Form 1099-K

New Law Lowers Filing Threshold –

What Does It Mean to

Your Clients?

Larry L Gray, CPA, CGMA

National Association of Tax Professionals

Rev 6/27/2023

1

2

3

4

What We Will Cover

Overview

Know the law

1099-K roadmap

Form 1099-K scenarios

Overview

Form 1099-K, Payment Card and Third-Party Network Transactions

• Reports payments and transactions from online platforms, apps or payment

c

ard processors

• Personal transactions such as sending money to family and friends, not in

exchange for goods or services, should not be reported on Form 1099-K

Form 1099-K

Who, what, why, when and how

• American Rescue Plan of 2021/IRS

• New, reduced 1099-K reporting threshold

• In 2023, >$1 trillion projected to transact via person-to-person (P2P) apps

• Reduced reporting threshold delayed until 2023 tax year (2024 filing season)

• IRS and real-world scenarios explained

What Is Impacted?

Third-party network transactions

Gig

economy players

U

ber

Lyft

DoorDash

Etc.

Platform

marketplaces

Facebook Marketplace

Amazon

eBay

Etc.

Person-to-person

(P2P) apps

PayPal

Venmo

Cash App

Etc.

What Is NOT Impacted By the Lower Threshold?

Payment card transactions

Credit & debit card

transactions

Visa

Mastercard

Amex

Discover

They are already

required to report

all amounts and

transactions

P2P Apps Have Seen Unprecedented Growth

• 64% of Americans use P2P

• 81% of 18 – 29-year-olds use P2P

• It is projected that Zelle*, Venmo and Cash App will have 225 million users

by 2025

Consumer Reports, Jan. 24, 2023

1

2

3

4

What Do We Tax Professionals Have To Do?

Communicate the law

Educate and train our clients

Verify if the 1099-K is correct

Report correctly on the tax return

Know the Law

The Law – Report Your Income

• There are no changes to what counts as income or how the tax is calculated

• You must report all your income on your tax return, unless it’s excluded

by law

Personal Hobby Business Investment

1

2

3

Know the Law – 1099s

1099-K

Used to report payment card and third-party network transactions

1099-NEC

R

einstated in 2020 to report payments made to

independent contractors

1099-MIS

C

Used to report nonemployee earnings from income streams like

royalties, rent and prize winnings

Form 1099-K

Used to report all payment card transactions

Debit cards Credit cards Stored-value cards

Form 1099-K, Cont.

Used to report third-party payment network transactions

above the minimum reporting thresholds

2022

G

ross payments that

exceed $20,000, AND

More than 200

transactions

2023

Gross payments for

goods and services that

exceed $600, AND

Any number of

transactions

Roadmap

If Your Client Gets a 1099-K, Ask Questions

• Personal?

• Hobby?

• Business?

• Investment?

• Transfer?

• Shared account?

Documentation?

Fees Paid to Sell Personal Items Online

• 1099-K reports gross amounts of payment transactions

• Not adjusted for

• Fees

• Refunds

• Chargebacks

• Other costs

Adjust your gain or loss on personal items

by your selling expenses.

Train Your Clients

Document, document and document

Documents must support personal, hobby, business or investment transactions.

Form 1099-K Scenarios

Received Form 1099-K in Error

If:

• 1099-K not yours or duplicate

• Payee TIN incorrect

• Gross amount incorrect

• # of transactions incorrect

• Merchant category code

(MCC) does not correctly

describe your business

Recourse:

• Contact payment settlement

entity (PSE)

