Future Developments

For the latest information about developments

related to Publication 1544, such as legislation

enacted after it was published, go to

www.irs.gov/pub1544.

What's New

Electronic filing. You may be able to file Form

8300 by using FinCEN's Bank Secrecy Act

(BSA) Electronic Filing (E-Filing) System. See

When, Where, and What To File, later.

Introduction

If, in a 12-month period, you receive more than

$10,000 in cash from one buyer as a result of a

transaction in your trade or business, you must

report it to the Internal Revenue Service (IRS)

and the Financial Crimes Enforcement Network

(FinCEN) on Form 8300,

Report of Cash Pay

ments Over $10,000 Received in a Trade or

Business

.

This publication explains why, when, and

where to report these cash payments. It also

discusses the substantial penalties for not re-

porting them.

Some organizations do not have to file Form

8300, including financial institutions and casi-

nos who must file FinCEN Report 112, BSA

Currency Transaction Report (BCTR). They are

not discussed in this publication.

This publication explains key issues and

terms related to Form 8300. You should also

read the instructions attached to the form. They

explain what to enter on each line.

Why Report These

Payments?

Drug dealers and smugglers often use large

cash payments to “launder” money from illegal

activities. Laundering means converting “dirty”

or illegally-gained money to “clean” money.

The government can often trace this laun-

dered money through the payments you report.

Laws passed by Congress require you to report

these payments. Your compliance with these

laws provides valuable information that can

stop those who evade taxes and those who

profit from the drug trade and other criminal ac-

tivities.

The USA PATRIOT Act of 2001 increased

the scope of these laws to help trace funds

used for terrorism.

Who Must File Form

8300?

Generally, any person in a trade or business

who receives more than $10,000 in cash in a

single transaction or in related transactions

must file Form 8300.

For example, you may have to file Form

8300 if you are a dealer in jewelry, furniture,

boats, aircraft, or automobiles; a pawnbroker;

an attorney; a real estate broker; an insurance

company; or a travel agency. Special rules for

Department

of the

Treasury

Internal

Revenue

Service

Publication 1544

(Rev. September 2014)

Cat. No. 12696A

Reporting Cash

Payments of

Over $10,000

(Received in a Trade or

Business)

Get forms and other information

faster and easier at IRS.gov

Userid: CPM Schema: tipx Leadpct: 95% Pt. size: 8

Draft Ok to Print

AH XSL/XML

Fileid: … ns/P1544/201409/A/XML/Cycle05/source (Init. & Date) _______

Page 1 of 6 14:41 - 11-Sep-2014

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Sep 11, 2014

clerks of federal or state courts are discussed

later under Bail received by court clerks.

However, you do not have to file Form 8300

if the transaction is not related to your trade or

business. For example, if you own a jewelry

store and sell your personal automobile for

more than $10,000 in cash, you would not sub-

mit a Form 8300 for that transaction.

Transaction defined. A “transaction” occurs

when:

Goods, services, or property are sold;

Property is rented;

Cash is exchanged for other cash;

A contribution is made to a trust or escrow

account;

A loan is made or repaid; or

Cash is converted to a negotiable instru-

ment, such as a check or a bond.

Person defined. A “person” includes an indi-

vidual, a company, a corporation, a partnership,

an association, a trust, or an estate.

Exempt organizations, including employee

plans, are also “persons.” However, exempt or-

ganizations do not have to file Form 8300 for a

more-than-$10,000 charitable cash contribution

they receive since it is not received in the

course of a trade or business.

Foreign transactions. You do not have to file

Form 8300 if the entire transaction (including

the receipt of cash) takes place outside of:

The 50 states,

The District of Columbia,

Puerto Rico, or

A possession or territory of the United

States.

However, you must file Form 8300 if any part of

the transaction (including the receipt of cash)

occurs in Puerto Rico or a possession or terri-

tory of the United States and you are subject to

the Internal Revenue Code.

Bail received by court clerks. Any clerk of a

federal or state court who receives more than

$10,000 in cash as bail for an individual

charged with any of the following criminal offen-

ses must file Form 8300:

1. Any federal offense involving a controlled

substance,

2. Racketeering,

3. Money laundering, and

4. Any state offense substantially similar to

(1), (2), or (3) above.

For more information about the rules that apply

to court clerks, see Section 1.6050I-2 of the In-

come Tax Regulations.

What Payments Must Be

Reported?

You must file Form 8300 to report cash paid to

you if it is:

1. Over $10,000,

2. Received as:

a. One lump sum of over $10,000,

b. Installment payments that cause the

total cash received within 1 year of the

initial payment to total more than

$10,000, or

c. Other previously unreportable pay-

ments that cause the total cash re-

ceived within a 12-month period to to-

tal more than $10,000,

3. Received in the course of your trade or

business,

4. Received from the same buyer (or agent),

and

5. Received in a single transaction or in rela-

ted transactions (defined later).

What Is Cash?

Cash is:

1. The coins and currency of the United

States (and any other country), and

2. A cashier's check, bank draft, traveler's

check, or money order you receive, if it

has a face amount of $10,000 or less and

you receive it in:

a. A designated reporting transaction

(defined later), or

b. Any transaction in which you know the

payer is trying to avoid the reporting of

the transaction on Form 8300.

Cash may include a cashier's check

even if it is called a “treasurer's check”

or “bank check.”

Cash does not include a check drawn on an

individual's personal account.

