Grant Thornton

May 2019

Leases

Navigating the guidance in

ASC 842

This publication was created for general information purposes, and does not constitute professional

advice on facts and circumstances specific to any person or entity. You should not act upon the

information contained in this publication without obtaining specific professional advice. No representation

or warranty (express or implied) is given as to the accuracy or completeness of the information contained

in this publication. Grant Thornton LLP (Grant Thornton) shall not be responsible for any loss sustained

by any person or entity that relies on the information contained in this publication. This publication is not a

substitute for human judgment and analysis, and it should not be relied upon to provide specific answers.

The conclusions reached on the examples included in this publication are based on the specific facts and

circumstances outlined. Entities with slightly different facts and circumstances may reach different

conclusions, based on considering all of the available information.

The content in this publication is based on information available as of May 1, 2019. We may update this

publication for evolving views as we continue to monitor the implementation process. For the latest

version, please visit grantthornton.com.

Portions of FASB Accounting Standards Codification® material included in this work are copyrighted by

the Financial Accounting Foundation, 401 Merritt 7, Norwalk, CT 06856, and are reproduced with

permission.

3

Contents

Introduction ............................................................................................................................... 8

1. Definitions ..........................................................................................................................10

1.1 Commencement date ............................................................................................... 10

1.2 Initial direct costs ..................................................................................................... 12

1.3 ‘Reasonably certain’ threshold ................................................................................... 15

1.4 Lease payments ...................................................................................................... 17

1.4.1 Fixed and in-substance fixed payments ................................................................19

1.4.2 Lease incentives ...............................................................................................22

1.4.3 Variable payments ............................................................................................22

1.4.4 Exercise price of an option to purchase the underlying asset ...................................27

1.4.5 Lease termination penalties ................................................................................27

1.4.6 Fees paid by the lessee to owners of a special-purpose entity .................................28

1.4.7 Amounts probable of being owed under a residual value guarantee ..........................29

1.5 Lease term ............................................................................................................. 31

1.5.1 Noncancellable period .......................................................................................32

1.5.2 Lessee option to extend or terminate a lease ........................................................33

1.5.3 Fiscal funding clauses .......................................................................................35

1.6 Economic life........................................................................................................... 36

1.7 Guarantees and indemnifications ............................................................................... 36

1.7.1 Indemnification payments...................................................................................36

1.7.2 Tax indemnification ...........................................................................................37

1.8 Discount rate........................................................................................................... 38

1.8.1 Lessor discount rate ..........................................................................................39

1.8.2 Lessee discount rate .........................................................................................40

1.9 Fair value ............................................................................................................... 43

1.9.1 Lessors that are not manufacturers or dealers .......................................................44

1.10 Master lease agreements .......................................................................................... 45

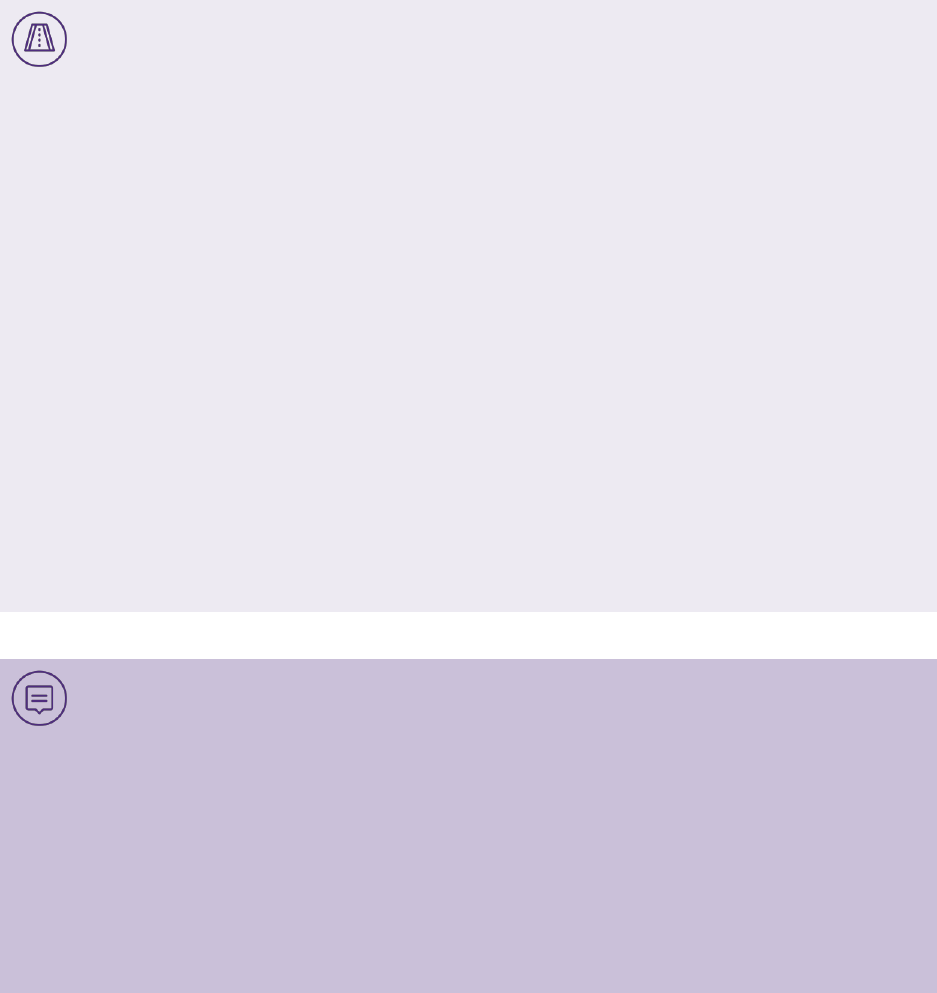

2. Lease identification..............................................................................................................47

2.1 Scope of leasing guidance ........................................................................................ 47

2.1.1 Lease versus service contract .............................................................................48

2.1.2 Service concession arrangements .......................................................................49

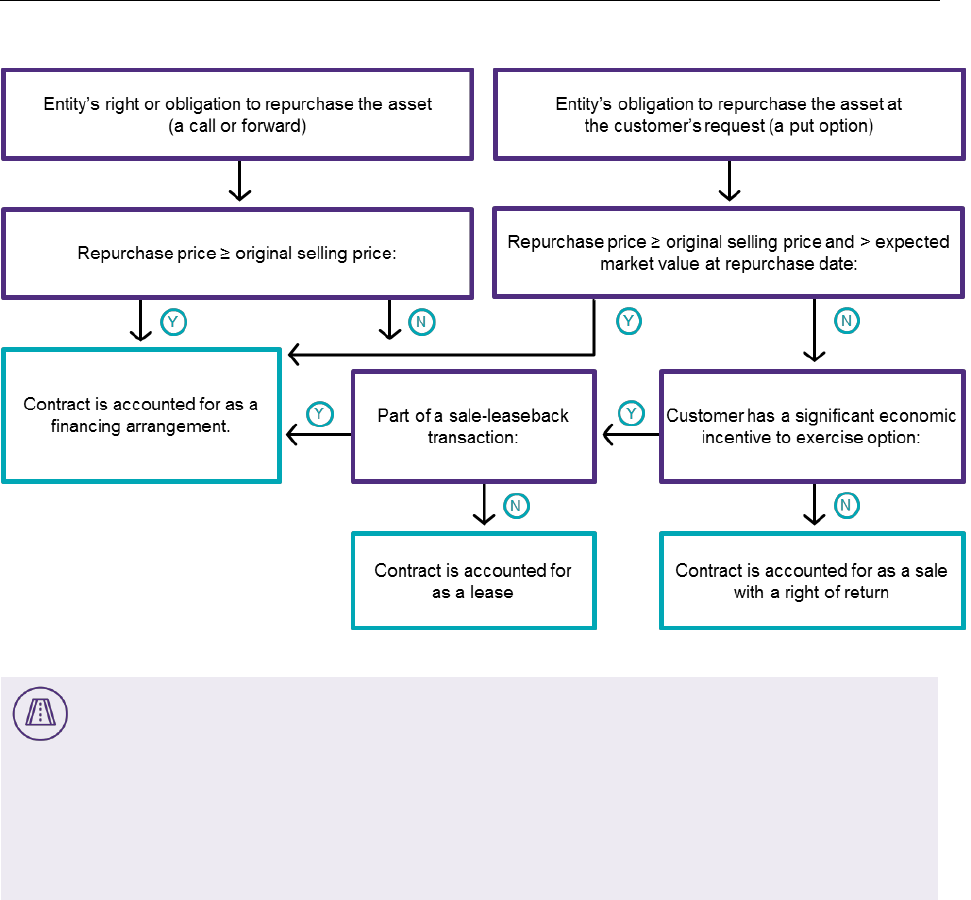

2.1.3 Sales with repurchase rights ...............................................................................50

2.2 Definition of a lease.................................................................................................. 52

2.2.1 Period of time ...................................................................................................55

2.2.2 Inception date versus commencement date ..........................................................56

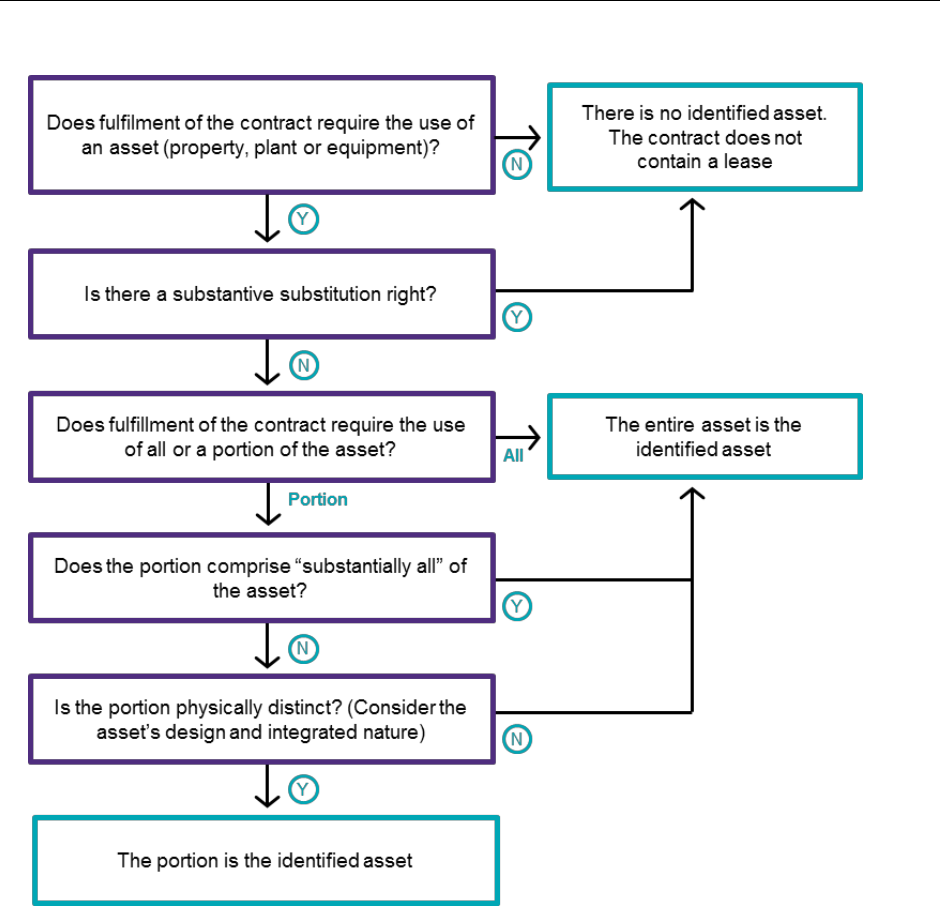

2.3 Identified asset ........................................................................................................ 57

2.3.1 Substitution rights .............................................................................................58

2.3.2 Portions of assets .............................................................................................64

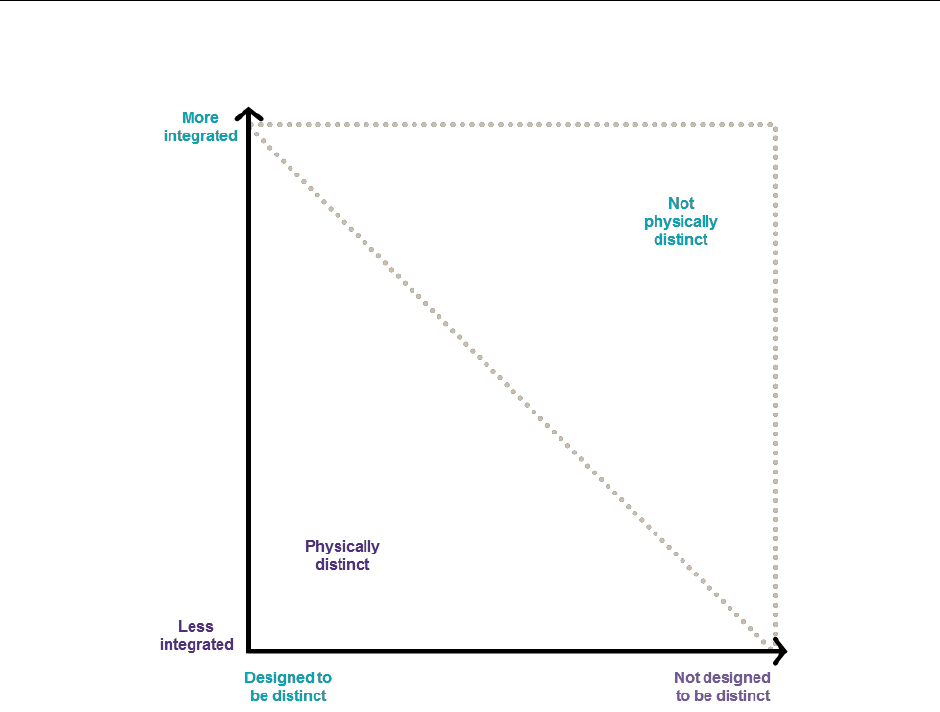

2.3.3 Physically distinct..............................................................................................65