• Name and number should be in

lower-left of form

• Contact filer

• Number shown in upper-left corner

of form

• Retain all correspondence

Received Form 1099-K in Error

No recourse…

1099-K Received in Error

800

Reimbursed a

friend $800 for

a concert ticket

he bought

1099-K Received in Error

800

Personal

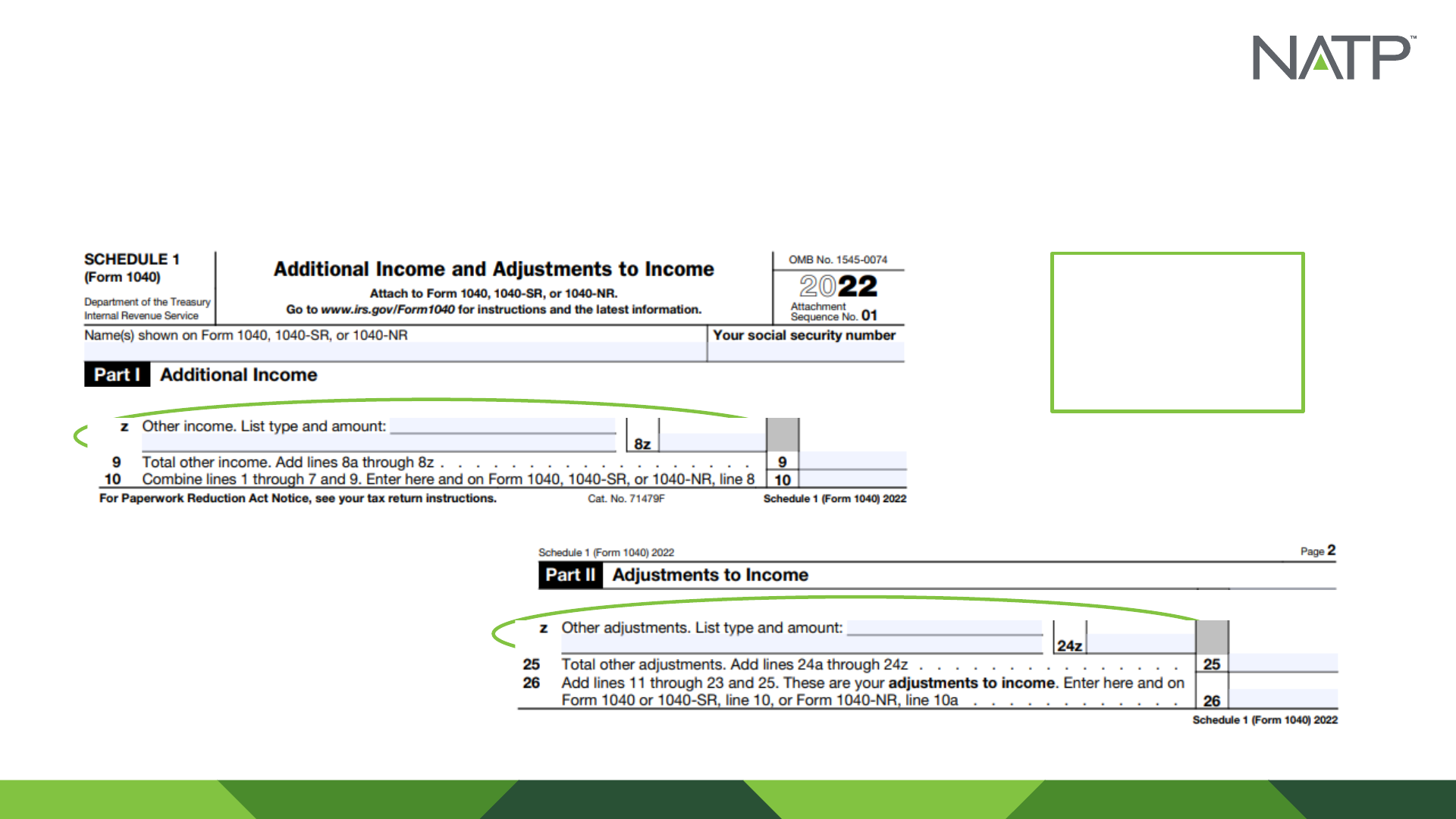

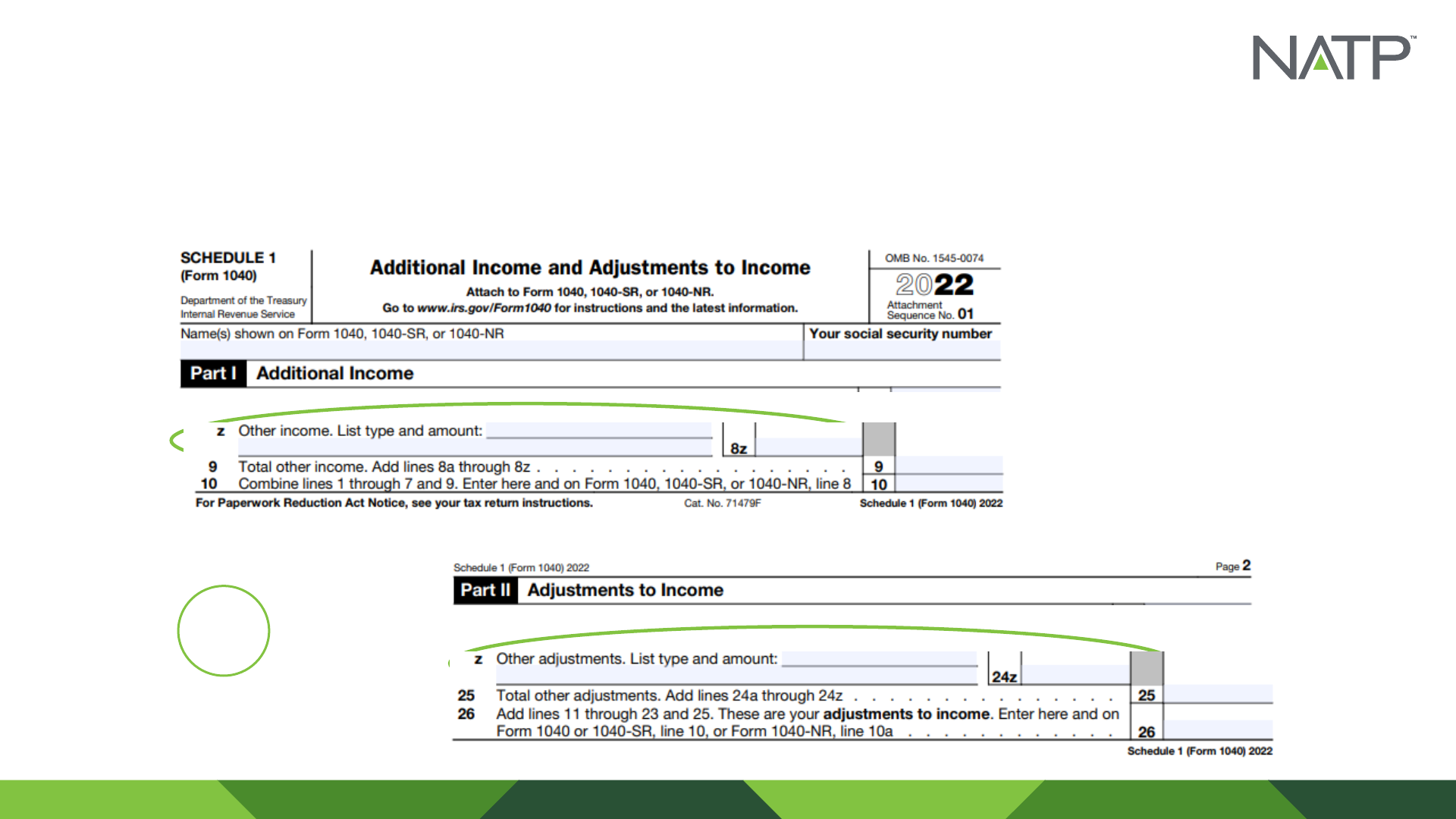

Personal Items Sold at a Loss

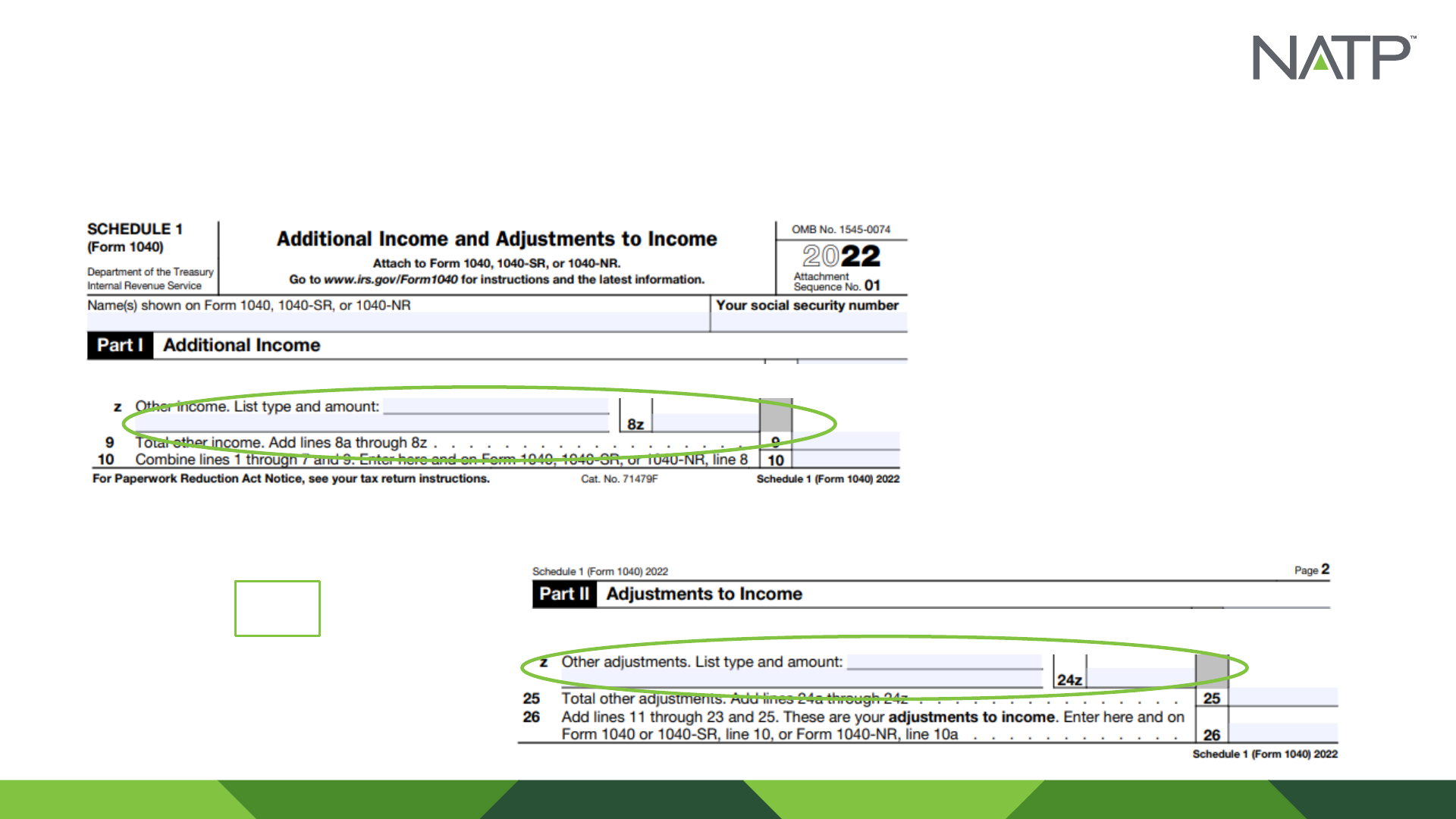

Form 1040, Sch. 1

You receive $600 for selling your couch online.

Cost of couch was $1,000.