A cashier's check, bank draft, traveler's

check, or money order with a face amount of

more than $10,000 is not treated as cash.

These items are not defined as cash and you

do not have to file Form 8300 when you receive

them because, if they were bought with cur-

rency, the bank or other financial institution that

issued them must file a report on FinCEN Re-

port 112.

Example 1. You are a coin dealer. Bob

Green buys gold coins from you for $13,200.

He pays for them with $6,200 in U.S. currency

and a cashier's check having a face amount of

$7,000. The cashier's check is treated as cash.

You have received more than $10,000 cash

and must file Form 8300 for this transaction.

Example 2. You are a retail jeweler. Mary

North buys an item of jewelry from you for

$12,000. She pays for it with a personal check

payable to you in the amount of $9,600 and

traveler's checks totaling $2,400. Because the

personal check is not treated as cash, you have

not received more than $10,000 cash in the

transaction. You do not have to file Form 8300.

Example 3. You are a boat dealer. Emily

Jones buys a boat from you for $16,500. She

pays for it with a cashier's check payable to you

in the amount of $16,500. The cashier's check

is not treated as cash because its face amount

is more than $10,000. You do not have to file

Form 8300 for this transaction.

Designated Reporting Transaction

A designated reporting transaction is the retail

sale of any of the following:

CAUTION

!

1.

A consumer durable, such as an automo-

bile or boat. A consumer durable is prop-

erty, other than land or buildings, that:

a. Is suitable for personal use,

b. Can reasonably be expected to last at

least 1 year under ordinary use,

c. Has a sales price of more than

$10,000, and

d. Can be seen or touched (tangible

property).

For example, a $20,000 car is a con-

sumer durable, but a $20,000 dump truck

or factory machine is not. The car is a con-

sumer durable even if you sell it to a buyer

who will use it in a business.

2. A collectible (for example, a work of art,

rug, antique, metal, gem, stamp, or coin).

3. Travel or entertainment, if the total sales

price of all items sold for the same trip or

entertainment event in one transaction (or

related transactions) is more than

$10,000.

To figure the total sales price of all items

sold for a trip or entertainment event, you in-

clude the sales price of items such as airfare,

hotel rooms, and admission tickets.

Example. You are a travel agent. Ed John-

son asks you to charter a passenger airplane to

take a group to a sports event in another city.

He also asks you to book hotel rooms and ad-

mission tickets for the group. In payment, he

gives you two money orders, each for $6,000.

You have received more than $10,000 cash in

this designated reporting transaction. You must

file Form 8300.

Retail sale. The term “retail sale” means any

sale made in the course of a trade or business

that consists mainly of making sales to ultimate

consumers.

Thus, if your business consists mainly of

making sales to ultimate consumers, all sales

you make in the course of that business are re-

tail sales. This includes any sales of items that

will be resold.

Broker or intermediary. A designated report-

ing transaction includes the retail sale of items

(1), (2), or (3) of the preceding list, even if the

funds are received by a broker or other interme-

diary, rather than directly by the seller.

Exceptions to Definition of Cash

A cashier's check, bank draft, traveler's check,

or money order you received in a designated re-

porting transaction is not treated as cash if one

of the following exceptions applies.

Exception for certain bank loans. A cash-

ier's check, bank draft, traveler's check, or

money order is not treated as cash if it is the

proceeds from a bank loan. As proof that it is

from a bank loan, you may rely on a copy of the

loan document, a written statement or lien in-

struction from the bank, or similar proof.

Example. You are a car dealer. Mandy

White buys a new car from you for $11,500.

She pays you with $2,000 of U.S. currency and

a cashier's check for $9,500 payable to you and

Page 2 of 6 Fileid: … ns/P1544/201409/A/XML/Cycle05/source 14:41 - 11-Sep-2014

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Page 2 Publication 1544 (September 2014)

her. You can tell that the cashier's check is the

proceeds of a bank loan because it includes in-

structions to you to have a lien put on the car as

security for the loan. For this reason, the cash-

ier's check is not treated as cash. You do not

have to file Form 8300 for the transaction.

Exception for certain installment sales. A

cashier's check, bank draft, traveler's check, or

money order is not treated as cash if it is re-

ceived in payment on a promissory note or an

installment sales contract (including a lease that

is considered a sale for federal tax purposes).

However, this exception applies only if:

1. You use similar notes or contracts in other

sales to ultimate consumers in the ordi-

nary course of your trade or business, and

2. The total payments for the sale that you

receive on or before the 60th day after the

sale are 50% or less of the purchase price.

Exception for certain down payment plans.

A cashier's check, bank draft, traveler's check,

or money order is not treated as cash if you re-

ceived it in payment for a consumer durable or

collectible, and all three of the following state-

ments are true.

1. You receive it under a payment plan re-

quiring:

a. One or more down payments, and

b. Payment of the rest of the purchase

price by the date of sale.

2. You receive it more than 60 days before

the date of sale.

3. You use payment plans with the same or

substantially similar terms when selling to

ultimate consumers in the ordinary course

of your trade or business.

Exception for travel and entertainment. A

cashier's check, bank draft, traveler's check, or

money order received for travel or entertain-

ment is not treated as cash if all three of the fol-

lowing statements are true.

1. You receive it under a payment plan re-

quiring:

a. One or more down payments, and

b. Payment of the rest of the purchase

price by the earliest date that any

travel or entertainment item (such as

airfare) is furnished for the trip or en-

tertainment event.

