105(l) Facility Lease Program

Technical

Assistance

Guidebook

ii

Table of Contents

Chapter 1 105 (l) Facility Lease Program .......................... 01

Chapter 2 Starting the Process ......................................... 04

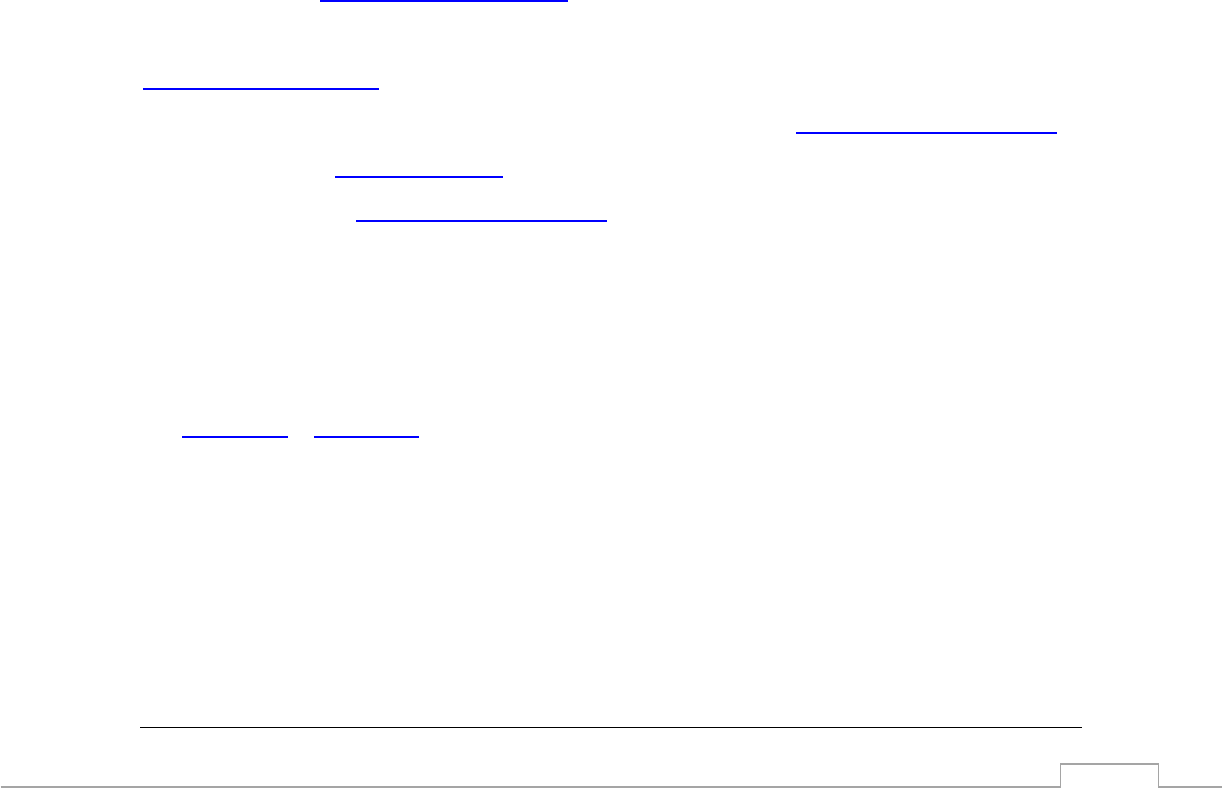

Process Map ................................................ …. 06

Chapter 3 Facility Details .................................................. 07

Chapter 4 Compensation Details for Cost Elements ......... 14

Chapter 5 Lease Details ................................................. … 19

Chapter 6 Executing a Facility Lease .............................. … 21

Chapter 7 Renewals ...................................................... … 24

Appendices Table of Contents ....................................... … 26

1

105(l) Facility Lease Program

hapter 1 introduces the 105 (l) facility lease program, available through the Office of

Facilities, Property, and Safety Management (OFPSM) Branch of Real Property & Leasing

(BRPL). Chapter 1 reviews how a Tribe can determine their eligibility for this program.

This chapter also provides descriptions of the types of compensation available for a Tribe under the

105 (l) facility lease.

What is the 105 (l) Facility Lease?

The 105 (l) lease is not a traditional lease. It more closely resembles a facility

cost agreement between Indian Affairs (IA) or Indian Health Service (IHS) and a

Federally Recognized Tribe or Tribal Organization (Tribe) to compensate the

Tribe for facility operational expenses. These expenses relate to the use of the facility to operate

contracted or compacted Programs, Functions, Services, and Activities (PFSAs). Section 105(l) of the

Chapter

1

C

2

Indian Self Determination and Education Assistance Act (ISDEAA) 25 USC §

5324 provides that Tribes

carrying out Federal functions under a self-determination contract or self-governance compact may

enter into a lease agreement. A Tribe may enter into a lease agreement with IA.

How do I know if my Tribe is eligible for a 105 (l) Facility Lease Program?

•

The Tribe must hold title to the facility; or

•

The Tribe must hold a leasehold interest in the facility; or

•

The Tribe must hold a trust interest in the facility.