Two ways to report:

Personal Items Sold at a Loss

Form 1040, Sch. 1

600

1099-K Personal item sold at a loss

1099-K P

ersonal item sold at a loss

600

OR

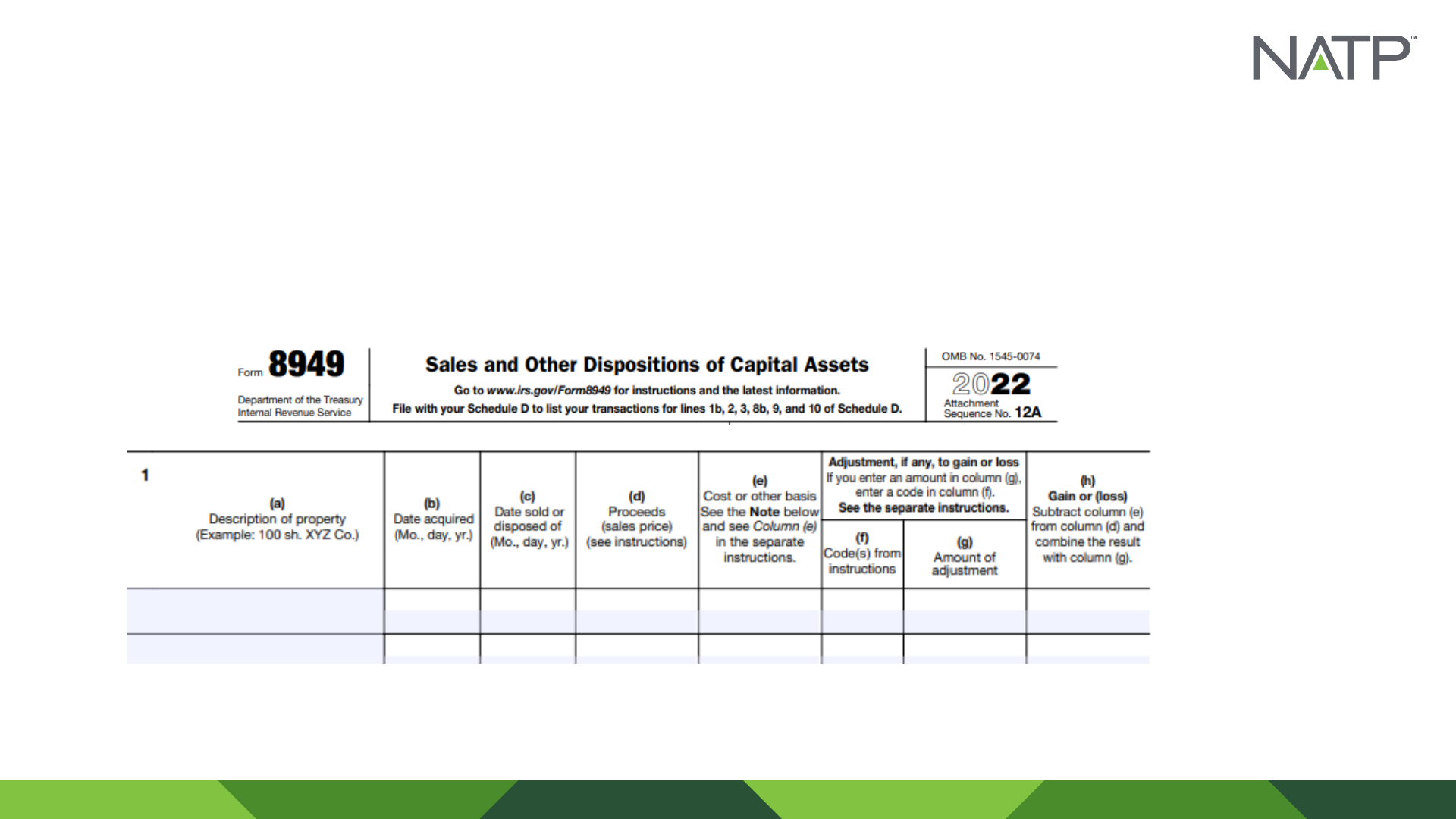

Personal Item Sold at a Loss

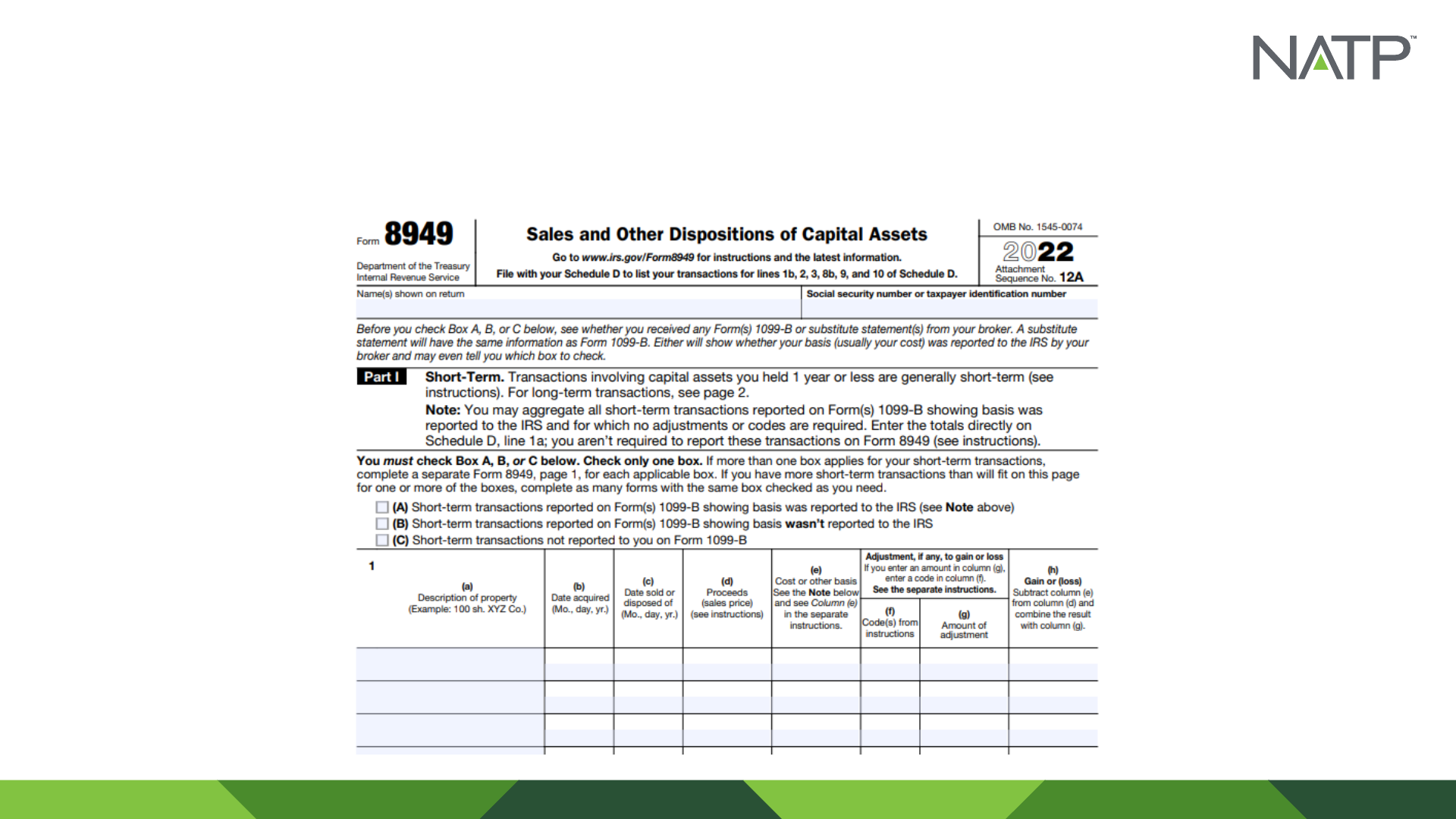

Form 8949 and Sch. D

• Okay to file here if there are other items to file on 8949 or Sch. D

Couch

10/01/20 02/14/22

$600

$1000

L $400

$0

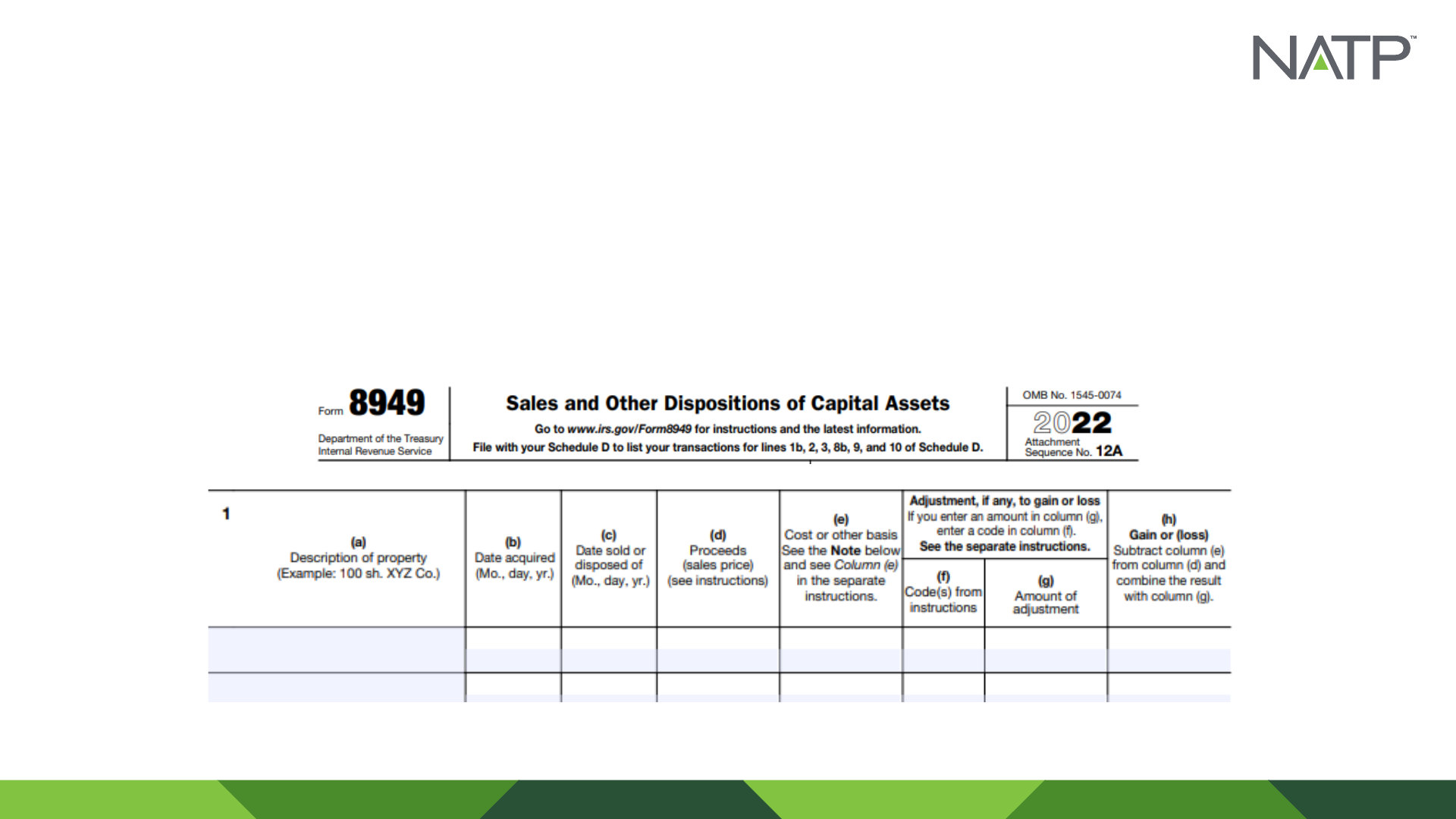

Personal Item Sold at a Gain

Form 8949 and Sch. D

Sold couch for $1,200.

• Okay to file here if there are other items to file on 8949 or Sch. D

Couch

10/01/20 02/14/22

$1200

$1000

$200

If No Receipt for Personal Items You Sold

• If records lost, destroyed or not available due to circumstances beyond your

control, and you are audited

• Examiners may allow you to present reconstructed records, or

• Examiners may accept oral testimony

Mix of Personal Items Sold

Some at a gain and others at a loss

• Your gains and losses are to be reported separately

and

• Gains on the sale of personal assets cannot be offset by losses from the

sale of personal assets

Mix of Personal Items Sold – Example

• Sold two sets of four tickets (bought for personal use) to two separate

sporting events for $1,000

• Sold one set for $800

• Sold the other set for $200

• Purchased each set for $250 ($500 total)