2. You receive it more than 60 days before

the date on which the final payment is due.

3. You use payment plans with the same or

substantially similar terms when selling to

ultimate consumers in the ordinary course

of your trade or business.

Taxpayer Identification

Number (TIN)

You must furnish the correct TIN of the person

or persons from whom you receive the cash. If

the transaction is conducted on the behalf of

another person or persons, you must furnish the

TIN of that person or persons. If you do not

know a person's TIN, you have to ask for it. You

may be subject to penalties for an incorrect or

missing TIN.

There are three types of TINs.

1. The TIN for an individual, including a sole

proprietor, is the individual's social secur-

ity number (SSN).

2. The TIN for a nonresident alien individual

who needs a TIN but is not eligible to get

an SSN is an IRS individual taxpayer iden-

tification number (ITIN). An ITIN has nine

digits, similar to an SSN.

3. The TIN for other persons, including cor-

porations, partnerships, and estates, is the

employer identification number (EIN).

Exception. You are not required to provide the

TIN of a person who is a nonresident alien indi-

vidual or a foreign organization if that person or

foreign organization:

1. Does not have income effectively connec-

ted with the conduct of a U.S. trade or

business;

2. Does not have an office or place of busi-

ness, or a fiscal or paying agent in the Uni-

ted States;

3. Does not file a federal tax return;

4. Does not furnish a withholding certificate

described in §1.1441-1(e)(2) or (3) or

1.1441-5(c)(2)(iv) or (3)(iii) to the extent

required under 1.1441-1(e)(4)(vii);

5. Does not have to furnish a TIN on any re-

turn, statement, or other document as re-

quired by the income tax regulations under

section 897 or 1445; or

6. In the case of a nonresident alien individ-

ual, the individual has not chosen to file a

joint federal income tax return with a

spouse who is a U.S. citizen or resident.

What Is a Related

Transaction?

Any transactions between a buyer (or an agent

of the buyer) and a seller that occur within a

24-hour period are related transactions. If you

receive over $10,000 in cash during two or

more transactions with one buyer in a 24-hour

period, you must treat the transactions as one

transaction and report the payments on Form

8300.

For example, if you sell two products for

$6,000 each to the same customer in 1 day and

the customer pays you in cash, these are rela-

ted transactions. Because they total $12,000

(more than $10,000), you must file Form 8300.

More than 24 hours between transactions.

Transactions are related even if they are more

than 24 hours apart if you know, or have reason

to know, that each is one of a series of connec-

ted transactions.

For example, you are a travel agent. A client

pays you $8,000 in cash for a trip. Two days

later, the same client pays you $3,000 more in

cash to include another person on the trip.

These are related transactions, and you must

file Form 8300 to report them.

What About Suspicious

Transactions?

If you receive $10,000 or less in cash, you may

voluntarily file Form 8300 if the transaction ap-

pears to be suspicious.

A transaction is suspicious if it appears that

a person is trying to cause you not to file Form

8300 or is trying to cause you to file a false or

incomplete Form 8300, or if there is a sign of

possible illegal activity.

If you are suspicious, you are encouraged to

call the local IRS Criminal Investigation Division

as soon as possible. Or, you can call the Fin-

CEN Financial Institution Hotline toll free at

1-866-556-3974.

When, Where, and What

To File

The amount you receive and when you receive

it determine when you must file. Generally, you

must file Form 8300 within 15 days after receiv-

ing a payment. If the Form 8300 due date (the

15th or last day you can timely file the form) falls

on a Saturday, Sunday, or legal holiday, it is de-

layed until the next day that is not a Saturday,

Sunday, or legal holiday.

More than one payment. In some transac-

tions, the buyer may arrange to pay you in cash

installment payments. If the first payment is

more than $10,000, you must file Form 8300

within 15 days. If the first payment is not more

than $10,000, you must add the first payment

and any later payments made within 1 year of

the first payment. When the total cash pay-

ments are more than $10,000, you must file

Form 8300 within 15 days.

After you file Form 8300, you must start a

new count of cash payments received from that

buyer. If you receive more than $10,000 in addi-

tional cash payments from that buyer within a

12-month period, you must file another Form

8300. You must file the form within 15 days of

the payment that causes the additional pay-

ments to total more than $10,000.

If you are already required to file Form 8300

and you receive additional payments within the

15 days before you must file, you can report all

the payments on one form.

Example. On January 10, you receive a

cash payment of $11,000. You receive addi-

tional cash payments on the same transaction

of $4,000 on February 15, $5,000 on March 20,

and $6,000 on May 12. By January 25, you

must file a Form 8300 for the $11,000 payment.

By May 27, you must file an additional Form

8300 for the additional payments that total

$15,000.

Amending a Report? If you are amending a

report, check box 1a at the top of Form 8300.

Complete the form in its entirety (Parts I-IV) and

include the amended information. Do not attach

a copy of the original report.

Where to file. Mail the form to the address

given in the Form 8300 instructions.

You may file the form electronically by using

FinCEN's BSA E-Filing System. To get more in-

formation, visit

bsaefiling.fincen.treas.gov.