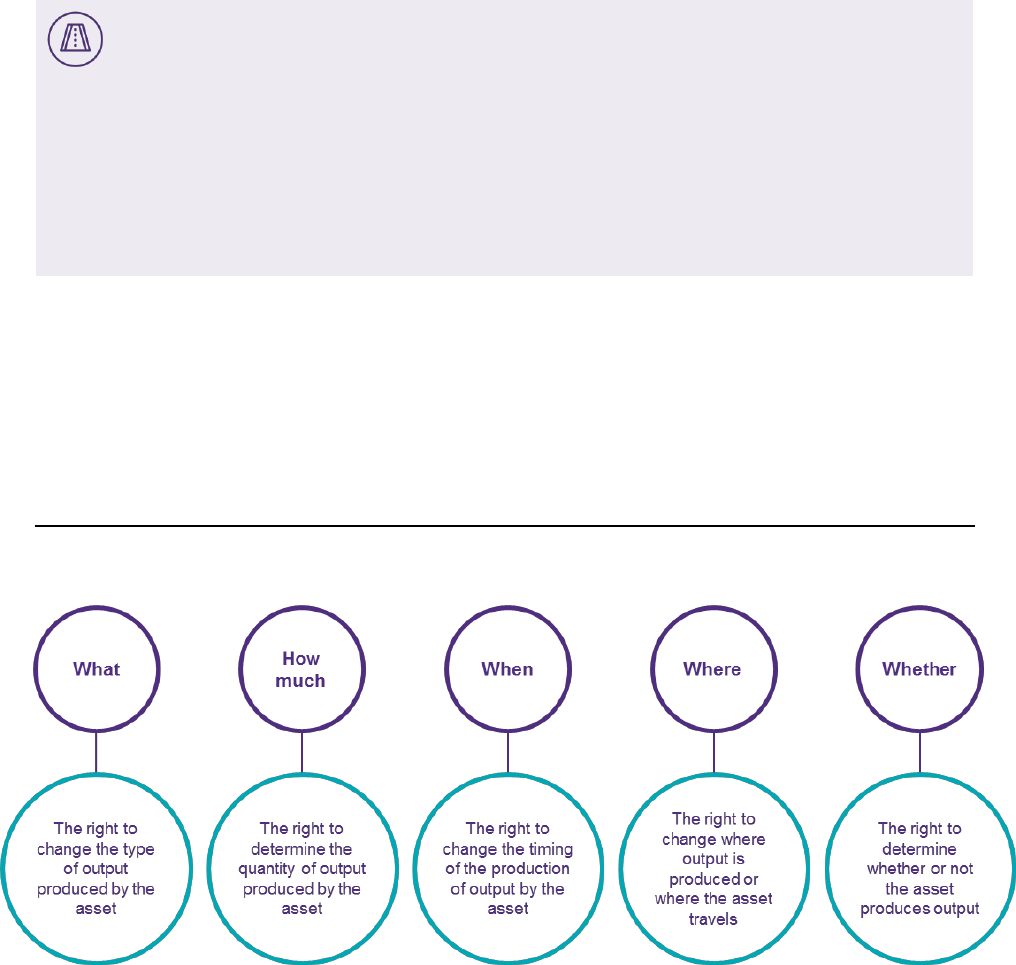

2.4 Right to control the use of the identified asset............................................................... 68

2.4.1 Right to receive economic benefits ......................................................................68

2.4.2 Right to direct the use........................................................................................71

2.4.3 Right to direct the use of assets that the customer can neither access nor possess.....77

2.4.4 Assets used to obtain or use a good or service ......................................................81

3. Components.......................................................................................................................84

3.1 Identifying lease and nonlease components ................................................................. 84

3.1.1 Lease components............................................................................................84

4

3.1.2 Nonlease components .......................................................................................89

3.1.3 Activities and payments that do not represent separate components.........................92

3.1.4 Obligations to pay lessor taxes and insurance premiums ........................................95

3.1.5 Lessee practical expedient .................................................................................95

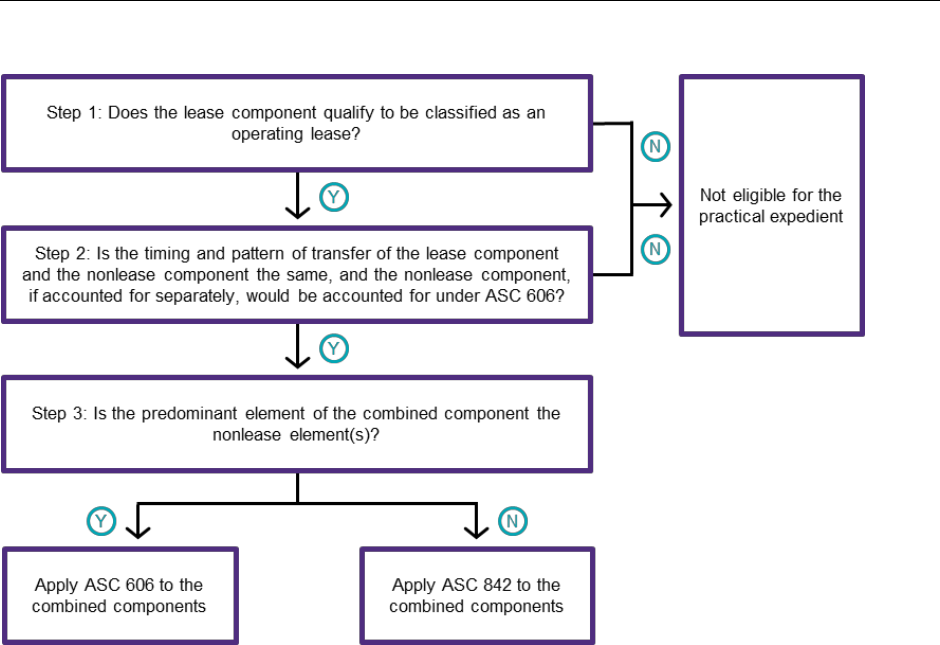

3.1.6 Lessor practical expedient ..................................................................................97

3.1.7 Contract combinations ..................................................................................... 103

3.2 Lessee measurement, allocation, and subsequent measurement of consideration ........... 104

3.2.1 Lessee measurement ...................................................................................... 104

3.2.2 Lessee initial allocation .................................................................................... 106

3.2.3 Lessee subsequent measurement and allocation ................................................. 107

3.3 Lessor measurement, allocation, and subsequent measurement of consideration ............ 108

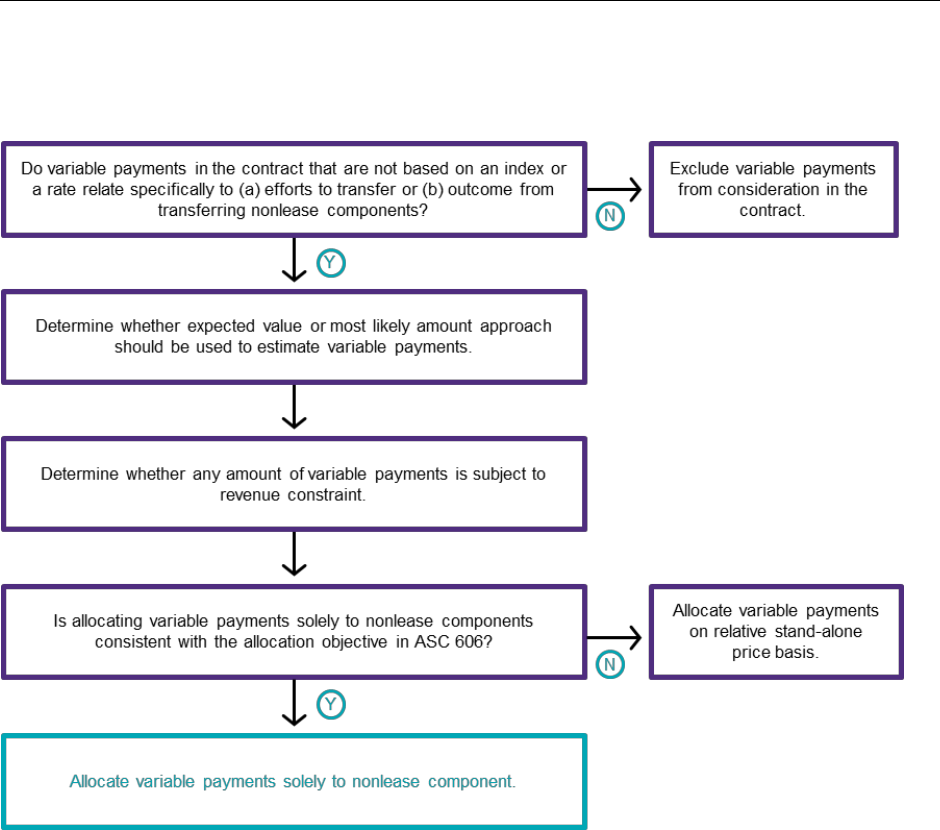

3.3.1 Lessor measurement ....................................................................................... 108

3.3.2 Lessor initial allocation..................................................................................... 114

3.3.3 Lessor subsequent measurement and allocation.................................................. 121

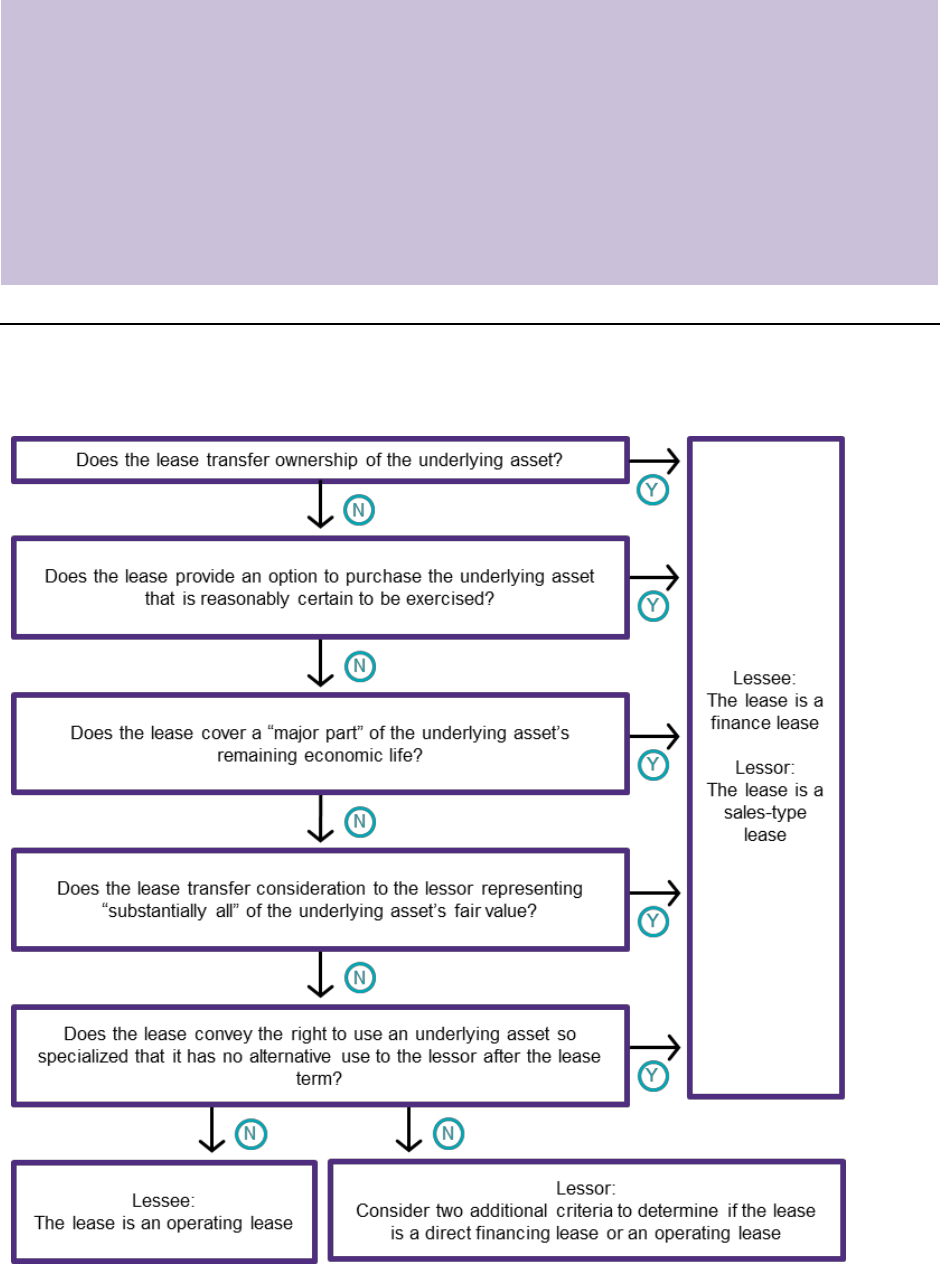

4. Lease classification ........................................................................................................... 123

