SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 1 of 25

No. 1/8/2016 - F.C. I

GOVERNMENT OF INDIA

MINISTRY OF COMMERCE & INDUSTRY

DEPARTMENT FOR PROMOTION OF INDUSTRY & INTERNAL TRADE

DATED: 17.08.2023

Standard Operating Procedure (SOP) for Processing Foreign Direct Investment

(FDI) Proposals

I.

Online Filing of Application

1.

Proposals for foreign investment requiring Government approval as per the

Consolidated FDI Policy dated 15.10.2020, as amended from time to time

(FDI Policy) and Foreign Exchange Management (Non-Debt Instruments)

Rules, 2019 dated 17.10.2019, as amended from time to time [FEM (NDI)

Rules] are required to be filed online through the National Single Window

System (NSWS). Administrative Ministries/ Departments will continue to

examine FDI proposals on Foreign Investment Facilitation Portal (FIF Portal).

2.

The applicant shall prepare FDI application as per the format and requirement

under the NSWS and upload documents digitally signed by authorized person

filing the application as listed in Annexure – I of this SOP. The applicant shall

also be required to file Security Clearance Form as per Annexure – II of this

SOP, wherever applicable (See para II (3) of this SOP).

3.

This SOP is aimed at rendering the process of filing FDI application

completely paperless. Therefore, applicant will not be required to file any

physical copy of any documents that are required for processing of FDI

proposals. In case authenticity of any scanned documents is in doubt then the

concern Administrative Ministry/Department may call for physical copy of

original documents with approval of the Secretary concerned.

4.

Competent Authorities shall not replicate an inter-Ministerial body in respective

Ministries/Departments to grant approval for foreign investment. The regime for

disposal of FDI proposals needs to be simpler in execution and expeditious in

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 2 of 25

disposal.

II.

Procedure for Processing of Applications Seeking Approval for Foreign

Investment

1.

After a proposal is filed online, Department for Promotion of Industry &

Internal Trade (DPIIT), under Ministry of Commerce & Industry, will identify

the concerned Administrative Ministry/Department and assign the proposal

within prescribed timeline as per part IV of this SOP to the concerned

Administrative Ministry/Department (Competent Authority) for processing and

disposal of the proposal. List of Competent Authorities is as per Chapter- 4 of

the FDI Policy. The Administrative Ministries/Departments shall process the

applications seeking post-facto approval in terms of para 4.1.2 of FDI Policy

2.

The same shall also be circulated online within prescribed timeline as per part

IV of this SOP by DPIIT to Reserve Bank of India (RBI) for comments from the

perspective of Foreign Exchange Management Act, 1999 (42 of 1999) and

rules/regulations thereunder (FEMA). Proposals for foreign investment requiring

security clearance shall additionally be referred to Ministry of Home Affairs

(MHA) for comments. Further, all proposals shall be forwarded to Ministry of

External Affairs (MEA) for information. MEA may give their comments

within the stipulated time period, wherever necessary. All comments shall be

provided directly to the concerned Administrative Ministry/Department.

3.

Following proposals shall require security clearance from MHA, as per the

extant FDI Policy:

i.

Investments in Broadcasting, Telecommunication, Satellites -

establishment and operation, Private Security Agencies, Defence,

Civil Aviation and Mining & mineral separation of titanium bearing

minerals and ores, its value addition and integrated activities.

ii.

Applications falling under the purview of Press Note 3 of 2020

dated 17.04.2020 read with Foreign Exchange Management (Non-

debt Instruments) Amendment Rules, 2020 dated 22.04.2020.

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 3 of 25

4.

Proposals requiring clarification from the point of view of FDI Policy may be

referred to DPIIT for clarification with the approval of Secretary of the

concerned Administrative Ministry/Department. Consultation with DPIIT will,

hence, be need based and not routine or regular.

5.

Consultation with any other Ministry/Department shall require full justification

and approval of Secretary of the concerned Administrative Ministry/

Department.

6.

All Ministries/ Departments consulted on any proposal including RBI, MHA

and MEA shall provide their comments within the timeline prescribed as per

Annexure V of this SOP. In case comments of consulted

Ministries/Departments and Regulatory Bodies are not received within the

prescribed time, it shall be presumed that they have no comments to offer. In

cases where MHA is not in a position to provide its comments within

prescribed timeline, it will intimate the concerned administrative

Ministry/Department of the expected time frame within which MHA shall be

able to give its comments.

7.

The Competent Authority shall, within the timeline prescribed as per Annexure

V of this SOP, scrutinize the proposal and documents attached therewith and

ask the applicant for relevant additional information/documents, if so required.

All such queries shall be raised only through FIF Portal to the applicant. To

the extent possible, all queries to the applicant shall be raised by the

Competent Authority in the initial communication itself.

8.

While examining the proposals, adequate care has to be exercised keeping in

view the FDI Policy, Press Notes, FEMA/RBI Notifications/Guidelines issued

from time to time. The Competent Authority should take into consideration the

sectoral requirements and the sectoral policies vis-à-vis the proposals.

9.

Once the processing of proposal is complete in all respect, the Competent

Authority shall take a decision within prescribed timeline as per Annexure V of

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 4 of 25

this SOP and convey the same to the applicant with a copy to all consulted

Ministries/Departments, Regulatory Agencies and DPIIT through FIF Portal

itself

10.

Further, in order to take appropriate decision on delayed FDI proposals and

those escalated by the processing Ministry/Department concerned for quicker

disposal, an inter-ministerial committee has been constituted, consisting of

Secretaries from DPIIT, Department of Economic Affairs, Ministry of

Corporate Affairs, MHA, concerned administrative Ministry/Department and

representatives from

R

BI

and

NITI A

a

y

og

to examine and guide the

concerned Administrative Ministry/department to process such proposals for

timely disposal.

11.

In case of proposals involving total foreign equity inflow of more than the limit

as stated in para 4.1.5 of Chapter - 4 of the FDI Policy, Competent Authority

shall place the same for consideration of Cabinet Committee on Economic

Affairs (CCEA) within the timeline prescribed as per Annexure V of this SOP.

After the receipt of the decision of CCEA, letter conveying decision shall be

issued within one (01) week.

12.

An application filed through NSWS seeking amendment(s) to earlier approvals

is to be considered as a valid application and this does not require a fresh

application.

13.

Closure: Where the FDI applications are incomplete i.e., either the applicant

has not submitted requisite documents/ information in proper format or the

applicant has not responded to the queries despite repeated reminders, the

Administrative Ministry/ Department may close the proposal after giving a final

reminder to the applicant. It should be noted that closure of FDI application

will not amount to its rejection and is without prejudice to the applicant re-

applying with all requisite documents. While closing the FDI applications, the

applicant may be advised to apply afresh along with all requisite documents, if

they so wish. The Competent Authority for the closure of the FDI proposal,

due to inadequate/incomplete information/documents shall be Secretary of the

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 5 of 25

concerned Administrative Ministry/Department.

14.

Rejection of Proposal or Insertion of Additional Conditions: In respect of

proposals where the Competent Authority proposes to reject the proposals or

in cases where conditions for approval are stipulated in addition to the

conditions laid down in the FDI Policy or sectoral laws/regulations,

concurrence of DPIIT shall compulsorily be sought by the Competent

Authority, with the approval of the Secretary concerned. Secretary, DPIIT is

the competent authority for decision on cases referred by other Administrative

Ministries/ Departments, seeking concurrence of DPIIT for rejection of the

proposal/ stipulation of additional conditions in approval letter. It is clarified

that concurrence of DPIIT is not required for imposing conditions concerning

compounding under FEMA provisions and/or compliance of laws/ regulations

of the land or court orders. Upon issue of rejection letter by the Administrative

Ministry/Department, a copy of the rejection letter should be marked to all

consulted Ministries, Departments and Regulatory agencies.

15.

Withdrawal by the Applicant: An applicant may withdraw its FDI proposal,

pending for decision, subject to submission of a duly authorized letter of

withdrawal clearly explaining the reasons for such withdrawal addressed to

the Competent Authority with a copy to DPIIT. Such withdrawal request

should be acknowledged by the Competent Authority on NSWS Portal, after

which the proposal shall be treated as withdrawn.

16.

Approval letter shall be issued by the Competent Authority in the format

prescribed at Annexure – III of this SOP.

17.

Surrender of Approval by the Applicant: If an applicant proposes to

surrender the approval letter granted to the investee entity/investor, then

concerned administrative Ministry/Department may accept the surrender of

the approval letter after the applicant submits such declaration in original

signed by the authorized representative of the applicant clearly explaining the

reasons for such surrender. Further, an acknowledgement in this regard has

to be sent to the applicant clearly indicating the date from which the approval

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 6 of 25

letter stands withdrawn. Copy of the same should be marked to all consulted

Ministries, Departments and Regulatory agencies.

18.

Rectification of mistakes in Approval Letter: The applicant may request for

rectification of typographical or grammatical mistakes in the text of Approval

Letter as apparent from the records. After necessary verification and due

diligence, the Administrative Ministry/ Department may issue corrigendum,

with approval of the Secretary concerned. Format for issuing corrigendum is

placed at Annexure-IV of this SOP. Rectification shall not entail any change

other than typographical or grammatical mistakes in the text of the Approval

Letter.

