Applying IFRS

A cl

oser look at

IFRS 16 Leases

Updated December 2020

1 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

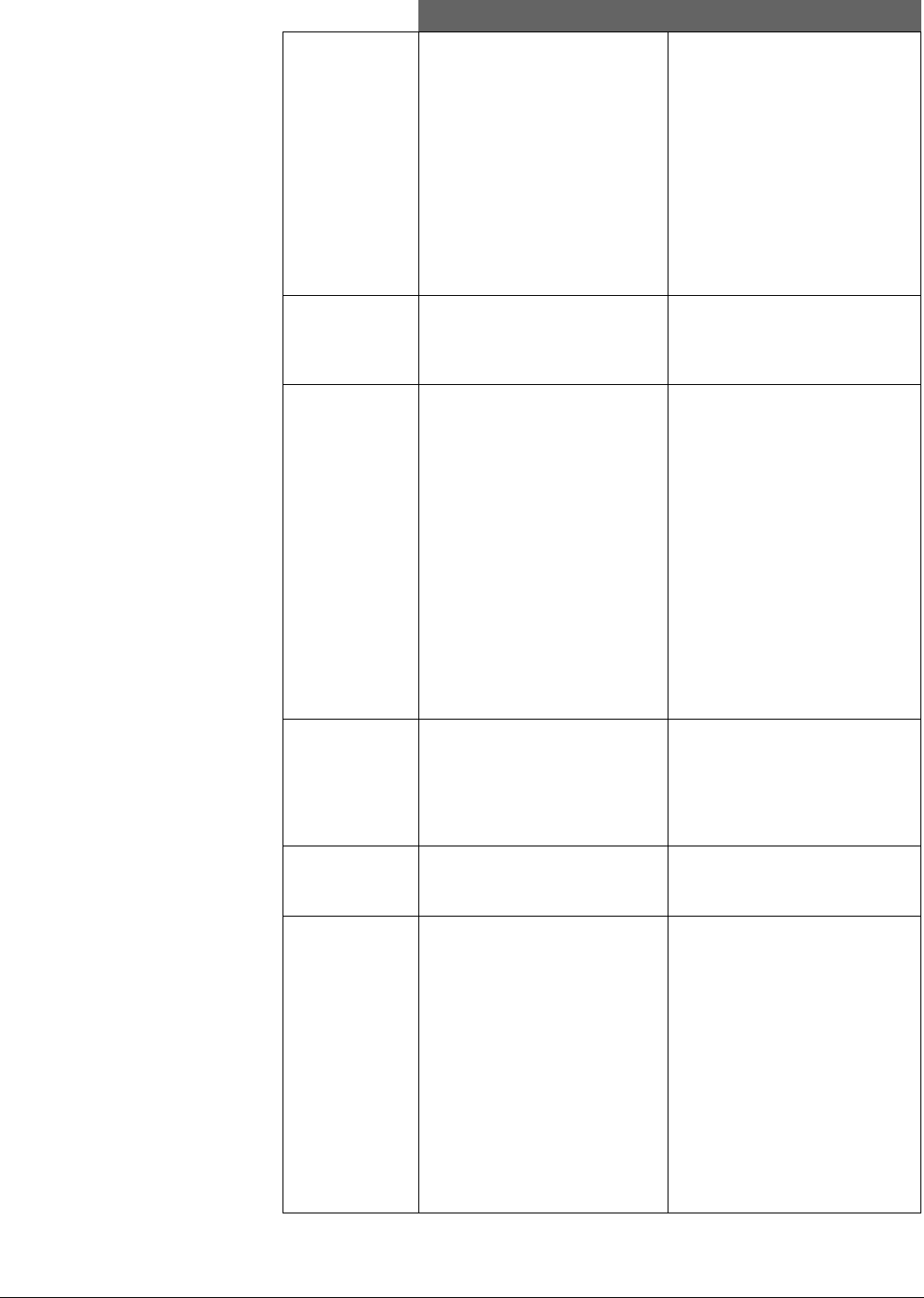

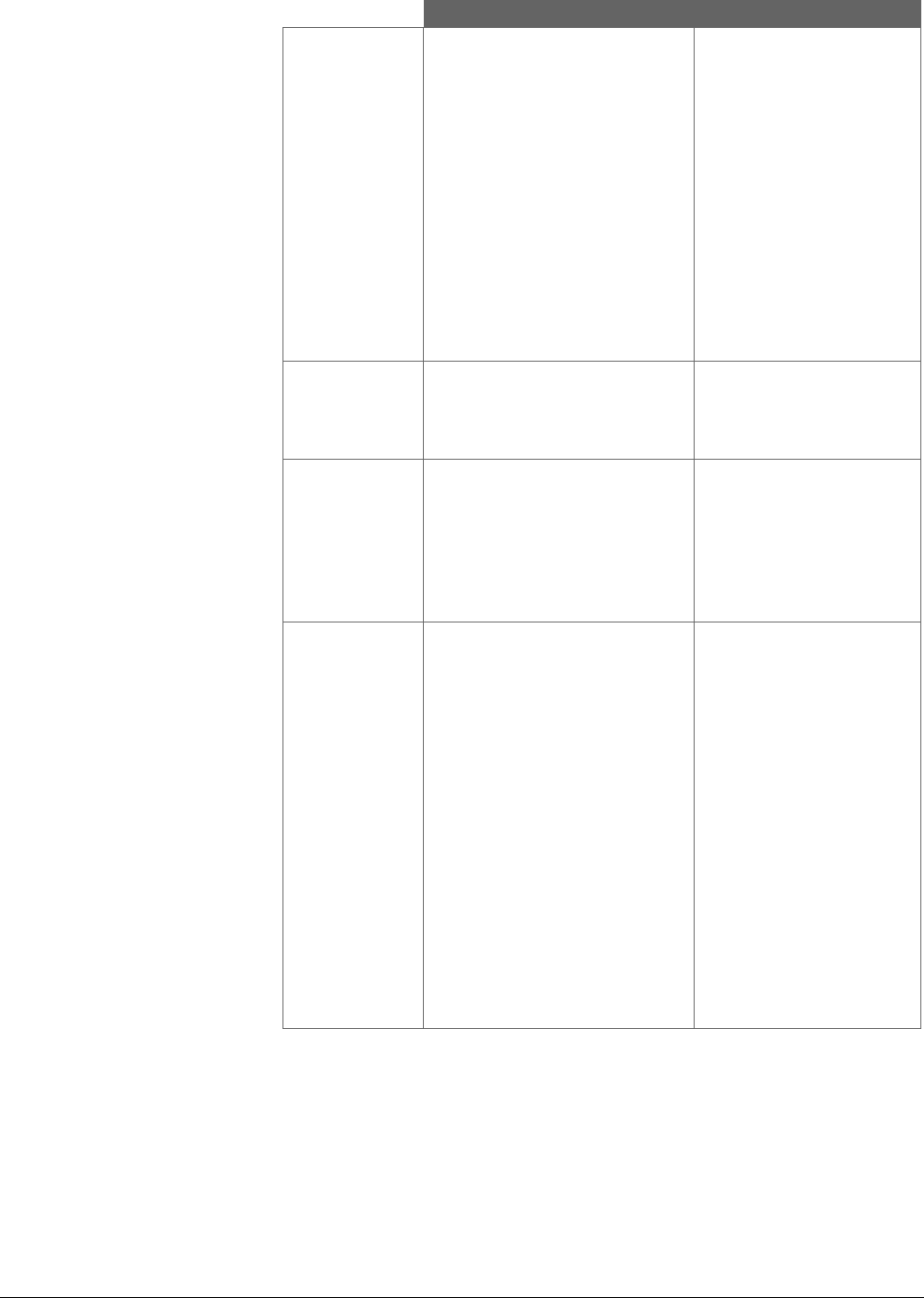

Contents

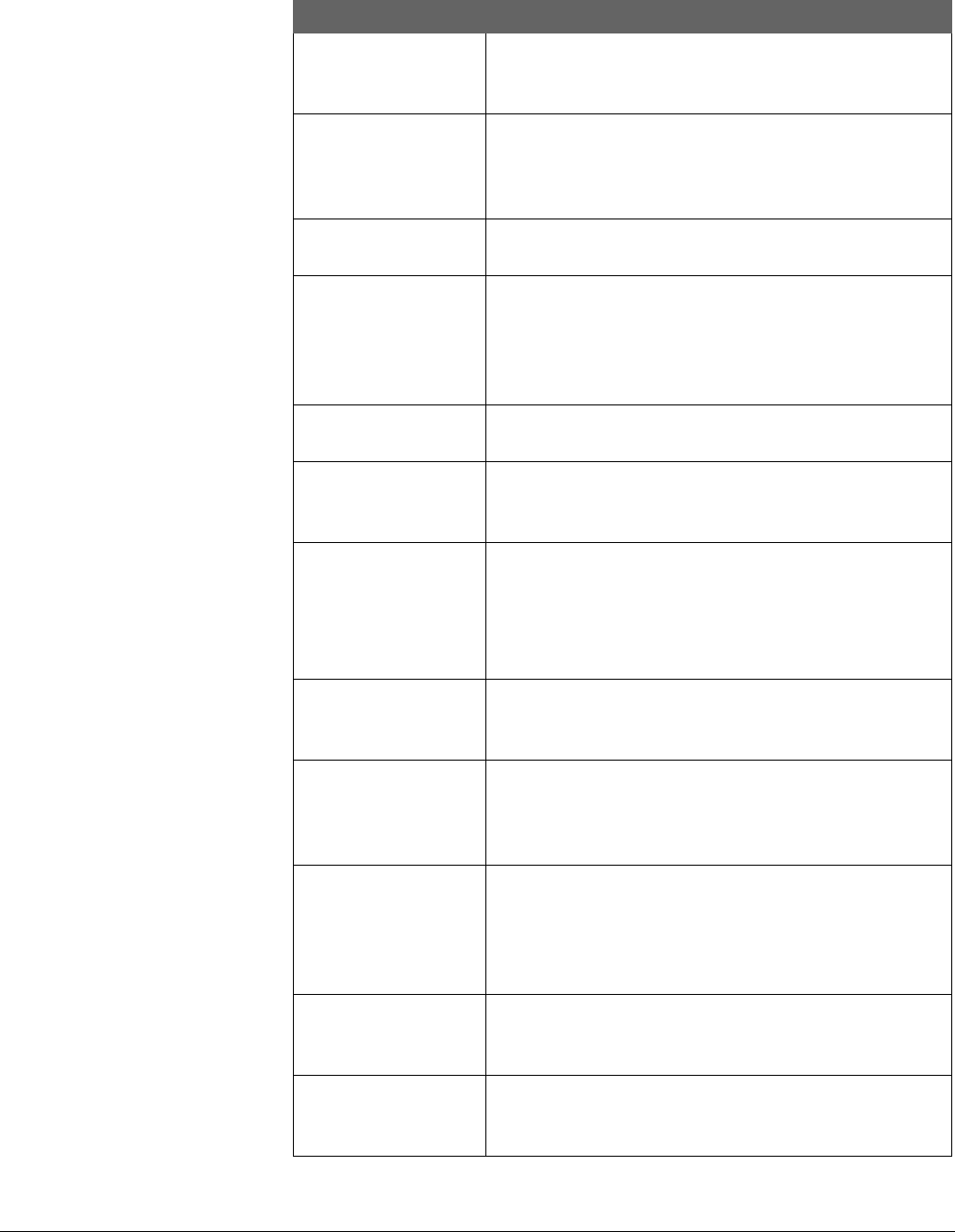

Overview 4

1. Objective and scope of IFRS 16 5

1.1 Objective of IFRS 16 5

1.2 Scope of IFRS 16 5

1.3 Recognition exemptions 6

2. What is a lease? 7

2.1 Determining whether an arrangement contains a lease 7

2.2 Identifying and separating lease and non-lease components of a

contract and allocating contract consideration 27

2.3 Contract combinations 36

3. Key concepts 37

3.1 Inception of a contract 37

3.2 Commencement date of the lease 37

3.3 Lessee involvement with the underlying asset before the

commencement date 38

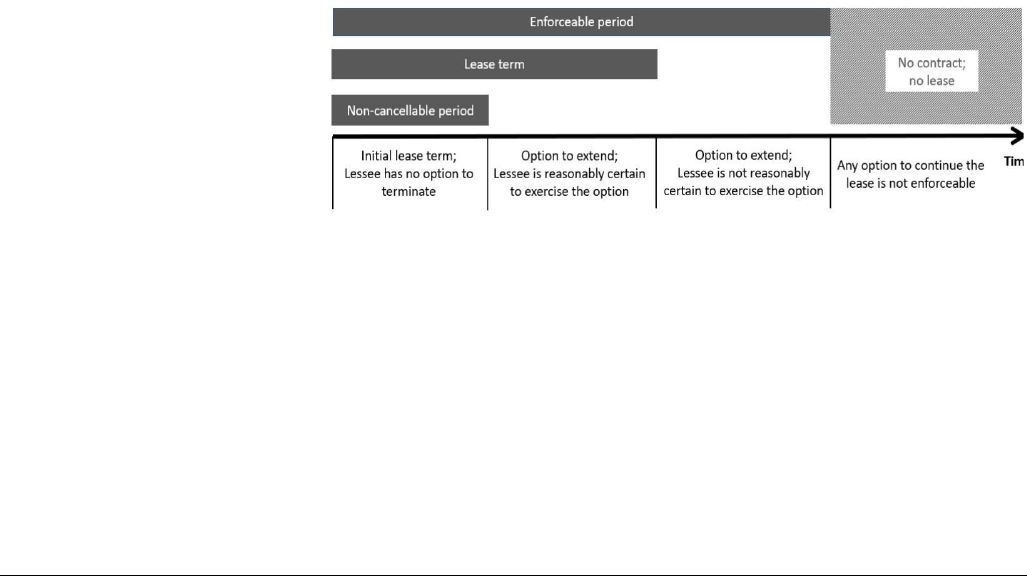

3.4 Lease term and purchase options 39

3.5 Lease payments 47

3.6 Discount rates 55

3.7 Initial direct costs 58

3.8 Economic life 60

3.9 Fair value 60

4. Lessee accounting 61

4.1 Initial recognition 61

4.2 Initial measurement 64

4.3 Subsequent measurement 66

4.4 Remeasurement of lease liabilities 71

4.5 Lease modifications 73

4.6 Other lessee matters 80

4.7 Presentation 81

4.8 Disclosure 83

5. Lessor accounting 89

5.1 Lease classification 89

5.2 Key concepts applied by lessor 91

5.3 Finance leases 92

5.4 Operating leases 102

5.5 Lease modifications 104

5.6 Other lessor matters 109

5.7 Presentation 109

5.8 Disclosure 110

6. Subleases 112

2 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

6.1 Definition 112

6.2 Intermediate lessor accounting 112

6.3 Sub-lessee accounting 115

6.4 Presentation 115

6.5 Disclosure 115

7. Sale and leaseback transactions 116

7.1 Determining whether the transfer of an asset is a sale 116

7.2 Transactions in which the transfer of an asset is a sale 119

7.3 Transactions in which the transfer of an asset is not a sale 126

7.4 Disclosure 127

8. Business combinations 128

8.1 Acquiree in a business combination is a lessee 128

8.2 Acquiree in a business combination is a lessor 129

9. Effective date and transition 130

9.1 Effective date 130

9.2 Transition 130

9.3 Lessee transition 131

9.4 Lessors 141

9.5 Other considerations 142

9.6 Disclosure 143

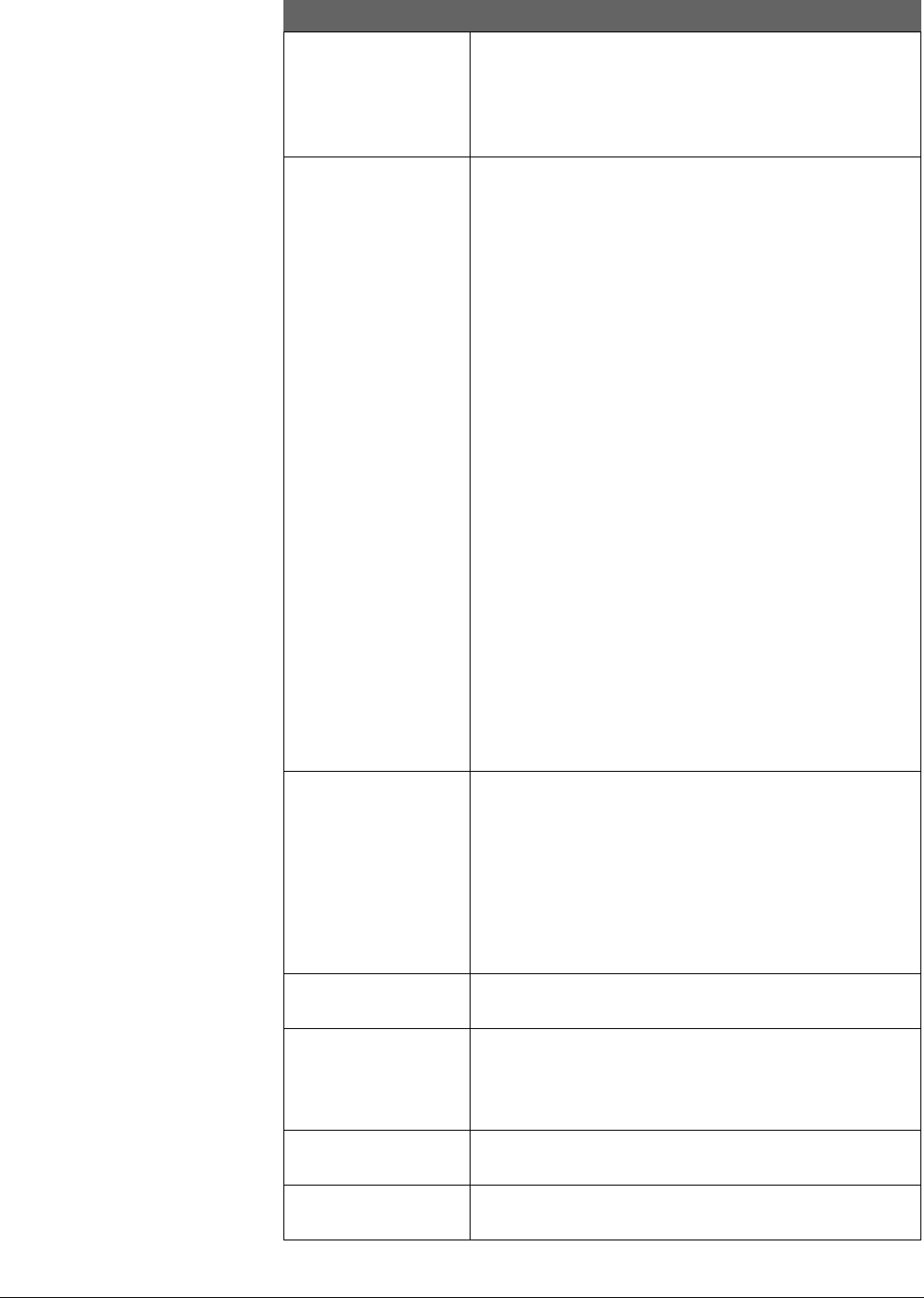

Appendix A: IFRS 16 Defined terms 145

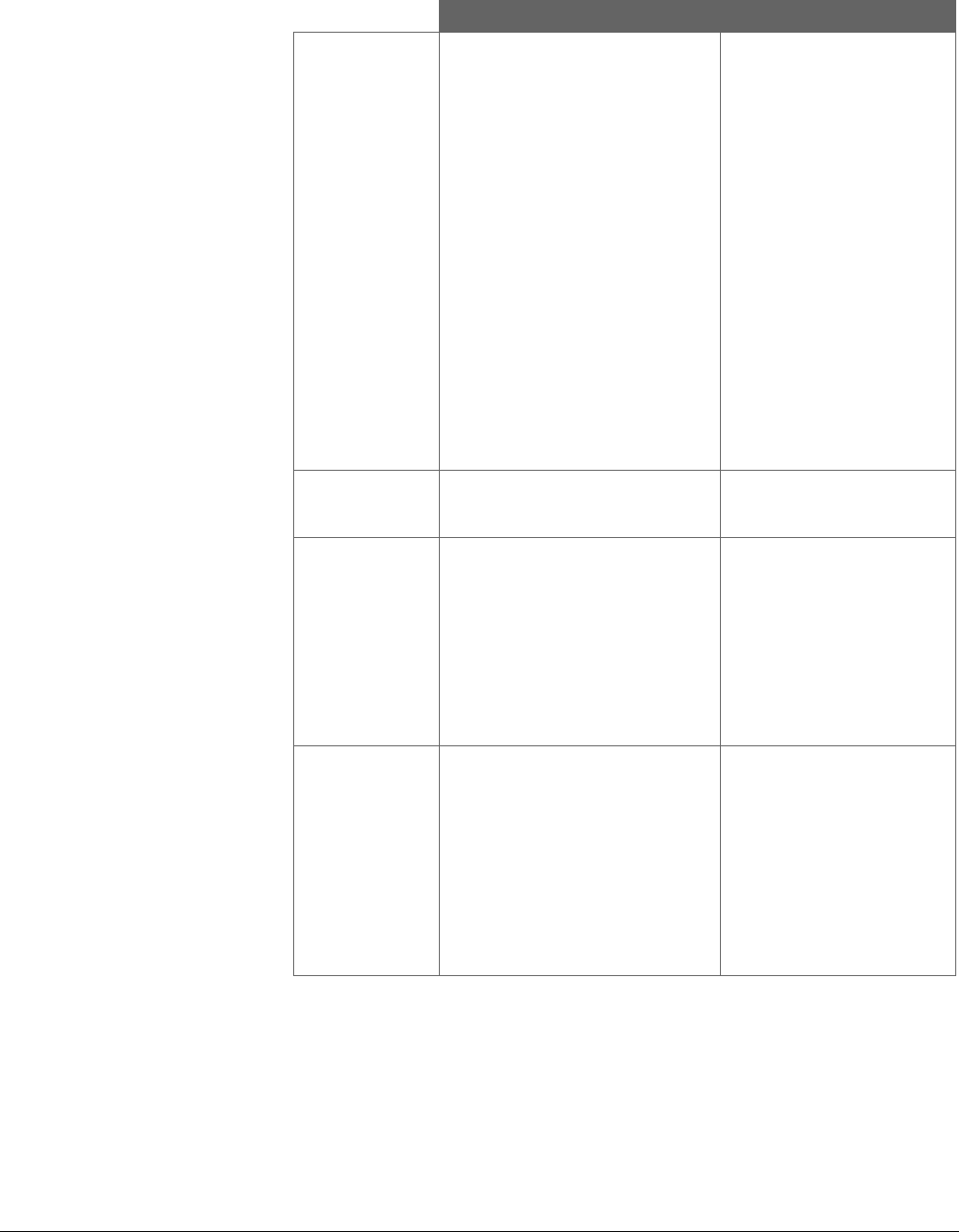

Appendix B: Key differences between IFRS 16 and IAS 17 148

Appendix C: Key differences between IFRS 16 and ASC 842 155

Appendix D: Summary of lease reassessment and remeasurement

requirements 162

3 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

What you need to know

• IFRS 16 Leases requires lessees to put most leases on their balance

sheets.

• Lessees apply a single accounting model for all leases, with certain

exemptions.

• For lessors, the accounting is substantially unchanged from the accounting

under IAS 17 Leases.

• IFRS 16 is effective for annual periods beginning on or after

1 January 2019, with limited early application permitted.

4 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

Overview

IFRS 16

Leases

requires lessees to recognise assets and liabilities for most

leases. The International Accounting Standards Board (IASB or the Board)

issued the standard after joint deliberations with the Financial Accounting

Standards Board (FASB), which issued a similar standard (ASC 842 Leases).

However, there are significant differences between the IASB and FASB

standards (e.g., lessees classify leases as finance or operating leases under

the FASB standard). These differences will result in certain transactions

being accounted for differently under IFRS and US GAAP. Appendix C of this

publication summarises the key differences between IFRS 16 and ASC 842.

IFRS 16 replaces IAS 17

Leases.

It requires lessees to recognise most leases on

their balance sheets and provides enhanced disclosure requirements. The IASB

believes this will result in a more faithful representation of lessees’ assets and

liabilities and greater transparency of lessees’ financial obligations and leasing

activities.

Under IFRS 16, leases are accounted for based on a ‘right-of-use model’.

The model reflects that, at the commencement date, a lessee has a financial

obligation to make lease payments to the lessor for its right to use the

underlying asset during the lease term. The lessor conveys that right to

use the underlying asset at lease commencement, which is the time when

it makes the underlying asset available for use by the lessee.

Entities will need to focus on whether an arrangement contains a lease

or a service agreement because there are significant differences in the

accounting. Although IFRS 16 changes how the definition of a lease is applied,

we believe that the assessment of whether a contract contains a lease will be

straightforward in most arrangements. However, judgement may be required

in applying the definition of a lease to certain arrangements, particularly those

that include significant services.

Lessor accounting under IFRS 16 is substantially unchanged from the accounting

under IAS 17. Lessors continue to classify all leases as operating or finance

leases.

IFRS 16 is effective for annual periods beginning on or after 1 January 2019.

Early application is permitted, provided the new revenue standard, IFRS 15

Revenue from Contracts with Customers

, has been applied, or is applied at

the same date as IFRS 16.

This publication discusses how IFRS 16 is applied and is intended to help

companies consider the effects of adopting and applying it. We encourage

preparers and users of financial statements to read this publication carefully and

consider the potential effects of the new standard.

The views we express in this publication represent our perspectives as of

December 2019. We may identify additional issues as we continue to analyse the

standard and entities interpret it, and our views may evolve during that process.

IFRS 16 requires lessees

to recognise most

leases on their balance

sheets.

5 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

1. Objective and scope of IFRS 16

1.1 Objective of IFRS 16

IFRS 16 sets out the principles for the recognition, measurement, presentation

and disclosure of leases. The objective is to ensure that lessees and lessors

provide relevant information in a manner that faithfully represents those

transactions. This information gives a basis for users of financial statements

to assess the effect that leases have on the financial position, financial

performance and cash flows of an entity.

IFRS 16 requires an entity to consider the terms and conditions of contracts and

all relevant facts and circumstances, and to apply the standard consistently to

contracts with similar characteristics and in similar circumstances.

1.2 Scope of IFRS 16

Extract from IFRS 16

3 An entity shall apply this Standard to all leases, including leases of right-of-

use assets in a sublease, except for:

(a)

leases to explore for or use minerals, oil, natural gas and similar non-

regenerative resources;

(b)

leases of biological assets within the scope of IAS 41

Agriculture

held

by a lessee;

(c)

service concession arrangements within the scope of IFRIC 12

Service

Concession Arrangements

(d)

licences of intellectual property granted by a lessor within the scope of

IFRS 15

Revenue from Contracts with Customers

; and

(e)

rights held by a lessee under licensing agreements within the scope of

IAS 38

Intangible Assets

for such items as motion picture films, video

recordings, plays, manuscripts, patents and copyrights.

4 A lessee may, but is not required to, apply this Standard to leases of

intangible assets other than those described in paragraph 3(e).

IFRS 16 applies to all leases, including leases of right-of-use assets in a sublease,

except for the following:

•

Leases to explore for, or use, minerals, oil, natural gas and similar non-

regenerative resources

•

Leases of biological assets within the scope of IAS 41

Agriculture

held by

a lessee

•

Service concession arrangements within the scope of IFRIC 12

Service

Concession Arrangements.

Entities should evaluate the applicability of

IFRIC 12 before evaluating whether an arrangement contains a lease.

•

Licences of intellectual property granted by a lessor within the scope of

IFRS 15

•

Rights held by a lessee under licensing agreements within the scope of

IAS 38

Intangible Assets

for such items as motion picture films, video

recordings, plays, manuscripts, patents and copyrights

6 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

A lessee is not required to apply IFRS 16 to leases of intangible assets not

covered by the exceptions above. However, a lessee could choose to account

for leases of such intangible assets under IFRS 16.

There are differing views about whether a licence of software is excluded from

the scope of IFRS 16 based on interpretations of paragraph 3(e) of IFRS 16. If

an entity determines that a licence of software is not excluded from the scope

of IFRS 16, paragraph 4 of IFRS 16 permits, but does not require, an entity to

account for the licence of software as a lease.

If a cloud computing arrangement contains a lease of an asset other than

a licence of software (or the entity has determined that a licence of software

is not excluded from the scope of IFRS 16 and has elected to account for leases

of intangible assets under IFRS 16), an entity should apply the provisions of

IFRS 16 to the cloud computing arrangement. This includes identifying and