4.1 Classification criteria – lessee and lessor................................................................... 125

4.1.1 Criterion 1: Transfer of ownership ...................................................................... 126

4.1.2 Criterion 2: Option to purchase.......................................................................... 127

4.1.3 Criterion 3: Lease term .................................................................................... 127

4.1.4 Criterion 4: Present value of lease payments and guaranteed residual value............ 129

4.1.5 Criterion 5: No alternative use ........................................................................... 130

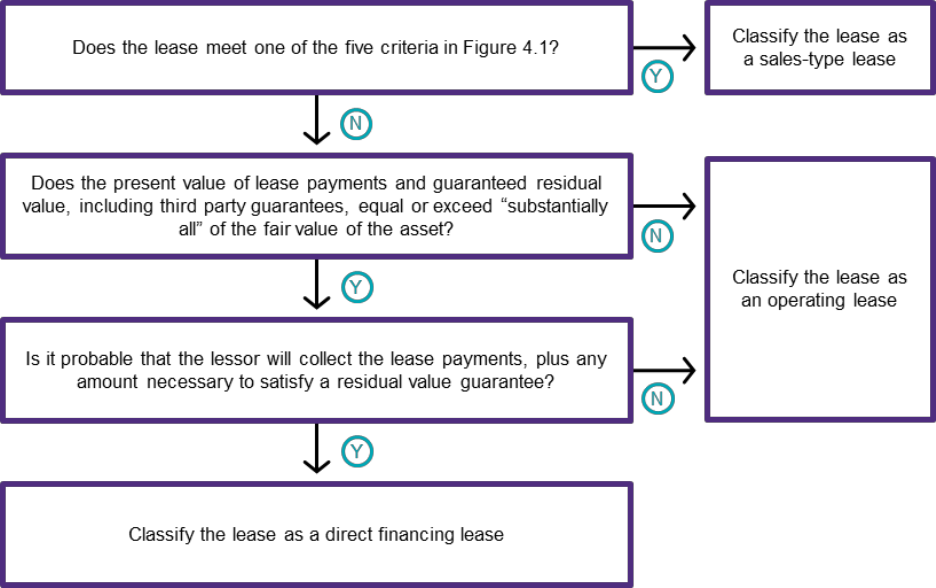

4.2 Additional lessor classification criteria ....................................................................... 132

4.2.1 Present value of lease payments and guaranteed residual value ............................ 134

4.2.2 Collectibility.................................................................................................... 134

4.3

Other classification matters ..................................................................................... 137

4.3.1 Reassessment of lease classification ................................................................. 137

4.3.2 Related-party lease classification ...................................................................... 137

4.3.3 Lessee indemnification for environmental contamination ....................................... 139

4.3.4 Leases involving facilities owned by a government unit or authority ........................ 139

4.3.5 Leases acquired in a business combination ........................................................ 141

5. Lessee accounting ............................................................................................................ 142

5.1 General ................................................................................................................ 142

5.1.1 Short-term leases ........................................................................................... 142

5.2 Initial measurement ................................................................................................ 145

5.2.1 Initial measurement of the lease liability.............................................................. 145

5.2.2 Initial measurement of the right-of-use asset ....................................................... 146

5.3 Finance lease subsequent measurement................................................................... 148

5.3.1 Finance lease expense recognition .................................................................... 149

5.4 Operating lease subsequent measurement ................................................................ 150

5.4.1 Operating lease expense recognition ................................................................. 152

5.4.2 Lease incentives neither paid nor payable at commencement ................................ 155

5.5 Amortization of leasehold improvements.................................................................... 157

5.6 Lessee costs to place the underlying asset in service .................................................. 157

5.7 Impairment of the right-of-use asset .......................................................................... 157

5.7.1 Post-impairment asset amortization – operating lease .......................................... 160

5.7.2 Post-impairment asset amortization – finance lease ............................................. 160

5.7.3 Example of impairment of a right-of-use asset ..................................................... 161

5.7.4 Lessee decision to abandon right-of-use asset .................................................... 162

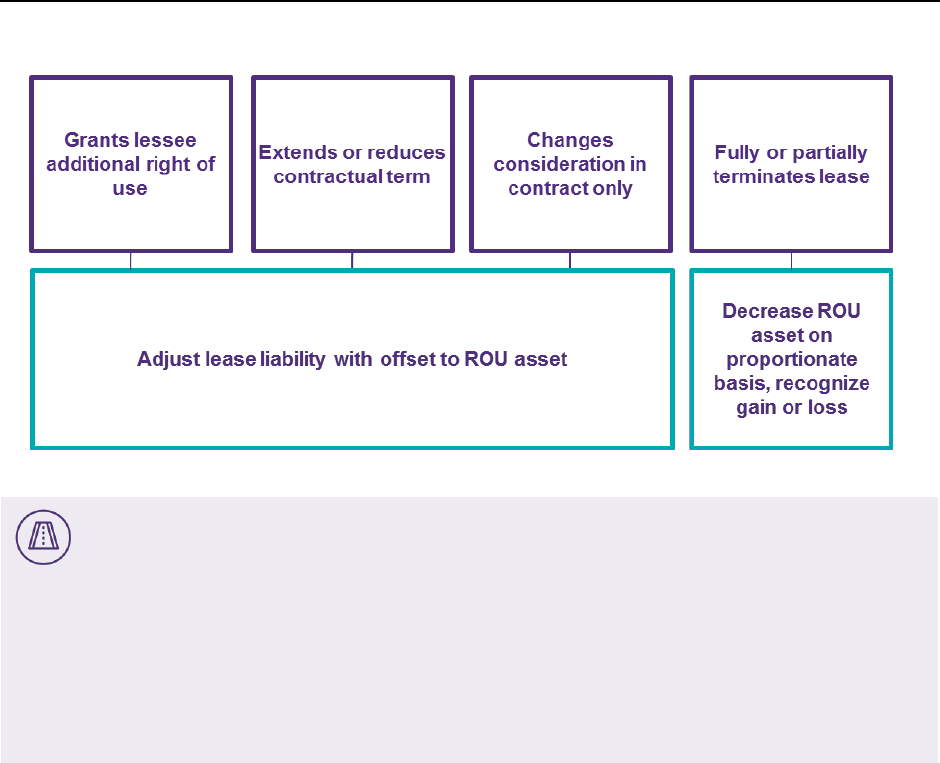

5.8 Lease modification ................................................................................................. 162

5.8.1 Modification accounted for as a separate contract ................................................ 163

5

5.8.2 Modification accounted for as a continuation of the existing contract ....................... 164

5.8.3 Lease modification in connection with refunding of tax-exempt debt........................ 174

5.9 Remeasurement of the lease ................................................................................... 174

5.9.1 Reassessment of lease term or option to purchase .............................................. 177

5.9.2 Recognizing the remeasurement ....................................................................... 182

5.10 Lease termination .................................................................................................. 183

5.11 Leases denominated in a foreign currency ................................................................. 184

5.11.1 Translation of periodic lease cost ...................................................................... 184

5.11.2 Modification or remeasurement of a foreign-currency-denominated lease ................ 186

5.12 Maintenance deposits............................................................................................. 187

6. Lessor accounting ............................................................................................................. 190

6.1 Sales-type leases .................................................................................................. 191

6.1.1 Initial recognition and measurement................................................................... 191

6.1.2 Subsequent recognition and measurement ......................................................... 194

6.1.3 Sales-type leases with significant variable payments ............................................ 197

6.1.4 Derecognition ................................................................................................. 198

6.1.5 Sales-type lease example ................................................................................ 198

6.2 Direct financing leases............................................................................................ 200

6.2.1 Initial recognition and measurement................................................................... 200

6.2.2 Subsequent recognition and measurement ......................................................... 202

6.2.3 Derecognition ................................................................................................. 204

6.2.4 Direct financing lease example.......................................................................... 204

6.3 Operating leases ................................................................................................... 207

6.3.1 Initial recognition and measurement................................................................... 207

6.3.2 Subsequent recognition and measurement ......................................................... 207

6.4 Collectibility........................................................................................................... 209

6.4.1 Sales-type leases and collectibility..................................................................... 210

6.4.2 Direct financing leases and collectibility .............................................................. 213

6.4.3 Operating leases and collectibility...................................................................... 213

6.5 Lessor costs to fulfil lease obligations........................................................................ 215

6.6 Sale of the lease receivable..................................................................................... 216

6.7 Sales of equipment with guaranteed minimum resale amount ....................................... 216

6.7.1 Guarantee payment......................................................................................... 217

6.7.2 Repurchase right ............................................................................................ 217

6.7.3 Contract with repurchase rights classified as an operating lease ............................ 218

6.7.4 Customer’s exercise of residual value guarantee ................................................. 219

6.7.5 Minimum resale value guarantees not in scope of derivative or guarantee guidance.. 219

6.8 Indemnification payments related to tax effects........................................................... 222

6.9 Impairment of the net investment in the lease ............................................................. 223

6.10 Modifications ......................................................................................................... 223

6.10.1 Modification of a sales-type lease ...................................................................... 225

6.10.2 Modification of a direct financing lease ............................................................... 228

6.10.3 Modification of an operating lease ..................................................................... 231

6.11 Terminations ......................................................................................................... 234

7. Sale-leaseback accounting ................................................................................................. 236

7.1 Determining if a transaction is within the scope of sale-leaseback guidance .................... 236

7.1.1 Lessee controls the underlying asset before the lease commencement date ............ 237

7.1.2 Lessee incurs construction or design costs before lease commencement ................ 238

7.1.3 Lessee indemnification for environmental contamination ....................................... 244

7.1.4 Sale subject to a preexisting lease..................................................................... 244

6

7.2 Determining whether the transfer of an asset is a sale ................................................. 245

7.2.1 Repurchase option .......................................................................................... 247

7.2.2 Seller-lessee guarantee of the residual value ...................................................... 248

7.2.3 Transfer of tax benefits .................................................................................... 249

7.3 Accounting for a transfer of assets that is a sale ......................................................... 250

7.3.1 Determining the transaction price ...................................................................... 251

7.3.2 Determining if the sale and leaseback is at fair value ............................................ 251

7.4 Accounting for a transfer of assets that is not a sale .................................................... 255

7.4.1 Accounting by a seller-lessee reasonably certain to exercise a repurchase option..... 258

7.4.2 Failed sale-leaseback subsequently meets the sale-leaseback criteria .................... 259

7.5 Sale-leaseback-sublease transactions ...................................................................... 262

8. Leveraged leases.............................................................................................................. 264

8.1 Overview .............................................................................................................. 264

8.2 Guidance.............................................................................................................. 266

9. Subleases ........................................................................................................................ 267

9.1 Sublease .............................................................................................................. 267

9.2 Sublease classification............................................................................................ 267

9.3 Sublessor’s initial and subsequent measurement of a sublease .................................... 268

9.3.1 Sublease of a portion of a leased asset .............................................................. 269

9.3.2 Sublessor discount rate ................................................................................... 270

9.3.3 Sublessor derecognition................................................................................... 271

9.4 Original lessor’s accounting for a sublease ................................................................ 271

9.5 Sublessee............................................................................................................. 272

10. Presentation and disclosure ................................................................................................ 273

10.1

Lessee presentation ............................................................................................... 273

10.1.1 Statement of financial position .......................................................................... 273

10.1.2 Statement of comprehensive income ................................................................. 274

10.1.3 Statement of cash flows ................................................................................... 275

10.2 Lessor presentation................................................................................................ 276

10.2.1 Statement of financial position .......................................................................... 276

10.2.2 Statement of comprehensive income ................................................................. 277

10.2.3 Statement of cash flows ................................................................................... 279

10.3 Overall disclosures................................................................................................. 280

10.3.1 Lessee disclosures.......................................................................................... 281

10.3.2 Lessor disclosures .......................................................................................... 288

10.4 Sale and leaseback transactions .............................................................................. 293

10.5 Leveraged leases .................................................................................................. 294

11. Transition......................................................................................................................... 296

11.1 Effective date ........................................................................................................ 296

11.1.1 SEC staff announcement on the definition of ‘public business entity’ ....................... 297

11.1.2 Early adoption ................................................................................................ 299

11.2 Transition methods................................................................................................. 301

11.2.1 Modified retrospective method .......................................................................... 302

11.2.2 Current period adjustment method..................................................................... 304

11.2.3 Transition for short-tem leases .......................................................................... 304

11.3 Practical expedients ............................................................................................... 305

11.3.1 Package of practical expedients ........................................................................ 305

11.3.2 Hindsight practical expedient ............................................................................ 306

11.3.3 Land easement practical expedient.................................................................... 308

11.3.4 Combining lease and nonlease components in transition ...................................... 309

Introduction 7

11.4 Amounts previously recognized in business combinations ............................................ 309

11.5

Disclosures ........................................................................................................... 310

11.5.1 Prior-period disclosures under the current-period adjustment transition method ........ 311

11.5.2 Disclosure of election of practical expedients ...................................................... 312

11.5.3 SEC reporting and transition ............................................................................. 312

11.6 Lessee transition ................................................................................................... 313

11.6.1 Leases classified as operating leases under legacy GAAP .................................... 314

11.6.2 Operating lease impairment model .................................................................... 317

11.6.3 Lessee transition example ................................................................................ 317

11.6.4 Foreign-currency-denominated leases in transition............................................... 320

11.6.5 Leases classified as capital leases under legacy GAAP ........................................ 325

11.6.6 Lessee modifications in transition ...................................................................... 328

11.6.7 Build-to-suit arrangements ............................................................................... 329

11.7 Lessor transition .................................................................................................... 331

11.7.1 Leases classified as operating leases under legacy GAAP .................................... 332

11.7.2 Leases classified as sales-type or direct financing leases under legacy GAAP ......... 334

11.7.3 Leases classified as leveraged leases under legacy GAAP ................................... 336

11.8 Transition for sale-leaseback transactions ................................................................. 337

Appendix A: Determining the incremental borrowing rate .............................................................. 340