19.

Compounding of Contraventions: FDI is a capital account transaction and

thus any violation of FDI regulations is covered by the penal provisions of

FEMA. Provisions of para 3 of Annexure-5 of FDI Policy and Section 15 of

Foreign Exchange Management Act, 1999 permit compounding of

contraventions, and Foreign Exchange (Compounding Proceedings) Rules,

2000, as amended from time to time, lays down the basic framework for the

compounding process. Administrative Ministries/ Departments are advised to

refer to the Master Direction- Compounding of Contraventions under FEMA,

1999 FED Master Direction No.4/2015-16 issued by the RBI, as amended

from time to time.

III.

Time Limits for processing FDI Proposals are prescribed as per

ANNEXURE-V

IV.

Monitoring & Review

1.

Each Ministry/ Department should have a dedicated FDI Cell with a nodal

officer not below the rank of Joint Secretary.

2.

Regular Review meeting on pendency of FDI proposals with concerned

Administrative Ministry(ies)/ Department(s) shall be convened by Secretary,

DPIIT, periodically every four (04) to six (06) weeks.

*************

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 7 of 25

ANNEXURE – I

Applicant shall upload documents digitally signed by authorized person

filing the application, as a part of FDI Application on National Single Window

System (NSWS). Security Clearance Form as per Annexure II for applicable

cases, is to be uploaded separately:

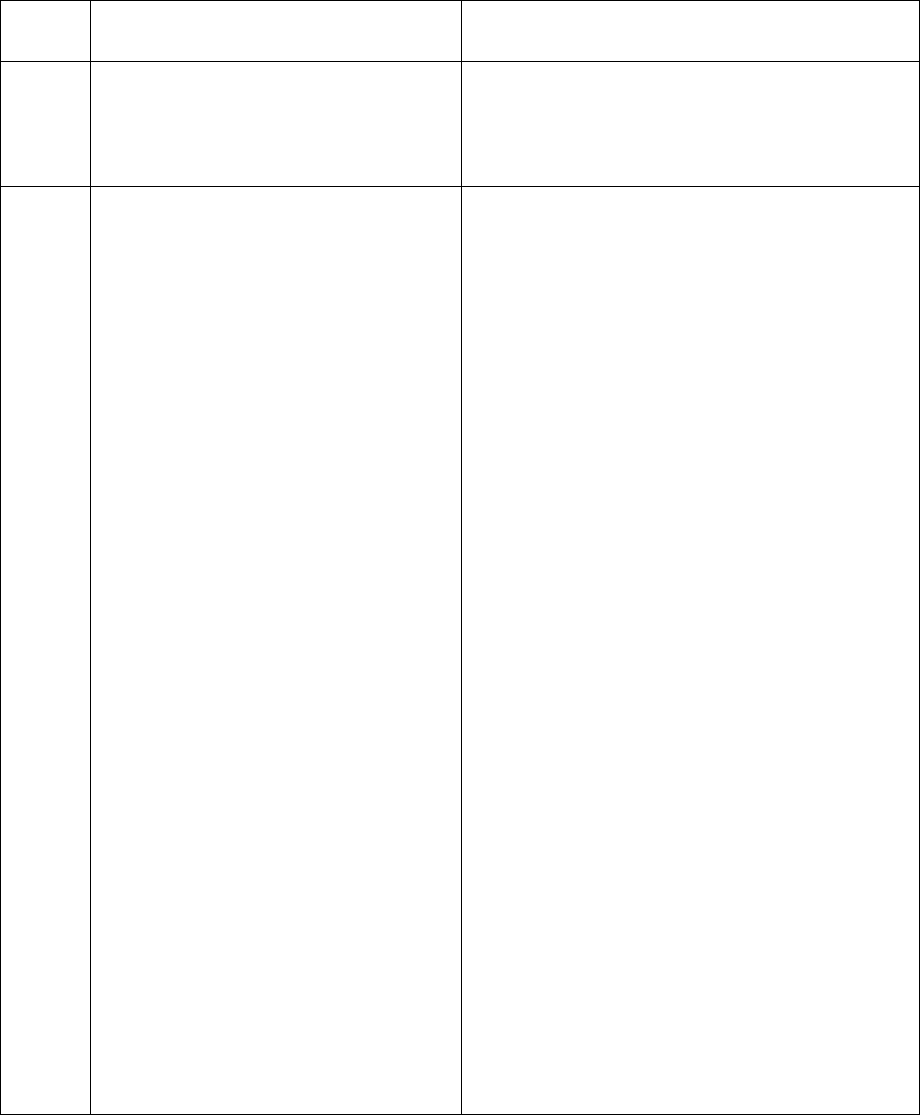

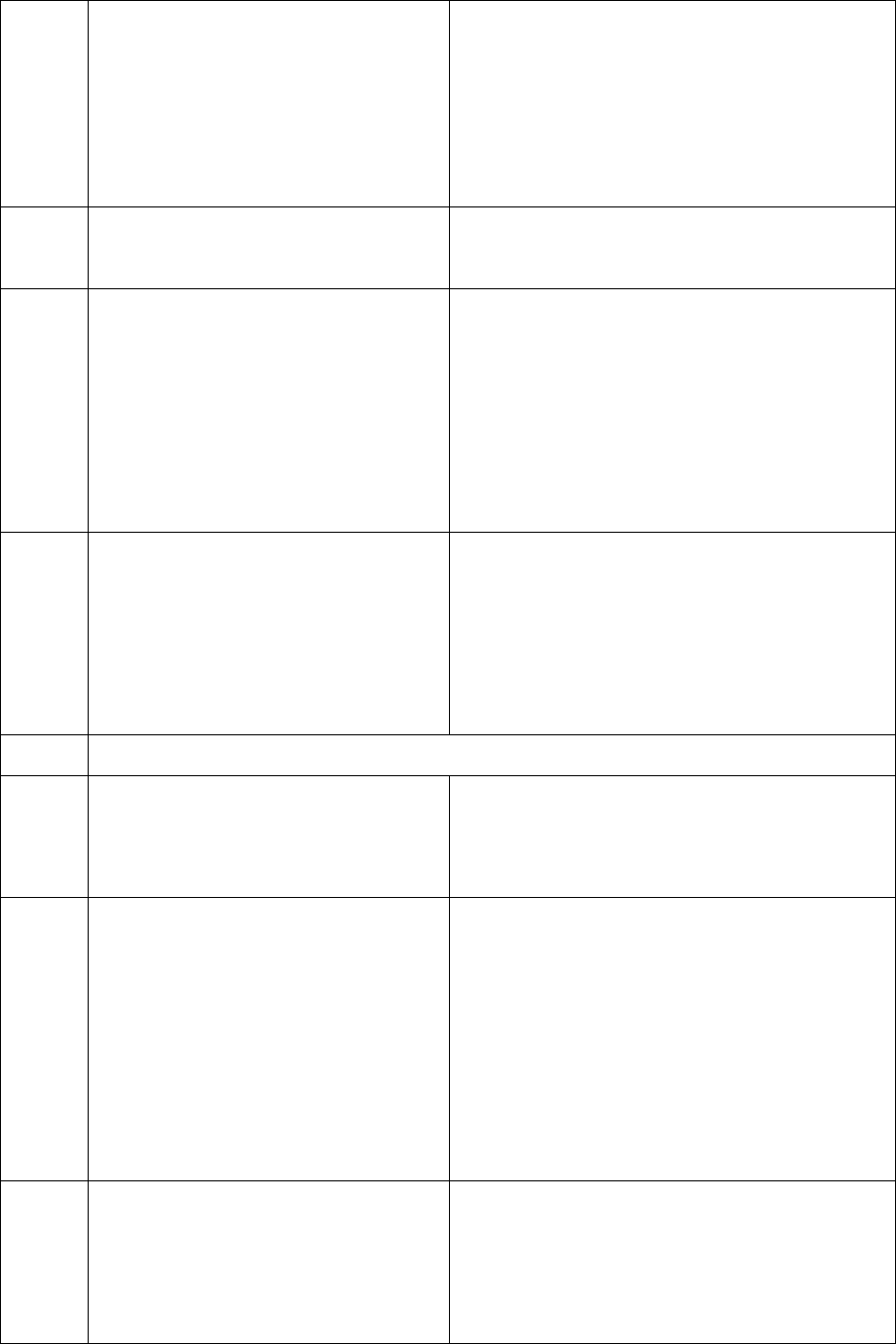

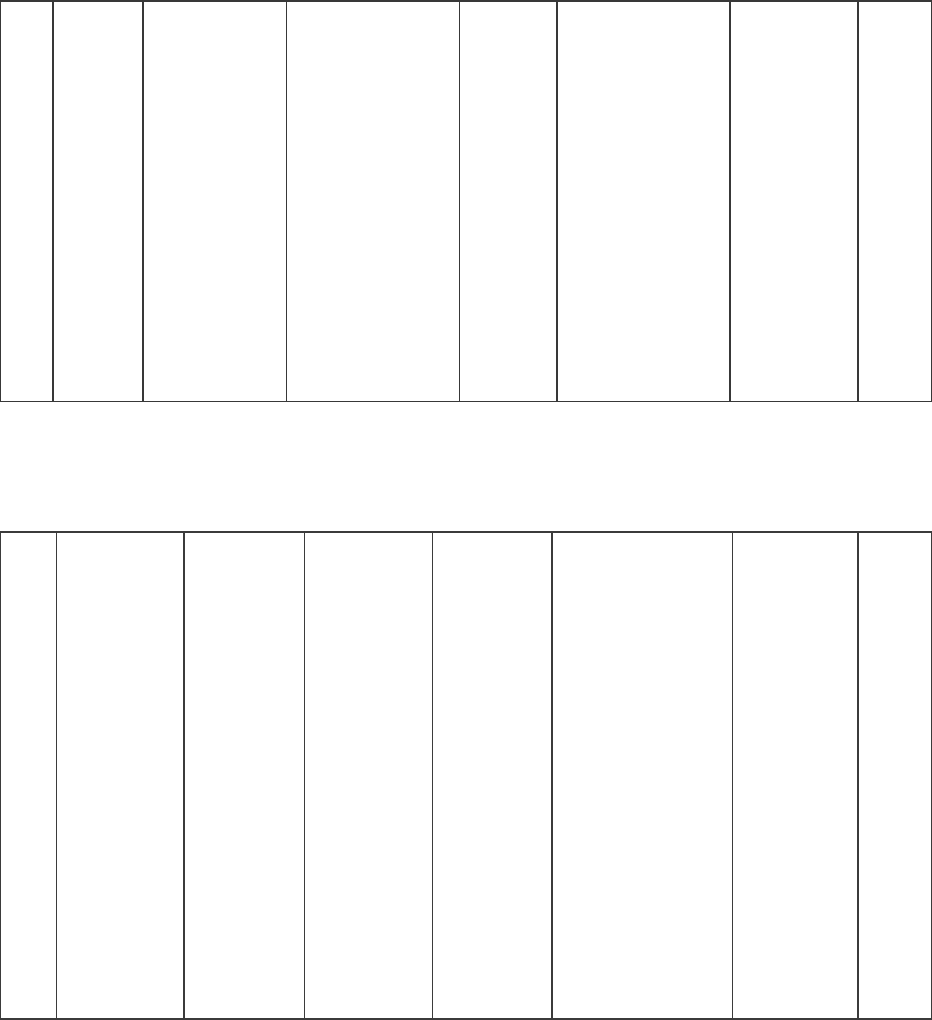

S. No.

Document

Description

1.

Letter of authorization by the

Applicant in favor of the

person(s) filing the Application

Letter of authorization needs to be on

the Applicant’s Letterhead signed by a

person competent to do so.

2.

Summary on FDI Proposal

On applicant’s letter head, brief shall

include details such as:

background of Investee(s) and

Investor(s);

existing and proposed business

activity/business model of the

Investee(s) and Investor(s);

details of beneficial ownership;

particulars of transaction for which

approval is sought;

reasons for seeking approval along

with relevant provisions of FDI Policy

and FEMA Rules/Regulations;

benefits arising from the proposal;

details of projected investments; and

Ownership and control of Investee (s)

and Investor (s);

address of correspondence for the

purpose of all communications

with/by the Department;

any other relevant information as

appropriate

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 8 of 25

3.

Shareholding pattern of the

Investee

Pre and Post transaction shareholding

pattern

4.

Diagrammatic representations

(i) Flow of funds from the investor to the

investee

(ii) Group structure / organizational chart

of the company clearly indicating inter-se

shareholding percentage and respective

place of incorporation / registration /

citizenship / residency

5.

Beneficial Ownership Details

a.

Details of Beneficial Ownership

from Countries sharing land

border with India

Entity-wise details of the existing

shareholders/ investors/ directors/

Investment committee members/General

Partners/Limited Partners/key

managerial personnel of all the upstream

entities (till the ultimate beneficial owner)

of Investor(s) and detail of other and

public shareholders; who are either from

a country sharing land border with India

or having beneficial ownership vested in

a country sharing land border with India,

along with their respective

degree/percentage of

ownership/shareholding/stake and

control in the relevant entity(ies), clearly

indicating the place of

incorporation/existing

citizenship/residency of all such

entities/individuals

b.

Details of Significant Beneficial

Owner (SBO)