separating lease and non-lease components and allocating contract

consideration, which is discussed at 3.2 below.

1.3 Recognition exemptions

IFRS 16 allows a lessee to elect not to apply the recognition requirements to:

a)

Short-term leases; and

b)

Leases for which the underlying asset is of low value.

These recognition exemptions are discussed further in section 4.1

7 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

2. What is a lease?

A lease is a contract (i.e., an agreement between two or more parties that

creates enforceable rights and obligations), or part of a contract, that conveys

the right to control the use of an identified asset for a period of time in exchange

for consideration.

IFRS 16 requires an entity to determine whether a contract is a lease or contains

a lease at the inception of the contract. The assessment of whether a contract

is or contains a lease will be straightforward in most arrangements. However,

judgement may be required in applying the definition of a lease to certain

arrangements. For example, in contracts that include significant services, we

believe that determining whether the contract conveys the right to direct the

use of an identified asset may be challenging. We discuss this further below.

2.1 Determining whether an arrangement contains a lease

Extract from IFRS 16

Appendix A

Defined terms

Lease

A contract, or part of a contract, that conveys the right to use an asset

(the underlying asset) for a period of time in exchange for consideration.

Contract

An agreement between two or more parties that creates enforceable rights

and obligations.

Period of use

The total period of time that an asset is used to fulfil a contract with

a customer (including any non-consecutive periods of time).

9 At inception of a contract, an entity shall assess whether the contract

is, or contains, a lease. A contract is, or contains, a lease if the contract

conveys the right to control the use of an identified asset for a period of

time in exchange for consideration. Paragraphs B9–B31 set out guidance

on the assessment of whether a contract is, or contains, a lease.

B9 To assess whether a contract conveys the right to control the use of

an identified asset (see paragraphs B13–B20) for a period of time, an entity

shall assess whether, throughout the

period of use

, the customer has both of

the following:

(a) the right to obtain substantially all of the economic benefits from use

of the identified asset (as described in paragraphs B21–B23); and

(b) the right to direct the use of the identified asset (as described in

paragraphs B24–B30).

B10 If the customer has the right to control the use of an identified asset for

only a portion of the term of the contract, the contract contains a lease for

that portion of the term.

8 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

Extract from IFRS 16 (cont’d)

B11 A contract to receive goods or services may be entered into by a joint

arrangement, or on behalf of a joint arrangement, as defined in IFRS 11

Joint

Arrangements

. In this case, the joint arrangement is considered to be the

customer in the contract. Accordingly, in assessing whether such a contract

contains a lease, an entity shall assess whether the joint arrangement has

the right to control the use of an identified asset throughout the period of use.

B12 An entity shall assess whether a contract contains a lease for each

potential separate lease component. Refer to paragraph B32 for guidance

on separate lease components.

2.1.1 Joint arrangements

Entities often enter into joint arrangements with other entities for certain

activities (e.g., exploration of oil and gas fields, development of pharmaceutical

products).

A contract for the use of an asset by a joint arrangement might be entered into

in a number of different ways, including:

•

Directly by the joint arrangement, if the joint arrangement has its own legal

identity

•

By each of the parties to the joint arrangement (i.e., the lead operator and

the other parties, commonly referred to as the non-operators) individually

signing the same arrangement

•

By one or more of the parties to the joint arrangement on behalf of the joint

arrangement. Generally, this would be evidenced in the contract and the

parties to the joint arrangement would have similar rights and obligations as

they would if they individually signed the arrangement. In these situations,

the facts and circumstances, as well as the legal position of each entity, need

to be evaluated carefully

•

By the lead operator of the joint arrangement in its own name, i.e., as

principal. This may occur when the lead operator leases equipment which

it then uses in fulfilling its obligations as the lead operator of the joint

arrangement and/or across a range of unrelated activities, including

other joint arrangements with unrelated activities, such as with other

joint operating parties

A contract to receive goods or services may be entered into by a joint

arrangement or on behalf of a joint arrangement, as defined by IFRS 11

Joint

Arrangements

. In this case, the joint arrangement is considered to be the

customer in the contract. Accordingly, in determining whether such a contract

contains a lease, an assessment needs to be made as to which party (e.g., the

joint arrangement or the lead operator) has the right to control the use of an

identified asset throughout the period of use.

If the parties to the joint arrangement collectively have the right to control

the use of an identified asset throughout the period of use as a result of their

collective control of the operation, the joint arrangement is the customer to

the contract that may contain a lease. It would be inappropriate to conclude that

the contract does not contain a lease on the grounds that each of the parties to

the joint arrangement either has rights to a non-physically distinct portion of

an underlying asset and, therefore, does not have the right to substantially all

9 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

of the economic benefits from the use of that underlying asset or does not

unilaterally direct its use. Determining if the parties to the joint arrangement

collectively have the right to control the use of an identified asset throughout

the period of use would require a careful analysis of the rights and obligations

of each party.

In the first three scenarios above, if it has been determined that a contract is,

or contains, a lease, each of the parties to the joint arrangement (i.e., the joint

operators comprising the lead operator and the non-operators) will account for

their respective interests in the joint arrangement (including any leases) under

paragraphs 20-23 of IFRS 11. Therefore, they will account for their individual

share of any right-of-use assets and lease liabilities, and associated depreciation

and interest.

In the fourth scenario (i.e., where the lead operator enters the arrangement in

its own name), the lead operator will need to assess whether the arrangement is,

or contains, a lease. If the lead operator controls the use of the identified asset,

it would recognise the entire right-of-use asset and lease liability on its balance

sheet. This would be the case even if it is entitled to bill the non-operator parties

their proportionate share of the costs under the joint operating agreement

(JOA).

If the lead operator determines that it is the lessee, it would also evaluate

whether it has entered into a sublease with the joint arrangement (as the

customer to the sublease). For example, the lead operator may enter into

a five-year equipment lease with a supplier, but may then enter into a two-year

arrangement with one of its joint arrangements, thereby yielding control of the

right to use the equipment to the joint arrangement during the two-year period.

In many cases, the lead operator will not meet the requirements to recognise

a sublease because the arrangement does not create legally enforceable rights

and obligations that convey the right to control the use of the asset to the joint

arrangement. However, the conclusion as to whether the joint arrangement is a

customer, i.e., the lessee in a contract with a lead operator, by virtue of the JOA,

would be impacted by the individual facts and circumstances.

If there is a sublease with the lead operator, IFRS 11 would require the non-

operators to recognise their respective share of the joint arrangement’s right-of-

use asset and lease liability and the lead operator would have to account for its

sublease to the joint arrangement separately. However, if no sublease existed,

the non-operators would recognise joint interest payables when incurred for

their share of the costs incurred by the lead operator in respect of the leased

asset.

In limited cases, the lead operator and non-operators will enter into a contract

directly with the supplier, in which the lead operator and non-operators are

proportionately liable for their share of the arrangement. In this case, the parties

with interests in the joint operation would recognise their proportionate share of

the leased asset, liability and lease expense in accordance with IFRS 11.

There has been considerable debate as to how the term “on behalf of the

joint arrangement” should be interpreted and applied in practice. The IFRS

Interpretations Committee (the Committee) discussed a question (in September

2018) relating to lease arrangements in a joint operation (JO) under IFRS 16.