Along with the above requirement, the following must apply:

•

The Tribe must also be currently using the facility to carry out a Federal PFSA.

•

The PFSA must be in an approved ISDEAA Self-Determination contract, Self-

Governance compact, or a Public Law 100-297 grant (Tribally Controlled School).

How does the Tribe prove interest in the facility?

•

Trust Title.

•

Quitclaim Deed, or Warranty Deed.

•

Lease or Rental Agreement.

What are the types of compensation available through the 105 (l) Lease?

Compensation may include multiple options. The 105 (l) Facility Lease Program can cover facility

operating costs. These costs may include rent, depreciation, reserve funds principal & interest, and

operation & maintenance expenses. These costs may also include repairs, alterations, and other

reasonable expenses. The Tribe chooses the type of compensation they would like to receive and

what best meets their needs. Tribes are eligible to receive compensation only if they are not

receiving compensation from other Federal or State funding for the same space.

The Tribe may choose from three categories of compensation fair market rental, cost elements in

the 25 CFR Section 900.70 only, or a combination of fair market rental and cost elements in the 25

CFR section 900.70.

3

a. Fair Market Rental

If a Tribe seeks lease compensation based upon fair market rental, they must provide a

Fair Market Rental Analysis (FMRA) for their area, compare the costs for similar

properties, describe how the costs were developed, and other supporting documents as

needed. Typically, an appraiser completes a FMRA. The appraiser will consider the age

of the facility, square footage, location, amenities, and the condition of the property, as

compared to similar properties in the area.

b. Cost elements listed in 25 CFR Section 900.70 only.

If a Tribe requests lease compensation based on the elements contained at 25 C.F.R. §

900.70 (a-h), then the Tribe must provide documents supporting each cost element

requested. Supporting documents should include a copy of the program’s general

ledger, a crosswalk between the cost elements and the general ledger, actual costs from

the previous year, contractor quotes, and/or copies of invoices.

c. Combination

A Tribe may request compensation based upon a combination of the cost elements listed

in 25 CFR Section 900.70 and fair market rental. There must be documentation for each.

The FMRA may document which “other reasonable expenses” are allowable under 25

C.F.R. § 900.70.

Incorporating 477 Programs

The employment and training programs eligible for compensation are those programs that are

integrated into Tribal Workforce Development plans. These plans are approved by the Indian Affairs

Division of Workforce Development under the authority of Public Law 102-477, the Indian

Employment, Training, and Related Services Demonstration Act of 1992, as amended. PL 102-477 is

then incorporated into ISDEAA contracts, compacts, and funding agreements.

4

Starting the Process

hapter 2 describes how a Tribe may begin the process of creating a 105 (l) lease proposal.

This chapter provides best practices for getting the lease proposal organized. In this chapter

you will find the Indian Affairs (IA), Office of Facilities, Property, and Safety Management

(OFPSM) Branch of Real Property & Leasing (BRPL) has provided an email address to send the lease

proposal. It also reviews when lease terms begin. A complete overview of the program is located in

the process map found at the end of the Chapter.

How does the Tribe start the process?

There is not a standard application. You may send a lease proposal to Indian

Affairs (IA), Office of Facilities, Property, and Safety Management (OFPSM) Branch

of Real Property & Leasing (BRPL) 105(l) mailbox at ISDEAA105L@BIA.GOV.

The lease proposal from the Federally Recognized Tribe or Tribal Organization

(Tribe) should confirm:

• The Tribe holds title to, a leasehold interest in, or a trust interest in a specific facility.

• The Tribe is using the facility to administer and deliver services under an approved

ISDEAA 638 compact or contract or 297 grant.

• The approved Self-Governance or Self-Determination contract/compact, or 297 grant

number associated with the Programs, Functions, Services, and Activities (PFSAs) that the

Tribe is conducting in the facility.

• The type of compensation the Tribe is seeking.

• The address of the facility for which the Tribe requests lease compensation.

Chapter

2

C

5

• The contact information for the Tribal representative(s) seeking the program. Please

include names, phone numbers, and email addresses.

What are the best practices a Tribe can take to organize internally to move along

the 105 (l) process effectively?

Based on the experience of Tribes who have completed several leases, the following actions are

recommended:

•

Establish a primary point of contact to work with Indian Affairs who can engage internal

stakeholders.

•

Establish an internal 105 (l) working group with representatives from the following areas:

budget/finance, facilities, Tribal leader executive office, and Tribal council office.

When we email ISDEAA105L@BIA.GOV to whom does that go?

This email mailbox will allow the Tribe to contact the Core ISDEAA team which includes the OFPSM,

Office of Self Governance (OSG), and the Department of Interior (DOI) Solicitor’s Office. If the Tribe

has a Self-Determination contract, OFPSM will also reach out to the IA Office of Self-Determination

and the appropriate BIA regional office. If the Tribe is operating a 297 Grant, OFPSM will also reach

out to the appropriate Bureau of Indian Education (BIE) Officials.

When does a lease term begin?

The Consolidated Appropriations Act of 2021 states that the initial lease term will start no earlier

than the date IA receives the lease proposal.

See Appendix A & Appendix B showing the two types of leases available.

