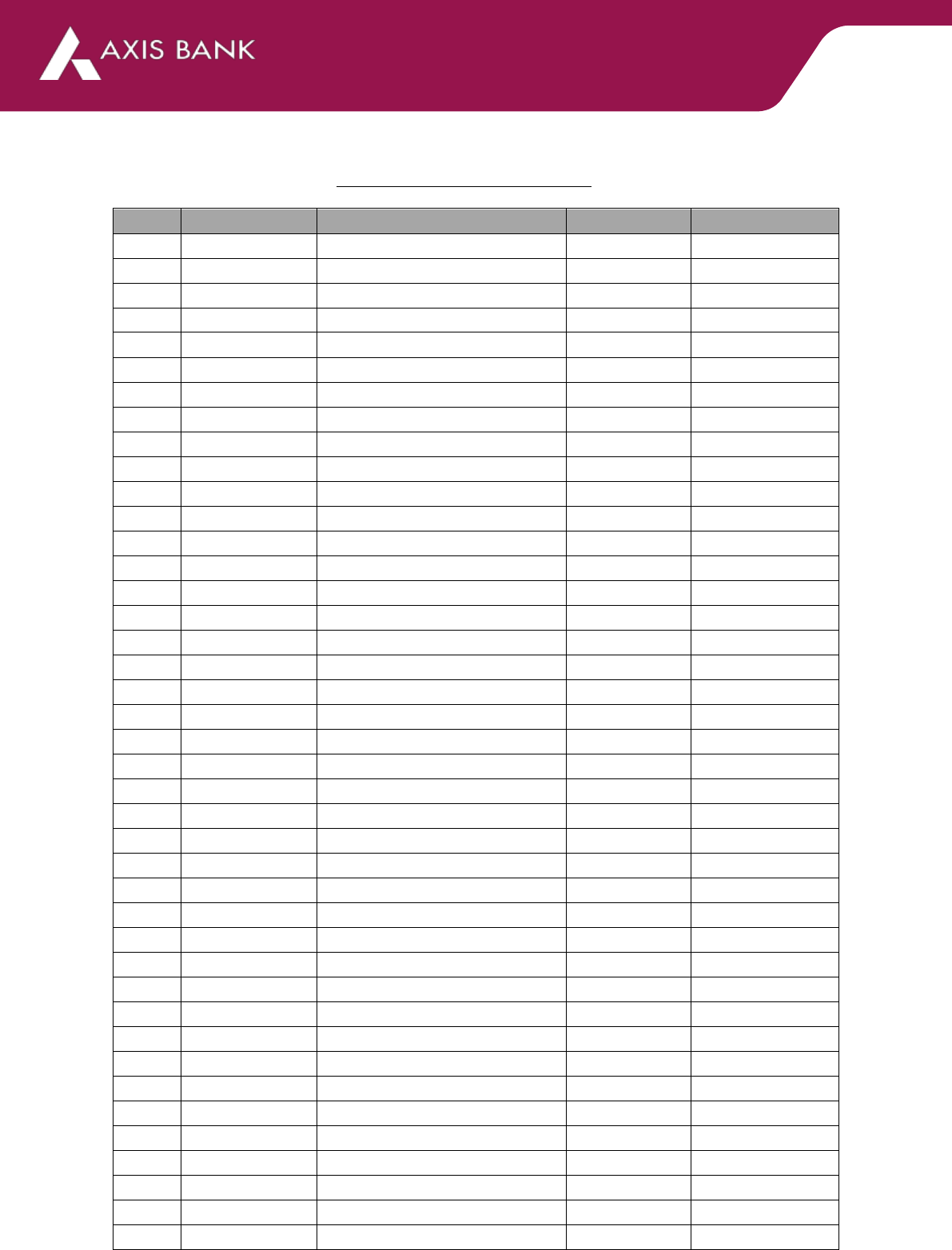

Lounge List* – Burgundy Debit Card

S. No.

City

Store Name

Terminal Type

Terminal

1

Ahmedabad

The Lounge

Domestic

Terminal 1

2

Ahmedabad

The Lounge

International

Terminal 2

3

Amritsar

Primus Lounge

Domestic

Terminal 1

4

Bangalore

BLR Domestic Lounge

Domestic

Terminal 1

5

Bangalore

080 Domestic Lounge

Domestic

Terminal 2

6

Bangalore

080 Domestic Lounge

International

Terminal 2

7

Bhubaneshwar

Bird Lounge

Domestic

Terminal 1

8

Calicut

Bird Lounge

International

Terminal 1

9

Chandigarh

The Cram Bar

Domestic

Terminal 1 (1st)