The question asked was how a lead operator (the party responsible for

undertaking the operations on behalf of the other joint operators) of a JO,

which is not structured through a separate vehicle, recognises a lease liability.

10 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

The question specifically focused on situations where the lead operator, as the

sole signatory, enters into a lease contract with a third-party supplier (lessor)

for an item of property, plant and equipment that will be operated jointly as part

of the JO’s activities. The lead operator has the right to recover a share of the

lease costs from the other joint operators in accordance with the contractual and

other arrangements governing the JO.

The Committee concluded, in the agenda decision published in March 2019, that

in accordance with IFRS 11, a joint operator identifies and recognises both:

(a) liabilities it incurs in relation to its interest in the JO; and

(b) its share of any liabilities incurred jointly with other parties to the joint

arrangement.

The Committee observed that identifying the liabilities that a joint operator

incurs and those incurred jointly, requires an assessment of the terms and

conditions in all contractual arrangements that relate to the JO, including

consideration of the laws pertaining to those agreements. The Committee

further observed, in accordance with IFRS 11, the liabilities a joint operator

recognises include those for which it has primary responsibility. Therefore, as

sole signatory and where a lead operator has primary responsibility for a lease,

the lead operator recognises 100% of the lease liability.

The Committee also highlighted the importance of disclosing information

about joint operations that is sufficient for a user of financial statements to

understand the activities of the joint operation and a joint operator’s interest

in that operation. Therefore, the Committee concluded that the principles and

requirements in IFRS standards provide an adequate basis for the lead operator

to identify and recognise its liabilities in relation to its interest in a JO and did not

to add this matter to its standard-setting agenda.

2.1.2 Identified asset

Extract from IFRS 16

B13 An asset is typically identified by being explicitly specified in a contract.

However, an asset can also be identified by being implicitly specified at the

time that the asset is made available for use by the customer.

B20 A capacity portion of an asset is an identified asset if it is physically

distinct (for example, a floor of a building). A capacity or other portion of an

asset that is not physically distinct (for example, a capacity portion of a fibre

optic cable) is not an identified asset, unless it represents substantially all of

the capacity of the asset and thereby provides the customer with the right

to obtain substantially all of the economic benefits from use of the asset.

An arrangement only contains a lease if there is an identified asset. Under

IFRS 16, an identified asset can be either implicitly or explicitly specified

in a contract.

11 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

Illustration 1 — Implicitly specified asset

Customer X enters into a five-year contract with Supplier Y for the use

of rolling stock specifically designed for Customer X. The rolling stock is

designed to transport materials used in Customer X’s production process

and is not suitable for use by other customers. The rolling stock is not

explicitly specified in the contract, but Supplier Y owns only one rolling stock

that is suitable for Customer X’s use. If the rolling stock does not operate

properly, the contract requires Supplier Y to repair or replace the rolling

stock. Assume that Supplier Y does not have a substantive substitution

right. Refer to section 2.1.3

Substantive substitution rights

.

Analysis

: The rolling stock is an identified asset. While the rolling stock is

not explicitly specified in the contract (e.g., by serial number), it is implicitly

specified because Supplier Y must use it to fulfil the contract.

Illustration 2 — Identified asset – implicitly specified at the time the asset is

made available for use by the customer

Customer X enters into a five-year contract with Supplier Y for the use of

a car. The specification of the car is specified in the contract (brand, type,

colour, options etc.). At inception of the contract the car is not yet built.

Analysis

: The car is an identified asset. Although the car cannot be identified

at inception of the contract, it is apparent that it will be identifiable at the

commencement of the lease. The car is identified by being implicitly specified

at the time that it is made available for use by the customer (i.e., at the

commencement date).

A capacity portion of an asset is an identified asset if it is physically distinct (e.g.,

a floor of a building). A capacity or other portion of an asset that is not physically

distinct (e.g., a capacity portion of a fibre optic cable) is not an identified asset

unless it represents substantially all of the capacity of the asset and thereby

provides the customer with the right to obtain substantially all of the economic

benefits from use of the asset.

How we see it

• Some contracts involve a dedicated cable that is part of the larger network

infrastructure (e.g., unbundled network element arrangements for the ‘last

mile’ to a customer location, ‘special access’ arrangements for a dedicated

connection between two locations). IFRS 16 does not specify or provide

examples that clarify that these arrangements are identified assets.

However, the FASB’s standard ASC 842 includes an additional example

that is similar to a dedicated cable (i.e., a segment of a pipeline that

connects a single customer to a larger pipeline). The example clarifies

that such segments of a larger pipeline are identified assets. As the IASB

has stated that both it and the FASB have reached the same conclusions

on the definition of a lease, we believe that, under IFRS 16, the last mile of

a network that connects a single customer to a larger network may be an

identified asset. However, such arrangements may, or may not, meet the

definition of a lease. Entities will need to be sensitive to this matter in both

these and other similar arrangements.

An identified asset can

be a physically distinct

portion of a larger

asset.

12 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

Illustration 3 — Identified asset – physically distinct portion of a larger asset

Customer X enters into a 12-year contract with Supplier Y for the right to

use three fibres within a fibre optic cable between New York and London.

The contract identifies three of the cable’s 20 fibres for use by Customer X.

The three fibres are dedicated solely to Customer X’s data for the duration

of the contract term. Assume that Supplier Y does not have a substantive

substitution right (refer to section 2.1.3

Substantive substitution rights

).

Analysis:

The three fibres are identified assets because they are physically

distinct and explicitly specified in the contract.

Illustration 4 — Identified asset – capacity portion of an asset

Scenario A

Customer X enters into a five-year contract with Supplier Y for the right

to transport oil from Country A to Country B through Supplier Y’s pipeline.

The contract provides that Customer X will have the right to use of 95% of

the pipeline’s capacity throughout the term of the arrangement.

Analysis

: The capacity portion of the pipeline is an identified asset. While

95% of the pipeline’s capacity is not physically distinct from the remaining

capacity of the pipeline, it represents substantially all of the capacity of

the entire pipeline and thereby provides Customer X with the right to

obtain substantially all of the economic benefits from use of the pipeline.

Scenario B

Assume the same facts as in Scenario A, except that Customer X has the right

to use 60% of the pipeline’s capacity throughout the term of the arrangement.

Analysis

: The capacity portion of the pipeline is not an identified asset

because 60% of the pipeline’s capacity is less than substantially all of

the capacity of the pipeline. Customer X does not have the right to

obtain substantially all of the economic benefits from use of the pipeline.

Land easements or rights of way are rights to use, access or cross another

entity’s land for a specified purpose. For example, a land easement might be

obtained for the right to construct and operate a pipeline or other assets (e.g.,

railway line, utility pipes or telecommunication lines) over, under or through

an existing area of land or body of water while allowing the landowner continued

use of the land for other purposes (e.g., farming), as long as the landowner does

not interfere with the rights conveyed in the land easement. A land easement

may be perpetual or for a specified term. It may provide for exclusive or non-

exclusive use of the land and may be prepaid or paid over a defined term.

Perpetual easements are outside the scope of IFRS 16, as the definition of

a lease requires the contract to be for a period of time. Therefore, entities

must carefully evaluate easement contracts to determine whether the contract

is perpetual or for a period of time. Examples of contracts that may appear

perpetual but are term-based include:

•

Very long-term contracts (e.g., the FASB indicated in the Basis for

Conclusions (BC113) to ASC 842 that very long-term leases of land

(e.g., 999 years) are in the scope of ASC 842)

13 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

•

Contracts with a stated non-cancellable lease term that “automatically

renews” if the lessee pays a periodic renewal fee. This is an in-substance

fixed term contract with optional renewal periods

•

Contracts that define the period of use as the period over which the assets

are used (e.g., as long as natural gas flows through a gathering system) is

a fixed term contract (i.e., terminated when production ceases) rather than

a perpetual contract because the gas reserves will ultimately be depleted

When determining whether a contract for a land easement or right of way

is a lease, entities will need to assess whether there is an identified asset and

whether the customer obtains substantially all of the economic benefits of the

identified asset and has the right to direct the use of that asset throughout the

period of use.

In June 2019, the IFRS Interpretations Committee discussed a contract for

subsurface rights. In the contract described, a pipeline operator obtains the

right to place an oil pipeline in underground space for 20 years in exchange for

consideration. The contract specifies the exact location and dimensions (path,

width and depth) of the underground space within which the pipeline will be

placed. The landowner retains the right to use the surface of the land above

the pipeline, but it has no right to access or otherwise change the use of

the specified underground space throughout the 20-year period of use. The

customer has the right to perform inspection, repairs and maintenance work

(including replacing damaged sections of the pipeline when necessary).

The Committee noted the following in the agenda decision:

•

Paragraph 3 of IFRS 16 requires an entity to apply IFRS 16 to all leases,

with limited exceptions. In the contract described in the request, none of

the exceptions in paragraphs 3 and 4 of IFRS 16 apply (see 1.2 above). In

particular, the Committee noted that the underground space is tangible.

Accordingly, if the contract contains a lease, IFRS 16 applies to that lease.

If the contract does not contain a lease, the entity would then consider which

other IFRS standard applies.

•

Applying paragraph B9 of IFRS 16, to meet the definition of a lease, the

customer must have both:

• the right to obtain substantially all the economic benefits from use of an

identified asset throughout the period of use; and

• the right to direct the use of the identified asset throughout the period of

use.

•

The specified underground space is physically distinct from the remainder

of the land. The contract’s specifications include the path, width and depth

of the pipeline, thereby defining a physically distinct underground space.

The space being underground does not in itself affect whether it is an

identified asset — the specified underground space is physically distinct in

the same way that a specified area of space on the land’s surface would be

physically distinct. As the landowner does not have the right to substitute

the underground space throughout the period of use, the Committee

concluded that the specified underground space is an identified asset as

described in paragraphs B13–B20.

14 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

•

The customer has the right to obtain substantially all the economic benefits

from use of the specified underground space throughout the 20-year period

of use. The customer has exclusive use of the specified underground space

throughout that period of use.

•

The customer has the right to direct the use of the specified underground

space throughout the 20-year period of use because the customer has the

right to operate the asset throughout the period of use without the supplier

having the right to change those operating instructions. How and for what

purpose the specified underground space will be used (i.e., to locate the

pipeline with specified dimensions through which oil will be transported)

is predetermined in the contract. The customer has the right to operate

the specified underground space by having the right to perform inspection,

repairs and maintenance work. The customer makes all the decisions about

the use of the specified underground space that can be made during the 20-

year period of use.

Consequently, the Committee concluded that the contract described in the

request contains a lease as defined in IFRS 16. The customer would therefore

apply IFRS 16 in accounting for that lease.

2.1.3 Substantive substitution rights

Extract from IFRS 16

B14 Even if an asset is specified, a customer does not have the right to use

an identified asset if the supplier has the substantive right to substitute the

asset throughout the period of use. A supplier’s right to substitute an asset

is substantive only if both of the following conditions exist:

(a) the supplier has the practical ability to substitute alternative assets

throughout the period of use (for example, the customer cannot prevent

the supplier from substituting the asset and alternative assets are readily

available to the supplier or could be sourced by the supplier within

a reasonable period of time); and

(b) the supplier would benefit economically from the exercise of its right to

substitute the asset (ie the economic benefits associated with substituting

the asset are expected to exceed the costs associated with substituting

the asset).

B15 If the supplier has a right or an obligation to substitute the asset only

on or after either a particular date or the occurrence of a specified event,

the supplier’s substitution right is not substantive because the supplier does

not have the practical ability to substitute alternative assets throughout the

period of use.

B16 An entity’s evaluation of whether a supplier’s substitution right is

substantive is based on facts and circumstances at inception of the contract

and shall exclude consideration of future events that, at inception of the

contract, are not considered likely to occur. Examples of future events that,

at inception of the contract, would not be considered likely to occur and,

thus, should be excluded from the evaluation include:

(a) an agreement by a future customer to pay an above market rate for use

of the asset;

15 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

Extract from IFRS 16 (cont’d)

(b) the introduction of new technology that is not substantially developed at

inception of the contract;

(c) a substantial difference between the customer’s use of the asset, or the

performance of the asset, and the use or performance considered likely

at inception of the contract; and

(d) a substantial difference between the market price of the asset during

the period of use, and the market price considered likely at inception of

the contract.

B17 If the asset is located at the customer’s premises or elsewhere, the costs

associated with substitution are generally higher than when located at the

supplier’s premises and, therefore, are more likely to exceed the benefits

associated with substituting the asset.

B18 The supplier’s right or obligation to substitute the asset for repairs and

maintenance, if the asset is not operating properly or if a technical upgrade

becomes available does not preclude the customer from having the right to

use an identified asset.

B19 If the customer cannot readily determine whether the supplier has

a substantive substitution right, the customer shall presume that any

substitution right is not substantive.

Even if an asset is specified, a customer does not have the right to use an

identified asset if, at inception of the contract, a supplier has the substantive

right to substitute the asset throughout the period of use (i.e., the total period

of time that an asset is used to fulfil a contract with a customer, including the

sum of any non-consecutive periods of time). A supplier’s right to substitute

an asset is substantive when both of the following conditions are met:

•

The supplier has the practical ability to substitute alternative assets

throughout the period of use (e.g., the customer cannot prevent the supplier

from substituting an asset and alternative assets are readily available to

the supplier or could be sourced by the supplier within a reasonable period

of time).

•

The supplier would benefit economically from the exercise of its right to

substitute the asset (i.e., the economic benefits associated with substituting

the asset are expected to exceed the costs associated with substituting the

asset).

The IASB indicated in the Basis for Conclusions (BC113) that the conditions

above are intended to differentiate between substitution rights that result in

a supplier controlling the use of an asset, rather than the customer, and rights

that do not change the substance or character of the contract.

If the supplier has a right or an obligation to substitute the asset only on or after

either a particular date, or the occurrence of a specified event, the supplier’s

substitution right is not substantive because the supplier does not have the

practical ability to substitute alternative assets throughout the period of use.

An entity’s evaluation of whether a supplier’s substitution right is substantive

is based on facts and circumstances at inception of the contract. At inception

of the contract, an entity should not consider future events that are not likely

16 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

to occur. IFRS 16 provides the following examples of circumstances that,

at inception of the contract, are not likely to occur and, thus, are excluded

from the evaluation of whether a supplier’s substitution right is substantive

throughout the period of use:

•

An agreement by a future customer to pay an above market rate for use of

the asset

•

The introduction of new technology that is not substantially developed at

inception of the contract

•

A substantial difference between the customer’s use of the asset, or the

performance of the asset, and the use or performance considered likely at

inception of the contract

•

A substantial difference between the market price of the asset during the

period of use, and the market price considered likely at inception of the

contract

The requirement that a substitution right must benefit the supplier economically

in order to be substantive is a new concept. The IASB indicated in the Basis for

Conclusions (BC113) that, in many cases, it will be clear that the supplier will not

benefit from the exercise of a substitution right because of the costs associated

with substituting an asset. The physical location of the asset may affect the costs

associated with substituting the asset. For example, if an asset is located at the

customer’s premises, the cost associated with substituting it is generally higher

than the cost of substituting a similar asset located at the supplier’s premises.

However, simply because a supplier concludes that the cost of substitution is not

significant does not automatically mean that it would economically benefit from

the right of substitution.

IFRS 16 further clarifies that a customer should presume that a supplier’s

substitution right is not substantive when the customer cannot readily determine

whether the supplier has a substantive substitution right. This requirement is

intended to clarify that a customer is not expected to exert undue effort to

provide evidence that a substitution right is not substantive. We believe that the

Board did not include a similar provision for suppliers, because they should have

sufficient information to make a determination of whether a substitution right is

substantive.

Contract terms that allow or require a supplier to substitute alternative assets

only when the underlying asset is not operating properly (e.g., a normal

warranty provision) or when a technical upgrade becomes available do not

create a substantive substitution right.

17 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

Illustration 5 — Substitution rights

Scenario A

Assume that an electronic data storage provider (supplier) provides services

through a centralised data centre, that involve the use of a specified server

(Server No. 9). The supplier maintains many identical servers in a single

accessible location and determines, at inception of the contract, that it is

permitted to and can easily substitute another server without the customer’s

consent throughout the period of use. Further, the supplier would benefit

economically from substituting an alternative asset, because doing this

would allow the supplier to optimise the performance of its network at only

a nominal cost. In addition, the supplier has made clear that it has negotiated

this right of substitution as an important right in the arrangement, and the

substitution right affected the pricing of the arrangement.

Analysis:

The customer does not have the right to use an identified asset

because, at the inception of the contract, the supplier has the practical

ability to substitute the server and would benefit economically from such

a substitution. However, if the customer could not readily determine whether

the supplier had a substantive substitution right (e.g., there is insufficient

transparency into the supplier’s operations), the customer would presume

the substitution right is not substantive and conclude that there is an

identified asset.

Scenario B

Assume the same facts as in Scenario A except that Server No. 9 is

customised, and the supplier does not have the practical ability to substitute

the customised asset throughout the period of use. Additionally, it is unclear

whether the supplier would benefit economically from sourcing a similar

alternative asset.

Analysis

: Because the supplier does not have the practical ability to substitute

the asset and there is no evidence of economic benefit to the supplier for

substituting the asset, the substitution right is non-substantive, and Server

No. 9 would be an identified asset. In this case, neither of the conditions of

a substitution right is met. As a reminder, both conditions must be met for

the supplier to have a substantive substitution right.

18 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

2.1.4 Right to obtain substantially all of the economic benefits from use of

the identified asset

Extract from IFRS 16

B21 To control the use of an identified asset, a customer is required to have

the right to obtain substantially all of the economic benefits from use of the

asset throughout the period of use (for example, by having exclusive use of

the asset throughout that period). A customer can obtain economic benefits

from use of an asset directly or indirectly in many ways, such as by using,

holding or sub-leasing the asset. The economic benefits from use of an asset

include its primary output and by-products (including potential cash flows

derived from these items), and other economic benefits from using the asset

that could be realised from a commercial transaction with a third party.