6

7

Facility Details

hapter 3 clarifies the nuances of questions about facilities and PFSAs. It addresses who

shoulders the long-term financial responsibilities for the facilities. Specifics are given on the

facility detail information that is necessary to arrive at reasonable compensation. The chapter also

explains how to handle shared and common spaces.

If our Tribe signs up for a 105(l) facility lease, will we lose the facility rights to the

government?

No. The 105 (l) facility lease program is compensation for the space where the

Tribe is operating the Federal 638 program. The facility rights are still fully the

responsibility of the Tribe. This also means that the 105 (l) facility

lease program does not negate or supersede any land contracts, rent to own, land for deed,

mortgage, bankruptcy, or other financial obligation the Tribe may have for the facility. The Tribe is

still fully financially responsible for the facility. The 105 (l) facility lease program is made available to

reduce the burden of running the ISDEAA Self-Determination contract, Self-Governance compact,

Tribally Controlled Schools (Public Law 100-297) grant Federal approved programs in the Tribe’s

facilities.

If we have multiple PFSA Programs in the same facility, do we need to make

multiple proposals?

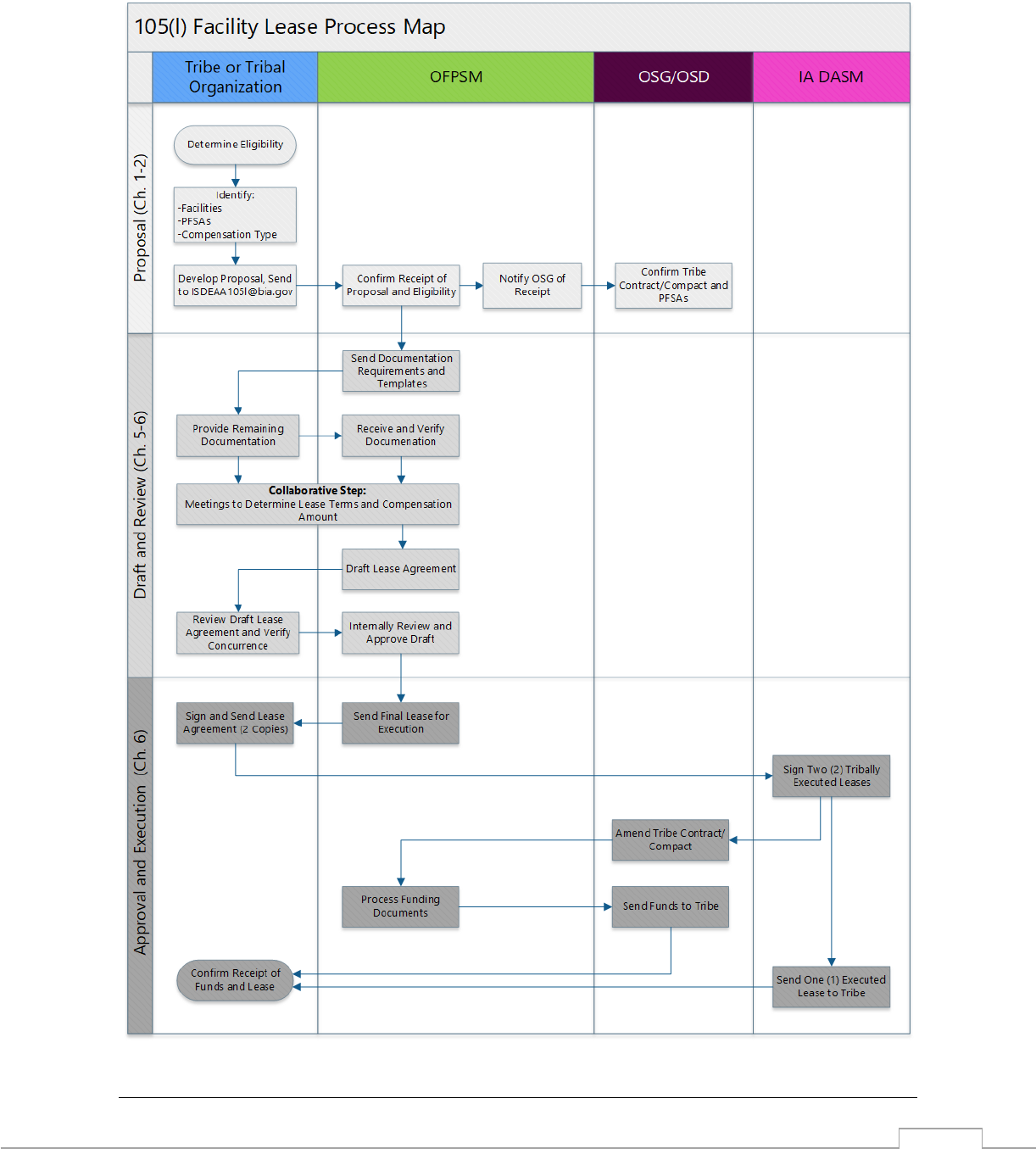

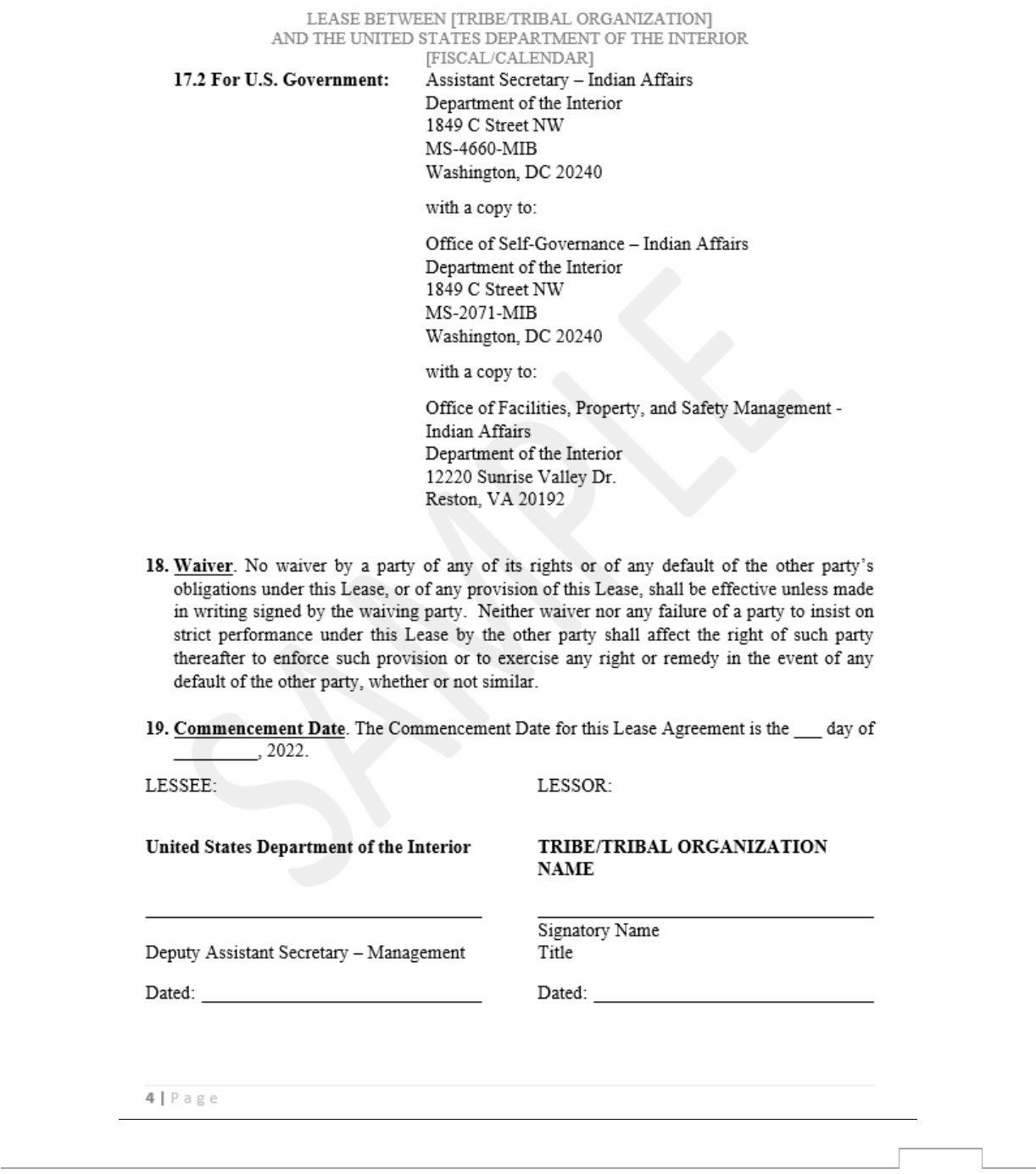

See Figure 1 below. The Tribe can make one proposal for one facility even if multiple PFSAs are

operating in the same location.

Chapter

3

C

8

What happens when we do have multiple programs in a facility and some of the

programs have Tribe or State funding?

The 105 (l) facility lease program can only compensate the Federal PFSA programs. Therefore, the

square footage for just those Federal programs inside the facility will need to be mapped out. The

funding may be prorated for the Federal PFSA area instead of the entire facility. See Figure 1 below.

How do we map out the area of the facility or square footage in a facility?

A simple markup of existing floor plans or drawings of the facility layout may be completed. This

may be drawn by hand on graph paper. Each block of the graph can represent one foot. The Tribe

may use a free software program to assist with drawing rooms, doors, and windows with accurate

square footage. The Tribe may also list the spaces, PFSAs, and square feet in an Excel document.

This is completely up to the Tribe’s preference.