In terms of the requirements under the

Companies Act, 2013 and Rules

thereunder

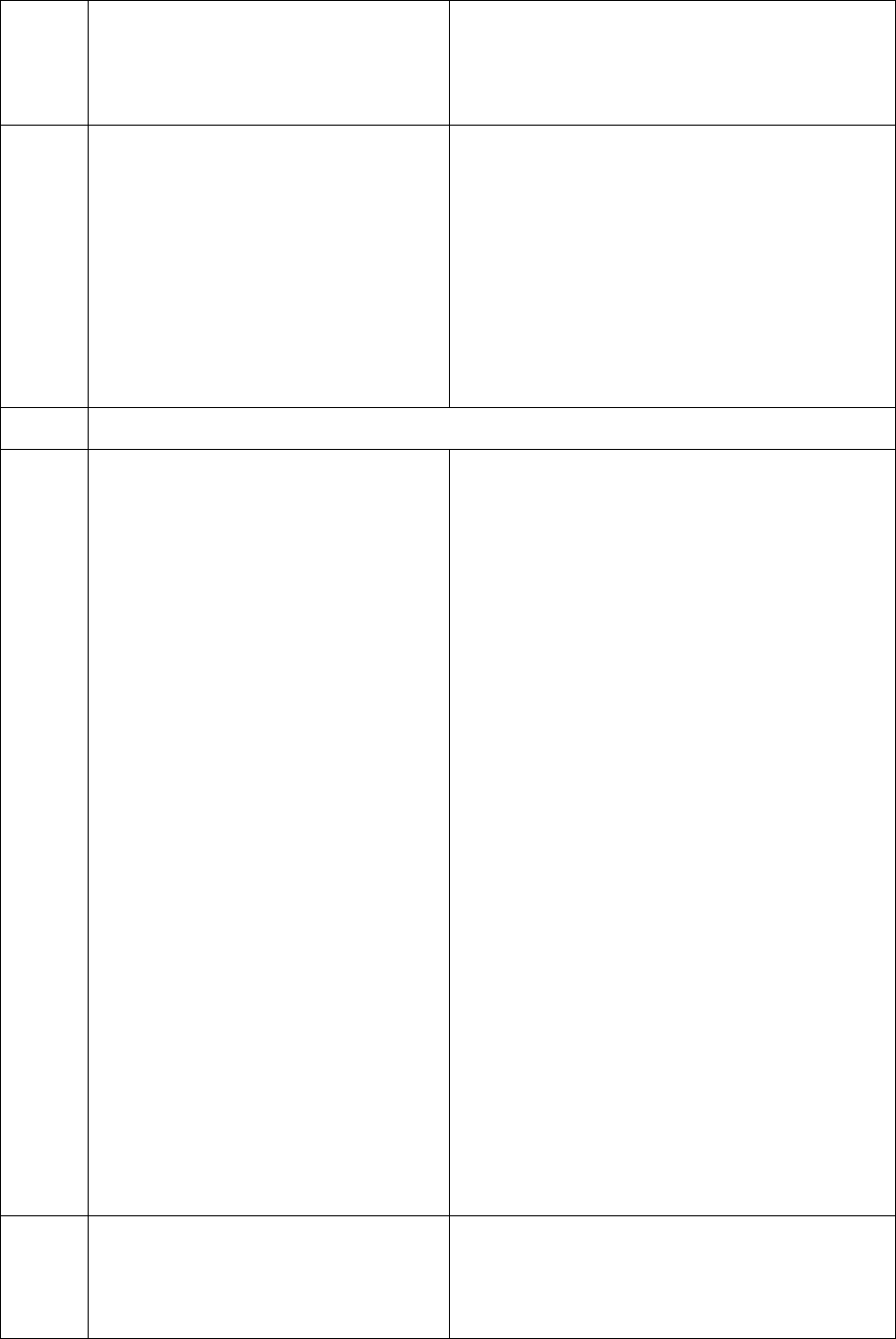

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 9 of 25

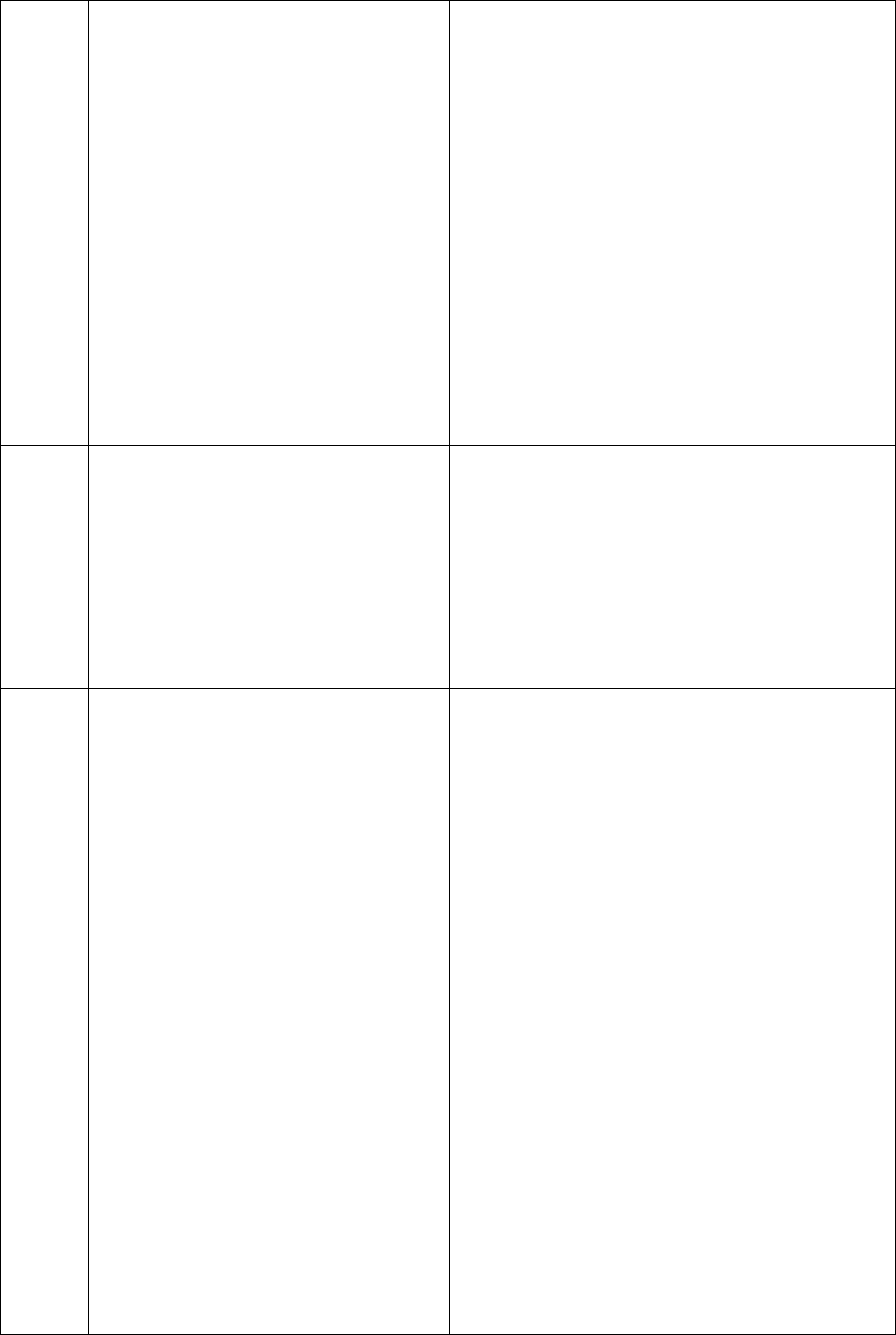

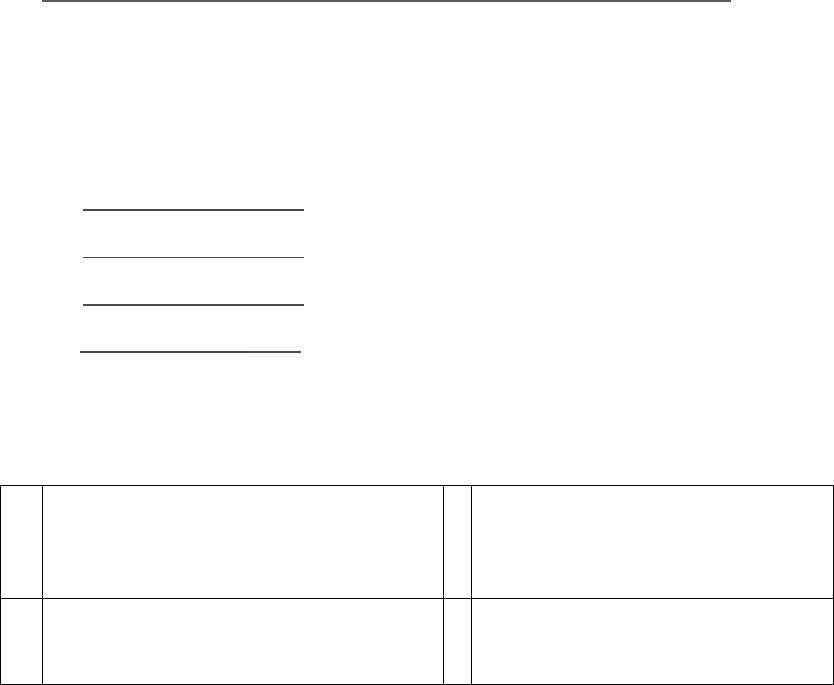

6.

Investee Documents

a.

Certificate of Incorporation (CoI)

of Investee

In case of yet to be incorporated

investee entities, a declaration on the

Applicant’s Letterhead may be

obtained that the investee is yet to be

incorporated and the same will be

incorporated after obtaining the

approval of the FDI by the

Government. The applicant shall be

required to submit CoI of the investee

within sixty (60) days of the issue of

approval letter by the Competent

Authority

b.

Memorandum of Association

(MoA) of the Investee

In case of a yet to be incorporated

Investee, a draft MoA shall be sought.

The applicant shall be required to

submit MoA of the investee within sixty

(60) days of the issue of approval letter

by the Competent Authority

c.

Article of Association (AoA) of

the Investee

In case of a yet to be incorporated

Investee, a draft AoA wherein internal

laws / by-laws of the Investee are

specified, shall be provided by the

applicant. However, the applicant shall

be required to submit AoA of the

investee within sixty (60) days of the

issue of approval letter by the

Competent Authority

d.

Board Resolution of the Investee

for proposed Investment

In case of yet to be incorporated

Investee, a letter of authority/consent

by the proposed shareholders /

promoters / directors / partners of the

investee in support of the application

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 10 of 25

shall be provided on Letterhead of

Investor

e.

Audited Financial Statement of

Last Financial Year of the

Investee

In case of yet to be incorporated

Investee or the Investee has not

completed first audit cycle at the time

of filing the application, a declaration

on the Letterhead to that effect may be

provided

7.

Investor Documents

Documents to be authenticated as per

Foreign Exchange (Authentication of

Documents) Rules, 2000

a.

Certificate of Incorporation (CoI)

of Investor

In case Foreign Investor(s) do/does not

have a CoI as per the laws of their

country, documents equivalent to CoI

and a declaration on Investor’s

Letterhead along with the necessary

regulation/circular/order to that effect

shall also be provided

b.

Memorandum of Association

(MoA) of the Investor

In case Foreign Investor(s) is / are not

required to have a separate MoA and

AoA as per the laws of their country,

foreign investors may provide

documents equivalent to MoA and a

declaration on Investor’s Letterhead

along with the necessary regulation /

circular / order to that effect shall be

provided

c.

Article of Association (AoA) of

the Investor

In case Foreign Investors are not

required to a have a separate MoA and

AoA as per the laws of their Country,

foreign investors may provide

documents equivalent to AoA and a

declaration along with the necessary

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 11 of 25

regulation/circular/order to that effect

shall be provided

d.

Board Resolution of the Investor

for the proposed Investment

On Investor’s letterhead

e.

Audited Financial Statement of

Last Financial Year of the

Investor

In case Foreign investor(s) is / are

exempted from the audit requirement

under any special law of a Country; a

declaration along

with the necessary regulation / circular

/ order to that effect shall be provided

8.

Copy(ies) of reporting

compliances in respect of

Downstream Investment(s), if

any

Copy of Form-DI reported on FIRMS

Portal

(https://firms.rbi.org.in/firms/faces/page

s/login.xhtml) and downstream

intimation given to DPIIT

9.

Past Approvals:

a.

Copy of relevant past Approvals.

Government/FIPB/SIA/RBI approvals

in respect of FDI brought in previously,

if any

b.

Reporting Documents in support

of past/existing foreign

investment in Investee

As required under para 3 of notification

no. FEMA.395/2019-RB dated

17.10.2019 the Foreign Exchange

Management (Mode of Payment and

Reporting of Non-Debt Instruments)

Regulations, 2019 issued by the

Reserve Bank of India (RBI).

10.

Signed executed copy(ies) of

the Investment Agreement/JV

agreement/shareholders

agreement/share transfer

Documents to be authenticated as per

Foreign Exchange (Authentication of

Documents) Rules, 2000, if applicable.