10

Chandigarh

Primus Lounge

International

Main Terminal/T1

11

Chandigarh

Primus Lounge

Domestic

Main Terminal

12

Chennai

Travel Club Lounge

Domestic

Terminal 4

13

Chennai

Travel Club Lounge

International

Terminal 3

14

Chennai

Travel Club Lounge B

Domestic

Terminal 1

15

Chennai

Travel Club Lounge A

Domestic

Terminal 1

16

Chennai

Travel Club Lounge Extn

International

Terminal 3

17

Coimbatore

Blackberry Lounge

Domestic

Terminal 1

18

Dehradun

Bird Lounge

Domestic

Terminal 1

19

Goa

Good Times Lounge and Bar

Domestic

Terminal 1

20

Guwahati

The Lounge

Domestic

Terminal 1

21

Hyderabad

Encalm Lounge

Domestic

Terminal 1

22

Hyderabad

Encalm Lounge

International

Terminal 1

23

Indore

Primus Lounge

Domestic

Terminal 1

24

Jaipur

Primus Lounge

Domestic

Terminal 1

25

Kannur

Pearl Lounge

Domestic

Main Terminal

26

Kannur

Pearl Lounge

International

Main Terminal

27

Kochi

Earth Lounge

Domestic

Terminal 1

28

Kochi

Earth Lounge

International

Terminal 3

29

Kolkata

Travel Club Lounge

Domestic

Terminal 1

30

Kolkata

Travel Club Lounge

International

Terminal 2

31

Lucknow

The Lounge

Domestic

Terminal 2

32

Madurai

Primus Lounge

Domestic

Terminal 1

33

Mumbai

Adani Lounge

Domestic

Terminal 2

34

Mumbai

Loyalty Lounge

International

