ENGG 401 Sample Midterm #3

Sample Questions for ENGG 401 Section A2 Midterm #3

© MGLipsett 2007

The questions in this document are in a format similar to what will appear on midterm #3,

with 20 multiple-choice questions and 25 true-false questions. Multiple choice questions are

weighted 2.5 marks each. True-false questions are worth 2 marks each.

The test will cover chapters 7, 8 and 9 of the course text, lectures 18 to 32 inclusive, and

other material distributed as part of the course or posted on the website. The test will be

open-book and open notes (hard copy only). Calculators are allowed (but no devices with

communications features enabled.) You should be able to complete this test in less than fifty

minutes.

Answers are given at the end of the document.

Questions 1 to 20: Multiple Choice

1) For the following set of future values of an engineering project, start-up occurs right at the

beginning of year 3.

Year

Future

Value

0 -105

1 -85

2 -55

3 25

4 25

5 28

6 35

7 45

8 45

9 48

10 49

What is the simple payback period for this project?

a) 2 years.

b) 5 years.

c) 6 years.

d) 7 years.

e) 9 years.

2) For the following cash flow series, which of the statements is true?

Year Future Value

0 $200.00

1 $200.00

2 $200.00

a) The NPV is $561.60 at a discount rate of 6%.

b) The NPV is $556.65 at a discount rate of 8%.

c) The IRR is 9.81%.

d) The payback is 2 years.

e) None of the above.

Page 1 of 10

ENGG 401 Sample Midterm #3

3) Which statement about project management is not true?

a) Projects involve change.

b) Projects entail risk.

c) Projects have definite objectives and schedules.

d) Project management is the same as operations management.

e) Project payback is calculated differently than payback for a general investment.

4) If the nominal interest rate is 8%, and the inflation rate is 3%, then the inflation corrected

interest rate is:

a) 3.00%

b) 3.15%

c) 4.85%

d) 5.00%

e) 8.00%

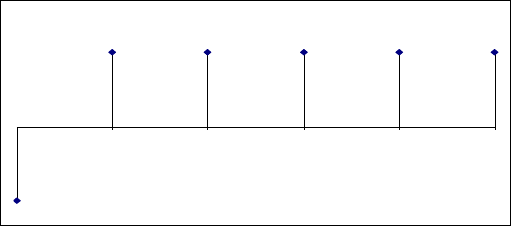

5) For the following cash flow diagram,

Cash Flow Diagram

-$50.00

$50.00 $50.00 $50.00 $50.00 $50.00

01234

5

the future value of this series of sum at the end of year five, for an interest rate of 5%, is:

a) $166.47

b) $200.00

c) $212.47

d) $340.10

e) None of the above.

6) Your company currently spends $10,000.00 per year to rent a light commercial shop

facility. This cost inflates by 2% per year. For a nominal return rate of 6%, what is the

present value of the annual rental cost two years from now?

a) $9,259.52

b) $9622.64

c) $10,392.00

d) $10,404.00

e) None of the above.

7) You are considering an investment that has a 60% probability of an NPV of $30,000 and

a 40% probability that it will have an NPV of $20,000. Your expectation is that it will have an

NPV of at least $25,000. What should you do?

a) Make the investment.

b) Reject the investment.

Page 2 of 10

ENGG 401 Sample Midterm #3

8) Which statement is true about valuation?

a) EBIT for small companies includes only basic salary.

b) Market focus is on past performance.

c) Regulators try to achieve a balance between openness and fairness.

d) Stock values are changed by interest rates, profitability, and prospectus.

e) None of the above.

9) Why should the results of an investment analysis be judged skeptically?

a) Analyses are precise but not necessarily accurate.

b) Forecasts are influenced by individual judgment, which may be faulty.

c) Investments are not always mutually exclusive of the rest of the business.

d) Assumptions may be faulty.

e) All of the above.

10) What is the Benefit-Cost Ratio of the following cash flow series?

i= 10%

Year n FV PV

0 -1000 -1000

1 300 272.7273

2 300 247.9339

3 300 225.3944

4 300 204.904

5 300 186.2764

NPV 137.236

a) 0.137

b) 1.137

c) 1.37

d) 1.50

e) None of the above.

11) The City of Edmonton is planning to expand its public transit service. Which option

should it choose?

Option A B C D

PW

benefits

$700 $340 $750 $950

PW costs $300 $350 $400 $500

BCR 2.33 0.97 1.88 1.90

a) Option A

b) Option B

c) Option C

d) Option D

e) None of the above.