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 12 of 25

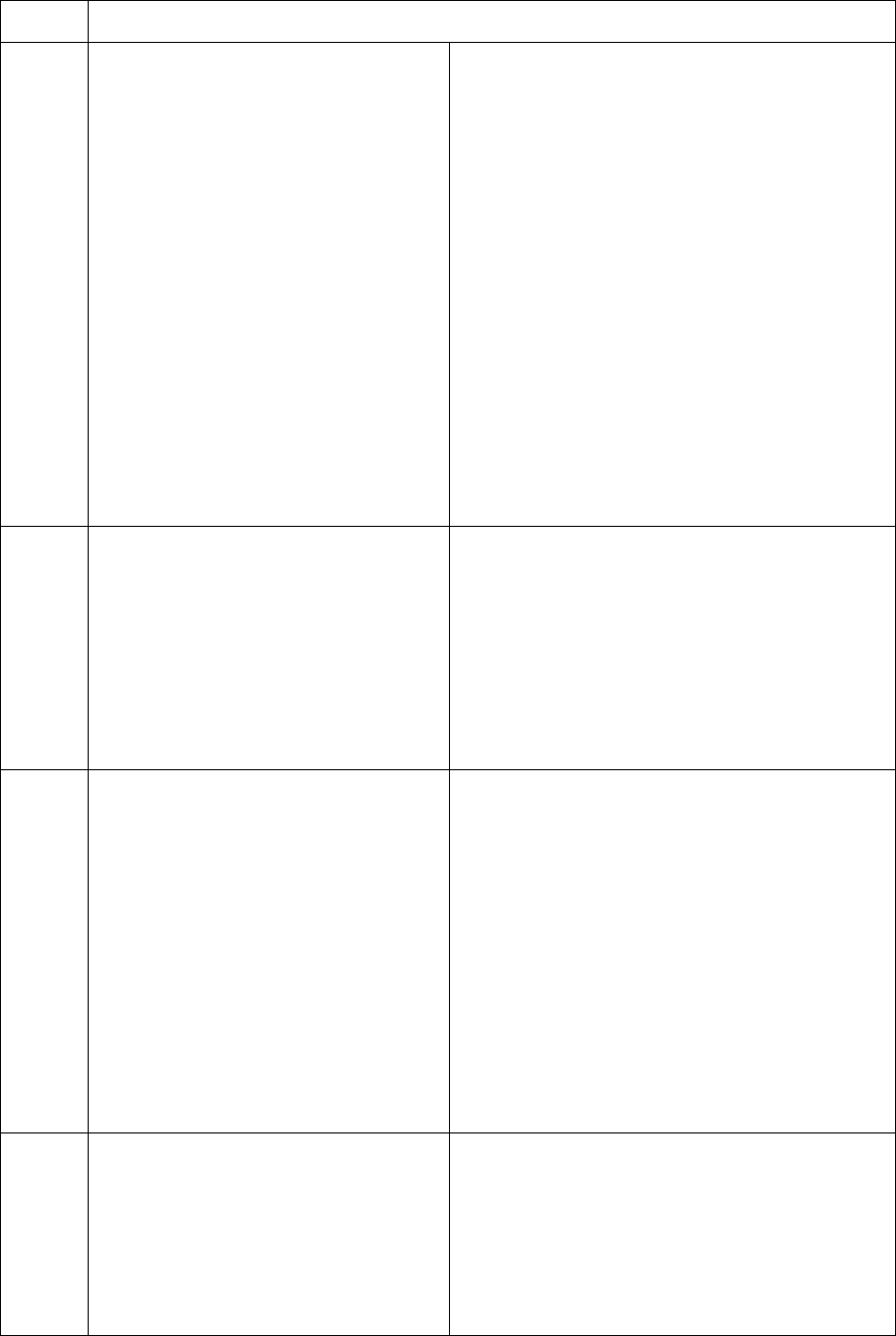

agreement/technology

transfer/trademark/brand

assignment agreement,

Approval(s) of NCLT /

competent authority in respect of

proposals involving mergers /

demergers / amalgamations as

applicable and required under

Companies Act, 2013 and rules

thereunder and/or any other

rules/regulations.

11.

Valuation certificate as required

in the FDI Policy and FEM Non-

Debt Instrument Rules 2019 and

the same should be on arm’s

length basis, wherever

applicable.

In case of shares issued by an Indian

company or transferred from a resident

to non-resident or transferred from a

non-resident to resident, as required

under pricing guidelines notified under

FEMA

12.

Provide an undertaking that the

Investee and Investors or their

respective Promoter(s) /

beneficial owner(s) /

Shareholder(s) / Director(s) /

Key Managerial Personnel is /

are not subject matter of any

negative / caution / debarred /

sanction list by the following:

(i)by National Government

(ii)by International Organisation

(iii)by statutory / regulatory /

investigative / enforcement

authority(ies) such as SEBI, RBI,

SFIO, Enforcement Directorate,

CBI, Income Tax Department

On the Applicant’s Letterhead

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 13 of 25

etc.

13.

Any other approval / consent /

NoC required by Investee or

Investor(s) from any

shareholder, third party or any

other entity in respect of the

proposed activity (ies)/

investment(s)/transaction(s).

As applicable

14.

Declaration for proposals not

falling under purview of Press

Note 3 (2020)

A signed declaration on the Applicant’s

letter head stating that none of the

investors/shareholders of the Indian

Investee company and the foreign

investor(s) including their respective

beneficial owners (having any

percentage of shareholding) are

situated in or are citizen(s) of

country(ies) sharing land border with

India.

15.

Duly notarized Affidavit on

stamp paper of ₹100/- only

A notarized Affidavit on stamp paper as

per format at Annexure VI by Person

Authorized as per Sr. No.1 above.

[Note: In case documents provided by the applicant are in foreign language then the said

document/language should be apostilled and translated into English language.]