Page 3 of 6 Fileid: … ns/P1544/201409/A/XML/Cycle05/source 14:41 - 11-Sep-2014

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Publication 1544 (September 2014) Page 3

Required statement to buyer. You must give

a written or electronic statement to each person

named on any Form 8300 you must file. You

can give the statement electronically only if the

recipient agrees to receive it in that format. The

statement must show the name and address of

your business, the name and phone number of

a contact person, and the total amount of re-

portable cash you received from the person

during the year. It must state that you are also

reporting this information to the IRS.

You must send this statement to the buyer

by January 31 of the year after the year in which

you received the cash that caused you to file

the form.

You must keep a copy of every Form

8300 you file for 5 years.

Examples

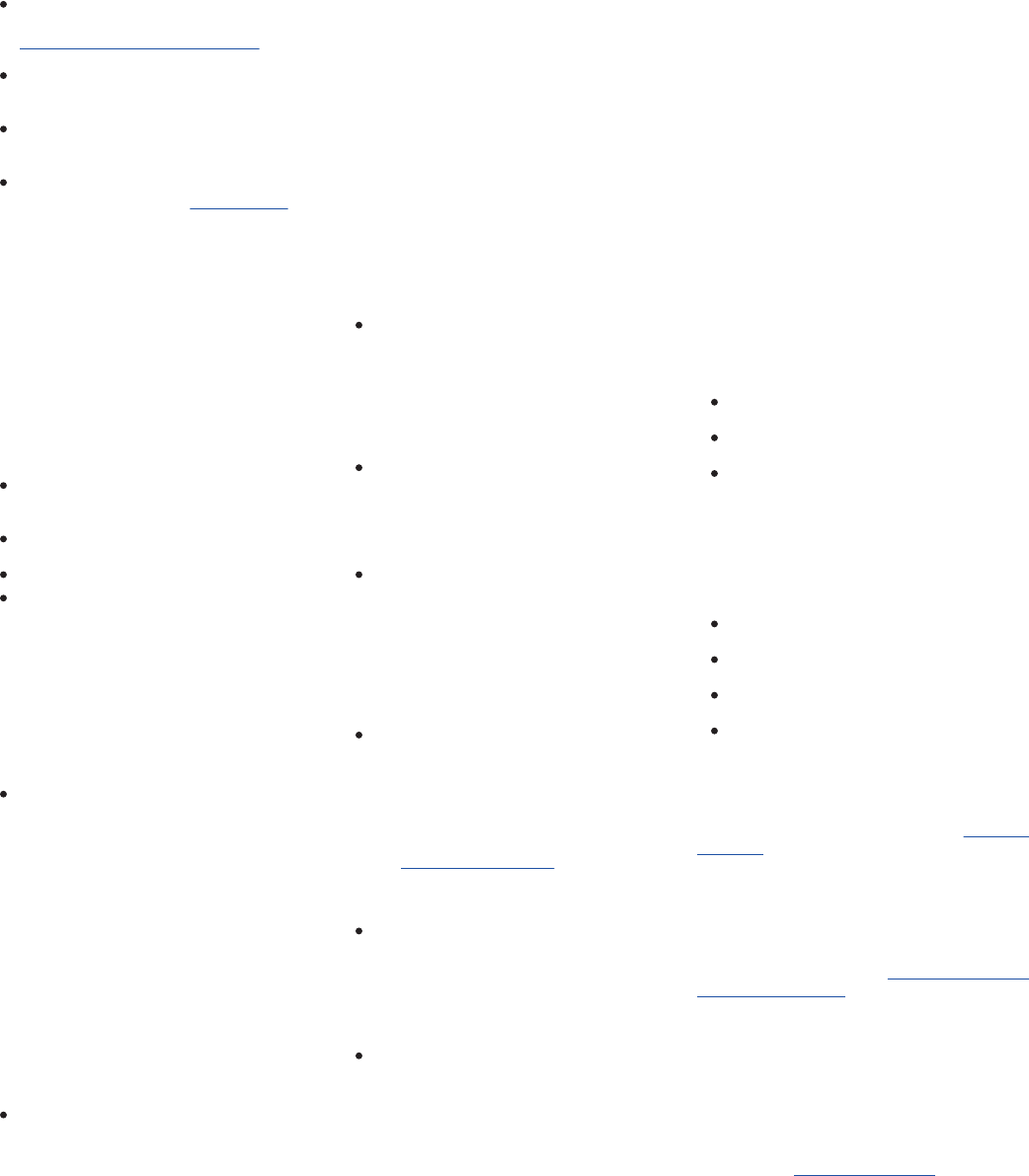

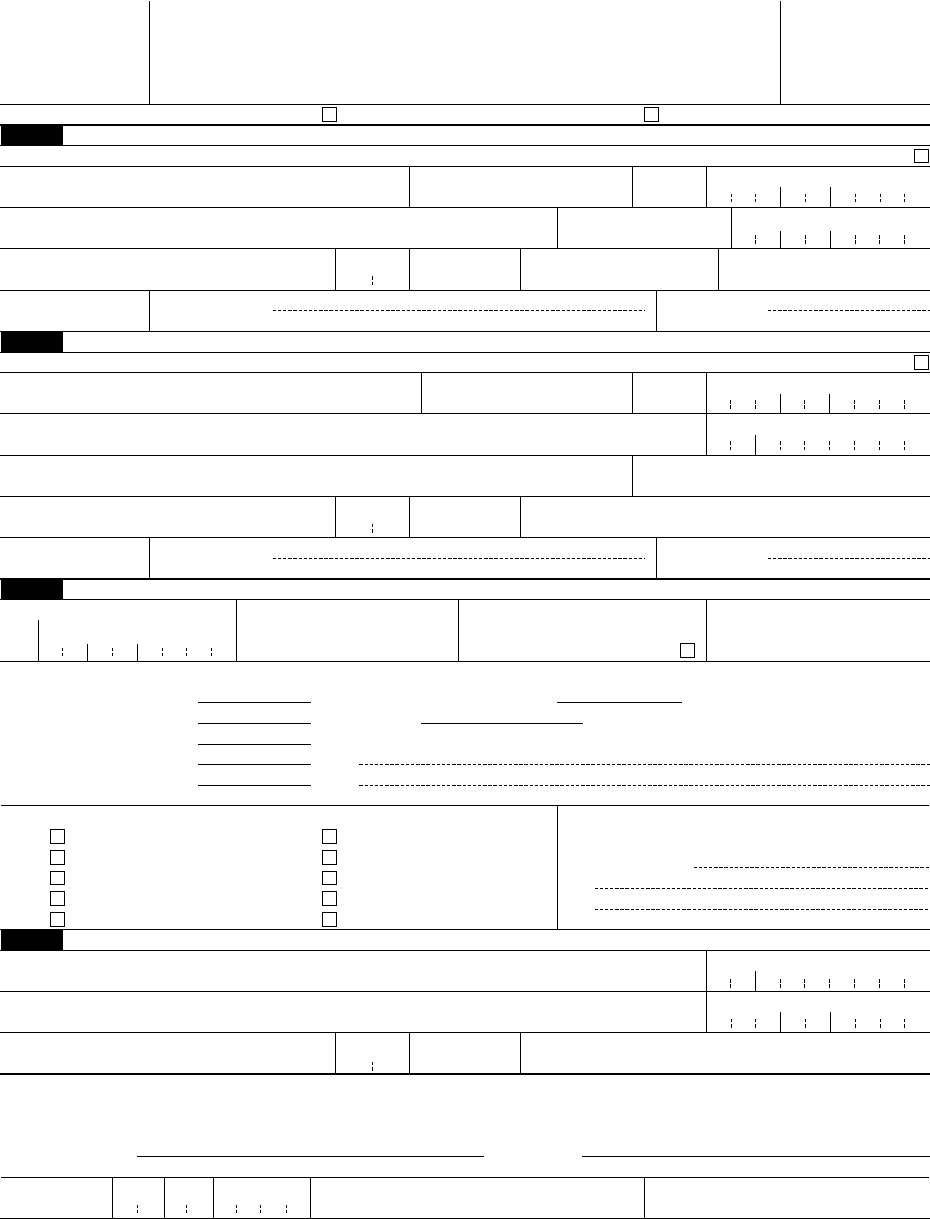

Example 1. Pat Brown is the sales man-

ager for Small Town Cars. On January 6, 2015,

Jane Smith buys a new car from Pat and pays

$18,000 in cash. Pat asks for identification from

Jane to get the necessary information to com-

plete Form 8300. A filled-in form is shown in this

publication.

Pat must mail the form to the address shown

in the form's instructions or file the form elec-

tronically using FinCen's BSA E-Filing System

by January 21, 2015. He must also send a

statement to Jane by January 31, 2016.

Example 2. Using the same facts given in

Example 1, suppose Jane had arranged to

make cash payments of $6,000 each on Janu-

ary 6, February 6, and March 6. Pat would have

to file a Form 8300 by February 23 (17 days af-

ter receiving total cash payments within 1 year

over $10,000 because February 21, 2015, is a