Terminal 2

35

Mumbai

Oasis Lounge

Domestic

Terminal 1B

36

Mumbai

Travel Club Lounge

Domestic

Terminal 1c

37

Nagpur

Mandarin Lounge

Domestic

Terminal 1

38

New Delhi

Encalm Lounge

Domestic

Terminal 3

39

New Delhi

Encalm Lounge

International

Terminal 3

40

New Delhi

Encalm Lounge

Domestic

Terminal 2

41

New Delhi

Encalm Lounge

Domestic

Terminal 1

2

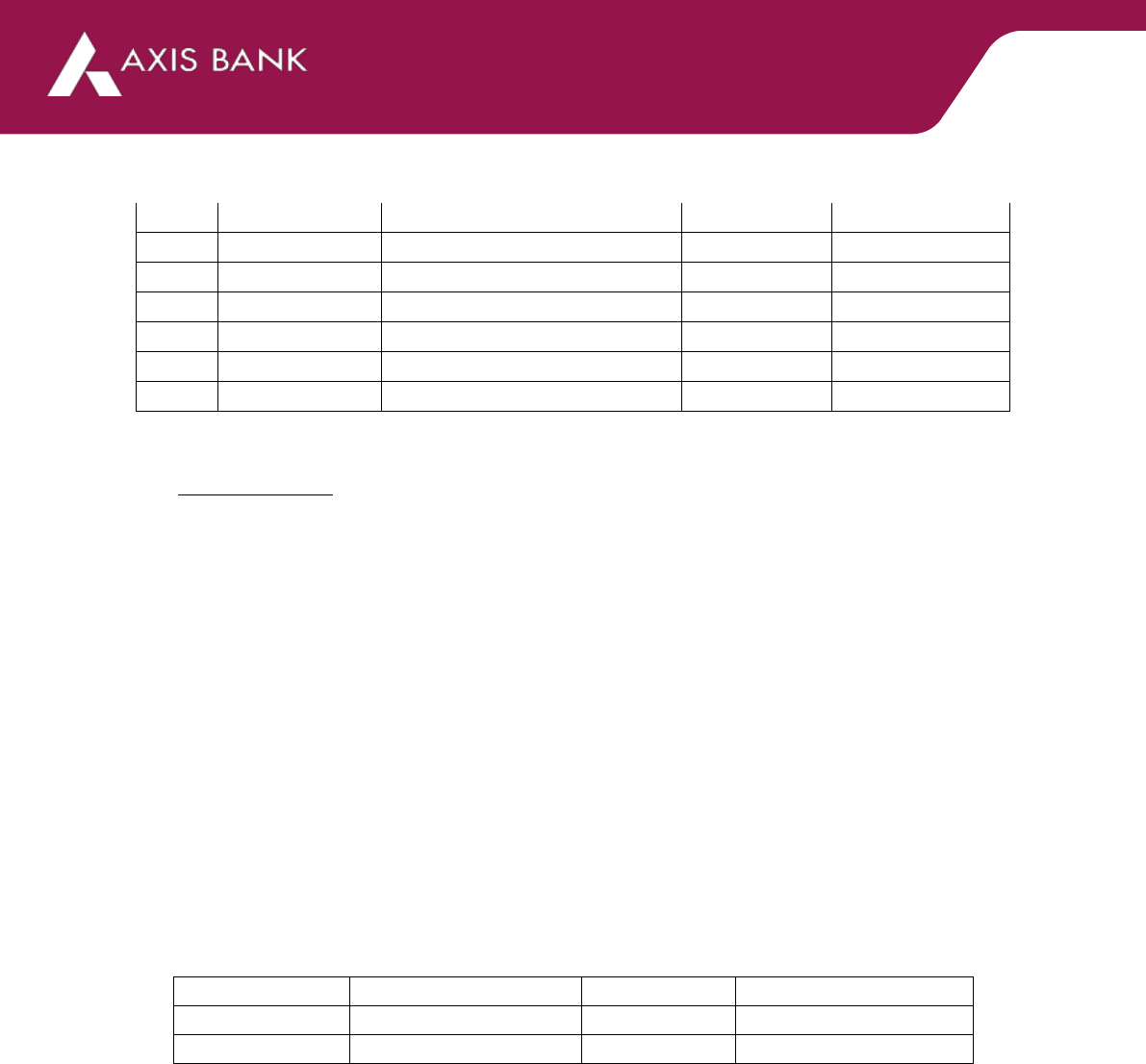

42

Patna

Zesto Executive Lounge

Domestic

Terminal 1

43

Pune

Earth Lounge

Domestic

Terminal 1

44

Ranchi

Cram Bar

Domestic

Main Terminal

45

Srinagar

Paahun The Executive Lounge

Domestic

Terminal 1

46

Trivandrum

The Lounge

International

Main Terminal

47

Vadodara

Premium Lounge

Domestic

Main Terminal

48

Varanasi

Take Off Bar

Domestic

Main Terminal

*List of participating lounges (applicable from Nov 4, 2023) and its availability lounge is subject to changes as per the Bank’s

policy without prior notice and / or basis the operational status of the lounge

Terms & Condions:

“Eligible Card” under the Program means debit card types issued by Axis Bank on Visa or Mastercard

Network Plaorms

“Eligible Cardholder” means a holder of an Eligible Debit Card

“Parcipang Airport Lounges” means the list of airport lounges that parcipate in the Program as shown

in above.