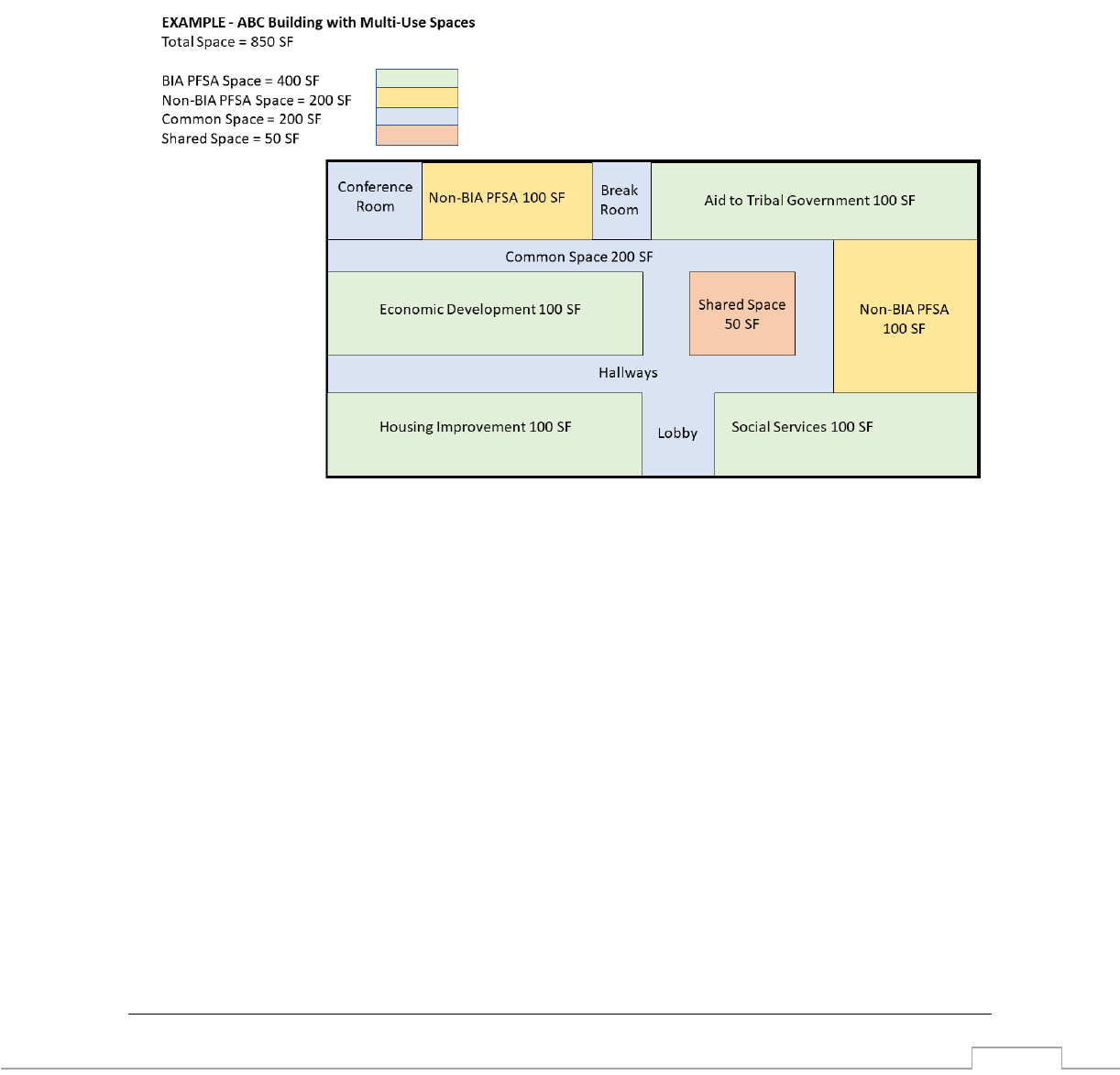

Photos

Both interior and exterior photos should be included in a Fair Market Rental Analysis or sent

separately in an email.

Inspection Reports

The Tribe should submit a copy of the most recent inspection report for each facility if available.

What needs to be included in the facility description?

Items a Tribe should include are as follows:

•

The location and address.

•

An architectural floor plan that shows gross square footage for all floors.

•

The date the facility was placed into service.

•

The Certificate of Occupancy.

•

Recent photos of the facility’s interior and exterior.

•

A recent inspection report of the condition of the facility if available.

9

•

A floor plan showing all the PFSAs, and any non-PFSAs, or if there are other tenants in the

facility.

Here is one example:

Figure 1

Commons Space

In a facility where the Tribe administers both ISDEAA and non-ISDEAA activities, usually, there are

Common Spaces the Tribe uses to carry out the approved PFSAs. These spaces are needed to

support the basic functions of the occupants within the facility. Some examples include break

rooms, restrooms, lobbies, stairwells, corridors, conference rooms, mechanical rooms, electrical

rooms, IT closets, etc. The Tribe will be compensated 100 percent for these types of Common

Spaces.

Shared Services Space

Many Tribes have Shared Services Spaces that support the administration and delivery of both

ISDEAA and non-ISDEAA activities – for example, Tribal finance departments, human resources

offices, or information technology operations. The Tribe is compensated for 50 percent of Shared

10

Services Space without the need to provide any supporting documents. Tribes that can provide

documentation to support costs of more than 50 percent would remain eligible to receive

compensation for those costs. This is consistent with the Office of Management and Budget (OMB)

approach to Tribal indirect costs. This approach recognizes that a Tribe is eligible for compensation

for a portion of the space occupied by a shared service. Finally, this option allows Tribes to recover

costs that may not be easy to obtain.