Saturday). Pat would not have to report the re-

maining $6,000 cash payment because it is not

more than $10,000. However, he could report it

if he felt it was a suspicious transaction.

Penalties

There are civil penalties for failure to:

File a correct Form 8300 by the date it is

due, and

Provide the required statement to those

named in the Form 8300.

If you intentionally disregard the requirement

to file a correct Form 8300 by the date it is due,

the penalty is the greater of:

1. $25,000, or

2. The amount of cash you received and

were required to report (up to $100,000).

There are criminal penalties for:

Willful failure to file Form 8300,

Willfully filing a false or fraudulent Form

8300,

Stopping or trying to stop Form 8300 from

being filed, and

Setting up, helping to set up, or trying to

set up a transaction in a way that would

make it seem unnecessary to file Form

8300.

If you willfully fail to file Form 8300, you can

be fined up to $250,000 for individuals

RECORDS

($500,000 for corporations) or sentenced to up

to 5 years in prison, or both. These dollar

amounts are based on Section 3571 of Title 18

of the U.S. Code.

The penalties for failure to file may also ap-

ply to any person (including a payer) who at-

tempts to interfere with or prevent the seller (or

business) from filing a correct Form 8300. This

includes any attempt to structure the transac-

tion in a way that would make it seem unneces-

sary to file Form 8300. Structuring means

breaking up a large cash transaction into small

cash transactions.

How To Get Tax Help

Whether it's help with a tax issue, preparing

your tax return or a need for a free publication

or form, get the help you need the way you want

it: online, use a smart phone, call or walk in to

an IRS office or volunteer site near you.