B22 When assessing the right to obtain substantially all of the economic

benefits from use of an asset, an entity shall consider the economic benefits

that result from use of the asset within the defined scope of a customer’s right

to use the asset (see paragraph B30). For example:

(a)

if a contract limits the use of a motor vehicle to only one particular

territory during the period of use, an entity shall consider only the

economic benefits from use of the motor vehicle within that territory,

and not beyond.

(b)

if a contract specifies that a customer can drive a motor vehicle only up

to a particular number of miles during the period of use, an entity shall

consider only the economic benefits from use of the motor vehicle for

the permitted mileage, and not beyond.

B23 If a contract requires a customer to pay the supplier or another party

a portion of the cash flows derived from use of an asset as consideration,

those cash flows paid as consideration shall be considered to be part of

the economic benefits that the customer obtains from use of the asset. For

example, if the customer is required to pay the supplier a percentage of sales

from use of retail space as consideration for that use, that requirement does

not prevent the customer from having the right to obtain substantially all of

the economic benefits from use of the retail space. This is because the cash

flows arising from those sales are considered to be economic benefits that

the customer obtains from use of the retail space, a portion of which it then

pays to the supplier as consideration for the right to use that space.

To control the use of an identified asset, a customer is required to have the right

to obtain substantially all of the economic benefits from use of the identified

asset throughout the period of use (e.g., by having exclusive use of the asset

throughout that period). The term ‘substantially all’ is not defined in IFRS 16.

However, entities might consider the term similarly to how it is used in IAS 17

in the context of lease classification.

A customer can obtain economic benefits either directly or indirectly (e.g., by

using, holding or subleasing the asset). Economic benefits include the asset’s

primary outputs (i.e., goods or services) and any by-products (e.g., renewable

energy credits that are generated through the use of the asset), including

potential cash flows derived from these items. Economic benefits also include

benefits from using the asset that could be realised from a commercial

transaction with a third party (e.g., subleasing the asset). However, economic

benefits arising from construction or ownership of the identified asset (e.g., tax

A lease conveys the

right to control the use

of an identified asset

for a period of time

in exchange for

consideration.

19 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

benefits related to excess tax depreciation and investment tax credits) are not

considered economic benefits derived from the use of the asset. Therefore, they

are not considered when assessing whether a customer has the right to obtain

substantially all of the economic benefits.

When assessing whether the customer has the right to obtain substantially all

of the economic benefits from the use of an asset, an entity must consider the

economic benefits that result from use of the asset within the defined scope of

the customer’s right to use the asset. A right that solely protects the supplier’s

interest in the underlying asset (e.g., limits on the number of miles a customer

can drive a supplier’s vehicle) does not, in and of itself, prevent the customer

from obtaining substantially all of the economic benefits from use of the asset

and, therefore, are not considered when assessing whether a customer has

the right to obtain substantially all of the economic benefits.

If a contract requires a customer to pay the supplier or another party a

portion of the cash flows derived from the use of an asset as consideration

(e.g., a percentage of sales from the use of retail space), those cash flows are

considered to be economic benefits that the customer derives from the use

of the asset.

2.1.5 Right to direct the use of the identified asset

Extract from IFRS 16

B24 A customer has the right to direct the use of an identified asset

throughout the period of use only if either:

(a) the customer has the right to direct how and for what purpose the asset is

used throughout the period of use (as described in paragraphs B25–B30);

or

(b) the relevant decisions about how and for what purpose the asset is used

are predetermined and:

(i) the customer has the right to operate the asset (or to direct others

to operate the asset in a manner that it determines) throughout the

period of use, without the supplier having the right to change those

operating instructions; or

(ii) the customer designed the asset (or specific aspects of the asset) in

a way that predetermines how and for what purpose the asset will be

used throughout the period of use.

Requiring a customer to have the right to direct the use of an identified asset is

a change from IFRIC 4. A contract may have met IFRIC 4’s control criterion if, for

example, the customer obtained substantially all of the output of an underlying

asset and met certain price-per-unit-of-output criteria even though the customer

did not have the right to direct the use of the identified asset as contemplated by

IFRS 16. Under IFRS 16, such arrangements would no longer be considered leases.

A customer has the right to direct the use of an identified asset throughout the

period of use when either:

•

The customer has the right to direct how and for what purpose the asset is

used throughout the period of use.

•

The relevant decisions about how and for what purpose an asset is used

are predetermined and the customer either: (1) has the right to operate

20 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

the asset, or to direct others to operate the asset in a manner that it

determines, throughout the period of use, without the supplier having the

right to change those operating instructions; or (2) designed the asset, or

specific aspects of the asset, in a way that predetermines how and for what

purpose the asset will be used throughout the period of use.

2.1.5.1 The right to direct how and for what purpose an asset is used

throughout the period of use

Extract from IFRS 16

B25 A customer has the right to direct how and for what purpose the asset

is used if, within the scope of its right of use defined in the contract, it can

change how and for what purpose the asset is used throughout the period of

use. In making this assessment, an entity considers the decision-making rights

that are most relevant to changing how and for what purpose the asset is used

throughout the period of use. Decision-making rights are relevant when they

affect the economic benefits to be derived from use. The decision-making

rights that are most relevant are likely to be different for different contracts,

depending on the nature of the asset and the terms and conditions of the

contract.

B26 Examples of decision-making rights that, depending on the

circumstances, grant the right to change how and for what purpose the asset

is used, within the defined scope of the customer’s right of use, include:

(a) rights to change the type of output that is produced by the asset (for

example, to decide whether to use a shipping container to transport

goods or for storage, or to decide upon the mix of products sold from

retail space);

(b) rights to change when the output is produced (for example, to decide

when an item of machinery or a power plant will be used);

(c) rights to change where the output is produced (for example, to decide

upon the destination of a truck or a ship, or to decide where an item of

equipment is used); and

(d) rights to change whether the output is produced, and the quantity of that

output (for example, to decide whether to produce energy from a power

plant and how much energy to produce from that power plant).

B27 Examples of decision-making rights that do not grant the right to change

how and for what purpose the asset is used include rights that are limited to

operating or maintaining the asset. Such rights can be held by the customer

or the supplier. Although rights such as those to operate or maintain an asset

are often essential to the efficient use of an asset, they are not rights to direct

how and for what purpose the asset is used and are often dependent on the

decisions about how and for what purpose the asset is used. However, rights

to operate an asset may grant the customer the right to direct the use of the

asset if the relevant decisions about how and for what purpose the asset is

used are predetermined (see paragraph B24(b)(i)).

A customer has the right to direct the use of an identified asset whenever it has

the right to direct how and for what purpose the asset is used throughout the

period of use (i.e., it can change how and for what purpose the asset is used

throughout the period of use). How and for what purpose an asset is used is

21 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

a single concept (i.e., ‘how’ an asset is used is not assessed separately from

‘for what purpose’ an asset is used).

When evaluating whether a customer has the right to change how and for what

purpose the asset is used throughout the period of use, the focus should be on

whether the customer has the decision-making rights that will most affect the

economic benefits that will be derived from the use of the asset. The decision-

making rights that are most relevant are likely to depend on the nature of the

asset and the terms and conditions of the contract.

The IASB indicated in the Basis for Conclusions (BC120) that decisions about

how and for what purpose an asset is used can be viewed as similar to the

decisions made by a board of directors. Decisions made by a board of directors

about the operating and financing activities of an entity are generally the most

relevant decisions rather than the actions of individuals in implementing those

decisions.

IFRS 16 provides the following examples of decision-making rights that grant

the right to change how and for what purpose an asset is used:

•

The right to change the type of output that is produced by the asset

(e.g., deciding whether to use a shipping container to transport goods

or for storage, deciding on the mix of products sold from a retail unit)

•

The right to change when the output is produced (e.g., deciding when

an item of machinery or a power plant will be used)

•

The right to change where the output is produced (e.g., deciding on the

destination of a truck or a ship, deciding where a piece of equipment is

used or deployed)

•

The right to change whether the output is produced and the quantity of that

output (e.g., deciding whether to produce energy from a power plant and

how much energy to produce from that power plant)

IFRS 16 also provides the following examples of decision-making rights that

do not grant the right to change how and for what purpose an asset is used:

•

Maintaining the asset

•

Operating the asset

Although the decisions about maintaining and operating the asset are often

essential to the efficient use of that asset, the right to make those decisions,

in and of itself, does not result in the right to change how and for what purpose

the asset is used throughout the period of use.

The customer does not need the right to operate the underlying asset to have

the right to direct its use. That is, the customer may direct the use of an asset

that is operated by the supplier’s personnel. However, as discussed below, the

right to operate an asset will often provide the customer the right to direct the

use of the asset if the relevant decisions about how and for what purpose the

asset is used are predetermined.

22 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

How we see it

We believe that the assessment of whether a contract is or contains a lease

will be straightforward in most arrangements. However, judgement may

be required in applying the definition of a lease to certain arrangements.

For example, in contracts that include significant services, we believe that

determining whether the contract conveys the right to direct the use of an

identified asset may be challenging.

2.1.5.2 The relevant decisions about how and for what purpose an asset is

used are predetermined

In some cases, it will not be clear whether the customer has the right to direct

the use of the identified asset. This could be the case when the most relevant

decisions about how and for what purpose an asset is used are predetermined

by contractual restrictions on the use of the asset (e.g., the decisions about the

use of the asset are agreed to by the customer and the supplier in negotiating

the contract, and those decisions cannot be changed). This could also be the

case when the most relevant decisions about how and for what purpose an

asset is used are, in effect, predetermined by the design of the asset. The IASB

indicated in the Basis for Conclusions (BC121) that it would expect decisions

about how and for what purpose an asset is used to be predetermined in few

cases. In such cases, a customer has the right to direct the use of an identified

asset throughout the period of use when the customer either:

•

Has the right to operate the asset, or direct others to operate the asset in

a manner it determines, throughout the period of use without the supplier

having the right to change those operating instructions

•

Designed the asset (or specific aspects of the asset) in a way that

predetermines how and for what purpose the asset will be used throughout

the period of use

Significant judgement may be required to assess whether a customer designed

the asset (or specific aspects of the asset) in a way that predetermines how

and for what purpose the asset will be used throughout the period of use.

See Example 9 in

IFRS 16 Leases Illustrative Examples

, for an example of

the evaluation of whether a customer designed the asset in a way that

predetermines how and for what purpose the asset will be used throughout

the period of use.

In January 2020, the IFRS Interpretations Committee issued an agenda decision

about whether the customer has the right to direct the use of a ship throughout

the five-year term of a contract. In the fact pattern described in the request:

a.

There is an identified asset (the ship) applying paragraphs B13–B20 of

IFRS 16

b.

The customer has the right to obtain substantially all of the economic

benefits from use of the ship throughout the five-year period of use applying

paragraphs B21–B23 of IFRS 16.

c.

Many, but not all, decisions about how, and for what purpose, the ship is

used are predetermined in the contract. The customer has the right to

make the remaining decisions about how, and for what purpose, the ship

is used throughout the period of use (i.e., the order of the voyages to the

designated ports during the contract term). In the fact pattern described in

23 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

the request, the customer has determined that this decision-making right is

relevant because it affects the economic benefits to be derived from use of

the ship

d.

The supplier operates and maintains the ship throughout the period of use

The Committee observed that, in the fact pattern described in the request,

because not all relevant decisions about how and for what purpose the ship is

used are predetermined, the customer considers paragraph B24(a) of IFRS 16

in assessing whether it has the right to direct the use of the ship.

Paragraph B24(a) specifies that a customer has the right to direct the use of an

identified asset throughout the period of use if it has ‘the right to direct how and

for what purpose the asset is used throughout the period of use (as described

in paragraphs B25–B30)’. To have the right to direct how and for what purpose

the asset is used, within the scope of its right of use defined in the contract,

the customer must be able to change how and for what purpose the asset is

used throughout the period of use (paragraph B25). In assessing whether that

is the case, an entity considers rights to make decisions during the period of use

that are most relevant to changing how and for what purpose the asset is used

throughout that period. Decision-making rights are relevant when they affect the

economic benefits to be derived from use (paragraph B25). An entity does not

consider decisions that are predetermined before the period of use unless the

conditions in paragraph B24(b)(ii) exist (paragraph B29).

The Committee observed that, in the fact pattern described in the request,

the customer has the right to direct how and for what purpose the ship is used

throughout the period of use. Within the scope of its right of use defined in the

contract, the customer can change how and for what purpose the ship is used

(i.e., the customer can change the order of the voyages to the designated ports

during the contract term). Despite many decisions about how and for what

purpose the ship is used being predetermined, such decisions define the scope

of the customer’s right of use. Therefore, in this fact pattern, the customer has

the right to make the decisions that are most relevant to changing how and for

what purpose the ship is used.

The Committee also observed that, although the operation and maintenance of

the ship are essential to its efficient use, the supplier’s decisions in this regard

do not give it the right to direct how and for what purpose the ship is used.

The Committee concluded that, in the fact pattern described in the request, the

customer has the right to direct the use of the ship throughout the period of use.

Consequently, the contract contains a lease. The Committee concluded that the

principles and requirements in IFRS 16 provide an adequate basis for an entity

to determine whether the contract described in the request contains a lease and,

therefore, decided not to add the matter to its standard-setting agenda.

24 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

2.1.5.3 Specifying the output of an asset before the period of use

Extract from IFRS 16

B28 The relevant decisions about how and for what purpose the asset is

used can be predetermined in a number of ways. For example, the relevant

decisions can be predetermined by the design of the asset or by contractual

restrictions on the use of the asset.

B29 In assessing whether a customer has the right to direct the use of an

asset, an entity shall consider only rights to make decisions about the use of

the asset during the period of use, unless the customer designed the asset

(or specific aspects of the asset) as described in paragraph B24(b)(ii).

Consequently, unless the conditions in paragraph B24(b)(ii) exist, an entity

shall not consider decisions that are predetermined before the period of use.

For example, if a customer is able only to specify the output of an asset before

the period of use, the customer does not have the right to direct the use of

that asset. The ability to specify the output in a contract before the period of

use, without any other decision-making rights relating to the use of the asset,

gives a customer the same rights as any customer that purchases goods or

services.

If a customer can only specify the output from an asset before the beginning

of the period of use and cannot change that output throughout the period

of use, the customer does not have the right to direct the use of that asset

unless it designed the asset, or specific aspects of the asset, as contemplated

in paragraph B24(b)(ii) of IFRS 16. If the customer did not design the asset or

aspects of it, the customer’s ability to specify the output in a contract that does

not give it any other relevant decision-making rights relating to the use of the

asset (e.g., the ability to change when, whether and what output is produced)

gives the customer the same rights as any customer that purchases goods or

service

s

in an arrangement (i.e., a contract that does not contain a lease).

2.1.5.4 Protective rights

Extract from IFRS 16

B30 A contract may include terms and conditions designed to protect the

supplier’s interest in the asset or other assets, to protect its personnel, or

to ensure the supplier’s compliance with laws or regulations. These are

examples of protective rights. For example, a contract may (i) specify the

maximum amount of use of an asset or limit where or when the customer can

use the asset, (ii) require a customer to follow particular operating practices,

or (iii) require a customer to inform the supplier of changes in how an asset

will be used. Protective rights typically define the scope of the customer’s

right of use but do not, in isolation, prevent the customer from having the

right to direct the use of an asset.

A supplier’s protective rights, in isolation, do not prevent the customer from

having the right to direct the use of an identified asset. Protective rights typically

define the scope of the customer’s right to use the asset without removing the

customer’s right to direct the use of the asset. Protective rights are intended

to protect a supplier’s interests (e.g., interests in the asset, its personnel,

compliance with laws and regulations) and might take the form of a specified

maximum amount of asset use, a restriction on where an asset may be used or

a requirement to follow specific operating instructions.

25 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

Illustration 6 — Right to direct the use of an asset

Customer X enters into a contract with Supplier Y to use a vehicle for a three-

year period. The vehicle is identified in the contract. Supplier Y cannot

substitute another vehicle unless the specified vehicle is not operational

(e.g., it breaks down).

Under the contract:

•

Customer X operates the vehicle (i.e., drives the vehicle) or directs others

to operate the vehicle (e.g., hires a driver).

•

Customer X decides how to use the vehicle (within contractual limitations,

discussed below). For example, throughout the period of use, Customer X

decides where the vehicle goes, as well as when or whether it is used

and what it is used for. Customer X can also change these decisions

throughout the period of use.

•

Supplier Y prohibits certain uses of the vehicle (e.g., moving it overseas)

and modifications to the vehicle to protect its interest in the asset.

Analysis

: Customer X has the right to direct the use of the identified vehicle

throughout the period of use. Customer X has the right to direct the use of

the vehicle because it has the right to change how the vehicle is used, when

or whether the vehicle is used, where the vehicle goes and what the vehicle

is used for.

Supplier Y’s limits on certain uses for the vehicle and modifications to it are

considered protective rights that define the scope of Customer X’s use of

the asset, but do not affect the assessment of whether Customer X directs

the use of the asset.