Introduction

Introduction

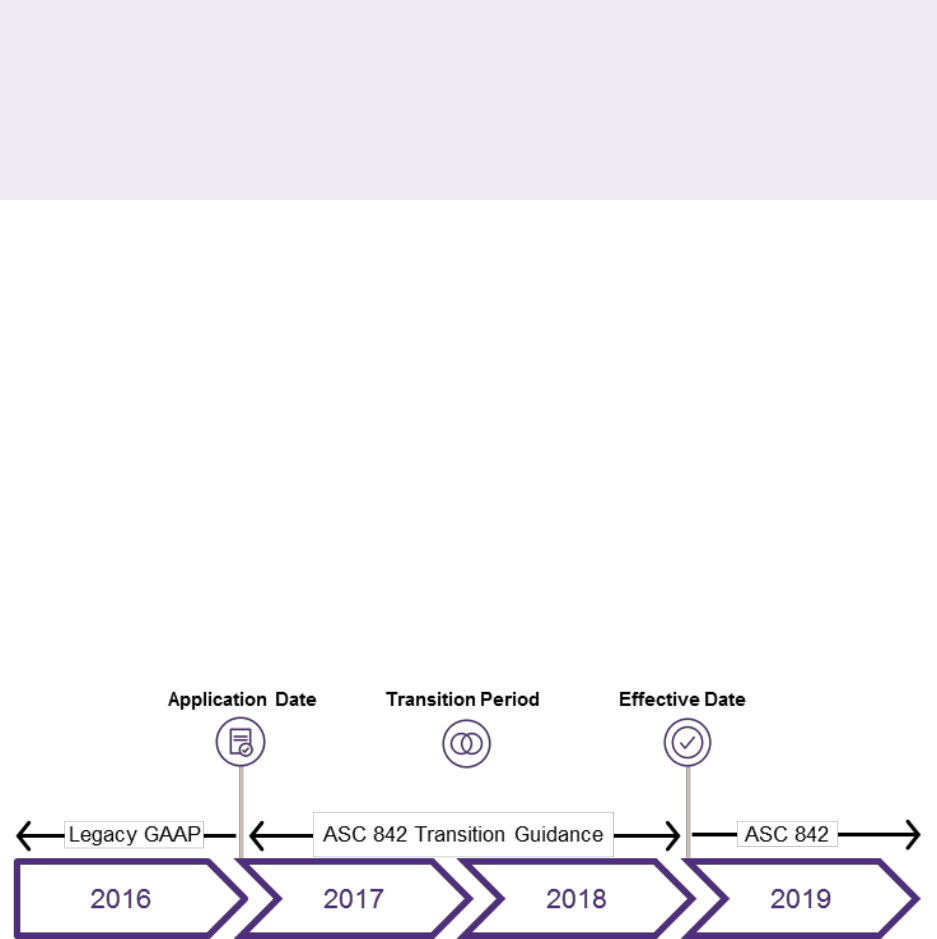

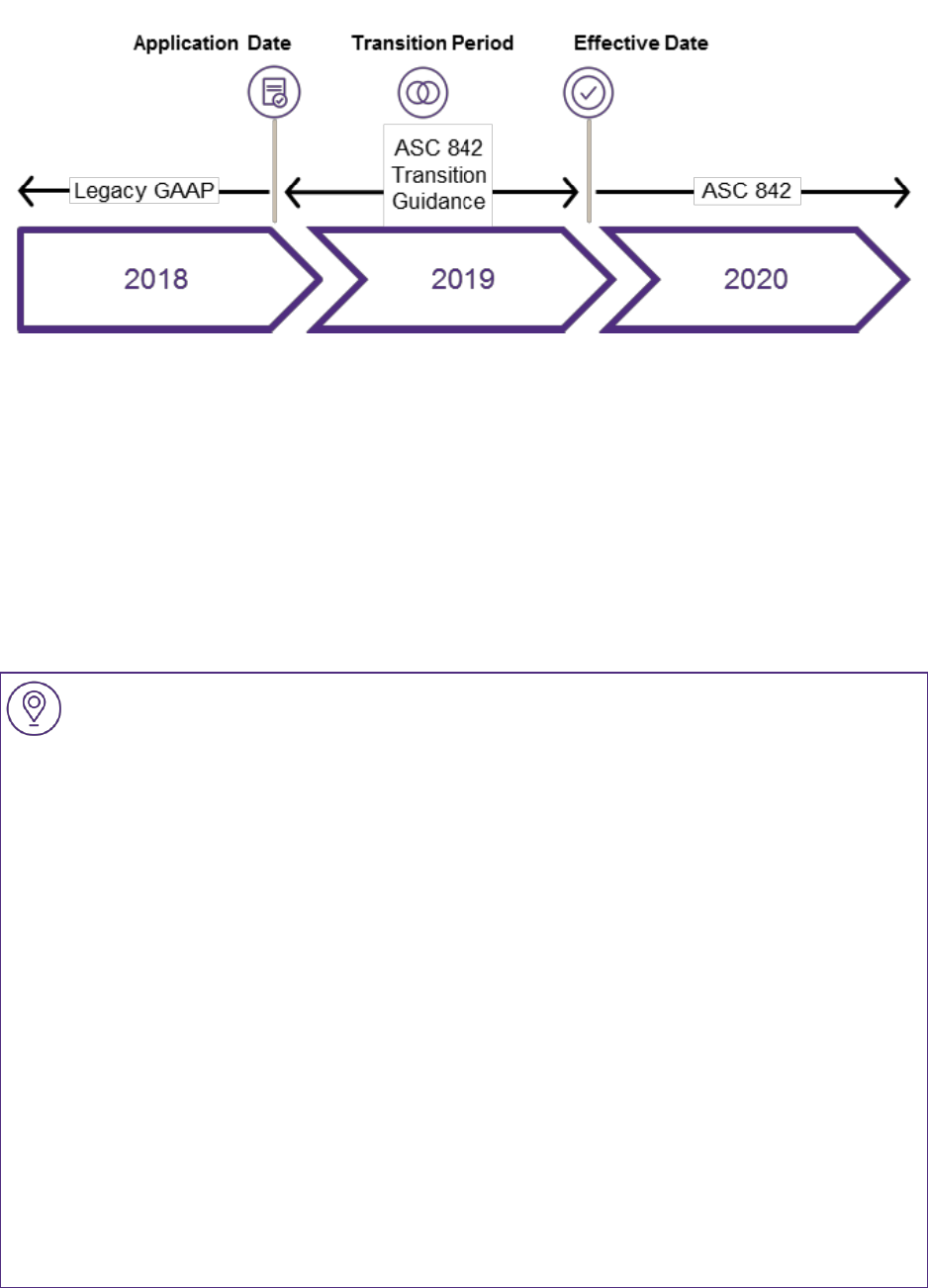

On February 25, 2016, the FASB released ASU 2016-02, Leases, completing its long-term project to

overhaul lease accounting. The ASU codifies ASC 842, Leases, which replaces the guidance in ASC 840

Leases. ASC 842 is effective for public business entities in fiscal years beginning after December 15,

2018. The effective date for most other entities is deferred for one year, meaning that most calendar-year

private companies will be required to adopt the new standard in 2020. Early adoption is permitted for all

entities.

The guidance in ASC 842 should generally be applied as follows:

Determine whether a contract is or contains a lease: A lease conveys the right to control the use

of identified property, plant, or equipment for a period of time in exchange for consideration.

Identify the lease and nonlease components in the contract, and allocate consideration to

them: Lease components are accounted for under ASC 842, and nonlease components are

accounted for under other relevant U.S. GAAP. Both lessees and lessors are permitted to combine

qualifying lease and nonlease components.

Classify the lease component(s): Lessees must classify leases as either finance or operating

leases, and lessors must classify leases as sales-type, direct financing, or operating leases.

Measure and recognize the lease component(s): Lessees must recognize an asset and liability on

the statement of financial position for most leases, measured primarily based on the present value of

the remaining lease payments. Lessors must recognize a net investment in the lease, and

derecognize the underlying asset, for sales-type and direct financing leases. For operating leases,

lessors retain the underlying asset on the statement of financial position.

Recognize lease expense or lease income over the lease term: Lessors and lessees must

generally recognize lease income or expense for operating leases on a straight-line basis over the

lease term. For finance leases, lessees must recognize interest expense based on the effective

interest method and amortization expense generally on a straight-line basis (the same way that

capital leases are accounted for under legacy GAAP) over the lease term. Lessors must recognize

up-front selling profit or loss on sales-type leases and interest income on the net investment in the

lease over the lease term for both sales-type and direct financing leases.

ASC 842 also addresses entities’ accounting for subleases, sale-leaseback transactions, and

arrangements in which the lessee is involved in constructing the underlying asset.

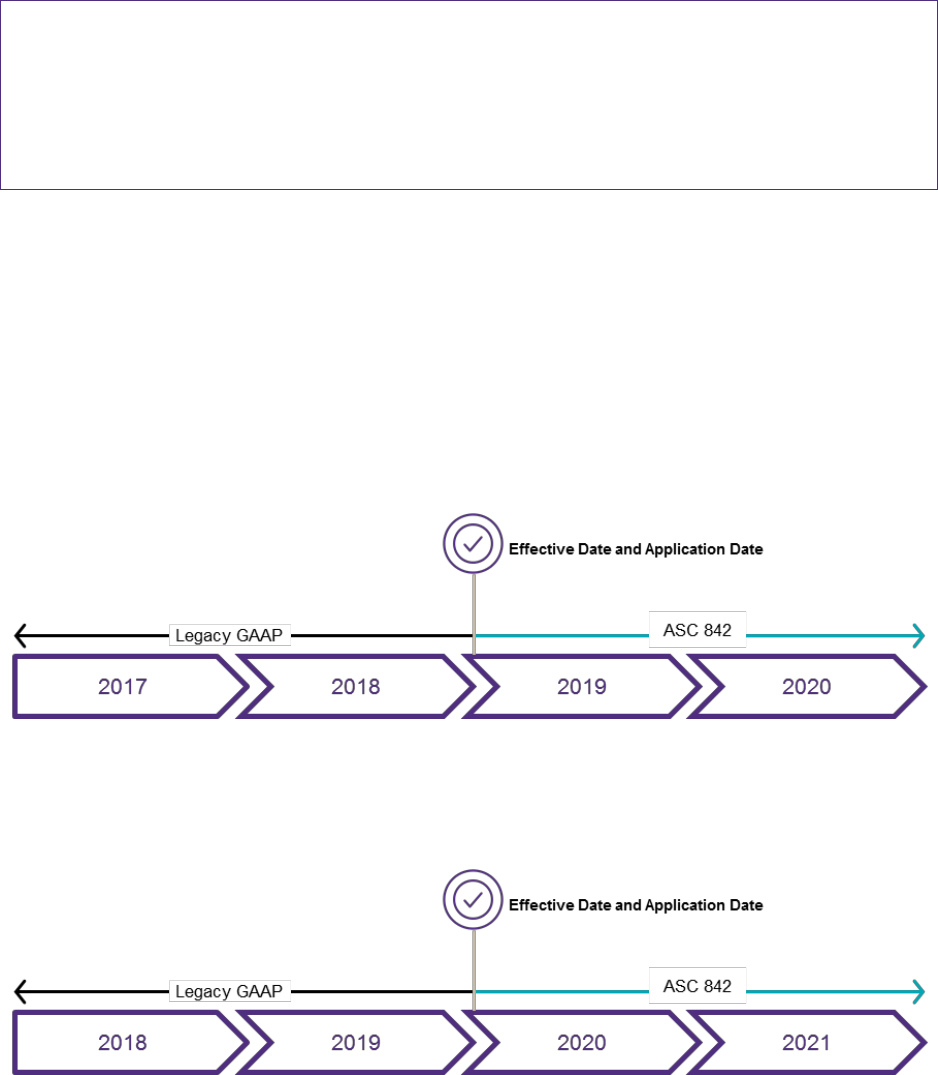

Entities have two choices for transition – a modified retrospective method, which requires application of

ASC 842 as of the beginning of the earliest period presented, or an alternative “current-period

adjustment” method, which requires application of ASC 842 as of the effective date.

Since ASU 2016-02 was issued, the FASB has issued the following ASUs to clarify and amend the

guidance in ASC 842, all of which are reflected in this guide:

• ASU 2018-01, Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842

• ASU 2018-10, Codification Improvements to Topic 842, Leases

Introduction 9

• ASU 2018-11, Leases (Topic 842): Targeted Improvements

• ASU 2018-20, Leases (Topic 842): Narrow-Scope Improvements for

Lessors

• ASU 2019-01, Leases (Topic 842): Codification Improvements

The remainder of this guide

Summarizes the leasing guidance and examples

Includes “Grant Thornton insights” on various topics

Provides practical insights on how the guidance may differ from legacy GAAP (“At the crossroads”)

Includes illustrative examples to demonstrate how to apply the guidance

Definitions 10

1. Definitions

There are many key terms and concepts referenced throughout ASC 842. These terms and concepts

apply to both lessees and lessors, and affect the classification, recognition, and measurement of leases.

These terms and concepts are discussed in this section, and are referenced throughout the other

sections of this publication.