Casa Blanca Community School

Indoor Photo: Casa Blanca Community School

11

Casa Blanca Community School

Casa Blanca Community School

Family Services Center

12

Lomack Building

Tugkar Building

Outdoor Photos – Casa Blanca Community School, Family Services Center, Lomack

Building, & Tugkar Building

13

Compensation Details

for Cost Elements

hapter 4 provides details on each of the cost elements in 900.70 (a-h). The cost elements

(a-h) line up in the excel document in Appendix C. The goal of the Indian Affairs (IA), Office

of Facilities, Property, and Safety Management (OFPSM) Branch of Real Property and

Leasing is for Tribes to feel confident in completing these forms. If the Tribe has any questions, please

do not hesitate to email ISDEAA105L@BIA.GOV. This chapter also provides information on how a Tribe

certifies financial information.

What are the cost elements in 900.70?

The cost elements at 900.70 include (a-h).

a) Rent (sublease).

b) Depreciation and use allowance based on the useful life of the facility based

on acquisition costs not financed with Federal funds.

c) Contributions to a reserve for replacement of facilities.

d) Principal and interest paid or accrued.

e) Operation and maintenance expenses.

f) Repairs to facilities and equipment.

g) Alterations needed to meet contract requirements.

h) Other reasonable expenses.

Chapter

4

C

14

What does the rental amount cover?

•

Rental monies owed.

•

Lease monies owed.

•

Sublease monies owed.

What is depreciation and use allowance?

In general terms, depreciation is accounting for the aging of the facility over time. Depreciation also

accounts for the actual annual use of the facility each year. Depreciation is calculated over 39 years

as per the Internal Revenue Service (IRS) publication 946. Facilities that are older than 39 years are

not eligible for depreciation as a cost element.

Per Appendix C Excel Document [105 (l) Template All-Areas Consolidated] Depreciation can be

calculated with or without P&I.

If the Tribe is uncertain of how to calculate depreciation in the Excel sheet, the OFPSM staff may

provide assistance.

If the Tribe is sending the Excel Spreadsheet as an attachment, please rename the document to

include the Tribe name, month, and year of submission. “105 (l) Lease [Tribe Name] Financial

Spreadsheet, [Month and Year]”.

What information is needed to request compensation for depreciation without

principal and interest?

•

The date the facility was originally placed into service

•

The total cost of construction.

•

The amount of non-Federal funding provided or borrowed by the Tribe used in the total

cost of construction.

•

The amount of funding provided from Federal sources used in the total cost of

construction.

15

What information is needed to request compensation for depreciation with principal

and interest?

•

The total cost of construction.

•

The total amount of funding provided or borrowed by the Tribe.

•

The amount of non-Federal funds used in the total cost of construction.

•

The total Principal paid by the Tribe for the loan prior to the start of the first 105 (l) lease.

•

The date the facility was originally placed into service.

•

The year that the loan started.

•

The length of the loan in years.

What is a Reserve Fund?

If a Tribe intends to request compensation for reserve funding (replacement of a roof, HVAC system,

boiler, etc.) compensation is based on:

•

The year the system or component was placed in service.

•

The replacement cost at the time that it was placed in service.

•

The expected system or component service life.

What information is needed to provide for Principal and Interest?

A schedule of payments is provided by the lender.

•

Annual Interest Rate.

•

Year the Loan Started.

•

The Loan Term in Number of Years (10, 15, 30 years).

•

Year of Lease.

•

Full construction cost of the facility not including soft costs or any supplemental funds

from Federal sources.

•

Any down payment or other off-setting payment provided by the Tribe.

16

What are operation and maintenance expenses?

•

Water, sewage.

•

Utilities.

•

Fuel.

•

Insurance.

•

Facility management supervision and custodial services.

•

Custodial and maintenance supplies.

•

Pest control.

•

Site maintenance (including snow and mud removal).

•

Trash and waste removal and disposal.

•

Fire protection/firefighting services and equipment.

•

Monitoring and preventive maintenance of facility structures and systems (HVAC,

Plumbing, Electrical, Elevators, Boilers, Fire Safety, Security, Roof, Foundation, Walls, and

Floors).

•

Unscheduled maintenance.

•

Scheduled maintenance (including replacement of floor coverings, lighting fixtures,

repainting).

•

Security services.

•

Management fees.

•

Other reasonable and necessary operation or maintenance costs justified by the

contractor.

What are Repairs to Facilities and Equipment?

Repairs to facilities and equipment are an unexpected cost. This includes work performed to return

equipment to service after a service failure or to prevent further damage to the facility. An example

is a roof repair to prevent internal water damage and mold. The Reserve Fund would manage full

roof replacements.

17

What are Alterations needed to meet contract requirements?

Alterations may be needed to properly administer the approved PFSAs to meet code or contract

requirements.

What are other reasonable expenses?

IA wanted to be prudent in providing some flexibility to capture any costs that are not already

included in another category.

How does the Tribe certify all financial information is correct?

The Tribe provides a written Certification of Financial Information signed by the designated Tribal

Chief Financial Officer (CFO). [See Appendix D]

18

Lease Details

hapter 5 addresses the length of time to negotiate a lease with Indian Affairs (IA), Office of

Facilities, Property, and Safety Management (OFPSM) Branch of Real Property & Leasing

(BRPL). This chapter provides the types of documents needed to support the lease agreement.