26 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

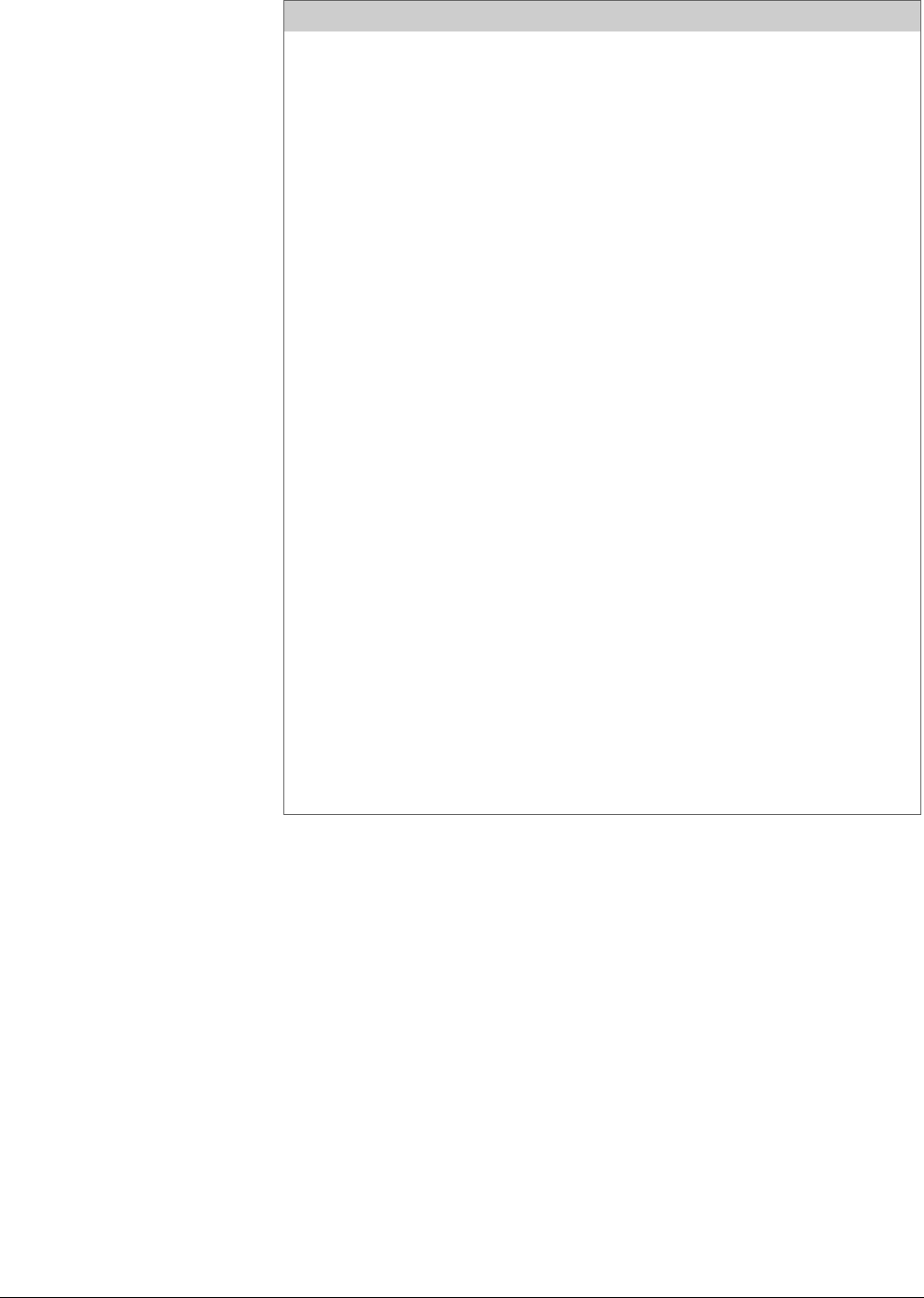

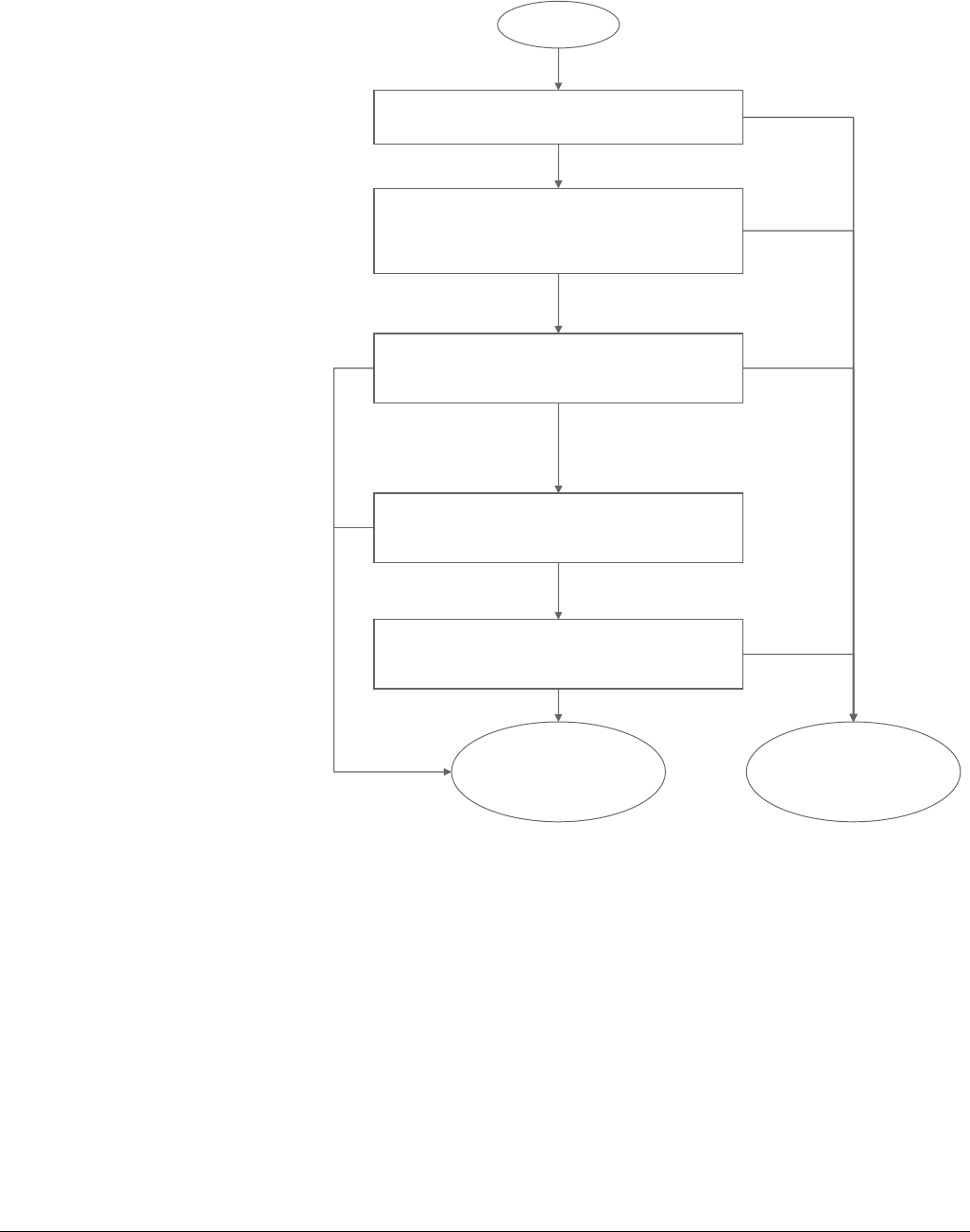

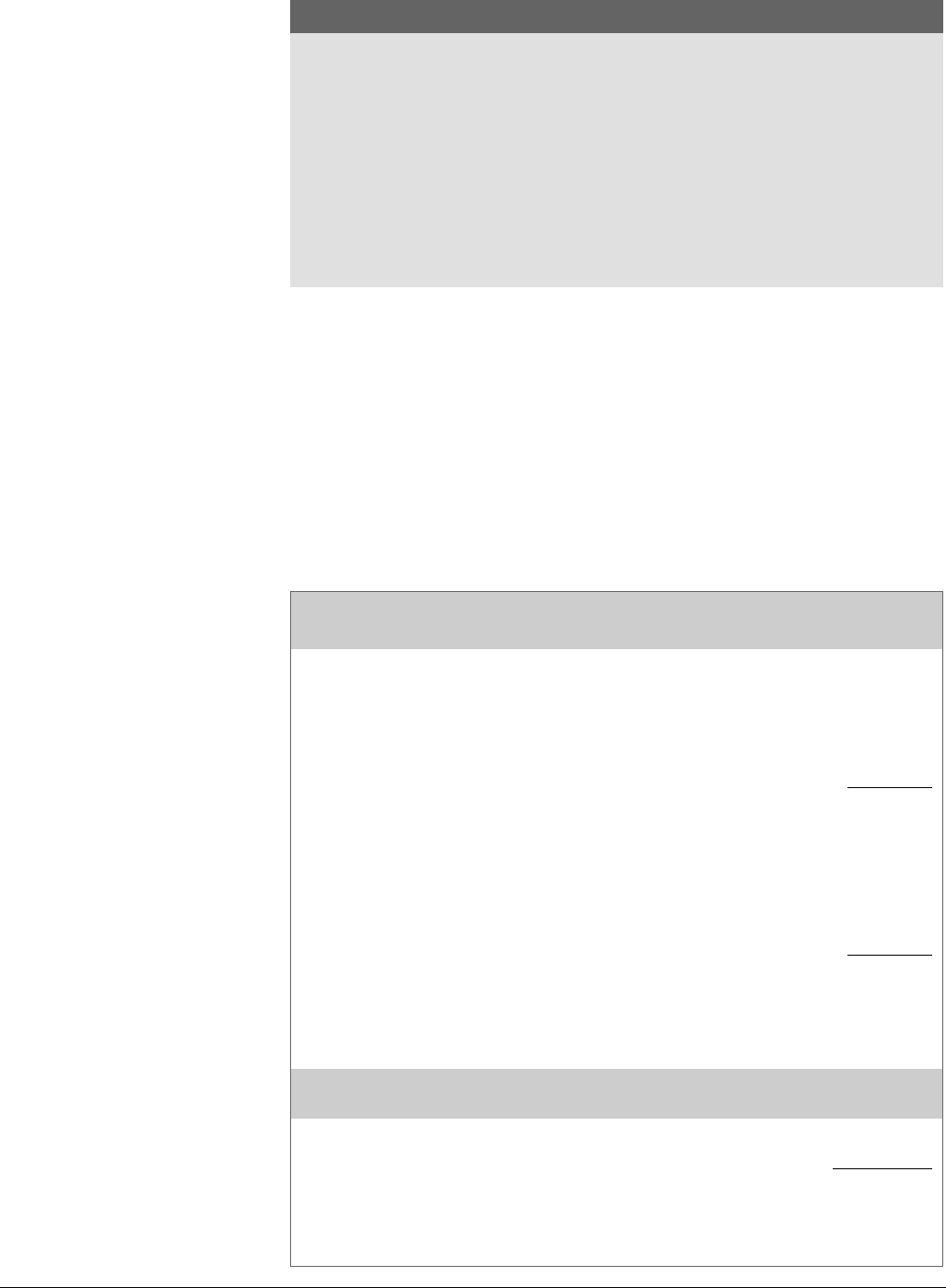

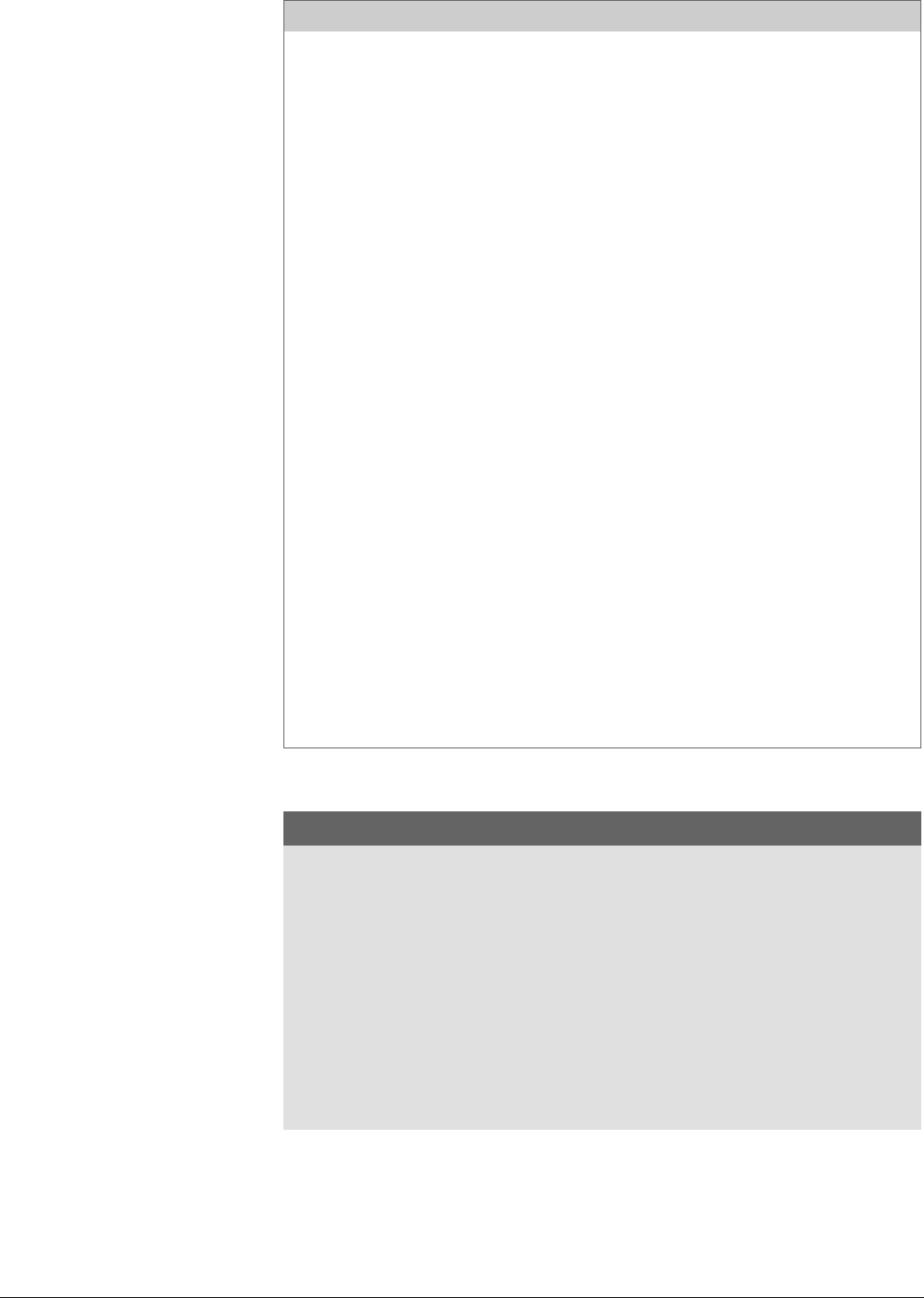

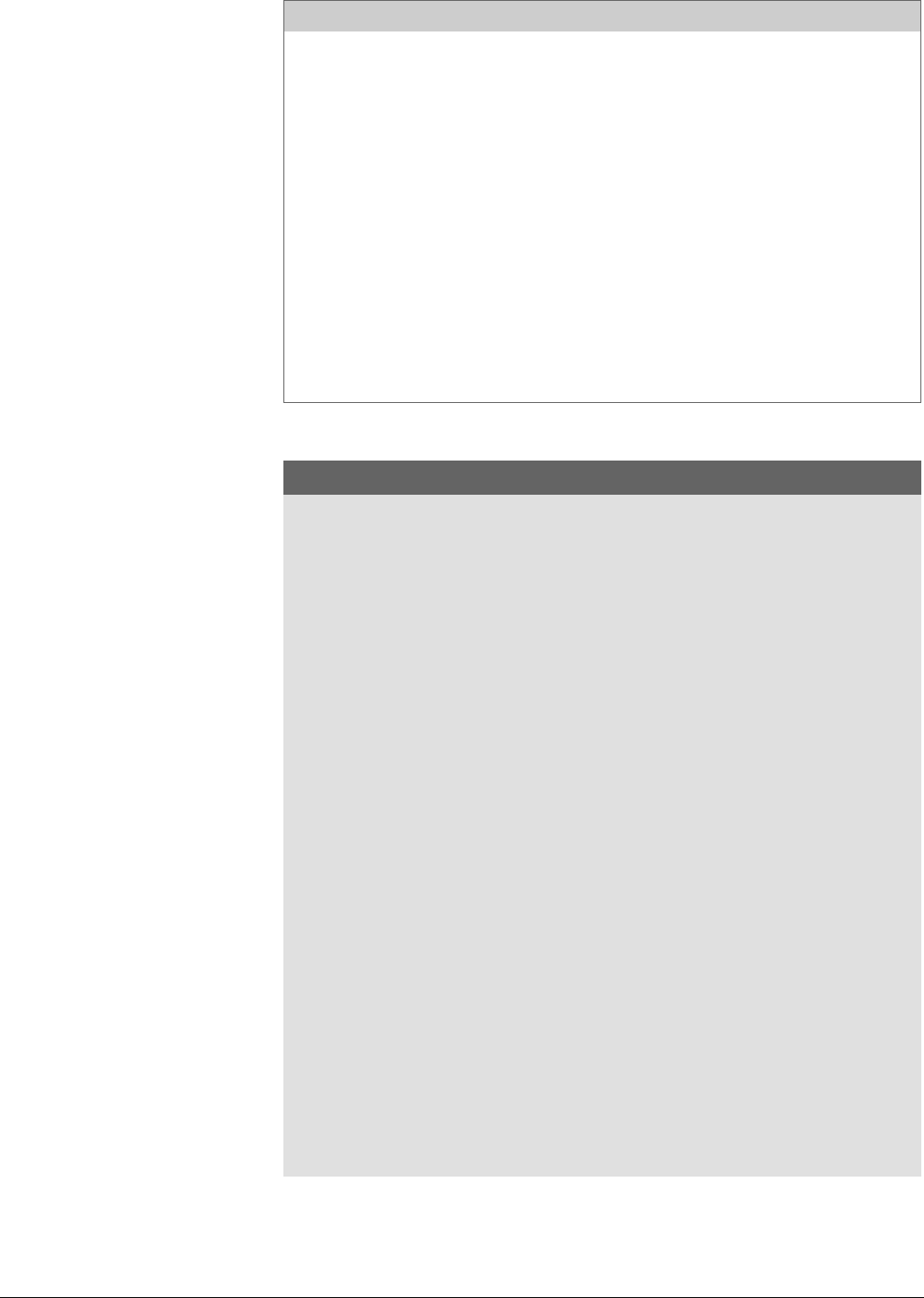

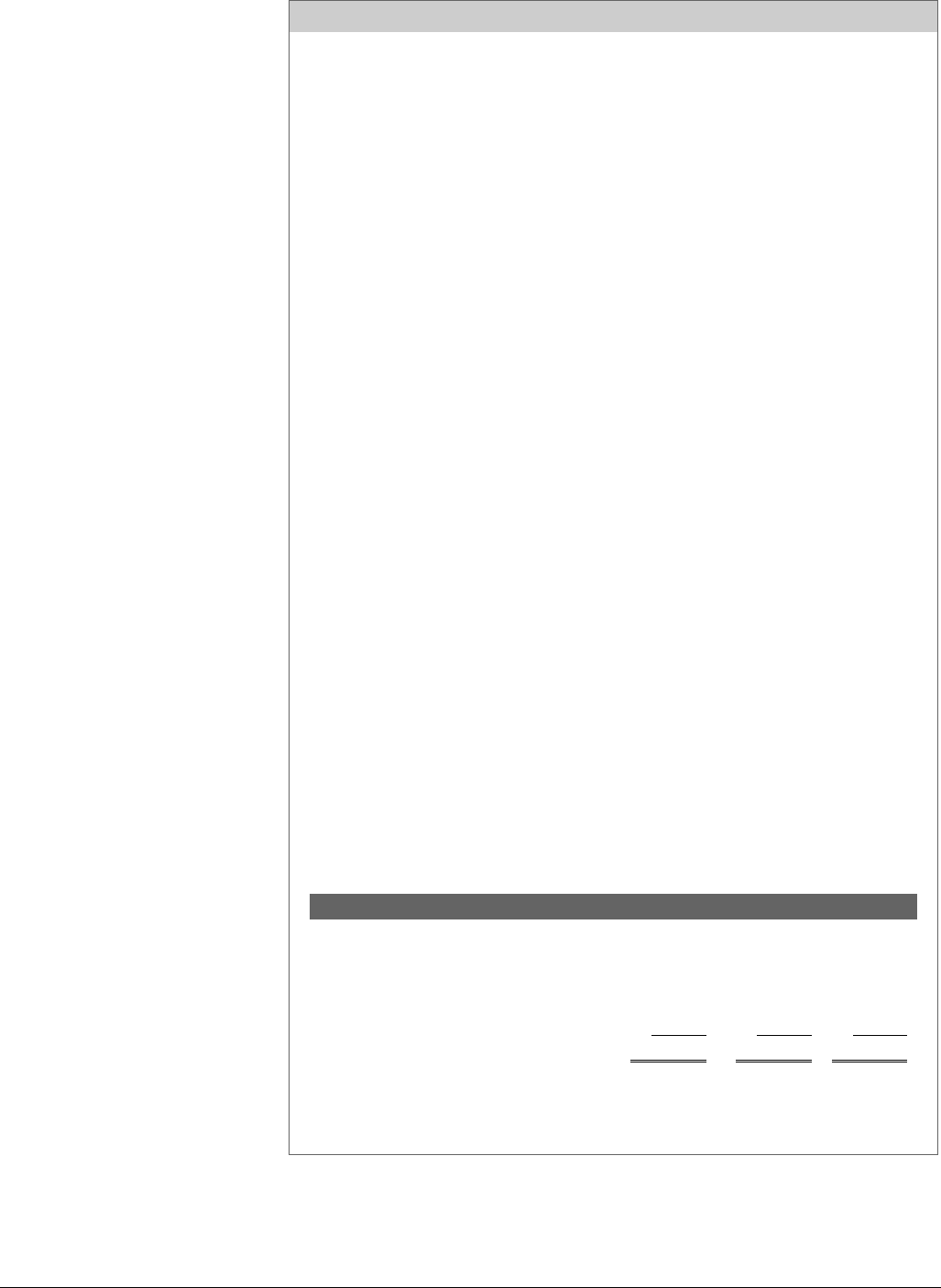

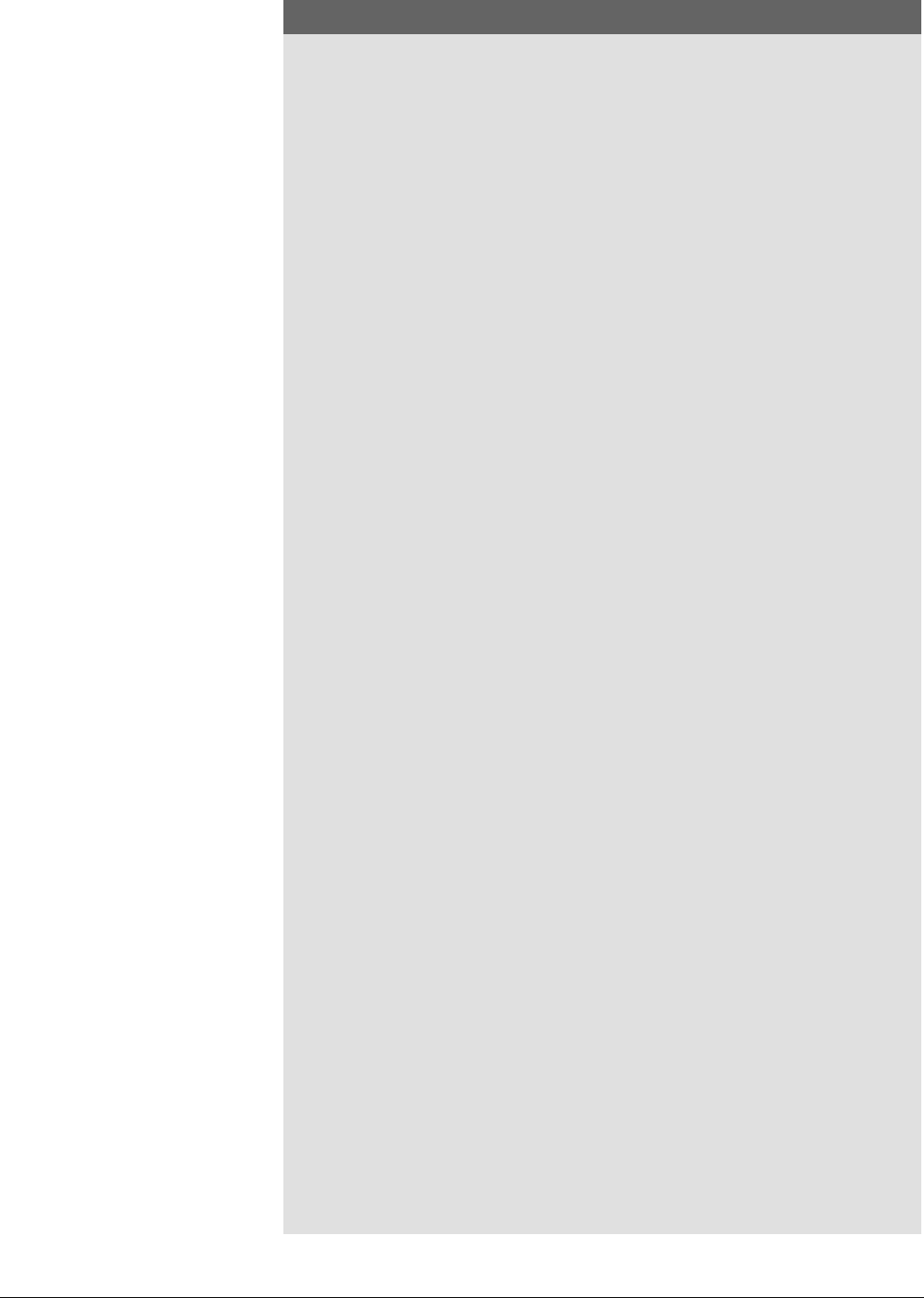

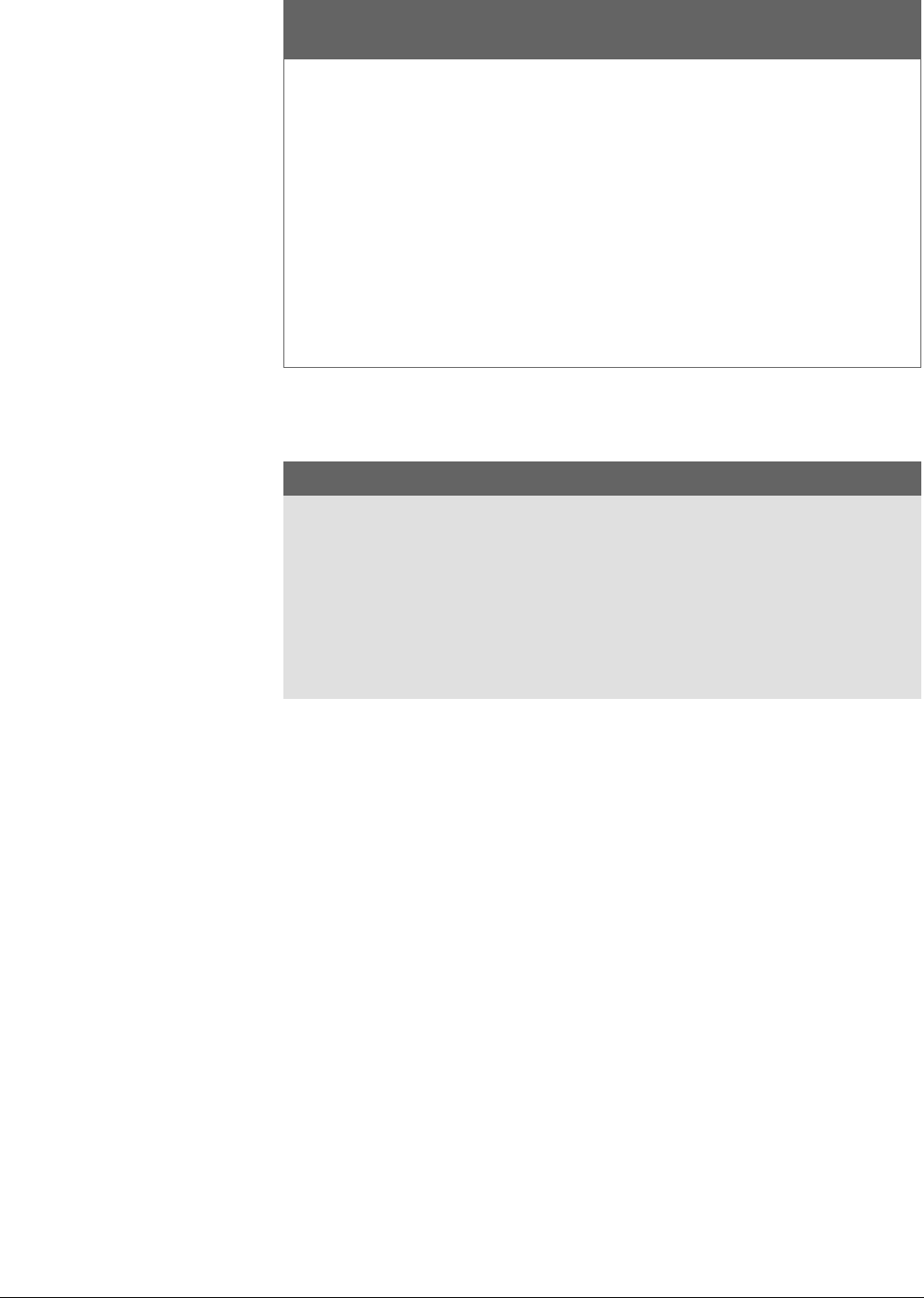

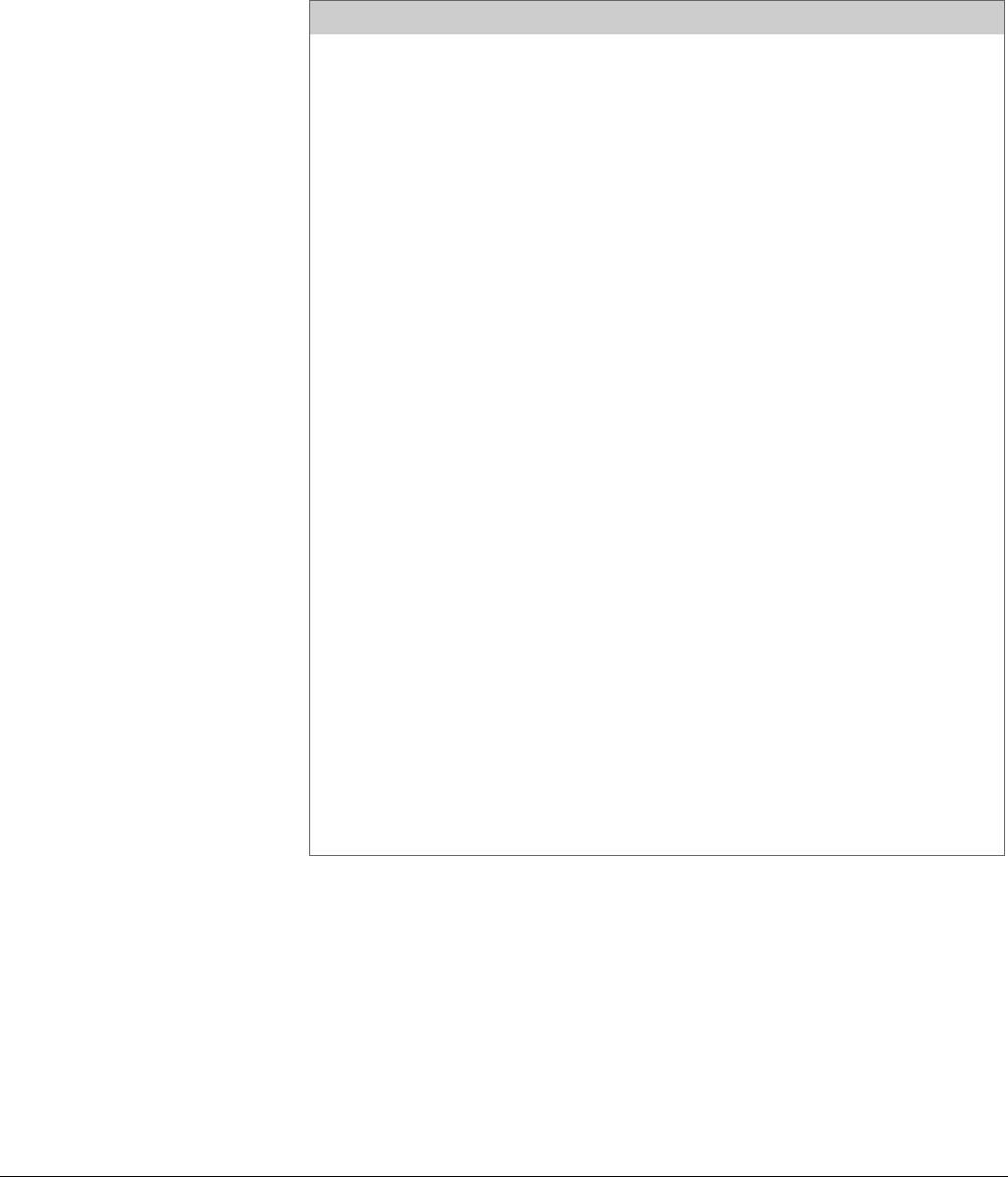

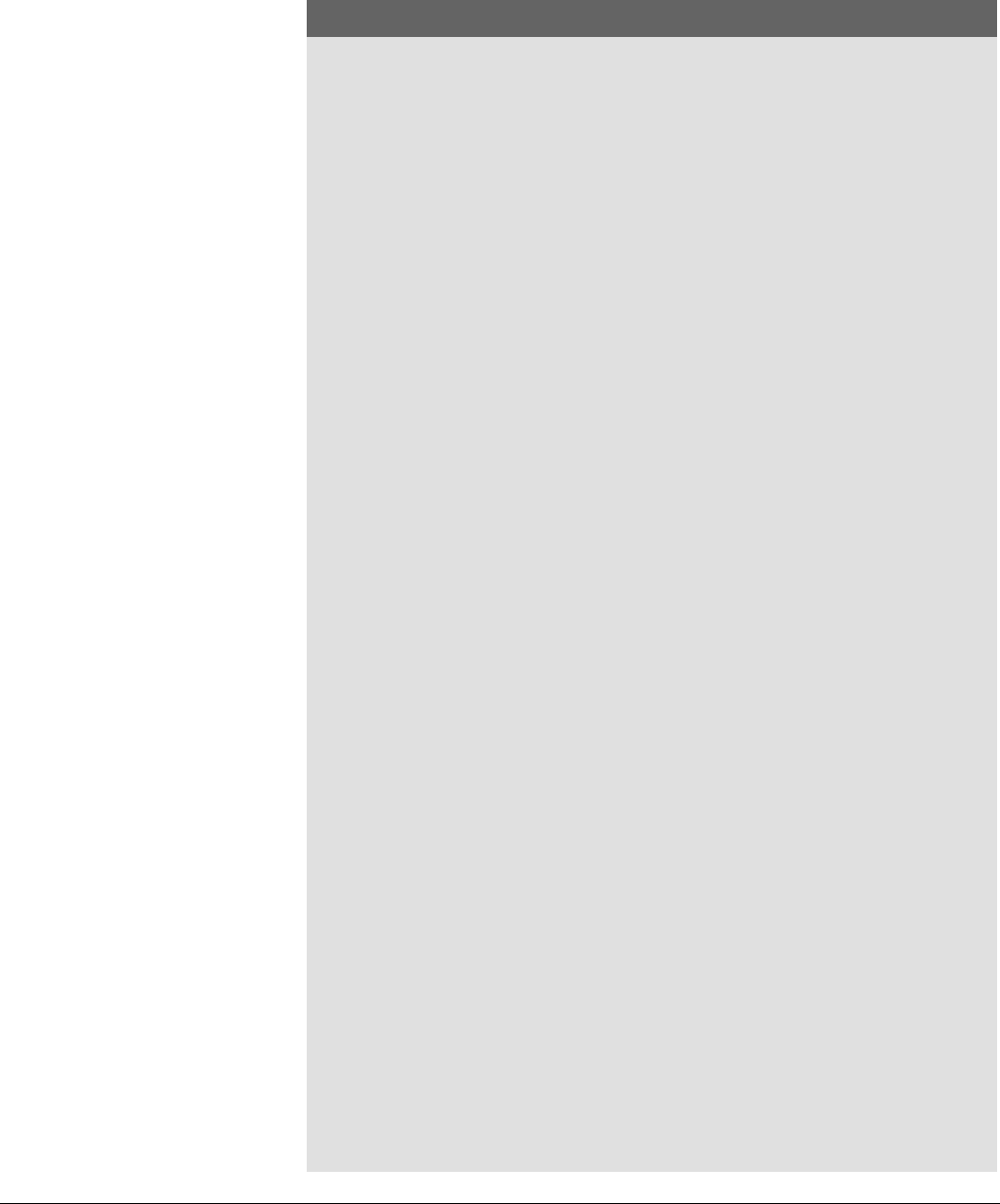

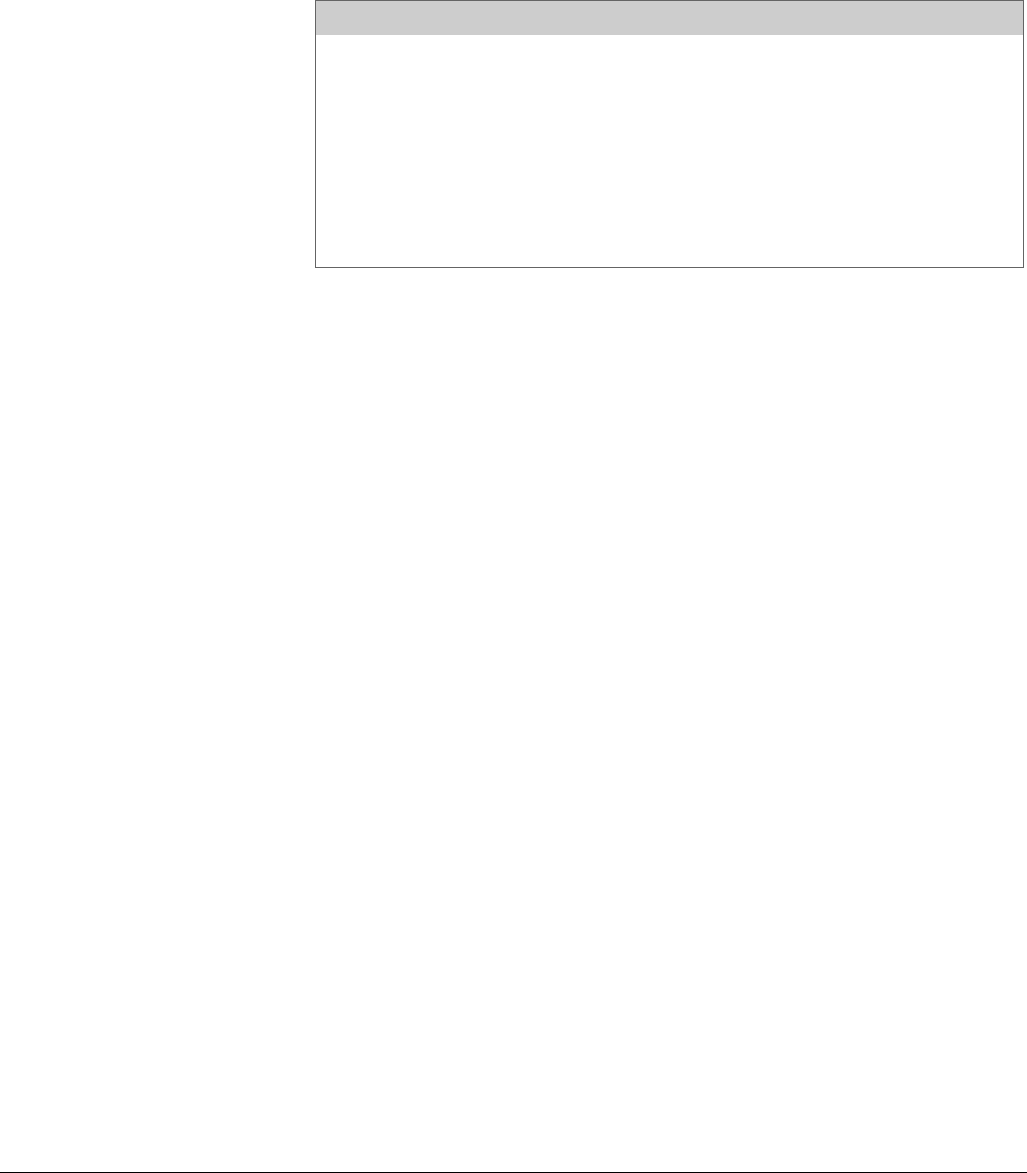

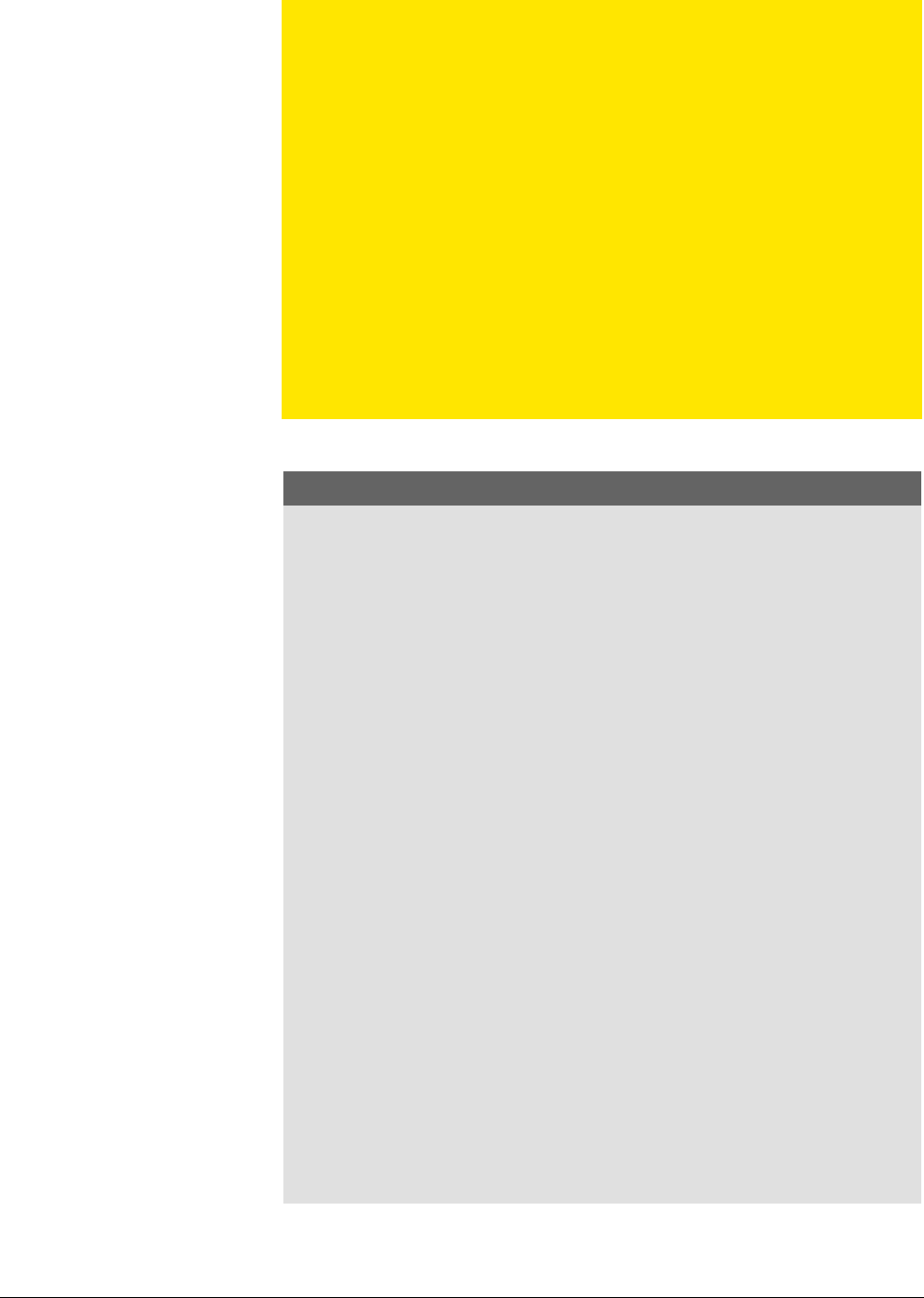

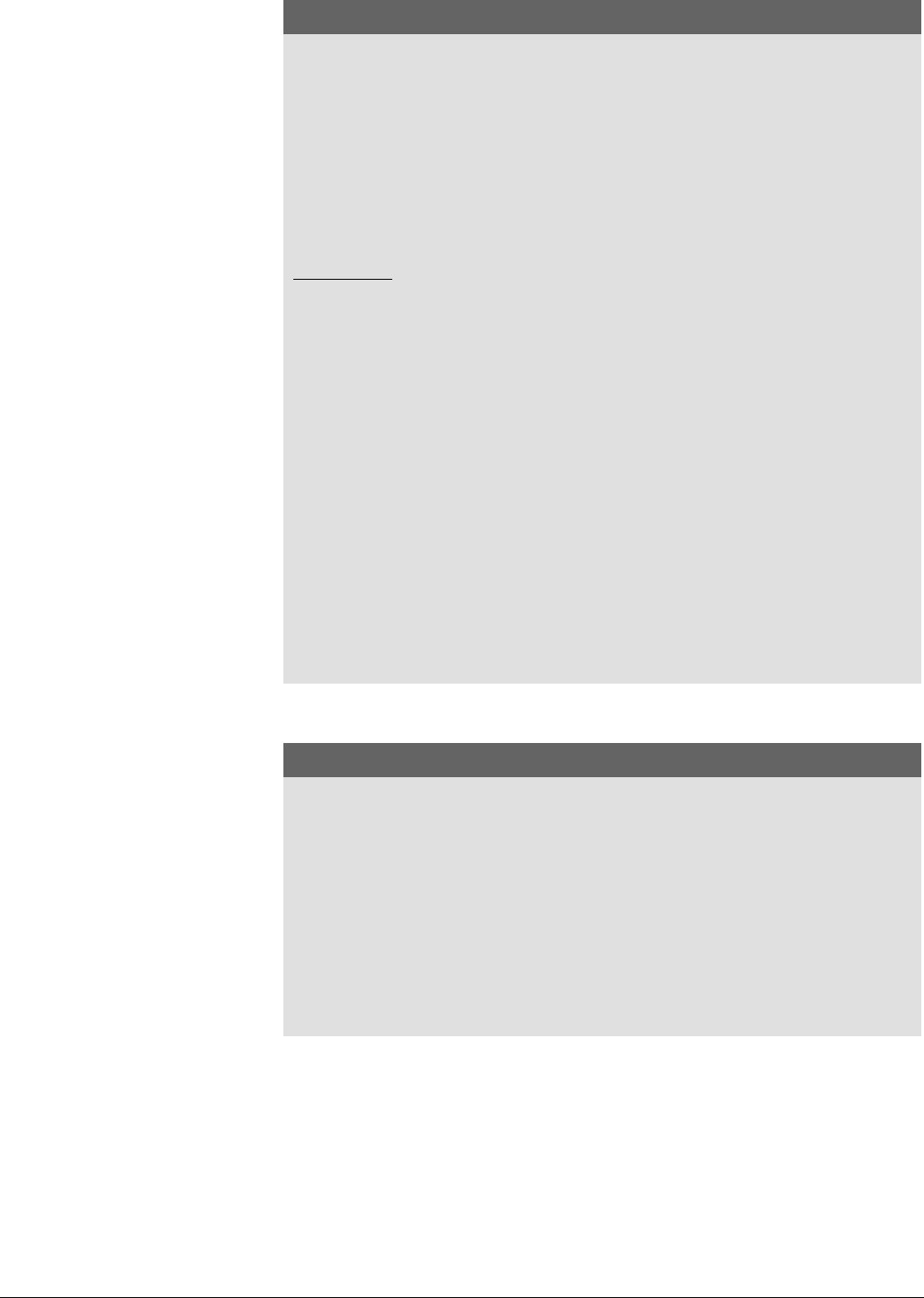

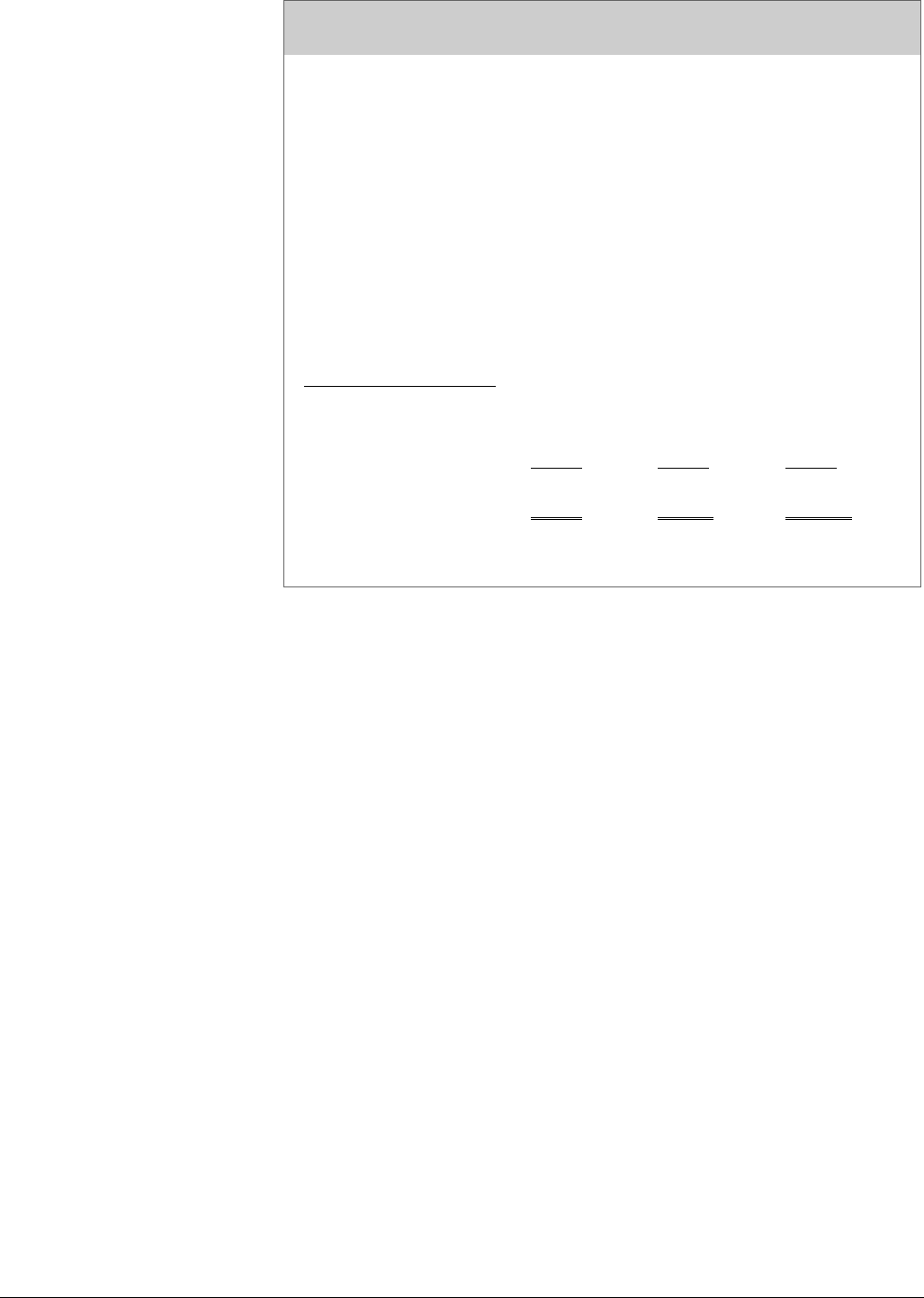

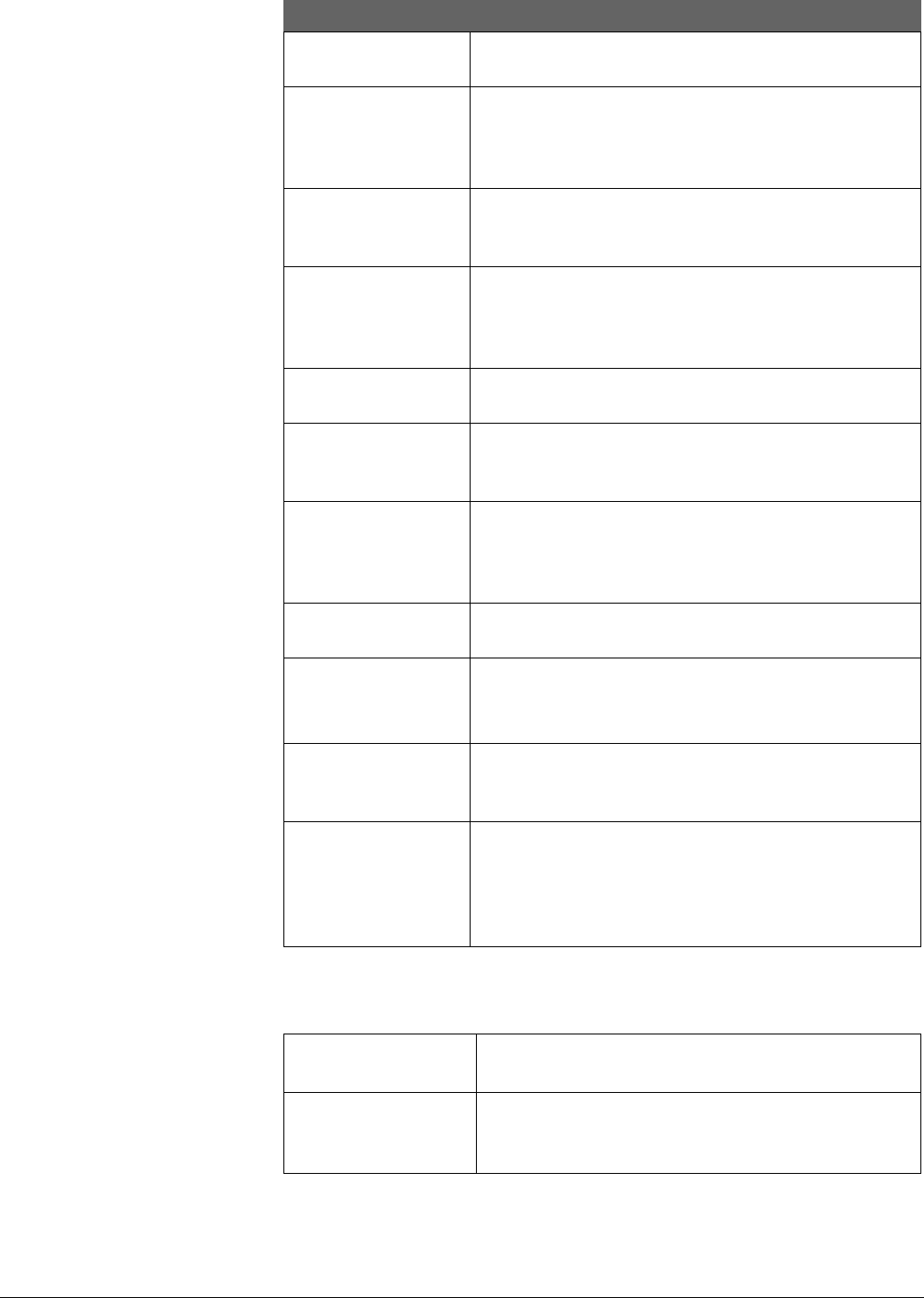

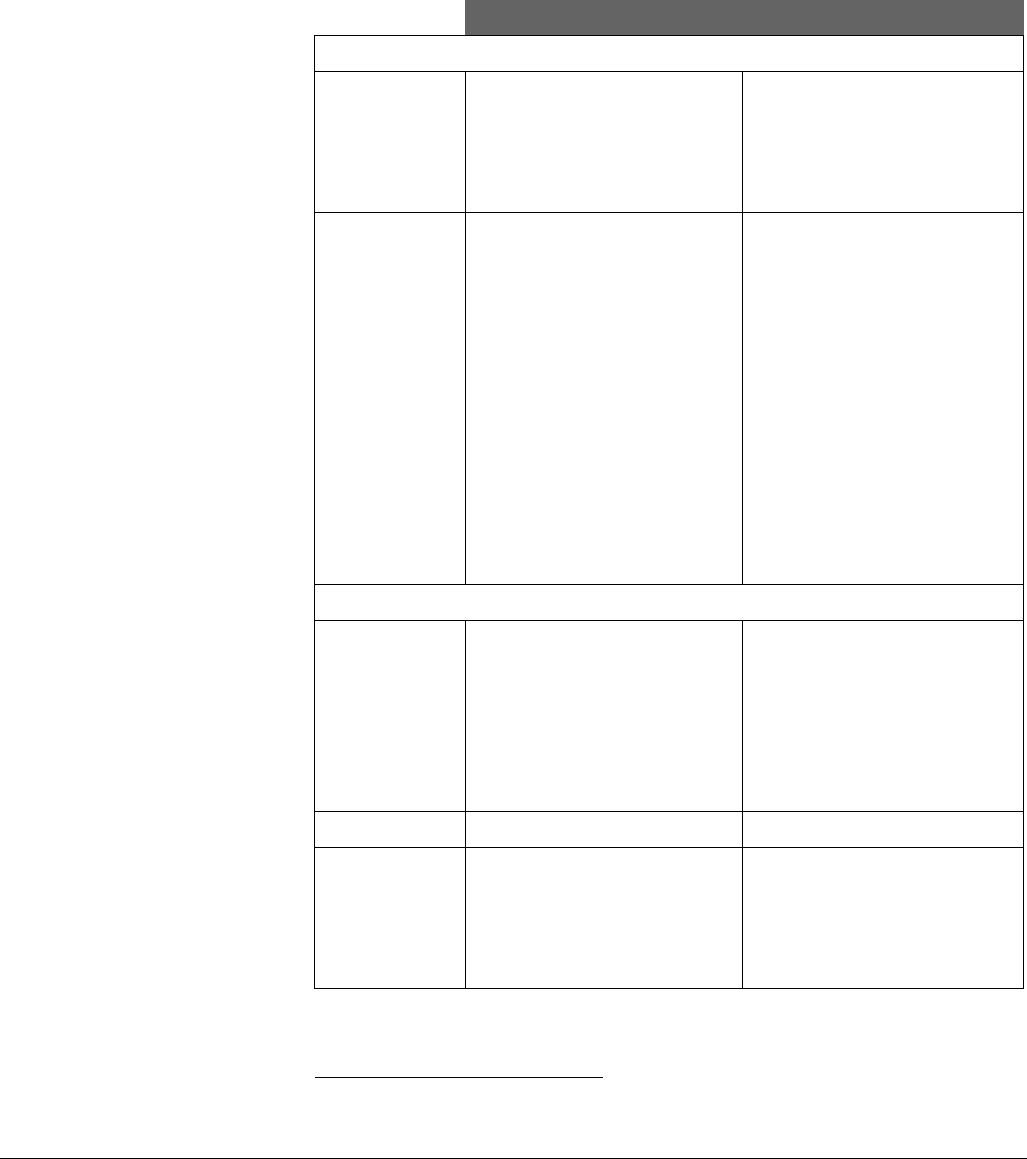

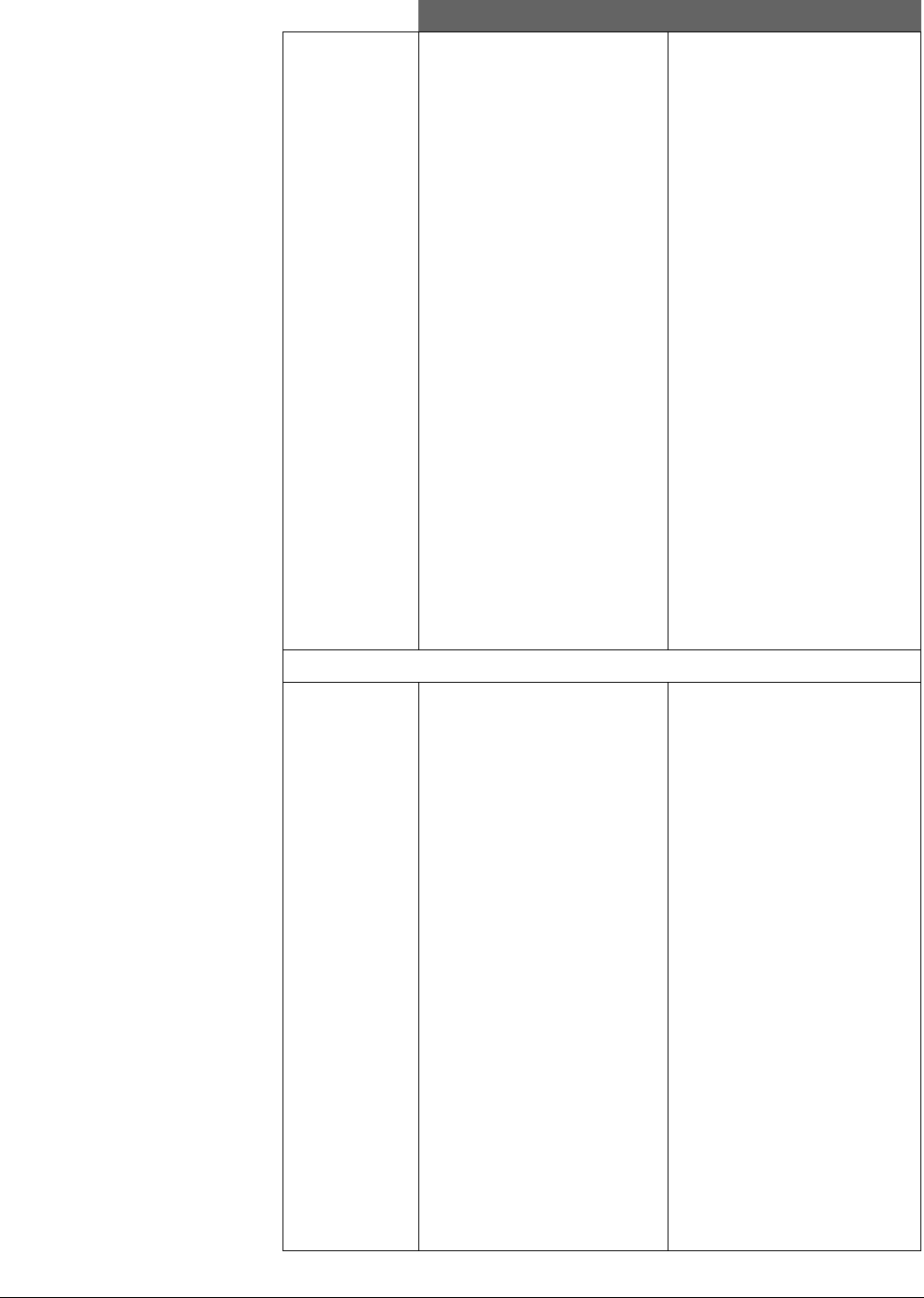

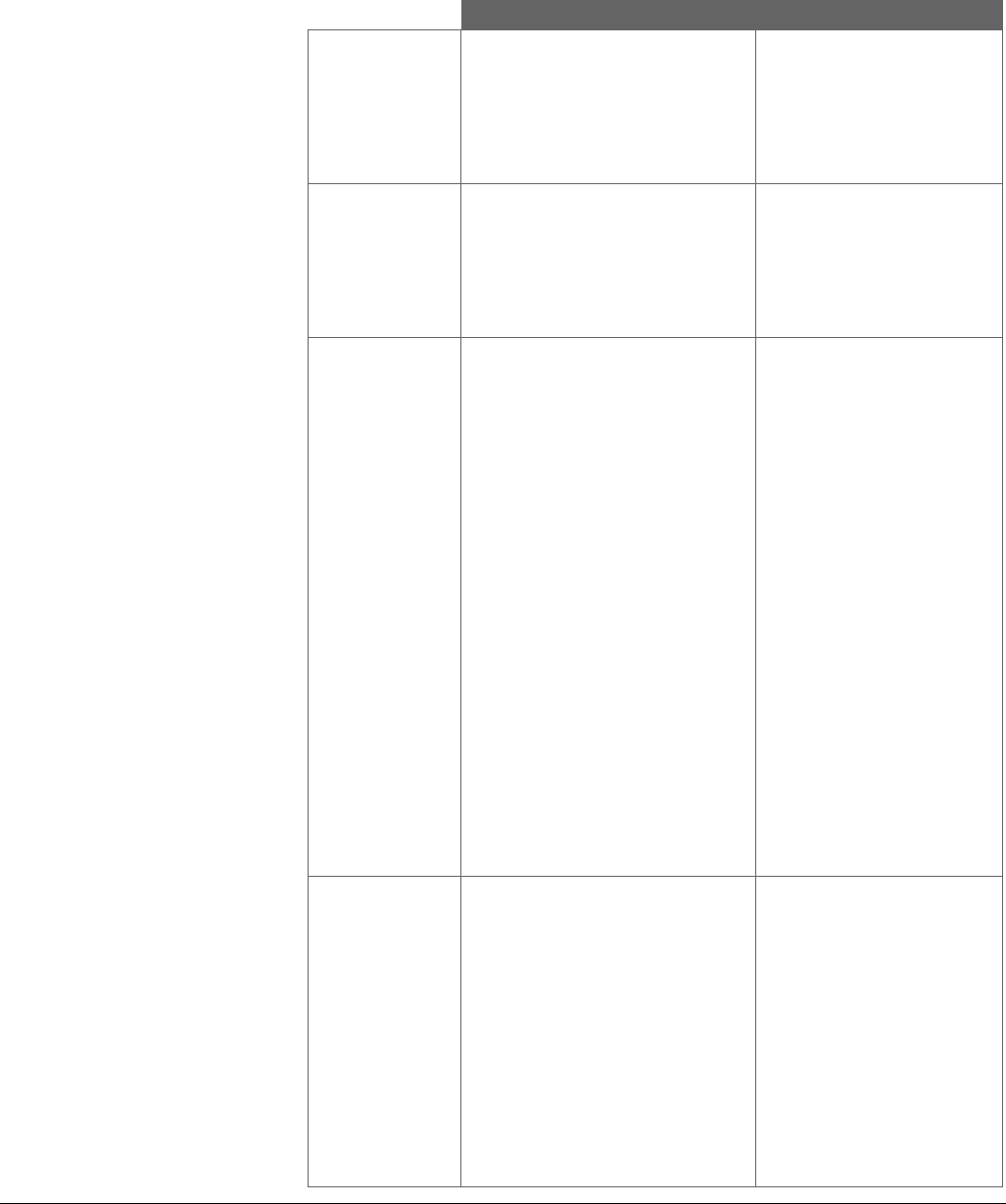

2.1.6 Flowchart

The following flowchart is included in IFRS 16’s application guidance and depicts

the decision-making process for determining whether an arrangement is or

contains a lease:

Start

Is there an identified asset?

Consider paragraphs B13-B20.

(refer to section 1.2.2, Identified asset)

Does the customer have the right to obtain substantially all of

the economic benefits from use of the asset throughout the

period of use? Consider paragraphs B21-B23. (refer to

section 1.2.3.1, Right to obtain substantially all of the

economic benefits from the use of the identified asset)

Does the customer or the supplier have the right to direct how

and for what purpose the identified asset is used throughout

the period of use? Consider paragraphs B25-B30. (refer to

section 1.2.3.2, Right to direct the use of the identified asset)