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 14 of 25

ANNEXURE – II

PROFORMA FOR APPLICATION FOR SECURITY CLEARANCE FOR FDI

PROPOSALS

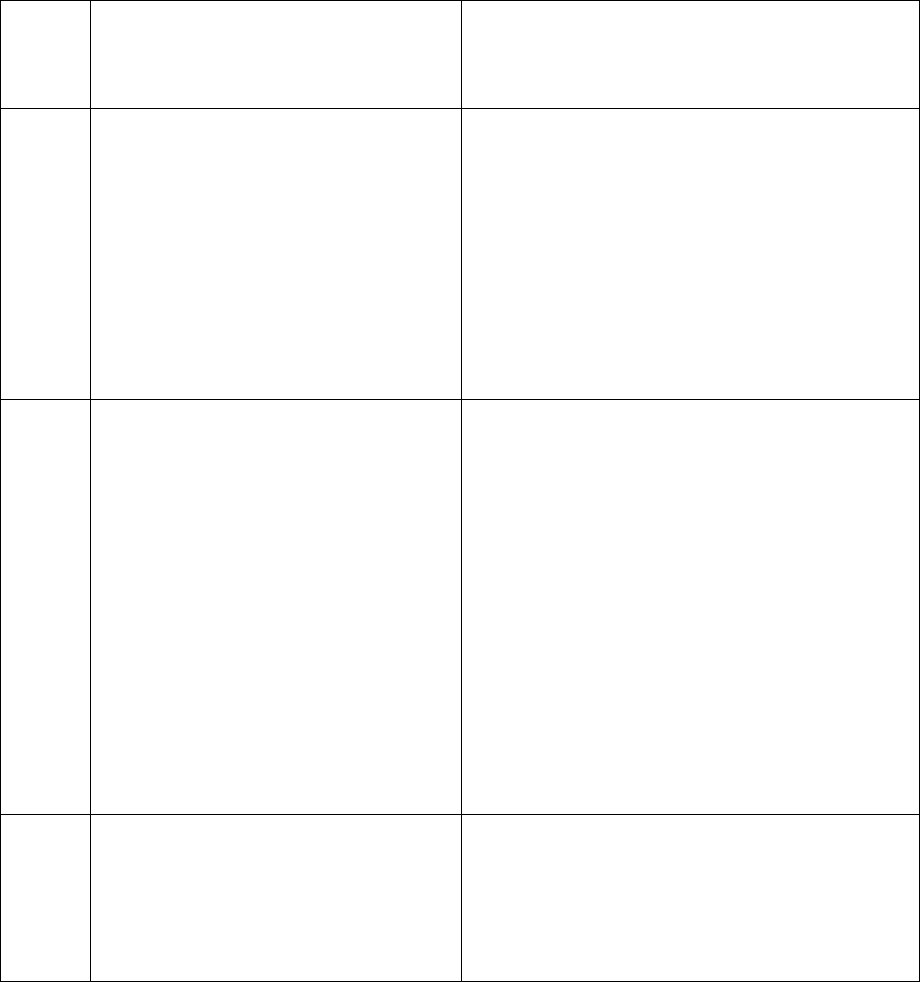

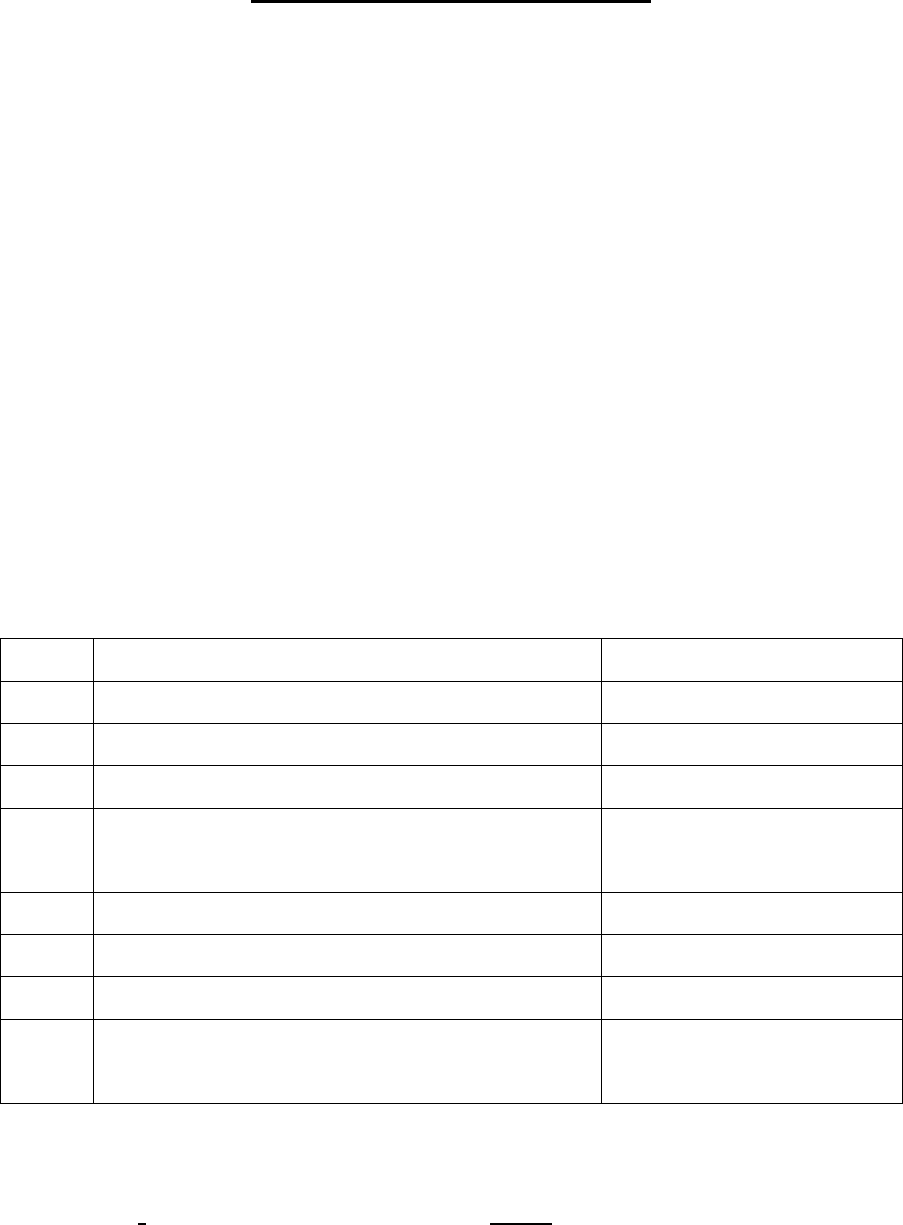

I. Details in respect of investee company:

SI.

No.

Name of

the

compan

y

Registratio

n

number

with date, if

incorporate

d

Registered

office

address and

corresponden

ce office

Previou

s name

of

the

compan

y, if any

Details of

earlier

approvals, if

any (ref. no. &

date)

Complete

details

about

the proposed

activities.

II. Details in respect of investor company(ies):

SI.

No.

Name of

the

company

Registrati

on

number

with date

Registered office

address and

correspondence

address

Previous

name of the

company if

any

*Ultimate

beneficial

ownership

of the

company

*Please enclose chart depicting the link between investor company and

ultimate beneficial owners / companies / organization along with details such

as address, parentage, passport details (in case of individuals) or company

registration details (in case of companies)

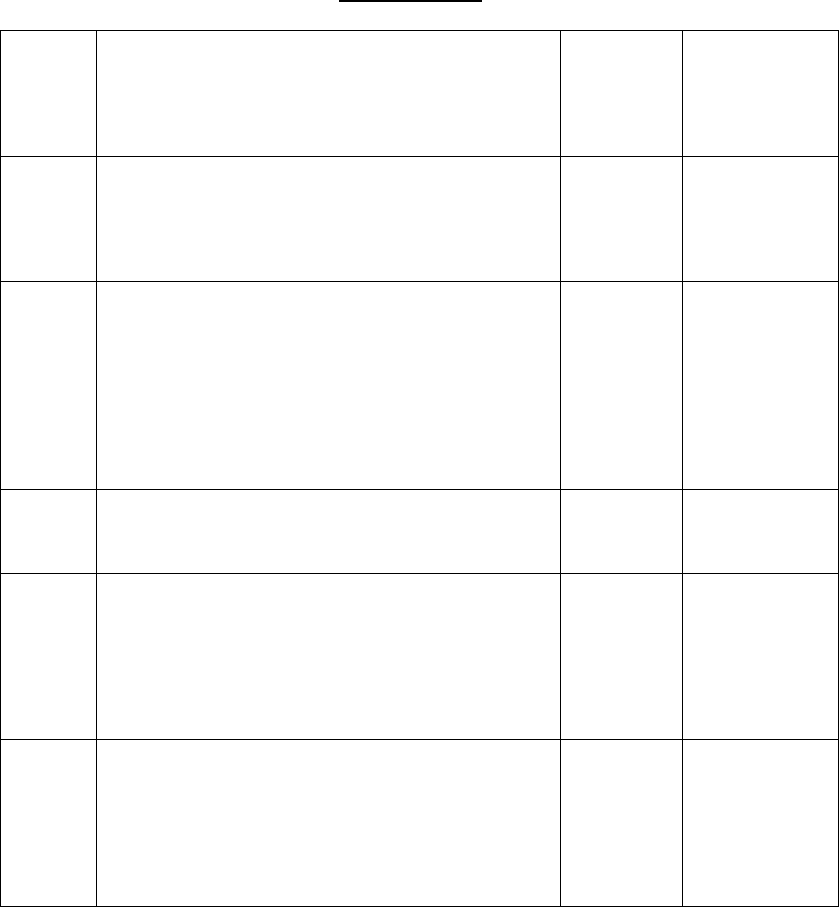

III.

Details in respect of Directors of investee company:

SI.

No

.

Full

Name of

Board

of

Director

s

Present

position

held

with

date

(Since

when)

Date

of

birth

Parenta

ge

(Name

of

father /

mother)

Present &

Permane

nt

Address

Nationality

(if holding

multiple

nationality,

all

must be

mentioned)

Passpo

rt

Nos.

and

issue

date,

if any

Contact

Address &

telephone

number

IV.

Details in respect of Directors of investor company(ies):

SI.

No

.

Full

Name of

Board of

Director

s

Present

position

held

with

date

(Since

when)

Date

of

birth

Parenta

ge

(Name

of

father /

mother)

Present &

Permanen

t

Address

Nationality

(if holding

multiple

nationality,

all

must be

mentioned)

Passpo

rt

Nos.