Free help with your tax return. You can get

free help preparing your return nationwide from

IRS-certified volunteers. The Volunteer Income

Tax Assistance (VITA) program helps

low-to-moderate income, elderly, people with

disabilities, and limited English proficient tax-

payers. The Tax Counseling for the Elderly

(TCE) program helps taxpayers age 60 and

older with their tax returns. Most VITA and TCE

sites offer free electronic filing and all volun-

teers will let you know about credits and deduc-

tions you may be entitled to claim. In addition,

some VITA and TCE sites provide taxpayers

the opportunity to prepare their own return with

help from an IRS-certified volunteer. To find the

nearest VITA or TCE site, you can use the VITA

Locator Tool on IRS.gov, download the IRS2Go

app, or call 1-800-906-9887.

As part of the TCE program, AARP offers

the Tax-Aide counseling program. To find the

nearest AARP Tax-Aide site, visit AARP's web-

site at

www.aarp.org/money/taxaide or call

1-888-227-7669. For more information on these

programs, go to IRS.gov and enter “VITA” in the

search box.

Internet. IRS.gov and IRS2Go are ready

when you are —24 hours a day, 7 days a week.

Download the free IRS2Go app from the

iTunes app store or from Google Play. Use

it to check your refund status, order tran-

scripts of your tax returns or tax account,

watch the IRS YouTube channel, get IRS

news as soon as it's released to the public,

subscribe to filing season updates or daily

tax tips, and follow the IRS Twitter news

feed, @IRSnews, to get the latest federal

tax news, including information about tax

law changes and important IRS programs.

Check the status of your 2013 refund with

the Where's My Refund? application on

IRS.gov or download the IRS2Go app and

select the

Refund Status option. The IRS

issues more than 9 out of 10 refunds in

less than 21 days. Using these applica-

tions, you can start checking on the status

of your return within 24 hours after we re-

ceive your e-filed return or 4 weeks after

you mail a paper return. You will also be

given a personalized refund date as soon

as the IRS processes your tax return and

approves your refund. The IRS updates

Where's My Refund? every 24 hours, usu-

ally overnight, so you only need to check

once a day.

Use the Interactive Tax Assistant (ITA) to

research your tax questions. No need to

wait on the phone or stand in line. The ITA

is available 24 hours a day, 7 days a week,

and provides you with a variety of tax infor-

mation related to general filing topics, de-

ductions, credits, and income. When you

reach the response screen, you can print

the entire interview and the final response

for your records. New subject areas are

added on a regular basis.

Answers not provided through ITA may be

found in Tax Trails, one of the Tax Topics

on IRS.gov which contain general individ-

ual and business tax information or by

searching the

IRS Tax Map, which in-

cludes an international subject index.

You can use the

IRS Tax Map, to search

publications and instructions by topic or

keyword. The IRS Tax Map integrates

forms and publications into one research

tool and provides single-point access to

tax law information by subject. When the

user searches the IRS Tax Map, they will

be provided with links to related content in

existing IRS publications, forms and in-

structions, questions and answers, and

Tax Topics.

Coming this filing season, you can immedi-

ately view and print for free all 5 types of

individual federal tax transcripts (tax re-

turns, tax account, record of account,

wage and income statement, and certifica-

tion of non-filing) using

Get Transcript.

You can also ask the IRS to mail a return

or an account transcript to you. Only the

mail option is available by choosing the

Tax Records option on the IRS2Go app by

selecting Mail Transcript on IRS.gov or by

calling 1-800-908-9946. Tax return and tax

account transcripts are generally available

for the current year and the past three

years.

Determine if you are eligible for the EITC

and estimate the amount of the credit with

the

Earned Income Tax Credit (EITC)

Assistant.

Visit Understanding Your IRS Notice or

Letter to get answers to questions about a

notice or letter you received from the IRS.

If you received the First Time Homebuyer

Credit, you can use the First Time

Homebuyer Credit Account Lookup tool

for information on your repayments and ac-

count balance.

Check the status of your amended return

using

Where's My Amended Return? Go to

IRS.gov and enter Where's My Amended

Return?

in the search box. You can gener-

ally expect your amended return to be pro-

cessed up to 12 weeks from the date we

receive it. It can take up to 3 weeks from

the date you mailed it to show up in our

system.

Make a payment using one of several safe

and convenient electronic payment options

available on IRS.gov. Select the Payment

tab on the front page of IRS.gov for more

information.

Determine if you are eligible and apply for

an online payment agreement, if you owe

more tax than you can pay today.

Figure your income tax withholding with

the

IRS Withholding Calculator on IRS.gov.

Use it if you've had too much or too little

withheld, your personal situation has

Page 4 of 6 Fileid: … ns/P1544/201409/A/XML/Cycle05/source 14:41 - 11-Sep-2014

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Page 4 Publication 1544 (September 2014)

changed, you're starting a new job or you

just want to see if you're having the right

amount withheld.

Determine if you might be subject to the Al-

ternative Minimum Tax by using the

Alternative Minimum Tax Assistant on

IRS.gov.

Request an Electronic Filing PIN by go-

ing to IRS.gov and entering Electronic Fil

ing PIN in the search box.

Download forms, instructions and publica-

tions, including accessible versions for

people with disabilities.

Locate the nearest Taxpayer Assistance

Center (TAC)

using the Office Locator tool

on IRS.gov, or choose the

Contact Us op-

tion on the IRS2Go app and search Local

Offices

. An employee can answer ques-

tions about your tax account or help you

set up a payment plan. Before you visit,

check the

Office Locator on IRS.gov, or

Local Offices under Contact Us on IRS2Go

to confirm the address, phone number,

days and hours of operation, and the serv-

ices provided. If you have a special need,

such as a disability, you can request an ap-

pointment. Call the local number listed in

the Office Locator, or look in the phone

book under United States Government, In-

ternal Revenue Service.