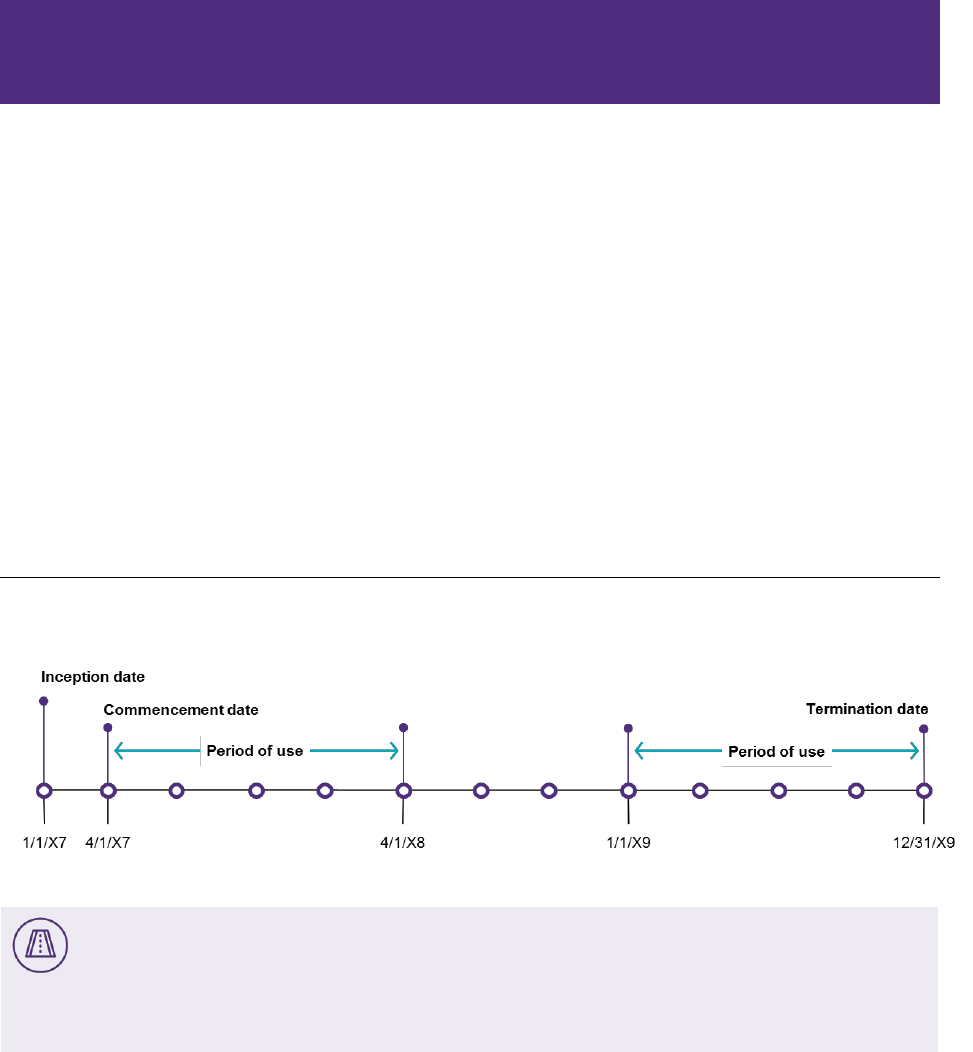

1.1 Commencement date

The lease accounting model in ASC 842 is based on the concept of control. Lease accounting is triggered

when control over the right to direct the use of an underlying asset transfers from the lessor to the lessee.

This transfer of control occurs on the commencement date of the lease, which is the date when the lessor

makes the underlying asset available for the lessee to use. The commencement date can occur even if

the lessee has not begun to use the underlying asset at that date. For instance, although a leased railcar

might initially sit empty in the lessee’s rail yard, as long as the lessee controls the right to use the asset

(that is, the lessee can use the asset whenever it chooses), the lease has commenced and should be

accounted for by both parties.

Commencement Date of the Lease: The date on which a lessor makes an underlying asset available for

use by a lessee. See paragraphs 842-10-55-19 through 55-21 for implementation guidance on the

commencement date.

At the crossroads: Commencement date versus inception date

Under ASC 842, many measurement inputs related to the lease, such as the discount rate and the fair

value of the underlying asset, are determined at the lease commencement date, whereas under legacy

GAAP, these inputs are determined at lease inception. Lease inception is the date when the contract

containing the lease is executed, meaning that there is a signed document as evidence of the

agreement and all principal provisions have been negotiated. Under ASC 842, lease components are

identified at the commencement date of the lease, concurrently with determining the appropriate

classification for each lease component and with measuring and allocating the consideration in the

contract. These determinations are made based on the facts and circumstances as of the

commencement date, whereas under legacy GAAP, these determinations are made based on the facts

and circumstances as of the inception date of the lease.

Since there might be a significant difference between lease inception and lease commencement dates,

ASC 842 requires a lessee to disclose information about leases that create significant rights and

obligations if the inception date has already occurred but the lease has not yet commenced as of the

reporting date, to ensure that financial statement users have information about the company’s future

commitments.

Definitions 11

Lease with an inception date before and commencement date after year-end

Lessee and Lessor enter into an agreement to lease a building. The lease is signed on November 30,

20X1, and Lessor will make the underlying asset available for use by Lessee on February 1, 20X2.

Therefore, the commencement date will occur, and the lease will be measured and recorded, on

February 1, 20X2. The lease is not recognized on Lessee’s statement of financial position at December

31, 20X1. However, the lease inception date has occurred, and Lessee is required to disclose

information about the lease in the notes to its 20X1 financial statements, provided the lease creates

significant rights and obligations for Lessee.

In some situations, the lessor makes the underlying asset available to the lessee before the lessee either

begins using the asset or starts making lease payments. For example, a lessee leases space in an office

building and must install leasehold improvements in the leased office space before moving in, at which

point, it must begin making lease payments. In this situation, the lessee obtains the right to use the

underlying asset once it can access the space to begin constructing its leasehold improvements.

Therefore, the lease commences when the lessee gains access, regardless of when the lessee is

required to begin making lease payments.

Distinguishing lease inception and commencement dates

On January 1, Lessee executes a contract with Lessor for the right to use an office building for a period

of five years. However, Lessor must make repairs to the building before granting Lessee access,

including repairs to the building’s foundation. Once the repairs are completed on March 1, Lessee is

granted access to the building, at which time Lessee’s contractor can begin installing leasehold

improvements. In this example, the contract inception date is January 1, and the commencement date

of the lease is March 1.

Now, assume that Lessee is not required to begin making lease payments until its contractor finishes

constructing the leasehold improvements, which occurs on June 1. The commencement date of the

lease is still March 1, because that is when Lessor makes the asset available for use by Lessee,

regardless of whether Lessee’s obligation to make lease payments is deferred for some period of time.

As a result, Lessee must classify, measure, and record the lease on March 1.

ASC 842-10-55-19

In some lease arrangements, the lessor may make the underlying asset available for use by the lessee

(for example, the lessee may take possession of or be given control over the use of the underlying

asset) before it begins operations or makes lease payments under the terms of the lease. During this

period, the lessee has the right to use the underlying asset and does so for the purpose of constructing

a lessee asset (for example, leasehold improvements).

ASC 842-10-55-20

Definitions 12

The contract may require the lessee to make lease payments only after construction is completed and

the lessee begins operations. Alternatively, some contracts require the lessee to make lease payments

when it takes possession of or is given control over the use of the underlying asset. The timing of when

lease payments begin under the contract does not affect the commencement date of the lease.

For building and ground leases, ASC 842 makes no distinction between the right to use the underlying

asset during a construction period and the right to use the asset once the construction has been

completed. Both a lessee and a lessor should recognize lease cost or income in the same manner both

during and after the construction period. For example, a lessee might enter into a ground lease and begin

constructing a cell tower (a leasehold improvement) on the leased land. Likewise, a lessee might enter

into a lease of office space and begin installing partitions, lights, and other leasehold improvements within

the leased office space. The lessee should begin recognizing lease cost and the lessor should either

recognize lease income or derecognize the underlying asset when the ground or office leases

commence, which might occur concurrent with or prior to the lessee beginning construction of its

leasehold improvements.

ASC 842-10-55-21

Lease costs (or income) associated with building and ground leases incurred (earned) during and after

a construction period are for the right to use the underlying asset during and after construction of a

lessee asset. There is no distinction between the right to use an underlying asset during a construction

period and the right to use that asset after the construction period. Therefore, lease costs (or income)

associated with ground or building leases that are incurred (earned) during a construction period

should be recognized by the lessee (or lessor) in accordance with the guidance in Subtopics 842-20

and 842-30, respectively. That guidance does not address whether a lessee that accounts for the sale

or rental of real estate projects under Topic 970 should capitalize rental costs associated with ground

and building leases.

A master lease agreement that provides the lessee with the right to use multiple assets may contain

multiple lease components with multiple commencement dates. See Section 1.10 for more information on

master lease agreements.

1.2 Initial direct costs

Initial direct costs are the incremental costs of entering into a lease that are only incurred as a direct

result of the lease being executed. Examples of initial direct costs include commissions paid upon

executing the lease and costs paid to existing tenants as an incentive to vacate the leased premises.

These costs are incurred only if the lease is executed and would not have been incurred if the lease had

been drafted and negotiated, but ultimately had not been signed by both parties.

Initial Direct Costs: Incremental costs of a lease that would not have been incurred if the lease had not

been obtained.

Definitions 13

A cost that would have been incurred if the lease had been negotiated and drafted but ultimately not

executed does not qualify as an initial direct cost and is therefore expensed as incurred. These costs

include general overhead costs (depreciation, occupancy and equipment costs, idle time); costs related to

activities performed by the lessor for advertising, soliciting potential lessees, servicing existing leases,

and other ancillary activities; and costs related to activities that occur before the lease is obtained, such

as acquiring tax or legal advice, negotiating lease conditions, or evaluating the creditworthiness of a

lessee. Similarly, lease-related payroll costs would not be considered incremental, as they could not be

avoided if a lease were not executed.

At the crossroads: Initial direct costs

Under legacy GAAP, “initial direct costs” of a lease are defined more broadly than in ASC 842, and

include many costs associated with the origination of a lease, such as evaluating a lessee’s financial

condition, negotiating lease terms, preparing documents, and closing the transaction. ASC 842 defines

“initial direct costs” more narrowly, including only costs that are truly incremental to executing a lease,

such as broker commissions and amounts paid to existing tenants to facilitate early termination of their

existing leases. Costs related to evaluating a lessee’s financial condition, negotiating lease terms,

preparing documents, and closing the transaction are no longer considered initial direct costs under

ASC 842. Therefore, lessees and lessors alike will find that more of their lease-related costs are

expensed as incurred under ASC 842 than under legacy GAAP.

The following example from ASC 842-10-55 illustrates a lessee and lessor’s analysis of costs incurred to

obtain a lease and their assessment of whether those costs meet the definition of “initial direct costs.”

ASC 842-10-30-9

Initial direct costs for a lessee or a lessor may include, for example, either of the following:

a. Commissions

b. Payments made to an existing tenant to incentivize that tenant to terminate its lease.

ASC 842-10-30-10

Costs to negotiate or arrange a lease that would have been incurred regardless of whether the lease

was obtained, such as fixed employee salaries, are not initial direct costs. The following items are

examples of costs that are not initial direct costs:

a. General overheads, including, for example, depreciation, occupancy and equipment costs,

unsuccessful origination efforts, and idle time

b. Costs related to activities performed by the lessor for advertising, soliciting potential lessees,

servicing existing leases, or other ancillary activities

c. Costs related to activities that occur before the lease is obtained, such as costs of obtaining tax or

legal advice, negotiating lease terms and conditions, or evaluating a prospective lessee’s financial

condition.

Definitions 14

Example 27—Initial Direct Costs

ASC 842-10-55-240

Lessee and Lessor enter into an operating lease. The following costs are incurred in connection with

the lease:

Travel costs related to lease proposal

$ 7,000

External legal fees

22,000

Allocation of employee costs for time negotiating lease terms and

conditions

6,000

Commissions to brokers

10,000

Total costs incurred by Lessor

$ 45,000

External legal fees

$ 15,000

Allocation of employee costs for time negotiating lease terms and

conditions

7,000

Payments made to existing tenant to obtain the lease

20,000

Total costs incurred by Lessee

$ 42,000

ASC 842-10-55-241

Lessor capitalizes initial direct costs of $10,000, which it recognizes ratably over the lease term,

consistent with its recognition of lease income. The $10,000 in broker commissions is an initial direct

cost because that cost was incurred only as a direct result of obtaining the lease (that is, only as a

direct result of the lease being executed). None of the other costs incurred by Lessor meet the

definition of initial direct costs because they would have been incurred even if the lease had not been

executed. For example, the employee salaries are paid regardless of whether the lease is obtained,

and Lessor would be required to pay its attorneys for negotiating and drafting the lease even if Lessee

did not execute the lease.

ASC 842-10-55-242

Lessee includes $20,000 of initial direct costs in the initial measurement of the right-of-use asset.

Lessee amortizes those costs ratably over the lease term as part of its total lease cost. Throughout the

lease term, any unamortized amounts from the original $20,000 are included in the measurement of the

right-of-use asset. The $20,000 payment to the existing tenant is an initial direct cost because that

cost is only incurred upon obtaining the lease; it would not have been owed if the lease had not been

executed. None of the other costs incurred by Lessee meet the definition of initial direct costs because

they would have been incurred even if the lease had not been executed (for example, the employee

salaries are paid regardless of whether the lease is obtained, and Lessee would be required to pay its

attorneys for negotiating and drafting the lease even if the lease was not executed).