• Purchased two months prior to selling them

Sold One Set of Tickets for $800

X

Tickets

3/15/22

5/15/22

800 250

550

Sold Set Two for $200

1099-K Personal item sold at a loss

200

OR

1099-K Personal item sold at a loss

200

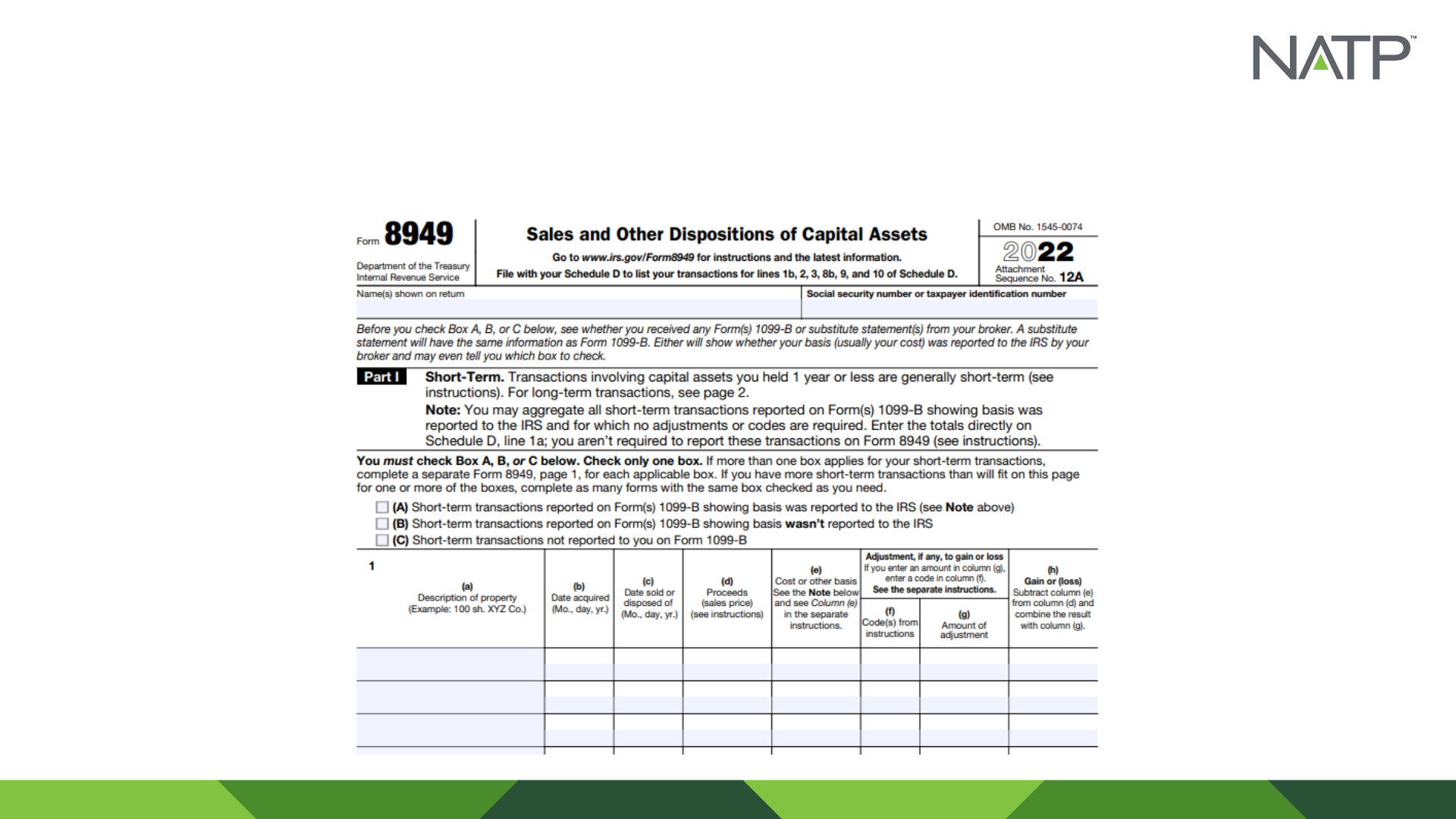

Sold One Set of Tickets for $800 & One Set for $200

X

Tickets

3/15/22

5/15/22

Tickets

3/15/22

5/15/22

200

250

L

50

800

250

550

0

Hobby

Hobby Rules

• Activity does not raise to the level of a trade or business