12) We sell money at a price that offsets which factors?

a) Liquidity, availability, safety and exchange rate.

b) Liquidity, availability, safety and durability

c) Liability, inflation, risk, and durability

d) Liquidity, inflation, security and exchange rate.

e) Illiquidity, availability, scarcity, and durability.

Page 3 of 10

ENGG 401 Sample Midterm #3

13) Which statement about equivalence is correct?

a) Equivalence of a sum at one point in time compared to another sum at another point

in time depends on the interest rate.

b) Different sums at different points in time can be equivalent to each other

c) In some circumstances, a future cash flow series can be equivalent to future cash

flow series.

d) All of the above.

e) None of the above.

14) Which statement is not true about risk?

a) All investments have an element of risk.

b) Risk is the likelihood of an event times the consequence.

c) Risk is a factor in setting interest rate.

d) High risk in an investment can be managed through contingencies, lowering the

hurdle rate interest rate, and mitigation tactics.

e) In general, investments in equity have more risk than investments in debt.

15) What is the breakeven capital cost for Project B (benefit $200/yr) compared to Project A

(benefit $300/yr) if the interest rate is 10%?

Year n A B

0 $-1000 ?

1 to 5 $300 $200

a) -$137.23

b) -$620.92

c) -$745.87

d) -$900.00

e) -$1,137.23

16) Which statement is true about Present Worth?

a) Present Worth is the comparable equivalent value at the present time of a future

sum, or a set of future sums, independent of discount rate.

b) Present worth analysis compares the net present value of multiple mutually inclusive

options.

c) Present worth includes all the incomes and expenditures, including costs before the

present time.

d) Present Worth Analysis is done to maximize the NPV of a combination of financing

and investment activities.

e) None of the above.

17) Capitalized cost:

a) is a special kind of present worth analysis that chooses between alternatives with

different durations.

b) is the NPV of a perpetual series of cash flows.

c) is a cash flow series that allows the principal to be withdrawn every year and the

amortization will always remain.

d) is also called a perturbuity.

e) is the future sum needed to provide a perpetual series of cash flows that will support

a capital project.

Page 4 of 10

ENGG 401 Sample Midterm #3

18) Internal Rate of Return is used:

a) To determine the interest rate at which benefits of a project are equivalent to its

costs.

b) To determine which investment to choose when one of two alternatives must be

chosen.

c) To determine the interest rate for an investment that yields no income.

d) To choose an investment that necessary to preserve the operation of the business.

e) To justify a “lost-leader” project of a strategic nature.

For Questions 19 and 20, consider the following future cash flow series.

Year n FV

0 -$700.00

1 $0.00

2 $150.00

3 $300.00

4 $450.00

19) The present value of future cash flow series is represented by which expression?

a) P = -700 + 150(P|A,i,4)

b) P = -700 + 150(G|A,i,4)

c) P = -700(F|P,I,4) + 150(G|P,i,4)

d) P = -700(A|P,i,4) + 150(A|G,i,4)

e) P = -700 + 150(P|G,i,4)

20) What is the approximate IRR?

a) 7.5%

b) 7.9%

c) 8.0%

d) 8.1%

e) 8.5%

True or False:

21) Interest rate, rate of return, and discount rate all have the same meaning.

22) An investment is worthwhile provided that the BCR is less than zero.

23) Inflation is exactly equal to the nominal interest rate minus the real interest rate.

24) Unclaimed capital costs are carried forward into a subsequent year at their discounted

present value amount.

25) Is the following expression true or false?

150 (P|A,10%, 4) = 200 (P|A,10%,4) - 50 (P|A,10%,4)

26) Payback does not consider the overall return on an investment.

Page 5 of 10

ENGG 401 Sample Midterm #3

27) Deferring an expense into the future is a tactic for reducing the present cost.

28) A small oil & gas company is considering investing in two different gas fields. Of the two

alternative investments being considered, Option A has the higher initial capital cost, with an

IRR of 26%. Option B has an IRR of 31%. The incremental IRR is 23%. For MARR of 25%,

which option should the company implement?

a) Option A.

b) Option B.

29) If a project has no return on the investment, then payback and IRR should be used to

compare the alternatives.

30) Taxes for an incremental cash flow may be negative if there is sufficient income from

other sources in the company from which to deduct taxes.

31) The disposal tax effect only applies when salvage value is less than expected in the year

in which an asset is sold.