Rules of access under the program

1. The Program is available ll July 30, 2025

2. The spend based lounge access criteria would be eecve from 1

st

May 2024. (Not Applicable to

Burgundy Private debit cardholders)

3. For above listed Debit Card variants (except Burgundy Private Debit card), card holder needs to full Rs

5000 spends criteria to enjoy complimentary lounge access in the current month.

4. Eligible spends will be determined based on billed transacons in the previous 3 calendar months – billed

transacons can be checked through Net Banking and Mobile Banking.

5. In case of a newly issued Debit Card, the minimum spend criteria is waived for the month of issuance

followed by the next 3 calendar months (as illustrated below)

Card issuance date

Lounge usage period

Min. spends (Rs.)

Min. spend period

12th Feb 2024

12th Feb to 31st May 2024

NA

NA

12th Feb 2024

1st to 30th Jun 2024

5,000

1st Mar to 31st May 2024

6. ATM transacons will NOT be counted as a valid spend under spends based lounge program. Only

purchases made in-store or online using your Axis Bank Debit Card will be considered as a valid spend.

7. Purchases in store or online worth Rs 5000 or more in a single transacon OR several transacons

totalling to Rs 5000 or more can be made. Both the situaons will be qualied.

8. Eligible Cardholders will be allowed access to all Parcipang Airport Lounges under the Program, based

on one of the following entry types:

• Entry Type 1: Free entry for eligible cardholder only (basis eligibility check), all eligible cards will be

validated at point of entry by swiping a transacon of a nominal fee (subject to authencaon of Rs.

2 for Visa and Rs. 25 for MasterCard (auto void)). The customer will be denied the free entry if the

Card authencaon fails upon this swipe.

• Entry Type 2: Paid entry (if complimentary visits are already ulised) for the Eligible Cardholder

according to the respecve prices of usage displayed at the Parcipang Airport Lounges, for

himself/herself only or for his/her accompanying guests (payment will be made directly at the

Parcipang Airport Lounge by the Eligible Cardholder).

3

9. The oer is not transferable, non-negoable and cannot be encashed.

10. Without prejudice to the foregoing paragraphs, Entry Type 1 may be restricted or unavailable:

• If Axis Bank withdraws the Entry Type 1 (either as a program or in relaon to any Eligible Cardholder

or at any Parcipang Airport Lounge) for any reason at its sole and absolute discreon; or

• If the maximum capacity for Axis Bank cardholders or an Eligible Card type or an Eligible Card type

issued by Axis Bank has been reached at the relevant Parcipang Airport

Lounge. In this regard it is to be noted that capacity limits at a Parcipang Airport Lounge may be

dierent for dierent Eligible Card types issued by Axis Bank. Axis Bank shall not be held responsible

under any circumstances for any such unavailability.

• Axis Bank makes no guarantee that any privileges, benets, or facilies under the Program or

otherwise will be made available by the Parcipang Airport Lounge to an Eligible Cardholder and

Axis Bank cannot be held liable for the same. Specically, the free lounge access to customer(s) may

be suspended if the validaon system at the Parcipang Airport Lounge is unable to validate and

authorize the customers’ Card due to any system malfuncon or connecvity issues.

11. Usage of the Parcipang Airport Lounges under the Program (under entry Type 1) is subject to access

limits/quota every quarter that will be determined by Axis Bank in its absolute discreon and any

aempted usage beyond such access limits/quota will be rejected by the Parcipang Airport Lounge.

12. All accompanying children (where permied) will be subject to the full guest fee unless otherwise stated.

13. Please note that addional charge may occur for meal/food/drink items (especially, Alcoholic Drinks) as

well as for services like Nap, Massage Service and Spa as per the discreon of the Parcipang Airport

Lounge.

14. Parcipang Airport Lounge sta are responsible for ensuring that all Eligible Cardholders who are using

the lounge under the Program swipe their Eligible Card (with a nominal authorizaon of Rs 2 for Visa and

Rs. 25 for Mastercard (auto void)) and will record the usage by swiping their Card and issuing a charge-slip

to the Eligible Cardholder.