Does the customer have the right to operate the asset

throughout the period of use without the supplier having the

right to change those operating instructions? (refer to section

1.2.3.2, Right to direct the use of the identified asset)

Did the customer design the asset (or specific aspects of the

asset) in a way that predetermines how and for what purpose

the asset will be used throughout the period of use? (refer to

section 1.2.3.2, Right to direct the use of the identified asset)

The contract contains

a lease

The contract does not

contain a lease

Yes

Yes

Neither; how and for what purpose the asset

will be used is predetermined

(refer to section 1.2.3.2, Right to direct the

use of the identified asset)

No

Yes

No

No

Supplier

No

Customer

Yes

27 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

2.1.7 Reassessment of the contract

Extract from IFRS 16

11 An entity shall reassess whether a contract is, or contains, a lease only if

the terms and conditions of the contract are changed.

Under IFRS 16, an entity reassesses whether a contract is or contains a lease

only if the terms and conditions of the contract are changed. A change in the

terms and conditions of a contract does not include the exercise of an option

(e.g., renewal option) or failure to exercise an option that is included in the

contract.

Refer to Appendix D for a summary of lessee and lessor reassessment and

remeasurement requirements.

2.2 Identifying and separating lease and non-lease components

of a contract and allocating contract consideration

2.2.1 Identifying and separating lease components of a contract

Extract from IFRS 16