and

issue

date,

if any

Contact

Address &

telephone

number

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE& INDUSTRY Page 15 of 25

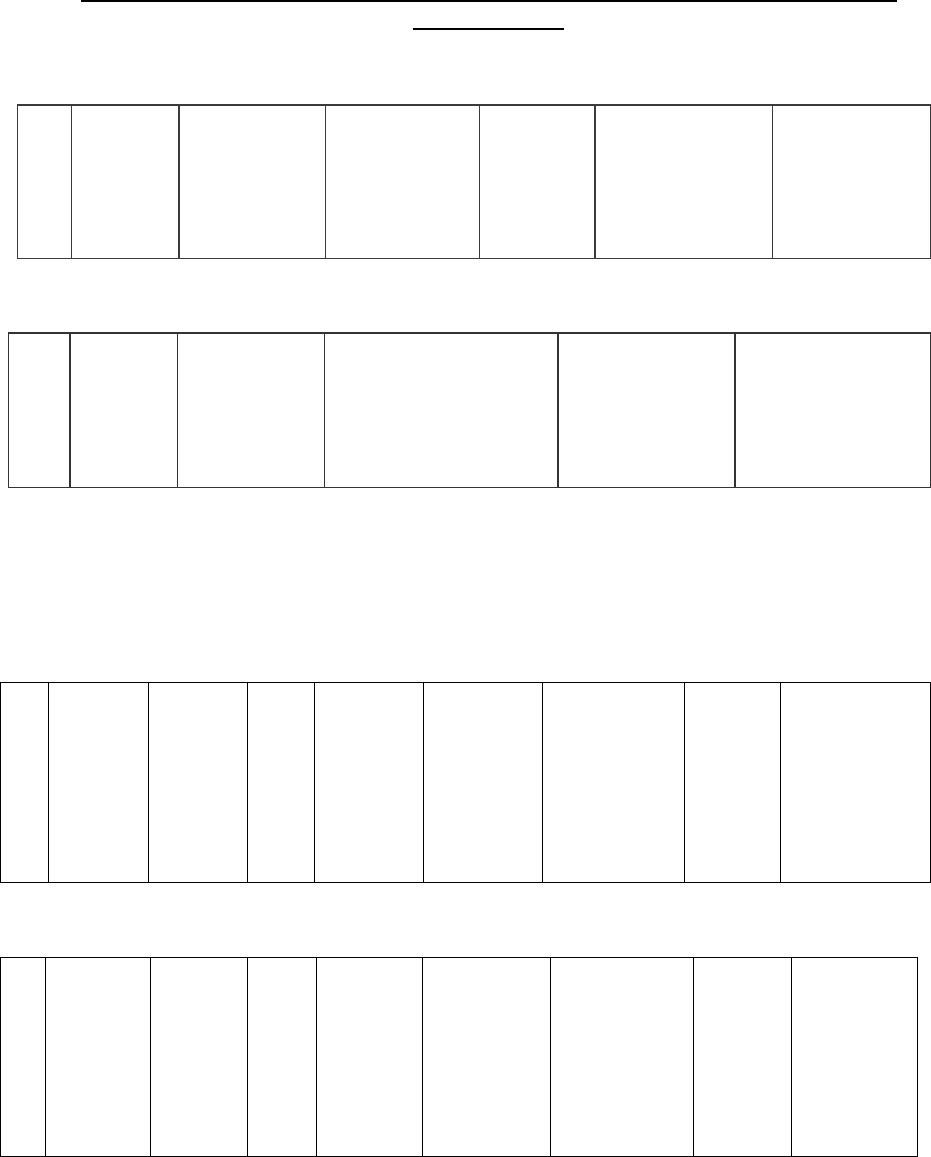

V. Details of shareholders of investee company (all

companies/entities/individuals with more than 10% shares):

SI.

No

.

Full

Name

of

individ

ual /

compa

ny

Parentage

(name of

father /

mother) in

case

of

individuals,

and

registration

number in

case

of

companies

Permanent

address /

present

address in

case of

individuals,

and registered

and

correspondenc

e

address in

case of

companies

Present

position

held, in

any,

in the

applica

nt

compa

ny

Nationality, in

case of

individual (if

holding

multiple

nationality,

all must be

mentioned) /

country

of registration,

in

case of

company

Passport

Nos.

and date

of

issue, if

any

(date of

birth, in

case

passport is

not

available)

for

individuals

% of

shares

held

in the

comp

any

VI.

Details of shareholders of investor company(ies) (all companies/entities/

individuals with more than 10% shares):

SI.

No.

Full Name

of

individual /

company

Parentag

e

(name of

father/

mother) in

case

of

individuals

,

and

registratio

n

number in

case

of

companie

s

Permanent

address /

present

address in

case of

individuals,

and

registered

and

correspon

dence

address in

case of

companie

s

Present

position

held, in

any,

in the

applicant

company

Nationality, in

case of

individual (if

holding

multiple

nationality,

all must be

mentioned) /

country

of registration,

in

case of

company

Passport

Nos.

and date

of

issue, if

any

(date of

birth, in

ca.se

passport is

not

available)

for

individuals

% of

share

s

held

in the

comp

any

VII. Foreign investor / investor company: Self-declaration regarding

presence/operation in China & Pakistan, if any

VIII.

Details of criminal cases, if any, against the investee company or its

director(s) as per annexure

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 16 of 25

Annexure to Security Clearance Form

Self-declaration for Investee Company and its director(s) / owners

a.

Name & address and registration number of the company

b.

Name and address of owners (in case of proprietorship firm)

/ directors of the

company

1.

___________

2.

___________

3.

___________

4.

_____________

c.

Are the company owners (in case of proprietorship firm) / directors listed

above, are the

subject of any?

1.

Preventive detention proceedings

under Public Safety Act / National

Security Act etc.

:

Yes/No

2.

Criminal investigation in which

chargesheet has been filed

:

Yes/No

d.

If yes, please provide following details

1. Case / FIR number

2. Detention / warrant number, if any,

3. Police station / district / agency

4. Sections of law under which case(s) has / have been filed

5. Name and place of the court

e.

The above mentioned details are in respect of both India and any other foreign

country.

(Signature)

Note: The above self-declaration is required to be filled and signed by the

authorized signatory of the applicant.

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 17 of 25

ANNEXURE – III

FORMAT FOR APPROVAL LETTER

F. No. ________

Government of India

Ministry of ________

Department of __________

<Place of issue>

Dated ______, 20____

To,

<Applicant Address>

Subject: FDI Proposal No. ____ in the case of _______ - reg.

Sir/Madam,

The undersigned is directed to convey the approval of Government of India to the

aforementioned FDI proposal, subject to the following terms and conditions:

1.

Name of Foreign Investor(s)

2.

Address of Foreign Investor(s)

3.

Name of Investee(s)

4.

Registered address of Investee(s)

5.

Item(s) of manufacture/ activity covered

by the foreign collaboration

a.

Existing

b.

Proposed

6.

Business Location of the Investee

7.

Amount of FDI inflow

(In INR terms and in words)

8. Foreign Investment: The total foreign investment is upto ___%.

_____(Name of the Foreign Investor)____ holds _____% of shares and

_______(Name of other Shareholders, if any)_____ holds ___% of shares.

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 18 of 25

9. The above approval is subject to the following conditions:

(i) Applicable conditionalities under the Consolidated FDI policy, as amended

from time to time (FDI Policy) read with Foreign Exchange Management (Non-

Debt Instruments) Rules, 2019 [FEM (NDI) Rules], as amended from time to

time.

(ii) Relevant Sectoral Laws, Regulations and Guidelines.

(iii) Claim of any tax relief under the Income-tax Act, 1961 or the relevant DTAA will be

examined independently by the tax authorities to determine the eligibility and extent

of such relief and the approval of Competent Authority by itself will not amount to any

recognition of eligibility for giving such relief.

(iv) Competent Authority approval by itself does not provide any immunity from tax

investigations to determine whether specific or general anti-avoidance Rules apply.

(v) The fair market value of various payments, services, assets, shares etc., determined

in accordance with FEMA Rules/Regulations or any other applicable

rules/regulations/guidelines, shall be examined by the tax authorities under the tax

laws and rules in force and may be varied accordingly for tax purposes; and

(vi) The taxation of dividend, future capital gains on alienation of shares by the foreign

investor, interest income and income of any other nature shall be examined by the

field formation in accordance with the provisions of Income-tax Act, 1961 and DTAA

applicable to the facts of the case.

(vii) Taxation of capital gains arising out of the proposed transaction shall

be examined by the field formation.

(viii) The onus of compliance with the sectoral or statutory caps on foreign

investment and attendant conditions, if any, shall be on the Investee(s).

(ix) No prior approval of the Competent Authority shall be required for increase in

the amount of foreign equity, provided that, there is no change in percentage

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 19 of 25

of foreign/NRI equity already approved and total foreign equity is upto INR

5000 crores (limit as stated in Para 4.2.1 (iv) of the FDI Policy). The Investee

shall only be required to notify such increase to the Competent Authority

within thirty days of receipt of funds as also allotment of shares to the non-

resident shareholders.

(x) In case of yet to be incorporated Investee, the Applicant shall submit the

Certificate of Incorporation, Memorandum of Association and Articles of

Association of the newly incorporated Investee to the Competent Authority

within sixty (60) days from the date of this Approval Letter.

(xi) In case of yet to be incorporated Investee, the Applicant shall submit the

Audited Financial Statements upon completion of first audit cycle of the

Investee to the Competent Authority.

(xii) The pricing of capital instruments shall be in accordance with the RBI/SEBI

guidelines. Mode of payment, documentation and reporting requirements shall

be complied in terms of the FEM(NDI) Rules; Foreign Exchange Management

(Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019

and as stipulated by RBI from time to time.

(xiii) All downstream investment(s) by the Investee(s) mentioned in this Approval

Letter shall be made in compliance of the relevant sectoral conditions on entry

route, conditionalities, caps and sectoral regulations and in compliance with

Para 3.8.4 of the FDI Policy read with Rule 23 of the FEM (NDI) Rules, as

applicable.

(xiv) Transfer of capital instruments of the Investee(s) mentioned in this

Approval Letter, by or to a person resident outside India shall be regulated in

terms of Annexure 3 of FDI Policy read with Rule 9 of the FEM (NDI) Rules,

as applicable.

(xv) This Approval Letter is subject to compliance with applicable State/Central

policies/laws/rules/regulations prevailing in India including but not limited to

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 20 of 25

Foreign Exchange Management Act, 1999 (FEMA), Income Tax Act, 1961,

Companies Act, 2013, Prevention of Money Laundering Act, 2002, Industrial

(Development & Regulation) Act, 1951, Environmental laws etc. as amended

from time to time.

(xvi) All foreign remittances shall be made as per the exchange rates

prevailing on the day of remittance.

(xvii) Any agreement(s) executed between the Foreign Investor(s) and the

Indian Investee shall be in conformity with the conditions of this Approval

Letter.