This chapter explains the negotiation process and clarifies items that are often requested. Additionally, this

chapter discusses how a Tribe might utilize the 105 (l) program lease for immediate compensation after

obtaining a new facility.

How long does it take to negotiate a lease?

Upon receiving the necessary documentation, Indian Affairs (IA) aims to execute leases

within 90 days. The process can take longer depending on the availability of staffing

resources, the amount of technical assistance required by the Tribe, and the ability to

understand and arrive at reasonable compensation. The first lease a Tribe establishes typically takes

longer but this experience speeds up the formulation of subsequent leases. Per program guidelines IA will

offer Tribes technical assistance if needed, this may also lengthen the time to negotiate a lease. The

process can also take longer if Tribes need more time to gather supportive documents.

See Appendix C, D, E (Tribal Resolution Sample).

What are the typical requests for clarification and documents requested?

•

Floor plans need to properly show the square feet (SF) for each PFSA.

•

Clearly indicating the Federal PFSAs that are operating in the facility space(s).

•

Documentation justifying cost elements.

•

Clearly identifying the shared services and common spaces.

Chapter

5

C

19

•

Identifying spaces that are already covered/compensated by IHS or other fund source(s).

This guidebook attempts to provide the information needed to begin the proposal and negotiation

process. However, after you begin to apply information to the Tribes’ specific facility and PFSAs, new cost

items may come up. For example:

•

Additional PFSA or common space is identified after the initial proposal is submitted.

•

The lease process without cost elements was easier than expected. The Tribe may decide

they want to add in some of their cost elements after all.

•

Two months into the process the roof is damaged by a hailstorm and now the Tribe would like

to include the repair cost element.

The Tribe can request changes to the lease compensation until the lease is signed. This is a part of the

negotiation process. There are many options. The OFPSM are here to support the Tribe in developing a

facility lease that really works best for the Tribe.

With proper planning, a Tribe could use the 105 (l) lease program to receive

compensation for a new facility.

It is possible for a Tribe to obtain a construction loan, plan, design, build a new facility, and then receive

compensation for Principal and Interest through a 105(l) lease. The facility must be used to carry out an

approved ISDEAA PFSA. IA does not get involved with the loan process. IA will work with the Tribe to

develop a Program of Requirements (POR) to meet the associated design requirements and code

compliance. The lease term would start once the facility has received a Certificate of Occupancy, is

occupied, and is being used to carry out an approved ISDEAA PFSA. Contact ISDEAA105L@BIA.GOV to

request more information.

20

Executing A Facility Lease

hapter 6 provides details on how a facility lease is processed with the Indian Affairs (IA),

Office of Facilities, Property, and Safety Management (OFPSM) Branch of Real Property &

Leasing (BRPL). This chapter states how quickly Tribes can expect receipt of a signed copy,

and who will send out their funding. This chapter explains how the funding is backdated. This Chapter

also explains when funding would need to end or be prorated.

How are facility leases processed?

Indian Affairs aims to complete leases within 90 days, but the process can take

longer if additional technical assistance is necessary or if Tribes need more time to

pull together the necessary information or get Tribal resolutions approving the

lease. After the ISDEAA Team and the Tribe agree the information is complete, they will work to

agree upon the compensation amount. The ISDEAA Team will then draft the lease, using the

standard lease template. The Office of the Solicitor Division of Indian Affairs conducts a legal

sufficiency review. Once the legal sufficiency review is complete, the ISDEAA Team will provide the

final draft to the Tribe for one last review and concurrence. Upon the Tribe’s concurrence, IA will

route the lease through their Department’s internal document review and approval system. Once all

approvals are documented, the ISDEAA Team will send the final lease agreement to the Tribe for

execution by the Tribe’s designated official, via a Tribal Resolution.

The Tribe is to wet sign and date two copies and mail (USPS) both to the following address for the

Deputy Assistant Secretary for Management’s (DASM’s) signature.

Chapter

6

C

21

Executive Assistant

Office of the Deputy Assistant Secretary for Management

Assistant Secretary – Indian Affairs

Department of the Interior

1849 C Street NW, MS 4650

Washington, DC 20240

***Alternatively, the Tribe can electronically sign the lease if IA and the Tribe agree to do so in

advance.

The DASM will sign the lease.

A copy of the fully executed lease will be returned to the Tribe and the Awarding Official (AO). The

AO will incorporate the lease agreement by an amendment in the ISDEAA agreement or 297 Grant

as an attachment. IA will send the funding to the AO. The AO will distribute the funds to the Tribe.

How quickly after the lease is signed will the Tribe receive official copies?

IA will send one original, fully executed lease to the Tribe within three business days of being signed.

Who is responsible to transfer the funding over to the Tribe?

The Awarding Official will transfer the funding to the Tribe once the lease is signed (known as the

executed copy) and the funds are received from OFPSM.

How far is funding backdated?

Funding and the initial lease term is backdated to the date the proposal for an initial lease is received

by IA. Example: The initial lease proposal may have been received on June 1, 2022, additional

documents and market analysis were received in August 2022, negotiations were entered, and the

Tribe signs the lease in October 2022. Tribes run on either Fiscal Years or Calendar Years. Fiscal

years run from October 1 to September 30. Calendar Years run from January 1 to December 31. If

the Tribe is a Fiscal Year Tribe and signs an initial lease in October, the lease term begins in June

when IA received the proposal, and the Tribe will want to complete a renewal lease the same year.