Apply for an Employer Identification

Number (EIN). Go to IRS.gov and enter

Apply for an EIN in the search box.

Read the Internal Revenue Code, regula-

tions, or other official guidance.

Read Internal Revenue Bulletins.

Sign up to receive local and national tax

news and more by email. Just click on

“subscriptions” above the search box on

IRS.gov and choose from a variety of op-

tions.

Phone. You can call the IRS, or you can carry

it in your pocket with the IRS2Go app on your

smart phone or tablet. Download the free

IRS2Go app from the iTunes app store or from

Google Play.

Call to locate the nearest volunteer help

site, 1-800-906-9887 or you can use the

VITA Locator Tool on IRS.gov, or down-

load the IRS2Go app. Low-to-moderate in-

come, elderly, people with disabilities, and

limited English proficient taxpayers can get

free help with their tax return from the na-

tionwide Volunteer Income Tax Assistance

(VITA) program. The Tax Counseling for

the Elderly (TCE) program helps taxpayers

age 60 and older with their tax returns.

Most VITA and TCE sites offer free elec-

tronic filing. Some VITA and TCE sites pro-

vide IRS-certified volunteers who can help

prepare your tax return. Through the TCE

program, AARP offers the Tax-Aide coun-

seling program; call 1-888-227-7669 to

find the nearest Tax-Aide location.

Call the automated Where's My Refund?

information hotline to check the status of

your 2013 refund 24 hours a day, 7 days a

week at 1-800-829-1954. If you e-file, you

can start checking on the status of your re-

turn within 24 hours after the IRS receives

your tax return or 4 weeks after you've

mailed a paper return. The IRS issues

more than 9 out of 10 refunds in less than

21 days. Where's My Refund? will give you

a personalized refund date as soon as the

IRS processes your tax return and ap-

proves your refund. Before you call this au-

tomated hotline, have your 2013 tax return

handy so you can enter your social secur-

ity number, your filing status, and the exact

whole dollar amount of your refund. The

IRS updates

Where's My Refund? every

24 hours, usually overnight, so you only

need to check once a day. Note, the above

information is for our automated hotline.

Our live phone and walk-in assistors can

research the status of your refund only if

it's been 21 days or more since you filed

electronically or more than 6 weeks since

you mailed your paper return.

Call the Amended Return Hotline,

1-866-464-2050, to check the status of

your amended return. You can generally

expect your amended return to be pro-

cessed up to 12 weeks from the date we

receive it. It can take up to 3 weeks from

the date you mailed it to show up in our

system.

Call 1-800-TAX-FORM (1-800-829-3676)

to order current-year forms, instructions,

publications, and prior-year forms and in-

structions (limited to 5 years). You should

receive your order within 10 business

days.

Call TeleTax, 1-800-829-4477, to listen to

pre-recorded messages covering general

and business tax information. If, between

January and April 15, you still have ques-

tions about the Form 1040, 1040A, or

1040EZ (like filing requirements, depend-

ents, credits, Schedule D, pensions and

IRAs or self-employment taxes), call

1-800-829-1040.

Call using TTY/TDD equipment,

1-800-829-4059 to ask tax questions or or-

der forms and publications. The TTY/TDD

telephone number is for people who are

deaf, hard of hearing, or have a speech

disability. These individuals can also con-

tact the IRS through relay services such as

the

Federal Relay Service.

Walk-in. You can find a selection of forms,

publications and services — in-person.

Products. You can walk in to some post of-

fices, libraries, and IRS offices to pick up

certain forms, instructions, and publica-

tions. Some IRS offices, libraries, and city

and county government offices have a col-

lection of products available to photocopy

from reproducible proofs.

Services. You can walk in to your local

TAC for face-to-face tax help. An em-

ployee can answer questions about your

tax account or help you set up a payment

plan. Before visiting, use the

Office Locator

tool on IRS.gov, or choose the Contact Us

option on the IRS2Go app and search Lo

cal Offices

for days and hours of operation,

and services provided.

Mail. You can send your order for forms, in-

structions, and publications to the address be-

low. You should receive a response within 10

business days after your request is received.

Internal Revenue Service

1201 N. Mitsubishi Motorway

Bloomington, IL 61705-6613

The Taxpayer Advocate Service Is Here to Help

You. The Taxpayer Advocate Service (TAS)

is your voice at the IRS. Our job is to ensure

that every taxpayer is treated fairly and that you

know and understand your rights.

What can TAS do for you? We can offer you

free help with IRS problems that you can't re-

solve on your own. We know this process can

be confusing, but the worst thing you can do is

nothing at all! TAS can help if you can't resolve

your tax problem and:

Your problem is causing financial difficul-

ties for you, your family, or your business.

You face (or your business is facing) an

immediate threat of adverse action.

You've tried repeatedly to contact the IRS

but no one has responded, or the IRS

hasn't responded by the date promised.

If you qualify for our help, you'll be assigned to

one advocate who'll be with you at every turn

and will do everything possible to resolve your

problem. Here's why we can help:

TAS is an independent organization within

the IRS.

Our advocates know how to work with the

IRS.