15. Eligible Cardholders will be charged on their Eligible Card based on the amount stated on the charge-slip

presented by the Parcipang Airport Lounge operator. Whilst it is the responsibility of the Parcipang

Airport Lounge sta to ensure a valid charge-slip is processed and printed by swiping the Eligible card, the

Eligible Cardholder is responsible for ensuring, before using the lounge facilies, that the charge-slip

correctly reects the applicable usage charges for his/her entry. The Eligible Cardholder must retain the

'Cardholder's' copy of the charge-slip for vericaon purposes, and no allegaons of error in charges will

be entertained without the charge-slip vericaon.

16. All usage of the Parcipang Airport Lounges under the Program is condional upon presentaon of a

valid Eligible Card, and Axis Bank, in its sole and absolute discreon, may alter, cancel, or amend eligibility

of any debit card, or Program benets, at any me without prior noce.

17. The privileges under this Program are to be construed as a standalone oer and cannot be clubbed

together and/or in any way be combined with any other oer of the Parcipang Airport Lounge in any

manner, or form. For the avoidance of doubt, privileges under the Program cannot be exchanged or

redeemed for cash.

18. All Parcipang Airport Lounges are not owned or operated by Axis Bank, but by third party organizaons.

Eligible Cardholders and relevant accompanying guests must abide by the rules and policies of each

respecve Parcipang Airport Lounge, which include, without limitaon:

• Access being denied to the lounge where there are space constraints or if the maximum capacity for

cardholders or an Eligible Card type or an Eligible Card type issued by Axis Bank has been reached at

the relevant Parcipang Airport Lounge.

• Admiance subject to users and their guests (including children) behaving and dressing in an orderly

and correct manner.

4

• Any infants or children causing upset to other users' comfort may be asked to vacate the lounge

facilies. Eligible Cardholders agree and acknowledge that they may be refused entry and/or asked

to vacate for non-compliance with the rules and policies and, for the avoidance of doubt, will not

make any complaints against, or hold Axis Bank responsible.

19. For the avoidance of doubt, Axis Bank makes no guarantee that any privileges, benets or facilies under

the Program or otherwise will be made available by the Parcipang Airport Lounge to an Eligible

Cardholder and Axis Bank will not be liable in any circumstances whatsoever in relaon to the provision

or non-provision (whether in whole or in part) of any of the adversed benets and facilies under the

Program.

20. Parcipang Airport Lounges may reserve the right to enforce a maximum stay policy (usually 2 or 3 hours)

to prevent overcrowding. This is at the discreon of the individual lounge operator who may impose a

charge for extended stays.

21. Parcipang Airport Lounges have no contractual obligaon to announce ights, nor to remind guests of

their ight boarding mes, and Eligible Cardholders are solely responsible for abiding by boarding mes

stated on their ight ckets. Accordingly, for the avoidance of doubt Axis Bank shall not be liable under

any circumstances in relaon to any failure to board ights (for any reason) by an Eligible Cardholder.

22. Axis Bank shall not be held responsible under any circumstances for any disputes that may occur in, or in

relaon to the usage of, a Parcipang Airport Lounge, including without limitaon, between the Eligible

Cardholder and another guest, airport user, or Parcipang Airport Lounge operator sta/representaves.

23. By parcipang in or using, or aempng to use, the Parcipang Airport Lounge under the Program, the

Eligible Cardholder agrees to:

• abide by the terms and condions set out herein and

• to defend and indemnify Axis Bank for any loss or damage caused to, or injury to or death of any

person or damage to or destrucon of any property arising out of the use of any Parcipang Airport

Lounge by the Eligible Cardholder and/or his/her accompanying guests.

• All disputes, if any, arising out of or in connecon with or as a result of above oers or otherwise

relang hereto shall be subject to the exclusive jurisdicon of the competent courts/tribunals in

Mumbai only, irrespecve of whether courts/tribunals in other areas have concurrent or similar

jurisdicon.