22

Their funding will cover June 1, 2022 – September 30, 2022. The new fiscal year will begin October 1,

and therefore a new funding year.

What happens if the Tribe stops performing the PFSA in that space?

If the PFSA is no longer operated in that space, the lease agreement is terminated. If the PFSA ends

or the facility is no longer able to support the PFSA before the end of the lease term, please contact

IA at ISDEAA105L@BIA.GOV. Since the lease compensation is paid on an annual basis, it will need to

be adjusted.

23

Renewals

hapter 7 focuses on providing the details on how a Tribe can prepare for renewing their 105

(l) lease with the Indian Affairs (IA), Office of Facilities, Property, and Safety Management

(OFPSM) Branch of Real Property & Leasing (BRPL). Specifics are given on the need for the

annual renewal. Details are provided on how to send the renewal request. The documents needed for

the renewal request are described.

How will we know when to renew?

Section 8 of the lease “Lease Term” requires the Tribe to provide notice of intent to

renew three months before the current lease expires. IA will also send a

notification of renewal.

How does the Tribe apply for renewal?

Send all updated information to ISDEAA105L@BIA.GOV.

Do we need to renegotiate the lease each year?

Only if the Tribe has changes to the lease would a renegotiation need to occur. Many Tribes may

renew with one meeting, phone call, or email. OFPSM sends a new lease draft out for the Tribe to

review and approve. Then the signature process can begin.

Chapter

7

C

24

What information needs to be sent as a part of the renewal request?

Requests for updates to the previous compensation will need to be sent to ISDEAA105L@BIA.GOV. If

compensation is based on Fair Market Rental Analysis (FMRA), a Consumer Price Index (CPI)

adjustment can be agreed on and used to calculate the lease renewal amount. If compensation is

based on Cost Elements or a combination of FMRA and Cost Elements, then the Tribe will need to

submit documentation to justify the lease renewal amount. If any new documents are submitted as

a part of a lease renewal, then a new CFO Cert will need to be submitted. If the initial Tribal

resolution does not include wording for renewals or is time-specific, then the Tribe will provide an

updated Resolution.

How are CPI adjustments calculated?

The CPI adjustment based on location can be calculated using the U.S Bureau of Labor Statistics

Consumer Price Index databases – All Urban Consumers “Top Picks” –

https://www.bls.gov/cpi/data.htm. When calculating annual CPI adjustments, Calendar Year Tribes

should use January of the previous year to January of the current year and Fiscal Year Tribes should

use October of the previous year to October of the current year.

26

Appendix A Lease Agreement Template for Self-Determination Tribe

27

28

29

30

31

Appendix B Lease Agreement Template for Self-Governance Tribe

32

33

34

35

36

Appendix C Excel Document 105 (l) Template All Areas Consolidated

37

Consolidated Summary

38

Appendix D CFO Certification

39

CHIEF FINANCIAL OFFICER/TREASURER CERTIFICATION

I, (insert name), Tribal Treasurer (or Chief Financial Officer) of the (insert name of Tribe or Tribal

Organization), hereby certify that the financial information provided to the Department of the Interior

for purposes of negotiating the (insert name of the facility) Facility Lease Agreement was prepared in

accordance with generally accepted accounting principles and that the information presented is, to the

best of my knowledge, a true and correct accounting of the costs associated with the (insert name of

facility) in xxxx year.

Signature Line Date: _____________________

Name

Title

40

Appendix E Tribal Resolution Sample

41

Tribal Resolution Sample

WHEREAS, federal law requires the Secretary of the U.S. Department of the Interior to enter into a lease

agreement with a tribe proposing a lease pursuant to Section 105(l) of Public Law 93-638, as amended

(codified at 25 U.S.C. § 5324(l)), with such lease compensation as calculated in accordance with 25 C.F.R.

Part 900 Subpart H (beginning at 25 C.F.R. § 900.69); and

WHEREAS, the U.S. Department of the Interior requires tribes and tribal organizations to certify that all

information provided by the tribe or tribal organization for purposes of calculation of calculating lease

compensation under Section 105(l) of Public Law 93-638 is true and correct; and

NOW THEREFORE BE IT RESOLVED, [Name and Title of Authorized Representative] is authorized to

submit a lease proposal to the U.S. Department of the Interior for the following facility(y/ies) pursuant

to Public Law 93-638:

[facility name], located at [facility address]

[facility name], located at [facility address]

BE IT FURTHER RESOLVED, [Name and Title of Authorized Representative] is authorized to negotiate and

execute said lease agreement and to take all measures necessary to implement said lease agreement for

[fiscal/calendar] year [YEAR] and subsequent lease periods for which funds are available; and

BE IT FURTHER RESOLVED, [Name and Title of Authorized Financial Representative] is hereby designated

as the appropriate official to verify the information provided by the tribe or tribal organization for

purposes of calculating lease compensation under Section 105(l) of Public Law 93-638, and is hereby

authorized to attest as to the accuracy of such.