Definitions 15

Grant Thornton insights: Initial direct costs in ASC 842 versus contract costs

in ASC 340-40

The terms “initial direct costs” and “costs to obtain a contract,” used in ASC 842 and the cost deferral

guidance related to revenue contracts in ASC 340-40, Other Assets and Deferred Costs: Contracts

With Customers, respectively, have similar definitions. In ASC 842, initial direct costs are defined as

“incremental costs of a lease that would not have been incurred if the lease had not been obtained.”

In ASC 340-40, incremental costs of obtaining a contract are described as “those costs that an entity

incurs to obtain a contract with a customer that it would not have incurred if the contract had not

been obtained (for example, a sales commission).” In paragraph BC306 of ASU 2016-02, the Board

notes that these terms are aligned intentionally and can be viewed conceptually in the same way.

Accordingly, entities should consider whether their processes for identifying initial direct costs and

incremental costs of obtaining a contract are aligned.

1.3 ‘Reasonably certain’ threshold

The FASB established a “reasonably certain” threshold for determining the likelihood that a lessee will

exercise an option in a lease. This threshold applies to a lessee’s option to extend or terminate a lease

and to purchase the underlying asset. An entity should consider all relevant economic factors, including

those related to the contract, the underlying asset, the market, and the entity, when determining whether

a lessee is “reasonably certain” to exercise an option in a lease. Each factor should be considered both

on its own and in conjunction with other factors to the extent that they are interrelated. Examples of

considerations contributing to the assessment of “reasonably certain” include, but are not limited to, the

following factors:

How contractual terms and conditions for optional periods compare with current market rates,

including

The amounts of lease payments made during the optional periods

The amounts of any variable lease payments or other contingent payments, such as payments for

termination penalties or residual value guarantees

The terms and conditions of options that can be exercised after the initial optional periods. For

example, a purchase option that is exercisable at a price that is expected to be below the then-

current fair value of the underlying asset, but is only exercisable during an optional renewal

period, might contribute to an entity’s assessment of whether the renewal option is reasonably

certain to be exercised.

Leasehold improvements that are expected to have significant economic value to the lessee when an

option to extend, terminate, or purchase the underlying asset can be exercised. A lessee that has

made a significant investment in a leased asset or property may have a greater economic incentive to

continue a contract or purchase an underlying asset at the end of the lease term.

Costs relating to the termination of the lease and signing a new lease, including the costs of

negotiation, relocation, identification of another asset to lease, and costs to return the underlying

asset to the condition or location specified in the contract

The importance of the underlying asset to the lessee’s operations, including whether the asset is

specialized and where it is located

Definitions 16

ASC 842-10-55-26

At the commencement date, an entity assesses whether the lessee is reasonably certain to exercise or

not to exercise an option by considering all economic factors relevant to that assessment—contract-

based, asset-based, market-based, and entity-based factors. An entity’s assessment often will require

the consideration of a combination of those factors because they are interrelated. Examples of

economic factors to consider include, but are not limited to, any of the following:

a. Contractual terms and conditions for the optional periods compared with current market rates, such

as:

1. The amount of lease payments in any optional period

2. The amount of any variable lease payments or other contingent payments, such as payments

under termination penalties and residual value guarantees

3. The terms and conditions of any options that are exercisable after initial optional periods (for

example, the terms and conditions of a purchase option that is exercisable at the end of an

extension period at a rate that is currently below market rates).

b. Significant leasehold improvements that are expected to have significant economic value for the

lessee when the option to extend or terminate the lease or to purchase the underlying asset

becomes exercisable.

c. Costs relating to the termination of the lease and the signing of a new lease, such as negotiation

costs, relocation costs, costs of identifying another underlying asset suitable for the lessee’s

operations, or costs associated with returning the underlying asset in a contractually specified

condition or to a contractually specified location.

d. The importance of that underlying asset to the lessee’s operations, considering, for example,

whether the underlying asset is a specialized asset and the location of the underlying asset.

The following excerpts from Examples 23 and 24 in ASC 842-10-55 illustrate how to apply the guidance

on assessing whether a lessee is “reasonably certain” to exercise a purchase option. Example 23

considers a situation where a lessee has the option to purchase the underlying asset at the end of the

lease term at an amount that is significantly below its expected residual value. Example 24 discusses a

situation where the underlying asset is customized to the specifications of the lessee, and is integral to

the lessee’s business operations.

Example 23—Lessee Purchase Option (excerpt)

ASC 842-10-55-211

Lessee enters into a 5-year lease of equipment with annual lease payments of $59,000, payable at the

end of each year. There are no initial direct costs incurred by Lessee or lease incentives. At the end of

Year 5, Lessee has an option to purchase the equipment for $5,000. The expected residual value of

the equipment at the end of the lease is $75,000. Because the exercise price of the purchase option is

significantly discounted from the expected fair value of the equipment at the time the purchase option

becomes exercisable, Lessee concludes that it is reasonably certain to exercise the purchase option.

Definitions 17

Example 24—Lessee Purchase Option (excerpt)

ASC 842-10-55-218

Lessee enters into a 5-year lease of specialized equipment with annual lease payments of $65,000,

payable in arrears. There are no initial direct costs or lease incentives. At the end of Year 5, Lessee

has an option to purchase the equipment for $90,000, which is the expected fair value of the equipment

at that date. Lessor constructed the equipment specifically for the needs of Lessee. Furthermore, the

specialized equipment is vital to Lessee’s business; without this asset, Lessee would be required

to halt operations while a new asset was built or customized. As such, Lessee concludes that it is

reasonably certain to exercise the purchase option because the specialized nature, specifications of

the asset, and its role in Lessee’s operations create a significant economic incentive for Lessee to do

so.

Grant Thornton insights: Reasonably certain versus more-likely-than-not

The threshold for including an optional period in the lease term is whether or not the entity is

“reasonably certain” that the lessee will exercise an option to extend the lease. “Reasonably certain”

is intended to be a high threshold, and reflects the existence of a significant economic incentive for

a lessee to exercise the option. The Board intentionally set this threshold at a higher level than the

“more-likely-than-not” threshold used in other areas of GAAP, which is generally regarded as being

more than a 50 percent likelihood of an event occurring.

At the crossroads: Reasonably assured and reasonably certain

Legacy GAAP uses the term “reasonably assured” with respect to whether an optional period should

be included in the lease term. The term that ASC 842 uses is “reasonably certain,” which converges

the terminology in ASC 842 with the terminology used in IFRS Standards. The Board states in

paragraph BC195 of ASU 2016-02 that it views “reasonably assured” and “reasonably certain” as

synonyms, and expects that the terms should be applied in the same way. Therefore, although the

legacy GAAP terminology has changed under ASC 842, the Board expects that the terms will be

applied in the same manner.

1.4 Lease payments

Many types of payments may be required under a lease agreement, but only certain payments are

included in the measurement of lease payments for purposes of classifying and recognizing the lease.