12 For a contract that is, or contains, a lease, an entity shall account for each

lease component within the contract as a lease separately from non-lease

components of the contract, unless the entity applies the practical expedient

in paragraph 15. Paragraphs B32–B33 set out guidance on separating

components of a contract.

B32 The right to use an underlying asset is a separate lease component if

both:

(a) the lessee can benefit from use of the underlying asset either on its own

or together with other resources that are readily available to the lessee.

Readily available resources are goods or services that are sold or leased

separately (by the lessor or other suppliers) or resources that the lessee

has already obtained (from the lessor or from other transactions or

events); and

(b) the underlying asset is neither highly dependent on, nor highly

interrelated with, the other underlying assets in the contract. For

example, the fact that a lessee could decide not to lease the underlying

asset without significantly affecting its rights to use other underlying

assets in the contract might indicate that the underlying asset is not highly

dependent on, or highly interrelated with, those other underlying assets.

B33 A contract may include an amount payable by the lessee for activities and

costs that do not transfer a good or service to the lessee. For example, a lessor

may include in the total amount payable a charge for administrative tasks,

or other costs it incurs associated with the lease, that do not transfer a good

or service to the lessee. Such amounts payable do not give rise to a separate

component of the contract, but are considered to be part of the total

consideration that is allocated to the separately identified components of

the contract.

16 Unless the practical expedient in paragraph 15 is applied, a lessee shall

account for non-lease components applying other applicable Standards.

B55 When a lease includes both land and buildings elements, a lessor shall

assess the classification of each element as a finance lease or an operating

lease separately applying paragraphs 62–66 and B53–B54. In determining

An entity reassesses

whether a contract

contains a lease only if

the terms and conditions of

the contract are changed.

28 December 2020 Applying IFRS - A closer look at IFRS 16 Leases

Extract from IFRS 16 (cont’d)

whether the land element is an operating lease or a finance lease, an

important consideration is that land normally has an indefinite economic life.

B56 Whenever necessary in order to classify and account for a lease of land

and buildings, a lessor shall allocate lease payments (including any lump-sum

upfront payments) between the land and the buildings elements in proportion

to the relative fair values of the leasehold interests in the land element and

buildings element of the lease at the inception date. If the lease payments

cannot be allocated reliably between these two elements, the entire lease is

classified as a finance lease, unless it is clear that both elements are operating

leases, in which case the entire lease is classified as an operating lease.

B57 For a lease of land and buildings in which the amount for the land element

is immaterial to the lease, a lessor may treat the land and buildings as a single