32) Other parameters being equal between two investments, a shorter payback period

means there is less risk.

33) Assets sales are treated in the same way as share sales.

34) One way to mitigate risk in changing foreign exchange rates is to use your own currency

as the basis.

35) Payback factors in the return that might be made after the payback period.

36) Front-end loading is a way to control costs later in a project by making key decisions as

early as possible.

37) Sensitivity analysis determines how much a decision factor affects the variation of

external constants.

38) Discounted payback at the IRR is the entire duration of the project.

39) A tornado diagram is used by meteorologists to assess weather risks.

40) Cash flow forecasts use actual cash flows that are expected to occur, not accounting

allowances.

41) Interest payments and repayments of principal are done before tax.

42) Actual dollars are inflation free.

43) Late projects and cost overruns reduce investor confidence.

44) Capital Cost Allowance in a given year is deducted from inflation-corrected income.

45) A company is considering two different investments. Option B has lower risk than Option

A, so the company should expect a higher return from investment option A.

Page 6 of 10

ENGG 401 Sample Midterm #3

Answers

1) c.

Payback occurs in year 9, but the payback period for the project starts in year 3 (right after

the end of year 2), so simple payback = 9 - 2 = 7 years.

2) b.

3) d.

4) c.

5) c.

This series is a combination of a present sum and a uniform series, and so it can be solved

as

= $50(F|A,5%,5) - $50(F|P,5%,5)

= $246.28 - $63.81

= $212.47

(which is how you would do it in an exam)

The spreadsheet approach, which of course is not an option for the midterm, gives the same

answer:

i= 5%

FV PV

0 -$50.00 -$63.81

1 $50.00 $60.78

2 $50.00 $57.88

3 $50.00 $55.13

4 $50.00 $52.50

5 $50.00 $50.00

net future

value:

$212.47

6) a.

You can calculate this in two ways: by finding the inflated future value and then taking its

present value, or by finding the uninflated future value and taking its present value with an

interest rate that has been corrected for inflation:

MARR = 6%

f = 2% Uninflated

Year FV infl PV@MARR Year FV PV @ MARRinlf

0 $10,000.00 $10000.00 0 $10,000.00 $10000.00

1 10200 $9622.64 1 $10,000.00 $9622.64

2 10404

$9259.52

2 $10,000.00

$9259.52

where

MARRinfl = (1 + MARR)/(1 + f) – 1.

= 3.92%

For most problems (except tax calculations), the second approach is probably faster using

the inflation corrected interest rate: in this problem PV = F(P|F,MARRinfl,2).

Page 7 of 10

ENGG 401 Sample Midterm #3

7) a.

Option A

Prob Benefit

0.4 20000

Option B

0.6 30000

Expected Benefit = 26000

The investment is expected to return more than the required NPV of $25,000.

8) e.

9) e.

10) b.

PW benefits 1137.236 BCR = 1.137

PW costs 1000

11) d

solve using incremental BCR

Option A B C D

PW benefits $700 $340 $750 $950

PW costs $300 $350 $400 $500

BCR 2.33 0.97 1.88 1.90

reject B

C - A D - A

IBCR 0.50 1.25

reject C reject A

12) b.

13) d.

14) d.

15) b.

The NPV of A is -1000 + 300(P|A,10%,5) = $137.23.

Breakeven occurs when the two NPVs are equivalent. Solve for the capital cost P

B

from B

137.23 = P

B

+ 200(P|A,10%,5), which yields B

P

B

= -$620. 92. B

(The cash flow series are shown below for clarity.)

i = 10% i = 10%

FV (A) PV (A) FV (B) PV (B)

0 -1000.00 -1000.00 -620.92 -620.92

1 300.00 272.73 200.00 181.82

2 300.00 247.93 200.00 165.29

3 300.00 225.39 200.00 150.26

4 300.00 204.90 200.00 136.60

Page 8 of 10

ENGG 401 Sample Midterm #3

5 300.00 186.28 200.00 124.18

NPV 137.23 NPV 137.23

16) d.

17) b.

18) a.

19) e.

20) b.

21 True.

22 False.

23 False.

24 False

25 True.

26 True.

27 True.

28 b) The less expensive option B.

29 False.

30 True.

31 False.

32 True.

33) False.

34) True.

35) False.

36) True.

37) False.

38) True.

39) False.

Page 9 of 10

ENGG 401 Sample Midterm #3

40) True.

41) False.

42) False.

43) True.

44) True.

45) True.

Page 10 of 10