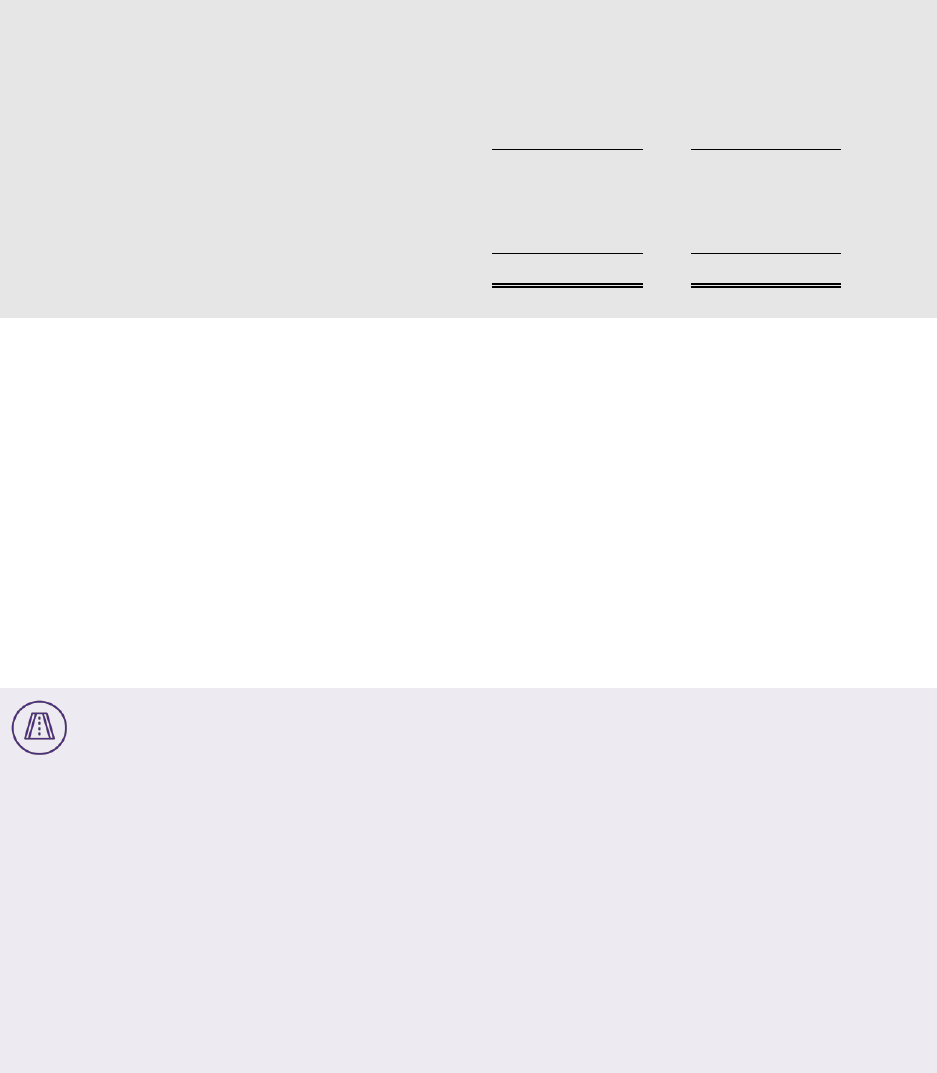

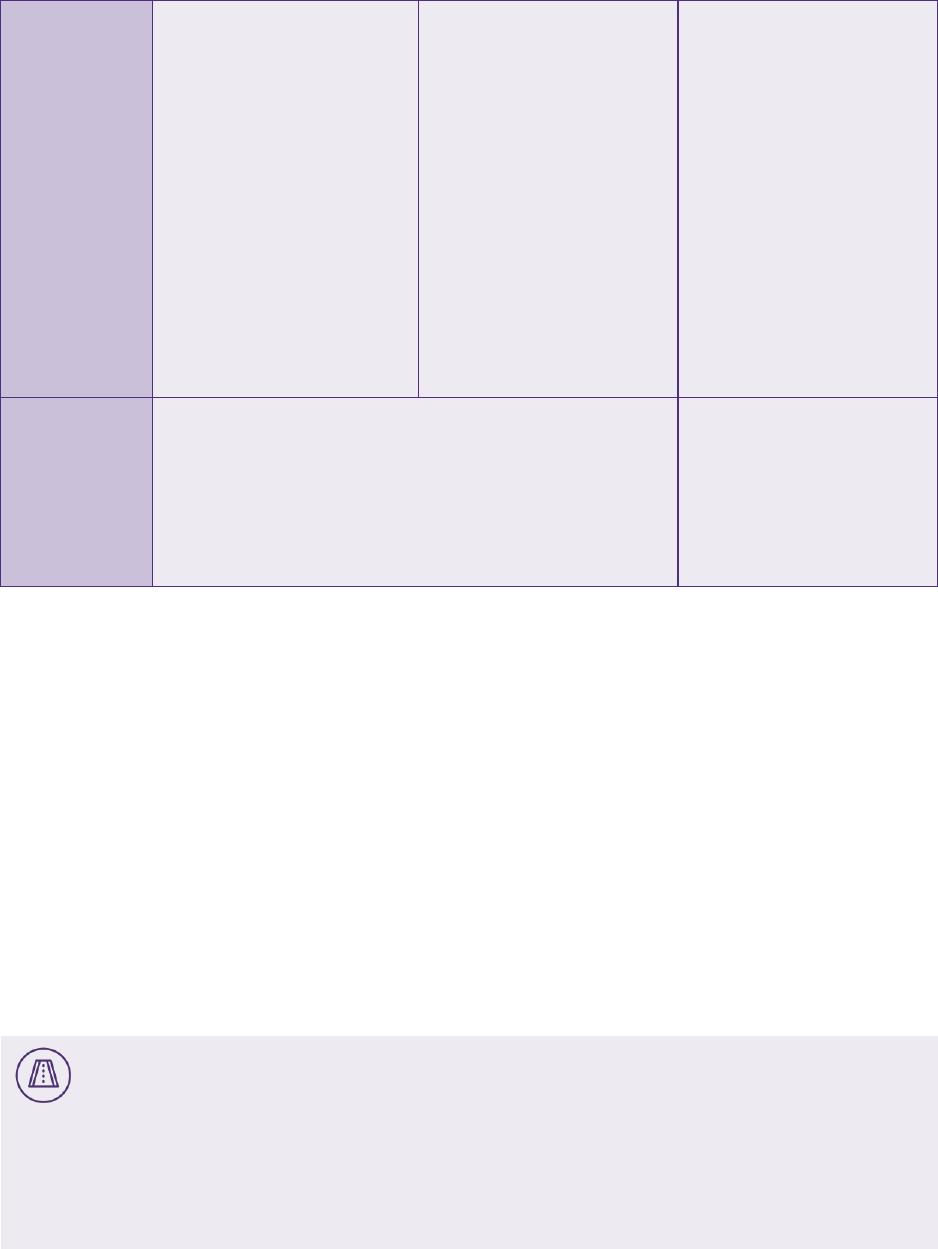

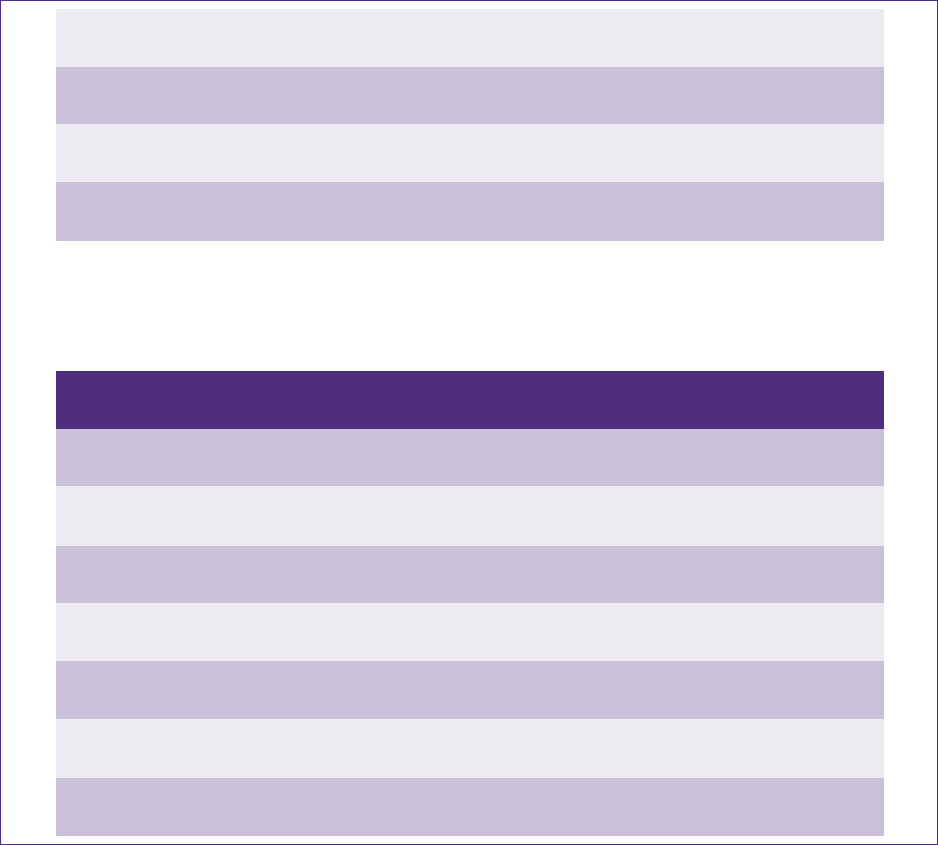

These items are summarized in Figure 1.1 below, and discussed in detail in the rest of this section.

Definitions 18

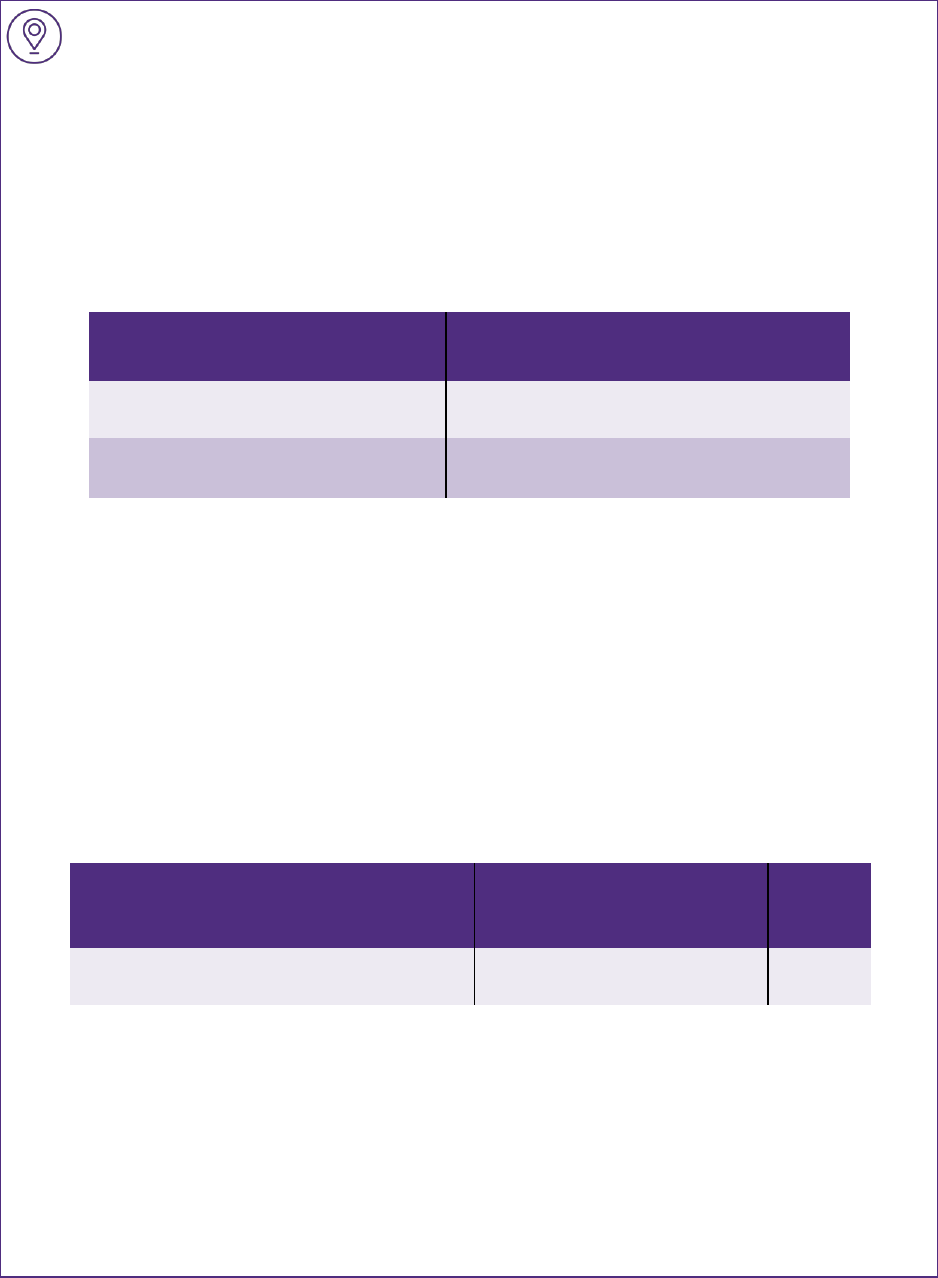

Figure 1.1: Lease payments at a glance

According to ASC 842, “lease payments” include the following elements:

Fixed payments, including in-substance fixed payments, minus lease incentives paid or payable to

the lessee. “In-substance fixed payments” are lease payments that appear to contain variability but

are effectively unavoidable, such as consumer price index (CPI) linked payments subject to a fixed

floor that is virtually certain to be applied at each payment adjustment date. “Lease incentives”

include payments made to, or on behalf of, a lessee, as well as losses incurred by a lessor from

assuming a lessee’s preexisting lease with a third party.

Variable lease payments that depend on an index or a rate, such as LIBOR or CPI

The exercise price of an option to purchase the underlying asset if the lessee is reasonably certain to

exercise that option

Lease termination penalty if the lease term assumes that a lease termination option will be exercised,

triggering payment of the penalty

Fees paid by the lessee to the owners of a special-purpose entity for structuring the transaction

Amounts that the lessee is probable of owing under a residual value guarantee (applies to the

lessee’s analysis only)

ASC 842 also specifically excludes the following types of payments from the definition of “lease

payments”:

Variable lease payments other than those dependent on an index or a rate

Include in lease payments

Exclude from lease payments

+ Fixed payments and in-substance fixed

payments, reduced by lease incentives paid or

payable to the lessee

+ Variable lease payments dependent on a rate

or index

+ Exercise price of options that a lessee is

reasonably certain to exercise

+ Termination penalties if termination is reasonably

certain

+ Fees paid by the lessee to owners of a special-

purpose entity for structuring the transaction

+ Amounts probable of being owed under a

residual value guarantee (lessee only)

- Variable lease payments not dependent on an

index or a rate

- Guarantee of the lessor’s debt

- Amounts allocated to nonlease components

Definitions 19

A guarantee of the lessor’s debt by the lessee

Amounts allocated to nonlease components in accordance with the guidance in 842-10-15-33 through

15-42

Lease Payments: See paragraph 842-10-30-5 for what constitutes lease payments from the perspective

of a lessee and a lessor.

ASC 842-10-30-5

At the commencement date, the lease payments shall consist of the following payments relating to the

use of the underlying asset during the lease term:

a. Fixed payments, including in substance fixed payments, less any lease incentives paid or payable

to the lessee (see paragraphs 842-10-55-30 through 55-31).

b. Variable lease payments that depend on an index or a rate (such as the Consumer Price Index or a

market interest rate), initially measured using the index or rate at the commencement date.

c. The exercise price of an option to purchase the underlying asset if the lessee is reasonably certain

to exercise that option (assessed considering the factors in paragraph 842-10-55-26).

d. Payments for penalties for terminating the lease if the lease term (as determined in accordance

with paragraph 842-10-30-1) reflects the lessee exercising an option to terminate the lease.

e. Fees paid by the lessee to the owners of a special-purpose entity for structuring the transaction.

However, such fees shall not be included in the fair value of the underlying asset for purposes of

applying paragraph 842-10-25-2(d).

f. For a lessee only, amounts probable of being owed by the lessee under residual value guarantees

(see paragraphs 842-10-55-34 through 55-36).

ASC 842-10-30-6

Lease payments do not include any of the following:

a. Variable lease payments other than those in paragraph 842-10-30-5(b)

b. Any guarantee by the lessee of the lessor’s debt

c. Amounts allocated to nonlease components in accordance with paragraphs 842-10-15-33 through

15-42.

1.4.1 Fixed and in-substance fixed payments

Lessees are required to include fixed payments, including in-substance fixed payments, in the calculation

of lease payments.

Definitions 20

Fixed payments

Fixed payments are unavoidable payments that are specified in the lease.

In-substance fixed payments

In-substance fixed payments are payments that may appear variable in form, but are, in substance,

unavoidable.

ASC 842-10-55-31

Lease payments include in substance fixed lease payments. In substance fixed payments are

payments that may, in form, appear to contain variability but are, in effect, unavoidable. In substance

fixed payments for a lessee or a lessor may include, for example, any of the following:

a. Payments that do not create genuine variability (such as those that result from clauses that do not

have economic substance)

b. The lower of the payments to be made when a lessee has a choice about which set of payments it

makes, although it must make at least one set of payments.

A common example of in-substance fixed payments are payments that escalate based on changes in the

CPI, subject to a cap. For example, a lease might specify that lease payments increase each year by

three times the annual change in CPI, subject to a cap of 2 percent per annum. If the lease payments are

structured to increase by 2 percent per year (that is, it is highly likely, based on historical information, that

three times the annual percentage change in CPI will exceed 2 percent), what would otherwise appear to

be variable CPI-based payments are considered in-substance fixed payments.

The economic substance of the variability of the payments must be considered when assessing in-

substance fixed payments. That is, variability based on performance or usage of the underlying asset

might be more substantive in the context of a lease than variability based on an external index or rate.

Therefore, payments based on a level of activity or volume of use of the underlying asset would be

viewed as variable rather than in-substance fixed payments, even if the level of activity or use is highly

certain, while payments that appear to contain variability based on an index (such as CPI) but are

structured such that the payments are virtually certain to be fixed would be viewed as in-substance fixed

payments.

In-substance fixed payments

Example 1: CPI-based adjustments

Lessee enters into an equipment lease specifying that for each month throughout the lease term,

Lessee must pay Lessor the sum of (a) $1,000 and (b) the greater of (i) $200 or (ii) the most recent

month-over-month percentage change in CPI times $1,000. The month-over-month percentage change

in CPI has not exceeded 2 percent over the past 120 months.

Lessee determines that the lease payments consist of the fixed payment of $1,000 per month plus an

in-substance fixed payment of $200 per month. Although the monthly payment appears to contain

variability, Lessee deems it remote that the variable component will exceed $200 per month. Since the

Definitions 21

additional $200 monthly payment is effectively unavoidable and does not vary based on the asset’s

level of activity or the volume of use, the total monthly fixed payment is $1,200.

Example 2: Two possible payment streams

A lease of a retail space in a newly developed shopping complex specifies lease payments of $100,000

per year plus 1 percent of the lessee’s annual sales in that space. If by the end of year two the

occupancy rate of the shopping center is above 90 percent, the minimum lease payments will increase

by 5 percent for the remaining three years, meaning the annual payments will increase to $105,000 per

year for the remainder of the lease. If by the end of year two the occupancy rate of the shopping center

is below 90 percent, then the annual payments remain at $100,000, but the lessee must remit an

additional payment of $20,000 to the lessor at the beginning of year three.

As there are two possible payment streams, the parties must analyze each possibility separately. If

the occupancy threshold is not reached by the end of year two, the minimum payments are $520,000.

If the occupancy threshold is reached by the end of year two, the minimum payments are $515,000.

Regardless of the likelihood that the occupancy threshold will be achieved, the minimum unavoidable

payment is $515,000, and therefore fixed payments of $515,000 are included in the lease payments by

the lessee and lessor.

The payment of 1 percent of sales is a variable payment based on the use of the asset and is therefore

excluded from the calculation of lease payments. Variable payments are recognized by both parties

once the sales have occurred and the payments are no longer variable.