• You only get COGS and no business expenses

• Report on Schedule 1, Additional Income and Adjustments to Income

Business

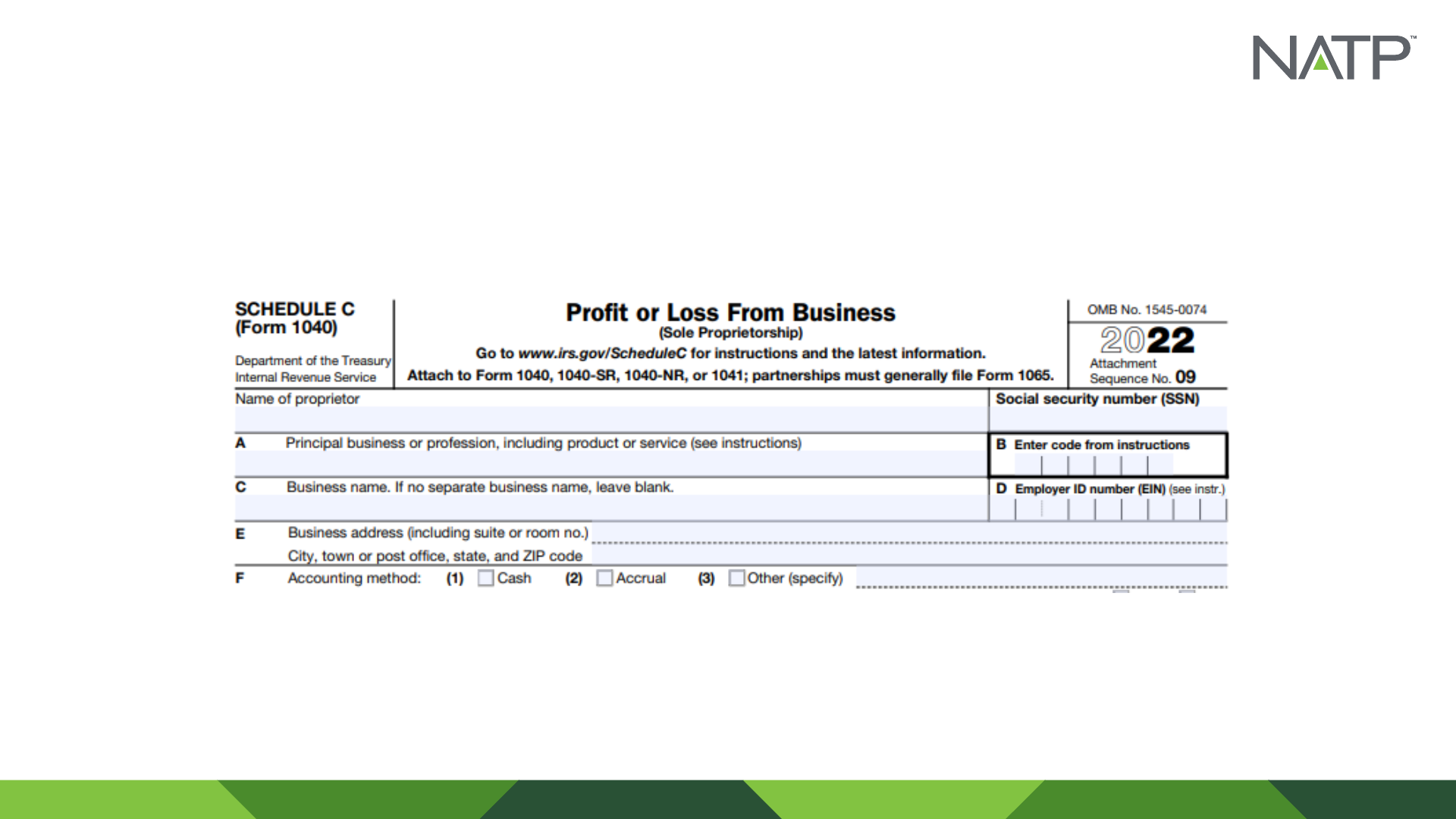

Schedule C – Trade or Business

Reconciling Information Reporting

Information reporting

• 1099-K

• 1099-NEC

• 1099-MISC

Method of payment

• Check

• Credit card

• Venmo

• ACH

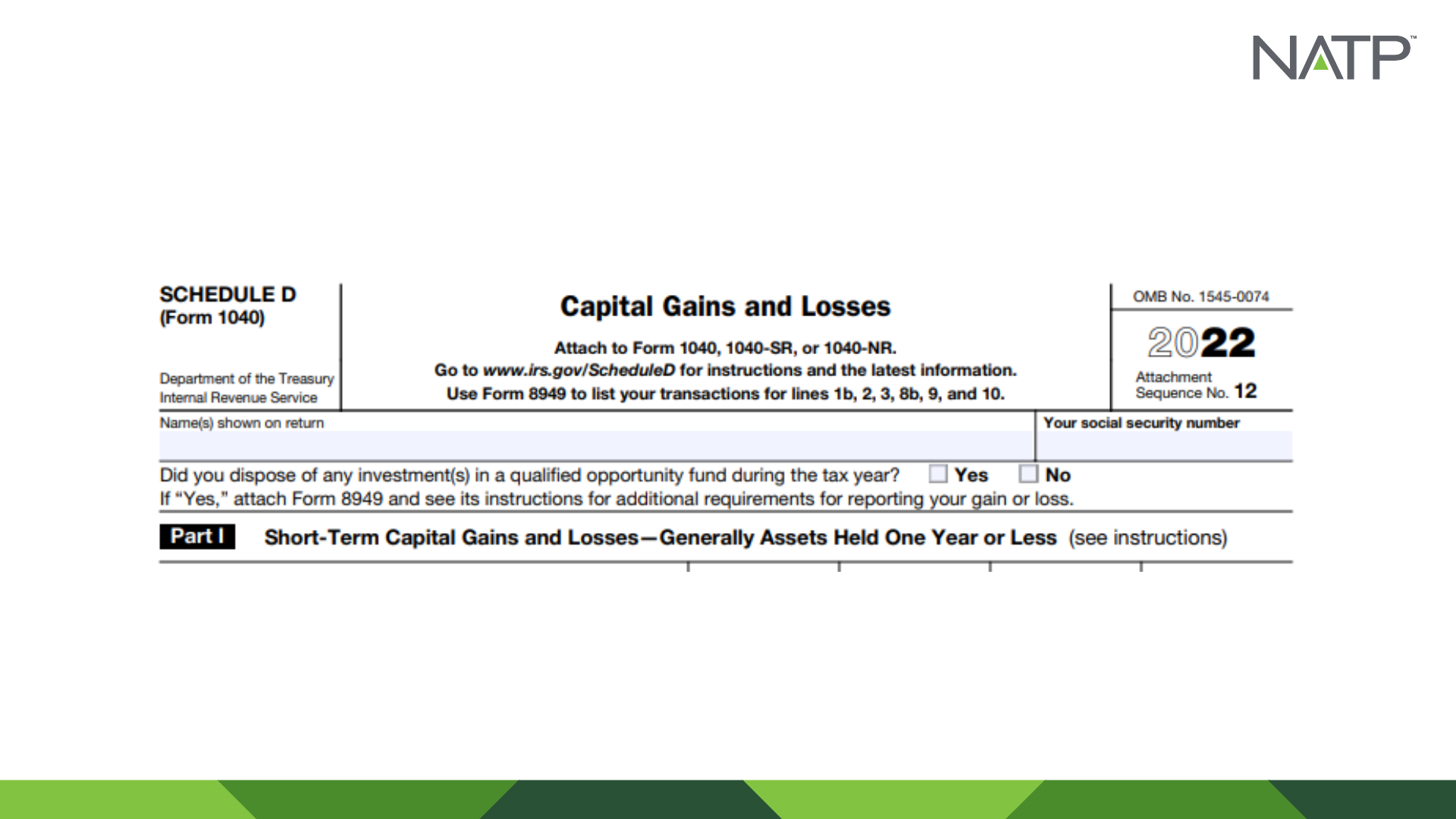

Investment

Schedule D

Other Issues

Other Issues

• Sharing your credit card terminal with another person or business

• Bought or sold your business during the year

Cont .

Other Issues, Cont.

• Change your business entity structure during the year

• Business use: multi-s

ources of income

Take-A-Ways

• Due diligence

• What questions to ask your clients

• Ignoring 1099-K = IRS notice

• Your roadmap

Contact Information

Larry L Gray, CPA, CGMA

219 W. State Route 72

Rolla, MO 65401

573-364-1700

larry@agccpa.com

THANK YOU!