Our services are free and tailored to meet

your needs.

We have offices in every state, the District

of Columbia, and Puerto Rico.

How can you reach us? If you think TAS can

help you, call your local advocate, whose num-

ber is in your local directory and at

Taxpayer

Advocate, or call us toll-free at 1-877-777-4778.

How else does TAS help taxpayers?

TAS also works to resolve large-scale, systemic

problems that affect many taxpayers. If you

know of one of these broad issues, please re-

port it to us through our

Systemic Advocacy

Management System.

Low Income Taxpayer Clinics. Low Income

Taxpayer Clinics (LITCs) serve individuals

whose income is below a certain level and need

to resolve tax problems such as audits, appeals

and tax collection disputes. Some clinics can

provide information about taxpayer rights and

responsibilities in different languages for indi-

viduals who speak English as a second lan-

guage. Visit

Taxpayer Advocate or see IRS

Publication 4134, Low Income Taxpayer Clinic

List.

Page 5 of 6 Fileid: … ns/P1544/201409/A/XML/Cycle05/source 14:41 - 11-Sep-2014

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Publication 1544 (September 2014) Page 5

IRS

Form

8300

(Rev. August 2014)

Department of the Treasury

Internal Revenue Service

Report of Cash Payments Over $10,000

Received in a Trade or Business

a

See instructions for definition of cash.

a

Use this form for transactions occurring after August 29, 2014. Do not use prior versions after this date.

For Privacy Act and Paperwork Reduction Act Notice, see the last page.

FinCEN

Form

8300

(Rev. August 2014)

OMB No. 1506-0018

Department of the Treasury

Financial Crimes

Enforcement Network

1 Check appropriate box(es) if: a

Amends prior report;

b

Suspicious transaction.

Part I Identity of Individual From Whom the Cash Was Received

2 If more than one individual is involved, check here and see instructions . . . . . . . . . . . . . . . . . . . .

a

3 Last name 4 First name 5 M.I. 6 Taxpayer identification number

7 Address (number, street, and apt. or suite no.)

8 Date of birth . . .

a

(see instructions)

M M D D Y Y Y Y

9 City 10 State 11 ZIP code 12 Country (if not U.S.) 13

Occupation, profession, or business

14 Identifying

document (ID)

a Describe ID

a

b Issued by

a

c Number

a

Part II Person on Whose Behalf This Transaction Was Conducted

15 If this transaction was conducted on behalf of more than one person, check here and see instructions . . . . . . . . . . .

a

16 Individual’s last name or organization’s name 17 First name 18 M.I. 19 Taxpayer identification number

20 Doing business as (DBA) name (see instructions) Employer identification number

21 Address (number, street, and apt. or suite no.) 22 Occupation, profession, or business

23 City 24 State 25 ZIP code 26 Country (if not U.S.)

27 Alien

identification (ID)

a Describe ID

a

b Issued by

a

c Number

a

Part III Description of Transaction and Method of Payment

28 Date cash received

M M D D Y Y Y Y

29 Total cash received

$ .00

30

If cash was received in

more than one payment,

check here . . .

a

31 Total price if different from

item 29

$ .00

32 Amount of cash received (in U.S. dollar equivalent) (must equal item 29) (see instructions):

a U.S. currency

$

.00

(Amount in $100 bills or higher $ .00 )

b Foreign currency

$

.00

(Country

a

)

c Cashier’s check(s)

$

.00

d Money order(s)

$

.00

e Bank draft(s)

$

.00

f Traveler’s check(s) $

.00

}

Issuer’s name(s) and serial number(s) of the monetary instrument(s)

a

33 Type of transaction

a

Personal property purchased

b

Real property purchased

c

Personal services provided

d

Business services provided

e

Intangible property purchased

f

Debt obligations paid

g

Exchange of cash

h

Escrow or trust funds

i

Bail received by court clerks

j

Other (specify in item 34)

a

34 Specific description of property or service shown in

33. Give serial or registration number, address, docket

number, etc.

a

Part IV Business That Received Cash

35 Name of business that received cash 36 Employer identification number

37 Address (number, street, and apt. or suite no.) Social security number

38 City 39 State 40 ZIP code 41 Nature of your business

42

Under penalties of perjury, I declare that to the best of my knowledge the information I have furnished above is true, correct,

and complete.

Signature

F

Authorized official

Title

F

43 Date of

signature

M M D D Y Y Y Y

44 Type or print name of contact person 45 Contact telephone number

IRS Form 8300 (Rev. 8-2014)

Cat. No. 62133S

FinCEN Form 8300 (Rev. 8-2014)

Smith Jane A

3 3

00

3 3

3

3

3

100 Main Street

Hometown

1

0

0

6

1 9

6

3

P A

10101

Cosmetic Distributor

Driver’s License

333-00-3333

PA

0

1

0

6

2 0

1

5

18,000

18,000

√

Go - Fast

4 - door sedan serial no xx -

ABCDEFG - 1234567

Small Town Cars

5000 Industrial Avenue

Hometown

P A

10101

Car Dealership

1 0

1

2

3 4

5

6

7

Pat Brown Sales Manager

0

1

0

6

2 0

1

5

Pat Brown 999-555-0555

Page 6 of 6 Fileid: … ns/P1544/201409/A/XML/Cycle05/source 14:41 - 11-Sep-2014

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Page 6 Publication 1544 (September 2014)