(xviii) (Any other conditions, as applicable)

10. The Administrative Ministry for the purpose of this approval is

_________Name of the Ministry/Department___________ and all future

correspondence with respect to this Approval Letter may be addressed to:

Name of Office : __________________

Office Postal Address : __________________

Office Email Address : __________________

Office Landline No. : __________________

11. The Administrative Ministry/Department is empowered to monitor the

compliance of conditions under this Approval Letter and may require Investee to

furnish necessary information/documentation in this regard at a given point of

time.

12. Any contravention/violation of FDI regulations is covered by the penal

provisions of the FEMA and is under the purview of Directorate of Enforcement

under the Ministry of Finance and Reserve Bank of India.

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 21 of 25

13. Acknowledgement of this Approval Letter confirming acceptance of the above

terms and conditions shall be communicated to the Administrative Ministry(s)/

Department(s) as mentioned above within 7 days of receipt of this letter.

Yours faithfully

(Name, Designation and

Official Contact Details

of the Officer)

SEAL OF THE MINISTRY

Copy for information and necessary action to:

1. Reserve Bank of India

2. FIF Cell, DPIIT

3. FDI Data Cell, DPIIT

4. MHA, MEA and any other Ministry/ Department/ Agency consulted

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 22 of 25

ANNEXURE – IV

FORMAT FOR CORRIGENDUM TO APPROVAL LETTER

F. No. ________

Government of India

Ministry of ________

Department of __________

<Place of issue>

Dated ______, 20____

To,

<Applicant Address>

Subject: FDI Proposal No. ____ in the case of _______ - reg.

Sir/Madam,

The undersigned is directed refer to approval letter No.____________

dated ______________issued in respect of FDI Proposal

No.______________of _________________ and the subsequent

request of the applicant dated___________for rectification of

typographic or grammatical mistakes as apparent from record and to

state the following:

a. Para ____of approval letter dated_____which states

“____________” may be read as “___________________”

b. …………………………….

c. ………………………….....

2.

All other terms and conditions of the original approval letter

dated__________remain unchanged.

Yours faithfully

(Name, Designation and

Official Contact Details of the Officer)

SEAL OF THE MINISTRY

Copy for information and necessary action to:

1. Reserve Bank of India

2. FIF Cell, DPIIT

3. FDI Data Cell, DPIIT

4. MHA, MEA and any other Ministry/ Department/ Agency consulted

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 23 of 25

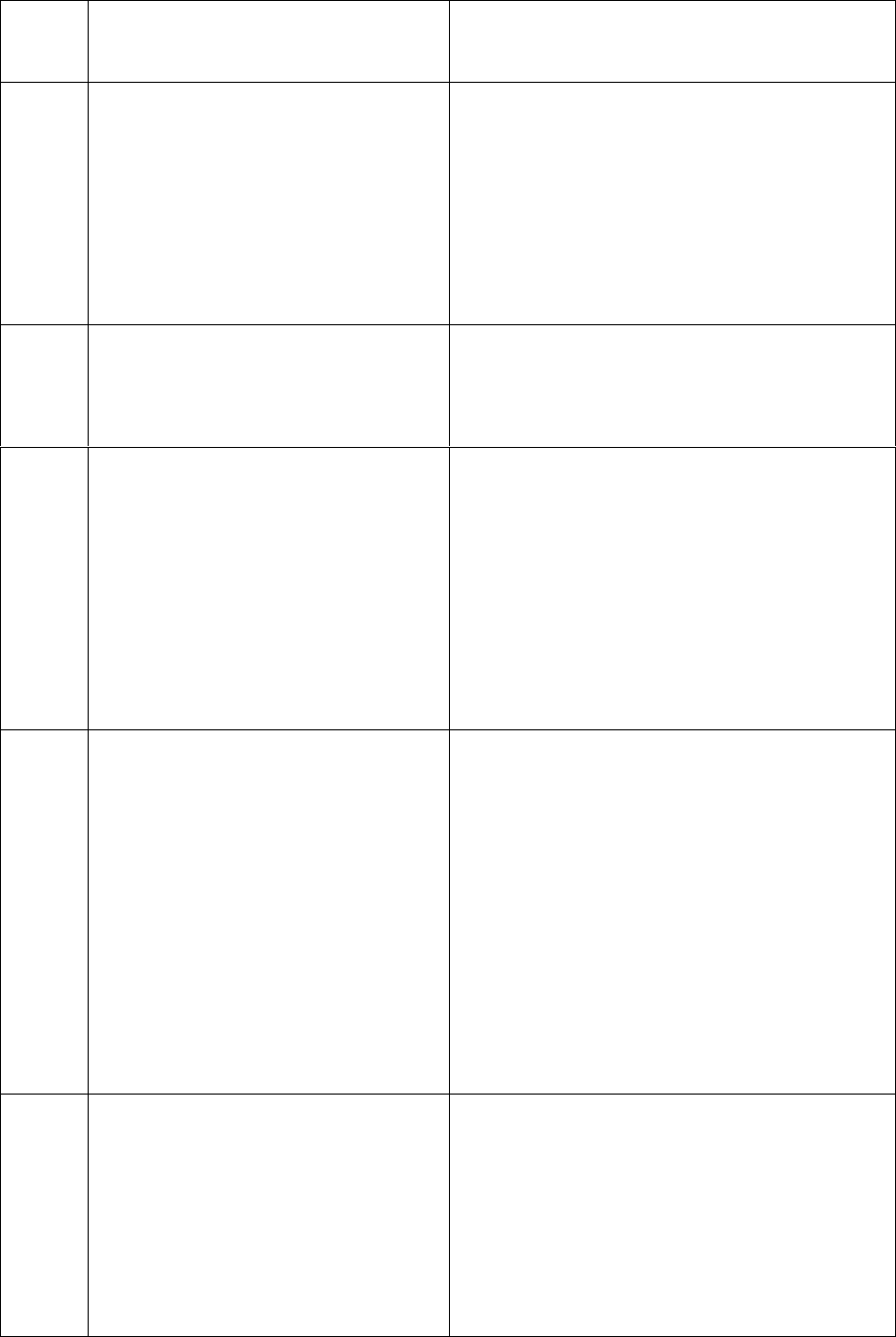

ANNEXURE-V

TIME LIMITS

S. No.

Action Points

Time

Period

Cumulative

Time

Period

(i)

Dissemination of proposal by DPIIT to the

Concerned Ministries/Departments, RBI,

MHA and MEA

2 days

(ii)

Initial scrutiny of the proposal and

documents attached therewith, and

seeking relevant additional

information/documents from the

applicant

12 days

2 Weeks

(iii)

Time limit for submission of clarification

by DPIIT on specific issues of FDI Policy

2 Weeks

4 Weeks

(iv)

Time limit for submission of comments

by MHA, MEA and any other consulted

Ministry/Department / RBI/ Regulator /

Stakeholder

6 Weeks

8 Weeks

(v)

Time limit for approval on proposals

by Competent Authority for grant of

approval

4 Weeks

12 Weeks

Note:

(i)

Additional time of two (02) weeks shall be given to DPIIT for

consideration of those proposals which are proposed for rejection or

where additional conditions are proposed to be imposed by the

Competent Authority.

(ii)

Time limits allocated shall exclude time taken by applicants in removing

deficiencies in the proposals or in supplying additional information, as

may be required by the Competent Authority.

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 24 of 25

Annexure-VI

[SHOULD BE ON A Rs.100/- STAMP PAPER]

FDI PROPOSAL No. _______ OF _____

In the application of:

[Name of Investor Entity(ies)/Person(s)]

and

[Name of Investee Entity(ies)/Person(s)]

Affidavit

Affidavit of Shri [Name of applicant], working at [Details of investor

organisation], residing at [Residential Address].

I, [Name of applicant], working at [Details of investor organisation], residing at

[Residential Address], do hereby solemnly affirm and state as under:

1. That I am working as [Designation] with the [Applicant], and residing at

[Residential Address] and am conversant with the facts of the present

application and therefore competent to swear this Affidavit.

2. That the accompanying application has been prepared by our advocate or

agent upon instructions from us and the contents therein are true and correct to

the best of my knowledge based on the official records of the Applicant

Entity/Person as well as the Investee Entity(ies) or person(s). The legal

submissions contained therein are true upon information received and believed

by me to be true.

3. I understand that this application will be considered solely on the basis of the

documents uploaded at the time of submitting the online application.

4. That the accompanying application has been prepared in compliance with all

SOP FOR FILING FDI PROPOSALS BY DPIIT, M/o COMMERCE & INDUSTRY Page 25 of 25

the guidelines and instructions issued by the Government from time to time.

(Signature)

DEPONENT

VERIFICATION

Verified at New Delhi on [date of submitting application] day of [Month], [Year]

that the contents of the above Affidavit are true and correct to the best of my

knowledge based on the official records of the Applicant Entity/Person as well

as the Investee Entity(ies) or person(s). No part of it is false and nothing

material has been concealed there from.

(Signature)

DEPONENT