Example 3: Production-based payments

Lessee enters into a lease of solar panels, which specifies that Lessee will pay an amount to Lessor

each month equal to the product of (a) a fixed price and (b) the number of megawatt hours of electricity

produced by the solar panels during that month. Although some minimum amount of megawatt hours of

electricity is virtually certain to be produced each month (provided the solar panels are operable), the

payments are variable rather than in-substance fixed because they are based on the underlying assets’

level of productivity.

Grant Thornton insights: Contracts that specify various conditional rates

Lease contracts may specify various rental rates that take effect based on current conditions. For

example, oil drilling rig contracts specify a variety of “day rates” that correspond to certain conditions,

such as when the rig is operating, when it is being moved, and when it is unable to operate due to

weather conditions. In certain conditions the day rate could be zero. In contracts where the rate could

fluctuate within a range that includes zero, a question arises whether the contract includes in-

substance fixed payments or solely variable payments.

We believe that these types of contracts contain in-substance fixed payments, based on the

contractual rate that reflects the lowest, nonprotective commercial rate included in the contract. A

rate of zero would not be appropriate, as such a rate represents a protective contract provision for

the lessee rather than a commercial contract rate.

Definitions 22

1.4.2 Lease incentives

The definition of lease payments includes fixed payments less any incentives paid or payable to the

lessee. In addition, any fixed payments included in the consideration in the contract that are not part of

the lease payments must be reduced by any other incentives paid or payable to the lessee. Lease

incentives include (1) payments made by the lessor to or on behalf of the lessee, and (2) losses incurred

by the lessor assuming a lessee’s lease with a third party.

As an inducement to enter into certain lease arrangements, the lessor may transfer cash directly to the

lessee or make payments to third parties on the lessee’s behalf. This practice is common in real estate

leases, where a lessor might fund the lessee’s improvements to the leased space. The funding might

occur via a lump-sum transfer of cash from the lessor to the lessee, periodic reimbursement of qualifying

costs incurred by the lessee, or direct payment from the lessor to the third-party contractor hired to

construct the improvements. Regardless of the form, the amounts transferred from the lessor to the

lessee or to a third party on the lessee’s behalf are lease incentives that reduce the consideration in the

contract for both the lessee and lessor.

In addition, a lessor might offer to assume a lessee’s existing lease as an incentive for the lessee to enter

into a new lease. Any loss incurred by the lessor in connection with assuming a lessee’s existing lease is

a lease incentive that reduces the consideration in the contract. The lessee’s and lessor’s estimate of this

loss would likely differ since the parties would perform independent estimates based on information

readily available to each. For example, the lessor might base its estimate on expected sublease income,

information that is not readily available to the lessee.

ASC 842-10-55-30

Lease incentives include both of the following:

a. Payments made to or on behalf of the lessee

b. Losses incurred by the lessor as a result of assuming a lessee’s preexisting lease with a third

party. In that circumstance, the lessor and the lessee should independently estimate any loss

attributable to that assumption. For example, the lessee’s estimate of the lease incentive could be

based on a comparison of the new lease with the market rental rate available for similar underlying

assets or the market rental rate from the same lessor without the lease assumption. The lessor

should estimate any loss on the basis of the total remaining costs reduced by the expected

benefits from the sublease of use of the assumed underlying asset.

1.4.3 Variable payments

A variable payment is a payment in a lease that varies based on changes in facts and circumstances

occurring after the commencement date, other than the passage of time. Examples of variables on which

payments may be based include sales at a retail location or megawatts of electricity produced by a power

plant. A variable payment may also be based on a rate or an index, for example, CPI, the prime rate, or

LIBOR.

Definitions 23

Variable Lease Payments: Payments made by a lessee to a lessor for the right to use an underlying

asset that vary because of changes in facts or circumstances occurring after the commencement date,

other than the passage of time.

The only variable payments included in “lease payments” are those that are based on an index or rate. A

common example is payments that increase over the lease term based on increases in CPI. Variable

payments based on an index or rate are included in lease payments based on the index or rate as of the

lease commencement date. The rate is not updated after commencement, unless there is a lease

modification that is not treated as a separate contract or another event occurs that requires

remeasurement, as discussed in Section 5.7 and 5.8 for lessees and Section 6.9 for lessors.

Variable payments based on an index or a rate

Example 1

A five-year lease that requires annual payments in advance specifies that the first payment is $100,000,

and that each subsequent payment will increase by one month LIBOR at the end of each year. One

month LIBOR at the commencement date of the lease is 2 percent. Since variable payments based on

an index or rate are included in the lease payments based on the index or rate at the commencement

date of the lease, the lease payments in this example equal $520,404, which reflects a series of five

payments starting at $100,000 and escalating by 2 percent per year on a compounding basis.

Example 2

A five-year lease that requires annual payments in advance specifies that the first payment will be

$100,000, and that each subsequent payment will increase by the percentage increase in CPI over

the past 12 months. If CPI decreases over a 12-month period, then the annual payment is the same

as the prior year’s payment. Since variable payments based on an index or rate are included in the

lease payments based on the index or rate at the commencement date of the lease, the future lease

payments are calculated assuming CPI is unchanged over the lease term. Therefore, in this example,

lease payments would equal $500,000, which reflects a series of five fixed payments of $100,000.

Variable payments not based on an index or a rate are excluded from lease payments in calculating the

consideration in the contract.

Grant Thornton insights: Variable payments that reset to market rates

It is common for leases to require that payments “reset” to market rates from time to time. When this is

the case, the adjusted lease payments are considered variable. We believe that the market rental rate

is a “rate,” as described in ASC 842-10-30-5(b) (included at the beginning of Section 1.4), although

ASC 842 does not explicitly state this.

Definitions 24

The guidance on lease payments in paragraph 28 of IFRS 16, Leases, which is an area of the new

lease accounting guidance where the FASB and IASB reached converged decisions, specifies that

“payments that vary to reflect changes in market rental rates” is an example of variable lease payments

that depend on an index or a rate. Therefore, similar to other variable payments that are based on an

index or rate, variable payments that are based on market rental rates should be included in lease

payments as of the commencement date using the market rental rate at lease commencement.

For example, a ten-year lease might require fixed payments for the first five years of the contract, with

payments for years six through ten equal to whatever the market rental rate is as of the end of year

five. In this contract, the lease payments for years six through ten are variable until the end of year

five, when they become fixed at the then-current market rate. The lease payments measured at the

commencement date would include payments for years six through ten of the lease term based on the

current market rental rate as of the lease commencement date. If the lease payments for years one

through five are fixed at $100,000 per year, and that amount represents a market rental rate as of

lease commencement, then the lease payments included in the consideration in the contract would

equal $1 million.

Continuing this example, the parties to the lease would not remeasure the lease payments when the

payments for years six through ten become fixed. As noted in ASC 842-10-35-4(b), a change in a

reference index or rate that was used to calculate some or all of the variable lease payments does not

constitute a resolution of a contingency that would require an entity to remeasure lease payments.

Rather, any difference between the actual lease payments in years six through ten and the lease

payments included in the consideration in the contract at lease commencement for years six through

ten would be recognized in the period incurred, in the same manner as variable lease payments that

are not based on an index or rate.

In some cases, a lease requires the lessee to remit noncash consideration to the lessor, and an entity

must consider whether such consideration is included in the lease payments.

Grant Thornton insights: Noncash consideration provided to a lessor

The guidance in ASC 842-10-30-6 and 55-15 specifically excludes certain types of noncash

consideration from lease payments, including a lessee’s guarantee of the lessor’s debt and a lessee’s

indemnification for environmental contamination. While these forms of noncash consideration are

specifically excluded from lease payments under ASC 842, they are still recognized in the financial

statements of the lessee in accordance with other Codification Topics.

Leases may also contain other types of noncash consideration, such as shares of stock and equity

warrants. All noncash consideration not specifically excluded from lease payments should be included

in lease payments based on its fair value at the lease commencement date. For example, if a lease

includes a provision that the lessee will issue fully vested stock warrants to the lessor, the fair value

of those warrants at the lease commencement date would be included in lease payments when

calculating the present value of lease payments for classification and recognition purposes. Entities

may refer to the guidance in ASC 606, Revenue from Contracts with Customers, for measuring

noncash consideration as a starting point in measuring the value of the noncash consideration in a

leasing arrangement.

Definitions 25

Distinguishing variable lease payments from asset retirement obligations (AROs)

Costs that a lessee must incur to revert a modified underlying asset back to its original condition before

returning it to the lessor generally do not meet the definition of a lease payment. Instead, such costs

should be accounted for in accordance with ASC 410-20, Asset Retirement and Environmental

Obligations: Asset Retirement Obligations. On the other hand, costs that a lessee must incur to dismantle

and remove an underlying asset from the lessee’s property at the end of the lease term should be

considered lease payments or variable lease payments, provided the contract obligates the lessee to

bear the costs of dismantling and removing the leased asset.

For example, the costs associated with a lessee’s contractual obligation to remove its own cell tower from

land it is leasing before returning the land to the lessor are accounted for based on the guidance on

asset retirement obligations in ASC 410-20. In contrast, a lessee’s cost to dismantle and remove leased

manufacturing equipment from its facility so that the equipment can be returned to the lessor at the end of

the lease term is treated as a variable lease payment associated with the equipment lease.

ASC 842-10-55-37

Obligations imposed by a lease agreement to return an underlying asset to its original condition if it

has been modified by the lessee (for example, a requirement to remove a lessee-installed leasehold

improvement) generally would not meet the definition of lease payments or variable lease payments

and would be accounted for in accordance with Subtopic 410-20 on asset retirement obligations. In

contrast, costs to dismantle and remove an underlying asset at the end of the lease term that are

imposed by the lease agreement generally would be considered lease payments or variable lease

payments.

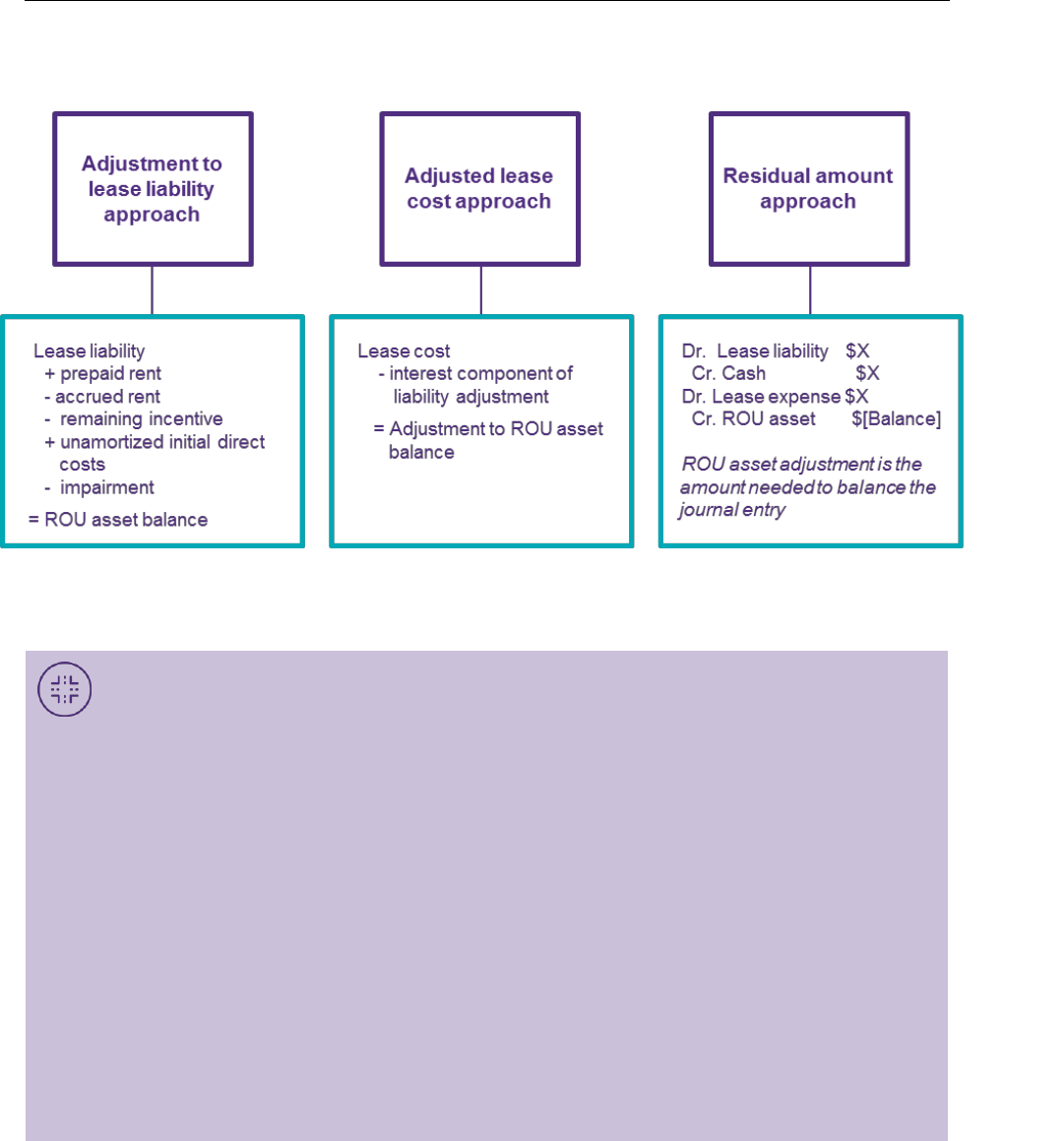

Variable lease payments and derivative instruments